UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-Q

|

| |

| þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2016March 31, 2017

OR

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from_____________to___________

Commission File Number 333-199861

MYLAN N.V.

(Exact name of registrant as specified in its charter)

|

| | |

| The Netherlands | | 98-1189497 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

Building 4, Trident Place, Mosquito Way, Hatfield, Hertfordshire, AL10 9UL, England

(Address of principal executive offices)

+44 (0) 1707-853-000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”filer,” “smaller reporting company,” and “smaller reporting“emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

| Large accelerated filer | | þ | | Accelerated filer | | ¨ |

| | | | | | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

| | | | | | |

| | | | Emerging growth company | | ¨ |

| | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to us the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

As of NovemberMay 4, 2016,2017, there were 535,105,253535,950,491 of the issuer’s €0.01 nominal value ordinary shares outstanding.

MYLAN N.V. AND SUBSIDIARIES

INDEX TO FORM 10-Q

For the Quarterly Period Ended

September 30, 2016March 31, 2017

|

| | |

| | Page |

| | PART I — FINANCIAL INFORMATION | |

| ITEM 1. | Condensed Consolidated Financial Statements (unaudited) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| ITEM 2. | | |

| | | |

| ITEM 3. | | |

| | | |

| ITEM 4. | | |

| | | |

| | PART II — OTHER INFORMATION | |

| ITEM 1. | | |

| | | |

| ITEM 1A. | | |

| | | |

| ITEM 6. | | |

| | | |

| | |

PART I — FINANCIAL INFORMATION

MYLAN N.V. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

(Unaudited; in millions, except per share amounts)

| | | | Three Months Ended | | Nine Months Ended | Three Months Ended |

| | September 30, | | September 30, | March 31, |

| | 2016 | | 2015 | | 2016 | | 2015 | 2017 | | 2016 |

| Revenues: | | | | | | | | | | |

| Net sales | $ | 3,029.5 |

| | $ | 2,676.2 |

| | $ | 7,745.5 |

| | $ | 6,887.8 |

| $ | 2,687.4 |

| | $ | 2,176.1 |

|

| Other revenues | 27.6 |

| | 19.0 |

| | 63.6 |

| | 50.8 |

| 32.1 |

| | 15.2 |

|

| Total revenues | 3,057.1 |

| | 2,695.2 |

| | 7,809.1 |

| | 6,938.6 |

| 2,719.5 |

| | 2,191.3 |

|

| Cost of sales | 1,773.8 |

| | 1,379.9 |

| | 4,447.1 |

| | 3,785.1 |

| 1,634.5 |

| | 1,284.3 |

|

| Gross profit | 1,283.3 |

| | 1,315.3 |

| | 3,362.0 |

| | 3,153.5 |

| 1,085.0 |

| | 907.0 |

|

| Operating expenses: | | | | | | | | | | |

| Research and development | 199.1 |

| | 174.8 |

| | 632.2 |

| | 512.9 |

| 217.5 |

| | 253.6 |

|

| Selling, general and administrative | 656.9 |

| | 537.1 |

| | 1,787.6 |

| | 1,584.5 |

| 631.3 |

| | 549.3 |

|

| Litigation settlements and other contingencies, net | 558.0 |

| | 2.3 |

| | 556.4 |

| | 19.1 |

| 9.0 |

| | (1.5 | ) |

| Total operating expenses | 1,414.0 |

| | 714.2 |

| | 2,976.2 |

| | 2,116.5 |

| 857.8 |

| | 801.4 |

|

| (Loss) earnings from operations | (130.7 | ) | | 601.1 |

| | 385.8 |

| | 1,037.0 |

| |

| Earnings from operations | | 227.2 |

| | 105.6 |

|

| Interest expense | 144.4 |

| | 95.1 |

| | 305.0 |

| | 268.5 |

| 138.2 |

| | 70.3 |

|

| Other expense, net | 50.2 |

| | 50.9 |

| | 184.0 |

| | 71.4 |

| 17.4 |

| | 16.3 |

|

| (Loss) earnings before income taxes and noncontrolling interest | (325.3 | ) | | 455.1 |

| | (103.2 | ) | | 697.1 |

| |

| Income tax (benefit) provision | (205.5 | ) | | 26.5 |

| | (165.7 | ) | | 44.0 |

| |

| Net (loss) earnings | (119.8 | ) | | 428.6 |

| | 62.5 |

| | 653.1 |

| |

| Net earnings attributable to the noncontrolling interest | — |

| | — |

| | — |

| | (0.1 | ) | |

| Net (loss) earnings attributable to Mylan N.V. ordinary shareholders | $ | (119.8 | ) | | $ | 428.6 |

| | $ | 62.5 |

| | $ | 653.0 |

| |

| (Loss) earnings per ordinary share attributable to Mylan N.V. ordinary shareholders: | | | | | | | | |

| Earnings before income taxes | | 71.6 |

| | 19.0 |

|

| Income tax provision | | 5.2 |

| | 5.1 |

|

| Net earnings | | $ | 66.4 |

| | $ | 13.9 |

|

| Earnings per ordinary share: | | | | |

| Basic | $ | (0.23 | ) | | $ | 0.87 |

| | $ | 0.12 |

| | $ | 1.40 |

| $ | 0.12 |

| | $ | 0.03 |

|

| Diluted | $ | (0.23 | ) | | $ | 0.83 |

| | $ | 0.12 |

| | $ | 1.32 |

| $ | 0.12 |

| | $ | 0.03 |

|

| Weighted average ordinary shares outstanding: | | | | | | | | | | |

| Basic | 523.6 |

| | 490.5 |

| | 505.9 |

| | 466.2 |

| 534.5 |

| | 489.8 |

|

| Diluted | 523.6 |

| | 514.0 |

| | 515.2 |

| | 493.2 |

| 536.9 |

| | 509.6 |

|

See Notes to Condensed Consolidated Financial Statements

3

MYLAN N.V. AND SUBSIDIARIES

Condensed Consolidated Statements of Comprehensive Earnings

(Unaudited; in millions)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | 2016 | | 2015 | | 2016 | | 2015 |

| | | | | | | | |

| Net (loss) earnings | $ | (119.8 | ) | | $ | 428.6 |

| | $ | 62.5 |

| | $ | 653.1 |

|

| Other comprehensive earnings (loss), before tax: | | | | | | | |

| Foreign currency translation adjustment | 290.6 |

| | (148.4 | ) | | 645.5 |

| | (526.7 | ) |

| Change in unrecognized gain (loss) and prior service cost related to defined benefit plans | 0.1 |

| | — |

| | (0.3 | ) | | 3.9 |

|

| Net unrecognized gain (loss) on derivatives in cash flow hedging relationships | 22.8 |

| | (84.2 | ) | | (22.9 | ) | | (67.4 | ) |

| Net unrecognized loss on derivatives in net investment hedging relationships | (10.4 | ) | | — |

| | (10.4 | ) | | — |

|

| Net unrealized gain (loss) on marketable securities | 21.5 |

| | (0.2 | ) | | 32.5 |

| | (0.4 | ) |

| Other comprehensive earnings (loss), before tax | 324.6 |

| | (232.8 | ) | | 644.4 |

| | (590.6 | ) |

| Income tax provision (benefit) | 13.7 |

| | (30.8 | ) | | 0.5 |

| | (24.0 | ) |

| Other comprehensive earnings (loss), net of tax | 310.9 |

| | (202.0 | ) | | 643.9 |

| | (566.6 | ) |

| Comprehensive earnings | 191.1 |

| | 226.6 |

| | 706.4 |

| | 86.5 |

|

| Comprehensive earnings attributable to the noncontrolling interest | — |

| | — |

| | — |

| | (0.1 | ) |

| Comprehensive earnings attributable to Mylan N.V. ordinary shareholders | $ | 191.1 |

| | $ | 226.6 |

| | $ | 706.4 |

| | $ | 86.4 |

|

|

| | | | | | | |

| | Three Months Ended |

| | March 31, |

| | 2017 | | 2016 |

| Net earnings | $ | 66.4 |

| | $ | 13.9 |

|

| Other comprehensive earnings (loss), before tax: | | | |

| Foreign currency translation adjustment | 434.2 |

| | 502.0 |

|

| Change in unrecognized loss and prior service cost related to defined benefit plans | — |

| | (0.3 | ) |

| Net unrecognized gain (loss) on derivatives in cash flow hedging relationships | 32.4 |

| | (49.1 | ) |

| Net unrecognized loss on derivatives in net investment hedging relationships | (9.9 | ) | | — |

