| For three months ended March 31, 2017 | ||||||||

| As previously | As | |||||||

| reported | Adjusted | |||||||

| Operating loss | $ | (1,465,882 | ) | $ | (1,465,882 | ) | ||

| Other income (expense): | ||||||||

| Incentive refund and interest income | 368 | 368 | ||||||

| Interest expense, net | (59,480 | ) | (59,480 | ) | ||||

| Gain from change in fair value of derivative warrants | 154,652 | 29,171 | ||||||

| Total other income (expense) | 95,540 | (29,941 | ) | |||||

| Net loss | $ | (1,370,342 | ) | $ | (1,495,823 | ) | ||

XG SCIENCES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30,MARCH 31, 2018 AND 2017

| Three months ended September 30, 2016 | ||||||||

| As previously | As | |||||||

| reported | Adjusted | |||||||

| Operating loss | $ | (1,331,390 | ) | $ | (1,331,390 | ) | ||

| Other income (expense): | ||||||||

| Interest expense, net | (56,013 | ) | (55,816 | ) | ||||

| Gain from change in fair value of derivative warrants | 108,056 | 26,738 | ||||||

| Government incentives | 24,197 | 24,000 | ||||||

| Loss on disposal of intangible assets | (18,609 | ) | (18,609 | ) | ||||

| Total other income (expense) | 57,631 | (23,687 | ) | |||||

| Net loss | $ | (1,273,759 | ) | $ | (1,355,077 | ) | ||

| Nine months ended September 30, 2016 | ||||||||

| As previously | As | |||||||

| reported | Adjusted | |||||||

| Operating loss | $ | (4,143,207 | ) | $ | (4,143,207 | ) | ||

| Other income (expense): | ||||||||

| Interest expense, net | (241,011 | ) | (240,588 | ) | ||||

| Gain from change in fair value of derivative warrants | 340,669 | 50,799 | ||||||

| Government incentives | 72,423 | 72,000 | ||||||

| Loss on disposal of intangible assets | (18,609 | ) | (18,609 | ) | ||||

| Total other income (expense) | 153,472 | (136,398 | ) | |||||

| Net loss | $ | (3,989,735 | ) | $ | (4,279,605 | ) | ||

| The impact to the balance sheet as of December 31, 2016 is as follows: | ||||||||

| As previously | As | |||||||

| reported | Adjusted | |||||||

| Derivative liability-warrants | $ | 7,900,249 | $ | 249,807 | ||||

| Total long-term liabilities | $ | 9,877,475 | $ | 2,227,033 | ||||

| Total liabilities | $ | 11,117,327 | $ | 3,466,885 | ||||

| Series A convertible preferred stock | $ | 21,634,597 | $ | 21,574,360 | ||||

| Accumulated deficit | $ | (48,899,530 | ) | $ | (41,188,851 | ) | ||

Total stockholders’ (deficit) equity | $ | (5,126,864 | ) | $ | 2,523,578 | |||

| Total liabilities and stockholder’s deficit | $ | 5,990,463 | $ | 5,990,463 | ||||

XG SCIENCES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2017Fair Value Measurements

The Company utilizes a valuation hierarchy that prioritizes fair value measurements based on the types of inputs used for the various valuation techniques related to its financial assets and financial liabilities in accordance to Accounting Standards Codification (“ASC”) Topic 820 Fair Value Measurements and Disclosures.

For financial instruments such as cash, accounts payable and other current liabilities, the Company considers the recorded value of such financial instruments approximate to the current fair value because of their short-term nature.

Recent Accounting Pronouncements

ASU No. 2014-09 (ASC 606), Revenue from Contracts with Customers became effective for us beginning with the first quarter of 2018, and we adopted the new accounting standard using the modified retrospective transition approach. The modified retrospective transition approach recognized any changes from the beginning of the year of initial application through retained earnings with no restatement of comparative periods. We will record revenue under ASC 606 at a single point in time, when control is transferred to the customer, which is consistent with past practice. We will continue to apply our current business processes, policies, systems and controls to support recognition and disclosure under the new standard. Based on the results of the evaluation, we have determined that the adoption of the new standard presents no material impact on our consolidated financial statements. Application of the transition requirements of the new standard did not have a material impact on opening retained earnings.

NOTE 3 — WARRANTS AND FINANCING AGREEMENTS

Dow LoanFacility

In December 2016, we entered into the Dow Facility which provides us with up to $10 million of secured debt financing at an interest rate of 5% per year, drawable at our request under certain conditions. We received $2 million at closing and an additional $1 million on July 18, 2017, and September 22, 2017 and December 4, 2017, respectively. We currently have $1 million of additional funding available on or before December 1, 2017 under the Dow Facility. After December 1, 2017, anAn additional $5 million becomes available ifonce we have raised $10 million of equity capital after October 31, 2016; however, we can make no assurances that we will raise such equity capital and be able to access the additional $5 million under the Dow Facility. As of May 14, 2018, we have sold 1,276,007 shares of common stock pursuant to our IPO at a price of $8.00 per share for gross proceeds of $10,208,056. However, only $7,007,024 of this amount has been raised during the measurement period beginning November 1, 2016. Thus, we still need to raise $2,992,976 of equity capital prior to the remaining $5.0 million under the Dow Facility becoming available to us.

The Dow Facility is senior to most of our other debt and is secured by all of our assets (Dow is subordinate only to the capital leases with AAOF, see Note 9)Aspen Advanced Opportunity Fund, LP (“AAOF”). The loan does not mature untilmatures on December 1, 2021 (subject to certain mandatory prepayments based on our equity financing activities). Interest is payable beginning January 1, 2017 although we may elect to capitalize interest through January 1, 2019. Dow received warrant coverage of one share of common stock for each $40 in loans received by us, equating to 20% warrant coverage, with an exercise price of $8.00 per share for the warrants issued at closing of the initial $2 million draw. After the initial closing, the strike price of future warrants issued areis subject to adjustment if we sell shares of common stock at a lower price. As of September 30, 2017,March 31, 2018, we had issued 100,000125,000 warrants to Dow, which are exercisable on or before the expiration date of December 1, 2023.

The aforementioned warrants meet the criteria for classification within stockholders’ equity. Proceeds were allocated between the debt and the warrants at their relative fair value. During the nine monthsfiscal year ended September 30,December 31, 2017, we recognized amortization expense of $98,384 was recognized$161,702, and the resulting in a carrying value of $3,814,703 for the Dow Loan as of September 30, 2017.

The Dow Facility entitles Dow to appoint an observer to our board of directors (the “Board”). Dow will maintain their observation right until the later of December 1, 2019 or when the amount of principal and interest outstanding under the Dow Facility is less than $5 million.

NOTE 4 — PRIVATE PLACEMENT AND PREEMPTIVE RIGHTS

Private Placement

In April 2015, we commenced a private placement offering of Series B Units consisting of shares of Series B Preferred Stock and warrants to purchase common stock at an offering price of $16.00 per Series B Unit. During the period April 2015 through December 2016, we sold 266,887 shares of Series B Convertible Preferred Stock and Warrants to purchase 222,262 shares of common stock, for aggregate gross proceeds of $4,270,192.

The private Series B Unit offering was terminated on February 25, 2016. As a result of our IPO and pursuant to certain exchange rights granted to participants in the Series B Unit offering, holders of Series B Preferred Stock received the right to exchange each share of Series B Preferred Stock they owned into two shares of common stock. Asbalance sheet as of December 31, 2016, all holders2017 was $4,794,596. During the three months ended March 31, 2018, we recognized amortization expense of Series B Preferred Stock had exercised their Series B exchange rights,$75,118, and as a result we issued 539,974 shares of restricted common stock in exchange for the 269,987 shares of Series B Preferred Stock that had been previously outstanding. Allresulting carrying value of the previously issued Series B Preferred StockDow Facility on our balance sheet as of March 31, 2018 was cancelled. Although the stock was cancelled all of the 224,897 warrants issued in connection with the Series B Units remain outstanding at September 30, 2017. Such warrants have an exercise price of $16.00 per share and expire between April 21 and June 30, 2022. These warrants were classified as derivative liabilities until September 30, 2017; at which time they were reclassified to equity (additional paid in capital). The reclassification was made on September 30, 2017 after determining that the exchange rights as defined in the Michigan “Certificate of Amendment – Corporation”, filed on August 19, 2016 no longer required liability classification (see Note 2).$4,869,714.

XG SCIENCES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2017

NOTE 5 – DERIVATIVE LIABILITY WARRANTS

At inception, the Series A Convertible Preferred Stock warrants issued in conjunction with convertible notes issued in 2013 (subsequently converted into Series A Preferred Stock), equipment financing leases procured in 2013 and 2014, and certain other pre-emptive rights and the common stock warrants issued in connection with the 2015 Series B Unit offering were derivative liabilities which require re-measurement at fair value each reporting period.

