UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

|

| | |

| (Mark One) | | |

| x |

| Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | | |

For the Quarterly Period Ended JuneSeptember 30, 2019 |

| or |

o |

| Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Transition Period from to . |

Commission file number 001-37427

HORIZON GLOBAL CORPORATION

(Exact name of registrant as specified in its charter) |

| | |

| | | |

Delaware (State or other jurisdiction of incorporation or organization) | | 47-3574483 (IRS Employer Identification No.) |

2600 W. Big Beaver Road, Suite 555

Troy, Michigan 48084

(Address of principal executive offices, including zip code)

(248) 593-8820

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | HZN | | New York Stock Exchange |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | |

Large accelerated filer o | | Accelerated filer x | | Non-accelerated filer o | | Smaller reporting company o | | Emerging growth company x |

| | | | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes x No o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of August 2,November 7, 2019, the number of outstanding shares of the Registrant’s common stock was 25,320,91225,387,388 shares.

HORIZON GLOBAL CORPORATION

Index

Forward-Looking Statements

This Quarterly Report on Form 10-Q may contain “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements speak only as of the date they are made and give our current expectations or forecasts of future events. These forward-looking statements can be identified by the use of forward-looking words, such as “may,” “could,” “should,” “estimate,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “target,” “plan” or other comparable words, or by discussions of strategy that may involve risks and uncertainties.

These forward-looking statements are subject to numerous assumptions, risks and uncertainties which could materially affect our business, financial condition or future results including, but not limited to, risks and uncertainties with respect to: the Company’s leverage; liabilities and restrictions imposed by the Company’s debt instruments; market demand; competitive factors; supply constraints; material and energy costs; technology factors; litigation; government and regulatory actions including the impact of any tariffs, quotas or surcharges; the Company’s accounting policies; future trends; general economic and currency conditions; various conditions specific to the Company’s business and industry; the Company’s ability to regain compliance with the New York Stock Exchange’s continued listing standards and maintain such compliance; the Company’s ability to successfully complete the sale of its Asia-Pacific segment; the success of the Company’s action plan, including the actual amount of savings and timing thereof; the success of our business improvement initiatives in Europe-Africa, including the amount of savings and timing thereof; the Company’s exposure to product liability claims from customers and end users, and the costs associated therewith; the Company’s ability to meet its covenants in the agreements governing its debt, includingdebt; or the contractually obligated prepayment on its first lien term loan, or obtain any amendments or waivers thereto;Company’s ability to maintain compliance with the New York Stock Exchange’s continued listing standards and other risks that are discussed in Item 1A, “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018. The risks described in our Annual Report and elsewhere in this report are not the only risks facing our Company. Additional risks and uncertainties not currently known to us or that we currently deemed to be immaterial also may materially adversely affect our business, financial position and results of operations or cash flows.

The cautionary statements set forth above should be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. We caution readers not to place undue reliance on the statements, which speak only as of the date of this report. We do not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statement to reflect events or circumstances after the date of this report or to reflect the occurrence of unanticipated events, except as otherwise required by law.

We disclose important factors that could cause our actual results to differ materially from our expectations implied by our forward-looking statements under Item 2, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere in this report. These cautionary statements qualify all forward-looking statements attributed to us or persons acting on our behalf. When we indicate that an event, condition or circumstance could or would have an adverse effect on us, we mean to include effects upon our business, financial and other conditions, results of operations, prospects and ability to service our debt.

PART I. FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

HORIZON GLOBAL CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited—dollars in thousands)

| |

| | June 30,

2019 |

| December 31,

2018 | | | | | |

| | | (unaudited) | | | | September 30,

2019 |

| December 31,

2018 |

| Assets | |

| |

| |

| |

|

| Current assets: | |

| |

| |

| |

|

| Cash and cash equivalents | | $ | 16,760 |

|

| $ | 27,650 |

| | $ | 16,360 |

|

| $ | 27,650 |

|

| Receivables, net of allowance for doubtful accounts of approximately $4.4 million and $5.1 million at June 30, 2019 and December 31, 2018, respectively. | | 137,660 |

|

| 108,340 |

| |

| Receivables, net of allowance for doubtful accounts of approximately $5.0 million and $4.8 million at September 30, 2019 and December 31, 2018, respectively | | | 93,480 |

|

| 95,170 |

|

| Inventories | | 177,830 |

|

| 173,690 |

| | 141,150 |

|

| 152,200 |

|

| Prepaid expenses and other current assets | | 9,250 |

|

| 9,690 |

| | 9,480 |

|

| 8,270 |

|

| Current assets held-for-sale | | | — |

| | 36,080 |

|

| Total current assets | | 341,500 |

| | 319,370 |

| | 260,470 |

| | 319,370 |

|

| Property and equipment, net | | 97,830 |

|

| 102,280 |

| | 78,670 |

|

| 86,500 |

|

| Operating lease right-of-use assets | | 72,220 |

| | — |

| | 56,170 |

| | — |

|

| Goodwill | | 12,700 |

|

| 12,660 |

| | 4,200 |

|

| 4,500 |

|

| Other intangibles, net | | 71,900 |

|

| 78,050 |

| | 60,350 |

|

| 69,400 |

|

| Deferred income taxes | | 2,510 |

| | 2,690 |

| | 440 |

| | 660 |

|

| Non-current assets held-for-sale | | | — |

| | 34,790 |

|

| Other assets | | 6,080 |

|

| 6,300 |

| | 5,700 |

|

| 6,130 |

|

| Total assets | | $ | 604,740 |

| | $ | 521,350 |

| | $ | 466,000 |

| | $ | 521,350 |

|

| Liabilities and Shareholders' Equity | |

| |

| |

| |

|

| Current liabilities: | |

| |

| |

| |

|

| Short-term borrowings and current maturities, long-term debt | | $ | 166,760 |

|

| $ | 13,860 |

| | $ | 24,270 |

|

| $ | 13,860 |

|

| Accounts payable | | 111,800 |

|

| 123,130 |

| | 79,440 |

|

| 102,350 |

|

| Short-term operating lease liabilities | | 13,190 |

| | — |

| | 9,850 |

| | — |

|

| Current liabilities held-for-sale | | | — |

| | 28,080 |

|

| Accrued liabilities | | 71,250 |

|

| 65,820 |

| | 53,020 |

|

| 58,520 |

|

| Total current liabilities | | 363,000 |

| | 202,810 |

| | 166,580 |

| | 202,810 |

|

| Gross long-term debt | | | 214,930 |

| | 382,220 |

|

| Unamortized debt issuance costs and discount | | | (34,200 | ) | | (31,570 | ) |

| Long-term debt | | 238,780 |

|

| 350,650 |

| | 180,730 |

| | 350,650 |

|

| Deferred income taxes | | 13,160 |

|

| 14,150 |

| | 8,280 |

|

| 12,620 |

|

| Long-term operating lease liabilities | | 59,020 |

| | — |

| | 50,890 |

| | — |

|

| Non-current liabilities held-for-sale | | | — |

| | 1,740 |

|

| Other long-term liabilities | | 19,100 |

|

| 19,960 |

| | 20,770 |

|

| 19,750 |

|

| Total liabilities | | 693,060 |

| | 587,570 |

| | 427,250 |

| | 587,570 |

|

| Contingencies (See Note 12) | |

|

| |

|

| |

| Shareholders' deficit: | | | | | |

| Contingencies (See Note 13) | | |

|

| |

|

|

| Shareholders' equity (deficit): | | | | | |

| Preferred stock, $0.01 par: Authorized 100,000,000 shares; Issued and outstanding: None | | — |

| | — |

| | — |

| | — |

|

| Common stock, $0.01 par: Authorized 400,000,000 shares; 26,003,240 shares issued and 25,316,734 outstanding at June 30, 2019, and 25,866,747 shares issued and 25,180,241 outstanding at December 31, 2018. | | 250 |

| | 250 |

| |

| Common stock warrants exercisable for 6,554,150 shares issued and outstanding at June 30, 2019; none issued and outstanding at December 31, 2018 | | 10,720 |

| | — |

| |

| Common stock, $0.01 par: Authorized 400,000,000 shares; 26,073,894 shares issued and 25,387,388 outstanding at September 30, 2019, and 25,866,747 shares issued and 25,180,241 outstanding at December 31, 2018 | | | 250 |

| | 250 |

|

| Common stock warrants exercisable for 6,487,674 shares issued and outstanding at September 30, 2019; none issued and outstanding at December 31, 2018 | | | 10,720 |

| | — |

|

| Paid-in capital | | 161,920 |

| | 160,990 |

| | 162,760 |

| | 160,990 |

|

| Treasury stock, at cost: 686,506 shares at June 30, 2019 and December 31, 2018 | | (10,000 | ) | | (10,000 | ) | |

| Treasury stock, at cost: 686,506 shares at September 30, 2019 and December 31, 2018 | | | (10,000 | ) | | (10,000 | ) |

| Accumulated deficit | | (255,900 | ) | | (222,720 | ) | | (110,390 | ) | | (222,720 | ) |

| Accumulated other comprehensive income | | 7,770 |

| | 7,760 |

| |

| Total Horizon Global shareholders' deficit | | (85,240 | ) | | (63,720 | ) | |

| Accumulated other comprehensive (loss) income | | | (11,250 | ) | | 7,760 |

|

| Total Horizon Global shareholders' equity (deficit) | | | 42,090 |

| | (63,720 | ) |

| Noncontrolling interest | | (3,080 | ) | | (2,500 | ) | | (3,340 | ) | | (2,500 | ) |

| Total shareholders' deficit | | (88,320 | ) | | (66,220 | ) | |

| Total shareholders' equity (deficit) | | | 38,750 |

| | (66,220 | ) |

| Total liabilities and shareholders' equity | | $ | 604,740 |

| | $ | 521,350 |

| | $ | 466,000 |

| | $ | 521,350 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

HORIZON GLOBAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited—dollars in thousands, except share and per share data)

