UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: December 31, 20222023

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-38355

| Nemaura Medical Inc. |

| (Exact name of registrant as specified in its charter) |

| nevada | 46-5027260 | |||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||

57 West 57th Street Manhattan, NY 10019 | ||||

| (Address of Principal Executive Offices) (Zip Code) | ||||

| 646-416-8000 | ||||

| (Registrant’s Telephone Number, Including Area Code) | ||||

| N/A | ||||

| (Former name, former address and former fiscal year, if changed since last report) | ||||

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | |

| Common Stock | NMRD |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer", "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | |

Non-accelerated Filer ☒

| Smaller reporting company☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No☒

The number of shares of common stock, par value $0.001 per share, outstanding as of February 23, 202312, 2024, was .

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). All statements, other than statements of historical fact, included in this Quarterly Report on Form 10-Q regarding development of our strategy, future operations, future financial position, projected costs, prospects, plans and objectives of management are forward-looking statements. Forward-looking statements may include, but are not limited to, statements about:

The words "believe," "anticipate," "design," "estimate," "plan," "predict," "seek," "expect," "intend," "may," "could," "should," "potential," "likely," "projects," "continue," "will," and "would" and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements reflect our current views with respect to future events, are based on assumptions and are subject to risks and uncertainties. We cannot guarantee that we actually will achieve the plans, intentions or expectations expressed in our forward-looking statements and you should not place undue reliance on these statements. There are a number of important factors that could cause our actual results to differ materially from those indicated or implied by forward-looking statements. These factors and the other cautionary statements made in this Quarterly Report on Form 10-Q should be read as being applicable to all related forward-looking statements whenever they appear herein. Except as required by law, we do not assume any obligation to update any forward-looking statement. We disclaim any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

NEMAURA MEDICAL INC.

TABLE OF CONTENTS

| 2 |

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

| NEMAURA MEDICAL INC. |

| Condensed Consolidated Balance Sheets |

December 31, (Unaudited) | March 31, | |||||||||||||||

December 31, 2022 (Unaudited) | March 31, 2022

| 2023 | 2023 | |||||||||||||

| ASSETS | ||||||||||||||||

| Current assets: | ||||||||||||||||

| Cash | $ | 7,340,840 | $ | 17,749,233 | ||||||||||||

| Cash and cash equivalents | $ | 137,416 | $ | 10,105,135 | ||||||||||||

| Inventory | 3,671,533 | 1,754,852 | ||||||||||||||

| Prepaid expenses and other receivables | 1,217,237 | 750,167 | 169,174 | 357,934 | ||||||||||||

| Accounts receivable - related party | 25,320 | 101,297 | ||||||||||||||

| Inventory | 2,352,407 | 1,487,771 | ||||||||||||||

| VAT receivable | 247,788 | 409,648 | ||||||||||||||

| Deposit on foreign exchange contract | 146,434 | 909,666 | ||||||||||||||

| Total current assets | 10,935,804 | 20,088,468 | 4,372,345 | 13,537,235 | ||||||||||||

| Property and equipment, net of accumulated depreciation | 581,903 | 532,508 | 558,697 | 641,906 | ||||||||||||

| Intangible assets, net of accumulated amortization | 1,443,991 | 1,480,980 | 238,033 | 384,092 | ||||||||||||

| Total other assets | 2,025,894 | 2,013,488 | ||||||||||||||

| Total assets | $ | 12,961,698 | $ | 22,101,956 | $ | 5,169,075 | $ | 14,563,233 | ||||||||

| LIABILITIES AND STOCKHOLDERS’ (DEFICIT) EQUITY | ||||||||||||||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||||||||||

| Current liabilities: | ||||||||||||||||

| Accounts payable | $ | 171,207 | $ | 136,310 | $ | 352,483 | $ | 326,641 | ||||||||

| Other liabilities and accrued expenses | 390,858 | 558,426 | 281,055 | 130,678 | ||||||||||||

| Foreign currency contract | 1,075,692 | 440,196 | ||||||||||||||

| Notes payable, current portion | 11,512,711 | 19,188,724 | 19,643,038 | 16,942,500 | ||||||||||||

| Deferred revenue | 69,681 | 259,256 | ||||||||||||||

| Payable to related parties | 800,403 | 920,780 | ||||||||||||||

| Deferred revenue, current portion | 1,184,412 | 123,640 | ||||||||||||||

| Foreign exchange contract derivative liability | 242,295 | 731,730 | ||||||||||||||

| Warrant liability | 492,000 | 3,092,000 | ||||||||||||||

| Total current liabilities | 13,220,149 | 20,582,912 | 22,995,686 | 22,267,969 | ||||||||||||

| Notes payable, net of current portion | 8,557,548 | — | ||||||||||||||

| Deferred revenue, net of current portion | 1,042,710 | 1,052,960 | ||||||||||||||

| Notes payable, non-current portion | — | 3,087,651 | ||||||||||||||

| Deferred revenue, non-current portion | — | 1,021,811 | ||||||||||||||

| Total liabilities | 22,820,407 | 21,635,872 | 22,995,686 | 26,377,431 | ||||||||||||

| Commitments and contingencies | — | — | ||||||||||||||

| Stockholders’ (deficit) equity: | ||||||||||||||||

| Stockholders’ deficit: | ||||||||||||||||

| Common stock, $ par value, shares authorized and and shares issued and outstanding at December 31, 2022 and March 31, 2022 | 24,103 | 24,103 | ||||||||||||||

| Common stock, $ par value, shares authorized and shares issued and outstanding at December 31, 2023 and March 31, 2023 | 28,899 | 28,899 | ||||||||||||||

| Additional paid-in capital | 38,296,198 | 38,295,775 | 40,991,377 | 40,991,377 | ||||||||||||

| Accumulated deficit | (47,192,364 | ) | (37,731,476 | ) | (57,843,297 | ) | (51,875,211 | ) | ||||||||

| Accumulated other comprehensive loss | (986,646 | ) | (122,318 | ) | (1,003,590 | ) | (959,263 | ) | ||||||||

| Total stockholders’ (deficit) equity | (9,858,709 | ) | 466,084 | |||||||||||||

| Total liabilities and stockholders’ (deficit) equity | $ | 12,961,698 | $ | 22,101,956 | ||||||||||||

| Total stockholders’ deficit | (17,826,611 | ) | (11,814,198 | ) | ||||||||||||

| Total liabilities and stockholders’ deficit | $ | 5,169,075 | $ | 14,563,233 | ||||||||||||

See notes to the unaudited condensed consolidated financial statements.

|

| Condensed Consolidated Statements of Operations and Comprehensive Loss |

(Unaudited)

|

Three Months Ended December 31, | Nine Months Ended December 31, | Three Months Ended December 31, | Nine Months Ended December 2023, | |||||||||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||||

| Sales | $ | 3,017 | $ | 183,628 | $ | 77,044 | $ | 183,628 | $ | — | $ | 3,017 | $ | — | $ | 77,044 | ||||||||||||||||

| Cost of Sales | (2,971 | ) | (172,393 | ) | (75,327 | ) | (172,393 | ) | — | (2,971 | ) | — | (75,327 | ) | ||||||||||||||||||

| Gross Profit | 46 | 11,235 | 1,717 | 11,235 | — | 46 | — | 1,717 | ||||||||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||||||||||

| Research and development | 393,747 | 412,341 | 980,862 | 987,711 | 291,104 | 393,747 | 1,332,664 | 980,862 | ||||||||||||||||||||||||

| General and administrative | 239,628 | 1,391,278 | 4,329,306 | 4,151,380 | 1,250,149 | 1,230,160 | 4,317,358 | 1,509,095 | ||||||||||||||||||||||||

| Total operating expenses | 633,375 | 1,803,619 | 5,310,168 | 5,139,091 | 1,541,253 | 1,623,907 | 5,650,022 | 2,489,957 | ||||||||||||||||||||||||

| Loss from operations | (633,329 | ) | (1,792,384 | ) | (5,308,451 | ) | (5,127,856 | ) | (1,541,253 | ) | (1,623,907 | ) | (5,650,022 | ) | (2,488,240 | ) | ||||||||||||||||

| Other income (expense) | ||||||||||||||||||||||||||||||||

| Interest expense | (1,082,949 | ) | (1,639,184 | ) | (4,152,437 | ) | (5,141,701 | ) | (1,925,678 | ) | (1,082,949 | ) | (3,407,499 | ) | (4,152,437 | ) | ||||||||||||||||

| Change in fair value of warrant liability | 1,003,000 | — | 2,600,000 | — | ||||||||||||||||||||||||||||

| Change in fair value of foreign exchange contract derivative liability | 302,453 | 990,532 | 489,435 | (2,820,211 | ) | |||||||||||||||||||||||||||

| Net loss | (1,716,278 | ) | (3,431,568 | ) | (9,460,888 | ) | (10,269,557 | ) | (2,161,478 | ) | (1,716,278 | ) | (5,968,086 | ) | (9,460,888 | ) | ||||||||||||||||

| Other comprehensive loss: | ||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | 556,080 | (25,065 | ) | (864,328 | ) | (142,922 | ) | 204,828 | (556,080 | ) | (44,327 | ) | (864,328 | ) | ||||||||||||||||||

| Comprehensive loss | $ | (1,160,198 | ) | $ | (3,456,633 | ) | $ | (10,325,216 | ) | $ | (10,412,479 | ) | $ | (1,956,650 | ) | $ | (4,831,171 | ) | $ | (6,012,413 | ) | $ | (10,325,216 | ) | ||||||||

| Net loss per share, basic and diluted | $ | (0.07 | ) | $ | (0.15 | ) | $ | (0.39 | ) | $ | (0.44 | ) | $ | ) | $ | ) | $ | ) | $ | ) | ||||||||||||

| Weighted average number of shares outstanding, basic and diluted | 24,103,196 | 23,313,629 | 24,102,976 | 23,244,345 | ||||||||||||||||||||||||||||

