UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 10-Q

_____________________________

(Mark One)

| | | | | |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023March 31, 2024

Or

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-37524

_____________________________

vTv Therapeutics Inc.

(Exact name of registrant as specified in its charter)

_____________________________

| | | | | |

| Delaware | 47-3916571 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

| |

3980 Premier Dr, Suite 310 High Point, NC | 27265 |

| (Address of principal executive offices) | (Zip Code) |

(336) 841-0300

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

_____________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, par value $0.01 per share | VTVT | NASDAQ Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | o | | Accelerated filer | o |

| Non-accelerated filer | o | | Smaller reporting company | x |

| Emerging growth company | o | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

| | | | | | | | |

| Class of Stock | | Shares Outstanding as of NovemberMay 9, 20232024 |

| Class A common stock, par value $0.01 per share | | 81,483,6002,432,857 | |

| Class B common stock, par value $0.01 per share | | 23,093,860577,349 | |

vTv THERAPEUTICS INC. AND SUBSIDIARIES

INDEX TO FORM 10-Q

FOR THE QUARTER ENDED SEPTEMBER 30, 2023MARCH 31, 2024

PART I – FINANCIAL INFORMATION

The financial statements and other disclosures contained in this report include those of vTv Therapeutics Inc. (“we”, the “Company” or the “Registrant”), which is the registrant, and those of vTv Therapeutics LLC (“vTv LLC”), which is the principal operating subsidiary of the Registrant. Unless the context suggests otherwise, references in this Quarterly Report on Form 10-Q to the “Company”, “we”, “us” and “our” refer to vTv Therapeutics Inc. and its consolidated subsidiaries.

vTv Therapeutics Inc.

Condensed Consolidated Balance Sheets

(in thousands, except number of shares and per share data)

| | September 30,

2023 | | December 31,

2022 |

| (Unaudited) | | |

| March 31,

2024 | | | March 31,

2024 | | December 31,

2023 |

| (Unaudited) | |

| Assets | |

| Assets | |

| Assets | Assets | |

| Current assets: | Current assets: | |

| Current assets: | |

| Current assets: | |

| Cash and cash equivalents | |

| Cash and cash equivalents | |

| Cash and cash equivalents | Cash and cash equivalents | $ | 8,238 | | | $ | 12,126 | |

| Accounts receivable | Accounts receivable | — | | | 173 | |

| G42 Promissory Note receivable | — | | | 12,243 | |

| | Prepaid expenses and other current assets | |

| Prepaid expenses and other current assets | |

| Prepaid expenses and other current assets | Prepaid expenses and other current assets | 1,872 | | | 2,537 | |

| Current deposits | Current deposits | 15 | | | 15 | |

| Total current assets | Total current assets | 10,125 | | | 27,094 | |

| Property and equipment, net | Property and equipment, net | 140 | | | 207 | |

| Operating lease right-of-use assets | Operating lease right-of-use assets | 272 | | | 349 | |

| Long-term investments | 4,387 | | | 5,588 | |

| | Total assets | Total assets | $ | 14,924 | | | $ | 33,238 | |

| Liabilities, Redeemable Noncontrolling Interest and Stockholders’ Deficit | | | |

| Total assets | |

| Total assets | |

| Liabilities, Redeemable Noncontrolling Interest and Stockholders’ Equity (Deficit) | |

| Current liabilities: | Current liabilities: | |

| Current liabilities: | |

| Current liabilities: | |

| Accounts payable and accrued expenses | |

| Accounts payable and accrued expenses | |

| Accounts payable and accrued expenses | Accounts payable and accrued expenses | $ | 9,620 | | | $ | 7,313 | |

| Current portion of operating lease liabilities | Current portion of operating lease liabilities | 165 | | | 154 | |

| Current portion of contract liabilities | Current portion of contract liabilities | 17 | | | 17 | |

| Current portion of notes payable | Current portion of notes payable | 473 | | | 224 | |

| Total current liabilities | Total current liabilities | 10,275 | | | 7,708 | |

| Contract liabilities, net of current portion | Contract liabilities, net of current portion | 18,669 | | | 18,669 | |

| Operating lease liabilities, net of current portion | Operating lease liabilities, net of current portion | 213 | | | 338 | |

| Warrant liability, related party | Warrant liability, related party | 278 | | | 684 | |

| Total liabilities | Total liabilities | 29,435 | | | 27,399 | |

| Commitments and contingencies | Commitments and contingencies | | Commitments and contingencies | | | |

| Redeemable noncontrolling interest | Redeemable noncontrolling interest | 10,722 | | | 16,579 | |

| Stockholders’ deficit: | |

| Class A common stock, $0.01 par value; 200,000,000 shares authorized, 81,483,600 shares outstanding as of September 30, 2023 and December 31, 2022 | 815 | | | 815 | |

| Class B common stock, $0.01 par value; 100,000,000 shares authorized, and 23,093,860 outstanding as of September 30, 2023 and December 31, 2022 | 232 | | | 232 | |

| Stockholders’ equity (deficit): | |

| Class A common stock, $0.01 par value; 200,000,000 shares authorized, 2,432,857 and 2,084,973 shares outstanding as of March 31, 2024 and December 31, 2023, respectively | |

| Class A common stock, $0.01 par value; 200,000,000 shares authorized, 2,432,857 and 2,084,973 shares outstanding as of March 31, 2024 and December 31, 2023, respectively | |

| Class A common stock, $0.01 par value; 200,000,000 shares authorized, 2,432,857 and 2,084,973 shares outstanding as of March 31, 2024 and December 31, 2023, respectively | |

| Class B common stock, $0.01 par value; 100,000,000 shares authorized, and 577,349 outstanding as of March 31, 2024 and December 31, 2023 | |

| | Additional paid-in capital | |

| Additional paid-in capital | |

| Additional paid-in capital | Additional paid-in capital | 254,912 | | | 253,737 | |

| Accumulated deficit | Accumulated deficit | (281,192) | | | (265,524) | |

| Total stockholders’ deficit attributable to vTv Therapeutics Inc. | (25,233) | | | (10,740) | |

| Total liabilities, redeemable noncontrolling interest and stockholders’ deficit | $ | 14,924 | | | $ | 33,238 | |

| Total stockholders’ equity (deficit) attributable to vTv Therapeutics Inc. | |

| Noncontrolling interest | |

| Total stockholders’ equity (deficit) | |

| Total liabilities, redeemable noncontrolling interest and stockholders’ equity (deficit) | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

vTv Therapeutics Inc.

Condensed Consolidated Statements of Operations - Unaudited

(in thousands, except number of shares and per share data)

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Three Months Ended

March 31, | |

| Three Months Ended

March 31, | |

| Three Months Ended

March 31, | |

| 2024 | |

| 2024 | |

| 2024 | |

| Revenue | |

| Revenue | |

| Revenue | Revenue | $ | — | | | $ | — | | | $ | — | | | $ | 2,009 | |

| Operating expenses: | Operating expenses: | |

| Operating expenses: | |

| Operating expenses: | |

| Research and development | |

| Research and development | |

| Research and development | Research and development | 2,824 | | | 3,055 | | | 11,457 | | | 8,393 | |

| General and administrative | General and administrative | 2,544 | | | 2,634 | | | 9,338 | | | 9,813 | |

| General and administrative | |

| General and administrative | |

| Total operating expenses | |

| Total operating expenses | |

| Total operating expenses | Total operating expenses | 5,368 | | | 5,689 | | | 20,795 | | | 18,206 | |

| Operating loss | Operating loss | (5,368) | | | (5,689) | | | (20,795) | | | (16,197) | |

| Other (expense) income, net | (3,640) | | | 403 | | | (1,514) | | | (2,998) | |

| Other income (expense) – related party | 341 | | | (324) | | | 406 | | | 221 | |

| Operating loss | |

| Operating loss | |

| Other income, net | |

| Other income, net | |

| Other income, net | |

| Other expense– related party | |

| Other expense– related party | |

| Other expense– related party | |

| Interest income | Interest income | 131 | | | 150 | | | 384 | | | 200 | |

| Interest expense | (4) | | | (8) | | | (6) | | | (9) | |

| Interest income | |

| Interest income | |

| | Loss before income taxes and noncontrolling interest | |

| | Loss before income taxes and noncontrolling interest | |

| | Loss before income taxes and noncontrolling interest | Loss before income taxes and noncontrolling interest | (8,540) | | | (5,468) | | | (21,525) | | | (18,783) | |

| Income tax provision | Income tax provision | — | | | — | | | — | | | 200 | |

| Income tax provision | |

| Income tax provision | |

| Net loss before noncontrolling interest | |

| Net loss before noncontrolling interest | |

| Net loss before noncontrolling interest | Net loss before noncontrolling interest | (8,540) | | | (5,468) | | | (21,525) | | | (18,983) | |

| Less: net loss attributable to noncontrolling interest | Less: net loss attributable to noncontrolling interest | (1,886) | | | (1,207) | | | (4,753) | | | (4,564) | |

| Less: net loss attributable to noncontrolling interest | |

| Less: net loss attributable to noncontrolling interest | |

| Net loss attributable to vTv Therapeutics Inc. | |

| Net loss attributable to vTv Therapeutics Inc. | |

| Net loss attributable to vTv Therapeutics Inc. | Net loss attributable to vTv Therapeutics Inc. | $ | (6,654) | | | $ | (4,261) | | | $ | (16,772) | | | $ | (14,419) | |

| Net loss attributable to vTv Therapeutics Inc. common shareholders | Net loss attributable to vTv Therapeutics Inc. common shareholders | $ | (6,654) | | | $ | (4,261) | | | $ | (16,772) | | | $ | (14,419) | |

| Net loss per share of vTv Therapeutics Inc. Class A common stock, basic and diluted | $ | (0.08) | | | $ | (0.05) | | | $ | (0.21) | | | $ | (0.20) | |

| Weighted average number of vTv Therapeutics Inc. Class A common stock, basic and diluted | 81,483,600 | | | 80,490,121 | | | 81,483,600 | | | 72,649,531 | |

| Net loss attributable to vTv Therapeutics Inc. common shareholders | |

| Net loss attributable to vTv Therapeutics Inc. common shareholders | |

Net loss per share of vTv Therapeutics Inc. Class A common stock, basic and diluted (*) | |

Net loss per share of vTv Therapeutics Inc. Class A common stock, basic and diluted (*) | |

Net loss per share of vTv Therapeutics Inc. Class A common stock, basic and diluted (*) | |

Weighted average number of vTv Therapeutics Inc. Class A common stock, basic and diluted (*) | |

Weighted average number of vTv Therapeutics Inc. Class A common stock, basic and diluted (*) | |

Weighted average number of vTv Therapeutics Inc. Class A common stock, basic and diluted (*) | |

| (*) Adjusted retroactively for reverse stock split | |

| (*) Adjusted retroactively for reverse stock split | |

| (*) Adjusted retroactively for reverse stock split | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

vTv Therapeutics Inc.