As mentioned in Note 2, during the three months ended September 30, 2017, we chose to adopt ASU 2017-11 which changed the classification analysis of certain warrants with anti-dilution features. Since we chose to early adopt ASU 2017-11 in an interim period, the adjustments were reflected as of the beginning of the fiscal year as a cumulative-effect adjustment to the Company’s beginning accumulated deficit as of January 1, 2016. As a result of adopting ASU 2017-11, the Company no longer recognizes a liability related to 972,720 warrants, which were only classified as liabilities a result of having anti-dilution features.

As mentioned in Note 4, 224,897 warrants related to the Series B offering were reclassified from derivative liabilities on the balance sheet to equity at September 30, 2017 because the requirement to classify them as liabilities was removed when we amended the Series B Certificate of Designation in August of 2016.

The initial value of the stock warrants issued as consideration for the equipment financing leases in 2013 and 2014 was recorded as a reduction of the capital lease obligation and is being amortized as part of the effective interest cost on the capital lease obligation (see Note 8).

In 2014 when we entered into financing agreements with Samsung, AAOF and XGS II, we provided our shareholders with preemptive rights to purchase shares of Series A Convertible Preferred Stock for every two shares of Series A Convertible Preferred Stock or Common Stock owned by the shareholder. In addition, for every two shares of Series A Convertible Preferred Stock purchased by a shareholder, we issued such shareholder a warrant to purchase one additional share of Series A Convertible Preferred Stock with the same terms as the warrants issued to AAOF and XGS II.

Also, as part of our private placement of Series B Units in April 2015, shareholders and holders of our convertible notes were provided the right to purchase their pro rata share of any class of stock that the Company sells or issues. The sale of Series B Preferred Stock in the April 2015 offering triggered the preemptive rights resulting in the issuance of shares of Series B Preferred Stock and warrants. As of September 30, 2017, the total number of Stock Warrants issued due to the preemptive rights offerings was 58,689.

XG SCIENCES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2017

The following table summarizes the fair value of the derivative liabilities as of September 30, 2017 and December 31, 2016:

| September 30, 2017 | December 31, 2016 | |||||||

| Warrants issued with Secured Convertible Notes | $ | — | $ | 6,554,160 | ||||

| Warrants issued with equipment financing leases | — | 655,418 | ||||||

| Warrants issued with preemptive rights | — | 443,790 | ||||||

| Warrants issued with April 2015 private placement of Series B Units | — | 246,881 | ||||||

| Adoption of accounting standard ASU 2017-11 | — | (7,650,442 | ) | |||||

| Total derivative liabilities | $ | — | $ | 249,807 | ||||

The Company estimated the fair value of their warrant derivative liabilities as of September 30, 2017 and December 31, 2016, using a lattice model and the following assumptions:

The value of the warrants is estimated using a binomial lattice model. Equivalent amounts reflect the net results of multiple modeling simulations that the lattice model applies to underlying assumptions. Because the Company is not publicly traded on a national exchange or to our knowledge, an over-the-counter market, the expected volatility of the Company’s stock was developed using historical volatility for a peer group for a period equal to the expected term of the warrants. The fair value of the warrants will be significantly influenced by the fair value of our common stock, stock price volatility, and the risk-free interest components of the lattice technique.

Changes in the fair value of Derivative Liabilities, carried at fair value, are reported as “Change in fair value of derivative liability — warrants” in the Statement of Operations. Comparative prior periods were prepared using the newly adopted ASU 2017-11 as follows:

| Three months ended September 30, | ||||||||

| 2017 | 2016 | |||||||

| Warrants issued with preemptive rights | $ | (506 | ) | $ | 26,423 | |||

| Warrants issued with April 2015 private placement of Series B Units | (42,648 | ) | 315 | |||||

| Total Derivative Gain (Loss) | $ | (43,154 | ) | $ | 26,738 | |||

MARCH 31, 2018 AND 2017

| Nine months ended September 30, | ||||||||

| 2017 | 2016 | |||||||

| Warrants issued with preemptive rights | $ | (545 | ) | $ | 48,964 | |||

| Warrants issued with April 2015 private placement of Series B Units | (46,067 | ) | 577 | |||||

| Warrants issued with Bridge Financing | 1,258 | |||||||

| Total Derivative Gain (Loss) | $ | (46,612 | ) | $ | 50,799 | |||

13

XG SCIENCES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2017

Subsequent to the Company’s early adoption of ASU 2017-11, which effected 972,720 warrants related to Series A Preferred stock, and the Company’s reclassification of 224,897 warrants related to Series B Preferred stock on September 30, 2017 (from derivative liabilities to equity) we are no longer required to record the change in fair values for these instruments.

NOTE 64 – STOCK WARRANTS ACCOUNTED FOR AS EQUITY INSTRUMENTS

The following table summarizes the common stock warrants (including the warrants previously accounted for as derivatives) outstanding at September 30, 2017,March 31, 2018, which are accounted for as equity instruments, all of which are exercisable:

| Date Issued | Expiration Date | Indexed Stock | Exercise Price | Number of Warrants | ||||||||

| 07/01/2009 | 07/01/2019 | Common | $ | 8.00 | 6,000 | |||||||

| 10/08/2012 | 10/08/2027 | Common | $ | 12.00 | 5,000 | |||||||

| 01/15/2014 – 12/31/2014 | 01/15/2024 | Series A Convertible Preferred | $ | 6.40 | 972,720 | |||||||

| 04/30/2015- 05/26/2015 | 04/30/2022 | Common | $ | 16.00 | 218,334 | |||||||

| 06/30/2015 | 06/30/2022 | Common | $ | 16.00 | 6,563 | |||||||

| 12/31/2015 | 12/31/2020 | Common | $ | 8.00 | 20,625 | |||||||

| 03/31/2016 | 03/31/2021 | Common | $ | 10.00 | 10,600 | |||||||

| 04/30/2016 | 04/30/2021 | Common | $ | 10.00 | 895 | |||||||

| 12/14/2016 | 12/01/2023 | Common | $ | 8.00 | 50,000 | |||||||

| 07/18/2017 | 12/01/2023 | Common | $ | 8.00 | 25,000 | |||||||

| 09/22/2017 | 12/01/2023 | Common | $ | 8.00 | 25,000 | |||||||

| 12/04/2017 | 12/01/2023 | Common | $ | 8.00 | 25,000 | |||||||

| 1,365,737 | ||||||||||||

| Date Issued | Expiration Date | Exercise Price | Number of Warrants | |||||||

| 07/01/2009 | 07/01/2019 | $ | 8.00 | 6,000 | ||||||

| 10/08/2012 | 10/08/2027 | $ | 12.00 | 5,000 | ||||||

| 01/15/2014 - 12/31/2014 | 01/15/2024 | $ | 6.40 | 972,720 | ||||||

| 04/30/2015- 05/26/2015 | 04/30/2022 | $ | 16.00 | 218,334 | ||||||

| 06/30/2015 | 06/30/2022 | $ | 16.00 | 6,563 | ||||||

| 12/14/2016 | 12/01/2023 | $ | 8.00 | 50,000 | ||||||

| 07/18/2017 | 12/01/2023 | $ | 8.00 | 25,000 | ||||||

| 09/22/2017 | 12/01/2023 | $ | 8.00 | 25,000 | ||||||

| 1,308,617 | ||||||||||

The warrants indexed to Series A Convertible Preferred Stock are currently exercisable and are exchangeable into 1.875 shares of common stock.

NOTE 5 — STOCKHOLDERS’ EQUITY (DEFICIT)

Common Stock

The Company is authorized to issue 25,000,000 shares of common stock, no par value per share of which 2,555,275 and 2,353,350 shares were issued and outstanding as of March 31, 2018 and December 31, 2017, respectively.

During the three months ended March 31, 2018, the Company issued 201,925 shares of common stock pursuant to the Offering. As of May 14, 2018, the Company has sold 1,276,007 shares of common stock in its IPO at a price of $8.00 per share for gross proceeds of $10,208,056.

