| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

2024

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE EXCHANGE ACT OF 1934 | ||||

_________

USA Technologies, Inc.

(Exact name of registrant as specified in its charter)

| Pennsylvania | 23-2679963 | |||||||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| 101 Lindenwood Drive | Malvern, | Pennsylvania | 19355 | ||||||||||||||

(Address of principal executive offices) | (Zip Code) | ||||||||||||||||

(Registrant’s telephone number, including area code)

| Title of Each Class | Trading Symbol | Name Of Each Exchange On Which Registered | ||||||

| Common Stock, no par value | CTLP | The NASDAQ Stock Market LLC | ||||||

☐

| Large accelerated filer |

| Accelerated filer |

| |||||||||

Non-accelerated filer |

| Smaller reporting company |

| |||||||||

Emerging growth company |

| |||||||||||

| Item 6. | Exhibits | ||||||||

|

|

|

|

|

|

|

|

| December 31, |

| June 30, | ||

($ in thousands, except shares) |

| 2017 |

| 2017 | ||

|

| (unaudited) |

| (audited) | ||

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

| $ | 15,386 |

| $ | 12,745 |

Accounts receivable, less allowance of $3,740 and $3,149, respectively |

|

| 15,472 |

|

| 7,193 |

Finance receivables, less allowance of $49 and $19, respectively |

|

| 5,517 |

|

| 11,010 |

Inventory |

|

| 11,215 |

|

| 4,586 |

Prepaid expenses and other current assets |

|

| 1,971 |

|

| 968 |

Total current assets |

|

| 49,561 |

|

| 36,502 |

|

|

|

|

|

|

|

Non-current assets: |

|

|

|

|

|

|

Finance receivables, less current portion |

|

| 11,215 |

|

| 8,607 |

Other assets |

|

| 1,120 |

|

| 687 |

Property and equipment, net |

|

| 12,622 |

|

| 12,111 |

Deferred income taxes |

|

| 14,774 |

|

| 27,670 |

Intangibles, net |

|

| 30,910 |

|

| 622 |

Goodwill |

|

| 64,449 |

|

| 11,492 |

Total non-current assets |

|

| 135,090 |

|

| 61,189 |

|

|

|

|

|

|

|

Total assets |

| $ | 184,651 |

| $ | 97,691 |

|

|

|

|

|

|

|

Liabilities and shareholders’ equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

| $ | 23,775 |

| $ | 16,054 |

Accrued expenses |

|

| 6,798 |

|

| 4,130 |

Line of credit, net |

|

| — |

|

| 7,036 |

Capital lease obligations and current obligations under long-term debt |

|

| 5,121 |

|

| 3,230 |

Income taxes payable |

|

| 6 |

|

| 10 |

Deferred revenue |

|

| 595 |

|

| — |

Deferred gain from sale-leaseback transactions |

|

| 198 |

|

| 239 |

Total current liabilities |

|

| 36,493 |

|

| 30,699 |

|

|

|

|

|

|

|

Long-term liabilities: |

|

|

|

|

|

|

Revolving credit facility |

|

| 10,000 |

|

| — |

Capital lease obligations and long-term debt, less current portion |

|

| 23,874 |

|

| 1,061 |

Accrued expenses, less current portion |

|

| 65 |

|

| 53 |

Deferred gain from sale-leaseback transactions, less current portion |

|

| 49 |

|

| 100 |

Total long-term liabilities |

|

| 33,988 |

|

| 1,214 |

|

|

|

|

|

|

|

Total liabilities |

| $ | 70,481 |

| $ | 31,913 |

|

|

|

|

|

|

|

Commitments and contingencies (Note 13) |

|

|

|

|

|

|

Shareholders’ equity: |

|

|

|

|

|

|

Preferred stock, no par value, 1,800,000 shares authorized, no shares issued |

|

| — |

|

| — |

Series A convertible preferred stock, 900,000 shares authorized, 445,063 issued and outstanding, with liquidation preferences of $19,109 and $18,775 at December 31, 2017 and June 30, 2017, respectively |

|

| 3,138 |

|

| 3,138 |

Common stock, no par value, 640,000,000 shares authorized, 53,619,898 and 40,331,645 shares issued and outstanding at December 31, 2017 and June 30, 2017, respectively |

|

| 307,053 |

|

| 245,999 |

Accumulated deficit |

|

| (196,021) |

|

| (183,359) |

Total shareholders’ equity |

|

| 114,170 |

|

| 65,778 |

Total liabilities and shareholders’ equity |

| $ | 184,651 |

| $ | 97,691 |

| ($ in thousands, except share data) | March 31, 2024 (Unaudited) | June 30, 2023 | ||||||||||||

| Assets | ||||||||||||||

| Current assets: | ||||||||||||||

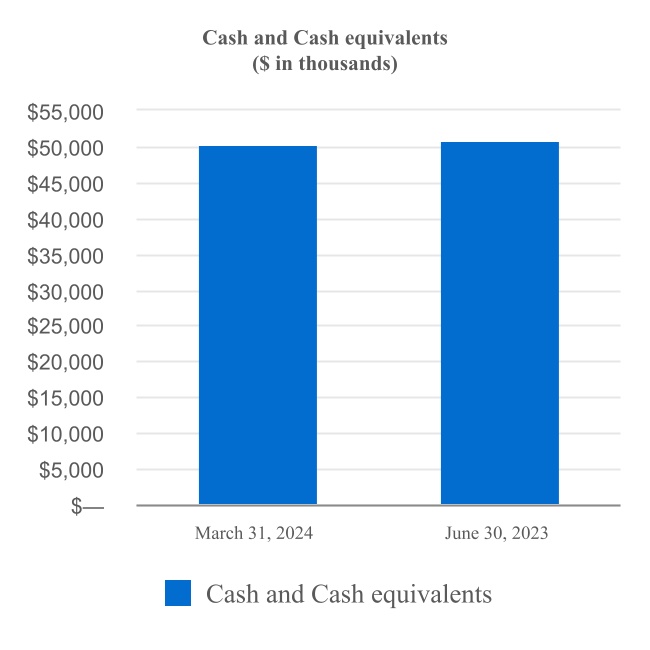

| Cash and cash equivalents | $ | 50,197 | $ | 50,927 | ||||||||||

| Accounts receivable, net | 43,324 | 30,162 | ||||||||||||

| Finance receivables, net | 5,781 | 6,668 | ||||||||||||

| Inventory, net | 37,364 | 31,872 | ||||||||||||

| Prepaid expenses and other current assets | 8,327 | 3,754 | ||||||||||||

| Total current assets | 144,993 | 123,383 | ||||||||||||

| Non-current assets: | ||||||||||||||

| Finance receivables due after one year, net | 11,041 | 13,307 | ||||||||||||

| Property and equipment, net | 30,320 | 25,281 | ||||||||||||

| Operating lease right-of-use assets | 8,164 | 2,575 | ||||||||||||

| Intangibles, net | 26,687 | 27,812 | ||||||||||||

| Goodwill | 94,008 | 92,005 | ||||||||||||

| Other assets | 4,688 | 5,249 | ||||||||||||

| Total non-current assets | 174,908 | 166,229 | ||||||||||||

| Total assets | $ | 319,901 | $ | 289,612 | ||||||||||

| Liabilities, convertible preferred stock, and shareholders’ equity | ||||||||||||||

| Current liabilities: | ||||||||||||||

| Accounts payable | $ | 64,128 | $ | 52,869 | ||||||||||

| Accrued expenses | 24,824 | 26,276 | ||||||||||||

| Current obligations under long-term debt | 1,450 | 882 | ||||||||||||

| Deferred revenue | 1,893 | 1,666 | ||||||||||||

| Total current liabilities | 92,295 | 81,693 | ||||||||||||

| Long-term liabilities: | ||||||||||||||

| Deferred income taxes | 409 | 275 | ||||||||||||

| Long-term debt, less current portion | 36,647 | 37,548 | ||||||||||||

| Operating lease liabilities, non-current | 9,035 | 2,504 | ||||||||||||

| Total long-term liabilities | 46,091 | 40,327 | ||||||||||||

| Total liabilities | 138,386 | 122,020 | ||||||||||||

| Commitments and contingencies (Note 15) | ||||||||||||||

| Convertible preferred stock: | ||||||||||||||

| Series A convertible preferred stock, 900,000 shares authorized, 385,782 issued and outstanding, with liquidation preferences of $22,722 and $22,144 at March 31, 2024 and June 30, 2023, respectively | 2,720 | 2,720 | ||||||||||||

| Shareholders’ equity: | ||||||||||||||

| Common stock, no par value, 640,000,000 shares authorized, 72,799,266 and 72,664,464 shares issued and outstanding at March 31, 2024 and June 30, 2023, respectively | 481,467 | 477,324 | ||||||||||||

| Accumulated deficit | (302,665) | (312,452) | ||||||||||||

| Accumulated other comprehensive loss | (7) | — | ||||||||||||

| Total shareholders’ equity | 178,795 | 164,872 | ||||||||||||

| Total liabilities, convertible preferred stock, and shareholders’ equity | $ | 319,901 | $ | 289,612 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Three months ended |

