UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-Q

|

| |

þ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2017March 31, 2020

|

| |

¨☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from_____________to___________

Commission File Number 333-199861

MYLAN N.V.

(Exact name of registrant as specified in its charter)

|

| | |

The Netherlands | | 98-118949798-1493528 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

Building 4, Trident Place, Mosquito Way, Hatfield, Hertfordshire, AL10 9UL, England

(Address of principal executive offices)

+44 (0) 1707-853-0001707-853-000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | |

| Title of each class: | | Trading Symbol(s): | | Name of each exchange on which registered: |

| | | | |

| Ordinary shares, nominal value €0.01 | | MYL | | The NASDAQ Stock Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ☑ No ¨☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ☑ No ¨☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

| Large accelerated filer | | þ☑ | | Accelerated filer | | ¨☐ |

| | | | | | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company)☐

| | Smaller reporting company | | ¨☐ |

| | | | | | | |

| | | | | Emerging growth company | | ¨☐ |

| | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to ususe the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨☐ No þ☑

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

As of November 2, 2017,May 6, 2020, there were 536,436,323516,944,470 of the issuer’s €0.01 nominal value ordinary shares outstanding.

MYLAN N.V. AND SUBSIDIARIES

INDEX TO FORM 10-Q

For the Quarterly Period Ended

September 30, 2017March 31, 2020

|

| | |

| | Page |

| | PART I — FINANCIAL INFORMATION | |

| ITEM 1. | Condensed Consolidated Financial Statements (unaudited) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | | |

| | |

| | |

| ITEM 2. | | |

| | |

| ITEM 3. | | |

| | | |

ITEM 3.4. | | |

| | |

ITEM 4. | | |

| | | |

| | PART II — OTHER INFORMATION | |

| ITEM 1. | | |

| | | |

| ITEM 1A. | | |

| | |

ITEM 5. | | |

| | | |

| ITEM 6. | | |

| | | |

| | |

PART I — FINANCIAL INFORMATION

MYLAN N.V. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

(Unaudited; in millions, except per share amounts)

| | | | Three Months Ended | | Nine Months Ended | Three Months Ended |

| | September 30, | | September 30, | March 31, |

| | 2017 | | 2016 | | 2017 | | 2016 | 2020 | | 2019 |

| Revenues: | | | | | | | | | | |

| Net sales | $ | 2,956.3 |

| | $ | 3,029.5 |

| | $ | 8,570.2 |

| | $ | 7,745.5 |

| $ | 2,588.2 |

| | $ | 2,460.6 |

|

| Other revenues | 30.8 |

| | 27.6 |

| | 98.6 |

|

| 63.6 |

| 31.0 |

|

| 34.9 |

|

| Total revenues | 2,987.1 |

| | 3,057.1 |

| | 8,668.8 |

| | 7,809.1 |

| 2,619.2 |

| | 2,495.5 |

|

| Cost of sales | 1,809.0 |

| | 1,773.8 |

| | 5,180.3 |

| | 4,447.1 |

| 1,713.1 |

| | 1,690.3 |

|

| Gross profit | 1,178.1 |

| | 1,283.3 |

| | 3,488.5 |

| | 3,362.0 |

| 906.1 |

| | 805.2 |

|

| Operating expenses: | | | | | | | | | | |

| Research and development | 182.3 |

| | 199.1 |

| | 580.9 |

| | 632.2 |

| 114.2 |

| | 172.6 |

|

| Selling, general and administrative | 664.6 |

| | 656.9 |

| | 1,916.8 |

| | 1,787.6 |

| 605.4 |

| | 607.9 |

|

| Litigation settlements and other contingencies, net | 15.2 |

| | 558.0 |

| | (25.8 | ) | | 556.4 |

| 1.8 |

| | 0.7 |

|

| Total operating expenses | 862.1 |

| | 1,414.0 |

| | 2,471.9 |

| | 2,976.2 |

| 721.4 |

| | 781.2 |

|

| Earnings (loss) from operations | 316.0 |

| | (130.7 | ) | | 1,016.6 |

| | 385.8 |

| |

| Earnings from operations | | 184.7 |

| | 24.0 |

|

| Interest expense | 131.8 |

| | 144.4 |

| | 406.3 |

| | 305.0 |

| 119.9 |

| | 131.2 |

|

| Other expense, net | 4.6 |

| | 50.2 |

| | 34.4 |

| | 184.0 |

| 34.1 |

| | 7.3 |

|

| Earnings (loss) before income taxes | 179.6 |

| | (325.3 | ) | | 575.9 |

| | (103.2 | ) | |

| Earnings (Loss) before income taxes | | 30.7 |

| | (114.5 | ) |

| Income tax provision (benefit) | 91.3 |

| | (205.5 | ) | | 124.2 |

| | (165.7 | ) | 9.9 |

| | (89.5 | ) |

| Net earnings (loss) | $ | 88.3 |

| | $ | (119.8 | ) | | $ | 451.7 |

| | $ | 62.5 |

| $ | 20.8 |

| | $ | (25.0 | ) |

| Earnings (loss) per ordinary share: | | | | | | | | |

| Earnings (Loss) per ordinary share: | | | | |

| Basic | $ | 0.17 |

| | $ | (0.23 | ) | | $ | 0.84 |

| | $ | 0.12 |

| $ | 0.04 |

| | $ | (0.05 | ) |

| Diluted | $ | 0.16 |

| | $ | (0.23 | ) | | $ | 0.84 |

| | $ | 0.12 |

| $ | 0.04 |

| | $ | (0.05 | ) |

| Weighted average ordinary shares outstanding: | | | | | | | | | | |

| Basic | 535.2 |

| | 523.6 |

| | 534.9 |

| | 505.9 |

| 516.4 |

| | 515.0 |

|

| Diluted | 537.0 |

| | 523.6 |

| | 537.0 |

| | 515.2 |

| 517.0 |

| | 515.0 |

|

See Notes to Condensed Consolidated Financial Statements

3

MYLAN N.V. AND SUBSIDIARIES

Condensed Consolidated Statements of Comprehensive EarningsLoss

(Unaudited; in millions)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| Net earnings (loss) | $ | 88.3 |

| | $ | (119.8 | ) | | $ | 451.7 |

| | $ | 62.5 |

|

| Other comprehensive earnings (loss), before tax: | | | | | | | |

| Foreign currency translation adjustment | 423.0 |

| | 290.6 |

| | 1,831.9 |

| | 645.5 |

|

| Change in unrecognized gain (loss) and prior service cost related to defined benefit plans | 1.1 |

| | 0.1 |

| | 2.4 |

| | (0.3 | ) |

| Net unrecognized (loss) gain on derivatives in cash flow hedging relationships | (4.5 | ) | | 22.8 |

| | 29.2 |

| | (22.9 | ) |

| Net unrecognized loss on derivatives in net investment hedging relationships | (72.1 | ) | | (10.4 | ) | | (203.2 | ) | | (10.4 | ) |

| Net unrealized (loss) gain on marketable securities | (8.9 | ) | | 21.5 |

| | 3.5 |

| | 32.5 |

|

| Other comprehensive earnings, before tax | 338.6 |

| | 324.6 |

| | 1,663.8 |

| | 644.4 |

|

| Income tax (benefit) provision | (5.8 | ) | | 13.7 |

| | 11.3 |

| | 0.5 |

|

| Other comprehensive earnings, net of tax | 344.4 |

| | 310.9 |

| | 1,652.5 |

| | 643.9 |

|

| Comprehensive earnings | $ | 432.7 |

| | $ | 191.1 |

| | $ | 2,104.2 |

| | $ | 706.4 |

|

|

| | | | | | | |

| | Three Months Ended |

| | March 31, |

| | 2020 | | 2019 |

| Net earnings (loss) | $ | 20.8 |

| | $ | (25.0 | ) |

| Other comprehensive loss, before tax: | | | |

| Foreign currency translation adjustment | (656.6 | ) | | (338.5 | ) |

| Change in unrecognized (loss) gain and prior service cost related to defined benefit plans | (1.6 | ) | | 0.2 |

|

| Net unrecognized (loss) gain on derivatives in cash flow hedging relationships | (51.4 | ) | | 26.0 |

|

| Net unrecognized gain on derivatives in net investment hedging relationships | 42.3 |

| | 58.1 |

|

| Net unrealized gain on marketable securities | 0.2 |

| | 0.4 |

|

| Other comprehensive loss, before tax | (667.1 | ) | | (253.8 | ) |

| Income tax (benefit) provision | (10.8 | ) | | 11.8 |

|

| Other comprehensive loss, net of tax | (656.3 | ) | | (265.6 | ) |

| Comprehensive loss | $ | (635.5 | ) | | $ | (290.6 | ) |

See Notes to Condensed Consolidated Financial Statements

4

MYLAN N.V. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(Unaudited; in millions, except share and per share amounts)

