UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 ☒

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended December 31, 20202021

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 ☐

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from _____________ to ___________

Commission File Number 1-084621-8462

GRAHAM CORPORATION

(Exact name of registrant as specified in its charter)

| |

Delaware | 16-1194720 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

20 Florence Avenue, Batavia, New York | 14020 |

(Address of principal executive offices) | (Zip Code) |

585-343-2216585-343-2216

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

Common Stock, Par Value $0.10 Per Share |

| GHM |

| NYSE |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | |

Large accelerated filer | ☐ | | Accelerated filer | ☐ |

Non-accelerated filer | ☒ |

| Smaller reporting company | ☒ |

Emerging growth company | ☐

| ☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

As of January 27, 2021,31, 2022, there were outstanding 9,988,66810,638,041 shares of the registrant’s common stock, par value $0.10 per share.

Graham Corporation and Subsidiaries

Index to Form 10-Q

As of December 31, 20202021 and March 31, 20202021 and for the Threethree and Nine-Month Periods Endednine months ended December 31, 2020 and 2019 2021

2

GRAHAM CORPORATION AND SUBSIDIARIES

FORM 10-Q

DECEMBER 31, 20202021

PART I – FINANCIAL INFORMATION

3

Item 1. Unaudited Condensed Consolidated Financial Statements Item 1.

| Unaudited Condensed Consolidated Financial Statements

|

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOMEOPERATIONS

(Unaudited)

| | | Three Months Ended | | | Nine Months Ended | | | Three Months Ended | | Nine Months Ended | |

| | December 31, | | | December 31, | | | December 31, | | | December 31, | | |

| | 2020 | | | 2019 | | | 2020 | | | 2019 | | | 2021 | | | 2020 | | | 2021 | | | 2020 | | |

| | (Amounts in thousands, except per share data) | | | (Amounts in thousands, except per share data) | | | (Amounts in thousands, except per share data) | | (Amounts in thousands, except per share data) | |

Net sales | | $ | 27,154 | | | $ | 25,286 | | | $ | 71,818 | | | $ | 67,522 | | | $ | 28,774 | | | $ | 27,154 | | | $ | 83,077 | | | $ | 71,818 | | |

Cost of products sold | | | 20,927 | | | | 21,242 | | | | 56,330 | | | | 53,816 | | | | 28,213 | | | | 20,927 | | | | 78,159 | | | | 56,330 | | |

Gross profit | | | 6,227 | | | | 4,044 | | | | 15,488 | | | | 13,706 | | | | 561 | | | | 6,227 | | | | 4,918 | | | | 15,488 | | |

Other expenses and income: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Selling, general and administrative | | | 4,936 | | | | 4,441 | | | | 13,091 | | | | 12,844 | | | | 4,729 | | | | 4,936 | | | | 14,534 | | | | 13,091 | | |

Selling, general and administrative – amortization | | | — | | | | — | | | | — | | | | 11 | | | | 274 | | | | — | | | | 639 | | | | — | | |

Other expense | | | — | | | | — | | | | — | | | | 523 | | |

Other operating income, net | | | | 140 | | | | — | | | | (962 | ) | | | — | | |

Operating (loss) income | | | | (4,582 | ) | | | 1,291 | | | | (9,293 | ) | | | 2,397 | | |

Other income | | | (55 | ) | | | (87 | ) | | | (164 | ) | | | (261 | ) | | | (111 | ) | | | (55 | ) | | | (416 | ) | | | (164 | ) | |

Interest income | | | (23 | ) | | | (318 | ) | | | (143 | ) | | | (1,080 | ) | | | (12 | ) | | | (23 | ) | | | (43 | ) | | | (143 | ) | |

Interest expense | | | 1 | | | | 2 | | | | 9 | | | | 9 | | | | 132 | | | | 1 | | | | 300 | | | | 9 | | |

Total other expenses and income | | | 4,859 | | | | 4,038 | | | | 12,793 | | | | 12,046 | | |

Income before provision for income taxes | | | 1,368 | | | | 6 | | | | 2,695 | | | | 1,660 | | |

Provision (benefit) for income taxes | | | 308 | | | | (3 | ) | | | 709 | | | | 364 | | |

Net income | | $ | 1,060 | | | $ | 9 | | | $ | 1,986 | | | $ | 1,296 | | |

(Loss) income before benefit provision for income taxes | | | | (4,591 | ) | | | 1,368 | | | | (9,134 | ) | | | 2,695 | | |

(Benefit) provision for income taxes | | | | (861 | ) | | | 308 | | | | (1,786 | ) | | | 709 | | |

Net (loss) income | | | $ | (3,730 | ) | | $ | 1,060 | | | $ | (7,348 | ) | | $ | 1,986 | | |

Per share data | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 0.11 | | | $ | — | | | $ | 0.20 | | | $ | 0.13 | | |

Net (loss) income | | | $ | (0.35 | ) | | $ | 0.11 | | | $ | (0.70 | ) | | $ | 0.20 | | |

Diluted: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 0.11 | | | $ | — | | | $ | 0.20 | | | $ | 0.13 | | |

Net (loss) income | | | $ | (0.35 | ) | | $ | 0.11 | | | $ | (0.70 | ) | | $ | 0.20 | | |

Weighted average common shares outstanding: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | 9,977 | | | | 9,884 | | | | 9,950 | | | | 9,874 | | | | 10,638 | | | | 9,977 | | | | 10,507 | | | | 9,950 | | |

Diluted | | | 9,977 | | | | 9,888 | | | | 9,950 | | | | 9,877 | | | | 10,638 | | | | 9,977 | | | | 10,507 | | | | 9,950 | | |

Dividends declared per share | | $ | 0.11 | | | $ | 0.11 | | | $ | 0.33 | | | $ | 0.32 | | | $ | 0.11 | | | $ | 0.11 | | | $ | 0.33 | | | $ | 0.33 | | |

See Notes to Condensed Consolidated Financial Statements.

43

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME

(Unaudited)

| | Three Months Ended | | | Nine Months Ended | | | | | | | | | | | | | | | | | | |

| | December 31, | | | December 31, | | | Three Months Ended | | Nine Months Ended | |

| | 2020 | | | 2019 | | | 2020 | | | 2019 | | | December 31, | | | December 31, | | |

| | (Amounts in thousands) | | | (Amounts in thousands) | | | 2021 | | | 2020 | | | 2021 | | | 2020 | | |

Net income | | $ | 1,060 | | | $ | 9 | | | $ | 1,986 | | | $ | 1,296 | | |

| | | (Amounts in thousands) | | (Amounts in thousands) | |

Net (loss) income | | | $ | (3,730 | ) | | $ | 1,060 | | | $ | (7,348 | ) | | $ | 1,986 | | |

Other comprehensive income: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Foreign currency translation adjustment | | | 261 | | | | 88 | | | | 416 | | | | (135 | ) | | | 108 | | | | 261 | | | | 201 | | | | 416 | | |

Defined benefit pension and other postretirement plans net of income tax expense of $61 and $55 for the three months ended December 31, 2020 and 2019, respectively, and $185 and $164 for the nine months ended December 31, 2020 and 2019, respectively | | | 205 | | | | 194 | | | | 614 | | | | 583 | | |

Defined benefit pension and other postretirement plans net

of income tax expense of $60 and $61 for the three months

ended December 31, 2021 and 2020, respectively, and $182

and $185 for the nine months ended December 31, 2021 and

2020, respectively | | | | 210 | | | | 205 | | | | 631 | | | | 614 | | |

Total other comprehensive income | | | 466 | | | | 282 | | | | 1,030 | | | | 448 | | | | 318 | | | | 466 | | | | 832 | | | | 1,030 | | |

Total comprehensive income | | $ | 1,526 | | | $ | 291 | | | $ | 3,016 | | | $ | 1,744 | | |

Total comprehensive (loss) income | | | $ | (3,412 | ) | | $ | 1,526 | | | $ | (6,516 | ) | | $ | 3,016 | | |

See Notes to Condensed Consolidated Financial Statements.

54

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | |

| | December 31, 2021 | | | March 31, 2021 | |

| | (Amounts in thousands, except per share data) | |

Assets | | | | | | |

Current assets: | | | | | | |

Cash and cash equivalents | | $ | 13,991 | | | $ | 59,532 | |

Investments | | | — | | | | 5,500 | |

Trade accounts receivable, net of allowances ($176 and $29 at December 31 and

March 31, 2021, respectively) | | | 36,650 | | | | 17,378 | |

Unbilled revenue | | | 24,930 | | | | 19,994 | |

Inventories | | | 20,428 | | | | 17,332 | |

Prepaid expenses and other current assets | | | 1,905 | | | | 512 | |

Income taxes receivable | | | 2,670 | | | | — | |

Total current assets | | | 100,574 | | | | 120,248 | |

Property, plant and equipment, net | | | 25,218 | | | | 17,618 | |

Prepaid pension asset | | | 7,121 | | | | 6,216 | |

Operating lease assets | | | 8,708 | | | | 95 | |

Goodwill | | | 22,823 | | | | — | |

Customer relationships | | | 11,456 | | | | — | |

Technology and technical know-how | | | 9,805 | | | | — | |

Other intangible assets, net | | | 10,173 | | | | — | |

Other assets | | | 202 | | | | 103 | |

Total assets | | $ | 196,080 | | | $ | 144,280 | |

Liabilities and stockholders’ equity | | | | | | |

Current liabilities: | | | | | | |

Short-term debt obligations | | $ | 9,750 | | | $ | — | |

Current portion of long-term debt | | | 2,000 | | | | — | |

Current portion of finance lease obligations | | | 23 | | | | 21 | |

Accounts payable | | | 14,650 | | | | 17,972 | |

Accrued compensation | | | 7,951 | | | | 6,106 | |

Accrued expenses and other current liabilities | | | 5,414 | | | | 4,628 | |

Customer deposits | | | 27,665 | | | | 14,059 | |

Operating lease liabilities | | | 1,114 | | | | 46 | |

Income taxes payable | | | — | | | | 741 | |

Total current liabilities | | | 68,567 | | | | 43,573 | |

Long-term debt | | | 17,000 | | | | — | |

Finance lease obligations | | | 17 | | | | 34 | |

Operating lease liabilities | | | 7,702 | | | | 37 | |

Deferred income tax liability | | | 977 | | | | 635 | |

Accrued pension and postretirement benefit liabilities | | | 1,958 | | | | 2,072 | |