| Six months ended | ||||||||

|

| December 31, |

| December 31, | ||||||||

($ in thousands, except shares and per share data) |

| 2017 |

| 2016 |

| 2017 |

| 2016 | ||||

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

License and transaction fees |

| $ | 22,853 |

| $ | 16,639 |

| $ | 42,797 |

| $ | 33,004 |

Equipment sales |

|

| 9,653 |

|

| 5,117 |

|

| 15,326 |

|

| 10,340 |

Total revenues |

|

| 32,506 |

|

| 21,756 |

|

| 58,123 |

|

| 43,344 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs of sales: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of services |

|

| 14,362 |

|

| 11,389 |

|

| 27,688 |

|

| 22,632 |

Cost of equipment |

|

| 8,943 |

|

| 4,033 |

|

| 14,033 |

|

| 8,211 |

Total costs of sales |

|

| 23,305 |

|

| 15,422 |

|

| 41,721 |

|

| 30,843 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

| 9,201 |

|

| 6,334 |

|

| 16,402 |

|

| 12,501 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

| 8,329 |

|

| 5,785 |

|

| 15,075 |

|

| 12,593 |

Integration and acquisition costs |

|

| 3,335 |

|

| 8 |

|

| 4,097 |

|

| 109 |

Depreciation and amortization |

|

| 737 |

|

| 307 |

|

| 982 |

|

| 515 |

Total operating expenses |

|

| 12,401 |

|

| 6,100 |

|

| 20,154 |

|

| 13,217 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating (loss) income |

|

| (3,200) |

|

| 234 |

|

| (3,752) |

|

| (716) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

| 251 |

|

| 200 |

|

| 331 |

|

| 273 |

Interest expense |

|

| (494) |

|

| (201) |

|

| (703) |

|

| (413) |

Change in fair value of warrant liabilities |

|

| - |

|

| - |

|

| - |

|

| (1,490) |

Total other expense, net |

|

| (243) |

|

| (1) |

|

| (372) |

|

| (1,630) |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income before income taxes |

|

| (3,443) |

|

| 233 |

|

| (4,124) |

|

| (2,346) |

(Provision) benefit for income taxes |

|

| (9,073) |

|

| - |

|

| (8,605) |

|

| 115 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

| (12,516) |

|

| 233 |

|

| (12,729) |

|

| (2,231) |

Preferred dividends |

|

| - |

|

| - |

|

| (334) |

|

| (334) |

Net (loss) income applicable to common shares |

| $ | (12,516) |

| $ | 233 |

| $ | (13,063) |

| $ | (2,565) |

Net (loss) income per common share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

| (0.24) |

|

| 0.01 |

|

| (0.26) |

|

| (0.07) |

Diluted |

|

| (0.24) |

|

| 0.01 |

|

| (0.26) |

|

| (0.07) |

Weighted average number of common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

| 52,150,106 |

|

| 40,308,934 |

|

| 49,861,735 |

|

| 39,398,469 |

Diluted |

|

| 52,150,106 |

|

| 40,730,712 |

|

| 49,861,735 |

|

| 39,398,469 |

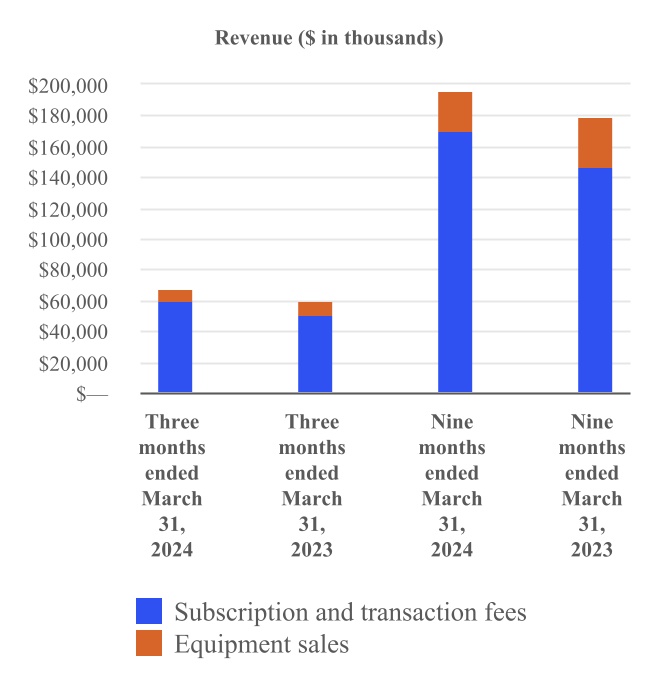

| Three months ended | Nine months ended | |||||||||||||||||||||||||

| March 31, | March 31, | |||||||||||||||||||||||||

| ($ in thousands, except share and per share data) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||

| Subscription and transaction fees | $ | 59,207 | $ | 51,245 | $ | 170,371 | $ | 147,252 | ||||||||||||||||||

| Equipment sales | 8,690 | 9,111 | 25,568 | 32,216 | ||||||||||||||||||||||

| Total revenues | 67,897 | 60,356 | 195,939 | 179,468 | ||||||||||||||||||||||

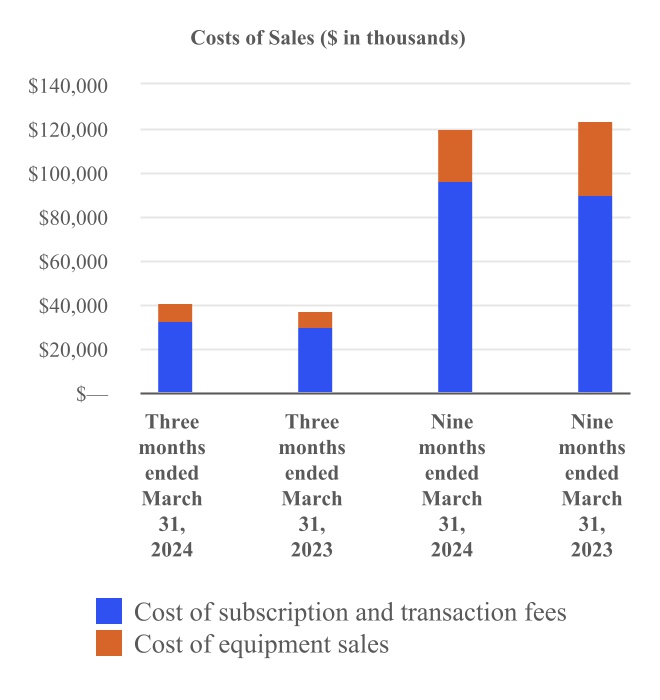

| Costs of sales: | ||||||||||||||||||||||||||

| Cost of subscription and transaction fees | 32,926 | 29,577 | 96,539 | 90,149 | ||||||||||||||||||||||

| Cost of equipment sales | 8,064 | 7,886 | 23,849 | 33,823 | ||||||||||||||||||||||

| Total costs of sales | 40,990 | 37,463 | 120,388 | 123,972 | ||||||||||||||||||||||

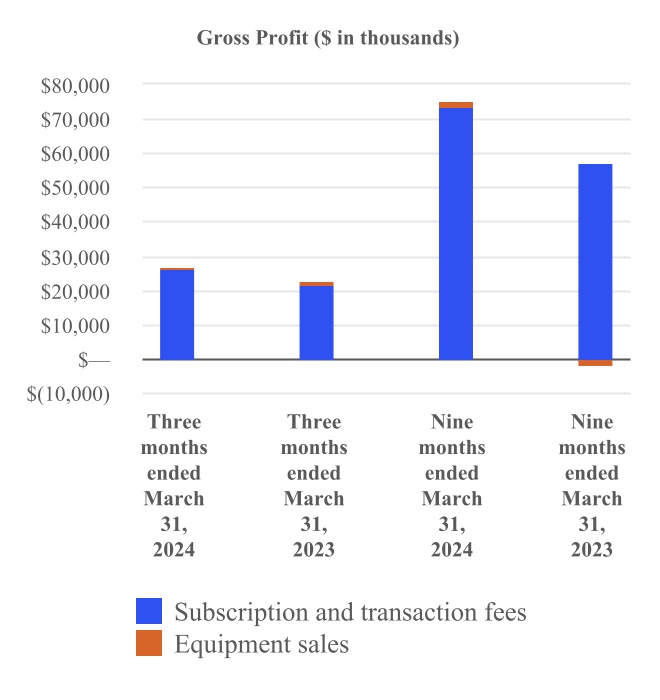

| Gross profit | 26,907 | 22,893 | 75,551 | 55,496 | ||||||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||||

| Sales and marketing | 5,747 | 3,154 | 14,256 | 8,888 | ||||||||||||||||||||||

| Technology and product development | 4,916 | 4,594 | 12,115 | 16,757 | ||||||||||||||||||||||

| General and administrative | 8,552 | 7,041 | 29,493 | 25,179 | ||||||||||||||||||||||

| Investigation, proxy solicitation and restatement expenses, net of insurance recoveries | — | (1,000) | — | (453) | ||||||||||||||||||||||

| Integration and acquisition expenses | 907 | — | 1,078 | 2,787 | ||||||||||||||||||||||

| Depreciation and amortization | 2,493 | 2,364 | 7,976 | 5,029 | ||||||||||||||||||||||

| Total operating expenses | 22,615 | 16,153 | 64,918 | 58,187 | ||||||||||||||||||||||

| Operating income (loss) | 4,292 | 6,740 | 10,633 | (2,691) | ||||||||||||||||||||||

| Other income (expense): | ||||||||||||||||||||||||||

| Interest income from cash and leases | 495 | 540 | 1,505 | 1,985 | ||||||||||||||||||||||