|

| | | | | | | |

| | March 31,

2020 | | December 31,

2019 |

| ASSETS |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 572.4 |

| | $ | 475.6 |

|

| Accounts receivable, net | 2,774.6 |

| | 3,058.8 |

|

| Inventories | 2,639.6 |

| | 2,670.9 |

|

| Prepaid expenses and other current assets | 613.9 |

| | 552.0 |

|

| Total current assets | 6,600.5 |

| | 6,757.3 |

|

| Property, plant and equipment, net | 2,067.0 |

| | 2,149.6 |

|

| Intangible assets, net | 11,046.9 |

| | 11,649.9 |

|

| Goodwill | 9,326.7 |

| | 9,590.6 |

|

| Deferred income tax benefit | 701.3 |

| | 703.1 |

|

| Other assets | 403.5 |

| | 405.0 |

|

| Total assets | $ | 30,145.9 |

| | $ | 31,255.5 |

|

| | | | |

| LIABILITIES AND EQUITY |

| Liabilities | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 1,273.5 |

| | $ | 1,528.1 |

|

| Income taxes payable | 254.3 |

| | 213.0 |

|

| Current portion of long-term debt and other long-term obligations | 1,487.7 |

| | 1,508.1 |

|

| Other current liabilities | 2,212.7 |

| | 2,319.9 |

|

| Total current liabilities | 5,228.2 |

| | 5,569.1 |

|

| Long-term debt | 11,197.8 |

| | 11,214.3 |

|

| Deferred income tax liability | 1,538.2 |

| | 1,627.5 |

|

| Other long-term obligations | 919.0 |

| | 960.8 |

|

| Total liabilities | 18,883.2 |

| | 19,371.7 |

|

| Equity | | | |

| Mylan N.V. shareholders’ equity | | | |

| Ordinary shares — nominal value €0.01 per ordinary share | | | |

| Shares authorized: 1,200,000,000 | | | |

| Shares issued: 541,542,294 and 540,746,871 as of March 31, 2020 and December 31, 2019 | 6.1 |

| | 6.1 |

|

| Additional paid-in capital | 8,657.9 |

| | 8,643.5 |

|

| Retained earnings | 6,051.9 |

| | 6,031.1 |

|

| Accumulated other comprehensive loss | (2,453.5 | ) | | (1,797.2 | ) |

| | 12,262.4 |

| | 12,883.5 |

|

| Less: Treasury stock — at cost | | | |

| Ordinary shares: 24,598,074 as of March 31, 2020 and December 31, 2019 | 999.7 |

| | 999.7 |

|

| Total equity | 11,262.7 |

| | 11,883.8 |

|

| Total liabilities and equity | $ | 30,145.9 |

| | $ | 31,255.5 |

|

|

| | | | | | | |

| | September 30,

2017 | | December 31,

2016 |

| ASSETS |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 614.9 |

| | $ | 998.8 |

|

| Accounts receivable, net | 3,220.2 |

| | 3,310.9 |

|

| Inventories | 2,548.1 |

| | 2,456.4 |

|

| Prepaid expenses and other current assets | 883.4 |

| | 756.4 |

|

| Total current assets | 7,266.6 |

| | 7,522.5 |

|

| Property, plant and equipment, net | 2,310.0 |

| | 2,322.2 |

|

| Intangible assets, net | 15,270.5 |

| | 14,447.8 |

|

| Goodwill | 9,984.7 |

| | 9,231.9 |

|

| Deferred income tax benefit | 559.8 |

| | 633.2 |

|

| Other assets | 427.3 |

| | 568.6 |

|

| Total assets | $ | 35,818.9 |

| | $ | 34,726.2 |

|

| | | | |

| LIABILITIES AND EQUITY |

| Liabilities | | | |

| Current liabilities: | | | |

| Trade accounts payable | $ | 1,276.1 |

| | $ | 1,348.1 |

|

| Short-term borrowings | — |

| | 46.4 |

|

| Income taxes payable | 14.8 |

| | 97.7 |

|

| Current portion of long-term debt and other long-term obligations | 793.0 |

| | 290.0 |

|

| Other current liabilities | 2,900.1 |

| | 3,258.5 |

|

| Total current liabilities | 4,984.0 |

| | 5,040.7 |

|

| Long-term debt | 13,992.4 |

| | 15,202.9 |

|

| Deferred income tax liability | 2,138.4 |

| | 2,006.4 |

|

| Other long-term obligations | 1,412.5 |

| | 1,358.6 |

|

| Total liabilities | 22,527.3 |

| | 23,608.6 |

|

| Equity | | | |

| Mylan N.V. shareholders’ equity | | | |

Ordinary shares — nominal value €0.01 per ordinary share

| | | |

| Shares authorized: 1,200,000,000 | | | |

| Shares issued: 537,660,870 and 536,639,291 as of September 30, 2017 and December 31, 2016 | 6.0 |

| | 6.0 |

|

| Additional paid-in capital | 8,570.5 |

| | 8,499.3 |

|

| Retained earnings | 5,393.8 |

| | 4,942.1 |

|

| Accumulated other comprehensive loss | (611.2 | ) | | (2,263.7 | ) |

| | 13,359.1 |

| | 11,183.7 |

|

| Noncontrolling interest | — |

| | 1.4 |

|

| Less: Treasury stock — at cost | | | |

| Ordinary shares: 1,311,193 as of September 30, 2017 and December 31, 2016 | 67.5 |

| | 67.5 |

|

| Total equity | 13,291.6 |

| | 11,117.6 |

|

| Total liabilities and equity | $ | 35,818.9 |

| | $ | 34,726.2 |

|

See Notes to Condensed Consolidated Financial Statements

5

MYLAN N.V. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash FlowsEquity

(Unaudited; in millions)millions, except share amounts)

|

| | | | | | | |

| | Nine Months Ended |

| | September 30, |

| | 2017 | | 2016 |

| Cash flows from operating activities: | | | |

| Net earnings | $ | 451.7 |

| | $ | 62.5 |

|

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | |

| Depreciation and amortization | 1,279.8 |

| | 1,046.4 |

|

| Share-based compensation expense | 64.2 |

| | 71.1 |

|

| Deferred income tax expense (benefit) | 17.4 |

| | (356.6 | ) |

| Loss from equity method investments | 77.2 |

| | 85.5 |

|

| Other non-cash items | 265.4 |

| | 226.1 |

|

| Litigation settlements and other contingencies, net | (45.2 | ) | | 558.6 |

|

| Write off of financing fees | — |

| | 35.8 |

|

| Unrealized losses on acquisition-related foreign currency derivatives | — |

| | 128.6 |

|

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 216.2 |

| | 183.3 |

|

| Inventories | (87.9 | ) | | (336.7 | ) |

| Trade accounts payable | (187.4 | ) | | (45.0 | ) |

| Income taxes | (149.3 | ) | | 51.3 |

|

| Other operating assets and liabilities, net | (332.8 | ) | | (13.2 | ) |

| Net cash provided by operating activities | 1,569.3 |

| | 1,697.7 |

|

| Cash flows from investing activities: | | | |

| Cash paid for acquisitions, net | (71.6 | ) | | (6,151.7 | ) |

| Capital expenditures | (156.4 | ) | | (239.5 | ) |

| Proceeds from the sale of assets | 31.1 |

| | — |

|

| Change in restricted cash | 12.6 |

| | (50.5 | ) |

| Purchase of marketable securities | (8.9 | ) | | (22.8 | ) |

| Proceeds from the sale of marketable securities | 8.9 |

| | 15.8 |

|

| Cash paid for Meda's unconditional deferred payment | — |

| | (308.0 | ) |

| Settlement of acquisition-related foreign currency derivatives | — |

| | (128.6 | ) |

| Payments for product rights and other, net | (558.8 | ) | | (196.3 | ) |

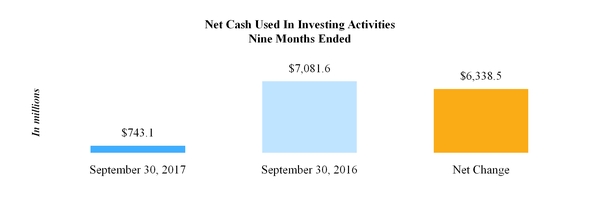

| Net cash used in investing activities | (743.1 | ) | | (7,081.6 | ) |

| Cash flows from financing activities: | | | |

| Payments of long-term debt | (1,747.3 | ) | | (1,067.0 | ) |

| Change in short-term borrowings, net | (48.3 | ) | | 48.6 |

|

| Taxes paid related to net share settlement of equity awards | (7.4 | ) | | (12.9 | ) |

