If we are unable to raise capital when needed or on attractive terms,satisfy certain conditions in our Credit Agreement, we couldwill be forcedunable to delay, reduce or eliminatedraw down the remaining amount of the term loan facility.

For our research and development programs or any future commercialization efforts.

We believe that our cash, cash equivalents and investments as of September 30, 2017, will enable us to fund our operating expenses and capital expenditure requirements into 2020. We have based this estimate on assumptions that may proveCredit Agreement, we must satisfy certain conditions to be wrong, and we could exhaust our available capital resources sooner than we currently expect. Our future funding requirements, both near and long-term, will dependeligible to draw down the tranche C term loans of $25.0 million. The tranche C term loans of $25.0 million may be drawn by us on many factors, including, but not limited to the:

initiation, progress, timing, costs and results of preclinical studies and clinical trials, including patient enrollment in such trials, for ganaxolone or any other future product candidates;

clinical development plans we establish for ganaxolone and any other future product candidates;

obligation to make royalty and non-royalty sublicense receipt payments to third-party licensors, if any, under our licensing agreements;

number and characteristics of product candidatesbefore December 31, 2023, provided that we discoversatisfy certain conditions described in the Credit Agreement, including (i) the completion of one or in-license and develop;

outcome, timing and costmore financings, including through the issuance of regulatory review by the FDA and comparable foreign regulatory authorities, including the potential for the FDAcommon stock, convertible debt, subordinated debt, a synthetic royalty or comparable foreign regulatory authorities to require that we perform more studies than those that we currently expect;

costs of filing, prosecuting, defending and enforcing any patent claims and maintaining and enforcing other intellectual property rights;

effects of competing technological and market developments;

costs and timing of the implementation of commercial-scale manufacturing activities; and

costs and timing of establishing sales, marketing and distribution capabilities for any product candidates fora sublicense in which we may receive regulatory approval.

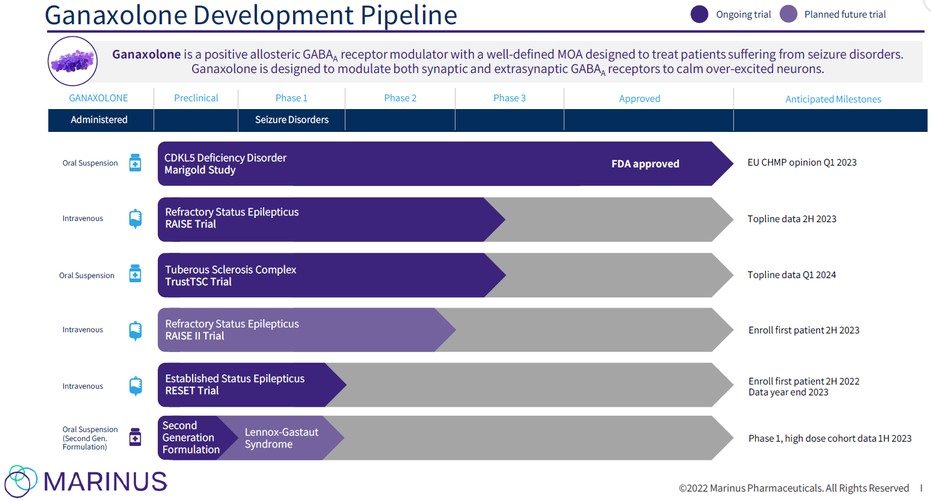

gross proceeds in an aggregate amount of at least $40.0 million and net proceeds in an aggregate amount of at least $36.0 million and (ii) either our current Phase 3 RAISE trial or a Phase 3 trial in tuberous sclerosis complex (TSC) achieving statistical significance (p value < 0.05) across all primary endpoints and ganaxolone being generally well tolerated, with a safety profile generally consistent with previous clinical trials. If we are unable to expand our operations or otherwise capitalize on our business opportunities due to a lack of capital, our ability to become profitable will be compromised. Failure to progress our product development or commercialization of ganaxolone as anticipated will have a negative effect on our business, future prospects and ability to obtain further financing on acceptable terms, if at all, and the value of the enterprise.

Raising additional capital could dilute our stockholders, restrict our operations or require us to relinquish rights to ganaxolone or any other future product candidates.

Until we can generate substantial revenue from product sales, if ever, we expect to seek additional capital through a combination of private and public equity offerings, debt financings, strategic collaborations and alliances and licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interests of stockholders will be diluted, and the terms may include liquidation or other preferences that adversely affect the rights of stockholders. Debt financing, if available, may involve agreements that include liens or restrictive covenants limiting our ability to take important actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we raise additional funds through strategic collaborations and alliances or licensing arrangements with third parties, we may have to relinquish valuable rights to ganaxolone or any other future product candidates in particular countries, or grant licenses on terms that are not favorable to us. If we are unable to raise additional funds through equity or debt financing when needed, we may be required to delay, limit, reduce or terminate our product development or commercialization efforts or grant rights to develop and market ganaxolone or any other future product candidates thatsatisfy those conditions, we would otherwise prefernot be able to developdraw down the tranche of loans and market ourselves.

We intend to expend our limited resources to pursue our sole clinical stage product candidate, ganaxolone, and may fail to capitalize on other indications, technologies or product candidates that may be more profitable or for which there may be a greater likelihood of success.

Because we have limited financial and managerial resources, we are focusing on research programs relating to ganaxolone, which concentrates the risk of product failure in the event ganaxolone proves to be ineffective or inadequate for clinical development or commercialization in this indication. As a result, we may forego or delay pursuit of opportunities for other technologies or product candidates that later could prove to have greater commercial potential. We may be unable to capitalize on viable commercial products or profitable market opportunities as a result of our resource allocation decisions. Our spending on proprietary research and development programs relating to ganaxolone may not yield any commercially viable products. If we do not accurately evaluate the commercial potential or target market for ganaxolone, we may relinquish valuable rights to ganaxolone through collaboration, licensing or other royalty arrangements in cases in which it would have been more advantageous for us to retain sole development and commercialization rights to ganaxolone.

Risks Related to Our Business and Development of Our Product

Our future success is dependent on the successful clinical development, regulatory approval and commercialization of ganaxolone, which is currently undergoing two clinical trials and will require significant capital resources and years of additional clinical development effort.

We do not have any products that have gained regulatory approval. Currently, our only clinical stage product candidate is ganaxolone. As a result, our business is dependent on our ability to successfully complete clinical development of, obtain regulatory approval for, and, if approved, successfully commercialize ganaxolone in a timely manner. We cannot commercialize ganaxolone in the United States without first obtaining regulatory approval from the FDA; similarly, we cannot commercialize ganaxolone outside of the United States without obtaining regulatory approval

from comparable foreign regulatory authorities. Before obtaining regulatory approvals for the commercial sale of ganaxolone for a target indication, we must demonstrate with substantial evidence gathered in preclinical studies and clinical trials, generally including two adequate and well-controlled clinical trials, and, with respect to approval in the United States, to the satisfaction of the FDA, that ganaxolone is safe and effective for use for that target indication and that the manufacturing facilities, processes and controls are adequate. Even if ganaxolone were to obtain approval from the FDA and comparable foreign regulatory authorities, any approval might contain significant limitations, such as restrictions as to specified age groups, warnings, precautions or contraindications, or may be subject to burdensome post-approval study or risk management requirements. If we are unable to obtain regulatory approval for ganaxolone in one or more jurisdictions, or any approval contains significant limitations, we may not be able to obtain sufficient fundingalternative financing on commercially reasonable terms or generate sufficient revenue to continueat all.

