The scheduled maturities, excluding interest, of the Company’s borrowings at

March 31,

| | | | | | | | | | | | | | | | | | | | | |

| | As of March 31, 2024 | |||||||||||||||||||

| | Within One | | One to Two | | Two to Three | | Three to | | Four to Five | | After Five | | | | ||||||

|

| Year |

| Years |

| Years |

| Four Years |

| Years |

| Years |

| Total | |||||||

| | (Dollars in thousands) | |||||||||||||||||||

Time deposits | | $ | 1,662,674 | | $ | 170,867 | | $ | 1,305 | | $ | 1,500 | | $ | 790 | | $ | — | | $ | 1,837,136 |

FHLB borrowings | |

| 1,549 | |

| 11,291 | |

| — | |

| 50,000 | |

| 15,000 | |

| — | |

| 77,840 |

SBA secured borrowing | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 7,778 | |

| 7,778 |

Trust preferred securities(1) | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 1,133 | |

| 1,133 |

Total | | $ | 1,664,223 | | $ | 182,158 | | $ | 1,305 | | $ | 51,500 | | $ | 15,790 | | $ | 8,911 | | $ | 1,923,887 |

| (1) | The contract value of the trust preferred securities is $2.6 million and is currently being accreted to the maturity date of 2035. |

29

Amounts reclassified from AOCI and the affected line items in the consolidated statements of operations during the

| | | | | | | | |

| | Three Months Ended March 31, | | Affected Line Item in the | ||||

|

| 2024 |

| 2023 |

| Statements of Operations | ||

| | (Dollars in thousands) | | | ||||

Realized gain on available-for-sale securities | | $ | 2 | | $ | 63 | | Other non-interest income |

Less: tax expense effect | |

| — | |

| 15 | | Income tax expense |

Realized gain on available-for-sale securities, net of income tax | | | 2 | | | 48 | | |

Loss on cash flow hedges | | | (1,124) | | | — | | Interest income - Loans |

Gain on cash flow hedges | | | 196 | | | — | | Interest expense - Deposits |

Less: tax benefit effect | | | (214) | | | — | | Income tax expense |

Net loss on cash flow hedges, net of tax | | | (714) | | | — | | |

Total reclassified amount | | $ | (712) | | $ | 48 | |

|

Note 10:

The Company and the Bank are subject to various regulatory capital requirements

administered by the federal banking agencies.The capital rules require the Company to maintain a

The Company and the Bank opted to exclude AOCI from the regulatory capital calculations. As a result, changes in AOCI, net of

30

The Company’s and the Bank’s actual capital amounts and ratios as of March

31,

| | | | | | | | | | | | | | | | |

| | | |

|

|

| Required to be Considered |

| Required to be Considered |

| ||||||

| | Actual | | Well Capitalized | | Adequately Capitalized(1) |

| |||||||||

|

| Amount |

| Ratio |

| Amount |

| Ratio |

| Amount |

| Ratio |

| |||

| | (Dollars in thousands) |

| |||||||||||||

March 31, 2024 |

| |

|

|

|

| |

|

|

|

| |

|

|

| |

Total Capital to Risk-Weighted Assets |

| |

|

|

|

| |

|

|

|

| |

|

|

| |

Consolidated | | $ | 825,110 |

| 11.4 | % | | N/A |

| N/A | | $ | 761,189 |

| 10.5 | % |

Bank | |

| 806,893 |

| 11.1 | | $ | 724,451 |

| 10.0 | % |

| 760,673 |

| 10.5 | |

Tier 1 Capital to Risk-Weighted Assets | |

|

|

|

| |

|

|

|

| |

|

|

|

| |

Consolidated | |

| 745,321 |

| 10.3 | |

| N/A |

| N/A | |

| 616,201 |

| 8.5 | |

Bank | |

| 727,104 |

| 10.0 | |

| 579,561 |

| 8.0 | |

| 615,783 |

| 8.5 | |

Common Equity Tier 1 to Risk-Weighted Assets | |

|

|

|

| |

|

|

|

| |

|

|

|

| |

Consolidated | |

| 736,438 |

| 10.2 | |

| N/A |

| N/A | |

| 507,460 |

| 7.0 | |

Bank | |

| 727,104 |

| 10.0 | |

| 470,893 |

| 6.5 | |

| 507,116 |

| 7.0 | |

Tier 1 Capital to Average Assets | |

|

|

|

| |

|

|

|

| |

|

|

|

| |

Consolidated | |

| 745,321 |

| 10.1 | |

| N/A |

| N/A | |

| 295,231 |

| 4.0 | |

Bank | | $ | 727,104 |

| 9.9 | % | $ | 369,073 |

| 5.0 | % | $ | 295,258 |

| 4.0 | % |

December 31, 2023 | |

|

|

|

| |

|

|

|

| |

|

|

|

| |

Total Capital to Risk-Weighted Assets | |

|

|

|

| |

|

|

|

| |

|

|

|

| |

Consolidated | | $ | 807,018 |

| 11.2 | % | | N/A |

| N/A | | $ | 756,285 |

| 10.5 | % |

Bank | |

| 800,522 |

| 11.1 | | $ | 719,705 |

| 10.0 | % |

| 755,691 |

| 10.5 | |

Tier 1 Capital to Risk-Weighted Assets | |

|

|

|

| |

|

|

|

| |

|

|

|

| |

Consolidated | |

| 727,723 |

| 10.1 | |

| N/A |

| N/A | |

| 612,231 |

| 8.5 | |

Bank | |

| 721,227 |

| 10.0 | |

| 575,764 |

| 8.0 | |

| 611,750 |

| 8.5 | |

Common Equity Tier 1 to Risk-Weighted Assets | |

|

|

|

| |

|

|

|

| |

|

|

|

| |

Consolidated | |

| 718,855 |

| 10.0 | |

| N/A |

| N/A | |

| 504,190 |

| 7.0 | |

Bank | |

| 721,227 |

| 10.0 | |

| 467,809 |

| 6.5 | |

| 503,794 |

| 7.0 | |

Tier 1 Capital to Average Assets | |

|

|

|

| |

|

|

|

| |

|

|

|

| |

Consolidated | |

| 727,723 |

| 10.0 | |

| N/A |

| N/A | |

| 292,517 |

| 4.0 | |

Bank | | $ | 721,227 |

| 9.9 | % | $ | 365,675 |

| 5.0 | % | $ | 292,540 |

| 4.0 | % |

| (1) | Represents the minimum capital required for capital adequacy under Basel III. Includes capital conservation buffer of 2.5%. |

31

The following table presents the computation of basic and diluted earnings per

common share:

| | | | | | | |

| | Three Months Ended March 31, | | ||||

|

| 2024 |

| 2023 | | ||

| | (Dollars in thousands, except per share data) | | ||||

Earnings per Common Share |

| |

| | |

| |

Net Income | | $ | 18,223 | | $ | 16,108 | |

Less: preferred stock dividends | | | 155 | | | — | |

Net income available to common stockholders | | | 18,068 | | | 16,108 | |

Weighted average common shares | |

| 49,510,808 | |

| 48,635,910 | |

Earnings per common share | | $ | 0.36 | | $ | 0.33 | |

Diluted Earnings per Common Share | |

|

| |

|

| |

Net Income | | $ | 18,223 | | $ | 16,108 | |

Less: preferred stock dividends | | | 155 | | | — | |

Net income available to common stockholders | | | 18,068 | | | 16,108 | |

Weighted average common shares | |

| 49,510,808 | |

| 48,635,910 | |

Effect of dilutive shares | |

| 456,830 | |

| 407,711 | |

Weighted average dilutive common shares | |

| 49,967,638 | |

| 49,043,621 | |

Diluted earnings per common share | | $ | 0.36 | | $ | 0.33 | |

Stock-based awards not included because to do so would be antidilutive | |

| 281,666 | |

| 916,080 | |

Dividends of dilutive common shares

Note 14:

Fair value is the price that would be received to sell an asset or paid to transfer a liability

in an orderly transaction betweenLevel 1 | Quoted prices in active markets for identical assets or liabilities. |

Level 2 | Observable inputs other than Level 1 prices, such as quoted prices for similar assets or liabilities, quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. |

Level 3 | Unobservable inputs supported by little or no market activity and significant to the fair value of the assets or liabilities. |

32

The following list presents the assets and liabilities recognized in the accompanying

consolidated statements of financial

| | | | | |

| Fair Value Description | Valuation | Where Fair Value | ||

Available-for-Sale Securities | Where quoted market prices are available in an active market, securities are classified within Level 1 of the valuation hierarchy. If quoted market prices are not available, then fair values are estimated by using quoted prices of securities with similar characteristics or independent asset pricing services and pricing models, the inputs of which are market-based or independently sourced market parameters, including, but not limited to, yield curves, interest rates, volatilities, prepayments, defaults, cumulative loss projections and cash flows. | | Level 2 | | Note 2: Securities |

Derivatives | Fair value of the interest rate swaps is obtained from independent pricing services based on quoted market prices for similar derivative contracts. | | Level 2 | | Note 6: Derivatives and |

Nonrecurring Measurements

The following tables present assets measured atthe fair value measurement on a non-recurring

| | | | | | | | | | | | |

| | | |

| March 31, 2024 | |||||||

| | | | | Fair Value Measurements Using | |||||||

| | | | | Quoted Prices in | | | | | | | |

| | | | | Active Markets for | | Significant Other | | Unobservable | |||

| | | | | Identical Assets | | Observable Inputs | | Inputs | |||

|

| Fair Value |

| (Level 1) |

| (Level 2) |

| (Level 3) | ||||

| | (Dollars in thousands) | ||||||||||

Collateral-dependent impaired loans | | $ | 2,288 | | $ | — | | $ | — | | $ | 2,288 |

