0001176948 srt:ParentCompanyMember srt:ReportableLegalEntitiesMember us-gaap:AdministrativeServiceMember 2018-01-01 2018-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

| | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 20192020

OR

|

| | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001-36429

ARES MANAGEMENT CORPORATION

(Exact name of Registrant as specified in its charter) |

| | | | |

| Delaware | 80-0962035 |

(State or other jurisdiction of

incorporation or organization)

| (I.R.S. Employer

Identification Number)

|

2000 Avenue of the Stars,, 12th 12th Floor,, Los Angeles,, CA90067

(Address of principal executive office) (Zip Code)

(310) 201‑4100(310) 201-4100

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: |

| | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, par value $0.01 per share | ARES | New York Stock Exchange |

| 7.00% Series A Preferred Stock, par value $0.01 per share | ARES.PRA | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S‑TS-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑acceleratednon-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company.” and “emerging growth company” in Rule 12b‑212b-2 of the Exchange Act.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large Accelerated Filer | x | Accelerated Filer | ☐ | Non‑AcceleratedNon-Accelerated Filer | ☐ | Smaller Reporting Company | ☐ | Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑212b-2 of the Exchange Act). Yes ☐ No x

As of July 29, 2019August 3, 2020 there were 107,486,372143,209,884 of the registrant’s shares of Class A common stock outstanding, 1,000 shares of the registrant's Class B common stock outstanding, and 1 share114,798,404 of the registrant's Class C common stock outstanding.

TABLE OF CONTENTS

Cautionary Note Regarding Forward‑LookingForward-Looking Statements

This report contains forward‑lookingforward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which reflect our current views with respect to, among other things, future events, operations and financial performance. You can identify these forward‑lookingforward-looking statements by the use of forward‑lookingforward-looking words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of those words, other comparable words or other statements that do not relate to historical or factual matters. The forward‑lookingforward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. Such forward‑lookingforward-looking statements are subject to various risks and uncertainties and assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy and liquidity. Some of these factors are described in this report and in our Annual reportReport on Form 10-K for the year ended December 31, 2018,2019, under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors.”Factors”. These factors should not be construed as exhaustive and should be read in conjunction with the risk factors and other cautionary statements that are included in this report and in our other periodic filings. If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, our actual results may vary materially from those indicated in these forward‑lookingforward-looking statements. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Therefore, you should not place undue reliance on these forward‑lookingforward-looking statements. Any forward‑lookingforward-looking statement speaks only as of the date on which it is made. We do not undertake any obligation to publicly update or review any forward‑lookingforward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. For a discussion of risks resulting from the coronavirus (“COVID-19”) pandemic and the impact on the U.S. and global economy, along with the oil and gas market disruption, see “Item 1A. Risk Factors” in this Quarterly Report on Form 10-Q.

References in this Quarterly Report on Form 10-Q to the “Ares Operating Group” refer to, collectively, Ares Holdings L.P. (“Ares Holdings”), Ares Offshore Holdings L.P. (“Ares Offshore”) and Ares Investments L.P. (“Ares Investments”). References in this Quarterly Report on Form 10-Q to an “Ares Operating Group Unit” or an “AOG Unit” refer to, collectively, a partnership unit in each of the Ares Operating Group entities. The use of any defined term in this report to mean more than one entities, persons, securities or other items collectively is solely for convenience of reference and in no way implies that such entities, persons, securities or other items are one indistinguishable group. For example, notwithstanding the use of the defined terms “Ares,” “we” and “our” in this report to refer to Ares Management Corporation and its subsidiaries, each subsidiary of Ares Management Corporation is a standalone legal entity that is separate and distinct from Ares Management Corporation and any of its other subsidiaries.

Under generally accepted accounting principles in the United States (“GAAP”), we are required to consolidate (a) entities other than limited partnerships and entities similar to limited partnerships in which we hold a majority voting interest or have majority ownership and control over the operational, financial and investing decisions of that entity, including Ares‑affiliatesAres-affiliates and affiliated funds and co‑investmentco-investment entities, for which we are presumed to have controlling financial interests, and (b) entities that we concluded are variable interest entities (“VIEs”), including limited partnerships and collateralized loan obligations, for which we are deemed to be the primary beneficiary. When an entity is consolidated, we reflect the assets, liabilities, revenues, expenses and cash flows of the entity in our consolidated financial statements on a gross basis, subject to eliminations from consolidation, including the elimination of the management fees, performance income and other fees that we earn from the entity. However, the presentation of performance related compensation and other expenses associated with generating such revenues is not affected by the consolidation process. In addition, as a result of the consolidation process, the net income attributable to third‑partythird-party investors in consolidated entities is presented as net income attributable to non‑controllingnon-controlling interests in Consolidated Funds in our Condensed Consolidated Statements of Operations. We also consolidate joint ventures that we have established with third-party investors for strategic distribution partnerships. The results of these entities are reflected on a gross basis in the consolidated financial statements, subject to eliminations from consolidation, and net income attributable to third-party investors in the consolidated joint ventures is included in net income attributable to non-controlling interests in Ares Operating Group entities.

In this quarterly reportQuarterly Report on Form 10-Q, in addition to presenting our results on a consolidated basis in accordance with GAAP, we present revenues, expenses and other results on a (i) “segment basis,” which deconsolidates these entitiesthe consolidated funds and removes the proportional results attributable to third-party investors in the consolidated joint ventures, and therefore shows the results of our reportable segments without giving effect to the consolidation of thethese entities and (ii) “Unconsolidated Reporting“unconsolidated reporting basis,” which shows the results of our reportable segments on a combined segment basis together with our Operations Management Group. In addition to our threereportable segments, we have an Operations Management Group (the “OMG”) that. The OMG consists of shared resource groups to support our reportable segments by providing infrastructure and administrative support in the areas of accounting/finance, operations, information technology, strategy and relationship management, legal, compliance and human resources. The OMG’s expenses are not allocated to our three reportable segments but we consider the cost

structure of the OMG when evaluating our financial performance. This information constitutes non‑GAAPnon-GAAP financial information within the meaning of Regulation G, as promulgated by the SEC. Our management uses this information to assess the performance of our reportable segments and ourthe OMG, and we believe that this information enhances the ability of shareholders to analyze our performance. For more information, see “Notes to the Condensed Consolidated Financial Statements - Note 14. Segment Reporting.”

Glossary

When used in this report, unless the context otherwise requires:

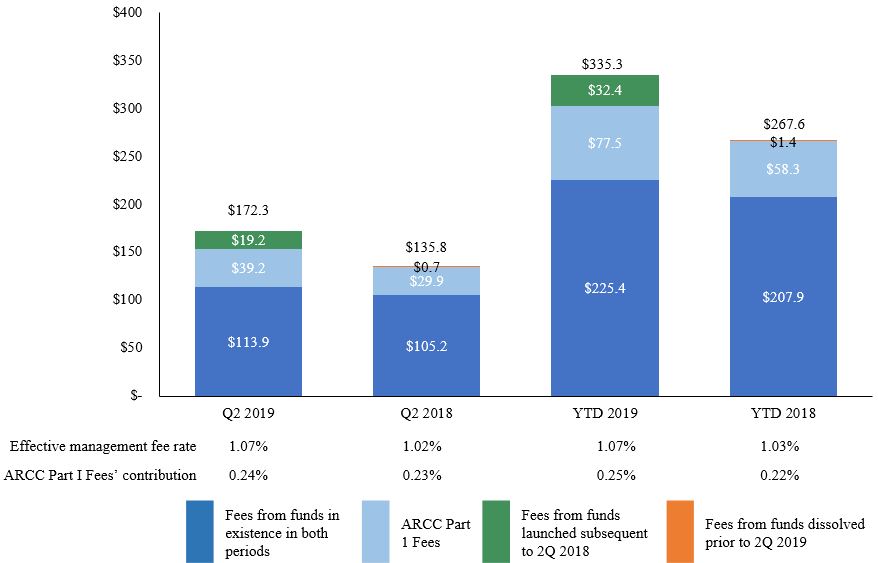

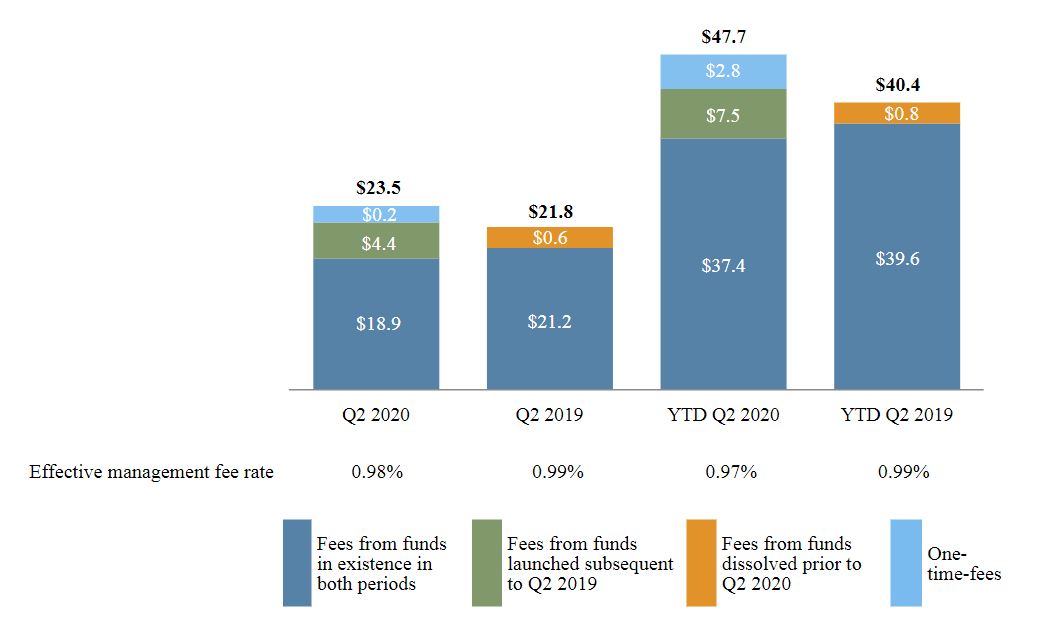

•“ARCC Part I Fees” refers to a quarterly performance income on the net investment income of Ares Capital Corporation (NASDAQ: ARCC) (“ARCC”). Such fees from ARCC are classified as management fees as they are paid quarterly, predictable and recurring in nature, are not subject to contingent repayment and are typically cash settledgenerally cash-settled each quarter;quarter, unless subject to a payment deferral;