Condensed Consolidated Statement of Changes in Redeemable Noncontrolling Interest and Stockholders’ DeficitEquity (Deficit) - Unaudited

(in thousands, except number of shares)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended September 30, 2023 |

| | | | Class A Common Stock | | Class B Common Stock | | | | | | |

| Redeemable

Noncontrolling

Interest | | | Shares | | Amount | | Shares | | Amount | | Additional

Paid-in

Capital | | Accumulated Deficit | | Total Stockholders' Deficit |

| Balances at June 30, 2023 | $ | 18,879 | | | | 81,483,600 | | | $ | 815 | | | 23,093,860 | | | $ | 232 | | | $ | 254,479 | | | $ | (280,809) | | | $ | (25,283) | |

| Net loss | (1,886) | | | | — | | | — | | | — | | | — | | | — | | | (6,654) | | | (6,654) | |

| Share-based compensation | — | | | | — | | | — | | | — | | | — | | | 433 | | | — | | | 433 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Change in redemption value of noncontrolling interest | (6,271) | | | | — | | | — | | | — | | | — | | | — | | | 6,271 | | | 6,271 | |

| Balances at September 30, 2023 | $ | 10,722 | | | | 81,483,600 | | | $ | 815 | | | 23,093,860 | | | $ | 232 | | | $ | 254,912 | | | $ | (281,192) | | | $ | (25,233) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended March 31, 2024 |

| | | | Class A Common Stock | | Class B Common Stock | | | | | | | | | | |

| Redeemable

Noncontrolling

Interest | | | Shares | | Amount | | Shares | | Amount | | Additional

Paid-in

Capital | | Accumulated Deficit | | Total vTv Therapeutics Inc Stockholders’ Equity (Deficit) | | Noncontrolling

Interest | | Total Stockholders'

Equity (Deficit) |

| Balances at December 31, 2023 | $ | 6,131 | | | | 2,084,973 | | | $ | 21 | | | 577,349 | | | $ | 6 | | | $ | 256,335 | | | $ | (281,042) | | | $ | (24,680) | | | $ | — | | | $ | (24,680) | |

| Net loss attributable to vTv Therapeutics Inc. | — | | | | — | | | — | | | — | | | — | | | — | | | (4,865) | | | (4,865) | | | — | | | (4,865) | |

Net loss attributable to redeemable noncontrolling interest(*) | (1,085) | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Change in redemption value of redeemable noncontrolling interest | 214 | | | | — | | | — | | | — | | | — | | | — | | | (214) | | | (214) | | | — | | | (214) | |

| Reclassification of redeemable noncontrolling interest to permanent equity (See Note 7) | (5,260) | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 5,260 | | | 5,260 | |

| Share-based compensation | — | | | | — | | | — | | | — | | | — | | | 220 | | | — | | | 220 | | | — | | | 220 | |

| Issuance of Class A common stock and pre-funded warrants, net offering costs | — | | | | 347,884 | | | 3 | | | — | | | — | | | 50,332 | | | — | | | 50,335 | | | — | | | 50,335 | |

| Net loss attributable to noncontrolling interest | — | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (69) | | | (69) | |

| Balances at March 31, 2024 | $ | — | | | | 2,432,857 | | | $ | 24 | | | 577,349 | | | $ | 6 | | | $ | 306,887 | | | $ | (286,121) | | | $ | 20,796 | | | $ | 5,191 | | | $ | 25,987 | |

| (*) Allocation of NCI net loss was a result from the reclassification to permanent equity on February 27, 2024 (See Note 7) | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended September 30, 2022 |

| | | | Class A Common Stock | | Class B Common Stock | | | | | | | | |

| Redeemable

Noncontrolling

Interest | | | Shares | | Amount | | Shares | | Amount | | Note Receivable for Common Stock | | Additional

Paid-in

Capital | | Accumulated Deficit | | Total Stockholders' Deficit |

| Balances at June 30, 2022 | $ | 15,916 | | | | 77,329,051 | | | $ | 773 | | | 23,093,860 | | | $ | 232 | | | $ | — | | | $ | 243,772 | | | $ | (253,303) | | | $ | (8,526) | |

| Net loss | (1,207) | | | | — | | | — | | | — | | | — | | | — | | | — | | | (4,261) | | | (4,261) | |

| Share-based compensation | — | | | | — | | | — | | | — | | | — | | | — | | | 338 | | | — | | | 338 | |

| Issuance of Class A common stock under CinRx purchase agreement, net of offering costs | — | | | | 4,154,549 | | | 42 | | | — | | | — | | | (4,000) | | | 9,336 | | | — | | | 5,378 | |

| Change in redemption value of noncontrolling interest | 9,498 | | | | — | | | — | | | — | | | — | | | — | | | — | | | (9,498) | | | (9,498) | |

| Balances at September 30, 2022 | $ | 24,207 | | | | 81,483,600 | | | $ | 815 | | | 23,093,860 | | | $ | 232 | | | $ | (4,000) | | | $ | 253,446 | | | $ | (267,062) | | | $ | (16,569) | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

vTv Therapeutics Inc.

Condensed Consolidated Statement of Changes in Redeemable Noncontrolling Interest and Stockholders’ Deficit - Unaudited

(in thousands, except number of shares)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the nine months ended September 30, 2023 |

| | | | Class A Common Stock | | Class B Common Stock | | | | | | |

| Redeemable

Noncontrolling

Interest | | | Shares | | Amount | | Shares | | Amount | | Additional

Paid-in

Capital | | Accumulated Deficit | | Total Stockholders' Deficit |

| Balances at December 31, 2022 | $ | 16,579 | | | | 81,483,600 | | | $ | 815 | | | 23,093,860 | | | $ | 232 | | | $ | 253,737 | | | $ | (265,524) | | | $ | (10,740) | |

| Net loss | (4,753) | | | | — | | | — | | | — | | | — | | | — | | | (16,772) | | | (16,772) | |

| Share-based compensation | — | | | | — | | | — | | | — | | | — | | | 1,175 | | | — | | | 1,175 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Change in redemption value of noncontrolling interest | (1,104) | | | | — | | | — | | | — | | | — | | | — | | | 1,104 | | | 1,104 | |

| Balances at September 30, 2023 | $ | 10,722 | | | | 81,483,600 | | | $ | 815 | | | 23,093,860 | | | $ | 232 | | | $ | 254,912 | | | $ | (281,192) | | | $ | (25,233) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the nine months ended September 30, 2022 |

| | | Class A Common Stock | | Class B Common Stock | | | | | | | | |

| Redeemable

Noncontrolling

Interest | | Shares | | Amount | | Shares | | Amount | | Note Receivable for Common Stock | | Additional

Paid-in

Capital | | Accumulated Deficit | | Total Stockholders' Deficit |

| Balances at December 31, 2021 | $ | 24,962 | | | 66,942,777 | | | $ | 669 | | | 23,093,860 | | | $ | 232 | | | $ | — | | | $ | 238,193 | | | $ | (248,834) | | | $ | (9,740) | |

| Net loss | (4,564) | | | — | | | — | | | — | | | — | | | — | | | — | | | (14,419) | | | (14,419) | |

| Share-based compensation | — | | | — | | | — | | | — | | | — | | | — | | | 981 | | | — | | | 981 | |

| Issuance of Class A common stock to collaboration partner, net of offering costs | — | | | 10,386,274 | | | 104 | | | — | | | — | | | — | | | 4,936 | | | — | | | 5,040 | |

| Issuance of Class A common stock under CinRx purchase agreement, net of offering costs | — | | | 4,154,549 | | | 42 | | | — | | | — | | | (4,000) | | | 9,336 | | | — | | | 5,378 | |

| Change in redemption value of noncontrolling interest | 3,809 | | | — | | | — | | | — | | | — | | | — | | | — | | | (3,809) | | | (3,809) | |

| Balances at September 30, 2022 | $ | 24,207 | | | 81,483,600 | | | $ | 815 | | | 23,093,860 | | | $ | 232 | | | $ | (4,000) | | | $ | 253,446 | | | $ | (267,062) | | | $ | (16,569) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended March 31, 2023 |

| | | | Class A Common Stock | | Class B Common Stock | | | | | | |

| Redeemable

Noncontrolling

Interest | | | Shares(*) | | Amount(*) | | Shares(*) | | Amount(*) | | Additional

Paid-in

Capital(*) | | Accumulated Deficit | | Total Stockholders' Deficit |

| Balances at December 31, 2022 | $ | 16,579 | | | | 2,084,973 | | | $ | 21 | | | 577,349 | | | $ | 6 | | | $ | 254,757 | | | $ | (265,524) | | | $ | (10,740) | |

| Net loss | (1,275) | | | | — | | | — | | | — | | | — | | | — | | | (4,499) | | | (4,499) | |

| Share-based compensation | — | | | | — | | | — | | | — | | | — | | | 343 | | | — | | | 343 | |

| Change in redemption value of noncontrolling interest | 4,296 | | | | — | | | — | | | — | | | — | | | — | | | (4,296) | | | (4,296) | |

| Balances at March 31, 2023 | $ | 19,600 | | | | 2,084,973 | | | $ | 21 | | | 577,349 | | | $ | 6 | | | $ | 255,100 | | | $ | (274,319) | | | $ | (19,192) | |

| (*) Adjusted retroactively for reverse stock split | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

vTv Therapeutics Inc.