Our Credit Agreement and Revenue Interest Financing Agreement contains restrictions that limit our flexibility in operating our business.

The Credit Agreement and the development of any other product candidateRevenue Interest Financing Agreement contain various covenants that we may in-license, develop or acquire in the future. Furthermore, even if we obtain regulatory approval for ganaxolone, we will still need to develop a commercial organization, establish commercially viable pricing and obtain approval for adequate reimbursement from third-party and government payers. If we are unable to successfully commercialize ganaxolone, we may not be able to earn sufficient revenue to continue our business.

Because the results of preclinical studies or earlier clinical trials are not necessarily predictive of future results, ganaxolone may not have favorable results in later preclinical studies or clinical trials or receive regulatory approval.

Success in preclinical studies and early clinical trials does not ensure that later trials will generate adequate data to demonstrate the efficacy and safety of ganaxolone. A number of companies in the pharmaceutical and biotechnology industries, including those with greater resources and experience, have suffered significant setbacks in preclinical studies and clinical trials, even after seeing promising results in earlier studies and trials. For example, while ganaxolone showed statistical separation from placebo in a Phase 2 study in adjunctive treatment of adults with focal onset seizures, ganaxolone failed to show a similar statistical separation in a Phase 3 study for the same indication. As a result, we discontinued our program in adult focal onset seizures and to focus our efforts on advancing ganaxolone in postpartum depression, status epilepticus, and pediatric orphan indications. We do not know whether the clinical trials we may conduct will demonstrate adequate efficacy and safety to result in regulatory approval to market ganaxolone in any particular jurisdiction or indication. If clinical trials underway or conducted in the future do not produce favorable results,limit our ability to achieve regulatory approval for ganaxolone may be adversely impacted.

The therapeutic efficacyengage in specified types of transactions without the prior consent of Oaktree and safetythe Lenders holding a majority of ganaxolone are unproven, and we may not be able to successfully develop and commercialize ganaxolone in the future.

Ganaxolone is a novel compound and its potential therapeutic benefit is unproven. OurTerm Loan commitments and/or Sagard, as applicable,. These covenants limit our ability to, generate revenue from ganaxolone, which we do not expect will occur for at least the next several years, if ever, will depend heavily on our successful development and commercialization after regulatory approval, which is subject to many potential risks and may not occur. Ganaxolone may interact with human biological systems in unforeseen, ineffective or harmful ways. If ganaxolone is associated with undesirable side effects or has characteristics that are unexpected, we may need to abandon its development or limit development to certain uses or subpopulations in which the undesirable side effects oramong other characteristics are less prevalent, less severe or more acceptable from a risk-benefit perspective. Many compounds that initially showed promise in early stage testing for treating the target indications for ganaxolone have later been found to cause side effects that prevented further development of the compound. As a result of these and other risks described herein that are inherent in the development of novel therapeutic agents, we may never successfully develop, enter into or maintain third-party licensing or collaboration transactions with respect to, or successfully commercialize, ganaxolone, in which case we will not achieve profitability and the value of our stock may decline.things:

| ● | sell, transfer, lease or dispose of our assets; |

| ● | create, incur or assume additional indebtedness; |

| ● | encumber or permit liens on certain of our assets; |

| ● | make restricted payments, including paying dividends on, repurchasing or making distributions with respect to our common stock; |

| ● | make specified investments (including acquisitions, loans and advances); |

| ● | consolidate, merge, sell or otherwise dispose of all or substantially all of our assets; |

| ● | enter into certain transactions with our affiliates; |

| ● | grant certain license rights related to our products, technology and other intellectual property rights; |

| ● | in the case of the Credit Agreement, permit our cash and cash equivalents held in certain deposit accounts to at any time be less than (i) from the funding of the tranche A-2 term loans until the funding of the tranche B term loans, $20.0 million and (ii) from the funding date of the tranche B term loans until the Maturity Date, $15.0 million; and |

| ● | in the case of the Revenue Interest Financing Agreement, permit our cash and cash equivalents held in certain deposit accounts to be less than (i) from the RIFA Closing Date until the repayment of the loans under the Credit Agreement, $15.0 million and (ii) thereafter, $10.0 million. |

Clinical development of product candidates involves a lengthy and expensive process with an uncertain outcome.

Clinical testing is expensive, can take many years to complete, and is inherently uncertain as to outcome. Failure can occur at any time during the clinical trial process.

We may experience delaysThe covenants in our ongoing or future clinical trialsCredit Agreement, Revenue Interest Financing Agreement and we do not know whether planned clinical trials will begin or enroll subjects on time, needrelated security agreements may limit our ability to be redesigned or be completed on schedule, if at all. There can be no assurance that the FDA or other foreign regulatory authorities will not put clinical trials of ganaxolone on clinical hold

now or in the future. Clinical trials may be delayed, suspended or prematurely terminated for a variety of reasons, such as:

delay or failure in reaching agreement with the FDA or a comparable foreign regulatory authority on a trial design that we are able to execute;

delay or failure in obtaining authorization to commence a trial or inability to comply with conditions imposed by a regulatory authority regarding the scope or design of a clinical trial;

delay or failure in reaching agreement on acceptable terms with prospective CROs and clinical trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites;

delay or failure in obtaining institutional review board (IRB) approval or the approval of other reviewing entities, including comparable foreign regulatory authorities, to conduct a clinical trial at each site;

withdrawal of clinical trial sites from our clinical trials as a result of changing standards of care or the ineligibility of a site to participate in our clinical trials;

delay or failure in recruiting and enrolling suitable study subjects to participate in a trial;

delay or failure in study subjects completing a trial or returning for post-treatment follow-up;

clinical sites and investigators deviating from a trial protocol, failing to conduct the trial in accordance with regulatory requirements, or dropping out of a trial;

inability to identify and maintain a sufficient number of trial sites, many of which may already be engaged in other clinical trial programs, including sometake certain actions that may be for competing product candidates with the same indication;

failure ofin our third-party clinical trial managers to satisfy their contractual duties or meet expected deadlines;

delay or failure in adding new clinical trial sites;

ambiguous or negative interim results or results that are inconsistent with earlier results;

feedback from the FDA, IRBs, data safety monitoring boards, or a comparable foreign regulatory authority, or results from earlier stage or concurrent preclinical studies and clinical trials, that might require modification to the protocol for the trial;

decision by the FDA, an IRB, a comparable foreign regulatory authority, or us, or recommendation by a data safety monitoring board or comparable foreign regulatory authority, to suspend or terminate clinical trials at any time for safety issues or for any other reason;

unacceptable risk-benefit profile, unforeseen safety issues or adverse side effects or adverse events;

failure of a product candidate to demonstrate any benefit;

difficulties in manufacturing or obtaining from third parties sufficient quantities of a product candidate for use in clinical trials;

lack of adequate funding to continue the clinical trial, including the incurrence of unforeseen costs due to enrollment delays, requirements to conduct additional clinical trials or increased expenses associated with the services of our CROs and other third parties;

political developments that affect our ability to develop and obtain approval for ganaxolone, or license rights to develop and obtain approval for ganaxolone, in a foreign country; or

changes in governmental regulations or administrative actions.

