TABLE OF CONTENTS

Index

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This Quarterly Report on Form 10-Q of NRG YieldClearway Energy LLC, together with its consolidated subsidiaries, or the Company, includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. The words "believes," "projects," "anticipates," "plans," "expects," "intends," "estimates" and similar expressions are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance and achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These factors, risks and uncertainties include the factors described under Item 1A — Risk Factors in Part I of the Company's Annual Report on Form 10-K for the year ended December 31, 2016, and under Item 1A - Risk Factors in Part II on the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2017,2020, as well as the following:

•The Company's ability to maintain and grow its quarterly distributions;

•Potential risks related to COVID-19 or any other pandemic;

•Potential risks related to the Company as a result of the NRG Transformation Plan;Company's relationships with GIP and CEG;

•The Company's ability to successfully identify, evaluate and consummate acquisitions from, and dispositions to, third parties;

•The Company's ability to acquire assets from NRG;GIP or CEG;

•The Company's ability to raise additional capital due to its indebtedness, corporate structure, market conditions or otherwise;

•Changes in law, including judicial decisions;

•Hazards customary to the power production industry and power generation operations such as fuel and electricity price volatility, unusual weather conditions (including wind and solar conditions), catastrophic weather-related or other damage to facilities, unscheduled generation outages, maintenance or repairs, unanticipated changes to fuel supply costs or availability due to higher demand, shortages, transportation problems or other developments, environmental incidents, or electric transmission or gas pipeline system constraints and the possibility that the Company may not have adequate insurance to cover losses as a result of such hazards;

•The Company's ability to operate its businesses efficiently, manage maintenance capital expenditures and costs effectively, and generate earnings and cash flows from its asset-based businesses in relation to its debt and other obligations;

•The willingness and ability of counterparties to the Company's offtake agreements to fulfill their obligations under such agreements;

•The Company's ability to enter into contracts to sell power and procure fuel on acceptable terms and prices as current offtake agreements expire;

•Government regulation, including compliance with regulatory requirements and changes in market rules, rates, tariffs and environmental laws;

•Operating and financial restrictions placed on the Company that are contained in the project-level debt facilities and other agreements of certain subsidiaries and project-level subsidiaries generally, in the NRG YieldClearway Energy Operating LLC amended and restated revolving credit facility and in the indentures governing the Senior Notes;

•Cyber terrorism and inadequate cybersecurity, or the occurrence of a catastrophic loss and the possibility that the Company may not have adequate insurance to cover losses resulting from such hazards or the inability of the Company's insurers to provide coverage;

•The Company's ability to engage in successful mergers and acquisitions activity; and

•The Company's ability to borrow additional funds and access capital markets, as well as the Company's substantial indebtedness and the possibility that the Company may incur additional indebtedness going forward.

Forward-looking statements speak only as of the date they were made, and the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The foregoing review of factors that could cause the Company's actual results to differ materially from those contemplated in any forward-looking statements included in this Quarterly Report on Form 10-Q should not be construed as exhaustive.

3

GLOSSARY OF TERMS

When the following terms and abbreviations appear in the text of this report, they have the meanings indicated below:

| 2025 Senior Notes | $ | |||||||

| 2026 Senior Notes | $350 million aggregate principal amount of 5.00% unsecured senior notes due 2026, issued by | |||||||

$850 million aggregate principal amount of 4.750% unsecured senior notes due 2028, issued by Clearway Energy Operating LLC | ||||||||

| 2031 Senior Notes | $925 million aggregate principal amount of 3.750% unsecured senior notes due 2031, issued by Clearway Energy Operating LLC | |||||||

| Adjusted EBITDA | A non-GAAP measure, represents earnings before interest, tax, depreciation and amortization adjusted for mark-to-market gains or losses, asset write offs and impairments; and factors which the Company does not consider indicative of future operating performance | |||||||

| Adjusted Gross Margin | A non-GAAP measure, represents total operating revenues, excluding contract amortization and mark-to-market for economic hedges, less cost of fuels. See Item 2 Management’s Discussion and Analysis of Financial Condition and Results of Operations – Management’s discussion of the results of operations for the quarters ended June 30, 2021 and 2020 for a discussion of this measure | |||||||

| AOCL | Accumulated Other Comprehensive Loss | |||||||

| ASC | The FASB Accounting Standards Codification, which the FASB established as the source of authoritative GAAP | |||||||

| ASU | Accounting Standards Updates - updates to the ASC | |||||||

| ATM | At-The-Market Equity Offering | |||||||

| CAFD | A non-GAAP measure, Cash Available and adjusted for development expenses | |||||||

| CEG Master Services Agreement | Master Services Agreements entered into as of August 31, 2018 between the Company, Clearway Energy, Inc., Clearway Energy Operating LLC, and CEG | |||||||

| CEG ROFO Agreement | Right of First Offer Agreement, entered into as of August 31, 2018, by and between Clearway Energy Group LLC and Clearway Energy, Inc., and solely for purposes of Section 2.4, GIP III Zephyr Acquisition Partners, L.P., as amended by the First Amendment dated February 14, 2019, the Second Amendment dated August 1, 2019, the Third Amendment dated December 6, 2019, the Fourth Amendment dated November 2, 2020 and the Fifth Amendment dated August 2, 2021 | |||||||

| CARES Act | The Coronavirus Aid, Relief, and Economic Security Act | |||||||

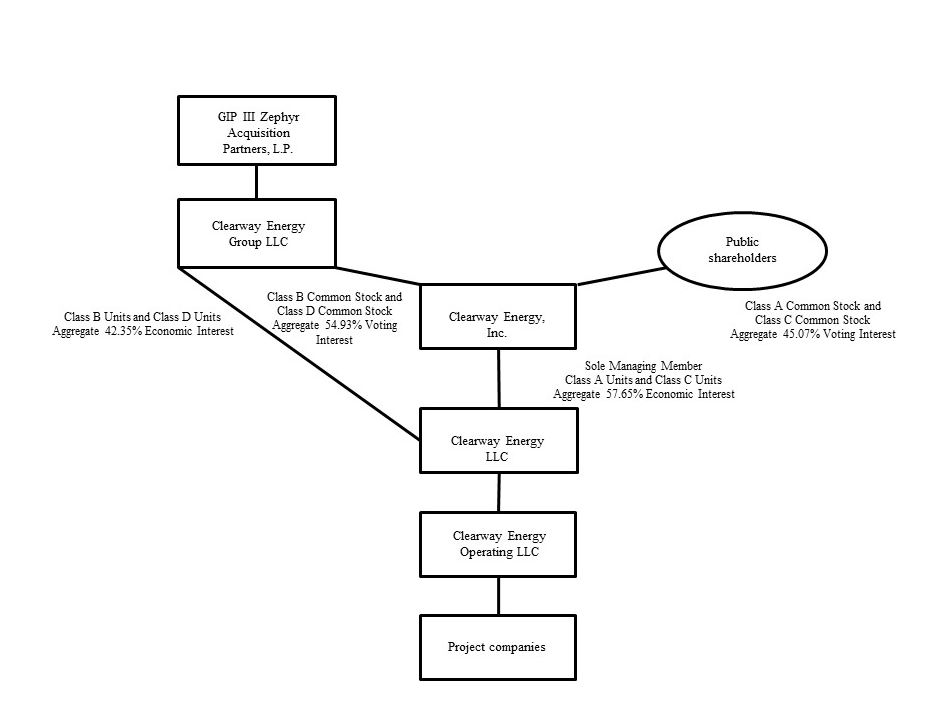

| Clearway Energy LLC | The holding company through which the projects are owned by Clearway Energy Group LLC, the holder of Class B and Class D units of the Company, and Clearway Energy, Inc., the holder of the Class A and Class C units | |||||||

| Clearway Energy Group LLC | The holder of all of Clearway Energy, Inc.'s Class B and Class D common shares stock,and Clearway Energy LLC'sthe Company’s Class B and Class D units and, from time to time, possibly shares of Clearway Energy, Inc.’s Class A and/or Class C common stock | |||||||

| Clearway Energy Operating LLC | The holder of the project assets that are owned by Clearway Energy LLC | |||||||

| COD | Commercial Operation Date | |||||||

| Company | Clearway Energy LLC, together with its consolidated subsidiaries | |||||||

| CVSR | California Valley Solar Ranch | |||||||

| CVSR Holdco LLC, the indirect owner of CVSR | ||||||||

4

| Distributed Solar | Solar power projects, typically less than 20 MW in size (on an alternating current, or AC, basis), that primarily sell power produced to customers for usage on site, or are interconnected to sell power into the local distribution grid | |||||||

| Drop Down Assets | Collectively, assets under common control acquired by the Company from NRG from January 1, 2014 through the period ended August 31, 2018 and from CEG from August 31, 2018 through the period ended June | |||||||

| EPA | United States Environmental Protection Agency | |||||||

| Exchange Act | The Securities Exchange Act of 1934, as amended | |||||||

| FASB | Financial Accounting Standards Board | |||||||

| Accounting principles generally accepted in the U.S. | ||||||||

| GenConn | GenConn Energy LLC | |||||||

| Collectively, Global Infrastructure Partners III-C Intermediate AIV 3, L.P., Global Infrastructure Partners III-A/B AIV 3, L.P., Global Infrastructure Partners III-C Intermediate AIV 2, L.P., Global Infrastructure Partners III-C2 Intermediate AIV, L.P. and GIP III Zephyr Friends & Family, LLC | ||||||||

| HLBV | Hypothetical Liquidation at Book Value | |||||||

| Mesquite Star Special LLC | ||||||||

| MMBtu | Million British Thermal Units | |||||||

| Megawatt | ||||||||

| MWh | Saleable megawatt hours, net of internal/parasitic load megawatt-hours | |||||||

| MWt | Megawatts Thermal Equivalent | |||||||

| Net Exposure | Counterparty credit exposure to | |||||||

| NRG | NRG Energy, Inc. | |||||||

| Power Purchase Agreement | ||||||||

| RPV Holdco | ||||||||

| RTO | Regional Transmission | |||||||

| Southern California Edison | ||||||||

| SEC | U.S. Securities and Exchange Commission | |||||||

| Senior Notes | Collectively, the | |||||||

| SPP | Solar Power Partners | |||||||

| Thermal Business | The Company's thermal business, which consists of thermal infrastructure assets that provide steam, hot water and/or chilled water, and in some instances electricity, to commercial businesses, universities, hospitals and governmental units | |||||||

| U.S. | United States of America | |||||||

| Utah Solar Portfolio | Collection consists of Four Brothers Solar, LLC, Granite Mountain Holdings, LLC, and Iron Springs Holdings, LLC, which are equity investments owned by Four Brothers Capital, LLC, Granite Mountain Capital, LLC, and Iron Springs Capital, LLC, respectively | |||||||