Condensed Consolidated Statements of Cash Flows - Unaudited

(in thousands)

| | Three Months Ended March 31, | | | Three Months Ended March 31, |

| 2024 | | | 2024 | | 2023 |

| Cash flows from operating activities: | |

| Net loss before noncontrolling interest | |

| Net loss before noncontrolling interest | |

| Net loss before noncontrolling interest | |

| Adjustments to reconcile net loss before noncontrolling interest to net cash used in operating activities: | |

| Depreciation expense | |

| Depreciation expense | |

| Depreciation expense | |

| Loss from promissory note early redemption | |

| Non-cash interest income | |

| Share-based compensation expense | |

| Change in fair value of investments | |

| Change in fair value of warrants, related party | |

| Changes in assets and liabilities: | |

| Accounts receivable | |

| Accounts receivable | |

| Accounts receivable | |

| Prepaid expenses and other current assets | |

| Other assets | |

| Accounts payable and accrued expenses | |

| | Other liabilities | |

| Other liabilities | |

| Other liabilities | |

| Net cash used in operating activities | |

| | | Nine Months Ended September 30, |

| | 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net loss before noncontrolling interest | $ | (21,525) | | | $ | (18,983) | |

| Adjustments to reconcile net loss before noncontrolling interest to net cash used in operating activities: | |

| Depreciation expense | 67 | | | 69 | |

| Loss from G42 Promissory Note early redemption | 313 | | | — | |

| Non-cash interest income | (100) | | | (200) | |

| Interest expense | — | | | 9 | |

| Share-based compensation expense | 1,175 | | | 981 | |

| Change in fair value of investments | (3,044) | | | 2,998 | |

| Impairment of investments in Anteris Bio, Inc. | 4,245 | | | — | |

| Change in fair value of warrants, related party | (406) | | | (221) | |

| Changes in assets and liabilities: | |

| Accounts receivable | 173 | | | — | |

| Prepaid expenses and other assets | 665 | | | 853 | |

| Accounts payable and accrued expenses | 2,270 | | | (1,417) | |

| Contract liabilities | — | | | 6,769 | |

| Net cash used in operating activities | (16,167) | | | (9,142) | |

| Cash flows from investing activities: | |

| Purchases of property and equipment | — | | | (21) | |

| Net cash used in investing activities | — | | | (21) | |

| Cash flows from financing activities: | Cash flows from financing activities: | |

| Proceeds from G42 Promissory Note early redemption related to sale of Class A common stock to collaboration partner | 12,030 | | | — | |

| Proceeds from sale of Class A common stock to collaboration partner, net of offering costs | — | | | 5,040 | |

| Proceeds from sale of Class A common stock and warrants, net of offering costs | — | | | 5,746 | |

| | Proceeds from debt issuance | 566 | | | 776 | |

| Cash flows from financing activities: | |

| | Cash flows from financing activities: | |

| Proceeds from sale of Class A common stock and pre-funded warrants, net of offering costs | |

| Proceeds from sale of Class A common stock and pre-funded warrants, net of offering costs | |

| Proceeds from sale of Class A common stock and pre-funded warrants, net of offering costs | |

| Proceeds from promissory note early redemption related to sale of Class A common stock to collaboration partner | |

| | Repayment of notes payable | |

| Repayment of notes payable | |

| Repayment of notes payable | Repayment of notes payable | (317) | | | (475) | |

| Net cash provided by financing activities | Net cash provided by financing activities | 12,279 | | | 11,087 | |

| Net (decrease) increase in cash and cash equivalents | (3,888) | | | 1,924 | |

| Net increase in cash and cash equivalents | |

| Total cash and cash equivalents, beginning of period | Total cash and cash equivalents, beginning of period | 12,126 | | | 13,415 | |

| Total cash and cash equivalents, end of period | Total cash and cash equivalents, end of period | $ | 8,238 | | | $ | 15,339 | |

| | Non-cash activities: | Non-cash activities: | |

| Non-cash activities: | |

| Non-cash activities: | |

| Change in redemption value of noncontrolling interest | Change in redemption value of noncontrolling interest | $ | (1,104) | | | $ | 3,809 | |

| Notes receivable recorded at fair value from collaboration partner | — | | | 11,891 | |

| Notes receivable for common stock from CinRx purchase agreement | $ | — | | | $ | 4,000 | |

| Change in redemption value of noncontrolling interest | |

| Change in redemption value of noncontrolling interest | |

| Reclassification of noncontrolling interest to additional paid-in capital | |

|

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

vTv Therapeutics Inc.

Notes to Condensed Consolidated Financial Statements – Unaudited

(dollar amounts are in thousands, unless otherwise noted)