| Interest income (expense) from debt and tax liabilities | 162 | (263) | (1,947) | (1,258) | ||||||||||||||||||||||

| Other expense, net | (209) | (13) | (158) | (112) | ||||||||||||||||||||||

| Total other income (expense), net | 448 | 264 | (600) | 615 | ||||||||||||||||||||||

| Income (loss) before income taxes | 4,740 | 7,004 | 10,033 | (2,076) | ||||||||||||||||||||||

| Provision for income taxes | (84) | (56) | (246) | (123) | ||||||||||||||||||||||

| Net income (loss) | 4,656 | 6,948 | 9,787 | (2,199) | ||||||||||||||||||||||

| Preferred dividends | (289) | (289) | (578) | (623) | ||||||||||||||||||||||

| Net income (loss) applicable to common shares | $ | 4,367 | $ | 6,659 | $ | 9,209 | $ | (2,822) | ||||||||||||||||||

| Net earnings (loss) per common share | ||||||||||||||||||||||||||

| Basic | $ | 0.06 | $ | 0.09 | $ | 0.13 | $ | (0.04) | ||||||||||||||||||

| Diluted | 0.06 | 0.09 | 0.12 | (0.04) | ||||||||||||||||||||||

| Weighted average number of common shares outstanding used to compute net earnings (loss) per share applicable to common shares | ||||||||||||||||||||||||||

| Basic | 72,851,498 | 72,491,373 | 72,770,582 | 71,771,135 | ||||||||||||||||||||||

| Diluted | 74,068,437 | 72,866,221 | 74,054,820 | 71,771,135 | ||||||||||||||||||||||

4

USA Technologies,

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series A |

|

|

|

|

|

| ||||||||

|

| Convertible |

|

|

|

|

|

| ||||||||

|

| Preferred Stock |

| Common Stock |

| Accumulated |

|

| ||||||||

($ in thousands, except shares) |

| Shares |

| Amount |

| Shares |

| Amount |

| Deficit |

| Total | ||||

Balance, June 30, 2017 |

| 445,063 |

| $ | 3,138 |

| 40,331,645 |

| $ | 245,999 |

| $ | (183,359) |

| $ | 65,778 |

Issuance of common stock in relation to public offering, net of offering costs incurred of $3,237 (a) |

| — |

|

| — |

| 9,583,332 |

|

| 39,888 |

|

| — |

|

| 39,888 |

Issuance of common stock as merger consideration(b) |

| — |

|

| — |

| 3,423,367 |

|

| 19,810 |

|

| — |

|

| 19,810 |

Stock based compensation |

| — |

|

| — |

| 281,554 |

|

| 1,356 |

|

| — |

|

| 1,356 |

Excess tax benefit from stock plans(c) |

| — |

|

| — |

| — |

|

| — |

|

| 67 |

|

| 67 |

Net loss |

| — |

|

| — |

| — |

|

| — |

|

| (12,729) |

|

| (12,729) |

Balance, December 31, 2017 |

| 445,063 |

| $ | 3,138 |

| 53,619,898 |

| $ | 307,053 |

| $ | (196,021) |

| $ | 114,170 |

|

|

|

|

|

|

See accompanying notes.

| Three months ended | Nine months ended | |||||||||||||||||||||||||

| March 31, | March 31, | |||||||||||||||||||||||||

| ($ in thousands) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| Net income (loss) | $ | 4,656 | $ | 6,948 | $ | 9,787 | $ | (2,199) | ||||||||||||||||||

| Foreign currency translation adjustments | 17 | — | (7) | — | ||||||||||||||||||||||

| Other comprehensive income (loss) | 17 | — | (7) | — | ||||||||||||||||||||||

| Total comprehensive income (loss) | $ | 4,673 | $ | 6,948 | $ | 9,780 | $ | (2,199) | ||||||||||||||||||

USA Technologies,Cantaloupe, Inc.

| Convertible Preferred Stock | Common Stock | Accumulated Deficit | Accumulated Other Comprehensive Income (Loss) | Total Shareholders' Equity | ||||||||||||||||||||||||||||||||||||||||

| ($ in thousands, except share data) | Shares | Amount | Shares | Amount | ||||||||||||||||||||||||||||||||||||||||

| Balance, June 30, 2023 | 385,782 | $ | 2,720 | 72,664,464 | $ | 477,324 | $ | (312,452) | $ | — | $ | 164,872 | ||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | 20,801 | 1,934 | — | — | 1,934 | |||||||||||||||||||||||||||||||||||||

| Exercise of stock options | — | — | 10,000 | 74 | — | — | 74 | |||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | 2,007 | — | 2,007 | |||||||||||||||||||||||||||||||||||||

| Balance, September 30, 2023 | 385,782 | 2,720 | 72,695,265 | 479,332 | (310,445) | — | 168,887 | |||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | 43,793 | 1,109 | — | — | 1,109 | |||||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | — | (24) | (24) | |||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | 3,124 | — | 3,124 | |||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2023 | 385,782 | 2,720 | 72,739,058 | 480,441 | (307,321) | (24) | 173,096 | |||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | 55,208 | 1,004 | — | — | 1,004 | |||||||||||||||||||||||||||||||||||||

| Exercise of stock options | — | — | 5,000 | 22 | — | — | 22 | |||||||||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | — | 17 | 17 | |||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | 4,656 | — | 4,656 | |||||||||||||||||||||||||||||||||||||

| Balance, March 31, 2024 | 385,782 | $ | 2,720 | 72,799,266 | $ | 481,467 | $ | (302,665) | $ | (7) | $ | 178,795 | ||||||||||||||||||||||||||||||||

| Convertible Preferred Stock | Common Stock | Accumulated Deficit | Accumulated Other Comprehensive Income (Loss) | Total Shareholders' Equity | ||||||||||||||||||||||||||||||||||||||||

| ($ in thousands, except share data) | Shares | Amount | Shares | Amount | ||||||||||||||||||||||||||||||||||||||||

| Balance, June 30, 2022 | 445,063 | $ | 3,138 | 71,188,053 | $ | 469,918 | $ | (313,085) | $ | — | $ | 156,833 | ||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | 30,077 | 1,318 | — | — | 1,318 | |||||||||||||||||||||||||||||||||||||

| Repurchase of Series A convertible preferred stock | (59,281) | (418) | — | (1,733) | — | — | (1,733) | |||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | (8,574) | — | (8,574) | |||||||||||||||||||||||||||||||||||||

| Balance, September 30, 2022 | 385,782 | 2,720 | 71,218,130 | 469,503 | (321,659) | — | 147,844 | |||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | 3,919 | 160 | — | — | 160 | |||||||||||||||||||||||||||||||||||||

| Common stock issued for acquisition | — | — | 1,240,920 | 3,942 | — | — | 3,942 | |||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | (573) | — | (573) | |||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2022 | 385,782 | 2,720 | 72,462,969 | 473,605 | (322,232) | — | 151,373 | |||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | 46,292 | 1,410 | — | — | 1,410 | |||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | 6,948 | — | 6,948 | |||||||||||||||||||||||||||||||||||||

| Balance, March 31, 2023 | 385,782 | $ | 2,720 | 72,509,261 | $ | 475,015 | $ | (315,284) | $ | — | $ | 159,731 | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| Six months ended | ||||

