UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM10-Q

☒QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended JuneSeptember 30, 20202023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: file number:001-39315

VROOM, INC.

(Exact nameName of registrantRegistrant as specifiedSpecified in its charter)Its Charter)

Delaware | 901112566 | |

(State or

| (I.R.S. Employer Identification |

1375 Broadway, 3600 W Sam Houston Pkwy S, Floor 114

New York, New York 10018Houston, Texas77042

(Address of principal executive offices) (Zip code)

(855) 524-1300(518)535-9125

(Registrant's telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Common Stock, $0.001 par value | VRM | Nasdaq Global Select |

Indicate by check mark whether the registrantregistrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrantRegistrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes☒No☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes☒No☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer |

|

Non-accelerated filer |

| Smaller reporting company |

|

Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes☐No☒

As of August 12, 2020, 119,336,588November 3, 2023, 139,769,070 shares of the registrants’ common stock were outstanding.

TABLE OF CONTENTS

Page | |||

| |||

| |||

Item 1. |

| ||

| |||

| |||

| |||

| |||

Notes to Condensed Consolidated Financial Statements (unaudited) |

| ||

Item 2. |

|

| |

Item 3. | Quantitative and Qualitative Disclosures |

| |

Item 4. |

| ||

| |||

Item 1. |

| ||

Item 1A. |

| ||

Item 2. |

| ||

Item 3. | 85 | ||

Item 4. | 85 | ||

Item 5. |

| ||

Item 6. |

| ||

| |||

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended, (the "Exchange Act"), about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this Quarterly Report on Form 10-Q, including statements regarding general economic and market conditions, our future results of operations and financial condition, business strategy, and plans and objectives of management for future operations, are forward-looking statements. In some cases, forward-looking statements may be identified by words such as "anticipate," "believe," “contemplate,”"contemplate," "continue," "could," "design," "estimate," "expect," "intend," "may," "plan," "potentially," "predict," "project," "should," “target,” "target," "will," “would,” "would," or the negative of these terms or other similar terms or expressions, although not all forward-looking statements contain these identifying words.

The forward-looking statements in this Quarterly Report on Form 10-Q are only predictions. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available. These forward-looking statements are subject to a number of known and unknown risks, uncertainties, assumptions, and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including risks described in the section titled "Risk Factors" and elsewhere in this Quarterly Report on Form 10-Q, regarding, among other things:10-Q.

the impact of the COVID-19 pandemic caused by the novel coronavirus;

we have a history of losses and we may not achieve or maintain profitability in the future;

we may not be able to generate sufficient revenue to generate positive cash flow on a sustained basis, and our revenue growth rate may decline;

we have a limited operating history and are still building out our foundational systems;

our recent, rapid growth may not be indicative of our future growth and, if we continue to grow rapidly, we may not be able to manage our growth effectively;

our business is subject to certain risks related to the operation of, and concentration of our revenues and gross profit from, Texas Direct Auto;

we have entered into outsourcing arrangements with a third party related to our customer experience team, and any difficulties experienced in these arrangements could result in an interruption of our ability to sell our vehicles and value-added products;

we rely on third-party carriers to transport our vehicle inventory throughout the United States. Thus, we are subject to business risks and costs associated with such carriers and with the transportation industry, many of which are out of our control;

the current geographic concentration where we provide reconditioning services and store inventory creates an exposure to local and regional downturns or severe weather or catastrophic occurrences that may materially and adversely affect our business, financial condition and results of operations; and

if we sustain cyber-attacks or other privacy or data security incidents that result in security breaches, we could suffer a loss of sales and increased costs, exposure to significant liability, reputational harm and other negative consequences.

We caution you that the foregoing list does not contain all of the forward-looking statements made in this Quarterly Report on Form 10-Q. Other sections of this Quarterly Report on Form 10-Q include additional factors that could harm our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time, and it is not possible for our management to predict all risk factors nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ from those contained in, or implied by, any forward-looking statements.

3

You should not rely upon forward-looking statements as predictions of future events. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.These forward-looking statements speak only as of the date of this Quarterly Report on Form 10-Q. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this report or to conform these statements to actual results or to changes in our expectations. You should read this Quarterly Report on Form 10-Q and the documents that we reference or incorporate by reference in this Quarterly Report on Form 10-Q and have filed as exhibits to this report with the understanding that our actual future results, levels of activity, performance, and achievements may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

4

3

SUMMARY RISK FACTORS

Our business is subject to numerous risks and uncertainties, including those described in Part II, Item 1A. “Risk Factors” in this Quarterly Report on Form 10-Q. You should carefully consider these risks and uncertainties when investing in our common stock. The principal risks and uncertainties affecting our business include, but are not limited to, the following:

4

5

PART I - FINANCIAL– FINANCIAL INFORMATION

VROOM, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share amounts)

(unaudited)

|

| As of December 31, |

|

| As of June 30, |

| ||

|

| 2019 |

|

| 2020 |

| ||

ASSETS |

|

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

| $ | 217,734 |

|

| $ | 651,035 |

|

Restricted cash |

|

| 1,853 |

|

|

| 21,853 |

|

Accounts receivable, net of allowance of $789 and $1,135, respectively |

|

| 30,848 |

|

|

| 15,287 |

|

Inventory |

|

| 205,746 |

|

|

| 141,063 |

|

Prepaid expenses and other current assets |

|

| 9,149 |

|

|

| 17,808 |

|

Total current assets |

|

| 465,330 |

|

|

| 847,046 |

|

Property and equipment, net |

|

| 7,828 |

|

|

| 9,783 |

|

Intangible assets, net |

|

| 572 |

|

|

| 297 |

|

Goodwill |

|

| 78,172 |

|

|

| 78,172 |

|

Operating lease right-of-use assets |

|

| — |

|

|

| 15,437 |

|

Other assets |

|

| 11,485 |

|

|

| 12,472 |

|

Total assets |

| $ | 563,387 |

|

| $ | 963,207 |

|

LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ (DEFICIT) EQUITY |

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

| $ | 18,987 |

|

| $ | 20,133 |

|

Accrued expenses |

|

| 38,491 |

|

|

| 40,898 |

|

Vehicle floorplan |

|

| 173,461 |

|

|

| 109,783 |

|

Deferred revenue |

|

| 17,323 |

|

|

| 15,488 |

|

Operating lease liabilities, current |

|

| — |

|

|

| 4,640 |

|

Other current liabilities |

|

| 11,572 |

|

|

| 13,115 |

|

Total current liabilities |

|

| 259,834 |

|

|

| 204,057 |

|

Operating lease liabilities, excluding current portion |

|

| — |

|

|

| 11,750 |

|

Other long-term liabilities |

|

| 3,073 |

|

|

| 1,965 |

|

Total liabilities |

|

| 262,907 |

|

|

| 217,772 |

|

Commitments and contingencies (Note 8) |

|

|

|

|

|

|

|

|

Redeemable convertible preferred stock, $0.001 par value; 86,123,364 and 10,000,000 shares authorized as of December 31, 2019 and June 30, 2020, respectively; 83,568,628 and zero shares issued and outstanding as of December 31, 2019 and June 30, 2020, respectively |

|

| 874,332 |

|

|

| — |

|

Stockholders’ (deficit) equity: |

|

|

|

|

|

|

|

|

Common stock, $0.001 par value; 113,443,854 and 500,000,000 shares authorized as of December 31, 2019 and June 30, 2020, respectively; 8,650,922 and 119,336,588 shares issued and outstanding as of December 31, 2019 and June 30, 2020, respectively |

|

| 8 |

|

|

| 119 |

|

Additional paid-in-capital |

|

| — |

|

|

| 1,424,675 |

|

Accumulated deficit |

|

| (573,860 | ) |

|

| (679,359 | ) |

Total stockholders’ (deficit) equity |

|

| (573,852 | ) |

|

| 745,435 |

|

Total liabilities, redeemable convertible preferred stock and stockholders’ (deficit) equity |

