ub

AXT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, in thousands, except per share data)

|

|

|

|

|

|

|

|

|

| September 30, |

| December 31, |

| ||

|

| 2017 |

| 2016 |

| ||

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

| $ | 48,078 |

| $ | 36,152 |

|

Short-term investments |

|

| 20,524 |

|

| 11,415 |

|

Accounts receivable, net of allowances of $857 and $1,013 as of September 30, 2017 and December 31, 2016 |

|

| 20,877 |

|

| 14,453 |

|

Inventories |

|

| 40,768 |

|

| 40,152 |

|

Related party notes receivable – current |

|

| 57 |

|

| — |

|

Prepaid expenses and other current assets |

|

| 5,682 |

|

| 5,114 |

|

Total current assets |

|

| 135,986 |

|

| 107,286 |

|

Long-term investments |

|

| 9,685 |

|

| 6,156 |

|

Property, plant and equipment, net |

|

| 42,255 |

|

| 27,805 |

|

Related party notes receivable – long-term |

|

| — |

|

| 157 |

|

Other assets |

|

| 11,696 |

|

| 12,842 |

|

Total assets |

| $ | 199,622 |

| $ | 154,246 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

| $ | 9,499 |

| $ | 6,691 |

|

Accrued liabilities |

|

| 9,284 |

|

| 9,260 |

|

Total current liabilities |

|

| 18,783 |

|

| 15,951 |

|

Long-term portion of royalty payments |

|

| 144 |

|

| 575 |

|

Other long-term liabilities |

|

| 278 |

|

| 330 |

|

Total liabilities |

|

| 19,205 |

|

| 16,856 |

|

Commitments and contingencies (Note 12) |

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

Preferred stock Series A, $0.001 par value; 2,000 shares authorized; 883 shares issued and outstanding as of September 30, 2017 and December 31, 2016 (Liquidation preference of $6.8 million and $6.6 million as of September 30, 2017 and December 31, 2016) |

|

| 3,532 |

|

| 3,532 |

|

Common stock, $0.001 par value; 70,000 shares authorized; 38,891 and 33,032 shares issued and outstanding as of September 30, 2017 and December 31, 2016 |

|

| 39 |

|

| 33 |

|

Additional paid-in capital |

|

| 228,516 |

|

| 194,177 |

|

Accumulated deficit |

|

| (57,971) |

|

| (64,985) |

|

Accumulated other comprehensive income |

|

| 2,275 |

|

| 253 |

|

Total AXT, Inc. stockholders’ equity |

|

| 176,391 |

|

| 133,010 |

|

Noncontrolling interests |

|

| 4,026 |

|

| 4,380 |

|

Total stockholders’ equity |

|

| 180,417 |

|

| 137,390 |

|

Total liabilities and stockholders’ equity |

| $ | 199,622 |

| $ | 154,246 |

|

| | | | | | |

|

| Three Months Ended | ||||

| | March 31, | ||||

| | 2024 |

| 2023 | ||

| | | | | | |

Revenue | | $ | 22,688 | | $ | 19,405 |

Cost of revenue | |

| 16,594 | |

| 14,295 |

Gross profit | |

| 6,094 | |

| 5,110 |

Operating expenses: | | | | | | |

Selling, general and administrative | |

| 6,227 | |

| 5,952 |

Research and development | |

| 3,214 | |

| 3,595 |

Total operating expenses | |

| 9,441 | |

| 9,547 |

Loss from operations | |

| (3,347) | |

| (4,437) |

Interest expense, net | |

| (349) | |

| (397) |

Equity in income of unconsolidated joint ventures | |

| 890 | |

| 1,034 |

Other income, net | |

| 1,032 | |

| 282 |

Loss before provision for income taxes | |

| (1,774) | |

| (3,518) |

Provision for income taxes | |

| 274 | |

| 148 |

Net loss | |

| (2,048) | |

| (3,666) |

Less: Net (income) loss attributable to noncontrolling interests and redeemable noncontrolling interests | |

| (35) | |

| 318 |

Net loss attributable to AXT, Inc. | | $ | (2,083) | | $ | (3,348) |

Net loss attributable to AXT, Inc. per common share: | | | | | | |

Basic | | $ | (0.05) | | $ | (0.08) |

Diluted | | $ | (0.05) | | $ | (0.08) |

Weighted-average number of common shares outstanding: | | | | | | |

Basic | |

| 42,987 | |

| 42,498 |

Diluted | |

| 42,987 | |

| 42,498 |

See accompanying notes to condensed consolidated financial statements.

34

AXT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, in thousands, except per share data)thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Three Months Ended |

| Nine Months Ended |

|

| ||||||||

|

| September 30, |

| September 30, |

|

| ||||||||

|

| 2017 |

| 2016 |

| 2017 |

| 2016 |

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

| $ | 28,168 |

| $ | 21,872 |

| $ | 72,341 |

| $ | 61,080 |

|

|

Cost of revenue |

|

| 17,035 |

|

| 14,294 |

|

| 47,664 |

|

| 42,222 |

|

|

Gross profit |

|

| 11,133 |

|

| 7,578 |

|

| 24,677 |

|

| 18,858 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

| 4,484 |

|

| 3,313 |

|

| 12,219 |

|

| 10,106 |

|

|

Research and development |

|

| 1,410 |

|

| 1,566 |

|

| 3,553 |

|

| 4,419 |

|

|

Restructuring charge |

|

| — |

|

| — |

|

| — |

|

| 226 |

|

|

Total operating expenses |

|

| 5,894 |

|

| 4,879 |

|

| 15,772 |

|

| 14,751 |

|

|

Income from operations |

|

| 5,239 |

|

| 2,699 |

|

| 8,905 |

|

| 4,107 |

|

|

Interest income, net |

|

| 122 |

|

| 105 |

|

| 334 |

|

| 303 |

|

|

Equity in loss of unconsolidated joint ventures |

|

| (266) |

|

| (581) |

|

| (1,387) |

|

| (1,437) |

|

|

Other (expense) income, net |

|

| (349) |

|

| 164 |

|

| (403) |

|

| 682 |

|

|

Income before provision for income taxes |

|

| 4,746 |

|

| 2,387 |

|

| 7,449 |

|

| 3,655 |

|

|

Provision for income taxes |

|

| 181 |

|

| 176 |

|

| 661 |

|

| 713 |

|

|

Net income |

|

| 4,565 |

|

| 2,211 |

|

| 6,788 |

|

| 2,942 |

|

|

Less: Net (income) loss attributable to noncontrolling interests |

|

| (146) |

|

| 18 |

|

| 226 |

|

| 480 |

|

|

Net income attributable to AXT, Inc. |

| $ | 4,419 |

| $ | 2,229 |

| $ | 7,014 |

| $ | 3,422 |

|

|

Net income attributable to AXT, Inc. per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

| $ | 0.11 |

| $ | 0.07 |

| $ | 0.19 |

| $ | 0.10 |

|

|

Diluted |

| $ | 0.11 |

| $ | 0.07 |

| $ | 0.18 |

| $ | 0.10 |

|

|

Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

| 38,499 |

|

| 32,110 |

|

| 36,999 |

|

| 32,043 |

|

|

Diluted |

|

| 40,095 |

|

| 33,138 |

|

| 38,469 |

|

| 32,615 |

|

|

| | | | | | | | |

| | Three Months Ended | | | ||||

| | March 31, | | | ||||

|

| 2024 |

| 2023 |

|

| ||

| | | | | | | | |

Net loss | | $ | (2,048) | | $ | (3,666) | | |

Other comprehensive income (loss), net of tax: | | | | | | | | |

Change in foreign currency translation gain (loss), net of tax | |

| (2,010) | |

| 887 | | |

Change in unrealized gain on available-for-sale debt investments, net of tax | |

| 7 | |

| 111 | | |

Total other comprehensive income (loss), net of tax | |

| (2,003) | |

| 998 | | |

Comprehensive loss attributable to AXT, Inc. | |

| (4,051) | |

| (2,668) | | |

Less: Comprehensive loss attributable to noncontrolling interests and redeemable noncontrolling interests | |

| 341 | |

| 178 | | |

Comprehensive loss attributable to AXT, Inc. | | $ | (3,710) | | $ | (2,490) | | |

See accompanying notes to condensed consolidated financial statements.

