UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

|

| |

| þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 20192020

OR

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________________ to ________________

Commission file number 001-37797

INNOVATE BIOPHARMACEUTICALS,9 METERS BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 27-3948465 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

8480 Honeycutt Road, Suite 120

Raleigh, North Carolina 27615

(Address of principal executive offices, including zip code)

(919) 275-1933

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock $0.0001 Par Value | INNTNMTR | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | |

| Large accelerated filer | ¨ | | Accelerated filer | þ

¨ |

| Non-accelerated filer | ¨

þ | | Smaller reporting company | þ |

| | | | Emerging growth company | þ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

As of August 6, 2019,10, 2020, the registrant had 35,883,953138,933,764 shares of common stock, par value $0.0001 per share, issued and outstanding.

.

TABLE OF CONTENTS

|

| | |

|

| | | |

| | |

| | | |

| | | |

| | | |

| | 2019 | |

| | | |

| | 2019 | |

| | | |

| | 2019 | |

| | | |

| | | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

|

| | | |

| | |

| | | |

| | |

| | | |

| UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | | |

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

INNOVATE BIOPHARMACEUTICALS,9 METERS BIOPHARMA, INC.

Condensed Consolidated Balance Sheets

| | | | | (Unaudited)

June 30, 2019 | | December 31, 2018 | | June 30, 2020 | | December 31, 2019 |

| Assets | | |

| | |

| | (Unaudited) | | |

|

| | | | | | | | | |

| Current assets: | | |

| | |

| | |

| | |

|

| Cash and cash equivalents | | $ | 13,337,898 |

| | $ | 5,728,900 |

| | $ | 13,473,467 |

| | $ | 4,592,932 |

|

| Restricted deposit | | 75,000 |

| | 75,000 |

| | 75,000 |

| | 75,000 |

|

| Prepaid expenses and other current assets | | 1,117,628 |

| | 504,907 |

| | 1,061,273 |

| | 555,052 |

|

| Deferred offering costs | | — |

| | 104,706 |

| |

| Total current assets | | 14,530,526 |

| | 6,413,513 |

| | 14,609,740 |

| | 5,222,984 |

|

| | | | | | | | | |

| Property and equipment, net | | 34,157 |

| | 35,095 |

| | 52,104 |

| | 25,422 |

|

| Right-of-use asset | | 69,325 |

| | — |

| | 14,705 |

| | 42,830 |

|

| Other assets | | 5,580 |

| | 5,580 |

| | 5,580 |

| | 5,580 |

|

| Total assets | | $ | 14,639,588 |

| | $ | 6,454,188 |

| | $ | 14,682,129 |

| | $ | 5,296,816 |

|

| | | | | | | | | |

| Liabilities and Stockholders’ Equity (Deficit) | | |

| | | | |

| | |

| | | | | | | | | |

| Current liabilities: | | |

| | | | |

| | |

| Accounts payable | | $ | 2,712,285 |

| | $ | 3,618,634 |

| | $ | 3,447,824 |

| | $ | 3,890,094 |

|

| Accrued expenses | | 974,091 |

| | 826,327 |

| | 3,284,095 |

| | 4,747,751 |

|

| Convertible note payable, net | | 4,044,212 |

| | 5,196,667 |

| |

| Derivative liability | | 999,000 |

| | 370,000 |

| |

| Convertible notes payable, net | | | 4,484,277 |

| | 3,184,655 |

|

| Derivative liabilities | | | 247,000 |

| | 408,000 |

|

| Warrant liabilities | | 660,200 |

| | — |

| | — |

| | 2,637,500 |

|

| Accrued interest | | 174,166 |

| | 101,624 |

| | 136,942 |

| | — |

|

| Lease liability, current portion | | 54,620 |

| | — |

| | 14,705 |

| | 42,830 |

|

| Total current liabilities | | 9,618,574 |

| | 10,113,252 |

| | 11,614,843 |

| | 14,910,830 |

|

| | | | | | | | | |

| Lease liability, net of current portion | | 14,705 |

| | — |

| |

| Total liabilities | | 9,633,279 |

| | 10,113,252 |

| |

| | | | | | |

| Commitments and contingencies (Note 8) | |

|

| |

|

| |

|

| |

|

|

| | | | | | | | | |

| Stockholders’ equity (deficit): | | | | | | | | |

| Preferred stock $0.0001 par value, 10,000,000 shares authorized; 0 shares issued and outstanding as of June 30, 2019 and December 31, 2018, respectively | | — |

| | — |

| |

| Common stock - $0.0001 par value, 350,000,000 shares authorized; 35,883,953 and 26,088,820 shares issued and outstanding as of June 30, 2019 and December 31, 2018, respectively | | 3,589 |

| | 2,609 |

| |

| Preferred stock $0.0001 par value, 10,000,000 shares authorized; 382,779 shares issued and 0 outstanding as of June 30, 2020 (unaudited); 0 issued and outstanding as of December 31, 2019 | | | — |

| | — |

|

| Common stock - $0.0001 par value, 350,000,000 shares authorized; 136,232,886 and 39,477,667 shares issued and outstanding as of June 30, 2020 (unaudited) and December 31, 2019, respectively | | | 13,625 |

| | 3,948 |

|

| Additional paid-in capital | | 57,441,695 |

| | 39,854,297 |

| | 121,818,976 |

| | 60,946,816 |

|

| Accumulated deficit | | (52,438,975 | ) | | (43,515,970 | ) | | (118,765,315 | ) | | (70,564,778 | ) |

| Total stockholders’ equity (deficit) | | 5,006,309 |

| | (3,659,064 | ) | | 3,067,286 |

| | (9,614,014 | ) |

| | | | | | |

| Total liabilities and stockholders’ equity (deficit) | | $ | 14,639,588 |

| | $ | 6,454,188 |

| | $ | 14,682,129 |

| | $ | 5,296,816 |

|

See accompanying notes to these condensed consolidated financial statements.

INNOVATE BIOPHARMACEUTICALS,9 METERS BIOPHARMA, INC.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

| | | | | Three Months Ended

June 30, | | Six Months Ended

June 30, | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | | 2019 | | 2018 | | 2019 | | 2018 | | 2020 | | 2019 | | 2020 | | 2019 |

| Operating expenses: | | | | | | |

| | |

| | | | | | |

| | |

|

| Research and development | | $ | 3,073,344 |

| | $ | 1,243,221 |

| | $ | 4,271,659 |

| | $ | 7,601,225 |

| | $ | 444,817 |

|

| $ | 3,073,344 |

| | $ | 3,043,802 |

|

| $ | 4,271,659 |

|

| Acquired in-process research and development | | | 32,266,893 |

|

| — |

|

| 32,266,893 |

|

| — |

|

| General and administrative | | 3,049,711 |

| | 2,132,850 |

| | 6,164,206 |

| | 7,103,463 |

| | 5,659,721 |

|

| 3,049,711 |

| | 7,329,528 |

|

| 6,164,206 |

|

| Warrant inducement expense | | | 6,467,048 |

|

| — |

| | 7,157,887 |

|

| — |

|

| Total operating expenses | | 6,123,055 |

| | 3,376,071 |

| | 10,435,865 |

| | 14,704,688 |

| | 44,838,479 |

| | 6,123,055 |

| | 49,798,110 |

| | 10,435,865 |

|

| | | | | | | | | | | | | | | | | |

| Loss from operations | | (6,123,055 | ) | | (3,376,071 | ) | | (10,435,865 | ) | | (14,704,688 | ) | | (44,838,479 | ) |

| (6,123,055 | ) | | (49,798,110 | ) | | (10,435,865 | ) |

| | | | | | | | | | | | | | | | | |

| Other income (expense): | | | | | | | | | | | | | | | | |

| Interest income | | 72,641 |

| | 54,637 |

| | 99,097 |

| | 85,129 |

| | 8,550 |

| | 72,641 |

| | 21,365 |

| | 99,097 |

|

| Interest expense | | (431,626 | ) | | (894,118 | ) | | (858,871 | ) | | (4,555,737 | ) | | (1,019,307 | ) | | (431,626 | ) | | (1,592,292 | ) | | (858,871 | ) |

| Loss on extinguishment of convertible note payable | | — |

| | — |

| | (1,049,166 | ) |

| — |

| | — |

| | — |

| | — |

|

| (1,049,166 | ) |

Change in fair value of derivative liability and extinguishment of derivative liability | | 181,000 |

|

| — |

| | 652,000 |

|

| — |

| | 193,000 |

|

| 181,000 |

| | 531,000 |

|

| 652,000 |

|

| Change in fair value of warrant liabilities | | 1,812,800 |

|

| — |

| | 2,669,800 |

|

| — |

| | 1,058,700 |

|

| 1,812,800 |

| | 2,637,500 |

|

| 2,669,800 |

|

| Total other income (expense), net | | 1,634,815 |

| | (839,481 | ) | | 1,512,860 |

| | (4,470,608 | ) | | 240,943 |

|

| 1,634,815 |

| | 1,597,573 |

|

| 1,512,860 |

|

| | | | | | | | | | | | | | | | | |

| Loss before income taxes | | (4,488,240 | ) | | (4,215,552 | ) | | (8,923,005 | ) | | (19,175,296 | ) | | (44,597,536 | ) | | (4,488,240 | ) | | (48,200,537 | ) | | (8,923,005 | ) |

| Benefit from income taxes | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| | | | | | | | | | | | | | | | | |

| Net loss | | $ | (4,488,240 | ) | | $ | (4,215,552 | ) | | $ | (8,923,005 | ) | | $ | (19,175,296 | ) | | $ | (44,597,536 | ) | | $ | (4,488,240 | ) | | $ | (48,200,537 | ) | | $ | (8,923,005 | ) |

| | | | | | | | | | | | | | | | | |

| Net loss per common share, basic and diluted | | $ | (0.13 | ) | | $ | (0.16 | ) | | $ | (0.29 | ) | | $ | (0.82 | ) | | $ | (0.57 | ) | | $ | (0.13 | ) | | $ | (0.81 | ) | | $ | (0.29 | ) |

| | | | | | | | | | | | | | | | | |

| Weighted-average common shares, basic and diluted | | 33,973,788 |

| | 25,695,171 |

| | 30,631,601 |

| | 23,481,834 |

| | 78,584,900 |

| | 33,973,788 |

| | 59,873,598 |

| | 30,631,601 |

|

See accompanying notes to these condensed consolidated financial statements.