Other long-term liabilities | | | 2,320 | | | | — | |

Total liabilities | | | 98,541 | | | | 46,351 | |

Commitments and contingencies (Note 10) | | | | | | |

Stockholders’ equity: | | | | | | |

Preferred stock, $1.00 par value, 500 shares authorized | | | — | | | | — | |

Common stock, $0.10 par value, 25,500 shares authorized, 10,810 and 10,748 shares

issued and 10,638 and 9,959 shares outstanding at December 31 and March 31, 2021,

respectively | | | 1,081 | | | | 1,075 | |

Capital in excess of par value | | | 27,608 | | | | 27,272 | |

Retained earnings | | | 78,500 | | | | 89,372 | |

Accumulated other comprehensive loss | | | (6,565 | ) | | | (7,397 | ) |

Treasury stock (172 and 790 shares at December 31 and March 31, 2021, respectively) | | | (3,085 | ) | | | (12,393 | ) |

Total stockholders’ equity | | | 97,539 | | | | 97,929 | |

Total liabilities and stockholders’ equity | | $ | 196,080 | | | $ | 144,280 | |

| | December 31, | | | March 31, | |

| | 2020 | | | 2020 | |

| | (Amounts in thousands, except per share data) | |

Assets | | | | | | | | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | $ | 63,792 | | | $ | 32,955 | |

Investments | | | 5,500 | | | | 40,048 | |

Trade accounts receivable, net of allowances ($30 and $33 at December 31 and March 31, 2020, respectively) | | | 19,884 | | | | 15,400 | |

Unbilled revenue | | | 14,950 | | | | 14,592 | |

Inventories | | | 17,463 | | | | 22,291 | |

Prepaid expenses and other current assets | | | 1,004 | | | | 906 | |

Income taxes receivable | | | 604 | | | | 485 | |

Total current assets | | | 123,197 | | | | 126,677 | |

Property, plant and equipment, net | | | 17,457 | | | | 17,587 | |

Prepaid pension asset | | | 4,091 | | | | 3,460 | |

Operating lease assets | | | 135 | | | | 243 | |

Other assets | | | 106 | | | | 153 | |

Total assets | | $ | 144,986 | | | $ | 148,120 | |

Liabilities and stockholders’ equity | | | | | | | | |

Current liabilities: | | | | | | | | |

Current portion of finance lease obligations | | $ | 21 | | | $ | 40 | |

Accounts payable | | | 15,753 | | | | 14,253 | |

Accrued compensation | | | 5,410 | | | | 4,453 | |

Accrued expenses and other current liabilities | | | 4,123 | | | | 3,352 | |

Customer deposits | | | 19,115 | | | | 26,983 | |

Operating lease liabilities | | | 80 | | | | 153 | |

Total current liabilities | | | 44,502 | | | | 49,234 | |

Finance lease obligations | | | 39 | | | | 55 | |

Operating lease liabilities | | | 45 | | | | 82 | |

Deferred income tax liability | | | 1,668 | | | | 721 | |

Accrued pension liability | | | 827 | | | | 747 | |

Accrued postretirement benefits | | | 572 | | | | 557 | |

Total liabilities | | | 47,653 | | | | 51,396 | |

Commitments and contingencies (Note 10) | | | | | | | | |

Stockholders’ equity: | | | | | | | | |

Preferred stock, $1.00 par value, 500 shares authorized | | | — | | | | — | |

Common stock, $0.10 par value, 25,500 shares authorized, 10,779 and 10,689 shares issued and 9,976 and 9,881 shares outstanding at December 31 and March 31, 2020, respectively | | | 1,078 | | | | 1,069 | |

Capital in excess of par value | | | 27,193 | | | | 26,361 | |

Retained earnings | | | 90,083 | | | | 91,389 | |

Accumulated other comprehensive loss | | | (8,526 | ) | | | (9,556 | ) |

Treasury stock (803 and 808 shares at December 31 and March 31, 2020, respectively) | | | (12,495 | ) | | | (12,539 | ) |

Total stockholders’ equity | | | 97,333 | | | | 96,724 | |

Total liabilities and stockholders’ equity | | $ | 144,986 | | | $ | 148,120 | |

See Notes to Condensed Consolidated Financial Statements.

5

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | Nine Months Ended | | | Nine Months Ended | |

| | December 31, | | | December 31, | |

| | 2020 | | | 2019 | | | 2021 | | | 2020 | |

Operating activities: | | (Dollar amounts in thousands) | | | (Dollar amounts in thousands) | |

Net income | | $ | 1,986 | | | $ | 1,296 | | |

Adjustments to reconcile net income to net cash provided (used) by operating activities: | | | | | | | | | |

Net (loss) income | | | $ | (7,348 | ) | | $ | 1,986 | |

Adjustments to reconcile net (loss) income to net cash (used) provided by operating

activities: | | | | | | | |

Depreciation | | | 1,458 | | | | 1,468 | | | | 2,232 | | | | 1,458 | |

Amortization | | | — | | | | 11 | | | | 1,765 | | | | — | |

Amortization of actuarial losses | | | 799 | | | | 747 | | | | 725 | | | | 799 | |

Equity-based compensation expense | | | 821 | | | | 731 | | | | 599 | | | | 821 | |

Gain on disposal or sale of property, plant and equipment | | | 3 | | | | (2 | ) | | | 22 | | | | 3 | |

Loss on sale of Energy Steel & Supply Co. | | | — | | | | 87 | | |

Change in fair value of contingent consideration | | | | (1,900 | ) | | | — | |

Deferred income taxes | | | 776 | | | | 33 | | | | 152 | | | | 776 | |

(Increase) decrease in operating assets: | | | | | | | | | | | | | | |

Accounts receivable | | | (4,220 | ) | | | (438 | ) | | | (10,964 | ) | | | (4,220 | ) |

Unbilled revenue | | | (284 | ) | | | (6,799 | ) | | | 2,186 | | | | (284 | ) |

Inventories | | | 4,999 | | | | 4,225 | | | | 579 | | | | 4,999 | |

Prepaid expenses and other current and non-current assets | | | (76 | ) | | | (7 | ) | | | (933 | ) | | | (76 | ) |

Income taxes receivable | | | (119 | ) | | | 301 | | | | (3,423 | ) | | | (119 | ) |

Operating lease assets | | | 116 | | | | 176 | | | | 744 | | | | 116 | |

Prepaid pension asset | | | (631 | ) | | | (653 | ) | | | (905 | ) | | | (631 | ) |

Increase (decrease) in operating liabilities: | | | | | | | | | | | | | | |

Accounts payable | | | 1,401 | | | | (3,036 | ) | | | (6,058 | ) | | | 1,401 | |

Accrued compensation, accrued expenses and other current and non-current liabilities | | | 1,754 | | | | (299 | ) | | | 465 | | | | 1,754 | |

Customer deposits | | | (8,092 | ) | | | (1,938 | ) | | | 7,553 | | | | (8,092 | ) |

Operating lease liabilities | | | (116 | ) | | | (101 | ) | | | (663 | ) | | | (116 | ) |

Long-term portion of accrued compensation, accrued pension liability and accrued postretirement benefits | | | 95 | | | | 79 | | | | 620 | | | | 95 | |

Net cash provided (used) by operating activities | | | 670 | | | | (4,119 | ) | |

Net cash (used) provided by operating activities | | | | (14,552 | ) | | | 670 | |

Investing activities: | | | | | | | | | | | | | | |

Purchase of property, plant and equipment | | | (1,462 | ) | | | (1,389 | ) | | | (1,909 | ) | | | (1,462 | ) |

Proceeds from disposal of property, plant and equipment | | | 6 | | | | 2 | | | | — | | | | 6 | |

Proceeds from the sale of Energy Steel & Supply Co. | | | — | | | | 602 | | |

Purchase of investments | | | (37,103 | ) | | | (141,414 | ) | | | — | | | | (37,103 | ) |

Redemption of investments at maturity | | | 71,651 | | | | 145,146 | | | | 5,500 | | | | 71,651 | |

Net cash provided by investing activities | | | 33,092 | | | | 2,947 | | |

Acquisition of Barber-Nichols, LLC | | | | (59,563 | ) | | | — | |

Net cash (used) provided by investing activities | | | | (55,972 | ) | | | 33,092 | |

Financing activities: | | | | | | | | | | | | | | |

Principal repayments on finance lease obligations | | | (35 | ) | | | (38 | ) | |

Increase in short-term debt obligations | | | | 9,750 | | | | — | |

Principal repayments on long-term debt | | | (4,599 | ) | | | — | | | | (1,000 | ) | | | (4,599 | ) |

Proceeds from the issuance of long-term debt | | | 4,599 | | | | — | | | | 20,000 | | | | 4,599 | |

Issuance of common stock | | | — | | | | 24 | | |

Principal repayments on finance lease obligations | | | | (15 | ) | | | (35 | ) |

Repayments on lease financing obligations | | | | (157 | ) | | | — | |

Payment of debt issuance costs | | | | (150 | ) | | | — | |

Dividends paid | | | (3,292 | ) | | | (3,163 | ) | | | (3,524 | ) | | | (3,292 | ) |

Purchase of treasury stock | | | (23 | ) | | | (230 | ) | | | (41 | ) | | | (23 | ) |

Net cash used by financing activities | | | (3,350 | ) | | | (3,407 | ) | |

Net cash provided (used) by financing activities | | | | 24,863 | | | | (3,350 | ) |

Effect of exchange rate changes on cash | | | 425 | | | | (143 | ) | | | 120 | | | | 425 | |

Net increase (decrease) in cash and cash equivalents, including cash classified within current assets held for sale | | | 30,837 | | | | (4,722 | ) | |

Net decrease in cash classified within current assets held for sale | | | — | | | | 552 | | |

Net increase (decrease) in cash and cash equivalents | | | 30,837 | | | | (4,170 | ) | |

Net (decrease) increase in cash and cash equivalents | | | | (45,541 | ) | | | 30,837 | |

Cash and cash equivalents at beginning of period | | | 32,955 | | | | 15,021 | | | | 59,532 | | | | 32,955 | |

Cash and cash equivalents at end of period | | $ | 63,792 | | | $ | 10,851 | | | $ | 13,991 | | | $ | 63,792 | |

See Notes to Condensed Consolidated Financial Statements.