Utility Scale Solar | Solar power projects, typically 20 MW or greater in size (on an alternating current, or AC, basis), that are interconnected into the transmission or distribution grid to sell power at a wholesale level | |||||||

| VaR | Value at Risk | |||||||

| VIE | Variable Interest Entity | |||||||

5

PART I - FINANCIAL INFORMATION

ITEM 1 — FINANCIAL STATEMENTS

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| Three months ended June 30, | Six months ended June 30, | ||||||||||||||||||||||

| (In millions) | 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||

| Operating Revenues | |||||||||||||||||||||||

| Total operating revenues | $ | 380 | $ | 329 | $ | 617 | $ | 587 | |||||||||||||||

| Operating Costs and Expenses | |||||||||||||||||||||||

| Cost of operations, exclusive of depreciation, amortization and accretion shown separately below | 107 | 87 | 217 | 180 | |||||||||||||||||||

| Depreciation, amortization and accretion | 128 | 99 | 256 | 201 | |||||||||||||||||||

| General and administrative | 9 | 11 | 19 | 20 | |||||||||||||||||||

| Transaction and integration costs | 1 | 0 | 3 | 1 | |||||||||||||||||||

| Development costs | 1 | 1 | 2 | 2 | |||||||||||||||||||

| Total operating costs and expenses | 246 | 198 | 497 | 404 | |||||||||||||||||||

| Operating Income | 134 | 131 | 120 | 183 | |||||||||||||||||||

| Other Income (Expense) | |||||||||||||||||||||||

| Equity in earnings of unconsolidated affiliates | 8 | 16 | 12 | 3 | |||||||||||||||||||

| Gain on sale of unconsolidated affiliate | 0 | 49 | 0 | 49 | |||||||||||||||||||

| Other income, net | 1 | 1 | 2 | 3 | |||||||||||||||||||

| Loss on debt extinguishment | 0 | 0 | (42) | (3) | |||||||||||||||||||

| Interest expense | (103) | (93) | (148) | (260) | |||||||||||||||||||

| Total other expense, net | (94) | (27) | (176) | (208) | |||||||||||||||||||

| Net Income (Loss) | 40 | 104 | (56) | (25) | |||||||||||||||||||

| Less: Loss attributable to noncontrolling interests and redeemable interests | (35) | (27) | (102) | (66) | |||||||||||||||||||

| Net Income Attributable to Clearway Energy LLC | $ | 75 | $ | 131 | $ | 46 | $ | 41 | |||||||||||||||

| Three months ended September 30, | Nine months ended September 30, | ||||||||||||||

| (In millions) | 2017 | 2016 (a) | 2017 | 2016 (a) | |||||||||||

| Operating Revenues | |||||||||||||||

| Total operating revenues | $ | 265 | $ | 272 | $ | 767 | $ | 789 | |||||||

| Operating Costs and Expenses | |||||||||||||||

| Cost of operations | 78 | 76 | 239 | 238 | |||||||||||

| Depreciation and amortization | 88 | 75 | 241 | 224 | |||||||||||

| General and administrative | 4 | 3 | 14 | 8 | |||||||||||

| Acquisition-related transaction and integration costs | — | — | 2 | — | |||||||||||

| Total operating costs and expenses | 170 | 154 | 496 | 470 | |||||||||||

| Operating Income | 95 | 118 | 271 | 319 | |||||||||||

| Other Income (Expense) | |||||||||||||||

| Equity in earnings of unconsolidated affiliates | 28 | 16 | 63 | 34 | |||||||||||

| Other income, net | 1 | 1 | 3 | 3 | |||||||||||

| Interest expense | (72 | ) | (68 | ) | (227 | ) | (204 | ) | |||||||

| Total other expense, net | (43 | ) | (51 | ) | (161 | ) | (167 | ) | |||||||

| Net Income | 52 | 67 | 110 | 152 | |||||||||||

| Less: Net loss attributable to noncontrolling interests | (23 | ) | (38 | ) | (56 | ) | (67 | ) | |||||||

| Net Income Attributable to NRG Yield LLC | $ | 75 | $ | 105 | $ | 166 | $ | 219 | |||||||

| Three months ended September 30, | Nine months ended September 30, | ||||||||||||||

| (In millions) | 2017 | 2016 (a) | 2017 | 2016 (a) | |||||||||||

| Net Income | $ | 52 | $ | 67 | $ | 110 | $ | 152 | |||||||

| Other Comprehensive Gain (Loss) | |||||||||||||||

| Unrealized gain (loss) on derivatives | 7 | 20 | 7 | (49 | ) | ||||||||||

| Other comprehensive gain (loss) | 7 | 20 | 7 | (49 | ) | ||||||||||

| Comprehensive Income | 59 | 87 | 117 | 103 | |||||||||||

| Less: Comprehensive loss attributable to noncontrolling interests | (23 | ) | (30 | ) | (56 | ) | (67 | ) | |||||||

| Comprehensive Income Attributable to NRG Yield LLC | $ | 82 | $ | 117 | $ | 173 | $ | 170 | |||||||

| (In millions) | September 30, 2017 | December 31, 2016 (a) | |||||

| ASSETS | (unaudited) | ||||||

| Current Assets | |||||||

| Cash and cash equivalents | $ | 178 | $ | 321 | |||

| Restricted cash | 140 | 165 | |||||

| Accounts receivable — trade | 126 | 92 | |||||

| Accounts receivable — affiliate | 1 | 1 | |||||

| Inventory | 38 | 39 | |||||

| Derivative instruments | — | 2 | |||||

| Notes receivable | 15 | 16 | |||||

| Prepayments and other current assets | 22 | 20 | |||||

| Total current assets | 520 | 656 | |||||

| Property, plant and equipment, net | 5,247 | 5,460 | |||||

| Other Assets | |||||||

| Equity investments in affiliates | 1,183 | 1,152 | |||||

| Intangible assets, net | 1,234 | 1,286 | |||||

| Derivative instruments | — | 1 | |||||

| Other non-current assets | 56 | 65 | |||||

| Total other assets | 2,473 | 2,504 | |||||

| Total Assets | $ | 8,240 | $ | 8,620 | |||

| LIABILITIES AND MEMBERS' EQUITY | |||||||

| Current Liabilities | |||||||

| Current portion of long-term debt — external | $ | 300 | $ | 291 | |||

| Accounts payable — trade | 27 | 23 | |||||

| Accounts payable — affiliate | 45 | 40 | |||||

| Derivative instruments | 23 | 32 | |||||

| Accrued expenses and other current liabilities | 94 | 85 | |||||

| Total current liabilities | 489 | 471 | |||||

| Other Liabilities | |||||||

| Long-term debt — external | 4,914 | 5,098 | |||||

| Long-term debt — affiliate | 618 | 618 | |||||

| Accounts payable — affiliate | 3 | 9 | |||||

| Derivative instruments | 43 | 44 | |||||

| Other non-current liabilities | 87 | 76 | |||||

| Total non-current liabilities | 5,665 | 5,845 | |||||

| Total Liabilities | 6,154 | 6,316 | |||||

| Commitments and Contingencies | |||||||

| Members' Equity | |||||||

| Contributed capital | 1,897 | 2,127 | |||||

| Retained earnings | 86 | 36 | |||||

| Accumulated other comprehensive loss | (78 | ) | (85 | ) | |||

| Noncontrolling interest | 181 | 226 | |||||

| Total Members' Equity | 2,086 | 2,304 | |||||

| Total Liabilities and Members’ Equity | $ | 8,240 | $ | 8,620 | |||

See accompanying notes to consolidated financial statements.

CONSOLIDATED STATEMENTS OF CASH FLOWSCOMPREHENSIVE INCOME (LOSS)

(Unaudited)

| Three months ended June 30, | Six months ended June 30, | ||||||||||||||||||||||

| (In millions) | 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||

| Net Income (Loss) | $ | 40 | $ | 104 | $ | (56) | $ | (25) | |||||||||||||||

| Other Comprehensive Income (Loss) | |||||||||||||||||||||||

| Unrealized gain (loss) on derivatives | 0 | 5 | 13 | (9) | |||||||||||||||||||

| Other comprehensive income (loss) | 0 | 5 | 13 | (9) | |||||||||||||||||||

| Comprehensive Income (Loss) | 40 | 109 | (43) | (34) | |||||||||||||||||||

| Less: Comprehensive loss attributable to noncontrolling interests and redeemable interests | (38) | (27) | (102) | (66) | |||||||||||||||||||

| Comprehensive Income Attributable to Clearway Energy LLC | $ | 78 | $ | 136 | $ | 59 | $ | 32 | |||||||||||||||

| Nine months ended September 30, | |||||||

| 2017 | 2016(a) | ||||||

| (In millions) | |||||||

| Cash Flows from Operating Activities | |||||||

| Net income | $ | 110 | $ | 152 | |||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

| Equity in earnings of unconsolidated affiliates | (63 | ) | (34 | ) | |||

| Distributions from unconsolidated affiliates | 52 | 43 | |||||

| Depreciation and amortization | 241 | 224 | |||||

| Amortization of financing costs | 7 | 6 | |||||

| Amortization of intangibles and out-of-market contracts | 52 | 57 | |||||

| Changes in derivative instruments | (2 | ) | (5 | ) | |||

| Loss on disposal of asset components | 8 | 5 | |||||

| Changes in prepaid and accrued liabilities for tolling agreements | 5 | 2 | |||||

