UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 10-Q

______________________________

|

| | | | |

| ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended December 31, 20172018

or

|

| | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

001-36587

(Commission File Number)

_____________________________

Catalent, Inc.

(Exact name of registrant as specified in its charter)

_____________________________

|

| | | | | | | |

| Delaware | | 20-8737688 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

| 14 Schoolhouse Road, Somerset, NJ | | 08873 |

| (Address of principal executive offices) | | (Zip code) |

(732) 537-6200

Registrant's telephone number, including area code

______________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

| | | | | | | | | | | | | |

Large accelerated filer x | | | Accelerated filer ¨ | |

Non-accelerated filer ¨ | | (Do not check if a smaller reporting company) | Smaller reporting company ¨ | |

| | | Emerging growth company ¨ | |

If an emerging growth company, indicate by check mark if the registrant has elected not use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

On February 2, 2018,1, 2019, there were 133,318,679145,632,701 shares of the Registrant's common stock, par value $0.01 per share, issued and outstanding.

CATALENT, INC. and Subsidiaries

INDEX TO FORM 10-Q

For the Three and Six Months Ended December 31, 20172018

| | | | | | | | |

| Item | | Page |

| | |

| Part I. | | |

| | |

| Item | | Page |

| | |

Part I. 1. | | |

| | |

Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

| Part II. | | |

| | |

| Item 1. | | |

| | |

| Item 1A. | | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

| Item 5. | | |

| | |

| Item 6. | | |

| | |

| | |

Special Note Regarding Forward-Looking Statements

In addition to historical information, this Quarterly Report on Form 10-Q may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are subject to the “safe harbor” created by those sections. All statements, other than statements of historical facts, included in this Quarterly Report on Form 10-Q are forward-looking statements. In some cases, you can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words.

These statements are based on assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions, expected future developments, and other factors they believe to be appropriate. Any forward-looking statement is subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements.

Some of the factors that may cause actual results, developments and business decisions to differ materially from those contemplated by such forward-looking statements include, but are not limited to, those described under the section entitled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended June 30, 20172018 (the "Fiscal 2018 10-K") and the following:

•We participate in a highly competitive market, and increased competition may adversely affect our business.

•The demand for our offerings depends in part on our customers’ research and development and the clinical and market success of their products. Our business, financial condition, and results of operations may be harmed if our customers spend less on, or are less successful in, these activities.

•We are subject to product and other liability risks that could exceed our anticipated costs or adversely affect our results of operations, financial condition, liquidity, and cash flows.

•Failure to comply with existing and future regulatory requirements could adversely affect our results of operations and financial condition or result in claims from customers.

•Failure to provide quality offerings to our customers could have an adverse effect on our business and subject us to regulatory actions or costly litigation.

•The services and offerings we provide are highly exacting and complex, and if we encounter problems providing the services or support required, our business could suffer.

•Our global operations are subject to economic, political, and regulatory risks, including the risks of changing regulatory standards or changing interpretations of existing standards, that could affect the profitability of our operations or require costly changes to our procedures.

•The referendum inexit of the United Kingdom (the "U.K.") and resulting decision of the U.K. government to consider exiting from the European Union could have future adverse effects on our operations, revenues, and costs, and therefore our profitability.

•If we do not enhance our existing or introduce new technology or service offerings in a timely manner, our offerings may become obsolete over time, customers may not buy our offerings, and our revenue and profitability may decline.

•We and our customers depend on patents, copyrights, trademarks, trade secrets, and other forms of intellectual property protections, but these protections may not be adequate.

•Our future results of operations are subject to fluctuations in the costs, availability, and suitability of the components of the products we manufacture, including active pharmaceutical ingredients, excipients, purchased components, and raw materials.

•Changes in market access or healthcare reimbursement for our customers’ products in the United States ("U.S.") or internationally, including possible changes to the possible repeal or replacement of theU.S. Affordable Care Act, in the United States, could adversely affect our results of operations and financial condition by affecting demand for our offerings.offerings or the financial health of our customers.

•As a global enterprise, fluctuations in the exchange rate of the U.S. dollar, our reporting currency, against foreign currencies could have a material adverse effect on our financial performance and results of operations.

The impact to our business of recently enacted U.S. tax legislation could differ materially from our current estimates.

•Tax legislative or regulatory initiatives or challenges to our tax positions could adversely affect our results of operations and financial condition.

•Our ability to use our net operating loss carryforwards and certain other tax attributes may be limited.

•Changes to the estimated future profitability of the business may require that we establish an additional valuation allowance against all or some portion of our net U.S. deferred tax assets.

•We are dependent on key personnel.

•We use advanced information and communication systems to run our operations, compile and analyze financial and operational data, and communicate among our employees, customers, and counter-parties, soand the risks generally associated with information and communications systems could adversely affect our results of operations. We are continuously working to install new, and upgrade existing, systems and provide employee awareness training around phishing, malware, and other cyber securitycyber-security risks to enhance the protections available to us, but such protections may be inadequate to address malicious attacks or inadvertent compromises of data security.

•We engage, from time to time, in acquisitions and other transactions that may complement or expand our business or divest of non-strategic businesses or assets. We may not be able to complete such transactions, and such transactions, if executed, pose significant risks, including risks relating to our ability to successfully and efficiently integrate acquisitions or execute on dispositions and realize anticipated benefits therefrom. The failure to execute or realize the full benefits from any such transaction could have a negative effect on our operations.

•Our offerings or our customers’ products may infringe on the intellectual property rights of third parties.

•We are subject to environmental, health, and safety laws and regulations, which could increase our costs and restrict our operations in the future.

•We are subject to labor and employment laws and regulations, which could increase our costs and restrict our operations in the future.

•Certain of our pension plans are underfunded, and additional cash contributions we may make to increase the funding level will reduce the cash available for our business, such as the payment of our interest expense.

•Our substantial leverage could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or in our industry, expose us to interest-rate risk to the extent of our variable rate debt, and prevent us from meeting our obligations under our indebtedness.

We caution you that the risks, uncertainties and other factors referenced above may not contain all of the risks, uncertainties, and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits, or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. There can be no assurance that (i) we have correctly measured or identified all of the factors affecting our business or the extent of these factors’ likely impact, (ii) the available information with respect to these factors on which such analysis is based is complete or accurate, (iii) such analysis is correct, or (iv) our strategy, which is based in part on this analysis, will be successful. All forward-looking statements in this report apply only as of the date of this report or as of the date they were made, and we undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required by law.

Social Media

We use our website (www.catalent.com), our corporate Facebook page (https://www.facebook.com/CatalentPharmaSolutions), and our corporate Twitter account (@catalentpharma) as channels for the distribution of

information. The information we post through these channels may be deemed material. Accordingly, investors should monitor these channels, in addition to following our press releases, Securities and Exchange Commission ("SEC") filings, and public conference calls and webcasts. The contents of our website and social media channels are not, however, a part of this report.

PART I. FINANCIAL INFORMATION

| |

Item 1. | Item 1. FINANCIAL STATEMENTS |

Catalent, Inc. and Subsidiaries

Consolidated Statements of Operations

(Unaudited; Dollars in millions, except per share data)

