UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

xQuarterly Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period endedJune 30, 2019

oTransition Report pursuant to 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period _____________to______________

Commission File Number:333-150582000-53565

| BLOX, INC. |

|

| Nevada | 20-8530914 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation of organization) | Identification No.) |

| (Address of principal executive offices) | (ZIP Code) |

Registrant’s telephone number, including area code:(604) 314-9293 |

| (Former name, former address and former fiscal year, if changed since last |

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days

☒Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☒Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.filer, a smaller reporting company, or an emerging growth company. See definitionthe definitions of ‘‘“large accelerated filer,” “accelerated filer,” “small reporting company” and large accelerated filer’’“emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Small reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐Yes ☒ No

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date:142,366,414142,822,664 shares of common stock as of August 20, 2018.2, 2019.

Transitional Small Business Disclosure Format ☐Yes☐ Yes ☒ No

BLOX, INC.

Quarterly Report on Form 10-Q

For The Quarterly Period Ended

June 30, 20182019

INDEX

i

PART I

As used in this quarterly report on Form 10-Q, the terms “we”, “us” “our”, the “Company” or the “registrant” refer to Blox Inc., a Nevada corporation, and its wholly-owned subsidiaries.

Our financial statements are stated in United States Dollars (US$) unless otherwise stated and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this quarterly report, unless otherwise specified, all references to “common shares” refer to the common shares in our capital stock.

Forward-Looking Statements

This quarterly report contains “forward-looking statements”. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including, but not limited to, any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objections of management for future operations; any statements concerning proposed new services or developments; any statements regarding future economic conditions or performance; any statements or belief; and any statements of assumptions underlying any of the foregoing.

Forward-looking statements may include the words “may,” “could,” “estimate,” “intend,” “continue,” “believe,” “expect” or “anticipate” or other similar words. These forward-looking statements present our estimates and assumptions only as of the date of this report. Accordingly, readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the dates on which they are made. Except as required by applicable law, including the securities laws of the United States, we do not intend, and undertake no obligation, to update any forward-looking statement.

Although we believe the expectations reflected in any of our forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of our forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and inherent risks and uncertainties. The factors impacting these risks and uncertainties include, but are not limited to:

| ● | our current lack of working capital; |

| ● | our ability to obtain any necessary financing on acceptable terms; |

| ● | timing and amount of funds needed for capital expenditures; |

| ● | timely receipt of regulatory approvals; |

| ● | our management team’s ability to implement our business plan; |

| ● | effects of government regulation; |

| ● | general economic and financial market conditions; |

| ● | our ability to complete the required feasibility study for permitting of the Mansounia concession in Guinea; |

| ● | our ability to develop our green mining business in Africa; and |

| ● | the fact that our accounting policies and methods are fundamental to how we report our financial condition and results of operations, and they may require our management to make estimates about matters that are inherently uncertain. |

ii

PART I - FINANCIAL INFORMATION

| Item 1. | Financial Statements |

The following unaudited interim financial statements of Blox, Inc. are included in this quarterly report on Form 10-Q.

Blox, Inc.

Condensed Interim Consolidated Balance Sheets

(Unaudited – Expressed in U.S. Dollars)

| As At | As At | As At | ||||||||||||||

| As At June 30, 2018 | March 31, 2018 (audited) | June 30, 2019 | March 31, 2019 | |||||||||||||

| (audited) | ||||||||||||||||

| ASSETS | ||||||||||||||||

| Current Assets | ||||||||||||||||

| Cash (Note 8) | $ | 4,625 | $ | 28,481 | $ | 8,996 | $ | 9,792 | ||||||||

| Prepaid expenses | 7,269 | 4,167 | 2,167 | 5,167 | ||||||||||||

| Total Current Assets | 11,894 | 32,648 | 11,163 | 14,959 | ||||||||||||

| Long term investments (Note 4) | 335,569 | 113,008 | 235,224 | 122,295 | ||||||||||||

| Equipment (Note 5) | 71,560 | 71,560 | 71,560 | 71,560 | ||||||||||||

| Mineral Property Interest (Note 6) | 931,722 | 931,722 | 931,722 | 931,722 | ||||||||||||

| Total Assets | $ | 1,350,745 | $ | 1,148,938 | $ | 1,249,669 | $ | 1,140,536 | ||||||||

| LIABILITIES | ||||||||||||||||

| Current Liabilities | ||||||||||||||||

| Accounts payable and accrued liabilities | $ | 92,960 | $ | 103,977 | $ | 280,610 | $ | 229,008 | ||||||||

| Due to shareholder (Note 11) | 124,211 | 56,200 | ||||||||||||||

| Due to shareholder (Note 9) | 341,346 | 329,346 | ||||||||||||||

| Total Liabilities | 217,171 | 160,177 | 621,956 | 558,354 | ||||||||||||

| STOCKHOLDERS’S EQUITY | ||||||||||||||||

| Common Stock (Note 7) | ||||||||||||||||

| - 400,000,000 authorized | ||||||||||||||||

| - 142,366,414 issued (March 31, 2018 – 108,611,814) | 1,305 | 967 | ||||||||||||||

| Common Stock(Note 7) - 400,000,000 authorized - 142,822,664 issued (March 31, 2019 – 142,822,664) | 1,309 | 1,309 | ||||||||||||||

| Additional Paid-in Capital | 7,303,136 | 5,957,211 | 7,337,352 | 7,337,352 | ||||||||||||

| Share Subscriptions Received | - | 1,469,516 | ||||||||||||||

| Contributed Surplus | 4,533,437 | 4,379,700 | 15,658,030 | 15,658,030 | ||||||||||||

| Accumulated Other Comprehensive Income | 138,731 | 35,794 | 123,295 | 55,019 | ||||||||||||

| Deficit | (10,843,035 | ) | (10,854,427 | ) | (22,492,273 | ) | (22,469,528 | ) | ||||||||

| Total Stockholders’ Equity | 1,133,574 | 988,761 | 627,713 | 582,182 | ||||||||||||

| Total Liabilities and Stockholders’ Equity $ | 1,350,745 | 1,148,938 | ||||||||||||||

| Total Liabilities and Stockholders’ Equity | $ | 1,249,669 | $ | 1,140,536 | ||||||||||||

See accompanying notes to the condensed interim consolidated financial statements.

2

Blox, Inc.

Condensed Interim Consolidated Statements of Comprehensive Income (Loss)

(Unaudited - Expressed in U.S. Dollars)

| Three Months Ended | Three Months Ended | |||||||||||||||

| June 30, 2018 | June 30, 2017 | June 30, 2019 | June 30, 2018 | |||||||||||||

| Operating Expenses | ||||||||||||||||

| Consulting and professional fees (Note 11) | $ | 61,104 | $ | 91,062 | $ | 34,505 | $ | 61,104 | ||||||||

| Depreciation | - | 193 | ||||||||||||||

| Exploration (Note 6) | 3,844 | 19,584 | 25,105 | 3,844 | ||||||||||||

| Foreign exchange | 1,237 | 21,654 | 1,777 | 1,237 | ||||||||||||

| Office and administration fees (Note 11) | 9,392 | 10,490 | 5,748 | 9,392 | ||||||||||||

| Travel | 8,852 | 2,311 | 263 | 8,852 | ||||||||||||

| Total Operating Expenses | (84,429 | ) | (145,294 | ) | (67,398 | ) | (84,429 | ) | ||||||||

| Other Income | ||||||||||||||||

| Unrealized gain on investment in warrants (Note 4) | 95,774 | - | 44,653 | 95,774 | ||||||||||||

| Interest income | 47 | - | - | 47 | ||||||||||||

| Net Income (Loss) for the Period | $ | 11,392 | (145,294 | ) | ||||||||||||

| Net (Loss) Income for the Period | (22,745 | ) | 11,392 | |||||||||||||

| Other Comprehensive Income | ||||||||||||||||

| Unrealized gain on investment in common shares (Note 4) | 102,937 | - | 68,276 | 102,937 | ||||||||||||

| Comprehensive Income (Loss) for the Period | $ | 114,329 | $ | (145,294 | ) | |||||||||||

| Comprehensive Income for the Period | $ | 45,531 | $ | 114,329 | ||||||||||||

| Net Earnings (Loss) Per Common Share | $ | 0.00 | $ | (0.00 | ) | |||||||||||

| Weighted Average Number of Shares Outstanding – Basic and diluted | 132,842,785 | 108,611,814 | ||||||||||||||

| Net (Loss) Earnings Per Common Share | $ | (0.00 | ) | $ | 0.00 | |||||||||||

| Weighted Average Number of Shares Outstanding – Basic | 142,822,664 | 132,842,785 | ||||||||||||||

See accompanying notes to the condensed interim consolidated financial statements.