| | | | | Three months ended

June 30, | | Six months ended

June 30, | | Three months ended

September 30, | | Nine months ended

September 30, |

| | | 2019 | | 2018 | | 2019 | | 2018 | | 2019 | | 2018 | | 2019 | | 2018 |

| Net sales | | $ | 223,160 |

| | $ | 233,340 |

| | $ | 432,820 |

| | $ | 450,150 |

| | $ | 177,850 |

| | $ | 194,030 |

| | $ | 548,170 |

| | $ | 576,250 |

|

| Cost of sales | | (179,110 | ) | | (185,770 | ) | | (356,690 | ) | | (364,130 | ) | | (149,560 | ) | | (159,500 | ) | | (460,010 | ) | | (472,120 | ) |

| Gross profit | | 44,050 |

| | 47,570 |

| | 76,130 |

| | 86,020 |

| | 28,290 |

| | 34,530 |

| | 88,160 |

| | 104,130 |

|

| Selling, general and administrative expenses | | (37,010 | ) | | (55,740 | ) | | (78,540 | ) | | (103,920 | ) | | (41,100 | ) | | (37,680 | ) | | (113,140 | ) | | (134,210 | ) |

| Impairment of goodwill and intangible assets | | — |

| | (55,700 | ) | | — |

| | (99,130 | ) | | — |

| | (26,640 | ) | | — |

| | (125,770 | ) |

| Net gain (loss) on dispositions of property and equipment | | 10 |

| | (270 | ) | | 1,470 |

| | (380 | ) | | 50 |

| | (110 | ) | | 1,500 |

| | (520 | ) |

| Operating profit (loss) | | 7,050 |

| | (64,140 | ) | | (940 | ) | | (117,410 | ) | |

| Other income (expense), net | | 400 |

| | (6,610 | ) | | (5,210 | ) | | (7,730 | ) | |

| Operating loss | | | (12,760 | ) | | (29,900 | ) | | (23,480 | ) | | (156,370 | ) |

| Other expense, net | | | (1,640 | ) | | (1,040 | ) | | (6,610 | ) | | (7,410 | ) |

| Interest expense | | (15,430 | ) | | (6,190 | ) | | (26,370 | ) | | (12,140 | ) | | (24,120 | ) | | (7,590 | ) | | (50,270 | ) | | (19,580 | ) |

| Loss before income tax | | (7,980 | ) | | (76,940 | ) | | (32,520 | ) | | (137,280 | ) | |

| Income tax (expense) benefit | | (160 | ) | | 9,780 |

| | (1,240 | ) | | 12,360 |

| |

| Net loss | | (8,140 | ) | | (67,160 | ) | | (33,760 | ) | | (124,920 | ) | |

| Loss from continuing operations before income tax | | | (38,520 | ) | | (38,530 | ) | | (80,360 | ) | | (183,360 | ) |

| Income tax benefit | | | 1,020 |

| | 1,420 |

| | 2,330 |

| | 15,770 |

|

| Net loss from continuing operations | | | (37,500 | ) | | (37,110 | ) | | (78,030 | ) | | (167,590 | ) |

| Income from discontinued operations, net of tax | | | 182,750 |

| | 4,110 |

| | 189,520 |

| | 9,670 |

|

| Net income (loss) | | | 145,250 |

| | (33,000 | ) | | 111,490 |

|

| (157,920 | ) |

| Less: Net loss attributable to noncontrolling interest | | (60 | ) | | (230 | ) | | (580 | ) | | (480 | ) | | (260 | ) | | (240 | ) | | (840 | ) | | (720 | ) |

| Net loss attributable to Horizon Global | | $ | (8,080 | ) | | $ | (66,930 | ) | | $ | (33,180 | ) | | $ | (124,440 | ) | |

| Net loss per share attributable to Horizon Global: | | | | | | | | | |

| Basic | | $ | (0.32 | ) | | $ | (2.68 | ) | | $ | (1.31 | ) | | $ | (4.98 | ) | |

| Diluted | | $ | (0.32 | ) | | $ | (2.68 | ) | | $ | (1.31 | ) | | $ | (4.98 | ) | |

| Net income (loss) attributable to Horizon Global | | | $ | 145,510 |

| | $ | (32,760 | ) | | $ | 112,330 |

| | $ | (157,200 | ) |

| Net income (loss) per share attributable to Horizon Global: | | | | | | | | | |

| Basic: | | | | | | | | | |

| Continuing operations | | | $ | (1.47 | ) | | $ | (1.47 | ) | | $ | (3.05 | ) | | $ | (6.67 | ) |

| Discontinued operations | | | 7.21 |

| | 0.16 |

| | 7.50 |

| | 0.39 |

|

| Total | | | 5.74 |

| | (1.31 | ) | | 4.45 |

| | (6.28 | ) |

| Diluted: | | | | | | | | | |

| Continuing operations | | | (1.47 | ) | | (1.47 | ) | | (3.05 | ) | | (6.67 | ) |

| Discontinued operations | | | 7.21 |

| | 0.16 |

| | 7.50 |

| | 0.39 |

|

| Total | | | 5.74 |

| | (1.31 | ) | | 4.45 |

| | (6.28 | ) |

| Weighted average common shares outstanding: | | | | | | | | | | | | | | | | |

| Basic | | 25,282,791 |

| | 25,017,725 |

| | 25,235,704 |

| | 24,990,573 |

| | 25,329,492 |

| | 25,101,847 |

| | 25,267,310 |

| | 25,028,072 |

|

| Diluted | | 25,282,791 |

| | 25,017,725 |

| | 25,235,704 |

| | 24,990,573 |

| | 25,329,492 |

| | 25,101,847 |

| | 25,267,310 |

| | 25,028,072 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

HORIZON GLOBAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(unaudited—dollars in thousands)

|

| | | | | | | | | | | | | | | | |

| | | Three months ended

June 30, | | Six months ended

June 30, |

| | | 2019 | | 2018 | | 2019 | | 2018 |

| Net loss | | $ | (8,140 | ) | | $ | (67,160 | ) | | $ | (33,760 | ) | | $ | (124,920 | ) |

| Other comprehensive income (loss), net of tax: | | | | | | | | |

| Foreign currency translation and other | | 80 |

| | (6,880 | ) | | 1,290 |

| | (3,720 | ) |

| Derivative instruments | | (210 | ) | | 790 |

| | (1,280 | ) | | 2,320 |

|

| Total other comprehensive income (loss), net of tax | | (130 | ) | | (6,090 | ) | | 10 |

| | (1,400 | ) |

| Total comprehensive loss | | (8,270 | ) | | (73,250 | ) | | (33,750 | ) | | (126,320 | ) |

| Less: Comprehensive loss attributable to noncontrolling interest | | (60 | ) | | (310 | ) | | (580 | ) | | (550 | ) |

| Comprehensive loss attributable to Horizon Global | | $ | (8,210 | ) | | $ | (72,940 | ) | | $ | (33,170 | ) | | $ | (125,770 | ) |

|

| | | | | | | | | | | | | | | | |

| | | Three months ended

September 30, | | Nine months ended

September 30, |

| | | 2019 | | 2018 | | 2019 | | 2018 |

| Net income (loss) | | $ | 145,250 |

| | $ | (33,000 | ) | | $ | 111,490 |

| | $ | (157,920 | ) |

| Other comprehensive loss, net of tax: | | | | | | | | |

| Foreign currency translation and other | | (1,320 | ) | | (680 | ) | | (30 | ) | | (4,400 | ) |

| Derivative instruments | | (440 | ) | | 640 |

| | (1,720 | ) | | 2,960 |

|

| Total other comprehensive loss, net of tax | | (1,760 | ) | | (40 | ) | | (1,750 | ) | | (1,440 | ) |

| Total comprehensive income (loss) | | 143,490 |

| | (33,040 | ) | | 109,740 |

| | (159,360 | ) |

| Less: Comprehensive loss attributable to noncontrolling interest | | (250 | ) | | (240 | ) | | (830 | ) | | (790 | ) |

| Comprehensive income (loss) attributable to Horizon Global | | $ | 143,740 |

| | $ | (32,800 | ) | | $ | 110,570 |

| | $ | (158,570 | ) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

HORIZON GLOBAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited—dollars in thousands)

| | | | | Six months ended

June 30, |

| Nine months ended

September 30, |

| | | 2019 | | 2018 |

| 2019 |

| 2018 |

| Cash Flows from Operating Activities: | | | | |

|

|

|

|

| Net loss | | $ | (33,760 | ) | | $ | (124,920 | ) | |

| Adjustments to reconcile net loss to net cash used for operating activities: | | | | | |

| Net income (loss) | | | $ | 111,490 |

| | $ | (157,920 | ) |

| Less: Net income from discontinued operations | | | 189,520 |

| | 9,670 |

|

| Net loss from continuing operations | | | (78,030 | ) | | (167,590 | ) |

| | | |

| |

|

| Adjustments to reconcile net loss from continued operations to net cash used for operating activities: | |

|

|

|

|

| Net (gain) loss on dispositions of property and equipment | | (1,470 | ) | | 380 |

|

| (1,500 | ) | | 520 |

|

| Depreciation | | 9,320 |

| | 8,240 |

|

| 11,980 |

| | 9,410 |

|

| Amortization of intangible assets | | 3,460 |

| | 4,140 |

|

| 4,800 |

| | 5,640 |

|

| Write off of operating lease assets | | | 4,250 |

| | — |

|

| Impairment of goodwill and intangible assets | | — |

| | 99,130 |

|

| — |

| | 125,770 |

|

| Amortization of original issuance discount and debt issuance costs | | 9,900 |

| | 3,870 |

|

| 18,570 |

| | 6,050 |

|

| Deferred income taxes | | (30 | ) | | (1,850 | ) |

| (3,390 | ) | | (3,370 | ) |

| Non-cash compensation expense | | 940 |

| | 1,210 |

|

| 1,790 |

| | 1,430 |

|

| Paid-in-kind interest | | 4,370 |

| | — |

|

| 7,620 |

| | — |

|

| Increase in receivables | | (32,330 | ) | | (40,450 | ) |

| (4,680 | ) | | (31,950 | ) |

| (Increase) decrease in inventories | | (10,630 | ) | | 530 |

| |

| Decrease in inventories | |

| 1,920 |

| | 5,630 |

|

| (Increase) decrease in prepaid expenses and other assets | | (940 | ) | | 1,510 |