Note 1: Description of Business and Basis of Presentation and Going Concern

Description of Business

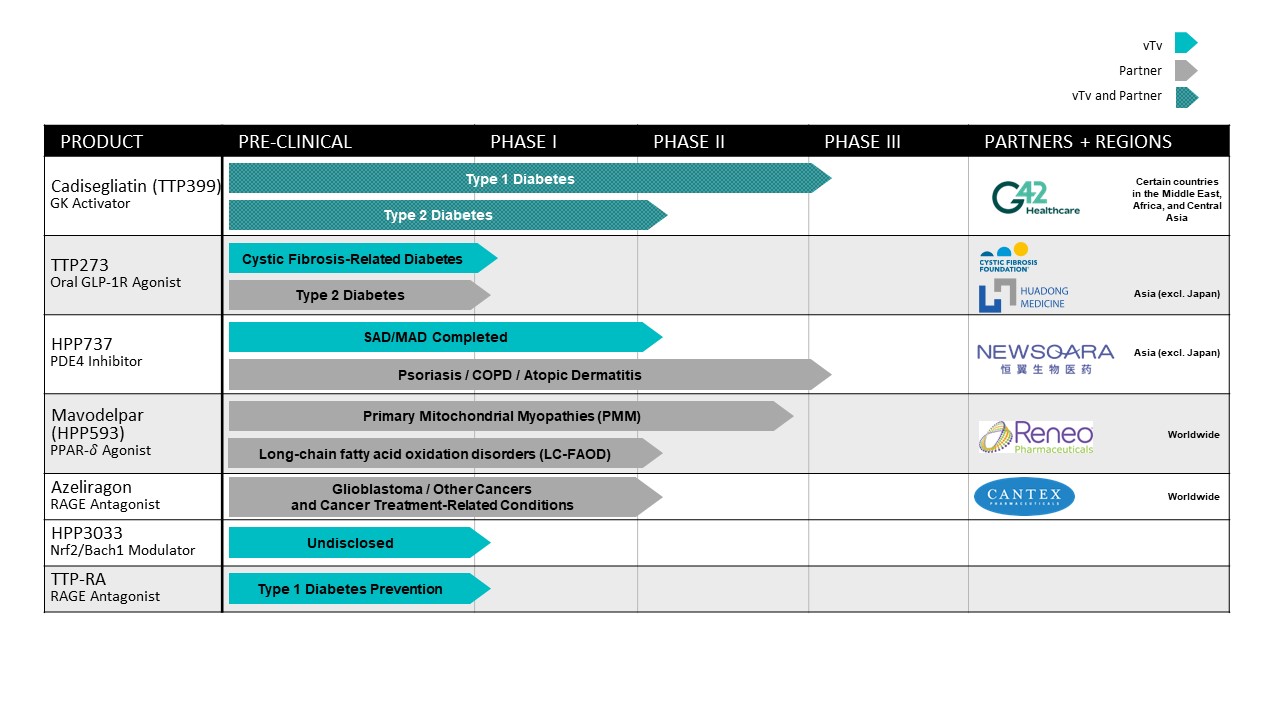

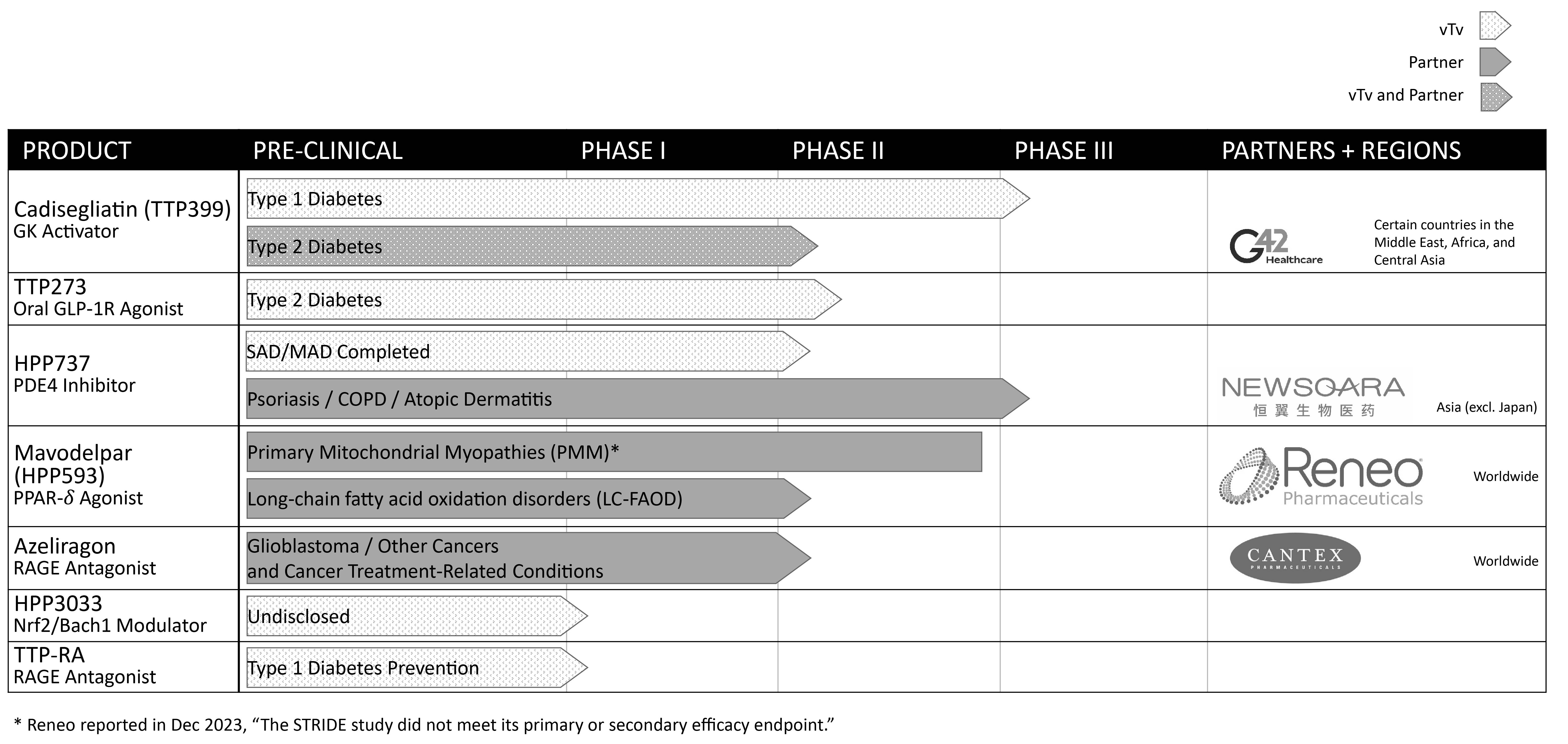

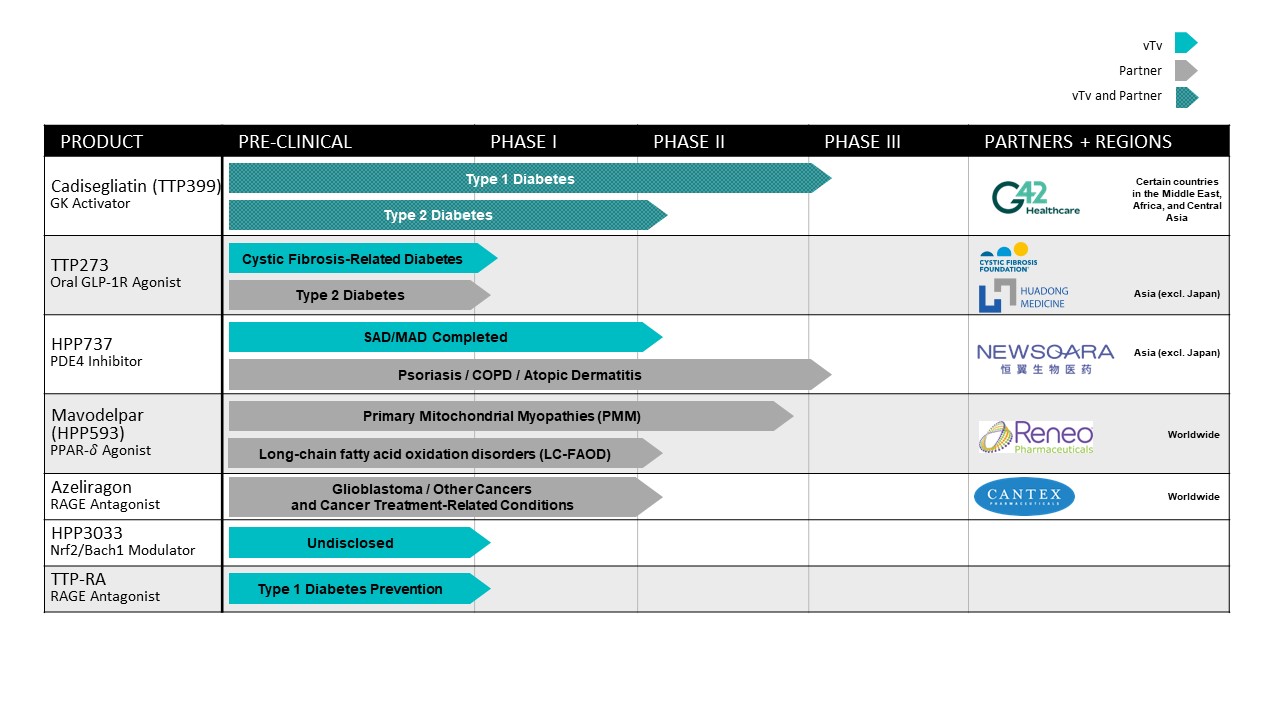

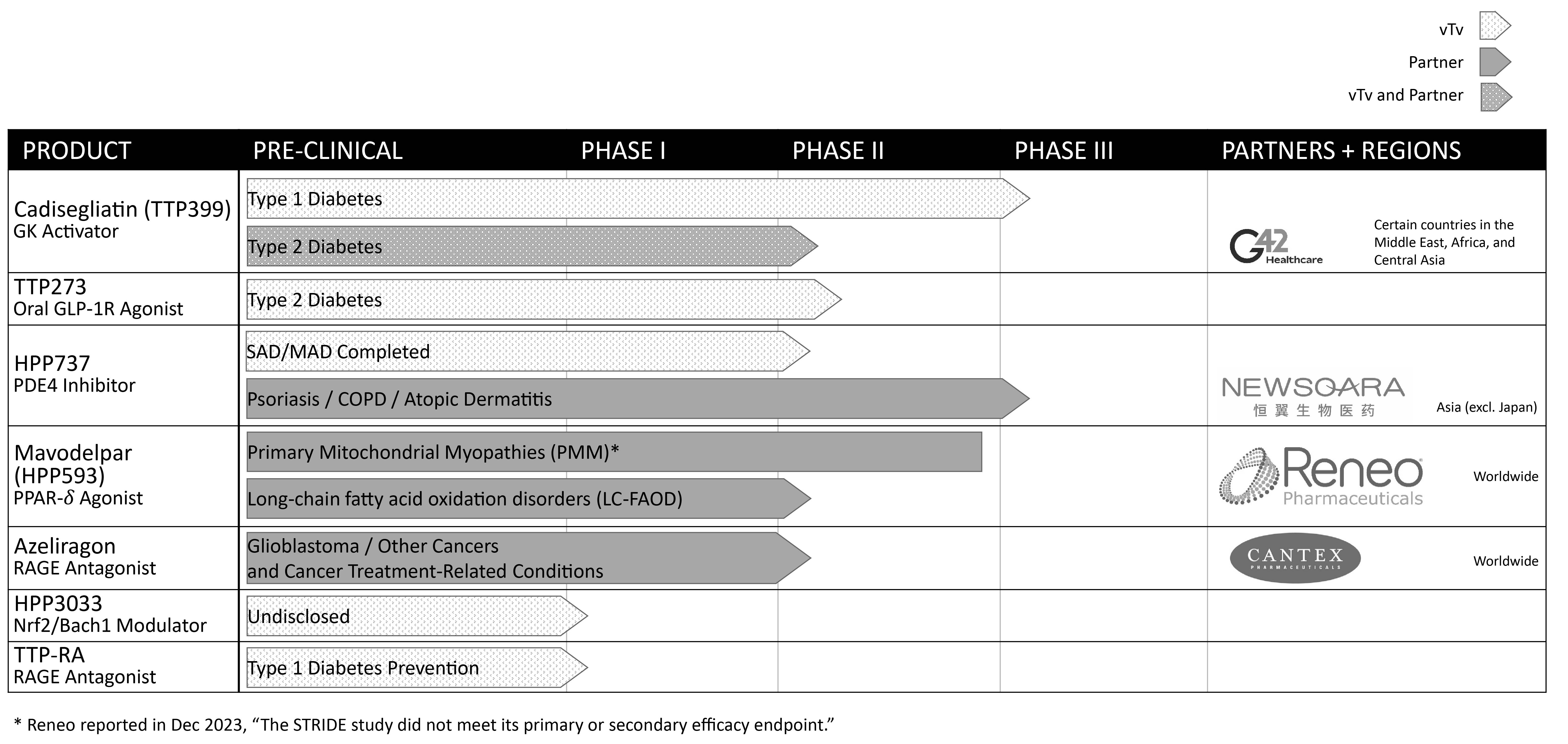

vTv Therapeutics Inc. (the “Company,” the “Registrant,” “we” or “us”) was incorporated in the state of Delaware in April 2015. The Company is a clinical stage pharmaceutical company focused on treating metabolic and inflammatory diseases to minimize their long-term complications and improve the lives of patients.through end-organ protection.