INNOVATE BIOPHARMACEUTICALS,9 METERS BIOPHARMA, INC.

Unaudited Condensed Consolidated Statements of Stockholders’ Equity (Deficit)

|

| | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2019 |

| |

| Common Stock Shares |

| Common Stock Amount |

| Additional Paid-in Capital |

| Accumulated Deficit |

| Total |

| Balance as of December 31, 2018 |

| 26,088,820 |

|

| $ | 2,609 |

|

| $ | 39,854,297 |

|

| $ | (43,515,970 | ) |

| $ | (3,659,064 | ) |

| Issuance of common stock and warrants |

| 4,886,782 |

|

| 489 |

|

| 11,474,766 |

|

| — |

|

| 11,475,255 |

|

| Allocation of warrants to liabilities | | — |

| | — |

| | (1,970,000 | ) | | — |

| | (1,970,000 | ) |

| Stock issuance costs |

| — |

|

| — |

|

| (319,819 | ) |

| — |

|

| (319,819 | ) |

| Share-based compensation | | — |

|

| — |

|

| 526,000 |

|

| — |

|

| 526,000 |

|

| Issuance of RSUs |

| 90,000 |

|

| 9 |

|

| (9 | ) |

| — |

|

| — |

|

| Net loss | | — |

| | — |

| | — |

| | (4,434,765 | ) | | (4,434,765 | ) |

| Balance as of March 31, 2019 | | 31,065,602 |

| | 3,107 |

| | 49,565,235 |

| | (47,950,735 | ) | | 1,617,607 |

|

| Issuance of common stock and warrants | | 4,318,272 |

|

| 432 |

|

| 8,744,069 |

|

| — |

|

| 8,744,501 |

|

| Allocation of warrants to liabilities | | — |

|

| — |

|

| (1,360,000 | ) |

| — |

|

| (1,360,000 | ) |

| Stock issuance costs | | — |

| | — |

| | (389,623 | ) | | — |

| | (389,623 | ) |

| Exercise of stock options | | 100,079 |

| | 10 |

| | 30,054 |

| | — |

| | 30,064 |

|

| Issuance of RSUs | | 400,000 |

|

| 40 |

|

| (40 | ) | | — |

| | — |

|

| Share-based compensation |

| — |

|

| — |

|

| 852,000 |

|

| — |

|

| 852,000 |

|

| Net loss |

| — |

|

| — |

|

| — |

|

| (4,488,240 | ) |

| (4,488,240 | ) |

| Balance as of June 30, 2019 |

| 35,883,953 |

|

| $ | 3,589 |

|

| $ | 57,441,695 |

|

| $ | (52,438,975 | ) |

| $ | 5,006,309 |

|

|

| | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2018 |

| | | Common Stock Shares* | | Common Stock Amount | | Additional Paid-in Capital | | Accumulated Deficit | | Total |

| Balance as of December 31, 2017 | | 11,888,240 |

| | $ | 11,888 |

| | $ | 7,167,189 |

| | $ | (19,353,691 | ) | | $ | (12,174,614 | ) |

| Change in par value from $0.001 to $0.0001 | | — |

| | (10,699 | ) | | 10,699 |

| | — |

| | — |

|

| Issuance of shares as a result of reverse recapitalization | | 1,864,808 |

| | 186 |

| | (978,860 | ) | | — |

| | (978,674 | ) |

| Issuance of common stock | | 7,111,631 |

| | 711 |

| | 16,136,950 |

| | — |

| | 16,137,661 |

|

| Warrants issued with common stock | | — |

| | — |

| | 1,995,000 |

| | — |

| | 1,995,000 |

|

| Warrants issued to placement agents | | — |

| | — |

| | 913,000 |

| | — |

| | 913,000 |

|

| Stock issuance costs | | — |

| | — |

| | (2,568,079 | ) | | — |

| | (2,568,079 | ) |

| Conversion of convertible debt and accrued interest | | 4,827,001 |

| | 483 |

| | 9,229,336 |

| | — |

| | 9,229,819 |

|

| Beneficial conversion feature | | — |

| | — |

| | 3,077,887 |

| | — |

| | 3,077,887 |

|

| Share-based compensation | | — |

| | — |

| | 7,174,000 |

| | — |

| | 7,174,000 |

|

| Net loss | | — |

| | — |

| | — |

| | (14,959,744 | ) | | (14,959,744 | ) |

| Balance as of March 31, 2018 | | 25,691,680 |

| | $ | 2,569 |

| | $ | 42,157,122 |

| | $ | (34,313,435 | ) | | $ | 7,846,256 |

|

| Exercise of warrants | | 3,922 |

| | 1 |

| | 12,471 |

| | — |

| | 12,472 |

|

| Share-based compensation | | — |

| | — |

| | (184,000 | ) | | — |

| | (184,000 | ) |

| Net loss | | — |

| | — |

| | — |

| | (4,215,552 | ) | | (4,215,552 | ) |

| Balance as of June 30, 2018 | | 25,695,602 |

| | $ | 2,570 |

| | $ | 41,985,593 |

| | $ | (38,528,987 | ) | | $ | 3,459,176 |

|

|

| | | | | | | | | | | | | | | | | | | | |

| Three and Six Months Ended June 30, 2020 |

| |

| Series A Preferred Shares | Series A Preferred Amount | Common Stock Shares | Common Stock Amount | Additional Paid-in Capital | Accumulated Deficit | Total |

| Balance as of December 31, 2019 |

| — |

| $ | — |

| 39,477,667 |

| $ | 3,948 |

| $ | 60,946,816 |

| $ | (70,564,778 | ) | $ | (9,614,014 | ) |

| Warrant exchange |

| — |

| — |

| 1,847,309 |

| 185 |

| 690,654 |

| — |

| 690,839 |

|

| Share-based compensation | | — |

| — |

| — |

| — |

| 276,000 |

| — |

| 276,000 |

|

| Stock issuance costs - Warrant exchange (FN-1) |

| — |

| — |

| — |

| — |

| (300,000 | ) | — |

| (300,000 | ) |

| Net loss | | — |

| — |

| — |

| — |

| — |

| (3,603,001 | ) | (3,603,001 | ) |

| Balance as of March 31, 2020 | | — |

| — |

| 41,324,976 |

| 4,133 |

| 61,613,470 |

| (74,167,779 | ) | (12,550,176 | ) |

| Issuance of common stock (RDD & Naia mergers) | | — |

| — |

| 42,695,948 |

| 4,270 |

| 28,749,756 |

| — |

| 28,754,026 |

|

| Issuance of preferred stock and warrants (FN-1) | | 382,779 |

| 38 |

| — |

| — |

| 22,560,956 |

| — |

| 22,560,994 |

|

| Stock issuance costs | | — |

| — |

| — |

| — |

| (3,589,703 | ) | — |

| (3,589,703 | ) |

| Share-based compensation | | — |

| — |

| — |

| — |

| 4,021,000 |

| — |

| 4,021,000 |

|

| Exercise of warrants | | — |

| — |

| 12,230,418 |

| 1,223 |

| 1,217,778 |

| — |

| 1,219,001 |

|

| Inducement expense | | — |

| — |

| — |

| — |

| 6,467,048 |

| — |

| 6,467,048 |

|

| Conversion of convertible debt and accrued interest | | — |

| — |

| 1,287,696 |

| 129 |

| 574,871 |

| — |

| 575,000 |

|

| Beneficial conversion feature | | — |

| — |

| — |

| — |

| 207,632 |

| — |

| 207,632 |

|

| Conversion of preferred stock to common stock | | (382,779 | ) | (38 | ) | 38,277,900 |

| 3,828 |

| (3,790 | ) | — |

| — |

|

| Issuance of RSUs | | — |

| — |

| 415,948 |

| 42 |

| (42 | ) | — |

| — |

|

| Net loss | | — |

| — |

| — |

| — |

| — |

| (44,597,536 | ) | (44,597,536 | ) |

| Balance as of June 30, 2020 |

| — |

| $ | — |

| 136,232,886 |

| $ | 13,625 |

| $ | 121,818,976 |

| $ | (118,765,315 | ) | $ | 3,067,286 |

|

* Common shares adjusted for the exchange ratio from the reverse recapitalization

|

| | | | | | | | | | | | | | | | | | | |

| Three and Six Months Ended June 30, 2019 |

| | | Common Stock Shares | | Common Stock Amount | | Additional Paid-in Capital | | Accumulated Deficit | | Total |