45

AXT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited, in thousands)

| | | | | | | |

| | Three Months Ended | | ||||

| | March 31, | | ||||

|

| 2024 |

| 2023 | | ||

Cash flows from operating activities: | | | | | | | |

Net Loss | | $ | (2,048) | | $ | (3,666) | |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | |

Depreciation and amortization | |

| 2,192 | |

| 2,118 | |

Amortization of marketable securities premium | |

| — | |

| 7 | |

Stock-based compensation | |

| 809 | |

| 915 | |

(Gain) Loss on disposal of equipment | |

| — | |

| 5 | |

Equity in income of unconsolidated joint ventures | |

| (890) | |

| (1,034) | |

Deferred tax assets | | | 40 | | | (10) | |

Changes in operating assets and liabilities: | | | | | | | |

Accounts receivable | |

| (6,076) | |

| 7,982 | |

Inventories | |

| (720) | |

| (1,466) | |

Prepaid expenses and other current assets | |

| (375) | |

| 1,965 | |

Other assets | |

| 65 | |

| (1,055) | |

Accounts payable | |

| 815 | |

| (3,351) | |

Accrued liabilities | |

| (558) | |

| (1,568) | |

Other long-term liabilities | |

| (2,060) | |

| (2,376) | |

Net cash used in operating activities | |

| (8,806) | |

| (1,534) | |

Cash flows from investing activities: | | | | | | | |

Purchases of property, plant and equipment | |

| (4,392) | |

| (3,616) | |

Proceeds from sales and maturities of available-for-sale debt securities | |

| 480 | |

| 2,903 | |

Net cash used in investing activities | |

| (3,912) | |

| (713) | |

Cash flows from financing activities: | | | | | | | |

Proceeds from common stock options exercised | |

| 20 | |

| 8 | |

Proceeds from short-term bank loans | |

| 12,858 | |

| 18,372 | |

Payments on short-term bank loans | | | (16,541) | | | (12,810) | |

Proceeds from capital increase in subsidiary shares from noncontrolling interests | | | — | | | 203 | |

Proceeds from long-term loan | | | 5,831 | | | — | |

Payments on long-term loan | | | (168) | | | — | |

Net cash provided by financing activities | |

| 2,000 | |

| 5,773 | |

Effect of exchange rate changes on cash and restricted cash | |

| 204 | |

| 19 | |

Net increase (decrease) in cash and restricted cash | |

| (10,514) | |

| 3,545 | |

Cash and restricted cash at the beginning of the year | |

| 50,114 | |

| 41,348 | |

Cash and restricted cash at the end of the period | | $ | 39,600 | | $ | 44,893 | |

Supplemental disclosure of non-cash flow information: | | | | | | | |

Notes receivables paid to purchase fixed assets | | $ | 1,377 | | $ | — | |

Investment in subsidiary shares from noncontrolling interest | | $ | — | | $ | 72 | |

Consideration payable in connection with construction in progress, included in accrued liabilities | | $ | 21 | | $ | — | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Three Months Ended |

| Nine Months Ended |

| ||||||||

|

| September 30, |

| September 30, |

| ||||||||

|

| 2017 |

| 2016 |

| 2017 |

| 2016 |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

| $ | 4,565 |

| $ | 2,211 |

| $ | 6,788 |

| $ | 2,942 |

|

Other comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in foreign currency translation gain (loss), net of tax |

|

| 1,135 |

|

| (233) |

|

| 2,457 |

|

| (1,801) |

|

Change in unrealized gain (loss) on available-for-sale investments, net of tax |

|

| 27 |

|

| (112) |

|

| (98) |

|

| (253) |

|

Total other comprehensive income (loss), net of tax |

|

| 1,162 |

|

| (345) |

|

| 2,359 |

|

| (2,054) |

|

Comprehensive income |

|

| 5,727 |

|

| 1,866 |

|

| 9,147 |

|

| 888 |

|

Less: Comprehensive (income) loss attributable to noncontrolling interests |

|

| (326) |

|

| 48 |

|

| (111) |

|

| 681 |

|

Comprehensive income attributable to AXT, Inc. |

| $ | 5,401 |

| $ | 1,914 |

| $ | 9,036 |

| $ | 1,569 |

|

See accompanying notes to condensed consolidated financial statements.

5

AXT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in thousands)

|

|

|

|

|

|

|

|

|

| Nine Months Ended |

| ||||

|

| September 30, |

| ||||

|

| 2017 |

| 2016 |

| ||

Cash flows from operating activities: |

|

|

|

|

|

|

|

Net income |

| $ | 6,788 |

| $ | 2,942 |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

| 3,361 |

|

| 3,620 |

|

Amortization of marketable securities premium |

|

| 124 |

|

| 85 |

|

Impairment charge on equity investee |

|

| 313 |

|

| — |

|

Stock-based compensation |

|

| 961 |

|

| 789 |

|

Realized gain on sale of available-for-sale securities |

|

| (77) |

|

| (429) |

|

Gain on disposal of equipment |

|

| — |

|

| (5) |

|

Loss from equity method investments, net |

|

| 1,074 |

|

| 1,437 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable |

|

| (6,206) |

|

| (72) |

|

Inventories |

|

| (66) |

|

| (1,092) |

|

Prepaid expenses and other current assets |

|

| (587) |

|

| (1,259) |

|

Other assets |

|

| 64 |

|

| 435 |

|

Accounts payable |

|

| 2,589 |

|

| 949 |

|

Accrued liabilities |

|

| (107) | * |

| (1,301) | * |

Other long-term liabilities, including royalties |

|

| (241) |

|

| (591) |

|

Net cash provided by operating activities |

|

| 7,990 |

|

| 5,508 |

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

Purchases of equipment |

|

| (16,557) |

|

| (2,200) |

|

Proceeds from sale of equipment |

|

| — |

|

| 35 |

|

Purchases of available-for-sale securities |

|

| (26,093) |

|

| (10,784) |

|

Proceeds from sales and maturities of available-for-sale securities |

|

| 13,310 |

|

| 12,316 |

|

Repayment of related party notes receivable |

|

| 108 |

|

| — |

|

Net cash used in investing activities |

|

| (29,232) |

|

| (633) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

Proceeds from issuance of common stock and options exercised, net of issuance costs |

|

| 33,384 |

|

| 428 |

|

Dividends paid by joint ventures to their minority shareholders |

|

| (465) |

|

| (39) |

|

Net cash provided by financing activities |

|

| 32,919 |

|

| 389 |

|

Effect of exchange rate changes on cash and cash equivalents |

|

| 249 |

|

| (478) |

|

Net increase in cash and cash equivalents |

|

| 11,926 |

|

| 4,786 |

|

Cash and cash equivalents at the beginning of the period |

|

| 36,152 |

|

| 24,875 |

|

Cash and cash equivalents at the end of the period |

| $ | 48,078 |

| $ | 29,661 |

|

* Dividend accrued but not paid by one of our consolidated subsidiaries of $521 and $520 was included in accrued liabilities as of September 30, 2017 and September 30, 2016, respectively.

See accompanying notes to condensed consolidated financial statements.

6

AXT, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 1. Basis of Presentation

The accompanying condensed consolidated financial statements of AXT, Inc. (“AXT,” the “Company,” “we,” “us,” and “our” refer to AXT, Inc. and all of its consolidated subsidiaries) are unaudited, and have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, this interim quarterly financial report does not include all disclosures required by accounting principles generally accepted in the United States of America.U.S. GAAP. In the opinion of our management, the unaudited condensed consolidated financial statements reflect all adjustments, consisting only of normal recurring adjustments, considered necessary to present fairly the financial position, results of operations and cash flows of AXT, and our consolidated subsidiariesInc. for all periods presented.

Certain reclassifications have been made to prior periods’ financial statements to conform to the current period presentation. These reclassifications did not result in any change in previously reported net income or total assets.

Our management has made a number of estimates and assumptions relating to the reporting of assets and liabilities and the disclosure of contingent assets and liabilities to prepare these condensed consolidated financial statements in conformity with accounting principles generally acceptedU.S. GAAP. Due to the COVID-19 pandemic, there has been uncertainty and disruption in the United States of America.global economy and financial markets. These estimates and assumptions may change as new events occur and additional information is obtained. Actual results could differ materially from those estimates.