| | | | Three Months Ended

December 31, | | Six Months Ended

December 31, | | Three Months Ended

December 31, | | | Six Months Ended

December 31, | |

| | 2017 | | 2016 | | 2017 | | 2016 | | 2018 | | 2017 | | 2018 | | 2017 |

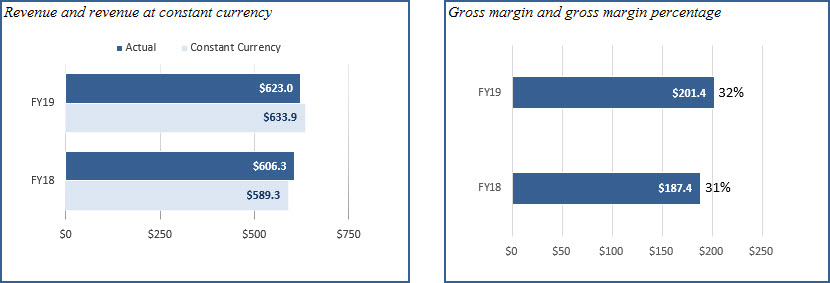

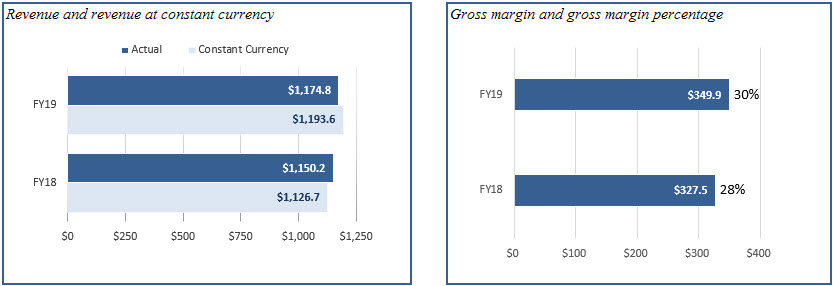

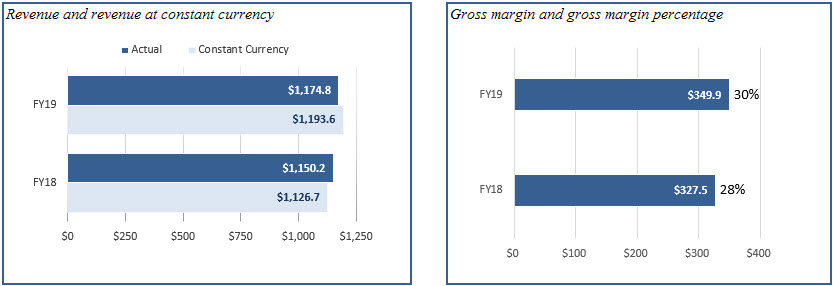

| Net revenue | $ | 606.3 |

| | $ | 483.7 |

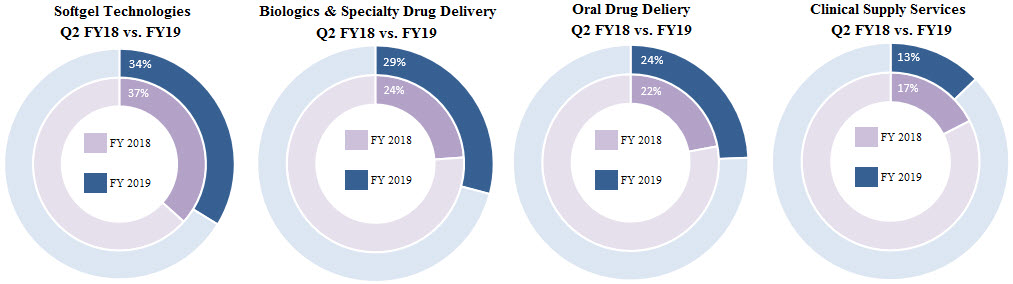

| | $ | 1,150.2 |

| | $ | 925.9 |

| Net revenue | $ | 623.0 | | $ | 606.3 | | $ | 1,174.8 | | $ | 1,150.2 |

| Cost of sales | 418.9 |

| | 335.8 |

| | 822.7 |

| | 653.9 |

| Cost of sales | 421.6 | | 418.9 | | 824.9 | | 822.7 |

| Gross margin | 187.4 |

| | 147.9 |

| | 327.5 |

| | 272.0 |

| Gross margin | 201.4 | | 187.4 | | 349.9 | | 327.5 |

| Selling, general and administrative expenses | 114.3 |

| | 96.2 |

| | 221.3 |

| | 194.4 |

| |

| Selling, general, and administrative expenses | | Selling, general, and administrative expenses | 123.2 | | 114.8 | | 238.7 | | 222.3 |

| Impairment charges and (gain)/loss on sale of assets | 4.2 |

| | 0.5 |

| | 4.2 |

| | 0.5 |

| Impairment charges and (gain)/loss on sale of assets | (0.1) | | 4.2 | | 2.8 | | 4.2 |

| Restructuring and other | 0.1 |

| | 3.3 |

| | 1.3 |

| | 4.4 |

| Restructuring and other | 0.1 | | 0.1 | | 9.8 | | 1.3 |

| | Operating earnings | 68.8 |

| | 47.9 |

| | 100.7 |

| | 72.7 |

| Operating earnings | 78.2 | | 68.3 | | 98.6 | | 99.7 |

| Interest expense, net | 27.2 |

| | 22.8 |

| | 51.5 |

| | 44.9 |

| Interest expense, net | 25.5 | | 27.2 | | 53.6 | | 51.5 |

| Other expense/(income), net | 13.6 |

| | (1.8 | ) | | 19.3 |

| | (3.9 | ) | |

| Earnings from continuing operations, before income taxes | 28.0 |

| | 26.9 |

| | 29.9 |

| | 31.7 |

| |

| Other expense, net | | Other expense, net | 1.4 | | 13.1 | | 7.1 | | 18.3 |

| Earnings from continuing operations before income taxes | | Earnings from continuing operations before income taxes | 51.3 | | 28.0 | | 37.9 | | 29.9 |

| Income tax expense | 49.9 |

| | 9.5 |

| | 48.0 |

| | 9.7 |

| Income tax expense | 2.3 | | 49.9 | | 3.3 | | 48.0 |

| | Net earnings/(loss) | $ | (21.9 | ) | | $ | 17.4 |

| | $ | (18.1 | ) | | $ | 22.0 |

| Net earnings/(loss) | $ | 49.0 | | $ | (21.9) | | $ | 34.6 | | $ | (18.1) |

| | | | | | | | | |

| | | | | | | | | |

| Earnings per share: | | | | | | | | |

| | | Earnings/(loss) per share: | | Earnings/(loss) per share: | |

| Basic | | | | | | | | Basic | |

| | Net earnings/(loss) | $ | (0.16 | ) | | $ | 0.14 |

| | $ | (0.14 | ) | | $ | 0.18 |

| Net earnings/(loss) | $ | 0.34 | | $ | (0.16) | | $ | 0.24 | | $ | (0.14) |

| Diluted | | |

|

| | | |

|

| Diluted | | | | |

| | Net earnings/(loss) | $ | (0.16 | ) | | $ | 0.14 |

| | $ | (0.14 | ) | | $ | 0.17 |

| Net earnings/(loss) | $ | 0.33 | | $ | (0.16) | | $ | 0.24 | | $ | (0.14) |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Catalent, Inc. and Subsidiaries

Consolidated Statements of Comprehensive Income/(Loss)

(Unaudited; Dollars in millions)

| | | | Three Months Ended

December 31, | | Six Months Ended

December 31, | | Three Months Ended

December 31, | | | Six Months Ended

December 31, | |

| | 2017 | | 2016 | | 2017 | | 2016 | | 2018 | | 2017 | | 2018 | | 2017 |

| Net earnings/(loss) | $ | (21.9 | ) | | $ | 17.4 |

| | $ | (18.1 | ) | | $ | 22.0 |

| Net earnings/(loss) | $ | 49.0 | | $ | (21.9) | | $ | 34.6 | | $ | (18.1) |

| Other comprehensive income/(loss), net of tax | | | | | | | | Other comprehensive income/(loss), net of tax | |

| Foreign currency translation adjustments | (13.4 | ) | | (64.4 | ) | | 24.7 |

| | (63.8 | ) | Foreign currency translation adjustments | (17.6) | | (13.4) | | (26.4) | | 24.7 |

| Pension and other post-retirement adjustments | 0.5 |

| | 0.7 |

| | 0.9 |

| | 1.5 |

| Pension and other post-retirement adjustments | 0.6 | | 0.5 | | 1.0 | | 0.9 |

| Available for sale investments | (3.0 | ) | | 15.3 |

| | (6.4 | ) | | 15.3 |

| Available for sale investments | — | | (3.0) | | — | | (6.4) |

| | Other comprehensive income/(loss), net of tax | (15.9 | ) | | (48.4 | ) | | 19.2 |

| | (47.0 | ) | Other comprehensive income/(loss), net of tax | (17.0) | | (15.9) | | (25.4) | | 19.2 |

| Comprehensive income/(loss) | $ | (37.8 | ) | | $ | (31.0 | ) | | $ | 1.1 |

| | $ | (25.0 | ) | Comprehensive income/(loss) | $ | 32.0 | | $ | (37.8) | | $ | 9.2 | | $ | 1.1 |

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Catalent, Inc. and Subsidiaries

