UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 10-Q

|

| | |

| (Mark One) | | |

| x |

| Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | | |

For the Quarterly Period Ended September 30, 20182019 |

| or |

o |

| Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Transition Period from to . |

Commission file number 001-37427

HORIZON GLOBAL CORPORATION

(Exact name of registrant as specified in its charter)

|

| | |

| | | |

Delaware (State or other jurisdiction of incorporation or organization) | | 47-3574483 (IRS Employer Identification No.) |

2600 W. Big Beaver Road, Suite 555

Troy, Michigan 48084

(Address of principal executive offices, including zip code)

(248) 593-8820

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | HZN | | New York Stock Exchange |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | |

Large accelerated filer o | | Accelerated filer x | | Non-accelerated filer o | | Smaller reporting company o | | Emerging growth company x |

| | | | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes x No o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of November 3, 2018,7, 2019, the number of outstanding shares of the Registrant’s common stock par value $0.01 per share, was 25,112,23925,387,388 shares.

HORIZON GLOBAL CORPORATION

Index

Forward-Looking Statements

This reportQuarterly Report on Form 10-Q may contain “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements speak only as of the date they are made and give our current expectations or forecasts of future events. These forward-looking statements can be identified by the use of forward-looking words, such as “may,” “could,” “should,” “estimate,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “target,���” “plan” or other comparable words, or by discussions of strategy that may involve risks and uncertainties.

These forward-looking statements are subject to numerous assumptions, risks and uncertainties which could materially affect our business, financial condition or future results including, but not limited to, risks and uncertainties with respect to: the Company’s integration of the Westfalia Group (“Westfalia Group” consists of Westfalia-Automotive Holding GmbHleverage; liabilities and TeIJs Holding B.V.); leverage; liabilitiesrestrictions imposed by the Company’s debt instruments; market demand; competitive factors; supply constraints; material and energy costs; technology factors; litigation; government and regulatory actions including the impact of any tariffs, quotas or surcharges; the Company’s accounting policies; future trends; general economic and currency conditions; various conditions specific to the Company’s business and industry; the success of the Company’s action plan, including the actual amount of savings and timing thereof; the success of our business improvement initiatives in Europe-Africa, including the amount of savings and timing thereof; the Company’s exposure to product liability claims from customers and end users, and the costs associated therewith; the Company’s ability to meet its covenants in the agreements governing its debt; or the Company’s ability to maintain compliance with the New York Stock Exchange’s continued listing standards and other risks that are discussed in Item 1A, “Risk Factors” and in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017.2018. The risks described in our Annual Report and elsewhere in this report are not the only risks facing our Company. Additional risks and uncertainties not currently known to us or that we currently deemed to be immaterial also may materially adversely affect our business, financial position and results of operations or cash flows.

The cautionary statements set forth above should be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. We caution readers not to place undoundue reliance on the statements, which speak only as of the date of this report. We do not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statement to reflect events or circumstances after the date of this report or to reflect the occurrence of unanticipated events, except as otherwise required by law.

We disclose important factors that could cause our actual results to differ materially from our expectations implied by our forward-looking statements under Item 2, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere in this report. These cautionary statements qualify all forward-looking statements attributed to us or persons acting on our behalf. When we indicate that an event, condition or circumstance could or would have an adverse effect on us, we mean to include effects upon our business, financial and other conditions, results of operations, prospects and ability to service our debt.

PART I. FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

HORIZON GLOBAL CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited—dollars in thousands)

| |

| | September 30,

2018 |

| December 31,

2017 | | | | | |

| | | (unaudited) | | | | September 30,

2019 |

| December 31,

2018 |

| Assets | |

| |

| |

| |

|

| Current assets: | |

| |

| |

| |

|

| Cash and cash equivalents | | $ | 27,310 |

|

| $ | 29,570 |

| | $ | 16,360 |

|

| $ | 27,650 |

|

| Receivables, net of reserves of approximately $4.5 million and $3.1 million at September 30, 2018 and December 31, 2017, respectively | | 122,250 |

|

| 91,770 |

| |

| Receivables, net of allowance for doubtful accounts of approximately $5.0 million and $4.8 million at September 30, 2019 and December 31, 2018, respectively | | | 93,480 |

|

| 95,170 |

|

| Inventories | | 161,110 |

|

| 171,500 |

| | 141,150 |

|

| 152,200 |

|

| Prepaid expenses and other current assets | | 11,930 |

|

| 10,950 |

| | 9,480 |

|

| 8,270 |

|

| Current assets held-for-sale | | | — |

| | 36,080 |

|

| Total current assets | | 322,600 |

| | 303,790 |

| | 260,470 |

| | 319,370 |

|

| Property and equipment, net | | 105,370 |

|

| 113,020 |

| | 78,670 |

|

| 86,500 |

|

| Operating lease right-of-use assets | | | 56,170 |

| | — |

|

| Goodwill | | 10,410 |

|

| 138,190 |

| | 4,200 |

|

| 4,500 |

|

| Other intangibles, net | | 81,930 |

|

| 90,230 |

| | 60,350 |

|

| 69,400 |

|

| Deferred income taxes | | 6,900 |

| | 4,290 |

| | 440 |

| | 660 |

|

| Non-current assets held-for-sale | | | — |

| | 34,790 |

|

| Other assets | | 9,170 |

|

| 11,510 |

| | 5,700 |

|

| 6,130 |

|

| Total assets | | $ | 536,380 |

| | $ | 661,030 |

| | $ | 466,000 |

| | $ | 521,350 |

|

| Liabilities and Shareholders' Equity | |

| |

| |

| |

|

| Current liabilities: | |

| |

| |

| |

|

| Current maturities, long-term debt | | $ | 12,530 |

|

| $ | 16,710 |

| |

| Short-term borrowings and current maturities, long-term debt | | | $ | 24,270 |

|

| $ | 13,860 |

|

| Accounts payable | | 109,390 |

|

| 138,730 |

| | 79,440 |

|

| 102,350 |

|

| Short-term operating lease liabilities | | | 9,850 |

| | — |

|

| Current liabilities held-for-sale | | | — |

| | 28,080 |

|

| Accrued liabilities | | 57,430 |

|

| 53,070 |

| | 53,020 |

|

| 58,520 |

|

| Total current liabilities | | 179,350 |

| | 208,510 |

| | 166,580 |

| | 202,810 |

|

| Gross long-term debt | | | 214,930 |

| | 382,220 |

|

| Unamortized debt issuance costs and discount | | | (34,200 | ) | | (31,570 | ) |

| Long-term debt | | 342,260 |

|

| 258,880 |

| | 180,730 |

| | 350,650 |

|

| Deferred income taxes | | 13,600 |

|

| 14,870 |

| | 8,280 |

|

| 12,620 |

|

| Long-term operating lease liabilities | | | 50,890 |

| | — |

|

| Non-current liabilities held-for-sale | | | — |

| | 1,740 |

|

| Other long-term liabilities | | 19,000 |

|

| 38,370 |

| | 20,770 |

|

| 19,750 |

|

| Total liabilities | | 554,210 |

| | 520,630 |

| | 427,250 |

| | 587,570 |

|

| Commitments and contingent liabilities | | — |

| | — |

| |

| Shareholders' equity: | | | | | |

| Contingencies (See Note 13) | | |

|

| |

|

|

| Shareholders' equity (deficit): | | | | | |

Preferred stock, $0.01 par: Authorized 100,000,000 shares;

Issued and outstanding: None | | — |

| | — |

| | — |

| | — |

|

Common stock, $0.01 par: Authorized 400,000,000 shares;

25,798,745 shares issued and 25,112,239 outstanding at September 30, 2018, respectively, and 25,625,571 shares issued and 24,939,065 outstanding at December 31, 2017, respectively | | 250 |

| | 250 |

| |

| Common stock, $0.01 par: Authorized 400,000,000 shares; 26,073,894 shares issued and 25,387,388 outstanding at September 30, 2019, and 25,866,747 shares issued and 25,180,241 outstanding at December 31, 2018 | | | 250 |

| | 250 |

|

| Common stock warrants exercisable for 6,487,674 shares issued and outstanding at September 30, 2019; none issued and outstanding at December 31, 2018 | | | 10,720 |

| | — |

|

| Paid-in capital | | 160,960 |

| | 159,830 |

| | 162,760 |

| | 160,990 |

|

| Treasury stock, at cost: 686,506 shares at September 30, 2018 and December 31, 2017 | | (10,000 | ) | | (10,000 | ) | |

| Treasury stock, at cost: 686,506 shares at September 30, 2019 and December 31, 2018 | | | (10,000 | ) | | (10,000 | ) |

| Accumulated deficit | | (175,960 | ) | | (18,760 | ) | | (110,390 | ) | | (222,720 | ) |

| Accumulated other comprehensive income | | 9,200 |

| | 10,570 |

| |

| Total Horizon Global shareholders' equity | | (15,550 | ) | | 141,890 |

| |

| Accumulated other comprehensive (loss) income | | | (11,250 | ) | | 7,760 |

|

| Total Horizon Global shareholders' equity (deficit) | | | 42,090 |

| | (63,720 | ) |

| Noncontrolling interest | | (2,280 | ) | | (1,490 | ) | | (3,340 | ) | | (2,500 | ) |

| Total shareholders' equity | | (17,830 | ) | | 140,400 |

| |

| Total shareholders' equity (deficit) | | | 38,750 |

| | (66,220 | ) |

| Total liabilities and shareholders' equity | | $ | 536,380 |

| | $ | 661,030 |

| | $ | 466,000 |

| | $ | 521,350 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

HORIZON GLOBAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS)OPERATIONS

(unaudited—dollars in thousands, except forshare and per share amounts)data)

