UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549D.C.20549

Form 10-Q

☑ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended SEPTEMBER 30,DECEMBER 31, 2020

☐ TRANSITIONTRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

ALTAIR INTERNATIONAL CORP.

(Exact name of registrant as specified in its charter)

| Nevada | 333-190235 | 99-0385465 |

| (State or other jurisdiction | (Commission File Number) | (IRS Employer |

| of Incorporation) | Identification Number) | |

| 322 North Shore Drive, Building 1B, Suite 200 Pittsburgh, PA 15212 |

|

(Address of principal executive offices)

| ||

| (412) 770-3140 | ||

| (Registrant’s Telephone Number) |

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files)files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” andfiler,” “smaller reporting company”company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated | Accelerated |

| Non-accelerated | Smaller reporting |

| Emerging growth company ☑ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of October 21, 2020,January 24, 2021, there were 537,732,553546,282,553 shares of the registrant’s $0.001 par value common stock issued and outstanding.

ALTAIR INTERNATIONAL CORP.

QUARTERLY REPORT

PERIOD ENDED SEPTEMBER 30, 2020

TABLE OF CONTENTS

| Page No. | |||

| PART I - FINANCIAL INFORMATION | |||

| Item 1. | Unaudited Financial Statements | ||

| Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations | ||

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 19 | |

| Item | Controls and Procedures | 19 | |

| PART II - OTHER INFORMATION | |||

| Item 1. | Legal Proceedings | 20 | |

| Item1A. | Risk Factors | 20 | |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 20 | |

| Item 3. | Defaults Upon Senior Securities | 20 | |

| Item 4. | Mine Safety Disclosures | 20 | |

| Item 5. | Other Information | 20 | |

| Item 6. | Exhibits | 20 | |

| Signatures | 21 |

Special Note Regarding Forward-Looking Statements

Information included in this Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”). This information may involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Altair International Corp. (the “Company”), to be materially different from future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, which involve assumptions and describe future plans, strategies and expectations of the Company, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project” or the negative of these words or other variations on these words or comparable terminology. These forward-looking statements are based on assumptions that may be incorrect, and there can be no assurance that these projections included in these forward-looking statements will come to pass. Actual results of the Company could differ materially from those expressed or implied by the forward-looking statements as a result of various factors. Except as required by applicable laws, the Company has no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future.

*Please note that throughout this Quarterly Report, and unless otherwise noted, the words "we," "our," "us," the "Company," or "ATAO" refers to Altair International Corp.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

ALTAIR INTERNATIONAL CORP.

INDEX TO FINANCIAL STATEMENTS

| Balance Sheets as of | F-1 | ||

| Statements of Operations for the Three and | F-2 | ||

| Statements of Stockholders’ Deficit for the Nine Months ended December 31, 2020 and 2019 (unaudited) | F-3 | ||

| Statements of Cash Flows for the | unaudited) | F-4 | |

| Notes to the Financial Statements | F-5 |

ALTAIR INTERNATIONAL CORP. BALANCE SHEETS | ||||||||

December 31, 2020 | March 31, 2020 | |||||||

| ASSETS | (Unaudited) | |||||||

| Current Assets: | ||||||||

| Cash | $ | 200,155 | $ | 26 | ||||

| Advances and deposits | 1,000 | 1,789 | ||||||

| Total Current Assets | 201,155 | 1,815 | ||||||

| Other asset | 30,000 | — | ||||||

| Total Assets | $ | 231,155 | $ | 1,815 | ||||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable | $ | 60,297 | $ | 8,186 | ||||

| Accounts payable – related party | 8,500 | — | ||||||

| Loans payable | 49,155 | 14,165 | ||||||

| Interest payable | 5,108 | 3,176 | ||||||

| Convertible notes payable | 224,500 | — | ||||||

| Loans payable – related party | — | 30,000 | ||||||

| Stock based compensation payable (Note 6) | 1,788,000 | — | ||||||

| Derivative liability | 368,001 | — | ||||||

| Total Current Liabilities | 2,503,561 | 55,527 | ||||||

| Loan payable | 100,000 | — | ||||||

| Total Liabilities | 2,603,561 | 55,527 | ||||||

| Stockholders' Deficit: | ||||||||

| Common Stock, $0.001 par value, 2,000,000,000 shares authorized; 538,182,553 shares issued and outstanding at December 31, 2020 and 496,732,553 at March 31, 2020, respectively | 538,183 | 496,733 | ||||||

| Additional paid in capital | 428,008 | 350,693 | ||||||

| Accumulated deficit | (3,338,597 | ) | (901,138 | ) | ||||

| Total Stockholders' Deficit | (2,372,406 | ) | (53,712 | ) | ||||

| Total Liabilities and Stockholders' Deficit | $ | 231,155 | $ | 1,815 | ||||

| The accompanying notes are an integral part of these unaudited financial statements. | ||||||||

| F-1 |

| ALTAIR INTERNATIONAL CORP. | ||||||||

| BALANCE SHEETS | ||||||||

| AS OF SEPTEMBER 30, 2020 AND MARCH 31, 2020 | ||||||||

September 30, 2020 | March 31, 2020 | |||||||

| (Unaudited) | (Audited) | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash | $ | 12,929 | $ | 26 | ||||

| Advances and deposits | — | 1,789 | ||||||

| Total current assets | 12,929 | 1,815 | ||||||

| Total assets | $ | 12,929 | $ | 1,815 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | ||||||||

| Current Liabilities | ||||||||

| Accounts payable | $ | 23,417 | $ | 8,186 | ||||

| Loans payable | 14,165 | 14,165 | ||||||

| Interest payable | 2,400 | 3,176 | ||||||

| Convertible notes payable | 112,500 | — | ||||||

| Derivative liability | 3,037 | — | ||||||

| Promissory note due to third party | 9,990 | — | ||||||

| Promissory note due to related party | — | 30,000 | ||||||

| Total current liabilities | 165,509 | 55,527 | ||||||

| Total Liabilities | 165,509 | 55,527 | ||||||

| Stockholders' Equity (Deficit) | ||||||||

| Common Stock, $0.001 par value, 2,000,000,000 shares authorized; 537,732,553 shares issued and outstanding at September 30, 2020 and 496,732,553 at March 31, 2020 | 537,733 | 496,733 | ||||||

| Additional paid-in-capital | 353,007 | 350,693 | ||||||

| Common stock to issue for services | 450 | — | ||||||

| Accumulated deficit | (1,043,770 | ) | (901,138 | ) | ||||

| Total stockholders' equity (deficit) | (152,580 | ) | (53,712 | ) | ||||

| Total liabilities and stockholders's equity (deficit) | $ | 12,929 | $ | 1,815 | ||||

| The accompanying notes are an integral part of these financial statements | ||||||||

| ALTAIR INTERNATIONAL CORP. | ||||||||||||||||

| STATEMENTS OF OPERATIONS | ||||||||||||||||

| (Unaudited) | ||||||||||||||||

| For the Three Months Ended | For the Nine Months Ended | |||||||||||||||

| December 31, | December 31, | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| Operating Expenses: | ||||||||||||||||

| Mining exploration expense | 22,875 | — | 79,001 | — | ||||||||||||

| Compensation – related party | 14,000 | — | 14,000 | — | ||||||||||||

| General and administrative | 1,890,280 | 345 | 1,971,210 | 1,035 | ||||||||||||

| Total operating expenses | 1,927,155 | 345 | 2,064,211 | 1,035 | ||||||||||||

| Loss from operations | (1,927,155 | ) | (345 | ) | (2,064,211 | ) | (1,035 | ) | ||||||||

| Other Expense: | ||||||||||||||||

| Interest expense | (2,708 | ) | (454 | ) | (5,247 | ) | (1,356 | ) | ||||||||

| Derivative liability expense | (364,964 | ) | — | (368,001 | ) | — | ||||||||||

| Total other expense | (367,672 | ) | (454 | ) | (373,248 | ) | (1,356 | ) | ||||||||

| Loss before provision for income taxes | (2,294,827 | ) | (799 | ) | (2,437,459 | ) | (2,391 | ) | ||||||||

| Provision for income taxes | — | — | — | — | ||||||||||||

| Net Loss | $ | (2,294,827 | ) | $ | (799 | ) | $ | (2,437,459 | ) | $ | (2,391 | ) | ||||

| Loss per share, basic and diluted | $ | — | $ | — | $ | — | $ | — | ||||||||

| Weighted average shares outstanding, basic and diluted | 538,118,966 | 496,732,553 | 521,032,735 | 496,732,553 | ||||||||||||