Blox, Inc.

Consolidated Statements of Changes in Stockholders’ Equity

Years ended March 31, 20182019 and 20172018

(Expressed in U.S. Dollars)

| Accumulated | ||||||||||||||||||||||||||||||||

| Additional | Share | Other | Total | |||||||||||||||||||||||||||||

| Common Stock | Paid-in | Subscriptions | Contributed | Comprehensive | Stockholders’ | |||||||||||||||||||||||||||

| Shares | Amount | Capital | Received | Surplus | Income | Deficit | Equity | |||||||||||||||||||||||||

| April 1, 2017 | 108,611,814 | $ | 967 | $ | 5,957,211 | $ | - | $ | 3,500,756 | $ | 15,491 | $ | (9,364,652 | ) | $ | 109,773 | ||||||||||||||||

| Net loss for the period | - | - | - | - | - | - | (145,294 | ) | (145,294 | ) | ||||||||||||||||||||||

| June 30, 2017 | 108,611,814 | $ | 967 | $ | 5,957,211 | $ | - | $ | 3,500,756 | $ | 15,491 | $ | (9,509,946 | ) | $ | (35,521 | ) | |||||||||||||||

| April 1, 2018 | 108,611,814 | $ | 967 | $ | 5,957,211 | $ | 1,469,516 | $ | 4,379,700 | $ | 35,794 | $ | (10,854,427 | ) | $ | 988,761 | ||||||||||||||||

| Private placement (Notes 7(a)&7(b)) | 30,000,000 | 300 | 752,700 | (1,469,516 | ) | 747,000 | - | - | 30,484 | |||||||||||||||||||||||

| Stock options exercised (Note 7(c)) | 3,754,600 | 38 | 593,225 | - | (593,263 | ) | - | - | - | |||||||||||||||||||||||

| Unrealized gain on investment in common shares (Note 4) | - | - | - | - | - | 102,937 | - | 102,937 | ||||||||||||||||||||||||

| Net income for the period | - | - | - | - | - | - | 11,392 | 11,392 | ||||||||||||||||||||||||

| June 30, 2018 | 142,366,414 | $ | 1,305 | $ | 7,303,136 | $ | - | $ | 4,533,437 | $ | 138,731 | $ | (10,843,035 | ) | $ | 1,133,574 | ||||||||||||||||

| Accumulated | ||||||||||||||||||||||||||||||||

| Additional | Share | Other | Total | |||||||||||||||||||||||||||||

| Common Stock | Paid-in | Subscriptions | Contributed | Comprehensive | Stockholders’ | |||||||||||||||||||||||||||

| Shares | Amount | Capital | Received | Surplus | Income | Deficit | Equity | |||||||||||||||||||||||||

| April 1, 2018 | 108,611,814 | $ | 967 | $ | 5,957,211 | $ | 1,469,516 | $ | 4,379,700 | $ | 35,794 | $ | (10,854,427 | ) | $ | 988,761 | ||||||||||||||||

| Private placement (Notes 7(a)&7(b)) | 30,000,000 | 300 | 752,700 | (1,469,516 | ) | 747,000 | - | - | 30,484 | |||||||||||||||||||||||

| Stock options exercised (Note 7(c)) | 3,754,600 | 38 | 593,225 | - | (593,263 | ) | - | - | - | |||||||||||||||||||||||

| Unrealized gain on investment in common shares (Note 4) | - | - | - | - | - | 102,937 | - | 102,937 | ||||||||||||||||||||||||

| Net income for the period | - | - | - | - | - | - | 11,392 | 11,392 | ||||||||||||||||||||||||

| June 30, 2018 | 142,366,414 | $ | 1,305 | $ | 7,303,136 | $ | - | $ | 4,533,437 | $ | 138,731 | $ | (10,843,035 | ) | $ | 1,133,574 | ||||||||||||||||

| April 1, 2019 | 142,822,664 | $ | 1,309 | $ | 7,337,352 | $ | - | $ | 15,658,030 | $ | 55,019 | $ | (22,469,528 | ) | $ | 582,182 | ||||||||||||||||

| Unrealized gain on investment in common shares (Note 4) | - | - | - | - | - | 68,276 | - | 68,276 | ||||||||||||||||||||||||

| Net loss for the period | - | - | - | - | - | - | (22,745 | ) | (22,745 | ) | ||||||||||||||||||||||

| June 30, 2019 | 142,822,664 | $ | 1,309 | $ | 7,337,352 | $ | - | $ | 15,658,030 | $ | 123,295 | $ | (22,492,273 | ) | $ | 627,713 | ||||||||||||||||

Blox, Inc.

Condensed Interim Consolidated Statements of Cash Flows

(Unaudited – Expressed in U.S. Dollars)

| Three Months Ended | Three Months Ended | |||||||||||||||

| June 30, 2018 | June 30, 2017 | June 30, 2019 | June 30, 2018 | |||||||||||||

| CASH PROVIDED BY (USED IN): | ||||||||||||||||

| OPERATING ACTIVITIES | ||||||||||||||||

| Net income (loss) for the period | $ | 11,392 | $ | (145,294 | ) | |||||||||||

| Net (loss) income for the period | $ | (22,745 | ) | $ | 11,392 | |||||||||||

| Non-cash items: | ||||||||||||||||

| Depreciation | - | 193 | ||||||||||||||

| Unrealized gain on investment in warrants | (95,774 | ) | - | (44,653 | ) | (95,774 | ) | |||||||||

| Changes in non-cash working capital: | ||||||||||||||||

| Prepaid expenses | (3,103 | ) | 3,882 | 3,000 | (3,103 | ) | ||||||||||

| Accounts payable and royalty payments payable | (11,016 | ) | 19,494 | |||||||||||||

| Accounts payable and accrued liabilities | 51,602 | (11,016 | ) | |||||||||||||

| Due to shareholder | 68,011 | - | 12,000 | 68,011 | ||||||||||||

| (30,490 | ) | (121,725 | ) | (796 | ) | (30,490 | ) | |||||||||

| INVESTING ACTIVITIES | ||||||||||||||||

| Purchase of long-term investments | (23,850 | ) | - | - | (23,850 | ) | ||||||||||

| FINANCING ACTIVITIES | ||||||||||||||||

| Proceeds from private placement | 30,484 | - | - | 30,484 | ||||||||||||

| Proceeds from loans | - | 113,811 | ||||||||||||||

| 30,484 | 113,811 | |||||||||||||||

| Decrease in Cash | (23,856 | ) | (7,914 | ) | (796 | ) | (23,856 | ) | ||||||||

| Cash, Beginning of Period | 28,481 | 14,085 | 9,792 | 28,481 | ||||||||||||

| Cash, End of Period | $ | 4,625 | $ | 6,171 | $ | 8,996 | $ | 4,625 | ||||||||

| Non-Cash Transactions: | ||||||||||||||||

| Cashless stock options exercised | $ | 593,263 | $ | - | $ | - | $ | 593,263 | ||||||||

See accompanying notes to the condensed interim consolidated financial statements.

Blox, Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three Months Ended June 30, 20182019 and 20172018

(Unaudited – Expressed in U.S. Dollars)

| 1. | Description of Business |

Blox, Inc. (the “Company”) was incorporated on July 21, 2005 under the laws of the state of Nevada. The address of the Company is #708, 1155 West Pender Street, Vancouver, British Columbia, V6E 2P4, Canada.#1177 Avenue of Americas 5th Floor, New York, NY 10036.

The Company is primarily engaged in acquiringdeveloping mineral assetsexploration projects in Guinea, West Africa and applying green innovation to traditional mining methods and combining renewable energy and technology into the process.Africa.

| 2. | Basis of Presentation |

(a) Statement of Compliance

| (a) | Statement of Compliance |

These condensed interim consolidated financial statements are presented in accordance with generally accepted accounting principles in the United States (“US GAAP”) and the rules and regulations of the Securities and Exchange Commission (“SEC”) and are expressed in U.S. dollars. The Company’s fiscal year-end is March 31.

(b) Basis of Presentation

| (b) | Basis of Presentation |

The condensed interim consolidated financial statements of the Company comprise the Company and its subsidiaries. These condensed interim consolidated financial statements are prepared on the historical cost basis. These condensed interim consolidated interim financial statements have also been prepared using the accrual basis of accounting, except for cash flow information. In the opinion of management, all adjustments (including normal recurring ones), considered necessary for the fair statement of results have been included in these financial statements. All intercompany balances and transactions have been eliminated upon consolidation. The interim results are not necessarily indicative of results for the full year ending March 31, 2019,2020, or future operating periods. For further information, see the Company’s annual consolidated financial statements for the year ended March 31, 2018,2019, including the accounting policies and notes thereto.

