TIMKENSTEEL CORPORATION

(Exact name of registrant as specified in its charter)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2017

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from

toCommission file number: 1-36313

TIMKENSTEEL CORPORATION

(Exact name of registrant as specified in its charter)

Ohio | 46-4024951 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

1835 Dueber Avenue SW, Canton, OH | 44706 | |

(Address of principal executive offices) | (Zip Code) | |

330.471.7000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

Title of each class | Trading symbol | Name of exchange in which registered | ||

Common shares | TMST | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act

Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial reporting accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Class | Outstanding at October 31, 2023 | |

Common Shares, without par value | 43,154,816 | |

TimkenSteel Corporation

Table of Contents

Page | ||

6 | ||

8 | ||

9 | ||

20 | ||

34 | ||

34 | ||

35 | ||

35 | ||

35 | ||

35 | ||

35 | ||

37 | ||

38 | ||

2

Part I. FINANCIAL INFORMATION

Item 1. Financial Statements

TimkenSteel Corporation

Consolidated Statements of Operations (Unaudited)

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2017 | 2016 | 2017 | 2016 | ||||||||||||

| (Dollars in millions, except per share data) | |||||||||||||||

| Net sales | $339.1 | $213.8 | $987.8 | $654.8 | |||||||||||

| Cost of products sold | 320.6 | 206.3 | 928.5 | 629.6 | |||||||||||

| Gross Profit | 18.5 | 7.5 | 59.3 | 25.2 | |||||||||||

| Selling, general and administrative expenses | 22.5 | 21.8 | 67.7 | 66.8 | |||||||||||

| Restructuring charges | — | — | — | 0.3 | |||||||||||

| Operating Loss | (4.0 | ) | (14.3 | ) | (8.4 | ) | (41.9 | ) | |||||||

| Interest expense | 3.7 | 3.9 | 11.0 | 8.0 | |||||||||||

| Other income (expense), net | 1.9 | (17.3 | ) | 10.7 | (12.1 | ) | |||||||||

| Loss Before Income Taxes | (5.8 | ) | (35.5 | ) | (8.7 | ) | (62.0 | ) | |||||||

| Provision (benefit) for income taxes | 0.1 | (13.3 | ) | 1.2 | (23.5 | ) | |||||||||

| Net Loss | ($5.9 | ) | ($22.2 | ) | ($9.9 | ) | ($38.5 | ) | |||||||

| Per Share Data: | |||||||||||||||

| Basic loss per share | ($0.13 | ) | ($0.50 | ) | ($0.22 | ) | ($0.87 | ) | |||||||

| Diluted loss per share | ($0.13 | ) | ($0.50 | ) | ($0.22 | ) | ($0.87 | ) | |||||||