The results of operations for the three and nine months ended September 30, 2017March 31, 2024 are not necessarily indicative of the results to be expected in the future or for the full fiscal year. It is recommended that these condensed consolidated financial statements be read in conjunction with our consolidated financial statements and the notes thereto included in our 20162023 Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on February 27, 2017 and our quarterly reports on Form 10-Q for the three months ended March 31, 2017 and June 30, 2017 filed with the SEC on May 8, 2017 and August 4, 2017, respectively. 15, 2024.

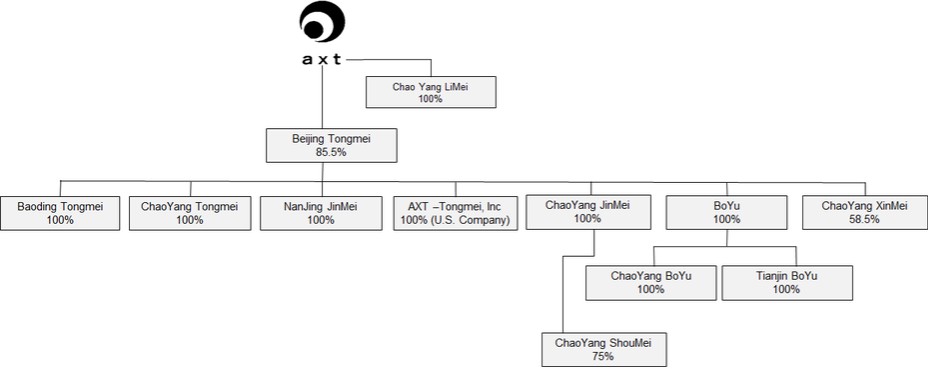

The condensed consolidated financial statements include the accounts of AXT and our wholly-owned subsidiary,consolidated subsidiaries, Beijing Tongmei Xtal Technology Co., Ltd. (“Tongmei”), and our majority-owned, or significantly controlled subsidiaries, Beijing JiYa Semiconductor MaterialAXT-Tongmei, Inc. (“AXT-Tongmei”), Baoding Tongmei Xtal Technology Co., Ltd. (“Baoding Tongmei”), ChaoYang Tongmei Xtal Technology Co., Ltd. (“ChaoYang Tongmei”), ChaoYang LiMei Semiconductor Technology Co., Ltd. (“ChaoYang LiMei”), ChaoYang XinMei High Purity Semiconductor Materials Co., Ltd. (“ChaoYang XinMei”), Nanjing JinMei Gallium Co., Ltd. (“JinMei”), ChaoYang JinMei Gallium Ltd. (“ChaoYang JinMei”), ChaoYang ShuoMei High Purity Semiconductor Materials Co., Ltd. (“ChaoYang ShuoMei”), MaAnShan JinMei Gallium Ltd., (“MaAnShan JinMei”) and Beijing BoYu Semiconductor Vessel Craftwork Technology Co., Ltd. (“BoYu”). All significant inter‑companyinter-company accounts and transactions have been eliminated. Investments in business entities in which we do not have controlling interests, but have the ability to exercise significant influence over operating and financial policies (generally 20-50% ownership), are accounted for by the equity method. As of March 31, 2024 and December 31, 2023, we have three companies accounted for by the equity method. In May 2023, we reduced our ownership in Emeishan Jia Mei High Purity Metals Co., Ltd. (“Jia Mei”) from 25% to 10% by selling a portion of our Jia Mei shares to an unrelated third party for approximately $827,000. As a result of our decreased ownership and the fact that we do not have the ability to exercise significant influence over Jia Mei’s operations, as of May 2023, we no longer reported Jia Mei as an equity investment in our condensed consolidated balance sheets. Our Jia Mei investment was re-measured to fair value at the time of sale. Any future changes to the fair value are recognized through net income (“fair value method”). For partially-ownedthe majority-owned subsidiaries that we consolidate, we reflect the noncontrolling interest of the portion we do not own as either noncontrolling interests in stockholder’s equity or as redeemable noncontrolling interests in temporary equity on our condensed consolidated balance sheets in stockholders’ equity and in our condensed consolidated statements of operations.

When warranted by favorable market conditions, we intend to construct facilities at the ChaoYang LiMei location to provide us with additional production capacity. For the three months ended March 31, 2024, expenses associated with ChaoYang LiMei had a de minimis impact on our condensed consolidated financial statements.

In February 2021, Tongmei signed a joint venture agreement with certain investors to fund a new company, ChaoYang XinMei. The agreement called for a total investment of approximately $3.0 million, of which Tongmei would

7

fund approximately $1.8 million for a 58.5 percent ownership of ChaoYang XinMei. In February 2021, Tongmei and the investors completed the initial funding of approximately $1.5 million. Tongmei’s portion of the investment was approximately $0.9 million. In May 2021, Tongmei and the investors completed the funding of the remaining balance of approximately $1.5 million. Tongmei’s portion of the final investment was approximately $0.9 million, for a total investment of approximately $1.8 million for a 58.5 percent ownership of ChaoYang XinMei. In September 2021 and October 2021, ChaoYang XinMei received funding from a minority investor of $0.9 million and $1.0 million, respectively. In December 2021 and January 2022, ChaoYang XinMei received funding from Tongmei of $1.4 million and $1.4 million, respectively. In January 2022, the China local government certified this additional funding in ChaoYang XinMei as an equity investment. In April 2022, Tongmei entered into a capital increase agreement (the “Capital Increase Agreement”) with minority investors to further invest approximately $4.5 million in ChaoYang XinMei. Tongmei’s portion of the investment was approximately $2.6 million, of which $1.1 million was invested in April 2022 and $0.8 million was invested in May 2022. The minority investors’ portion of the investment was approximately $1.9 million, of which $0.7 million was invested in April 2022 and $0.6 million was invested in May 2022. As a result, noncontrolling interests increased $1.4 million and redeemable noncontrolling interests increased $0.1 million. In July 2022, Tongmei and the minority investors further invested $0.8 million and $0.6 million in ChaoYang XinMei, respectively. This completed the investment obligations under the Capital Increase Agreement. As a result, noncontrolling interests increased $610,000 and redeemable noncontrolling interests increased $57,000. Tongmei’s ownership remained at 58.5% after these equity investments.

In April 2022, ChaoYang JinMei signed a joint venture agreement with certain investors to fund a new company, ChaoYang ShuoMei, our consolidated subsidiary (the “ChaoYang ShuoMei Joint Venture Agreement”). The ChaoYang ShuoMei Joint Venture Agreement called for a total investment of approximately $4.4 million, of which ChaoYang JinMei would fund approximately $3.3 million for a 75 percent ownership of ChaoYang ShuoMei. In July and August 2022, ChaoYang JinMei completed the initial funding of $1.0 million in ChaoYang ShuoMei. In August 2022, the investor invested $334,000 in ChaoYang ShuoMei. As a result, noncontrolling interests increased $406,000 and redeemable noncontrolling interests increased $73,000. In January 2023, ChaoYang ShuoMei received $0.5 million in funding from ChaoYang JinMei and $0.2 million in funding from one of the minority investors. As a result, noncontrolling interests increased $0.2 million and redeemable noncontrolling interests increased $36,000. In May 2023, ChaoYang ShuoMei received $1.0 million in funding from ChaoYang JinMei and $0.3 million in funding from one of the minority investors. As a result, noncontrolling interests increased $0.4 million and redeemable noncontrolling interests increased $75,000. In August 2023, ChaoYang ShuoMei received $0.6 million in funding from ChaoYang JinMei and $0.2 million in funding from one of the minority investors. As a result, noncontrolling interests increased $0.2 million and redeemable noncontrolling interests increased $44,000. ChaoYang JinMei has completed its investment obligations under the ChaoYang ShuoMei Joint Venture Agreement. ChaoYang JinMei’s ownership of ChaoYang ShuoMei remained at 75% after these equity investments.