Foreclosed assets held-for-sale | | | 5,374 | | | — | | | — | | | 5,374 |

| | | | | | | | | | | | |

| | | |

| December 31, 2023 | |||||||

| | | | | Fair Value Measurements Using | |||||||

| | | | | Quoted Prices in | | | | | |

| |

| | | | | Active Markets for | | Significant Other | | Unobservable | |||

| | | | | Identical Assets | | Observable Inputs | | Inputs | |||

|

| Fair Value |

| (Level 1) |

| (Level 2) |

| (Level 3) | ||||

| | (Dollars in thousands) | ||||||||||

Collateral-dependent impaired loans |

| $ | 10,570 | | $ | — | | $ | — | | $ | 10,570 |

| | | | | | | | | | | | |

Following is a description of the valuation methodologies and inputs used for

assets measured at fair value on aCollateral-Dependent Impaired Loans, Net of ACL

33

Foreclosed Assets Held-for-Sale

Unobservable (Level 3) Inputs

The following tables present quantitative information about unobservable

inputs used in

| | | | | | | | | |

| | March 31, 2024 | |||||||

| | | | | | | Unobservable | | Range |

|

| Fair Value |

| Valuation Techniques |

| Inputs |

| (Weighted Average) | |

| | (Dollars in thousands) | |||||||

Collateral-dependent impaired loans | | $ | 2,288 |

| Appraisal of collateral |

| Appraisal adjustments (1) |

| 0% - 25% |

Foreclosed assets held-for-sale | | $ | 5,374 |

| Appraisal of held property |

| Appraisal adjustments (1) |

| 10% - 10% |

| | | | | | | | | |

| | December 31, 2023 | |||||||

| | | | | | | Unobservable | | Range |

|

| Fair Value |

| Valuation Techniques |

| Inputs |

| (Weighted Average) | |

| | (Dollars in thousands) | |||||||

Collateral-dependent impaired loans |

| $ | 10,570 |

| Appraisal of collateral |

| Appraisal adjustments (1) |

| 0% - 56% |

| (1) | Appraisals may be adjusted by management for qualitative factors such as economic conditions and estimated liquidation expenses. |

34

The following tables present the estimated fair values of the Company’s financial

instruments at March 31,

| | | | | | | | | | | | |

| | March 31, 2024 | ||||||||||

| | Carrying | | Fair Value Measurements | ||||||||

|

| Amount |

| Level 1 |

| Level 2 |

| Level 3 | ||||

| | (Dollars in thousands) | ||||||||||

Financial Assets |

| |

|

| |

|

| |

|

| |

|

Cash and cash equivalents | | $ | 206,773 | | $ | 206,773 | | $ | — | | $ | — |

Available-for-sale securities | |

| 786,603 | |

| — | |

| 786,603 | |

| — |

Loans, net of allowance for credit losses | |

| 6,174,331 | |

| — | |

| — | |

| 6,139,784 |

Restricted equity securities | |

| 3,752 | |

| — | |

| — | |

| 3,752 |

Interest receivable | |

| 37,833 | |

| — | |

| 37,833 | |

| — |

Equity securities | |

| 6,917 | |

| — | |

| — | |

| 6,917 |

Derivative assets | |

| 9,054 | |

| — | |

| 9,054 | |

| — |

| | | | | | | | | | | | |

Financial Liabilities | |

|

| |

|

| |

|

| |

|

|

Deposits | | $ | 6,587,146 | | $ | 954,240 | | $ | — | | $ | 5,663,040 |

Federal Home Loan Bank advances | |

| 77,840 | |

| — | |

| 71,735 | |

| — |

Other borrowings | |

| 8,911 | |

| — | |

| 9,885 | |

| — |

Interest payable | |

| 19,921 | |

| — | |

| 19,921 | |

| — |

Derivative liabilities | |

| 17,138 | |

| — | |

| 17,138 | |

| — |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | December 31, 2023 | ||||||||||

| | Carrying | | Fair Value Measurements | ||||||||

|

| Amount |

| Level 1 |

| Level 2 |

| Level 3 | ||||

| | (Dollars in thousands) | ||||||||||

Financial Assets |

| |

|

| |

|

| |

|

| |

|

Cash and cash equivalents | | $ | 255,229 | | $ | 255,229 | | $ | — | | $ | — |

Available-for-sale securities | |

| 766,653 | |

| — | |

| 766,653 | |

| — |

Loans, net of allowance for credit losses | |

| 6,054,228 | |

| — | |

| — | |

| 6,036,887 |

Restricted equity securities | |

| 3,950 | |

| — | |

| — | |

| 3,950 |

Interest receivable | |

| 37,294 | |

| — | |

| 37,294 | |

| — |

Equity securities | |

| 5,794 | |

| — | |

| — | |

| 5,794 |

Derivative assets | |

| 7,581 | |

| — | |

| 7,581 | |

| — |

| | | | | | | | | | | | |

Financial Liabilities | |

|

| |

|

| |

|

| |

|

|

Deposits | | $ | 6,491,276 | | $ | 990,458 | | $ | — | | $ | 5,547,203 |

Federal Home Loan Bank advances | |

| 77,889 | |

| — | |

| 72,123 | |

| — |

Other borrowings | |

| 8,950 | |

| — | |

| 9,891 | |

| — |

Interest payable | |

| 18,529 | |

| — | |

| 18,529 | |

| — |

Derivative liabilities | |

| 13,594 | |

| — | |

| 13,594 | |

| — |

35

| | | | | | |

|

| March 31, 2024 |

| December 31, 2023 | ||

| | (Dollars in thousands) | ||||

Commitments to originate loans | | $ | 97,741 | | $ | 59,728 |

Standby letters of credit | |

| 75,672 | |

| 74,139 |

Lines of credit | |

| 1,897,172 | |

| 2,008,356 |

Commitment related to investment fund | |

| 3,026 | |

| 4,206 |

Total | | $ | 2,073,611 | | $ | 2,146,429 |

The following management's discussion and analysis of our financial condition

and results of operations should be read in36

Performance Measures

| | | | | | | | | | | | | | | | | |

| | As of or for the Three Months Ended | | ||||||||||||||

|

| March 31, 2024 |

| December 31, 2023 |

| September 30, 2023 |

| June 30, 2023 | | March 31, 2023 | | | |||||

| | (Dollars in thousands, except per share data) | | | |||||||||||||

Return on average assets(1) |

| | 1.00 | % | | 0.97 | % | | 0.94 | % | | 0.93 | % | | 0.97 | % | |

Adjusted return on average assets(1)(2) |

| | 1.00 | % | | 1.07 | % | | 1.04 | % | | 1.00 | % | | 1.04 | % | |

Return on average common equity(1) |

| | 10.36 | % | | 10.71 | % | | 10.19 | % | | 10.00 | % | | 10.54 | % | |

Adjusted return on average common equity(1)(2) |

| | 10.36 | % | | 11.89 | % | | 11.26 | % | | 10.81 | % | | 11.30 | % | |

Earnings per common share | | $ | 0.36 | | $ | 0.35 | | $ | 0.34 | | $ | 0.33 | | $ | 0.33 | | |

Diluted earnings per common share | | $ | 0.36 | | $ | 0.35 | | $ | 0.34 | | $ | 0.33 | | $ | 0.33 | | |

Adjusted diluted earnings per common share(2) | | $ | 0.36 | | $ | 0.39 | | $ | 0.37 | | $ | 0.35 | | $ | 0.35 | | |

Efficiency ratio(3) | |

| 60.31 | % |

| 57.05 | % |

| 59.49 | % |

| 62.02 | % |

| 60.81 | % | |

Adjusted efficiency ratio - fully tax equivalent ("FTE")(2)(3)(4) | |

| 58.31 | % |

| 51.87 | % |

| 55.17 | % |

| 57.27 | % |

| 56.42 | % | |

Ratio of equity to assets | |

| 9.56 | % |

| 9.59 | % |

| 8.96 | % |

| 9.15 | % |

| 9.36 | % | |

| (1) | Interim periods annualized |

| (2) | Represents a non-GAAP financial measure. See “Non-GAAP Financial Measures” below for a reconciliation to the most directly comparable financial measure calculated and presented in accordance with generally accepted accounting principles (“GAAP”). |

| (3) | We calculate efficiency ratio as non-interest expense divided by the sum of net interest income and non-interest income. |

| (4) | Tax exempt income (tax-free municipal securities) is calculated on a tax equivalent basis. The incremental tax rate used is 21.0%. |

First Quarter 20232024 Highlights

During the first quarter ended March 31, 2023,2024, we accomplished the following:

| ● | Operating revenue(1) improved $0.8 million from the fourth quarter of 2023 and decreased $0.4 million from the first quarter of 2023 |

| ● | Grew loans $121 million, or 2%, for the quarter and 8% annualized |

| ● | Grew deposits $96 million, or 1%, for the quarter and 6% annualized |

| ● | Credit quality remained stable with non-performing assets decreasing to 0.27% of total assets and annualized net charge-offs representing 0.10% of average loans |

| ● | Returned capital to stockholders of $1.5 million during the quarter via share buybacks at a weighted average price of $13.10 per share |

| ● | Continued to build capital with total risk-based capital increasing to 11.4% and common equity Tier 1 capital increasing to 10.2% |

| ● | Grew book value per common share 1% to $14.47 at March 31, 2024 compared to December 31, 2023; tangible book value per common share(2) also grew 1% to $13.70 during the same period |

| (1) | Net interest income plus non-interest income. |

| (2) | Represents a non-GAAP financial measure. See “Non-GAAP Financial Measures” below for a reconciliation to the most directly comparable financial measure calculated and presented in accordance with GAAP. |