| Dividends per share | $— | $— | $— | $— | |||||||||||

|

| Three Months Ended September 30, |

|

| Nine Months Ended September 30, |

| ||||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||

(Dollars in millions, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

| ||||

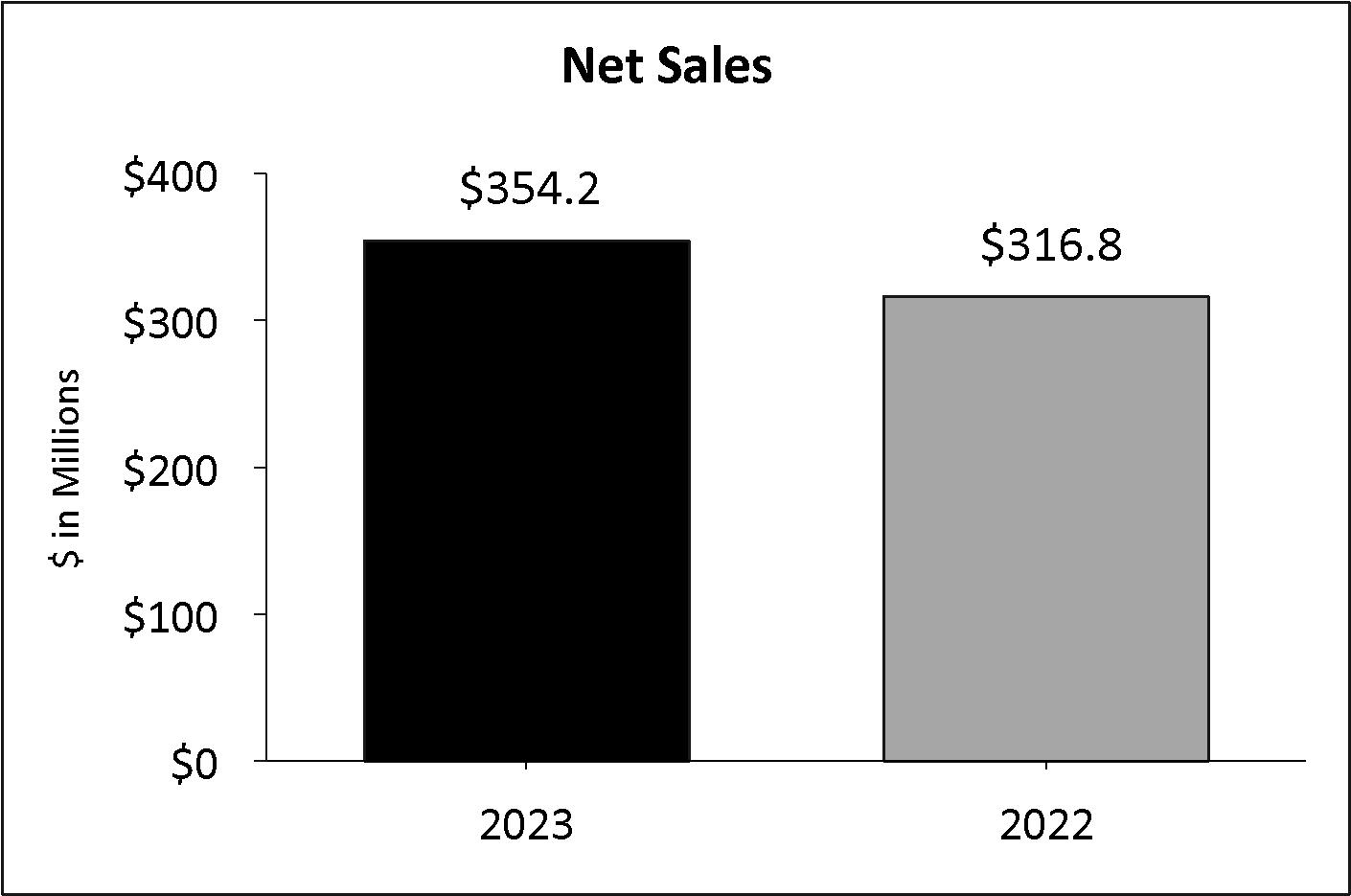

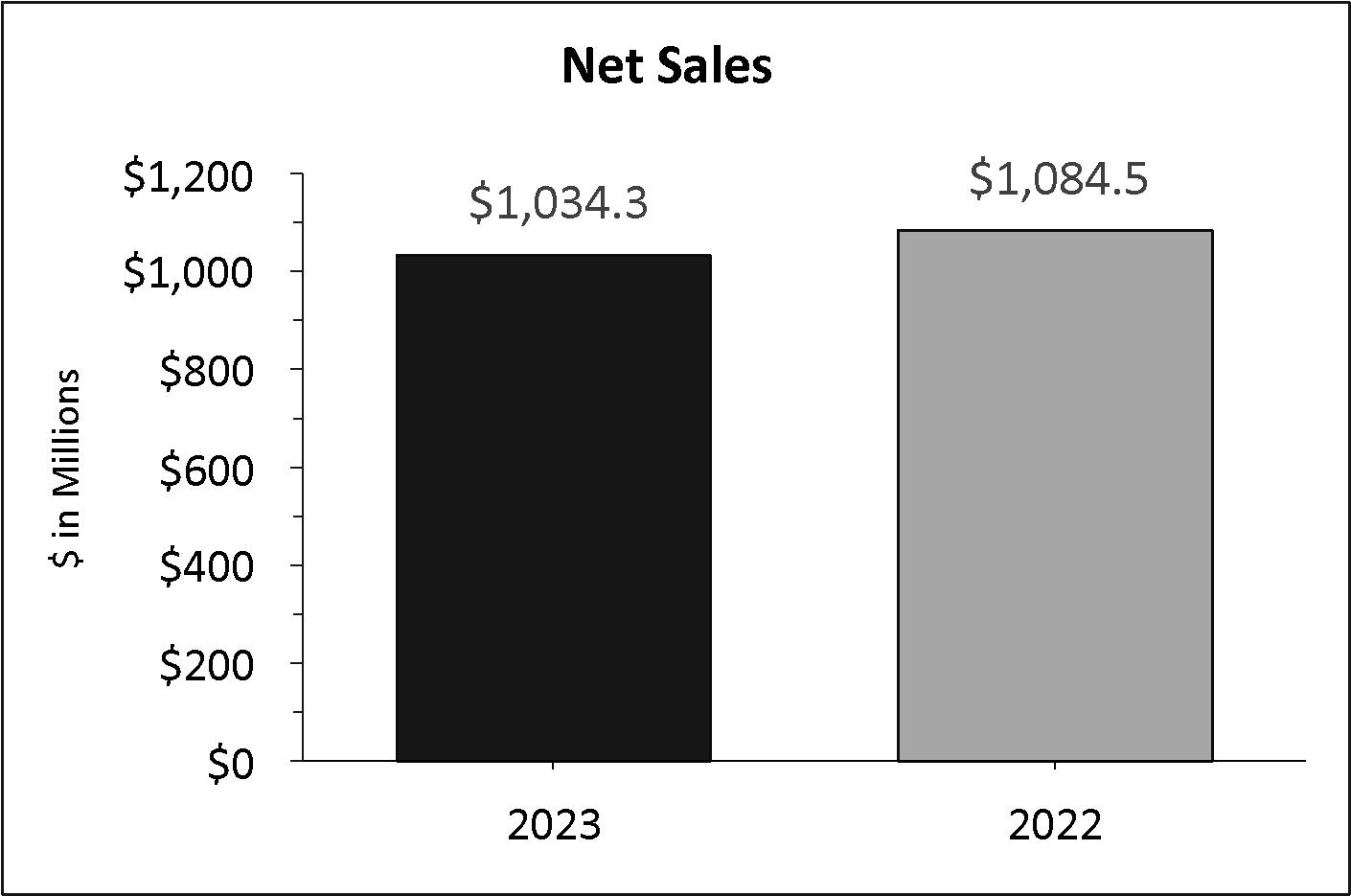

Net sales |

| $ | 354.2 |

|

| $ | 316.8 |

|

| $ | 1,034.3 |

|

| $ | 1,084.5 |

|

Cost of products sold |

|

| 303.2 |

|

|

| 311.2 |

|

|

| 889.2 |

|

|

| 937.5 |

|

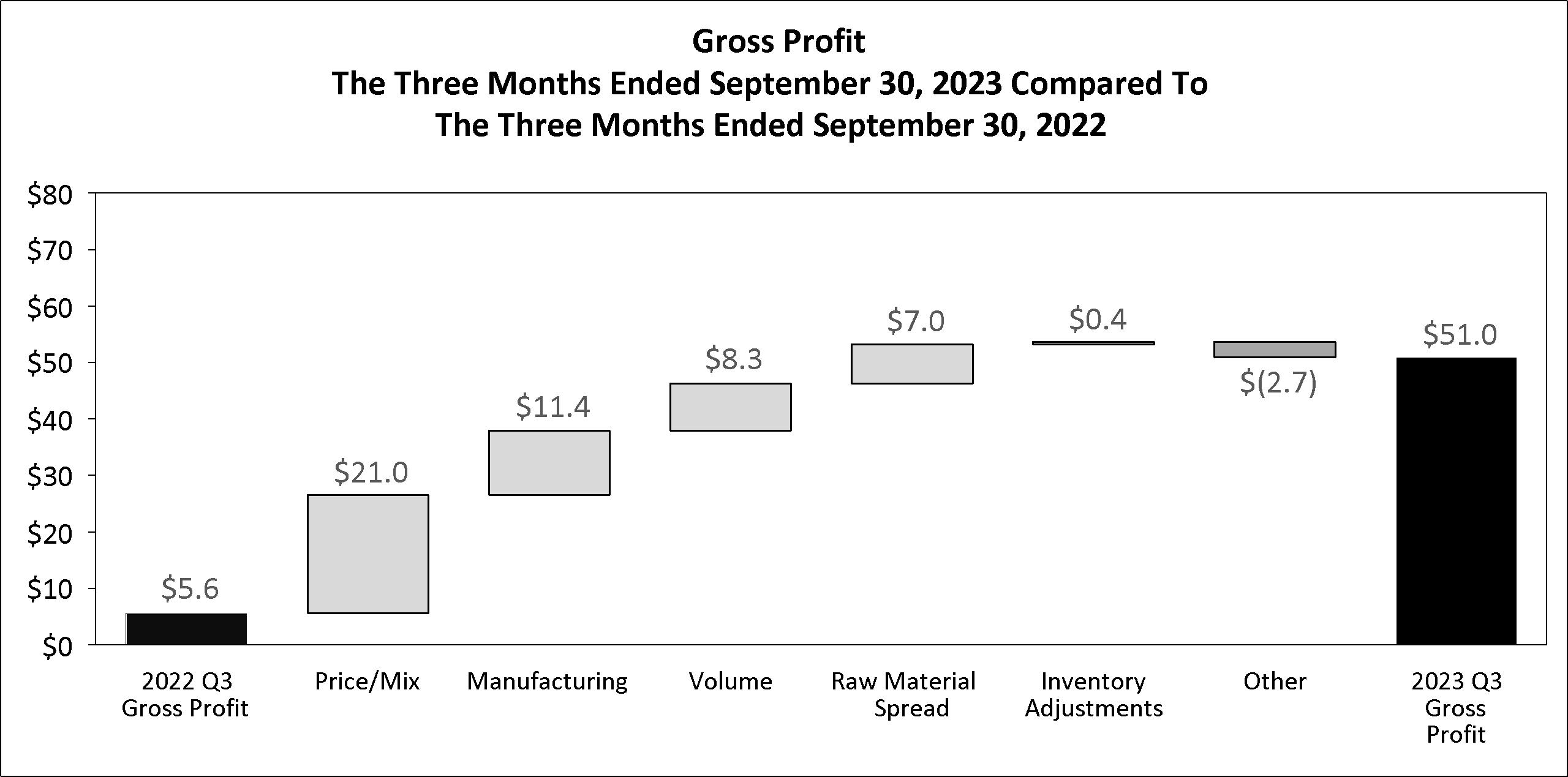

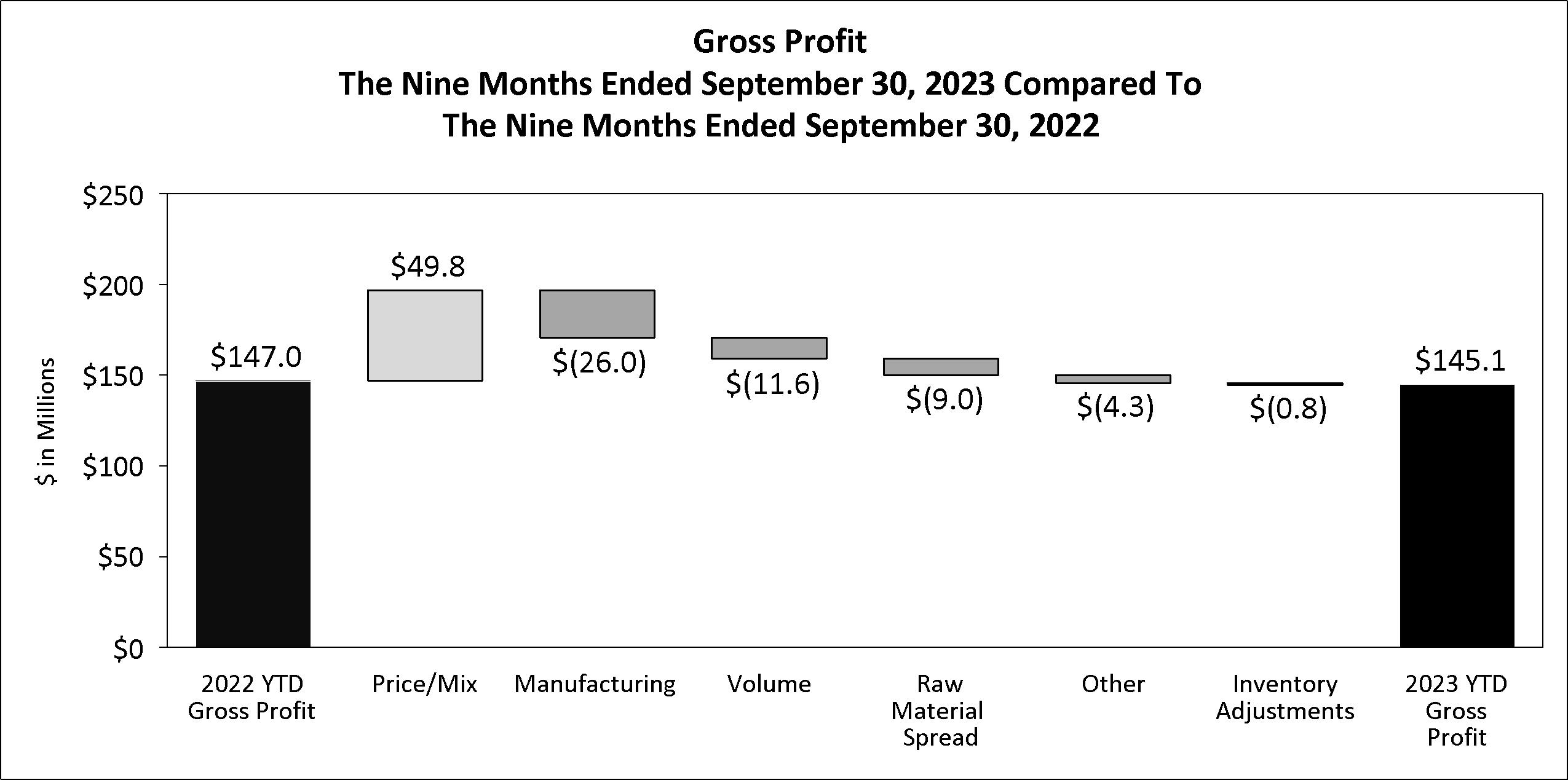

Gross Profit |

|

| 51.0 |

|

|

| 5.6 |

|

|

| 145.1 |

|

|

| 147.0 |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

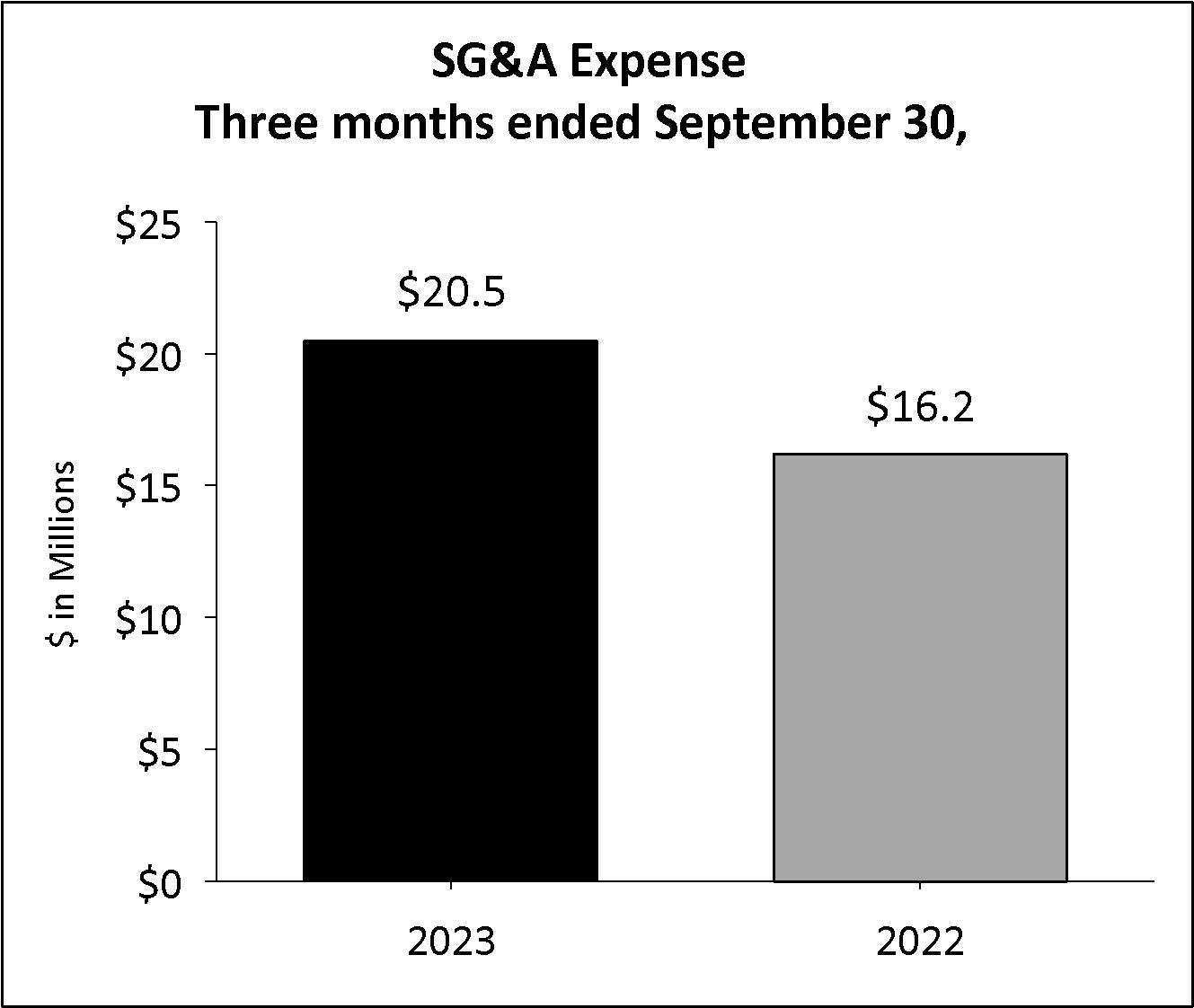

Selling, general and administrative expenses |

|

| 20.5 |

|

|

| 16.2 |

|

|

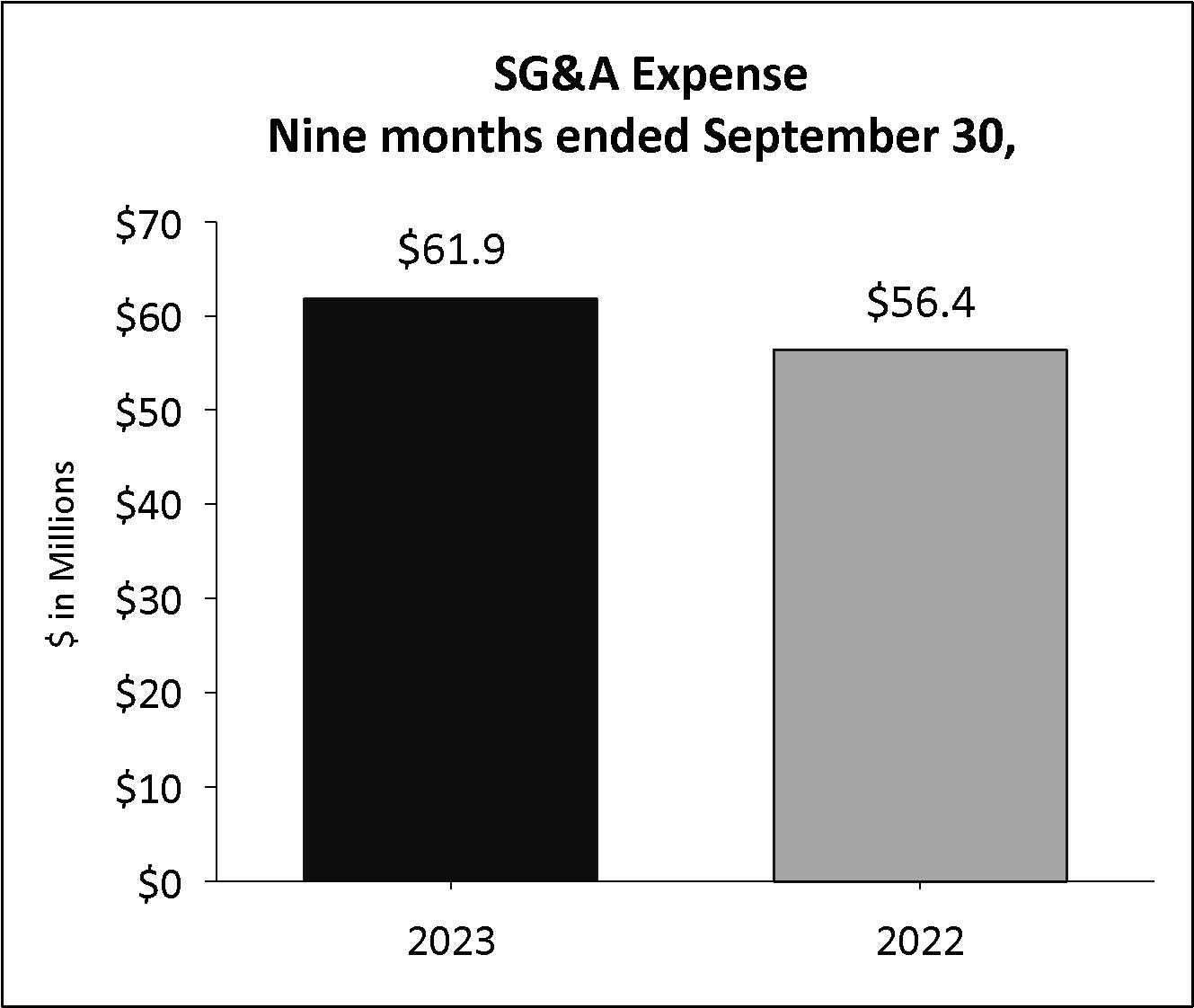

| 61.9 |

|

|

| 56.4 |

|

Restructuring charges |

|

| — |

|

|

| — |

|

|

| — |

|

|

| 0.8 |

|

Loss (gain) on sale or disposal of assets, net |

|

| (0.3 | ) |

|

| 1.9 |

|

|

| (2.8 | ) |

|

| 2.5 |

|

Interest (income) expense, net |

|

| (1.8 | ) |

|

| (0.2 | ) |

|

| (5.0 | ) |

|

| 1.6 |

|

Loss on extinguishment of debt |

|

| — |

|

|

| 0.1 |

|

|

| 11.4 |

|

|

| 43.1 |

|

Other (income) expense, net |

|

| (2.0 | ) |

|

| 0.2 |

|

|

| (13.1 | ) |

|

| (58.8 | ) |

Income (Loss) Before Income Taxes |

|

| 34.6 |

|

|

| (12.6 | ) |

|

| 92.7 |

|

|

| 101.4 |

|

Provision (benefit) for income taxes |

|

| 9.8 |

|

|

| 0.7 |

|

|

| 24.6 |

|

|

| 3.1 |

|

Net Income (Loss) |

| $ | 24.8 |

|

| $ | (13.3 | ) |

| $ | 68.1 |

|

| $ | 98.3 |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Per Share Data: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Basic earnings (loss) per share |

| $ | 0.56 |

|

| $ | (0.29 | ) |

| $ | 1.55 |

|

| $ | 2.12 |

|

Diluted earnings (loss) per share |

| $ | 0.51 |

|

| $ | (0.29 | ) |

| $ | 1.43 |

|

| $ | 1.91 |

|

See accompanying Notes to Unauditedthe unaudited Consolidated Financial Statements.

3

TimkenSteel Corporation

Consolidated StatementsStatement of Comprehensive LossIncome (Loss) (Unaudited)

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2017 | 2016 | 2017 | 2016 | ||||||||||||

| (Dollars in millions) | |||||||||||||||

| Net Loss | ($5.9 | ) | ($22.2 | ) | ($9.9 | ) | ($38.5 | ) | |||||||

| Other comprehensive income, net of tax: | |||||||||||||||

| Foreign currency translation adjustments | 0.3 | (0.5 | ) | 1.1 | (2.8 | ) | |||||||||

| Pension and postretirement liability adjustments | 0.1 | — | 0.4 | 0.8 | |||||||||||

| Other comprehensive income, net of tax | 0.4 | (0.5 | ) | 1.5 | (2.0 | ) | |||||||||

| Comprehensive Loss, net of tax | ($5.5 | ) | ($22.7 | ) | ($8.4 | ) | ($40.5 | ) | |||||||

|

| Three Months Ended September 30, |

|

| Nine Months Ended September 30, |

| ||||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||

(Dollars in millions) |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Net income (loss) |

| $ | 24.8 |

|

| $ | (13.3 | ) |

| $ | 68.1 |

|

| $ | 98.3 |

|

Other comprehensive income (loss), net of benefit (provision) for income taxes of $0.2 million and $0.2 million for the three months ended September 30, 2023 and 2022, and $0 million and $0.6 million for the nine months ended September 30, 2023 and 2022 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Foreign currency translation adjustments |

|

| (0.7 | ) |

|

| (2.3 | ) |

|

| (0.5 | ) |

|

| (5.4 | ) |

Pension and postretirement liability adjustments |

|

| (1.1 | ) |

|

| (0.8 | ) |

|

| (2.5 | ) |

|

| (2.7 | ) |

Other comprehensive income (loss), net of tax |

|

| (1.8 | ) |

|

| (3.1 | ) |

|

| (3.0 | ) |

|

| (8.1 | ) |

Comprehensive Income (Loss), net of tax |

| $ | 23.0 |

|

| $ | (16.4 | ) |

| $ | 65.1 |

|

| $ | 90.2 |

|

See accompanying Notes to Unauditedthe unaudited Consolidated Financial Statements.

4

TimkenSteel Corporation

Consolidated Balance Sheets (Unaudited)

| September 30, 2017 | December 31, 2016 | ||||||

| (Dollars in millions) | |||||||