| Contingent consideration payments | (10.1 | ) | | (15.5 | ) |

| Payments of financing fees | (8.7 | ) | | (95.3 | ) |

| Proceeds from issuance of long-term debt | 555.8 |

| | 6,519.8 |

|

| Proceeds from exercise of stock options | 12.8 |

| | 11.1 |

|

| Acquisition of noncontrolling interest | — |

| | (1.0 | ) |

| Other items, net | (0.7 | ) | | 1.6 |

|

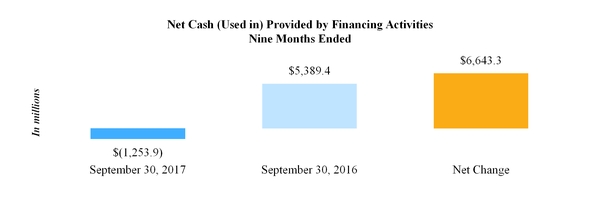

| Net cash (used in) provided by financing activities | (1,253.9 | ) | | 5,389.4 |

|

| Effect on cash of changes in exchange rates | 43.8 |

| | 15.1 |

|

| Net (decrease) increase in cash and cash equivalents | (383.9 | ) | | 20.6 |

|

| Cash and cash equivalents — beginning of period | 998.8 |

| | 1,236.0 |

|

| Cash and cash equivalents — end of period | $ | 614.9 |

| | $ | 1,256.6 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Additional Paid-In Capital | | Retained

Earnings | | | | | | Accumulated Other Comprehensive Loss | | Total

Equity |

| | Ordinary Shares | | | | Treasury Stock | | |

| | Shares | | Cost | | | | Shares | | Cost | | |

| Balance at December 31, 2019 | 540,746,871 |

| | $ | 6.1 |

| | $ | 8,643.5 |

| | $ | 6,031.1 |

| | 24,598,074 |

| | $ | (999.7 | ) | | $ | (1,797.2 | ) | | $ | 11,883.8 |

|

| Net earnings | — |

| | — |

| | — |

| | 20.8 |

| | — |

| | — |

| | — |

| | 20.8 |

|

| Other comprehensive loss, net of tax | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (656.3 | ) | | (656.3 | ) |

| Issuance of restricted stock and stock options exercised, net | 795,423 |

| | — |

| | 0.6 |

| | — |

| | — |

| | — |

| | — |

| | 0.6 |

|

| Taxes related to the net share settlement of equity awards | — |

| | — |

| | (5.6 | ) | | — |

| | — |

| | — |

| | — |

| | (5.6 | ) |

| Share-based compensation expense | — |

| | — |

| | 19.4 |

| | — |

| | — |

| | — |

| | — |

| | 19.4 |

|

| Balance at March 31, 2020 | 541,542,294 |

| | $ | 6.1 |

| | $ | 8,657.9 |

| | $ | 6,051.9 |

| | 24,598,074 |

| | $ | (999.7 | ) | | $ | (2,453.5 | ) | | $ | 11,262.7 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Additional Paid-In Capital | | Retained

Earnings | | | | | | Accumulated Other Comprehensive Loss | | Total

Equity |

| | Ordinary Shares | | | | Treasury Stock | | |

| | Shares | | Cost | | | | Shares | | Cost | | |

| Balance at December 31, 2018 | 539,289,665 |

| | $ | 6.0 |

| | $ | 8,591.4 |

| | $ | 6,010.7 |

| | 23,490,867 |

| | $ | (999.7 | ) | | $ | (1,441.3 | ) | | $ | 12,167.1 |

|

| Net loss | — |

| | — |

| | — |

| | (25.0 | ) | | — |

| | — |

| | — |

| | (25.0 | ) |

| Other comprehensive loss, net of tax | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (265.6 | ) | | (265.6 | ) |

| Issuance of restricted stock and stock options exercised, net | 653,679 |

| | — |

| | 2.3 |

| | — |

| | — |

| | — |

| | — |

| | 2.3 |

|

| Taxes related to the net share settlement of equity awards | — |

| | — |

| | (5.2 | ) | | — |

| | — |

| | — |

| | — |

| | (5.2 | ) |

| Share-based compensation expense | — |

| | — |

| | 18.0 |

| | — |

| | — |

| | — |

| | — |

| | 18.0 |

|

| Cumulative effect of the adoption of new accounting standards | — |

| | — |

| | — |

| | 3.6 |

| | — |

| | — |

| | (3.6 | ) | | — |

|

| Balance at March 31, 2019 | 539,943,344 |

| | $ | 6.0 |

| | $ | 8,606.5 |

| | $ | 5,989.3 |

| | 23,490,867 |

| | $ | (999.7 | ) | | $ | (1,710.5 | ) | | $ | 11,891.6 |

|

See Notes to Condensed Consolidated Financial Statements

6

MYLAN N.V. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

(Unaudited; in millions)

|

| | | | | | | |

| | Three Months Ended |

| | March 31, |

| | 2020 | | 2019 |

| Cash flows from operating activities: | | | |

| Net earnings (loss) | $ | 20.8 |

| | $ | (25.0 | ) |

| Adjustments to reconcile net (loss) earnings to net cash provided by (used in) operating activities: | | | |

| Depreciation and amortization | 415.0 |

| | 500.5 |

|

| Share-based compensation expense | 19.4 |

| | 18.0 |

|

| Deferred income tax (benefit) expense | (43.9 | ) | | 6.7 |

|

| Loss from equity method investments | 17.3 |

| | 17.0 |

|

| Other non-cash items | 28.7 |

| | (2.3 | ) |

| Litigation settlements and other contingencies, net | 7.2 |

| | (3.7 | ) |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 73.6 |

| | 62.8 |

|

| Inventories | (131.8 | ) | | (183.0 | ) |

| Accounts payable | (201.0 | ) | | (277.5 | ) |

| Income taxes | 10.8 |

| | (213.6 | ) |

| Other operating assets and liabilities, net | 75.0 |

| | 60.4 |

|

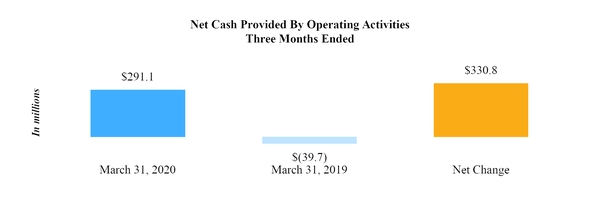

| Net cash provided by (used in) operating activities | 291.1 |

| | (39.7 | ) |

| Cash flows from investing activities: | | | |

| Cash paid for acquisitions, net | — |

| | (7.1 | ) |

| Capital expenditures | (43.4 | ) | | (53.1 | ) |

| Purchase of available for sale securities and other investments | (53.6 | ) | | (7.8 | ) |

| Proceeds from the sale of marketable securities | 18.1 |

| | 7.6 |

|

| Payments for product rights and other, net | (67.1 | ) | | (15.4 | ) |

| Proceeds from the sale of assets | 0.4 |

| | 0.2 |

|

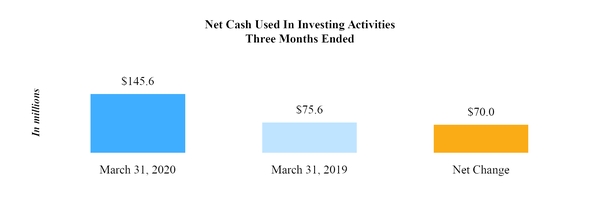

| Net cash used in investing activities | (145.6 | ) | | (75.6 | ) |

| Cash flows from financing activities: | | | |

| Proceeds from issuance of long-term debt | 33.1 |

| | 0.1 |

|

| Payments of long-term debt | (33.0 | ) | | (0.2 | ) |

| Change in short-term borrowings, net | — |

| | (1.5 | ) |

| Taxes paid related to net share settlement of equity awards | (5.0 | ) | | (7.1 | ) |

| Contingent consideration payments | (19.3 | ) | | (31.8 | ) |

| Payments of financing fees | — |

| | (1.2 | ) |

| Proceeds from exercise of stock options | 0.6 |

| | 2.4 |

|

| Other items, net | (1.2 | ) | | (0.8 | ) |

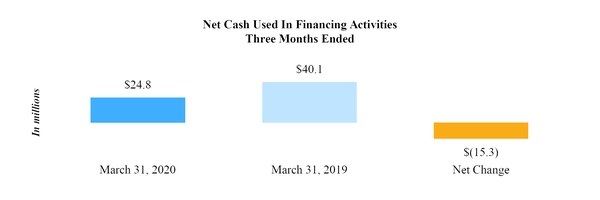

| Net cash used in financing activities | (24.8 | ) | | (40.1 | ) |

| Effect on cash of changes in exchange rates | (23.9 | ) | | (3.0 | ) |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 96.8 |

| | (158.4 | ) |

| Cash, cash equivalents and restricted cash — beginning of period | 491.1 |

| | 389.3 |

|

| Cash, cash equivalents and restricted cash — end of period | $ | 587.9 |

| | $ | 230.9 |

|

See Notes to Condensed Consolidated Financial Statements

7

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited)

1.General

The accompanying unaudited Condensed Consolidated Financial Statementscondensed consolidated financial statements (“interim financial statements”) of Mylan N.V. and subsidiaries (“Mylan” or the “Company”) were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”) for reporting on Form 10-Q; therefore, as permitted under these rules, certain footnotes and other financial information included in audited financial statements were condensed or omitted. The interim financial statements contain all adjustments (consisting of only normal recurring adjustments) necessary to present fairly the interim results of operations, comprehensive earnings, financial position, equity and cash flows for the periods presented.