Study subject enrollment, a significant factor in the timing of clinical trials, is affected by many factors including the size and nature of the subject population, the proximity of subjects to clinical sites, the eligibility criteria for the trial, the design of the clinical trial, ability to obtain and maintain subject consents, risk that enrolled subjects will drop out before completion, competing clinical trials and clinicians’ and subjects’ perceptions as to the potential advantages of the product candidate being studied in relation to other available therapies, including any new drugs that may be approved or product candidates that may be studied in competing clinical trials for the indications we are investigating. Some of our clinical trials are directed at small patient populations. Patient enrollment in these studies could be particularly challenging.long-term best interests. In the past, we have experienced delays in enrolling patients in studies directed at small patient populations. We rely on CROs and clinical trial sites to ensure the proper and timely conduct of our clinical trials, and while we have agreements governing their committed activities, we have limited influence over their actual performance.

If we experience delays in the completion of any clinical trial of ganaxolone, the commercial prospects of ganaxolone may be harmed, and our ability to generate product revenue from ganaxolone, if approved, will be delayed. In addition, any delays in completing our clinical trials will increase our costs, slow down our development and approval process for ganaxolone and jeopardize our ability to commence product sales and generate revenues. In addition, many of the factors that could cause a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of ganaxolone.

Ganaxolone may cause undesirable side effects or have other properties that could delay or prevent its regulatory approval, limit the commercial profile of an approved label, or result in significant negative consequences following any marketing approval.

Undesirable side effects caused by ganaxolone could cause us or regulatory authorities to interrupt, delay or halt clinical trials and could result in a restrictive label or the delay or denial of regulatory approval by the FDA or other comparable foreign regulatory authority. Although ganaxolone has generally been well tolerated by subjects in our earlier-stage clinical trials, in some cases there were side effects, and some of the side effects were severe. Specifically, in our most recently completed clinical trial, where ganaxolone was administered as an adjunctive to standard therapy in adult subjects with focal onset seizures, the most frequent side effects (those reported in greater than 5% of ganaxolone subjects) were dizziness, fatigue and somnolence (or drowsiness). More side effects of the Central Nervous System (CNS) were categorized as severe as compared to side effects of other body systems.

If these side effects are reported in future clinical trials, or if other safety or toxicity issues are reported in our future clinical trials, we may not receive approval to market ganaxolone, which could prevent us from ever generating revenue or achieving profitability. Furthermore, although we are currently developing ganaxolone for three indications, negative safety findings in any one indication could force us to delay or discontinue development in other indications. Results of our clinical trials could reveal an unacceptably high severity and prevalence of side effects. In such an event our clinical trials could be suspended or terminated and the FDA or comparable foreign regulatory authorities could order us to cease further development, or deny approval, of ganaxolone for any or all targeted indications. Drug-related side effects could affect study subject recruitment or the ability of enrolled subjects to complete our future clinical trials and may result in potential product liability claims.

Additionally, if ganaxolone receives marketing approval, and we or others later identify undesirable side effects caused by ganaxolone, a number of potentially significant negative consequences could result, including:

we may be forced to suspend marketing of ganaxolone;

regulatory authorities may withdraw their approvals of ganaxolone;

regulatory authorities may require additional warnings on the label that could diminish the usage or otherwise limit the commercial success of ganaxolone;

we may be required to conduct post-marketing studies;

we could be sued and held liable for harm caused to subjects or patients; and

our reputation may suffer.

Any of these events could prevent us from achieving or maintaining market acceptance of ganaxolone, if approved.

Even if ganaxolone receives regulatory approval, we may still face regulatory difficulties.

Even if we obtain regulatory approval for ganaxolone, it would be subject to ongoing requirements by the FDA and comparable foreign regulatory authorities governing the manufacture, quality control, further development, labeling, packaging, storage, distribution, safety surveillance, import, export, advertising, promotion, recordkeeping and reporting of safety and other post-market information. The safety profile of ganaxolone will continue to be closely monitored by the FDA and comparable foreign regulatory authorities after approval. If new safety information becomes available after approval of ganaxolone, the FDA or comparable foreign regulatory authorities may require labeling changes or establishment of a Risk Evaluation and Mitigation Strategy (REMS) or similar strategy, impose significant restrictions on ganaxolone’s indicated uses or marketing, or impose ongoing requirements for potentially costly post-approval studies or post-market surveillance. For example, the label ultimately approved for ganaxolone, if it achieves marketing approval, may include restrictions on use.

In addition, manufacturers of drug products and their facilities are subject to continual review and periodic inspections by the FDA and other regulatory authorities for compliance with current good manufacturing practices (cGMP) and other regulations. If we or a regulatory authority discover previously unknown problems with a product, such as adverse events of unanticipated severity or frequency, or problems with the facility where the product is manufactured, a regulatory authority may impose restrictions on that product, the manufacturing facility or us, including requiring recall or withdrawal of the product from the market or suspension of manufacturing. If we, ganaxolone or the manufacturing facilities for ganaxolone fail to comply with applicable regulatory requirements, a regulatory authority may:

issue warning letters or untitled letters;

mandate modifications to promotional materials or require us to provide corrective information to healthcare practitioners;

require us to enter into a consent decree, which can include imposition of various fines, reimbursements for inspection costs, required due dates for specific actions and penalties for noncompliance;

seek an injunction or impose civil or criminal penalties or monetary fines;

suspend or withdraw regulatory approval;

suspend any ongoing clinical trials;

refuse to approve pending applications or supplements to applications filed by us;

suspend or impose restrictions on operations, including costly new manufacturing requirements; or

seize or detain products, refuse to permit the import or export of products, or require us to initiate a product recall.

The occurrence of any event or penalty described above may inhibit or preclude our ability to commercialize ganaxolone and generate revenue.

The FDA’s and other regulatory authorities’ policies may change, and additional government regulations may be enacted that could prevent, limit or delay regulatory approval of ganaxolone. We cannot predict the likelihood, nature or extent of government regulation that may arise from future legislation or administrative action, either in the United States or abroad. If we are slow or unable to adapt to changes in existing requirements or the adoption of new requirements or policies, or if we are not able to maintain regulatory compliance, we may lose any marketing approval that we may have obtained, and we may not achieve or sustain profitability, which would adversely affect our business, prospects, financial condition and results of operations.

Advertising and promotion of any product candidate that obtains approval in the United States will be heavily scrutinized by, among others, the FDA, the Department of Justice (DOJ), the Office of Inspector General of the Department of Health and Human Services (HHS), state attorneys general, members of Congress and the public. Violations, including promotion of our products for unapproved or off-label uses, are subject to enforcement letters, inquiries and investigations, and civil and criminal sanctions by the FDA or other government agencies. Additionally, advertising and promotion of any product candidate that obtains approval outside of the United States will be heavily scrutinized by comparable foreign regulatory authorities.