| | | | | Three months ended

September 30, | | Nine months ended

September 30, | | Three months ended

September 30, | | Nine months ended

September 30, |

| | | 2018 | | 2017 | | 2018 | | 2017 | | 2019 | | 2018 | | 2019 | | 2018 |

| Net sales | | $ | 227,840 |

| | $ | 240,120 |

| | $ | 677,990 |

| | $ | 696,990 |

| | $ | 177,850 |

| | $ | 194,030 |

| | $ | 548,170 |

| | $ | 576,250 |

|

| Cost of sales | | (184,220 | ) | | (181,700 | ) | | (548,350 | ) | | (525,510 | ) | | (149,560 | ) | | (159,500 | ) | | (460,010 | ) | | (472,120 | ) |

| Gross profit | | 43,620 |

| | 58,420 |

| | 129,640 |

| | 171,480 |

| | 28,290 |

| | 34,530 |

| | 88,160 |

| | 104,130 |

|

| Selling, general and administrative expenses | | (40,920 | ) | | (45,130 | ) | | (145,220 | ) | | (134,610 | ) | | (41,100 | ) | | (37,680 | ) | | (113,140 | ) | | (134,210 | ) |

| Impairment | | (26,640 | ) | | — |

| | (125,770 | ) | | — |

| |

| Operating profit (loss) | | (23,940 | ) | | 13,290 |

| | (141,350 | ) | | 36,870 |

| |

| Other expense, net: | | | | | | | | | |

| Impairment of goodwill and intangible assets | | | — |

| | (26,640 | ) | | — |

| | (125,770 | ) |

| Net gain (loss) on dispositions of property and equipment | | | 50 |

| | (110 | ) | | 1,500 |

| | (520 | ) |

| Operating loss | | | (12,760 | ) | | (29,900 | ) | | (23,480 | ) | | (156,370 | ) |

| Other expense, net | | | (1,640 | ) | | (1,040 | ) | | (6,610 | ) | | (7,410 | ) |

| Interest expense | | (7,650 | ) | | (5,540 | ) | | (19,790 | ) | | (16,650 | ) | | (24,120 | ) | | (7,590 | ) | | (50,270 | ) | | (19,580 | ) |

| Loss on extinguishment of debt | | — |

| | — |

| | — |

| | (4,640 | ) | |

| Other expense, net | | (1,510 | ) | | (1,310 | ) | | (9,240 | ) | | (2,560 | ) | |

| Other expense, net | | (9,160 | ) | | (6,850 | ) | | (29,030 | ) | | (23,850 | ) | |

| Income (loss) before income tax benefit | | (33,100 | ) | | 6,440 |

| | (170,380 | ) | | 13,020 |

| |

| Loss from continuing operations before income tax | | | (38,520 | ) | | (38,530 | ) | | (80,360 | ) | | (183,360 | ) |

| Income tax benefit | | 100 |

| | 120 |

| | 12,460 |

| | 3,350 |

| | 1,020 |

| | 1,420 |

| | 2,330 |

| | 15,770 |

|

| Net loss from continuing operations | | | (37,500 | ) | | (37,110 | ) | | (78,030 | ) | | (167,590 | ) |

| Income from discontinued operations, net of tax | | | 182,750 |

| | 4,110 |

| | 189,520 |

| | 9,670 |

|

| Net income (loss) | | (33,000 | ) | | 6,560 |

| | (157,920 | ) | | 16,370 |

| | 145,250 |

| | (33,000 | ) | | 111,490 |

|

| (157,920 | ) |

| Less: Net loss attributable to noncontrolling interest | | (240 | ) | | (330 | ) | | (720 | ) | | (920 | ) | | (260 | ) | | (240 | ) | | (840 | ) | | (720 | ) |

| Net income (loss) attributable to Horizon Global | | $ | (32,760 | ) | | $ | 6,890 |

| | $ | (157,200 | ) | | $ | 17,290 |

| | $ | 145,510 |

| | $ | (32,760 | ) | | $ | 112,330 |

| | $ | (157,200 | ) |

| Net income (loss) per share attributable to Horizon Global: | | | | | |

| |

| | | | | | | | |

| Basic | | $ | (1.31 | ) | | $ | 0.28 |

| | $ | (6.28 | ) | | $ | 0.70 |

| |

| Diluted | | $ | (1.31 | ) | | $ | 0.27 |

| | $ | (6.28 | ) | | $ | 0.69 |

| |

| Basic: | | | | | | | | | |

| Continuing operations | | | $ | (1.47 | ) | | $ | (1.47 | ) | | $ | (3.05 | ) | | $ | (6.67 | ) |

| Discontinued operations | | | 7.21 |

| | 0.16 |

| | 7.50 |

| | 0.39 |

|

| Total | | | 5.74 |

| | (1.31 | ) | | 4.45 |

| | (6.28 | ) |

| Diluted: | | | | | | | | | |

| Continuing operations | | | (1.47 | ) | | (1.47 | ) | | (3.05 | ) | | (6.67 | ) |

| Discontinued operations | | | 7.21 |

| | 0.16 |

| | 7.50 |

| | 0.39 |

|

| Total | | | 5.74 |

| | (1.31 | ) | | 4.45 |

| | (6.28 | ) |

| Weighted average common shares outstanding: | | | | | | | | | | | | | | | | |

| Basic | | 25,101,847 |

| | 24,948,410 |

| | 25,028,072 |

| | 24,728,643 |

| | 25,329,492 |

| | 25,101,847 |

| | 25,267,310 |

| | 25,028,072 |

|

| Diluted | | 25,101,847 |

| | 25,379,252 |

| | 25,028,072 |

| | 25,154,800 |

| | 25,329,492 |

| | 25,101,847 |

| | 25,267,310 |

| | 25,028,072 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

HORIZON GLOBAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)LOSS

(unaudited—dollars in thousands)

| | | | | Three months ended

September 30, | | Nine months ended

September 30, | | Three months ended

September 30, | | Nine months ended

September 30, |

| | | 2018 | | 2017 | | 2018 | | 2017 | | 2019 | | 2018 | | 2019 | | 2018 |

| Net income (loss) | | $ | (33,000 | ) | | $ | 6,560 |

| | $ | (157,920 | ) | | $ | 16,370 |

| | $ | 145,250 |

| | $ | (33,000 | ) | | $ | 111,490 |

| | $ | (157,920 | ) |

| Other comprehensive income (loss), net of tax: | | | | | | | | | |

| Foreign currency translation | | (680 | ) | | 2,020 |

| | (4,400 | ) | | 15,520 |

| |

| Derivative instruments (Note 9) | | 640 |

| | (1,080 | ) | | 2,960 |

| | 170 |

| |

| Total other comprehensive income (loss) | | (40 | ) | | 940 |

| | (1,440 | ) | | 15,690 |

| |

| Other comprehensive loss, net of tax: | | | | | | | | | |

| Foreign currency translation and other | | | (1,320 | ) | | (680 | ) | | (30 | ) | | (4,400 | ) |

| Derivative instruments | | | (440 | ) | | 640 |

| | (1,720 | ) | | 2,960 |

|

| Total other comprehensive loss, net of tax | | | (1,760 | ) | | (40 | ) | | (1,750 | ) | | (1,440 | ) |

| Total comprehensive income (loss) | | (33,040 | ) | | 7,500 |

| | (159,360 | ) | | 32,060 |

| | 143,490 |

| | (33,040 | ) | | 109,740 |

| | (159,360 | ) |

| Less: Comprehensive loss attributable to noncontrolling interest | | (240 | ) | | (320 | ) | | (790 | ) | | (900 | ) | | (250 | ) | | (240 | ) | | (830 | ) | | (790 | ) |

| Comprehensive income (loss) attributable to Horizon Global | | $ | (32,800 | ) | | $ | 7,820 |

| | $ | (158,570 | ) | | $ | 32,960 |

| | $ | 143,740 |

| | $ | (32,800 | ) | | $ | 110,570 |

| | $ | (158,570 | ) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

HORIZON GLOBAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited—dollars in thousands)

| | | | | Nine months ended

September 30, |

| Nine months ended

September 30, |

| | | 2018 | | 2017 |

| 2019 |

| 2018 |

| Cash Flows from Operating Activities: | | | | |

|

|

|

|

| Net income (loss) | | $ | (157,920 | ) | | $ | 16,370 |

| | $ | 111,490 |

| | $ | (157,920 | ) |

| Adjustments to reconcile net income (loss) to net cash used for operating activities: | | | | | |

| Net loss on dispositions of property and equipment | | 490 |

| | 330 |

| |

| Less: Net income from discontinued operations | | | 189,520 |

| | 9,670 |

|

| Net loss from continuing operations | | | (78,030 | ) | | (167,590 | ) |

| | | |

| |

|

| Adjustments to reconcile net loss from continued operations to net cash used for operating activities: | |

