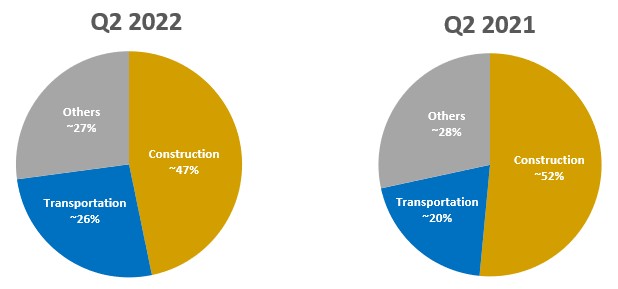

Through our unreserved auctions, online marketplaces, listings, and private brokerage services, we sell a broad range of primarily used commercial and industrial assets as well as government surplus. Construction and transportation assets comprise the majority of the equipment sold by GTV dollar value. Customers selling equipment through our sales channels include end users (such as construction companies), equipment dealers, original equipment manufacturers (“OEMs”) and other equipment owners (such as rental companies). Our customers participate in a variety of sectors, including construction, transportation, agriculture, energy, and natural resources.

We also provide our customers with a wide array of value added services aligned with our growth strategy to create a global marketplace for used equipment services and solutions. Our other services include access to equipment financing, asset appraisals and inspections, online equipment listing, logistical services, and ancillary services such as equipment refurbishment. We offer our customers asset technology solutions to manage the end to end disposition process of their assets and provide market data intelligence to make more accurate and reliable business decisions. Additionally, we offer our customers an innovative technology platform that supports equipment lifecycle management and parts procurement integration with both original equipment manufacturers and dealers, as well as software as a service platform for end-to-end parts procurement and digital catalogs and diagrams.

We operate globally with locations in more than 12 countries, including the U.S.,United States, Canada, the Netherlands, Australia, and the United Arab Emirates, and the Netherlands, andmaintain a presence in 48 countries where customers are able to sell from their own yards. In addition, we employ more than 2,600 full time2,700 full-time employees worldwide.

Discontinuation of the proposed acquisition of Euro Auctions

On August 9, 2021, we entered into a Sale and Purchase Agreement (“SPA”) pursuant to which we agreed to purchase Euro Auctions Limited, William Keys & Sons Holdings Limited, Equipment & Plant Services Ltd, and Equipment Sales Ltd. (collectively, “Euro Auctions”), each being a private limited company incorporated in Northern Ireland (the “Euro Auctions Acquisition”), for a purchase price of approximately £775 million (approximately $1.02 billion) in cash, which was to be paid on closing. On April 29, 2022, the Company announced its decision to discontinue the Phase 2 review by the Competition and Markets Authority (“CMA”). The SPA automatically terminated on June 28, 2022.

Impact of COVID-19 to our Business

In March 2020, the World Health Organization declared the outbreak of COVID-19 as a global pandemic which quickly spread(“COVID-19”).

In response, we transitioned all of our traditional live onsite auctions to online bidding utilizing our existing online bidding technology. As restrictions ease, we began to return to travel and to welcome in-person attendance at several of our live onsite auctions, and we continue to consider a transition back to our other onsite auction events throughout the world resultingyear. The health and welfare of our employees, customers and suppliers continues to be a top priority and we continue to operate with precautionary measures in significant global economic disruption that materially impacted several countries and regions in which we operate, including the United States, Canada, Europe, the Middle East, Australia and Asia. It has resulted in travel restrictions, economic uncertainty, and business slowdowns or shutdowns in affected areas and has negatively disrupted global manufacturing and workforce participation, including our own.place, as appropriate.

