UNITED STATES OF AMERICA

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-Q

(Mark One)

|

| |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| |

| | For the quarterly period ended March 31, 20172018 |

|

| |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| |

| | For the transition period from__________ to __________ |

Commission File No.: 000-09881

SHENANDOAH TELECOMMUNICATIONS COMPANY

(Exact name of registrant as specified in its charter)

|

| | |

| VIRGINIA | | 54-1162807 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

500 Shentel Way, Edinburg, Virginia 22824

(Address of principal executive offices) (Zip Code)

(540) 984-4141

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | |

| Large accelerated filer ☑ | Accelerated filer ☐ | Non-accelerated filer ☐ |

| Smaller reporting company☐ | Emerging growth company☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☑

The number of shares of the registrant’s common stock outstanding on April 26, 201727, 2018 was 49,109,626.49,539,170.

SHENANDOAH TELECOMMUNICATIONS COMPANY

INDEX

| | | | | Page Numbers | | Page Numbers |

| PART I. | FINANCIAL INFORMATION | | | FINANCIAL INFORMATION | | |

| | | | | | | |

| Item 1. | Financial Statements | | | Financial Statements | | |

| | | | | | | |

| | | | - | | | |

| | | | | | | |

| | | | | |

| | | | | | | |

| | | | | |

| | | | | | | |

| | | | - | | | |

| | | | | | | |

| | | | - | | | | - | |

| | | | | | | |

| Item 2. | | | - | | | | - | |

| | | | | | | |

| Item 3. | | | | |

| | | | | | | |

| Item 4. | | | | |

| | | | | |

| PART II. | OTHER INFORMATION | | OTHER INFORMATION | |

| | | | | |

| Item 1A. | | | | |

| | | | | |

| Item 2. | | | | |

| | | | | |

| Item 6. | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

SHENANDOAH TELECOMMUNICATIONS COMPANY AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

|

| | | | | | | | |

| ASSETS | | March 31,

2017 | | December 31,

2016 |

| | | | | |

| Current Assets | | | | |

| Cash and cash equivalents | | $ | 39,927 |

| | $ | 36,193 |

|

| Accounts receivable, net | | 68,709 |

| | 69,789 |

|

| Inventory, net | | 24,855 |

| | 39,043 |

|

| Prepaid expenses and other | | 16,989 |

| | 16,440 |

|

| Total current assets | | 150,480 |

| | 161,465 |

|

| | | | | |

| Investments, including $3,058 and $2,907 carried at fair value | | 10,607 |

| | 10,276 |

|

| | | | | |

| Property, plant and equipment, net | | 689,948 |

| | 698,122 |

|

| | | | | |

| Other Assets | | |

| | |

|

| Intangible assets, net | | 443,308 |

| | 454,532 |

|

| Goodwill | | 144,001 |

| | 145,256 |

|

| Deferred charges and other assets, net | | 14,645 |

| | 14,756 |

|

| Total assets | | $ | 1,452,989 |

| | $ | 1,484,407 |

|

(Continued)

SHENANDOAH TELECOMMUNICATIONS COMPANY AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

| | | | | | March 31,

2018 | | December 31,

2017 |

| ASSETS | | | | | |

| Current Assets: | | | | | |

| Cash and cash equivalents | | | $ | 49,448 |

| | $ | 78,585 |

|

| Accounts receivable, net | | | 51,095 |

| | 54,184 |

|

| Income taxes receivable | | | 8,360 |

| | 17,311 |

|

| Inventory, net | | | 8,161 |

| | 5,704 |

|

| Prepaid expenses and other | | | 64,200 |

| | 17,111 |

|

| Total current assets | | | 181,264 |

| | 172,895 |

|

| Investments, including $3,268 and $3,279 carried at fair value | | | 11,717 |

| | 11,472 |

|

| Property, plant and equipment, net | | | 672,017 |

| | 686,327 |

|

| Other Assets: | | | |

| | |

|

| Intangible assets, net | | | 413,537 |

| | 380,979 |

|

| Goodwill | | | 146,497 |

| | 146,497 |

|

| Deferred charges and other assets, net | | | 33,934 |

| | 13,690 |

|

| Total assets | | | $ | 1,458,966 |

| | $ | 1,411,860 |

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | March 31,

2017 | | December 31,

2016 | | | | |

| | | | | | |

| Current Liabilities | | | | | |

| Current Liabilities: | | | | | |

| Current maturities of long-term debt, net of unamortized loan fees | | $ | 38,124 |

| | $ | 32,041 |

| | $ | 74,486 |

| | $ | 64,397 |

|

| Accounts payable | | 25,390 |

| | 72,810 |

| | 27,194 |

| | 28,953 |

|

| Advanced billings and customer deposits | | 21,029 |

| | 20,427 |

| | 6,919 |

| | 21,153 |

|

| Accrued compensation | | 3,678 |

| | 9,465 |

| | 4,534 |

| | 9,167 |

|

| Income taxes payable | | 3,958 |

| | 435 |

| |

| Accrued liabilities and other | | 18,174 |

| | 29,085 |

| | 17,471 |

| | 13,914 |

|

| Total current liabilities | | 110,353 |

| | 164,263 |

| | 130,604 |

| | 137,584 |

|

| | | | | | |

| Long-term debt, less current maturities, net of unamortized loan fees | | 810,873 |

| | 797,224 |

| | 736,387 |

| | 757,561 |

|

| | | | | | |

| Other Long-Term Liabilities | | |

| | |

| |

| Other Long-Term Liabilities: | | | |

| | |

|

| Deferred income taxes | | 149,763 |

| | 151,837 |

| | 115,809 |

| | 100,879 |

|

| Deferred lease payable | | 19,230 |

| | 18,042 |

| |

| Deferred lease | | | 19,543 |

| | 15,782 |

|

| Asset retirement obligations | | 19,386 |

| | 15,666 |

| | 21,164 |

| | 21,211 |

|

| Retirement plan obligations | | 17,892 |

| | 17,738 |

| | 13,236 |

| | 13,328 |

|

| Other liabilities | | 26,057 |

| | 23,743 |

| | 13,787 |

| | 15,293 |

|

| Total other long-term liabilities | | 232,328 |

| | 227,026 |

| | 183,539 |

| | 166,493 |

|

| | | | | | |

| Commitments and Contingencies | |

|

| |

|

| |

| | | | | | |

| Shareholders’ Equity | | |

| | |

| |

| Common stock | | 46,083 |

| | 45,482 |

| |

| Shareholders’ Equity: | | | |

| | |

|

| Common stock, no par value, authorized 96,000 shares; issued and outstanding 49,539 shares in 2018 and 49,328 shares in 2017. | | | 45,075 |

| | 44,787 |

|

| Retained earnings | | 245,965 |

| | 243,624 |

| | 352,069 |

| | 297,205 |

|

| Accumulated other comprehensive income, net of taxes | | 7,387 |

| | 6,788 |

| |

| Accumulated other comprehensive income (loss), net of taxes | | | 11,292 |

| | 8,230 |

|

| Total shareholders’ equity | | 299,435 |

| | 295,894 |

| | 408,436 |

| | 350,222 |

|

| | | | | | |

| Total liabilities and shareholders’ equity | | $ | 1,452,989 |

| | $ | 1,484,407 |

| | $ | 1,458,966 |

| | $ | 1,411,860 |

|

See accompanying notes to unaudited condensed consolidated financial statements.

SHENANDOAH TELECOMMUNICATIONS COMPANY AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOMEOPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(in thousands, except per share amounts)

|

| | | | | | | | |

| | | Three Months Ended

March 31, |

| | | 2017 | | 2016 |

| | | | | |

| Operating revenues | | $ | 153,880 |

| | $ | 92,571 |

|

| | | | | |

| Operating expenses: | | |

| | |

|

| Cost of goods and services, exclusive of depreciation and amortization shown separately below | | 53,761 |

| | 31,762 |

|

| Selling, general and administrative, exclusive of depreciation and amortization shown separately below | | 40,153 |