Principles of Consolidation

vTv Therapeutics Inc. is a holding company, and its principal asset is a controlling equity interest in vTv Therapeutics LLC (“vTv LLC”), the Company’s principal operating subsidiary, which is a clinical stage pharmaceutical company engaged in the discovery and development of orally administered small molecule drug candidates to fill significant unmet medical needs.

The Company has determined that vTv LLC is a variable-interest entity (“VIE”) for accounting purposes and that vTv Therapeutics Inc. is the primary beneficiary of vTv LLC because (through its managing member interest in vTv LLC and the fact that the senior management of vTv Therapeutics Inc. is also the senior management of vTv LLC) it has the power and benefits to direct all of the activities of vTv LLC, which include those that most significantly impact vTv LLC’s economic performance. vTv Therapeutics Inc. has therefore consolidated vTv LLC’s results pursuant to Accounting Standards Codification Topic 810, “Consolidation” in its Condensed Consolidated Financial Statements. The assets and liabilities of vTv LLC represent substantially all of the Company's consolidated assets and liabilities with the exception of the Warrants.

Various holders own nonvotingnon-voting interests in vTv LLC, representing a 22.1%19.2% economic interest in vTv LLC, effectively restricting vTv Therapeutics Inc.’s interest to 77.9%80.8% of vTv LLC’s economic results, subject to increase in the future, should vTv Therapeutics Inc. purchase additional nonvotingnon-voting common units (“vTv Units”) of vTv LLC, or should the holders of vTv Units decide to exchange such units (together with shares of the Company’s Class B common stock, par value $0.01 (“Class B common stock”)) for shares of Class A common stock (or cash) pursuant to the Exchange Agreement (as defined in Note 9)8). vTv Therapeutics Inc. has provided financial and other support to vTv LLC in the form of its purchase of vTv Units with the net proceeds of the Company’s initial public offering (“IPO”) in 2015, its registered direct offering in March 2019, and its agreeing to be a co-borrower under the Venture Loan and Security Agreement (the “Loan Agreement”) with Horizon Technology Finance Corporation and Silicon Valley Bank (together, the “Lenders”) which was entered into in 2016. vTv Therapeutics Inc. entered into the letter agreements with MacAndrews and Forbes Group LLC (“M&F Group”), a related party and an affiliate of MacAndrews & Forbes Incorporated (together with its affiliates “MacAndrews”) in December 2017, July 2018, December 2018, March 2019, September 2019, and December 2019 (each a “Letter Agreement” and collectively, the “Letter Agreements”). In addition, vTv Therapeutics Inc. also entered into the Controlled Equity OfferingSM Sales Agreement (the “Sales Agreement”) with Cantor Fitzgerald & Co. (“Cantor Fitzgerald”) (the “ATM Offering”), the purchase agreement with Lincoln Park Capital Fund, LLC (“Lincoln Park”) (the “LPC Purchase Agreement”), thea common stock purchase agreement with G42 Investments AI Holding RSC Ltd (“G42 Investments”) (the “G42 Purchase Agreement”) and, the common stock and warrant purchase agreement with CinPax, LLC and CinRx, LLC, respectively (the “CinRx Purchase Agreement”). In addition vTv Therapeutics Inc also entered into a Securities Purchase Agreement with Private Placement Investors and the sales agreement with Cowen and Company, LLC (“TD Cowen”) (“TD Cowen Sales Agreement”). vTv Therapeutics Inc. will not be required to provide financial or other support for vTv LLC. However, vTv Therapeutics Inc. will control its business and other activities through its managing member interest in vTv LLC, and its management is the management of vTv LLC. Nevertheless, because vTv Therapeutics Inc. will have no material assets other than its interests in vTv LLC, any financial difficulties at vTv LLC could result in vTv Therapeutics Inc. recognizing a loss.

Going Concern and Liquidity

To date, the Company has not generated any product revenue and has not achieved profitable operations. The continuing development of our drug candidates will require additional financing. From its inception through September 30, 2023,March 31, 2024, the Company has funded its operations primarily through a combination of private placements of common and preferred equity, research collaboration agreements, upfront and milestone payments for license agreements, debt and equity financings and the completion of its IPO in August 2015. As of September 30, 2023,March 31, 2024, the Company had an accumulated deficit of $281.2$286.1 million and has generated net losses in each year of its existence.

As of September 30, 2023,March 31, 2024, the Company’s liquidity sources included cash and cash equivalents of $8.2$52.3 million.

Based on our current operating plan, we believe that our current cash and cash equivalents will allow us to meet our liquidity requirements for at least the next twelve months.

On February 27, 2024, we entered into a securities purchase agreement (the “Securities Purchase Agreement”) with certain institutional accredited investors (the “Private Placement Investors”), pursuant to which we agreed to issue and sell to the first quarterPrivate Placement Investors in a private placement (the “Private Placement”) (i) an aggregate of 2024. To meet464,377 shares (the “Private Placement Shares”) of our future funding requirementsClass A common stock, at a purchase price of $11.81 per share, and (ii) pre-funded warrants (the “Private Placement Pre-Funded Warrants”) to purchase up to an aggregate of 3,853,997 shares of our Class A common stock (the “Private Placement Warrant Shares”) at a purchase price of $11.80 per Private Placement Pre-Funded Warrant (representing the $11.81 per Private Placement Share purchase price less the exercise price of $0.01 per Private Placement Warrant Share). We received aggregate gross proceeds from the Private Placement of approximately $51.0 million, before deducting offering expenses payable by us. The Private Placement Pre-Funded Warrants are exercisable at any time after their original issuance and will not expire.

On March 5, 2024, the Company entered into a letter agreement with the third quarter of 2024, including

funding the ongoing and future clinical trials of cadisegliatin (TTP399), we are evaluating several financing strategies, including direct equity investments and the potential licensing and monetization of other Company programs.

The Company may also use its remaining availability of $37.3 million under its Sales Agreement with Cantor FitzgeraldPrivate Placement Investors pursuant to which the Private Placement Investors agreed to exchange an aggregate of 116,493 Private Placement Shares for an aggregate of 116,590 Private Placement Pre-Funded Warrants.

On February 28, 2024, we entered into a sales agreement (the “TD Cowen Sales Agreement”) with Cowen and Company, LLC (“TD Cowen”), pursuant to which we may offer and sell, from time to time, through or to TD Cowen, as sales agent or principal, shares of the Company’sour Class A common stock, and the abilityhaving an aggregate offering price of up to $50.0 million (the “TD Cowen ATM Offering”). Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell an additional 9,437,376 shares of Class A common stock under the LPC Purchase Agreement basedsecurities registered on the remaining numberregistration statement relating to the TD Cowen ATM Offering with a value exceeding more than one-third of registered shares. However,our public float in any 12-month period so long as our public float remains below $75.0 million. Under the ability to use these sourcesterms of capital is dependent onthe TD Cowen Sales Agreement, we will pay TD Cowen a numbercommission of factors, including3.0% of the prevailing market priceaggregate proceeds from the sale of shares and the volume of trading in the Company’s Class A common stock. See Note 9 for further details.

If we are unable to raise additional capital as and when needed,reimburse certain legal fees or upon acceptable terms, such failure would have a significant negative impact on our financial condition. As such, these conditions raise substantial doubt about the Company’s ability to continue as a going concern.

The Company’s financial statements have been prepared assuming the Company will continue as a going concern, which contemplates, among other things, the realization of assets and satisfaction of liabilities in the normal course of business. The Condensed Consolidated Financial Statements do not include adjustments to reflect the possible future effects on the recoverability and classification of recorded assets or the amounts of liabilities that might be necessary should the Company be unable to continue as a going concern.disbursements.

Note 2: Summary of Significant Accounting Policies

Unaudited Interim Financial Information

The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The accompanying Condensed Consolidated Balance Sheet as of September 30, 2023,March 31, 2024, Condensed Consolidated Statements of Operations for the three and nine months ended September 30,March 31, 2024 and 2023, and 2022, Condensed Consolidated Statement of Changes in Redeemable Noncontrolling Interest and Stockholders’ DeficitEquity (Deficit) for the three and nine months ended September 30,March 31, 2024 and 2023 and 2022 and Condensed Consolidated Statements of Cash Flows for the ninethree months ended September 30,March 31, 2024 and 2023 and 2022 are unaudited. These unaudited financial statements have been prepared in accordance with the rules and regulations of the United States Securities and Exchange Commission (“SEC”) for interim financial information. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. These financial statements should be read in conjunction with the audited financial statements and the accompanying notes for the year ended December 31, 2022,2023, contained in the Company’s Annual Report on Form 10-K. The unaudited interim financial statements have been prepared on the same basis as the annual financial statements and, in the opinion of management, reflect all adjustments (consisting of normal recurring adjustments) necessary to state fairly the Company’s financial position as of September 30, 2023,March 31, 2024, the results of operations for the three and nine months ended September 30,March 31, 2024 and 2023 and 2022 and cash flows for the ninethree months ended September 30, 2023March 31, 2024 and 2022.2023. The December 31, 20222023 Condensed Consolidated Balance Sheet included herein was derived from the audited financial statements but does not include all disclosures or notes required by GAAP for complete financial statements.

The financial data and other information disclosed in these notes to the financial statements related to the three and nine months ended September 30,March 31, 2024 and 2023 and 2022 are unaudited. Interim results are not necessarily indicative of results for an entire year.