(c) Reporting and Functional Currencies

| (c) | Reporting and Functional Currencies |

The functional currency of an entity is the currency of the primary economic environment in which the entity operates. The functional currency of the Company is the Canadian dollar (“CAD”). The Company’s reporting currency is the US dollar.

Transactions:

Monetary assets and liabilities denominated in foreign currencies are translated into functional currencies of the Company and its subsidiaries using period end foreign currency exchange rates and expenses are translated using the exchange rate approximating those in effect on the date of the transactions during the reporting periods in which the expenses were transacted. Non-monetary assets and liabilities are translated at their historical foreign currency exchange rates. Gains and losses resulting from foreign exchange transactions are included in the determination of net income or loss for the period.

Translations:

Foreign currency financial statements are translated into the Company’s reporting currency, the US dollar as follows:

| (i) | All of the assets and liabilities are translated at the rate of exchange in effect on the balance sheet date; |

| (ii) | Expenses are translated at the exchange rate approximating those in effect on the date of the transactions; and |

| (iii) | Exchange gains and losses arising from translation are included in other comprehensive income. |

6

Blox, Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three Months Ended June 30, 20182019 and 20172018

(Unaudited – Expressed in U.S. Dollars)

| 2. | Basis of Presentation(continued) |

(d) Significant Accounting Judgments and Estimates (continued)

| (d) | Significant Accounting Judgments and Estimates |

The preparation of these consolidated financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and reported amounts of expenses during the period. Actual outcomes could differ from these estimates. Revisions to accounting estimates are recognized in the period in which the estimate is revised and may affect both the period of revision and future periods.

In applying the Company’s accounting policies, management has made certain judgments that may have a significant effect on the consolidated financial statements. Such judgments include the determination of the functional currencies and use of the going concern assumption.

(i) Determination of Functional Currencies

| (i) | Determination of Functional Currencies |

In determining the Company’s functional currency, it periodically reviews its primary and secondary indicators to assess the primary economic environment in which the entity operates in determining the Company’s functional currencies. The Company analyzes the currency that mainly influences labor, material and other costs of providing goods or services which is often the currency in which such costs are denominated and settled. The Company also analyzes secondary indicators such as the currency in which funds from financing activities such as equity issuances are generated and the funding dependency of the parent company whose predominant transactional currency is the Canadian dollar. Determining the Company’s predominant economic environment requires significant judgment.

(ii) Going Concern

| (ii) | Going Concern |

These condensed interim consolidated financial statements have been prepared on a going concern basis, which implies the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has incurred a net incomeloss of $11,392$22,745 for the three months ended June 30, 20182019 and has incurred cumulative losses since inception of $10,843,035$22,492,273 as at June 30, 2018.2019.

These factors raise substantial doubt about the ability of the Company to continue as going concern. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary debt and/or equity financing to continue operations. These condensed interim consolidated financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern. Management of the Company has undertaken steps as part of a plan to sustain operations for the next fiscal year including plans to raise additional equity financing, controlling costs and reducing operating losses.

| 3. | Recent Accounting Pronouncements |

The Company has implemented all new accounting pronouncements that are in effect. These pronouncements did not have any material impact on the financial statements unless otherwise disclosed, and the Company does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

Blox, Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three Months Ended June 30, 20182019 and 20172018

(Unaudited – Expressed in U.S. Dollars)

| 4. | Long Term Investments |

| Fair Value as at | ||||||||||||

| Number | June 30, 2018 | March 31, 2018 | ||||||||||

| FVTPL | ||||||||||||

| Share purchase warrants | 3,333,333 | $ | 118,907 | $ | 48,375 | |||||||

| 1,000,000 | 35,672 | - | ||||||||||

| 154,579 | 48,375 | |||||||||||

| Available-for-sale | ||||||||||||

| Common shares | 3,333,333 | 139,223 | 64,633 | |||||||||

| 1,000,000 | 41,767 | - | ||||||||||

| 180,990 | 64,633 | |||||||||||

| Total investment: | $ | 335,569 | $ | 113,008 | ||||||||

| Fair Value as at | ||||||||||

| Number | June 30, 2019 | March 31, 2019 | ||||||||

| FVTPL | ||||||||||

| Share purchase warrants | 3,333,333 | $ | 53,015 | $ | 19,046 | |||||

| 1,000,000 | 16,654 | 5,970 | ||||||||

| 69,669 | 25,016 | |||||||||

| Available-for-sale | ||||||||||

| Common shares | 3,333,333 | 127,350 | 74,830 | |||||||

| 1,000,000 | 38,205 | 22,449 | ||||||||

| 165,555 | 97,279 | |||||||||

| Total investment: | $ | 235,224 | $ | 122,295 | ||||||

On April 16, 2018, the Company participated in a private placement offering by its strategic partner, Ashanti Sankofa Inc (TSX.V- ASI), which shares the same management group and board of directors as the Company. The Company purchased 1,000,000 units at CAD$0.03 per unit for a total cost of $23,850 (CAD$30,000). Each unit consists of one common share and one transferable share purchase warrant with each warrant entitling the holder to acquire one additional common share at a price of CAD$0.05 for a period of 24 months from the closing of the private placement. On the date of issuance, the Company determined the fair value of the common share and warrants to be $13,420 and $10,430, respectively.

As at June 30, 2018,2019, the fair value of common shares was $180,990$165,555 which resulted in an unrealized gain of $102,937$68,276 that was recorded in other comprehensive income. In addition, the fair value of warrants was $154,579,$69,669, which resulted in an unrealized gaina loss of $95,774$44,653 that was recorded in net income.

The June 30, 20182019 fair value of the warrants was determined with the Black-Scholes option pricing model using the following assumptions: risk free interest rate of 1.92%1.69%, volatility of 200.6%125.3% – 127.7%, annual rate of dividend of 0%, and expected life of 20.75 years.

| 5. | Equipment |

| Machinery | Total | Machinery | Total | |||||||||||||

| Cost | ||||||||||||||||

| Balance at June 30 & March 31, 2018 | $ | 232,620 | $ | 232,620 | ||||||||||||

| Balance at June 30 & March 31, 2019 | $ | 232,620 | $ | 232,620 | ||||||||||||

| Accumulated Depreciation | ||||||||||||||||

| Balance at June 30 & March 31, 2018 | $ | 161,060 | $ | 161,060 | ||||||||||||

| Balance at June 30 & March 31, 2019 | $ | 161,060 | $ | 161,060 | ||||||||||||

| Carrying amounts | ||||||||||||||||

| As at June 30 & March 31, 2018 | $ | 71,560 | $ | 71,560 | ||||||||||||

| As at June 30 & March 31, 2019 | $ | 71,560 | $ | 71,560 | ||||||||||||

Machinery in the amount of $71,560 has not been placed into production and is not currently being depreciated.

Blox, Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three Months Ended June 30, 20182019 and 20172018

(Unaudited – Expressed in U.S. Dollars)

| 6. | Mineral Property Interest |

The Company entered into a Deed of Assignment and Assumption Agreement dated July 24, 2014 (the “Assumption Agreement”) among Joseph Boampong Memorial Institute Ltd. (“JBMIL”) and Equus Mining Ltd. (“EML”), Burey Gold Guinee sarl (“BGGs”) and Burey Gold Limited (“BGL”) and, collectively with EML and BGGs, (the “Vendors”), pursuant to which the Company agreed to assume JBMIL’s right to acquire a 78% beneficial interest in the Mansounia Concession (the “Property”) from the Vendors. The Company exercised that right and acquired a 78% beneficial interest in the Property.

The Property lies in the southwest margin of the Siguiri Basin, in the Kouroussa Prefecture, Kankan Region, in Guinea, West Africa and covers a surface area of 145 square kilometres. The Property is located approximately 80 kilometres west, by road, from the country’s third largest city, Kankan.

An exploration permit for the Property was granted by the Ministère des Mines et de la Géologie on August 20, 2013. As part of its due diligence, the Company obtained a legal opinion which confirmed that the license was in good standing at the time of acquisition. It is the Company’s intention to obtain an exploitation permit to allow the Company the right to mine and dispose of minerals for 15 years, with a possible 5-year extension. The Company has commenced work on the feasibility study required for obtaining this permit.