|

| Net unrealized gain on marketable securities | 7.7 |

| | 4.4 |

|

| Other comprehensive earnings, before tax | 464.4 |

| | 457.0 |

|

| Income tax provision (benefit) | 13.7 |

| | (16.8 | ) |

| Other comprehensive earnings, net of tax | 450.7 |

| | 473.8 |

|

| Comprehensive earnings | $ | 517.1 |

| | $ | 487.7 |

|

See Notes to Condensed Consolidated Financial Statements

4

MYLAN N.V. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(Unaudited; in millions, except share and per share amounts)

| | | | September 30,

2016 | | December 31,

2015 | March 31,

2017 | | December 31,

2016 |

ASSETS | | Assets | | | | | | |

| Current assets: | | | | | | |

| Cash and cash equivalents | $ | 1,256.6 |

| | $ | 1,236.0 |

| $ | 723.8 |

| | $ | 998.8 |

|

| Accounts receivable, net | 3,098.9 |

| | 2,689.1 |

| 2,872.0 |

| | 3,310.9 |

|

| Inventories | 2,687.5 |

| | 1,951.0 |

| 2,547.8 |

| | 2,456.4 |

|

| Prepaid expenses and other current assets | 922.1 |

| | 596.6 |

| 921.9 |

| | 756.4 |

|

| Total current assets | 7,965.1 |

| | 6,472.7 |

| 7,065.5 |

| | 7,522.5 |

|

| Property, plant and equipment, net | 2,284.2 |

| | 1,983.9 |

| 2,338.0 |

| | 2,322.2 |

|

| Intangible assets, net | 15,613.4 |

| | 7,221.9 |

| 14,370.0 |

| | 14,447.8 |

|

| Goodwill | 9,633.1 |

| | 5,380.1 |

| 9,394.1 |

| | 9,231.9 |

|

| Deferred income tax benefit | 441.8 |

| | 457.6 |

| 564.0 |

| | 633.2 |

|

| Other assets | 600.9 |

| | 751.5 |

| 541.0 |

| | 568.6 |

|

| Total assets | $ | 36,538.5 |

| | $ | 22,267.7 |

| $ | 34,272.6 |

| | $ | 34,726.2 |

|

| | | | | | | |

LIABILITIES AND EQUITY | | Liabilities | | | | | | |

| Current liabilities: | | | | | | |

| Trade accounts payable | $ | 1,254.9 |

| | $ | 1,109.6 |

| $ | 1,141.4 |

| | $ | 1,348.1 |

|

| Short-term borrowings | 54.2 |

| | 1.3 |

| 31.0 |

| | 46.4 |

|

| Income taxes payable | 164.5 |

| | 92.4 |

| 31.0 |

| | 97.7 |

|

| Current portion of long-term debt and other long-term obligations | 4,434.6 |

| | 1,077.0 |

| 294.4 |

| | 290.0 |

|

| Other current liabilities | 3,645.8 |

| | 1,841.9 |

| 3,026.4 |

| | 3,258.5 |

|

| Total current liabilities | 9,554.0 |

| | 4,122.2 |

| 4,524.2 |

| | 5,040.7 |

|

| Long-term debt | 11,328.6 |

| | 6,295.6 |

| 14,700.8 |

| | 15,202.9 |

|

| Deferred income tax liability | 2,189.6 |

| | 718.1 |

| 2,019.1 |

| | 2,006.4 |

|

| Other long-term obligations | 1,637.5 |

| | 1,366.0 |

| 1,372.5 |

| | 1,358.6 |

|

| Total liabilities | 24,709.7 |

| | 12,501.9 |

| 22,616.6 |

| | 23,608.6 |

|

| Equity | | | | | | |

| Mylan N.V. shareholders’ equity | | | | | | |

| Ordinary shares — nominal value €0.01 per ordinary share | | | | | | |

| Shares authorized: 1,200,000,000 | | | | | | |

| Shares issued: 536,384,447 and 491,928,095 as of September 30, 2016 and December 31, 2015 | 6.0 |

| | 5.5 |

| |

| Shares issued: 537,237,925 and 536,639,291 as of March 31, 2017 and December 31, 2016 | | 6.0 |

| | 6.0 |

|

| Additional paid-in capital | 8,484.6 |

| | 7,128.6 |

| 8,522.0 |

| | 8,499.3 |

|

| Retained earnings | 4,524.6 |

| | 4,462.1 |

| 5,008.5 |

| | 4,942.1 |

|

| Accumulated other comprehensive loss | (1,120.4 | ) | | (1,764.3 | ) | (1,813.0 | ) | | (2,263.7 | ) |

| | 11,894.8 |

| | 9,831.9 |

| 11,723.5 |

| | 11,183.7 |

|

| Noncontrolling interest | 1.5 |

| | 1.4 |

| — |

| | 1.4 |

|

| Less: Treasury stock — at cost |

| | |

| | |

| Shares: 1,311,193 as of September 30, 2016 and December 31, 2015 | 67.5 |

| | 67.5 |

| |

| Ordinary shares: 1,311,193 as of March 31, 2017 and December 31, 2016 | | 67.5 |

| | 67.5 |

|

| Total equity | 11,828.8 |

| | 9,765.8 |

| 11,656.0 |

| | 11,117.6 |

|

| Total liabilities and equity | $ | 36,538.5 |

| | $ | 22,267.7 |

| $ | 34,272.6 |

| | $ | 34,726.2 |

|

| | | | | | | |

See Notes to Condensed Consolidated Financial Statements

5

MYLAN N.V. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

(Unaudited; in millions)

| | | | Nine Months Ended | Three Months Ended |

| | September 30, | March 31, |

| | 2016 | | 2015 | 2017 | | 2016 |

| Cash flows from operating activities: | | | | | | |

| Net earnings | $ | 62.5 |

| | $ | 653.1 |

| $ | 66.4 |

| | $ | 13.9 |

|

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | | | | |

| Depreciation and amortization | 1,046.4 |

| | 691.4 |

| 415.5 |

| | 297.1 |

|

| Share-based compensation expense | 71.1 |

| | 66.4 |

| 23.1 |

| | 26.5 |

|

| Deferred income tax benefit | (356.6 | ) | | (62.2 | ) | |

| Deferred income tax expense | | 35.6 |

| | 38.5 |

|

| Loss from equity method investments | 85.5 |

| | 77.5 |

| 33.2 |

| | 30.9 |

|

| Other non-cash items | 226.1 |

| | 206.2 |

| 98.8 |

| | 81.0 |

|

| Litigation settlements and other contingencies, net | 558.6 |

| | 19.1 |

| 8.9 |

| | 0.3 |

|

| Write off of financing fees | 35.8 |

| | — |

| |

| Losses on acquisition-related foreign currency derivatives | 128.6 |

| | — |

| |

| Changes in operating assets and liabilities: | | | | | | |

| Accounts receivable | 183.3 |

| | (54.3 | ) | 286.7 |

| | 83.5 |

|

| Inventories | (336.7 | ) | | (288.4 | ) | (105.6 | ) | | (222.8 | ) |

| Trade accounts payable | (45.0 | ) | | 242.5 |

| (242.7 | ) | | (57.2 | ) |

| Income taxes | 51.3 |

| | (178.5 | ) | (175.0 | ) | | (84.7 | ) |

| Other operating assets and liabilities, net | (13.2 | ) | | (16.3 | ) | 8.0 |

| | (126.5 | ) |

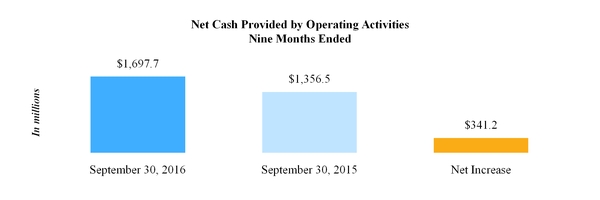

| Net cash provided by operating activities | 1,697.7 |

| | 1,356.5 |

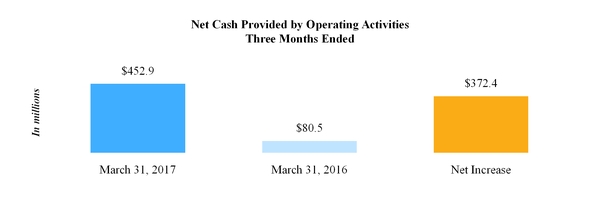

| 452.9 |

| | 80.5 |

|

| Cash flows from investing activities: | | | | | | |

| Cash paid for acquisitions, net | | (71.6 | ) | | — |

|

| Capital expenditures | (239.5 | ) | | (207.3 | ) | (58.4 | ) | | (51.8 | ) |

| Proceeds from sale of assets | | 31.1 |

| | — |

|

| Change in restricted cash | (50.5 | ) | | 25.9 |

| 12.7 |

| | — |

|

| Purchase of marketable securities | (22.8 | ) | | (59.1 | ) | (2.3 | ) | | (8.5 | ) |

| Proceeds from sale of marketable securities | 15.8 |

| | 29.4 |

| 2.3 |

| | 5.9 |

|

| Cash paid for acquisitions, net | (6,151.7 | ) | | — |

| |

| Cash paid for Meda's unconditional deferred payment | (308.0 | ) | | — |

| |

| Settlement of acquisition-related foreign currency derivatives | (128.6 | ) | | — |

| |

| Payments for product rights and other, net | (196.3 | ) | | (428.2 | ) | (77.9 | ) | | (105.6 | ) |

