UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________

FORM 10-Q

_______________________________________

|

| |

ý☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 20192020

OR

|

| |

o☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 1-13881

_________________________________________________

MARRIOTT INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

_______________________________________ |

| | | | | | |

| Delaware | | 52-2055918 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

| | | | | | | |

10400 Fernwood Road | | Bethesda | | Maryland | | 20817 |

| (Address of principal executive offices) | | 20817

(Zip Code) |

(301) (301) 380-3000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Class A Common Stock, $0.01 par value | | MAR | | Nasdaq Global Select Market |

| Class A Common Stock, $0.01 par value | | MAR | | Chicago Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

| Large accelerated filer | | ý | | Accelerated filer | | ¨ |

| Non-accelerated filer | | ¨ | | Smaller Reporting Company | | ¨☐ |

| | | | | Emerging growth company | | ¨☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ |

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨☐ No ý

Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

Class A Common Stock, $0.01 par value | | MAR | | Nasdaq Global Select Market

Chicago Stock Exchange

|

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 332,988,834324,255,928 shares of Class A Common Stock, par value $0.01 per share, outstanding at April 30, 2019.2020.

MARRIOTT INTERNATIONAL, INC.

FORM 10-Q TABLE OF CONTENTS

|

| | |

| | | Page No. |

| | | |

| Part I. | | |

| | | |

| Item 1. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 2. | | |

| | | |

| | | |

| | | |

| Item 3. | | |

| | | |

| Item 4. | | |

| | | |

| Part II. | | |

| | | |

| Item 1. | | |

| | | |

| Item 1A. | | |

| | | |

| Item 2. | | |

|

|

|

| Item 6. | | |

| | | |

| | | |

PART I – FINANCIAL INFORMATION

Item 1.Financial Statements

MARRIOTT INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

($ in millions, except per share amounts)

(Unaudited)

| | | | Three Months Ended | Three Months Ended |

| | March 31, 2019 | | March 31, 2018 | March 31, 2020 |

| March 31, 2019 |

| REVENUES | | | | | | |

| Base management fees | $ | 282 |

| | $ | 273 |

| $ | 214 |

| | $ | 282 |

|

| Franchise fees | 450 |

| | 417 |

| 415 |

| | 450 |

|

| Incentive management fees | 163 |

| | 155 |

| — |

| | 163 |

|

| Gross fee revenues | 895 |

| | 845 |

| 629 |

| | 895 |

|

| Contract investment amortization | (14 | ) | | (18 | ) | (25 | ) | | (14 | ) |

| Net fee revenues | 881 |

| | 827 |

| 604 |

| | 881 |

|

| Owned, leased, and other revenue | 375 |

| | 406 |

| 280 |

| | 375 |

|

| Cost reimbursement revenue | 3,756 |

| | 3,776 |

| 3,797 |

| | 3,756 |

|

| | 5,012 |

| | 5,009 |

| 4,681 |

| | 5,012 |

|

| OPERATING COSTS AND EXPENSES | | | | | | |

| Owned, leased, and other-direct | 325 |

| | 336 |

| 272 |

| | 325 |

|

| Depreciation, amortization, and other | 54 |

| | 54 |

| 150 |

| | 54 |

|

| General, administrative, and other | 222 |

| | 247 |

| 270 |

| | 222 |

|

| Merger-related costs and charges | 9 |

| | 34 |

| |

| Merger-related costs and (recoveries) charges | | (2 | ) | | 9 |

|

| Reimbursed expenses | 3,892 |

| | 3,808 |

| 3,877 |

| | 3,892 |

|

| | 4,502 |

| | 4,479 |

| 4,567 |

| | 4,502 |

|

| OPERATING INCOME | 510 |

| | 530 |

| 114 |

| | 510 |

|

| Gains and other income, net | 5 |

| | 59 |

| |

| (Losses) gains and other income, net | | (4 | ) | | 5 |

|

| Interest expense | (97 | ) | | (75 | ) | (93 | ) | | (97 | ) |

| Interest income | 6 |

| | 5 |

| 6 |

| | 6 |

|

| Equity in earnings | 8 |

| | 13 |

| |

| Equity in (losses) earnings | | (4 | ) | | 8 |

|

| INCOME BEFORE INCOME TAXES | 432 |

| | 532 |

| 19 |

| | 432 |

|

| Provision for income taxes | (57 | ) | | (112 | ) | |

| Benefit (provision) for income taxes | | 12 |

| | (57 | ) |

| NET INCOME | $ | 375 |

| | $ | 420 |

| $ | 31 |

| | $ | 375 |

|

| EARNINGS PER SHARE | | | | | | |

| Earnings per share - basic | $ | 1.10 |

| | $ | 1.17 |

| $ | 0.10 |

| | $ | 1.10 |

|

| Earnings per share - diluted | $ | 1.09 |

| | $ | 1.16 |

| $ | 0.09 |

| | $ | 1.09 |

|

See Notes to Condensed Consolidated Financial Statements.

MARRIOTT INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

($ in millions)

(Unaudited)

| | | | Three Months Ended | Three Months Ended |

| | March 31, 2019 | | March 31, 2018 | March 31, 2020 | | March 31, 2019 |

| Net income | $ | 375 |

| | $ | 420 |

| $ | 31 |

| | $ | 375 |

|

| Other comprehensive (loss) income: | | | | | | |

| Foreign currency translation adjustments | 33 |

| | 152 |

| (383 | ) | | 33 |

|

| Derivative instrument adjustments, net of tax | (1 | ) | | (3 | ) | |

| Reclassification of (income) loss, net of tax | (1 | ) | | 13 |

| |

| Derivative instrument adjustments and other, net of tax | | 13 |

| | (1 | ) |

| Reclassification of gains, net of tax | | (8 | ) | | (1 | ) |

| Total other comprehensive (loss) income, net of tax | 31 |

| | 162 |

| (378 | ) | | 31 |

|

| Comprehensive income | $ | 406 |

| | $ | 582 |

| |

| Comprehensive (loss) income | | $ | (347 | ) | | $ | 406 |

|

See Notes to Condensed Consolidated Financial Statements.

MARRIOTT INTERNATIONAL, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

($ in millions)

| | | | (Unaudited) | | | (Unaudited) | | |

| | March 31,

2019 | | December 31,

2018 | March 31,

2020 | | December 31,

2019 |

| ASSETS | | | | | | |

| Current assets | | | | | | |

| Cash and equivalents | $ | 258 |

| | $ | 316 |

| $ | 1,760 |

| | $ | 225 |

|

| Accounts and notes receivable, net | 2,218 |

| | 2,133 |

| 2,068 |

| | 2,395 |

|

| Prepaid expenses and other | 259 |

| | 257 |

| 213 |

| | 252 |

|

| Assets held for sale | | 8 |

| | 255 |

|

| | 2,735 |

| | 2,706 |

| 4,049 |

| | 3,127 |

|

| Property and equipment, net | 1,961 |

| | 1,956 |

| 1,854 |

| | 1,904 |

|

| Intangible assets | | | | | | |

| Brands | 5,959 |

| | 5,790 |

| 5,839 |

| | 5,954 |

|

| Contract acquisition costs and other | 2,643 |

| | 2,590 |

| 2,647 |

| | 2,687 |

|

| Goodwill | 9,053 |

| | 9,039 |

| 8,901 |

| | 9,048 |

|

| | 17,655 |

| | 17,419 |

| 17,387 |

| | 17,689 |

|

| Equity method investments | 584 |

| | 732 |

| 562 |

| | 577 |

|

| Notes receivable, net | 124 |

| | 125 |

| 144 |

| | 117 |

|

| Deferred tax assets | 171 |

| | 171 |

| 155 |

| | 154 |

|

| Operating lease assets | 979 |

| | — |

| 782 |

| | 888 |

|

| Other noncurrent assets | 537 |

| | 587 |

| 616 |

| | 595 |

|

| | $ | 24,746 |

| | $ | 23,696 |

| $ | 25,549 |

| | $ | 25,051 |

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | |

| LIABILITIES AND SHAREHOLDERS’ (DEFICIT) EQUITY | | | | |

| Current liabilities | | | | | | |

| Current portion of long-term debt | $ | 231 |

| | $ | 833 |

| $ | 1,664 |

| | $ | 977 |

|

| Accounts payable | 745 |

| | 767 |

| 828 |

| | 720 |

|

| Accrued payroll and benefits | 1,039 |

| | 1,345 |

| 1,211 |

| | 1,339 |

|

| Liability for guest loyalty program | 2,625 |

| | 2,529 |

| 1,550 |

| | 2,258 |

|

| Accrued expenses and other | 1,208 |

| | 963 |

| 1,263 |

| | 1,383 |

|

| | 5,848 |

| | 6,437 |

| 6,516 |

| | 6,677 |

|

| Long-term debt | 10,025 |

| | 8,514 |

| 10,569 |

| | 9,963 |

|

| Liability for guest loyalty program | 2,888 |

| | 2,932 |

| 4,294 |

| | 3,460 |

|

| Deferred tax liabilities | 441 |

| | 485 |

| 212 |

| | 290 |

|

| Deferred revenue | 743 |

| | 731 |

| 862 |

| | 840 |

|

| Operating lease liabilities | 889 |

| | — |

| 846 |

| | 882 |

|

| Other noncurrent liabilities | 2,309 |

| | 2,372 |

| 2,270 |

| | 2,236 |

|

| Shareholders’ equity | | | | |

| Shareholders’ (deficit) equity | | | | |

| Class A Common Stock | 5 |

| | 5 |

| 5 |

| | 5 |

|

| Additional paid-in-capital | 5,706 |

| | 5,814 |

| 5,711 |

| | 5,800 |

|

| Retained earnings | 9,219 |

| | 8,982 |

| 9,504 |

| | 9,644 |

|

| Treasury stock, at cost | (12,967 | ) | | (12,185 | ) | (14,501 | ) | | (14,385 | ) |

