UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2020March 31, 2021

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 1-7665

LYDALL INC /DE/Lydall, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | | | | | 06-0865505 |

| (State or Other Jurisdiction of Incorporation or Organization) | | | | | | (I.R.S. Employer Identification No.) |

| | | | | | |

| One Colonial Road | , | Manchester | , | Connecticut | | 06042 |

| (Address of principal executive offices) | | | | | | (zip code) |

(860) 646-1233

(Registrant’s telephone number, including area code)

None

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | LDL | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐Accelerated filer ☒Non-accelerated filer ☐ Smaller reporting company ☐Emerging growth company☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| | | | | |

Total Shares outstanding JulyApril 15, 20202021 | 17,760,77718,018,995 | |

LYDALL, INC.

INDEXTABLE OF CONTENTS

| | | | | | | | | | | |

| | | | Page

Number |

| | | |

| | | |

| | | |

Part I. | Financial Information | | I |

| | | |

| Item 1. | | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 2. | | |

| | | |

| Item 3. | | |

| | | |

| Item 4. | | |

| | | Part II |

Part II. | Other Information | | |

| | | |

| Item 1. | | |

| | | |

| Item 1A. | | |

| | | |

| Item 2. | | |

| Item 5. | | | |

| | | |

| | | |

| Item 6. | | |

| | | |

Signature | Signatures | | |

|

| | |

Lydall, Inc. and its subsidiaries are hereafter collectively referred to as “Lydall,” the “Company” or the “Registrant.” Lydall and its subsidiaries’ names, abbreviations thereof, logos, and product and service designators are all either the registered or unregistered trademarks or trade names of Lydall, Inc. and its subsidiaries.

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Any statements contained in this Quarterly Report on Form 10-Q that are not statements of historical fact may be deemed to be forward-looking statements. All such forward-looking statements are intended to provide management’s current expectations for the future operating and financial performance of the Company based on current assumptions relating to the Company’s business, the economy and future conditions. Forward-looking statements generally can be identified through the use of words such as “believes,” “anticipates,” “may,” “should,” “will,” “plans,” “projects,” “expects,” “expectations,” “estimates,” “forecasts,” “predicts,” “targets,” “prospects,” “strategy,” “signs” and other words of similar meaning in connection with the discussion of future operating or financial performance. Forward-looking statements may include, among other things, statements relating to future sales, earnings, cash flow, results of operations, uses of cash and other measures of financial performance. Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties and changes in circumstances that are difficult to predict. Accordingly, the Company’s actual results may differ materially from those contemplated by the forward-looking statements. Investors, therefore, are cautioned against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Forward-looking statements in this Quarterly Report on Form 10-Q include, among others, statements relating to:

•The impact of the coronavirus pandemic ("COVID-19") on the Company's businesses;

•Overall economic and business conditions and the effects on the Company’s markets;

•Ability to meet financial covenants in the Company's credit agreement;

•Outlook for the third quarter and full year 2020;

•Ability to improve operational effectiveness;

•Expected vehicle production in the North American, European or Asian markets;

•Growth opportunities in markets served by the Company;

•Expected costs and future savings associated with restructuring, reduction-in-force, or other cost savings programs;

•Expected gross margin, operating margin and working capital improvements from cost control and other improvement programs;

•Future impact of raw material commodity costs;

•Product development and new business opportunities;

•Future strategic transactions, including but not limited to: acquisitions, joint ventures, alliances, licensing agreements and divestitures;

•Pension plan funding;

•Future cash flow and uses of cash;

•Future amounts of stock-based compensation expense;

•Future earnings and other measurements of financial performance;

•Ability to meet cash operating requirements;

•Future levels of indebtedness and capital spending;

•Future impact of the variability of interest rates and foreign currency exchange rates and impacts of hedging instruments;

•Expected future impact of recently issued accounting pronouncements upon adoption;

•Future effective income tax rates and realization of deferred tax assets;

•Estimates of fair values of reporting units and long-lived assets used in assessing goodwill and long-lived assets for possible impairment; and

•The expected outcomes of legal proceedings and other contingencies, including environmental matters.

All forward-looking statements are inherently subject to a number of risks and uncertainties that could cause the actual results of the Company to differ materially from those reflected in forward-looking statements made in this Quarterly Report on Form 10-Q, as well as in press releases and other statements made from time to time by the Company’s authorized officers. Such risks and uncertainties include, among others, the duration, severity, and impact of COVID-19 or other new pandemics and the measures taken in response thereto, worldwide economic cycles and political changes and uncertainties that affect the markets which the Company’s businesses serve, which could have an effect on demand for the Company’s products and impact the Company’s profitability; challenges encountered by the Company in the execution of restructuring programs; disruptions in the global credit and financial markets, including diminished liquidity and credit availability; changes in international trade agreements and policies, including tariff regulation and trade restrictions; swings in consumer confidence and spending; unstable economic growth; volatility in foreign currency exchange rates; raw material pricing and supply issues; fluctuations in unemployment rates; retention of key employees; increases in fuel prices; and outcomes of legal proceedings, claims and investigations, as well as other risks and uncertainties identified in Part II, Item 1A - Risk Factors of this Quarterly Report on Form 10-Q, and Part I, Item 1A - Risk Factors of the Company's Annual Report on Form 10-K for the year ended December 31, 2019. The Company does not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

PART I. FINANCIAL INFORMATION

Item 1. Financial StatementsFINANCIAL STATEMENTS

LYDALL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In Thousands Except Per Share Amounts)thousands, except per share amounts) (Unaudited)