37

Results of Operations

Income from Operations

Net income totaled $18.2 million, or $0.36 per diluted common share, for the quarter with our newer markets and verticals contributingmeaningfully as we realize scale

Return on average assets

Net Interest Income

Our profitability depends in substantial part on average equity

The following tables present,table presents, for the periods indicated, average statement

| | | | | | | | | | | | | | | | | |

|

| For the Three Months Ended March 31, | |||||||||||||||

| | 2024 | | 2023 | | ||||||||||||

| | | | | Interest | | | | | | | Interest | | | | ||

| | Average | | Income / | | | | Average | | Income / | | | | ||||

|

| Balance |

| Expense |

| Yield / Rate(4) |

| Balance |

| Expense |

| Yield / Rate(4) |

| ||||

| | (Dollars in thousands) | |||||||||||||||

Interest-earning assets: | |

| | |

| | |

| |

| | |

| | |

| |

Securities - taxable | | $ | 445,952 | | $ | 4,606 |

| 4.13 | % | $ | 268,705 | | $ | 2,111 |

| 3.14 | % |

Securities - tax-exempt - FTE(1) | |

| 392,505 | |

| 3,089 |

| 3.15 | |

| 542,268 | |

| 4,591 |

| 3.39 | |

Federal funds sold | |

| — | |

| — |

| — | |

| 1,757 | |

| 5 |

| 1.15 | |

Interest-bearing deposits in other banks | |

| 168,653 | |

| 1,981 |

| 4.72 | |

| 195,289 | |

| 2,009 |

| 4.17 | |

Gross loans, net of unearned income(2)(3) | |

| 6,159,447 | |

| 110,099 |

| 7.19 | |

| 5,539,954 | |

| 89,618 |

| 6.56 | |

Total interest-earning assets - FTE(1) | |

| 7,166,557 | | $ | 119,775 |

| 6.72 | % |

| 6,547,973 | | $ | 98,334 |

| 6.08 | % |

Allowance for credit losses | |

| (73,683) | |

| | | | |

| (63,235) | |

| | | | |

Other non-interest-earning assets | |

| 251,228 | |

| | | | |

| 228,063 | |

| | | | |

Total assets | | $ | 7,344,102 | |

| | | | | $ | 6,712,801 | |

| | | | |

Interest-bearing liabilities | |

|

| |

|

|

|

| |

|

| |

|

|

|

| |

Transaction deposits | | $ | 878,446 | | $ | 7,930 |

| 3.63 | % | $ | 542,366 | | $ | 3,500 |

| 2.62 | % |

Savings and money market deposits | |

| 2,848,979 | |

| 31,675 |

| 4.47 | |

| 2,881,726 | |

| 23,569 |

| 3.32 | |

Time deposits | |

| 1,820,013 | |

| 22,506 |

| 4.97 | |

| 1,100,444 | |

| 9,656 |

| 3.56 | |

Total interest-bearing deposits | |

| 5,547,438 | |

| 62,111 |

| 4.50 | |

| 4,524,536 | |

| 36,725 |

| 3.29 | |

FHLB and short-term borrowings | |

| 77,874 | |

| 471 |

| 2.43 | |

| 272,754 | |

| 2,535 |

| 3.77 | |

Trust preferred securities, net of fair value adjustments | |

| 1,121 | |

| 63 |

| 22.60 | |

| 1,062 | |

| 56 |

| 21.39 | |

Non-interest-bearing deposits | |

| 900,216 | |

| — |

| — | |

| 1,194,788 | |

| — |

| — | |

Cost of funds | |

| 6,526,649 | | $ | 62,645 |

| 3.86 | % |

| 5,993,140 | | $ | 39,316 |

| 2.66 | % |

Other liabilities | |

| 108,105 | | | | | | |

| 99,451 | | | | | | |

Stockholders’ equity | |

| 709,348 | | | | | | |

| 620,210 | | | | | | |

Total liabilities and stockholders’ equity | | $ | 7,344,102 | | | | | | | $ | 6,712,801 | | | | | | |

Net interest income - FTE(1) | | | | | $ | 57,130 | | | |

| | | $ | 59,018 | | | |

Net interest spread - FTE(1) | | | | | | |

| 2.86 | % |

| | | | |

| 3.42 | % |

Net interest margin - FTE(1) | | | | | | |

| 3.20 | % |

| | | | |

| 3.65 | % |

(1) | Calculated on an FTE basis. Tax-free municipal securities are exempt from Federal taxes. The incremental tax rate used is 21.0%. |

(2) | Loans, net of unearned income includes non-accrual loans of $12 million and $10 million as of March 31, 2024 and 2023, respectively. |

(3) | Loan interest income includes loan fees of $4 million for the three months ended March 31, 2024 and 2023. |

(4) | Actual unrounded values are used to calculate the reported yield or rate. Accordingly, recalculations using the amounts in thousands as disclosed in this report may not produce the same amounts. |

38

| | | | | | | | | | | | | | | | | |

Net interest income - FTE

The FTE yield on earning assets increased 64 basis points from the first quarter of 2023 to the impactfirst quarter of

Average earning assets totaled $7.2 billion for the three-month period ended March 31, 2024, resulting in an increase of $0.6 billion for the period, compared to the same period in 2023. The increase was driven by higher average

The Company currently anticipates net interest margin to narrow from

Provision for Credit Losses

| | | | | | |

| | For the Three Months Ended | ||||

| | March 31, | ||||

| | 2024 | | 2023 | ||

| | (Dollars in thousands) | ||||

Provision for credit losses - loans |

| $ | 2,855 |

| $ | 4,996 |

Provision for credit losses - off-balance sheet | |

| (1,200) | |

| (575) |

Total provision for credit losses | | $ | 1,655 | | $ | 4,421 |

Provision expense of $1.7 million for the

Non-Interest Income

The components of non-interest income were as follows for the periods

shown:

| | | | | | | | | | | | | |

| | Three Months Ended March 31, |

| | |||||||||

| | | | | | | | Change |

| | |||

| | 2024 |

| 2023 |

| $ |

| % | | | |||

| | (Dollars in thousands) | | | |||||||||

Service charges and fees on client accounts | | $ | 2,104 | | $ | 1,829 | | $ | 275 | | 15 | % | |

ATM and credit card interchange income | |

| 1,487 | |

| 1,264 | |

| 223 | | 18 | | |

Gain on sale of loans | |

| 537 | |

| 187 | |

| 350 | | 187 | | |

Income from bank-owned life insurance | |

| 456 | |

| 411 | |

| 45 | | 11 | | |

Swap fees and credit valuation adjustments, net | |

| 158 | |

| 90 | |

| 68 | | 76 | | |

Other non-interest income | |

| 847 | |

| 640 | |

| 207 | | 32 | | |

Total non-interest income | | $ | 5,589 | | $ | 4,421 | | $ | 1,168 | | 26 | % | |

| | | | | | | | | | | | | |

Non-interest income to average assets | |

| 0.31 | % |

| 0.27 | % |

|

| |

| | |

The changes in non-interest income were driven primarily by the following:

39

credit card interchange income was due to the

Non-Interest Expense

The components of non-interest expense were as follows for the periods indicated:

| | | | | | | | | | | | | |

| | Three Months Ended March 31, |

| | |||||||||

| | | | | | | | Change |

| | |||

| | 2024 |

| 2023 |

| $ |

| % | | | |||

| | (Dollars in thousands) | | | |||||||||

Salary and employee benefits | | $ | 23,585 | | $ | 22,622 | | $ | 963 | | 4 | % | |

Occupancy | |

| 3,206 | |

| 2,974 | |

| 232 | | 8 | | |

Professional fees | |

| 972 | |

| 2,618 | |

| (1,646) | | (63) | | |

Deposit insurance premiums | |

| 1,906 | |

| 1,531 | |

| 375 | | 24 | | |

Data processing | |

| 970 | |

| 1,242 | |

| (272) | | (22) | | |

Advertising | |

| 558 | |

| 752 | |

| (194) | | (26) | | |

Software and communication | |

| 1,824 | |

| 1,651 | |

| 173 | | 10 | | |

Foreclosed assets, net | |

| 229 | |

| 149 | |

| 80 | | 54 | | |

Core deposit intangible amortization | |

| 931 | |

| 822 | |

| 109 | | 13 | | |

Other non-interest expense | |

| 3,324 | |

| 3,731 | |

| (407) | | (11) | | |

Total non-interest expense | | $ | 37,505 | | $ | 38,092 | | $ | (587) | | (2) | % | |

| | | | | | | | | | | | | |

Non-interest expense to average assets | |

| 2.05 | % |

| 2.30 | % |

|

| |

| | |

Non-interest expense increased $10.4 million for the three-monthperiod ended March 31, 20232024 decreased $0.6 million compared to the same period in

Our GAAP efficiency ratio for the first quarter of expense

Income Taxes

Our income tax expense differs from the amount that would be calculated

using the federal statutory tax rate, primarily from

40

The tax-exempt benefit diminishes as the Company’s ratio of taxable income to tax-exempt income increases. We currently anticipate the effective tax rate to remain in the range of 20% to 22% for the remainder of 2024. Our income tax and effective tax rate is presented below for the periods indicated:

| | | | | | | |

| Three Months Ended March 31, | | | ||||

| 2024 |

| 2023 | | | ||

| (Dollars in thousands) | | | ||||

Income tax expense | $ | 4,800 | | $ | 4,021 | | |

Income before income taxes | $ | 23,023 | | $ | 20,129 | | |

Effective tax rate |

| 21 | % |

| 20 | % | |

Discussion and Analysis - Financial Condition

Total assets were $7.5 billion at March 31, 2024 compared to $7.4 billion at December 31, 2023, an increase of $0.1 billion, or 1%. Cash and cash equivalents decreased $48 million, or 19%, and investment securities increased $20 million, or 3%, from December 31, 2023. Loans increased $121 million, or 2%, from December 31, 2023, and the allowance for credit losses increased $1 million to $75 million at March 31, 2024. Total deposits increased $96 million to $6.6 billion at March 31, 2024, compared to December 31, 2023. Federal Home Loan Bank (“FHLB”) advances totaled $78 million and were flat compared to December 31, 2023.

