UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

| | | | | |

| |

| (Mark One) | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2023March 31, 2024

| | | | | |

| Or |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission File Number 001-36198

INTERCONTINENTAL EXCHANGE, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 46-2286804 |

(State or other jurisdiction of

incorporation or organization) | (IRS Employer

Identification Number) |

| | | | | |

5660 New Northside Drive, Atlanta, Georgia | 30328 |

| (Address of principal executive offices) | (Zip Code) |

(770) 857-4700

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, $0.01 par value per share | ICE | New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☑ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of August 1, 2023,April 29, 2024, the number of shares of the registrant’s Common Stock outstanding was 560,301,373573,584,580 shares.

INTERCONTINENTAL EXCHANGE, INC.

Form 10-Q

Quarterly Period Ended June 30, 2023March 31, 2024

TABLE OF CONTENTS

| | | | | | | | |

| | |

| | |

| PART I. | Financial Statements | |

| Item 1. | | |

| Consolidated Balance Sheets as of June 30, 2023March 31, 2024 and December 31, 20222023 | |

| Consolidated Statements of Income for the six months and three months ended June 30,March 31, 2024 and 2023 and 2022 | |

| Consolidated Statements of Comprehensive Income for the six months and three months ended June 30,March 31, 2024 and 2023 and 2022 | |

| Consolidated Statements of Changes in Equity and Redeemable Non-Controlling Interest for the six months and three months ended June 30,March 31, 2024 and 2023 and 2022 | |

| Consolidated Statements of Cash Flows for the sixthree months ended June 30,March 31, 2024 and 2023 and 2022 | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| PART II. | Other Information | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

| |

PART I. Financial Statements

Item 1. Consolidated Financial Statements

Intercontinental Exchange, Inc. and Subsidiaries

Consolidated Balance Sheets

(In millions, except per share amounts)

| | As of | | As of

December 31, 2022 |

| June 30, 2023 | |

| (Unaudited) | |

| As of | | | As of | | As of

December 31, 2023 |

| March 31, 2024 | |

| (Unaudited) | |

| (Unaudited) | |

| (Unaudited) | |

| Assets: | |

| Assets: | |

| Assets: | Assets: | | | |

| Current assets: | Current assets: | |

| Current assets: | |

| Current assets: | |

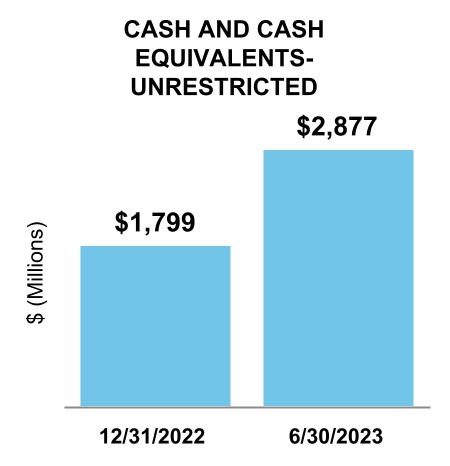

| Cash and cash equivalents | |

| Cash and cash equivalents | |

| Cash and cash equivalents | Cash and cash equivalents | $ | 2,877 | | | $ | 1,799 | |

| Short-term restricted cash and cash equivalents | Short-term restricted cash and cash equivalents | 5,413 | | | 6,149 | |

| Restricted short-term investments | 735 | | | — | |

| Short-term restricted investments | |

| Cash and cash equivalent margin deposits and guaranty funds | Cash and cash equivalent margin deposits and guaranty funds | 86,917 | | | 141,990 | |

| Invested deposits, delivery contracts receivable and unsettled variation margin | Invested deposits, delivery contracts receivable and unsettled variation margin | 1,412 | | | 5,382 | |

| Customer accounts receivable, net of allowance for doubtful accounts of $25 and $22 at June 30, 2023 and December 31, 2022, respectively | 1,313 | | | 1,169 | |

| Customer accounts receivable, net of allowance for doubtful accounts of $19 and $21 at March 31, 2024 and December 31, 2023, respectively | |

| Prepaid expenses and other current assets | Prepaid expenses and other current assets | 555 | | | 458 | |

| Total current assets | Total current assets | 99,222 | | | 156,947 | |

| Property and equipment, net | Property and equipment, net | 1,718 | | | 1,767 | |

| Other non-current assets: | Other non-current assets: | | | |

| Goodwill | |

| Goodwill | |

| Goodwill | Goodwill | 21,134 | | | 21,111 | |

| Other intangible assets, net | Other intangible assets, net | 12,814 | | | 13,090 | |

| Long-term restricted cash and cash equivalents | Long-term restricted cash and cash equivalents | 205 | | | 405 | |

| Long-term restricted investments | Long-term restricted investments | 199 | | | — | |

| Other non-current assets | Other non-current assets | 991 | | | 1,018 | |

| Total other non-current assets | Total other non-current assets | 35,343 | | | 35,624 | |

| Total assets | Total assets | $ | 136,283 | | | $ | 194,338 | |

| | Liabilities and Equity: | Liabilities and Equity: | |

| Liabilities and Equity: | |

| Liabilities and Equity: | |

| Current liabilities: | Current liabilities: | |

| Current liabilities: | |

| Current liabilities: | |

| Accounts payable and accrued liabilities | |

| Accounts payable and accrued liabilities | |

| Accounts payable and accrued liabilities | Accounts payable and accrued liabilities | $ | 919 | | | $ | 866 | |

| Section 31 fees payable | Section 31 fees payable | 173 | | | 223 | |

| Accrued salaries and benefits | Accrued salaries and benefits | 226 | | | 352 | |

| Deferred revenue | Deferred revenue | 437 | | | 170 | |

| Short-term debt | Short-term debt | — | | | 4 | |

| Margin deposits and guaranty funds | Margin deposits and guaranty funds | 86,917 | | | 141,990 | |

| Invested deposits, delivery contracts payable and unsettled variation margin | Invested deposits, delivery contracts payable and unsettled variation margin | 1,412 | | | 5,382 | |

| Other current liabilities | Other current liabilities | 120 | | | 184 | |

| Total current liabilities | Total current liabilities | 90,204 | | | 149,171 | |

| Non-current liabilities: | Non-current liabilities: | | | |

| Non-current deferred tax liability, net | Non-current deferred tax liability, net | 3,256 | | | 3,493 | |

| Non-current deferred tax liability, net | |

| Non-current deferred tax liability, net | |

| Long-term debt | Long-term debt | 18,128 | | | 18,118 | |

| Accrued employee benefits | Accrued employee benefits | 156 | | | 160 | |

| Non-current operating lease liability | Non-current operating lease liability | 218 | | | 254 | |

| Other non-current liabilities | Other non-current liabilities | 432 | | | 381 | |

| Total non-current liabilities | Total non-current liabilities | 22,190 | | | 22,406 | |

| Total liabilities | Total liabilities | 112,394 | | | 171,577 | |

| Commitments and contingencies | Commitments and contingencies | | | | Commitments and contingencies | | | |

|

| | | Equity: | Equity: | |

| Intercontinental Exchange, Inc. stockholders’ equity: | Intercontinental Exchange, Inc. stockholders’ equity: | |

| Intercontinental Exchange, Inc. stockholders’ equity: | |

| Intercontinental Exchange, Inc. stockholders’ equity: | |

| Preferred stock, $0.01 par value; 100 shares authorized; none issued or outstanding | Preferred stock, $0.01 par value; 100 shares authorized; none issued or outstanding | — | | | — | |

| Common stock, $0.01 par value; 1,500 shares authorized; 636 and 634 issued at June 30, 2023 and December 31, 2022, respectively, and 560 and 559 shares outstanding at June 30, 2023 and December 31, 2022, respectively | 6 | | | 6 | |

| Treasury stock, at cost; 76 and 75 shares at June 30, 2023 and December 31, 2022, respectively | (6,276) | | | (6,225) | |

| Preferred stock, $0.01 par value; 100 shares authorized; none issued or outstanding | |

| Preferred stock, $0.01 par value; 100 shares authorized; none issued or outstanding | |

| Common stock, $0.01 par value; 1,500 shares authorized; 650 and 649 issued at March 31, 2024 and December 31, 2023, respectively, and 573 shares outstanding at both March 31, 2024 and December 31, 2023 | |

| Treasury stock, at cost; 77 and 76 shares at March 31, 2024 and December 31, 2023, respectively | |

| Additional paid-in capital | Additional paid-in capital | 14,449 | | | 14,313 | |

| Retained earnings | Retained earnings | 15,925 | | | 14,943 | |

| Accumulated other comprehensive loss | Accumulated other comprehensive loss | (284) | | | (331) | |

| Total Intercontinental Exchange, Inc. stockholders’ equity | Total Intercontinental Exchange, Inc. stockholders’ equity | 23,820 | | | 22,706 | |

| Non-controlling interest in consolidated subsidiaries | Non-controlling interest in consolidated subsidiaries | 69 | | | 55 | |

| Total equity | Total equity | 23,889 | | | 22,761 | |

| Total liabilities and equity | Total liabilities and equity | $ | 136,283 | | | $ | 194,338 | |

See accompanying notes.

Intercontinental Exchange, Inc. and Subsidiaries

Consolidated Statements of Income

(In millions, except per share amounts)

(Unaudited)

| | Six Months Ended June 30, | | Three Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Three Months Ended March 31, | |

| Three Months Ended March 31, | |

| Three Months Ended March 31, | |

| 2024 | |

| 2024 | |

| 2024 | |

| Revenues: | |

| Revenues: | |

| Revenues: | Revenues: | | | | | | | |

| Exchanges | Exchanges | $ | 3,214 | | | $ | 3,247 | | | $ | 1,541 | | | $ | 1,604 | |

| Exchanges | |

| Exchanges | |

| Fixed income and data services | |

| Fixed income and data services | |

| Fixed income and data services | Fixed income and data services | 1,109 | | | 1,021 | | | 546 | | | 512 | |

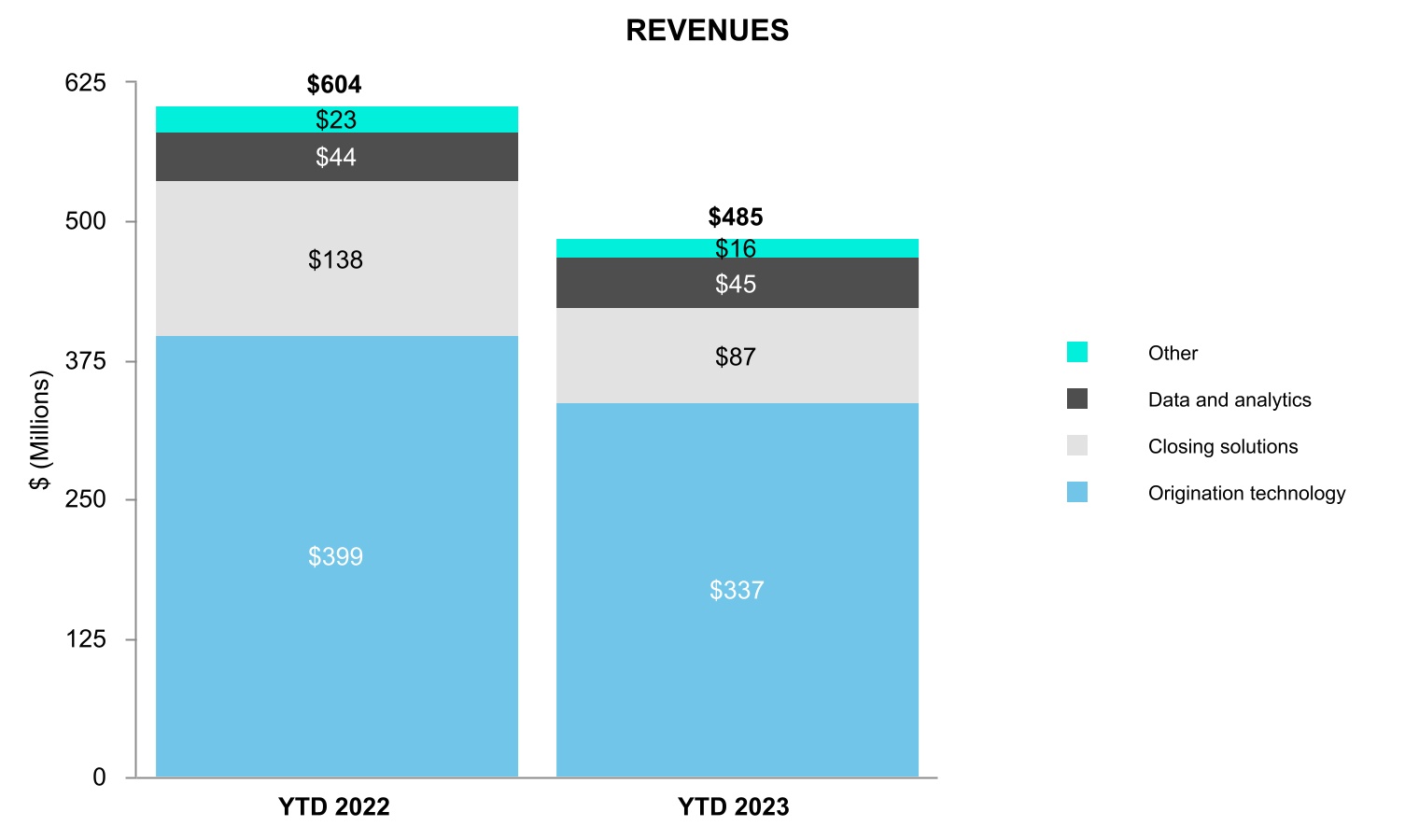

| Mortgage technology | Mortgage technology | 485 | | | 604 | | | 249 | | | 297 | |

| Mortgage technology | |

| Mortgage technology | |

| Total revenues | |

| Total revenues | |

| Total revenues | Total revenues | 4,808 | | | 4,872 | | | 2,336 | | | 2,413 | |

| Transaction-based expenses: | Transaction-based expenses: | | | | | | | |

| Transaction-based expenses: | |

| Transaction-based expenses: | |

| Section 31 fees | |

| Section 31 fees | |

| Section 31 fees | Section 31 fees | 175 | | | 174 | | | 56 | | | 123 | |

| Cash liquidity payments, routing and clearing | Cash liquidity payments, routing and clearing | 849 | | | 985 | | | 392 | | | 476 | |

| Cash liquidity payments, routing and clearing | |

| Cash liquidity payments, routing and clearing | |

| Total revenues, less transaction-based expenses | |

| Total revenues, less transaction-based expenses | |

| Total revenues, less transaction-based expenses | Total revenues, less transaction-based expenses | 3,784 | | | 3,713 | | | 1,888 | | | 1,814 | |

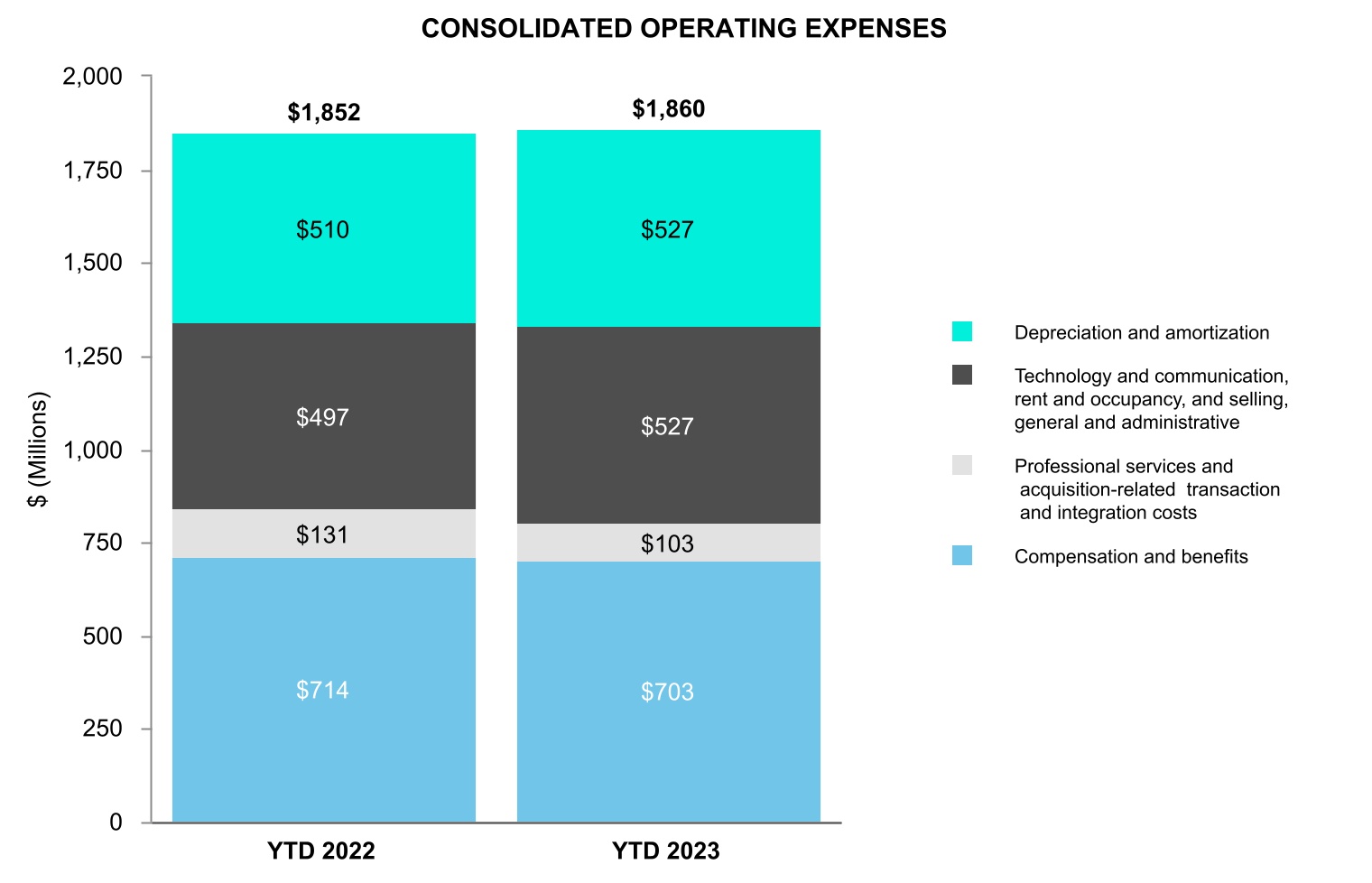

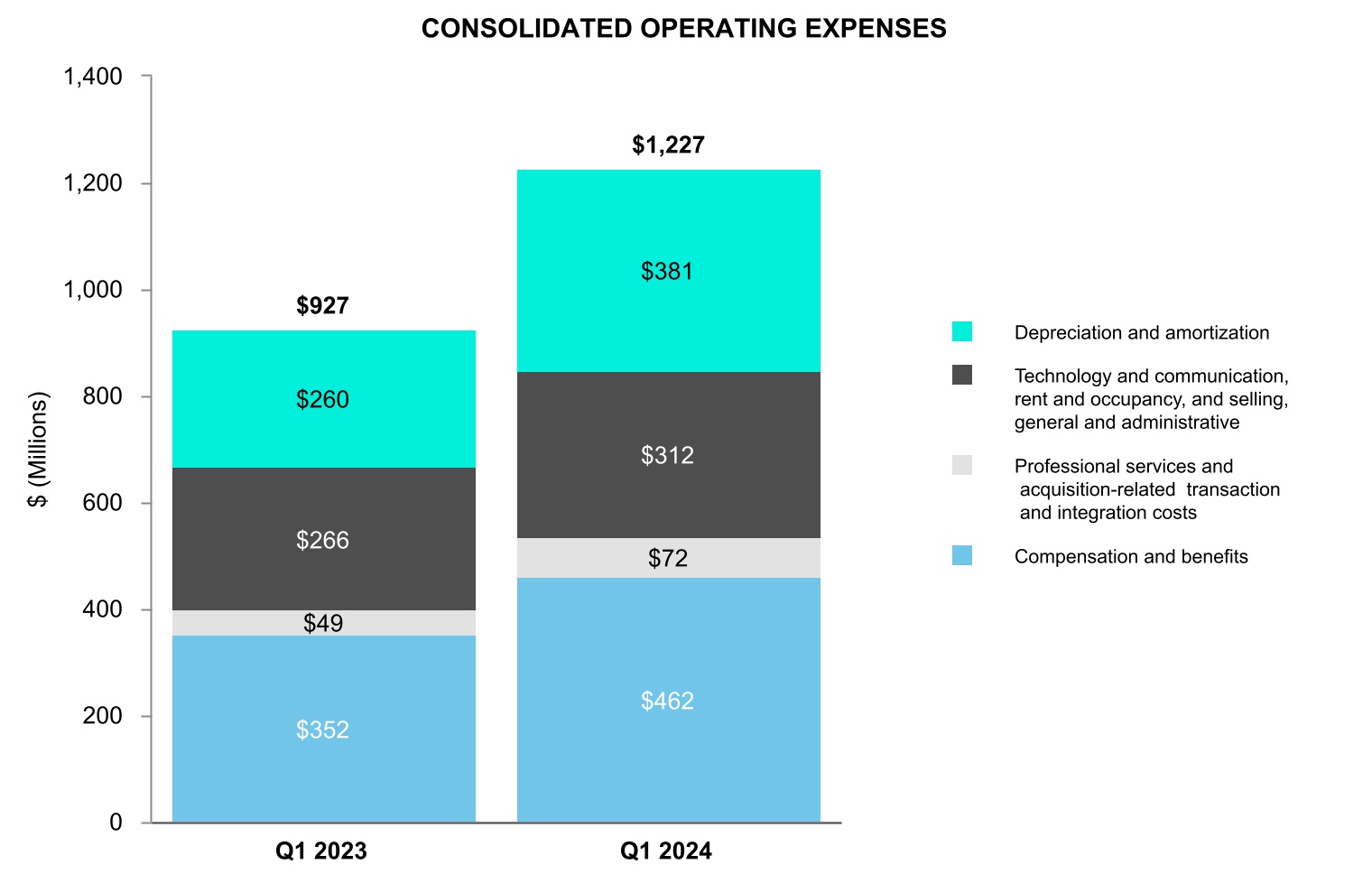

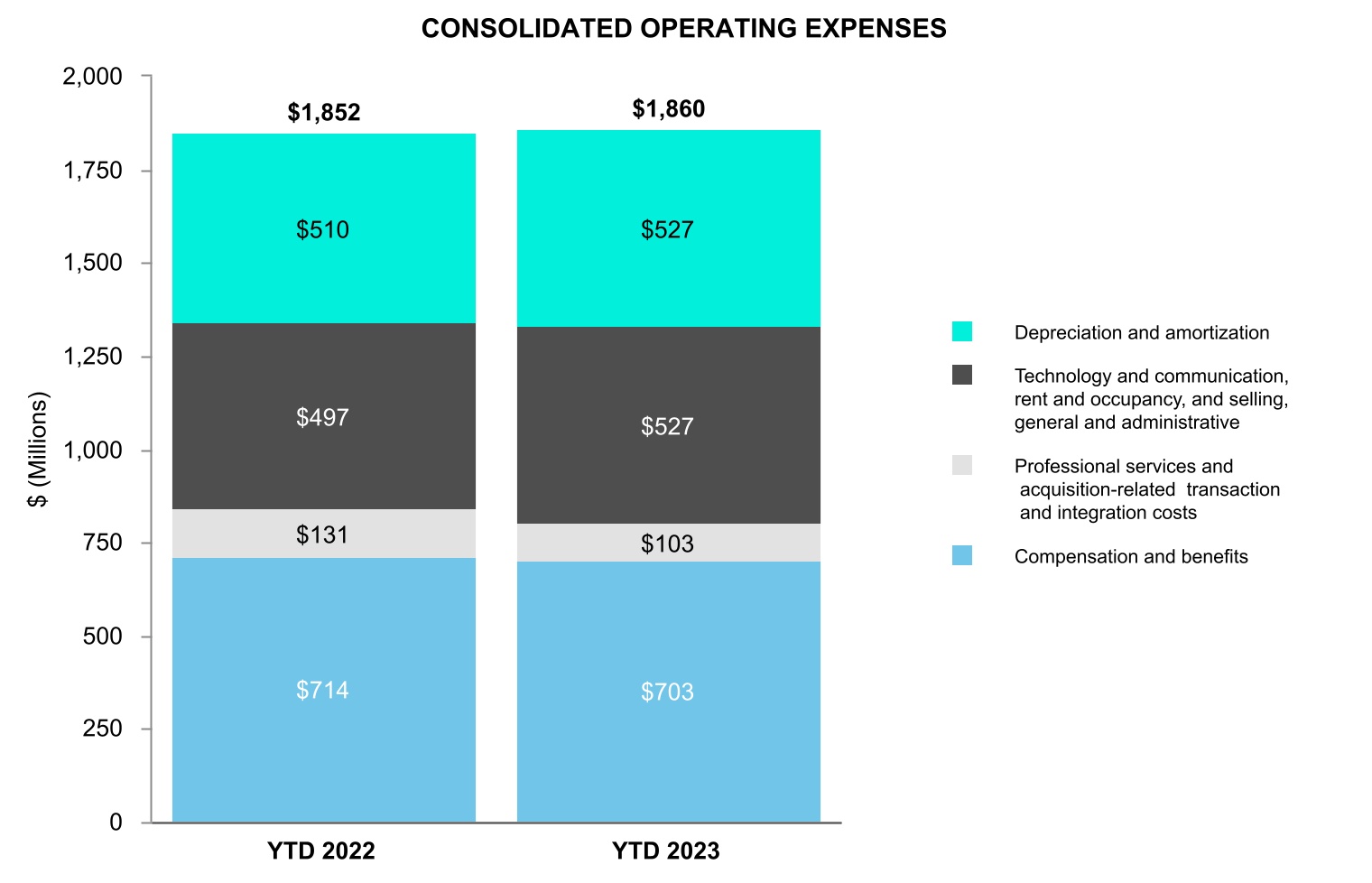

| Operating expenses: | Operating expenses: | | | | | | | |

| Operating expenses: | |

| Operating expenses: | |

| Compensation and benefits | |

| Compensation and benefits | |

| Compensation and benefits | Compensation and benefits | 703 | | | 714 | | | 351 | | | 355 | |

| Professional services | Professional services | 57 | | | 69 | | | 29 | | | 35 | |

| Professional services | |

| Professional services | |

| Acquisition-related transaction and integration costs | |

| Acquisition-related transaction and integration costs | |

| Acquisition-related transaction and integration costs | Acquisition-related transaction and integration costs | 46 | | | 62 | | | 25 | | | 53 | |

| Technology and communication | Technology and communication | 345 | | | 344 | | | 173 | | | 169 | |

| Technology and communication | |

| Technology and communication | |

| Rent and occupancy | |

| Rent and occupancy | |

| Rent and occupancy | Rent and occupancy | 45 | | | 41 | | | 25 | | | 20 | |

| Selling, general and administrative | Selling, general and administrative | 137 | | | 112 | | | 63 | | | 57 | |

| Selling, general and administrative | |

| Selling, general and administrative | |

| Depreciation and amortization | |

| Depreciation and amortization | |

| Depreciation and amortization | Depreciation and amortization | 527 | | | 510 | | | 267 | | | 256 | |

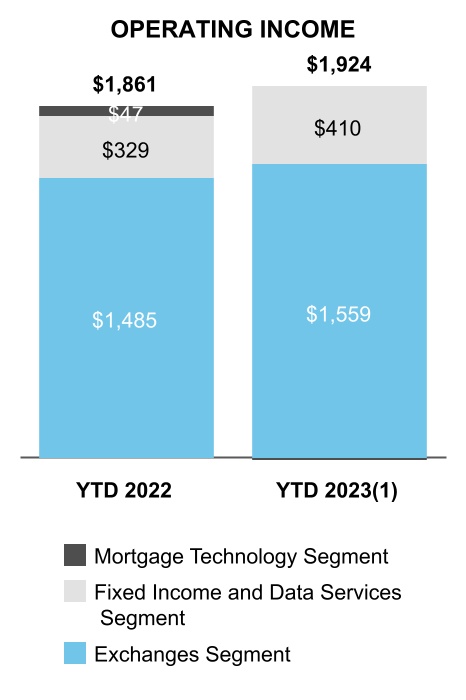

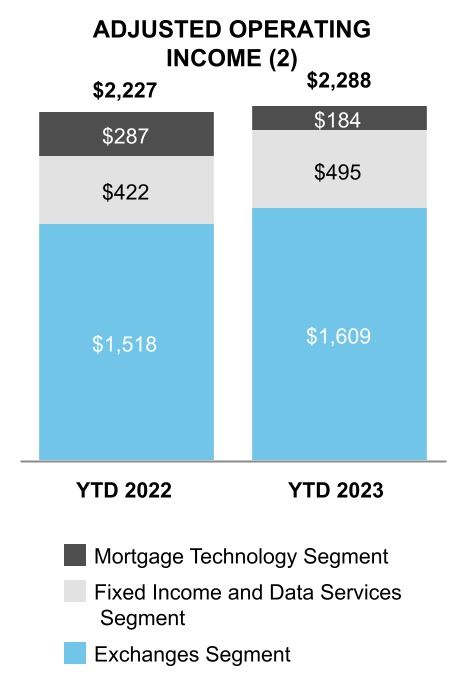

| Total operating expenses | Total operating expenses | 1,860 | | | 1,852 | | | 933 | | | 945 | |

| Total operating expenses | |

| Total operating expenses | |

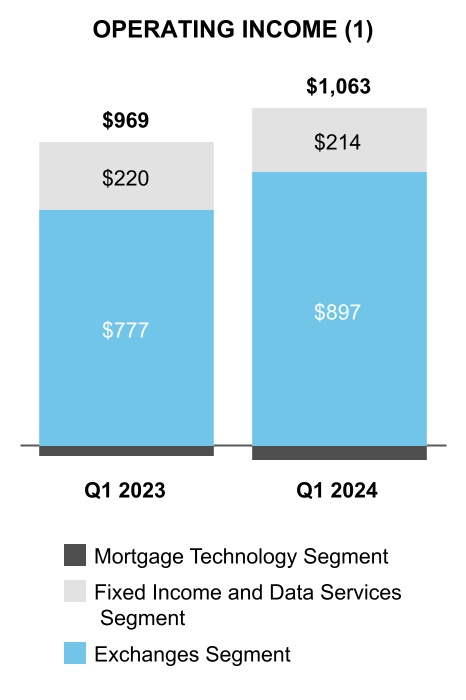

| Operating income | |

| Operating income | |

| Operating income | Operating income | 1,924 | | | 1,861 | | | 955 | | | 869 | |

| Other income/(expense): | Other income/(expense): | | | | | | | |

| Other income/(expense): | |

| Other income/(expense): | |

| Interest income | |

| Interest income | |

| Interest income | Interest income | 193 | | | 9 | | | 102 | | | 8 | |

| Interest expense | Interest expense | (351) | | | (264) | | | (175) | | | (161) | |

| Interest expense | |

| Interest expense | |

| Other income/(expense), net | |

| Other income/(expense), net | |

| Other income/(expense), net | Other income/(expense), net | (70) | | | (35) | | | (35) | | | 23 | |

| Total other income/(expense), net | Total other income/(expense), net | (228) | | | (290) | | | (108) | | | (130) | |

| Total other income/(expense), net | |

| Total other income/(expense), net | |

| Income before income tax expense | |

| Income before income tax expense | |

| Income before income tax expense | Income before income tax expense | 1,696 | | | 1,571 | | | 847 | | | 739 | |

| Income tax expense | Income tax expense | 207 | | | 338 | | | 32 | | | 173 | |

| Income tax expense | |

| Income tax expense | |

| Net income | |

| Net income | |

| Net income | Net income | $ | 1,489 | | | $ | 1,233 | | | $ | 815 | | | $ | 566 | |

| Net income attributable to non-controlling interest | Net income attributable to non-controlling interest | (35) | | | (21) | | | (16) | | | (11) | |

| Net income attributable to non-controlling interest | |

| Net income attributable to non-controlling interest | |

| Net income attributable to Intercontinental Exchange, Inc. | |

| Net income attributable to Intercontinental Exchange, Inc. | |

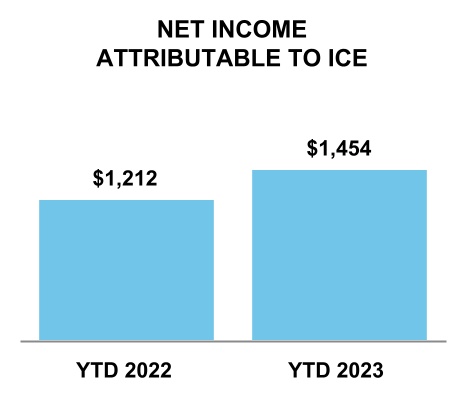

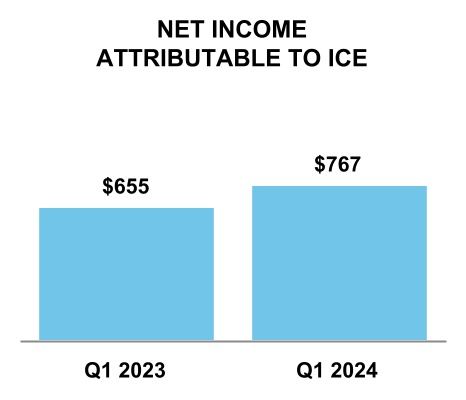

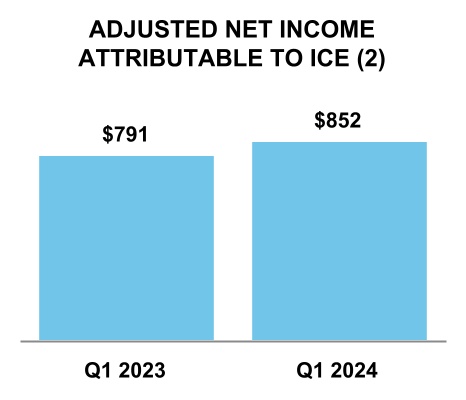

| Net income attributable to Intercontinental Exchange, Inc. | Net income attributable to Intercontinental Exchange, Inc. | $ | 1,454 | | | $ | 1,212 | | | $ | 799 | | | $ | 555 | |

| Earnings per share attributable to Intercontinental Exchange, Inc. common stockholders: | Earnings per share attributable to Intercontinental Exchange, Inc. common stockholders: | | | | | | | |

| Earnings per share attributable to Intercontinental Exchange, Inc. common stockholders: | |

| Earnings per share attributable to Intercontinental Exchange, Inc. common stockholders: | |

| Basic | |

| Basic | |

| Basic | Basic | $ | 2.60 | | | $ | 2.17 | | | $ | 1.43 | | | $ | 0.99 | |

| Diluted | Diluted | $ | 2.59 | | | $ | 2.16 | | | $ | 1.42 | | | $ | 0.99 | |

| Diluted | |

| Diluted | |

| Weighted average common shares outstanding: | |

| Weighted average common shares outstanding: | |

| Weighted average common shares outstanding: | Weighted average common shares outstanding: | | | | | | | |

| Basic | Basic | 560 | | | 560 | | | 560 | | | 558 | |

| Basic | |

| Basic | |

| Diluted | Diluted | 561 | | | 562 | | | 561 | | | 560 | |

| Diluted | |

| Diluted | |

See accompanying notes.

Intercontinental Exchange, Inc. and Subsidiaries

Consolidated Statements of Comprehensive Income

(In millions)

(Unaudited)

| | Three Months Ended March 31, | |

| Three Months Ended March 31, | |

| Three Months Ended March 31, | |

| 2024 | |

| 2024 | |

| 2024 | |

| Net income | |

| Net income | |

| Net income | |

| Other comprehensive income/(loss): | |

| Other comprehensive income/(loss): | |

| Other comprehensive income/(loss): | |

| Foreign currency translation adjustments | |

| Foreign currency translation adjustments | |

| Foreign currency translation adjustments | |

| Change in equity method investment | |

| Change in equity method investment | |

| Change in equity method investment | |

| | | Six Months Ended June 30, | | Three Months Ended June 30, |

| Other comprehensive income/(loss) | |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | $ | 1,489 | | | $ | 1,233 | | | $ | 815 | | | $ | 566 | |

| Other comprehensive income/(loss): | | | | | | | |

| Foreign currency translation adjustments | 47 | | | (109) | | | 31 | | | (84) | |

| | Other comprehensive income/(loss) | |

| | Other comprehensive income/(loss) | Other comprehensive income/(loss) | 47 | | | (109) | | | 31 | | | (84) | |

| Comprehensive income | Comprehensive income | $ | 1,536 | | | $ | 1,124 | | | $ | 846 | | | $ | 482 | |

| Comprehensive income | |

| Comprehensive income | |

| Comprehensive income attributable to non-controlling interest | |

| Comprehensive income attributable to non-controlling interest | |

| Comprehensive income attributable to non-controlling interest | Comprehensive income attributable to non-controlling interest | (35) | | | (21) | | | (16) | | | (11) | |

| Comprehensive income attributable to Intercontinental Exchange, Inc. | Comprehensive income attributable to Intercontinental Exchange, Inc. | $ | 1,501 | | | $ | 1,103 | | | $ | 830 | | | $ | 471 | |

| Comprehensive income attributable to Intercontinental Exchange, Inc. | |

| Comprehensive income attributable to Intercontinental Exchange, Inc. | |

See accompanying notes.

Intercontinental Exchange, Inc. and Subsidiaries

Consolidated Statements of Changes in Equity and Redeemable Non-Controlling Interest

(In millions)

(Unaudited)

| | Intercontinental Exchange, Inc. Stockholders’ Equity | |

| Intercontinental Exchange, Inc. Stockholders’ Equity | |

| Intercontinental Exchange, Inc. Stockholders’ Equity | |

| Common

Stock | |

| Common

Stock | |

| Common

Stock | |

| Shares | |

| Shares | |

| Shares | |

| Balance, as of December 31, 2023 | |

| Balance, as of December 31, 2023 | |

| Balance, as of December 31, 2023 | |

| | Intercontinental Exchange, Inc. Stockholders’ Equity | | Non-

Controlling

Interest in

Consolidated

Subsidiaries | | Total

Equity | |

| Other comprehensive loss | |

| | Common

Stock | | Treasury Stock | | Additional

Paid-in

Capital | | Retained

Earnings | | Accumulated

Other

Comprehensive

Income/(Loss) | |

| Other comprehensive loss | |

| | Shares | | Value | | Shares | | Value | | Additional

Paid-in

Capital | | Retained

Earnings | | Accumulated

Other

Comprehensive

Income/(Loss) | | Non-

Controlling

Interest in

Consolidated

Subsidiaries | | Total

Equity |

| Balance, as of December 31, 2022 | 634 | | | $ | 6 | | | (75) | | | $ | (6,225) | | | |

| Other comprehensive income | — | | | — | | | — | | | — | | | — | | | — | | | 47 | | | |

| | Other comprehensive loss | |

| Exercise of common stock options | |

| Exercise of common stock options | |

| Exercise of common stock options | Exercise of common stock options | — | | | — | | | — | | | — | | | 24 | | | — | | | — | | | — | | | 24 | | |

| | Payments relating to treasury shares | Payments relating to treasury shares | — | | | — | | | (1) | | | (51) | | | — | | | — | | | — | | | — | | | (51) | | |

| | Payments relating to treasury shares | |

| | Payments relating to treasury shares | |

| Stock-based compensation | |

| Stock-based compensation | |

| Stock-based compensation | Stock-based compensation | — | | | — | | | — | | | — | | | 94 | | | — | | | — | | | — | | | 94 | | |

| Issuance under the employee stock purchase plan | Issuance under the employee stock purchase plan | — | | | — | | | — | | | — | | | 18 | | | — | | | — | | | — | | | 18 | | |

| Contribution from equity partners | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 9 | | | 9 | | |

| Issuance under the employee stock purchase plan | |

| Issuance under the employee stock purchase plan | |

| | Issuance of restricted stock | |

| | Issuance of restricted stock | |

| | Issuance of restricted stock | Issuance of restricted stock | 2 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | |

| | Distributions of profits | Distributions of profits | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (30) | | | (30) | | |

| | Distributions of profits | |

| | Distributions of profits | |

| Dividends paid to stockholders | |

| Dividends paid to stockholders | |

| Dividends paid to stockholders | Dividends paid to stockholders | — | | | — | | | — | | | — | | | — | | | (472) | | | — | | | — | | | (472) | | |

| | Net income/(loss) attributable to non-controlling interest | — | | | — | | | — | | | — | | | — | | | (35) | | | — | | | 35 | | | — | | |

| Net income attributable to non-controlling interest | |

| | Net income attributable to non-controlling interest | |

| | Net income attributable to non-controlling interest | |

| Net income | Net income | — | | | — | | | — | | | — | | | — | | | 1,489 | | | — | | | — | | | 1,489 | | |

| Balance, as of June 30, 2023 | 636 | | | $ | 6 | | | (76) | | | $ | (6,276) | | | $ | 14,449 | | | $ | 15,925 | | | $ | (284) | | | $ | 69 | | | $ | 23,889 | | |

| Net income | |

| Net income | |

| Balance, as of March 31, 2024 | |

| Balance, as of March 31, 2024 | |

| Balance, as of March 31, 2024 | |

| | Intercontinental Exchange, Inc. Stockholders’ Equity | | Non-

Controlling

Interest in

Consolidated

Subsidiaries | | Total

Equity | |

| Common

Stock | | Treasury Stock | | Additional

Paid-in

Capital | | Retained

Earnings | | Accumulated

Other

Comprehensive

Income/(Loss) | |

| Shares | | Value | | Shares | | Value | |

| Balance, as of March 31, 2023 | 635 | | | $ | 6 | | | (76) | | | $ | (6,274) | | | $ | 14,388 | | | $ | 15,362 | | | $ | (315) | | | $ | 44 | | | $ | 23,211 | | |

| Intercontinental Exchange, Inc. Stockholders’ Equity | | | Intercontinental Exchange, Inc. Stockholders’ Equity | | Non-

Controlling

Interest in

Consolidated

Subsidiaries | | Total

Equity |

| Common

Stock | |

| Shares | |

| Shares | |

| Shares | |

| Balance, as of December 31, 2022 | |

| Balance, as of December 31, 2022 | |

| Balance, as of December 31, 2022 | |

| Other comprehensive income | Other comprehensive income | — | | | — | | | — | | | — | | | — | | | — | | | 31 | | | — | | | 31 | | |

| | Exercise of common stock options | Exercise of common stock options | — | | | — | | | — | | | — | | | 14 | | | — | | | — | | | — | | | 14 | | |

| | Payments relating to treasury shares | |

| Payments relating to treasury shares | |

| Payments relating to treasury shares | Payments relating to treasury shares | — | | | — | | | — | | | (2) | | | — | | | — | | | — | | | — | | | (2) | | |

| Stock-based compensation | Stock-based compensation | — | | | — | | | — | | | — | | | 47 | | | — | | | — | | | — | | | 47 | | |

| | Contribution from equity partners | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 9 | | | 9 | | |

| Issuance under the employee stock purchase plan | |

| Issuance of restricted stock | Issuance of restricted stock | 1 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | |

| | Distributions of profits | |

| Dividends paid to stockholders | Dividends paid to stockholders | — | | | — | | | — | | | — | | | — | | | (236) | | | — | | | — | | | (236) | | |

| | Net income/(loss) attributable to non-controlling interest | — | | | — | | | — | | | — | | | — | | | (16) | | | — | | | 16 | | | — | | |

| Net income attributable to non-controlling interest | |

| Net income attributable to non-controlling interest | |

| Net income attributable to non-controlling interest | |

| Net income | Net income | — | | | — | | | — | | | — | | | — | | | 815 | | | — | | | — | | | 815 | | |

| Balance, as of June 30, 2023 | 636 | | | $ | 6 | | | (76) | | | $ | (6,276) | | | $ | 14,449 | | | $ | 15,925 | | | $ | (284) | | | $ | 69 | | | $ | 23,889 | | |

| Balance, as of March 31, 2023 | |

Intercontinental Exchange, Inc. and Subsidiaries

Consolidated Statements of Changes in Equity and Redeemable Non-Controlling Interest - (Continued)

(In millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Intercontinental Exchange, Inc. Stockholders’ Equity | | Non-

Controlling

Interest in

Consolidated

Subsidiaries | | Total

Equity |

| Common

Stock | | Treasury Stock | | Additional

Paid-in

Capital | | Retained

Earnings | | Accumulated

Other

Comprehensive

Income/(Loss) | |

| Shares | | Value | | Shares | | Value | |

| Balance, as of December 31, 2021 | 631 | | | $ | 6 | | | (70) | | | $ | (5,520) | | | $ | 14,069 | | | $ | 14,350 | | | $ | (196) | | | $ | 39 | | | $ | 22,748 | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | — | | | — | | | (109) | | | — | | | (109) | |

| Exercise of common stock options | — | | | — | | | — | | | — | | | 20 | | | — | | | — | | | — | | | 20 | |

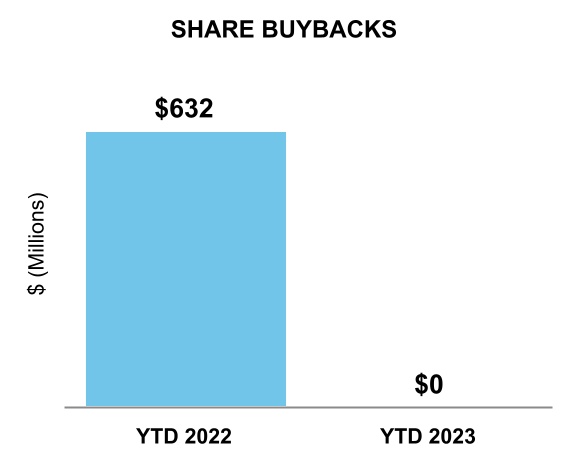

| Repurchases of common stock | — | | | — | | | (4) | | | (632) | | | — | | | — | | | — | | | — | | | (632) | |

| Payments relating to treasury shares | — | | | — | | | (1) | | | (71) | | | — | | | — | | | — | | | — | | | (71) | |

| Stock-based compensation | — | | | — | | | — | | | — | | | 88 | | | — | | | — | | | — | | | 88 | |

| Issuance under the employee stock purchase plan | — | | | — | | | — | | | — | | | 24 | | | — | | | — | | | — | | | 24 | |

| Issuance of restricted stock | 2 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Distributions of profits | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (13) | | | (13) | |

| Dividends paid to stockholders | — | | | — | | | — | | | — | | | — | | | (427) | | | — | | | — | | | (427) | |

| | | | | | | | | | | | | | | | | |

| Net income/(loss) attributable to non-controlling interest | — | | | — | | | — | | | — | | | — | | | (21) | | | — | | | 21 | | | — | |

| Net income | — | | | — | | | — | | | — | | | — | | | 1,233 | | | — | | | — | | | 1,233 | |

| Balance, as of June 30, 2022 | 633 | | | $ | 6 | | | (75) | | | $ | (6,223) | | | $ | 14,201 | | | $ | 15,135 | | | $ | (305) | | | $ | 47 | | | $ | 22,861 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Intercontinental Exchange, Inc. Stockholders’ Equity | | Non-

Controlling

Interest in

Consolidated

Subsidiaries | | Total

Equity | | |

| Common

Stock | | Treasury Stock | | Additional

Paid-in

Capital | | Retained

Earnings | | Accumulated

Other

Comprehensive

Income/(Loss) | |

| Shares | | Value | | Shares | | Value | |

| Balance, as of March 31, 2022 | 633 | | | $ | 6 | | | (74) | | | $ | (6,064) | | | $ | 14,153 | | | $ | 14,793 | | | $ | (221) | | | $ | 36 | | | $ | 22,703 | | | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | — | | | — | | | (84) | | | — | | | (84) | | | |

| | | | | | | | | | | | | | | | | | | |

| Exercise of common stock options | — | | | — | | | — | | | — | | | 5 | | | — | | | — | | | — | | | 5 | | | |

| | | | | | | | | | | | | | | | | | | |

| Repurchases of common stock | — | | | — | | | (1) | | | (157) | | | — | | | — | | | — | | | — | | | (157) | | | |

| Payments relating to treasury shares | — | | | — | | | — | | | (2) | | | — | | | — | | | — | | | — | | | (2) | | | |

| Stock-based compensation | — | | | — | | | — | | | — | | | 43 | | | — | | | — | | | — | | | 43 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Dividends paid to stockholders | — | | | — | | | — | | | — | | | — | | | (213) | | | — | | | — | | | (213) | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Net income/(loss) attributable to non-controlling interest | — | | | — | | | — | | | — | | | — | | | (11) | | | — | | | 11 | | | — | | | |

| Net income | — | | | — | | | — | | | — | | | — | | | 566 | | | — | | | — | | | 566 | | | |

| Balance, as of June 30, 2022 | 633 | | | $ | 6 | | | (75) | | | $ | (6,223) | | | $ | 14,201 | | | $ | 15,135 | | | $ | (305) | | | $ | 47 | | | $ | 22,861 | | | |

See accompanying notes.

Intercontinental Exchange, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(In millions)

(Unaudited) | | Three Months Ended March 31, | |

| Three Months Ended March 31, | |

| Three Months Ended March 31, | |

| 2024 | |

| 2024 | |

| 2024 | |

| Operating activities: | |

| Operating activities: | |

| Operating activities: | |

| Net income | |

| Net income | |

| Net income | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| Depreciation and amortization | |

| Depreciation and amortization | |

| Depreciation and amortization | |

| | Stock-based compensation | |

| | Stock-based compensation | |

| | Stock-based compensation | |

| Deferred taxes | |

| Deferred taxes | |

| Deferred taxes | |

| | Loss on investments | |

| | Loss on investments | |

| | Loss on investments | |

| Net losses from unconsolidated investees | |

| Net losses from unconsolidated investees | |

| Net losses from unconsolidated investees | |

| | Other | |

| | Other | |

| | Other | |

| Changes in assets and liabilities: | |

| Changes in assets and liabilities: | |

| Changes in assets and liabilities: | |

| Customer accounts receivable | |

| Customer accounts receivable | |

| Customer accounts receivable | |

| Other current and non-current assets | |

| Other current and non-current assets | |

| Other current and non-current assets | |

| Section 31 fees payable | |

| Section 31 fees payable | |

| Section 31 fees payable | |

| Deferred revenue | |

| Deferred revenue | |

| Deferred revenue | |

| Other current and non-current liabilities | |

| Other current and non-current liabilities | |

| Other current and non-current liabilities | |

| Total adjustments | |

| Total adjustments | |

| Total adjustments | |

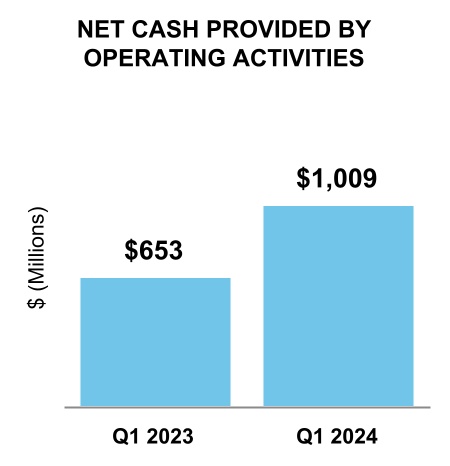

| Net cash provided by operating activities | |

| Net cash provided by operating activities | |

| Net cash provided by operating activities | |

| | Investing activities: | |

| | Investing activities: | |

| | Investing activities: | |

| Capital expenditures | |

| Capital expenditures | |

| Capital expenditures | |

| Capitalized software development costs | |

| Capitalized software development costs | |

| Capitalized software development costs | |

| Purchases of invested margin deposits | |

| Purchases of invested margin deposits | |

| Purchases of invested margin deposits | |

| Proceeds from sales of invested margin deposits | |

| Proceeds from sales of invested margin deposits | |

| Proceeds from sales of invested margin deposits | |

| | Proceeds from sale of Promissory Note | |

| | Proceeds from sale of Promissory Note | |

| | Proceeds from sale of Promissory Note | |

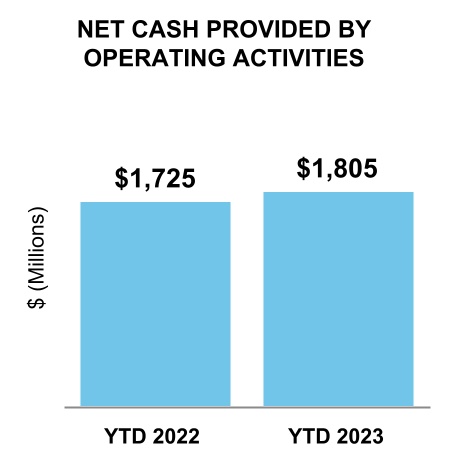

| | | Six Months Ended June 30, | |

| | 2023 | | 2022 | |

| Operating activities: | | | | |

| Net income | $ | 1,489 | | | $ | 1,233 | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | 527 | | | 510 | | |

| Stock-based compensation | 85 | | | 76 | | |

| Deferred taxes | (239) | | | (147) | | |

| Gain on sale of Euroclear investment | — | | | (41) | | |

| Purchases of restricted investments | |

| | Net losses from unconsolidated investees | 65 | | | 57 | | |

| | Purchases of restricted investments | |

| | Purchases of restricted investments | |

| Proceeds from sales of restricted investments | |

| Proceeds from sales of restricted investments | |

| Proceeds from sales of restricted investments | |

| Other | Other | 26 | | | 21 | | |

| Changes in assets and liabilities: | | |

| Customer accounts receivable | (181) | | | (177) | | |

| Other current and non-current assets | (66) | | | (48) | | |

| Section 31 fees payable | (50) | | | 115 | | |

| Deferred revenue | 279 | | | 292 | | |

| Other current and non-current liabilities | (130) | | | (166) | | |

| Total adjustments | 316 | | | 492 | | |

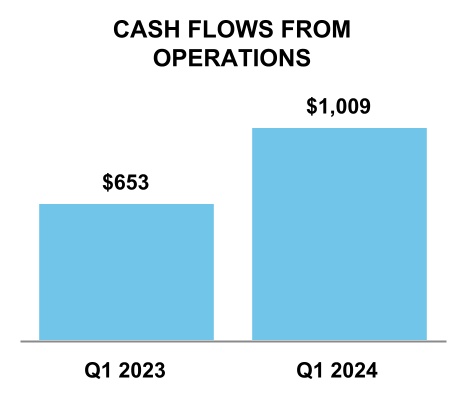

| Net cash provided by operating activities | 1,805 | | | 1,725 | | |

| Other | |

| Other | |

| | Investing activities: | | |

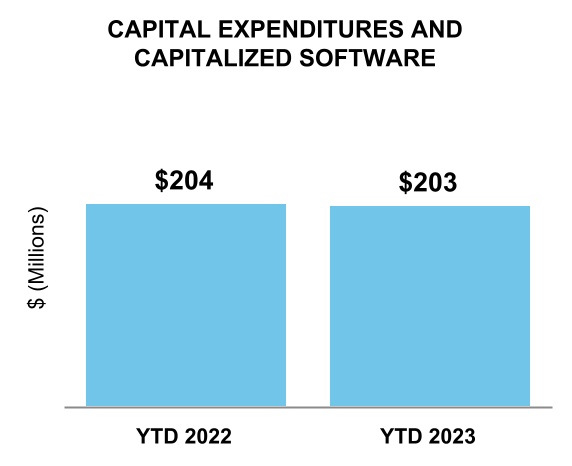

| Capital expenditures | (61) | | | (70) | | |

| Capitalized software development costs | (142) | | | (134) | | |

| Purchases of invested margin deposits | (771) | | | (1,431) | | |

| Proceeds from sales of invested margin deposits | 3,078 | | | 3,815 | | |

| Cash paid for acquisitions, net of cash acquired | (5) | | | (36) | | |

| Net cash provided by investing activities | |

| | Purchases of equity and equity method investments | (6) | | | (43) | | |

| Proceeds from sale of Euroclear investment | — | | | 741 | | |

| | Purchases of investments | (949) | | | — | | |

| | Other | — | | | 1 | | |

| Net cash provided by investing activities | |

| | Net cash provided by investing activities | Net cash provided by investing activities | 1,144 | | | 2,843 | | |

| | Financing activities: | Financing activities: | | |

| | Financing activities: | |

| | Proceeds from/(repayments of) debt facilities, net | (4) | | | 5,186 | | |

| Financing activities: | |

| | Repayments of debt | |

| | Repayments of debt | |

| | Repayments of debt | |

| | Redemption of commercial paper, net | Redemption of commercial paper, net | — | | | (1,012) | | |

| Capital contributions from non-controlling interests | 9 | | | — | | |

| Repurchases of common stock | — | | | (632) | | |

| | Redemption of commercial paper, net | |

| | Redemption of commercial paper, net | |

| | Dividends to stockholders | Dividends to stockholders | (472) | | | (427) | | |

| Change in cash and cash equivalent margin deposits and guaranty funds | (57,380) | | | 16,163 | | |

| | Dividends to stockholders | |

| | Dividends to stockholders | |

| Change in cash and cash equivalent margin deposits and guaranty funds liability | |

| Change in cash and cash equivalent margin deposits and guaranty funds liability | |

| Change in cash and cash equivalent margin deposits and guaranty funds liability | |

| Payments relating to treasury shares received for restricted stock tax payments and stock option exercises | |

| Payments relating to treasury shares received for restricted stock tax payments and stock option exercises | |

| Payments relating to treasury shares received for restricted stock tax payments and stock option exercises | Payments relating to treasury shares received for restricted stock tax payments and stock option exercises | (50) | | | (71) | | |

| | Other | Other | 11 | | | 31 | | |

| Net cash provided by/(used in) financing activities | (57,886) | | | 19,238 | | |

| | Other | |

| | Other | |

| Net cash used in financing activities | |

| Net cash used in financing activities | |

| Net cash used in financing activities | |

| Effect of exchange rate changes on cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds | Effect of exchange rate changes on cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds | 6 | | | (19) | | |

| Net increase/(decrease) in cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds | (54,931) | | | 23,787 | | |

| Effect of exchange rate changes on cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds | |

| Effect of exchange rate changes on cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds | |

| Net decrease in cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds | |

| Net decrease in cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds | |

| Net decrease in cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds | |

| Cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds at beginning of period | |

| Cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds at beginning of period | |

| Cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds at beginning of period | Cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds at beginning of period | 150,343 | | | 147,976 | | |

| Cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds at end of period | Cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds at end of period | $ | 95,412 | | | $ | 171,763 | | |

| | Cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds at end of period | |

| Cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds at end of period | |

Intercontinental Exchange, Inc. and Subsidiaries

Consolidated Statements of Cash Flows (Continued)

(In millions)

(Unaudited)

| | As of June 30, 2023 | | As of June 30, 2022 | |

| | Three Months Ended March 31, | |

| | Three Months Ended March 31, | |

| | Three Months Ended March 31, | |

| | 2024 | |

| | 2024 | |

| | 2024 | |

| Supplemental cash flow disclosure: | |

| Supplemental cash flow disclosure: | |

| Supplemental cash flow disclosure: | Supplemental cash flow disclosure: | | | | | |

| Cash paid for income taxes | Cash paid for income taxes | | $ | 536 | | | $ | 524 | | |

| Cash paid for income taxes | |

| Cash paid for income taxes | |

| Cash paid for interest | |

| Cash paid for interest | |

| Cash paid for interest | Cash paid for interest | | $ | 341 | | | $ | 226 | | |

| | Reconciliation of the components of cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds to the balance sheet: | | |

| Reconciliation of the components of cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds to the consolidated balance sheets: | |

| | Reconciliation of the components of cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds to the consolidated balance sheets: | |

| | Reconciliation of the components of cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds to the consolidated balance sheets: | |

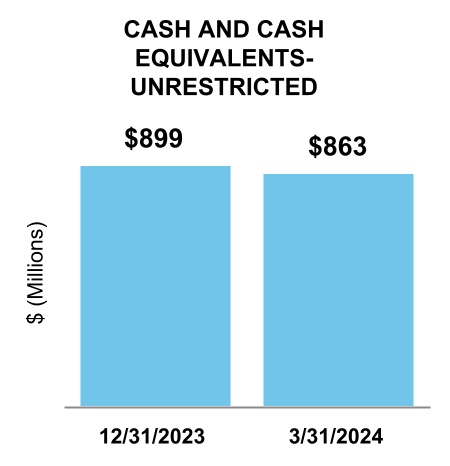

| Cash and cash equivalents | |

| Cash and cash equivalents | |

| Cash and cash equivalents | Cash and cash equivalents | | $ | 2,877 | | | $ | 830 | | |

| Short-term restricted cash and cash equivalents | Short-term restricted cash and cash equivalents | | 5,413 | | | 6,045 | | |

| Short-term restricted cash and cash equivalents | |

| Short-term restricted cash and cash equivalents | |

| Long-term restricted cash and cash equivalents | |

| Long-term restricted cash and cash equivalents | |

| Long-term restricted cash and cash equivalents | Long-term restricted cash and cash equivalents | | 205 | | | 405 | | |

| Cash and cash equivalent margin deposits and guaranty funds | Cash and cash equivalent margin deposits and guaranty funds | | 86,917 | | | 164,483 | | |

| Cash and cash equivalent margin deposits and guaranty funds | |

| Cash and cash equivalent margin deposits and guaranty funds | |

| Total | Total | | $ | 95,412 | | | $ | 171,763 | | |

| Total | |

| Total | |

See accompanying notes.

Intercontinental Exchange, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

(Unaudited)

1.Description of Business

Nature of Business and Organization

Intercontinental Exchange, Inc. is a leading global provider of market infrastructure,technology and data services and technology solutions to a broad range of customers including financial institutions, corporations and government entities. TheseOur products, which span major asset classes including futures, equities, fixed income and United States, or U.S., residential mortgages, provide our customers with access to mission critical tools that are designed to increase asset class transparency and workflow efficiency. Our business is conducted through three reportable business segments:

•Exchanges: We operate regulated marketplacesmarketplace technology for the listing, trading and clearing of a broad array of derivatives contracts and financial securities.securities as well as data and connectivity services related to our exchanges and clearing houses.

•Fixed Income and Data Services: We provide fixed income pricing, reference data, indices, analytics and execution services as well as global credit default swap, or CDS, clearing and multi-asset class data delivery solutions.technology.

•Mortgage Technology: We provide a technology platform that offers customers comprehensive, digital workflow tools that aim to address the inefficiencies and mitigate risks that exist in the U.S. residential mortgage market life cycle from application through closing, servicing and the secondary market.

We operate marketplaces, technology and provide data services in the U.S., United Kingdom, or U.K., European Union, or EU, Canada, Asia Pacific and the Middle East.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles, or U.S. GAAP, pursuant to the rules and regulations of the Securities and Exchange Commission, or SEC, regarding interim financial reporting. Accordingly, the unaudited consolidated financial statements do not include all of the information and footnotes required by U.S. GAAP for complete financial statements and should be read in conjunction with our audited consolidated financial statements and related notes thereto for the year ended December 31, 2022.2023. The accompanying unaudited consolidated financial statements reflect all adjustments that are, in our opinion, necessary for a fair presentation of results for the interim periods presented. We believe that these adjustments are of a normal recurring nature.

Preparing financial statements in conformity with U.S. GAAP requires us to make certain estimates and assumptions that affect the amounts that are reported in our consolidated financial statements and accompanying disclosures.notes. Actual amounts could differ from those estimates. The results of operations for the six months and three months ended June 30, 2023March 31, 2024 are not necessarily indicative of the results to be expected for any future period or the full fiscal year.

These statements include the accounts of our wholly-owned and controlled subsidiaries. All intercompany balances and transactions between us and our wholly-owned and controlled subsidiaries have been eliminated in consolidation. For consolidated subsidiaries in which our ownership is less than 100% and for which we have control over the assets and liabilities and the management of the entity, the outside stockholders’ interests are shown as non-controlling interests.

We have considered the impacts of macroeconomic conditions during the quarter, including interest rates, the inflationary environment, election outcomes, geopolitical events and military conflicts, including repercussions from the conflictconflicts in Ukraine, Israel and Gaza and the impactimpacts that any of the foregoing may have on the global economy and on our business. As of June 30, 2023,March 31, 2024, our businesses and operations, including our exchanges, clearing houses, listings venues, data services businesses and mortgage platforms, have not suffered a material negative impact as a result of these events. There continues to be uncertainty surrounding the current macroeconomic environment and the impact that it may have on the global economy and on our business.

Recently Adopted Accounting Pronouncements

During the sixthree months ended June 30, 2023,March 31, 2024, there were no significant changes to the new and recently adopted accounting pronouncements applicable to us from those disclosed in Note 2 to the consolidated financial statements in Part II, Item 8 of our Annual Report on Form 10-K for the year ended December 31, 2022,2023, or the 20222023 Form 10-K.

3. Pending AcquisitionAcquisitions and Divestitures

Pending Acquisition of Black Knight, Inc.

On May 4, 2022,September 5, 2023, we announced that we had entered into a definitive agreement to acquireacquired 100% of the equity interests in Black Knight, Inc., or Black Knight, a software, data and analytics company that serves the housing finance continuum, including real estate data, mortgage lending and servicing, as well as the secondary markets. Pursuant to that certain Agreement and Plan of Merger, dated as of May 4, 2022, among ICE, Sand Merger Sub Corporation, a wholly owned subsidiary of ICE, or Sub, and Black Knight, which we refer to as the “merger agreement,” Sub will merge with and into Black Knight, which we refer to as the “merger,” with Black Knight surviving as a wholly owned subsidiary of ICE.

On March 7, 2023, ICE and Black Knight announced that, in connection with the merger agreement, Black Knight has entered into an agreement to sell its Empower loan origination business. On March 7, 2023, ICE and Black Knight also entered into an amendment to the merger agreement to reduce the value of thefor aggregate transaction consideration toof approximately $11.7 billion as of March 7, 2023, or $75 per share of Black Knight common stock, with cash comprising 90% of the value of the aggregate transaction consideration and shares of our common stock comprising 10% of the value of the aggregate transaction consideration.$11.8 billion. The aggregate cash component of the transaction consideration is fixed atwas $10.5 billion, and the valuebillion. We issued 10.9 million shares of the aggregateICE common stock component of the transaction consideration will fluctuate withto Black Knight stockholders, which was based on the market price of our common stock and will be determined based on the average of the volume weighted averages of the trading prices of our common stock on each of the ten consecutive trading days ending three trading days prior to the closing of the merger. If consummated, weWe expect that this transaction will build on our position as a provider of end-to-end electronic workflow solutions for the rapidly evolving U.S. residential mortgage industry. We believe the Black Knight ecosystem adds value for clients of all sizes across the mortgage and real estate lifecycles by helping organizations lower costs, increase efficiencies, grow their businesses, and reduce risk.

On March 30,September 14, 2023, our amended proxy statement/prospectus on Form S-4 was declared effective byor the SEC, and on April 28, 2023, Black Knight stockholders approved the amendment toDivestiture Date, in connection with the merger agreement.

On July 17, 2023,agreement, we announced that we have agreed to sellsold Black Knight’sKnight's Optimal Blue businessand Empower loan origination system, or LOS, businesses, or the Divestitures, to subsidiaries of Constellation Software, Inc. The cash proceeds from the same purchaser as that of the Empower business for $700Divestitures were $241 million. The structure of this proposedthe Optimal Blue transaction includesalso included a paymentpromissory note with a face value of $200 million in cash, with the remainder financed by a $500 million, promissory noteor the Promissory Note, issued by the purchaser to Black Knight, as a subsidiary of ICE, at the closing of the transaction. The closingPromissory Note had a 40-year term with a maturity date of September 5, 2063, and a coupon interest rate of 7.0% per year. The Promissory Note was valued at $235 million on the proposedDivestiture Date. In accordance with Accounting Standards Codification, or ASC, 805, Business Combinations, or ASC 805, as well as ASC 360, Impairment and Disposal of Long-Lived Assets, we are required to measure an acquired long-lived asset or disposal group that is classified as held for sale at the acquisition date at fair value less cost to sell. Accordingly, there was no gain or loss recognized on the Divestitures.

For the period between the acquisition date of September 5, 2023 through the Divestiture Date, the discontinued operations of Empower and Optimal Blue divestiture transaction is subjectwere immaterial.

Pursuant to the closing of our acquisition ofAgreement Containing Consent Orders entered into between the Federal Trade Commission, or the FTC, and ICE and Black Knight, the closingPromissory Note was required to be sold within six months of the Divestiture Date. We elected the fair value option for the right to receive the net proceeds of the sale of the Promissory Note. As of December 31, 2023, we wrote down the value of the Promissory Note to $75 million based on Level 3 inputs, resulting in a fair value loss of $160 million. In February 2024, the FTC approved the buyer of the Promissory Note, and we completed the sale of the Promissory Note and received the $75 million of proceeds thereafter.

The estimated net fair value of the consideration transferred for Black Knight was approximately $11.4 billion as of the acquisition date, which consisted of Black Knight’s Empower loan origination systemthe following (in millions):

| | | | | | |

| Transaction Consideration | |

| Cash | $ | 10,542 | | |

| ICE common stock* | 1,274 | | |

| Converted vested Black Knight awards | 22 | | |

| Total preliminary purchase price | $ | 11,838 | | |

| Less: Divestitures | (476) | | |

| Total net preliminary purchase price | $ | 11,362 | | |

*Fair value of the ICE common stock is based on the ICE closing stock price on September 1, 2023, the last business andday prior to the satisfaction of other customary closing conditions.acquisition close.

The transactionpurchase price has been allocated to the net tangible and identifiable intangible assets and liabilities based on the preliminary respective estimated fair values on the date of acquisition. The excess of the purchase price over the net tangible and identifiable intangible assets has been recorded as goodwill, of which $186 million is expected to closebe deductible for tax purposes. Goodwill represents potential revenue synergies related to new product development, various expense synergies and opportunities to enter new markets, and is assigned to our Mortgage Technology business segment. The preliminary net purchase price allocation is as follows (in millions):

| | | | | | |

| Net Preliminary Purchase Price Allocation | |

| Cash and cash equivalents | $ | 108 | | |

| Property and equipment | 119 | | |

| Goodwill | 9,421 | | |

| Identifiable intangibles | 4,948 | | |

| Debt acquired | (2,397) | | |

| Other assets and liabilities, net | 78 | | |

| Deferred tax liabilities on identifiable intangibles | (1,266) | | |

| Other deferred tax assets | 351 | | |

| Net preliminary purchase price | $ | 11,362 | | |

In performing the net preliminary purchase price allocation, we considered, among other factors, the intended future use of acquired assets, analysis of historical financial performance and estimates of future performance of the Black Knight business. For the identified intangible assets, the fair values have been preliminarily determined using the income and cost approaches and are partially based on inputs that are unobservable including forecasted future cash flows, revenue and margin growth rates, customer attrition rates and discount rates that require judgement and are subject to change. We have not yet obtained all of the information related to the fair value of the acquired assets and liabilities.

The primary areas of the preliminary purchase price allocation that are not yet finalized relate to the valuation of the identifiable intangible assets, income taxes and certain other tangible assets and liabilities. The allocation of the purchase price will be finalized upon the completion of the analysis of the acquired assets and liabilities within one year of the date of acquisition.

The following table sets forth the components of the preliminary intangible assets associated with the acquisition as of March 31, 2024 (in millions, except years):

| | | | | | | | | | | | |

| Acquisition-Date Preliminary Fair Value | | Weighted average life (Years) | |

| Developed Technology | $ | 1,176 | | | 10 | |

| Trademarks/Tradenames | 159 | | | 19 | |

| Customer Relationships | 3,034 | | | 13 | |

| Data and Databases | 579 | | | 10 | |

| Total | $ | 4,948 | | | 12 | |

Black Knight revenues of $270 million, which are included in our mortgage technology revenues, and operating expenses of $288 million were recorded in our consolidated statement of income for the three months ended March 31, 2024.

The financial information in the second half oftable below combines the historical results for us and Black Knight for the three months ended March 31, 2023, followingon a pro forma basis, as though the receipt of regulatory approvals, a favorable resolutioncompanies had been combined as of the FTC litigation concerning thisbeginning of the prior period presented (in millions). The unaudited pro forma financial information is presented for informational purposes only and is not indicative of the results of operations that would have been achieved if the acquisition had taken place at the beginning of the period presented. Such unaudited pro forma financial information is based on the historical financial statements of ICE and Black Knight. This unaudited pro forma financial information is based on estimates and assumptions that have been made solely for purposes of developing such unaudited pro forma information, including, without limitation, purchase accounting adjustments, interest expense on debt issued to finance the purchase price, acquisition-related transaction costs, the removal of historical Black Knight intangible asset amortization and the satisfactionaddition of customary closing conditions. See Note 13 where additional detailsintangible asset amortization related to this acquisition. The unaudited pro forma financial information does not reflect any synergies or operating cost reductions that have been and may be achieved from the combined operations. | | | | | |

| Three months ended March 31, 2023 |

| Total revenues, less transaction-based expenses | $ | 2,175 | |

| Net income attributable to ICE | $ | 544 | |

Transaction-based expenses included within revenues, less transaction-based expenses in the table above were not impacted by pro forma adjustments and agree to the amounts presented historically in our consolidated statements of this transaction are discussed.income as they relate solely to ICE and not to Black Knight.

4. Investments

Equity Investments Subject to ASU 2016-01

Our equity investments are subject to valuation under Accounting Standards Update, or ASU, 2016-01, Financial Instruments- Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities, or ASU 2016-01. See Note 14 for a discussion of our determination of fair value of our financial instruments, which were not material as of June 30, 2023.

Investment in Euroclear

We previously owned a 9.8% stake in Euroclear, plc, or Euroclear, that we originally purchased for $631 million. We participated on the Euroclear Board of Directors, and we classified our investment in Euroclear as an equity investment.

During the three months ended June 30, 2022, we completed the sale of our 9.8% stake in Euroclear. The carrying value of our investment was $700 million at the time of the sale and was classified within other current assets on our balance sheet. We recorded a net gain on the sale of $41 million, which was included in other income, during the three months ended June 30, 2022.

Equity Method Investments

Our equity method investments include the Options Clearing Corporation, or OCC, and Bakkt Holdings, LLC, or Bakkt, among others. Our equity method investments are included in other non-current assets in the accompanying consolidated

balance sheet.sheets. We initially record our equity method investments at cost. At the end of each reporting period, we record our share of profits or losses of our equity method investments as equity earnings included in other income and adjust the carrying value of our equity method investment accordingly. In addition, if and when our equity method investments issue cash dividends to us, we deduct the amount of these dividends from the carrying amount of that investment. We assess the carrying value periodically if impairment indicators are present.

We recognized $65$42 million and $57$35 million as our share of estimated losses, net, from our equity method investments during the six months ended June 30, 2023 and 2022, respectively, and $30 million and $15 million as our share of losses, net, from our equity method investments during the three months ended June 30,March 31, 2024 and 2023, and 2022, respectively. The estimated losses during both the six months and three months ended June 30, 2023 and 2022 are primarily related to our investment in Bakkt, partially offset by our share of OCC profits. Both periods include adjustments to reflect the difference between reported prior period actual results from our original estimates.

When performing our assessment of the carrying value of our investments, we consider, among other things, the length of time and the extent to which the market value has been less than our cost basis, if applicable, the investee's financial condition and near-term prospects, the economic or technological environment in which our investees operate, weakening of the general market condition of the related industry, whether an investee can continue as a going concern, any impairment charges recorded by an investee on goodwill, intangible or long-lived assets, and our intent and ability to retain the investment for a period of time sufficient to allow for any anticipated recovery in market value.

Investment in OCC

We own a 40% interest in OCC through a direct investment by the New York Stock Exchange, or NYSE. OCC is regulated by the SEC as a registered clearing agency and by the Commodity Futures Trading Commission, or CFTC, as a derivatives clearing organization. OCC serves as a clearing house for securities options, securitysecurities futures, commodity futures and options on futures traded on various independent exchanges. OCC clears securities options traded on NYSE Arca and NYSE Amex Options, along with other non-affiliated exchanges.

Investment in Bakkt

As of June 30,March 31, 2024 and December 31, 2023, we held an approximate 55% and 64% economic interest in Bakkt.Bakkt, respectively. As a result of limitations on ICE from the Bakkt voting agreement entered into in connection with Bakkt's merger with VIH, we hold a minority voting interest in Bakkt and treat it as an equity method investment. The decrease in ownership during the three months ended March 31, 2024 is related to Bakkt's offering of shares of its Class A common stock and warrants to purchase shares of its Class A common stock, which diluted our ownership. As part of the offering, on February 29, 2024, we entered into a securities purchase agreement to purchase shares of Bakkt's Class A common stock and warrants to purchase additional shares of Bakkt's Class A common stock for a total of $10 million, of which approximately $2 million was paid as of March 31, 2024.

As of March 31, 2024, the carrying value of our investment in Bakkt was determined to be $14 million. As Bakkt is a public company with a readily available market price, the fair value of our investment using the quoted market price of Bakkt Class A common stock as of March 31, 2024 was $82 million.

5. Revenue Recognition

Substantially all of our revenues are considered to be revenues from contracts with customers. The related accounts receivable balances are recorded in our consolidated balance sheets as customer accounts receivable. We do not have obligations for warranties, returns or refunds to customers, other than rebates, which are settled each period and therefore do not result in variable consideration. We do not have significant revenue recognized from performance obligations that were satisfied in prior periods, and we do not have any transaction price allocated to unsatisfied performance obligations other than in our deferred revenue.periods. Certain judgments and estimates are used in the identification and timing of satisfaction of performance obligations and the related allocation of transaction price. We believe that these represent a faithful depiction of the transfer of services to our customers.

Deferred revenue represents our contract liabilities related to our annual, original and other listings revenues, certain data services, clearing services, mortgage technology services and other revenues. Deferred revenue is our only significant contract liability. See Note 7 for our discussion of deferred revenue balances, activity, and expected timing of recognition.

For all of our contracts with customers, except for listings and certain data, clearing and mortgage services, our performance obligations are short term in nature and there is no significant variable consideration. In addition, we have elected the practical expedient of excluding sales taxes from transaction prices. We have assessed the costs incurred to obtain or fulfill a contract with a customer, which are primarily our sales commissions.

Refer to NoteNotes 2 and 5 to the consolidated financial statements included in Part II, Item 8 of our 20222023 Form 10-K where we describe our revenue recognition accounting policies and our primary revenue contract classifications are described in detail.detail, respectively.

The following table depicts the disaggregation of our revenuerevenues according to business line and segment (in millions). Amounts here have been aggregated as they follow consistent revenue recognition patterns, and are consistent with the segment information in Note 15:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Exchanges Segment | | Fixed Income and Data Services Segment | | Mortgage Technology Segment | | Total Consolidated |

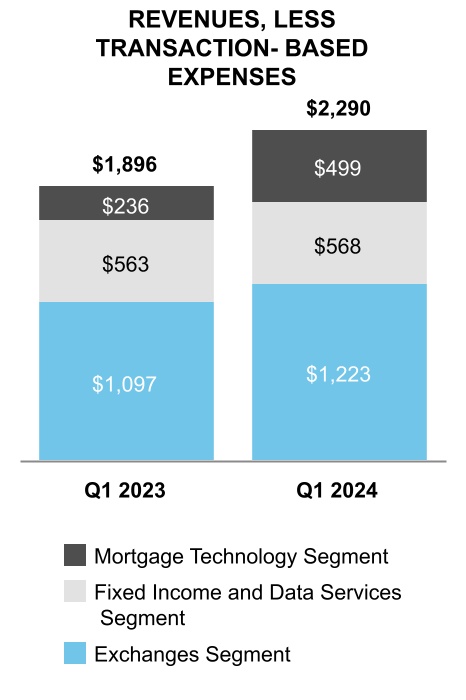

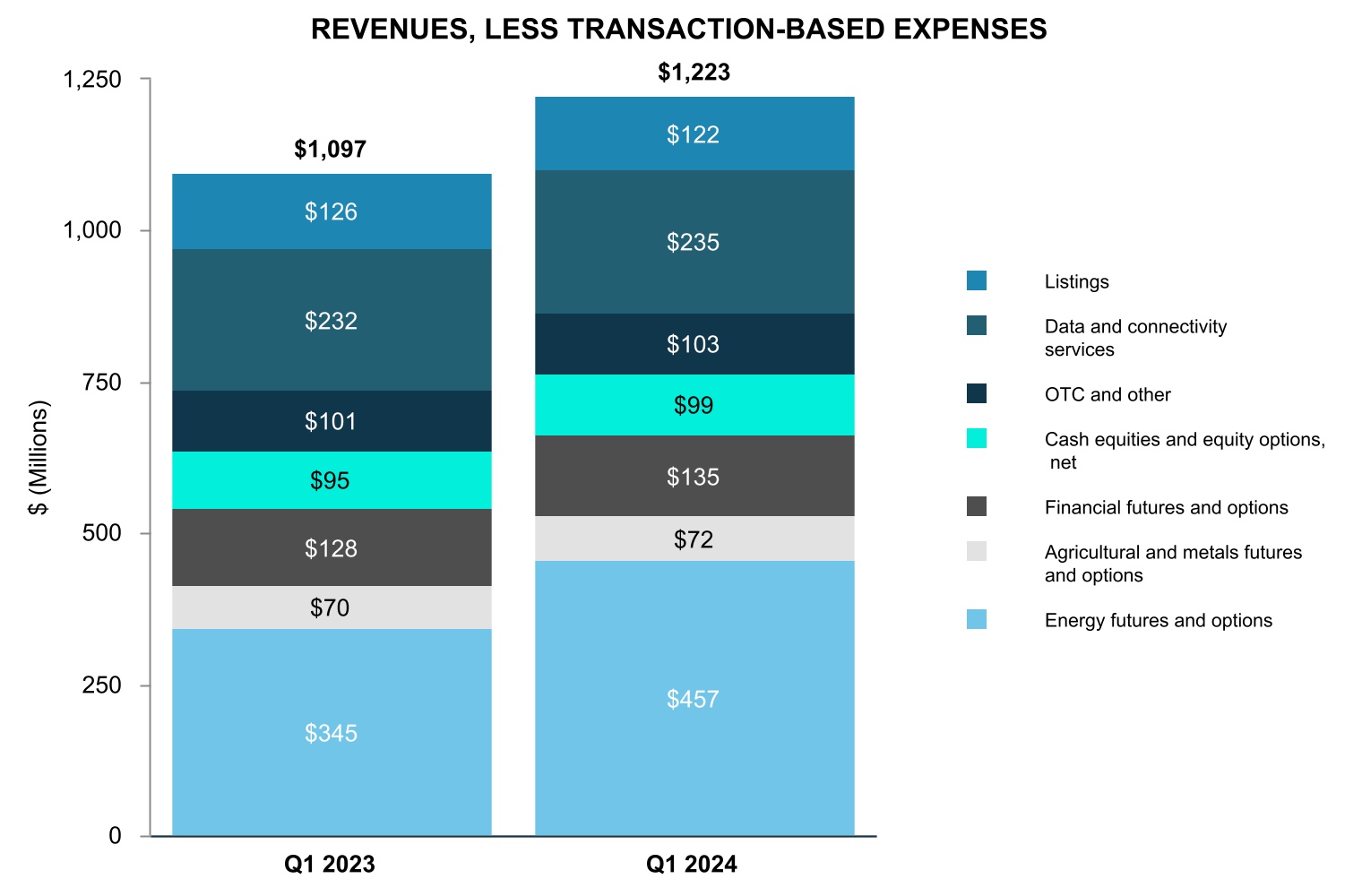

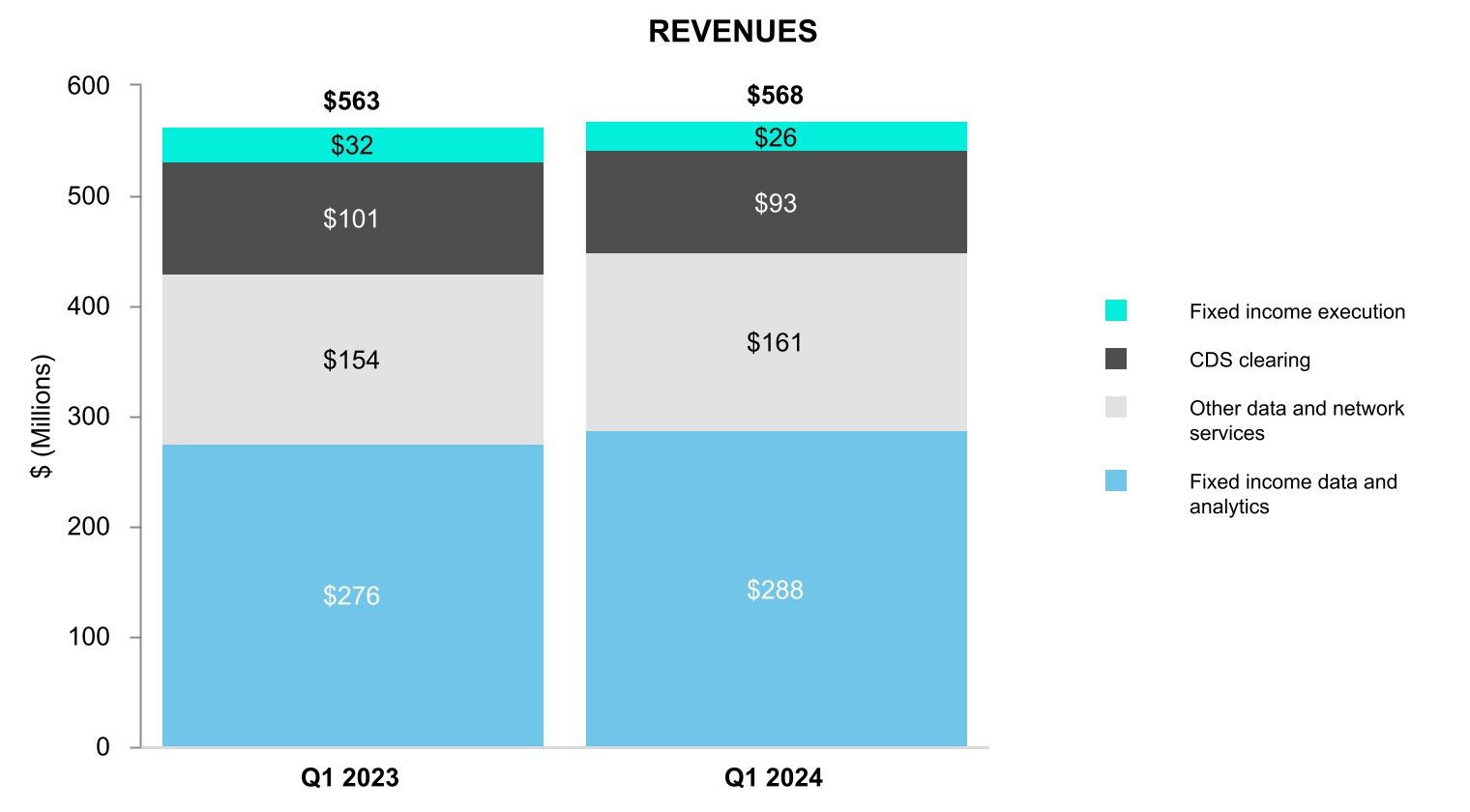

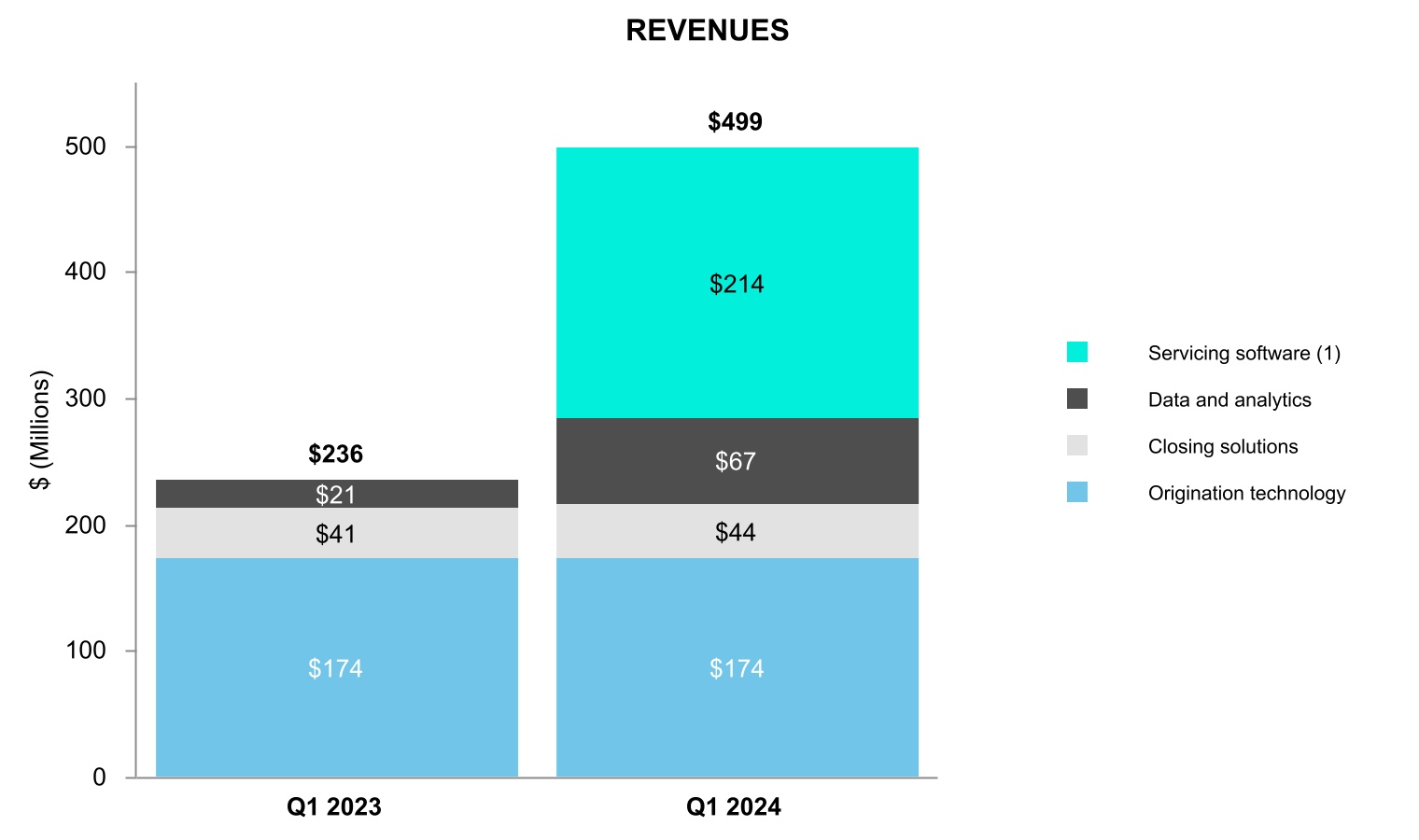

| Three Months Ended March 31, 2024: | | | | | | | |

Total revenues (1) | $ | 1,734 | | | $ | 568 | | | $ | 499 | | | $ | 2,801 | |

| Transaction-based expenses | 511 | | | — | | | — | | | 511 | |

| Total revenues, less transaction-based expenses | $ | 1,223 | | | $ | 568 | | | $ | 499 | | | $ | 2,290 | |

| | | | | | | |

| Timing of Revenue Recognition | | | | | | | |

| Services transferred at a point in time | $ | 742 | | | $ | 111 | | | $ | 106 | | | $ | 959 | |

| Services transferred over time | 481 | | | 457 | | | 393 | | | 1,331 | |

| Total revenues, less transaction-based expenses | $ | 1,223 | | | $ | 568 | | | $ | 499 | | | $ | 2,290 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Exchanges Segment | | Fixed Income and Data Services Segment | | Mortgage Technology Segment | | Total Consolidated |

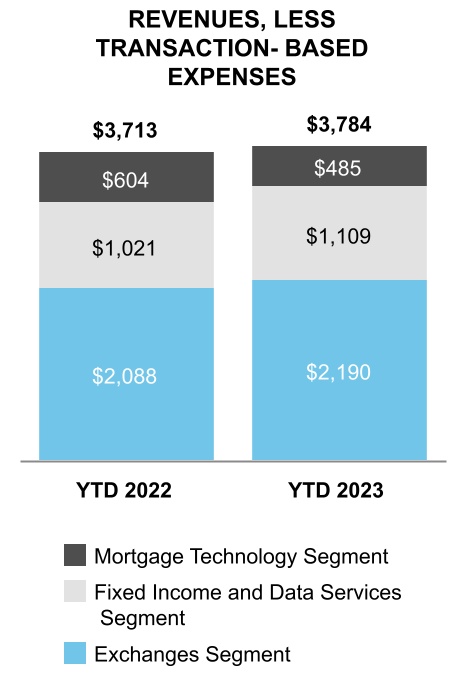

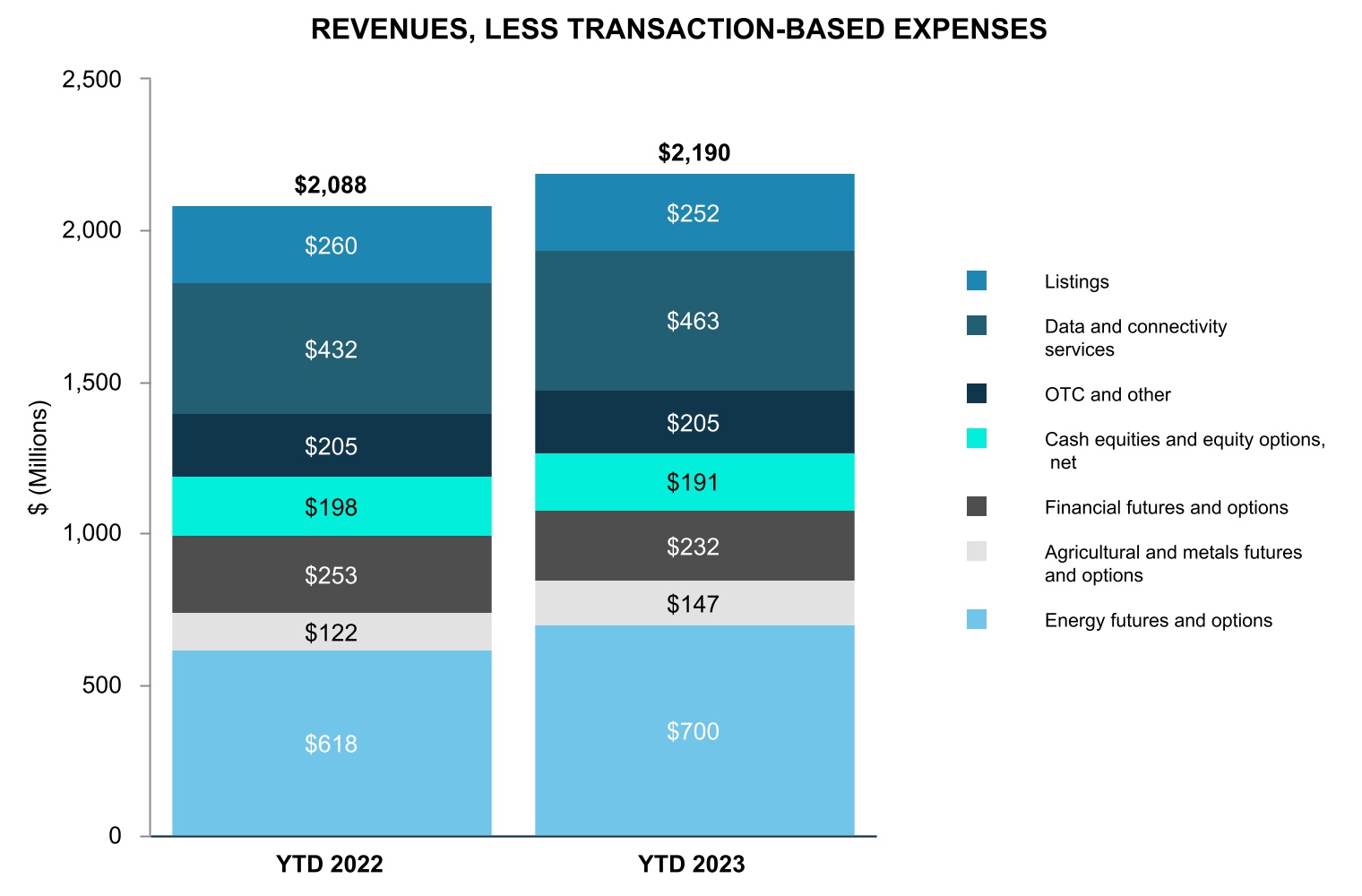

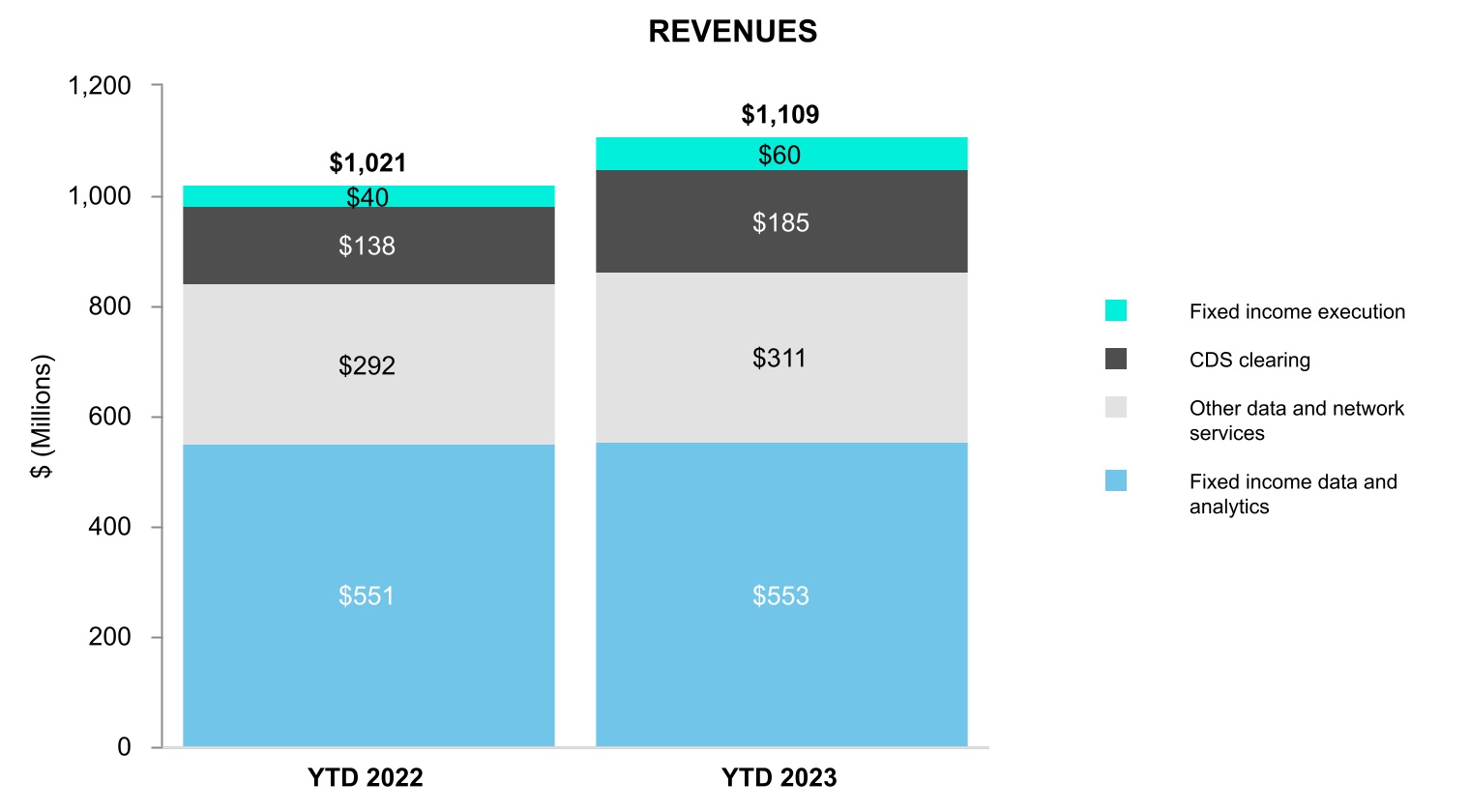

| Six Months Ended June 30, 2023: | | | | | | | |

| Total revenues | $ | 3,214 | | | $ | 1,109 | | | $ | 485 | | | $ | 4,808 | |

| Transaction-based expenses | 1,024 | | | — | | | — | | | 1,024 | |

| Total revenues, less transaction-based expenses | $ | 2,190 | | | $ | 1,109 | | | $ | 485 | | | $ | 3,784 | |

| | | | | | | |

| Timing of Revenue Recognition | | | | | | | |

| Services transferred at a point in time | $ | 1,263 | | | $ | 229 | | | $ | 148 | | | $ | 1,640 | |

| Services transferred over time | 927 | | | 880 | | | 337 | | | 2,144 | |

| Total revenues, less transaction-based expenses | $ | 2,190 | | | $ | 1,109 | | | $ | 485 | | | $ | 3,784 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Exchanges Segment | | Fixed Income and Data Services Segment | | Mortgage Technology Segment | | Total Consolidated |

| Three Months Ended March 31, 2023: | | | | | | | |

Total revenues (1) | $ | 1,673 | | | $ | 563 | | | $ | 236 | | | $ | 2,472 | |

| Transaction-based expenses | 576 | | | — | | | — | | | 576 | |

| Total revenues, less transaction-based expenses | $ | 1,097 | | | $ | 563 | | | $ | 236 | | | $ | 1,896 | |

| | | | | | | |

| Timing of Revenue Recognition | | | | | | | |

| Services transferred at a point in time | $ | 635 | | | $ | 123 | | | $ | 67 | | | $ | 825 | |

| Services transferred over time | 462 | | | 440 | | | 169 | | | 1,071 | |

| Total revenues, less transaction-based expenses | $ | 1,097 | | | $ | 563 | | | $ | 236 | | | $ | 1,896 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Exchanges Segment | | Fixed Income and Data Services Segment | | Mortgage Technology Segment | | Total Consolidated |

| Three Months Ended June 30, 2023: | | | | | | | |

| Total revenues | $ | 1,541 | | | $ | 546 | | | $ | 249 | | | $ | 2,336 | |

| Transaction-based expenses | 448 | | | — | | | — | | | 448 | |

| Total revenues, less transaction-based expenses | $ | 1,093 | | | $ | 546 | | | $ | 249 | | | $ | 1,888 | |

| | | | | | | |

| Timing of Revenue Recognition | | | | | | | |

| Services transferred at a point in time | $ | 628 | | | $ | 106 | | | $ | 81 | | | $ | 815 | |

| Services transferred over time | 465 | | | 440 | | | 168 | | | 1,073 | |

| Total revenues, less transaction-based expenses | $ | 1,093 | | | $ | 546 | | | $ | 249 | | | $ | 1,888 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Exchanges Segment | | Fixed Income and Data Services Segment | | Mortgage Technology Segment | | Total Consolidated |

| Six Months Ended June 30, 2022: | | | | | | | |

| Total revenues | $ | 3,247 | | | $ | 1,021 | | | $ | 604 | | | $ | 4,872 | |

| Transaction-based expenses | 1,159 | | | — | | | — | | | 1,159 | |

| Total revenues, less transaction-based expenses | $ | 2,088 | | | $ | 1,021 | | | $ | 604 | | | $ | 3,713 | |

| | | | | | | |

| Timing of Revenue Recognition | | | | | | | |

| Services transferred at a point in time | $ | 1,197 | | | $ | 159 | | | $ | 270 | | | $ | 1,626 | |

| Services transferred over time | 891 | | | 862 | | | 334 | | | 2,087 | |

| Total revenues, less transaction-based expenses | $ | 2,088 | | | $ | 1,021 | | | $ | 604 | | | $ | 3,713 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Exchanges Segment | | Fixed Income and Data Services Segment | | Mortgage Technology Segment | | Total Consolidated |

| Three Months Ended June 30, 2022: | | | | | | | |

| Total revenues | $ | 1,604 | | | $ | 512 | | | $ | 297 | | | $ | 2,413 | |

| Transaction-based expenses | 599 | | | $ | — | | | $ | — | | | 599 | |

| Total revenues, less transaction-based expenses | $ | 1,005 | | | $ | 512 | | | $ | 297 | | | $ | 1,814 | |

| | | | | | | |

| Timing of Revenue Recognition | | | | | | | |

| Services transferred at a point in time | $ | 563 | | | $ | 83 | | | $ | 128 | | | $ | 774 | |

| Services transferred over time | 442 | | | 429 | | | 169 | | | 1,040 | |

| Total revenues, less transaction-based expenses | $ | 1,005 | | | $ | 512 | | | $ | 297 | | | $ | 1,814 | |

The Exchanges segment and the Fixed Income and Data Services segment revenues above include data services revenues. Our data services revenues are transferred over time, and a majority of those revenues are performed over a short period of time of one month or less and relate to subscription-based data services billed monthly, quarterly or annually in advance. These revenues are recognized ratably over time as our data delivery performance obligations are met consistently throughout the period.

The Exchanges segment revenues transferred over time in the tabletables above also include services related to listings, services related to risk management of open interest performance obligations and services related to regulatory fees, trading permits, and software licenses.

The Fixed Income and Data Services segment revenues transferred over time in the tabletables above also include services related to risk management of open interest performance obligations, primarily in our CDS business.

The Mortgage Technology segment revenues transferred over time in the tabletables above primarily relate to our origination technology revenue where performance obligations consist of a series of distinct services and are recognized over the

contract terms as subscription performance obligations are satisfied and, to a lesser extent, professional services revenues and revenues from certain of our data and analytics and servicing software offerings.

The components of services transferred over time for each of our segments are as follows:

| | Three Months Ended March 31, | |

| Three Months Ended March 31, | |

| Three Months Ended March 31, | |

| | | Six Months Ended June 30, | | Three Months Ended June 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Exchanges Segment: | Exchanges Segment: | | | | | |

| Exchanges Segment: | |

| Exchanges Segment: | |

| Data services revenues | |

| Data services revenues | |

| Data services revenues | Data services revenues | $ | 463 | | | $ | 432 | | | $ | 231 | | | $ | 218 | |

| Services transferred over time related to risk management of open interest performance obligations | Services transferred over time related to risk management of open interest performance obligations | 151 | | | 139 | | | $ | 75 | | | $ | 63 | |

| Services transferred over time related to risk management of open interest performance obligations | |

| Services transferred over time related to risk management of open interest performance obligations | |

| Services transferred over time related to listings | |

| Services transferred over time related to listings | |

| Services transferred over time related to listings | Services transferred over time related to listings | 252 | | | 260 | | | $ | 126 | | | $ | 131 | |

| Services transferred over time related to regulatory fees, trading permits, and software licenses | Services transferred over time related to regulatory fees, trading permits, and software licenses | 61 | | | 60 | | | $ | 33 | | | $ | 30 | |

| Services transferred over time related to regulatory fees, trading permits, and software licenses | |

| Services transferred over time related to regulatory fees, trading permits, and software licenses | |

| Total | |

| Total | |

| Total | Total | $ | 927 | | | $ | 891 | | | $ | 465 | | | $ | 442 | |

| | Fixed Income Data Services Segment: | Fixed Income Data Services Segment: | |

| | Fixed Income Data Services Segment: | |

| | Fixed Income Data Services Segment: | |

| Data services revenues | |

| Data services revenues | |

| Data services revenues | Data services revenues | $ | 864 | | | $ | 843 | | | $ | 434 | | | $ | 421 | |

| Services transferred over time related to risk management of open interest performance obligations in our CDS business | Services transferred over time related to risk management of open interest performance obligations in our CDS business | 16 | | | 19 | | | $ | 6 | | | $ | 8 | |

| Services transferred over time related to risk management of open interest performance obligations in our CDS business | |

| Services transferred over time related to risk management of open interest performance obligations in our CDS business | |

| Total | |

| Total | |

| Total | Total | $ | 880 | | | $ | 862 | | | $ | 440 | | | $ | 429 | |

| | Mortgage Technology Segment: | Mortgage Technology Segment: | |

| Subscription revenues | $ | 329 | | | $ | 316 | | | $ | 164 | | | $ | 160 | |

| Professional service revenues and other | 8 | | | 18 | | | $ | 4 | | | $ | 9 | |

| | Mortgage Technology Segment: | |

| | Mortgage Technology Segment: | |

| Recurring revenues | |

| Recurring revenues | |

| Recurring revenues | |

| Other | |

| Other | |

| Other | |

| Total | |

| Total | |

| Total | Total | $ | 337 | | | $ | 334 | | | $ | 168 | | | $ | 169 | |

| | Total consolidated revenues transferred over time | Total consolidated revenues transferred over time | $ | 2,144 | | | $ | 2,087 | | | $ | 1,073 | | | $ | 1,040 | |

| | Total consolidated revenues transferred over time | |

| | Total consolidated revenues transferred over time | |

Transaction Price Allocated to Future Performance Obligations

Our disclosure of transaction price allocated to future performance obligations excludes the following:

•Volume-based fees in excess of contractual minimums and other usage-based fees to the extent they are part of a single performance obligation and meet certain variable consideration allocation criteria;

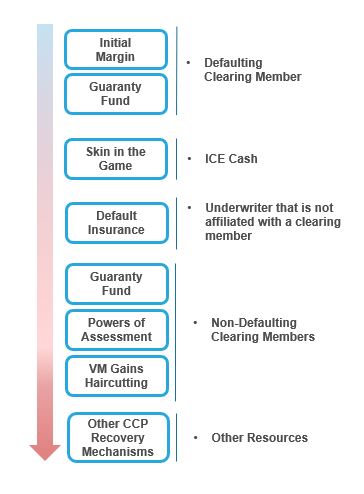

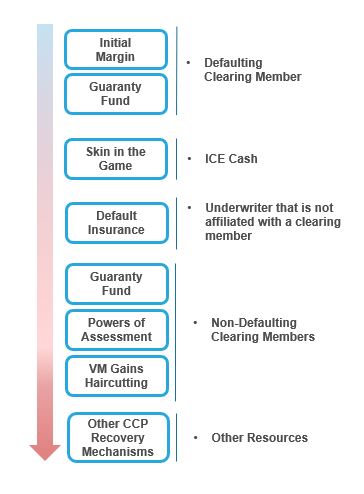

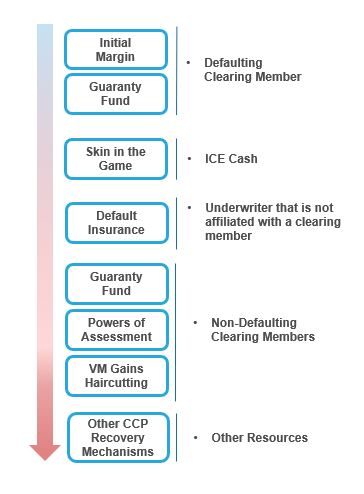

•Performance obligations that are part of a contract with an original expected duration of one year or less; and