UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| (Mark One) | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended September 30, 20222023 |

| OR |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission File Number: 001-39548

BENTLEY SYSTEMS, INCORPORATED

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 95-3936623 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

| 685 Stockton Drive | | |

| Exton, Pennsylvania | | 19341 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (610) 458-5000

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Class B Common Stock, par value $0.01 per share | | BSY | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S‑T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b‑2 of the Exchange Act.

| | | | | |

| Large accelerated filer ☒ | Accelerated filer ☐ |

| Non-accelerated filer ☐ | Smaller reporting company ☐ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act). Yes ☐ No ☒

As of November 1, 2022,October 31, 2023, the registrant had 11,601,75711,567,627 shares of Class A and 276,790,956284,354,543 shares of Class B Common Stock outstanding.

BENTLEY SYSTEMS, INCORPORATED AND SUBSIDIARIES

FORM 10-Q

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report includes forward‑looking statements. All statements contained in this report other than statements of historical facts, including statements regarding our future results of operations and financial position, our business strategy, and plans and our objectives for future operations, are forward‑looking statements. The words “believe,” “may,” “will,” “could,” “would,” “seeks,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” and similar expressions, as well as statements regarding our focus for the future, are intended to identify forward‑looking statements. We have based these forward‑looking statements largely on our current expectations, projections, and assumptions about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short‑term and long‑term business operations and objectives, and financial needs. These forward‑looking statements are subject to a number of risks, uncertainties, and assumptions, including those described in the section titled “Risk Factors.” Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward‑looking statements we may make. In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward‑looking statements. The forward‑looking statements, as well as our report as a whole, are subject to risks and uncertainties.

These statements are only current predictions and are subject to known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels of activity, performance, or achievements to be materially different from those anticipated by the forward‑looking statements. We discuss many of these risks in this report in greater detail in the section titled “Risk Factors” and elsewhere in this report. You should not rely upon forward‑looking statements as predictions of future events.

Although we believe that the expectations reflected in the forward‑looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, achievements, events, or circumstances reflected in the forward‑looking statements will occur. Except as required by law, we undertake no obligation to update any of these forward‑looking statements after the date of this report to conform these statements to actual results or revised expectations.

PART I. FINANCIAL INFORMATION

Item 1. Unaudited Consolidated Financial Statements

BENTLEY SYSTEMS, INCORPORATED AND SUBSIDIARIES

Consolidated Balance Sheets

(in thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | | | | |

| | September 30, 2022 | | December 31, 2021 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 72,856 | | | $ | 329,337 | |

| Accounts receivable | | 214,459 | | | 241,807 | |

| Allowance for doubtful accounts | | (10,802) | | | (6,541) | |

| Prepaid income taxes | | 17,414 | | | 16,880 | |

| Prepaid and other current assets | | 32,224 | | | 34,348 | |

| Total current assets | | 326,151 | | | 615,831 | |

| Property and equipment, net | | 30,753 | | | 31,823 | |

| Operating lease right-of-use assets | | 41,499 | | | 50,818 | |

| Intangible assets, net | | 301,173 | | | 245,834 | |

| Goodwill | | 2,193,053 | | | 1,588,477 | |

| Investments | | 21,690 | | | 6,438 | |

| Deferred income taxes | | 52,751 | | | 71,376 | |

| Other assets | | 74,367 | | | 48,646 | |

| Total assets | | $ | 3,041,437 | | | $ | 2,659,243 | |

| Liabilities and Stockholders’ Equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 16,860 | | | $ | 16,483 | |

| Accruals and other current liabilities | | 337,442 | | | 323,603 | |

| Deferred revenues | | 186,358 | | | 224,610 | |

| Operating lease liabilities | | 15,078 | | | 17,482 | |

| Income taxes payable | | 8,405 | | | 6,696 | |

| Current portion of long-term debt | | 5,000 | | | 5,000 | |

| Total current liabilities | | 569,143 | | | 593,874 | |

| Long-term debt | | 1,776,610 | | | 1,430,992 | |

| Deferred compensation plan liabilities | | 71,013 | | | 94,890 | |

| Long-term operating lease liabilities | | 28,776 | | | 35,274 | |

| Deferred revenues | | 15,252 | | | 7,983 | |

| Deferred income taxes | | 43,817 | | | 65,014 | |

| Income taxes payable | | 8,893 | | | 7,725 | |

| Other liabilities | | 7,734 | | | 14,269 | |

| Total liabilities | | 2,521,238 | | | 2,250,021 | |

| Commitments and contingencies (Note 18) | | | | |

| Stockholders’ equity: | | | | |

| Preferred stock, $0.01 par value, authorized 100,000,000 shares; none issued or outstanding as of September 30, 2022 and December 31, 2021 | | — | | | — | |

| Class A Common Stock, $0.01 par value, authorized 100,000,000 shares; issued and outstanding 11,601,757 shares as of September 30, 2022 and December 31, 2021, and Class B Common Stock, $0.01 par value, authorized 1,800,000,000 shares; issued and outstanding 276,816,008 and 270,924,962 shares as of September 30, 2022 and December 31, 2021, respectively | | 2,884 | | | 2,825 | |

| Additional paid-in capital | | 1,005,075 | | | 937,805 | |

| Accumulated other comprehensive loss | | (101,929) | | | (91,774) | |

| Accumulated deficit | | (385,831) | | | (439,634) | |

| Total stockholders’ equity | | 520,199 | | | 409,222 | |

| Total liabilities and stockholders’ equity | | $ | 3,041,437 | | | $ | 2,659,243 | |

See accompanying notes to consolidated financial statements.

BENTLEY SYSTEMS, INCORPORATED AND SUBSIDIARIES

Consolidated Statements of Operations

(in thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | 2022 | | 2021 | | 2022 | | 2021 |

| Revenues: | | | | | | | | |

| Subscriptions | | $ | 235,307 | | | $ | 215,135 | | | $ | 708,731 | | | $ | 589,702 | |

| Perpetual licenses | | 9,460 | | | 11,866 | | | 31,213 | | | 33,373 | |

| Subscriptions and licenses | | 244,767 | | | 227,001 | | | 739,944 | | | 623,075 | |

| Services | | 23,565 | | | 24,387 | | | 72,190 | | | 74,239 | |

| Total revenues | | 268,332 | | | 251,388 | | | 812,134 | | | 697,314 | |

| Cost of revenues: | | | | | | | | |

| Cost of subscriptions and licenses | | 37,371 | | | 31,056 | | | 107,904 | | | 89,882 | |

| Cost of services | | 21,812 | | | 23,176 | | | 66,758 | | | 67,090 | |

| Total cost of revenues | | 59,183 | | | 54,232 | | | 174,662 | | | 156,972 | |

| Gross profit | | 209,149 | | | 197,156 | | | 637,472 | | | 540,342 | |

| Operating expense (income): | | | | | | | | |

| Research and development | | 63,827 | | | 57,334 | | | 189,966 | | | 157,913 | |

| Selling and marketing | | 46,114 | | | 44,392 | | | 141,676 | | | 114,846 | |

| General and administrative | | 37,794 | | | 35,329 | | | 128,981 | | | 110,233 | |

| Deferred compensation plan | | (4,576) | | | 88,965 | | | (21,873) | | | 89,327 | |

| Amortization of purchased intangibles | | 10,446 | | | 8,676 | | | 30,869 | | | 16,703 | |

| Total operating expenses | | 153,605 | | | 234,696 | | | 469,619 | | | 489,022 | |

| Income (loss) from operations | | 55,544 | | | (37,540) | | | 167,853 | | | 51,320 | |

| Interest expense, net | | (8,382) | | | (3,836) | | | (23,046) | | | (8,608) | |

| Other income (expense), net | | 180 | | | (957) | | | 14,318 | | | 9,748 | |

| Income (loss) before income taxes | | 47,342 | | | (42,333) | | | 159,125 | | | 52,460 | |

| (Provision) benefit for income taxes | | (9,664) | | | (5,025) | | | (8,221) | | | 5,090 | |

| Loss from investment accounted for using the equity method, net of tax | | (681) | | | (664) | | | (1,846) | | | (2,939) | |

| Net income (loss) | | 36,997 | | | (48,022) | | | 149,058 | | | 54,611 | |

| Less: Net income (loss) attributable to participating securities | | (11) | | | (3) | | | (31) | | | (6) | |

| Net income (loss) attributable to Class A and Class B common stockholders | | $ | 36,986 | | | $ | (48,025) | | | $ | 149,027 | | | $ | 54,605 | |

| Per share information: | | | | | | | | |

| Net income (loss) per share, basic | | $ | 0.12 | | | $ | (0.16) | | | $ | 0.48 | | | $ | 0.18 | |

| Net income (loss) per share, diluted | | $ | 0.12 | | | $ | (0.16) | | | $ | 0.46 | | | $ | 0.17 | |

| Weighted average shares, basic | | 310,116,104 | | | 308,195,379 | | | 308,959,801 | | | 305,119,985 | |

| Weighted average shares, diluted | | 325,170,383 | | | 308,195,379 | | | 332,077,834 | | | 314,658,136 | |

| | | | | | | | |

| | | | | | | | | | | | | | |

| | September 30, 2023 | | December 31, 2022 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 66,963 | | | $ | 71,684 | |

| Accounts receivable | | 243,488 | | | 296,376 | |

| Allowance for doubtful accounts | | (8,312) | | | (9,303) | |

| Prepaid income taxes | | 25,972 | | | 18,406 | |

| Prepaid and other current assets | | 46,128 | | | 38,732 | |

| Total current assets | | 374,239 | | | 415,895 | |

| Property and equipment, net | | 38,309 | | | 32,251 | |

| Operating lease right-of-use assets | | 41,434 | | | 40,249 | |

| Intangible assets, net | | 259,979 | | | 292,271 | |

| Goodwill | | 2,251,312 | | | 2,237,184 | |

| Investments | | 30,332 | | | 22,270 | |

| Deferred income taxes | | 61,664 | | | 52,636 | |

| Other assets | | 77,574 | | | 72,249 | |

| Total assets | | $ | 3,134,843 | | | $ | 3,165,005 | |

| Liabilities and Stockholders’ Equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 26,389 | | | $ | 15,176 | |

