BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 3 - Commercial Mortgage Loans

The following table is a summary of the Company's commercial mortgage loans, held-for-investment,held for investment, carrying values by class (in(dollars in thousands):

___________________

| March 31, 2020 | December 31, 2019 | ||||||

| Senior loans | $ | 2,653,564 | $ | 2,721,325 | |||

| Mezzanine loans | 9,117 | 41,638 | |||||

| Total gross carrying value of loans | 2,662,681 | 2,762,963 | |||||

Less: Allowance for credit losses (1) | 21,702 | 921 | |||||

| Total commercial mortgage loans, held for investment, net | $ | 2,640,979 | $ | 2,762,042 | |||

| September 30, 2017 | December 31, 2016 | ||||||

| Senior loans | $ | 1,254,879 | $ | 901,907 | |||

| Mezzanine loans | 32,186 | 136,830 | |||||

| Subordinated loans | — | 10,000 | |||||

| Total gross carrying value of loans | 1,287,065 | 1,048,737 | |||||

| Less: Allowance for loan losses | 1,959 | 2,181 | |||||

| Total commercial mortgage loans, held for investment, net | $ | 1,285,106 | $ | 1,046,556 | |||

| Nine Months Ended September 30, 2017 | Nine Months Ended September 30, 2016 | ||||||

| Beginning of period | $ | 2,181 | $ | 888 | |||

| Provision for loan losses | (222 | ) | 721 | ||||

| Charge-offs | — | — | |||||

| Recoveries | — | — | |||||

| Ending allowance for loan losses | $ | 1,959 | $ | 1,609 | |||

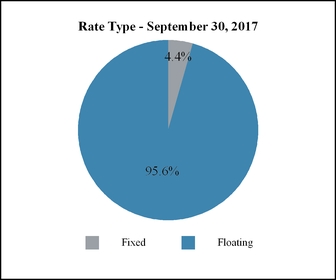

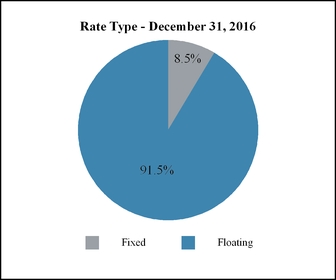

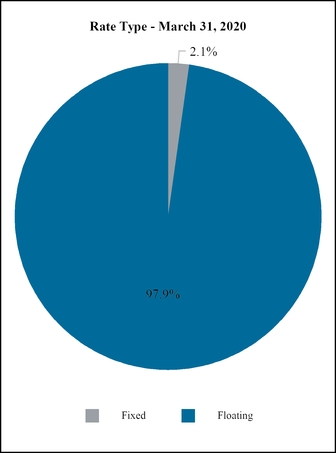

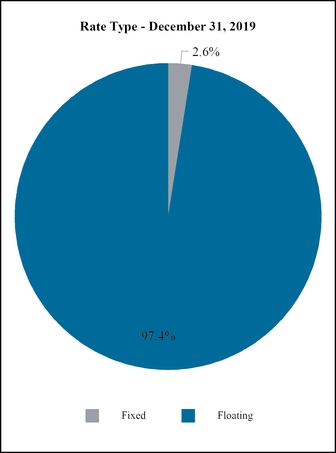

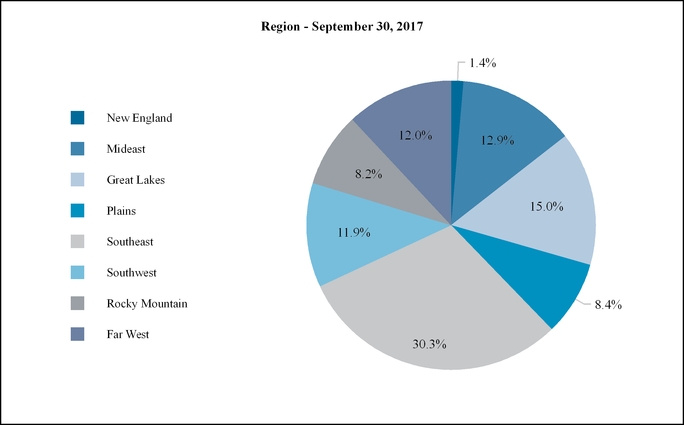

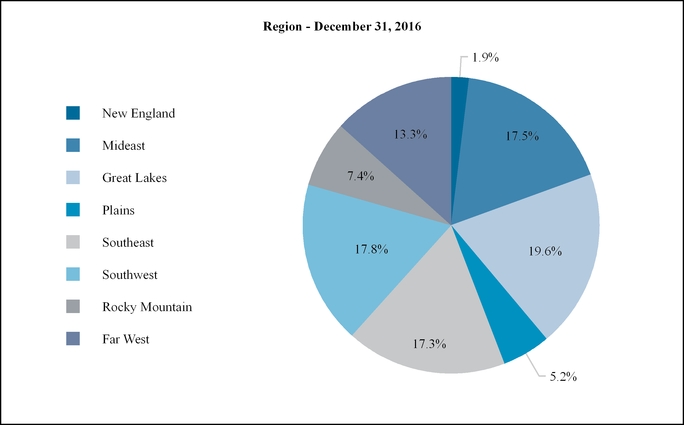

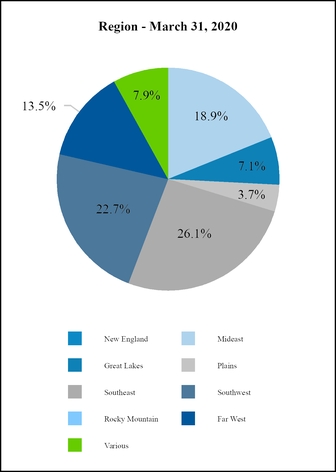

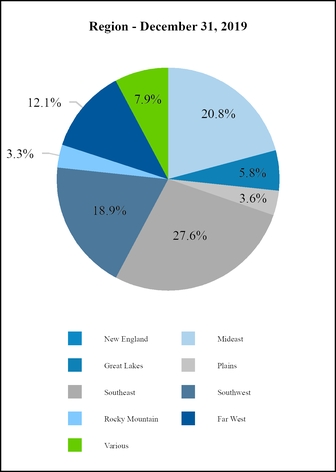

As of September 30, 2017March 31, 2020 and December 31, 2016,2019, the Company's total commercial mortgage loan portfolio, excluding commercial mortgage loans accounted for under the fair value option, was comprised of 73118 and 71122 loans, respectively.

Allowance for Credit Losses

The following table presents the activity in the Company's allowance for credit losses, excluding the unfunded loan commitments, for the three months ended March 31, 2020 (dollars in thousands):

| March 31, 2020 | ||||||||||||||||||||||||||||||||||||

| Multifamily | Retail | Office | Industrial | Mixed Use | Hospitality | Self Storage | Mobile Housing | Total | ||||||||||||||||||||||||||||

| Beginning Balance | $ | 322 | $ | 202 | $ | 249 | $ | 23 | $ | 4 | $ | 103 | $ | — | $ | 18 | $ | 921 | ||||||||||||||||||

| Cumulative-effect adjustment upon adoption of ASU 2016-13 | 3,220 | 386 | 1,966 | 434 | 9 | 739 | 399 | 58 | 7,211 | |||||||||||||||||||||||||||

| Current Period: | ||||||||||||||||||||||||||||||||||||

| Increase/(decrease) for credit losses | 8,647 | 565 | 2,358 | 1,875 | 28 | 655 | (123 | ) | (8 | ) | 13,997 | |||||||||||||||||||||||||

| Write-offs | — | — | — | — | — | (427 | ) | — | — | (427 | ) | |||||||||||||||||||||||||

| Ending Balance | $ | 12,189 | $ | 1,153 | $ | 4,573 | $ | 2,332 | $ | 41 | $ | 1,070 | $ | 276 | $ | 68 | $ | 21,702 | ||||||||||||||||||

The increase in the provision for credit losses during the three months ended March 31, 2020 of $13,997 is primarily driven by the significant adverse change in the overall economic outlook due to the COVID-19 pandemic. These are allowance for credit losses on commercial mortgage loans, held-for-investment, as of March 31, 2020 and December 31, 2019.

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2020

(Unaudited)

The following table presents the activity in the Company's allowance for credit losses, for the unfunded loan commitments, for the three months ended March 31, 2020 (dollars in thousands):

| March 31, 2020 | ||||||||||||||||||||||||||||||||||||

| Multifamily | Retail | Office | Industrial | Mixed Use | Hospitality | Self Storage | Mobile Housing | Total | ||||||||||||||||||||||||||||

| Beginning Balance | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||

| Cumulative-effect adjustment upon adoption of ASU 2016-13 | 239 | 40 | 150 | 30 | 1 | 57 | 28 | 5 | 550 | |||||||||||||||||||||||||||

| Current Period: | ||||||||||||||||||||||||||||||||||||

Increase/(decrease) for credit losses | 56 | (40 | ) | 242 | 257 | (1 | ) | 117 | (28 | ) | (3 | ) | 600 | |||||||||||||||||||||||

| Write-offs | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

| Ending Balance | $ | 295 | $ | — | $ | 392 | $ | 287 | $ | — | $ | 174 | $ | — | $ | 2 | $ | 1,150 | ||||||||||||||||||

The following table represents the composition by loan type of the Company's commercial mortgage loans portfolio, excluding commercial mortgage loans, held-for-sale, measured at fair value (dollars in thousands):

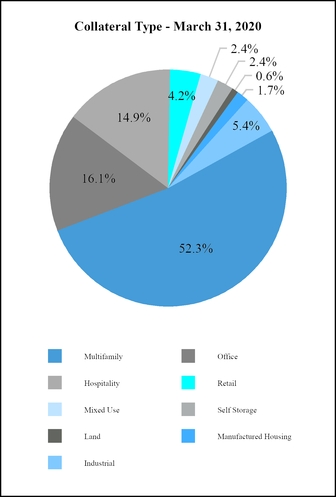

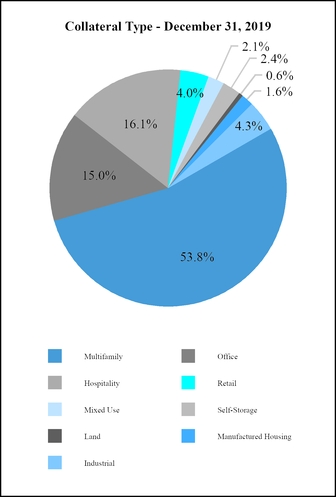

| March 31, 2020 | December 31, 2019 | |||||||||||||

| Loan Type | Par Value | Percentage | Par Value | Percentage | ||||||||||

| Multifamily | $ | 1,395,956 | 52.3 | % | $ | 1,491,971 | 53.9 | % | ||||||

| Office | 430,870 | 16.1 | % | 414,772 | 15.0 | % | ||||||||

| Hospitality | 398,186 | 14.9 | % | 446,562 | 16.1 | % | ||||||||

| Industrial | 144,093 | 5.4 | % | 118,743 | 4.3 | % | ||||||||

| Retail | 111,620 | 4.2 | % | 111,620 | 4.0 | % | ||||||||

| Mixed Use | 65,040 | 2.4 | % | 58,808 | 2.1 | % | ||||||||

| Self Storage | 63,057 | 2.4 | % | 67,767 | 2.4 | % | ||||||||

| Land | 16,400 | 0.6 | % | 16,400 | 0.6 | % | ||||||||

| Manufactured Housing | 44,911 | 1.7 | % | 44,656 | 1.6 | % | ||||||||

| Total | $ | 2,670,133 | 100.0 | % | $ | 2,771,299 | 100.0 | % | ||||||

As of March 31, 2020 and December 31, 2019, the Company's total commercial mortgage loans, held-for-sale, measured at fair value comprised of 8 and 7 loans, respectively. As of March 31, 2020 and December 31, 2019, the contractual principal outstanding of commercial mortgage loans, held-for-sale, measured at fair value was $93.7 million and $112.5 million, respectively. As of March 31, 2020 and December 31, 2019, none of the Company's commercial mortgage loans, held-for-sale, measured at fair value were in default or greater than ninety days past due.