| | | Three Months Ended

June 30, | | | Six Months Ended

June 30, | | | | | | | | | | | | |

| | 2020 | | 2019 | | 2020 | | 2019 | | | For the Three Months Ended

|

| | (Unaudited) | | | (Unaudited) | | | | March 31, 2021 | | March 31, 2020 |

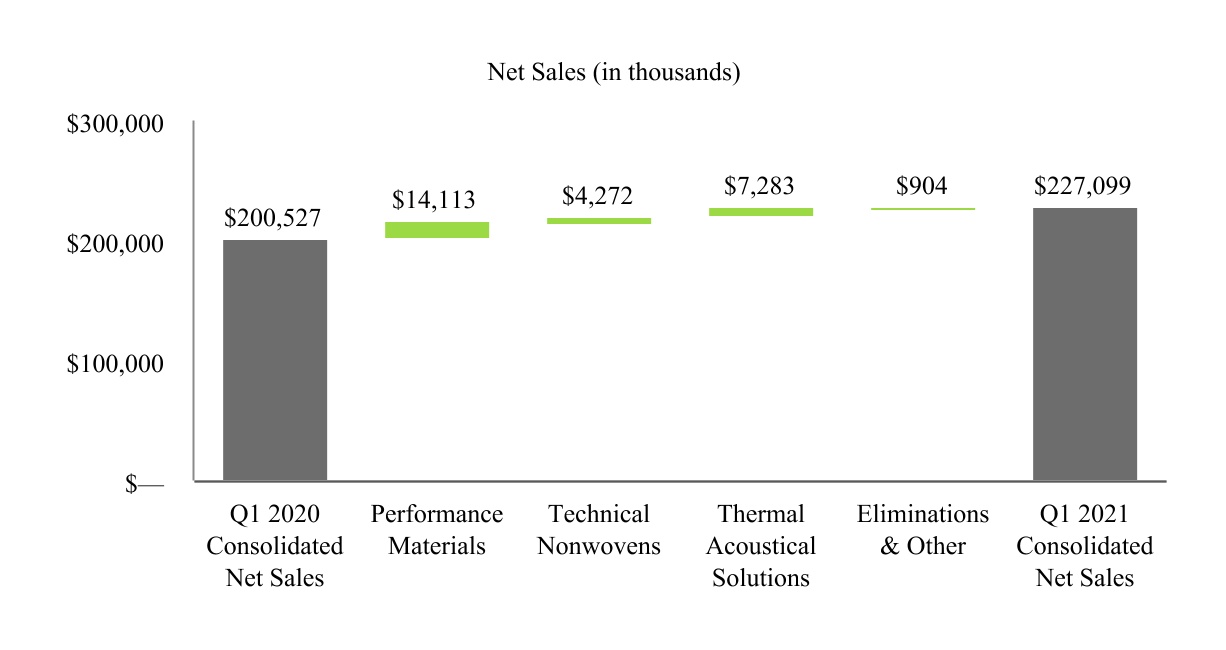

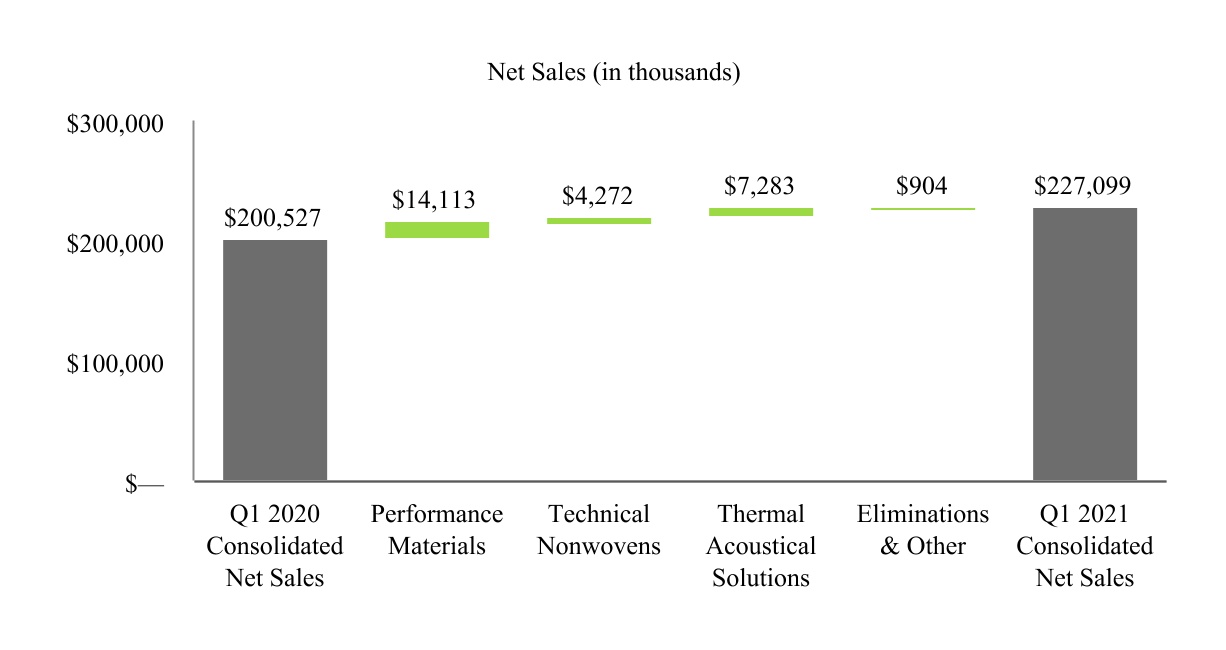

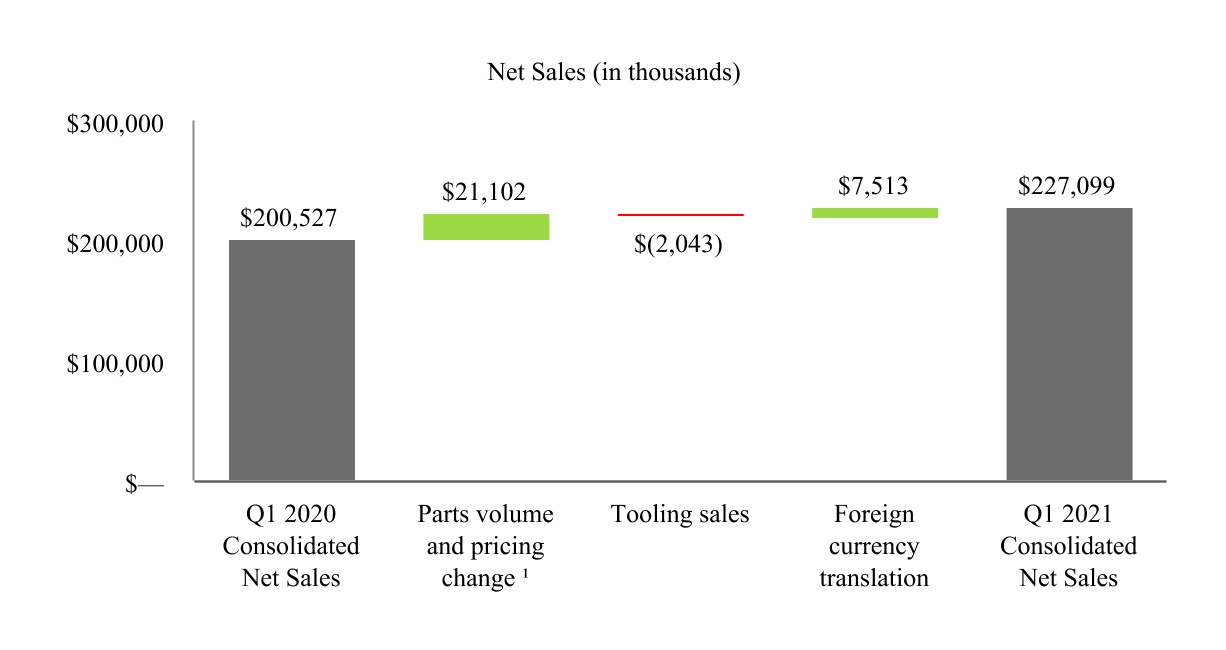

| Net sales | Net sales | $ | 146,160 | | | $ | 220,811 | | | $ | 346,687 | | | $ | 438,836 | | Net sales | | $ | 227,099 | | | $ | 200,527 | |

| Cost of sales | Cost of sales | 117,742 | | | 175,536 | | | 279,701 | | | 351,505 | | Cost of sales | | 178,550 | | | 161,959 | |

| Gross profit | Gross profit | 28,418 | | | 45,275 | | | 66,986 | | | 87,331 | | Gross profit | | 48,549 | | | 38,568 | |

| Selling, product development and administrative expenses | Selling, product development and administrative expenses | 30,164 | | | 32,096 | | | 63,191 | | | 65,102 | | Selling, product development and administrative expenses | | 35,633 | | | 33,027 | |

| Impairment of goodwill and other long-lived assets | Impairment of goodwill and other long-lived assets | — | | | — | | | 61,109 | | | — | | Impairment of goodwill and other long-lived assets | | 0 | | | 61,109 | |

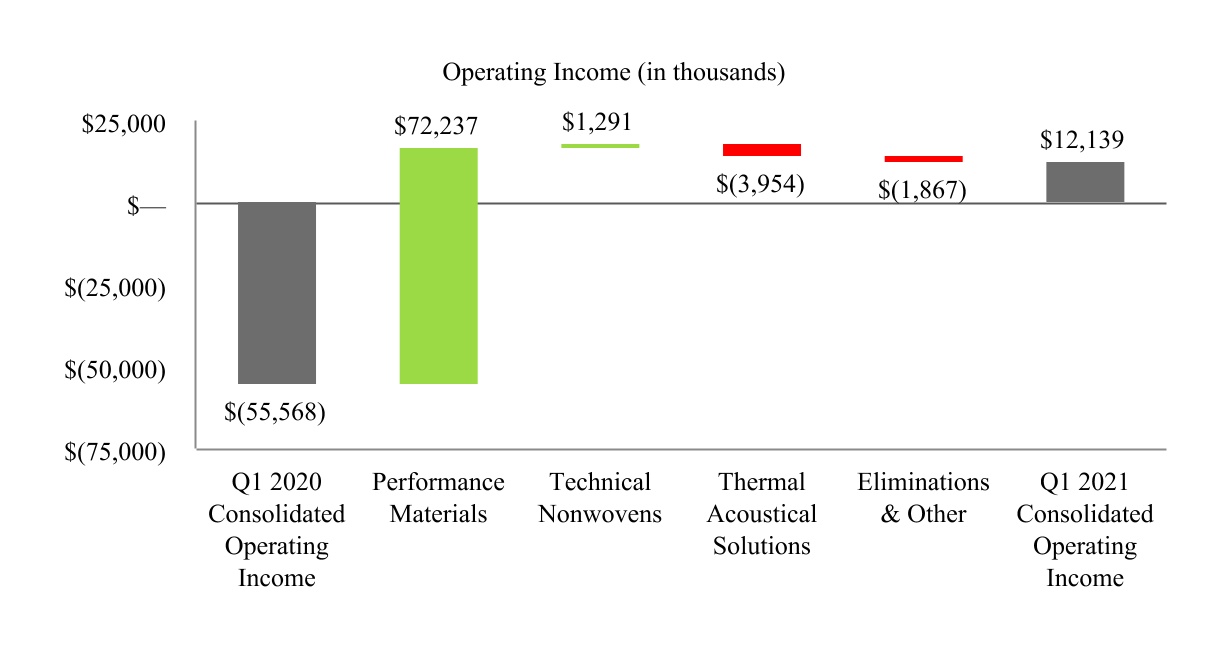

| Operating (loss) income | (1,746) | | | 13,179 | | | (57,314) | | | 22,229 | | |

| | Restructuring expenses | | Restructuring expenses | | 777 | | | 0 | |

| Operating income (loss) | | Operating income (loss) | | 12,139 | | | (55,568) | |

| (Gain) loss on the sale of a business | | (Gain) loss on the sale of a business | | 698 | | | 0 | |

| Employee benefit plans settlement expenses | Employee benefit plans settlement expenses | — | | | 25,515 | | | 385 | | | 25,515 | | Employee benefit plans settlement expenses | | 0 | | | 385 | |

| Interest expense | Interest expense | 4,476 | | | 3,731 | | | 7,333 | | | 7,359 | | Interest expense | | 3,448 | | | 2,857 | |

| Other expense (income), net | 248 | | | (873) | | | (170) | | | (474) | | |

| Loss before income taxes | (6,470) | | | (15,194) | | | (64,862) | | | (10,171) | | |

| Income tax benefit | (595) | | | (8,199) | | | (2,610) | | | (7,093) | | |

| Other (income) expense, net | | Other (income) expense, net | | 86 | | | (418) | |

| Income (loss) before income taxes | | Income (loss) before income taxes | | 7,907 | | | (58,392) | |

| Income tax expense (benefit) | | Income tax expense (benefit) | | 2,821 | | | (2,015) | |

| (Income) loss from equity method investment | (Income) loss from equity method investment | (18) | | | (49) | | | 26 | | | (22) | | (Income) loss from equity method investment | | (8) | | | 44 | |

| Net loss | $ | (5,857) | | | $ | (6,946) | | | $ | (62,278) | | | $ | (3,056) | | |

| Loss per share: | | | | | | | | |

| Net income (loss) | | Net income (loss) | | $ | 5,094 | | | $ | (56,421) | |

| Earnings (loss) per share: | | Earnings (loss) per share: | | | | |

| Basic | Basic | $ | (0.34) | | | $ | (0.40) | | | $ | (3.59) | | | $ | (0.18) | | Basic | | $ | 0.29 | | | $ | (3.25) | |

| Diluted | Diluted | $ | (0.34) | | | $ | (0.40) | | | $ | (3.59) | | | $ | (0.18) | | Diluted | | $ | 0.28 | | | $ | (3.25) | |

| Weighted average number of common shares outstanding: | Weighted average number of common shares outstanding: | | | Weighted average number of common shares outstanding: | | |

| Basic | Basic | 17,372 | | | 17,267 | | | 17,354 | | | 17,260 | | Basic | | 17,545 | | | 17,336 | |

| Diluted | Diluted | 17,372 | | | 17,267 | | | 17,354 | | | 17,260 | | Diluted | | 17,888 | | | 17,336 | |

See accompanying Notesnotes to Condensed Consolidated Financial Statements.condensed consolidated financial statements.