| $ | 563,387 |

|

| $ | 963,207 |

|

|

| As of |

|

| As of |

| ||

|

| 2023 |

|

| 2022 |

| ||

ASSETS |

|

|

|

|

|

| ||

Current Assets: |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ | 208,562 |

|

| $ | 398,915 |

|

Restricted cash (including restricted cash of consolidated VIEs of $47.2 million and $24.7 million, respectively) |

|

| 80,517 |

|

|

| 73,095 |

|

Accounts receivable, net of allowance of $8.9 million and $21.5 million, respectively |

|

| 9,022 |

|

|

| 13,967 |

|

Finance receivables at fair value (including finance receivables of consolidated VIEs of $12.2 million and $11.5 million, respectively) |

|

| 12,901 |

|

|

| 12,939 |

|

Finance receivables held for sale, net (including finance receivables of consolidated VIEs of $338.4 million and $305.9 million, respectively) |

|

| 399,836 |

|

|

| 321,626 |

|

Inventory |

|

| 240,676 |

|

|

| 320,648 |

|

Beneficial interests in securitizations |

|

| 5,287 |

|

|

| 20,592 |

|

Prepaid expenses and other current assets (including other current assets of consolidated VIEs of $24.3 million and $11.7 million, respectively) |

|

| 56,889 |

|

|

| 58,327 |

|

Total current assets |

|

| 1,013,690 |

|

|

| 1,220,109 |

|

Finance receivables at fair value (including finance receivables of consolidated VIEs of $376.7 million and $119.6 million, respectively) |

|

| 387,796 |

|

|

| 140,235 |

|

Property and equipment, net |

|

| 49,220 |

|

|

| 50,201 |

|

Intangible assets, net |

|

| 138,644 |

|

|

| 158,910 |

|

Operating lease right-of-use assets |

|

| 30,836 |

|

|

| 23,568 |

|

Other assets (including other assets of consolidated VIEs of $2.0 million and $0 million, respectively) |

|

| 26,525 |

|

|

| 26,004 |

|

Total assets |

| $ | 1,646,711 |

|

| $ | 1,619,027 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

| ||

Current Liabilities: |

|

|

|

|

|

| ||

Accounts payable |

| $ | 27,280 |

|

| $ | 34,702 |

|

Accrued expenses (including accrued expenses of consolidated VIEs of $3.3 million and $1.5 million, respectively) |

|

| 57,435 |

|

|

| 76,795 |

|

Vehicle floorplan |

|

| 212,486 |

|

|

| 276,988 |

|

Warehouse credit facilities of consolidated VIEs |

|

| 294,653 |

|

|

| 229,518 |

|

Current portion of long term debt (including current portion of securitization debt of consolidated VIEs at fair value of $186.6 million and $47.2 million, respectively) |

|

| 197,045 |

|

|

| 47,239 |

|

Deferred revenue |

|

| 12,487 |

|

|

| 10,655 |

|

Operating lease liabilities, current |

|

| 9,511 |

|

|

| 9,730 |

|

Other current liabilities |

|

| 12,284 |

|

|

| 17,693 |

|

Total current liabilities |

|

| 823,181 |

|

|

| 703,320 |

|

Long term debt, net of current portion (including securitization debt of consolidated VIEs of $175.3 million and $32.6 million at fair value, respectively) |

|

| 521,353 |

|

|

| 402,154 |

|

Operating lease liabilities, excluding current portion |

|

| 26,938 |

|

|

| 20,129 |

|

Other long-term liabilities (including other long-term liabilities of consolidated VIEs of $9.5 million and $7.4 million, respectively) |

|

| 16,969 |

|

|

| 18,183 |

|

Total liabilities |

|

| 1,388,441 |

|

|

| 1,143,786 |

|

Commitments and contingencies (Note 13) |

|

|

|

|

|

| ||

Stockholders’ equity: |

|

|

|

|

|

| ||

Common stock, $0.001 par value; 500,000,000 shares authorized as of September 30, 2023 and December 31, 2022; 139,752,858 and 138,201,903 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively |

|

| 135 |

|

|

| 135 |

|

Additional paid-in-capital |

|

| 2,083,046 |

|

|

| 2,075,798 |

|

Accumulated deficit |

|

| (1,824,911 | ) |

|

| (1,600,692 | ) |

Total stockholders’ equity |

|

| 258,270 |

|

|

| 475,241 |

|

Total liabilities and stockholders’ equity |

| $ | 1,646,711 |

|

| $ | 1,619,027 |

|

See accompanyingnotes to these unaudited condensed consolidated financial statements.

5

6

VROOM, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share amounts)

(unaudited)

| Three Months Ended June 30, |

|

| Six Months Ended June 30, |

|

| Three Months Ended |

|

| Nine Months Ended |

| ||||||||||||||||||||

| 2019 |

|

| 2020 |

|

| 2019 |

|

| 2020 |

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||||||

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Retail vehicle, net | $ | 200,402 |