In the United States, promoting ganaxolone for unapproved indications can also subject us to false claims litigation under federal and state statutes, and other litigation and/or investigation, which can lead to civil and criminal penalties and fines and agreements that materially restrict the manner in which we promote or distribute our drug products. These false claims statutes include the federal False Claims Act, which allows any individual to bring a lawsuit against a pharmaceutical company on behalf of the federal government alleging submission of false or fraudulent claims, or causing to present such false or fraudulent claims, for payment by a federal program such as Medicare or Medicaid. If the government prevails in the lawsuit, the individual will share in any fines or settlement funds. Since 2004, these False Claims Act lawsuits against pharmaceutical companies have increased significantly in volume and breadth, leading to several substantial civil and criminal settlements based on certain sales practices promoting off-label drug uses. This increasing focus and scrutiny has increased the risk that a pharmaceutical company will have to defend a false claim action, pay settlement fines or restitution, agree to comply with burdensome reporting and compliance obligations, and be excluded from the Medicare, Medicaid and other federal and state healthcare programs. If we do not lawfully promote our approved products, we may become subject to such litigation and/or investigation and, if we are not successful in defending against such actions, those actions could compromise our ability to become profitable.

Failure to obtain regulatory approval in international jurisdictions would prevent ganaxolone from being marketed in these jurisdictions.

In order to market and sell our products in the European Union and many other jurisdictions, we must obtain separate marketing approvals and comply with numerous and varying regulatory requirements. The approval procedure varies among countries and can involve additional testing. The time required to obtain approval may differ substantially from that required to obtain FDA approval. The regulatory approval process outside the United States generally includes all of the risks associated with obtaining FDA approval. In addition, many countries outside the United States require that a product be approved for reimbursement before the product can be approved for sale in that country. We may not obtain approvals from regulatory authorities outside the United States on a timely basis, if at all. Approval by the FDA does not ensure approval by regulatory authorities in other countries or jurisdictions, and approval by one regulatory authority outside the United States does not ensure approval by regulatory authorities in other countries or jurisdictions or by the FDA. We may not be able to file for marketing approvals and may not receive necessary approvals to commercialize our products in any market. If we are unable to obtain approval of ganaxolone by regulatory authorities in

the European Union or another country or jurisdiction, the commercial prospects of ganaxolone may be significantly diminished and our business prospects could decline.

We may not be able to obtain orphan drug exclusivity for ganaxolone or any other product candidates for which we seek it, which could limit the potential profitability of ganaxolone or such other product candidates.

Regulatory authorities in some jurisdictions, including the United States and Europe, may designate drugs for relatively small patient populations as orphan drugs. Under the Orphan Drug Act, the FDA may designate a product as an orphan drug if it is a drug intended to treat a rare disease or condition, which is generally defined as a patient population of fewer than 200,000 individuals in the United States. Generally, if a product with an orphan drug designation subsequently receives the first marketing approval for an indication for which it receives the designation, then the product is entitled to a period of marketing exclusivity that precludes the applicable regulatory authority from approving another marketing application for the same drug for the same indication for the exclusivity period except in limited situations. For purposes of small molecule drugs, the FDA defines “same drug” as a drug that contains the same active moiety and is intended for the same use as the drug in question. A designated orphan drug may not receive orphan drug exclusivity if it is approved for a use that is broader than the indication for which it received orphan designation.

We have received orphan drug designation for treating CDD, PCDH19-PE, FXS and SE with ganaxolone and expect that we may in the future pursue orphan drug designations for ganaxolone forbreach one or more additional indications. However, obtainingcovenants, Oaktree and/or Sagard may choose to declare an orphan drug designation can be difficultevent of default and we may not be successful in doing so for additional ganaxolone indications or any future product candidates. Even if we were to obtain orphan drug exclusivity for a product candidate, that exclusivity may not effectively protect the product from the competition of different drugs for the same condition, which could be approved during the exclusivity period. Additionally, after an orphan drug is approved, the FDA could subsequently approve another application for the same drug for the same indication if the FDA concludes that the later drug is shown to be safer, more effective or makes a major contribution to patient care. Orphan drug exclusive marketing rights(i) in the United States also may be lost if the FDA later determines that the request for designation was materially defective or if the manufacturer is unable to assure sufficient quantitycase of the drugCredit Agreement, require that we immediately repay all amounts outstanding under the Credit Agreement, plus penalties and interest, terminate the Lenders’ commitments to meetfund any undrawn Term Loan tranches and foreclose on the needscollateral

granted to them to secure the rare disease obligations under the Credit Agreement and the other loan documents and/or condition. The failure to obtain an orphan drug designation for any product candidates we may develop,(ii) in the inability to maintain that designation for the durationcase of the applicable period, or the inability to obtain or maintain orphan drug exclusivity could reduce our ability to make sufficient salesRevenue Interest Financing Agreement, require that we repurchase all, but not less than all, of the applicable product candidate to balance our expenses incurred to develop it, which would have a negative impact on our operational results and financial condition.

Our business and operations would sufferSagard’s interest in the event of computer system failures.

DespitePayments and foreclose on the implementation of security measures, our internal computer systems, and those of our CROs and other third parties on which we rely, are vulnerablecollateral granted to damage from computer viruses, unauthorized access, natural disasters, fire, terrorism, war and telecommunication and electrical failures. In addition, our systems safeguard important confidential personal data regarding subjects enrolled in our clinical trials. If a disruption event werethem to occur and cause interruptions in our operations, it could result in a material disruption of our drug development programs. For example,secure the loss of data relating to completed, ongoing or planned clinical trials could result in delays in our regulatory approval efforts and cause us to incur significant additional costs to recover or reproduceobligations under the data. To the extent that any disruption or security breach results in a loss of or damage to our data or applications, or inappropriate disclosure of confidential or proprietary information, we could incur liabilityRevenue Interest Financing Agreement and the further development of ganaxolone could be delayed.

Business disruptions could seriously harm our future revenue and financial condition and increase our costs and expenses.

Our operations could be subject to earthquakes, power shortages, telecommunications failures, water shortages, floods, hurricanes, typhoons, fires, extreme weather conditions, medical epidemics and other natural or man-made disasters or business interruptions, for which we are predominantly self-insured. The occurrence of any of these business disruptions could seriously harm our operations and financial condition and increase our costs and expenses. We rely on third-party manufacturers to produce ganaxolone. Our ability to obtain clinical supplies of ganaxolone could be disrupted

if the operations of these suppliers are affected by a man-made or natural disaster or other business interruption. The ultimate impact on us, our significant suppliers and our general infrastructure of being in certain geographical areas is unknown, but our operations and financial condition could suffer in the event of a major earthquake, fire or other natural disaster.

Risks Related to the Commercialization of Our Product

Our commercial success depends upon attaining significant market acceptance of ganaxolone, if approved, among physicians, patients, government and private payers and others in the medical community.

Even if ganaxolone receives regulatory approval, it may not gain market acceptance among physicians, patients, government and private payers, or others in the medical community. Market acceptance of ganaxolone, if we receive approval, depends on a number of factors, including the:

efficacy and safety of ganaxolone, or ganaxolone administered with other drugs, each as demonstrated in clinical trials and post-marketing experience;

clinical indications for which ganaxolone is approved;

acceptance by physicians and patients of ganaxolone as a safe and effective treatment;

potential and perceived advantages of ganaxolone over alternative treatments;

safety of ganaxolone seen in a broader patient group, including its use outside the approved indications should physicians choose to prescribe for such uses;

prevalence and severity of any side effects;

product labeling or product insert requirements of the FDA or other regulatory authorities;

timing of market introduction of ganaxolone as well as competitive products;

cost of treatment in relation to alternative treatments;

availability of coverage and adequate reimbursement and pricing by government and private payers;

relative convenience and ease of administration; and

effectiveness of our sales and marketing efforts.