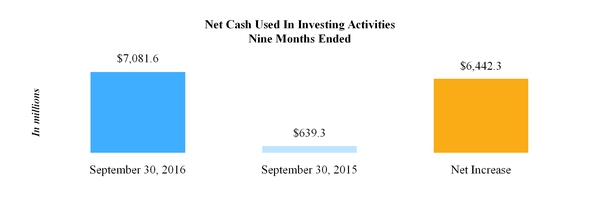

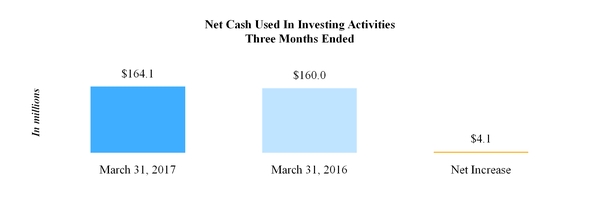

| Net cash used in investing activities | (7,081.6 | ) | | (639.3 | ) | (164.1 | ) | | (160.0 | ) |

| Cash flows from financing activities: | | | | | | |

| Payments of financing fees | (95.3 | ) | | (114.7 | ) | |

| Payments of long-term debt | | (550.0 | ) | | — |

|

| Change in short-term borrowings, net | 48.6 |

| | (329.7 | ) | (17.6 | ) | | 65.1 |

|

| Proceeds from convertible note hedge | — |

| | 1,970.8 |

| |

| Proceeds from issuance of long-term debt | 6,519.8 |

| | 2,390.0 |

| |

| Payments of long-term debt | (1,067.0 | ) | | (4,334.1 | ) | |

| Proceeds from exercise of stock options | 11.1 |

| | 92.8 |

| |

| Taxes paid related to net share settlement of equity awards | (12.9 | ) | | (31.7 | ) | (6.1 | ) | | (6.9 | ) |

| Contingent consideration payments | (15.5 | ) | | — |

| (3.8 | ) | | — |

|

| Acquisition of noncontrolling interest | (1.0 | ) | | (11.7 | ) | |

| Payments of financing fees | | (3.7 | ) | | (31.6 | ) |

| Proceeds from exercise of stock options | | 5.0 |

| | 3.6 |

|

| Other items, net | 1.6 |

| | 49.6 |

| 0.5 |

| | 0.3 |

|

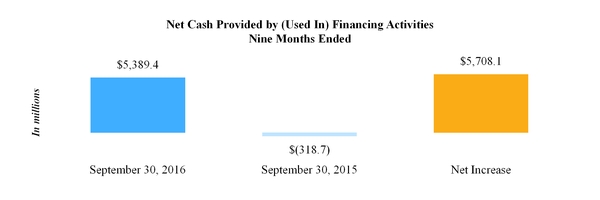

| Net cash provided by (used in) financing activities | 5,389.4 |

| | (318.7 | ) | |

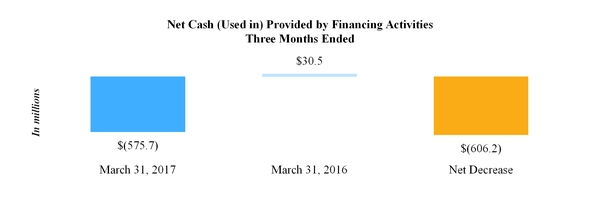

| Net cash (used in) provided by financing activities | | (575.7 | ) | | 30.5 |

|

| Effect on cash of changes in exchange rates | 15.1 |

| | (37.0 | ) | 11.9 |

| | 12.4 |

|

| Net increase in cash and cash equivalents | 20.6 |

| | 361.5 |

| |

| Net decrease in cash and cash equivalents | | (275.0 | ) | | (36.6 | ) |

| Cash and cash equivalents — beginning of period | 1,236.0 |

| | 225.5 |

| 998.8 |

| | 1,236.0 |

|

| Cash and cash equivalents — end of period | $ | 1,256.6 |

| | $ | 587.0 |

| $ | 723.8 |

| | $ | 1,199.4 |

|

| Supplemental disclosures of cash flow information — | | | | |

| Non-cash transactions: | | | | |

| Ordinary shares issued for acquisition | $ | 1,281.7 |

| | $ | 6,305.8 |

| |

See Notes to Condensed Consolidated Financial Statements

6

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited)

The accompanying unaudited Condensed Consolidated Financial Statements (“interim financial statements”) of Mylan N.V. and subsidiaries (“Mylan” or the “Company”) were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”) for reporting on Form 10-Q; therefore, as permitted under these rules, certain footnotes and other financial information included in audited financial statements were condensed or omitted. The interim financial statements contain all adjustments (consisting of only normal recurring adjustments) necessary to present fairly the interim results of operations, comprehensive earnings, financial position and cash flows for the periods presented. For periods prior to February 27, 2015, the Company’s interim financial statements present the accounts of Mylan Inc. and subsidiaries.

These interim financial statements should be read in conjunction with the Consolidated Financial Statements and Notes thereto in Mylan N.V.’s Annual Report on Form 10-K for the year ended December 31, 20152016, as amended. The December 31, 20152016 Condensed Consolidated Balance Sheet was derived from audited financial statements.

The interim results of operations, and comprehensive earnings for the three and nine months ended September 30, 2016 and cash flows for the ninethree months ended September 30, 2016March 31, 2017 are not necessarily indicative of the results to be expected for the full fiscal year or any other future period.

| |

| 2. | Revenue Recognition and Accounts Receivable |

The Company recognizes net sales when title and risk of loss pass to its customers and when provisions for estimates, including discounts, sales allowances, price adjustments, returns, chargebacks and other promotional programs are reasonably determinable.

Accounts receivable are presented net of allowances relating to these provisions. No significant revisions were made to the methodology used in determining these provisions or the nature of the provisions during the ninethree months ended September 30, 2016.March 31, 2017. Such allowances were $1.83$2.14 billion and $1.84$2.05 billion at September 30, 2016March 31, 2017 and December 31, 2015,2016, respectively. Other current liabilities include $824.1$616.5 million and $681.8$809.0 million at September 30, 2016March 31, 2017 and December 31, 2015,2016, respectively, for certain sales allowances and other adjustments that are paid to customers.settled in cash.

Accounts receivable, net was comprised of the following at March 31, 2017 and December 31, 2016, respectively:

|

| | | | | | | |

| (In millions) | March 31,

2017 | | December 31,

2016 |

| Trade receivables, net | $ | 2,568.2 |

| | $ | 3,015.4 |

|

| Other receivables | 303.8 |

| | 295.5 |

|

| Accounts receivable, net | $ | 2,872.0 |

| | $ | 3,310.9 |

|

Through its wholly owned subsidiary Mylan Pharmaceuticals Inc. (“MPI”), the Company has access to a $400 million accounts receivable securitization facility (the “Receivables Facility”). The receivables underlying any borrowings are included in accounts receivable, net, in the Condensed Consolidated Balance Sheets. There were $759.3854.8 million and $914.2 million$1.13 billion of securitized accounts receivable at September 30, 2016March 31, 2017 and December 31, 20152016, respectively.

| |

| 3. | Recent Accounting Pronouncements |

In October 2016,March 2017, the Financial Accounting Standards Board (“FASB”(the “FASB”) issued Accounting Standards Update 2016-16,2017-07, Income TaxesCompensation - Retirement Benefits (Topic 740)715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost (“ASU 2016-16”2017-07”), which reducesrequires companies to disaggregate the complexityservice cost component from the other components of net benefit cost and disclose the amount of net benefit cost that is included in the accounting standardsincome statement or capitalized in assets, by allowingline item. This guidance requires companies to report the recognitionservice cost component in the same line item(s) as other compensation costs and to report other pension-related costs (which include interest costs, amortization of currentpension-related costs from prior periods and deferredgains or losses on plan assets) separately and exclude them from the subtotal of operating income. This guidance also allows only the service cost component to be eligible for capitalization when applicable. This guidance is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2017. This guidance should be applied retrospectively for the presentation of the service cost component and the

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

other components of net periodic pension cost and net periodic postretirement benefit cost in the income taxesstatement and prospectively, on and after the effective date, for the capitalization of the service cost component of net periodic pension cost and net periodic postretirement benefit in assets. The update allows a practical expedient that permits a company to use the amounts disclosed in its pension and other postretirement plan note for the prior comparative periods as the estimation basis for applying the retrospective presentation requirements. The Company is currently assessing the impact of the adoption of this guidance on its consolidated financial statements and disclosures.

