UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | |

[X] | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

SeptemberMarch 30, 20172024

OR

| | | | | |

| ☐ | |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-36353

Perrigo Company plc

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Ireland | | Not Applicable |

| | |

Ireland | | Not Applicable |

(State or other jurisdiction of

incorporation or organization)

| | (I.R.S. Employer

Identification No.)

|

| |

Treasury Building, Lower Grand Canal Street, Dublin 2, Ireland | | - |

(Address of principal executive offices) | | (Zip Code) |

The Sharp Building, Hogan Place, Dublin 2, Ireland D02 TY74

+353 1 7094000

(Registrant’sAddress, including zip code, and telephone number, including

area code)code, of registrant’s principal executive offices)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

________________________________________ Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Ordinary shares, €0.001 par value | PRGO | New York Stock Exchange |

| 3.900% Notes due 2024 | PRGO24 | New York Stock Exchange |

| 4.375% Notes due 2026 | PRGO26 | New York Stock Exchange |

| 4.650% Notes due 2030 | PRGO30 | New York Stock Exchange |

| 5.300% Notes due 2043 | PRGO43 | New York Stock Exchange |

| 4.900% Notes due 2044 | PRGO44 | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such report)reports), and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ]Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES [X] NO [ ]Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| Large accelerated filer | [X]☒ | | Accelerated filer | [ ]☐ | | Non-accelerated filer | [ ]☐ | | (Do not check if smaller reporting company)

| Smaller reporting company | [ ]☐ |

| Emerging growth company | [ ]☐ | | | | | | | | | |

| | | | | | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | [ ]☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] YES [X] NO☐ Yes ☒ No

As of NovemberMay 3, 2017,2024, there were 140,840,721136,320,433 ordinary shares outstanding.

PERRIGO COMPANY PLC

FORM 10-Q

INDEX

| | | | | | | | |

| PAGE NUMBER |

| |

| |

| PART I. FINANCIAL INFORMATION | |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| 1 | | |

| | |

| 2 | | |

| | |

| | |

| | |

| 3 | | |

| | |

| 4 | | |

| | |

| 5 | | |

| | |

| 6 | | |

| | |

| 7 | | |

| | |

| 8 | | |

| | |

| 9 | | |

| | |

| 10 | | |

| | |

| 11 | | |

| | |

| 12 | | |

| | |

| 13 | | |

| | |

| 14 | | |

| | |

| 15 | | |

| | |

| 16 | | |

| | |

| | |

| | |

| |

| | |

| |

| | |

| |

| | |

| PART II. OTHER INFORMATION | |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

|

| | |

| | PAGE NUMBER |

| |

| | |

| PART I. FINANCIAL INFORMATION | |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| 1 | | |

| | | |

| 2 | | |

| | | |

| 3 | | |

| | | |

| 4 | | |

| | | |

| 5 | | |

| | | |

| 6 | | |

| | | |

| 7 | | |

| | | |

| 8 | | |

| | | |

| 9 | | |

| | | |

| 10 | | |

| | | |

| 11 | | |

| | | |

| 12 | | |

| | | |

| 13 | | |

| | | |

| 14 | | |

| | | |

| 15 | | |

| | | |

| 16 | | |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| PART II. OTHER INFORMATION | |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this report are “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created thereby. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our, or our industry’s actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by any forward-looking statements. In particular, statements about our expectations, beliefs, plans, objectives, assumptions, future events or future performance contained in this report, including certain statements contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” "forecast," “predict,” “potential” or the negative of those terms or other comparable terminology.

Please see Item 1A of our Form 10-K for the year ended December 31, 2016 for a discussion of certain important risk factors that relate to forward-looking statements contained in this report and Part II, Item 1A of this Form 10-Q. We haveThe Company has based these forward-looking statements on ourits current expectations, assumptions, estimates and projections. While we believethe Company believes these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond ourthe Company’s control, including: supply chain impacts on the timing, amountCompany’s business, including those caused or exacerbated by armed conflict, trade and costother economic sanctions and/or disease; general economic, credit, and market conditions; the impact of the war in Ukraine and any share repurchases;escalation thereof, including the effects of economic and political sanctions imposed by the United States, United Kingdom, European Union, and other countries related thereto; the outbreak or escalation of conflict in other regions where we do business; future impairment charges;charges, if we determine that the successcarrying amount of management transition;specific assets may not be recoverable from the expected future cash flows of such assets; customer acceptance of new products; competition from other industry participants, some of whom have greater marketing resources or larger market shares in certain product categories than we do;the Company does; pricing pressures from customers and consumers; potential third-party claimsresolution of uncertain tax positions and litigation, includingany litigation relating to our restatement of previously-filed financial information; potential impacts ofthereto, ongoing or future government investigations and regulatory initiatives; resolution of uncertain tax positions;uncertainty regarding the Company’s ability to obtain and maintain its regulatory approvals; potential costs and reputational impact of product recalls or sales halts; potential adverse changes to U.S. and foreign tax, reform legislation; general economic conditions;healthcare and other government policy; the effect of the coronavirus (COVID-19) pandemic and its variants, or other epidemic or pandemic disease; the timing, amount and cost of any share repurchases (or the absence thereof) and/or any refinancing of outstanding debt at or prior to maturity; fluctuations in currency exchange rates and interest rates; the consummation and success of the proposed sale of the HRA Rare Diseases portfolio, including the risk that the parties fail to obtain the required regulatory approvals or to fulfill the other conditions to closing on the expected timeframe or at all, the occurrence of any other event, change or circumstance that could delay the transaction or result in the termination of the sale agreement or that the Company faces higher than anticipated costs in connection with the proposed sale; the risk that potential costs or liabilities incurred or retained in connection with the sale of the Company's Rx business may exceed the Company’s estimates or adversely affect the Company’s business or operations; the Company’s ability to achieve the benefits expected from the acquisitions of Héra SAS ("HRA Pharma") and Nestlé’s Gateway infant formula plant along with the U.S. and Canadian rights to the GoodStart® infant formula brand and other related formula brands ("Gateway") and/or the risks that the Company’s synergy estimates are inaccurate or that the Company faces higher than anticipated integration or other costs in connection with the acquisitions; risks associated with the integration of HRA Pharma and Gateway, including the risk that growth rates are adversely affected by any delay in the integration of sales and distribution networks; the consummation and success of other announced and unannounced acquisitions or dispositions, and ourthe Company’s ability to realize the desired benefits thereof; and the Company’s ability to execute and achieve the desired benefits of announced cost-reduction efforts and other initiatives. In addition, we may identifystrategic initiatives and investments, including the Company’s ability to achieve the expected benefits from its ongoing restructuring programs described herein. Adverse results with respect to pending litigation could have a material adverse impact on the Company's operating results, cash flows and liquidity, and could ultimately require the use of corporate assets to pay damages, reducing assets that would otherwise be unable to remediate one or more material weaknesses in our internal control over financial reporting. Furthermore, we and/or our subsidiaries may incur additional tax liabilities in respect of 2016 and prior years as a result of any restatement or may be found to have breached certain provisions of Irish company legislation in respect of prior financial statements and if so may incur additional expenses and penalties.available for other corporate purposes. These and other important factors, including those discussed in our Form 10-K for the year ended December 31, 2016, in2023, this report under “Risk Factors” and in any subsequent filings with the United States Securities and Exchange Commission, may cause actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. The forward-looking statements in this report are made only as of the date hereof, and unless otherwise required by applicable securities laws, we disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

This report contains trademarks, trade names and service marks that are the property of Perrigo Company plc, as well as, for informational purposes, trademarks, trade names, and service marks that are the property of other organizations. Solely for convenience, certain trademarks, trade names, and service marks referred to in this report appear without the ®,™ and SM symbols, but those references are not intended to indicate that we or the applicable owner, as the case may be, will not assert, to the fullest extent under applicable law, our or their rights to such trademarks, trade names, and service marks.