|

| December 31, | ||||

($ in thousands) |

| 2017 |

| 2016 | ||

OPERATING ACTIVITIES: |

|

|

|

|

|

|

Net loss |

| $ | (12,729) |

| $ | (2,231) |

Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

Non-cash stock based compensation |

|

| 1,356 |

|

| 445 |

Gain on disposal of property and equipment |

|

| (83) |

|

| (31) |

Non-cash interest and amortization of debt discount |

|

| 86 |

|

| 26 |

Bad debt expense |

|

| 291 |

|

| 450 |

Depreciation and amortization |

|

| 3,476 |

|

| 2,564 |

Change in fair value of warrant liabilities |

|

| - |

|

| 1,490 |

Excess tax benefits |

|

| 67 |

|

| - |

Deferred income taxes, net |

|

| 8,537 |

|

| (115) |

Recognition of deferred gain from sale-leaseback transactions |

|

| (93) |

|

| (430) |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

| (5,290) |

|

| (2,347) |

Finance receivables |

|

| 7,958 |

|

| 2,119 |

Inventory |

|

| (5,822) |

|

| (2,689) |

Prepaid expenses and other current assets |

|

| (606) |

|

| (542) |

Accounts payable and accrued expenses |

|

| 6,950 |

|

| (3,840) |

Income taxes payable |

|

| 40 |

|

| (12) |

Net cash provided by (used in) operating activities |

|

| 4,138 |

|

| (5,143) |

|

|

|

|

|

|

|

INVESTING ACTIVITIES: |

|

|

|

|

|

|

Purchase of property and equipment, including rentals |

|

| (1,767) |

|

| (1,944) |

Proceeds from sale of property and equipment, including rentals |

|

| 157 |

|

| 61 |

Cash used for Cantaloupe acquisition |

|

| (65,181) |

|

| - |

Net cash used in investing activities |

|

| (66,791) |

|

| (1,883) |

|

|

|

|

|

|

|

FINANCING ACTIVITIES: |

|

|

|

|

|

|

Cash used in retirement of common stock |

|

| - |

|

| (31) |

Proceeds from exercise of common stock warrants |

|

| - |

|

| 6,193 |

Payment of debt issuance costs |

|

| (445) |

|

| - |

Proceeds from issuance of long-term debt |

|

| 25,100 |

|

| - |

Proceeds from revolving credit facility |

|

| 10,000 |

|

| - |

Issuance of common stock in public offering, net |

|

| 39,888 |

|

| - |

Repayment of capital lease obligations and long-term debt |

|

| (9,249) |

|

| (374) |

Net cash provided by financing activities |

|

| 65,294 |

|

| 5,788 |

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents |

|

| 2,641 |

|

| (1,238) |

Cash and cash equivalents at beginning of year |

|

| 12,745 |

|

| 19,272 |

Cash and cash equivalents at end of period |

| $ | 15,386 |

| $ | 18,034 |

|

|

|

|

|

|

|

Supplemental disclosures of cash flow information: |

|

|

|

|

|

|

Interest paid in cash |

| $ | 557 |

| $ | 469 |

Income taxes paid in cash (refund), net |

| $ | - |

| $ | - |

Supplemental disclosures of noncash financing and investing activities: |

|

|

|

|

|

|

Equity issued in connection with Cantaloupe Acquisition |

| $ | 19,810 |

| $ | - |

Equipment and software acquired under capital lease |

| $ | 227 |

| $ | 272 |

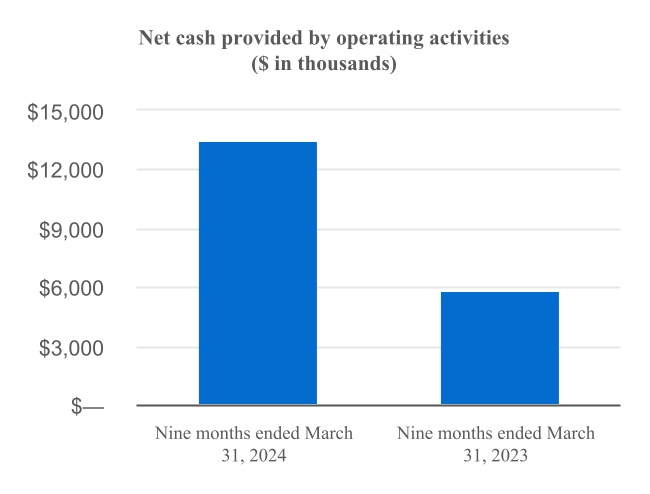

| Nine months ended | ||||||||||||||

| March 31, | ||||||||||||||

| ($ in thousands) | 2024 | 2023 | ||||||||||||

| Cash flows from operating activities: | ||||||||||||||

| Net income (loss) | $ | 9,787 | $ | (2,199) | ||||||||||

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | ||||||||||||||

| Stock based compensation | 4,047 | 2,889 | ||||||||||||

| Amortization of debt issuance costs and discounts | 93 | 87 | ||||||||||||

| Provision for expected losses | 3,423 | 1,823 | ||||||||||||

| Provision for inventory reserve | 92 | 25 | ||||||||||||

| Depreciation and amortization included in operating expenses | 7,976 | 5,029 | ||||||||||||

| Depreciation included in cost of subscription and transaction fees for rental equipment | 1,137 | 852 | ||||||||||||

| Non-cash lease expense | 1,070 | (429) | ||||||||||||

| Deferred income taxes | 134 | 72 | ||||||||||||

| Other | 527 | 363 | ||||||||||||

| Changes in operating assets and liabilities: | ||||||||||||||

| Accounts receivable | (16,471) | 9,589 | ||||||||||||

| Finance receivables | 3,038 | (653) | ||||||||||||

| Inventory | (5,584) | (8,245) | ||||||||||||

| Prepaid expenses and other assets | (3,762) | (746) | ||||||||||||

| Accounts payable and accrued expenses | 8,455 | (2,868) | ||||||||||||

| Operating lease liabilities | (655) | 183 | ||||||||||||

| Deferred revenue | 174 | 1 | ||||||||||||

| Net cash provided by operating activities | 13,481 | 5,773 | ||||||||||||

| Cash flows from investing activities: | ||||||||||||||

| Acquisition of business, net of cash acquired | (4,750) | (35,855) | ||||||||||||

| Capital expenditures | (9,175) | (12,634) | ||||||||||||

| Net cash used in investing activities | (13,925) | (48,489) | ||||||||||||

| Cash flows from financing activities: | ||||||||||||||

| Proceeds from long-term debt | — | 25,000 | ||||||||||||

| Repayment of long-term debt | (389) | (580) | ||||||||||||

| Contingent consideration paid for acquisition | — | (1,000) | ||||||||||||

| Proceeds from exercise of common stock options | 96 | — | ||||||||||||

| Repurchase of Series A Convertible Preferred Stock | — | (2,153) | ||||||||||||

| Net cash (used in) provided by financing activities | (293) | 21,267 | ||||||||||||

| Effect of currency exchange rate changes on cash and cash equivalents | 7 | — | ||||||||||||

| Net decrease in cash and cash equivalents | (730) | (21,449) | ||||||||||||

| Cash and cash equivalents at beginning of year | 50,927 | 68,125 | ||||||||||||

| Cash and cash equivalents at end of period | $ | 50,197 | $ | 46,676 | ||||||||||

Supplemental disclosures of cash flow information: | ||||||||||||||

| Interest paid in cash | $ | 2,628 | $ | 1,869 | ||||||||||

| Income taxes paid in cash | $ | 142 | $ | 44 | ||||||||||

| Common stock issued in business combination | $ | — | $ | 3,942 | ||||||||||

6

USA Technologies,Cantaloupe, Inc.

USA Technologies,

On November 9, 2017, the Company acquired all of the outstanding equity interests of Cantaloupe Systems, Inc. (“Cantaloupe”), pursuant to the Agreement and Plan of Merger (“Merger Agreement”). Cantaloupe is a premier provider of cloud and mobile solutions for vending, micro markets, and office coffee service. The acquisition expanded the Company’s existing platform to become an end-to-end enterprise platform integrating Cantaloupe’s Seed Cloud which provides cloud and mobile solutions for dynamic route scheduling, automated pre-kitting, responsive merchandising, inventory management, warehouse and accounting management, as well as cashless vending. The combined companies complete the value chain for customers by providing both top-line revenue generating services as well as bottom line business efficiency services to help operators of unattendedmicro-markets and smart retail, machines run their business better. The combination also marrieslaundromats, metered parking terminals, amusement and entertainment venues, IoT services and more.

INTERIM FINANCIAL INFORMATION

Preparation

BASIS OF PRESENTATION

Certain reclassifications of prior year’s data have been made to conform to current year’s presentation. As disclosed in Note 3, the Company incurred integration and acquisition expenses during the current period and deemed it appropriate to have such costs individually captioned within the statement of operations. Accordingly, the Company retrospectively reclassified integration and acquisition costs incurred in the corresponding periods from the previous fiscal year to conform to the current period’s presentation.

7

2. ACCOUNTING POLICIES

RECENT ACCOUNTING PRONOUNCEMENTS

Accounting pronouncements adopted in fiscal year 2018

In January 2017, the Financial Accounting Standards Board (the "FASB") issued Accounting Standards Update No. 2017-04 ("ASU 2017-04"), which eliminates Step 2 from the goodwill impairment test. Under ASU 2017-04, an entity should perform its annual, or interim, goodwill impairment test by comparing the fair value of aeach reporting unit with its carrying amount. An entity should recognize an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value; however, the loss recognized should not exceed the total amount of goodwill allocated to that reporting unit. Additionally, an entity should consider income tax effects from any tax deductible goodwill on the carrying amount of the reporting unit when measuring the goodwill impairment loss, if applicable. ASU 2017-04period. The resulting translation adjustment is effective for annual or any interim goodwill impairment tests in fiscal years beginning after December 15, 2019. We early adopted ASU 2017-04 for impairment tests to be performed on testing dates after July 1, 2017, which did not impact our consolidated financial statements.

In March 2016, the FASB issued ASU No. 2016-09, Compensation - Stock Compensation (Topic 718), Improvements to Employee Share-Based Payment Accounting, which modifies the accounting for certain aspects of share-based payments to employees. The new guidance requires excess tax benefits and tax deficiencies to be recorded in the income statement when stock awards vest or are settled. In addition, cash flows related to excess tax benefits are to be separately classified as an operating activity apart from other income tax cash flows. The standard also allows the Company to repurchase more of an employee’s vested shares for tax withholding purposes without triggering liability accounting, and clarifies that all cash payments made to tax authorities on an employee’s behalf for withheld shares should be presented as a financing activitycomponent of other comprehensive income (loss) and is included in accumulated comprehensive income (loss) within equity in our condensed consolidated balance sheets. Gains and losses on transactions denominated in currencies other than the statement of cash flows. The Company adopted this standard as of July 1, 2017.

The primary impact of adoption was the recognition of excess tax benefitsfunctional currency are generally included in the Company's provision fordetermining net income taxes which is applied prospectively starting July 1, 2017 in accordance with the guidance. Adoption of the new standard resulted in the recognition of $16 thousand of excess tax benefits in the Company's provision for income taxes for the six months ended December 31, 2017. Through June 30, 2017 excess tax benefits were reflected as a reduction of deferred tax assets via reducing actual operating loss carryforwards because such benefits had not reduced income taxes payable. Under the new standard the treatment of excess tax benefits changed and the cumulative excess tax benefits as of June 30, 2017 amounting to $67 thousand were credited to accumulated deficit.