| | 21,426 |

|

| Integration and acquisition expenses | | 4,489 |

| | 332 |

|

| Depreciation and amortization | | 44,804 |

| | 17,739 |

|

| Total operating expenses | | 143,207 |

| | 71,259 |

|

| Operating income | | 10,673 |

| | 21,312 |

|

| | | | | |

| Other income (expense): | | |

| | |

|

| Interest expense | | (9,100 | ) | | (1,619 | ) |

| Gain on investments, net | | 120 |

| | 88 |

|

| Non-operating income, net | | 1,255 |

| | 468 |

|

| Income before income taxes | | 2,948 |

| | 20,249 |

|

| | | | | |

| Income tax expense | | 607 |

| | 6,368 |

|

| Net income | | 2,341 |

| | 13,881 |

|

| | | | | |

| Other comprehensive income (loss): | | |

| | |

|

| Unrealized gain (loss) on interest rate hedge, net of tax | | 599 |

| | (1,048 | ) |

| Comprehensive income | | $ | 2,940 |

| | $ | 12,833 |

|

| | | | | |

| Earnings per share: | | |

| | |

|

| Basic | | $ | 0.05 |

| | $ | 0.29 |

|

| Diluted | | $ | 0.05 |

| | $ | 0.28 |

|

| Weighted average shares outstanding, basic | | 49,050 |

| | 48,563 |

|

| Weighted average shares outstanding, diluted | | 49,834 |

| | 49,249 |

|

|

| | | | | | | | |

| | | Three Months Ended

March 31, |

| | | 2018 | | 2017 |

| | | | | |

| Service revenues and other | | $ | 134,153 |

| | $ | 150,521 |

|

| Equipment revenues | | 17,579 |

| | 3,359 |

|

| Total operating revenues | | 151,732 |

| | 153,880 |

|

| | | | | |

| Operating expenses: | | |

| | |

|

| Cost of services | | 49,342 |

| | 48,776 |

|

| Cost of goods sold | | 15,805 |

| | 4,985 |

|

| Selling, general and administrative | | 28,750 |

| | 40,153 |

|

| Acquisition, integration and migration expenses | | — |

| | 4,489 |

|

| Depreciation and amortization | | 43,487 |

| | 44,804 |

|

| Total operating expenses | | 137,384 |

| | 143,207 |

|

| Operating income (loss) | | 14,348 |

| | 10,673 |

|

| | | | | |

| Other income (expense): | | |

| | |

|

| Interest expense | | (9,332 | ) | | (9,100 | ) |

| Gain (loss) on investments, net | | (32 | ) | | 120 |

|

| Non-operating income (loss), net | | 1,021 |

| | 1,255 |

|

| Income (loss) before income taxes | | 6,005 |

| | 2,948 |

|

| | | | | |

| Income tax expense (benefit) | | 1,176 |

| | 607 |

|

| Net income (loss) | | 4,829 |

| | 2,341 |

|

| | | | | |

| Other comprehensive income (loss): | | |

| | |

|

| Unrealized gain (loss) on interest rate hedge, net of tax | | 3,062 |

| | 599 |

|

| Comprehensive income (loss) | | $ | 7,891 |

| | $ | 2,940 |

|

| | | | | |

| Earnings (loss) per share: | | |

| | |

|

| Basic | | $ | 0.10 |

| | $ | 0.05 |

|

| Diluted | | $ | 0.10 |

| | $ | 0.05 |

|

| Weighted average shares outstanding, basic | | 49,474 |

| | 49,050 |

|

| Weighted average shares outstanding, diluted | | 50,024 |

| | 49,834 |

|

See accompanying notes to unaudited condensed consolidated financial statements.

SHENANDOAH TELECOMMUNICATIONS COMPANY AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

(in thousands, except per share amounts)

|

| | | | | | | | | | | | | | | | | | | |

| | | Shares | | Common Stock | | Retained Earnings | | Accumulated Other Comprehensive Income, net of tax | | Total |

| Balance, December 31, 2015 | | 48,475 |

| | $ | 32,776 |

| | $ | 256,747 |

| | $ | 415 |

| | $ | 289,938 |

|

| | | | | | | | | | | |

| Net loss | | — |

| | — |

| | (895 | ) | | — |

| | (895 | ) |

| Other comprehensive gain, net of tax | | — |

| | — |

| | — |

| | 6,373 |

| | 6,373 |

|

| Dividends declared ($0.25 per share) | | — |

| | — |

| | (12,228 | ) | | — |

| | (12,228 | ) |

| Dividends reinvested in common stock | | 19 |

| | 524 |

| | — |

| | — |

| | 524 |

|

| Stock based compensation | | — |

| | 3,506 |

| | — |

| | — |

| | 3,506 |

|

| Stock options exercised | | 371 |

| | 3,359 |

| | — |

| | — |

| | 3,359 |

|

| Common stock issued for share awards | | 190 |

| | — |

| | — |

| | — |

| | — |

|

| Common stock issued | | 2 |

| | 14 |

| | — |

| | — |

| | 14 |

|

| Common stock issued to acquire non-controlling interests of nTelos | | 76 |

| | 10,400 |

| | — |

| | — |

| | 10,400 |

|

| Common stock repurchased | | (198 | ) | | (5,097 | ) | | — |

| | — |

| | (5,097 | ) |

| | | | | | | | | | | |

| Balance, December 31, 2016 | | 48,935 |

| | $ | 45,482 |

| | $ | 243,624 |

| | $ | 6,788 |

| | $ | 295,894 |

|

| Net income | | — |

| | — |

| | 2,341 |

| | — |

| | 2,341 |

|

| Other comprehensive gain, net of tax | | — |

| | — |

| | — |

| | 599 |

| | 599 |

|

| Stock based compensation | | — |

| | 1,822 |

| | — |

| | — |

| | 1,822 |

|

| Common stock issued for share awards | | 129 |

| | — |

| | — |

| | — |

| | — |

|

| Common stock issued | | 1 |

| | 5 |

| | — |

| | — |

| | 5 |

|

| Common stock issued to acquire non-controlling interests of nTelos | | 76 |

| | — |

| | — |

| | — |

| | — |

|

| Common stock repurchased | | (43 | ) | | (1,226 | ) | | — |

| | — |

| | (1,226 | ) |

| Balance, March 31, 2017 | | 49,098 |

| | $ | 46,083 |

| | $ | 245,965 |

| | $ | 7,387 |

| | $ | 299,435 |

|

|

| | | | | | | | | | | | | | | | | | | |

| | | Shares of Common Stock (no par value) | | Additional Paid in Capital | | Retained Earnings | | Accumulated Other Comprehensive Income (Loss) | | Total |

| Balance, December 31, 2017 | | 49,328 |

| | $ | 44,787 |

| | $ | 297,205 |

| | $ | 8,230 |

| | $ | 350,222 |

|

| | | | | | | | | | |

|

|

| Change in accounting principle - adoption of accounting standard (Note 2) | | — |

| | — |

| | 50,035 |

| | — |

| | 50,035 |

|

| Net income (loss) | | — |

| | — |

| | 4,829 |

| | — |

| | 4,829 |

|

| Other comprehensive gain (loss), net of tax of $1.1 million | | — |

| | — |

| | — |

| | 3,062 |

| | 3,062 |

|

| Stock based compensation | | 177 |

| | 2,037 |

| | — |

| | — |

| | 2,037 |

|

| Stock options exercised | | 15 |

| | 104 |

| | — |

| | — |

| | 104 |

|

| Common stock issued | | — |

| | 5 |

| | — |

| | — |

| | 5 |

|

| Shares retired for settlement of employee taxes upon issuance of vested equity awards | | (57 | ) | | (1,858 | ) | | — |

| | — |

| | (1,858 | ) |

| Common stock issued to acquire non-controlling interests of nTelos | | 76 |

| | — |

| | — |

| | — |

| | — |

|

| Balance, March 31, 2018 | | 49,539 |

| | $ | 45,075 |

| | $ | 352,069 |

| | $ | 11,292 |

| | $ | 408,436 |

|

See accompanying notes to unaudited condensed consolidated financial statements.

SHENANDOAH TELECOMMUNICATIONS COMPANY AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

|

| | | | | | | | |

| | | Three Months Ended

March 31, |

| | | 2017 | | 2016 |

| Cash Flows From Operating Activities | | | | |

| Net income | | $ | 2,341 |

| | $ | 13,881 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | |

| | |

|

| Depreciation | | 37,878 |

| | 17,454 |

|

| Amortization reflected as operating expense | | 6,926 |

| | 285 |

|

| Amortization reflected as contra revenue | | 4,978 |

| | — |

|

| Amortization reflected as rent expense | | 258 |

| | — |

|

| Provision for bad debt | | 420 |

| | 345 |

|

| Straight line adjustment to management fee revenue | | 4,206 |

| | — |

|

| Stock based compensation expense | | 1,566 |

| | 1,048 |

|

| Deferred income taxes | | (2,910 | ) | | (1,489 | ) |

| Net gain on disposal of equipment | | (28 | ) | | (15 | ) |

| Unrealized gain on investments | | (120 | ) | | (16 | ) |

| Net gains from patronage and equity investments | | (200 | ) | | (210 | ) |

| Amortization of long term debt issuance costs | | 1,202 |

| | 132 |

|

| Other | | — |

| | 3,039 |

|

| Changes in assets and liabilities: | | |

| | |

|

| (Increase) decrease in: | | |

| | |

|

| Accounts receivable | | 1,629 |

| | 2,470 |

|

| Inventory, net | | 14,188 |

| | (267 | ) |

| Other assets | | (190 | ) | | 988 |

|

| Increase (decrease) in: | | |

| | |

|

| Accounts payable | | (39,399 | ) | | 1,895 |

|

| Income taxes payable | | 3,523 |

| | 6,981 |

|

| Deferred lease payable | | 1,331 |

| | 208 |

|

| Other deferrals and accruals | | (13,101 | ) | | (3,559 | ) |

| Net cash provided by operating activities | | 24,498 |

| | 43,170 |

|

| | | | | |

| Cash Flows From Investing Activities | | |

| | |

|

| Acquisition of property, plant and equipment | | (38,587 | ) | | (20,537 | ) |

| Proceeds from sale of equipment | | 117 |

| | 145 |

|

| Cash distributions from investments | | 3 |

| | 45 |

|

| Additional contributions to investments | | (14 | ) | | — |

|

| Cash disbursed for acquisition | | — |

| | (2,480 | ) |

| Net cash used in investing activities | | (38,481 | ) | | (22,827 | ) |

(Continued)

SHENANDOAH TELECOMMUNICATIONS COMPANY AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

|

| | | | | | | | |

| | | Three Months Ended

March 31, |

| | | 2017 | | 2016 |

| Cash Flows From Financing Activities | | | | |

| Principal payments on long-term debt | | $ | (6,062 | ) | | $ | (5,750 | ) |

| Amounts borrowed under debt agreements | | 25,000 |

| | — |

|

| Cash paid for debt issuance costs | | — |

| | (1,528 | ) |

| Repurchases of common stock | | (1,226 | ) | | (3,526 | ) |

| Proceeds from issuances of common stock | | 5 |

| | 2,809 |

|

| Net cash provided by/(used in) financing activities | | 17,717 |

| | (7,995 | ) |

| | | | | |

| Net increase in cash and cash equivalents | | 3,734 |

| | 12,348 |

|

| | | | | |

| Cash and cash equivalents: | | |

| | |

|

| Beginning | | 36,193 |

| | 76,812 |

|

| Ending | | $ | 39,927 |

| | $ | 89,160 |

|

| | | | | |

| Supplemental Disclosures of Cash Flow Information | | |

| | |

|

| Cash payments for: | | |

| | |

|

| Interest, net of capitalized interest of $577 and $146, respectively | | $ | 8,380 |

| | $ | 1,632 |

|

| | | | | |

| Income taxes paid, net of refunds received | | $ | — |

| | $ | 876 |

|

Non-cash investing and financing activities:

At March 31, 2017 and 2016, accounts payable included approximately $6.4 million and $1.2 million, respectively, associated with capital expenditures. Cash flows for accounts payable and acquisition of property, plant and equipment exclude this activity.