| Changes in other working capital | (35 | ) | (6 | ) | |||

| Net Cash Provided by Operating Activities | 375 | 444 | |||||

| Cash Flows from Investing Activities | |||||||

| Payments for the Drop Down Assets | (176 | ) | (77 | ) | |||

| Capital expenditures | (23 | ) | (16 | ) | |||

| Cash receipts from notes receivable | 11 | 11 | |||||

| Return of investment from unconsolidated affiliates | 32 | 16 | |||||

| Investments in unconsolidated affiliates | (48 | ) | (69 | ) | |||

| Net Cash Used in Investing Activities | (204 | ) | (135 | ) | |||

| Cash Flows from Financing Activities | |||||||

| Net contributions from noncontrolling interests | 13 | 7 | |||||

| Net distributions and return of capital to NRG prior to the acquisition of Drop Down Assets | (49 | ) | (126 | ) | |||

| Proceeds from the issuance of Class C units | 33 | — | |||||

| Payments of distributions | (149 | ) | (127 | ) | |||

| Payments of debt issuance costs | (4 | ) | (6 | ) | |||

| Proceeds from the revolving credit facility | — | 60 | |||||

| Payments for the revolving credit facility | — | (366 | ) | ||||

| Proceeds from the issuance of long-term debt — external | 41 | 550 | |||||

| Payments for long-term debt | (224 | ) | (204 | ) | |||

| Net Cash Used in Financing Activities | (339 | ) | (212 | ) | |||

| Net Decrease in Cash, Cash Equivalents and Restricted Cash | (168 | ) | 97 | ||||

| Cash, Cash Equivalents and Restricted Cash at Beginning of Period | 486 | 241 | |||||

| Cash, Cash Equivalents and Restricted Cash at End of Period | $ | 318 | $ | 338 | |||

See accompanying notes to consolidated financial statements.

8

CONSOLIDATED BALANCE SHEETS

| (In millions) | June 30, 2021 | December 31, 2020 | |||||||||

| ASSETS | (unaudited) | ||||||||||

| Current Assets | |||||||||||

| Cash and cash equivalents | $ | 138 | $ | 268 | |||||||

| Restricted cash | 332 | 197 | |||||||||

| Accounts receivable — trade | 203 | 143 | |||||||||

| Accounts receivable — affiliates | 1 | 0 | |||||||||

| Inventory | 43 | 42 | |||||||||

| Prepayments and other current assets | 50 | 58 | |||||||||

| Total current assets | 767 | 708 | |||||||||

| Property, plant and equipment, net | 7,537 | 7,217 | |||||||||

| Other Assets | |||||||||||

| Equity investments in affiliates | 639 | 741 | |||||||||

| Intangible assets for power purchase agreements, net | 2,188 | 1,231 | |||||||||

| Other intangible assets, net | 136 | 139 | |||||||||

| Derivative instruments | 4 | 1 | |||||||||

| Right of use assets, net | 349 | 337 | |||||||||

| Other non-current assets | 143 | 114 | |||||||||

| Total other assets | 3,459 | 2,563 | |||||||||

| Total Assets | $ | 11,763 | $ | 10,488 | |||||||

| LIABILITIES AND MEMBERS' EQUITY | |||||||||||

| Current Liabilities | |||||||||||

| Current portion of long-term debt — external | $ | 518 | $ | 384 | |||||||

| Current portion of long-term debt — affiliate | 1 | 1 | |||||||||

| Accounts payable — trade | 59 | 72 | |||||||||

| Accounts payable — affiliates | 16 | 20 | |||||||||

| Derivative instruments | 44 | 38 | |||||||||

| Accrued interest expense | 55 | 44 | |||||||||

| Accrued expenses and other current liabilities | 64 | 79 | |||||||||

| Total current liabilities | 757 | 638 | |||||||||

| Other Liabilities | |||||||||||

| Long-term debt — external | 7,434 | 6,585 | |||||||||

| Derivative instruments | 145 | 135 | |||||||||

| Long-term lease liabilities | 361 | 345 | |||||||||

| Other non-current liabilities | 179 | 173 | |||||||||

| Total non-current liabilities | 8,119 | 7,238 | |||||||||

| Total Liabilities | 8,876 | 7,876 | |||||||||

| Commitments and Contingencies | 0 | 0 | |||||||||

| Members' Equity | |||||||||||

| Contributed capital | 1,578 | 1,723 | |||||||||

| Accumulated deficit | (4) | (50) | |||||||||

| Accumulated other comprehensive loss | (22) | (33) | |||||||||

| Noncontrolling interest | 1,335 | 972 | |||||||||

| Total Members' Equity | 2,887 | 2,612 | |||||||||

| Total Liabilities and Members’ Equity | $ | 11,763 | $ | 10,488 | |||||||

See accompanying notes to consolidated financial statements.

9

CLEARWAY ENERGY LLC

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Six months ended June 30, | |||||||||||

| (In millions) | 2021 | 2020 | |||||||||

| Cash Flows from Operating Activities | |||||||||||

| Net Loss | $ | (56) | $ | (25) | |||||||

| Adjustments to reconcile net loss to net cash provided by operating activities: | |||||||||||

| Equity in earnings of unconsolidated affiliates | (12) | (3) | |||||||||

| Distributions from unconsolidated affiliates | 16 | 10 | |||||||||

| Depreciation, amortization and accretion | 256 | 201 | |||||||||

| Amortization of financing costs and debt discounts | 7 | 7 | |||||||||

| Amortization of intangibles | 70 | 45 | |||||||||

| Loss on debt extinguishment | 42 | 3 | |||||||||

| Reduction (increase) in carrying amount of right-of-use assets | 5 | (1) | |||||||||

| Gain on sale of unconsolidated affiliate | 0 | (49) | |||||||||

| Changes in derivative instruments | 15 | 100 | |||||||||

| Cash used in changes in other working capital | |||||||||||

| Changes in prepaid and accrued liabilities for tolling agreements | (76) | (77) | |||||||||

| Changes in other working capital | (26) | (28) | |||||||||

| Net Cash Provided by Operating Activities | 241 | 183 | |||||||||

| Cash Flows from Investing Activities | |||||||||||

| Acquisitions, net of cash acquired | (211) | 0 | |||||||||

| Acquisition of Drop Down Asset | (132) | 0 | |||||||||

| Consolidation of DGPV Holdco 3 LLC | 0 | 17 | |||||||||

| Capital expenditures | (93) | (83) | |||||||||

| Asset purchase from affiliate | (21) | 0 | |||||||||

| Cash receipts from notes receivable | 4 | 0 | |||||||||

| Return of investment from unconsolidated affiliates | 20 | 23 | |||||||||

| Investments in unconsolidated affiliates | 0 | (10) | |||||||||

| Proceeds from sale of assets | 0 | 90 | |||||||||

| Other | 13 | 3 | |||||||||

| Net Cash (Used in) Provided by Investing Activities | (420) | 40 | |||||||||

| Cash Flows from Financing Activities | |||||||||||

| Net contributions from noncontrolling interests | 162 | 154 | |||||||||

| Contributions from CEG | 103 | 0 | |||||||||

| Buyout of Repowering Partnership II LLC noncontrolling interest | 0 | (70) | |||||||||

| Net proceeds from the issuance of Class C units | 0 | 38 | |||||||||

| Payments of distributions | (132) | (84) | |||||||||

| Proceeds from the revolving credit facility | 300 | 265 | |||||||||

| Payments for the revolving credit facility | (233) | (265) | |||||||||

| Proceeds from the issuance of long-term debt — external | 1,016 | 286 | |||||||||

| Proceeds from the issuance of long-term debt — affiliate | 0 | 3 | |||||||||

| Payments of debt issuance costs | (13) | (2) | |||||||||

| Payments for long-term debt — external | (1,028) | (502) | |||||||||

| Payments for long-term debt — affiliate | 0 | (45) | |||||||||

| Other | 9 | 0 | |||||||||

| Net Cash Provided by (Used in) Financing Activities | 184 | (222) | |||||||||

| Net Increase in Cash, Cash Equivalents and Restricted Cash | 5 | 1 | |||||||||

| Cash, Cash Equivalents and Restricted Cash at beginning of period | 465 | 414 | |||||||||

| Cash, Cash Equivalents and Restricted Cash at end of period | $ | 470 | $ | 415 | |||||||

See accompanying notes to consolidated financial statements.

10

CLEARWAY ENERGY LLC

CONSOLIDATED STATEMENTS OF MEMBERS' EQUITY

For the Six Months Ended June 30, 2021

(Unaudited)

| (In millions) | Contributed Capital | Retained Earnings (Accumulated Deficit) | Accumulated Other Comprehensive Loss | Noncontrolling Interest | Total Members' Equity | ||||||||||||||||||||||||

| Balances at December 31, 2020 | $ | 1,723 | $ | (50) | $ | (33) | $ | 972 | $ | 2,612 | |||||||||||||||||||

| Net loss | — | (29) | — | (68) | (97) | ||||||||||||||||||||||||

| Unrealized gain on derivatives | — | — | 10 | 3 | 13 | ||||||||||||||||||||||||

| (Distributions) contributions from CEG, non-cash | (2) | — | — | 29 | 27 | ||||||||||||||||||||||||

| Contributions from CEG, cash | 103 | — | — | — | 103 | ||||||||||||||||||||||||

| Contributions from noncontrolling interests, net of distributions, cash | — | — | — | 126 | 126 | ||||||||||||||||||||||||

| Agua Caliente acquisition | — | — | — | 273 | 273 | ||||||||||||||||||||||||

| Rattlesnake Drop Down | (118) | — | — | — | (118) | ||||||||||||||||||||||||

| Distributions paid to CEG on Class B and Class D units | (28) | — | — | — | (28) | ||||||||||||||||||||||||

| Distributions paid to Clearway Energy, Inc. | (38) | — | — | — | (38) | ||||||||||||||||||||||||

| Balance as of March 31, 2021 | $ | 1,640 | $ | (79) | $ | (23) | $ | 1,335 | $ | 2,873 | |||||||||||||||||||

| Net income (loss) | — | 75 | — | (36) | 39 | ||||||||||||||||||||||||

| Unrealized gain (loss) on derivatives | — | — | 1 | (2) | (1) | ||||||||||||||||||||||||

| Contributions from CEG, non-cash | 3 | — | — | — | 3 | ||||||||||||||||||||||||

| Contributions from noncontrolling interests, net of distributions, cash | — | — | — | 38 | 38 | ||||||||||||||||||||||||

| Rattlesnake Drop Down | 1 | — | — | — | 1 | ||||||||||||||||||||||||

| Distributions paid to CEG on Class B and Class D units | (28) | — | — | — | (28) | ||||||||||||||||||||||||

| Distributions paid to Clearway Energy, Inc. | (38) | — | — | — | (38) | ||||||||||||||||||||||||

| Balance as of June 30, 2021 | $ | 1,578 | $ | (4) | $ | (22) | $ | 1,335 | $ | 2,887 | |||||||||||||||||||

11

CLEARWAY ENERGY LLC

CONSOLIDATED STATEMENTS OF MEMBERS' EQUITY

For the Six Months Ended June 30, 2020

(Unaudited)

| (In millions) | Contributed Capital | Retained Earnings (Accumulated Deficit) | Accumulated Other Comprehensive Loss | Noncontrolling Interest | Total Members' Equity | ||||||||||||||||||||||||

| Balances at December 31, 2019 | $ | 1,882 | $ | 5 | $ | (37) | $ | 323 | $ | 2,173 | |||||||||||||||||||

| Net loss | — | (90) | — | (39) | (129) | ||||||||||||||||||||||||

| Unrealized loss on derivatives | — | — | (14) | — | (14) | ||||||||||||||||||||||||

| Contributions from CEG, cash | — | — | — | 4 | 4 | ||||||||||||||||||||||||

| Contributions from tax equity interests, net of distributions, cash | — | — | — | 150 | 150 | ||||||||||||||||||||||||

| Net proceeds from the sales of units, Clearway Energy, Inc. | 10 | — | — | — | 10 | ||||||||||||||||||||||||

| Distributions to tax equity investors, non-cash | — | — | — | (1) | (1) | ||||||||||||||||||||||||

| Distributions paid to CEG on Class B and Class D units | (24) | 0 | — | — | (24) | ||||||||||||||||||||||||

| Distributions paid to Clearway Energy, Inc. | (18) | 0 | — | — | (18) | ||||||||||||||||||||||||

| Balances at March 31, 2020 | $ | 1,850 | $ | (85) | $ | (51) | $ | 437 | $ | 2,151 | |||||||||||||||||||

| Net income (Loss) | — | 131 | — | (27) | 104 | ||||||||||||||||||||||||

| Unrealized gain on derivatives | — | — | 5 | — | 5 | ||||||||||||||||||||||||

| Contributions from CEG, non-cash | 8 | — | — | — | 8 | ||||||||||||||||||||||||

| Contributions from CEG, cash | — | — | — | 2 | 2 | ||||||||||||||||||||||||

| Distributions to tax equity interests, net of contributions, cash | — | — | — | (3) | (3) | ||||||||||||||||||||||||

| Net proceeds from the sales of units, Clearway Energy, Inc. | 28 | — | — | — | 28 | ||||||||||||||||||||||||

| Distributions to tax equity investors, non-cash | — | — | — | (2) | (2) | ||||||||||||||||||||||||

| Consolidation of DGPV Holdco 3 | (51) | — | — | 8 | (43) | ||||||||||||||||||||||||

| Buyout of Repowering Partnership II LLC noncontrolling interest | (60) | — | — | (10) | (70) | ||||||||||||||||||||||||

| Distributions paid to CEG on Class B and Class D units | (24) | — | — | — | (24) | ||||||||||||||||||||||||

| Distributions paid to Clearway Energy, Inc. | (18) | — | — | — | (18) | ||||||||||||||||||||||||

| Balances at June 30, 2020 | $ | 1,733 | $ | 46 | $ | (46) | $ | 405 | $ | 2,138 | |||||||||||||||||||

12

CLEARWAY ENERGY LLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 1 — Nature of Business

assets across North America. The Company owns a diversified portfolio of contracted renewable and conventional generation and thermalis indirectly owned by Global Infrastructure Partners III. Global Infrastructure Management, LLC is an independent fund manager that invests in infrastructure assets in energy and transport sectors, and Global Infrastructure Partners III is its third equity fund. The Company is sponsored by GIP through GIP's portfolio company, CEG.

The Company is one of the largest renewable energy owners in the U.S. The Company’s contracted generation portfolio collectively represents 5,080with over 4,700 net MW as of September 30, 2017. Eachinstalled wind and solar generation projects. The Company's over 8,000 net MW of these assets sells substantially allalso includes approximately 2,500 net MW of its output pursuant to long-term offtake agreements with creditworthy counterparties. The weighted average remaining contract duration of these offtake agreements was approximately 16 years as of September 30, 2017 based on CAFD. The Company also owns thermal infrastructure assets with an aggregate steam and chilled water capacity of 1,319 net MWt and electricenvironmentally-sound, highly efficient generation capacity of 123 net MW. These thermal infrastructure assets provide steam, hot and/or chilled water, and, in some instances, electricity to commercial businesses, universities, hospitals and governmental units in multiple locations, principally through long-term contracts or pursuant to rates regulated by state utility commissions.

| Projects | Percentage Ownership | Net Capacity (MW)(a) | Offtake Counterparty | Expiration | ||||||

| Conventional | ||||||||||

| El Segundo | 100 | % | 550 | Southern California Edison | 2023 | |||||

| GenConn Devon | 50 | % | 95 | Connecticut Light & Power | 2040 | |||||

| GenConn Middletown | 50 | % | 95 | Connecticut Light & Power | 2041 | |||||

| Marsh Landing | 100 | % | 720 | Pacific Gas and Electric | 2023 | |||||

| Walnut Creek | 100 | % | 485 | Southern California Edison | 2023 | |||||

| 1,945 | ||||||||||

| Utility Scale Solar | ||||||||||

| Agua Caliente | 16 | % | 46 | Pacific Gas and Electric | 2039 | |||||

| Alpine | 100 | % | 66 | Pacific Gas and Electric | 2033 | |||||

| Avenal | 50 | % | 23 | Pacific Gas and Electric | 2031 | |||||

| Avra Valley | 100 | % | 26 | Tucson Electric Power | 2032 | |||||

| Blythe | 100 | % | 21 | Southern California Edison | 2029 | |||||

| Borrego | 100 | % | 26 | San Diego Gas and Electric | 2038 | |||||

| CVSR | 100 | % | 250 | Pacific Gas and Electric | 2038 | |||||

| Desert Sunlight 250 | 25 | % | 63 | Southern California Edison | 2035 | |||||

| Desert Sunlight 300 | 25 | % | 75 | Pacific Gas and Electric | 2040 | |||||

| Kansas South | 100 | % | 20 | Pacific Gas and Electric | 2033 | |||||

| Roadrunner | 100 | % | 20 | El Paso Electric | 2031 | |||||

| TA High Desert | 100 | % | 20 | Southern California Edison | 2033 | |||||

Utah Solar Portfolio (b) (e) | 50 | % | 265 | PacifiCorp | 2036 | |||||

| 921 | ||||||||||

| Distributed Solar | ||||||||||

| Apple I LLC Projects | 100 | % | 9 | Various | 2032 | |||||

| AZ DG Solar Projects | 100 | % | 5 | Various | 2025 - 2033 | |||||

| 14 | ||||||||||

| Wind | ||||||||||

| Alta I | 100 | % | 150 | Southern California Edison | 2035 | |||||

| Alta II | 100 | % | 150 | Southern California Edison | 2035 | |||||

| Alta III | 100 | % | 150 | Southern California Edison | 2035 | |||||

| Alta IV | 100 | % | 102 | Southern California Edison | 2035 | |||||

| Alta V | 100 | % | 168 | Southern California Edison | 2035 | |||||

Alta X (b) | 100 | % | 137 | Southern California Edison | 2038 | |||||

Alta XI (b) | 100 | % | 90 | Southern California Edison | 2038 | |||||

| Buffalo Bear | 100 | % | 19 | Western Farmers Electric Co-operative | 2033 | |||||

Crosswinds (b) (f) | 99 | % | 21 | Corn Belt Power Cooperative | 2027 | |||||

Elbow Creek (b) (f) | 100 | % | 122 | NRG Power Marketing LLC | 2022 | |||||

Elkhorn Ridge (b) (f) | 66.7 | % | 54 | Nebraska Public Power District | 2029 | |||||

Forward (b) (f) | 100 | % | 29 | Constellation NewEnergy, Inc. | 2017 | |||||

Goat Wind (b) (f) | 100 | % | 150 | Dow Pipeline Company | 2025 | |||||

Hardin (b) (f) | 99 | % | 15 | Interstate Power and Light Company | 2027 | |||||

| Laredo Ridge | 100 | % | 80 | Nebraska Public Power District | 2031 | |||||

Lookout (b) (f) | 100 | % | 38 | Southern Maryland Electric Cooperative | 2030 | |||||

| Projects | Percentage Ownership | Net Capacity (MW)(a) | Offtake Counterparty | Expiration | ||||||

Odin (b) (f) | 99.9 | % | 20 | Missouri River Energy Services | 2028 | |||||

| Pinnacle | 100 | % | 55 | Maryland Department of General Services and University System of Maryland | 2031 | |||||

San Juan Mesa (b) (f) | 75 | % | 90 | Southwestern Public Service Company | 2025 | |||||

Sleeping Bear (b) (f) | 100 | % | 95 | Public Service Company of Oklahoma | 2032 | |||||

| South Trent | 100 | % | 101 | AEP Energy Partners | 2029 | |||||

Spanish Fork (b) (f) | 100 | % | 19 | PacifiCorp | 2028 | |||||

Spring Canyon II (b) | 90.1 | % | 29 | Platte River Power Authority | 2039 | |||||

Spring Canyon III (b) | 90.1 | % | 25 | Platte River Power Authority | 2039 | |||||

| Taloga | 100 | % | 130 | Oklahoma Gas & Electric | 2031 | |||||

Wildorado (b) (f) | 100 | % | 161 | Southwestern Public Service Company | 2027 | |||||

| 2,200 | ||||||||||

| Thermal | ||||||||||

| NRG Dover Energy Center LLC | 100 | % | 103 | NRG Power Marketing LLC | 2018 | |||||

| Thermal generation | 100 | % | 20 | Various | Various | |||||

| 123 | ||||||||||

Total net generation capacity(c) | 5,203 | |||||||||

Thermal equivalent MWt (d) | 100 | % | 1,319 | Various | Various | |||||

growing dividend income.Substantially all of the Company's generation assets are under long-term contractual arrangements for the output or capacity from these assets. The thermal assets are comprised

Clearway Energy, Inc. consolidates the results of district energy systems and combined heat and power plants that produce steam, hot water and/or chilled water and, in some instances, electricity at a central plant. Certain district energy systems are subject to rate regulation by state public utility commissions (although they may negotiate certain rates) while the other district energy systems have rates determined by negotiated bilateral contracts.