LYDALL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) INCOME

(In Thousands)thousands) (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | | | Six Months Ended

June 30, | | |

| 2020 | | 2019 | | 2020 | | 2019 |

| (Unaudited) | | | | (Unaudited) | | |

| Net loss | $ | (5,857) | | | $ | (6,946) | | | $ | (62,278) | | | $ | (3,056) | |

| Other comprehensive income (loss): | | | | | | | |

| Foreign currency translation adjustments | 5,146 | | | 2,457 | | | (4,811) | | | 2,330 | |

| Pension liability adjustment, net of tax | — | | | 19,159 | | | 331 | | | 19,374 | |

| Unrealized loss on hedging activities, net of tax | (685) | | | (1,351) | | | (239) | | | (2,026) | |

| | | | | | | |

| Comprehensive (loss) income | $ | (1,396) | | | $ | 13,319 | | | $ | (66,997) | | | $ | 16,622 | |

| | | | | | | | | | | | | | | |

| | | For the Three Months Ended

|

| | | | | March 31, 2021 | | March 31, 2020 |

| Net income (loss) | | | | | $ | 5,094 | | | $ | (56,421) | |

| Other comprehensive income (loss), net of tax: | | | | | | | |

| Foreign currency translation adjustments | | | | | (3,014) | | | (9,957) | |

| Pension liability adjustment, net of taxes of $0.1 million and $0.1 million, respectively | | | | | 365 | | | 331 | |

| Unrealized gain (loss) on hedging activities, net of taxes of $0.9 million and $0.1 million, respectively | | | | | 3,018 | | | 446 | |

| Other comprehensive income (loss) | | | | | 369 | | | (9,180) | |

| Total comprehensive income (loss) | | | | | $ | 5,463 | | | $ | (65,601) | |

See accompanying Notesnotes to Condensed Consolidated Financial Statements.condensed consolidated financial statements.

LYDALL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except per share amounts) (Unaudited)

| | | | | | | | | | | |

| March 31, 2021 | | December 31, 2020 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 88,717 | | | $ | 102,176 | |

| Accounts receivable, net of allowance for doubtful accounts of $2,313 and $2,402, respectively | 135,464 | | | 116,947 | |

| Contract assets | 25,959 | | | 32,403 | |

| Inventories | 81,448 | | | 78,996 | |

| Taxes receivable | 10,031 | | | 6,652 | |

| Prepaid expenses | 4,937 | | | 4,870 | |

| Other current assets | 7,922 | | | 7,348 | |

| Total current assets | 354,478 | | | 349,392 | |

| Property, plant and equipment, at cost | 505,573 | | | 506,509 | |

| Accumulated depreciation | (295,557) | | | (291,996) | |

| Property, plant and equipment, net | 210,016 | | | 214,513 | |

| Operating lease right-of-use assets | 26,163 | | | 22,243 | |

| Goodwill | 87,195 | | | 87,595 | |

| Other intangible assets, net | 90,796 | | | 95,121 | |

| Other assets, net | 6,729 | | | 6,598 | |

| Total assets | $ | 775,377 | | | $ | 775,462 | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities: | | | |

| Current portion of long-term debt | $ | 9,789 | | | $ | 9,789 | |

| | | |

| Accounts payable | 113,416 | | | 101,905 | |

| Accrued payroll and other compensation | 22,114 | | | 24,589 | |

| Accrued taxes | 8,339 | | | 8,214 | |

| | | |

| Derivative liabilities | 7,966 | | | 11,996 | |

| Restructuring liabilities | 2,042 | | | 9,431 | |

| Other accrued liabilities | 22,733 | | | 21,705 | |

| Total current liabilities | 186,399 | | | 187,629 | |

| Long-term debt | 251,202 | | | 260,649 | |

| Long-term operating lease liabilities | 21,220 | | | 17,947 | |

| Deferred tax liabilities | 31,411 | | | 27,174 | |

| Benefit plan liabilities | 17,930 | | | 21,691 | |

| Other long-term liabilities | 2,665 | | | 2,676 | |

| | | |

| Commitments and Contingencies (Note 15) | 0 | | 0 |

| Stockholders' equity: | | | |

| Preferred stock, $0.01 per share par value, 500 shares authorized (NaN issued or outstanding) | 0 | | | 0 | |

| Common stock, $0.01 per share par value, 30,000 shares authorized (25,741 and 25,555 shares issued, respectively) | 257 | | | 256 | |

| Capital in excess of par value | 101,361 | | | 99,770 | |

| Retained earnings | 271,998 | | | 266,904 | |

| Accumulated other comprehensive income (loss) | (17,973) | | | (18,342) | |

| Less treasury stock, 7,722 and 7,717 shares of common stock, respectively, at cost | (91,093) | | | (90,892) | |

| Total stockholders’ equity | 264,550 | | | 257,696 | |

| Total liabilities and stockholders’ equity | $ | 775,377 | | | $ | 775,462 | |

See accompanying notes to condensed consolidated financial statements.

LYDALL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands) (Unaudited)

| | | | | | | | | | | |

| For the Three Months Ended |

| | March 31, 2021 | | March 31, 2020 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | 5,094 | | | $ | (56,421) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| | | |

| Depreciation and amortization | 11,366 | | | 12,152 | |

| Amortization of debt issuance costs | 134 | | | 78 | |

| Impairment of goodwill and long-lived assets | 0 | | | 61,109 | |

| Deferred income taxes | 3,224 | | | (2,896) | |

| (Gain) loss on the sale of a business | 698 | | | 0 | |

| Employee benefit plans settlement expenses | 0 | | | 385 | |

| Stock-based compensation | 1,125 | | | 914 | |

| | | |

| (Gain) loss on disposition of property, plant and equipment | 0 | | | 20 | |

| (Gain) loss from equity method investment | (8) | | | 44 | |

| Other, net | (106) | | | 0 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (21,817) | | | (7,800) | |

| Contract assets | 6,298 | | | 1,313 | |

| Inventories | (3,127) | | | (2,026) | |

| Income taxes (receivable) payable | (3,424) | | | (546) | |

| Prepaid expenses and other assets | (1,053) | | | 526 | |

| Accounts payable | 11,456 | | | 21,127 | |

| Accrued payroll and other compensation | (2,185) | | | (68) | |

| | | |

| Deferred revenue | 21 | | | 0 | |

| Accrued taxes payable | 245 | | | (1,447) | |

| | | |

| Benefit plan liabilities | (3,517) | | | (450) | |

| Other, net | (4,204) | | | 727 | |

| Net cash provided by (used for) operating activities | 220 | | | 26,741 | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (8,119) | | | (9,157) | |

| Collections of finance receivables | 1,379 | | | 1,658 | |

| Payments from divestitures | (2,715) | | | 0 | |

| | | |

| | | |

| Net cash provided by (used for) investing activities | (9,455) | | | (7,499) | |

| Cash flows from financing activities: | | | |

| Proceeds from borrowings | 0 | | | 20,000 | |

| Debt repayments | (9,499) | | | (4,500) | |

| Proceeds from servicing receivables | 4,557 | | | 2,852 | |

| Common stock issued | 642 | | | 31 | |

| Common stock repurchased | (201) | | | (8) | |

| Net cash provided by (used for) financing activities | (4,501) | | | 18,375 | |

| Effect of exchange rate changes on cash | 277 | | | (1,121) | |

| Increase (decrease) in cash and cash equivalents | (13,459) | | | 36,496 | |

| Cash and cash equivalents at beginning of period | 102,176 | | | 51,331 | |

| Cash and cash equivalents at end of period | $ | 88,717 | | | $ | 87,827 | |

See accompanying notes to condensed consolidated financial statements.