The adoption of ASU No. 2016-09 did not impact our statement of cash flows forperiod. For the three and sixnine months ended DecemberMarch 31, 2016.

Accounting pronouncements to be adopted.

The Company is evaluating whether the effects of the following recent accounting pronouncements or any other recently issued, but not yet effective accounting standards, will have a material effect on the Company’s consolidated financial position, results of operations or cash flows.

In May 2014, the FASB issued ASU 2014-09, “Revenue from Contracts2024 and 2023, our transaction gains and losses were insignificant.

The Company’s project plan includes a three-phase approach to implementing this standard update. The Company is currently evaluating the impact of the potential changes identified by its initial phase one assessment work which included internal surveys of the business, holding revenue recognition workshops with sales and business unit finance leadership, and reviewing a representative sample of revenue arrangements across the business to initially identify a set of applicable qualitative revenue recognition changes related to the new standard update. During the quarter, the Company completed an acquisition of Cantaloupe and has commenced the phase one assessment of the recently acquired business.

8

The objectives for the second phase of the project will be to establish and document key accounting policies and assess disclosures, business process and control impacts resulting from the New Standard. New policies and procedures identified during phase two will be applied to both historical Company revenue streams and those of the recently acquired business to ensure compliance with the New Standard. Lastly, the objectives of phase three will comprise effectively implementing the new standard update and embedding the new accounting treatment into the Company’s business processes and controls to support the financial reporting requirements. Phase three is expected to be completed in the fourth quarter of fiscal year 2018.

The2023, the Company is still evaluatingpresented convertible preferred stock on its consolidated statements of shareholders’ equity and changed the impact that the New Standard will have on the Company’s consolidated financial statements and will be unable to quantify its impact until the third phasename of the project hasstatement to consolidated statements of convertible preferred stock and shareholders’ equity accordingly.Prior period amounts have been completed. The standard is expectedreclassified to impactconform to the Company’s revenue recognition processes, primarily in the areas of the allocation of contract revenues. An entity can electcurrent period presentation.

Income Tax Disclosures

In June 2016, the FASB issued ASU No. 2016-13, “Financial Instruments – Credit Losses (Topic 326).” The new guidance introduces the accounting for estimated credit losses pertainingalso remove disclosures related to certain typesunrecognized tax benefits and deferred taxes. ASU

In August 2016,2023, which is the FASB issued ASU No. 2016-15, “Statement of Cash Flows (Topic 230), Classification of Certain Cash Receipts and Cash Payments.” The new guidance makes eight targeted changes to how cash receipts and cash paymentsCompany's fiscal year 2025 annual reporting period. Interim disclosures are presented and classified in the statement of cash flows. This pronouncement will be effectiverequired for the Company beginning with the year ending June 30, 2019, and interim periods within that fiscal year. Early adoption is permitted, including adoption in an interim period. If an entity early adopts the amendments in an interim period, any adjustments should be reflected as of the beginning of the fiscal year that includes that interim period. An entity that elects early adoption must adopt all of the amendments in the same period. The new guidance requires adoption on a retrospective basis unless it is impracticable to apply, in which case the company would be required to apply the amendments prospectively as of the earliest date practicable. Upon adoption, the Company does not anticipate significant changes to the Company's existing accounting policies or presentation of the Statement of Cash Flows.

In January 2017, the FASB issued ASU No. 2017-01, “Business Combinations (Topic 805), Clarifying the Definition of a Business.” ASU 2017-01 provides guidance in ascertaining whether a collection of assets and activities is considered a business. Adoption of the amendment will be applied prospectively effective for annual periodsyears beginning after December 15, 2017 with2024, which is the Company's fiscal year 2026 interim reporting periods. Retrospective application is required for all prior periods presented, and early adoption permissible for specific transactions. Adoption is notpermitted. We are currently assessing the impact of the requirements on our consolidated financial statements and disclosures.

| Nine months ended March 31, | ||||||||||||||

| ($ in thousands) | 2024 | 2023 | ||||||||||||

| Beginning balance of allowance as of June 30 | $ | 10,815 | $ | 9,328 | ||||||||||

| Provision for expected losses | 958 | 1,044 | ||||||||||||

| Write-offs | (60) | (127) | ||||||||||||

| Balance at September 30 | 11,713 | 10,245 | ||||||||||||

| Provision for expected losses | 1,266 | 91 | ||||||||||||

| Write-offs | (134) | (214) | ||||||||||||

| Balance at December 31 | 12,845 | 10,122 | ||||||||||||

| Provision for expected losses | 1,085 | 296 | ||||||||||||

| Write-offs | (735) | — | ||||||||||||

| Balance at March 31 | $ | 13,195 | $ | 10,418 | ||||||||||

| ($ in thousands) | March 31, 2024 | June 30, 2023 | ||||||||||||

| Current finance receivables, net | $ | 5,781 | $ | 6,668 | ||||||||||

| Finance receivables due after one year, net | 11,041 | 13,307 | ||||||||||||

| Total finance receivables, net of allowance of $2,212 and $2,098, respectively | $ | 16,822 | $ | 19,975 | ||||||||||

| Leases by Origination | ||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | Up to 1 Year Ago | Between 1 and 2 Years Ago | Between 2 and 3 Years Ago | Between 3 and 4 Years Ago | Between 4 and 5 Years Ago | More than 5 Years Ago | Total | |||||||||||||||||||||||||||||||||||||

| Current | $ | 2,284 | $ | 7,423 | $ | 4,399 | $ | 1,225 | $ | 523 | $ | 25 | $ | 15,879 | ||||||||||||||||||||||||||||||

| 30 days and under | 12 | 70 | 87 | 40 | 72 | 42 | 323 | |||||||||||||||||||||||||||||||||||||

| 31-60 days | 6 | 48 | 65 | 31 | 45 | 40 | 235 | |||||||||||||||||||||||||||||||||||||

| 61-90 days | 5 | 43 | 54 | 26 | 40 | 35 | 203 | |||||||||||||||||||||||||||||||||||||

| Greater than 90 days | 41 | 716 | 436 | 65 | 272 | 864 | 2,394 | |||||||||||||||||||||||||||||||||||||

| Total finance receivables | $ | 2,348 | $ | 8,300 | $ | 5,041 | $ | 1,387 | $ | 952 | $ | 1,006 | $ | 19,034 | ||||||||||||||||||||||||||||||

| Leases by Origination | ||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | Up to 1 Year Ago | Between 1 and 2 Years Ago | Between 2 and 3 Years Ago | Between 3 and 4 Years Ago | Between 4 and 5 Years Ago | More than 5 Years Ago | Total | |||||||||||||||||||||||||||||||||||||

| Current | $ | 6,595 | $ | 6,505 | $ | 3,304 | $ | 1,306 | $ | 846 | $ | 829 | $ | 19,385 | ||||||||||||||||||||||||||||||

| 30 days and under | 66 | 73 | 69 | 52 | 22 | 68 | 350 | |||||||||||||||||||||||||||||||||||||

| 31-60 days | 53 | 40 | 32 | 42 | 19 | 71 | 257 | |||||||||||||||||||||||||||||||||||||

| 61-90 days | 60 | 52 | 26 | 32 | 16 | 71 | 257 | |||||||||||||||||||||||||||||||||||||

| Greater than 90 days | 155 | 132 | 197 | 233 | 271 | 836 | 1,824 | |||||||||||||||||||||||||||||||||||||

| Total finance receivables | $ | 6,929 | $ | 6,802 | $ | 3,628 | $ | 1,665 | $ | 1,174 | $ | 1,875 | $ | 22,073 | ||||||||||||||||||||||||||||||

| Nine months ended March 31, | ||||||||||||||

| ($ in thousands) | 2024 | 2023 | ||||||||||||

| Balance at June 30 | $ | 2,098 | $ | 760 | ||||||||||

| Provision for expected losses | 51 | 392 | ||||||||||||

| Write-offs | — | — | ||||||||||||

| Balance at September 30 | 2,149 | 1,152 | ||||||||||||

| Provision for expected losses | 108 | — | ||||||||||||

| Write-offs | — | (288) | ||||||||||||

| Balance at December 31 | 2,257 | 864 | ||||||||||||

| Provision for expected losses | (45) | — | ||||||||||||

| Write-offs | — | — | ||||||||||||

| Balance at March 31 | $ | 2,212 | $ | 864 | ||||||||||

| ($ in thousands) | |||||

| 2024 | $ | 7,096 | |||

| 2025 | 6,228 | ||||

| 2026 | 4,371 | ||||

| 2027 | 2,295 | ||||

| 2028 | 695 | ||||

| Thereafter | 14 | ||||

| Total amounts to be collected | 20,699 | ||||

| Less: interest | (1,665) | ||||

| Less: allowance for uncollectible receivables | (2,212) | ||||

| Total finance receivables | $ | 16,822 | |||

| ($ in thousands) | Balance Sheet Classification | As of March 31, 2024 | As of June 30, 2023 | |||||||||||||||||

| Assets: | Operating lease right-of-use assets | $ | 8,164 | $ | 2,575 | |||||||||||||||

| Liabilities: | ||||||||||||||||||||

| Current | Accrued expenses | $ | 738 | $ | 1,266 | |||||||||||||||

| Long-term | Operating lease liabilities, non-current | 9,035 | 2,504 | |||||||||||||||||

| Total lease liabilities | $ | 9,773 | $ | 3,770 | ||||||||||||||||

| ($ in thousands) | Nine months ended March 31, 2024 | Nine months ended March 31, 2023 | |||||||||