| ASSETS | |||||||

| Current Assets | |||||||

| Cash and cash equivalents | $25.8 | $25.6 | |||||

| Accounts receivable, net of allowances (2017 - $2.6 million; 2016 - $2.1 million) | 160.6 | 91.6 | |||||

| Inventories, net | 219.5 | 164.2 | |||||

| Deferred charges and prepaid expenses | 4.2 | 2.8 | |||||

| Other current assets | 7.4 | 6.2 | |||||

| Total Current Assets | 417.5 | 290.4 | |||||

| Property, Plant and Equipment, Net | 701.6 | 741.9 | |||||

| Other Assets | |||||||

| Pension assets | 9.8 | 6.2 | |||||

| Intangible assets, net | 20.9 | 25.0 | |||||

| Other non-current assets | 6.0 | 6.4 | |||||

| Total Other Assets | 36.7 | 37.6 | |||||

| Total Assets | $1,155.8 | $1,069.9 | |||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||

| Current Liabilities | |||||||

| Accounts payable, trade | $133.8 | $87.0 | |||||

| Salaries, wages and benefits | 30.4 | 20.3 | |||||

| Accrued pension and postretirement costs | 3.0 | 3.0 | |||||

| Other current liabilities | 21.4 | 20.4 | |||||

| Total Current Liabilities | 188.6 | 130.7 | |||||

| Non-Current Liabilities | |||||||

| Convertible notes, net | 69.2 | 66.4 | |||||

| Other long-term debt | 95.2 | 70.2 | |||||

| Accrued pension and postretirement costs | 196.2 | 192.1 | |||||

| Deferred income taxes | 0.7 | — | |||||

| Other non-current liabilities | 13.2 | 13.1 | |||||

| Total Non-Current Liabilities | 374.5 | 341.8 | |||||

| Shareholders’ Equity | |||||||

| Preferred shares, without par value; authorized 10.0 million shares, none issued | — | — | |||||

Common shares, without par value; authorized 200.0 million shares; issued 2017 and 2016 - 45.7 million shares | — | — | |||||

| Additional paid-in capital | 842.3 | 845.6 | |||||

| Retained deficit | (204.1 | ) | (193.9 | ) | |||

| Treasury shares - 2017 - 1.3 million; 2016 - 1.5 million | (37.6 | ) | (44.9 | ) | |||

| Accumulated other comprehensive loss | (7.9 | ) | (9.4 | ) | |||

| Total Shareholders’ Equity | 592.7 | 597.4 | |||||

| Total Liabilities and Shareholders’ Equity | $1,155.8 | $1,069.9 | |||||

|

| September 30, |

|

| December 31, |

| ||

(Dollars in millions) |

|

|

|

|

|

| ||

ASSETS |

|

|

|

|

|

| ||

Current Assets |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ | 225.4 |

|

| $ | 257.2 |

|

Accounts receivable, net of allowances (2023 - $1.9 million; 2022 - $1.0 million) |

|

| 135.8 |

|

|

| 79.4 |

|

Inventories, net |

|

| 255.4 |

|

|

| 192.4 |

|

Deferred charges and prepaid expenses |

|

| 11.5 |

|

|

| 6.4 |

|

Other current assets |

|

| 2.4 |

|

|

| 21.2 |

|

Total Current Assets |

|

| 630.5 |

|

|

| 556.6 |

|

|

|

|

|

|

| |||

Property, plant and equipment, net |

|

| 487.6 |

|

|

| 486.1 |

|

Operating lease right-of-use assets |

|

| 11.2 |

|

|

| 12.5 |

|

Pension assets |

|

| 19.3 |

|

|

| 19.4 |

|

Intangible assets, net |

|

| 3.0 |

|

|

| 5.0 |

|

Other non-current assets |

|

| 2.2 |

|

|

| 2.4 |

|

Total Assets |

| $ | 1,153.8 |

|

| $ | 1,082.0 |

|

|

|

|

|

|

| |||

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

| ||

Current Liabilities |

|

|

|

|

|

| ||

Accounts payable |

| $ | 148.5 |

|

| $ | 113.2 |

|

Salaries, wages and benefits |

|

| 20.6 |

|

|

| 21.2 |

|

Accrued pension and postretirement costs |

|

| 2.0 |

|

|

| 2.0 |

|

Current operating lease liabilities |

|

| 5.4 |

|

|

| 6.0 |

|

Current convertible notes, net |

|

| 13.1 |

|

|

| 20.4 |

|

Other current liabilities |

|

| 17.4 |

|

|

| 23.9 |

|

Total Current Liabilities |

|

| 207.0 |

|

|

| 186.7 |

|

|

|

|

|

|

| |||

Credit Agreement |

|

| — |

|

|

| — |

|

Non-current operating lease liabilities |

|

| 5.9 |

|

|

| 6.5 |

|

Accrued pension and postretirement costs |

|

| 170.4 |

|

|

| 162.9 |

|

Deferred income taxes |

|

| 26.6 |

|

|

| 25.9 |

|

Other non-current liabilities |

|

| 13.6 |

|

|

| 13.5 |

|

Total Liabilities |

|

| 423.5 |

|

|

| 395.5 |

|

|

|

|

|

|

| |||

Shareholders’ Equity |

|

|

|

|

|

| ||

Preferred shares, without par value; authorized 10.0 million shares, none issued |