Investment Portfolio

The primary objective of our investment portfolio is to ensure adequate liquidity, including serving as a contingent, on-balance sheet source of liquidity. In addition, we manage the portfolio in a manner that optimizes earnings, manages credit and interest rate risk, and meets pledging and regulatory capital requirements. As of March 31, 2024, our portfolio was 100% available-for-sale and totaled $787 million, an increase of $20 million from December 31, 2023.

The increase in the investment portfolio was driven by the purchase of $40 million in mortgage-backed securities and $5 million in collateralized mortgage obligations. The increase was partially offset by an increase of $11 million in the unrealized loss on available-for-sale securities and $13 million of paydowns and maturities in investment securities. Our current investment strategy includes reducing the concentration in municipal investments, investing in lower risk-weighted assets and restructuring the portfolio to increase liquidity and provide more balanced cash flow. For additional information, including information regarding other securities owned by the Company, see “Note 2: Securities” in the notes to consolidated financial statements – unaudited.

The following table shows with respect to our portfolio of available-for-sale securities, the estimated fair value, percent of the portfolio of available-for-sale securities and weighted average yield of such securities as of the dates indicated:

| | | | | | | | | | | | | | | | | | |

|

| As of March 31, 2024 |

| | As of December 31, 2023 | | ||||||||||||

| | Estimated | | Percent of | | Weighted |

| | Estimated | | Percent of | | Weighted | | ||||

|

| Fair Value |

| portfolio |

| Average Yield | | | Fair Value |

| portfolio |

| Average Yield | | ||||

Available-for-sale securities |

| (Dollars in thousands) | ||||||||||||||||

Federal agency obligations | | $ | 10,031 | | 1 | | | 6.38 | % | | $ | 10,072 | | 1 | % | | 6.41 | % |

U.S. Treasury securities | | | — | | — | | | — | | | | 4,968 | | 1 | | | 5.56 | |

Mortgage-backed - GSE residential | | | 228,660 | | 29 | | | 3.39 | | | | 212,462 | | 28 | | | 3.15 | |

Collateralized mortgage obligations - GSE residential | |

| 70,268 | | 9 | |

| 5.36 | | |

| 49,944 | | 7 | |

| 5.12 | |

State and political subdivisions | |

| 347,783 | | 44 | |

| 2.58 | | |

| 355,897 | | 46 | |

| 2.61 | |

Small Business Administration loan pools | | | 121,293 | | 16 | | | 4.86 | | | | 124,778 | | 16 | | | 4.87 | |

Corporate bonds | |

| 8,568 | | 1 | |

| 5.69 | | |

| 8,532 | | 1 | |

| 5.68 | |

Total available-for-sale securities | | $ | 786,603 | | 100 | % | | 3.46 | % | | $ | 766,653 | | 100 | % | | 3.35 | % |

41

Loan Portfolio

Refer to “Note

| | | | | | | | | |

| | | | | | | | December 31, 2023, vs. |

|

| | As of | | As of | | March 31, 2024 |

| ||

|

| March 31, 2024 |

| December 31, 2023 |

| % Change |

| ||

| | (Dollars in thousands) | | |

| ||||

Commercial and industrial | | $ | 2,179,562 | | $ | 2,160,212 |

| 1 | % |

Energy | |

| 221,217 | |

| 214,218 |

| 3 | |

Commercial real estate - owner-occupied | |

| 577,812 | |

| 566,253 |

| 2 | |

Commercial real estate - non-owner-occupied | |

| 2,769,936 | |

| 2,685,534 |

| 3 | |

Residential real estate | |

| 468,628 | |

| 464,095 |

| 1 | |

Consumer | |

| 32,032 | |

| 37,378 |

| (14) | |

Total | | $ | 6,249,187 | | $ | 6,127,690 |

| 2 | % |

Our loan portfolio remains balanced with 44% of loans in commercial and industrial and owner-occupied commercial real estate and 44% of loans in non-owner-occupied commercial real estate.

The Company provides a mix of variable- and fixed-rate commercial and industrial loans across various industries. Our commercial and industrial loan portfolio is comprised of diverse industry segments. The largest segment as of March 31, 2024 was restaurants. Details of the Company’s commercial and industrial loan portfolio by industry as of March 31, 2024, December 31, 2023, and December 31, 2022 are provided below with loans acquired in 2022 excluded as of December 31, 2022:

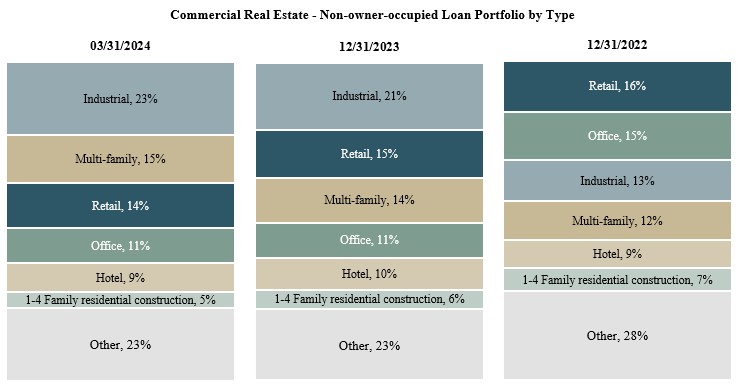

Our commercial real estate - non-owner-occupied loan portfolio is comprised of construction and development loans, multifamily loans and investor commercial real estate loans. Management regularly monitors the credit risk of our commercial real estate portfolio, including periodic portfolio reviews of all outstanding credits, sensitivity testing of the impacts of the current interest rate environment on borrower financial condition and overall credit risk profile. In

42

addition, management engages third-party specialists to review the loan portfolio on a regular basis. Management actively monitors credit risk including oversight of credit and lending strategies, exposures and objectives of the Company. Management’s monitoring activities are reviewed by the Risk Committee of the Board of Directors of the Company on a regular basis.

As of March 31, 2024, the highest commercial real estate - non-owner-occupied property type, industrial, accounted for 23% of total commercial real estate - non-owner-occupied exposure. Details of our commercial real estate - non-owner-occupied loan portfolio by type as of March 31, 2024, December 31, 2023, and December 31, 2022 are provided below with loans acquired in 2022 excluded from December 31, 2022:

43

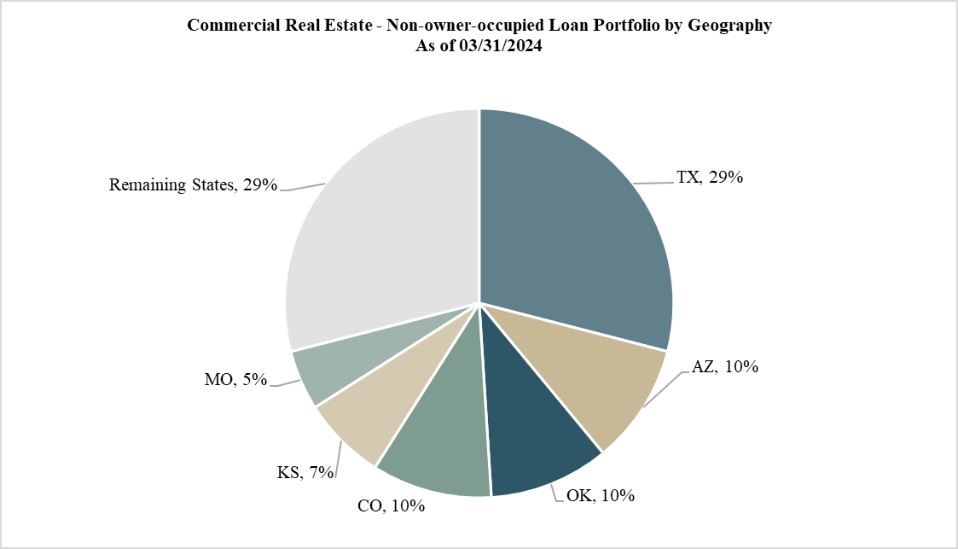

Our commercial real estate - non-owner-occupied loan portfolio is comprised predominately of in-market relationships with 71% of commercial real estate loans located within our footprint of Kansas, Missouri, Texas, Oklahoma, Arizona and Colorado as of March 31, 2024. A detail of our commercial real estate - non-owner-occupied loan portfolio by geography (based upon location of collateral) as of March 31, 2024 is presented below:

The following tables show the contractual maturities of our gross loans and sensitivity to interest rate changes at March 31, 2024 and December 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of March 31, 2024 | |||||||||||||||||||||||||

| | | | | | | | Due in One Year through Five | | Due in Five Year through | | | | | | | | | | ||||||||

| | Due in One Year or Less | | Years | | Fifteen Years | | Due after Fifteen Years | | | | ||||||||||||||||

| | | | | Adjustable | | | | | Adjustable | | | | | Adjustable | | | | | Adjustable | | | | ||||

|

| Fixed Rate |

| Rate |

| Fixed Rate |

| Rate |

| Fixed Rate |

| Rate |

| Fixed Rate |

| Rate |

| Total | |||||||||

| | (Dollars in thousands) | |||||||||||||||||||||||||

Commercial and industrial | | $ | 112,125 | | $ | 617,329 | | $ | 315,356 | | $ | 967,120 | | $ | 75,745 | | $ | 72,045 | | $ | 19,814 | | $ | 28 | | $ | 2,179,562 |

Energy | | | 89 | | | 3,650 | | | — | | | 217,478 | | | — | | | — | | | — | | | — | | | 221,217 |

Commercial real estate - owner-occupied |

| | 17,648 |

| | 26,018 |

| | 175,639 |

| | 73,160 |

| | 117,129 |

| | 117,933 |

| | 2,510 |

| | 47,775 |

| | 577,812 |

Commercial real estate - non-owner-occupied |

| | 104,365 |

| | 527,061 |

| | 570,727 |

| | 1,193,492 |

| | 88,460 |

| | 182,120 |

| | 9,550 |

| | 94,161 |

| | 2,769,936 |

Residential real estate |

| | 4,805 |

| | 2,003 |

| | 25,470 |

| | 12,034 |

| | 68,340 |

| | 26,473 |

| | 3,028 |

| | 326,475 |

| | 468,628 |

Consumer |

| | 9,819 |

| | 14,379 |

| | 5,420 |

| | 2,250 |

| | 31 |

| | 133 |

| | — |

| | — |

| | 32,032 |

Total | | $ | 248,851 | | $ | 1,190,440 | | $ | 1,092,612 | | $ | 2,465,534 | | $ | 349,705 | | $ | 398,704 | | $ | 34,902 | | $ | 468,439 | | $ | 6,249,187 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

44

| | As of December 31, 2023 | |||||||||||||||||||||||||

| | | | | | | | Due in One Year through Five | | Due in Five Year through | | | | | | | | | | ||||||||

| | Due in One Year or Less | | Years | | Fifteen Years | | Due after Fifteen Years | | | | ||||||||||||||||

| | | | | Adjustable | | | | | Adjustable | | | | | Adjustable | | | | | Adjustable | | | | ||||

|

| Fixed Rate |

| Rate |

| Fixed Rate |

| Rate |

| Fixed Rate |

| Rate |

| Fixed Rate |

| Rate |

| Total | |||||||||

| | (Dollars in thousands) | |||||||||||||||||||||||||

Commercial and industrial | | $ | 125,460 | | $ | 608,786 | | $ | 335,330 | | $ | 926,646 | | $ | 64,907 | | $ | 78,996 | | $ | 19,826 | | $ | 261 | | $ | 2,160,212 |

Energy | | | 107 | | | 3,631 | | | 340 | | | 210,140 | | | — | | | — | | | — | | | — | | | 214,218 |

Commercial real estate - owner-occupied |

| | 14,772 |

| | 25,907 |

| | 180,194 |

| | 76,358 |

| | 101,018 |

| | 117,019 |

| | 2,524 |

| | 48,461 |

| | 566,253 |

Commercial real estate - non-owner-occupied |

| | 75,518 |

| | 427,082 |

| | 596,545 |

| | 1,161,103 |

| | 113,622 |

| | 197,637 |

| | 16,436 |

| | 97,591 |

| | 2,685,534 |

Residential real estate |

| | 5,537 |

| | 1,364 |

| | 29,156 |

| | 11,717 |

| | 65,086 |

| | 27,356 |

| | 3,036 |

| | 320,843 |

| | 464,095 |

Consumer |

| | 15,464 |

| | 13,763 |

| | 6,448 |

| | 1,633 |

| | 23 |

| | 47 |

| | — |

| | — |

| | 37,378 |

Total | | $ | 236,858 | | $ | 1,080,533 | | $ | 1,148,013 | | $ | 2,387,597 | | $ | 344,656 | | $ | 421,055 | | $ | 41,822 | | $ | 467,156 | | $ | 6,127,690 |

The stated interest rate (which excludes the effects of non-refundable loan origination and commitment fees, net of costs and the accretion of fair value marks) of gross loans was as follows at March 31, 2024:

| | | | | | | | | | | | | | | | | | |

| | As of March 31, 2024 | ||||||||||||||||

| | Fixed | | | Variable | | | Total | ||||||||||

| | | | Weighted | | | | Weighted | | | | Weighted | ||||||

|

| Balance |

| average rate |

| Balance |

| average rate | | Balance |

| average rate | ||||||

| | (Dollars in thousands) |

| |||||||||||||||

Commercial and industrial | | $ | 523,040 | | 5.35 | % | | $ | 1,656,522 | | 8.46 | % | | $ | 2,179,562 | | 7.74 | % |

Energy | | | 89 | | 6.50 | % | | | 221,128 | | 9.00 | % | | | 221,217 | | 9.00 | % |

Commercial real estate - owner-occupied |

| | 312,926 |

| 4.48 | % |

| | 264,886 |

| 6.54 | % | | | 577,812 |

| 5.43 | % |

Commercial real estate - non-owner-occupied |

| | 773,102 |

| 5.08 | % |

| | 1,996,834 |

| 7.59 | % | | | 2,769,936 |

| 6.89 | % |

Residential real estate |

| | 101,643 |

| 4.08 | % |

| | 366,985 |

| 4.02 | % | | | 468,628 |

| 4.03 | % |

Consumer |

| | 15,270 |

| 6.35 | % |

| | 16,762 |

| 8.62 | % | | | 32,032 |

| 7.54 | % |

Total | | $ | 1,726,070 | | | | | $ | 4,523,117 | | | | | $ | 6,249,187 | | | |

Allowance for Credit Losses

The ACL represents our best estimate of the expected credit losses in the Company’s loan portfolio and off-balance sheet commitments, measured over the contractual life of the underlying instrument. The allocation in one portfolio segment does not preclude its availability to absorb losses in other segments. The table below presents the allocation of the allowance for credit losses as of the dates indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | March 31, 2024 |

| December 31, 2023 |

| ||||||||||||||||||||||

| | ACL Amount | |

| |

| | ACL Amount | |

| |

|

| ||||||||||||||

| | | | | | | | | | | Percent of | | Percent of | | | | | | | | | | | Percent of | | Percent of | |

| | | | | Off-Balance | | | | | ACL to | | Loans to | | | | | Off-Balance | | | | | ACL to | | Loans to | | ||

|

| Loans |

| Sheet |

| Total |

| Total ACL |

| Total Loans |

| Loans |

| Sheet |

| Total |

| Total ACL |

| Total Loans |

| ||||||

| | (Dollars in thousands) |

| ||||||||||||||||||||||||

Commercial and industrial | | $ | 33,821 | | $ | 1,008 | | $ | 34,829 | | 44 | % | 35 | % | $ | 32,244 | | $ | 954 | | $ | 33,198 | | 42 | % | 35 | % |

Energy |

| | 3,169 |

| | — |

| | 3,169 |

| 4 |

| 4 |

| | 3,143 |

| | 149 |

| | 3,292 |

| 4 |

| 3 | |

Commercial real estate - owner-occupied |

| | 6,385 |

| | 89 |

| | 6,474 |

| 8 |

| 9 |

| | 6,445 |

| | 125 |

| | 6,570 |

| 8 |

| 9 | |

Commercial real estate - non-owner-occupied |

| | 27,989 |

| | 4,020 |

| | 32,009 |

| 40 |

| 44 |

| | 28,130 |

| | 5,096 |

| | 33,226 |

| 42 |

| 44 | |

Residential real estate |

| | 3,466 |

| | 95 |

| | 3,561 |

| 4 |

| 7 |

| | 3,456 |

| | 89 |

| | 3,545 |

| 4 |

| 8 | |

Consumer |

| | 26 |

| | 1 |

| | 27 |

| — |

| 1 |

| | 44 |

| | — |

| | 44 |

| — |

| 1 | |

Gross loans | | $ | 74,856 | | $ | 5,213 | | $ | 80,069 |

| 100 | % | 100 | % | $ | 73,462 | | $ | 6,413 | | $ | 79,875 |

| 100 | % | 100 | % |

Refer to “Note 3: Loans and Allowance for Credit Losses” within the notes to consolidated financial statements -

45

unaudited for a summary of the changes in the ACL.

Charge-offs and Recoveries

Net charge-offs were $1.5 million for the three-month period ended March 31, 2024 and were primarily due to charge-offs on two commercial and industrial loans, two commercial real estate – non-owner-occupied loans and one credit card account. One of the charge-offs on commercial real estate – non-owner-occupied loans was a partial charge-off of a commercial construction non-accrual credit that moved to foreclosed assets held for sale during the quarter. The table below provides the ratio of net charge-offs (recoveries) to average loans outstanding based on our loan categories for the periods indicated:

| | | | | | | | | | | | |

| | For the Quarter Ended | | |||||||||

|

| March 31, 2024 |

| December 31, 2023 |

| September 30, 2023 |

| June 30, 2023 |

| March 31, 2023 |

| |

Commercial and industrial |

| 0.14 | % | 0.35 | % | 0.24 | % | 0.14 | % | 0.31 | % | |

Energy |

| (0.23) |

| — |

| — | | (0.23) |

| — | | |

Commercial real estate - owner-occupied |

| — |

| — |

| — | | — |

| — | | |

Commercial real estate - non-owner-occupied |

| 0.13 |

| — |

| — | | — |

| — | | |

Residential real estate |

| — |

| — |

| — | | — |

| — | | |

Consumer |

| — |

| 0.01 |

| — | | 0.04 |

| — | | |

Total net charge-offs to average loans |

| 0.10 | % | 0.12 | % | 0.09 | % | 0.04 | % | 0.12 | % | |

Non-performing Assets and Other Asset Quality Metrics

Non-performing assets include: (i) non-performing loans - includes non-accrual loans, loans past due 90 days or more and still accruing; (ii) foreclosed assets held for sale; (iii) repossessed assets; and (iv) impaired debt securities.