| Balance as of December 31, 2018 | | 26,088,820 |

| | $ | 2,609 |

| | $ | 39,854,297 |

| | $ | (43,515,970 | ) | | $ | (3,659,064 | ) |

| Issuance of common stock and warrants | | 4,886,782 |

| | 489 |

| | 11,474,766 |

| | — |

| | 11,475,255 |

|

| Allocation of warrants to liabilities | | — |

| | — |

| | (1,970,000 | ) | | — |

| | (1,970,000 | ) |

| Stock issuance costs | | — |

| | — |

| | (319,819 | ) | | — |

| | (319,819 | ) |

| Share-based compensation | | — |

| | — |

| | 526,000 |

| | — |

| | 526,000 |

|

| Issuance of RSUs | | 90,000 |

| | 9 |

| | (9 | ) | | — |

| | — |

|

| Net loss | | — |

| | — |

| | — |

| | (4,434,765 | ) | | (4,434,765 | ) |

| Balance as of March 31, 2019 | | 31,065,602 |

| | 3,107 |

| | 49,565,235 |

| | (47,950,735 | ) | | 1,617,607 |

|

| Issuance of common stock and warrants | | 4,318,272 |

| | 432 |

| | 8,744,069 |

| | — |

| | 8,744,501 |

|

| Allocation of warrants to liabilities | | — |

| | — |

| | (1,360,000 | ) | | — |

| | (1,360,000 | ) |

| Stock issuance costs | | — |

| | — |

| | (389,623 | ) | | — |

| | (389,623 | ) |

| Exercise of stock options | | 100,079 |

| | 10 |

| | 30,054 |

| | — |

| | 30,064 |

|

| Issuance of RSUs | | 400,000 |

| | 40 |

| | (40 | ) | | — |

| | — |

|

| Share-based compensation | | — |

| | — |

| | 852,000 |

| | — |

| | 852,000 |

|

| Net loss | | — |

| | — |

| | — |

| | (4,488,240 | ) | | (4,488,240 | ) |

| Balance as of June 30, 2019 | | 35,883,953 |

| | $ | 3,589 |

| | $ | 57,441,695 |

| | $ | (52,438,975 | ) | | $ | 5,006,309 |

|

See accompanying notes to these condensed consolidated financial statements.

INNOVATE BIOPHARMACEUTICALS,9 METERS BIOPHARMA, INC.

Unaudited Condensed Consolidated Statements of Cash Flows

| | | | | Six Months Ended

June 30, | | Six Months Ended

June 30, |

| | | 2019 | | 2018 | | 2020 | | 2019 |

| Cash flows from operating activities | | |

| | |

| | |

| | |

|

| Net loss | | $ | (8,923,005 | ) | | $ | (19,175,296 | ) | | $ | (48,200,537 | ) | | $ | (8,923,005 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | — |

| | | | |

| Share-based compensation | | 1,378,000 |

| | 6,990,000 |

| | 4,297,000 |

| | 1,378,000 |

|

| Write-off of deferred offering costs | | 100,056 |

| | — |

| | — |

| | 100,056 |

|

| Accrued interest on convertible notes | | 174,166 |

| | 25,578 |

| | 136,942 |

| | 174,166 |

|

| Amortization of debt discount | | 382,212 |

| | 1,171,985 |

| | 1,154,847 |

| | 382,212 |

|

| Beneficial conversion feature | | | 207,632 |

|

| — |

|

| Depreciation | | 10,413 |

| | 9,279 |

| | 9,745 |

| | 10,413 |

|

| Beneficial conversion feature | | — |

| | 3,077,887 |

| |

| Loss on disposal and write-offs of property and equipment | | | 7,031 |

| | — |

|

| Change in fair value of derivative liability | | (282,000 | ) | | — |

| | (531,000 | ) | | (282,000 | ) |

| Change in fair value of warrant liability | | (2,669,800 | ) | | — |

| | (2,637,500 | ) | | (2,669,800 | ) |

| Warrant inducement expense | | | 7,157,887 |

|

| — |

|

| Acquired in-process research and development | | | 28,754,026 |

|

| — |

|

| Extinguishment of derivative liability | | (370,000 | ) | | — |

| | — |

| | (370,000 | ) |

| Loss on extinguishment of debt | | 1,049,166 |

| | — |

| | — |

| | 1,049,166 |

|

| Changes in operating assets and liabilities: | | | | | |

| Changes in operating assets and liabilities, net of acquisitions: | | | | | |

| Prepaid expenses and other assets | | (592,375 | ) | | (70,074 | ) | | (506,221 | ) | | (592,375 | ) |

| Accounts payable | | (1,058,692 | ) | | (289,697 | ) | | (526,498 | ) | | (1,058,692 | ) |

| Accrued expenses | | 147,764 |

| | (1,020,430 | ) | | 1,764,111 |

| | 147,764 |

|

| Accrued interest | | (101,624 | ) | | — |

| | 82,579 |

| | (101,624 | ) |

| Net cash used in operating activities | | (10,755,719 | ) | | (9,280,768 | ) | | (8,829,956 | ) | | (10,755,719 | ) |

| | | | | | |

| Cash flows from investing activities | | | | | | | | |

| Purchase of property and equipment | | (9,475 | ) | | (13,943 | ) | | (2,543 | ) | | (9,475 | ) |

| Loan payments from related party | | — |

| | 75,000 |

| |

| Net cash (used in) provided by investing activities | | (9,475 | ) | | 61,057 |

| |

| | | | | | |

| Purchase of in-process research and development, net of assets acquired | | | (3,184,454 | ) | | — |

|

| Net cash used in investing activities | | | (3,186,997 | ) | | (9,475 | ) |

| Cash flows from financing activities | | | | | | | | |

| Borrowings from convertible notes | | 5,000,000 |

| | 3,345,000 |

| | 2,500,000 |

| | 5,000,000 |

|

| Payments of convertible notes | | (6,245,833 | ) | | (275,000 | ) | | (1,469,804 | ) | | (6,245,833 | ) |

| Payments of debt issuance costs | | (57,000 | ) | | (20,000 | ) | | (23,000 | ) | | (57,000 | ) |

| Proceeds from the exercise of stock options | | 15,574 |

| | — |

| | — |

| | 15,574 |

|

| Proceeds from issuance of common stock and warrants | | 20,706,919 |

| | 18,132,661 |

| | — |

| | 20,706,919 |

|

| Payment of deferred offering costs | | (1,045,468 | ) | | (1,655,079 | ) | |

| Proceeds from issuance of preferred stock and warrants | | | 22,560,994 |

|

| — |

|

| Payment of offering costs | | | (3,889,703 | ) | | (1,045,468 | ) |

| Proceeds from exercise of warrants | | | 1,219,001 |

| | — |

|

| Net cash provided by financing activities | | 18,374,192 |

| | 19,527,582 |

| | 20,897,488 |

| | 18,374,192 |

|

| | | | | | |

| Net increase in cash and cash equivalents | | 7,608,998 |

| | 10,307,871 |

| | 8,880,535 |

| | 7,608,998 |

|

| | | | | | |

| Cash and cash equivalents as of beginning of period | | 5,728,900 |

| | 355,563 |

| | 4,592,932 |

| | 5,728,900 |

|

| | | | | | |

| Cash and cash equivalents as of end of period | | $ | 13,337,898 |

| | $ | 10,663,434 |

| | $ | 13,473,467 |

| | $ | 13,337,898 |

|

| | | | | | | | | |

| Supplemental disclosure of cash flow information | | | | |

| | | | |

|

| Cash paid during the period for interest | | $ | 418,927 |

| | $ | 280,287 |

| | $ | 54,578 |

| | $ | 418,927 |

|

| | | | | | | | | |

| Supplemental disclosure of non-cash financing activities | | |

| | | | |

| | |

| Conversion of convertible notes and accrued interest to common stock | | $ | — |

| | $ | 9,229,336 |

| | $ | 575,000 |

| | $ | — |

|

| Assumption of liabilities from reverse recapitalization transaction | | $ | — |

| | $ | 978,674 |

| |

| Warrants issued to placement agents | | $ | — |

| | $ | 913,000 |

| |

| Non-cash addition of derivative liability | | $ | 1,281,000 |

| | $ | — |

| | $ | 370,000 |

| | $ | 1,281,000 |

|

| Non-cash addition of deferred offering costs | | $ | 151,137 |

| | $ | — |

| |

| Addition of non-cash stock issuance and deferred offering costs | | | $ | 28,754,026 |

| | $ | 151,137 |

|

| Receivable for stock options and warrants exercised | | $ | 14,490 |

|

| $ | 12,472 |

| | $ | — |

|

| $ | 14,490 |

|

See accompanying notes to these condensed consolidated financial statements.

INNOVATE BIOPHARMACEUTICALS,9 METERS BIOPHARMA, INC.