|

| — |

|

|

| — |

|

Common shares, without par value; authorized 200.0 million shares; |

|

| — |

|

|

| — |

|

Additional paid-in capital |

|

| 842.2 |

|

|

| 847.0 |

|

Retained deficit |

|

| (55.0 | ) |

|

| (123.1 | ) |

Treasury shares - 2023 - 3.8 million; 2022 - 3.0 million |

|

| (68.6 | ) |

|

| (52.1 | ) |

Accumulated other comprehensive income (loss) |

|

| 11.7 |

|

|

| 14.7 |

|

Total Shareholders’ Equity |

|

| 730.3 |

|

|

| 686.5 |

|

Total Liabilities and Shareholders’ Equity |

| $ | 1,153.8 |

|

| $ | 1,082.0 |

|

See accompanying Notes to Unauditedthe unaudited Consolidated Financial Statements.

5

TimkenSteel Corporation

(Dollars in millions) |

| Common |

|

| Additional |

|

| Retained |

|

| Treasury |

|

| Accumulated |

|

| Total |

| ||||||

Balance As of December 31, 2022 |

|

| 44,064,891 |

|

| $ | 847.0 |

|

| $ | (123.1 | ) |

| $ | (52.1 | ) |

| $ | 14.7 |

|

| $ | 686.5 |

|

Net income (loss) |

|

| — |

|

|

| — |

|

|

| 14.4 |

|

|

| — |

|

|

| — |

|

|

| 14.4 |

|

Other comprehensive income (loss) |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (0.6 | ) |

|

| (0.6 | ) |

Stock-based compensation expense |

|

| — |

|

|

| 2.6 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 2.6 |

|

Stock option activity |

|

| 101,130 |

|

|

| 1.3 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 1.3 |

|

Purchase of treasury shares, including excise tax |

|

| (514,086 | ) |

|

| — |

|

|

| — |

|

|

| (9.4 | ) |

|

| — |

|

|

| (9.4 | ) |

Issuance of treasury shares |

|

| 555,062 |

|

|

| (11.4 | ) |

|

| — |

|

|

| 11.4 |

|

|

| — |

|

|

| — |

|

Shares surrendered for taxes |

|

| (176,720 | ) |

|

| — |

|

|

| — |

|

|

| (3.4 | ) |

|

| — |

|

|

| (3.4 | ) |

Balance As of March 31, 2023 |

|

| 44,030,277 |

|

| $ | 839.5 |

|

| $ | (108.7 | ) |

| $ | (53.5 | ) |

| $ | 14.1 |

|

| $ | 691.4 |

|

Net income (loss) |

|

| — |

|

|

| — |

|

|

| 28.9 |

|

|

| — |

|

|

| — |

|

|

| 28.9 |

|

Other comprehensive income (loss) |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (0.6 | ) |

|

| (0.6 | ) |

Stock-based compensation expense |

|

| — |

|

|

| 2.9 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 2.9 |

|

Stock option activity |

|

| 76,030 |

|

|

| 0.6 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 0.6 |

|

Purchase of treasury shares, including excise tax |

|

| (650,271 | ) |

|

| — |

|

|

| — |

|

|

| (11.4 | ) |

|

| — |

|

|

| (11.4 | ) |

Issuance of treasury shares |

|

| 29,356 |

|

|

| (1.8 | ) |

|

| — |

|

|

| 1.8 |

|

|

| — |

|

|

| — |

|

Balance As of June 30, 2023 |

|

| 43,485,392 |

|

| $ | 841.2 |

|

| $ | (79.8 | ) |

| $ | (63.1 | ) |

| $ | 13.5 |

|

| $ | 711.8 |

|

Net income (loss) |

|

| — |

|

|

| — |

|

|

| 24.8 |

|

|

| — |

|

|

| — |

|

|

| 24.8 |

|

Other comprehensive income (loss) |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (1.8 | ) |

|

| (1.8 | ) |

Stock-based compensation expense |

|

| — |

|

|

| 3.0 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 3.0 |

|

Stock option activity |

|

| 61,075 |

|

|

| 0.5 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 0.5 |

|

Purchase of treasury shares, including excise tax |

|

| (352,860 | ) |

|

| (0.3 | ) |

|

| — |

|

|

| (7.7 | ) |

|

| — |

|

|

| (8.0 | ) |

Issuance of treasury shares |

|

| 56,131 |

|

|

| (2.2 | ) |

|

| — |

|

|

| 2.2 |

|

|

| — |

|

|

| — |

|

Shares surrendered for taxes |

|

| (740 | ) |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Balance As of September 30, 2023 |

|

| 43,248,998 |

|

| $ | 842.2 |

|

| $ | (55.0 | ) |

| $ | (68.6 | ) |

| $ | 11.7 |

|

| $ | 730.3 |

|

6

(Dollars in millions) |

| Common |

|

| Additional |

|

| Retained |

|

| Treasury |

|

| Accumulated |

|

| Total |

| ||||||

Balance As of December 31, 2021 |

|

| 46,268,855 |

|

| $ | 832.1 |

|

| $ | (188.2 | ) |

| $ | — |

|

| $ | 20.7 |

|

| $ | 664.6 |

|

Net income (loss) |

|

| — |

|

|

| — |

|

|

| 37.1 |

|

|

| — |

|

|

| — |

|

|

| 37.1 |

|

Other comprehensive income (loss) |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (1.9 | ) |

|

| (1.9 | ) |

Stock-based compensation expense |

|

| 298,648 |

|

|

| 2.1 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 2.1 |

|

Stock option activity |

|

| 406,750 |

|

|

| 6.3 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 6.3 |

|

Purchase of treasury shares |

|

| (169,816 | ) |

|

| — |

|

|

| — |

|

|

| (3.4 | ) |

|

| — |

|

|

| (3.4 | ) |

Shares surrendered for taxes |

|

| (91,853 | ) |

|

| (0.2 | ) |

|

| — |

|

|

| (1.4 | ) |

|

| — |

|

|

| (1.6 | ) |

Balance As of March 31, 2022 |

|

| 46,712,584 |

|

| $ | 840.3 |

|

| $ | (151.1 | ) |

| $ | (4.8 | ) |

| $ | 18.8 |

|

| $ | 703.2 |

|

Net income (loss) |

|

| — |

|

|

| — |

|

|

| 74.5 |

|

|

| — |

|

|

| — |

|

|

| 74.5 |

|

Other comprehensive income (loss) |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (3.1 | ) |

|

| (3.1 | ) |

Stock-based compensation expense |

|

| 44,157 |

|

|

| 2.2 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 2.2 |

|

Stock option activity |

|

| 92,290 |

|

|

| 1.5 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 1.5 |

|

Purchase of treasury shares |

|

| (437,638 | ) |

|

| — |

|

|

| — |

|

|

| (9.3 | ) |

|

| — |

|

|

| (9.3 | ) |

Issuance of treasury shares |

|

| 2,285 |

|

|

| (0.1 | ) |

|

| — |

|

|

| 0.1 |

|

|

| — |

|

|

| — |

|

Shares surrendered for taxes |

|

| (2,285 | ) |

|

| — |

|

|

| — |

|

|

| (0.1 | ) |

|

| — |

|

|

| (0.1 | ) |

Balance As of June 30, 2022 |

|

| 46,411,393 |

|

| $ | 843.9 |

|

| $ | (76.6 | ) |

| $ | (14.1 | ) |

| $ | 15.7 |

|

| $ | 768.9 |

|

Net income (loss) |

|

| — |

|

|

| — |

|

|

| (13.3 | ) |

|

| — |

|

|

| — |

|

|

| (13.3 | ) |

Other comprehensive income (loss) |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (3.1 | ) |

|

| (3.1 | ) |

Stock-based compensation expense |

|

| — |

|

|

| 2.2 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 2.2 |

|

Stock option activity |

|

| — |

|

|

| 0.1 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 0.1 |

|

Purchase of treasury shares |

|

| (1,252,112 | ) |

|

| — |

|

|

| — |

|

|

| (19.7 | ) |

|

| — |

|

|

| (19.7 | ) |

Issuance of treasury shares |

|

| 10,724 |

|

|

| (0.2 | ) |

|

| — |

|

|

| 0.2 |

|

|

| — |

|

|

| — |

|

Shares surrendered for taxes |

|

| (348 | ) |

|

|

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

| |

Balance As of September 30, 2022 |

|

| 45,169,657 |

|

| $ | 846.0 |

|

| $ | (89.9 | ) |

| $ | (33.6 | ) |

| $ | 12.6 |

|

| $ | 735.1 |

|

See accompanying Notes to the unaudited Consolidated Financial Statements.

7

TimkenSteel Corporation

Consolidated Statements of Cash Flows (Unaudited)

| Nine Months Ended September 30, | |||||||

| 2017 | 2016 | ||||||

| (Dollars in millions) | |||||||

| CASH PROVIDED (USED) | |||||||

| Operating Activities | |||||||

| Net loss | ($9.9 | ) | ($38.5 | ) | |||

| Adjustments to reconcile net loss to net cash provided by operating activities: | |||||||

| Depreciation and amortization | 56.4 | 56.2 | |||||

| Amortization of deferred financing fees and debt discount | 3.1 | 1.9 | |||||

| Impairment charges and loss on sale or disposal of assets | 0.4 | 1.0 | |||||

| Deferred income taxes | 0.7 | (24.9 | ) | ||||

| Stock-based compensation expense | 4.9 | 4.6 | |||||

| Pension and postretirement expense | 4.6 | 23.4 | |||||

| Pension and postretirement contributions and payments | (2.5 | ) | (3.1 | ) | |||

| Reimbursement from postretirement plan assets | — | 13.3 | |||||

| Changes in operating assets and liabilities: | |||||||

| Accounts receivable, net | (69.0 | ) | (23.0 | ) | |||

| Inventories, net | (55.3 | ) | 18.5 | ||||

| Accounts payable, trade | 46.8 | 23.6 | |||||

| Other accrued expenses | 10.7 | (8.4 | ) | ||||

| Deferred charges and prepaid expenses | (1.4 | ) | 7.6 | ||||

| Other, net | (1.2 | ) | 3.3 | ||||

| Net Cash (Used) Provided by Operating Activities | (11.7 | ) | 55.5 | ||||

| Investing Activities | |||||||

| Capital expenditures | (11.9 | ) | (26.1 | ) | |||

| Net Cash Used by Investing Activities | (11.9 | ) | (26.1 | ) | |||

| Financing Activities | |||||||

| Proceeds from exercise of stock options | 0.2 | — | |||||

| Shares surrendered for employee taxes on stock compensation | (1.4 | ) | — | ||||

| Credit agreement repayments | (5.0 | ) | (130.0 | ) | |||

| Credit agreement borrowings | 30.0 | — | |||||

| Debt issuance costs | — | (4.8 | ) | ||||

| Proceeds from issuance of convertible notes | — | 86.3 | |||||

| Net Cash Provided (Used) by Financing Activities | 23.8 | (48.5 | ) | ||||

| Effect of exchange rate changes on cash | — | — | |||||

| Increase (Decrease) In Cash and Cash Equivalents | 0.2 | (19.1 | ) | ||||

| Cash and cash equivalents at beginning of period | 25.6 | 42.4 | |||||

| Cash and Cash Equivalents at End of Period | $25.8 | $23.3 | |||||

|

| Nine Months Ended September 30, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

