UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q | | | | | |

| ☒ | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended March 31, 20232024

| | | | | |

| ☐ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number: 333-203369

Clearway Energy LLC

(Exact name of registrant as specified in its charter) | | | | | | | | | | | |

| Delaware | | 32-0407370 |

(State or other jurisdiction

of incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | |

| 300 Carnegie Center, Suite 300 | Princeton | New Jersey | 08540 |

| (Address of principal executive offices) | (Zip Code) |

(609) 608-1525

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No x

As of April 28, 2023,30, 2024, there were 34,613,853 Class A units outstanding, 42,738,750 Class B units outstanding, 82,385,88482,454,344 Class C units outstanding, and 42,336,750 Class D units outstanding. There is no public market for the registrant's outstanding units.

TABLE OF CONTENTS

Index | | | | | |

| CAUTIONARY STATEMENT REGARDING FORWARD LOOKING INFORMATION | |

| GLOSSARY OF TERMS | |

| PART I — FINANCIAL INFORMATION | |

| ITEM 1 — FINANCIAL STATEMENTS AND NOTES | |

| ITEM 2 — MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |

| ITEM 3 — QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |

| ITEM 4 — CONTROLS AND PROCEDURES | |

| PART II — OTHER INFORMATION | |

| ITEM 1 — LEGAL PROCEEDINGS | |

| ITEM 1A — RISK FACTORS | |

| ITEM 2 — UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | |

| ITEM 3 — DEFAULTS UPON SENIOR SECURITIES | |

| ITEM 4 — MINE SAFETY DISCLOSURES | |

| ITEM 5 — OTHER INFORMATION | |

| ITEM 6 — EXHIBITS | |

| SIGNATURES | |

| |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This Quarterly Report on Form 10-Q of Clearway Energy LLC, together with its consolidated subsidiaries, or the Company, includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. The words “believes,” “projects,” “anticipates,” “plans,” “expects,” “intends,” “estimates” and similar expressions are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance and achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These factors, risks and uncertainties include the factors described under Item 1A — Risk Factors in Part I of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022,2023, as well as the following:

•The Company’s ability to maintain and grow its quarterly distributions;

•Potential risks related to the Company's relationships with GIP, TotalEnergiesCEG and CEG;its owners;

•The Company’s ability to successfully identify, evaluate and consummate acquisitions from, and dispositions to, third parties;

•The Company’s ability to acquire assets from CEG;

•The Company’s ability to borrow additional funds and access capital markets, as well as the Company’s substantial indebtedness and the possibility that the Company may incur additional indebtedness going forward;

•Changes in law, including judicial decisions;

•Hazards customary to the power production industry and power generation operations such as fuel and electricity price volatility, unusual weather conditions (including wind and solar conditions), catastrophic weather-related or other damage to facilities, unscheduled generation outages, maintenance or repairs, unanticipated changes to fuel supply costs or availability due to higher demand, shortages, transportation problems or other developments, environmental incidents, or electric transmission or gas pipeline system constraints and the possibility that the Company may not have adequate insurance to cover losses as a result of such hazards;

•The Company’s ability to operate its businesses efficiently, manage maintenance capital expenditures and costs effectively, and generate earnings and cash flows from its asset-based businesses in relation to its debt and other obligations;

•The willingness and ability of counterparties to the Company’s offtake agreements to fulfill their obligations under such agreements;

•The Company’s ability to enter into contracts to sell power and procure fuel on acceptable terms and prices as current offtake agreements expire;prices;

•Government regulation, including compliance with regulatory requirements and changes in market rules, rates, tariffs and environmental laws;

•Operating and financial restrictions placed on the Company that are contained in the project-levelfacility-level debt facilities and other agreements of certain subsidiaries and project-levelfacility-level subsidiaries generally, in the Clearway Energy Operating LLC amended and restated revolving credit facility and in the indentures governing the Senior Notes; and

•Cyber terrorism and inadequate cybersecurity, or the occurrence of a catastrophic loss and the possibility that the Company may not have adequate insurance to cover losses resulting from such hazards or the inability of the Company’s insurers to provide coverage.

Forward-looking statements speak only as of the date they were made, and the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The foregoing review of factors that could cause the Company’s actual results to differ materially from those contemplated in any forward-looking statements included in this Quarterly Report on Form 10-Q should not be construed as exhaustive.

GLOSSARY OF TERMS

When the following terms and abbreviations appear in the text of this report, they have the meanings indicated below:

| | | | | | |

| 2028 Senior Notes | $850 million aggregate principal amount of 4.75% unsecured senior notes due 2028, issued by Clearway Energy Operating LLC | |

| 2031 Senior Notes | $925 million aggregate principal amount of 3.75% unsecured senior notes due 2031, issued by Clearway Energy Operating LLC | |

| 2032 Senior Notes | $350 million aggregate principal amount of 3.75% unsecured senior notes due 2032, issued by Clearway Energy Operating LLC | |

| Adjusted EBITDA | A non-GAAP measure, represents earnings before interest (including loss on debt extinguishment), tax, depreciation and amortization adjusted for mark-to-market gains or losses, asset write offs and impairments; and factors which the Company does not consider indicative of future operating performance | |

| | |

| | |

| ASC | The FASB Accounting Standards Codification, which the FASB established as the source of

| |

ASU | Accounting Standards Updates - updates to the ASC | |

| ATM Program | At-The-Market Equity Offering Program | |

Bridge Loan AgreementBESS | Senior secured bridge credit agreement entered into by Clearway Energy Operating LLC that provided a term loan facility in an aggregate principal amount of $335 million that was repaid on May 3, 2022Battery energy storage system | |

| BlackRock | BlackRock, Inc. | |

| | |

| CAFD | A non-GAAP measure, Cash Available for Distribution is defined as of March 31, 20232024 as Adjusted EBITDA plus cash distributions/return of investment from unconsolidated affiliates, cash receipts from notes receivable, cash distributions from noncontrolling interests, adjustments to reflect sales-type lease cash payments and payments for lease expenses, less cash distributions to noncontrolling interests, maintenance capital expenditures, pro-rata Adjusted EBITDA from unconsolidated affiliates, cash interest paid, income taxes paid, principal amortization of indebtedness, changes in prepaid and accrued capacity payments and adjusted for development expenses | |

Capistrano Wind Portfolio | | Five wind projects representing 413 MW of capacity, which includes Broken Bow and Crofton Bluffs located in Nebraska, Cedro Hill located in Texas and Mountain Wind Power I and II located in Wyoming |

| CEG | Clearway Energy Group LLC (formerly Zephyr Renewables LLC) | |

| CEG Master Services Agreement | Amended and Restated Master Services Agreements entered intoAgreement, dated as of August 31, 2018 and amended on February 2, 2023 betweenApril 30, 2024, among the Company, Clearway, Inc., Clearway Energy Operating LLC and CEG | |

| | |

| Clearway, Inc. | Clearway Energy, Inc., the holder of the Company’s Class A and Class C units | |

| Clearway Energy Group LLC | The holder of all shares of Clearway, Inc.’s Class B and Class D common stock and the Company’s Class B and Class D units and, from time to time, possibly shares of Clearway, Inc.’s Class A and/or Class C common stock | |

| Clearway Energy Operating LLC | The holder of the project assetsfacilities that are owned by the Company | |

| Clearway Renew | Clearway Renew LLC, a subsidiary of CEG, and its wholly-owned subsidiaries | |

| | |

| Company | Clearway Energy LLC, together with its consolidated subsidiaries | |

| CVSR | California Valley Solar Ranch | |

| CVSR Holdco | CVSR Holdco LLC, the indirect owner of CVSR | |

| | |

| | |

| | |

| | |

| Distributed Solar | Solar power projects,facilities, typically less than 20 MW in size (on an alternating current, or AC, basis), that primarily sell power produced to customers for usage on site, or are interconnected to sell power into the local distribution grid | |

| Drop Down Assets | Assets under common control acquired by the Company from CEG | |

| | |

| | |

| | |

| ERCOT | Electric Reliability Council of Texas, the ISO and the regional reliability coordinator of the various electricity systems within Texas | |

| | |

| | |

| Exchange Act | The Securities Exchange Act of 1934, as amended | |

| FASB | Financial Accounting Standards Board | |

| GAAP | Accounting principles generally accepted in the U.S. | |

| GenConn | GenConn Energy LLC | |

| GIM | Global Infrastructure Management, LLC, the manager of GIP | |

| GIP | Global Infrastructure Partners | |

| HLBV | Hypothetical Liquidation at Book Value | |

| IRA | Inflation Reduction Act of 2022 | |

| ISO | Independent System Operator, also referred to as an RTO | |

| | | | | | |

KKR | KKR Thor Bidco, LLC, an affiliate of Kohlberg Kravis Roberts & Co. L.P. | |

LIBOR | London Inter-Bank Offered Rate | |

| | |

| Mesquite Star | Mesquite Star Special LLC | |

| | |

| MMBtu | Million British Thermal Units | |

| Mt. Storm | NedPower Mount Storm LLC | |

| MW | Megawatt | |

| MWh | Saleable megawatt hours, net of internal/parasitic load megawatt-hours | |