LYDALL, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In Thousands)

| | | | | | | | | | | |

| June 30,

2020 | | December 31,

2019 |

| (Unaudited) | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 92,546 | | | $ | 51,331 | |

| Accounts receivable, net of allowance for doubtful accounts of $2,647 and $1,842, respectively | 100,767 | | | 107,786 | |

| Contract assets | 27,969 | | | 28,245 | |

| Inventories | 80,300 | | | 80,544 | |

| Taxes receivable | 2,235 | | | 3,427 | |

| Prepaid expenses | 4,389 | | | 3,814 | |

| Other current assets | 8,562 | | | 8,450 | |

| Total current assets | 316,768 | | | 283,597 | |

| Property, plant and equipment, at cost | 483,013 | | | 487,371 | |

| Accumulated depreciation | (276,577) | | | (265,729) | |

| Property, plant and equipment, net | 206,436 | | | 221,642 | |

| Operating lease right-of-use assets | 21,392 | | | 23,116 | |

| Goodwill | 83,951 | | | 133,912 | |

| Other intangible assets, net | 104,595 | | | 115,577 | |

| Other assets, net | 7,391 | | | 8,093 | |

| Total assets | $ | 740,533 | | | $ | 785,937 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Current portion of long-term debt | $ | 9,855 | | | $ | 9,928 | |

| | | |

| Accounts payable | 78,108 | | | 73,426 | |

| Accrued payroll and other compensation | 20,130 | | | 17,198 | |

| Accrued taxes | 11,152 | | | 5,638 | |

| | | |

| Other accrued liabilities | 25,106 | | | 23,668 | |

| Total current liabilities | 144,351 | | | 129,858 | |

| Long-term debt | 275,655 | | | 262,713 | |

| Long-term operating lease liabilities | 17,157 | | | 18,424 | |

| Deferred tax liabilities | 28,327 | | | 34,561 | |

| Benefit plan liabilities | 18,528 | | | 18,957 | |

| Other long-term liabilities | 3,253 | | | 3,004 | |

| | | |

| Commitments and Contingencies (Note 15) | | | |

| Stockholders’ equity: | | | |

| Preferred stock | — | | | — | |

| Common stock | 255 | | | 253 | |

| Capital in excess of par value | 95,985 | | | 94,140 | |

| Retained earnings | 278,351 | | | 340,629 | |

| Accumulated other comprehensive loss | (30,698) | | | (25,979) | |

| Treasury stock, at cost | (90,631) | | | (90,623) | |

| Total stockholders’ equity | 253,262 | | | 318,420 | |

| Total liabilities and stockholders’ equity | $ | 740,533 | | | $ | 785,937 | |

See accompanying Notes to Condensed Consolidated Financial Statements.

LYDALL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands)

| | | | | | | | | | | |

| For the Six Months Ended June 30, | | |

| | 2020 | | 2019 |

| | (Unaudited) | | |

| Cash flows from operating activities: | | | |

| Net loss | $ | (62,278) | | | $ | (3,056) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Gain on divestiture | — | | | (1,459) | |

| Depreciation and amortization | 24,842 | | | 24,001 | |

| Impairment of goodwill and long-lived assets | 61,109 | | | — | |

| Deferred income taxes | (6,048) | | | (12,358) | |

| Employee benefit plans settlement expenses | 385 | | | 25,515 | |

| Stock-based compensation | 1,799 | | | 1,475 | |

| Other, net | 53 | | | — | |

| Loss on disposition of property, plant and equipment | 25 | | | — | |

| Loss (Income) from equity method investment | 26 | | | (22) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 3,063 | | | (1,988) | |

| Contract assets | 222 | | | 1,231 | |

| Inventories | (353) | | | (4,660) | |

| Accounts payable | 8,342 | | | 10,227 | |

| Accrued payroll and other compensation | 2,974 | | | 3,000 | |

| | | |

| Accrued taxes | 5,833 | | | 308 | |

| | | |

| Other, net | 421 | | | (5,995) | |

| Net cash provided by operating activities | 40,415 | | | 36,219 | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (15,472) | | | (20,287) | |

| Collections of finance receivables | 3,390 | | | — | |

| Proceeds from divestiture | — | | | 2,298 | |

| Proceeds from the sale of property, plant and equipment | 2 | | | 295 | |

| Business acquisitions, net of cash acquired | — | | | 869 | |

| Net cash used for investing activities | (12,080) | | | (16,825) | |

| Cash flows from financing activities: | | | |

| Proceeds from borrowings | 20,000 | | | — | |

| Debt repayments | (7,001) | | | (25,169) | |

| Factoring liability | 458 | | | — | |

| Common stock issued | 33 | | | — | |

| Common stock repurchased | (8) | | | (43) | |

| Net cash provided by (used for) financing activities | 13,482 | | | (25,212) | |

| Effect of exchange rate changes on cash | (602) | | | (3) | |

| Increase (decrease) in cash and cash equivalents | 41,215 | | | (5,821) | |

| Cash and cash equivalents at beginning of period | 51,331 | | | 49,237 | |

| Cash and cash equivalents at end of period | $ | 92,546 | | | $ | 43,416 | |

Non-cash capital expenditures of $2.7 million and $2.3 million were included in accounts payable at June 30, 2020 and 2019, respectively.

See accompanying Notes to Condensed Consolidated Financial Statements.

LYDALL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(Unaudited)

For the Three Months Ended June 30, 2020

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| In thousands of dollars and shares | Common Stock Shares | | Common Stock Amount | | Capital in Excess of Par Value | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Treasury Stock | | Total Stockholders' Equity |

| Balance at March 31, 2020 | 25,401 | | | $ | 254 | | | $ | 94,905 | | | $ | 284,208 | | | $ | (35,159) | | | $ | (90,631) | | | $ | 253,577 | |

| Net loss | | | | | | | (5,857) | | | | | | | (5,857) | |

| Other comprehensive income, net of tax | | | | | | | | | 4,461 | | | | | 4,461 | |

| | | | | | | | | | | | | |

| Stock issued under employee plans | 23 | | | 1 | | | | | | | | | | | 1 | |

| Stock-based compensation expense | | | | | 720 | | | | | | | | | 720 | |

| Stock issued to directors | 43 | | | | | 360 | | | | | | | | | 360 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Balance at June 30, 2020 | 25,467 | | | $ | 255 | | | $ | 95,985 | | | $ | 278,351 | | | $ | (30,698) | | | $ | (90,631) | | | $ | 253,262 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

For the Six Months Ended June 30, 2020

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| In thousands of dollars and shares | Common Stock Shares | | Common Stock Amount | | Capital in Excess of Par Value | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Treasury Stock | | Total Stockholders' Equity |

| Balance at December 31, 2019 | 25,328 | | | $ | 253 | | | $ | 94,140 | | | $ | 340,629 | | | $ | (25,979) | | | $ | (90,623) | | | $ | 318,420 | |

| Net loss | | | | | | | (62,278) | | | | | | | (62,278) | |

| Other comprehensive loss, net of tax | | | | | | | | | (4,719) | | | | | (4,719) | |

| Stock repurchased | | | | | | | | | | | (8) | | | (8) | |

| Stock issued under employee plans | 93 | | | 2 | | | 30 | | | | | | | | | 32 | |

| Stock-based compensation expense | | | | | 1,455 | | | | | | | | | 1,455 | |

| Stock issued to directors | 46 | | | | | 360 | | | | | | | | | 360 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Balance at June 30, 2020 | 25,467 | | | $ | 255 | | | $ | 95,985 | | | $ | 278,351 | | | $ | (30,698) | | | $ | (90,631) | | | $ | 253,262 | |

See accompanying Notes to Condensed Consolidated Financial Statements.

LYDALL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY - CONTINUED

(Unaudited)

For the Three Months Ended June 30, 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| In thousands of dollars and shares | Common Stock Shares | | Common Stock Amount | | Capital in Excess of Par Value | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Treasury Stock | | Total Stockholders' Equity |

| Balance at March 31, 2019 | 25,228 | | | $ | 252 | | | $ | 91,713 | | | $ | 415,032 | | | $ | (43,272) | | | $ | (90,511) | | | $ | 373,214 | |

| Net loss | | | | | | | (6,946) | | | | | | | (6,946) | |

| Other comprehensive income, net of tax | | | | | | | | | 20,265 | | | | | 20,265 | |

| Stock repurchased | | | | | | | | | | | (13) | | | (13) | |

| Stock issued (canceled) under employee plans | (3) | | | 1 | | | 12 | | | | | | | | | 13 | |

| Stock-based compensation expense | | | | | 332 | | | | | | | | | 332 | |

| Stock issued to directors | 10 | | | | | 240 | | | | | | | | | 240 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Balance at June 30, 2019 | 25,235 | | | $ | 253 | | | $ | 92,297 | | | $ | 408,086 | | | $ | (23,007) | | | $ | (90,524) | | | $ | 387,105 | |

For the Six Months Ended June 30, 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| In thousands of dollars and shares | Common Stock Shares | | Common Stock Amount | | Capital in Excess of Par Value | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Treasury Stock | | Total Stockholders' Equity |

| Balance at December 31, 2018 | 25,254 | | | $ | 253 | | | $ | 90,851 | | | $ | 411,325 | | | $ | (42,685) | | | $ | (90,469) | | | $ | 369,275 | |

| Net loss | | | | | | | (3,056) | | | | | | | (3,056) | |

| Other comprehensive income, net of tax | | | | | | | | | 19,678 | | | | | 19,678 | |

| Stock repurchased | | | | | | | | | | | (55) | | | (55) | |

| Stock issued (canceled) under employee plans | (29) | | | | | 12 | | | | | | | | | 12 | |

| Stock-based compensation expense | | | | | 1,194 | | | | | | | | | 1,194 | |

| Stock issued to directors | 10 | | | | | 240 | | | | | | | | | 240 | |

Adoption of ASC 606 (1) | | | | | | | (183) | | | | | | | (183) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Balance at June 30, 2019 | 25,235 | | | $ | 253 | | | $ | 92,297 | | | $ | 408,086 | | | $ | (23,007) | | | $ | (90,524) | | | $ | 387,105 | |

(1) During the three-month period ended March 31, 2019, the Company recorded an adjustment reducing retained earnings and contract assets by $0.2 million to correct an error in the adoption of ASC 606.