Clearway Energy, Inc. owns 57.65% of the economic interests in seven utility-scale solar farms located in Utah that were part of NRG's November 2, 2016 acquisitionthe Company, with CEG owning 42.35% of projects from SunEdison, or the Utah Solar Portfolio. Theeconomic interests of the Company paid total cash considerationas of $130 million, plus a $2 million working capital adjustment, and assumed non-recourse debt of $328 million, which is consolidated, as well as its pro-rata share of non-recourse project-level debt of $135 million. The acquisition was funded with cash on hand.June 30, 2021.

13

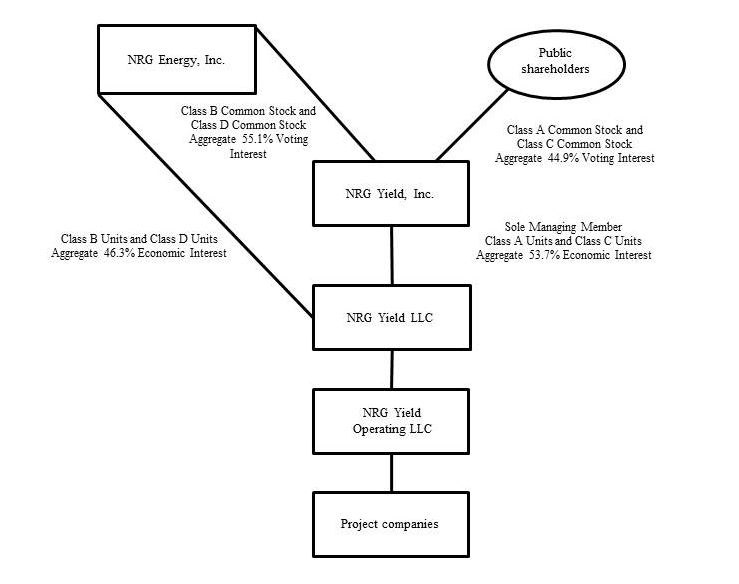

The acquisitionsfollowing table represents the structure of the August 2017 Drop Down Assets and March 2017 Drop Down Assets were accounted forCompany as transfers of entities under common control. The accounting guidance requires retrospective combinationJune 30, 2021:

Basis of the entities for all periods presented as if the combinations had been in effect from the beginning of the financial statement period or from the date the entities were under common control (if later than the beginning of the financial statement period).Presentation

The accompanying unaudited interim consolidated financial statements have been prepared in accordance with the SEC’s regulations for interim financial information and with the instructions to Form 10-Q. Accordingly, they do not include all of the information and notes required by GAAP for complete financial statements. The following notes should be read in conjunction with the accounting policies and other disclosures as set forth in the notes to the consolidated financial statements for the year ended December 31, 2016 included in the Company's May 9, 20172020 Form 8-K.10-K. Interim results are not necessarily indicative of results for a full year.

In the opinion of management, the accompanying unaudited interim consolidated financial statements contain all material adjustments consisting of normal and recurring accruals necessary to present fairly the Company's consolidated financial position as of SeptemberJune 30, 2017,2021, and the results of operations, comprehensive income (loss) and cash flows for the three and ninesix months ended SeptemberJune 30, 20172021 and 2016.2020.

Note 2 — Summary of Significant Accounting Policies

Use of Estimates

The preparation of consolidated financial statements in accordance with GAAP requires management to make estimates and assumptions. These estimates and assumptions impact the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities as of the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could be different from these estimates.

14

Cash and Cash Equivalents, and Restricted Cash

Cash and cash equivalents include highly liquid investments with an original maturity of three months or less at the time of purchase. Cash and cash equivalents held at project subsidiaries was $125 million and $149 million as of June 30, 2021 and December 31, 2020, respectively.

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the consolidated balance sheets that sum to the total of the same such amounts shown in the statements of cash flows:

| June 30, 2021 | December 31, 2020 | ||||||||||

| (In millions) | |||||||||||

| Cash and cash equivalents | $ | 138 | $ | 268 | |||||||

| Restricted cash | 332 | 197 | |||||||||

| Cash, cash equivalents and restricted cash shown in the statement of cash flows | $ | 470 | $ | 465 | |||||||

Restricted cash consists primarily of funds held to satisfy the requirements of certain debt agreements and funds held within the Company's projects that are restricted in their use. As of June 30, 2021, these restricted funds were comprised of $131 million designated to fund operating expenses, approximately $38 million designated for current debt service payments, and $130 million restricted for reserves including debt service, performance obligations and other reserves, as well as capital expenditures. The remaining $33 million is held in distribution reserve accounts.

In 2020, the members of the partnerships holding the Oahu Solar and Kawailoa Solar projects submitted applications to the state of Hawaii for refundable tax credits based on the cost of construction of the projects. In April 2021, the members of the partnerships contributed their respective portions of the tax credits in the amount of $49 million to the Oahu Solar and Kawailoa project companies, which is reflected in restricted cash on the Company's consolidated balance sheet with an offsetting adjustment to noncontrolling interests. In accordance with the projects' related agreements, the cash will be held in a restricted account and utilized to offset future invoiced amounts under the projects' PPAs.

Accumulated Depreciation, Accumulated Amortization

The following table presents the accumulated depreciation included in the property, plant and equipment, net, and accumulated amortization included in intangible assets, net, respectively, as of SeptemberJune 30, 20172021 and December 31, 2016:2020:

| September 30, 2017 | December 31, 2016 | ||||||

| (In millions) | |||||||

| Property, Plant and Equipment Accumulated Depreciation | $ | 1,189 | $ | 951 | |||

| Intangible Assets Accumulated Amortization | 216 | 163 | |||||

| (In millions) | |||

| Balance as of December 31, 2016 as reported | $ | 313 | |

| Less: Adjustment for August 2017 Drop Down Assets | (87 | ) | |

| Balance as of December 31, 2016 as recast | 226 | ||

| Capital contributions from tax equity investors, net of distributions | 11 | ||

| Comprehensive loss | (56 | ) | |

| Balance as of September 30, 2017 | $ | 181 | |

| June 30, 2021 | December 31, 2020 | ||||||||||

| (In millions) | |||||||||||

| Property, Plant and Equipment Accumulated Depreciation | $ | 2,573 | $ | 2,323 | |||||||

| Intangible Assets Accumulated Amortization | 556 | 487 | |||||||||

Distributions

The following table lists the distributions paid on NRG Yield LLC'sthe Company's Class A, B, C and D units during the ninesix months ended SeptemberJune 30, 2017:2021:

| Third Quarter 2017 | Second Quarter 2017 | First Quarter 2017 | |||||||||

| Distributions per Class A, B, C and D unit | $ | 0.28 | $ | 0.27 | $ | 0.26 | |||||

| Second Quarter 2021 | First Quarter 2021 | ||||||||||||||||||||||

| Distributions per Class A, B, C and D unit | $ | 0.329 | $ | 0.324 | |||||||||||||||||||

On October 31, 2017,July 23, 2021 the Company declared a distribution on its Class A, Class B, Class C and Class D units of $0.288$0.3345 per unit payable on DecemberSeptember 15, 20172021 to unit holders of record as of DecemberSeptember 1, 2017.2021.

Revenue Recognition

Revenue from Contracts with Customers

15

revenue streams detailed below, except in circumstances where the ATM Program

Thermal Revenues

Steam and chilled water revenue is recognized as the Company transfers the product to the customer, based on customer usage as determined by meter readings taken at month-end. Some locations read customer meters throughout the month and recognize estimated revenue for the period between meter read date and month-end. For thermal contracts, the Company’s performance obligation to deliver steam and chilled water is satisfied over time and revenue is recognized based on the invoiced amount. The Thermal Business subsidiaries collect, and remit state and local taxes associated with sales to their customers, as required by governmental authorities. These taxes are presented on a net basis in the income statement.

As contracts for steam and chilled water are long-term contracts, the Company has performance obligations under these contracts that have not yet been satisfied. These performance obligations have transaction prices that are both fixed and variable, and that vary based on the contract duration, customer type, inception date and other contract-specific factors. For the fixed price contracts, the Company cannot accurately estimate the amount of its unsatisfied performance obligations as it will vary based on customer usage, which will depend on factors such as weather and customer activity.

Power Purchase Agreements, or PPAs

The majority of the equity distribution agreement, NRG Yield, Inc. may offerCompany’s revenues are obtained through PPAs or other contractual agreements. Energy, capacity and sell shares of its Class C common stock par value $0.01 per share,where applicable, renewable attributes, from time to time through the sales agents up to an aggregate sales price of $150 million through an at-the-market equity offering program, or the ATM Program. NRG Yield, Inc. may also sell shares of its Class C common stock to anymajority of the sales agents,Company’s renewable energy assets and certain conventional energy plants is sold through long-term PPAs and tolling agreements to a single counterparty, which is often a utility or commercial customer. The majority of these PPAs are accounted for as principals forleases as the Company retained its own account, athistorical lease assessments and classification upon adoption of ASC 842. ASC 842 requires the minimum lease payments received to be amortized over the term of the lease and contingent rentals are recorded when the achievement of the contingency becomes probable. Judgment is required by management in determining the economic life of each generating facility, in evaluating whether certain lease provisions constitute minimum payments or represent contingent rent and other factors in determining whether a price agreed uponcontract contains a lease and whether the lease is an operating lease or capital lease. Certain of these leases have no minimum lease payments and all of the rental income under these leases is recorded as contingent rent on an actual basis when the electricity is delivered.