NOTES TO UNAUDITED CONSOLIDATED CONDENSED FINANCIAL STATEMENTS

NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Business Description

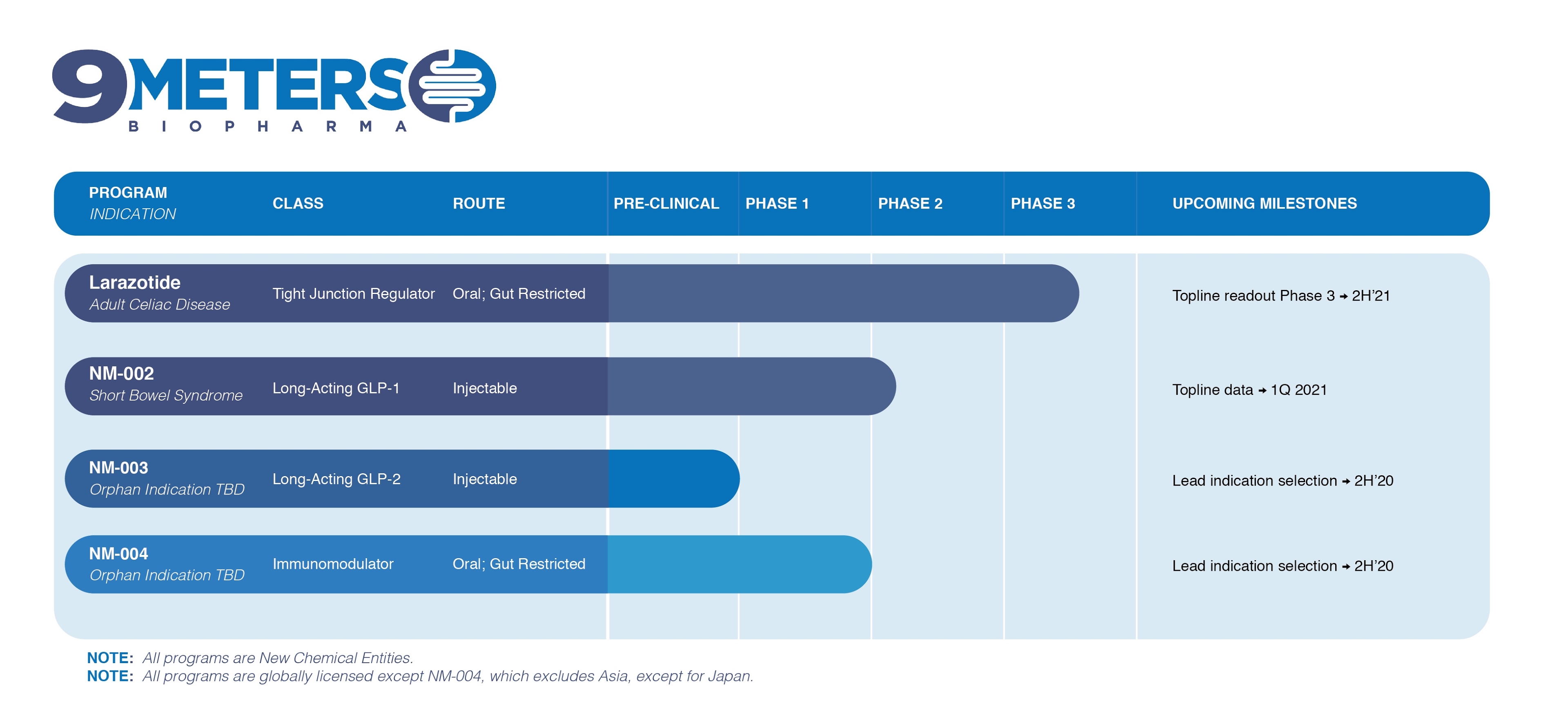

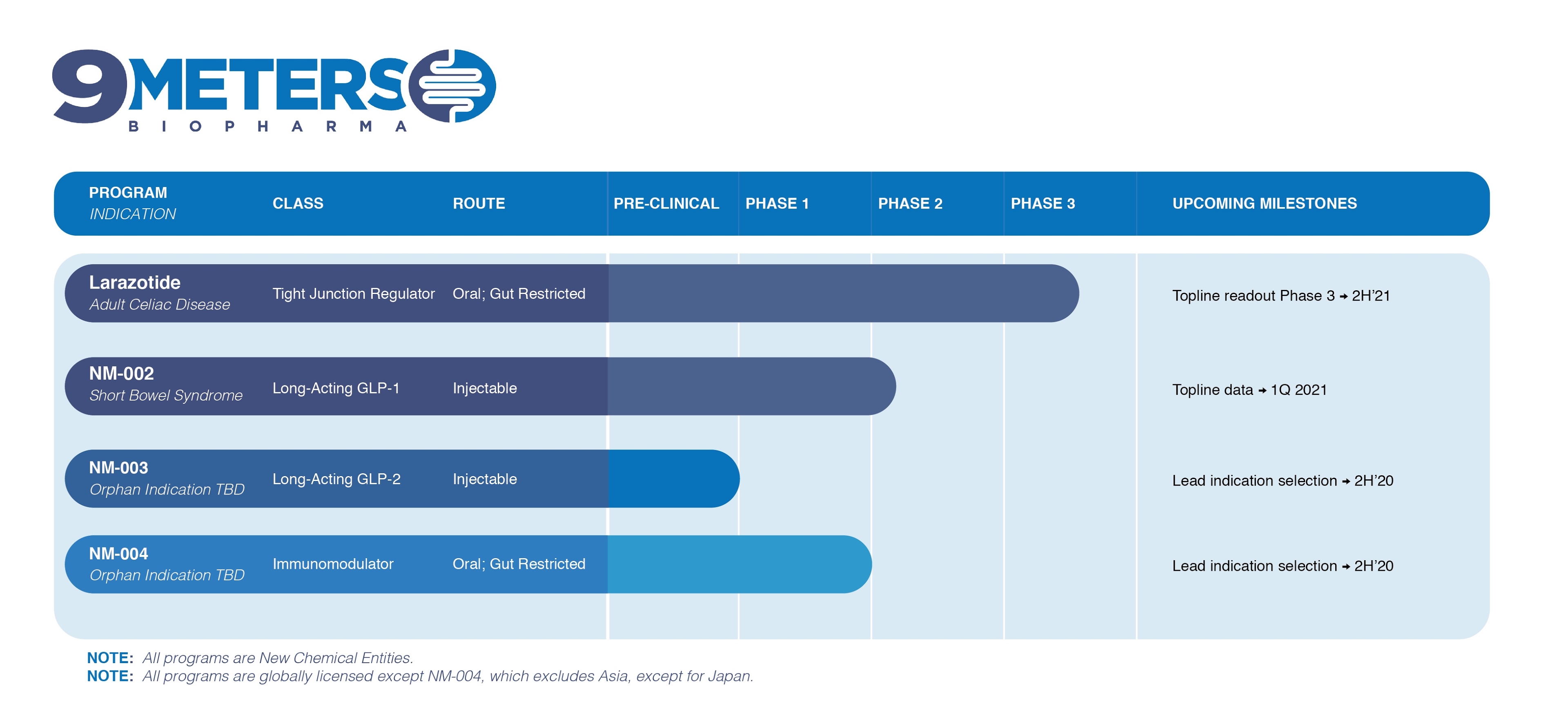

Innovate Biopharmaceuticals,9 Meters Biopharma, Inc. (the “Company” or “Innovate”) is a clinical-stage biopharmaceutical company developing novel medicines for autoimmunefocused on orphan, rare and inflammatory diseases with unmet medical needs.needs in gastroenterology. The Company’s pipeline includes drug candidates for celiac disease, nonalcoholic steatohepatitis (NASH)NM-002, a proprietary long-acting GLP-1 agonist for short bowel syndrome (SBS), alcoholic steatohepatitis (ASH), Crohn’san orphan designated disease and ulcerative colitis.larazotide, a Phase 3 tight junction regulator being evaluated for celiac disease.

On January 29, 2018, Monster Digital, Inc.April 30, 2020, the Company completed its merger with privately-held RDD Pharma, Ltd., an Israel corporation (“Monster”RDD”) (the “RDD Merger”) and privately heldchanged its name from Innovate Biopharmaceuticals, Inc. (“Private Innovate”) completed a reverse recapitalization in accordance with the terms of the Agreement and Plan of Merger and Reorganization, dated July 3, 2017, as amended (the “Merger Agreement”), by and among Monster, Monster Merger Sub, Inc. (“Merger Sub”) and Private Innovate. In connection with the transaction, Private Innovate changed its name to IB Pharmaceuticals Inc. (“IB Pharmaceuticals”). Pursuant to the Merger Agreement, Merger Sub merged with and into IB Pharmaceuticals with IB Pharmaceuticals surviving as the wholly owned subsidiary of Monster (the “Merger”). Immediately following the Merger, Monster changed its name to Innovate Biopharmaceuticals, Inc. (“Innovate”). On March 29, 2018, IB Pharmaceuticals was merged into Innovate and ceased to exist.

Monster, a Delaware corporation (formed in November 2010), and its subsidiary SDJ Technologies, Inc. (“SDJ”), was an importer of high-end memory storage products, flash memory and action sports cameras marketed and sold under the Monster Digital brand name acquired under a long-term licensing agreement with Monster, Inc. In September 2017, Monster incorporated MD Holding Co, Inc. (“MDH”), a Delaware corporation, and transferred all of the businesses and assets of Monster, including all shares of SDJ and those liabilities of Monster not assumed by Innovate pursuant to the Merger to MDH. In January 2018, the name of MDH was changed to NLM Holding Co.,9 Meters Biopharma, Inc.

On January 29, 2018, prior to the Merger, Private Innovate completed an equity financing (the “Equity Issuance”). See Note 3—Merger and Financing.

Basis of Presentation

The unaudited condensed consolidated interim financial statements have been prepared by the Company pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”) for interim financial reporting. These financial statements are unaudited and, in the opinion of management, include all adjustments (consisting of normal recurring adjustments and accruals) necessary for a fair statement of the balance sheets, operating results, and cash flows for the periods presented in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). Operating results for the three and six months ended June 30, 20192020 are not necessarily indicative of the results that may be expected for the fiscal year ending December 31, 2019.2020. Certain information and footnote disclosure normally included in the annual financial statements prepared in accordance with U.S. GAAP have been omitted in accordance with the SEC’s rules and regulations for interim reporting. The Company’s financial position, results of operations and cash flows are presented in U.S. Dollars.