See accompanying Notes to Condensed Consolidated Financial Statements.

LYDALL, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Basis of Financial Statement Presentation

Description of Business

Lydall, Inc. and its subsidiaries (the “Company” or “Lydall”) design and manufacture specialty engineered nonwoven filtration media, industrial thermal insulating solutions, and thermal and acoustical barriers for filtration/separation and heat abatement and sound dampening applications.

Recent Developments - COVID-19

The impact of the novel strain of the coronavirus identified in late 2019 (“COVID-19”) has grown throughout the world, including in all global and regional markets served by the Company. During the first quarter of 2020, governmental authorities implemented numerous measures attempting to contain and mitigate the effects of COVID-19, including travel bans and restrictions, quarantines, social distancing orders, shelter in place orders and shutdowns of non-essential activities. The Company’s manufacturing facilities are located in areas that have been affected by the pandemic and the shutdowns. Certain Company facilities in the United States, Europe and Asia carried out shutdowns as a result of government-imposed restrictions or in conjunction with customer plant closures during the first quarter. The Company’s Asia facilities did not resume operations until late February and other facilities ramped back up moderately, in line with customer demand, during the second quarter. Although the Company is beginning to see an increase in orders, it does not expect operations supporting the automotive markets to reach pre-COVID-19 production levels in the near term.

Thermal Acoustical Solutions (“TAS”) Developments

As previously disclosed, the Company ramped down its Thermal Acoustical Solutions operations in North Carolina, as well as in France and Germany coinciding with the shutdown of its major automotive customers' facilities in those regions beginning in late March 2020. During the first quarter of 2020, TAS sales were down 11.2% from 2019 as the pandemic expanded. April’s parts sales were heavily impacted by customer shutdowns with sales declining approximately 90% from the previous year. TAS began to ramp up production in mid-May 2020 in North America and Europe as customers began to re-open their plants in these regions, with sequential monthly sales growth in both May and June. However, given the facility shutdowns early in the quarter, parts sales in the second quarter were down 62.1% from the previous year.

Technical Nonwovens (“TNW”) Developments

During the first quarter of 2020, TNW experienced slowdowns in all geographic locations except Canada; predominantly in its facilities in South Carolina, the United Kingdom and China operations. TNW’s Texel business in Canada, however, is a leading supplier of nonwoven products used in the production of healthcare applications including medical wipes, pads, and gowns. In response to the COVID-19 pandemic, the Company re-prioritized its manufacturing capabilities in North America and Europe to focus on serving customers for these products.

TNW’s sales in the first quarter of 2020 declined 12.5% from the comparable period in 2019. In the second quarter, softer industrial end markets and lower sales into automotive applications resulted in year over year sales decline in both April and May periods. While down from the prior year, sales in June increased sequentially from May, with seasonal increases in demand for geosynthetics and higher automotive demand partially offsetting weaker industrial end markets. Second quarter sales were down 25.0% in Industrial Filtration and 9.3% in Advanced Materials businesses.

Performance Materials (“PM”) Developments

Performance Materials’ sealing businesses also experienced slowdowns during the first quarter of 2020 as a result of its exposure to automotive end market applications, impacting the Sealing and Advanced Solutions business. In contrast, PM’s Filtration business has been deemed an essential supplier to certain customers which has driven incremental demand in specialty filtration product lines, including media used in N95 respirator, surgical, and medical masks. PM’s sales in the first quarter of 2020 were up 1.0% from the comparative period in 2019. PM’s Filtration sales were very strong in April, with gains of approximately 20.0% from the prior year, and this demand continued through the remainder of the quarter, with second quarter Filtration sales up 19.8% from the previous year. In contrast, exposure to automotive and other end markets resulted in sales decline of approximately 28.6% in the Sealing and Advanced Solutions business, with year over year sales declines spread across all months.

As a result of continued strong demand for filtration products during the second quarter, the Company approved additional investments to add two production lines in Performance Materials’ Rochester facility for the production of meltblown filtration media used in the N95 respirator, surgical and medical masks based on the significant increase in demand. In addition, the Company reached an agreement with the U.S. Government that provides partial funding of the investment in the production lines in addition to funding for other technical resources.

Looking Forward

Any ramp up of production continues to be dependent on the Company’s customers resuming operations and no additional outbreaks of COVID-19 that could cause a second slow-down in demand impacting the Company’s ability to operate because of government mandates, employee illnesses or other related unforeseen events. The Company anticipates the global automotive industry will stabilize in the third quarter, but that volumes in the second half of 2020 will be lower than the comparative 2019 period as a result of the global economic slowdown caused by the COVID-19 pandemic. New vehicle sales are highly dependent on the strength of the consumer. If unemployment remains at higher levels, new vehicle sales could be significantly lower than historical and previously projected sales levels. The Company expects to face continued headwinds in its Performance Material's sealing businesses but stronger demand for filtration products is expected to offset this. Additionally, the Company expects seasonally strong construction activity driving geosynthetic demand, coupled with stable demand for medical related nonwoven products, to be offset by softness in industrial end markets in its Technical Nonwovens segment in the second half of 2020.

Liquidity and Cash Preservation

The recent automotive production ramp down across most of the world has impacted the Company's daily working capital significantly. The Company experienced working capital cash flow improvements through June 30, 2020 but does not expect the benefits to continue if production does not further ramp up. Upon ramping up production, the Company expects initial cash outflows to support working capital requirements and capital projects for its investments in new meltblown production equipment followed by a more normalized working capital flow over time.

The Company has also taken significant measures to reduce its overall cash expenditures, including the furlough or lay-off of hourly/salary plant workers and select furloughs of corporate and other salaried employees, deferred company contributions to its pension plans and matching contributions under the Company's 401(k) defined contribution plan, reduction of purchase obligations for raw materials and reduction/delay of non-critical capital spending. With these actions initiated in early 2020, the Company has reduced its monthly cash expenditures and plans to continue to do so as long as the COVID-19 pandemic continues.

In addition, the Company has taken advantage of specific benefits, including wage recovery provided by social programs in Europe and China and deferred domestic employer tax in the U.S. through the Coronavirus Aid, Relief and Economic Security (“CARES”) Act. Through June 30, 2020, the Company benefited from $1.7 million in social cost reimbursements predominately in Europe and China. The Company plans to continue to pursue, wherever it qualifies, governmental assistance. The Company may also take advantage of governmental programs such as the Main Street Lending Program, to help defray costs. The Company cannot guarantee, however, that it will qualify for, or receive, any additional assistance that it pursues.

As noted above, the Company reached an agreement with the U.S. Government in June 2020 that provides funding to cover a portion of the cost to install two new production lines for the production of meltblown material for N95 respirator, surgical and medical masks and for other technical resources. The Company will receive monthly payments in accordance with the agreement to fund up to $13.5 million.

In addition to the significant measures taken to reduce and contain costs, the Company took action in March 2020 to provide additional liquidity, primarily including a $20.0 million draw down on its amended credit facility. On May 11, 2020, the Company entered into an amended credit agreement (see Note 6, "Long-term Debt and Financing Arrangements" for the key amended terms and conditions) to modify certain financial maintenance covenants, at least one of which the Company expected to fail during the second quarter of 2020 as a result of the impact of COVID-19. The Company was in compliance with those modified financial covenants as of and for the three-month period ended June 30, 2020, and management does not anticipate noncompliance in the foreseeable future.

During the first half of 2020, the Company generated $40.4 million of net cash provided by operations and had cash on hand of $92.5 million as of June 30, 2020. The Company continues to maintain the necessary capital to meet its debt obligations and interest payments. As previously disclosed in late 2019, the Company entered into arrangements with a banking institution to sell trade accounts receivable balances for selected customers. The Company continues to sell trade accounts receivable balances under these arrangements. See Transfer of Financial Assets under Note 1, “Basis of Financial Statement Presentation” for more information.

The spread of COVID-19 and the measures taken to constrain the spread of the virus have had, and will continue to have, a material negative impact on the Company’s financial results, and such negative impact may continue well beyond the containment of such outbreak. There is inherent uncertainty in the assumptions the Company uses to estimate its future liquidity due to the impact of the COVID-19 outbreak. In addition, the magnitude, duration and speed of the global pandemic is uncertain. Consequently, the impact on the Company's business, financial condition or longer-term financial or operational results is uncertain. However, management believes, based on the actions taken to reduce cash expenditures and the Company’s financial position that net cash provided by operations combined with its cash and cash equivalents and borrowing availability under its Credit Facility will be sufficient to fund its current obligations, capital spending, debt service requirements and working capital needs over at least the next twelve months.