Perrigo Company plc - Item 1

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (UNAUDITED)

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | March 30, 2024 | | April 1, 2023 | | | | |

| Net sales | $ | 1,082.1 | | | $ | 1,181.7 | | | | | |

| Cost of sales | 724.4 | | | 767.9 | | | | | |

| Gross profit | 357.7 | | | 413.8 | | | | | |

| | | | | | | |

| Operating expenses | | | | | | | |

| Distribution | 24.9 | | | 28.6 | | | | | |

| Research and development | 29.0 | | | 31.1 | | | | | |

| Selling | 150.3 | | | 167.9 | | | | | |

| Administration | 130.4 | | | 135.0 | | | | | |

| | | | | | | |

| Restructuring | 44.3 | | | 3.4 | | | | | |

| Other operating expense (income), net | 34.0 | | | (0.7) | | | | | |

| Total operating expenses | 412.9 | | | 365.3 | | | | | |

| | | | | | | |

| Operating (loss) income | (55.2) | | | 48.5 | | | | | |

| | | | | | | |

| | | | | | | |

| Interest expense, net | 43.0 | | | 43.7 | | | | | |

| Other (income) expense, net | 0.4 | | | 0.5 | | | | | |

| | | | | | | |

| Income (loss) from continuing operations before income taxes | (98.6) | | | 4.3 | | | | | |

| Income tax (benefit) expense | (102.7) | | | 5.4 | | | | | |

| Income (loss) from continuing operations | 4.1 | | | (1.1) | | | | | |

| Income (loss) from discontinued operations, net of tax | (2.1) | | | (1.9) | | | | | |

| Net income (loss) | $ | 2.0 | | | $ | (3.0) | | | | | |

| | | | | | | |

| Earnings (loss) per share | | | | | | | |

| Basic | | | | | | | |

| Continuing operations | $ | 0.03 | | | $ | (0.01) | | | | | |

| Discontinued operations | (0.02) | | | (0.01) | | | | | |

| Basic earnings (loss) per share | $ | 0.01 | | | $ | (0.02) | | | | | |

| Diluted | | | | | | | |

| Continuing operations | $ | 0.03 | | | $ | (0.01) | | | | | |

| Discontinued operations | (0.02) | | | (0.01) | | | | | |

| Diluted earnings (loss) per share | $ | 0.01 | | | $ | (0.02) | | | | | |

| | | | | | | |

| Weighted-average shares outstanding | | | | | | | |

| Basic | 136.6 | | | 134.9 | | | | | |

| Diluted | 137.6 | | | 134.9 | | | | | |

|

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30,

2017 | | October 1,

2016 | | September 30,

2017 | | October 1,

2016 |

| Net sales | $ | 1,231.3 |

| | $ | 1,261.6 |

| | $ | 3,663.1 |

| | $ | 3,949.3 |

|

| Cost of sales | 733.5 |

| | 777.1 |

| | 2,196.4 |

| | 2,385.2 |

|

| Gross profit | 497.8 |

| | 484.5 |

| | 1,466.7 |

| | 1,564.1 |

|

| | | | | | | | |

| Operating expenses | | | | | | | |

| Distribution | 21.5 |

| | 21.6 |

| | 64.2 |

| | 65.9 |

|

| Research and development | 38.4 |

| | 50.2 |

| | 120.8 |

| | 142.5 |

|

| Selling | 143.5 |

| | 154.6 |

| | 454.1 |

| | 506.9 |

|

| Administration | 123.3 |

| | 105.4 |

| | 326.9 |

| | 317.2 |

|

| Impairment charges | 7.8 |

| | 1,614.4 |

| | 47.4 |

| | 2,028.8 |

|

| Restructuring | 3.8 |

| | 6.6 |

| | 54.7 |

| | 17.9 |

|

| Other operating income | (2.9 | ) | | — |

| | (41.0 | ) | | — |

|

| Total operating expenses | 335.4 |

| | 1,952.8 |

| | 1,027.1 |

| | 3,079.2 |

|

| | | | | | | | |

| Operating income (loss) | 162.4 |

| | (1,468.3 | ) | | 439.6 |

| | (1,515.1 | ) |

| | | | | | | | |

| Change in financial assets | 2.6 |

| | 377.4 |

| | 24.2 |

| | 1,492.6 |

|

| Interest expense, net | 34.7 |

| | 54.6 |

| | 133.1 |

| | 163.2 |

|

| Other (income) expense, net | (3.6 | ) | | 1.0 |

| | (1.1 | ) | | 32.4 |

|

| Loss on extinguishment of debt | — |

| | 0.7 |

| | 135.2 |

| | 1.1 |

|

| Income (loss) before income taxes | 128.7 |

| | (1,902.0 | ) | | 148.2 |

| | (3,204.4 | ) |

| Income tax expense (benefit) | 84.2 |

| | (311.8 | ) | | 101.8 |

| | (550.7 | ) |

| Net income (loss) | $ | 44.5 |

| | $ | (1,590.2 | ) | | $ | 46.4 |

| | $ | (2,653.7 | ) |

| | | | | | | | |

| Earnings (loss) per share | | | | | | | |

| Basic | 0.31 |

| | (11.10 | ) | | $ | 0.33 |

| | $ | (18.53 | ) |

| Diluted | $ | 0.31 |

| | $ | (11.10 | ) | | $ | 0.32 |

| | $ | (18.53 | ) |

| | | | | | | | |

| Weighted-average shares outstanding | | | | | | | |

| Basic | 141.3 |

| | 143.3 |

| | 142.5 |

| | 143.2 |

|

| Diluted | 141.7 |

| | 143.3 |

| | 142.8 |

| | 143.2 |

|

| | | | | | | | |

| Dividends declared per share | $ | 0.160 |

| | $ | 0.145 |

| | $ | 0.480 |

| | $ | 0.435 |

|

See accompanying Notes to the Condensed Consolidated Financial StatementsStatements.

Perrigo Company plc - Item 1

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in millions)

(unaudited)

| | | | | | | | | | | | | | | |

| Three Months Ended | | |

| March 30, 2024 | | April 1, 2023 | | | | |

| Net income (loss) | $ | 2.0 | | | $ | (3.0) | | | | | |

| Other comprehensive income (loss): | | | | | | | |

| Foreign currency translation adjustments | (58.3) | | | 52.7 | | | | | |

| Change in fair value of derivative financial instruments, net of tax | 10.9 | | | (31.5) | | | | | |

| | | | | | | |

| Change in post-retirement and pension liability, net of tax | (1.0) | | | (0.5) | | | | | |

| Other comprehensive income (loss), net of tax | (48.4) | | | 20.7 | | | | | |

| Comprehensive income (loss) | $ | (46.4) | | | $ | 17.7 | | | | | |

|

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30,

2017 | | October 1,

2016 | | September 30,

2017 | | October 1,

2016 |

| Net income (loss) | $ | 44.5 |

| | $ | (1,590.2 | ) | | $ | 46.4 |

| | $ | (2,653.7 | ) |

| Other comprehensive income: | | | | | | | |

| Foreign currency translation adjustments | 69.9 |

| | 27.5 |

| | 289.9 |

| | 71.5 |

|

| Change in fair value of derivative financial instruments, net of tax | 0.1 |

| | 3.6 |

| | 8.7 |

| | (3.5 | ) |

| Change in fair value of investment securities, net of tax | (8.1 | ) | | 9.8 |

| | (24.4 | ) | | 18.4 |

|

| Change in post-retirement and pension liability, net of tax | (1.2 | ) | | (0.2 | ) | | (1.2 | ) | | 0.4 |

|

| Other comprehensive income, net of tax | 60.7 |

| | 40.7 |

| | 273.0 |

| | 86.8 |

|

| Comprehensive income (loss) | $ | 105.2 |

| | $ | (1,549.5 | ) | | $ | 319.4 |

| | $ | (2,566.9 | ) |

See accompanying Notes to the Condensed Consolidated Financial StatementsStatements.