|

|

|

|

| Net (gain) loss on dispositions of property and equipment | |

| (1,500 | ) | | 520 |

|

| Depreciation | | 12,540 |

| | 10,280 |

|

| 11,980 |

| | 9,410 |

|

| Amortization of intangible assets | | 6,170 |

| | 7,660 |

|

| 4,800 |

| | 5,640 |

|

| Write off of operating lease assets | | | 4,250 |

| | — |

|

| Impairment of goodwill and intangible assets | | 125,770 |

| | — |

|

| — |

| | 125,770 |

|

| Amortization of original issuance discount and debt issuance costs | | 6,050 |

| | 5,090 |

|

| 18,570 |

| | 6,050 |

|

| Deferred income taxes | | (3,370 | ) | | 840 |

|

| (3,390 | ) | | (3,370 | ) |

| Loss on extinguishment of debt | | — |

| | 4,640 |

| |

| Non-cash compensation expense | | 1,430 |

| | 2,760 |

|

| 1,790 |

| | 1,430 |

|

| Amortization of purchase accounting inventory step-up | | — |

| | 420 |

| |

| Paid-in-kind interest | |

| 7,620 |

| | — |

|

| Increase in receivables | | (35,120 | ) | | (28,360 | ) |

| (4,680 | ) | | (31,950 | ) |

| (Increase) decrease in inventories | | 5,980 |

| | (7,920 | ) | |

| Decrease in prepaid expenses and other assets | | 1,410 |

| | 3,490 |

| |

| Increase (decrease) in accounts payable and accrued liabilities | | (30,060 | ) | | (17,440 | ) | |

| Decrease in inventories | |

| 1,920 |

| | 5,630 |

|

| (Increase) decrease in prepaid expenses and other assets | |

| (2,770 | ) | | 1,150 |

|

| Decrease in accounts payable and accrued liabilities | |

| (15,560 | ) | | (27,450 | ) |

| Other, net | | 590 |

| | (480 | ) |

| (10,800 | ) | | 220 |

|

| Net cash used for operating activities | | (66,040 | ) | | (2,320 | ) | |

| Net cash used for operating activities for continuing operations | | | (65,800 | ) | | (74,540 | ) |

| Cash Flows from Investing Activities: | | | | | | | | |

| Capital expenditures | | (10,820 | ) | | (20,270 | ) | | (8,460 | ) | | (9,660 | ) |

| Acquisition of businesses, net of cash acquired | | — |

| | (19,800 | ) | |

| Net proceeds from sale of business | | | 214,570 |

| | — |

|

| Net proceeds from disposition of property and equipment | | 160 |

| | 1,080 |

| | 1,470 |

| | (280 | ) |

| Net cash used for investing activities | | (10,660 | ) | | (38,990 | ) | |

| Net cash provided by (used for) investing activities for continuing operations | | | 207,580 |

| | (9,940 | ) |

| Cash Flows from Financing Activities: | | | | | | | | |

| Proceeds from borrowings on credit facilities | | 12,550 |

| | 36,970 |

| | 13,780 |

| | 12,550 |

|

| Repayments of borrowings on credit facilities | | (14,390 | ) | | (41,630 | ) | | (6,520 | ) | | (14,390 | ) |

| Proceeds from Term B Loan, net of issuance costs | | 45,430 |

| | — |

| |

| Repayments of borrowings on Term B Loan, inclusive of transaction costs | | (6,490 | ) | | (187,820 | ) | |

| Proceeds from ABL Revolving Debt | | 72,430 |

| | 114,500 |

| |

| Proceeds from Second Lien Term Loan, net of issuance costs | | | 35,520 |

| | 45,430 |

|

| Repayments of borrowings on First Lien Term Loan, inclusive of transaction costs | | | (173,430 | ) | | (6,490 | ) |

| Proceeds from ABL Revolving Debt, net of issuance costs | | | 68,790 |

| | 72,430 |

|

| Repayments of borrowings on ABL Revolving Debt | | (34,830 | ) | | (94,500 | ) | | (112,510 | ) | | (34,830 | ) |

| Proceeds from issuance of common stock, net of offering costs | | — |

| | 79,920 |

| |

| Repurchase of common stock | | — |

| | (10,000 | ) | |

| Proceeds from issuance of Convertible Notes, net of issuance costs | | — |

| | 121,130 |

| |

| Proceeds from issuance of Warrants, net of issuance costs | | — |

| | 20,930 |

| |

| Payments on Convertible Note Hedges, inclusive of issuance costs | | — |

| | (29,680 | ) | |

| Proceeds from issuance of Series A Preferred Stock | | | 5,340 |

| | — |

|

| Proceeds from issuance of Warrants | | | 5,380 |

| | — |

|

| Other, net | | (300 | ) | | (240 | ) | | (10 | ) | | (300 | ) |

| Net cash provided by financing activities | | 74,400 |

| | 9,580 |

| |

| Net cash (used for) provided by financing activities for continuing operations | | | (163,660 | ) | | 74,400 |

|

| Discontinued Operations: | | | | | |

| Net cash provided by discontinued operating activities | | | 11,430 |

| | 8,500 |

|

| Net cash used for discontinued investing activities | | | (1,120 | ) | | (720 | ) |

| Net cash provided by (used for) discontinued financing activities | | | — |

| | — |

|

| Net cash provided by discontinued operations | | | 10,310 |

| | 7,780 |

|

| Effect of exchange rate changes on cash | | 40 |

| | 1,960 |

| | 280 |

| | 40 |

|

| Cash and Cash Equivalents: | | | | | | | | |

| Decrease for the period | | (2,260 | ) | | (29,770 | ) | | (11,290 | ) | | (2,260 | ) |

| At beginning of period | | 29,570 |

| | 50,240 |

| | 27,650 |

| | 29,570 |

|

| At end of period | | $ | 27,310 |

| | $ | 20,470 |

| | $ | 16,360 |

|

| $ | 27,310 |

|

| Supplemental disclosure of cash flow information: | | | | | | | | |

| Cash paid for interest | | $ | 13,520 |

| | $ | 10,090 |

| | $ | 19,730 |

| | $ | 13,430 |

|

| Cash paid for taxes | | $ | 4,340 |

| | $ | 6,110 |

| | $ | 480 |

| | $ | 2,170 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

HORIZON GLOBAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Nine Months Ended September 30, 2018

(unaudited—dollars in thousands)

| | | | | Common

Stock | | Paid-in

Capital | | Treasury Stock | | Accumulated Deficit | | Accumulated

Other

Comprehensive

Income (Loss) | | Total Horizon Global Shareholders’ Equity | | Noncontrolling Interest | | Total Shareholders’ Equity | | Common

Stock | | Common Stock Warrants | | Paid-in

Capital | | Treasury Stock | | Accumulated Deficit | | Accumulated

Other

Comprehensive

Income (Loss) | | Total Horizon Global Shareholders’ Deficit | | Noncontrolling Interest | | Total Shareholders’ Deficit |

| Balance at December 31, 2017, as reported | | $ | 250 |

| | $ | 159,490 |

| | $ | (10,000 | ) | | $ | (17,860 | ) | | $ | 10,010 |

| | $ | 141,890 |

| | $ | (1,490 | ) | | $ | 140,400 |

| |

| Impact of ASU 2018-02 | | — |

| | 340 |

| | — |

| | (900 | ) | | 560 |

| | — |

| | — |

| | — |

| |

| Balance at December 31, 2017, as restated | | 250 |

| | 159,830 |

| | (10,000 | ) | | (18,760 | ) | | 10,570 |

| | 141,890 |

| | (1,490 | ) | | 140,400 |

| |

| Balance at January 1, 2019 | | | $ | 250 |

| | $ | — |

| | $ | 160,990 |

| | $ | (10,000 | ) | | $ | (222,720 | ) | | $ | 7,760 |

| | $ | (63,720 | ) | | $ | (2,500 | ) | | $ | (66,220 | ) |

| Net loss | | — |

| | — |

| | — |

| | (57,510 | ) | | — |

| | (57,510 | ) | | (250 | ) | | (57,760 | ) | | — |

| | — |

| | — |

| | — |

| | (25,100 | ) | | — |

| | (25,100 | ) | | (520 | ) | | (25,620 | ) |

| Other comprehensive income, net of tax | | — |

| | — |

| | — |

| | — |

| | 4,680 |

| | 4,680 |

| | 10 |

| | 4,690 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 140 |

| | 140 |

| | — |

| | 140 |

|

| Shares surrendered upon vesting of employees' share based payment awards to cover tax obligations | | — |

| | (200 | ) | | — |

| | — |

| | — |

| | (200 | ) | | — |

| | (200 | ) | |

| Shares surrendered upon vesting of employees share based payment awards to cover tax obligations | | | — |

| | — |

| | (10 | ) | | — |

| | — |

| | — |

| | (10 | ) | | — |

| | (10 | ) |

| Non-cash compensation expense | | — |

| | 720 |

| | — |

| | — |

| | — |

| | 720 |

| | — |

| | 720 |

| | — |

| | — |

| | 350 |

| | — |

| | — |

| | — |

| | 350 |

| | — |

| | 350 |

|

| Balance at March 31, 2018 | | 250 |

| | 160,350 |

| | (10,000 | ) | | (76,270 | ) | | 15,250 |

| | 89,580 |

| | (1,730 | ) | | 87,850 |

| |

| Net loss | | — |

| | — |

| | — |

| | (66,930 | ) | | — |

| | (66,930 | ) | | (230 | ) | | (67,160 | ) | |

| Issuance of Warrants | | | — |

| | 5,380 |

| | — |

| | — |

| | — |

| | — |

| | 5,380 |

| | — |

| | 5,380 |

|

| Balance at March 31, 2019 | | | 250 |

|

| 5,380 |

|

| 161,330 |

|

| (10,000 | ) |

| (247,820 | ) |

| 7,900 |

|

| (82,960 | ) |

| (3,020 | ) |

| (85,980 | ) |

| Net Loss | | | — |

| | — |

| | — |

| | — |

| | (8,080 | ) | | — |

| | (8,080 | ) | | (60 | ) | | (8,140 | ) |

| Other comprehensive income, net of tax | | | — |

| | — |

| | — |

| | — |

| | — |

| | (130 | ) | | (130 | ) | | — |

| | (130 | ) |

| Non-cash compensation expense | | | — |

| | — |

| | 590 |

| | — |

| | — |

| | — |

| | 590 |

| | — |

| | 590 |

|

| Issuance of Warrants | | | — |

| | 5,340 |

| | — |

| | — |

| | — |

| | — |

| | 5,340 |

| | — |

| | 5,340 |

|

| Balance as of June 30, 2019 | | | 250 |

| | 10,720 |

| | 161,920 |

| | (10,000 | ) | | (255,900 | ) | | 7,770 |

| | (85,240 | ) | | (3,080 | ) | | (88,320 | ) |

| Net income | | | — |

| | — |

| | — |

| | — |

| | 145,510 |

| | — |

| | 145,510 |

| | (260 | ) | | 145,250 |

|

| Other comprehensive loss, net of tax | | — |

| | — |

| | — |

| | — |

| | (6,010 | ) | | (6,010 | ) | | (80 | ) | | (6,090 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | (1,760 | ) | | (1,760 | ) | | — |