| Accumulated other comprehensive loss | (360 | ) | | (391 | ) | (739 | ) | | (361 | ) |

| | 1,603 |

| | 2,225 |

| (20 | ) | | 703 |

|

| | $ | 24,746 |

| | $ | 23,696 |

| $ | 25,549 |

| | $ | 25,051 |

|

See Notes to Condensed Consolidated Financial Statements.

MARRIOTT INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

($ in millions)

(Unaudited)

| | | | Three Months Ended | Three Months Ended |

| | March 31, 2019 | | March 31, 2018 | March 31, 2020 | | March 31, 2019 |

| OPERATING ACTIVITIES | | | | | | |

| Net income | $ | 375 |

| | $ | 420 |

| $ | 31 |

| | $ | 375 |

|

| Adjustments to reconcile to cash provided by operating activities: | | | | | | |

| Depreciation, amortization, and other | 68 |

| | 73 |

| 175 |

| | 68 |

|

| Share-based compensation | 40 |

| | 42 |

| 41 |

| | 40 |

|

| Income taxes | (7 | ) | | 24 |

| (71 | ) | | (7 | ) |

| Liability for guest loyalty program | 52 |

| | 208 |

| 126 |

| | 52 |

|

| Contract acquisition costs | (56 | ) | | (29 | ) | (39 | ) | | (56 | ) |

| Merger-related charges | (10 | ) | | (16 | ) | (12 | ) | | (10 | ) |

| Working capital changes | (401 | ) | | (98 | ) | 245 |

| | (401 | ) |

| Gain on asset dispositions | (4 | ) | | (60 | ) | — |

| | (4 | ) |

| Other | 94 |

| | 111 |

| 18 |

| | 94 |

|

| Net cash provided by operating activities | 151 |

| | 675 |

| 514 |

| | 151 |

|

| INVESTING ACTIVITIES | | | | | | |

| Capital expenditures | (66 | ) | | (64 | ) | (59 | ) | | (66 | ) |

| Dispositions | 2 |

| | 108 |

| 260 |

| | 2 |

|

| Loan advances | — |

| | (12 | ) | (32 | ) | | — |

|

| Loan collections | 4 |

| | 5 |

| 4 |

| | 4 |

|

| Other | (28 | ) | | 12 |

| (8 | ) | | (28 | ) |

| Net cash (used in) provided by investing activities | (88 | ) | | 49 |

| |

| Net cash provided by (used in) investing activities | | 165 |

| | (88 | ) |

| FINANCING ACTIVITIES | | | | | | |

| Commercial paper/Credit Facility, net | 665 |

| | 627 |

| 1,317 |

| | 665 |

|

| Issuance of long-term debt | 841 |

| | — |

| — |

| | 841 |

|

| Repayment of long-term debt | (603 | ) | | (13 | ) | (66 | ) | | (603 | ) |

| Issuance of Class A Common Stock | 5 |

| | 4 |

| — |

| | 5 |

|

| Dividends paid | (139 | ) | | (118 | ) | (156 | ) | | (139 | ) |

| Purchase of treasury stock | (797 | ) | | (815 | ) | (150 | ) | | (797 | ) |

| Share-based compensation withholding taxes | (95 | ) | | (95 | ) | (95 | ) | | (95 | ) |

| Net cash used in financing activities | (123 | ) | | (410 | ) | |

| (DECREASE) INCREASE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH | (60 | ) | | 314 |

| |

| Net cash provided by (used in) financing activities | | 850 |

| | (123 | ) |

| INCREASE (DECREASE) IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH | | 1,529 |

| | (60 | ) |

CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, beginning of period (1) | 360 |

| | 429 |

| 253 |

| | 360 |

|

CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, end of period (1) | $ | 300 |

| | $ | 743 |

| $ | 1,782 |

| | $ | 300 |

|

| |

(1) | The 20192020 amounts include beginning restricted cash of $44$28 million at December 31, 2018,2019, and ending restricted cash of $42$22 million at March 31, 2019,2020, which we present in the “Prepaid expenses and other” and “Other noncurrent assets” captions of our Balance Sheets. |

See Notes to Condensed Consolidated Financial Statements.

MARRIOTT INTERNATIONAL, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1. BASIS OF PRESENTATION

The condensed consolidated financial statements present the results of operations, financial position, and cash flows of Marriott International, Inc. and subsidiaries (referred to in this report as “we,” “us,” “Marriott,” or “the Company”). In order to make this report easier to read, we also refer throughout to (i) our Condensed Consolidated Financial Statements as our “Financial Statements,” (ii) our Condensed Consolidated Statements of Income as our “Income Statements,” (iii) our Condensed Consolidated Balance Sheets as our “Balance Sheets,” (iv) our Condensed Consolidated Statements of Cash Flows as our “Statements of Cash Flows,” (v) our properties, brands, or markets in the United States (“U.S.”) and Canada as “North America” or “North American,” and (vi) our properties, brands, or markets in our Caribbean and Latin America region, Europe, and Middle East and Africa regions as “Other International,”segment, and together with those in our Asia Pacific segment, as “International.” In addition, references throughout to numbered “Footnotes”“Notes” refer to the numbered Notes in these Notes to Condensed Consolidated Financial Statements, unless otherwise noted.stated.

These Financial Statements have not been audited. We have condensed or omitted certain information and footnote disclosures normally included in financial statements presented in accordance with U.S. generally accepted accounting principles (“GAAP”). The financial statements in this report should be read in conjunction with the consolidated financial statements and notes thereto in our Annual Report on Form 10-K for the fiscal year ended December 31, 20182019 (“2018 2019 Form 10-K”10-K”). Certain terms not otherwise defined in this Form 10-Q have the meanings specified in our 2018 2019 Form 10-K.10-K.

Preparation of financial statements that conform with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the financial statements, the reported amounts of revenues and expenses during the reporting periods, and the disclosures of contingent liabilities. The uncertainty created by the coronavirus and efforts to contain it (“COVID-19”) has made such estimates more difficult and subjective. Accordingly, ultimate results could differ from those estimates.

The accompanying Financial Statements reflect all normal and recurring adjustments necessary to present fairly our financial position as of March 31, 20192020 and December 31, 2018,2019, the results of our operations for the three months ended March 31, 20192020 and March 31, 2018,2019, and cash flows for the three months ended March 31, 20192020 and March 31, 2018. As described in Part II, Item 8 of our 2018 Form 10-K, in the 2018 fourth quarter, we identified errors related to our Loyalty Program, which resulted in the understatement of cost reimbursement revenue, net of reimbursed expenses. We presented revised information for the 2018 first, second, and third quarters in our 2018 Form 10-K, and the accompanying Income Statement for the three months ended March 31, 2018 reflects the revised information.2019. Interim results may not be indicative of fiscal year performance because of seasonal and short-term variations.variations, as well as the impact of COVID-19. We have eliminated all material intercompany transactions and balances between entities consolidated in these Financial Statements.

The accompanying Financial Statements also reflect our adoption of ASU 2016-02. See the “New Accounting Standards Adopted” caption below for additional information.

New Accounting Standards Adopted

Accounting Standards Update (“ASU”) No. 2016-022016-13 - “Leases”“Financial Instruments-Credit Losses” (Topic 842)326).