| Accruals and other current liabilities | | 403,428 | | | 362,048 | |

| Deferred revenues | | 211,815 | | | 226,955 | |

| Operating lease liabilities | | 11,430 | | | 14,672 | |

| Income taxes payable | | 18,879 | | | 4,507 | |

| Current portion of long-term debt | | 8,750 | | | 5,000 | |

| Total current liabilities | | 680,691 | | | 628,358 | |

| Long-term debt | | 1,580,752 | | | 1,775,696 | |

| Deferred compensation plan liabilities | | 79,537 | | | 77,014 | |

| Long-term operating lease liabilities | | 31,355 | | | 27,670 | |

| Deferred revenues | | 15,189 | | | 16,118 | |

| Deferred income taxes | | 43,530 | | | 51,235 | |

| Income taxes payable | | 7,317 | | | 8,105 | |

| Other liabilities | | 4,311 | | | 7,355 | |

| Total liabilities | | 2,442,682 | | | 2,591,551 | |

| Commitments and contingencies (Note 18) | | | | |

| Stockholders’ equity: | | | | |

| Preferred stock, $0.01 par value, authorized 100,000,000 shares; none issued or outstanding as of September 30, 2023 and December 31, 2022 | | — | | | — | |

| Class A Common Stock, $0.01 par value, authorized 100,000,000 shares; issued and outstanding 11,567,627 and 11,601,757 shares as of September 30, 2023 and December 31, 2022, respectively, and Class B Common Stock, $0.01 par value, authorized 1,800,000,000 shares; issued and outstanding 283,676,579 and 277,412,730 shares as of September 30, 2023 and December 31, 2022, respectively | | 2,952 | | | 2,890 | |

| Additional paid-in capital | | 1,108,816 | | | 1,030,466 | |

| Accumulated other comprehensive loss | | (95,128) | | | (89,740) | |

| Accumulated deficit | | (325,183) | | | (370,866) | |

| Non-controlling interest | | 704 | | | 704 | |

| Total stockholders’ equity | | 692,161 | | | 573,454 | |

| Total liabilities and stockholders’ equity | | $ | 3,134,843 | | | $ | 3,165,005 | |

See accompanying notes to consolidated financial statements.

BENTLEY SYSTEMS, INCORPORATED AND SUBSIDIARIES

Consolidated Statements of Comprehensive Income (Loss)Operations

(in thousands)thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | 2022 | | 2021 | | 2022 | | 2021 |

| Net income (loss) | | $ | 36,997 | | | $ | (48,022) | | | $ | 149,058 | | | $ | 54,611 | |

| Other comprehensive loss, net of taxes: | | | | | | | | |

| Foreign currency translation adjustments | | (12,809) | | | (27,014) | | | (10,192) | | | (55,709) | |

| Actuarial gain on retirement plan, net of tax effect of $(5), $(8), $(15), and $(25), respectively | | 11 | | | 20 | | | 37 | | | 62 | |

| Total other comprehensive loss, net of taxes | | (12,798) | | | (26,994) | | | (10,155) | | | (55,647) | |

| Comprehensive income (loss) | | $ | 24,199 | | | $ | (75,016) | | | $ | 138,903 | | | $ | (1,036) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | | |

| Subscriptions | | $ | 270,751 | | | $ | 235,307 | | | $ | 807,839 | | | $ | 708,731 | |

| Perpetual licenses | | 11,887 | | | 9,460 | | | 33,152 | | | 31,213 | |

| Subscriptions and licenses | | 282,638 | | | 244,767 | | | 840,991 | | | 739,944 | |

| Services | | 23,974 | | | 23,565 | | | 76,781 | | | 72,190 | |

| Total revenues | | 306,612 | | | 268,332 | | | 917,772 | | | 812,134 | |

| Cost of revenues: | | | | | | | | |

| Cost of subscriptions and licenses | | 42,088 | | | 37,371 | | | 124,175 | | | 107,904 | |

| Cost of services | | 22,588 | | | 21,812 | | | 74,111 | | | 66,758 | |

| Total cost of revenues | | 64,676 | | | 59,183 | | | 198,286 | | | 174,662 | |

| Gross profit | | 241,936 | | | 209,149 | | | 719,486 | | | 637,472 | |

| Operating expense (income): | | | | | | | | |

| Research and development | | 65,465 | | | 63,827 | | | 203,382 | | | 189,966 | |

| Selling and marketing | | 53,757 | | | 46,114 | | | 160,262 | | | 141,676 | |

| General and administrative | | 42,678 | | | 37,794 | | | 128,743 | | | 128,981 | |

| Deferred compensation plan | | (3,160) | | | (4,576) | | | 4,763 | | | (21,873) | |

| Amortization of purchased intangibles | | 9,517 | | | 10,446 | | | 29,567 | | | 30,869 | |

| Total operating expenses | | 168,257 | | | 153,605 | | | 526,717 | | | 469,619 | |

| Income from operations | | 73,679 | | | 55,544 | | | 192,769 | | | 167,853 | |

| Interest expense, net | | (10,047) | | | (9,134) | | | (30,623) | | | (23,521) | |

| Other income, net | | 5,953 | | | 932 | | | 7,207 | | | 14,793 | |

| Income before income taxes | | 69,585 | | | 47,342 | | | 169,353 | | | 159,125 | |

| Provision for income taxes | | (16,514) | | | (9,664) | | | (22,107) | | | (8,221) | |

| Loss from investments accounted for using the equity method, net of tax | | (44) | | | (681) | | | (44) | | | (1,846) | |

| Net income | | $ | 53,027 | | | $ | 36,997 | | | $ | 147,202 | | | $ | 149,058 | |

| Per share information: | | | | | | | | |

| Net income per share, basic | | $ | 0.17 | | | $ | 0.12 | | | $ | 0.47 | | | $ | 0.48 | |

| Net income per share, diluted | | $ | 0.16 | | | $ | 0.12 | | | $ | 0.46 | | | $ | 0.46 | |

| Weighted average shares, basic | | 313,069,132 | | | 310,116,104 | | | 311,915,808 | | | 308,959,801 | |

| Weighted average shares, diluted | | 332,825,186 | | | 325,170,383 | | | 332,144,893 | | | 332,077,834 | |

| | | | | | | | |

See accompanying notes to consolidated financial statements.

BENTLEY SYSTEMS, INCORPORATED AND SUBSIDIARIES

Consolidated Statements of Stockholders’ EquityComprehensive Income

(in thousands, except share data)thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2022 |

| | | | | | | Accumulated | | | | |

| Class A and Class B | | Additional | | Other | | | | Total |

| Common Stock | | Paid-in | | Comprehensive | | Accumulated | | Stockholders’ |

| Shares | | Par Value | | Capital | | Loss | | Deficit | | Equity |

| Balance, June 30, 2022 | 288,154,159 | | | $ | 2,882 | | | $ | 981,203 | | | $ | (89,131) | | | $ | (397,961) | | | $ | 496,993 | |

| Net income | — | | | — | | | — | | | — | | | 36,997 | | | 36,997 | |

| Other comprehensive loss | — | | | — | | | — | | | (12,798) | | | — | | | (12,798) | |

| Dividends declared | — | | | — | | | — | | | — | | | (8,592) | | | (8,592) | |

| Shares issued in connection with deferred compensation plan | 97,591 | | | 1 | | | (1) | | | — | | | — | | | — | |

| Deferred compensation plan elective participant deferrals | — | | | — | | | 1,586 | | | — | | | — | | | 1,586 | |

| Shares issued in connection with Executive Bonus Plan | 125,195 | | | 1 | | | 4,416 | | | — | | | — | | | 4,417 | |

| Shares issued in connection with employee stock purchase plan | 197,657 | | | 2 | | | 5,722 | | | — | | | (152) | | | 5,572 | |

| Stock option exercises, net | 218,018 | | | 2 | | | 992 | | | — | | | (59) | | | 935 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Stock-based compensation expense | — | | | — | | | 11,158 | | | — | | | — | | | 11,158 | |

| Shares related to restricted stock, net | 58,270 | | | — | | | (1) | | | — | | | (1,060) | | | (1,061) | |

| Repurchase of Class B Common Stock under approved program | (433,125) | | | (4) | | | — | | | — | | | (15,004) | | | (15,008) | |

| Balance, September 30, 2022 | 288,417,765 | | | $ | 2,884 | | | $ | 1,005,075 | | | $ | (101,929) | | | $ | (385,831) | | | $ | 520,199 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2022 |

| | | | | | | Accumulated | | | | |

| Class A and Class B | | Additional | | Other | | | | Total |

| Common Stock | | Paid-in | | Comprehensive | | Accumulated | | Stockholders’ |

| Shares | | Par Value | | Capital | | Loss | | Deficit | | Equity |

| Balance, December 31, 2021 | 282,526,719 | | | $ | 2,825 | | | $ | 937,805 | | | $ | (91,774) | | | $ | (439,634) | | | $ | 409,222 | |

| Net income | — | | | — | | | — | | | — | | | 149,058 | | | 149,058 | |

| Other comprehensive loss | — | | | — | | | — | | | (10,155) | | | — | | | (10,155) | |

| Dividends declared | — | | | — | | | — | | | — | | | (25,623) | | | (25,623) | |

| Shares issued in connection with deferred compensation plan, net | 3,523,386 | | | 35 | | | (27) | | | — | | | (24,254) | | | (24,246) | |