MWt | Megawatts Thermal Equivalent | |

| Net Exposure | Counterparty credit exposure to Clearway, Inc. net of collateral | |

| | |

| | |

| | |

NOLs | Net Operating Losses | |

| | |

NPNS | Normal Purchases and Normal Sales | |

| | |

OCI/OCLOCI | Other comprehensive income/lossincome | |

| O&M | Operations and Maintenance | |

| PG&E | Pacific Gas and Electric Company | |

| PJM | PJM Interconnection, LLC | |

| PPA | Power Purchase Agreement | |

| | |

PTCRA | Production Tax CreditResource adequacy | |

| | |

| RENOM | Clearway Renewable Operation & Maintenance LLC, a wholly-owned subsidiary of CEG | |

| Rosie Central BESS | Rosie BESS Devco LLC | |

| | |

| RTO | Regional Transmission Organization | |

| SCE | Southern California Edison | |

| SEC | U.S. Securities and Exchange Commission | |

| Senior Notes | Collectively, the 2028 Senior Notes, the 2031 Senior Notes and the 2032 Senior Notes | |

| SOFR | Secured Overnight Financing Rate | |

| SPP | Solar Power Partners | |

| SREC | Solar Renewable Energy Credit | |

| | |

| Thermal Business | The Company’s thermal business, which consists of thermal infrastructure assets that provide steam, hot water and/or chilled water, and in some instances electricity, to commercial businesses, universities, hospitals and governmental units |

| | |

| TotalEnergies | TotalEnergies SE | |

| U.S. | United States of America | |

| Utah Solar Portfolio | Seven utility-scale solar farms located in Utah, representing 530 MW of capacity | |

| Utility Scale Solar | Solar power projects,facilities, typically 20 MW or greater in size (on an alternating current, or AC, basis), that are interconnected into the transmission or distribution grid to sell power at a wholesale level | |

| VIE | Variable Interest Entity | |

| | |

PART I -— FINANCIAL INFORMATION

ITEM 1 — FINANCIAL STATEMENTS

CLEARWAY ENERGY LLC

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | Three months ended March 31, |

| | | Three months ended March 31, | |

| | | Three months ended March 31, | |

| | | Three months ended March 31, | |

| (In millions) | (In millions) | | | 2023 | | 2022 | (In millions) | | | | | 2024 | | 2023 |

| Operating Revenues | Operating Revenues | | | | | |

| Total operating revenues | Total operating revenues | | | $ | 288 | | | $ | 214 | |

| Total operating revenues | |

| Total operating revenues | |

| Operating Costs and Expenses | Operating Costs and Expenses | | | | | |

| Cost of operations, exclusive of depreciation, amortization and accretion shown separately below | |

| Cost of operations, exclusive of depreciation, amortization and accretion shown separately below | |

| Cost of operations, exclusive of depreciation, amortization and accretion shown separately below | Cost of operations, exclusive of depreciation, amortization and accretion shown separately below | | | 108 | | | 128 | |

| Depreciation, amortization and accretion | Depreciation, amortization and accretion | | | 128 | | | 124 | |

| | General and administrative | General and administrative | | | 10 | | | 12 | |

| General and administrative | |

| General and administrative | |

| Transaction and integration costs | Transaction and integration costs | | | — | | | 2 | |

| Development costs | | | — | | | 1 | |

| | Total operating costs and expenses | Total operating costs and expenses | | | 246 | | | 267 | |

| Total operating costs and expenses | |

| Total operating costs and expenses | |

| Operating (Loss) Income | |

| Other Income (Expense) | |

| Equity in earnings (losses) of unconsolidated affiliates | |

| Equity in earnings (losses) of unconsolidated affiliates | |

| Equity in earnings (losses) of unconsolidated affiliates | |

| | Operating Income (Loss) | | | 42 | | | (53) | |

| Other Income (Expense) | | | | | |

| Equity in (losses) earnings of unconsolidated affiliates | | | (3) | | | 4 | |

| | Other income, net | |

| | Other income, net | |

| | Other income, net | Other income, net | | | 8 | | | — | |

| Loss on debt extinguishment | Loss on debt extinguishment | | | — | | | (2) | |

| Interest expense | Interest expense | | | (99) | | | (47) | |

| Total other expense, net | Total other expense, net | | | (94) | | | (45) | |

| Net Loss | Net Loss | | | (52) | | | (98) | |

| Less: Net loss attributable to noncontrolling interests and redeemable noncontrolling interests | Less: Net loss attributable to noncontrolling interests and redeemable noncontrolling interests | | | (30) | | | (40) | |

| Net Loss Attributable to Clearway Energy LLC | Net Loss Attributable to Clearway Energy LLC | | | $ | (22) | | | $ | (58) | |

|

See accompanying notes to consolidated financial statements.

CLEARWAY ENERGY LLC

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(Unaudited)

| | | | Three months ended March 31, |

| | | Three months ended March 31, | |

| | | Three months ended March 31, | |

| | | Three months ended March 31, | |

| (In millions) | (In millions) | | | 2023 | | 2022 | (In millions) | | | | | 2024 | | 2023 |

| Net Loss | Net Loss | | | $ | (52) | | | $ | (98) | |

| Other Comprehensive (Loss) Income | | |

| Unrealized (loss) gain on derivatives and changes in accumulated OCI/OCL | | | (4) | | | 16 | |

| Other comprehensive (loss) income | | | (4) | | | 16 | |

| Other Comprehensive Loss | |

| Unrealized loss on derivatives and changes in accumulated OCI | |

| Unrealized loss on derivatives and changes in accumulated OCI | |

| Unrealized loss on derivatives and changes in accumulated OCI | |

| Other comprehensive loss | |

| Comprehensive Loss | Comprehensive Loss | | | (56) | | | (82) | |

| Less: Comprehensive loss attributable to noncontrolling interests and redeemable noncontrolling interests | Less: Comprehensive loss attributable to noncontrolling interests and redeemable noncontrolling interests | | | (31) | | | (37) | |

| Comprehensive Loss Attributable to Clearway Energy LLC | Comprehensive Loss Attributable to Clearway Energy LLC | | | $ | (25) | | | $ | (45) | |

See accompanying notes to consolidated financial statements.

CLEARWAY ENERGY LLC

CONSOLIDATED BALANCE SHEETS

| | (In millions) | (In millions) | March 31, 2023 | | December 31, 2022 | (In millions) | March 31, 2024 | | December 31, 2023 |

| ASSETS | ASSETS | (Unaudited) | | |

| Current Assets | Current Assets | |

| Current Assets | |

| Current Assets | |

| Cash and cash equivalents | |

| Cash and cash equivalents | |

| Cash and cash equivalents | Cash and cash equivalents | $ | 576 | | | $ | 657 | |

| | Restricted cash | |

| Restricted cash | |

| Restricted cash | Restricted cash | 437 | | | 339 | |

| Accounts receivable — trade | Accounts receivable — trade | 150 | | | 153 | |

| | Inventory | Inventory | 49 | | | 47 | |

| Inventory | |

| Inventory | |

| Derivative instruments | Derivative instruments | 27 | | | 26 | |

| | Note receivable — affiliate | |

| Note receivable — affiliate | |

| Note receivable — affiliate | |

| Prepayments and other current assets | Prepayments and other current assets | 50 | | | 54 | |

| Total current assets | Total current assets | 1,289 | | | 1,276 | |

| Property, plant and equipment, net | Property, plant and equipment, net | 7,863 | | | 7,421 | |

| Other Assets | Other Assets | | | |

| Equity investments in affiliates | |

| Equity investments in affiliates | |

| Equity investments in affiliates | Equity investments in affiliates | 346 | | | 364 | |

| Intangible assets for power purchase agreements, net | Intangible assets for power purchase agreements, net | 2,443 | | | 2,488 | |

| Other intangible assets, net | Other intangible assets, net | 75 | | | 77 | |

| Derivative instruments | Derivative instruments | 64 | | | 63 | |

| Right-of-use assets, net | Right-of-use assets, net | 554 | | | 527 | |

| Other non-current assets | Other non-current assets | 115 | | | 96 | |

| Total other assets | Total other assets | 3,597 | | | 3,615 | |

| Total Assets | Total Assets | $ | 12,749 | | | $ | 12,312 | |

| LIABILITIES AND MEMBERS’ EQUITY | LIABILITIES AND MEMBERS’ EQUITY | | | |

| Current Liabilities | Current Liabilities | |

| Current Liabilities | |

| Current Liabilities | |

| Current portion of long-term debt — external | |

| Current portion of long-term debt — external | |

| Current portion of long-term debt — external | Current portion of long-term debt — external | $ | 366 | | | $ | 322 | |

| Current portion of long-term debt — affiliate | Current portion of long-term debt — affiliate | 2 | | | 2 | |

| Accounts payable — trade | Accounts payable — trade | 70 | | | 55 | |

| Accounts payable — affiliates | Accounts payable — affiliates | 53 | | | 24 | |

| Derivative instruments | Derivative instruments | 39 | | | 50 | |

| Accrued interest expense | Accrued interest expense | 36 | | | 54 | |

| | Accrued expenses and other current liabilities | Accrued expenses and other current liabilities | 60 | | | 95 | |

| Accrued expenses and other current liabilities | |

| Accrued expenses and other current liabilities | |

| Total current liabilities | Total current liabilities | 626 | | | 602 | |

| Other Liabilities | Other Liabilities | | | |

| Long-term debt — external | |

| Long-term debt — external | |

| Long-term debt — external | Long-term debt — external | 6,769 | | | 6,491 | |

| Deferred income taxes | Deferred income taxes | 4 | | | 4 | |

| Derivative instruments | Derivative instruments | 296 | | | 303 | |

| Long-term lease liabilities | Long-term lease liabilities | 577 | | | 548 | |

| Other non-current liabilities | Other non-current liabilities | 204 | | | 197 | |

| Total other liabilities | Total other liabilities | 7,850 | | | 7,543 | |

| Total Liabilities | Total Liabilities | 8,476 | | | 8,145 | |

| Redeemable noncontrolling interest in subsidiaries | Redeemable noncontrolling interest in subsidiaries | 9 | | | 7 | |

| Commitments and Contingencies | Commitments and Contingencies | | | | Commitments and Contingencies | | | |

| Members’ Equity | Members’ Equity | |

| Contributed capital | Contributed capital | 1,279 | | | 1,308 | |

| Contributed capital | |

| Contributed capital | |

| Retained earnings | Retained earnings | 1,142 | | | 1,240 | |

| Accumulated other comprehensive income | Accumulated other comprehensive income | 18 | | | 21 | |

| Noncontrolling interest | Noncontrolling interest | 1,825 | | | 1,591 | |

| Total Members’ Equity | Total Members’ Equity | 4,264 | | | 4,160 | |

| Total Liabilities and Members’ Equity | Total Liabilities and Members’ Equity | $ | 12,749 | | | $ | 12,312 | |

See accompanying notes to consolidated financial statements.

