UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2017March 31, 2021

or

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 001-34735

RYERSON HOLDING CORPORATION

(Exact name of registrant as specified in its charter)

| 26-1251524 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

227 W. Monroe St., 27th Floor

Chicago, Illinois 60606

(Address of principal executive offices)

(312) 292-5000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading symbol(s) | Name of each exchange on which registered |

Common Stock, $0.01 par value, 100,000,000 shares authorized | RYI | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See definitionthe definitions of “large accelerated filer”, “accelerated filer”,filer,” “accelerated filer,” “smaller reporting company”company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ |

| Accelerated filer | ☒ |

| Emerging growth company | ☐ |

|

|

|

|

|

|

|

|

Non-accelerated filer | ☐ |

| Smaller reporting company | ☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Yes ☐ No ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

As of November 3, 2017,April 30, 2021, there were 37,208,58138,474,594 shares of Common Stock, par value $0.01 per share, outstanding.

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES

INDEX

|

|

| PAGE NO. |

| |||

|

|

|

|

| Item 1. |

| |

|

|

|

|

|

| 3 | |

|

|

|

|

|

| 4 | |

|

|

|

|

|

| 5 | |

|

|

|

|

|

| Notes to Condensed Consolidated Financial Statements (Unaudited) | 6 |

|

|

|

|

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

|

|

|

|

| Item 3. |

| |

|

|

|

|

| Item 4. |

| |

|

|

| |

| |||

|

|

|

|

| Item 1. |

| |

|

|

|

|

| Item 1A. |

| |

|

|

|

|

| Item 2. |

| |

|

|

|

|

| Item 3. |

| |

|

|

|

|

| Item 4. |

| |

|

|

|

|

| Item 5. |

| |

|

|

|

|

| Item 6. |

| |

|

|

| |

| |||

PART I. FINANCIALFINANCIAL INFORMATION

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES

Condensed Consolidated Statements of Comprehensive Income (Unaudited)

(In millions, except per share data)

|

| Three Months Ended |

|

| Nine Months Ended |

|

| Three Months Ended |

| |||||||||||||||

|

| September 30, |

|

| September 30, |

|

| March 31, |

| |||||||||||||||

|

| 2017 |

|

| 2016 |

|

| 2017 |

|

| 2016 |

|

| 2021 |

|

| 2020 |

| ||||||

Net sales |

| $ | 864.2 |

|

| $ | 735.1 |

|

| $ | 2,554.1 |

|

| $ | 2,177.5 |

|

| $ | 1,147.3 |

|

| $ | 1,010.3 |

|

Cost of materials sold |

|

| 719.2 |

|

|

| 589.7 |

|

|

| 2,108.1 |

|

|

| 1,721.5 |

|

|

| 949.4 |

|

|

| 814.5 |

|

Gross profit |

|

| 145.0 |

|

|

| 145.4 |

|

|

| 446.0 |

|

|

| 456.0 |

|

|

| 197.9 |

|

|

| 195.8 |

|

Warehousing, delivery, selling, general and administrative |

|

| 119.2 |

|

|

| 109.1 |

|

|

| 353.2 |

|

|

| 331.5 |

| ||||||||

Restructuring and other charges |

|

| — |

|

|

| 2.5 |

|

|

| — |

|

|

| 2.5 |

| ||||||||

Warehousing, delivery, selling, general, and administrative |

|

| 171.8 |

|

|

| 155.7 |

| ||||||||||||||||

Gain on sale of assets |

|

| (20.3 | ) |

|

| — |

| ||||||||||||||||

Operating profit |

|

| 25.8 |

|

|

| 33.8 |

|

|

| 92.8 |

|

|

| 122.0 |

|

|

| 46.4 |

|

|

| 40.1 |

|

Other income and (expense), net |

|

| (1.4 | ) |

|

| (0.2 | ) |

|

| (2.0 | ) |

|

| (13.2 | ) |

|

| 0.3 |

|

|

| 0.9 |

|

Interest and other expense on debt |

|

| (23.2 | ) |

|

| (23.6 | ) |

|

| (67.8 | ) |

|

| (67.5 | ) |

|

| (13.5 | ) |

|

| (21.7 | ) |

Income before income taxes |

|

| 1.2 |

|

|

| 10.0 |

|

|

| 23.0 |

|

|

| 41.3 |

|

|

| 33.2 |

|

|

| 19.3 |

|

Provision (benefit) for income taxes |

|

| (0.7 | ) |

|

| 1.6 |

|

|

| 5.3 |

|

|

| 14.0 |

| ||||||||

Provision for income taxes |

|

| 7.6 |

|

|

| 2.9 |

| ||||||||||||||||

Net income |

|

| 1.9 |

|

|

| 8.4 |

|

|

| 17.7 |

|

|

| 27.3 |

|

|

| 25.6 |

|

|

| 16.4 |

|

Less: Net income attributable to noncontrolling interest |

|

| 0.2 |

|

|

| 0.2 |

|

|

| 0.6 |

|

|

| — |

|

|

| 0.3 |

|

|

| — |

|

Net income attributable to Ryerson Holding Corporation |

| $ | 1.7 |

|

| $ | 8.2 |

|

| $ | 17.1 |

|

| $ | 27.3 |

|

| $ | 25.3 |

|

| $ | 16.4 |

|

Comprehensive income |

| $ | 7.8 |

|

| $ | 6.9 |

|

| $ | 33.4 |

|

| $ | 34.7 |

|

| $ | 28.0 |

|

| $ | 6.2 |

|

Less: Comprehensive income attributable to noncontrolling interest |

|

| 0.2 |

|

|

| 0.1 |

|

|

| 0.9 |

|

|

| — |

|

|

| 0.2 |

|

|

| — |

|

Comprehensive income attributable to Ryerson Holding Corporation |

| $ | 7.6 |

|

| $ | 6.8 |

|

| $ | 32.5 |

|

| $ | 34.7 |

|

| $ | 27.8 |

|

| $ | 6.2 |

|

Basic and diluted earnings per share |

| $ | 0.05 |

|

| $ | 0.23 |

|

| $ | 0.46 |

|

| $ | 0.82 |

| ||||||||

Basic earnings per share |

| $ | 0.66 |

|

| $ | 0.43 |

| ||||||||||||||||

Diluted earnings per share |

| $ | 0.66 |

|

| $ | 0.43 |

| ||||||||||||||||

See Notes to Condensed Consolidated Financial Statements.

3

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES

Condensed Consolidated Statements of Cash Flows (Unaudited)

(In millions)

|

| Nine Months Ended |

| |||||

|

| September 30, |

| |||||

|

| 2017 |

|

| 2016 |

| ||

Operating activities: |

|

|

|

|

|

|

|

|

Net income |

| $ | 17.7 |

|

| $ | 27.3 |

|

Adjustments to reconcile net income to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

| 34.1 |

|

|

| 31.8 |

|

Stock-based compensation |

|

| 1.5 |

|

|

| 1.0 |

|

Deferred income taxes |

|

| 6.9 |

|

|

| 13.4 |

|

Provision for allowances, claims and doubtful accounts |

|

| 0.5 |

|

|

| 2.1 |

|

Loss on retirement of debt |

|

| — |

|

|

| 7.2 |

|

Other-than-temporary impairment charge on available-for-sale investments |

|

| 0.2 |

|

|

| 2.8 |

|

Restructuring and other charges |

|

| — |

|

|

| 2.5 |

|

Premium and fees paid related to debt modification |

|

| — |

|

|

| (15.6 | ) |

Non-cash (gain) loss from derivatives |

|

| 1.9 |

|

|

| (8.2 | ) |

Other items |

|

| (0.7 | ) |

|

| (0.2 | ) |

Change in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Receivables |

|

| (91.5 | ) |

|

| (54.9 | ) |

Inventories |

|

| (117.5 | ) |

|

| (67.3 | ) |

Other assets |

|

| (4.2 | ) |

|

| 13.9 |

|

Accounts payable |

|

| 66.3 |

|

|

| 38.2 |

|

Accrued liabilities |

|

| 22.6 |

|

|

| 17.9 |

|

Accrued taxes payable/receivable |

|

| (2.5 | ) |

|

| 1.3 |

|

Deferred employee benefit costs |

|

| (28.6 | ) |

|

| (36.1 | ) |

Net adjustments |

|

| (111.0 | ) |

|

| (50.2 | ) |

Net cash used in operating activities |

|

| (93.3 | ) |

|

| (22.9 | ) |

Investing activities: |

|

|

|

|

|

|

|

|

Acquisitions, net of cash acquired |

|

| (49.2 | ) |

|

| — |

|

(Increase) Decrease in restricted cash |

|

| (0.3 | ) |

|

| 0.2 |

|

Capital expenditures |

|

| (15.8 | ) |

|

| (19.7 | ) |

Proceeds from sale of property, plant and equipment |

|

| 3.7 |

|

|

| 3.2 |

|

Net cash used in investing activities |

|

| (61.6 | ) |

|

| (16.3 | ) |

Financing activities: |

|

|

|

|

|

|

|

|

Net proceeds from issuance of common stock |

|

| — |

|

|

| 71.5 |

|

Long-term debt issued |

|

| — |

|

|

| 650.0 |

|

Repayment of debt |

|

| (0.1 | ) |

|

| (689.0 | ) |

Net proceeds of short-term borrowings |

|

| 73.4 |

|

|

| 3.2 |

|

Net increase in book overdrafts |

|

| 60.3 |

|

|

| 20.1 |

|

Long-term debt issuance costs |

|

| — |

|

|

| (5.2 | ) |

Principal payments on capital lease obligations |

|

| (12.0 | ) |

|

| (3.9 | ) |

Contributions from non-controlling interest |

|

| — |

|

|

| 0.3 |

|

Proceeds from sale leaseback transactions |

|

| 22.4 |

|

|

| — |

|

Net cash provided by financing activities |

|

| 144.0 |

|

|

| 47.0 |

|

Net increase (decrease) in cash and cash equivalents |

|

| (10.9 | ) |

|

| 7.8 |

|

Effect of exchange rate changes on cash and cash equivalents |

|

| 3.8 |

|

|

| 2.2 |

|

Net change in cash and cash equivalents |

|

| (7.1 | ) |

|

| 10.0 |

|

Cash and cash equivalents—beginning of period |

|

| 80.7 |

|

|

| 63.2 |

|

Cash and cash equivalents—end of period |

| $ | 73.6 |

|

| $ | 73.2 |

|

Supplemental disclosures: |

|

|

|

|

|

|

|

|

Cash paid during the period for: |

|

|

|

|

|

|

|

|

Interest paid to third parties |

| $ | 44.6 |

|

| $ | 49.2 |

|

Income taxes, net |

|

| 1.5 |

|

|

| 1.4 |

|

Noncash investing activities: |

|

|

|

|

|

|

|

|

Asset additions under capital leases and sale-leasebacks |

| $ | 34.6 |

|

| $ | 2.1 |

|

|

| Three Months Ended |

| |||||

|

| March 31, |

| |||||

|

| 2021 |

|

| 2020 |

| ||

Operating activities: |

|

|

|

|

|

|

|

|

Net income |

| $ | 25.6 |

|

| $ | 16.4 |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

| 13.6 |

|

|

| 13.3 |

|

Stock-based compensation |

|

| 1.6 |

|

|

| 0.6 |

|

Deferred income taxes |

|

| 4.5 |

|

|

| 14.6 |

|

Provision for allowances, claims, and doubtful accounts |

|

| 1.6 |

|

|

| 1.4 |

|

Gain on sale of assets |

|

| (20.3 | ) |

|

| — |

|

Pension settlement charge |

|

| 0.2 |

|

|

| 0.4 |

|

Gain on retirement of debt |

|

| — |

|

|

| (0.8 | ) |

Non-cash loss from derivatives |

|

| 9.1 |

|

|

| 2.7 |

|

Other items |

|

| — |

|

|

| (0.1 | ) |

Change in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Receivables |

|

| (165.2 | ) |

|

| (69.4 | ) |

Inventories |

|

| (12.3 | ) |

|

| (4.1 | ) |

Other assets and liabilities |

|

| (19.7 | ) |

|

| 5.1 |

|

Accounts payable |

|

| 118.5 |

|

|

| 98.5 |

|

Accrued liabilities |

|

| 13.0 |

|

|

| 16.1 |

|

Accrued taxes payable/receivable |

|

| 0.5 |

|

|

| (14.2 | ) |

Deferred employee benefit costs |

|

| (18.0 | ) |

|

| (7.7 | ) |

Net adjustments |

|

| (72.9 | ) |

|

| 56.4 |

|

Net cash (used in) provided by operating activities |

|

| (47.3 | ) |

|

| 72.8 |

|

Investing activities: |

|

|

|

|

|

|

|

|

Capital expenditures |

|

| (6.5 | ) |

|

| (6.9 | ) |

Proceeds from sale of property, plant, and equipment |

|

| 29.0 |

|

|

| — |

|

Other items |

|

| (0.5 | ) |

|

| — |

|

Net cash provided by (used in) investing activities |

|

| 22.0 |

|

|

| (6.9 | ) |

Financing activities: |

|

|

|

|

|

|

|

|

Repayment of debt |

|

| (0.4 | ) |

|

| (54.2 | ) |

Net proceeds of short-term borrowings |

|

| 1.2 |

|

|

| 168.2 |

|

Net increase (decrease) in book overdrafts |

|

| 9.4 |

|

|

| (31.2 | ) |

Principal payments on finance lease obligations |

|

| (2.5 | ) |

|

| (3.4 | ) |

Other items |

|

| (0.1 | ) |

|

| — |

|

Net cash provided by financing activities |

|

| 7.6 |

|

|

| 79.4 |

|

Net increase (decrease) in cash, cash equivalents, and restricted cash |

|

| (17.7 | ) |

|

| 145.3 |

|

Effect of exchange rate changes on cash, cash equivalents, and restricted cash |

|

| (0.4 | ) |

|

| (0.4 | ) |

Net change in cash, cash equivalents, and restricted cash |

|

| (18.1 | ) |

|

| 144.9 |

|

Cash, cash equivalents, and restricted cash—beginning of period |

|

| 62.5 |

|

|

| 59.8 |

|

Cash, cash equivalents, and restricted cash—end of period |

| $ | 44.4 |

|

| $ | 204.7 |

|

Supplemental disclosures: |

|

|

|

|

|

|

|

|

Cash paid during the period for: |

|

|

|

|

|

|

|

|

Interest paid to third parties, net |

| $ | 22.8 |

|

| $ | 6.5 |

|

Income taxes, net |

|

| 2.3 |

|

|

| 1.9 |

|

Noncash investing activities: |

|

|

|

|

|

|

|

|

Asset additions under operating leases |

|

| 6.1 |

|

|

| 0.4 |

|

Asset additions under finance leases and sale-leasebacks |

|

| 1.7 |

|

|

| 0.1 |

|

See Notes to Condensed Consolidated Financial Statements.

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES

Condensed Consolidated Balance Sheets

(In millions, except shares)shares and per share data)

|

| September 30, |

|

| December 31, |

|

| March 31, |

|

| December 31, |

| ||||

|

| 2017 |

|

| 2016 |

|

| 2021 |

|

| 2020 |

| ||||

|

| (unaudited) |

|

|

|

|

|

| (unaudited) |

|

|

|

|

| ||

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

| $ | 73.6 |

|

| $ | 80.7 |

|

| $ | 43.3 |

|

| $ | 61.4 |

|

Restricted cash |

|

| 1.3 |

|

|

| 1.0 |

|

|

| 1.1 |

|

|

| 1.1 |

|

Receivables less provision for allowances, claims and doubtful accounts of $5.6 in 2017 and $4.6 in 2016 |

|

| 425.4 |

|

|

| 326.0 |

| ||||||||

Receivables less provisions of $2.1 at March 31, 2021 and $1.7 at December 31, 2020 |

|

| 544.1 |

|

|

| 378.9 |

| ||||||||

Inventories |

|

| 691.7 |

|

|

| 563.4 |

|

|

| 617.2 |

|

|

| 604.5 |

|

Prepaid expenses and other current assets |

|

| 30.7 |

|

|

| 26.7 |

|

|

| 89.4 |

|

|

| 57.5 |

|

Total current assets |

|

| 1,222.7 |

|

|

| 997.8 |

|

|

| 1,295.1 |

|

|

| 1,103.4 |

|

Property, plant, and equipment, at cost |

|

| 727.6 |

|

|

| 668.7 |

|

|

| 819.1 |

|

|

| 822.9 |

|

Less: Accumulated depreciation |

|

| 309.7 |

|

|

| 280.5 |

|

|

| 407.2 |

|

|

| 401.1 |

|

Property, plant and equipment, net |

|

| 417.9 |

|

|

| 388.2 |

| ||||||||

Deferred income taxes |

|

| 8.6 |

|

|

| 24.4 |

| ||||||||

Property, plant, and equipment, net |

|

| 411.9 |

|

|

| 421.8 |

| ||||||||

Operating lease assets |

|

| 110.6 |

|

|

| 108.3 |

| ||||||||

Other intangible assets |

|

| 48.5 |

|

|

| 40.8 |

|

|

| 42.2 |

|

|

| 43.2 |

|

Goodwill |

|

| 115.3 |

|

|

| 103.2 |

|

|

| 121.2 |

|

|

| 120.3 |

|

Deferred charges and other assets |

|

| 4.3 |

|

|

| 4.3 |

|

|

| 5.2 |

|

|

| 5.1 |

|

Total assets |

| $ | 1,817.3 |

|

| $ | 1,558.7 |

|

| $ | 1,986.2 |

|

| $ | 1,802.1 |

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable |

| $ | 362.5 |

|

| $ | 230.4 |

|

| $ | 493.2 |

|

| $ | 365.1 |

|

Salaries, wages and commissions |

|

| 38.0 |

|

|

| 36.8 |

| ||||||||

Salaries, wages, and commissions |

|

| 62.7 |

|

|

| 43.1 |

| ||||||||

Other accrued liabilities |

|

| 62.0 |

|

|

| 37.7 |

|

|

| 98.9 |

|

|

| 78.3 |

|

Short-term debt |

|

| 20.2 |

|

|

| 19.2 |

|

|

| 18.1 |

|

|

| 13.8 |

|

Current portion of operating lease liabilities |

|

| 21.8 |

|

|

| 20.7 |

| ||||||||

Current portion of deferred employee benefits |

|

| 8.3 |

|

|

| 8.3 |

|

|

| 6.6 |

|

|

| 6.6 |

|

Total current liabilities |

|

| 491.0 |

|

|

| 332.4 |

|

|

| 701.3 |

|

|

| 527.6 |

|

Long-term debt |

|

| 1,021.4 |

|

|

| 944.3 |

|

|

| 723.3 |

|

|

| 726.2 |

|

Deferred employee benefits |

|

| 261.1 |

|

|

| 298.8 |

|

|

| 211.6 |

|

|

| 231.6 |

|

Noncurrent operating lease liabilities |

|

| 92.3 |

|

|

| 93.0 |

| ||||||||

Deferred income taxes |

|

| 63.3 |

|

|

| 58.2 |

| ||||||||

Other noncurrent liabilities |

|

| 58.2 |

|

|

| 32.5 |

|

|

| 19.7 |

|

|

| 20.4 |

|

Total liabilities |

|

| 1,831.7 |

|

|

| 1,608.0 |

|

|

| 1,811.5 |

|

|

| 1,657.0 |

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ryerson Holding Corporation stockholders’ equity (deficit): |

|

|

|

|

|

|

|

| ||||||||

Preferred stock, $0.01 par value; 7,000,000 shares authorized and no shares issued at 2017 and 2016 |

|

| — |

|

|

| — |

| ||||||||

Common stock, $0.01 par value; 100,000,000 shares authorized; 37,421,081 and 37,345,117 shares issued at 2017 and 2016, respectively |

|

| 0.4 |

|

|

| 0.4 |

| ||||||||

Ryerson Holding Corporation stockholders’ equity: |

|

|

|

|

|

|

|

| ||||||||

Preferred stock, $0.01 par value; 7,000,000 shares authorized and 0 shares issued at March 31, 2021 and December 31, 2020 |

|

| — |

|

|

| — |

| ||||||||

Common stock, $0.01 par value; 100,000,000 shares authorized; 38,329,897 shares issued at March 31, 2021 and December 31, 2020 |

|

| 0.4 |

|

|

| 0.4 |

| ||||||||

Capital in excess of par value |

|

| 376.9 |

|

|

| 375.4 |

|

|

| 384.7 |

|

|

| 383.1 |

|

Accumulated deficit |

|

| (95.1 | ) |

|

| (112.2 | ) | ||||||||

Treasury stock at cost – Common stock of 212,500 shares in 2017 and 2016 |

|

| (6.6 | ) |

|

| (6.6 | ) | ||||||||

Retained earnings |

|

| 59.1 |

|

|

| 33.8 |

| ||||||||

Treasury stock at cost – Common stock of 212,500 shares at March 31, 2021 and December 31, 2020 |

|

| (6.6 | ) |

|

| (6.6 | ) | ||||||||

Accumulated other comprehensive loss |

|

| (292.4 | ) |

|

| (307.8 | ) |

|

| (269.4 | ) |

|

| (271.9 | ) |

Total Ryerson Holding Corporation stockholders’ equity (deficit) |

|

| (16.8 | ) |

|

| (50.8 | ) | ||||||||

Total Ryerson Holding Corporation stockholders’ equity |

|

| 168.2 |

|

|

| 138.8 |

| ||||||||

Noncontrolling interest |

|

| 2.4 |

|

|

| 1.5 |

|

|

| 6.5 |

|

|

| 6.3 |

|

Total equity (deficit) |

|

| (14.4 | ) |

|

| (49.3 | ) | ||||||||

Total equity |

|

| 174.7 |

|

|

| 145.1 |

| ||||||||

Total liabilities and equity |

| $ | 1,817.3 |

|

| $ | 1,558.7 |

|

| $ | 1,986.2 |

|

| $ | 1,802.1 |

|

See Notes to Condensed Consolidated Financial Statements.

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES

Notes to Condensed Consolidated Financial Statements (Unaudited)

NOTE 1: FINANCIAL STATEMENTS

Ryerson Holding Corporation (“Ryerson Holding”), a Delaware corporation, is the parent company of Joseph T. Ryerson & Son, Inc. (“JT Ryerson”), a Delaware corporation. Affiliates of Platinum Equity, LLC (“Platinum”) own approximately 21,037,500 shares of our common stock, which is approximately 57%55% of our issued and outstanding common stock.

We are a leading value-added processor and distributor of industrial metals service center, with operations in the United States through JT Ryerson, in Canada through our indirect wholly-owned subsidiary Ryerson Canada, Inc., a Canadian corporation (“Ryerson Canada”), and in Mexico through our indirect wholly-owned subsidiary Ryerson Metals de Mexico, S. de R.L. de C.V., a Mexican corporation (“Ryerson Mexico”). In addition to our North American operations, we conduct materials processing and distribution operations in China through an indirect wholly-owned subsidiary, Ryerson China Limited (“Ryerson China”)., a Chinese limited liability company. Unless the context indicates otherwise, Ryerson Holding, JT Ryerson, Ryerson Canada, Ryerson China, and Ryerson Mexico together with their subsidiaries, are collectively referred to herein as “Ryerson,” “we,” “us,” “our,” or the “Company.”

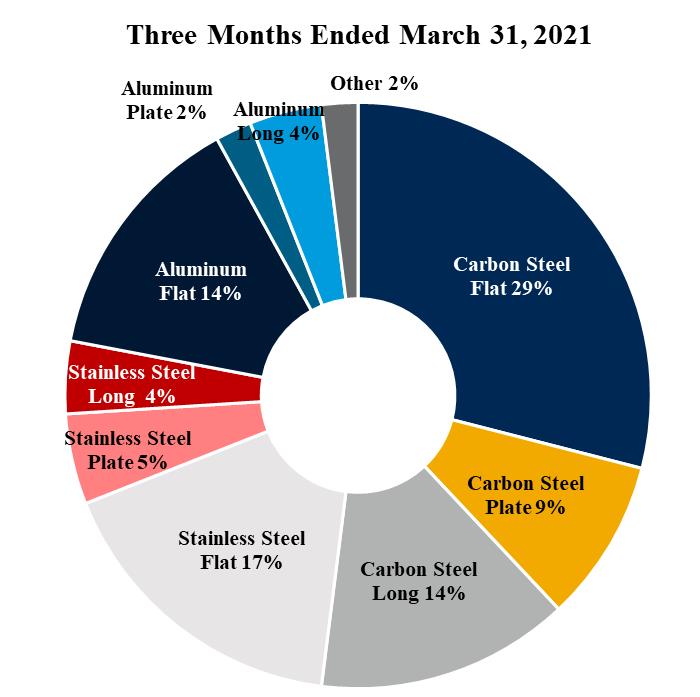

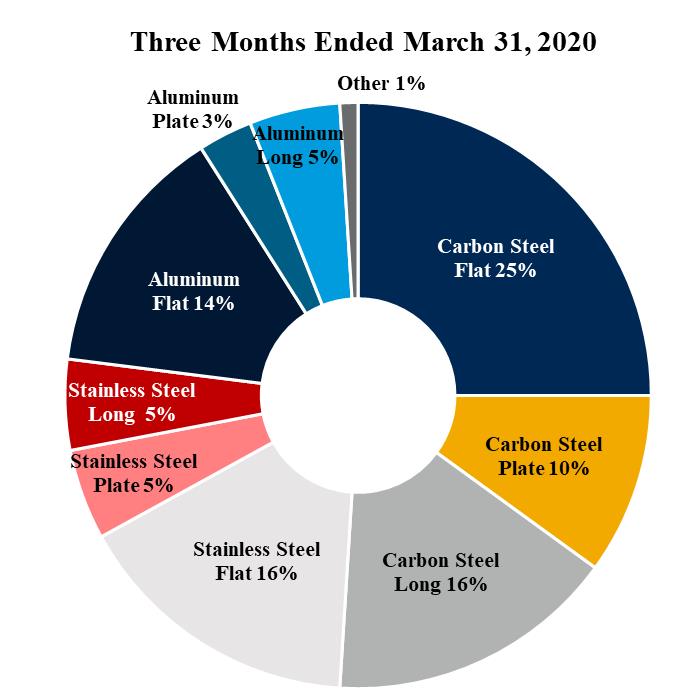

The following table shows our percentage of sales by major product lines for the three and nine months ended September 30, 2017 and 2016, respectively:

|

| Three Months Ended |

|

| Nine Months Ended |

| ||||||||||

|

| September 30, |

|

| September 30, |

| ||||||||||

Product Line |

| 2017 |

|

| 2016 |

|

| 2017 |

|

| 2016 |

| ||||

Carbon Steel Flat |

|

| 29 | % |

|

| 29 | % |

|

| 28 | % |

|

| 27 | % |

Carbon Steel Plate |

|

| 10 |

|

|

| 9 |

|

|

| 10 |

|

|

| 9 |

|

Carbon Steel Long |

|

| 12 |

|

|

| 13 |

|

|

| 12 |

|

|

| 14 |

|

Stainless Steel Flat |

|

| 17 |

|

|

| 17 |

|

|

| 18 |

|

|

| 16 |

|

Stainless Steel Plate |

|

| 4 |

|

|

| 4 |

|

|

| 4 |

|

|

| 4 |

|

Stainless Steel Long |

|

| 4 |

|

|

| 3 |

|

|

| 4 |

|

|

| 4 |

|

Aluminum Flat |

|

| 16 |

|

|

| 16 |

|

|

| 15 |

|

|

| 16 |

|

Aluminum Plate |

|

| 3 |

|

|

| 3 |

|

|

| 3 |

|

|

| 3 |

|

Aluminum Long |

|

| 4 |

|

|

| 4 |

|

|

| 4 |

|

|

| 5 |

|

Other |

|

| 1 |

|

|

| 2 |

|

|

| 2 |

|

|

| 2 |

|

Total |

|

| 100 | % |

|

| 100 | % |

|

| 100 | % |

|

| 100 | % |

Results of operations for any interim period are not necessarily indicative of results of any otherfuture periods or for the year. The condensed consolidated financial statements as of September 30, 2017March 31, 2021 and for the three-monththree months ended March 31, 2021 and nine-month periods ended September 30, 2017 and 20162020 are unaudited, but in the opinion of management, include all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of results for such periods. The year-end condensed consolidated balance sheet data contained in this report was derived from audited financial statements, but does not include all disclosures required by U.S. generally accepted accounting principles generally accepted in the United States of America.(“GAAP”). These condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and related notes contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016.2020.

NOTENOTE 2: RECENT ACCOUNTING PRONOUNCEMENTS

Impact of Recently Issued Accounting Standards—Adopted

In March 2016,December 2019, the Financial Accounting Standards Board (“FASB”) issued Accounting StandardStandards Update (“ASU”) 2016-07, 2019-12, “InvestmentsIncome Taxes – Equity Method and Joint Ventures: Simplifying the Transition to the Equity Method of Accounting. for Income Taxes.” The amendment eliminates the retroactive adjustments to an investment upon it qualifyingguidance removes certain exceptions for the equity method of accounting as a result of an increase in the level of ownership interest or degree of influence by the investor. ASU 2016-07 requires that the equity method investor add the cost of acquiring the additional interest in the investee to the current basis of the investor's previously held interest and adopt the equity method of accounting as of the date the investment qualifiesrecognizing deferred taxes for equity method accounting.investments, performing intraperiod allocation, and calculating income taxes in interim periods. The update was effectiveASU also adds guidance to reduce complexity in certain areas, including recognizing deferred taxes for interimgoodwill and annual reporting periods beginning after December 15, 2016.allocating taxes to members of a consolidated group, among others. We adopted this guidance for our fiscal year beginningas of January 1, 2017. The adoption of this guidance did not have an2021 and there was no impact onto our consolidated financial statements.

In January 2017, the FASB issued ASU 2017-01, “Clarifying the Definition of a Business”. The guidance in ASU 2017-01 was issued to provide clarity of the definition of a business with the objective to assist entities in the evaluation of whether a transaction should be accounted for as an acquisition of assets or a business. The update is effective for fiscal years beginning after December 15, 2017, and is to be applied on a prospective basis. Early adoption is permitted. We adopted this guidance for our fiscal year beginning January 1, 2017. The adoption of this guidance did not have an impact on our consolidated financial statements.

In January 2017, the FASB issued ASU 2017-04, “Simplifying the Test for Goodwill Impairment”. The objective of the guidance in ASU 2017-04 is to simplify how an entity is required to test goodwill for impairment by eliminating Step 2 from the goodwill impairment test. To test goodwill under this amendment, an entity should perform its annual impairment test by comparing the fair value of a reporting unit with its carrying amount. An impairment charge is recognized in the amount that the carrying amount exceeds the reporting unit’s fair value; however, the loss should not exceed the total amount of goodwill allocated to the reporting unit. The update is effective for fiscal years beginning after December 15, 2020, and is to be applied on a prospective basis. Early adoption is permitted. We adopted this guidance for our fiscal year beginning January 1, 2017. The adoption of this guidance did not have an impact on our consolidated financial statements.

In August 2017, the FASB issued ASU 2017-12, “Targeted Improvements to Accounting for Hedging Activities”. The objective of the amendments is to better align an entity’s risk management activities and financial reporting for hedging relationships. Changes are made to both the designation and measurement guidance for qualifying hedging relationships and the presentation of hedge results. Certain targeted improvements are also made to simplify the application of hedge accounting guidance and ease the administrative burden of hedge documentation requirements and assessing hedge effectiveness. The update is effective for fiscal years beginning after December 15, 2018, and the amended presentation and disclosure guidance is to be applied on a prospective basis. Early adoption is permitted in any interim or annual period. We adopted this guidance effective July 1, 2017. The adoption of this guidance did not have an impact on our consolidated financial statements.

Impact of Recently Issued Accounting Standards—Not Yet Adopted

In May 2014,No accounting pronouncements have been issued that we have not yet adopted.

NOTE 3: CASH, CASH EQUIVALENTS, AND RESTRICTED CASH

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported within the FASB issued ASU 2014-09, “Revenue from Contracts with Customers,” which creates Accounting Standards Codification (“ASC”) 606 “Revenue from Contracts with Customers” and supersedes the revenue recognition requirements in ASC 605 “Revenue Recognition.” The guidance in ASU 2014-09 and subsequently issued amendments outlines a comprehensive model for all entities to use in accounting for revenue arising from contracts with customers as well as required disclosures. Under the new standard, recognition of revenue occurs when a customer obtains control of promised goods or services in an amountCondensed Consolidated Balance Sheets that reflects the consideration which the entity expects to receive in exchange for those goods or services. The new standard requires additional disclosure of the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers including significant judgments and changes in judgments. The new standard permits two methods of adoption: the full retrospective method or the modified retrospective transition method. We will adopt the new standard effective January 1, 2018 using the modified retrospective transition method with the cumulative effect recordedsum to the opening balance of retained earnings as of the date of adoption.

We have established a project management team to analyze the impact of the new standard. The team is evaluating our different revenue streams and reviewing representative contracts with customers to identify if there are differences that would result from the application of the new standard as compared to our current accounting policies and practices. Under the new standard, the Company expects to recognize revenue on an over time basis for a subset of revenues associated with custom fabricated products instead of upon delivery of the fabricated product to the customer. The Company has not yet completed the process of quantifying the effects on our consolidated financial statements of the changes that may result from adoption. The Company is implementing new business processes and internal controls in order to recognize revenue in accordance with the new standard. We believe our implementation of the new standard is progressing in a timely manner to allow for proper recognition, presentation, and disclosure upon adoption.

In January 2016, the FASB issued ASU 2016-01, "Financial Instruments – Overall: Recognition and Measurement of Financial Assets and Financial Liabilities." The amendments in ASU 2016-01 change the accounting for non-consolidated equity investments that are not accounted for under the equity method of accounting by requiring changes in fair value to be recognized in net income. Under current guidance, changes in fair value for investments of this nature are recognized in accumulated other comprehensive income as a component of stockholders’ equity. Additionally, ASU 2016-01 simplifies the impairment assessment of equity investments without readily determinable fair values; requires entities to use the exit price when estimating the fair value of financial instruments; and modifies various presentation disclosure requirements for financial instruments. The amendments should be applied by means of a cumulative-effect adjustment to the balance sheet astotal of the beginning of the fiscal year of adoption. The amendments related to equity securities without readily determinable fair values (including disclosure requirements) should be applied prospectively to equity investments that exist as of the date of adoption. The update is effective for interim and annual reporting periods beginning after December 15, 2017. Early adoption is permitted. We will adopt this guidance for our fiscal year beginning

January 1, 2018. We do not expect the adoption of this guidance to have a material impact on our consolidated financial statements. Our available-for-sale investment as of September 30, 2017 has a fair value of $0.1 million.

In February 2016, the FASB issued ASU 2016-02, “Leases” codifiedending cash balances shown in ASC 842, “Leases.” The guidance requires lessees to recognize assets and liabilities on the balance sheet for the rights and obligations created by all leases with terms of more than 12 months. The amendment also will require disclosures designed to give financial statement users information on the amount, timing, and uncertainty of cash flows arising from leases. These disclosures include qualitative and quantitative information. The update is effective for interim and annual reporting periods beginning after December 15, 2018. Entities are required to use a modified retrospective approach for leases that exist or are entered into after the beginning of the earliest comparative period in the financial statements, and have the option to use certain relief. Full retrospective application is prohibited. Early adoption is permitted. We will adopt this guidance for our fiscal year beginning January 1, 2019. The Company is working to gather lists of all leases and is in the process of implementing a lease software to be used for lease tracking, reporting and disclosures. We are still assessing the impact of adoption on our consolidated financial statements.

In June 2016, the FASB issued ASU 2016-13, “Financial Instruments – Credit Losses: Measurement of Credit Losses on Financial Instruments.” The amendment requires financial assets measured at amortized cost basis to be presented at the net amount expected to be collected, thus eliminating the probable initial recognition threshold and instead reflecting the current estimate of all expected credit losses. The amendment also requires that credit losses relating to available-for-sale debt securities be recorded through an allowance for credit losses rather than a write-down, thus enabling the ability to record reversals of credit losses in current period net income. The update is effective for interim and annual reporting periods beginning after December 15, 2019. An entity will apply the amendment through a cumulative-effect adjustment to retained earnings as of the beginning of the first reporting period in which the guidance is effective (that is, a modified-retrospective approach). A prospective transition approach is required for debt securities for which an-other-than-temporary impairment had been recognized before the effective date. The effect of a prospective transition approach is to maintain the same amortized cost basis before and after the effective date of this update. Early adoption is permitted only for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. We will adopt this guidance for our fiscal year beginning January 1, 2020. We are still assessing the impact of adoption on our consolidated financial statements.

In August 2016, the FASB issued ASU 2016-15, “Statement of Cash Flows – Classification of Certain Cash Receipts and Certain Cash Payments.” The amendments address the diversity in practice in how certain cash receipts and cash payments are presented and classified in the statement of cash flows. The update is effective for interim and annual reporting periods beginning after December 15, 2017. The amendments should be applied using a retrospective transition method to each period presented. If it is impracticable to apply the amendments retrospectively for some of the issues, the amendments for those issues would be applied prospectively as of the earliest date practicable. Early adoption is permitted. We will adopt this guidance for our fiscal year beginning January 1, 2018. The adoption of this guidance is not expected to have a material impact on our consolidated financial statements.

In October 2016, the FASB issued ASU 2016-16, “Income Taxes – Intra-Entity Transfers of Assets Other Than Inventory.” The amendment requires an entity to recognize the income tax consequences of an intra-entity transfer of an asset other than inventory when the transfer occurs. The update is effective for interim and annual reporting periods beginning after December 15, 2017. The amendments should be applied on a modified retrospective basis through a cumulative-effect adjustment directly to retained earnings as of the beginning of the period of adoption. Early adoption is permitted. We will adopt this guidance for our fiscal year beginning January 1, 2018. The adoption of this guidance is not expected to have a material impact on our consolidated financial statements.

In November 2016, the FASB issued ASU 2016-18 “Statement of Cash Flows – Restricted Cash.” The amendment requires entities to include in their cash and cash-equivalent balances in the statement of cash flows those amounts that are deemed to be restricted cash and restricted cash equivalents. The ASU does not define the terms “restricted cash” and “restricted cash equivalents.” The amendment is effective for interim and annual reporting periods beginning after December 15, 2017. The amendments should be applied using a retrospective transition method to each period presented. Early adoption is permitted. We will adopt this guidance for our fiscal year beginning January 1, 2018. The adoption of this guidance is not expected to have a material impact on our consolidated financial statements.

In March 2017, the FASB issued ASU 2017-07, “Compensation – Retirement Benefits: Improving the Presentation of Net Periodic Pension Cost and Net Periodic Post Retirement Benefit Cost”. The amendment requires entities to disaggregate the service cost component from the other components of net benefit cost and limits the capitalization of net benefit cost to only the service cost component. The amendment also provides explicit guidance on how to present the service cost component and the other components of net benefit cost in the statement of comprehensive income. The amendments are effective for interim and annual reporting periods beginning after December 15, 2017. The disclosure requirements of the amendments should be applied retrospectively and the requirements concerning capitalization of the net service costs should be applied prospectively. We will adopt this guidance for our

fiscal year beginning January 1, 2018. Adoption of this guidance will result in a reclass within the lines of the Condensed Consolidated Statements of Comprehensive Income, with no impact on gross margins, and is not expected to have a material impact on our consolidated financial statements.Cash Flows:

|

| March 31, |

|

| December 31, |

| ||

|

| 2021 |

|

| 2020 |

| ||

|

| (In millions) |

| |||||

Cash and cash equivalents |

| $ | 43.3 |

|

| $ | 61.4 |

|

Restricted cash |

|

| 1.1 |

|

|

| 1.1 |

|

Total cash, cash equivalents, and restricted cash |

| $ | 44.4 |

|

| $ | 62.5 |

|

In May 2017,We had cash restricted for the FASB issued ASU 2017-09, “Compensation – Stock Compensation: Scopepurposes of Modification Accounting”. The amendment provides guidance about which changes to the terms and conditionscovering letters of a share-based payment award require an entity to apply the accounting guidance on modifications to share-based payment awards. The guidance is effectivecredit that can be presented for interim and annual reporting periods beginning after December 15, 2017. We will adopt this guidance for our fiscal year beginning January 1, 2018. The adoption of this guidance is not expected to have a material impact on our consolidated financial statements.potential insurance claims.

NOTE 3:4: INVENTORIES

The Company primarily uses the last-in, first-out (LIFO) method of valuing inventory. Interim LIFO calculations are based on actual inventory levels.