Upon the closing of the Merger, the outstanding shares of Private Innovate were exchanged for shares of common stock of Monster at an exchange ratio of one share of Private Innovate common stock to 0.37686604 shares of Monster common stock (the “Exchange Ratio”). All common share amounts and per share amounts have been adjusted to reflect this Exchange Ratio, which was effected upon the Merger.

The Merger has been accounted for as a reverse recapitalization. Prior to the Merger, Monster spun-out all of its pre-merger business assets and liabilities before it acquired Private Innovate. The owners and management of Private Innovate have actual or effective voting and operating control of the combined company. In the Merger transaction, Monster is the accounting acquiree and Private Innovate is the accounting acquirer. A reverse recapitalization is equivalent to the issuance of stock by the private operating company for the net monetary assets of the accounting acquiree accompanied by a recapitalization with accounting similar to that resulting from a reverse acquisition, except that no goodwill or intangible assets are recorded.

Immediately prior to the effective time of the Merger, Monster effected a reverse stock split at a ratio of one new share for every ten shares of its common stock outstanding. In connection with the Merger, 1,864,808 shares of the Company’s common stock were transferred to the existing Monster stockholders and the Company assumed approximately $1.0 million in liabilities from Monster for certain transaction costs and tail insurance coverage for its directors and officers, which were recorded as a

INNOVATE BIOPHARMACEUTICALS, INC.

NOTES TO UNAUDITED CONDENSED FINANCIAL STATEMENTS

reduction of additional paid-in capital. In addition, warrants to purchase up to 154,403 shares of the Company’s common stock remained outstanding after completion of the Merger. These warrants have a weighted-average exercise price of $55.31 per share and expire in 2021 and 2022.

The accompanying unaudited financial statements and related notes reflect the historical results of Private Innovate prior to the Merger and of the combined company following the Merger, and do not include the historical results of Monster prior to the completion of the Merger. These financial statements and related notes should be read in conjunction with the audited financial statements and related notes thereto for the year ended December 31, 2018,2019, included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018,2019, filed with the SEC on March 18, 2019.20, 2020.

Except as noted below under the section entitled “Recently Issued Accounting Standards—Accounting Pronouncements Adopted”,Adopted,” there have been no material changes to the Company’s significant accounting policies during the three and six months ended June 30, 2019,2020, as compared to the significant accounting policies disclosed in Note 1 of the Company’s financial statements for the years ended December 31, 2019 and 2018 and 2017.included in the Company’s Annual Report on Form 10-K. However, the following accounting policies are the most critical in fully understanding the Company’s financial condition and results of operations.

Basis of Consolidation

The accompanying consolidated financial statements reflect the operations of the Company and its wholly owned subsidiaries. All intercompany accounts and transactions have been eliminated in consolidation.

Shelf Registration Filing

On March 15, 2018, the Company filed a shelf registration statement that was declared effective on July 13, 2018. Under the shelf registration statement, the Company may, from time to time, sell its common stock in one or more offerings up to an aggregate dollar amount of $175 million (of which up(Prior to an aggregate ofthe program’s termination on March 19, 2020, $40 million mayof this amount could be sold in an “at-the-market” offering as defined in Rule 415 of the Securities Act; the useAct of this facility was suspended on June 24, 2019)1933, as amended (“ATM”)). In addition, the selling stockholders included in the shelf registration statement may from time to time sell up to an aggregate amount of 13,990,403 shares of the Company’s common stock (including up to 2,051,771 shares issuable upon exercise of warrants) in one or more offerings.

On July 22, 2020, the Company filed a prospectus supplement and associated sales agreement related to an ATM pursuant to which the Company may sell, from time to time, common stock with an aggregate offering price of up to $40 million through SunTrust Robinson Humphrey, as sales agent, for general corporate purposes. As of August 12, 2020, the Company had not sold any shares under the ATM. See Note 9—Subsequent Events for additional details.

9 METERS BIOPHARMA, INC.

NOTES TO UNAUDITED CONSOLIDATED CONDENSED FINANCIAL STATEMENTS

March 2019 Offering

On March 17, 2019, the Company entered into a securities purchase agreement (the “Purchase Agreement”) with SDS Capital Partners II, LLC and certain other accredited investors, pursuant to which the Company sold, on March 18, 2019, 4,181,068 shares of common stock and issued short-term warrants (the “Short-Term Warrants”) to purchase up to 4,181,068 shares of common stock, and long-term warrants (the “March Long-Term Warrants”) to purchase up to 2,508,634 shares of common stock. Pursuant to the Purchase Agreement, the Company issued the common stock and warrants at a purchase price of $2.33 per share for aggregate proceeds of approximately $9.7 million.

The March Long-Term Warrants issued will bewere exercisable for five years commencing on the six-month anniversary of March 18, 2019, havehad an initial exercise price of $2.56 per share, subject to certain adjustments, and havehad an expiration date of March 18, 2024. Any March Long-Term Warrant that has not been exercised by the expiration date shall be automatically exercised via cashless exercise. The Short-Term Warrants arewere originally exercisable for a period of one year from March 18, 2019, havehad an expiration date of March 18, 2020 and havehad an initial exercise price of $4.00 per share, subject to certain adjustments. If at any time after March 18, 2019, the weighted-average price of the Company’s common stock exceeds $5.25 for ten consecutive trading days, the Company may call the outstanding Short-Term Warrants and require that they be exercised in cash, except to the extent that such exercise would surpass the beneficial ownership limitations, as specified in the Purchase Agreement. If not previously exercised in full, at the expiration of their applicable terms, the warrants shall be automatically exercised via cashless exercise. The Short-Term Warrants and March Long-Term Warrants are classifiedwere accounted for as warrant liabilities in accordance with Accounting Standards Codification (“ASC”) 480—Distinguishing Liabilities from Equity.

On February 6, 2020, the Company and the holders of the Company’s outstanding Short-Term Warrants amended the Short-Term Warrants to extend the exercise period of each Short-Term Warrant by six months. The Short-Term Warrants, as amended, were exercisable for up to an aggregate of 4,181,068 shares of the Company’s common stock, par value $0.0001 per share, until September 18, 2020. In addition, on February 12, 2020, the accompanying condensed balance sheet.Company offered to amend outstanding warrants, including the Short-Term Warrants, to (i) shorten the exercise period to expire concurrently with the closing of the RDD Merger on April 30, 2020 and (ii) reduce the exercise price to $0.10 per share (the “Offer to Amend and Exercise”). All other terms of each Short-Term Warrant remained in full force and effect and were not impacted by this amendment. On April 29, 2020, upon closing of the Offer to Amend and Exercise, the Short-Term Warrants were fully exercised at an exercise price of $0.10 per share.

Additional Issuance of Warrants

On April 25, 2019, the Company entered into an amendment (the “Amendment”) to the Purchase Agreement dated as of March 17, 2019, between the Company and each purchaser party thereto. The Amendment (i) deleted Section 4.12 of the Purchase Agreement, which generally prohibited the Company from issuing, entering into agreements to issue, announcing proposed issuances, selling or granting certain securities between the date of the Purchase Agreement and the date that was 45 days following the closing date thereunder and (ii) gave each purchaser the right to purchase, for $0.125 per underlying share, an additional warrant to purchase shares of the Company’s common stock having an exercise price per share of $2.13 and otherwise having the terms of the March Long-Term Warrants (collectively, the “New Warrants”) pursuant to a securities purchase agreement to be entered into among the Company and each purchaser that desires to purchase the New Warrants. On May 17, 2019, the Company and each purchaser entered into such Securities Purchase Agreement (the “New Agreement”), and the Company issued New Warrants exercisable for an aggregate of 3,897,010 shares of the Company’s common stock.

INNOVATE BIOPHARMACEUTICALS, INC.

NOTES TO UNAUDITED CONDENSED FINANCIAL STATEMENTS

The New Warrants arewere exercisable for five years beginning on the six monthssix-month anniversary of the date of issuance until the five-year anniversary of their date of issuance. The New Warrants havehad an initial exercise price equal to $2.13 per share, subject to certain adjustments. However, any holder may increase or decrease such percentageThe New Warrants were accounted for as warrant liabilities in accordance with ASC 480—Distinguishing Liabilities from Equity.

Offer to any other percentage not in excess of 9.99% upon notice toAmend and Exercise

On February 12, 2020, the Company provided that any increaseoffered to amend certain outstanding warrants in such percentage shall not be effective until 61 days after such notice. If not previously exercisedthe Offer to Amend and Exercise. The warrants amended included the warrants classified as equity issued in full, at2018 (the “2018 Equity Warrants”), the expiration of their applicable terms,outstanding Short-Term Warrants and the outstanding March Long-Term Warrants and the New Warrants will be automatically exercised via cashless exercise, in which case the holder would receive upon such exercise the net numberWarrants. On April 29, 2020, an aggregate of 12,230,418 shares if any, of common stock determined according towere tendered, amended and exercised for $0.10 per share for aggregate gross proceeds of approximately $1.2 million. All of the formula set forth in the New Warrants. TheShort-Term Warrants, March Long-Term Warrants and New Warrants are classified as warrant liabilities on the accompanying condensed balance sheet.were fully exercised at an exercise price of $0.10 per share.

April 2019 Offering

On April 29, 2019, the Company entered into a Securities Purchase Agreement (the “April Purchase Agreement”) with certain institutional and accredited investors providing for the sale by the Company of up to 4,318,272 shares of its common stock at a purchase price of $2.025 per share.