CLEARWAY ENERGY LLC

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited) | | | | | | | | | | | |

| Three months ended March 31, |

| (In millions) | 2023 | | 2022 |

| Cash Flows from Operating Activities | | | |

| Net Loss | $ | (52) | | | $ | (98) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Equity in losses (earnings) of unconsolidated affiliates | 3 | | | (4) | |

| Distributions from unconsolidated affiliates | 6 | | | 11 | |

| Depreciation, amortization and accretion | 128 | | | 124 | |

| Amortization of financing costs and debt discounts | 3 | | | 4 | |

| Amortization of intangibles | 47 | | | 42 | |

| Loss on debt extinguishment | — | | | 2 | |

| | | |

| Reduction in carrying amount of right-of-use assets | 4 | | | 4 | |

| | | |

| | | |

| Changes in derivative instruments and amortization of accumulated OCI/OCL | 3 | | | 82 | |

| | | |

| Cash used in changes in other working capital: | | | |

| Changes in prepaid and accrued liabilities for tolling agreements | (39) | | | (44) | |

| Changes in other working capital | (28) | | | (30) | |

| Net Cash Provided by Operating Activities | 75 | | | 93 | |

| Cash Flows from Investing Activities | | | |

| | | |

| | | |

| Acquisition of Drop Down Assets, net of cash acquired | (7) | | | (51) | |

| | | |

| | | |

| Capital expenditures | (88) | | | (47) | |

| | | |

| | | |

| Return of investment from unconsolidated affiliates | 9 | | | 3 | |

| | | |

| | | |

| | | |

| | | |

| Other | — | | | 3 | |

| Net Cash Used in Investing Activities | (86) | | | (92) | |

| Cash Flows from Financing Activities | | | |

| Contributions from noncontrolling interests, net of distributions | 214 | | | 26 | |

| Contributions from (distributions to) CEG, net | 59 | | | (3) | |

| | | |

| | | |

| | | |

| Payments of distributions | (76) | | | (70) | |

| Distributions to CEG of escrowed amounts | — | | | (64) | |

| Proceeds from the revolving credit facility | — | | | 80 | |

| Payments for the revolving credit facility | — | | | (20) | |

| Proceeds from the issuance of long-term debt — external | 42 | | | 194 | |

| | | |

| Payments of debt issuance costs | (7) | | | (4) | |

| Payments for short-term and long-term debt — external | (204) | | | (317) | |

| | | |

| Other | — | | | (6) | |

| Net Cash Provided by (Used in) Financing Activities | 28 | | | (184) | |

| Reclassification of Cash to Assets Held-for-Sale | — | | | (5) | |

| Net Increase (Decrease) in Cash, Cash Equivalents and Restricted Cash | 17 | | | (188) | |

| Cash, Cash Equivalents and Restricted Cash at beginning of period | 996 | | | 654 | |

| Cash, Cash Equivalents and Restricted Cash at end of period | $ | 1,013 | | | $ | 466 | |

| | | | | | | | | | | |

| Three months ended March 31, |

| (In millions) | 2024 | | 2023 |

| Cash Flows from Operating Activities | | | |

| Net Loss | $ | (59) | | | $ | (52) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Equity in (earnings) losses of unconsolidated affiliates | (12) | | | 3 | |

| Distributions from unconsolidated affiliates | 9 | | | 6 | |

| Depreciation, amortization and accretion | 154 | | | 128 | |

| Amortization of financing costs and debt discounts | 4 | | | 3 | |

| Amortization of intangibles | 46 | | | 47 | |

| Loss on debt extinguishment | 1 | | | — | |

| | | |

| Reduction in carrying amount of right-of-use assets | 4 | | | 4 | |

| | | |

| | | |

| | | |

| Changes in derivative instruments and amortization of accumulated OCI | 2 | | | 3 | |

| | | |

| Cash used in changes in other working capital: | | | |

| Changes in prepaid and accrued liabilities for tolling agreements | (10) | | | (39) | |

| Changes in other working capital | (58) | | | (28) | |

| Net Cash Provided by Operating Activities | 81 | | | 75 | |

| Cash Flows from Investing Activities | | | |

| | | |

| Acquisition of Drop Down Assets, net of cash acquired | (111) | | | (7) | |

| | | |

| | | |

| Capital expenditures | (98) | | | (88) | |

| | | |

| | | |

| | | |

| Return of investment from unconsolidated affiliates | 4 | | | 9 | |

| | | |

| | | |

| | | |

| | | |

| Other | 2 | | | — | |

| Net Cash Used in Investing Activities | (203) | | | (86) | |

| Cash Flows from Financing Activities | | | |

| Contributions from noncontrolling interests, net of distributions | 215 | | | 214 | |

| (Distributions to) contributions from CEG, net | (8) | | | 59 | |

| | | |

| | | |

| Payments of distributions | (81) | | | (76) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Proceeds from the issuance of long-term debt — external | 74 | | | 42 | |

| | | |

| Payments of debt issuance costs | — | | | (7) | |

| Payments for long-term debt — external | (166) | | | (204) | |

| | | |

| | | |

| Net Cash Provided by Financing Activities | 34 | | | 28 | |

| | | |

| Net (Decrease) Increase in Cash, Cash Equivalents and Restricted Cash | (88) | | | 17 | |

| Cash, Cash Equivalents and Restricted Cash at Beginning of Period | 1,051 | | | 996 | |

| Cash, Cash Equivalents and Restricted Cash at End of Period | $ | 963 | | | $ | 1,013 | |

See accompanying notes to consolidated financial statements.

CLEARWAY ENERGY LLC

CONSOLIDATED STATEMENTS OF MEMBERS’ EQUITY

For the Three Months Ended March 31, 2024

(Unaudited)

| | (In millions) | (In millions) | Contributed Capital | | Retained Earnings | | Accumulated

Other

Comprehensive Income | | Noncontrolling Interest | | Total

Members’ Equity | (In millions) | Contributed Capital | | Retained Earnings | | Accumulated

Other

Comprehensive Income | | Noncontrolling Interest | | Total

Members’ Equity |

| Balances at December 31, 2022 | $ | 1,308 | | | $ | 1,240 | | | $ | 21 | | | $ | 1,591 | | | $ | 4,160 | |

| Balances at December 31, 2023 | |

| Net loss | Net loss | — | | | (22) | | | — | | | (33) | | | (55) | |

| Unrealized loss on derivatives and changes in accumulated OCI | — | | | — | | | (3) | | | (1) | | | (4) | |

| Unrealized (loss) gain on derivatives and changes in accumulated OCI | |

| | Contributions from CEG, net of distributions, cash | 30 | | | — | | | — | | | — | | | 30 | |

| Distributions to CEG, net of contributions, cash | |

| Distributions to CEG, net of contributions, cash | |

| Distributions to CEG, net of contributions, cash | |

| Contributions from noncontrolling interests, net of distributions, cash | Contributions from noncontrolling interests, net of distributions, cash | — | | | — | | | — | | | 215 | | | 215 | |

| | Transfers of assets under common control | Transfers of assets under common control | (59) | | | — | | | — | | | 53 | | | (6) | |

| | Distributions paid to Clearway, Inc. | |

| Distributions paid to Clearway, Inc. | |

| Distributions paid to Clearway, Inc. | Distributions paid to Clearway, Inc. | — | | | (32) | | | — | | | — | | | (32) | |

| Distributions paid to CEG Class B and Class D unit holders | Distributions paid to CEG Class B and Class D unit holders | — | | | (44) | | | — | | | — | | | (44) | |

| Balances at March 31, 2023 | $ | 1,279 | | | $ | 1,142 | | | $ | 18 | | | $ | 1,825 | | | $ | 4,264 | |

| Other | |

| Balances at March 31, 2024 | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Contributed Capital | | Retained Earnings (Accumulated Deficit) | | Accumulated

Other

Comprehensive

Loss | | Noncontrolling Interest | | Total

Members’ Equity |

| Balances at December 31, 2021 | $ | 1,495 | | | $ | 43 | | | $ | (13) | | | $ | 1,692 | | | $ | 3,217 | |

| Net loss | — | | | (58) | | | — | | | (42) | | | (100) | |

| Unrealized gain on derivatives and changes in accumulated OCL | — | | | — | | | 13 | | | 3 | | | 16 | |

| Distributions to CEG, net of contributions, cash | (3) | | | — | | | — | | | — | | | (3) | |

| | | | | | | | | |

| Contributions from noncontrolling interests, net of distributions, cash | — | | | — | | | — | | | 28 | | | 28 | |

| Transfers of assets under common control | (46) | | | — | | | — | | | 9 | | | (37) | |

| | | | | | | | | |

| Distributions paid to Clearway, Inc. | (40) | | | — | | | — | | | — | | | (40) | |

| Distributions paid to CEG Class B and Class D unit holders | (5) | | | (25) | | | — | | | — | | | (30) | |

| Balances at March 31, 2022 | $ | 1,401 | | | $ | (40) | | | $ | — | | | $ | 1,690 | | | $ | 3,051 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Contributed Capital | | Retained Earnings | | Accumulated

Other

Comprehensive Income | | Noncontrolling Interest | | Total

Members’ Equity |

| Balances at December 31, 2022 | $ | 1,308 | | | $ | 1,240 | | | $ | 21 | | | $ | 1,591 | | | $ | 4,160 | |

| Net loss | — | | | (22) | | | — | | | (33) | | | (55) | |

| Unrealized loss on derivatives and changes in accumulated OCI | — | | | — | | | (3) | | | (1) | | | (4) | |

| | | | | | | | | |

| Contributions from CEG, net of distributions, cash | 30 | | | — | | | — | | | — | | | 30 | |

| Contributions from noncontrolling interests, net of distributions, cash | — | | | — | | | — | | | 215 | | | 215 | |

| Transfers of assets under common control | (59) | | | — | | | — | | | 53 | | | (6) | |

| | | | | | | | | |

| Distributions paid to Clearway, Inc. | — | | | (32) | | | — | | | — | | | (32) | |

| Distributions paid to CEG Class B and Class D unit holders | — | | | (44) | | | — | | | — | | | (44) | |

| Balances at March 31, 2023 | $ | 1,279 | | | $ | 1,142 | | | $ | 18 | | | $ | 1,825 | | | $ | 4,264 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

See accompanying notes to consolidated financial statements.