Perrigo Company plc - Item 1

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions, except share and per share amounts)

(unaudited)

| | March 30, 2024 | | | March 30, 2024 | | December 31, 2023 |

| Assets | |

| | Cash, cash equivalents and restricted cash | |

| | September 30,

2017 | | December 31,

2016 |

| Assets | | | |

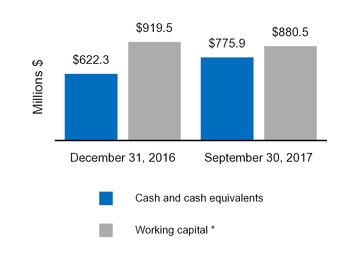

| Cash and cash equivalents | $ | 775.9 |

| | $ | 622.3 |

|

| Accounts receivable, net of allowance for doubtful accounts of $6.2 million and $6.3 million, respectively | 1,076.6 |

| | 1,176.0 |

|

| Cash, cash equivalents and restricted cash | |

| | Cash, cash equivalents and restricted cash | |

| | Accounts receivable, net of allowance for credit losses of $8.1 and $7.8, respectively | |

| Accounts receivable, net of allowance for credit losses of $8.1 and $7.8, respectively | |

| Accounts receivable, net of allowance for credit losses of $8.1 and $7.8, respectively | |

| Inventories | 821.9 |

| | 795.0 |

|

| | Prepaid expenses and other current assets | 297.4 |

| | 212.0 |

|

| Prepaid expenses and other current assets | |

| Prepaid expenses and other current assets | |

| | Total current assets | 2,971.8 |

| | 2,805.3 |

|

| Total current assets | |

| Total current assets | |

| | Property, plant and equipment, net | 822.3 |

| | 870.1 |

|

| Financial assets | — |

| | 2,350.0 |

|

| Goodwill and other indefinite-lived intangible assets | 4,255.4 |

| | 4,163.9 |

|

| Other intangible assets, net | 3,347.4 |

| | 3,396.8 |

|

| Non-current deferred income taxes | 22.4 |

| | 72.1 |

|

| Property, plant and equipment, net | |

| Property, plant and equipment, net | |

| Operating lease assets | |

| | Goodwill and indefinite-lived intangible assets | |

| Goodwill and indefinite-lived intangible assets | |

| Goodwill and indefinite-lived intangible assets | |

| Definite-lived intangible assets, net | |

| Deferred income taxes | |

| | Other non-current assets | |

| Other non-current assets | |

| Other non-current assets | 423.3 |

| | 211.9 |

|

| Total non-current assets | 8,870.8 |

| | 11,064.8 |

|

| Total assets | $ | 11,842.6 |

| | $ | 13,870.1 |

|

| Liabilities and Shareholders’ Equity | | | |

| | Accounts payable | |

| | Accounts payable | |

| | Accounts payable | $ | 477.1 |

| | $ | 471.7 |

|

| Payroll and related taxes | 133.4 |

| | 115.8 |

|

| Accrued customer programs | 368.8 |

| | 380.3 |

|

| Accrued liabilities | 274.6 |

| | 263.3 |

|

| Other accrued liabilities | |

| Accrued income taxes | 61.5 |

| | 32.4 |

|

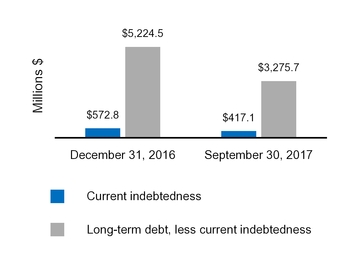

| | Current indebtedness | 417.1 |

| | 572.8 |

|

| Current indebtedness | |

| Current indebtedness | |

| | Total current liabilities | 1,732.5 |

| | 1,836.3 |

|

| Total current liabilities | |

| Total current liabilities | |

| | Long-term debt, less current portion | 3,275.7 |

| | 5,224.5 |

|

| Non-current deferred income taxes | 357.7 |

| | 389.9 |

|

| Long-term debt, less current portion | |

| Long-term debt, less current portion | |

| Deferred income taxes | |

| | Other non-current liabilities | |

| Other non-current liabilities | |

| Other non-current liabilities | 434.9 |

| | 461.8 |

|

| Total non-current liabilities | 4,068.3 |

| | 6,076.2 |

|

| Total liabilities | 5,800.8 |

| | 7,912.5 |

|

| Commitments and contingencies - Note 14 | | | |

| Contingencies - Refer to Note 15 | | Contingencies - Refer to Note 15 | | | |

| Shareholders’ equity | | | |

| Controlling interest: | | | |

| Preferred shares, $0.0001 par value, 10 million shares authorized | — |

| | — |

|

| Ordinary shares, €0.001 par value, 10 billion shares authorized | 7,900.1 |

| | 8,135.0 |

|

| Accumulated other comprehensive income (loss) | 191.2 |

| | (81.8 | ) |

| Controlling interests: | |

| Controlling interests: | |

| Controlling interests: | |

| Preferred shares, $0.0001 par value per share, 10 shares authorized | |

| Preferred shares, $0.0001 par value per share, 10 shares authorized | |

| Preferred shares, $0.0001 par value per share, 10 shares authorized | |

| Ordinary shares, €0.001 par value per share, 10,000 shares authorized | |

| Accumulated other comprehensive income | |

| Retained earnings (accumulated deficit) | (2,049.6 | ) | | (2,095.1 | ) |

| Total controlling interest | 6,041.7 |

| | 5,958.1 |

|

| Noncontrolling interest | 0.1 |

| | (0.5 | ) |

| | Total shareholders’ equity | |

| | Total shareholders’ equity | |

| | Total shareholders’ equity | 6,041.8 |

| | 5,957.6 |

|

| Total liabilities and shareholders' equity | $ | 11,842.6 |

| | $ | 13,870.1 |

|

| | | | |

| Supplemental Disclosures of Balance Sheet Information | | | |

| Ordinary shares, issued and outstanding (in millions) | 140.8 |

| | 143.4 |

|

| Supplemental Disclosures of Balance Sheet Information | |

| Supplemental Disclosures of Balance Sheet Information | |

| Preferred shares, issued and outstanding | |

| Preferred shares, issued and outstanding | |

| Preferred shares, issued and outstanding | |

| Ordinary shares, issued and outstanding | |

See accompanying Notes to the Condensed Consolidated Financial StatementsStatements.

Perrigo Company plc - Item 1

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(in millions, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Ordinary Shares

Issued | | Accumulated

Other

Comprehensive

Income | | Retained

Earnings

(Accumulated Deficit) | | Total |

| | Shares | | Amount |

| Balance at December 31, 2022 | 134.7 | | | $ | 6,936.7 | | | $ | (27.0) | | | $ | (2,067.6) | | | $ | 4,842.1 | |

| | | | | | | | | |

| Net loss | — | | | — | | | — | | | (3.0) | | | (3.0) | |

| Other comprehensive loss | — | | | — | | | 20.7 | | | — | | | 20.7 | |

| | | | | | | | | |

| Restricted stock plan | 1.0 | | | — | | | — | | | — | | | — | |

| | | | | | | | | |

| Compensation for restricted stock | — | | | 24.9 | | | — | | | — | | | 24.9 | |

| Cash dividends, $0.26 per share | — | | | (36.2) | | | — | | | — | | | (36.2) | |

| Shares withheld for payment of employees' withholding tax liability | (0.4) | | | (14.6) | | | — | | | — | | | (14.6) | |

| | | | | | | | | |

| Balance at April 1, 2023 | 135.3 | | | $ | 6,910.8 | | | $ | (6.3) | | | $ | (2,070.6) | | | $ | 4,833.9 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Ordinary Shares

Issued | | Accumulated

Other

Comprehensive

Income | | Retained

Earnings

(Accumulated Deficit) | | Total |

| | Shares | | Amount |

| Balance at December 31, 2023 | 135.5 | | | $ | 6,837.5 | | | $ | 10.7 | | | $ | (2,080.3) | | | $ | 4,767.9 | |

| | | | | | | | | |

| Net income | — | | | — | | | — | | | 2.0 | | | 2.0 | |

| Other comprehensive income | — | | | — | | | (48.4) | | | — | | | (48.4) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Compensation for restricted stock | 1.2 | | | 15.6 | | | — | | | — | | | 15.6 | |

| Cash dividends, $0.27 per share | — | | | (37.6) | | | — | | | — | | | (37.6) | |

| Shares withheld for payment of employees' withholding tax liability | (0.4) | | | (12.5) | | | — | | | — | | | (12.5) | |

| Balance at March 30, 2024 | 136.3 | | | $ | 6,803.0 | | | $ | (37.7) | | | $ | (2,078.3) | | | $ | 4,687.0 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

See accompanying Notes to the Condensed Consolidated Financial Statements.