The accompanying notes are an integral part of these unaudited financial statements.

| F-2 |

| ALTAIR INTERNATIONAL CORP. | ||||||||||||||||

| STATEMENTS OF OPERATIONS | ||||||||||||||||

| (Unaudited) | ||||||||||||||||

| Three Month Period Ended September 30, 2020 | Three Month Period Ended September 30, 2019 | Six Month Period Ended September 30, 2020 | Six Month Period Ended September 30, 2019 | |||||||||||||

| Expenses | ||||||||||||||||

| Total General and Administrative expenses | $ | 43,951 | $ | 345 | $ | 80,930 | $ | 690 | ||||||||

| Mining exploration expenses | 56,126 | — | 56,126 | — | ||||||||||||

| Derivative liability expense | 1,452 | — | 3,037 | — | ||||||||||||

| Interest expense | 1,806 | 454 | 2,539 | 902 | ||||||||||||

| Loss (earnings) before income taxes | 103,335 | 799 | 142,632 | 1,592 | ||||||||||||

| Income taxes | — | — | — | — | ||||||||||||

| Net loss (earnings) | $ | 103,335 | $ | 799 | $ | 142,632 | $ | 1,592 | ||||||||

| Loss (earnings) per share - Basic and diluted | $ | 0.0002 | $ | 0.0000 | $ | 0.0003 | $ | 0.0000 | ||||||||

| Weighted Average Shares - Basic and diluted | 516,254,292 | 496,732,553 | 507,356,965 | 496,732,553 | ||||||||||||

| The accompanying notes are an integral part of these financial statements. | ||||||||||||||||

ALTAIR INTERNATIONAL CORP. STATEMENTS OF STOCKHOLDERS’ DEFICIT FOR THE NINE MONTHS ENDED DECEMBER 31, 2020 AND 2019 (Unaudited) | ||||||||||||||||||||

| Common Stock | Additional Paid in | Accumulated | ||||||||||||||||||

| Shares | Amount | Capital | Deficit | Total | ||||||||||||||||

| Balance, March 31, 2020 | 496,732,553 | $ | 496,733 | $ | 350,693 | $ | (901,138 | ) | $ | (53,712 | ) | |||||||||

| Shares issued for Director services | 4,000,000 | 4,000 | — | — | 4,000 | |||||||||||||||

| Shares issued for debt settlement | 11,000,000 | 11,000 | 2,315 | — | 13,315 | |||||||||||||||

| Net loss | — | — | — | (39,297 | ) | (39,297 | ) | |||||||||||||

| Balance, June 30, 2020 | 511,732,553 | 511,733 | 353,008 | (940,435 | ) | (75,694 | ) | |||||||||||||

| Shares issued for Officer services | 26,000,000 | 26,000 | — | — | 26,000 | |||||||||||||||

| Net loss | — | — | — | (103,335 | ) | (103,335 | ) | |||||||||||||

| Balance, September 30, 2020 | 537,732,553 | 537,733 | 353,008 | (1,043,770 | ) | (153,029 | ) | |||||||||||||

| Shares granted for services | 450,000 | 450 | — | — | 450 | |||||||||||||||

| Warrant expense | — | — | 75,000 | — | 75,000 | |||||||||||||||

| Net loss | — | — | — | (2,294,827 | ) | (2,294,827 | ) | |||||||||||||

| Balance, December 31, 2020 | 538,182,553 | $ | 538,183 | $ | 428,008 | $ | (3,338,597 | ) | $ | (2,372,406 | ) | |||||||||

| Common Stock | Additional Paid in | Accumulated | ||||||||||||||||||

| Shares | Amount | Capital | Deficit | Total | ||||||||||||||||

| Balance, March 31, 2019 | 496,732,553 | $ | 496,733 | $ | 350,693 | $ | (895,882 | ) | $ | (48,456 | ) | |||||||||

| Net loss | — | — | — | (793 | ) | (793 | ) | |||||||||||||

| Balance, June 30, 2019 | 496,732,553 | 496,733 | 350,693 | (896,675 | ) | (49,249 | ) | |||||||||||||

| Net loss | — | — | — | (799 | ) | (799 | ) | |||||||||||||

| Balance, September 30, 2019 | 496,732,553 | $ | 496,733 | $ | 350,693 | $ | (897,474 | ) | $ | (50,048 | ) | |||||||||

| Net loss | — | — | — | (799 | ) | (799 | ) | |||||||||||||

| Balance, December 31, 2019 | 496,732,553 | $ | 496,733 | $ | 350,693 | $ | (898,273 | ) | $ | (50,847 | ) | |||||||||

The accompanying notes are an integral part of these unaudited financial statements.

| F-3 |

| ALTAIR INTERNATIONAL CORP. | ||||||||

| STATEMENTS OF CASH FLOWS | ||||||||

| (Unaudited) | ||||||||

| Six Month Period Ended September 30, 2020 | Six Month Period Ended September 30, 2019 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net income (loss) | $ | (142,632 | ) | $ | (1,592 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities | ||||||||

| Stock issued for debt settlement | 3,314 | — | ||||||

| Stock issued for services | 30,000 | — | ||||||

| Stock to be issued for services | 450 | — | ||||||

| Changes in: | ||||||||

| Advances and deposits | 1,789 | — | ||||||

| Accounts payable | 15,231 | 600 | ||||||

| Interest payable | (776 | ) | 902 | |||||

| (92,624 | ) | (90 | ) | |||||

| CASH FLOWS FROM INVESTING ACTIVITIES | — | — | ||||||

| CASH FLOW FROM FINANCING ACTIVITIES | ||||||||

| Proceeds from convertible notes | 112,500 | — | ||||||

| Proceeds from promissory note | 9,990 | — | ||||||

| Derivative liability expense | 3,037 | — | ||||||

| Payments on Promissory Note due to related party | (20,000 | ) | — | |||||

| 105,527 | — | |||||||

| NET INCREASE IN CASH AND CASH EQUIVALENTS | 12,903 | (90 | ) | |||||

| CASH AND CASH EQUIVALENTS | ||||||||

| Beginning of period | 26 | 136 | ||||||

| End of period | $ | 12,929 | $ | 46 | ||||

| Supplemental disclosures of cash flow information | ||||||||

| Taxes paid | $ | — | $ | — | ||||

| Interest paid | $ | — | $ | — | ||||

| The accompanying notes are an integral part of these financial statements. | ||||||||

ALTAIR INTERNATIONAL CORP. STATEMENTS OF CASH FLOWS (Unaudited) | ||||||||

| For the Nine Months Ended December 31, | ||||||||

| 2020 | 2019 | |||||||

| CASH FLOW FROM OPERATING ACTIVITIES: | ||||||||

| Net loss | $ | (2,437,458 | ) | $ | (2,391 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Stock based compensation | 1,893,450 | — | ||||||

| Derivative liability expense | 368,001 | — | ||||||

| Changes in Operating Assets and Liabilities: | ||||||||

| Advances and deposits | 789 | — | ||||||

| Accounts payable | 60,611 | 920 | ||||||

| Accrued interest | 5,246 | 1,355 | ||||||

| Net Cash Used in Operating Activities | (109,361 | ) | (116 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Payment for exploration earn in option | (30,000 | ) | — | |||||

| Net Used in by Investing Activities | (30,000 | ) | — | |||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Proceeds from convertible notes payable | 224,500 | — | ||||||

| Proceeds from loans payable | 134,990 | — | ||||||

| Repayment of related party loan | (20,000 | ) | — | |||||

| Net Cash Provided by Financing Activities | 339,490 | — | ||||||

| Net Increase in Cash | 200,129 | (116 | ) | |||||

| Cash at Beginning of Period | 26 | 136 | ||||||

| Cash at End of Period | $ | 200,155 | $ | 20 | ||||

| Cash paid during the period for: | ||||||||

| Interest | $ | — | $ | — | ||||

| Income taxes | $ | — | $ | — | ||||

| Supplemental non-cash disclosure: | ||||||||

| Related party debt settled with common stock | $ | 13,314 | $ | — | ||||

The accompanying notes are an integral part of these unaudited financial statements.