•“ARCC Part II Fees” refers to fees that are paid in arrears as of the end of each calendar year when the cumulative aggregate realized capital gains exceed the cumulative aggregate realized capital losses and aggregate unrealized capital depreciation, less the aggregate amount of ARCC Part II Fees paid in all prior years since inception;

•“Ares”, “the Company”the “Company”, “we”, “us” and “our” refer to (i) Ares Management Corporation and its subsidiaries following the Conversion and (ii) Ares Management, L.P. and its subsidiaries prior to the Conversion;subsidiaries;

•“Ares Operating Group Unit” or an “AOG Unit” refers to, collectively, a partnership unit in each of the Ares Operating Group entities;

•“assets under management” or “AUM” refers to the assets we manage. For our funds other than CLOs, our AUM represents the sum of the net asset value ("NAV") of such funds, the drawn and undrawn debt (at the fund‑levelfund-level including amounts subject to restrictions) and uncalled committed capital (including commitments to funds that have yet to commence their investment periods). NAV refers to the fair value of the assets of a fund less the liabilities of the fund. For our funds that are CLOs, our AUM is equal to initial principal amounts adjusted for paydowns;

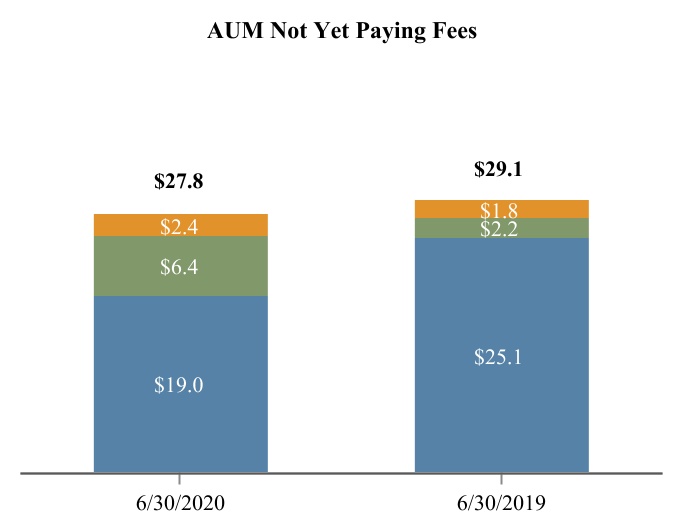

•“AUM not yet paying fees” (also referred to as "shadow AUM") refers to AUM that is not currently paying fees and is eligible to earn management fees upon deployment;

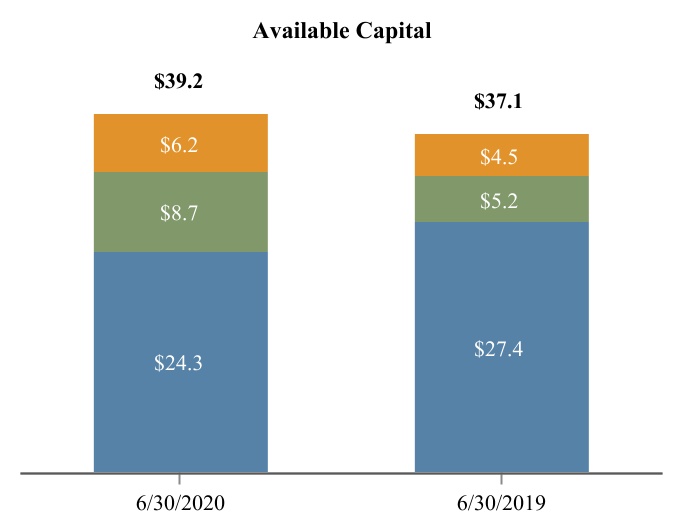

•“available capital” (also referred to as “dry powder”) is comprised of uncalled committed capital and undrawn amounts under credit facilities and may include AUM that may be canceled or not otherwise available to invest;

•“Class B membership interests” refers to the interests that were retained by the former owners of Crestline Denali Capital LLC and represent the financial interests in the subordinated notes of the CLOs;

•“CLOs” refers to “our funds” that are structured as collateralized loan obligations;

“Conversion” refers to our conversion effective November 26, 2018 from a Delaware limited partnership named Ares Management, L.P. into a Delaware corporation named Ares Management Corporation;

•“Consolidated Funds” refers collectively to certain Ares‑affiliatedAres-affiliated funds, related co‑investmentco-investment entities and certain CLOs that are required under GAAP to be consolidated in our consolidated financial statements;

“Co‑Founders” refers to Michael Arougheti, David Kaplan, John Kissick, Antony Ressler and Bennett Rosenthal;

•“Credit Facility” refers to the revolving credit facility of the Ares Operating Group;

•“effective management fee rate” represents the annualized fees divided by the average fee paying AUM for the period, excluding the impact of one-time catch-up fees;

•“fee paying AUM” or “FPAUM” refers to the AUM from which we directly earn management fees. Fee paying AUMFPAUM is equal to the sum of all the individual fee bases of our funds that directly contribute to our management fees;

•“fee related earnings” or “FRE”, a non-GAAP measure, is used to assess core operating performance by determining whether recurring revenue, primarily consisting of management fees, is sufficient to cover operating expenses and to generate profits. FRE differs from income before taxes computed in accordance with GAAP as it excludes performance income, performance related compensation, investment income from our Consolidated Funds and non-consolidated funds and certain other items that we believe are not indicative of our core operating performance;

•“GAAP” refers to accounting principles generally accepted in the United States of America;

•“Holdco Members” refers to Michael Arougheti, David Kaplan, Antony Ressler, Bennett Rosenthal, Ryan Berry, R. Kipp deVeer and Michael McFerran;

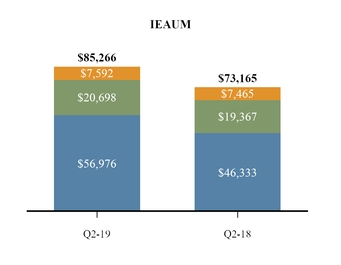

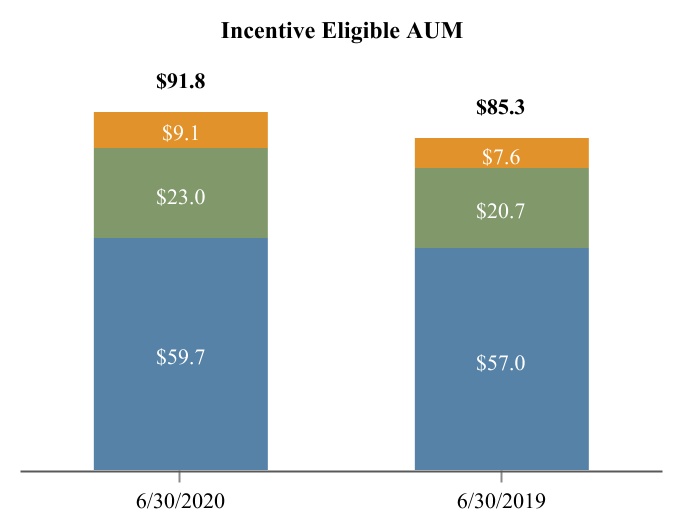

•“Incentive eligible AUM” or “IEAUM” refers to the AUM of our funds from which performance income may be generated, regardless of whether or not they are currently generating performance income. It generally represents the NAV plus uncalled equity or total assets plus uncalled debt, as applicable, of our funds for which we are entitled to receive a performance income, excluding capital committed by us and our professionals (from which we generally do not earn performance income). With respect to ARCC's AUM, only ARCC Part II Fees may be generated from IEAUM;

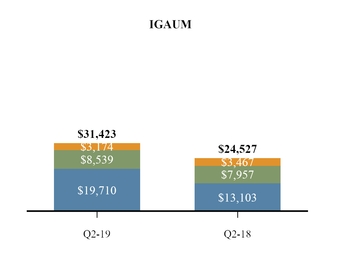

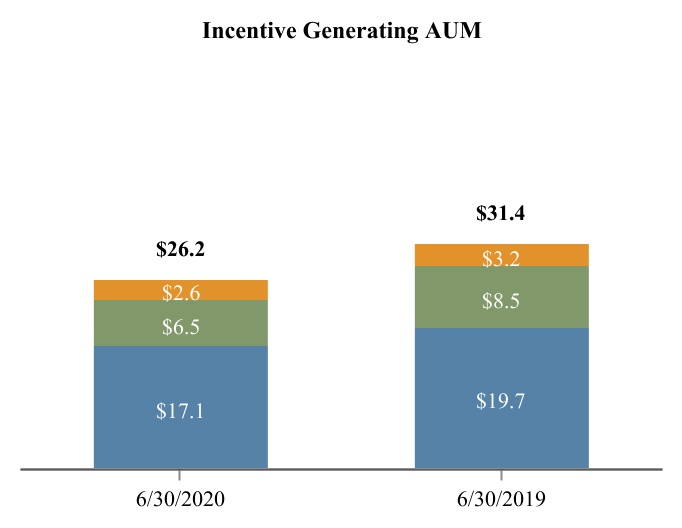

•“Incentive generating AUM” or “IGAUM” refers to the AUM of our funds that are currently generating performance income on a realized or unrealized basis, performance income.basis. It generally represents the NAV or total assets of our funds, as applicable, for which we are entitled to receive performance income, excluding capital committed by us and our professionals (from which we generally do not earn performance income). With respect to ARCC's AUM,ARCC is only included in IGAUM when ARCC Part II Fees may be generated from IGAUM;are being generated;