| | (1,760 | ) |

| Shares surrendered upon vesting of employees' share based payment awards to cover tax obligations | | — |

| | (10 | ) | | — |

| | — |

| | — |

| | (10 | ) | | — |

| | (10 | ) | |

| Non-cash compensation expense | | — |

| | 490 |

| | — |

| | — |

| | — |

| | 490 |

| | — |

| | 490 |

| | — |

| | — |

| | 840 |

| | — |

| | — |

| | — |

| | 840 |

| | — |

| | 840 |

|

| Balance at June 30, 2018 | | 250 |

| | 160,830 |

| | (10,000 | ) | | (143,200 | ) | | 9,240 |

| | 17,120 |

| | (2,040 | ) | | 15,080 |

| |

| Net loss | | — |

| | — |

| | — |

| | (32,760 | ) | | — |

| | (32,760 | ) | | (240 | ) | | (33,000 | ) | |

| Other comprehensive loss, net of tax | | — |

| | — |

| | — |

| | — |

| | (40 | ) | | (40 | ) | |

| | (40 | ) | |

| Shares surrendered upon vesting of employees' share based payment awards to cover tax obligations | | — |

| | (90 | ) | | — |

| | — |

| | — |

| | (90 | ) | | — |

| | (90 | ) | |

| Non-cash compensation expense | | — |

| | 220 |

| | — |

| | — |

| | — |

| | 220 |

| | — |

| | 220 |

| |

| Balance at September 30, 2018 | | $ | 250 |

| | $ | 160,960 |

| | $ | (10,000 | ) | | $ | (175,960 | ) | | $ | 9,200 |

| | $ | (15,550 | ) | | $ | (2,280 | ) | | $ | (17,830 | ) | |

| Amounts reclassified from AOCI | | | — |

| | — |

| | — |

| | — |

| | — |

| | (17,260 | ) | | (17,260 | ) | | — |

| | (17,260 | ) |

| Balance at September 30, 2019 | | | $ | 250 |

|

| $ | 10,720 |

|

| $ | 162,760 |

|

| $ | (10,000 | ) |

| $ | (110,390 | ) |

| $ | (11,250 | ) |

| $ | 42,090 |

|

| $ | (3,340 | ) |

| $ | 38,750 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Common

Stock | | Common Stock Warrants | | Paid-in

Capital | | Treasury Stock | | Accumulated Deficit | | Accumulated

Other

Comprehensive

Income (Loss) | | Total Horizon Global Shareholders’ Equity | | Noncontrolling Interest | | Total Shareholders’ Equity |

| Balance at December 31, 2017, as reported | | $ | 250 |

| | $ | — |

| | $ | 159,490 |

| | $ | (10,000 | ) | | $ | (17,860 | ) | | $ | 10,010 |

| | $ | 141,890 |

| | $ | (1,490 | ) | | $ | 140,400 |

|

| Impact of ASU 2018-02 | | — |

| | — |

| | 340 |

| | — |

| | (900 | ) | | 560 |

| | — |

| | — |

| | — |

|

| Balance at January 1, 2018, as restated | | 250 |

|

| — |

|

| 159,830 |

|

| (10,000 | ) |

| (18,760 | ) |

| 10,570 |

|

| 141,890 |

|

| (1,490 | ) |

| 140,400 |

|

| Net loss | | — |

| | — |

| | — |

| | — |

| | (57,510 | ) | | — |

| | (57,510 | ) | | (250 | ) | | (57,760 | ) |

| Other comprehensive income, net of tax | | — |

| | — |

| | — |

| | — |

| | — |

| | 4,680 |

| | 4,680 |

| | 10 |

| | 4,690 |

|

| Shares surrendered upon vesting of employees share based payment awards to cover tax obligations | | — |

| | — |

| | (200 | ) | | — |

| | — |

| | — |

| | (200 | ) | | — |

| | (200 | ) |

| Non-cash compensation expense | | — |

| | — |

| | 720 |

| | — |

| | — |

| | — |

| | 720 |

| | — |

| | 720 |

|

| Balance at March 31, 2018 | | 250 |

|

| — |

|

| 160,350 |

|

| (10,000 | ) |

| (76,270 | ) |

| 15,250 |

| | 89,580 |

| | (1,730 | ) | | 87,850 |

|

| Net loss | | — |

| | — |

| | — |

| | — |

| | (66,930 | ) | | — |

| | (66,930 | ) | | (230 | ) | | (67,160 | ) |

| Other comprehensive income, net of tax | | — |

| | — |

| | — |

| | — |

| | — |

| | (6,010 | ) | | (6,010 | ) | | (80 | ) | | (6,090 | ) |

| Shares surrendered upon vesting of employees share based payment awards to cover tax obligations | | — |

| | — |

| | (10 | ) | | — |

| | — |

| | — |

| | (10 | ) | | — |

| | (10 | ) |

| Non-cash compensation expense | | — |

| | — |

| | 490 |

| | — |

| | — |

| | — |

| | 490 |

| | — |

| | 490 |

|

| Balance at June 30, 2018 | | 250 |

| | — |

| | 160,830 |

| | (10,000 | ) | | (143,200 | ) | | 9,240 |

| | 17,120 |

| | (2,040 | ) | | 15,080 |

|

| Net loss | | — |

| | — |

| | — |

| | — |

| | (32,760 | ) | | — |

| | (32,760 | ) | | (240 | ) | | (33,000 | ) |

| Other comprehensive income, net of tax | | — |

| | — |

| | — |

| | — |

| | — |

| | (40 | ) | | (40 | ) | | — |

| | (40 | ) |

| Shares surrendered upon vesting of employees share based payment awards to cover tax obligations | | — |

| | — |

| | (90 | ) | | — |

| | — |

| | — |

| | (90 | ) | | — |

| | (90 | ) |

| Non-cash compensation expense | | — |

| | — |

| | 220 |

| | — |

| | — |

| | — |

| | 220 |

| | — |

| | 220 |

|

| Balance at September 30, 2018 | | $ | 250 |

| | $ | — |

| | $ | 160,960 |

| | $ | (10,000 | ) | | $ | (175,960 | ) | | $ | 9,200 |

| | $ | (15,550 | ) | | $ | (2,280 | ) | | $ | (17,830 | ) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

HORIZON GLOBAL CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

1. Nature of Operations and Basis of Presentation

Horizon Global Corporation (“Horizon,” “Horizon Global,” “we,” or the “Company”) is a global designer, manufacturer and distributor of a wide variety of high quality, custom-engineered towing, trailering, cargo management and other related accessories. These products are designed to support original equipment manufacturers (“OEMs”) and original equipment suppliersservicers (“OESs”) (collectively, “OEs”), aftermarket and retail customers within the agricultural, automotive, construction, horse/livestock, industrial, marine, military, recreational, trailer and utility markets. The Company groups its operating segmentsbusiness into reportableoperating segments by the region in which sales and manufacturing efforts are focused. TheAs a result of the Company’s reportablesale of its Horizon Asia-Pacific operating segment (“APAC”), the Company’s operating segments are Horizon Americas Horizon Europe-Africa, and Horizon Asia-Pacific.Europe-Africa. See Note 10,17, “Segment Information,” for further information on each of the Company’s reportableoperating segments. Historical information has been retrospectively adjusted to reflect the classification of APAC as discontinued operations. Discontinued operations are further discussed in Note 3, “Discontinued Operations”.

The accompanying unaudited condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”) for interim financial information and should be read in conjunction with the consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017.2018. Accordingly, they do not include all of the information and footnotes required by accounting principles generally accepted in the United States (“U.S. GAAP”) for complete financial statements. It is management’s opinion that these financial statements contain all adjustments, including adjustments of a normal and recurring nature, necessary for a fair presentation of financial position and results of operations. Results of operations for interim periods are not necessarily indicative of results for the full year.

2. New Accounting Pronouncements

Accounting pronouncements recently adopted

In June 2018, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2018-07, “Compensation - Stock Compensation (Topic 718)” (“ASU 2018-07”). ASU 2018-07 expands the scope of Accounting Standard Codification (“ASC”) 718 to include all share-based payment arrangements related to the acquisition of goods and services from both nonemployeesnon-employees and employees. ASU 2018-07 is effective for fiscal years, and interim periods within those years, beginning after December 15, 2018 with early adoption permitted. The Company is in process of assessing the impact of the adoption ofadopted ASU 2018-07 on January 1, 2019, and there was no impact on the Company’s condensed consolidated financial statements.