The Company does not have any components of other comprehensive income recorded within its Condensed Consolidated Financial Statements, and, therefore, does not separately present a statement of comprehensive income in its Condensed Consolidated Financial Statements.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

On an ongoing basis, the Company evaluates its estimates, including those related to the grant date fair value of equity awards, the fair value of warrants to purchase shares of its Class A common stock, the fair value of its Class B common stock, the useful lives of property and equipment and the fair value of the Company’s debt, among others. The Company bases its estimates on historical experience and on various other assumptions that it believes to be reasonable, the results of which form the basis for making judgments about the carrying value of assets and liabilities.

Concentration of Credit Risk

Financial instruments that potentially expose the Company to concentrations of credit risk consist principally of cash on deposit with onemultiple financial institution.institutions. The balance of the cash account frequently exceedexceeds insured limits. The associated risk of concentration for cash and cash equivalents is mitigated by transferring a majority of our cash to a AAA rated money market account with a creditworthy institution.

One hundred percent (100%)customer represented 100% of the revenue earned during the ninethree months ended September 30, 2022 was attributable from the satisfaction of a development milestone from the First Huadong Amendment (as defined herein).March 31, 2024. The Company did not have any revenue during the three months ended September 30, 2022. The Company did not have any revenue during the three and nine months ended September 30,March 31, 2023.

Cash and Cash Equivalents

The Company considers any highly liquid investments with an original maturity of three months or less to be cash and cash equivalents.

Investments

Investments in entities in which the Company has no control or significant influence, is not the primary beneficiary, and have a readily determinable fair value are classified as equity investments with readily determinable fair value. The investments are measured at fair value based on a quoted market price per unit in active markets multiplied by the number of units held without consideration of transaction costs (Level 1). Gains and losses are recorded in other income (expense), net on the Condensed Consolidated Statements of Operations.

Equity investments without readily determinable fair value include ownership rights that do not provide the Company with control or significant influence and these investments do not have readily determinable fair values. The Company has elected to measure its equity investments without readily determinable fair values at cost minus impairment, if any, plus or minus changes resulting from observable price changes in orderly transactions for the identical or similar investment.

Revenue Recognition

The Company uses the revenue recognition guidance established by ASC 606, Revenue From Contracts With Customers (“ASC 606”). When an agreement falls under the scope of other standards, such as ASC 808, Collaborative Arrangements (“ASC 808”), the Company will apply the recognition, measurement, presentation, and disclosure guidance in ASC 606 to the performance obligations in the agreements if those performance obligations are with a customer. Revenue recognized by analogizing to ASC 606, is recorded as collaboration revenue on the statements of operations.

The majority of the Company’s revenue results from its license and collaboration agreements associated with the development of investigational drug products. The Company accounts for a contract when it has approval and commitment from both parties, the rights of the parties are identified, payment terms are identified, the contract has commercial substance and collectability of consideration is probable. For each contract meeting these criteria, the Company identifies the performance obligations included within the contract. A performance obligation is a promise in a contract to transfer a distinct good or service to the customer. The Company then recognizes revenue under each contract as the related performance obligations are satisfied. The Company will recognize collaboration revenue under ASC 808 as a stand-ready obligation under ASC 606 over time based on the estimated period of performance.

The transaction price under the contract is determined based on the value of the consideration expected to be received in exchange for the transferred assets or services. Development, regulatory and sales milestones included in the Company’s collaboration agreements are considered to be variable consideration. The amount of variable consideration expected to be received is included in the transaction price when it becomes probable that the milestone will be met. For contracts with multiple performance obligations, the contract’s transaction price is allocated to each performance obligation using the Company’s best estimate of the standalone selling price of each distinct good or service in the contract. The primary method used to estimate standalone selling price is the expected cost plus margin approach. Revenue is recognized over the related period over which the Company expects the services to be provided using a proportional performance model or a straight-line method of recognition if there is no discernible pattern over which the services will be provided.

Research and Development

Major components of research and development costs include cash compensation, depreciation expense on research and development property and equipment, costs of preclinical studies, clinical trials and related clinical manufacturing, costs

of drug development, costs of materials and supplies, facilities cost, overhead costs, regulatory and compliance costs, and fees paid to consultants and other entities that conduct certain research and development activities on the Company’s behalf. Research and development costs are expensed as incurred.

The Company records accruals based on estimates of the services received, efforts expended and amounts owed pursuant to contracts with numerous contract research and manufacturing organizations. In the normal course of business, the Company contracts with third parties to perform various clinical study activities in the ongoing development of potential products. The financial terms of these agreements are subject to negotiation and variation from contract to contract and may result in uneven payment flows. Payments under the contracts depend on factors such as the achievement of certain events and the completion of portions of the clinical study or similar conditions. The objective of the Company’s accrual policy is to match the recording of expenses in its financial statements to the actual services received and efforts expended. As such, expense accruals related to clinical studies are recognized based on the Company’s estimate of the degree of completion of the event or events specified in the specific clinical study.

The Company records nonrefundable advance payments it makes for future research and development activities as prepaid expenses. Prepaid expenses are recognized as expensesexpense in the Condensed Consolidated Statements of Operations as the Company receives the related goods or services.

Research and development costs that are reimbursed under a cost-sharing arrangement are reflected as a reduction of research and development expense.

Recently Issued Accounting Pronouncements Not Yet Adopted

Fair Value Measurements:Segment Reporting: In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): “Improvements to Reportable Segment Disclosures” In June 2022,(ASU 2023-07). The ASU expands public entities' segment disclosures by requiring disclosures of significant segment expenses that are regularly provided to the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2022-03 Fair Value Measurements (Topic 820): Fair Value MeasurementCODM and included within each reported measure of Equity Securities Subject to Contractual Sale Restrictions. These amendments clarify thatsegment profit or loss, an amount and description of its composition for other segment items, and interim disclosures of a contractual restrictionreportable segment's profit or loss and assets. Early adoption is permitted. Since the Company only has one segment, the Company does not expect an impact when adopting this ASU on the saleCompany's Consolidated Financial Statements and disclosures.

Income Taxes: In December 2023, the FASB issued ASU 2023-09: “Improvements to Income Tax Disclosures” (“ASU 2023-09”). The ASU is intended to enhance the transparency and decision usefulness of an equity security is not considered part ofincome tax disclosures. The amendments in the unit of account ofASU address investor requests for enhanced income tax information primarily through changes to the equity securityrate reconciliation and therefore, is not considered in measuring fair value. This guidance isincome taxes paid information. ASU 2023-09 will be effective for public business entities for fiscal years, including interim periods within those fiscal years,us in the annual period beginning after December 15, 2023. EarlyJanuary 1, 2025, though early adoption is permitted. The Company has assessedis currently evaluating the presentational effect that ASU 2022-03 and early adopted the guidance during the second quarter of 2022. The adoption did not2023-09 will have a material impact on the Company's Condensed Consolidated Financial Statements.Statements and disclosures, and we expect considerable changes to our income tax disclosures.

Note 3: Collaboration Agreements

G42 Purchase Agreement and Cogna Collaborative and License Agreement

The Company and G42 Investments AI Holding RSC Ltd, a private limited company (“G42 Investments”), entered into a Common Stock Purchase Agreement (the “G42 Purchase Agreement”) on May 31, 2022,, pursuant to which the Company sold to G42 Investments 10,386,274259,657 shares of the Company’s Class A common stock at a price per share of approximately $2.41,$96.40, for an aggregate purchase price of $25.0 million, which was paid (i) $12.5 million in cash at the closing and (ii) $12.5 million in the form of a promissory note of G42 Investments to be paid at May 31, 2023 (the “G42 Promissory Note”). As part of the G42 Purchase Agreement, G42 Investments nominated a director as appointee and the Company’s board of directors approved appointing the new director to the Company’s board. On February 28, 2023, the Company and G42 Investments amended the G42 Purchase Agreement and modified the G42 Promissory Note to accelerate the payment due under the note. Pursuant to the amendment, on February 28, 2023, the Company received $12.0 million, which reflected the original amount due under the G42 Promissory Note less a 3.75% discount, in full satisfaction of the note, resulting in a loss of $0.3 million and was recognized as a component of other income/(expense)income, net in the Company’s Condensed Consolidated Statements of Operations.

G42 Investments has agreed to certain transfer restrictions (including restrictions on short sales or similar transactions) and restrictions on further acquisitions of shares, in each case subject to specified exceptions. Following the expiration of a lock up period, from the period May 31, 2022 until December 31, 2024 (or if earlier, the date of receipt of U.S. Food and Drug Administration (“FDA”) approval in the U.S. for cadisegliatin (TTP399), the Company has granted to G42 Investments

certain shelf and piggyback registration rights with respect to those shares of Class A common stock issued to G42 Investments pursuant to the G42 Purchase Agreement, including the ability to conduct an underwritten offering to resell such shares under certain circumstances. The registration rights include customary cooperation, cut-back, expense reimbursement, and indemnification provisions.

Contemporaneously with the G42 Purchase Agreement, effective on May 31, 2022, the Company entered into a collaboration and license agreement (the “Cogna Agreement”) with Cogna Technology Solutions LLC, an affiliate of G42 Investments (“Cogna”), which requires Cogna to work with the Company in performing clinical trials for cadisegliatin

(TTP399)TTP399) as well as jointly creating a global development plan to develop, market, and commercialize cadisegliatin (TTP399) in certain countries in the Middle East, Africa, and Central Asia (the “Partner Territory”). Under the terms of the Cogna Agreement, Cogna will obtain a license under certain intellectual property controlled by the Company to enable it to fulfill its obligations and exercise its rights under the Cogna agreement, including to develop and commercializcommercialize e cadisegliatin (TTP399) in the Partner Territory, but will not have access to the various intellectual property (“IP”) related to the license and cadisegliatin (TTP399). Specifically, the Company will share various protocols with Cogna related to conducting the clinical trials and will provide the patient dosages and placebo of cadisegliatin (TTP399) needed to conduct the trials.