In April 2022, Tongmei signed a joint venture agreement with certain investors to fund a new company, ChaoYang KaiMei Quartz Co., Ltd. (“ChaoYang KaiMei”) (the “ChaoYang KaiMei Joint Venture Agreement”), which called for a total investment of approximately $7.6 million, of which Tongmei would fund approximately $3.0 million for a 40 percent ownership of ChaoYang KaiMei. In July 2022, Tongmei and the investors completed the initial funding of approximately $2.2 million. Tongmei’s portion of the investment was approximately $0.9 million. In January 2023, Tongmei made an investment of $0.9 million to ChaoYang KaiMei. In each of July 2023 and August 2023, Tongmei made an investment of approximately $0.6 million in ChaoYang KaiMei. In September 2023, Tongmei entered into another joint venture agreement with the same group of investors. This new agreement called for additional investment of approximately $5.6 million, with Tongmei committing to fund approximately $2.3 million. In December 2023, Tongmei made its initial additional investment of approximately $0.6 million in ChaoYang KaiMei. These contributions culminated in the fulfillment of all of Tongmei’s financial obligations under the ChaoYang KaiMei Joint Venture Agreement. Tongmei’s ownership of ChaoYang KaiMei remained at 40% after these equity investments.

All activities for MaAnShan JinMei ceased during the first half of 2022 and the subsidiary was subsequently dissolved in May 2022. The dissolution of MaAnShan JinMei had a de minimis impact on the condensed consolidated results.

8

During the quarter ended December 31, 2020, Tongmei entered into two sets of definitive transaction documents, each consisting of a capital increase agreement along with certain supplemental agreements in substantially the same form (collectively, the “Capital Investment Agreements”), with several private equity investors in China.

In preparation for Tongmei’s application for a listing of shares in an initial public offering (the “IPO”) on the Shanghai Stock Exchange’s Sci-Tech innovAtion boaRd (the “STAR Market”), in late December 2020, we reorganized our entity structures in China. JinMei and BoYu and their subsidiaries were assigned to Tongmei and effectively merged with Tongmei although they retained their own respective legal entity status and are wholly owned subsidiaries of Tongmei. The 33% minority interest stakeholders of BoYu converted their ownership to a 7.59% minority interest in Tongmei. The 8.5% minority interest stakeholders, employees of JinMei, converted their ownership to a 0.38% minority interest in Tongmei. Further, a number of employees, key managers and contributors purchased a 0.4% minority interest in Tongmei. Additionally, Baoding Tongmei and ChaoYang Tongmei, were assigned to Tongmei as wholly owned subsidiaries. In 2020, the private equity funds (the “Investors”) had transferred approximately $48.1 million of new capital to Tongmei. An additional investment of approximately $1.5 million of new capital was funded in January 2021. Under China regulations these investments must be formally approved by the appropriate government agency and are not deemed to be dilutive until such approval is granted. The government approved the approximately $49 million investment in its entirety on January 25, 2021, at which time the Investors owned a redeemable noncontrolling interest in Tongmei of 7.28%. As of March 31, 2024, Tongmei’s noncontrolling interests and redeemable noncontrolling interests totaled approximately 14.5%. We remain the controlling stakeholder of Tongmei and hold a majority of the board of director positions of Tongmei. In June 2021, we sold AXT-Tongmei to Tongmei for $1. Since Tongmei is 85.5% owned by us, and the transaction was between common interest holders, the transaction was accounted for at net book value and resulted in an increase of $1.2 million to noncontrolling interests and $1.2 million to redeemable noncontrolling interests.

Note 2. Investments and Fair Value Measurements

Our cash and cash equivalents consist of cash and instruments with original maturities of less than three months. Our investments consist of instruments with original maturities of more than three months.months. As of September 30, 2017March 31, 2024 and December 31, 2016,2023, our cash cash equivalents and debt investments are classified as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | March 31, 2024 | | December 31, 2023 |

| ||||||||||||||||||||

|

| | |

| Gross |

| Gross |

| | |

| | |

| Gross |

| Gross |

| | |

| ||||

| | Amortized | | Unrealized | | Unrealized | | Fair | | Amortized | | Unrealized | | Unrealized | | Fair |

| ||||||||

|

| Cost |

| Gain |

| (Loss) |

| Value |

| Cost |

| Gain |

| (Loss) |

| Value |

| ||||||||

Classified as: | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and restricted cash | | $ | 39,600 | | $ | — | | $ | — | | $ | 39,600 | | $ | 50,114 | | $ | — | | $ | — | | $ | 50,114 | |

Investments (available-for-sale): | | | | | | | | | | | | | | | | | | | | | | | | | |

Certificates of deposit 1 | |

| 1,680 | |

| — | | | (13) | |

| 1,667 | |

| 2,160 | |

| — | | | (20) | |

| 2,140 | |

Total cash, restricted cash and investments | | $ | 41,280 | | $ | — | | $ | (13) | | $ | 41,267 | | $ | 52,274 | | $ | — | | $ | (20) | | $ | 52,254 | |

Contractual maturities on investments: | | | | | | | | | | | | | | | | | | | | | | | | | |

Due within 1 year 2 | | $ | 1,680 | | | | | | | | $ | 1,667 | | $ | 2,160 | | | | | | | | $ | 2,140 | |

| | $ | 1,680 | | | | | | | | $ | 1,667 | | $ | 2,160 | | | | | | | | $ | 2,140 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| September 30, 2017 |

| December 31, 2016 |

| ||||||||||||||||||||

|

|

|

|

| Gross |

| Gross |

|

|

|

|

|

|

| Gross |

| Gross |

|

|

|

| ||||

|

| Amortized |

| Unrealized |

| Unrealized |

| Fair |

| Amortized |

| Unrealized |

| Unrealized |

| Fair |

| ||||||||

|

| Cost |

| Gain |

| (Loss) |

| Value |

| Cost |

| Gain |

| (Loss) |

| Value |

| ||||||||

Classified as: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash |

| $ | 47,054 |

| $ | — |

| $ | — |

| $ | 47,054 |

| $ | 23,948 |

| $ | — |

| $ | — |

| $ | 23,948 |

|

Cash equivalents: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certificates of deposit 1 |

|

| 1,024 |

|

| — |

|

| — |

|

| 1,024 |

|

| 12,204 |

|

| — |

|

| — |

|

| 12,204 |

|

Total cash and cash equivalents |

|

| 48,078 |

|

| — |

|

| — |

|

| 48,078 |

|

| 36,152 |

|

| — |

|

| — |

|

| 36,152 |

|

Investments (available-for-sale): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certificates of deposit 2 |

|

| 6,618 |

|

| 1 |

|

| (12) |

|

| 6,607 |

|

| 8,999 |

|

| 1 |

|

| (20) |

|

| 8,980 |

|

Corporate bonds |

|

| 23,644 |

|

| — |

|

| (42) |

|

| 23,602 |

|

| 8,479 |

|

| — |

|

| (47) |

|

| 8,432 |

|

Corporate equity securities |

|

| — |

|

| — |

|

| — |

|

| — |

|

| 48 |

|

| 111 |

|

| — |

|

| 159 |

|

Total investments |

|

| 30,262 |

|

| 1 |

|

| (54) |

|

| 30,209 |

|

| 17,526 |

|

| 112 |

|

| (67) |

|

| 17,571 |

|

Total cash, cash equivalents and investments |

| $ | 78,340 |

| $ | 1 |

| $ | (54) |

| $ | 78,287 |

| $ | 53,678 |

| $ | 112 |

| $ | (67) |

| $ | 53,723 |

|

Contractual maturities on investments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Due within 1 year 3 |

| $ | 20,549 |

|

|

|

|

|

|

| $ | 20,524 |

| $ | 11,325 |

|

|

|

|

|

|

| $ | 11,415 |

|

Due after 1 through 5 years 4 |

|

| 9,713 |

|

|

|

|

|

|

|

| 9,685 |

|

| 6,201 |

|

|

|

|

|

|

|

| 6,156 |

|

|

| $ | 30,262 |

|

|

|

|

|

|

| $ | 30,209 |

| $ | 17,526 |

|

|

|

|

|

|

| $ | 17,571 |

|

| 1. |

|

|

| Certificates of deposit with original maturities of more than three months. |

| 2. |

| Classified as “Short-term investments” in our condensed consolidated balance sheets. |

|

|

We manage our debt investments as a single portfolio of highly marketable securities that is intended to be available to meet our current cash requirements. We have no investments in auction rate securities. Certificates of deposit and corporate bonds are typically held until maturity. Corporate equity securities have no maturity and may be sold at any time. Our holding of corporate equity securities consists of common stock of GCS Holdings, Inc. (“GHI”) (previously Global Communication Semiconductors, Inc.), a Taiwan publicly-traded company. We began classifying GHI as an available-for-sale security in

Historically, the second quarter of 2015 when we determined that there was sufficient trading volume in the exchange for the stock to be deemed readily marketable.