See notes to the unaudited condensed consolidated financial statements.

NEMAURA MEDICAL INC.

Condensed Consolidated Statements of Changes in Stockholders’ (Deficit) EquityDeficit

Three and Nine Months Ended December 31, 20222023 and 20212022 (Unaudited)

| Common Stock | ||||||||||||||||||||||||

| Shares | Amount ($) | Additional Paid-in Capital ($) | Accumulated Deficit ($) | Accumulated Other Comprehensive (Loss) Income ($) | Total Stockholders’ Equity (Deficit) ($) | |||||||||||||||||||

| Balance at September 30, 2022 | 24,102,866 | 24,103 | 38,295,775 | (45,476,086 | ) | (1,542,726 | ) | (8,698,934 | ) | |||||||||||||||

| Shares issued under ATM facility | 330 | — | 423 | — | — | 423 | ||||||||||||||||||

| Foreign currency translation adjustment | — | — | — | — | 556,080 | 556,080 | ||||||||||||||||||

| Net loss | — | — | — | (1,716,278 | ) | — | (1,716,278 | ) | ||||||||||||||||

| Balance at December 31, 2022 | 24,103,196 | 24,103 | 38,296,198 | (47,192,364 | ) | (986,646 | ) | (9,858,709 | ) | |||||||||||||||

| Balance at September 30, 2021 | 23,308,049 | 23,308 | 35,007,626 | (30,682,660 | ) | 17,710 | 4,365,984 | |||||||||||||||||

| Shares issued under ATM facility | 22,524 | 23 | 114,386 | — | — | 114,409 | ||||||||||||||||||

| Foreign currency translation adjustment | — | — | — | — | (25,065 | ) | (25,065 | ) | ||||||||||||||||

| Net loss | — | — | — | (3,431,568 | ) | — | (3,431,568 | ) | ||||||||||||||||

| Balance at December 31, 2021 | 23,330,573 | 23,331 | 35,122,012 | (34,114,228 | ) | (7,355 | ) | 1,023,760 | ||||||||||||||||

| Common Stock | Additional Paid-in | Accumulated | Accumulated Other Comprehensive | Total Stockholders’ | ||||||||||||||||||||

| Shares | Amount | Capital | Deficit | (Loss) Income | (Deficit) | |||||||||||||||||||

| Balance at September 30, 2023 | 28,899,402 | $ | 28,899 | $ | 40,991,377 | $ | (55,681,819 | ) | $ | (1,208,418 | ) | $ | (15,869,961 | ) | ||||||||||

| Foreign currency translation adjustment | — | — | — | — | 204,828 | 204,828 | ||||||||||||||||||

| Net loss | — | — | — | (2,161,478 | ) | — | (2,161,478 | ) | ||||||||||||||||

| Balance at December 31, 2023 | 28,899,402 | $ | 28,899 | $ | 40,991,377 | $ | (57,843,297 | ) | $ | (1,003,590 | ) | $ | (17,826,611 | ) | ||||||||||

| Balance at March 31, 2023 | 28,899,402 | $ | 28,899 | $ | 40,991,377 | $ | (51,875,211 | ) | $ | (959,263 | ) | $ | (11,814,198 | ) | ||||||||||

| Foreign currency translation adjustment | — | — | — | — | (44,327 | ) | (44,327 | ) | ||||||||||||||||

| Net loss | — | — | — | (5,968,086 | ) | — | (5,968,086 | ) | ||||||||||||||||

| Balance at December 31, 2023 | 28,899,402 | $ | 28,899 | $ | 40,991,377 | $ | (57,843,297 | ) | $ | (1,003,590 | ) | $ | (17,826,611 | ) | ||||||||||

| Common Stock | Additional Paid-in | Accumulated | Accumulated Other Comprehensive | Total Stockholders’ | ||||||||||||||||||||

| Shares | Amount | Capital | Deficit | (Loss) Income | (Deficit) | |||||||||||||||||||

| Balance at September 30, 2022 | 24,102,866 | $ | 24,103 | $ | 38,295,775 | $ | (45,476,086 | ) | $ | (1,542,726 | ) | $ | (8,698,934 | ) | ||||||||||

| Shares issued under ATM facility | 330 | 423 | 423 | |||||||||||||||||||||

| Foreign currency translation adjustment | — | — | — | — | 556,080 | 556,080 | ||||||||||||||||||

| Net loss | — | — | — | (1,716,278 | ) | — | (1,716,278 | ) | ||||||||||||||||

| Balance at December 31, 2022 | 24,103,196 | $ | 24,103 | $ | 38,296,198 | $ | (47,192,364 | ) | $ | (986,646 | ) | $ | (9,858,709 | ) | ||||||||||

| Balance at March 31, 2022 | 24,102,866 | $ | 24,103 | $ | 38,295,775 | $ | (37,731,476 | ) | $ | (122,318 | ) | $ | 466,084 | |||||||||||

| Shares issued under ATM facility | 330 | 423 | 423 | |||||||||||||||||||||

| Foreign currency translation adjustment | — | — | — | — | (864,328 | ) | (864,328 | ) | ||||||||||||||||

| Net loss | — | — | — | (9,460,888 | ) | — | (9,460,888 | ) | ||||||||||||||||

| Balance at December 31, 2022 | 24,103,196 | $ | 24,103 | $ | 38,296,198 | $ | (47,192,364 | ) | $ | (986,646 | ) | $ | (9,858,709 | ) | ||||||||||

See notes to the unaudited condensed consolidated financial statements.

NEMAURA MEDICAL INC.

Condensed Consolidated Statements of Changes in Stockholders’ Equity (deficit)

Nine Months Ended December 31, 2022 and 2021 (Unaudited)

| Common Stock | ||||||||||||||||||||||||

| Shares | Amount ($) | Additional Paid-in Capital ($) | Accumulated Deficit ($) | Accumulated Other Comprehensive (Loss) Income ($) | Total Stockholders’ Equity (Deficit) ($) | |||||||||||||||||||

| Balance at March 31, 2022 | 24,102,866 | 24,103 | 38,295,775 | (37,731,476 | ) | (122,318 | ) | 466,084 | ||||||||||||||||

| Shares issued under ATM facility | 330 | — | 423 | — | — | 423 | ||||||||||||||||||

| Foreign currency translation adjustment | — | — | — | — | (864,328 | ) | (864,328 | ) | ||||||||||||||||

| Net loss | — | — | — | (9,460,888 | ) | — | (9,460,888 | ) | ||||||||||||||||

| Balance at December 31, 2022 | 24,103,196 | 24,103 | 38,296,198 | (47,192,364 | ) | (986,646 | ) | (9,858,709 | ) | |||||||||||||||

| Balance at March 31, 2021 | 22,941,157 | 22,941 | 32,044,335 | (23,844,671 | ) | 135,567 | 8,358,172 | |||||||||||||||||

| Shares issued under ATM facility | 22,524 | 23 | 114,386 | — | — | 114,409 | ||||||||||||||||||

| Exercise of warrants | 366,892 | 367 | 2,963,291 | — | — | 2,963,658 | ||||||||||||||||||

| Foreign currency translation adjustment | — | — | — | — | (142,922 | ) | (142,922 | ) | ||||||||||||||||

| Net loss | — | — | — | (10,269,557 | ) | — | (10,269,557 | ) | ||||||||||||||||

| Balance at December 31, 2021 | 23,330,573 | 23,331 | 35,122,012 | (34,114,228 | ) | (7,355 | ) | 1,023,760 | ||||||||||||||||