•“management fees” refers to fees we earn for advisory services provided to our funds, which are generally based on a defined percentage of fair value of assets, total commitments, invested capital, net asset value, net investment income, total assets or par value of the investment portfolios managed by us and also include ARCC Part I Fees that are classified as management fees as they are predictable and recurring in nature, not subject to contingent repayment and generally cash‑settled each quarter;Fees;

•“net inflows of capital” refers to net new commitments during the period, including equity and debt commitments and gross inflows into our open-ended managed accounts and sub-advised accounts, as well as new debt and equity offeringsissuances by our publicly traded vehicles minus redemptions from our open-ended funds, managed accounts and sub-advised accounts;

•“net performance income” refers to performance income net of performance related compensation. Performance related compensation which is the portion of the performance income earned from certain funds that is payable to our professionals;

•“our funds” refers to the funds, alternative asset companies, co-investment vehicles and other entities and accounts that are managed or co‑managedco-managed by the Ares Operating Group, and which are structured to pay fees. It also includes funds managed by Ivy Hill Asset Management, L.P., a wholly owned portfolio company of ARCC and a registered investment adviser;

•“performance income” refers to income we earn based on the performance of a fund that is generally based on certain specific hurdle rates as defined in the fund’s investment management or partnership agreements and may be either an incentive fee or carried interest;

•“permanent capital” refers to capital of our funds that do not have redemption provisions or a requirement to return capital to investors upon exiting the investments made with such capital, except as required by applicable law. Such funds currently consist of ARCC, Ares Commercial Real Estate Corporation (“ACRE”) and Ares Dynamic Credit Allocation Fund, Inc. (“ARDC”). Such funds may be required, or elect, to return all or a portion of capital gains and investment income;

“performance income” refers to income we earn based on the performance of a fund, that is generally based on certain specific hurdle rates as defined in the fund’s investment management or partnership agreements and may be either an incentive fee or carried interest;

•“realized income” or “RI”, a non-GAAP measure, is an operating metric used by management to evaluate performance of the business based on operating performance and the contribution of each of the business segments to that performance, while removing the fluctuations of unrealized income and expense,losses, which may or may not be eventually realized at the levels presented and whose realizations depend more on future outcomes than current business operations. RI differs from net income by excluding (a) income tax expense, (b) operating results of our Consolidated Funds, (c) depreciation and amortization expense, (d) the effects of changes arising from corporate actions, (e) unrealized gains and losses related to performance income and investment performance and (f) certain other items that we believe are not indicative of our operating performance. Changes arising from corporate actions include equity-based compensation expenses, the amortization of intangible assets, transaction

costs associated with mergers, acquisitions and capital transactions, underwriting costs and expenses incurred in connection with corporate reorganization.reorganization;

•“SEC” refers to the Securities and Exchange Commission;

•“Senior Notes” or the "AFC Notes" refers to senior notes issued by a wholly owned subsidiary of Ares Holdings;

"Series A Preferred Stock"Stock” refers to the preferred stock, $0.01 par value per share, of the Company designated as 7.00% Series A Preferred Stock; and

•“Term Loans”2024 Senior Notes” refers to term loans heldsenior notes issued by a wholly owned subsidiariessubsidiary of Ares Management LLC (“AM LLC”).Holdings in October 2014 with a maturity in October 2024; and

•“2030 Senior Notes” refers to senior notes issued by a wholly owned subsidiary of Ares Holdings in June 2020 with a maturity in June 2030.

References in this Quarterly Report on Form 10-Q to (1) “common shares” and “preferred shares” refer to shares of our Class A common stock and the Series A Preferred Stock, respectively, previously outstanding prior to our Conversion and (2) “common shareholders” and “preferred shareholders” refer to holders of shares of our Class A common stock and shares of the Series A Preferred Stock, respectively, prior to our Conversion.

Many of the terms used in this report, including AUM, FPAUM, FRE and RI, may not be comparable to similarly titled measures used by other companies. In addition, our definitions of AUM and FPAUM are not based on any definition of AUM or FPAUM that is set forth in the agreements governing the investment funds that we manage and may differ from definitions of AUM or FPAUM set forth in other agreements to which we are a party or definitions used by the SEC or other regulatory bodies. Further, FRE and RI are not measures of performance calculated in accordance with GAAP. We use FRE and RI as measures of operating performance, not as measures of liquidity. FRE and RI should not be considered in isolation or as substitutes for operating income, net income, operating cash flows, or other income or cash flow statement data prepared in accordance with GAAP. The use of FRE and RI without consideration of related GAAP measures is not adequate due to the adjustments described above. Our management compensates for these limitations by using FRE and RI as supplemental measures to our GAAP results. We present these measures to provide a more complete understanding of our performance as our management measures it. Amounts and percentages throughout this report may reflect rounding adjustments and consequently totals may not appear to sum.

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

Ares Management Corporation

Condensed Consolidated Statements of Financial Condition

(Amounts in Thousands, Except Share Data)

| | | | | | | | | | | |

| As of June 30, | | As of December 31, |

| | 2020 | | 2019 |

| (unaudited) | | |

| Assets | | | |

| Cash and cash equivalents | $ | 890,040 | | | $ | 138,384 | |

| Investments (includes accrued carried interest of $1,003,827 and $1,134,967 at June��30, 2020 and December 31, 2019, respectively) | 1,479,487 | | | 1,663,664 | |

| Due from affiliates | 258,126 | | | 268,099 | |

| Other assets | 368,696 | | | 341,293 | |

| Right-of-use operating lease assets | 140,041 | | | 143,406 | |

| Assets of Consolidated Funds: | | | |

| Cash and cash equivalents | 258,400 | | | 606,321 | |

| Investments, at fair value | 10,005,632 | | | 8,727,947 | |

| Due from affiliates | 7,201 | | | 6,192 | |

| Receivable for securities sold | 276,692 | | | 88,809 | |

| Other assets | 35,642 | | | 30,081 | |

| Total assets | $ | 13,719,957 | | | $ | 12,014,196 | |

| Liabilities | | | |

| Accounts payable, accrued expenses and other liabilities | $ | 104,017 | | | $ | 88,173 | |

| Accrued compensation | 123,123 | | | 37,795 | |

| Due to affiliates | 61,025 | | | 71,445 | |

| Performance related compensation payable | 715,181 | | | 829,764 | |

| Debt obligations | 642,474 | | | 316,609 | |

| Operating lease liabilities | 164,521 | | | 168,817 | |

| Liabilities of Consolidated Funds: | | | |

| Accounts payable, accrued expenses and other liabilities | 60,975 | | | 61,857 | |

| Payable for securities purchased | 449,169 | | | 500,146 | |

| CLO loan obligations, at fair value | 9,228,687 | | | 7,973,748 | |

| Fund borrowings | 167,037 | | | 107,244 | |

| Total liabilities | 11,716,209 | | | 10,155,598 | |

| Commitments and contingencies | | | |

| Non-controlling interest in Consolidated Funds | 506,201 | | | 618,020 | |

| Non-controlling interest in Ares Operating Group entities | 552,490 | | | 472,288 | |

| Stockholders' Equity | | | |

| Series A Preferred Stock, $0.01 par value, 1,000,000,000 shares authorized (12,400,000 shares issued and outstanding at June 30, 2020 and December 31, 2019) | 298,761 | | | 298,761 | |

| Class A common stock, $0.01 par value, 1,500,000,000 shares authorized (135,335,943 shares and 115,242,028 shares issued and outstanding at June 30, 2020 and December 31, 2019, respectively) | 1,353 | | | 1,152 | |

| | | |

| Class B common stock, $0.01 par value, 1,000 shares authorized (1,000 shares issued and outstanding at June 30, 2020 and December 31, 2019) | — | | | — | |

| Class C common stock, $0.01 par value, 499,999,000 shares authorized (114,798,404 shares and 1 share issued and outstanding at June 30, 2020 and December 31, 2019, respectively) | 1,148 | | | — | |

| Additional paid-in-capital | 800,077 | | | 525,244 | |

| Retained earnings | (145,045) | | | (50,820) | |

| Accumulated other comprehensive loss, net of tax | (11,237) | | | (6,047) | |

| Total stockholders' equity | 945,057 | | | 768,290 | |

| Total equity | 2,003,748 | | | 1,858,598 | |

| Total liabilities, non-controlling interests and equity | $ | 13,719,957 | | | $ | 12,014,196 | |

|

| | | | | | | |

| | As of June 30, | | As of December 31, |

| | 2019 | | 2018 |

| | (unaudited) | | |

| Assets | |

| | |

|

| Cash and cash equivalents | $ | 247,220 |

| | $ | 110,247 |

|

| Investments (includes accrued carried interest of $1,071,954 and $841,079, at June 30, 2019 and December 31, 2018, respectively) | 1,566,042 |