9 METERS BIOPHARMA, INC.

NOTES TO UNAUDITED CONSOLIDATED CONDENSED FINANCIAL STATEMENTS

Pursuant to the April Purchase Agreement, the Company agreed to issue unregistered warrants (the “April Warrants”) to purchase up to 4,318,272 shares of common stock. Subject to certain ownership limitations, the April Warrants arewere exercisable beginning on the date of their issuance until the five-and-a-half-year anniversary of their date of issuance at an initial exercise price of $2.13.$2.13 per share. The exercise price of the April Warrants iswas subject to adjustment for stock splits, reverse splits, and similar capital transactions as described in the April Warrants. Upon a fundamental transaction, the holder shall have the right to receive payment in cash, or under certain circumstances in other consideration, from the Company at the Black-Scholes value as described in the April Warrants. The April Warrants may be exercisable on a “cashless” basis while there is no effective registration statement or current prospectus available for the shares of common stock issuable upon exercise of the April Warrants. A holder will not have the right to exercise any portion of the April Warrant if the holder (together with its affiliates) would beneficially own in excess of 4.99% (or, at the election of the holder, 9.99%) of the number of shares of common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the April Warrants. However, any holder may increase or decrease such percentage to any other percentage not in excess of 9.99% upon notice to the Company, provided that any increase in such percentage shall not be effective until 61 days after such notice. If not previously exercised in full, at the expiration of their terms, the April Warrants will be automatically exercised via cashless exercise.

The net proceeds from the offering and the private placement were approximately $7.9 million, after deducting commissions and estimated offering costs. The Company granted the placement agent warrants to purchase up to 215,914 shares of common stock (the “Placement Agent Warrants”). The Placement Agent Warrants havehad substantially the same terms as the April Warrants, except that the Placement Agent Warrants havehad an exercise price of $2.53 per share and havehad a term of 5 years from the effective date of the offering. The Company also paid the placement agent a reimbursement for non-accountable expenses in the amount of $35,000 and a reimbursement for legal fees and expenses of the placement agent in the amount of $25,000. TheOn December 19, 2019, the Company and each of the purchasers of the April Warrants and Placement Agent Warrants (collectively, the “Exchange Warrants”) entered into separate exchange agreements (the “Exchange Agreement”), pursuant to which the Company agreed to issue to the purchasers an aggregate of 5,441,023 shares of the Company’s common stock (the “Exchange Shares”), at a ratio of 1.2 Exchange Shares for each purchaser warrant in exchange for the cancellation and termination of all of the outstanding Exchange Warrants. See “Fair Value of Financial Instruments” below for additional details.

RDD Merger Financing

On April 29, 2020, the Company entered into a securities purchase agreement with various investors (the “Private Placement”) pursuant to which the Company agreed to issue and sell to the investors units consisting of one share of Series A Convertible Preferred Stock (the "Series A Preferred Stock") and one five-year warrant (the "Warrants") to purchase one share of Series A Preferred stock (the "Units"). On May 4, 2020, the Company closed the Private Placement with accredited investors pursuant to which the Company sold an aggregate of (i) 382,779 shares of Series A Convertible Preferred Stock, par value $0.0001 per share, which converted into 38,277,900 shares of common stock on June 30, 2020, and (ii) five-year warrants to purchase up to 382,779 shares of Series A Preferred Stock (the “Preferred Warrants”), which are classifiedconvertible into 38,277,900 shares of common stock (the “RDD Merger Financing”). The exercise price of the warrants is $58.94 per share of Series A Preferred Stock, subject to adjustments as warrant liabilities onprovided under the accompanying condensed balance sheet.terms of the warrants. In addition, broker warrants covering 8,112 Units and broker warrants covering 10,899 shares of Series A Preferred Stock, which are convertible into 2,712,300 shares of common stock, were issued in connection with the RDD Merger Financing. Gross proceeds from the RDD Merger Financing were approximately $22.6 million with net proceeds of approximately $19.2 million after deducting commissions and estimated offering costs. See Note 3—Merger & Acquisition for additional details.

Business Risks

The Company faces risks, including those associated with biopharmaceutical companies whose products are in the various stages of development. These risks include, among others, risks related to the potential effects of the ongoing coronavirus outbreak and related mitigation efforts on the Company's clinical, financial and operational activities, the Company’s need for additional financing to achieve key development milestones, the need to defend intellectual property rights, and the dependence on key members of management. See Note 2—Liquidity and Going Concern for further discussion of the risks related to the coronavirus outbreak.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and disclosures made in the accompanying notes to the financial statements. Areas of the financial statements where estimates may have the most significant effect include accrued expenses, share-based compensation, valuation of the derivative liability and warrant liabilities, valuation allowance for income tax assets, management’s estimate of the acquisition costs associated with acquired in-process research and development and management’s assessment of the Company’s ability to continue as a going concern. Changes in the facts or circumstances underlying these estimates could result in material changes and actual results could differ from these estimates.

Accrued Expenses

The Company incurs periodic expenses such as research and development, licensing fees, salaries and benefits, and professional fees. The Company is required to estimate its expenses resulting from obligations under contracts with clinical

INNOVATE BIOPHARMACEUTICALS, INC.

NOTES TO UNAUDITED CONDENSED FINANCIAL STATEMENTS

research organizations, vendors and consulting agreements that have been incurred by the Company prior to being invoiced. This process involves reviewing quotations and contracts, identifying services that have been performed on the Company’s behalf and estimating

9 METERS BIOPHARMA, INC.

NOTES TO UNAUDITED CONSOLIDATED CONDENSED FINANCIAL STATEMENTS

the level of service performed and the associated cost incurred for the service when the Company has not yet been invoiced or otherwise notified of the actual cost. The majority of the Company’s service providers invoice monthly in arrears for services performed or when contractual milestones are met. The Company estimates accrued expenses as of each balance sheet date based on facts and circumstances known at that time.

Accrued expenses consisted of the following:

| | | | | June 30, 2019 | | December 31, 2018 | | June 30,

2020

(Unaudited) | | December 31, 2019 |

| Accrued compensation and benefits | | $ | 621,905 |

| | $ | 697,334 |

| | $ | 1,105,521 |

| | $ | 574,332 |

|

| Accrued clinical expenses | | | 1,995,441 |

| | 4,143,269 |

|

| Other accrued expenses | | 352,186 |

| | 128,993 |

| | 183,133 |

| | 30,150 |

|

| Total | | $ | 974,091 |

| | $ | 826,327 |

| | $ | 3,284,095 |

| | $ | 4,747,751 |

|

Derivative Liability

The Company accounts for derivative instruments in accordance with Accounting Standards Codification (“ASC”)ASC 815, Derivative and Hedging, which establishes accounting and reporting standards for derivative instruments, including certain derivative instruments embedded in other financial instruments or contracts and requires recognition of all derivatives on the condensed consolidated balance sheet at fair value. The Company’s derivative financial instrument consistsinstruments consist of an embedded optionoptions in the Company’s convertible debt.notes. The embedded derivative includesderivatives include provisions that provide the noteholder with certain conversion and put rights at various conversion or redemption values as well as certain call options for the Company. See Note 4—Debt for further details.

WarrantClassification of Warrants

The Company accounts for warrants in accordance with ASC 480, Distinguishing Liabilities

from Equity and ASC 815, Derivatives and Hedging, to determine whether the warrants should be classified as equity or liability.The warrants the Company issued during 2019 are freestanding financial instruments that contain net settlement options and may require the Company to settle these warrants in cash under certain circumstances. As such, the Company has classified these warrants as liabilities on the accompanying condensed consolidated balance sheets. The warrant liabilities arewere initially recorded at fair value on the date of issuance and will bewere subsequently re-measured to fair value at each balance sheet date until the warrant liabilities are settled.were exercised. Changes in the fair value of the warrants are recognized as a non-cash component of other income and expense in the accompanying condensed consolidated statements of operations and comprehensive loss. All of the warrants accounted for as warrant liabilities have been exercised or settled as of June 30, 2020.

On May 4, 2020, the Company issued the Preferred Warrants, which are freestanding financial instruments that give the warrant holder the right but not the obligation to purchase the equity security at the warrant exercise price. The Company is not required to settle these warrants in cash and as such, the Company has classified these warrants as equity on the accompanying condensed consolidated balance sheets.

Research and Development

Research and development expenses consist of costs incurred to further the Company’s research and development activities and include salaries and related employee benefits, manufacturing of pharmaceutical active ingredients and drug products, costs associated with clinical trials, nonclinical activities, regulatory activities, research-related overhead expenses and fees paid to expert consultants, external service providers and contract research organizations which conduct certain research and development activities on behalf of the Company. Costs incurred in the research and development of products are charged to research and development expense as incurred.

Costs for preclinical studies and clinical trial activities are recognized based on an evaluation of the vendors’ progress towards completion of specific tasks, using data such as patient enrollment, clinical site activations or information provided by vendors regarding their actual costs incurred. Payments for these activities are based on the terms of individual contracts and payment timing may differ significantly from the period in which the services were performed. The Company determines accrual estimates through reports from and discussions with applicable personnel and outside service providers as to the progress or state of completion of trials, or the services completed. The estimates of accrued expenses as of each balance sheet date are based on the facts and circumstances known at the time. Although the Company does not expect its estimates to be materially different from amounts incurred, the Company’s estimates and assumptions for clinical trial costs could differ significantly from actual costs incurred, which could result in increases or decreases in research and development expenses in future periods when actual results are known.

9 METERS BIOPHARMA, INC.

NOTES TO UNAUDITED CONSOLIDATED CONDENSED FINANCIAL STATEMENTS

Nonrefundable advance payments for goods and services that will be used in future research and development activities are expensed when the goods have been received or when the activity is performed, rather than when payment is made.