During the three months ended March 31, 2017, we sold the remainder of our GHI stock; therefore, there were no GHI transactions in the three months ended September 30, 2017. During the nine months ended September 30, 2017, our cash proceeds from sales of GHI stock were $125,000. Our cost was $48,000 and our gross realized gain from sales of GHI stock was $77,000. As of September 30, 2017, we no longer hold any GHI stock.

During the three months ended September 30, 2016, we sold some of our GHI stock and our cash proceeds from sales of available-for-sale-investments were $113,000. Our cost was $29,000 and our gross realized gain from sales of available-for-sale-investments was $84,000. During the nine months ended September 30, 2016, we sold some of our GHI stock and our cash proceeds from sales of available-for-sale investments were $581,000. Our cost was $152,000 and our gross realized gain from sales of available-for-sale investments was $429,000.

8

The gross unrealized losses related to our portfolio of available-for-sale debt securities were immaterial, and primarily due to changes in interest ratesnormal market fluctuations and market andnot due to increased credit conditionsrisk or other valuation concerns. There was an insignificant amount of the underlying securities. We have determined that the gross unrealized losses on our available-for-sale debt securities as of September 30, 2017 areMarch 31, 2024, and historically, such gross unrealized losses have been temporary in nature.nature and we believe that it is

9

probable the principal and interest will be collected in accordance with the contractual terms. We periodically review our debt investment portfolio at least quarterly, or when there are changes in credit risks or other potential valuation concerns, to identify and evaluate investments that have indications of possible impairment.whether an allowance for credit losses or impairment would be necessary. Factors considered in determining whether a loss is temporary include the magnitude of the decline in market value, the length of time the market value has been below cost (or adjusted cost), credit quality, and our ability and intent to hold the securities for a period of time sufficient to allow for any anticipated recovery in market value.

A portion of our investments would generate a loss if we sold them on September 30, 2017. The following table summarizes the fair value and gross unrealized losses related to available-for-sale debt securities, aggregated by investment category and length of time that individual securities have been in a continuous unrealized loss position as of September 30, 2017March 31, 2024 (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||

|

| In Loss Position |

| In Loss Position |

| Total In |

| |||||||||||||||||||||||||||||||||||||||||||||

|

| < 12 months |

| > 12 months |

| Loss Position |

| |||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

| Gross |

|

|

|

| Gross |

|

|

|

| Gross |

| ||||||||||||||||||||||||||||||||||||

|

| Fair |

| Unrealized |

| Fair |

| Unrealized |

| Fair |

| Unrealized |

| |||||||||||||||||||||||||||||||||||||||

As of September 30, 2017 |

| Value |

| (Losses) |

| Value |

| (Losses) |

| Value |

| (Losses) |

| |||||||||||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | |||||||||||||||||||||||||||||||||

| | In Loss Position | | In Loss Position | | Total In |

| |||||||||||||||||||||||||||||||||||||||||||||

| | < 12 months | | > 12 months | | Loss Position |

| |||||||||||||||||||||||||||||||||||||||||||||

| | | | | Gross | | | | | Gross | | | | | Gross |

| ||||||||||||||||||||||||||||||||||||

| | Fair | | Unrealized | | Fair | | Unrealized | | Fair | | Unrealized |

| |||||||||||||||||||||||||||||||||||||||

As of March 31, 2024 |

| Value |

| (Losses) |

| Value |

| (Losses) |

| Value |

| (Losses) |

| |||||||||||||||||||||||||||||||||||||||

Investments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | | | | | | | | ||||||||||||||

Certificates of deposit |

| $ | 2,564 |

| $ | (6) |

| $ | 2,344 |

| $ | (6) |

| $ | 4,908 |

| $ | (12) |

| | $ | — | | $ | — | | $ | 1,667 | | $ | (13) | | $ | 1,667 | | $ | (13) | | ||||||||||||||

Corporate bonds |

|

| 23,602 |

|

| (42) |

|

| — |

|

| — |

|

| 23,602 |

|

| (42) |

| |||||||||||||||||||||||||||||||||

Total in loss position |

| $ | 26,166 |

| $ | (48) |

| $ | 2,344 |

| $ | (6) |

| $ | 28,510 |

| $ | (54) |

| | $ | — | | $ | — | | $ | 1,667 | | $ | (13) | | $ | 1,667 | | $ | (13) | | ||||||||||||||

The following table summarizes the fair value and gross unrealized losses related to available-for-sale debt securities, aggregated by investment category and length of time that individual securities have been in a continuous unrealized loss position as of December 31, 20162023 (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||

|

| In Loss Position |

| In Loss Position |

| Total In |

| |||||||||||||||||||||||||||||||

|

| < 12 months |

| > 12 months |

| Loss Position |

| |||||||||||||||||||||||||||||||

|

|

|

| Gross |

|

|

| Gross |

|

|

| Gross |

| |||||||||||||||||||||||||

|

| Fair |

| Unrealized |

| Fair |

| Unrealized |

| Fair |

| Unrealized |

| |||||||||||||||||||||||||

As of December 31, 2016 |

| Value |

| (Loss) |

| Value |

| (Loss) |

| Value |

| (Loss) |

| |||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | |||||||||||||||||||||

| | In Loss Position | | In Loss Position | | Total In |

| |||||||||||||||||||||||||||||||

| | < 12 months | | > 12 months | | Loss Position |

| |||||||||||||||||||||||||||||||

|

|

| |

| Gross |

| |

| Gross |

| |

| Gross |

| ||||||||||||||||||||||||

| | Fair | | Unrealized | | Fair | | Unrealized | | Fair | | Unrealized |

| |||||||||||||||||||||||||

As of December 31, 2023 | | Value | | (Loss) | | Value | | (Loss) | | Value | | (Loss) |

| |||||||||||||||||||||||||

Investments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | | | | | | | |

Certificates of deposit |

| $ | 5,211 |

| $ | (20) |

| $ | 1,200 |

| $ | — |

| $ | 6,411 |

| $ | (20) |

| | $ | — | | $ | — | | $ | 2,140 | | $ | (20) | | $ | 2,140 | | $ | (20) | |

Corporate bonds |

|

| 5,037 |

|

| (35) |

|

| 3,395 |

|

| (12) |

|

| 8,432 |

|

| (47) |

| |||||||||||||||||||

Total in loss position |

| $ | 10,248 |

| $ | (55) |

| $ | 4,595 |

| $ | (12) |

| $ | 14,843 |

| $ | (67) |

| | $ | — | | $ | — | | $ | 2,140 | | $ | (20) | | $ | 2,140 | | $ | (20) | |

Restricted Cash

We maintain restricted cash in connection with cash balances temporarily restricted for regular business operations. These balances have been excluded from the Company’s cash balance. As of March 31, 2024, $13.8 million was included in restricted cash in our condensed consolidated balance sheets.

Investments in Privately-held Raw Material Companies

We have made strategic investments in private companies located in China in order to gain access at a competitive cost to raw materials that are critical to our substrate business (see Note 7). The investment balances for all of thesethe non-consolidated companies including minority investments indirectly in privately-held companies made by our consolidated subsidiaries, are accounted for under the equity method, and included in “Other assets” in the condensed consolidated balance sheets, and totaled $10.1$13.2 million and $11.3$12.5 million as of September 30, 2017March 31, 2024 and December 31, 2016,2023, respectively. As of September 30, 2017,March 31, 2024, there were seventhree companies accounted for under the equity method. There were no impairment charges in the three months ended September 30, 2017. The nine months ended September 30, 2017 include an impairment chargeOne of $313,000 forour equity investments, Beijing JiYa Semiconductor Material Co., Ltd. (“JiYa”), determined one of their equity investments was fully impaired and wrote the gallium companies. During the first quarter of 2017, management determined that it is unlikely that this company will recover from the difficult pricing environment and we had written the investmentasset balance down to zero. We hadThis resulted in a $754,000 impairment charge in our second quarter 2023 financial results. Except as mentioned above, there were no impairment charges for the remainder of these investments during the three and nine months ended September 30, 2016.March 31, 2024 and 2023.