|

| $ | 196,150 |

|

| $ | 379,152 |

|

| $ | 504,862 |

|

| $ | 147,710 |

|

| $ | 234,353 |

|

| $ | 419,548 |

|

| $ | 1,283,263 |

|

Wholesale vehicle |

| 54,531 |

|

|

| 50,921 |

|

|

| 106,651 |

|

|

| 106,497 |

|

|

| 30,898 |

|

|

| 47,604 |

|

|

| 75,593 |

|

|

| 270,489 |

|

Product, net |

| 5,491 |

|

|

| 5,736 |

|

|

| 9,236 |

|

|

| 16,780 |

|

|

| 13,075 |

|

|

| 13,181 |

|

|

| 36,499 |

|

|

| 51,954 |

|

Finance |

|

| 40,823 |

|

|

| 40,654 |

|

|

| 114,939 |

|

|

| 120,005 |

| |||||||||||||||

Other |

| 473 |

|

|

| 286 |

|

|

| 917 |

|

|

| 726 |

|

|

| 3,128 |

|

|

| 5,005 |

|

|

| 10,700 |

|

|

| 13,841 |

|

Total revenue |

| 260,897 |

|

|

| 253,093 |

|

|

| 495,956 |

|

|

| 628,865 |

|

|

| 235,634 |

|

|

| 340,797 |

|

|

| 657,279 |

|

|

| 1,739,552 |

|

Cost of sales |

| 247,052 |

|

|

| 245,486 |

|

|

| 470,099 |

|

|

| 602,871 |

| ||||||||||||||||

Cost of sales: |

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||

Retail vehicle |

|

| 144,654 |

|

|

| 218,726 |

|

|

| 414,917 |

|

|

| 1,234,138 |

| |||||||||||||||

Wholesale vehicle |

|

| 32,393 |

|

|

| 49,178 |

|

|

| 81,019 |

|

|

| 276,749 |

| |||||||||||||||

Product |

|

| 917 |

|

|

| — |

|

|

| 2,518 |

|

|

| — |

| |||||||||||||||

Finance |

|

| 8,481 |

|

|

| 4,699 |

|

|

| 22,755 |

|

|

| 10,368 |

| |||||||||||||||

Other |

|

| 1,095 |

|

|

| 863 |

|

|

| 3,170 |

|

|

| 2,969 |

| |||||||||||||||

Total cost of sales |

|

| 187,540 |

|

|

| 273,466 |

|

|

| 524,379 |

|

|

| 1,524,224 |

| |||||||||||||||

Total gross profit |

| 13,845 |

|

|

| 7,607 |

|

|

| 25,857 |

|

|

| 25,994 |

|

|

| 48,094 |

|

|

| 67,331 |

|

|

| 132,900 |

|

|

| 215,328 |

|

Selling, general and administrative expenses |

| 43,692 |

|

|

| 47,911 |

|

|

| 80,275 |

|

|

| 106,291 |

|

|

| 79,586 |

|

|

| 134,643 |

|

|

| 263,078 |

|

|

| 475,627 |

|

Depreciation and amortization |

| 1,501 |

|

|

| 1,083 |

|

|

| 3,034 |

|

|

| 2,049 |

|

|

| 11,010 |

|

|

| 9,833 |

|

|

| 31,845 |

|

|

| 27,728 |

|

Impairment charges |

|

| — |

|

|

| 1,017 |

|

|

| 1,353 |

|

|

| 206,127 |

| |||||||||||||||

Loss from operations |

| (31,348 | ) |

|

| (41,387 | ) |

|

| (57,452 | ) |

|

| (82,346 | ) |

|

| (42,502 | ) |

|

| (78,162 | ) |

|

| (163,376 | ) |

|

| (494,154 | ) |

Gain on debt extinguishment |

|

| — |

|

|

| (37,917 | ) |

|

| (19,640 | ) |

|

| (37,917 | ) | |||||||||||||||

Interest expense |

| 3,388 |

|

|

| 1,297 |

|

|

| 6,106 |

|

|

| 4,123 |

|

|

| 12,058 |

|

|

| 9,704 |

|

|

| 30,915 |

|

|

| 28,617 |

|

Interest income |

| (1,415 | ) |

|

| (715 | ) |

|

| (3,264 | ) |

|

| (2,671 | ) |

|

| (5,506 | ) |

|

| (5,104 | ) |

|

| (16,369 | ) |

|

| (12,991 | ) |

Revaluation of preferred stock warrant |

| 60 |

|

|

| 21,260 |

|

|

| 142 |

|

|

| 20,470 |

| ||||||||||||||||

Other income, net |

| (12 | ) |

|

| (53 | ) |

|

| (31 | ) |

|

| (86 | ) | ||||||||||||||||

Other loss, net |

|

| 33,543 |

|

|

| 5,383 |

|

|

| 65,019 |

|

|

| 26,897 |

| |||||||||||||||

Loss before provision (benefit) for income taxes |

| (33,369 | ) |

|

| (63,176 | ) |

|

| (60,405 | ) |

|

| (104,182 | ) |

|

| (82,597 | ) |

|

| (50,228 | ) |

|

| (223,301 | ) |

|

| (498,760 | ) |

Provision (benefit) for income taxes |

| (29 | ) |

|

| 52 |

|

|

| 74 |

|

|

| 105 |

|

|

| 260 |

|

|

| 899 |

|

|

| 918 |

|

|

| (22,085 | ) |

Net loss | $ | (33,340 | ) |

| $ | (63,228 | ) |

| $ | (60,479 | ) |

| $ | (104,287 | ) |

| $ | (82,857 | ) |

| $ | (51,127 | ) |

| $ | (224,219 | ) |

| $ | (476,675 | ) |

Accretion of redeemable convertible preferred stock |

| (25,879 | ) |

|

| — |

|

|

| (43,843 | ) |

|

| — |

| ||||||||||||||||

Net loss attributable to common stockholders | $ | (59,219 | ) |

| $ | (63,228 | ) |

| $ | (104,322 | ) |

| $ | (104,287 | ) | ||||||||||||||||

Net loss per share attributable to common stockholders, basic and diluted | $ | (6.90 | ) |

| $ | (2.00 | ) |

| $ | (12.16 | ) |

| $ | (5.21 | ) |

| $ | (0.59 | ) |

| $ | (0.37 | ) |

| $ | (1.61 | ) |

| $ | (3.46 | ) |

Weighted-average number of shares outstanding used to compute net loss per share attributable to common stockholders, basic and diluted |

| 8,580,150 |

|

|

| 31,599,497 |

|

|

| 8,579,539 |

|

|

| 20,035,476 |

|

|

| 139,692,323 |

|

|

| 138,118,679 |

|

|

| 139,123,352 |

|

|

| 137,817,839 |

|

See accompanying notes to these unaudited condensed consolidated financial statements.

6

7

VROOM, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN REDEEMABLE CONVERTIBLESTOCKHOLDERS’ EQUITY

PREFERRED STOCK AND STOCKHOLDERS’ (DEFICIT) EQUITY

(in thousands, except share amounts)

(unaudited)

|

| Redeemable Convertible Preferred Stock |

|

|

| Common Stock |

|

| Additional Paid-in |

|

| Accumulated |

|

| Total Stockholders’ |

| |||||||||||||

|

| Shares |

|

| Amount |

|

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| (Deficit) Equity |

| |||||||

Balance at December 31, 2018 |

|

| 66,825,300 |

|

| $ | 519,100 |

|

|

|

| 8,571,386 |

|

| $ | 8 |

|

| $ | — |

|

| $ | (296,874 | ) |

| $ | (296,866 | ) |

Stock-based compensation |

|

| — |

|

| $ | — |

|

|

|

| — |

|

| $ | — |

|

| $ | 869 |

|

| $ | — |

|

| $ | 869 |

|

Exercise of stock options |

|

| — |

|

|

| — |

|

|

|

| 101,950 |

|

|

| — |

|

|

| 347 |

|

|

| — |

|

|

| 347 |

|

Repurchase of common stock |

|

| — |

|

|

| — |

|

|

|

| (93,186 | ) |

|

| — |

|

|

| (1,216 | ) |

|

| 674 |

|

|

| (542 | ) |

Accretion of redeemable convertible preferred stock |

|

| — |

|

|

| 17,964 |

|

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (17,964 | ) |

|

| (17,964 | ) |

Net loss |

|

| — |

|

|

| — |

|

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (27,139 | ) |

|

| (27,139 | ) |

Balance at March 31, 2019 |

|

| 66,825,300 |

|

| $ | 537,064 |

|

|

|

| 8,580,150 |

|

| $ | 8 |

|

| $ | — |

|

| $ | (341,303 | ) |

| $ | (341,295 | ) |

Stock-based compensation |

|

| — |

|

| $ | — |

|

|

|

| — |

|

| $ | — |

|

| $ | 667 |

|

| $ | — |

|

| $ | 667 |

|

Exercise of stock options |

|

| — |

|

|

| — |

|

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Repurchase of common stock |

|

| — |

|

|

| — |

|

|

|

| — |

|

|

| — |

|

|

| (667 | ) |

|

| 667 |

|

|

| — |

|

Accretion of redeemable convertible preferred stock |

|

| — |

|

|

| 25,879 |

|

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (25,879 | ) |

|

| (25,879 | ) |

Net loss |

|

| — |

|

|

| — |

|

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (33,340 | ) |

|

| (33,340 | ) |

Balance at June 30, 2019 |

|

| 66,825,300 |

|

| $ | 562,943 |

|

|

|

| 8,580,150 |

|

| $ | 8 |

|

| $ | — |

|

| $ | (399,855 | ) |

| $ | (399,847 | ) |

|

| Common Stock |

|

| Additional |

|

| Accumulated |

|

| Total |

| ||||||||

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| Equity |

| |||||

Balance at December 31, 2021 |

|

| 137,092,891 |

|

| $ | 135 |

|

| $ | 2,063,841 |

|

| $ | (1,148,782 | ) |

| $ | 915,194 |

|

Stock-based compensation |

|

| — |

|

| $ | — |

|

| $ | 3,629 |

|

| $ | — |

|

| $ | 3,629 |

|

Vesting of restricted stock units |

|

| 602,630 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Net loss |

|

| — |

|

|

| — |

|

|

| — |

|

|

| (310,459 | ) |

|

| (310,459 | ) |

Balance at March 31, 2022 |

|

| 137,695,521 |

|

| $ | 135 |

|

| $ | 2,067,470 |

|

| $ | (1,459,241 | ) |

| $ | 608,364 |

|

Stock-based compensation |

|

| — |

|

| $ | — |

|

| $ | 1,776 |

|

| $ | — |

|

| $ | 1,776 |

|

Vesting of restricted stock units |

|

| 50,516 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Issuance of restricted stock purchase agreement |