Perrigo Company plc - Item 1

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

| | | | | | | | | | | |

| Three Months Ended |

| | March 30, 2024 | | April 1, 2023 |

| Cash Flows From (For) Operating Activities | | | |

| Net income (loss) | $ | 2.0 | | | $ | (3.0) | |

| Adjustments to derive cash flows: | | | |

| Depreciation and amortization | 81.4 | | | 88.7 | |

| Restructuring charges | 44.3 | | | 3.4 | |

| Share-based compensation | 15.6 | | | 24.9 | |

| Amortization of debt discount | 0.4 | | | 0.7 | |

| Gain on sale of assets | — | | | (3.9) | |

| | | |

| | | |

| | | |

| Deferred income taxes | (11.0) | | | (9.9) | |

| Other non-cash adjustments, net | (7.4) | | | 6.4 | |

| Subtotal | 125.3 | | | 107.3 | |

| Increase (decrease) in cash due to: | | | |

| Accrued income taxes | (81.6) | | | 2.5 | |

| Accounts receivable | (51.9) | | | (39.8) | |

| Payroll and related taxes | (51.6) | | | (34.3) | |

| Accounts payable | (16.7) | | | (29.8) | |

| Prepaid expenses and other current assets | (1.7) | | | 17.1 | |

| Inventories | 10.6 | | | (28.6) | |

| Accrued customer programs | 18.2 | | | 6.8 | |

| Accrued liabilities | 30.6 | | | 8.0 | |

| Other operating, net | 17.4 | | | 10.2 | |

| Subtotal | (126.7) | | | (87.9) | |

| Net cash (for) from operating activities | (1.4) | | | 19.4 | |

| Cash Flows From (For) Investing Activities | | | |

| Additions to property, plant and equipment | (25.1) | | | (23.2) | |

| | | |

| | | |

| | | |

| | | |

| Proceeds from sale of assets | — | | | 1.8 | |

| Proceeds from royalty rights | 1.6 | | | 1.8 | |

| | | |

| Net cash for investing activities | (23.5) | | | (19.6) | |

| Cash Flows For Financing Activities | | | |

| Cash dividends | (37.6) | | | (36.2) | |

| Payments on long-term debt | (9.8) | | | (5.9) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Other financing, net | (13.0) | | | (8.6) | |

| Net cash for financing activities | (60.4) | | | (50.7) | |

| Effect of exchange rate changes on cash and cash equivalents | (7.5) | | | 3.2 | |

| Net decrease in cash and cash equivalents | (92.8) | | | (47.7) | |

| Cash, cash equivalents and restricted cash of continuing operations, beginning of period | 751.3 | | | 600.7 | |

| | | |

| | | |

| Cash, cash equivalents and restricted cash of continuing operations, end of period | $ | 658.5 | | | $ | 553.0 | |

|

| | | | | | | |

| | Nine Months Ended |

| | September 30,

2017 | | October 1,

2016 |

| Cash Flows From (For) Operating Activities | | | |

| Net income (loss) | $ | 46.4 |

| | $ | (2,653.7 | ) |

| Adjustments to derive cash flows | | | |

| Depreciation and amortization | 333.1 |

| | 338.4 |

|

| Share-based compensation | 28.1 |

| | 15.3 |

|

| Impairment charges | 47.4 |

| | 2,028.8 |

|

| Change in financial assets | 24.2 |

| | 1,492.6 |

|

| Loss on extinguishment of debt | 135.2 |

| | 1.1 |

|

| Restructuring charges | 54.7 |

| | 17.9 |

|

| Deferred income taxes | (16.3 | ) | | (674.1 | ) |

| Amortization of debt premium | (18.4 | ) | | (24.6 | ) |

| Other non-cash adjustments, net | (27.2 | ) | | 34.5 |

|

| Subtotal | 607.2 |

| | 576.2 |

|

| Increase (decrease) in cash due to: | | | |

| Accounts receivable | 38.4 |

| | 113.0 |

|

| Inventories | (28.3 | ) | | 25.1 |

|

| Accounts payable | (6.0 | ) | | (57.7 | ) |

| Payroll and related taxes | (36.7 | ) | | (40.0 | ) |

| Accrued customer programs | (15.8 | ) | | (73.7 | ) |

| Accrued liabilities | (18.8 | ) | | (90.0 | ) |

| Accrued income taxes | (61.5 | ) | | 5.2 |

|

| Other, net | 3.5 |

| | (9.4 | ) |

| Subtotal | (125.2 | ) | | (127.5 | ) |

| Net cash from operating activities | 482.0 |

| | 448.7 |

|

| Cash Flows From (For) Investing Activities | | | |

| Proceeds from royalty rights | 86.4 |

| | 259.5 |

|

| Acquisitions of businesses, net of cash acquired | — |

| | (436.8 | ) |

| Asset acquisitions | — |

| | (65.1 | ) |

| Additions to property, plant and equipment | (55.2 | ) | | (84.6 | ) |

| Net proceeds from sale of business and other assets | 46.7 |

| | 58.5 |

|

Proceeds from sale of the Tysabri® financial asset | 2,200.0 |

| | — |

|

| Other investing, net | (5.8 | ) | | (1.0 | ) |

| Net cash from (for) investing activities | 2,272.1 |

| | (269.5 | ) |

| Cash Flows From (For) Financing Activities | | | |

| Issuances of long-term debt | — |

| | 1,190.3 |

|

| Payments on long-term debt | (2,243.7 | ) | | (545.8 | ) |

| Borrowings (repayments) of revolving credit agreements and other financing, net | — |

| | (803.6 | ) |

| Deferred financing fees | (4.2 | ) | | (2.8 | ) |

| Premium on early debt retirement | (116.1 | ) | | (0.6 | ) |

| Issuance of ordinary shares | 0.5 |

| | 8.2 |

|

| Repurchase of ordinary shares | (191.5 | ) | | — |

|

| Cash dividends | (68.7 | ) | | (62.4 | ) |

| Other financing | 2.7 |

| | (17.4 | ) |

| Net cash (for) financing activities | (2,621.0 | ) | | (234.1 | ) |

| Effect of exchange rate changes on cash and cash equivalents | 20.5 |

| | (0.2 | ) |

| Net increase (decrease) in cash and cash equivalents | 153.6 |

| | (55.1 | ) |

| Cash and cash equivalents, beginning of period | 622.3 |

| | 417.8 |

|

| Cash and cash equivalents, end of period | $ | 775.9 |

| | $ | 362.7 |

|

See accompanying Notes to the Condensed Consolidated Financial StatementsStatements.

Perrigo Company plc - Item 1

Note 1

NOTE 1 –- SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

General Information

The Company

Perrigo Company plc was incorporated under the laws of Ireland on June 28, 2013 and became the successor registrant of Perrigo Company, a Michigan corporation, on December 18, 2013 in connection with the acquisition of Elan Corporation, plc ("Elan"). Unless the context requires otherwise, the terms "Perrigo," the "Company," "we," "our," "us," and similar pronouns used herein refer to Perrigo Company plc, its subsidiaries, and all predecessors of Perrigo Company plc and its subsidiaries.

We are a leading global healthcare company, delivering value to our customers and consumers by providing Quality Affordable Healthcare Products®. Founded in 1887 as a packager of home remedies, we have built a unique business model that is best described as the convergence of a fast-moving consumer goods company, a high-quality pharmaceutical manufacturing organization and a world-class supply chain network. We believe we are one of the world's largest manufacturers of over-the-counter (“OTC”) healthcare products and suppliers of infant formulas for the store brand market. We also are a leading provider of branded OTC products throughout Europeover-the-counter ("OTC") health and wellness solutions that are designed to enhance individual well-being and empower consumers to proactively prevent or treat conditions that can be self-managed. Our vision is to provide the U.S., as well as a leading producer of generic standard topical products such as creams, lotions, and gels, as well as inhalants and injections ("extended topical") prescription drugs.best self-care for everyone. We are headquartered in Ireland and sell our products primarily in North America and Europe as well as in other markets including Australia, Israel and China.around the world.

Basis of Presentation

The accompanyingOur unaudited Condensed Consolidated Financial Statements have been prepared in accordanceconformity with U.S.accounting principles generally accepted accounting principlesin the United States of America ("U.S. GAAP") for interim financial information and with the instructions to Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. The unaudited Condensed Consolidated Financial Statements should be read in conjunction with the consolidated financial statementsConsolidated Financial Statements and footnotes included in our Annual Report on Form 10-K for the year ended December 31, 2016.2023. In the opinion of management, all adjustments (consisting of normal recurring accruals and other adjustments) considered necessary for a fair presentation of the unaudited Condensed Consolidated Financial Statements have been included and include our accounts and the accounts of all majority-owned subsidiaries. All intercompany transactions and balances have been eliminated in consolidation. Certain prior period amounts have been reclassified to conform to the current period presentation. Some amounts in this report may not add due to rounding.

Segment Reporting

Our reporting and operating segments are as follows:

•Consumer Self-Care Americas ("CSCA") comprises our consumer self-care business in the U.S. and Canada.