During the quarter ended March 31, 2017, the Company recorded an increase in the fair value of interest rate swaps of $972 thousand, an increase in deferred tax liabilities of $373 thousand, and an increase to accumulated other comprehensive income of $599 thousand. |

| | | | | | | | |

| | | Three Months Ended

March 31, |

| | | 2018 | | 2017 |

| Cash Flows From Operating Activities | | | | |

| Net income (loss) | | $ | 4,829 |

| | $ | 2,341 |

|

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | |

| | |

|

| Depreciation | | 36,634 |

| | 37,878 |

|

| Amortization reflected as operating expense | | 6,853 |

| | 6,926 |

|

| Amortization reflected as rent expense | | 81 |

| | 258 |

|

| Bad debt expense | | 369 |

| | 420 |

|

| Stock based compensation expense, net of amount capitalized | | 2,037 |

| | 1,566 |

|

| Waived Management Fee | | 9,048 |

| | 9,184 |

|

| Deferred income taxes | | (4,336 | ) | | (2,910 | ) |

| Net (gain) loss on disposal of equipment | | (4 | ) | | (28 | ) |

| (Gain) loss on investments | | 33 |

| | (120 | ) |

| Net (gain) loss from patronage and equity investments | | (830 | ) | | (200 | ) |

| Amortization of long-term debt issuance costs | | 1,129 |

| | 1,202 |

|

| Accrued interest on long-term debt | | 296 |

| | 93 |

|

| Changes in assets and liabilities: | | |

| | |

|

| Accounts receivable | | 3,271 |

| | 1,629 |

|

| Inventory, net | | (2,457 | ) | | 14,188 |

|

| Income taxes receivable | | 8,950 |

| | — |

|

| Other assets | | (4,076 | ) | | (190 | ) |

| Accounts payable | | 216 |

| | (39,399 | ) |

| Income taxes payable | | — |

| | 3,523 |

|

| Deferred lease | | 736 |

| | 1,331 |

|

| Other deferrals and accruals | | (1,919 | ) | | (13,194 | ) |

| Net cash provided by (used in) operating activities | | $ | 60,860 |

| | $ | 24,498 |

|

| Cash Flows From Investing Activities | | |

| | |

|

| Acquisition of property, plant and equipment | | (24,382 | ) | | (38,587 | ) |

| Proceeds from sale of assets | | 263 |

| | 117 |

|

| Cash distributions (contributions) from investments | | 1 |

| | (11 | ) |

| Sprint expansion | | (52,000 | ) | | — |

|

| Net cash provided by (used in) investing activities | | $ | (76,118 | ) | | $ | (38,481 | ) |

| Cash Flows From Financing Activities | | | | |

| Principal payments on long-term debt | | $ | (12,125 | ) | | $ | (6,062 | ) |

| Proceeds from credit facility borrowings | | — |

| | 25,000 |

|

| Proceeds from revolving credit facility borrowings | | 15,000 |

| | — |

|

| Principal payments on revolving credit facility | | (15,000 | ) | | — |

|

| Taxes paid for equity award issuances | | (1,754 | ) | | (1,226 | ) |

| Proceeds from issuance of common stock | | — |

| | 5 |

|

| Net cash provided by (used in) financing activities | | $ | (13,879 | ) | | $ | 17,717 |

|

| Net increase (decrease) in cash and cash equivalents | | $ | (29,137 | ) | | $ | 3,734 |

|

| Cash and cash equivalents, beginning of period | | 78,585 |

| | 36,193 |

|

| Cash and cash equivalents, end of period | | $ | 49,448 |

| | $ | 39,927 |

|

| Supplemental Disclosures of Cash Flow Information | | | | |

| Cash payments for: | | | | |

| Interest, net of capitalized interest of $309 and $577, respectively | | $ | 8,513 |

| | $ | 8,380 |

|

| Income tax refunds received, net of taxes paid | | $ | (3,439 | ) | | $ | — |

|

| Capital expenditures payable | | $ | 5,279 |

| | $ | 6,366 |

|

See accompanying notes to unaudited condensed consolidated financial statements.

SHENANDOAH TELECOMMUNICATIONS COMPANY AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 1. Basis of Presentation

The interim condensed consolidated financial statements of Shenandoah Telecommunications Company and Subsidiaries (collectively, the “Company”) are unaudited. In the opinion of management, all adjustments necessary for a fair presentation of the interim results have been reflected therein. All such adjustments weretherein in accordance with accounting principles generally accepted in the United States ("GAAP") for interim financial reporting and as required by Rule 10-01 of a normalRegulation S-X. Accordingly, the unaudited condensed consolidated financial statements may not include all of the information and recurring nature. Prior year amounts have been reclassified in some cases to conform to the current year presentation. Thesenotes required by GAAP for audited financial statementsstatements. The information contained herein should be read in conjunction with the audited consolidated financial statements and related notesincluded in the Company’sCompany's Annual Report on Form 10-K for the year ended December 31, 2016. 2017.

Adoption of New Accounting Principles

There have been no developments related to recently issued accounting standards, including the expected dates of adoption and estimated effects on the Company's unaudited condensed consolidated financial statements and note disclosures, from those disclosed in the Company's 2017 Annual Report on Form 10-K, that would be expected to impact the Company except for the topics discussed below.

The accompanyingCompany adopted ASU 2014-09, Revenue from Contracts with Customers (“Topic 606”), and all related amendments, effective January 1, 2018, using the modified retrospective method as discussed in Note 2, Revenue from Contracts with Customers. The Company recognized the cumulative effect of applying the new revenue standard as an adjustment to the opening balance sheetof retained earnings. The comparative information at December 31,has not been retrospectively modified and continues to be reported under the accounting standards in effect for those periods.

In February 2016, the Financial Accounting Standards Board ("FASB") issued ASU No. 2016-02, Leases (Topic 842), which requires lessees to recognize a right-of-use asset and a lease liability for all leases with terms greater than 12 months. The standard also requires disclosures by lessees and lessors about the amount, timing and uncertainty of cash flows arising from leases, as well as changes in the categorization of rental costs, from rent expense to interest and depreciation expense. Other effects may occur depending on the types of leases and the specific terms of them utilized by particular lessees. The ASU is effective for the Company on January 1, 2019, and early application is permitted. Modified retrospective application is required. In September 2017 and January 2018, the FASB issued ASU No. 2017-13, Revenue Recognition (Topic 605), Revenue from Contracts with Customers (Topic 606), Leases (Topic 840), and Leases (Topic 842), and ASU No. 2018-01, Leases (Topic 842), Land Easement Practical Expedient for Transition to Topic 842, which provided additional implementation guidance on the previously issued ASU. Management has not yet completed its assessment of the impact of the new standard on the Company’s Consolidated Financial Statements. The Company is in the early stages of implementation and currently believes that the most notable impact to its financial statements upon the adoption of this ASU will be the recognition of a material right-of-use asset and a lease liability for its real estate and equipment leases.

In February 2018, the FASB issued ASU No. 2018-02, "Income Statement - Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income" (ASU 2018-02). Under existing U.S. GAAP, the effects of changes in tax rates and laws on deferred tax balances are recorded as a component of income tax expense in the period in which the law was derivedenacted. When deferred tax balances related to items originally recorded in accumulated other comprehensive income are adjusted, certain tax effects become stranded in accumulated other comprehensive income. The amendments in ASU 2018-02 allow a reclassification from accumulated other comprehensive income to retained earnings for stranded tax effects resulting from the audited2017 Tax Cuts and Jobs Act. The amendments in this ASU also require certain disclosures about stranded tax effects. The guidance is effective for fiscal years beginning after December 31, 2016 consolidated balance sheet. Operating revenues15, 2018, and income (loss) from operations forinterim periods within those fiscal years. Early adoption in any interim period are not necessarily indicativeis permitted. The Company is currently evaluating the timing and impact of results that may be expected for the entire year.adopting ASU 2018-02.

| |

2. | Acquisition of NTELOS Holdings Corp. and Exchange with Sprint |

On May 6, 2016, the Company completed its previously announced acquisition of NTELOS Holdings Corp. (“nTelos”) for $667.8 million, net of cash acquired. The acquisition was entered into to improve shareholder value through the expansion of the Company's Wireless service area and customer base while strengthening our relationship with Sprint Corporation ("Sprint"). The purchase price was financed by a credit facility arranged by CoBank, ACB, Royal Bank of Canada, Fifth Third Bank, Bank of America, N.A., Capital One, National Association, Citizens Bank N.A., and Toronto Dominion (Texas) LLC. The Company has accounted for the acquisition of nTelos under the acquisition method of accounting, in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 805, “Business Combinations”, and has accounted for measurement period adjustments under Accounting Standards Update (“ASU”) 2015-16, “Simplifying the Accounting for Measurement Period Adjustments”. Under the acquisition method of accounting, the total purchase price is allocated to the tangible and intangible assets acquired and liabilities assumed in connection with the acquisition based on their estimated fair values.