Steps Taken to Protect Employees

The Company continues to monitor the global outbreak and spread of COVID-19 and to take steps to mitigate the potential risks to the Company and its employees posed by its spread and related circumstances and economic impacts. As the Company’s operations ramp up production and bring employees back to work, it has implemented changes to help ensure the safety and health of all our employees and continues to assess and update its business continuity plans in the context of this pandemic. The Company established the Lydall Emergency Preparedness Team (“LEPT”), implementing strict travel restrictions, enforcing rigorous hygiene protocols, increasing sanitization efforts at all facilities and implementing remote working arrangements for the majority of its employees who work outside the plants. The Company will continue its work to ensure it maintains a safe and healthy work environment and continue to allow remote working arrangements as long as necessary where appropriate.BASIS OF FINANCIAL STATEMENT PRESENTATION

Basis of Presentation

The accompanying Condensed Consolidated Financial Statements include the accounts of Lydall, Inc. and its subsidiaries.subsidiaries (collectively, “Lydall”, "the Company”, “we”, and “our”). All financial information is unaudited for the interim periods reported. All significant intercompany transactions have been eliminated in the Condensed Consolidated Financial Statements. The Condensed Consolidated Financial Statements have been prepared in accordance with accounting principlesU.S. generally accepted in the United States of Americaaccounting principles (“U.S. GAAP”). The year-end Condensed Consolidated Balance Sheet wasamounts have been derived from the audited financial statements for the year ended December 31, 2019,2020, but does not include all disclosures required by U.S. GAAP. In the opinion of management, the condensed consolidated financial information reflects all adjustments necessary for a fair statement of the Company’s consolidated financial position, results of operations, and cash flows for the interim periods reported, but do not include all the disclosures required by U.S. GAAP. All such adjustments are of a normal recurring nature, unless otherwise disclosed in this report. Certain amounts in prior year financial statements and notes thereto have been reclassified to conform to current year presentation. The statements should be read in conjunction with the consolidated financial statements and accompanying notes included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019.2020.

UseAdditional Cash Flow Information

Non-cash investing activities include non-cash capital expenditures of Estimates$1.6 million and $2.3 million that were included in Accounts payable on the Company's Condensed Consolidated Statements of Cash Flows at March 31, 2021 and 2020, respectively.

Risks and Uncertainties

Worldwide economic cycles, political changes, and the COVID-19 pandemic affect the markets that the Company’s businesses serve, affect demand for the Company's products, and could impact profitability. Among other factors, disruptions in the global credit and financial markets, including diminished liquidity and credit availability, changes in international trade agreements, swings in consumer confidence and spending, and unstable economic growth, disruptions to the global automotive supply chain, and fluctuations in unemployment rates have caused economic instability and can have a negative impact on the Company’s results of operations, financial condition, and liquidity.

Transfers of Financial Assets

The preparationCompany accounts for transfers of condensed consolidated financial statementsassets as sold when it has surrendered control over the related assets. Whether control has been relinquished requires, among other things, an evaluation of relevant legal considerations and an assessment of the nature and extent of the Company's continuing involvement with the assets transferred. Gains or losses and any expenditures stemming from the transfers are included in conformity with U.S. GAAP requires management to make estimates and assumptions that affectOther (income) expense, net on the reported amountsCompany's Condensed Consolidated Statements of assetsOperations. Assets obtained and liabilities andincurred in connection with transfers reported as sold are initially recognized on the disclosure of contingent assets and liabilitiesCompany's Condensed Consolidated Balance Sheets at the date of the condensed consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. The full extent to which the COVID-19 pandemic will directly or indirectly impact the Company’s business, results of operations and financial condition, including sales, expenses, reserves and allowances, manufacturing, research and development costs and employee-related amounts, will depend on future developments that are highly uncertain, including as a result of new information that may emerge concerning COVID-19 and the actions taken to contain it or treat COVID-19. The Company has made estimates of the impact of COVID-19 within its financial statements and there may be changes to those estimates in future periods. Actual results could differ from those estimates.

Recent Accounting Pronouncements Adoptedfair value.

Effective January 1, 2020,The Company maintains arrangements with banking institutions to sell trade accounts receivable balances for select customers. Under the programs, the Company adoptedhas no risk of loss due to credit default and is charged a fee based on the Financial Accounting Standards Board ("FASB") Accounting Standards Update ("ASU") 2016-13, "Financial Instruments - Credit Losses (Topic 326)." The new standard amends guidance on reporting credit losses for assets held at amortized cost basis. Thenominal value of receivables sold and the time between the sale of the trade accounts receivables to banking institutions and collection from the customer. Under one of the programs, the Company has determinedservices the only financial assets subjecttrade receivables after the sale to the new standard are itsbank and receives 90.0% of the trade receivables in cash at the time of sale and contract assets. The adoptionthe remaining 10.0% in cash, net of this ASU did not have any impact onfees, when the Company’s consolidated financial statementscustomer pays. Total trade accounts receivable balances sold under both arrangements were $34.1 million and disclosures.$32.7 million during the three-month periods ended March 31, 2021 and 2020, respectively. Total cash received was $31.2 million and $30.2 million during the three-month periods ended March 31, 2021 and 2020, respectively. Total fees incurred were $0.1 million and $0.1 million during the three-month periods ended March 31, 2021 and 2020, respectively.

Effective January 1, 2020,The Company's senior secured revolving credit agreement permits the Company adopted the FASB issued ASU 2018-13, "Fair Value Measurement (Topic 820): Disclosure Framework-Changes to the Disclosure Requirementssell trade accounts receivable balances to approved third parties in connection with Receivable Purchases Agreements, or other similar agreements. At any given time, outstanding trade accounts receivable balances sold cannot exceed $10.0 million for Fair Value Measurement," which adds, amendsa certain approved customer and removes certain disclosure requirements related to fair value measurements. Among$50.0 million in aggregate for any other changes, this standard requires certain additional disclosure surrounding Level 3 assets, including changes in unrealized gains or losses in other comprehensive income and certain inputs in those measurements. Please refer to Note 5, “Impairmentsapproved group of Goodwill and Other Long-Lived Assets”, for discussion of the inputs used in the quantitative impairment assessments for the three-month period ended March 31, 2020.customers.

Effective January 1, 2020, the Company adopted FASB issued ASU2018-15, "Intangibles - Goodwill and Other - Internal-Use Software (Subtopic 350-40); Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract."The amendments in this update require implementation costs incurred by customers in cloud computing arrangements (i.e., hosting arrangements) to be capitalized under the same premises of authoritative guidance for internal-use software, and deferred over the noncancellable term of the cloud computing arrangement plus any option renewal periods that are reasonably certain to be exercised by the customer or for which the exercise is controlled by the service

provider. The adoption of this ASU did not have any impact on the Company’s consolidated financial statements and disclosures.2. RECENT ACCOUNTING STANDARDS

Recent Accounting Standards Adopted

In March 2020,December 2019, the FASB issued ASU 2020-04, "Reference Rate Reform2019-12, "Income Taxes (Topic 848); Facilitation740): Simplifying the Accounting for Income Taxes". The new standard is intended to simplify accounting for income taxes by removing certain exceptions to the general principles in Topic 740, and by clarifying and amending existing guidance in other areas of the Effects of Reference Rate Reform on Financial Reporting." The amendments in this update are elective, and provide optional expedients and exceptions in accounting for contracts, hedging relationships, and other transactions that reference LIBOR or another reference rate expected to be discontinued because of reference rate reform. The guidance in this update issame topic. This ASU was effective for transactions entered into between March 12,fiscal years and interim periods beginning after December 15, 2020 and December 31, 2022.with early adoption permitted. The Company adopted this ASU upon issuance and notesthere was no material impact to the Company's consolidated financial statementsConsolidated Financial Statements and disclosures as of June 30, 2020.March 31, 2021.

Recent Accounting Pronouncements Not Yet Adopted

In January 2020, the FASB issued ASU 2020-01, "Investments— "Investments - Equity Securities (Topic 321), Investments—Investments - Equity Method and Joint Ventures (Topic 323), and Derivatives and Hedging (Topic 815)." The amendments in this update are intended to reduce diversity in practice and increase comparability of the accounting for interaction of equity securities, investments accounted for under the equity method of accounting, and the accounting for certain forward contracts and purchased options accounted for under Topic 815. This ASU iswas effective for fiscal years and interim periods beginning after December 15, 2020 with early adoption permitted. The Company is currently evaluatingadopted this ASU upon issuance and notes that it did not have a material impact on the impactCompany's Consolidated Financial Statements and disclosures as of this update on its consolidated financial statements and related disclosures.March 31, 2021.

In December 2019,March 2020, the FASB issued ASU 2019-12, "Income Taxes2020-04, "Reference Rate Reform (Topic 740)848): SimplifyingFacilitation of the Effects of Reference Rate Reform on Financial Reporting." The amendments in this update are elective, and provide optional expedients and exceptions in accounting for contracts, hedging relationships, and other transactions that reference LIBOR or another reference rate expected to be discontinued because of reference rate reform. In January 2021, the FASB issued ASU 2021-01 to provide additional clarity around Topic 848. Specifically, certain provisions of Topic 848, if elected by an entity, apply to derivative instruments that use an interest rate for margining, discounting, or contract price alignment that is modified as a result of reference rate reform. The guidance in this update is effective for transactions entered into between March 12, 2020 and December 31, 2022. The Company adopted this ASU upon issuance and there was no material impact to the Company's Consolidated Financial Statements and disclosures as of March 31, 2021.

In October 2020, the FASB issued ASU 2020-10, "Codification Improvements." The amendments in this update are intended to clarify the location of certain disclosure guidance within the ASC, as well as clarify certain guidance in cases where the original guidance may have been unclear. These amendments do not change U.S. GAAP. This ASU was effective for fiscal years and interim periods beginning after December 15, 2020. The Company adopted this ASU upon issuance and notes no impact to the Company's Consolidated Financial Statements and disclosures as of March 31, 2021.

Recent Accounting for Income Taxes"Standards Not Yet Adopted

In August 2020, the FASB issued ASU 2020-06, "Debt-Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging-Contracts in Entity’s Own Equity (Subtopic 815-40)." The new standard isamendments in this update are intended to simplify the accounting for income taxes by removing certain exceptions to the general principles in Topic 740,convertible debt instruments and by clarifying and amending existing guidance in other areas of the same topic.convertible preferred stock. This ASU is effective for fiscal years and interim periods beginning after December 15, 20202021 with early adoption permitted. The Company is currently evaluating the impact of this update on its consolidated financial statements and related disclosures.