|

| 356,718 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Net loss |

|

| — |

|

|

| — |

|

|

| — |

|

|

| (115,089 | ) |

|

| (115,089 | ) |

Balance at June 30, 2022 |

|

| 138,102,755 |

|

| $ | 135 |

|

| $ | 2,069,246 |

|

| $ | (1,574,330 | ) |

| $ | 495,051 |

|

Stock-based compensation |

|

| — |

|

| $ | — |

|

| $ | 1,208 |

|

| $ | — |

|

| $ | 1,208 |

|

Vesting of restricted stock units |

|

| 51,308 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Net loss |

|

| — |

|

|

| — |

|

|

| — |

|

|

| (51,127 | ) |

|

| (51,127 | ) |

Balance at September 30, 2022 |

|

| 138,154,063 |

|

| $ | 135 |

|

| $ | 2,070,454 |

|

| $ | (1,625,457 | ) |

| $ | 445,132 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

| Common Stock |

|

| Additional |

|

| Accumulated |

|

| Total |

| ||||||||

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| Equity |

| |||||

Balance at December 31, 2022 |

|

| 138,201,903 |

|

| $ | 135 |

|

| $ | 2,075,798 |

|

| $ | (1,600,692 | ) |

| $ | 475,241 |

|

Stock-based compensation |

|

| — |

|

| $ | — |

|

| $ | 2,041 |

|

| $ | — |

|

| $ | 2,041 |

|

Vesting of restricted stock units |

|

| 600,108 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Net loss |

|

| — |

|

|

| — |

|

|

| — |

|

|

| (75,044 | ) |

|

| (75,044 | ) |

Balance at March 31, 2023 |

|

| 138,802,011 |

|

| $ | 135 |

|

| $ | 2,077,839 |

|

| $ | (1,675,736 | ) |

| $ | 402,238 |

|

Stock-based compensation |

|

| — |

|

| $ | — |

|

| $ | 2,316 |

|

| $ | — |

|

| $ | 2,316 |

|

Vesting of restricted stock units |

|

| 847,279 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Net loss |

|

| — |

|

|

| — |

|

|

| — |

|

|

| (66,318 | ) |

|

| (66,318 | ) |

Balance at June 30, 2023 |

|

| 139,649,290 |

|

| $ | 135 |

|

| $ | 2,080,155 |

|

| $ | (1,742,054 | ) |

| $ | 338,236 |

|

Stock-based compensation |

|

| — |

|

| $ | — |

|

| $ | 2,891 |

|

| $ | — |

|

| $ | 2,891 |

|

Vesting of restricted stock units |

|

| 103,568 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Net loss |

|

| — |

|

|

| — |

|

|

| — |

|

|

| (82,857 | ) |

|

| (82,857 | ) |

Balance at September 30, 2023 |

|

| 139,752,858 |

|

| $ | 135 |

|

| $ | 2,083,046 |

|

| $ | (1,824,911 | ) |

| $ | 258,270 |

|

|

| Redeemable Convertible Preferred Stock |

|

|

| Common Stock |

|

| Additional Paid-in |

|

| Accumulated |

|

| Total Stockholders’ |

| |||||||||||||

|

| Shares |

|

| Amount |

|

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| (Deficit) Equity |

| |||||||

Balance at December 31, 2019 |

|

| 83,568,628 |

|

| $ | 874,332 |

|

|

|

| 8,650,922 |

|

| $ | 8 |

|

| $ | — |

|

| $ | (573,860 | ) |

| $ | (573,852 | ) |

Stock-based compensation |

|

| — |

|

| $ | — |

|

|

|

| — |

|

| $ | — |

|

| $ | 600 |

|

| $ | — |

|

| $ | 600 |

|

Exercise of stock options |

|

| — |

|

|

| — |

|

|

|

| 2,774 |

|

|

| — |

|

|

| 6 |

|

|

| — |

|

|

| 6 |

|

Repurchase of common stock |

|

| — |

|

|

| — |

|

|

|

| (200,000 | ) |

|

| — |

|

|

| (606 | ) |

|

| (1,212 | ) |

|

| (1,818 | ) |

Issuance of Series H redeemable convertible preferred stock, net of issuance costs |

|

| 1,964,766 |

|

|

| 26,714 |

|

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Net loss |

|

| — |

|

|

| — |

|

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (41,059 | ) |

|

| (41,059 | ) |

Balance at March 31, 2020 |

|

| 85,533,394 |

|

| $ | 901,046 |

|

|

|

| 8,453,696 |

|

| $ | 8 |

|

| $ | — |

|

| $ | (616,131 | ) |

| $ | (616,123 | ) |

Issuance of common stock |

|

| — |

|

| $ | — |

|

|

|

| 183,870 |

|

| $ | — |

|

| $ | 2,127 |

|

| $ | — |

|

| $ | 2,127 |

|

Conversion of redeemable convertible preferred stock to common stock |

|

| (85,533,394 | ) |

|

| (901,046 | ) |

|

|

| 85,533,394 |

|

|

| 86 |

|

|

| 900,960 |

|

|

| — |

|

|

| 901,046 |

|

Conversion of redeemable convertible preferred stock warrant to common stock warrant |

|

| — |

|

|

| — |

|

|

|

| — |

|

|

| — |

|

|

| 21,873 |

|

|

| — |

|

|

| 21,873 |

|

Issuance of common stock in IPO, net of offering costs |

|

| — |

|

|

| — |

|

|

|

| 24,437,500 |

|

|

| 24 |

|

|

| 496,486 |

|

|

| — |

|

|

| 496,510 |

|

Stock-based compensation |

|

| — |

|

|

| — |

|

|

|

| — |

|

|

| — |

|

|

| 4,100 |

|

|

| — |

|

|

| 4,100 |

|

Exercise of stock options |

|

| — |

|

|

| — |

|

|

|

| 500 |

|

|

| — |

|

|

| 7 |

|

|

| — |

|

|

| 7 |

|

Exercise of common stock warrants |

|

| — |

|

|

| — |

|

|

|

| 636,112 |

|

|

| 1 |

|

|

| — |

|

|

| — |

|

|

| 1 |

|

Vesting of restricted stock units |

|

| — |

|

|

| — |

|

|

|

| 133,334 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Common stock shares withheld to satisfy employee tax withholding obligations |

|

| — |

|

|

| — |

|

|

|

| (41,818 | ) |

|

| — |

|

|

| (878 | ) |

|

| — |

|

|

| (878 | ) |

Net loss |

|

| — |

|

|

| — |

|

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (63,228 | ) |

|

| (63,228 | ) |

Balance at June 30, 2020 |

|

| — |

|

| $ | — |

|

|

|

| 119,336,588 |

|

| $ | 119 |

|

| $ | 1,424,675 |

|

| $ | (679,359 | ) |

| $ | 745,435 |

|

See accompanyingnotes to these unaudited condensed consolidated financial statements.

78

VROOM, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

|

| Six Months Ended June 30, |

| |||||

|

| 2019 |

|

| 2020 |

| ||

Operating activities |

|

|

|

|

|

|

|

|

Net loss |

| $ | (60,479 | ) |

| $ | (104,287 | ) |

Adjustments to reconcile net loss to net cash (used in) provided by operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