The global spread of the coronavirus disease 2019 (“COVID-19”) has created significant volatility, uncertainty and economic disruption affecting the markets we serve in North America, Europe and Rest of World, including Asia. Certain significant impacts of COVID-19 on our business are discussed in these notes to the condensed consolidated financial statements.

These interim financial statements should be read in conjunction with the Consolidated Financial Statementsconsolidated financial statements and Notesnotes thereto in Mylan N.V.’s Annual Report on Form 10-K for the year ended December 31, 20162019, as amended.amended (the “2019 Form 10-K”). The December 31, 2016Condensed Consolidated Balance Sheet2019condensed consolidated balance sheet was derived from audited financial statements.

The interim results of operations, and comprehensive earnings for the three and nine months ended September 30, 2017 and cash flows for the ninethree months ended September 30, 2017March 31, 2020 are not necessarily indicative of the results to be expected for the full fiscal year or any other future period.

| |

| 2. | Revenue Recognition and Accounts Receivable |

The Company recognizes revenue in accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 606, Revenue from Contracts with Customers (“ASC 606”). Under ASC 606, the Company recognizes net revenue for product sales when title and riskcontrol of loss passthe promised goods or services is transferred to itsour customers and whenin an amount that reflects the consideration we expect to be entitled to in exchange for those goods or services. Revenues are recorded net of provisions for estimates,variable consideration, including discounts, sales allowances,rebates, governmental rebate programs, price adjustments, returns, chargebacks, promotional programs and other promotional programs are reasonably determinable.

Accounts receivablesales allowances. Accruals for these provisions are presented in the condensed consolidated financial statements as reductions in determining net sales and as a contra asset in accounts receivable, net (if settled via credit) and other current liabilities (if paid in cash).

Our net sales may be impacted by wholesaler and distributor inventory levels of allowances relatingour products, which can fluctuate throughout the year due to these provisions. the seasonality of certain products, pricing, the timing of product demand, purchasing decisions and other factors. Such fluctuations may impact the comparability of our net sales between periods.

Consideration received from licenses of intellectual property is recorded as other revenues. Royalty or profit share amounts, which are based on sales of licensed products or technology, are recorded when the customer’s subsequent sales or usages occur. Such consideration is included in other revenue in the condensed consolidated statements of operations.

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

The following table presents the Company’s net sales by therapeutic franchise for each of our reportable segments for the three months ended March 31, 2020 and 2019, respectively:

|

| | | | | | | | | | | | | | | |

| (In millions) | North America | | Europe | | Rest of World | | Total |

| Three Months Ended March 31, 2020 | | | | | | | |

| Central Nervous System & Anesthesia | $ | 141.2 |

| | $ | 225.7 |

| | $ | 60.4 |

| | $ | 427.3 |

|

| Infectious Disease | 45.1 |

| | 72.3 |

| | 229.7 |

| | 347.1 |

|

| Respiratory & Allergy | 280.6 |

| | 133.4 |

| | 49.7 |

| | 463.7 |

|

| Cardiovascular | 66.1 |

| | 128.9 |

| | 33.2 |

| | 228.2 |

|

| Gastroenterology | 37.4 |

| | 151.2 |

| | 59.0 |

| | 247.6 |

|

| Diabetes & Metabolism | 65.1 |

| | 77.1 |

| | 27.5 |

| | 169.7 |

|

| Dermatology | 30.2 |

| | 77.3 |

| | 19.7 |

| | 127.2 |

|

| Women’s Healthcare | 84.4 |

| | 61.3 |

| | 17.7 |

| | 163.4 |

|

| Oncology | 129.1 |

| | 18.6 |

| | 24.6 |

| | 172.3 |

|

| Immunology | 9.1 |

| | 25.6 |

| | 8.2 |

| | 42.9 |

|

Other (1) | 67.2 |

| | 50.5 |

| | 81.1 |

| | 198.8 |

|

| Total | $ | 955.5 |

| | $ | 1,021.9 |

| | $ | 610.8 |

| | $ | 2,588.2 |

|

|

| | | | | | | | | | | | | | | |

| (In millions) | North America | | Europe | | Rest of World | | Total |

| Three Months Ended March 31, 2019 | | | | | | | |

| Central Nervous System & Anesthesia | $ | 135.7 |

| | $ | 190.3 |

| | $ | 64.0 |

| | $ | 390.0 |

|

| Infectious Disease | 18.1 |

| | 58.8 |

| | 215.6 |

| | 292.5 |

|

| Respiratory & Allergy | 238.6 |

| | 107.8 |

| | 43.7 |

| | 390.1 |

|

| Cardiovascular | 46.9 |

| | 100.7 |

| | 34.2 |

| | 181.8 |

|

| Gastroenterology | 34.2 |

| | 127.8 |

| | 77.5 |

| | 239.5 |

|

| Diabetes & Metabolism | 151.0 |

| | 57.2 |

| | 39.2 |

| | 247.4 |

|

| Dermatology | 13.9 |

| | 61.6 |

| | 20.4 |

| | 95.9 |

|

| Women’s Healthcare | 78.9 |

| | 44.6 |

| | 15.1 |

| | 138.6 |

|

| Oncology | 124.8 |

| | 17.6 |

| | 29.0 |

| | 171.4 |

|

| Immunology | 10.1 |

| | 7.2 |

| | 6.4 |

| | 23.7 |

|

Other (1) | 70.7 |

| | 121.7 |

| | 97.3 |

| | 289.7 |

|

| Total | $ | 922.9 |

| | $ | 895.3 |

| | $ | 642.4 |

| | $ | 2,460.6 |

|

| |

(1) | Other consists of numerous therapeutic franchises, none of which individually exceeds 5% of consolidated net sales. |

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

Variable Consideration and Accounts Receivable

The following table presents a reconciliation of gross sales to net sales by each significant category of variable consideration during the three months ended March 31, 2020 and 2019, respectively:

|

| | | | | | | |

| | Three Months Ended |

| | March 31, |

| (In millions) | 2020 | | 2019 |

| Gross sales | $ | 4,424.0 |

| | $ | 4,158.5 |

|

| Gross to net adjustments: | | | |

| Chargebacks | (854.4 | ) | | (703.7 | ) |

| Rebates, promotional programs and other sales allowances | (845.6 | ) | | (856.2 | ) |

| Returns | (59.0 | ) | | (45.8 | ) |

| Governmental rebate programs | (76.8 | ) | | (92.2 | ) |

| Total gross to net adjustments | $ | (1,835.8 | ) | | $ | (1,697.9 | ) |

| Net sales | $ | 2,588.2 |

| | $ | 2,460.6 |

|

No significant revisions were made to the methodology used in determining these provisions or the nature of the provisions during the ninethree months ended September 30, 2017.March 31, 2020. Such allowances were $1.92 billion and $2.05 billioncomprised of the following at September 30, 2017March 31, 2020 and December 31, 2016, respectively. Other current liabilities include $808.9 million and $809.0 million at September 30, 2017 and December 31, 2016, respectively, for certain sales allowances and other adjustments that are settled in cash.2019, respectively:

|

| | | | | | | |

| (In millions) | March 31,

2020 | | December 31,

2019 |

| Accounts receivable, net | $ | 1,393.8 |

| | $ | 1,512.0 |

|

| Other current liabilities | 700.5 |

| | 796.5 |

|

| Total | $ | 2,094.3 |

| | $ | 2,308.5 |

|

Accounts receivable, net was comprised of the following at September 30, 2017March 31, 2020 and December 31, 2016,2019, respectively:

|

| | | | | | | |

| (In millions) | March 31,

2020 | | December 31,

2019 |

| Trade receivables, net | $ | 2,429.2 |

| | $ | 2,640.1 |

|

| Other receivables | 345.4 |

| | 418.7 |

|

| Accounts receivable, net | $ | 2,774.6 |

| | $ | 3,058.8 |

|

|

| | | | | | | |

| (In millions) | September 30,

2017 | | December 31,

2016 |

| Trade receivables, net | $ | 2,822.6 |

| | $ | 3,015.4 |

|

| Other receivables | 397.6 |

| | 295.5 |

|

| Accounts receivable, net | $ | 3,220.2 |

| | $ | 3,310.9 |

|

Through its wholly owned subsidiary Mylan Pharmaceuticals Inc. (“MPI”), the Company has access to a $400$400 million accounts receivable securitization facility (the “Receivables Facility”) and a $200 million note securitization facility (the “Note Securitization Facility”). The receivables underlying any borrowings are included in accounts receivable, net, in the Condensed Consolidated Balance Sheets.condensed consolidated balance sheets. There were $785.6$373.1 million and $1.13 billion$407.0 million of securitized accounts receivable at September 30, 2017March 31, 2020 and December 31, 2016,2019, respectively.

Accounts Receivable Factoring Arrangements

We have entered into accounts receivable factoring agreements with financial institutions to sell certain of our non-U.S. accounts receivable. These transactions are accounted for as sales and result in a reduction in accounts receivable because the agreements transfer effective control over and risk related to the receivables to the buyers. Our factoring agreements do not allow for recourse in the event of uncollectibility, and we do not retain any interest in the underlying accounts receivable once sold. We derecognized $125.7 million and $90.1 million of accounts receivable as of March 31, 2020 and December 31, 2019, respectively, under these factoring arrangements.

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

| |

| 3. | Recent Accounting Pronouncements |

In August 2017, the FinancialAdoption of New Accounting Standards Board (the “FASB”)and Amended SEC Rules

In June 2016, the FASB issued Accounting Standards Update 2017-12, Derivatives2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses (“ASU 2016-13”), which requires an organization to measure all expected credit losses for financial assets held at the reporting date based on historical experience, current conditions, and Hedgingreasonable and supportable forecasts. Financial institutions and other organizations will now use forward-looking information to better inform their credit loss estimates. In May 2019, the FASB issued ASU 2019-05, Financial Instruments - Credit Losses (Topic 815)326):Targeted ImprovementsTransition Relief (“ASU 2019-05”). ASU 2019-05 provides transition relief for ASU 2016-13 by providing entities with an alternative to irrevocably elect the fair value option for eligible financial assets measured at amortized cost upon adoption of ASU 2016-13. The Company applied the provisions of ASU 2016-13 and its subsequent revisions as of January 1, 2020 and the adoption did not have a material impact on its condensed consolidated financial statements and disclosures.

In August 2018, the FASB issued Accounting Standards Update 2018-13, Fair Value Measurement (Topic 820) Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-03”), which adds to and modifies certain disclosure requirements for fair value measurements including a requirement to disclose changes in unrealized gains and losses included in other comprehensive income for recurring Level 3 fair value measurements and a requirement to disclose the range and weighted average used to develop significant inputs for Level 3 fair value measurements. The Company applied the provisions of ASU 2018-13 as of January 1, 2020. The adoption of this guidance did not have a material impact on the Company’s disclosures.

In August 2018, the FASB issued Accounting Standards Update 2018-15, Intangibles - Goodwill and Other - Internal-Use Software: Customer’s Accounting for Hedging ActivitiesImplementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract (“ASU 2018-15”). The objective of this update is to improveclarify and align the accounting and capitalization of implementation costs for hosting arrangements, regardless of whether they convey a license to the hosted software. The updated guidance will require an entity in a hosting arrangement that is a service contract, to follow guidance in ASC 350 to determine which implementation costs to capitalize as an asset and which costs to expense. The Company applied the provisions of ASU 2018-15 as of January 1, 2020. The adoption of this guidance did not have a material impact on the Company’s condensed consolidated financial statements and disclosures.

In November 2018, the FASB issued Accounting Standards Update 2018-18, Collaborative Arrangements (Topic 808)—Clarifying the Interaction between Topic 808 and Topic 606 (“ASU 2018-18”). The amendments in ASU 2018-18 make targeted improvements to U.S. GAAP for collaborative arrangements by clarifying that certain transactions between collaborative arrangement participants should be accounted for as revenue under Topic 606 when the collaborative arrangement participant is a customer in the context of a unit of account. In those situations, all the guidance in Topic 606 should be applied, including recognition, measurement, presentation, and disclosure requirements. In addition, unit-of-account guidance in Topic 808 was aligned with the guidance in Topic 606 (that is, a distinct good or service) when an entity is assessing whether the collaborative arrangement or a part of the arrangement is within the scope of Topic 606. The Company applied the provisions of ASU 2018-18 as of January 1, 2020. The adoption of this guidance did not have a material impact on the Company’s condensed consolidated financial statements and disclosures.

In March 2020, the SEC amended Rule 3-10 of Regulation S-X regarding the financial reportingdisclosure requirements for guarantors and issuers of hedging relationships to better portrayguaranteed securities registered or being registered. Among other things, the economic resultsamendments narrow the circumstances that require separate financial statements of an entity’s risk management activitiessubsidiary issuers and guarantors and streamline the alternative disclosures required in itslieu of those financial statements. The amendments in this update also make certain targeted improvements to simplify the applicationeffective date of the hedgeamendment is January 4, 2021 with earlier voluntary compliance permitted. We have chosen to voluntarily comply with the amended rules effective during the three months ended March 31, 2020 and have included the required disclosures as a component of Item 2. Management’s Discussion and Analysis of Results of Operations and Financial Condition of this Form 10-Q as permitted by the amendments.

Accounting Standards Issued Not Yet Adopted

In January 2020, the FASB issued Accounting Standards Update 2020-01, Clarifying the Interactions Between Topic 321, Topic 323, and Topic 815 (“ASU 2020-01”), which clarifies that an entity should consider observable transactions that require it to either apply or discontinue the equity method of accounting for the purposes of applying the measurement alternative in accordance with Topic 321 immediately before applying or upon discontinuing the equity method. In addition, ASU 2020-01 states that for the purpose of applying paragraph 815-10-15-141(a) an entity should not consider whether, upon

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

the settlement of the forward contract or exercise of the purchased option, individually or with existing investments, the underlying securities would be accounted for under the equity method in Topic 323 or the fair value option in accordance with the financial instruments guidance in current U.S. GAAP based on feedback received from preparers, auditors, users, and other stakeholders. This guidance isTopic 825. ASU 2020-01 will be effective for fiscal years, beginning after December 15, 2018, and interim periods within those fiscal years, beginning after December 15, 2020 with early adoption permitted, including adoption in any interim period.period permitted. The Company is currently assessing the impact of the adoption of this guidance on its condensed consolidated financial statements and disclosures.

In March 2020, the FASB issued Accounting Standards Update 2020-04, Reference Rate Reform (Topic 848) Facilitation of the Effects of Reference Rate Reform on Financial Reporting (“ASU 2020-04”), which provides optional expedients and exceptions for applying U.S. GAAP to contracts, hedging relationships, and other transactions affected by reference rate reform if certain criteria are met. ASU 2020-04 applies only to contracts, hedging relationships, and other transactions that reference the London Interbank Offered Rate (“LIBOR”) or another reference rate expected to be discontinued because of reference rate reform. Entities can apply the provisions of ASU 2020-04 immediately, as applicable, and generally the provisions of the guidance are available through December 31, 2022 as entities transition away from reference rates that are expected to be discontinued. The Company is currently assessing the impact of the adoption of this guidance on its condensed consolidated financial statements and disclosures.

In addition, the following recently issued accounting standards have not been adopted. Refer to the Company’s Annual Report on Form 10-K for the year ended December 31, 2019, as amended, for additional information and their potential impacts.