Series A Convertible Preferred Stock

The Company is authorized to issue up to 3,000,000 shares of Series A Convertible Preferred Stock (the “Series A Preferred”). Each share of the Series A Preferred, which has a liquidation preference of $12.00 per share, is convertible at any time, at the option of the holder, into one share of Common Stock at the lower of: (a) $12.00 per share, or (b) 80% of the price at which the Company sells any equity or equity-linked securities in the future. The Series A Preferred also contains typical anti-dilution provisions that provide for adjustment of the conversion price to reflect stock splits, stock dividends, or similar events. The Series A Preferred is subject to mandatory conversion into Common Stock upon the listing of the Company’s common stock on a Qualified National Exchange. However, the Series A Preferred is not subject to the mandatory conversion until all outstanding convertible securities are also converted into common stock. The Series A Preferred ranks senior to all other equity or equity equivalent securities of the Company other than those securities which are explicitly senior or pari passu in rights and liquidation preference to the Series A Preferred and pari passu with the Company’s Series B Preferred Stock.

The Company issued 1,456,126 shares of Series A Preferred in connection with the conversion of certain convertible notes on December 31, 2015.

In December 2015, the conversion price of the Series A Preferred was reduced from $12.00 to $6.40 (80% of $8.00), and thus, each share of Series A Preferred Stock is convertible into 1.875 shares of common stock.

As of March 31, 2018, and December 31, 2017, the Company had 1,864,956 and 1,857,816 shares of Series A Preferred Stock issued and outstanding, respectively.

XG SCIENCES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2018 AND 2017

During the three months ended March 31, 2018, the Company issued 7,140 shares of Series A Preferred to AAOF as payment under the terms of their Master Leasing Agreement.

Series B Convertible Preferred Stock

As of March 31, 2018, and December 31, 2017, 1,500,000 shares have been designated as Series B Convertible Preferred Stock (“Series B Preferred”), of which no shares were issued and outstanding. Each share of the Series B Preferred, which has a liquidation preference of $16.00 per share, is convertible at any time, at the option of the holder, into one share of common stock at $16.00 per share. The Series B Preferred also contains typical anti-dilution provisions that provide for adjustment of the conversion price to reflect stock splits, stock dividends, or similar events. Each share of Series B Preferred is subject to mandatory conversion into common stock at the then-effective Series B conversion rate upon the public listing by the Company of its common stock on a Qualified National Exchange. However, the Series B Preferred is not subject to the mandatory conversion until all outstanding convertible securities are also converted into common stock. The Series B Preferred ranks senior to all other equity or equity equivalent securities of the Company other than those securities which are explicitly senior or pari passu in rights and liquidation preference to the Series B Preferred and pari passu with the Company’s Series A Preferred.

NOTE 76 – EQUITY INCENTIVE PLAN

We previously established the 2007 Stock Option Plan (the “2007 Plan”), which was scheduled to expire on October 30, 2017 and under which we granted key employees and directors options to purchase shares of our common stock at not less than fair market value as of the grant date. On May 4, 2017, the Board approved the 2017 Equity Incentive Plan (the “2017 Plan”) to replace the 2007 Stock Option Plan, which became effective upon the approval of the stockholders holding a majority of the voting power in the Company on July 18, 2017. The 2017 Plan replacesreplaced the 2007 Plan and authorizes us to issuegrant awards (stock options and restricted stock) with respect ofup to a maximum of 1,200,000 shares of our common stock, which equals the number of shares authorized under the 2007 Plan, as amended.stock.

On July 24, 2017, certain stock options from the prior incentive stock option plan2007 Plan were cancelled and replacement stock options were awarded. The replacement stock option awards have an exercise price of $8.00 per share and a seven-year term, areterm. Fifty percent of such awards vested 50% on the date of grant with the remaining vesting over a 4 year4-year period, from the date issued, and are subject to certain other terms. Each option holder received options equal to 150% of the number of cancelled stock options. The cancellation and reissuance of the stock options were treated as a modification under ASC 718, Compensation-Stock Compensation. Incremental compensation cost of approximately$1,015,758 was measured as the excess of the fair value of the modified award over the fair value of the original award immediately before the terms were modified. Compensation cost of approximately $501,071 was recorded on the date of cancellation for awards that were vested on the date of the modification. For unvested awards, compensation cost of approximately $514,687 will be recorded over the remaining requisite service period. The fair values of the replacement options granted were estimated on the dates of grant using the Black Scholes option-pricing model using the following assumptions: Stock price: $8.00, Exercise Price: $8.00, Expected Term: 3.51-4.78, Volatility: 34.78% - 36.87%, Risk free rate: 1.53% - 1.83%.

On August 10, 2017, the Company granted stock options and restricted stock to each of its boardBoard members as part of theirits Board compensation package. Each of the 4 boardindependent Board members received 2,500 stock options and 2,500 shares of restricted stock for their boardBoard services. The options were granted at a price of $8.00 per share and had an aggregate grant date fair value of $26,120. The options vest ratably over a four-year period beginning on the one-year anniversary. The restricted stock issued to the boardBoard members havehas an aggregate fair value of $80,000 and vest ratably in arrears over four quarters on the last day of each fiscal quarter following the grant date. As of September 30, 2017, 2,500March 31, 2018, 7,500 shares of restricted stock had vested, resulting in total compensation expense of $20,000.

XG SCIENCES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2017$60,000.

A summary of the stock option activity for the ninethree months ended September 30, 2017March 31, 2018 is as follows:

| Weighted | ||||||||

| Number | Average | |||||||

| Of | Exercise | |||||||

| Options | Price | |||||||

| Options outstanding at beginning of year | 369,750 | $ | 11.89 | |||||

| Changes during the year: | ||||||||

| Expired | (12,000 | ) | 12.00 | |||||

| Cancellation of existing options | (357,750 | ) | 12.00 | |||||

| Issuance of replacement options | 536,625 | 8.00 | ||||||

| New Options Granted – at market price | 108,000 | 8.00 | ||||||

| Exercised | — | — | ||||||

| Options outstanding at end of Period | 644,625 | 8.00 | ||||||

| Options exercisable at end of Period | 322,158 | 8.00 | ||||||

| Weighted | ||||||||

| Number | Average | |||||||

| Of | Exercise | |||||||

| Options | Price | |||||||

| Options outstanding at December 31, 2017 | 677,125 | $ | 8.00 | |||||

| Changes during the period: | ||||||||

| Expired | — | — | ||||||

| New Options Granted – at market price | 10,000 | 8.00 | ||||||

| Exercised | — | — | ||||||

| Options outstanding at March 31, 2018 | 687,125 | $ | 8.00 | |||||

| Options exercisable at March 31, 2018 | 337,158 | $ | 8.00 | |||||

XG SCIENCES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2018 AND 2017

All options granted thus far under the 2017 Plan have an exercise price of $8.00 per share and vesting of the options ranges from immediate to 20% per year, with most options vesting on a straight-line basis over a four-year period from the date of grant. The options expire in seven years from the date of grant.

During the three months ended March 31, 2018, the Company granted 10,000 employee stock options with an aggregate grant date fair value of $28,755. The fair valuesvalue of the options granted arewas estimated on the datesdate of grant using the Black Scholes option-pricing model. Vestingmodel using the following assumptions: Stock price: $8.00, Exercise Price: $8.00, Expected Term: 4.75, Volatility: 37.34%, Risk free rate: 2.65%, Dividend rate: 0%. As of March 31, 2018, 687,125 stock options and 10,000 shares of restricted stock awards were outstanding under our 2017 Plan.

Stock-based compensation expense was $87,764 and $88,370 for the three months ended March 31, 2018 and 2017, respectively. As of March 31, 2018 there was approximately $895,00 in unrecognized compensation cost related to the options granted range from immediately to 25% per year, with most ofunder the replacement options vesting 50% on date of grant with the remaining vesting over a 4 year period from the date issued. The options expire in seven years from date of grant. 2017 plan.

NOTE 87 – CAPITAL LEASES

As of September 30, 2017March 31, 2018, and December 31, 2016,2017, we have capital lease obligations as follows:

| September 30, 2017 | December 31, 2016 | March 31, 2018 | December 31, 2017 | |||||||||||||

| Capital lease obligations | $ | 214,191 | $ | 449,368 | $ | 114,970 | $ | 149,120 | ||||||||

| Unamortized warrant discount | (23,252 | ) | (65,595 | ) | (8,346 | ) | (15,040 | ) | ||||||||

| Net obligations | 190,939 | 383,773 | 106,624 | 134,080 | ||||||||||||

| Short-term portion of obligations | (159,628 | ) | (268,667 | ) | (91,985 | ) | (118,553 | ) | ||||||||

| Long-term portion of obligations | $ | 31,311 | $ | 115,106 | $ | 14,639 | $ | 15,527 | ||||||||

Our AAOF capital lease obligations are four-year leases starting on January 1, 2014 and January 1, 2015. Our other capital leases expire at various dates in 2018, have average effective interest rates of 0% and contain bargain purchase options that allow us to purchase the leased property for a minimal amount upon the expiration of the lease term.