| Deferred compensation plan elective participant deferrals | — | | | — | | | 4,694 | | | — | | | — | | | 4,694 | |

| Shares issued in connection with Executive Bonus Plan, net | 284,992 | | | 3 | | | 16,307 | | | — | | | (5,197) | | | 11,113 | |

| Shares issued in connection with employee stock purchase plan | 307,406 | | | 3 | | | 10,332 | | | — | | | (273) | | | 10,062 | |

| Stock option exercises, net | 2,272,603 | | | 23 | | | 6,832 | | | — | | | (8,459) | | | (1,604) | |

| Acquisition option exercises, net | 185,178 | | | 2 | | | (2) | | | — | | | — | | | — | |

| Shares issued for stock grants, net | 13,632 | | | — | | | 450 | | | — | | | — | | | 450 | |

| Stock-based compensation expense | — | | | — | | | 28,687 | | | — | | | — | | | 28,687 | |

| Shares related to restricted stock, net | 199,975 | | | 2 | | | (3) | | | — | | | (3,208) | | | (3,209) | |

| Repurchase of Class B Common Stock under approved program | (896,126) | | | (9) | | | — | | | — | | | (28,241) | | | (28,250) | |

| Balance, September 30, 2022 | 288,417,765 | | | $ | 2,884 | | | $ | 1,005,075 | | | $ | (101,929) | | | $ | (385,831) | | | $ | 520,199 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | | $ | 53,027 | | | $ | 36,997 | | | $ | 147,202 | | | $ | 149,058 | |

| Other comprehensive loss, net of taxes: | | | | | | | | |

| Foreign currency translation adjustments | | (7,294) | | | (12,809) | | | (5,416) | | | (10,192) | |

| Actuarial (loss) gain on retirement plan, net of tax effect of $(8), $(5), $(15), and $(15), respectively | | (6) | | | 11 | | | 28 | | | 37 | |

| Total other comprehensive loss, net of taxes | | (7,300) | | | (12,798) | | | (5,388) | | | (10,155) | |

| Comprehensive income | | $ | 45,727 | | | $ | 24,199 | | | $ | 141,814 | | | $ | 138,903 | |

See accompanying notes to consolidated financial statements.

BENTLEY SYSTEMS, INCORPORATED AND SUBSIDIARIES

Consolidated Statements of Stockholders’ Equity

(in thousands, except share data)

(unaudited)

| | | Three Months Ended September 30, 2021 | | Three Months Ended September 30, 2023 |

| | | Accumulated | | | | Accumulated | |

| | Class A and Class B | | Additional | | Other | | Total | | Class A and Class B | | Additional | | Other | | Non- | | Total |

| | Common Stock | | Paid-in | | Comprehensive | | Accumulated | | Stockholders’ | | Common Stock | | Paid-In | | Comprehensive | | Accumulated | | Controlling | | Stockholders’ |

| | Shares | | Par Value | | Capital | | Loss | | Deficit | | Equity | | Shares | | Par Value | | Capital | | Loss | | Deficit | | Interest | | Equity |

| Balance, June 30, 2021 | 281,189,127 | | | $ | 2,812 | | | $ | 910,951 | | | $ | (54,886) | | | $ | (386,346) | | | $ | 472,531 | | |

| Net loss | — | | | — | | | — | | | — | | | (48,022) | | | (48,022) | | |

| Balance, June 30, 2023 | | Balance, June 30, 2023 | 294,712,983 | | | $ | 2,947 | | | $ | 1,085,066 | | | $ | (87,828) | | | $ | (357,117) | | | $ | 704 | | | $ | 643,772 | |

| Net income | | Net income | — | | | — | | | — | | | — | | | 53,027 | | | — | | | 53,027 | |

| Other comprehensive loss | Other comprehensive loss | — | | | — | | | — | | | (26,994) | | | — | | | (26,994) | | Other comprehensive loss | — | | | — | | | — | | | (7,300) | | | — | | | — | | | (7,300) | |

| | Dividends declared | Dividends declared | — | | | — | | | — | | | — | | | (8,485) | | | (8,485) | | Dividends declared | — | | | — | | | — | | | — | | | (14,768) | | | — | | | (14,768) | |

| Shares issued in connection with deferred compensation plan, net | Shares issued in connection with deferred compensation plan, net | 88,920 | | | 1 | | | — | | | — | | | (3,773) | | | (3,772) | | Shares issued in connection with deferred compensation plan, net | 63,267 | | | — | | | — | | | — | | | (2,127) | | | — | | | (2,127) | |

| Deferred compensation plan elective participant deferrals | Deferred compensation plan elective participant deferrals | — | | | — | | | 527 | | | — | | | — | | | 527 | | Deferred compensation plan elective participant deferrals | — | | | — | | | 61 | | | — | | | — | | | — | | | 61 | |

| Deferred compensation plan modification | — | | | — | | | (4,739) | | | — | | | — | | | (4,739) | | |

| Shares issued in connection with Executive Bonus Plan, net | 41,172 | | | — | | | 4,292 | | | — | | | (1,870) | | | 2,422 | | |

| Shares issued in connection with employee stock purchase plan | 104,716 | | | 1 | | | 3,845 | | | — | | | (438) | | | 3,408 | | |

| Shares issued in connection with executive bonus plan, net | | Shares issued in connection with executive bonus plan, net | 34,313 | | | — | | | 3,251 | | | — | | | (1,430) | | | — | | | 1,821 | |

| Shares issued and repurchased in connection with employee stock purchase plan, net | | Shares issued and repurchased in connection with employee stock purchase plan, net | 162,459 | | | 2 | | | 5,429 | | | — | | | (623) | | | — | | | 4,808 | |

| Stock option exercises, net | Stock option exercises, net | 612,277 | | | 6 | | | 699 | | | — | | | (5,951) | | | (5,246) | | Stock option exercises, net | 185,255 | | | 2 | | | 888 | | | — | | | (419) | | | — | | | 471 | |

| | Stock-based compensation expense | Stock-based compensation expense | — | | | — | | | 5,835 | | | — | | | — | | | 5,835 | | Stock-based compensation expense | — | | | — | | | 14,122 | | | — | | | — | | | — | | | 14,122 | |

| Shares related to restricted stock, net | Shares related to restricted stock, net | 2,352 | | | — | | | — | | | — | | | (5,644) | | | (5,644) | | Shares related to restricted stock, net | 85,929 | | | 1 | | | (1) | | | — | | | (1,726) | | | — | | | (1,726) | |

| Balance, September 30, 2021 | 282,038,564 | | | $ | 2,820 | | | $ | 921,410 | | | $ | (81,880) | | | $ | (460,529) | | | $ | 381,821 | | |

| | Balance, September 30, 2023 | | Balance, September 30, 2023 | 295,244,206 | | | $ | 2,952 | | | $ | 1,108,816 | | | $ | (95,128) | | | $ | (325,183) | | | $ | 704 | | | $ | 692,161 | |

| | | Nine Months Ended September 30, 2021 | | Nine Months Ended September 30, 2023 |

| | | Accumulated | | | | Accumulated | |

| | Class A and Class B | | Additional | | Other | | Total | | Class A and Class B | | Additional | | Other | | Non- | | Total |

| | Common Stock | | Paid-in | | Comprehensive | | Accumulated | | Stockholders’ | | Common Stock | | Paid-In | | Comprehensive | | Accumulated | | Controlling | | Stockholders’ |

| | Shares | | Par Value | | Capital | | Loss | | Deficit | | Equity | | Shares | | Par Value | | Capital | | Loss | | Deficit | | Interest | | Equity |

| Balance, December 31, 2020 | 272,154,504 | | | $ | 2,722 | | | $ | 741,113 | | | $ | (26,233) | | | $ | (376,003) | | | $ | 341,599 | | |

| Balance, December 31, 2022 | | Balance, December 31, 2022 | 289,014,487 | | | $ | 2,890 | | | $ | 1,030,466 | | | $ | (89,740) | | | $ | (370,866) | | | $ | 704 | | | $ | 573,454 | |

| Net income | Net income | — | | | — | | | — | | | — | | | 54,611 | | | 54,611 | | Net income | — | | | — | | | — | | | — | | | 147,202 | | | — | | | 147,202 | |

| Other comprehensive loss | Other comprehensive loss | — | | | — | | | — | | | (55,647) | | | — | | | (55,647) | | Other comprehensive loss | — | | | — | | | — | | | (5,388) | | | — | | | — | | | (5,388) | |

| Shares issued related to acquisition | 3,141,342 | | | 31 | | | 182,359 | | | — | | | — | | | 182,390 | | |

| Purchase of capped call options, net of tax of $12,584 | — | | | — | | | (39,021) | | | — | | | — | | | (39,021) | | |

| Dividends declared | Dividends declared | — | | | — | | | — | | | — | | | (25,076) | | | (25,076) | | Dividends declared | — | | | — | | | — | | | — | | | (43,992) | | | — | | | (43,992) | |

| Shares issued in connection with deferred compensation plan, net | Shares issued in connection with deferred compensation plan, net | 2,290,999 | | | 23 | | | — | | | — | | | (65,707) | | | (65,684) | | Shares issued in connection with deferred compensation plan, net | 2,845,448 | | | 28 | | | (28) | | | — | | | (38,456) | | | — | | | (38,456) | |

| Deferred compensation plan elective participant deferrals | Deferred compensation plan elective participant deferrals | — | | | — | | | 2,020 | | | — | | | — | | | 2,020 | | Deferred compensation plan elective participant deferrals | — | | | — | | | 1,712 | | | — | | | — | | | — | | | 1,712 | |

| Deferred compensation plan modification | — | | | — | | | (4,739) | | | — | | | — | | | (4,739) | | |