CLEARWAY ENERGY LLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 1 — Nature of Business

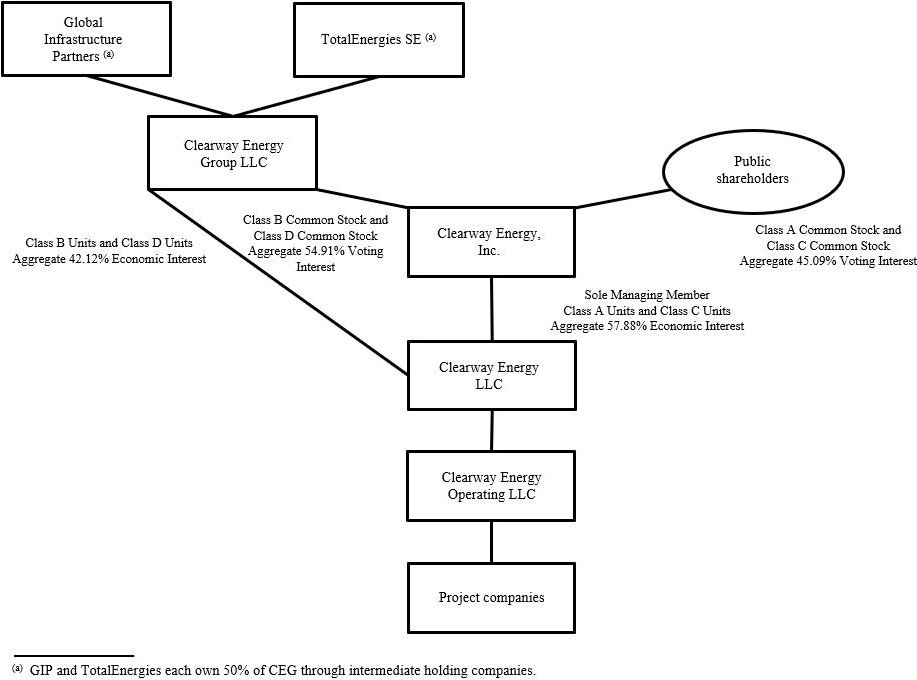

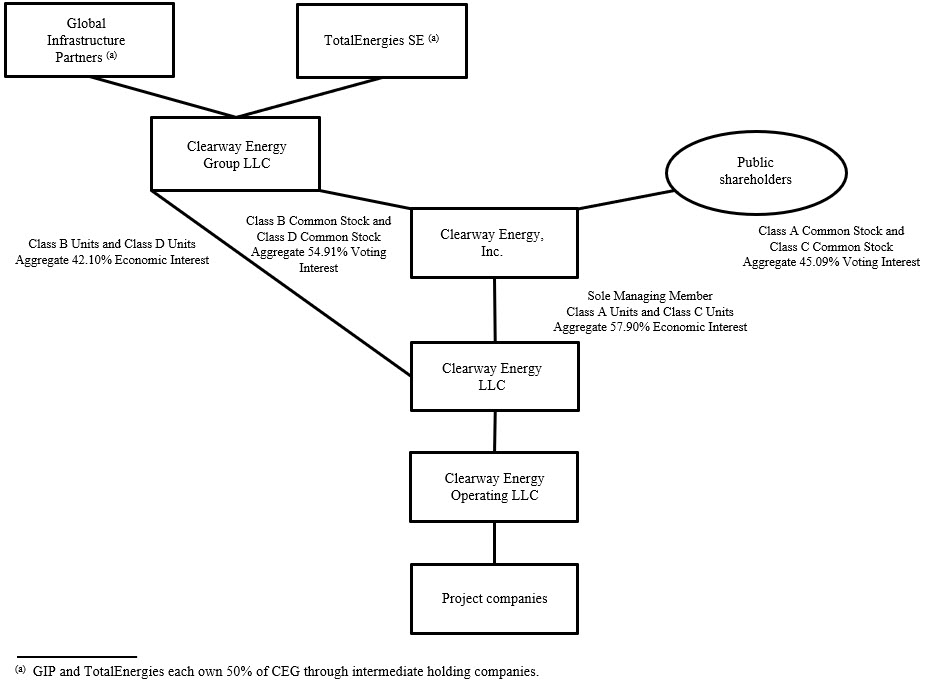

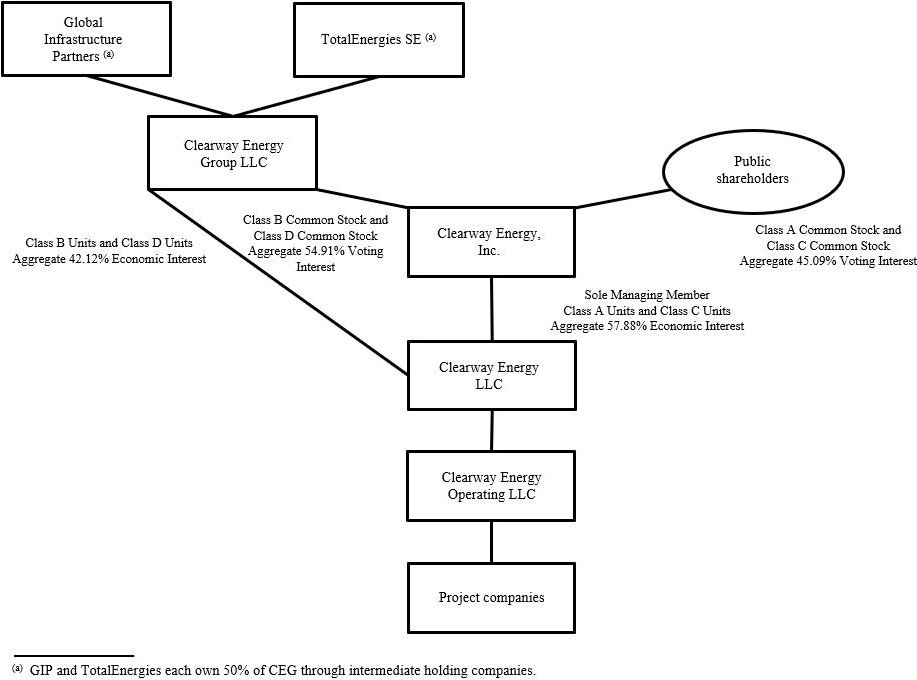

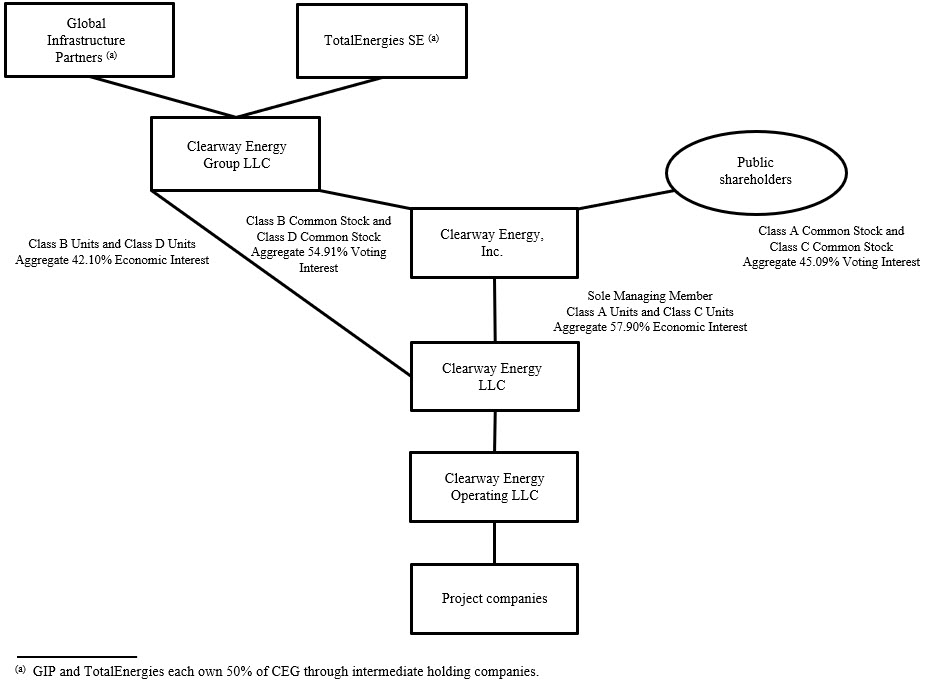

Clearway Energy LLC, together with its consolidated subsidiaries, or the Company, is an energy infrastructure investor with a focus on investments in clean energy and owner of modern, sustainable and long-term contracted assets across North America. The Company is sponsored by GIP and TotalEnergies through the portfolio company, Clearway Energy Group LLC, or CEG, which is equally owned by GIP and TotalEnergies. GIP is an independent infrastructure fund manager that makes equity and debt investments in infrastructure assets and businesses. TotalEnergies is a global multi-energy company. CEG is a leading developer of renewable energy infrastructure in the U.S.