NOTE 98 —Customer, Supplier, country, and Product Concentrations

Grants and Licensing Revenue Concentration

For the three months ended September 30, 2017, one grantor accounted for 100% of the total grant revenue. During the nine months ended September 30, 2017, two grantors accounted for 25% and 75% of total grant revenue. During the three months ended September 30, 2016, two grantors accounted for 50% each of the total grant revenue, and for the nine months ended September 30, 2016, two grantors accounted for 12% and 88% of the total grant revenue in each period. There was no licensing or grant revenue to report during the first quarter of 2018. Two grantors accounted for 94% and 6% respectively of total grant revenue reported during the three months ended September 30,first quarter of 2017. LicensingThe company’s licensing revenue forin the nine months ended September 30,first quarter of 2017 and for the three and nine months ended 2016, came from one licensor.

Product Concentration

ConcentrationsDuring the first quarter of 2018 and 2017, we had concentrations of product salesrevenue from only one product that was greater than 10% of total product sales are shown inrevenues. Revenue from one of the table below.Company’s graphene nanoplatelets materials, Grade C 500 m2/g, was 83% as of March 31, 2018 and 29% as of March 31, 2017. We attempt to minimize the risk associated with product concentrations by continuing to develop new products to add to our portfolio of products offered.

| For the Three Months Ended September 30, | For the Nine Months Ended September 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Grade C-300 HP | * | * | 14% | * | ||||||||||||

| Grade C-500 | 66% | * | 41% | * | ||||||||||||

| Grade R-10 | * | 16% | * | 12% | ||||||||||||

| Grade M-15 | * | 16% | * | 14% | ||||||||||||

* Denotes less than 10% of product sales.

XG SCIENCES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2017portfolio.

Customer Concentration

During the three months ended September 30,first quarter of 2018, we had one customer whose purchases accounted for 83% of total product revenues. During the first quarter of 2017 we had two customers whose purchases accounted for 19%that represented 29% and 65%22 % of total product sales. During the three months ended September 30, 2016 we had three customers who accounted for 10%, 12%revenues. At March 31, 2018 and 21% of product sales.

For the nine months ended September 30, 2017 we had two customers whose purchases accounted for 17%, and 36% of product sales. During the nine months ended September 30, 2016 we had two customers whose purchases accounted for 11% each of product sales.

At September 30, 2017, there were two customers who had an accounts receivable balance greater than 10% of our total outstanding receivable balance. At September 30, 2016, there were two customers whoeach had an accounts receivable balance greater than 10% of our total outstanding receivable balance.

Country Concentration

We sell our products on a worldwide basis. Revenue derived from customers outside of the U.S. during the first quarter of 2018 was 3% as compared with 40% during the first quarter of 2017. All of these sales are denominated in U.S. dollars.

International sales for the three months ended September 30, 2017As of March 31, 2018, there were 33%no foreign countries with greater than 10% of product sales as compared with 54% forrevenue. During the three monthsquarter ended September 30, 2016. One country, China, accounted for 19% of product sales for the three months ended September 30,March 31, 2017, and three countries, China, the United Kingdom and South Korea, accounted for 10%, 14%, and 20%, respectively, of product sales for the three months ended September 30, 2016.

International sales for the nine months ended September 30, 2017 were 34% of product sales as compared with 66% for the nine months ended September 30, 2016. One country, China, accounted for approximately 17% of product sales for the nine months ended September 30, 2017 and two countries, the United Kingdom and South Korea accounted for 10%approximately 24% and 30%16%, respectively, of total product sales for the nine months ended September 30, 2016.revenue.

XG SCIENCES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2018 AND 2017

Suppliers

We buy raw materials used in manufacturing from several sources. These materials are available from a large number of sources. Thus, we believe aA change in suppliers would havehas no material effect on ourthe Company’s operations. We did not have any purchases from one supplierany suppliers that were moregreater than 10% of total purchases forduring the three monthsquarters ended March 31, 2018 and nine months ended September 30, 2017 and 2016.2017.

NOTE 109 - RELATED PARTY TRANSACTIONS

We have a licensing agreement for exclusive use of patents and pending patents with Michigan State University (“MSU”), a shareholder of the Company via the MSU Foundation. DuringWe incurred $12,500 of licensing expense in each of the three monthsmonth periods ended September 30, 2017March 31, 2018 and 2016 we recorded licensing expense of $12,500 per quarter. During the nine months ended September 30, 2017 and 2016 we recorded licensing expense of $37,500 in each period.2017.

We have also entered into product licensing agreements with POSCO, a shareholder. See below for POSCO. Other than MSU and POSCO, there were nocertain other royalty expenses or revenue recognized during the three or nine months ended September 30, 2017 and 2016.

The Company and POSCO, a shareholder of the Company, entered into a license agreement dated June 8, 2011, pursuant to which POSCO agreed to pay a minimum annual royalty of $100,000 per year if certain circumstances existed, among other things. The Company believed that this minimum annual royalty became due annually beginning on February 28, 2015, and up until June 30, 2017, recorded thisshareholders. No royalty revenue at a rate of $25,000 per quarter. POSCO disputed its obligation to pay this minimum annual royalty, and did not pay the royalty in any prior year. We filed a demand for arbitration in the International Court of Arbitration on March 9, 2016, in an effort to resolve the dispute. Pursuant to a confidential settlement, on November 3, 2017, the Company and POSCO agreed to settle the dispute and to dismiss the arbitration. Based on terms of the settlement, no allowance is considered necessary. At September 30, 2017 weor expenses have a balance of $175,000 reflected in other current assets on the condensed consolidated balance sheet. This represents an accrual of licensing revenue of $100,000 for three and a half years less 50% to reflect an estimate of the portion of 2017, 2016, 2015, and 2014 licensing fees we believed to be not collectible. At December 31, 2016 the accrued licensing fees and allowance netted together was $150,000.

XG SCIENCES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2017

On March 18, 2013, we entered into a series of agreements with two private investment funds: Aspen Advanced Opportunity Fund, LP (“AAOF”) and XGS II, LLC (“XGS II”), and pursuant to a Shareholders’ Agreement dated March 18, 2013 (as amended on February 26, 2016), a principal of each private fund serves as a member of our Board of Directors. These financing agreements were amended and restated on July 12, 2013 to provide for expanded financing commitments from AAOF and XGS II. Pursuantbeen recognized related to these agreements AAOF and XGS II agreed to provide $10 million of financing to the Company in the form of Secured Convertible Notes and AAOF agreed to provide an additional $1.0 million of lease financing arrangements. All of the principal and accrued interest on the Secured Convertible Notes issued to AAOF and XGS II were converted into Series A Preferred Stock in December 2016.

Duringduring the three months ended September 30,March 31, 2018. For the three months ended March 31, 2017, $25,000 of royalty revenue was recorded from POSCO, a shareholder.

During each of the three months ended March 31, 2018 and 20162017 we issued 7,140 shares per period of Series A Preferred Stock to AAOF as payment for lease financing obligations under the terms of the Master Lease Agreement, dated March 18, 2013. For the nine months ended September 30, 2017 and 2016 we issued a total of 21,420 shares per period as payment for lease obligations.

On AugustNOTE 10 2017 restricted common stock in the amount of 2,500 shares, vesting at 25% or 625 shares on September 30, 2017, December 31, 2017, March 31, 2017, and June 30, 2017 was granted to each of four Board members: Steven C. Jones, Arnold Allemang, Dave Pendell, and Peifeng (Molly) Zhang. These awards were pursuant to the 2017 Equity Incentive Plan. In addition to the restricted stock, these Board members also received 2,500 stock options granted on August 10, 2017. These options vest equally over four years starting on the 1st anniversary of the date of grant. Both the restricted stock and the stock options have an exercise price of $8.00 per share. The options expire on the seventh anniversary of the date of grant.

NOTE 11 – OTHER SUBSEQUENT EVENTS

During the period from OctoberApril 1 through November 13, 2017,May 14, 2018, we received common stock proceeds of $405,000$858,000 for the sale of 50,625 shares.107,250 shares of common stock in our IPO.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

In this Quarterly Report on Form 10-Q, unless otherwise indicated, the words “we”, “us”, “our”, “XG”, “XGS”, “XG Sciences” or the “Company” refer to XG Sciences, Inc. and its wholly owned subsidiary, XG Sciences IP, LLC, a Michigan limited liability company.

Introduction

The following discussion and analysis should be read in conjunction with the unaudited condensed consolidated financial statements, and the notes thereto included herein. The information contained below includes statements of the Company’s or management’s beliefs, expectations, hopes, goals and plans that, if not historical, are forward-looking statements subject to certain risks and uncertainties that could cause actual results to differ materially from those anticipated in the forward-looking statements. For a discussion on forward-looking statements, see the information set forth in the introductory note to this quarterly report on Form 10-Q under the caption “Forward-Looking Statements”, which information is incorporated herein by reference.