|

| (2,770 | ) | | 1,150 |

|

| (Decrease) increase in accounts payable and accrued liabilities | | (360 | ) | | 12,590 |

| |

| Decrease in accounts payable and accrued liabilities | |

| (15,560 | ) | | (27,450 | ) |

| Other, net | | 2,770 |

| | 260 |

|

| (10,800 | ) | | 220 |

|

| Net cash used for operating activities | | (48,760 | ) | | (35,360 | ) | |

| Net cash used for operating activities for continuing operations | | | (65,800 | ) | | (74,540 | ) |

| Cash Flows from Investing Activities: | | | | | | | | |

| Capital expenditures | | (6,630 | ) | | (7,790 | ) | | (8,460 | ) | | (9,660 | ) |

| Net proceeds from sale of business | | 4,970 |

| | — |

| | 214,570 |

| | — |

|

| Net proceeds from disposition of property and equipment | | 1,580 |

| | 140 |

| | 1,470 |

| | (280 | ) |

| Net cash used for investing activities | | (80 | ) | | (7,650 | ) | |

| Net cash provided by (used for) investing activities for continuing operations | | | 207,580 |

| | (9,940 | ) |

| Cash Flows from Financing Activities: | | | | | | | | |

| Proceeds from borrowings on credit facilities | | 14,100 |

| | 2,630 |

| | 13,780 |

| | 12,550 |

|

| Repayments of borrowings on credit facilities | | (840 | ) | | (8,670 | ) | | (6,520 | ) | | (14,390 | ) |

| Proceeds from Second Lien Term Loan, net of issuance costs | | 35,520 |

| | — |

| | 35,520 |

| | 45,430 |

|

| Repayments of borrowings on First Lien Term Loan, inclusive of transaction costs | | (10,090 | ) | | (3,940 | ) | | (173,430 | ) | | (6,490 | ) |

| Proceeds from ABL Revolving Debt, net of issuance costs | | 60,340 |

| | 66,110 |

| | 68,790 |

| | 72,430 |

|

| Repayments of borrowings on ABL Revolving Debt | | (72,080 | ) | | (13,510 | ) | | (112,510 | ) | | (34,830 | ) |

| Proceeds from issuance of Series A Preferred Stock | | 5,340 |

| | — |

| | 5,340 |

| | — |

|

| Proceeds from issuance of Warrants | | 5,380 |

| | — |

| | 5,380 |

| | — |

|

| Other, net | | (10 | ) | | (210 | ) | | (10 | ) | | (300 | ) |

| Net cash provided by financing activities | | 37,660 |

| | 42,410 |

| |

| Net cash (used for) provided by financing activities for continuing operations | | | (163,660 | ) | | 74,400 |

|

| Discontinued Operations: | | | | | |

| Net cash provided by discontinued operating activities | | | 11,430 |

| | 8,500 |

|

| Net cash used for discontinued investing activities | | | (1,120 | ) | | (720 | ) |

| Net cash provided by (used for) discontinued financing activities | | | — |

| | — |

|

| Net cash provided by discontinued operations | | | 10,310 |

| | 7,780 |

|

| Effect of exchange rate changes on cash | | 290 |

| | (80 | ) | | 280 |

| | 40 |

|

| Cash and Cash Equivalents: | | | | | | | | |

| Decrease for the period | | (10,890 | ) | | (680 | ) | | (11,290 | ) | | (2,260 | ) |

| At beginning of period | | 27,650 |

| | 29,570 |

| | 27,650 |

| | 29,570 |

|

| At end of period | | $ | 16,760 |

| | $ | 28,890 |

| | $ | 16,360 |

|

| $ | 27,310 |

|

| Supplemental disclosure of cash flow information: | | | | | | | | |

| Cash paid for interest | | $ | 11,750 |

| | $ | 7,550 |

| | $ | 19,730 |

| | $ | 13,430 |

|

| Cash paid for taxes | | $ | 4,950 |

| | $ | 3,770 |

| | $ | 480 |

| | $ | 2,170 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

HORIZON GLOBAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(unaudited—dollars in thousands)

| | | | | Common

Stock | | Common Stock Warrants | | Paid-in

Capital | | Treasury Stock | | Accumulated Deficit | | Accumulated

Other

Comprehensive

Income (Loss) | | Total Horizon Global Shareholders’ Deficit | | Noncontrolling Interest | | Total Shareholders’ Deficit | | Common

Stock | | Common Stock Warrants | | Paid-in

Capital | | Treasury Stock | | Accumulated Deficit | | Accumulated

Other

Comprehensive

Income (Loss) | | Total Horizon Global Shareholders’ Deficit | | Noncontrolling Interest | | Total Shareholders’ Deficit |

| Balance at January 1, 2019 | | $ | 250 |

| | $ | — |

| | $ | 160,990 |

| | $ | (10,000 | ) | | $ | (222,720 | ) | | $ | 7,760 |

| | $ | (63,720 | ) | | $ | (2,500 | ) | | $ | (66,220 | ) | | $ | 250 |

| | $ | — |

| | $ | 160,990 |

| | $ | (10,000 | ) | | $ | (222,720 | ) | | $ | 7,760 |

| | $ | (63,720 | ) | | $ | (2,500 | ) | | $ | (66,220 | ) |

| Net loss | | — |

| | — |

| | — |

| | — |

| | (25,100 | ) | | — |

| | (25,100 | ) | | (520 | ) | | (25,620 | ) | | — |

| | — |

| | — |

| | — |

| | (25,100 | ) | | — |

| | (25,100 | ) | | (520 | ) | | (25,620 | ) |

| Other comprehensive income, net of tax | | — |

| | — |

| | — |

| | — |

| | — |

| | 140 |

| | 140 |

| | — |

| | 140 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 140 |

| | 140 |

| | — |

| | 140 |

|

| Shares surrendered upon vesting of employees; share based payment awards to cover tax obligations | | — |

| | — |

| | (10 | ) | | — |

| | — |

| | — |

| | (10 | ) | | — |

| | (10 | ) | |

| Shares surrendered upon vesting of employees share based payment awards to cover tax obligations | | | — |

| | — |

| | (10 | ) | | — |

| | — |

| | — |

| | (10 | ) | | — |

| | (10 | ) |

| Non-cash compensation expense | | — |

| | — |

| | 350 |

| | — |

| | — |

| | — |

| | 350 |

| | — |

| | 350 |

| | — |

| | — |

| | 350 |

| | — |

| | — |

| | — |

| | 350 |

| | — |

| | 350 |

|

| Issuance of Warrants | | — |

| | 5,380 |

| | — |

| | — |

| | — |

| | — |

| | 5,380 |

| | — |

| | 5,380 |

| | — |

| | 5,380 |

| | — |

| | — |

| | — |

| | — |

| | 5,380 |

| | — |

| | 5,380 |

|

| Balance at March 31, 2019 | | 250 |

|

| 5,380 |

|

| 161,330 |

|

| (10,000 | ) |

| (247,820 | ) |

| 7,900 |

|

| (82,960 | ) |

| (3,020 | ) |

| (85,980 | ) | | 250 |

|

| 5,380 |

|

| 161,330 |

|

| (10,000 | ) |

| (247,820 | ) |

| 7,900 |

|

| (82,960 | ) |

| (3,020 | ) |

| (85,980 | ) |

| Net Loss | | — |

| | — |

| | — |

| | — |

| | (8,080 | ) | | — |

| | (8,080 | ) | | (60 | ) | | (8,140 | ) | | — |

| | — |

| | — |

| | — |

| | (8,080 | ) | | — |

| | (8,080 | ) | | (60 | ) | | (8,140 | ) |

| Other comprehensive income, net of tax | | — |

| | — |

| | — |

| | — |

| | — |

| | (130 | ) | | (130 | ) | | — |

| | (130 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | (130 | ) | | (130 | ) | | — |

| | (130 | ) |

| Non-cash compensation expense | | — |

| | — |

| | 590 |

| | — |

| | — |

| | — |

| | 590 |

| | — |

| | 590 |

| | — |

| | — |

| | 590 |

| | — |

| | — |

| | — |

| | 590 |

| | — |

| | 590 |

|

| Issuance of Warrants | | | | 5,340 |

| | | | | | | | | | 5,340 |

| | | | 5,340 |

| | — |

| | 5,340 |

| | — |

| | — |

| | — |

| | — |

| | 5,340 |

| | — |

| | 5,340 |

|

| Balance at June 30, 2019 | | $ | 250 |

|

| $ | 10,720 |

|

| $ | 161,920 |

|

| $ | (10,000 | ) |

| $ | (255,900 | ) |

| $ | 7,770 |

|

| $ | (85,240 | ) |

| $ | (3,080 | ) |

| $ | (88,320 | ) | |

| Balance as of June 30, 2019 | | | 250 |

| | 10,720 |

| | 161,920 |

| | (10,000 | ) | | (255,900 | ) | | 7,770 |

| | (85,240 | ) | | (3,080 | ) | | (88,320 | ) |

| Net income | | | — |

| | — |

| | — |

| | — |

| | 145,510 |

| | — |

| | 145,510 |

| | (260 | ) | | 145,250 |

|

| Other comprehensive loss, net of tax | | | — |

| | — |

| | — |

| | — |

| | — |

| | (1,760 | ) | | (1,760 | ) | | — |

| | (1,760 | ) |

| Non-cash compensation expense | | | — |

| | — |

| | 840 |

| | — |

| | — |

| | — |

| | 840 |

| | — |

| | 840 |

|

| Amounts reclassified from AOCI | | | — |

| | — |

| | — |

| | — |

| | — |

| | (17,260 | ) | | (17,260 | ) | | — |

| | (17,260 | ) |

| Balance at September 30, 2019 | | | $ | 250 |

|

| $ | 10,720 |

|

| $ | 162,760 |

|

| $ | (10,000 | ) |

| $ | (110,390 | ) |

| $ | (11,250 | ) |

| $ | 42,090 |

|

| $ | (3,340 | ) |

| $ | 38,750 |

|

| | | | | Common

Stock | | Common Stock Warrants | | Paid-in

Capital | | Treasury Stock | | Accumulated Deficit | | Accumulated

Other

Comprehensive

Income (Loss) | | Total Horizon Global Shareholders’ Equity | | Noncontrolling Interest | | Total Shareholders’ Equity | | Common