| 3,146 |

|

|

| 2,059 |

|

Amortization of debt issuance costs |

|

| 179 |

|

|

| 375 |

|

Stock-based compensation expense |

|

| 1,536 |

|

|

| 4,700 |

|

Loss on disposal of property and equipment |

|

| 764 |

|

|

| — |

|

Provision for inventory obsolescence |

|

| 1,889 |

|

|

| (1,564 | ) |

Revaluation of preferred stock warrant |

|

| 142 |

|

|

| 20,470 |

|

Other |

|

| — |

|

|

| 632 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

| (14,544 | ) |

|

| 14,863 |

|

Inventory |

|

| (76,209 | ) |

|

| 66,247 |

|

Prepaid expenses and other current assets |

|

| (1,814 | ) |

|

| (7,909 | ) |

Other assets |

|

| (1,488 | ) |

|

| (1,285 | ) |

Accounts payable |

|

| 6,501 |

|

|

| 919 |

|

Accrued expenses |

|

| 7,224 |

|

|

| 4,714 |

|

Deferred revenue |

|

| 2,664 |

|

|

| (1,835 | ) |

Other liabilities |

|

| 2,592 |

|

|

| 1,905 |

|

Net cash (used in) provided by operating activities |

|

| (127,897 | ) |

|

| 4 |

|

Investing activities |

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

| (794 | ) |

|

| (3,128 | ) |

Net cash used in investing activities |

|

| (794 | ) |

|

| (3,128 | ) |

Financing activities |

|

|

|

|

|

|

|

|

Repayments of long-term debt |

|

| (3,340 | ) |

|

| — |

|

Proceeds from vehicle floorplan |

|

| 420,518 |

|

|

| 465,663 |

|

Repayments of vehicle floorplan |

|

| (349,545 | ) |

|

| (529,341 | ) |

Payment of vehicle floorplan upfront commitment fees |

|

| — |

|

|

| (1,125 | ) |

Proceeds from the issuance of redeemable convertible preferred stock, net |

|

| — |

|

|

| 21,694 |

|

Repurchase of common stock |

|

| (542 | ) |

|

| (1,818 | ) |

Common stock shares withheld to satisfy employee tax withholding obligations |

|

| — |

|

|

| (878 | ) |

Proceeds from the issuance of common stock in connection with IPO, net of underwriting discount |

|

| — |

|

|

| 504,023 |

|

Payments of costs related to IPO |

|

| — |

|

|

| (1,740 | ) |

Proceeds from exercise of stock options |

|

| 347 |

|

|

| 13 |

|

Other financing activities |

|

| 268 |

|

|

| (66 | ) |

Net cash provided by financing activities |

|

| 67,706 |

|

|

| 456,425 |

|

Net (decrease) increase in cash, cash equivalents and restricted cash |

|

| (60,985 | ) |

|

| 453,301 |

|

Cash, cash equivalents and restricted cash at the beginning of period |

|

| 163,509 |

|

|

| 219,587 |

|

Cash, cash equivalents and restricted cash at the end of period |

| $ | 102,524 |

|

| $ | 672,888 |

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

|

|

Cash paid for interest |

| $ | 5,176 |

|

| $ | 2,743 |

|

Cash paid for income taxes |

| $ | 209 |

|

| $ | — |

|

Supplemental disclosure of non-cash investing and financing activities: |

|

|

|

|

|

|

|

|

Accretion of redeemable convertible preferred stock |

| $ | 43,843 |

|

| $ | — |

|

Costs related to IPO included in accrued expenses and accounts payable |

| $ | — |

|

| $ | 5,051 |

|

Conversion of redeemable convertible preferred stock warrant to common stock warrant |

| $ | — |

|

| $ | 21,873 |

|

Issuance of common stock as upfront payment to nonemployee |

| $ | — |

|

| $ | 2,127 |

|

Accrued property and equipment expenditures |

| $ | 101 |

|

| $ | 611 |

|

|

| Nine Months Ended |

| |||||

|

| 2023 |

|

| 2022 |

| ||

Operating activities |

|

|

|

|

|

| ||

Net loss |

| $ | (224,219 | ) |

| $ | (476,675 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

| ||

Impairment charges |

|

| 1,353 |

|

|

| 206,127 |

|

Gain on debt extinguishment |

|

| (19,640 | ) |

|

| (37,917 | ) |

Depreciation and amortization |

|

| 32,421 |

|

|

| 28,005 |

|

Amortization of debt issuance costs |

|

| 3,418 |

|

|

| 3,777 |

|

Realized gains on securitization transactions |

|

| — |

|

|

| (45,589 | ) |

Deferred taxes |

|

| — |

|

|

| (23,855 | ) |

Losses on finance receivables and securitization debt, net |

|

| 80,246 |

|

|

| 39,464 |

|

Stock-based compensation expense |

|

| 7,248 |

|

|

| 6,613 |

|

Provision to record inventory at lower of cost or net realizable value |

|

| (15,867 | ) |

|

| (5,033 | ) |

Provision for bad debt |

|

| 995 |

|

|

| 18,448 |

|

Provision to record finance receivables held for sale at lower of cost or fair value |

|

| 4,375 |

|

|

| 3,831 |

|

Amortization of unearned discounts on finance receivables at fair value |

|

| (20,273 | ) |

|

| (12,121 | ) |

Other, net |

|

| (11,792 | ) |

|

| (5,441 | ) |

Changes in operating assets and liabilities: |

|

|

|

|

|

| ||

Finance receivables, held for sale |

|

|

|

|

|

| ||

Originations of finance receivables held for sale |

|

| (420,793 | ) |

|

| (483,167 | ) |

Principal payments received on finance receivables held for sale |

|

| 71,906 |

|

|

| 38,297 |

|

Proceeds from sale of finance receivables held for sale, net |

|

| — |

|

|

| 509,612 |

|

Other |

|

| (868 | ) |

|

| (5,924 | ) |

Accounts receivable |

|

| 3,950 |

|

|

| 63,252 |

|

Inventory |

|

| 95,839 |

|

|

| 293,589 |

|

Prepaid expenses and other current assets |

|

| 17,316 |

|

|

| 12,420 |

|

Other assets |

|

| 2,097 |

|

|

| (2,678 | ) |

Accounts payable |

|

| (7,422 | ) |

|

| (22,183 | ) |

Accrued expenses |

|

| (19,914 | ) |

|

| (27,020 | ) |

Deferred revenue |

|

| 1,832 |

|

|

| (59,490 | ) |

Other liabilities |

|

| (7,839 | ) |

|

| (39,444 | ) |

Net cash used in operating activities |

|

| (425,631 | ) |

|

| (23,102 | ) |

Investing activities |

|

|

|

|

|

| ||

Finance receivables at fair value |

|

|

|

|

|

| ||

Purchases of finance receivables at fair value |

|

| (3,392 | ) |

|

| (49,475 | ) |

Principal payments received on finance receivables at fair value |

|

| 136,644 |

|

|

| 106,829 |

|

Proceeds from sale of finance receivables at fair value, net |

|

| — |

|

|

| 43,262 |

|

Consolidation of VIEs |

|

| 11,409 |

|

|

| — |

|

Principal payments received on beneficial interests |

|

| 4,334 |

|

|

| 5,571 |

|

Purchase of property and equipment |

|

| (11,553 | ) |

|

| (19,968 | ) |

Acquisition of business, net of cash acquired of $47.9 million |

|

| — |

|

|

| (267,488 | ) |

Net cash provided by (used in) investing activities |

|

| 137,442 |

|

|

| (181,269 | ) |

Financing activities |

|

|

|

|

|

| ||

Proceeds from borrowings under secured financing agreements |

|

| 261,991 |

|

|

| — |

|

Principal repayment under secured financing agreements |

|

| (159,384 | ) |

|

| (176,909 | ) |

Proceeds from financing of beneficial interests in securitizations |

|

| 24,506 |

|

|

| — |

|

Principal repayments of financing of beneficial interests in securitizations |

|

| (5,699 | ) |

|

| — |

|

Proceeds from vehicle floorplan |

|

| 436,586 |

|

|

| 1,286,000 |

|

Repayments of vehicle floorplan |

|

| (501,088 | ) |

|

| (1,453,529 | ) |

Proceeds from warehouse credit facilities |

|

| 332,700 |

|

|

| 419,000 |

|

Repayments of warehouse credit facilities |

|

| (269,698 | ) |

|

| (460,566 | ) |

Repurchases of convertible senior notes |

|

| (13,194 | ) |

|

| (18,458 | ) |

Other financing activities |

|

| (1,462 | ) |

|

| (1,977 | ) |

Net cash provided by (used in) financing activities |

|

| 105,258 |

|

|

| (406,439 | ) |

Net decrease in cash, cash equivalents and restricted cash |

|

| (182,931 | ) |

|

| (610,810 | ) |

Cash, cash equivalents and restricted cash at the beginning of period |

|

| 472,010 |

|

|

| 1,214,775 |

|

Cash, cash equivalents and restricted cash at the end of period |

| $ | 289,079 |

|

| $ | 603,965 |

|

(Continued on following page)

9

VROOM, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (continued)

(in thousands)

(unaudited)

Supplemental disclosure of cash flow information: |

|

|

|

|

|

| ||

Cash paid for interest |

| $ | 40,424 |

|

| $ | 24,619 |

|

Cash paid for income taxes |

| $ | 5,153 |

|

| $ | 2,062 |

|

Supplemental disclosure of non-cash investing and financing activities: |

|

|

|

|

|

| ||

Finance receivables from consolidation of 2022-2 securitization transaction |

| $ | 180,706 |

|

| $ | — |

|

Elimination of beneficial interest from the consolidation of 2022-2 securitization transaction |

| $ | 9,811 |

|

| $ | — |

|

Securitization debt from consolidation of 2022-2 securitization transaction |

| $ | 186,386 |

|

| $ | — |

|

Reclassification of finance receivables held for sale to finance receivables at fair value, net |

| $ | 248,081 |

|

| $ | — |

|

Fair value of beneficial interests received in securitization transactions |

| $ | — |

|

| $ | 30,082 |

|

See accompanyingnotes to these unaudited condensed consolidated financial statements.