(Dollars in millions) |

|

|

|

|

|

| ||

CASH PROVIDED (USED) |

|

|

|

|

|

| ||

Operating Activities |

|

|

|

|

|

| ||

Net income (loss) |

| $ | 68.1 |

|

| $ | 98.3 |

|

Adjustments to reconcile net income (loss) to net cash provided (used) by operating activities: |

|

|

|

|

|

| ||

Depreciation and amortization |

|

| 42.8 |

|

|

| 43.7 |

|

Amortization of deferred financing fees |

|

| 0.4 |

|

|

| 0.6 |

|

Loss on extinguishment of debt |

|

| 11.4 |

|

|

| 43.1 |

|

Loss (gain) on sale or disposal of assets, net |

|

| (2.8 | ) |

|

| 2.5 |

|

Deferred income taxes |

|

| 0.7 |

|

|

| (0.5 | ) |

Stock-based compensation expense |

|

| 8.5 |

|

|

| 6.5 |

|

Pension and postretirement (benefit) expense, net |

|

| 6.4 |

|

|

| (44.7 | ) |

Changes in operating assets and liabilities: |

|

|

|

|

|

| ||

Accounts receivable, net |

|

| (56.1 | ) |

|

| 0.5 |

|

Inventories, net |

|

| (62.7 | ) |

|

| 5.4 |

|

Accounts payable |

|

| 34.1 |

|

|

| (19.9 | ) |

Other accrued expenses |

|

| (9.7 | ) |

|

| (12.5 | ) |

Pension and postretirement contributions and payments |

|

| (2.4 | ) |

|

| (4.9 | ) |

Deferred charges and prepaid expenses |

|

| (5.0 | ) |

|

| (3.1 | ) |

Other, net |

|

| 17.5 |

|

|

| (4.2 | ) |

Net Cash Provided (Used) by Operating Activities |

|

| 51.2 |

|

|

| 110.8 |

|

|

|

|

|

|

| |||

Investing Activities |

|

|

|

|

|

| ||

Capital expenditures |

|

| (36.2 | ) |

|

| (15.7 | ) |

Proceeds from disposals of property, plant and equipment |

|

| 1.7 |

|

|

| 3.0 |

|

Net Cash Provided (Used) by Investing Activities |

|

| (34.5 | ) |

|

| (12.7 | ) |

|

|

|

|

|

| |||

Financing Activities |

|

|

|

|

|

| ||

Purchase of treasury shares |

|

| (28.5 | ) |

|

| (32.4 | ) |

Proceeds from exercise of stock options |

|

| 2.4 |

|

|

| 7.9 |

|

Shares surrendered for employee taxes on stock compensation |

|

| (3.4 | ) |

|

| (1.7 | ) |

Repayments on convertible notes |

|

| (18.7 | ) |

|

| (67.6 | ) |

Debt issuance costs |

|

| — |

|

|

| (0.7 | ) |

Net Cash Provided (Used) by Financing Activities |

|

| (48.2 | ) |

|

| (94.5 | ) |

Increase (Decrease) in Cash, Cash Equivalents, and Restricted Cash |

|

| (31.5 | ) |

|

| 3.6 |

|

Cash, cash equivalents, and restricted cash at beginning of period |

|

| 257.8 |

|

|

| 259.6 |

|

Cash, Cash Equivalents, and Restricted Cash at End of Period |

| $ | 226.3 |

|

| $ | 263.2 |

|

|

|

|

|

|

|

| ||

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported within the Consolidated Balance Sheets that sum to the total of the same such amounts shown in the Consolidated Statements of Cash Flows: |

| |||||||

|

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ | 225.4 |

|

| $ | 262.5 |

|

Restricted cash reported in other current assets |

|

| 0.9 |

|

|

| 0.7 |

|

Total cash, cash equivalents, and restricted cash shown in the Consolidated Statements of Cash Flows |

| $ | 226.3 |

|

| $ | 263.2 |

|

See accompanying Notes to Unauditedthe unaudited Consolidated Financial Statements.

8

TimkenSteel Corporation

Notes to Unaudited Consolidated Financial Statements

(dollars in millions, except per share data)

Note1- Company and Basis of Presentation

The accompanying Unauditedunaudited Consolidated Financial Statements have been prepared by TimkenSteel Corporation (the “Company” or “TimkenSteel”) in accordance with generally accepted accounting principles in the United States (U.S. GAAP)(“U.S. GAAP”) for interim financial information. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) and disclosures considered necessary for a fair presentation have been included. For further information, refer to TimkenSteel’s Auditedaudited Consolidated Financial Statements and Notes included in its Annual Report on Form 10-K for the year ended December 31, 2016.2022.

Note2-Recent Accounting Pronouncements

Adoption of New Accounting Standards

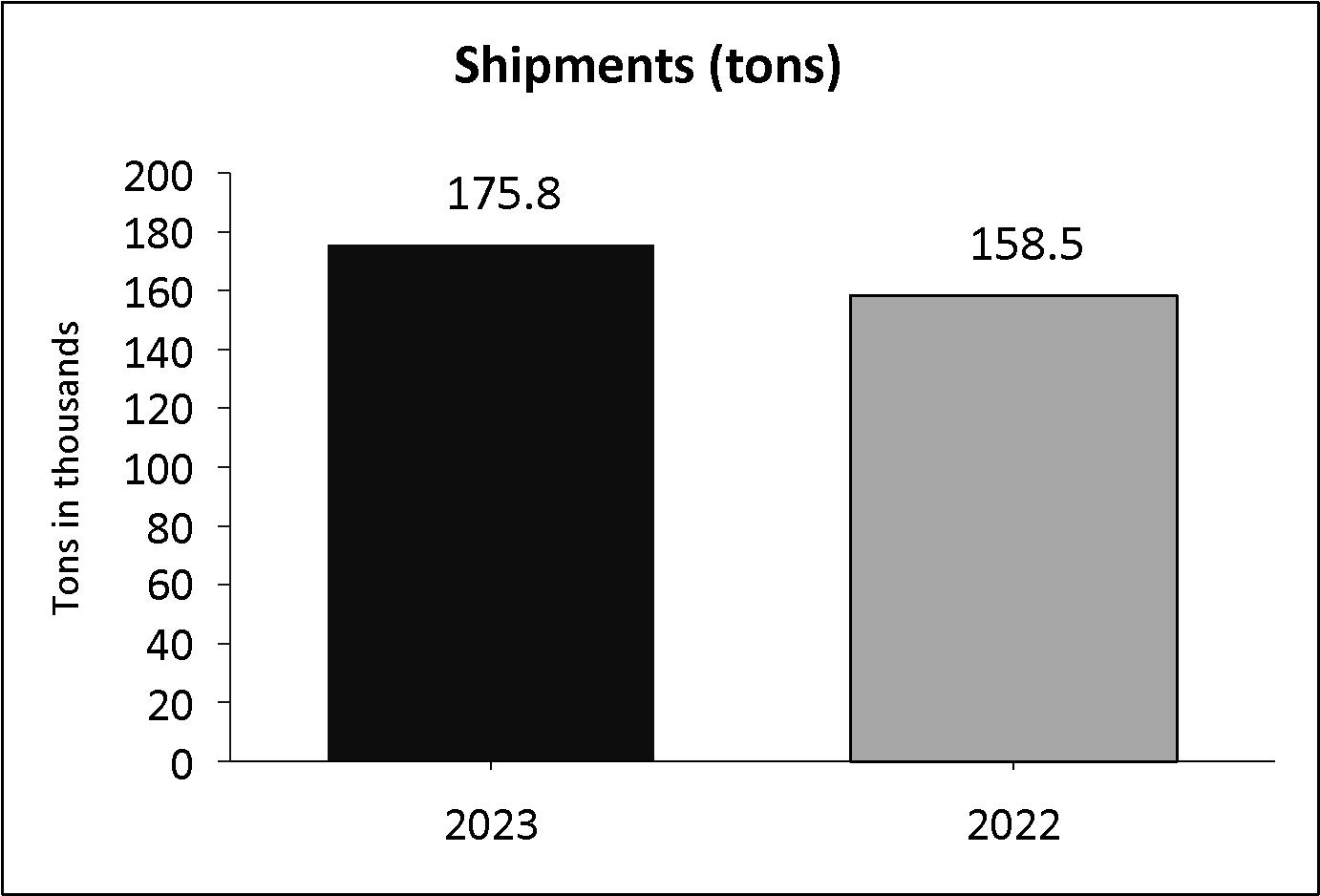

The Company or TimkenSteel) manufactures alloy steel, as well as carbon and micro-alloy steel, with an annual melt capacity of approximately 2 million tons and shipment capacity of 1.5 million tons. TimkenSteel’s portfolio includes special bar quality (SBQ) bars, seamless mechanical tubing (tubes) and value-add solutions, such as precision steel components. In addition, TimkenSteel supplies machining and thermal treatment services, as well as manages raw material recycling programs, which are used as a feeder system for the Company’s melt operations. The Company’s products and services are used in a diverse range of demanding applicationsdid not adopt any Accounting Standard Updates (“ASU”) in the following market sectors: oilthird quarter of 2023. Additionally, there are no current ASUs issued, but not adopted, that are expected to have an impact on the Company.

Legislation related to the COVID-19 Pandemic

Due to a provision in the Coronavirus Aid, Relief, and gas; oil country tubular goods (OCTG); automotive; industrial equipment; mining; construction; rail; aerospace and defense; heavy truck; agriculture; and power generation.

The CARES Act also provided for an employee retention credit (“Employee Retention Credit”), which is a refundable tax credit against certain employment taxes. The Company adoptedqualified for the following Accounting Standard Updates (ASU)tax credit in the second and third quarters of 2020 and accrued a benefit of $2.3 million in the fourth quarter of 2020 related to the Employee Retention Credit in other (income) expense, net on the Consolidated Statements of Operations. The Company filed for this credit in the second quarter of 2021 and received a portion of the proceeds from the Internal Revenue Service ("IRS") in the amount of $0.5 million during the nine months ended September 30, 2017. Withfourth quarter of 2021. The Company received the exceptionremaining $1.8 million of ASU 2017-07, which is discussed below, the adoption of these standards did not have a material impact on the Unaudited Consolidated Financial Statements or the related Notes to the Unaudited Consolidated Financial Statements.

Note3-Revenue Recognition

| September 30, 2017 | December 31, 2016 | ||||||

| Inventories, net: | |||||||

| Manufacturing supplies | $36.6 | $37.9 | |||||

| Raw materials | 31.7 | 16.2 | |||||

| Work in process | 96.3 | 58.6 | |||||

| Finished products | 63.5 | 59.6 | |||||

| Subtotal | 228.1 | 172.3 | |||||

| Allowance for surplus and obsolete inventory | (8.6 | ) | (8.1 | ) | |||

| Total Inventories, net | $219.5 | $164.2 | |||||

| September 30, 2017 | December 31, 2016 | ||||||

| Property, Plant and Equipment, net: | |||||||

| Land | $13.4 | $13.3 | |||||

| Buildings and improvements | 418.9 | 420.6 | |||||

| Machinery and equipment | 1,354.1 | 1,352.0 | |||||

| Construction in progress | 51.6 | 63.9 | |||||

| Subtotal | 1,838.0 | 1,849.8 | |||||

| Less allowances for depreciation | (1,136.4 | ) | (1,107.9 | ) | |||

| Property, Plant and Equipment, net | $701.6 | $741.9 | |||||

| September 30, 2017 | December 31, 2016 | ||||||||||||||||||||||

| Gross Carrying Amount | Accumulated Amortization | Net Carrying Amount | Gross Carrying Amount | Accumulated Amortization | Net Carrying Amount | ||||||||||||||||||

| Intangible Assets Subject to Amortization: | |||||||||||||||||||||||

| Customer relationships | $6.3 | $4.0 | $2.3 | $6.3 | $3.7 | $2.6 | |||||||||||||||||

| Technology use | 9.0 | 5.8 | 3.2 | 9.0 | 5.2 | 3.8 | |||||||||||||||||

| Capitalized software | 58.5 | 43.1 | 15.4 | 58.9 | 40.3 | 18.6 | |||||||||||||||||

| Total Intangible Assets | $73.8 | $52.9 | $20.9 | $74.2 | $49.2 | $25.0 | |||||||||||||||||

| September 30, 2017 | December 31, 2016 | ||||||

| Principal | $86.3 | $86.3 | |||||

| Less: Debt issuance costs, net of amortization | (1.8 | ) | (2.1 | ) | |||

| Less: Debt discount, net of amortization | (15.3 | ) | (17.8 | ) | |||

| Convertible notes, net | $69.2 | $66.4 | |||||

The following table sets forth total interest expense recognized related toprovides the Convertible Notes:

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2017 | 2016 | 2017 | 2016 | ||||||||||||

| Contractual interest expense | $1.3 | $1.3 | $3.9 | $1.7 | |||||||||||

| Amortization of debt issuance costs | 0.1 | 0.1 | 0.1 | 0.3 | 0.2 | ||||||||||

| Amortization of debt discount | 0.9 | 0.7 | 2.5 | 0.9 | |||||||||||

| Total | $2.3 | $2.1 | $6.7 | $2.8 | |||||||||||

| September 30, 2017 | December 31, 2016 | ||||||

| Variable-rate State of Ohio Water Development Revenue Refunding Bonds, maturing on November 1, 2025 (0.862% as of September 30, 2017) | $12.2 | $12.2 | |||||

| Variable-rate State of Ohio Air Quality Development Revenue Refunding Bonds, maturing on November 1, 2025 (0.862% as of September 30, 2017) | 9.5 | 9.5 | |||||

| Variable-rate State of Ohio Pollution Control Revenue Refunding Bonds, maturing on June 1, 2033 (0.862% as of September 30, 2017) | 8.5 | 8.5 | |||||

| Amended Credit Agreement, due 2019 (LIBOR plus applicable spread) | 65.0 | 40.0 | |||||

| Total Other Long-Term Debt | $95.2 | $70.2 | |||||

| Foreign Currency Translation Adjustments | Pension and Postretirement Liability Adjustments | Total | |||||||||

| Balance at December 31, 2016 | ($7.0 | ) | ($2.4 | ) | ($9.4 | ) | |||||

| Other comprehensive income before reclassifications, before income tax | 1.1 | — | 1.1 | ||||||||

| Amounts reclassified from accumulated other comprehensive loss, before income tax | — | 1.1 | 1.1 | ||||||||

| Income tax benefit | — | (0.7 | ) | (0.7 | ) | ||||||

| Net current period other comprehensive income, net of income taxes | 1.1 | 0.4 | 1.5 | ||||||||

| Balance at September 30, 2017 | ($5.9 | ) | ($2.0 | ) | ($7.9 | ) | |||||

| Foreign Currency Translation Adjustments | Pension and Postretirement Liability Adjustments | Total | |||||||||

| Balance at December 31, 2015 | ($5.0 | ) | ($2.9 | ) | ($7.9 | ) | |||||

| Other comprehensive loss before reclassifications, before income tax | (2.8 | ) | — | (2.8 | ) | ||||||

| Amounts reclassified from accumulated other comprehensive loss, before income tax | — | 1.2 | 1.2 | ||||||||

| Income tax benefit | — | (0.4 | ) | (0.4 | ) | ||||||

| Net current period other comprehensive (loss) income, net of income taxes | (2.8 | ) | 0.8 | (2.0 | ) | ||||||

| Balance as of September 30, 2016 | ($7.8 | ) | ($2.1 | ) | ($9.9 | ) | |||||

| Total | Additional Paid-in Capital | Retained Deficit | Treasury Shares | Accumulated Other Comprehensive Loss | |||||||||||||||

| Balance at December 31, 2016 | $597.4 | $845.6 | ($193.9 | ) | ($44.9 | ) | ($9.4 | ) | |||||||||||

| Net loss | (9.9 | ) | — | (9.9 | ) | — | — | ||||||||||||

| Pension and postretirement adjustment, net of tax | 0.4 | — | — | — | 0.4 | ||||||||||||||

| Foreign currency translation adjustments | 1.1 | — | — | — | 1.1 | ||||||||||||||

| Stock-based compensation expense | 4.9 | 4.9 | — | — | — | ||||||||||||||

| Stock option activity | 0.2 | 0.2 | — | — | — | ||||||||||||||

| Issuance of treasury shares | — | (8.4 | ) | (0.3 | ) | 8.7 | — | ||||||||||||

| Shares surrendered for taxes | (1.4 | ) | — | — | (1.4 | ) | — | ||||||||||||

| Balance at September 30, 2017 | $592.7 | $842.3 | ($204.1 | ) | ($37.6 | ) | ($7.9 | ) | |||||||||||

| Three Months Ended September 30, 2017 | Three Months Ended September 30, 2016 | ||||||||||||||

| Components of net periodic benefit cost: | Pension | Postretirement | Pension | Postretirement | |||||||||||

| Service cost | $4.6 | $0.4 | $3.9 | $0.4 | |||||||||||

| Interest cost | 12.3 | 2.1 | 13.2 | 2.4 | |||||||||||

| Expected return on plan assets | (17.7 | ) | (1.3 | ) | (18.1 | ) | (1.5 | ) | |||||||

| Amortization of prior service cost | 0.1 | 0.2 | 0.1 | 0.2 | |||||||||||

| Net remeasurement loss | 2.3 | — | 20.4 | — | |||||||||||

| Net Periodic Benefit Cost | $1.6 | $1.4 | $19.5 | $1.5 | |||||||||||

| Nine Months Ended September 30, 2017 | Nine Months Ended September 30, 2016 | ||||||||||||||

| Components of net periodic benefit cost: | Pension | Postretirement | Pension | Postretirement | |||||||||||

| Service cost | $13.8 | $1.2 | $11.7 | $1.2 | |||||||||||

| Interest cost | 36.8 | 6.3 | 39.8 | 7.1 | |||||||||||

| Expected return on plan assets | (52.9 | ) | (4.0 | ) | (53.6 | ) | (4.4 | ) | |||||||

| Amortization of prior service cost | 0.3 | 0.8 | 0.4 | 0.8 | |||||||||||

| Net remeasurement loss | 2.3 | — | 20.4 | — | |||||||||||

| Net Periodic Benefit Cost | $0.3 | $4.3 | $18.7 | $4.7 | |||||||||||

|

| Three Months Ended September 30, |

|

| Nine Months Ended September 30, |

| ||||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||

Industrial |

| $ | 173.7 |

|

| $ | 146.0 |

|

| $ | 486.2 |

|

| $ | 529.2 |

|

Mobile |

|

| 140.1 |

|

|

| 130.0 |

|

|

| 404.8 |

|

|

| 427.0 |

|

Energy |

|

| 35.6 |

|

|

| 36.0 |

|

|

| 127.7 |

|

|

| 107.3 |

|

Other (1) |

|

| 4.8 |

|

|

| 4.8 |

|

|

| 15.6 |

|

|

| 21.0 |

|

Total Net Sales |

| $ | 354.2 |

|

| $ | 316.8 |

|

| $ | 1,034.3 |

|

| $ | 1,084.5 |

|

(1)“Other” sales by end-market sector relates to the Company’s scrap sales.

9

The service cost component is includedfollowing table provides the major sources of revenue by product type for the three and nine months ended September 30, 2023 and 2022:

|

| Three Months Ended September 30, |

|

| Nine Months Ended September 30, |

| ||||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||

Bar |

| $ | 240.9 |

|

| $ | 206.5 |

|

| $ | 712.8 |

|

| $ | 738.1 |

|

Manufactured components |

|

| 65.2 |

|

|

| 60.7 |

|

|

| 178.4 |

|

|

| 181.3 |

|

Tube |

|

| 43.3 |

|

|

| 44.8 |

|

|

| 127.5 |

|

|

| 144.1 |

|

Other (2) |

|

| 4.8 |

|

|

| 4.8 |

|

|

| 15.6 |

|

|

| 21.0 |

|

Total Net Sales |

| $ | 354.2 |

|

| $ | 316.8 |

|

| $ | 1,034.3 |

|

| $ | 1,084.5 |

|

(2) “Other” sales by product type relates to the Company’s scrap sales.

Contract liabilities are recognized when the Company has received consideration from a customer to transfer goods at a future point in cost of products soldtime. Contract liabilities are primarily related to deferred revenue resulting from any cash payments received in advance from customers and selling, general and administrative expenses. The non-service cost components of net periodic benefit costs are included in other income (expense), netcurrent liabilities on the Consolidated Balance Sheets. Contract liabilities totaled $0.7 million and $5.1 million as of September 30, 2023 and 2022, respectively.

Note4-Restructuring Charges

The Company did not have any restructuring charges for the three and nine months ended September 30, 2023. Additionally, there were no restructuring charges incurred during the third quarter of 2022. Restructuring charges totaled $0.8 million for the nine months ended September 30, 2022. The charges incurred in 2022, which were related to severance and employee-related benefits, were the result of organizational changes.

TimkenSteel recorded reserves for such restructuring charges as other current liabilities on the Consolidated Balance Sheets. The reserve balance at September 30, 2023 is expected to be substantially used in the Unauditednext twelve months.

The following is a summary of the restructuring reserve for the nine months ended September 30, 2023 and 2022:

Balance at December 31, 2022 |

| $ | 0.5 |

|

Expenses |

|

| — |

|

Payments |

|

| (0.4 | ) |

Balance at September 30, 2023 |

| $ | 0.1 |

|

Balance at December 31, 2021 |

| $ | 4.7 |

|

Expenses |

|

| 0.8 |

|

Payments |

|

| (4.7 | ) |

Balance at September 30, 2022 |

| $ | 0.8 |

|

Note 5 - Disposition of Non-Core Assets

TimkenSteel Material Services Facility

During the first quarter of 2020, management completed its previously announced plan to close the Company’s TimkenSteel Material Services (“TMS”) facility in Houston and began selling the assets at the facility.

Land and buildings of $4.3 million associated with TMS were classified as assets held for sale on the Consolidated Balance Sheets as of December 31, 2021. All of these assets were sold during the third quarter of 2022. Net cash proceeds of $2.8 million were received and a loss on sale of assets of $1.5 million was recognized on the Consolidated Statements of Operations. Operations during 2022.

10

Small-Diameter Seamless Mechanical Tubing Machinery and Equipment

In the third quarter of 2020, TimkenSteel informed customers that as of December 31, 2020 the Company would discontinue the commercial offering of specific small-diameter seamless mechanical tubing products.

In the fourth quarter of 2022, TimkenSteel entered into an agreement to sell the machinery and equipment used in the manufacturing of these specific products. TimkenSteel received down payments totaling $3.4 million, with $1.7 million received in 2022 and the remaining $1.7 million received in 2023. The Company utilizedfinal payment resulted in a gain on disposal of assets of $3.4 million in the practical expedient approach, based on amounts previously disclosed, to reclassify non-service componentssecond quarter of net periodic benefit cost from cost2023. The gain, which has been recognized in the Consolidated Statement of products sold and selling, general and administrative expenses, into other income (expense),Operations, was partially offset by asset write downs throughout 2023.

Note6–Other (Income) Expense, net on the Unaudited Consolidated Statements of Operations.

The following table sets forthprovides the amounts reclassified intocomponents of other income (expense),(income) expense, net for the three and nine months ended September 30, 2016.2023 and 2022:

|

| Three Months Ended September 30, |

|

| Nine Months Ended September 30, |

| ||||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||

Pension and postretirement non-service benefit (income) loss |

| $ | (1.2 | ) |

| $ | (3.0 | ) |

| $ | (3.7 | ) |

| $ | (19.8 | ) |

Loss (gain) from remeasurement of benefit plans |

|

| (1.0 | ) |

|

| 4.8 |

|

|

| 1.7 |

|

|

| (37.2 | ) |

Foreign currency exchange (gain) loss |

|

| — |

|

|

| — |

|

|

| (0.1 | ) |

|

| (0.1 | ) |

Insurance recoveries |

|

| — |

|

|

| (1.5 | ) |

|

| (11.3 | ) |

|

| (1.5 | ) |

Miscellaneous (income) expense |

|

| 0.2 |

|

|

| (0.1 | ) |

|

| 0.3 |

|

|

| (0.2 | ) |

Total other (income) expense, net |

| $ | (2.0 | ) |

| $ | 0.2 |

|

| $ | (13.1 | ) |

| $ | (58.8 | ) |

| Three | Nine | |||||||

Months ended September 30, 2016 | ||||||||

| Cost of products sold | ($13.3 | ) | ($7.7 | ) | ||||

| Selling, general and administrative expenses | (3.4 | ) | (2.8 | ) | ||||

| ($16.7 | ) | ($10.5 | ) | |||||

The TimkenSteel Corporation Bargaining Unit Pension Plan ("Bargaining Plan"), the TimkenSteel Corporation Retirement Plan (Salaried Plan) has(“Salaried Plan”), and the Supplemental Pension Plan of TimkenSteel Corporation ("Supplemental Plan") each have a provision that permits employees to elect to receive their pension benefits in a lump sum.sum upon retirement. In the thirdfirst quarter of 2017 and 2016,2023, the cumulative cost of all settlements exceededlump sum payments was projected to exceed the sum of the service costcosts and interest cost components of net periodic pension cost for the Salaried Plan. TheAs a result, the Company completed a full remeasurement of its pension obligations and plan assets associated with the Salaried Plan asduring each quarter of September 30, 2017 and 2016, which resulted in a non-cash pre-tax loss2023.

A gain of $1.0 million from the remeasurement of $2.3 million and $20.4 million, respectively, included in other income (expense), net on the Unaudited Consolidated Statements of Operations.

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2017 | 2016 | 2017 | 2016 | ||||||||||||

| Numerator: | |||||||||||||||

| Net loss for basic and diluted earnings per share | ($5.9 | ) | ($22.2 | ) | ($9.9 | ) | ($38.5 | ) | |||||||

| Denominator: | |||||||||||||||

| Weighted average shares outstanding, basic | 44,433,094 | 44,221,310 | 44,373,264 | 44,215,373 | |||||||||||

| Dilutive effect of stock-based awards | — | — | — | — | |||||||||||

| Weighted average shares outstanding, diluted | 44,433,094 | 44,221,310 | 44,373,264 | 44,215,373 | |||||||||||

| Basic loss per share | ($0.13 | ) | ($0.50 | ) | ($0.22 | ) | ($0.87 | ) | |||||||

| Diluted loss per share | ($0.13 | ) | ($0.50 | ) | ($0.22 | ) | ($0.87 | ) | |||||||

A net loss of $4.8 million from the remeasurement of these benefit plans was recognized for the three months ended September 30, 2022. This loss was due to $73.6 million of investment losses on plan assets and lump sum basis losses, partially offset by a gain of $68.8 million primarily driven by a decrease in the pension liability due to an increase in discount rate.

A net gain of $37.2 million from the remeasurement of these benefit plans was recognized for the nine months ended September 30, 2022. This gain was driven by a $299.9 million decrease in the pension liability primarily due to an increase in discount rate, partially offset by a loss of $262.7 million driven by investment losses on plan assets and lump sum basis losses.

For more details on the aforementioned remeasurements, refer to “Note 11 - Retirement and Postretirement Plans.”

During the second half of 2022, the Faircrest melt shop experienced unplanned operational downtime. TimkenSteel recognized insurance recoveries of $11.3 million related to the unplanned downtime in the first half of 2023, of which $9.8 million was recorded during the first quarter and $1.5 million was recorded in the second quarter. Additional amounts, if any, and timing of potential recoveries are uncertain at

11

this time. For further information related to previous insurance recoveries, refer to "Note 7 - Other (Income) Expense, net" in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

Note7-Income Taxes

TimkenSteel’s provision (benefit) for income taxes in interim periods is computed by applying the appropriate estimated annual effective tax rates to income or loss before income taxes for the period. In addition, non-recurring or discrete items, including interest on prior-year tax liabilities, are recorded during the periods in which they occur.

|

| Three Months Ended September 30, |

|

| Nine Months Ended September 30, |

| ||||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||

Provision (benefit) for incomes taxes |

| $ | 9.8 |

|

| $ | 0.7 |

|

| $ | 24.6 |

|

| $ | 3.1 |

|

Effective tax rate |

|

| 28.3 | % |

|

| (5.6 | )% |

|

| 26.5 | % |

|

| 3.1 | % |

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2017 | 2016 | 2017 | 2016 | ||||||||||||

| Provision (benefit) for income taxes | $0.1 | ($13.3 | ) | $1.2 | ($23.5 | ) | |||||||||

| Effective tax rate | (1.5 | )% | 37.5 | % | (14.0 | )% | 37.9 | % | |||||||

Income tax expense for the three months ended September 30, 2023 was calculated using forecasted multi-jurisdictional annual effective tax rates to determine a blended annual effective tax rate. The effective tax rate for the three and nine months ended September 30, 2023 was 28.3% and 26.5%, respectively, compared to a rate of (5.6)% and 3.1% for the prior year. The change was primarily related to higher federal and state taxes due to the reversal of the Company's full valuation allowance as of December 31, 2022, which offset the prior year utilization of loss carryforwards. Additionally, there are limitations on the tax deductibility of the first quarter of 2023 loss on extinguishment of debt on the Convertible Senior Notes due 2025.

For the nine months ended September 30, 20172023, TimkenSteel made $17.0 million in U.S. federal payments, $3.4 million in state and local tax payments, and $1.2 million in foreign tax payments. For the nine months ended September 30, 2022, TimkenSteel made $2.0 million in U.S. federal payments, $2.2 million in state and local tax payments, and $0.2 million in foreign tax payments.

Note 8 - Earnings (Loss) Per Share

Basic earnings (loss) per share is computed based upon the weighted average number of common shares outstanding. Diluted earnings (loss) per share is computed based upon the weighted average number of common shares outstanding plus the dilutive effect of common share equivalents calculated using the treasury stock method or if-converted method. For the Convertible Notes, the Company utilizes the if-converted method to calculate diluted earnings (loss) per share. Under the if-converted method, the Company adjusts net earnings to add back interest expense (including amortization of debt issuance costs) recognized on the Convertible Notes and includes the number of shares potentially issuable related to the Convertible Notes in the weighted average shares outstanding. Treasury shares are excluded from the denominator in calculating both basic and diluted earnings (loss) per share.

Equity-based Awards

Common share equivalents for shares issuable for equity-based awards amounted to 3.4 million shares for the three and nine months ended September 30, 2023. For the three and nine months ended September 30, 2023, 0.3 million shares and 0.7 million shares, respectively, were excluded from the computation of diluted earnings (loss) per share, primarily related to options with exercise prices above the average market price of our common shares (i.e., “underwater” options), because the effect of their inclusion would have been anti-dilutive. The difference between the remaining 3.1 million shares and 2.7 million shares assumed issued and the year1.0 million shares and 0.7 million shares assumed purchased with potential proceeds for the three and nine months ended December 31, 2016, operating losses generatedSeptember 30, 2023, respectively, were included in the U.S. resulted in a decreasedenominator of the diluted earnings (loss) per share calculation.

Common share equivalents for shares issuable for equity-based awards amounted to 3.9 million shares and 4.1 million shares for the three and nine months ended September 30, 2022, respectively. For the three months ended September 30, 2022, common share equivalents for shares issuable for equity-based awards were excluded from the computation of diluted earnings (loss) per share, because the effect of their inclusion would have been anti-dilutive.

For the nine months ended September 30, 2022, 1.1 million shares were excluded from the computation of diluted earnings (loss) per share, primarily related to options with exercise prices above the average market price of our common shares (i.e., “underwater” options), because the effect of their inclusion would have been anti-dilutive. The difference between the remaining 3.0 million shares assumed issued and the 0.9 million shares assumed purchased with potential proceeds were included in the carrying valuedenominator of the Company’s U.S. net deferred tax liability todiluted earnings (loss) per share calculation.

12

Convertible Notes

Common share equivalents for shares issuable upon the point that would resultconversion of outstanding Convertible Notes were included in a net U.S. deferred tax asset atthe computation of diluted earnings (loss) per share for the three and nine months ended September 30, 2017 and December 31, 2016. In light2023 as these shares would be dilutive.

Common share equivalents for shares issuable upon the conversion of TimkenSteel’s recent operating performanceoutstanding Convertible Notes were excluded from the computation of diluted earnings (loss) per share for the three months ended September 30, 2022 as these shares would be anti-dilutive. Additionally, common share equivalents for shares issuable upon the conversion of outstanding Convertible Notes were included in the U.S. and current industry conditions, the Company assessed, based upon all available evidence, and concluded that it was more likely than not that it would not realize its U.S. deferred tax assets. As a result, in the fourth quartercomputation of 2016, the Company recorded full valuation allowance on its net U.S. deferred tax asset of $15.6 million. Going forward, the need to maintain valuation allowances against deferred tax assets in the U.S. and other affected countries will cause variability in the Company’s effective tax rate. The Company will maintain a full valuation allowance against its deferred tax assets in the U.S. and applicable foreign countries until sufficient positive evidence exists to conclude that a valuation allowance is not necessary. The increase in the effective tax ratediluted earnings (loss) per share for the nine months ended September 30, 20172022 as these shares would be dilutive.

In the first quarter of 2023, TimkenSteel repurchased $7.5 million of outstanding principal related to the Convertible Notes. There were no repurchases related to the Convertible Notes during the second or third quarters of 2023. These repurchases of Convertible Notes reduced weighted average diluted shares outstanding by approximately 1.0 million shares and 0.7 million shares for the three and nine months ended September 30, 2023. Refer to “Note 10 – Financing Arrangements” for additional information on the Convertible Notes.

During the first half of 2022, TimkenSteel repurchased $25.2 million of outstanding principal related to the Convertible Notes. There were no repurchases related to the Convertible Notes during the third quarter of 2022. These repurchases of Convertible Notes reduced weighted average diluted shares outstanding by 2.0 million shares for the nine months ended September 30, 2022. Refer to “Note 10 – Financing Arrangements” for additional information on the Convertible Notes.

The following table sets forth the reconciliation of the numerator and the denominator of basic and diluted earnings (loss) per share for the three and nine months ended September 30, 2023 and 2022:

|

| Three Months Ended September 30, |

|

| Nine Months Ended September 30, |

| ||||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||

Numerator: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Net income (loss), basic |

| $ | 24.8 |

|

| $ | (13.3 | ) |

| $ | 68.1 |

|

| $ | 98.3 |

|

Add convertible notes interest |

|

| 0.2 |

|

|

| — |

|

|

| 0.8 |

|

|

| 1.5 |

|

Net income (loss), diluted |

| $ | 25.0 |

|

| $ | (13.3 | ) |

| $ | 68.9 |

|

| $ | 99.8 |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Denominator: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Weighted average shares outstanding, basic |

|

| 44.1 |

|

|

| 46.0 |

|

|

| 44.0 |

|

|

| 46.3 |

|

Dilutive effect of stock-based awards |

|

| 2.1 |

|

|

| — |

|

|

| 2.0 |

|

|

| 2.1 |

|

Dilutive effect of convertible notes |

|

| 1.7 |

|

|

| — |

|

|

| 2.0 |

|

|

| 3.9 |

|

Weighted average shares outstanding, diluted |

|

| 47.9 |

|

|

| 46.0 |

|

|

| 48.0 |

|

|

| 52.3 |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Basic earnings (loss) per share |

| $ | 0.56 |

|

| $ | (0.29 | ) |

| $ | 1.55 |

|

| $ | 2.12 |

|

Diluted earnings (loss) per share |

| $ | 0.51 |

|

| $ | (0.29 | ) |

| $ | 1.43 |

|

| $ | 1.91 |

|

Note9-Inventories

The components of inventories, net of reserves as of September 30, 2023 and December 31, 2022 were as follows:

|

| September 30, |

|

| December 31, |

| ||

Manufacturing supplies |

| $ | 49.0 |

|

| $ | 36.9 |

|

Raw materials |

|

| 20.4 |

|

|

| 23.9 |

|

Work in process |

|

| 137.5 |

|

|

| 94.7 |

|

Finished products |

|

| 49.0 |

|

|

| 37.4 |

|

Gross inventory |

|

| 255.9 |

|

|

| 192.9 |

|

Allowance for inventory reserves |

|

| (0.5 | ) |

|

| (0.5 | ) |

Total inventories, net |

| $ | 255.4 |

|

| $ | 192.4 |

|

13

Note10-Financing Arrangements

For a detailed discussion of the Company's long-term debt and credit arrangements, refer to “Note 14 - Financing Arrangements” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

The following table summarizes the current and non-current debt as of September 30, 2023 and December 31, 2022:

|

| September 30, |

|

| December 31, |

| ||

Credit Agreement |

| $ | — |

|

| $ | — |

|

Convertible Senior Notes due 2025 |

|

| 13.1 |

|

|

| 20.4 |

|

Total debt |

| $ | 13.1 |

|

| $ | 20.4 |

|

Less current portion of debt |

|

| 13.1 |

|

|

| 20.4 |

|

Total non-current portion of debt |

| $ | — |

|

| $ | — |

|

Amended Credit Agreement

On September 30, 2022, TimkenSteel Corporation (the “Company”), as borrower, and certain domestic subsidiaries of the Company, as subsidiary guarantors (the “Subsidiary Guarantors”), entered into a Fourth Amended and Restated Credit Agreement (the “Amended Credit Agreement”), with JPMorgan Chase Bank, N.A., as administrative agent (the “Administrative Agent”), and the lenders party thereto (collectively, the “Lenders”), which further amends and restates the Company’s existing secured Third Amended and Restated Credit Agreement, dated as of October 15, 2019.

As of September 30, 2023, the amount available under the Amended Credit Agreement was $293.7 million, reflective of the Company’s asset borrowing base with no outstanding borrowings. Additionally, the Company is primarilyin compliance with all covenants outlined in the Amended Credit Agreement.

Convertible Senior Notes due 2025

The principal amount of the Convertible Senior Notes due 2025 upon issuance was $46.0 million. Transaction costs related to the Convertible Senior Notes due 2025 incurred upon issuance were $1.5 million. These costs are amortized to interest expense over the term of the notes. The Convertible Senior Notes due 2025 mature on December 1, 2025. The Convertible Senior Notes due 2025 are convertible at the option of holders in certain circumstances and during certain periods into the Company’s common shares, cash, or a combination thereof, at the Company’s election.

The Indenture for the Convertible Senior Notes due 2025 provides that notes will become convertible during a quarter when the share price for 20 trading days during the final 30 trading days of the immediately preceding quarter was greater than 130% of the conversion price. This criterion was met during the third quarter of 2023 and as such the notes can be converted at the option of the holders beginning October 1 through December 31, 2023. Whether the notes will be convertible following such period will depend on if this criterion, or another conversion condition, is met in the future. As such, the Convertible Senior Notes due 2025 are classified as a current liability in the Consolidated Balance Sheets as of September 30, 2023. This criterion was also met as of December 31, 2022. To date, no holders have elected to convert their notes during any optional conversion periods.

For details regarding all conversion mechanics and methods of settlement, refer to the Indenture for the Convertible Senior Notes due 2025 filed as an exhibit to a discreteForm 8-K on December 15, 2020 and incorporated by reference in our most recent 10-K filing.

In the first quarter of 2023, TimkenSteel repurchased a total of $7.5 million aggregate principal amount of its Convertible Senior Notes due 2025. Total cash paid to noteholders was $18.7 million. A loss on extinguishment of debt of $11.4 million was recognized, including a charge of approximately $1.0$0.2 million recordedfor unamortized debt issuance costs related to the portion of debt extinguished, as well as the related transaction costs. There were no repurchases related to the Convertible Notes in the second or third quarters of 2023.

14

For additional details regarding the Convertible Notes please refer to “Note 14 - Financing Arrangements” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

The components of the Convertible Senior Notes due 2025 as of September 30, 2023 and December 31, 2022 were as follows:

|

| September 30, |

|

| December 31, |

| ||

Principal |

| $ | 13.3 |

|

| $ | 20.8 |

|

Less: Debt issuance costs, net of amortization |

|

| (0.2 | ) |

|

| (0.4 | ) |

Convertible Senior Notes due 2025, net |

| $ | 13.1 |

|

| $ | 20.4 |

|

The following table sets forth interest expense recognized specifically related to the Convertible Notes:

|

| Three Months Ended September 30, |

|

| Nine Months Ended September 30, |

| ||||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||

Contractual interest expense |

| $ | 0.2 |

|

| $ | 0.3 |

|

| $ | 0.7 |

|

| $ | 1.4 |

|

Amortization of debt issuance costs |

|

| — |

|

|

| — |

|

|

| 0.1 |

|

|

| 0.1 |

|

Total |

| $ | 0.2 |

|

| $ | 0.3 |

|

| $ | 0.8 |

|

| $ | 1.5 |

|

The total cash interest paid for the nine months ended September 30, 2023 and 2022 was $1.3 million and $2.3 million, respectively.

Fair Value Measurement

The fair value of the Convertible Senior Notes due 2025 was approximately $37.0 million and $53.4 million as of September 30, 2023 and December 31, 2022, respectively. The fair value of the Convertible Senior Notes due 2025, which falls within Level 2 of the fair value hierarchy as defined by applicable accounting guidance, is based on a valuation model primarily using observable market inputs and requires a recurring fair value measurement on a quarterly basis.

TimkenSteel’s Credit Facility is variable-rate debt. As such, any outstanding carrying value is a reasonable estimate of fair value as interest rates on these borrowings approximate current market rates. This valuation falls within Level 2 of the fair value hierarchy and is based on quoted prices for similar assets and liabilities in active markets that are observable either directly or indirectly. There were no outstanding borrowings on the Credit Facility as of September 30, 2023 and December 31, 2022.

Interest (Income) Expense, net

The following table provides the components of interest (income) expense, net for the three and nine months ended September 30, 2023 and 2022:

|

| Three Months Ended September 30, |

|

| Nine Months Ended September 30, |

| ||||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||

Interest expense |

| $ | 0.6 |

|

| $ | 0.9 |

|

| $ | 1.9 |

|

| $ | 3.0 |

|

Interest income |

|

| (2.4 | ) |

|

| (1.1 | ) |

|

| (6.9 | ) |

|

| (1.4 | ) |

Interest (income) expense, net |

| $ | (1.8 | ) |

| $ | (0.2 | ) |

| $ | (5.0 | ) |

| $ | 1.6 |

|

Interest income primarily relates to interest earned on cash invested in a money market fund and deposits with financial institutions. The carrying value, which approximates the fair value, of the Company’s money market investment was $96.2 million as of September 30, 2023. The money market fund is a cash equivalent and is included in cash and cash equivalents on the Consolidated Balance Sheets. The fund consists of highly liquid investments with an average maturity of three months or less and falls within Level 1 of the fair value hierarchy as defined by applicable accounting guidance. Additionally as of September 30, 2023, the Company had $118.5 million of cash held in other accounts which generate interest income at a rate similar to the money market fund.

15

Treasury Shares

On December 20, 2021, TimkenSteel announced that its Board of Directors authorized a share repurchase program under which the Company may repurchase up to $50.0 million of its outstanding common shares. The share repurchase program is intended to return capital to shareholders while also offsetting dilution from annual equity compensation awards. The share repurchase program does not require the Company to acquire any dollar amount or number of shares and may be modified, suspended, extended or terminated by the Company at any time without prior notice. On November 2, 2022, the Board of Directors authorized an additional $75.0 million share repurchase program. This authorization reflects the continued confidence of the Board and senior leadership in the Company’s ability to generate sustainable through-cycle profitability while maintaining a strong balance sheet and cash flow.

For the three months ended September 30, 2023, the Company repurchased approximately 0.4 million common shares in the open market at an aggregate cost of $7.7 million, which equates to an average repurchase price of $21.82 per share. For the nine months ended September 30, 2023, the Company repurchased approximately 1.5 million common shares in the open market at an aggregate cost of $28.5 million, which equates to an average repurchase price of $18.81 per share. As of September 30, 2023, the Company had a balance of $44.5 million remaining on its authorized share repurchase program.

For the three months ended September 30, 2022, the Company repurchased approximately 1.3 million common shares in the open market at an aggregate cost of $19.7 million, which equates to an average repurchase price of $15.72 per share. For the nine months ended September 30, 2022, the Company repurchased approximately 1.9 million common shares in the open market at an aggregate cost of $32.4 million, which equates to an average repurchase price of $17.42 per share.

In October 2023, the Company repurchased approximately 0.1 million common shares in the open market at an aggregate cost of $1.9 million, which equates to an average repurchase price of $20.53 per share. As of October 31, 2023, the Company had $42.6 million remaining under its authorized share repurchase program.

Note11-Retirement and Postretirement Plans

Plan Amendments and Updates

Bargaining Plan

On October 29, 2021, the United Steelworkers ("USW") Local 1123 voted to ratify a new four-year contract (the “Contract”). The Contract is in effect until September 27, 2025 and resulted in several changes to the Bargaining Plan which increased the pension liability by $14.2 million in 2021. These plan amendments were recognized in other comprehensive income (loss) in 2021 and began to be amortized as part of the pension net periodic benefit cost in the first quarter of 2017.2022. The primary change that drove the increase in the pension liability was the addition of a full lump sum form of payment for participants commencing benefits on or after January 1, 2022. In addition, the plan is now closed to new entrants effective January 1, 2022.