The following table represents the composition by loan type of the Company's commercial mortgage loans, held-for-sale, measured at fair value (dollars in thousands):

| March 31, 2020 | December 31, 2019 | |||||||||||||

| Loan Type | Par Value | Percentage | Par Value | Percentage | ||||||||||

| Multifamily | $ | 41,000 | 43.8 | % | $ | 78,250 | 69.6 | % | ||||||

| Industrial | 23,625 | 25.2 | % | 23,625 | 21.0 | % | ||||||||

| Retail | 21,193 | 22.6 | % | 2,613 | 2.3 | % | ||||||||

| Office | 6,000 | 6.4 | % | — | — | % | ||||||||

| Manufactured Housing | 1,850 | 2.0 | % | — | — | % | ||||||||

| Hospitality | — | — | % | 8,000 | 7.1 | % | ||||||||

| Total | $ | 93,668 | 100.0 | % | $ | 112,488 | 100.0 | % | ||||||

Loan Credit Quality and Vintage

18

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The following tables present the amortized cost of our commercial mortgage loans, held for investment at March 31, 2020, by loan type, the Company’s internal risk rating and year of origination. The risk ratings are updated as of March 31, 2020.

| As of March 31, 2020 | ||||||||||||||||||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | Prior | Total | |||||||||||||||||||||||||

| Multifamily: | ||||||||||||||||||||||||||||||||

| Risk Rating: | ||||||||||||||||||||||||||||||||

| 1-2 internal grade | $ | 177,191 | $ | 456,036 | $ | 617,533 | $ | 34,875 | $ | — | $ | — | $ | 3,489 | $ | 1,289,124 | ||||||||||||||||

| 3-4 internal grade | — | — | 65,805 | 37,812 | — | — | — | 103,617 | ||||||||||||||||||||||||

| Total Multifamily Loans | $ | 177,191 | $ | 456,036 | $ | 683,338 | $ | 72,687 | $ | — | $ | — | $ | 3,489 | $ | 1,392,741 | ||||||||||||||||

| Retail: | ||||||||||||||||||||||||||||||||

| Risk Rating: | ||||||||||||||||||||||||||||||||

| 1-2 internal grade | $ | — | $ | 54,618 | $ | 16,319 | $ | — | $ | — | $ | — | $ | 9,450 | $ | 80,387 | ||||||||||||||||

| 3-4 internal grade | — | 3,501 | 43,907 | — | — | — | — | 47,408 | ||||||||||||||||||||||||

| Total Retail Loans | $ | — | $ | 58,119 | $ | 60,226 | $ | — | $ | — | $ | — | $ | 9,450 | $ | 127,795 | ||||||||||||||||

| Office: | ||||||||||||||||||||||||||||||||

| Risk Rating: | ||||||||||||||||||||||||||||||||

| 1-2 internal grade | $ | 49,163 | $ | 173,988 | $ | 97,936 | $ | 41,645 | $ | — | $ | 10,700 | $ | — | $ | 373,432 | ||||||||||||||||

| 3-4 internal grade | — | — | 45,259 | 10,506 | — | — | — | 55,765 | ||||||||||||||||||||||||

| Total Office Loans | $ | 49,163 | $ | 173,988 | $ | 143,195 | $ | 52,151 | $ | — | $ | 10,700 | $ | — | $ | 429,197 | ||||||||||||||||

| Industrial: | ||||||||||||||||||||||||||||||||

| Risk Rating: | ||||||||||||||||||||||||||||||||

| 1-2 internal grade | $ | 25,241 | $ | 84,576 | $ | — | $ | — | $ | — | $ | 33,655 | $ | — | $ | 143,472 | ||||||||||||||||

| 3-4 internal grade | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||

| Total Industrial Loans | $ | 25,241 | $ | 84,576 | $ | — | $ | — | $ | — | $ | 33,655 | $ | — | $ | 143,472 | ||||||||||||||||

| Mixed Use: | ||||||||||||||||||||||||||||||||

| Risk Rating: | ||||||||||||||||||||||||||||||||

| 1-2 internal grade | $ | — | $ | — | $ | 52,097 | $ | 12,953 | $ | — | $ | — | $ | — | $ | 65,050 | ||||||||||||||||

| 3-4 internal grade | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||

| Total Mixed Use Loans | $ | — | $ | — | $ | 52,097 | $ | 12,953 | $ | — | $ | — | $ | — | $ | 65,050 | ||||||||||||||||

| Hospitality: | ||||||||||||||||||||||||||||||||

| Risk Rating: | ||||||||||||||||||||||||||||||||

| 1-2 internal grade | $ | — | $ | 8,735 | $ | 20,962 | $ | — | $ | — | $ | — | $ | — | $ | 29,697 | ||||||||||||||||

| 3-4 internal grade | — | 161,948 | 114,190 | 90,940 | — | — | — | 367,078 | ||||||||||||||||||||||||

| Total Hospitality Loans | $ | — | $ | 170,683 | $ | 135,152 | $ | 90,940 | $ | — | $ | — | $ | — | $ | 396,775 | ||||||||||||||||

| Self Storage: | ||||||||||||||||||||||||||||||||

| Risk Rating: | ||||||||||||||||||||||||||||||||

| 1-2 internal grade | $ | — | $ | — | $ | 62,937 | $ | — | $ | — | $ | — | $ | — | $ | 62,937 | ||||||||||||||||

| 3-4 internal grade | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||

| Total Self Storage Loans | $ | — | $ | — | $ | 62,937 | $ | — | $ | — | $ | — | $ | — | $ | 62,937 | ||||||||||||||||

19

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2020

(Unaudited)

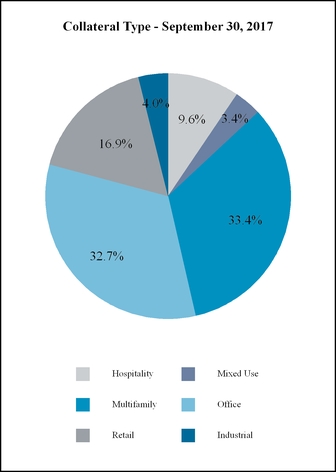

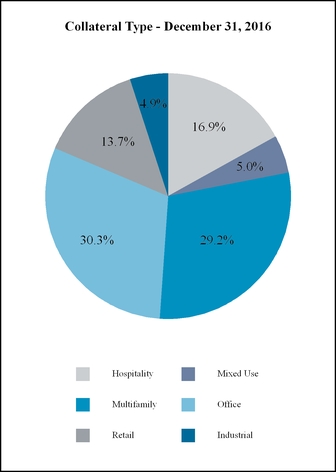

| September 30, 2017 | December 31, 2016 | |||||||||||||

| Loan Type | Par Value | Percentage | Par Value | Percentage | ||||||||||

| Office | $ | 433,110 | 32.7 | % | $ | 340,944 | 31.6 | % | ||||||

| Multifamily | 441,431 | 33.4 | % | 329,203 | 30.6 | % | ||||||||

| Hospitality | 126,673 | 9.6 | % | 143,582 | 13.3 | % | ||||||||

| Retail | 223,315 | 16.9 | % | 154,684 | 14.4 | % | ||||||||

| Mixed Use | 45,235 | 3.4 | % | 56,136 | 5.2 | % | ||||||||

| Industrial | 53,208 | 4.0 | % | 52,688 | 4.9 | % | ||||||||

Total (1) | $ | 1,322,972 | 100.0 | % | $ | 1,077,237 | 100.0 | % | ||||||

| (1) Excludes $60.95 million in commercial mortgage loans held-for-sale, measured at fair value in the Company's TRS segment | ||||||||||||||

| Manufactured Housing: | ||||||||||||||||||||||||||||||||

| Risk Rating: | ||||||||||||||||||||||||||||||||

| 1-2 internal grade | $ | — | $ | 44,714 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 44,714 | ||||||||||||||||

| 3-4 internal grade | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||

| Total Manufactured Housing Loans | $ | — | $ | 44,714 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 44,714 | ||||||||||||||||

| Total | $ | 251,595 | $ | 988,116 | $ | 1,136,945 | $ | 228,731 | $ | — | $ | 44,355 | $ | 12,939 | $ | 2,662,681 | ||||||||||||||||

Past Due Status

The following table presents an aging summary of the loans amortized cost basis at March 31, 2020 (dollars in thousands):

__________________

| Multifamily | Retail | Office | Industrial | Mixed Use | Hospitality | Self Storage | Mobile Housing | Total | ||||||||||||||||||||||||||||

| Status: | ||||||||||||||||||||||||||||||||||||

| Current | $ | 1,392,741 | $ | 127,795 | $ | 383,938 | $ | 143,472 | $ | 65,050 | $ | 339,700 | $ | 62,937 | $ | 44,714 | $ | 2,560,347 | ||||||||||||||||||

1-29 days past due(1) | — | — | 45,259 | — | — | — | — | — | 45,259 | |||||||||||||||||||||||||||

| 30-59 days past due | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

| 60-89 days past due | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

| 90-119 days past due | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

120+ days past due(2) | — | — | — | — | — | 57,075 | — | — | 57,075 | |||||||||||||||||||||||||||

| Total | $ | 1,392,741 | $ | 127,795 | $ | 429,197 | $ | 143,472 | $ | 65,050 | $ | 396,775 | $ | 62,937 | $ | 44,714 | $ | 2,662,681 | ||||||||||||||||||

(1) For the three months ended March 31, 2020, interest income recognized on this loan was $0.6 million.

