31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2022March 31, 2023

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-51173

Catalyst Biosciences, Inc.

(Exact Name of Registrant as Specified in its Charter)

Delaware | 56-2020050 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

611 Gateway Blvd., Suite South San Francisco, California | 94080 |

(Address of Principal Executive Offices) | (Zip Code) |

(650) 871-0761

(Registrant’s Telephone Number, Including Area Code)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

Common Stock |

| CBIO |

| NASDAQ |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer | ☐ |

| Accelerated filer | ☐ |

Non-accelerated filer | ☒ |

| Smaller reporting company | ☒ |

Emerging growth company | ☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of July 29, 2022,May 8, 2023, the number of outstanding shares of the registrant’s common stock, par value $0.001 per share, was 31,477,053.37,759,825.

CATALYST BIOSCIENCES, INC.

TABLE OF CONTENTS

|

|

|

| Page No. | ||

|

|

|

|

| ||

| 3 | |||||

|

|

|

|

| ||

Item 1. |

|

| 3 | |||

|

|

|

|

| ||

|

|

| 3 | |||

|

|

|

|

| ||

|

|

| 4 | |||

|

|

|

|

| ||

|

|

| 5 | |||

|

|

|

|

| ||

|

|

| 6 | |||

| ||||||

|

|

|

|

| ||

|

| Notes to the Unaudited Interim Condensed Consolidated Financial Statements |

|

| ||

|

|

|

|

| ||

Item 2. |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| 17 | ||

|

|

|

|

| ||

Item 3. |

|

|

| |||

|

|

|

|

| ||

Item 4. |

|

|

| |||

|

|

|

|

| ||

|

| |||||

|

|

|

|

| ||

Item 1. |

|

|

| |||

|

|

|

|

| ||

Item 1A. |

|

|

| |||

|

|

|

|

| ||

Item 2. |

|

|

| |||

|

|

|

|

| ||

Item 3. |

|

|

| |||

|

|

|

|

| ||

Item 4. |

|

|

| |||

|

|

|

|

| ||

Item 5. |

|

|

| |||

|

|

|

|

| ||

Item 6. |

|

|

| |||

|

|

|

|

| ||

|

| |||||

|

|

|

|

| ||

| 28 | |||||

PART I. FINANCIAL INFORMATION

ITEM 1. | FINANCIAL STATEMENTS |

Catalyst Biosciences, Inc.

Condensed Consolidated Balance Sheets

(In thousands, except share and per share amounts)

|

| June 30, 2022 |

|

| December 31, 2021 |

|

| March 31, 2023 |

|

| December 31, 2022 |

| ||||

|

| (Unaudited) |

|

|

|

|

|

| (Unaudited) |

|

|

|

|

| ||

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

| $ | 75,394 |

|

| $ | 44,347 |

|

| $ | 8,099 |

|

| $ | 21,666 |

|

Short-term investments |

|

| — |

|

|

| 2,504 |

| ||||||||

Accounts and other receivables, net |

|

| 5,000 |

|

|

| 1,818 |

| ||||||||

Accounts and other receivables |

|

| 5,000 |

|

|

| 5,000 |

| ||||||||

Prepaid and other current assets |

|

| 914 |

|

|

| 2,807 |

|

|

| 915 |

|

|

| 1,540 |

|

Total current assets |

|

| 81,308 |

|

|

| 51,476 |

|

|

| 14,014 |

|

|

| 28,206 |

|

Long-term receivable from GCBP |

|

| 4,550 |

|

|

| — |

| ||||||||

Other assets, noncurrent |

|

| 168 |

|

|

| 472 |

|

|

| 168 |

|

|

| 168 |

|

Right-of-use assets |

|

| 1,733 |

|

|

| 2,744 |

|

|

| 17 |

|

|

| 66 |

|

Property and equipment, net |

|

| 164 |

|

|

| 970 |

|

|

| 1 |

|

|

| 4 |

|

Total assets |

| $ | 83,373 |

|

| $ | 55,662 |

|

| $ | 18,750 |

|

| $ | 28,444 |

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

| ||||||||

Liabilities, redeemable convertible preferred stock and stockholders’ deficit |

|

|

|

|

|

|

|

| ||||||||

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable |

| $ | 1,037 |

|

| $ | 6,419 |

|

| $ | 16 |

|

| $ | 194 |

|

Accrued compensation |

|

| 911 |

|

|

| 1,467 |

|

|

| 1,085 |

|

|

| 2,582 |

|

Deferred revenue |

|

| — |

|

|

| 230 |

| ||||||||

Other accrued liabilities |

|

| 948 |

|

|

| 4,072 |

|

|

| 743 |

|

|

| 1,452 |

|

Dividends payable |

|

| — |

|

|

| 7,558 |

| ||||||||

CVR derivative liability |

|

| 5,000 |

|

|

| 5,000 |

| ||||||||

Operating lease liability |

|

| 1,415 |

|

|

| 1,977 |

|

|

| — |

|

|

| 38 |

|

Total current liabilities |

|

| 4,311 |

|

|

| 14,165 |

|

|

| 6,844 |

|

|

| 16,824 |

|

Operating lease liability, noncurrent |

|

| — |

|

|

| 408 |

| ||||||||

CVR derivative liability, noncurrent |

|

| 4,550 |

|

|

| — |

| ||||||||

Total liabilities |

|

| 4,311 |

|

|

| 14,573 |

|

|

| 11,394 |

|

|

| 16,824 |

|

Commitments and contingencies (Note 9) |

|

|

|

|

|

|

|

| ||||||||

Stockholders’ equity: |

|

|

|

|

|

|

|

| ||||||||

Preferred stock, $0.001 par value, 5,000,000 shares authorized; 0 shares issued and outstanding |

|

| — |

|

| — |

| |||||||||

Common stock, $0.001 par value, 100,000,000 shares authorized; 31,477,053 and 31,409,707 shares issued and outstanding at June 30, 2022 and December 31, 2021, respectively |

|

| 31 |

|

|

| 31 |

| ||||||||

Commitments and Contingencies (Note 9) |

|

|

|

|

|

|

|

| ||||||||

Redeemable convertible preferred stock, $0.001 par value, 123,418 shares authorized; 12,340 shares issued and outstanding at March 31, 2023 and December 31, 2022 |

|

| 33,309 |

|

|

| 33,309 |

| ||||||||

Stockholders’ deficit: |

|

|

|

|

|

|

|

| ||||||||

Common stock, $0.001 par value, 100,000,000 shares authorized; 37,759,825 and 37,756,574 shares issued and outstanding at March 31, 2023 and December 31, 2022, respectively |

|

| 37 |

|

|

| 37 |

| ||||||||

Additional paid-in capital |

|

| 444,629 |

|

|

| 443,752 |

|

|

| 384,686 |

|

|

| 389,210 |

|

Accumulated deficit |

|

| (365,598 | ) |

|

| (402,694 | ) |

|

| (410,676 | ) |

|

| (410,936 | ) |

Total stockholders’ equity |

|

| 79,062 |

|

|

| 41,089 |

| ||||||||

Total liabilities and stockholders’ equity |

| $ | 83,373 |

|

| $ | 55,662 |

| ||||||||

Total stockholders’ deficit |

|

| (25,953 | ) |

|

| (21,689 | ) | ||||||||

Total liabilities, redeemable convertible preferred stock and stockholders’ deficit |

| $ | 18,750 |

|

| $ | 28,444 |

| ||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

Catalyst Biosciences, Inc.