Inventories, at stated LIFO value, were classified at September 30, 2017March 31, 2021 and December 31, 20162020 as follows:

|

| September 30, |

|

| December 31, |

| ||

|

| 2017 |

|

| 2016 |

| ||

|

| (In millions) |

| |||||

In process and finished products |

| $ | 691.7 |

|

| $ | 563.4 |

|

|

| March 31, |

|

| December 31, |

| ||

|

| 2021 |

|

| 2020 |

| ||

|

| (In millions) |

| |||||

In process and finished products |

| $ | 617.2 |

|

| $ | 604.5 |

|

If current cost had been used to value inventories, such inventories would have been $79$21 million higher and $115$63 million lower than reported at September 30, 2017March 31, 2021 and December 31, 2016,2020, respectively. Approximately 89%90% and 90%91% of inventories are accounted for under the LIFO method at September 30, 2017March 31, 2021 and December 31, 2016,2020, respectively. Non-LIFO inventories consist primarily of inventory at our foreign facilities using the weighted-averagemoving average cost and the specific cost methods. Substantially all of our inventories consist of finished products.

Inventories are stated at the lower of cost or market value. We record amounts required, if any, to reduce the carrying value of inventory to its lower of cost or market as a charge to cost of materials sold. The lower of cost or market reserve totaled zero and $23.9 million at September 30, 2017 and December 31, 2016, respectively.

The Company has consignment inventory at certain customer locations, which totaled $11.2$6.0 million and $11.1$4.8 million at September 30, 2017March 31, 2021 and December 31, 2016,2020, respectively.

NOTE 5: LEASES

The Company leases various assets including real estate, trucks, trailers, mobile equipment, processing equipment, and IT equipment. The Company has noncancelable operating leases expiring at various times through 2032 and finance leases expiring at various times through 2027.

The following table summarizes the location and amount of lease assets and lease liabilities reported in our Condensed Consolidated Balance Sheet as of March 31, 2021 and December 31, 2020:

|

|

|

| March 31, |

|

| December 31, |

| ||

Leases |

| Balance Sheet Location |

| 2021 |

|

| 2020 |

| ||

|

|

|

| (In millions) |

| |||||

Assets |

|

|

|

|

|

|

|

|

|

|

Operating lease assets |

| Operating lease assets |

| $ | 110.6 |

|

| $ | 108.3 |

|

Finance lease assets |

| Property, plant, and equipment, net(a) |

|

| 41.0 |

|

|

| 45.5 |

|

Total lease assets |

|

|

| $ | 151.6 |

|

| $ | 153.8 |

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

Current |

|

|

|

|

|

|

|

|

|

|

Operating |

| Current portion of operating lease liabilities |

| $ | 21.8 |

|

| $ | 20.7 |

|

Finance |

| Other accrued liabilities |

|

| 8.5 |

|

|

| 9.0 |

|

Noncurrent |

|

|

|

|

|

|

|

|

|

|

Operating |

| Noncurrent operating lease liabilities |

|

| 92.3 |

|

|

| 93.0 |

|

Finance |

| Other noncurrent liabilities |

|

| 13.8 |

|

|

| 14.3 |

|

Total lease liabilities |

|

|

| $ | 136.4 |

|

| $ | 137.0 |

|

(a) | Finance lease assets were recorded net of accumulated amortization of $20.5 million and $21.0 million as of March 31, 2021 and December 31, 2020, respectively. |

The following table summarizes the location and amount of lease expense reported in our Condensed Consolidated Statements of Comprehensive Income for the three months ended March 31, 2021 and 2020:

|

|

|

| Three Months Ended March 31, |

| |||||

Lease Expense |

| Location of Lease Expense Recognized in Income |

| 2021 |

|

| 2020 |

| ||

|

|

|

| (In millions) |

| |||||

Operating lease expense |

| Warehousing, delivery, selling, general, and administrative |

| $ | 6.2 |

|

| $ | 6.0 |

|

Finance lease expense |

|

|

|

|

|

|

|

|

|

|

Amortization of lease assets |

| Warehousing, delivery, selling, general, and administrative |

|

| 1.5 |

|

|

| 1.6 |

|

Interest on lease liabilities |

| Interest and other expense on debt |

|

| 0.2 |

|

|

| 0.3 |

|

Variable lease expense |

| Warehousing, delivery, selling, general, and administrative |

|

| 0.8 |

|

|

| 0.8 |

|

Short-term lease expense |

| Warehousing, delivery, selling, general, and administrative |

|

| 0.5 |

|

|

| 0.8 |

|

Total lease expense |

|

|

| $ | 9.2 |

|

| $ | 9.5 |

|

The following table presents maturity analysis of lease liabilities at March 31, 2021:

Maturity of Lease Liabilities |

| Operating Leases(a) |

|

| Finance Leases |

| ||

|

| (In millions) |

| |||||

2021 |

| $ | 19.0 |

|

| $ | 7.2 |

|

2022 |

|

| 22.5 |

|

|

| 6.9 |

|

2023 |

|

| 17.9 |

|

|

| 4.4 |

|

2024 |

|

| 16.5 |

|

|

| 3.5 |

|

2025 |

|

| 12.9 |

|

|

| 1.1 |

|

After 2025 |

|

| 39.3 |

|

|

| 0.6 |

|

Total lease payments |

|

| 128.1 |

|

|

| 23.7 |

|

Less: Interest(b) |

|

| (14.0 | ) |

|

| (1.4 | ) |

Present value of lease liabilities(c) |

| $ | 114.1 |

|

| $ | 22.3 |

|

(a) | There were 0 operating leases with options to extend lease terms that are reasonably certain of being exercised or operating leases signed but not yet commenced. |

(b) | Calculated using the discount rate for each lease. |

(c) | Includes the current portion of $21.8 million for operating leases and $8.5 million for finance leases. |

The following table shows the weighted-average remaining lease term and discount rate for operating and finance leases, respectively, at March 31, 2021 and December 31, 2020:

|

| March 31, |

|

| December 31, |

| ||

Lease Term and Discount Rate |

| 2021 |

|

| 2020 |

| ||

|

|

|

|

|

|

|

|

|

Weighted-average remaining lease term (years) |

|

|

|

|

|

|

|

|

Operating leases |

|

| 7.0 |

|

|

| 7.3 |

|

Finance leases |

|

| 2.9 |

|

|

| 2.8 |

|

Weighted-average discount rate |

|

|

|

|

|

|

|

|

Operating leases |

|

| 3.3 | % |

|

| 3.4 | % |

Finance leases |

|

| 4.2 | % |

|

| 4.4 | % |

Information reported in our Condensed Consolidated Statement of Cash Flows for the three months ended March 31, 2021 and 2020 is summarized below:

|

| Three Months Ended March 31, |

| |||||

Other Information |

| 2021 |

|

| 2020 |

| ||

|

| (In millions) |

| |||||

Cash paid for amounts included in the measurement of lease liabilities |

|

|

|

|

|

|

|

|

Operating cash flows from operating leases |

| $ | 6.8 |

|

| $ | 6.2 |

|

Operating cash flows from finance leases |

|

| 0.2 |

|

|

| 0.3 |

|

Financing cash flows from finance leases |

|

| 2.5 |

|

|

| 3.4 |

|

Assets obtained in exchange for lease obligations: |

|

|

|

|

|

|

|

|

Operating leases |

|

| 6.1 |

|

|

| 0.4 |

|

Finance leases |

|

| 1.7 |

|

|

| 0.1 |

|

NOTE 4:6: GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill, which represents the excess of cost over the fair value of net assets acquired, amounted to $115.3$121.2 million and $103.2$120.3 million at September 30, 2017March 31, 2021 and December 31, 2016,2020, respectively. We recognized $12.1 million of goodwill during the first nine months of 2017 related to the acquisitions discussed in Note 5: Acquisitions. Pursuant to ASC 350, “Intangibles – Goodwill and Other,” we review the recoverability of goodwill annually as of October 1 or whenever significant events or changes occur which might impair the recovery of recorded amounts. The most recently completed impairment test of goodwill was performed as of October 1, 2016,2020, and it was determined that no0 impairment existed in 2016.existed.

Other intangible assets with finite useful lives continue to be amortized over their useful lives. During the first nine months of 2017 we recognized $12.2 million in intangibles related to the acquisitions discussed in Note 5: Acquisitions. We review the recoverability of our long-lived assets whenever events or changes in circumstances indicate the carrying amount of such assets may not be recoverable.

Our Critical Accounting Policies and Estimates for goodwill and intangibles assets are disclosed in Note 1 to the Consolidated Financial Statements and in Management's Discussion and Analysis of our Annual Report on Form 10-K for the fiscal year ended December 31, 2020. We continue to monitor the significant global economic uncertainty as a result of the COVID-19 pandemic to assess the outlook for demand for our products and the impact on our business and our overall financial performance. A lack of further recovery or a deterioration in current market conditions, a trend of weaker than expected financial performance in our business, or a lack of further recovery or a decline in the Company’s market capitalization, among other factors, could result in an impairment charge in future periods which could have a material adverse effect on our financial statements.

NOTE 5: ACQUISITIONS

On January 19, 2017, Ryerson Holding acquired The Laserflex Corporation (“Laserflex”), a privately-owned metal fabricator specializing in laser fabrication metal processing and welding with locations in Columbus, Ohio and Wellford, South Carolina. The acquisition is not material to our consolidated financial statements.

On February 15, 2017, Ryerson Holding acquired Guy Metals, Inc. (“Guy Metals”), a privately-owned metal service center company located in Hammond, Wisconsin. The acquisition is not material to our consolidated financial statements.

Long-term debt consisted of the following at September 30, 2017March 31, 2021 and December 31, 2016:2020:

|

| September 30, |

|

| December 31, |

|

| March 31, |

|

| December 31, |

| ||||

|

| 2017 |

|

| 2016 |

|

| 2021 |

|

| 2020 |

| ||||

|

| (In millions) |

|

| (In millions) |

| ||||||||||

Ryerson Credit Facility |

| $ | 385.1 |

|

| $ | 312.0 |

|

| $ | 282.0 |

|

| $ | 285.0 |

|

11.00% Senior Secured Notes due 2022 |

|

| 650.0 |

|

|

| 650.0 |

| ||||||||

8.50% Senior Secured Notes due 2028 |

|

| 450.0 |

|

|

| 450.0 |

| ||||||||

Foreign debt |

|

| 19.5 |

|

|

| 19.2 |

|

|

| 16.3 |

|

|

| 12.1 |

|

Other debt |

|

| 1.7 |

|

|

| — |

|

|

| 7.4 |

|

|

| 7.8 |

|

Unamortized debt issuance costs and discounts |

|

| (14.7 | ) |

|

| (17.7 | ) |

|

| (14.3 | ) |

|

| (14.9 | ) |

Total debt |

|

| 1,041.6 |

|

|

| 963.5 |

|

|

| 741.4 |

|

|

| 740.0 |

|

Less: Short-term foreign debt |

|

| 19.5 |

|

|

| 19.2 |

|

|

| 16.3 |

|

|

| 12.1 |

|

Less: Other short-term debt |

|

| 0.7 |

|

|

| — |

|

|

| 1.8 |

|

|

| 1.7 |

|

Total long-term debt |

| $ | 1,021.4 |

|

| $ | 944.3 |

|

| $ | 723.3 |

|

| $ | 726.2 |

|

Ryerson Credit Facility

OnOn November 16, 2016, Ryerson entered into an amendment with respect to its $1.0 billion revolving credit facility (as amended, the “Ryerson“Old Credit Facility”), to reduce the total facility size from $1.0 billion (the “Old Credit Facility”) to $750 million, reduce the interest rate on outstanding borrowings by 25 basis points, reduce commitment fees on amounts not borrowed by 2.5 basis points, and to extend the maturity date to November 16, 2021. The Old Credit Facility was amended a second time on June 28, 2018, to increase the facility size from $750 million to $1.0 billion. On September 23, 2019, a third amendment was entered into to supplement the facility and add a U.S. “first-in, last-out” sub-facility of $67.9 million (the “Old FILO Facility”). The Old FILO Facility was equal in subordination with the other borrowings under the revolving credit facility and matured as of June 30, 2020. The Old FILO Facility supplemented

our borrowing capacity by providing additional collateral on eligible accounts receivable and inventory. On November 5, 2020, Ryerson entered into a fourth amendment to extend the maturity date to November 5, 2025 (as amended, the “Ryerson Credit Facility” or “Credit Facility”). The aggregate facility size of $1.0 billion remained unchanged. The fourth amendment also added the ability to convert up to $100 million of commitments under the Ryerson Credit Facility into a “first-in, last-out” sub-facility (the “FILO Facility”). Subject to certain limitations, such conversion can be made from time to time (but no more than twice in the aggregate) prior to the date that is two years after November 5, 2020.

At September 30, 2017March 31, 2021, Ryerson had $385.1$282 million of outstanding borrowings, $15$11 million of letters of credit issued, and $291$509 million available under the Ryerson Credit Facility compared to $312.0$285 million of outstanding borrowings, $16$11 million of letters of credit issued, and $225$277 million available at December 31, 2016.2020. Total credit availability is limited by the amount of eligible accounts receivable, inventory, and qualified cash pledged as collateral under the agreement insofar as Ryerson is subject to a borrowing base comprised of the aggregate of these three amounts, less applicable reserves. Eligible accounts receivable, at any date of determination, is comprised of the aggregate value of all accounts directly created by a borrower (and in the case of Canadian accounts, a Canadian guarantor) in the ordinary course of business arising out of the sale of goods or the rendering of services, each of which has been invoiced, with such receivables adjusted to exclude various ineligible accounts, including, among other things, those to which a borrower (or guarantor, as applicable) does not have sole and absolute title and accounts arising out of a sale to an employee, officer, director, or affiliate of a borrower (or guarantor, as applicable). Eligible inventory, at any date of determination, is comprised of the net orderly liquidation value of all inventory owned by a borrower (and in the case of Canadian accounts, a Canadian guarantor).borrower. Qualified cash consists of cash in an eligible deposit account that is subject to customary restrictions and liens in favor of the lenders.

The Ryerson Credit Facility has an allocation of $660 million to the Company’s subsidiaries in the United States and an allocation of $90 million to Ryerson Holding’s Canadian subsidiary that is a borrower. Amounts outstanding under the Ryerson Credit Facility bear interest at (i) a rate determined by reference to (A) the base rate (the highest of the Federal Funds Rate plus 0.50%, Bank of America, N.A.’s prime rate, and the one-month LIBOR rate plus 1.00%, however, in no event shall the base rate be less than 1.25%), or (B) a LIBOR rate (with a floor of 0.25%) or, (ii) for Ryerson Holding’s Canadian subsidiary that is a borrower, (A) a rate determined by reference to the Canadian base rate (the greatest of the Federal Funds Rate plus 0.50%, Bank of America-Canada Branch’s “base rate” for commercial loans in U.S. Dollars made at its “base rate”, and the 30 day LIBOR rate plus 1.00%), (B) the prime rate (the greater of Bank of America-Canada Branch’s “prime rate” for commercial loans made by it in Canada in Canadian Dollars and the one-month Canadian bankers’ acceptance rate (with a floor of 0.25%) plus 1.00%), or (C) the bankers’ acceptance rate. Therate, however, in no event shall the Canadian base rate or the Canadian prime rate be less than 1.25%). Until November 5, 2021 the spread over the base rate and prime rate is fixed at 0.50% and the spread over the LIBOR for the bankers’ acceptances is fixed at 1.50%. After November 5, 2021, the spread over the base rate and prime rate will be between 0.25% and 0.50% and the spread over the LIBOR and for the bankers’ acceptances iswill be between 1.25% and 1.50%, depending on the amount available to be borrowed under the Ryerson Credit Facility. The spread with respect to the FILO Facility, if any, will be determined at the time the commitments under the Ryerson Credit Facility are converted into such FILO Facility. Ryerson also pays commitment fees on amounts not borrowed at a rate of 0.225%. Overdue amounts and all amounts owed during the existence of a default bear interest at 2%2.00% above the rate otherwise applicable thereto. Ryerson also pays commitment fees on amounts not borrowed at a rate of 0.23%.Loans advanced under the FILO Facility may only be prepaid if all then outstanding revolving loans are repaid in full.