The Company is one of the largest renewable energy owners in the U.S. with over 5,500approximately 6,200 net MW of installed wind, solar and solar generation projects.battery energy storage system, or BESS, facilities. The Company’s over 8,000approximately 8,700 net MW of assets also includes approximately 2,500 net MW of environmentally-sound, highly efficient natural gas-fired generation facilities. Through this environmentally-sound, diversified and primarily contracted portfolio, the Company endeavors to increase distributions to its unit holders. The majority of the Company’s revenues are derived from long-term contractual arrangements for the output or capacity from these assets.

Clearway Energy, Inc., or Clearway, Inc., consolidates the results of the Company through its controlling interest, with CEG’s interest shown as contributed capital in the Company’s consolidated financial statements. The holders of Clearway, Inc.’s outstanding shares of Class A and Class C common stock are entitled to dividends as declared. CEG receives its distributions from the Company through its ownership of the Company’s Class B and Class D units.

As of March 31, 2023,2024, Clearway, Inc. owned 57.88%57.90% of the economic interests of the Company, with CEG owning 42.12%42.10% of the economic interests of the Company.

The following table represents a summarized structure of the Company as of March 31, 2023:2024:

Basis of Presentation

The accompanying unaudited interim consolidated financial statements have been prepared in accordance with the SEC’s regulations for interim financial information and with the instructions to Form 10-Q. Accordingly, they do not include all of the information and notes required by GAAP for complete financial statements. The following notes should be read in conjunction with the accounting policies and other disclosures as set forth in the notes to the consolidated financial statements included in the Company’s 20222023 Form 10-K. Interim results are not necessarily indicative of results for a full year.

In the opinion of management, the accompanying unaudited interim consolidated financial statements contain all material adjustments consisting of normal and recurring accruals necessary to present fairly the Company’s consolidated financial position as of March 31, 2023,2024, and results of operations, comprehensive loss and cash flows for the three months ended March 31, 20232024 and 2022.2023.

Note 2 — Summary of Significant Accounting Policies

Use of Estimates

The preparation of consolidated financial statements in accordance with GAAP requires management to make estimates and assumptions. These estimates and assumptions impact the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities as of the date of the consolidated financial statements. They also impact the reported amounts of net earnings during the reporting periods. Actual results could be different from these estimates.

Cash, Cash Equivalents and Restricted Cash

Cash and cash equivalents include highly liquid investments with an original maturity of three months or less at the time of purchase. Cash and cash equivalents held at project subsidiariessubsidiary facilities was $125$141 million and $121$125 million as of March 31, 20232024 and December 31, 2022,2023, respectively.

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the consolidated balance sheets that sum to the total of the same such amounts shown in the consolidated statements of cash flows:

| | | | March 31, 2023 | | December 31, 2022 | | March 31, 2024 | | December 31, 2023 |

| | | (In millions) | | (In millions) |

| Cash and cash equivalents | Cash and cash equivalents | $ | 576 | | | $ | 657 | |

| Restricted cash | Restricted cash | 437 | | | 339 | |

| Cash, cash equivalents and restricted cash shown in the consolidated statements of cash flows | Cash, cash equivalents and restricted cash shown in the consolidated statements of cash flows | $ | 1,013 | | | $ | 996 | |

Restricted cash consists primarily of funds held to satisfy the requirements of certain debt agreements and funds held within the Company’s projectsfacilities that are restricted in their use. As of March 31, 2023,2024, these restricted funds were comprised of $143$173 million designated to fund operating expenses, $168$187 million designated for current debt service payments and $97$87 million restricted for reserves including debt service, performance obligations and other reserves as well as capital expenditures. The remaining $29$38 million is held in distributions reserve accounts.

Supplemental Cash Flow Information

The following table provides a disaggregation of the amounts classified as Acquisition of Drop Down Assets, net of cash acquired, shown in the consolidated statements of cash flows:

| | | | | | | | | | | | | | |

| | Three months ended March 31, |

| | 2024 | | 2023 |

| | (In millions) |

| Cash paid to acquire Drop Down Assets | | $ | (112) | | | $ | (21) | |

| Cash acquired from the acquisition of Drop Down Assets | | 1 | | | 14 | |

| Acquisition of Drop Down Assets, net of cash acquired | | $ | (111) | | | $ | (7) | |

Accumulated Depreciation and Accumulated Amortization

The following table presents the accumulated depreciation included in property, plant and equipment, net, and accumulated amortization included in intangible assets, net as of March 31, 2023 and December 31, 2022:net:

| | March 31, 2023 | | December 31, 2022 |

| (In millions) |

| March 31, 2024 | | | March 31, 2024 | | December 31, 2023 |

| (In millions) | | | (In millions) |

| Property, Plant and Equipment Accumulated Depreciation | Property, Plant and Equipment Accumulated Depreciation | $ | 3,110 | | | $ | 3,024 | |

| Intangible Assets Accumulated Amortization | Intangible Assets Accumulated Amortization | 925 | | | 877 | |

Distributions

The following table lists distributions paid on the Company's Class A, B, C and D units during the three months ended March 31, 2023:2024:

| | | | | | | | | | | | | |

| | | | | | | First Quarter 20232024 |

| Distributions per Class A, B, C and D unit | | | | | | | $ | 0.37450.4033 | |

On May 3, 2023,9, 2024, the Company declared a distribution on its Class A, Class B, Class C and Class D units of $0.3818$0.4102 per unit payable on June 15, 202317, 2024 to unit holders of record as of June 1, 2023.

Redeemable Noncontrolling Interests

To the extent that a third party has the right to redeem their interests for cash or other assets, the Company has included the noncontrolling interest attributable to the third party as a component of temporary equity in the mezzanine section of the consolidated balance sheet. The following table reflects the changes in the Company’s redeemable noncontrolling interest balance for the three months ended March 31, 2023:

| | | | | | | | |

| | (In millions) |

Balance at December 31, 2022 | | $ | 7 | |

Cash distributions to redeemable noncontrolling interests | | (1) | |

Comprehensive income attributable to redeemable noncontrolling interests | | 3 | |

Balance at March 31, 2023 | | $ | 9 | |

3, 2024.

Revenue Recognition

Disaggregated Revenues

The following tables represent the Company’s disaggregation of revenue from contracts with customers along with the reportable segment for each category:

| | Three months ended March 31, 2023 |

| Three months ended March 31, 2024 | |

| Three months ended March 31, 2024 | |

| Three months ended March 31, 2024 | |

| (In millions) | |

| (In millions) | |

| (In millions) | (In millions) | Conventional Generation | | Renewables | | | Total |

Energy revenue (a) | Energy revenue (a) | $ | 1 | | | $ | 198 | | | | $ | 199 | |

Energy revenue (a) | |

Energy revenue (a) | |

Capacity revenue (a) | Capacity revenue (a) | 100 | | | 5 | | | | 105 | |

Capacity revenue (a) | |

Capacity revenue (a) | |

| Other revenues | |

| Other revenues | |

| Other revenues | |

| Contract amortization | Contract amortization | (6) | | | (41) | | | | (47) | |

| Other revenues | — | | | 12 | | | | 12 | |

| Contract amortization | |

| Contract amortization | |

| Mark-to-market for economic hedges | |

| Mark-to-market for economic hedges | |

| Mark-to-market for economic hedges | Mark-to-market for economic hedges | — | | | 19 | | | | 19 | |

| Total operating revenues | Total operating revenues | 95 | | | 193 | | | | 288 | |

| Total operating revenues | |

| Total operating revenues | |

| Less: Mark-to-market for economic hedges | |

| Less: Mark-to-market for economic hedges | |

| Less: Mark-to-market for economic hedges | Less: Mark-to-market for economic hedges | — | | | (19) | | | | (19) | |

| Less: Lease revenue | Less: Lease revenue | (101) | | | (156) | | | | (257) | |

| Less: Lease revenue | |

| Less: Lease revenue | |

| Less: Contract amortization | |

| Less: Contract amortization | |

| Less: Contract amortization | Less: Contract amortization | 6 | | | 41 | | | | 47 | |

| Total revenue from contracts with customers | Total revenue from contracts with customers | $ | — | | | $ | 59 | | | | $ | 59 | |

| Total revenue from contracts with customers | |

| Total revenue from contracts with customers | |

|

(a) The following amounts of energy and capacity revenue relate to leases and are accounted for under ASC 842:

| | | | | | | | | | | | | | | | | |

| (In millions) | Conventional Generation | | Renewables | | Total |

| Energy revenue | $ | 1 | | | $ | 169 | | | $ | 170 | |

| Capacity revenue | 28 | | | 8 | | | 36 | |

| | | | | |

| Total | $ | 29 | | | $ | 177 | | | $ | 206 | |

| | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, 2023 | | | | |

| (In millions) | Conventional Generation | | Renewables | | Total | | | | |

Energy revenue (a) | $ | 1 | | | $ | 198 | | | $ | 199 | | | | | |

Capacity revenue (a) | 100 | | | 5 | | | 105 | | | | | |

| Other revenues | — | | | 12 | | | 12 | | | | | |

| Contract amortization | (6) | | | (41) | | | (47) | | | | | |

| Mark-to-market for economic hedges | — | | | 19 | | | 19 | | | | | |

| Total operating revenues | 95 | | | 193 | | | 288 | | | | | |

| Less: Mark-to-market for economic hedges | — | | | (19) | | | (19) | | | | | |

| Less: Lease revenue | (101) | | | (156) | | | (257) | | | | | |

| Less: Contract amortization | 6 | | | 41 | | | 47 | | | | | |

| Total revenue from contracts with customers | $ | — | | | $ | 59 | | | $ | 59 | | | | | |

| | | | | | | | | |

(a) The following amounts of energy and capacity revenue relate to leases and are accounted for under ASC 842:

| | | | | | | | | | | | | | | | | |

| (In millions) | Conventional Generation | | Renewables | | Total |

| Energy revenue | $ | 1 | | | $ | 152 | | | $ | 153 | |

| Capacity revenue | 100 | | | 4 | | | 104 | |

| Total | $ | 101 | | | $ | 156 | | | $ | 257 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, 2022 |

| (In millions) | Conventional Generation | | Renewables | | Thermal | | | | | | Total |