| Shares issued in connection with Executive Bonus Plan, net | 190,619 | | | 2 | | | 16,013 | | | — | | | (6,586) | | | 9,429 | | |

| Shares issued in connection with employee stock purchase plan | 104,716 | | | 1 | | | 3,845 | | | — | | | (438) | | | 3,408 | | |

| Shares issued in connection with executive bonus plan, net | | Shares issued in connection with executive bonus plan, net | 171,510 | | | 2 | | | 13,055 | | | — | | | (5,756) | | | — | | | 7,301 | |

| Shares issued in connection with employee stock purchase plan, net | | Shares issued in connection with employee stock purchase plan, net | 315,840 | | | 3 | | | 9,985 | | | — | | | (845) | | | — | | | 9,143 | |

| Stock option exercises, net | Stock option exercises, net | 4,269,335 | | | 42 | | | 4,987 | | | — | | | (34,978) | | | (29,949) | | Stock option exercises, net | 2,422,082 | | | 24 | | | 10,566 | | | — | | | (6,408) | | | — | | | 4,182 | |

| Shares issued for stock grants | 7,824 | | | — | | | 450 | | | — | | | — | | | 450 | | |

| Shares issued for stock grants, net | | Shares issued for stock grants, net | 12,639 | | | — | | | 600 | | | — | | | — | | | — | | | 600 | |

| Stock-based compensation expense | Stock-based compensation expense | — | | | — | | | 14,383 | | | — | | | — | | | 14,383 | | Stock-based compensation expense | — | | | — | | | 42,465 | | | — | | | — | | | — | | | 42,465 | |

| Shares related to restricted stock, net | Shares related to restricted stock, net | (120,775) | | | (1) | | | — | | | — | | | (6,352) | | | (6,353) | | Shares related to restricted stock, net | 462,200 | | | 5 | | | (5) | | | — | | | (6,062) | | | — | | | (6,062) | |

| Balance, September 30, 2021 | 282,038,564 | | | $ | 2,820 | | | $ | 921,410 | | | $ | (81,880) | | | $ | (460,529) | | | $ | 381,821 | | |

| | Balance, September 30, 2023 | | Balance, September 30, 2023 | 295,244,206 | | | $ | 2,952 | | | $ | 1,108,816 | | | $ | (95,128) | | | $ | (325,183) | | | $ | 704 | | | $ | 692,161 | |

See accompanying notes to consolidated financial statements.

BENTLEY SYSTEMS, INCORPORATED AND SUBSIDIARIES

Consolidated Statements of Cash FlowsStockholders’ Equity

(in thousands)thousands, except share data)

(unaudited)

| | | | | | | | | | | | | | |

| | Nine Months Ended |

| | September 30, |

| | 2022 | | 2021 |

| Cash flows from operating activities: | | | | |

| Net income | | $ | 149,058 | | | $ | 54,611 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 53,644 | | | 35,946 | |

| Bad debt allowance | | 5,199 | | | 466 | |

| Deferred income taxes | | (13,670) | | | (17,788) | |

| Stock-based compensation expense | | 51,359 | | | 32,853 | |

| Deferred compensation plan | | (21,873) | | | 89,327 | |

| Amortization and write-off of deferred debt issuance costs | | 5,468 | | | 4,160 | |

| Change in fair value of derivative | | (29,318) | | | (9,198) | |

| Foreign currency remeasurement loss | | 14,445 | | | 103 | |

| Other non-cash items, net | | (1,006) | | | 2,939 | |

| Changes in assets and liabilities, net of effect from acquisitions: | | | | |

| Accounts receivable | | 12,550 | | | 26,305 | |

| Prepaid and other assets | | 7,779 | | | 11,310 | |

| Accounts payable, accruals, and other liabilities | | 28,765 | | | 29,047 | |

| Deferred revenues | | (26,725) | | | (40,496) | |

| Income taxes payable, net of prepaid income taxes | | 2,523 | | | (12,168) | |

| Net cash provided by operating activities | | 238,198 | | | 207,417 | |

| Cash flows from investing activities: | | | | |

| Purchases of property and equipment and investment in capitalized software | | (12,982) | | | (11,152) | |

| Proceeds from sale of aircraft | | 2,380 | | | — | |

| Acquisitions, net of cash acquired | | (719,539) | | | (1,033,695) | |

| Other investing activities | | (10,304) | | | (3,000) | |

| Net cash used in investing activities | | (740,445) | | | (1,047,847) | |

| Cash flows from financing activities: | | | | |

| Proceeds from credit facilities | | 753,376 | | | 682,083 | |

| Payments of credit facilities | | (408,714) | | | (860,228) | |

| Proceeds from convertible senior notes, net of discounts and commissions | | — | | | 1,233,377 | |

| Payments of debt issuance costs | | — | | | (5,643) | |

| Purchase of capped call options | | — | | | (51,555) | |

| | | | |

| Repayment of term loan | | (3,750) | | | — | |

| Payments of financing leases | | (123) | | | (147) | |

| Payments of acquisition debt and other consideration | | (6,996) | | | (741) | |

| Payments of dividends | | (25,828) | | | (25,076) | |

| Proceeds from stock purchases under employee stock purchase plan | | 10,335 | | | 3,846 | |

| Proceeds from exercise of stock options | | 6,855 | | | 5,039 | |

| Payments for shares acquired including shares withheld for taxes | | (42,213) | | | (111,306) | |

| Repurchase of Class B Common Stock under approved program | | (28,250) | | | — | |

| Net cash provided by financing activities | | 254,692 | | | 869,649 | |

| Effect of exchange rate changes on cash and cash equivalents | | (8,926) | | | 4,530 | |

| (Decrease) increase in cash and cash equivalents | | (256,481) | | | 33,749 | |

| Cash and cash equivalents, beginning of year | | 329,337 | | | 122,006 | |

| Cash and cash equivalents, end of period | | $ | 72,856 | | | $ | 155,755 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2022 |

| | | | | | | Accumulated | | | | | | |

| Class A and Class B | | Additional | | Other | | | | | | Total |

| Common Stock | | Paid-In | | Comprehensive | | Accumulated | | | | Stockholders’ |

| Shares | | Par Value | | Capital | | Loss | | Deficit | | | | Equity |

| Balance, June 30, 2022 | 288,154,159 | | | $ | 2,882 | | | $ | 981,203 | | | $ | (89,131) | | | $ | (397,961) | | | | | $ | 496,993 | |

| Net income | — | | | — | | | — | | | — | | | 36,997 | | | | | 36,997 | |

| Other comprehensive loss | — | | | — | | | — | | | (12,798) | | | — | | | | | (12,798) | |

| Dividends declared | — | | | — | | | — | | | — | | | (8,592) | | | | | (8,592) | |

| Shares issued in connection with deferred compensation plan | 97,591 | | | 1 | | | (1) | | | — | | | — | | | | | — | |

| Deferred compensation plan elective participant deferrals | — | | | — | | | 1,586 | | | — | | | — | | | | | 1,586 | |

| Shares issued in connection with executive bonus plan, net | 125,195 | | | 1 | | | 4,416 | | | — | | | — | | | | | 4,417 | |

| Shares issued in connection with employee stock purchase plan, net | 197,657 | | | 2 | | | 5,722 | | | — | | | (152) | | | | | 5,572 | |

| Stock option exercises, net | 218,018 | | | 2 | | | 992 | | | — | | | (59) | | | | | 935 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Stock-based compensation expense | — | | | — | | | 11,158 | | | — | | | — | | | | | 11,158 | |

| Shares related to restricted stock, net | 58,270 | | | — | | | (1) | | | — | | | (1,060) | | | | | (1,061) | |

| Repurchases of Class B Common Stock under approved program | (433,125) | | | (4) | | | — | | | — | | | (15,004) | | | | | (15,008) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Balance, September 30, 2022 | 288,417,765 | | | $ | 2,884 | | | $ | 1,005,075 | | | $ | (101,929) | | | $ | (385,831) | | | | | $ | 520,199 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2022 |

| | | | | | | Accumulated | | | | | | |

| Class A and Class B | | Additional | | Other | | | | | | Total |

| Common Stock | | Paid-In | | Comprehensive | | Accumulated | | | | Stockholders’ |

| Shares | | Par Value | | Capital | | Loss | | Deficit | | | | Equity |

| Balance, December 31, 2021 | 282,526,719 | | | $ | 2,825 | | | $ | 937,805 | | | $ | (91,774) | | | $ | (439,634) | | | | | $ | 409,222 | |

| Net income | — | | | — | | | — | | | — | | | 149,058 | | | | | 149,058 | |

| Other comprehensive loss | — | | | — | | | — | | | (10,155) | | | — | | | | | (10,155) | |

| Dividends declared | — | | | — | | | — | | | — | | | (25,623) | | | | | (25,623) | |

| Shares issued in connection with deferred compensation plan, net | 3,523,386 | | | 35 | | | (27) | | | — | | | (24,254) | | | | | (24,246) | |

| Deferred compensation plan elective participant deferrals | — | | | — | | | 4,694 | | | — | | | — | | | | | 4,694 | |

| Shares issued in connection with executive bonus plan, net | 284,992 | | | 3 | | | 16,307 | | | — | | | (5,197) | | | | | 11,113 | |

| Shares issued in connection with employee stock purchase plan, net | 307,406 | | | 3 | | | 10,332 | | | — | | | (273) | | | | | 10,062 | |

| Stock option exercises, net | 2,272,603 | | | 23 | | | 6,832 | | | — | | | (8,459) | | | | | (1,604) | |

| Acquisition option exercises, net | 185,178 | | | 2 | | | (2) | | | — | | | — | | | | | — | |

| Shares issued for stock grants, net | 13,632 | | | — | | | 450 | | | — | | | — | | | | | 450 | |

| Stock-based compensation expense | — | | | — | | | 28,687 | | | — | | | — | | | | | 28,687 | |

| Shares related to restricted stock, net | 199,975 | | | 2 | | | (3) | | | — | | | (3,208) | | | | | (3,209) | |

| Repurchases of Class B Common Stock under approved program | (896,126) | | | (9) | | | — | | | — | | | (28,241) | | | | | (28,250) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Balance, September 30, 2022 | 288,417,765 | | | $ | 2,884 | | | $ | 1,005,075 | | | $ | (101,929) | | | $ | (385,831) | | | | | $ | 520,199 | |

See accompanying notes to consolidated financial statements.