Overview of our Business

XG Sciences was formed in May 2006 for the purpose of commercializing certain technology to produce graphene nanoplatelets. First isolated and characterized in 2004, graphene is a single layer of carbon atoms configured in an atomic-scale honeycomb lattice. Among many noted properties, monolayer graphene is harder than diamonds, lighter than steel but significantly stronger, and conducts electricity better than copper. Graphene nanoplatelets are particles consisting of multiple layers of graphene. Graphene nanoplatelets have unique capabilities for energy storage, thermal conductivity, electrical conductivity, barrier properties, lubricity and the ability to impart physical property improvements when incorporated into plastics or other matrices.

We believe the unique properties of graphene and graphene nanoplatelets will enable numerous new product applications and the market for such products will quickly grow to be a significant market opportunity. Our business model is to design, manufacture and sell advanced materials we call xGnP®graphene nanoplatelets and value-added products incorporating xGnP® nanoplatelets. We currently have hundreds of customers trialing our products for numerous applications, including, but not limited to lithium ion batteries, lead acid batteries, thermally conductive adhesives, composites, thermal transfer fluids, thermal management and heat transfer, inks and coatings, printed electronics, construction materials, cement, and military uses. We believe our proprietary processes have enabled us to be a low-cost producer of high quality, graphene nanoplatelets and value-added integrated products containing graphene nanoplatelets and that we are well positioned to address a wide range of end-use applications.

Our Customers

We sell products to customers around the world and have sold materials to over 1,000 customers in 47 countries since 2008. Some of these customers are research organizations and some are commercial organizations. Our customers have included well-known automotive and OEM suppliers around the world (Ford, Johnson Controls, Magna, Honda Engineering) world-scale, global-scale lithium ion battery manufacturers in the US,U.S., South Korea and China (Samsung SDI, LG Chemical, Lishen, A123) and diverse specialty material companies (3M, BASF, Henkel, Dow Chemical, DuPont), as well as leading research centers such as Lawrence Livermore National Laboratory and Oakridge National Laboratory. We have also licensed some of our base manufacturing technology to other companies, and we consider technology licensing a component of our business model. Our licensees include POSCO, the fourth largest steel manufacturer in the world by volume of output, and Cabot Corporation (“Cabot”), a leading global specialty chemicals and performance materials company. These licensees further extend our technology through their customer networks. Ultimately, we believe we will benefit in terms of royalties on sales of xGnP® nanoplatelets produced and sold by our licensees. TheAs can be seen in the below bar charts showchart, the cumulative number of customers and total orders fulfilled by year based on actual purchaseshas steadily grown over the last ten years.

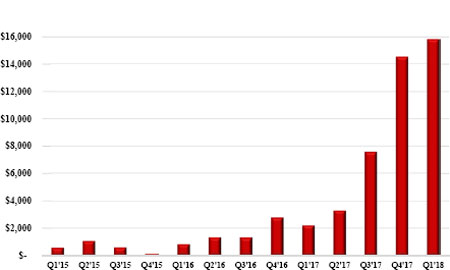

Cumulative Customers, By Year

We believe average order size is an indicator of commercial traction. The majority of our materialscustomers are still ordering in smaller quantities consistent with their development and engineering qualification work. As can be seen in the chart below, our quarterly average order size was relatively modest until 2017, when a number of customers reached commercial status with different product applications. These data represent orders shipped in the respective quarter and exclude no charge orders targeted mainly for free samples or materials usedR&D purposes. The data show that the average order size has increased steadily over the last two years, and we believe that it will continue to increase through 2018 as more customers commercialize products using our materials. As a result of this increasing order size, in joint development programs.2017 our customer shipments increased by over 600% to almost 18 metric tons of products from the 2.5 metric tons shipped in 2016. In the first quarter of 2018, we saw an incremental increase in the average order size to $15,827 from $14,541 in the fourth quarter of 2017. Also, in the first quarter of 2018, we shipped products containing over 10 metric tons of graphene nanoplatelets, on a dry powder basis, up from just over 9 metric tons in the fourth quarter of 2017, on a similar basis.

Average Order Size of Fulfilled Orders

Our Products

Our Products

Bulk MaterialsMaterials.. We target our xGnP® nanoplatelets for use in a wide range of large and growing end-use markets. Our proprietary manufacturing processes allow us to produce nanoplatelets with varying performance characteristics that can be tuned to specific end-use applications based on customer requirements. We currently offer four commercial “grades” of bulk graphene nanoplatelet materials, each of which is available in various particle sizes and thickness, which allows for surface areas ranging from 50 to 800 square meters per gram of material depending on the product. Other grades may be made available, depending on the needs for specific applications. In addition, we sell our xGnP® graphene nanoplatelets in the form of pre-dispersed mixtures with water, alcohol, or other organic solvents and resins. In addition to selling bulk graphene nanoplatelets, we also offer the following integrated, value-added products that contain our graphene nanoplatelets in various forms.forms:

Composites.These consist of compositions of specially designed xGnP® graphene nanoplatelets formulated in pre-dispersed mixtures that can be easily dispersed in various polymers. Our integrated composites portfolio includes pre-compounded resins derived from a range of thermoplastics as well as mother batches of resins and xGnP® nanoplatelets and their combination with resins and fibers for use in various end-use applications that may include industrial, automotive and sporting goods and which have demonstrated efficacy in standard injection molding, compression molding, blow molding and 3-D processes, to name but a few. In addition, we offer various bulk materials with demonstrated efficacy in plastic composites to impart improved physical performance to such matrices, which may be supplied as dry powders or as aqueous or solvent-based dispersions or cakes. We have also targeted use of our graphene nanoplatelets as an additive in cement mixtures, which we believe results in improved barrier resistance, durability, toughness and corrosion protection. Our GNP®Concrete Additive promotes the formation of more uniform and smaller grain structure in cement. This fine-grain and uniform structure gives the concrete improvements in flexural and compressive strength. In addition, the embedded graphene nanoplatelets will stop cracks from forming and retard crack propagation, should any cracks form – the combination of which will improve lifetime and durability of cement.

Energy Storage Materials. These consist of specialty advanced materials that have been formulated for specific applications in the energy storage segment. Chief among these is our proprietary, specially formulated silicon-graphene composite material (also referred to as “SiG” or “XG SiG®”) for use in lithium-ion battery anodes. XG SiG® targets the never-ending need for higher battery capacity and longer life. In several customer trials, our SiG material has demonstrated the potential to increase battery energy storage capacity by 3-5x what is currently available with conventional lithium ion batteries today. Additionally, we offer various bulk materials for use as conductive additives for cathodes and anodes in lithium-ion batteries, as an additive to anode slurries for lead-carbon batteries, as a component in coatings for current collectors in lithium-ion batteries and we are investigating the use of our materials as part of other battery components.

Composites.Inks and Coatings. These consist of an aqueous-based compositionspecially-formulated dispersions of speciallyxGnP®together with solvents, binders, and other additives to make electrically or thermally conductive products designed xGnP® graphene nanoplatelets formulatedfor printing or coating and which are showing promise in diverse customer applications such as advanced packaging, electrostatic dissipation and thermal management. We also offer a set of standardized ink formulations suitable for printing. These inks offer the capability to be easily dispersed in concreteprint electrical circuits or antennas and targeted specifically for consumer and industrial applications. Use of our GNP® Concrete Additive in cement mixtures results in improved barrier resistance, durability, toughness and corrosion protection. The graphene nanoplatelets promote the formation of more uniform and smaller grain structure in the cement. This fine-grain and uniform structure gives concrete improvements in flexural and compressive strength. In addition, the embedded graphene nanoplatelets will stop cracks from forming and retard crack propagation, should any cracks form – the combination of which will improve lifetime and durability. We intend to further extend our integrated composites portfolio to include pre-compounded resins derived from a range of thermoplastics as well as mother batches of resins and xGnP® nanoplatelets and their combination with resins and fibers for use various end-use applications. In addition, we offer various bulk materials with demonstrated efficacy in plastic composites to impart improved physical performance to such matrices, which may be supplied as dry powderssuitable for other electrical or as aqueous or solvent-based dispersions or cakes.thermal applications. All of these formulations can be customized for specific customer requirements.