The preliminary allocation of the purchase price was based upon management’s preliminary valuation of the fair value of tangible and intangible assets acquired and liabilities assumed of nTelos, with the excess recorded as goodwill. During the first quarter of 2017, the Company made adjustments to the preliminary estimates of fair value resulting in immaterial changes to previously estimated fair values of fixed assets, asset retirement obligation liabilities, accounts receivable and deferred taxes. These adjustments resulted in a $1.3 million reduction to goodwill as shown in the table below. The Company continues to review certain tax positions acquired in the nTelos acquisition.

Changes in the carrying amount of goodwill during the three months ended March 31, 2017 are shown below (in thousands):

|

| | | | | | | | | |

| | December 31,

2016 | Purchase Accounting Adjustments | March 31,

2017 |

| Goodwill - Wireline segment | $ | 10 |

| $ | — |

| $ | 10 |

|

| Goodwill - Cable segment | 104 |

| — |

| 104 |

|

| Goodwill - Wireless segment | 145,142 |

| (1,255 | ) | 143,887 |

|

| Goodwill as of March 31, 2017 | $ | 145,256 |

| $ | (1,255 | ) | $ | 144,001 |

|

Following are the unaudited pro forma results of the Company for the period ended March 31, 2016, as if the acquisition of nTelos had occurred at the beginning of the period. (in thousands)

|

| | | | |

| | | March 31,

2016 |

| Operating revenues | | $ | 173,248 |

|

| Income before income taxes | | $ | 16,905 |

|

In connection with these transactions, the Company incurs costs which include the nTelos back office staff and support functions until the nTelos legacy customers are migrated to the Sprint billing platform; costs of the handsets to be provided to

nTelos legacyNote 2. Revenue from Contracts with Customers

The Company earns revenue primarily through the sale of our wireless telecommunications services, wireless equipment, and business, residential, and enterprise cable and wireline services that include video, internet, voice, and data services as follows: |

| | | | | | | | | | | | | | | | |

| (in thousands) | | Wireless | | Cable | | Wireline | | Consolidated |

| Wireless service | | $ | 89,760 |

| | $ | — |

| | $ | — |

| | $ | 89,760 |

|

| Wireless equipment | | 17,374 |

| | — |

| | — |

| | 17,374 |

|

| Business, residential and enterprise | | — |

| | 29,131 |

| | 10,691 |

| | 39,822 |

|

| Tower | | 2,896 |

| | 1,046 |

| | 5,665 |

| | 9,607 |

|

| Other | | 368 |

| | 1,534 |

| | 3,351 |

| | 5,253 |

|

| Total revenue | | 110,398 |

| | 31,711 |

| | 19,707 |

| | 161,816 |

|

| Internal revenues | | (1,239 | ) | | (1,031 | ) | | (7,814 | ) | | (10,084 | ) |

| Total operating revenue | | $ | 109,159 |

| | $ | 30,680 |

| | $ | 11,893 |

| | $ | 151,732 |

|

Wireless service

The majority of the Company's revenue is earned through providing network access to Sprint under the affiliate agreement, which represents approximately 59% of consolidated revenues. Wireless service revenue is variable based on billed revenues to Sprint’s subscribers in the Company's affiliate area, less applicable fees retained by Sprint. The Company's fee related to Sprint’s postpaid customers is the amount Sprint bills its subscribers that is reduced by customer credits, write-offs of subscriber receivables, and an 8% management and 8.6% service fee retained by Sprint. The Company is also charged for the costs of subsidized handsets sold through Sprint’s national channels as they migratewell as commissions paid by Sprint to third-party resellers in the Company's service territory.

The Company's fee related to Sprint’s prepaid customers is the amount Sprint billing platform; severance costsbills its customer less certain charges to acquire and support the customer, based on national averages for back office and other former nTelos employees who will not be retained permanently;Sprint’s prepaid programs. Sprint retains a 6% management fee on prepaid wireless revenues, and costs to shut down certain cell sitesprovide support to Sprint’s prepaid customers.

The Company considers Sprint, rather than Sprint's subscribers, to be the customer under the new revenue standard and related backhaul contracts. We have incurred $7.1 millionthe Company's performance obligation is to provide Sprint a series of continuous network access services. Under Topic 606, the Company's revenues are variable based on the amount Sprint bills its customer each month reduced by the retained management and service fees. The reimbursement to Sprint for the costs of subsidized handsets sold through Sprint’s national channels, as well as commissions paid by Sprint to third-party resellers in our service territory represent consideration payable to a customer that is not in exchange for a distinct service under Topic 606. Therefore, these reimbursements result in increases to our contract asset position that are subsequently recognized as a reduction of revenue over the average subscriber life of approximately two years which is the period the Company expects those payments to result in increased revenues. Historically, under ASC 605 the customer was considered the Sprint subscriber rather than Sprint and as a result, reimbursement payments to Sprint for costs of subsidized handsets and commissions were recorded as operating expenses in the period incurred. During 2017, these costs in the three months ended March 31, 2017, including $0.1totaled $63.5 million reflectedrecorded in cost of goods and services, and $2.5$16.9 million reflectedrecorded in selling, general and administrative costs incosts. On January 1, 2018, upon adoption, the Company recorded a wireless contract asset of approximately $42.8 million. During the three monthsmonth period ended March 31, 2017.

2018, payments that increased the wireless contract asset balance totaled $13.8 and amortization reflected as a reduction of revenue totaled approximately $13.4 million. The wireless contract asset balance as of March 31, 2018 was approximately$43.2 million.

| |

3. | Property, Plant and Equipment |

Wireless equipment

The Company owns and operates Sprint-branded retail stores within their geographic territory from which the Company sells equipment, primarily wireless handsets, and service to Sprint subscribers. Equipment is generally purchased from Sprint and resold to subscribers under subsidized plans or under equipment financing plans. The equipment financing plans are operated by Sprint who purchases equipment from the Company and resells the equipment to subscribers under financing plans. Historically, under ASC 605, the Company concluded that the Company was the agent in these equipment financing transactions and recorded revenues net of related handset costs which were approximately $63.8 million in 2017. Under Topic 606 the Company concluded that the Company is the principal in the transaction as the Company controls the inventory prior to sale and accordingly revenues and handset costs are recorded on a gross basis.

Property, plantBusiness, residential and enterprise

The Company earns revenue in the cable and wireline segments from business, residential, and enterprise customers where the performance obligations are to provide cable and telephone network services, sell and lease equipment consistedand wiring services, and

lease fiber-optic cable strands. The Company's arrangements are generally composed of contracts that are cancellable at the customer’s discretion without penalty at any time. As there are multiple performance obligations in these arrangements, the Company recognizes revenue based on the standalone selling price of each distinct good or service. The Company generally recognized these revenues over time as customers simultaneously receive and consume the benefits of the following (in thousands):service, with the exception of equipment sales and home wiring which are recognized as revenue at a point in time when control transfers and when installation is complete, respectively.

Under Topic 606, the Company concluded that installation services do not represent a separate performance obligation. Accordingly, installation fees are allocated to services and are recognized ratably over the longer of the contract term or the period the unrecognized portion of the fee remains material to the contract, typically 10 and 11 months for cable and wireline customers, respectively. Historically, the Company deferred these fees over the estimated customer life of 42 months. Additionally, the Company incurs commission and installation costs related to in-house and third-party vendors that were previously expensed as incurred. Under Topic 606, the Company capitalizes and amortizes these commission and installation costs over the expected benefit period which is approximately 44 months, 72 months, and 46 months, for cable, wireline, and enterprise business, respectively.

Tower / Other

Tower revenues consist primarily of tower space leases accounted for under Topic 840, Leases, and Other revenues include network access-related charges to for service provided to customers across all three operating segments.

The cumulative effect of the changes made to our consolidated January 1, 2018 balance sheet for the adoption of the new revenue standard were as follows:

|

| | | | | | | | | | | | |

| (in thousands) | | Balance at December 31, 2017 | | Adjustments due to Topic 606 | | Balance at January 1, 2018 |

| Assets | | | | | | |

| Prepaid expenses and other | | $ | 17,111 |

| | $ | 36,577 |

| | $ | 53,688 |

|

| Deferred charges and other | | 13,690 |

| | 16,107 |

| | 29,797 |

|

| Liabilities | | | | | | |

| Advanced billing and customer deposits | | $ | 21,153 |

| | $ | (14,302 | ) | | $ | 6,851 |

|

| Deferred income taxes | | 100,879 |

| | 18,151 |

| | 119,030 |

|

| Other long-term liabilities | | 15,293 |

| | (1,200 | ) | | 14,093 |

|

| Retained earnings | | 297,205 |

| | 50,035 |

| | 347,240 |

|

In accordance with the new revenue standard requirements, the disclosure of the impact of adoption on our consolidated income statement and balance sheet was as follows:

|

| | | | | | | | | | | | |

| | | Three Months Ended March 31, 2018 |

| (in thousands) | | As Reported | | Balances without Adoption of Topic 606 | | Effect of Change Higher/(Lower) |