|

| NEMAURA MEDICAL INC. |

| Condensed Consolidated Statements of Cash Flows |

| (Unaudited) |

| Nine Months Ended December 31, | ||||||||||||||||

| 2022 | 2021 | Nine Months Ended December 31, | ||||||||||||||

| 2023 | 2022 | |||||||||||||||

| Cash Flows From Operating Activities: | ||||||||||||||||

| Net loss | $ | (9,460,888 | ) | $ | (10,269,557 | ) | $ | (5,968,086 | ) | $ | (9,460,888 | ) | ||||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||||||||||

| Depreciation and amortization | 268,595 | 139,751 | 309,684 | 268,595 | ||||||||||||

| Inventory write down | 104,449 | — | ||||||||||||||

| Amortization of debt discount | 4,152,437 | 5,141,701 | 1,803,126 | 4,152,437 | ||||||||||||

| Change in fair value of foreign currency contract | 635,494 | 199,522 | ||||||||||||||

| Changes in assets and liabilities: | ||||||||||||||||

| Prepaid expenses and other receivables | (467,070 | ) | 797,155 | |||||||||||||

| Addition of PIK monitoring fee to note payable | 488,022 | — | ||||||||||||||

| Change in fair value of foreign exchange contract derivative liability. | (489,435 | ) | 635,494 | |||||||||||||

| Change in fair value of warrant liability | (2,600,000 | ) | — | |||||||||||||

| Changes in operating assets and liabilities: | ||||||||||||||||

| Prepaid expenses and other receivables, VAT receivable and deposit on foreign exchange deposit | 1,113,853 | (467,070 | ) | |||||||||||||

| Inventory | (864,636 | ) | (533,656 | ) | (2,021,130 | ) | (864,636 | ) | ||||||||

| Accounts payable | 34,897 | (77,075 | ) | 25,842 | 34,897 | |||||||||||

| Due to (from) related parties | 75,977 | (301,387 | ) | |||||||||||||

| Other liabilities and accrued expenses | (167,568 | ) | 264,786 | |||||||||||||

| Receivable/payable to related parties | (120,378 | ) | 75,977 | |||||||||||||

| Accrued expense and other liabilities | 150,377 | (167,568 | ) | |||||||||||||

| Deferred revenue | (297,419 | ) | 285,266 | — | (297,419 | ) | ||||||||||

| Net cash used in operating activities | (6,090,181 | ) | (4,353,494 | ) | (7,203,676 | ) | (6,090,181 | ) | ||||||||

| Cash Flows From Investing Activities: | ||||||||||||||||

| Capitalized patent costs | (135,168 | ) | (60,241 | ) | — | (135,168 | ) | |||||||||

| Capitalized software development costs | (27,879 | ) | (460,466 | ) | — | (27,879 | ) | |||||||||

| Purchase of property and equipment | (275,758 | ) | (359,301 | ) | (76,807 | ) | (275,758 | ) | ||||||||

| Net cash used in investing activities | (438,805 | ) | (880,008 | ) | (76,807 | ) | (438,805 | ) | ||||||||

| Cash Flows From Financing Activities: | ||||||||||||||||

| Proceeds from issuance of common stock | 696 | 118,791 | — | 696 | ||||||||||||

| Equity issuance cost paid | (273 | ) | (4,382 | ) | — | (273 | ) | |||||||||

| Proceeds from issuance of notes payable | 4,700,000 | — | ||||||||||||||

| Proceeds from warrant exercise | — | 2,963,658 | ||||||||||||||

| Repayments of note payable | (7,974,282 | ) | (6,500,000 | ) | ||||||||||||

| Proceeds from issuance of note payable | 6,500,000 | 4,700,000 | ||||||||||||||

| Principal payments on notes payable | (9,178,261 | ) | (7,974,282 | ) | ||||||||||||

| Net cash used in financing activities | (3,273,859 | ) | (3,421,933 | ) | (2,678,261 | ) | (3,273,859 | ) | ||||||||

| Effect of exchange rate changes on cash | (605,548 | ) | (163,658 | ) | ||||||||||||

| Net decrease in cash | (10,408,393 | ) | (8,819,093 | ) | ||||||||||||

| Net decrease in cash and restricted cash | (9,958,745 | ) | (9,802,845 | ) | ||||||||||||

| Effect of exchange rate changes on cash and cash equivalents | (8,975 | ) | (605,548 | ) | ||||||||||||

| Cash and cash equivalent at beginning of period | 10,105,135 | 17,749,233 | ||||||||||||||

| Cash, cash equivalent at end of period | $ | 137,416 | $ | 7,340,840 | ||||||||||||

| Cash at beginning of period | 17,749,233 | 31,865,371 | ||||||||||||||

| Cash at end of period | 7,340,840 | 23,046,278 | ||||||||||||||

| Cash paid for: | ||||||||||||||||

| Interest | $ | 921,000 | $ | 1,522,372 | ||||||||||||

| Supplemental disclosure of non-cash financing activities: | ||||||||||||||||

| Release of prepayment from equity compensation | — | 50,000 | ||||||||||||||

| Monitoring fees related to notes payable | 1,522,372 | — | ||||||||||||||

| Supplemental schedule of non-cash transactions: | ||||||||||||||||

| Debt discount recognized upon issuance of notes payable | $ | 1,310,000 | $ | — | ||||||||||||

See notes to the unaudited condensed consolidated financial statements.

NEMAURA MEDICAL INC.

Notes to Condensed Consolidated Financial Statements

For the Nine Months Ended December 31, 2023 and 2022

(Unaudited)

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTIVITIESSUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nemaura Medical Inc. (“Nemaura” or the “Company”), through its operating subsidiaries, performs medical device research and manufacturing of a continuous glucose monitoring system (“CGM”), named sugarBEAT®. The sugarBEAT® device is a non-invasive, wireless device for use by persons with Type I and Type II diabetes and may also be used to screen pre-diabetic patients.patients and support obesity and weight-loss programs. The sugarBEAT® device extracts analytes, such as glucose, to the surface of the skin in a non-invasive manner where it is measured using unique sensors and interpreted using a unique algorithm.

Nemaura isGoing Concern

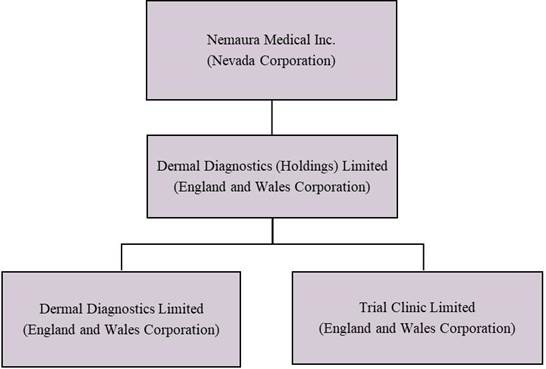

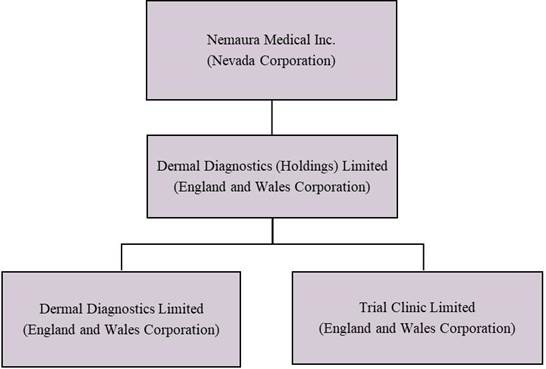

The accompanying unaudited financial statements have been prepared on a Nevada holding company organizedgoing concern basis, which contemplates the realization of assets and the settlement of liabilities and commitments in 2013. Nemaura owns 100%the normal course of business. As reflected in the accompanying unaudited financial statements, for the nine months ended December 31, 2023, the Company recorded a net loss of $5,968,086and used cash in operations of $7,203,676. These factors raise substantial doubt about the Company’s ability to continue as a going concern within one year of the stockdate that the financial statements are issued. In addition, the Company’s independent registered public accounting firm in Dermal Diagnostic (Holdings) Limited, an England and Wales corporation (“DDHL”) formed on December 11, 2013, which in turn owns 100% of Dermal Diagnostics Limited, an England and Wales corporation formed on January 20, 2009 (“DDL”), and 100% of Trial Clinic Limited, an England and Wales corporation formed on January 12, 2011 (“TCL”).

DDL is a diagnostic medical device company headquartered in Loughborough, Leicestershire, England, and is engaged in the discovery, development, and commercialization of diagnostic medical devices. The Company’s initial focus has beenits report on the development of the sugarBEAT® device, which consists of a disposable patch containing a sensor, and a non-disposable miniature wireless transmitter with a re-chargeable power source, which is designed to enable trending or tracking of blood glucose levels. All ofCompany’s March 31, 2023 financial statements, raised substantial doubt about the Company’s operations and assets are located in England.