ASU 2016-02 introduces a lessee model2016-13 requires the use of an impairment methodology that brings substantially all leases ontoreflects an estimate of expected credit losses, measured over the balance sheet. Under the standard, a lessee recognizescontractual life of an instrument, based on its balance sheet a lease liabilityinformation about past events, current conditions, and a right-of-use asset for most leases, including operating leases. The new standard also distinguishes leases as either finance leases or operating leases. This distinction affects how leases are measured and presented in the income statement and statementforecasts of cash flows.future economic conditions. We adopted ASU 2016-022016-13 in the 20192020 first quarter using the modified retrospective transition method. Our accountingUpon adoption, we increased our allowance for finance leases remained substantially unchanged. Adoption of the standard resultedcredit losses in the recording“Accounts and notes receivable, net” caption of $1,013our Balance Sheets by $19 million, of operating lease assets and $1,053from $82 million of operating lease liabilities, as ofat December 31, 2019 to $101 million at January 1, 2019.2020. We did not adjustalso recorded a $4 million decrease in the “Deferred tax liabilities” caption of our prior periodBalance Sheets and a $15 million cumulative-effect adjustment to retained earnings on our Balance Sheets. Adoption

In the 2020 first quarter, we further increased our allowance for credit losses by $78 million, primarily due to the negative economic impact caused by COVID-19 and our estimate of the standard did not impact our Income Statements or our Statements of Cash Flows.future economic conditions. The allowance for credit losses was $178 million at March 31, 2020.

WhenNOTE 2. DISPOSITIONS

In the 2020 first quarter, we adopted ASU 2016-02, we applied the package of practical expedients allowed by the standard, and therefore, we did not reassess:

Whether any expired or existing contracts are or contain leases under the new definition;

The lease classificationsold a North America property for any expired or existing leases; or

Whether previously capitalized costs$268 million. We will continue to qualify as initial direct costs.

See Footnote 7. Leases for disclosures required by ASU 2016-02.operate the hotel under a long-term management agreement.

2. ACQUISITIONS

In the 2019 first quarter, we accelerated our option to acquire our partner’s remaining interests in two joint ventures. As a result of the transaction, we recognized an indefinite-lived brand asset for AC Hotels by Marriott of $156 million and management and franchise contract assets, with a weighted-average term of 24 years, totaling $34 million.

NOTE 3. EARNINGS PER SHARE

The table below presents the reconciliation of the earnings and number of shares used in our calculations of basic and diluted earnings per share:

|

| | | | | | | |

| | Three Months Ended |

| (in millions, except per share amounts) | March 31, 2020 | | March 31, 2019 |

| Computation of Basic Earnings Per Share | | | |

| Net income | $ | 31 |

| | $ | 375 |

|

| Shares for basic earnings per share | 325.4 |

| | 339.6 |

|

| Basic earnings per share | $ | 0.10 |

| | $ | 1.10 |

|

| Computation of Diluted Earnings Per Share | | | |

| Net income | $ | 31 |

| | $ | 375 |

|

| Shares for basic earnings per share | 325.4 |

| | 339.6 |

|

| Effect of dilutive securities | | | |

| Share-based compensation | 2.0 |

| | 3.2 |

|

| Shares for diluted earnings per share | 327.4 |

| | 342.8 |

|

| Diluted earnings per share | $ | 0.09 |

| | $ | 1.09 |

|

|

| | | | | | | |

| | Three Months Ended |

| (in millions, except per share amounts) | March 31, 2019 | | March 31, 2018 |

| Computation of Basic Earnings Per Share | | | |

| Net income | $ | 375 |

| | $ | 420 |

|

| Shares for basic earnings per share | 339.6 |

| | 358.4 |

|

| Basic earnings per share | $ | 1.10 |

| | $ | 1.17 |

|

| Computation of Diluted Earnings Per Share | | | |

| Net income | $ | 375 |

| | $ | 420 |

|

| Shares for basic earnings per share | 339.6 |

| | 358.4 |

|

| Effect of dilutive securities | | | |

| Share-based compensation | 3.2 |

| | 4.9 |

|

| Shares for diluted earnings per share | 342.8 |

| | 363.3 |

|

| Diluted earnings per share | $ | 1.09 |

| | $ | 1.16 |

|

NOTE 4. SHARE-BASED COMPENSATION

RSUs and PSUs

We granted 1.51.6 million restricted stock units (“RSUs”) during the 20192020 first quarter to certain officers and key employees, and those units vest generally over four years in equal annual installments commencing one year after the grant date. We also granted 0.1 million performance-based RSUs (“PSUs”) in the 20192020 first quarter to certain executive officers, which are earned, subject to continued employment and the satisfaction of certain performance conditions based on achievement of pre-established targets for gross room openings, active Marriott Bonvoy™ loyalty member penetration,growth, and adjusted operating income growth over, or at the end of, a three-year performance period. RSUs, including PSUs, granted in the 20192020 first quarter had a weighted average grant-date fair value of $117.$112 per unit.

We recorded share-based compensation expense for RSUs and PSUs of $38 million in the 20192020 first quarter and $39$38 million in the 20182019 first quarter. Deferred compensation costs for unvested awards for RSUs and PSUs totaled $314$318 million at March 31, 20192020 and $167$176 million at December 31, 2018.2019.

NOTE 5. INCOME TAXES

Our effective tax rate decreasedwas a benefit of 63.5 percent for the 2020 first quarter compared to a provision of 13.2 percent for the 2019 first quarter from 21.1 percent for the 2018 first quarter,quarter. The decrease in our effective tax rate was primarily due to the prior year tax expense incurred for uncertain tax positions relating to legacy-Starwood operations, the prior year state income tax expense due to a change in our position regarding the future remittancemore favorable impact from stock based compensation as a percentage of accumulated earnings of non-U.S. subsidiaries, prior year tax on dispositions, and increased earnings in jurisdictions with lower tax rates. The decrease was partially offset by the 2018 release of tax reserves due to the completion of certain examinations.pre-tax book income.

We paid cash for income taxes, net of refunds, of $59 million in the 2020 first quarter and $64 million in the 2019 first quarter and $88 million in the 2018 first quarter.

NOTE 6. COMMITMENTS AND CONTINGENCIES

Guarantees

We present the maximum potential amount of our future guarantee fundings and the carrying amount of our liability for our debt service, operating profit, and other guarantees (excluding contingent purchase obligations) for which we are the primary obligor at March 31, 20192020 in the following table:

|

| | | | | | | | |

($ in millions) Guarantee Type | | Maximum Potential Amount of Future Fundings | | Recorded Liability for Guarantees |

| Debt service | | $ | 53 |

| | $ | 6 |

|

| Operating profit | | 225 |

| | 153 |

|

| Other | | 14 |

| | 3 |

|

| | | $ | 292 |

| | $ | 162 |

|

|

| | | | | | | | |

($ in millions) Guarantee Type | | Maximum Potential Amount of Future Fundings | | Recorded Liability for Guarantees |

| Debt service | | $ | 116 |

| | $ | 15 |

|

| Operating profit | | 195 |

| | 98 |

|

| Other | | 9 |

| | 1 |

|

| | | $ | 320 |

| | $ | 114 |

|

Contingent Purchase Obligation

Sheraton Grand Chicago. We granted the owner a one-time right, exercisable in 2022, to require us to purchase the leasehold interest in the land and the hotel for $300 million in cash (the “put option”). If the owner exercises the put option, we have the option to purchase, at the same time the put transaction closes, the underlying fee simple interest in the underlying land for an additional $200 million in cash. We accounted for the put option as a guarantee, and our recorded liability at March 31, 20192020 was $57 million.

Starwood Data Security Incident

Description of Event

On November 30, 2018, we announced a data security incident involving unauthorized access to the Starwood reservations database (the “Data Security Incident”). Working with leading security experts, we determined that there was unauthorized access to the Starwood network since 2014 and that an unauthorized party had copied information from the Starwood reservations database and taken steps towards removing it. While our forensic review of the incident is now complete, certain data analytics work continues. We have completed the planned phase out of the operation of the The Starwood reservations database effective as of the end of 2018is no longer used for business operations.

Expenses and Insurance Recoveries

Inthe 2020 first quarter, we recorded $15 million of expenses and $17 million of accrued insurance recoveries, and in the 2019 first quarter, we recorded $44 million of expenses related to the Data Security Incident and $46 million of accrued insurance recoveries, which we recordedrelated to the Data Security Incident. We received insurance recoveries of $24 million in either the “Reimbursed expenses” or “Merger-related costs2020 first quarter and charges” captions of our Income Statements.$40 million in the 2019 first quarter. Expenses in the 2020 first quarter primarily included customer care and legal costs. We recognize insurance recoveries when they are probable of receipt and present them in our Income Statements in the same caption as the related loss,expense, up to the amount of total lossexpense incurred in prior and current periods.

We present expenses and insurance recoveries related to the Data Security Incident in either the “Reimbursed expenses” or “Merger-related costs and (recoveries) charges” captions of our Income Statements.