| | 1,326,137 |

|

| Due from affiliates | 234,081 |

| | 199,377 |

|

| Other assets | 358,091 |

| | 377,651 |

|

| Right-of-use operating lease assets | 152,579 |

| | — |

|

| Assets of Consolidated Funds: | | | |

| Cash and cash equivalents | 376,328 |

| | 384,644 |

|

| Investments, at fair value | 7,926,615 |

| | 7,673,165 |

|

| Due from affiliates | 15,888 |

| | 17,609 |

|

| Receivable for securities sold | 76,993 |

| | 42,076 |

|

| Other assets | 25,912 |

| | 23,786 |

|

| Total assets | $ | 10,979,749 |

| | $ | 10,154,692 |

|

| Liabilities | | | |

| Accounts payable, accrued expenses and other liabilities | $ | 76,838 |

| | $ | 83,221 |

|

| Accrued compensation | 114,936 |

| | 29,389 |

|

| Due to affiliates | 65,527 |

| | 82,411 |

|

| Performance related compensation payable | 772,592 |

| | 641,737 |

|

| Debt obligations | 566,277 |

| | 480,952 |

|

| Right-of-use operating lease liabilities | 179,192 |

| | — |

|

| Liabilities of Consolidated Funds: | | | |

| Accounts payable, accrued expenses and other liabilities | 75,647 |

| | 83,876 |

|

| Payable for securities purchased | 369,465 |

| | 471,390 |

|

| CLO loan obligations, at fair value | 7,030,841 |

| | 6,678,091 |

|

| Fund borrowings | 126,110 |

| | 209,284 |

|

| Total liabilities | 9,377,425 |

| | 8,760,351 |

|

| Commitments and contingencies |

| |

|

| Non-controlling interest in Consolidated Funds | 613,943 |

| | 503,637 |

|

| Non-controlling interest in Ares Operating Group entities | 352,882 |

| | 302,780 |

|

| Stockholders' Equity | | | |

| Series A Preferred Stock, $0.01 par value, 1,000,000,000 shares authorized (12,400,000 shares issued and outstanding at June 30, 2019 and December 31, 2018) | 298,761 |

| | 298,761 |

|

| Class A common stock, $0.01 par value, 1,500,000,000 shares authorized (107,458,309 shares and 101,594,095 shares issued and outstanding at June 30, 2019 and at December 31, 2018, respectively) | 1,075 |

| | 1,016 |

|

| Class B common stock, $0.01 par value, 1,000 shares authorized (1,000 shares issued and outstanding at June 30, 2019 and at December 31, 2018) | — |

| | — |

|

| Class C common stock, $0.01 par value, 499,999,000 shares authorized (1 share issued and outstanding at June 30, 2019 and at December 31, 2018) | — |

| | — |

|

| Additional paid-in-capital | 379,789 |

| | 326,007 |

|

| Retained earnings | (35,247 | ) | | (29,336 | ) |

| Accumulated other comprehensive loss, net of tax | (8,879 | ) | | (8,524 | ) |

| Total stockholders' equity | 635,499 |

| | 587,924 |

|

| Total equity | 1,602,324 |

| | 1,394,341 |

|

| Total liabilities, non-controlling interests and equity | $ | 10,979,749 |

| | $ | 10,154,692 |

|

See accompanying notes to the condensed consolidated financial statements.

Ares Management Corporation

Condensed Consolidated Statements of Operations

(Amounts in Thousands, Except Share Data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended June 30, | | | | Six months ended June 30, | | | | |

| | 2020 | | 2019 | | 2020 | | 2019 | | |

| Revenues | | | | | | | | | |

| Management fees (includes ARCC Part I Fees of $41,306, $85,229 and $39,157, $77,550 for the three and six months ended June 30, 2020 and 2019, respectively) | $ | 266,867 | | | $ | 237,846 | | | $ | 530,716 | | | $ | 462,505 | | | |

| Carried interest allocation | 303,278 | | | 119,712 | | | 72,402 | | | 317,005 | | | |

| Incentive fees | 331 | | | 10,220 | | | (2,918) | | | 27,035 | | | |

| Principal investment income (loss) | 23,645 | | | 5,844 | | | (3,078) | | | 34,603 | | | |

| Administrative, transaction and other fees | 8,637 | | | 11,200 | | | 19,045 | | | 20,871 | | | |

| Total revenues | 602,758 | | | 384,822 | | | 616,167 | | | 862,019 | | | |

| Expenses | | | | | | | | | |

| Compensation and benefits | 185,131 | | | 162,170 | | | 365,215 | | | 319,016 | | | |

| Performance related compensation | 237,108 | | | 92,688 | | | 69,209 | | | 249,208 | | | |

| General, administrative and other expenses | 58,084 | | | 65,416 | | | 120,415 | | | 116,603 | | | |

| | | | | | | | | |

| Expenses of Consolidated Funds | 3,244 | | | 15,427 | | | 10,687 | | | 19,981 | | | |

| Total expenses | 483,567 | | | 335,701 | | | 565,526 | | | 704,808 | | | |

| Other income (expense) | | | | | | | | | |

| Net realized and unrealized gains (losses) on investments | 290 | | | 521 | | | (7,744) | | | 3,997 | | | |

| Interest and dividend income | 1,978 | | | 1,652 | | | 3,768 | | | 3,496 | | | |

| Interest expense | (6,082) | | | (5,793) | | | (11,388) | | | (11,382) | | | |

| Other income, net | 2,181 | | | 4,797 | | | 7,645 | | | 300 | | | |

| Net realized and unrealized gains (losses) on investments of Consolidated Funds | 83,522 | | | (116) | | | (171,239) | | | 4,248 | | | |

| Interest and other income of Consolidated Funds | 116,314 | | | 102,206 | | | 229,539 | | | 195,390 | | | |

| Interest expense of Consolidated Funds | (76,297) | | | (68,005) | | | (156,538) | | | (132,917) | | | |

| Total other income (expense) | 121,906 | | | 35,262 | | | (105,957) | | | 63,132 | | | |

| Income (loss) before taxes | 241,097 | | | 84,383 | | | (55,316) | | | 220,343 | | | |

| Income tax expense | 24,421 | | | 9,505 | | | 3,805 | | | 23,889 | | | |

| Net income (loss) | 216,676 | | | 74,878 | | | (59,121) | | | 196,454 | | | |

| Less: Net income (loss) attributable to non-controlling interests in Consolidated Funds | 85,186 | | | 8,346 | | | (81,220) | | | 25,970 | | | |

| Less: Net income (loss) attributable to non-controlling interests in Ares Operating Group entities | 75,119 | | | 34,393 | | | (3,236) | | | 93,396 | | | |

| Net income attributable to Ares Management Corporation | 56,371 | | | 32,139 | | | 25,335 | | | 77,088 | | | |

| Less: Series A Preferred Stock dividends paid | 5,425 | | | 5,425 | | | 10,850 | | | 10,850 | | | |

| Net income attributable to Ares Management Corporation Class A common stockholders | $ | 50,946 | | | $ | 26,714 | | | $ | 14,485 | | | $ | 66,238 | | | |

| Net income per share of Class A common stock: | | | | | | | | | |

| Basic | $ | 0.36 | | | $ | 0.24 | | | $ | 0.08 | | | $ | 0.60 | | | |

| Diluted | $ | 0.35 | | | $ | 0.23 | | | $ | 0.08 | | | $ | 0.58 | | | |

| Weighted-average shares of Class A common stock: | | | | | | | | | |

| Basic | 133,639,194 | | | 105,188,966 | | | 126,002,867 | | | 104,054,035 | | | |

| Diluted | 146,904,357 | | | 116,603,887 | | | 126,002,867 | | | 113,657,864 | | | |

|

| | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2019 | | 2018 | | 2019 | | 2018 |

| Revenues | | | | | | | |

| Management fees (includes ARCC Part I Fees of $39,157, $77,550 and $29,866, $58,283 for the three and six months ended June 30, 2019 and 2018, respectively) | $ | 237,846 |

| | $ | 194,032 |

| | $ | 462,505 |

| | $ | 383,547 |

|

| Carried interest allocation | 119,712 |

| | (13,444 | ) | | 317,005 |

| | 40,685 |

|

| Incentive fees | 10,220 |

| | 7,740 |

| | 27,035 |

| | 12,811 |

|

| Principal investment income | 5,844 |

| | 1,871 |

| | 34,603 |

| | 6,780 |

|

| Administrative, transaction and other fees | 11,200 |

| | 13,964 |

| | 20,871 |

| | 26,429 |

|

| Total revenues | 384,822 |

| | 204,163 |

| | 862,019 |

| | 470,252 |

|

| Expenses | | | | | | | |

| Compensation and benefits | 162,170 |

| | 138,992 |

| | 319,016 |

| | 273,631 |

|

| Performance related compensation | 92,688 |

| | (13,005 | ) | | 249,208 |

| | 12,873 |

|

| General, administrative and other expenses | 65,416 |

| | 59,918 |

| | 116,603 |

| | 104,368 |

|

| Expenses of Consolidated Funds | 15,427 |

| | 35,112 |

| | 19,981 |

| | 36,428 |

|

| Total expenses | 335,701 |

| | 221,017 |

| | 704,808 |

| | 427,300 |

|

| Other income (expense) | | | | | | | |

| Net realized and unrealized gain on investments | 521 |

| | 3,267 |

| | 3,997 |

| | 2,428 |

|

| Interest and dividend income | 1,652 |

| | 2,356 |

| | 3,496 |

| | 5,703 |

|

| Interest expense | (5,793 | ) | | (6,076 | ) | | (11,382 | ) | | (12,945 | ) |

| Other income (expense), net | 4,797 |

| | (1,987 | ) | | 300 |

| | (2,298 | ) |

| Net realized and unrealized gain (loss) on investments of Consolidated Funds | (116 | ) | | 34,487 |

| | 4,248 |

| | 21,402 |

|

| Interest and other income of Consolidated Funds | 102,206 |

| | 92,633 |

| | 195,390 |

| | 157,055 |

|

| Interest expense of Consolidated Funds | (68,005 | ) | | (56,754 | ) | | (132,917 | ) | | (101,179 | ) |