During the fiscal year ended March 31, 2021, the Board of Directors assessed the adequacy of the group’s organizational structure and concluded that the intermediate holding company that sat below Nemaura Medical Inc., Region Green Limited (a British Virgin Islands corporation), was no longer required as the entity had been effectively dormant since inception and no longer represented a requirementability to be maintained. It was therefore determined that Region Green Limited should be unwound, with the intention that the assets held by Region Green Limited be transferred up to Nemaura Medical Inc. following which Region Green Limited would be dissolved.

The transfer of assets took place on March 5, 2021 and Region Green Limited was formally dissolved as of April 23, 2021.

The following diagram illustrates Nemaura’s corporate structure as of December 31, 2022:

The Company was incorporated in 2013 and has reported recurring losses from operations to date and an accumulated deficit of $47,192,364 as of December 31, 2022. These operations have resulted in the successful completion of clinical programs to support a CE mark (European Union (“EU”) approval of the product) approval, as wellcontinue as a De Novo 510(k) medical device application togoing concern. The financial statements do not include any adjustments that might be necessary if the U.S. Food and Drug Administration (“FDA”) submission.

The Company expectsis unable to continue to incur losses from operations until revenues are generated through licensing fees or product sales. However, given the completion of the requisite clinical programs, these losses are expected to decrease over time. Management has entered into licensing, supply, or collaboration agreements with unrelated third parties relating to the United Kingdom (“UK”), Europe, Qatar, and all countries in the Gulf Cooperation Council.

Going Concern

As identified under Item 1A, included in the Company’s Annual Report on Form 10-K for the year ended March 31, 2022, as filed with the SEC, management is aware of the need to raise additional funds in order to finance the ongoing commercialization of sugarBEAT®. The Company had $7,340,840 of cash at December 31, 2022. The Company has debt on its balance sheet which will reach maturity in July 2024.a going concern.

In evaluating the going concern position of the Company,company, management has considered the ability of the Company to raise additional funding in combination with one or more of the different funding options available to it at this time. Based on current and ongoing engagement with potential funding providers managementand believes that there is a reasonable expectation that fundingfinancing to fund future operations could be provided by one, equity and/or more,debt financing. There can be no assurance that funding would be available, or that the terms of the following options:

Equitysuch funding –would be on favorable terms if available. Even if the Company has immediate accessis able to funds throughobtain additional financing, it may contain undue restrictions on our operations, in the ATM facility that is currentlycase of debt financing, or cause substantial dilution for our stockholders, in place; in addition to this, there are various alternative mechanisms available to the Company similar to those used previously e.g. direct sale of shares to interested third parties, as well as other mechanisms to sell common stock via an underwritten agreement or the further exercise of warrants by the current warrant holders etc. The Company completed a Registered Direct Offering and concurrent Private Placement in January 2023 which has increased cash by $7,655,974.

Debt funding – the Company continues to be in ongoing discussions with third party debt providers, including the incumbent, to enable the existing debt facility to be restructured or renewed, should management feel that this route offers a more attractive option compared to the salecase of equity that is dependent on the current market conditions.

Alternative funding as used in the past such as the sale of licenses. As product development is now at a significant more advanced stage then it was, it is management’s belief that the sufficient funding could be provided through the sale of licenses or a large-scale partnership that could bring in additional funds and infrastructure to support the commercial growth ambitions of the company.

However, as a consequence of this funding requirement being triggered without the funding bridge having been put in place by the filing date of these unaudited condensed consolidated financial statements, Financial Accounting Standards Board’s (the “FASB”) Accounting Standards Codification (“ASC”) 205-40: “Going Concern”, requires that management recognize and disclose this point as an event which creates a substantial doubt as to the Company’s ability to continue as a going concern for at least one year from the date of filing of these unaudited condensed consolidated financial statements.

Following the receipt of the CE mark approval in the EU, and in support of our plans for similar certification with the FDA in the U.S., our plan is to utilize the cash on hand to continue establishing commercial manufacturing operations for the commercial supply of the sugarBEAT® device and sensor patches in our target markets.

Management's strategic plans include the following:

financing.

NOTE 2 – BASIS OF PRESENTATION

(a)Basis of presentationPresentation

The accompanying unaudited condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the SEC, and do not include all of the information and footnotes required by U.S. generally accepted accounting principles (“U.S. GAAP”) for complete financial statements. However, such information reflects all adjustments consisting of normal recurring accruals which are, in the opinion of management, necessary for a fair statementpresentation of the financial condition and results of operations for the interim periods. The results for the three-three and nine-nine months ended December 31, 20222023 are not indicative of annual results. The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with U.S. GAAP for interim financial information and with the instructions to Form 10-Q and Article 8 of Regulation S-X. These unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K for the year ended March 31, 2022, as filed with the SEC.2023.

The accompanying unaudited condensed consolidated financial statements include the accounts of the Company and the Company’s subsidiaries. References to “we”, “us”, “our”, or the “Company” refer to Nemaura Medical Inc. and its consolidated subsidiaries. The unaudited condensed consolidated financial statements are prepared in accordance with U.S. GAAP, and all significant intercompany balances and transactions have been eliminated in consolidation.

The functional currency for the majority of the Company’s operations is the Great Britain Pound Sterling (“GBP”), and the reporting currency is the U.S. Dollar (“USD”). Financial statements for foreign subsidiaries are translated into USD using period end exchange rates for assets and liabilities and average exchange rates for each period for revenue, costs and expenses.

Reclassification - We have reclassified certain amounts as previously disclosed within the March 31, 2022 consolidated balance sheets to conform to our current period presentation. The reclassification of $440,196 from Other liabilities and accrued expenses to Foreign currency contract at March 31, 2022 has no impact to prior year net loss, current quarter net loss or year-to-date net loss.

(b) – Summary of Significant Accounting Policies

Use of Estimates

The preparation of theconsolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts reported inof assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and accompanying notes. Actual results could differ materially from those estimates. The Company’s most significantthe reported amounts of revenues and expenses during the periods presented. Significant estimates include the useful lifeassumptions used in the accrual for potential liabilities, the net realizable value of intangible assets,inventory, the valuation of foreign currency contractdebt and equity instruments, the fair value of derivative liabilities, valuation allowance onof stock options issued for services, and deferred tax assets.

Our estimates are often based on complex judgments, probabilities and assumptions that management believes to be reasonable, but that are inherently uncertain and unpredictable. It is also possible that other professionals, applying reasonable judgment to the same facts and circumstances, could develop and support a range of alternative estimated amounts. For a complete discussion of our critical accounting policies, see the “Critical Accounting Policies” section of the Management’s Discussion & Analysis in our March 31, 2022 Form 10-K.

Cash and Cash Equivalents

Cash includes cash deposited in major financial institutions in the United Kingdom. The Company’s cash balances exceed amounts covered by the Financial Services Compensation scheme. The Company has never suffered a loss due to such excess balances.

The Company considers highly liquid investments with maturities of three months or lessvaluation allowances. Actual results may differ from the date of purchase to be cash equivalents. These investments are carried at cost, which approximates fair value. As of December 31, 2022 and March 31, 2022, the Company had no cash equivalents.those estimates.

Revenue Recognition

The Company recognizes revenue in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 606, Revenue from Contracts with Customers (“ASC 606”). The underlying principle of ASC 606 is to recognize revenue to depict the transfer of goods or services to customers at the amount expected to be collected. ASC 606 creates a five-step model that requires entities to exercise judgment when obligations underconsidering the terms of acontract(s), which include (1) identifying the contract or agreement with a customer, are satisfied; generally this occurs with(2) identifying our performance obligations in the transfer of controlcontract or access ofagreement, (3) determining the Company’s licenses or performance of services. Revenue is measured astransaction price, (4) allocating the amount of consideration the company expects to receive in exchange for transferring goods or providing services. A performance obligation is a promise in a contract to transfer a distinct good or servicetransaction price to the customer,separate performance obligations, and is the unit of account in the contract. A contract’s transaction price is allocated to(5) recognizing revenue as each distinct performance obligation and recognized as revenue when, or as, the performance obligation is satisfied.

