UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒

Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Quarterly Period Ended June 30, 2020March 31, 2021

☐

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period fromto

Commission File Number: : 001-39070

MONOPAR THERAPEUTICS INC.

(Exact name of registrant as specified in its charter)

| DELAWARE | | 32-0463781 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. employer identification number) |

| 1000 Skokie Blvd., Suite 350, Wilmette, IL | | 60091 |

| (Address of principal executive offices) | | (zip code) |

(847) 388-0349

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value | | MNPR | | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐☒ | | Smaller reporting company | ☒ |

| | | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The number of shares outstanding with respect to each of the classes of our common stock, as of July 31, 2020,April 30, 2021, is set forth below:

| | Number of shares outstanding | |

Common Stock, par value $0.001 per share | 10,736,396

| 12,569,933 | |

| | | |

MONOPAR THERAPEUTICS INC.

TABLE OF CONTENTS

| | | | |

| Page |

| | | | | | |

|

| | | | | | | 2

3 |

| | | | | | | 2

3 |

| | | | | | | 3 4 |

| | | | | | | 4

5 |

| | | | | | | 5 7 |

| | | | | | | 6 8 |

| | | | | | | 19

20 |

| | | | | | | 30

33 |

| | | | | | | |

| | | | | | |

| | | | | | | 31

34 |

| | | | | | | 32

35 |

| | | | | | | |

| | | | | | | |

| | | | | | 33

36 |

| | | | | | | |

Forward-Looking Statements

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Act”) and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts included in this Quarterly Report on Form 10-Q are forward-looking statements. The words “hopes,” “believes,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “expects,” “intends,” “may,” “could,” “should,” “would,” “will,” “continue,” and similar expressions are intended to identify forward-looking statements. The following uncertainties and factors, among others, could affect future performance and cause actual results to differ materially from those matters expressed in or implied by forward-looking statements:

●

our ability to raise sufficient funds by mid-2021in the next 12 months in order for us to startcomplete the Phase 3 portion of our Validive Phase 2b/3 clinical trial and thereafter in orderif required complete a smaller second confirmatory Phase 3 clinical trial, to completecontinue the trial, support furtherclinical development of camsirubicin in and beyond the Phase 2dose escalation run-in clinical trial, to support further development of potential radio-immuno-therapeutics to treat severe COVID-19 (patients with SARS-CoV-2 infection), to support further development of MNPR-101 and related compounds and generally to support our current and any future product candidates through completion of clinical trials, approval processes and, if applicable, commercialization;commercialization;

●

our ability to find a suitable pharmaceutical partner to further our development efforts, if we are unable to raise sufficient additional financing;

●

risks and uncertainties associated with our research and development activities, including our clinical trials;

●

estimated timeframes for our clinical trials and regulatory reviews for approval to market products;

●

plans to research, develop, gain approval and commercialize our current and future product candidates;

●

the rate and degree of market acceptance and the competitive clinical efficacy and safety of any products for which we receive marketing approval;

●

the difficulties of commercialization, marketing and product manufacturing capabilities and overall strategy;

●

uncertainties of intellectual property position and strategy;

●

challengingdelivering strong future financial performance;

●

the risks inherent in our estimates regarding expenses, capital requirements and need for additional financing;

●

the uncertain impact of government laws and regulations;

●

our ability to attract and retain key personnel;

●

the risks inherent in our estimates regarding expenses, capital requirements and the availability of additional financing;

●

the impact of government laws and regulations including increased governmental control of healthcare;

●

the uncertain impact of the COVID-19 pandemic on our ability to advance our clinical programs and raise additional financing; and

●

uncertainty of financial and operational projections.

Although we believe that the expectations reflected in such forward-looking statements are appropriate, we can give no assurance that such expectations will be realized. Cautionary statements are disclosed in this Quarterly Report on Form 10-Q. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements. We undertake no obligation to update any statements made in this Quarterly Report on Form 10-Q or elsewhere, including without limitation any forward-looking statements, except as required by law.

Any forward-looking statements in this Quarterly Report on Form 10-Q reflect our current views with respect to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected in this information.

Risks Associated With Our Business

Our business is subject to numerous risks and uncertainties, including those highlighted in “Item 1A - Risk Factors” of our Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 25, 2021. These risks include, among others, the following:

●

We are a clinical stage biopharmaceutical company with a history of financial losses. We expect to continue to incur significant losses for the foreseeable future and may never achieve or maintain cash self-sufficiency or profitability, which could result in a decline in the market value of our common stock.

●

Funds raised to-date are not sufficient to 1) complete our Validive Phase 2b/3 ("VOICE") clinical program, including, if required, completing a smaller second Phase 3 confirmatory clinical trial; 2) continue the clinical development of camsirubicin beyond the dose escalation run-in clinical trial; or 3) to support continued development of MNPR-101 and related compounds. If we are unable to raise enough funds in the next 12 months from the sale of our common stock or other financing efforts, we will have to consider strategic options such as out-licensing Validive or other product candidates, entering into a clinical or commercial partnership, or terminating one or more programs. There can be no assurance that we can find a suitable partner on satisfactory terms.