Non-performing assets decreased $4.4 million during the quarter to $20.4 million at March 31, 2024. The decrease was due to client principal reductions, partial charge-offs on non-accrual loans, and two credits that were 90+ days past due and still accruing at December 31, 2023, which were brought current during the first quarter of 2024. Additionally, one commercial construction credit that was in non-accrual loans at December 31, 2023 was moved to foreclosed assets held for sale during the first quarter of 2024. The non-performing assets to total assets ratio decreased from 0.34% at December 31, 2023 to 0.27% at March 31, 2024. Annualized net charge-offs were 0.10% for the first quarter of 2024 compared to 0.12% in the quarter ended December 31, 2023 and the first quarter of 2023.

The Company continues to monitor the U.S. economic indicators, including the inflation rate, the unemployment rate, commodity prices, interest rates, and potential supply chain disruptions and the impact they may have on the Company’s markets, clients, and prospects. The Company is monitoring the impact of the interest rate environment on the commercial real estate market and enterprise and leverage loans that is currently partially mitigated by low debt-to-equity ratios. As of March 31, 2024, the Company did not identify any systemic issues within its loan portfolio that would materially affect the credit quality of the loan portfolio. However, there could be some risk rating migration in certain sectors of the commercial real estate portfolio in the future as many projects are faced with higher interest rates, operating costs, and property taxes.

46

The table below summarizes our non-performing assets and related ratios as of the dates indicated:

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

|

| For the Quarter Ended | | |||||||||||||

| | March 31, | | December 31, | | September 30, | | June 30, | | March 31, | | |||||

| | 2024 | | 2023 | | 2023 | | 2023 | | 2023 | | |||||

Asset quality | | (Dollars in thousands) | | |||||||||||||

Non-accrual loans | | $ | 12,082 | | $ | 18,451 | | $ | 20,380 | | $ | 12,867 | | $ | 9,490 | |

Loans 90+ days past due and still accruing | |

| 2,925 | |

| 6,339 | |

| 15,750 | |

| 433 | |

| 868 | |

Total non-performing loans | |

| 15,007 | |

| 24,790 | |

| 36,130 | |

| 13,300 | |

| 10,358 | |

Foreclosed assets held-for-sale | |

| 5,377 | |

| — | |

| — | |

| — | |

| 855 | |

Total non-performing assets | | $ | 20,384 | | $ | 24,790 | | $ | 36,130 | | $ | 13,300 | | $ | 11,213 | |

| | | | | | | | | | | | | | | | |

Loans 30 - 89 days past due | | $ | 46,381 | | $ | 2,028 | | $ | 29,457 | | $ | 13,333 | | $ | 5,056 | |

| | | | | | | | | | | | |

Asset quality metrics (%) |

|

|

|

|

|

|

|

|

|

|

| |

Non-performing loans to total loans |

| 0.24 | % | 0.40 | % | 0.61 | % | 0.23 | % | 0.18 | % | |

Non-performing assets to total assets |

| 0.27 |

| 0.34 |

| 0.50 | | 0.19 | | 0.16 | | |

ACL to total loans |

| 1.20 |

| 1.20 |

| 1.20 | | 1.17 | | 1.15 | | |

ACLs + RUC to total loans(1) |

| 1.28 |

| 1.30 |

| 1.31 | | 1.30 | | 1.30 | | |

ACL to non-performing loans |

| 499 |

| 296 |

| 198 | | 508 | | 629 | | |

Classified Loans / (Capital + ACL) |

| 15.9 |

| 14.9 |

| 14.2 | | 9.7 | | 9.4 | | |

Classified Loans / (Capital + ACL + RUC)(1) |

| 15.8 |

| 14.8 |

| 14.0 | | 9.6 | | 9.3 | | |

(1) | Includes the accrual for off-balance sheet credit risk from unfunded commitments. |

Deposits and Other Borrowings

At March 31, 2024, our deposits totaled $6.6 billion, an increase of $96 million or 1% from December 31, 2023. The increase included a $126 million increase in money market, NOW and savings deposits and $6 million in time deposits, partially offset by a decrease of $36 million in non-interest-bearing deposits. Approximately 77% of the increase in money market, NOW and savings deposits was from new and existing client money, with the remainder representing an increase in wholesale funding. Other borrowings include FHLB advances, SBA loan secured borrowings, and our trust preferred security and totaled $87 million at both March 31, 2024 and December 31, 2023.

The following table sets forth the maturity of time deposits as of March 31, 2024:

| | | | | | | | | | | | | | | |

|

| As of March 31, 2024 | |||||||||||||

| | Three Months or | | Three to Six | | Six to Twelve | | After Twelve | | | | ||||

|

| Less |

| Months |

| Months |

| Months |

| Total | |||||

| | (Dollars in thousands) | |||||||||||||

Time deposits in excess of FDIC insurance limit | | $ | 169,726 | | $ | 141,238 | | $ | 167,485 | | $ | 16,439 | | $ | 494,888 |

Time deposits below FDIC insurance limit |

| | 626,115 |

| | 336,914 |

| | 221,196 |

| | 158,023 |

| | 1,342,248 |

Total time deposits | | $ | 795,841 | | $ | 478,152 | | $ | 388,681 | | $ | 174,462 | | $ | 1,837,136 |

As of March 31, 2024, the Company had approximately $2.6 billion of uninsured deposits, which is an estimated amount based on the same methodologies and assumptions used for the Bank’s regulatory reporting requirements. Excluding pass-thru accounts where clients have deposit insurance at the correspondent financial institution, our uninsured deposits were $2.2 billion, or 33% of total deposits as of March 31, 2024. The average client account balance as of March 31, 2024 was less than $250 thousand for both individual accounts and business accounts in total after excluding pass-through and insured cash sweep deposits. We have geographic and industry diversity within our deposit base as the majority of our deposits are located in our footprint states of Kansas, Oklahoma, Texas, Missouri, Arizona, Colorado and New Mexico. The Company believes that its current capital ratios and liquidity are sufficient to mitigate the risks of uninsured deposits.

47

Liquidity and Capital Resources

Liquidity

We manage our liquidity based upon factors that include the level and quality of capital and our overall financial condition, the trend and volume of problem assets, our balance sheet risk exposure, the level of deposits as a percentage of total loans, the amount of non-deposit funding used to fund assets, the availability of unused funding sources and off-balance sheet obligations, the availability of assets to be readily converted into cash without undue loss, the amount of cash and liquid securities we hold, and other factors. We also conduct contingency funding plan stress tests at least annually to assess potential liquidity outflows or funding problems resulting from economic disruptions, volatility in the financial markets, unexpected credit events or other significant occurrences deemed potentially problematic by management. The Company’s liquidity strategy is to maintain adequate, but not excessive, liquidity to meet the daily cash flow needs of our clients while attempting to achieve maximum earnings for our stockholders. The Company measures liquidity needs through daily balance sheet monitoring, weekly cash projections and monthly liquidity measures reviewed in conjunction with Board-approved liquidity policy limits. The Company's short-term and long-term liquidity requirements are primarily met through cash flow from operations, redeployment of prepaying and maturing balances in our loan portfolio and security portfolio, increases in client deposits and wholesale deposits. The Company believes that other alternative sources of funds are available to supplement these primary sources to the extent necessary to meet additional liquidity requirements on either a short-term or long-term basis. Liquidity resources can be derived from two sources: (i) on-balance sheet liquidity resources, which represent funds currently on the statement of financial condition and (ii) off-balance sheet liquidity resources, which represent funds available from third-party sources. The Company’s on-balance sheet and off-balance sheet liquidity resources consisted of the following as of the dates indicated:

| | | | | | | |

|

| March 31, 2024 |

| December 31, 2023 |

| ||

| | (Dollars in thousands) | |||||

On-balance sheet liquidity(1) | | $ | 993,376 | | $ | 1,021,882 | |

Off-balance sheet liquidity(2) | |

| 1,481,420 | |

| 1,496,225 | |

Total liquidity | | $ | 2,474,796 | | $ | 2,518,107 | |

On-balance sheet liquidity as a percent of assets | |

| 13 | % |

| 14 | % |

Total liquidity as a percent of assets | |

| 33 | % |

| 34 | % |

| (1) | On-balance sheet liquidity represents funds on the consolidated statements of financial condition – unaudited. It consists of overnight funds, short-term deposits with other banks, and unpledged AFS securities. |

| (2) | Off-balance sheet liquidity represents funds available from third-party sources including credit lines, FHLB and Federal Reserve Bank. |

The consolidated statements of cash flows - unaudited summarize our sources and uses of cash by type of activity for the three-months ended March 31, 2024 and 2023. As of March 31, 2024 and 2023, we had cash and cash equivalents of $207 million and $263 million, respectively. During the three-months ended March 31, 2024 and 2023, operating activities provided $19.8 million and $24.3 million of cash, respectively, while financing activities provided $93.6 million and $271.4 million of cash, respectively. The primary drivers of lower cash provided by financing activities in the first quarter of 2024 were a smaller increase in time deposits, lower line of credit borrowings, and current quarter share repurchases, partially offset by an increase in demand and savings, NOW and money market accounts. Cash usage from investing activities was $161.8 million and $332.9 million for the three-months ended March 31, 2024 and 2023, respectively. The primary driver of lower cash used in the first quarter of 2024 for investing activities was that the prior year first quarter included more loan origination volume.