Renewable Energy Credits, or RECs

Renewable energy credits, or RECs, are usually sold through long-term PPAs. Revenue from the sale of self-generated RECs is recognized when the related energy is generated and simultaneously delivered even in cases where there is a certification lag as it has been deemed to be perfunctory.

In a bundled contract to sell energy, capacity and/or self-generated RECs, all performance obligations are deemed to be delivered at the same time and hence, timing of sale. Duringrecognition of revenue for all performance obligations is the first ninesame and occurs over time. In such cases, it is often unnecessary to allocate transaction price to multiple performance obligations.

16

Disaggregated Revenues

The following tables represent the Company’s disaggregation of revenue from contracts with customers along with the reportable segment for each category for the three and six months ended June 30, 2021 and 2020, respectively:

| Three months ended June 30, 2021 | |||||||||||||||||||||||||||||||||||

| (In millions) | Conventional Generation | Renewables | Thermal | Total | |||||||||||||||||||||||||||||||

Energy revenue(a) | $ | 2 | $ | 261 | $ | 29 | $ | 292 | |||||||||||||||||||||||||||

Capacity revenue(a) | 113 | 0 | 15 | 128 | |||||||||||||||||||||||||||||||

| Contract amortization | (6) | (30) | (1) | (37) | |||||||||||||||||||||||||||||||

| Other revenue | 0 | 22 | 6 | 28 | |||||||||||||||||||||||||||||||

| Mark-to-market for economic hedges | 0 | (31) | 0 | (31) | |||||||||||||||||||||||||||||||

| Total operating revenue | 109 | 222 | 49 | 380 | |||||||||||||||||||||||||||||||

| Less: Mark-to-market for economic hedges | 0 | 31 | 0 | 31 | |||||||||||||||||||||||||||||||

| Less: Lease revenue | (115) | (228) | 0 | (343) | |||||||||||||||||||||||||||||||

| Less: Contract amortization | 6 | 30 | 1 | 37 | |||||||||||||||||||||||||||||||

| Total revenue from contracts with customers | $ | 0 | $ | 55 | $ | 50 | $ | 105 | |||||||||||||||||||||||||||

(a) The following amounts of 2017, Yield, Inc. issued 1,921,866 sharesenergy and capacity revenue relate to leases and are accounted for under ASC 842:

| (In millions) | Conventional Generation | Renewables | Thermal | Total | ||||||||||||||||||||||

| Energy revenue | $ | 2 | $ | 228 | $ | 0 | $ | 230 | ||||||||||||||||||

| Capacity revenue | 113 | 0 | 0 | 113 | ||||||||||||||||||||||

| Total | $ | 115 | $ | 228 | $ | 0 | $ | 343 | ||||||||||||||||||

| Six months ended June 30, 2021 | |||||||||||||||||||||||

| (In millions) | Conventional Generation | Renewables | Thermal | Total | |||||||||||||||||||

Energy revenue(a) | $ | 3 | $ | 387 | $ | 58 | $ | 448 | |||||||||||||||

Capacity revenue(a) | 220 | 0 | 28 | 248 | |||||||||||||||||||

| Contract amortization | (12) | (55) | (2) | (69) | |||||||||||||||||||

| Other revenue | 0 | 31 | 14 | 45 | |||||||||||||||||||

| Mark-to-market for economic hedges | 0 | (55) | 0 | (55) | |||||||||||||||||||

| Total operating revenue | 211 | 308 | 98 | 617 | |||||||||||||||||||

| Less: Mark-to-market for economic hedges | 0 | 55 | 0 | 55 | |||||||||||||||||||

| Less: Lease revenue | (223) | (373) | (1) | (597) | |||||||||||||||||||

| Less: Contract amortization | 12 | 55 | 2 | 69 | |||||||||||||||||||

| Total revenue from contracts with customers | $ | 0 | $ | 45 | $ | 99 | $ | 144 | |||||||||||||||

(a) The following amounts of Class C common stockenergy and capacity revenue relate to leases and are accounted for under ASC 842:

| (In millions) | Conventional Generation | Renewables | Thermal | Total | ||||||||||||||||||||||

| Energy revenue | $ | 3 | $ | 373 | $ | 1 | $ | 377 | ||||||||||||||||||

| Capacity revenue | 220 | 0 | 0 | 220 | ||||||||||||||||||||||

| Total | $ | 223 | $ | 373 | $ | 1 | $ | 597 | ||||||||||||||||||

17

| Three months ended June 30, 2020 | |||||||||||||||||||||||||||||

| (In millions) | Conventional Generation | Renewables | Thermal | Total | |||||||||||||||||||||||||

Energy revenue(a) | $ | 1 | $ | 195 | $ | 22 | $ | 218 | |||||||||||||||||||||

Capacity revenue(a) | 112 | 0 | 12 | 124 | |||||||||||||||||||||||||

| Contract amortization | (6) | (16) | 0 | (22) | |||||||||||||||||||||||||

| Other revenue | 0 | 4 | 8 | 12 | |||||||||||||||||||||||||

| Mark-to-market for economic hedges | 0 | (3) | 0 | (3) | |||||||||||||||||||||||||

| Total operating revenue | 107 | 180 | 42 | 329 | |||||||||||||||||||||||||

| Less: Mark-to-market for economic hedges | 0 | 3 | 0 | 3 | |||||||||||||||||||||||||

| Less: Lease revenue | (113) | (181) | 0 | (294) | |||||||||||||||||||||||||

| Less: Contract amortization | 6 | 16 | 0 | 22 | |||||||||||||||||||||||||

| Total revenue from contracts with customers | $ | 0 | $ | 18 | $ | 42 | $ | 60 | |||||||||||||||||||||

(a) The following amounts of energy and capacity revenue relate to leases and are accounted for under ASC 842:

| (In millions) | Conventional Generation | Renewables | Thermal | Total | ||||||||||||||||||||||

| Energy revenue | $ | 1 | $ | 181 | $ | 0 | $ | 182 | ||||||||||||||||||

| Capacity revenue | 112 | 0 | 0 | 112 | ||||||||||||||||||||||

| Total | $ | 113 | $ | 181 | $ | 0 | $ | 294 | ||||||||||||||||||

| Six months ended June 30, 2020 | ||||||||||||||||||||||||||

| (In millions) | Conventional Generation | Renewables | Thermal | Total | ||||||||||||||||||||||

Energy revenue(a) | $ | 3 | $ | 320 | $ | 50 | $ | 373 | ||||||||||||||||||

Capacity revenue(a) | 219 | 0 | 26 | 245 | ||||||||||||||||||||||

| Contract amortization | (12) | (31) | (1) | (44) | ||||||||||||||||||||||

| Other revenue | 0 | 6 | 15 | 21 | ||||||||||||||||||||||

| Mark-to-market for economic hedges | 0 | (8) | 0 | (8) | ||||||||||||||||||||||

| Total operating revenue | 210 | 287 | 90 | 587 | ||||||||||||||||||||||

| Less: Mark-to-market for economic hedges | 0 | 8 | 0 | 8 | ||||||||||||||||||||||

| Less: Lease revenue | (222) | (296) | (1) | (519) | ||||||||||||||||||||||

| Less: Contract amortization | 12 | 31 | 1 | 44 | ||||||||||||||||||||||

| Total revenue from contracts with customers | $ | 0 | $ | 30 | $ | 90 | $ | 120 | ||||||||||||||||||

(a) The following amounts of energy and capacity revenue relate to leases and are accounted for under ASC 842:

| (In millions) | Conventional Generation | Renewables | Thermal | Total | ||||||||||||||||||||||

| Energy revenue | $ | 3 | $ | 296 | $ | 1 | $ | 300 | ||||||||||||||||||

| Capacity revenue | 219 | 0 | 0 | 219 | ||||||||||||||||||||||

| Total | $ | 222 | $ | 296 | $ | 1 | $ | 519 | ||||||||||||||||||

Contract Amortization

Assets and liabilities recognized from power sales agreements assumed through acquisitions related to the ATM Programsale of electric capacity and energy in future periods for gross proceedswhich the fair value has been determined to be significantly less (more) than market are amortized to revenue over the term of $35 million, with commission feeseach underlying contract based on actual generation and/or contracted volumes or on a straight-line basis, where applicable.