Consolidated Balance Sheets

(Unaudited; Dollars in millions, except share and per share data)

| | | | December 31,

2017 | | June 30,

2017 | | December 31,

2018 | | June 30,

2018 |

| ASSETS | | | | ASSETS | | | |

| Current assets: | | | | Current assets: | |

| Cash and cash equivalents | $ | 329.5 |

| | $ | 288.3 |

| Cash and cash equivalents | $ | 207.9 | | $ | 410.2 |

| Trade receivables, net | 427.9 |

| | 488.8 |

| Trade receivables, net | 551.3 | | 555.8 |

| Inventories | 212.7 |

| | 184.9 |

| Inventories | 235.2 | | 209.1 |

| Prepaid expenses and other | 105.4 |

| | 97.8 |

| Prepaid expenses and other | 77.1 | | 65.2 |

| Total current assets | 1,075.5 |

| | 1,059.8 |

| Total current assets | 1,071.5 | | 1,240.3 |

| Property, plant, and equipment, net | 1,256.2 |

| | 995.9 |

| Property, plant, and equipment, net | 1,285.8 | | 1,270.6 |

| Other assets: | | | | Other assets: | |

| Goodwill | 1,408.3 |

| | 1,044.1 |

| Goodwill | 1,421.4 | | 1,397.2 |

| Other intangibles, net | 582.0 |

| | 273.1 |

| Other intangibles, net | 581.0 | | 544.9 |

| Deferred income taxes | 34.3 |

| | 53.9 |

| Deferred income taxes | 31.7 | | 32.9 |

| Other | 30.8 |

| | 27.5 |

| Other | 50.2 | | 45.2 |

| Total assets | $ | 4,387.1 |

| | $ | 3,454.3 |

| Total assets | $ | 4,441.6 | | $ | 4,531.1 |

| | | | | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |

| LIABILITIES AND SHAREHOLDER’S DEFICIT | | LIABILITIES AND SHAREHOLDER’S DEFICIT | |

| Current liabilities: | | | | Current liabilities: | |

| Current portion of long-term obligations and other short-term borrowings | $ | 69.9 |

| | $ | 24.6 |

| Current portion of long-term obligations and other short-term borrowings | $ | 69.9 | | $ | 71.9 |

| Accounts payable | 164.3 |

| | 163.2 |

| Accounts payable | 184.4 | | 192.1 |

| Other accrued liabilities | 249.8 |

| | 281.2 |

| Other accrued liabilities | 260.0 | | 312.9 |

| Total current liabilities | 484.0 |

| | 469.0 |

| Total current liabilities | 514.3 | | 576.9 |

| Long-term obligations, less current portion | 2,672.5 |

| | 2,055.1 |

| Long-term obligations, less current portion | 2,130.0 | | 2,649.4 |

| Pension liability | 127.3 |

| | 129.5 |

| Pension liability | 129.6 | | 131.6 |

| Deferred income taxes | 40.7 |

| | 31.7 |

| Deferred income taxes | 50.1 | | 32.5 |

| Other liabilities | 57.1 |

| | 45.5 |

| Other liabilities | 54.6 | | 54.0 |

| Commitment and contingencies (see Note 13) | | | | |

| Commitment and contingencies (see Note 14) | | Commitment and contingencies (see Note 14) | |

| | | | | |

| Shareholders' equity/(deficit): | | | | |

| Common stock $0.01 par value; 1.0 billion shares authorized on December 31, 2017 and June 30, 2017, 133,318,039 and 125,049,867 issued and outstanding on December 31, 2017 and June 30, 2017, respectively. | 1.3 |

| | 1.3 |

| |

| Preferred stock $0.01 par value; 100 million authorized on December 31, 2017 and June 30, 2017, 0 issued and outstanding on December 31, 2017 and June 30, 2017. | — |

| | — |

| |

| Shareholders' equity: | | Shareholders' equity: | |

| Common stock $0.01 par value; 1.0 billion shares authorized on December 31, 2018 and June 30, 2018, 145,622,900 and 133,423,628 issued and outstanding on December 31, 2018 and June 30, 2018, respectively. | | Common stock $0.01 par value; 1.0 billion shares authorized on December 31, 2018 and June 30, 2018, 145,622,900 and 133,423,628 issued and outstanding on December 31, 2018 and June 30, 2018, respectively. | 1.5 | | 1.3 |

| Preferred stock $0.01 par value; 100 million authorized on December 31, 2018 and June 30, 2018, 0 issued and outstanding on December 31, 2018 and June 30, 2018. | | Preferred stock $0.01 par value; 100 million authorized on December 31, 2018 and June 30, 2018, 0 issued and outstanding on December 31, 2018 and June 30, 2018. | — | | — |

| | Additional paid in capital | 2,272.9 |

| | 1,992.0 |

| Additional paid in capital | 2,735.1 | | 2,283.3 |

| Accumulated deficit | (973.8 | ) | | (955.7 | ) | Accumulated deficit | (822.4) | | (872.1) |

| Accumulated other comprehensive income/(loss) | (294.9 | ) | | (314.1 | ) | Accumulated other comprehensive income/(loss) | (351.2) | | (325.8) |

| Total shareholders' equity | 1,005.5 |

| | 723.5 |

| |

| Total liabilities and shareholders' equity | $ | 4,387.1 |

| | $ | 3,454.3 |

| |

| | Total shareholder's equity | | Total shareholder's equity | 1,563.0 | | 1,086.7 |

| Total liabilities and shareholder’s equity | | Total liabilities and shareholder’s equity | $ | 4,441.6 | | $ | 4,531.1 |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Catalent, Inc. and Subsidiaries

Consolidated Statement of Changes in Shareholders' Equity/(Deficit)

(Unaudited; Dollars in millions, except share data in thousands)

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Shares of Common Stock | | Common Stock | | Additional

Paid in

Capital | | Accumulated Deficit | | Accumulated Other Comprehensive Income/(Loss) | | Total Shareholders' Equity/ (Deficit) |

| Balance at June 30, 2017 | 125,049.9 |

| | $ | 1.3 |

| | $ | 1,992.0 |

| | $ | (955.7 | ) | | $ | (314.1 | ) | | $ | 723.5 |

|

| Equity offering, sale of common stock | 7,354.2 |

| | — |

| | 277.8 |

| | | | | | 277.8 |

|

Share issuances related to equity-based compensation | 913.9 |

| |

| | | | | | | | — |

|

| Equity compensation | | | | | 15.5 |

| | | | | | 15.5 |

|

Cash paid, in lieu of equity, for tax withholding | | | | | (12.4 | ) | | | | | | (12.4 | ) |

| Net earnings/(loss) | | | | | | | (18.1 | ) | | | | (18.1 | ) |

Other comprehensive income/(loss), net tax | | | | | | | | | 19.2 |

| | 19.2 |

|

| Balance at December 31, 2017 | 133,318.0 |

| | $ | 1.3 |

| | $ | 2,272.9 |

| | $ | (973.8 | ) | | $ | (294.9 | ) | | $ | 1,005.5 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares of Common Stock | | Common Stock | | Additional

Paid in

Capital | | | | Accumulated Deficit | | Accumulated Other Comprehensive Income/(Loss) | | | | Total Shareholders' Equity/ (Deficit) |

| Balance at June 30, 2018 | 133,423.6 | | $ | 1.3 | | $ | 2,283.3 | | | | $ | (872.1) | | $ | (325.8) | | | | $ | 1,086.7 |

| Cumulative effect of change in accounting for ASC 606, net of tax | | | | | | | | | 15.1 | | | | | | 15.1 |

| Equity offering, sale of common stock | 11,431.4 | | 0.1 | | 445.4 | | | | | | | | | | 445.5 |

| | | | | | | | | | | | | | | |

Share issuances related to stock-based compensation | 767.9 | | 0.1 | | (0.1) | | | | | | | | | | — |

| Stock-based compensation | | | | | 17.5 | | | | | | | | | | 17.5 |

Cash paid, in lieu of equity, for tax withholding | | | | | (11.0) | | | | | | | | | | (11.0) |

| | | | | | | | | | | | | | | |

| Net earnings | | | | | | | | | 34.6 | | | | | | 34.6 |

Other comprehensive income/(loss), net of

tax | | | | | | | | | | | (25.4) | | | | (25.4) |

| Balance at December 31, 2018 | 145,622.9 | | $ | 1.5 | | $ | 2,735.1 | | | | $ | (822.4) | | $ | (351.2) | | | | $ | 1,563.0 |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Catalent, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(Unaudited; Dollars in millions)