Deferred Revenues

Contracts

In March 2014, the Company executed an Exclusive Marketing Rights agreement with customers consistDallas Burston Pharma (“DB Pharma”)(now known as MySugarWatch Limited “MSW”), a Jersey (Channel Island) based company for the exclusive right to sell the Company’s SugarBEAT® device in the UK and Republic of licensing arrangementsIreland, both direct to consumer and through prescriptions by general practitioners. The agreement has a term of five years and automatically renewed for another five years unless terminated by either party. As part of the agreement, the Company received a non-refundable upfront fee of £1 million ($1.6 million). Pursuant to current accounting guidelines, the Company recorded the upfront fee of £1 million as a lesser extent,deferred revenue (i.e. liability) and is being amortized to revenues based upon the corresponding sale of the Company’s SugarBEAT devices. As of December 31, 2023 and March 31, 2023, the outstanding deferred revenues amounted to $1,184,412 and $1,145,451, respectively or approximately £875,000GBP.

The agreement is scheduled to expire in March 2024, however, the Company expects that it will be renewed for another five years based upon the ongoing relationship with MSW.

Cash and cash equivalents

Cash and cash equivalents consists primarily of cash deposits maintained in the United Kingdom (“UK”). We maintain cash balances in U.S. Dollar (“USD”), Great Britain Pound Sterling (“GBP”), and the Euro. The following table, reported in USD, disaggregates our cash balances by currency denomination:

| Schedule of cash and cash equivalents | ||||||||

| December 31, 2023 | March 31, 2023 (audited) | |||||||

| Cash denominated in: | ||||||||

| USD | $ | 13,169 | $ | 5,606,972 | ||||

| GBP | 65,925 | 4,446,720 | ||||||

| Euro | 58,322 | 51,443 | ||||||

| Total | $ | 137,416 | $ | 10,105,135 | ||||

Inventory

As of December 31, 2023 and March 31, 2023, inventory consisted of the following:

| Schedule of inventory | ||||||||

December 31, 2023 | March 31, 2023, (audited) | |||||||

| Raw materials | $ | 3,553,811 | $ | 1,586,777 | ||||

| Finished goods | 117,722 | 168,075 | ||||||

| Total Inventories | $ | 3,671,533 | $ | 1,754,852 | ||||

Inventories are stated at the lower of cost or net realizable value, with cost determined on a first-in, first-out (“FIFO”) basis. For the nine months ended December 31, 2023, there were additional general write-downs of inventory of approximately $104,000.

Research and development expenses

The Company charges research and development expenses to operations as incurred. Research and development expenses primarily consist of salaries and related expenses for personnel and outside contractor and consulting services. Revenues from licensingOther research and royalty feesdevelopment expenses include the costs of materials and supplies used in research and development, prototype manufacturing, clinical studies, related information technology and an allocation of facilities costs.

Basic loss per share is computed by dividing the loss available to common shareholders by the weighted-average number of common shares outstanding during the period. Diluted loss per share is computed similar to basic loss per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive. Diluted loss per common share reflects the potential dilution that could occur if convertible debentures, options and warrants were to be exercised or converted or otherwise resulted in the issuance of common stock that then shared in the earnings of the entity.

Since the effects of outstanding options and warrants are receivedanti-dilutive for the nine months ended December 31, 2023 and 2022, shares of common stock underlying these instruments have been excluded from the grantingcomputation of exclusive sales, marketing, manufacturingloss per common share.

The following sets forth the number of shares of common stock underlying outstanding options and distribution rights associated with the Company’s functional intellectual property (IP). The Company’s performance obligation is satisfied at a point in time (upon delivery to the customer), where the Company has no remaining obligation to support or maintain the intellectual property licensed to the customer. The Company typically requires a non-refundable license fee, paid upfront.warrants as of December 31, 2023 and 2022:

| Schedule of common stock underlying outstanding options | ||||||||

| December 31, | December 31, | |||||||

| 2023 | 2022 | |||||||

| Stock Warrants | 5,233,551 | 1,573,098 | ||||||

| Stock options | 40,000 | 40,000 | ||||||

| 5,273,551 | 1,613,098 | |||||||

Revenue from license fees are recognized at a point in time when the Company transfers the functional IP to the customer as long as management believes the total consideration owed by the customer for the license fee is probable of being received.Stock-Based Compensation

The Company’s contracts do not include multiple performance obligationsCompany periodically issues share-based awards to employees and non-employees and consultants for services rendered. Stock options vest and expire according to terms established at the issuance date of each grant. Stock grants are measured at the grant date fair value. Stock-based compensation cost is measured at fair value on the grant date and is generally recognized as a charge to operations ratably over the requisite service, or variable consideration. Sincevesting, period. Recognition of compensation expense for non-employees is in the same period and manner as if the Company had paid cash for the services.

The Company values its equity awards using the Black-Scholes option-pricing model, and accounts for forfeitures when they occur. Use of the Black-Scholes option pricing model requires the input of subjective assumptions, including expected volatility, expected term, and a risk-free interest rate. The expected volatility is based on the historical volatility of the Company’s revenuecommon stock, calculated utilizing a look-back period approximately equal to the contractual life of the stock option being granted. The expected life of the stock option is generated from a small number of customer contracts,calculated as the Company does not have material contract assets or liabilities.mid-point between the vesting period and the contractual term (the “simplified method”). The risk-free interest rate is estimated using comparable published federal funds rates.

Fair valueValue of financial instrumentsFinancial Instruments

In accordance

The authoritative guidance with the FASB ASC 820, “Fair Value Measurements and Disclosures,” the Company determines therespect to fair value of financial instruments with the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 820 establishesestablished a fair value hierarchy based onthat prioritizes the level of independent, objective evidence surrounding the inputs to valuation techniques used to measure fair value. Avalue into three levels and requires that assets and liabilities carried at fair value be classified and disclosed in one of three categories, as presented below. Disclosure as to transfers in and out of Levels 1 and 2, and activity in Level 3 fair value measurements, is also required. Fair value of a financial instrument’s categorization withininstrument is defined as the amount at which the instrument could be exchanged in a current transaction between willing parties.

The three levels of the fair value hierarchy isare as follows:

Level 1 - Valuations based upon the lowest level of input that is significant to the fair value measurement. ASC 820 prioritizes the inputs into three levels that may be used to measure fair value:

Level 1: Applies to assets or liabilities for which there areon unadjusted quoted prices in active markets for identical assets or liabilities.liabilities that the entity has the ability to access.

Level 2: Applies to assets or liabilities for which there are inputs other than quoted prices that are observable for the asset or liability such as - Valuations based on quoted prices for similar assets or liabilities, in active markets; quoted prices for identical assets or liabilities in markets with insufficient volumethat are not active, or infrequent transactions (less active markets); or model-derived valuations in which significantother inputs that are observable or can be derived principally from, or corroborated by observable market data.

Level 3: Applies todata for substantially the full term of the assets or liabilities for which thereliabilities.

Level 3 - Valuations based on inputs that are unobservable, inputs to the valuation methodologysupported by little or no market activity and that are significant to the measurement of the fair value of the assets or liabilities.

Intangible Assets

The Foreign exchange contract derivative liability is valued using Level 2 fair values while the warrant liability is valued using Level 3 fair values.

The following table sets forth by level, within the fair value hierarchy, the Company’s intangiblefinancial assets consistand liabilities at fair value as of patents relatingDecember 31, 2023 and March 31, 2023:

| Schedule of assets and liabilities at fair value | ||||||||||||||||

| December 31, 2023 | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Assets | ||||||||||||||||

| Total assets | $ | — | $ | — | $ | — | $ | — | ||||||||

| Liabilities | ||||||||||||||||

| Foreign exchange contract derivative liability | $ | — | $ | 242,295 | $ | — | $ | 242,295 | ||||||||

| Warrant derivative liability | — | — | 492,000 | 492,000 | ||||||||||||

| Total liabilities | $ | — | $ | 242,295 | $ | 492,000 | $ | 734,295 | ||||||||

| March 31, 2023 (audited) | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Assets | ||||||||||||||||

| Total assets | $ | — | $ | — | $ | — | $ | — | ||||||||

| Liabilities | ||||||||||||||||

| Foreign exchange contract derivative liability | $ | — | $ | 731,730 | $ | — | $ | 731,730 | ||||||||

| Warrant derivative liability | — | — | 3,092,000 | 3,092,000 | ||||||||||||

| Total liabilities | $ | — | $ | 731,730 | $ | 3,092,000 | $ | 3,823,730 | ||||||||

The following table provides a roll-forward of the warrant derivative liability measured at fair value on a recurring basis using unobservable level 3 inputs for the nine months ended December 31, 2023:

| Schedule of warrant derivative liability measured at fair value on a recurring basis | ||||

| Warrant derivative liability | ||||

| Balance as of beginning of period – March 31, 2023 | $ | 3,092,000 | ||

| Change in fair value of warrant derivative liability | (2,600,000 | ) | ||

| Balance as of end of period – December 31, 2023 | $ | 492,000 | ||

As of December 31, 2023 and March 31, 2023, the Company’s outstanding warrants were treated as derivative liabilities and changes in the fair value were recognized in earnings (see Note 3).