18

Contract Balances

The following table reflects the contract assets and liabilities included on the Company’s balance sheet as of $346 thousand. Yield, Inc. used the net proceeds to acquire 1,921,866 Class C units from the Company. At SeptemberJune 30, 2017, approximately $115 million remains available for issuance under the ATM Program.2021 and December 31, 2020:

| June 30, 2021 | December 31, 2020 | ||||||||||

| (In millions) | |||||||||||

| Accounts receivable, net - Contracts with customers | $ | 66 | $ | 57 | |||||||

| Accounts receivable, net - Leases | 137 | 86 | |||||||||

| Total accounts receivable, net | $ | 203 | $ | 143 | |||||||

Note 3 — Business Acquisitions and Dispositions

19

The following is a summary of assets and liabilities transferred in connection with the acquisition of the November 2017 Drop Down Assets as of September 30, 2017:

| (In millions) | |||

| Assets: | |||

| Current assets | $ | 11 | |

| Property, plant and equipment | 84 | ||

| Non-current assets | 32 | ||

| Total assets | 127 | ||

| Liabilities: | |||

Debt (Current and non-current) (a) | 31 | ||

| Other current and non-current liabilities | 3 | ||

| Total liabilities assumed | 34 | ||

| Net assets acquired | $ | 93 | |

January 12, 2021:

| (In millions) | Rattlesnake | |||||||

| Current Assets | $ | 8 | ||||||

| Property, plant and equipment | 200 | |||||||

| Right-of-use asset | 12 | |||||||

| Total assets acquired | 220 | |||||||

Debt(a) | 176 | |||||||

| Long-term lease liabilities | 12 | |||||||

| Other current and non-current liabilities | 18 | |||||||

| Total liabilities assumed | 206 | |||||||

| Net assets acquired | $ | 14 | ||||||

(a)Net of $2Repaid at acquisition date utilizing $107 million of netcontributed by tax equity investor recorded in noncontrolling interest and $103 million contributed by CEG, both recorded as contributed capital. Of the $210 million contributed, $176 million was utilized to pay down the acquired debt, issuance costs.$29 million was utilized to fund project reserve accounts and $5 million was utilized to pay associated fees.

| For the three months ended | For the nine months ended | ||||||||||||||

| September 30, 2017 | September 30, 2016 | September 30, 2017 | September 30, 2016 | ||||||||||||

| Total operating revenues | $ | 269 | $ | 275 | $ | 777 | $ | 798 | |||||||

| Net income | 30 | 69 | 90 | 155 | |||||||||||

The following is a summary of assets and liabilities acquired in connection with the acquisition as of February 3, 2021:

| (In millions) | Agua Caliente | |||||||

| Restricted cash | $ | 91 | ||||||

| Property, plant and equipment | 154 | |||||||

| Intangible asset for power purchase agreement | 1,022 | |||||||

| Other currents assets | 9 | |||||||

| Total assets acquired | 1,276 | |||||||

| Accounts payable and other current liabilities | 5 | |||||||

| Debt | 716 | |||||||

| Total liabilities assumed | 721 | |||||||

| Noncontrolling interest | 273 | |||||||

| Equity method investment removed | (80) | |||||||

| Net assets acquired | $ | 202 | ||||||

Fair value measurements

The fair values of the property, plant and equipment, and intangible assets at the acquisition date were measured primarily based on significant inputs that are not observable in the market and thus represent a Level 3 measurement as defined in ASC 820, Fair Value Measurement. Significant inputs were as follows:

Property, plant and equipment — The estimated fair values were determined primarily based on an income method using discounted cash flows and validated using a cost approach based on the replacement cost of the assets less economic obsolescence. The income approach was applied by determining the enterprise value for each acquired entity and subtracting the fair value of the intangible assets and working capital paid through September 30, 2017. The acquisitionto determine the implied value of the March 2017 Droptangible fixed assets. This methodology was primarily relied upon as the forecasted cash flows incorporate the specific attributes of each asset including

20

age, useful life, equipment condition, and technology. The income approach also allows for an accurate reflection of current and expected market dynamics such as supply and demand and the regulatory environment as of the acquisition date.

Long-term debt— The fair value of the long-term debt was determined by discounting future cash on hand.flows at current interest rates for similar instruments with equivalent credit quality.

Noncontrolling interest— The Company recorded the noncontrolling interest utilizing the cost accumulation model, as the acquisition was an asset acquisition, which maintained the carrying value for the pre-existing equity, with the value increased incrementally based on the value of the Company's newly acquired interest.

Mt. Storm Wind Acquisition — On April 23, 2021, the Company acquired 100% of the equity interests in NedPower Mount Storm LLC, or Mt. Storm, from Castleton Commodities International for approximately $96 million before working capital and purchase price adjustments in the net amount of $4 million, representing a total cash outflow of $100 million. Mt. Storm is a 264 MW wind project located in Grant County, West Virginia. Mt. Storm has a 10 year energy hedge with an investment-grade counterparty. The acquisition was determined to be an asset acquisition and the purchase price was allocated to the fair value of the assets acquired and liabilities assumed on the acquisition date as follows:

| (In millions) | Mt. Storm | |||||||

| Current Assets | $ | 3 | ||||||

| Property, plant and equipment | 108 | |||||||

| Intangible asset | 2 | |||||||

| Total assets acquired | 113 | |||||||

| Accounts payable and other liabilities | 4 | |||||||

| Derivative instruments | 9 | |||||||

| Total liabilities assumed | 13 | |||||||

| Net assets acquired | $ | 100 | ||||||

Fair value measurements

The fair values of the property, plant and equipment, derivative instrument and intangible asset at the acquisition date were measured primarily based on significant inputs that are not observable in the market and thus represent a Level 3 measurement as defined in ASC 820, Fair Value Measurement.

Property, plant and equipment — The estimated fair values of property, plant and equipment were determined primarily based on an income method using discounted cash flows.

Intangible assets— The estimated fair value of the intangible asset was using a market approach based on quoted prices of renewable energy credits in the applicable market.

Derivative instruments— The estimated fair value of the derivative instruments was determined based on the discounted cash flows associated with the acquired commodity contract.

2020 Dispositions

Sale of RPV Holdco 1 LLC — On May 14, 2020, the Company sold its interests in RPV Holdco 1 LLC, or RPV Holdco, to Spruce Power for net proceeds of approximately $75 million. The Company previously accounted for its interest in RPV Holdco as an equity method investments.investment. The Company also assumed non-recourse debtsale of $41 million and $287 million on Agua Caliente Borrower 2the investment resulted in a gain of approximately $49 million.

Sale of Energy Center Dover LLC and Energy Center Smyrna LLC Assets — On March 3, 2020, the Utah Solar Portfolio, respectively, as further describedCompany, through Clearway Thermal LLC, sold 100% of its interests in Note 7, Long-term Debt, as well as its pro-rata shareEnergy Center Dover LLC and Energy Center Smyrna LLC to DB Energy Assets, LLC for cash proceeds of non-recourse project-level debt of Agua Caliente Solar LLC, as further described in approximately $15 million.

21

Note 4 — Investments Accounted for by the Equity Method and Variable Interest Entities.

| (In millions) | |||

| Assets: | |||

| Cash | $ | 6 | |

| Equity investment in projects | 456 | ||

| Total assets acquired | 462 | ||

| Liabilities: | |||

Debt (Current and non-current) (a) | 320 | ||

| Other current and non-current liabilities | 3 | ||

| Total liabilities assumed | 323 | ||

| Net assets acquired | $ | 139 | |

| Three months ended September 30, 2016 | Nine months ended September 30, 2016 | ||||||||||||||||||||||||||||||

| As Previously Reported | March 2017 Drop Down Assets | August 2017 Drop Down Assets | As Currently Reported | As Previously Reported | March 2017 Drop Down Assets | August 2017 Drop Down Assets | As Currently Reported | ||||||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||||||||||

| Total operating revenues | $ | 272 | $ | — | $ | — | $ | 272 | $ | 789 | $ | — | $ | — | $ | 789 | |||||||||||||||

| Operating income | 118 | — | — | 118 | 319 | — | — | 319 | |||||||||||||||||||||||

| Net income | 64 | 3 | — | 67 | 147 | 5 | — | 152 | |||||||||||||||||||||||

| Net income attributable to Yield LLC | 100 | 3 | 2 | 105 | 209 | 5 | 5 | 219 | |||||||||||||||||||||||

Entities that are Consolidated

The Company has a controlling financial interest in certain entities which have been identified as VIEs under ASC 810, Consolidations, or ASC 810.Consolidation. These arrangements are primarily related to tax equity arrangements entered into with third parties in order to monetize certain tax creditsattributes associated with wind and solar facilities, as further described inunder Item 15 — Note 5, Investments Accounted for by the Equity Method and Variable Interest Entities, to the consolidated financial statements for the year ended December 31, 2016included in the Company's May 9, 20172020 Form 8-K.10-K.

Summarized financial information for the Company's consolidated VIEs consisted of the following as of SeptemberJune 30, 2017:2021:

| (In millions) | Alta TE Holdco | Buckthorn Renewables, LLC | DGPV Funds(a) | Kawailoa Partnership | Langford TE Partnership LLC | Lighthouse Renewable Holdco LLC | ||||||||||||||||||||||||||||||||

| Other current and non-current assets | $ | 59 | $ | 4 | $ | 96 | $ | 42 | $ | 15 | $ | 41 | ||||||||||||||||||||||||||

| Property, plant and equipment | 344 | 206 | 611 | 138 | 135 | 437 | ||||||||||||||||||||||||||||||||

| Intangible assets | 218 | 0 | 16 | 0 | 2 | 0 | ||||||||||||||||||||||||||||||||

| Total assets | 621 | 210 | 723 | 180 | 152 | 478 | ||||||||||||||||||||||||||||||||

| Current and non-current liabilities | 38 | 10 | 77 | 106 | 17 | 126 | ||||||||||||||||||||||||||||||||

| Total liabilities | 38 | 10 | 77 | 106 | 17 | 126 | ||||||||||||||||||||||||||||||||

| Noncontrolling interest | 26 | 51 | 4 | 51 | 74 | 313 | ||||||||||||||||||||||||||||||||

| Net assets less noncontrolling interests | $ | 557 | $ | 149 | $ | 642 | $ | 23 | $ | 61 | $ | 39 | ||||||||||||||||||||||||||

(a)DGPV Funds is comprised of DGPV Fund 2 LLC, Clearway & EFS Distributed Solar LLC, DGPV Fund 4 LLC, Golden Puma Fund LLC, Renew Solar CS4 Fund LLC and Chestnut Fund LLC.

| (In millions) | Oahu Solar Partnership | Pinnacle Repowering Partnership LLC | Rattlesnake TE Holdco LLC | Rosie TargetCo LLC | Wildorado TE Holdco | Other (a) | |||||||||||||||||||||||||||||

| Other current and non-current assets | $ | 50 | $ | 12 | $ | 31 | $ | 27 | $ | 21 | $ | 16 | |||||||||||||||||||||||

| Property, plant and equipment | 175 | 100 | 196 | 255 | 232 | 178 | |||||||||||||||||||||||||||||

| Intangible assets | 0 | 19 | 0 | 0 | 0 | 1 | |||||||||||||||||||||||||||||

| Total assets | 225 | 131 | 227 | 282 | 253 | 195 | |||||||||||||||||||||||||||||

| Current and non-current liabilities | 117 | 102 | 21 | 101 | 18 | 44 | |||||||||||||||||||||||||||||

| Total liabilities | 117 | 102 | 21 | 101 | 18 | 44 | |||||||||||||||||||||||||||||

| Noncontrolling interest | 35 | 27 | 98 | 147 | 127 | 99 | |||||||||||||||||||||||||||||

| Net assets less noncontrolling interests | $ | 73 | $ | 2 | $ | 108 | $ | 34 | $ | 108 | $ | 52 | |||||||||||||||||||||||

(a)Other is comprised of Crosswind Transmission, LLC, Hardin Hilltop Wind LLC, Elbow Creek TE Holdco and Spring Canyon TE Holdco projects.