(2) For the three months ended March 31, 2020, interest income recognized on this loan was $0.0 million.

As of September 30, 2017March 31, 2020, the Company had two loans on non-accrual status with a cost basis of $57.1 million and $45.3 million. As of December 31, 2016,2019, the Company's total commercial mortgage loans, held for sale, measured at fair value comprisedCompany had one loan on non-accrual status with a cost basis of 4 and 0 loans, respectively.

| September 30, 2017 | December 31, 2016 | |||||||||||||

| Loan Type | Par Value | Percentage | Par Value | Percentage | ||||||||||

| Industrial | $ | 11,600 | 19.1 | % | $ | — | — | % | ||||||

| Mixed Use | 14,150 | 23.2 | % | — | — | % | ||||||||

| Multifamily | 7,200 | 11.8 | % | — | — | % | ||||||||

| Retail | 28,000 | 45.9 | % | — | — | % | ||||||||

| Total | $ | 60,950 | 100.0 | % | $ | — | — | % | ||||||

$57.1 million.

Credit Characteristics

As part of the Company's process for monitoring the credit quality of its commercial mortgage loans, excluding those held-for-sale, measured at fair value, it performs a quarterly loan portfolio assessment and assigns risk ratings to each of its loans. The loans are ratedscored on a 5-point scale of 1 to 5 as follows:

| Investment Rating | Summary Description | |

| 1 | Investment exceeding fundamental performance expectations and/or capital gain expected. Trends and risk factors since time of investment are favorable. | |

| 2 | Performing consistent with expectations and a full return of principal and interest expected. Trends and risk factors are neutral to favorable. | |

| 3 | Performing investments requiring closer monitoring. Trends and risk factors show some deterioration. | |

| 4 | Underperforming investment with the potential of some interest loss but still expecting a positive return on investment. Trends and risk factors are negative. | |

| 5 | Underperforming investment with expected loss of interest and some principal. | |

20

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2020

(Unaudited)

All commercial mortgage loans, excluding loans classified as commercial mortgage loans, held-for-sale, measured at fair value within the consolidated balance sheets, are assigned an initial risk rating of 2.0. As of September 30, 2017March 31, 2020 and December 31, 2016,2019, the weighted average risk rating of the loans was 2.22.3 and 2.1, respectively. As of

The following table represents the allocation by risk rating for the Company's commercial mortgage loans, held for investment (dollars in thousands):

| March 31, 2020 | December 31, 2019 | |||||||||||||||

| Risk Rating | Number of Loans | Par Value | Risk Rating | Number of Loans | Par Value | |||||||||||

| 1 | — | $ | — | 1 | — | $ | — | |||||||||

| 2 | 90 | 2,094,654 | 2 | 113 | 2,452,330 | |||||||||||

| 3 | 27 | 518,404 | 3 | 8 | 298,994 | |||||||||||

| 4 | 1 | 57,075 | 4 | 1 | 19,975 | |||||||||||

| 5 | — | — | 5 | — | — | |||||||||||

| 118 | $ | 2,670,133 | 122 | $ | 2,771,299 | |||||||||||

| Nine Months Ended September 30, 2017 | Nine Months Ended September 30, 2016 | ||||||

| Balance at Beginning of Year | $ | 1,046,556 | $ | 1,124,201 | |||

| Acquisitions and originations | 566,490 | 42,236 | |||||

| Dispositions | (68,514 | ) | — | ||||

| Principal repayments | (228,814 | ) | (48,127 | ) | |||

| Discount accretion and premium amortization* | 1,604 | 1,704 | |||||

| Loans transferred to commercial real estate loans, held-for-sale, at fair value | (31,207 | ) | — | ||||

| Fees capitalized into carrying value of loans | (1,231 | ) | — | ||||

| Provision for loan losses | 222 | (721 | ) | ||||

| Balance at End of Period | $ | 1,285,106 | $ | 1,119,293 | |||

| Three Months Ended March 31, | For the Year Ended December 31, | ||||||

| 2020 | 2019 | ||||||

| Balance at Beginning of Year | $ | 2,762,042 | $ | 2,206,830 | |||

| Cumulative-effect adjustment upon adoption of ASU 2016-13 | (7,211 | ) | — | ||||

| Acquisitions and originations | 288,825 | 1,326,983 | |||||

| Principal repayments | (366,058 | ) | (771,774 | ) | |||

| Discount accretion/premium amortization | 1,751 | 6,264 | |||||

| Loans reclassified to held-for-sale | (9,619 | ) | — | ||||

| Loans transferred from/(to) commercial real estate loans, held-for-sale | — | 10,100 | |||||

| Net fees capitalized into carrying value of loans | (1,181 | ) | (5,339 | ) | |||

| Increase/(decrease) for credit losses | (13,997 | ) | (3,007 | ) | |||

| Charge-off from allowance | 427 | 6,922 | |||||

| Transfer on foreclosure to real estate owned | (14,000 | ) | — | ||||

| Transfer on deed in lieu of foreclosure to real estate owned | — | (14,937 | ) | ||||

| Balance at End of Period | $ | 2,640,979 | $ | 2,762,042 | |||

date.

The following is a summary of the Company's real estate securities, CMBS (in(dollars in thousands):

| Weighted Average | ||||||||||||||||

| Number of Investments | Interest Rate | Maturity | Par Value | Fair Value | ||||||||||||

| September 30, 2017 | — | — | % | n/a | $ | — | $ | — | ||||||||

| December 31, 2016 | 6 | 5.8 | % | February 2020 | 50,000 | 49,049 | ||||||||||

| March 31, 2020 | ||||||||

| Type | Interest Rate | Maturity | Par Value | Fair Value | ||||

| CMBS 1 | 3.7% | 5/15/2022 | $13,250 | $10,408 | ||||

21

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2020

(Unaudited)

| CMBS 2 | 2.8% | 6/26/2025 | 11,488 | 10,250 | ||||

| CMBS 3 | 3.1% | 2/15/2036 | 40,000 | 34,728 | ||||

| CMBS 4 | 2.4% | 5/15/2036 | 18,500 | 14,672 | ||||

| CMBS 5 | 2.1% | 5/15/2036 | 15,000 | 14,259 | ||||

| CMBS 6 | 2.2% | 5/15/2037 | 13,500 | 11,279 | ||||

| CMBS 7 | 2.4% | 5/15/2037 | 15,000 | 12,538 | ||||

| CMBS 8 | 2.2% | 6/15/2037 | 7,000 | 6,386 | ||||

| CMBS 9 | 2.6% | 2/15/2036 | 9,600 | 8,695 | ||||

| CMBS 10 | 2.5% | 8/15/2036 | 10,000 | 9,083 | ||||

| CMBS 11 | 2.6% | 6/15/2037 | 8,000 | 7,330 | ||||

| CMBS 12 | 2.3% | 7/15/2038 | 13,000 | 10,802 | ||||

| CMBS 13 | 2.3% | 9/15/2037 | 32,000 | 27,563 | ||||

| CMBS 14 | 2.7% | 9/15/2037 | 24,000 | 20,628 | ||||

| CMBS 15 | 2.3% | 10/19/2038 | 50,000 | 42,408 | ||||

| CMBS 16 | 2.7% | 10/19/2038 | 26,000 | 22,210 | ||||

| CMBS 17 | 2.2% | 6/15/2034 | 15,000 | 13,332 | ||||

| CMBS 18 | 2.5% | 6/15/2034 | 6,500 | 5,606 | ||||

| CMBS 19 | 2.9% | 6/15/2034 | 12,000 | 10,417 | ||||

| CMBS 20 | 2.0% | 12/15/2036 | 20,000 | 17,920 | ||||

| CMBS 21 | 2.3% | 12/15/2036 | 25,000 | 22,221 | ||||

| CMBS 22 | 2.1% | 2/15/2035 | 22,500 | 18,255 | ||||

| CMBS 23 | 2.5% | 2/15/2035 | 16,000 | 13,166 | ||||

| CMBS 24 | 2.5% | 2/15/2035 | 2,000 | 1,646 | ||||

| CMBS 25 | 2.1% | 2/15/2035 | 2,200 | 1,785 | ||||

| CMBS 26 | 2.6% | 3/15/2035 | 12,500 | 11,153 | ||||

| CMBS 27 | 3.0% | 3/15/2035 | 25,665 | 23,056 | ||||

| CMBS 28 | 2.3% | 3/15/2037 | 28,000 | 25,601 | ||||

| CMBS 29 | 2.6% | 3/15/2037 | 15,000 | 13,763 | ||||

| December 31, 2019 | ||||||||

| Type | Interest Rate | Maturity | Par Value | Fair Value | ||||

| CMBS 1 | 4.7% | 5/15/2022 | $13,250 | $13,274 | ||||

| CMBS 2 | 3.8% | 6/26/2025 | 12,131 | 12,151 | ||||

| CMBS 3 | 4.1% | 2/15/2036 | 40,000 | 40,186 | ||||

| CMBS 4 | 3.7% | 5/15/2036 | 18,500 | 18,535 | ||||

| CMBS 5 | 3.1% | 5/15/2036 | 15,000 | 15,019 | ||||

| CMBS 6 | 3.2% | 5/15/2037 | 13,500 | 13,525 | ||||

| CMBS 7 | 3.4% | 5/15/2037 | 15,000 | 15,028 | ||||

| CMBS 8 | 3.2% | 6/15/2037 | 7,000 | 7,013 | ||||

| CMBS 9 | 3.6% | 2/15/2036 | 9,600 | 9,641 | ||||

| CMBS 10 | 3.5% | 8/15/2036 | 10,000 | 10,027 | ||||

| CMBS 11 | 3.6% | 6/15/2037 | 8,000 | 8,015 | ||||

| CMBS 12 | 3.3% | 7/15/2038 | 13,000 | 13,022 | ||||

| CMBS 13 | 3.3% | 9/15/2037 | 32,000 | 32,074 | ||||

| CMBS 14 | 3.7% | 9/15/2037 | 24,000 | 24,084 | ||||

22

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2020

(Unaudited)

| CMBS 15 | 3.3% | 10/19/2038 | 50,000 | 50,094 | ||||

| CMBS 16 | 3.7% | 10/19/2038 | 26,000 | 26,029 | ||||

| CMBS 17 | 3.2% | 6/15/2034 | 15,000 | 15,022 | ||||

| CMBS 18 | 3.5% | 6/15/2034 | 6,500 | 6,509 | ||||

| CMBS 19 | 3.9% | 6/15/2034 | 12,000 | 12,022 | ||||

| CMBS 20 | 3.1% | 12/15/2036 | 20,000 | 20,021 | ||||

| CMBS 21 | 3.4% | 12/15/2036 | 25,000 | 25,025 | ||||

The Company classified its CMBS investments as available-for-saleavailable for sale as of September 30, 2017March 31, 2020 and December 31, 2016.2019. These investments are reported at fair value in the consolidated balance sheets with changes in fair value recorded in "accumulatedaccumulated other comprehensive income or loss"(loss). The weighted average contractual maturity for CLO investments included within the CMBS portfolio as of March 31, 2020 and December 31, 2019 was 16 and 17 years. The weighted average contractual maturity for single asset single borrower "SASB" investments as of March 31, 2020 and December 31, 2019 was 14 and 5 years.