The Company believes the carrying amounts of certain financial instruments, including cash, accounts receivable, and accounts payable and accrued liabilities, approximate fair value due to the sensorshort-term nature of such instruments and algorithm that are granted in some territories, and pending still in others. The Company also plans to file further patents asexcluded from the opportunity arises. The cost of issued patents is capitalized and amortized over the life of the patents which is 20 years. The costs of patents in development are expensed as incurred. Any unamortized costs previously capitalized associated with patents that have expired or have been abandoned are written off as an impairment loss. The company has also capitalized certain software development costs which are regularly reviewed to ensure that if development has been abandoned, costs are written off as an impairment loss.

fair value tables above.

Share-Based PaymentsInflation

The Company measures the cost of services received in exchange for an award of equity instrumentsdoes not believe that inflation has had a material effect on its operations to employees and nonemployees baseddate, other than its impact on the grant date fair value of the award, whichgeneral economy. However, there is recognized as compensation expense over the vesting term.

Income Taxes

The Company accounts for income taxes under the asset and liability method, which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements. Under this method, deferred tax assets and liabilities are determined on the basis of the differences between the financial statement and tax bases of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. The effect of a change in tax rates on deferred tax assets and liabilities is recognized in income in the period that includes the enactment date.

The Company recognizes deferred tax assets to the extent that management believes these assets are more likely than not to be realized. In making such a determination, management considers all available positive and negative evidence, including future reversals of existing taxable temporary differences, projected future taxable income, tax-planning strategies, and results of recent operations. If we determinerisk that the Company would be ableCompany’s operating costs could become subject to realize deferred tax assetsinflationary and interest rate pressures in the future, which would have the effect of increasing the Company’s operating costs (including, specifically, clinical trial costs in excess of their net recorded amount,countries where the Company would make an adjustmentis applying to the deferred tax asset valuation allowance,sell its products), and which would reduceput additional stress on the provision for income taxes.Company’s working capital resources.

(c) Recently adoptedRecent accounting pronouncements

Accounting standard updatesManagement believes that any recently issued, but not yet added were assessed and determined to be eithereffective, accounting pronouncements, if currently adopted, would not applicable or not expected to have a material impacteffect on ourthe Company’s unaudited condensed consolidated financial statements.

NOTE 3 – LICENSING AGREEMENTS

United Kingdom and the Republic of Ireland, the Channel Islands, and the Isle of Man

In March 2014, the Company entered into an Exclusive Marketing Rights Agreement (the “Marketing Rights Agreement”) with an unrelated third party (the “Licensee”), that granted to the Licensee the exclusive right to market and promote the sugarBEAT® device and related patches under its own brand in the UK and the Republic of Ireland, the Channel Islands, and the Isle of Man. The Company received a non-refundable, up-front cash payment of GBP 1,000,000 (approximately $1.20 million and $1.31 million as of December 31, 2022 and March 31, 2022, respectively), upon signing the Marketing Rights Agreement. The upfront payment received from the Marketing Rights Agreement has been deferred and will be recorded as income over the term of the Marketing Rights Agreement, which commenced upon the first delivery of the sugarBEAT® device to the Licensee in December 2021. Consequently, approximately $70,000, and $259,000 is included in deferred revenue classified as a current liability as of December 31, 2022 and March 31, 2022, respectively, with the remainder being shown in the non-current portion of deferred revenue.

NOTE 42 – RELATED PARTY TRANSACTIONS

DDL has a service agreement with Nemaura Pharma Limited (“Pharma”), an entity controlled by the Company’s President and Chief Executive officer, to provide development, manufacture, and regulatory approval process under Pharma’s ISO13485 accreditation. Pharma invoices DDL for these services on a cost-plus basis.

The table below provides a summary of activity between the Company and Pharma for the nine months ended December 31, 2023 and 2022.

| Schedule of related party transactions | ||||||||

Nine Months Ended December 31, 2023 (unaudited) | Nine Months Ended December 31, 2022 (unaudited) | |||||||

| Due to (from) related parties at beginning of period | $ | 920,782 | $ | (101,297 | ) | |||

| Amounts invoiced by Pharma to DDL, NM and TCL, primarily relating to research and development expenses | 4,211,705 | 2,833,546 | ||||||

| Amounts invoiced by DDL to Pharma | — | (3,159 | ) | |||||

| Amounts received from Pharma | — | 4,452 | ||||||

| Amounts paid by DDL to Pharma | (4,311,770 | ) | (2,789,939 | ) | ||||

| Foreign exchange differences | (20,314 | ) | 31,077 | |||||

| Due to (from) related parties at end of period | $ | 800,403 | $ | (25,320 | ) | |||

NOTE 3 – DERIVATIVE LIABILITIES

Warrant liability

In January 2023, the Company completed an equity offering, which included the issuance of 4,796,206 warrants. Upon the occurrence of certain transactions (“Fundamental Transactions,” as defined), the warrants provide for a value determined using a Black Scholes model with inputs calculated as described in the warrant agreement which includes a 100% floor on the volatility input to be utilized. The Company has determined that this provision introduces leverage to the holders of the warrants that could result in a value that would be greater than the settlement amount of a fixed-for-fixed option on the Company’s own equity shares. Accordingly, pursuant to ASC 815, the Company has classified the fair value of the warrants as a liability to be re-measured at the end of every reporting period with the change in value reported in the statement of operations.

The warrant liability was valued at the following dates using a Black-Scholes model with the following assumptions:

| Schedule of warrant liability | ||||||||

December 31, 2023 | March 31, 2023 | |||||||

| Warrant liability: | ||||||||

| Stock price | $ | 0.22 | $ | 0.90 | ||||

| Risk-free interest rate | % | % | ||||||

| Expected volatility | % | % | ||||||

| Expected life (in years) | ||||||||

| Expected dividend yield | ||||||||

| Fair value of Warrant liability | $ | 492,000 | $ | 3,092,000 | ||||

The risk-free rate is based on the U.S. Treasury yield curve in effect at the time of measurement commensurate with expected life of the warrants. Expected volatility was determined based on the historical volatility data of the Company, and the expected term of the warrants granted are determined based on the duration of time the warrants are expected to be outstanding. The dividend yield on the Company’s warrants is assumed to be zero as the Company has not historically paid dividends.

Foreign exchange contract liability

The Company is exposed to the impact of foreign currency exchange fluctuations as a significant proportion of its expenses are denominated in GBP, and the Company’s cash is in USD and GBP. In February 2021, the Company entered into a forward contract to sell USD and buy GBP. The contract meets the definition of a derivative subject to the guidance of ASC 815, does not qualify for hedge accounting, and accordingly is recognized at fair value, with changes in fair value recognized in earnings.

The term of the contract is 25 months, beginning July, 2022, and 2021,ending August, 2024. The contract initially had a maximum notional amount of $6,250,000 (and a maximum leveraged amount equal to two times the notional amount, or $12,500,000). $250,000 of the contractual notional amount is settled (expires) each month through August 2024. On each monthly settlement date, if the USD/GBP spot rate is above $1.359, the Company has the right to convert $250,000 USD into GBP at a fixed rate of $1.359. If the spot rate is between $1.359 and $1.319 on the settlement date, the Company has no obligations, but can convert $250,000 USD into GBP at the spot rate. Finally, if the spot rate is below $1.319 on the monthly settlement date, the Company is obligated to convert $500,000 USD (the settlement date leveraged amount) into GBP at the fixed rate of $1.359. Alternatively, instead of selling $500,000 USD, the Company can pay the difference in the spot rate and the year ended$1.359 exchange rate for $500,000 USD (net settle) to the counterparty.

At December 31, 2023 and March 31, 2022.2023, the fair value of the foreign currency contract liability was valued as follows:

| Schedule of fair value of the foreign currency contract liability | ||||||||

December 31, 2023 | March 31, 2023 | |||||||

| Notional Amount | $ | 2,000,000 | $ | 4,250,000 | ||||

| Leveraged amount (used to determine fair value of contract liability) | $ | 4,000,000 | $ | 8,500,000 | ||||

| Expected remaining term (in months) | 8 | 17 | ||||||

| Fair Value: | ||||||||

| Foreign currency contract liability | $ | 242,295 | $ | 731,730 | ||||

| Schedule of related party transactions | ||||||||||||

Nine Months Ended December 31, 2022 (unaudited) | Nine Months Ended December 31, 2021 (unaudited) | Year Ended March 31, 2022 | ||||||||||

| Due to (from) related parties at beginning of period | $ | (101,297 | ) | $ | 148,795 | $ | 148,795 | |||||

| Amounts invoiced by Pharma to DDL | 2,833,546 | 2,114,801 | 3,245,985 | |||||||||

| Amounts invoiced by DDL to Pharma | (3,159 | ) | (2,495 | ) | (2,495 | ) | ||||||

| Amounts paid by DDL to Pharma | (2,785,487 | ) | (2,316,544 | ) | (3,492,962 | ) | ||||||

| Foreign exchange differences | 31,077 | (97,149 | ) | (620 | ) | |||||||

| Due to (from) related parties at end of period | $ | (25,320 | ) | $ | (152,592 | ) | $ | (101,297 | ) | |||

The Company’s foreign currency forward contracts are measured at fair value on a recurring basis and are classified as Level 2 fair value measurement. As of December 31, 2023, and March 31, 2023, the Company has deposited $146,434, and $909,666, respectively, as collateral with the counterparty related to the foreign currency forward contract and recorded as part of prepaid expenses and other receivables in the accompanying balance sheet.