7 |

| |

| Accounting Standard Update | Effective Date |

ASU 2018-14: Compensation-Retirement Benefits-Defined Benefit Plans-General (Subtopic 715-20) Disclosure Framework-Changes to the Disclosure Requirements for Defined Benefit Plans | January 1, 2021 |

| |

| 4. | Acquisitions and Other Transactions |

Upjohn Business Combination Agreement

On July 29, 2019, the Company, Pfizer Inc. (“Pfizer”), Upjohn Inc., a wholly-owned subsidiary of Pfizer (“Upjohn” or “Newco”), and certain other affiliated entities entered into a Business Combination Agreement (the “Business Combination Agreement”) pursuant to which the Company will combine with Pfizer’s Upjohn Business (the “Upjohn Business”) in a Reverse Morris Trust transaction (the “Combination”). Newco, which will be the parent entity of the combined Upjohn Business and Mylan business, will be renamed “Viatris” effective as of the closing of the Combination. The Upjohn Business is a global, primarily off-patent branded and generic established medicines business, which includes 20 primarily off-patent solid oral dose legacy brands, such as Lyrica, Lipitor, Celebrex and Viagra.

Prior to the Combination and pursuant to a Separation and Distribution Agreement (the “Separation Agreement”), dated as of July 29, 2019, between Pfizer and Newco, Pfizer will, among other things, transfer to Newco substantially all of the assets and liabilities comprising the Upjohn Business (the “Separation”) and, thereafter, Pfizer will distribute to Pfizer stockholders all of the issued and outstanding shares of Newco (the “Distribution”). When the Distribution and Combination are completed, Pfizer stockholders as of the record date of the Distribution will own 57% of the outstanding shares of Newco common stock, and Mylan shareholders as of immediately before the Combination will own 43% of the outstanding shares of Newco common stock, in each case on a fully diluted basis. Newco will make a cash payment to Pfizer equal to $12 billion, to be funded with the proceeds of debt to be incurred by Newco in connection with the foregoing transactions, as partial consideration for the contribution of the Upjohn Business from Pfizer to Newco.

Newco has obtained commitments for the initial financing of the transaction in the form of a bridge loan from certain financial institutions. If Newco obtains additional funding by issuing securities or obtaining other loans, the amount of the bridge facility will be correspondingly reduced. The bridge loan is subject to customary terms and conditions including a financial covenant.

The consummation of the Combination is subject to the satisfaction (or, if applicable, valid waiver) of various conditions, including (a) the expiration or termination of any applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and the rules and regulations promulgated thereunder and the receipt of regulatory approvals in certain other jurisdictions, (b) the consummation of the Separation and the Distribution in accordance with the

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

In May 2017,terms of the FASB issued Accounting Standards Update 2017-09, Compensation - Stock Compensation (Topic 718): ScopeSeparation Agreement, (c) the approval of Modification Accounting (“ASU 2017-09”), which amends the scopeCombination by Mylan shareholders, (d) the absence of modification accounting for share-based payment arrangements. ASU 2017-09 provides guidance onany legal restraint (including legal actions or proceedings pursued by U.S. state authorities in the typesrelevant states) preventing the consummation of changesthe transactions, (e) in the case of Pfizer’s and Newco’s obligations to consummate the transactions, (i) the distribution of $12 billion in cash from Upjohn to Pfizer in accordance with the terms or conditions of share-based payment awards to which an entity would be required to apply modification accounting under Accounting Standards Codification 718. Specifically, an entity would not apply modification accounting if the fair value, vesting conditions and classification of the awards areSeparation Agreement and (ii) the same immediately before and after the modification. This guidance is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2017, with early adoption permitted, including adoption in any interim period. The Company is currently assessing the impact of the adoption of this guidance on its consolidated financial statements and disclosures.

In March 2017, the FASB issued Accounting Standards Update 2017-07, Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost, which requires companies to disaggregate the service cost component from the other components of net benefit cost and disclose the amount of net benefit cost that is included in the income statement or capitalized in assets,receipt by line item. This guidance requires companies to report the service cost component in the same line item(s) as other compensation costs and to report other pension-related costs (which include interest costs, amortization of pension-related costs from prior periods and gains or losses on plan assets) separately and exclude them from the subtotal of operating income. This guidance also allows only the service cost component to be eligible for capitalization when applicable. This guidance is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2017. This guidance should be applied retrospectively for the presentation of the service cost component and the other components of net periodic pension cost and net periodic postretirement benefit cost in the income statement and prospectively, on and after the effective date, for the capitalization of the service cost component of net periodic pension cost and net periodic postretirement benefit in assets. The update allows a practical expedient that permits a company to use the amounts disclosed in its pension and other postretirement plan note for the prior comparative periods as the estimation basis for applying the retrospective presentation requirements. The Company is currently assessing the impact of the adoption of this guidance on its consolidated financial statements and disclosures.

In January 2017, the FASB issued Accounting Standards Update 2017-04, Intangibles - Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment (“ASU 2017-04”), which simplifies the subsequent measurement of goodwill by eliminating Step 2 from the goodwill impairment test which previously required measurement of any goodwill impairment loss by comparing the implied fair valuePfizer of a reporting unit’s goodwill with the carrying amount of that goodwill. Under ASU 2017-04, an entity should perform its annual, or interim, goodwill impairment test by comparing the fair value of a reporting unit with its carrying value and recognize an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value; without exceeding the total amount of goodwill allocated to that reporting unit. This guidance is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019, with early adoption permitted. The Company has elected to early adopt this guidance as of January 1, 2017 and is applying it on a prospective basis. The adoption did not have a material impact on its condensed consolidated financial statements.

In January 2017, the FASB issued Accounting Standards Update 2017-01, Business Combinations (Topic 805) Clarifying the Definition of a Business, which narrows the definition of a business and requires an entity to evaluate if substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset or a group of similar identifiable assets, which would not constitute the acquisition of a business. The guidance also requires a business to include at least one substantive process and narrows the definition of outputs. This guidance is effective for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years, with early adoption permitted. The Company has elected to early adopt this guidance as of January 1, 2017 and will apply it on a prospective basis. The adoption did not have a material impact on its condensed consolidated financial statements.

In March 2016, the FASB issued Accounting Standards Update 2016-09, Compensation - Stock Compensation (Topic 718)U.S. Internal Revenue Service (“ASU 2016-09”IRS”), which simplifies the accounting for share-based compensation payments. The new standard requires all excess tax benefits ruling and tax deficiencies (includingopinion of its tax benefits of dividends on share-based payment awards) to be recognized as income tax expense or benefit on the income statement. The tax effects of exercised or vested awards should be treated as discrete items in the reporting period in which they occur. ASU 2016-09 also addresses the classification of excess tax benefits in the statement of cash flows. As required, the Company applied the provisions of ASU 2016-09 on a prospective basis as of January 1, 2017 and the adoption did not have a material impact on its condensed consolidated financial statements.

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

In May 2014, the FASB issued Accounting Standards Update 2014-09, Revenue from Contracts with Customers (updated with Accounting Standards Update 2015-14, 2016-08, 2016-10, 2016-12 and 2016-20), which revises accounting guidance on revenue recognition that will supersede nearly all existing revenue recognition guidance under U.S. GAAP. The core principal of this guidance is that an entity should recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration which the entity expects to receive in exchange for those goods or services. This guidance also requires additional disclosure about the nature, amount, timing and uncertainty of revenue and cash flows arising from customer contracts, including significant judgments and changes in judgments and assets recognized from costs incurred to obtain or fulfill a contract. This guidance is effective for fiscal years beginning after December 15, 2017, and for interim periods within those fiscal years, and can be applied using a full retrospective or modified retrospective approach. The Company has substantially completed its review of revenue arrangements and currently is finalizing the quantification of any impact. Although the Company is continuing to assess the impact of the new standard, based upon its preliminary assessment, the Company believes that there may be arrangements under which the Company will recognize revenue earlier under the new standard, however such arrangements are not expected to be a significant part of the Company’s operations. In addition, upon implementation there may be certain changes in the presentation of certain items, including changes related to the classification of certain costs in the consolidated statements of operations. The Company currently expects to adopt the standard using the modified retrospective approach.

| |

4. | Acquisitions and Other Transactions |

Meda AB

On February 10, 2016, the Company issued an offer announcement under the Nasdaq Stockholm’s Takeover Rules and the Swedish Takeover Act (collectively, the “Swedish Takeover Rules”) setting forth a public offer to the shareholders of Meda AB (publ.) (“Meda”) to acquire all of the outstanding shares of Meda (the “Offer”), with an enterprise value, including the net debt of Meda, of approximately Swedish kronor (“SEK” or “kr”) 83.6 billion (based on a SEK/USD exchange rate of 8.4158) or $9.9 billion at announcement. On August 2, 2016, the Company announced that the Offer was accepted by Meda shareholders holding an aggregate of approximately 343 million shares, representing approximately 94% of the total number of outstanding Meda shares, as of July 29, 2016, and the Company declared the Offer unconditional. On August 5, 2016, settlement occurredcounsel with respect to the Meda shares duly tendered by July 29, 2016Combination, and as a result, Meda became a controlled subsidiary of(f) other customary closing conditions. On March 17, 2020, Pfizer received the Company. PursuantIRS ruling with respect to the terms ofCombination, which is generally binding, unless the Offer, each Meda shareholder that duly tendered Meda shares into the Offer received at settlement (1) in respect of 80% of the number of Meda shares tendered by such shareholder, 165kr in cash per Meda share, and (2) in respect of the remaining 20% of the number of Meda shares tendered by such shareholder, 0.386 of the Company’s ordinary shares per Meda share (subjectrelevant facts or circumstances change prior to treatment of fractional shares as described in the offer document published on June 16, 2016). The non-tendered shares were required to be acquired for cash through a compulsory acquisition proceeding, in accordance with the Swedish Companies Act (Sw. aktiebolagslagen (2005:551)). The compulsory acquisition proceeding price accrued interest as required by the Swedish Companies Act. Meda’s shares were delisted from the Nasdaq Stockholm exchange on August 23, 2016.closing.