Litigation, Claims, and Government Investigations

To date,Following our announcement of the Data Security Incident, approximately 100 lawsuits have beenwere filed by consumers and others against us in U.S. federal, U.S. state and Canadian courts related to the Data Security Incident.incident. All but one of the U.S. cases have been consolidated and transferred to the U.S. District Court for the District of Maryland, pursuant to orders of the U.S. Judicial Panel on Multidistrict Litigation (the “MDL”). The vast majority of theseplaintiffs in the U.S. and Canadian cases, are putative consumer class actions, in which the plaintiffs, who generally purport to represent various classes of consumers, generally claim to have been harmed by alleged actions and/or omissions by the Company in connection with the Data Security Incident and assert a variety of common law and statutory claims seeking monetary damages, injunctive relief, costs and

attorneys’ fees, and other related relief. All ofAmong the U.S. cases have been consolidated and transferred toin the U.S. District Court for the District of Maryland, pursuant to orders of the U.S. Judicial Panel on Multidistrict Litigation (MDL). In addition,MDL proceeding is a putative class action lawsuit that was filed against us and certain of our current officers and directors on December 1, 2018, alleging violations of the federal securities laws in connection with statements regarding our cybersecurity systems and controls, and seeking certification of a class of affected persons, unspecified monetary damages, costs and attorneys’ fees, and other related relief. TwoThe MDL proceeding also includes 2 shareholder derivative complaints that were also filed on February 26, 2019 and March 15, 2019, respectively, against the Company, certain of its officers and certain of the members of our Board of Directors, alleging, among other claims, breach of fiduciary duty, corporate waste, unjust enrichment, mismanagement and violations of the federal securities laws, and seeking unspecified monetary damages and restitution, changes to the Company’s corporate governance and internal procedures, costs and attorneys’ fees, and other related relief. These cases are also covered byA third shareholder derivative complaint was filed in the Delaware Court of Chancery on December 3, 2019 against the Company and certain of its officers and certain current and former members of our Board of Directors, alleging claims and seeking relief generally similar to the claims made and relief sought in the other two derivative cases. This case will not be consolidated with the MDL order.proceeding. We dispute the allegations in the lawsuits described above and intend to defendare vigorously defending against such claims. We have filed motions to dismiss several of these cases, some of which have been denied, but the cases generally remain at an early stage. There has been some consolidation of the Canadian cases, with 5 cases now pending across 5 provinces, and we expect there could be further consolidation in the future. In addition, in April 2019, we received a letter purportedly on behalf of a shareholder of the Company (also one of the named plaintiffs in the putative securities class action described above) demanding that our Board of Directors take action against the Company’s current and certain former officers and directors to recover damages for alleged breaches of fiduciary duties and related claims arising from the Data Security Incident. The Board of Directors has constituted a demand review committee to investigate the claims made in the demand letter, and the committee has retained independent counsel to assist with the investigation. The committee’s investigation is ongoing.

In addition, numerous U.S. federal, U.S. state and foreign governmental authorities are investigating, or otherwise seeking information and/or documents related to, the Data Security Incident and related matters, including Attorneys General offices from all 50 states and the District of Columbia, the Federal Trade Commission, the Securities and Exchange Commission, certain committees of the U.S. Senate and House of Representatives, the Information Commissioner’s Office in the United Kingdom (“ICO”(the “ICO”) as lead supervisory authority in the European Economic Area, and regulatory authorities in various other jurisdictions. FollowingIn July 2019, the ICO issued a formal notice of intent under the U.K. Data Protection Act 2018 proposing a fine in the amount of £99 million against the Company in relation to the Data Security Incident (the “Proposed ICO Fine”). In late August 2019, we submitted a written response to the ICO notified us that it had opened an investigation intovigorously defending our position, and we have continued to engage with the Company’s online privacy policy and related practices and an investigation into the Company’s handling of data subject access requests. These investigations are separate from the ICO’s investigation related toICO regarding the Data Security Incident. Incident and Proposed ICO Fine. We mutually agreed with the ICO to an extension of the regulatory process until September 30, 2020 and the ICO proceeding is ongoing. Our accrual for this loss contingency, which we present in the “Accrued expenses and other” caption of our Balance Sheets, of $65 million at December 31, 2019, remained unchanged at March 31, 2020.

While we believe it is reasonably possible that we may incur additional losses associated with the above described proceedings and investigations related to the Data Security Incident, it is not possible to estimate the amount of loss or range of loss, if any, in excess of the amounts already incurred that might result from adverse judgments, settlements, fines, penalties, or other resolution of these proceedings and investigations based on the current stage of these proceedings and investigations, the absence of specific allegations as to alleged damages, the uncertainty as to the certification of a class or classes and the size of any certified class, if applicable, and/or the lack of resolution of significant factual and legal issues.

7. NOTE 7. LEASES

We enter into operating and finance leases primarily for hotels, offices, and equipment. Most leases have initial terms of up to 20 years, and contain one or more renewals at our option, generally for five- or 10-year periods. We have generally not included these renewal periods in the lease term as it is not reasonably certain that we will exercise the renewal option. In addition, our leases generally contain fixed and variable components. The variable components of leases of land or building facilities are primarily based on operating performance of the leased property. Our lease agreements may also include non-lease components, such as common area maintenance, which we combine with the lease component to account for both as a single lease component. We calculate the present value of future payments using a discount rate equal to our incremental borrowing rate.

The following table details the composition of lease expense for the 2019 first quarter:

|

| | | | |

| | | Three Months Ended |

| ($ in millions) | | March 31, 2019 |

Operating lease cost | | $ | 45 |

|

| Variable lease cost | | 27 |

|

The following tables presentpresents our future minimum lease payments and additional information about our lease obligations as of March 31, 2019:2020:

|

| | | | | | | |

| ($ in millions) | Operating Leases | | Finance Leases |

2020, remaining | $ | 135 |

| | $ | 10 |

|

| 2021 | 171 |

| | 13 |

|

| 2022 | 166 |

| | 13 |

|

| 2023 | 115 |

| | 13 |

|

| 2024 | 106 |

| | 14 |

|

| Thereafter | 570 |

| | 151 |

|

| Total minimum lease payments | $ | 1,263 |

| | $ | 214 |

|

| Less: Amount representing interest | (280 | ) | | (58 | ) |

Present value of minimum lease payments | $ | 983 |

| | $ | 156 |

|

| | | | |

Current (1) | 137 |

| | 6 |

|

Noncurrent (2) | 846 |

| | 150 |

|

| | $ | 983 |

| | $ | 156 |

|

|

| | | | | | | |

| ($ in millions) | Operating Leases | | Finance Leases |

2019, remaining | $ | 132 |

| | $ | 10 |

|

| 2020 | 161 |

| | 13 |

|

| 2021 | 142 |

| | 13 |

|

| 2022 | 136 |

| | 13 |

|

| 2023 | 107 |

| | 13 |

|

| Thereafter | 665 |

| | 165 |

|

| Total minimum lease payments | $ | 1,343 |

| | $ | 227 |

|

| Less: Amount representing interest | (323 | ) | | (65 | ) |

Present value of minimum lease payments | $ | 1,020 |

| | $ | 162 |

|

| |

(1) | Operating leases recorded in the “Accrued expenses and other” and finance leases recorded in the “Current portion of long-term debt” captions of our Balance Sheets. |

| |

(2) | Operating leases recorded in the “Operating lease liabilities” and finance leases recorded in the “Long-term debt” captions of our Balance Sheets. |

As of March 31, 2019,2020, we had entered into an agreement that we expect to account for as an operating lease with a 20-year term for our new headquarters office, which is not reflected in our Balance Sheets or in the table above as the lease has not commenced.

|

| | |

| March 31, 2019 |

Weighted Average Remaining Lease Term (in years) | |

Operating leases | 11 |

|

Finance leases | 15 |

|

Weighted Average Discount Rate | |

Operating leases | 5.0 | % |

Finance leases | 4.4 | % |

The following table detailsIn the classification2020 first quarter, we recorded impairment charges of lease liabilities$74 million for right-of-use assets and $16 million for property and equipment, including leasehold improvements, in the “Depreciation, amortization, and other” caption of our Balance Sheets:

|

| | | | | |

| ($ in millions) | Caption | | March 31, 2019 |

| Operating lease liabilities | | | |

| Current | Accrued expenses and other | | $ | 131 |

|

| Noncurrent | Operating lease liabilities | | 889 |

|

| | | | $ | 1,020 |

|

| Finance lease liabilities | | | |

| Current | Current portion of long-term debt | | $ | 6 |

|

| Noncurrent | Long-term debt | | 156 |

|

| | | | $ | 162 |

|

The following table presents supplementalIncome Statements relating to the impact of COVID-19 on several North America leased hotels. We determined that we may not be able to fully recover the carrying amount of these North America hotel leases after evaluating the assets for recovery due to declines in market performance and future cash flow information forprojections. We estimated the 2019 first quarter:

|

| | | | |

| | | Three Months Ended |

| ($ in millions) | | March 31, 2019 |

| Cash paid for amounts included in the measurement of lease liabilities: | | |

| Operating cash outflows for operating leases | | $ | 44 |

|

| Operating cash outflows for finance leases | | 2 |

|

| Financing cash outflows for finance leases | | 1 |

|

NOTE 8. LONG-TERM DEBT

We provide detail on our long-term debt balances, net of discounts, premiums, and debt issuance costs, in the following table at the end of the 20192020 first quarter and year-end 2018:2019:

|

| | | | | | | |

| | At Period End |

| ($ in millions) | March 31,

2020 | | December 31,

2019 |

| Senior Notes: | | | |

Series L Notes, interest rate of 3.3%, face amount of $350, maturing September 15, 2022