•Consumer Self-Care International ("CSCI") comprises our consumer self-care business outside of the U.S. and Canada, primarily in Europe and Australia.

We previously had an Rx segment which was comprised of our generic prescription pharmaceuticals business in the U.S., and other pharmaceuticals and diagnostic business in Israel, which have been divested. Following the divestiture, there were no substantial assets or operations left in this segment. The Rx segment was reported as Discontinued Operations in 2021, and is presented as such for all periods in this report (refer to Note 3).

Our segments reflect the way in which our chief operating decision maker, who is our CEO, makes operating decisions, allocates resources and manages the growth and profitability of the Company. Financial information related to our business segments and geographic locations can be found in Note 2 and Note 16.

Foreign Currency Translation and Transactions

We translate our non-U.S. dollar-denominated operations’ assets and liabilities into U.S. dollars at current rates of exchange as of the balance sheet date and income and expense items at the average exchange rate for the reporting period. Translation adjustments resulting from exchange rate fluctuations are recorded in the cumulative translation account, a component of Accumulated other comprehensive income (loss) ("AOCI"). Gains or losses from foreign currency transactions are included in Other (income) expense, net.

Perrigo Company plc - Item 1

Note 1

Cash, Cash Equivalents and Restricted Cash

Recent Accounting Standard Pronouncements

Cash and cash equivalents consist primarily of demand deposits and other short-term investments with maturities of three months or less at the date of purchase.

Below are recent accounting standard updates that we are still assessing to determine

We have $7.0 million of restricted cash as of March 30, 2024 and December 31, 2023 in the effect on our Condensed Consolidated Financial Statements.Balance Sheets. We entered into an agreement to extend a credit line to an existing customer in exchange for a cash security deposit. The agreement requires the cash to be held in a separate account and will be returned to the customer at the expiration of the agreement provided all credits have been paid as agreed.

Allowance for Credit Losses

Expected credit losses on trade receivables and contract assets are measured collectively by geographic location. Historical credit loss experience provides the primary basis for estimation of expected credit losses and is adjusted for current conditions and for reasonable and supportable forecasts. Receivables that do not believe that any other recently issued accounting standards could have a material effectshare risk characteristics are evaluated on our Condensed Consolidated Financial Statements. As new accounting pronouncementsan individual basis and are issued, we will adopt those that are applicable undernot included in the circumstances.collective evaluation. The following table presents the allowance for credit losses activity (in millions):

| | | | | | | | | | | | | | | |

| Three Months Ended | | |

| March 30, 2024 | | April 1, 2023 | | | | |

| Balance at beginning of period | $ | 7.8 | | | $ | 6.8 | | | | | |

| Provision for credit losses, net | 0.3 | | | — | | | | | |

| Receivables written-off | — | | | (0.3) | | | | | |

| Recoveries collected | 0.1 | | | — | | | | | |

| | | | | | | |

| Currency translation adjustment | (0.1) | | | 0.6 | | | | | |

| Balance at end of period | $ | 8.1 | | | $ | 7.1 | | | | | |

|

| | | | | | |

Recently Issued Accounting Standards Adopted |

Standard | | Description | | Date of adoption | | Effect on the Financial Statements or Other Significant Matters |

Clarifying the Definition of a Business | | This update clarifies the definition of a business and addresses whether transactions should be accounted for as asset acquisitions or business combinations (or divestitures). The guidance includes an initial threshold that an acquired set of assets will not be considered a business if substantially all of the fair value of the assets acquired is concentrated in a single tangible or identifiable intangible asset (or group of similar assets). If the acquired set does not pass the initial threshold, then the guidance requires that, to be a business, the set must include an input and a substantive process that together significantly contribute to the ability to create outputs. Different factors are considered to determine whether the set includes a substantive process, such as the inclusion of an organized workforce. Further, the guidance removes language stating that a business need not include all of the inputs and processes that the seller used in operating the business. | | January 1, 2017 | | We early adopted this new standard and will apply it prospectively when determining whether transactions should be accounted for as asset acquisitions (divestitures) or business combinations (divestitures). During the nine months ended September 30, 2017, we applied the new guidance when determining whether certain product divestitures represented sales of assets or businesses.

|

Improvements to Employee Share-Based Payment Accounting

| | This guidance is intended to simplify several aspects of the accounting for share-based payment award transactions. It will require all income tax effects of awards to be recorded through the income statement when the awards vest or settle as opposed to certain amounts being recorded in additional paid-in capital. An entity will also have to elect whether to account for forfeitures as they occur or by estimating the number of awards expected to be forfeited and adjusting the estimate when it is likely to change (as currently required). The guidance will also increase the amount an employer can withhold to cover income taxes on awards. | | January 1, 2017 | | We adopted this standard as of January 1, 2017. We elected to estimate the number of awards expected to be forfeited and adjust the estimate when it is likely to change, consistent with past practice. We did not change the amounts that we withhold to cover income taxes on awards. As the requirement to record all income tax effects of vested or settled awards through the income statement is prospective in nature, there was no cumulative effect of adopting the standard on our balance sheet. |

Perrigo Company plc - Item 1

Note 1

|

| | | | | | |

Recently Issued Accounting Standards Not Yet Adopted |

Standard | | Description | | Effective Date | | Effect on the Financial Statements or Other Significant Matters |

Revenue from Contracts with Customers | | The core principle of the guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. To achieve that core principle, an entity should apply the following steps: identify the contract(s) with a customer; identify the performance obligations in the contract; determine the transaction price; allocate the transaction price to the performance obligations in the contract; and recognize revenue when (or as) the entity satisfies a performance obligation. This guidance allows for two adoption methods, full retrospective approach or modified retrospective approach. | | January 1, 2018 | | We continue to evaluate the implications of adoption of the new revenue standard on our Consolidated Financial Statements. We have completed an initial assessment and are in the process of quantifying the adoption impact, if any, related to certain topics identified through our evaluation process. Our assessment of the new revenue standard has been focused on, but has not been limited to, the concepts of over-time versus point-in-time revenue recognition patterns, variable consideration, and identification of performance obligations. We will not complete our final assessment and quantification of the impact of the new revenue standard on our Consolidated Financial Statements until the adoption date. Our analysis indicates that certain contract manufacturing and private label arrangements may require revenue recognition over-time in situations in which we produce products that have no alternative use and we have an enforceable right to payment for performance completed to date, inclusive of a reasonable profit margin. This may result in an acceleration of revenue recognition for certain contractual arrangements as compared to recognition under current accounting literature. We plan to adopt the new revenue standard effective January 1, 2018 using the modified retrospective method. |

Intra-Entity Asset Transfers of Assets Other Than Inventory | | Under the new guidance, the tax impact to the seller on the profit from the transfers and the buyer’s deferred tax benefit on the increased tax basis would be recognized when the transfers occur, resulting in the recognition of expense sooner than under historical guidance. The guidance excludes intra-entity transfers of inventory. For intra-entity transfers of inventory, the Financial Accounting Standards Board ("FASB") decided to retain current GAAP, which requires an entity to recognize the income tax consequences when the inventory has been sold to an outside party. | | January 1, 2018 | | We are currently evaluating the implications of adoption on our Consolidated Financial Statements. |

Financial Instruments - Recognition and Measurement of Financial Assets and Liabilities | | The objective of this simplification update is to improve the decision usefulness of financial instrument reporting, and it principally affects accounting for equity investments currently classified as available for sale and financial liabilities where the fair value option has been elected. Entities will have to measure many equity investments at fair value and recognize changes in fair value in net income rather than other comprehensive income as required under current U.S. GAAP. | | January 1, 2018 | | We have identified certain investments that will require an adjustment, however, at this time, we are unable to estimate the impact of adopting this standard as the significance of the impact will depend upon our equity investments as of the date of adoption. |

Perrigo Company plc - Item 1

Note 1

|

| | | | | | |

Recently Issued Accounting Standards Not Yet Adopted (continued) |

Standard | | Description | | Effective Date | | Effect on the Financial Statements or Other Significant Matters |

Leases | | This guidance was issued to increase transparency and comparability among organizations by requiring recognition of lease assets and lease liabilities on the balance sheet and disclosure of key information about leasing arrangements. For leases with a term of 12 months or less, lessees are permitted to make an election to not recognize right-of-use assets and lease liabilities. Upon adoption, lessees will apply the new standard as of the beginning of the earliest comparative period presented in the financial statements, however lessees will be able to exclude leases that expire as of the implementation date. Early adoption is permitted. | | January 1, 2019 | | We are currently evaluating the implications of adoption on our Consolidated Financial Statements and have commenced the first step of identifying a task force to take the lead in implementing the new Lease standard. |