| | | | | | | | | | | |

| Six Months Ended

December 31, | | |

| 2018 | | 2017 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net earnings/(loss) | $ | 34.6 | | $ | (18.1) |

| | | |

| | | |

| Adjustments to reconcile earnings/(loss) from operations to net cash from operations: | | | |

| Depreciation and amortization | 107.5 | | 85.8 |

| Non-cash foreign currency transaction (gain)/loss, net | 3.2 | | 7.1 |

| Amortization and write-off of debt financing costs | 6.1 | | 2.5 |

| Asset impairments charges and (gain)/loss on sale of assets | 2.8 | | 4.2 |

| | | |

| Reclassification of financing fees paid | — | | 11.8 |

| Stock-based compensation | 17.5 | | 15.5 |

| Provision/(benefit) for deferred income taxes | (0.1) | | 35.6 |

| Provision for bad debts and inventory | 5.1 | | 3.5 |

| Change in operating assets and liabilities: | | | |

| Decrease/(increase) in trade receivables | 3.1 | | 104.6 |

| Decrease/(increase) in inventories | (26.0) | | — |

| Increase/(decrease) in accounts payable | (11.3) | | (0.4) |

Other assets/accrued liabilities, net — current and non-current | (58.0) | | (76.1) |

| | | |

| | | |

| Net cash provided by operating activities | 84.5 | | 176.0 |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Acquisition of property and equipment and other productive assets | (81.3) | | (82.9) |

| Proceeds from sale of property and equipment | — | | 1.8 |

| Proceeds from sale of subsidiaries | — | | 3.4 |

| | | |

| Payment for acquisitions, net of cash acquired | (127.5) | | (748.0) |

| | | |

| | | |

| Net cash (used in) investing activities | (208.8) | | (825.7) |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| Net change in other borrowings | (4.9) | | (0.6) |

| | | |

| Proceeds from borrowing, net | — | | 442.6 |

| Payments related to long-term obligations | (503.4) | | (9.4) |

| Financing fees paid | — | | (15.6) |

| | | |

| Proceeds from sale of common stock, net | 445.5 | | 277.8 |

| Cash paid, in lieu of equity, for tax-withholding obligations | (11.0) | | (12.4) |

| | | |

| | | |

| Net cash (used in)/provided by financing activities | (73.8) | | 682.4 |

| Effect of foreign currency exchange on cash | (4.2) | | 8.5 |

| NET INCREASE/(DECREASE) IN CASH AND EQUIVALENTS | (202.3) | | 41.2 |

| CASH AND EQUIVALENTS AT BEGINNING OF PERIOD | 410.2 | | 288.3 |

| CASH AND EQUIVALENTS AT END OF PERIOD | $ | 207.9 | | $ | 329.5 |

| SUPPLEMENTARY CASH FLOW INFORMATION: | | | |

| Interest paid | $ | 52.2 | | $ | 41.5 |

| Income taxes paid, net | $ | 24.4 | | $ | 8.0 |

|

| | | | | | | |

| | Six Months Ended

December 31, |

| | 2017 | | 2016 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net earnings/(loss) | $ | (18.1 | ) | | $ | 22.0 |

|

| Adjustments to reconcile earnings from continued operations to net cash from operations: | | | |

| Depreciation and amortization | 85.8 |

| | 71.3 |

|

| Non-cash foreign currency transaction (gain)/loss, net | 7.1 |

| | (3.4 | ) |

| Amortization and write off of debt financing costs | 2.5 |

| | 4.3 |

|

| Asset impairments and (gain)/loss on sale of assets | 4.2 |

| | 0.5 |

|

| Reclassification of financing fees paid | 11.8 |

| | — |

|

| Equity compensation | 15.5 |

| | 11.8 |

|

| Provision/(benefit) for deferred income taxes | 35.6 |

| | 0.9 |

|

| Provision for bad debts and inventory | 3.5 |

| | 3.3 |

|

| Change in operating assets and liabilities: | | | |

| Decrease/(increase) in trade receivables | 104.6 |

| | 41.4 |

|

| Decrease/(increase) in inventories | — |

| | (17.9 | ) |

| Increase/(decrease) in accounts payable | (0.4 | ) | | (14.6 | ) |

| Other assets/accrued liabilities, net - current and non-current | (76.1 | ) | | (23.6 | ) |

| Net cash provided by operating activities | 176.0 |

| | 96.0 |

|

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Acquisition of property and equipment and other productive assets | (82.9 | ) | | (54.1 | ) |

| Proceeds from sale of property and equipment | 1.8 |

| | 1.3 |

|

| Proceeds from sale of subsidiaries | 3.4 |

| | — |

|

| Payment for acquisitions, net of cash acquired | (748.0 | ) | | (85.7 | ) |

| Net cash (used in) investing activities | (825.7 | ) | | (138.5 | ) |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| Net change in other borrowings | (0.6 | ) | | (5.6 | ) |

| Proceeds from borrowing, net | 442.6 |

| | 397.4 |

|

| Payments related to long-term obligations | (9.4 | ) | | (209.2 | ) |

| Financing fees paid | (15.6 | ) | | (6.4 | ) |

| Proceeds from sale of common stock, net | 277.8 |

| | — |

|

| Cash paid, in lieu of equity, for tax withholding obligations | (12.4 | ) | | (0.5 | ) |

| Net cash provided by financing activities | 682.4 |

| | 175.7 |

|

| Effect of foreign currency on cash | 8.5 |

| | (9.0 | ) |

| NET INCREASE/(DECREASE) IN CASH AND EQUIVALENTS | 41.2 |

| | 124.2 |

|

| CASH AND EQUIVALENTS AT BEGINNING OF PERIOD | 288.3 |

| | 131.6 |

|

| CASH AND EQUIVALENTS AT END OF PERIOD | $ | 329.5 |

| | $ | 255.8 |

|

| SUPPLEMENTARY CASH FLOW INFORMATION: | | | |

| Interest paid | $ | 41.5 |

| | $ | 39.4 |

|

| Income taxes paid, net | $ | 8.0 |

| | $ | 19.7 |

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Catalent, Inc. and Subsidiaries

Notes to Unaudited Consolidated Financial Statements

| |

1. | BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

1. BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Business

Catalent, Inc. (“Catalent”("Catalent" or the “Company”"Company") directly and wholly owns PTS Intermediate Holdings LLC (“("Intermediate Holdings”Holdings"). Intermediate Holdings directly and wholly owns Catalent Pharma Solutions, Inc. (“("Operating Company”Company"). The financial results of Catalent are comprised of the financial results of Operating Company and its subsidiaries on a consolidated basis.

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States (“GAAP”("GAAP") for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and notes required by GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation have been included. Operating results for the six months ended December 31, 20172018 are not necessarily indicative of the results that may be expected for the year ending June 30, 2018.2019. The consolidated balance sheet at June 30, 20172018 has been derived from the audited consolidated financial statements at that date but does not include all of the information and footnotes required by GAAP for complete financial statements. For further information on the Company's accounting policies and footnotes, refer to the consolidated financial statements and footnotes thereto included in the Company’s Annual Report on Form 10-K for the year ended June 30, 20172018 filed with the Securities and Exchange Commission ("SEC"(the "SEC").