If ganaxolone is approved but fails to achieve market acceptance among physicians, patients, government or private payers or others in the medical community, or the products or product candidates that are being administered with ganaxolone are restricted, withdrawn or recalled, or fail to be approved, as the case may be, we may not be able to generate significant revenues, which would compromise our ability to become profitable.

If we are unable to establish sales and marketing capabilities or enter into agreements with third parties to market and sell ganaxolone, we may be unable to generate any revenue.

We do not currently have an organization for the sale, marketing and distribution of pharmaceutical products and the cost of establishing and maintaining such an organization may exceed the cost-effectiveness of doing so. In order to market any products that may be approved by the FDA and comparable foreign regulatory authorities, we must build our sales, marketing, managerial and other non-technical capabilities or make arrangements with third parties to perform these services. If we are unable to establish adequate sales, marketing and distribution capabilities, whether independently or with third parties, we may not be able to generate product revenue and may not become profitable. We

will be competing with many companies that currently have extensive and well-funded sales and marketing operations. Without an internal commercial organization or the support of a third party to perform sales and marketing functions, we may be unable to compete successfully against these more established companies. To the extent we rely on third parties to commercialize ganaxolone, if approved, we may have little or no control over the marketing and sales efforts of such third parties, and our revenues from product sales may be lower than if we had commercialized ganaxolone ourselves.

A variety of risks associated with marketing ganaxolone internationally could materially adversely affect our business.

We plan to seek regulatory approval for ganaxolone outside of the United States, and, accordingly, we expect that we will be subject to additional risks related to operating in foreign countries if we obtain the necessary approvals, including:

differing regulatory requirements in foreign countries;

the potential for so-called parallel importing, which is what happens when a local seller, faced with high or higher local prices, opts to import goods from a foreign market (with low or lower prices) rather than buying them locally;

unexpected changes in tariffs, trade barriers, price and exchange controls and other regulatory requirements;

economic weakness, including inflation, or political instability in particular foreign economies and markets;

compliance with tax, employment, immigration and labor laws for employees living or traveling abroad;

foreign taxes, including withholding of payroll taxes;

foreign currency fluctuations, which could result in increased operating expenses and reduced revenues, and other obligations incident to doing business in another country;

difficulties staffing and managing foreign operations;

workforce uncertainty in countries where labor unrest is more common than in the United States;

challenges enforcing our contractual and intellectual property rights, especially in those foreign countries that do not respect and protect intellectual property rights to the same extent as the United States;

production shortages resulting from any events affecting raw material supply or manufacturing capabilities abroad; and

business interruptions resulting from geo-political actions, including war and terrorism.

These and other risks associated with our international operations may materially adversely affect our ability to attain or maintain profitable operations.

Even if we are able to commercialize ganaxolone, it may not receive coverage and adequate reimbursement from third-party payers, which could harm our business.

Our ability to commercialize ganaxolone successfully will depend, in part, on the extent to which coverage and adequate reimbursement for ganaxolone and related treatments will be available from government health administration authorities, private health insurers and other organizations. Government authorities and third-party payers, such as private health insurers and health maintenance organizations, determine which medications they will cover and establish reimbursement levels. A primary trend in the United States healthcare industry and elsewhere is cost containment.

Government authorities and third-party payers have attempted to control costs by limiting coverage and the amount of reimbursement for particular medications. Increasingly, third-party payers are requiring that drug companies provide them with predetermined discounts from list prices and are challenging the prices charged for drugs. Third-party payers may also seek additional clinical evidence, beyond the data required to obtain marketing approval, demonstrating clinical benefits and value in specific patient populations before covering ganaxolone for those patients. We cannot be sure that coverage and adequate reimbursement will be available for ganaxolone and, if reimbursement is available, what the level of reimbursement will be. Coverage and reimbursement may impact the demand for, or the price of, ganaxolone, if we obtain marketing approval. If reimbursement is not available or is available only at limited levels, we may not be able to successfully commercialize ganaxolone even if we obtain marketing approval.

There may be significant delays in obtaining coverage and reimbursement for newly approved drugs, and coverage may be more limited than the purposes for which the drug is approved by the FDA or comparable foreign regulatory authorities. Moreover, eligibility for coverage and reimbursement does not imply that any drug will be paid for in all cases or at a rate that covers our costs, including research, development, manufacture, sale and distribution. Interim reimbursement levels for new drugs, if applicable, may also not be sufficient to cover our costs and may only be temporary. Reimbursement rates may vary according to the use of the drug and the clinical setting in which it is used, may be based on reimbursement levels already set for lower cost drugs and may be incorporated into existing payments for other services. Net prices for drugs may be reduced by mandatory discounts or rebates required by government healthcare programs or private payers and by any future relaxation of laws that presently restrict imports of drugs from countries where they may be sold at lower prices than in the United States. Third-party payers often rely upon Medicare coverage policy and payment limitations in setting their own reimbursement policies. Our inability to obtain coverage and profitable reimbursement rates from both government-funded and private payers for any approved products that we developtransaction documents. Such repayment could have a material adverse effect on our business, operating results our ability to raise capital needed to commercialize products and our overall financial condition.

We face substantial competition, which may result in others discovering, developing or commercializing products before or more successfully than we do.

The development and commercialization of new drug products is highly competitive. We face competition with respect to ganaxolone, and will face competition with respect to any other product candidates that we may seek to develop or commercialize in the future, from major pharmaceutical companies, specialty pharmaceutical companies and biotechnology companies worldwide. There are a number of large pharmaceutical and biotechnology companies that currently market and sell products or are pursuing the development of products for the treatment of the disease indications for which we are developing ganaxolone. Some of these competitive products and therapies are based on scientific approaches that are the same as, or similar to, our approach, and others are based on entirely different approaches. For example, there are several companies developing product candidates that target the same GABAA, neuroreceptor that we are targeting or that are testing product candidates in the same indications that we are testing. Potential competitors also include academic institutions, government agencies and other public and private research organizations that conduct research, seek patent protection and establish collaborative arrangements for research, development, manufacturing and commercialization.

Ganaxolone is presently being developed primarily as a neuropsychiatric therapeutic. There are a variety of marketed therapies available for these patients.

Specifically, there are more than 15 approved AEDs available in the United States and worldwide, including the generic products levetiracetam, lamotrigine, carbamazepine, oxcarbazepine, valproic acid and topiramate. Recent market entrants include branded products developed by Lundbeck, UCB, Eisai, and Sunovion Pharmaceuticals. Additionally, there are several drugs in development for the treatment of pediatric genetic epilepsies and behavioral and mental health conditions associated with FXS, including compounds being developed by GW Pharmaceuticals, Zogenix, Sunovion Pharmaceuticals, Zynerba, Alcobra and Neuren Pharmaceuticals. Sage Therapeutics is developing molecules with a similar mechanism of action as ganaxolone for treatment of SE and PPD.

Many of the approved drugs are well established therapies or products and are widely accepted by physicians, patients and third-party payers. Insurers and other third-party payers may also encourage the use of generic products.

These factors may make it difficult for us to achieve market acceptance at desired levels or in a timely manner to ensure viability of our business.

More established companies may have a competitive advantage over us due to their greater size, cash flows and institutional experience. Compared to us, many of our competitors may have significantly greater financial, technical and human resources.