The following table shows the amortized cost, allowance for expected credit losses, unrealized gains/lossesgain/(loss) and fair value of the Company's CMBS investments as of September 30, 2017 and December 31, 2016 (inby investment type (dollars in thousands):

| Amortized Cost | Unrealized Gains | Unrealized Losses | Fair Value | |||||||||||||

| September 30, 2017 | $ | — | $ | — | $ | — | $ | — | ||||||||

| December 31, 2016 | 49,548 | — | (499 | ) | 49,049 | |||||||||||

| Amortized Cost | Credit Loss Allowance | Unrealized Gain | Unrealized Loss | Fair Value | ||||||||||||||||

| March 31, 2020 | ||||||||||||||||||||

| CLOs | $ | 411,234 | $ | — | $ | — | $ | (59,830 | ) | $ | 351,404 | |||||||||

| SASB | 98,511 | — | — | (8,755 | ) | 89,756 | ||||||||||||||

| Total | $ | 509,745 | $ | — | $ | — | $ | (68,585 | ) | $ | 441,160 | |||||||||

| December 31, 2019 | ||||||||||||||||||||

| CLOs | 330,000 | $ | — | 1 | (881 | ) | 329,120 | |||||||||||||

| SASB | 57,294 | — | — | (98 | ) | 57,196 | ||||||||||||||

| Total | $ | 387,294 | $ | — | $ | 1 | $ | (979 | ) | $ | 386,316 | |||||||||

As of September 30, 2017,March 31, 2020 the Company held no CMBS positions. As of December 31, 2016, the Company held 629 CMBS positions with an aggregate carrying value of $49.5$510 million and an unrealized loss of $0.5$69 million, of which 2two positions had a totalan unrealized loss of $0.2 million for a period greater than 12twelve months. As of December 31, 2019, the Company held 21 CMBS positions with an aggregate carrying value of $387 million and an unrealized loss of $1 million, of which two positions had an unrealized loss for a period greater than twelve months.

The Companyfollowing table provides information on the unrealized losses and fair value on the Company's real estate securities, CMBS, available for sale that were in an unrealized loss position, and for which an allowance for credit losses has recognizednot been recorded as of March 31, 2020 and December 31, 2019 (amounts in thousands):

| Fair Value | Unrealized Loss | ||||||||||||||

| Securities with an unrealized loss less than 12 months | Securities with an unrealized loss greater than 12 months | Securities with an unrealized loss less than 12 months | Securities with an unrealized loss greater than 12 months | ||||||||||||

| March 31, 2020 | |||||||||||||||

| CLOs | $ | 341,003 | $ | 10,401 | $ | (56,944 | ) | $ | (2,886 | ) | |||||

| SASB | 79,506 | 10,250 | (7,468 | ) | (1,287 | ) | |||||||||

| Total | $ | 420,509 | $ | 20,651 | $ | (64,412 | ) | $ | (4,173 | ) | |||||

| December 31, 2019 | |||||||||||||||

| CLOs | $ | 315,845 | $ | 13,275 | $ | (863 | ) | $ | (17 | ) | |||||

| SASB | 45,045 | 12,151 | (67 | ) | (31 | ) | |||||||||

| Total | $ | 360,890 | $ | 25,426 | $ | (930 | ) | $ | (48 | ) | |||||

23

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2020

(Unaudited)

As of March 31, 2020 and December 31, 2019, there are two securities with unrealized losses reflected in the table above. After evaluating the securities, we concluded that the unrealized losses reflected above were noncredit-related and would be recovered from the securities’ estimated future cash flows. We considered a gainnumber of $0.2 millionfactors in reaching this conclusion, including that we did not intend to sell the securities, it was not considered more likely than not that we would be forced to sell the securities prior to recovering our amortized cost, and that there were no material credit events that would have caused us to otherwise conclude that we would not recover our cost. The allowance for credit losses is calculated using a discounted cash flow approach and is measured as the nine months ended September 30, 2017 and recognizeddifference between the original cash flows expected to be collected to the revised cash flows expected to be collected discounted using the effective interest rate, limited by the amount that the fair value is less than the amortized cost basis. Significant judgment is used in projecting cash flows. As a result, actual income and/or credit losses could be materially different from what is currently projected and/or reported.

The following table provides information on the amounts of gain/(loss) on the Company's real estate securities, CMBS, available for sale (dollars in thousands):

| Three Months Ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| Unrealized gain/(loss) available-for-sale securities | $ | (67,607 | ) | $ | 145 | |||

| Reclassification of net (gain)/loss on available-for-sale securities included in net income (loss) from sales of securities | — | — | ||||||

| Unrealized gain/(loss) available-for-sale securities, net of reclassification adjustment | $ | (67,607 | ) | $ | 145 | |||

The amounts reclassified for net (gain)/loss on available for sale securities from sales of approximately $1 million for the three and nine months ended September 30, 2016, recorded withinsecurities are included in the realized (gain)/loss on sale of real estate securities in the Company's consolidated statements of operations. The Company did not have any realized gains or losses duringCompany's unrealized gain/(loss) on available for sale securities is net of tax. Due to the three months ended September 30, 2017.Company's designation as a REIT, there was no tax impact on unrealized gain/(loss) on available for sale securities.

The following table provides information on the amountsdeterioration in fair value of gains (losses) on the Company's real estate securities CMBS, available-for-sale:for both collateralized loan obligations and other securities as of March 31, 2020 can be attributed mainly to the market down-turn and volatility as a result of high unemployment and credit uncertainties related to the outbreak of COVID-19. Management currently does not have the intention to sell any of the real estate securities as of March 31, 2020.

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2020

(Unaudited)

Note 5 - Real Estate Owned

The following table summarizes the Company's real estate owned assets as of March 31, 2020 (dollars in thousands):

| As of March 31, 2020 | ||||||||||||||||||||||||

| Acquisition Date | Property Type | Primary Location(s) | Land | Building and Improvements | Furniture, Fixtures and Equipment | Accumulated Depreciation | Real Estate Owned, net | |||||||||||||||||

August 2019 (1)(2) | Hotel | Chicago, IL | $ | — | $ | 8,337 | $ | — | $ | (139 | ) | $ | 8,198 | |||||||||||

October 2019 (1) | Office | Jeffersonville, IN | 1,887 | 21,989 | 3,565 | (333 | ) | 27,108 | ||||||||||||||||

March 2020 (1)(3) | Hotel | Knoxville, TN | 3,800 | 7,838 | 2,362 | — | 14,000 | |||||||||||||||||

| $ | 5,687 | $ | 38,164 | $ | 5,927 | $ | (472 | ) | $ | 49,306 | ||||||||||||||

________________________

(1)Refer to Note 2 for the useful life of the above assets

(2)Represents assets acquired by the Company by completing a deed-in-lieu of foreclosure transaction

(3)Represents assets acquired by the Company by completing a foreclosure transaction

The following table summarizes the Company's real estate asset acquisitions for the year ended December 31, 2019 (dollars in thousands):

| As of December 31, 2019 | ||||||||||||||||||||||||

| Acquisition Date | Property Type | Primary Location(s) | Land | Building and Improvements | Furniture, Fixtures and Equipment | Accumulated Depreciation | Real Estate Owned, net | |||||||||||||||||

August 2019 (1)(2) | Hotel | Chicago, IL | $ | — | $ | 8,110 | $ | — | $ | (86 | ) | $ | 8,024 | |||||||||||

October 2019 (1) | Office | Jeffersonville, IN | 1,887 | 25,554 | — | (133 | ) | 27,309 | ||||||||||||||||

| $ | 1,887 | $ | 33,664 | $ | — | $ | (219 | ) | $ | 35,333 | ||||||||||||||

________________________

(1)Refer to Note 2 for the useful life of the above assets

(2)Represents assets acquired by the Company by completing a deed-in-lieu of foreclosure transaction

Depreciation expense for the three months ended March 31, 2020 and March 31, 2019 totaled $0.3 million and $0.0 million, respectively.

25

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 6 - Leases

Operating Right of Use Asset

The following table summarizes the Company's operating right of use asset recognized in the consolidated balance sheets as of March 31, 2020 (dollars in thousands):

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Unrealized gains (losses) available-for-sale securities | $ | (448 | ) | $ | 1,449 | $ | 19 | $ | (1,124 | ) | ||||||

| Reclassification of net (gains) losses on available-for-sale securities included in net income (loss) | — | 1,159 | 481 | 1,159 | ||||||||||||

| Unrealized gains (losses) available-for-sale securities, net of reclassification adjustment | $ | (448 | ) | $ | 2,608 | $ | 500 | $ | 35 | |||||||

| The amounts reclassified for net (gain) loss on available-for-sale securities are included in the realized (gain) loss on sale of real estate securities in the Company's consolidated statements of operations. | ||||||||||||||||

| March 31, 2020 | ||||||||||||||||

| Acquisition Date | Property Type | Primary Location(s) | Operating Right of Use Asset, Gross | Accumulated Amortization | Operating Right of Use Asset, net of Amortization | |||||||||||

| August 2019 | Hotel | Chicago, IL | $ | 6,109 | $ | (207 | ) | $ | 5,902 | |||||||

| $ | 6,109 | $ | (207 | ) | $ | 5,902 | ||||||||||

The following table summarizes the Company's operating right of use asset recognized in the consolidated balance sheets as of December 31, 2019 (dollars in thousands):

| December 31, 2019 | ||||||||||||||||

| Acquisition Date | Property Type | Primary Location(s) | Operating Right of Use Asset, Gross | Accumulated Amortization | Operating Right of Use Asset, net of Amortization | |||||||||||

| August 2019 | Hotel | Chicago, IL | $ | 6,109 | $ | (130 | ) | $ | 5,979 | |||||||

| $ | 6,109 | $ | (130 | ) | $ | 5,979 | ||||||||||

Operating Lease Liabilities

On August 19, 2019, in conjunction with the deed-in-lieu of foreclosure transaction, the Company assumed a non-cancelable ground lease for the land on which the property is located and classified the lease as an operating lease. The ground lease requires monthly rental payments with annual increases of 3%. The initial term of the lease expires in 2067 and can be renewed for a sixty-year period. Rent expense for this operating lease for the three months ended March 31, 2020 and March 31, 2019 totaled $0.2 million and $0.0 million, respectively.