Derivatives and Hedging | | This update was issued to enable entities to better portray the economics of their risk management activities in the financial statements and enhance the transparency and understandability of hedge results. In addition, the amendments simplify the application of hedge accounting in certain situations. Under the new rule, the entity’s ability to hedge non-financial and financial risk components is expanded. The guidance eliminates the requirement to separately measure and report hedge ineffectiveness and also eases certain documentation and assessment requirements. Early adoption is permitted. | | January 1, 2019 | | We are currently evaluating the implications of adoption on our Consolidated Financial Statements.

|

Measurement of Credit Losses on Financial Instruments | | This guidance changes the impairment model for most financial assets and certain other instruments, replacing the current "incurred loss" approach with an "expected loss" credit impairment model, which will apply to most financial assets measured at amortized cost and certain other instruments, including trade and other receivables, loans, held-to-maturity debt securities, and off-balance sheet credit exposures such as letters of credit. Early adoption is permitted. | | January 1, 2020 | | We are currently evaluating the new standard for potential impacts on our receivables, debt, and other financial instruments. |

Intangibles - Goodwill and Other Simplifying the Test for Goodwill | | The objective of this update is to reduce the cost and complexity of subsequent goodwill accounting by simplifying the impairment test by removing the Step 2 requirement to perform a hypothetical purchase price allocation when the carrying value of a reporting unit exceeds its fair value. If a reporting unit’s carrying value exceeds its fair value, an entity would record an impairment charge based on that difference, limited to the amount of goodwill attributed to that reporting unit. The proposal would not change the guidance on completing Step 1 of the goodwill impairment test. The proposed guidance would be applied prospectively. Early adoption is permitted. | | January 1, 2020 | | We are currently evaluating the implications of adoption on our Consolidated Financial Statements.

|

Perrigo Company plc - Item 1

Note 2

NOTE 2 – DIVESTITURES- REVENUE RECOGNITION

Current Year DivestituresThe following is a summary of our net sales by category (in millions):

| | | | | | | | | | | | | | | |

| Three Months Ended | | |

| March 30, 2024 | | April 1, 2023 | | | | |

CSCA(1) | | | | | | | |

| Upper Respiratory | $ | 130.3 | | | $ | 153.7 | | | | | |

| Digestive Health | 122.2 | | | 124.0 | | | | | |

| Nutrition | 90.6 | | | 138.5 | | | | | |

| Pain and Sleep-Aids | 82.6 | | | 103.4 | | | | | |

| Healthy Lifestyle | 71.3 | | | 73.4 | | | | | |

| Oral Care | 64.7 | | | 83.3 | | | | | |

| Skin Care | 49.6 | | | 69.8 | | | | | |

| Women's Health | 27.2 | | | 12.3 | | | | | |

| Vitamins, Minerals, and Supplements ("VMS") | 4.2 | | | 4.5 | | | | | |

Other CSCA(2) | 1.4 | | | 0.8 | | | | | |

| Total CSCA | $ | 644.1 | | | $ | 763.7 | | | | | |

| CSCI | | | | | | | |

| Skin Care | $ | 114.7 | | | $ | 83.4 | | | | | |

| Upper Respiratory | 69.1 | | | 84.8 | | | | | |

| Healthy Lifestyle | 64.6 | | | 66.4 | | | | | |

| Pain and Sleep-Aids | 51.4 | | | 49.9 | | | | | |

| VMS | 44.6 | | | 47.8 | | | | | |

| Women's Health | 32.0 | | | 29.1 | | | | | |

| Oral Care | 28.7 | | | 29.1 | | | | | |

| Digestive Health | 9.5 | | | 8.8 | | | | | |

Other CSCI(3) | 23.3 | | | 18.8 | | | | | |

| Total CSCI | 437.9 | | | 418.1 | | | | | |

| | | | | | | |

| Total net sales | $ | 1,082.1 | | | $ | 1,181.7 | | | | | |

On January 3, 2017, we sold

(1) We updated our global reporting product categories as a result of legacy Rx sales being moved out of Other CSCA and into respective categories. These product categories have been adjusted retroactively to reflect the changes and have no impact on historical financial position, results of operations, or cash flows.

(2) Consists primarily of product sales and royalty income related to supply and distribution agreements and other miscellaneous or otherwise uncategorized product lines and markets, none of which is greater than 10% of the segment net sales.

(3) Consists primarily of our Rare Diseases business and other miscellaneous or otherwise uncategorized product lines and other adjustments, none of which is greater than 10% of the segment net sales.

While the majority of revenue is recognized at a point in time, certain Abbreviated New Drug Applications ("ANDAs")of our product revenue is recognized over time. Customer contracts recognized over time exist predominately in contract manufacturing arrangements, which occur in both the CSCA and CSCI segments. Contract manufacturing revenue was $72.2 million for $15.0the three months ended March 30, 2024, and $90.0 million for the three months ended April 1, 2023.

We also recognize a portion of the store brand OTC product revenues in the CSCA segment on an over time basis; however, the timing difference between over time and point in time revenue recognition for store brand contracts is not significant due to the short time period between the customization of the product and shipment or delivery.

The following table provides information about contract assets from contracts with customers (in millions):

| | | | | | | | | | | | | | | | | |

| Balance Sheet Location | | March 30, 2024 | | December 31, 2023 |

| Short-term contract assets | Prepaid expenses and other current assets | | $ | 25.7 | | | $ | 28.5 | |

Perrigo Company plc - Item 1

Note 2

We generated net sales in the following geographic locations(1) (in millions):

| | | | | | | | | | | | | | | |

| Three Months Ended | | |

| March 30, 2024 | | April 1, 2023 | | | | |

| U.S. | $ | 632.3 | | | $ | 750.0 | | | | | |

Europe(2) | 419.7 | | | 407.3 | | | | | |

All other countries(3) | 30.1 | | | 24.4 | | | | | |

| Total net sales | $ | 1,082.1 | | | $ | 1,181.7 | | | | | |

(1) The net sales by geography are derived from the location of the entity that sells to a third party,party.

(2) Includes Ireland net sales of $4.3 million for the three months ended March 30, 2024, and $7.3 million for the three months ended April 1, 2023.

(3) Includes net sales generated primarily in Australia and Canada.

NOTE 3 - DISCONTINUED OPERATIONS

Our discontinued operations primarily consist of our former Rx segment, which was recorded as a gainheld our prescription pharmaceuticals business in Other operating income on the Condensed Consolidated Statements of OperationsU.S. and our pharmaceuticals and diagnostic businesses in our Prescription Pharmaceuticals ("RX"Israel (collectively, the “Rx business”) segment..

On February 1, 2017,July 6, 2021, we completed the sale of the animal health pet treats plant fixed assets within our Consumer Healthcare AmericasRx business to Altaris Capital Partners, LLC ("CHCA"Altaris") segment,for aggregate consideration of $1.55 billion. The consideration included a $53.3 million reimbursement related to Abbreviated New Drug Application (“ANDA") for a generic topical lotion which Altaris delivered in cash to Perrigo pursuant to the terms of the definitive agreement during the first quarter of 2022.

Under the terms of a transition services agreement ("TSA"), we provided transition services which were previously classifiedsubstantially completed as held-for sale.of the end of the third quarter of 2022. We received $7.7 millionalso entered into reciprocal supply agreements pursuant to which Perrigo will supply certain products to the Rx business and the Rx business will supply certain products to Perrigo. The supply agreements have a term of four years, extendable up to seven years by the party who is the purchaser of the products under such agreement. We also extended distribution rights to the Rx business for certain OTC products owned and manufactured by Perrigo that may be fulfilled through pharmacy channels, in proceeds, which resulted in an immaterial loss.return for a share of the net profits.