In February 2018, the FASB issued ASU 2018-02, “Income Statement - Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income” (“ASU 2018-02”). ASU 2018-02 allows a reclassification from accumulated other comprehensive income to retained earnings for stranded tax effects resulting from the Tax Cuts and Jobs Act (the “2017 Tax Act”). ASU 2018-02 is effective for fiscal years, and interim periods within those years, beginning after December 15, 2018, with early adoption permitted. It must be applied either in the period of adoption or retrospectively to each period in which the effect of the change in the U.S. federal corporate income tax rate from the 2017 Tax Act is recognized. The Company adopted the standard in the third quarter of 2018 and the impact of the adoption of ASU 2018-02 is approximately a $0.9 million increase to accumulated deficit, a $0.3 million decrease to paid-in capital, and a $0.6 million decrease to accumulated other comprehensive income.

In August 2017, the FASB issued ASU 2017-12, “Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities” (“ASU 2017-12”). ASU 2017-12 eliminates the requirement to separately measure and report hedge ineffectiveness and generally requires, for qualifying hedges, the entire change in the fair value of a hedging instrument to be presented in the same income statement line as the hedged item. The guidance also modifies the accounting for components excluded from the assessment of hedge effectiveness, eases documentation and assessment requirements and modifies certain disclosure requirements. ASU 2017-12 is effective for fiscal years beginning after December 15, 2018, including interim periods within those annual periods, with early adoption permitted and should be applied on a modified retrospective basis. The Company is in the process of assessing the impact of the adoption ofadopted ASU 2017-12 on the condensed consolidated financial statements.

In May 2017, the FASB issued ASU 2017-09, “Compensation-Stock Compensation (Topic 718): Scope of Modification Accounting” (“ASU 2017-09”). ASU 2017-09 amends the scope of modification accounting for share-based payment arrangements and provides guidance on when an entity would be required to apply modification accounting. This guidance is effective for all entities for annual periods beginning after December 15, 2017, including interim periods within those annual periods, with early adoption permitted and should be applied on a prospective basis. The Company adopted ASU 2017-09 on January 1, 2018, on a prospective basis,2019, and there was no impact on the condensed consolidated financial statements.

In January 2017, the FASB issued ASU 2017-01, “Business Combinations (Topic 805): Clarifying the Definition of a

HORIZON GLOBAL CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

Business” (“ASU 2017-01”). ASU 2017-01 provides clarification on the definition of a business and adds guidance to assist entities with evaluating whether transactions should be accounted for as acquisitions (or disposals) of assets or businesses. This guidance is effective for public entities for fiscal years beginning after December 15, 2017, including interim periods within those annual periods, and should be applied on a prospective basis. As of January 1, 2018, ASU 2017-01 became effective for the Company for any new acquisitions (or disposals), and there was no impact on the condensed consolidated financial statements.

In October 2016, the FASB issued ASU 2016-16, “Income Taxes (Topic 740): Intra-Entity Transfers of Assets Other Than Inventory” (“ASU 2016-16”). ASU 2016-16 provides an amendment to the accounting guidance related to the recognition of income tax consequences of an intra-entity transfer of an asset other than inventory. Under the new guidance, an entity is required to recognize the income tax consequences of an intra-entity transfer of an asset other than inventory when the transfer occurs. Under the current guidance, the income tax effects are deferred until the asset has been sold to an outside party. The Company adopted ASU 2016-16 on January 1, 2018, on a modified retrospective basis, and there was no impact on the condensed consolidated financial statements.

In August 2016, the FASB issued ASU 2016-15, “Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments (a consensus of the Emerging Issues Task Force)” (“ASU 2016-15”). ASU 2016-15 was issued to reduce differences in practice with respect to how specific transactions are classified in the statement of cash flows. This guidance is effective for public entities for fiscal years beginning after December 15, 2017, including interim periods within those annual periods, with early adoption permitted and should be applied on a retrospective basis. The Company adopted ASU 2016-15 on January 1, 2018, and there was no impact on theCompany’s condensed consolidated financial statements.

In February 2016, the FASB issued ASU 2016-02, “Leases (Topic 842)” (“ASU 2016-02”), which supersedes the leaseslease requirements in “Leases (Topic 840).” The objective of this update is to establish the principles that lessees and lessors shall apply to report useful information to users of financial statements about the amount, timing, and uncertainty of cash flows arising from a lease. The FASB has subsequently issued an additional ASU that provides entities with an additional (and optional) transition method to adopt the new leases standard. Under this new transition method, an entity initially appliesguidance, lessees are required to recognize on the newbalance sheet a lease liability and a right-of-use (“ROU”) asset for all leases, standardwith the exception of short-term leases with terms of twelve months or less. The lease liability represents the lessee’s obligation to make lease payments arising from a lease and will be measured as the present value of the lease payments. The ROU asset represents the lessee’s right to use a specified asset for the lease term, and will be measured at the adoption datelease liability amount, adjusted for lease prepayment, lease incentives received and recognizes a cumulative-effect adjustment to the opening balance of retained earnings in the period of adoption. The amendments also provide lessors with a practical expedient, by class of underlying asset, to not separate non-lease components from the associated lease component and, instead, to account for those components as a single component if the non-lease components otherwise would be accounted for under the revenue guidance (Topic 606) and certain criteria are met. ASU 2016-02 is effective for fiscal years beginning after December 15, 2018, including interim periods within those annual periods, with early adoption permitted. The Company is in the process of assessing the impact of the adoption of ASU 2016-02 on the condensed consolidated financial statements. The Company expects the impact to the condensed consolidated balance sheet to be significant. The Company plans to elect the practical expedients upon transition that will retain the lease classification andlessee’s initial direct costs for any leases that exist prior to adoption of the standard. Horizon will not reassess whether any contracts entered into prior to adoption are leases. costs.

The Company has formed a cross-functional implementation team and is inelected the processpackage of cataloging its existingpractical expedients, excluding the lease contracts and evaluating changesterm hindsight, as permitted by the transition guidance. The Company has made an accounting policy election to its systems to implementexempt leases with an initial term of twelve months or less from balance sheet recognition. Instead, short-term leases will be expensed over the new guidance.lease term.

Accounting Standards Update 2014-09

In May 2014, the FASB issued ASU 2014-09, “Revenue from Contracts with Customers (Topic 606)” (“ASU 2014-09” or “Topic 606”). ASU 2014-09 supersedes most of the existing guidance on revenue recognition in ASC Topic 605, “Revenue Recognition” (“Topic 605”), and establishes a broad principle that would require an entity to recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The Company adopted Topic 606 as ofthe standard on January 1, 2018 using2019, by applying the modified retrospective method without restatement of comparative periods' financial information, as permitted by the transition method.guidance. The comparative information has not been restated and continues to be reported understandard had a material impact on the accounting standards in effect for those periods. The Company did not record a cumulative adjustment related to the adoption of ASU 2014-09, and the effects of adoption were not significant. See Note 3, “Revenues,” for further information.

HORIZON GLOBAL CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

Company’s condensed consolidated balance sheet, but did not have a material impact on its condensed consolidated statements of operations and cash flows. The most significant impact was the recognition of ROU assets and lease liabilities for operating leases, while the Company’s accounting for finance leases remained substantially unchanged.

See Note 12 “Leases,” for the impact of the adoption which resulted in the recognition of ROU assets and corresponding lease liabilities.

3. RevenuesDiscontinued Operations

Revenue RecognitionOn September 19, 2019, the Company completed the sale of its subsidiaries that comprised APAC to Hayman Pacific BidCo Pty Ltd., an affiliate of Pacific Equity Partners, for $209.6 million in net cash proceeds after payment of transaction costs, in a net debt free sale. The sale resulted in the recognition of a gain of $180.5 million, of which $17.3 million was related to the cumulative translation adjustment that was reclassified to earnings, which is reflected within the income from discontinued operations, net of taxes line of the condensed consolidated statement of operations.

The Company classified APAC assets and liabilities as held-for-sale as of December 31, 2018 in the accompanying condensed consolidated balance sheet and has classified APAC’s operating results and the gain on the sale as discontinued operations in the accompanying condensed consolidated statement of operations for all periods presented in accordance with ASC 205, “Discontinued Operations.” Prior to being classified as held-for-sale, APAC was included as a separate operating segment.