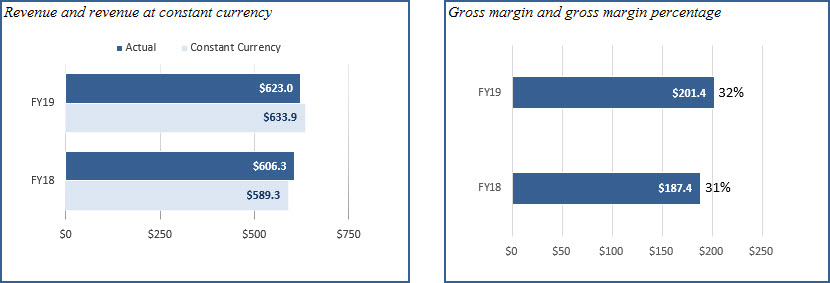

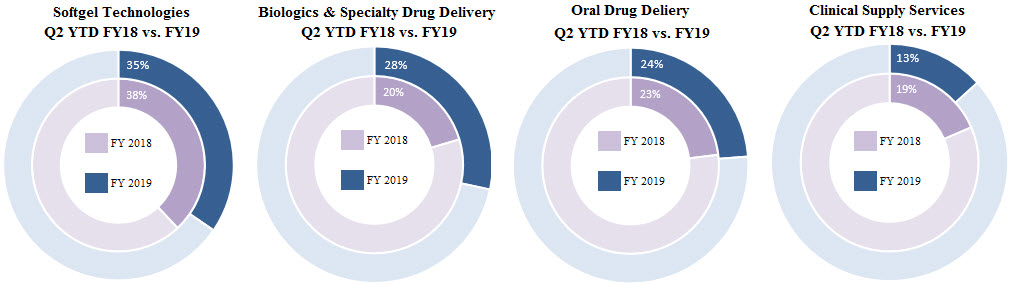

UseIn fiscal 2018, the Company engaged in a business reorganization to better align its internal business unit structure with its "Follow the Molecule" strategy and the increased focus on its biologics-related offerings. Under the revised structure, the Company created two new operating segments from the former Drug Delivery Solutions segment:

•Biologics and Specialty Drug Delivery, which encompasses biologic cell-line development and manufacturing, development and manufacturing services for blow-fill-seal unit doses, prefilled syringes, vials, and cartridges; analytical development and testing services for large molecules; and development and manufacturing for inhaled products for delivery via metered dose inhalers, dry powder inhalers, and intra-nasal sprays; and

•Oral Drug Delivery, which encompasses comprehensive formulation development, manufacturing, and analytical development capabilities using advanced processing technologies such as bioavailability enhancement, controlled release, particle size engineering, and taste-masking for solid oral-dose forms.

Each of Estimates

the two new segments reports through a separate management team and ultimately reports to the Company's Chief Executive Officer who is designated as the Chief Operating Decision Maker for segment reporting purposes. The preparation of financial statementsCompany's operating segments are the same as its reporting segments. All prior-period comparative segment information has been restated to reflect the current reportable segments in conformityaccordance with GAAP requires management to make estimates and assumptions that affect amounts reported in the financial statements and accompanying notes. Such estimates include, but are not limited to, allowance for doubtful accounts, inventory and long-lived asset valuation, goodwill and other intangible asset valuation and impairment, equity-based compensation, income taxes, and pension plan asset and liability valuation. Actual amounts may differ from these estimated amounts.Accounting Standards Codification ("ASC") 280, Segment Reporting.

Foreign Currency Translation

The financial statements of the Company’s operations outside the U.S. are generally measured using the local currency as the functional currency. Adjustments to translate the assets and liabilities of these foreign operations into U.S. dollars are accumulated as a component of other comprehensive income/(loss) utilizing period-end exchange rates. The currency fluctuations related to certain long-term inter-company loans deemed to not be repayable in the foreseeable future have been recorded within cumulative translation adjustment,In June 2018, as a component of other comprehensive income/(loss). In addition, the currency fluctuation associated with the portionresult of the Company’s euro-denominated debt designatedthree-year cumulative consumer price index exceeding 100%, Argentina was classified as having a net investment hedge is included as a component of other comprehensive income/(loss). Foreign currency transaction gains and losses calculated by utilizing weighted average exchange rates forhighly inflationary economy. Beginning on July 1, 2018, the period are included in the consolidated statements of operations in the other (income)/expense, net line item. Foreign currency translation gains and losses generated from inter-company loans that are long-term in nature, but may be repayable in the foreseeable future, are also recorded within the other (income)/expense, net line item on the consolidated statements of operations.

Revenue Recognition

In accordance with Accounting Standards Codification ("ASC") 605 Revenue Recognition, the Company recognizes revenue when persuasive evidence of an arrangement exists, product delivery has occurred or the services have been rendered, the price is fixed or determinable and collectability is reasonably assured. In cases where the Company has multiple contracts with the same customer, the Company evaluates those contracts to assess if the contracts are linked or are separate arrangements. Factors the Company considers include the timing of negotiation, interdependency with other contracts or elements and payment terms. The Company and its customers generally view each contract discussion as a separate arrangement.

Manufacturing and packaging service revenue is recognized upon delivery of the product in accordance with the terms of the contract, which specify when transfer of title and risk of loss occurs. Some of the Company’s manufacturing contracts with

its customers have annual minimum purchase requirements. At the end of the contract year, revenue is recognized for the unfilled purchase obligation in accordance with the contract terms. Development service contracts generally take the form of a fee-for-service arrangement. After the Company has evidence of an arrangement, the price is determinable and there is a reasonable expectation regarding payment, the Company recognizes revenue at the point in time the service obligation is completed and accepted by the customer. Examples of output measures include a formulation report, analytical and stability testing, clinical batch production or packaging and the storage and distribution of a customer’s clinical trial material. Development service revenue is primarily driven by the Company’s Drug Delivery Solutions segment.

Arrangements containing multiple elements, including service arrangements, are accounted for in accordance with the provisions of ASC 605-25Revenue Recognition—Multiple-Element Arrangements. The Company determines the separate units of account in accordance with ASC 605-25. If the deliverable meets the criteria of a separate unit of accounting, the arrangement consideration is allocated to each element based upon its relative selling price. In determining the best evidence of selling price of a unit of account, the Company utilizes vendor-specific objective evidence (“VSOE”), which is the price the Company charges when the deliverable is sold separately. When VSOE is not available, management uses relevant third-party evidence (“TPE”) of selling price, if available. When neither VSOE nor TPE of selling price exists, management uses its best estimate of selling price.

Goodwill

The Company accounts for purchased goodwill and intangible assets with indefinite lives in accordance with ASC 350 Goodwill, Intangible and Other Assets. Under ASC 350, goodwill and intangible assets with indefinite lives are not amortized, but instead are tested for impairment at least annually. The Company's annual goodwill impairment test was conductedits Argentine operations as of April 1, 2017. The Company assesses goodwill for possible impairment by comparing the carrying value of its reporting units to their fair values. The Company determines the fair value of its reporting units utilizing estimated future discounted cash flows and incorporates assumptions that it believes marketplace participants would utilize. In addition, the Company uses comparative market information and other factors to corroborate the discounted cash flow results.

Property and Equipment and Other Definite Lived Intangible Assets

Property and equipment are stated at cost. Depreciation expense is computed using the straight-line method over the estimated useful lives of the assets, including capital lease assets that are amortized over the shorter of their useful lives or the terms of the respective leases. The Company generally uses the following ranges of useful lives for its property and equipment categories: buildings and improvements — 5 to 50 years; machinery and equipment — 3 to 10 years; and furniture and fixtures — 3 to 7 years. Depreciation expense was $30.7 million and $58.3 million for the three and six months ended December 31, 2017, respectively, and $24.4 million and $49.2 million for the three and six months ended December 31, 2016, respectively. Depreciation expense includes amortization of assets related to capital leases. The Company charges repairs and maintenance costs to expense as incurred. The amount of capitalized interest was immaterial for all periods presented.

Intangible assets with finite lives, primarily including customer relationships, patents and trademarks are amortized over their useful lives. The Company evaluates the recoverability of its other long-lived assets, including amortizing intangible assets, if circumstances indicate impairment may have occurred pursuant to ASC 360 Property, Plant and Equipment. This analysis is performed by comparing the respective carrying values of the assets to the current and expected future cash flows, on an un-discounted basis, to be generated from such assets. If such analysis indicates that the carrying value of these assets is not recoverable, the carrying value of such assets is reduced to fair value through a charge to the consolidated statements of operations. Fair value is determined based on assumptions the Company believes marketplace participants would utilize and comparable marketplace information in similar arm's length transactions. Impairment charges related to definite lived intangible assets and property, plant and equipment were not material for the three and six months ended December 31, 2017 and 2016.highly inflationary.

Research and Development Costs

The Company expenses research and development costs as incurred. Costs incurred in connection with the development of new offerings and manufacturing process improvements are recorded within selling, general, and administrative expenses. Such research and development costs included in selling, general, and administrative expenses amounted to $1.5$1.0 million and $1.5 million for the three and six months ended December 31, 2018, respectively, and $1.5 million and $3.3 million for the three and six months ended December 31, 2017,, respectively, and $1.5 million and $3.0 million for the three and six months ended December 31, 2016, respectively. Costs incurred in connection with research and

development services the Company provides to customers and services performed in support of the commercial manufacturing process for customers are recorded within cost of sales. Such research and development costs included in cost of sales amounted to $12.4$14.3 million and $25.6 million for the three and six months ended December 31, 2018, respectively, and $12.4 million and $22.4 million for the three and six months ended December 31, 2017,, respectively, and $11.0 million and $21.3 million for the three and six months ended December 31, 2016, respectively.