Thermal Management Materials. These consist mainly of two types of products, our XG Leaf® sheet products and various thermal interface materials (“TIM”) in the form of custom greases or pastes. XG Leaf® is a family of sheet products ideally suited for use in thermal management in portable electronics, which may include cell phones, tablets and notebook PC’s. As these devices continue to adopt faster electronics, higher data management capabilities, brighter displays with ever increasing definition, they generate more and more heat. Managing that heat is a key requirement for the portable electronics market and our XG Leaf® product line is well suited to address the need. These sheets are made using special formulations of xGnP® graphene nanoplatelets as precursors, along with other materials for specific applications. There are several different types of XG Leaf® available in various thicknesses, depending on the end-use requirements for thermal conductivity, electrical conductivity, or resistive heating. Our custom XG TIM™® greases and pastes are also designed to be used in various high temperature environments. Additionally, we offer various bulk materials for use as active components in liquids, coatings and plastic composites to impart improved thermal management performance to such matrices.

19

Inks and Coatings. These consist of specially-formulated dispersions of xGnP®together with solvents, binders, and other additives to make electrically or thermally conductive products designed for printing or coating and which are showing promise in diverse customer applications such as advanced packaging, electrostatic dissipation and thermal management. We also offer a set of standardized ink formulations suitable for printing. These inks offer the capability to print electrical circuits or antennas, or might be suitable for other electrical or thermal applications. All of these formulations can be customized for specific customer requirements.

Our Focus Areas

We believe we are a “platform play” in advanced materials, because our proprietary processes allow us to produce varying grades of graphene nanoplatelets that can be mapped to a variety of applications in many market segments. However, we are prioritizing our efforts in specific areas and with specific customers that we believe represent opportunities for either relatively near-term revenue or especially large and attractive markets. At this time, we are focused on three high priority areas: Composites, Energy Storage, and more broadly, Thermal Management and Composites.Management. The following table shows examples of the types of applications we are pursuing, the expecting timing of revenue and the addressable market size of selected market opportunities.

XGS Market/Application Focus Areas & 2018 Market Size

| (1) | Avicenne Energy, “The Worldwide Rechargeable Battery Market 2014 |

| (2) | Avicenne Energy, |

| (3) | Avicenne Energy, The Battery Show; Novi, MI; September, 2017. & Internal Estimates. |

| (4) | ArcActive via Nanalyze, April 3, 2015. |

| (5) | ArcActive via Nanalyze, April 3, 2015 & Internal Estimates. |

| (6) | Future Markets Insights, “Consumer Electronics Market: Global Industry Analysis and opportunity Assessment 2015 – 2020”, May 8, 2015. |

| (7) | Prismark, “Market Assessment: Thin Carbon-Based Heat Spreaders”, August 2014. |

| (8) | Reporterlink.com, “Semiconductor & IC Packaging Materials Market…”, May 2014. |

| (9) | Prismark, 2015. |

| (10) | Grand View Research, “Global Plastics Market Analysis…”, August 2014. |

| (11) | From |

20

Commercialization Process

Because graphene is a new material, most of our customers are still developing applications that use our products. Commercialization is a process, the exact timing of which is often difficult to predict. It starts with our own internal R&D to validate performance for an identified market or customer-specific need. Our customers then validate the performance of our materials and determine whether our products can be incorporated into their manufacturing processes. This is initially done at pilot projectproduction scale levels. Our customers then have to introduce products that incorporate our materials to their own customers to validate performance. After their customers have validated performance, our customers will then move to commercial scale production. Every customer goes through the same process, but will do so at varying speeds, depending on the customer, the product application and the end-use market. Thus, we are not always able to predict when our customers will begin ordering commercial volumes of our materials or predict their expected volumes over time. However, as customers move through the process, we generally receive feedback and gain greater insights regarding their commercialization plans. The following are examples of where our products are providing value to our customers at levels that are either in commercial production or we believe will warrant their use on a commercial basis (see also Exhibit 99.1 to Post-Effective Amendment No. 5 to the Existing Registration Statement for our Summary Customer Pipeline validating the value of our products in various end-use markets and applications):basis.

| Callaway Golf Company incorporated our graphene nanoplatelets into the outer core of their Chrome Soft golf balls, resulting in a new class of golf ball that enables higher driving speeds, greater distance and increased control, which is allowing Calloway to command a premium price for their golf balls in the marketplace, and | ||

| • | Lead acid battery manufacturer demonstrating approximately 90% improvement in measured cycle life, appreciable improvement in capacity and charge acceptance and without any loss in water retention performance, and | |

| Automotive parts supplier demonstrating improvements in thermal stability for polymer composites incorporating our materials, allowing for approximately 20% higher operating temperatures and a 50% improvement in strength at the elevated temperature, and | ||

| Construction company demonstrating less than one weight percent of our product in construction material composites improves flexural strength by more than 30%, and | ||

| Plastics composite part manufacturer demonstrating 7-30% improvement in strength and 40% improvement in modulus when used in sheet molding compound, and | ||

| Engineering design firm for automotive manufacturers found approximately 20% reduction in operating temperature and in thermal uniformity when XG Leaf®replaces standard cooling fins in lithium ion battery packs, and | ||

| Plastic composite parts manufacturer demonstrating 25% increase in tensile strength and 15% improvement in flex modulus for a high-density polyethylene composite. | ||

The process of “designing-in” new materials is relatively complex and involves the use of relatively small amounts of the new material in laboratory and engineering development for an extended period of time. Following successful development, customers that incorporate our materials into their products will then order much larger quantities of material to support commercial production. Although, our customers are under no obligation to report to us on the usage of our materials, some have indicated that they have introduced or will soon introduce commercial products that use our materials. Thus, while many of our customers are currently purchasing our materials in kilogram (one or two pound) quantities, some are now ordering at multiple ton quantities and we believe many will require tens of tons or even hundreds of tons of material whenas they commercialize products that incorporate our materials. We also believe that those customers already in production will increase their order volume as demand increases and others will begin to move into commercial volume production as they gain more experience in working with our materials and engage new customers. For example, in the first half of 2017 we shipped a 13.4 metric ton ordertons of product for various end-use customers and in the second half of 2017 we shipped just shy of 14 metric tons. In the fourth quarter of 2016 to a customer who is currently moving into larger scale production and had previously used smaller quantities.2017, we received orders that exceeded our then capacity. In the first quarter of 20172018 we shipped 1.6products comprising over 10 metric tons of graphene nanoplatelets. In addition, we used approximately 300 Kg of dry powder for various end-use customersto produce and another 1.8 metric tons in the second quarter. In the third quarter of 2017 we shipped over 5.7 tons and based on known customer demand we forecast shipping more than 15ship approximately 9 metric tons of additional product in the fourth quarterform of 2017.a slurry, cake or other integrated products. This demand profile is further evidence that we are transitioning into higher-volume production,production. Based on customer forecasts and management estimates, we expect further, sizable increases in demandto ship from 100 to 200 metric tons in 2018.

We also believe average order size is an indicator of commercial traction. The majority of our customers are still ordering in smaller quantities consistent with their development and engineering qualification work. The average order sizes, by quarter from the first quarter of 2015 through third quarter of 2017 are given below. These data represent orders shipped in the respective quarter and exclude no charge orders targeted mainly for R&D purposes. The data show that the average order size has increased steadily over the last two years, and we believe that it will continue to increase in the fourth quarter of 2017 and in 2018 as more customers commercialize products using our materials.

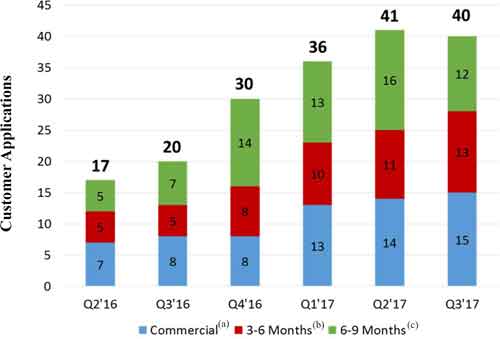

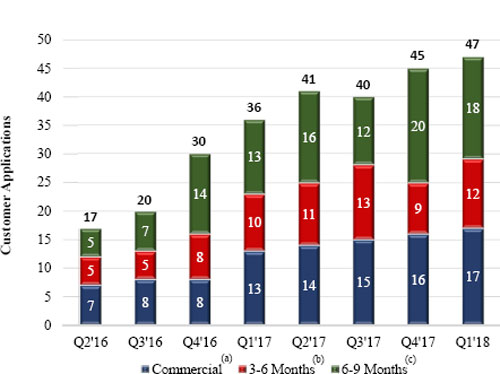

2017 and 2018Expected Revenue

We are tracking the commercial and development status of more than 10075 different customer applications using our materials with some customers pursuing multiple applications. As of September 30, 2017,March 31, 2018, we had fifteenseventeen specific customer applications where our materials are incorporated into our customers’ products and such customers are actively promoting or selling these products to their own customers. In addition, we have another thirteentwelve customer applications where our customers have indicated that they expect to begin shipping product incorporating our materials in the next 3 – 6 months and we have another twelveeighteen customer applications where our customers have indicated an intent to commercialize in the next 6 – 9 months. We are also haveworking with numerous additional customers with whom we are working that have not yet indicated an exact date for commercialization, but we believe have the potential to contribute to revenue in 2018. The following graphic demonstrates the trend over the past 68 quarters as an increasing number of customers indicate their intent to commercialize applications and move into actively selling or promoting products for future sales. We anticipate that the average order size for these customers will increase in the fourth quarter of 2017 and throughout 2018 as their demand grows. As a result, we believe we will begin shipping significantly greater quantities of our products, and thus begincontinue scaling revenue in the last quarter of 2017 and inthrough 2018. Based on the status of current discussions with customers and their feedback on the performance of our materials in their products, we believe we will be able to recognize approximately $15$8 – $30$15 million of revenue in 2018, although this cannot be assured.