In May 2023, we reduced our ownership in Jia Mei from 25% to 10% by selling a portion of our Jia Mei shares to an unrelated third party for approximately $827,000. As a result of our decreased ownership and the fact that we do not have the ability to exercise significant influence over Jia Mei’s operations, we adopted the fair value method of accounting to report on the investment in Jia Mei. Our investments under the fair value method are reviewed for other-than-temporary declines in value on a quarterly basis. We monitor our investments for impairment and record reductions

910

in carrying value when events or changes in circumstances indicate that the carrying value may not be recoverable. As of March 31, 2024, our investments in this unconsolidated company had a carrying value of $551,000 and were included in “Other assets” in the condensed consolidated balance sheets. As a result of the share sale, we recognized a gain of $575,000. Additionally, in accordance with Accounting Standards Codification (“ASC”) 321-10-35-2, we adjusted the investment in Jia Mei to its fair value at the time of the sale, which resulted in a gain of $383,000. The gain resulting from the sale and the subsequent remeasurement was incorporated as a component of “Equity in income of unconsolidated joint ventures” in the condensed consolidated statements of operations in the second quarter of 2023.

Fair Value Measurements

We invest primarily in money market accounts, certificates of deposits, corporate bonds and notes, government securities and government securities. Accounting Standards Codification (“ASC”) Topicmoney market accounts. We review our debt investment portfolio for credit loss at least quarterly or when there are changes in credit risk or other potential valuation concerns. As of March 31, 2024 and December 31, 2023, the total unrealized loss, net of tax, included in accumulated other comprehensive income was immaterial. We believe it is probable the principal and interest will be collected in accordance with the contractual terms, and the unrealized loss on these securities was due to normal market fluctuations, and not due to increased credit risk or other valuation concerns. ASC 820, Fair Value Measurements and Disclosures (“ASC 820”), establishes three levels of inputs that may be used to measure fair value. Level 1 instrument valuations are obtained from real-time quotes for transactions in active exchange markets of the asset or identical assets. Level 2 instrument valuations are obtained from readily-available,readily- available, observable pricing sources for comparable instruments. Level 3 instrument valuations are obtained from unobservable inputs in which there is little or no market data, which require us to develop our own assumptions. On a recurring basis, we measure certain financial assets and liabilities at fair value, primarily consisting of our short-term and long-term debt investments.

The type of instrument valued based on quoted market prices in active markets includeincludes our money market funds, which are generally classified within Level 1 of the fair value hierarchy. Other than corporate equity securities which are based on quoted market prices and classified as Level 1, weWe classify our available-for-sale debt securities, including certificates of deposit and corporate bonds, as having Level 2 inputs. The valuation techniques used to measure the fair value of these financial instruments having Level 2 inputs were derived from bank statements, quoted market prices, broker or dealer statements or quotations, or alternative pricing sources with reasonable levels of price transparency.

We place short-term foreign currency hedges that are intended to offset the potential cash exposure related to fluctuations in the exchange rate between the United States dollar and Japanese Yen.yen. We measure the fair value of these foreign currency hedges at each month end and quarter end using current exchange rates and in accordance with generally accepted accounting principles.U.S. GAAP. At quarter end, any foreign currency hedges not settled are netted in “Accrued liabilities” on the condensed consolidated balance sheetsheets and classified as Level 3 assets and liabilities. As of September 30, 2017March 31, 2024, the net change in fair value from the placement of the hedge to settlement at each month end during the quarter had a de minimis impact toon the condensed consolidated results.

There were no changes in valuation techniques or related inputs in the three and nine months ended September 30, 2017.March 31, 2024. There have been no transfersbetweenfair value measurements levels during the three and nine months ended September 30, 2017.March 31, 2024.

The following table summarizes our financial assets and liabilities measured at fair value on a recurring basis in accordance with ASC 820 as of September 30, 2017March 31, 2024 (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

|

|

|

|

| Quoted Prices in |

|

|

|

| Significant |

| |||||||||||||||

|

|

|

|

| Active Markets of |

| Significant Other |

| Unobservable |

| ||||||||||||||||

|

| Balance as of |

| Identical Assets |

| Observable Inputs |

| Inputs |

| |||||||||||||||||

|

| September 30, 2017 |

| (Level 1) |

| (Level 2) |

| (Level 3) |

| |||||||||||||||||

| | | | | | | | | | | | | | |||||||||||||

|

| | |

| Quoted Prices in |

| | | | Significant |

| |||||||||||||||

| | | | | Active Markets of | | Significant Other | | Unobservable |

| ||||||||||||||||

| | Balance as of | | Identical Assets | | Observable Inputs | | Inputs |

| |||||||||||||||||

|

| March 31, 2024 |

| (Level 1) |

| (Level 2) |

| (Level 3) |

| |||||||||||||||||

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

Cash equivalents and investments: |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Investments: | | | | | | | | | | | | | | |||||||||||||

Certificates of deposit |

| $ | 7,631 |

| $ | — |

| $ | 7,631 |

| $ | — |

| | $ | 1,667 | | $ | — | | $ | 1,667 | | $ | — | |

Corporate bonds |

|

| 23,602 |

|

| — |

|

| 23,602 |

|

| — |

| |||||||||||||

Total |

| $ | 31,233 |

| $ | — |

| $ | 31,233 |

| $ | — |

| | $ | 1,667 | | $ | — | | $ | 1,667 | | $ | — | |

1011

The following table summarizes our financial assets and liabilities measured at fair value on a recurring basis in accordance with ASC 820 as of December 31, 20162023 (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

|

|

|

|

| Quoted Prices in |

|

|

|

| Significant |

| |||||||||||||||

|

|

|

|

| Active Markets of |

| Significant Other |

| Unobservable |

| ||||||||||||||||

|

| Balance as of |

| Identical Assets |

| Observable Inputs |

| Inputs |

| |||||||||||||||||

|

| December 31, 2016 |

| (Level 1) |

| (Level 2) |

| (Level 3) |

| |||||||||||||||||

| | | | | | | | | | | | | | |||||||||||||

|

| | |

| Quoted Prices in |

| | | | Significant |

| |||||||||||||||

| | | | | Active Markets of | | Significant Other | | Unobservable |

| ||||||||||||||||

| | Balance as of | | Identical Assets | | Observable Inputs | | Inputs |

| |||||||||||||||||

|

| December 31, 2023 |

| (Level 1) |

| (Level 2) |

| (Level 3) |

| |||||||||||||||||

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

Cash equivalents and investments: |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Investments: | | | | | | | | | | | | | | |||||||||||||

Certificates of deposit |

| $ | 21,184 |

| $ | — |

| $ | 21,184 |

| $ | — |

| | $ | 2,140 | | $ | — | | $ | 2,140 | | $ | — | |

Corporate bonds |

|

| 8,432 |

|

| — |

|

| 8,432 |

|

| — |

| |||||||||||||

Corporate equity securities |

|

| 159 |

|

| 159 |

|

| — |

|

| — |

| |||||||||||||

Total |

| $ | 29,775 |

| $ | 159 |

| $ | 29,616 |

| $ | — |

| | $ | 2,140 | | $ | — | | $ | 2,140 | | $ | — | |

Items Measured at Fair Value on a Nonrecurring Basis

Certain assets that are subject to nonrecurring fair value measurements are not included in the table above. These assets include investments in privately-held companies accounted for by the equity or costfair value method (See(see Note 7). There were no impairment charges in the three months ended September 30, 2017. The nine months ended September 30, 2017 include an impairment charge of $313,000 for one of the gallium companies. During the first quarter of 2017, management determined that it is unlikely that this company will recover from the difficult pricing environment and we had written the investment down to zero. Except as mentioned, weWe did not record any other-than-temporary impairment charges for the remainder of these investments during the three and nine months ended September 30, 2017March 31, 2024 and 2016.2023, respectively.