Acquired In-process Research and Development

The Company has acquired, and may in the future acquire, rights to develop and commercialize new drug candidates and/or other in-process research and development assets. The up-front acquisition payments, as well as future milestone payments that are deemed probable to achieve and do not meet the definition of a derivative, are expensed as acquired in-process research and development provided that the drug has not achieved regulatory approval for marketing, and, absent obtaining such approval, have no alternative future use.

Share-Based Compensation

INNOVATE BIOPHARMACEUTICALS, INC.

NOTES TO UNAUDITED CONDENSED FINANCIAL STATEMENTS

The Company recognizes share-based compensation expense for grants of stock options to employees and non-employee members of the Company’s board of directors based on the grant-date fair value of those awards using the Black-Scholes option-pricing model. Share-based compensation expense is generally recognized on a straight-line basis over the requisite service period for awards expected to vest.

Prior to adoption of Accounting Standards Update (“ASU”) 2018-07, Compensation-Stock Compensation (Topic 718): Improvements to Non-employee Share-Based Payment Accounting, share-based compensation expense related to stock options granted to non-employees, other than non-employee directors, was adjusted each reporting period for changes in the fair value of the Company’s stock until the measurement date. The measurement date was generally considered to be the date when all services had been rendered or the date that options were fully vested. Effective January 1, 2019, the Company adopted ASU 2018-07, which no longer requires the re-measurement of the fair value for stock options awarded to non-employees. ASU 2018-07 expands the scope of Topic 718 to include share-based payment transactions for acquiring goods and services from non-employees.

Share-based compensation expense for both employees and non-employees includes an estimate, which is made at the time of grant, of the number of awards that are expected to be forfeited. This estimate is revised, if necessary, in subsequent periods if actual forfeitures differ from those estimates. Under the Black-Scholes option-pricing model, fair value is calculated based on assumptions with respect to:

Expected dividend yield. The expected dividend yield is assumed to be zero as the Company has never paid dividends and has no current plans to pay any dividends on the Company’s common stock.

Expected stock-price volatility. Due to limited trading history as a public company, the expected volatility is derived from the average historical volatilities of publicly traded companies within the Company’s industry that the Company considers to be comparable to the Company’s business over a period approximately equal to the expected term. In evaluating comparable companies, the Company considers factors such as industry, stage of life cycle, financial leverage, size and risk profile.

Risk-free interest rate. The risk-free interest rate is based on the U.S. Treasury yield in effect at the time of grant for zero coupon U.S. Treasury notes with maturities approximately equal to the expected term.

Expected term. The expected term represents the period that the stock-based awards are expected to be outstanding. Due to limited history of stock option exercises, the Company estimates the expected term of employee stock options based on the simplified method, which calculates the expected term as the average of the time-to-vesting and the contractual life of the options. Pursuant to ASU-2018-07,Accounting Standards Update (“ASU”) 2018-07, the Company has elected to use the contractual life of the option as the expected term for non-employee options.

Periodically, the boardBoard may approve the grant of restricted stock units (“RSUs”) pursuant to the Innovate Biopharmaceuticals, Inc.Company’s 2012 Omnibus Incentive Plan, as amended, which represent the right to receive shares of the Company’s common stock based on terms of the agreement. The fair value of RSUs is recognized as share-based compensation expense generally on a straight-line basis over the service period, net of estimated forfeitures. The grant date fair value of an RSU represents the closing price of the Company’s common stock on the date of grant.

Share-based Compensation Adjustment to Prior Period Results

In preparing the Company’s financial statements for the year ended December 31, 2018, the Company determined that an immaterial error was made in the amount of share-based compensation expense recorded in the Company’s Quarterly Report on Form 10-Q for March 31, 2018, which was filed with the SEC on May 15, 2018. The error resulted in an overstatement of share-based compensation expense of approximately $1.2 million for the first quarter of 2018 and the subsequent year-to-date periods through September 30, 2018. The Company disclosed this error in its Annual Report on Form 10-K for the year ended December 31, 2018, which was filed with the SEC on March 18, 2019. The Company has revised its previously reported financial results for the six months ending June 30, 2018 to correct the error. The Company concluded that this correction did not have a material impact on its previously issued quarterly financial statements or the audited financial statements for the year ended December 31, 2018. The financial results for the six months ended June 30, 2018 included within this Quarterly Report on Form 10-Q reflect the adjustment to the prior period.

INNOVATE BIOPHARMACEUTICALS, INC.

NOTES TO UNAUDITED CONDENSED FINANCIAL STATEMENTS

Fair Value of Financial Instruments

Fair value is defined as the price that would be received for sale of an asset or paid for transfer of a liability, in an orderly transaction between market participants at the measurement date. U.S. GAAP establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Financial instruments recorded in the accompanying condensed consolidated balance sheets are categorized based on the inputs to valuation techniques as follows:

•Level 1 - defined as observable inputs based on unadjusted quoted prices for identical instruments in active markets;

•Level 2 - defined as inputs other than Level 1 that are either directly or indirectly observable in the marketplace for identical or similar instruments in markets that are not active; and

9 METERS BIOPHARMA, INC.

NOTES TO UNAUDITED CONSOLIDATED CONDENSED FINANCIAL STATEMENTS

•Level 3 - defined as unobservable inputs in which little or no market data exists where valuations are derived from techniques in which one or more significant inputs are unobservable.

The fair value of the embedded derivative issued in connection with the SeniorUnsecured Convertible Note and the Unsecured ConvertibleAdditional Note, further described in Note 4—Debt, was determined by using a Monte Carlo simulation technique (“MCS”) to value the embedded derivative associated with each note. As part of the MCS valuation, a discounted cash flow (“DCF”) model is used to value the debt on a stand-alone basis and determine the discount rate to utilize in both the DCF and MCS models. The significant estimates used in the DCF model include the time to maturity of the convertible debt and calculated discount rate, which includes an estimate of the Company’s specific risk premium. The MCS methodology calculates the theoretical value of an option based on certain parameters, including: (i) the threshold of exercising the option, (ii) the price of the underlying security, (iii) the time to expiration, or expected term, (iv) the expected volatility of the underlying security, (v) the risk-free rate and (vi) the number of paths.

These valuation techniques involve management’s estimates and judgment based on unobservable inputs and are classified in Level 3. The table below summarizes the valuation inputs into the MCS model for the derivative liability associated with the SeniorUnsecured Convertible Note asand the Additional Convertible Note on their respective dates of December 31, 2018 and for the derivative liability associated with the Unsecured Convertible Noteissuance as of March 8, 2019 and January 10, 2020, respectively, and at the end of the period as of June 30, 2019.2020.

| | | | | Derivative Liability | | Derivative Liability |

| | | June 30, | March 8, | December 31, | | June 30, | January 10, | March 8, |

| | | 2019 | 2018 | | 2020 | 2019 |

| Expected dividend yield | | | | |

| Discount rate | | 29.1 | % | 29.3 | % | 13.6 | % | | 24.5 | % | 21.6 | % | 29.3 | % |

| Expected stock price volatility | | 105.6 | % | 101.1 | % | 105.6 | % | | 76.7 | % | 103.9 | % | 101.1 | % |

| Risk-free interest rate | | 1.8 | % | 2.5 | % | 2.5 | % | | 0.2 | % | 1.6 | % | 2.5 | % |

| Expected term | | 20 months |

| 24 months |

| 21 months |

| | 1.1 years |

| 2 years |

| 2 years |

|

| Price of the underlying common stock | | $ | 1.16 |

| $ | 1.99 |

| $ | 2.31 |

| | $ | 0.57 |

| $ | 0.65 |

| $ | 1.99 |

|

The fair valuevalues of the warrants issued pursuant to the Purchase Agreementsat their respective dates of issuance further described above in the sections entitled “March 2019 Offering,” “Additional Issuance of Warrants,” and “April 2019 Offering” were determined through the use of an MCS model. The MCS methodology calculates the theoretical value of an option based on certain parameters, including (i) the threshold of exercising the option, (ii) the price of the underlying security, (iii) the time to expiration, or expected term, (iv) the expected volatility of the underlying security, (v) the risk-free interest rate and (vi) the number of paths. Given the high level of the selected volatilities, the methodology selected simulates the Company’s market value of invested capital (“MVIC”) through the maturity date of the respective warrants (ranging from one year to five-and-a-half years). Further, the estimated future stock price of the Company is calculated by subtracting the debt plus accrued interest from the MVIC. The significant estimates used in the MCS model include management’s estimated probability of future financing and liquidation events.