Earnings / (Loss) Per Share

The Company reports net earnings/(loss) per share in accordance with ASC 260Earnings per Share. Under ASC 260, basic earnings per share, which excludes dilution, is computed by dividing net earnings or loss available to common stockholders by the weighted average number of common shares outstanding for the period. Diluted earnings per share reflects the potential dilution caused by securities that could be exercised or converted into common shares, and is computed by dividing net earnings or loss available to common stockholders by the weighted average of common shares outstanding plus the dilutive potential common shares. Diluted earnings per share includes in-the-money stock options, restricted stock units, and unvested restricted stock using the treasury stock method. During a loss period, the assumed exercise of in-the-money stock options has an anti-dilutive effect, and, therefore, these instruments are excluded from the computation of diluted earnings per share.

Equity-Based Compensation

The Company accounts for its equity-based compensation awards pursuant to ASC 718 Compensation—Stock Compensation. ASC 718 requires companies to recognize compensation expense using a fair value based method for costs related to share-based payments including stock options and restricted stock units. The expense is measured based on the grant date fair value of the awards, and the expense is recorded over the applicable requisite service period using the accelerated attribution method. Forfeitures are recognized as and when they occur. In the absence of an observable market price for a share-based award, the fair value is based upon a valuation methodology that takes into consideration various factors, including the exercise price of the award, the expected term of the award, the current price of the underlying shares, the expected volatility of the underlying share price based on peer companies, the expected dividends on the underlying shares and the risk-free interest rate.

The terms of the Company’s equity-based compensation plans permit an employee holding vested stock options to elect to have the Company withhold a portion of the shares otherwise issuable upon the employee's exercise of the option, a so-called "net settlement transaction," as a means of paying the exercise price meeting tax withholding requirements, or both.

Marketable Securities

Marketable securities consist of investments that have a readily determinable fair value based on quoted market price of the investment, which is considered a Level 1 fair value measurement. Under ASC 320, Investments—Debt and Equity Securities, these investments are classified as available-for-sale and are reported at fair value in other current assets on the Company's consolidated balance sheet. Unrealized holding gains and losses are reported within accumulated other comprehensive income/(loss). Under the Company's accounting policy, a decline in the fair value of marketable securities is deemed to be "other than temporary" and such marketable securities are generally considered to be impaired if their fair value is less than the Company's cost basis for a period based on the particular facts and circumstances surrounding the investment. If a decline in the fair value of a marketable security below the Company's cost basis is determined to be other than temporary, such marketable security is written down to its estimated fair value as a new cost basis and the amount of the write-down is included in earnings as an impairment charge.

Recent Financial Accounting Standards

Recently Adopted Accounting Standards

In July 2015,May 2014, the Financial Accounting StandardsStandard Board (the "FASB"("FASB") issued Accounting Standards Update ("ASU") 2015-11, Simplifying the Measurement of Inventory2014-09, Revenue from Contracts with Customers, which was codified as ASC 606 and superseded nearly all existing revenue-recognition guidance. The guidance’s core principle is that a company will recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. In doing so, the guidance creates a five-step model that requires an entitya company to measure inventory at lowerexercise judgment when considering the terms of costthe contracts and net realizable value. Net realizable valueall relevant facts and circumstances. The five steps require a company to identify customer contracts, identify the separate performance obligations, determine the transaction price, allocate the transaction price to the separate performance obligations, and recognize revenue when or as each performance obligation is satisfied. The guidance allows for either full retrospective adoption, where the estimated selling pricesstandard is applied to all periods presented, or modified retrospective adoption, where the standard is applied only to the most current period presented in the ordinary course of business, less reasonably predictable costs of completion, disposal and transportation. The ASU is effective for public reporting entities in fiscal years beginning after December 15, 2016.financial statements. The Company adopted this ASU prospectively inthe guidance as of July 1, 2018 using the modified retrospective approach applied to contracts that were not completed as of that date. The Company recorded a cumulative effect adjustment to the fiscal 2018. The2019 opening balance of its accumulated deficit upon adoption of this ASU did not have any material impact to the Company's consolidated financial statements.guidance, which decreased beginning accumulated deficit by $15.1 million.

In August 2016, the FASB issued ASU 2016-15 Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments, whichThe following table provides clarification on the presentation and classification of certain cash receipts and cash payments in the statement of cash flows. The guidance will be effective for publicly reporting entities in fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. Early adoption is permitted in any interim or annual period. The Company early adopted this ASU retrospectively in fiscal 2018. The adoption of this ASU did not have any material impact to the Company's consolidated financial statements.

New Accounting Standards Not Adopted as of December 31, 2017

In August 2017, the FASB issued ASU 2017-12, Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities, which reduces the complexity of and simplifies the application of hedge accounting by preparers. The ASU will be effective for fiscal years beginning after December 15, 2018, and interim periods within those years. Early adoption is permitted. The Company is currently evaluating the impact of adopting thisthe guidance on itsthe Company’s financial statements:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Three months Ended December 31, 2018 | | | | | | Six months Ended December 31, 2018 | | | | |

| (Dollars in millions) | As Reported | | Effects of Change | | Amount without Adoption of ASC 606 | | As Reported | | Effects of Change | | Amount without Adoption of ASC 606 |

| Net revenue | $ | 623.0 | | $ | 5.0 | | $ | 628.0 | | $ | 1,174.8 | | $ | 18.6 | | $ | 1,193.4 |

| Cost of sales | 421.6 | | 20.2 | | 441.8 | | 824.9 | | 31.6 | | 856.5 |

| Gross margin | 201.4 | | (15.2) | | 186.2 | | 349.9 | | (13.0) | | 336.9 |

| Earnings from continuing operations before income taxes | 51.3 | | (15.2) | | 36.1 | | 37.9 | | (13.0) | | 24.9 |

| Income tax expense | 2.3 | | (4.0) | | (1.7) | | 3.3 | | (3.8) | | (0.5) |

| Net earnings/(loss) | $ | 49.0 | | $ | (11.2) | | $ | 37.8 | | $ | 34.6 | | $ | (9.2) | | $ | 25.4 |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

The impact of ASC 606 on the Company's consolidated financial statements.balance sheet is immaterial.

In May 2017,The adoption of ASC 606resulted in three primary changes as compared to the FASB issued ASU 2017-09, Compensation—Stock Compensation (Topic 718): Scope of Modification Accounting, which clarifies when an entity will apply modification accounting for changes to stock-based compensation arrangements. Modification accounting applies if the value, vesting conditions, or classificationprevious revenue recognition guidance: (a) revenue from commercial product supply is recognized following successful completion of the awards changes. The ASU will be effectiverequired quality assurance process where it was previously recognized upon shipment of the product to the customer; (b) earlier recognition of revenue from certain commercial supply contract cancellations is recognized as variable consideration as the Company’s performance obligations are satisfied rather than only upon agreement of the amount with the customer; and (c) revenue from sourcing comparator drug product for annual periods beginning after December 15, 2017, and interim periods within those annual periods. Early adoptionclinical supply services is permitted. The Company is currently evaluatingrecorded net of the impactcost of adopting this guidance on its consolidated financial statements.procuring it rather than at full value with a corresponding expense. Refer to Note 2 for the Company's revenue recognition policy.

In March 2017, the FASB issued ASU 2017-07, Compensation—Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost, which requires entities to report the service cost component of the net periodic benefit cost in the same income statement line as other compensation costs arising from services rendered by employees during the reporting period. The other components of the net benefit costs will be presented in the income statement separately from the service cost and below the income from operations subtotal. The Company adopted this guidance as of July 1, 2018, on a retrospective basis, which had an effect on the consolidated statement of operations for the three and six months ended December 31, 2017. The following table summarizes the Company's As Previously Reported and As Adjusted changes to the consolidated statement of operations for the three and six months ended December 31, 2017:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2017 | | | | Six Months Ended December 31, 2017 | | |

| (Dollars in millions) | As Previously Reported | | As Adjusted | | As Previously Reported | | As Adjusted |

| Selling, general, and administrative expenses | $ | 114.3 | | $ | 114.8 | | $ | 221.3 | | $ | 222.3 |

| Operating earnings | 68.8 | | 68.3 | | 100.7 | | 99.7 |

| Other expense, net | 13.6 | | 13.1 | | 19.3 | | 18.3 |

In August 2017, the FASB issued ASU will be2017-12, Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities, which reduces the complexity of and simplifies the application of hedge accounting by issuers. The ASU is effective for public reporting entities in fiscal years beginning after December 15, 2017,2018 and interim periods within those years. Early adoption is permitted in the first interim period of a fiscal year.permitted. The Company is currently evaluating the impact of adoptingearly adopted this guidance as of July 1, 2018 on itsa prospective basis. The adoption of this guidance was not material to the Company's consolidated financial statements.

In May 2017, the FASB issued ASU 2017-09, Compensation—Stock Compensation (Topic 718): Scope of Modification Accounting, which clarifies when an entity will apply modification accounting for changes to stock-based compensation arrangements. Modification accounting applies if the value, vesting conditions, or classification of an award changes. The Company adopted this guidance prospectively at the beginning of fiscal 2019. The adoption of this guidance was not material to the Company's consolidated financial statements.

In January 2017, the FASB issued ASU 2017-01, Business Combinations (Topic 805): Clarifying the Definition of a Business, which provides additional guidance on the definition of a business to assist entities with evaluating whether transactions should be accounted for as acquisitions of assets or businesses. The Company adopted this guidance prospectively at the beginning of fiscal 2019. The adoption of this guidance was not material to the Company's consolidated financial statements.

In January 2016, the FASB issued ASU 2016-01, Financial Instruments—Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities, which changes the accounting for equity investments and financial liabilities under the fair value option, and presentation and disclosure requirements for financial instruments. The ASU requires equity investments with readily determinable fair values to be measured at fair value and to recognize change in fair value in net earnings. The ASU is not applicable to equity investments accounted for under the equity method of accounting or those that result in consolidation of the investee. The Company adopted this guidance at the beginning of fiscal 2019. The adoption of this guidance was not material to the Company's consolidated financial statements.

New Accounting Standards Not Adopted as of December 31, 2018

In August 2018, the FASB issued ASU 2018-15, Intangibles—Goodwill and Other—Internal-Use Software (Subtopic 350-40): Customer's Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract, which aligns the requirements for capitalizing implementation costs incurred in a hosting arrangement that is a service contract with the requirements for capitalizing implementation costs incurred to develop or obtain internal-use software. The ASU will be effective for public reporting entities in fiscal years beginning after December 15, 20172019 and interim periods within those fiscal years.years and allows for either a retrospective or prospective application. The Company is currently evaluating the impact of adopting this guidance on its consolidated financial statements.

In February 2018, the FASB issued ASU 2018-02, Income Statement—Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income, which permits an entity to reclassify to retained earnings the stranded tax effects caused by the Tax Cuts and Jobs Act of 2017 on items within accumulated other comprehensive income/(loss). The ASU will be effective for fiscal years beginning after December 15, 2018 and interim periods within those years. Early adoption is permitted. The Company is currently evaluating the impact of adopting this guidance on its consolidated financial statements.

In June 2016, the FASB issued ASU 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which introduces a new accounting model Credit Expected Credit Losses model ("CECL"). CECL requires earlier recognition of credit losses, while also providing additional transparency about credit risk. The CECL model utilizes a lifetime expected credit loss measurement objective for the recognition of credit losses for receivables at the time the financial asset is originated or acquired. The expected credit losses are adjusted each period for changes in expected lifetime credit losses. This model replaces the multiple existing impairment models in current GAAP, which generally require that a loss be incurred before it is recognized. The new standard will also apply to receivables arising from revenue transactions such as contract assets and accounts receivables. The ASU will be effective for fiscal years beginning after December 15, 2019. The Company is currently evaluating the impact of adopting this guidance on its consolidated financial statements.

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842), which will supersede ASCASC 840 Leases. The new guidance requires lessees to recognize most leases on their balance sheets for the rights and obligations created by those leases. The guidance requires enhanced disclosures regarding the amount, timing, and uncertainty of cash flows arising from leases and will be effective for publiclypublic reporting entities in annual reporting periods beginning after December 15, 2018 and interim periods within those fiscal years. Early adoption is permitted. The guidance is required to be adopted using the modified retrospective approach. The Company anticipates that most of its operating leases will result in the recognition of additional assets and corresponding liabilities on its consolidated balance sheets. The Company continues to evaluate the impact of adopting this guidance and its implication on its consolidated financial statements.

In May 2014, the FASB issued ASU No. 2014-09Revenue from Contracts with Customers, whichwill supersede nearly all existing revenue recognition guidance. The new guidance’s core principle is that a company will recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. In doing so, the new guidance creates a five-step model that requires a

company to exercise judgment when considering the terms of the contracts and all relevant facts and circumstances. The five steps require a company to identify customer contracts, identify the separate performance obligations, determine the transaction price, allocate the transaction price to the separate performance obligations and recognize revenue when each performance obligation is satisfied. On July 9, 2015, the FASB approved a one-year deferral of the effective date so that the new guidance is effective for public entities for annual and interim periods beginning after December 15, 2017. The new guidance allows for either full retrospective adoption, where the standard is applied to all periods presented, or modified retrospective adoption where the standard is applied only to the most current period presented in the financial statements. Early adoption is permitted. The Company has identified its revenue streams, reviewed the initial impacts of adopting of the new standard on those revenue streams, and appointed a governance committee and project management leader. While the Company continues to assess all potential impacts of the standard, it has preliminarily assessed that the timing of revenue recognition may change for certain contractual arrangements containing minimum volume commitments in which the price is not fixed or determinable pursuant to the terms of the agreement. Under the current standard, the related pricing adjustments are considered to be contingent, while under the new standard they will likely be accounted for as variable consideration and revenue might be recognized earlier provided that the Company can reliably estimate the amount expected to be realized. Further, the Company has preliminarily determined that, for commercial supply arrangements, revenue will be recognized at the point in time of completing the required quality assurance process. The Company expects to adopt the new standard on a modified retrospective basis.

Transaction Overview:

On October 23, 2017, the Company acquired 100% of the equity interest in Cook Pharmica LLC (now doing business as Catalent Indiana, LLC, "Catalent Indiana") for an aggregate nominal purchase price of $950 million, subject to adjustment, in order to enhance the Company's biologics capabilities. Catalent Indiana is a biologics-focused contract development and manufacturing organization with capabilities across biologics development, clinical and commercial cell culture manufacturing, formulation, finished-dose manufacturing, and packaging.

The Company accounted for the transaction using the acquisition method of accounting for business combinations, in accordance with ASC 805 Business Combinations. The total consideration was (in thousands):

|

| | | |

| Cash paid at closing | $ | 748,002 |

|

| Fair value of deferred consideration at closing | | 184,838 |

|

| Total consideration | $ | 932,840 |

|

In addition to the cash paid at the closing of the acquisition, the agreement governing the purchase includes a deferred consideration arrangement that requires the Company to pay an additional $200.0 million in $50.0 million increments on each of the first four anniversaries of the closing. The fair value of the deferred consideration recognized on the acquisition date was estimated by calculating the risk-adjusted present value of four deferred cash payments and includes a component of imputed interest. This deferred consideration is included in current and long-term obligations within the consolidated balance sheet at December 31, 2017.

Following the acquisition, the operating results of the Catalent Indiana business have been included in the consolidated financial statements. For the period from the acquisition date through December 31, 2017, Catalent Indiana's net revenue was $40.4 million and pre-tax earnings were $7.9 million. Transaction costs incurred as a result of the acquisition of $1.9 million and $10.4 million are included in selling, general and administrative expenses for the three and six months ending December 31, 2017, respectively.

Valuation Assumptions and Preliminary Purchase Price Allocation:

2. REVENUE RECOGNITION

The Company estimated fair values at the date of acquisition for the preliminary allocation of consideration to the net tangible and intangible assets acquired and liabilities assumed. During the measurement period, the Company will continue to obtain information to assist in finalizing the fair value of net assets acquired, which may differ materially from these preliminary estimates. If any measurement period adjustment is material, the Company will record those adjustments, including any related impact on net income, in the reporting period in which the adjustments are determined.