As a result of these factors, our competitors may obtain regulatory approval of their products before we are able to, which may limit our ability to develop or commercialize ganaxolone. Our competitors may also develop drugs that are safer, more effective, more widely used and cheaper than ours, and may also be more successful than us in manufacturing and marketing their products. These appreciable advantages could render ganaxolone obsolete or non-competitive before we can recover the expenses of ganaxolone’s development and commercialization.

Mergers and acquisitions in the pharmaceutical and biotechnology industries may result in even more resources being concentrated among a smaller number of our competitors. Smaller and other early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. These thirdThird parties, compete with us in recruiting and retaining qualified scientific, management and commercial personnel, establishing clinical trial sites and subject registration for clinical trials, as well as in acquiring technologies complementary to, or necessary for, our programs.

Product liability lawsuits against us could cause us to incur substantial liabilities and to limit commercialization of ganaxolone or other product candidates that we may develop.

We face an inherent risk of product liability exposure related to the testing of ganaxolone by us or our investigators in human clinical trials and will face an even greater risk if ganaxolone receives regulatory approval and we subsequently commercialize it. Product liability claims may be brought against us by study subjects enrolled in our clinical trials, patients, healthcare providers or others using, administering or selling ganaxolone. If we cannot successfully defend ourselves against claims that ganaxolone caused injuries, we could incur substantial liabilities. Regardless of merit or eventual outcome, liability claims may result in, for example:

decreased demand for ganaxolone;

termination of clinical trial sites or entire trial programs;

injury to our reputation and significant negative media attention;

withdrawal of clinical trial subjects;

significant costs to defend the related litigation;

substantial monetary awards to clinical trial subjects or patients;

loss of revenue;

diversion of management and scientific resources from our business operations;

the inability to commercialize ganaxolone; and

increased scrutiny and potential investigation by, among others, the FDA, the DOJ, the Office of Inspector General of the HHS, state attorneys general, members of Congress and the public.

We currently have product liability insurance coverage, which may not be adequate to cover all liabilities that we may incur. Insurance coverage is increasingly expensive. We may not be able to maintain insurance coverage at a reasonable cost or in an amount adequate to satisfy any liability that may arise. We intend to expand our product liability

insurance coverage to include the sale of commercial products if we obtain marketing approval for ganaxolone, but we may be unable to obtain commercially reasonable product liability insurance for ganaxolone, if approved for marketing. Large judgments have been awarded in class action lawsuits based on drugs that had unanticipated side effects. A successful product liability claim or series of claims brought against us, particularly if judgments exceed our insurance coverage, could decrease our cash and adversely affect our business.

Risks Related to Our Dependence on Third Parties

We rely on third parties to conduct our preclinical studies and clinical trials. If these third parties do not successfully carry out their contractual duties or meet expected deadlines, we may not be able to obtain regulatory approval for or commercialize ganaxolone.

We rely on third-party CROs to monitor and manage data for our ongoing preclinical and clinical programs. We rely on these parties for execution of our preclinical studies and clinical trials, and we control only some aspects of their activities. Nevertheless, we are responsible for ensuring that each of our preclinical studies and clinical trials are conducted in accordance with the applicable protocol and legal, regulatory and scientific requirements and standards, and our reliance on the CROs does not relieve us of our regulatory responsibilities. We also rely on third parties to assist in conducting our preclinical studies in accordance with Good Laboratory Practices (GLP) and the Animal Welfare Act requirements. We and our CROs are required to comply with federal regulations and Good Clinical Practices (GCP), which are international requirements meant to protect the rights and health of subjects that are enforced by the FDA, the Competent Authorities of the Member States of the European Economic Area and comparable foreign regulatory authorities for ganaxolone and any future product candidates in clinical development. Regulatory authorities enforce GCP through periodic inspections of trial sponsors, principal investigators and trial sites. If we or any of our CROs fail to comply with applicable GCP, the clinical data generated in our clinical trials may be deemed unreliable and the FDA or comparable foreign regulatory authorities may require us to perform additional clinical trials before approving our marketing applications. We cannot assure you that upon inspection by a given regulatory authority, such regulatory authority will determine that any of our clinical trials comply with GCP requirements. In addition, our clinical trials must be conducted with product produced under cGMP requirements. Failure to comply with these regulations may require us to repeat preclinical studies and clinical trials, which would delay the regulatory approval process.

Our CROs are not our employees, and except for remedies available to us under our agreements with such CROs, we cannot control whether or not they devote sufficient time and resources to our ongoing clinical, nonclinical and preclinical programs. If CROs do not successfully carry out their contractual duties or obligations or meet expected deadlines or if the quality or accuracy of the data they obtain is compromised due to the failure to adhere to our protocols, regulatory requirements or for other reasons, our preclinical studies and clinical trials may be extended, delayed or terminated and we may not be able to obtain regulatory approval for or successfully commercialize ganaxolone. As a result, our results of operations and the commercial prospects for ganaxolone would be harmed, our costs could increase and our ability to generate revenue could be delayed.

Because we have relied on third parties, our internal capacity to perform these functions is limited. Outsourcing these functions involves risk that third parties may not perform to our standards, may not produce results in a timely manner or may fail to perform at all. In addition, the use of third-party service providers requires us to disclose our proprietary information to these parties, which could increase the risk that this information will be misappropriated. We currently have a small number of employees, which limits the internal resources we have available to identify and monitor our third-party providers. To the extent we are unable to identify and successfully manage the performance of third-party service providers in the future, our business may be adversely affected. Though we carefully manage our relationships with our CROs, there can be no assurance that we will not encounter challenges or delays in the future or that these delays or challenges will not have a material adverse impact on our business, financial condition and prospects.

If we lose our relationships with CROs, our drug development efforts could be delayed.

We rely on third-party vendors and CROs for preclinical studies and clinical trials related to our drug development efforts. Switching or adding additional CROs would involve additional cost and requires management time and focus. Our CROs generally have the right to terminate their agreements with us in the event of an uncured material breach. In addition, some of our CROs have an ability to terminate their respective agreements with us, or research projects pursuant to such agreements, if, in the reasonable opinion of the relevant CRO, the safety of the subjects participating in our clinical trials warrants such termination. These agreements or research projects may also be terminated if we make a general assignment for the benefit of our creditors or if we are liquidated. Identifying, qualifying and managing performance of third-party service providers can be difficult, time consuming and cause delays in our development programs. In addition, there is a natural transition period when a new CRO commences work and the new CRO may not provide the same type or level of services as the original provider. If any of our relationships with our third-party CROs terminate, we may not be able to enter into arrangements with alternative CROs or to do so on commercially reasonable terms.

Our experience manufacturing ganaxolone is limited to the needs of our preclinical studies and clinical trials. We have no experience manufacturing ganaxolone on a commercial scale and have no manufacturing facility. We are dependent on third-party manufacturers for the manufacture of ganaxolone as well as on third parties for our supply chain, and if we experience problems with any such third parties, the manufacturing of ganaxolone could be delayed.

We do not own or operate facilities for the manufacture of ganaxolone. We currently have no plans to build our own clinical or commercial scale manufacturing capabilities. We currently rely on contract manufacturing organizations (CMOs) for the chemical manufacture of active pharmaceutical ingredients for ganaxolone and other CMOs for the production of the ganaxolone nanoparticulate formulation into capsules, liquid suspension and IV. To meet our projected needs for preclinical and clinical supplies to support our activities through regulatory approval and commercial manufacturing, the CMOs with whom we currently work will need to increase the scale of production. We may need to identify additional CMOs for continued production of supply for ganaxolone. Although alternative third-party suppliers with the necessary manufacturing and regulatory expertise and facilities exist, it could be expensive and take a significant amount of time to arrange for alternative suppliers. If we are unable to arrange for alternative third-party manufacturing sources on commercially reasonable terms, in a timely manner or at all, we may not be able to complete development of ganaxolone, or market or distribute ganaxolone.