Energy revenue (a) | $ | — | | | $ | 195 | | | $ | 37 | | | | | | | $ | 232 | |

Capacity revenue (a) | 114 | | | — | | | 14 | | | | | | | 128 | |

| Contract amortization | (6) | | | (36) | | | — | | | | | | | (42) | |

| Other revenues | — | | | 14 | | | 8 | | | | | | | 22 | |

| Mark-to-market for economic hedges | — | | | (126) | | | — | | | | | | | (126) | |

| Total operating revenues | 108 | | | 47 | | | 59 | | | | | | | 214 | |

| Less: Mark-to-market for economic hedges | — | | | 126 | | | — | | | | | | | 126 | |

| Less: Lease revenue | (114) | | | (162) | | | (1) | | | | | | | (277) | |

| Less: Contract amortization | 6 | | | 36 | | | — | | | | | | | 42 | |

| Total revenue from contracts with customers | $ | — | | | $ | 47 | | | $ | 58 | | | | | | | $ | 105 | |

(a) The following amounts of energy and capacity revenue relate to leases and are accounted for under ASC 842:

| | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Conventional Generation | | Renewables | | Thermal | | Total |

| Energy revenue | $ | — | | | $ | 162 | | | $ | 1 | | | $ | 163 | |

| Capacity revenue | 114 | | | — | | | — | | | 114 | |

| Total | $ | 114 | | | $ | 162 | | | $ | 1 | | | $ | 277 | |

Contract Balances

The following table reflects the contract assets and liabilities included on the Company’s consolidated balance sheets:

| | | | | | | | | | | |

| March 31, 2023 | | December 31, 2022 |

| (In millions) |

| Accounts receivable, net - Contracts with customers | $ | 40 | | | $ | 37 | |

| Accounts receivable, net - Leases | 110 | | | 116 | |

| Total accounts receivable, net | $ | 150 | | | $ | 153 | |

Recently Adopted Accounting Standards

In March 2020, the FASB issued ASU No. 2020-4, Facilitation of the Effects of Reference Rate Reform on Financial Reporting. The amendments provide for optional expedients and exceptions for applying GAAP to contracts, hedging relationships and other transactions affected by reference rate reform if certain criteria are met. These amendments apply only to contracts that reference LIBOR or another reference rate expected to be discontinued because of reference rate reform, which affects certain of the Company’s debt and interest rate swap agreements. The guidance is effective for all entities as of March 20, 2020 through December 31, 2022. In December 2022, the FASB issued ASU No. 2022-6, Deferral of the Sunset Date of Reference Rate Reform, to extend the end of the transition period to December 31, 2024. As of March 31, 2023, the Company has amended the majority of the contracts that previously used LIBOR as a reference rate and elected to apply relief to certain modified cash flow interest rate swap and debt agreements. The adoption did not have a material impact on the Company’s financial statements. The Company intends to amend the remaining contracts that use LIBOR as a reference rate no later than June 30, 2023, the LIBOR cessation date. | | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| (In millions) |

| Accounts receivable, net - Contracts with customers | $ | 62 | | | $ | 66 | |

| Accounts receivable, net - Leases | 122 | | | 105 | |

| Total accounts receivable, net | $ | 184 | | | $ | 171 | |

Note 3 — Acquisitions and Dispositions

Acquisitions

Daggett 3Cedar Creek Drop Down — — On February 17, 2023,April 16, 2024, the Company, through its indirect subsidiary, Daggett Solar InvestmentCedar Creek Wind Holdco LLC, acquired Cedar Creek Holdco LLC, a 160 MW wind facility that is located in Bingham County, Idaho, from Clearway Renew for cash consideration of $117 million. Cedar Creek Wind Holdco LLC consolidates as primary beneficiary, Cedar Creek TE Holdco LLC, a tax equity fund that owns the Cedar Creek wind facility. Also on April 16, 2024, a tax equity investor contributed $108 million to acquire the Class A membership interests in Daggett TargetCoCedar Creek TE Holdco LLC. Cedar Creek has a 25-year PPA with an investment-grade utility that commenced in March 2024. The acquisition was funded with existing sources of liquidity.

Texas Solar Nova 2 Drop Down — On March 15, 2024, the Company, through its indirect subsidiary, TSN1 TE Holdco LLC, the indirect owner of the Daggett 3 solar project,acquired Texas Solar Nova 2, LLC, a 300200 MW solar project with matching storage capacityfacility that is currently under construction, located in San Bernardino, California,Kent County, Texas, from Clearway Renew LLC, a subsidiary of CEG, for cash consideration of $21 million. Simultaneously,$112 million, $17 million of which was funded by the Company with the remaining $95 million funded through a cash equity investor acquired the Class B membership interests in Daggett TargetCo LLCcontribution from Clearway Renew LLC for cash consideration of $129 million. The Company and the cash equity investor then contributed their Class A and B membership interests, respectively, into Daggettin Lighthouse Renewable Holdco 2 LLC, which is a partnership between the Company and the cash equity investor, which consolidates Daggett TargetCo LLC. Daggett TargetCopartnership. Lighthouse Renewable Holdco 2 LLC indirectly consolidates as the indirect owner of the primary beneficiary, TSN1 TE Holdco LLC, a tax equity fund Daggett TE Holdco LLC, whichthat owns the Daggett 3Texas Solar Nova 1 and Texas Solar Nova 2 solar project,facilities, as further described in Note 4, Investments Accounted for by the Equity Method and Variable Interest Entities. Daggett 3Texas Solar Nova 2 has PPAsan 18-year PPA with an investment-grade counterpartiescounterparty that have a 15-year weighted average contract duration that commence when the underlying operating assets reach commercial operations, which is expected to occur for the majority of the operating assetscommenced in the second quarter of 2023.March 2024. The Daggett 3Texas Solar Nova 2 operations are reflected in the Company’s Renewables segment and the acquisitionCompany’s portion of the purchase price was funded with existing sources of liquidity. The acquisition was determined to be an asset acquisition and the Company consolidates Daggett 3Texas Solar Nova 2 on a prospective basis in its financial statements. The assets and liabilities transferred to the Company relate to interests under common control and were recorded at historical cost in accordance with ASC 805-50, Business Combinations - Related Issues. The difference between the cash paid of $21$112 million and the historical cost of the Company’s net assets acquired of $15$72 million was recorded as an adjustment to CEG’s contributed capital balance.capital. In addition, the Company reflected $21$9 million of the Company’s purchase price, which was contributed back to the Company by CEG to pay down the acquired long-term debt, in the line item contributions fromdistributions to CEG, net of distributionscontributions in the consolidated statementstatements of members’ equity.

The following is a summary of assets and liabilities transferred in connection with the acquisition as of February 17, 2023:March 15, 2024:

| | | | | | | | |

| (In millions) | | Daggett 3Texas Solar Nova 2 |

Restricted cashCash | | $ | 141 | |

| Property, plant and equipment | | 534280 | |

Right-of-use-assets,Right-of-use assets, net | | 3121 | |

| Derivative assets | | 276 | |

| Other current and non-current assets | | 4 | |

| | |

| Total assets acquired | | 606312 | |

| | |

Long-term debt (a) | | 480194 | |

| Long-term lease liabilities | | 3319 | |

Other current and non-current liabilities(b) | | 78 | | 27 | |

| Total liabilities assumed | | 591240 | |

| Net assets acquired | | $ | 1572 | |

(a)Includes a $181an $80 million construction loan, $75 million sponsor equity bridgeterm loan and $229a $115 million tax equity bridge loan, offset by $5$1 million in unamortized debt issuance costs. See Note 7, Long-term Debt,, for further discussion of the long-term debt assumed in the acquisition.

(b) Includes $32 million of project costs that were subsequently funded by CEG and will be repaid with the proceeds expected to be received when the project reaches substantial completion.

Note 4 — Investments Accounted for by the Equity Method and Variable Interest Entities

Entities that are not Consolidated

The Company has an interestinterests in an entityentities that isare considered a VIEVIEs under ASC 810, but for which it is not considered the primary beneficiary. The Company accounts for its interestinterests in this entitythese entities and entities in which it has a significant investment under the equity method of accounting, as further described under Item 15 — Note 5, Investments Accounted for by the Equity Method and Variable Interest Entities, to the consolidated financial statements included in the Company’s 20222023 Form 10-K.

The following table reflects the Company’s equity investments in unconsolidated affiliates as of March 31, 2024:

| | | | | | | | |

| Name | Economic Interest | Investment Balance (a) |

| | (In millions) |

| Avenal | 50% | $ | 6 | |

| Desert Sunlight | 25% | 219 | |

| Elkhorn Ridge | 67% | 13 | |

GenConn (b) | 50% | 76 | |

Rosie Central BESS (b) | 50% | 28 | |

| San Juan Mesa | 75% | 7 | |

| | $ | 349 | |

(a) The Company’s maximum exposure to loss as of March 31, 2023 is limited to its equity investment in the unconsolidated entities, as further summarized in the table below:

| | | | | | | | |

| Name | Economic

Interest | Investment Balance |

| | (In millions) |

| Avenal | 50% | $ | 7 | |

| Desert Sunlight | 25% | 226 | |

| Elkhorn Ridge | 67% | 20 | |

GenConn (a) | 50% | 80 | |

| San Juan Mesa | 75% | 13 | |

| | $ | 346 | |

(a)(b) GenConn is a variable interest entity.and Rosie Central BESS are VIEs.