On November 1, 2016,February 13, 2020, the Company made an offer to the remaining Meda shareholders to tender all their Meda shares for cash consideration of 161.31kr per Meda share (the “November Offer”) to provide such remaining shareholders with an opportunity to sell their shares in Meda to the Company in advance of the automatic acquisition of their shares for cashregistration statement on Form S-4 filed by Newco in connection with the compulsory acquisition proceeding. At the end of November 2016, Mylan completed the acquisition of approximately 19 million Meda shares duly tendered for aggregate cash consideration of approximately $330.3 million. In March 2017, the Company received full legal ownership to the remaining non-tendered Meda shares in exchange for a cash payment of approximately $71.6 million, equal to the uncontested portion of the compulsory acquisition price plus statutory interest, and the Company’s arrangement of a customary bank guarantee to secure the payment of any additional cash consideration that may be awarded to the former Meda shareholders in the compulsory acquisition proceeding. In October 2017, the arbitration tribunal awarded a price of 163.07kr per Meda share, plus statutory interest of 1.5% per annum, to the former Meda shareholders subject to the compulsory acquisition proceeding. Mylan expects to pay an additional approximately $0.9 million plus interest to such former Meda shareholders and, in accordance with Swedish law, pay the fees of the arbitrators and costs of other parties to the compulsory acquisition proceeding. Mylan expects that the award will become final in mid-December 2017, at which time Mylan will cause the bank guarantee to be released, definitively concluding the compulsory acquisition proceeding. As of September 30, 2017, the Company continues to maintain the bank guarantee as required by Swedish law.

On August 5, 2016, the total purchase priceCombination was approximately $6.92 billion, net of cash acquired, which includes cash consideration paid of approximately $5.3 billion, the issuance of approximately 26.4 million Mylan N.V. ordinary shares

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

at a fair value of approximately $1.3 billion based on the closing price of the Company’s ordinary shares on August 5, 2016, as reporteddeclared effective by the NASDAQ Global Select Stock Market (“NASDAQ”) and an assumed liability of approximately $431.0 million related to the November Offer and the compulsory acquisition proceeding for the non-tendered Meda shares. In accordance with U.S. GAAP, the Company used the acquisition method of accounting to account for this transaction. Under the acquisition method of accounting, the assets acquired and liabilities assumed in the transaction have been recorded at their respective estimated fair values at the acquisition date.

During the nine months ended September 30, 2017, adjustments were made to the preliminary purchase price and are reflected as “Measurement Period Adjustments” in the table below. The allocation of the $6.92 billion purchase price to the assets acquired and liabilities assumed for Meda is as follows: |

| | | | | | | | | | | |

| (In millions) | Preliminary Purchase Price Allocation as of December 31, 2016 (a) | | Measurement Period Adjustments (b) | | Purchase Price Allocation as of September 30, 2017 (as adjusted) |

| Current assets (excluding inventories and net of cash acquired) | $ | 482.5 |

| | $ | (9.2 | ) | | $ | 473.3 |

|

| Inventories | 463.1 |

| | 5.0 |

| | 468.1 |

|

| Property, plant and equipment | 177.5 |

| | — |

| | 177.5 |

|

| Identified intangible assets | 8,060.7 |

| | — |

| | 8,060.7 |

|

| Goodwill | 3,676.9 |

| | 7.7 |

| | 3,684.6 |

|

| Other assets | 9.5 |

| | (0.7 | ) | | 8.8 |

|

| Total assets acquired | 12,870.2 |

| | 2.8 |

| | 12,873.0 |

|

| Current liabilities | (1,105.9 | ) | | (4.9 | ) | | (1,110.8 | ) |

| Long-term debt, including current portion | (2,864.6 | ) | | — |

| | (2,864.6 | ) |

| Deferred tax liabilities | (1,613.9 | ) | | 0.7 |

| | (1,613.2 | ) |

| Pension and other postretirement benefits | (322.3 | ) | | — |

| | (322.3 | ) |

| Other noncurrent liabilities | (42.4 | ) | | 1.4 |

| | (41.0 | ) |

| Net assets acquired | $ | 6,921.1 |

| | $ | — |

| | $ | 6,921.1 |

|

____________ | |

(a)

| As previously reported in the Company’s December 31, 2016 Annual Report on Form 10-K, as amended. |

| |

(b)

| The measurement period adjustments recorded during the nine months ended September 30, 2017 are primarily related to certain income tax adjustments and working capital related estimates to reflect facts and circumstances that existed as of the acquisition date. |

The acquisition of Meda createdSEC, Newco filed a more diversified and expansive portfolio of branded and generic medicines along with a strong and growing portfolio of over-the-counter (“OTC”) products. The combined company has a balanced global footprint with significant scale in key geographic markets, particularly the U.S. and Europe. The acquisition of Meda also expanded our presence in emerging markets, which includes countries in Africa, as well as countries throughout Asia and the Middle East, and is complemented by Mylan’s presence in India, Brazil and Africa (including South Africa). The Company recorded a step-up in the fair value of inventory of approximately $107 million at the acquisition date, which was fully amortized as of December 31, 2016.

The identified intangible assets of $8.06 billion are comprised of product rights and licenses that have a weighted average useful life of 20 years. Significant assumptions utilized in the valuation of identified intangible assets were based on company specific information and projections which are not observable in the market and are thus considered Level 3 measurements as defined by U.S. GAAP. The goodwill of $3.68 billion arising from the acquisition consisted largely of the value of the employee workforce and the expected value of products to be developed in the future. Approximately $3.4 billion of goodwill recognized was allocated to the Europe segment, with approximately $290 million allocated to the North America segment, and approximately $6 million allocated to the Rest of World segment. None of the goodwill recognized in this transaction is currently expected to be deductible for income tax purposes.

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

RenaissanceTopicals Business

On June 15, 2016, the Company completed the acquisition of the non-sterile, topicals-focused business (the “Topicals Business”) of Renaissance Acquisition Holdings, LLC (“Renaissance”) for approximately $1.0 billion in cash at closing, including amounts deposited into escrow for potential contingent payments, subject to customary adjustments. The Topicals Business provided the Company with a complementary portfolio of approximately 25 products, an active pipeline of approximately 25 products, and an established U.S. sales and marketing infrastructure targeting dermatologists. The Topicals Business also provided an integrated manufacturing and development platform. In accordance with U.S. GAAP, the Company used the acquisition method of accounting to account for this transaction. Under the acquisition method of accounting, the assets acquired and liabilities assumed in the transaction were recorded at their respective estimated fair values at the acquisition date. The U.S. GAAP purchase price was $972.7 million, which includes estimated contingent consideration of approximately $16 million related to the potential $50 million payment contingent on the achievement of certain 2016 financial targets. The final resolution of the contingent consideration has not been completed at September 30, 2017. The $50 million contingent payment remains in escrow and is classified as restricted cash included in prepaid expenses and other current assets on the Condensed Consolidated Balance Sheets at September 30, 2017 and December 31, 2016.

The allocation of the $972.7 million purchase price to the assets acquired and liabilities assumed for the Topicals Business is as follows: |

| | | |

| (In millions) | |

| Current assets (excluding inventories) | $ | 57.7 |

|

| Inventories | 74.2 |

|

| Property, plant and equipment | 54.8 |

|

| Identified intangible assets | 467.0 |

|

| In-process research and development | 275.0 |

|

| Goodwill | 318.6 |

|

| Other assets | 0.1 |

|

| Total assets acquired | 1,247.4 |

|

| Current liabilities | (74.2 | ) |

| Deferred tax liabilities | (194.6 | ) |

| Other noncurrent liabilities | (5.9 | ) |

| Net assets acquired | $ | 972.7 |

|

The acquisition of the Topicals Business broadened the Company’s dermatological portfolio. The amount allocated to in-process research and development (“IPR&D”) represents an estimate of the fair value of purchased in-process technology for research projects that, as of the closing date of the acquisition, had not reached technological feasibility and had no alternative future use. The fair value of IPR&D of $275.0 million was based on the excess earnings method, which utilizes forecasts of expected cash inflows (including estimates for ongoing costs) and other contributory charges. A discount rate of 12.5% was utilized to discount net cash inflows to present values. IPR&D is accounted for as an indefinite-lived intangible asset and will be subject to impairment testing until completion or abandonment of the projects. Upon successful completion and launch of each product, the Company will make a determination of the estimated useful life of the individual asset. The acquired IPR&D projects are in various stages of completion and the estimated costs to complete these projects total approximately $48 million, which is expected to be incurred through 2019. There are risks and uncertainties associatedprospectus with the timelySEC in connection with the Combination and successful completion ofMylan filed a definitive proxy statement with the projects includedSEC in IPR&D, and no assurances can be given thatconnection with the underlying assumptions used to estimate the fair value of IPR&D will not change or the timely completion of each project to commercial success will occur.

The identified intangible assets of $467.0 million are comprised of $454.0 million of product rights and licenses that have a weighted average useful life of 14 years and $13.0 million of contract manufacturing agreements that have a weighted average useful life of five years. Significant assumptions utilized in the valuation of identified intangible assets were based on company specific information and projections which are not observable in the market and are thus considered Level 3 measurements as defined by U.S. GAAP.

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

The goodwill of $318.6 million arising from the acquisition consisted largely of the value of the employee workforce and the expected value of products to be developed in the future. All of the goodwill was assigned to the North America segment. None of the goodwill recognized in this transaction is currently expected to be deductible for income tax purposes. The acquisition did not have a material impact on a pro forma basis for the three and nine month periods ended September 30, 2016.

Unaudited Pro Forma Financial Results

The following table presents supplemental unaudited pro forma information for the acquisition of Meda, as if it had occurred on January 1, 2015. The unaudited pro forma results reflect certain adjustments related to past operating performance and acquisition accounting adjustments, such as increased amortization expense based on the fair value of assets acquired, the impact of transaction costs and the related income tax effects. The unaudited pro forma results do not include any anticipated synergies which may be achievable, or have been achieved, subsequent to the closing of the Meda transaction. Accordingly, the unaudited pro forma results are not necessarily indicative of the results that actually would have occurred had the acquisitions been completed on the stated dates above, nor are they indicative of the future operating results of Mylan N.V. and its subsidiaries.

|

| | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| (Unaudited, in millions, except per share amounts) | 2016 | | 2016 |

| Total revenues | $ | 3,168.6 |

| | $ | 9,008.2 |

|

| Net (loss) earnings | $ | (111.4 | ) | | $ | 132.0 |

|

| (Loss) earnings per ordinary share: | | | |

| Basic | $ | (0.21 | ) | | $ | 0.25 |

|

| Diluted | $ | (0.21 | ) | | $ | 0.25 |

|

| Weighted average ordinary shares outstanding: | | | |

| Basic | 533.9 |

| | 526.9 |

|

| Diluted | 533.9 |

| | 536.2 |

|

Other Transactions

On February 14, 2017, the Company entered into a joint development and marketing agreement for a respiratory product that resulted in approximately $50 million in research and development (“R&D”) expense in the first quarter of 2017.Combination.

On March 29, 2017, the Company26, 2020, Mylan and Pfizer announced that it had completed its acquisition of the global rightsdue to the Cold-EEZE® brand cold remedy line from ProPhase Labs, Inc. for approximately $50 million in cash. The Company accounted for this transaction as an asset acquisition andunprecedented circumstances surrounding the asset is being amortized over a useful life of 15 years.

On June 2, 2017, the Company completed the acquisition of additional intellectual property rights and marketing authorizations in certain rest of world markets for a product that the Company previously licensed in certain European markets. The acquisition price was $128.0 million and the Company accounted for this transaction as an asset acquisition. The intangible asset is being amortized over a useful life of five years.

On June 19, 2017, the Company completed the acquisition of a portfolio of four generic pharmaceutical productsCOVID-19 pandemic, including associated delays in the U.S. The acquisition priceregulatory review process, the Combination is now anticipated to close in the second half of 2020. It was $277.9 millionalso announced that, in light of increased meeting and other restrictions due to COVID-19 developments in the Company accounted for this transaction as an asset acquisition. The intangible asset recognized totaled $252.5 millionNetherlands, Mylan’s extraordinary general meeting of shareholders to approve certain matters in connection with the remaining assets primarily consisting of receivables. The intangible asset is being amortized over a useful life of seven years.

On September 29, 2017, the Company completed the acquisition of intellectual property rights and marketing authorizations relatedCombination was rescheduled from April 27, 2020 to a product in certain markets for $40 million. The Company accounted for this transaction as an asset acquisition and the asset is being amortized over a useful life of five years.

On October 3, 2017, the Company completed the acquisition of a U.S. based developer and manufacturer of active pharmaceutical ingredients (“API”) for approximately $189 million, which includes $15 million of contingent payments based

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

on the achievement of certain financial results of the acquired business following the closing of the transaction. The Company will account for this transaction as the acquisition of a business. Due to the limited time since the acquisition date and limitations on access to the financial information prior to the acquisition date, the initial accounting for the business combination was incomplete at November 6, 2017. As a result, the Company was unable to provide amounts recognized as of the acquisition date for major classes of assets and liabilities acquired resulting from the acquisition, including information related to contingencies and goodwill. The Company anticipates that the majority of the goodwill will be assigned to the North America and Rest of World segments and does not currently expect the goodwill recognized to be deductible for income tax purposes. The acquisition does not have a material impact on the Company’s results of operations on a pro forma basis for the three and nine month periods ended SeptemberJune 30, 2017 and 2016.

As part of the Meda acquisition, the Company acquired the in-licensed rights to Betadine in certain European markets. These rights were set to expire on December 31, 2017. Under the licensing agreement, Meda had a binding option to acquire a perpetual license for the rights to Betadine under certain conditions. In October 2017, the Company finalized an agreement to acquire the perpetual license. An estimated liability of approximately $300 million for the purchase of these rights was accrued for on the Meda acquisition opening balance sheet. The Company does not expect that a material adjustment to this liability will be necessary upon closing of the transaction in early 2018.2020.

| |

| 5. | Share-Based Incentive Plan |

The Company’s shareholders have approved the 2003 Long-Term Incentive Plan (as amended, the “2003 Plan”). Under the 2003 Plan, 55,300,000 ordinary shares are reserved for issuance to key employees, consultants, independent contractors and non-employee directors of the Company through a variety of incentive awards, including: stock options, stock appreciation rights (“SAR”), restricted ordinary shares restricted stockand units, performance awards (“PSU”), other stock-based awards and short-term cash awards. Stock option awards are granted with an exercise price equal to the fair market value of the ordinary shares underlying the stock options at the date of the grant, generally become exercisable over periods ranging from three to four years,, and generally expire in ten years. Since approval of the 2003 Plan, no further grants of stock options have been made under any other previous plan.

The following table summarizes stock option and SAR (together, “stock awards”) activity:

|

| | | | | | |

| | Number of Shares Under Stock Awards | | Weighted Average Exercise Price per Share |

| Outstanding at December 31, 2019 | 6,347,709 |

| | $ | 36.97 |

|

| Granted | 699,491 |

| | 17.61 |

|

| Exercised | (27,615 | ) | | 21.13 |

|

| Forfeited | (240,740 | ) | | 25.19 |

|

| Outstanding at March 31, 2020 | 6,778,845 |

| | $ | 35.45 |

|

| Vested and expected to vest at March 31, 2020 | 6,572,572 |

| | $ | 35.72 |

|

| Exercisable at March 31, 2020 | 5,145,065 |

| | $ | 38.65 |

|

|

| | | | | | |

| | Number of Shares Under Stock Awards | | Weighted Average Exercise Price per Share |

| Outstanding at December 31, 2016 | 7,699,441 |

| | $ | 33.38 |

|

| Granted | 905,521 |

| | 42.93 |

|

| Exercised | (659,621 | ) | | 19.62 |

|

| Forfeited | (381,659 | ) | | 49.16 |

|

| Outstanding at September 30, 2017 | 7,563,682 |

| | $ | 34.92 |

|

| Vested and expected to vest at September 30, 2017 | 7,314,174 |

| | $ | 34.53 |

|

| Exercisable at September 30, 2017 | 5,707,402 |

| | $ | 31.37 |

|