| F-4 |

| ALTAIR INTERNATIONAL CORP. | ||||||||||||||||||||||||

| STATEMENTS OF STOCKHOLDERS' DEFICIT | ||||||||||||||||||||||||

| For the six month period ended September 30, 2020 | ||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||

| Common Stock | Amount | Additional Paid-In-Capital | Capital Stock Subscribed | Accumulated Deficit | Total | |||||||||||||||||||

| Balance at March 31, 2020 | 496,732,553 | $ | 496,732 | $ | 350,694 | $ | — | $ | (901,138 | ) | $ | (53,712 | ) | |||||||||||

| Common shares issued for Director services | 4,000,000 | $ | 4,000 | $ | — | $ | — | — | 4,000 | |||||||||||||||

| Common shares issued for debt settlement at $0.0012 per share | 11,000,000 | $ | 11,000 | $ | 2,315 | $ | — | — | 13,314 | |||||||||||||||

| Net loss for the 3 months ended June 30, 2020 | (39,297 | ) | $ | (39,297 | ) | |||||||||||||||||||

| Balance at June 30, 2020 | 511,732,553 | $ | 511,732 | $ | 353,009 | $ | — | $ | (940,435 | ) | $ | (75,695 | ) | |||||||||||

| Common shares issued for Officer services | 26,000,000 | $ | 26,000 | $ | — | $ | — | $ | — | $ | 26,000 | |||||||||||||

| Stock to be issued for consultant services | 450,000 | $ | — | $ | 450 | $ | — | $ | 450 | |||||||||||||||

| Net loss for the 3 months ended September 30, 2020 | $ | (103,335 | ) | $ | (103,335 | ) | ||||||||||||||||||

| Balance at September 30, 2020 | 538,182,553 | $ | 537,732 | $ | 353,009 | $ | 450 | $ | (1,043,770 | ) | $ | (152,580 | ) | |||||||||||

| For the six month period ended September 30, 2019 | ||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||

| Common Stock | Amount | Additional Paid-In-Capital | Capital Stock Subscribed | Accumulated Deficit | Total | |||||||||||||||||||

| Balance at March 31, 2019 | 496,732,553 | $ | 496,733 | $ | 350,693 | $ | — | $ | (895,882 | ) | $ | (48,456 | ) | |||||||||||

| Net loss for the 3 months ended June 30, 2019 | $ | (793 | ) | $ | (793 | ) | ||||||||||||||||||

| Balance at June 30, 2019 | 496,732,553 | $ | 496,733 | $ | 350,693 | $ | — | $ | (896,675 | ) | $ | (49,249 | ) | |||||||||||

| Net loss for the 3 months ended September 30, 2019 | $ | (799 | ) | $ | (799 | ) | ||||||||||||||||||

| Balance at September 30, 2019 | 496,732,553 | $ | 496,733 | $ | 350,693 | $ | (897,474 | ) | $ | (50,048 | ) | |||||||||||||

| The accompanying notes are an integral part of these financial statements. | ||||||||||||||||||||||||

ALTAIR INTERNATIONAL CORP.

Notes to the Financial Statements

September 30, 2020

(Unaudited)

The results for the six months ended September 30, 2020 are not necessarily indicative of the results of operations for the full year. These financial statements and related footnotes should be read in conjunction with the financial statements and footnotes thereto included in the Company’s Annual Report on Form 10K for the year ended MarchDecember 31, 2020 filed with the Securities and Exchange Commission.

(Unaudited)

The accompanying financial statements have been prepared by the Company without audit. In the opinion of management, all adjustments (which include only normal recurring adjustments) necessary to present fairly the financial position, results of operations, and cash flows at September 30, 2020 and for the related periods presented have been made.

NOTE 1 - ORGANIZATION AND BUSINESS OPERATIONS

Organization and Description of Business

ALTAIR INTERNATIONAL CORP. (the “Company”) was incorporated under the laws of the State of Nevada on December 20, 2012. The Company’s physical address is 322 North Shore Drive, Building1B,Building 1B, Suite 200, Pittsburgh, PA 15212. The Company is in the development stage as defined under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 915-205 "Development-Stage Entities.”

Mining Lease

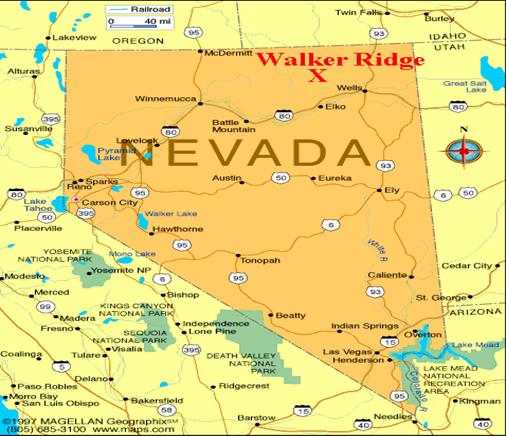

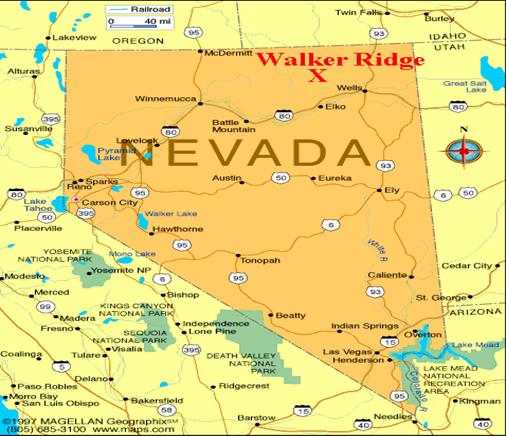

The Company is currently engaged in identifying and assessing new business opportunities. In this regard, the Company entered into a Mining Lease effective August 3, 2020 with Oliver Geoservices LLC (“OGS”)under which the Company received an exclusive lease to mine certain unpatented lode mining claims known as the Walker Ridge located in Elko CountryCounty, Nevada for a period of five years. The lease can be extended for an additional twenty years if certain extension payments are made within the term of the lease. The Company made an initial payment of $25,000 to secure the lease and is required to make advance royalty payments to maintain its exclusivity commencing December 1, 2020,January 31, 2021, starting at $25,000 and increasing in $25,000 increments each year for the initial five yearfive-year term to $100,000 as well as issuing common shares to OGS in accordance with the following schedule.

| On or before December 1, 2021 | 500,000 common shares |

| On or before December 1, 2022 | 500,000 common shares |

| On or before December 1, 2023 | 750,000 common shares |

| On or before December 1, 2024 | 750,000 common shares |

In addition, a 3% net smelter fee royalty is payable on all mineral production from the leased property. The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the Agreement which was filed as Exhibit 1.01 to a Form 8-K dated August 14, 2020.

The Company had previously planned to enter into license and distribution agreements for oral thin film nutraceutical products. This plan was abandoned in the 2017 fiscal year as the Company was unable to obtain the working capital required to bring the products to market.

Since inception (December 20, 2012) through September 30,Earn-In Agreement

On November 23, 2020, the Company has not generated any revenue and has accumulated lossesentered into an Earn-In Agreement with American Lithium Minerals, Inc. (“AMLM”) under which we agreed to make total payments of $1,043,770.

In management’s opinion all adjustments necessary$75,000 to AMLM in exchange for a fair statement10% undivided interest in 63 unpatented placer mining claims comprised of the results for the interim periods haveapproximately 1,260 acres, and 3 unpatented lode mining claims in Nevada. This $75,000 obligation has been made, and that all adjustments have been made to maintain the books in accordance with GAAP. Furthermore, sufficient disclosures have been made in order to ensure that the interim financial statements will not be misleading.