Condensed Consolidated Statements of Operations

(In thousands, except share and per share amounts)

(Unaudited)

|

| Three Months Ended June 30, |

|

| Six Months Ended June 30, |

|

| Three Months Ended March 31, |

| |||||||||||||||

|

| 2022 |

|

| 2021 |

|

| 2022 |

|

| 2021 |

|

| 2023 |

|

| 2022 |

| ||||||

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Collaboration |

| $ | — |

|

| $ | 1,132 |

|

| $ | 794 |

|

| $ | 2,599 |

|

| $ | — |

|

| $ | 794 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses (income): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of collaboration |

|

| — |

|

|

| 1,139 |

|

|

| 798 |

|

|

| 2,619 |

|

|

| — |

|

|

| 798 |

|

Research and development |

|

| 1,871 |

|

|

| 15,389 |

|

|

| 11,574 |

|

|

| 32,402 |

|

|

| 588 |

|

|

| 9,703 |

|

General and administrative |

|

| 3,844 |

|

|

| 4,518 |

|

|

| 8,838 |

|

|

| 9,930 |

|

|

| 3,970 |

|

|

| 4,994 |

|

Gain on disposal of assets, net |

|

| (57,245 | ) |

| — |

|

|

| (57,245 | ) |

| — |

|

|

| (4,736 | ) |

|

| — |

| ||

Total operating expenses (income) |

|

| (51,530 | ) |

|

| 21,046 |

|

|

| (36,035 | ) |

|

| 44,951 |

|

|

| (178 | ) |

|

| 15,495 |

|

Income (loss) from operations |

|

| 51,530 |

|

|

| (19,914 | ) |

|

| 36,829 |

|

|

| (42,352 | ) |

|

| 178 |

|

|

| (14,701 | ) |

Interest and other income (expense), net |

|

| 102 |

|

|

| (14 | ) |

|

| 267 |

|

|

| (14 | ) | ||||||||

Interest and other income, net |

|

| 96 |

|

|

| 165 |

| ||||||||||||||||

Income (loss) before income taxes |

|

| 274 |

|

|

| (14,536 | ) | ||||||||||||||||

Income tax expenses |

|

| 14 |

|

|

| — |

| ||||||||||||||||

Net income (loss) |

| $ | 51,632 |

|

| $ | (19,928 | ) |

| $ | 37,096 |

|

| $ | (42,366 | ) |

| $ | 260 |

|

| $ | (14,536 | ) |

Net income (loss) per share attributable to common stockholders, basic |

| $ | 1.64 |

|

| $ | (0.64 | ) |

| $ | 1.18 |

|

| $ | (1.42 | ) |

| $ | 0.01 |

|

| $ | (0.46 | ) |

Net income (loss) per share attributable to common stockholders, diluted |

| $ | 1.64 |

|

| $ | (0.64 | ) |

| $ | 1.18 |

|

| $ | (1.42 | ) |

| $ | 0.01 |

|

| $ | (0.46 | ) |

Shares used to compute net income (loss) per share attributable to common stockholders, basic |

|

| 31,477,053 |

|

|

| 31,348,602 |

|

|

| 31,466,630 |

|

|

| 29,875,202 |

|

|

| 37,758,416 |

|

|

| 31,456,090 |

|

Shares used to compute net income (loss) per share attributable to common stockholders, diluted |

|

| 31,482,925 |

|

|

| 31,348,602 |

|

|

| 31,469,566 |

|

|

| 29,875,202 |

|

|

| 37,984,324 |

|

|

| 31,456,090 |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Cash dividends paid per common share |

| $ | 0.24 |

|

| $ | — |

| ||||||||||||||||

CVR cash dividends paid per common share |

| $ | 0.01 |

|

| $ | — |

| ||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

Catalyst Biosciences, Inc.

Condensed Consolidated Statements of Comprehensive Income (Loss)

(In thousands)

(Unaudited)

|

| Three Months Ended June 30, |

|

| Six Months Ended June 30, |

| ||||||||||

|

| 2022 |

|

| 2021 |

|

| 2022 |

|

| 2021 |

| ||||

Net income (loss) |

| $ | 51,632 |

|

| $ | (19,928 | ) |

| $ | 37,096 |

|

| $ | (42,366 | ) |

Other comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized loss on available-for-sale debt securities |

|

| — |

|

|

| (3 | ) |

|

| — |

|

|

| (3 | ) |

Total comprehensive income (loss) |

| $ | 51,632 |

|

| $ | (19,931 | ) |

| $ | 37,096 |

|

| $ | (42,369 | ) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Catalyst Biosciences, Inc.

Condensed Consolidated Statements of Redeemable Convertible Preferred Stock and Stockholders’ Equity (Deficit)

(In thousands, except share amounts)

(Unaudited)

|

| Redeemable Convertible Preferred Stock |

|

| Common Stock |

|

| Additional Paid-In |

|

| Accumulated |

|

| Total Stockholders' |

| |||||||||||||||||||||||||||||||||||||||||||||

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| Deficit |

| |||||||||||||||||||||||||||||||||||||||

Balance at December 31, 2022 |

|

| 12,340 |

|

| $ | 33,309 |

|

|

| 37,756,574 |

|

| $ | 37 |

|

| $ | 389,210 |

|

| $ | (410,936 | ) |

| $ | (21,689 | ) | ||||||||||||||||||||||||||||||||

Stock-based compensation expense |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 210 |

|

|

| — |

|

|

| 210 |

| ||||||||||||||||||||||||||||||||

Issuance of common stock from stock grants |

|

| — |

|

|

| — |

|

|

| 3,251 |

|

|

| — |

|

|

| 2 |

|

|

| — |

|

|

| 2 |

| ||||||||||||||||||||||||||||||||

CVR cash dividends paid related to GCBP Agreement ($0.01 per share) |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (206 | ) |

|

| — |

|

|

| (206 | ) | ||||||||||||||||||||||||||||||||

CVR derivative liability |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (4,530 | ) |

|

| — |

|

|

| (4,530 | ) | ||||||||||||||||||||||||||||||||

Net income |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 260 |

|

|

| 260 |

| ||||||||||||||||||||||||||||||||

Balance at March 31, 2023 |

|

| 12,340 |

|

| $ | 33,309 |

|

|

| 37,759,825 |

|

| $ | 37 |

|

| $ | 384,686 |

|

| $ | (410,676 | ) |

| $ | (25,953 | ) | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||

|

| Convertible Preferred Stock |

|

| Common Stock |

|

| Additional Paid-In |

|

| Accumulated Other Comprehensive |

|

| Accumulated |

|

| Total Stockholders' |

|

| Redeemable Convertible Preferred Stock |

|

| Common Stock |

|

| Additional Paid-In |

|

| Accumulated |

|

| Total Stockholders’ |

| |||||||||||||||||||||||||||

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Capital |

|

| Income (Loss) |

|

| Deficit |

|

| Equity |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| Equity |

| |||||||||||||||

Balance at December 31, 2021 |

|

| — |

|

| $ | — |

|

|

| 31,409,707 |

|

| $ | 31 |

|

| $ | 443,752 |

|

| $ | — |

|

| $ | (402,694 | ) |

| $ | 41,089 |

|

|

| — |

|

| $ | — |

|

|

| 31,409,707 |

|

| $ | 31 |

|

| $ | 443,752 |

|

| $ | (402,694 | ) |

| $ | 41,089 |

|

Stock-based compensation expense |

|

| — |

|

|

| — |

|

|

| 32,684 |

|

|

| — |

|

|

| 515 |

|

|

| — |

|

|

| — |

|

|

| 515 |

|

|

| — |

|

|

| — |

|

|

| 32,684 |

|

|

| — |

|

|

| 515 |

|

|

| — |

|

|

| 515 |

|

Issuance of common stock from stock grants and option exercises |

|

| — |

|

|

| — |

|

|

| 34,662 |

|

|

| — |

|

|

| 16 |

|

|

| — |

|

|

| — |

|

|

| 16 |

| ||||||||||||||||||||||||||||

Issuance of common stock from stock grants |

|

| — |

|

|

| — |

|

|

| 34,662 |

|

|

| — |

|

|

| 16 |

|

|

| — |

|

|

| 16 |

| ||||||||||||||||||||||||||||||||

Net loss |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (14,536 | ) |

|

| (14,536 | ) |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (14,536 | ) |

|

| (14,536 | ) |

Balance at March 31, 2022 |

|

| — |

|

|

| — |

|

|

| 31,477,053 |

|

|

| 31 |

|

|

| 444,283 |

|

|

| — |

|

|

| (417,230 | ) |

|

| 27,084 |

|

|

| — |

|

| $ | — |

|

|

| 31,477,053 |

|

| $ | 31 |

|

| $ | 444,283 |

|

| $ | (417,230 | ) |

| $ | 27,084 |

|

Stock-based compensation expense |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 346 |

|

|

| — |

|

|

| — |

|

|

| 346 |

| ||||||||||||||||||||||||||||

Net income |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 51,632 |

|

|

| 51,632 |

| ||||||||||||||||||||||||||||

Balance at June 30, 2022 |

|

| — |

|

| $ | — |

|

|

| 31,477,053 |

|

| $ | 31 |

|

| $ | 444,629 |

|

| $ | — |

|

| $ | (365,598 | ) |

| $ | 79,062 |

| ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

|

| Convertible Preferred Stock |

|

| Common Stock |

|

| Additional Paid-In |

|

| Accumulated Other Comprehensive |

|

| Accumulated |

|

| Total Stockholders’ |

| ||||||||||||||||||||||||||||||||||||||||||

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Capital |

|

| Income (Loss) |

|

| Deficit |

|

| Equity |

| ||||||||||||||||||||||||||||||||||||

Balance at December 31, 2020 |

|

| — |

|

| $ | — |

|

|

| 22,097,820 |

|

| $ | 22 |

|

| $ | 390,803 |

|

| $ | 5 |

|

| $ | (314,761 | ) |

| $ | 76,069 |

| ||||||||||||||||||||||||||||

Stock-based compensation expense |

|

| — |

|

|

| — |

|

|

| 10,149 |

|

|

| — |

|

|

| 1,026 |

|

|

| — |

|

|

| — |

|

|

| 1,026 |

| ||||||||||||||||||||||||||||

Issuance of common stock from stock grants and option exercises |

|

| — |

|

|

| — |

|

|

| 38,058 |

|

|

| — |

|

|

| 182 |

|

|

| — |

|

|

| — |

|

|

| 182 |

| ||||||||||||||||||||||||||||

Issuance of common stock for public offering, net of issuance costs of $3,563 |

|

| — |

|

|

| — |

|

|

| 9,185,000 |

|

|

| 9 |

|

|

| 49,241 |

|

|

| — |

|

|

| — |

|

|

| 49,250 |

| ||||||||||||||||||||||||||||

Net loss |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (22,438 | ) |

|

| (22,438 | ) | ||||||||||||||||||||||||||||

Balance at March 31, 2021 |

|

| — |

|

|

| — |

|

|

| 31,331,027 |

|

|

| 31 |

|

|

| 441,252 |

|

|

| 5 |

|

|

| (337,199 | ) |

|

| 104,089 |

| ||||||||||||||||||||||||||||

Stock-based compensation expense |

|

| — |

|

|

| — |

|

|

| 13,713 |

|

|

| — |

|

|

| 983 |

|

|

| — |

|

|

| — |

|

|

| 983 |

| ||||||||||||||||||||||||||||

Issuance of common stock from stock grants and option exercises |

|

| — |

|

|

| — |

|

|

| 5,000 |

|

|

| — |

|

|

| 23 |

|

|

| — |

|

|

| — |

|

|

| 23 |

| ||||||||||||||||||||||||||||

Unrealized loss on available-for-sale debt securities |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (3 | ) |

|

| — |

|

|

| (3 | ) | ||||||||||||||||||||||||||||

Net loss |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (19,928 | ) |

|

| (19,928 | ) | ||||||||||||||||||||||||||||

Balance at June 30, 2021 |

|

| — |

|

| $ | — |

|

|

| 31,349,740 |

|

| $ | 31 |

|

| $ | 442,258 |

|

| $ | 2 |

|

| $ | (357,127 | ) |

| $ | 85,164 |

| ||||||||||||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

Catalyst Biosciences, Inc.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

|

| Six Months Ended June 30, |

|

| Three Months Ended March 31, |

| ||||||||||

|

| 2022 |

|

| 2021 |

|

| 2023 |

|

| 2022 |

| ||||

Operating Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

| $ | 37,096 |

|

| $ | (42,366 | ) |

| $ | 260 |

|

| $ | (14,536 | ) |

Adjustments to reconcile net income (loss) to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

| 861 |

|

|

| 2,009 |

|

|

| 210 |

|

|

| 515 |

|

Depreciation and amortization |

|

| 180 |

|

|

| 90 |

|

|

| 3 |

|

|

| 113 |

|

Change in fair value of long-term receivables |

|

| (20 | ) |

|

| — |

| ||||||||

Change in fair value of derivative liabilities |

|

| 20 |

|

|

| — |

| ||||||||

Bad debt expense |

|

| 200 |

|

| — |

|

|

| — |

|

|

| 200 |

| |

Net gain on disposal of assets |

|

| (57,245 | ) |

| — |

|

|

| (4,736 | ) |

|

| — |

| |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts and other receivables |

|

| 1,618 |

|

|

| 1,342 |

|

|

| — |

|

|

| 1,054 |

|

Prepaid and other current assets |

|

| 2,197 |

|

|

| (2,338 | ) |

|

| 625 |

|

|

| 1,485 |

|

Accounts payable |

|

| (5,382 | ) |

|

| (4,091 | ) |

|

| (178 | ) |

|

| (1,713 | ) |

Accrued compensation and other accrued liabilities |

|

| (3,680 | ) |

|

| 663 |

|

|

| (2,411 | ) |

|

| 1,036 |

|

Operating lease liability and right-of-use asset |

|

| 41 |

|

|

| 157 |

|

|

| 11 |

|

|

| 26 |

|

Deferred revenue |

|

| (230 | ) |

|

| 55 |

|

|

| — |

|

|

| (230 | ) |

Net cash flows used in operating activities |

|

| (24,344 | ) |

|

| (44,479 | ) |

|

| (6,216 | ) |

|

| (12,050 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from maturities of short-term investments |

|

| 2,504 |

|

|

| 38,632 |

|

|

| — |

|

|

| 2,504 |

|

Proceeds from the sale of property and equipment |

|

| 447 |

|

|

| — |

| ||||||||

Proceeds from the sale of complement portfolio to Vertex |

|

| 55,000 |

|

| — |

| |||||||||

Payment of transaction costs in connection with sale of complement portfolio to Vertex |

|

| (2,576 | ) |

|

|

|

| ||||||||

Purchases of property and equipment |

|

| — |

|

|

| (347 | ) | ||||||||

Proceeds from the sale of legacy rare bleeding disorder program to GCBP |

|

| 1,000 |

|

|

| — |

| ||||||||

Payment of transaction costs in connection with the sale of legacy rare bleeding disorder program to GCBP |

|

| (589 | ) |

|

| — |

| ||||||||

Net cash flows provided by investing activities |

|

| 55,375 |

|

|

| 38,285 |

|

|

| 411 |

|

|

| 2,504 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of common stock for public offering, net of issuance costs |

|

| — |

|

|

| 49,250 |

| ||||||||

Issuance of common stock from stock grants and option exercises |

|

| 16 |

|

|

| 205 |

| ||||||||

Net cash flow provided by financing activities |

|

| 16 |

|

|

| 49,455 |

| ||||||||

Net increase in cash and cash equivalents |

|

| 31,047 |

|

|

| 43,261 |

| ||||||||

Payment of dividends |

|

| (7,764 | ) |

|

| — |

| ||||||||

Issuance of common stock from stock grants |

|

| 2 |

|

|

| 16 |

| ||||||||

Net cash flows (used in) provided by financing activities |

|

| (7,762 | ) |

|

| 16 |

| ||||||||

Net decrease in cash and cash equivalents |

|

| (13,567 | ) |

|

| (9,530 | ) | ||||||||

Cash and cash equivalents at beginning of the period |

|

| 44,347 |

|

|

| 30,360 |

|

|

| 21,666 |

|

|

| 44,347 |

|

Cash and cash equivalents at end of the period |

| $ | 75,394 |

|

| $ | 73,621 |

|

| $ | 8,099 |

|

| $ | 34,817 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Disclosure of Non-Cash Investing and Financing Activities: |

|

|

|

|

|

|

|

| ||||||||

Right-of-use assets obtained in exchange for operating lease liabilities |

| $ | — |

|

| $ | 1,850 |

| ||||||||

Supplemental Disclosure on Non-Cash Investing and Financing Activities: |

|

|

|

|

|

|

|

| ||||||||

CVR derivative liability |

| $ | 4,530 |

|

| $ | — |

| ||||||||

Accrued transaction costs related to GCBP asset sale |

| $ | 205 |

|

| $ | — |

| ||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

Catalyst Biosciences, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1. | Nature of Operations and Liquidity |

Catalyst Biosciences, Inc. and its subsidiary (the “Company” or “Catalyst”) iswas a biopharmaceutical company with expertise in protease engineering. Prior to ceasing research and development activities in March 2022, the Company had several protease assets that maywere designed to address unmet medical needs in disorders of the complement or coagulation systems. As discussed further below, the Company recently completed a purchase agreement to acquire a clinical-stage drug candidate for the treatment of NASH (nonalcoholic steatohepatitis, a severe form of nonalcoholic fatty liver disease). Concurrent with this purchase agreement, the Company entered into a separate business combination agreement to acquire an indirect controlling interest in a China-based pharmaceutical company. The Company is exploring several strategic alternativeswill continue to monetizeevaluate the Company’s remaining assetsimpact of the novel coronavirus disease (“COVID-19”) pandemic on its business, operations, and is focused on distributing its available cash after paying or reserving for its obligations and liabilities, to stockholders.requirements. The Company is located in South San Francisco, California and operates in 1one segment.

On May 19, 2022, Catalyst entered into and closed on an asset purchase agreement with Vertex Pharmaceuticals IncorporatedInc. (“Vertex”), pursuant to which Vertex acquired Catalyst’s complement portfolio, including CB 2782-PEG and CB 4332, as well as its complement-related intellectual property including the ProTUNEtmTM and ImmunoTUNEtmTM platforms (Seeplatforms. See Note 12). After the transaction of its complement portfolio,11, Restructuring.

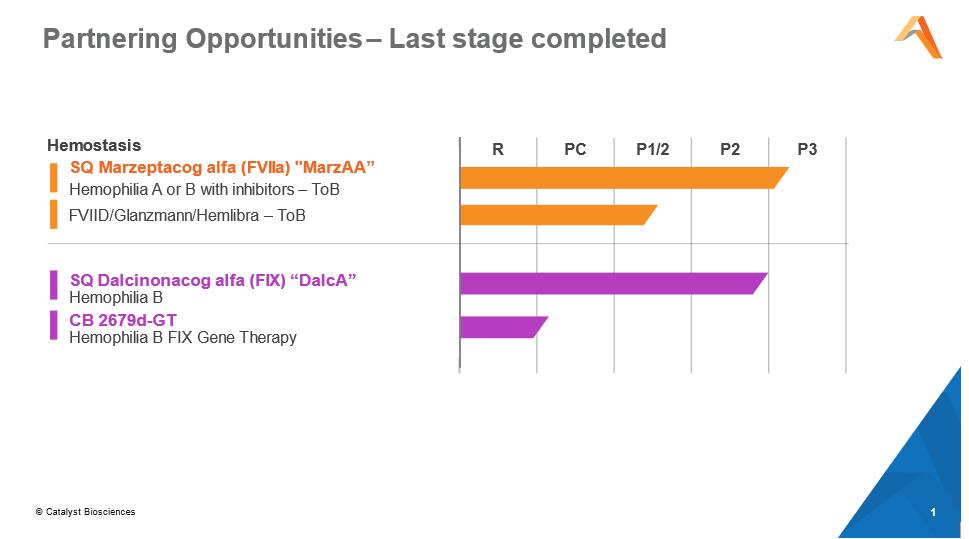

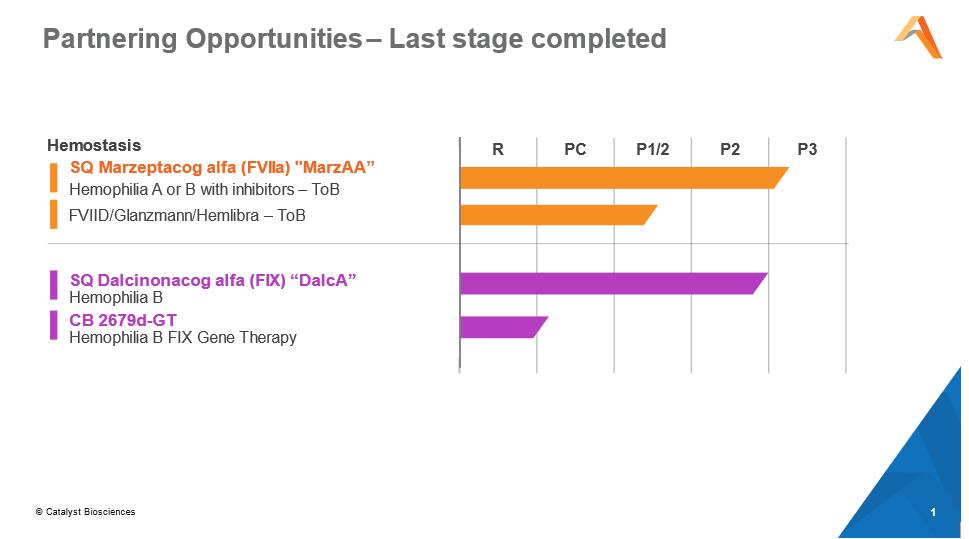

On February 27, 2023, Catalyst entered into and closed on an asset purchase agreement with GC Biopharma Corp. (“GCBP”), pursuant to which GCBP acquired Catalyst’s product candidates consist oflegacy rare bleeding disorder program, including the coagulation related assets marzeptacog alfa (activated) (“MarzAA”), dalcinonacog alfa (“DalcA”), and CB 2679d-GT. MarzAACB-2679d-GT. See Note 11, Restructuring.

F351 Asset Acquisition

On December 26, 2022, the Company executed and closed an Asset Purchase Agreement, which was amended on March 29, 2023 (the “F351 Agreement”), with GNI Group Ltd. and GNI Hong Kong Limited (together “GNI”) to purchase all of the assets and intellectual property rights primarily related to the proprietary Hydronidone compound (collectively, the “F351 Assets”), other than such assets and intellectual property rights located in the People’s Republic of China. At the closing of the agreement on December 26, 2022, the Company paid $35.0 million in the form of 6,266,521 shares of Catalyst common stock and 12,340 shares of newly designated Series X redeemable convertible preferred stock (“Catalyst Convertible Preferred Stock”). Each share of Catalyst Convertible Preferred Stock is convertible into 10,000 shares of common stock, subject to stockholder approval under Nasdaq rules and subject to a SQ administered next generation engineered coagulation Factor VIIabeneficial ownership conversion blocker. For additional information, see Note 3, F351 Asset Acquisition.

Business Combination Agreement

Concurrent with the F351 Asset acquisition, the Company signed a definitive agreement, as amended on March 29, 2023, with GNI Group Ltd., GNI Hong Kong Limited, GNI USA, Inc., Continent Pharmaceuticals Inc. and Shanghai Genomics, Inc. (collectively, “GNI”) and other minority stockholders to acquire an indirect controlling interest in Beijing Continent Pharmaceutical Co Ltd. (“FVIIa”BC”), a commercial-stage pharmaceutical company based in China and majority-owned subsidiary of GNI, in exchange for newly issued shares of common stock (the “Business Combination Agreement”). The closing of the transactions under the Business Combination Agreement will be subject to stockholder approval at a stockholder meeting expected to be held in the third quarter of 2023 and certain customary closing conditions. For additional information, see Note 9, Commitments and Contingencies.

Contingent Value Rights Agreement

Pursuant to the Business Combination Agreement, on December 26, 2022, Catalyst and the Rights Agent (as defined therein) executed a contingent value rights agreement, as amended on March 29, 2023 (the “CVR Agreement”), pursuant to which each holder of Catalyst common stock as of January 5, 2023 (the “CVR Holders”), excluding GNI, received one contractual contingent value right (a “CVR”) issued by the Company for each share of Catalyst common stock held by such holder. Each CVR entitles the treatmentholder thereof to receive certain cash payments in the future. For additional information, see Note 9, Commitments and Contingencies.

Liquidity

On January 12, 2023, the Company paid a one-time cash dividend of episodic bleeding and prophylaxis in subjects with rare bleeding disorders. DalcA is a next-generation SQ administered FIX. CB 2679d-GT is an AAV-based gene therapy construct harboring$0.24 per share to the DalcA sequence. Both MarzAA and DalcA have shown sustained efficacy and safety in mid-stage clinical trials and are availableCompany’s common stockholders of record as of close of business on January 5, 2023, excluding GNI. The aggregate amount of the special dividend payment was approximately $7.6 million.

On March 8, 2023, the Company distributed the net cash proceeds received from the GCBP asset sale of $0.2 million, or $0.01 per share, to the CVR Holders, excluding GNI. See Note 11, Restructuring, for partnering. CB 2679d-GT has obtained preclinical proof-of-concept and is also available for partnering.additional information regarding this distribution.

The Company had a net income of $37.1$0.3 million for the sixthree months ended June 30, 2022 andMarch 31, 2023. As of March 31, 2023, the Company had an accumulated deficit of $365.6$410.7 million as of June 30, 2022. As of June 30, 2022, the Company had $75.4 million ofand cash and cash equivalents. equivalents of $8.1 million. Its primary uses of cash are to fund operating expenses and general and administrative expenditures. As part of the F351 Agreement, the Company issued 12,340 shares of Catalyst Convertible Preferred Stock, which upon stockholder approval, will be converted to 123,400,000 shares of common stock, subject to applicable beneficial ownership limitations. The terms of the Catalyst Convertible Preferred Stock include a cash settlement feature which provide that, if the Company’s stockholders fail to approve the conversion of the Catalyst Convertible Preferred Stock by September 30, 2023, the Company could be required to make cash payments to the holders of Catalyst Convertible Preferred Stock significantly in excess of its current liquidity. The Company believes that stockholders who are entitled to vote on the conversion proposal at the Company’s 2023 Annual Meeting of Stockholders, which is expected to be held in the third quarter of 2023, will vote to approve the proposal. However, as the vote of the Company’s common stockholders is outside of the control of the Company, there is substantial doubt about its existing cash and cash equivalentsability to continue as of June 30, 2022 will be sufficient to fund its cash requirementsa going concern for at least the next 12 months following the issuance of these condensed consolidated financial statements. The accompanying condensed consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and satisfaction of liabilities in the ordinary course of business. The condensed consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might result from the date of the filingoutcome of this report. The Company will continue to evaluate the impact of the novel coronavirus disease (“COVID-19”) pandemic on its business, operations, and cash requirements.uncertainty.

2. | Summary of Significant Accounting Policies |

Basis of Presentation

The Company’s condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) and following the requirements of the Securities and Exchange Commission (the “SEC”) for interim reporting. As permitted under those rules, certain footnotes or other financial information that are normally required by GAAP can be condensed or omitted. These financial statements have been prepared on the same basis as the Company’s annual financial statements and, in the opinion of management, reflect all adjustments, consisting only of normal recurring adjustments, which are necessary for a fair presentation of the Company’s financial information. These interim results and cash flows for any interim period are not necessarily indicative of the results to be expected for the year ending December 31, 2022,2023, or for any other future annual or interim period.

The accompanying condensed consolidated financial statements and related financial information should be read in conjunction with the consolidated financial statements filed with the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 (“Annual2022 (the “Annual Report”).

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the condensed consolidated financial statements and accompanying notes. On an ongoing basis, management evaluates its estimates, including those related to revenue recognition, allowance of doubtful accounts, long-term receivable, contingent value rights, operating lease right-of-use assets and liabilities, accrued expenses, income taxes and stock-based compensation. The Company bases its estimates on various assumptions that the Company believes to be reasonable under the circumstances. Actual results could differ from those estimates.

Accounting Pronouncements Recently Adopted

In June 2016, the FASB issued ASU 2016-13, Measurement of Credit Losses on Financial Instruments. The main objective of ASU 2016-13 is to provide financial statement users with more decision-useful information about an entity's expected credit losses on financial instruments and other commitments to extend credit at each reporting date. To achieve this objective, the amendments in this update replace the incurred loss impairment methodology currently used today with a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to develop credit loss estimates. ASU 2016-13 is effective for the Company for fiscal years beginning after December 15, 2022, including interim periods within those fiscal years, using a modified retrospective approach. The Company adopted ASU 2016-13 and related updates as of January 1, 2023 and the adoption did not have a material impact on its condensed consolidated financial statements.

Long-Term Receivable

The Company determined that the hold-back from the GCBP asset sale in February 2023 qualified as a long-term receivable. The receivable is considered a loan held for investment since the Company has the intent and ability to hold to maturity. Catalyst has

elected to account for the receivable under the fair value option method of accounting and any changes in fair value are recorded in interest and other income, net on the condensed consolidated statement of operations. Refer to Note 4, Fair Value Measurements and Note 11, Restructuring, for additional information regarding the long-term receivable and GCBP asset sale.

Net Income (Loss) Perper Share Attributable to Common Stockholders

The Company calculates basic and diluted net income (loss) per share attributable to common stockholders in conformity with the two-class method required for participating securities. The Catalyst Convertible Preferred Stock contractually entitles the holders of such shares to participate in dividends but such participation is contingent upon the completion of the merger with GNI. As a result, the Catalyst Convertible Preferred Stock is excluded from the basic EPS calculation, as these shares are not participating securities until the merger with GNI closes. As such, net income for the periods presented was not allocated to these securities. During periods of loss, the Company allocates no loss to participating securities because they have no contractual obligation to share in the losses of the Company.

Basic net income (loss) per share attributable to common stockholders is calculated by dividing the net income (loss) by the weighted average number of shares of common stock outstanding during the period. period, without consideration for potentially dilutive securities. Participating securities are excluded from the basic weighted average common shares outstanding.

Diluted net income (loss) per share attributable to common stockholders is based on the weighted average number of shares of common stockshares outstanding during the period, adjusted to include the assumed exerciseincluding potential dilutive common shares. For purposes of certainthis calculation, outstanding stock options and warrants using the treasury stock method.are considered potential dilutive common shares. The calculation assumes that any proceeds that could be obtainedof diluted EPS does not consider the effect of the Catalyst Convertible Preferred Stock since conversion is contingent upon exercisethe occurrence of options and warrants would be used to purchase common stock at the average market price during the period. Adjustments to the denominator are required to reflect the related dilutive shares.

8

Catalyst Biosciences, Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

Accounting Pronouncements Recently Adopted

In May 2021, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2021-04, Earnings Per Share (Topic 260), Debt—Modifications and Extinguishments (Subtopic 470-50), Compensation—Stock Compensation (Topic 718), and Derivatives and Hedging—Contracts in Entity’s Own Equity (Subtopic 815-40): Issuer’s Accounting for Certain Modifications or Exchanges of Freestanding Equity-Classified Written Call Options. The amendments in ASU 2021-04 provide guidance to clarify and reduce diversity in an issuer’s accounting for modifications or exchanges of freestanding equity-classified written call options (for example, warrants) that remain equity classified after modification or exchange. The amendments in this ASU 2021-04 are effective for all entities for fiscal years beginning after December 15, 2021, and interim periods within those fiscal years, with early adoption permitted, including interim periods within those fiscal years. The Company adopted ASU 2021-04 and related updates on January 1, 2022, and the adoption did not have a material impact on its condensed consolidated financial statements.specified future event.

3. | F351 Asset Acquisition |

On December 26, 2022, the Company acquired the F351 Assets from GNI in accordance with the terms of the F351 Agreement as discussed in Note 1, Nature of Operations and Liquidity. Under the terms of the F351 Agreement, the Company issued 6,266,521 shares of common stock and 12,340 shares of Catalyst Convertible Preferred Stock.

The Company concluded that the F351 acquisition was not the acquisition of a business, as substantially all of the fair value of the gross assets acquired was concentrated in a single identifiable asset, the intellectual property rights (outside of China) to a clinical stage drug candidate for the treatment of liver fibrosis, or the F351 Assets.

Subject to stockholder approval, each share of Catalyst Convertible Preferred Stock issued under the F351 Agreement is convertible into 10,000 shares of common stock. The Company is required to hold a stockholders’ meeting to request the approval of the conversion of the Catalyst Convertible Preferred Stock into shares of common stock in accordance with Nasdaq Listing Rule 5635(a) (the “Conversion Proposal”). The Company expects to hold its 2023 Annual Meeting of Stockholders in the third quarter of 2023 and will include the following matters as proposals to be voted on at the meeting: (i) the Conversion Proposal and (ii) if necessary or appropriate, the approval of an amendment to the Company’s certificate of incorporation to authorize sufficient shares of common stock for the conversion of the Catalyst Convertible Preferred Stock issued pursuant to the F351 Agreement.

In March 2023, the Company amended the F351 Agreement and the Catalyst Convertible Preferred Stock Certificate of Designation to extend the deadline for the cash settlement of the Catalyst Convertible Preferred Stock from June 26, 2023 to September 30, 2023. Under the amended terms, if the Company’s stockholders do not approve the conversion of the Catalyst Convertible Preferred Stock by September 30, 2023, then the Catalyst Convertible Preferred Stock would be redeemable at the option of the holders for cash equal to the closing price of the common stock on the last trading day prior to the holder’s redemption request. Using the closing price on May 8, 2023 of $0.21, if all the currently outstanding Catalyst Convertible Preferred Stock was redeemed for cash, the Company would be required to make a payment of approximately $25.9 million. The Company has insufficient liquidity to make such a payment, if required.

4. | Fair Value Measurements |

For a description of the fair value hierarchy and the Company’s fair value methodology, see “Part II - Item 8 - Financial Statements and Supplementary Data - Note 3 – Summary of Significant Accounting Policies” in the Company’s Annual Report. There were no significant changes in these methodologies during the sixthree months ended June 30, 2022.March 31, 2023.

The following tables present the fair value hierarchy for assets and liabilities measured at fair value on a recurring basis as of June 30, 2022March 31, 2023 and December 31, 20212022 (in thousands):

|

| June 30, 2022 |

|

| March 31, 2023 |

| ||||||||||||||||||||||||||

|

| Level 1 |

|

| Level 2 |

|

| Level 3 |

|

| Total |

|

| Level 1 |

|

| Level 2 |

|

| Level 3 |

|

| Total |

| ||||||||

Financial assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Money market funds(1) |

| $ | 75,394 |

|

| $ | — |

|

| $ | — |

|

| $ | 75,394 |

|

| $ | 8,099 |

|

| $ | — |

|

| $ | — |

|

| $ | 8,099 |

|

Long-term receivable from GCBP |

|

| — |

|

|

| — |

|

|

| 4,550 |

|

|

| 4,550 |

| ||||||||||||||||

Total financial assets |

| $ | 75,394 |

|

| $ | — |

|

| $ | — |

|

| $ | 75,394 |

|

| $ | 8,099 |

|

| $ | — |

|

| $ | 4,550 |

|

| $ | 12,649 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Financial liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

CVR derivative liability |

| $ | — |

|

| $ | — |

|

| $ | 5,000 |

|

| $ | 5,000 |

| ||||||||||||||||

CVR derivative liability, noncurrent |

|

| — |

|

|

| — |

|

|

| 4,550 |

|

|

| 4,550 |

| ||||||||||||||||

Total financial liabilities |

| $ | — |

|

| $ | — |

|

| $ | 9,550 |

|

| $ | 9,550 |

| ||||||||||||||||

|

| December 31, 2021 |

|

| December 31, 2022 |

| ||||||||||||||||||||||||||

|

| Level 1 |

|

| Level 2 |

|

| Level 3 |

|

| Total |

|

| Level 1 |

|

| Level 2 |

|

| Level 3 |

|

| Total |

| ||||||||

Financial assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Money market funds(1) |

| $ | 44,347 |

|

| $ | — |

|

| $ | — |

|

| $ | 44,347 |

|

| $ | 21,666 |

|

| $ | — |

|

| $ | — |

|

| $ | 21,666 |

|

U.S. government agency securities(2) |

|

| 2,504 |

|

|

| — |

|

|

| — |

|

|

| 2,504 |

| ||||||||||||||||

Total financial assets |

| $ | 46,851 |

|

| $ | — |

|

| $ | — |

|

| $ | 46,851 |

|

| $ | 21,666 |

|

| $ | — |

|

| $ | — |

|

| $ | 21,666 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Financial liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

CVR derivative liability |

| $ | — |

|

| $ | — |

|

| $ | 5,000 |

|

| $ | 5,000 |

| ||||||||||||||||

Total financial liabilities |

| $ | — |

|

| $ | — |

|

| $ | 5,000 |

|

| $ | 5,000 |

| ||||||||||||||||

| (1) | Included in cash and cash equivalents on the accompanying condensed consolidated balance |

|

|

The carrying amounts of cash and cash equivalents, accounts and other receivables, accounts payable, and accrued liabilities approximate their fair values due to the short-term maturity of these instruments.

Derivative Liabilities and Long-term Receivables

9

Catalyst Biosciences, Inc.

NotesThe CVR derivative liability relates to Condensed Consolidated Financial Statements (Unaudited)

|

|

Cash equivalents and short-term investments (debt securities)the CVR Agreement executed in connection with the Business Combination Agreement. The fair value of this derivative liability is based on significant unobservable inputs, which are classified as available-for-sale securities, consistedrepresent Level 3 measurements within the fair value hierarchy. The estimated fair value of the CVR liability was determined based on the anticipated amount and timing of projected cash flows to be received from Vertex pursuant to the Vertex asset purchase agreement. As of March 31, 2023, the Company expects to receive a $5.0 million hold-back payment from Vertex in the second quarter of 2023, which will be distributed, net of expenses, to the holders of Catalyst common stock as of January 5, 2023 under the CVR Agreement. The CVR liability was initially recorded at $5.0 million at issuance on December 26, 2022 and there was no change in the estimated fair value as of March 31, 2023.

The long-term receivable and the corresponding CVR derivative liability, noncurrent relate to the asset purchase agreement with GCBP. The fair value of this long-term receivable and derivative liability is based on significant unobservable inputs, which represent Level 3 measurements within the fair value hierarchy. The estimated fair value of the long-term receivable and CVR derivative liability, noncurrent was determined based on the anticipated amount and timing of projected cash flows to be received from GCBP pursuant to the GCBP asset purchase agreement discounted to their present values using an estimated discount rate of 5.05%. As of March 31, 2023, the Company expects to receive a $5.0 million hold-back payment from GCBP in the first quarter of 2025, which will be distributed, net of expenses, to the holders of Catalyst common stock as of January 5, 2023 under the CVR Agreement.

The following table sets forth the changes in the estimated fair value of the Company’s Level 3 financial assets and liabilities (in thousands):

June 30, 2022 |

| Amortized Cost |

|

| Gross Unrealized Gains |

|

| Gross Unrealized Losses |

|

| Estimated Fair Value |

| ||||

Money market funds (cash equivalents) |

| $ | 75,394 |

|

| $ | — |

|

| $ | — |

|

| $ | 75,394 |

|

Total financial assets |

| $ | 75,394 |

|

| $ | — |

|

| $ | — |

|

| $ | 75,394 |

|

Classified as: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 75,394 |

|

Total financial assets |

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 75,394 |

|

|

| Long-term receivable |

|

| CVR derivative |

| ||

|

| from GCBP |

|

| liability, noncurrent |

| ||

Balance at December 31, 2022 |

| $ | — |

|

| $ | — |

|

Additions in the period |

|

| 4,530 |

|

|

| 4,530 |

|

Changes in fair value |

|

| 20 |

|

|

| 20 |

|

Balance at March 31, 2023 |

| $ | 4,550 |

|

| $ | 4,550 |

|

December 31, 2021 |

| Amortized Cost |

|

| Gross Unrealized Gains |

|

| Gross Unrealized Losses |

|

| Estimated Fair Value |

| ||||

Money market funds (cash equivalents) |

| $ | 44,347 |

|

| $ | — |

|

| $ | — |

|

| $ | 44,347 |

|

U.S. government agency securities |

|

| 2,504 |

|

|

| — |

|

|

| — |

|

|

| 2,504 |

|

Total financial assets |

| $ | 46,851 |

|

| $ | — |

|

| $ | — |

|

| $ | 46,851 |

|

Classified as: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 44,347 |

|

Short-term investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2,504 |

|

Total financial assets |

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 46,851 |

|

There have been 0 material realized gains or losses on available-for-sale debt securities for the periods presented. As of June 30, 2022, the Company had 0 available-for-sale debt securities.

5. | Lease |

Operating lease liabilities are recognized based on the present value of the future minimum lease payments over the lease term. In calculating the present value of the lease payments, the Company has elected to utilize its incremental borrowing rate based on the original lease term and not the remaining lease term. The lease includes non-lease components (e.g., common area maintenance) that are paid separately from rent based on actual costs incurred and, therefore, were not included in the right-of-use asset and lease liability but are reflected as an expense in the period incurred.

The Company leases office space for its corporate headquarters, located in South San Francisco, CA. The lease term is through April 30, 2023 and there are no stated renewal options. The Company currently has a month-to-month lease that will continue to be utilized following the expiration of the corporate headquarters lease.

In March 2022, the Company entered into a sublease agreement for one of its leased facilitiesfacility that commenced in April 2022. Under the terms of the sublease agreement, the Company will receive $0.2 million in base lease payments over the term of the sublease, which ends in April 2023.2023. For the three and six months ended June 30, 2022,March 31, 2023, the Company recognized sublease income of $38,000. The sublease agreement began in April 2022, so no sublease income was recognized during the three months ended March 31, 2022.

For the three and six months ended June 30,March 31, 2023 and 2022, the Company’s operating lease expense was $0.6$0.1 million and $1.1$0.5 million, respectively.For

The Company has historically prepaid one month’s worth of rent expense, therefore as of March 31, 2023, the three and six months ended June 30, 2021, the Company’s operatingCompany does not have any remaining lease expense was $0.4 million and $0.6 million, respectively.

payments under its current lease agreement. The present value assumptions used in calculating the present value of the lease payments were as follows:

| June 30, 2022 |

|

| December 31, 2021 |

|

| March 31, 2023 |

|

| December 31, 2022 |

| ||||

Weighted-average remaining lease term | 0.8 years |

|

| 1.3 years |

|

| 0 years |

|

| 0.3 years |

| ||||

Weighted-average discount rate |

| 4.8 | % |

|

| 4.8 | % |

|

| 0.0 | % |

|

| 4.3 | % |

10

Catalyst Biosciences, Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

The maturity of the Company’s operating lease liabilities as of June 30, 2022 were as follows (in thousands):

Year Ending December 31, | Amount |

| |

Remaining in 2022 | $ | 1,029 |

|

2023 |

| 410 |

|

Total undiscounted lease payments |

| 1,439 |

|

Less imputed interest |

| (24 | ) |

Total operating lease liability | $ | 1,415 |

|

Supplemental cash flow information related to operating leases was as follows (in thousands):

| Six Months Ended June 30, |

| |||||

| 2022 |

|

| 2021 |

| ||

Cash paid for amounts included in the measurement of lease liabilities | $ | 1,015 |

|

| $ | 680 |

|

|

| Three Months Ended March 31, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

Cash paid for amounts included in the measurement of lease liabilities |

| $ | 39 |

|

| $ | 502 |

|

6. |

|

2018 Omnibus Incentive Plan

In June 2018, stockholders of the Company approved the Company’s 2018 Omnibus Incentive Plan (the “2018 Plan”). The 2018 Plan had previously been approved by the Company’s Board of Directors (the “Board”) and the Compensation Committee (the “Committee”) of the Board, subject to stockholder approval. The 2018 Plan became effective on June 13, 2018. On June 9, 2021, the stockholders of the Company approved an amendment previously approved by the Board to increase the number of shares of common stock reserved for issuance under the 2018 Plan by 2,500,000 to a total of 5,300,000 shares. The amendment became effective immediately upon stockholder approval. After the option modification (as discussed below), the number of shares of common stock reserved for issuance under the 2018 Plan increased to a total of 31,456,403. As of March 31, 2023, there were 25,521,867 shares of common stock available for future grant.

Performance-Based Stock Option GrantGrants

In June 2022, the Committee approved the issuance of an option grant to purchase 400,000 shares (2,457,917 shares after the option modification discussed below) of common stock to the Chief Executive Officer pursuant to the 2018 Plan, which will vest upon (a) the achievement of a specified performance goal and (b) the grantees’grantee’s continued employment during the service period. ForDuring the sixthree months ended June 30, 2022,March 31, 2023, this award was cancelled. Prior to cancellation, no expense has been recognized related to this award.award and no options have vested.

Special Cash Dividend

On January 12, 2023, the Company paid a special, one-time cash dividend of $7.6 million (or $0.24 per share) to the Company’s common stockholders of record as of the close of business on January 5, 2023. The Company determined, in accordance with the adjustment provision of the 2018 Plan, that the special cash dividend was unusual and non-recurring and that appropriate adjustment to the stock options to purchase shares of the Company’s common stock outstanding under the 2018 Plan was required. The Company treated this adjustment as a modification to the original stock option grants because the terms of the agreements were modified in order to preserve the value of the option awards after a large non-recurring cash dividend. These options were amended to decrease the exercise price and increase the number of shares subject to the stock option on a proportionate basis. No incremental value was provided to the option holders as a result of the modification and no additional compensation cost was recorded by the Company.

The following table summarizes stock option activity under the Company’s 2018 Plan and related information:

|

| Number of Shares Underlying Outstanding Options |

|

| Weighted- Average Exercise Price |

|

| Weighted- Average Remaining Contractual Term (Years) |

| |||

Outstanding — December 31, 2021 |

|

| 2,603,630 |

|

| $ | 7.70 |

|

|

| 7.46 |

|

Options granted |

|

| 1,314,200 |

|

| $ | 0.72 |

|

|

|

|

|

Options forfeited |

|

| (1,173,227 | ) |

| $ | 4.19 |

|

|

|

|

|

Options expired |

|

| (47,192 | ) |

| $ | 12.84 |

|

|

|

|

|

Outstanding — June 30, 2022 |

|

| 2,697,411 |

|

| $ | 5.64 |

|

|

| 7.85 |

|

Exercisable — June 30, 2022 |

|

| 1,375,625 |

|

| $ | 9.01 |

|

|

|

|

|

|

| Number of Shares Underlying Outstanding Options |

|

| Weighted- Average Exercise Price |

|

| Weighted- Average Remaining Contractual Term (Years) |

| |||

Outstanding — December 31, 2022 |

|

| 8,678,767 |

|

| $ | 1.42 |

|

|

| 7.47 |

|

Options granted (1) |

|

| 14,008,093 |

|

| $ | 0.86 |

|

|

|

|

|

Options forfeited and cancelled (1) |

|

| (14,210,119 | ) |

| $ | 0.91 |

|

|

|

|

|

Options expired |

|

| (12,174 | ) |

| $ | 36.16 |

|

|

|

|

|

Outstanding — March 31, 2023 |

|

| 8,464,567 |

|

| $ | 1.30 |

|

|

| 6.01 |

|

Exercisable — March 31, 2023 |

|

| 7,306,692 |

|

| $ | 1.40 |

|

|

|

|

|

(1) | Includes options that were cancelled and re-granted as part of the option modification from the special cash dividend, as further discussed above. |

Valuation Assumptions

The Company estimated the fair value of stock options granted using the Black-Scholes option-pricing formula and a single option award approach. Due to its limited relevant historical data, the Company estimated its volatility considering a number of factors including the use of the volatility of comparable public companies. The expected term of options granted under the Plan, all of which qualify as “plain vanilla” per SEC Staff Accounting Bulletin 107, is determined based on the simplified method due to the Company’s limited relevant history. The risk-free rate is based on the yield of a U.S. Treasury security with a term consistent with the option. This fair value is being amortized ratably over the requisite service periods of the awards, which is generally the vesting period.

11

Catalyst Biosciences, Inc.The only options granted during the quarter ended March 31, 2023 were as a result of the option modification. Since no new stock options were granted during the quarter ended March 31, 2023, all weighted-average assumptions for the period were not applicable.

Notes to Condensed Consolidated Financial Statements (Unaudited)

The fair value of employee stock options was estimated using the following weighted-average assumptions:

|

| Three Months Ended March 31, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

Employee Stock Options: |

|

|

|

|

|

|

|

|

Risk-free interest rate |

|

| — |

|

|

| 1.87 | % |

Expected term (in years) |

|

| — |

|

|

| 6.1 |

|

Dividend yield |

|

| — |

|

|

| — |

|

Volatility |

|

| — |

|

|

| 91.54 | % |

Weighted-average fair value of stock options granted |

| $ | — |

|

| $ | 0.39 |

|

|

| Three Months Ended June 30, |

|

| Six Months Ended June 30, |

| ||||||||||

|

| 2022 |

|

| 2021 |

|

| 2022 |

|

| 2021 |

| ||||

Employee Stock Options: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Risk-free rate |

|

| 2.93 | % |

|

| 0.96 | % |

|

| 2.22 | % |

|

| 0.74 | % |

Expected term (in years) |

|

| 6.0 |

|

|

| 5.7 |

|

|

| 6.0 |

|

|

| 6.0 |

|

Dividend yield |

| 0 |

|

| 0 |

|

| 0 |

|

| 0 |

| ||||

Volatility |

|

| 91.82 | % |

|

| 92.79 | % |

|

| 91.63 | % |

|

| 93.64 | % |

Weighted-average fair value of stock options granted |

| $ | 0.87 |

|

| $ | 3.37 |

|

| $ | 0.55 |

|

| $ | 4.45 |

|

Total stock-based compensation expense recognized was as follows (in thousands):

|

| Three Months Ended June 30, |

|

| Six Months Ended June 30, |

|

| Three Months Ended March 31, |

| |||||||||||||||

|

| 2022 |

|

| 2021 |

|

| 2022 |

|

| 2021 |

|

| 2023 |

|

| 2022 |

| ||||||

Research and development |

| $ | 83 |

|

| $ | 394 |

|

| $ | 211 |

|

| $ | 763 |

|

| $ | 66 |

|

| $ | 128 |

|

General and administrative(1) |

|

| 263 |

|

|

| 589 |

|

|

| 650 |

|

|

| 1,246 |

|

|

| 144 |

|

|

| 387 |

|

Total stock-based compensation expense |

| $ | 346 |

|

| $ | 983 |

|

| $ | 861 |

|

| $ | 2,009 |

|

| $ | 210 |

|

| $ | 515 |

|

| (1) |

|

As of June 30, 2022, 3,013,716 shares of common stock were available for future grant.

7. | Collaborations |

Mosaic

In October 2017, the Company entered into a strategic research collaboration with Mosaic Biosciences (“Mosaic”) to develop intravitreal anti-complement factor 3 (C3) products for the treatment of dry Age-related Macular Degeneration (AMD) and other retinal diseases. The Company subsequently amended this agreement in December 2018, December 2019 and May 2020.

Under the as amended Mosaic collaboration agreement, Mosaic is eligible to receive up to $4.0 million in potential future milestone payments related to regulatory and clinical development events for CB 2782-PEG and an additional anti-complement product candidate in lieu of the Company’s prior obligations to pay Mosaic a double-digit percentage of funds the Company receives from Biogen or any other amounts the Company receives related to sublicense fees, research and development payments, or any other research, regulatory, clinical or commercial milestones and royalties on any other development candidates.