The preliminary purchase price allocation to assets acquired and liabilities assumed in the transaction is (in thousands):

|

| | | |

| Accounts Receivable | $ | 37,021 |

|

| Inventory | | 25,144 |

|

| Other current assets | | 1,344 |

|

| Property, plant and equipment | | 221,139 |

|

| Identifiable intangible assets | | 330,000 |

|

| Trade and other payables | | 5,380 |

|

| Deferred revenue | | 18,132 |

|

| Total identifiable net assets | | 591,136 |

|

| Goodwill | | 341,704 |

|

| Total assets acquired and liabilities assumed | $ | 932,840 |

|

The carrying value of trade receivables, raw materials inventory and trade payables, as well as certain other current and non-current assets and liabilities, generally represented the fair value at the date of acquisition.

Property, plant and equipment was valued using a combination of the sales comparison approach and cost approach, which is based on current replacement and/or reproduction cost of the asset as new, less depreciation attributable to physical, functional, and economic factors. The Company then determined the remaining useful life based on the anticipated life of the asset and Company policy for similar assets.

Customer relationship intangible assets of $330 million were valued using the multi-period excess-earnings method, a method that values the intangible asset using the present value of the after-tax cash flows attributable to the intangible asset only. The significant assumptions used in developing the valuation included the estimated annual net cash flows (including application of an appropriate margin to forecastedrecognizes revenue selling and marketing costs, return on working capital, contributory asset charges and other factors), the discount rate which appropriately reflects the risk inherent in each future cash flow stream, the assessment of the asset’s life cycle, as well as other factors. The assumptions used in the financial forecasts were based on historical data, supplemented by current and anticipated growth rates, management plans, and market comparable information. Fair value determinations require considerable judgment and are sensitive to changes in underlying assumptions and factors. Preliminary assumptions may change and may result in significant changes to the final valuation. The customer relationship intangible asset has a weighted average useful life of 14 years.

Goodwill has preliminarily been allocated to our Drug Delivery Solutions segment as shown in Note 3, Goodwill. Goodwill is expected to be deductible for tax purposes and is mainly comprised of the following: growth from an expected increase in capacity utilization, potential new customers and the biologic expertise and know-how acquired with the acquisition of Catalent Indiana's workforce.

Pro Forma Results:

The following table provides unaudited pro forma results for the Company, prepared in accordance with ASC 805,606. The Company generally earns its revenue by supplying goods or providing services under contracts with its customers in three primary revenue streams: manufacturing and commercial product supply, development services, and clinical supply services. The Company measures the revenue from customers based on the consideration specified in its contracts, excluding any sales incentive or amount collected on behalf of a third party.

The company generally expenses sales commissions as incurred because either the amortization period is one year or less, or the balance with an amortization period greater than one year is not material.

The following tables allocate revenue for the three and six months ended December 31, 20172018 by type of activity and December 31, 2016, as if the Company had acquired Catalent Indiana as of July 1, 2016.reporting segment (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, 2018 | Softgel Technologies | | Biologics & Specialty Drug Delivery | | Oral Drug Delivery | | Clinical Supply Services | | Total |

| Manufacturing & commercial product supply | $ | 197.0 | | $ | 88.6 | | $ | 100.5 | | $ | — | | $ | 386.1 |

| Development services | 16.7 | | 95.7 | | 53.5 | | — | | 165.9 |

| Clinical supply services | — | | — | | — | | 80.8 | | 80.8 |

| Total | $ | 213.7 | | $ | 184.3 | | $ | 154.0 | | $ | 80.8 | | $ | 632.8 |

| | | Inter-segment revenue elimination | | | | | | (9.8) |

| | | | | Combined net revenue | | | | $ | 623.0 |

|

| | | | | | | | | | | | | | | |

| | For the Three Months Ended | | For the Six Months Ended |

| | December 31, 2017 | | December 31, 2016 | | December 31, 2017 | | December 31, 2016 |

| | (in millions, except per share data) |

| Revenue | $ | 621.0 |

| | $ | 531.1 |

| | $ | 1,216.2 |

| | $ | 1,016.6 |

|

| Net income/(loss) | (10.5 | ) | | 17.6 | | | (1.0 | ) | | (0.6 | ) |

| Basic earnings/(loss) per share | (0.08 | ) | | 0.13 | | | (0.01 | ) | | 0.00 | |

| Diluted earnings/(loss) per share | (0.08 | ) | | 0.13 | | | (0.01 | ) | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six months ended December 31, 2018 | Softgel Technologies | | Biologics & Specialty Drug Delivery | | Oral Drug Delivery | | Clinical Supply Services | | Total |

| Manufacturing & commercial product supply | $ | 381.4 | | $ | 162.4 | | $ | 182.2 | | $ | — | | $ | 726.0 |

| Development services | 31.5 | | 176.5 | | 101.9 | | — | | 309.9 |

| Clinical supply services | — | | — | | — | | 158.5 | | 158.5 |

| Total | $ | 412.9 | | $ | 338.9 | | $ | 284.1 | | $ | 158.5 | | $ | 1,194.4 |

| | | Inter-segment revenue elimination | | | | | | (19.6) |

| | | | | Combined net revenue | | | | $ | 1,174.8 |

The unaudited pro forma financial information was preparedfollowing table allocates revenue by the location where the goods were made or the service performed:

| | | | | | | | | | | | | | |

| (Dollars in millions) | | Three months ended December 31, 2018 | | Six months ended December 31, 2018 |

| | | | |

| United States | | $ | 315.1 | | $ | 579.5 |

| Europe | | 214.8 | | 411.2 |

| International Other | | 119.7 | | 227.3 |

| Elimination of revenue attributable to multiple locations | | (26.6) | | (43.2) |

| Total | | $ | 623.0 | | $ | 1,174.8 |

Manufacturing & Commercial Product Supply Revenue

Manufacturing and commercial product supply revenue consists of revenue earned by manufacturing products supplied to customers under long-term commercial supply arrangements. The Company recognizes revenue for manufacturing and supplying commercial products as control is transferred to the customer, which is measured based on product that has successfully completed contractually required quality assurance process. Revenue is measured based on the historical informationamount of Catalentconsideration the Company expects to receive in exchange for providing these products and Catalent Indiana. In order to reflectservices. The contractual performance obligation generally includes manufacture and the acquisition on July 1, 2016,completion of product quality release testing procedures specified in the unaudited pro formal financial information includes adjustments

to reflect the incremental amortization expensecontract. These activities are interdependent and thus are considered to be incurreda single combined performance obligation. Payment is typically due 30 to 90 days after the goods are shipped to the customer based on the fair valuepayment terms set forth in the applicable customer agreement.

Development Services Revenue

Development services contracts generally take the form of short-term, fee-for-service arrangements. Performance obligations vary, but frequently include (1) the delivery of a formulation report, analytical and stability testing report, or other report on product- or molecule-based studies or (2) the manufacture of products under development or otherwise not intended for commercial sale. The transaction prices for these arrangements include fixed consideration of the intangible assets acquired,amounts stated in the incremental depreciation expense relatedcontracts for each promised good or service, which are generally considered to be separate performance obligations. The Company recognizes revenue when or as control of each individual performance obligation is transferred to the fair value adjustmentscustomer and exercises judgment in determining the timing of revenue recognition by analyzing the point in time or period over which the customer has the ability to direct the use of and obtain substantially all of the remaining benefits of the arrangement. Control generally transfers to the customer when services have been completed or the customer has accepted the product or service deliverable and the Company has right to payment based on the terms of the agreement.

In certain arrangements, the Company recognizes revenue over time as the Company satisfies performance obligations. Satisfaction of the performance obligations is measured using an output method measure of progress based on effort expended by the Company. In other arrangements, revenue is recognized when the customer has taken legal title to or accepted the product or service deliverable and the Company has a right to payment based on the terms of the arrangement.

Development services contracts may also include certain success-based milestone payments for completed performance obligations, such as regulatory approval and product validation prior to the commencement of commercial supply. Revenue associated with Catalent Indiana's property, plantdevelopmental milestones is considered variable consideration and equipment,is typically recognized when the additional interest expense associatedsuccess-based milestone is achieved, and no significant revenue reversal is anticipated.

The Company allocates consideration to each performance obligation based on the relative selling price. Payment is typically due 30 to 90 days following the completion of services provided to the customer based on the payment terms set forth in the applicable customer agreement. Certain development service arrangements require a portion of the contract consideration to be received in advance at the commencement of the contract and is initially recorded as a contract liability.

Clinical Supply Services Revenue