(effective interest rate of 3.4%) | 349 |

| | 349 |

|

Series M Notes, interest rate of 3.4%, face amount of $350, maturing October 15, 2020

(effective interest rate of 3.6%) | 350 |

| | 349 |

|

Series N Notes, interest rate of 3.1%, face amount of $400, maturing October 15, 2021

(effective interest rate of 3.4%) | 399 |

| | 398 |

|

Series O Notes, interest rate of 2.9%, face amount of $450, maturing March 1, 2021

(effective interest rate of 3.1%) | 449 |

| | 449 |

|

Series P Notes, interest rate of 3.8%, face amount of $350, maturing October 1, 2025

(effective interest rate of 4.0%) | 346 |

| | 346 |

|

Series Q Notes, interest rate of 2.3%, face amount of $750, maturing January 15, 2022

(effective interest rate of 2.5%) | 747 |

| | 747 |

|

Series R Notes, interest rate of 3.1%, face amount of $750, maturing June 15, 2026

(effective interest rate of 3.3%) | 744 |

| | 744 |

|

Series U Notes, interest rate of 3.1%, face amount of $291, maturing February 15, 2023

(effective interest rate of 3.1%) | 291 |

| | 291 |

|

Series V Notes, interest rate of 3.8%, face amount of $318, maturing March 15, 2025

(effective interest rate of 2.8%) | 332 |

| | 332 |

|

Series W Notes, interest rate of 4.5%, face amount of $278, maturing October 1, 2034

(effective interest rate of 4.1%) | 291 |

| | 291 |

|

Series X Notes, interest rate of 4.0%, face amount of $450, maturing April 15, 2028 (effective interest rate of 4.2%) | 444 |

| | 444 |

|

Series Y Notes, floating rate, face amount of $550, maturing December 1, 2020 (effective interest rate of 2.2% at March 31, 2020) | 549 |

| | 549 |

|

Series Z Notes, interest rate of 4.2%, face amount of $350, maturing December 1, 2023 (effective interest rate of 4.4%) | 348 |

| | 347 |

|

Series AA Notes, interest rate of 4.7%, face amount of $300, maturing December 1, 2028 (effective interest rate of 4.8%) | 297 |

| | 297 |

|

Series BB Notes, floating rate, face amount of $300, maturing March 8, 2021 (effective interest rate of 1.6% at March 31, 2020) | 299 |

| | 299 |

|

Series CC Notes, interest rate of 3.6%, face amount of $550, maturing April 15, 2024 (effective interest rate of 3.9%) | 591 |

| | 564 |

|

Series DD Notes, interest rate of 2.1%, face amount of $550, maturing October 3, 2022 (effective interest rate of 2.4%) | 561 |

| | 543 |

|

| | | | |

| Commercial paper | 2,011 |

| | 3,197 |

|

| Credit Facility | 2,500 |

| | — |

|

| Finance lease obligations | 156 |

| | 157 |

|

| Other | 179 |

| | 247 |

|

| | $ | 12,233 |

| | $ | 10,940 |

|

| Less: Current portion of long-term debt | (1,664 | ) | | (977 | ) |

| | $ | 10,569 |

| | $ | 9,963 |

|

|

| | | | | | | |

| | At Period End |

| ($ in millions) | March 31,

2019 | | December 31,

2018 |

| Senior Notes: | | | |

Series K Notes, interest rate of 3.0%, face amount of $600, matured March 1, 2019

(effective interest rate of 4.4%) | $ | — |

| | $ | 600 |

|

Series L Notes, interest rate of 3.3%, face amount of $350, maturing September 15, 2022

(effective interest rate of 3.4%) | 349 |

| | 349 |

|

Series M Notes, interest rate of 3.4%, face amount of $350, maturing October 15, 2020

(effective interest rate of 3.6%) | 349 |

| | 349 |

|

Series N Notes, interest rate of 3.1%, face amount of $400, maturing October 15, 2021

(effective interest rate of 3.4%) | 398 |

| | 397 |

|

Series O Notes, interest rate of 2.9%, face amount of $450, maturing March 1, 2021

(effective interest rate of 3.1%) | 448 |

| | 448 |

|

Series P Notes, interest rate of 3.8%, face amount of $350, maturing October 1, 2025

(effective interest rate of 4.0%) | 345 |

| | 345 |

|

Series Q Notes, interest rate of 2.3%, face amount of $750, maturing January 15, 2022

(effective interest rate of 2.5%) | 745 |

| | 745 |

|

Series R Notes, interest rate of 3.1%, face amount of $750, maturing June 15, 2026

(effective interest rate of 3.3%) | 744 |

| | 743 |

|

Series T Notes, interest rate of 7.2%, face amount of $181, maturing December 1, 2019

(effective interest rate of 2.3%) | 186 |

| | 188 |

|

Series U Notes, interest rate of 3.1%, face amount of $291, maturing February 15, 2023

(effective interest rate of 3.1%) | 291 |

| | 291 |

|

Series V Notes, interest rate of 3.8%, face amount of $318, maturing March 15, 2025

(effective interest rate of 2.8%) | 334 |

| | 335 |

|

Series W Notes, interest rate of 4.5%, face amount of $278, maturing October 1, 2034

(effective interest rate of 4.1%) | 292 |

| | 292 |

|

Series X Notes, interest rate of 4.0%, face amount of $450, maturing April 15, 2028 (effective interest rate of 4.2%) | 443 |

| | 443 |

|

Series Y Notes, floating rate, face amount of $550, maturing December 1, 2020 (effective interest rate of 3.2% at March 31, 2019) | 548 |

| | 547 |

|

Series Z Notes, interest rate of 4.2%, face amount of $350, maturing December 1, 2023 (effective interest rate of 4.4%) | 347 |

| | 347 |

|

Series AA Notes, interest rate of 4.7%, face amount of $300, maturing December 1, 2028 (effective interest rate of 4.8%) | 297 |

| | 297 |

|

Series BB Notes, floating rate, face amount of $300, maturing March 8, 2021 (effective interest rate of 3.2% at March 31, 2019) | 298 |

| | — |

|

Series CC Notes, interest rate of 3.6%, face amount of $550, maturing April 15, 2024 (effective interest rate of 3.9%) | 550 |

| | — |

|

| | | | |

| Commercial paper | 2,911 |

| | 2,245 |

|

| Credit Facility | — |

| | — |

|

| Finance lease obligations | 162 |

| | 163 |

|

| Other | 219 |

| | 223 |

|

| | $ | 10,256 |

| | $ | 9,347 |

|

| Less: Current portion of long-term debt | (231 | ) | | (833 | ) |

| | $ | 10,025 |

| | $ | 8,514 |

|

We paid cash for interest, net of amounts capitalized, of $63 million in the 2020 first quarter and $70 million in the 2019 first quarter and $51 million in the 2018 first quarter.

We are party to a multicurrency revolving credit agreement (the(as amended, the “Credit Facility”) that provides for up to $4$4.5 billion of aggregate effective borrowings to support our commercial paper program and general corporate needs, including working capital, capital expenditures, share repurchases, letters of credit, and acquisitions. Borrowings under the Credit Facility generally bear interest at LIBOR (the London Interbank Offered Rate) plus a spread based

on our public debt rating. We also pay quarterly fees on the Credit Facility at a rate based on our public debt rating. While anyWe classify outstanding borrowings under the Credit Facility and outstanding commercial paper borrowings and/or borrowings under our Credit Facility generally have short-term maturities, we classify the outstanding borrowings as

long-term based on our ability and intent to refinance the outstanding borrowings on a long-term basis. The Credit Facility expires on June 10, 2021. See28, 2024.

We borrowed $2.5 billion under the “Cash RequirementsCredit Facility in late March 2020 and Our Credit Facility” caption lateranother $2.0 billion in this reportearly April 2020, resulting in the “Liquidity and Capital Resources” section of Item 2 below for further information on our Credit Facility being fully drawn as of April 2, 2020, with a total of $4.5 billion outstanding. On May 1, 2020, we repaid $1.25 billion, reducing the total outstanding borrowings under the Credit Facility to $3.25 billion as of May 1, 2020. Our borrowings under the Credit Facility were to increase our cash position and available borrowing capacity at March 31, 2019.preserve financial flexibility in light of the impact on global markets resulting from COVID-19. Remaining proceeds from the Credit Facility borrowings may be used to repay commercial paper when it matures and for general corporate or other purposes permitted by the Credit Facility.