Reliance on third-party manufacturers entails risks to which we would not be subject if we manufactured ganaxolone ourselves, including reliance on the third party for regulatory compliance and quality assurance, the possibility of breach of the manufacturing agreement by the third party because of factors beyond our control, including a failure to synthesize and manufacture ganaxolone or any products we may eventually commercialize in accordance with our specifications, and the possibility of termination or nonrenewal of the agreement by the third party, based on its own business priorities, at a time that is costly or damaging to us. In addition, the FDA and other regulatory authorities would require that ganaxolone and any products that we may eventually commercialize be manufactured according to cGMP and similar foreign standards. Any failure by our third-party manufacturers to comply with cGMP or failure to scale up manufacturing processes, including any failure to deliver sufficient quantities of ganaxolone in a timely manner, could lead to a delay in, or failure to obtain, regulatory approval of ganaxolone. In addition, such failure could be the basis for the FDA to issue a warning letter, withdraw approvals for ganaxolone previously granted to us, or take other regulatory or legal action, including recall or seizure of outside supplies of ganaxolone, total or partial suspension of production, suspension of ongoing clinical trials, refusal to approve pending applications or supplemental applications, detention of product, refusal to permit the import or export of products, injunction, or imposing civil and criminal penalties.

Any significant disruption in our supplier relationships could harm our business. Any significant delay in the supply of ganaxolone or its key materials for an ongoing preclinical study or clinical trial could considerably delay completion of our preclinical study or clinical trial, product testing and potential regulatory approval of ganaxolone. If our manufacturers or we are unable to purchase these key materials after regulatory approval has been obtained for ganaxolone, the commercial launch of ganaxolone would be delayed or there would be a shortage in supply, which would impair our ability to generate revenues from the sale of ganaxolone.

We may elect to enter into licensing or collaboration agreements to partner ganaxolone in territories currently retained by us. Our dependence on such relationships may adversely affect our business.

Because we have limited resources, we may seek to enter into collaboration agreements with other pharmaceutical or biotechnology companies. Any failure by our partners to perform their obligations or any decision by our partners to terminate these agreements could negatively impact our ability to successfully develop, obtain regulatory approvals for and commercialize ganaxolone. In the event we grant exclusive rights to such partners, we would be precluded from potential commercialization of ganaxolone within the territories in which we have a partner. In addition, any termination of our collaboration agreements will terminate the funding we may receive under the relevant collaboration agreement and may impair our ability to fund further development efforts and our progress in our development programs.

Our commercialization strategy for ganaxolone may depend on our ability to enter into agreements with collaborators to obtain assistance and funding for the development and potential commercialization of ganaxolone in the territories in which we seek to partner. Despite our efforts, we may be unable to secure additional collaborative licensing or other arrangements that are necessary for us to further develop and commercialize ganaxolone. Supporting diligence activities conducted by potential collaborators and negotiating the financial and other terms of a collaboration agreement are long and complex processes with uncertain results. Even if we are successful in entering into one or more collaboration agreements, collaborations may involve greater uncertainty for us, as we have less control over certain aspects of our collaborative programs than we do over our proprietary development and commercialization programs. We may determine that continuing a collaboration under the terms provided is not in our best interest, and we may terminate the collaboration. Our potential future collaborators could delay or terminate their agreements, and as a result ganaxolone may never be successfully commercialized.

Further, our potential future collaborators may develop alternative products or pursue alternative technologies either on their own or in collaboration with others, including our competitors, and the priorities or focus of our collaborators may shift such that ganaxolone receives less attention or resources than we would like, or they may be terminated altogether. Any such actions by our potential future collaborators may adversely affect our business prospects and ability to earn revenue. In addition, we could have disputes with our potential future collaborators, such as the interpretation of terms in our agreements. Any such disagreements could lead to delays in the development or commercialization of ganaxolone or could result in time-consuming and expensive litigation or arbitration, which may not be resolved in our favor.

Government funding for certain of our programs adds uncertainty to our research efforts with respect to those programs and may impose requirements that increase the costs of commercialization and production of product candidates developed under those government-funded programs.

Our preclinical studies and clinical trials to evaluate ganaxolone in FXS patients have been conducted with the MIND Institute at the University of California, Davis which receives funding from the United States Department of Defense (DoD) for such studies and trials. In addition, our preclinical studies and clinical trials to evaluate ganaxolone in patients suffering from posttraumatic stress disorder (PTSD) have been primarily conducted by the United States Department of Veterans Affairs, which also receives funding from the DoD. Programs funded by the United States government and its agencies, including the DoD, include provisions that confer on the government substantial rights and remedies, many of which are not typically found in commercial contracts, including powers of the government to:

terminate agreements, in whole or in part, for any reason or no reason;

reduce or modify the government’s obligations under such agreements without the consent of the other party;

claim rights, including intellectual property rights, in products and data developed under such agreements;

audit contract-related costs and fees, including allocated indirect costs;

suspend the contractor from receiving new contracts pending resolution of alleged violations of procurement laws or regulations;

impose United States manufacturing requirements for products that embody inventions conceived or first reduced to practice under such agreements;

suspend or debar the contractor from doing future business with the government; and

control and potentially prohibit the export of products.

We may not have the right to prohibit the United States government from using or allowing others to use certain technologies developed by us, and we may not be able to prohibit third-party companies, including our competitors, from using those technologies in providing products and services to the United States government. The United States government generally obtains the right to royalty-free use of technologies that are developed under United States government contracts.

In addition, government contracts normally contain additional requirements that may increase our costs of doing business, reduce our profits, and expose us to liability for failure to comply with these terms and conditions. These requirements include, for example:

specialized accounting systems unique to government contracts;

mandatory financial audits and potential liability for price adjustments or recoupment of government funds after such funds have been spent;

public disclosures of certain contract information, which may enable competitors to gain insights into our research program; and

mandatory socioeconomic compliance requirements, including labor standards, non-discrimination and affirmative action programs and environmental compliance requirements.

If we fail to maintain compliance with these requirements, we may be subject to potential contract liability and to termination of our contracts.

Changes in government budgets and agendas may result in a decreased and de-prioritized emphasis on supporting the development of ganaxolone in patients suffering from certain FXS-associated behavioral symptoms. Although we intend to fund a portion of our development programs for ganaxolone in patients with FXS, any reduction or delay in DoD funding to our collaborators may force us to suspend or terminate these programs or seek alternative funding, which may not be available on non-dilutive terms, terms favorable to us or at all.

If our third-party manufacturers use hazardous and biological materials in a manner that causes injury or violates applicable law, we may be liable for damages.

