000-55931

FORM 10-Q

(Mark One)

| ||

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

2021

| |||||

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

000-55931

|

| ||||||||||||||||

Maryland | 81-0696966 | ||||||||||||||||

| (State or other jurisdiction of

| (I.R.S. Employer

| ||||||||||||||||

| 345 Park Avenue | |||||||||||||||||

| New York | , | NY | 10154 | ||||||||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||||||||

345 Park Avenue

New York, New York 10154

(Address of principal executive offices) (Zip Code)

(212) 583-5000

(

code: (212) 583-5000

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Large accelerated filer |

| ☐ | Accelerated filer | ☐ | |||||||||||||

| Non-accelerated filer |

|

| Smaller reporting company | ☐ | |||||||||||||

| Emerging growth company |

| ☐ | |||||||||||||||

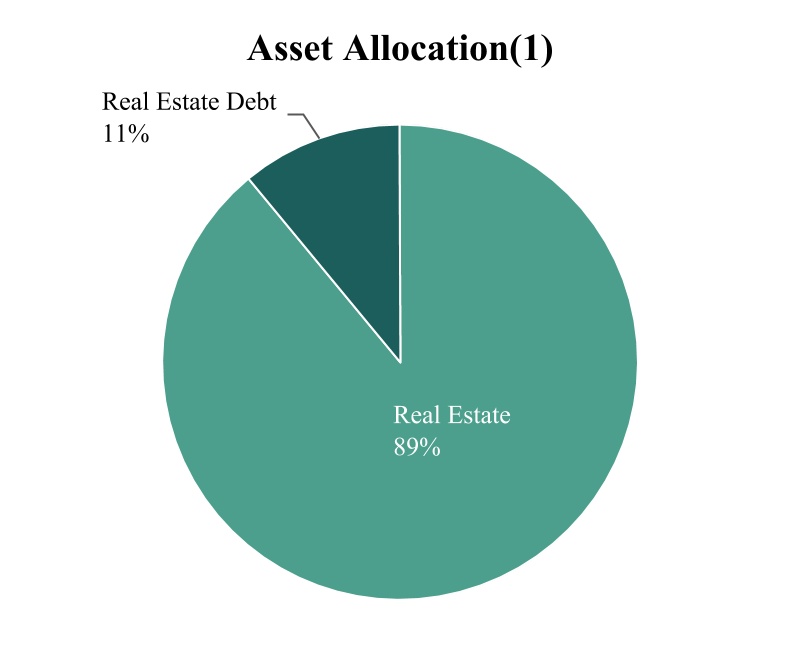

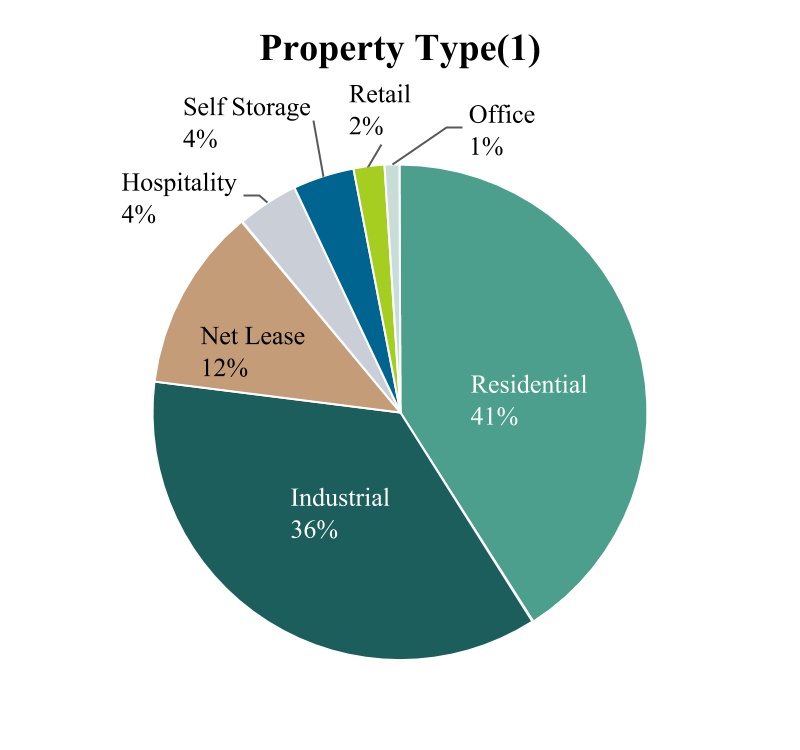

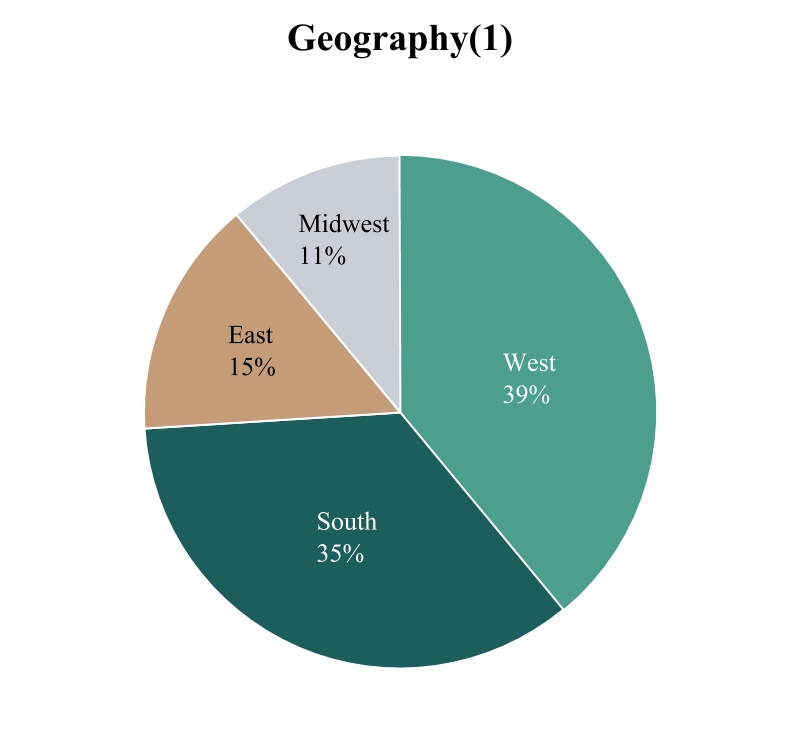

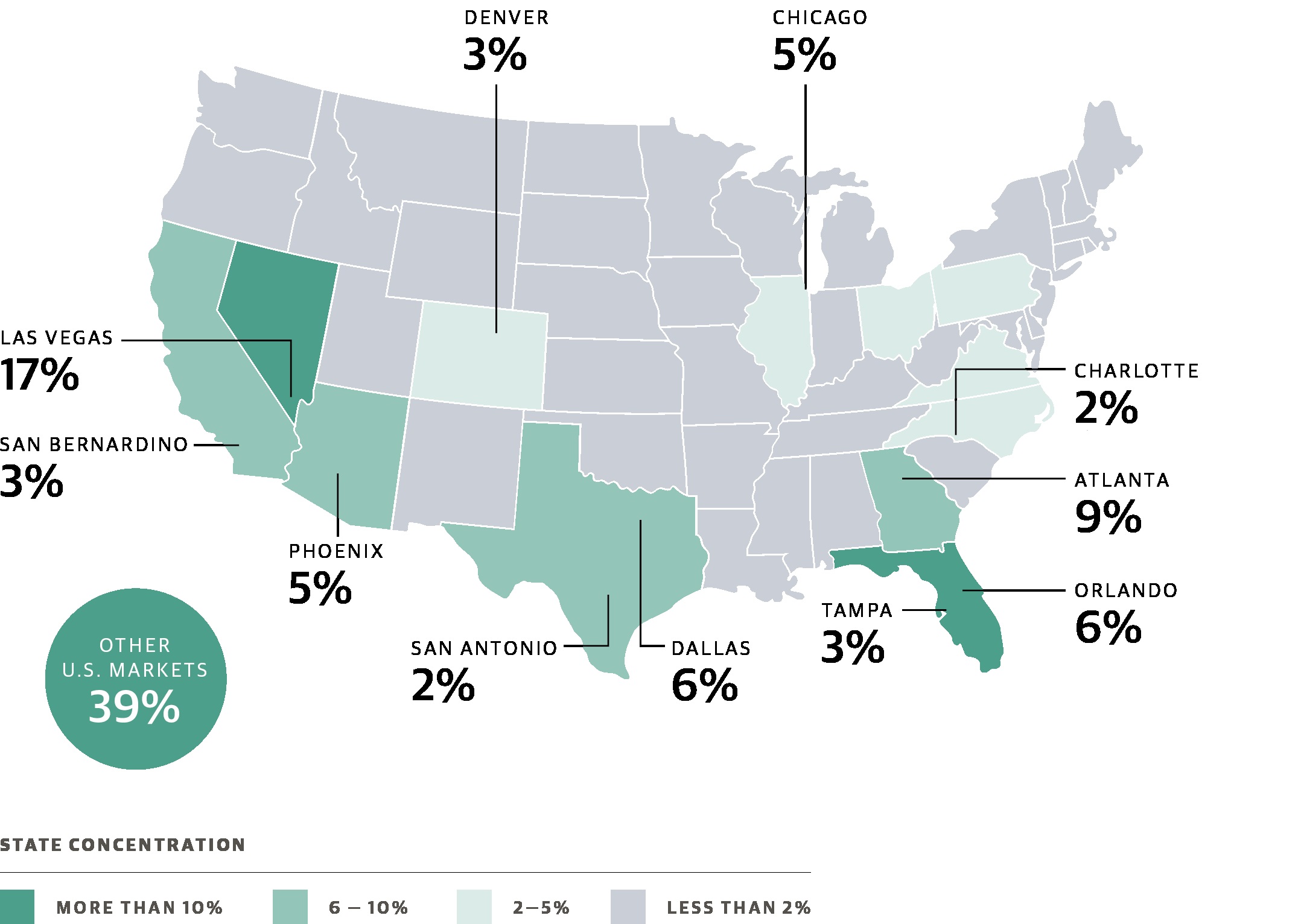

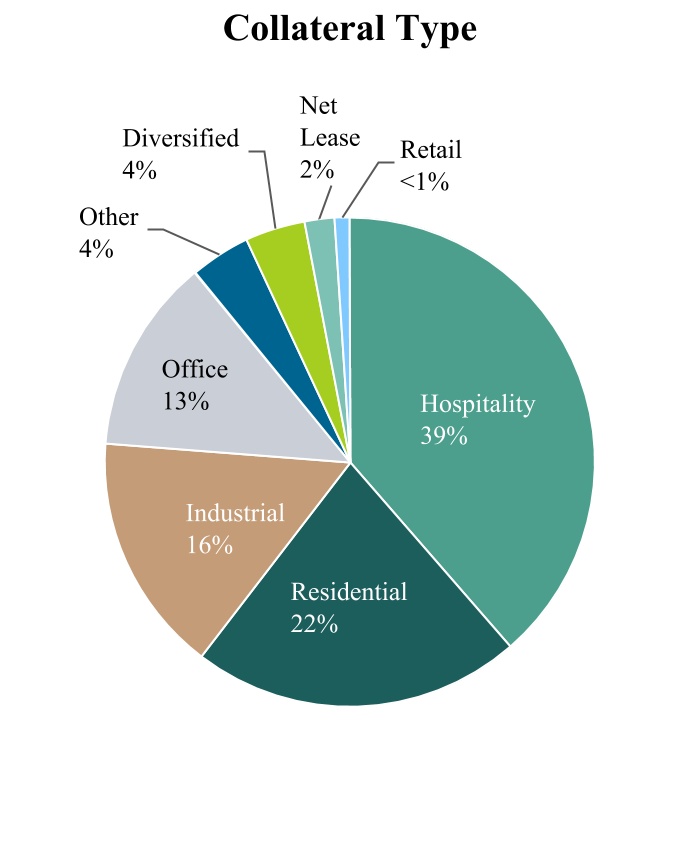

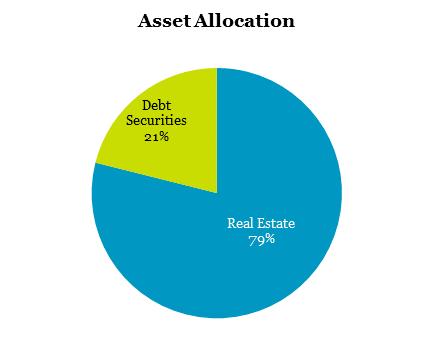

ITEM 1. ITEM 2. ITEM 3. ITEM 4. PART II. ITEM 1. ITEM 1A. ITEM 2. ITEM 3. ITEM 4. ITEM 5. ITEM 6. September 30, December 31, 2017 2016 Assets Investments in real estate, net $ 2,234,133 $ — Investments in real estate-related securities 644,371 — Cash and cash equivalents 30,820 200 Restricted cash 105,881 — Intangible assets, net 88,510 — Other assets 23,754 — Total assets $ 3,127,469 $ 200 Liabilities and Equity Mortgage notes, term loan, and revolving credit facility, net $ 1,155,391 $ — Repurchase agreements 478,455 — Affiliate line of credit 122,676 — Due to affiliates 101,983 86 Subscriptions received in advance 98,435 — Accounts payable, accrued expenses, and other liabilities 58,103 29 Total liabilities $ 2,015,043 $ 115 Commitments and contingencies — — Equity Preferred stock, $0.01 par value per share, 100,000,000 shares authorized; none issued and outstanding as of September 30, 2017 and December 31, 2016 — — Common stock — Class S shares, $0.01 par value per share, 500,000,000 shares authorized; 98,779,308 and no shares issued and outstanding as of September 30, 2017 and December 31, 2016, respectively 988 — Common stock — Class T shares, $0.01 par value per share, 500,000,000 shares authorized; 2,208,763 and no shares issued and outstanding as of September 30, 2017 and December 31, 2016, respectively 22 — Common stock — Class D shares, $0.01 par value per share, 500,000,000 shares authorized; 1,225,700 and no shares issued and outstanding as of September 30, 2017 and December 31, 2016, respectively 12 — Common stock — Class I shares, $0.01 par value per share, 500,000,000 shares authorized; 23,277,430 and 20,000 shares issued and outstanding as of September 30, 2017 and December 31, 2016, respectively 233 — Additional paid-in capital 1,177,444 200 Accumulated deficit and cumulative distributions (75,129 ) (115 ) Total stockholders' equity 1,103,570 85 Non-controlling interests 8,856 — Total equity 1,112,426 85 Total liabilities and equity $ 3,127,469 $ 200 Three Months Ended September 30, Nine Months Ended September 30, For the Period March 2, 2016 (date of initial capitalization) through September 30, 2017 2016 2017 2016 Revenues Rental revenue $ 33,599 $ — $ 55,727 $ — Tenant reimbursement income 3,230 — 5,503 — Hotel revenue 9,874 — 15,048 — Other revenue 2,201 — 3,409 — Total revenues 48,904 — 79,687 — Expenses Rental property operating 15,938 — 25,632 — Hotel operating 6,668 — 9,617 — General and administrative 1,716 — 5,969 — Management fee 3,712 — 3,712 — Performance participation allocation 5,711 — 10,952 — Depreciation and amortization 40,359 — 65,145 — Total expenses 74,104 — 121,027 — Other income (expense) Income from real estate-related securities 4,026 — 7,435 — Interest income 36 — 418 — Interest expense (10,866 ) — (16,413 ) — Other expenses (27 ) (55 ) Total other (expense) income (6,831 ) — (8,615 ) — Net loss before income tax (32,031 ) — (49,955 ) — Income tax benefit 184 — 140 — Net loss $ (31,847 ) $ — $ (49,815 ) $ — Net loss attributable to non-controlling interests $ 122 $ — $ 122 $ — Net loss attributable to BREIT stockholders $ (31,725 ) $ — $ (49,693 ) $ — Net loss per share of common stock — basic and diluted $ (0.28 ) $ — $ (0.66 ) $ — Weighted-average shares of common stock outstanding, basic and diluted 112,585,463 20,000 75,771,929 20,000 Par Value Accumulated Common Common Common Common Additional Deficit and Total Stock Stock Stock Stock Paid-in Cumulative Stockholders' Non-controlling Total Class S Class T Class D Class I Capital Distributions Equity Interests Equity Balance at December 31, 2016 $ — $ — $ — $ — $ 200 $ (115 ) $ 85 $ — $ 85 Common stock issued 978 22 12 230 1,262,811 — 1,264,053 — 1,264,053 Offering costs — — — — (98,938 ) — (98,938 ) — (98,938 ) Distribution reinvestment 10 — — 3 13,481 — 13,494 — 13,494 Common stock repurchased — — — — (187 ) — (187 ) — (187 ) Amortization of restricted stock grants — — — — 77 — 77 — 77 Net loss — — — — — (49,693 ) (49,693 ) (122 ) (49,815 ) Distributions declared on common stock — — — — — (25,321 ) (25,321 ) — (25,321 ) Contributions from non-controlling interests — — — — — — — 8,978 8,978 Balance at September 30, 2017 $ 988 $ 22 $ 12 $ 233 $ 1,177,444 $ (75,129 ) $ 1,103,570 $ 8,856 $ 1,112,426 Nine Months Ended September 30, 2017 For the Period March 2, 2016 (date of initial capitalization) through September 30, 2016 Cash flows from operating activities: Net loss $ (49,815 ) — Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation and amortization 65,145 — Unrealized gain on changes in fair value of financial instruments (993 ) — Realized loss on settlement of real estate-related securities 177 — Straight-line rent adjustment (1,118 ) — Amortization of above- and below-market lease intangibles (792 ) — Amortization of below-market and prepaid ground lease intangibles 156 — Amortization of deferred financing costs 771 — Amortization of restricted stock grants 77 — Bad debt expense 709 — Change in assets and liabilities: (Increase) / decrease in other assets (10,824 ) — Increase / (decrease) in due to affiliates 18,523 — Increase / (decrease) in accounts payable, accrued expenses, and other liabilities 22,244 — Net cash provided by operating activities 44,260 — Cash flows from investing activities: Acquisitions of real estate (2,245,885 ) — Capital improvements to real estate (3,290 ) — Pre-acquisition costs (9,201 ) — Purchase of real estate-related securities (660,151 ) — Proceeds from settlement of real estate-related securities 16,596 — Net cash used in investing activities (2,901,931 ) — Cash flows from financing activities: Proceeds from issuance of common stock 1,264,053 — Offering costs paid (15,388 ) — Subscriptions received in advance 98,435 — Repurchase of common stock (187 ) — Borrowings from mortgage notes, term loan, and revolving credit facility 1,055,913 — Borrowings under repurchase agreements 491,026 — Settlement of repurchase agreements (12,571 ) — Borrowings from affiliate line of credit 617,650 — Repayments on affiliate line of credit (495,150 ) — Payment of deferred financing costs (12,384 ) — Contributions from non-controlling interests 8,978 — Distributions (6,203 ) — Net cash provided by financing activities 2,994,172 — Net change in cash and cash equivalents and restricted cash 136,501 — Cash and cash equivalents and restricted cash, beginning of period $ 200 $ 200 Cash and cash equivalents and restricted cash, end of period $ 136,701 $ 200 Reconciliation of cash and cash equivalents and restricted cash to the consolidated balance sheets: Cash and cash equivalents $ 30,820 $ 200 Restricted cash 105,881 — Total cash and cash equivalents and restricted cash $ 136,701 $ 200 Non-cash investing and financing activities: Assumption of mortgage notes in conjunction with acquisitions of real estate $ 107,369 — Assumption of other liabilities in conjunction with acquisitions of real estate $ 17,093 — Accrued capital expenditures and acquisition related costs $ 314 — Accrued pre-acquisition costs $ 905 — Accrued distributions $ 5,624 — Accrued stockholder servicing fee due to affiliate $ 75,998 — Accrued offering costs due to affiliate $ 7,552 — Distribution reinvestment $ 13,494 — Accrued deferred financing costs $ 307 — the real estate group of Blackstone, a leading global investment manager. The Company Certain of the joint ventures formed by the Company provide the other partner a profits interest based on certain internal rate of return hurdles being achieved. Any profits interest due to the other partner is reported within non-controlling interests. Investments in Real Estate Class S Class T Class D Class I Selling commissions and dealer manager fees (% of transaction price) up to 3.5% up to 3.5% — — Stockholder servicing fee (% of NAV) 0.85% 0.85% 0.25% — Recent Accounting Pronouncements September 30, 2017 Building and building improvements $ 1,850,698 Land and land improvements 367,012 Furniture, fixtures and equipment 40,364 Total 2,258,074 Accumulated depreciation (23,941 ) Investments in real estate, net $ 2,234,133 Property Name Ownership Interest Number of Properties Location Sector Acquisition Date Purchase Price(1) Hyatt Place UC Davis(2) 100% 1 Davis, CA Hotel Jan. 2017 $ 32,687 Sonora Canyon 100% 1 Mesa, AZ Multifamily Feb. 2017 40,983 Stockton 100% 1 Stockton, CA Industrial Feb. 2017 32,751 Bakers Centre 100% 1 Philadelphia, PA Retail Mar. 2017 54,223 TA Multifamily Portfolio 100% 6 Various(3) Multifamily Apr. 2017 432,593 HS Industrial Portfolio 100% 38 Various(4) Industrial Apr. 2017 405,930 Emory Point(2) 100% 1 Atlanta, GA Multifamily(5) May 2017 201,578 Nevada West 100% 3 Las Vegas, NV Multifamily May 2017 170,965 Hyatt Place San Jose Downtown 100% 1 San Jose, CA Hotel June 2017 65,321 Mountain Gate & Trails 100% 2 Las Vegas, NV Multifamily June 2017 83,572 Elysian West 100% 1 Las Vegas, NV Multifamily July 2017 107,027 Florida Select-Service 4-Pack 100% 4 Tampa & Orlando, FL Hotel July 2017 58,973 Hyatt House Downtown Atlanta 100% 1 Atlanta, GA Hotel Aug. 2017 35,332 Harbor 5 100% 5 Dallas, TX Multifamily Aug. 2017 146,161 Gilbert Multifamily 90% 2 Gilbert, AZ Multifamily Sept. 2017 147,039 Domain & GreenVue Multifamily 100% 2 Dallas, TX Multifamily Sept. 2017 134,452 Fairfield Industrial 100% 11 Fairfield, NJ Industrial Sept. 2017 74,283 ACG II Multifamily Portfolio 94% 4 Various (6) Multifamily Sept. 2017 148,038 85 $ 2,371,908 TA Multifamily Portfolio HS Industrial Portfolio Emory Point Nevada West All Other Total Building and building improvements $ 337,889 $ 345,391 $ 171,709 $ 145,305 $ 847,905 $ 1,848,199 Land and land improvements 68,456 45,081 — 17,409 235,876 366,822 Furniture, fixtures and equipment 4,651 — 3,040 2,833 28,892 39,416 In-place lease intangibles 21,880 20,793 11,207 5,418 46,094 105,392 Below-market ground lease intangibles — — — — 4,683 4,683 Above-market lease intangibles 24 2,726 84 — 465 3,299 Below-market lease intangibles (307 ) (8,061 ) (576 ) — (3,749 ) (12,693 ) Prepaid ground lease rent — — 16,114 — — 16,114 Other intangibles — — — — 676 676 Total purchase price $ 432,593 $ 405,930 $ 201,578 $ 170,965 $ 1,160,842 $ 2,371,908 Assumed mortgage notes(1) — — — — 108,971 108,971 Net purchase price $ 432,593 $ 405,930 $ 201,578 $ 170,965 $ 1,051,871 $ 2,262,937 September 30, 2017 Intangible assets: In-place lease intangibles $ 104,735 Below-market ground lease intangibles 4,683 Above-market lease intangibles 3,299 Prepaid ground lease rent 16,114 Other 676 Total intangible assets 129,507 Accumulated amortization: In-place lease amortization (40,496 ) Below-market ground lease amortization (62 ) Above-market lease amortization (314 ) Prepaid ground lease rent amortization (94 ) Other (31 ) Total accumulated amortization (40,997 ) Intangible assets, net $ 88,510 Intangible liabilities: Below-market lease intangibles $ 12,693 Accumulated amortization (1,106 ) Intangible liabilities, net $ 11,587 In-place Lease Intangibles Below-market Ground Lease Intangibles Above-market Lease Intangibles Pre-paid Ground Lease Intangibles Below-market Lease Intangibles 2017 (remaining) $ 23,448 $ 22 $ 194 $ 57 $ (743 ) 2018 20,145 89 722 227 (2,745 ) 2019 6,370 89 496 227 (2,060 ) 2020 5,264 89 473 227 (1,866 ) 2021 4,101 89 442 227 (1,617 ) Thereafter 4,911 4,243 658 15,055 (2,556 ) $ 64,239 $ 4,621 $ 2,985 $ 16,020 $ (11,587 ) Number of Investments Credit Rating(1) Collateral Weighted Average Coupon(2) Weighted Average Maturity Date Face Amount Cost Basis Fair Value 5 BBB Office, Hospitality, Industrial, Retail L+2.16% 4/28/2030 $ 132,034 $ 132,034 $ 132,363 11 BB Hospitality, Office, Retail, Multifamily L+3.22% 4/5/2034 333,578 333,466 333,777 8 B Hospitality, Office, Multifamily L+4.12% 11/30/2032 177,950 177,878 178,231 24 $ 643,562 $ 643,378 $ 644,371 Property Interest Rate(1) Maturity Dates Principal Balance Amortization Period Prepayment Provisions(2) TA Multifamily (excluding 55 West) 3.76% 6/1/2024 $ 211,249 Interest Only Yield Maintenance Industrial Properties - Term Loan L+2.10% 6/1/2022 146,000 Interest Only Spread Maintenance Industrial Properties - Revolving Credit Facility L+2.10% 6/1/2022 146,000 Interest Only None Emory Point 3.66% 5/5/2024 130,000 Interest Only(4) Yield Maintenance Nevada West 3.75% 9/1/2024 121,380 Interest Only Yield Maintenance Elysian West 3.77% 9/1/2024 75,400 Interest Only Yield Maintenance 55 West (part of TA Multifamily Portfolio) L+2.18% 5/9/2022(3) 63,600 Interest Only Spread Maintenance Mountain Gate & Trails 3.75% 9/1/2024 59,985 Interest Only Yield Maintenance Gilbert Vistara 4.09% 10/1/2028 48,129 Interest Only Yield Maintenance Gilbert Redstone 4.92% 4/10/2029 40,484 Interest Only(5) Yield Maintenance ACG II - Highlands 3.62% 10/1/2024 27,715 Interest Only Yield Maintenance Sonora Canyon 3.76% 6/1/2024 26,455 Interest Only Yield Maintenance ACG II - Brooks Landing 4.60% 10/6/2025 24,500 Interest Only Yield Maintenance ACG II - Woodlands 4.83% 3/6/2024 23,485 Interest Only(5) Yield Maintenance ACG II - Sterling Pointe 5.36% 1/6/2024 18,900 Interest Only(5) Yield Maintenance Total principal balance 1,163,282 Deferred financing costs, net (9,493 ) Premium on assumed debt, net 1,602 Mortgage notes, term loan, and revolving credit facility, net $ 1,155,391 Year Amount 2017 (remaining) $ — 2018 227 2019 510 2020 622 2021 834 Thereafter 1,161,089 Total $ 1,163,282 Facility Interest Rate(1) Maturity Dates(2) Security Interests Collateral Assets(3) Outstanding Balance Prepayment Provisions Citi MRA L+1.25% - L+1.70% 10/16/2017 - 12/28/2017 CMBS $ 580,899 $ 429,294 None RBC MRA L+1.25% - L+1.45% 10/20/2017 CMBS 63,472 49,161 None $ 644,371 $ 478,455 September 30, 2017 December 31, 2016 Real estate taxes payable $ 15,867 $ — Intangible liabilities, net 11,587 — Accounts payable and accrued expenses 9,501 — Tenant security deposits 5,685 — Distribution payable 5,624 — Accrued interest expense 4,397 — Prepaid rental income 4,098 — Other 1,344 29 Total $ 58,103 $ 29 Classification Number of Shares (in thousands) Par Value Preferred Stock 100,000 $ 0.01 Class S Shares 500,000 $ 0.01 Class T Shares 500,000 $ 0.01 Class D Shares 500,000 $ 0.01 Class I Shares 500,000 $ 0.01 Total 2,100,000 Nine Months Ended September 30, 2017 Class S Class T Class D Class I Total Beginning balance — — — 20 20 Common stock issued 97,801 2,206 1,221 22,932 124,160 Distribution reinvestment 993 3 5 313 1,314 Common stock repurchased (15 ) — — (4 ) (19 ) Directors’ restricted stock grant(1) — — — 16 16 Ending balance 98,779 2,209 1,226 23,277 125,491 Class S Class I Class D Class T Aggregate distributions declared per share of common stock $ 0.3245 $ 0.3245 $ 0.2471 $ 0.2030 Stockholder servicing fee per share of common stock (0.0598 ) — (0.0108 ) (0.0289 ) Net distributions declared per share of common stock $ 0.2647 $ 0.3245 $ 0.2363 $ 0.1741 September 30, 2017 December 31, 2016 Accrued stockholder servicing fee $ 75,998 $ — Performance participation allocation 10,952 — Advanced organization and offering costs 9,389 — Accrued management fee 3,712 — Accrued affiliate service provider expenses 1,797 — Advanced expenses 135 86 Total $ 101,983 $ 86 Year Future Commitments 2017 (remaining) $ 60 2018 239 2019 239 2020 239 2021 239 Thereafter 13,233 Total $ 14,249 Year Future Minimum Rents 2017 (remaining) $ 9,562 2018 37,139 2019 31,378 2020 28,275 2021 24,021 Thereafter 59,734 Total $ 190,109 September 30, 2017 Multifamily $ 1,588,958 Industrial 524,988 Hotel 200,301 Retail 55,644 Real Estate-Related Securities 646,373 Other (Corporate) 111,205 Total assets $ 3,127,469 Multifamily Industrial Hotel Retail Real Estate- Related Securities Total Revenues: Rental revenue $ 24,911 $ 7,737 $ — $ 951 $ — $ 33,599 Tenant reimbursement income 964 2,036 — 230 — 3,230 Hotel revenue — — 9,874 — — 9,874 Other revenue 2,182 7 — 12 — 2,201 Total revenues 28,057 9,780 9,874 1,193 — 48,904 Expenses: Rental property operating 12,588 3,029 — 321 — 15,938 Hotel operating — — 6,668 — — 6,668 Total expenses 12,588 3,029 6,668 321 — 22,606 Income from real estate-related securities — — — — 4,026 4,026 Segment net operating income $ 15,469 $ 6,751 $ 3,206 $ 872 $ 4,026 $ 30,324 Depreciation and amortization $ 32,606 $ 5,408 $ 1,862 $ 483 $ — $ 40,359 Other income (expense): General and administrative (1,716 ) Management fee (3,712 ) Performance participation allocation (5,711 ) Interest income 36 Interest expense (10,866 ) Other expenses (27 ) Income tax benefit 184 Net loss $ (31,847 ) Net loss attributable to non-controlling interests 122 Net loss attributable to BREIT stockholders $ (31,725 ) Multifamily Industrial Hotel Retail Real Estate- Related Securities Total Revenues: Rental revenue $ 39,466 $ 14,357 $ — $ 1,904 $ — $ 55,727 Tenant reimbursement income 1,472 3,703 — 328 — 5,503 Hotel revenue — — 15,048 — — 15,048 Other revenue 3,385 6 — 18 — 3,409 Total revenues 44,323 18,066 15,048 2,250 — 79,687 Expenses: Rental property operating 19,473 5,664 — 495 — 25,632 Hotel operating — — 9,617 — — 9,617 Total expenses 19,473 5,664 9,617 495 — 35,249 Income from real estate-related securities — — — — 7,435 7,435 Segment net operating income $ 24,850 $ 12,402 $ 5,431 $ 1,755 $ 7,435 $ 51,873 Depreciation and amortization $ 51,205 $ 9,852 $ 3,119 $ 969 $ — $ 65,145 Other income (expense): General and administrative (5,969 ) Management fee (3,712 ) Performance participation allocation (10,952 ) Interest income 418 Interest expense (16,413 ) Other expenses (55 ) Income tax benefit 140 Net loss $ (49,815 ) Net loss attributable to non-controlling interests 122 Net loss attributable to BREIT stockholders $ (49,693 ) Sector and Property/Portfolio Name Number of Properties Location Acquisition Date Ownership Interest(1) Acquisition Price (in thousands)(2) Sq. Feet (in thousands)/ Number of Rooms/Units Occupancy Rate(3) Multifamily: TA Multifamily Portfolio 6 Various(4) Apr. 2017 100% $ 432,593 2,514 units 94% Emory Point 1 Atlanta, GA May 2017 100% 201,578 750 units 100% Nevada West Multifamily 3 Las Vegas, NV May 2017 100% 170,965 972 units 92% Gilbert Multifamily 2 Gilbert, AZ Sept. 2017 90% 147,039 748 units 93% ACG II Multifamily 4 Various(5) Sept. 2017 94% 148,038 932 units 98% Harbor 5 5 Dallas, TX Aug. 2017 100% 146,161 1,192 units 94% Domain & GreenVue Multifamily 2 Dallas, TX Sept. 2017 100% 134,452 803 units 84% Elysian West 1 Las Vegas, NV July 2017 100% 107,027 466 units 91% Mountain Gate & Trails 2 Las Vegas, NV June 2017 100% 83,572 539 units 96% Sonora Canyon 1 Mesa, AZ Feb. 2017 100% 40,983 388 units 93% Total Multifamily 27 1,612,408 9,304 units Industrial: HS Industrial Portfolio 38 Various(4) Apr. 2017 100% 405,930 5,972 sq. ft. 96% Fairfield Industrial 11 Fairfield, NJ Sept. 2017 100% 74,283 578 sq. ft. 100% Stockton 1 Stockton, CA Feb. 2017 100% 32,751 878 sq. ft. 87% Total Industrial 50 512,964 7,428 sq. ft. Hotel: Hyatt Place San Jose Downtown 1 San Jose, CA June 2017 100% 65,321 236 rooms 83% Florida Select-Service 4-Pack 4 Tampa & Orlando, FL July 2017 100% 58,973 469 rooms 71% Hyatt House Downtown Atlanta 1 Atlanta, GA Aug. 2017 100% 35,332 150 rooms 78% Hyatt Place UC Davis 1 Davis, CA Jan. 2017 100% 32,687 127 rooms 87% Total Hotel 7 192,313 982 rooms Retail: Bakers Centre 1 Philadelphia, PA Mar. 2017 100% 54,223 237 sq. ft. 95% Total Retail 1 54,223 237 sq. ft. Total Investments in Real Estate 85 $ 2,371,908 Number of Investments Credit Rating(1) Collateral Weighted Average Coupon(2) Weighted Average Maturity Date Face Amount Cost Basis Fair Value 5 BBB Office, Hospitality, Industrial, Retail L+2.16% 4/28/2030 $ 132,034 $ 132,034 $ 132,363 11 BB Hospitality, Office, Retail, Multifamily L+3.22% 4/5/2034 333,578 333,466 333,777 8 B Hospitality, Office, Multifamily L+4.12% 11/30/2032 177,950 177,878 178,231 24 $ 643,562 $ 643,378 $ 644,371 Three Months Ended Nine Months Ended September 30, 2017 September 30, 2017 Rental revenue Multifamily $ 24,911 $ 39,466 Industrial 7,737 14,357 Retail 951 1,904 Total rental revenue 33,599 55,727 Hotel revenue 9,874 15,048 Total rental and hotel revenue $ 43,473 $ 70,775 Year Number of Expiring Leases Annualized Base Rent(1) % of Total Annualized Base Rent Expiring Square Feet % of Total Square Feet Expiring 2017 (remainder) 1 $ 418 1% 131 2% 2018 24 6,906 16% 1,129 15% 2019 19 5,575 13% 982 13% 2020 16 3,960 9% 641 9% 2021 21 8,082 18% 1,465 20% 2022 16 5,781 13% 907 12% 2023 19 6,341 14% 1,099 15% 2024 9 1,579 4% 190 3% 2025 8 2,937 7% 484 7% 2026 4 571 1% 73 1% Thereafter 4 1,720 4% 189 3% Total 141 $ 43,870 100% 7,290 100% Three Months Ended September 30, 2017 Nine Months Ended September 30, 2017 Property Average Daily Rate RevPAR Average Daily Rate RevPAR Hyatt Place UC Davis $ 160 $ 143 $ 165 $ 144 Hyatt Place San Jose Downtown $ 197 $ 163 $ 213 $ 177 Florida Select-Service 4-Pack $ 107 $ 76 $ 108 $ 76 Hyatt House Downtown Atlanta $ 175 $ 136 $ 175 $ 136 Three Months Ended September 30, 2017 Nine Months Ended September 30, 2017 Revenues Rental revenue $ 33,599 $ 55,727 Tenant reimbursement income 3,230 5,503 Hotel revenue 9,874 15,048 Other revenue 2,201 3,409 Total revenues 48,904 79,687 Expenses Rental property operating 15,938 25,632 Hotel operating 6,668 9,617 General and administrative 1,716 5,969 Management fee 3,712 3,712 Performance participation allocation 5,711 10,952 Depreciation and amortization 40,359 65,145 Total expenses 74,104 121,027 Other income (expense) Income from real estate-related securities 4,026 7,435 Interest income 36 418 Interest expense (10,866 ) (16,413 ) Other expense (27 ) (55 ) Total other (expense) income (6,831 ) (8,615 ) Income before income tax (32,031 ) (49,955 ) Income tax benefit 184 140 Net loss (31,847 ) (49,815 ) Net loss attributable to non-controlling interests 122 122 Net loss attributable to BREIT stockholders $ (31,725 ) $ (49,693 ) Three Months Ended September 30, 2017 Nine Months Ended September 30, 2017 Net loss attributable to BREIT stockholders $ (31,725 ) $ (49,693 ) Adjustments: Real estate depreciation and amortization 40,359 65,145 Amount attributable to non-controlling interests for above adjustment (169 ) (169 ) Funds from Operations attributable to BREIT stockholders $ 8,465 $ 15,283 Three Months Ended September 30, 2017 Nine Months Ended September 30, 2017 Funds from Operations attributable to BREIT stockholders $ 8,465 $ 15,283 Adjustments: Straight-line rental income (551 ) (1,118 ) Amortization of above- and below-market lease intangibles (427 ) (792 ) Amortization of below-market and prepaid ground lease intangible 79 156 Organization costs — 1,838 Unrealized gains (losses) from changes in the fair value of real estate-related securities 641 (966 ) Amortization of restricted stock awards 25 77 Performance participation allocation 5,711 10,952 Adjusted Funds from Operations attributable to BREIT stockholders $ 13,943 $ 25,430 Components of NAV September 30, 2017 Investments in real property $ 2,437,266 Investments in real estate-related securities 644,371 Cash and cash equivalents 30,820 Restricted cash 105,881 Other assets 22,553 Debt obligations (1,756,385 ) Subscriptions received in advance (98,435 ) Other liabilities (48,836 ) Accrued performance participation allocation (10,952 ) Management fee payable (3,712 ) Accrued stockholder servicing fees(1) (744 ) Non-controlling interests in joint venture (9,025 ) Net Asset Value $ 1,312,802 Number of outstanding shares 125,491 NAV Per Share Class S Shares Class I Shares Class D Shares Class T Shares Total Monthly NAV $ 1,033,848 $ 243,433 $ 12,718 $ 22,803 $ 1,312,802 Number of outstanding shares 98,779 23,277 1,226 2,209 125,491 NAV Per Share $ 10.4662 $ 10.4579 $ 10.3763 $ 10.3239 Property Type Discount Rate Exit Capitalization Rate Multifamily 7.8% 5.7% Industrial 7.1% 6.7% Hospitality 9.8% 9.5% Input Hypothetical Change Multifamily Investment Values Industrial Investment Values Hospitality Investment Values Discount Rate 0.25% decrease +1.9% +1.5% +0.9% (weighted average) 0.25% increase (1.9%) (1.5%) (0.9%) Exit Capitalization Rate 0.25% decrease +2.8% +2.4% +1.9% (weighted average) 0.25% increase (2.7%) (2.2%) (1.8%) Reconciliation of Stockholders’ Equity to NAV September 30, 2017 Stockholders’ equity under U.S. GAAP $ 1,103,570 Adjustments: Accrued stockholder servicing fee 75,254 Organization and offering costs 9,389 Unrealized real estate appreciation 60,080 Accumulated depreciation and amortization 64,509 NAV $ 1,312,802 Three Months Ended September 30, 2017 Nine Months Ended September 30, 2017 Amount Percentage Amount Percentage Distributions Paid in cash $ 5,033 33 % $ 8,221 32 % Reinvested in shares 10,018 67 % 17,100 68 % Total distributions $ 15,051 100 % $ 25,321 100 % Sources of Distributions Cash flows from operating activities $ 15,051 100 % $ 25,321 100 % Offering proceeds — — % — — % Total sources of distributions $ 15,051 100 % $ 25,321 100 % Cash flows from operating activities $ 24,776 $ 44,260 Funds from Operations $ 8,465 $ 15,283 Indebtedness Interest Rate(1) Maturity Dates(2)(3) Maximum Facility Size Principal Balance Loans secured by our properties: TA Multifamily (excluding 55 West) 3.76% 6/1/2024 N/A $ 211,249 Industrial Properties - Term Loan L+2.10% 6/1/2022 N/A 146,000 Industrial Properties - Revolving Credit Facility L+2.10% 6/1/2022 146,000 146,000 Emory Point 3.66% 5/5/2024 N/A 130,000 Nevada West 3.75% 9/1/2024 N/A 121,380 Elysian West 3.77% 9/1/2024 N/A 75,400 55 West (part of TA Multifamily Portfolio) L+2.18% 5/9/2022(2) N/A 63,600 Mountain Gate & Trails 3.75% 9/1/2024 N/A 59,985 Gilbert Vistara 4.09% 10/1/2028 N/A 48,129 Gilbert Redstone 4.92% 4/10/2029 N/A 40,484 ACG II - Highlands 3.62% 10/1/2024 N/A 27,715 Sonora Canyon 3.76% 6/1/2024 N/A 26,455 ACG II - Brooks Landing 4.60% 10/6/2025 N/A 24,500 ACG II - Woodlands 4.83% 3/6/2024 N/A 23,485 ACG II - Sterling Pointe 5.36% 1/6/2024 N/A 18,900 Total loans secured by our properties 1,163,282 Repurchase agreement borrowings: Citi MRA L+1.25% - L+1.70% 10/16/2017 - 12/28/2017 N/A 429,294 RBC MRA L+1.25% - L+1.45% 10/20/2017 N/A 49,161 BAML MRA — — N/A — Total repurchase agreement borrowings 478,455 Line of Credit L+2.25% 1/23/2018 250,000 122,676 Citi Line of Credit(4) L+2.25% 10/26/2018 300,000 — Total indebtedness $ 1,764,413 Nine Months Ended September 30, 2017 Cash flows provided by operating activities $ 44,260 Cash flows used in investing activities (2,901,931 ) Cash flows provided by financing activities 2,994,172 Net increase in cash and cash equivalents and restricted cash $ 136,501 See Note 2 — “Summary of Significant Accounting Policies” to our condensed consolidated financial statements in this quarterly report on Form 10-Q for a discussion concerning recent accounting pronouncements. Obligations Total Less than 1 year 1-3 years 3-5 years More than 5 years Organizational and offering costs $ 9,389 $ 1,408 $ 3,756 $ 3,756 $ 469 Ground leases 14,249 239 478 478 13,054 Indebtedness (1) 1,947,404 524,129 89,108 381,789 952,378 Total $ 1,971,042 $ 525,776 $ 93,342 $ 386,023 $ 965,901 year ended December 31, 2020. Real Estate Debt Class S Shares Class I Shares Class D Shares Class T Shares Total Offering proceeds: Shares sold 98,779,308 23,241,230 1,225,700 2,208,763 125,455,001 Gross offering proceeds $ 997,265 $ 231,177 $ 12,454 $ 23,157 $ 1,264,053 Selling commissions and dealer manager fees (11,431 ) — — (659 ) (12,090 ) Accrued stockholder servicing fees (4,008 ) — (6 ) (28 ) (4,042 ) Other offering costs — — — — — Net offering proceeds $ 981,826 $ 231,177 $ 12,448 $ 22,470 $ 1,247,921 Use of offering proceeds: Purchase of real estate (2,245,885 ) Capital improvements to real estate (3,290 ) Pre-acquisition costs (9,201 ) Purchase of real estate-related securities (660,151 ) Proceeds from settlement of real estate-related securities 16,596 Repurchase of common stock (187 ) Borrowings from mortgage notes, term loan, and revolving credit facility 1,055,913 Borrowings under repurchase agreements 491,026 Settlement of repurchase agreements (12,571 ) Borrowings from Line of Credit 617,650 Repayments on Line of Credit (495,150 ) Payment of deferred financing costs (12,384 ) Contributions from non-controlling interests 8,978 Distributions to stockholders (6,203 ) Working capital 37,758 Cash and cash equivalents $ 30,820 quarter based on the average of the aggregate NAV per month over the prior three months. All unsatisfied repurchase requests must be resubmitted after the start of the next month or quarter, or upon the recommencement of the share repurchase plan, as applicable. Period Total Number of Shares Redeemed or Repurchased Average Price Paid per Share Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs Maximum Number of Shares that May Yet Be Purchased Pursuant to the Program July 1 – July 31, 2017 — $ — — (1) August 1 - August 31, 2017 3,594 9.80 3,594 (1) September 1 - September 30, 2017 15,327 9.90 15,327 (1) Total 18,921 $ 9.85 18,921 (1) 32.1 + 32.2 + 101.INS Inline XBRL Instance Document 101.SCH Inline XBRL Taxonomy Extension Schema Document 101.SCH Inline XBRL Taxonomy Extension Calculation Linkbase Document 101.LAB Inline XBRL Taxonomy Extension Label Linkbase Document 101.PRE Inline XBRL Taxonomy Extension Presentation Linkbase Document 101.DEF Inline XBRL Taxonomy Extension Definition Linkbase Document /s/ Frank Cohen Date Frank Cohen Chief Executive Officer (Principal Executive Officer) /s/ Date Chief Financial Officer and Treasurer (Principal Financial PART I. 346233738393939404141414243share and per share data) June 30, 2021 December 31, 2020 Assets Investments in real estate, net $ 33,951,388 $ 32,457,713 1,242,531 816,220 Investments in real estate debt 5,729,378 4,566,306 Cash and cash equivalents 1,680,991 333,388 Restricted cash 2,243,237 711,135 Other assets 3,134,330 1,799,253 Total assets $ 47,981,855 $ 40,684,015 Liabilities and Equity Mortgage notes, term loans, and secured revolving credit facilities, net $ 19,662,010 $ 19,976,161 Secured financings of investments in real estate debt 350,598 2,140,993 Unsecured revolving credit facilities 0 0 Due to affiliates 1,318,639 887,660 Other liabilities 3,344,477 1,465,194 Total liabilities 24,675,724 24,470,008 Commitments and contingencies 0 0 Redeemable non-controlling interests 43,646 30,056 Equity Common stock — Class S shares, $0.01 par value per share, 3,000,000 shares authorized; 921,838 and 702,853 shares issued and outstanding as of June 30, 2021 and December 31, 2020, respectively 9,218 7,029 Common stock — Class I shares, $0.01 par value per share, 6,000,000 shares authorized; 1,326,271 and 927,080 shares issued and outstanding as of June 30, 2021 and December 31, 2020, respectively 13,262 9,270 Common stock — Class T shares, $0.01 par value per share, 500,000 shares authorized; 50,188 and 45,943 shares issued and outstanding as of June 30, 2021 and December 31, 2020, respectively 502 459 Common stock — Class D shares, $0.01 par value per share, 500,000 shares authorized; 181,506 and 124,141 shares issued and outstanding as of June 30, 2021 and December 31, 2020, respectively 1,815 1,241 Additional paid-in capital 26,842,197 19,059,045 Accumulated deficit and cumulative distributions (4,008,476) (3,224,318) Total stockholders' equity 22,858,518 15,852,726 Non-controlling interests attributable to third party joint ventures 153,817 143,253 Non-controlling interests attributable to BREIT OP unitholders 250,150 187,972 Total equity 23,262,485 16,183,951 Total liabilities and equity $ 47,981,855 $ 40,684,015 share and per share data)Three Months Ended June 30, Six Months Ended June 30, 2021 2020 2021 2020 Revenues Rental revenue $ 680,809 $ 553,717 $ 1,333,725 $ 1,085,812 Hospitality revenue 102,660 21,781 160,803 149,253 Other revenue 26,714 17,249 49,110 32,564 Total revenues 810,183 592,747 1,543,638 1,267,629 Expenses Rental property operating 247,985 187,035 485,690 355,423 Hospitality operating 75,093 44,523 130,773 143,829 General and administrative 7,789 6,913 14,749 13,595 Management fee 92,183 53,423 165,278 102,925 Performance participation allocation 299,373 0 442,588 0 Impairment of investments in real estate 0 6,126 0 6,126 Depreciation and amortization 399,621 347,352 800,008 676,157 Total expenses 1,122,044 645,372 2,039,086 1,298,055 Other income (expense) Income from unconsolidated entities 70,028 25,336 104,710 38,605 Income (loss) from investments in real estate debt 116,573 492,889 355,934 (523,258) Net gain on dispositions of real estate 7,372 0 22,802 371 Interest income 9 233 95 1,980 Interest expense (181,529) (176,579) (363,147) (365,083) Loss on extinguishment of debt (2,757) 0 (6,173) (1,237) Other income (expense) 125,583 29,078 233,529 (19,770) Total other income (expense) 135,279 370,957 347,750 $ (868,392) Net (loss) income $ (176,582) $ 318,332 $ (147,698) $ (898,818) Net (income) loss attributable to non-controlling interests in third party joint ventures $ (264) $ 966 $ (323) $ 1,203 Net (income) loss attributable to non-controlling interests in BREIT OP 2,089 (4,859) 1,736 $ 11,967 Net (loss) income attributable to BREIT stockholders $ (174,757) $ 314,439 $ (146,285) $ (885,648) Net (loss) income per share of common stock — basic and diluted $ (0.08) $ 0.20 $ (0.07) $ (0.59) Weighted-average shares of common stock outstanding, basic and diluted 2,315,262 1,585,584 2,127,915 1,492,549 StatementStatements of Changes in Equity (Unaudited)thousands)thousands, except per share data)Par Value Accumulated

Deficit and

Cumulative

DistributionsNon-

controlling

Interests

Attributable

to Third Party

Joint VenturesNon-

controlling

Interests

Attributable

to BREIT OP

UnitholdersCommon

Stock

Class SCommon

Stock

Class ICommon

Stock

Class TCommon

Stock

Class DAdditional

Paid-in

CapitalTotal

Stockholders'

EquityTotal

EquityBalance at March 31, 2021 $ 7,835 $ 10,427 $ 471 $ 1,470 $ 21,507,160 $ (3,485,251) $ 18,042,112 $ 142,932 $ 254,072 $ 18,439,116 Common stock issued 1,363 2,919 30 339 5,595,388 — 5,600,039 — — 5,600,039 Offering costs — — — — (184,323) — (184,323) — — (184,323) Distribution reinvestment 61 67 4 11 173,079 — 173,222 — — 173,222 Common stock/units repurchased (41) (152) (3) (5) (242,356) — (242,557) — (160) (242,717) Amortization of compensation awards — 1 — — 124 — 125 — 692 817 Net loss ($195 allocated to redeemable non‑controlling interests) — — — — — (174,757) (174,757) 457 (2,087) (176,387) Distributions declared on common stock ($0.1615 gross per share) — — — — — (348,468) (348,468) — — (348,468) Contributions from non-controlling interests — — — — — — — 14,597 2,150 16,747 Distributions to and redemptions of non-controlling interests — — — — — — — (4,169) (4,517) (8,686) Allocation to redeemable non-controlling interests — — — — (6,875) — (6,875) — — (6,875) Balance at June 30, 2021 $ 9,218 $ 13,262 $ 502 $ 1,815 $ 26,842,197 $ (4,008,476) $ 22,858,518 $ 153,817 $ 250,150 $ 23,262,485 Par Value Accumulated

Deficit and

Cumulative

DistributionsNon-

controlling

Interests

Attributable

to Third Party

Joint VenturesNon-

controlling

Interests

Attributable

to BREIT OP

UnitholdersCommon

Stock

Class SCommon

Stock

Class ICommon

Stock

Class TCommon

Stock

Class DAdditional

Paid-in

CapitalTotal

Stockholders'

EquityTotal

EquityBalance at March 31, 2020 $ 6,111 $ 7,830 $ 439 $ 964 $ 16,278,758 $ (2,830,046) $ 13,464,056 $ 161,305 $ 190,241 $ 13,815,602 Common stock issued 258 474 12 73 875,751 — 876,568 — — 876,568 Offering costs — — — — (28,581) — (28,581) — — (28,581) Distribution reinvestment 54 51 3 8 123,128 — 123,244 — — 123,244 Common stock/units repurchased (101) (156) (14) (13) (297,305) — (297,589) — (1,420) (299,009) Amortization of compensation awards — 1 — — 99 — 100 — 500 600 — — — — — 314,439 314,439 (651) 4,854 318,642 Distributions declared on common stock ($0.1577 gross per share) — — — — — (234,382) (234,382) — — (234,382) Contributions from non-controlling interests — — — — — — — 1,916 1,257 3,173 Distributions to and redemptions of non-controlling interests — — — — — — — (3,111) (3,439) (6,550) Allocation to redeemable non-controlling interests — — — — 206 — 206 — — 206 Balance at June 30, 2020 $ 6,322 $ 8,200 $ 440 $ 1,032 $ 16,952,056 $ (2,749,989) $ 14,218,061 $ 159,459 $ 191,993 $ 14,569,513 Par Value Accumulated

Deficit and

Cumulative

Distributions Non-

controlling

Interests

Attributable

to Third Party

Joint VenturesNon-

controlling

Interests

Attributable

to BREIT OP

Unitholders Common

Stock

Class SCommon

Stock

Class ICommon

Stock

Class TCommon

Stock

Class DAdditional

Paid-in

CapitalTotal

Stockholders'

EquityTotal

EquityBalance at December 31, 2020 $ 7,029 $ 9,270 $ 459 $ 1,241 $ 19,059,045 $ (3,224,318) $ 15,852,726 $ 143,253 $ 187,972 $ 16,183,951 Common stock issued 2,180 4,371 44 566 8,511,302 — 8,518,463 — — 8,518,463 Offering costs — — — — (291,617) — (291,617) — — (291,617) Distribution reinvestment 118 125 7 21 323,125 — 323,396 — — 323,396 Common stock/units repurchased (109) (506) (8) (13) (750,252) — (750,888) (129) (1,450) (752,467) Amortization of compensation awards — 2 — — 244 — 246 — 1,869 2,115 Net loss ($538 allocated to redeemable non‑controlling interests) — — — — — (146,285) (146,285) 859 (1,734) (147,160) Distributions declared on common stock ($0.3215 gross per share) — — — — — (637,873) (637,873) — — (637,873) Contributions from non-controlling interests — — — — — — — 16,826 72,466 89,292 Distributions to and redemptions of non-controlling interests — — — — — — — (6,992) (8,973) (15,965) Allocation to redeemable non-controlling interests — — — — (9,650) — (9,650) — — (9,650) Balance at June 30, 2021 $ 9,218 $ 13,262 $ 502 $ 1,815 $ 26,842,197 $ (4,008,476) $ 22,858,518 $ 153,817 $ 250,150 $ 23,262,485 Par Value Accumulated Deficit and

Cumulative

Distributions Non-

controlling

Interests

Attributable

to Third Party

Joint VenturesNon-

controlling

Interests

Attributable

to BREIT OP

Unitholders Common

Stock

Class SCommon

Stock

Class ICommon

Stock

Class TCommon

Stock

Class DAdditional

Paid-in

CapitalTotal

Stockholders'

EquityTotal

EquityBalance at December 31, 2019 $ 5,308 $ 4,743 $ 398 $ 847 $ 11,716,721 $ (1,422,885) $ 10,305,132 $ 157,795 $ 151,721 $ 10,614,648 Common stock issued 1,243 3,713 60 214 5,946,595 — 5,951,825 — — 5,951,825 Offering costs — — — — (126,380) — (126,380) — — (126,380) Distribution reinvestment 99 88 6 15 227,958 — 228,166 — — 228,166 Common stock/units repurchased (328) (346) (24) (44) (812,734) — (813,476) — (1,755) (815,231) Amortization of compensation awards — 2 — — 198 — 200 — 1,000 1,200 Net loss ($1,010 allocated to redeemable non-controlling interests) — — — — — (885,648) (885,648) (208) (11,952) (897,808) Distributions declared on common stock ($0.3169 gross per share) — — — — — (441,456) (441,456) — — (441,456) Contributions from non-controlling interests — — — — — — — 11,171 59,893 71,064 Distributions to and redemptions of non-controlling interests — — — — — — — (9,299) (6,914) (16,213) Allocation to redeemable non-controlling interests — — — — (302) — (302) — — (302) Balance at June 30, 2020 $ 6,322 $ 8,200 $ 440 $ 1,032 $ 16,952,056 $ (2,749,989) $ 14,218,061 $ 159,459 $ 191,993 $ 14,569,513 Six Months Ended June 30, 2021 2020 Cash flows from operating activities: Net loss $ (147,698) $ (898,818) Adjustments to reconcile net loss to net cash provided by operating activities: Management fee Management fee 165,278 102,925 Performance participation allocation Performance participation allocation 442,588 0 Impairment of investments in real estate Impairment of investments in real estate 0 6,126 Depreciation and amortization 800,008 676,157 Net gain on dispositions of real estate Net gain on dispositions of real estate (22,802) (371) Loss on extinguishment of debt Loss on extinguishment of debt 6,173 1,237 Unrealized (gain) loss on changes in fair value of financial instruments Unrealized (gain) loss on changes in fair value of financial instruments (492,756) 648,455 Income from unconsolidated entities Income from unconsolidated entities (104,710) (38,605) Distributions from unconsolidated entities Distributions from unconsolidated entities 52,215 35,091 Other items Other items (4,895) (23,964) Change in assets and liabilities: (Increase) / decrease in other assets (70,386) (36,825) Increase / (decrease) in due to affiliates (1,880) 5,775 Increase / (decrease) in other liabilities Increase / (decrease) in other liabilities 52,107 7,612 Net cash provided by operating activities 673,242 484,795 Cash flows from investing activities: Acquisitions of real estate (2,087,840) (2,939,159) Capital improvements to real estate (171,046) (144,293) Proceeds from disposition of real estate Proceeds from disposition of real estate 94,977 4,488 Pre-acquisition costs and deposits Pre-acquisition costs and deposits (51,025) (11,671) Investment in unconsolidated entities Investment in unconsolidated entities (364,758) (808,312) Purchase of investments in real estate debt Purchase of investments in real estate debt (1,092,842) (874,326) Proceeds from sale/repayment of investments in real estate debt Proceeds from sale/repayment of investments in real estate debt 321,914 200,533 Purchase of real estate-related equity securities Purchase of real estate-related equity securities (955,601) (463,695) Sale of real estate-related equity securities Sale of real estate-related equity securities 0 102,932 Net cash used in investing activities (4,306,221) (4,933,503) Cash flows from financing activities: Proceeds from issuance of common stock 7,843,419 5,047,278 Offering costs paid (69,527) (48,008) Subscriptions received in advance 2,072,884 175,886 Repurchase of common stock (643,916) (720,157) Repurchase of management fee shares Repurchase of management fee shares (172,230) (76,631) Redemption of redeemable non-controlling interest Redemption of redeemable non-controlling interest (111,949) (83,625) Redemption of affiliate service provider incentive compensation awards Redemption of affiliate service provider incentive compensation awards (1,083) (1,755) Borrowings under mortgage notes, term loans, and secured revolving credit facilities Borrowings under mortgage notes, term loans, and secured revolving credit facilities 737,274 6,108,651 Repayments of mortgage notes, term loans, and secured revolving credit facilities Repayments of mortgage notes, term loans, and secured revolving credit facilities (1,064,309) (5,400,290) Borrowings under secured financings of investments in real estate debt Borrowings under secured financings of investments in real estate debt 0 1,490,542 Repayments of secured financings of investments in real estate debt Repayments of secured financings of investments in real estate debt (1,782,500) (2,216,689) Borrowings under affiliate unsecured revolving credit facility Borrowings under affiliate unsecured revolving credit facility 60,000 175,000 Repayments of affiliate unsecured revolving credit facility Repayments of affiliate unsecured revolving credit facility (60,000) (175,000) Borrowings under unsecured revolving credit facilities Borrowings under unsecured revolving credit facilities 0 130,000 Repayments of unsecured revolving credit facilities Repayments of unsecured revolving credit facilities 0 (130,000) Payment of deferred financing costs (18,119) (31,354) Contributions from non-controlling interests 15,687 22,017 Distributions to and redemptions of non-controlling interests Distributions to and redemptions of non-controlling interests (13,459) (14,251) Distributions (279,488) (189,722) Net cash provided by financing activities 6,512,684 4,061,892 Net change in cash and cash equivalents and restricted cash 2,879,705 (386,816) Cash and cash equivalents and restricted cash, beginning of period 1,044,523 1,109,702 Cash and cash equivalents and restricted cash, end of period $ 3,924,228 $ 722,886 Reconciliation of cash and cash equivalents and restricted cash to the condensed consolidated balance sheets: Reconciliation of cash and cash equivalents and restricted cash to the condensed consolidated balance sheets: Cash and cash equivalents $ 1,680,991 $ 263,067 Restricted cash 2,243,237 459,819 Total cash and cash equivalents and restricted cash $ 3,924,228 $ 722,886 Non-cash investing and financing activities: Assumption of mortgage notes in conjunction with acquisitions of real estate $ 0 $ 224,123 Assumption of other liabilities in conjunction with acquisitions of real estate $ 12,725 $ 1,482 Assumption of other liabilities in conjunction with acquisitions of investments in unconsolidated entities $ 9,249 $ 0 Accrued pre-acquisition costs $ 5,647 $ 0 Accrued capital expenditures and acquisition related costs $ 12,392 $ 6,920 Accrued distributions $ 35,257 $ 23,814 Accrued stockholder servicing fee due to affiliate $ 223,489 $ 79,593 Redeemable non-controlling interest issued as settlement of performance participation allocation $ 192,648 $ 141,396 Exchange of redeemable non-controlling interest for Class I shares $ 12,246 $ 9,228 Exchange of redeemable non-controlling interest for Class I or Class B units $ 68,453 $ 48,543 Allocation to redeemable non-controlling interest $ 9,650 $ 302 Distribution reinvestment $ 323,396 $ 228,166 Accrued common stock repurchases $ 68,283 $ 52,096 Accrued common stock repurchases due to affiliate $ 0 $ 17,762 Payable for unsettled investments in real estate debt $ 200,263 $ 1,487 Receivable for unsettled investments in real estate debt $ 29,564 $ 0 See accompanying notes to consolidated financial statements.was formed on November 16, 2015 as a Maryland corporation and intends to qualify as a real estate investment trust (“REIT”) for U.S. federal income tax purposes commencing with the taxable year ending December 31, 2017. The Company was organized to investinvests primarily in stabilized income-oriented commercial real estate in the United States and, to a lesser extent, invest in real estate-related securities.estate debt. The Company is the sole general partner of BREIT Operating Partnership, L.P., a Delaware limited partnership (“BREIT OP”). BREIT Special Limited Partner L.L.C.L.P. (the “Special Limited Partner”), a wholly-owned subsidiary of The Blackstone Group L.P.Inc. (together with its affiliates, “Blackstone”), owns a special limited partner interest in BREIT OP. Substantially all of the Company’s business is conducted through BREIT OP. The Company and BREIT OP are externally managed by BX REIT Advisors L.L.C. (the “Adviser”), an affiliate. The Adviser is part of Blackstone.haswas formed on November 16, 2015 as a Maryland corporation and qualifies as a real estate investment trust (“REIT”) for U.S. federal income tax purposes.$5.0$24.0 billion in shares of common stock, consisting of up to $4.0$20.0 billion in shares in its primary offering and up to $1.0$4.0 billion in shares pursuant to its distribution reinvestment plan, which the Company began using to offer shares of its common stock in February 2021 (the “Current Offering” and with the Previous Offerings, the “Offering”). The Company intends to sell any combination of four4 classes of shares of its common stock, with a dollar value up to the maximum aggregate amount of the Current Offering. The share classes have different upfront selling commissions, dealer manager fees and ongoing stockholder servicing fees. As of January 1, 2017, the Company had satisfied the minimum offering requirement and the Company’s board of directors authorized the release of proceeds from escrow. As of September 30, 2017, the Company issued and sold 125,491,201 shares of the Company’s common stock (consisting of 98,779,308 Class S shares, 23,277,430 Class I shares, 1,225,700 Class D shares, and 2,208,763 Class T shares). The Company intends to continue selling shares on a monthly basis.SeptemberJune 30, 2017,2021, the Company owned 18 investments in real estate and had 24 positions in commercial mortgage-backed securities (“CMBS”).1,463 properties. The Company currently operates in five8 reportable segments: Multifamily,Residential, Industrial, Hotel,Net Lease, Hospitality, Self Storage, Retail, and Retail Properties,Office properties, and Investments in Real Estate-Related Securities.Estate Debt. Residential includes various forms of rental housing including multifamily, student housing and manufactured housing. Net Lease includes the real estate assets of The Bellagio Las Vegas (the “Bellagio”) and the unconsolidated interest in the MGM Grand and Mandalay Bay joint venture. Any additional unconsolidated interests are included in the respective property segment as further described in Note 4 – Investments in Unconsolidated Entities. Financial results by segment are reported in Note 1415 — Segment Reporting.All intercompany transactions have been eliminated in consolidation. The condensed consolidated financial statements, including the condensed notes thereto, are unaudited and exclude some of the disclosures required in audited financial statements. Management believes it has made all necessary adjustments, consisting of only normal recurring items, so that the condensed consolidated financial statements are presented fairly and that estimates made in preparing itsthe Company's condensed consolidated financial statements are reasonable and prudent. The accompanying unaudited condensed consolidated interim financial statements should be read in conjunction with the audited consolidated financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 20162020 filed with the SEC.ourthe Company’s subsidiaries, and joint ventures in which we havethe Company has a controlling interest. All intercompany balances and transactions have been eliminated in consolidation.theeach joint venturesventure is included in non-controlling interests as equity of the Company. The non-controlling partner’s interest is generally computed as the joint venture partner’s ownership percentage.June 30, 2021 December 31, 2020 Level I Level 2 Level 3 Total Level I Level 2 Level 3 Total Assets: Investments in real estate debt $ 0 $ 5,554,513 $ 174,865 $ 5,729,378 $ 0 $ 4,445,414 $ 120,892 $ 4,566,306 Equity securities 1,338,420 338,400 119,341 1,796,161 327,935 271,250 0 599,185 Investments in unconsolidated entities 0 0 422,616 422,616 0 0 0 0 Derivatives 0 24,817 0 24,817 0 0 0 0 Total $ 1,338,420 $ 5,917,730 $ 716,822 $ 7,972,972 $ 327,935 $ 4,716,664 $ 120,892 $ 5,165,491 Liabilities: Derivatives $ 0 $ 27,664 $ 0 $ 27,664 $ 0 $ 55,536 $ 0 $ 55,536 Total $ 0 $ 27,664 $ 0 $ 27,664 $ 0 $ 55,536 $ 0 $ 55,536 Investments in

Real Estate DebtInvestments in

Unconsolidated EntitiesTotal Balance as of December 31, 2020 $ 120,892 $ 0 $ 0 $ 120,892 Purchases 46,550 374,007 119,341 539,898 Distributions 0 (5,619) 0 (5,619) Included in net income Unrealized gain included in income from unconsolidated entities 0 54,228 0 54,228 Discount accretion included in income (loss) from investments in real estate debt 728 0 0 728 Unrealized gain included in income (loss) from investments in real estate debt 6,695 0 0 6,695 Balance as of June 30, 2021 $ 174,865 $ 422,616 $ 119,341 $ 716,822 June 30, 2021 Fair Value Valuation Technique Unobservable Inputs Weighted Average Impact to Valuation from an Increase in Input Investments in real estate debt $ 174,865 Discounted cash flow Yield 8.1% Decrease Investments in unconsolidated entities $ 422,616 Discounted cash flow Discount Rate 6.6% Decrease Exit Capitalization Rate 4.6% Decrease Weighted Average Cost of Capital 12.0% Decrease Equity securities $ 119,341 Market comparable Enterprise Value/

Forward EBITDA Multiple19.7x Increase December 31, 2020 Fair Value Valuation Technique Unobservable Input Rate Impact to Valuation from an Increase in Input Investments in real estate debt $ 120,892 Discounted cash flow Yield 10.3% Decrease June 30, 2021 December 31, 2020 Building and building improvements $ 27,744,892 $ 25,991,610 Land and land improvements 7,876,089 7,626,381 Furniture, fixtures and equipment 560,464 495,395 114,535 114,535 56,008 56,008 Total 36,351,988 34,283,929 Accumulated depreciation and amortization (2,400,600) (1,826,216) Investments in real estate, net $ 33,951,388 $ 32,457,713 Segments Number of Transactions Number of Properties Sq. Ft. (in thousands)/Units Residential properties 11 17 6,092 units $ 1,313,475 Industrial properties 3 28 3,556 sq.ft. 529,895 Office properties 1 1 361 sq.ft. 251,171 15 46 $ 2,094,541 Amount Building and building improvements $ 1,647,231 Land and land improvements 311,249 Furniture, fixtures and equipment 43,150 In-place lease intangibles 97,399 Above-market lease intangibles 310 Below-market lease intangibles (4,798) Total purchase price 2,094,541 0 Net purchase price $ 2,094,541 Three Months Ended

June 30, 2021Six Months Ended

June 30, 2021Segments Number of Properties Net Proceeds Net Gain Number of Properties Net Proceeds Net Gain Residential properties 1 $ 21,054 $ 7,372 5 $ 94,977 $ 22,802 1 $ 21,054 $ 7,372 5 $ 94,977 $ 22,802 Three Months Ended

June 30, 2020Six Months Ended

June 30, 2020Segments Number of Properties Net Proceeds Net Gain Number of Properties Net Proceeds Net Gain Industrial properties 0 $ 0 $ 0 1 $ 4,488 $ 371 0 $ 0 $ 0 1 $ 4,488 $ 371 Assets: June 30, 2021 Investments in real estate, net $ 13,654 Other assets 1,356 Total assets $ 15,010 Liabilities: Mortgage notes $ 0 Other liabilities 145 Total liabilities $ 145 Joint Venture Segment Ownership

InterestJune 30, 2021 December 31, 2020 Net Lease 49.9% $ 819,915 $ 816,220 Industrial 85.0% 249,648 0 Industrial 41.0% 172,968 0 Total $ 1,242,531 $ 816,220 Three Months Ended June 30, 2021 Joint Venture Ownership

InterestTotal

Revenue of Unconsolidated Joint VenturesNet Income of Unconsolidated Joint Ventures BREIT's

ShareAmortization of Outside Basis BREIT

Income from Unconsolidated EntitiesMGM Grand & Mandalay Bay 49.9% $ 98,681 $ 50,445 $ 25,171 $ (35) $ 25,136 85.0% 0 0 0 0 25,977 41.0% 0 0 0 0 18,915 Total $ 70,028 Six Months Ended June 30, 2021 Joint Venture Ownership

InterestTotal

Revenue of Unconsolidated Joint VenturesNet Income of Unconsolidated Joint Ventures BREIT's

ShareAmortization of Outside Basis BREIT

Income from Unconsolidated EntitiesMGM Grand & Mandalay Bay 49.9% $ 197,363 $ 101,313 $ 50,555 $ (73) $ 50,482 85.0% 0 0 0 0 31,336 41.0% 0 0 0 0 22,892 Total $ 104,710 Three Months Ended June 30, 2020 Joint Venture Ownership

InterestTotal

RevenueNet Income of Unconsolidated Joint Ventures BREIT's

ShareAmortization of Outside Basis BREIT

Income from Unconsolidated EntitiesMGM Grand & Mandalay Bay 49.9% $ 98,681 $ 50,847 $ 25,373 $ (37) $ 25,336 Six Months Ended June 30, 2020 Joint Venture Ownership

InterestTotal

RevenueNet Income of Unconsolidated Joint Ventures BREIT's

ShareAmortization of Outside Basis BREIT

Income from Unconsolidated EntitiesMGM Grand & Mandalay Bay 49.9% $ 149,118 $ 77,479 $ 38,662 $ (57) $ 38,605 June 30, 2021 Type of Security/Loan Face

AmountCost

BasisFair

ValueL+2.5% 9/25/2025 $ 5,013,759 $ 4,869,931 $ 4,887,941 Corporate bonds L+4.2% 10/21/2027 161,861 161,149 164,149 RMBS 3.9% 8/27/2031 52,291 52,446 52,597 Total real estate securities 3.4% 11/11/2025 5,227,911 5,083,526 5,104,687 Term loans L+3.1% 9/9/2021 451,274 418,725 449,826 Mezzanine loans L+6.3% 1/28/2025 183,750 181,701 174,865 Total real estate loans L+4.0% 8/21/2022 635,024 600,426 624,691 Total investments in real estate debt 3.5% 7/5/2025 $ 5,862,935 $ 5,683,952 $ 5,729,378 December 31, 2020 Type of Security/Loan Face

AmountCost

BasisFair

ValueL+2.0% 1/17/2026 $ 4,093,201 $ 3,949,824 $ 3,753,428 Corporate bonds 5.0% 5/3/2027 179,398 178,219 183,203 RMBS 4.5% 10/24/2049 22,429 22,602 22,510 Total real estate securities 3.2% 3/29/2026 4,295,028 4,150,645 3,959,141 Term loans L+3.1% 1/7/2022 488,824 438,445 486,273 Mezzanine loans L+6.9% 12/15/2024 134,750 134,424 120,892 Total real estate loans L+3.8% 8/8/2022 623,574 572,869 607,165 Total investments in real estate debt 3.5% 10/3/2025 $ 4,918,602 $ 4,723,514 $ 4,566,306 June 30, 2021 December 31, 2020 Cost

BasisFair

ValuePercentage Based on Fair Value Cost

BasisFair

ValuePercentage Based on Fair Value Hospitality $ 2,252,404 $ 2,231,066 39% $ 2,046,529 $ 1,904,256 42% Residential 1,189,590 1,244,355 22% 748,086 797,840 17% Industrial 903,524 916,248 16% 612,884 610,504 13% Office 754,007 738,429 13% 720,665 681,596 15% Other 238,202 236,325 4% 238,202 213,654 5% Diversified 221,907 225,246 4% 234,527 225,077 5% Net Lease 106,943 121,077 2% 105,246 117,219 3% Retail 17,375 16,632 0% 17,375 16,160 0% Total $ 5,683,952 $ 5,729,378 100% $ 4,723,514 $ 4,566,306 100% June 30, 2021 December 31, 2020 Credit Rating Cost

BasisFair

ValuePercentage Based on Fair Value Cost

BasisFair

ValuePercentage Based on Fair Value AAA $ 13,405 $ 13,369 0% $ 10,044 $ 10,047 0% AA 710 710 0% 776 779 0% A 257,359 272,447 5% 262,097 267,023 6% BBB 821,502 819,972 14% 797,918 753,393 17% BB 1,536,903 1,546,976 27% 1,435,891 1,381,221 30% B 1,407,974 1,394,523 24% 1,186,975 1,114,977 24% CCC 35,165 36,059 1% 32,402 34,839 1% Other 1,610,934 1,645,322 29% 997,411 1,004,027 22% Total $ 5,683,952 $ 5,729,378 100% $ 4,723,514 $ 4,566,306 100% Fair Value Income (Loss) Three Months Ended June 30, Six Months Ended June 30, June 30, 2021 December 31, 2020 2021 2020 2021 2020 CMBS $ 1,759,738 $ 1,749,877 $ 32,969 $ 199,457 $ 102,312 $ (183,971) Loans 566,369 545,539 14,473 16,766 (4,099) 9,992 Total $ 2,326,107 $ 2,295,416 $ 47,442 $ 216,223 $ 98,213 $ (173,979) June 30, 2021 Principal Balance Outstanding Indebtedness Maximum

Facility SizeJune 30, 2021 December 31, 2020 Fixed rate loans: Fixed rate mortgages 3.8% 8/26/2027 N/A $ 13,006,707 $ 13,124,595 Variable rate loans: Floating rate mortgages L+1.8% 5/25/2026 N/A 4,914,122 4,544,044 Variable rate term loans L+1.7% 3/18/2024 N/A 1,795,520 1,761,920 Variable rate secured revolving credit facilities 0 — $ 2,185,344 0 481,725 Variable rate mezzanine loans L+3.5% 3/9/2025 N/A 71,100 202,200 Total variable rate loans L+1.8% 10/21/2025 6,780,742 6,989,889 Total loans secured by real estate 3.1% 1/7/2027 19,787,449 20,114,484 Premium on assumed debt, net 14,214 15,191 Deferred financing costs, net (139,653) (153,514) Mortgage notes, term loans, and secured revolving credit facilities, net $ 19,662,010 $ 19,976,161 Year Amount 2021 (remaining) $ 5,814 2022 523,256 2023 491,796 2024 3,042,855 2025 4,126,110 2026 3,564,585 Thereafter 8,033,033 Total $ 19,787,449 June 30, 2021 Borrowing's Outstanding Weighted Average Maturity Date CMBS $ 96,120 $ 158,543 L+1.2% 2/18/2023 Term Loan 254,478 391,504 L+1.8% 4/2/2022 $ 350,598 $ 550,047 L+1.6% December 31, 2020 Borrowing's Outstanding Weighted Average Maturity Date CMBS $ 1,733,623 $ 2,697,714 L+1.6% 6/21/2021 Term Loans 292,406 452,578 L+1.8% 3/17/2022 Corporate Bonds 111,540 138,215 L+0.8% 3/6/2021 RMBS 3,424 4,646 L+1.5% 3/30/2021 $ 2,140,993 $ 3,293,153 L+1.6% June 30, 2021 December 31, 2020 Accrued stockholder servicing fee $ 828,900 $ 605,411 Performance participation allocation 442,588 192,648 Accrued management fee 33,549 22,253 Accrued affiliate service provider expenses 8,261 10,151 Advanced organization and offering costs 3,068 4,090 Other 2,273 53,107 Total $ 1,318,639 $ 887,660 June 30, 2021 Plan Year Unrecognized Compensation Cost as of December 31, 2020 Value of New Awards Issued Amortization of Compensation Cost for the Six Months Ended June 30, 2021 Unrecognized Compensation Cost Remaining Amortization Period 2019 $ 3,363 $ 0 $ (1,083) $ 2,280 1.5 years 2020 0 0 0 0 — 2021 0 8,500 (1,062) 7,438 3.5 years $ 3,363 $ 8,500 $ (2,145) $ 9,718 2021 2020 2021 2020 2021 2020 Link Industrial Properties L.L.C. $ 15,831 $ 13,691 $ 188 $ 260 $ 575 $ 39 LivCor, L.L.C. 10,193 6,689 315 77 1,196 701 BRE Hotels and Resorts LLC 2,762 4,326 (5) 156 0 0 ShopCore Properties TRS Management LLC 1,471 1,356 9 7 42 0 Revantage Corporate Services, L.L.C. 726 469 0 0 0 0 Equity Office Management, L.L.C. 352 150 8 0 0 0 Total $ 31,335 $ 26,681 $ 515 $ 500 $ 1,813 $ 740 2021 2020 2021 2020 2021 2020 Link Industrial Properties L.L.C. $ 31,959 $ 26,022 $ 605 $ 521 $ 818 $ 553 LivCor, L.L.C. 20,918 12,324 697 154 2,075 1,761 BRE Hotels and Resorts LLC 5,443 7,649 127 312 0 0 ShopCore Properties TRS Management LLC 2,895 2,121 25 13 82 315 Revantage Corporate Services, L.L.C. 1,379 957 0 0 0 0 Equity Office Management, L.L.C. 964 295 16 0 0 0 Total $ 63,558 $ 49,368 $ 1,470 $ 1,000 $ 2,975 $ 2,629 June 30, 2021 December 31, 2020 Equity securities $ 1,796,161 $ 599,185 Real estate intangibles, net 630,428 738,259 Straight-line rent receivable 215,506 155,108 Receivables, net 160,409 109,159 Prepaid expenses 67,782 50,092 Pre-acquisition costs 61,694 241 Deferred leasing costs, net 62,265 49,533 Derivatives 24,817 0 Deferred financing costs, net 23,881 22,740 Held for sale assets 15,010 0 Other 76,377 74,936 Total $ 3,134,330 $ 1,799,253 June 30, 2021 December 31, 2020 Subscriptions received in advance $ 2,072,884 $ 508,817 Payable for unsettled investments in real estate debt 200,263 0 Accounts payable and accrued expenses 159,502 104,866 Real estate taxes payable 150,326 117,362 Distribution payable 126,149 90,892 Intangible liabilities, net 116,614 128,639 Right of use lease liability - operating leases 85,779 85,065 Prepaid rental income 84,712 95,165 Stock repurchases payable 68,283 83,350 Tenant security deposits 66,017 57,489 Right of use lease liability - financing leases 58,191 57,727 Accrued interest expense 45,841 50,065 Derivatives 27,664 55,536 Held for sale liabilities 145 0 Other 82,107 30,221 Total $ 3,344,477 $ 1,465,194 June 30, 2021 December 31, 2020 Intangible assets: In-place lease intangibles $ 1,014,562 $ 1,094,561 Above-market lease intangibles 46,056 49,261 Other 33,229 32,549 Total intangible assets 1,093,847 1,176,371 Accumulated amortization: In-place lease amortization (429,998) (407,256) Above-market lease amortization (21,136) (20,291) Other (12,285) (10,565) Total accumulated amortization (463,419) (438,112) Real estate intangibles, net $ 630,428 $ 738,259 Intangible liabilities: Below-market lease intangibles $ 187,950 $ 194,158 Total intangible liabilities 187,950 194,158 Accumulated amortization: Below-market lease amortization (71,336) (65,519) Total accumulated amortization (71,336) (65,519) Intangible liabilities, net $ 116,614 $ 128,639 In-place Lease

IntangiblesAbove-market

Lease IntangiblesBelow-market

Lease Intangibles2021 (remaining) $ 140,091 $ 4,094 $ (14,956) 2022 130,777 6,639 (26,328) 2023 86,704 4,166 (21,587) 2024 60,548 2,891 (17,255) 2025 47,205 2,256 (13,041) 2026 36,231 1,652 (9,827) Thereafter 83,008 3,222 (13,620) $ 584,564 $ 24,920 $ (116,614) June 30, 2021 Interest Rate Derivatives Number of Instruments Notional Amount Strike Index Weighted Average Maturity (Years) Interest Rate Swaps - Investments in real estate debt 49 $ 1,062,960 1.1% LIBOR 5.6 Interest Rate Swaps - Property debt 6 $ 1,500,000 1.0% LIBOR 7.0 December 31, 2020 Interest Rate Derivatives Number of Instruments Notional Amount Strike Index Weighted Average Maturity (Years) Interest Rate Swaps - Investments in real estate debt 53 $ 929,560 1.3% LIBOR 6.3 June 30, 2021 December 31, 2020 Foreign Currency Forward Contracts Number of Instruments Notional Amount Number of Instruments Notional Amount Buy USD / Sell EUR Forward 9 € 283,594 7 € 219,430 Buy USD / Sell GBP Forward 7 £ 53,082 2 £ 25,093 June 30, 2021 December 31, 2020 June 30, 2021 December 31, 2020 Interest rate derivatives $ 14,148 $ 0 $ 27,568 $ 46,144 Foreign currency forward contracts 10,669 0 96 9,392 Total Derivatives $ 24,817 $ 0 $ 27,664 $ 55,536 Type of Derivative Realized/Unrealized Gain (Loss) Location of Gain (Loss) Recognized in Net Income Three Months Ended June 30, 2021 2020 Foreign Currency Forward Contract Realized (loss) gain Income from investments in real estate debt $ (4,102) $ 1,613 Interest Rate Swap - Investments in real estate debt Realized (loss) Income from investments in real estate debt (274) 0 Foreign Currency Forward Contract Unrealized gain Income from investments in real estate debt 4,640 (7,326) Interest Rate Swap – Investments in real estate debt Unrealized gain (loss) Income from investments in real estate debt (11,492) (5,439) Interest Rate Swap – Property debt Unrealized gain Other income (expense) (27,348) 0 $ (38,576) $ (11,152) Type of Derivative Realized/Unrealized Gain (Loss) Location of Gain (Loss) Recognized in Net Income Six Months Ended June 30, 2021 2020 Foreign Currency Forward Contract Realized (loss) gain Income from investments in real estate debt $ (8,580) $ 1,969 Interest Rate Swap - Investments in real estate debt Realized (loss) Income from investments in real estate debt (14,964) (1,711) Foreign Currency Forward Contract Unrealized gain Income from investments in real estate debt 19,965 (5,097) Interest Rate Swap – Investments in real estate debt Unrealized gain (loss) Income from investments in real estate debt 42,930 (63,263) Interest Rate Swap – Property debt Unrealized gain Other income (expense) (10,147) 0 $ 29,204 $ (68,102) Classification Number of Shares

(in thousands)Par Value Preferred Stock 100,000 $ 0.01 Class S Shares 3,000,000 $ 0.01 Class I Shares 6,000,000 $ 0.01 Class T Shares 500,000 $ 0.01 Class D Shares 500,000 $ 0.01 Total 10,100,000 Three Months Ended June 30, 2021 Class S Class I Class T Class D Total March 31, 2021 783,521 1,042,750 47,115 146,954 2,020,340 Common stock issued 136,282 292,072 3,020 33,893 465,267 Distribution reinvestment 6,111 6,687 335 1,140 14,273 Common stock repurchased (4,076) (15,238) (282) (481) (20,077) 0 0 0 0 0 June 30, 2021 921,838 1,326,271 50,188 181,506 2,479,803 Six Months Ended June 30, 2021 Class S Class I Class T Class D Total December 31, 2020 702,853 927,080 45,943 124,141 1,800,017 Common stock issued 218,053 437,290 4,403 56,514 716,260 Distribution reinvestment 11,807 12,522 672 2,141 27,142 Common stock repurchased (10,875) (50,626) (830) (1,290) (63,621) 0 5 0 0 5 June 30, 2021 921,838 1,326,271 50,188 181,506 2,479,803 Three Months Ended June 30, 2021 Class S Class I Class T Class D Aggregate gross distributions declared per share of common stock $ 0.1615 $ 0.1615 $ 0.1615 $ 0.1615 Stockholder servicing fee per share of common stock (0.0262) 0 (0.0258) (0.0076) Net distributions declared per share of common stock $ 0.1353 $ 0.1615 $ 0.1357 $ 0.1539 Six Months Ended June 30, 2021 Class S Class I Class T Class D Aggregate gross distributions declared per share of common stock $ 0.3215 $ 0.3215 $ 0.3215 $ 0.3215 Stockholder servicing fee per share of common stock (0.0509) 0 (0.0502) (0.0147) Net distributions declared per share of common stock $ 0.2706 $ 0.3215 $ 0.2713 $ 0.3068 June 30, 2021 June 30, 2020 Balance at the beginning of the year $ 274 $ 272 Settlement of prior year performance participation allocation 192,648 141,396 Repurchases (111,949) (83,625) Conversion to Class I and Class B units (68,453) (48,543) Conversion to Class I shares (12,246) (9,228) GAAP income allocation (1) (15) Distributions (8) (6) Fair value allocation 34 4 Ending balance $ 299 $ 255 Three Months Ended June 30, Six Months Ended June 30, 2021 2020 2021 2020 Fixed lease payments $ 616,068 $ 506,046 $ 1,207,108 $ 983,331 Variable lease payments 64,741 47,671 126,617 102,481 Rental revenue $ 680,809 $ 553,717 $ 1,333,725 $ 1,085,812 Year Future Minimum Rents 2021 (remaining) $ 514,787 2022 988,808 2023 884,034 2024 778,531 2025 696,405 2026 616,555 Thereafter 9,009,183 Total $ 13,488,303 Operating

LeasesFinancing

Leases2021 (remaining) $ 2,043 $ 1,563 2022 4,093 3,174 2023 4,132 3,269 2024 4,183 3,367 2025 4,423 3,468 2026 4,530 3,572 Thereafter 595,398 323,447 Total undiscounted future lease payments 618,802 341,860 Difference between undiscounted cash flows and discounted cash flows (533,023) (283,669) Total lease liability $ 85,779 $ 58,191 Three Months Ended June 30, Six Months Ended June 30, 2021 2020 2021 2020 Fixed ground rent expense $ 1,025 $ 1,014 $ 2,046 $ 2,026 Variable ground rent expense 26 1 26 18 Total cash portion of ground rent expense 1,051 1,015 2,072 2,044 Straight-line ground rent expense 1,643 1,691 3,290 3,434 Total operating lease costs $ 2,694 $ 2,706 $ 5,362 $ 5,478 Three Months Ended June 30, Six Months Ended June 30, 2021 2020 2021 2020 Interest on lease liabilities $ 759 $ 737 $ 1,518 $ 1,474 Amortization of right-of-use assets 252 257 499 509 Total financing lease costs $ 1,011 $ 994 $ 2,017 $ 1,983 June 30, 2021 December 31, 2020 Residential $ 15,350,917 $ 13,701,615 Industrial 12,642,621 11,498,912 Net Lease 5,213,010 5,199,651 Hospitality 2,401,770 2,196,429 Self Storage 1,523,867 1,593,430 Retail 688,744 700,045 Office 700,870 447,630 Investments in Real Estate Debt 6,014,628 4,763,309 Other (Corporate) 3,445,428 582,994 Total assets $ 47,981,855 $ 40,684,015 Residential Industrial Net

LeaseHospitality Self

StorageRetail Office Investments in

Real Estate

DebtTotal Revenues: Rental revenue $ 302,095 $ 236,908 $ 82,794 $ 0 $ 33,673 $ 14,667 $ 10,672 $ 0 $ 680,809 Hospitality revenue 0 0 0 102,660 0 0 0 0 102,660 Other revenue 18,476 2,144 0 3,318 2,161 457 158 0 26,714 Total revenues 320,571 239,052 82,794 105,978 35,834 15,124 10,830 0 810,183 Expenses: Rental property operating 150,642 72,191 249 0 17,253 4,626 3,024 0 247,985 Hospitality operating 0 0 0 75,093 0 0 0 0 75,093 Total expenses 150,642 72,191 249 75,093 17,253 4,626 3,024 0 323,078 Income from unconsolidated entities 0 44,892 25,136 0 0 0 0 0 70,028 Income from investments in real estate debt 0 0 0 0 0 0 0 116,573 116,573 Income from investments in equity securities 95,442 33,769 22,085 0 0 0 2,344 0 153,640 Segment net operating income (loss) $ 265,371 $ 245,522 $ 129,766 $ 30,885 $ 18,581 $ 10,498 $ 10,150 $ 116,573 $ 827,346 Depreciation and amortization $ (167,943) $ (136,649) $ (28,637) $ (22,870) $ (32,063) $ (6,575) $ (4,884) $ 0 $ (399,621) General and administrative $ (7,789) Management fee (92,183) Performance participation allocation (299,373) Impairment of investments in real estate 0 Net gain on dispositions of real estate 7,372 Interest income 9 Interest expense (181,529) Loss on extinguishment of debt (2,757) Other income (expense) (28,057) Net loss $ (176,582) Net income attributable to non-controlling interests in third party joint ventures $ (264) Net loss attributable to non-controlling interests in BREIT OP 2,089 Net loss attributable to BREIT stockholders $ (174,757) Residential Industrial Net

LeaseHospitality Self

StorageRetail Office Investments in

Real Estate

DebtTotal Revenues: Rental revenue $ 241,793 $ 209,583 $ 82,794 $ 0 $ 3,897 $ 12,679 $ 2,971 $ 0 $ 553,717 Hospitality revenue 0 0 0 21,781 0 0 0 0 21,781 Other revenue 14,007 1,157 0 1,263 464 228 130 0 17,249 Total revenues 255,800 210,740 82,794 23,044 4,361 12,907 3,101 0 592,747 Expenses: Rental property operating 115,236 64,048 13 0 2,341 4,331 1,066 0 187,035 Hospitality operating 0 0 0 44,523 0 0 0 0 44,523 Total expenses 115,236 64,048 13 44,523 2,341 4,331 1,066 0 231,558 Income from unconsolidated entities 0 0 25,336 0 0 0 0 0 25,336 Income from investments in real estate debt 0 0 0 0 0 0 0 492,889 492,889 Income from investments in equity securities 3,124 3,508 19,700 0 0 0 3,318 0 29,650 Segment net operating income $ 143,688 $ 150,200 $ 127,817 $ (21,479) $ 2,020 $ 8,576 $ 5,353 $ 492,889 $ 909,064 Depreciation and amortization $ (145,595) $ (138,798) $ (29,040) $ (22,753) $ (1,452) $ (8,174) $ (1,540) $ 0 $ (347,352) General and administrative $ (6,913) Management fee (53,423) Performance participation allocation 0 Impairment of investments in real estate (6,126) Net gain on dispositions of real estate 0 Interest income 233 Interest expense (176,579) Loss on extinguishment of debt 0 Other income (expense) (572) Net income $ 318,332 Net loss attributable to non-controlling interests in third party joint ventures $ 966 Net income attributable to non-controlling interests in BREIT OP (4,859) Net income attributable to BREIT stockholders $ 314,439 Residential Industrial Net

LeaseHospitality Self

StorageRetail Office Investments in

Real Estate

DebtTotal Revenues: Rental revenue $ 590,548 $ 463,668 $ 165,589 $ 0 $ 64,648 $ 29,097 $ 20,175 $ 0 $ 1,333,725 Hospitality revenue 0 0 0 160,803 0 0 0 0 160,803 Other revenue 32,540 5,994 0 4,994 4,157 1,214 211 0 49,110 Total revenues 623,088 469,662 165,589 165,797 68,805 30,311 20,386 0 1,543,638 Expenses: Rental property operating 290,583 146,063 470 0 32,961 9,535 6,078 0 485,690 Hospitality operating 0 0 0 130,773 0 0 0 0 130,773 Total expenses 290,583 146,063 470 130,773 32,961 9,535 6,078 0 616,463 Income from unconsolidated entities 0 54,228 50,482 0 0 0 0 0 104,710 Income from investments in real estate debt 0 0 0 0 0 0 0 355,934 355,934 Income from investments in equity securities 151,495 55,411 30,963 0 0 0 6,882 0 244,751 Segment net operating income (loss) $ 484,000 $ 433,238 $ 246,564 $ 35,024 $ 35,844 $ 20,776 $ 21,190 $ 355,934 $ 1,632,570 Depreciation and amortization $ (335,986) $ (268,544) $ (57,136) $ (45,576) $ (69,814) $ (14,185) $ (8,767) $ 0 $ (800,008) General and administrative $ (14,749) Management fee (165,278) Performance participation allocation (442,588) Impairment of investments in real estate 0 Net gain on dispositions of real estate 22,802 Interest income 95 Interest expense (363,147) Loss on extinguishment of debt (6,173) Other income (expense) (11,222) Net loss $ (147,698) Net income attributable to non-controlling interests in third party joint ventures $ (323) Net loss attributable to non-controlling interests in BREIT OP 1,736 Net loss attributable to BREIT stockholders $ (146,285) Residential Industrial Net

LeaseHospitality Self

StorageRetail Office Investments in

Real Estate DebtTotal Revenues: Rental revenue $ 468,912 $ 410,980 $ 165,589 $ 0 $ 7,461 $ 26,922 $ 5,948 $ 0 $ 1,085,812 Hospitality revenue 0 0 0 149,253 0 0 0 0 149,253 Other revenue 26,092 1,998 0 2,837 911 506 220 0 32,564 Total revenues 495,004 412,978 165,589 152,090 8,372 27,428 6,168 0 1,267,629 Expenses: Rental property operating 219,796 121,218 114 0 4,443 7,751 2,101 0 355,423 Hospitality operating 0 0 0 143,829 0 0 0 0 143,829 Total expenses 219,796 121,218 114 143,829 4,443 7,751 2,101 0 499,252 Income from unconsolidated entities 0 0 38,605 0 0 0 0 0 38,605 Loss from investments in real estate debt 0 0 0 0 0 0 0 (523,258) (523,258) Income (loss) from investments in

equity securities(5,766) 13,571 (12,197) 0 0 0 100 0 (4,292) Segment net operating income $ 269,442 $ 305,331 $ 191,883 $ 8,261 $ 3,929 $ 19,677 $ 4,167 $ (523,258) $ 279,432 Depreciation and amortization $ (272,921) $ (276,922) $ (57,195) $ (45,546) $ (3,681) $ (16,809) $ (3,083) $ 0 $ (676,157) General and administrative (13,595) Management fee (102,925) Performance participation allocation 0 Impairment of investments in real estate (6,126) Net gain on dispositions of real estate 371 Interest income 1,980 Interest expense (365,083) Loss on extinguishment of debt (1,237) Other income (expense) (15,478) Net loss $ (898,818) Net loss attributable to non-controlling interests in third party joint ventures $ 1,203 Net loss attributable to non-controlling interests in BREIT OP 11,967 Net loss attributable to BREIT stockholders $ (885,648)

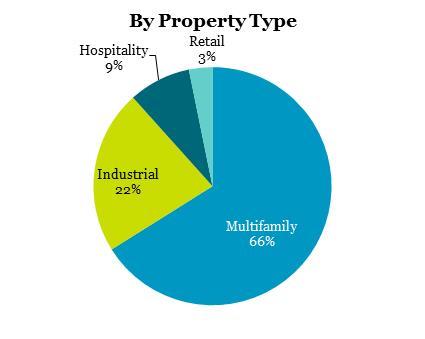

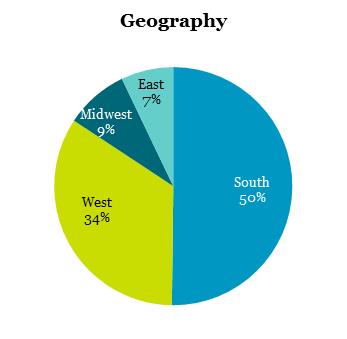

Segment Sq. Feet (in

thousands)/

Units/KeysPercentage of Total Revenues 298 93,174 units 94% $14,506 $ 17,442,161 $ 623,088 38% Industrial 938 154,011 sq. ft. 96% $5.30 15,734,206 523,890 32% Net lease 3 24,748 sq. ft. N/A N/A 5,553,514 216,071 13% Hospitality 58 9,672 keys 49% $120.91/$59.24 2,070,331 165,797 10% Self Storage 150 10,958 sq. ft. 94% $12.32 1,664,941 68,805 4% Retail 13 2,018 sq. ft. 96% $23.94 681,686 30,311 2% Office 3 946 sq. ft. 99% $35.76 654,579 20,386 1% Total 1,463 $ 43,801,418 $ 1,648,348 100% Segment and Investment Number of