6

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

NINE MONTHS ENDED DECEMBER 31, 20202021

(Dollar Amounts in Thousands)

(Unaudited)

(Unaudited)

| | Common Stock | | | Capital in | | | | | | | Accumulated Other | | | | | | | Total | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Par | | | Excess of | | | Retained | | | Comprehensive | | | Treasury | | | Stockholders' | | | Common Stock | | | Capital in | | | | Accumulated

Other | | | | Total | |

| | Shares | | | Value | | | Par Value | | | Earnings | | | Loss | | | Stock | | | Equity | | | | | Par | | Excess of | | Retained | | Comprehensive | | Treasury | | Stockholders' | |

Balance at April 1, 2020 | | | 10,689 | | | $ | 1,069 | | | $ | 26,361 | | | $ | 91,389 | | | $ | (9,556 | ) | | $ | (12,539 | ) | | $ | 96,724 | | |

Comprehensive income | | | | | | | | | | | | | | | (1,818 | ) | | | 214 | | | | | | | | (1,604 | ) | |

| | | Shares | | | Value | | | Par Value | | | Earnings | | | Loss | | | Stock | | | Equity | |

Balance at April 1, 2021 | | | 10,748 | | $ | 1,075 | | $ | 27,272 | | $ | 89,372 | | $ | (7,397 | ) | | $ | (12,393 | ) | | $ | 97,929 | |

Comprehensive loss | | | | | | | | | | | | (3,126 | ) | | 298 | | | | | (2,828 | ) |

Issuance of shares | | | 113 | | | | 11 | | | | (11 | ) | | | | | | | | | | | | | | | — | | | 135 | | 13 | | (13 | ) | | | | | | | | | | | — | |

Forfeiture of shares | | | (22 | ) | | | (2 | ) | | | 2 | | | | | | | | | | | | | | | | — | | | (9 | ) | | (1 | ) | | 1 | | | | | | | | | | | — | |

Dividends | | | | | | | | | | | | | | | (1,097 | ) | | | | | | | | | | | (1,097 | ) | | | | | | | | | | | (1,177 | ) | | | | | | | | (1,177 | ) |

Recognition of equity-based compensation expense | | | | | | | | | | | 164 | | | | | | | | | | | | | | | | 164 | | | | | | | | | 353 | | | | | | | | | | | 353 | |

Issuance of treasury stock | | | | | | | | | (194 | ) | | | | | | | | 9,158 | | 8,964 | |

Purchase of treasury stock | | | | | | | | | | | | | | | | | | | | | | | (23 | ) | | | (23 | ) | | | | | | | | | | | | | | | | | | (41 | ) | | | (41 | ) |

Balance at June 30, 2020 | | | 10,780 | | | | 1,078 | | | | 26,516 | | | | 88,474 | | | | (9,342 | ) | | | (12,562 | ) | | | 94,164 | | |

Balance at June 30, 2021 | | | 10,874 | | 1,087 | | 27,419 | | 85,069 | | (7,099 | ) | | (3,276 | ) | | 103,200 | |

Comprehensive loss | | | | | | | | | | | | (492 | ) | | 216 | | | | | (276 | ) |

Issuance of shares | | | 27 | | 3 | | (3 | ) | | | | | | | | | | | — | |

Forfeiture of shares | | | (91 | ) | | (9 | ) | | 9 | | | | | | | | | | | — | |

Dividends | | | | | | | | | | | | (1,177 | ) | | | | | | | | (1,177 | ) |

Recognition of equity-based

compensation expense | | | | | | | | | (23 | ) | | | | | | | | | | | (23 | ) |

Issuance of treasury stock | | | | | | | | | | (63 | ) | | | | | | | | | 191 | | | | 128 | |

Balance at September 30, 2021 | | | 10,810 | | 1,081 | | 27,339 | | 83,400 | | (6,883 | ) | | (3,085 | ) | | 101,852 | |

Comprehensive income | | | | | | | | | | | | | | | 2,744 | | | | 350 | | | | | | | | 3,094 | | | | | | | | | | | | (3,730 | ) | | 318 | | | | | (3,412 | ) |

Dividends | | | | | | | | | | | | | | | (1,098 | ) | | | | | | | | | | | (1,098 | ) | | | | | | | | | | | (1,170 | ) | | | | | | | | (1,170 | ) |

Recognition of equity-based compensation expense | | | | | | | | | | | 330 | | | | | | | | | | | | | | | | 330 | | | | | | | | | 269 | | | | | | | | | | | 269 | |

Issuance of treasury stock | | | | | | | | | | | 20 | | | | | | | | | | | | 67 | | | | 87 | | |

Balance at September 30, 2020 | | | 10,780 | | | | 1,078 | | | | 26,866 | | | | 90,120 | | | | (8,992 | ) | | | (12,495 | ) | | | 96,577 | | |

Comprehensive income | | | | | | | | | | | | | | | 1,060 | | | | 466 | | | | | | | | 1,526 | | |

Forfeiture of shares | | | (1 | ) | | | | | | | | | | | | | | | | | | | | | | | — | | |

Dividends | | | | | | | | | | | | | | | (1,097 | ) | | | | | | | | | | | (1,097 | ) | |

Recognition of equity-based compensation expense | | | | | | | | | | | 327 | | | | | | | | | | | | | | | | 327 | | |

Balance at December 31, 2020 | | | 10,779 | | | $ | 1,078 | | | $ | 27,193 | | | $ | 90,083 | | | $ | (8,526 | ) | | $ | (12,495 | ) | | $ | 97,333 | | |

Balance at December 31, 2021 | | | | 10,810 | | | $ | 1,081 | | | $ | 27,608 | | | $ | 78,500 | | | $ | (6,565 | ) | | $ | (3,085 | ) | | $ | 97,539 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

See Notes to Condensed Consolidated Financial Statements.

7

GRAHAM CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

NINE MONTHS ENDED DECEMBER 31, 20192020

(Dollar Amounts in Thousands)

(Unaudited)

(Unaudited)

| | Common Stock | | | Capital in | | | | | | | Accumulated Other | | | | | | | Total | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Par | | | Excess of | | | Retained | | | Comprehensive | | | Treasury | | | Stockholders' | | | Common Stock | | | Capital in | | | | Accumulated

Other | | | | Total | |

| | Shares | | | Value | | | Par Value | | | Earnings | | | Loss | | | Stock | | | Equity | | | | | Par | | Excess of | | Retained | | Comprehensive | | Treasury | | Stockholders' | |

Balance at April 1, 2019 | | | 10,650 | | | $ | 1,065 | | | $ | 25,277 | | | $ | 93,847 | | | $ | (8,833 | ) | | $ | (12,390 | ) | | $ | 98,966 | | |

Cumulative effect of change in accounting principle | | | | | | | | | | | | | | | (80 | ) | | | | | | | | | | | (80 | ) | |

| | | Shares | | | Value | | | Par Value | | | Earnings | | | Loss | | | Stock | | | Equity | |

Balance at April 1, 2020 | | | 10,689 | | $ | 1,069 | | $ | 26,361 | | $ | 91,389 | | $ | (9,556 | ) | | $ | (12,539 | ) | | $ | 96,724 | |

Comprehensive income | | | | | | | | | | | | | | | 82 | | | | 107 | | | | | | | | 189 | | | | | | | | | | | | (1,818 | ) | | 214 | | | | | (1,604 | ) |

Issuance of shares | | | 83 | | | | 8 | | | | (8 | ) | | | | | | | | | | | | | | | — | | | 113 | | 11 | | (11 | ) | | | | | | | | | | | — | |

Forfeiture of shares | | | (34 | ) | | | (3 | ) | | | 3 | | | | | | | | | | | | | | | | — | | | (22 | ) | | (2 | ) | | 2 | | | | | | | | | | | — | |

Dividends | | | | | | | | | | | | | | | (988 | ) | | | | | | | | | | | (988 | ) | | | | | | | | | | | (1,097 | ) | | | | | | | | (1,097 | ) |

Recognition of equity-based compensation expense | | | | | | | | | | | 88 | | | | | | | | | | | | | | | | 88 | | | | | | | | | 164 | | | | | | | | | | | 164 | |

Purchase of treasury stock | | | | | | | | | | | | | | | | | | | | | | | (230 | ) | | | (230 | ) | | | | | | | | | | | | | | | | | | (23 | ) | | | (23 | ) |

Balance at June 30, 2019 | | | 10,699 | | | | 1,070 | | | | 25,360 | | | | 92,861 | | | | (8,726 | ) | | | (12,620 | ) | | | 97,945 | | |

Balance at June 30, 2020 | | | 10,780 | | 1,078 | | 26,516 | | 88,474 | | (9,342 | ) | | (12,562 | ) | | 94,164 | |

Comprehensive income | | | | | | | | | | | | | | | 1,205 | | | | 59 | | | | | | | | 1,264 | | | | | | | | | | | | 2,744 | | 350 | | | | | 3,094 | |

Dividends | | | | | | | | | | | | | | | (1,087 | ) | | | | | | | | | | | (1,087 | ) | | | | | | | | | | | (1,098 | ) | | | | | | | | (1,098 | ) |

Recognition of equity-based compensation expense | | | | | | | | | | | 324 | | | | | | | | | | | | | | | | 324 | | | | | | | | | 330 | | | | | | | | | | | 330 | |

Issuance of treasury stock | | | | | | | | | | | 30 | | | | | | | | | | | | 19 | | | | 49 | | | | | | | | | | 20 | | | | | | | | | | 67 | | | | 87 | |

Balance at September 30, 2019 | | | 10,699 | | | | 1,070 | | | | 25,714 | | | | 92,979 | | | | (8,667 | ) | | | (12,601 | ) | | | 98,495 | | |

Balance at September 30, 2020 | | | 10,780 | | 1,078 | | 26,866 | | 90,120 | | (8,992 | ) | | (12,495 | ) | | 96,577 | |

Comprehensive income | | | | | | | | | | | | | | | 9 | | | | 282 | | | | | | | | 291 | | | | | | | | | | | | 1,060 | | 466 | | | | | 1,526 | |

Issuance of shares | | | 2 | | | | | | | | 24 | | | | | | | | | | | | | | | | 24 | | |

Forfeiture of shares | | | (1 | ) | | | | | | | | | | | | | | | | | | | | | | | — | | | (1 | ) | | | | | | | | | | | | | | | | | — | |

Dividends | | | | | | | | | | | | | | | (1,088 | ) | | | | | | | | | | | (1,088 | ) | | | | | | | | | | | (1,097 | ) | | | | | | | | (1,097 | ) |

Recognition of equity-based compensation expense | | | | | | | | | | | 319 | | | | | | | | | | | | | | | | 319 | | | | | | | | | 327 | | | | | | | | | | | 327 | |

Balance at December 31, 2019 | | | 10,700 | | | $ | 1,070 | | | $ | 26,057 | | | $ | 91,900 | | | $ | (8,385 | ) | | $ | (12,601 | ) | | $ | 98,041 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at December 31, 2020 | | | | 10,779 | | | $ | 1,078 | | | $ | 27,193 | | | $ | 90,083 | | | $ | (8,526 | ) | | $ | (12,495 | ) | | $ | 97,333 | |

See Notes to Condensed Consolidated Financial Statements.