In August 2018, the FASB issued ASU No. 2018-14, "Compensation - Retirement Benefits - Defined Benefit Plans - General (Subtopic 715-20): Disclosure Framework - Changes to the Disclosure Requirements for Defined Benefit Plans." This ASU requires entities to disclose the weighted-average interest crediting rates for cash balance plans and other plans with promised interest crediting rates. This ASU also requires entities to disclose an explanation for significant gains and losses related to changes in the benefit obligation for the period. This ASU is effective for fiscal years beginning after December 15, 2020 with early adoption permitted. The Company is currently evaluating the impactdoes not expect the adoption of this ASU willupdate to have a material impact on its consolidated financial statementsConsolidated Financial Statements and disclosures.

Significant Accounting Policies

The Company’s significant accounting policies are detailed in Note 1, “Significant Accounting Policies” within Part IV, Item 15 of the Company’s Annual Report on Form 10-K for the year ended December 31, 2019.

Risks and Uncertainties

Worldwide economic cycles, political changes and the COVID-19 pandemic affect the markets that the Company’s businesses serve and affect demand for the Company's products and could impact profitability. Among other factors, disruptions in the global credit and financial markets, including diminished liquidity and credit availability, changes in international trade agreements, swings in consumer confidence and spending, unstable economic growth and fluctuations in unemployment rates has caused economic instability and can have a negative impact on the Company’s results of operations, financial condition and liquidity.

Transfers of Financial Assets

In December 2019, the Company entered into 2 arrangements with a banking institution to sell trade accounts receivable balances for select customers. Under the programs, the Company has no risk of loss due to credit default, with the exception of $0.5 million of trade accounts receivable balances sold from our foreign operations, and is charged a fee based on the nominal value of receivables sold and the time between the sale of the trade accounts receivables to banking institutions and collection from the customer. Under one of the programs, the Company services the trade receivables after sale and receives 90.0% of the trade receivables in cash at the time of sale and the remaining 10.0% in cash, net of fees, at the earlier of customer payment or 150 days. In the three-month and six-month periods ended June 30, 2020, under both programs, the Company sold $10.3 million and $43.0 million, respectively, in trade receivable balances, received $40.0 million in total cash under the programs, and incurred $0.1 million in fees. The Company expects to receive the remainder, net of fees, in the third quarter of 2020.

Condensed Consolidated Statements of Comprehensive Income

In connection with the preparation of its 2019 audited financial statements, the Company identified that in its previously filed unaudited interim financial statements for the three-month and six-month periods ended June 30, 2019 and the nine-month period ended September 30, 2019, the Company had incorrectly excluded from its Condensed Consolidated Statements of Comprehensive Income the impact to comprehensive income resulting from the settlement of its U.S. Lydall Pension Plan (see Note 11, "Employer Sponsored Benefit Plans"). As a result, unaudited comprehensive income for such periods was understated by approximately $19.0 million. This error did not have any impact on the Company’s corresponding previously filed Condensed Consolidated Balance Sheets, Condensed Consolidated Statements of Operations or Condensed Consolidated Statements of Cash Flows. Management has concluded that such errors did not result in the previously issued unaudited financial statements being materially misstated. The Company will revise the Condensed Consolidated Statements of Comprehensive Income for the nine-month period ended September 30, 2019 in connection with the future filing of its Quarterly Report on Form 10-Q for the period ended September 30, 2020. In connection with the filing of this Quarterly Report on Form 10-Q, the Company did, however, revise the Condensed Consolidated Statements of Comprehensive Income for the three-month and six-month periods ended June 30, 2019 as follows:

| | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2019 | | | Six Months Ended June 30, 2019 | |

| In thousands | As reported | As revised | | As reported | As revised |

| Pension liability adjustment, net of tax | $ | 143 | | $ | 19,159 | | | $ | 358 | | $ | 19,374 | |

| Comprehensive (loss) income | $ | (5,697) | | $ | 13,319 | | | $ | (2,394) | | $ | 16,622 | |

2. Revenue from Contracts with Customers3. REVENUE FROM CONTRACTS WITH CUSTOMERS

The Company accounts for revenue in accordance with ASC 606, "Revenue from Contracts fromwith Customers". Revenues are generated from the design and manufacture of specialty engineered filtration media, industrial thermal insulating solutions, automotive thermal and acoustical barriers for filtration/separation and thermal/acoustical applications. The Company’s revenue recognition policies require the Company to make significant judgments and estimates. In applying the Company’s revenue recognition policy, determinations must be made as to when the control of products passes to the Company’s customers which can be either at a point in time or over time. Revenue is generally recognized at a point in time when control passes to customers upon shipment of the Company’s products and revenue is generally recognized over time when control of the Company’s products transfers to customers during the manufacturing process. The Company analyzes several factors, including, but not limited to, the nature of the products being sold and contractual terms and conditions in contracts with customers to help the Company make such judgments about revenue recognition. Unfulfilled performance obligations are generally expected to be satisfied within one year.

Contract Assets and Liabilities

The Company’s contract assets primarily include unbilled amounts typically resulting from sales under contracts when the over time method of revenue recognition is utilized and revenue recognized exceeds the amount billed to the customer. These unbilled accounts receivable in contract assets are transferred to accounts receivable upon invoicing, typically when the right to payment becomes unconditional, in which case payment is due based only upon the passage of time.

The Company’s contract liabilities primarily relate to billings and advance payments received from customers and deferred revenue. These contract liabilities represent the Company’s obligation to transfer its products to its customers for which the Company has received, or is owed, consideration from its customers. Contract liabilities are included in Other long-termaccrued liabilities onin the Company’sCompany's Condensed Consolidated Balance Sheets.

Contract assets and liabilities consisted of the following:

| | In thousands | In thousands | | June 30, 2020 | | December 31, 2019 | | Dollar Change | In thousands | | | At March 31, 2021 | | At December 31, 2020 | | Dollar Change |

| Contract assets | Contract assets | | $ | 27,969 | | | $ | 28,245 | | | $ | (276) | | Contract assets | | | $ | 25,959 | | | $ | 32,403 | | | $ | (6,444) | |

| Contract liabilities | Contract liabilities | | $ | 3,762 | | | $ | 1,441 | | | $ | 2,321 | | Contract liabilities | | | $ | 3,786 | | | $ | 3,686 | | | $ | 100 | |

The $0.3$6.4 million decrease in contract assets from December 31, 20192020 to June 30, 2020March 31, 2021 was primarily due to timing of tooling billings to customers.customers and to a lesser extent, the billings on last-time buys of membrane-based filtration media initiated in December 2020 in the Company's Netherlands facility.

The $2.3$0.1 million increase in contract liabilities from December 31, 20192020 to June 30, 2020March 31, 2021 was primarily due to an increase in customer deposits, offset by $0.9$1.4 million of revenue recognized in the first sixthree months of 20202021 related to contract liabilities at December 31, 2019.2020.

Disaggregated Revenue

The Company disaggregates revenue from customers by geographic region, as it believes this disclosure best depicts how the nature, amount, timing, and uncertainty of the Company's revenuerevenues and cash flows are affected by economic factors. Disaggregated revenue by geographical region for the three-month and six-month periods ended June 30, 2020March 31, 2021 and 20192020 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended June 30, 2020 | | | | | | | | |

| In thousands | | Performance Materials | | Technical Nonwovens | | Thermal Acoustical Solutions | | Eliminations and Other | | Consolidated Net Sales |

| | | | | | | | | | |

| North America | | $ | 40,190 | | | $ | 31,236 | | | $ | 22,575 | | | $ | (1,668) | | | $ | 92,333 | |

| Europe | | 16,501 | | | 15,418 | | | 11,424 | | | (100) | | | 43,243 | |

| Asia | | 1,782 | | | 5,353 | | | 3,449 | | | — | | | 10,584 | |

| Total Net Sales | | $ | 58,473 | | | $ | 52,007 | | | $ | 37,448 | | | $ | (1,768) | | | $ | 146,160 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended March 31, 2021 | | For the Three Months Ended March 31, 2020 |

| In thousands | | North America | | Europe | | Asia | | Total Net Sales | | North America | | Europe | | Asia | | Total Net Sales |

| | | | | | | | | | | | | | | | |

| Performance Materials | | $ | 58,874 | | | $ | 16,924 | | | $ | 3,535 | | | $ | 79,333 | | | $ | 45,917 | | | $ | 17,275 | | | $ | 2,028 | | | $ | 65,220 | |

| Technical Nonwovens | | 35,838 | | | 16,899 | | | 8,938 | | | 61,675 | | | 35,731 | | | 16,938 | | | 4,734 | | | 57,403 | |

| Thermal Acoustical Solutions | | 60,653 | | | 26,113 | | | 4,278 | | | 91,044 | | | 57,101 | | | 23,540 | | | 3,120 | | | 83,761 | |

| Eliminations and Other | | (4,678) | | | (275) | | | 0 | | | (4,953) | | | (5,677) | | | (180) | | | 0 | | | (5,857) | |

| Total net sales | | $ | 150,687 | | | $ | 59,661 | | | $ | 16,751 | | | $ | 227,099 | | | $ | 133,072 | | | $ | 57,573 | | | $ | 9,882 | | | $ | 200,527 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended June 30, 2019 | | | | | | | | |