In consideration for the acquisition of the interest in the Property, the Company paid in cash $100,000 to BGL and $40,000 to EML and issued BGL and EML an aggregate of 6,514,350 shares of common stock of the Company (the “First Tranche Shares”), at a deemed price of $0.1765 per share, for an aggregate deemed value of $1,150,000. The First Tranche Shares were issued to BGL and EML in the proportions of 71.43% and 28.57%, respectively. For accounting purposes, the Company recorded the cash payment of $140,000, and $10,000 for an independent valuation of the Property. Additionally, $781,722 was capitalized to mineral property interests, being the fair value of the first tranche of shares. The fair value of the first tranche shares was based on the closing price of the Company’s shares on the OTCQB on July 24, 2014.

Within 14 days of commercial gold production being publicly declared from ore mined from the Property, the Company will issue BGL and EML a second tranche of shares of common stock of the Company (the “Second Tranche Shares”). The number of Second Tranche Shares to be issued shall be calculated by dividing $1,150,000 by the volume weighted average share price of the Company’s common stock over a 20-day period preceding the issuance date. The Second Tranche Shares shall be issued to BGL and EML in the proportions of 71.43% and 28.57%, respectively.

The Company submitted an application to Ministrere des Mines for mining permit on December 7, 2018. The mining exploration permit for the Company expired on April 30, 2019. On June 27, 2019, Ministere des Mines sent a letter to the Company to extend the mining exploration license for twelve months. Subsequent to this quarter, in July, the mining exploration license for the Company was renewed for twelve months on December 11, 2017, and the Company is now proceeding with the feasibility study phase.renewed.

Mansounia Property, West Africa | Mansounia Property, West Africa | |||||||

| Acquisition of mineral property interest | ||||||||

| Cash payment | $ | 150,000 | $ | 150,000 | ||||

| Issuance of 6,514,350 common shares | 781,722 | 781,722 | ||||||

| Balance, June 30 & March 31, 2018 | $ | 931,722 | ||||||

| Balance, June 30 & March 31, 2019 | $ | 931,722 | ||||||

During the three months ended June 30, 2018,2019, the Company spent $3,844$25,105 (2018 – $19,584)$3,844) on the property.

Blox, Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three Months Ended June 30, 20182019 and 20172018

(Unaudited – Expressed in U.S. Dollars)

| 7. | Common Stock |

(a)

| (a) | Private Placement |

Year ended March 31, 2019

On September 29, 2017, the Company entered into an agreement with Waratah Capital Ltd. (“Waratah”), a controlling shareholder, whereby Waratah and the Company agreed that in order to allow the Company to finalize its acquisition of Quivira Gold Ltd. pursuant to the Share Purchase Agreement dated June 22, 2013 among the Company, Quivira Gold Ltd. and Waratah (the “Quivira Agreement”), the Bridge Loan Agreement dated as of April 17, 2015, and amended on April 28, 2016 and November 1, 2016 between the Company and Waratah would be cancelled and the Company will utilize the loan proceeds advanced to close a private placement of $1,500,000 required to consummate the Company’s acquisition of Quivira Gold Ltd.

On April 24, 2018, the Company closed the private placement as part of the Quivira acquisition and issued 30,000,000 units at a price of $0.05 per unit for gross proceeds of $1,500,000. Each unit consists of one common share and one transferable share purchase warrant exercisable at a price of $0.05 per share for a term of five years.

(b) Three months ended June 30, 2019

There were no shares issued for the three months ended June 30, 2019.

| (b) | Warrants |

Year ended March 31, 2019

On April 24, 2018, the Company issued 30,000,000 share purchase warrants as part of the $1,500,000 private placement. The warrants expire five years from the date of issuance and are exercisable at $0.05 per share. The fair value of these warrants was determined with the Black-Scholes option pricing model using the following assumptions: risk free interest rate of 2.73%, volatility of 204.3%, annual rate of dividend of 0%, and expected life of 5 years.

Three months ended June 30, 2019

There were no warrants issued for the three months ended June 30, 2019.

The following table summarizes historical information about the Company’s warrants:

Number of Warrants | Weighted Average Exercise Price ($) | Weighted Average Life Remaining (Years) | ||||||||||

| Balance, March 31, 2018 | 88,000,000 | 0.05 | 0.70 | |||||||||

| Issued | 30,000,000 | 0.05 | 4.80 | |||||||||

| Balance, June 30, 2018 | 118,000,000 | 0.05 | 1.74 | |||||||||

| Number of Warrants | Weighted Average Exercise Price ($) | Weighted Average Life Remaining (Years) | ||||||||||

| Balance, March 31, 2019 | 117,543,750 | 0.05 | 1.72 | |||||||||

| Balance, June 30, 2019 | 117,543,750 | 0.05 | 1.49 | |||||||||

As at June 30, 2018,2019, the following warrants were outstanding and exercisable:

Number of Warrants | Exercise Price | Expiry Date | ||||||||

| 88,000,000 | $ | 0.05 | February 27, 2019 | |||||||

| 30,000,000 | $ | 0.05 | April 24, 2023 | |||||||

| Number of Warrants | Exercise Price | Expiry Date | ||||||

| 87,543,750 | $ | 0.05 | February 27, 2020 | |||||

| 30,000,000 | $ | 0.05 | April 24, 2023 | |||||

| 117,543,750 | ||||||||

Blox, Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three Months Ended June 30, 2019 and 2018

(Unaudited – Expressed in U.S. Dollars)

| 7. | Common Stock(continued) |

| (c) | Stock Options |

(c) Stock OptionsYear ended March 31, 2019

On June 26, 2018, 4,000,000 stock options were exercised via cashless exercise at a price of $0.01 per share, resulting in issuance of 3,754,600 common shares. The cash component, equivalent to $40,000, is calculated as 245,400 shares at $0.163, the closing market price of the Company on the date of issuance.

Three months ended June 30, 2019

There were no stock options granted for the three months ended June 30, 2019.

The following table summarizes historical information about the Company’s incentive stock options:

Number of options | Weighted Average Exercise Price ($) | Weighted Average Life Remaining (Years) | |||||||||

| Balance, March 31, 2018 | 7,650,000 | 0.12 | 3.20 | ||||||||

| Exercised | (4,000,000 | ) | 0.01 | 2.10 | |||||||

| Balance, June 30, 2018 | 3,650,000 | 0.25 | 4.00 | ||||||||

Blox, Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three Months Ended June 30, 2018 and 2017

(Unaudited – Expressed in U.S. Dollars)

(c) Stock Options (continued)

| Number of options | Weighted Average Exercise Price ($) | Weighted Average Life Remaining (Years) | ||||||||||

| Balance, March 31, 2019 | 2,150,000 | 0.23 | 2.80 | |||||||||

| Balance, June 30, 2019 | 2,150,000 | 0.23 | 2.50 | |||||||||

At June 30, 2018,2019, the following stock options were outstanding and exercisable:

Number of Options | Exercise Price | Weighted Average Remaining Life in Years | Expiry Date | |||||||||||

| 650,000 | $ | 0.15 | 1.1 | August 7, 2019 | ||||||||||

| 3,000,000 | $ | 0.27 | 4.6 | February 15, 2023 | ||||||||||

| Number of Options | Exercise Price | Weighted Average Remaining Life in Years | Expiry Date | |||||||||

| 650,000 | $ | 0.15 | 0.1 | August 7, 2019 | ||||||||

| 1,500,000 | $ | 0.27 | 3.6 | February 15, 2023 | ||||||||

| 2,150,000 | ||||||||||||

| 8. | Fair Value of Financial Instruments |

The following provides an analysis of financial instruments that are measured subsequent to initial recognition at fair value, grouped into Levels 1 to 3 based on the degree to which fair value is observable:

Level 1 – fair value measurements are those derived from quoted prices (unadjusted) in active markets for identical assets or liabilities;

Level 2 – fair value measurements are those derived from inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices); and

Level 3 – fair value measurements are those derived from valuation techniques that include inputs for the asset or liability that are not based on observable market data (unobservable inputs).

Level 2 and 3 financial instruments are measured using management’s best estimate of fair value, where the inputs into the determination of fair value require significant management judgment to estimation. Valuations based on unobservable inputs are highly subjective and require significant judgments. Changes in such judgments could have a material impact on fair value estimates. In addition, since estimates are as of a specific point in time, they are susceptible to material near-term changes. Changes in economic conditions may also dramatically affect the estimated fair values.