On April 6, 2017, we completedIn connection with the sale, Perrigo retained certain pre-closing liabilities arising out of our India Active Pharmaceutical Ingredients ("API"antitrust (refer to Note 15 - Contingencies under the header "Price-Fixing Lawsuits") businessand opioid matters and the Company’s Albuterol recall, subject to, Strides Shasun Limited.in each case, Altaris' obligation to indemnify the Company for fifty percent of these liabilities up to an aggregate cap on Altaris' obligation of $50.0 million. We received $22.2 millionhave not requested payments from Altaris related to the indemnity of proceeds, inclusive of an estimated working capital adjustment, which resulted in an immaterial gain recorded in our Other segment. Prior to closing the sale, we determined that the carrying value of the India API business exceeded its fair value less the cost to sell, resulting in an impairment charge of $35.3 million, which was recorded in Impairment charges on the Consolidated Statements of Operations for the year ended December 31, 2016.

On August 25, 2017, we completed the sale of our Russian business, which was previously classified as held-for-sale, to Alvogen Pharma LLC and Alvogen CEE Kft. The total sale price was €12.7 million ($15.1 million), inclusive of an estimated working capital adjustment, which resulted in an immaterial gain recorded in our Consumer Healthcare International ("CHCI") segment. Prior to closing the sale, we determined that the carrying value of the Russian business exceeded its fair value less the cost to sell, resulting in an impairment charge of $3.7 million, which was recorded in Impairment charges on the Condensed Consolidated Statements of Operations forthese liabilities during the three months ended JulyMarch 30, 2024.

Current and prior period reported net loss from discontinued operations primarily relates to legal fees, partially offset by an income tax benefit.

NOTE 4 - INVENTORIES

Major components of inventory were as follows (in millions):

| | | | | | | | | | | |

| March 30, 2024 | | December 31, 2023 |

| Finished goods | $ | 642.7 | | | $ | 646.8 | |

| Work in process | 236.0 | | | 241.9 | |

| Raw materials | 242.6 | | | 252.2 | |

| Total inventories | $ | 1,121.3 | | | $ | 1,140.9 | |

Perrigo Company plc - Item 1 2017.

Note 5

Prior Year Divestitures

NOTE 5 - INVESTMENTS

On August 5, 2016, we completed

The following table summarizes the salemeasurement category, balance sheet location, and balances of our U.S. Vitamins, Minerals, and Supplements ("VMS") business within our CHCA segment to International Vitamins Corporation ("IVC") for $61.8 million inclusive of an estimated working capital adjustment. Prior to closing the sale, we determined that the carrying value of the VMS business exceeded itsequity securities (in millions):

| | | | | | | | | | | | | | | | | | | | |

| Measurement Category | | Balance Sheet Location | | March 30, 2024 | | December 31, 2023 |

| Fair value method | | Prepaid expenses and other current assets | | $ | — | | | $ | 0.1 | |

Fair value method(1) | | Other non-current assets | | $ | 1.1 | | | $ | 1.3 | |

| Equity method | | Other non-current assets | | $ | 59.5 | | | $ | 60.1 | |

(1) Measured at fair value lessusing the cost to sell, resultingNet Asset Value practical expedient.

The following table summarizes the expense recognized in an impairment chargeearnings of $6.2 million,our equity securities (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended | | |

| Measurement Category | | Income Statement Location | | March 30, 2024 | | April 1, 2023 | | | | |

| Fair value method | | Other operating expense (income), net | | $ | 0.1 | | | $ | 0.1 | | | | | |

| Equity method | | Other operating expense (income), net | | $ | 0.6 | | | $ | 0.7 | | | | | |

NOTE 6 - LEASES

The balance sheet locations of our lease assets and liabilities were as follows (in millions):

| | | | | | | | | | | | | | | | | | | | |

| Assets | | Balance Sheet Location | | March 30, 2024 | | December 31, 2023 |

| Operating | | Operating lease assets | | $ | 176.7 | | | $ | 183.6 | |

| Finance | | Other non-current assets | | 13.4 | | | 13.7 | |

| Total | | | | $ | 190.1 | | | $ | 197.3 | |

| | | | | | | | | | | | | | | | | | | | |

| Liabilities | | Balance Sheet Location | | March 30, 2024 | | December 31, 2023 |

| Current | | | | | | |

| Operating | | Other accrued liabilities | | $ | 26.6 | | | $ | 27.5 | |

| Finance | | Current indebtedness | | 1.9 | | | 1.9 | |

| Non-Current | | | | | | |

| Operating | | Other non-current liabilities | | 152.5 | | | 159.6 | |

| Finance | | Long-term debt, less current portion | | 13.0 | | | 13.2 | |

| Total | | | | $ | 194.0 | | | $ | 202.2 | |

Perrigo Company plc - Item 1

Note 6

The below tables show our lease assets and liabilities by reporting segment (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Assets |

| | Operating | | Financing | | | | |

| | March 30, 2024 | | December 31, 2023 | | March 30, 2024 | | December 31, 2023 | | | | | | | | |

| CSCA | | $ | 77.3 | | | $ | 79.3 | | | $ | 12.7 | | | $ | 12.8 | | | | | | | | | |

| CSCI | | 42.0 | | | 44.7 | | | 0.2 | | | 0.3 | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Unallocated | | 57.4 | | | 59.6 | | | 0.5 | | | 0.6 | | | | | | | | | |

| Total | | $ | 176.7 | | | $ | 183.6 | | | $ | 13.4 | | | $ | 13.7 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Liabilities |

| | Operating | | Financing |

| | March 30, 2024 | | December 31, 2023 | | March 30, 2024 | | December 31, 2023 |

| CSCA | | $ | 79.2 | | | $ | 81.6 | | | $ | 14.1 | | | $ | 14.2 | |

| CSCI | | 45.5 | | | 47.8 | | | 0.2 | | | 0.3 | |

| | | | | | | | |

| | | | | | | | |

| Unallocated | | 54.4 | | | 57.7 | | | 0.6 | | | 0.6 | |

| Total | | $ | 179.1 | | | $ | 187.1 | | | $ | 14.9 | | | $ | 15.1 | |

Lease expense was as follows (in millions):

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | March 30, 2024 | | April 1, 2023 | | | | |

Operating leases(1) | | $ | 11.6 | | | $ | 12.0 | | | | | |

| | | | | | | | |

| Finance leases | | | | | | | | |

| Amortization | | $ | 0.6 | | | $ | 1.1 | | | | | |

| Interest | | 0.1 | | | 0.1 | | | | | |

| Total finance leases | | $ | 0.7 | | | $ | 1.2 | | | | | |

(1) Includes short-term leases and variable lease costs, which was recorded in Impairment charges on the Condensed Consolidated Statementsare immaterial.

The annual future maturities of Operations for the year ended December 31, 2016.our leases as of March 30, 2024 are as follows (in millions):

| | | | | | | | | | | | | | | | | | | | |

| | Operating Leases | | Finance Leases | | Total |

| 2024 | | $ | 24.3 | | | $ | 1.8 | | | $ | 26.1 | |

| 2025 | | 30.3 | | | 1.9 | | | 32.2 | |

| 2026 | | 24.4 | | | 1.6 | | | 26.0 | |

| 2027 | | 22.6 | | | 1.6 | | | 24.2 | |

| 2028 | | 16.5 | | | 1.6 | | | 18.1 | |

| After 2028 | | 88.9 | | | 9.0 | | | 97.9 | |

| Total lease payments | | $ | 207.0 | | | $ | 17.5 | | | $ | 224.5 | |

| Less: Interest | | 27.9 | | | 2.6 | | | 30.5 | |

| Present value of lease liabilities | | $ | 179.1 | | | $ | 14.9 | | | $ | 194.0 | |

Perrigo Company plc - Item 1

Note 6

Our weighted average lease terms and discount rates are as follows:

| | | | | | | | | | | | | | |

| | March 30, 2024 | | April 1, 2023 |

| Weighted-average remaining lease term (in years) | | | | |

| Operating leases | | 9.72 | | 10.85 |

| Finance leases | | 9.43 | | 9.49 |

| Weighted-average discount rate | | | | |

| Operating leases | | 3.3 | % | | 2.5 | % |

| Finance leases | | 3.5 | % | | 3.0 | % |

Our lease cash flow classifications are as follows (in millions):

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | March 30, 2024 | | April 1, 2023 |

| Cash paid for amounts included in the measurement of lease liabilities | | | | |

| Operating cash flows for operating leases | | $ | 8.5 | | | $ | 9.0 | |

| Operating cash flows for finance leases | | $ | 0.1 | | | $ | 0.1 | |

| Financing cash flows for finance leases | | $ | 0.5 | | | $ | 1.0 | |

| | | | |

| Leased assets obtained in exchange for new finance lease liabilities | | $ | 0.3 | | | $ | — | |

| Leased assets obtained in exchange for new operating lease liabilities | | $ | 1.7 | | | $ | 1.4 | |