| In thousands | | Performance Materials | | Technical Nonwovens | | Thermal Acoustical Solutions | | Eliminations and Other | | Consolidated Net Sales |

| | | | | | | | | | |

| North America | | $ | 47,822 | | | $ | 42,667 | | | $ | 64,235 | | | $ | (6,466) | | | $ | 148,258 | |

| Europe | | 15,729 | | | 17,791 | | | 25,203 | | | (175) | | | 58,548 | |

| Asia | | 1,551 | | | 8,620 | | | 3,834 | | | — | | | 14,005 | |

| Total Net Sales | | $ | 65,102 | | | $ | 69,078 | | | $ | 93,272 | | | $ | (6,641) | | | $ | 220,811 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Six Months Ended June 30, 2020 | | | | | | | | |

| In thousands | | Performance Materials | | Technical Nonwovens | | Thermal Acoustical Solutions | | Eliminations and Other | | Consolidated Net Sales |

| | | | | | | | | | |

| North America | | $ | 86,107 | | | $ | 66,967 | | | $ | 79,676 | | | $ | (7,345) | | | $ | 225,405 | |

| Europe | | 33,776 | | | 32,356 | | | 34,964 | | | (280) | | | 100,816 | |

| Asia | | 3,810 | | | 10,087 | | | 6,569 | | | — | | | 20,466 | |

| Total Net Sales | | $ | 123,693 | | | $ | 109,410 | | | $ | 121,209 | | | $ | (7,625) | | | $ | 346,687 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Six Months Ended June 30, 2019 | | | | | | | | |

| In thousands | | Performance Materials | | Technical Nonwovens | | Thermal Acoustical Solutions | | Eliminations and Other | | Consolidated Net Sales |

| | | | | | | | | | |

| North America | | $ | 94,199 | | | $ | 79,856 | | | $ | 127,837 | | | $ | (12,734) | | | $ | 289,158 | |

| Europe | | 32,386 | | | 36,840 | | | 51,645 | | | (381) | | | 120,490 | |

| Asia | | 3,097 | | | 17,988 | | | 8,103 | | | — | | | 29,188 | |

| Total Net Sales | | $ | 129,682 | | | $ | 134,684 | | | $ | 187,585 | | | $ | (13,115) | | | $ | 438,836 | |

3. Inventories4. INVENTORIES

Inventories as of June 30, 2020March 31, 2021 and December 31, 20192020 were as follows:

| | In thousands | In thousands | | June 30,

2020 | | December 31,

2019 | In thousands | | At March 31, 2021 | | At December 31, 2020 |

| Raw materials | Raw materials | | $ | 35,148 | | | $ | 36,322 | | Raw materials | | $ | 37,116 | | | $ | 32,258 | |

| Work in process | Work in process | | 15,531 | | | 14,873 | | Work in process | | 16,504 | | | 17,087 | |

| Finished goods | Finished goods | | 29,621 | | | 29,349 | | Finished goods | | 27,828 | | | 29,651 | |

| | Total inventories | Total inventories | | $ | 80,300 | | | $ | 80,544 | | Total inventories | | $ | 81,448 | | | $ | 78,996 | |

Included in workWork in process isincludes net tooling inventory of $2.2$3.2 million and $1.8$2.8 million at June 30, 2020March 31, 2021 and December 31, 2019,2020, respectively.

4. Goodwill and Other Intangible Assets5. GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill:Goodwill

The Company testsperforms an assessment of its goodwill for impairment at least annually, in the fourth quarter, and whenever events or changes in circumstances indicate that the carrying value may exceed its fair value. There were no such events or changes in circumstances during the three month period ended June 30, 2020. See Note 5, "Impairments of Goodwill and Other Long-Lived Assets", for discussion of the goodwill impairment recorded during the three month period ended March 31, 2020.

The changes in the carrying amount of goodwill by segment as of and for the six-month period ended June 30, 2020 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| In thousands | | December 31,

2019 | | Currency translation adjustments | | Impairment | | June 30,

2020 |

| | | | | | | | |

| Performance Materials | | $ | 80,658 | | | $ | (45) | | | $ | (48,671) | | | $ | 31,942 | |

| Technical Nonwovens | | 53,254 | | | (1,245) | | | — | | | 52,009 | |

| Total goodwill | | $ | 133,912 | | | $ | (1,290) | | | $ | (48,671) | | | $ | 83,951 | |

Goodwill Impairment

During the three-month period ended March 31, 2020,2021.

The following table sets forth the change in carrying value of goodwill for each reportable segment and for the Company performed a goodwill impairment analysis in the Performance Materials and Technical Nonwovens reporting units and recorded a goodwill impairment chargeas of $48.7 million in the Performance Materials reporting unit. See Note 5, "Impairments of Goodwill and Other Long-Lived Assets", for further discussion of the goodwill impairment.March 31, 2021:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| In thousands | | Performance Materials | | Technical Nonwovens | | Thermal Acoustical Solutions | | Total |

| Gross balance at December 31, 2020 | | $ | 143,659 | | | $ | 55,607 | | | $ | 12,160 | | | $ | 211,426 | |

| Accumulated impairment | | (111,671) | | | 0 | | | (12,160) | | | (123,831) | |

| Net balance at December 31, 2020 | | 31,988 | | | 55,607 | | | 0 | | | 87,595 | |

| | | | | | | | |

| Foreign currency translation | | (23) | | | (377) | | | 0 | | | (400) | |

| Net balance at March 31, 2021 | | $ | 31,965 | | | $ | 55,230 | | | $ | 0 | | | $ | 87,195 | |

Other Intangible Assets:Assets

The table below presents the gross carrying amount and, as applicable, the accumulated amortization of the Company’s acquired intangible assets, other than goodwill, as of March 31, 2021 and December 31, 2020. These amounts are included in “OtherOther intangible assets, net” innet on the Company's Condensed Consolidated Balance Sheets asSheets.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | At March 31, 2021 | | At December 31, 2020 |

| In thousands | | Amortization Period | | Gross Carrying Amount | | Accumulated Amortization | | Gross Carrying Amount | | Accumulated Amortization |

| Amortized intangible assets | | | | | | | | | | |

| Customer Relationships | | 10 - 14 years | | $ | 143,184 | | | $ | (53,970) | | | $ | 143,479 | | | $ | (50,076) | |

| Patents | | 28 years | | 650 | | | (619) | | | 650 | | | (616) | |

| Technology | | 15 years | | 2,500 | | | (1,185) | | | 2,500 | | | (1,144) | |

| Trade Names | | 3 - 5 years | | 7,446 | | | (7,210) | | | 7,495 | | | (7,167) | |

| License Agreements | | 10 years | | 0 | | | 0 | | | 185 | | | (185) | |

| Other | | 7 - 15 years | | 459 | | | (459) | | | 467 | | | (467) | |

| Total other intangible assets | | | | $ | 154,239 | | | $ | (63,443) | | | $ | 154,776 | | | $ | (59,655) | |

Estimated amortization expense for total intangible assets is expected to be $16.5 million, $14.5 million, $12.8 million, $11.4 million, $9.8 million and $30.1 million, for each of June 30, 2020 andthe years ending December 31, 2019:2021 through 2025 and thereafter, respectively.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | June 30, 2020 | | | | December 31, 2019 | | |

| In thousands | | Gross Carrying Amount | | Accumulated Amortization | | Gross Carrying Amount | | Accumulated Amortization |

| Amortized intangible assets | | | | | | | | |

| Customer Relationships | | $ | 141,462 | | | $ | (39,622) | | | $ | 142,400 | | | $ | (30,648) | |

| Patents | | 760 | | | (661) | | | 759 | | | (607) | |

| Technology | | 2,500 | | | (1,060) | | | 2,500 | | | (977) | |

| Trade Names | | 7,205 | | | (5,989) | | | 7,293 | | | (5,143) | |

| License Agreements | | 611 | | | (611) | | | 610 | | | (610) | |

| Other | | 550 | | | (550) | | | 551 | | | (551) | |

| Total amortized intangible assets | | $ | 153,088 | | | $ | (48,493) | | | $ | 154,113 | | | $ | (38,536) | |

5. Impairments of Goodwill and Other Long-Lived Assets6. LONG-TERM DEBT AND FINANCING ARRANGEMENTS

DuringThe long-term debt payable under the three-month period endedCompany’s amended and restated 2018 senior secured revolving credit agreement (as amended to-date, the "2018 Amended Credit Agreement") at March 31, 2021 and December 31, 2020 the Company experienced disruptions in some operations from lower customer demand directly attributable to the COVID-19 pandemic. Many of the Company's automotive customers temporarily ceased operations due to the impact of the COVID-19 pandemic on the global economy resulting in the following:consisted of:

• | | | | | | | | | | | | | | | | | | | | | | | | | | |

| In thousands | | Effective Rate | | Maturity | | At March 31, 2021 | | At December 31, 2020 |

| Revolver loan | | 4.25 | % | | 8/31/2023 | | $ | 127,500 | | | $ | 134,500 | |

| Term loan, net of debt issuance costs | | 4.25 | % | | 8/31/2023 | | 133,491 | | | 135,938 | |

| | | | | | | | |

| | | | | | | 260,991 | | | 270,438 | |

| Less portion due within one year | | | | | | (9,789) | | | (9,789) | |

| Total long-term debt, net of debt issuance costs | | | | | | $ | 251,202 | | | $ | 260,649 | |