Blox, Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three Months Ended June 30, 2019 and 2018

(Unaudited – Expressed in U.S. Dollars)

| 8. | Fair Value of Financial Instruments(continued) |

The following table sets forth the Company’s financial assets measured at fair value by level within the fair value hierarchy:

| Level 1 | Level 2 | Level 3 | Total June 30, 2018 | Level 1 | Level 2 | Level 3 | Total June 30, 2019 | |||||||||||||||||||||||||

| Cash | $ | 4,625 | $ | - | $ | - | $ | 4,625 | $ | 8,996 | $ | - | $ | - | $ | 8,996 | ||||||||||||||||

| Long-term investment – Shares | 180,990 | - | - | 180,990 | 165,555 | - | - | 165,555 | ||||||||||||||||||||||||

| Long-term investment – Warrants | - | - | 154,579 | 154,579 | - | - | 69,669 | 69,669 | ||||||||||||||||||||||||

| Total | $ | 185,615 | $ | - | $ | 157,579 | $ | 340,194 | $ | 174,551 | $ | - | $ | 69,669 | $ | 244,220 | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total March 31, 2018 | |||||||||||||

| Cash | $ | 28,481 | $ | - | $ | - | $ | 28,481 | ||||||||

| Long-term investment – Shares | 64,633 | - | - | 64,633 | ||||||||||||

| Long-term investment – Warrants | - | - | 48,375 | 48,375 | ||||||||||||

| Total | $ | 93,114 | $ | - | $ | 48,375 | $ | 141,489 | ||||||||

Blox, Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three Months Ended June 30, 2018 and 2017

(Unaudited – Expressed in U.S. Dollars)

| Level 1 | Level 2 | Level 3 | Total March 31, 2019 | |||||||||||||

| Cash | $ | 9,792 | $ | - | $ | - | $ | 9,792 | ||||||||

| Long-term investment – Shares | 97,279 | - | - | 97,279 | ||||||||||||

| Long-term investment – Warrants | - | - | 25,016 | 25,016 | ||||||||||||

| Total | $ | 107,071 | $ | - | $ | 25,016 | $ | 132,087 | ||||||||

| 9. | Due to Shareholder |

During the three months ended June 30, 2018,2019, the Company received advances from Waratah Capital Ltd. (“Waratah”), a controlling shareholder of the Company, in the amount of $68,011.$12,000. As at June 30, 2018,2019, the Company was indebted to Waratah for $124,211$341,346 (March 31, 20182019 - $56,200)$329,346). The advances from shareholder are unsecured, non-interest bearing and have no fixed repayment terms.

| 10. | Commitments |

On June 22, 2013, the Company entered into a share purchase agreement with Waratah Capital Ltd. (“Waratah”) where the Company agreed to purchase all of Waratah’s right, title, and interest in the Quivira Gold (“Quivira”) shares, of which Waratah holds 100% of the outstanding shares. As consideration for the Quivira shares, the Company will issue to Waratah 60,000,000 shares of common stock and 60,000,000 warrants. Each warrant entitles the holder to purchase one additional common share at $0.05 for a period of five years from the closing date. Quivira, a subsidiary of Waratah Investments, owns and operates gold and diamond mining properties in Ghana.

The closing of the agreement is subject to the completion of due diligence and the completion of a private placement for $1,500,000 (Note 7(a)).$1,500,000. The private placement closed during the year ended March 31, 2019. As of the issuance date of these financial statements, the due diligence has not yet been completed.

| 11. | Related Party Transactions |

The Company’s related parties include its subsidiaries, key management personnel, controlling shareholders, and strategic partner. Transactions with related parties for goods and services are based on the exchange amount as agreed to by the related parties.

The Company incurred the following expenses with related parties during the three months ended June 30, 20182019 and 2017:2018:

| Three Months Ended June 30, | ||||||||

| 2018 | 2017 | |||||||

| Compensation – Directors | $ | 22,924 | $ | 29,715 | ||||

| Compensation – Former Director | - | 27,484 | ||||||

| Compensation – Officer | 7,744 | 4,640 | ||||||

| Compensation – Former Officer | 12,262 | 11,688 | ||||||

| $ | 42,930 | $ | 73,527 | |||||

During the three months ended June 30, 2018, $2,179 (2017 - $2,097) were paid for bookkeeping services to a company owned by a former officer of the Company.

As at June 30, 2018, the Company was indebted to its related parties for the amounts as below:

| June 30, 2018 | March 31, 2018 | |||||||

| Accounts payable and accrued liabilities | $ | 73,689 | $ | 57,014 | ||||

| Due to shareholder (Note 9) | 124,211 | 56,200 | ||||||

As at June 30, 2018, $73,689 (March 31, 2018 - $57,014) remains unpaid to directors and officers for consulting and professional fees. These amounts owing is unsecured, non-interest bearing and have no fixed repayment terms.

| Three Months Ended June 30, | ||||||||

| 2019 | 2018 | |||||||

| Compensation – Interim CEO | $ | 13,500 | $ | 6,935 | ||||

| Compensation – Former CEO | - | 15,989 | ||||||

| Compensation – CFO | 6,750 | 7,744 | ||||||

| Compensation – Former Officer | - | 12,262 | ||||||

| $ | 20,250 | $ | 42,930 | |||||

12

Blox, Inc.

Notes to Condensed Interim Consolidated Financial Statements

Three Months Ended June 30, 20182019 and 20172018

(Unaudited – Expressed in U.S. Dollars)

| 11. | Related Party Transactions(continued) |

As at June 30, 2019, the Company was indebted to its related parties for the amounts as below:

| June 30, 2019 | March 31, 2019 | |||||||

| Accounts payable and accrued liabilities | $ | 114,762 | $ | 93,104 | ||||

| Due to shareholder (Note 9) | 341,346 | 329,346 | ||||||

These amounts owing is unsecured, non-interest bearing and have no fixed repayment terms.

| 12. | Geographical Area Information |

| Canada | Africa | Total | ||||||||||

| June 30, 2018: | ||||||||||||

| Current assets | $ | 11,894 | $ | - | $ | 11,894 | ||||||

| Long term investments | 335,569 | - | 335,569 | |||||||||

| Equipment | - | 71,560 | 71,560 | |||||||||

| Mineral property interest | - | 931,722 | 931,722 | |||||||||

| Total assets | $ | 347,463 | $ | 1,003,282 | $ | 1,350,745 | ||||||

| Total liabilities | $ | 217,171 | $ | - | $ | 217,171 | ||||||

| March 31, 2018: | ||||||||||||

| Current assets | $ | 32,648 | $ | - | $ | 32,648 | ||||||

| Long term investments | 113,008 | - | 113,008 | |||||||||

| Equipment | - | 71,560 | 71,560 | |||||||||

| Mineral property interest | - | 931,722 | 931,722 | |||||||||

| Total assets | $ | 145,656 | $ | 1,003,282 | $ | 1,148,938 | ||||||

| Total liabilities | $ | 160,177 | $ | - | $ | 160,177 | ||||||

| Canada | Africa | Total | ||||||||||

| June 30, 2019: | ||||||||||||

| Current assets | $ | 9,751 | $ | 1,412 | $ | 11,163 | ||||||

| Long term investments | 235,224 | - | 235,224 | |||||||||

| Equipment | - | 71,560 | 71,560 | |||||||||

| Mineral property interest | - | 931,722 | 931,722 | |||||||||

| Total assets | $ | 244,975 | $ | 1,004,694 | $ | 1,249,669 | ||||||

| Total liabilities | $ | 540,704 | $ | 81,252 | $ | 621,956 | ||||||

| March 31, 2019: | ||||||||||||

| Current assets | $ | 13,367 | $ | 1,592 | $ | 14,959 | ||||||

| Long term investments | 122,295 | - | 122,295 | |||||||||

| Equipment | - | 71,560 | 71,560 | |||||||||

| Mineral property interest | - | 931,722 | 931,722 | |||||||||

| Total assets | $ | 135,662 | $ | 1,004,874 | $ | 1,140,536 | ||||||

| Total liabilities | $ | 509,401 | $ | 48,953 | $ | 558,354 | ||||||

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion should be read in conjunction with our financial statements and the related notes that appear elsewhere in this quarterly report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to such differences include those discussed below and elsewhere in this quarterly report on Form 10-Q.

Overview

We were incorporated in the State of Nevada on July 21, 2005, under the name “Nava Resources, Inc.” for the purpose of conducting mineral exploration activities. We were authorized to issue 400,000,000 shares of common stock, having a par value of $0.001 per share. On January 4, 2007, we obtained written consent from our shareholders to amend our Articles of Incorporation to change the par value of our common stock from $0.001 to $0.00001 per share, which change was effected on February 28, 2007. Effective July 30, 2013, we changed our name from “Nava Resources, Inc.” to “Blox, Inc.”.