NOTE 2 - GOING CONCERN

The financial statements have been prepared on a going concern basis, which assumesfully satisfied by the Company will be able to realize its assets($30,000 paid 12/8/2020 and discharge its liabilities$45,000 paid 1/5/2021), resulting in Altair owning a 10% undivided interest in the normal course of business for the foreseeable future.claims. The Company has incurred losses since inception resultingthe option to increase its ownership interest by an additional 50% by a total payment of $1,300,648 for exploration and development costs as follows: $100,648 within year one for an additional 10/%, $600,000 in year two for an accumulated deficit of $1,043,770 as of September 30, 2020additional 20% and further losses are anticipated$600,000 in year three for an additional 20% ownership interest. The Earn-In Agreement grants Altair the development of its business raising substantial doubt aboutexclusive right to explore the Company’s ability to continue as a going concern. The ability to continue as a going concern is dependent upon the Company generating profitable operations in the future and/or obtaining the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management intends to finance operating costs over the next twelve months with existing cash on hand, loans from third parties and/or private placement of common stock. properties.

NOTE 32 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanyingCompany’s unaudited financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”), and pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”) and reflect all adjustments, consisting of normal recurring adjustments, which management believes are necessary to fairly present the financial position, results of operations and cash flows of the Company as of and for the sixnine month periods ending September 30,December 31, 2020 and 2019not necessarily indicative of the results to be expected for the full year ending March 31, 2021. These unaudited financial statements should be read in conjunction with the financial statements and related notes included in the Company’s Annual Report on Form 10-K for the year endingended March 31, 2020.

Use of estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results may differ from those estimates.

Cash and Cash Equivalents

For purposes of the statement of cash flows, the Company considers all highly liquid instruments purchased with an original maturity of three months or less to be cash equivalents.

The Company's bank accounts are deposited in insured institutions. The funds are insured up to $250,000. At September 30,December 31, 2020 the Company's bank deposits did not exceed the insured amounts.

Convertible Promissory Notes

| F-5 |

The Company has issued Promissory Notes with conversion provisions that allow the holder to convert the note into shares of the Company at a discount. The Company records an expense calculated at the date of issuance based on the amount the note could be converted into at that time, over and above the note payable.

Mining Expenses

The Company records all mining exploration and evaluation costs as expenses in the period in which they are incurred.

Basic and Diluted Income (Loss) Per Share

The Company computes loss per share in accordance with “ASC-260”, “Earnings per Share” which requires presentation of both basic and diluted earnings per share on the face of the statement of operations. Basic loss per share is computed by dividing net loss available to common shareholders by the weighted average number of outstanding common shares during the period. Diluted loss per share gives effect to all dilutive potential common shares outstanding during the period. Dilutive loss per share excludes all potential common shares if their effect is anti-dilutive.

Income Taxes

The Company follows the liability method of accounting for income taxes. Under this method, deferred income tax assets and liabilities are recognized for the estimated tax consequences attributable to differences between the financial statement carrying values and their respective income tax basis (temporary differences). The effect on deferred income tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

Fair Value of Financial Instruments

The Company follows paragraph 825-10-50-10 of the FASB ASC 820 "Fair Value MeasurementsAccounting Standards Codification for disclosures about fair value of its financial instruments and Disclosures"paragraph 820-10-35-37 of the FASB Accounting Standards Codification (“Paragraph 820-10-35-37”) to measure the fair value of its financial instruments. Paragraph 820-10-35-37 establishes a three-tierframework for measuring fair value in accounting principles generally accepted in the United States of America (U.S. GAAP), and expands disclosures about fair value measurements. To increase consistency and comparability in fair value measurements and related disclosures, Paragraph 820-10-35-37 establishes a fair value hierarchy which prioritizes the inputs in measuringto valuation techniques used to measure fair value. The hierarchy prioritizes the inputsvalue into three levels based on the extent to which inputs used in measuringbroad levels. The fair value are observable inhierarchy gives the market.

These tiers include:

Level 1: defined as observable inputs such ashighest priority to quoted prices in active markets;

Level 2: defined as inputs other than quoted prices(unadjusted) in active markets thatfor identical assets or liabilities and the lowest priority to unobservable inputs. The three levels of fair value hierarchy defined by Paragraph 820-10-35-37 are either directly or indirectly observable; anddescribed below:

Level 3: defined as unobservable inputs in which little or no market data exists, therefore requiring an entity to develop its own assumptions.

| Level 1: | Quoted market prices available in active markets for identical assets or liabilities as of the reporting date. |

| Level 2: | Pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date. |

| Level 3: | Pricing inputs that are generally unobservable inputs and not corroborated by market data. |

The carrying amountsamount of the Company’s financial assets and liabilities, such as cash, prepaid expenses and accrued liabilitiesexpenses approximate their fair valuesvalue because of the short maturity of thesethose instruments.

Use The Company’s notes payable approximates the fair value of Estimatessuch instruments as the notes bear interest rates that are consistent with current market rates.

The preparationfollowing table classifies the Company’s liabilities measured at fair value on a recurring basis into the fair value hierarchy as of financial statementsDecember 31, 2020:

| Description | Level 1 | Level 2 | Level 3 | Total Losses | ||||||||||||||

| Derivative | $ | — | $ | — | $ | 368,001 | $ | (368,001 | ) | |||||||||

| Total | $ | — | $ | — | $ | 368,001 | $ | (368,001 | ) | |||||||||

Recently Adopted Accounting Pronouncements

The Company has implemented all new accounting pronouncements that are in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dateeffect. These pronouncements did not have any material impact on the financial statements unless otherwise disclosed, and the reported amountCompany does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of revenues and expenses during the reporting period. Actual results could differ from those estimates.operations.

Reclassifications

NOTE 3 - GOING CONCERN

Certain reclassificationsThe Company’s unaudited financial statements have been madeprepared on a going concern basis, which assumes the Company will be able to the prior period financial information to conform to the presentation usedrealize its assets and discharge its liabilities in the normal course of business for the foreseeable future. The Company has incurred losses since inception resulting in an accumulated deficit of $3,338,597 as of December 31, 2020 ($1,893,450 of the accumulated deficit in non-cash stock-based compensation expense). Further losses are anticipated in the development of its business raising substantial doubt about the Company’s ability to continue as a going concern. The ability to continue as a going concern is dependent upon the Company generating profitable operations in the future and/or obtaining the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management intends to finance operating costs over the next twelve months with existing cash on hand, loans from third parties and/or private placement of common stock. The financial statements forof the six month period September 30, 2020.Company do not include any adjustments that may result from the outcome of these uncertainties.

| F-6 |

NOTE 4 – PROMISSORYCONVERTIBLE NOTES PAYABLE

A summary of the Company’s convertible notes as of December 31, 2020 is presented below:

Williams Ten, LLC

| Note Holder | Date | Maturity Date | Interest | Balance March 31, 2020 | Additions | Balance December 31, 2020 | ||||||||||||||||

| Williams Ten, LLC (1) | 5/11/2020 | 5/11/2021 | 8 | % | — | $ | 15,000 | $ | 15,000 | |||||||||||||

| EROP Capital, LLC (2) | 5/13/2020 | 5/13/2021 | 8 | % | — | 20,000 | 20,000 | |||||||||||||||

| Thirty 05, LLC (1) | 5/18/2020 | 5/18/2021 | 8 | % | — | 17,500 | 17,500 | |||||||||||||||

| EROP Capital, LLC (2) | 6/5/2020 | 6/5/2021 | 8 | % | — | 10,000 | 10,000 | |||||||||||||||

| EROP Capital, LLC (2) | 7/16/2020 | 7/16/2021 | 8 | % | — | 7,500 | 7,500 | |||||||||||||||

| EROP Capital, LLC (2) | 8/14/2020 | 8/14/2021 | 8 | % | — | 12,500 | 12,500 | |||||||||||||||

| Thirty 05, LLC (3) | 8/14/2020 | 8/14/2021 | 8 | % | — | 12,500 | 12,500 | |||||||||||||||

| EROP Capital, LLC (2) | 8/27/2020 | 8/27/2021 | 8 | % | — | 7,500 | 7,500 | |||||||||||||||

| EROP Capital, LLC (1) | 9/30/2020 | 9/30/2021 | 8 | % | — | 10,000 | 10,000 | |||||||||||||||

| EROP Capital, LLC (1) | 12/3/2020 | 12/3/2021 | 8 | % | — | 7,000 | 7,000 | |||||||||||||||

| EROP Capital, LLC (1) | 12/7/2020 | 12/7/2021 | 8 | % | — | 30,000 | 30,000 | |||||||||||||||

| Thirty 05, LLC (3) | 12/31/2020 | 12/20/2021 | 8 | % | — | 75,000 | 75,000 | |||||||||||||||

| Total | $ | — | $ | 224,500 | $ | 224,500 | ||||||||||||||||

On May 11, 2020, the Company issued a convertible note payable to Williams Ten, LLC in the amount of $15,000.