| Operating revenues | | $ | 151,732 |

| | $ | 155,871 |

| | $ | (4,139 | ) |

| Operating expenses: | | | | | | |

| Cost of services | | 49,342 |

| | 49,199 |

| | 143 |

|

| Cost of goods sold | | 15,805 |

| | 6,118 |

| | 9,687 |

|

| Selling, general and administrative | | 28,750 |

| | 42,968 |

| | (14,218 | ) |

|

| | | | | | | | |

| | | March 31,

2017 | | December 31,

2016 |

| Plant in service | | $ | 1,124,446 |

| | $ | 1,085,318 |

|

| Plant under construction | | 61,980 |

| | 73,759 |

|

| | | 1,186,426 |

| | 1,159,077 |

|

| Less accumulated amortization and depreciation | | 496,478 |

| | 460,955 |

|

| Net property, plant and equipment | | $ | 689,948 |

| | $ | 698,122 |

|

|

| | | | | | | | | |

| | | Three Months Ended March 31, 2018 |

| (in thousands) | | As Reported | | Balances without Adoption of Topic 606 | | Effect of Change Higher/(Lower) |

| Assets | | | | | | |

| Prepaid expenses and other | | 64,200 |

| | 27,086 |

| | 37,114 |

|

| Deferred charges and other | | 33,934 |

| | 18,115 |

| | 15,819 |

|

| Liabilities | | | | | | |

| Deferred income taxes | | 115,809 |

| | 97,591 |

| | 18,218 |

|

| Advanced billing and customer deposits | | 6,919 |

| | 21,221 |

| | (14,302 | ) |

| Other long-term liabilities | | 13,787 |

| | 14,987 |

| | (1,200 | ) |

| Retained earnings | | 352,069 |

| | 301,852 |

| | 50,217 |

|

Remaining performance obligations and transaction price allocated

On March 31, 2018, the Company had approximately $2.5 million of transaction price allocated to unsatisfied performance obligations, which is exclusive of contracts with original expected duration of one year or less. The Company expects to recognize approximately $0.5 million of this amount as revenue during the remaining three quarters of 2018, $0.5 million in 2019, an additional $0.4 million by 2020, and the balance thereafter.

Contract acquisition costs and costs to fulfill contracts

Capitalized contract costs represent contract fulfillment costs and contract acquisition costs which include commissions and installation costs in our cable and wireline segments. Capitalized contract costs are amortized on a straight line basis over the contract term plus expected renewals. The Company applies the practical expedient to expense contract acquisition costs when incurred if the amortization period would be twelve months or less. The amortization of these costs is included in cost of services, and selling, general and administrative expenses. Amounts capitalized were approximately $9.7 million as of March 31, 2018 of which $4.6 million is presented as prepaid expenses and other and $5.1 million is presented as deferred charges and other assets, net. Amortization recognized during the three-month period ended at March 31, 2018 was approximately $1.3 million. There was no impairment loss in relation to the costs capitalized.

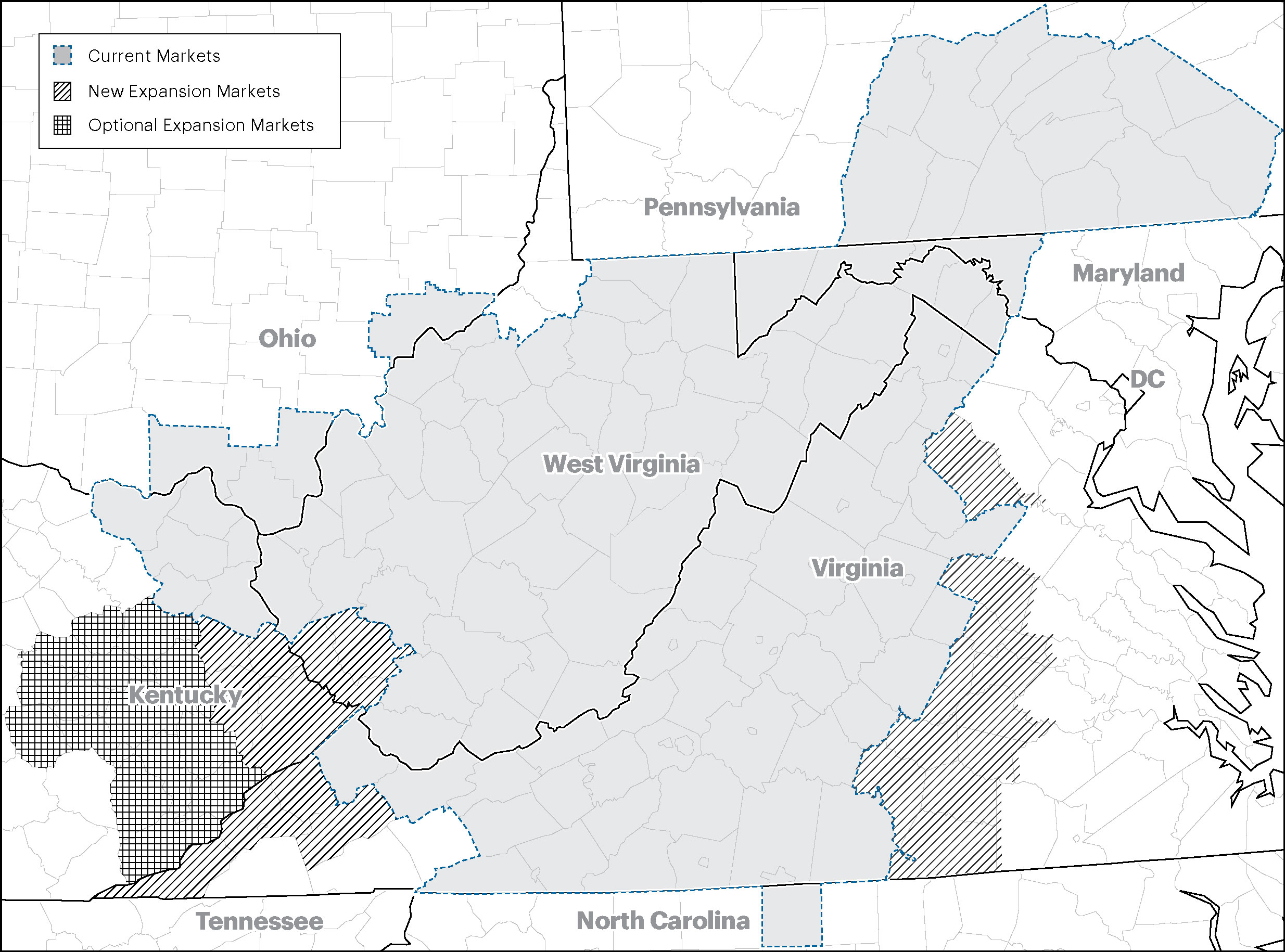

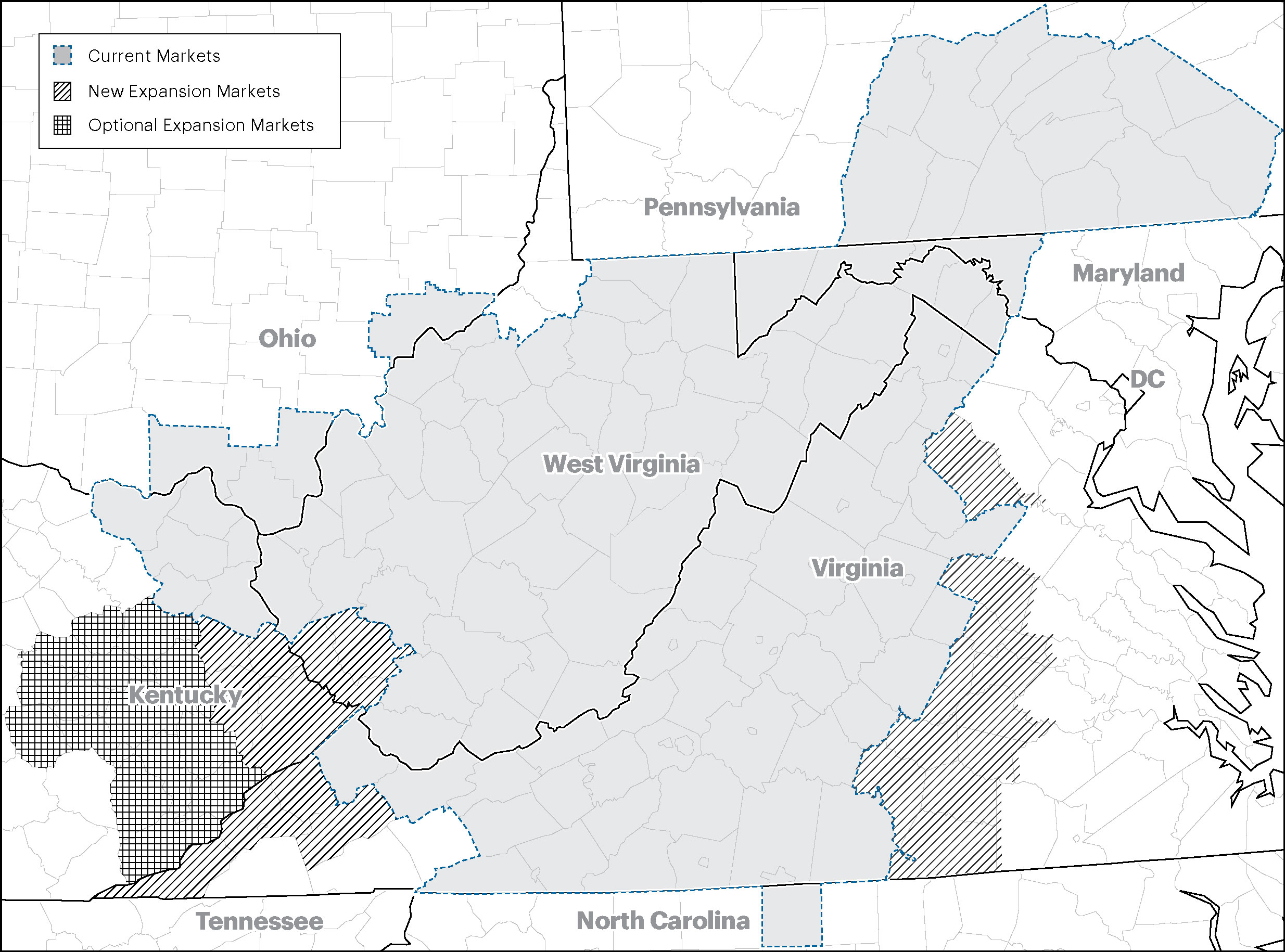

Note 3. Acquisition

Sprint Territory Expansion: Effective February 1, 2018, the Company signed an expansion agreement with Sprint to expand our wireless service area to include certain areas in Kentucky, Pennsylvania, Virginia and West Virginia, (the “Expansion Area”). The agreement includes certain network build out requirements in the Expansion Area, and the ability to utilize Sprint’s spectrum in the Expansion Area. Pursuant to the expansion agreement, Sprint agreed to, among other things, transition the provision of network coverage in the Expansion Area from Sprint to the Company. The Expansion Agreement required a payment of $52.0 million for the right to service the Expansion Area pursuant to the Affiliate Agreements plus an optional payment of up to $5.0 million for certain equipment at the Sprint cell sites in the Expansion Area. The option is exercisable at the Company's discretion. The acquisition was accounted for as an asset acquisition.