| Total other income | 35,262 |

| | 67,926 |

| | 63,132 |

| | 70,166 |

|

| Income before taxes | 84,383 |

| | 51,072 |

| | 220,343 |

|

| 113,118 |

|

| Income tax expense | 9,505 |

| | 36,903 |

| | 23,889 |

| | 24,528 |

|

| Net income | 74,878 |

| | 14,169 |

| | 196,454 |

| | 88,590 |

|

| Less: Net income attributable to non-controlling interests in Consolidated Funds | 8,346 |

| | 9,882 |

| | 25,970 |

| | 10,249 |

|

| Less: Net income attributable to non-controlling interests in Ares Operating Group entities | 34,393 |

| | 16,062 |

| | 93,396 |

| | 49,168 |

|

| Net income (loss) attributable to Ares Management Corporation | 32,139 |

| | (11,775 | ) | | 77,088 |

|

| 29,173 |

|

| Less: Series A Preferred Stock dividends paid | 5,425 |

| | 5,425 |

| | 10,850 |

| | 10,850 |

|

| Net income (loss) attributable to Ares Management Corporation Class A common stockholders | $ | 26,714 |

| | $ | (17,200 | ) | | $ | 66,238 |

|

| $ | 18,323 |

|

| Net income (loss) attributable to Ares Management Corporation per share of Class A common stock: | | | | | | | |

| Basic | $ | 0.24 |

| | $ | (0.20 | ) | | $ | 0.60 |

| | $ | 0.16 |

|

| Diluted | $ | 0.23 |

| | $ | (0.20 | ) | | $ | 0.58 |

| | $ | 0.16 |

|

Weighted-average shares of Class A common stock:(1) | | | | | | | |

| Basic | 105,188,966 |

| | 98,037,252 |

| | 104,054,035 |

| | 91,861,946 |

|

| Diluted | 116,603,887 |

| | 98,037,252 |

| | 113,657,864 |

| | 91,861,946 |

|

Dividend declared and paid per share of Class A common stock(1) | $ | 0.32 |

| | $ | 0.37 |

| | $ | 0.64 |

| | $ | 0.77 |

|

(1) Three and six months ended June 30, 2018 represents common units.

Substantially all revenue is earned from affiliated funds of the Company. See accompanying notes to the condensed consolidated financial statements.

Ares Management Corporation

Condensed Consolidated Statements of Comprehensive Income

(Amounts in Thousands)

(unaudited)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2019 | | 2018 | | 2019 | | 2018 |

| Net income | $ | 74,878 |

| | $ | 14,169 |

| | $ | 196,454 |

| | $ | 88,590 |

|

| Other comprehensive income: | | | | | | | |

| Foreign currency translation adjustments, net of tax | (1,991 | ) | | (12,377 | ) | | (907 | ) | | (6,892 | ) |

| Total comprehensive income | 72,887 |

| | 1,792 |

| | 195,547 |

| | 81,698 |

|

| Less: Comprehensive income attributable to non-controlling interests in Consolidated Funds | 9,852 |

| | 4,193 |

| | 25,817 |

| | 7,735 |

|

| Less: Comprehensive income attributable to non-controlling interests in Ares Operating Group entities | 32,535 |

| | 12,131 |

| | 92,997 |

| | 47,340 |

|

| Comprehensive income (loss) attributable to Ares Management Corporation | $ | 30,500 |

|

| $ | (14,532 | ) | | $ | 76,733 |

| | $ | 26,623 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | | | Six months ended June 30, | | | | | |

| | 2020 | | 2019 | | 2020 | | 2019 | | | |

| | | | | | | | | | |

| Net income (loss) | $ | 216,676 | | | $ | 74,878 | | | $ | (59,121) | | | $ | 196,454 | | | | |

| Other comprehensive income (loss): | | | | | | | | | | |

| Foreign currency translation adjustments, net of tax | 2,687 | | | (1,991) | | | (11,521) | | | (907) | | | | |

| Total comprehensive income (loss) | 219,363 | | | 72,887 | | | (70,642) | | | 195,547 | | | | |

| Less: Comprehensive income (loss) attributable to non-controlling interests in Consolidated Funds | 88,315 | | | 9,852 | | | (82,778) | | | 25,817 | | | | |

| Less: Comprehensive income (loss) attributable to non-controlling interests in Ares Operating Group entities | 75,065 | | | 32,535 | | | (8,009) | | | 92,997 | | | | |

| Comprehensive income attributable to Ares Management Corporation | $ | 55,983 | | | $ | 30,500 | | | $ | 20,145 | | | $ | 76,733 | | | | |

See accompanying notes to the condensed consolidated financial statements.

Ares Management Corporation

Condensed Consolidated Statements of Changes in Equity

(Amounts in Thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Series A Preferred Stock | | Class A Common Stock | | Class C Common Stock | | Additional Paid-in-Capital | | Retained Earnings | | Accumulated Other Comprehensive Income (loss) | | Non-Controlling Interest in Ares Operating Group Entities | | Non-Controlling Interest in Consolidated Funds | | Total Equity |

| Balance at December 31, 2019 | $ | 298,761 | | | $ | 1,152 | | | $ | — | | | $ | 525,244 | | | $ | (50,820) | | | $ | (6,047) | | | $ | 472,288 | | | $ | 618,020 | | | $ | 1,858,598 | |

| Consolidation and deconsolidation of funds, net | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (3,882) | | | (3,882) | |

| Changes in ownership interests and related tax benefits | — | | | 40 | | | — | | | (196,670) | | | — | | | — | | | 122,551 | | | — | | | (74,079) | |

| Issuances of common stock | — | | | 121 | | | 1,152 | | | 382,061 | | | — | | | — | | | — | | | — | | | 383,334 | |

| Capital contributions | — | | | — | | | — | | | — | | | — | | | — | | | 42,012 | | | 133,265 | | | 175,277 | |

| Dividends/Distributions | (5,425) | | | — | | | — | | | — | | | (51,090) | | | — | | | (55,748) | | | (13,492) | | | (125,755) | |

| Net loss | 5,425 | | | — | | | — | | | — | | | (36,461) | | | — | | | (78,355) | | | (166,406) | | | (275,797) | |

| Currency translation adjustment, net of tax | — | | | — | | | — | | | — | | | — | | | (4,802) | | | (4,719) | | | (4,687) | | | (14,208) | |

| Equity compensation | — | | | — | | | — | | | 16,420 | | | — | | | — | | | 16,137 | | | — | | | 32,557 | |

| Stock option exercises | — | | | 11 | | | — | | | 19,540 | | | — | | | — | | | — | | | — | | | 19,551 | |

| Balance at March 31, 2020 | 298,761 | | | 1,324 | | | 1,152 | | | 746,595 | | | (138,371) | | | (10,849) | | | 514,166 | | | 562,818 | | | 1,975,596 | |

| Consolidation and deconsolidation of funds, net | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 1,475 | | | 1,475 | |

| Changes in ownership interests and related tax benefits | — | | | 4 | | | (4) | | | (9,702) | | | — | | | — | | | 9,796 | | | — | | | 94 | |

| Expenses incurred upon issuance of common stock | — | | | — | | | — | | | (181) | | | — | | | — | | | — | | | — | | | (181) | |

| Capital contributions | — | | | — | | | — | | | — | | | — | | | — | | | 229 | | | (9,570) | | | (9,341) | |

| Dividends/Distributions | (5,425) | | | — | | | — | | | — | | | (57,620) | | | — | | | (59,949) | | | (136,837) | | | (259,831) | |

| Net income | 5,425 | | | — | | | — | | | — | | | 50,946 | | | — | | | 75,119 | | | 85,186 | | | 216,676 | |

| Currency translation adjustment, net of tax | — | | | — | | | — | | | — | | | — | | | (388) | | | (54) | | | 3,129 | | | 2,687 | |

| Equity compensation | — | | | — | | | — | | | 15,500 | | | — | | | — | | | 13,183 | | | — | | | 28,683 | |

| Stock option exercises | — | | | 25 | | | — | | | 47,865 | | | — | | | — | | | — | | | — | | | 47,890 | |

| Balance at June 30, 2020 | $ | 298,761 | | | $ | 1,353 | | | $ | 1,148 | | | $ | 800,077 | | | $ | (145,045) | | | $ | (11,237) | | | $ | 552,490 | | | $ | 506,201 | | | $ | 2,003,748 | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Series A Preferred Stock | | Class A Common Stock | | Additional Paid-in-Capital | | Retained Earnings | | Accumulated

Other

Comprehensive

Income (loss) | | Non-Controlling

Interest in

Ares Operating

Group Entities | | Non-Controlling

Interest in Consolidated

Funds | | Total

Equity |

| Balance at December 31, 2018 | $ | 298,761 |

| | $ | 1,016 |

| | $ | 326,007 |

| | $ | (29,336 | ) | | $ | (8,524 | ) | | $ | 302,780 |

| | $ | 503,637 |

| | $ | 1,394,341 |

|

| Relinquished with deconsolidation of funds | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (55 | ) | | (55 | ) |