The note has conversion provisions allowing the holder to convert the note into shares of the Company at a discount, as described in the table below. At issuance the value of the conversion feature was less than the face amount of the note payable.

At September 30, 2020 the balanceTotal accrued interest on the outstanding convertible note payable with interest accrued was $15,467.

Further details of the outstanding convertible noteabove Notes as of September 30,December 31, 2020, are as follows:was $4,779.

EROP Capital, LLC

On May 13, 2020, the Company issued a convertible note payable to EROP Capital, LLC in the amount of $20,000.

The note has conversion provisions allowing the holder to convert the note into shares of the Company at a discount, as described in the table below. The Company recorded an expense of $1,057 which was calculated at issuance (May 13, 2020) based on the amount the note could be converted into at that time, over and above the note payable.

At September 30, 2020 the balance on the outstanding convertible note payable with interest accrued was $20,614.

Further details of the outstanding convertible note as of September 30, 2020 are as follows:

Thirty 05, LLC

On May 18, 2020, the Company issued a convertible note payable to Thirty 05, LLC in the amount of $17,500.

The note has conversion provisions allowing the holder to convert the note into shares of the Company at a discount, as described in the table below. At issuance the value of the conversion feature was less than the face amount of the note payable.

At September 30, 2020 the balance on the outstanding convertible note payable with interest accrued was $18,018.

Further details of the outstanding convertible note as of September 30, 2020 are as follows:

EROP Capital, LLC

On June 5, 2020, the Company issued a convertible note payable to EROP Capital, LLC in the amount of $10,000.

The Company determined there to be an embedded derivative liability present per the criteria of ASC 815, which requires the elements of the instrument to be bifurcated. The note has conversion provisions allowing the holder to convert the note into shares of the Company at a discount, as described in the table below. The Company recorded an expense of $528 which was calculated at issuance (June 5, 2020) based on the amount the note could be converted into at that time, over and above the note payable.

At September 30, 2020 the balance on the outstanding convertible note payable with interest accrued was $10,256.

Further details of the outstanding convertible note as of September 30, 2020 are as follows:

EROP Capital, LLC

On July 16, 2020, the Company issued a convertible note payable to EROP Capital, LLC in the amount of $7,500.

The note has conversion provisions allowing the holder to convert the note into shares of the Company at a discount, as described in the table below. The Company recorded an expense of $396 which was calculated at issuance (July 16, 2020) based on the amount the note could be converted into at that time, over and above the note payable.

At September 30, 2020 the balance on the outstanding convertible note payable with interest accrued was $7,651.

Further details of the outstanding convertible note as of September 30, 2020 are as follows:

EROP Capital, LLC

On August 14, 2020, the Company issued a convertible note payable to EROP Capital, LLC in the amount of $12,500.

The note has conversion provisions allowing the holder to convert the note into shares of the Company at a discount, as described in the table below. The Company recorded an expense of $660 which was calculated at issuance (August 14, 2020) based on the amount the note could be converted into at that time, over and above the note payable.

At September 30, 2020 the balance on the outstanding convertible note payable with interest accrued was $12,629.

Further details of the outstanding convertible note as of September 30, 2020 are as follows:

Thirty 05, LLC

On August 14, 2020, the Company issued a convertible note payable to Thirty 05, LLC in the amount of $12,500.

The note has conversion provisions allowing the holder to convert the note into shares of the Company at a discount, as described in the table below. At issuance the value of the conversion feature was less than the face amount of the note payable.

At September 30, 2020 the balance on the outstanding convertible note payable with interest accrued was $12,629.

Further details of the outstanding convertible note as of September 30, 2020 are as follows:

EROP Capital, LLC

On August 27, 2020, the Company issued a convertible note payable to EROP Capital, LLC in the amount of $7,500.

The note has conversion provisions allowing the holder to convert the note into shares of the Company at a discount, as described in the table below. The Company recorded an expense of $396 which was calculated at issuance (August 27, 2020) based on the amount the note could be converted into at that time, over and above the note payable.

At September 30, 2020 the balance on the outstanding convertible note payable with interest accrued was $7,556.

Further details of the outstanding convertible note as of September 30, 2020 are as follows:

EROP Capital, LLC

On September 30, 2020, the Company issued a convertible note payable to EROP Capital, LLC in the amount of $10,000.

The note has conversion provisions allowing the holder to convert the note into shares of the Company at a discount, as described in the table below. At issuance the value of the conversion feature was less than the face amount of the note payable.

At September 30, 2020 the balance on the outstanding convertible note payable with interest accrued was $10,000.

Further details of the outstanding convertible note as of September 30, 2020 are as follows:

| On notice, the Note holder has the right to convert all or a portion of the outstanding balance of the Note into common shares of the Company at a rate of the lesser of (i) $0.25 or (ii) |

| (3) | On notice, the Note holder has the right to convert all or a portion of the outstanding balance of the Note into common shares of the Company at a rate of the lesser of (i)$0.25 or 70% of the lowest closing bid price of the common stock in the 15 days prior to conversion. |

| F-7 |

A summary of the activity of the derivative liability for the notes above is as follows:

| Balance at March 31, 2020 | $ | — | ||

| Increase to derivative due to new issuances | 189,392 | |||

| Decrease to derivative due to conversion/repayments | — | |||

| Derivative loss due to mark to market adjustment | 178,609 | |||

| Balance at December 31, 2020 | $ | 368,001 |

A summary of quantitative information about significant unobservable inputs (Level 3 inputs) used in measuring the Company’s derivative liability that are categorized within Level 3 of the fair value hierarchy as of December 31, 2020 is as follows:

| Inputs | December 31, 2020 | ||

| Stock price | $ | 0.29 | |

| Conversion price | $ | 0.175 – 0.20 | |

| Volatility (annual) | 442.86% - 735.46% | ||

| Risk-free rate | .09 - .10 | ||

| Dividend rate | — | ||

| Years to maturity | .36 - 1 | ||

NOTE 5 – LOANS PAYABLE

A summary of the Company’s loans payable as of December 31, 2020 is presented below:

| Note Holder | Date | Maturity Date | Interest | Balance March 31, 2020 | Additions | Balance December 31, 2020 | ||||||||||||||||

| Third party | 8/24/2020 | 8/24/2021 | 0 | % | 14,165 | $ | — | $ | 14,165 | |||||||||||||

| Byron Hampton | 8/24/2020 | 8/24/2021 | 8 | % | — | 9,990 | 9,990 | |||||||||||||||

| Byron Hampton | 12/22/2020 | 12/22/2021 | 8 | % | — | 5,000 | 5,000 | |||||||||||||||

| Byron Hampton | 12/30/2020 | 12/30/2021 | 8 | % | — | 20,000 | 20,000 | |||||||||||||||

| EROP Enterprises, LLC | 12/29/2020 | 12/29/2022 | 6 | % | — | 100,000 | 100,000 | |||||||||||||||

| Total | $ | 14,165 | $ | 134,990 | $ | 149,155 | ||||||||||||||||

Total accrued interest on the above notes payable as of December 31, 2020 was $329.

Byron Hampton

| F-8 |

NOTE 6 – COMMON STOCK

On August 24,September 1, 2020, the Company entered into a service agreement with Oliver Goeservices LLC for a term of one year. Per the terms of the agreement the Company will issue them 300,000 shares of common stock per month. In addition, they received 150,000 shares of common stock for services provided prior to the execution of the service agreement. As of December 31, 2020, Oliver Goeservices LLC received 450,000 shares of common stock for total non-cash expense of $450. In addition, 900,000 shares have not yet been issued a promissory note payable to Mr. Byron Hampton inby the amounttransfer agent and have been disclosed on the balance sheet as stock-based compensation payable. The shares were valued at the closing stock price on the date of $9,990. The note has no conversion provisions.grant for total non-cash expense of $168,000.