In April 2020, we entered into an amendment to the 2019Credit Facility. The amendment waives the quarterly-tested leverage covenant in the Credit Facility through and including the first quarter of 2021 (which waiver period may end sooner at our election), adjusts the required leverage levels for the covenant when it is re-imposed at the end of the waiver period, and imposes a new monthly-tested liquidity covenant for the duration of the waiver period. The amendment also makes certain other amendments to the terms of the Credit Facility, including increasing the interest and fees payable on the Credit Facility for the duration of the period during which the waiver of the leverage covenant remains in effect, tightening certain existing covenants, and imposing additional covenants for the duration of the waiver period. These covenant changes include tightening the lien covenant and the covenant on dividends, share repurchases and distributions, and imposing new covenants limiting asset sales, investments and discretionary capital expenditures.

In April 2020, we issued $300 million$1.6 billion aggregate principal amount of LIBOR plus 0.6505.750 percent Series BBEE Notes due March 8, 2021May 1, 2025 (the “Series BB Notes”) and $550 million aggregate principal amount of 3.600 percent Series CC Notes due April 15, 2024 (the “Series CCEE Notes”). We will pay interest on the Series BBEE Notes in March, June, September,on May 1 and DecemberNovember 1 of each year, commencing in June 2019, and will pay interest on the Series CC Notes in April and October of each year, commencing in October 2019.November 1, 2020. We received net proceeds of approximately $841 million$1.581 billion from the offering of the Series BB Notes and Series CCEE Notes, after deducting the underwriting discount and estimated expenses, which were made available for general corporate purposes, which may include working capital, capital expenditures, acquisitions, stock repurchases, or repayment of outstanding commercial paper or other borrowings.purposes.

NOTE 9. FAIR VALUE OF FINANCIAL INSTRUMENTS

We believe that the fair values of our current assets and current liabilities approximate their reported carrying amounts. We present the carrying values and the fair values of noncurrent financial assets and liabilities that qualify as financial instruments, determined under current guidance for disclosures on the fair value of financial instruments, in the following table:

|

| | | | | | | | | | | | | | | |

| | March 31, 2020 | | December 31, 2019 |

| ($ in millions) | Carrying Amount | | Fair Value | | Carrying Amount | | Fair Value |

| Senior, mezzanine, and other loans | $ | 144 |

| | $ | 138 |

| | $ | 117 |

| | $ | 112 |

|

| Total noncurrent financial assets | $ | 144 |

| | $ | 138 |

| | $ | 117 |

| | $ | 112 |

|

| | | | | | | | |

| Senior Notes | $ | (5,740 | ) | | $ | (5,316 | ) | | $ | (6,441 | ) | | $ | (6,712 | ) |

| Commercial paper / Credit Facility | (4,511 | ) | | (4,511 | ) | | (3,197 | ) | | (3,197 | ) |

| Other long-term debt | (168 | ) | | (156 | ) | | (174 | ) | | (179 | ) |

| Other noncurrent liabilities | (177 | ) | | (177 | ) | | (196 | ) | | (196 | ) |

| Total noncurrent financial liabilities | $ | (10,596 | ) | | $ | (10,160 | ) | | $ | (10,008 | ) | | $ | (10,284 | ) |

|

| | | | | | | | | | | | | | | |

| | March 31, 2019 | | December 31, 2018 |

| ($ in millions) | Carrying Amount | | Fair Value | | Carrying Amount | | Fair Value |

| Senior, mezzanine, and other loans | $ | 124 |

| | $ | 120 |

| | $ | 125 |

| | $ | 116 |

|

| Total noncurrent financial assets | $ | 124 |

| | $ | 120 |

| | $ | 125 |

| | $ | 116 |

|

| | | | | | | | |

| Senior Notes | $ | (6,778 | ) | | $ | (6,828 | ) | | $ | (5,928 | ) | | $ | (5,794 | ) |

| Commercial paper | (2,911 | ) | | (2,911 | ) | | (2,245 | ) | | (2,245 | ) |

| Other long-term debt | (180 | ) | | (183 | ) | | (184 | ) | | (182 | ) |

| Other noncurrent liabilities | (152 | ) | | (152 | ) | | (153 | ) | | (153 | ) |

| Total noncurrent financial liabilities | $ | (10,021 | ) | | $ | (10,074 | ) | | $ | (8,510 | ) | | $ | (8,374 | ) |

In the 2020 first quarter, we determined that the carrying value of our Credit Facility borrowings approximated fair value because they bear interest at a market rate. See Note 13. Fair Value of Financial Instruments and the “Fair Value Measurements” caption of FootnoteNote 2. Summary of Significant Accounting Policies of our 20182019 Form 10-K for more information on the input levels we use in determining fair value.

NOTE 10. ACCUMULATED OTHER COMPREHENSIVE LOSS AND SHAREHOLDERS’ EQUITY

The following tables detail the accumulated other comprehensive loss activity for the 20192020 first quarter and 20182019 first quarter:

|

| | | | | | | | | | | |

| ($ in millions) | Foreign Currency Translation Adjustments | | Derivative Instrument and Other Adjustments | | Accumulated Other Comprehensive Loss |

| Balance at year-end 2019 | $ | (368 | ) | | $ | 7 |

| | $ | (361 | ) |

Other comprehensive (loss) income before reclassifications (1) | (383 | ) | | 13 |

| | (370 | ) |

| Reclassification of gains | — |

| | (8 | ) | | (8 | ) |

| Net other comprehensive loss | (383 | ) | | 5 |

| | (378 | ) |

| Balance at March 31, 2020 | $ | (751 | ) | | $ | 12 |

| | $ | (739 | ) |

|

| | | | | | | | | | | | | | | |

| ($ in millions) | Foreign Currency Translation Adjustments | | Derivative Instrument Adjustments | | Pension and Postretirement Adjustments | | Accumulated Other Comprehensive Loss |

| Balance at year-end 2018 | $ | (403 | ) | | $ | 8 |

| | $ | 4 |

| | $ | (391 | ) |

Other comprehensive income (loss) before reclassifications (1) | 33 |

| | (1 | ) | | — |

| | 32 |

|

| Reclassification of income | — |

| | (1 | ) | | — |

| | (1 | ) |

| Net other comprehensive income (loss) | 33 |

| | (2 | ) | | — |

| | 31 |

|

| Balance at March 31, 2019 | $ | (370 | ) | | $ | 6 |

| | $ | 4 |

| | $ | (360 | ) |

|

| | | | | | | | | | | |

| ($ in millions) | Foreign Currency Translation Adjustments | | Derivative Instrument and Other Adjustments | | Accumulated Other Comprehensive Loss |

| Balance at year-end 2018 | $ | (403 | ) | | $ | 12 |

| | $ | (391 | ) |

Other comprehensive (loss) income before reclassifications (1) | 33 |

| | (1 | ) | | 32 |

|

| Reclassification of losses | — |

| | (1 | ) | | (1 | ) |

| Net other comprehensive (loss) income | 33 |

| | (2 | ) | | 31 |

|

| Balance at March 31, 2019 | $ | (370 | ) | | $ | 10 |

| | $ | (360 | ) |

|

| | | | | | | | | | | | | | | | | | | |

| ($ in millions) | Foreign Currency Translation Adjustments | | Derivative Instrument Adjustments | | Available-For-Sale Securities Unrealized Adjustments | | Pension and Postretirement Adjustments | | Accumulated Other Comprehensive Loss |

| Balance at year-end 2017 | $ | (23 | ) | | $ | (10 | ) | | $ | 4 |

| | $ | 12 |

| | $ | (17 | ) |

Other comprehensive income (loss) before reclassifications (1) | 152 |

| | (3 | ) | | — |

| | — |

| | 149 |

|

| Reclassification of losses | 9 |

| | 4 |

| | — |

| | — |

| | 13 |

|

| Net other comprehensive income | 161 |

| | 1 |

| | — |

| | — |

| | 162 |

|

| Adoption of ASU 2016-01 | — |

| | — |

| | (4 | ) | | — |

| | (4 | ) |

| Balance at March 31, 2018 | $ | 138 |

| | $ | (9 | ) | | $ | — |

| | $ | 12 |

| | $ | 141 |

|

| |

(1) | Other comprehensive (loss) income before reclassifications for foreign currency translation adjustments includes intra-entity foreign currency transactions that are of a long-term investment nature, which resulted in a gaingains of $11 million for the 2020 first quarter and $8 million for the 2019 first quarter and loss of $36 million for the 2018 first quarter. |

The following table detailstables detail the changes in common shares outstanding and shareholders’ (deficit) equity for the 20192020 first quarter and 20182019 first quarter:

| | | (in millions, except per share amounts) | (in millions, except per share amounts) | | | (in millions, except per share amounts) | | |