Note 3. Inventories

The components of inventories are summarized below (in thousands):

|

|

|

|

|

|

|

| |||||||

|

| September 30, |

| December 31, |

| |||||||||

|

| 2017 |

| 2016 |

| |||||||||

| | | | | | | | |||||||

| | March 31, | | December 31, | | |||||||||

|

| 2024 |

| 2023 |

| |||||||||

Inventories: |

|

|

|

|

|

|

| | | | | | | |

Raw materials |

| $ | 21,000 |

| $ | 17,485 |

| | $ | 28,501 | | $ | 32,910 | |

Work in process |

|

| 17,178 |

|

| 20,410 |

| |

| 54,281 | |

| 50,008 | |

Finished goods |

|

| 2,590 |

|

| 2,257 |

| |

| 3,161 | |

| 3,585 | |

|

| $ | 40,768 |

| $ | 40,152 |

| |||||||

| | $ | 85,943 | | $ | 86,503 | | |||||||

As of September 30, 2017March 31, 2024 and December 31, 2016,2023, carrying values of inventories were net of inventory reserves of $12.9$22.2 million and $12.0$21.9 million, respectively, for excess and obsolete inventory and $263,000$213,000 and $254,000,$78,000, respectively, for lower of cost or net realizable value reserves.

Note 4. Property, Plant and Equipment, Net

The components of our property, plant and equipment are summarized below (in thousands):

|

|

|

|

|

|

|

| |||||||

|

| September 30, |

| December 31, |

| |||||||||

|

| 2017 |

| 2016 |

| |||||||||

| | | | | | | | |||||||

| | March 31, | | December 31, | | |||||||||

| | 2024 | | 2023 | | |||||||||

Property, plant and equipment: |

|

|

|

|

|

|

| | | | | | | |

Machinery and equipment, at cost |

| $ | 42,970 |

| $ | 41,254 |

| | $ | 66,472 | | $ | 65,918 | |

Less: accumulated depreciation and amortization |

|

| (40,017) |

|

| (37,311) |

| | | (42,065) | | | (42,112) | |

Building, at cost |

|

| 31,327 |

|

| 29,600 |

| | | 124,200 | | | 125,786 | |

Less: accumulated depreciation and amortization |

|

| (10,951) |

|

| (9,654) |

| | | (23,791) | | | (23,339) | |

Leasehold improvements, at cost |

|

| 5,351 |

|

| 4,942 |

| |

| 7,470 | |

| 7,596 | |

Less: accumulated depreciation and amortization |

|

| (4,093) |

|

| (3,608) |

| | | (6,014) | | | (5,984) | |

Construction in progress |

|

| 17,668 |

|

| 2,582 |

| |

| 36,850 | |

| 38,483 | |

|

| $ | 42,255 |

| $ | 27,805 |

| |||||||

| | $ | 163,122 | | $ | 166,348 | | |||||||

11

As of September 30, 2017,March 31, 2024, the balance of construction in processprogress was $17.7$36.9 million, of which $13.6$29.4 million was fromrelated to our buildings in our new Dingxing location, $1.5and Kazuo locations, $2.9 million was for manufacturing equipment purchases not yet placed in service and $2.6$4.6 million was from ourfor construction in processprogress for our other consolidated subsidiaries. As of December 31, 2023, the balance of construction in progress was $38.5 million, of which $31.2

12

million was for our buildings in our new Dingxing and Kazuo locations, $3.1 million was for manufacturing equipment purchases not yet placed in service and $4.2 million was for our construction in progress for our other consolidated subsidiaries.

Note 5. Accrued Liabilities

The components of accrued liabilities are summarized below (in thousands):

|

|

|

|

|

|

|

| |||||||

|

| September 30, |

| December 31, |

| |||||||||

|

| 2017 |

| 2016 |

| |||||||||

| | | | | | | | |||||||

| | March 31, | | December 31, | | |||||||||

|

| 2024 |

| 2023 |

| |||||||||

Accrued compensation and related charges | | $ | 2,941 | | $ | 3,707 | | |||||||

Preferred stock dividends payable |

| $ | 2,901 |

| $ | 2,901 |

| | | 2,901 | | | 2,901 | |

Accrued compensation and related charges |

|

| 1,449 |

|

| 2,610 |

| |||||||

Advance from customers |

|

| 771 |

|

| 238 |

| |||||||

Current portion of royalty payments |

|

| 575 |

|

| 575 |

| |||||||

Payable in connection with construction in progress | | | 1,613 | | | 7,249 | | |||||||

Other tax payable | | | 652 | | | 493 | | |||||||

Advances from customers | | | 535 | | | 305 | | |||||||

Accrued product warranty | | | 495 | | | 703 | | |||||||

Accrued professional services |

|

| 541 |

|

| 583 |

| | | 471 | | | 868 | |

Dividends payable by consolidated joint ventures |

|

| 521 |

|

| 499 |

| |||||||

Current portion of operating lease liabilities | | | 463 | | | 458 | | |||||||

Other personnel-related costs | | | 276 | | | 286 | | |||||||

Accrued income taxes |

|

| 330 |

|

| 203 |

| | | 272 | | | — | |

Accrued product warranty |

|

| 138 |

|

| 251 |

| |||||||

Accrual for sales returns | | | 34 | | | 39 | | |||||||

Other accrued liabilities |

|

| 2,058 |

|

| 1,400 |

| | | 2,044 | | | 2,010 | |

|

| $ | 9,284 |

| $ | 9,260 |

| |||||||

| | $ | 12,697 | | $ | 19,019 | | |||||||

| | | | | | | | |||||||

Note 6. Related Party Transactions

In August 2011,September 2021 and October 2021, our consolidated joint venture, Beijing JiYa Semiconductor Material Co., Ltd. (“JiYa”), entered intosubsidiary, ChaoYang XinMei, received funding from a non-interest bearing note agreementminority investor of $0.9 million and $1.0 million, respectively. As of December 31, 2021, $1.9 million was included in the amount of $1.6 million for a loan to one of its equity investment entities. The original term of the loan was for two years and ten months with three periodic principal payments required. After various amendments to the terms of the note, in December 2013, the parties agreed to delay all principal repayment until December 2017. In December 2016, we determined that this receivable was in substance an investment and began re-classifying this long termshort-term loan from “Related party notes receivable – long-term” to “Other assets” in our consolidated balance sheets. As of September 30, 2017 and December 31, 2016, we included $1.2 million and $1.4 million in “Other assets” in our condensed consolidated balance sheets, respectively.

JiYa also purchases raw materials from one of its equity investment entities for production in the ordinary course of business. As of September 30, 2017 and December 31, 2016, amounts payable of $1.8 million and $1.8 million, respectively, were included in “Accounts payable” in our condensed consolidated balance sheets.

JiYa also sold raw materials to one of its equity investment entities for production in the ordinary course of business. As of September 30, 2017 and December 31, 2016, amounts receivable of $326,000 and $313,000, respectively, were included in “Accounts receivable”noncontrolling interest in our condensed consolidated balance sheets. DuringIn December 2021 and January 2022, the three months ended December 31, 2016, we deemedsame subsidiary received funding from Tongmei of $1.4 million and $1.4 million, respectively. In January 2022, the collectionChina local government certified this additional funding in ChaoYang XinMei as an equity investment. As a result, noncontrolling interests increased $2.2 million and redeemable noncontrolling interests increased $0.2 million. Short-term loan from noncontrolling interest decreased to $0. In April 2022, Tongmei entered into the Capital Increase Agreement with minority investors to further invest $4.5 million in ChaoYang XinMei. In April 2022 and May 2022, ChaoYang XinMei received funding from Tongmei of $1.1 million and $0.8 million, respectively, as equity investments. In April 2022 and May 2022, the outstanding amount to be improbableminority investors invested $0.7 million and established an allowance$0.6 million, respectively. As a result, noncontrolling interests increased $1.4 million and redeemable noncontrolling interests increased $0.1 million. In July 2022, Tongmei and the minority investors further invested $0.8 million and $0.6 million in full. There have since been no additional sales made on credit toChaoYang XinMei, respectively. This completed the customerinvestment obligations under the Capital Increase Agreement. As a result, noncontrolling interests increased $610,000 and as ofredeemable noncontrolling interests increased $57,000. Tongmei’s ownership remained at 58.5% after these equity investments.