Upon a fundamental transaction (as defined in the applicable warrant agreement), each holder of Short-Term Warrants and each holder of the March Long-Term Warrants and New Warrants (collectively, the “Long-Term Warrants”) can elect to require the Company or a successor entity to purchase such holder’s outstanding, unexercised warrants for a cash payment (or under certain circumstances other consideration) equal to the Black-Scholes value of the warrants on the date of consummation of the fundamental transaction, calculated in accordance with the terms and using the assumptions specified in the applicable warrant agreement. Due to the RDD Merger, the Company entered into the Exchange Agreements with the holders of the Exchange Warrants, pursuant to which the Company agreed to issue the purchasers an aggregate of 5,441,023 shares in exchange for the cancellation and termination of the Exchange Warrants. On December 26, 2019, an aggregate of 2,994,762 warrants were exchanged for 3,593,714 shares of the Company’s common stock. During the six months ended June 30, 2020, 1,539,424 warrants were exchanged for 1,847,309 shares of the Company’s common stock. In addition, the Company amended the Short-Term Warrants and Long-Term Warrants in the Offer to Amend in Exercise on February 12, 2020. Management assumed that the holders of the Short-Term Warrants and Long-Term Warrants would elect to receive cash payments under the respective warrant agreements following completion of the RDD Merger. As such, the Company determined the fair value of the Short-Term Warrants and Long-Term Warrants immediately prior to the Offer to Amend and Exercise, for financial reporting purposes, through the use of the Black-Scholes model. Subsequent to the Offer to Amend and Exercise, the Company determined the fair value of the Short-Term Warrants and Long-Term Warrants using the reduced exercise price of $0.10 as of March 31, 2020 and April 28, 2020. The estimates underlying the assumptions used in both the MCS model and Black-Scholes model are subject to risks and uncertainties and may change over time, and the assumptions used in both the MCS model and the Black-Scholes model for financial reporting purposes

9 METERS BIOPHARMA, INC.

NOTES TO UNAUDITED CONSOLIDATED CONDENSED FINANCIAL STATEMENTS

generally differ from the assumptions that would be applied in determining a payout under the applicable warrant agreements. These valuation techniques involve management’s estimates and judgment based on unobservable inputs and are classified in Level 3.

The March Long-term Warrants,Company recognized a gain in fair value of the New Warrants, the AprilShort-Term Warrants and Long-Term Warrants of approximately $1.1 million and $2.6 million during the Placement Agentthree and six months ended June 30, 2020, respectively, and $1.8 million and $2.7 million during the three and six months ended June 30, 2019, respectively. All of the Short-Term Warrants are referredand Long-Term Warrants were exercised in the Offer to collectively asAmend and Exercise, which closed on April 29, 2020. During the “Long-term Warrants.”

INNOVATE BIOPHARMACEUTICALS, INC.

NOTES TO UNAUDITED CONDENSED FINANCIAL STATEMENTS

three and six months ended June 30, 2020, the Company recognized warrant inducement expense of approximately $6.5 million and $7.2 million, respectively. There was no warrant inducement expense recognized during the three and six months ended June 30, 2019. The warrant inducement expense represents the accounting fair value of consideration issued to induce conversion of the Exchange Warrants and exercise of the warrants in the Offer to Amend and Exercise.

The table below summarizes the valuation inputs into the MCS model for the warrant liabilitiesShort-Term Warrants and Long-Term Warrants at their respective dates of issuance.

| | | | Short-Term Warrants | Long-Term Warrants | Short-Term Warrants | Long-Term Warrants |

| | March 18, 2019 | March 18, 2019 | May 1, 2019 | May 17, 2019 | March 18, 2019 | March 18, 2019 | May 17, 2019 |

| Conversion price | $ | 4.00 |

| $ | 2.56 |

| $ 2.13 - $ 2.53 |

| $ | 2.13 |

| $ | 4.00 |

| $ | 2.56 |

| $ | 2.13 |

|

| Expected stock price volatility | 122.0 | % | 85.2 | % | 84.1 | % | 83.4 | % | 122.0 | % | 85.2 | % | 83.4 | % |

| Risk-free interest rate | 2.5 | % | 2.2 | % | 2.2 | % | 2.2 | % | 2.5 | % | 2.2 | % | 2.2 | % |

| Expected term | 1 year |

| 5 years |

| 5 - 5.5 years |

| 5 years |

| 1 year |

| 5 years |

| 5 years |

|

| Price of the underlying common stock | $ | 2.48 |

| $ | 2.48 |

| $ | 1.54 |

| $ | 1.58 |

| $ | 2.48 |

| $ | 2.48 |

| $ | 1.58 |

|

The table below summarizes the range of valuation inputs into the MCSBlack-Scholes model for the Exchange Warrants on their date of issuance and immediately prior to the exchange.

|

| | | | | | |

| | Exchange Warrants |

| | May 1, 2019 | January 6, 2020 |

| Conversion price | $ 2.13 - $ 2.53 |

| $ | 2.13 |

|

| Expected stock price volatility | 84.1 | % | 87.3 | % |

| Risk-free interest rate | 2.2 | % | 1.7 | % |

| Expected term | 5 - 5.5 years |

| 4.9 years |

|

| Price of the underlying common stock | $ | 1.54 |

| $ | 0.58 |

|

The table below summarizes the range of valuation inputs into the Black-Scholes model for the warrant liabilities as of June 30, 2019.February 11, 2020, immediately prior to the reduction in exercise price pursuant to the Offer to Amend and Exercise.

| | | | Short-Term Warrants | Long-Term Warrants | Short-Term Warrants | Long-Term Warrants |

| | June 30, 2019 | February 11, 2020 |

| Conversion price | $ | 4.00 |

| $2.13 - $2.56 |

| $ | 4.00 |

| $2.13 - $2.56 |

|

| Expected stock price volatility | 85.3 | % | 83% - 83.5% |

| 97.1 | % | 87.9% - 89.2% |

|

| Risk-free interest rate | 2.0 | % | 1.8% - 2.0% |

| 1.6 | % | 1.7 | % |

| Expected term | 1 year |

| 5 - 5.5 years |

| 7 months |

| 4 years 2 months |

|

| Price of the underlying common stock | $ | 1.16 |

| 1.16 |

| $ | 0.79 |

| $ | 0.79 |

|

9 METERS BIOPHARMA, INC.

NOTES TO UNAUDITED CONSOLIDATED CONDENSED FINANCIAL STATEMENTS

The following table summarizes the fair value hierarchy of financial liabilities measured at fair value as of June 30, 20192020 and December 31, 2018.2019, respectively.

| | | | June 30, 2019 | June 30, 2020 |

| | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total |

| Derivative liability | $ | — |

| $ | — |

| $ | 999,000 |

| $ | 999,000 |

| $ | — |

| $ | — |

| $ | 247,000 |

| $ | 247,000 |

|

| Warrant liabilities | — |

| — |

| 660,200 |

| 660,200 |

| — |

| — |

| — |

| — |

|

| Total liabilities at fair value | $ | — |

| $ | — |

| $ | 1,659,200 |

| $ | 1,659,200 |

| $ | — |

| $ | — |

| $ | 247,000 |

| $ | 247,000 |

|

| | | | December 31, 2018 | December 31, 2019 |

| | Quoted Prices in Active Markets for Identical Assets

(Level 1) | Significant Other Observable Inputs

(Level 2) | Significant Unobservable Inputs

(Level 3) | Total | Quoted Prices in Active Markets for Identical Assets

(Level 1) | Significant Other Observable Inputs

(Level 2) | Significant Unobservable Inputs

(Level 3) | Total |

| Derivative liability | $ | — |

| $ | — |

| $ | 370,000 |

| $ | 370,000 |

| $ | — |

| $ | — |

| $ | 408,000 |

| $ | 408,000 |

|

| Warrant liabilities | — |

| — |

| — |

| — |

| — |

| — |

| 2,637,500 |

| 2,637,500 |

|

| Total liabilities at fair value | $ | — |

| $ | — |

| $ | 370,000 |

| $ | 370,000 |

| $ | — |

| $ | — |

| $ | 3,045,500 |

| $ | 3,045,500 |

|

INNOVATE BIOPHARMACEUTICALS, INC.

NOTES TO UNAUDITED CONDENSED FINANCIAL STATEMENTS

The following table summarizes the changes in fair value of the derivative liability and warrant liabilities classified in Level 3. Gains and losses reported in this table include changes in fair value that are attributable to unobservable inputs.

|

| | | | |

| | Six Months Ended June 30, 2019 | |

| Beginning balance as of December 31, 2018 | $ | 370,000 |

| |

| Issuance of warrant liabilities | | 3,330,000 |

| |

| Extinguishment of derivative liability (the Senior Convertible Note) | | (370,000 | ) | |

| Issuance of derivative liability (the Unsecured Convertible Note) | | 1,281,000 |

| |

| Change in fair value of warrant liabilities | | (2,669,800 | ) | |

| Change in fair value of derivative liability | | (282,000 | ) | |

| Ending balance as of June 30, 2019 | $ | 1,659,200 |

| |

| | |

| The amount of total gain for the period included in earnings attributable to the change in unrealized gains relating to the fair value liabilities still held at the reporting date | $ | 2,951,800 |

| |

| | |

|

| | | |

| | Six Months Ended June 30, 2020 |

| Beginning balance as of December 31, 2019 | $ | 3,045,500 |

|

| Issuance of derivative liability (the Additional Note) | 370,000 |

|

| Exchange of the April Warrants | (380,600 | ) |

| Change in fair value of warrant liabilities | (1,198,200 | ) |

| Change in fair value of derivative liability | (531,000 | ) |

| Exercise of the Short-Term Warrants and Long-Term Warrants | (1,058,700 | ) |

| Ending balance as of June 30, 2020 | $ | 247,000 |

|

| | |

| The amount of total gain for the period included in earnings attributable to the change in unrealized gains relating to the fair value liabilities still held at the end of the period | $ | 531,000 |

|

| | |

There were no gains or losses included in earnings attributable to changes in unrealized gains or losses for fair value assets or liabilities during the three and six months ended June 30, 2018.

The cumulative unrealized gain relating to the change in fair value of the derivative liability and warrant liabilities of $2,951,800$1,729,200, the gain on exercise of the warrants in the Offer to Amend and Exercise of $1,058,700 and the extinguishmentgain on exchange of derivative liabilitythe April Warrants of $370,000$380,600 for the six months ended June 30, 20192020 is included in other income (expense) in the condensed consolidated statements of operations and comprehensive loss.