Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

PBF LOGISTICS LP

TABLE OF CONTENTS

EXPLANATORY NOTE

PBF Logistics LP (“PBFX” or the “Partnership”) is a Delaware limited partnership formed in February 2013. PBF Logistics GP LLC (“PBF GP” or “our general partner”) serves as the general partner of PBFX. PBF GP is wholly-owned by PBF Energy Company LLC (“PBF LLC”). PBF Energy Inc. (“PBF Energy”) is the sole managing member of PBF LLC and, as of September 30, 2017,2020, owned 96.6%99.2% of the total economic interest in PBF LLC. In addition, PBF LLC is the sole managing member of PBF Holding Company LLC (“PBF Holding”), a Delaware limited liability company and affiliate of PBFX. PBF LLC owns 18,459,497 of PBFX’s29,953,631 PBFX common units constituting an aggregate 44.1%of 48.0% limited partner interest in PBFX, and owns all of PBFX’s incentive distribution rights (“IDRs”), with the remaining 55.9%52.0% limited partner interest owned by public unitholders as of September 30, 2017.2020.

Unless the context otherwise requires, references in this Quarterly Report on Form 10-Q for the quarter ended September 30, 2020 (this “Form 10-Q”) to “Predecessor,” and “we,” “our,” “us,” or like terms, when used in the context of periods prior to PBFX’s initial public offering, which closed on May 14, 2014 (the “Offering”),the completion of certain acquisitions from PBF LLC, refer to PBF MLP Predecessor, our predecessor for accounting purposes (our “Predecessor”), which includes assets, liabilities and results of operations of certain crude oil, refined products, natural gas and refined productintermediates transportation, terminaling, storage and storageprocessing assets previously operated and owned by PBF Holding’s subsidiaries Delaware City Refining Company LLC (“DCR”), Toledo Refining Company LLC (“TRC”), and PBF Holding’s previously held subsidiaries, Delaware Pipeline Company LLC (“DPC”), Torrance Valley Pipeline Company LLC (“TVPC”), and Paulsboro Natural Gas Pipeline Company LLC (“PNGPC”).subsidiaries. As of September 30, 2017,2020, PBF Holding, together with its subsidiaries, owns and operates fivesix oil refineries and related

facilities in North America. PBF Energy, through its ownership of PBF LLC, controls all of the business and affairs of PBFX and PBF Holding.

References in this Form 10-Q to “PBF Logistics LP,” “PBFX,” the “Partnership” and“Partnership,” “we,” “our,” or “us,” or like terms used in the context of periods on or after May 14, 2014,the completion of certain acquisitions from PBF LLC, refer to PBF Logistics LP and its subsidiaries.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 10-Q (including information incorporated by reference) contains certain “forward-looking statements,” as defined in the Private Securities Litigation Reform Act of 1995, which involve risks and uncertainties. You can identify forward-looking statements because they contain words such as “believes,” “expects,” “may,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,”“estimates” or “anticipates” or similar expressions that relate to our strategy, plans or intentions. All statements we make relating to our estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results or to our expectations regarding future industry trends are forward-looking statements. In addition, we, through our senior management, from time to time, make forward-looking public statements concerning our expected future operations and performance and other developments. These forward-looking statements are subject to risks and uncertainties that may change at any time, and,time; therefore, our actual results may differ materially from those that we expected. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based uponon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors and, of course, it is impossible for us to anticipate all factors that could affect our actual results.

Important factors that could cause actual results to differ materially from our expectations, which we refer to as “cautionary statements,” are disclosed under “Item 1A. Risk Factors,”Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” andOperations,” elsewhere in this Form 10-Q;10-Q, in our Annual Report on Form 10-K for the year ended December 31, 2016, which we refer to as our 20162019 (our “2019 Form 10-K; in our Form 8-K issued May 11, 2017, which retrospectively adjusted items 6, 7 and 8 of our 2016 Form 10-K to give effect to the acquisition of PNGPC,10-K”) and in our other filings with the U.S. Securities and Exchange Commission (“SEC”). All forward-looking information in this Form 10-Q and subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements. Some of the factors that we believe couldaffect our results include:

our limited operating history as a separate public partnership;

•changes in general economic conditions;conditions, including market and macro-economic disruptions resulting from the coronavirus disease 2019 (“COVID-19”) pandemic and related governmental and consumer responses;

•our ability to make, complete and integrate acquisitions from affiliates or third parties;parties, and to realize the benefits from such acquisitions;

•our ability to have sufficient cash from operations to enable us to pay the minimum quarterly distribution;

•competitive conditions in our industry;

•actions taken by our customers and competitors;

•the supply of, and demand for, crude oil, refined products, natural gas and logistics services;

•our ability to successfully implement our business plan;

•our dependence on PBF Energy for a substantial majority of our revenues, whichrevenue subjects us to the business risks of PBF Energy, which include the possibility that contracts will not be renewed because they are no longer beneficial for PBF Energy;

•a substantial majority of our revenue is generated at certain of PBF Energy’s facilities, particularly at PBF Energy’s Delaware City, Toledo and Torrance refineries, and any adverse development at any of these facilities could have a material adverse effect on us;

•our ability to complete internal growth projects on time and on budget;

•the price and availability of debt and equity financing;

•operating hazards and other risks incidental to handlingthe processing of crude oil petroleumand the receiving, handling, storage and transferring of crude oil, refined products, natural gas and natural gas;

intermediates;

•natural disasters, weather-related delays, casualty losses and other matters beyond our control;

•the threat of cyber-attacks;

•our and PBF Energy’s increased dependence on technology;

•interest rates;

•labor relations;

•changes in the availability and cost of capital;

•the effects of existing and future laws and governmental regulations, including those related to the shipment of crude oil by trains;rail;

•changes in insurance markets impacting costs and the level and types of coverage available;

•the timing and extent of changes in commodity prices and demand for PBF Energy’s refined products and natural gas and the differential in the prices of different crude oils;

•the suspension, reduction or termination of PBF Energy’s obligations under our commercial agreements;

•disruptions due to equipment interruption or failure at our facilities, PBF Energy’s facilities or third-party facilities on which our business is dependent;

incremental costs as a separate public partnership;

•our general partner and its affiliates, including PBF Energy, have conflicts of interest with us and limited duties to us and our unitholders, and they may favor their own interests to the detriment of us and our other common unitholders;

•our partnership agreement restricts the remedies available to holders of our common units for actions taken by our general partner that might otherwise constitute breaches of fiduciary duty;

•holders of our common units have limited voting rights and are not entitled to elect our general partner or its directors;

•our tax treatment depends on our status as a partnership for U.S. federal income tax purposes, as well as our not being subject to a material amount of entity level taxation by individual states;

•changes at any time (including on a retroactive basis) in the tax treatment of publicly traded partnerships, including related impacts on potential dropdown transactions with PBF LLC, or an investment in our common units;

•our unitholders will be required to pay taxes on their share of our taxable income even if they do not receive any cash distributions from us;

•the effects of future litigation; and

•other factors discussed elsewhere in this Form 10-Q.

We caution you that the foregoing list of important factors may not contain all of the material factors that are important to you. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this Form 10-Q may not in fact occur. Accordingly, investors should not place undue reliance on those statements.

Our forward-looking statements speak only as of the date of this Form 10-Q. Except as required by applicable law, including the securities laws of the United States,U.S., we undertake no obligation to update or revise any forward-looking statements. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing.

PART 1 - FINANCIAL INFORMATION

Item 1. Financial Statements

PBF LOGISTICS LP

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited, in thousands, except unit data)

| | | | | | | | | | | | | | |

| | September 30,

2020 | | December 31,

2019 |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 27,851 | | | $ | 34,966 | |

| | | | |

| Accounts receivable - affiliates | | 55,902 | | | 48,056 | |

| Accounts receivable | | 9,410 | | | 7,351 | |

| Prepaids and other current assets | | 4,393 | | | 3,828 | |

| Total current assets | | 97,556 | | | 94,201 | |

| Property, plant and equipment, net | | 829,832 | | | 854,610 | |

| Goodwill | | 6,332 | | | 6,332 | |

| Other non-current assets | | 8,047 | | | 17,859 | |

| Total assets | | $ | 941,767 | | | $ | 973,002 | |

| | | | |

| LIABILITIES AND EQUITY | | | | |

| Current liabilities: | | | | |

| Accounts payable - affiliates | | $ | 6,569 | | | $ | 6,454 | |

| Accounts payable | | 5,013 | | | 10,224 | |

| Accrued liabilities | | 36,047 | | | 27,839 | |

| | | | |

| | | | |

| Deferred revenue | | 5,503 | | | 3,189 | |

| Total current liabilities | | 53,132 | | | 47,706 | |

| Long-term debt | | 733,414 | | | 802,104 | |

| Other long-term liabilities | | 1,665 | | | 18,109 | |

| Total liabilities | | 788,211 | | | 867,919 | |

| | | | |

| Commitments and contingencies (Note 10) | | | | |

| | | | |

| Equity: | | | | |

| | | | |

| Common unitholders (62,360,524 and 62,130,035 units issued and outstanding, as of September 30, 2020 and December 31, 2019, respectively) | | 153,556 | | | 105,083 | |

| | | | |

| | | | |

| | | | |

| | | | |

| Total equity | | 153,556 | | | 105,083 | |

| Total liabilities and equity | | $ | 941,767 | | | $ | 973,002 | |

|

| | | | | | | | |

| | | September 30, 2017 | | December 31,

2016 |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 39,420 |

| | $ | 64,221 |

|

| Marketable securities - current | | — |

| | 40,024 |

|

| Accounts receivable - affiliates | | 36,045 |

| | 37,863 |

|

| Accounts receivable | | 1,106 |

| | 4,294 |

|

| Prepaid expenses and other current assets | | 2,083 |

| | 1,657 |

|

| Total current assets | | 78,654 |

| | 148,059 |

|

| Property, plant and equipment, net | | 675,793 |

| | 608,802 |

|

| Other non-current assets | | 30 |

| | — |

|

| Total assets | | $ | 754,477 |

| | $ | 756,861 |

|

| LIABILITIES AND EQUITY | | | | |

| Current liabilities: | | | | |

| Accounts payable - affiliates | | $ | 19,938 |

| | $ | 7,631 |

|

| Accounts payable and accrued liabilities | | 29,917 |

| | 20,871 |

|

| Current portion of long-term debt | | — |

| | 39,664 |

|

| Affiliate note payable | | 11,600 |

| | — |

|

| Deferred revenue | | 991 |

| | 952 |

|

| Total current liabilities | | 62,446 |

| | 69,118 |

|

| Long-term debt | | 533,136 |

| | 532,011 |

|

| Other long-term liabilities | | 2,070 |

| | 3,161 |

|

| Total liabilities | | 597,652 |

| | 604,290 |

|

| | | | | |

| Commitments and contingencies (Note 9) | |

| |

|

| | | | | |

| Equity: | | | | |

| Net Investment - Predecessor | | — |

| | 6,231 |

|

Common unitholders (41,894,846 and 25,844,118 units issued and outstanding, as of September 30, 2017 and December 31, 2016, respectively)(1) | | (18,453 | ) | | 241,275 |

|

| Subordinated unitholder - PBF LLC (0 and 15,886,553 units issued and outstanding, as of September 30, 2017 and December 31, 2016, respectively) | | — |

| | (276,083 | ) |

| IDR holder - PBF LLC | | 2,526 |

| | 1,266 |

|

| Total PBF Logistics LP equity | | (15,927 | ) | | (27,311 | ) |

| Noncontrolling interest | | 172,752 |

| | 179,882 |

|

| Total equity | | 156,825 |

| | 152,571 |

|

| Total liabilities and equity | | $ | 754,477 |

| | $ | 756,861 |

|

(1) Subsequent to the conversion of the PBFX subordinated units held by PBF LLC, common units held by the public and PBF LLC are shown in total. Refer to Notes 6 “Equity” and 8 “Net Income per Unit” in the accompanying Notes to Condensed Consolidated Financial Statements for further discussion regarding the subordinated units’ conversion.

See Notes to Condensed Consolidated Financial Statements.

56

PBF LOGISTICS LP

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited, in thousands, except unit and per unit data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

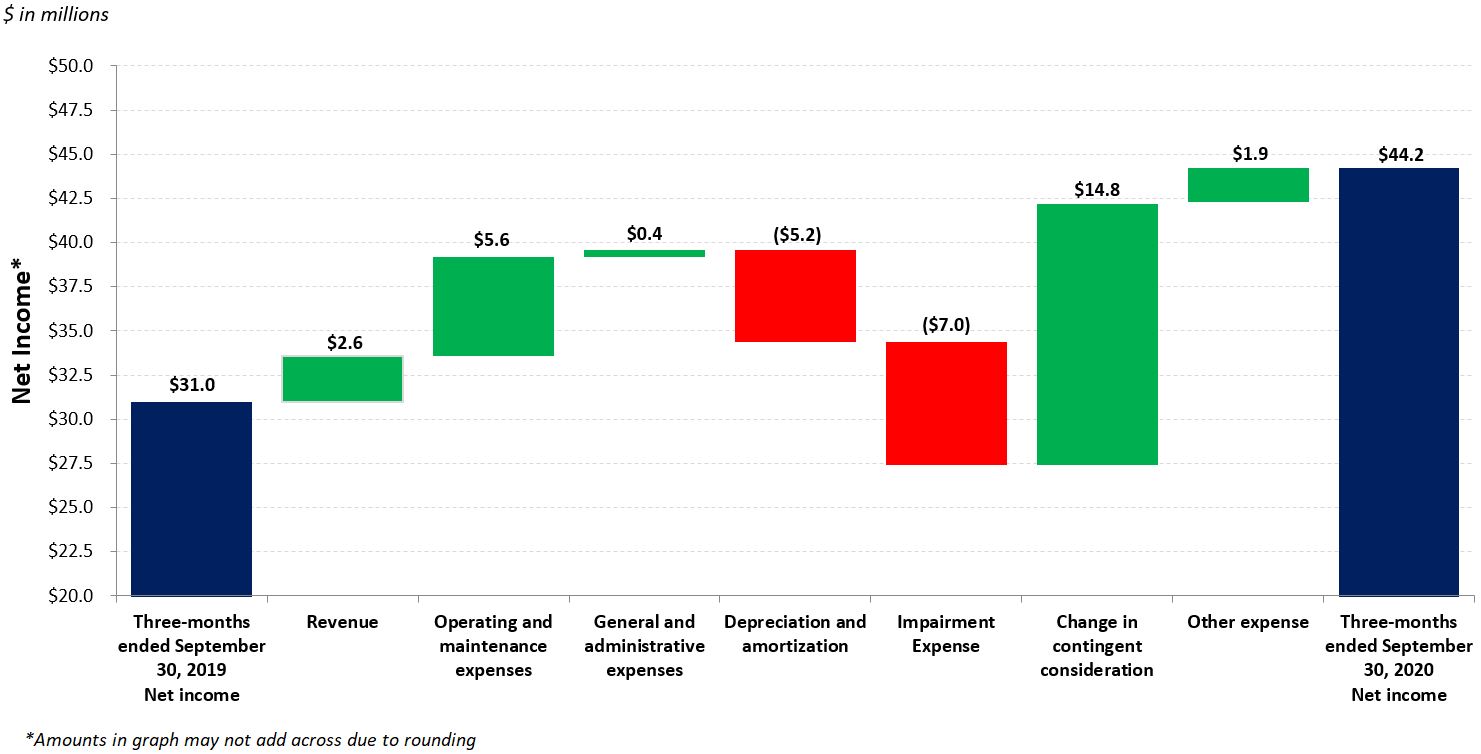

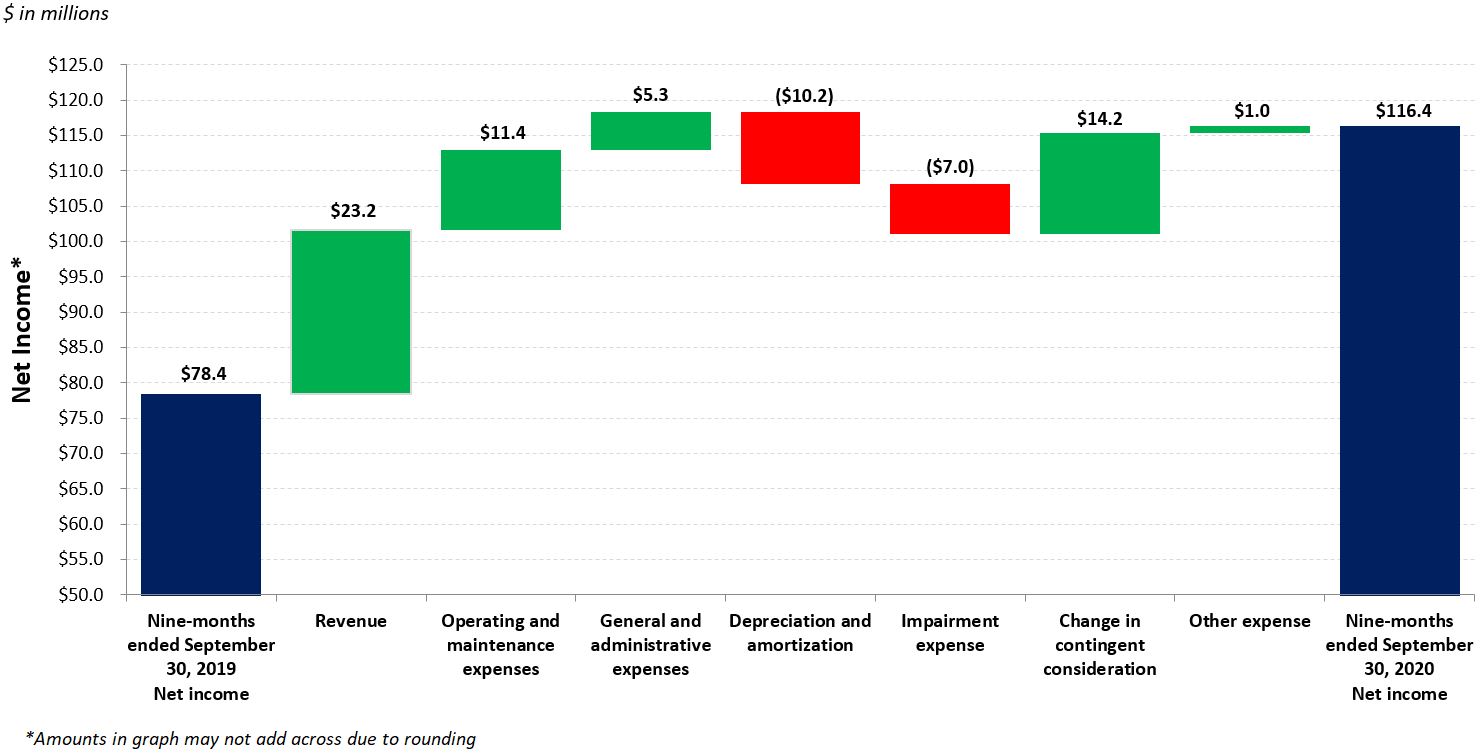

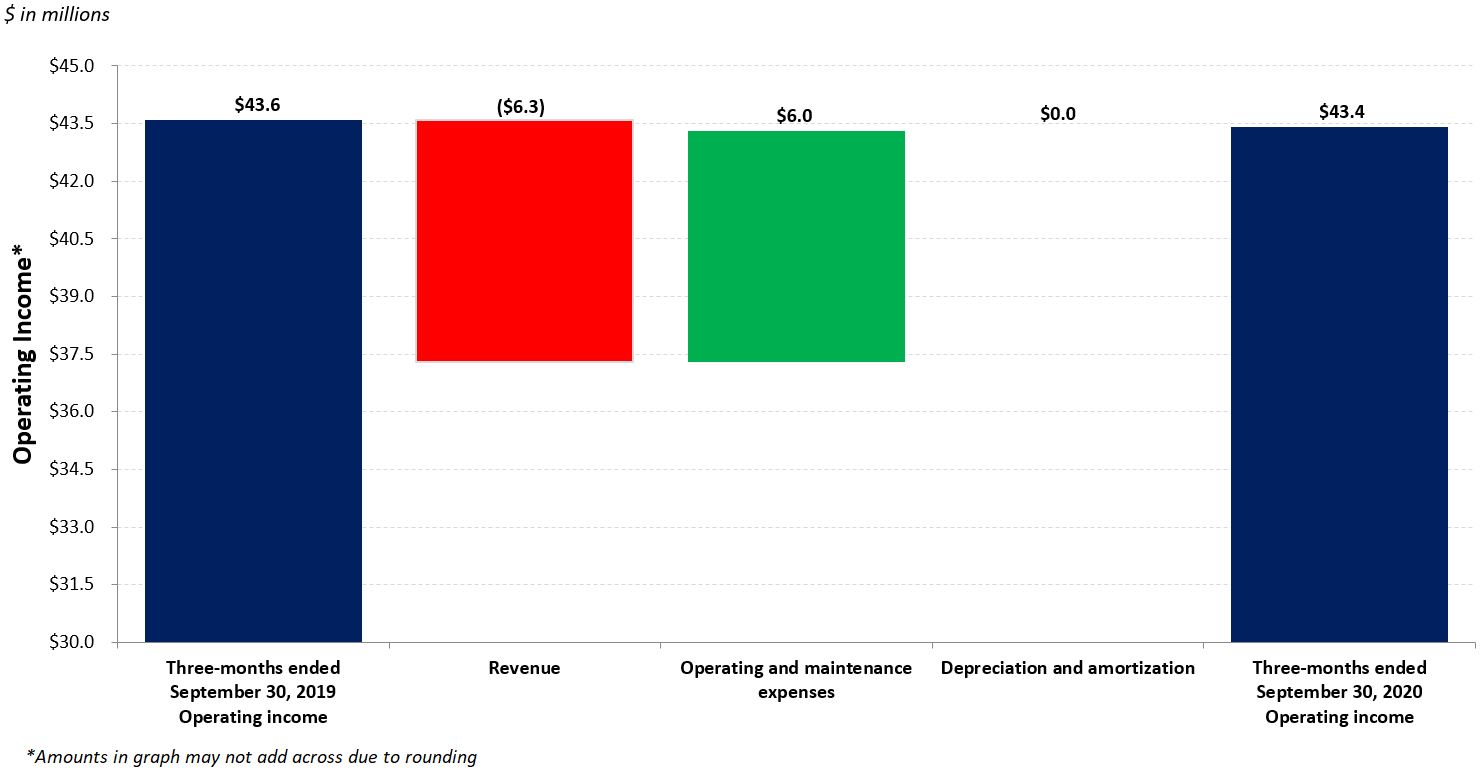

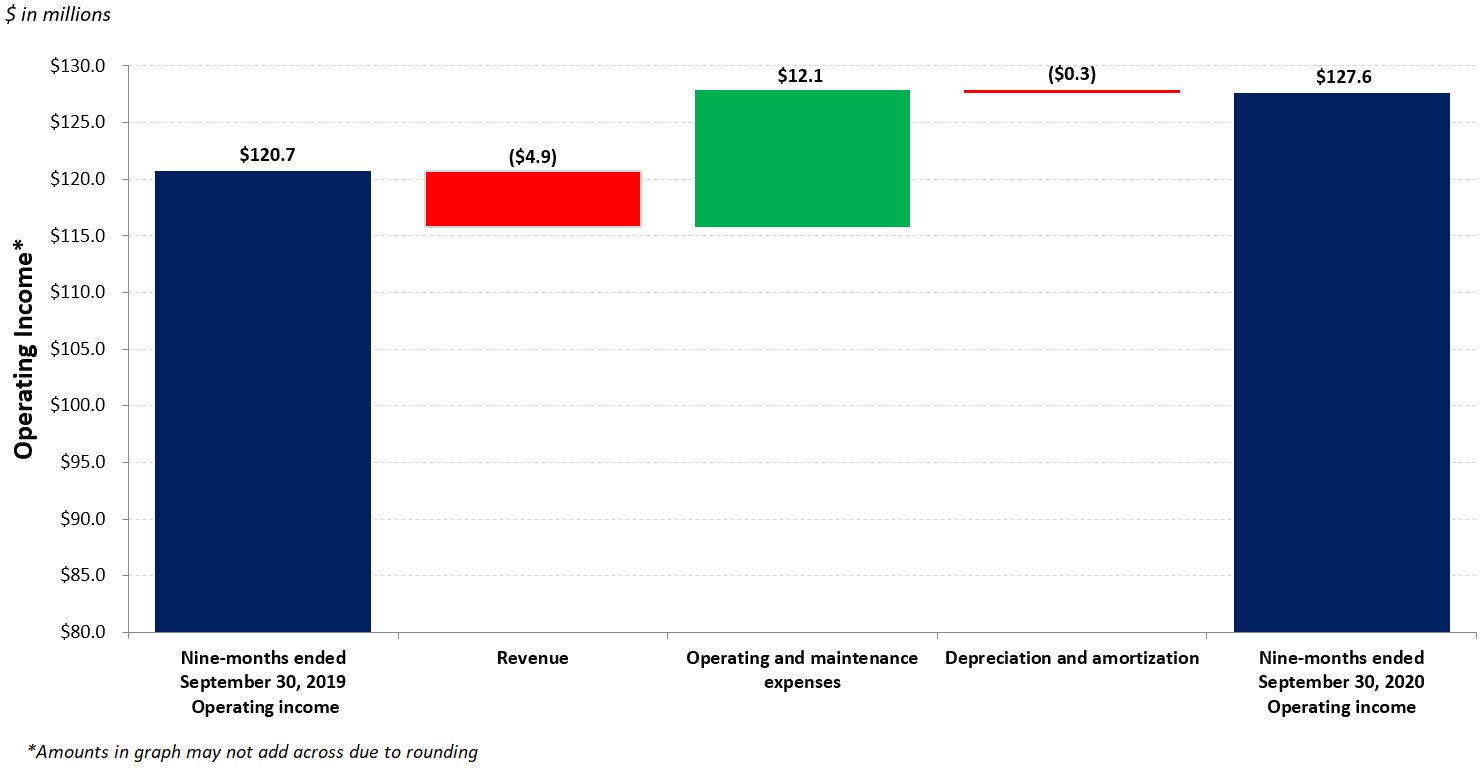

| | | 2020 | | 2019 | | 2020 | | 2019 |

| Revenue: | | | | | | | | |

| Affiliate | | $ | 70,716 | | | $ | 78,026 | | | $ | 218,681 | | | $ | 224,014 | |

| Third-party | | 18,294 | | | 8,351 | | | 52,487 | | | 23,958 | |

| Total revenue | | 89,010 | | | 86,377 | | | 271,168 | | | 247,972 | |

| | | | | | | | |

| Costs and expenses: | | | | | | | | |

| Operating and maintenance expenses | | 22,730 | | | 28,356 | | | 75,385 | | | 86,825 | |

| General and administrative expenses | | 4,112 | | | 4,552 | | | 12,798 | | | 18,142 | |

| Depreciation and amortization | | 14,305 | | | 9,079 | | | 36,821 | | | 26,654 | |

| Impairment expense | | 7,000 | | | 0 | | | 7,000 | | | 0 | |

| Change in contingent consideration | | (14,765) | | | 0 | | | (14,235) | | | 0 | |

| Total costs and expenses | | 33,382 | | | 41,987 | | | 117,769 | | | 131,621 | |

| | | | | | | | |

| Income from operations | | 55,628 | | | 44,390 | | | 153,399 | | | 116,351 | |

| | | | | | | | |

| Other expense: | | | | | | | | |

| Interest expense, net | | (10,544) | | | (12,230) | | | (33,929) | | | (34,359) | |

| Amortization of loan fees and debt premium | | (328) | | | (444) | | | (1,309) | | | (1,339) | |

| Accretion on discounted liabilities | | (594) | | | (722) | | | (1,726) | | | (2,255) | |

| | | | | | | | |

| Net income | | 44,162 | | | 30,994 | | | 116,435 | | | 78,398 | |

| | | | | | | | |

| Less: Net income attributable to noncontrolling interest | | 0 | | | 0 | | | 0 | | | 7,881 | |

| | | | | | | | |

| | | | | | | | |

| Net income attributable to PBF Logistics LP unitholders | | $ | 44,162 | | | $ | 30,994 | | | $ | 116,435 | | | $ | 70,517 | |

| | | | | | | | |

| Net income per limited partner unit: | | | | | | | | |

| Common units - basic | | $ | 0.71 | | | $ | 0.50 | | | $ | 1.87 | | | $ | 1.23 | |

| Common units - diluted | | 0.71 | | | 0.50 | | | 1.87 | | | 1.23 | |

| | | | | | | | |

| | | | | | | | |

| Weighted-average limited partner units outstanding: | | | | | | | | |

| Common units - basic | | 62,519,105 | | | 62,361,974 | | | 62,424,217 | | | 57,314,382 | |

| Common units - diluted | | 62,529,489 | | | 62,460,669 | | | 62,429,475 | | | 57,385,166 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2017 | | 2016* | | 2017 | | 2016* |

| Revenue: | | | | | | | | |

| Affiliate | | $ | 62,359 |

| | $ | 43,842 |

| | $ | 176,916 |

| | $ | 118,356 |

|

| Third-party | | 3,135 |

|

| 4,591 |

|

| 11,384 |

|

| 7,285 |

|

| Total revenue | | 65,494 |

| | 48,433 |

| | 188,300 |

| | 125,641 |

|

| | | | | | | | | |

| Costs and expenses: | | | | | | | | |

| Operating and maintenance expenses | | 15,930 |

| | 12,903 |

| | 47,203 |

| | 26,885 |

|

| General and administrative expenses | | 3,534 |

| | 4,420 |

| | 12,947 |

| | 13,896 |

|

| Depreciation and amortization | | 5,610 |

| | 5,347 |

| | 16,672 |

| | 9,543 |

|

| Total costs and expenses | | 25,074 |

| | 22,670 |

| | 76,822 |

| | 50,324 |

|

| | | | | | | | | |

| Income from operations | | 40,420 |

| | 25,763 |

| | 111,478 |

| | 75,317 |

|

| | | | | | | | | |

| Other expense: | | | | | | | | |

| Interest expense, net | | (7,416 | ) | | (7,280 | ) | | (22,493 | ) | | (21,298 | ) |

| Amortization of loan fees | | (332 | ) | | (416 | ) | | (1,125 | ) | | (1,261 | ) |

| Net income | | 32,672 |

| | 18,067 |

| | 87,860 |

| | 52,758 |

|

| Less: Net loss attributable to Predecessor | | — |

| | (4,428 | ) | | (150 | ) | | (5,085 | ) |

| Less: Net income attributable to noncontrolling interest | | 3,799 |

| | 1,621 |

| | 11,218 |

| | 1,621 |

|

| Net income attributable to the partners | | 28,873 |

| | 20,874 |

| | 76,792 |

| | 56,222 |

|

| Less: Net income attributable to the IDR holder | | 2,526 |

| | 1,125 |

| | 6,319 |

| | 2,765 |

|

| Net income attributable to PBF Logistics LP unitholders | | $ | 26,347 |

| | $ | 19,749 |

| | $ | 70,473 |

| | $ | 53,457 |

|

| | | | | | | | | |

Net income per limited partner unit(1): | | | | | | | | |

| Common units - basic | | $ | 0.63 |

| | $ | 0.50 |

| | $ | 1.69 |

| | $ | 1.44 |

|

| Common units - diluted | | 0.63 |

| | 0.50 |

| | 1.69 |

| | 1.44 |

|

| Subordinated units - basic and diluted | | — |

| | 0.50 |

| | 1.61 |

| | 1.45 |

|

| | | | | | | | | |

Weighted-average limited partner units outstanding(1): | | | | | | | | |

| Common units - basic | | 42,127,288 |

| | 23,492,796 |

| | 33,280,957 |

| | 21,094,154 |

|

| Common units - diluted | | 42,161,008 |

| | 23,571,691 |

| | 33,309,555 |

| | 21,103,919 |

|

| Subordinated units - basic and diluted | | — |

| | 15,886,553 |

| | 8,787,068 |

| | 15,886,553 |

|

| | | | | | | | | |

| Cash distributions declared per unit | | $ | 0.48 |

| | $ | 0.44 |

| | $ | 1.41 |

| | $ | 1.29 |

|

* Prior-period financial information has been retrospectively adjusted for the PNGPC Acquisition (as defined in Note 1 “Description of the Business and Basis of Presentation” in the accompanying Notes to Condensed Consolidated Financial Statements).

(1) PBFX bases its calculation of net income per limited partner unit on the weighted-average number of limited partner units outstanding during the period. The weighted-average number of common and subordinated units reflects the conversion of the subordinated units to common units on June 1, 2017. Refer to Notes 6 “Equity” and 8 “Net Income per Unit” in the accompanying Notes to Condensed Consolidated Financial Statements for further discussion.

See Notes to Condensed Consolidated Financial Statements.

67

PBF LOGISTICS LP

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands)

| | | | | | | | | | | | | | |

| | | Nine Months Ended

September 30, |

| | | 2020 | | 2019 |

| Cash flows from operating activities: | | | | |

| Net income | | $ | 116,435 | | | $ | 78,398 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 36,821 | | | 26,654 | |

| Impairment expense | | 7,000 | | | 0 | |

| Amortization of loan fees and debt premium | | 1,309 | | | 1,339 | |

| Accretion on discounted liabilities | | 1,726 | | | 2,255 | |

| Unit-based compensation expense | | 3,242 | | | 5,622 | |

| Change in contingent consideration | | (14,235) | | | 0 | |

| Changes in operating assets and liabilities: | | | | |

| Accounts receivable - affiliates | | (7,846) | | | (29,351) | |

| Accounts receivable | | (2,059) | | | 2,369 | |

| Prepaids and other current assets | | (565) | | | (1,486) | |

| | | | |

| Accounts payable - affiliates | | 115 | | | 137 | |

| Accounts payable | | (5,674) | | | 1,894 | |

| Accrued liabilities | | 7,748 | | | 9,672 | |

| Deferred revenue | | 2,314 | | | 81 | |

| Other assets and liabilities | | (4,902) | | | (1,941) | |

| Net cash provided by operating activities | | 141,429 | | | 95,643 | |

| | | | |

| Cash flows from investing activities: | | | | |

| | | | |

| | | | |

| Expenditures for property, plant and equipment | | (9,635) | | | (23,180) | |

| | | | |

| | | | |

| Net cash used in investing activities | | $ | (9,635) | | | $ | (23,180) | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

|

| | | | | | | | |

| | | Nine Months Ended September 30, |

| | | 2017 | | 2016* |

| Cash flows from operating activities: | | | | |

| Net income | | $ | 87,860 |

| | $ | 52,758 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 16,672 |

| | 9,543 |

|

| Amortization of deferred financing fees | | 1,125 |

| | 1,261 |

|

| Unit-based compensation expense | | 4,515 |

| | 3,673 |

|

| Changes in operating assets and liabilities: | | | | |

| Accounts receivable - affiliates | | 818 |

| | (6,322 | ) |

| Accounts receivable | | 3,188 |

| | (3,981 | ) |

| Prepaid expenses and other current assets | | (329 | ) | | 2,234 |

|

| Accounts payable - affiliates | | 500 |

| | (1,077 | ) |

| Accounts payable and accrued liabilities | | 7,705 |

| | 9,563 |

|

| Deferred revenue | | 39 |

| | 889 |

|

| Other assets and liabilities | | (1,128 | ) | | (256 | ) |

| Net cash provided by operations | | 120,965 |

| | 68,285 |

|

| | | | | |

| Cash flows from investing activities: | | | | |

| Plains Asset Purchase | | — |

| | (98,373 | ) |

| Toledo Terminal Acquisition | | (10,097 | ) | | — |

|

| Expenditures for property, plant and equipment | | (61,344 | ) | | (8,043 | ) |

| Purchase of marketable securities | | (75,036 | ) | | (1,779,997 | ) |

| Maturities of marketable securities | | 115,060 |

| | 1,954,274 |

|

| Net cash (used in) provided by investing activities | | (31,417 | ) | | 67,861 |

|

| | | | | |

| Cash flows from financing activities: | | | | |

| Proceeds from issuance of common units, net of underwriters’ discount and commissions | | — |

| | 138,255 |

|

| Distribution to PBF LLC related to Acquisitions from PBF | | — |

| | (175,000 | ) |

| Distributions to unitholders | | (62,794 | ) | | (48,043 | ) |

| Distributions to TVPC members | | (17,348 | ) | | — |

|

| Contribution from parent | | 5,457 |

| | 4,076 |

|

| Proceeds from revolving credit facility | | — |

| | 174,700 |

|

| Repayment of revolving credit facility | | — |

| | (30,000 | ) |

| Repayment of term loan | | (39,664 | ) | | (174,536 | ) |

| Deferred financing costs | | — |

| | (5 | ) |

| Net cash used in financing activities | | (114,349 | ) | | (110,553 | ) |

| | | | | |

| Net change in cash and cash equivalents | | (24,801 | ) | | 25,593 |

|

| Cash and cash equivalents at beginning of year | | 64,221 |

| | 18,678 |

|

| Cash and cash equivalents at end of period | | $ | 39,420 |

| | $ | 44,271 |

|

| | | | | |

| Supplemental disclosure of non-cash investing and financing activities: | | | | |

| Contribution of net assets from PBF LLC | | $ | — |

| | $ | 15 |

|

| Accrued capital expenditures | | 14,859 |

| | 738 |

|

| Issuance of affiliate note payable | | 11,600 |

| | — |

|

* Prior-period financial information has been retrospectively adjusted for the PNGPC Acquisition (as defined in Note 1 “Description of the Business and Basis of Presentation” in the accompanying Notes to Condensed Consolidated Financial Statements).

See Notes to Condensed Consolidated Financial Statements.

78

PBF LOGISTICS LP

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (continued)

(unaudited, in thousands)

| | | | | | | | | | | | | | |

| | | Nine Months Ended

September 30, |

| | | 2020 | | 2019 |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Cash flows from financing activities: | | | | |

| | | | |

| Proceeds from issuance of common units | | $ | 0 | | | $ | 132,483 | |

| | | | |

| Acquisition of TVPC noncontrolling interest | | 0 | | | (200,000) | |

| Distributions to unitholders | | (69,718) | | | (91,611) | |

| | | | |

| | | | |

| Distributions to TVPC members | | 0 | | | (8,500) | |

| | | | |

| | | | |

| Proceeds from revolving credit facility | | 100,000 | | | 228,000 | |

| | | | |

| | | | |

| Repayment of revolving credit facility | | (170,000) | | | (101,000) | |

| | | | |

| Deferred financing costs and other | | 809 | | | 835 | |

| Net cash used in financing activities | | (138,909) | | | (39,793) | |

| | | | |

| Net change in cash and cash equivalents | | (7,115) | | | 32,670 | |

| Cash and cash equivalents, beginning of period | | 34,966 | | | 19,908 | |

| Cash and cash equivalents, end of period | | $ | 27,851 | | | $ | 52,578 | |

| | | | |

| Supplemental disclosure of non-cash investing and financing activities: | | | | |

| Accrued and unpaid capital expenditures | | $ | 843 | | | $ | 338 | |

| Contribution of net assets from PBF LLC | | 0 | | | 242 | |

| | | | |

| Units issued in connection with the IDR Restructuring | | 0 | | | 215,300 | |

| | | | |

| Assets acquired under operating leases | | 0 | | | 482 | |

See Notes to Condensed Consolidated Financial Statements.

9

PBF LOGISTICS LP

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT BARREL, DEKATHERM, UNIT AND PER UNIT DATA)

1. DESCRIPTION OF THE BUSINESS AND BASIS OF PRESENTATION

PBF Logistics LP (“PBFX” or the “Partnership”) is a Delaware master limited partnership formed in February 2013. PBF Logistics GP LLC (“PBF GP” or “our general partner”) serves as the general partner of PBFX. PBF GP is wholly-owned by PBF Energy Company LLC (“PBF LLC”). PBF Energy Inc. (“PBF Energy”) is the sole managing member of PBF LLC and, as of September 30, 2017,2020, owned 96.6%99.2% of the total economic interest in PBF LLC. In addition, PBF LLC is the sole managing member of PBF Holding Company LLC (“PBF Holding”), a Delaware limited liability company and affiliate of PBFX. PBF LLC owns 18,459,497 of PBFX’sowned 29,953,631 PBFX common units constituting an aggregate 44.1%of 48.0% limited partner interest in PBFX, and owns all of PBFX’s incentive distribution rights (“IDRs”), with the remaining 55.9%52.0% limited partner interest owned by public unitholders as of September 30, 2017.2020.

PBFX engages in the processing of crude oil and the receiving, handling, storage and transferring of crude oil, refined products, natural gas and intermediates. The Partnership does not take ownership of or receive any payments based on the value of the crude oil, products, natural gas or intermediates that it handles and does not engage in the trading of any commodities. PBFX’s assets are integral to the operations of PBF Holding’s refineries.

On February 28, 2017, the Partnership’s wholly-owned subsidiary, PBFX Operating Company LP (“PBFX Op Co”), acquired from PBF LLC all the issuedrefineries, and, outstanding limited liability company interests of Paulsboro Natural Gas Pipeline Company LLC (“PNGPC”) for an aggregate purchase price of $11,600 (the “PNGPC Acquisition”). PNGPC owns and operates an existing interstate natural gas pipeline which serves PBF Holding’s Paulsboro Refinery (the “Paulsboro Natural Gas Pipeline”) and is subject to regulation by the Federal Energy Regulatory Commission (“FERC”). In connection with the PNGPC Acquisition, the Partnership constructed a new pipeline (the “New Pipeline”) to replace the existing pipeline, which commenced services in August 2017. This acquisition was accounted for as a transfer of assets between entities under common control under U.S. generally accepted accounting principles (“GAAP”). Refer to Note 2 “Acquisitions” of the Notes to Condensed Consolidated Financial Statements for further discussion regarding the PNGPC Acquisition.

Effective February 2017, PBFX Op Co assumed construction of a crude oil storage tank at PBF Holding’s Chalmette Refinery (the “Chalmette Storage Tank”), which is expected to be in service and operational during the fourth quarter of 2017. PBFX Op Co and Chalmette Refining, L.L.C. (“Chalmette Refining”), a wholly-owned subsidiary of PBF Holding, have entered into a twenty-year lease for the premises upon which the tank will be located and the Project Management Agreement (as defined in Note 10 “Related Party Transactions” of the Notes to Condensed Consolidated Financial Statements) pursuant to which Chalmette Refining has managed the construction of the tank.

On April 17, 2017, the Partnership’s wholly-owned subsidiary, PBF Logistics Products Terminals LLC (“PLPT”), acquired the Toledo, Ohio refined products terminal assets (the “Toledo Terminal”) from Sunoco Logistics Partners L.P. (the “Seller”) for an aggregate purchase price of $10,000, plus working capital (the “Toledo Terminal Acquisition”). The Toledo Terminal is directly connected to, and currently supplied by, PBF Holding’s Toledo Refinery. This acquisition was accounted for as a business combination under GAAP. Refer to Note 2 “Acquisitions” of the Notes to Condensed Consolidated Financial Statements for further discussion regarding the Toledo Terminal Acquisition.

Subsequent to the Partnership’s initial public offering (the “Offering”), the Acquisitions from PBF (as defined below), the purchase of the four refined product terminals located in and around Philadelphia (the “East Coast Terminals”) and the Toledo Terminal Acquisition,result, the Partnership continues to generate a substantial majority of its revenue from transactions with PBF Holding. Additionally, certain of PBFX’s assets generate revenue from third-party transactions.

Business Developments

On October 1, 2018, we acquired from Crown Point International LLC (“Crown Point”), its wholly-owned subsidiary, CPI Operations LLC (“CPI”). In connection with the acquisition, the purchase and sale agreement included an earn-out provision related to an existing commercial agreement with a third party, based on the future results of certain acquired idled assets, which recommenced operations in October 2019. Pursuant to the terms of the commercial agreement, in the third quarter of 2020, the counterparty exercised its right to terminate the contract at the conclusion of the current contract year, resulting in an adjustment to the Contingent Consideration (as defined in Note 10 “Commitments and Contingencies” of the Notes to Condensed Consolidated Financial Statements). Refer to Note 10 “Commitments and Contingencies” of the Notes to Condensed Consolidated Financial Statements for further discussion. In addition, as a result of the contract termination, the Partnership recorded an impairment charge to write-down the related processing unit assets and customer contract intangible asset of $3,000 and $4,000, respectively. The impairment charge represents a write-down of the CPI assets due to the reduction of future earnings as a result of the contract termination. The fair values of the assets were determined using the income approach and was based on the expected future net cash flows over the remaining contractual period. Level 3 assumptions were used in the calculation to determine the net cash flows used in the impairment analysis. The assumptions included an estimate of future revenue based on the terms of the contract, an estimate of operating and maintenance expenses associated with the operation of the assets and an estimate of the cost to shut-down the facility at the conclusion of the contractual period. Refer to Note 5 “Property, Plant and Equipment, Net” and Note 6 “Goodwill and Intangibles” of the Notes to Condensed Consolidated Financial Statements for further discussion.

Principles of Combination and Consolidation and Basis of Presentation

In connection with, the Offering, PBF LLC contributed the assets, liabilities and results of operations of certain crude oil terminaling assetssubsequent to, the Partnership. The assets consisted of a double loop track with ancillary

PBF LOGISTICS LP

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT BARREL, DEKATHERM, UNIT AND PER UNIT DATA)

pumping and unloading equipment (the “DCR Rail Terminal”PBFX’s initial public offering (“IPO”) and a crude truck unloading terminal consisting of lease automatic custody transfer (“LACT”) units (the “Toledo Truck Terminal”).

Subsequent to the Offering,, the Partnership has acquired certain assets from PBF LLC a heavy crude oil rail unloading facility at the Delaware City Refinery (the “DCR West Rack”), a tank farm and related facilities, which included a propane storage and loading facility (the “Toledo Storage Facility”), an interstate petroleum products pipeline (the “Delaware City Products Pipeline”) and truck loading rack (the “Delaware City Truck Rack”), which are collectively(collectively referred to as the “Delaware City Products Pipeline and Truck Rack,”“Contributed Assets”). Such acquisitions completed subsequent to the San Joaquin Valley pipeline system, which consistsIPO were made through a series of the M55, M1 and M70 crude pipeline systems including pipeline stationsdropdown transactions with storage capacity and truck unloading capacity (the “Torrance Valley Pipeline”), and the Paulsboro Natural Gas Pipeline. These transactions are collectivelyPBF LLC (collectively referred to as the “Acquisitions from PBF.” Subsequent to the Acquisitions from PBF, the DCR Rail Terminal, the Toledo Truck Terminal, the DCR West Rack, the Toledo Storage Facility, the Delaware City Products Pipeline and Truck Rack, the Torrance Valley Pipeline and the Paulsboro Natural Gas Pipeline are collectively referred to as the “Contributed Assets.”PBF”). The assets, liabilities and results of operations of the Contributed Assets prior to their acquisition by PBFX are collectively referred to as the “Predecessor.” The transactions through which PBFX acquired the Contributed Assets were transfers of assets between entities under common control. Accordingly, theThe accompanying condensed consolidated financial statements and related notes present solely the consolidated financial position and consolidated financial results of operations and cash flow of our Predecessor for all periods presented priorPBFX. Refer to the effective date of each transaction. The financial statements of our Predecessor have been prepared from the separate records maintained by PBF Energy and may not necessarily be indicative of the conditions that would have existed or the results of operations if the Predecessor had been operated as an unaffiliated entity. See (i) the Annual Report on Form 10-K for the year ended December 31, 20162019 (the “2016“2019 Form 10-K”) and Form 8-K issued May 11, 2017, which retrospectively adjusted items 6, 7 and 8 of the 2016 Form 10-K to give effect to the acquisition of PNGPC for additional

PBF LOGISTICS LP

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT UNIT AND PER UNIT DATA)

information regarding the Acquisitions from PBF and the commercial agreements and amendments to other agreementsthat were entered into or amended with related parties executed in connection with these acquisitions, and (ii) Note 2 “Acquisitions” of the Notes to Condensed Consolidated Financial Statements for further discussion regarding the PNGPC Acquisition.acquisitions.

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with GAAPU.S. generally accepted accounting principles (“GAAP”) for interim financial information. Accordingly, theythese unaudited condensed consolidated financial statements do not include all of the information and footnotes required by GAAP for complete financial statements. In the opinion of management, PBFX has included all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation of the financial position, and the results of operations and cash flows of PBFX for the periods presented. The results of operations for the three and nine months ended September 30, 20172020 are not necessarily indicative of the results that may be expected for the full year.

The Predecessor generally did not historically operate its respective assets for the purpose of generating revenuesrevenue independent of other PBF Energy businesses prior to the OfferingIPO or for assets acquired in the Acquisitions from PBF, with the exception of the Delaware City Products Pipeline, prior to the effective dates of each transaction.the Acquisitions from PBF. All intercompany accounts and transactions have been eliminated.

RecentRecently Adopted Accounting PronouncementsGuidance

In August 2015,June 2016, the Financial Accounting Standards Board (“FASB”(the “FASB”) issued Accounting Standards Update (“ASU”) No. 2015-14, “Revenue from Contracts with Customers2016-13, “Financial Instruments—Credit Losses (Topic 606): Deferral326); Measurement of the Effective Date”Credit Losses on Financial Instruments” (“ASU 2015-14”2016-13”), which defers. This guidance amends the effectiveguidance on measuring credit losses on financial assets held at amortized cost. ASU 2016-13 requires the measurement of all expected credit losses for financial assets held at the reporting date of ASU No. 2014-09, “Revenue from Contracts with Customers” (“ASU 2014-09”) for all entities by one year. Additional ASUs have been issued in 2016based on historical experience, current conditions and 2017 that provide certain implementationreasonable and supportable forecasts. This guidance related to ASU 2014-09 (collectively, the Partnership refers to ASU 2014-09 and these additional ASUs as the “Updated Revenue Recognition Guidance”). The Updated Revenue Recognition Guidance will replace most existing revenue recognition guidance in GAAP when it becomes effective. Under ASU 2015-14, this guidance becomesis effective for interim and annual periodsfiscal years beginning after December 15, 20172019, including interim periods within those fiscal years. The Partnership adopted ASU 2016-13 effective January 1, 2020. The adoption of ASU 2016-13 did not have a material impact on the Partnership’s condensed consolidated financial statements. Refer to Note 4 “Current Expected Credit Losses” of the Notes to Condensed Consolidated Financial Statements for further disclosure related to the adoption of this pronouncement.

Recently Issued Accounting Pronouncements

In March 2020, the FASB issued ASU 2020-04, “Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting” (“ASU 2020-04”). The amendments in ASU 2020-04 provide optional guidance to alleviate the burden in accounting for reference rate reform by allowing certain expedients and permitsexceptions in applying GAAP to contracts, hedging relationships and other transactions affected by the useexpected market transition from London Interbank Offering Rate, also known as LIBOR, and other interbank rates. The amendments in ASU 2020-04 are effective for all entities at any time beginning on March 12, 2020 through December 31, 2022 and may be applied from the beginning of eitheran interim period that includes the retrospectiveissuance date of ASU 2020-04. The Partnership is currently evaluating the impact of this new standard on its condensed consolidated financial statements and related disclosures.

2. REVENUE

Revenue Recognition

Revenue is recognized when control of the promised goods or modified retrospective transition method. Under ASU 2015-14, early adoptionservices is permitted only astransferred to our customers, in an amount that reflects the consideration the Partnership expects to be entitled to in exchange for those goods or services.

As disclosed in Note 12 “Segment Information” of annual reporting periods beginning after December 15, 2016,

the Notes to Condensed Consolidated Financial Statements, the Partnership’s business consists of 2 reportable segments: (i) Transportation and Terminaling and (ii) Storage.

PBF LOGISTICS LP

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT BARREL, DEKATHERM, UNIT AND PER UNIT DATA)

The following table provides information relating to the Partnership’s revenue for each service category by segment for the periods presented:

including interim reporting periods within that reporting period. | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Transportation and Terminaling Segment | | | | | | | | |

| Terminaling | | $ | 35,468 | | | $ | 39,399 | | | $ | 108,196 | | | $ | 105,904 | |

| Pipeline | | 19,974 | | | 21,089 | | | 60,732 | | | 60,042 | |

| Other | | 11,550 | | | 12,781 | | | 35,016 | | | 42,938 | |

| Total | | 66,992 | | | 73,269 | | | 203,944 | | | 208,884 | |

| Storage Segment | | | | | | | | |

| Storage | | 13,815 | | | 13,108 | | | 41,366 | | | 39,088 | |

| Other | | 8,203 | | | 0 | | | 25,858 | | | 0 | |

| Total | | 22,018 | | | 13,108 | | | 67,224 | | | 39,088 | |

| Total Revenue | | $ | 89,010 | | | $ | 86,377 | | | $ | 271,168 | | | $ | 247,972 | |

PBFX recognizes revenue by charging fees for crude oil and refined products terminaling, pipeline, storage and processing services based on contractual rates applied to the greater of contractual minimum volume commitments (“MVCs”), as applicable, or actual volumes transferred, stored or processed.

Minimum Volume Commitments

Transportation and Terminaling Segment

The Partnership’s Transportation and Terminaling segment consists of product terminals, pipelines, crude unloading facilities and other facilities capable of transporting and handling crude oil, refined products and natural gas. Certain of the affiliate and third-party Transportation and Terminaling commercial agreements contain MVCs. Under these commercial agreements, if the Partnership’s customer fails to transport its minimum throughput volumes during any specified period, the customer will pay the Partnership has establishedan amount equal to the difference in actual volumes transported and/or throughput and the minimum volumes required under the agreement multiplied by the applicable contractual rate (each a working group to assess the Updated Revenue Recognition Guidance, including its impact “deficiency payment”). Deficiency payments are initially recorded as deferred revenueon the Partnership’s business processes, accounting systems, controls and financial statement disclosures.balance sheets for all contracts in which the MVC deficiency makeup period is contractually longer than a fiscal quarter.

Certain of the Partnership’s customers may apply deficiency payment amounts as a credit against volumes throughput in excess of its MVC, as applicable, during subsequent quarters under the terms of the applicable agreement. The Partnership will adopt this new standard effective January 1, 2018, usingrecognizes operating revenue for the modified retrospective application. Under that method,deficiency payments when credits are used for volumes transported in excess of MVCs or at the cumulative effectend of initially applying the standard iscontractual period. Unused credits determined to have a remote chance of being utilized by customers in the future are recognized as an adjustment to the opening balance of retained earnings, and revenues reportedoperating revenue in the periods priorperiod when that determination is made. The use or recognition of the credits is recorded as a reduction to the date of adoption are not changed. deferred revenue.

Storage Segment

The working group is progressing through its implementation planPartnership earns storage revenue under crude oil and continues to evaluate the impact of this new standard on the Partnership’s consolidated financial statements and related disclosures. Additionally,refined products storage contracts. In addition, the Partnership has begun training the relevant staffearns storage revenue under its processing agreement at its corporate headquartersEast Coast storage facility. Certain of these affiliate and at PBF Holding's refineries onthird-party contracts contain capacity reservation agreements, under which the Updated Revenue Recognition Guidance, including potential impacts on internal reporting and disclosure requirements. Although the Partnership’s analysis of the new standard is stillPartnership collects a fee for reserving storage capacity for customers in process and interpretative and industry specific guidance is still developing,its facilities. Customers generally pay reservation fees based on the results to date, we have reached tentative conclusions for most contract types and do not believe revenue recognition patterns will change materially. However, it is expected thatlevel of storage capacity reserved rather than the new standard will have some impact on presentation and disclosures in its financial statements and internal controls.actual volumes stored.

In February 2016, the FASB issued ASU No. 2016-02, “Leases (Topic 842)” (“ASU 2016-02”), to increase the transparency and comparability about leases among entities. The new guidance requires lessees to recognize a lease liability and a corresponding lease asset for virtually all lease contracts. It also requires additional disclosures about leasing arrangements. ASU 2016-02 is effective for interim and annual periods beginning after December 15, 2018, and requires a modified retrospective approach to adoption. Early adoption is permitted. The Partnership has established a working group to study the new guidance in ASU 2016-02. This working group was formed during 2016 and has begun the process of compiling a central repository for all leases the Partnership and its subsidiaries entered into for further analysis as the implementation project progresses. It is not anticipated that the Partnership will early adopt this new guidance. The working group continues to evaluate the impact of this new standard on the Partnership’s Consolidated Financial Statements and related disclosures. At this time, the Partnership has identified that the most significant impacts of this new guidance will be to bring nearly all leases on its balance sheet with “right of use assets” and “lease obligation liabilities” as well as accelerating the interest expense component of financing leases. The working group is in the early stages of its implementation plan and continues to evaluate the impact of this new standard, including certain industry specific issues on the Partnership’s consolidated financial statements and related disclosures.

In January 2017, the FASB issued ASU No. 2017-01, “Business Combinations (Topic 805): Clarifying the Definition of a Business” (“ASU 2017-01”), which provides guidance to assist entities with evaluating when a set of transferred assets and activities is a business. Under ASU 2017-01, it is expected that the definition of a business will be narrowed and more consistently applied. ASU 2017-01 is effective for annual periods beginning after December 15, 2017, including interim periods within those periods. The amendments in ASU 2017-01 should be applied prospectively on or after the effective date. Early adoption is permitted, and the Partnership early adopted the new standard in its consolidated financial statements and related disclosures effective January 1, 2017.

In May 2017, the FASB issued ASU No. 2017-09, “Compensation—Stock Compensation (Topic 718): Scope of Modification Accounting” (“ASU 2017-09”), which provides guidance to provide clarity and reduce both diversity in practice and cost and complexity when applying the guidance in Topic 718, Compensation—Stock Compensation, to a change to the terms or conditions of a share-based payment award. The amendments in ASU 2017-09 require an entity to account for the effects of a modification unless all the following are met: (i) the fair value of the modified award is the same as the fair value of the original award immediately before the original award is modified. If the modification does not affect any of the inputs to the valuation technique that the entity uses to value the award, the entity is not required to estimate the value immediately before and after the modification; (ii) the vesting conditions of the modified award are the same as the vesting conditions of the original award immediately before the original award is modified; and (iii) the classification of the modified award as an equity instrument or a liability instrument is the same as the classification of the original award immediately before the original award is modified. The guidance in ASU 2017-09 should be applied prospectively. The amendments in this ASU are effective for annual periods beginning after December 15, 2017, including interim periods within

PBF LOGISTICS LP

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT BARREL, DEKATHERM, UNIT AND PER UNIT DATA)

MVC Payments to be Received

those annual periods.

As of September 30, 2020, MVC payments to be received, based on future performance obligations of the Partnership, related to noncancelable commercial terminaling, pipeline and storage agreements were as follows:

| | | | | |

| Remainder of 2020 | $ | 30,044 | |

| 2021 | 113,204 | |

| 2022 | 90,321 | |

| 2023 | 87,798 | |

| 2024 | 87,011 | |

| Thereafter | 86,773 | |

Total MVC payments to be received (1)(2) | $ | 495,151 | |

(1) All fixed consideration from contracts with customers is included in the amounts presented above. Variable consideration that is constrained or not required to be estimated is excluded.

(2) Arrangements deemed leases are excluded from this table.

Leases

Lessor Disclosures

The Partnership has leased certain of its assets under lease agreements with varying terms up to fifteen years, including leases of storage, terminaling, pipeline and processing assets. Certain of these leases include options to extend or renew the lease for one or more years. These options are included in the lease term when it is reasonably certain that the option will applybe exercised. The Partnership’s agreements generally do not provide an option for the guidance prospectively for any modificationslessee to its stock compensation plans occurring afterpurchase the effective dateleased equipment at the end of the new standard.

2. ACQUISITIONS

PNGPC Acquisition

On February 28, 2017,lease term. However, in connection with the affiliate lease agreement for the interstate natural gas pipeline at PBF Holding’s Paulsboro Refinery (the “Paulsboro Natural Gas Pipeline”), the Partnership closed the PNGPC Acquisition, which had been contemplated bygranted a contribution agreement dated asright of February 15, 2017 betweenfirst refusal in favor of PBF LLC such that the Partnership andwould be required to give PBF LLC (the “PNGPC Contribution Agreement”). PursuantHolding the first opportunity to the PNGPC Contribution Agreement, the Partnership, through its wholly-owned subsidiary, PBFX Op Co, acquired from PBF LLC all of the issued and outstanding limited liability company interests of PNGPC, which owns and operatespurchase the Paulsboro Natural Gas Pipeline at market value prior to selling to an existing interstate natural gas pipeline which serves PBF Holding’s Paulsboro Refinery and is subject to regulation by the FERC. In connection with the PNGPC Acquisition,unrelated third party.

At inception, the Partnership constructeddetermines if an arrangement contains a lease and whether that lease meets the New Pipelineclassification criteria of a finance or operating lease. As of September 30, 2020, all of the Partnership’s leases have been determined to replacebe operating leases. Some of the existing pipeline, which commenced services in August 2017.

In considerationPartnership’s lease arrangements contain lease components (e.g., MVCs) and non-lease components (e.g., maintenance, labor charges, etc.). The Partnership accounts for the PNGPC limited liability company interests,lease and non-lease components as a single lease component for every asset class.

Certain of the Partnership’s lease agreements include MVCs that are adjusted periodically based on a specified index or rate. The leases are initially measured using the projected payments adjusted for the index or rate in effect at the commencement date. The Partnership’s lease agreements do not contain any material residual value guarantees or material restrictive covenants.

The Partnership expects to derive significant future benefits from its leased assets following the end of the lease term, as the remaining useful life would be sufficient to allow the Partnership delivered to PBF LLC (i) an $11,600 intercompany promissory note in favorenter into new leases for such assets.

In the normal course of Paulsboro Refining Company LLC (“PRC”), a wholly-owned subsidiary ofbusiness, the Partnership enters into contracts with PBF Holding (the “Affiliate Note Payable”), (ii) an expansion rights and rightits refineries whereby PBF Holding and its refineries lease certain of first refusal agreement in favor of PBF LLCthe Partnership’s storage, terminaling and pipeline assets. The Partnership believes the terms and conditions under these leases are generally no less favorable to either party than those that could have been negotiated with unaffiliated parties with respect to similar services. The terms for these affiliate leases range from one to fifteen years. Leases with affiliates represent approximately 95% of the New Pipeline and (iii) an assignment and assumption agreement with respect to certain outstanding litigation involving PNGPC and the existing pipeline. As the PNGPC Acquisition was considered a transfer of assets between entities under common control, the PNGPC assets and liabilities were transferred at their historical carrying value, whose net value was $11,538 as of February 28, 2017. The financial information contained herein of PBFX has been retrospectively adjusted to include the historical results of PNGPC as if it was owned by the Partnership for all periods presented. Net loss attributable to the PNGPC Acquisition prior to the effective date was allocated entirely to PBF GP as if only PBF GP had rights to that net loss; therefore, there is no retrospective adjustment to netundiscounted contractual future rental income per unit.

The following tables presentfrom the Partnership’s statement of financial position and results of operations giving retrospective effect to the PNGPC Acquisition. For the nine months ended September 30, 2017, and the three and nine months ended September 30, 2016, respectively, the results of PNGPC prior to the PNGPC Acquisition are included under “PNGPC.” Results of PNGPC subsequent to the acquisition are included in “PBF Logistics LP.”leased assets.

PBF LOGISTICS LP

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT BARREL, DEKATHERM, UNIT AND PER UNIT DATA)

The table below quantifies lease revenue for the three and nine months ended September 30, 2020 and 2019:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Affiliate | | $ | 36,212 | | | $ | 39,615 | | | $ | 112,600 | | | $ | 114,395 | |

| Third-party | | 13,449 | | | 4,764 | | | 40,173 | | | 13,466 | |

| Total lease revenue | | $ | 49,661 | | | $ | 44,379 | | | $ | 152,773 | | | $ | 127,861 | |

|

| | | | | | | | | | | | |

| | | December 31, 2016 |

| | | PBF Logistics LP | | PNGPC | | Consolidated |

| ASSETS | | | | | | |

| Current assets: | | | | | | |

| Cash and cash equivalents | | $ | 64,221 |

| | $ | — |

| | $ | 64,221 |

|

| Marketable securities - current | | 40,024 |

| | — |

| | 40,024 |

|

| Accounts receivable - affiliates | | 37,863 |

| | — |

| | 37,863 |

|

| Accounts receivable | | 4,294 |

| | — |

| | 4,294 |

|

| Prepaid expenses and other current assets | | 1,657 |

| | — |

| | 1,657 |

|

| Total current assets | | 148,059 |

| | — |

| | 148,059 |

|

| Property, plant and equipment, net | | 600,071 |

| | 8,731 |

| | 608,802 |

|

| Total assets | | $ | 748,130 |

| | $ | 8,731 |

| | $ | 756,861 |

|

| LIABILITIES AND EQUITY | | | | | | |

| Current liabilities: | | | | | | |

| Accounts payable - affiliates | | $ | 7,631 |

| | $ | — |

| | $ | 7,631 |

|

| Accounts payable and accrued liabilities | | 18,371 |

| | 2,500 |

| | 20,871 |

|

| Current portion of long-term debt | | 39,664 |

| | — |

| | 39,664 |

|

| Deferred revenue | | 952 |

| | — |

| | 952 |

|

| Total current liabilities | | 66,618 |

| | 2,500 |

| | 69,118 |

|

| Long-term debt | | 532,011 |

| | — |

| | 532,011 |

|

| Other long-term liabilities | | 3,161 |

| | — |

| | 3,161 |

|

| Total liabilities | | 601,790 |

| | 2,500 |

| | 604,290 |

|

| | | | | | | |

| Commitments and contingencies | | | | | | |

| | | | | | | |

| Equity: | | | | | | |

| Net investment - Predecessor | | — |

| | 6,231 |

| | 6,231 |

|

Common unitholders (1) | | 241,275 |

| | — |

| | 241,275 |

|

| Subordinated unitholder - PBF LLC | | (276,083 | ) | | — |

| | (276,083 | ) |

| IDR holder - PBF LLC | | 1,266 |

| | — |

| | 1,266 |

|

| Total PBF Logistics LP equity | | (33,542 | ) | | 6,231 |

| | (27,311 | ) |

| Noncontrolling interest | | 179,882 |

| | — |

| | 179,882 |

|

| Total equity | | 146,340 |

| | 6,231 |

| | 152,571 |

|

| Total liabilities and equity | | $ | 748,130 |

| | $ | 8,731 |

| | $ | 756,861 |

|

Undiscounted Cash Flows

(1) Subsequent to

The table below presents the conversionfixed component of the PBFX subordinated units heldundiscounted cash flows to be received for each of the periods presented for the Partnership’s operating leases with customers as of September 30, 2020:

| | | | | |

| Remainder of 2020 | $ | 42,202 | |

| 2021 | 150,038 | |

| 2022 | 139,835 | |

| 2023 | 138,474 | |

| 2024 | 137,252 | |

| Thereafter | 240,209 | |

| Total undiscounted cash flows to be received | $ | 848,010 | |

Assets Under Lease

The Partnership’s assets that are subject to lease are included in “Property, plant and equipment, net” within the Partnership’s condensed consolidated balance sheets. The table below quantifies, by PBF LLC, common units heldcategory within property, plant and equipment, the assets that are subject to lease as of September 30, 2020 and December 31, 2019:

| | | | | | | | | | | | | | |

| | September 30,

2020 | | December 31,

2019 |

| Land | | $ | 98,337 | | | $ | 98,337 | |

| Pipelines | | 319,873 | | | 318,459 | |

| Terminals and equipment | | 83,387 | | | 83,149 | |

| Storage facilities and processing units | | 174,982 | | | 177,084 | |

| | | 676,579 | | | 677,029 | |

| Accumulated depreciation | | (99,751) | | | (77,243) | |

| Net assets subject to lease | | $ | 576,828 | | | $ | 599,786 | |

Deferred Revenue

The Partnership records deferred revenue when cash payments are received or due in advance of performance, including amounts which are refundable. Deferred revenue was $5,503 and $3,189 as of September 30, 2020 and December 31, 2019, respectively. The increase in the deferred revenue balance as of September 30, 2020 is primarily driven by the publictiming and PBF LLC are shownextent of cash payments received in total. Refer to Notes 6 “Equity”advance of satisfying the Partnership’s performance obligations for the comparative periods.

The Partnership’s payment terms vary by the type and 8 “Net Income per Unit” inlocation of the Notes to Condensed Consolidated Financial Statements for further discussion regardingcustomer and the subordinated units’ conversion.

services offered. The period between invoicing and when payment is due is not significant (i.e., generally within two months).

PBF LOGISTICS LP

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT BARREL, DEKATHERM, UNIT AND PER UNIT DATA)

For certain services and customer types, the Partnership requires payment before the services are performed for the customer.

3. ACQUISITIONS

Acquisitions from PBF

The following Acquisitions from PBF were transactions between affiliate companies. As a result, the acquisitions were accounted for as transfers of assets between entities under common control in accordance with GAAP. The assets and liabilities of the Acquisitions from PBF were transferred at their historical carrying value.

TVPC Acquisition

On April 24, 2019, the Partnership entered into a Contribution Agreement with PBF LLC, pursuant to which the Partnership acquired from PBF LLC all of the issued and outstanding limited liability company interests of TVP Holding Company LLC (“TVP Holding”), which held the remaining 50% equity interest in Torrance Valley Pipeline Company LLC (“TVPC”) (the “TVPC Acquisition”). The TVPC Acquisition closed on May 31, 2019 for total consideration of $200,000 in cash, which was financed through proceeds from the 2019 Registered Direct Offering (as defined in Note 8 “Equity” of the Notes to Condensed Consolidated Financial Statements) and borrowings under the Partnership’s Revolving Credit Facility (as defined in Note 7 “Debt” of the Notes to Condensed Consolidated Financial Statements). As a result of the TVPC Acquisition, the Partnership owns 100% of the equity interest in TVPC.

Acquisition Expenses

PBFX incurred acquisition-related costs of $6 and $116 for the three and nine months ended September 30, 2020, respectively, primarily consisting of consulting and legal expenses related to pending and non-consummated acquisitions. Acquisition-related costs were $234 and $1,285 for the three and nine months ended September 30, 2019, respectively, primarily consisting of consulting and legal expenses related to the TVPC Acquisition and other pending and non-consummated acquisitions. These costs are included in “General and administrative expenses” within the Partnership’s condensed consolidated statements of operations.

4. CURRENT EXPECTED CREDIT LOSSES

Credit Losses

The Partnership has exposure to credit losses through its collection of fees charged to customers for terminaling, pipeline, storage and processing services. The Partnership evaluates creditworthiness on an individual customer basis. The Partnership utilizes a financial review model for purposes of evaluating creditworthiness, which is based on information from financial statements and credit reports. The financial review model enables the Partnership to assess the customer’s risk profile and determine credit limits on the basis of their financial strength, including but not limited to, their liquidity, leverage, debt serviceability, longevity and how they pay their bills. The Partnership may require security in the form of letters of credit or cash payments in advance of product and services delivery for certain customers that are deemed higher risk. Additionally, the Partnership may hold customers’ product in storage at its facilities as collateral and/or deny access to its facilities, as allowable under commercial law or its contractual agreements, should payment not be received.

The Partnership reviews each customer’s credit risk profile at least annually, or more frequently if warranted. Following the widespread market disruption that has resulted from the coronavirus disease 2019 (“COVID-19”) pandemic and related governmental and consumer responses, the Partnership has been

|

| | | | | | | | | | | | |

| | | Nine Months Ended September 30, 2017 |

| | | PBF Logistics LP | | PNGPC | | Consolidated Results |

| Revenue: | | | | | | |

| Affiliate | | $ | 176,916 |

| | $ | — |

| | $ | 176,916 |

|

| Third-party | | 11,384 |

| | — |

| | 11,384 |

|

| Total revenue | | 188,300 |

| | — |

| | 188,300 |

|

| | | | | | | |

| Costs and expenses: | | | | | | |

| Operating and maintenance expenses | | 47,163 |

| | 40 |

| | 47,203 |

|

| General and administrative expenses | | 12,947 |

| | — |

| | 12,947 |

|

| Depreciation and amortization | | 16,562 |

| | 110 |

| | 16,672 |

|

| Total costs and expenses | | 76,672 |

| | 150 |

| | 76,822 |

|

| | | | | | | |

| Income (loss) from operations | | 111,628 |

| | (150 | ) | | 111,478 |

|

| | | | | | | |

| Other expense: | | | | | | |

| Interest expense, net | | (22,493 | ) | | — |

| | (22,493 | ) |

| Amortization of loan fees | | (1,125 | ) | | — |

| | (1,125 | ) |

| Net income (loss) | | 88,010 |

| | (150 | ) | | 87,860 |

|

| Less: Net loss attributable to Predecessor | | — |

| | (150 | ) | | (150 | ) |

| Less: Net income attributable to noncontrolling interest | | 11,218 |

| | — |

| | 11,218 |

|

| Net income attributable to the partners | | 76,792 |

| | — |

| | 76,792 |

|

| Less: Net income attributable to the IDR holder | | 6,319 |

| | — |

| | 6,319 |

|

| Net income attributable to PBF Logistics LP unitholders | | $ | 70,473 |

| | $ | — |

| | $ | 70,473 |

|

PBF LOGISTICS LP

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT BARREL, DEKATHERM, UNIT AND PER UNIT DATA)

performing ongoing credit reviews of its customers including monitoring for any negative credit events such as customer bankruptcy or insolvency events. Based on its credit assessments, the Partnership may adjust payment terms or limit available trade credit for customers, and customers within certain industries, which are deemed to be at a higher risk.

The Partnership performs a quarterly allowance for doubtful accounts analysis to assess whether an allowance needs to be recorded for any outstanding trade receivables. In estimating credit losses, management reviews accounts that are past due, have known disputes or have experienced any negative credit events that may result in future collectability issues. There was 0 allowance for doubtful accounts recorded as of September 30, 2020 and December 31, 2019.

5. PROPERTY, PLANT AND EQUIPMENT, NET

Property, plant and equipment, net consisted of the following:

| | | | | | | | | | | | | | |

| | September 30,

2020 | | December 31,

2019 |

| Land | | $ | 115,957 | | | $ | 115,957 | |

| Pipelines | | 343,948 | | | 342,533 | |

| Terminals and equipment | | 315,720 | | | 315,322 | |

| Storage facilities and processing units | | 193,044 | | | 194,843 | |

| Construction in progress | | 14,306 | | | 8,093 | |

| | | 982,975 | | | 976,748 | |

| Accumulated depreciation | | (153,143) | | | (122,138) | |

| Property, plant and equipment, net | | $ | 829,832 | | | $ | 854,610 | |

Depreciation expense was $31,065 and $26,278 for the nine months ended September 30, 2020 and 2019, respectively.

During the third quarter of 2020, the Partnership recorded a $3,000 impairment write-down of the processing unit assets in connection with a termination of a commercial agreement within the Storage Segment. The remaining carrying value of the processing unit assets will be depreciated over the remaining life of the contract which ceases in the fourth quarter of 2020.

6. GOODWILL AND INTANGIBLES

The global crisis resulting from the spread of COVID-19 has had a substantial impact on the economy and overall consumer demand. As a result of the significant decrease in the Partnership’s unit price and market capitalization during the quarters ended March 31, 2020 and June 30, 2020, the Partnership deemed impairment triggering events had occurred. As such, the Partnership performed interim impairment assessments and concluded that the carrying value of its goodwill was not impaired at the end of either reporting period.

The Partnership performed its annual goodwill impairment assessment as of July 1, 2020 and determined that the carrying value of goodwill was not impaired. As of September 30, 2020, the carrying amount of goodwill was $6,332, all of which was recorded within the Transportation and Terminaling segment.

|

| | | | | | | | | | | | |

| | | Three Months Ended September 30, 2016 |

| | | PBF Logistics LP | | PNGPC | | Consolidated Results |

| Revenue: | | | | | | |

| Affiliate | | $ | 43,842 |

| | $ | — |

| | $ | 43,842 |

|

| Third-party | | 4,591 |

| | — |

| | 4,591 |

|

| Total revenue | | 48,433 |

| | — |

| | 48,433 |

|

| | | | | | | |

| Costs and expenses: | | | | | | |

| Operating and maintenance expenses | | 12,814 |

| | 89 |

| | 12,903 |

|

| General and administrative expenses | | 4,419 |

| | 1 |

| | 4,420 |

|

| Depreciation and amortization | | 5,140 |

| | 207 |

| | 5,347 |

|

| Total costs and expenses | | 22,373 |

| | 297 |

| | 22,670 |

|

| | | | | | | |

| Income (loss) from operations | | 26,060 |

| | (297 | ) | | 25,763 |

|

| | | | | | | |

| Other expense: | | | | | | |

| Interest expense, net | | (7,280 | ) | | — |

| | (7,280 | ) |

| Amortization of loan fees | | (416 | ) | | — |

| | (416 | ) |

| Net income (loss) | | 18,364 |

| | (297 | ) | | 18,067 |

|

| Less: Net loss attributable to Predecessor | | (4,131 | ) | | (297 | ) | | (4,428 | ) |

| Less: Net income attributable to noncontrolling interest | | 1,621 |

| | — |

| | 1,621 |

|

| Net income attributable to the partners | | 20,874 |

| | — |

| | 20,874 |

|

| Less: Net income attributable to the IDR holder | | 1,125 |

| | — |

| | 1,125 |

|

| Net income attributable to PBF Logistics LP unitholders | | $ | 19,749 |

| | $ | — |

| | $ | 19,749 |

|

PBF LOGISTICS LP

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT BARREL, DEKATHERM, UNIT AND PER UNIT DATA)

The Partnership’s net intangibles consisted of the following:

| | | | | | | | | | | | | | |

| | September 30,

2020 | | December 31,

2019 |

| Customer contracts | | $ | 9,300 | | | $ | 13,300 | |

| Customer relationships | | 5,900 | | | 5,900 | |

| | 15,200 | | | 19,200 | |

| Accumulated amortization | | (7,457) | | | (1,701) | |

Total intangibles, net (1) | | $ | 7,743 | | | $ | 17,499 | |

|

| | | | | | | | | | | | |

| | | Nine Months Ended September 30, 2016 |

| | | PBF Logistics LP | | PNGPC | | Consolidated Results |

| Revenue: | | | | | | |

| Affiliate | | $ | 118,356 |

| | $ | — |

| | $ | 118,356 |

|

| Third-party | | 7,285 |

| | — |

| | 7,285 |

|

| Total revenue | | 125,641 |

| | — |

| | 125,641 |

|

| | | | | | | |

| Costs and expenses: | | | | | | |

| Operating and maintenance expenses | | 26,555 |

| | 330 |

| | 26,885 |

|

| General and administrative expenses | | 13,893 |

| | 3 |

| | 13,896 |

|

| Depreciation and amortization | | 8,922 |

| | 621 |

| | 9,543 |

|

| Total costs and expenses | | 49,370 |

| | 954 |

| | 50,324 |

|

| | | | | | | |

| Income (loss) from operations | | 76,271 |

| | (954 | ) | | 75,317 |

|

| | | | | | | |

| Other expense: | | | | | | |

| Interest expense, net | | (21,298 | ) | | — |

| | (21,298 | ) |

| Amortization of loan fees | | (1,261 | ) | | — |

| | (1,261 | ) |

| Net income (loss) | | 53,712 |

| | (954 | ) | | 52,758 |

|

| Less: Net loss attributable to Predecessor | | (4,131 | ) | | (954 | ) | | (5,085 | ) |

| Less: Net income attributable to noncontrolling interest | | 1,621 |

| | — |

| | 1,621 |

|

| Net income attributable to the partners | | 56,222 |

| | — |

| | 56,222 |

|

| Less: Net income attributable to the IDR holder | | 2,765 |

| | — |

| | 2,765 |

|

| Net income attributable to PBF Logistics LP unitholders | | $ | 53,457 |

| | $ | — |

| | $ | 53,457 |

|

Toledo Terminal Acquisition

On April 17, 2017,(1) Intangibles, net are included in “Other non-current assets” within the Partnership’s wholly-owned subsidiary, PLPT, completed the Toledo Terminal Acquisition. The Toledo Terminal is directly connected to,condensed consolidated balance sheets.

Amortization expense was $5,756 and currently supplied by, PBF Holding’s Toledo Refinery.

The aggregate purchase price$376 for the Toledo Terminal Acquisition was $10,000, plus working capital. The consideration was funded in full with cash on hand.

PBFX accounted for the Toledo Terminal Acquisition as a business combination under GAAP whereby the Partnership recognizes assets acquired and liabilities assumed at their estimated fair values as of the date of acquisition. The entire purchase consideration of $10,000 was allocated to Property, plant and equipment.

Acquisition Expenses