Under the Cogna Agreement, Cogna has the right to develop and commercialize the cadisegliatin (TTP399) in the Partner Territory at its own cost once restrictions on the use of the IP have been lifted by the Company. The Cogna Agreement determined which specific countries in the Partner Territory that Cogna may pursue development and commercialization and provides the Company with the ability to determine when Cogna can benefit from this IP through the powers granted to the Company to approve the global development plan. Further, the Company may supply at cost, or Cogna may manufacture, cadisegliatin (TTP399) for commercial sale under terms to be agreed upon by the parties at a later date.

Separately, the Company will conduct its clinical trials for cadisegliatin (TTP399) outside of the Partner Territory at its own cost. The results of each party’s clinical trials will be combined by the Company to seek FDA approval in the United States for cadisegliatin (TTP399). On December 21, 2022, G42 Healthcare Technology Solutions LLC (formerly known as Cogna Technology Solutions LLC) novated its rights and obligation under the Cogna agreement to G42 Healthcare Research Technology Projects LLC (“G42 Healthcare”), an affiliate of G42 Investments. As a result of the novation, all reference to Cogna herein shall be deemed to refer to G42 Healthcare.

The G42 Purchase Agreement also provides for, following the receipt of FDA approval ofthe cadisegliatin (TTP399),FDA Approval, at the option of G42 Investments, either (a) the issuance of the Company’s Class A common stock (the “Milestone Shares”) having an aggregate value equal to $30.0 million or (b) the payment by the Company of $30.0 million in cash (the “Milestone Cash Payment”). The issuance of the Milestone Shares or the payment of the Milestone Cash Payment, as applicable, is conditioned upon receipt of the cadisegliatin FDA approvalApproval and subject to certain limitations and conditions set forth in the G42 Purchase Agreement. There can be no assurance that the cadisegliatinFDA approvalApproval will be granted or as to the timing thereof.

Once commercialization takes place in the Partner Territory, the Company will receive royalties in the single digits from Cogna on the net sales of cadisegliatin (TTP399) for a period of at least ten years after the first commercial sale of cadisegliatin (TTP399) in the Partner Territory.

Common stock is generally recorded at fair value at the date of issuance. In determining the fair value of the Class A common stock issued to G42 Investments, the Company considered the closing price of the common stock on the effective date. The Company did not make an adjustment to the fair value for sale restrictions on the stock in accordance with guidance recently adopted in ASU 2022-03. See the “Recently Issued Accounting Guidance” in this quarterly report on Form 10-Q for details of the ASU. Accordingly, the Company determined that cash consideration of $5.7 million should be recorded as fair value of the Class A common stock at the effective date, utilizing the Class A common stock closing price of $0.55$22.04 at the effective date.

A premium was paid on the Class A common stock by G42 Investments of $18.7 million, net of a note receivable discount of $0.6 million. This premium is determined to be the transaction price for all remaining obligations under the agreements, which will be accounted for under ASC 808 or ASC 606 based on determination of the unit of account.

The Company determined that certain commitments under the agreements are in the scope of ASC 808 as both the Company and Cogna are active participants in the clinical trials of cadisegliatin (TTP399), and both are exposed to significant risks and rewards based on the success of the clinical trials and subsequent FDA approval. Cogna is determined to be a vendor of the Company during the clinical trial phase, working on the Company’s behalf to complete R&Dresearch and development activities, and not in a customer capacity. The Company accounted for the commitments related to the clinical trials, which includes transfer of trial protocols, supply of clinical trial dosages, and collaboration on the joint development committee (“JDC”) as an ASC 808 unit of account, applying the recognition and measurement principles of ASC 606 by analogy. The Company

will recognize collaboration revenue for its development activities under ASC 808 over time based on the estimated period of performance.

By applying the principals in ASC 606 by analogy, the Company identified the performance obligation and considered the timing of satisfaction of the obligation to account for the pattern of revenue recognition. In order to recognize collaboration revenue, generally, the Company would begin satisfying its performance obligation and Cogna would need to be able to use and benefit from delivery of the assets or services. The performance obligation under the agreements that fall within the ASC 808 unit of account are concentrated in the clinical trials. As of September 30, 2023,March 31, 2024, the clinical trials had not

commenced. Accordingly, no collaboration revenue was recognized for the ASC 808 unit of account during the three and nine months ended September 30, 2023.March 31, 2024.

The Company identified certain commitments that are in the scope of ASC 606 as Cogna’s relationship is that of a customer for these commitments. The significant performance obligations that are in the scope of ASC 606 are (1) the development, commercialization and manufacturing license of the IP once restrictions on the use of the IP have been lifted by the Company and (2) a potential material right to a commercial supply agreement. The Company will recognize revenue from the development, commercial and manufacturing license at a point in time when the Company releases the restrictions on the use of the IP, which is expected to be after cadisegliatin (TTP399) is approved by the FDA. The Company will recognize revenue from the material right related to Cogna’s ability to purchase the commercial supply at cost as Cogna purchases the commercial supply from the Company, which will occur after the completion of the initial clinical trials (if Cogna decides to purchase the clinical supply from the Company). As a result, the Company has not recognized any revenue under the ASC 606 unit of account during the three and nine months ended September 30, 2023.March 31, 2024.

On February 28, 2023, the Company and G42 Investments amended the G42 Purchase Agreement and modified the G42 Promissory Note to accelerate the payment due under the note. Pursuant to the amendment, on February 28, 2023, the Company received $12.0 million, which reflected the original amount due under the G42 Promissory Note less a 3.75% discount, in full satisfaction of the note, resulting in a loss of $0.3 million and was recognized as a component of other income/(expense)income,net in the Company’s Condensed Consolidated Statements of Operations. The G42 Promissory Note receivable was classified and accounted for under ASC 310 “ReceivablesReceivables“ (“ASC 310”) and was initially measured at its fair value of $11.9 million. The Company also recorded the $18.7 million as deferred revenue in the Condensed Consolidated Balance Sheets, as none of the underlying performance obligations had been satisfied as of and for the three and nine months ended September 30, 2023.March 31, 2024.

HuadongNewsoara License Agreement

The Company is party to a license agreement with Hangzhou Zhongmei Huadong PharmaceuticalNewsoara Biopharma Co., Ltd., (“Huadong”Newsoara”) (the “Huadong“Newsoara License Agreement”), under which HuadongNewsoara obtained an exclusive and sublicensable license to develop and commercialize the Company’s glucagon-like peptide-1 receptor agonistphosphodiesterase type 4 inhibitors (“GLP-1r”PDE4”) program, including the compound TTP273HPP737, for therapeutic uses in humans or animals, in China, Hong Kong, Macau, Taiwan and certain other Pacific Rimpacific rim countries including Australia and South Korea (collectively, the “Huadong“Newsoara License Territory”). Additionally, under the HuadongNewsoara License Agreement, the Company obtained a nonexclusive,non-exclusive, sublicensable, royalty-free license to develop and commercialize certain HuadongNewsoara patent rights and know-how related to the Company’s GLP-1rPDE4 program for therapeutic uses in humans or animals outside of the HuadongNewsoara License Territory.

On January 14, 2021, theThe Company entered into the first amendment to the Huadong License Agreement ( the “First Huadong Amendment”) which eliminated the Company’s obligation to sponsor a multi-region clinical trial (the “Phase 2 MRCT”), and corresponding obligation to contribute up to $3.0 million in support of such trial. The amendment also reduced the total potential development and regulatory milestone payments by $3.0 million.

Prior to the First Amendment, the Company hadhas fully allocated a portion of the transaction price to the obligation to sponsor and conduct a portion of the Phase 2 MRCT. Upon the removal of this performance obligation, the Company evaluated the impact of the modification under the provisions of ASC 606 and performed a reallocation of the transaction price among the remaining performance obligations. The majority of the transaction price originally allocated to the Phase 2 MRCT performance obligation was reallocated to the license and technology transfer services combined performance obligation discussed below, which had already been completed. The reallocation of the purchase price in connection with the First Huadong Amendment was made based on the relative estimated selling prices of the remaining performance obligations.

The significant performance obligations under the Huadong License Agreement, as amended, were determined to be (i) the exclusive license to develop and commercialize the Company’s GLP-1r program, (ii) technology transfer services related to the chemistry and manufacturing know-how for a defined period after the effective date, (iii) the Company’s obligation to participate on a joint development committee (the “JDC”), and (iv) other obligations considered to be immaterial in nature.

The Company has determined that the license and technology transfer services related to the chemistry and manufacturing know-how represent a combined performance obligation because they were not capable of being distinct on their own. The Company also determined that there was no discernible pattern in which the technology transfer services would be provided during the transfer service period. As such, the Company recognized the revenue related to this combined performance obligation using the straight-line method over the transfer service period. In the first quarter of 2022, the transaction price for this performance obligation was increased by $2.0 million due to the satisfaction of a development milestone under the license agreement. This amount was fully recognized as revenue during the nine months ended

September 30, 2022 as the related performance obligation was fully satisfied. No revenue related to this combined performance obligation was recognized during the nine months ended September 30, 2023.