| Changes in ownership interests and related tax benefits | — |

| | 15 |

| | (6,339 | ) | | — |

| | — |

| | (12,073 | ) | | — |

| | (18,397 | ) |

| Contributions | — |

| | — |

| | — |

| | — |

| | — |

| | 1,876 |

| | 54,035 |

| | 55,911 |

|

| Dividends/Distributions | (5,425 | ) | | — |

| | — |

| | (35,367 | ) | | — |

| | (40,112 | ) | | (20,736 | ) | | (101,640 | ) |

| Net income | 5,425 |

| | — |

| | — |

| | 39,524 |

| | — |

| | 59,003 |

| | 17,624 |

| | 121,576 |

|

| Currency translation adjustment | — |

| | — |

| | — |

| | — |

| | 1,284 |

| | 1,459 |

| | (1,659 | ) | | 1,084 |

|

| Equity compensation | — |

| | — |

| | 12,637 |

| | — |

| | — |

| | 14,367 |

| | — |

| | 27,004 |

|

| Balance at March 31, 2019 | 298,761 |

| | 1,031 |

| | 332,305 |

| | (25,179 | ) | | (7,240 | ) | | 327,300 |

| | 552,846 |

| | 1,479,824 |

|

| Changes in ownership interests and related tax benefits | — |

| | 5 |

| | (32,128 | ) | | — |

| | — |

| | 20,615 |

| | — |

| | (11,508 | ) |

| Repurchases of Class A common stock | — |

| | (4 | ) | | (10,445 | ) | | — |

| | — |

| | — |

| | — |

| | (10,449 | ) |

| Contributions | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 61,464 |

| | 61,464 |

|

| Dividends/Distributions | (5,425 | ) | | — |

| | — |

| | (36,782 | ) | | — |

| | (40,103 | ) | | (10,219 | ) | | (92,529 | ) |

| Net income | 5,425 |

| | — |

| | — |

| | 26,714 |

| | — |

| | 34,393 |

| | 8,346 |

| | 74,878 |

|

| Currency translation adjustment | — |

| | — |

| | — |

| | — |

| | (1,639 | ) | | (1,858 | ) | | 1,506 |

| | (1,991 | ) |

| Equity compensation | — |

| | — |

| | 11,306 |

| | — |

| | — |

| | 12,535 |

| | — |

| | 23,841 |

|

| Stock option exercises | — |

| | 43 |

| | 78,751 |

| | — |

| | — |

| | — |

| | — |

| | 78,794 |

|

| Balance at June 30, 2019 | $ | 298,761 |

| | $ | 1,075 |

| | $ | 379,789 |

| | $ | (35,247 | ) | | $ | (8,879 | ) | | $ | 352,882 |

| | $ | 613,943 |

| | $ | 1,602,324 |

|

See accompanying notes to the condensed consolidated financial statements.

Ares Management Corporation

Condensed Consolidated Statements of Changes in Equity

(Amounts in Thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Series A Preferred Stock | | Class A Common Stock | | Additional Paid-in-Capital | | Retained Earnings | | Accumulated Other Comprehensive Income (loss) | | Non-Controlling Interest in Ares Operating Group Entities | | Non-Controlling Interest in Consolidated Funds | | Total Equity |

| Balance at December 31, 2018 | | $ | 298,761 | | | $ | 1,016 | | | $ | 326,007 | | | $ | (29,336) | | | $ | (8,524) | | | $ | 302,780 | | | $ | 503,637 | | | $ | 1,394,341 | |

| Relinquished with deconsolidation of funds | | — | | | — | | | — | | | — | | | — | | | — | | | (55) | | | (55) | |

| Changes in ownership interests and related tax benefits | | — | | | 15 | | | (6,339) | | | — | | | — | | | (12,073) | | | — | | | (18,397) | |

| Contributions | | — | | | — | | | — | | | — | | | — | | | 1,876 | | | 54,035 | | | 55,911 | |

| Dividends/Distributions | | (5,425) | | | — | | | — | | | (35,367) | | | — | | | (40,112) | | | (20,736) | | | (101,640) | |

| Net income | | 5,425 | | | — | | | — | | | 39,524 | | | — | | | 59,003 | | | 17,624 | | | 121,576 | |

| Currency translation adjustment, net of tax | | — | | | — | | | — | | | — | | | 1,284 | | | 1,459 | | | (1,659) | | | 1,084 | |

| Equity compensation | | — | | | — | | | 12,637 | | | — | | | — | | | 14,367 | | | — | | | 27,004 | |

| Balance at March 31, 2019 | | 298,761 | | | 1,031 | | | 332,305 | | | (25,179) | | | (7,240) | | | 327,300 | | | 552,846 | | | 1,479,824 | |

| Changes in ownership interests and related tax benefits | | — | | | 5 | | | (32,128) | | | — | | | — | | | 20,615 | | | — | | | (11,508) | |

| Repurchases of Class A common stock | | — | | | (4) | | | (10,445) | | | — | | | — | | | — | | | — | | | (10,449) | |

| Contributions | | — | | | — | | | — | | | — | | | — | | | — | | | 61,464 | | | 61,464 | |

| Dividends/Distributions | | (5,425) | | | — | | | — | | | (36,782) | | | — | | | (40,103) | | | (10,219) | | | (92,529) | |

| Net income | | 5,425 | | | — | | | — | | | 26,714 | | | — | | | 34,393 | | | 8,346 | | | 74,878 | |

| Currency translation adjustment, net of tax | | — | | | — | | | — | | | — | | | (1,639) | | | (1,858) | | | 1,506 | | | (1,991) | |

| Equity compensation | | — | | | — | | | 11,306 | | | — | | | — | | | 12,535 | | | — | | | 23,841 | |

| Stock option exercises | | — | | | 43 | | | 78,751 | | | — | | | — | | | — | | | — | | | 78,794 | |

| Balance at June 30, 2019 | | 298,761 | | | 1,075 | | | 379,789 | | | (35,247) | | | (8,879) | | | 352,882 | | | 613,943 | | | 1,602,324 | |

| Changes in ownership interests and related tax benefits | | — | | | 1 | | | (94,004) | | | — | | | — | | | 95,212 | | | — | | | 1,209 | |

| | | | | | | | | | | | | | | | |

| Contributions | | — | | | 70 | | | 206,635 | | | — | | | — | | | — | | | 49,391 | | | 256,096 | |

| Dividends/Distributions | | (5,425) | | | — | | | — | | | (36,967) | | | — | | | (48,970) | | | (34,620) | | | (125,982) | |

| Net income | | 5,425 | | | — | | | — | | | 27,906 | | | — | | | 42,636 | | | 15,908 | | | 91,875 | |

| Currency translation adjustment, net of tax | | — | | | — | | | — | | | — | | | (2,131) | | | (2,352) | | | (4,946) | | | (9,429) | |

| Equity compensation | | — | | | — | | | 10,816 | | | — | | | — | | | 11,577 | | | — | | | 22,393 | |

| Stock option exercises | | — | | | 1 | | | 4,295 | | | — | | | — | | | — | | | — | | | 4,296 | |

| Balance at September 30, 2019 | | 298,761 | | | 1,147 | | | 507,531 | | | (44,308) | | | (11,010) | | | 450,985 | | | 639,676 | | | 1,842,782 | |

| | | | | | | | | | | | | | | | |

| Changes in ownership interests and related tax benefits | | — | | | 1 | | | (1,505) | | | — | | | — | | | 1,587 | | | — | | | 83 | |

| Contributions | | — | | | — | | | — | | | — | | | — | | | — | | | 7,961 | | | 7,961 | |

| Dividends/Distributions | | (5,425) | | | — | | | — | | | (39,552) | | | — | | | (45,814) | | | (30,707) | | | (121,498) | |

| Net income | | 5,425 | | | — | | | — | | | 33,040 | | | — | | | 48,184 | | | (2,174) | | | 84,475 | |

| Currency translation adjustment, net of tax | | — | | | — | | | — | | | — | | | 4,963 | | | 5,431 | | | 3,264 | | | 13,658 | |

| Equity compensation | | — | | | — | | | 11,801 | | | — | | | — | | | 11,915 | | | — | | | 23,716 | |

| Stock option exercises | | — | | | 4 | | | 7,417 | | | — | | | — | | | — | | | — | | | 7,421 | |

| Balance at December 31, 2019 | | $ | 298,761 | | | $ | 1,152 | | | $ | 525,244 | | | $ | (50,820) | | | $ | (6,047) | | | $ | 472,288 | | | $ | 618,020 | | | $ | 1,858,598 | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Preferred

Equity | | Series A Preferred Stock | | Shareholders'

Equity | | Class A Common Stock | | Additional Paid-in-Capital | | Retained Earnings | | Accumulated

Other

Comprehensive

Income (loss) | | Non-Controlling

Interest in

Ares Operating

Group Entities | | | Non-Controlling

Interest in Consolidated

Funds | | Total

Equity |

| Balance at December 31, 2017 | $ | 298,761 |

| | $ | — |

| | $ | 279,065 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | (4,208 | ) | | $ | 358,186 |

| | | $ | 528,488 |

| | $ | 1,460,292 |

|

| Cumulative effect of the adoption of ASC 606 | — |

| | — |

| | (10,827 | ) | | — |

| | — |

| | — |

| | — |

| | (17,117 | ) | | | 5,333 |

| | (22,611 | ) |

| As adjusted balance at January 1, 2018 | 298,761 |

| | — |

| | 268,238 |

| | — |

| | — |

| | — |

| | (4,208 | ) | | 341,069 |

| | | 533,821 |

| | 1,437,681 |

|

| Adoption of ASU 2018-02 | — |

| | — |

| | 1,202 |

| | — |

| | — |

| | — |

| | (1,202 | ) | | — |

| | | — |

| | — |

|

| Changes in ownership interests and related tax benefits | — |

| | — |

| | (8,351 | ) | | — |

| | — |

| | — |

| | — |

| | 18,810 |

| | | — |

| | 10,459 |

|

| Contributions | — |

| | — |

| | 105,441 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | | 8,000 |

| | 113,441 |

|

| Dividends/Distributions | (5,425 | ) | | — |

| | (33,103 | ) | | — |

| | — |

| | — |

| | — |

| | (58,677 | ) | | | (983 | ) | | (98,188 | ) |

| Net income | 5,425 |

| | — |

| | 35,523 |

| | — |

| | — |

| | — |

| | — |

| | 33,106 |

| | | 367 |

| | 74,421 |

|

| Currency translation adjustment | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 1,409 |