The following tables presentpresents the Company’s net sales disaggregated by major sales channel for the three and nine months ended September 30, 2018:results from discontinued operations:

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, 2018 |

| | | Horizon Americas | | Horizon Europe-Africa | | Horizon

Asia-Pacific | | Total |

| | | (dollars in thousands) |

| Net Sales | | | | | | | | |

| Automotive OEM | | $ | 20,320 |

| | $ | 40,650 |

| | $ | 5,740 |

| | $ | 66,710 |

|

| Automotive OES | | 1,700 |

| | 12,600 |

| | 15,190 |

| | 29,490 |

|

| Aftermarket | | 38,470 |

| | 19,980 |

| | 6,170 |

| | 64,620 |

|

| Retail | | 29,600 |

| | — |

| | 2,860 |

| | 32,460 |

|

| Industrial | | 11,160 |

| | — |

| | 3,850 |

| | 15,010 |

|

| E-commerce | | 13,750 |

| | 1,290 |

| | — |

| | 15,040 |

|

| Other | | 510 |

| | 4,000 |

| | — |

| | 4,510 |

|

| Total | | $ | 115,510 |

| | $ | 78,520 |

| | $ | 33,810 |

| | $ | 227,840 |

|

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2019 | | 2018 | | 2019 | | 2018 |

| | | (dollars in thousands) | | (dollars in thousands) |

| Net sales | | $ | 29,750 |

| | $ | 33,810 |

| | $ | 92,300 |

| | $ | 101,760 |

|

| Cost of sales | | (22,250 | ) | | (24,720 | ) | | (68,530 | ) | | (76,250 | ) |

| Selling, general and administrative expenses | | (3,050 | ) | | (3,130 | ) | | (9,580 | ) | | (10,510 | ) |

| Interest expense | | (80 | ) | | (60 | ) | | (310 | ) | | (210 | ) |

| Other expense. net | | (210 | ) | | (470 | ) | | (400 | ) | | (1,800 | ) |

| Income before income tax expense | | 4,160 |

| | 5,430 |

| | 13,480 |

| | 12,990 |

|

| Income tax expense | | (1,900 | ) | | (1,320 | ) | | (4,450 | ) | | (3,320 | ) |

Gain on sale of discontinued operations

| | $ | 180,490 |

| | $ | — |

| | $ | 180,490 |

| | $ | — |

|

| Income from discontinued operations, net of tax | | $ | 182,750 |

| | $ | 4,110 |

| | $ | 189,520 |

| | $ | 9,670 |

|

|

| | | | | | | | | | | | | | | | |

| | | Nine Months Ended September 30, 2018 |

| | | Horizon Americas | | Horizon Europe-Africa | | Horizon

Asia-Pacific | | Total |

| | | (dollars in thousands) |

| Net Sales | | | | | | | | |

| Automotive OEM | | $ | 60,320 |

| | $ | 134,930 |

| | $ | 18,250 |

| | $ | 213,500 |

|

| Automotive OES | | 4,230 |

| | 39,980 |

| | 45,170 |

| | 89,380 |

|

| Aftermarket | | 96,700 |

| | 65,180 |

| | 19,210 |

| | 181,090 |

|

| Retail | | 96,330 |

| | — |

| | 8,050 |

| | 104,380 |

|

| Industrial | | 31,680 |

| | — |

| | 11,080 |

| | 42,760 |

|

| E-commerce | | 29,340 |

| | 3,880 |

| | — |

| | 33,220 |

|

| Other | | 1,210 |

| | 12,450 |

| | — |

| | 13,660 |

|

| Total | | $ | 319,810 |

| | $ | 256,420 |

| | $ | 101,760 |

| | $ | 677,990 |

|

Revenue is recognized when obligations under the terms of a contract with the Company’s customers are satisfied; generally, this occurs with the transfer of control of its towing, trailering, cargo management and other related accessory products. Revenue is measured as the amount of consideration the Company expects to receive in exchange for transferring its products. Sales, value add, and other taxes the Company collects concurrent with revenue-producing activities are excluded from revenue. The Company’s payment terms vary by the type and location of its customers and the products offered. The term between invoicing and when payment is due is not significant.

For the majority of the Company’s sales arrangements, the Company deems control to transfer at a single point in time and recognizes revenue when it ships products from its manufacturing facilities to its customers. Once a product has shipped, the customer is able to direct the use of, and obtain substantially all of the remaining benefits from, the asset. The Company considers control to transfer upon shipment because the Company has a present right to payment at that time, the customer has legal title to the asset, and the customer has significant risks and rewards of ownership of the asset.

For certain sales arrangements within the automotive OEM and automotive OES sales channels, the Company deems control to transfer over time, and recognizes revenue as products are manufactured, when the terms of the arrangement include both a right

The following tables presents the Company’s assets and liabilities held for sale:

HORIZON GLOBAL CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

to payment and contractual restrictions against the alternative use of its products. For revenue recognized over time, the Company estimates the amount of revenue earned at a given point during the production cycle based on certain costs factors such as raw materials and labor, incurred to date, plus a reasonable profit. The Company believes this method, which is the cost-to-cost input method, best estimates the revenue recognizable for these arrangement. At September 30, 2018, the aggregate amount of the transaction prices allocated to remaining performance obligations was not material, and the Company will recognize this revenue as the manufacturing of the products is completed, which is expected to occur over the next 12 months.Provisions for customer volume rebates, product returns, discounts and allowances are variable consideration and are recorded as a reduction of revenue in the same period the related sales are recorded. Such provisions are calculated using historical averages adjusted for any expected changes due to current business conditions. Consideration given to customers for cooperative advertising is recognized as a reduction of revenue as there is no distinct good or service received in return for the advertising. The Company uses the most likely amount method to estimate variable consideration. Adjustments to estimates of variable consideration for previously recognized revenue were insignificant during the three and nine months ended September 30, 2018.

Contract Balances

The timing of revenue recognition, billings and cash collections and payments results in billed accounts receivable, unbilled receivables (contract assets), and deferred revenues (contract liabilities).

Revenue recognized over time gives rise to contract assets, which represent revenue recognized but unbilled. The Company’s sales arrangements satisfied over time create contract assets when revenue is recognized as the products are manufactured, as payment is not contractually required until the products have shipped. Contract assets in these arrangements are reclassified to accounts receivable upon shipment. At September 30, 2018, total opening and closing balances of contract assets were not material.

Contract liabilities are comprised of customer payments received or due in advance of the Company’s performance. At September 30, 2018, total opening and closing balances of deferred revenue were not material. The Company recognizes deferred revenue as net sales after the Company has transferred control of the products to the customer and all revenue recognition criteria is met. For the three and nine months ended September 30, 2018, the total amount of revenue recognized from revenue deferred in prior periods was not material.

Additionally, the Company monitors the aging of uncollected billings and adjusts its accounts receivable allowance on a quarterly basis, as necessary, based upon its evaluation of the probability of collection. The adjustments made by the Company due to the write-off of uncollectible amounts have been immaterial for all periods presented. At September 30, 2018 and December 31, 2017, the Company’s accounts receivable, net of reserves were $122.3 million and $91.8 million, respectively.

Practical Expedients

The Company elects the practical expedient to expense costs incurred to obtain a contract with a customer when the amortization period would have been one year or less. These costs include sales commissions as the Company has determined annual compensation is commensurate with annual sales activities.

The Company elects the practical expedient that does not require the Company to adjust consideration for the effects of a significant financing component when the period between shipment of its products and customer’s payment is one year or less.

4. Facility Closures

Solon, Ohio and Mosinee, Wisconsin |

| | | | |

| | | December 31, 2018 |

| | | (dollars in thousands) |

| Assets | | |

| Current assets: | | |

| Receivables, net of allowance for doubtful accounts | | $ | 13,170 |

|

| Inventories | | 21,490 |

|

| Prepaid expenses and other current assets | | 1,420 |

|

| Total current assets | | 36,080 |

|

| Non-current assets: | | |

| Property and equipment, net | | 15,780 |

|

| Goodwill | | 8,160 |

|

| Other intangibles, net | | 8,650 |

|

| Deferred income taxes | | 2,030 |

|

| Other assets | | 170 |

|

| Total non-current assets | | 34,790 |

|

| Assets held-for-sale | | $ | 70,870 |

|

| Liabilities | | |

| Current liabilities: | | |

| Accounts payable | | $ | 20,780 |

|

| Accrued liabilities | | 7,300 |

|

| Total current liabilities | | 28,080 |

|

| Non-current liabilities: | | |

| Deferred income taxes | | 1,530 |

|

| Other long-term liabilities | | 210 |

|

| Total non-current liabilities | | 1,740 |

|

| Total liabilities held-for-sale | | $ | 29,820 |

|

In the first quarter of 2018, the Company announced plans to close its facility in Solon, Ohio along with an engineering center in Mosinee, Wisconsin. The activities at these locations have been consolidated and moved to the headquarters of the Horizon Americas segment, located in Plymouth, Michigan. As of September 30, 2018, the Company vacated the Solon, Ohio and Mosinee, Wisconsin facilities. The Company is party to lease agreements for these facilities for which it has non-cancellable future rental obligations. The Company exited the facilities during the third quarter of 2018, and recorded a liability of approximately $1.5 million within accrued liabilities and other long-term liabilities in the Company’s condensed consolidated balance sheets as of September 30, 2018. The lease agreements expire in 2019 and 2022, respectively.