The Company recorded the following in the wireless segment:

|

| | | | | | |

| ($ in thousands) | | Estimated Useful Life | | February 1, 2018 |

| Affiliate Contract Expansion | | 12 | | $ | 45,148 |

|

| Option to acquire tangible assets | | — | | 6,497 |

|

| Off-market leases - favorable | | 16.5* | | 3,665 |

|

| Off-market leases - unfavorable | | 4.2* | | (3,310 | ) |

| Total | | | | $ | 52,000 |

|

*Estimated useful lives are approximate and represent the average of the remaining useful lives of the underlying leases.

The options to acquire tangible assets are classified as "Prepaid expenses and other" within current assets on the Company's balance sheet. The option is exercisable at any time and expires in two years. The option was measured for fair value using a cost approach on a recurring basis and using Level 3 inputs. The off-market leases - favorable and off-market leases - unfavorable, are classified as "Intangible assets, net" and "Deferred lease", respectively, on the Company's balance sheet. Refer to Note 6, Fair Value Measurements, and Note 8, Goodwill and Other Intangible Assets, for additional information.

Note 4. Customer Concentration

Significant Contractual Relationship

In 1999, the Company executed a Management Agreement (the “Agreement”) with Sprint whereby the Company committed to construct and operate a PCS network using CDMA air interface technology. Under the Agreement, the Company was the exclusive PCS Affiliate of Sprint providing wireless mobility communications network products and services on the 1900 MHz band in its territory across a multi-state area covering large portions of central and western Virginia, south-central Pennsylvania, West Virginia, and portions of Maryland, North Carolina, Kentucky, and Ohio. Since then, the Company’s wireless service area has expanded to include new portions of south-central and western Virginia, West Virginia, and small portions of Kentucky and Ohio. The Company is authorized to use the Sprint brand in its territory, and operate its network under Sprint’s radio spectrum licenses. As an exclusive PCS Affiliate of Sprint, the Company has the exclusive right to build, own and maintain its portion of Sprint’s nationwide PCS network, in the aforementioned areas, to Sprint’s specifications. The term of the Agreement was initially set for 20 years and was automatically renewable for three 10-year options, unless terminated by either party under provisions outlined in the Agreement. Upon non-renewal by either party, the Company has the obligation to sell the business at 90% of “Entire Business Value” (“EBV”) as defined in the Agreement. EBV is defined as i) the fair market value of a going concern paid by a willing buyer to a willing seller; ii) valued as if the business will continue to utilize existing brands and operate under existing agreements; and, iii) valued as if Manager (Shentel) owns the spectrum. Determination of EBV is made by an independent appraisal process. The Agreement has been amended numerous times.

Amendment to the Affiliate agreement related to the acquisition of Expansion Area: Effective with the acquisition of Expansion Area on February 1, 2018, the Company amended its Agreement with Sprint to expand our wireless service area to include certain areas in Kentucky, Pennsylvania, Virginia and West Virginia. The agreement includes certain network build out requirements in the Expansion Area, and the ability to utilize Sprint’s spectrum in the Expansion Area along with certain other amendments to the Affiliate Agreements. Pursuant to the Expansion Agreement, Sprint agreed to, among other things, transition the provision of network coverage in the Expansion Area from Sprint to us.

Note 5. Earnings (Loss) Per Share ("EPS")

Basic EPS was computed by dividing net income per share was computed onor loss by the weighted average number of shares outstanding.of common stock outstanding during the period. Diluted net income (loss) per share was computed under the treasury stock method, assuming the conversion as of the beginning of the period, for all dilutive stock options. Of 913 thousandDiluted EPS was computed by dividing net income by the sum of the weighted average number of shares of common stock outstanding and 991 thousandpotentially dilutive securities outstanding during the period under the treasury stock method. Potentially dilutive securities include stock options and restricted stock units and shares and options outstanding at March 31, 2017 and 2016, respectively, 125 thousand and 136 thousand were anti-dilutive, respectively. These shares and options have been excluded fromthat the computationsCompany is contractually obligated to issue in the future.

The following table indicates the computation of basic and diluted earnings per share for their respective period. There were no adjustments to net income for either period.

Investments include $3.1 million and $2.9 million of investments carried at fair value as of March 31, 2017 and December 31, 2016, respectively, consisting of equity, bond and money market mutual funds. Investments carried at fair value were acquired under a rabbi trust arrangement related to the Company’s nonqualified Supplemental Executive Retirement Plan (the “SERP”). The Company purchases investments in the trust to mirror the investment elections of participants in the SERP; gains and losses on the investments in the trust are reflected as increases or decreases in the liability owed to the participants. During the three months ended March 31, 2017, the Company recognized $32 thousand in dividend2018 and interest income from investments, and recorded net unrealized gains of $120 thousand on these investments. Fair values for these investments held under the rabbi trust were determined by Level 1 quoted market prices for the underlying mutual funds.2017:

|

| | | | | | | | |

| | | Three Months Ended

March 31, |

| (in thousands, except per share amounts) | | 2018 | | 2017 |

| Calculation of net income (loss) per share: | | | | |

| Net income (loss) | | $ | 4,829 |

| | $ | 2,341 |

|

| Weighted average shares outstanding | | 49,474 |

| | 49,050 |

|

| Basic income (loss) per share | | $ | 0.10 |

| | $ | 0.05 |

|

| | | | | |

| Effect of stock options outstanding: | | | | |

| Basic weighted average shares outstanding | | 49,474 |

| | 49,050 |

|

| Effect from dilutive shares and options outstanding | | 550 |

| | 784 |

|

| Diluted weighted average shares outstanding | | 50,024 |

| | 49,834 |

|

| Diluted income (loss) per share | | $ | 0.10 |

| | $ | 0.05 |

|

At March 31, 2017 and December 31, 2016, other investments, comprisedThe computation of equity securities which dodiluted EPS does not include certain unvested awards, on a weighted average basis, because their inclusion would have readily determinable fair values, consistan anti-dilutive effect on EPS. The awards excluded because of the following:their anti-dilutive effect are as follows:

|

| | | | | | | |

| | 3/31/2017 | | 12/31/2016 |

| Cost method: | (in thousands) |

| CoBank | $ | 6,296 |

| | $ | 6,177 |

|

| Other – Equity in other telecommunications partners | 740 |

| | 742 |

|

| | 7,036 |

| | 6,919 |

|

| Equity method: | | | |

| Other | 513 |

| | 450 |

|

| Total other investments | $ | 7,549 |

| | $ | 7,369 |

|

|

| | | | | | |

| | | Three Months Ended

March 31, |

| (in thousands) | | 2018 | | 2017 |

| Awards excluded from the computation of diluted net income per share because their inclusion would have been anti-dilutive | | 141 |

| | 125 |

|

Note 6. Fair Value Measurements

The following tables present the hierarchy for financial assets and liabilities measured at fair value on a recurring basis as of March 31, 2018 and December 31, 2017:

|

| | | | | | | | | | | | | | | | |

| (in thousands) | | March 31, 2018 |

| Balance sheet location: | | Level 1 | | Level 2 | | Level 3 | | Total |

| Cash Equivalents: | | | | | | | | |

| Money market funds | | $ | 151 |

| | $ | — |

| | $ | — |

| | $ | 151 |

|

| Prepaid expenses & other: | | | | | | | | |

| Interest rate swaps | | — |

| | 3,673 |

| | — |

| | 3,673 |

|

| Option to acquire tangible assets | | | | | | 6,497 |

| | 6,497 |

|

| Deferred charges & other assets, net: | | | | | | | | |

| Interest rate swaps | | — |

| | 13,692 |

| | — |

| | 13,692 |

|

| Total | | $ | 151 |

| | $ | 17,365 |

| | $ | 6,497 |

| | $ | 24,013 |

|

|

| | | | | | | | | | | | | | | | |

| (in thousands) | | December 31, 2017 |

| Balance sheet location: | | Level 1 | | Level 2 | | Level 3 | | Total |

| Cash Equivalents: | | | | | | | | |

| Money market funds | | $ | 150 |

| | $ | — |

| | $ | — |

| | $ | 150 |

|

| Prepaid expenses & other: | | | | | | | | |

| Interest rate swaps | | — |

| | 2,411 |

| | — |

| | 2,411 |

|

| Deferred charges & other assets, net: | | | | | | | | |

| Interest rate swaps | | — |

| | 10,776 |

| | — |

| | 10,776 |

|

| Total | | $ | 150 |

| | $ | 13,187 |

| | $ | — |

| | $ | 13,337 |

|

The following table presents our financial instruments measured at fair value using unobservable inputs (Level 3):

|

| | | | | | | | |

| | | Fair Value Measurements Using Unobservable Inputs (Level 3) |

| | | March 31, 2018 | | December 31, 2017 |

| Balance, beginning of period | | $ | — |

| | $ | — |

|

| Sprint Territory Expansion (Note 3): | | | | |

| Option to acquire tangible assets | | 6,497 |

| | — |

|

| Balance, end of period | | $ | 6,497 |

| | $ | — |

|

The option is exercisable at any time and expires in two years. The option was measured for fair value using a cost approach on a recurring basis and using Level 3 inputs including the cost of the underlying assets to be acquired and the contractual selling price of those assets.