The following table summarizes the Company's schedule of minimum future lease payments as of March 31, 2020 (dollars in thousands):

| Minimum Future Lease Payments | March 31, 2020 | |||

| 2020 (April - December) | $ | 300 | ||

| 2021 | 410 | |||

| 2022 | 422 | |||

| 2023 | 435 | |||

| 2024 | 448 | |||

| 2025 and beyond | 39,438 | |||

| Total undiscounted lease payments | $ | 41,453 | ||

| Less: Amount representing interest | (35,277 | ) | ||

| Present value of lease liability | $ | 6,176 | ||

26

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2020

(Unaudited)

The following table summarizes the Company's schedule of minimum future lease payments as of December 31, 2019 (dollars in thousands):

| Minimum Future Lease Payments | December 31, 2019 | |||

| 2020 | $ | 398 | ||

| 2021 | 410 | |||

| 2022 | 422 | |||

| 2023 | 435 | |||

| 2024 | 448 | |||

| 2025 and beyond | 39,438 | |||

| Total undiscounted lease payments | $ | 41,551 | ||

| Less: Amount representing interest | (35,415 | ) | ||

| Present value of lease liability | $ | 6,136 | ||

The discount rate used to calculate the lease liability as of March 31, 2020 and December 31, 2019 is 9%. The remaining lease term is 47.70 years as of March 31, 2020 and 47.95 as of December 31, 2019.

Intangible Lease Asset

The following table summarizes the Company's intangible lease asset recognized in the consolidated balance sheets as of March 31, 2020 (dollars in thousands):

| March 31, 2020 | ||||||||||||||||

| Acquisition Date | Property Type | Primary Location(s) | Intangible Lease Asset, Gross | Accumulated Amortization | Intangible Lease Asset, Net of Amortization | |||||||||||

| October 2019 | Office | Jeffersonville, IN | $ | 14,509 | $ | (344 | ) | $ | 14,165 | |||||||

| $ | 14,509 | $ | (344 | ) | $ | 14,165 | ||||||||||

The following table summarizes the Company's intangible lease asset recognized in the consolidated balance sheets as of December 31, 2019 (dollars in thousands):

| December 31, 2019 | ||||||||||||||||

| Acquisition Date | Property Type | Primary Location(s) | Intangible Lease Asset, Gross | Accumulated Amortization | Intangible Lease Asset, Net of Amortization | |||||||||||

| October 2019 | Office | Jeffersonville, IN | $ | 14,509 | $ | (131 | ) | $ | 14,377 | |||||||

| $ | 14,509 | $ | (131 | ) | $ | 14,377 | ||||||||||

Rental Income

On October 15, 2019, the Company purchased an office building that was subject to an existing triple net lease. The minimum rental amount due under the lease is subject to annual increases of 1.5%. The initial term of the lease expires in 2037 and contains renewal options for four consecutive five-year terms. The remaining lease term is 17.1 years. Rental income for this operating lease for the three months ended March 31, 2020 and March 31, 2019 totaled $0.7 million and $0.0 million, respectively.

27

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2020

(Unaudited)

The following table summarizes the Company's schedule of future minimum rents to be received under the lease (dollars in thousands):

| Minimum Rents | March 31, 2020 | |||

| 2020 (April - December) | $ | 1,903 | ||

| 2021 | 2,568 | |||

| 2022 | 2,607 | |||

| 2023 | 2,646 | |||

| 2024 | 2,686 | |||

| 2025 and beyond | 36,894 | |||

| Total minimum rent | $ | 49,304 | ||

AmortizationExpense

Intangible lease assets are amortized using the straight-line method over the contractual life of the lease, of a period up to 20.0 years. The weighted average life of intangible assets as of March 31, 2020 is approximately 17.1 years. Amortization expense for the three months ended March 31, 2020 and March 31, 2019 totaled $0.2 million and $0.0 million, respectively.

The following table summarizes the Company's expected amortization for intangible assets over the next five years, assuming no further acquisitions or dispositions (dollars in thousands):

| Amortization Expense | March 31, 2020 | |||

| 2020 (April - December) | $ | (619 | ) | |

| 2021 | (825 | ) | ||

| 2022 | (825 | ) | ||

| 2023 | (825 | ) | ||

| 2024 | (825 | ) | ||

Note 57 - Debt

Repurchase Agreements - Commercial Mortgage Loans

The Company has entered into repurchase facilities with JPMorgan Chase Bank, National Association (the "JPM Repo Facility"), Goldman Sachs Bank USA (the "GS Repo Facility"), U.S.U.S Bank National Association (the "USB Repo Facility"), Barclays Bank PLC (the "Barclays Revolver Facility" and the "Barclays Repo Facility"), Wells Fargo Bank, National Association (the "WF Repo Facility"), and Credit Suisse AG (the "CS Repo Facility" and together with the JPM Repo Facility, GS Repo Facility, USB Repo Facility, WF Repo Facility, Barclays Revolver Facility, and Barclays Repo Facility, the "Repo Facilities").

The JPM Repo Facility has aFacilities are financing sources through which the Company may pledge one or more mortgage loans to the financing entity in exchange for funds typically at an advance rate of between 65% to 80% of the principal amount of the mortgage loan being pledged.

The details of the Company's Repo Facilities at March 31, 2020 and December 31, 2019 are as follows (dollars in thousands):

| As of March 31, 2020 | |||||||||||||||||

| Repurchase Facility | Committed Financing | Amount Outstanding | Interest Expense(1) | Ending Weighted Average Interest Rate | Maturity | ||||||||||||

JPM Repo Facility (2) | $ | 300,000 | $ | 119,604 | $ | 1,362 | 3.83 | % | 1/30/2021 | ||||||||

USB Repo Facility (3) | 100,000 | 8,250 | 152 | 3.18 | % | 6/15/2020 | |||||||||||

CS Repo Facility (4) | 200,000 | 71,740 | 1,349 | 4.06 | % | 9/27/2020 | |||||||||||

WF Repo Facility (5) | 175,000 | — | 396 | N/A | 11/21/2020 | ||||||||||||

Barclays Revolver Facility (6) | 100,000 | 4,200 | 51 | 5.34 | % | 9/20/2021 | |||||||||||

Barclays Repo Facility (7) | 300,000 | 30,730 | 332 | 3.24 | % | 3/15/2022 | |||||||||||

| Total | $ | 1,175,000 | $ | 234,524 | $ | 3,642 | |||||||||||

__________________________

28

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2020

(Unaudited)

(1) For the three months ended March 31, 2020. Includes amortization of deferred financing costs.

(2) On September 3, 2019, the committed financing amount was downsized from $520 million to $300 million and the maturity date of June 12, 2019 plus a one-year extension at the Company's option and provides upwas amended to $300.0 million in advances. The GS Repo Facility has a maturity date of December 27, 2018, with a one-year extension at the Company’s option, which may be exercised upon the satisfaction of certain conditions, and provides up to $250.0 million in advances. The USB Repo Facility matures on July 15, 2020, withJanuary 30, 2021.

(3) Includes two one-year extensions at the option of an indirect wholly-owned subsidiary of the Company, which may be exercised upon the satisfaction of certain conditions, and provides up to $100.0 million in advances. The CS Repo Facility matures on August 30, 2018 and provides up to $250.0 million in advances. Prior to the end of each calendar quarter,conditions.

(4) On March 26, 2020, the Company may request anexercised the extension of the termination date for an additional 364 days from the end of such calendar quarter subject tooption upon the satisfaction of certain conditions, and approvals. extended the term maturity to September 27, 2020.

(5) Includes three one-year extensions at the Company’s option, which may be exercised upon the satisfaction of certain conditions.

(6) On September 13, 2019, the Company exercised the extension option, and extended the term maturity to September 20, 2021. There is one more one-year extension option available at the Company's discretion.

(7) Includes two one-year extensions at the Company's option.

| As of December 31, 2019 | |||||||||||||||||

| Repurchase Facility | Committed Financing | Amount Outstanding | Interest Expense(1) | Ending Weighted Average Interest Rate | Maturity | ||||||||||||

JPM Repo Facility (2) | $ | 300,000 | $ | 107,526 | $ | 6,862 | 4.51 | % | 1/30/2021 | ||||||||

USB Repo Facility (3) | 100,000 | — | 622 | N/A | 6/15/2020 | ||||||||||||

CS Repo Facility (4) | 300,000 | 87,375 | 5,563 | 4.84 | % | 3/27/2020 | |||||||||||

WF Repo Facility (5) | 175,000 | 24,942 | 1,333 | 3.65 | % | 11/21/2020 | |||||||||||

Barclays Revolver Facility (6) | 100,000 | — | 976 | N/A | 9/20/2021 | ||||||||||||

Barclays Repo Facility (7) | 300,000 | 32,700 | 1,260 | 3.80 | % | 3/15/2022 | |||||||||||

| Total | $ | 1,275,000 | $ | 252,543 | $ | 16,616 | |||||||||||

_______________________

(1) For the twelve months ended December 31, 2019. Includes amortization of deferred financing costs.

(2) On September 3, 2019, the committed financing amount was downsized from $520 million to $300 million and the maturity date was amended to January 30, 2021.

(3) Includes two one-year extensions at the option of an indirect wholly-owned subsidiary of the Company, which may be exercised upon the satisfaction of certain conditions.

(4) On March 26, 2019, the Company exercised the extension option upon the satisfaction of certain conditions, and extended the term maturity to March 27, 2020.

(5) Includes three one-year extensions at the Company’s option, which may be exercised upon the satisfaction of certain conditions.

(6) On September 13, 2019, the Company exercised the extension option, and extended the term maturity to September 20, 2021. There is one more one-year extension option available at the Company's discretion.

(7) Includes two one-year extensions at the Company's option.

The Company expects to use the advances from the Repo Facilities are all subject to various adjustments.

The Repo Facilities generally provide that in the event of a decrease in the value of the Company's collateral, the lenders can demand additional collateral. Should the value of the Company’s collateral decrease as a result of deteriorating credit quality, resulting margin calls may cause an adverse change in the Company’s liquidity position. As of September 30, 2017March 31, 2020 and December 31, 2016,2019, the Company is in compliance with all debt covenants.

On March 23, 2020, the Company transferred $15.2 million of its interest in a term loan to Sterling National Bank ("SNB") via a participation agreement. The Company incurred $13.0 thousand of interest expense on SNB for the three months ended March 31, 2020.