HORIZON GLOBAL CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

4. Revenues

Revenue Recognition

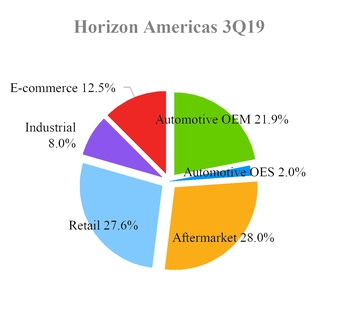

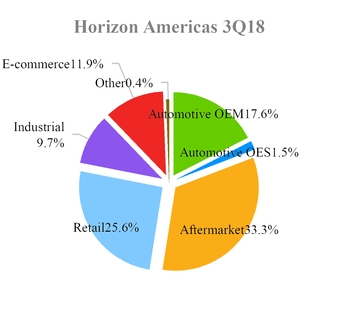

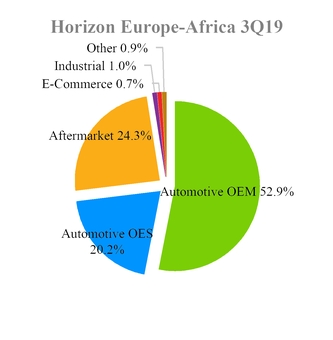

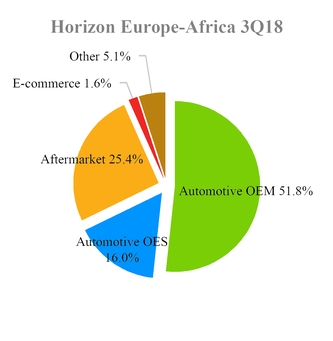

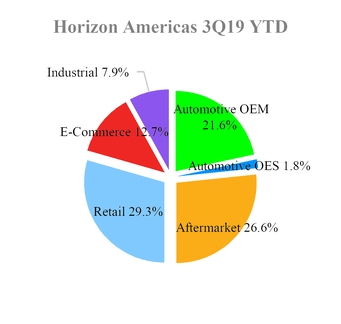

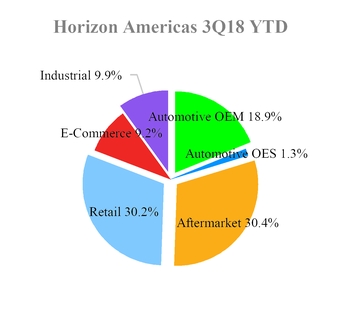

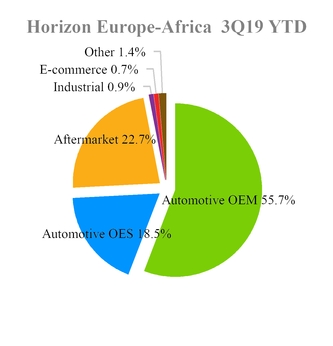

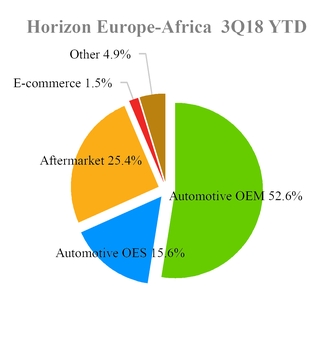

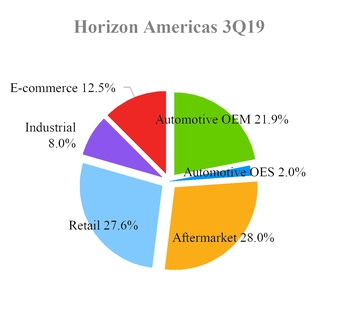

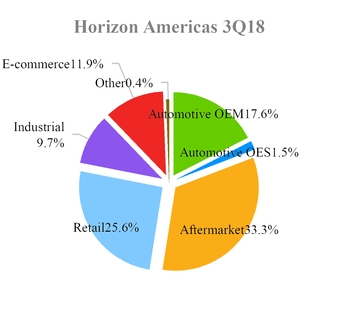

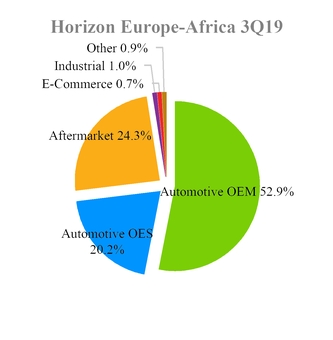

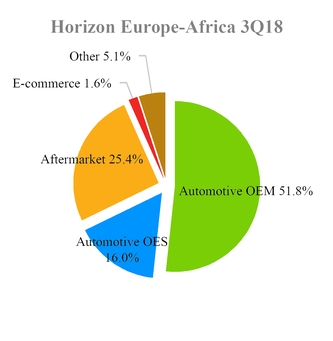

The Company disaggregates revenue from contracts with customers by major sales channel. The Company determined that disaggregating revenue into these categories best depicts how the nature, amount, timing, and uncertainty of revenue and cash flows are affected by economic factors. The Automotive OEM channel represents sales to automotive vehicle manufacturers. The Automotive OES channel primarily represents sales to automotive vehicle dealerships. The Aftermarket channel represents sales to automotive installers and warehouse distributors. The Retail channel represents sales to direct-to-consumer retailers. The Industrial channel represents sales to non-automotive manufacturers and dealers of agricultural equipment, trailers, and other custom assemblies. The E-Commerce channel represents sales to direct-to-consumer retailers who utilize the internet to purchase the Company’s products. The Other channel represents sales that do not fit into a category described above and these sales are considered ancillary to the Company’s core operating activities.

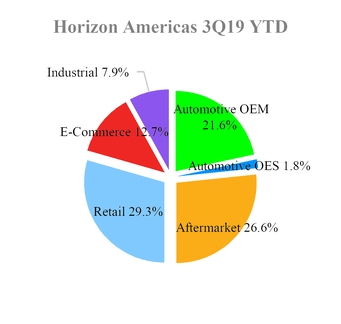

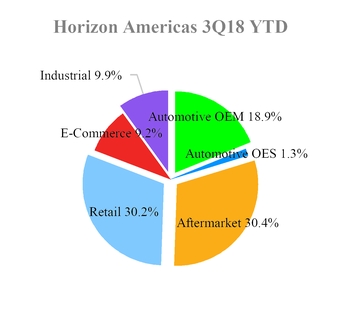

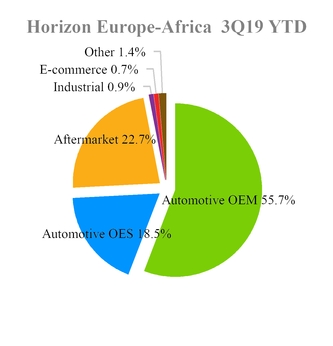

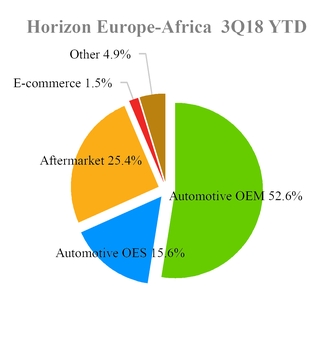

The following tables present the Company’s net sales by major sales channel:

|

| | | | | | | | | | | | |

| | | Three Months Ended September 30, 2019 |

| | | Horizon Americas | | Horizon Europe-Africa | | Total |

| | | (dollars in thousands) |

| Net Sales | | | | | | |

| Automotive OEM | | $ | 21,050 |

| | $ | 43,200 |

| | $ | 64,250 |

|

| Automotive OES | | 1,960 |

| | 16,510 |

| | 18,470 |

|

| Aftermarket | | 26,920 |

| | 19,840 |

| | 46,760 |

|

| Retail | | 26,600 |

| | — |

| | 26,600 |

|

| Industrial | | 7,650 |

| | 780 |

| | 8,430 |

|

| E-commerce | | 12,040 |

| | 560 |

| | 12,600 |

|

| Other | | — |

| | 740 |

| | 740 |

|

| Total | | $ | 96,220 |

| | $ | 81,630 |

| | $ | 177,850 |

|

|

| | | | | | | | | | | | |

| | | Three Months Ended September 30, 2018 |

| | | Horizon Americas | | Horizon Europe-Africa | | Total |

| | | (dollars in thousands) |

| Net Sales | | | | | | |

| Automotive OEM | | $ | 20,320 |

| | $ | 40,650 |

| | $ | 60,970 |

|

| Automotive OES | | 1,700 |

| | 12,600 |

| | 14,300 |

|

| Aftermarket | | 38,470 |

| | 19,980 |

| | 58,450 |

|

| Retail | | 29,600 |

| | — |

| | 29,600 |

|

| Industrial | | 11,160 |

| | — |

| | 11,160 |

|

| E-commerce | | 13,750 |

| | 1,290 |

| | 15,040 |

|

| Other | | 510 |

| | 4,000 |

| | 4,510 |

|

| Total | | $ | 115,510 |

| | $ | 78,520 |

| | $ | 194,030 |

|

HORIZON GLOBAL CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

|

| | | | | | | | | | | | |

| | | Nine Months Ended September 30, 2019 |

| | | Horizon Americas | | Horizon Europe-Africa | | Total |

| | | (dollars in thousands) |

| Net Sales | | | | | | |

| Automotive OEM | | $ | 64,970 |

| | $ | 137,900 |

| | $ | 202,870 |

|

| Automotive OES | | 5,380 |

| | 45,840 |

| | 51,220 |

|

| Aftermarket | | 79,910 |

| | 56,200 |

| | 136,110 |

|

| Retail | | 88,230 |

| | — |

| | 88,230 |

|

| Industrial | | 23,860 |

| | 2,340 |

| | 26,200 |

|

| E-commerce | | 38,300 |

| | 1,650 |

| | 39,950 |

|

| Other | | 20 |

| | 3,570 |

| | 3,590 |

|

| Total | | $ | 300,670 |

| | $ | 247,500 |

| | $ | 548,170 |

|

|

| | | | | | | | | | | | |

| | | Nine Months Ended September 30, 2018 |

| | | Horizon Americas | | Horizon Europe-Africa | | Total |

| | | (dollars in thousands) |

| Net Sales | | | | | | |

| Automotive OEM | | $ | 60,320 |

| | $ | 134,930 |

| | $ | 195,250 |

|

| Automotive OES | | 4,230 |

| | 39,980 |

| | 44,210 |

|

| Aftermarket | | 96,700 |

| | 65,180 |

| | 161,880 |

|

| Retail | | 96,330 |

| | — |

| | 96,330 |

|

| Industrial | | 31,680 |

| | — |

| | 31,680 |

|

| E-commerce | | 29,340 |

| | 3,880 |

| | 33,220 |

|

| Other | | 1,220 |

| | 12,460 |

| | 13,680 |

|

| Total | | $ | 319,820 |

| | $ | 256,430 |

| | $ | 576,250 |

|

During the second quarter of 2018, the Company finalized workforce consolidation plans related to the facility closures. There were no severancethree and other employee-related costs incurred in the three months ended September 30, 2018 and approximately $3.4 million of severance and other employee-related costs in the nine months ended September 30, 2018.2019 and 2018, adjustments to estimates of variable consideration for previously recognized revenue were insignificant. At September 30, 2019 and December 31, 2018, total opening and closing balances of contract assets and deferred revenue were not material.