Common Shares Outstanding | Common Shares Outstanding | | | Total | | Class A Common Stock | | Additional Paid-in- Capital | | Retained Earnings | | Treasury Stock, at Cost | | Accumulated Other Comprehensive Loss | Common Shares Outstanding | | | Total | | Class A Common Stock | | Additional Paid-in-Capital | | Retained Earnings | | Treasury Stock, at Cost | | Accumulated Other Comprehensive Loss |

| 339.1 |

| | Balance at year-end 2018 | $ | 2,225 |

| | $ | 5 |

| | $ | 5,814 |

| | $ | 8,982 |

| | $ | (12,185 | ) | | $ | (391 | ) | |

| 324.0 | |

| | Balance at year-end 2019 | $ | 703 |

| | $ | 5 |

| | $ | 5,800 |

| | $ | 9,644 |

| | $ | (14,385 | ) | | $ | (361 | ) |

| — |

| | Adoption of ASU 2016-02 | 1 |

| | — |

| | — |

| | 1 |

| | — |

| | — |

|

| | Adoption of ASU 2016-13 | (15 | ) | | — |

| | — |

| | (15 | ) | | — |

| | — |

|

| — |

| | Net income | 375 |

| | — |

| | — |

| | 375 |

| | — |

| | — |

|

| | Net income | 31 |

| | — |

| | — |

| | 31 |

| | — |

| | — |

|

| — |

| | Other comprehensive income | 31 |

| | — |

| | — |

| | — |

| | — |

| | 31 |

|

| | Other comprehensive income | (378 | ) | | — |

| | — |

| | — |

| | — |

| | (378 | ) |

| — |

| | Dividends ($0.41 per share) | (139 | ) | | — |

| | — |

| | (139 | ) | | — |

| | — |

|

| | Dividends ($0.48 per share) | (156 | ) | | — |

| | — |

| | (156 | ) | | — |

| | — |

|

| 1.7 |

| | Share-based compensation plans | (62 | ) | | — |

| | (108 | ) | | — |

| | 46 |

| | — |

| |

| (6.7 | ) | | Purchase of treasury stock | (828 | ) | | — |

| | — |

| | — |

| | (828 | ) | | — |

| |

| 334.1 |

| | Balance at March 31, 2019 | $ | 1,603 |

| | $ | 5 |

| | $ | 5,706 |

| | $ | 9,219 |

| | $ | (12,967 | ) | | $ | (360 | ) | |

| 1.2 | |

| | Share-based compensation plans | (55 | ) | | — |

| | (89 | ) | | — |

| | 34 |

| | — |

|

| (1.0 | | ) | | Purchase of treasury stock | (150 | ) | | — |

| | — |

| | — |

| | (150 | ) | | — |

|

| 324.2 | |

| | Balance at March 31, 2020 | (20 | ) | | 5 |

| | 5,711 |

| | 9,504 |

| | (14,501 | ) | | (739 | ) |

|

| | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share amounts) | | |

Common Shares Outstanding | | | Total | | Class A Common Stock | | Additional Paid-in-Capital | | Retained Earnings | | Treasury Stock, at Cost | | Accumulated Other Comprehensive Loss |

| 339.1 |

| | Balance at year-end 2018 (as adjusted) | 2,225 |

| | 5 |

| | 5,814 |

| | 8,982 |

| | (12,185 | ) | | (391 | ) |

| — |

| | Adoption of ASU 2016-02 | 1 |

| | — |

| | — |

| | 1 |

| | — |

| | — |

|

| — |

| | Net income | 375 |

| | — |

| | — |

| | 375 |

| | — |

| | — |

|

| — |

| | Other comprehensive income | 31 |

| | — |

| | — |

| | — |

| | — |

| | 31 |

|

| — |

| | Dividends ($0.41 per share) | (139 | ) | | — |

| | — |

| | (139 | ) | | — |

| | — |

|

| 1.7 |

| | Share-based compensation plans | (62 | ) | | — |

| | (108 | ) | | — |

| | 46 |

| | — |

|

| (6.7 | ) | | Purchase of treasury stock | (828 | ) | | — |

| | — |

| | — |

| | (828 | ) | | — |

|

| 334.1 |

| | Balance at March 31, 2019 | 1,603 |

| | 5 |

| | 5,706 |

| | 9,219 |

| | (12,967 | ) | | (360 | ) |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share amounts) | | |

Common Shares Outstanding | | | Total | | Class A Common Stock | | Additional Paid-in- Capital | | Retained Earnings | | Treasury Stock, at Cost | | Accumulated Other Comprehensive Loss |

| 359.1 |

| | Balance at year-end 2017 (as previously reported) | $ | 3,731 |

| | $ | 5 |

| | $ | 5,770 |

| | $ | 7,391 |

| | $ | (9,418 | ) | | $ | (17 | ) |

| — |

| | Adoption of ASU 2014-09 | (149 | ) | | — |

| | — |

| | (149 | ) | | — |

| | — |

|

| 359.1 |

| | Balance at year-end 2017 (as adjusted) | 3,582 |

| | 5 |

| | 5,770 |

| | 7,242 |

| | (9,418 | ) | | (17 | ) |

| — |

| | Adoption of ASU 2016-01 | — |

| | — |

| | — |

| | 4 |

| | — |

| | (4 | ) |

| — |

| | Adoption of ASU 2016-16 | 372 |

| | — |

| | — |

| | 372 |

| | — |

| | — |

|

| — |

| | Net income | 420 |

| | — |

| | — |

| | 420 |

| | — |

| | — |

|

| — |

| | Other comprehensive income | 162 |

| | — |

| | — |

| | — |

| | — |

| | 162 |

|

| — |

| | Dividends ($0.33 per share) | (118 | ) | | — |

| | — |

| | (118 | ) | | — |

| | — |

|

| 1.3 |

| | Share-based compensation plans | (48 | ) | | — |

| | (85 | ) | | — |

| | 37 |

| | — |

|

| (5.6 | ) | | Purchase of treasury stock | (782 | ) | | — |

| | — |

| | — |

| | (782 | ) | | — |

|

| 354.8 |

| | Balance at March 31, 2018 | $ | 3,588 |

| | $ | 5 |

| | $ | 5,685 |

| | $ | 7,920 |

| | $ | (10,163 | ) | | $ | 141 |

|

NOTE 11. CONTRACTS WITH CUSTOMERS

Our current and noncurrent Loyalty Program liability increased by $52$126 million, to $5,513$5,844 million at March 31, 20192020, from $5,461$5,718 million at December 31, 2018,2019, primarily reflecting an increase in points earned by members, partially offset by deferred$462 million of revenue of $543 million that we recognized in the 2020 first quarter, that was deferred as of December 31, 2019. The current portion of our Loyalty Program liability decreased compared to December 31, 2019 due to lower estimated redemptions in the short-term as a result of COVID-19.

In May 2020, we signed amendments to the existing agreements for our U.S.-issued co-brand credit cards associated with our Loyalty Program. These amendments provided the Company with $920 million of cash from the prepayment of certain future revenues, the early payment of a previously committed signing bonus, and the pre-purchase of Marriott Bonvoy points and other consideration. We will record the cash receipts in the deferred revenue and liability for guest loyalty program captions on our Balance Sheet. We will recognize revenue related to the license of our intellectual property as the credit cards are used and revenue related to the points and free night certificates as the points and free night certificates are redeemed. See the “Loyalty Program” caption of Note 2 of our 2019 Form 10-K for more information on our performance obligations.

We did not recognize incentive management fees in the 2020 first quarter.quarter because there is significant uncertainty as to whether we will be entitled to such fees on a full year basis due to the impact of COVID-19 on future hotel performance.

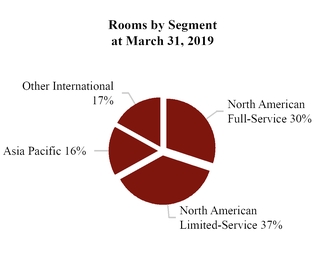

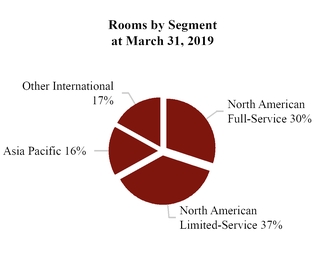

NOTE 12. BUSINESS SEGMENTS

We areBeginning in the 2020 first quarter, we modified our segment structure due to a diversified global lodging company with operationschange in the way management evaluates results and allocates resources within the Company, resulting in the following reportable businessoperating segments:

North American Full-Service, which includes our Luxury and Premium brands located in the U.S. and Canada;

North American Limited-Service, which includes our Select brands located in the U.S. and Canada; and

America; Asia Pacific, which includes all brand tiers in our Asia Pacific region.