| Supplemental cash flow information: | |||||||||||

| Cash paid for amounts included in the measurement of operating lease liabilities | $ | 1,827 | $ | 1,793 | |||||||

| Non-cash activity: | |||||||||||

| Lease assets obtained in exchange for new operating lease liabilities | $ | 6,657 | $ | — | |||||||

| ($ in thousands) | Operating Leases | ||||

| Remainder of 2024 | $ | 321 | |||

| 2025 | 1,623 | ||||

| 2026 | 2,341 | ||||

| 2027 | 1,792 | ||||

| 2028 | 1,359 | ||||

| Thereafter | $ | 6,570 | |||

| Total lease payments | $ | 14,006 | |||

| Less: Imputed interest | (4,233) | ||||

| Present value of lease liabilities | $ | 9,773 | |||

| ($ in thousands) | March 31, 2024 | June 30, 2023 | ||||||||||||

| Cost | $ | 30,955 | 28,398 | |||||||||||

| Accumulated depreciation | (24,605) | (23,221) | ||||||||||||

| Net | $ | 6,350 | $ | 5,177 | ||||||||||

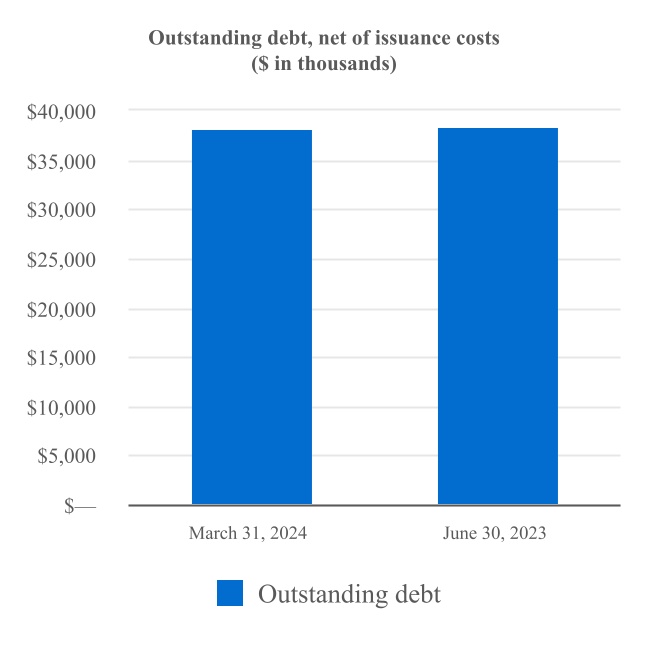

| As of March 31, | As of June 30, | |||||||||||||

| ($ in thousands) | 2024 | 2023 | ||||||||||||

| JPMorgan Credit Facility* | $ | 38,188 | $ | 38,563 | ||||||||||

| Other obligations | 36 | 50 | ||||||||||||

| Less: unamortized issuance costs and debt discount | (127) | (183) | ||||||||||||

| Total | 38,097 | 38,430 | ||||||||||||

| Less: debt and other financing arrangements, current | (1,450) | (882) | ||||||||||||

| Debt and other financing arrangements, noncurrent | $ | 36,647 | $ | 37,548 | ||||||||||

| Three months ended | Nine months ended | |||||||||||||||||||||||||

| March 31, | March 31, | |||||||||||||||||||||||||

| ($ in thousands) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

| JPMorgan Credit Facility* | 894 | 1,142 | 2,718 | 1,733 | ||||||||||||||||||||||

| Other interest (income) expense on tax liabilities | (1,056) | (879) | (771) | (475) | ||||||||||||||||||||||

| Total interest (income) expense, net on debt and tax liabilities | $ | (162) | $ | 263 | $ | 1,947 | $ | 1,258 | ||||||||||||||||||

9

| 2024 | $ | 568 | |||

| 2025 | 1,333 | ||||

| 2026 | 36,323 | ||||

| Principal amounts payable | 38,224 | ||||

| Unamortized issuance costs | (127) | ||||

| Total outstanding debt | $ | 38,097 | |||

| As of March 31, | As of June 30, | |||||||||||||

| ($ in thousands) | 2024 | 2023 | ||||||||||||

| Sales tax reserve | 10,793 | $ | 13,597 | |||||||||||

| Accrued compensation and related sales commissions | 3,112 | 4,069 | ||||||||||||

| Operating lease liabilities, current | 738 | 1,266 | ||||||||||||

| Accrued professional fees | 5,726 | 4,196 | ||||||||||||

| Accrued taxes and filing fees payable | 1,630 | 1,944 | ||||||||||||

| Other accrued expenses | 1,333 | 762 | ||||||||||||

| Consideration withheld for acquisitions* | 1,492 | 442 | ||||||||||||

| Total accrued expenses | $ | 24,824 | $ | 26,276 | ||||||||||

| As of March 31, 2024 | ||||||||||||||||||||||||||

| ($ in thousands) | Gross | Accumulated Amortization | Net | Amortization Period | ||||||||||||||||||||||

| Intangible assets: | ||||||||||||||||||||||||||

| Brand and tradenames | $ | 2,611 | $ | (1,747) | $ | 864 | 1 - 7 years | |||||||||||||||||||

| Developed technology | 20,462 | (12,868) | 7,594 | 5 - 6 years | ||||||||||||||||||||||

| Customer relationships | 27,224 | (8,995) | 18,229 | 5 - 18 years | ||||||||||||||||||||||

| Total intangible assets | $ | 50,297 | $ | (23,610) | $ | 26,687 | ||||||||||||||||||||

| Goodwill | 94,008 | — | 94,008 | Indefinite | ||||||||||||||||||||||

3. ACQUISITION OF CANTALOUPE SYSTEMS, INC.

As of June 30, 2023 ($ in thousands) Gross Accumulated

AmortizationNet Amortization

PeriodIntangible assets: Brand and tradenames 2,161 (1,414) 747 1 - 7 years Developed technology 20,188 (11,066) 9,122 5 - 6 years Customer relationships 24,714 (6,771) 17,943 5 - 18 years Total intangible assets $ 47,063 $ (19,251) $ 27,812 Goodwill 92,005 — 92,005 Indefinite

ordering platform. The acquisition expandedpositions Cantaloupe for expansion into the Company’s existing platform to become an end-to-end enterprise platform integrating Cantaloupe’s Seed Cloud which provides cloudlarge and mobile solutions for dynamic route scheduling, automated pre-kitting, responsive merchandising, inventory management, warehouserapidly growing sports, entertainment, and accounting management, as well as cashless vending. In addition to new technology and services, due to Cantaloupe’s existing customer base, the acquisition expands the Company’s footprint into new global markets.

The preliminary fair valuerestaurant sectors with a comprehensive suite of the purchase price consideration consisted of the following:

| ||

|

|

|

|

| |

|

|

|

|

|

|

|

The Company financed a portion of the purchase price with proceeds from a $25.0 million term loan (“Term Loan”) and $10.0 million of borrowings under a line of credit (“Revolving Credit Facility”), provided by JPMorgan Chase Bank, N.A., for an aggregate principal amount of $35.0 million. Refer to Note 9 for additional details.

10

The following table summarizes the fair value of total consideration transferred to the holders of all of the outstanding equity interests of Cantaloupe at the acquisition date of November 9, 2017:

|

|

|

|

|

| Cantaloupe | |

($ in thousands) |

| Systems, Inc. | |

Accounts receivable |

| $ | 3,232 |

Finance receivables, current portion |

|

| 1,640 |

Inventory |

|

| 782 |

Prepaid expense and other current assets |

|

| 682 |

Finance receivables, less current portion |

|

| 3,483 |

Other assets |

|

| 50 |

Property and equipment |

|

| 1,573 |

Intangibles |

|

| 30,800 |

Goodwill |

|

| 52,957 |

Total assets acquired |

|

| 95,199 |

Accounts payable |

|

| (1,591) |

Accrued expenses |

|

| (1,832) |

Deferred revenue |

|

| (626) |

Capital lease obligations and current obligations under long-term debt |

|

| (666) |

Capital lease obligations and long-term debt, less current portion |

|

| (1,134) |

Deferred income tax liabilities |

|

| (4,359) |

Total net assets acquired |

| $ | 84,991 |

| ($ in thousands) | Amount | ||||

| Cash and cash equivalents | $ | 84 | |||

| Property and equipment, net | 1,160 | ||||

| Intangible assets | 2,600 | ||||

| Other assets | 381 | ||||

| Total identifiable assets acquired | 4,225 | ||||

| Accounts payable | (442) | ||||

| Other liabilities | (52) | ||||

| Total liabilities assumed | (494) | ||||

| Total identifiable net assets | 3,731 | ||||

| Goodwill | 1,105 | ||||

| Fair value of total consideration transferred | $ | 4,836 | |||

basis over the estimated useful lives of the respective assets.