22

| (In millions) | NRG Wind TE Holdco | Alta Wind TE Holdco | Spring Canyon | ||||||||

| Other current and non-current assets | $ | 175 | $ | 17 | $ | 4 | |||||

| Property, plant and equipment | 417 | 443 | 96 | ||||||||

| Intangible assets | 2 | 265 | — | ||||||||

| Total assets | 594 | 725 | 100 | ||||||||

| Current and non-current liabilities | 206 | 9 | 6 | ||||||||

| Total liabilities | 206 | 9 | 6 | ||||||||

| Noncontrolling interest | 22 | 96 | 63 | ||||||||

| Net assets less noncontrolling interests | $ | 366 | $ | 620 | $ | 31 | |||||

Rattlesnake TE Holdco LLC —As described in Note 3, Acquisitions and Dispositions, on January 12, 2021, the Company acquired CEG's equity interest and a third party investor's minority interest in CWSP Rattlesnake Holding LLC for $132 million. CWSP Rattlesnake Holding LLC owns Rattlesnake Class B LLC, which owns the Class B membership interests in Rattlesnake TE Holdco LLC, which is a VIE. Rattlesnake Class B LLC is the primary beneficiary and managing member and consolidates its interest in Rattlesnake TE Holdco LLC, which owns the Rattlesnake wind project. Subsequent to the acquisition, on January 12, 2021 the third party tax equity investor contributed $107 million into Rattlesnake TE Holdco LLC in exchange for the Class A membership interests. The proceeds from the tax equity contribution along with cash contributed by CEG were used to repay a portion of the $176 million of the outstanding principal under the Rattlesnake Class B LLC credit facility.

The Company utilizes the HLBV method to determine the net income or loss allocated to tax equity noncontrolling interest.

Pinnacle Repowering Partnership LLC — On February 26, 2021, the Company entered into an amended agreement with CWSP Pinnacle Holding LLC, an indirect subsidiary of CEG, with respect to Pinnacle Repowering Partnership LLC in order to facilitate the repowering of the Pinnacle wind project, a 55 MW wind facility located in Mineral County, West Virginia. On March 10, 2021, the Company contributed its interest in the Pinnacle wind project to Pinnacle Repowering Partnership LLC concurrent with entering into a financing agreement as further described in Note 7, Long-term Debt. The Company owns 100% of the Class A membership interests in Pinnacle Repowering Partnership LLC, which is a VIE, and the Company consolidates its interest as the primary beneficiary and managing member. CWSP Pinnacle Holding LLC owns 100% of the Class B membership interests in Pinnacle Repowering Partnership LLC and is entitled to allocations of 15% of the cash distributions from the partnership. On March 10, 2021, CWSP Pinnacle Holding LLC contributed $27 million in equipment to the partnership, which was a transfer of assets under common control and recorded at historical cost in property, plant and equipment, with a corresponding non-cash contribution in Pinnacle Repowering Partnership LLC's noncontrolling interests. Additionally, on March 10, 2021, the Pinnacle wind project acquired equipment from CEG for $21 million in cash consideration.

Entities that are not Consolidated

The Company has interests in entities that are considered VIEs under ASC 810, but for which it is not considered the primary beneficiary.The Company accounts for its interests in these entities and entities in which it has a significant investment under the equity method of accounting, as further described inunder Item 15 — Note 5,Investments Accounted for by the Equity Method and Variable Interest Entities, to the consolidated financial statements for the year ended December 31, 2016included in the Company's May 9, 2017 2020Form 8-K.10-K.

The Company's maximum exposure to loss as of SeptemberJune 30, 20172021 is limited to its equity investment in the unconsolidated entities, as further summarized in the table below:

| Name | Economic Interest | Investment Balance | ||||||

| (In millions) | ||||||||

| Avenal | 50% | $ | (3) | |||||

| Desert Sunlight | 25% | 244 | ||||||

| Elkhorn Ridge | 67% | 34 | ||||||

GenConn(a) | 50% | 88 | ||||||

| San Juan Mesa | 75% | 29 | ||||||

Utah Solar Portfolio(b) | 50% | 247 | ||||||

| $ | 639 | |||||||

| (In millions) | Maximum exposure to loss | ||

| Four Brothers Solar, LLC | $ | 221 | |

| Granite Mountain Holdings, LLC | 81 | ||

| Iron Springs Holdings, LLC | 56 | ||

| GenConn Energy LLC | 102 | ||

| NRG DGPV Holdco 1 LLC | 71 | ||

| NRG RPV Holdco 1 LLC | 65 | ||

| NRG DGPV Holdco 2 LLC | 54 | ||

| NRG DGPV Holdco 3 LLC | 20 | ||

23

| Three months ended September 30, | Nine months ended September 30, | |||||||||||||||

| (In millions) | 2017 | 2016 | 2017 | 2016 | ||||||||||||

| Income Statement Data: | ||||||||||||||||

| Utah Solar Portfolio | ||||||||||||||||

| Operating revenues | $ | 23 | $ | — | $ | 60 | $ | — | ||||||||

| Operating income | 9 | — | 17 | — | ||||||||||||

| Net income | 9 | — | 17 | — | ||||||||||||

| September 30, 2017 | December 31, 2016 | |||||||||||||||

| Balance Sheet Data: | (In millions) | |||||||||||||||

| Utah Solar Portfolio | ||||||||||||||||

| Current assets | $ | 25 | $ | 20 | ||||||||||||

| Non-current assets | 1,091 | 1,105 | ||||||||||||||

| Current liabilities | 9 | 14 | ||||||||||||||

| Non-current liabilities | 21 | 38 | ||||||||||||||

Note 5 — Fair Value of Financial Instruments

Fair Value Accounting under ASC 820

ASC 820 establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three levels as follows:

•Level 1—quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access as of the measurement date.

•Level 2—inputs other than quoted prices included within Level 1 that are directly observable for the asset or liability or indirectly observable through corroboration with observable market data.

•Level 3—unobservable inputs for the asset or liability only used when there is little, if any, market activity for the asset or liability at the measurement date.

In accordance with ASC 820, the Company determines the level in the fair value hierarchy within which each fair value measurement in its entirety falls, based on the lowest level input that is significant to the fair value measurement.

For cash and cash equivalents, restricted cash, accounts receivable accounts receivable — affiliate,trade, accounts payable — trade, current portion of the accounts payable — affiliates, accrued expenses and other liabilities, the carrying amounts approximate fair value because of the short-term maturity of those instruments and are classified as Level 1 within the fair value hierarchy.

The estimated carrying amounts and fair values of the Company’s recorded financial instruments not carried at fair market value are as follows:

| As of September 30, 2017 | As of December 31, 2016 | ||||||||||||||

| Carrying Amount | Fair Value | Carrying Amount | Fair Value | ||||||||||||

| (In millions) | |||||||||||||||

| Assets: | |||||||||||||||

Notes receivable (a) | $ | 18 | $ | 18 | $ | 30 | $ | 30 | |||||||

| Liabilities: | |||||||||||||||

| Long-term debt — affiliate | 618 | 626 | 618 | 608 | |||||||||||

Long-term debt — external, including current portion (b) | $ | 5,268 | $ | 5,301 | $ | 5,451 | $ | 5,435 | |||||||

| As of June 30, 2021 | As of December 31, 2020 | ||||||||||||||||||||||

| Carrying Amount | Fair Value | Carrying Amount | Fair Value | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||

| Long-term debt, including current portion — affiliate | $ | 1 | $ | 1 | $ | 1 | $ | 1 | |||||||||||||||

Long-term debt, including current portion — external (a) | $ | 8,030 | $ | 8,006 | $ | 7,048 | $ | 7,020 | |||||||||||||||

(a) Includes the long-term portion of notes receivable, which is recorded in other noncurrent assets on the Company's consolidated balance sheets.

24

The fair value of the Company's publicly-traded long-term debt is based on quoted market prices and is classified as Level 2 within the fair value hierarchy. The fair value of debt securities, non-publicly traded long-term debt and certain notes receivable of the Company are based on expected future cash flows discounted at market interest rates, or current interest rates for similar instruments with equivalent credit quality and are classified as Level 3 within the fair value hierarchy. The following table presents the level within the fair value hierarchy for long-term debt, including current portion as of SeptemberJune 30, 20172021 and December 31, 2016:2020:

| As of September 30, 2017 | As of December 31, 2016 | ||||||||||||||

| Level 2 | Level 3 | Level 2 | Level 3 | ||||||||||||

| (In millions) | |||||||||||||||

| Long-term debt, including current portion | $ | 884 | $ | 5,043 | $ | 833 | $ | 5,210 | |||||||

| As of June 30, 2021 | As of December 31, 2020 | ||||||||||||||||||||||

| Level 2 | Level 3 | Level 2 | Level 3 | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Long-term debt, including current portion | $ | 2,166 | $ | 5,841 | $ | 1,906 | $ | 5,115 | |||||||||||||||

Recurring Fair Value Measurements

The Company records its derivative assets and liabilities at fair market value on its consolidated balance sheet. The following table presents assets and liabilities measured and recorded at fair value on the Company's consolidated balance sheets on a recurring basis and their level within the fair value hierarchy:

| As of June 30, 2021 | As of December 31, 2020 | ||||||||||||||||||||||||||||||||||||||||

Fair Value (a) | Fair Value (a) | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | Level 2 | Level 3 | Level 2 | Level 3 | |||||||||||||||||||||||||||||||||||||

| Derivative assets: | |||||||||||||||||||||||||||||||||||||||||