| (a) | Customer applications where our materials are used in customer products and they are actively |

| (b) | Customer applications where our customers are indicating that they expect to begin shipping products incorporating our materials in the next 3-6 months. |

| (c) | Customer applications where our customers are indicating an intent to commercialize in the next 6-9 months. | |

Additional 10’s of customers demonstrating efficacy and moving through qualification process.

Addressable Markets

The markets that we serve are large and rapidly growing. For example, as shown in the figure below, Avicenne Energy (“The Rechargeable(The Battery Market, 2014 – 2025”, July 2015)Show, Novi MI, September 2017) estimates that the market for materials used in lithium ion battery anodesbatteries is currently approximately $1$10.4 billion but is expected to approximately double over the next ten years.and with a double-digit compound annual growth rate. We believe our ability to address next generation anodebattery materials represents a significant opportunity for us.

2016 Lithium Ion Battery Value Chain – Market Demand

According to Prismark Partners, LLC, a leading electronics industry consulting firm specializing in advanced materials, the 2014 market for finished graphitic heat spreaders as sold to the OEM and EMS companies with adhesive, PET, and/or copper backing for selected portable applications was $600 million, and is expected to reach $900 million in 2018. The market is currentlyhas been in a significant expansion period driven by the demand for portable devices. In a press release dated June 30, 2016,October 17, 2017, Gartner, Inc., a leading research organization, estimated the 20162018 global smartphone market at 1.9more than 1.6 billion units and worldwide combined shipments of devices (PC’s, tablets, ultraphonesultra phones and mobile devices weredevices) are expected to reach 2.42.35 billion units in 2016).2018. Every cell phone has some form of thermal management system, and we believe many of the new smart phones and other portable devices being developed can benefit from the thermal management properties of our XG Leaf® product line. In August 2016,November 2017, International Data Corporation (IDC) in their Worldwide Quarterly Tablet Tracker, estimated the global shipment of tablets in 2016the third quarter at 183.440 million units.units (Q1 at 36.2 million units and Q2 at 37.9 million units). Thus, we believe our XG Leaf® product line is well positioned to address a very large and rapidly growing market.

Our Intellectual Property

Some of our proprietary manufacturing processes were developed at Michigan State University (MSU) and licensed to us in 2006. We license three U.S. patents and patent applications from MSU. However, overOn August 8, 2016, we signed an agreement acquiring an exclusive license to Metna’s background IP for use of graphene nanoplatelets as additives to concrete mixtures. For purposes of the agreement, Metna’s background IP relates to the U.S. Patent 8,951,343. Also, on August 8, 2016, we entered into a second agreement for an exclusive license related to all Metna’s background technology and foreground technology, including any jointly-owned foreground technology where the end use is known to be any graphite additive dispersed in concrete mixtures. Over time, our scientists and engineers have made many further discoveries and inventions that are embodied in the form of (as(and as of September 30, 2017)March 31, 2018): eight additional U.S. patents, 11ten foreign patents, 1716 additional U.S. patent applications, and numerous trade secrets. For each patent application filed in the U.S., we make a determination on the nature and value of the patent. For many of the applications filed in the U.S., additional filings are made in other countries such as the European Union, Japan, South Korea, China, Taiwan or other applicable countries. As of September 30, 2017,March 31, 2018, we maintained 36 international patent applications. These filings and analyses are made on a case-by-case basis. Typically, patents that are defensive in nature are not filed abroad, while those that are protective of active XGS products or applications are filed in relevant countries abroad. Our general IP strategy is to keep as trade secrets those manufacturing processes that are difficult to enforce should they be disclosed and to seek patent coverage for other manufacturing processes, materials derived from those processes, unique combinations of materials and end uses of materials containing graphene nanoplatelets. We believe that the combination of our rights under the MSU license, our patents and patent applications, and our trade secrets create a strong intellectual property position.

Operating Segment

We have one reportable operating segment that manufactures xGnP® graphene nanoplatelets and value-added products produced therefrom, conducts research on graphene nanoplatelets and related products, and licenses our technology as appropriate. As of September 30, 2017,March 31, 2018, we shipped products on a worldwide basis, but all of our assets were located within the United States.

Results of Operations for the Three and Nine Months Ended September 30, 2017March 31, 2018 Compared with the Three and Nine Months Ended September 30, 2016March 31, 2017

| Summary Income Statement | For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2017 | 2016 | Change | 2017 | 2016 | Change | For the Three Months Ended March 31, | ||||||||||||||||||||||||||||||

| Total Revenue | $ | 472,261 | $ | 163,967 | $ | 308,294 | $ | 1,038,529 | $ | 514,110 | $ | 524,419 | ||||||||||||||||||||||||

| 2018 | 2017 (Restated) | Change | ||||||||||||||||||||||||||||||||||

| Total Revenues | $ | 886,337 | $ | 282,189 | $ | 604,148 | ||||||||||||||||||||||||||||||

| Cost of Goods Sold | 716,261 | 367,395 | 348,866 | 1,712,875 | 1,172,397 | 540,478 | 1,214,774 | 487,920 | 726,854 | |||||||||||||||||||||||||||

| Gross Loss | (244,000 | ) | (203,428 | ) | (40,572 | ) | (674,346 | ) | (658,287 | ) | (16,059 | ) | (328,437 | ) | (205,731 | ) | (122,706 | ) | ||||||||||||||||||

| Research & Development Expense | 215,949 | 231,312 | (15,363 | ) | 706,575 | 866,668 | (160,093 | ) | 277,063 | 263,564 | 13,499 | |||||||||||||||||||||||||

| Sales, General & Administrative Expense | 1,466,505 | 896,650 | 569,855 | 3,386,857 | 2,618,252 | 768,605 | 1,186,679 | 996,587 | 190,092 | |||||||||||||||||||||||||||

| Total Operating Expense | 1,682,454 | 1,127,962 | 554,492 | 4,093,432 | 3,484,920 | 608,512 | 1,463,742 | 1,260,151 | 203,591 | |||||||||||||||||||||||||||

| Operating Loss | (1,926,454 | ) | (1,331,390 | ) | (595,064 | ) | (4,767,778 | ) | (4,143,207 | ) | (624,571 | ) | (1,792,179 | ) | (1,465,882 | ) | (326,298 | ) | ||||||||||||||||||

| Other Income (Expense) | (105,968 | ) | (23,687 | ) | (82,281 | ) | (296,983 | ) | (136,398 | ) | (160,585 | ) | ||||||||||||||||||||||||

| Other Expense | (81,916 | ) | (29,941 | ) | (51,975 | ) | ||||||||||||||||||||||||||||||

| Net Loss | $ | (2,032,422 | ) | $ | (1,355,077 | ) | $ | (677,345 | ) | $ | (5,064,761 | ) | $ | (4,279,605 | ) | $ | (785,156 | ) | $ | (1,874,095 | ) | $ | (1,495,823 | ) | $ | (378,272 | ) | |||||||||

Revenue

RevenueRevenues for the three and nine months ended September 30,March 31, 2018 and 2017, and 2016, by category, are shown below.