As a result of the acquisition of Cantaloupe, the Company incurred the following integration and acquisition costs and other one-time charges related to the acquisition in the three and six months ended December 31, 2017:

|

|

|

|

|

|

|

|

| Three months ended |

| Six months ended | ||

($ in thousands) |

| December 31, 2017 |

| December 31, 2017 | ||

Cost of equipment |

|

|

|

|

|

|

Acquired inventory fair market value step-up |

| $ | 23 |

| $ | 23 |

Operating expenses |

|

|

|

|

|

|

Integration and acquisition costs |

|

| 3,335 |

|

| 4,097 |

Interest expense |

|

|

|

|

|

|

Write-off of deferred financing costs |

|

| 55 |

|

| 55 |

Total integration and acquisition-related costs |

| $ | 3,413 |

| $ | 4,175 |

11

Supplemental disclosure of pro forma information

The following supplemental unaudited pro forma information presents the combined results of USAT and Cantaloupe as if the acquisition of Cantaloupe occurred on July 1, 2016. This supplemental pro forma information has been prepared for comparative purposes and does not purport to be indicative of what would have occurred had the acquisition been made on July 1, 2016, nor are they indicative of any future results.

The pro forma results include adjustments for the preliminary purchase accounting impact of the Cantaloupe acquisition (including, but not limited to, amortization associated with the acquired intangible assets, and the interest expense and amortization of deferred financing fees associated with the Term Loan and Revolving Credit Facility that were used to finance a portionabove allocation of the purchase price along withis provisional and is still subject to change within the related tax impacts) andmeasurement period. The final allocation of the alignmentpurchase price is expected to be completed as soon as practicable, but no later than one year from the date of accounting policies. Other material non-recurring adjustments are reflected in the pro forma and described below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Three months ended December 31, |

| Six months ended December 31, | ||||||||

(In thousands, except per share data) |

| 2017 |

| 2016 |

| 2017 |

| 2016 | ||||

Revenues |

| $ | 34,772 |

| $ | 27,521 |

| $ | 67,642 |

| $ | 54,704 |

Net loss attributable to USAT |

|

| (10,632) |

|

| (428) |

|

| (10,552) |

|

| (5,458) |

Net loss attributable to USAT common shares |

| $ | (10,632) |

| $ | (428) |

| $ | (10,886) |

| $ | (5,792) |

Net loss per share - basic and diluted |

|

| (0.20) |

|

| (0.01) |

|

| (0.20) |

|

| (0.11) |

Weighted average number of common shares outstanding - basic and diluted |

|

| 53,619,921 |

|

| 53,315,633 |

|

| 53,584,368 |

|

| 52,369,824 |

The supplemental unaudited pro forma earningsthat were expensed for the sixthree and nine months ended DecemberMarch 31, 2016 were adjusted to include $4.1 million of2024. These costs are recorded within integration and acquisition costs.

4. FINANCE RECEIVABLES

Finance receivables consistexpenses in the Condensed Consolidated Statements of Operations.

|

|

|

|

|

|

|

|

| December 31, |

| June 30, | ||

($ in thousands) |

| 2017 |

| 2017 | ||

Total finance receivables |

| $ | 16,732 |

| $ | 19,617 |

Less current portion |

|

| 5,517 |

|

| 11,010 |

Non-current portion of finance receivables |

| $ | 11,215 |

| $ | 8,607 |

| ($ in thousands) | |||||

| Closing cash consideration | $ | 36,605 | |||

| Stock consideration | 4,506 | ||||

| Fair value of total consideration transferred | $ | 41,111 | |||

| ($ in thousands) | Amount | ||||

| Cash and cash equivalents | $ | 391 | |||

| Accounts receivable | 1,780 | ||||

| Inventories | 2,011 | ||||

| Intangible assets | 15,538 | ||||

| Other assets | 629 | ||||

| Total identifiable assets acquired | 20,349 | ||||

| Accounts payable | (2,410) | ||||

| Tax liabilities | (3,033) | ||||

| Total liabilities assumed | (5,443) | ||||

| Total identifiable net assets | 14,906 | ||||

| Goodwill | 26,205 | ||||

| Fair value of total consideration transferred | $ | 41,111 | |||

|

|

|

|

|

|

|

|

| December 31, |

| June 30, | ||

($ in thousands) |

| 2017 |

| 2017 | ||

Performing |

| $ | 16,325 |

| $ | 19,515 |

Nonperforming |

|

| 407 |

|

| 102 |

Total |

| $ | 16,732 |

| $ | 19,617 |

12

Age Analysis of Past Due Finance Receivables

As of December 31, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 30 and Under |

| 31 – 60 |

| 61 – 90 |

| Greater than |

| Total |

|

|

| Total | |||||||

|

| Days Past |

| Days Past |

| Days Past |

| 90 Days Past |

| Non- |

|

|

| Finance | |||||||

($ in thousands) |

| Due |

| Due |

| Due |

| Due |

| Performing |

| Performing |

| Receivables | |||||||

QuickStart Leases |

| $ | 40 |

| $ | 85 |

| $ | 162 |

| $ | 120 |

| $ | 407 |

| $ | 16,325 |

| $ | 16,732 |

Age Analysis of Past Due Finance Receivables

As of June 30, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 30 and Under |

| 31 – 60 |

| 61 – 90 |

| Greater than |

| Total |

|

|

| Total | |||||||

|

| Days Past |

| Days Past |

| Days Past |

| 90 Days Past |

| Non- |

|

|

| Finance | |||||||

($ in thousands) |

| Due |

| Due |

| Due |

| Due |

| Performing |

| Performing |

| Receivables | |||||||

QuickStart Leases |

| $ | 29 |

| $ | 3 |

| $ | 35 |

| $ | 35 |

| $ | 102 |

| $ | 19,515 |

| $ | 19,617 |

5. INVENTORY

Inventory, net of reserves, was $11.2third-party valuation consultants. Amounts allocated to identifiable intangible assets included $7.5 million related to developed technology, $7.5 million related to customer relationships, and $4.6$0.5 million as of December 31, 2017 and June 30, 2017, respectively. Inventory consists of finished goods. The Company's inventories are valued at the lower of cost or net realizable value.

The Company establishes allowances for obsolescence of inventory based upon quality considerations and assumptions about future demand and market conditions.

related to trade names. The fair value of Cantaloupe inventoriesthe acquired includeddeveloped technology was determined using a multi-period excess earnings method. The fair market value step-up of $23 thousand. In the threeacquired customer relationships was determined using the with-and-without method which estimates the value using the cash flow impact in a scenario where the customer relationships are not in place. The significant unobservable inputs used in the valuation of the customer relationship asset and six months ended December 31, 2017,acquired developed technology asset are the revenue growth rates used in the development of the projected financial information used as an input to calculate those values and the discount rate applied. The recognized intangible assets will be amortized on a straight-line basis over the estimated useful lives of the respective assets. The estimated useful lives for developed technology, customer relationship, trade names were 5, 5 and 3 years, respectively.

6. EARNINGS PER SHARE

The calculationonly reporting unit.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Three months ended December 31, | ||||||||||||||

|

| 2017 |

| 2016 | ||||||||||||

|

| Net Loss |

| Shares |

| Per-Share |

| Net Income |

| Shares |

| Per-Share | ||||

|

| (Numerator) |

| (Denominator) |

| Amount |

| (Numerator) |

| (Denominator) |

| Amount | ||||

Net (loss) income from continuing operations |

| $ | (12,516) |

|

|

|

|

|

| $ | 233 |

|

|

|

|

|

Less: Preferred stock dividends |

|

| - |

|

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic EPS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income available to common shareholders |

|

| (12,516) |

| 52,150,106 |

| $ | (0.24) |

|

| 233 |

| 40,308,934 |

| $ | 0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of Dilutive Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Incremental shares |

|

| - |

| - | (a) |

|

|

|

| - |

| 421,778 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted EPS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income available to common shareholders plus assumed conversions |

| $ | (12,516) |

| 52,150,106 |

| $ | (0.24) |

| $ | 233 |

| 40,730,712 |

| $ | 0.01 |

13

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Six months ended December 31, | ||||||||||||||

|

| 2017 |

| 2016 | ||||||||||||

|

| Net Loss |

| Shares |

| Per-Share |

| Net Loss |

| Shares |

| Per-Share | ||||

|

| (Numerator) |

| (Denominator) |

| Amount |

| (Numerator) |

| (Denominator) |

| Amount | ||||

Net loss from continuing operations |

| $ | (12,729) |

|

|

|

|

|

| $ | (2,231) |

|

|

|

|

|

Less: Preferred stock dividends |

|

| (334) |

|

|

|

|

|

|

| (334) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic EPS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss available to common shareholders |

|

| (13,063) |

| 49,861,735 |

| $ | (0.26) |

|

| (2,565) |

| 39,398,469 |

| $ | (0.07) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of Dilutive Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Incremental shares |

|

| - |

| - | (a) |

|

|

|

| - |

| - | (a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted EPS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss available to common shareholders plus assumed conversions |

| $ | (13,063) |

| 49,861,735 |

| $ | (0.26) |

| $ | (2,565) |

| 39,398,469 |

| $ | (0.07) |

|

|

The changes inabove table represents the average number of shares that were anti-dilutive in the three and six months ended December 31, 2017 compared to the same period last year, were due to warrants exercised in connection with our common stock during September 2016.