BENTLEY SYSTEMS, INCORPORATED AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

| | | | | | | | | | | | | | |

| | Nine Months Ended |

| | September 30, |

| | 2022 | | 2021 |

| Supplemental information: | | | | |

| Cash paid for income taxes | | $ | 20,696 | | | $ | 32,359 | |

| Income tax refunds | | 2,194 | | | 7,820 | |

| Interest paid | | 17,647 | | | 3,281 | |

| Non-cash investing and financing activities: | | | | |

| Cost method investment, non-cash exchange | | 6,022 | | | — | |

| Shares issued related to acquisition | | — | | | 182,390 | |

| Contingent acquisition consideration | | — | | | 5,581 | |

| Deferred, non-contingent consideration, net | | 157 | | | 10,081 | |

Convertible senior notes expenses included in Accounts payable | | — | | | 375 | |

Capped call options expenses included in Accounts payable | | — | | | 50 | |

| | | | |

| Share-settled Executive Bonus Plan awards | | 16,310 | | | 16,015 | |

| Deferred compensation plan elective participant deferrals | | 4,694 | | | 2,020 | |

See accompanying notes to consolidated financial statements. | | | | | | | | | | | | | | |

| | Nine Months Ended |

| | September 30, |

| | 2023 | | 2022 |

| Cash flows from operating activities: | | | | |

| Net income | | $ | 147,202 | | | $ | 149,058 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 52,787 | | | 53,644 | |

| Deferred income taxes | | (14,632) | | | (13,670) | |

| Stock-based compensation expense | | 56,092 | | | 51,359 | |

| Deferred compensation plan | | 4,763 | | | (21,873) | |

| Amortization of deferred debt issuance costs | | 5,469 | | | 5,468 | |

| Change in fair value of derivative | | (4,102) | | | (29,318) | |

| Foreign currency remeasurement loss | | 3,198 | | | 14,445 | |

| Other | | 2,464 | | | 4,193 | |

| Changes in assets and liabilities, net of effect from acquisitions: | | | | |

| Accounts receivable | | 56,065 | | | 12,550 | |

| Prepaid and other assets | | (1,246) | | | 7,779 | |

| Accounts payable, accruals, and other liabilities | | 33,437 | | | 28,765 | |

| Deferred revenues | | (17,688) | | | (26,725) | |

| Income taxes payable, net of prepaid income taxes | | 5,834 | | | 2,523 | |

| Net cash provided by operating activities | | 329,643 | | | 238,198 | |

| Cash flows from investing activities: | | | | |

| Purchases of property and equipment and investment in capitalized software | | (18,906) | | | (12,982) | |

| Proceeds from sale of aircraft | | — | | | 2,380 | |

| Acquisitions, net of cash acquired | | (23,110) | | | (719,539) | |

| Purchases of investments | | (11,352) | | | (10,304) | |

| Proceeds from investments | | 2,123 | | | — | |

| Net cash used in investing activities | | (51,245) | | | (740,445) | |

| Cash flows from financing activities: | | | | |

| Proceeds from credit facilities | | 442,566 | | | 753,376 | |

| Payments of credit facilities | | (634,718) | | | (408,714) | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Repayments of term loan | | (3,750) | | | (3,750) | |

| Payments of contingent and non-contingent consideration | | (3,039) | | | (6,996) | |

| Payments of dividends | | (43,992) | | | (25,828) | |

| Proceeds from stock purchases under employee stock purchase plan | | 9,988 | | | 10,335 | |

| Proceeds from exercise of stock options | | 10,590 | | | 6,855 | |

| Payments for shares acquired including shares withheld for taxes | | (57,527) | | | (42,213) | |

| Repurchases of Class B Common Stock under approved program | | — | | | (28,250) | |

| Other | | (137) | | | (123) | |

| Net cash (used in) provided by financing activities | | (280,019) | | | 254,692 | |

| Effect of exchange rate changes on cash and cash equivalents | | (3,100) | | | (8,926) | |

| Decrease in cash and cash equivalents | | (4,721) | | | (256,481) | |

| Cash and cash equivalents, beginning of year | | 71,684 | | | 329,337 | |

| Cash and cash equivalents, end of period | | $ | 66,963 | | | $ | 72,856 | |

BENTLEY SYSTEMS, INCORPORATED AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

| | | | | | | | | | | | | | |

| | Nine Months Ended |

| | September 30, |

| | 2023 | | 2022 |

| Supplemental information: | | | | |

| Cash paid for income taxes | | $ | 29,467 | | | $ | 20,696 | |

| Income tax refunds | | 764 | | | 2,194 | |

| Interest paid | | 29,370 | | | 17,647 | |

| Non-cash investing and financing activities: | | | | |

| Cost method investment | | 3,500 | | | 6,022 | |

| | | | |

| | | | |

| Deferred, non-contingent consideration, net | | 525 | | | 157 | |

| | | | |

| | | | |

| | | | |

| Share-settled executive bonus plan awards | | 13,057 | | | 16,310 | |

| Deferred compensation plan elective participant deferrals | | 1,712 | | | 4,694 | |

See accompanying notes to consolidated financial statements.

BENTLEY SYSTEMS, INCORPORATED

Notes to Consolidated Financial Statements

(in thousands, except share and per share data)

(unaudited)

Note 1: Basis of Presentation

Basis of Presentation — The accompanying unaudited consolidated financial statements include the accounts of Bentley Systems, Incorporated and its wholly-owned subsidiaries (“Bentley”Bentley Systems, Incorporated” or the “Company”) and its wholly-owned subsidiaries,, and have been prepared in accordance with accounting principlesUnited States generally accepted in the United States of Americaaccounting principles (“U.S. GAAP”) and in accordance with the rules and regulations of the United States Securities and Exchange Commission (“SEC”) regarding interim financial reporting. Accordingly, they do not include all the information and notes required by U.S. GAAP for annual financial statements. These unaudited consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in Part II, Item 8 of the Company’s 20212022 Annual Report on Form 10‑K on file with the SEC.K. In management’s opinion, the accompanying unaudited consolidated financial statements contain all adjustments (consisting of normal, recurring and non-recurring adjustments) that were considered necessary for the fair statement of the Company’s financial position, results of operations, and cash flows atas of the dates and for the periods indicated. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect reported amounts in the financial statements and accompanying notes. Actual results could differ materially from those estimates. The December 31, 20212022 consolidated balance sheet included herein is derived from the Company’s audited consolidated financial statements.

Certain reclassifications of prior period amounts have been made to conform to the current period presentation.

Business Combinations — On January 31, 2022, the Company completed the acquisition of Power Line Systems, a leader in software for the design of overhead electric power transmission lines and their structures, for $695,968 in cash, net of cash acquired. On June 17, 2021, the Company completed the acquisition of Seequent Holdings Limited (“Seequent”), a leader in software for geological and geophysical modeling, geotechnical stability, and cloud services for geodata management and collaboration, for $883,336 in cash, net of cash acquired, plus 3,141,342 shares of the Company’s Class B Common Stock (see Note 4).

Deferred Compensation — Under the Company’s unfunded amended and restated Bentley Systems, Incorporated Nonqualified Deferred Compensation Plan (the “DCP”), certain officers and key employees may defer all or any part of their incentive compensation, and the Company may make discretionary awards on behalf of such participants. Elective participant deferrals and discretionary Company awards are received in the form of phantom shares of the Company’s Class B Common Stock, which are valued for tax and accounting purposes in the same manner as actual shares of Class B Common Stock, and are recorded as stock‑based compensation expense in the consolidated statements of operations (see Note 15).

In August 2021, the Company’s Board of Directors approved an amendment to the DCP, which offered to certain active executives in the DCP a one‑time, short‑term election to reallocate a limited portion of their DCP holdings from phantom shares of the Company’s Class B Common Stock into other phantom investment funds. The offer to reallocate was subject to a proration mechanism which adjusted the aggregate elections to a maximum of 1,500,000 phantom shares of the Company’s Class B Common Stock. This resulted in a reduction of 1,500,000 shares in both the basic and diluted count of Company shares.

While DCP participants’ investments in phantom shares remain equity classified, as they will be settled in shares of Class B Common Stock upon eventual distribution, the amendment and elections resulted in a change to liability classification for the reallocated phantom investments, as they will be settled in cash upon eventual distribution. As a result, during For the three and nine months ended September 30, 2021, the Company reclassified cumulative compensation cost of $4,739 from Additional paid-in capital to Accruals and other current liabilities or Deferred compensation plan liabilities in the consolidated balance sheet and recognized a compensation charge of $90,721 to Deferred compensation plan expenses in the consolidated statements of operations to record the reallocated deferred compensation plan liabilities at their fair value of $95,460. Subsequent2023, payments related to the one‑time reallocation, these diversified deferred compensation plan liabilities are marked to market at the end of each reporting period, with changesCompany’s interest rate swap were recognized in the liabilities recorded as an expense (income) to Deferred compensation planOther income (expense), net in the consolidated statements of operations (see Note 12).and the corresponding prior period amounts, which were previously recognized in Interest expense, net, were reclassified to conform to the current period presentation. For the three and nine months ended September 30, 2022, the amounts reclassified were not material, and Income before income taxes and Net income in the consolidated statements of operations did not change as a result of these reclassifications.