| Summary of Revenue | For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||||||||||

| 2017 | 2016 | Change | 2017 | 2016 | Change | |||||||||||||||||||

| Product Sales | $ | 446,795 | $ | 88,856 | $ | 357,939 | $ | 863,574 | $ | 230,635 | $ | 632,939 | ||||||||||||

| Grants | 25,466 | 50,111 | (24,645 | ) | 124,955 | 208,475 | (83,520 | ) | ||||||||||||||||

| Licensing | — | 25,000 | (25,000 | ) | 50,000 | 75,000 | (25,000 | ) | ||||||||||||||||

| Total Revenue | $ | 472,261 | $ | 163,967 | $ | 308,294 | $ | 1,038,529 | $ | 514,110 | $ | 524,419 | ||||||||||||

| For the Three Months Ended March 31, | ||||||||||||

| 2018 | 2017 | Change | ||||||||||

| Product Sales | $ | 886,337 | $ | 157,700 | $ | 728,637 | ||||||

| Grants | — | 99,489 | (99,489 | ) | ||||||||

| Licensing Revenues | — | 25,000 | (25,000 | ) | ||||||||

| Total | $ | 886,337 | $ | 282,189 | $ | 604,148 | ||||||

Product sales consist of two broad categories: (1) material sold to customers for research or development purposes; and (2) production orders for customers. Typically, the order sizes for the first category are relatively small, however we expect orders in the second category to be much larger in the future. For the three months ended September 30, 2017,March 31, 2018, product sales increased by $357,939,$728,637, or 403% from the comparable period in the prior year. For the nine months ended September 30, 2017, product sales increased by $632,939, or 274%462% from the comparable period in the prior year. The main reason for the increase in product sales was customers moving through development programs towards commercialization, requiring larger quantities of our materials for advanced testing, pilot production and commercial-scale production activities. We believe that those customers already in production will increase their order volume as demand increases and other customers will begin to move into commercial volume production as they gain more experience in working with our materials and engage their own customers. As a result of this movement, we shipped 1.6over 10 metric tons of bulk powders in the first quarter of 2017 and 1.8 metric tons of bulk powders in the second quarter of 2017. In the third quarter of 2017 we shipped over 5.7 metric tons and based on known customer demand we forecast shipping more than 15 metric tons of product in the fourth quarter of 2017.three months ended March 31, 2018.

We ship our products from our Lansing, MI manufacturing facilities to customers around the world. During the three months ended September 30, 2017,March 31, 2018, we shipped materials to customers in 1612 countries, as compared to 1620 countries during the same three-month period in 2016.2017. For the three months ended, September 30, 2017,March 31, 2018, there were no shipments to onlyany one country accounted for more than 10% of product sales, China. For the three months ended September 30, 2016, shipments to three countries, South Korea, China and the United Kingdom accounted for more than 10% of product sales.

During the first nine months ended September 30, 2017, we shipped materials to customers in 29 different countries, versus 24 countries the same nine-month period in 2016. For the nine months ended September 30, 2017, shipments to only once country, China,that accounted for more than 10% of product sales. For the first ninethree months ended September 30, 2016,March 31, 2017, shipments to two countries, South Korea and the United Kingdom accounted for more than 10% of product sales.

Order Summary

The table below shows a comparison of domestic and international orders fulfilled (note that this does not include orders for free samples). The table also includes the average order size for product sales. These numbers indicate that our customer base remains active with research and development projects that use our materials, but that the order size is increasing as more customers order for production purposes or approach commercial status with products using our materials. The average order size for the product revenue during the first ninethree months ended September 30, 2017March 31, 2018 increased by 259%613% as compared to the same period in 2016.2017. Although the average size of these orders is still relatively small, we have begun shipping in metric ton quantities to multiple customers.

| For the Three Months Ended September 30, | For the Nine Months Ended September 30, | |||||||||||||||||||||||

| 2017 | 2016 | Change | 2017 | 2016 | Change | |||||||||||||||||||

| Number of orders - domestic | 22 | 39 | (17 | ) | 89 | 91 | (2 | ) | ||||||||||||||||

| Number of orders - international | 37 | 29 | 8 | 125 | 114 | 11 | ||||||||||||||||||

| Number of orders - total | 59 | 68 | (9 | ) | 214 | 205 | 9 | |||||||||||||||||

| Average order size for product sales recorded in r Statement of Operations | $ | 7,573 | $ | 1,307 | $ | 6,266 | $ | 4,035 | $ | 1,125 | $ | 2,910 | ||||||||||||

| Percentage change | 480 | % | 259 | % | ||||||||||||||||||||

| For the Three Months Ended March 31, | Change | |||||||||||||||

| 2018 | 2017 | % | ||||||||||||||

| Number of orders – domestic | 38 | 30 | 8 | 26.7 | ||||||||||||

| Number of orders – international | 18 | 41 | (23 | ) | (56.1 | ) | ||||||||||

| Number of orders – total | 56 | 71 | (15 | ) | (21.1 | ) | ||||||||||

| Average order size for product sales recorded in Statement of Operations | $ | 15,827 | $ | 2,221 | 13,606 | 612.6 | ||||||||||

Grant Revenue

There was no grant revenue for the three months ended March 31, 2018. Grant revenue for the three and nine months September 30,ended March 31, 2017 and 2016 consisted of proceeds from sources as shown in the table below:

| For the Three Months Ended September 30 | For the Nine Months Ended September 30 | |||||||||||||||||||||||||||||||

| 2017 | % | 2016 | % | 2017 | % | 2016 | % | |||||||||||||||||||||||||

| Mercedes Benz North America | $ | 25,466 | 100 | % | $ | — | — | % | $ | 31,208 | 25 | % | $ | — | — | % | ||||||||||||||||

| Department of Energy | — | — | 25,111 | 50 | 93,747 | 75 | 183,475 | 88 | ||||||||||||||||||||||||

| Grand Valley State | — | — | 25,000 | 50 | — | 25,000 | 12 | |||||||||||||||||||||||||

| Total | $ | 25,466 | 100 | % | $ | 50,111 | 100 | % | $ | 124,955 | 100 | % | $ | 208,475 | 100 | % | ||||||||||||||||

| For the Three Months Ended March 31, | ||||||||

| 2018 | 2017 | |||||||

| US Department of Energy Grant | $ | — | $ | 93,747 | ||||

| Daimler / University of Michigan | — | 5,742 | ||||||

| Total | $ | — | $ | 99,489 | ||||

Licensing Revenue

For the three months ended March 31, 2018 we had no licensing revenue. Licensing revenue for the three months ended March 31, 2017 was $25,000. The Company andlicensing revenue in 2017 was from POSCO, a shareholder of the Company, entered into aCompany. The original license agreement dated June 8, 2011 pursuant to which POSCO agreed to pay a minimum annual royalty of $100,000 per year if certain circumstances existed, among other things. The Company believed that this minimum annual royalty became due annually beginning on February 28, 2015, and up until June 30, 2017, recorded this royalty revenue at a rate of $25,000 per quarter. POSCO disputed its obligation to pay this minimum annual royalty, and did not pay the royalty in any prior year. We filed a demand for arbitration in the International Court of Arbitration on March 9, 2016, in an effort to resolve the dispute. Pursuant to a confidential settlement,was modified on November 3, 2017,2017. Under the Company and POSCO agreed to settle the dispute and to dismiss the arbitration. Based on terms of the settlement,revised agreement no allowance is considered necessary. At September 30, 2017 we have a balance of $175,000 reflected in other current assets on the condensed consolidated balance sheet. This represents an accrual of licensing revenue of $100,000 for three and a half years less 50% to reflect an estimate of the portion of 2017, 2016, 2015, and 2014 licensing fees we believed to be not collectible. At December 31, 2016 the accrued licensing fees and allowance netted together was $150,000.is due from POSCO.

Cost of Goods Sold

We use a standard cost system to estimate the direct costs of products sold. Direct costs include estimates of raw material costs, packaging, freight charges net of those billed to customers, and an allocation for direct labor and manufacturing overhead. Because of the nature of our production processes, there is a substantial fixed manufacturing expense requirement that represents the ongoing cost of maintaining production facilities that are not directly related to products sold, so we use a “full capacity” allocation of overhead based on an estimate of what product costs would be if the manufacturing facilities were operating on a full-time basis and producing products at the designed capacity. This estimate involves estimating both the level of expenses as well as production amounts as if the manufacturing facility were operating on a continuous 24 hour per day, 5 day per week production schedule.

Gross Profit Summary

The following table shows the relationship of direct costs to product sales for the three and nine months ended September 30, 2017March 31, 2018 and 2016:2017:

| Gross Profit Summary | For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2017 | 2016 | Change | 2017 | 2016 | Change | |||||||||||||||||||||||||||||||

Direct Margin and Gross Profit Summary | For the Three Months Ended March 31, | |||||||||||||||||||||||||||||||||||

| 2018 | 2017 | Change | ||||||||||||||||||||||||||||||||||

| Product Sales | $ | 446,795 | $ | 88,856 | $ | 357,939 | $ | 863,574 | $ | 230,635 | $ | 632,939 | $ | 886,337 | $ | 157,700 | $ | 728,637 | ||||||||||||||||||