7. GOODWILL AND INTANGIBLES

Intangible asset balances and goodwill consistedfinal allocation of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

| As of December 31, 2017 |

|

| |||||||

|

|

|

| Accumulated |

|

|

| Amortization | |||

($ in thousands) |

| Gross |

| Amortization |

| Net |

| Period | |||

Intangible assets: |

|

|

|

|

|

|

|

|

|

|

|

Non-compete agreements |

|

| 2 |

|

| (2) |

|

| — |

| 2 years |

Brand and tradenames |

|

| 1,695 |

|

| (96) |

|

| 1,599 |

| 3 - 7 years |

Developed technology |

|

| 10,939 |

|

| (499) |

|

| 10,440 |

| 5 - 6 years |

Customer relationships |

|

| 19,049 |

|

| (178) |

|

| 18,871 |

| 10 - 18 years |

Total intangible assets |

| $ | 31,685 |

| $ | (775) |

| $ | 30,910 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill |

|

| 64,449 |

|

| — |

|

| 64,449 |

| Indefinite |

|

|

|

|

|

|

|

|

|

|

|

|

Total intangible assets & goodwill |

| $ | 96,134 |

|

| (775) |

| $ | 95,359 |

|

|

14

|

|

|

|

|

|

|

|

|

|

|

|

|

| As of June 30, 2017 |

|

| |||||||

|

|

|

| Accumulated |

|

|

| Amortization | |||

($ in thousands) |

| Gross |

| Amortization |

| Net |

| Period | |||

Intangible assets: |

|

|

|

|

|

|

|

|

|

|

|

Non-compete agreements |

|

| 2 |

|

| (2) |

|

| — |

| 2 years |

Brand |

|

| 95 |

|

| (48) |

|

| 47 |

| 3 years |

Developed technology |

|

| 639 |

|

| (191) |

|

| 448 |

| 5 years |

Customer relationships |

|

| 149 |

|

| (22) |

|

| 127 |

| 10 years |

Total intangible assets |

| $ | 885 |

| $ | (263) |

| $ | 622 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill |

|

| 11,492 |

|

| — |

|

| 11,492 |

| Indefinite |

|

|

|

|

|

|

|

|

|

|

|

|

Total intangible assets & goodwill |

| $ | 12,377 |

|

| (263) |

| $ | 12,114 |

|

|

Forcertain assets and liabilities of Delicious Nutritious LLC, doing business as Yoke Payments (“Yoke”), a micro market payments company. The acquisition of Yoke was accounted for as a business combination using the threeacquisition method of accounting which includes the results of operations of the acquired business from the date of acquisition. The purchase price of the acquired company is allocated between tangible and six months ended December 31, 2017, there was $472 thousand and $516 thousand in amortization expense related to intangible assets respectively,acquired and liabilities assumed from the acquired business based on their estimated fair values using primarily Level 3 inputs under ASC Topic 820, Fair Value Measurement, with the residual of the purchase price recorded as comparedgoodwill.

8. LINE OF CREDIT

During the fiscal year ended Junedeferred cash payment due on or before July 30, 2016, the Company entered into a Loan and Security Agreement and other ancillary documents (as amended, the “Heritage Loan Documents”) with Heritage Bank of Commerce (“Heritage Bank”), providing for a secured asset-based revolving line of credit in an amount of up to $12.0 million (the “Heritage Line of Credit”) at an interest rate calculated2022 based on the Federal Reserves’ Prime plus 2.25%. The Heritage Lineachievement of Credit and the Company’s obligations under the Heritage Loan Documents were secured by substantially all of the Company’s assets, including its intellectual property.

During March 2017,certain sales growth targets. On July 27, 2022, the Company entered intomade the third amendmentcash payment of $1 million in accordance with Heritage Bank that extended the maturity date of the Heritage Line of Credit from March 29, 2017 to September 30, 2018.

On November 9, 2017, the Company paid all amounts due in respect of principal, interest, and fees, and satisfied all of its obligations under the Loan and Security Agreement dated as of March 29, 2016, as amended, and ancillary agreements by and between the Company and Heritage Bank of Commerce. The Company recorded a charge of $55 thousand to write-off any remaining deferred financing costs related to the Heritage Line of Credit to interest expense for the three and six months ended December 31, 2017. Pursuant to such payment, all commitments of Heritage Bank of Commerce were terminated, and the Heritage Loan and Security Agreement was terminated. As such, there was no outstanding balance on the Heritage Line of Credit at December 31, 2017.

9. DEBT

Revolving Credit Facility and Term Loan

On November 9, 2017,agreement consideration.

| ($ in thousands) | Amount | ||||

| Consideration | |||||

| Cash | $ | 2,966 | |||

| Contingent consideration arrangement | 1,000 | ||||

| Fair value of total consideration transferred | 3,966 | ||||

| Recognized amounts of identifiable assets | |||||

| Total net assets acquired | 21 | ||||

| Identifiable intangible assets | 1,235 | ||||

| Total identifiable net assets | 1,256 | ||||

| Goodwill | $ | 2,710 | |||

The proceeds of the Term Loan and borrowings under the Revolving Credit Facility, in an aggregate principal amount equal to $35.0 million, were used by the Company to finance a portionfinal allocation of the purchase price, fornoting no material measurement period adjustments. Pro forma financial information of the acquisition of Cantaloupe ($27.8 million) and repay existing indebtednessis not presented due to Heritage Bank of Commerce ($7.2 million). Future borrowings under the Revolving Credit Facility may be used by the Company for working capital and general corporate purposesimmaterial impact of the financial results of Yoke in the Company's Consolidated Financial Statements.

| Three months ended March 31, | Nine months ended March 31, | ||||||||||||||||||||||||||||||||||

| ($ in thousands) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||||||||

| Transaction fees | $ | 40,034 | $ | 33,389 | $ | 114,956 | $ | 97,076 | |||||||||||||||||||||||||||

| Subscription fees | 19,173 | 17,856 | 55,415 | 50,176 | |||||||||||||||||||||||||||||||

| Subscription and transaction fees | $ | 59,207 | $ | 51,245 | $ | 170,371 | $ | 147,252 | |||||||||||||||||||||||||||

| Equipment sales | 8,690 | 9,111 | 25,568 | 32,216 | |||||||||||||||||||||||||||||||

| Total revenues | $ | 67,897 | $ | 60,356 | $ | 195,939 | $ | 179,468 | |||||||||||||||||||||||||||

| Three months ended March 31, | ||||||||||||||

| ($ in thousands) | 2024 | 2023 | ||||||||||||

| Deferred revenue, beginning of the period | $ | 1,788 | $ | 1,970 | ||||||||||

| Deferred revenue, end of the period | 1,893 | 1,894 | ||||||||||||

| Revenue recognized in the period from amounts included in deferred revenue at the beginning of the period | $ | 268 | $ | 94 | ||||||||||

| Nine months ended March 31, | ||||||||||||||

| ($ in thousands) | 2024 | 2023 | ||||||||||||

| Deferred revenue, beginning of the period | $ | 1,666 | $ | 1,893 | ||||||||||

| Deferred revenue, end of the period | 1,893 | 1,894 | ||||||||||||

| Revenue recognized in the period from amounts included in deferred revenue at the beginning of the period | $ | 475 | $ | 319 | ||||||||||

15

Loans under($ in thousands) As of March 31, 2024 Remainder of fiscal year 2024 $ 1,520 2025 5,941 2026 3,793 Thereafter — Total $ 11,254

AsCondensed Consolidated Balance Sheet. None of December 31, 2017, the outstanding balances for the Revolving Credit Facility and the Term Loanthese capitalized contract costs were $10.0 million and $24.6 million, respectively.

Other Long-Term Borrowings

The Company periodically enters into capital lease obligations to finance network servers, computers, office furniture and equipment related support for use in its daily operations. During the six months ended December 31, 2017, the Company entered into capital lease obligations totaling $227 thousand, comprised of monthly installments of $7 thousand due within three years. The value of the acquired equipment is included in property and equipment and depreciated accordingly.

In connection with the acquisition of Cantaloupe, the Company assumed debt of $1.8 million. At December 31, 2017, the debt is comprised of $550 thousand of promissory notes bearing an interest rate of a 5% and maturing on April 5, 2020 with principal and interest payments due monthly, $830 thousand of promissory notes bearing an interest rate of 10% and maturing on September 30, 2021 with principal and interest payments due quarterly, and $356 thousand of promissory notes bearing an interest rate of 12% and maturing on December 15, 2019 with principal and interest payments due quarterly.

10. FAIR VALUE OF FINANCIAL INSTRUMENTS

As of December 31, 2017, the Company held no level 1, level 2, or level 3 financial instruments.

As of June 30, 2016, 2.2 million warrants with a fair value of $3.7 million comprised the Company’s Level 3 financial instruments. The Level 3 financial instruments consisted of common stock warrants issued by the Company in March 2011 to purchase shares of the Company’s common stock. The Level 3 financial instruments included features requiring liability treatment of the warrants, with the fair value of the common stock based on valuations performed by an independent third-party valuation firm. The fair value was determined using proprietary valuation models using the quality of the underlying securities of the warrants, restrictions on the warrants and security underlying the warrants, time restrictions and precedent sale transactions completed in the secondary market or in other private transactions. During the three months ended September 30, 2016, all of the aforementioned warrants were exercised resulting in a $5.2 million reclassification to Common Stock and the net difference of $1.5 million was recorded as a loss on fair value associated with the warrant liability.

11. INCOME TAXES

On December 22, 2017, the “Tax Cuts and Jobs Act” (the “Act”) was signed into law. Substantially all of the provisions of the Act are effective for taxable years beginning after December 31, 2017. The Act includes significant changes to the Internal Revenue Code of 1986 (as amended, the “Code”), including amendments which significantly change the taxation of individuals, and business entities. The Act contains numerous provisions impacting the Company, the most significant of which reduces the Federal corporate statutory tax rate from 34% to 21%.