Unsecured Debt

On March 26, 2020, the Company and certain of its subsidiaries entered into a financing arrangementmaterial amendment to an existing lending agreement with Pacific Western BankSecurity Benefit Life Insurance Company ("SBL"), secured by a pledge of equity interests in certain of the Company’s subsidiaries, for term financing (“PWB Financing”) on May 17, 2017.a total commitment of $100 million with a maturity of February 10, 2023 and a rate of one-month LIBOR + 4.5%. The PWB Financing providedamendment revised the terms of the existing SBL lending agreement, entered into in February 2020, to permit the Company with $36.2 million and is collateralized by a portfolio asset of $54.2 million. The PWB Financing currently accrues interest at per annum rates equal to the sum of (i) the applicable LIBOR index rate plus (ii) a margin of 4.00%. The PWB Financing initially matures on June 9, 2019, with two one-year extension options at the Company’s option. As of September 30, 2017, the Company had $30.5 million outstandingborrow under the PWB Financing.agreement. The Company incurred $0.7 million$17.0 thousand of interest expense on the PWB Financinglending agreement with SBL for the ninethree months ended September 30, 2017, including amortizationMarch 31, 2020. As of deferred financing cost.March 31, 2020 there was no outstanding balance.

29

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2020

(Unaudited)

Repurchase Agreements - Real Estate Securities

The Company has entered into various Master Repurchase Agreements (the "MRAs") that allow the Company to sell real estate securities while providing a fixed repurchase price for the same real estate securities in the future. The repurchase contracts on each security under an MRA generally mature in 30 to 9030-90 days and terms are adjusted for current market rates as necessary. As of September 30, 2017, the Company pledged Tranche C of RFT 2015-FL1 under its MRAs. As of December 31, 2016, the Company pledged Tranche C of RFT 2015-FL1 and its real estate securities available for sale under its MRAs.

Below is a summary of the Company's MRAs as of September 30, 2017March 31, 2020 and December 31, 2016 (in2019 (dollars in thousands):

________________________

| Weighted Average | |||||||||||||||||

| Counterparty | Amount Outstanding | Accrued Interest | Collateral Pledged (1) | Interest Rate | Days to Maturity | ||||||||||||

| As of March 31, 2020 | |||||||||||||||||

| JP Morgan Securities LLC | $ | 159,879 | $ | 595 | $ | 202,688 | 2.21 | % | 11 | ||||||||

| Wells Fargo Securities, LLC | 159,924 | 955 | 190,623 | 2.32 | % | 12 | |||||||||||

| Barclays Capital Inc. | 79,047 | 365 | 106,965 | 2.28 | % | 17 | |||||||||||

| Citigroup Global Markets, Inc. | 98,030 | 653 | 109,500 | 2.60 | % | 16 | |||||||||||

| Total/Weighted Average | $ | 496,880 | $ | 2,568 | $ | 609,776 | 2.33 | % | 13 | ||||||||

| As of December 31, 2019 | |||||||||||||||||

| JP Morgan Securities LLC | $ | 83,353 | $ | 124 | $ | 93,500 | 2.53 | % | 20 | ||||||||

| Wells Fargo Securities, LLC | $ | 178,304 | $ | 1,199 | $ | 209,873 | 2.94 | % | 11 | ||||||||

| Barclays Capital Inc. | $ | 40,720 | $ | 221 | $ | 47,475 | 2.81 | % | 23 | ||||||||

| Citigroup Global Markets, Inc. | 91,982 | 413 | 103,453 | 2.69 | % | 19 | |||||||||||

| Total/Weighted Average | $ | 394,359 | $ | 1,957 | $ | 454,301 | 2.79 | % | 16 | ||||||||

| Weighted Average | |||||||||||||||||

| Counterparty | Amount Outstanding | Accrued Interest | Fair Value Collateral Pledged (*) | Interest Rate | Days to Maturity | ||||||||||||

| As of September 30, 2017 | |||||||||||||||||

| J.P. Morgan Securities LLC | $ | 39,035 | $ | 74 | $ | 55,764 | 2.97 | % | 6 | ||||||||

| Total/Weighted Average | $ | 39,035 | $ | 74 | $ | 55,764 | 2.97 | % | 6 | ||||||||

| As of December 31, 2016 | |||||||||||||||||

| J.P. Morgan Securities LLC | $ | 59,122 | $ | 96 | $ | 92,658 | 2.55 | % | 6 | ||||||||

| Citigroup Global Markets, Inc. | 3,879 | 1 | 4,850 | 2.11 | % | 26 | |||||||||||

| Wells Fargo Securities, LLC | 3,638 | 4 | 4,850 | 2.05 | % | 13 | |||||||||||

| Total/Weighted Average | $ | 66,639 | $ | 101 | $ | 102,358 | 2.50 | % | 8 | ||||||||

Collateralized Loan ObligationObligations

On October 19, 2015, RFT 2015-FL1January 15, 2020, the Company called all of the outstanding notes issued by BSPRT 2017-FL2 Issuer, Ltd. (the “2015 Issuer”), a wholly owned indirect subsidiary of the Company. The outstanding principal of the notes on the date of the call was $21.0 million. The Company recognized all the remaining unamortized deferred financing costs of $4.5 million recorded within the Interest expense line of the consolidated statements of operations, which was a non-cash charge.

As of March 31, 2020 and RFT 2015-FL1December 31, 2019 the notes issued by BSPRT 2018-FL3 Issuer, Ltd. and BSPRT 2018-FL3 Co-Issuer, LLC, (the “2015 Co-Issuer”), both wholly owned indirect subsidiaries of the Company, entered into an indenture with the OP, as advancing agent, U.S. Bank National Association as note administrator and U.S. Bank National Association as trustee, which governs the issuance of approximately $350.2 million principal balance secured floating rate notes (the “Notes”). In addition, concurrently with the issuance of the Notes, the 2015 Issuer also issued 78,188,494 Preferred Shares, par value of $0.001 per share and with an aggregate liquidation preference and notional amount equal to $1,000 per share (the “Preferred Shares”), which were not offered as part of closing the indenture. For U.S. federal income tax purposes, the 2015 Issuer and 2015 Co-Issuer are disregarded entities.

As of March 31, 2020 and December 31, 2019 the notes issued by BSPRT 2018-FL4 Issuer, Ltd. and BSPRT 2018-FL4 Co-Issuer, LLC, each wholly owned indirect subsidiaries of the Company, are collateralized by interests in a pool of 53 and 49 mortgage assets having a principal balance of $868.7 million and $867.9 million, respectively (the "2018-FL4 Mortgage Assets"). The sale of the 2018-FL4 Mortgage Assets to BSPRT 2018-FL4 Issuer is governed by a Mortgage Asset Purchase Agreement dated as of October 19, 2015,12, 2018, between the Company and the 2015BSPRT 2018-FL4 Issuer. In connection with the securitization, the 2015 Issuer and 2015 Co-Issuer offered and sold the following classes of Notes to third parties: Class A, Class B and Class C. A wholly owned subsidiary of the Company retained approximately $56.0 million of the total $76.0 million of Class C and all of the preferred equity in the Issuer. The retained Class C and its related interest income and the preferred equity are eliminated in the Company's consolidated financial statements. The Company, as the holder of preferred equity in the 2015 Issuer, will absorb the first losses of the CLO, which may have a negative impact to the Company's result of operations. The issuance of the CLO also results in an increase in interest expense within the Consolidated Statements of Operations.

As of September 30, 2017March 31, 2020 and December 31, 2019, the CLO Notesnotes issued in 2017by BSPRT 2019-FL5 Issuer, Ltd. and BSPRT 2019-FL5 Co-Issuer, LLC, each wholly owned indirect subsidiaries of the Company, are collateralized by interests in a pool of 2353 and 48 mortgage assets having a total principal balance of $418.1$803.4 million and $809.4 million respectively (the “Mortgage Assets”"2019-FL5 Mortgage Assets") originated by a subsidiary of the Company.. The sale of the 2019-FL5 Mortgage Assets to the 2017BSPRT 2019-FL5 Issuer is governed by a Mortgage Asset Purchase Agreement dated as of June 29, 2017,May 30, 2019, between the Company and the 2017BSPRT 2019-FL5 Issuer. In connection with the securitization, the 2017 Issuer and 2017 Co-Issuer offered and sold the following classes of Notes to third parties: Class A, Class B and Class C. A wholly owned subsidiary of the Company retained all of the preferred equity in the 2017 Issuer. The Company, as the holder of preferred equity in the 2017 Issuer, will absorb the first losses of the CLO, which may have a negative impact to the Company's result of operations. The issuance of the CLO also results in an increase in interest expense within the Consolidated Statements of Operations.

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The Company, through its wholly-owned subsidiaries, holds the preferred equity tranches of the above CLOs of approximately $256.9 million and $305.4 million as of March 31, 2020 and December 31, 2019, respectively. The following tables representtable represents the terms of the 2015notes issued by the 2018-FL3 Issuer, 2018-FL4 Issuer and 2017 CLOs issued, respectively.2019-FL5 Issuer (the "CLOs), respectively, as of March 31, 2020 (dollars in thousands):

| CLO Facility | Tranche | Par Value Issued | Par Value Outstanding (1) | Interest Rate | Maturity Date | |||||||||

| 2018-FL3 Issuer | Tranche A | $ | 286,700 | $ | 275,800 | 1M LIBOR + 105 | 10/15/2034 | |||||||

| 2018-FL3 Issuer | Tranche A-S | 77,775 | 77,775 | 1M LIBOR + 135 | 10/15/2034 | |||||||||

| 2018-FL3 Issuer | Tranche B | 41,175 | 41,175 | 1M LIBOR + 165 | 10/15/2034 | |||||||||

| 2018-FL3 Issuer | Tranche C | 39,650 | 39,650 | 1M LIBOR + 255 | 10/15/2034 | |||||||||

| 2018-FL3 Issuer | Tranche D | 42,700 | 42,700 | 1M LIBOR + 345 | 10/15/2034 | |||||||||

| 2018-FL4 Issuer | Tranche A | 416,827 | 416,827 | 1M LIBOR + 105 | 9/15/2035 | |||||||||

| 2018-FL4 Issuer | Tranche A-S | 73,813 | 73,813 | 1M LIBOR + 130 | 9/15/2035 | |||||||||

| 2018-FL4 Issuer | Tranche B | 56,446 | 56,446 | 1M LIBOR + 160 | 9/15/2035 | |||||||||

| 2018-FL4 Issuer | Tranche C | 68,385 | 68,385 | 1M LIBOR + 210 | 9/15/2035 | |||||||||

| 2018-FL4 Issuer | Tranche D | 57,531 | 57,531 | 1M LIBOR + 275 | 9/15/2035 | |||||||||

| 2019-FL5 Issuer | Tranche A | 407,025 | 407,025 | 1M LIBOR + 115 | 5/15/2029 | |||||||||

| 2019-FL5 Issuer | Tranche A-S | 76,950 | 76,950 | 1M LIBOR + 148 | 5/15/2029 | |||||||||

| 2019-FL5 Issuer | Tranche B | 50,000 | 50,000 | 1M LIBOR + 140 | 5/15/2029 | |||||||||