Stock | | Common Stock Warrants | | Paid-in

Capital | | Treasury Stock | | Accumulated Deficit | | Accumulated

Other

Comprehensive

Income (Loss) | | Total Horizon Global Shareholders’ Equity | | Noncontrolling Interest | | Total Shareholders’ Equity |

| Balance at January 1, 2018 | | $ | 250 |

| | $ | — |

| | $ | 159,490 |

| | $ | (10,000 | ) | | $ | (17,860 | ) | | $ | 10,010 |

| | $ | 141,890 |

| | $ | (1,490 | ) | | $ | 140,400 |

| |

| Balance at December 31, 2017, as reported | | | $ | 250 |

| | $ | — |

| | $ | 159,490 |

| | $ | (10,000 | ) | | $ | (17,860 | ) | | $ | 10,010 |

| | $ | 141,890 |

| | $ | (1,490 | ) | | $ | 140,400 |

|

| Impact of ASU 2018-02 | | | — |

| | — |

| | 340 |

| | — |

| | (900 | ) | | 560 |

| | — |

| | — |

| | — |

|

| Balance at January 1, 2018, as restated | | | 250 |

|

| — |

|

| 159,830 |

|

| (10,000 | ) |

| (18,760 | ) |

| 10,570 |

|

| 141,890 |

|

| (1,490 | ) |

| 140,400 |

|

| Net loss | | — |

| | — |

| | — |

| | — |

| | (57,510 | ) | | — |

| | (57,510 | ) | | (250 | ) | | (57,760 | ) | | — |

| | — |

| | — |

| | — |

| | (57,510 | ) | | — |

| | (57,510 | ) | | (250 | ) | | (57,760 | ) |

| Other comprehensive income, net of tax | | — |

| | — |

| | — |

| | — |

| | — |

| | 4,680 |

| | 4,680 |

| | 10 |

| | 4,690 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 4,680 |

| | 4,680 |

| | 10 |

| | 4,690 |

|

| Shares surrendered upon vesting of employees; share based payment awards to cover tax obligations | | — |

| | — |

| | (200 | ) | | — |

| | — |

| | — |

| | (200 | ) | | — |

| | (200 | ) | |

| Shares surrendered upon vesting of employees share based payment awards to cover tax obligations | | | — |

| | — |

| | (200 | ) | | — |

| | — |

| | — |

| | (200 | ) | | — |

| | (200 | ) |

| Non-cash compensation expense | | — |

| | — |

| | 720 |

| | — |

| | — |

| | — |

| | 720 |

| | — |

| | 720 |

| | — |

| | — |

| | 720 |

| | — |

| | — |

| | — |

| | 720 |

| | — |

| | 720 |

|

| Balance at March 31, 2018 | | 250 |

|

| — |

|

| 160,010 |

|

| (10,000 | ) |

| (75,370 | ) |

| 14,690 |

| | 89,580 |

| | (1,730 | ) | | 87,850 |

| | 250 |

|

| — |

|

| 160,350 |

|

| (10,000 | ) |

| (76,270 | ) |

| 15,250 |

| | 89,580 |

| | (1,730 | ) | | 87,850 |

|

| Net loss | | — |

| | — |

| | — |

| | — |

| | (66,930 | ) | | — |

| | (66,930 | ) | | (230 | ) | | (67,160 | ) | | — |

| | — |

| | — |

| | — |

| | (66,930 | ) | | — |

| | (66,930 | ) | | (230 | ) | | (67,160 | ) |

| Other comprehensive income, net of tax | | — |

| | — |

| | — |

| | — |

| | — |

| | (6,010 | ) | | (6,010 | ) | | (80 | ) | | (6,090 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | (6,010 | ) | | (6,010 | ) | | (80 | ) | | (6,090 | ) |

| Shares surrendered upon vesting of employees; share based payment awards to cover tax obligations | | — |

| | — |

| | (10 | ) | | — |

| | — |

| | — |

| | (10 | ) | | — |

| | (10 | ) | |

| Shares surrendered upon vesting of employees share based payment awards to cover tax obligations | | | — |

| | — |

| | (10 | ) | | — |

| | — |

| | — |

| | (10 | ) | | — |

| | (10 | ) |

| Non-cash compensation expense | | — |

| | — |

| | 490 |

| | — |

| | — |

| | — |

| | 490 |

| | — |

| | 490 |

| | — |

| | — |

| | 490 |

| | — |

| | — |

| | — |

| | 490 |

| | — |

| | 490 |

|

| Balance at June 30, 2018 | | $ | 250 |

| | $ | — |

| | $ | 160,490 |

| | $ | (10,000 | ) | | $ | (142,300 | ) | | $ | 8,680 |

| | $ | 17,120 |

| | $ | (2,040 | ) | | $ | 15,080 |

| | 250 |

| | — |

| | 160,830 |

| | (10,000 | ) | | (143,200 | ) | | 9,240 |

| | 17,120 |

| | (2,040 | ) | | 15,080 |

|

| Net loss | | | — |

| | — |

| | — |

| | — |

| | (32,760 | ) | | — |

| | (32,760 | ) | | (240 | ) | | (33,000 | ) |

| Other comprehensive income, net of tax | | | — |

| | — |

| | — |

| | — |

| | — |

| | (40 | ) | | (40 | ) | | — |

| | (40 | ) |

| Shares surrendered upon vesting of employees share based payment awards to cover tax obligations | | | — |

| | — |

| | (90 | ) | | — |

| | — |

| | — |

| | (90 | ) | | — |

| | (90 | ) |

| Non-cash compensation expense | | | — |

| | — |

| | 220 |

| | — |

| | — |

| | — |

| | 220 |

| | — |

| | 220 |

|

| Balance at September 30, 2018 | | | $ | 250 |

| | $ | — |

| | $ | 160,960 |

| | $ | (10,000 | ) | | $ | (175,960 | ) | | $ | 9,200 |

| | $ | (15,550 | ) | | $ | (2,280 | ) | | $ | (17,830 | ) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

HORIZON GLOBAL CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

1. General

Nature of operationsOperations and basisBasis of presentation.Presentation

Horizon Global Corporation (“Horizon,” “Horizon Global,” “we,” or the “Company”) is a global designer, manufacturer and distributor of a wide variety of high quality, custom-engineered towing, trailering, cargo management and other related accessories. These products are designed to support original equipment manufacturers (“OEMs”) and original equipment servicers (“OESs”) (collectively, “OEs”), aftermarket and retail customers within the agricultural, automotive, construction, horse/livestock, industrial, marine, military, recreational, trailer and utility markets. The Company groups its business into operating segments by the region in which sales and manufacturing efforts are focused. TheAs a result of the Company’s sale of its Horizon Asia-Pacific operating segment (“APAC”), the Company’s operating segments are Horizon Americas Horizon Europe-Africa, and Horizon Asia-Pacific.Europe-Africa. See Note 16,17, “Segment Information,” for further information on each of the Company’s operating segments. Historical information has been retrospectively adjusted to reflect the classification of APAC as discontinued operations. Discontinued operations are further discussed in Note 3, “Discontinued Operations”.

The accompanying unaudited condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”) for interim financial information and should be read in conjunction with the consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018. Accordingly, they do not include all of the information and footnotes required by accounting principles generally accepted in the United States (“U.S. GAAP”) for complete financial statements. It is management’s opinion that these financial statements contain all adjustments, including adjustments of a normal and recurring nature, necessary for a fair presentation of financial position and results of operations. Results of operations for interim periods are not necessarily indicative of results for the full year.

2. New Accounting Pronouncements

Accounting pronouncements recently adopted

In June 2018, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2018-07, “Compensation - Stock Compensation (Topic 718)” (“ASU 2018-07”). ASU 2018-07 expands the scope of Accounting Standard Codification (“ASC”) 718 to include all share-based payment arrangements related to the acquisition of goods and services from both non-employees and employees. ASU 2018-07 is effective for fiscal years, and interim periods within those years, beginning after December 15, 2018 with early adoption permitted. The Company adopted ASU 2018-07 on January 1, 2019, and there was no impact on the Company’s condensed consolidated financial statements.

In August 2017, the FASB issued ASU 2017-12, “Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities” (“ASU 2017-12”). ASU 2017-12 eliminates the requirement to separately measure and report hedge ineffectiveness and generally requires, for qualifying hedges, the entire change in the fair value of a hedging instrument to be presented in the same income statement line as the hedged item. The guidance also modifies the accounting for components excluded from the assessment of hedge effectiveness, eases documentation and assessment requirements and modifies certain disclosure requirements. ASU 2017-12 is effective for fiscal years beginning after December 15, 2018, including interim periods within those annual periods, with early adoption permitted and should be applied on a modified retrospective basis. The Company adopted ASU 2017-12 on January 1, 2019, and there was no impact on the Company’s condensed consolidated financial statements.

In February 2016, the FASB issued ASU 2016-02, “Leases (Topic 842)” (“ASU 2016-02”), which supersedes the lease requirements in “Leases (Topic 840).” The objective of this update is to establish the principles that lessees and lessors shall apply to report useful information to users of financial statements about the amount, timing, and uncertainty of cash flows arising from a lease. Under this guidance, lessees are required to recognize on the balance sheet a lease liability and a right-of-use (“ROU”) asset for all leases, with the exception of short-term leases with terms of twelve months or less. The lease liability represents the lessee’s obligation to make lease payments arising from a lease and will be measured as the present value of the lease payments. The ROU asset represents the lessee’s right to use a specified asset for the lease term, and will be measured at the lease liability amount, adjusted for lease prepayment, lease incentives received and the lessee’s initial direct costs.