At September 30, 2020 the balance on the outstanding note payable with interest accrued was $10,071.

Further details of the outstanding note as of September 30, 2020 are as follows:

Interest expense for these notes as of September 30, 2020 and 2019 was $2,400 and $0.

Outstanding balances on the convertible notes and the promissory note as of September 30, 2020 and 2019 were $124,890 and $0. Furthermore, the total outstanding derivative liabilities on the convertible notes as of September 30, 2020 and 2019 were $3,037 and $0.

NOTE 5 – COMMON STOCK

The Company has 2,000,000,000 common shares authorized with a par value of $0.001 per share.

The Company had 496,732,553 common shares issued and outstanding at March 31, 2020.

During the three month period ended June 30,On December 9, 2020, the Company issued 11,000,000 of its common shares in partial settlement of the outstanding balance ofentered into two separate service agreements with Paul Pelosi to be a Promissory Note due to Alan Smith. In addition, the Company issued 4,000,000 common shares to Mr. Leonard Lovallo for his role as an independent member of the Company’s Boardadvisory board. Both agreements are for a term of Directors.one year. Per the terms of the agreements the Company will issue Mr. Pelosi a total of 6,000,000 shares of common stock. 50% of the shares are to be issued and earned immediately with the other 50% issued and earned on June 30, 2021. As of December 31, 2020, the 3,000,000 shares have not yet been issued by the transfer agent and have been disclosed on the balance sheet as stock-based compensation payable. The shares were valued at the closing stock price on the date of grant for total non-cash expense of $870,000.

On December 14, 2020, the Company entered into a service agreement with Adam Fishman to be a member of the Company’s advisory board for a term of one year. Per the terms of the agreements the Company will issue Mr. Fishman 5,000,000 shares of common stock. 50% of the shares are to be issued and earned immediately with the other 50% issued and earned on June 30, 2021. As of December 31, 2020, the 2,500,000 shares have not yet been issued by the transfer agent and have been disclosed on the balance sheet as stock-based compensation payable. The shares were valued at the closing stock price on the date of grant for total non-cash expense of $750,000.

Refer to Note 8 for common stock issued to related parties.

NOTE 7 – WARRANTS

On October 15, 2020, the Company entered into a service agreement with a third party for a term of six months. Per the terms of the agreement the party was granted 1,000,000 warrants to purchase shares of common stock. The warrant vest on April 15, 2021.

The Company had 511,732,553 common shares issuedwarrants have an exercise price of $0.25 and outstanding at June 30, 2020.

expire in three years. The aggregate fair value of the warrants totaled $180,000 based on the Black Scholes Merton pricing model using the following estimates: stock price of $0.18, exercise price of $0.25, 1.57% risk free rate, 735.46% volatility and expected life of the warrants of 3 years. The value of the warrants is being amortized to expense over the six-month term of the agreement. During the three month periodnine months ended September 30,December 31, 2020, the Company issued 26,000,000 common shares to Mr. Leonard Lovallo for his role as Chief Executive Office and Presidentrecognized $75,000 of the Company.expense.

A summary of the status of the Company’s outstanding stock warrants and changes during the year is presented below:

| Number of Warrants | Weighted Average Price | Weighted Average Fair Value | Aggregate Intrinsic Value | |||||||||||||||

| Outstanding, March 31, 2020 | — | $ | — | $ | — | $ | — | |||||||||||

| Issued | 1,000,000 | $ | 0.25 | $ | 0.18 | |||||||||||||

| Exercised | — | $ | — | $ | — | |||||||||||||

| Expired | — | $ | — | $ | — | |||||||||||||

| Outstanding, December 31, 2020 | 1,000,000 | $ | 0.25 | $ | 0.18 | $ | — | |||||||||||

| Exercisable, December 31, 2020 | — | $ | — | — | $ | — | ||||||||||||

| Range of Exercise Prices | Number Outstanding 12/31/2020 | Weighted Average Remaining Contractual Life | Weighted Average Exercise Price | ||||

| $0.25 | 1,000,000 | 2.79 years | $0. 25 | ||||

The Companyaggregate intrinsic value represents the total pretax intrinsic value, based on warrants with an exercise price less than the Company’s stock price as of December 31, 2018, which would have been received by the warrant holder had 537,732,553 common shares issued and outstanding at September 30, 2020.

the warrant holder exercised their warrants as of that date.

| F-9 |

NOTE 68 – RELATED PARTY TRANSACTIONS

On September 29, 2017, a Promissory Note (the “Note”) in the principal amount of $45,000 was issued to Alan Smith the Company’s former sole officer and director for loans made to the Company in prior periods. The Note was unsecured and bore interest at 6% per annum. The Note matured March 31, 2018. On June 29, 2018, the Company made a partial payment of $15,000 on the Note. The balance of the Note including principal and interest was repaid through a cash payment of $20,000 and the issuance of 11,000,000 common shares valued at $0.0012 per share in the three monththree-month period ended June 30, 2020.

On April 10, 2018, the Company agreed to pay the former sole officer and director of the Company $2,500 per month for a period of 4 months for the provision of management and financial services. On September 1, 2018, the Company agreed to extend this contract on a month-to-month basis at the existing rate of $2,500 per month. $22,500 was paid and $5,000 accrued as payable to February 28, 2019 when the agreement was terminated. The payable amount was paid in the three monththree-month period ended June 30, 2020.

On April 29, 2020 the Company entered into a General Services Agreement with Alan Smith, a director and the Company’s sole officer for the performance of duties of a CEO including the provision of management and financial services. The Agreement commenced May 1, 2020 and was to remain in full force and effect until December 31, 2010.2020. Under the terms of the Agreement, Alan Smith received the following compensation:

| i) | A monthly fee of $2,500; |

| ii) | Payment of past fee accruals in cash in the amount $5,000; |

| iii) | Settlement of the of the outstanding balance of the Promissory Note due to Alan Smith in the amount of $30,000 plus accrued interest through the payment of $20,000 in cash and the issuance of 11,000,000 common shares at $0.0012 per share. |

On September 1, 2020 Mr. Smith notified the Company of his need to resign from his positions with the Company for health reasons. The General Services Agreement was therefore terminated. A new agreement was reached with

During the nine months ended December 31, 2020, Company issued 4,000,000 common shares to Mr. Smith whereby he will provide managementLeonard Lovallo for his role as an independent member of the Company’s Board of Directors and financial consulting services to26,000,000 common shares for his role as Chief Executive Office and President of the Company on a month by month basis at $2,500 per month.Company.

NOTE 79 – SUBSEQUENT EVENTS

In accordance with ASC 855-10,SFAS 165 (ASC 855-10) management has performed an evaluation of subsequent events through the Company has analyzed its operations from October 1, 2020date that the financial statements were available to November 3, 2020be issued and has determined that it has no otherdoes not have any material subsequent events to disclose in these financial statements.statements other than the following.

On January 3, 2021, the Company made a $45,000 payment to AMLM per the terms of its END OF NOTES TO FINANCIAL STATEMENTSEarn-In Agreement (Note 1).

Subsequent to December 31, 2020, the Company issued 5,500,000 shares of common stock that had been granted but not yet issued as of December 31, 2020.

Subsequent to December 31, 2020, the Company issued 1,500,000 shares of common stock to Oliver Geoservices LLC pursuant to the terms of its service agreements; 900,000 of which were shares granted as of December 31, 2020.

Subsequent to December 31, 2020, the Company issued 2,000,000 shares of common stock pursuant to the terms of its binding term sheet with St. Georges Eco-Mining Corp.

Subsequent to December 31, 2020, the Company engaged a geological surveying company for the purposes of providing a NI 43-101 report on the Walker Ridge property.

Subsequent to December 31, 2020, the Company has, due to a variety of factors, allowed certain of the Walker Ridge claims to expire, while maintaining in good standing its agreement with Oliver Geoservices LLC.

| F-10 |

| ITEM 2. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION OR PLAN OF OPERATION |

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. You should read this report completely and with the understanding that actual future results may be materially different from what we expect. The forward-looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Our Business

Altair International Corp. (“Altair”) is a development stage company that was incorporated in Nevada on December 20, 2012.