Properties

Mansounia Property, Guinea, West Africa

On August 6, 2014, wethe Company announced that weit had entered into a Deed of Assignment and Assumption Agreement dated July 24, 2014 (the “Assumption Agreement”“Assumption Agreement”) with Joseph Boampong Memorial Institute Ltd. (“JBMIL”JBMIL”) and Equus Mining Ltd. (“EML”EML”), Burey Gold Guinee sarl (“BGGs”BGGs”) and Burey Gold Limited (“BGL”BGL”) and, collectively with EML and BGGs, (the “Vendors”“Vendors”), pursuant to which we agreed to assume JBMIL’s right to acquire a 78% beneficial interest in the Mansounia Concession (the “Mansounia Property”“Mansounia Property”) from the Vendors, which right was exercised.

The Mansounia Property lies in the southwest margin of the Siguiri Basin, in the Kouroussa Prefecture, Kankan Region, in Guinea, West Africa and covers a surface area of 145 square kilometres. The Mansounia Property is located approximately 80 kilometres west, by road, from the country’s third largest city, Kankan.

An exploration permit for the Mansounia Property was granted by the Ministère des Mines et de la Géologie on August 20, 2013. On October 25, 2016, an exploration permit extension was granted for a period of 12-months. The purpose of the extension was to provide time to complete the required feasibility study and environmental impact assessment that will be submitted to Ministre des Mines et de la Géologie and the La Ministre de l’Environnement, des Eaux et Forêts. Work has commenced on the feasibility study and a consultant has been engaged to commence the environmental impact assessment. It is our intention to obtain an exploitation permit, which would give us the exclusive right to mine and dispose of minerals for 15 years, with a possible five-year extension. In February 2017, our directors and management teams from Vancouver and Guinea met in Accra, Ghana, to further the process of advancing a project viability study for the Mansounia Property. The environmental impact assessment of the concession is in progress. Once completed, the results of these two studies will be presented to the Guinea Ministry of Mines and Geology and the Environmental Protection Agency in Guinea, with a view to advancing towards an exploitation license.

In consideration for the acquisition of the interest in the Mansounia Property, we paid approximately $100,000 to BGL and $40,000 to EML and on July 31, 2014, issued BGL and EML an aggregate of 6,514,350 shares of common stock of our company (the “First“First Tranche Shares”Shares”), at a deemed price of $0.1765 per share, for an aggregate deemed value of $1,150,000. The First Tranche Shares were issued to BGL and EML in the proportions of 71.43% and 28.57%, respectively. For accounting purposes, we recorded the cash payment of $150,000 plus $781,722 as the fair value of the First Tranche Shares in mineral interest. The fair value of the First Tranche Shares was based on the closing price of our shares on the OTCQB on July 24, 2014.

Within 14 days14-days of commercial gold production being publicly declared from ore mined from the Mansounia Property, we will issue BGL and EML a second tranche of shares of our common stock (the “Second“Second Tranche Shares”Shares”). The number of Second Tranche Shares to be issued shall be calculated by dividing $1,150,000 by the volume weighted average share price of our common stock over a 20-day period preceding the issuance date. The Second Tranche Shares shall be issued to BGL and EML in the proportions of 71.43% and 28.57%, respectively.

The Mansounia Gold Project lies in the southwest margin of the Siguiri Basin, in the Kouroussa Prefecture, Kankan Region, in Guinea, West Africa and covers a surface area of 145 square kilometres. The Mansounia Property is located approximately 60 kilometres west, by road, from the country’s third largest city, Kankan.

An exploration permit for the Mansounia Property was granted by the Ministère des Mines et de la Géologie on August 20, 2013. On December 17, 2017, an exploration permit extension was granted for a period of 12-months. The purpose of the extension was to provide time to complete the required feasibility study and environmental impact assessment to, National standards, that will be submitted to Ministre des Mines et de la Géologie and the La Ministre de l’Environnement, des Eaux et Forêts. Work is continuing on the feasibility study, the environmental impact assessment has been completed and we are in discussions with appropriate consultants to commence the community development plan and other remaining documentation. In July 2017, we announced the completion of field activities associated with a detailed Environmental and Social Impact Assessment (ESIA), which concludes a significant stage toward obtaining a Mining License for the Mansounia Gold Project in Guinea.

It is our intention to obtain a Mining License, which would give us the exclusive right to mine and dispose of minerals for 15-years, with a possible five-year extension. The Company submitted an application to Ministere des Mines for Mining License on December 7, 2018. On June 13, 2019, the Company made a presentation of a feasibility study to the National Commission as part of the process of obtaining the Mining License. The Company is moving on the next step of fulfilling the government’s recommendations on the feasibility study. In July 2019, the Company renewed the exploration permit for 12 months.

The ESIA document is used to communicate and discuss details of the project to all stakeholders, including government departments, environmental and other regulators, local communities as well as current and prospective shareholders. Apart from assessing the project’s environmental impact, the document also covers risk mitigation and potential benefits to local residents. The ESIA is the beginning of an ongoing process of involvement on all social and environmental fronts.

We engaged the internationally credentialed SAMEC (Security Africa Mining and Environmental Consulting) based in Conakry, to undertake the field-associated aspects of the ESIA program, which included - but was not limited to - addressing the following aspects:program.

Based on the highly encouraging results obtained from historical soils geochemical programs and in-line with recent desktop and field studies undertaken by Spiers Geological Consultants (SGC 2016), a number of key target areas were identified for follow-up field activities. Our understanding of the deposit and surrounding areas continues to grow with each field season, and, to date, robust geological and structural context for the area/s havehas been developed using modelling software. The model iswas based on and continually refined, using the pre-existing regional geochemical soil and rock chip sampling and drill-hole data from the Mansounia Property area. Further funding is required to explore these new target areas, which is now a priority for management.

We retained theWest African consulting group, Scott-Taylor Ltd., was retained to undertake a thorough site visit as part of the process of further examining the economic potential of the Mansounia Property. Scott-Taylor Ltd. undertook a field visit to the Mansounia Property to focus on areas where significant outcrops exist, in addition to the verification of collar locations for selected previously drilled RC and Diamond holes.

The deep weathering and extensive lateritic cover hashave resulted in limited outcrop of Birimian lithologies within the project area. Reconnaissance mapping located outcrops of weathered brecciated granitoid, volcano sedimentary and metasedimentary lithologies. A number of outcrops with extensive quartz veining were identified, particularly within the brecciated granitoid and were sampled.

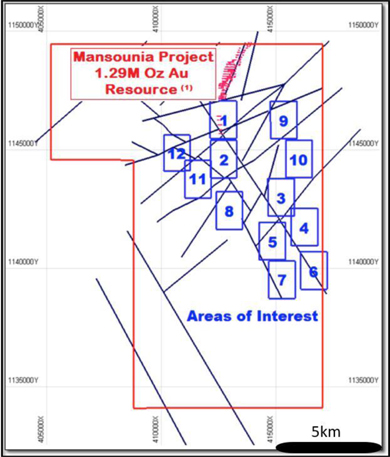

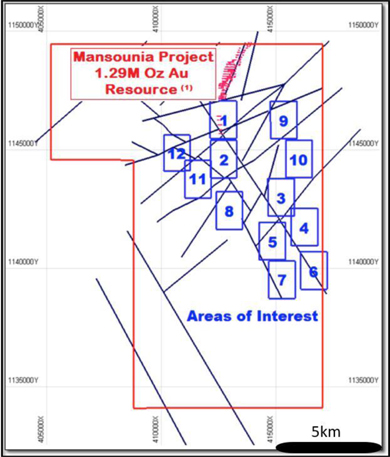

Previous structural analysis has identified a number of target areas for further exploration. The rock chip samples reported in this new release are located with target area 5, as shown below.

Mansounia Project: Current target areas.

In total, 15 samples were collected for assays during the field visit. Four samples returned gold grades from 0.49g/t to 3.04g/t are shown below.

| Sample ID | Eastings | Northing | RL | Au (ppm) 1 | Au (ppm) 2 | |||||

| Man002 | 415153 | 1141509 | 424 | 1.03 | 0.92 | |||||

| Man003 | 415155 | 1141509 | 424 | 3.08 | 3.00 | |||||

| Man007 | 415172 | 1141545 | 441 | 0.49 | 0.48 | |||||

| Man012 | 415103 | 1141596 | 419 | 1.04 | 1.02 |

The most encouraging aspect of the assay results from the outcrop samples is the fact that these samples are located approximately five kilometers south of the Mansounia resource area and indicate that gold mineralization occurs to the south of the currently identified Mansounia deposit. These outcrop sampling assays arewere very encouraging and warrantwarranted further exploration to unlock the full potential of the Mansounia license area.