The following; Europe, Middle East and Africa (“EMEA”); and Caribbean and Latin America (“CALA”). Our CALA operating segments dosegment does not meet the applicable accounting criteria for separate disclosure as a reportable business segments: Caribbean and Latin America, Europe, and Middle East and Africa.segment. We present these operating segments together as “Other International”revised the prior period amounts shown in the tables below.below to conform to our current presentation.

We evaluate the performance of our operating segments using “segment profits” which is based largely on the results of the segment without allocating corporate expenses, income taxes, indirect general, administrative, and other expenses, or merger-related costs and recoveries/charges. We assign gains and losses, equity in earnings or losses from our joint ventures, and direct general, administrative, and other expenses to each of our segments. “Unallocated corporate” represents“Unallocated corporate and other” includes a portion of our revenues, including license fees we receive from our credit card programs, and fees from vacation ownership licensing agreements, revenues and expenses for our Loyalty Program, general, administrative, and other expenses, merger-related costs and recoveries/charges, equity in earnings or losses, and other gains or losses that we do not allocate to our segments.segments as well as results of our CALA operating segment.

Our President and Chief Executive Officer, who is our chief operating decision maker, monitors assets for the consolidated company but does not use assets by operating segment when assessing performance or making operating segment resource allocations.

Segment Revenues

The following tables present our revenues disaggregated by segment and major revenue stream for the three months ended March 31, 2020 first quarter and 2019 and March 31, 2018:first quarter:

| | | | Three Months Ended March 31, 2019 | Three Months Ended March 31, 2020 |

| ($ in millions) | North American Full-Service | | North American Limited-Service | | Asia Pacific | | Other International | | Total | North America | | Asia Pacific | | EMEA | | Total |

| Gross fee revenues | $ | 316 |

| | $ | 212 |

| | $ | 118 |

| | $ | 129 |

| | $ | 775 |

| $ | 406 |

| | $ | 32 |

| | $ | 46 |

| | $ | 484 |

|

| Contract investment amortization | (8 | ) | | (3 | ) | | — |

| | (3 | ) | | (14 | ) | (19 | ) | | (1 | ) | | (4 | ) | | (24 | ) |

| Net fee revenues | 308 |

| | 209 |

| | 118 |

| | 126 |

| | 761 |

| 387 |

| | 31 |

| | 42 |

| | 460 |

|

| Owned, leased, and other revenue | 147 |

| | 31 |

| | 41 |

| | 144 |

| | 363 |

| 102 |

| | 31 |

| | 91 |

| | 224 |

|

| Cost reimbursement revenue | 2,850 |

| | 529 |

| | 111 |

| | 259 |

| | 3,749 |

| 3,331 |

| | 107 |

| | 211 |

| | 3,649 |

|

| Total segment revenue | $ | 3,305 |

| | $ | 769 |

| | $ | 270 |

| | $ | 529 |

| | $ | 4,873 |

| |

| Unallocated corporate | | | | | | | | | 139 |

| |

| Total reportable segment revenue | | $ | 3,820 |

| | $ | 169 |

| | $ | 344 |

| | $ | 4,333 |

|

| Unallocated corporate and other | | | | | | | | 348 |

|

| Total revenue | | | | | | | | | $ | 5,012 |

| | | | | | | $ | 4,681 |

|

| | | | Three Months Ended March 31, 2018 | Three Months Ended March 31, 2019 |

| ($ in millions) | North American Full-Service | | North American Limited-Service | | Asia Pacific | | Other International | | Total | North America | | Asia Pacific | | EMEA | | Total |

| Gross fee revenues | $ | 299 |

| | $ | 196 |

| | $ | 117 |

| | $ | 122 |

| | $ | 734 |

| $ | 528 |

| | $ | 118 |

| | $ | 84 |

| | $ | 730 |

|

| Contract investment amortization | (11 | ) | | (3 | ) | | — |

| | (4 | ) | | (18 | ) | (11 | ) | | — |

| | (2 | ) | | (13 | ) |

| Net fee revenues | 288 |

| | 193 |

| | 117 |

| | 118 |

| | 716 |

| 517 |

| | 118 |

| | 82 |

| | 717 |

|

| Owned, leased, and other revenue | 155 |

| | 33 |

| | 47 |

| | 158 |

| | 393 |

| 178 |

| | 41 |

| | 122 |

| | 341 |

|

| Cost reimbursement revenue | 2,856 |

| | 514 |

| | 111 |

| | 251 |

| | 3,732 |

| 3,379 |

| | 111 |

| | 214 |

| | 3,704 |

|

| Total segment revenue | $ | 3,299 |

| | $ | 740 |

| | $ | 275 |

| | $ | 527 |

| | $ | 4,841 |

| |

| Unallocated corporate | | | | | | | | | 168 |

| |

| Total reportable segment revenue | | $ | 4,074 |

| | $ | 270 |

| | $ | 418 |

| | $ | 4,762 |

|

| Unallocated corporate and other | | | | | | | | 250 |

|

| Total revenue | | | | | | | | | $ | 5,009 |

| | | | | | | $ | 5,012 |

|

Segment Profits and Losses

|

| | | | | | | |

| | Three Months Ended |

| ($ in millions) | March 31, 2020 | | March 31, 2019 |

| North America | $ | 158 |

| | $ | 491 |

|

| Asia Pacific | (10 | ) | | 103 |

|

| EMEA | (37 | ) | | 57 |

|

| Unallocated corporate and other | (5 | ) | | (128 | ) |

| Interest expense, net of interest income | (87 | ) | | (91 | ) |

| Income taxes | 12 |

| | (57 | ) |

| Net Income | $ | 31 |

| | $ | 375 |

|

|

| | | | | | | |

| | Three Months Ended |

| ($ in millions) | March 31, 2019 | | March 31, 2018 |

| North American Full-Service | $ | 289 |

| | $ | 277 |

|

| North American Limited-Service | 202 |

| | 182 |

|

| Asia Pacific | 103 |

| | 112 |

|

| Other International | 95 |

| | 159 |

|

| Unallocated corporate | (166 | ) | | (128 | ) |

| Interest expense, net of interest income | (91 | ) | | (70 | ) |

| Income taxes | (57 | ) | | (112 | ) |

| Net Income | $ | 375 |

| | $ | 420 |

|

Item 2.Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking StatementsCautionary Statement

All statements in this report are made as of the date this Form 10-Q is filed with the U.S. Securities and Exchange Commission (the “SEC”). We undertake no obligation to publicly update or revise these statements, whether as a result of new information, future events or otherwise. We make forward-looking statements in Management’s Discussion and Analysis of Financial Condition and Results of Operations and elsewhere in this report based on the beliefs and assumptions of our management and on information currently available to us.us through the date this Form 10-Q is filed with the SEC. Forward-looking statements include information aboutrelated to the expected effects on our possible or assumed future resultsbusiness of operations, which follow underCOVID-19, including the headings “Businessperformance of the company’s hotels; RevPAR, occupancy, booking and Overview,” “Liquiditycancellation trends; the nature and Capital Resources,”impact of contingency plans and cost and investment reductions; our liquidity expectations; other statements throughout this report that are preceded by, followed by, or that include the words “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” or similar expressions.expressions; and similar statements concerning anticipated future events and expectations that are not historical facts.

Any numberWe caution you that these statements are not guarantees of future performance and are subject to numerous evolving risks and uncertainties could cause actual resultsthat we may not be able to differ materially from those we express in our forward-looking statements,accurately predict or assess, including the risks and uncertainties we describe below and other factors we describe from time to time in our periodic filings with the U.S. SecuritiesSEC. Risks that could affect our results of operations, liquidity and Exchange Commission (the “SEC”). We therefore caution you not to rely unduly on any forward-looking statement. The forward-looking statementscapital resources, and other aspects of our business discussed in this report speak only asForm 10-Q include the duration and scope of COVID-19, including whether and to what extent a resurgence of the datevirus could occur after the pandemic initially subsides; its short and longer-term impact on the demand for travel, transient and group business, and levels of this report,consumer confidence; actions governments, businesses and individuals take in response to the pandemic, including limiting or banning travel and/or in-person gatherings; the impact of the pandemic and actions taken in response to the pandemic on global and regional economies, travel, and economic activity, including the duration and magnitude of its impact on unemployment rates and consumer discretionary spending; the ability of our owners and franchisees to successfully navigate the impacts of COVID-19; the pace of recovery when the pandemic subsides; general economic uncertainty in key global markets and a worsening of global economic conditions or low levels of economic growth; the effects of steps we undertake no obligationand our property owners and franchisees take to update reduce operating costs and/or revise any forward-looking statement, whether dueenhance certain health and cleanliness protocols at our hotels; competitive conditions in the lodging industry; relationships with clients and property owners; the availability of capital to new information, future developments, or otherwise.

finance hotel growth and refurbishment; the extent to which we experience adverse effects from data security incidents; and changes in tax laws in countries in which we earn significant income. In addition, see the “Item 1A. Risk Factors” caption in the “Part II-OTHER INFORMATION” section of this report.