The Company is currently engaged in identifying and assessing new business opportunities. In this regard, the Company entered into a Mining Lease effective August 3, 2020 with Oliver Geoservices LLC under which the Company received an exclusive lease to mine certain unpatented lode mining claims known as the Walker Ridge located in Elko CountryCounty, Nevada for a period of five years. The lease can be extended for an additional twenty years if certain extension payments are made within the term of the lease. The Company made an initial payment of $25,000 to secure the lease and is required to make advance royalty payments to maintain its exclusivity commencing December 1, 2020, starting at $25,000 and increasing in $25,000 increments each year for the initial five year term to $100,000 as well as a 3% net smelter fee royalty on all mineral production from the leased property. The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the Agreement which was filed as Item 1.01 to a Form 8-K filed on August 14, 2020.

The Company has completed the staking process of 187 claims on the Walker Ridge site. The claims must be registered with the Nevada Bureau of Land Management. We estimate that the cost to register the claims to be between $40,000 and $50,000. To date, we have not registered the claims. The Company is currently awaiting completion by the United States Forestry Service (the “USFS”) of the calculations for the required Reclamation Bond which is required to begin work on the drill site. We estimate the value of the bond to be between $40,000 and $50,000.

About Walker Ridge

Location

The Walker Ridge Property is located in Elko County, Nevada, approximately 40 air miles (64 km) north of Elko. It is reached by driving north approximately 55 miles (88 km) from Elko on highway 225 to the PX ranch near mile marker 55. Traveling west on the gravel road for 20 miles (32 km) reaches the eastern boundary of the property. The center of the target area is at a latitude/longitude of 41 30’38” North and 115 55’48” West. Driving time from Elko to the property is approximately one hour.

Walker Ridge Property History

A large area (boundaries uncertain), located between the Jerritt Canyon and Big Springs properties, including ground covered by the present Walker Ridge Property claims, was explored by Tenneco (subsequently acquired by Echo Bay). From 1985-87, Tenneco/Echo Bay conducted geologic mapping, rock chip and soil geochemistry sampling (3400 samples) and drilled 31 shallow holes (maximum depth 400 ft or 122m), mostly to the southwest of the Walker Ridge Property. There are no useable maps available from this work, only summary reports. One shallow hole drilled within the present claim block (Figure 7.3), hole number FC1-87, intercepted Snow Canyon Fm below McAfee Quartzite at 245 feet (75m). It was anomalous in gold from there to TD at 300 feet (91m).

Independence Mining Company optioned the same property from Echo Bay between 1988 and 1993, drilling 6 holes totaling 4,920 feet (1,500m), southwest of the present claims. A deep rotary/core hole reached favorable Carlin-style host lithologies (Roberts Mountain Formation) at 1,495 feet (456m), or approximately 6,000 feet (1,830m) above mean sea level. There are no maps showing this work currently available, only summary reports. Echo Bay was absorbed by Kinross several years ago. It is possible that some of that data may be preserved in the archives of Kinross.

In 2007 an infill soil sampling program was carried out by Stratos over the central part of the current claim block to reduce the sample spacing to 200 feet (60m). The Company optioned the property in 2011. At the direction of the Company, Walker Ridge Gold Corp staked additional claims in 2011 and 2012. All claim staking has been paid by the Company and all additional claims have become a part of the option agreement. The Company has carried out gravity and CSAMT geophysical surveys in the fall of 2012.

There are no resource estimates, historical or current, and no recorded production from the property.

| 14 |

Risk Factors

As it applies to the Company’s mining and mineral exploration activities, the Company is in the business of acquiring, exploring and, if warranted, developing and exploiting natural exploration and evaluation assets. Due to the nature of the Company's proposed business and the present stage of exploration of its exploration and evaluation assets, the following risk factors, among others, will apply:

The Mining Industry is Intensely Competitive: The Company's business is the acquisition and exploration of exploration and evaluation assets. The mining industry is intensely competitive, and the Company will compete with other companies that have far greater resources.

Resource Exploration and Development is Generally a Speculative Business: Resource exploration and development is a speculative business and involves a high degree of risk, including, among other things, unprofitable efforts resulting not only from the failure to discover resource deposits but from finding resource deposits which, though present, are insufficient in size to return a profit from production. The marketability of natural resources that may be acquired or discovered by the Company will be affected by numerous factors beyond the control of the Company. These factors include market fluctuations, the proximity and capacity of natural resource markets, government regulations, including regulations relating to prices, taxes, royalties, land use, importing and exporting of resources and environmental protection.

The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in the Company not receiving an adequate return on invested capital. The vast majority of exploration projects do not result in the discovery of commercially mineable deposits of ore.

Fluctuation of Metal Prices: Even if commercial quantities of resource deposits are discovered by the Company, there is no guarantee that a profitable market will exist for the sale of the metals produced. Factors beyond the control of the Company may affect the marketability of any substances discovered. The prices of various metals have experienced significant movement over short periods of time, and are affected by numerous factors beyond the control of the Company, including international economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates and global or regional consumption patterns, speculative activities and increased production due to improved mining and production methods.

The supply of and demand for metals are affected by various factors, including political events, economic conditions and production costs in major producing regions. There can be no assurance that the price of any commodities will be such that any of the properties in which the Company has, or has the right to acquire, an interest may be mined at a profit.

Permits and Licenses: The operations of the Company will require consents, approvals, licenses and/or permits from various governmental authorities. There can be no assurance that the Company will be able to obtain all necessary consents, approvals, licenses and permits that may be required to carry out exploration, development and mining operations at its projects.

No Assurance of Profitability: The Company has no history of earnings and, due to the nature of its business, there can be no assurance that the Company will ever be profitable. The Company has not paid dividends on its shares since incorporation and does not anticipate doing so in the foreseeable future. The only present source of funds available to the Company is from the sale of its common shares or, possibly, from the sale or optioning of a portion of its interest in its exploration and evaluation assets.

Even if the results of exploration are encouraging, the Company may not have sufficient funds to conduct the further exploration that may be necessary to determine whether or not a commercially mineable deposit exists. While the Company may generate additional working capital through further equity offerings or through the sale or possible syndication of its property, there can be no assurance that any such funds will be available on favorable terms, or at all. At present, it is impossible to determine what amounts of additional funds, if any, may be required. Failure to raise such additional capital could put the continued viability of the Company at risk.

Uninsured or Uninsurable Risks: The Company may become subject to liability for pollution or hazards against which it cannot insure or against which it may elect not to insure where premium costs are disproportionate to the Company's perception of the relevant risks. The payment of such insurance premiums and of such liabilities would reduce the funds available for exploration and production activities.

Government Regulation: Any exploration, development or mining operations carried on by the Company will be subject to government legislation, policies and controls relating to prospecting, development, production, environmental protection, mining taxes and labor standards. In addition, the profitability of any mining prospect is affected by the market for precious and/or base metals which is influenced by many factors including changing production costs, the supply and demand for metals, the rate of inflation, the inventory of metal producing corporations, the political environment and changes in international investment patterns.

| 15 |

Environmental Matters: Existing and possible future environmental legislation, regulations and actions could cause significant expense, capital expenditures, restrictions and delays in the activities of the Company, the extent of which cannot be predicted and which may well be beyond the capacity of the Company to fund. The Company's right to exploit any mining properties is and will continue to be subject to various reporting requirements and to obtaining certain government approvals and there can be no assurance that such approvals, including environment approvals, will be obtained without inordinate delay or at all.

Insufficient Financial Resources: The Company does not presently have sufficient financial resources to undertake by itself the exploration and development of any significant exploration and development programs. The development of the Company's property will therefore depend upon the Company's ability to obtain financing through the joint venturing of projects, private placement financing, public financing or other means. There can be no assurance that the Company will be successful in obtaining the required financing. Failure to raise the required funds could result in the Company losing, or being required to dispose of, its interest in its property. In particular, failure by the Company to raise the funding necessary to maintain in good standing the various option agreements it has entered into could result in the loss of the rights of the Company to such property. In addition, should the Company incur significant losses in future periods, it may be unable to continue as a going concern, and realization of assets and settlement of liabilities in other than the normal course of business may be at amounts significantly different from those reflected in its current financial statements.