Note 2: Recent Accounting Pronouncements

Recently Adopted Accounting Guidance

In March 2020, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2020‑04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting (“ASU 2020‑04”), which provides optional expedients and exceptions for applying U.S. GAAP to contracts, hedging relationships, and other transactions affected by reference rate reform if certain criteria are met. ASU 2020‑04 applies only to contracts, hedging relationships, and other transactions that reference the London Interbank Offered Rate (“LIBOR”) or another reference rate expected to be discontinued because of reference rate reform between March 12, 2020 and December 31, 2022. In December 2022, the FASB issued ASU No. 2022‑06, Reference Rate Reform (Topic 848): Deferral of the Sunset Date of Topic 848, which provides optional guidance to ease the potential burden in accounting for (or recognizing the effects of) reference rate reform on financial reporting by extending the sunset date of Topic 848 to December 31, 2024. The expedients and exceptions provided by ASU 2020‑04these ASUs do not apply to contract modifications made and hedging relationships entered into or evaluated after December 31, 2022,2024, except for hedging relationships existing as of December 31, 2022,2024, that an entity has elected certain optional expedients for and that are retained through the end of the hedging relationship. The Company had no transactions that were impacted by ASU 2020‑04adopted these ASUs during the nine months ended September 30, 2022.

Recently Adopted Accounting Guidance

In October 2021, the FASB issued ASU No. 2021‑08, Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from Contracts with Customers (“ASU 2021‑08”), which improves the comparability of accounting for acquired revenue contracts with customers in a business combination. The new guidance is meant to reduce diversity in practice and inconsistencies related to recognition of an acquired contract liability and revenue contract payment terms and their effect on subsequent revenue recognized by the acquirer. During the fourthsecond quarter of 2021,2023 (see Note 10) and the Company early adopted the ASU effective January 1, 2021 using the modified retrospective method of adoption and retrospectively recasted interim prior period amounts presented in the accompanying unaudited consolidated financial statements for acquisitions subsequent to January 1, 2021. The adoption of this ASU did not have a material impact on the accompanying unauditedCompany’s consolidated financial statements.

Note 3: Revenue from Contracts with Customers

NatureDisaggregation of Products and ServicesRevenues

The Company generatesCompany’s revenues from subscriptions, perpetual licenses, and services.

Subscriptions

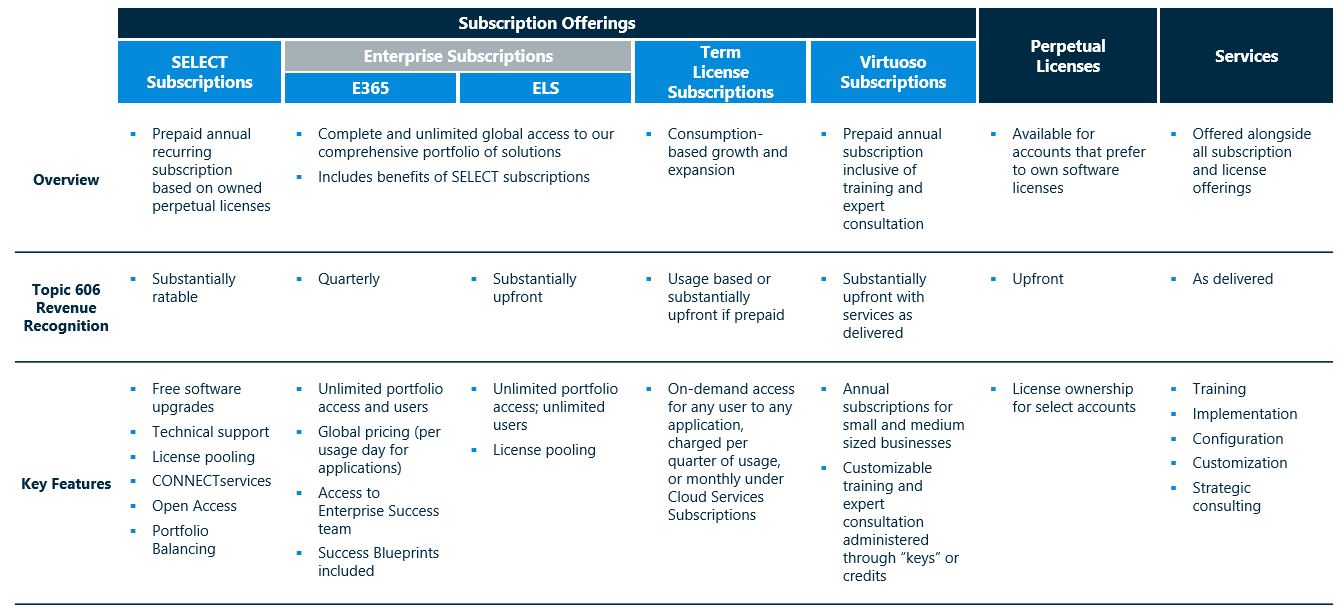

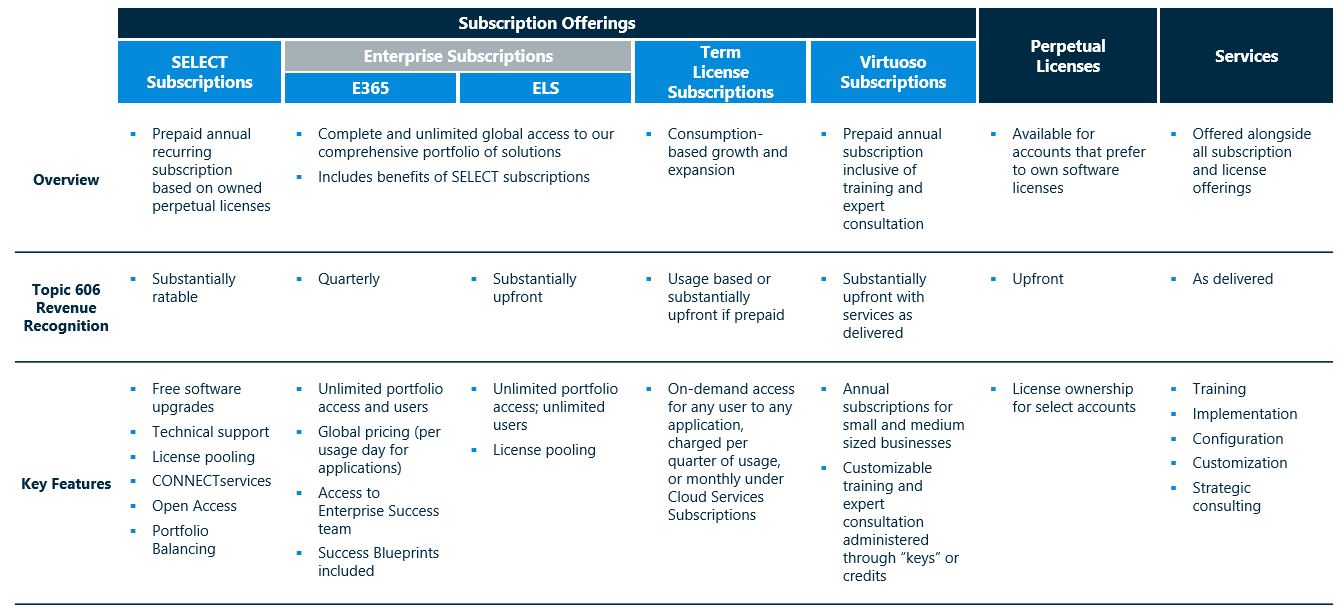

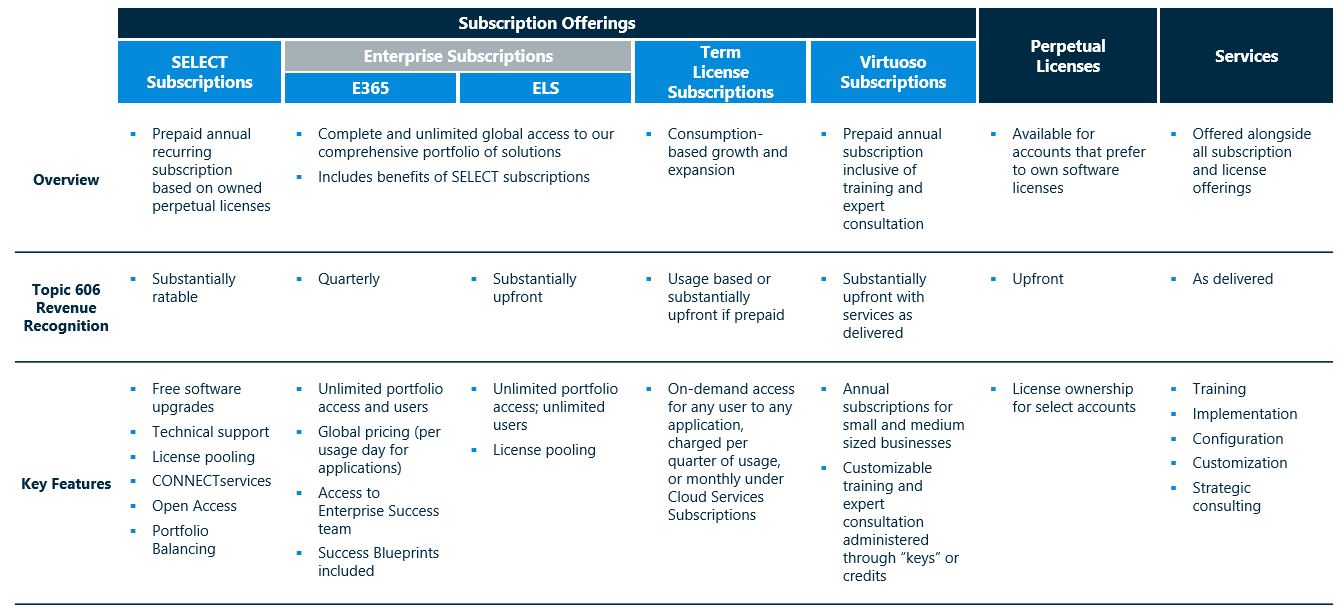

SELECT subscriptions — The Company provides prepaid annual recurring subscriptions that accounts (which are based on distinct contractual and billing relationships with the Company, where affiliated entities of a single parent company may each have an independent account with the Company) can elect to add to a new or previously purchased perpetual license. SELECT provides accounts with benefits, including upgrades, comprehensive technical support, pooled licensing benefits, annual portfolio balancing exchange rights, learning benefits, certain Azure‑based cloud collaboration services, mobility advantages, and access to other available benefits. SELECT subscriptions revenues are recognized as distinct performance obligations are satisfied. The performance obligations within the SELECT offering, outsideconsist of the portfolio balancing exchange right, are concurrently delivered and have the same pattern of recognition. These performance obligations are accounted for ratably over the term as a single performance obligation.following:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Subscriptions: | | | | | | | |