Off-balance sheet liquidity slightly decreased from December 31, 2023 to March 31, 2024 due to normal fluctuations in our available third party sources.

The Company purchased $1.5 million of common stock during the first three months of 2024 under its previously approved share repurchase program. As of March 31, 2024, $14.4 million remained available for repurchase

48

under our share repurchase program. The amount and timing of such future share repurchases will be dependent on a number of factors, including the price of our common stock, overall capital levels and cash flow needs. There is no assurance that we will repurchase up to the full amount remaining under our program.

Dividends of $155 thousand related to the Series A Non-Cumulative Perpetual Preferred Stock were declared and paid by the Company during the three months ended March 31, 2024. On May 2, 2024, the Board of Directors declared a quarterly dividend on Series A Non-Cumulative Perpetual Preferred Stock in the amount of $20.00 per share to be payable on June 17, 2024 to stockholders of record as of May 31, 2024.

The Company believes that its current on and off-balance sheet liquidity will be sufficient to meet anticipated cash requirements for the next 12 months and thereafter. The Company believes that it has several on and off-balance sheet options to address reductions in cash and cash equivalents in order to maintain appropriate liquidity.

Contractual Obligations and Off-Balance Sheet Arrangements

The Company is subject to contractual obligations made in the ordinary course of business. The obligations include deposit liabilities, other borrowed funds, operating leases, and preferred dividends. To the extent declared by the Board of Directors, the Company pays $0.6 million of cash dividends per year to holders of our preferred stock. Refer to “Note 7: Time Deposits and Other Borrowings” and “Note 4: Leases” within the notes to consolidated financial statements – unaudited for information regarding the Company’s significant contractual cash obligations and contractual obligations to third parties on lease obligations, respectively.

As a financial services provider, the Company is a party to various financial instruments with off-balance sheet risks, such as commitments to extend credit. Off-balance sheet arrangements represent the Company’s future cash requirements. However, a portion of these commitments may expire without being drawn upon. Refer to “Note 12: Commitments and Credit Risk” within the notes to consolidated financial statements – unaudited for a reconciliationlisting of the statutory rateCompany’s off-balance sheet arrangements.

The Company’s short-term and long-term contractual obligations, including off-balance sheet obligations, may be satisfied through the Company’s on-balance sheet and off-balance sheet liquidity discussed above.

Capital Requirements

The Company and the Bank are subject to various regulatory capital requirements administered by the federal banking agencies. The regulatory capital requirements involve quantitative measures of the Company’s

Critical Accounting Policies and Estimates

Our consolidated financial statements are prepared in accordance with GAAP and with general practices within the financial services industry. Application of these principles requires management to make complex and subjective estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. The Company bases estimates on historical experience and on various other assumptions that it believes to be reasonable under current circumstances. These assumptions form the basis for management judgments about the carrying values of assets and liabilities that are not readily available from independent, objective sources. The Company evaluates estimates on an ongoing basis. Use of alternative assumptions may have resulted in significantly different estimates. Actual results may differ from these estimates.

A discussion of these policies can be found in the section captioned “Critical Accounting Policies and Estimates” in Management’s Discussion and Analysis of Financial Condition and Results of Operations included in the

49

2023 and 2022,Form 10-K. There have been no changes in the Company’s effective tax ratebenefited primarily from

Recent Accounting Pronouncements

Refer to tax-exempt interest.We currently anticipate the Company’s effective tax rate to remain within the

Non-GAAP Financial Measures

In addition to disclosing financial measures determined in accordancewith U.S. generally accepted accounting principles

These non-GAAP financial measures should not be considered a substitute for financial information presented

in accordance with

A reconciliation of non-GAAP financial measures to the comparable GAAP financial measures follows.

| | | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | |

|

| Quarter Ended | | | |||||||||||||

| | 3/31/2024 |

| 12/31/2023 |

| 9/30/2023 |

| 6/30/2023 | | 3/31/2023 | | | |||||

Adjusted net income: | | (Dollars in thousands, except per share data) | | | |||||||||||||

Net income (GAAP) | | $ | 18,223 | | $ | 17,651 | | $ | 16,863 | | $ | 16,047 | | $ | 16,108 | | |

Add: Acquisition costs | |

| — | |

| 1,300 | |

| 1,328 | |

| 338 | |

| 1,477 | | |

Add: Acquisition - Day 1 CECL provision | |

| — | |

| — | |

| 900 | |

| — | |

| — | | |

Add: Employee separation | |

| — | |

| — | |

| — | |

| 1,300 | |

| — | | |

Add: Loss on bond repositioning | | | — | | | 1,130 | | | — | | | — | | | — | | |

Less: Tax effect(1) | |

| — | |

| (510) | |

| (468) | |

| (344) | |

| (310) | | |

Adjusted net income | | $ | 18,223 | | $ | 19,571 | | $ | 18,623 | | $ | 17,341 | | $ | 17,275 | | |

Preferred stock dividends | | | 155 | | | 155 | | | 155 | | | 103 | | | — | | |

Diluted weighted average common shares outstanding | |

| 49,967,638 | |

| 49,788,962 | |

| 49,480,107 | |

| 48,943,325 | |

| 49,043,621 | | |

Diluted earnings per common share (GAAP) | | $ | 0.36 | | $ | 0.35 | | $ | 0.34 | | $ | 0.33 | | $ | 0.33 | | |

Adjusted diluted earnings per common share | | $ | 0.36 | | $ | 0.39 | | $ | 0.37 | | $ | 0.35 | | $ | 0.35 | | |

| (1) | Represents the tax impact of the adjustments at a tax rate of 21.0%, plus permanent tax expense associated with merger related transactions. |

| | | | | | | | | | | | | | | | | |

50

|

| | | | | | | | | | | | | | | | |

|

| Quarter Ended | | | |||||||||||||

| | 3/31/2024 |

| 12/31/2023 |

| 9/30/2023 |

| 6/30/2023 | | 3/31/2023 | | | |||||

Adjusted return on average assets: |

| (Dollars in thousands, except per share data) | | | |||||||||||||

Net income | | $ | 18,223 | | $ | 17,651 | | $ | 16,863 | | $ | 16,047 | | $ | 16,108 | | |

Adjusted net income | |

| 18,223 | |

| 19,571 | |

| 18,623 | |

| 17,341 | |

| 17,275 | | |

Average assets | | $ | 7,344,102 | | $ | 7,231,611 | | $ | 7,114,228 | | $ | 6,929,972 | | $ | 6,712,801 | | |

Return on average assets (GAAP) | |

| 1.00 | % |

| 0.97 | % |

| 0.94 | % |

| 0.93 | % |

| 0.97 | % | |

Adjusted return on average assets | |

| 1.00 | % |

| 1.07 | % |

| 1.04 | % |

| 1.00 | % |

| 1.04 | % | |

| | | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | |

|

| Quarter Ended | | | |||||||||||||

| | 3/31/2024 |

| 12/31/2023 |

| 9/30/2023 |

| 6/30/2023 | | 3/31/2023 | | | |||||

Adjusted return on average common equity: |

| (Dollars in thousands, except per share data) | | | |||||||||||||

Net income | | $ | 18,223 | | $ | 17,651 | | $ | 16,863 | | $ | 16,047 | | $ | 16,108 | | |

Preferred stock dividends | | | 155 | | | 155 | | | 155 | | | 103 | | | — | | |

Net income attributable to common stockholders | | $ | 18,068 | | $ | 17,496 | | $ | 16,708 | | $ | 15,944 | | $ | 16,108 | | |

| | | | | | | | | | | | | | | | | |

Adjusted net income | |

| 18,223 | |

| 19,571 | |

| 18,623 | |

| 17,341 | |

| 17,275 | | |

Preferred stock dividends | | | 155 | | | 155 | | | 155 | | | 103 | | | — | | |

Adjusted net income attributable to common stockholders | | $ | 18,068 | | $ | 19,416 | | $ | 18,468 | | $ | 17,238 | | $ | 17,275 | | |

Average common equity | | $ | 701,598 | | $ | 647,882 | | $ | 650,494 | | $ | 639,741 | | $ | 619,952 | | |

Return on average common equity (GAAP) | |

| 10.36 | % |

| 10.71 | % |

| 10.19 | % |

| 10.00 | % |

| 10.54 | % | |

Adjusted return on average common equity | |

| 10.36 | % |

| 11.89 | % |

| 11.26 | % |

| 10.81 | % |

| 11.30 | % | |

| | | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | |

|

| Quarter Ended | | | |||||||||||||

| | 3/31/2024 |

| 12/31/2023 |

| 9/30/2023 |

| 6/30/2023 | | 3/31/2023 | | | |||||

Tangible common stockholders’ equity: |

| (Dollars in thousands, except per share data) | | | |||||||||||||

Total stockholders’ equity (GAAP) | | $ | 714,971 | | $ | 708,143 | | $ | 643,051 | | $ | 651,483 | | $ | 645,491 | | |