A program to commence auger drilling and regolith mapping proximal to the currently drilled Mansounia resource, including the area where the rock chip samples were collected, was in the process of being carried out at the time this report was being compiled. No results are available at this time. In the event of positive results from the As a result, an auger drilling program itwas designed and implemented with the assistance of Sahara Natural Resources. The new drilling target was defined after an extensive database compilation and exploration targeting exercise undertaken by Sahara Natural Resources on the historical data held by Blox in the region. Sahara is anticipated that RCthe largest exploration services group in West Africa with 200 geoscientists operating between Burkina Faso, Ghana, Cote D’Ivoire, Mali, Senegal, Mauritania and Aircore drilling will then be carried out to follow up any identified geochemical anomalies identified by the auger drilling program.Guinea.

On July 6, 2018, the Company announced that a new drilling target hashad been defined by a 2.5km long Gold in Soil anomaly, defined by Sahara, at the Mansounia Gold Project. This area formed part of a thorough auger drilling and regolith mapping program designed to aid in the delineation of potential mineralization 5km south-east of the current existing resource. Field activities also included trenching and pitting across the area of anomalous soil and outcrop samples. Some extensional auger drilling to the south west of the existing resource was also conducted. As Blox is currently moving towards a mining license at the Mansounia Gold Project, (see Exhibit)the auger drilling was also intended to sterilise a portion of the concession for feasibility work.

On October 26, 2018, Blox announced that 2500-meters of auger drilling had been completed. The results identified five new gold targets, including doubling the previous gold-in-soil strike from 2.5km to 5km (identified as Target C in Figure 1 below). In addition, the existing Mansounia resource was extended by up to 1km. Results from across the northern and eastern portions of the concession returned highly anomalous results of up to 1526ppb gold.

The Mansounia South target has never had modern drilling completed. The 5km anomaly remains untested and open to the north and south. Blox will continue to explore the strike extensions with auger drilling to refine targets to enable resource drilling to follow up. Extensional soil and auger drilling completed to the south west of the existing 1.29-million ounce resource identified highly anomalous gold contiguous with current drilling. The targets A, B, C, D and E in Figure 1 have never been drilled. Target A is an extension to the current resource and is open to the south. Targets B, C, D and E are open to the north and south. Additional auger drilling will be completed in the hope of further extending these targets.

Figure 1. Mansounia Gold Project – Strike extension of the newly identified Mansounia Gold-in-Soil anomaly planned auger drilling program, auger anomaly occurrences and historical drill collars.

In total, 184 auger drill samples were taken from the planned 400-hole program. The laterite cap was in excess of 10m deep in most drill locations, instead of the 5m cover anticipated. As a result, it was not possible to complete all 400 planned holes before the onset of the wet season made further drilling impossible. Despite the slightly truncated program, positive drill results were returned from every line drilled. Blox will consider extensional resource drilling at targets A and B below following the closure of the West African wet season.

Management is excited about the new drill targets identified and the extensions of the drill ready targets unveiled by the auger drilling. Anomalies were revealed in every drill line commenced, which is a very positive sign. These results have given Blox confidence to move forward with its plans to raise capital to complete the current auger program and then plan high quality resource extensional drilling. The Company is also well advanced towards the submission of its Mining License application for the Mansounia Gold Project.

Pramkese, Osenase and Asamankese, Ghana, West Africa

On June 22, 2013, we entered into a share purchase agreement with Waratah Investments Limited (“Waratah”) whereby we agreed purchase all of Waratah’s right, title, and interest in the Quivira Gold (“Quivira”) shares, of which Waratah holds 100% of the outstanding shares. As consideration for the Quivira shares, we agreed to issue to Waratah 60,000,000 shares of common stock and 60,000,000 warrants. Each warrant entitles the holder to purchase one additional common share at $0.05 for a period of five years from the closing date. Quivira, a subsidiary of Waratah, owns and operates gold and diamond mining properties in Ghana.

The closing of the agreement iswas subject to the completion of a private placement financing of up to $1,500,000, consistingUS$1,500,000, which private placement was completed in April 2018. We issued 30,000,000 units (the “Units”) at a price of units priced at $0.05US$0.05 per unit with each unitfor aggregate gross proceeds of US$1,500,000. US$1,100,000 of the proceeds were advanced as non-interest bearing loans since 2014 and were utilized to be comprisedcover general and administrative expenses, as well as to carry out exploration work on our mineral properties. The remaining balance of US$400,000 was received by April 2018. Each Unit consists of one common share and one share purchase warrant exercisableentitling the holder thereof to purchase one additional common share at a price of $0.05 per share for a term of five years. years from the date of issuance.

Closing the Agreement is also conditional upon receiving legal opinions of Ghana counsel confirming various matters relating to the laws of Ghana, including corporate and title opinions; the Company receiving legal opinions of Australian counsel confirming various matters relating to the laws of Australia, including corporate and title opinions; completion of certain ongoing transactions by Quivira relating to the transfer of title to certain assets and to an assignment of debt; and preparation of U.S. GAAP consolidated financial statements for Quivira.

Field work on the three Birim region concessions has been ongoing to maintain compliance while the Company’s prime focus is on the Mansounia Gold Project.

Our directors conducted their first visit to Ghana in August 2015, when they visited the Birim Region where the three Ghanaian concessions are located. The objective was to carry out a geological reconnaissance over the areas to identify potentially favourable lithologies. The directors inspected the existing field programs in Ghana and oversaw the planning and implementation of programs for the near future.

Going Concern

Our financial statements are prepared using generally accepted accounting principles in the United States of America applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. We have not yet established an ongoing source of revenues sufficient to cover our operating costs and to allow us to continue as a going concern. We have incurred a net incomeloss of $11,392$22,745 for the three months ended June 30, 2018,2019, and have incurred cumulative losses since inception of $10,843,035.$22,492,273. These factors raise substantial doubt about the ability of the Company to continue as going concern. Our ability to continue as a going concern is dependent on our ability to continue obtaining adequate capital to fund operating losses until we become profitable. If we are unable to obtain adequate capital, we could be forced to significantly curtail or cease operations.

We will need to raise additional funds to finance continuing operations. However, there are no assurances that we will be successful in raising additional funds. Without sufficient additional financing, it would be unlikely for us to continue as a going concern. Our ability to continue as a going concern is dependent upon our ability to successfully accomplish the plans described in this quarterly report and eventually secure other sources of financing and attain profitable operations.

Results of Operations

Three Months Ended June 30, 20182019 and 20172018

The following summary of our results of operations should be read in conjunction with our unaudited consolidated interim financial statements for the three months ended June 30, 20182019 and 2017,2018, which are included herein.

Expenses

| Three Months Ended June 30, | ||||||||

| 2019 $ | 2018 $ | |||||||

| Consulting and professional fees | 34,505 | 61,104 | ||||||

| Exploration expenses | 25,105 | 3,844 | ||||||

| Foreign exchange | 1,777 | 1,237 | ||||||

| Office and administration | 5,748 | 9,392 | ||||||

| Travel expenses | 263 | 8,852 | ||||||

| Operating Expenses | (67,398 | ) | (84,429 | ) | ||||

| Unrealized gain on investment in warrants | 44,653 | 95,774 | ||||||

| Interest income | - | 47 | ||||||

| Net (loss) income | (22,745 | ) | 11,392 | |||||

| Other Comprehensive Income | ||||||||

| Unrealized gain on investment in common shares | 68,276 | 102,937 | ||||||

| Comprehensive Income for the Period | 45,531 | 114,329 | ||||||

The expensesnet loss for the three months ended June 30, 2019 (“Q1 2020) were $22,745 as follows:

| Three Months Ended June 30 | ||||||||

| 2018 $ | 2017 $ | |||||||

| Consulting and professional fees | 61,104 | 91,062 | ||||||

| Depreciation | - | 193 | ||||||

| Exploration expenses (Note 5) | 3,844 | 19,584 | ||||||

| Foreign exchange | 1,237 | 21,654 | ||||||

| Office and administration (Note 11) | 9,392 | 10,490 | ||||||

| Travel expenses | 8,852 | 2,311 | ||||||

| Operating Expenses | (84,429 | ) | (145,294 | ) | ||||

| Unrealized gain on investment in warrants | 95,774 | - | ||||||

| Interest income | 47 | - | ||||||

| Net income (loss) | 11,392 | (145,294 | ) | |||||

We incurred acompared to the net income of $11,392 for the three months ended June 30, 2018 (“Q1 2019”),2019) of $11,392. Operating expenses for the Q1 2020 are totaled $67,398 compared to the Q1 2019 of $84,429, a decrease of $17,031. Some of the more items contributing to the net loss of $145,294, inand comprehensive loss for the same period in June 30, 2017 (“Q1 2018”). Overall, the operating cost in2020 and Q1 2019 is much lower than Q1 2018. In Q1 2019, an unrealized gain of $95,774 incurred is primarily due to holding the investment in ASI’s warrants. The following is a breakdown of the operating expenses during Q1 2019, compared to Q1 2018: consulting and professional fees decreased from $91,062 in Q1 2018 to $61,104 in Q1 2019; office and administration expenses decreased slight from $10,490 in Q1 2018 to $9,392 in Q1 2019; foreign exchange decreased from $21,654 from Q1 2018 to $1,237 in Q1 2019; travel costs were increased from $2,311 in Q1 2018 to $8,852 in Q1 2019; and the explorations costs decreased from $19,584 for Q1 2018 to $3,844 in Q1 2019 due to slight decreased activity on the Mansounia Property.as follows:

| ● | Exploration expenses of $25,105 (June 30, 2018 - $3,844). The exploration increased significantly when compared to the cost in Q1 2019. In Q1 2020, the Company has hired more geological consultants to work on feasibility towards obtaining the mining license. |

| ● | Consulting and professional fees of $34,505 (June 30, 2018 - $61,104). The decrease is result of cutting back the management fees in the current quarter. |

| ● | Office and administration costs of $5,748 (June 30, 2018: $9,392). The decrease is a result of cutting back the operating cost in the current quarter. |

| ● | Gain on the investment in warrants of $44,653 (June 30, 2018: $95,774). The decrease is due to holding the investment in Ashanti Sankofa Inc’s (TSX.V-ASI)’ warrants. The fair value of warrants of ASI decreased during the current quarter. |

| ● | Unrealized gain on the investment in common shares of $68,276 (June 30, 2018: $102,937). The unrealized gain in the current year is due to holding the investment in Ashanti Sankofa Inc’s (TSX.V-ASI)’ common shares. The market value of ASI’s common shares increased for the current year. |

Management anticipates operating expenses will materially increase in future periods as we focus on green mineral development and incur increased costs as a result of being a public company with a class of securities registered under theSecurities Exchange Act of 1934.

Liquidity and Capital Resources

Working Capital

| Continuing Operations | June 30, 2018 | March 31, 2018 | June 30, 2019 | March 31, 2019 | ||||||||||||

| Current Assets | $ | 11,894 | $ | 32,648 | $ | 11,163 | $ | 14,959 | ||||||||

| Current Liabilities | 217,171 | 160,177 | 621,956 | 558,354 | ||||||||||||

| Working Capital Deficit | $ | (205,277 | ) | $ | (127,529 | ) | $ | (610,793 | ) | $ | (543,395 | ) | ||||

Current Assets

The nominal decrease in current assets as of June 30, 20182019 compared to March 31, 20182019 was primarily due to a decrease in cash from $28,481$9,792 to $4,625.$8,996.

Current Liabilities

Current liabilities as at June 30, 20182019 increased by $56,994$63,602 since March 31, 2018,2019, primarily due to additional expenses being incurred during the current quarter.

Cash Flow

Our cash flow was as follows:

| Three months Ended June 30 | Three months Ended June 30, | |||||||||||||||

| 2018 $ | 2017 $ | 2019 $ | 2018 $ | |||||||||||||

| Net cash used in operating activities | (30,490 | ) | (121,725 | ) | (796 | ) | (30,490 | ) | ||||||||

| Net cash used in investing activities | (23,850 | ) | - | - | (23,850 | ) | ||||||||||

| Net cash provided by financing activities | 30,484 | 113,811 | - | 30,484 | ||||||||||||

| Increase (decrease) in cash and cash equivalents | (23,856 | ) | (7,914 | ) | ||||||||||||

| Decrease in cash and cash equivalents | (796 | ) | (23,856 | ) | ||||||||||||

Operating activities

The decrease in net cash used in operating activities for the three months ended June 30, 2018,2019, compared to the same period in 20172018 was primarily as a result of decreased operating activities on the Mansounia property in the current quarter.

Investing activities

The increase in investing activities forFor the three months ended June 30, 2018 as the Company participated in Ashanti Sankofa Inc (TSX.V-ASI)’s private placement in April. There were no investing activities incurred for the three months ended June 30, 2019, compared to the same period in 2019.

Financing activities

There is a decrease net cash provided bywere no financing activities incurred for the three months ended June 30, 2018,2019, compared to the same period in 2017.2019.

Critical Accounting Policies

There have been no significant changes to the critical accounting policies as described in our Annual Form 10-K for the year ended March 31, 2018.2019.

Cash Requirements

Our current cash position is not sufficient to meet our present and near-term cash needs. We will require additional cash resources, including the sale of equity or debt securities, to meet our planned capital expenditures and working capital requirements. For the next 12 months we estimate that our capital needs will be $250,000$300,000 to $500,000 and we currently have approximately $4,600$9,000 in cash. We will seek to sell additional equity or debt securities or obtain additional credit facilities. The sale of additional equity securities will result in dilution to our stockholders. The incurrence of indebtedness will result in increased debt service obligations and could require us to agree to operating and financial covenants that could restrict our operations or modify our plans to grow the business. Financing may not be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us, or at all, will limit our ability to expand our business operations and could harm our overall business prospects.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to our stockholders.

Contractual Obligations

Not applicable.

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk |

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

| Item4. | Controls and Procedures |

Evaluation of Disclosure Controls and Procedures

We maintain “disclosure controls and procedures,” as such term is defined in Rule 13a-15(e) under the Securities Exchange Act of 1934 (the “Exchange Act”), that are designed to ensure that information required to be disclosed in our Exchange Act reports is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission rules and forms, and that such information is accumulated and communicated to our management, including our Principal Executive Officer and Principal Financial Officer, as appropriate, to allow timely decisions regarding required disclosure. We conducted an evaluation under the supervision and with the participation of our Principal Executive Officer and Principal Financial Officer, of the effectiveness of the design and operation of our disclosure controls and procedures as of the end of the period covered by this report pursuant to Rule 13a-15 of the Exchange Act. Based on this Evaluation, our Principal Executive Officer and Principal Financial Officer concluded that our Disclosure Controls were effective as of the end of the period covered by this report.

Changes in Internal Control Over Financial Reporting

There were no changes in our internal controls that occurred during the quarter covered by this report that have materially affected, or are reasonably likely to materially affect our internal controls.

| Item 1. | Legal Proceedings |

We are not a party to any pending legal proceeding. Management is not aware of any threatened litigation, claims or assessments.

| Item 1A. | Risk Factors |

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds |

Year ended March 31, 2019

On September 29, 2017, the Company entered into an agreement with Waratah Capital Ltd. (“Waratah”), a controlling shareholder, whereby Waratah and the Company agreed that in order to allow the Company to finalize its acquisition of Quivira Gold Ltd. pursuant to the Share Purchase Agreement dated June 22, 2013 among the Company, Quivira Gold Ltd. and Waratah (the “Quivira Agreement”), the Bridge Loan Agreement dated as of April 17, 2015, and amended on April 28, 2016 and November 1, 2016 between the Company and Waratah would be cancelled and the Company will utilize the loan proceeds advanced to close a private placement of $1,500,000 required to consummate the Company’s acquisition of Quivira Gold Ltd.

On April 24, 2018, the Company closed the private placement as part of the Quivira acquisition and issued 30,000,000 units at a price of $0.05 per unit for gross proceeds of $1,500,000. Each unit consists of one common share and one transferable share purchase warrant exercisable at a price of $0.05 per share for a term of five years.

The above securities were issued to non-US persons (as that term is defined in Regulation S of the Securities Act of 1933), in offshore transactions relying on Regulation S of the Securities Act of 1933, as amended.

Three months ended June 30, 2019

No unregistered sales of equity securities incurred.

| Item 3. | Defaults Upon Senior Securities |

None.

| Item 4. | Mine Safety Disclosure |

Not applicable.

| Item 5. | Other Information |

On June 26, 21018, Donna Moroney resigned as the Corporate Secretary of the Company.

On July 13, 2018, Trevor Pickett29, 2019, Ronald Renee was appointed as the Chief Executive Officer of the Company on a permanent basis from his current interim position.

On the same date, Kevin Thomson was resigned as a technical Director of the Company.

** XBRL (Extensible Business Reporting Language) information is furnished and not filed or a part of a registration statement or prospectus for purposes of Sections 11 or 12 of theSecurities Act of 1933, as amended, is deemed not filed for purposes of Section 18 of theSecurities Exchange Act of 1934, as amended, and otherwise is not subject to liability under these sections.

Pursuant to the requirements of Section 13 or 15(d) of theSecurities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

BLOX INC.

24 | ||||||||||||||||||||||||||