A portion of the transaction price allocated to the obligation to participate in the JDC to oversee the development of products and the Phase 2 MRCT in accordance with the development plan remained deferred as of September 30, 2023, and revenue will be recognized using the proportional performance model over the period of the Company’s participation on the JDC. The unrecognized amount of the transaction price allocated to this performance obligation as of September 30, 2023 was immaterial. An immaterial amount of revenue for this performance obligation was recognized during the nine months ended September 30, 2022. No revenue for this performance obligation has been recognized during the nine months ended September 30, 2023.

Anteris License Agreement

On December 11, 2020, the Company entered into a license agreement with Anteris Bio, Inc. (“Anteris”) (the “Anteris License Agreement”), under which Anteris obtained a worldwide, exclusive and sublicensable license to develop and commercialize the Company’s Nrf2 activator, HPP971.

Under the terms of the Anteris License Agreement, Anteris paid the Company an initial license fee of $2.0 million. The Company is eligible to receive additional potential development, regulatory, and sales-based milestone payments totaling up to $151.0 million. Anteris is also obligated to pay vTv royalty payments at a double-digit rate based on annual net sales of licensed products. Such royalties will be payable on a licensed product-by-licensed product basis until the latest of expiration of the licensed patents covering a licensed product in a country, expiration of data exclusivity rights for a licensed product in a country, or a specified number of years after the first commercial sale of a licensed product in a country. As additional consideration, the Company received preferred stock representing a minority ownership interest in Anteris.

Pursuant to the terms of the Anteris License Agreement, the Company was required to provide technology transfer services for a 30 day period after the effective date. In accordance with ASC 606, the Company identified all of the performance obligations at the inception of the Anteris License Agreement. The significant obligations were determined to be the license and the technology transfer services. The Company has determined that the license and technology transfer services representwhich represents a single performance obligation because they were not capable of being distinct on their own. The transaction priceCompany recognized revenue for this performance obligation using the straight-line method over the transfer service period. The revenue for this performance obligation has been fully allocated torecognized as of March 31, 2024. In the first quarter of 2024, the transaction price for this combined performance obligation and consistedwas increased by $1.0 million due to the satisfaction of a development milestone under the $2.0 million initial license paymentNewsoara License Agreement. This amount was fully recognized as wellrevenue during the three months ended March 31, 2024, as the fair value of the equity interest received in Anteris of $4.2 million. Therelated performance obligation was fully satisfied. No revenue related to this performance obligation was fully recognized during the year ended December 31, 2020, as the technology transfer servicesand there were considered complete as of that date. No revenue was recognized relatedno changes to the Anteris License Agreementtransaction price during the three and nine months ended September 30, 2023 and 2022.

On September 25, 2023, Anteris notified the Company that it was terminating the Anteris License Agreement. Under the terms of the Anteris License Agreement, the termination would become effective ninety days following the receipt of notice, or December 24,March 31, 2023. The Company has begun the process of winding up the license, including obtaining all regulatory, manufacturing and other records generated by Anteris during the term of the Anteris License Agreement.

On October 16, 2023, the Company received a Section228(e) notice from Anteris. that the stockholders voted in favor of the dissolution of the Company and the adoption of a plan of Liquidation and Dissolution (“Plan of Dissolution”). (See Note 14).

Contract Liabilities

Contract liabilities related to the Company’s collaboration agreements consisted of the following (in thousands):

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| Current portion of contract liabilities | $ | 17 | | | $ | 17 | |

| Contract liabilities, net of current portion | 18,669 | | | 18,669 | |

| Total contract liabilities | $ | 18,686 | | | $ | 18,686 | |

Note 4: Share-Based Compensation

The Company has issued nonqualifiednon-qualified stock option awards to management, other key employees, consultants, and nonemployeenon-employee directors. These option awards generally vest ratably over a three-year period and the option awards expire after a term of ten years from the date of grant. As of September 30, 2023,March 31, 2024, the Company had total unrecognized stock-based compensation expense for its outstanding stock option awards of approximately $1.8$1.3 million, which is expected to be

recognized over a weighted average period of 2.22.1 years. The weighted average grant date fair value of options granted during the ninethree months ended September 30,March 31, 2023 and 2022 was $0.76 and $0.68$0.80 per option, respectively.option. There were no options granted during the three months ended March 31, 2024. The aggregate intrinsic value of the in-the-money awards outstanding at September 30, 2023March 31, 2024 was immaterial.de minimis.

On February 23, 2024, in connection with the Private Placement, several directors resigned as members of the Company’s Board of Directors, effective on the closing of the Private Placement. As a result of their resignations, 14,340 stock options to purchase shares of common stock were modified to increase the time period to exercise the options and 7,590 stock options to purchase shares of common stock were modified to accelerate vesting at the termination date. All the unvested options were modified to be fully vested as of the posting of the Private Placement which resulted in a reduction in their fair value. The Company incurred $0.1 million reduction in stock compensation expense for the modifications for the three months ended March 31, 2024.

The following table summarizes the activity related to the stock option awards for the ninethree months ended September 30, 2023:March 31, 2024:

| | | | | | | | | | | |

| Number of Shares | | Weighted

Average Exercise Price |

| Awards outstanding at December 31, 2022 | 8,418,571 | | | $ | 2.17 | |

| Granted | 1,176,868 | | | 0.87 | |

| Forfeited | (50,000) | | | 1.29 | |

| Awards outstanding at September 30, 2023 | 9,545,439 | | | $ | 2.01 | |

| Options exercisable at September 30, 2023 | 5,018,072 | | | $ | 3.04 | |

| Weighted average remaining contractual term | 6.6 Years | | |

| Options vested and expected to vest at September 30, 2023 | 8,188,444 | | | $ | 2.21 | |

| Weighted average remaining contractual term | 7.5 Years | | |

| | | | | | | | | | | |

| Number of Shares | | Weighted

Average Exercise Price |

| Awards outstanding at December 31, 2023 | 249,247 | | | $ | 77.53 | |

| | | |

| Forfeited | (625) | | | 28.80 | |

| Awards outstanding at March 31, 2024 | 248,622 | | | $ | 77.65 | |

| Options exercisable at March 31, 2024 | 163,336 | | | $ | 102.02 | |

| Weighted average remaining contractual term | 6.4 Years | | |

| Options vested and expected to vest at March 31, 2024 | 220,524 | | | $ | 83.88 | |

| Weighted average remaining contractual term | 7.0 Years | | |

Compensation expense related to the grants of stock options is included in research and development and general and administrative expense as follows (in thousands):

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Three Months Ended March 31, | |

| Three Months Ended March 31, | |

| Three Months Ended March 31, | |

| 2024 | |

| 2024 | |

| 2024 | |

| Research and development | |

| Research and development | |

| Research and development | Research and development | $ | 113 | | | $ | 109 | | | $ | 316 | | | $ | 289 | |

| General and administrative | General and administrative | 320 | | | 229 | | | 859 | | | 692 | |

| General and administrative | |

| General and administrative | |

| Total share-based compensation expense | Total share-based compensation expense | $ | 433 | | | $ | 338 | | | $ | 1,175 | | | $ | 981 | |

| Total share-based compensation expense | |

| Total share-based compensation expense | |

Note 5: Investments

In connection with the Reneo Pharmaceuticals, Inc. (“Reneo”) and Anteris License Agreements, the Company received equity ownership interests of less than 20% of the voting equity of the investees. Further, the Company does not have the ability to exercise significant influence over the investees. The investments are classified as long-term investments in the Company’s Condensed Consolidated Balance Sheets.

Reneo completed its initial public offering in April 2021. Prior to Reneo becoming a publicly traded company, the Company’s investment in Reneo did not have a readily determinable fair value and was measured at cost less impairment, adjusted for any changes in observable prices, under the measurement alternative. Subsequent to Reneo’s initial public offering, the Company’s investment in Reneo is considered to have a readily determinable fair value and, as such, is adjusted to its fair value each period with changes in fair value recognized as a component of net loss.

The Company’s investment in Anteris does not have a readily determinable fair value and is measured at cost less impairment, adjusted for any changes in observable prices.

The Company’s investments consist of the following:

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| Equity investment with readily determinable fair value: | | | |

| Reneo common stock | $ | 4,387 | | | $ | 1,343 | |

| | | |

| Equity investment without readily determinable fair values assessed under the measurement alternative: | | | |

| Anteris preferred stock | — | | | 4,245 | |

| Total | $ | 4,387 | | | $ | 5,588 | |

The Company recognized an unrealized gain on its investment in Reneo of $0.6 million and $3.0 million for the three and nine months ended September 30, 2023, respectively. The Company recognized an unrealized gain on its investment in Reneo of $0.4 million and an unrealized loss of $3.0 million for the three and nine months ended September 30, 2022,

respectively. These adjustments were recognized as a component of other income/(expense) in the Company’s Condensed Consolidated Statements of Operations.

On October 16, 2023, the Company received a Section228(e) notice from Anteris that the stockholders voted in favor of the dissolution of Anteris and the adoption of a plan of Liquidation and Dissolution (“Plan of Dissolution”). The Company determined the carrying value of this investment was not expected to be recoverable due to the Plan of Dissolution. As a result, the Company recorded a $4.2 million impairment charge during the three and nine months ended September 30, 2023.

On October 30, 2023, the Company entered into a Common Stock Repurchase Agreement (the “Repurchase Agreement”) with Reneo to purchase all of its common stock held by vTv LLC for total proceeds to vTv LLC of approximately $4.4 million.

Note 6:5: Commitments and Contingencies

Legal Matters

From time to time, the Company is involved in various legal proceedings arising in the normal course of business. If a specific contingent liability is determined to be probable and can be reasonably estimated, the Company accrues and discloses the amount. The Company is not currently a party to any material legal proceedings.

Novo Nordisk