The Company has elected the package of practical expedients, excluding the lease term hindsight, as permitted by the transition guidance. The Company has made an accounting policy election to exempt leases with an initial term of twelve months or less from balance sheet recognition. Instead, short-term leases will be expensed over the lease term.

The Company adopted the standard on January 1, 2019, by applying the modified retrospective method without restatement of comparative periods' financial information, as permitted by the transition guidance. The standard had a material impact on the Company’s condensed consolidated balance sheet, but did not have an impact on its condensed consolidated statements of operations

HORIZON GLOBAL CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

Company’s condensed consolidated balance sheet, but did not have a material impact on its condensed consolidated statements of operations and cash flows. The most significant impact was the recognition of ROU assets and lease liabilities for operating leases, while the Company’s accounting for finance leases remained substantially unchanged.

See Note 1112 “Leases,” for the impact of the adoption which resulted in the recognition of ROU assets and corresponding lease liabilities.

3. Discontinued Operations

On September 19, 2019, the Company completed the sale of its subsidiaries that comprised APAC to Hayman Pacific BidCo Pty Ltd., an affiliate of Pacific Equity Partners, for $209.6 million in net cash proceeds after payment of transaction costs, in a net debt free sale. The sale resulted in the recognition of a gain of $180.5 million, of which $17.3 million was related to the cumulative translation adjustment that was reclassified to earnings, which is reflected within the income from discontinued operations, net of taxes line of the condensed consolidated statement of operations.

The Company classified APAC assets and liabilities as held-for-sale as of December 31, 2018 in the accompanying condensed consolidated balance sheet and has classified APAC’s operating results and the gain on the sale as discontinued operations in the accompanying condensed consolidated statement of operations for all periods presented in accordance with ASC 205, “Discontinued Operations.” Prior to being classified as held-for-sale, APAC was included as a separate operating segment.

The following tables presents the Company’s results from discontinued operations:

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2019 | | 2018 | | 2019 | | 2018 |

| | | (dollars in thousands) | | (dollars in thousands) |

| Net sales | | $ | 29,750 |

| | $ | 33,810 |

| | $ | 92,300 |

| | $ | 101,760 |

|

| Cost of sales | | (22,250 | ) | | (24,720 | ) | | (68,530 | ) | | (76,250 | ) |

| Selling, general and administrative expenses | | (3,050 | ) | | (3,130 | ) | | (9,580 | ) | | (10,510 | ) |

| Interest expense | | (80 | ) | | (60 | ) | | (310 | ) | | (210 | ) |

| Other expense. net | | (210 | ) | | (470 | ) | | (400 | ) | | (1,800 | ) |

| Income before income tax expense | | 4,160 |

| | 5,430 |

| | 13,480 |

| | 12,990 |

|

| Income tax expense | | (1,900 | ) | | (1,320 | ) | | (4,450 | ) | | (3,320 | ) |

Gain on sale of discontinued operations

| | $ | 180,490 |

| | $ | — |

| | $ | 180,490 |

| | $ | — |

|

| Income from discontinued operations, net of tax | | $ | 182,750 |

| | $ | 4,110 |

| | $ | 189,520 |

| | $ | 9,670 |

|

The following tables presents the Company’s assets and liabilities held for sale:

HORIZON GLOBAL CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

|

| | | | |

| | | December 31, 2018 |

| | | (dollars in thousands) |

| Assets | | |

| Current assets: | | |

| Receivables, net of allowance for doubtful accounts | | $ | 13,170 |

|

| Inventories | | 21,490 |

|

| Prepaid expenses and other current assets | | 1,420 |

|

| Total current assets | | 36,080 |

|

| Non-current assets: | | |

| Property and equipment, net | | 15,780 |

|

| Goodwill | | 8,160 |

|

| Other intangibles, net | | 8,650 |

|

| Deferred income taxes | | 2,030 |

|

| Other assets | | 170 |

|

| Total non-current assets | | 34,790 |

|

| Assets held-for-sale | | $ | 70,870 |

|

| Liabilities | | |

| Current liabilities: | | |

| Accounts payable | | $ | 20,780 |

|

| Accrued liabilities | | 7,300 |

|

| Total current liabilities | | 28,080 |

|

| Non-current liabilities: | | |

| Deferred income taxes | | 1,530 |

|

| Other long-term liabilities | | 210 |

|

| Total non-current liabilities | | 1,740 |

|

| Total liabilities held-for-sale | | $ | 29,820 |

|

HORIZON GLOBAL CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

4. Revenues

Revenue Recognition

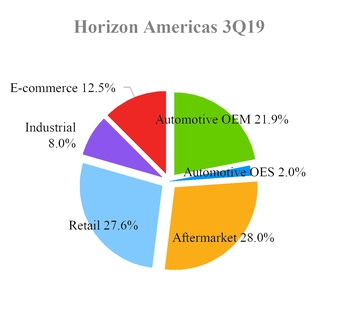

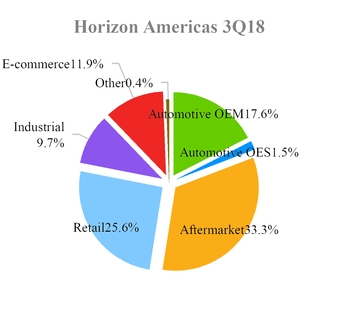

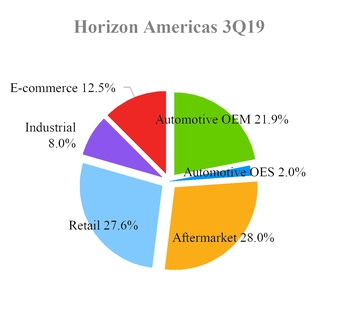

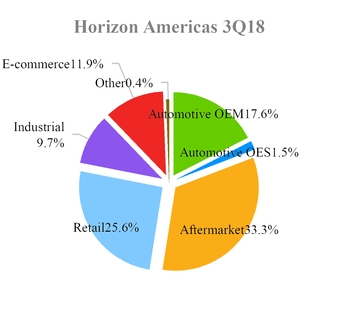

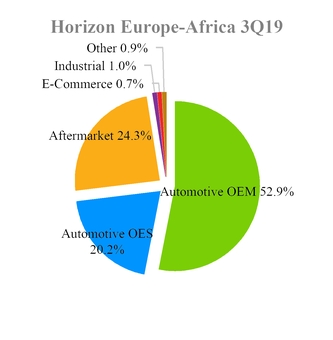

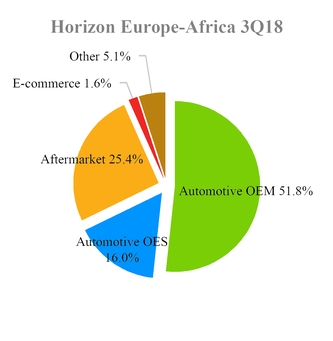

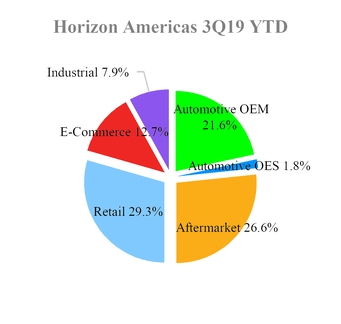

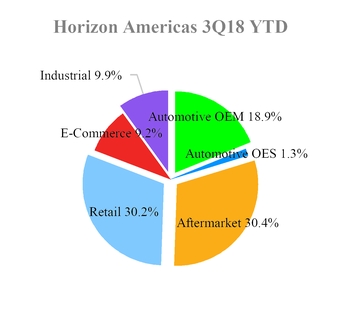

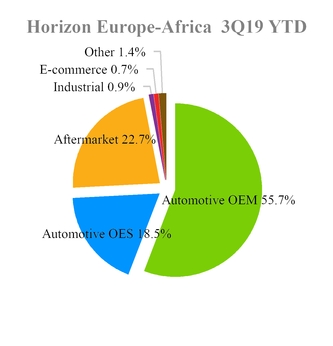

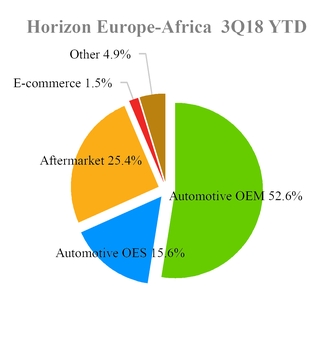

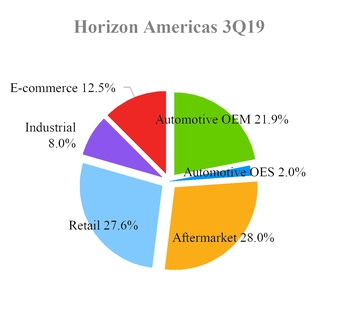

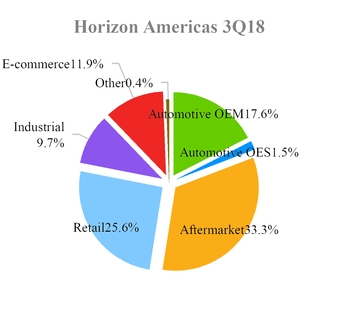

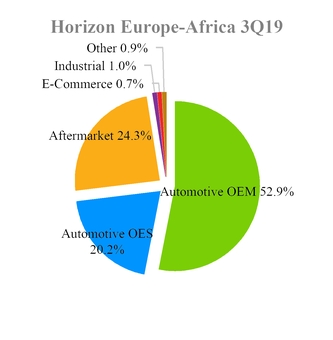

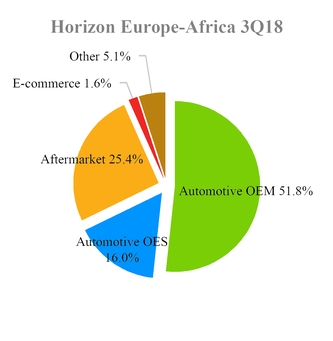

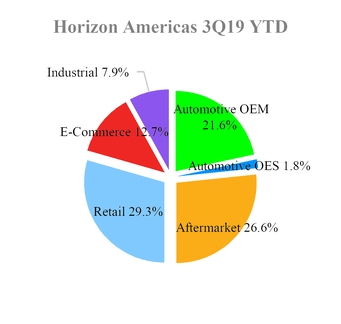

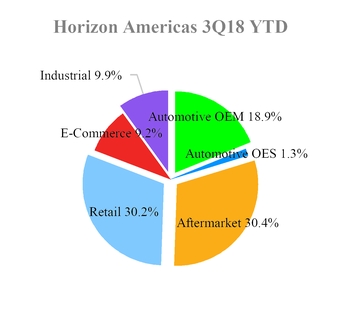

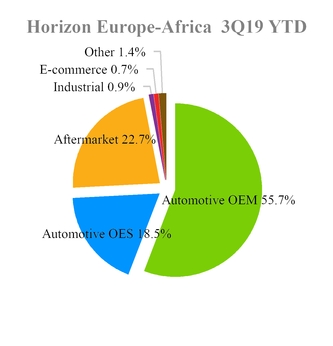

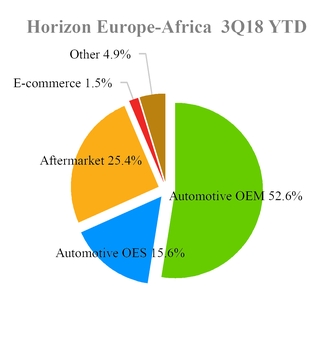

The Company disaggregates revenue from contracts with customers by major sales channel. The Company determined that disaggregating revenue into these categories best depicts how the nature, amount, timing, and uncertainty of revenue and cash flows are affected by economic factors. The Automotive OEM channel represents sales to automotive vehicle manufacturers. The Automotive OES channel primarily represents sales to automotive vehicle dealerships. The Aftermarket channel represents sales to automotive installers and warehouse distributors. The Retail channel represents sales to direct-to-consumer retailers. The Industrial channel represents sales to non-automotive manufacturers and dealers of agricultural equipment, trailers, and other custom assemblies. The E-Commerce channel represents sales to direct-to-consumer retailers who utilize the internet to purchase the Company’s products. The Other channel represents sales that do not fit into a category described above and these sales are considered ancillary to the Company’s core operating activities.

The following tables present the Company’s net sales disaggregated by major sales channel as follows:channel:

| | | | | Three Months Ended June 30, 2019 | | Three Months Ended September 30, 2019 |

| | | Horizon Americas | | Horizon Europe-Africa | | Horizon

Asia-Pacific | | Total | | Horizon Americas | | Horizon Europe-Africa | | Total |

| | | (dollars in thousands) | | (dollars in thousands) |

| Net Sales | | | | | | | | | | | | | | |

| Automotive OEM | | $ | 23,670 |

| | $ | 45,910 |

| | $ | 5,610 |

| | $ | 75,190 |

| | $ | 21,050 |

| | $ | 43,200 |

| | $ | 64,250 |

|

| Automotive OES | | 1,810 |

| | 16,030 |

| | 14,380 |

| | 32,220 |

| | 1,960 |

| | 16,510 |

| | 18,470 |

|

| Aftermarket | | 28,850 |

| | 20,080 |

| | 5,150 |

| | 54,080 |

| | 26,920 |

| | 19,840 |

| | 46,760 |

|

| Retail | | 33,180 |

| | — |

| | 2,150 |

| | 35,330 |

| | 26,600 |

| | — |

| | 26,600 |

|

| Industrial | | 6,930 |

| | 860 |

| | 3,280 |

| | 11,070 |

| | 7,650 |

| | 780 |

| | 8,430 |

|

| E-commerce | | 14,480 |

| | 580 |

| | — |

| | 15,060 |

| | 12,040 |

| | 560 |

| | 12,600 |

|

| Other | | — |

| | 210 |

| | — |

| | 210 |

| | — |

| | 740 |

| | 740 |

|

| Total | | $ | 108,920 |

| | $ | 83,670 |

| | $ | 30,570 |

| | $ | 223,160 |

| | $ | 96,220 |

| | $ | 81,630 |

| | $ | 177,850 |

|

| | | | | Three Months Ended June 30, 2018 | | Three Months Ended September 30, 2018 |

| | | Horizon Americas | | Horizon Europe-Africa | | Horizon

Asia-Pacific | | Total | | Horizon Americas | | Horizon Europe-Africa | | Total |

| | | (dollars in thousands) | | (dollars in thousands) |

| Net Sales | | | | | | | | | | | | | | |

| Automotive OEM | | $ | 19,950 |

| | $ | 47,360 |

| | $ | 6,120 |

| | $ | 73,430 |

| | $ | 20,320 |

| | $ | 40,650 |

| | $ | 60,970 |

|

| Automotive OES | | 1,660 |

| | 12,890 |

| | 16,260 |

| | 30,810 |

| | 1,700 |

| | 12,600 |

| | 14,300 |

|

| Aftermarket | | 31,710 |

| | 24,410 |

| | 6,300 |

| | 62,420 |

| | 38,470 |

| | 19,980 |

| | 58,450 |

|

| Retail | | 34,580 |

| | — |

| | 2,080 |

| | 36,660 |

| | 29,600 |

| | — |

| | 29,600 |

|

| Industrial | | 10,300 |

| | — |

| | 3,660 |

| | 13,960 |

| | 11,160 |

| | — |

| | 11,160 |

|

| E-commerce | | 9,570 |

| | 1,270 |

| | — |

| | 10,840 |

| | 13,750 |

| | 1,290 |

| | 15,040 |

|

| Other | | 310 |

| | 4,910 |

| | — |

| | 5,220 |

| | 510 |

| | 4,000 |

| | 4,510 |

|

| Total | | $ | 108,080 |

| | $ | 90,840 |

| | $ | 34,420 |

| | $ | 233,340 |

| | $ | 115,510 |

| | $ | 78,520 |

| | $ | 194,030 |

|

HORIZON GLOBAL CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

| | | | | Six Months Ended June 30, 2019 | | Nine Months Ended September 30, 2019 |

| | | Horizon Americas | | Horizon Europe-Africa | | Horizon

Asia-Pacific | | Total | | Horizon Americas | | Horizon Europe-Africa | | Total |

| | | (dollars in thousands) | | (dollars in thousands) |

| Net Sales | | | | | | | | | | | | | | |

| Automotive OEM | | $ | 43,910 |

| | $ | 94,830 |

| | $ | 12,370 |

| | $ | 151,110 |

| | $ | 64,970 |

| | $ | 137,900 |

| | $ | 202,870 |

|

| Automotive OES | | 3,420 |

| | 29,330 |

| | 27,600 |

| | 60,350 |

| | 5,380 |

| | 45,840 |

| | 51,220 |

|

| Aftermarket | | 53,000 |

| | 36,370 |

| | 10,910 |

| | 100,280 |

| | 79,910 |

| | 56,200 |

| | 136,110 |

|

| Retail | | 61,620 |

| | — |

| | 4,870 |

| | 66,490 |

| | 88,230 |

| | — |

| | 88,230 |

|

| Industrial | | 16,210 |

| | 1,560 |

| | 6,810 |

| | 24,580 |

| | 23,860 |

| | 2,340 |

| | 26,200 |

|

| E-commerce | | 26,260 |

| | 1,100 |

| | — |

| | 27,360 |

| | 38,300 |

| | 1,650 |

| | 39,950 |

|

| Other | | — |

| | 2,650 |

| | — |

| | 2,650 |

| | 20 |

| | 3,570 |

| | 3,590 |

|

| Total | | $ | 204,420 |

| | $ | 165,840 |

| | $ | 62,560 |

| | $ | 432,820 |

| | $ | 300,670 |

| | $ | 247,500 |

| | $ | 548,170 |

|

| | | | | Six Months Ended June 30, 2018 | | Nine Months Ended September 30, 2018 |

| | | Horizon Americas | | Horizon Europe-Africa | | Horizon

Asia-Pacific | | Total | | Horizon Americas | | Horizon Europe-Africa | | Total |

| | | (dollars in thousands) | | (dollars in thousands) |

| Net Sales | | | | | | | | | | | | | | |

| Automotive OEM | | $ | 40,000 |

| | $ | 94,280 |

| | $ | 12,510 |

| | $ | 146,790 |

| | $ | 60,320 |

| | $ | 134,930 |

| | $ | 195,250 |

|

| Automotive OES | | 2,530 |

| | 27,380 |

| | 29,980 |

| | 59,890 |

| | 4,230 |

| | 39,980 |

| | 44,210 |

|

| Aftermarket | | 58,230 |

| | 45,200 |

| | 13,040 |

| | 116,470 |

| | 96,700 |

| | 65,180 |

| | 161,880 |

|

| Retail | | 66,730 |

| | — |

| | 5,190 |

| | 71,920 |

| | 96,330 |

| | — |

| | 96,330 |

|

| Industrial | | 20,520 |

| | — |

| | 7,230 |

| | 27,750 |

| | 31,680 |

| | — |

| | 31,680 |

|

| E-commerce | | 15,590 |

| | 2,590 |

| | — |

| | 18,180 |

| | 29,340 |

| | 3,880 |

| | 33,220 |

|

| Other | | 700 |

| | 8,450 |

| | — |

| | 9,150 |

| | 1,220 |

| | 12,460 |

| | 13,680 |

|

| Total | | $ | 204,300 |

| | $ | 177,900 |

| | $ | 67,950 |

| | $ | 450,150 |

| | $ | 319,820 |

| | $ | 256,430 |

| | $ | 576,250 |

|

During the three and sixnine months ended JuneSeptember 30, 2019 and 2018, adjustments to estimates of variable consideration for previously recognized revenue were insignificant. At JuneSeptember 30, 2019 and December 31, 2018, total opening and closing balances of contract assets and deferred revenue were not material.

