Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Results of Operations

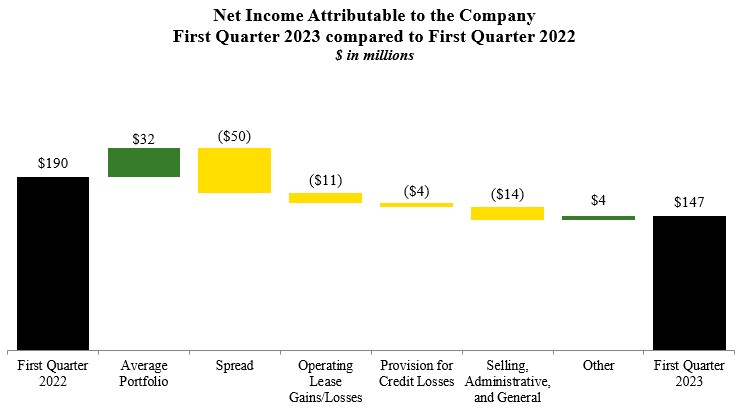

All amounts are presented in millions of dollars unless otherwise specified.

Overview

Organization

The Company primarily generates revenues and cash by financingWe provide financial solutions that enable John Deere dealers’ salescustomers and dealers to advance their lives and livelihoods. Through our offering of retail notes, leases, ofand revolving charge accounts, customers are able to finance new and used productionJohn Deere equipment, as well as parts, services, and precision agriculture, small agriculture and turf, and construction and forestry equipment. In addition, the Companyother input costs needed to run their operations. We also providesprovide wholesale financing to dealers of the foregoing equipment and finances retail revolving charge accounts.John Deere dealers.

Smart Industrial Operating Model and Leap Ambitions

John Deere’sDeere announced the Smart Industrial Operating Model in 2020. This operating model is focusedbased on making significant investmentsthree focus areas:

(a)Production systems: A strategic alignment of products and solutions around John Deere customers’ operations.

(b)Technology stack: Investments in strengthening itstechnology, as well as research and development, that deliver intelligent solutions to John Deere customers through digital capabilities, in digital, automation, autonomy, and alternative propulsionpower technologies. These technologies are intended

(c)Lifecycle solutions: The integration of John Deere’s aftermarket and support capabilities to increase worksite efficiency, improve yields, lower input costs,more effectively manage customer equipment, service, and ease labor constraints. technology needs across the full lifetime of a John Deere product.

John Deere’s Leap Ambitions were launched in 2022. These ambitions are goals designed to boost economic value and sustainability for John Deere’s customers. The ambitions align across the production systems of John Deere customers, seeking to optimize their operations to deliver better outcomes with fewer resources. As an enabling business, the Company iswe are fully integrated with John Deere’s Smart Industrial operating modelOperating Model and isare focused on providing financial solutions to help John Deere achieve its Leap Ambitions. John Deere and the Company anticipate opportunities in this area, as John Deere, the Company, and their customers have a vested interest in sustainable practices.

In February 2023,January 2024, John Deere released its 2022 Sustainability2023 Business Impact Report, available at JohnDeere.com/sustainability. This report identifies important progress on John Deere’s Leap Ambitions in fiscal year 2022.2023. The information in John Deere’s 2022 Sustainability2023 Business Impact Report is not incorporated by reference into, and does not form a part of, this Quarterly Report on Form 10-Q.

Trends and Economic Conditions

The Company’sOur volume of Receivables and Leases is largely dependent upon the level of retail sales and leases of John Deere products. The level of John Deere retail sales and leases is responsive to a variety of economic, financial, climatic, legislative, and other factors that influence supply and demand for its products.

Industry TrendsSales Outlook for Fiscal Year 20232024

Industry sales of large agricultural machinery in the U.S.Agriculture and Canada for 2023 are forecasted to increase 5 to 10 percent compared to 2022. Industry sales of small agriculturalTurf

Construction and turf equipment in the U.S. and Canada are expected to be down about 5 percent in 2023. Industry sales of agricultural machinery in Europe are forecasted to be flat to up 5 percent, while South American industry sales of tractors and combines are expected to be flat to up 5 percent in 2023. Asia industry sales are forecasted to be down moderately in 2023. On an industry basis, North American construction equipment and compact construction equipment sales are both expected to be flat to up 5 percent in 2023. Global forestry and global roadbuilding industry sales are each expected to be flat.Forestry

23