In Q2, 2021,the first six months of 2022, our ability to move equipment to and from our auction sites and across borders continues to vary regionallyhas improved with Asia and Australia continuing to be negatively impacted as regional governments continue to enforce travel restrictions and quarantine requirements. In these regions, the restrictions have also resultedrequirements continuing to lift particularly in some challenges in customer interactionsAustralia and challenges for our customersEurope, but with certain countries within Asia continuing to complete equipment inspections. In our International region, travel and quarantine restrictions are slowly being lifted as people become vaccinated, which is slowly driving up our auction volumes as equipment can be moved between borders more easily.experience lockdowns. In the United States and Canada, COVID-19 has not materially impacted on our ability to operate our businesses and move equipment. Globally, a recent surge inwe continued to see heightened shipping, fuel and freight costs combined with extended lead times, is making transportation of equipment both more costly and more challenging, which is negatively impacting the buying and selling behavioursbehaviour of our customers. Additionally, COVID-19 is still impactingin combination with various macro economic factors impacted the supply chains of new equipment production, which isin turn negatively affectingaffected the supply of used equipment being sold through allthroughout our regions, most predominantly in North America.America.

Our top priority regardingFor a further discussion of risks to our business and operating results arising from COVID-19, please refer to the COVID-19 pandemic remains the health and welfare“Risk Factors” section of our employees, customers, suppliers and others with whom we partner to runAnnual Report on Form 10-K for the year ended December 31, 2021.

Impact of Russia-Ukraine conflict on our business activities. We continue to adhere to all local government and jurisdictional safety guidelines, and, in some instances, we are applying additional over-and-above safety measures. Many of our employees continue to work from home on a temporary basis and travel continues to be quite limited given ongoing travel restrictions.Business

SinceOn February 24, 2022, the beginninggeopolitical situation in Eastern Europe intensified with Russia’s invasion of the COVID-19 pandemic, we continue to be able to operateUkraine, sharply affecting economic and serve our customers’ equipmentglobal financial markets. Subsequent economic sanctions on Russia have exacerbated ongoing economic challenges, including issues such as rising inflation, global supply chain disruption and immediate liquidity needs through our platform of auction technology solutions and online auction capabilities. In addition to running our IronPlanet weekly featured online auction, our online Marketplace-E solution and our GovPlanet online auctions, we modified our operationsincrease in March 2020 to transition all of our traditional live on site industrial auctions and events to online bidding. Buyers are generally still able to visit our auction sitesfuel prices.

The rise in advance of the auctions to conduct inspections and pick up equipment post auction, but we have not been holding live auction events in our theatres. As restrictions ease in the US and elsewhere we will be considering a transition backfuel cost has impacted us to some measure of in-person attendance at our on site auction events.

Our priority is to continue to support our employees, and we are actively monitoring the situation and changing dynamics in each of our respective regions and adjusting our operations as necessary. To this date, layoffs or furlough activities relatedextent due to the COVID-19 pandemic have been limitedsurge in scope.

The extenttransportation costs which has impacted both the cost and timing of the ongoing impactexport and import of the COVID-19 pandemic onequipment between countries globally and contributed to an increase in operating costs of our operational and financial performance, including our ability to execute our business strategies and initiatives, will depend on future developments, including the duration and spread of the pandemic in light of new variants, time of mass vaccine distribution, and any related restrictions placed by respective global governments, as well as supply and demand impacts driven by our consignor and buyer base, all of which are uncertain and cannot be easily predicted. Although at the time of this filing, we continue to operate our auctions in all regions, there is no assurance that our operations could not be impacted in the future.

We continue to actively monitor the evolving impact COVID-19 is having in the world and remain ready to take further actions or adjust our response based on any new governmental guidance or recommendations. It is unknown how long the pandemic will last, or whether we will see a resurgence of cases as new variants develop or spread, how many people are ultimately going to be affected by it, and the long-term implications to local or global economies. Equally, it is still not easily discernable to understand the real effects of the COVID-19 pandemic on equipment supply, buyer demand, and potential pricing volatility, or the potential impact on our buyers’ ability to pay or secure financing. Additionally, there is a level of uncertainty over the long-term impact the COVID-19 pandemic may have on our third party vendors, partners and the service providers with whom we currently do business with today. As such, given the ongoing nature of the COVID-19 pandemic, we are not able to reasonably estimate the future impacts on our business operations, results of operations, cash flows, financial performance or our ability to pay dividends.