| 2019-FL5 Issuer | Tranche C | 61,374 | 61,374 | 1M LIBOR + 200 | 5/15/2029 | |||||||||

| 2019-FL5 Issuer | Tranche D | 48,600 | 5,000 | 1M LIBOR + 240 | 5/15/2029 | |||||||||

| 2019-FL5 Issuer | Tranche E | 20,250 | 3,000 | 1M LIBOR + 285 | 5/15/2029 | |||||||||

| $ | 1,825,201 | $ | 1,753,451 | |||||||||||

| 2015 Facility ($000s) | Par Value Issued | Par Value Outstanding (*) | Interest Rate | Maturity Date | ||||||||

| As of September 30, 2017 | ||||||||||||

| Tranche A | $ | 231,345 | $ | 124,690 | 1M LIBOR + 175 | 8/1/2030 | ||||||

| Tranche B | 42,841 | 42,841 | 1M LIBOR + 388 | 8/1/2030 | ||||||||

| Tranche C | 76,044 | 20,000 | 1M LIBOR + 525 | 8/1/2030 | ||||||||

| $ | 350,230 | $ | 187,531 | |||||||||

| As of December 31, 2016 | ||||||||||||

| Tranche A | $ | 231,345 | $ | 222,195 | 1M LIBOR + 175 | 8/1/2030 | ||||||

| Tranche B | 42,841 | 42,841 | 1M LIBOR + 388 | 8/1/2030 | ||||||||

| Tranche C | 76,044 | 20,000 | 1M LIBOR + 525 | 8/1/2030 | ||||||||

| $ | 350,230 | $ | 285,036 | |||||||||

31

| 2017 Facility ($000s) | Par Value Issued | Par Value Outstanding | Interest Rate | Maturity Date | ||||||||

| As of September 30, 2017 | ||||||||||||

| Tranche A | $ | 223,600 | $ | 223,600 | 1M LIBOR + 135 | 7/1/2027 | ||||||

| Tranche B | 48,000 | 48,000 | 1M LIBOR + 240 | 7/1/2027 | ||||||||

| Tranche C | 67,900 | 67,900 | 1M LIBOR + 425 | 7/1/2027 | ||||||||

| $ | 339,500 | $ | 339,500 | |||||||||

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2020

(Unaudited)

The following table represents the terms of the notes issued by the 2017-FL1 Issuer, 2017-FL2 Issuer, 2018-FL3 Issuer and 2018-FL4 Issuer, as of December 31, 2019 (dollars in thousands):

| CLO Facility | Tranche | Par Value Issued | Par Value Outstanding (1) | Interest Rate | Maturity Date | |||||||||

| 2017-FL2 Issuer | Tranche A | $ | 237,970 | $ | — | 1M LIBOR + 82 | 10/15/2034 | |||||||

| 2017-FL2 Issuer | Tranche A-S | 36,357 | — | 1M LIBOR + 110 | 10/15/2034 | |||||||||

| 2017-FL2 Issuer | Tranche B | 26,441 | — | 1M LIBOR + 140 | 10/15/2034 | |||||||||

| 2017-FL2 Issuer | Tranche C | 25,339 | — | 1M LIBOR + 215 | 10/15/2034 | |||||||||

| 2017-FL2 Issuer | Tranche D | 35,255 | 21,444 | 1M LIBOR + 345 | 10/15/2034 | |||||||||

| 2018-FL3 Issuer | Tranche A | 286,700 | 286,700 | 1M LIBOR + 105 | 10/15/2034 | |||||||||

| 2018-FL3 Issuer | Tranche A-S | 77,775 | 77,775 | 1M LIBOR + 135 | 10/15/2034 | |||||||||

| 2018-FL3 Issuer | Tranche B | 41,175 | 41,175 | 1M LIBOR + 165 | 10/15/2034 | |||||||||

| 2018-FL3 Issuer | Tranche C | 39,650 | 39,650 | 1M LIBOR + 255 | 10/15/2034 | |||||||||

| 2018-FL3 Issuer | Tranche D | 42,700 | 42,700 | 1M LIBOR + 345 | 10/15/2034 | |||||||||

| 2018-FL4 Issuer | Tranche A | 416,827 | 416,827 | 1M LIBOR + 105 | 9/15/2035 | |||||||||

| 2018-FL4 Issuer | Tranche A-S | 73,813 | 73,813 | 1M LIBOR + 130 | 9/15/2035 | |||||||||

| 2018-FL4 Issuer | Tranche B | 56,446 | 56,446 | 1M LIBOR + 160 | 9/15/2035 | |||||||||

| 2018-FL4 Issuer | Tranche C | 68,385 | 68,385 | 1M LIBOR + 210 | 9/15/2035 | |||||||||

| 2018-FL4 Issuer | Tranche D | 57,531 | 57,531 | 1M LIBOR + 275 | 9/15/2035 | |||||||||

| 2019-FL5 Issuer | Tranche A | 407,025 | 407,025 | 1M LIBOR + 115 | 5/15/2029 | |||||||||

| 2019-FL5 Issuer | Tranche A-S | 76,950 | 76,950 | 1M LIBOR + 148 | 5/15/2029 | |||||||||

| 2019-FL5 Issuer | Tranche B | 50,000 | 50,000 | 1M LIBOR + 140 | 5/15/2029 | |||||||||

| 2019-FL5 Issuer | Tranche C | 61,374 | 61,374 | 1M LIBOR + 200 | 5/15/2029 | |||||||||

| 2019-FL5 Issuer | Tranche D | 48,600 | 24,300 | 1M LIBOR + 240 | 5/15/2029 | |||||||||

| 2019-FL5 Issuer | Tranche E | 20,250 | 20,250 | 1M LIBOR + 285 | 5/15/2029 | |||||||||

| $ | 2,186,563 | $ | 1,822,345 | |||||||||||

(1) Excludes $261.4 million of CLO notes, held by the Company, which are eliminated within the collateralized loan obligation line of the consolidated balance sheets as of December 31, 2019.

32

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2020

(Unaudited)

The below table reflects the total assets and liabilities of the Company's twooutstanding CLOs. The CLOs are considered VIEs and are consolidated into the Company's consolidated financial statements as of September 30, 2017March 31, 2020 and December 31, 20162019 as the Company is the primary beneficiary of the VIEs.VIE. The Company is the primary beneficiary of the CLOs because (i) the Company has the power to direct the activities that most significantly affect the VIEs'VIE’s economic performance and (ii) the right to receive benefits from the VIEs or the obligation to absorb losses of the VIEs that could be significant to the VIEs.VIE.

-17

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTSSeptember 30, 2017(Unaudited)

_______________________________________________

BasicThe Company uses the two-class method in calculating basic and diluted earnings per share. Net income/(loss) is allocated between our common share (“EPS”) is computed by dividingstock and other participating securities based on their participation rights. Diluted net income ofper share has been computed using the Company by the weighted-average number of common shares outstanding. Diluted EPS is computed in the same manner as basic EPS, except theweighted average number of shares is increased to include additionalof common shares that would have beenstock outstanding if potential common shares with aand other dilutive effect had been issued. Potential common shares consist primarily of share-based compensation awards calculated using the treasury stock method. As of September 30, 2017 and September 30, 2016, the Company did not have any anti-dilutive common shares outstanding.securities. The following table ispresents a summaryreconciliation of the numerators and denominators of the basic and diluted net incomeearnings per share computationcomputations and the calculation of basic and diluted earnings per share for the three and nine months ended September 30, 2017March 31, 2020 and 2016, respectively:March 31, 2019 (in thousands, except share and per share data):

OnAs of March 31, 2020 and December 30, 2014,31, 2019, the Company filed with the Maryland State Department of Assessmentshad 40,514 and Taxation articles supplementary to its charter that reclassified 1,000 authorized but unissued40,500 shares of the Company’s common stock asSeries A Preferred Stock outstanding, respectively and 1,400 shares of convertible stock and setSeries C Preferred Stock outstanding.

-18

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTSSeptember 30, 2017(Unaudited)

Company, with payouts dependent on the achievement of certain stockholder total return thresholds. Subsequent to September 30, 2016, the Company determined that as a result of the termination of the advisory agreement between the Former Advisor and the Company a triggering event had occurred. Based on the Company’s determination of the enterprise value of the Company on the date of the triggering event, the total distributions paid to the Company’s stockholders through the date of the triggering event, and the sum ofactivity in the Company's stockholders’ invested capital as ofSeries A Preferred Stock for the date ofperiods ended March 31, 2020 and March 31, 2019, respectively (dollars in thousands, except share amounts):

On May 13, 2013, the Company's board of directors authorized and declared a distribution calculated daily at a rate of $0.00565068493 per day, which is equivalent to $2.0625 per annum, per share of common stock. In March 2016, the Company's board of directors ratified the existing distribution amount equivalent to $2.0625 per annum for calendar year 2016. On November 10, 2016 the Company’s board of directors changed the DRIP offer price to $20.05, which is equal to the estimated per-share NAV as of September 30, 2016 approved by the board of directors. In August 2017, the Company’s board of directors authorized and declared a distribution calculated daily at a rate of $0.00394521 per day, which is equivalent to $1.44 per annum, per share of common stock. The price change was applied to the reinvestment of distributions commencing with the October 2016 distributions. On May 10, 2017, the Company’s board of directors changed the methodology used to determine the DRIP offer price to be the lesser of (i) the Company’s most recent estimated per-share NAV, as approved by the Company’s board of directors from time to time, and (ii) the Company’s book value per share, computed in accordance with GAAP. Based on this new methodology, the DRIP offer price for May 2017, June 2017 and July 2017 was $19.62 per share, which was the GAAP book value per share as of March 31, 2017. The DRIP offer price for September 2017, October 2017 and November 2017 was $19.29 per share, which was the GAAP book value per share as of June 30, 2017. Starting December 2017 the DRIP offer price will be $19.02 per share, which is the Company's estimated per share NAV as of September 30, 2017.

-19

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTSSeptember 30, 2017(Unaudited)

-2037

September 30, 2017March 31, 2020

The Company entered intoAdvisory Agreement Fees and ReimbursementsThe Advisor receives an acquisition fee of 1.0% of the principal amount funded by the Company makes or was required to originate or acquire commercial mortgage loans (or anticipated net equity funded bymake the following payments and reimbursements to the Advisor:Until September 29, 2016, the Former Advisor served as the Company’s advisorthree months ended March 31, 2020 and March 31, 2019 and the Companyassociated payable as of March 31, 2020 and December 31, 2019 (dollars in thousands):

________________________Duringduring the three and nine months ended September 30, 2017, the Company paid acquisition feesMarch 31, 2020 and expenses of $3.0March 31, 2019 were $2.1 million and $9.0$1.8 million respectively, of which $1.7$2.0 million and $4.2$1.5 million respectively, have been recognizedwere capitalized within the commercial mortgage loans, held for investment line of the consolidated balance sheets for the periods ended March 31, 2020 and 2019.