| | 2,103 |

| | | 3,175 |

| | 6,687 |

|

| Equity compensation | — |

| | — |

| | 8,285 |

| | — |

| | — |

| | — |

| | — |

| | 12,409 |

| | | — |

| | 20,694 |

|

| Balance at March 31, 2018 | 298,761 |

| | — |

| | 377,235 |

| | — |

| | — |

| | — |

| | (4,001 | ) | | 348,820 |

| | | 544,380 |

| | 1,565,195 |

|

| Changes in ownership interests and related tax benefits | — |

| | — |

| | 15,816 |

| | — |

| | — |

| | — |

| | — |

| | (4,711 | ) | | | — |

| | 11,105 |

|

| Contributions | — |

| | — |

| | 842 |

| | — |

| | — |

| | — |

| | — |

| | 764 |

| | | 62,990 |

| | 64,596 |

|

| Dividends/Distributions | (5,425 | ) | | — |

| | (36,640 | ) | | — |

| | — |

| | — |

| | — |

| | (53,174 | ) | | | (34,346 | ) | | (129,585 | ) |

| Net income | 5,425 |

| | — |

| | (17,200 | ) | | — |

| | — |

| | — |

| | — |

| | 16,062 |

| | | 9,882 |

| | 14,169 |

|

| Currency translation adjustment | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (2,757 | ) | | (3,931 | ) | | | (5,689 | ) | | (12,377 | ) |

| Equity compensation | — |

| | — |

| | 9,928 |

| | — |

| | — |

| | — |

| | — |

| | 12,218 |

| | | — |

| | 22,146 |

|

| Balance at June 30, 2018 | 298,761 |

| | — |

| | 349,981 |

| | — |

| | — |

| | — |

| | (6,758 | ) | | 316,048 |

| | | 577,217 |

| | 1,535,249 |

|

| Changes in ownership interests and related tax benefits | — |

| | — |

| | (34,678 | ) | | — |

| | — |

| | — |

| | — |

| | 3,499 |

| | | — |

| | (31,179 | ) |

| Contributions | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 917 |

| | | — |

| | 917 |

|

| Dividends/Distributions | (5,425 | ) | | — |

| | (34,667 | ) | | — |

| | — |

| | — |

| | — |

| | (30,928 | ) | | | (11,466 | ) | | (82,486 | ) |

| Net income | 5,425 |

| | — |

| | 10,485 |

| | — |

| | — |

| | — |

| | — |

| | 18,133 |

| | | 13,169 |

| | 47,212 |

|

| Currency translation adjustment | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (645 | ) | | (774 | ) | | | (500 | ) | | (1,919 | ) |

| Equity compensation | — |

| | — |

| | 10,600 |

| | — |

| | — |

| | — |

| | — |

| | 12,925 |

| | | — |

| | 23,525 |

|

| Balance at September 30, 2018 | 298,761 |

| | — |

| | 301,721 |

| | — |

| | — |

| | — |

| | (7,403 | ) | | 319,820 |

| | | 578,420 |

| | 1,491,319 |

|

| Consolidation of a new fund | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | | 42,942 |

| | 42,942 |

|

| Changes in ownership interests and related tax benefits | — |

| | — |

| | 501 |

| | — |

| | 9,140 |

| | — |

| | — |

| | (1,237 | ) | | | — |

| | 8,404 |

|

| Contributions | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 1,447 |

| | | 19 |

| | 1,466 |

|

| Dividends/Distributions | — |

| | (5,425 | ) | | (91 | ) | | — |

| | — |

| | (30,348 | ) | | — |

| | (35,018 | ) | | | (112,915 | ) | | (183,797 | ) |

| Net income | — |

| | 5,425 |

| | 5,500 |

| | — |

| | — |

| | 1,012 |

| | — |

| | 7,306 |

| | | (2,906 | ) | | 16,337 |

|

| Currency translation adjustment | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (1,121 | ) | | (1,335 | ) | | | (1,923 | ) | | (4,379 | ) |

| Equity compensation | — |

| | — |

| | 7,432 |

| | — |

| | 2,820 |

| | — |

| | — |

| | 11,797 |

| | | — |

| | 22,049 |

|

| Reclassifications resulting from conversion to a corporation | (298,761 | ) | | 298,761 |

| | (315,063 | ) | | 1,016 |

| | 314,047 |

| | — |

| | — |

| | — |

| | | — |

| | — |

|

| Balance at December 31, 2018 | $ | — |

| | $ | 298,761 |

| | $ | — |

| | $ | 1,016 |

| | $ | 326,007 |

| | $ | (29,336 | ) | | $ | (8,524 | ) | | $ | 302,780 |

| | | $ | 503,637 |

| | $ | 1,394,341 |

|

See accompanying notes to the condensed consolidated financial statements.

Ares Management Corporation

Condensed Consolidated Statements of Cash Flows

(Amounts in Thousands)

(unaudited)

| | | | | Six months ended June 30, | |

| | | | 2020 | | 2019 | |

| Cash flows from operating activities: | | Cash flows from operating activities: | | | | |

| Net income (loss) | | Net income (loss) | $ | (59,121) | | | $ | 196,454 | | |

| Adjustments to reconcile net income (loss) to net cash used in operating activities | | Adjustments to reconcile net income (loss) to net cash used in operating activities | 128,836 | | | 48,114 | | |

| | | | For the Six Months Ended June 30, | |

| | 2019 | | 2018 | |

| Cash flows from operating activities: | | | | |

| Net income | $ | 196,454 |

| | $ | 88,590 |

| |

| Adjustments to reconcile net income to net cash used in operating activities | 48,114 |

| | 225,963 |

| |

| Adjustments to reconcile net income to net cash used in operating activities allocable to non-controlling interests in Consolidated Funds | (1,360,106 | ) | | (1,634,788 | ) | |

| | Adjustments to reconcile net income (loss) to net cash used in operating activities allocable to non-controlling interests in Consolidated Funds | | Adjustments to reconcile net income (loss) to net cash used in operating activities allocable to non-controlling interests in Consolidated Funds | (496,873) | | | (1,360,106) | | |

| | Cash flows due to changes in operating assets and liabilities | (12,824 | ) | | 66,969 |

| Cash flows due to changes in operating assets and liabilities | 114,974 | | | (12,824) | | |

| Cash flows due to changes in operating assets and liabilities allocable to non-controlling interests in Consolidated Funds | (162,950 | ) | | (34,335 | ) | |

| | Cash flows due to changes in operating assets and liabilities allocable to non-controlling interest in Consolidated Funds: | | Cash flows due to changes in operating assets and liabilities allocable to non-controlling interest in Consolidated Funds: | 161,345 | | | (162,950) | | |

| | Net cash used in operating activities | (1,291,312 | ) | | (1,287,601 | ) | Net cash used in operating activities | (150,839) | | | (1,291,312) | | |

| Cash flows from investing activities: | |

| | |

| Cash flows from investing activities: | | | | |

| Purchase of furniture, equipment and leasehold improvements, net | (5,653 | ) | | (7,126 | ) | Purchase of furniture, equipment and leasehold improvements, net | (8,080) | | | (5,653) | | |

| Acquisitions | | Acquisitions | (35,844) | | | — | | |

| Net cash used in investing activities | (5,653 | ) | | (7,126 | ) | Net cash used in investing activities | (43,924) | | | (5,653) | | |

| Cash flows from financing activities: | |

| | |

| Cash flows from financing activities: | | | | |

| Proceeds from issuance of common shares | — |

| | 105,333 |

| |

| Net proceeds from issuance of Class A common stock | | Net proceeds from issuance of Class A common stock | 383,154 | | | — | | |

| Proceeds from credit facility | 235,000 |

| | 325,000 |

| Proceeds from credit facility | 790,000 | | | 235,000 | | |

| Proceeds from term notes | — |

| | 44,050 |

| |

| Proceeds from senior notes | | Proceeds from senior notes | 399,084 | | | — | | |

| Repayments of credit facility | (150,000 | ) | | (410,000 | ) | Repayments of credit facility | (860,000) | | | (150,000) | | |

| Repayments of term loans | — |

| | (206,089 | ) | |

| | Dividends and distributions | (152,364 | ) | | (181,594 | ) | Dividends and distributions | (224,407) | | | (152,364) | | |

| Series A Preferred Stock dividends and distributions | (10,850 | ) | | (10,850 | ) | |

| Series A Preferred Stock dividends | | Series A Preferred Stock dividends | (10,850) | | | (10,850) | | |

| | Repurchases of Class A common stock | (10,449 | ) | | — |

| Repurchases of Class A common stock | — | | | (10,449) | | |

| Stock option exercises | 78,794 |

| | 950 |

| Stock option exercises | 67,441 | | | 78,794 | | |

| | Taxes paid related to net share settlement of equity awards | (31,424 | ) | | (17,225 | ) | Taxes paid related to net share settlement of equity awards | (74,335) | | | (31,424) | | |

| | Other financing activities | (3,258 | ) | | 764 |

| Other financing activities | (1,889) | | | (3,258) | | |

| Allocable to non-controlling interests in Consolidated Funds: | |

| | |

| Allocable to non-controlling interests in Consolidated Funds: | | | |

| Contributions from non-controlling interests in Consolidated Funds | 115,499 |

| | 70,990 |

| Contributions from non-controlling interests in Consolidated Funds | 123,695 | | | 115,499 | | |

| Distributions to non-controlling interests in Consolidated Funds | (30,955 | ) | | (35,329 | ) | Distributions to non-controlling interests in Consolidated Funds | (150,329) | | | (30,955) | | |

| Borrowings under loan obligations by Consolidated Funds | 1,934,087 |

| | 2,206,816 |

| Borrowings under loan obligations by Consolidated Funds | 608,355 | | | 1,934,087 | | |

| Repayments under loan obligations by Consolidated Funds | (528,955 | ) | | (599,801 | ) | Repayments under loan obligations by Consolidated Funds | (87,689) | | | (528,955) | | |

| Net cash provided by financing activities | 1,445,125 |

| | 1,293,015 |

| Net cash provided by financing activities | 962,230 | | | 1,445,125 | | |

| Effect of exchange rate changes | (11,187 | ) | | 8,231 |

| Effect of exchange rate changes | (15,811) | | | (11,187) | | |

| Net change in cash and cash equivalents | 136,973 |

|

| 6,519 |

| Net change in cash and cash equivalents | 751,656 | | | 136,973 | | |

| Cash and cash equivalents, beginning of period | 110,247 |

| | 118,929 |

| Cash and cash equivalents, beginning of period | 138,384 | | | 110,247 | | |

| Cash and cash equivalents, end of period | $ | 247,220 |

| | $ | 125,448 |

| Cash and cash equivalents, end of period | $ | 890,040 | | | $ | 247,220 | | |

|

See accompanying notes to the condensed consolidated financial statements.