Financial instruments on the condensed consolidated balance sheets that approximate fair value include: cashNote 7. Property, Plant and cash equivalents, receivables, investments carried at fair value, payables, accrued liabilities, interest rate swaps and variable rate long-term debt.Equipment

| |

7. | Derivative Instruments, Hedging Activitiesand Accumulated Other Comprehensive Income

|

The Company’s objectives in using interest rate derivatives are to add stability to cash flowsProperty, plant and to manage its exposure to interest rate movements. To accomplish these objectives, the Company primarily uses interest rate swaps as part of its interest rate risk management strategy. Interest rate swaps (both those designated as cash flow hedges as well as those not designated as cash flow hedges) involve the receipt of variable-rate amounts from a counterparty in exchange for the Company making fixed-rate payments over the lifeequipment consisted of the agreements without exchange of the underlying notional amount.

The Company entered into a pay-fixed, receive-variable interest rate swap of $174.6 million of notional principal in September 2012. This interest rate swap was designated as a cash flow hedge. The outstanding notional amount of this cash flow hedge was $131.0 million as of March 31, 2017. The outstanding notional amount decreases based upon scheduled principal payments on the 2012 debt.

In May 2016, the Company entered into a pay-fixed, receive-variable interest rate swap of $256.6 million of notional principal with three counterparties. This interest rate swap was designated as a cash flow hedge. The outstanding notional amount of this cash flow hedge was $302.4 million as of March 31, 2017. The outstanding notional amount increases based upon draws expected to be made under a portion of the Company's Term Loan A-2 debt and as the 2012 interest rate swap's notional principal decreases, and will decrease as the Company makes scheduled principal payments on the 2016 debt. In combination with the swap entered into in 2012 described above, the Company is hedging approximately 50% of the expected outstanding debt.

The effective portion of changes in the fair value of interest rate swaps designated and that qualify as cash flow hedges is recorded in accumulated other comprehensive income and is subsequently reclassified into earnings in the period that the hedged forecasted transaction affects earnings. The Company uses its derivatives to hedge the variable cash flows associated with existing variable-rate debt. The ineffective portion of the change in fair value of the derivative is recognized directly in earnings through interest expense. No hedge ineffectiveness was recognized during any of the periods presented.

Amounts reported in accumulated other comprehensive income related to the interest rate swaps designated and qualified as a cash flow hedge, are reclassified to interest expense as interest payments are made on the Company’s variable-rate debt. As of March 31, 2017, the Company estimates that $237 thousand will be reclassified as a reduction of interest expense during the next twelve months.

The table below presents the fair value of the Company’s derivative financial instrument as well as its classification on the condensed consolidated balance sheet as of March 31, 2017 and December 31, 2016 (in thousands): following:

|

| | | | | | | | | | |

| | | Derivatives |

| | | Fair Value as of |

| | | Balance Sheet Location | | March 31,

2017 | | December 31,

2016 |

| Derivatives designated as hedging instruments: | | | | | | |

| Interest rate swap | | | | |

| | |

|

| | | Prepaid expenses and other | | $ | 237 |

| | $ | — |

|

| | | Deferred charges and other assets, net | | 11,958 |

| | 12,118 |

|

| | | Accrued liabilities and other | | — |

| | (895 | ) |

| Total derivatives designated as hedging instruments | | | | $ | 12,195 |

| | $ | 11,223 |

|

The fair value of interest rate swaps is determined using a pricing model with inputs that are observable in the market (level 2 fair value inputs).

The table below presents change in accumulated other comprehensive income by component for the three months ended March 31, 2017 (in thousands):

|

| | | | | | | | | | | | |

| | | Gains on Cash Flow Hedges | | Income Tax Expense | | Accumulated Other Comprehensive Income |

| Balance as of December 31, 2016 | | $ | 11,223 |

| | $ | (4,435 | ) | | $ | 6,788 |

|

| Other comprehensive income before reclassifications | | 541 |

| | (208 | ) | | 333 |

|

| Amounts reclassified from accumulated other comprehensive income (to interest expense) | | 431 |

| | (165 | ) | | 266 |

|

| Net current period other comprehensive income | | 972 |

| | (373 | ) | | 599 |

|

| Balance as of March 31, 2017 | | $ | 12,195 |

| | $ | (4,808 | ) | | $ | 7,387 |

|

|

| | | | | | | | |

| (in thousands) | | March 31, 2018 | | December 31, 2017 |

| Plant in service | | $ | 1,245,079 |

| | $ | 1,219,185 |

|

| Plant under construction | | 57,005 |

| | 62,202 |

|

| | | 1,302,084 |

| | 1,281,387 |

|

| Less accumulated amortization and depreciation | | 630,067 |

| | 595,060 |

|

| Net property, plant and equipment | | $ | 672,017 |

| | $ | 686,327 |

|

Note 8. Goodwill and Other Intangible Assets

8. Intangible Assets, NetGoodwill consisted of the following:

|

| | | | | | | |

| (in thousands) | March 31, 2018 | | December 31, 2017 |

| Goodwill - Wireless | $ | 146,383 |

| | $ | 146,383 |

|

| Goodwill - Cable | 104 |

| | 104 |

|

| Goodwill - Wireline | 10 |

| | 10 |

|

| Goodwill | $ | 146,497 |

| | $ | 146,497 |

|

Intangible assets consist of the following at March 31, 20172018 and December 31, 2016:2017:

| | | | March 31, 2017 | | December 31, 2016 | March 31, 2018 | | December 31, 2017 |

| | Gross Carrying Amount | | Accumulated Amortization | | Net | | Gross Carrying Amount | | Accumulated Amortization | | Net | |

| (in thousands) | | Gross Carrying Amount | | Accumulated Amortization | | Net | | Gross Carrying Amount | | Accumulated Amortization | | Net |

| Non-amortizing intangibles: | Non-amortizing intangibles: | | | | | | | | | | | | | | | | | |

| Cable franchise rights | $ | 64,334 |

| | $ | — |

| | $ | 64,334 |

| | $ | 64,334 |

| | $ | — |

| | $ | 64,334 |

| $ | 64,334 |

| | $ | — |

| | $ | 64,334 |

| | $ | 64,334 |

| | $ | — |

| | $ | 64,334 |

|

| Railroad crossing rights | 97 |

| | — |

| | 97 |

| | 97 |

| | — |

| | 97 |

| 141 |

| | — |

| | 141 |

| | 141 |

| | — |

| | 141 |

|

| | 64,431 |

| | — |

| | 64,431 |

| | 64,431 |

| | — |

| | 64,431 |

| 64,475 |

| | — |

| | 64,475 |

| | 64,475 |

| | — |

| | 64,475 |

|

| | | | | | | | | | | | | | | | | | | | | | | |

Finite-lived intangibles: | | Affiliate contract expansion | 284,102 |

| | (19,008 | ) | | 265,094 |

| | 284,102 |

| | (14,030 | ) | | 270,072 |

| |

| Acquired subscribers – wireless | 120,855 |

| | (25,387 | ) | | 95,468 |

| | 120,855 |

| | (18,738 | ) | | 102,117 |

| |

| Affiliate contract expansion - wireless | | 455,306 |

| | (121,808 | ) | | 333,498 |

| | 410,157 |

| | (105,964 | ) | | 304,193 |

|

| Favorable leases - wireless | 16,950 |

| | (1,531 | ) | | 15,419 |

| | 16,950 |

| | (1,130 | ) | | 15,820 |

| 16,768 |

| | (1,589 | ) | | 15,179 |

| | 13,103 |

| | (1,222 | ) | | 11,881 |

|

| Acquired subscribers – cable | 25,265 |

| | (24,802 | ) | | 463 |

| | 25,265 |

| | (24,631 | ) | | 634 |

| |

| Acquired subscribers - cable | | 25,265 |

| | (25,138 | ) | | 127 |

| | 25,265 |

| | (25,100 | ) | | 165 |

|

| Other intangibles | 3,230 |

| | (797 | ) | | 2,433 |

| | 2,212 |

| | (754 | ) | | 1,458 |

| 463 |

| | (205 | ) | | 258 |

| | 463 |

| | (198 | ) | | 265 |

|

| Total finite-lived intangibles | 450,402 |

| | (71,525 | ) | | 378,877 |

| | 449,384 |

| | (59,283 | ) | | 390,101 |

| 497,802 |

| | (148,740 | ) | | 349,062 |

| | 448,988 |

| | (132,484 | ) | | 316,504 |

|

| Total intangible assets | $ | 514,833 |

| | $ | (71,525 | ) | | $ | 443,308 |

| | $ | 513,815 |

| | $ | (59,283 | ) | | $ | 454,532 |

| $ | 562,277 |

| | $ | (148,740 | ) | | $ | 413,537 |

| | $ | 513,463 |

| | $ | (132,484 | ) | | $ | 380,979 |

|

Affiliate contract expansion is amortized over the expected benefit period and is further reduced by the amount of waived management fees received from Sprint which totaled $69.7 million since May 6, 2016, the date of the non-monetary exchange.