Entities that are Consolidated

As further described under Item 15 — Note 5, Investments Accounted for by the Equity Method and Variable Interest Entities, to the consolidated financial statements included in the Company’s 20222023 Form 10-K, the Company has a controlling financial interest in certain entities which have been identified as VIEs under ASC 810, Consolidations, or ASC 810. These arrangements are primarily related to tax equity arrangements entered into with third parties in order to monetize certain tax credits associated with wind, solar and solarBESS facilities. The Company also has a controlling financial interest in certain partnership arrangements with third-party investors, which also have also been identified as VIEs. Under the Company’s arrangements that have been identified as VIEs, the third-party investors are allocated earnings, tax attributes and distributable cash in accordance with the respective limited liability company agreements. Many of these arrangements also provide a mechanism to facilitate achievement of the investor’s specified return by providing incremental cash distributions to the investor at a specified date if the specified return has not yet been achieved.

The discussion below describes material changes to VIEsfollowing is a summary of significant activity during the three months ended March 31, 2023.2024 related to the Company’s consolidated VIEs:

DaggettLighthouse Renewable Holdco 2 LLC —

As described in Note 3, Acquisitions and Dispositions, on February 17, 2023, Daggett Solar InvestmentMarch 15, 2024, TSN1 TE Holdco LLC, an indirect subsidiary of the Company, acquired the Class A membership interests in Daggett TargetCo LLC while a cash equity investor acquired the Class B membership interests.Texas Solar Nova 2, LLC. The Company, and the cash equity investor then contributed their Class A and B membership interests, respectively, into Daggettthrough Lighthouse Renewable Holdco 2 LLC, a partnership, consolidates TSN1 TE Holdco LLC, a partnership betweentax equity fund that owns the CompanyTexas Solar Nova 1 and the cash equity investor, and concurrently, Daggett TargetCo LLC became a wholly-owned subsidiary of Daggett Renewable Holdco LLC. The Company consolidates Daggett Renewable Holdco LLC as a VIE as the Company is the primary beneficiary, through its role as managing member.Texas Solar Nova 2 solar facilities. The Company recorded the noncontrolling interest of the cash equity investor in DaggettLighthouse Renewable Holdco 2 LLC at historical carrying amount, with the offset to contributed capital. The Class A membership interests in TSN1 TE Holdco LLC are held by a tax equity investor and are reflected as noncontrolling interest on the Company’s consolidated balance sheet.

Daggett Renewable Holdco LLC

Effective January 1, 2024, the Company and the cash equity investor in Daggett Renewable HoldCo LLC and Daggett 2 TargetCo LLC, consolidates, as the indirect owner of the primary beneficiary, a tax equity fund, Daggett TE Holdco2 solar and BESS facility, agreed to transfer Daggett 2 TargetCo LLC which owns theto Daggett 3 solar project. The tax equity investor’s interest is shown as noncontrolling interest and the HLBV method is utilized to allocate the income or losses of Daggett TERenewable Holdco LLC. As the transfer was among entities under common control, the transaction was recognized at historical cost and no gain or loss was recognized.

Summarized financial information for the Company’s consolidated VIEs consisted of the following as of March 31, 2023:2024:

| | (In millions) | (In millions) | Alta TE Holdco LLC | | Buckthorn Renewables, LLC | | DGPV Funds (a) | | Daggett Renewable Holdco LLC (b) | | Langford TE Partnership LLC | | Lighthouse Renewable Holdco LLC (c) | (In millions) | Buckthorn Holdings, LLC | | DGPV Funds (a) | | Langford TE Partnership LLC | | Daggett Renewable Holdco LLC (b) | | Lighthouse Renewable Holdco LLC (c) | | Lighthouse Renewable Holdco 2 LLC (d) |

| Other current and non-current assets | Other current and non-current assets | $ | 55 | | | $ | 3 | | | $ | 73 | | | $ | 147 | | | $ | 13 | | | $ | 122 | |

| Property, plant and equipment | Property, plant and equipment | 296 | | | 192 | | | 516 | | | 559 | | | 121 | | | 823 | |

| Intangible assets | Intangible assets | 196 | | | — | | | 14 | | | — | | | 2 | | | — | |

| Total assets | Total assets | 547 | | | 195 | | | 603 | | | 706 | | | 136 | | | 945 | |

| Current and non-current liabilities | Current and non-current liabilities | 38 | | | 11 | | | 65 | | | 493 | | | 54 | | | 305 | |

| Total liabilities | Total liabilities | 38 | | | 11 | | | 65 | | | 493 | | | 54 | | | 305 | |

| Noncontrolling interest | Noncontrolling interest | 38 | | | 26 | | | 18 | | | 231 | | | 65 | | | 513 | |

| Net assets less noncontrolling interest | Net assets less noncontrolling interest | $ | 471 | | | $ | 158 | | | $ | 520 | | | $ | (18) | | | $ | 17 | | | $ | 127 | |

(a) DGPV Funds is comprised of Clearway & EFS Distributed Solar LLC, DGPV Fund 4 LLC, Golden Puma Fund LLC, Renew Solar CS4 Fund LLC and Chestnut Fund LLC, which are all tax equity funds.

(b) Daggett Renewable Holdco LLC consolidates Daggett TE Holdco LLC and Daggett 2 TE Holdco LLC, which is aare consolidated VIE.VIEs.

(c) Lighthouse Renewable Holdco LLC consolidates Mesquite Star Tax Equity Holdco LLC, Black Rock TE Holdco LLC Mililani TE Holdco LLC and WaiawaMililani TE Holdco LLC, which are consolidated VIEs.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Lighthouse Renewable Holdco 2 LLC(a) | | Oahu Solar LLC | | Pinnacle Repowering TE Holdco LLC | | Rattlesnake TE Holdco LLC | | Rosie TargetCo LLC | | Wildorado TE Holdco LLC | | Other (b) |

| Other current and non-current assets | $ | 44 | | | $ | 39 | | | $ | 7 | | | $ | 15 | | | $ | 35 | | | $ | 25 | | | $ | 16 | |

| Property, plant and equipment | 357 | | | 162 | | | 101 | | | 182 | | | 236 | | | 205 | | | 151 | |

| Intangible assets | — | | | — | | | 16 | | | — | | | — | | | — | | | 1 | |

| Total assets | 401 | | | 201 | | | 124 | | | 197 | | | 271 | | | 230 | | | 168 | |

| Current and non-current liabilities | 132 | | | 22 | | | 5 | | | 17 | | | 98 | | | 21 | | | 74 | |

| Total liabilities | 132 | | | 22 | | | 5 | | | 17 | | | 98 | | | 21 | | | 74 | |

| Noncontrolling interest | 233 | | | 26 | | | 42 | | | 87 | | | 127 | | | 109 | | | 68 | |

| Net assets less noncontrolling interest | $ | 36 | | | $ | 153 | | | $ | 77 | | | $ | 93 | | | $ | 46 | | | $ | 100 | | | $ | 26 | |

(a)(d) Lighthouse Renewable Holdco 2 LLC consolidates Mesquite Sky TE Holdco LLC, Mesquite Star Tax Equity Holdco LLC and TSN1 TE Holdco LLC, which isare consolidated VIEs.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Oahu Solar LLC | | Rattlesnake TE Holdco LLC | | Rosie TargetCo LLC | | VP-Arica TargetCo LLC (a) | | Wildorado TE Holdco LLC | | Other (b) |

| Other current and non-current assets | $ | 37 | | | $ | 14 | | | $ | 303 | | | $ | 101 | | | $ | 29 | | | $ | 27 | |

| Property, plant and equipment | 155 | | | 173 | | | 528 | | | 1,019 | | | 184 | | | 234 | |

| Intangible assets | — | | | — | | | — | | | 2 | | | — | | | 15 | |

| Total assets | 192 | | | 187 | | | 831 | | | 1,122 | | | 213 | | | 276 | |

| Current and non-current liabilities | 22 | | | 17 | | | 397 | | | 893 | | | 17 | | | 91 | |

| Total liabilities | 22 | | | 17 | | | 397 | | | 893 | | | 17 | | | 91 | |

| Noncontrolling interest | 22 | | | 81 | | | 180 | | | 68 | | | 97 | | | 91 | |

| Net assets less noncontrolling interest | $ | 148 | | | $ | 89 | | | $ | 254 | | | $ | 161 | | | $ | 99 | | | $ | 94 | |

(a) VP-Arica TargetCo LLC consolidates VP-Arica TE Holdco LLC, a consolidated VIE.VIE that owns the Victory Pass and Arica solar and BESS facilities.

(b) Other is comprised of Elbow Creek TE Holdco LLC, Pinnacle Repowering TE Holdco LLC and the Spring Canyon TE Holdco LLC.facilities.

Note 5 — Fair Value of Financial Instruments

Fair Value Accounting under ASC 820

ASC 820 establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three levels as follows:

•Level 1—quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access as of the measurement date.

•Level 2—inputs other than quoted prices included within Level 1 that are directly observable for the asset or liability or indirectly observable through corroboration with observable market data.

•Level 3—unobservable inputs for the asset or liability only used when there is little, if any, market activity for the asset or liability at the measurement date.

In accordance with ASC 820, the Company determines the level in the fair value hierarchy within which each fair value measurement in its entirety falls, based on the lowest level input that is significant to the fair value measurement.