5. Goodwill and Other Intangible Assets

Changes in the carrying amount of goodwill for the nine months ended September 30, 20182019 are summarized as follows:

|

| | | | | | | | | | | | | | | | |

| | | Horizon Americas | | Horizon Europe-Africa | | Horizon

Asia-Pacific | | Total |

| | | (dollars in thousands) |

| Balance at December 31, 2017 | | | | | | | | |

| Goodwill | | $ | 5,280 |

| | $ | 126,160 |

| | $ | 6,750 |

| | $ | 138,190 |

|

| Accumulated impairment losses | | — |

| | — |

| | — |

| | — |

|

| Net beginning balance | | 5,280 |

| | 126,160 |

| | 6,750 |

| | 138,190 |

|

| Impairment | | — |

| | (124,660 | ) | | — |

| | (124,660 | ) |

| Foreign currency translation and other | | (970 | ) | | (1,500 | ) | | (650 | ) | | (3,120 | ) |

| Balance at September 30, 2018 | | $ | 4,310 |

| | $ | — |

| | $ | 6,100 |

| | $ | 10,410 |

|

|

| | | | |

| (dollars in thousands) | | Horizon Americas |

| | | |

| Balance at December 31, 2018 | | $ | 4,500 |

|

| Foreign currency translation | | (300 | ) |

| Balance at September 30, 2019 | | $ | 4,200 |

|

During the first quarter of 2018, the Company continued to experience a decline in market capitalization. Additionally, the Europe-Africa reporting unit did not perform in-line with forecasted results driven by a shift in volume to lower margin programs as well as increased commodity costs, which negatively impacted margins. As a result, an indicator of impairment was identified during the first quarter of 2018. The Company performed an interim quantitative assessment as of March 31, 2018, utilizing a combination of the income and market approaches, which were weighted evenly. The results of the quantitative analysis performed indicated the carrying value of the reporting unit exceeded the fair value of the reporting unit by $43.4 million, and accordingly an impairment was recorded. Key assumptions used in the analysis were a discount rate of 13.5%, a terminal growth rate of 2.5% and EBITDA margin.

Due to the impairment indicators noted above, the Company also performed an interim impairment assessment of indefinite-lived intangible assets in the first quarter of 2018 in the Horizon Europe-Africa reportable segment. Based on the results of our analyses, there were certain trade names where the estimated fair values approximated the carrying values. Key assumptions used in the analysis were discount rates of 13.5% to 16.0% and royalty rates ranging from 0.5% to 1.0%.

During the second quarter of 2018, the Company continued to experience a decline in market capitalization. Additionally, the Europe-Africa reporting unit did not perform in-line with forecasted results driven by an unfavorable shift in volume to lower margin channels as well as increased commodity costs, which negatively impacted margins. Further, the expected benefits of shifting production to lower cost manufacturing sites have not been realized. As a result, an indicator of impairment was identified during the second quarter of 2018. The Company performed an interim quantitative assessment as of June 30, 2018, utilizing a combination of the income and market approaches. The income approach was weighted 75%, while the market approach was weighted 25%. The results of the quantitative analysis performed indicated the carrying value of the reporting unit exceeded the fair value of the reporting unit by $54.6 million and, accordingly, an impairment was recorded. Key assumptions used in the analysis were a discount rate of 14.0%, a terminal growth rate of 2.5% and EBITDA margin.

Due to the impairment indicators noted above, the Company performed an interim impairment assessment for indefinite-lived intangible assets within the Horizon Europe-Africa reportable segment, for which the gross carrying amounts totaled approximately $12.1 million as of June 30, 2018. Based on the results of the Company’s analyses, it was determined that the carrying values of the Westfalia and Terwa trade names exceeded their fair values by $1.1 million and, accordingly, an impairment was recorded. Key assumptions used in the analysis were discount rates of 15.0% and royalty rates ranging from 0.5% to 1.0%.

During the third quarter of 2018, the Europe-Africa reporting unit continued to underperform in relation to forecasted results driven by increased commodity costs and the failure to realize benefits from previously implemented synergy plans. The Company performed an interim quantitative assessment as of August 31, 2018, utilizing a combination of the income and market approaches. The income approach was weighted 75%, while the market approach was weighted 25%. The results of the quantitative analysis performed indicated the carrying value of the reporting unit exceeded fair value and, accordingly, an impairment of $26.6 million was recorded. Key assumptions used in the analysis were a discount rate of 13.5%, a terminal growth rate of 2.5% and EBITDA margin.

HORIZON GLOBAL CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

Due to impairment indicators noted above, the Company performed an interim impairment assessment for indefinite-lived intangible assets within the Europe-Africa reportable segment as of August 31, 2018, for which the gross carrying amounts totaled approximately $10.9 million as of September 30, 2018. Based on the results of the Company’s analyses, the carrying value of the trademarks approximated fair value. Key assumptions used in the analysis were discount rates of 14.5%, and royalty rates ranging from 0.5% to 1.0%.

The gross carrying amounts and accumulated amortization of the Company’s other intangibles as of September 30, 2018 and December 31, 2017 are summarized below. The Company amortizes these assets over periods ranging from two to 20 years.as follows.

| | | | | September 30, 2018 | | December 31, 2017 | | As of

September 30, 2019 |

| Intangible Category by Useful Life | | Gross Carrying Amount | | Accumulated Amortization | | Gross Carrying Amount | | Accumulated Amortization | | Gross Carrying Amount | | Accumulated Amortization | | Net Carrying Amount |

| | | (dollars in thousands) | | (dollars in thousands) |

| Finite-lived intangible assets: | | | | | | | | | | | | | | |

| Customer relationships, 2 – 20 years | | $ | 178,240 |

| | $ | (126,170 | ) | | $ | 180,850 |

| | $ | (121,750 | ) | |

| Technology and other, 3 – 15 years | | 21,200 |

| | (15,930 | ) | | 19,950 |

| | (15,260 | ) | |

| Trademark/Trade names, 1 - 8 years | | 730 |

| | (230 | ) | | 730 |

| | (190 | ) | |

| Customer relationships (2 – 20 years) | | | $ | 162,940 |

| | $ | (129,020 | ) | | $ | 33,920 |

|

| Technology and other (3 – 15 years) | | | 20,590 |

| | (14,630 | ) | | 5,960 |

|

| Trademark/Trade names (1 – 8 years) | | | 150 |

| | (150 | ) | | — |

|

| Total finite-lived intangible assets | | 200,170 |

| | (142,330 | ) | | 201,530 |

| | (137,200 | ) | | 183,680 |

| | (143,800 | ) | | 39,880 |

|

| Trademark/Trade names, indefinite-lived | | 24,090 |

| | — |

| | 25,900 |

| | — |

| | 20,470 |

| | — |

| | 20,470 |

|

| Total other intangible assets | | $ | 224,260 |

| | $ | (142,330 | ) | | $ | 227,430 |

| | $ | (137,200 | ) | | $ | 204,150 |

| | $ | (143,800 | ) | | $ | 60,350 |

|

|

| | | | | | | | | | | | |

| | | As of

December 31, 2018 |

| Intangible Category by Useful Life | | Gross Carrying Amount | | Accumulated Amortization | | Net Carrying Amount |

| | | (dollars in thousands) |

| Finite-lived intangible assets: | | | | | | |

| Customer relationships (2 – 20 years) | | $ | 168,230 |

| | $ | (124,510 | ) | | $ | 43,720 |

|

| Technology and other (3 – 15 years) | | 20,490 |

| | (15,400 | ) | | 5,090 |

|

| Trademark/Trade names (1 – 8 years) | | 150 |

| | (150 | ) | | — |

|

| Total finite-lived intangible assets | | 188,870 |

| | (140,060 | ) | | 48,810 |

|

| Trademark/Trade names, indefinite-lived | | 20,590 |

| | — |

| | 20,590 |

|

| Total other intangible assets | | $ | 209,460 |

| | $ | (140,060 | ) | | $ | 69,400 |

|

On March 1, 2019, the Company entered into an agreement of sale of certain business assets in its Europe-Africa operating segment, via a share and asset sale (the “Sale”). Under the terms of the Sale, effective March 1, 2019, the Company disposed of certain non-automotive business assets that operated using the Terwa brand for $5.5 million, which included a $0.5 million note receivable. The Sale resulted in a $3.6 million loss recorded in Other expense, net in the condensed consolidated statements of operations, including a $3.0 million reduction of net intangibles related to customer relationships.

Amortization expense related to intangible assets as included in the accompanying condensed consolidated statements of income (loss)operations is summarized as follows:

| | | | | Three months ended

September 30, | | Nine months ended

September 30, | | Three months ended September 30, | | Nine months ended September 30, |

| | | 2018 | | 2017 | | 2018 | | 2017 | | 2019 | | 2018 | | 2019 | | 2018 |