Note 9. Other Assets and Accrued Liabilities

Prepaid expenses and other, classified as current assets, included the following:

| |

9. | Accrued and Other liabilities |

|

| | | | | | | | |

| (in thousands) | | March 31, 2018 | | December 31, 2017 |

| Prepaid rent | | $ | 9,687 |

| | $ | 10,519 |

|

| Prepaid maintenance expenses | | 4,282 |

| | 3,062 |

|

| Interest rate swaps | | 3,673 |

| | 2,411 |

|

| Deferred contract and other costs | | 46,558 |

| | 1,119 |

|

| Prepaid expenses and other | | $ | 64,200 |

| | $ | 17,111 |

|

Deferred contract and other costs include amounts reimbursed to Sprint for commissions and device costs, and commissions and installation costs in the Company’s Cable and Wireline segments. The deferred contract and other costs increased due to the adoption of Topic 606. Refer to Note 2, Revenue from Contracts with Customers, for additional information.

Deferred charges and other assets, classified as long-term assets, included the following:

|

| | | | | | | | |

| (in thousands) | | March 31, 2018 | | December 31, 2017 |

| Interest rate swaps | | $ | 13,692 |

| | $ | 10,776 |

|

| Deferred contract and other costs | | 20,242 |

| | 2,914 |

|

| Deferred charges and other assets, net | | $ | 33,934 |

| | $ | 13,690 |

|

Deferred contract and other costs include amounts reimbursed to Sprint for commissions and device costs, and commissions and installation costs in the Company’s Cable and Wireline segments. The deferred contract and other costs increased due to the adoption of Topic 606. Refer to Note 2, Revenue from Contracts with Customers, for additional information.

Accrued liabilities and other, includesclassified as current liabilities, included the following (in thousands):

following:

| | | | | March 31, 2017 | | December 31, 2016 | |

| (in thousands) | | | March 31, 2018 | | December 31, 2017 |

| Sales and property taxes payable | | $ | 4,742 |

| | $ | 6,628 |

| | $ | 4,969 |

| | $ | 3,872 |

|

| Severance accrual, current portion | | 3,553 |

| | 4,267 |

| |

| Asset retirement obligations, current portion | | 884 |

| | 5,841 |

| |

| Severance accrual | | | 261 |

| | 1,028 |

|

| Asset retirement obligations | | | 923 |

| | 492 |

|

| Accrued programming costs | | | 3,029 |

| | 2,805 |

|

| Other current liabilities | | 8,995 |

| | 12,349 |

| | 8,289 |

| | 5,717 |

|

| Accrued liabilities and other | | $ | 18,174 |

| | $ | 29,085 |

| | $ | 17,471 |

| | $ | 13,914 |

|

Other liabilities, includeclassified as long-term liabilities, included the following (in thousands):

following:

| | | | | March 31,

2017 | | December 31,

2016 | |

| (in thousands) | | | March 31, 2018 | | December 31, 2017 |

| Non-current portion of deferred revenues | | $ | 7,735 |

| | $ | 8,933 |

| | $ | 12,523 |

| | $ | 14,030 |

|

| Straight-line management fee waiver | | 16,180 |

| | 11,974 |

| |

| Other | | 2,142 |

| | 2,836 |

| | 1,264 |

| | 1,263 |

|

| Other liabilities | | $ | 26,057 |

| | $ | 23,743 |

| | $ | 13,787 |

| | $ | 15,293 |

|

The Company's asset retirement obligations are included in the balance sheet caption "Asset retirement obligations" and "Accrued liabilities and other". The Company records the fair value of an asset retirement obligation as a liability in the period in which it incurs a legal obligation associated with the retirement and removal of leasehold improvements or equipment. The Company also records a corresponding asset, which is depreciated over the life of the leasehold improvement or equipment. Subsequent to the initial measurement of the asset retirement obligation, the obligation is adjusted at the end of each period to reflect the passage of time and changes in the estimated future cash flows underlying the obligation. The terms associated with its operating leases, and applicable zoning ordinances of certain jurisdictions, define the Company’s obligations which are estimated and vary based on the size of the towers.

Note 10. Long-Term Debt and Revolving Lines of Credit

Total debt at March 31, 20172018 and December 31, 20162017 consists of the following:

|

| | | | | | | | |

| (In thousands) | | March 31, 2017 | | December 31, 2016 |

| Term loan A-1 | | $ | 466,813 |

| | $ | 472,875 |

|

| Term loan A-2 | | 400,000 |

| | 375,000 |

|

| | | 866,813 |

| | 847,875 |

|

| Less: unamortized loan fees | | 17,816 |

| | 18,610 |

|

| Total debt, net of unamortized loan fees | | $ | 848,997 |

| | $ | 829,265 |

|

| | | | | |

| Current maturities of long term debt, net of unamortized loan fees | | $ | 38,124 |

| | $ | 32,041 |

|

| Long-term debt, less current maturities, net of unamortized loan fees | | $ | 810,873 |

| | $ | 797,224 |

|

|

| | | | | | | | |

| (in thousands) | | March 31, 2018 | | December 31, 2017 |

| Term loan A-1 | | $ | 424,375 |

| | $ | 436,500 |

|

| Term loan A-2 | | 400,000 |

| | 400,000 |

|

| | | 824,375 |

| | 836,500 |

|

| Less: unamortized loan fees | | 13,502 |

| | 14,542 |

|

| Total debt, net of unamortized loan fees | | $ | 810,873 |

| | $ | 821,958 |

|

| | | | | |

| Current maturities of long term debt, net of unamortized loan fees | | $ | 74,486 |

| | $ | 64,397 |

|

| Long-term debt, less current maturities, net of unamortized loan fees | | $ | 736,387 |

| | $ | 757,561 |

|

As of March 31, 2017, our2018, the Company's indebtedness totaled $866.8approximately $824.4 million, in term loansexcluding unamortized loan fees of $13.5 million, with an annualized effectiveoverall weighted average interest rate of approximately 3.91% after considering4.02%. As of March 31, 2018, the impact of the interest rate swap contract and unamortized loan costs. The balance consists of the $466.8 million Term Loan A-1 bears interest at a variable rate (3.73% as of March 31, 2017) that resets monthly based on one monthone-month LIBOR plus a margin of 2.75%2.25%, andwhile the $400 million Term Loan A-2 bears interest at a variable rate (3.98% as of March 31, 2017) that resets monthly based on one monthone-month LIBOR plus a margin of 3.00%2.50%. At March 31, 2018, one-month LIBOR was 1.88%. LIBOR resets monthly.

The Term Loan A-1 requires quarterly principal repayments of $6.1 million, which began on September 30, 2016 and continued through June 30, 2017, then increasing to $12.1 million quarterly from September 30, 2017 through June 30, 2020; then increasing to $18.2 million quarterly from September 30, 2020 through March 31, 2021, with further increases at that time through maturity inthe remaining balance due June 30, 2021. The Term Loan A-2 requires quarterly principal repayments of $10.0 million beginning on September 30, 2018 through March 31, 2023, with the remaining balance due June 30, 2023.

The 2016 credit agreement also required the Company to enter into one or more hedge agreements to manage its exposure to interest rate movements. The Company elected to hedge the minimum required under the 2016 credit agreement, and entered into a pay-fixed, receive-variable swap on 50% of the aggregate expected principal balance of the term loans outstanding. The Company will receive one month LIBOR and pay a fixed rate of 1.16%, in addition to the 2.25% initial spread on Term Loan A-1 and the 2.50% initial spread on Term Loan A-2.

The 2016 credit agreement contains affirmative and negative covenants customary to secured credit facilities, including covenants restricting the ability of the Company and its subsidiaries, subject to negotiated exceptions, to incur additional indebtedness and additional liens on their assets, engage in mergers or acquisitions or dispose of assets, pay dividends or make other distributions, voluntarily prepay other indebtedness, enter into transactions with affiliated persons, make investments, and change the nature of the Company’s and its subsidiaries’ businesses.

Indebtedness outstanding under any of the facilities may be accelerated by an Event of Default, as defined in the 2016 credit agreement.

The Facilities are secured by a pledge by the Company of its stock and membership interests in its subsidiaries, a guarantee by the Company’s subsidiaries other than Shenandoah Telephone Company, and a security interest in substantially all of the assets of the Company and the guarantors.

The Company is subject to certain financial covenants to be measured on a trailing twelve month basis each calendar quarter unless otherwise specified. These covenants include:

a limitation on the Company’s total leverage ratio, defined as indebtedness divided by earnings before interest, taxes, depreciation and amortization, or EBITDA, of less than or equal to 3.75 to 1.00 from the closing date through December 30, 2018, then 3.25 to 1.00 through December 30, 2019, and 3.00 to 1.00 thereafter;

a minimum debt service coverage ratio, defined as EBITDA minus certain cash taxes divided by the sum of all scheduled principal payments on the Term Loans and scheduled principal payments on other indebtedness plus cash interest expense, greater than 2.00 to 1.00;

the Company must maintain a minimum liquidity balance of greater than $25 million. The balance is defined as availability under the revolver facility plus unrestricted cash and cash equivalents on deposit in a deposit account for which a control agreement has been delivered to the administrative agent under the 2016 credit agreement, of greater than $25 million at all times.agreement.