98

GRAHAM CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(Amounts in thousands, except per share data)

NOTE 1 – BASIS OF PRESENTATION:

Graham Corporation's (the "Company's") Condensed Consolidated Financial Statements include its wholly-owned foreign subsidiaries located in Suzhou, China and Ahmedabad, India.India at December 31, 2021 and March 31, 2021, and its recently acquired wholly-owned subsidiary, Barber-Nichols, LLC ("BN"), located in Arvada, Colorado at December 31, 2021 and for the period June 1, 2021 through December 31, 2021 (See Note 2). The Condensed Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the U.S. ("GAAP") for interim financial information and the instructions to Form 10-Q and Rule 8-03 of Regulation S-X, each as promulgated by the U.S. Securities and Exchange Commission. The Company's Condensed Consolidated Financial Statements do not include all information and notes required by GAAP for complete financial statements. The unaudited Condensed Consolidated Balance Sheet as of March 31, 20202021 presented herein was derived from the Company’s audited Consolidated Balance Sheet as of March 31, 2020.2021. For additional information, please refer to the consolidated financial statements and notes included in the Company's Annual Report on Form 10-K for the fiscal year ended March 31, 20202021 ("fiscal 2020"2021"). In the opinion of management, all adjustments, including normal recurring accruals considered necessary for a fair presentation, have been included in the Company's Condensed Consolidated Financial Statements.

The Company's results of operations and cash flows for the three and nine months ended December 31, 20202021 are not necessarily indicative of the results that may be expected for the current fiscal year, which ends March 31, 20212022 ("fiscal 2021"2022"). The three-month period ended December 31, 2021 is also referred to as “the third quarter”.

Going Concern - The accompanying condensed consolidated financial statements are prepared in accordance with generally accepted accounting principles applicable to a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

The Company determined that as of December 31, 2021, it did not meet its financial covenants required by its loan agreement to maintain a maximum total leverage ratio of 3.25 to 1.0, nor did it maintain a minimum fixed charge coverage ratio of 1.2 to 1.0. On February 4, 2022, management obtained a waiver from Bank of America waiving their right to call the debt immediately due and payable as of December 31, 2021. As a term of receiving the waiver, until such time as Bank of America has received all required financial information with respect to the Company for the period ending on or about March 31, 2022, and such financial information confirms to the Bank of America's satisfaction that no default exists at such time, the Company will not permit the principal balance outstanding under the line of credit with Bank of America to exceed $15,000. Absent a waiver or an amendment of the loan agreement, the Company anticipates that it will not meet these covenants as of March 31, 2022, which would be an event of default. Violation of its covenants under the loan agreement provides the bank with the option to accelerate the maturity of the term loan under the loan agreement, which carries a balance of $19,000 as of December 31, 2021 and the revolving credit facility, which has a principal balance outstanding of $9,750 as of December 31, 2021. If the Company's lenders accelerate the maturity of the term loan and the revolving credit facility, the Company does not have sufficient cash to repay the outstanding debt. These conditions and events raise substantial doubt about the Company's ability to continue as a going concern within one year after the date that these financial statements were issued.

In response to these conditions, management has begun to actively engage in negotiations with the bank regarding amendments to its term loan and its revolving credit facility and related financial covenants. However, this plan has not been finalized and is not within the Company's control, and therefore cannot be deemed probable. As a result, the Company has concluded that management's plans do not alleviate substantial doubt about the Company's ability to continue as a going concern. The condensed consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts and classification of liabilities that might result from the outcome of this uncertainty.

NOTE 2 – ACQUISITION:

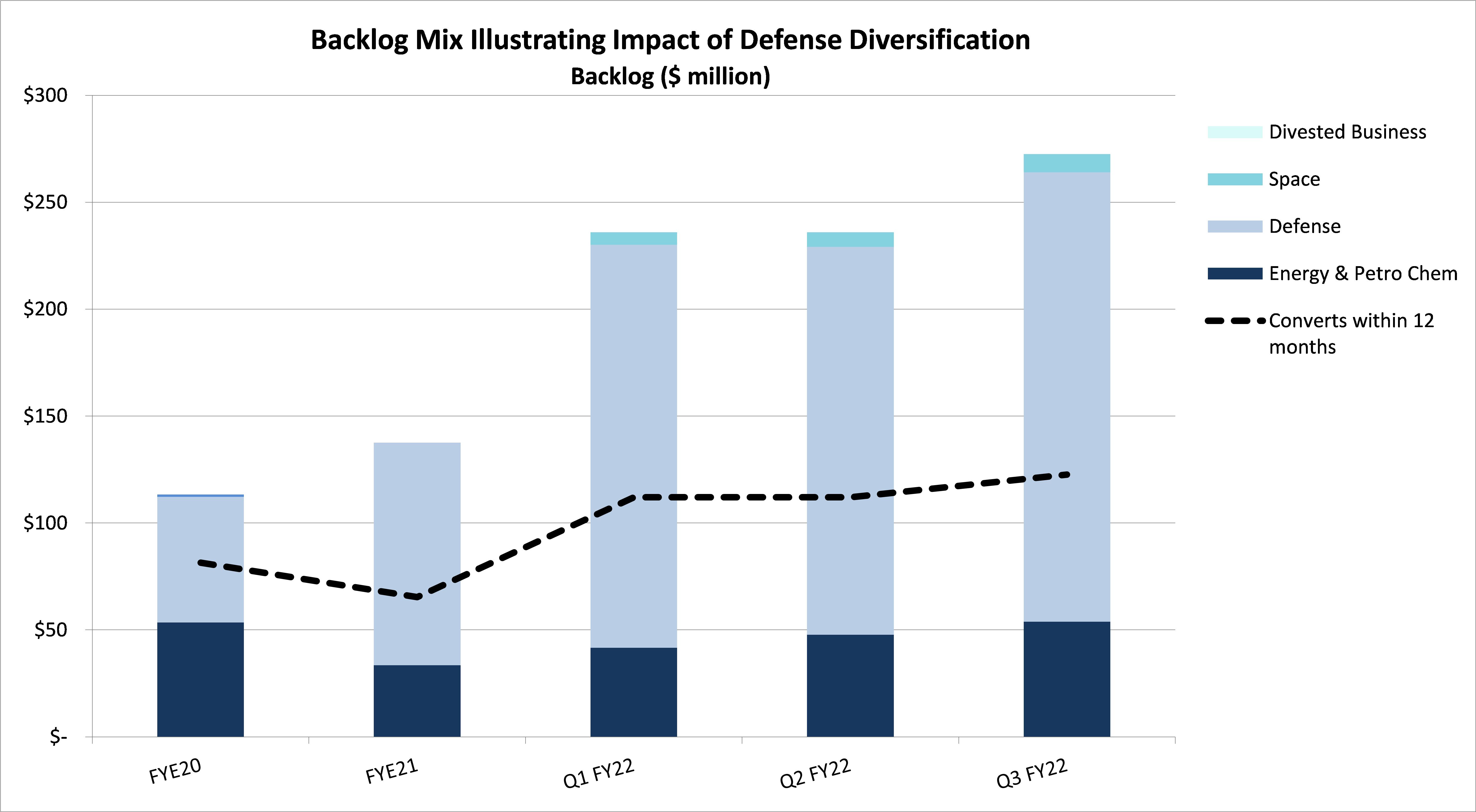

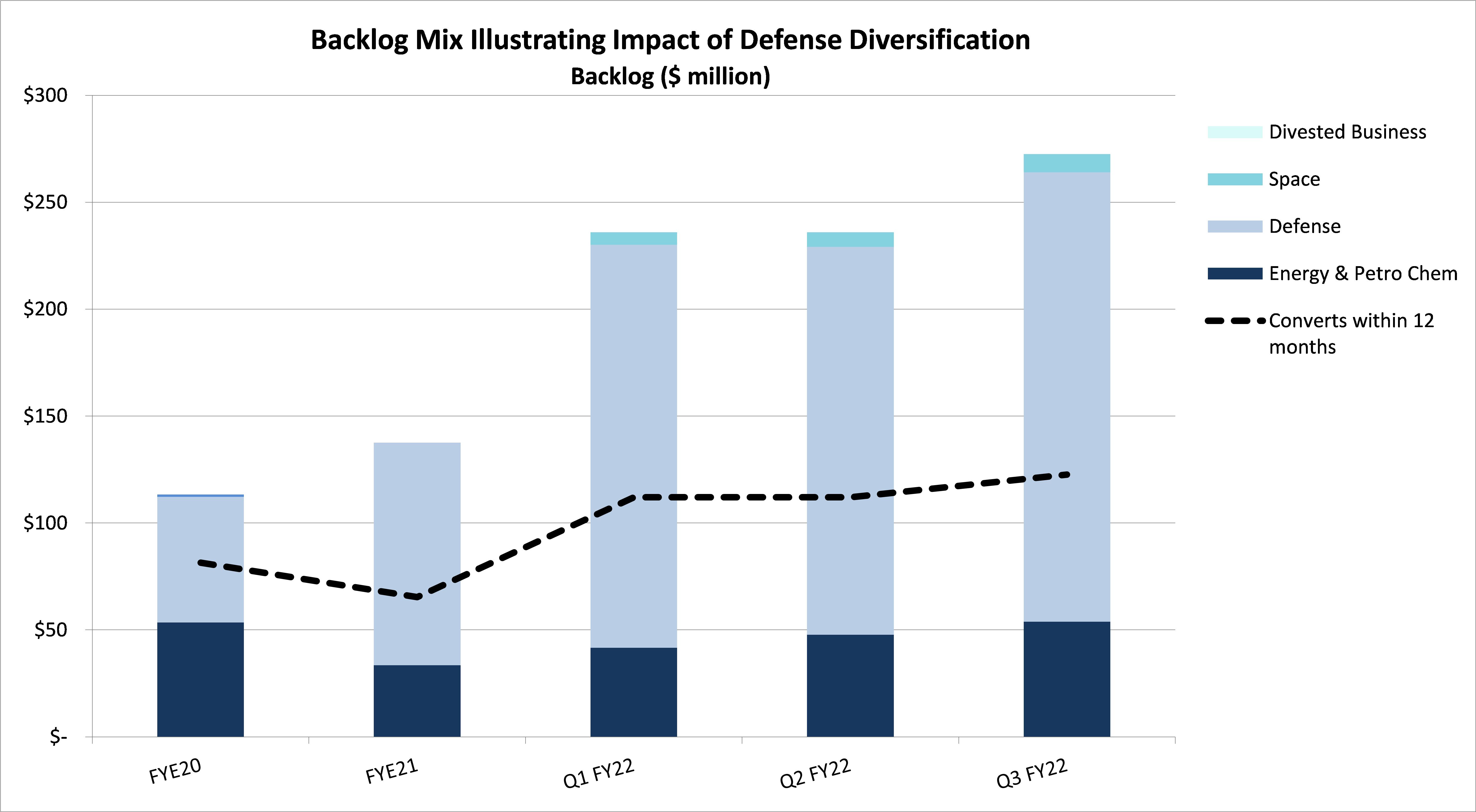

On June 1, 2021, the Company completed its acquisition of Barber-Nichols, LLC ("BN"), a privately-owned designer and manufacturer of turbomachinery products located in Arvada, Colorado that serves the defense and aerospace industry as well as the energy and cryogenic markets. The Company believes this acquisition furthers its growth strategy through market and product diversification, broadens its offerings and strengthens its presence in the defense industry, builds on its presence in the energy markets and adds capabilities in the space industry.

This transaction was accounted for as a business combination which requires that assets acquired and liabilities assumed be recognized at their fair value as of the acquisition date. The purchase price of $72,014 was comprised of 610 shares of the Company's

9

common stock, representing a value of $8,964 at a price of $14.69 per share, and cash consideration of $61,150, subject to certain potential adjustments, including a customary working capital adjustment. The cash consideration was funded through cash on-hand and debt proceeds (See Note 15). The purchase agreement included a contingent earn-out dependent upon certain financial measures of BN post-acquisition, in which the sellers were eligible to receive up to $14,000 in additional cash consideration. At June 30, 2021, a liability of $1,900 was recorded for the contingent earn-out. Subsequent to the acquisition, the earn out agreement was terminated and the contingent liability was reversed into Other operating income, net, on the Company’s Condensed Statement of Operations. Prior to the acquisition, BN and Ascent Properties Group, LLC, a related party, entered into a nine year operating lease agreement for an office and manufacturing building in Arvada, Colorado. This lease was acquired as part of the Company's acquisition of BN and has a monthly payment in the amount of $40 with a 3% yearly escalation. Acquisition related costs of $111 and $373 were expensed in the three and nine month periods ending December 31, 2021, and are included in Selling, general and administrative expenses in the Condensed Consolidated Statement of Operations.

The cost of the acquisition was preliminarily allocated to the assets acquired and liabilities assumed based upon its estimated fair value at the date of the acquisition and the amount exceeding the fair value of $22,923 was recorded as goodwill, which is not deductible for tax purposes. During the second quarter of fiscal 2022, the preliminary valuation of backlog was increased by $100, therefore goodwill was reduced to $22,823. As the values of certain assets and liabilities are preliminary in nature, they are subject to adjustment as additional information is obtained, including, but not limited to, the finalization of the valuation of intangible assets, the final reconciliation and confirmation of tangible assets. The valuation of acquisition-related intangible assets will be finalized within twelve months of the close of the acquisition. The fair value of acquisition-related intangible assets includes customer relationships, technology and technical know-how, backlog and trade name. Backlog and trade name are included in the line item "Other intangible assets, net" in the Condensed Consolidated Balance Sheet. Customer relationships were valued using an income approach, specifically the Multi Period Excess Earnings method, which incorporates assumptions regarding retention rate, new customer growth and customer related costs. Trade name and technology and technical know-how were both valued using a Relief from Royalty method, which develops a market based royalty rate used to reflect the after tax royalty savings attributable to owning the intangible asset. The fair value of backlog was determined using a net realizable value methodology, and was computed as the present value of the expected sales attributable to backlog less the remaining costs to fulfill the backlog. Changes to the preliminary valuation may result in material adjustments to the fair value of assets and liabilities acquired.

The purchase price was allocated to specific intangible assets on a preliminary basis as follows:

| | | | | | |

| | Fair Value Assigned | | | Weighted Average Amortization Period |

At December 31, 2021 | | | | | |

Intangibles subject to amortization: | | | | | |

Customer relationships | | $ | 11,800 | | | 20 years |

Technology and technical know-how | | | 10,100 | | | 20 years |

Backlog | | | 3,900 | | | 4 years |

| | $ | 25,800 | | | |

Intangibles not subject to amortization: | | | | | |

Tradename | | | 7,400 | | | Indefinite |

| | $ | 7,400 | | | |

Technology and technical know-how and customer relationships are amortized in selling, general and administrative expense on a straight line basis over their estimated useful lives. Backlog is amortized in cost of products sold over the projected conversion period based on management estimates at time of purchase. Intangible amortization was $756 and $1,765 for the three and nine months ended December 31, 2021. The estimated annual amortization expense is as follows:

| | | | |

| | Annual Amortization | |

Remainder of 2022 | | $ | 756 | |

2023 | | | 2,476 | |

2024 | | | 1,782 | |

2025 | | | 1,318 | |

2026 | | | 1,095 | |

2027 and thereafter | | | 16,608 | |

Total intangible amortization | | $ | 24,035 | |

| | | |

10

During the three months ended December 31, 2021, the Company made adjustments to the initial purchase price allocation of accounts receivable and accounts payable in the amount of $80.. The following table summarizes the preliminary allocation of the cost of the acquisition, as adjusted, to the assets acquired and liabilities assumed as of the close of the acquisition:

| | | | |

| | June 1, | |

| | 2021 | |

Assets acquired: | | | |

Cash and cash equivalents | | $ | 1,587 | |

Accounts receivable | | | 8,074 | |

Unbilled revenue | | | 7,068 | |

Inventory | | | 3,669 | |

Other current assets | | | 409 | |

Property, plant & equipment | | | 8,037 | |

Operating lease asset | | | 9,026 | |

Goodwill | | | 22,823 | |

Backlog | | | 3,900 | |

Customer relationships | | | 11,800 | |

Technology and technical know-how | | | 10,100 | |

Tradename | | | 7,400 | |

Total assets acquired | | | 93,893 | |

Liabilities assumed: | | | |

Accounts payable | | | 2,656 | |

Accrued compensation | | | 1,341 | |

Other current liabilities | | | 665 | |

Customer deposits | | | 6,048 | |

Operating lease liabilities | | | 9,066 | |

Other long term liabilities | | | 2,103 | |

Total liabilities assumed | | | 21,879 | |

Purchase price | | $ | 72,014 | |

The Condensed Consolidated Statement of Operations for the three and nine months ended December 31, 2021 includes net sales of BN of $11,968 and $31,925, respectively. The following unaudited pro forma information presents the consolidated results of operations of the Company as if the BN acquisition had occurred at the beginning of each of the fiscal periods presented:

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Nine Months Ended | |

| | December 31, | | | December 31, | |

| | 2021 | | | 2020 | | | 2021 | | | 2020 | |

Net sales | | $ | 28,774 | | | $ | 40,649 | | | $ | 94,890 | | | $ | 117,009 | |

Net (loss) income | | | (3,646 | ) | | | (684 | ) | | | (5,902 | ) | | | 4,465 | |

(Loss) earnings per share | | | | | | | | | | | | |

Basic | | $ | (0.34 | ) | | $ | (0.06 | ) | | $ | (0.55 | ) | | $ | 0.42 | |

Diluted | | $ | (0.34 | ) | | $ | (0.06 | ) | | $ | (0.55 | ) | | $ | 0.42 | |

The unaudited pro forma information presents the combined operating results of Graham Corporation and BN, with the results prior to the acquisition date adjusted to include the pro forma impact of the adjustment of depreciation of fixed assets based on the preliminary purchase price allocation, the adjustment to interest income reflecting the cash paid in connection with the acquisition, including acquisition-related expenses, at the Company’s weighted average interest income rate, interest expense and loan origination fees at the Company’s current interest rate, amortization expense related to the fair value adjustments for intangible assets, non-recurring acquisition-related costs and the impact of income taxes on the pro forma adjustments utilizing the applicable statutory tax rate.

The unaudited pro forma results are presented for illustrative purposes only. These pro forma results do not purport to be indicative of the results that would have actually been obtained if the acquisition occurred as of the beginning of each of the periods presented, nor does the pro forma data intend to be a projection of results that may be obtained in the future.

11

NOTE 3 – REVENUE RECOGNITION:

The Company recognizes revenue on contracts when or as it satisfies a performance obligation by transferring control of the product to the customer. For contracts in which revenue is recognized upon shipment, control is generally transferred when products are shipped, title is transferred, significant risks of ownership have transferred, the Company has rights to payment, and rewards of ownership pass to the customer. For contracts in which revenue is recognized over time, control is generally transferred as the Company creates an asset that does not have an alternative use to the Company and the Company has an enforceable right to payment for the performance completed to date.

The following table presents the Company’s revenue disaggregated by product line and geographic area:

| | | Three Months Ended | | | Nine Months Ended | | | Three Months Ended | | | Nine Months Ended | | |

| | December 31, | | | December 31, | | | December 31, | | | December 31, | | |

Product Line | | 2020 | | | 2019 | | | 2020 | | | 2019 | | | 2021 | | | 2020 | | | 2021 | | | 2020 | | |

Heat transfer equipment | | $ | 8,165 | | | $ | 7,062 | | | $ | 32,145 | | | $ | 21,394 | | | $ | 6,284 | | | $ | 8,165 | | | $ | 21,754 | | | $ | 32,145 | | |

Vacuum equipment | | | 14,969 | | | | 12,969 | | | | 26,901 | | | | 27,232 | | | | 5,412 | | | | 14,969 | | | | 13,946 | | | | 26,901 | | |

Fluid systems | | | | 6,939 | | | | — | | | | 15,342 | | | | — | | |

Power systems | | | | 5,030 | | | | — | | | | 16,583 | | | | — | | |

All other | | | 4,020 | | | | 5,255 | | | | 12,772 | | | | 18,896 | | | | 5,109 | | | | 4,020 | | | | 15,452 | | | | 12,772 | | |

Net sales | | $ | 27,154 | | | $ | 25,286 | | | $ | 71,818 | | | $ | 67,522 | | | $ | 28,774 | | | $ | 27,154 | | | $ | 83,077 | | | $ | 71,818 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Geographic Region | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asia | | $ | 11,211 | | | $ | 723 | | | $ | 20,903 | | | $ | 4,960 | | | $ | 1,493 | | | $ | 11,211 | | | $ | 10,485 | | | $ | 20,903 | | |

Canada | | | 1,874 | | | | 2,666 | | | | 4,804 | | | | 5,910 | | | | 924 | | | | 1,874 | | | | 3,011 | | | | 4,804 | | |

Middle East | | | 806 | | | | 7,498 | | | | 2,243 | | | | 8,783 | | | | 627 | | | | 806 | | | | 2,202 | | | | 2,243 | | |

South America | | | 2,426 | | | | 808 | | | | 5,238 | | | | 3,284 | | | | 242 | | | | 2,426 | | | | 720 | | | | 5,238 | | |

U.S. | | | 10,716 | | | | 13,409 | | | | 37,406 | | | | 43,589 | | | | 24,737 | | | | 10,716 | | | | 64,832 | | | | 37,406 | | |

All other | | | 121 | | | | 182 | | | | 1,224 | | | | 996 | | | | 751 | | | | 121 | | | | 1,827 | | | | 1,224 | | |

Net sales | | $ | 27,154 | | | $ | 25,286 | | | $ | 71,818 | | | $ | 67,522 | | | $ | 28,774 | | | $ | 27,154 | | | $ | 83,077 | | | $ | 71,818 | | |

A performance obligation represents a promise in a contract to provide a distinct good or service to a customer. The Company accounts for a contract when it has approval and commitment from both parties, the rights of the parties are identified, payment terms are identified, the contract has commercial substance and collectability of consideration is probable. Transaction price reflects the amount of consideration to which the Company expects to be entitled in exchange for transferred products. A contract’s transaction

10

price is allocated to each distinct performance obligation and revenue is recognized as the performance obligation is satisfied. In certain cases, the Company may separate a contract into more than one performance obligation, while in other cases, several products may be part of a fully integrated solution and are bundled into a single performance obligation. If a contract is separated into more than one performance obligation, the Company allocates the total transaction price to each performance obligation in an amount based on the estimated relative standalone selling prices of the promised goods underlying each performance obligation. The Company has made an accounting policy election to exclude from the measurement of the contract price all taxes assessed by government authorities that are collected by the Company from its customers. The Company does not adjust the contract price for the effects of a financing component if the Company expects, at contract inception, that the period between when a product is transferred to a customer and when the customer pays for the product will be one year or less. Shipping and handling fees billed to the customer are recorded in revenue and the related costs incurred for shipping and handling are included in cost of products sold.

Revenue on the majority of the Company’s contracts, as measured by number of contracts, is recognized upon shipment to the customer. Revenue on larger contracts, which are fewer in number but represent the majority of revenue, is recognized over time. Revenue from contracts that is recognized upon shipment accounted for approximately 40%25% and 20%40% of revenue for the three-month periods ended December 31, 20202021 and 2019,2020, respectively, and revenue from contracts that is recognized over time accounted for approximately 60%75% and 80%60% of revenue for the three-month periods ended December 31, 20202021 and 2019,2020, respectively. Revenue from contracts that is recognized upon shipment accounted for approximately 50%25% and 30%50% of revenue for the nine-month periods ended December 31, 20202021 and 2019,2020, respectively, and revenue from contracts that is recognized over time accounted for approximately 50%75% and 70%50% of revenue for the nine-month periods ended December 31, 20202021 and 2019,2020, respectively. During the nine months ended December 31, 2020,2021, revenue recognized over time as a percentage of total revenue was lowerhigher as compared with the prior year period due to the prior year having limited production on large contracts during the first quarter of fiscal 2021 as a result of the COVID-19 pandemic, as well as the completion of two large projects in China which did not meet the criteria for recognizing revenue over time. The Company recognizes revenue over time when contract performance results in the creation of a product for which the Company does not have an alternative use and the contract includes an enforceable right to payment in an amount that corresponds directly with the

12

value of the performance completed. To measure progress towards completion on performance obligations for which revenue is recognized over time the Company utilizes an input method based upon a ratio of direct labor hours incurred to date to management’s estimate of the total labor hours to be incurred on each contract, an input method based upon a ratio of total contract costs incurred to date to management’s estimate of the total contract costs to be incurred or an output method based upon completion of operational milestones, depending upon the nature of the contract. The Company has established the systems and procedures essential to developing the estimates required to account for performance obligations over time. These procedures include monthly review by management of costs incurred, progress towards completion, identified risks and opportunities, sourcing determinations, changes in estimates of costs yet to be incurred, availability of materials, and execution by subcontractors. Sales and earnings are adjusted in current accounting periods based on revisions in the contract value due to pricing changes and estimated costs at completion. Losses on contracts are recognized immediately when evident to management.

The timing of revenue recognition, invoicing and cash collections affect trade accounts receivable, unbilled revenue (contract assets) and customer deposits (contract liabilities) on the Condensed Consolidated Balance Sheets. Unbilled revenue represents revenue on contracts that is recognized over time and exceeds the amount that has been billed to the customer. Unbilled revenue is separately presented in the Condensed Consolidated Balance Sheets. The Company may have an unconditional right to payment upon billing and prior to satisfying the performance obligations. The Company will then record a contract liability and an offsetting asset of equal amount until the deposit is collected and the performance obligations are satisfied. Customer deposits are separately presented in the Condensed Consolidated Balance Sheets. Customer deposits are not considered a significant financing component as they are generally received less than one year before the product is completed or used to procure specific material on a contract, as well as related overhead costs incurred during design and construction.

Net contract assets (liabilities) consisted of the following:

| | | December 31, 2020 | | | March 31, 2020 | | | Change | | | December 31, 2021 | | | March 31, 2021 | | | Change | |

| | | | | | | | | | | | | | | | | | | | |

Unbilled revenue (contract assets) | | $ | 14,950 | | | $ | 14,592 | | | $ | 358 | | | $ | 24,930 | | | $ | 19,994 | | | $ | 4,936 | |

Customer deposits (contract liabilities) | | | (19,115 | ) | | | (26,983 | ) | | | 7,868 | | | | (27,665 | ) | | | (14,059 | ) | | | (13,606 | ) |

Net contract liabilities | | $ | (4,165 | ) | | $ | (12,391 | ) | | $ | 8,226 | | | $ | (2,735 | ) | | $ | 5,935 | | | $ | (8,670 | ) |

Contract liabilities at December 31, 2020 and March 31, 20202021 include $3,290$6,468 and $3,660,$1,603, respectively, of customer deposits for which the Company has an unconditional right to collect payment. Trade accounts receivable, as presented on the Condensed Consolidated Balance Sheets, includes corresponding balances at December 31, 2020 and March 31, 2020,2021, respectively. Revenue recognized in the three and nine months ended December 31, 20202021 that was included in the contract liability balance at March 31, 20202021 and the contract liability balance acquired on June 1, 2021 of $6,048, was $5,518$5,659 and $15,568,$18,951, respectively. Changes in the net contract liability balance during the nine months ended December 31, 20202021 were impacted by a $358$4,936 increase in contract assets, of which $27,109$36,141 was due to contract progress and the acquisition of BN’s contract assets of $7,068 offset by invoicing to customers of $26,751.$38,273. In addition, contract liabilities increased $7,868$13,606 driven new customer deposits of $26,509 offset by revenue recognized in the current period that was included in the contract liability balance at March 31, 2020 offset by new customer deposits2021, and the acquisition of $7,700.BN’s contract liabilities of $6,048.

11

Receivables billed but not paid under retainage provisions in the Company’s customer contracts were $2,840$2,786 and $2,016$3,747 at December 31, 2020 and March 31, 2020,2021, respectively.

Incremental costs to obtain a contract consist of sales employee and agent commissions. Commissions paid to employees and sales agents are capitalized when paid and amortized to selling, general and administrative expense when the related revenue is recognized. Capitalized costs, net of amortization, to obtain a contract were $60$149 and $45$39 at December 31, 2020 and March 31, 2020,2021, respectively, and are included in the line item "Prepaid expenses and other current assets" in the Condensed Consolidated Balance Sheets. The related amortization expense was $309$12 and $53$309 in the three months ended December 31, 20202021 and 2019,2020, respectively, and $561$46 and $139$561 in the nine months ended December 31, 20202021 and 2019, respectively.2020

The Company’s remaining unsatisfied performance obligations represent a measure of the total dollar value of work to be performed on contracts awarded and in progress. The Company also refers to this measure as backlog. As of December 31, 2020,2021, the Company had remaining unsatisfied performance obligations of $149,736.$272,599. The Company expects to recognize revenue on approximately 45%40% to 50%50% of the remaining performance obligations within one year 20%, 25% to 25%35% in one to two years and the remaining beyond two years.

NOTE 3 – INVESTMENTS:

Investments consist of certificates of deposits with financial institutions. All investments have original maturities of greater than three months and less than one year and are classified as held-to-maturity, as the Company believes it has the intent and ability to hold the securities to maturity. Investments are stated at amortized cost which approximates fair value. All investments held by the Company at December 31, 2020 are scheduled to mature on or before March 25, 2021.

NOTE 4 – INVENTORIES:

Inventories are stated at the lower of cost or net realizable value, using the average cost method.

13

Major classifications of inventories are as follows:

| | | December 31, | | | March 31, | | | December 31, | | March 31, | |

| | 2020 | | | 2020 | | | 2021 | | | 2021 | |

Raw materials and supplies | | $ | 3,389 | | | $ | 3,061 | | | $ | 3,951 | | | $ | 3,490 | |

Work in process | | | 12,386 | | | | 18,018 | | | | 14,997 | | | | 12,196 | |

Finished products | | | 1,688 | | | | 1,212 | | | | 1,480 | | | | 1,646 | |

Total | | $ | 17,463 | | | $ | 22,291 | | | $ | 20,428 | | | $ | 17,332 | |

NOTE 5 – EQUITY-BASED COMPENSATION:

The 2020 Graham Corporation Equity Incentive Plan (the "2020 Plan") was, as approved by the Company’s stockholders at the Annual Meeting on August 11, 2020, and provides for the issuance of 422 shares of common stock in connection with grants of incentive stock options, non-qualified stock options, restricted stock units and stock awards to officers, key employees and outside directors. The shares available for issuance include 112 remaining shares that remain available shares under the Company’s prior plan, the Amended and Restated 2000 Graham Corporation Incentive Plan to Increase Shareholder Value (the "2000(the"2000 Plan"). As of August 11, 2020, the effective date of the 2020 Plan, 0 further awards will be granted under the 2000 Plan. However, any previously outstanding award grantedstock options for 33 shares and 53 shares of unvested restricted stock under the 2000 Plan remains subject to the terms of such plan until the time it is no longer outstanding.such options expire or are exercised and such shares of restricted stock vest or are forfeited.

NaN restricted stock awards were granted in the three-month periods ended December 31, 20202021 and 2019. Restricted2020. 162 and 113 restricted stock awards were granted in the nine-month periods ended December 31, 2021 and 2020, respectively. 88 restricted shares and 201954 restricted shares were 113 and 83, respectively. Restricted shares of 54 and 40 granted to officers in fiscal 20212022 and fiscal 2020,2021, respectively, that vest 100%100% on the third anniversary of the grant date subject to the satisfaction of the performance metrics for the applicable three-year period. Restricted54 restricted shares of 38 and 2838 restricted shares granted to officers and key employees in fiscal 20212022 and fiscal 2020,2021, respectively, vest 33⅓% per year over a three-year term. Restricted20 restricted shares of 21 and 1521 restricted shares granted to directors in fiscal 20212022 and fiscal 2020,2021, respectively, vest 100%100% on the first year anniversary of the grant date. Stock options may be granted at prices not less than the fair market value at the date of grant and expire no later than ten years after the date of grant. NaN stock option awards were granted in the three-month or nine-month periods ended December 31, 20202021 and 2019.2020.

During the three months ended December 31, 20202021 and 2019,2020, the Company recognized equity-based compensation costs related to restricted stock awards of $312$260 and $308,$312, respectively. The income tax benefit recognized related to equity-based compensation was $72$58 and $67$72 for the three months ended December 31, 20202021 and 2019,2020, respectively. During the nine months ended December 31, 20202021 and 2019,2020, the Company recognized equity-based compensation costs related to restricted stock awards of $783$575 and $709,$783, respectively. The income tax benefit recognized related to equity-based compensation was $183$127 and $156$183 for the nine months ended December 31, 2021 and 2020, and 2019, respectively.

The Company has an Employee Stock Purchase Plan (the "ESPP"), which allows eligible employees to purchase shares of the Company's common stock at a discount of up to 15%15% of its fair market value on the (1) last, (2) first or (3) lower of the last or first day of the six-month offering period. A total of 200 shares of common stock may be purchased under the ESPP. During the three months ended December 31, 20202021 and 2019,2020, the Company recognized equity-based compensation costs of $15$9 and $11,$15, respectively, related to the ESPP and $4$1 and $3,$4, respectively, of related tax benefits. During the nine monthsnine-months ended December 31, 20202021 and 2019,2020, the Company recognized equity-based compensation costs of $38$24 and $22,$38, respectively, related to the ESPP and $9$5 and $5,$9, respectively, of related tax benefits.

NOTE 6 – (LOSS) INCOME PER SHARE:

Basic (loss) income per share is computed by dividing net (loss) income by the weighted average number of common shares outstanding for the period. Diluted (loss) income per share is calculated by dividing net (loss) income by the weighted average number

14

of common shares outstanding and, when applicable, potential common shares outstanding during the period. A reconciliation of the numerators and denominators of basic and diluted (loss) income per share is presented below:

| | Three Months Ended | | | Nine Months Ended | |

| | December 31, | | | December 31, | |

| | 2020 | | | 2019 | | | 2020 | | | 2019 | |

Basic income per share | | | | | | | | | | | | | | | | |

Numerator: | | | | | | | | | | | | | | | | |

Net income | | $ | 1,060 | | | $ | 9 | | | $ | 1,986 | | | $ | 1,296 | |

Denominator: | | | | | | | | | | | | | | | | |

Weighted average common shares outstanding | | | 9,977 | | | | 9,884 | | | | 9,950 | | | | 9,874 | |

Basic income per share | | $ | 0.11 | | | $ | — | | | $ | 0.20 | | | $ | .13 | |

Diluted income per share | | | | | | | | | | | | | | | | |

Numerator: | | | | | | | | | | | | | | | | |

Net income | | $ | 1,060 | | | $ | 9 | | | $ | 1,986 | | | $ | 1,296 | |

Denominator: | | | | | | | | | | | | | | | | |

Weighted average common shares outstanding | | | 9,977 | | | | 9,884 | | | | 9,950 | | | | 9,874 | |

Stock options outstanding | | | — | | | | 4 | | | | — | | | | 3 | |

Weighted average common and potential common shares outstanding | | | 9,977 | | | | 9,888 | | | | 9,950 | | | | 9,877 | |

Diluted income per share | | $ | 0.11 | | | $ | — | | | $ | 0.20 | | | $ | 0.13 | |

| | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Nine Months Ended | | |

| | December 31, | | | December 31, | | |

| | 2021 | | | 2020 | | | 2021 | | | 2020 | | |

Basic (loss) income per share | | | | | | | | | | | | | |

Numerator: | | | | | | | | | | | | | |

Net (loss) income | | $ | (3,730 | ) | | $ | 1,060 | | | $ | (7,348 | ) | | $ | 1,986 | | |

Denominator: | | | | | | | | | | | | | |

Weighted average common shares

outstanding | | | 10,638 | | | | 9,977 | | | | 10,507 | | | | 9,950 | | |

Basic (loss) income per share | | $ | (0.35 | ) | | $ | 0.11 | | | $ | (0.70 | ) | | $ | 0.20 | | |

| | | | | | | | | | | | | |

Diluted (loss) income per share | | | | | | | | | | | | | |

Numerator: | | | | | | | | | | | | | |

Net (loss) income | | $ | (3,730 | ) | | $ | 1,060 | | | $ | (7,348 | ) | | $ | 1,986 | | |

Denominator: | | | | | | | | | | | | | |

Weighted average common shares

outstanding | | | 10,638 | | | | 9,977 | | | | 10,507 | | | | 9,950 | | |

Stock options outstanding | | | — | | | | — | | | | — | | | | — | | |

Weighted average common and

potential common shares

outstanding | | | 10,638 | | | | 9,977 | | | | 10,507 | | | | 9,950 | | |

Diluted (loss) income per share | | $ | (0.35 | ) | | $ | 0.11 | | | $ | (0.70 | ) | | $ | 0.20 | | |

OptionsNone of the options to purchase a total of 3733 shares of common stock at December 31, 2021 were outstandingincluded in the computation of diluted income per share as the affect would be anti-dilutive due to the net losses in the quarters. None of the options to purchase 37 shares of common stock at December 31, 2020 but were not included in the above computation of diluted income per share given their exercise prices as they would not be dilutive upon issuance.

NOTE 7 – PRODUCT WARRANTY LIABILITY:

The reconciliation of the changes in the product warranty liability is as follows:

| | | Three Months Ended | | | Nine Months Ended | | | Three Months Ended | | | Nine Months Ended | | |

| | December 31, | | | December 31, | | | December 31, | | | December 31, | | |

| | 2020 | | | 2019 | | | 2020 | | | 2019 | | | 2021 | | | 2020 | | | 2021 | | | 2020 | | |

Balance at beginning of period | | $ | 308 | | | $ | 348 | | | $ | 359 | | | $ | 366 | | | $ | 449 | | | $ | 308 | | | $ | 626 | | | $ | 359 | | |

Expense for product warranties | | | 28 | | | | 67 | | | | 23 | | | | 96 | | |

BNI warranty accrual acquired | | | | — | | | | | | | 169 | | | | | |

Expense (income) for product warranties | | | | 19 | | | | 28 | | | | (2 | ) | | | 23 | | |

Product warranty claims paid | | | (21 | ) | | | (3 | ) | | | (67 | ) | | | (50 | ) | | | (35 | ) | | | (21 | ) | | | (360 | ) | | | (67 | ) | |

Balance at end of period | | $ | 315 | | | $ | 412 | | | $ | 315 | | | $ | 412 | | | $ | 433 | | | $ | 315 | | | $ | 433 | | | $ | 315 | | |

Income of $2 for product warranties in the nine months ended December 31, 2021 resulted from the reversal of provisions made that were no longer required due to lower claims experience.

The product warranty liability is included in the line item "Accrued expenses and other current liabilities" in the Condensed Consolidated Balance Sheets.

NOTE 8 – CASH FLOW STATEMENT:

Interest paid was $9$263 and $9 in each of the nine-month periods ended December 31, 2021 and 2020, and 2019.respectively. Income taxes paid for the nine months ended December 31, 2021 and 2020 were $1,388and 2019 were $51 and $27,$51, respectively.

In the nine months ended December 31, 2020 and 2019, non-cash activities included the issuance of treasury stock valued at $87 and $49, respectively, to the Company’s ESPP.

At December 31, 20202021 and 2019,2020, there were $37$80 and $10,$37, respectively, of capital purchases that were recorded in accounts payable and are not included in the caption "Purchase of property, plant and equipment" in the Condensed Consolidated Statements of Cash Flows.

15

The cash utilized for the acquisition of BN of $59,563 included the cash consideration of $61,150, net of cash acquired of $1,587. In the nine months ended December 31, 2021, non-cash activities included the issuance of 610 treasury shares valued at $8,964, included as part of the consideration for the acquisition of BN.

In the second quarter ended September 30, 2021, non-cash activities included pension adjustments, net of income tax, of $68.

NOTE 9 – EMPLOYEE BENEFIT PLANS:

The components of pension cost are as follows:

| | | Three Months Ended | | | Nine Months Ended | | | Three Months Ended | | | Nine Months Ended | |

| | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | 2020 | | | 2019 | | | 2020 | | | 2019 | | | 2021 | | | 2020 | | | 2021 | | | 2020 | |

Service cost | | $ | 115 | | | $ | 124 | | | $ | 346 | | | $ | 372 | | | $ | 93 | | | $ | 115 | | | $ | 280 | | | $ | 346 | |

Interest cost | | | 303 | | | | 322 | | | | 909 | | | | 968 | | | | 296 | | | | 303 | | | | 894 | | | | 909 | |

Expected return on assets | | | (628 | ) | | | (663 | ) | | | (1,885 | ) | | | (1,992 | ) | | | (681 | ) | | | (628 | ) | | | (2,045 | ) | | | (1,885 | ) |

Amortization of actuarial loss | | | 259 | | | | 242 | | | | 779 | | | | 726 | | | | 265 | | | | 259 | | | | 707 | | | | 779 | |

Net pension cost | | $ | 49 | | | $ | 25 | | | $ | 149 | | | $ | 74 | | | $ | (27 | ) | | $ | 49 | | | $ | (164 | ) | | $ | 149 | |

The Company made 0 contributions to its defined benefit pension plan during the nine months ended December 31, 20202021 and does 0t0t expect to make any contributions to the plan for the balance of fiscal 2021.2022.

During the second quarter ended September 30, 2021, the Company remeasured the projected benefit obligation to the supplemental executive retirement plan due to the retirement of the Company’s chief executive officer, who was the only active participant in the plan. Recognition of an actuarial gain, net of tax, of $68 was included in other comprehensive (loss) income.

The components of the postretirement benefit cost are as follows:

| | | Three Months Ended | | | Nine Months Ended | | | Three Months Ended | | Nine Months Ended | |

| | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | 2020 | | | 2019 | | | 2020 | | | 2019 | | | 2021 | | | 2020 | | | 2021 | | | 2020 | |

Interest cost | | $ | 4 | | | $ | 5 | | | $ | 13 | | | $ | 16 | | | $ | 3 | | | $ | 4 | | | $ | 10 | | | $ | 13 | |

Amortization of actuarial loss | | | 7 | | | | 7 | | | | 20 | | | | 21 | | | | 6 | | | | 7 | | | | 18 | | | | 20 | |

Net postretirement benefit cost | | $ | 11 | | | $ | 12 | | | $ | 33 | | | $ | 37 | | | $ | 9 | | | $ | 11 | | | $ | 28 | | | $ | 33 | |

The Company paid 0 benefits related to its postretirement benefit plan during the nine months ended December 31, 2020.2021. The Company expects to pay benefits of approximately $77$72 for the balance of fiscal 2021.2022.

The components of net periodic benefit cost other than service cost are included in the line item “Other income”"Other income" in the Condensed Consolidated Statements of Income.Operations.

The Company self-funds the medical insurance coverage it provides to its U.S. based employees.employees in certain locations. The Company maintains a stop loss insurance policy in order to limit its exposure to claims. The liability of $138$133 and $124$184 on December 31, 20202021 and March 31, 2020,2021, respectively, related to the self-insured medical plan is primarily based upon claim history and is included in the caption “Accrued compensation”"Accrued compensation" as a current liability in the Condensed Consolidated Balance Sheets.

NOTE 10 – COMMITMENTS AND CONTINGENCIES:

The Company has been named as a defendant in lawsuits alleging personal injury from exposure to asbestos allegedly contained in, or accompanying, products made by the Company. The Company is a co-defendant with numerous other defendants in these lawsuits and intends to vigorously defend itself against these claims. The claims in the Company’s current lawsuits are similar to those made in previous asbestos-related suits that named the Company as a defendant, which either were dismissed when it was shown that the Company had not supplied products to the plaintiffs’ places of work or were settled for immaterial amounts. The Company cannot provide any assurances that any pending or future matters will be resolved in the same manner as previous lawsuits.

14

As of December 31, 2020,2021, the Company was subject to the claims noted above, as well as other legal proceedings and potential claims that have arisen in the ordinary course of business.

16

Although the outcome of the lawsuits, legal proceedings or potential claims to which the Company is, or may become, a party to cannot be determined and an estimate of the reasonably possible loss or range of loss cannot be made for the majority of the claims, management does not believe that the outcomes, either individually or in the aggregate, will have a material adverse effect on the Company’s results of operations, financial position or cash flows.

NOTE 11 – INCOME TAXES:

The Company files federal and state income tax returns in several domestic and international jurisdictions. In most tax jurisdictions, returns are subject to examination by the relevant tax authorities for a number of years after the returns have been filed. The Company is subject to U.S. federal examination for the tax years 20162017 through 20192020 and examination in state tax jurisdictions for the tax years 20152016 through 2019.2020. The Company is subject to examination in the People’s Republic of China for tax years 20162017 through 20192020 and in India for tax year 2019.2019 through 2020.

There was 0 liability for unrecognized tax benefits at either December 31, 20202021 or March 31, 2020.2021.

NOTE 12 – CHANGES IN ACCUMULATED OTHER COMPREHENSIVE LOSS:

The changes in accumulated other comprehensive loss by component for the nine months ended December 31, 20202021 and 20192020 are as follows:

| | | | | | | | | | | | |

| | Pension and

Other

Postretirement

Benefit Items | | | Foreign

Currency

Items | | | Total | |

Balance at April 1, 2021 | | $ | (7,698 | ) | | $ | 301 | | | $ | (7,397 | ) |

Other comprehensive income before reclassifications | | | 68 | | | | 201 | | | | 269 | |

Amounts reclassified from accumulated other comprehensive

loss | | | 563 | | | | — | | | | 563 | |

Net current-period other comprehensive income | | | 631 | | | | 201 | | | | 832 | |

Balance at December 31, 2021 | | $ | (7,067 | ) | | $ | 502 | | | $ | (6,565 | ) |

| | | | | | | | | | | | |

| | Pension and

Other

Postretirement

Benefit Items | | | Foreign

Currency

Items | | | Total | |

Balance at April 1, 2020 | | $ | (9,472 | ) | | $ | (84 | ) | | $ | (9,556 | ) |

Other comprehensive loss before reclassifications | | | — | | | | 416 | | | | 416 | |

Amounts reclassified from accumulated other comprehensive

loss | | | 614 | | | | — | | | | 614 | |

Net current-period other comprehensive income | | | 614 | | | | 416 | | | | 1,030 | |

Balance at December 31, 2020 | | $ | (8,858 | ) | | $ | 332 | | | $ | (8,526 | ) |

| | Pension and Other Postretirement Benefit Items | | | Foreign Currency Items | | | Total | |

Balance at April 1, 2020 | | $ | (9,472 | ) | | $ | (84 | ) | | $ | (9,556 | ) |

Other comprehensive income before reclassifications | | | — | | | | 416 | | | | 416 | |

Amounts reclassified from accumulated other comprehensive loss | | | 614 | | | | — | | | | 614 | |

Net current-period other comprehensive income | | | 614 | | | | 416 | | | | 1,030 | |

Balance at December 31, 2020 | | $ | (8,858 | ) | | $ | 332 | | | $ | (8,526 | ) |

| | Pension and Other Postretirement Benefit Items | | | Foreign Currency Items | | | Total | |

Balance at April 1, 2019 | | $ | (8,947 | ) | | $ | 114 | | | $ | (8,833 | ) |

Other comprehensive loss before reclassifications | | | — | | | | (135 | ) | | | (135 | ) |

Amounts reclassified from accumulated other comprehensive loss | | | 583 | | | | — | | | | 583 | |

Net current-period other comprehensive income (loss) | | | 583 | | | | (135 | ) | | | 448 | |

Balance at December 31, 2019 | | $ | (8,364 | ) | | $ | (21 | ) | | $ | (8,385 | ) |

The reclassifications out of accumulated other comprehensive loss by component for the three and nine months ended December 31, 20202021 and 20192020 are as follows:

| | | | | | | | | | | | |

Details about Accumulated Other

Comprehensive Loss Components | | Amount Reclassified from

Accumulated Other

Comprehensive Loss | | | | Affected Line Item in the Condensed

Consolidated Statements of Income |

| | Three Months Ended | | | | |

| | December 31, | | | | |

| | 2021 | | | | 2020 | | | | |

Pension and other postretirement benefit items: | | | | | | | | | | |

Amortization of actuarial loss | | $ | (270 | ) | (1) | | $ | (266 | ) | (1) | | Loss before benefit for income taxes |

| | | (60 | ) | | | | (61 | ) | | | Benefit for income taxes |

| | $ | (210 | ) | | | $ | (205 | ) | | | Net loss |

17

| | | | | | | | | | | | |

Details about Accumulated Other

Comprehensive Loss Components | | Amount Reclassified from

Accumulated Other

Comprehensive Loss | | | | Affected Line Item in the Condensed

Consolidated Statements of Income |

| | Nine Months Ended | | | | |

| | December 31, | | | | |

| | 2021 | | | | 2020 | | | | |

Pension and other postretirement benefit items: | | | | | | | | | | |

Amortization of actuarial loss | | $ | (725 | ) | (1) | | $ | (799 | ) | (1) | | Loss before benefit for income taxes |

| | | (162 | ) | | | | (185 | ) | | | Benefit for income taxes |

| | $ | (563 | ) | | | $ | (614 | ) | | | Net loss |

Details about Accumulated Other Comprehensive Loss Components | | Amount Reclassified from Accumulated Other Comprehensive Loss | | | | Affected Line Item in the Condensed Consolidated Statements of Income |

| | Three Months Ended | | | | |

| | December 31, | | | | |

| | 2020 | | | | 2019 | | | | |

Pension and other postretirement benefit items: | | | | | | | | | | | | |

Amortization of actuarial loss | | $ | (266 | ) | (1) | | $ | (249 | ) | (1) | | Income before provision for income taxes |

| | | (61 | ) | | | | (55 | ) | | | Provision for income taxes |

| | $ | (205 | ) | | | $ | (194 | ) | | | Net income |

These accumulated other comprehensive loss components are included within the computation of pension and other postretirement benefit costs. See Note 9.