In January 2017, the FASB issued Accounting Standards Update 2017-04, Intangibles - Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment (“ASU 2017-04”), which simplifies the subsequent measurement of goodwill by eliminating Step 2 from the goodwill impairment test which previously required measurement of any goodwill impairment loss by comparing the implied fair value of a reporting unit’s goodwill with the carrying amount of that goodwill. Under ASU 2017-04, an intra-entityentity should perform its annual, or interim, goodwill impairment test by comparing the fair value of a reporting unit with its carrying value and recognize an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value; without exceeding the total amount of goodwill allocated to that reporting unit. This guidance is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019, with early adoption permitted. The Company has elected to early adopt this guidance as of January 1, 2017 and will apply it on a prospective basis. The adoption did not have a material impact on its condensed consolidated financial statements.

In January 2017, the FASB issued Accounting Standards Update 2017-01, Business Combinations (Topic 805) Clarifying the Definition of a Business (“ASU 2017-01”), which narrows the definition of a business and requires an entity to evaluate if substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset transfer, other than inventory, whenor a group of similar identifiable assets, which would not constitute the transfer occurs.acquisition of a business. The guidance also requires a business to include at least one substantive process and narrows the definition of outputs. This guidance is effective for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years, with early adoption permitted using a modified retrospective transition approach.permitted. The Company is currently assessing the impact of the adoption ofhas elected to early adopt this guidance as of January 1, 2017 and will apply it on a prospective basis. The adoption did not have a material impact on its condensed consolidated financial statements and disclosures.

In August 2016, the FASB issued Accounting Standards Update 2016-15, Statement of Cash Flows (Topic 230) (“ASU 2016-15”), which clarifies how certain cash receipts and cash payments should be presented in the Statement of Cash Flows. This guidance is effective for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years, with early adoption permitted using a retrospective transition approach. The Company is currently assessing the impact of the adoption of this guidance on its Statement of Cash Flows.statements.

In March 2016, the FASB issued Accounting Standards Update 2016-09, Compensation - Stock Compensation (Topic 718) (“ASU 2016-09”), which simplifies the accounting for share-based compensation payments. The new standard requires all excess tax benefits and tax deficiencies (including tax benefits of dividends on share-based payment awards) to be recognized as income tax expense or benefit on the income statement. The tax effects of exercised or vested awards should be treated as discrete items in the reporting period in which they occur. This guidance is effective for fiscal years,ASU 2016-09 also addresses the classification of excess tax benefits in the statement of cash flows. As required, the Company applied the provisions of ASU 2016-09 on a prospective basis as of January 1, 2017 and interim periods within

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

those years, beginning after December 15, 2016, with early adoption permitted. The Company is currently assessing the impact of the adoption of this guidancedid not have a material impact on its condensed consolidated financial statements and disclosures.

In February 2016, the FASB issued Accounting Standards Update 2016-02, Leases (Topic 840) (“ASU 2016-02”), which provides principles for the recognition, measurement, presentation and disclosure of leases for both lessees and lessors. The new standard requires lessees to apply a dual approach, classifying leases as either finance or operating leases based on the principle of whether or not the lease is effectively a financed purchase by the lessee. This classification will determine whether lease expense is recognized based on an effective interest method or on a straight-line basis over the term of the lease. A lessee is also required to record a right-of-use asset and a lease liability for all leases with a term of greater than twelve months regardless of classification. Leases with a term of twelve months or less will be accounted for similar to existing guidance for operating leases. This guidance is effective for annual and interim periods beginning after December 15, 2018, with early adoption permitted. The Company is currently assessing the impact of the adoption of this guidance on its consolidated financial statements and disclosures.

In January 2016, the FASB issued Accounting Standards Update 2016-01, Recognition and Measurement of Financial Assets and Financial Liabilities (“ASU 2016-01”), which requires that most equity investments be measured at fair value, with subsequent changes in fair value recognized in net income (other than those accounted for under equity method of accounting). The amendments in this update also require an entity to present separately in other comprehensive earnings the portion of the total change in the fair value of a liability resulting from a change in the instrument-specific credit risk when the entity has elected to measure the liability at fair value in accordance with the fair value option for financial instruments. ASU 2016-01 also impacts financial liabilities under the fair value option and the presentation and disclosure requirements for financial instruments. This guidance is effective for fiscal years, and interim periods within those years, beginning after December 15, 2017. The Company is currently assessing the impact of the adoption of this guidance on its consolidated financial statements and disclosures.statements.

In May 2014, the FASB issued Accounting Standards Update 2014-09, Revenue from Contracts with Customers (“ASU 2014-09” updated with “ASU 2015-14”, “ASU 2016-08”, “ASU 2016-10”, “ASU 2016-12” and “ASU 2016-12”2016-20”), which revises accounting guidance on revenue recognition that will supersede nearly all existing revenue recognition guidance under U.S. GAAP. The core principal of this guidance is that an entity should recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration which the entity expects to receive in exchange for those goods or services. This guidance also requires additional disclosure about the nature, amount, timing and uncertainty of revenue and cash flows arising from customer contracts, including significant judgments and changes in judgments and assets recognized from costs incurred to obtain or fulfill a contract. This guidance is effective for fiscal years beginning after December 15, 2017, and for interim periods within those fiscal years, and can be applied using a full retrospective or modified retrospective approach. The Company continues to review specific revenue arrangements, including customer and collaboration contracts, and expects to complete the review in the third quarter of 2017. The Company is currently assessing the impact ofstill evaluating the adoption of this guidance on its consolidated financial statements and disclosures.method it will elect upon implementation.

| |

| 4. | Acquisitions and Other Transactions |

Meda AB

On February 10, 2016, the Company issued an offer announcement under the Nasdaq Stockholm’s Takeover Rules and the Swedish Takeover Act (collectively, the “Swedish Takeover Rules”) setting forth a public offer to the shareholders of Meda AB (publ.) (“Meda”) to acquire all of the outstanding shares of Meda (the “Offer”), with an enterprise value, including the net debt of Meda, of approximately Swedish kronor (“SEK” or “kr”) 83.6 billion (based on a SEK/USD exchange rate of 8.4158) or $9.9 billion at announcement. On August 2, 2016, the Company announced that the Offer was accepted by Meda

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

shareholders holding an aggregate of approximately 343 million shares, representing approximately 94% of the total number of outstanding Meda shares, as of July 29, 2016, and the Company declared the Offer unconditional. On August 5, 2016, settlement occurred with respect to the Meda shares duly tendered by July 29, 2016 and, as a result, Meda is nowbecame a controlled subsidiary of the Company. Pursuant to the terms of the Offer, each Meda shareholder that duly tendered Meda shares into the Offer received at settlement (1) in respect of 80% of the number of Meda shares tendered by such shareholder, 165kr in cash per Meda share, and (2) in respect of the remaining 20% of the number of Meda shares tendered by such shareholder, 0.386 of the Company’s ordinary shares per Meda share (subject to treatment of fractional shares as described in the offer document published on June 16, 2016). The non-tendered shares willwere required to be acquired for cash through a compulsory acquisition proceeding, in accordance with the Swedish Companies Act (Sw. aktiebolagslagen (2005:551)), with advance title to such non-tendered shares expected to be acquired within six to twelve months of the acquisition date.. The compulsory acquisition proceeding price will accrueaccrued interest as required by the Swedish Companies Act. Meda’s shares were delisted from the Nasdaq Stockholm

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

exchange on August 23, 2016.

On November 1, 2016, the Company made an offer to the remaining Meda shareholders to tender all their Meda shares for cash consideration of 161.31kr per Meda share (the “November Offer”) to provide such remaining shareholders with an opportunity to sell their shares in Meda to the Company in advance of the automatic acquisition of their shares for cash in connection with the compulsory acquisition proceeding. The acceptance periodAt the end of November 2016, Mylan completed the acquisition of approximately 19 million Meda shares duly tendered for aggregate cash consideration of approximately $330.3 million. In March 2017, the November Offer expires on November 23, 2016 and settlement is expectedCompany received full legal ownership to occur on or around November 30, 2016.the remaining non-tendered Meda shareholders who tender their shares in the November Offer will not have the right to withdraw their acceptances, and there are no conditionsexchange for a cash payment of approximately $71.6 million, equal to the completionuncontested portion of the November Offer. Any Meda shareholders that do not accept the November Offer will automatically receive all-cash considerationcompulsory acquisition price plus statutory interest, for theirand the Company’s arrangement of a customary bank guarantee to secure the payment of any additional cash consideration that may be awarded to the former Meda shares as determinedshareholders in the compulsory acquisition proceeding. The November Offer is not being made, nor will any tender of shares be accepted from or on behalf of holders in, any jurisdiction in which the making of the November Offer or the acceptance of any tender of shares would contravene applicable laws or regulations or require any offer documents, filings or other measures. In connection with either the November Offer orarbitration tribunal conducting the compulsory acquisition proceeding it has been assumed thatwill determine whether to award any such additional cash consideration at the fair valuecompletion of the non-tendered sharescompulsory acquisition proceeding, which is currently expected to occur in 2017 or 2018. As of March 31, 2017, the Company continues to maintain the bank guarantee as required by Swedish law. The Company does not expect that any additional payments in connection with the compulsory acquisition proceeding would be approximately 161kr per share at settlement.material to the consolidated financial statements.