NOTE 54 – NOTES PAYABLE

| Schedule of notes payable | ||||||||

December 31, 2023 (unaudited) | March 31, 2023 | |||||||

| Note Payable Agreement 2 | $ | 13,551,346 | $ | 14,772,293 | ||||

| Note Payable Agreement 3 | 6,365,649 | 6,024,941 | ||||||

| Note Payable Agreements 4 and 5 | — | — | ||||||

| Total notes payable | 19,916,995 | 20,797,234 | ||||||

| Unamortized debt discount | (273,957 | ) | (767,083 | ) | ||||

| Notes payable, net of note discounts | 19,643,038 | 20,030,151 | ||||||

| Current portion | (19,643,038 | ) | (16,942,500 | ) | ||||

| Non-current portion | $ | — | $ | 3,087,651 | ||||

At October 5, 2023, the Company had four note payable agreements (Notes #2, #3, #4, and #5) outstanding. Effective October 5, 2023, the Company entered into standstill agreements for Notes #2 and #3, pursuant to which the investors would not seek repayment of any portion of the notes during the period from October 5, 2023 to October 31, 2023. In consideration, the Company agreed to pay a standstill fee of $1,300,000, that was added to the note principal of Notes #2 and #3.

On October 5, 2023, the Company entered into termination agreements to terminate and cancel Notes #4 and #5, which had an aggregate balance of principal and accrued interest of $7,940,657. In consideration, a principal payment of $3,000,000 was made, and $4,940,657 was added to the principal of Notes #2 and #3.

NOTE PURCHASEPAYABLE AGREEMENT 12

On April 15, 2020,February 8, 2021, the Company entered intoissued a note purchase agreement (the “Note Purchase Agreement 1”payable (“Note 2”) to a third-party investor. The note was for $24,015,000, originally matured on February 9, 2023 (see below), and is secured by and amongall the assets of the Company. Beginning in March 2023, the monthly principal payments are $1,000,000 per month. In addition, the Company DDL, TCL andis required to accrue a third-party investor (the “Investor”).

Pursuantmonthly PIK fee equal to 0.833% of the outstanding balance, which is in substance interest at an annual rate of approximately 10%, that is added to the terms ofnote principal each month. In October 2022 Note Purchase Agreement2 was amended to extend the maturity from February 9, 2023 to July 1, 2024. In consideration, the Company agreed to issue and sellpay aggregate fees of $2,304,539 to the Investor,investor which were added to the principal balance of Note 2.

As of March 31, 2023, outstanding balance of note payable amounted to $14,772,293. On October 5, 2023, $3,143,134 was added to the principal of Note 2 related to the termination of Notes 4 and 5 and addition of the Investor agreedstandstill fee (see above). During the nine months ended December 31, 2023, principal payments of $4,364,081 were made. As of December 31, 2023, outstanding balance of note payable amounted to purchase from$13,551,346.

NOTE PAYABLE AGREEMENT 3

On May 20, 2022, the Company issued a secured promissory note (the “2020 Secured Note”) in the original principal amount ofpayable (“Note 3) to a third-party investor. The note was for $6,015,000. In consideration thereof,, matures on April 15, 2020, (i) the Investor (a) paid $1,000,000 in cash, (b) issued to the Company (1) Investor Note #1 in the principal amount of $2,000,000 (“Investor Note #1”),May 20, 2024, and (2) Investor Note #2 in the principal amount of $2,000,000 (“Investor Note #2” and together with Investor Note #1, the “2020 Investor Notes”), and (ii) the Company delivered the 2020 Secured Note on behalf of the Company, to the Investor, against delivery of the 2020 Purchase Price. For these purposes, the “2020 Purchase Price” means the Investor’s initial cash purchase price, together with the sum of the initial principal amounts of the Investor Notes.

The 2020 Secured Note is secured by all the Collateral (as hereinafter defined).assets of the Company. The 2020 Secured Note carriesCompany received cash proceeds of $4,700,000, resulting in a discount of $1,315,000 made up of an original issue discount (“OID”) of $1,000,000 (, commission of $16.7300,000%). that was paid from proceeds, and $15,000 to cover transaction expenses. In addition, the Company agreedis required to pay $15,000 to the Investor to cover the Investor’s legal fees, accounting costs, due diligence, monitoring and other transaction costs incurred in connection with the purchase and sale of the 2020 Secured Note (the “Transaction Expense Amount”). In addition to this,accrue a payment of $325,000 was made to Ascendiant Capital Markets, LLC (“Ascendiant”) for structuring the agreement between both parties. The 2020 Purchase Price for the 2020 Secured Note is $4,675,000, computed as follows: $6,015,000 original principal balance, less: OID, Transaction Expense Amount, and commission paid.

The borrowing period is 24 months, and the Company shall pay the outstanding balance and all fees on maturity. A monitoringmonthly PIK fee equal to 0.833%0.833% of the outstanding balance, will automatically bewhich is in substance interest at an annual rate of approximately 10%, that is added to the outstanding balance on the first day of each month. The debt less the discount and transaction expenses will be accreted over the term of the 2020 Secured Note using the effective interest method.

Security Agreement

On April 15, 2020, the Company entered into the Security Agreement by the Company, DDL and TCL, in favor of the Investor (the “2020 Security Agreement”). Pursuant to the terms of the 2020 Security Agreement, the Company granted the Investor a first-priority security interest in all rights, title, interest, claims and demands of the Company in and to all of the Company’s patents and all other proprietary rights, and all rights corresponding to the Company’s patents throughout the world, now owned and existing, and all replacements, proceeds, products, and accessions thereof (the “Collateral”).

Note Purchase Agreement 1 was settled in full on April 22, 2022.

NOTE PURCHASE AGREEMENT 2

On February 8, 2021, the Company entered into an additional note purchase agreement (“Note Purchase Agreement 2”) with the Investor. Pursuant to the terms of Note Purchase Agreement 2, the Company agreed to issue and sell to the Investor, and the Investor agreed to purchase from the Company, a secured promissory note (the “Secured Note 2”) in the original principal amount of $24,015,000. The Secured Note 2 carries an OID of $4,000,000 (16.7%), and the Company agreed to pay $15,000 to the Investor to cover the Investor’s transaction expenses. In addition to this, a commission of $1,200,000 was also payable to Ascendiant.

In consideration thereof, on February 9, 2021, (i) the Investor paid $20,000,000 in cash to the Company, and (ii) the Company delivered Secured Note 2 on behalf of the Company, to the Investor, against the delivery of the 2021 Purchase Price. For these purposes, the “2021 Purchase Price” means the Investor’s initial cash purchase price. After adjusting for transaction expenses of $1,200,000, cash proceeds received were $18,800,000.

The borrowing terms for Note Purchase Agreement 2 were originally consistent with those of Note Purchase Agreement 1, with the borrowing period being 24 months from the date of the agreement, the Company being required to pay the outstanding balance and all fees on maturity, and a monitoring fee equal to 0.833% of the outstanding balance being automatically added to the outstanding balance on the first day of each month. The debt less discount and transaction expenses will be accreted over the term of the Secured Note 2note using the effective interest rate method.

On October 21, 2022, the Company entered into an amendment to Note Purchase Agreement 2. Pursuant to the terms of the amendment, the Company and Investor agreed to extend the maturity date of Note Purchase Agreement 2 to July 1, 2024. In consideration thereof, the Company agreed to pay to the Investor an extension fee in the amount of 5% ofAt March 31, 2023, the outstanding balance of Note Purchase Agreement 2, which resulted in $813,834 being added onto the liability due to the Investor.