Ares Management Corporation

Notes to the Unaudited Condensed Consolidated Financial Statements (Continued)

(Dollars in Thousands, Except Share Data and As Otherwise Noted)

1. ORGANIZATION

Ares Management Corporation ("the Company"(the “Company”), a Delaware corporation, together with its subsidiaries, is a leading global alternative investment manager operating three integrated businesses across Credit, Private Equity and Real Estate. Information about segments should be read together with Note 14, “Segment"Note 14. Segment Reporting.” Subsidiaries of the Company serve as the general partners and/or investment managers to various investment funds and managed accounts within each investment group (the “Ares Funds”). SuchThese subsidiaries provide investment advisory services to the Ares Funds in exchange for management fees. Ares is managed and operated by its Board of Directors and Executive Management Committee. Unless the context requires otherwise, references to “Ares” or the “Company” refer to Ares Management, L.P., together with its subsidiaries prior to November 26, 2018 and thereafter to Ares Management Corporation, together with its subsidiaries.

The accompanying unaudited financial statements include the condensed consolidated results of the Company and its subsidiaries. The Company is a holding company, and the Company’s soleCompany's assets areinclude equity interests in Ares Holdings Inc. (“AHI”), Ares Offshore Holdings, Ltd., and Ares AI Holdings L.P. In this quarterly report, the following of the Company’s subsidiaries are collectively referred to as the “Ares Operating Group” or “AOG”: Ares Offshore Holdings L.P. (“Ares Offshore”), Ares Holdings L.P. (“Ares Holdings”), and Ares Investments L.P.L.P (“Ares Investments”). The Company, indirectly through its wholly owned subsidiaries, is the general partner of each of the Ares Operating Group entities. The Company operates and controls all of the businesses and affairs of and conducts all of its material business activities through the Ares Operating Group.

Non-Controlling Interests in Ares Operating Group Entities

On February 21, 2020, the Company completed its acquisition of the Class A membership interests (the “Class A membership interests”) in Crestline Denali Capital LLC (“Crestline Denali”). The Class A membership interests entitle the Company to the fees associated with managing 7 collateral management contracts. The Class B membership interests of Crestline Denali (the “Class B membership interests”) were retained by the former owners of Crestline Denali and represent the financial interests in the subordinated notes of the collateralized loan obligations.

The non-controlling interests in Ares Operating Group (“AOG”)AOG entities represent a component of equity and net income attributable to the owners of the Ares Operating Group Units (“AOG Units”) that are not held directly or indirectly by the Company. These owners consist predominantly of Ares Owners Holdings L.P. but also include other strategic distribution partnerships with whom the Company has established joint ventures. In connection with the Company's control over Crestline Denali, the Company also consolidates investments and financial results that are attributable to the Class B membership interests to which the Company has no economic rights or obligations. Equity and income (loss) attributable to the Class B membership interests is included within non-controlling interests in AOG entities. Non-controlling interests in AOG entities are adjusted for contributions to and distributions from AOG during the reporting period and are allocated income from the AOG entities based on their historical ownership percentage for the proportional number of days in the reporting period.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying condensed consolidated financial statements are prepared in accordance with the generally accepted accounting principles in the United States (“GAAP”) for interim financial information and instructions to the Quarterly Report on Form 10-Q. The condensed consolidated financial statements, including these notes, are unaudited and exclude some of the disclosures required in annual financial statements. Management believes it has made all necessary adjustments so that the condensed consolidated financial statements are presented fairly and that estimates made in preparing its condensed consolidated financial statements are reasonable and prudent, and that all such adjustments are of a normal recurring nature. The operating results presented for interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. These condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements included in the Annual Report on Form 10-K for the year ended December 31, 20182019 filed with the SEC.Securities and Exchange Commission (“SEC”).

The condensed consolidated financial statements includeAs of June 30, 2020, the accounts and activitiesimpact of the AOG entities, their consolidated subsidiariesoutbreak of the coronavirus pandemic (“COVID-19”) continues to unfold. As a result, management's estimates and certain Consolidated Funds.All intercompany balancesassumptions may be subject to a higher degree of variability and transactions have been eliminated upon consolidation.

The Company has reclassified certain prior period amounts to conform tovolatility that may result in material differences from the current year presentation.

Adoption of ASC 842

Effective January 1, 2019, the Company adopted the Financial Accounting Standards Board (“FASB”) Topic 842 (“ASC 842”), Leases. The Company adopted ASC 842 under the modified retrospective approach using the practical expedient provided for within paragraph 842-10-65-1; therefore, the presentation of prior year periods has not been adjusted. No cumulative effect of initially adopting ASC 842 as an adjustment to the opening balance of components of equity as of January 1, 2019 was necessary as the recognition of the right-of-use operating lease assets equaled the corresponding lease liabilities. The amount established in conjunction with the implementation was consistent with the amount previously disclosed.

Ares Management Corporation

Notes to the Unaudited Condensed Consolidated Financial Statements (Continued)

(Dollars in Thousands, Except Share Data and As Otherwise Noted)

The condensed consolidated financial statements include the accounts and activities of the AOG entities, their consolidated subsidiaries and certain Consolidated Funds. All intercompany balances and transactions have been eliminated upon consolidation.

The Company has entered into operatingreclassified certain prior period amounts to conform to the current year presentation.

Cash and finance leases for corporate officesCash Equivalents

Cash and certain equipment and makes the determination if an arrangement constitutes a lease at inception. Operating leases are included in right-of-use operating lease assets and right-of-use operating lease liabilities in the Company's Condensed Consolidated Statements of Financial Condition. Finance leases are included in accounts payable, accrued expenses and other liabilities in the Condensed Consolidated Statements of Financial Condition. Leases with an initial term of 12 months or less are not recorded on the Condensed Consolidated Statements of Financial Condition.

Right-of-use leases assets represent the Company's right to use an underlying assetcash equivalents for the lease termCompany includes investments with maturities at purchase of less than three months, money market funds and right-of-use lease liabilities representdemand deposits. Cash and cash equivalents held at Consolidated Funds represents cash that, although not legally restricted, is not available to support the Company's obligation to make lease payments arising from the lease. Operating lease right-of-use assets and liabilities are recognized at commencement date based on the present value of lease payments over the lease term. As mostgeneral liquidity needs of the Company's leases do not provide an implicit rate,Company, as the use of such amounts is generally limited to the activities of the Consolidated Funds.

At June 30, 2020 and December 31, 2019, the Company uses the its incremental borrowing rate based on the information available at commencement datehad cash balances with financial institutions in determining the present valueexcess of lease payments.Federal Deposit Insurance Corporation insured limits. The Company usesmonitors the implicit rate when readily determinable. The right-of-use operating lease asset also includes any lease prepayments and excludes lease incentives. Lease terms may include options to extend or terminate the lease when it is reasonably certain that the company will exercise that option. Lease expense is primarily recognized on a straight-line basis over the lease term. The Company has lease agreements with lease and non-lease components, which are generally accounted for separately. However, for certain equipment leases where the non-lease components are not material, the Company account for the lease and non-lease components as a single lease component.credit standing of these financial institutions.

Recent Accounting Pronouncements

The Company considers the applicability and impact of all accounting standard updates ("ASU"(“ASU”) issued.issued by the Financial Accounting Standards Board (“FASB”). ASUs not listed below were assessed and either determined to be not applicable or expected to have minimal impact on its condensed consolidated financial statements.

In May 2016,December 2019, the FASB issued ASU 2016-13,2019-12, Financial Instruments - Credit LossesIncome Taxes (Topic 326)740): MeasurementSimplifying the Accounting for Income Taxes. The amendments in this update simplify the accounting for income taxes by removing certain exceptions to the general principles in Topic 740. The amendments also improve consistent application of Credit Losses on Financial Instruments. The objectiveand simplify GAAP for other areas of the guidance inTopic 740 by clarifying and amending existing guidance. ASU 2016-13 is to allow entities to recognize estimated credit losses in the period that the change in valuation occurs. ASU 2016-13 requires an entity to present financial assets measured on an amortized cost basis on the balance sheet net of an allowance for credit losses. Available for sale and held to maturity debt securities are also required to be held net of an allowance for credit losses. The guidance should be applied using a modified retrospective approach. ASU 2016-132019-12 is effective for public entities for annual reporting periods beginning after December 15, 2019 and interim periods within those reporting periods. Early adoption is permitted for annual and quarterly reporting periods beginning after December 15, 2018. In April and May 2019, ASU 2019-04, Codification Improvements to Topic 326, Financial Instruments-Credit Losses, Topic 815, Derivatives and Hedging, and Topic 825, Financial Instruments and ASU 2019-05, Financial Instruments-Credit Losses (Topic 326): Targeted Transition Relief, were issued to provide clarification to previously issued credit losses guidance (ASU 2016-13) that has not yet been implemented. These updates are required to be adopted with ASU 2016-13. The Company is currently evaluating the impact of these pronouncements on its condensed consolidated financial statements.