NOTE 3 –7 - GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill

Changes in the carrying amount of goodwill, by reportable segment, were as follows (in millions): |

| | | | | | | | | | | | | | | | | | | | |

| Reporting Segments: | | December 31,

2016 | | Business divestitures | | Re-class to assets held-for-sale | | Currency translation adjustment | | September 30,

2017 |

| CHCA | | $ | 1,810.6 |

| | $ | — |

| | $ | — |

| | $ | 2.9 |

| | $ | 1,813.5 |

|

| CHCI | | 1,070.8 |

| | (4.1 | ) | | — |

| | 122.3 |

| | 1,189.0 |

|

| RX | | 1,086.6 |

| | — |

| | — |

| | 6.5 |

| | 1,093.1 |

|

| Other | | 81.4 |

| | — |

| | (32.6 | ) | | 7.6 |

| | 56.4 |

|

| Total goodwill | | $ | 4,049.4 |

| | $ | (4.1 | ) | | $ | (32.6 | ) | | $ | 139.3 |

| | $ | 4,152.0 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2023 | | | | | | | | | | | | Currency translation adjustments | | March 30, 2024 |

CSCA(1) | | $ | 2,080.9 | | | | | | | | | | | | | $ | (1.7) | | | $ | 2,079.2 | |

CSCI(2) | | 1,448.2 | | | | | | | | | | | | | (34.5) | | | 1,413.7 | |

| | | | | | | | | | | | | | | | |

| Total goodwill | | $ | 3,529.1 | | | | | | | | | | | | | $ | (36.2) | | | $ | 3,492.9 | |

As discussed in our Form 10-K for the year ended(1) We had accumulated goodwill impairments of $6.1 million as of March 30, 2024 and December 31, 2016, during the three months ended April 2, 20162023.

(2) We had accumulated goodwill impairments of $968.4 million as of March 30, 2024 and October 1, 2016, we identified indicators of impairment for our Branded Consumer Healthcare - Rest of World ("BCH-ROW") reporting unit and recorded impairment charges of $130.5 million and $675.6 million, respectively. In addition, during the three months ended October 1, 2016, we identified impairment indicators in our Branded Consumer Healthcare - Belgium ("BCH-Belgium") reporting unit and recorded impairment charges of $62.3 million. The impairment charges for both reporting units were recorded within our CHCI segment.December 31, 2023.

Perrigo Company plc - Item 1

Note 37

Intangible Assets

Other intangibleIntangible assets and related accumulated amortization consisted of the following (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | March 30, 2024 | | December 31, 2023 | | |

| | Gross | | Accumulated

Amortization | | Gross | | Accumulated

Amortization | | | | |

Indefinite-lived intangibles:(1) | | | | | | | | | | | |

| Trademarks, trade names, and brands | $ | 3.3 | | | $ | — | | | $ | 3.4 | | | $ | — | | | | | |

| In-process research and development | 1.9 | | | — | | | 1.9 | | | — | | | | | |

| Total indefinite-lived intangibles | $ | 5.2 | | | $ | — | | | $ | 5.3 | | | $ | — | | | | | |

| Definite-lived intangibles: | | | | | | | | | | | |

| Distribution and license agreements and supply agreements | $ | 88.7 | | | $ | 56.3 | | | $ | 90.8 | | | $ | 57.5 | | | | | |

| Developed product technology, formulations, and product rights | 528.2 | | | 243.9 | | | 534.0 | | | 238.4 | | | | | |

| Customer relationships and distribution networks | 1,840.7 | | | 1,112.8 | | | 1,868.1 | | | 1,108.9 | | | | | |

| Trademarks, trade names, and brands | 2,453.3 | | | 627.6 | | | 2,502.0 | | | 609.3 | | | | | |

| Non-compete agreements | 2.1 | | | 2.1 | | | 2.1 | | | 2.1 | | | | | |

| Total definite-lived intangibles | $ | 4,913.0 | | | $ | 2,042.7 | | | $ | 4,997.0 | | | $ | 2,016.2 | | | | | |

| Total intangible assets | $ | 4,918.2 | | | $ | 2,042.7 | | | $ | 5,002.3 | | | $ | 2,016.2 | | | | | |

|

| | | | | | | | | | | | | | | |

| | September 30, 2017 | | December 31, 2016 |

| | Gross | | Accumulated Amortization | | Gross | | Accumulated Amortization |

Definite-lived intangibles: | | | | | | | |

| Distribution and license agreements, supply agreements | $ | 310.2 |

| | $ | 157.5 |

| | $ | 305.6 |

| | $ | 120.4 |

|

| Developed product technology, formulations, and product rights | 1,355.4 |

| | 568.8 |

| | 1,418.1 |

| | 526.0 |

|

| Customer relationships and distribution networks | 1,623.7 |

| | 424.5 |

| | 1,489.9 |

| | 307.5 |

|

| Trademarks, trade names, and brands | 1,317.5 |

| | 111.0 |

| | 1,189.3 |

| | 55.3 |

|

| Non-compete agreements | 14.7 |

| | 12.3 |

| | 14.3 |

| | 11.2 |

|

| Total definite-lived intangibles | $ | 4,621.5 |

| | $ | 1,274.1 |

| | $ | 4,417.2 |

| | $ | 1,020.4 |

|

Indefinite-lived intangibles: | | | | | | | |

| Trademarks, trade names, and brands | $ | 52.0 |

| | $ | — |

| | $ | 50.5 |

| | $ | — |

|

| In-process research and development | 51.4 |

| | — |

| | 64.0 |

| | — |

|

| Total indefinite-lived intangibles | 103.4 |

| | — |

| | 114.5 |

| | — |

|

| Total other intangible assets | $ | 4,724.9 |

| | $ | 1,274.1 |

| | $ | 4,531.7 |

| | $ | 1,020.4 |

|

(1) Certain intangible assets are denominated in currencies other than the U.S. dollar; therefore, their gross and accumulated amortization balancesnet carrying values are subject to foreign currency movements.

We recorded amortization expense of $88.5$58.4 million and $89.7$65.4 million for the three months ended SeptemberMarch 30, 20172024 and OctoberApril 1, 2016, respectively, and $261.3 million and $263.9 million for the nine months ended September 30, 2017 and October 1, 2016,2023, respectively.

We recorded an impairment charge within our RX segment of $12.7 million on certain In Process Research and Development ("IPR&D") assets during the nine months ended September 30, 2017 due to changes in the projected development and regulatory timelines for various projects. During the nine months ended September 30, 2017, we recorded a decrease in the contingent consideration liability associated with certain IPR&D assets in Other operating income on the Condensed Consolidated Statements of Operations (refer to Note 6).

During the three months ended July 1, 2017, we identified impairment indicators for our Lumara Health, Inc. ("Lumara") product assets. The primary impairment indicators included the decline in our 2017 performance expectations and a reduction in our long-range revenue growth forecast. The assessment utilized the multi-period excess earnings method to determine fair value and resulted in an impairment charge of $18.5 million in Impairment charges on the Condensed Consolidated Statements of Operations within our RX segment, which represented the difference between the carrying amount of the intangible assets and their estimated fair value.

As discussed in our Form 10-K for the year ended December 31, 2016, during the three months ended April 2, 2016, we identified indicators of impairment associated with certain indefinite-lived intangible assets acquired in conjunction with our acquisition of Omega Pharma Invest N.V. ("Omega") and recorded an impairment charge of $273.4 million. In addition, during the three months ended October 1, 2016, we identified indicators of impairment associated with certain indefinite-lived and definite-lived intangible brand category assets acquired in conjunction with the Omega acquisition. As a result of these additional indicators, we recorded impairment charges of $575.7 million on our indefinite-lived assets and $290.9 million on our definite-lived assets. The impairment charges for both the indefinite-lived assets and definite-lived assets were recorded within our CHCI segment.

In addition, due to reprioritization of certain brands in the CHCI segment and change in performance expectations for the cough/cold/allergy, anti-parasite, personal care, lifestyle, and natural health brands, we

Perrigo Company plc - Item 1

Note 3

reclassified $364.5 million and $674.4 million of indefinite-lived assets to definite-lived assets with useful lives of 20 years, which we began amortizing during the second and third quarters of 2016, respectively.

NOTE 4 - ACCOUNTS RECEIVABLE FACTORING