45. Goodwill and Other Intangible Assets

Changes in the carrying amount of goodwill for the sixnine months ended JuneSeptember 30, 2019 are summarized as follows:

| | | | | Horizon Americas | | Horizon

Asia-Pacific | | Total | |

| (dollars in thousands) | | | Horizon Americas |

| | | (dollars in thousands) | | |

| Balance at December 31, 2018 | | $ | 4,500 |

| | $ | 8,160 |

| | $ | 12,660 |

| | $ | 4,500 |

|

| Foreign currency translation | | 30 |

| | 10 |

| | 40 |

| | (300 | ) |

| Balance at June 30, 2019 | | $ | 4,530 |

| | $ | 8,170 |

| | $ | 12,700 |

| |

| Balance at September 30, 2019 | | | $ | 4,200 |

|

HORIZON GLOBAL CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

The gross carrying amounts and accumulated amortization of the Company’s other intangibles are summarized below.as follows.

| | | | | June 30, 2019 | | December 31, 2018 | | As of

September 30, 2019 |

| Intangible Category by Useful Life | | Gross Carrying Amount | | Accumulated Amortization | | Gross Carrying Amount | | Accumulated Amortization | | Gross Carrying Amount | | Accumulated Amortization | | Net Carrying Amount |

| | | (dollars in thousands) | | (dollars in thousands) |

| Finite-lived intangible assets: | | | | | | | | | | | | | | |

| Customer relationships, 2 – 20 years | | $ | 174,200 |

| | $ | (131,030 | ) | | $ | 177,910 |

| | $ | (127,740 | ) | |

| Technology and other, 3 – 15 years | | 21,260 |

| | (15,540 | ) | | 21,000 |

| | (15,910 | ) | |

| Trademark/Trade names, 1 – 8 years | | 730 |

| | (280 | ) | | 730 |

| | (250 | ) | |

| Customer relationships (2 – 20 years) | | | $ | 162,940 |

| | $ | (129,020 | ) | | $ | 33,920 |

|

| Technology and other (3 – 15 years) | | | 20,590 |

| | (14,630 | ) | | 5,960 |

|

| Trademark/Trade names (1 – 8 years) | | | 150 |

| | (150 | ) | | — |

|

| Total finite-lived intangible assets | | 196,190 |

| | (146,850 | ) | | 199,640 |

| | (143,900 | ) | | 183,680 |

| | (143,800 | ) | | 39,880 |

|

| Trademark/Trade names, indefinite-lived | | 22,560 |

| | — |

| | 22,310 |

| | — |

| | 20,470 |

| | — |

| | 20,470 |

|

| Total other intangible assets | | $ | 218,750 |

| | $ | (146,850 | ) | | $ | 221,950 |

| | $ | (143,900 | ) | | $ | 204,150 |

| | $ | (143,800 | ) | | $ | 60,350 |

|

|

| | | | | | | | | | | | |

| | | As of

December 31, 2018 |

| Intangible Category by Useful Life | | Gross Carrying Amount | | Accumulated Amortization | | Net Carrying Amount |

| | | (dollars in thousands) |

| Finite-lived intangible assets: | | | | | | |

| Customer relationships (2 – 20 years) | | $ | 168,230 |

| | $ | (124,510 | ) | | $ | 43,720 |

|

| Technology and other (3 – 15 years) | | 20,490 |

| | (15,400 | ) | | 5,090 |

|

| Trademark/Trade names (1 – 8 years) | | 150 |

| | (150 | ) | | — |

|

| Total finite-lived intangible assets | | 188,870 |

| | (140,060 | ) | | 48,810 |

|

| Trademark/Trade names, indefinite-lived | | 20,590 |

| | — |

| | 20,590 |

|

| Total other intangible assets | | $ | 209,460 |

| | $ | (140,060 | ) | | $ | 69,400 |

|

On March 1, 2019, the Company entered into an agreement of sale of certain business assets in its Europe-Africa operating segment, via a share and asset sale (the “Sale”). Under the terms of the Sale, effective March 1, 2019, the Company disposed of certain non-automotive business assets that operated using the Terwa brand for $5.5 million, which included a $0.5 million note receivable. The Sale resulted in a $3.6 million loss recorded in Other expense, net in the condensed consolidated statements of operations, including a $3.0 million reduction of net intangibles related to customer relationships.

Amortization expense related to intangible assets as included in the accompanying condensed consolidated statements of operations is summarized as follows:

|

| | | | | | | | | | | | | | | | |

| | | Three months ended June 30, | | Six months ended June 30, |

| | | 2019 | | 2018 | | 2019 | | 2018 |

| | | (dollars in thousands) |

| Technology and other, included in cost of sales | | $ | 270 |

| | $ | 290 |

| | $ | 720 |

| | $ | 560 |

|

| Customer relationships and Trademark/Trade names, included in selling, general and administrative expenses | | 1,120 |

| | 1,620 |

| | 2,740 |

| | 3,580 |

|

| Total amortization expense | | $ | 1,390 |

| | $ | 1,910 |

| | $ | 3,460 |

| | $ | 4,140 |

|

5. Inventories

Inventories consist of the following components:

|

| | | | | | | | |

| | | June 30,

2019 | | December 31,

2018 |

| | | (dollars in thousands) |

| Finished goods | | $ | 104,480 |

| | $ | 103,090 |

|

| Work in process | | 19,420 |

| | 19,660 |

|

| Raw materials | | 53,930 |

| | 50,940 |

|

| Total inventories | | $ | 177,830 |

| | $ | 173,690 |

|

|

| | | | | | | | | | | | | | | | |

| | | Three months ended September 30, | | Nine months ended September 30, |

| | | 2019 | | 2018 | | 2019 | | 2018 |

| | | (dollars in thousands) |

| Technology and other, included in cost of sales | | $ | 260 |

| | $ | 430 |

| | $ | 980 |

| | $ | 990 |

|

| Customer relationships and Trademark/Trade names, included in selling, general and administrative expenses | | 1,410 |

| | 1,600 |

| | 3,820 |

| | 4,650 |

|

| Total amortization expense | | $ | 1,670 |

| | $ | 2,030 |

| | $ | 4,800 |

| | $ | 5,640 |

|

HORIZON GLOBAL CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

6. Inventories

Inventories consist of the following components:

|

| | | | | | | | |

| | | September 30,

2019 | | December 31,

2018 |

| | | (dollars in thousands) |

| Finished goods | | $ | 80,440 |

| | $ | 89,000 |

|

| Work in process | | 12,880 |

| | 16,160 |

|

| Raw materials | | 47,830 |

| | 47,040 |

|

| Total inventories | | $ | 141,150 |

| | $ | 152,200 |

|

HORIZON GLOBAL CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

7. Property and Equipment, Net

Property and equipment, net consists of the following components:

| | | | | June 30,

2019 | | December 31,

2018 | | September 30,

2019 | | December 31,

2018 |

| | | (dollars in thousands) | | (dollars in thousands) |

| Land and land improvements | | $ | 460 |

| | $ | 460 |

| | $ | 440 |

| | $ | 460 |

|

| Buildings | | 24,010 |

| | 21,440 |

| | 20,460 |

| | 18,680 |

|

| Machinery and equipment | | 162,660 |

| | 161,750 |

| | 120,840 |

| | 121,230 |

|

| | | 187,130 |

| | 183,650 |

| | 141,740 |

| | 140,370 |

|

| Less: Accumulated depreciation | | 89,300 |

| | 81,370 |

| |

| Accumulated depreciation | | | (63,070 | ) | | (53,870 | ) |

| Property and equipment, net | | $ | 97,830 |

| | $ | 102,280 |

| | $ | 78,670 |

| | $ | 86,500 |

|

Depreciation expense included in the accompanying condensed consolidated statements of operations is as follows:

| | | | | | | | | | | | Three months ended

September 30, | | Nine months ended

September 30, |

| | | Three months ended

June 30, | | Six months ended

June 30, | | (dollars in thousands) |

| | | 2019 | | 2018 | | 2019 | | 2018 | | 2019 | | 2018 | | 2019 | | 2018 |

| | | (dollars in thousands) | | (dollars in thousands) |

| Depreciation expense, included in cost of sales | | $ | 4,460 |

| | $ | 3,810 |

| | $ | 8,380 |

| | $ | 7,600 |

| | $ | 3,170 |

| | $ | 2,960 |

| | $ | 9,760 |

| | $ | 8,630 |

|

| Depreciation expense, included in selling, general and administrative expense | | 590 |

| | 300 |

| | 940 |

| | 640 |

| | 1,420 |

| | 270 |

| | 2,220 |

| | 780 |

|

| Total depreciation expense | | $ | 5,050 |

| | $ | 4,110 |

| | $ | 9,320 |

| | $ | 8,240 |

| | $ | 4,590 |

| | $ | 3,230 |

| | $ | 11,980 |

| | $ | 9,410 |

|

7.8. Accrued and Other Long-term Liabilities

Accrued liabilities consist of the following components:

| | | | | June 30,

2019 | | December 31,

2018 | | September 30,

2019 | | December 31,

2018 |

| | | (dollars in thousands) | | (dollars in thousands) |

| Customer incentives | | | $ | 12,700 |

| | $ | 9,990 |

|

| Customer claims | | $ | 16,110 |

| | $ | 14,160 |

| | 10,370 |

| | 14,130 |

|

| Accrued compensation | | 14,250 |

| | 10,230 |

| | 8,890 |

| | 5,680 |

|

| Customer incentives | | 12,740 |

| | 10,100 |

| |

| Accrued professional services | | 4,260 |

| | 4,770 |

| | 3,940 |

| | 4,380 |

|

| Restructuring | | 3,980 |

| | 7,530 |

| | 2,450 |

| | 7,530 |

|

| Deferred purchase price | | 3,260 |

| | 3,400 |

| | 750 |

| | 3,400 |

|

| Short-term tax liabilities | | 1,260 |

| | 1,930 |

| | 750 |

| | 1,130 |

|

| Cross currency swap | | — |

| | 1,610 |

| | — |

| | 1,610 |

|

| Other | | 15,390 |

| | 12,090 |

| | 13,170 |

| | 10,670 |

|

| Total accrued liabilities | | $ | 71,250 |

| | $ | 65,820 |

| | $ | 53,020 |

| | $ | 58,520 |

|

HORIZON GLOBAL CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

Other long-term liabilities consist of the following components:

| | | | | June 30,

2019 | | December 31,

2018 | | September 30,

2019 | | December 31,

2018 |

| | | (dollars in thousands) | | (dollars in thousands) |

| Long-term tax liabilities | | $ | 6,490 |

| | $ | 6,270 |

| | $ | 6,220 |

| | $ | 6,270 |

|

| Deferred purchase price | | | 2,440 |

| | 30 |

|

| Restructuring | | 2,200 |

| | 2,580 |

| | 1,980 |

| | 2,580 |

|

| Deferred purchase price | | 250 |

| | 30 |

| |

| Other | | 10,160 |

| | 11,080 |

| | 10,130 |

| | 10,870 |

|

| Total other long-term liabilities | | $ | 19,100 |

| | $ | 19,960 |

| | $ | 20,770 |

| | $ | 19,750 |

|

89. Long-term Debt

The Company’s long-term debt consists of the following:

| | | | | June 30,

2019 | | December 31,

2018 | | September 30,

2019 | | December 31,

2018 |

| | | (dollars in thousands) | | (dollars in thousands) |

| ABL Facility | | $ | 51,190 |

| | $ | 61,570 |

| | $ | 19,660 |

| | $ | 61,570 |

|

| First Lien Term Loan | | 187,000 |

| | 190,520 |

| | 25,010 |

| | 190,520 |

|

| Second Lien Term Loan | | 53,170 |

| | — |

| | 55,060 |

| | — |

|

| Convertible Notes | | 125,000 |

| | 125,000 |

| | 125,000 |

| | 125,000 |

|

| Bank facilities, capital leases and other long-term debt | | 31,790 |

| | 18,990 |

| | 14,470 |

| | 18,990 |

|

| | | 448,150 |

| | 396,080 |

| |

| Gross debt | | | 239,200 |

| | 396,080 |

|

| Less: | | | | | |

| Current maturities, long-term debt | | | 24,270 |

| | 13,860 |

|

| Gross long-term debt | | | 214,930 |

| | 382,220 |

|

| Less: | | | | | | | | |

| Unamortized debt issuance costs and original issuance discount on First Lien Term Loan | | 6,750 |

| | 7,380 |

| | 790 |

| | 7,380 |

|

| Unamortized debt issuance costs and discount on Second Lien Term Loan | | 14,720 |

| | — |

| | 13,800 |

| | — |

|

| Unamortized debt issuance costs and discount on Convertible Notes | | 21,140 |

| | 24,190 |

| | 19,610 |

| | 24,190 |

|

| Current maturities, long-term debt | | 166,760 |

| | 13,860 |

| |

| Unamortized debt issuance costs and discount | | | 34,200 |

| | 31,570 |

|

| Long-term debt | | $ | 238,780 |

| | $ | 350,650 |

| | $ | 180,730 |

| | $ | 350,650 |

|

ABL Facility

In February 2019, the Company amended its existing revolving credit facility (the “ABL Facility”) to permit the Company to enter into the Senior Term Loan Agreement (as defined below) and make certain indebtedness, asset sale, investment and restricted payment baskets covenants more restrictive.

In March 2019, the Company amended the ABL Facility to permit the Company to enter into the Second Lien Term Loan Agreement (as defined below) and provide for certain other modifications of the ABL Facility. In particular, the ABL Facility was modified to (a) increase the interest rate by 1.0%, (b) reduce the total facility size to $90.0 million and (c) limit the ability to add debtincur additional indebtedness in the future.

In September 2019, the Company amended its existing ABL Facility to provide consent for the sale of APAC, provide consent for the Company’s prepayment of First Lien Term Loan, as discussed below, and increase the existing block by $5.0 million to a total block of $10.0 million, making the effective facility size $80.0 million.

HORIZON GLOBAL CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

The ABL Facility consists of (i) a U.S. sub-facility, in an aggregate principal amount of up to $85.0 million (subject to availability under a U.S.-specific borrowing base) (the “U.S. Facility”), (ii) a Canadian sub-facility, in an aggregate principal amount of up to $2.0 million (subject to availability under a Canadian-specific borrowing base) (the “Canadian Facility”), and (iii) a U.K. sub-facility in an aggregate principal amount of up to $3.0 million (subject to availability under a U.K.-specific borrowing base) (the “U.K. Facility”). The ABL Facility also includes a $20.0 million U.S. letter of credit sub-facility. All facilities under the ABL

HORIZON GLOBAL CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

Facility mature on June 30, 2020 and are presented in “short-term borrowings and current maturities, long-term debt” in the accompanying JuneSeptember 30, 2019 condensed consolidated balance sheet.

The Company incurred debt issuance costs of approximately $1.4$0.5 million in connection with the MarchSeptember 2019 amendment of the ABL Facility. These debt issuance costs will be amortized into interest expense over the contractual term of the loan. The Company recognized $0.4$0.3 million and $0.5$0.8 million of amortization of debt issuance costs for the three and sixnine months ended JuneSeptember 30, 2019, respectively, and $0.1 million and $0.2$0.4 million for the three and sixnine months ended JuneSeptember 30, 2018, respectively which are included in the accompanying condensed consolidated statements of operations. There were $1.6$2.0 million and $0.8 million of unamortized debt issuance costs included in other assets in the accompanying condensed consolidated balance sheets as of JuneSeptember 30, 2019 and December 31, 2018, respectively.

There was $51.2$19.7 million and $61.6 million outstanding under the ABL Facility as of JuneSeptember 30, 2019 and December 31, 2018, respectively, with a weighted average interest rate of 6.4%7.0% and 4.4%, respectively. Total letters of credit issued under the ABL Facility at JuneSeptember 30, 2019 and December 31, 2018 were $5.0$7.8 million and $3.4 million, respectively. The Company had $27.4$44.5 million and $10.3 million of availability under the ABL Facility as of JuneSeptember 30, 2019 and December 31, 2018, respectively.

First Lien Term Loan (formerly “Term Loan”)

In February 2019, the Company amended and restated the existing term loan agreement (the “First Lien Term Loan AgreementAgreement”) to permit the Company to enter into the Senior Term Loan Agreement and tightened certain indebtedness, asset sale, investment and restricted payment baskets.

In March 2019, the Company amended the existing Term Loan Agreementterm loan agreement (“Sixth Term Amendment”) (the “First Lien Term Loan Agreement”) to permit the Company to enter into the Second Lien Term Loan Agreement;Agreement, amend certain financial covenants to provide for relief based on the Company’s 2018 and 2019 budget,make them less restrictive and make certain other affirmative and negative covenants more restrictive.

Pursuant to the Sixth Term Amendment, the prior net leverage covenant ratio was eliminated and replaced with a first lien leverage covenant starting with the 12-month period ending September 2019 as follows:

September 30, 2019: 8.25:1.00

December 31, 2019: 6.25:1.00

March 31, 2020: 5.50:1.00

June 30, 2020: 5.00:1.00

September 30, 2020 and each fiscal quarter ending thereafter: 4.75:1.00

The Sixth Term Amendment also added a fixed charge coverage covenant starting with fiscal quarter ending March 31, 2020, a minimum liquidity covenant of $15.0 million starting March 31, 2019, and a maximum capital expenditure covenant of $15.0 million for 2019 and $25.0 million annually thereafter. The interest rate on the First Lien Term Loan Agreement was also amended to add 3.0% paid-in-kind interest in addition to the existing cash pay interest.

OnIn May 7, 2019, the Company entered into the Seventh Amendmentseventh amendment to Credit Agreementcredit agreement (the “Seventh Term Amendment”) to amend the First Lien Term Loan Agreement, which extended its $100.0 million prepayment requirement from on or before March 31, 2020, to on or before May 15, 2020.

Debt issuance costsIn September 2019, the Company amended the existing First Lien Term Loan Agreement (“Eighth Term Amendment”) to provide consent for the sale of approximately $5.6 million were incurredthe Company’s APAC segment, provide consent for the Company to meet its prepayment obligation of the First Lien Term Loan, remove prepayment penalties and make certain negative covenants less restrictive. In September 2019, the Company paid down a portion of its First Lien Term Loan’s outstanding principal plus fees and paid-in-kind interest in connectionthe amount of $172.9 million.

Pursuant to the Eighth Term Amendment, the prior first lien leverage covenant was eliminated and replaced with the Sixth Term Amendment. secured net leverage ratio starting with the fiscal quarter ending December 31, 2020 as follows:

December 31, 2020: 6.00 to 1.00

March 31, 2021: 6.00 to 1.00

June 30, 2021 and each fiscal quarter ending thereafter: 5.00 to 1.00

In accordance with ASC 470-50, “Modifications and Extinguishments,” the Company recorded approximately $0.7 million of issuance costs in selling, general and administrative expense in the accompanying condensed consolidated statements of operations during the sixnine months ended JuneSeptember 30, 2019 and capitalizedwrote off approximately $4.9$5.2 million of debt issuance costs that will be amortized into interest expense overdue to the contractual termmodification of the loan usingFirst Lien Term Loan for the effective interest method. Debt issuance costs incurred in connection withSeptember 19, 2019 amendment, which were recorded to selling, general and administrative expense within the Seventh Term Amendment were immaterial.accompanying condensed consolidated statements of operations.

HORIZON GLOBAL CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

The Company recorded approximately $0.5$5.2 million and $3.5$8.7 million of unamortized debt issuance costs to interest expense for the three and sixnine months ended JuneSeptember 30, 2019, respectively, due to the extinguishment of debt for certain lenders in the loan syndicate in connection with the Sixth, Seventh and SeventhEighth Term Amendments.

HORIZON GLOBAL CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)