Our research and development activities involve the controlled use of potentially hazardous substances, including chemical and biological materials by our third-party manufacturers. Our manufacturers are subject to federal, state and local laws and regulations in the United States governing the use, manufacture, storage, handling and disposal of medical, radioactive and hazardous materials. We cannot completely eliminate the risk of contamination or injury resulting from medical, radioactive or hazardous materials. As a result of any such contamination or injury we may incur liability or local, city, state or federal authorities may curtail the use of these materials and interrupt our business operations. In the event of an accident, we could be held liable for damages or penalized with fines, and the liability could exceed our resources. We do not have any insurance for liabilities arising from medical radioactive or hazardous materials. Compliance with applicable environmental laws and regulations is expensive, and current or future

environmental regulations may impair our research, development and production efforts, which could harm our business, prospects, financial condition or results of operations.

Risks Related to Regulatory Compliance

Recently enacted and future legislation, including potentially unfavorable pricing regulations or other healthcare reform initiatives, may increase the difficulty and cost for us to obtain marketing approval of and commercialize ganaxolone and affect the prices we may obtain.

The regulations that govern, among other things, marketing approvals, coverage, pricing and reimbursement for new drug products vary widely from country to country. In the United States and some foreign jurisdictions, there have been a number of legislative and regulatory changes and proposed changes regarding the healthcare system that could prevent or delay marketing approval of ganaxolone, restrict or regulate post-approval activities and affect our ability to successfully sell ganaxolone, if we obtain marketing approval.

In the United States, the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, or Medicare Modernization Act, changed the way Medicare covers and pays for pharmaceutical products. The legislation expanded Medicare coverage for drug purchases by the elderly and introduced a new reimbursement methodology based on average sales prices for physician administered drugs. In recent years, Congress has considered further reductions in Medicare reimbursement for drugs administered by physicians. The Centers for Medicare and Medicaid Services, the agency that runs the Medicare program, also has the authority to revise reimbursement rates and to implement coverage restrictions for some drugs. Cost reduction initiatives and changes in coverage implemented through legislation or regulation could decrease utilization of and reimbursement for any approved products, which in turn would affect the price we can receive for those products. While the Medicare Modernization Act and Medicare regulations apply only to drug benefits for Medicare beneficiaries, private payers often follow Medicare coverage policy and payment limitations in setting their own reimbursement rates. Therefore, any reduction in reimbursement that results from federal legislation or regulation may result in a similar reduction in payments from private payers.

In March 2010, the Patient Protection and Affordable Care Act and the Health Care and Education Affordability Reconciliation Act of 2010 (Affordable Care Act)Ovid Therapeutics, Inc., a sweeping law intended to broaden access to health insurance, reduce or constrain the growth of healthcare spending, enhance remedies against fraud and abuse, add new transparency requirements for healthcare and health insurance industries, impose new taxes and fees on pharmaceutical and medical device manufacturers and impose additional health policy reforms was signed into law. The Affordable Care Act expanded manufacturers’ rebate liability to include covered drugs dispensed to individuals who are enrolled in Medicaid managed care organizations, increased the minimum rebate due for innovator drugs from 15.1% of average manufacturer price (AMP) to 23.1% of AMP and capped the total rebate amount for innovator drugs at 100.0% of AMP. The Affordable Care Act and subsequent legislation also changed the definition of AMP. Furthermore, the Affordable Care Act imposes a significant annual, nondeductible fee on companies that manufacture or import certain branded prescription drug products. Substantial new provisions affecting compliance have also been enacted, which may affect our business practices with healthcare practitioners, and a significant number of provisions are not yet, or have only recently become, effective. Although it is too early to determine the effect of the Affordable Care Act, it appears likely to continue the pressure on pharmaceutical pricing, especially under the Medicare program, and may also increase our regulatory burdens and operating costs.

In addition, other legislative changes have been proposed and adopted since the Affordable Care Act was enacted. In August 2011, the Budget Control Act of 2011 was signed into law, which, among other things, creates the Joint Select Committee on Deficit Reduction to recommend to Congress proposals in spending reductions. The Joint Select Committee did not achieve a targeted deficit reduction of an amount greater than $1.2 trillion for the years 2013 through 2021, triggering the legislation’s automatic reduction to several government programs. This includes aggregate reductions to Medicare payments to healthcare providers of up to 2.0% per fiscal year, starting in 2013. In January 2013, the American Taxpayer Relief Act of 2012 was signed into law, which, among other things, reduced Medicare payments to several categories of healthcare providers and increased the statute of limitations period for the government to recover overpayments to providers from three to five years. If we ever obtain regulatory approval and commercialization of ganaxolone, these new laws may result in additional reductions in Medicare and other healthcare funding, which could

have a material adverse effect on our customers and accordingly, our financial operations. Legislative and regulatory proposals have been made to expand post-approval requirements and restrict sales and promotional activities for pharmaceutical products. We cannot be sure whether additional legislative changes will be enacted, or whether FDA regulations, guidance or interpretations will be changed, or what the impact of such changes on the marketing approvals of ganaxolone may be.

In the United States, the European Union and other potentially significant markets for ganaxolone, government authorities and third-party payers are increasingly attempting to limit or regulate the price of medical products and services, particularly for new and innovative products and therapies, which has resulted in lower average selling prices. Furthermore, the increased emphasis on managed healthcare in the United States and on country and regional pricing and reimbursement controls in the European Union will put additional pressure on product pricing, reimbursement and usage, which may adversely affect our future product sales and results of operations. These pressures can arise from rules and practices of managed care groups, judicial decisions and governmental laws and regulations related to Medicare, Medicaid and healthcare reform, pharmaceutical reimbursement policies and pricing in general.

Some countries require approval of the sale price of a drug before it can be marketed. In many countries, the pricing review period begins after marketing or product licensing approval is granted. In some foreign markets, prescription pharmaceutical pricing remains subject to continuing governmental control even after initial approval is granted. As a result, we might obtain marketing approval for ganaxolone in a particular country, but then be subject to price regulations that delay our commercial launch of the product, possibly for lengthy time periods, which could negatively impact the revenue we are able to generate from the sale of the product in that particular country. Adverse pricing limitations may hinder our ability to recoup our investment in ganaxolone even if ganaxolone obtains marketing approval.

Laws and regulations governing international operations may preclude us from developing, manufacturing and selling product candidates outside of the United States and require us to develop and implement costly compliance programs.

As we seek to expand our operations outside of the United States, we must comply with numerous laws and regulations in each jurisdiction in which we plan to operate. The creation and implementation of international business practices compliance programs is costly and such programs are difficult to enforce, particularly where reliance on third parties is required.

The Foreign Corrupt Practices Act (FCPA) prohibits any United States individual or business from paying, offering, authorizing payment or offering of anything of value, directly or indirectly, to any foreign official, political party or candidate for the purpose of influencing any act or decision of the foreign entity in order to assist the individual or business in obtaining or retaining business. The FCPA also obligates companies whose securities are listed in the United States to comply with certain accounting provisions requiring such companies to maintain books and records that accurately and fairly reflect all transactions of the corporation, including international subsidiaries, and to devise and maintain an adequate system of internal accounting controls for international operations. The anti-bribery provisions of the FCPA are enforced primarily by the DOJ. The SEC is involved with enforcement of the books and records provisions of the FCPA.

Compliance with the FCPA is expensive and difficult, particularly in countries in which corruption is a recognized problem. In addition, the FCPA presents particular challenges in the pharmaceutical industry, because, in many countries, hospitals are operated by the government, and doctors and other hospital employees are considered foreign officials. Certain payments to hospitals in connection with clinical trials and other work have been deemed to be improper payments to government officials and have led to FCPA enforcement actions.