Enterprise subscriptions (1) | $ | 111,318 | | | $ | 89,041 | | | $ | 318,896 | | | $ | 252,461 | |

| SELECT subscriptions | 63,406 | | | 63,609 | | | 190,834 | | | 196,786 | |

| Term license subscriptions | 96,027 | | | 82,657 | | | 298,109 | | | 259,484 | |

| Subscriptions | 270,751 | | | 235,307 | | | 807,839 | | | 708,731 | |

| Perpetual licenses | 11,887 | | | 9,460 | | | 33,152 | | | 31,213 | |

| Subscriptions and licenses | 282,638 | | | 244,767 | | | 840,991 | | | 739,944 | |

| Services: | | | | | | | |

| Recurring | 3,606 | | | 4,557 | | | 12,733 | | | 13,431 | |

| Other | 20,368 | | | 19,008 | | | 64,048 | | | 58,759 | |

| Services | 23,974 | | | 23,565 | | | 76,781 | | | 72,190 | |

| Total revenues | $ | 306,612 | | | $ | 268,332 | | | $ | 917,772 | | | $ | 812,134 | |

(1)Enterprise subscriptions — The Company provides enterprise subscription offerings, which provide its enterprise accounts with complete and unlimited global access includes revenue attributable to the Company’s comprehensive portfolio of solutions. Enterprise 365 (“E365”) subscriptions are charged to accounts based upon daily usage. of $107,681 and $80,298 for the three months ended September 30, 2023 and 2022, respectively, and $301,260 and $221,801 for the nine months ended September 30, 2023 and 2022, respectively.

The daily usage fee includes a term license component, SELECT maintenanceCompany recognizes perpetual licenses and support, hosting, and Success Blueprints, which are designed to achieve business outcomes through more efficient and effective use of the Company’s software. E365 revenues are recognized based upon usage incurred by the account. Usage is defined as distinct user access on a daily basis. E365 subscriptions can contain quarterly usage floors or collars. The term of E365 subscriptions aligns with calendar quarters and revenue is recognized based on actual usage. Alternatively, Enterprise License Subscriptions (“ELS”) provide access for a prepaid fee, which is based on the account’s usage of software in the preceding year, to effectively create a fee‑certain consumption‑based arrangement. ELS contain a term license component, SELECT maintenance and support, and performance consulting days. The SELECT maintenance and support benefits under ELS do not include a portfolio balancing performance obligation. Revenue is allocated to the various performance obligations based on their respective standalone selling price (“SSP”). Revenue allocated to the term license component is recognized upon deliveryof subscriptions as revenue when either the licenses are delivered or at the start of the subscription term whileterm. For the three months ended September 30, 2023 and 2022, the Company recognized $147,340 and $125,140 of license related revenues, for the SELECT maintenancerespectively, of which $135,453 and support and the performance consulting days are recognized as delivered over the subscription term. Billings in advance are recorded as Deferred revenues in the consolidated balance sheets.

Term license subscriptions — The Company provides annual, quarterly, and monthly term licenses for its software products. Term license subscriptions contain a term license component and SELECT maintenance and support. Revenue is allocated to the various performance obligations based on their SSP. Annual term licenses (“ATL”) are generally prepaid annually for named user access to specific products and include the Company’s Virtuoso subscriptions sold via the Company’s Virtuosity eStore for practitioner licenses. Virtuoso subscriptions are bundles with customizable training and expert consultation administered through “keys” or credits. Quarterly term license (“QTL”) subscriptions allow accounts to pay quarterly in arrears for license usage that is beyond their prepaid subscriptions. Monthly term license (“MTL”) subscriptions are identical to QTL subscriptions, except for the term of the license, and the manner in which they are monetized. MTL subscriptions require a Cloud Services Subscription (“CSS”), which is described below. For ATL, revenue allocated$115,680, respectively, were attributable to the term license component is recognized upon delivery at the start of the subscription term while revenue for the SELECT maintenance and support is recognized as delivered over the subscription term. For Virtuoso keys, revenue is recognized as services are delivered. BillingsCompany’s subscription‑based commercial offerings recorded in advance are recorded as Deferred revenuesSubscriptions in the consolidated balance sheets.statements of operations. For usage‑the nine months ended September 30, 2023 and 2022, the Company recognized $444,186 and $380,237 of license related revenues, respectively, of which $411,034 and $349,024, respectively, were attributable to the term license component of the Company’s subscription‑based QTLcommercial offerings recorded in Subscriptions in the consolidated statements of operations.

The Company derived 8% and MTL subscriptions,7% of its total revenues are recognized based upon usage incurred bythrough channel partners for the account. Usage is defined as peak usage over the respective terms. The terms of QTLthree months ended September 30, 2023 and MTL subscriptions align with calendar quarters and calendar months,2022, respectively, and revenue is recognized based on actual usage.7% of its total revenues through channel partners for the nine months ended September 30, 2023 and 2022.

Visas and Passports are quarterly or annual term licenses enabling usersRevenue from external customers is attributed to access specific project or enterprise information and entitles users to certain functionalityindividual countries based upon the location of the Company’s ProjectWise and AssetWise systems. The Company’s standard offeringscustomer. Revenues by geographic region are usage based with monetization through the Company’s CSS program as described below.follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

Americas (1) | $ | 162,367 | | | $ | 141,599 | | | $ | 489,548 | | | $ | 440,218 | |

| Europe, the Middle East, and Africa (“EMEA”) | 86,956 | | | 75,416 | | | 263,232 | | | 227,696 | |

| Asia-Pacific (“APAC”) | 57,289 | | | 51,317 | | | 164,992 | | | 144,220 | |

| Total revenues | $ | 306,612 | | | $ | 268,332 | | | $ | 917,772 | | | $ | 812,134 | |

CSS is a program designed to streamline(1)Americas includes the procurement, administration,United States (“U.S.”), Canada, and payment process. The program requires an estimation of annual usage for CSS eligible offerings and a deposit of funds in advance. Actual consumption is monitored and invoiced againstLatin America (including the deposit on a calendar quarter basis. CSS balances not utilized for eligible products or services may roll over to future periods or are refundable. Paid and unconsumed CSS balances are recorded in Accruals and other current liabilities in the consolidated balance sheets. Software and services consumed under CSS are recognized pursuantCaribbean). Revenue attributable to the applicable revenue recognition guidanceU.S. totaled $129,510 and $122,372 for the respective software or servicethree months ended September 30, 2023 and classified as subscriptions or services based on their respective nature.

Perpetual licenses

Perpetual licenses may be sold with or without attaching a SELECT subscription. Historically, attachment2022, respectively, and retention of the SELECT subscription has been high given the benefits of the SELECT subscription discussed above. Perpetual licenses revenues are recognized upon delivery of the license to the user.

Services

The Company provides professional services, including training, implementation, configuration, customization,$384,807 and strategic consulting services. The Company performs projects on both a time and materials and a fixed fee basis. Certain of the Company’s fixed‑fee arrangements, including its Success Services offerings, are structured as subscription‑like, packaged offerings that are annually recurring in nature. Success Services are standard service offerings that provide a level of dedicated professional services above the standard technical support offered to all accounts as part of their SELECT or enterprise agreement. Revenues are recognized as services are performed.

The Company primarily utilizes its direct internal sales force and also has arrangements through independent channel partners to promote and sell Bentley products and subscriptions to end‑users. Channel partners are authorized to promote the sale of an authorized set of Bentley products and subscriptions within an authorized geography under a Channel Partner Agreement.

Significant Judgments and Estimates

The Company’s contracts with customers may include promises to transfer licenses (perpetual or term‑based), maintenance, and services to a user. Judgment is required to determine if the promises are separate performance obligations, and if so, the allocation of the transaction price to each performance obligation. When an arrangement includes multiple performance obligations which are concurrently delivered and have the same pattern of transfer to the customer, the Company accounts for those performance obligations as a single performance obligation. For contracts with more than one performance obligation, the transaction price is allocated among the performance obligations in an amount that depicts the relative SSP of each obligation. Judgment is required to determine the SSP for each distinct performance obligation. In instances where SSP is not directly observable, such as when the Company does not sell the product or service separately, the Company determines the SSP using information that may include market conditions and other observable inputs. The Company uses a range of amounts to estimate SSP when it sells each of the products and services separately and needs to determine whether there is a discount that should be allocated based on the relative SSP of the various products and services.