The Company and the Investor previously agreed to reduce the maximum monthly redemption amount from $2,000,000 to $500,000 from June 2022 to February 2023, which reduction remains in force. Pursuant to the terms of the amendment, the Company and Investor agreed to reduce the maximum monthly redemption amount during the period beginning March 2023 until Note Purchase Agreement 2 is paid in full from $2,000,000 to $1,000,000; provided, however, that upon the occurrence of an event of default under the Note Purchase Agreement 2, the maximum monthly redemption amount will automatically be increased back to $2,000,000.

Security Agreement

On February 8, 2021, the 2020 Security Agreement3 was extended to include Note Purchase Agreement 2, which is also secured against all of the Company’s assets owned as of February 9, 2021 and extends to any assets acquired at any time that the Company’s obligations under Secured Note 2 are outstanding.

NOTE PURCHASE AGREEMENT 3

On May 20, 2022, the Company entered into a new note purchase agreement (“Note Purchase Agreement 3”) by and among the Company, DDL, TCL and a third-party investor.

Pursuant to the terms of the Note Purchase Agreement 3, the Company agreed to issue and sell to the Investor and the Investor agreed to purchase from the Company a secured promissory note (the “Secured Note”) in the original principal amount of $6,015,000. In consideration thereof, on May 20, 2022 (the closing date), (i) the Investor paidOn October 5, 2023, $5,000,000 in cash, and (ii) the Company delivered the Secured Note on behalf of the Company, to the Investor, against delivery of the Purchase Price. For these purposes, the “Purchase Price” means the Investor’s initial cash purchase price.

The Secured Note is secured by the Collateral (as hereinafter defined). The Secured Note carries an original issue discount (“OID”) of $1,000,000 (16.7%). In addition, the Company agreed to pay $15,000 to the Investor to cover the Investor’s legal fees, accounting costs, due diligence, monitoring and other transaction costs incurred in connection with the purchase and sale of the Secured Note (the “Transaction Expense Amount”). In addition to this, a payment of $300,0002,164,829 was made to Ascendiant Capital Markets, LLC, (the “Commission”) for structuring the agreement between both parties. The Purchase Price for the Secured Note is $4,700,000, computed as follows: $6,015,000 original principal balance, less: OID, Transaction Expense Amount, and commission paid.

The borrowing period is 24 months, and the Company shall pay the outstanding balance and all fees on maturity. A monitoring fee equal to 0.833% of the outstanding balance will automatically be added to the outstanding balance onprincipal of Note 3 related to the first daytermination of each month. The debt less the discountNotes 4 and transaction expenses will be accreted over the term5 and addition of the Note usingstandstill fee (see above). During the effective interest method.

Security Agreement

On May 20, 2022, the Company entered into the Security Agreement by the Company, DDL and TCL, in favornine months ended December 31, 2023, principal payments of the Investor (the “Security Agreement”). Pursuant to the terms of the Security Agreement, the Company granted the Investor a first-priority security interest in all rights, title, interest, claims and demands of the Company in and to all of the Company’s patents and all other proprietary rights, and all rights corresponding to the Company’s patents throughout the world, now owned and existing, and all replacements, proceeds, products, and accessions thereof.$1,814,180 were made. As of December 31, 2022, long-term debt matures as follows:

| ||||||

NOTE 6 – STOCKHOLDERS’ (DEFICIT) EQUITY

During2023, the three month period ended December 31, 2022, shares were sold under the ATM Equity Distribution Agreement in place with H.C. Wainwright & Co., for total gross proceedsoutstanding balance of Note 3 was $696, with associated costs of $2736,365,649. other shares were issued during the nine month period ended December 31, 2022.

During the nine month period ended December 31, 2021, 366,892 warrants were exercised generating gross proceeds2023, debt discount amortization of $2,963,658. There were a total of 1,573,098493,125 warrants outstanding at this date. During the three month period endedwas recorded. At December 31, 2021, shares were sold under the ATM Equity Distribution Agreement in place with H.C. Wainwright & Co., for total gross proceeds of $118,791, with associated costs of $4,382. other shares were issued during the three and nine month periods ended December 31, 2021.

Loss per share

The following table sets forth the computation of basic and diluted loss per share for the periods indicated.

| Schedule of earnings (loss) per share | ||||||||||||||||

Three Months Ended December 31, | Nine Months Ended December 31, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| (in Dollars, except Share Amounts) | (in Dollars, except Share Amounts) | |||||||||||||||

| Net loss attributable to common stockholders | (1,716,278 | ) | (3,431,568 | ) | (9,460,888 | ) | (10,269,557 | ) | ||||||||

| Weighted average basic and diluted shares outstanding | 24,103,196 | 23,313,629 | 24,102,976 | 23,244,345 | ||||||||||||

| Basic and diluted loss per share: | (0.07 | ) | (0.15 | ) | (0.39 | ) | (0.44 | ) | ||||||||

The Company excludes warrants outstanding, which are anti-dilutive given the Company is in a loss position, from the basic and diluted loss per share calculation.

Basic loss per share is computed by dividing loss available to common stockholders by the weighted-average number of common shares outstanding during the period. For the three and nine month periods ended December 31, 2022, warrants to purchase 1,573,098 shares of common stock and a unit purchase option to purchase 9,710 shares of common stock, as well as warrants to purchase 9,710 shares of common stock, were considered anti-dilutive and were excluded from the calculation of diluted loss per share. For the three and nine month periods ended December 31, 2021, warrants to purchase 1,573,098 shares of common stock and a unit purchase option to purchase 9,710 shares of common stock, as well as warrants to purchase 9,710 shares of common stock, were considered anti-dilutive and were also excluded from the calculation of diluted loss per share.

NOTE 7 – OTHER ITEMS

The outbreak of COVID-19 in December 2019 has since rapidly increased its exposure globally. On March 11, 2020, the World Health Organization declared the outbreak a pandemic. We continue to monitor the impact of COVID-19 on our own operations and are working with our employees, suppliers and other stakeholders to mitigate the risks posed by its spread, but COVID-19 is not expected to have any long-term detrimental effect on the Company’s success. While key suppliers have not been accessible throughout the whole period of the outbreak, we have been able to be flexible in our priorities and respond favorably to the challenges faced during the outbreak. We have also seen a surge in the uptake of technologies for remote monitoring of patients and patient self-monitoring, which potentially enhances the prospects for the Company, its CGM product and its planned digital healthcare offering.

NOTE 8 – SUBSEQUENT EVENTS

Management has evaluated subsequent events and transactions for potential recognition or disclosure in the financial statements through February 23, 2023, the date these financial statements were available to be issued.

The Company commenced a Registered Direct Offering and concurrent Private Placement on January 27, 2023 with two healthcare-focused U.S. institutional investors to sell shares of its common stock, pursuant to a registered direct offering and warrants to purchase up to 4,796,206 shares in a concurrent private placement. The combined purchase price for one share and one warrant was $. The warrants have an exercise price of $2.00 per share and are initially exercisable at the later of shareholder approval or six months following the date of issuance and will expire 5.5 five and a half years from January 31, 2023, the closing date.unamortized debt discount was $273,958.

NOTE PAYABLE AGREEMENTS 4 and 5

In August 2023, the Company issued two notes payable to two third party investors (“Notes 4 and 5”) , with a face value of $7,810,000 in exchange for cash of $6,500,000 or an original issue discount of $1,310,000. The aggregate gross proceeds fromnotes were secured by all tangible and intangible assets of the Registered Direct OfferingCompany and will mature in 24 months or in August 2025. The notes did not bear any interest; however, the implied annual interest rate is 9.5% based upon the OID rate of 19% and annual monitoring fee of 9.9%. As a result, the Company recorded a debt discount of $1,310,000 to account the note's original issue discount, commission and direct costs computed which is being amortized over interest expense over the term of the note payable.

On October 2023, the Company and the concurrent Private Placement werenoteholders amended the two notes payable. As part of the amendment, the Company paid the noteholder $8.43 million before deducting placement agentin principal and the remaining balance of $4,810,000 and accrued interest of $130,657, was transferred and added to the outstanding principal balance of Note 2 for $2,775,828 and Note 3 for $2,164,829, issued in May 2022 and October 2022, respectively. In addition, the Company also incurred additional fees of $367,306 as part of the amendment of notes payable 4 and other estimated offering expenses.5, which was added to Note 2. In addition, the Company also expensed the entire debt discount of $1,310,000. As of result of these amendments, notes payable 4 and 5 were extinguished and cancelled by the noteholder.

LINE OF CREDIT

In November 2023, the Company executed a line of credit (LOC) with a third party financing company, Streeterville Capital LLC. Pursuant to the LOC agreement, the Company can loan up to $10 million at a rate of 10% per annum and a 20% original issue discount for a period of one year. The LOC is secured by all tangible and intangible assets of the Company. The Company received net proceeds of $7,655,974 after costs.has not yet made advances or drawdowns against the LOC.

ITEM 2: MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS