transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services and has included additional disclosure requirements. The majority of the Company’s revenue is derived from tenant leases at multifamily, office, retail, and industrial properties and the Company has concluded that the adoption of ASU2014-09 did not have an impact on both the rental revenue and tenant reimbursement income revenue streams. The Company has adopted this standard on January 1, 2018 using the modified retrospective method, and the cumulative impact did not have an impact on equity. Accordingly, there are no differences between the amounts as reported in the Company’s Consolidated Balance Sheet as of June 30, 2018 and its Consolidated Statements of Operations for the three and six months ended June 30, 2018 compared to without the adoption of ASU 2014-09. However, upon adoption of the new leasing standard, ASU 2014-09 may impact the presentation of certain lease and non-lease components of revenue. See below for a further description of the expected impact the new leasing standard may have on the Company.

In February 2016, the FASB issued ASU 2016-02 Leases (Topic 842) (“ASU 2016-02”) which will supersede Topic 840, Leases. This ASU applies to all entities that enter into a lease. Lessees will be required to report assets and liabilities that arise from leases. Lessor accounting is expected to remain unchanged except in certain circumstances. The ASU also contains certain practical expedients, which the Company plans to elect.

9

The Company is electing the transition package of practical expedients permitted within the new standard, which among other things, allows the Company to carryforward the historical lease classification.

In addition, the Company will elect the practical expedient not to separate lease and non-lease components whereby both components are accounted for and recognized as lease components. Under ASC 842 as a lessor, lease components will be recognized on a straight line basis, while non-lease components will be recognized in accordance with the new revenue standard. The Company is in the process of evaluating the impact the ASU will have on its consolidated financial statements. The Company’s tenant reimbursement revenues generated from common area and maintenance services that are provided to its tenants are considered a non-lease component that must be separated, allocated based on the transaction price allocation guidance and accounted for according to the new revenue standard.

In January 2018, the FASB issued a proposal for comment that would allow lessors to elect a similar practical expedient by class of underlying assets to not separate non-lease components from the lease component. The lessor’s practical expedient election would be limited to circumstances in which (i) the timing and pattern of revenue recognition are the same for the non-lease component and the related lease component and (ii) the combined single lease component would be classified as an operating lease. If the exposed practical expedient is issued in its existing form, the Company expects to elect the practical expedient which would allow the Company the ability to combine the lease and non-lease components if the underlying asset meets the two criteria above. This ASU is effective for public business entities for fiscal years beginning after December 15, 2018, including all interim periods within those fiscal years. The proposed changes were approved by the FASB in July 2018. Management has completed its initial scoping for the adoption of the ASU 2016-02 and does not expect the adoption of such guidance to materially impact the Company.

Recently Adopted:

In August 2016, the FASB issued ASU 2016-15, “Statement of Cash Flows (Topic 230) - Classification of Certain Cash Receipts and Cash Payments” (“ASU 2016-15”). ASU 2016-15 clarifies the presentation of certain cash receipts and cash payments in the statement of cash flows. The primary updates include additions and clarifications of the classification of cash flows related to certain debt repayment activities, contingent consideration payments related to business combinations, proceeds from insurance policies, distributions from equity method investees, and cash flows related to securitized receivables. This update is effective for annual periods beginning after December 15, 2017, including interim periods within those fiscal years. The ASU requires retrospective application to all prior periods presented upon adoption. The Company adopted this standard on January 1, 2018 with no material impact on the Company’s consolidated financial statements and related disclosures.

In November 2016, FASB issued ASU 2016-18, “Statement of Cash Flows (Topic 230): Restricted Cash” ("ASU 2016-18"). The amendments in this ASU require that a statement of cash flows explain the change during the period in the total of cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents. Therefore, amounts generally described as restricted cash and restricted cash equivalents should be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the statements of cash flows. GAAP currently does not include specific guidance on the cash flow classification and presentation of changes in restricted cash. This update is effective for annual periods beginning after December 15, 2017, including interim periods within those fiscal years. The ASU requires retrospective application to all prior periods presented upon adoption. The Company adopted this standard on January 1, 2018 with no material impact on the Company’s consolidated financial statements and related disclosures.

In May 2017, the FASB issued ASU 2017-09 “Compensation – Stock Compensation (Topic 718) - Scope of Modification Accounting,” which provides guidance about which changes to the terms or conditions of a share-based payment award require an entity to apply modification accounting. The amendments in this update will be applied prospectively to an award modified on or after the adoption date. This standard is effective for annual periods beginning after December 15, 2017, and interim periods within those fiscal years. The Company adopted this standard on January 1, 2018 with no material impact on the Company’s consolidated financial statements and related disclosures.

Note 3. Investments in Real Estate

Investments in real estate, net consisted of the following (in thousands):

| | | June 30, 2018 | | December 31, 2017 | | | March 31,

2019 | | | December 31,

2018 | |

Building and building improvements | | $ | 156,538 | | $ | 94,545 | | | $ | 249,522 | | | $ | 249,552 | |

Land and land improvements | | | 31,414 | | 18,558 | | | | 46,609 | | | | 46,609 | |

Furniture, fixtures and equipment | | | 3,239 | | | 1,842 | | | | 3,345 | | | | 3,249 | |

| | | | | | | |

Total | | | 191,191 | | | 114,945 | | | | 299,476 | | | | 299,410 | |

Accumulated depreciation | | | (1,830 | ) | | (123 | ) | | | (7,181 | ) | | | (5,036 | ) |

| | | | | | | |

Investments in real estate, net | | $ | 189,361 | | $ | 114,822 | | | $ | 292,295 | | | $ | 294,374 | |

| | | | | | | |

Depreciation expense was $0.9 million and $1.7$2.1 million for the three and six months ended June 30, 2018, respectively.March 31, 2019.

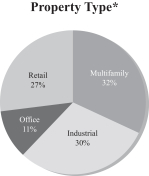

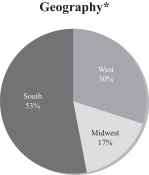

In JuneThe Company had no property acquisitions in the three months ended March 31, 2019 and during the year ended December 31, 2018, the Company acquired interests in twofour real property investments, which were comprised of one office, multifamily, industrial and one multifamilya retail property. These property acquisitions have been accounted for as asset acquisitions.

The following table provides further details of the properties acquired during the period ended June 30, 2018 (in thousands):

Property Name | | Ownership Interest | | | Number of Properties | | Location | | Sector | | Acquisition Date | | Purchase Price | |

Defoor Hills | | 100% | | | 1 | | Atlanta, GA | | Office | | June 2018 | | $ | 33,808 | |

Tacara at Steiner Ranch | | 100% | | | 1 | | Austin, TX | | Multifamily | | June 2018 | | | 47,909 | |

| | | | | | 2 | | | | | | | | $ | 81,717 | |

The following table summarizes the purchase price allocation for the properties acquired during the period ended June 30, 2018 (in thousands):

| | Defoor Hills | | | Tacara at Steiner Ranch | | | Total | |

Building and building improvements | | $ | 25,600 | | | $ | 36,320 | | | $ | 61,920 | |

Land and land improvements | | | 4,471 | | | | 8,385 | | | | 12,856 | |

Furniture, fixtures and equipment | | | — | | | | 1,397 | | | | 1,397 | |

In-place lease intangibles | | | 1,965 | | | | 1,807 | | | | 3,772 | |

Other intangibles | | | 1,772 | | | | — | | | | 1,772 | |

Total purchase price | | $ | 33,808 | | | $ | 47,909 | | | $ | 81,717 | |

Note 4. Investments in Real Estate-Related Securities

As of June 30,March 31, 2019 and March 31, 2018, the Company’s investments in real estate-related securities included shares of common stock of publicly-traded real estate investment trusts.REITs. As described in Note 2, the Company records its investments in real estate-related securities at fair value on its Consolidated Balance Sheets.

The following table summarizes the components of realized and unrealized income from real estate-related securities during the three and six months ended June 30,March 31, 2019 and March 31, 2018:

| | Three Months | | | Six Months | |

| | Ended | | | Ended | |

| | June 30, 2018 | | | June 30, 2018 | |

Unrealized gains | | $ | 1,578 | | | $ | 1,852 | |

Realized gains | | | 7 | | | | 7 | |

Dividend income | | | 197 | | | | 311 | |

Total | | $ | 1,782 | | | $ | 2,170 | |

| | | | | | | | |

| | | Three Months

Ended

March 31, 2019 | | | Three Months

Ended

March 31, 2018 | |

Unrealized gains | | $ | 4,769 | | | $ | 274 | |

Realized (losses) | | | (76 | ) | | | — | |

Dividend income | | | 293 | | | | 114 | |

| | | | | | | | |

Total | | $ | 4,986 | | | $ | 388 | |

| | | | | | | | |

11

Note 5. Investment in International Affiliated Funds

Investment in ECF:

On December 22, 2017, the Company entered into a subscription agreement to invest approximately $30 million (€25 million) into ECF. As of March 31, 2019, the Company had funded $18.6 million (€16.2 million) and has a remaining unfunded commitment of approximately $11.4 million (€8.8 million). As described in Note 2, the Company records its investment in ECF using the equity method on its Consolidated Balance Sheets. While the