The Company’s SELECT agreement provides users with perpetual licenses a right to exchange software for other eligible perpetual licenses on an annual basis upon renewal. The Company refers to this option as portfolio balancing and has concluded that the portfolio balancing feature represents a material right resulting in the deferral of the associated revenue. Judgment is required to estimate the percentage of users who may elect to portfolio balance and considers inputs such as historical user elections. This feature is available once per term and must be exercised prior to the respective renewal term. The Company recognizes the associated revenue upon election or when the portfolio balancing right expires. This right is included in the initial and subsequent renewal terms and the Company reestablishes the revenue deferral$346,961 for the material right upon the beginning of the renewal term. As ofnine months ended September 30, 2023 and 2022, and December 31, 2021, the Company has deferred $16,874 and $18,020, respectively, related to portfolio balancing exchange rights which is included in respectively.Deferred revenues in the consolidated balance sheets.

Contract Assets and Contract Liabilities

| | | September 30, 2022 | | December 31, 2021 | | September 30, 2023 | | December 31, 2022 |

| | | Contract assets | Contract assets | $ | 491 | | | $ | 336 | | Contract assets | $ | 472 | | | $ | 575 | |

| Deferred revenues | Deferred revenues | 201,610 | | | 232,593 | | Deferred revenues | 227,004 | | | 243,073 | |

As of September 30, 20222023 and December 31, 2021,2022, the Company’s contract assets relate to performance obligations completed in advance of the right to invoice and are included in Prepaid and other current assets in the consolidated balance sheets. Contract assets were not impaired as of September 30, 2022 and2023 or December 31, 2021.2022.

Deferred revenues consist of billings made or payments received in advance of revenue recognition from subscriptions and services. The timing of revenue recognition may differ from the timing of billings to users.

For the nine months ended September 30, 2023, $183,335 of revenues that were included in the December 31, 2022 deferred revenues balance were recognized. There were additional deferrals of $169,368 for the nine months ended September 30, 2023, which were primarily related to new billings and acquisitions. For the nine months ended September 30, 2022, $174,194 of revenues that were included in the December 31, 2021 deferred revenues balance were recognized. There were additional deferrals of $158,125 for the nine months ended September 30, 2022, which were primarily related to new billings and acquisitions (see Note 4). For the nine months endedacquisitions.

As of September 30, 2021, $164,539 of revenues that were2023 and December 31, 2022, the Company has deferred $17,873 and $17,338, respectively, related to portfolio balancing exchange rights which is included in Deferred revenues in the December 31, 2020 deferred revenuesconsolidated balance were recognized. There were additional deferrals of $161,578, which were primarily related to new billings and acquisitions (see Note 4).sheets.

Remaining Performance Obligations

The Company’s contracts with customers include amounts allocated to performance obligations that will be satisfied at a later date. As of September 30, 2022,2023, amounts allocated to these remaining performance obligations are $201,610,$227,004, of which the Company expects to recognize approximately 92%93% over the next 12 months with the remaining amount thereafter.

Disaggregation of RevenuesNote 4: Acquisitions

The Company’s revenues consistaggregate details of the following:Company’s acquisition activity are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2022 | | 2021 | | 2022 | | 2021 |

| Subscriptions: | | | | | | | |

| SELECT subscriptions | $ | 63,609 | | | $ | 66,648 | | | $ | 196,786 | | | $ | 199,722 | |

Enterprise subscriptions (1) | 89,041 | | | 75,381 | | | 252,461 | | | 214,058 | |

| Term license subscriptions | 82,657 | | | 73,106 | | | 259,484 | | | 175,922 | |

| Subscriptions | 235,307 | | | 215,135 | | | 708,731 | | | 589,702 | |

| Perpetual licenses | 9,460 | | | 11,866 | | | 31,213 | | | 33,373 | |

| Subscriptions and licenses | 244,767 | | | 227,001 | | | 739,944 | | | 623,075 | |

| Services: | | | | | | | |

| Recurring | 4,557 | | | 5,160 | | | 13,431 | | | 16,243 | |

| Other | 19,008 | | | 19,227 | | | 58,759 | | | 57,996 | |

| Services | 23,565 | | | 24,387 | | | 72,190 | | | 74,239 | |

| Total revenues | $ | 268,332 | | | $ | 251,388 | | | $ | 812,134 | | | $ | 697,314 | |

| | | | | | | | | | | | | |

| Acquisitions Completed during |

| Nine Months Ended | | |

| September 30, | | |

| 2023 | | 2022 | | |

| |

| | | | | |

| Number of acquisitions | 2 | | | 4 | | | |

Cash paid at closing (1) | $ | 23,375 | | | $ | 738,810 | | | |

| Cash acquired | (265) | | | (19,271) | | | |

| Net cash paid | $ | 23,110 | | | $ | 719,539 | | | |

(1)Enterprise subscriptions includes revenue attributable to E365 subscriptions of $80,298 and $60,102 forOf the three months ended September 30, 2022 and 2021, respectively, and $221,801 and $162,120cash paid at closing for the nine months ended September 30, 2023 and 2022, $1,000 and 2021, respectively.

The Company recognizes perpetual licenses$3,000, respectively, was deposited into an escrow account to secure any potential indemnification and the term license component of subscriptions as revenue when either the licenses are delivered or at the startother obligations of the subscription term. For the three months ended September 30, 2022 and 2021, the Company recognized $125,140 and $109,000 of license related revenues, respectively, of which $115,680 and $97,134, respectively, were attributable to the term license component of the Company’s subscription‑based commercial offerings recorded in Subscriptions in the consolidated statements of operations. For the nine months ended September 30, 2022 and 2021, the Company recognized $380,237 and $293,277 of license related revenues, respectively, of which $349,024 and $259,904, respectively, were attributable to the term license component of the Company’s subscription‑based commercial offerings recorded in Subscriptions in the consolidated statements of operations.

The Company derived 7% of its total revenues through channel partners for the three and nine months ended September 30, 2022 and 2021.

Revenue from external customers is attributed to individual countries based upon the location of the customer. Revenues by geographic region are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2022 | | 2021 | | 2022 | | 2021 |

Americas (1) | $ | 141,599 | | | $ | 127,996 | | | $ | 440,218 | | | $ | 349,752 | |

| Europe, the Middle East, and Africa (“EMEA”) | 75,416 | | | 76,502 | | | 227,696 | | | 219,507 | |

| Asia-Pacific (“APAC”) | 51,317 | | | 46,890 | | | 144,220 | | | 128,055 | |

| Total revenues | $ | 268,332 | | | $ | 251,388 | | | $ | 812,134 | | | $ | 697,314 | |

(1)Americas includes the United States (“U.S.”), Canada, and Latin America (including the Caribbean). Revenue attributable to the U.S. totaled $122,372 and $105,089 for the three months ended September 30, 2022 and 2021, respectively, and $346,961 and $289,718 for the nine months ended September 30, 2022 and 2021, respectively.seller.

Note 4: Acquisitions

For the nine months ended September 30, 2022 and the year ended December 31, 2021, the Company completed a number of acquisitions, for an aggregate purchase price of $738,814 and $1,269,844, respectively. On January 31, 2022, the Company completed the acquisition of Power Line Systems (“PLS”), a leader in software for the design of overhead electric power transmission lines and their structures, for $695,968 in cash, net of cash acquired. On June 17, 2021, the Company completed the acquisition of Seequent, a leader in software for geological and geophysical modeling, geotechnical stability, and cloud services for geodata management and collaboration, for $883,336 in cash, net of cash acquired, plus 3,141,342 shares of the Company’s Class B Common Stock. The operating results of the acquired businesses except for Seequent, were not material, individually or in the aggregate, to the Company’s consolidated statements of operations.

The aggregate details of the Company’s acquisition activity are as follows:

| | | | | | | | | | | | | |

| Acquisitions Completed in |

| Nine Months Ended | | Year Ended | | |

| September 30, 2022 | | December 31, 2021 | | |

| |

| | | | | |

| Number of acquisitions | 4 | | | 13 | | | |

Cash paid at closing (1) | $ | 738,810 | | | $ | 1,072,820 | | | |

| Cash acquired | (19,271) | | | (37,837) | | | |

| Net cash paid | $ | 719,539 | | | $ | 1,034,983 | | | |

(1)Of the cash paid at closing for the nine months ended September 30, 2022 and year ended December 31, 2021, $3,000 and $8,701, respectively, was deposited into an escrow account to secure any potential indemnification and other obligations of the seller.

The fair value of the contingent consideration from acquisitions is included in the consolidated balance sheets as follows:

| | | | | | | | | | | |

| September 30, 2022 | | December 31, 2021 |

| |

| | | |

| Accruals and other current liabilities | $ | 1,244 | | | $ | 5,382 | |

| Other liabilities | — | | | 1,231 | |

| Contingent consideration from acquisitions | $ | 1,244 | | | $ | 6,613 | |

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| |

| | | |

| Accruals and other current liabilities | $ | 3 | | | $ | 1,196 | |

| | | |

| Contingent consideration from acquisitions | $ | 3 | | | $ | 1,196 | |

The fair value of non-contingent consideration from acquisitions is included in the consolidated balance sheets as follows:

| | | September 30, 2022 | | December 31, 2021 | | September 30, 2023 | | December 31, 2022 |

| | | Accruals and other current liabilities | Accruals and other current liabilities | $ | 2,923 | | | $ | 4,751 | | Accruals and other current liabilities | $ | 3,966 | | | $ | 2,434 | |

| Other liabilities | Other liabilities | 2,995 | | | 6,177 | | Other liabilities | — | | | 2,977 | |

| Non-contingent consideration from acquisitions | Non-contingent consideration from acquisitions | $ | 5,918 | | | $ | 10,928 | | Non-contingent consideration from acquisitions | $ | 3,966 | | | $ | 5,411 | |

The operating results of the acquired businesses are included in the Company’s consolidated financial statements from the closing date of each respective acquisition. The purchase price for each acquisition has been allocated to the net tangible and intangible assets and liabilities based on their estimated fair values at the respective acquisition date.