810

VROOM, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

1. Description of Business and Basis of Presentation

Description of Business and Organization

Vroom, Inc., and its wholly owned subsidiaries (collectively, “the Company”) is an innovative, end-to-end ecommerce platform that is transforming the used vehicle industry by offering a better way to buy and a better way to sell used vehicles.

In December 2015, the Company acquired Houston-based Left Gate Property Holding, LLC (d/b/a Texas Direct Auto and herein referred to as “TDA”Vroom). The acquisition included the Company's proprietary vehicle reconditioning center, the Texas Direct Auto ("TDA") whichdealership, and Sell Us Your Car® centers. Left Gate Property Holding, LLC was renamed Vroom Automotive, LLC in March 2021, and is the Company’s sole physical retail location.primary operating entity for the Company's purchases and sales of used vehicles. In January 2021, the Company acquired Vast Holdings, Inc. (d/b/a CarStory). On February 1, 2022, the ("Acquisition Date"), the Company completed the acquisition of Unitas Holdings Corp. (now known as Vroom Finance Corporation), including its wholly owned subsidiaries United PanAm Financial Corp. (now known as Vroom Automotive Financial Corporation) and United Auto Credit Corporation ("UACC").

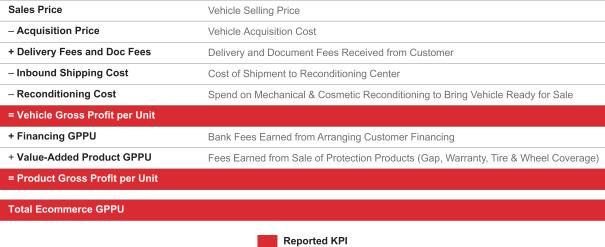

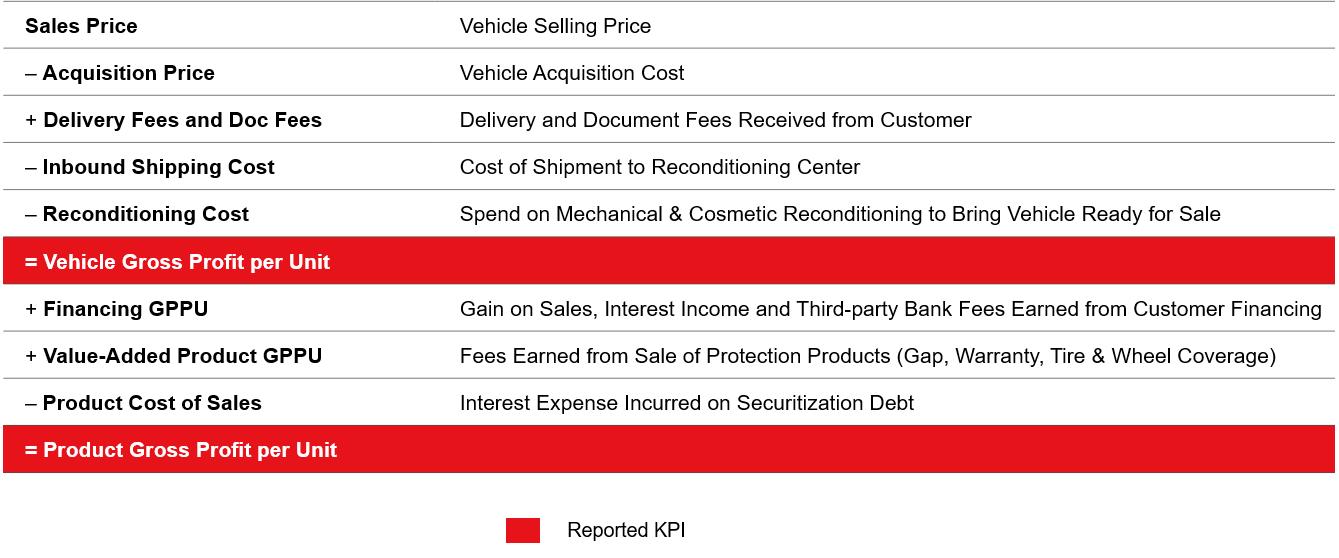

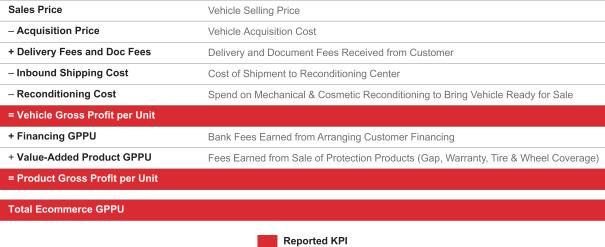

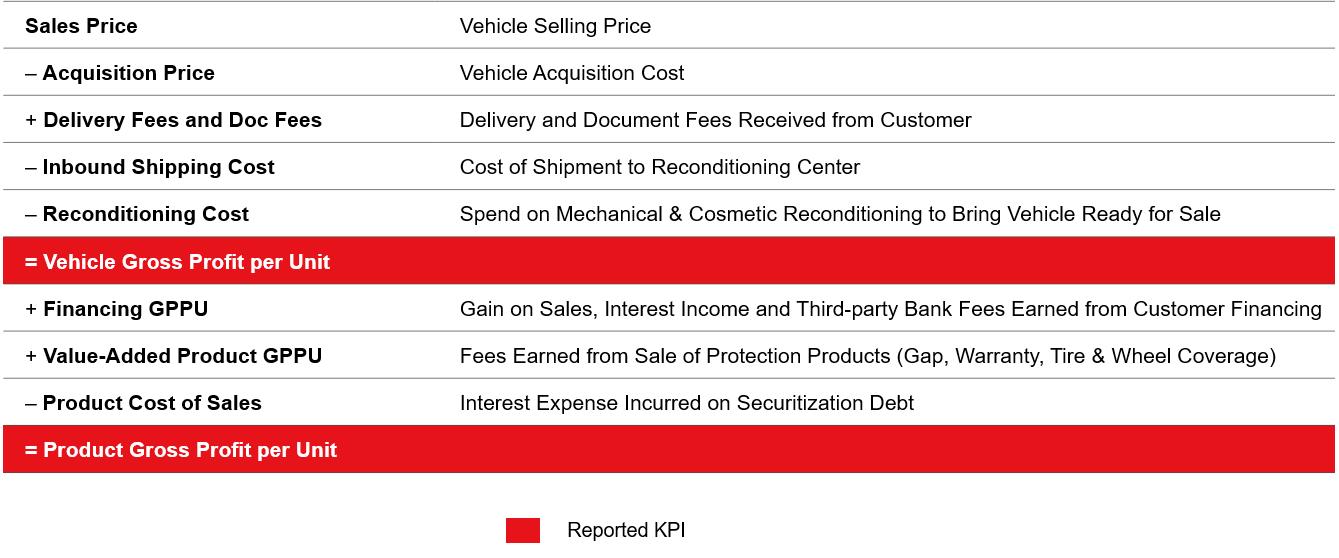

The Company currently is organized into three reportable segments: Ecommerce, TDA,Wholesale, and Wholesale.Retail Financing. The Ecommerce reportable segment represents retail sales of used vehicles through the Company’s ecommerce platform, and feesrevenue earned on sales of value-added products associated with those vehicles sales. The TDA reportable segment represents retail sales of used vehicles from TDAvehicle financing originated by UACC or the Company's third-party financing sources and fees earned on sales of value-added products associated with those vehicles sales. The Wholesale reportable segment represents sales of used vehicles through wholesale auctions.channels. The Retail Financing reportable segment represents UACC’s operations with its network of third-party dealership customers, which primarily consists of the purchases and servicing of vehicle installment contracts, but excluding financing of vehicle sales to Vroom customers.

The Company was incorporated in Delaware on January 31, 2012 under the name BCM Partners III, Corp. On June 25, 2013, the Company changed its name to Auto America, Inc. and on July 9, 2015, the Company changed its name to Vroom, Inc.

Stock Split

In connection with the closing of the Company’s initial public offering (“IPO”) on June 11, 2020, the Company effected a 2-for-1 forward stock split of the Company’s common stock, which became effective immediately prior to the consummation of the IPO. All shares of the Company’s common stock, stock-based instruments, and per-share data included in these condensed consolidated financial statements have been retroactively adjusted as though the stock split has been effected prior to all periods presented.

Initial Public Offering

The Company closed its IPO on June 11, 2020 in which it sold 24,437,500 shares of common stock at the public offering price of $22.00 per share, including 3,187,500 shares sold pursuant to exercise by the underwriters of their option to purchase additional shares. The Company received proceeds of $504.0 million from the IPO, net of the underwriting discount and before deducting offering expenses of $7.5 million. In addition, in accordance with their terms and consistent with the conversion rates discussed in Note 10 - Redeemable Convertible Preferred Stock and Stockholders’ (Deficit) Equity, all shares of the Company’s outstanding redeemable convertible preferred stock were automatically converted into common stock upon the closing of the IPO.

Basis of Presentation

The interim condensed consolidated financial statements of the Company have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) and applicable rules and regulations of the U.S. Securities and Exchange Commission ("SEC") regarding interim financial reporting. The condensed consolidated balance sheet as of December 31, 2019,2022, included herein, was derived from the audited consolidated financial statements as of that date. Certain information and note disclosures normally included in the financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to such rules and regulations. Therefore, these interim condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes included in the final prospectus dated June 8, 2020 and filed withAnnual Report on Form 10-K for the SEC pursuant to Rule 424(b)(4) under the Securities Act of 1933, as amended, (the "Securities Act"), on June 9, 2020 (the "Prospectus").year ended December 31, 2022.

The unaudited interim condensed consolidated financial statements have been prepared on the same basis as the audited consolidated financial statements, and in management’s opinion, include all adjustments, which consist of only normal recurring adjustments necessary for the fair statement of the Company’s condensed consolidated balance sheet as of JuneSeptember 30, 20202023 and its results of operations for the three and sixnine months ended JuneSeptember 30, 20192023 and 2020.2022. The results for the three and sixnine months ended JuneSeptember 30, 20202023 are not necessarily indicative of the results expected for the current fiscal year or any other future periods. Certain prior year amounts have been reclassified to conform to the current year presentation.

9

VROOM, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Except as described elsewhere in Note 2 to the condensed consolidated financial statements, there have been no material changes to the Company's significant accounting policies as described in the Prospectus.

Principles of Consolidation

The accompanying condensed consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All intercompany accounts and transactions have been eliminated in consolidation.

11

VROOM, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

2. Summary of Significant Accounting Policies

Use of Estimates

The preparation of condensed consolidated financial statements in accordance with U.S. GAAP requires management to make estimates, assumptions and judgments that affect the reported amounts of assets, liabilities, revenue, and expenses and related disclosures. On an ongoing basis, the Company evaluates its estimates, including, among others, those related to income taxes, the realizability of inventory, stock-based compensation, contingencies, revenue-related reserves, fair value measurements, goodwill, and useful lives of property and equipment and intangible assets. The Company bases its estimates on historical experience, market conditions, and on various other assumptions that are believed to be reasonable. Actual results may differ from these estimates.

Beginning in the first quarter of 2020, the COVID-19 pandemic caused by the novel coronavirus has negatively impacted, and may continue to negatively impact, the macroeconomic environment in the United States and globally, as well as the Company’s business, financial condition and results of operations. Due to the evolving and uncertain nature of COVID-19, it is reasonably possible that it could materially impact the Company’s estimates, particularly those noted above that require consideration of forecasted financial information, in the near to medium term. The ultimate impact will depend on numerous evolving factors that the Company may not be able to accurately predict, including the duration and extent of the pandemic, the impact of federal, state, local and foreign governmental actions, consumer behavior in response to the pandemic and other economic and operational conditions the Company may face.

Comprehensive Loss

The Company did notnot have any other comprehensive income or loss for the three and sixnine months ended JuneSeptember 30, 20192023 and 2020.2022. Accordingly, net loss and comprehensive loss are the same for the periods presented.

Restricted Cash

Restricted cash as of December 31, 2019 and June 30, 2020primarily includes cash deposits required under letter of credit agreements as explained in Note 8 – Commitments and Contingencies. Restricted cash as of June 30, 2020 also includes a $20.0 million cash deposit required under the Company’s 20202022 Vehicle Floorplan Facility as explained in Note 710 – Vehicle Floorplan Facilities.Facility and UACC restricted cash. UACC collects and services receivables under the securitization transactions and warehouse credit facilities. These collections are restricted for use until properly remitted each month under the terms of the servicing agreement. Refer to Note 11 — Warehouse Credit Facilities of Consolidated VIEs and Note 12 — Long Term Debt for further detail.

Finance Receivables

AdvertisingFinance receivables consist of installment contracts the Company originates through UACC to finance the vehicles it sells, as well as installment contracts acquired by UACC from its existing network of third-party dealership customers.

The Company's finance receivables are generally secured by the vehicles being financed.

Finance receivables over 90 days delinquent are considered nonaccrual finance receivables. Interest income is subsequently recognized only to the extent cash payments are received. Finance receivables may be restored to accrual status when a customer settles all delinquency balances and future interest and principal payments are reasonably assured.

Finance Receivables Held for Sale, Net

Finance receivables that the Company intends to sell and not hold to maturity are classified as held-for-sale. The Company intends to sell finance receivables either through securitization transactions or forward flow arrangements. Finance receivables classified as held for sale are recorded at the lower of cost or fair value. Deferred acquisition costs and any discounts or premiums are deferred until the finance receivables are sold and are then recognized as part of the total gain or loss on sale and recorded in “Finance Revenue” and "Product, net" in the condensed consolidated statements of operations. Refer to Note 3 – Revenue Recognition.

The Company records a valuation allowance to report finance receivables at the lower of amortized cost basis or fair value. To determine the valuation allowance, finance receivables are evaluated collectively as they represent a large group of smaller-balance homogeneous loans. To the extent that actual experience differs from estimates, significant adjustments to the Company's valuation allowance may be needed. Fair value adjustments are recorded in "Other loss, net" in the condensed consolidated statements of operations. Principal balances of finance receivables are charged-off when the Company is unable to sell the finance receivable and the related vehicle has been repossessed and liquidated or the receivable has otherwise been deemed uncollectible. As of September 30, 2023 and December 31, 2022, the

12

VROOM, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

valuation allowance for finance receivables classified as held for sale was $15.3 million and $10.5 million, respectively. Refer to Note 16 – Financial Instruments and Fair Value Measurements.

Finance Receivables at Fair Value

Finance receivables at fair value represent finance receivables that the Company does not intend to sell in the immediate future and for which the fair value option was elected. Fair value adjustments are recorded in "Other loss, net" in the condensed consolidated statements of operations. Refer to Note 16 – Financial Instruments and Fair Value Measurements.

Consolidated CFEs

The Company elected the fair value option upon consolidation of the assets and liabilities of its variable interest entities ("VIEs") related to the 2021-1, 2022-2, and 2023-1 securitization transactions. Refer to Note 4 – Variable Interest Entities and Securitizations. These VIEs are consolidated collateralized financing entities (CFEs) and are accounted for using the measurement alternative in accordance with ASU 2014-13, Measuring the Financial Assets and Liabilities of a Consolidated Collateralized Financing Entity (“ASU 2014-13"). During the three and nine months ended September 30, 2023 and 2022, the Company recognized the following revenue and expenses associated with these CFEs in the condensed consolidated statements of operations:

|

| Three Months Ended |

|

| Nine Months Ended |

| ||||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||

Finance revenue |

| $ | 22,936 |

|

| $ | 9,999 |

|

| $ | 62,704 |

|

| $ | 35,039 |

|

Product revenue |

| $ | 3,198 |

|

| $ | — |

|

| $ | 9,172 |

|

| $ | — |

|

Finance cost of sales |

| $ | (5,246 | ) |

| $ | (937 | ) |

| $ | (14,075 | ) |

| $ | (2,941 | ) |

Product cost of sales |

| $ | (917 | ) |

| $ | — |

|

| $ | (2,518 | ) |

| $ | — |

|

Other loss, net |

| $ | (23,709 | ) |

| $ | (3,479 | ) |

| $ | (47,919 | ) |

| $ | (15,798 | ) |

The assets and liabilities of the CFEs are presented as part of the current and noncurrent “Finance receivables at fair value”, “Current portion of long term debt”, and "Long term debt, net of current portion", respectively, on the condensed consolidated balance sheets. Refer to Note 4 – Variable Interest Entities and Securitizations and Note 16 – Financial Instruments and Fair Value Measurements for further details.

Business Combinations

The Company uses its best estimates and assumptions to assign fair value to the tangible and intangible assets acquired and liabilities assumed at the acquisition date. The Company’s estimates are inherently uncertain and subject to refinement. During the measurement period, which may be up to one year from the acquisition date, the Company may record adjustments to the fair value of these tangible and intangible assets acquired and liabilities assumed, with the corresponding offset to goodwill. The Company will continue to collect information and reevaluate these estimates and assumptions quarterly and record any adjustments to the Company’s preliminary estimates to goodwill provided that the Company is within the measurement period. Upon the conclusion of the measurement period or final determination of the fair value of assets acquired or liabilities assumed, whichever comes first, any subsequent adjustments will be recorded to the Company’s condensed consolidated statement of operations.

Advertising

Advertising costs are expensed as incurred and are included within “Selling, general and administrative expenses” in the condensed consolidated statements of operations. Advertising expenses were $12.7$13.4 million and $11.6$14.9 million for the three months ended JuneSeptember 30, 20192023 and 2020,2022, respectively, and $19.8$39.9 million and $29.5$69.8 million for the sixnine months ended JuneSeptember 30, 20192023 and 2020,2022, respectively.

13

VROOM, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Shipping and Handling

The Company’s logistics costs related to transporting its used vehicle inventory primarily include third-party transportation fees. The portion of these

Logistics costs related to inbound transportation from the point of acquisition to the relevant reconditioning facility isare included in cost of sales when the related used vehicle is sold. Logistics costs not included in cost of sales are accounted for as costs to fulfilfulfill contracts with customers and are included in “Selling, general and administrative expenses” in the condensed consolidated statements of operations and were $2.7$2.2 million and $5.5$4.9 million for the three months ended JuneSeptember 30, 20192023 and 2020,2022, respectively, and $4.9$6.3 million and $11.3$39.9 million for the sixnine months ended JuneSeptember 30, 20192023 and 2020,2022, respectively.

10

VROOM, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Concentration of Credit Risk and Significant Customers

The Company’s principal financial instruments subject to potential concentration of credit risk are cash and cash equivalents and accounts receivable, which are unsecured. The Company’s cash and cash equivalentsbalances are maintained at various large, reputable financial institutions. Deposits held with financial institutions may at times exceed the amount of insurance provided on such deposits. Generally, these deposits may be redeemed upon demand and, therefore, management believes they bear minimal risk. The Company’s cash equivalents primarily consist of money market funds that hold investments in highly liquid U.S. treasury securities and commercial paper investments. Concentration of credit risk with respect to accounts receivable is generally mitigated by a large customer base.

For the three and sixnine months ended JuneSeptember 30, 20192023 and 2020,2022, no customer represented 10% or more of the Company’s revenues and no customer represented more than 10% of the Company’s accounts receivable as of September 30, 2023 and December 31, 2019 and June 30, 2020.2022.

Liquidity

The Company has had negative cash flows and generated losses from operations since inception and has historically had to rely on debt and equity financing to fund its operations. Further, the Company expects to incur additional losses in the future.

As of September 30, 2023, the Company had cash and cash equivalents of $208.6 million and restricted cash of $80.5 million. The primary source of liquidity is cash generated through financing activities.

Since inception, the Company has relied on borrowings under its vehicle floorplan facilities to finance its inventory. The term of the vehicle floorplan facility generally matures within one to two years and the Company typically renews those facilities at least annually. The 2022 Vehicle Floorplan Facility has a borrowing capacity of $228.1 million as of September 30, 2023, of which it has funded primarily through issuances$15.6 million was unutilized and provides a committed credit line of common and preferred stock.up to $500.0 million which is scheduled to mature on March 31, 2024. The Company has historically funded vehicle inventory purchases throughcommenced discussions with its vehiclefloorplan lender, Ally Bank and Ally Financial (together “Ally”), regarding an amended floorplan facility (referthat would extend the term beyond the current expiration date. Ally recently indicated its willingness to Note 7 –extend the floorplan facility beyond June 2024 would be contingent upon the Company raising additional capital. The 2022 Vehicle Floorplan Facilities). As further discussed in Note 7,Facility remains a committed facility through March 31, 2024. Prior to that date, the Company entered intointends to continue its discussions with Ally over the terms of an amended facility and may engage with other lenders over the terms of an alternative facility. In the event that a new vehicle floorplan facilitycapital raise is required by Ally or another lender, there can be no assurance that such additional capital would be available in March 2020 which increased the borrowing capacity uprequired amount or on terms acceptable to $450.0 million and extended the term through March 2021.

In accordance with Accounting Standards Update No. 2014-15, Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern (Subtopic 205-40), the Company, has evaluated whether there is substantial doubt aboutif at all. Failure to secure floorplan financing beyond the expiration of the 2022 Vehicle Floorplan Facility would have a material adverse effect on the Company’s ability to meetfinance its obligations within one year from the financial statement issuance date. In connectioninventory and operate its core used automotive sales business.

UACC has four warehouse credit facilities with the previous issuancean aggregate borrowing limit of the consolidated financial statements$825.0 million as of and for the year ended December 31, 2019, uncertainties relatingSeptember 30, 2023. As of September 30, 2023, outstanding borrowings related to the COVID-19 pandemic, combined with the Company’s lossesWarehouse Credit Facilities were $294.7 million and negative cash flows from operations since inception, and the fact that management’s planexcess borrowing capacity was $72.5 million. Refer to obtain additional capital had not yet been completed, raised substantial doubt about the Company’s ability to continue as a going concern. However, following the successful completionNote 11 – Warehouse Credit Facilities of the Company’s IPO in June 2020, in which it raised proceeds of $504.0 million from the IPO, net of the underwriting discount and before deducting offering expenses of $7.5 million as described above, management completed an updated evaluation of the Company’s ability to continue as going concern and has concluded the factors that previously raised substantial doubt about the Company’s ability to continue as going concern no longer exist as of the issuance date of these condensed consolidated financial statements.Consolidated VIEs for further discussion.

Nonemployee Share-Based Payments