We attempt to minimize interest rate risk exposure through the utilization of interest rate swaps, which are derivative financial instruments. During March 2017,In June 2019, we entered into an interest rate swap to fix interest on $150$60 million of our floating rate debt under the Ryerson Credit Facility at a rate of 1.658%1.729% through March 2020. TheJune 2022. In November 2019, we entered into another interest rate swap has reset dates and critical terms that matchto fix interest on $100 million of our existingfloating rate debt andunder the anticipated critical termsRyerson Credit Facility at a rate of future debt.1.539% through November 2022. The weighted average interest rate on the outstanding borrowings under the Ryerson Credit Facility including the interest rate swap swaps was 2.7 percent2.7% and 2.2 percent2.9% at September 30, 2017March 31, 2021 and December 31, 2016,2020, respectively.

Borrowings under the Ryerson Credit Facility are secured by first-priority liens on all of the inventory, accounts receivables, lockbox accounts, and related assets of the borrowers and the guarantors.

The Ryerson Credit Facility also contains covenants that, among other things, restrict Ryerson Holding and its restricted subsidiaries with respect to the incurrence of debt, the creation of liens, transactions with affiliates, mergers and consolidations, sales of assets, and acquisitions. The Ryerson Credit Facility also requires that, if availability under the Ryerson Credit Facility declines to a certain level, Ryerson maintain a minimum fixed charge coverage ratio as of the end of each fiscal quarter, and includes defaults upon (among other things) the occurrence of a change of control of Ryerson and a cross-default to other financing arrangements.

The Ryerson Credit Facility contains events of default with respect to, among other things, default in the payment of principal when due or the payment of interest, fees, and other amounts due thereunder after a specified grace period, material misrepresentations, failure to perform certain specified covenants, certain bankruptcy events, the invalidity of certain security agreements or guarantees, material judgments, and the occurrence of a change of control of Ryerson. If such an event of default occurs, the lenders under the Ryerson Credit Facility will be entitled to various remedies, including acceleration of amounts outstanding under the Ryerson Credit Facility and all other actions permitted to be taken by secured creditors.

The lenders under the Ryerson Credit Facility maycould reject a borrowing request if any event, circumstance, or development has occurred that has had or could reasonably be expected to have a material adverse effect on the Company. If Ryerson Holding, JT Ryerson, any of the other borrowers, or any restricted subsidiaries of JT Ryerson becomes insolvent or commences bankruptcy proceedings, all amounts borrowed under the Ryerson Credit Facility will become immediately due and payable.

Net proceeds of short-term borrowings that are reflected in the Condensed Consolidated Statements of Cash Flows represent borrowings under the Ryerson Credit Facility with original maturities less than three months.

20222028 Notes

On May 24, 2016,July 22, 2020, JT Ryerson issued $650$500 million in aggregate principal amount of the 2022 Notesits 8.50% senior secured notes due 2028 (the “2022“2028 Notes”). The 20222028 Notes bear interest at a rate of 11.00%8.50% per annum. The 20222028 Notes are fully and unconditionally guaranteed on a senior secured basis by all of our existing and future domestic subsidiaries that are co-borrowers or that have guarantee obligations under the Ryerson Credit Facility. The net proceeds from the issuance of the 2028 Notes, along with available cash, were used to (i) redeem all of the 11.0% Senior Secured Notes due 2022 (the “2022 Notes”) and (ii) pay related transaction fees, expenses, and premiums. During the fourth quarter of 2020, a principal amount of $50.0 million of the 2028 Notes was redeemed for $51.5 million and retired. As a result, $450 million in aggregate principal amount remained outstanding at March 31, 2021.

The 20222028 Notes and the related guarantees are secured by a first-priority security interest in substantially all of JT Ryerson’s and each guarantor’s present and future assets located in the United States (other than receivables, inventory, cash deposit accounts and related general intangibles, certain other assets, and proceeds thereof)thereof, which are secured pursuant to a second-priority security interest), subject to certain exceptions and customary permitted liens. The 2022 Notes and the related guarantees are also secured on a second-priority basis by a lien on the assets that secure JT Ryerson’s and the Company’s obligations under the Ryerson Credit Facility.

The 20222028 Notes will be redeemable, in whole or in part, at any time on or after May 15, 2019August 1, 2023 at certain redemption prices. The redemption price for the 20222028 Notes if redeemed during the twelve months beginning (i) May 15, 2019August 1, 2023 is 105.50%104.250%, (ii) May 15, 2020August 1, 2024 is 102.75%102.125%, and (iii) May 15, 2021August 1, 2025 and thereafter is 100.00%100.000%. All redemption amounts also include accrued and unpaid interest, if any, to, but not including, the redemption date. JT Ryerson may also redeem some or all of the 20222028 Notes before May 15, 2019August 1, 2023 at a redemption price of 100.00%100.000% of the principal amount, plus accrued and unpaid interest, if any, to, but not including, the redemption date, plus a “make-whole” premium. In addition, JT Ryerson may redeem up to 35%40% of the 2022outstanding 2028 Notes before May 15, 2019 with respect to the 2022 NotesAugust 1, 2023 with the net cash proceeds from certain equity offerings at a price equal to 111.00%, with respect to the 2022 Notes,108.500% of the principal amount thereof,of the Notes, plus accrued but unpaid interest, if any, to, but not including, the redemption date. Furthermore, JT Ryerson may redeem the 2028 Notes at any time and from time to time prior to August 1, 2023 in an aggregate principal amount equal to up to 10% of the original aggregate principal amount of the 2028 Notes during each twelve month period commencing on July 22, 2020 at a redemption price of 103.000%, plus accrued and unpaid interest, if any.any, to, but not including, the redemption date. JT Ryerson may also redeem the 2028 Notes at any time prior to August 1, 2022 in an aggregate principal amount equal to $100.0 million on a one-time basis from the net cash proceeds received from the sale of real property, at a redemption price of 104.000% plus accrued and unpaid interest, if any, to, but not including, the redemption date. In addition, JT Ryerson may be required to make an offer to purchase the 20222028 Notes upon the sale of certain assets or upon a change of control.

The 2022Company evaluated the redemption options within the 2028 Notes for embedded derivatives and determined that one redemption option required bifurcation as it is not clearly and closely related to the debt agreement. The Company recorded the

embedded derivative as of December 31, 2020 based on a fair value of $2.3 million within other current assets in the Condensed Consolidated Balance Sheet. As of March 31, 2021, the fair value was determined to be $2.6 million with the change of $0.3 million recognized within other income and (expense), net on the Condensed Consolidated Statements of Comprehensive Income. Refer to Note 10: Derivatives and Fair Value Measurements for further discussion of the embedded derivative.

The 2028 Notes contain customary covenants that, among other things, limit, subject to certain exceptions, our ability, and the ability of our restricted subsidiaries, to incur additional indebtedness, pay dividends on our capital stock or repurchase our capital stock, make investments, sell assets, engage in acquisitions, mergers, or consolidations, or create liens or use assets as security in other transactions. Subject to certain exceptions, JT Ryerson may only pay dividends to Ryerson Holding to

During the extentfirst three months of 50%2020, a principal amount of future net income, once prior losses are offset.

The net proceeds from the issuance$54.6 million of the 2022 Notes along with borrowings under the Ryerson Credit Facility, were used to (i) repurchase and/or redeem in full the $569.9 million balance of JT Ryerson’s 9% Senior Secured Notes due 2017 (the “2017 Notes”), plus accrued and unpaid interest thereon up to, but not including, the repayment date, (ii) repurchase $95 million of the 11.25% Senior Secured Notes due 2018 (the “2018 Notes”), and (iii) pay related fees, expenses and premiums.

The Company applied the provisions of ASC 470-50, “Modifications and Extinguishments” in accounting for the issuance of the 2022 Notes, redemption of the 2017 Notes and partial repurchase of the 2018 Notes. The evaluation of the accounting under ASC 470-50 was performed on a creditor by creditor basis in order to determine if the terms of the debt were substantially different and, as a result, whether to apply modification or extinguishment accounting. For the lenders where it was determined that the terms of the debt were not substantially different, modification accounting was applied. For the remaining lenders, extinguishment accounting was applied. In connection with this debt modification and extinguishment, the Company recorded a $16.0 million loss within other income and (expense), net on the Condensed Consolidated Statement of Comprehensive Income during 2016, primarily attributed to the costs incurred with third parties for arrangement fees, legal and other services related to the modified debt, as well as redemption