TheOn August 5, 2016, the total purchase price was approximately $6.92 billion, net of cash acquired, which includes cash consideration paid of approximately $5.3 billion, the issuance of approximately 26.4 million Mylan N.V. ordinary shares at a fair value of approximately $1.3 billion based on the closing price of the Company’s ordinary shares on August 5, 2016, as reported by the NASDAQ Global Select Stock Market (the “NASDAQ”(“NASDAQ”) and an assumed liability of approximately $431.0 million related to the November Offer and the compulsory acquisition proceeding offor the non-tendered Meda shares, which is classified as a current liability on the Condensed Consolidated Balance Sheet.shares. In accordance with U.S. GAAP, the Company used the acquisition method of accounting to account for this transaction. Under the acquisition method of accounting, the assets acquired and liabilities assumed in the transaction have been recorded at their respective estimated fair values at the acquisition date. Acquisition related costs of approximately $65.8 million and $212.5 million were incurred during

During the three and nine months ended September 30, 2016, respectively, whichMarch 31, 2017, adjustments were recordedmade to the preliminary purchase price and are reflected as components of research and development expense (“R&D”), selling, general and administrative expense (“SG&A”), interest expense and other expense, net“Measurement Period Adjustments” in the Condensed Consolidated Statements of Operations. For the three and nine months ended September 30, 2016, these costs include approximately $44.4 million and $128.6 million, respectively, of losses on non-designated foreign currency forward and option contracts entered into in order to economically hedge the SEK purchase price of the Offer (explained further in Note 11Financial Instruments and Risk Management). For the nine months ended September 30, 2016 acquisition related costs include approximately $45.2 million of financing fees related to the terminated 2016 Bridge Credit Agreement (explained further in Note 12Debt).

table below. The preliminary allocation of the $6.92 billion purchase price to the assets acquired and liabilities assumed for Meda is as follows:

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

|

| | | |

| (In millions) | |

| Current assets (excluding inventories and net of cash acquired) | $ | 470.2 |

|

| Inventories | 465.7 |

|

| Property, plant and equipment | 177.5 |

|

| Identified intangible assets | 8,060.7 |

|

| Goodwill | 3,677.6 |

|

| Other assets | 9.3 |

|

| Total assets acquired | 12,861.0 |

|

| Current liabilities | (1,088.4 | ) |

| Long-term debt, including current portion | (2,864.6 | ) |

| Deferred tax liabilities | (1,628.1 | ) |

| Pension and other postretirement benefits | (322.3 | ) |

| Other noncurrent liabilities | (36.5 | ) |

| Net assets acquired | $ | 6,921.1 |

|

|

| | | | | | | | | | | |

| (In millions) | Preliminary Purchase Price Allocation as of December 31, 2016 (a) | | Measurement Period Adjustments (b) | | Preliminary Purchase Price Allocation as of March 31, 2017 (as adjusted) |

| Current assets (excluding inventories and net of cash acquired) | $ | 482.5 |

| | $ | — |

| | $ | 482.5 |

|

| Inventories | 463.1 |

| | — |

| | 463.1 |

|

| Property, plant and equipment | 177.5 |

| | — |

| | 177.5 |

|

| Identified intangible assets | 8,060.7 |

| | — |

| | 8,060.7 |

|

| Goodwill | 3,676.9 |

| | 1.7 |

| | 3,678.6 |

|

| Other assets | 9.5 |

| | — |

| | 9.5 |

|

| Total assets acquired | 12,870.2 |

| | 1.7 |

| | 12,871.9 |

|

| Current liabilities | (1,105.9 | ) | | — |

| | (1,105.9 | ) |

| Long-term debt, including current portion | (2,864.6 | ) | | — |

| | (2,864.6 | ) |

| Deferred tax liabilities | (1,613.9 | ) | | (1.7 | ) | | (1,615.6 | ) |

| Pension and other postretirement benefits | (322.3 | ) | | — |

| | (322.3 | ) |

| Other noncurrent liabilities | (42.4 | ) | | — |

| | (42.4 | ) |

| Net assets acquired | $ | 6,921.1 |

| | $ | — |

| | $ | 6,921.1 |

|

| |

(a) | As previously reported in the Company’s December 31, 2016 Annual Report on Form 10-K, as amended. |

| |

(b) | The measurement period adjustments were recorded in the first quarter of 2017 and are primarily related to certain income tax adjustments to reflect facts and circumstances that existed as of the acquisition date. |

The preliminary fair value estimates for the assets acquired and liabilities assumed were based upon preliminary calculations, valuations and assumptions that are subject to change as the Company obtains additional information during the

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

measurement period (up to one year from the acquisition date). The primary areas subject to change relate to the finalization of the working capital components the valuation of intangible assets and income taxes.

The acquisition of Meda createscreated a more diversified and expansive portfolio of branded and generic medicines along with a strong and growing portfolio of over-the-counter (“OTC”) products. The combined company has a balanced global footprint with significant scale in key geographic markets, particularly the U.S. and Europe. The acquisition of Meda also provides Mylan with entry into a number of new and attractiveexpanded our presence in emerging markets, including China, Southeastwhich includes countries in Africa, as well as countries throughout Asia Russia,and the Middle East, and Mexico,is complemented by Mylan’s presence in India, Brazil and Africa.Africa (including South Africa). The Company recorded a step-up in the fair value of inventory of approximately $107 million. Duringmillion at the three and nine months ended September 30, 2016, the Company recorded amortizationacquisition date, which was fully amortized as of the inventory step-up of approximately $42.8 million, which is included in cost of sales in the Condensed Consolidated Statements of Operations.December 31, 2016.

The identified intangible assets of $8.06 billion are comprised of product rights and licenses that have a weighted average useful life of 20 years. Significant assumptions utilized in the valuation of identified intangible assets were based on company specific information and projections which are not observable in the market and are thus considered Level 3 measurements as defined by U.S. GAAP. The goodwill of $3.68 billion arising from the acquisition consisted largely of the value of the employee workforce and the expected value of products to be developed in the future. The newly acquired operations havefinal allocation of goodwill to Mylan’s reportable segments has not been included incompleted; however, the Generics segment for the three and nine months ended September 30, 2016. In addition, allmajority of the goodwill was assignedis expected to be allocated to the GenericsEurope segment. None of the goodwill recognized in this transaction is currently expected to be deductible for income tax purposes.

The settlement of the Offer constituted an Acceleration Event (as defined in the Rottapharm Agreement referred to below) under the Sale and Purchase Agreement, dated as of July 30, 2014 (the “Rottapharm Agreement”), among Fidim S.r.l., Meda Pharma S.p.A and Meda, the occurrence of which accelerated an unconditional deferred purchase price payment of approximately $308 million (€275 million) relating to Meda’s acquisition of Rottapharm S.p.A. which otherwise would have been payable in January 2017. The amount was paid as of September 30, 2016.

The operating results of Meda have been included in the Company’s Condensed Consolidated Statements of Operations since the acquisition date. The total revenues of Meda for the period from the acquisition date to September 30, 2016, were $331.1 million and net loss, net of tax, was $260.6 million. The net loss, net of tax, includes the effects of the purchase accounting adjustments and acquisition related costs.

Renaissance Topicals Business

On June 15, 2016, the Company completed the acquisition of the non-sterile, topicals-focused business (the “Topicals Business”) of Renaissance Acquisition Holdings, LLC (“Renaissance”) for approximately $1.0 billion in cash at closing, including amounts deposited into escrow for potential contingent payments, subject to customary adjustments. The Topicals Business providesprovided the Company with a complementary portfolio of approximately 25 products, an active pipeline of approximately 25 products, and an established U.S. sales and marketing infrastructure targeting dermatologists. The Topicals Business also providesprovided an integrated manufacturing and development platform. In accordance with U.S. GAAP, the Company

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

used the acquisition method of accounting to account for this transaction. Under the acquisition method of accounting, the assets acquired and liabilities assumed in the transaction were recorded at their respective estimated fair values at the acquisition date. The U.S. GAAP purchase price was $972.7 million, which includes estimated contingent consideration of approximately $16 million related to the potential $50 million payment contingent on the achievement of certain 2016 financial targets. The $50 million contingent payment has been paid into escrow. remains in escrow and is classified as restricted cash included in prepaid expenses and other current assets on the Condensed Consolidated Balance Sheets at March 31, 2017 and December 31, 2016.