For cash and cash equivalents, restricted cash, accounts receivable — trade, note receivable — affiliate, accounts payable — trade, accounts payable — affiliates and accrued expenses and other current liabilities, the carrying amounts approximate fair value because of the short-term maturity of those instruments and are classified as Level 1 within the fair value hierarchy.

The carrying amountsamount and estimated fair valuesvalue of the Company’s recorded financial instrumentsinstrument not carried at fair market value or that dodoes not approximate fair value areis as follows:

| | As of March 31, 2023 | | As of December 31, 2022 |

| Carrying Amount | | Fair Value | | Carrying Amount | | Fair Value |

| (In millions) |

| As of March 31, 2024 | | | As of March 31, 2024 | | As of December 31, 2023 |

| Carrying Amount | | | Carrying Amount | | Fair Value | | Carrying Amount | | Fair Value |

| (In millions) | | | (In millions) |

| | Long-term debt, including current portion — affiliate | Long-term debt, including current portion — affiliate | $ | 2 | | | $ | 2 | | | $ | 2 | | | $ | 2 | |

| | Long-term debt, including current portion — affiliate | |

| | Long-term debt, including current portion — affiliate | |

Long-term debt, including current portion — external (a) | Long-term debt, including current portion — external (a) | 7,197 | | | 6,760 | | | 6,874 | | | 6,288 | |

(a) Excludes net debt issuance costs, which are recorded as a reduction to long-term debt on the Company’s consolidated balance sheets.

The fair value of the Company’s publicly-traded long-term debt is based on quoted market prices and is classified as Level 2 within the fair value hierarchy. The fair value of debt securities, non-publicly traded long-term debt and certain notes receivable of the Company are based on expected future cash flows discounted at market interest rates, or current interest rates for similar instruments with equivalent credit quality and are classified as Level 3 within the fair value hierarchy. The following table presents the level within the fair value hierarchy for long-term debt, including current portion:

| | | | | | | | | | | | | | | | | | | | | | | |

| As of March 31, 2023 | | As of December 31, 2022 |

| Level 2 | | Level 3 | | Level 2 | | Level 3 |

| | (In millions) |

| Long-term debt, including current portion | $ | 1,904 | | | $ | 4,858 | | | $ | 1,836 | | | $ | 4,454 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| As of March 31, 2024 | | As of December 31, 2023 |

| Level 2 | | Level 3 | | Level 2 | | Level 3 |

| | (In millions) |

| Long-term debt, including current portion | $ | 1,890 | | | $ | 5,742 | | | $ | 1,940 | | | $ | 5,672 | |

Recurring Fair Value Measurements

The Company records its derivative assets and liabilities at fair market value on its consolidated balance sheet.sheets. The following table presents assets and liabilities measured and recorded at fair value on the Company’s consolidated balance sheets on a recurring basis and their level within the fair value hierarchy:

| | | As of March 31, 2023 | | As of December 31, 2022 |

| | Fair Value (a) | | Fair Value (a) |

| | | As of March 31, 2024 | |

| | | As of March 31, 2024 | |

| | | As of March 31, 2024 | | | As of December 31, 2023 |

| | | Fair Value (a) | | | | | Fair Value (a) | | Fair Value (a) |

| (In millions) | (In millions) | | Level 2 | | Level 3 | | | Level 2 | | Level 3 | |

| Derivative assets: | Derivative assets: | | | | | | | | | | |

| | Derivative assets: | |

| Derivative assets: | |

Energy-related commodity contracts (c) | |

Energy-related commodity contracts (c) | |

Energy-related commodity contracts (c) | |

| Interest rate contracts | Interest rate contracts | | $ | 91 | | | $ | — | | | | $ | 89 | | | $ | — | | |

Other financial instruments (b) | | — | | | 18 | | | | — | | | 17 | | |

| Interest rate contracts | |

| Interest rate contracts | |

Other financial instruments (d) | |

Other financial instruments (d) | |

Other financial instruments (d) | |

| Total assets | |

| Total assets | |

| Total assets | Total assets | | $ | 91 | | | $ | 18 | | | | $ | 89 | | | $ | 17 | | |

| Derivative liabilities: | Derivative liabilities: | | | | | | | | | | |

| Commodity contracts | | $ | — | | | $ | 334 | | | | $ | — | | | $ | 353 | | |

| Derivative liabilities: | |

| Derivative liabilities: | |

Energy-related commodity contracts (e) | |

Energy-related commodity contracts (e) | |

Energy-related commodity contracts (e) | |

| Interest rate contracts | |

| Interest rate contracts | |

| Interest rate contracts | Interest rate contracts | | 1 | | | — | | | | — | | | — | | |

| Total liabilities | Total liabilities | | $ | 1 | | | $ | 334 | | | | $ | — | | | $ | 353 | | |

| Total liabilities | |

| Total liabilities | |

(a)There were no derivative assets classified as Level 1 or Level 3 and no liabilities classified as Level 1 as of March 31, 20232024 and December 31, 2022.2023.

(b) The Company’s interest rate swaps are measured at fair value using an income approach, which uses readily observable inputs, such as forward interest rates (e.g., SOFR) and contractual terms to estimate fair value.

(c)Includes long-term backbone transportation service contracts classified as Level 2 and short-term heat rate call option contracts classified as Level 3.

(d) Includes SREC contract.

(e) As of March 31, 2024 and December 31, 2023, amounts include $361 million and $325 million related to long-term power commodity contracts and zero and $5 million related to short-term heat rate call option contracts, respectively.

The following table reconciles the beginning and ending balances for instruments that are recognized at fair value in the consolidated financial statements using significant unobservable inputs:

| | | | Three months ended March 31, |

| | | 2023 | | 2022 |

| | | | Three months ended March 31, | |

| | | | Three months ended March 31, | |

| | | | Three months ended March 31, | |

| | | | | | 2024 | | | | | | | | 2024 | | 2023 |

| (In millions) | (In millions) | | | Fair Value Measurement Using Significant Unobservable Inputs (Level 3) | (In millions) | | | | Fair Value Measurement Using Significant Unobservable Inputs (Level 3) |

| Beginning balance | Beginning balance | | | $ | (336) | | | $ | (154) | |

| Settlements | Settlements | | | 4 | | | 6 | |

| | Additions due to loss of NPNS exception | | | — | | | (21) | |

| Total gains (losses) for the period included in earnings | | | 16 | | | (111) | |

| | Total (losses) gains for the period included in earnings | |

| | Total (losses) gains for the period included in earnings | |

| | Total (losses) gains for the period included in earnings | |

| Ending balance | Ending balance | | | $ | (316) | | | $ | (280) | |

| Change in unrealized gains included in earnings for derivatives and other financial instruments held as of March 31, 2023 | | | $ | 16 | | | |

| Change in unrealized losses included in earnings for derivatives and other financial instruments held as of March 31, 2024 | | Change in unrealized losses included in earnings for derivatives and other financial instruments held as of March 31, 2024 | | | | | | $ | (21) | | | |

Derivative and Financial Instruments Fair Value Measurements

The Company's contracts are non-exchange-traded and valued using prices provided by external sources. The Company uses quoted observable forward prices to value its energy-related commodity contracts, which includes long-term power commodity contracts and heat rate call option contracts. To the extent that observable forward prices are not available, the quoted prices reflect the average of the forward prices from the prior year, adjusted for inflation. As of March 31, 2023,2024, contracts valued with prices provided by models and other valuation techniques make up 6% of derivative assets and 100% of derivative liabilities and other financial instruments.

The Company’s significant positions classified as Level 3 include physical and financial energy-related commodity contracts executed in illiquid markets. The significant unobservable inputs used in developing fair value include illiquid power tenors and location pricing, which is derived by extrapolating pricing as a basis to liquid locations. The tenor pricing and basis spread are based on observable market data when available or derived from historic prices and forward market prices from similar observable markets when not available.

The following table quantifies the significant unobservable inputs used in developing the fair value of the Company’s Level 3 positions:

| | March 31, 2023 |

| Fair Value | | Input/Range |

| Assets | Liabilities | Valuation Technique | Significant Unobservable Input | Low | High | Weighted Average |

| (In millions) | |

| Commodity Contracts | $ | — | | $ | (334) | | Discounted Cash Flow | Forward Market Price (per MWh) | $ | 20.81 | | $ | 80.18 | | $ | 39.87 | |

| March 31, 2024 | | | March 31, 2024 |

| Fair Value | | | Fair Value | | Input/Range |

| Assets | | | Assets | Liabilities | Valuation Technique | Significant Unobservable Input | Low | High | Weighted Average |

| (In millions) | |

| Long-term Power Commodity Contracts | |

| Long-term Power Commodity Contracts | |

| Long-term Power Commodity Contracts | |

| Heat Rate Call Option Commodity Contracts | |

| | | Option Model | |

| Other Financial Instruments | Other Financial Instruments | 18 | | — | | Discounted Cash Flow | Forecast annual generation levels of certain DG solar facilities | 58,539 MWh | 117,078 MWh | 112,897 MWh | Other Financial Instruments | 14 | | — | — | | Discounted Cash Flow | Discounted Cash Flow | Forecast annual generation levels of certain DG solar facilities | 60,801 MWh | 121,602 MWh | 115,622 MWh |

The following table provides the impact on the fair value measurements to increases/(decreases) in significant unobservable inputs as of March 31, 2023:2024:

| | | | | | | | | | | | | | |

| Type | Significant Unobservable Input | Position | Change In Input | Impact on Fair Value Measurement |

| Energy-Related Commodity Contracts | Forward Market Price Power | Sell | Increase/(Decrease) | Lower/(Higher) |

| Energy-Related Commodity Contracts | Forward Market Price Gas | Sell | Increase/(Decrease) | Higher/(Lower) |

| Other Financial Instruments | Forecast Generation Levels | Sell | Increase/(Decrease) | Higher/(Lower) |

| | | | |