-2138

September 30, 2017March 31, 2020

expenses included in CommercialOther TransactionsDuring the three and nine months ended September 30, 2016,On March 26, 2020, the Company paid acquisition fees and expensescertain of $0.3its subsidiaries entered into a material amendment to an existing lending agreement with SBL, an entity that also holds 14,950 of the Company’s outstanding shares of Series A Preferred Stock, secured by a pledge of equity interests in certain of the Company’s subsidiaries, for a total commitment of $100.0 million with a maturity of February 10, 2023 and $0.6 million respectively, and recognizeda rate of one-month LIBOR + 4.5%. The amendment revised the same amounts respectively,terms of the existing SBL lending agreement, entered into in Acquisition fees and expensesFebruary 2020, to permit the Company to borrow under the agreement. The Company incurred $17 thousand of interest expense on the Company's consolidated statements of operations. The Company did not capitalize any acquisitions expenseslending agreement with SBL for the three and nine months ended September 30, 2016.The Company paid the Former Advisor, or its affiliates, a monthly asset management fee equal to one-twelfthMarch 31, 2020. As of 0.75% of the cost of the Company's assets. The asset management feeMarch 31, 2020 there was based on the lower of the cost of the Company's assets and the fair value of the Company's assets (fair value consist of the market value of each portfolio investment as determined by the Former Advisor in accordance with the Company's valuation guidelines).During the three and nine months ended September 30, 2017, the Company incurred $2.3 million and $7.0 million in asset management fees, respectively. During the three and nine months ended September 30, 2016, the Company incurred $1.1 million and $7.1 million in asset management fees, respectively. These asset management fees are recorded in "Asset management and subordinated performance fee" within the consolidated statements of operations.The Company is required to pay the Advisor an annual subordinated performance fee calculated on the basis of total return to stockholders, payable monthly in arrears, such that for any year in which total return on stockholders’ capital exceeds 6.0% per annum, the Former Advisor will be entitled to 15.0% of the excess total return; provided that in no event will the annual subordinated performance fee payable to the Former Advisor exceed 10.0% of the aggregate total return for such year. This fee will be payable only upon the sale of assets, distributions or other event which results in the Company's return on stockholders’ capital exceeding 6.0% per annum.The Company did not incur an annual subordinated performance fee during the three and nine months ended September 30, 2017 and September 30, 2016. These subordinated performance fees are recorded in "Asset management and subordinated performance fees" within the Company's consolidated statements of operations.The table below depicts related party fees and reimbursements in connection with the operations of the Company for the three and nine months ended September 30, 2017 and 2016 and the associated payable as of September 30, 2017 and December 31, 2016 (in thousands):

The payables as of September 30, 2017 and December 31, 2016 in the table above are included in "Due to affiliates" in the Company's consolidated balance sheets.Subject to the limitations outlined below, the Company reimbursed the Former Advisor's cost of providing administrative services and personnel costs in connection with other services provided, in addition to paying an asset management fee;outstanding balance.

-22

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTSSeptember 30, 2017(Unaudited)

however, the Company did not reimburse the Former Advisor for personnel costs in connection with services for which the Former Advisor received acquisition fees or disposition fees. For the three and nine months ended September 30, 2017, the Company incurred $1.5 million and $3.3 million of administrative costs in connection with the operations of the Company, which is included in "Administrative services expenses" in the consolidated statements of operations. For the three and nine months ended September 30, 2016, the Company incurred $2.5 million and $3.8 million of administrative costs in connection with the operations of the Company, which is included in "Administrative services expenses" in the consolidated statements of operations.The Advisor is required to pay any expenses in which the Company's operating expenses as defined by North American Securities Administrators Association at the end of the four preceding fiscal quarters exceeds the greater of (i) 2.0% of average invested assets or (ii) 25.0% of net income for such expense year. For the preceding four fiscal quarters, the Company did not exceed the greater of the two aforementioned criteria as of September 30, 2017.The Company has also established a restricted share plan for the benefit of employees, directors, employees of the Advisor and its affiliates.

values, these real estate securities are classified in either Level II or Level III of the fair value hierarchy. The Company obtains current market spread information where available and uses this information in evaluating and validating the market price of all CMBS.securities. Depending upon the significance of the fair value inputs used in determining these fair values, these real estate securities are classified in either Level II or Level III of the fair value hierarchy. As of September 30, 2017 the Company had no CMBS. As ofMarch 31, 2020 and December 31, 2016,2019 the Company obtained broker quotesthird party pricing for determining the fair value of each CMBS investment, used. As the broker quotes were both limited and non-binding, the Company has classified the CMBS asresulting in a Level III.

II classification.

-2339

September 30, 2017March 31, 2020

-2441

September 30, 2017March 31, 2020

The following table summarizes the valuation method and significant unobservable inputs used for the Company’s financial instruments that are categorized within Level III of the fair value hierarchy as of September 30, 2017. Both observable and unobservable inputs may be used to determine the fair value of positions that the Company has classified within the Level III category. As a result, the unrealized gains and losses for assets and liabilities within the Level III category may include changes in fair value that were attributable to both observable and unobservable inputs.

(1) In determining certain of these inputs, the Company evaluates a variety of factors including economic conditions, industry and market developments, market valuations of comparable companies and company specific developments including exit strategies and realization opportunities. The Company has determined that market participants would take these inputs into account when valuing the investments.(2) Inputs were weighted based on the fair value of the investments included in the range.

-25

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTSSeptember 30, 2017(Unaudited)

The following table presents additional information about the Company’s financial instruments which are measured at fair value on a recurring basis as of September 30, 2017 and December 31, 2016 for which the Company has used Level III inputs to determine fair value (in thousands):

________________________(1) - Unrealized gains included in Other comprehensive income ("OCI") are attributable to assets held at December 31, 2016.

-26

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTSSeptember 30, 2017(Unaudited)

Financial Instruments Measured at Fair Value on a Non-Recurring BasisThe following table presents the Company's financial instruments carried at fair value on a non-recurring basis in the consolidated balance sheets by its level in the fair value hierarchy as of September 30, 2017 and December 31, 2016 (in thousands):

(1) Fair value of the Commercial mortgage loans, held-for-sale as presented in the consolidated balance sheets is recorded at lower of cost or fair value. This treatment resulted in assets of $31,180 and $21,179 at September 30, 2017 and December 31, 2016, respectively.

A reviewIncreases or decreases in any of the fair value hierarchy classification is conducted on a quarterly basis. Changesabove unobservable inputs in the type of inputs mayisolation would result in a reclassification for certain assets. The Company's policy with respect to transfers between levels of thelower or higher fair value hierarchy is to recognize transfers into and out of each levelmeasurement for such assets.

-27

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTSSeptember 30, 2017(Unaudited)

1(1) The carrying value is gross of $2.0$21.7 million and $2.2$0.9 million of allowance for loancredit losses as of September 30, 2017March 31, 2020 and December 31, 2016,2019, respectively.

-28

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTSSeptember 30, 2017(Unaudited)

| Assets (dollars in thousands) | March 31, 2020 | December 31, 2019 | ||||||

Cash (1) | $ | 28,680 | $ | 89,946 | ||||

Commercial mortgage loans, held for investment, net (2) | 2,235,406 | 2,294,663 | ||||||

| Accrued interest receivable | 10,522 | 6,254 | ||||||

| Total Assets | $ | 2,274,608 | $ | 2,390,863 | ||||

| Liabilities | ||||||||

Notes payable (3)(4) | $ | 2,006,137 | $ | 2,064,601 | ||||

| Accrued interest payable | 1,659 | 2,576 | ||||||

| Total Liabilities | $ | 2,007,796 | $ | 2,067,177 | ||||

| Assets ($000s) | September 30, 2017 | December 31, 2016 | ||||||

Cash (1) | $ | 37,615 | $ | 5 | ||||

Commercial mortgage loans, held for investment, net of allowance of $1,431 and $1,017 (2) | 699,928 | 417,057 | ||||||

| Accrued interest receivable | 1,899 | 1,101 | ||||||

| Total assets | $ | 739,442 | $ | 418,163 | ||||

| Liabilities | ||||||||

Notes payable (3)(4) | $ | 571,303 | $ | 334,246 | ||||

| Interest payable | 980 | 564 | ||||||

| Total liabilities | $ | 572,283 | $ | 334,810 | ||||

(1) Includes $37.5$28.2 million and $89.3 million of cash held by the servicer related to CLO loan payoffs as of September 30, 2017.March 31, 2020 and December 31, 2019, respectively.

(2) The balance is presented net of allowance for loancredit loss of $1.4$10.5 million and $1.0$0.8 million as of September 30, 2017March 31, 2020 and December 31, 2016,2019, respectively.

(3) Includes $55.8$267.1 million and $55.8$261.4 million of Tranche C of Company issued CLO notes, held by the Company, which eliminatesare eliminated within the Collateralcollateralized loan obligationsobligation line of the consolidated balance sheets as of September 30, 2017March 31, 2020 and December 31, 2016,2019, respectively.

(4) The balance is presented net of deferred financing cost and discount of $11.5$14.4 million and $6.8$19.2 million as of September 30, 2017March 31, 2020 and December 31, 2016,2019, respectively.

33

BENEFIT STREET PARTNERS REALTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2020

(Unaudited)

Note 68 - Net IncomeEarnings Per Share

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2017 | 2016 | 2017 | 2016 | ||||||||||||

| Net income (in thousands) | $ | 6,975 | $ | 5,373 | $ | 19,305 | $ | 23,653 | |||||||

| Basic weighted average shares outstanding | 31,741,679 | 31,516,876 | 31,778,169 | 31,622,796 | |||||||||||

| Unvested restricted shares | 14,824 | 7,035 | 12,098 | 6,274 | |||||||||||

| Diluted weighted average shares outstanding | 31,756,503 | 31,523,911 | 31,790,267 | 31,629,070 | |||||||||||

| Basic net income per share | $ | 0.22 | $ | 0.17 | $ | 0.61 | $ | 0.75 | |||||||

| Diluted net income per share | $ | 0.22 | $ | 0.17 | $ | 0.61 | $ | 0.75 | |||||||

| Three Months Ended March 31, | |||||||

| Numerator | 2020 | 2019 | |||||

| Net income/(Loss) | $ | (7,400 | ) | $ | 19,890 | ||

| Less: Preferred stock dividends | 4,515 | 3,320 | |||||

| Less: Undistributed earnings allocated to preferred stock | — | 462 | |||||

| Net income/(Loss) attributable to common shareholders (for basic and diluted earnings per share) | (11,915 | ) | 16,108 | ||||

| Denominator | |||||||

| Weighted-average common shares outstanding for basic earnings per share | 44,263,334 | 39,798,215 | |||||