The preliminary allocation of the $972.7 million purchase price to the assets acquired and liabilities assumed for the Topicals Business is as follows:

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

| | | (In millions) | | |

| Current assets (excluding inventories) | $ | 68.8 |

| $ | 57.7 |

|

| Inventories | 74.2 |

| 74.2 |

|

| Property, plant and equipment | 54.8 |

| 54.8 |

|

| Identified intangible assets | 467.0 |

| 467.0 |

|

| In-process research and development | 275.0 |

| 275.0 |

|

| Goodwill | 307.3 |

| 318.6 |

|

| Other assets | 0.9 |

| 0.1 |

|

| Total assets acquired | 1,248.0 |

| 1,247.4 |

|

| Current liabilities | (65.0 | ) | (74.2 | ) |

| Deferred tax liabilities | (203.6 | ) | (194.6 | ) |

| Other noncurrent liabilities | (6.7 | ) | (5.9 | ) |

| Net assets acquired | $ | 972.7 |

| $ | 972.7 |

|

The preliminary fair value estimates for the assets acquired and liabilities assumed were based upon preliminary calculations, valuations and assumptions that are subject to change as the Company obtains additional information during the measurement period (up to one year from the acquisition date). The primary areas subject to change relate to the finalization of the working capital adjustmentcomponents and income taxes.

The acquisition of the Topicals Business broadened the Company’s dermatological portfolio. The amount allocated to in-process research and development (“IPR&D”) represents an estimate of the fair value of purchased in-process technology for research projects that, as of the closing date of the acquisition, had not reached technological feasibility and had no alternative future use. The fair value of IPR&D of $275.0 million was based on the excess earnings method, which utilizes forecasts of expected cash inflows (including estimates for ongoing costs) and other contributory charges. A discount rate of 12.5% was utilized to discount net cash inflows to present values. IPR&D is accounted for as an indefinite-lived intangible asset and will be subject to impairment testing until completion or abandonment of the projects. Upon successful completion and launch of each product, the Company will make a determination of the estimated useful life of the individual asset. The acquired IPR&D projects are in various stages of completion and the estimated costs to complete these projects total approximately $65$59 million, which is expected to be incurred through 2018. There are risks and uncertainties associated with the timely and successful completion of the projects included in IPR&D, and no assurances can be given that the underlying assumptions used to estimate the fair value of IPR&D will not change or the timely completion of each project to commercial success will occur.

The identified intangible assets of $467.0 million are comprised of $454.0 million of product rights and licenses that have a weighted average useful life of 14 years and $13.0 million of contract manufacturing agreements that have a weighted average useful life of five years. Significant assumptions utilized in the valuation of identified intangible assets were based on company specific information and projections which are not observable in the market and are thus considered Level 3 measurements as defined by U.S. GAAP.

The goodwill of $307.3$318.6 million arising from the acquisition consisted largely of the value of the employee workforce and the expected value of products to be developed in the future. All of the goodwill was assigned to the GenericsNorth America segment. None of the goodwill recognized in this transaction is currently expected to be deductible for income tax purposes. Acquisition related costs of approximately $3.6 million were incurred during the nine months ended September 30, 2016 related to this transaction, which were recorded as a component of SG&A in the Condensed Consolidated Statements of Operations. The acquisition did not have a material impact on the Company’s results of operations since the acquisition date or on a pro forma basis for the three and nine month periodsperiod ended September 30, 2016 and 2015.

Jai Pharma Limited

On November 20, 2015, the Company completed the acquisition of certain female healthcare businesses from Famy Care Limited (such businesses “Jai Pharma Limited”). Jai Pharma Limited is a specialty women’s healthcare company with global leadership in generic oral contraceptive products, through its wholly owned subsidiary Mylan Laboratories Limited forMarch 31, 2016.

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

a cash payment of $750 million plus additional contingent payments of up to $50 million for the filing for approval with, and receipt of approval from, the U.S. Food and Drug Administration of a product under development by Jai Pharma Limited.

In accordance with U.S. GAAP, the Company used the acquisition method of accounting to account for this transaction. Under the acquisition method of accounting, the assets acquired and liabilities assumed in the transaction were recorded at their respective estimated fair values at the acquisition date. The U.S. GAAP purchase price was $711.1 million, which excludes the $50 million paid into escrow at closing that is contingent upon at least one of two former principal shareholders of Jai Pharma Limited continuing to provide consulting services to Jai Pharma Limited for the two year post-closing period, which amount is being treated as compensation expense over the service period. The U.S. GAAP purchase price also excludes $7 million of working capital and other adjustments and includes estimated contingent consideration of approximately $18 million related to the $50 million contingent payment. During the nine months ended September 30, 2016, adjustments were made to the preliminary purchase price allocation recorded at November 20, 2015. The adjustments recorded in respect of goodwill, current liabilities and deferred tax liabilities are reflected in the “measurement period adjustments” column of the table below. As of September 30, 2016, the preliminary allocation of the $711.1 million purchase price to the assets acquired and liabilities assumed for Jai Pharma Limited is as follows: |

| | | | | | | | | | | |

| (In millions) | Preliminary Purchase Price Allocation as of November 20, 2015 (a) | | Measurement Period Adjustments (b) | | Preliminary Purchase Price Allocation as of September 30, 2016 (as adjusted) |

| Current assets (excluding inventories) | $ | 25.7 |

| | $ | — |

| | $ | 25.7 |

|

| Inventories | 4.9 |

| | — |

| | 4.9 |

|

| Property, plant and equipment | 17.2 |

| | — |

| | 17.2 |

|

| Identified intangible assets | 437.0 |

| | — |

| | 437.0 |

|

| In-process research and development | 98.0 |

| | — |

| | 98.0 |

|

| Goodwill | 317.2 |

| | 8.1 |

| | 325.3 |

|

| Other assets | 0.7 |

| | — |

| | 0.7 |

|

| Total assets acquired | 900.7 |

| | 8.1 |

| | 908.8 |

|

| Current liabilities | (9.1 | ) | | (1.9 | ) | | (11.0 | ) |

| Deferred tax liabilities | (180.5 | ) | | (6.2 | ) | | (186.7 | ) |

| Net assets acquired | $ | 711.1 |

| | $ | — |

| | $ | 711.1 |

|

____________ | |

(a)

| As previously reported in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015, as amended. |

| |

(b)

| The measurement period adjustments were recorded in the first quarter of 2016 and are related to the recognition of certain goodwill, current liabilities and adjustments to deferred tax liabilities to reflect facts and circumstances that existed as of the acquisition date. |

The goodwill of $325.3 million arising from the acquisition consisted largely of the value of the employee workforce and the expected value of products to be developed in the future. All of the goodwill was assigned to the Generics segment. The preliminary fair value estimates for the assets acquired and liabilities assumed were based upon preliminary calculations, valuations and assumptions that are subject to change as the Company obtains additional information during the measurement period (up to one year from the acquisition date). The primary areas subject to change relate to the finalization of the working capital adjustment and income taxes, which will be finalized in the fourth quarter of 2016. During the three months ended September 30, 2016, the Company received approvals from the relevant Indian regulatory authorities to legally merge its wholly owned subsidiary, Jai Pharma Limited, into Mylan Laboratories Limited. The merger resulted in the recognition of a deferred tax asset of $150 million for the tax deductible goodwill in excess of the book goodwill with a corresponding benefit to income tax provision for the three and nine months ended September 30, 2016. On a pro forma basis, the acquisition did not have a material impact on the Company’s results of operations for the three and nine months ended September 30, 2015.

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

EPD Business

On February 27, 2015 (the “EPD Transaction Closing Date”), the Company completed the acquisition (the “EPD Transaction”) of Mylan Inc. and Abbott Laboratories’ non-U.S. developed markets specialty and branded generics business (the “EPD Business”) in an all-stock transaction. Mylan N.V.’s purchase price for the EPD Business, which was on a debt-free basis, was $6.31 billion based on the closing price of Mylan Inc.’s stock as of the EPD Transaction Closing Date, as reported by the NASDAQ.

The operating results of the EPD Business have been included in the Company’s Condensed Consolidated Statements of Operations since February 27, 2015. The total revenues of the acquired EPD Business for the period from the acquisition date to September 30, 2015 were $1.01 billion and the net loss, net of tax, was $68.6 million. The net loss, net of tax, includes the effects of the purchase accounting adjustments and acquisition related costs.