Uncertainty of Resource Estimates/Reserves: The Company has not established the presence of any proven and probable reserves at its exploration and evaluation asset. There can be no assurance that subsequent testing or future studies will establish proven and probable reserves at the Company's exploration and evaluation asset. The failure to establish proven and probable reserves could restrict the Company's ability to successfully implement its strategies for long-term growth

growth.

The Company had previously planned to enter into license and distribution agreements for oral thin film nutraceutical products. This plan was abandoned in the 2017 fiscal year as the Company was unable to obtain the working capital required to bring the products to market.

RESULTS OF OPERATIONS

We have incurred recurring losses to date. Our financial statements have been prepared assuming that we will continue as a going concern and accordingly do not include adjustments relating to the recoverability and realization of assets and classification of liabilities that might be necessary should we be unable to continue in operation.

We expect we will require additional capital to meet our long term operating requirements. Management intends to finance operating costs over the next twelve months with existing cash on hand, loans from third parties and\or private placements of common stock. No assurance can be given that such funds will be available.

Working Capital

As of September 30, 2020 | As of March 31, 2020 | |||||||

| Total Current Assets | $ | 12,929 | 1,815 | |||||

| Total Current Liabilities | 165,509 | 55,527 | ||||||

| Working Capital (Deficit) | $ | (152,580 | ) | (53,712 | ) | |||

Cash Flows

Six Months Ended September 30, 2020 | Six Months Ended 2019 | |||||||

| Cash Flows from (used in) Operating Activities | $ | (92,624 | ) | (90 | ) | |||

| Cash Flow from (used in) Investing Activities | — | — | ||||||

| Cash Flows from (used in) Financing Activities | 105,527 | |||||||

| Net Increase (decrease) in Cash during period | $ | 12,903 | (90 | ) | ||||

Operating Revenues

During the six month period ending September 30, 2020, the Company did not record any revenue. During fiscal year ended March 31, 2020, the Company did not generate any revenue.

Operating Expenses and Net Loss

Operating expenses during the three month period ended September 30, 2020 were $100,077 consistingResults of general and administrative expenses of $43,951, which includes corporate overhead and financial and contracted services, and mining expenses of $56,126, as compared to $345 general and administrative expensesoperations for the three month periodmonths ended September 30,December 31, 2020 compared to December 31, 2019.

Revenues

InterestThe Company has not recognized any revenue to date.

Operating Expenses

Mining and exploration expense for the three month periodmonths ended September 30,December 31, 2020 was $1,806$22,875 compared to $0 for the three months ended December 31, 2019. The Company’s mining and exploration expense has increased in the current period as it pursues its new mining activities.

Compensation expense – related party for the three months ended December 31, 2020 was $14,000 compared to $0 for the three months ended December 31, 2019. In the current period the Company incurred $14,000 of compensation expense for its new CEO.

General and administrative expense for the three months ended December 31, 2020 was $1,890,280 compared to $345 for the three months ended December 31, 2019. In the current period we incurred $1,818,450 of non-cash stock compensation expense and $75,000 of non-cash warrant expense.

Other Expense

Total other expense for the three months ended December 31, 2020, was $367,672, which consisted of $2,708 of interest expense and $364,964 of derivative expense associated with our convertible notes, compared to $454 forof interest expense in the three month period ended September 30, 2019.prior period.

Net Loss

Net loss for the three monththree-month period ended September 30,December 31, 2020 was $103,335,$2,294,827, in comparison to a net loss of $799 for the three months ended September 30,December 31, 2019. The large increase to our net loss is largely attributed to our non-cash stock-based compensation expense.

Results of operations for the nine months ended December 31, 2020 compared to December 31, 2019.

Revenues

The Company has not recognized any revenue to date.

Operating Expenses

Mining and exploration expense for the nine months ended December 31, 2020 was $79,001 compared to $0 for the nine months ended December 31, 2019. The Company’s mining and exploration expense has increased in the current period as it pursues its new mining activities.

Compensation expense – related party for the nine months ended December 31, 2020 was $14,000 compared to $0 for the nine months ended December 31, 2019. In the current period the Company incurred $14,000 of compensation expense for its new CEO.

General and administrative expense for the nine months ended December 31, 2020 was $1,971,210 compared to $1,035 for the nine months ended December 31, 2019. In the current period we incurred $1,818,450 of non-cash stock compensation expense and $75,000 of non-cash warrant expense.

Other Expense

Total other expense for the nine months ended December 31, 2020, was $373,248, which consisted of $5,247 of interest expense and $368,001 of derivative expense associated with our convertible notes, compared to $1,356 of interest expense in the prior period.

Net Loss

Net loss for the nine-month period ended December 31, 2020 was $2,437,459, in comparison to a net loss of $2.391 for the nine months ended December 31, 2019. The large increase to our net loss is largely attributed to our non-cash stock-based compensation expense.

Liquidity and Capital Resources

At September 30, 2020, the Company’s current assets were $12,929 and at March 31, 2020 were $1,815. At September 30, 2020, the Company had total liabilities of $165,509, consisting of $$23,417 in accounts payable, $14,165 in loans payable to a third party, $2,400 in interest payable, $112,500 in convertible notes payable, a promissory note of $9,990 and a derivative liability of 3,037. At September 30, 2020, the Company had a working capital deficit of $152,580.

At September 30, 2019, the Company’s current assets were $2,191 and at March 31, 2019 were $2,281. At September 30, 2019, the Company had total liabilities of $52,239, consisting of $5,800 in accounts payable, interest payable of $2,274, a $30,000 Promissory Note payable to a related party and $14,165 in loans payable to a third party. At September 30, 2019, the Company had a working capital deficit of $50,048.

Cash flow from/used in Operating ActivitiesActivities.

We have not generated positive cash flows from operating activities. During the six monthnine-month period ended September 30,December 31, 2020, the Company used $92,624$109,361 of cash for operating activities. For the six month period ended September 30, 2019 the Company used $90activities compared to $116 of cash for operating activities.activities in the prior period.

Cash flow used in Investing Activities.

During the nine months ended December 31, 2020, we paid $30,000 as part of our Earn-In Agreement with American Lithium Minerals, Inc.

Cash flow from Financing Activities

We have financed our operations primarily from either advancements or the issuance of equity and debt instruments. During the sixnine month period ended September 30,December 31, 2020 the Company received $122,490$359,490 of cash from financing activities offset by payments of $20,000 to settle loans payable to related parties. The Company also recorded a derivative liability expense of $3,037 in the period.

During the six month period ended September 30, 2019, the Company received $0 of cash net of loan repayments from financing activities.

Going Concern

We have not attained profitable operations and are dependent upon obtaining financing to pursue any extensive acquisitions and activities. For these reasons, our auditors stated in their report on our audited financial statements that they have substantial doubt that we will be able to continue as a going concern without further financing. The financial statements have been prepared "assuming that we will continue as a going concern," which contemplates that we will realize our assets and satisfy our liabilities and commitments in the ordinary course of business.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

Future Financings

We will continue to rely on equity sales of our common shares or debt financing arrangements in order to continue to fund our business operations. Issuances of additional shares will result in dilution to existing stockholders. There is no assurance that we will achieve any additional sales of the equity securities or arrange for debt or other financing to fund our operations and other activities.

| 17 |

Critical Accounting Policies

Our financial statements and accompanying notes have been prepared in accordance with United States generally accepted accounting principles applied on a consistent basis. The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods.

We regularly evaluate the accounting policies and estimates that we use to prepare our financial statements. A complete summary of these policies is included in the notes to our financial statements. In general, management's estimates are based on historical experience, on information from third party professionals, and on various other assumptions that are believed to be reasonable under the facts and circumstances. Actual results could differ from those estimates made by management.

Contractual Obligations

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Recently Issued Accounting Pronouncements

The Company has implemented all new accounting pronouncements that are in effect. These pronouncements did not have any material impact on the financial statements unless otherwise disclosed, and the Company does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

| 18 |

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |