UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

| |

| (Mark One) | |

x☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 20182019

or

|

| |

¨☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-55599

Hines Global Income Trust, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

| Maryland | 80-0947092 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | | |

| 2800 Post Oak Boulevard | |

| Suite 5000 | |

| Houston | Texas | 77056-6118 |

| (Address of principal executive offices) | (Zip code) |

(888)220-6121

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act: None.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes xYes☒ No ¨☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes xYes☒ No ¨☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | | |

Large accelerated filer¨ | ☐ | | Accelerated filer¨ | ☐ | | Non-accelerated filer¨ | (Do not check if a smaller reporting company)☒ |

Smaller reporting companyx | ☒ | | | | | Emerging growth companyx | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange Act.x | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨☐ No x☒

As of August 9, 2018,1, 2019, approximately 19.219.0 million shares of the registrant’s Class AX common stock, 20.0 million shares of the registrant’s Class TX common stock, 0.1 million shares of the registrant’s Class IX common stock, 0.821.0 million shares of the registrant’s Class T common stock, 0.35.6 million shares of the registrant’s Class D common stock and 5,9463.7 million shares of the registrant’s Class I common stock were outstanding.

TABLE OF CONTENTS

|

| | |

| PART I – FINANCIAL INFORMATION |

| Item 1. | Condensed Consolidated Financial Statements (Unaudited): | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| PART II – OTHER INFORMATION |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

PART I - FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

HINES GLOBAL INCOME TRUST, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | | | June 30, 2018 | | December 31, 2017 | June 30, 2019 | | December 31, 2018 |

| | (in thousands, except per share amounts) | (in thousands, except per share amounts) |

| ASSETS | | | | | | |

| Investment property, net | $ | 550,769 |

| | $ | 572,833 |

| $ | 917,662 |

| | $ | 787,189 |

|

| Investments in real estate-related securities | | 19,833 |

| | 9,599 |

|

| Cash and cash equivalents | 33,780 |

| | 18,170 |

| 34,353 |

| | 27,138 |

|

| Restricted cash | 3,357 |

| | 6,383 |

| 7,026 |

| | 9,848 |

|

| Derivative instruments | 71 |

| | 110 |

| 63 |

| | 174 |

|

| Tenant and other receivables, net | 6,392 |

| | 8,402 |

| 11,007 |

| | 8,995 |

|

| Intangible lease assets, net | 84,348 |

| | 95,137 |

| 54,086 |

| | 90,697 |

|

| Right-of-use asset, net | | 33,691 |

| | — |

|

| Deferred leasing costs, net | 4,746 |

| | 4,615 |

| 18,031 |

| | 13,282 |

|

| Other assets | 3,394 |

| | 3,367 |

| 3,012 |

| | 1,907 |

|

| Total assets | $ | 686,857 |

| — |

| $ | 709,017 |

| $ | 1,098,764 |

| | $ | 948,829 |

|

| LIABILITIES AND EQUITY | | | | | | |

| Liabilities: | | | | | | |

| Accounts payable and accrued expenses | $ | 14,542 |

| | $ | 15,570 |

| $ | 21,183 |

| | $ | 26,186 |

|

| Due to affiliates | 18,620 |

| | 16,642 |

| 30,205 |

| | 26,022 |

|

| Intangible lease liabilities, net | 14,907 |

| | 15,939 |

| 18,290 |

| | 18,034 |

|

| Other liabilities | 5,593 |

| | 8,601 |

| 10,310 |

| | 55,391 |

|

| Distributions payable | 1,844 |

| | 1,868 |

| 2,860 |

| | 2,024 |

|

| Note payable to affiliate | — |

| | 11,200 |

| — |

| | 55,000 |

|

| Notes payable, net | 362,008 |

| | 365,652 |

| 596,812 |

| | 487,439 |

|

| Total liabilities | $ | 417,514 |

| | $ | 435,472 |

| 679,660 |

| | 670,096 |

|

| | | | | | | |

| Commitments and contingencies (Note 11) | — |

| | — |

| — |

| | — |

|

| | | | | | | |

| Equity: | | | | | | |

| Stockholders’ equity: | | | | | | |

| Preferred shares, $0.001 par value per share; 500,000 preferred shares authorized, none issued or outstanding as of June 30, 2018 and December 31, 2017 | — |

| | — |

| |

| Preferred shares, $0.001 par value per share; 500,000 preferred shares authorized, none issued or outstanding as of June 30, 2019 and December 31, 2018 | | — |

| | — |

|

| Common shares, $0.001 par value per share (Note 6) | 40 |

| | 39 |

| 62 |

| | 44 |

|

| Additional paid-in capital | 336,437 |

| | 336,761 |

| 533,778 |

| | 371,274 |

|

| Accumulated distributions in excess of earnings | (69,273 | ) | | (68,193 | ) | (113,933 | ) | | (91,711 | ) |

| Accumulated other comprehensive income (loss) | 2,139 |

| | 4,938 |

| (803 | ) | | (874 | ) |

| Total stockholders’ equity | 269,343 |

| | 273,545 |

| 419,104 |

| | 278,733 |

|

| Noncontrolling interests | — |

| | — |

| — |

| | — |

|

| Total equity | 269,343 |

| | 273,545 |

| 419,104 |

| | 278,733 |

|

| Total liabilities and equity | $ | 686,857 |

| | $ | 709,017 |

| $ | 1,098,764 |

| | $ | 948,829 |

|

See notes to the condensed consolidated financial statements.

HINES GLOBAL INCOME TRUST, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

For the Three and Six Months Ended June 30, 20182019 and 20172018

(UNAUDITED)

| | | | Three Months Ended June 30, | | Six Months Ended June 30, | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2018 | | 2017 | | 2018 | | 2017 | 2019 | | 2018 | | 2019 | | 2018 |

| | (in thousands, except per share amounts) | (in thousands, except per share amounts) |

| Revenues: | | | | | | | | | | | | | | |

| Rental revenue | $ | 15,725 |

| | $ | 14,496 |

| | $ | 32,168 |

| | $ | 28,082 |

| $ | 23,018 |

| | $ | 15,725 |

| | $ | 44,468 |

| | $ | 32,168 |

|

| Other revenue | 249 |

| | 248 |

| | 537 |

| | 447 |

| 536 |

| | 249 |

| | 823 |

| | 537 |

|

| Total revenues | 15,974 |

|

| 14,744 |

| | 32,705 |

| | 28,529 |

| 23,554 |

|

| 15,974 |

| | 45,291 |

| | 32,705 |

|

| Expenses: | |

| | |

| | | | | |

| | |

| | | | |

| Property operating expenses | 2,668 |

| | 2,271 |

| | 5,494 |

| | 4,254 |

| 5,170 |

| | 2,668 |

| | 10,706 |

| | 5,494 |

|

| Real property taxes | 2,018 |

| | 2,971 |

| | 4,099 |

| | 5,091 |

| 2,699 |

| | 2,018 |

| | 5,297 |

| | 4,099 |

|

| Property management fees | 344 |

| | 253 |

| | 656 |

| | 478 |

| 940 |

| | 344 |

| | 1,644 |

| | 656 |

|

| Depreciation and amortization | 6,959 |

| | 7,611 |

| | 14,300 |

| | 14,905 |

| 9,741 |

| | 6,959 |

| | 19,069 |

| | 14,300 |

|

| Acquisition related expenses | 10 |

| | 230 |

| | 144 |

| | 2,091 |

| 13 |

| | 10 |

| | 17 |

| | 144 |

|

| Asset management and acquisition fees | 1,214 |

| | 1,221 |

| | 2,420 |

| | 7,656 |

| |

| Asset management fees | | 1,801 |

| | 1,214 |

| | 3,288 |

| | 2,420 |

|

| Performance participation allocation | 1,185 |

| | — |

| | 2,777 |

| | — |

| 1,476 |

| | 1,185 |

| | 2,597 |

| | 2,777 |

|

| General and administrative expenses | 659 |

| | 517 |

| | 1,511 |

| | 1,279 |

| 948 |

| | 659 |

| | 1,795 |

| | 1,511 |

|

| Total expenses | 15,057 |

| | 15,074 |

| | 31,401 |

| | 35,754 |

| 22,788 |

| | 15,057 |

| | 44,413 |

| | 31,401 |

|

| Income (loss) before other income (expenses) | 917 |

| | (330 | ) | | 1,304 |

| | (7,225 | ) | |

| Other income (expenses): | | | | | | | | | | | | | | |

| Gain (loss) on derivative instruments | (45 | ) | | (27 | ) | | (47 | ) | | (74 | ) | (77 | ) | | (45 | ) | | (1,187 | ) | | (47 | ) |

| Gain (loss) on investments in real estate-related securities | | 161 |

| | — |

| | 1,327 |

| | — |

|

| Gain on sale of real estate | — |

| | — |

| | 14,491 |

| | — |

| — |

| | — |

| | — |

| | 14,491 |

|

| Foreign currency gains (losses) | (291 | ) | | 234 |

| | (316 | ) | | 295 |

| (267 | ) | | (291 | ) | | (336 | ) | | (316 | ) |

| Interest expense | (2,677 | ) | | (2,314 | ) | | (5,491 | ) | | (4,592 | ) | (4,317 | ) | | (2,677 | ) | | (8,514 | ) | | (5,491 | ) |

| Interest income | 34 |

| | 4 |

| | 47 |

| | 13 |

| 244 |

| | 34 |

| | 372 |

| | 47 |

|

| Income (loss) before benefit (provision) for income taxes | (2,062 | ) | | (2,433 | ) | | 9,988 |

| | (11,583 | ) | (3,490 | ) | | (2,062 | ) | | (7,460 | ) | | 9,988 |

|

| Benefit (provision) for income taxes | 654 |

| | 325 |

| | (20 | ) | | 229 |

| 40 |

| | 654 |

| | 11 |

| | (20 | ) |

| Net income (loss) | (1,408 | ) | | (2,108 | ) | | 9,968 |

| | (11,354 | ) | (3,450 | ) | | (1,408 | ) | | (7,449 | ) | | 9,968 |

|

| Net (income) loss attributable to noncontrolling interests | (3 | ) | | (3 | ) | | (6 | ) | | (6 | ) | (4 | ) | | (3 | ) | | (7 | ) | | (6 | ) |

| Net income (loss) attributable to common stockholders | $ | (1,411 | ) | | $ | (2,111 | ) | | $ | 9,962 |

| | $ | (11,360 | ) | $ | (3,454 | ) | | $ | (1,411 | ) | | $ | (7,456 | ) | | $ | 9,962 |

|

| Basic and diluted income (loss) per common share | $ | (0.04 | ) |

| $ | (0.06 | ) |

| $ | 0.25 |

|

| $ | (0.36 | ) | $ | (0.06 | ) |

| $ | (0.04 | ) |

| $ | (0.14 | ) |

| $ | 0.25 |

|

| Weighted average number of common shares outstanding | 39,489 |

| | 34,582 |

| | 39,443 |

| | 31,985 |

| 57,004 |

| | 39,489 |

| | 52,049 |

| | 39,443 |

|

| | | | | | | | | | | | | | | |

| Comprehensive income (loss): | | | | | | | | | | | | | | |

| Net income (loss) | $ | (1,408 | ) | | $ | (2,108 | ) | | $ | 9,968 |

| | $ | (11,354 | ) | $ | (3,450 | ) | | $ | (1,408 | ) | | $ | (7,449 | ) | | $ | 9,968 |

|

| Other comprehensive income (loss): |

|

| |

|

| |

|

| |

|

|

|

| |

|

| |

|

| |

|

|

| Foreign currency translation adjustment | (5,515 | ) | | 3,732 |

| | (2,799 | ) | | 4,150 |

| 2,091 |

| | (5,515 | ) | | 71 |

| | (2,799 | ) |

| Comprehensive income (loss) | $ | (6,923 | ) | | $ | 1,624 |

| | $ | 7,169 |

| | $ | (7,204 | ) | $ | (1,359 | ) | | $ | (6,923 | ) | | $ | (7,378 | ) | | $ | 7,169 |

|

| Comprehensive (income) loss attributable to noncontrolling interests | (3 | ) | | (3 | ) | | (6 | ) | | (6 | ) | (4 | ) | | (3 | ) | | (7 | ) | | (6 | ) |

| Comprehensive income (loss) attributable to common stockholders | $ | (6,926 | ) | | $ | 1,621 |

| | $ | 7,163 |

| | $ | (7,210 | ) | $ | (1,363 | ) | | $ | (6,926 | ) | | $ | (7,385 | ) | | $ | 7,163 |

|

See notes to the condensed consolidated financial statements.

HINES GLOBAL INCOME TRUST, INC.

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY

For the Six Months Ended June 30, 20182019 and 20172018

(UNAUDITED)

(In thousands)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Hines Global Income Trust, Inc. Stockholders |

| | Common Shares | | Additional Paid-in Capital | | Accumulated Distributions in Excess of Earnings | | Accumulated Other Comprehensive Income (Loss) | | Total Stockholders’ Equity | | Noncontrolling Interests |

| | Shares | | Amount | | | | | |

| Balance as of January 1, 2019 | 43,584 |

| | $ | 44 |

| | $ | 371,274 |

| | $ | (91,711 | ) | | $ | (874 | ) | | $ | 278,733 |

| | $ | — |

|

| Issuance of common shares | 6,109 |

| | 7 |

| | 62,886 |

| | — |

| | — |

| | 62,893 |

| | — |

|

| Distributions declared | — |

| | — |

| | — |

| | (6,704 | ) | | — |

| | (6,704 | ) | | (3 | ) |

| Redemption of common shares | (362 | ) | | — |

| | (4,014 | ) | | — |

| | — |

| | (4,014 | ) | | — |

|

| Selling commissions, dealer manager fees and distribution and stockholder servicing fees | — |

| | — |

| | (4,366 | ) | | — |

| | — |

| | (4,366 | ) | | — |

|

| Offering costs | — |

| | — |

| | (1,240 | ) | | — |

| | — |

| | (1,240 | ) | | — |

|

| Net income (loss) | — |

| | — |

| | — |

| | (4,002 | ) | | — |

| | (4,002 | ) | | 3 |

|

| Foreign currency translation adjustment | — |

| | — |

| | — |

| | — |

| | (2,020 | ) | | (2,020 | ) | | — |

|

| Balance as of March 31, 2019 | 49,331 |

| | $ | 51 |

| | $ | 424,540 |

| | $ | (102,417 | ) | | $ | (2,894 | ) | | $ | 319,280 |

| | $ | — |

|

| Issuance of common shares | 11,785 |

| | 11 |

| | 121,908 |

| | — |

| | — |

| | 121,919 |

| | — |

|

| Distributions declared | — |

| | — |

| | — |

| | (8,062 | ) | | — |

| | (8,062 | ) | | (4 | ) |

| Redemption of common shares | (402 | ) | | — |

| | (3,111 | ) | | — |

| | — |

| | (3,111 | ) | | — |

|

| Selling commissions, dealer manager fees and distribution and stockholder servicing fees | — |

| | — |

| | (8,511 | ) | | — |

| | — |

| | (8,511 | ) | | — |

|

| Offering costs | — |

| | — |

| | (1,048 | ) | | — |

| | — |

| | (1,048 | ) | | — |

|

| Net income (loss) | — |

| | — |

| | — |

| | (3,454 | ) | | — |

| | (3,454 | ) | | 4 |

|

| Foreign currency translation adjustment | — |

| | — |

| | — |

| | — |

| | 2,091 |

| | 2,091 |

| | — |

|

| Balance as of June 30, 2019 | 60,714 |

| | $ | 62 |

| | $ | 533,778 |

| | $ | (113,933 | ) | | $ | (803 | ) | | $ | 419,104 |

| | $ | — |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Hines Global Income Trust, Inc. Stockholders |

| | Common Shares | | Additional Paid-in Capital | | Accumulated Distributions in Excess of Earnings | | Accumulated Other Comprehensive Income (Loss) | | Total Stockholders’ Equity | | Noncontrolling Interests |

| | Shares | | Amount | | | | | |

| Balance as of January 1, 2018 | 39,256 |

| | $ | 39 |

| | $ | 336,761 |

| | $ | (68,193 | ) | | $ | 4,938 |

| | $ | 273,545 |

| | $ | — |

|

| Issuance of common shares | 772 |

| | 1 |

| | 7,588 |

| | — |

| | — |

| | 7,589 |

| | — |

|

Distributions declared (1) | — |

| | — |

| | — |

| | (11,042 | ) | | — |

| | (11,042 | ) | | (6 | ) |

| Redemption of common shares | (528 | ) | | — |

| | (6,244 | ) | | — |

| | — |

| | (6,244 | ) | | — |

|

| Selling commissions, dealer manager fees and distribution and stockholder servicing fees | — |

| | — |

| | (24 | ) | | — |

| | — |

| | (24 | ) | | — |

|

| Offering costs | — |

| | — |

| | (1,644 | ) | | — |

| | — |

| | (1,644 | ) | | — |

|

| Net income (loss) | — |

| | — |

| | — |

| | 9,962 |

| | — |

| | 9,962 |

| | 6 |

|

| Foreign currency translation adjustment | — |

| | — |

| | — |

| | — |

| | (2,799 | ) | | (2,799 | ) | | — |

|

| Balance as of June 30, 2018 | 39,500 |

| | $ | 40 |

| | $ | 336,437 |

| | $ | (69,273 | ) | | $ | 2,139 |

| | $ | 269,343 |

| | $ | — |

|

| |

(1) | For the three months ended June 30, 2018, the Company declared cash distributions, net of any applicable distributions and stockholder servicing fees, of approximately $0.15 for Class AX, Class IX, Class D, and Class I shares, and $0.13 for Class TX, Class T, and Class S shares. For the six months ended June 30, 2018, the Company declared cash distributions, net of any applicable distributions and stockholder servicing fees, of approximately $0.30 for Class AX and Class I shares, $0.26 for Class TX, Class T, and Class S shares, and $0.29 for Class IX and Class D shares. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Hines Global Income Trust, Inc. Stockholders |

| | Common Shares | Additional Paid-in Capital | | Accumulated Distributions in Excess of Earnings | | Accumulated Other Comprehensive Income (Loss) | | Total Stockholders’ Equity | | Noncontrolling Interests |

| | Shares | | Amount | | | | | |

| Balance as of January 1, 2018 | 39,256 |

| | $ | 39 |

| | $ | 336,761 |

| | $ | (68,193 | ) | | $ | 4,938 |

| | $ | 273,545 |

| | $ | — |

|

| Issuance of common shares | 308 |

| | — |

| | 2,990 |

| | — |

| | — |

| | 2,990 |

| | — |

|

| Distributions declared | — |

| | — |

| | — |

| | (5,514 | ) | | — |

| | (5,514 | ) | | (3 | ) |

| Redemption of common shares | (133 | ) | | — |

| | (2,032 | ) | | — |

| | — |

| | (2,032 | ) | | — |

|

| Selling commissions, dealer manager fees and distribution and stockholder servicing fees | — |

| | — |

| | 4 |

| | — |

| | — |

| | 4 |

| | — |

|

| Offering costs | — |

| | — |

| | (17 | ) | | — |

| | — |

| | (17 | ) | | — |

|

| Net income (loss) | — |

| | — |

| | — |

| | 11,373 |

| | — |

| | 11,373 |

| | 3 |

|

| Foreign currency translation adjustment | — |

| | — |

| | — |

| | — |

| | 2,716 |

| | 2,716 |

| | — |

|

| Balance as of March 31, 2018 | 39,431 |

| | $ | 39 |

| | $ | 337,706 |

| | $ | (62,334 | ) | | $ | 7,654 |

| | $ | 283,065 |

| | $ | — |

|

| Issuance of common shares | 464 |

| | 1 |

| | 4,598 |

| | — |

| | — |

| | 4,599 |

| | — |

|

| Distributions declared | — |

| | — |

| | — |

| | (5,528 | ) | | — |

| | (5,528 | ) | | (3 | ) |

| Redemption of common shares | (395 | ) | | — |

| | (4,212 | ) | | — |

| | — |

| | (4,212 | ) | | — |

|

| Selling commissions, dealer manager fees and distribution and stockholder servicing fees | — |

| | — |

| | (28 | ) | | — |

| | — |

| | (28 | ) | | — |

|

| Offering costs | — |

| | — |

| | (1,627 | ) | | — |

| | — |

| | (1,627 | ) | | — |

|

| Net income (loss) | — |

| | — |

| | — |

| | (1,411 | ) | | — |

| | (1,411 | ) | | 3 |

|

| Foreign currency translation adjustment | — |

| | — |

| | — |

| | — |

| | (5,515 | ) | | (5,515 | ) | | — |

|

| Balance as of June 30, 2018 | 39,500 |

| | $ | 40 |

| | $ | 336,437 |

| | $ | (69,273 | ) | | $ | 2,139 |

| | $ | 269,343 |

| | $ | — |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Hines Global Income Trust, Inc. Stockholders |

| | Common Shares | Additional Paid-in Capital | | Accumulated Distributions in Excess of Earnings | | Accumulated Other Comprehensive Income (Loss) | | Total Stockholders’ Equity | | Noncontrolling Interests |

| | Shares | | Amount | | | | | |

| Balance as of January 1, 2017 | 26,542 |

| | $ | 26 |

| | $ | 224,134 |

| | $ | (31,222 | ) | | $ | (2,755 | ) | | $ | 190,183 |

| | $ | — |

|

| Issuance of common shares | 10,166 |

| | 10 |

| | 100,128 |

| | — |

| | — |

| | 100,138 |

| | — |

|

Distributions declared (1) | — |

| | — |

| | — |

| | (8,699 | ) | | — |

| | (8,699 | ) | | (6 | ) |

| Redemption of common shares | (125 | ) | | — |

| | (1,198 | ) | | — |

| | — |

| | (1,198 | ) | | — |

|

| Selling commissions, dealer manager fees and distribution and stockholder servicing fees | — |

| | — |

| | (7,968 | ) | | — |

| | — |

| | (7,968 | ) | | — |

|

| Offering costs | — |

| | — |

| | (2,386 | ) | | — |

| | — |

| | (2,386 | ) | | — |

|

| Net income (loss) | — |

| | — |

| | — |

| | (11,360 | ) | | — |

| | (11,360 | ) | | 6 |

|

| Foreign currency translation adjustment | — |

| | — |

| | — |

| | — |

| | 4,150 |

| | 4,150 |

| | — |

|

| Balance as of June 30, 2017 | 36,583 |

| | $ | 36 |

| | $ | 312,710 |

| | $ | (51,281 | ) | | $ | 1,395 |

| | $ | 262,860 |

| | $ | — |

|

| |

(1) | For the three months ended June 30, 2017, the Company declared cash distributions, net of any applicable distributions and stockholder servicing fees, of approximately $0.15 for Class AX shares, $0.13 for Class TX shares, and $0.10 for Class IX shares. For the six months ended June 30, 2017, the Company declared cash distributions, net of any applicable distributions and stockholder servicing fees, of approximately $0.29 for Class AX shares, $0.25 for Class TX shares, and $0.10 for Class IX shares. |

See notes to the condensed consolidated financial statements.

HINES GLOBAL INCOME TRUST, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Six Months Ended June 30, 20182019 and 20172018

| | | | 2018 | | 2017 | 2019 | | 2018 |

| | (In thousands) | (In thousands) |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | |

| Net income (loss) | $ | 9,968 |

| | $ | (11,354 | ) | $ | (7,449 | ) | | $ | 9,968 |

|

| Adjustments to reconcile net income (loss) to net cash from (used in) operating activities: | | | | | | |

| Depreciation and amortization | 14,307 |

| | 14,609 |

| 19,673 |

| | 14,307 |

|

| Gain on sale of real estate | (14,491 | ) | | — |

| — |

| | (14,491 | ) |

| Foreign currency (gains) losses | 316 |

| | (295 | ) | 336 |

| | 316 |

|

| (Gain) loss on derivative instruments | 47 |

| | 74 |

| 1,187 |

| | 47 |

|

| (Gain) loss on investments in real estate-related securities | | (1,327 | ) | | — |

|

| Changes in assets and liabilities: | | | | | | |

| Change in other assets | 384 |

| | (493 | ) | (683 | ) | | 384 |

|

| Change in tenant and other receivables | 1,933 |

| | (2,675 | ) | (2,032 | ) | | 1,933 |

|

| Change in deferred leasing costs | (4,335 | ) | | (476 | ) | (5,616 | ) | | (4,335 | ) |

| Change in accounts payable and accrued expenses | (198 | ) | | 5,016 |

| (3,629 | ) | | (198 | ) |

| Change in other liabilities | (2,947 | ) | | 503 |

| (5,958 | ) | | (2,947 | ) |

| Change in due to affiliates | 1,755 |

| | (1,128 | ) | (2,680 | ) | | 1,755 |

|

| Net cash from operating activities | 6,739 |

| | 3,781 |

| |

| Net cash from (used in) operating activities | | (8,178 | ) | | 6,739 |

|

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | |

| Investments in acquired properties and lease intangibles | — |

| | (131,758 | ) | (182,714 | ) | | — |

|

| Capital expenditures at operating properties | (8,095 | ) | | (420 | ) | (3,886 | ) | | (8,095 | ) |

| Proceeds from sale of real estate | 37,087 |

| | — |

| — |

| | 37,087 |

|

| Purchases of real estate-related securities | | (14,086 | ) | | — |

|

| Proceeds from settlement of real estate-related securities | | 5,180 |

| | — |

|

| Net cash from (used in) investing activities | 28,992 |

| | (132,178 | ) | (195,506 | ) | | 28,992 |

|

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | |

| Proceeds from issuance of common shares | 1,628 |

| | 96,882 |

| 177,269 |

| | 1,628 |

|

| Redemption of common shares | (5,174 | ) | | (1,196 | ) | (7,704 | ) | | (5,174 | ) |

| Payment of offering costs | — |

| | (2,319 | ) | (2,734 | ) | | — |

|

| Payment of selling commissions, dealer manager fees and distribution and stockholder servicing fees | (1,322 | ) | | (4,798 | ) | (5,570 | ) | | (1,322 | ) |

| Distributions paid to stockholders and noncontrolling interests | (5,111 | ) | | (3,866 | ) | (6,394 | ) | | (5,111 | ) |

| Proceeds from notes payable | — |

| | 24,386 |

| 109,935 |

| | — |

|

| Payments on notes payable | (844 | ) | | (819 | ) | (957 | ) | | (844 | ) |

| Proceeds from related party note payable | 15,500 |

| | 7,000 |

| 44,000 |

| | 15,500 |

|

| Payments on related party note payable | (26,700 | ) | | (63,000 | ) | (99,000 | ) | | (26,700 | ) |

| Change in security deposit liability | 100 |

| | (18 | ) | 250 |

| | 100 |

|

| Deferred financing costs paid | (127 | ) | | (405 | ) | (631 | ) | | (127 | ) |

| Payments related to interest rate contracts | (10 | ) | | (169 | ) | (39 | ) | | (10 | ) |

| Net cash from (used in) financing activities | (22,060 | ) | | 51,678 |

| 208,425 |

| | (22,060 | ) |

| Effect of exchange rate changes on cash, restricted cash and cash equivalents | (1,087 | ) | | 745 |

| (348 | ) | | (1,087 | ) |

| Net change in cash, restricted cash and cash equivalents | 12,584 |

| | (75,974 | ) | 4,393 |

| | 12,584 |

|

| Cash, restricted cash and cash equivalents, beginning of period | 24,553 |

| | 99,713 |

| 36,986 |

| | 24,553 |

|

| Cash, restricted cash and cash equivalents, end of period | $ | 37,137 |

| | $ | 23,739 |

| $ | 41,379 |

| | $ | 37,137 |

|

See notes to the condensed consolidated financial statements.

HINES GLOBAL INCOME TRUST INC, INC.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

For the Three and Six Months Ended June 30, 20182019 and 20172018

1. ORGANIZATION

The accompanying interim unaudited condensed consolidated financial information has been prepared according to the rules and regulations of the United States Securities and Exchange Commission (“SEC”). In the opinion of management, all adjustments and eliminations, consisting only of normal recurring adjustments, necessary to present fairly and in conformity with accounting principles generally accepted in the United States of America (“GAAP”) the financial position of Hines Global Income Trust, Inc. as of June 30, 20182019 and December 31, 2017,2018, the results of operations for the three and six months ended June 30, 20182019 and 20172018 and cash flows for the six months ended June 30, 20182019 and 20172018 have been included. The results of operations for such interim periods are not necessarily indicative of the results for the full year. Certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted according to such rules and regulations. For further information, refer to the financial statements and footnotes included in Hines Global Income Trust, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2017.2018.

Hines Global Income Trust, Inc. (the “Company”), formerly known as Hines Global REIT II, Inc., was incorporated in Maryland on July 31, 2013, to invest in a diversified portfolio of quality commercial real estate properties and other real estate investments throughout the United States and internationally, and to a lesser extent, invest in real-estate related securities. The Company is sponsored by Hines Interests Limited Partnership (“Hines”), a fully integrated global real estate investment and management firm that has acquired, developed, owned, operated and sold real estate for over 60 years. The Company is managed by Hines Global REIT II Advisors LP (the “Advisor”), an affiliate of Hines. The Company intends to conductconducts substantially all of its operations through Hines Global REIT II Properties, LP (the “Operating Partnership”). An affiliate of the Advisor, Hines Global REIT II Associates LP, owns less than a 1% limited partner interest in the Operating Partnership as of June 30, 20182019 and the Advisor also owns the special limited partnership interest in the Operating Partnership. The Company has elected to be taxed as a real estate investment trust, or REIT, for U.S. federal income tax purposes beginning with its taxable year ended December 31, 2015.

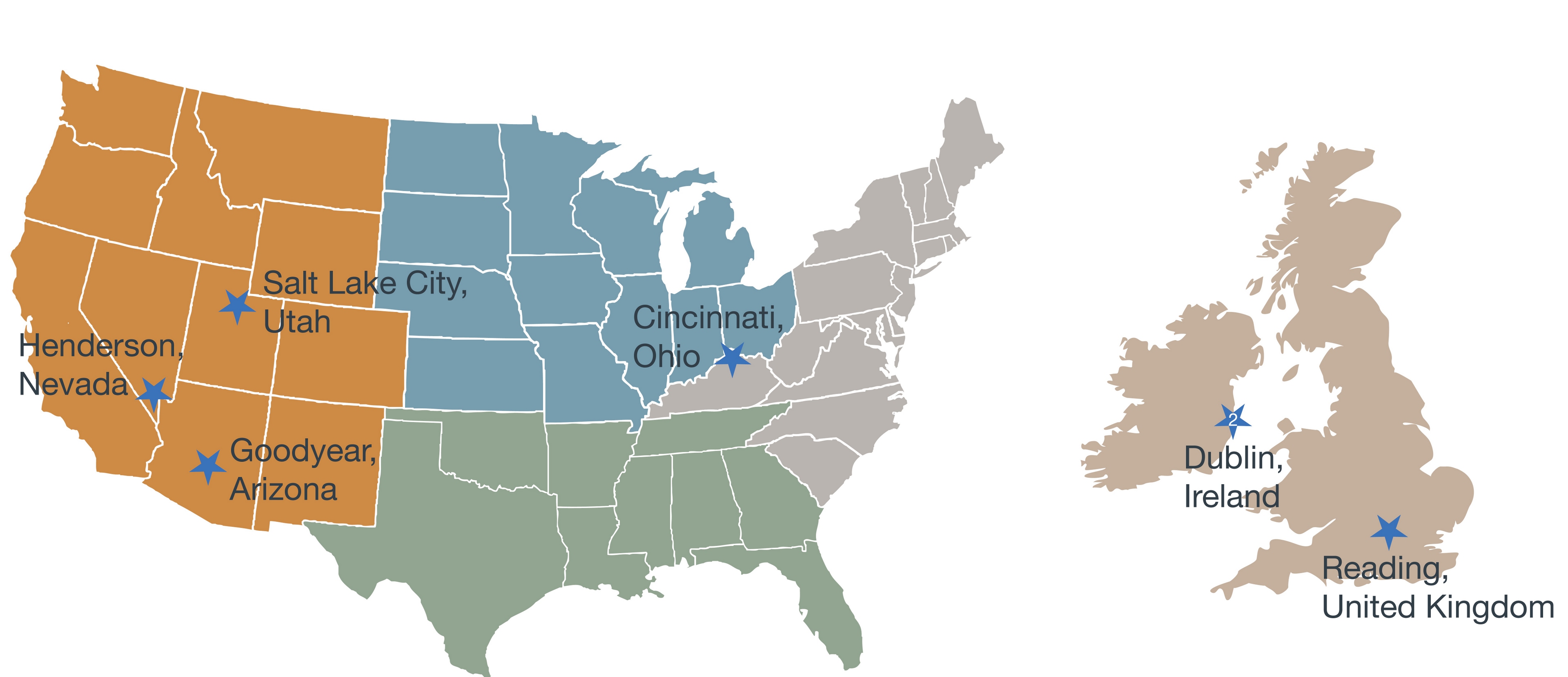

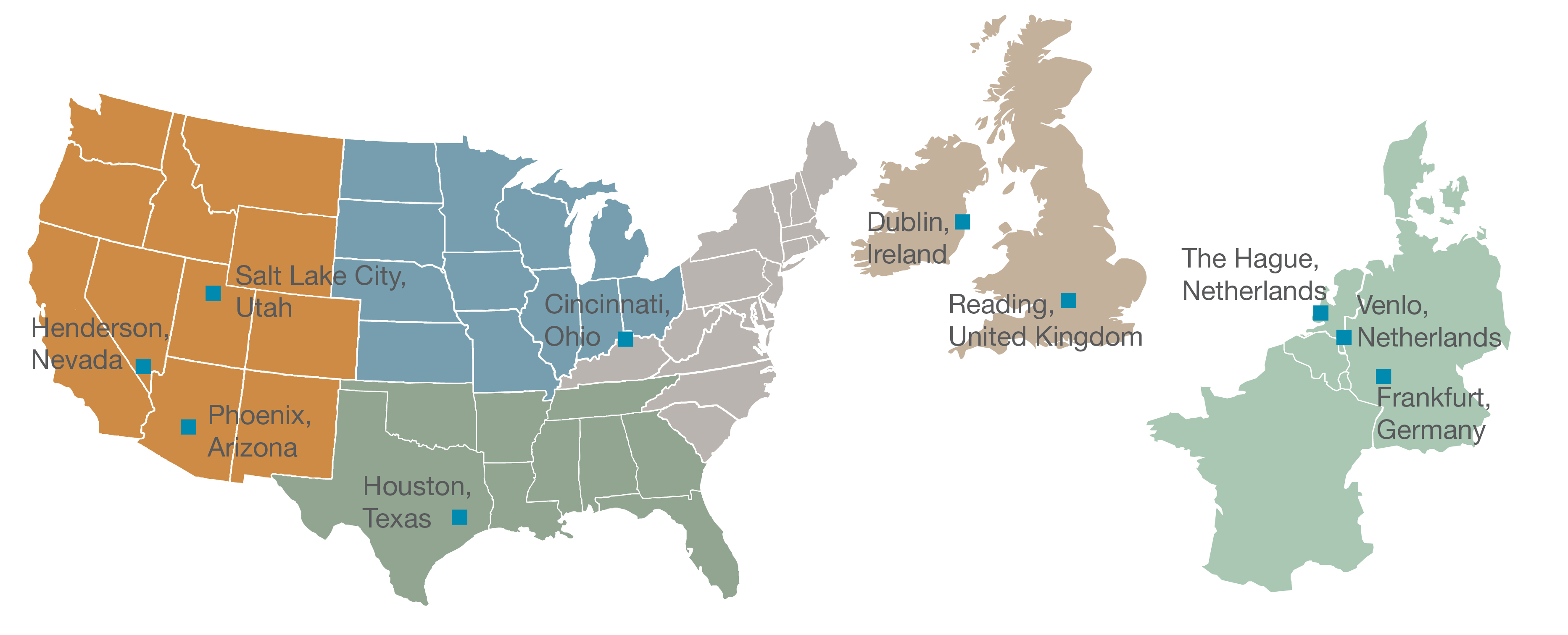

As of June 30, 2018,2019, the Company owned direct real estate investments in seveneleven properties totaling 2.57.3 million square feet that were 98%96% leased. The Company raises capital for its investments through public offerings of its common stock. The Company commenced its initial public offering of up to $2.5 billion in shares of its common stock (the “Initial Offering”) in August 2014, and commenced its second public offering of up to $2.5 billion in shares of common stock including $500.0 million of shares offered under its distribution reinvestment plan (the “Follow-On Offering”) in December 2017. As of August 9, 2018,14, 2019, the Company had received gross offering proceeds of $424.6$738.9 million from the sale of 43.373.8 million shares through its public offerings, including shares issued pursuant to its distribution reinvestment plan.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The condensed consolidated financial statements of the Company included in this Quarterly Report on Form 10-Q include the accounts of Hines Global Income Trust, Inc. and the Operating Partnership (over which the Company exercises financial and operating control). All intercompany balances and transactions have been eliminated in consolidation.

Investments in Real Estate-Related Securities

In the fourth quarter of 2018, the Company made its initial investments in real estate-related securities and as of June 30, 2019 has $20.0 million invested in these securities. These securities consist of common equities, preferred equities and debt investments of publicly traded REITs. The Company has elected to classify these investments as trading securities and carry such investments at fair value. These assets are valued on a recurring basis, which resulted in a realized gain of $165,000 and an unrealized loss of $4,000 for the three months ended June 30, 2019, and a realized gain of $228,000 and an unrealized gain of $1.1 million for the six months ended June 30, 2019, both of which are recorded in “gain (loss) on investments in real estate-related securities” in the Condensed Consolidated Statements of Operations and Comprehensive Income (Loss). In July 2019, the Company made an additional $15.0 million investment in real estate-related securities.

Tenant and Other Receivables

Tenant and other receivable balances consistreceivables consists primarily of base rents, tenant reimbursements and receivables attributable to straight-line rent. Straight-line rent and receivables were $4.4 millionrelated to base rents and $4.0 million as of June 30, 2018 and December 31, 2017, respectively.tenant reimbursements. Straight-line rent receivable consists of the difference between the tenants’ rents calculated on a straight-line basis from the date of acquisition or lease commencement over the remaining terms of the related leases and the tenants’ actual rents due under the lease agreementsagreements. Straight-line rent receivables were $7.3 million and is included in tenant and other receivables in the accompanying consolidated condensed balance sheets.

As$5.8 million as of June 30, 20182019 and December 31, 2017, tenant and other receivables included $0.7 million and $2.3 million, respectively, in receivables from third-parties related to working capital reserves and transactions costs related to the acquisition of the Queen’s Court Student Residences.2018, respectively.

Other Assets

Other assets included the following (in thousands):

|

| | | | | | | | |

| | | June 30, 2019 | | December 31, 2018 |

| Prepaid insurance | | $ | 806 |

| | $ | 493 |

|

| Prepaid property taxes | | 347 |

| | 80 |

|

Deferred tax assets (1) | | 979 |

| | 844 |

|

| Other | | 880 |

| | 490 |

|

| Other assets | | $ | 3,012 |

| | $ | 1,907 |

|

|

| | | | | | | | |

| | | June 30, 2018 | | December 31, 2017 |

Deferred offering costs (1) | | $ | 1,383 |

| | $ | 1,525 |

|

| Prepaid insurance | | 138 |

| | 97 |

|

| Prepaid property taxes | | — |

| | 76 |

|

| Deferred tax assets | | 976 |

| | 944 |

|

| Other | | 897 |

| (2) | 725 |

|

| Other assets | | $ | 3,394 |

| | $ | 3,367 |

|

| |

| (1) | Represents offering costs incurred byIncludes the Advisor which will be released into equityeffects of a valuation allowance of $1.7 million and $0.8 million as gross proceeds from the Follow-On Offering are raised. See Note 7—Related Party Transactions for additional information regarding the Company’s organizationof June 30, 2019 and offering costs. |

| |

(2) | Includes $0.5 million of capitalized acquisition costs related to pending acquisitions.

December 31, 2018, respectively. |

Revenue Recognition

The Financial Accounting Standards Board ("FASB") issued accounting standards update ("ASU") 2014-09 which superseded the revenue recognition requirements under previous guidance. We adopted ASU 2014-09 on January 1, 2018. ASU 2014-09 requires the use of a new five-step model to recognize revenue from contracts with customers. The five-step model requires that the Company identify the contract with the customer, identify the performance obligations in the contract, determine the transaction price, allocate the transaction price to the performance obligations in the contract and recognize revenue when it satisfies the performance obligations. Management has concluded that the majority of the Company’s total revenue, with the exception of gains and losses from the sale of real estate, consist of rental income from leasing arrangements, which is specifically excluded from the standard. Excluding gains and losses on the sale of real estate (as discussed further below), the Company concluded that its remaining revenue streams were immaterial and, as such, the adoption of ASU 2014-09 did not have a material impact on the Company’s condensed consolidated financial statements.

As of January 1, 2018, the Company began accounting for the sale of real estate properties under ASU 2017-05 and provides for revenue recognition based on completed performance obligations, which typically occurs upon the transfer of ownership of a real estate asset. The Company sold 2819 Loker Avenue East on March 30, 2018, which was considered a non-financial real estate asset with no performance obligations subsequent to the transfer of ownership. The Company recognized a gain on sale of real estate of $14.5 million related to this sale. The Company has had no other sales of real estate assets since its inception.

Recently Adopted Accounting Pronouncements

In May 2014, the FASB, issued ASU 2014-09 to provide guidance on recognizing revenue from contracts with customers. This ASU’s core objective is for an entity to recognize revenue based on the consideration it expects to receive in exchange for goods or services. The Company has evaluated controls around the implementation of ASU 2014-09 and there was no significant impact on our control structure. See “— Revenue Recognition” above for additional information regarding the adoption of this standard.

In October 2016, the FASB issued ASU 2016-16 which removes the prohibition in ASC 740 against the immediate recognition of the current and deferred income tax effects of intra-entity transfers of assets other than inventory. The ASU is intended to reduce the complexity of ASC 740 and the diversity in practice related to the tax consequences of certain types of intra-entity asset transfers. ASU 2016-16 will be effective for annual periods beginning after December 31, 2017. The Company adopted ASU 2016-16 beginning January 1, 2018 and recorded deferred tax assets, along with a full valuation allowance, related to its subsidiaries in Ireland.

In January 2017, the FASB issued ASU 2017-01 to clarify the definition of a business with the objective of adding guidance to assist entities with evaluating whether transactions should be accounted for as acquisitions (or disposals) of assets or businesses. The Company expects that most of its real estate transactions completed after January 1, 2018 will be accounted

for using the asset acquisition guidance and, accordingly, acquisition fees (if any) and expenses related to those acquisitions will be capitalized. The amendments to the FASB Accounting Standards Codification were effective for public entities for annual and interim periods in fiscal years beginning after December 15, 2017. The Company adopted ASU 2017-01 on January 1, 2018.

In February 2017, the FASB issued ASU 2017-05 to clarify that a financial asset is within the scope of Subtopic 610-20 if it meets the definition, as amended, of an in substance nonfinancial asset. The provisions of ASU 2017-05 are effective for the Company as of January 1, 2018 as described above in “— Revenue Recognition.”

New Accounting Pronouncements

In February 2016, the FASB issued ASU 2016-02 which will requirerequires companies that lease assets to recognize on the balance sheet the right-of-use assets and related lease liabilities.liabilities (“ASC 842”). The accounting by companies that own the assets leased by the lessee (the lessor) will remainremains largely unchanged from current GAAP.the adoption of ASC 842. The new standard requires aCompany adopted ASC 842 beginning January 1, 2019 and is using the modified retrospective transition approach for all leases existing at, or entered into after, the date of initial application, with an optionapproach. No adjustment to use certain transition relief. The guidance is effective for public entities for fiscal years beginning after December 15, 2018 and interim periods within those fiscal years. Early adoption is permitted.opening retained earnings was required.

In July 2018, the FASB issued ASU 2018-11, which allows lessors to account for lease and non-lease components by class of underlying assets, as a single lease component if certain criteria are met. Also, theThe new standard indicates thatpermits companies are permitted to recognize a cumulative-effect adjustment to the opening balance of retained earnings in the period of adoption in lieu of the modified retrospective approachrestating prior periods and provides other optional practical expedients.

On January 1, 2019, the Company elected the following practical expedients:

The transition method in which the application date of January 1, 2019 is the beginning of the reporting period that the Company first applied the new guidance.

The practical expedient package which allows an entity not to reassess (1) whether any expired or existing contracts are or contain leases; (2) the lease classification for any expired or existing leases; (3) initial direct costs for any existing leases.

As an accounting policy election, a lessor may choose not to separate the non-lease components, by class of underlying assets, from the lease components and instead account for both types of components as a single component under certain conditions.

As an accounting policy election, a lessee may choose not to separate the non-lease components, by class of underlying assets, from the lease components and instead account for both types of components as a single component. The Company is inelected to apply the processpractical expedient for all of evaluatingits leases to account for the lease and non-lease components as a single, combined operating lease component.

The Company completed its evaluation of the impact that the adoption of ASU 2016-02ASC 842 will have on the Company’s consolidated financial statements relating to its leases regardless of whether it isfrom both the lessee and lessor orperspective. Based on the lessee. For leases in whichCompany’s analysis, the Company isidentified the lessor, itfollowing changes to result from its adoption of ASC 842:

Lessor Accounting

The Company is entitled to receive tenant reimbursements for operating expenses such as real estate taxes, insurance andfor common area maintenance,maintenance. Based on guidance in these ASUs, such revenue is defined as a non-lease component, which would be accounted for in accordance with ASC 606. However, the Company elected to apply the practical expedient for all of which it expectsits leases to account for thesethe lease and non-lease components as a single, combined operating lease component sincecomponent.

Capitalization of leasing costs is limited to initial direct costs. Initial direct costs have been defined as incremental costs of a lease that would not have been incurred if the timinglease had not been obtained. Legal costs are no longer capitalized, but expensed as incurred. There is no change in the Company’s accounting for lease inducements and commissions.

The Company’s existing leases continue to be classified as operating leases, however, leases entered into or modified after January 1, 2019 may be classified as either operating or sales-type leases, based on specific classification criteria. The Company believes all of its leases will continue to be classified as operating leases, and all operating leases will continue to have a similar pattern of transfer is the same in accordance with ASU 2018-11. The Company has currently identified certain areas the Company believes may be impacted by the adoption of ASU 2016-02, which include:recognition as under current GAAP.

Lessee Accounting

The Company has a ground lease agreementagreements in which the Company is the lessee of thefor land atunderneath Bishop’s Square that the Company currently accounts for as an operating lease. The Company previously recognized an amount related to this ground lease as part of the allocation of the purchase price of Bishop’s Square, which was recorded to intangible lease assets, net. The lease has a remaining term of 763 years. Upon adoption of ASU 2016-02,ASC 842 on January 1, 2019, the Company will record any rightsdetermined the lease liability is immaterial and obligations under thisreclassified approximately €29.7 million (approximately $33.9 million assuming a rate of $1.14 per EUR as of January 1, 2019, the date of adoption) from intangible lease as anassets, net to right-of-use asset, and liability at fair valuenet in the Company’s consolidated balance sheets.Condensed Consolidated Balance Sheets.

Determination of costs to be capitalized associated with leases. ASU 2016-02 will limit the capitalization associated with certain costs to costs that are a direct result of obtaining a lease.New Accounting Pronouncements

In August 2018, the FASB issued ASU No. 2018-13, "Changes to the Disclosure Requirements for Fair Value Measurement." This ASU amends and removes several disclosure requirements including the valuation processes for Level 3 fair value measurements. The ASU also modifies some disclosure requirements and requires additional disclosures for changes in unrealized gains and losses included in other comprehensive income for recurring Level 3 fair value measurements and requires the range and weighted average of significant unobservable inputs used to develop Level 3 fair value measurements. The ASU is effective for fiscal years beginning after December 15, 2019, including interim periods therein. Early adoption is permitted for any eliminated or modified disclosures upon issuance of this ASU. The Company is currently assessing the impact the adoption of this guidance will have on its financial statements.

3. INVESTMENT PROPERTY

Investment property consisted of the following amounts as of June 30, 20182019 and December 31, 20172018 (in thousands):

| | | | June 30, 2018 | | December 31, 2017 | June 30, 2019 | | December 31, 2018 |

Buildings and improvements (1) | $ | 481,955 |

| | $ | 491,289 |

| $ | 773,380 |

| | $ | 693,834 |

|

| Less: accumulated depreciation | (23,240 | ) | | (18,172 | ) | (40,003 | ) | | (30,574 | ) |

| Buildings and improvements, net | 458,715 |

| | 473,117 |

| 733,377 |

| | 663,260 |

|

| Land | 92,054 |

| | 99,716 |

| 184,285 |

| | 123,929 |

|

| Investment property, net | $ | 550,769 |

| | $ | 572,833 |

| $ | 917,662 |

| | $ | 787,189 |

|

| |

| (1) | Included in buildings and improvements is approximately $11.7 million and $4.3 million of construction-in-progress related to the expansion of Bishop’s Square as of June 30, 2018 and December 31, 2017, respectively. In October 2017, the Company commenced construction at Bishop’s Square to add an additional floor and make various upgrades to the property. The construction was completed in July 2019. Included in buildings and improvements is approximately $16.7 million and $14.5 million of construction-in-progress related to the expansion of Bishop’s Square as of June 30, 2019 and December 31, 2018, respectively. |

Recent Acquisition of Investment Property

In March 2018,May 2019, the Company sold 2819 Loker Avenue East, a Class–Aacquired ABC Westland, an industrial property located in Carlsbad, California. The contract salesHague, Netherlands. The net purchase price for 2819 Loker Avenue EastABC Westland was $38.3 million.€116.4 million (approximately $130.3 million assuming a rate of $1.12 per EUR as of the acquisition date), exclusive of transaction costs and working capital reserves. The Company acquired 2819 Loker Avenue East in December 2014amount recognized for a contractthe asset acquisition as of the acquisition date was determined by allocating the net purchase price of $25.4 million. The Company recognized a gain on sale of this asset of $14.5 million, which was recorded in gain on sale of real estate on the condensed consolidated statements of operations and comprehensive income (loss).as follows (in thousands):

|

| | | | | | | | |

Building and

Improvements | | Land | | In-place Lease Intangibles | | Out-of-Market Lease Intangibles, Net | | Total |

| $74,059 | (1) | $59,664 | | $6,902 | | $(1,124) | | $139,501 |

| |

| (1) | Amount includes approximately €14.1 million (approximately $15.8 million assuming a rate of $1.12 per EUR as of the acquisition date) of solar panels at date of acquisition, which are to be depreciated using the straight-line method assuming a useful life of 25 years. |

As of June 30, 2018,2019, the cost basis and accumulated amortization related to lease intangibles are as follows (in thousands):

| | | | Lease Intangibles | Lease Intangibles |

| | In-Place Leases | | Out-of-Market Lease Assets | | Out-of-Market Lease Liabilities | In-Place Leases (1) | | Out-of-Market Lease Assets | | Out-of-Market Lease Liabilities |

| | | |

| Cost | $ | 108,287 |

| | $ | 4,705 |

| | $ | (18,367 | ) | $ | 87,802 |

| | $ | 5,692 |

| | $ | (23,458 | ) |

| Less: accumulated amortization | (26,797 | ) | | (1,847 | ) | | 3,460 |

| (36,950 | ) | | (2,458 | ) | | 5,168 |

|

| Net | $ | 81,490 |

| | $ | 2,858 |

| | $ | (14,907 | ) | $ | 50,852 |

| | $ | 3,234 |

| | $ | (18,290 | ) |

| |

| (1) | The Company adopted ASC 842 beginning January 1, 2019 and reclassified certain assets from Intangible lease assets, net to Right-of-use asset, net in the Company’s Condensed Consolidated Balance Sheets. See Note 2—Summary of Significant Accounting Policies for more information on the adoption of ASC 842. |

As of December 31, 2017,2018, the cost basis and accumulated amortization related to lease intangibles were as follows (in thousands):

| | | | Lease Intangibles | Lease Intangibles |

| | In-Place Leases | | Out-of-Market Lease Assets | | Out-of-Market Lease Liabilities | In-Place Leases | | Out-of-Market Lease Assets | | Out-of-Market Lease Liabilities |

| | | |

| Cost | $ | 116,222 |

| | $ | 4,716 |

| | $ | (18,490 | ) | $ | 118,585 |

| | $ | 5,558 |

| | $ | (22,318 | ) |

| Less: accumulated amortization | (24,430 | ) | | (1,371 | ) | | 2,551 |

| (31,320 | ) | | (2,126 | ) | | 4,284 |

|

| Net | $ | 91,792 |

| | $ | 3,345 |

| | $ | (15,939 | ) | $ | 87,265 |

| | $ | 3,432 |

| | $ | (18,034 | ) |

Amortization expense of in-place leases was $3.8$4.6 million and $4.8$3.8 million for the three months ended June 30, 20182019 and 2017, respectively. Net amortization of out-of-market leases resulted in an increase to rental revenue of $0.2 million and $0.3 million for the three months ended June 30, 2018, and 2017, respectively.

Amortization expense of in-place leases was $7.8 million and $9.5 million for the six months ended June 30, 2018 and 2017, respectively. Net amortization of out-of-market leases resulted in an increase to rental revenue of $0.5 million and $0.6$0.2 million for the three months ended June 30, 2019 and 2018, respectively.

Amortization expense of in-place leases was $9.3 million and $7.8 million for the six months ended June 30, 2019 and 2018, respectively. Net amortization of out-of-market leases resulted in an increase to rental revenue of $0.6 million and 2017,$0.5 million for the six months ended June 30, 2019 and 2018, respectively.

Anticipated amortization of the Company’s in-place leases and out-of-market leases, net for the period from July 1, 20182019 through December 31, 20182019 and for each of the years ending December 31, 20192020 through December 31, 20222023 are as follows (in thousands):

| | | | In-Place Lease | | Out-of-Market Leases, Net | In-Place Lease | | Out-of-Market Leases, Net |

| July 1, 2018 through December 31, 2018 | $ | 6,267 |

| | $ | (417 | ) | |

| 2019 | $ | 10,103 |

| | $ | (882 | ) | |

| July 1, 2019 through December 31, 2019 | | $ | 7,462 |

| | $ | (1,026 | ) |

| 2020 | $ | 7,862 |

| | $ | (1,239 | ) | $ | 11,770 |

| | $ | (1,673 | ) |

| 2021 | $ | 5,603 |

| | $ | (1,065 | ) | $ | 7,388 |

| | $ | (1,495 | ) |

| 2022 | $ | 3,611 |

| | $ | (1,130 | ) | $ | 4,741 |

| | $ | (1,314 | ) |

| 2023 | | $ | 4,172 |

| | $ | (988 | ) |

Leases

Leases

The Company’s leases are generally for terms of 15 years or less and may include multiple options to extend the lease term upon tenant election. The Company’s leases typically do not include an option to purchase. Generally, the Company does not expect the value of its real estate assets to be impacted materially at the end of any individual lease term, as the Company is typically able to re-lease the space and real estate assets tend to hold their value over a long period of time. Tenant terminations prior to the lease end date occasionally result in a one-time termination fee based on the remaining unpaid lease payments including variable payments and could be material to the tenant. Many of the Company’s leases have increasing minimum rental rates during the terms of the leases through escalation provisions. In addition, the majority of the Company’s leases provide for separate billings for variable rent, such as, reimbursements of real estate taxes, maintenance and insurance and may include an amount based on a percentage of the tenants’ sales. Total billings related to expense reimbursements from tenants for the three and six months ended June 30, 2019, was $2.8 million and $5.7 million, respectively, which is included in Rental revenue on the Condensed Consolidated Statements of Operations and Comprehensive Income (Loss).

The Company has entered into non-cancelable lease agreements with tenants for space. As of June 30, 2018,2019, the approximate fixed future minimum rentals for the period from July 1, 20182019 through December 31, 2018,2019, for each of the years ending December 31, 20192020 through 20222023 and thereafter related to the Company’s commercial properties are as follows (in thousands):

| | | | Fixed Future Minimum Rentals | Fixed Future Minimum Rentals |

| July 1, 2018 through December 31, 2018 | $ | 19,372 |

| |

| 2019 | 35,875 |

| |

| July 1, 2019 through December 31, 2019 | | $ | 31,699 |

|

| 2020 | 29,645 |

| 58,037 |

|

| 2021 | 25,201 |

| 50,520 |

|

| 2022 | 20,093 |

| 42,001 |

|

| 2023 | | 39,174 |

|

| Thereafter | 105,384 |

| 199,061 |

|

| Total | $ | 235,570 |

| $ | 420,492 |

|

During the six months ended June 30, 20182019 and 2017,2018, the Company did not earn more than 10% of its revenue from any individual tenant.

4. DEBT FINANCING

As of June 30, 20182019 and December 31, 2017,2018, the Company had approximately $364.1$600.5 million and $379.3$545.8 million of debt outstanding, with a weighted average yearyears to maturity of 3.43.0 years and 3.82.9 years, respectively, and a weighted average interest rate of 2.72%2.49% and 2.63%2.85%, respectively. The following table provides additional information regarding the Company’s debt outstanding at June 30, 20182019 and December 31, 20172018 (in thousands):

| | | Description | | Origination or Assumption Date | | Maturity Date | | Maximum Capacity in Functional Currency | | Interest Rate Description | | Interest Rate as of June 30, 2018 | | Principal Outstanding at June 30, 2018 | | Principal Outstanding at December 31, 2017 | | Origination or Assumption Date | | Maturity Date | | Maximum Capacity in Functional Currency | | Interest Rate Description | | Interest Rate as of June 30, 2019 | | Principal Outstanding at June 30, 2019 | | Principal Outstanding at December 31, 2018 |

| Secured Mortgage Debt | | | | | | | | | | | | | | | | | | | | | | |

| Bishop's Square | | 3/3/2015 | | 3/2/2022 | | € | 55,200 |

| | Euribor + 1.30% (1) | | 1.30% | | $ | 64,479 |

| | $ | 66,124 |

| | 3/3/2015 | | 3/2/2022 | | € | 55,200 |

| | Euribor + 1.30% (1) | | 1.30% | | $ | 62,740 |

| | $ | 63,171 |

|

| Domain Apartments | | 1/29/2016 | | 1/29/2020 | | $ | 34,300 |

| | Libor + 1.60% | | 3.69% | | 34,300 |

| | 34,300 |

| | 1/29/2016 | | 1/29/2020 | | $ | 34,300 |

| | Libor + 1.60% | | 4.00% | | 34,300 |

| | 34,300 |

|

| Cottonwood Corporate Center | | 7/5/2016 | | 8/1/2023 | | $ | 78,000 |

| | Fixed | | 2.98% | | 74,967 |

| | 75,811 |

| | 7/5/2016 | | 8/1/2023 | | $ | 78,000 |

| | Fixed | | 2.98% | | 73,241 |

| | 74,110 |

|

| Goodyear Crossing II | | 8/18/2016 | | 8/18/2021 | | $ | 29,000 |

| | Libor + 2.00% | | 3.98% | | 29,000 |

| | 29,000 |

| | 8/18/2016 | | 8/18/2021 | | $ | 29,000 |

| | Libor + 2.00% | | 4.44% | | 29,000 |

| | 29,000 |

|

| Rookwood Commons | | 1/6/2017 | | 7/1/2020 | | $ | 67,000 |

| | Fixed | | 3.13% | | 67,000 |

| | 67,000 |

| | 1/6/2017 | | 7/1/2020 | | $ | 67,000 |

| | Fixed | | 3.13% | | 67,000 |

| | 67,000 |

|

| Rookwood Pavilion | | 1/6/2017 | | 7/1/2020 | | $ | 29,000 |

| | Fixed | | 2.87% | | 29,000 |

| | 29,000 |

| | 1/6/2017 | | 7/1/2020 | | $ | 29,000 |

| | Fixed | | 2.87% | | 29,000 |

| | 29,000 |

|

| Montrose Student Residences | | 3/24/2017 | | 3/23/2022 | | € | 22,605 |

| | Euribor + 1.85% (2) | | 1.85% | | 26,405 |

| | 27,079 |

| | 3/24/2017 | | 3/23/2022 | | € | 22,605 |

| | Euribor + 1.85% (2) | | 1.85% | | 25,693 |

| | 25,869 |

|

| Queen's Court Student Residences | | 12/18/2017 | | 12/18/2022 | | £ | 29,500 |

| | Libor + 2.00% (3) | | 2.57% | | 38,949 |

| | 39,798 |

| | 12/18/2017 | | 12/18/2022 | | £ | 29,500 |

| | Libor + 2.00% (3) | | 2.88% | | 37,436 |

| | 37,565 |

|

| Venue Museum District | | | 9/21/2018 | | 10/9/2020 | | $ | 45,000 |

| | Libor + 1.95% (4) | | 4.36% | | 45,000 |

| | 45,000 |

|

| Fresh Park Venlo | | | 10/3/2018 | | 8/15/2023 | | € | 75,000 |

| | Euribor + 1.50% (5) | | 1.50% | | 85,225 |

| | 85,809 |

|

| Maintal Logistics | | | 2/21/2019 | | 2/28/2024 | | € | 23,500 |

| | Euribor + 1.10% (6) | | 1.10% | | 26,621 |

| | — |

|

| ABC Westland | | | 5/3/2019 | | 2/15/2024 | | € | 75,000 |

| | Euribor + 1.50% (7) | | 1.50% | | 85,245 |

| | — |

|

| Notes Payable | Notes Payable | | | | | | | | $ | 364,100 |

| | $ | 368,112 |

| Notes Payable | | | | | | | | $ | 600,501 |

| | $ | 490,824 |

|

| Affiliate Note Payable | | | | | | | | | | | | |

| Credit Facility with Hines | | 10/2/2017 | | 12/31/2018 | | $ | 75,000 |

| | Variable | | N/A | | — |

| | 11,200 |

| | 10/2/2017 | | 12/31/2019 | | $ | 75,000 |

| | Variable | | N/A | | — |

| | 55,000 |

|

| Total Note Payable to Affiliate | Total Note Payable to Affiliate | | | | $ | — |

| | $ | 11,200 |

| Total Note Payable to Affiliate | | | | $ | — |

| | $ | 55,000 |

|

| Total Principal Outstanding | Total Principal Outstanding | | | | $ | 364,100 |

| | $ | 379,312 |

| Total Principal Outstanding | | | | $ | 600,501 |

| | $ | 545,824 |

|

| Unamortized discount | Unamortized discount | | | | (422 | ) | | (528 | ) | Unamortized discount | | | | (210 | ) | | (316 | ) |

| Unamortized financing fees | Unamortized financing fees | | | | (1,670 | ) | | (1,932 | ) | Unamortized financing fees | | | | (3,479 | ) | | (3,069 | ) |

| Total | Total | | | | $ | 362,008 |

| | $ | 376,852 |

| Total | | | | $ | 596,812 |

| | $ | 542,439 |

|

| |

| (1) | On the loan origination date, and as extended on February 20, 2018, the Company entered into a 2.00% Euribor interest rate cap agreement for €55.2 million (approximately $64.5 million assuming a rate of $1.17 per EUR as of June 30, 2018)the full amount borrowed as an economic hedge against the variability of future interest rates on this borrowing. |

| |

| (2) | On the loan origination date, the Company entered into a 1.25% Euribor interest rate cap agreement for €17.0 million (approximately $19.8$19.3 million assuming a rate of $1.17$1.14 per EUR as of June 30, 2018)2019) of the full amount borrowed as an economic hedge against the variability of future interest rates on this borrowing. |

| |

| (3) | On the loan origination date, the Company entered into a 2.00% LiborLIBOR interest rate cap agreement for £22.1 million (approximately $29.2$28.1 million assuming a rate of $1.32$1.27 per GBP as of June 30, 2018)2019) of the full amount borrowed as an economic hedge against the variability of future interest rates on this borrowing. |

| |

| (4) | On the loan origination date, the Company entered into a 3.50% LIBOR interest rate cap agreement for the full amount borrowed as an economic hedge against the variability of future interest rates on this borrowing. |

| |

| (5) | On the loan origination date, the Company entered into a 2.00% Euribor interest rate cap agreement for €52.5 million (approximately $59.7 million assuming a rate of $1.14 per EUR as of June 30, 2019) as an economic hedge against the variability of future interest rates on this borrowing. |

| |

| (6) | In February 2019, the Company entered into a secured mortgage loan to fund the acquisition of Maintal Logistics, which was acquired on December 31, 2018. Funding for the acquisition, which relates to the $43.8 million recorded within other liabilities on the Condensed Consolidated Balance Sheet as of December 31, 2018, was not required until the loan closed in February 2019. On the loan origination date, the Company entered into a 2.00% Euribor interest rate cap agreement for €16.5 million (approximately $18.7 million assuming a rate of $1.14 per EUR as of June 30, 2019) as an economic hedge against the variability of future interest rates on this borrowing. |

| |

| (7) | On the loan origination date, the Company entered into a 1.00% Euribor interest rate cap agreement for €52.5 million |

(approximately $58.8 million assuming a rate of $1.12 per EUR as of June 30, 2019) as an economic hedge against the variability of future interest rates on this borrowing.

Hines Credit Facility

ForDuring the period from January 2018 throughsix months ended June 2018,30, 2019, the Company made draws of $15.5$44.0 million and made payments of $26.7$99.0 million under its uncommitted loan agreementcredit facility with Hines (the “Hines Credit Facility”) with Hines for a maximum principal amount of $75.0 million. Additionally, from. The Company had no outstanding balance on June 30, 2019. From July 1, 20182019 through August 14, 2018,2019, the Company made no subsequent draws or payments under itsthe Hines Credit Facility, which resulted in the Company having no outstanding balance under its Hines Credit Facility as of August 14, 2018.Facility.

Financial Covenants

The Company’s mortgage agreements and other loan documents for the debt described in the table above contain customary events of default, with corresponding grace periods, including payment defaults, bankruptcy-related defaults, and customary covenants, including limitations on liens and indebtedness and maintenance of certain financial ratios. As of June 30, 2019, Goodyear Crossing II was out of compliance with a loan covenant related to its secured mortgage debt. In August 2019, the lender provided a waiver of the covenant that was out of compliance, as the property met certain conditions set forth by the lender. The Company is not aware of any other instances of noncompliance with financial covenants on any of its other loans as of June 30, 2018.2019.

Principal Payments on Debt

The Company is required to make the following principal payments on its outstanding notes payable for the period from July 1, 20182019 through December 31, 2018,2019, for each of the years ending December 31, 20192020 through December 31, 20222023 and for the period thereafter (in thousands).

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Payments Due by Year |

| | July 1, 2018 through December 31, 2018 | | 2019 | | 2020 | | 2021 | | 2022 | | Thereafter |

| Principal payments | $ | 856 |

| | $ | 1,751 |

| | $ | 132,104 |

| | $ | 30,859 |

| | $ | 131,748 |

| | $ | 66,782 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Payments Due by Year |

| | July 1, 2019 through December 31, 2019 | | 2020 | | 2021 | | 2022 | | 2023 | | Thereafter |

| Principal payments | $ | 994 |

| | $ | 177,388 |

| | $ | 31,143 |

| | $ | 128,068 |

| | $ | 152,289 |

| | $ | 110,619 |

|

As of August 14, 2019, the Company is required to make $130.3 million in principal payments on its outstanding notes payable that mature through August 2020. The Company expects to be able to repay with cash on hand or proceeds raised from its current offering, or to be able to refinance the debt terms on the principal outstanding.

LIBOR is expected to be discontinued after 2021. As of June 30, 2019 the Company has one loan with a variable interest rate tied to LIBOR with a maturity beyond 2021. The loan agreement provides procedures for determining a replacement or alternative rate in the event that LIBOR is unavailable. However, there can be no assurances as to whether such replacement or alternative rate will be more or less favorable than LIBOR. The Company intends to monitor the developments with respect to the potential phasing out of LIBOR after 2021 and work with its lenders to ensure any transition away from LIBOR will have minimal impact on its financial condition, but can provide no assurances regarding the impact of the discontinuation of LIBOR.

5. DERIVATIVE INSTRUMENTS

The Company has entered into several interest rate cap contracts in connection with certain of its secured mortgage loans in order to limit its exposure against the variability of future interest rates on its variable interest rate borrowings. The Company’s interest rate cap contracts have economically limited the interest rate on the loan to which they relate. The Company has not designated these derivatives as hedges for accounting purposes. The Company has not entered into a master netting arrangement with its third-party counterparty and does not offset on its condensed consolidated balance sheetsCondensed Consolidated Balance Sheets the fair value amount recorded for its derivative instruments.

The Company has also entered into foreign currency forward contracts as economic hedges against the variability of foreign exchange rates related to certain cash flows of some of its international investments. These forward contracts fixed the currency exchange rates on each of the investments to which they related. The Company did not designate any of these contracts as fair value or cash flow hedges for accounting purposes. In December 2018, the Company entered into a €15.0 million foreign currency forward contract with an effective date of December 20, 2018 and a trade date of February 25, 2019, in connection with the funding of the Maintal Logistics acquisition. Additionally, in March 2019, the Company entered into an initial €46.0 million foreign currency forward contract with an effective date of March 1, 2019 and a trade date of March 20,

2019, in connection with the acquisition of ABC Westland. Upon settlement of the initial forward contract in March 2019, the Company entered into a new €46.0 million foreign currency forward contract in connection with the acquisition of ABC Westland with an effective date of March 31, 2019 and a trade date of April 3, 2019. See Note 3—Investment Property for additional information regarding the purchase of ABC Westland.

The table below provides additional information regarding the Company’s interest rate contracts (in thousands, except percentages).

|

| | | | | | | | | | | | | |

| Interest Rate Contracts | | | | | | | | |

| Type | | Effective Date | | Expiration Date | | Notional Amount (1) | | Interest Rate Received | | Pay Rate /Strike Rate |

| Interest rate cap | | March 3, 2015 | | April 25, 2020 (2) | | $ | 64,479 |

| | Euribor | | 2.00 | % |

| Interest rate cap | | March 24, 2017 | | March 23, 2022 | | $ | 19,804 |

| | Euribor | | 1.25 | % |

| Interest rate cap | | December 20, 2017 | | December 20, 2020 | | $ | 29,212 |

| | Libor | | 2.00 | % |

|

| | | | | | | | | | | | | |

| Interest Rate Cap Contracts | | | | | | | | | | |

| Property | | Effective Date | | Expiration Date | | Notional Amount (1) | | Interest Rate Received | | Pay Rate /Strike Rate |

| Bishop’s Square | | March 3, 2015 | | April 25, 2020 | | $ | 62,735 |

| | Euribor | | 2.00 | % |

| Montrose Student Residences | | March 24, 2017 | | March 23, 2022 | | $ | 19,268 |

| | Euribor | | 1.25 | % |

| Queen’s Court Student Residences | | December 20, 2017 | | December 20, 2020 | | $ | 28,077 |

| | LIBOR | | 2.00 | % |

| Venue Museum District | | September 21, 2018 | | October 9, 2020 | | $ | 45,000 |

| | LIBOR | | 3.50 | % |

| Fresh Park Venlo | | October 8, 2018 | | August 15, 2023 | | $ | 59,652 |

| | Euribor | | 2.00 | % |

| Maintal Logistics | | February 28, 2019 | | February 28, 2024 | | $ | 18,695 |

| | Euribor | | 2.00 | % |

| ABC Westland | | May 3, 2019 | | February 15, 2024 | | $ | 58,800 |

| | Euribor | | 1.00 | % |

| |

| (1) | For notional amounts denominated in a foreign currency, amounts have been translated at a rate based on the rate in effect on June 30, 2018.2019. |

| |

(2) | On February 20, 2018, the Company extended the expiration date on its interest rate cap contract relating to the Bishop’s Square secured facility agreement with DekaBank Deutsche Girozentrale from April 25, 2018 to April 25, 2020. |

The table below presents the effects of the changes in fair value of the Company’s derivative instruments in the Company’s Condensed Consolidated Statements of Operations and Comprehensive Income (Loss) for the three and six months ended June 30, 2019 and 2018 (in thousands):

|

| | | | | | | | | | | | | | | | |

| | | Gain (Loss) Recorded on Derivative Instruments |

| | | Three months ended June 30, | | Six months ended June 30, |

| | | 2019 | | 2018 | | 2019 | | 2018 |

| Derivatives not designated as hedging instruments: | | | | | | | | |

| Interest rate caps | | $ | (151 | ) | | $ | (45 | ) | | $ | (311 | ) | | $ | (47 | ) |

| Foreign currency forward contracts | | 74 |

| | — |

| | (876 | ) | | — |

|

| Total gain (loss) on derivatives | | $ | (77 | ) | | $ | (45 | ) |

| $ | (1,187 | ) |

| $ | (47 | ) |

6. STOCKHOLDERS’ EQUITY

Public Offering

On November 30, 2017, the Company (i) redesignated its issued and outstanding Class A shares of common stock, Class T shares of common stock, Class I shares of common stock and Class J shares of common stock as “Class AX shares,” “Class TX shares,” “Class IX shares” and “Class JX shares,” (collectively, the “IPO Shares”) respectively, and (ii) reclassified the authorized but unissued portion of its common stock into four additional classes of shares of common stock: “Class T shares,” “Class S shares,” “Class D shares,” and “Class I shares.” The Company is offering its shares of common stock in the Follow-On Offering in any combination of Class T shares, Class S shares, Class D shares and Class I shares (collectively, the “Follow-On Offering Shares”). All shares of the Company’s common stock have the same voting rights and rights upon liquidation, although distributions received by the Company’s stockholders are expected to differ due to the distribution and stockholder servicing fees payable with respect to the applicable share classes, which reduce distributions.

Common Stock

As of June 30, 20182019 and December 31, 2017,2018, the Company had the following classes of shares of common stock authorized, issued and outstanding (in thousands): | | | | June 30, 2018 | | December 31, 2017 | June 30, 2019 | | December 31, 2018 |

| | Shares Authorized | | Shares Issued | | Shares Outstanding | | Shares Authorized | | Shares Issued | | Shares Outstanding | Shares Authorized | | Shares Issued | | Shares Outstanding | | Shares Authorized | | Shares Issued | | Shares Outstanding |

| Class AX common stock, $0.001 par value per share | 40,000 | | 19,242 | | 19,242 | | 40,000 | | 19,206 | | 19,206 | 40,000 | | 18,960 | | 18,960 | | 40,000 | | 19,123 | | 19,123 |

| Class TX common stock, $0.001 par value per share | 40,000 | | 20,003 | | 20,003 | | 40,000 | | 19,958 | | 19,958 | 40,000 | | 19,951 | | 19,951 | | 40,000 | | 19,969 | | 19,969 |

| Class IX common stock, $0.001 par value per share | 10,000 | | 94 | | 94 | | 10,000 | | 92 | | 92 | 10,000 | | 98 | | 98 | | 10,000 | | 96 | | 96 |

| Class JX common stock, $0.001 par value per share | 10,000 | | — | | — | | 10,000 | | — | | — | 10,000 | | — | | — | | 10,000 | | — | | — |

| Class T common stock, $0.001 par value per share | 350,000 | | 123 | | 123 | | 350,000 | | — | | — | 350,000 | | 15,021 | | 15,021 | | 350,000 | | 2,858 | | 2,858 |

| Class S common stock, $0.001 par value per share | 350,000 | | — | | — | | 350,000 | | — | | — | 350,000 | | — | | — | | 350,000 | | — | | — |

| Class D common stock, $0.001 par value per share | 350,000 | | 38 | | 38 | | 350,000 | | — | | — | 350,000 | | 4,497 | | 4,497 | | 350,000 | | 1,479 | | 1,479 |

| Class I common stock, $0.001 par value per share | 350,000 | | — | | — | | 350,000 | | — | | — | 350,000 | | 2,187 | | 2,187 | | 350,000 | | 59 | | 59 |

The tables below provide information regarding the issuances and redemptions of each class of the Company’s common stock during the six months ended June 30, 20182019 and 20172018 (in thousands). There were no Class JX S and IS shares issued, redeemed or outstanding during the six months ended June 30, 2018.2019.

| | | | Class AX | | Class TX | | Class IX | | Class T | | Class D | | Total | Class AX | | Class TX | | Class IX | | Class T | | Class D | | Class I | | Total |

| | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount |

| Balance as of January 1, 2018 | 19,206 |

| | $ | 19 |

| | 19,958 |

| | $ | 20 |

| | 92 |

| | $ | — |

| | — |

| | $ | — |

| | — |

| | $ | — |

| | 39,256 |

| | $ | 39 |

| |

| Balance as of January 1, 2019 | | 19,123 |

| | $ | 19 |

| | 19,969 |

| | $ | 21 |

| | 96 |

| | $ | — |

| | 2,858 |

| | $ | 3 |

| | 1,479 |

| | $ | 1 |

| | 59 |

| | $ | — |

| | 43,584 |

| | $ | 44 |

|

| Issuance of common shares | 288 |

| | — |

| | 321 |

| | 1 |

| | 2 |

| | — |

| | 123 |

| | — |

| | 38 |

| | — |

| | 772 |

| | 1 |

| 136 |

| | — |

| | 155 |

| | 1 |

| | 1 |

| | — |

| | 4,011 |

| | 4 |

| | 1,198 |

| | 1 |

| | 608 |

| | 1 |

| | 6,109 |

| | 7 |

|

| Redemption of common shares | (252 | ) | | — |

| | (276 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (528 | ) | | — |

| (163 | ) | | — |

| | (195 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | (4 | ) | | — |

| | — |

| | — |

| | (362 | ) | | — |

|

| Balance as of June 30, 2018 | 19,242 |

| | $ | 19 |

| | 20,003 |

| | $ | 21 |

| | 94 |

| | $ | — |

| | 123 |

| | $ | — |

| | 38 |

| | $ | — |

| | 39,500 |

| | $ | 40 |

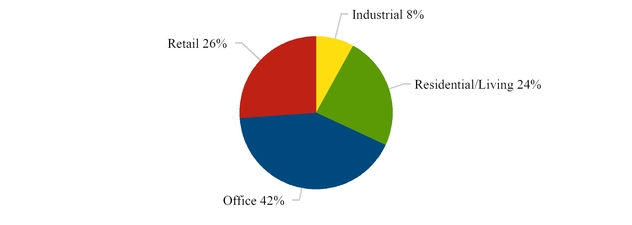

| |