Less: goodwill and other intangible assets | |

| 30,404 | |

| 31,335 | |

| 32,293 | |

| 27,457 | |

| 28,259 | | |

Less: preferred stock | | | 7,750 | | | 7,750 | | | 7,750 | | | 7,750 | | | 7,750 | | |

Tangible common stockholders’ equity | | $ | 676,817 | | $ | 669,058 | | $ | 603,008 | | $ | 616,276 | | $ | 609,482 | | |

Common Shares outstanding at end of period | |

| 49,400,466 | |

| 49,335,888 | |

| 49,295,036 | |

| 48,653,487 | |

| 48,600,618 | | |

Book value per common share (GAAP) | | $ | 14.47 | | $ | 14.35 | | $ | 13.04 | | $ | 13.39 | | $ | 13.28 | | |

Tangible book value per common share | | $ | 13.70 | | $ | 13.56 | | $ | 12.23 | | $ | 12.67 | | $ | 12.54 | | |

| | | | | | | | | | | | | | | | | |

51

|

| Quarter Ended | | | |||||||||||||

|

| 3/31/2024 |

| 12/31/2023 |

| 9/30/2023 |

| 6/30/2023 | | 3/31/2023 | | | |||||

| | (Dollars in thousands, except per share data) | | | |||||||||||||

Adjusted Efficiency Ratio - FTE(1) |

| |

|

| |

|

| |

| | | | | | | | |

Non-interest expense | | $ | 37,505 | | $ | 35,049 | | $ | 36,354 | | $ | 37,412 | | $ | 38,092 | | |

Less: Acquisition costs | |

| — | |

| (1,300) | |

| (1,328) | |

| (338) | |

| (1,477) | | |

Less: Core deposit intangible amortization | |

| (931) | |

| (957) | |

| (922) | |

| (802) | |

| (822) | | |

Less: Employee separation | |

| — | |

| — | |

| — | |

| (1,300) | |

| — | | |

Adjusted Non-interest expense (numerator) | | $ | 36,574 | | $ | 32,792 | | $ | 34,104 | | $ | 34,972 | | $ | 35,793 | | |

Net interest income | |

| 56,594 | |

| 56,954 | |

| 55,127 | |

| 54,539 | |

| 58,221 | | |

Tax equivalent interest income(1) | |

| 536 | |

| 654 | |

| 707 | |

| 750 | |

| 797 | | |

Non-interest income | |

| 5,589 | |

| 4,483 | |

| 5,981 | |

| 5,779 | |

| 4,421 | | |

Add: Loss on bond repositioning | | | — | | | 1,130 | | | — | | | — | | | — | | |

Total tax-equivalent income (denominator) | | $ | 62,719 | | $ | 63,221 | | $ | 61,815 | | $ | 61,068 | | $ | 63,439 | | |

Efficiency Ratio (GAAP) | |

| 60.31 | % |

| 57.05 | % |

| 59.49 | % |

| 62.02 | % |

| 60.81 | % | |

Adjusted Efficiency Ratio - FTE(1) | |

| 58.31 | % |

| 51.87 | % |

| 55.17 | % |

| 57.27 | % |

| 56.42 | % | |

| (1) | Tax exempt income (tax-free municipal securities) is calculated on a tax equivalent basis. The incremental tax rate used is 21.0%. |

ITEM 3.QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Interest Rate Risk

A primary component of market risk is interest rate volatility. Interest rate risk management is a key element of the

Company’sOur exposure to interest rate risk is managed by the Asset/Liability Committee (“ALCO”). The in accordance with policies approved by the Board of Directors. ALCO uses a combination of

52

ALCO evaluates interest rate risk using a rate shock method and rate ramp method. In a rate shock analysis, rates change

| | | | | | | | | |

Hypothetical Change in Interest Rate - Rate Shock |

| ||||||||

| | March 31, 2024 | | March 31, 2023 |

| ||||

Change in Interest Rate | | Percent Change in | | Percent Change in | | Percent Change in | | Percent Change in |

|

(Basis Points) |

| Net Interest Income |

| Fair Value of Equity |

| Net Interest Income |

| Fair Value of Equity |

|

+300 |

| (4.4) | % | (22.9) | % | 2.0 | % | (18.4) | % |

+200 |

| (3.0) |

| (15.8) |

| 1.3 |

| (12.3) | |

+100 |

| (1.5) |

| (8.0) |

| 0.6 |

| (5.8) | |

Base |

| — | % | — | % | — | % | — | % |

-100 |

| 2.1 |

| 8.1 |

| (0.7) |

| 5.7 | |

-200 |

| 4.3 |

| 16.3 |

| (1.7) |

| 11.7 | |

-300 |

| 5.6 |

| 26.8 |

| (5.3) |

| 17.6 | |

| | | | | |

Hypothetical Change in Interest Rate - Rate Ramp |

| ||||

| | March 31, 2024 | | March 31, 2023 | |

Change in Interest Rate | | Percent Change in | | Percent Change in | |

(Basis Points) |

| Net Interest Income |

| Net Interest Income |

|

+300 | | (2.3) | % | (0.1) | % |

+200 |

| (1.5) |

| (0.1) | |

+100 |

| (0.9) |

| — | |

Base |

| — | % | — | % |

-100 |

| 0.8 |

| 0.1 | |

-200 |

| 1.8 |

| 0.1 | |

-300 |

| 2.6 |

| (0.6) | |

The Company’s position is slightly assetliability sensitive as of March 31, 2023which decreased compared to both2024 and has changed from an asset sensitive position as of March 31, 2022 and

The models the Company uses include assumptions regarding interest rates and balance changes. The aggregate

non-maturity beta assumption utilized as of March 31,53

magnitude,

and frequencyEvaluation of Disclosure Controls and Procedures

The Company’s management, with the participation of the Company’s Chief Executive

Officer and Chief Financial Officer, hasChanges in Internal Control over Financial Reporting

Our internal control over financial reporting continues to be updated

as necessary to accommodate modifications to our businessIn the normal course of business, we are named or threatened to be namedas a defendant in various lawsuits. Management,

In addition to the other information set forth in this report, you should carefully consider

the factors discussed in Part I, "Item 1A.ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS |

(a) | None. |

(b) | Not applicable. |

54

(c) | Share Repurchase Program |

| | | | | | | | | | |

| | | | | | | | | Approximate Dollar Value of Shares | |

| | Total Number of | | | | | Total Number of Shares | | that may yet be Purchased as Part | |

Calendar | | Shares | | Average Price | | Purchased as Part of Publicly | | of Publicly Announced Plans or | ||

Month |

| Repurchased |

| Paid per Share |

| Announced Plans or Programs |

| Programs | ||

January 1 - 31 |

| — | | $ | — |

| — | | $ | 15,872,867 |

February 1 - 29 |

| 29,900 | | $ | 13.33 |

| 29,900 | | $ | 15,345,322 |

March 1 - 31 |

| 82,272 | | $ | 13.01 |

| 82,272 | | $ | 14,403,779 |

Total |

| 112,172 | | $ | 13.10 |

| 112,172 | |

|

|

On May 10, 2022, the Company announced that its Board of Directors approved

a share repurchase program under which theThe Company’s ability to pay dividends to its stockholders and repurchase shares is affected by both general corporate law requirements and the regulations and policies of the Federal Reserve applicable to bank holding companies, including the Basel III Capital Rules. In addition, so long as any Series A Preferred Stock remains outstanding, unless full dividends for the most recently completed dividend period have been declared and paid (or declared and the payment amount has been set aside), the Company may not, subject to certain exceptions, declare, pay or set aside for payment any dividend on its common stock, or repurchase or redeem its common stock. The Company's principal source of funds to pay distributions on its common stock, other than further issuances of securities, is dividends received from its wholly owned subsidiaries. Furthermore, the ability of the Company's wholly owned subsidiaries to pay dividends to the Company would depend on the earnings or financial condition of such wholly owned subsidiaries and various business considerations. In addition, various federal and state statutes limit the amount of dividends that the Company's wholly owned subsidiaries may pay to the Company without regulatory approval.

Item 5.Other Information

(a) | None |

(b) | None |

(c) | Trading Arrangements |

During the three months ended March 31, 2024, no director or officer (as defined in Rule 16a-1(f) under the Exchange Act) of the Company adopted or terminated a “Rule 10b5-1 trading arrangement” or “non-Rule 10b5-1 trading arrangement,” as each term is defined in Item 408 of Regulation S-K.

55

ITEM 6. EXHIBITS

| ||

|---|---|---|

Exhibit | Exhibit Description | |

3.1 | | |

3.2 | | |

3.3 | | |

3.4 | | |

31.1* | | |

31.2* | | |

32.1** | | |

101.INS* | | XBRL Instance Document - the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document |

101.SCH* | | XBRL Taxonomy Extension Schema Document |

101.CAL* | | XBRL Taxonomy Extension Calculation Linkbase Document |

101.DEF* | | XBRL Taxonomy Extension Definition Linkbase Document |

101.LAB* | | XBRL Taxonomy Extension Label Linkbase Document |

101.PRE* | | XBRL Taxonomy Extension Presentation Linkbase Document |

104* | | Cover Page Interactive Data File (formation in Inline XBRL and contained in Exhibit 101) |

**Furnished Herewith

†Indicates a management contract or compensatory plan arrangement

56

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed

on its

| ||

| CrossFirst Bankshares, Inc. | |

| | |

Date: May 3, 2024 | | /s/ Benjamin R. Clouse |

| | Benjamin R. Clouse |

| | Chief Financial Officer |

| | (Duly authorized officer and principal financial officer) |

| | |

| | |

57