Unaudited Pro Forma Financial Results

The following table presents supplemental unaudited pro forma information for the acquisitionsacquisition of Meda, as if it had occurred on January 1, 2015, and the EPD Business, as if it had occurred on January 1, 2014.2015. The unaudited pro forma results reflect certain adjustments related to past operating performance and acquisition accounting adjustments, such as increased amortization expense based on the fair value of assets acquired, the impact of transaction costs and the related income tax effects. The unaudited pro forma results do not include any anticipated synergies which may be achievable, or have been achieved, subsequent to the closing of the Meda transaction and EPD Transaction.transaction. Accordingly, the unaudited pro forma results are not necessarily indicative of the results that actually would have occurred had the acquisitions been completed on the stated dates above, nor are they indicative of the future operating results of Mylan N.V. and its subsidiaries.

| | | | Three Months Ended | | Nine Months Ended | Three Months Ended |

| | September 30, | | September 30, | March 31, |

| (Unaudited, in millions, except per share amounts) | 2016 | | 2015 | | 2016 | | 2015 | 2016 |

| Total revenues | $ | 3,168.6 |

| | $ | 3,506.4 |

| | $ | 9,008.2 |

| | $ | 8,895.0 |

| $ | 2,687.7 |

|

| Net (loss) earnings attributable to Mylan N.V. ordinary shareholders | $ | (111.4 | ) | | $ | 381.2 |

| | $ | 132.0 |

| | $ | 405.8 |

| |

| (Loss) earnings per ordinary share attributable to Mylan N.V. ordinary shareholders: | | | | | | | | |

| Net earnings | | $ | 10.1 |

|

| Earnings per ordinary share: | | |

| Basic | $ | (0.21 | ) | | $ | 0.74 |

| | $ | 0.25 |

| | $ | 0.78 |

| $ | 0.02 |

|

| Diluted | $ | (0.21 | ) | | $ | 0.71 |

| | $ | 0.25 |

| | $ | 0.75 |

| $ | 0.02 |

|

| Weighted average ordinary shares outstanding: | | | | | | | | |

| Basic | 533.9 |

| | 516.9 |

| | 526.9 |

| | 517.0 |

| 518.0 |

|

| Diluted | 533.9 |

| | 540.4 |

| | 536.2 |

| | 544.0 |

| 537.8 |

|

Other Transactions

During the second quarter of 2016,On March 29, 2017, the Company entered into an agreementannounced that it had completed its acquisition of the global rights to acquire a marketed pharmaceutical productthe Cold-EEZE® brand cold remedy line from ProPhase Labs, Inc. for an upfront payment of approximately $57.9$50 million which is included in investing activities in the Condensed Consolidated Statements of Cash Flows.cash. The Company accounted for this transaction as an asset acquisition and the asset is amortizing the product rightbeing amortized over a weighted useful life of five15 years.

On January 8, 2016,February 14, 2017, the Company entered into an agreement with Momenta Pharmaceuticals, Inc. (“Momenta”) to develop, manufacture and commercialize up to six of Momenta’s current biosimilar candidates, including Momenta’s biosimilar candidate, ORENCIA® (abatacept). As part of the agreement, Mylan made an up-front cash payment of $45 million to Momenta. Under the terms of the agreement, Momenta is eligible to receive additional contingent milestone payments of up to $200 million. The Company and Momenta will jointly be responsible for producta joint development and will equally sharemarketing agreement for a respiratory product that resulted in approximately $50 million in research and development (“R&D”) expense in the costs and profits related to the products. Under the agreement, Mylan will lead the worldwide commercialization efforts.

On November 2, 2016, the Company and Momenta announced that dosing had begun in a Phase 1 study to compare the pharmacokinetics, safety and immunogenicity of M834, a proposed bisoimilar or ORENCIA® (abatacept), to U.S. and

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

European Union sourced ORENCIA® in normal healthy volunteers. Under the agreement, Momenta has achieved the milestone necessary to earn a $25 million payment from the Company which will be paid in the fourthfirst quarter of 2016.

In accordance with ASC 730, Research and Development,the Company is accounting for the contingent milestone payments as non-refundable advance payments for services to be used in future R&D activities, which are required to be capitalized until the related services have been performed. More specifically, as costs are incurred within the scope of the collaboration, the Company will record its share of the costs as R&D expense. In addition to the upfront cash payment, during the three and nine months ended September 30, 2016 the Company incurred approximately $9.0 million and $22.3 million, respectively, of R&D expense related to this collaboration. To the extent the contingent milestone payments made by the Company exceed the liability incurred, a prepaid asset will be reflected on the Company’s Condensed Consolidated Balance Sheet. To the extent the contingent milestone payments made by the Company are less than the expense incurred, the difference between the payment and the expense will be recorded as a liability on the Company’s Condensed Consolidated Balance Sheet.2017.

| |

| 5. | Share-Based Incentive Plan |

The Company’s shareholders have approved the 2003 Long-Term Incentive Plan (as amended, the “2003 Plan”). Under the 2003 Plan, 55,300,000 ordinary shares are reserved for issuance to key employees, consultants, independent contractors and non-employee directors of the Company through a variety of incentive awards, including: stock options, stock appreciation rights (“SAR”), restricted ordinary shares and units, performance awards (“PSU”), other stock-based awards and short-term cash awards. Stock option awards are granted atwith an exercise price equal to the fair market value of the ordinary shares underlying the options at the date of the grant, generally become exercisable over periods ranging from three to four years, and generally expire in ten years. UponSince approval of the 2003 Plan, no further grants of stock options have been made under any other previous plans.

The following table summarizes stock option and SAR (“stock awards”) activity:

|

| | | | | | |

| | Number of Shares Under Stock Awards | | Weighted Average Exercise Price per Share |

| Outstanding at December 31, 2015 | 7,732,499 |

| | $ | 31.85 |

|

| Granted | 780,254 |

| | 46.15 |

|

| Exercised | (496,440 | ) | | 23.52 |

|

| Forfeited | (166,571 | ) | | 51.26 |

|

| Outstanding at September 30, 2016 | 7,849,742 |

| | $ | 33.39 |

|

| Vested and expected to vest at September 30, 2016 | 7,537,727 |

| | $ | 32.78 |

|

| Exercisable at September 30, 2016 | 5,704,835 |

| | $ | 27.71 |

|

As of September 30, 2016, stock awards outstanding, stock awards vested and expected to vest and stock awards exercisable had average remaining contractual terms of 6.0 years, 5.9 years and 5.0 years, respectively. Also, at September 30, 2016, stock awards outstanding, stock awards vested and expected to vest and stock awards exercisable had aggregate intrinsic values of $75.9 million, $75.7 million and $75.0 million, respectively.plan.

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

The following table summarizes stock option and SAR (together, “stock awards”) activity:

|

| | | | | | |

| | Number of Shares Under Stock Awards | | Weighted Average Exercise Price per Share |

| Outstanding at December 31, 2016 | 7,699,441 |

| | $ | 33.38 |

|

| Granted | 706,995 |

| | 45.02 |

|

| Exercised | (242,795 | ) | | 21.27 |

|

| Forfeited | (161,159 | ) | | 50.43 |

|

| Outstanding at March 31, 2017 | 8,002,482 |

| | $ | 34.43 |

|

| Vested and expected to vest at March 31, 2017 | 7,723,468 |

| | $ | 33.98 |

|

| Exercisable at March 31, 2017 | 5,976,527 |

| | $ | 30.24 |

|

As of March 31, 2017, stock awards outstanding, stock awards vested and expected to vest, and stock awards exercisable had average remaining contractual terms of 5.9 years, 5.8 years and 4.9 years, respectively. Also, at March 31, 2017, stock awards outstanding, stock awards vested and expected to vest and stock awards exercisable had aggregate intrinsic values of $73.5 million, $73.4 million and $73.0 million, respectively.

A summary of the status of the Company’s nonvested restricted stockordinary shares and restricted stock unit awards, including performance restricted stock units and restricted ordinary sharesPSUs (collectively, “restricted stock awards”), as of September 30, 2016March 31, 2017 and the changes during the ninethree months ended September 30, 2016March 31, 2017 are presented below:

| | | | Number of Restricted Stock Awards | | Weighted Average Grant-Date Fair Value per Share | Number of Restricted Stock Awards | | Weighted Average Grant-Date Fair Value per Share |

| Nonvested at December 31, 2015 | 4,474,436 |

| | $ | 40.70 |

| |

| Nonvested at December 31, 2016 | | 5,667,830 |

| | $ | 42.46 |

|

| Granted | 2,619,679 |

| | 45.15 |

| 1,255,062 |

| | 45.17 |

|

| Released | (1,072,156 | ) | | 41.95 |

| (483,902 | ) | | 52.54 |

|

| Forfeited | (326,916 | ) | | 41.65 |

| (117,259 | ) | | 49.99 |

|

| Nonvested at September 30, 2016 | 5,695,043 |

| | $ | 42.49 |

| |

| Nonvested at March 31, 2017 | | 6,321,731 |

| | $ | 42.09 |

|

As of September 30, 2016March 31, 2017, the Company had $165.0181.8 million of total unrecognized compensation expense, net of estimated forfeitures, related to all of its stock-based awards, which will be recognized over the remaining weighted average vesting period of 2.42.2 years. The total intrinsic value of stock awards exercised and restricted stock units released during the ninethree months ended September 30, 2016March 31, 2017 and 20152016 was $49.126.1 million and $254.940.1 million, respectively.

| |

| 6. | Pensions and Other Postretirement Benefits |

Defined Benefit Plans

The Company sponsors various defined benefit pension plans in several countries. Benefits provided generally depend on length of service, pay grade and remuneration levels. The Company maintains an historic smalltwo fully frozen defined benefit pension planplans in the U.S., and employees in the U.S. and Puerto Rico are generally provided retirement benefits through defined contribution plans. The Company acquired net unfunded pension and other postretirement liabilities of approximately $322.3 million as a result of the Meda transaction.

The Company also sponsors other postretirement benefit plans. There areplans including plans that provide for postretirement supplemental medical coverage. Benefits from these plans are paidprovided to employees and their spouses and dependents who meet various minimum age and service requirements. In addition, there arethe Company sponsors other plans that provide for life insurance benefits and postretirement medical coverage for certain officers and management employees.

Net Periodic Benefit Cost

Components of net periodic benefit cost for the three and nine months ended September 30,March 31, 2017 and 2016 and 2015 were as follows: |

| | | | | | | | | | | | | | | |

| | Pension and Other Postretirement Benefits |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| (In millions) | 2016 | | 2015 | | 2016 | | 2015 |

| Service cost | $ | 4.8 |

| | $ | 2.8 |

| | $ | 12.6 |

| | $ | 8.5 |

|

| Interest cost | 2.8 |

| | 1.2 |

| | 5.7 |

| | 3.6 |

|

| Expected return on plan assets | (3.0 | ) | | (1.4 | ) | | (7.0 | ) | | (4.1 | ) |

| Plan curtailment, settlement and termination | — |

| | 0.3 |

| | — |

| | 0.8 |

|

| Amortization of prior service costs | 0.1 |

| | 0.1 |

| | 0.2 |

| | 0.2 |

|

| Recognized net actuarial losses | 0.2 |

| | 0.3 |

| | 0.7 |

| | 0.9 |

|

| Net periodic benefit cost | $ | 4.9 |

| | $ | 3.3 |

| | $ | 12.2 |

| | $ | 9.9 |

|

The Company is making the minimum mandatory contributions to its U.S. defined benefit pension plans in the 2016 plan year. The Company expects to make total benefit payments of approximately $20.2 million and contributions to pension and other postretirement benefit plans of approximately $17.7 million in 2016.

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

| |

7. | Balance Sheet Components |

Selected balance sheet components consist of the following:

|

| | | | | | | |

| (In millions) | September 30,

2016 | | December 31,

2015 |

| Inventories: | | | |

| Raw materials | $ | 825.1 |

| | $ | 592.4 |

|

| Work in process | 469.8 |

| | 387.0 |

|

| Finished goods | 1,392.6 |

| | 971.6 |

|

| | $ | 2,687.5 |

| | $ | 1,951.0 |

|

|

| | | | | | | |

| Property, plant and equipment: | | | |

| Land and improvements | $ | 145.0 |

| | $ | 124.5 |

|

| Buildings and improvements | 1,074.9 |

| | 950.6 |

|

| Machinery and equipment | 2,215.6 |

| | 1,928.4 |

|

| Construction in progress | 344.8 |

| | 290.5 |

|

| Gross property, plant and equipment | 3,780.3 |

| | 3,294.0 |

|

| Accumulated depreciation | 1,496.1 |

| | 1,310.1 |

|

| Property, plant and equipment, net | $ | 2,284.2 |

| | $ | 1,983.9 |

|

|

| | | | | | | |

| Other current liabilities: | | | |

| Legal and professional accruals, including litigation accruals | $ | 610.8 |

| | $ | 122.6 |

|

| Payroll and employee benefit plan accruals | 429.7 |

| | 367.9 |

|

| Accrued sales allowances | 824.1 |

| | 681.8 |

|

| Accrued interest | 114.3 |

| | 25.1 |

|

| Fair value of financial instruments | 25.2 |

| | 19.8 |

|

| Compulsory acquisition proceeding | 431.0 |

| | — |

|

| Other | 1,210.7 |

| | 624.7 |

|

| | $ | 3,645.8 |

| | $ | 1,841.9 |

|

Included in prepaid expenses and other current assets in the Condensed Consolidated Balance Sheets was $156.8 million and $106.6 million of restricted cash at September 30, 2016 and December 31, 2015, respectively. During the nine months ended September 30, 2016, the Company recorded restricted cash of approximately $50 million related to amounts deposited in escrow, for potential contingent consideration payments related to the acquisition of the Topicals Business. An additional $100 million of restricted cash was classified in other long-term assets at December 31, 2015, principally related to amounts deposited in escrow, or restricted amounts, for potential contingent consideration payments related to the acquisition of Agila Specialties Private Limited (“Agila”), which the Company acquired in 2013 from Strides Arcolab Limited (“Strides”). At September 30, 2016, this amount was reclassified to current restricted cash in conjunction with the Strides Settlement, as defined in Note 18 Contingencies.

Included in legal and professional accruals, including litigation accruals at September 30, 2016 is $465 million for a settlement with the U.S. Department of Justice and other government agencies related to the classification of the EpiPen® Auto-Injector and EpiPen Jr® Auto-Injector (collectively, “EpiPen® Auto-Injector”) for purposes of the Medicaid Drug Rebate Program (the “Medicaid Drug Rebate Program Settlement”), as discussed further in Note 18 Contingencies.

At the close of the Meda transaction and at September 30, 2016, the Company recorded a current liability of $431 million related to the purchase of the non-tendered shares of Meda pursuant to the compulsory acquisition proceeding. Included in other current liabilities at September 30, 2016 is approximately $350 million of accrued expenses assumed from Meda.

Contingent consideration included in other current liabilities totaled $128.6 million and $35.0 million at September 30, 2016 and December 31, 2015, respectively. During the nine months ended September 30, 2016, the Company recorded

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

|

| | | | | | | |

| | Pension and Other Postretirement Benefits |

| | March 31, |

| (In millions) | 2017 | | 2016 |

| Service cost | $ | 5.0 |

| | $ | 3.9 |

|

| Interest cost | 3.7 |

| | 1.5 |

|

| Expected return on plan assets | (3.5 | ) | | (2.0 | ) |

| Amortization of prior service costs | 0.1 |

| | 0.1 |

|

| Recognized net actuarial losses | 0.2 |

| | 0.2 |

|

| Net periodic benefit cost | $ | 5.5 |

| | $ | 3.7 |

|

The Company is making the minimum mandatory contributions to its U.S. defined benefit pension plans in the 2017 plan year. The Company expects to make total benefit payments of $16approximately $30.4 million and contributions to pension and other postretirement benefit plans of approximately $30.2 million in 2017.

| |

| 7. | Balance Sheet Components |

Selected balance sheet components consist of the following:

Inventories

|

| | | | | | | |

| (In millions) | March 31,

2017 | | December 31,

2016 |

| Raw materials | $ | 833.8 |

| | $ | 783.4 |

|

| Work in process | 427.3 |

| | 436.0 |

|

| Finished goods | 1,286.7 |

| | 1,237.0 |

|

| Inventories | $ | 2,547.8 |

| | $ | 2,456.4 |

|

Prepaid and other current liabilitiesassets related |

| | | | | | | |

| (In millions) | March 31,

2017 | | December 31, 2016 |

| Prepaid expenses | $ | 177.0 |

| | $ | 169.1 |

|

| Restricted cash | 135.8 |

| | 148.1 |

|

| Available-for-sale securities | 91.3 |

| | 83.7 |

|

| Fair value of financial instruments | 88.2 |

| | 62.2 |

|

| Trading securities | 30.7 |

| | 29.6 |

|

| Other current assets | 398.9 |

| | 263.7 |

|

| Prepaid expenses and other current assets | $ | 921.9 |

| | $ | 756.4 |

|

Prepaid expenses consist primarily of prepaid rent, insurance and other individually insignificant items.

MYLAN N.V. AND SUBSIDIARIES

Notes to the acquisition of the Topicals BusinessCondensed Consolidated Financial Statements (Unaudited) - Continued

Property, plant and made $15.5 million of contingent consideration payments. During the third quarter of 2016,equipment, net

|

| | | | | | | |

| (In millions) | March 31,

2017 | | December 31, 2016 |

| Machinery and equipment | $ | 2,245.3 |

| | $ | 2,227.9 |

|

| Buildings and improvements | 1,124.8 |

| | 1,106.5 |

|

| Construction in progress | 330.4 |