In September 30, 2017 the existing outstanding amount continues to be fully reserved.

Beginning in 2012,2022, our consolidated joint venture, Nanjing JinMei Gallium Co., Ltd. (“JinMei”), is contractually obligated under an agency sales agreementsubsidiary, ChaoYang LiMei completed the sale of land and its attached buildings to sell raw material on behalf of its equity investment entity. JinMei bills the customers and remits the receipts, net of its portions of sales commission, to this equity investment entity. For the three months ended September 30, 2017 and 2016, JinMei has recorded $2,000 and $0, respectively, income from agency sales. For the nine months ended September 30, 2017 and 2016, Jin Mei has recorded $3,000 and $1,000 income from agency sales, respectively, which were included in “Other (expense) income, net” in the condensed consolidated statements of operations.

In March 2012, our wholly-owned subsidiary, Beijing Tongmei Xtal Technology Co., Ltd. (“Tongmei”), entered into an operating lease for the land it owns with our consolidated joint venture, Beijing BoYu Semiconductor Vessel Craftwork Technology Co., Ltd. (“BoYu”). The lease agreement for the land of approximately 22,081 square feet

12

commenced on January 1, 2012 for a term of 10 years with annual lease payments of $24,000 subject to a 5% increase at each third year anniversary. The annual lease payment is due by January 31st of each year.

Tongmei has paid certain amounts on behalf of Donghai County Dongfang High Purity Electronic Materials Co., Ltd. (“Dongfang”), its equity investment entity, to purchase materials. The original agreement was signed between Tongmei and Dongfang in 2014 and the date of repayment was set as December 31, 2015. In 2015, both parties agreed to delay the date of repayment to December 31, 2017. During the three months ended September 30, 2017, the repayment of principle and interest totaling $55,000 was received by our wholly-owned subsidiary. As of September 30, 2017, the balance of $57,000 was included in “Related party notes receivable – current”. As of December 31, 2016, the balance of $107,000 was included in “Related party notes receivable – long-term” in our condensed consolidated balance sheets.

In April 2014, Tongmei loaned an additional $44,000 to Dongfang. The loan bears interest at 6.15% per annum and comes due on December 31, 2017. During the three months ended June 30, 2017, the repayment of the principal and interest totaling $53,000 was received by our wholly-owned subsidiary. As of September 30, 2017 and December 31, 2016, this balance, including both principal and accrued interest, was $0 and $50,000, respectively, and was included in “Related party notes receivable – long-term” in our condensed consolidated balance sheets.

Tongmei also purchases raw materials from Dongfang for production in the ordinary course of business. As of September 30, 2017 and December 31, 2016, amounts payable of $0 and $210,000, respectively, were included in “Accounts payable” in our condensed consolidated balance sheets.

Tongmei purchases raw materials from one of our equity investment entities, Emei Shan Jiamei Materials Co. Ltd. (“Jiamei”)entity, ChaoYang KaiMei, for production in the ordinary coursea total consideration of business.$1.5 million. In January 2023, ChaoYang KaiMei paid to ChaoYang LiMei $1.5 million. As of September 30, 2017 and December 31, 2016, amounts payable of $0 and $377,000, respectively, were included in “Accounts payable” in our condensed consolidated balance sheets.

Tongmei also purchases raw materials from one of our equity investment entities, Xilingol Tongli Germanium Refine Co. Ltd. (“Tongli”), for production in the ordinary course of business. As of September 30, 2017 and December 31, 2016, amounts payable of $433,000 and $246,000, respectively, were included in “Accounts payable” in our condensed consolidated balance sheets.

In July 2017, Tongmei, provided an inter-company loan to JinMei in the amount of $751,000 in preparation for the acquisition of the land use rights and the construction of a new building. The inter-company loan carries an interest rate of 4.9% per annum and is due in three installments between December 2021 and December 2023. JinMei is in the process of relocating its headquarters and manufacturing operations to an alternative location. Currently, JinMei has identified a site as a possible candidate and the estimated costs for the land use rights acquisition and facility construction is expected to be approximately $6 million.

In April 2016, our consolidated joint venture, BoYu, provided a personal loan of $177,000 to one of its executive employees. This loan is secured by the executive employee’s shares in BoYu. The loan bears interest at 2.75% per annum. Principal and accrued interest are due on March 31, 2019. During the three months ended June 30, 2017, the repayment of the principal and interest totaling $180,000 were received by our consolidated joint venture. As of September 30, 2017 and December 31, 2016, these balances, including both principal and accrued interest, were2024, $0 and $179,000, respectively, andmillion was included in “Prepaid expenses and other current assets” in our condensed consolidated balance sheets.

Tongmei also purchases raw materials from one of JiYa’s equity investment entities for production in the ordinary course of business. As of September 30, 2017 and December 31, 2016, amounts payable of $0 and $146,000, respectively, were included in “Accounts payable” in our condensed consolidated balance sheets.

Beijing Kaide Quartz Co. Ltd. (“Kaide”) has been a supplier of customized quartz tubes to the Company since 2004. Beijing XiangHeMing Trade Co. Ltd. (“XiangHeMing”) is a significant shareholder of Kaide. XiangHeMing was previously owned by, among others, certain immediate family members of Davis Zhang, our former President, China Operations, until at least sometime in 2004, at which time the official Chinese government records indicate that Mr.

13

Zhang’s immediate family members transferred their ownership of XiangHeMing to a third party. However, we are currently unable to conclusively determine whether Mr. Zhang’s immediate family members retained any economic interest in XiangHeMing after the transfer. As of September 30, 2017 and December 31, 2016, amounts payable to Kaide of $579,000 and $323,000, respectively, were included in “Accounts payable” in our condensed consolidated balance sheets.

Our Related Party Transactions Policy seeks to prohibit all conflicts of interest in transactions between related parties and us, unless they have been approved by our Board of Directors. This policy applies to all of our employees, directors, and our consolidated subsidiaries. Our executive officers retain board seats on the board of directors of the companies in which we have invested in our China joint ventures. See Note 7 for further details.

13

Note 7. Investments in Privately-Held Raw Material Companies

We have made strategic investments in private companies located in China in order to gain access at a competitive cost to raw materials that are critical to our substrate business. We have six direct investments. Our consolidated subsidiaries have also made investments in private companies. We have four indirect investments. These companies form part of our overall supply chain.chain strategy.

The six directAs of March 31, 2024, the investments are summarized below (in thousands):

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

|

| Investment Balance as of |

|

|

|

|

| |||||||||||||||

|

| September 30, |

| December 31, |

| Accounting |

| Ownership |

| |||||||||||||

| | | | | | | | | | | | |||||||||||

| | Investment Balance as of | | | | | | |||||||||||||||

| | March 31, | | December 31, | | Accounting | | Ownership | * | |||||||||||||

Company |

| 2017 |

| 2016 |

| Method |

| Percentage |

|

| 2024 |

| 2023 |

| Method |

| Percentage | | ||||

Nanjing JinMei Gallium Co., Ltd. | | $ | 592 | | $ | 592 |

| Consolidated |

| ** 85.5 | % | |||||||||||

ChaoYang JinMei Gallium Co., Ltd. | | | 1,820 | | | 1,820 | | Consolidated | | ** 85.5 | % | |||||||||||

Beijing BoYu Semiconductor Vessel Craftwork Technology Co., Ltd. | |

| 1,346 | |

| 1,346 |

| Consolidated |

| ** 85.5 | % | |||||||||||

ChaoYang ShuoMei High Purity Semiconductor Materials Co., Ltd. | | | 3,122 | | | 3,122 | | Consolidated | | **** 75.0 | % | |||||||||||

ChaoYang XinMei High Purity Semiconductor Materials Co., Ltd. | | | 7,331 | | | 7,331 | | Consolidated |

| *** 58.5 | % | |||||||||||

| | $ | 14,211 | | $ | 14,211 | | | | | | |||||||||||

| | | | | | | | | | | | |||||||||||

Beijing JiYa Semiconductor Material Co., Ltd. |

| $ | 3,331 |

| $ | 3,331 |

| Consolidated |