●

We have a limited operating history, no revenues from operations, and are dependent upon raising capital to continue our drug development programs.

●

We do not have and may never have any approved products on the market. Our business is highly dependent upon receiving approvals from various U.S. and international governmental agencies and will be severely harmed if we are not granted approval to manufacture and sell our product candidates.

●

Our clinical trials may not yield sufficiently conclusive results for regulatory agencies to approve the use of our products, which will adversely affect our financial condition.

●

If we experience delays or difficulties in the enrollment of subjects in clinical trials, our receipt of necessary regulatory approvals will be delayed or prevented, which will materially delay our program schedules and adversely affect our financial condition.

●

We rely on third parties to conduct our drug product manufacturing, non-clinical studies, and our clinical trials. If these third parties do not or cannot successfully carry out their contractual duties or meet expected deadlines or performance goals, the initiation or conduct of our clinical trials may be delayed and we may be unable to obtain regulatory approval for, or commercialize, our current product candidates or any future products, and our financial condition will be adversely affected.

●

We face significant competition from other biotechnology and pharmaceutical companies, in targeted medical indications, and our operating results will suffer if we fail to compete effectively. Competition and technological change may make our product candidates obsolete or non-competitive.

●

The termination of third-party licenses will adversely affect our rights to important compounds or technologies.

●

If we and our third-party licensors do not obtain and preserve protection for our respective intellectual property rights, our competitors may be able to develop competing drugs, which will adversely affect our financial condition.

●

If we lose key management leadership, and/or scientific personnel, and if we cannot recruit qualified employees or other significant personnel for future personnel requirements, we may experience program delays and increased compensation and operational costs, and our business will be materially disrupted.

●

The COVID-19 pandemic could have a substantial negative impact on our business, financial condition, operating results, stock price and ability raise additional funds.

PART I

Item 1. Financial Statements

Monopar Therapeutics Inc.

Condensed Consolidated

Balance Sheets

(Unaudited)

| | | | | |

| Assets | | |

| Current assets: | | |

| Cash and cash equivalents | $12,546,189 | $13,213,929 | $25,723,113 | $16,737,109 |

| Other current assets | 183,416 | 15,711 | 114,569 | 62,690 |

| Total current assets | 12,729,605 | 13,229,640 | 25,837,682 | 16,799,799 |

| | | |

| Other non-current assets | 73,050 | 122,381 | 68,858 |

| Total assets | $12,802,655 | $13,352,021 | $25,906,540 | $16,868,657 |

| Liabilities and Stockholders’ Equity | | |

| Liabilities and Stockholders' Equity | | |

| Current liabilities: | | |

| Accounts payable, accrued expenses and other current liabilities | $525,748 | $724,165 | $806,272 | $1,176,666 |

| Current portion of bank loan | 47,379 | — | |

| Total current liabilities | 573,127 | 724,165 | |

| Total current liabilities and total liabilities | | 806,272 | 1,176,666 |

| | | |

| Long-term liabilities: | | |

| Non-current portion of bank loan | 75,021 | — | |

| Total long-term liabilities | 75,021 | — | |

| Total liabilities | 648,148 | 724,165 | |

| Commitments and contingencies (Note 6) | | |

| Stockholders’ equity: | | |

| Common stock, par value of $0.001 per share, 40,000,000 authorized, 10,735,973 and 10,587,632 shares issued and outstanding at June 30, 2020 and December 31, 2019, respectively | 10,736 | 10,587 | |

| Common stock, par value of $0.001 per share, 40,000,000 shares authorized, 12,569,933 and 11,453,465 shares issued and outstanding at March 31, 2021 and December 31, 2020, respectively | | 12,570 | 11,453 |

| Additional paid-in capital | 40,572,598 | 38,508,825 | 59,161,975 | 47,873,570 |

| Accumulated other comprehensive loss | (11,554) | (10,970) | (5,099) | (7,873) |

| Accumulated deficit | (28,417,273) | (25,880,586) | (34,069,178) | (32,185,159) |

| Total stockholders' equity | 12,154,507 | 12,627,856 | 25,100,268 | 15,691,991 |

| Total liabilities and stockholders’ equity | $12,802,655 | $13,352,021 | |

| Total liabilities and stockholders' equity | | $25,906,540 | $16,868,657 |

* Derived from the Company’s audited consolidated financial statements.

The accompanying notes are an integral

part of these condensed consolidated financial statements.

Monopar Therapeutics Inc.

Statements of Operations and Comprehensive Loss

(Unaudited)

| | Three Months Ended June 30, | Six Months Ended June 30, |

| | | | | |

| Operating expenses: | | | | |

| Research and development | $832,503 | $329,294 | $1,176,910 | $1,164,894 |

| General and administrative | 631,629 | 602,815 | 1,423,236 | 1,174,524 |

| Total operating expenses | 1,464,132 | 932,109 | 2,600,146 | 2,339,418 |

| Loss from operations | (1,464,132) | (932,109) | (2,600,146) | (2,339,418) |

| Other income: | | | | |

| Interest income, net | 18,322 | 26,409 | 63,459 | 57,483 |

| Net loss | (1,445,810) | (905,700) | (2,536,687) | (2,281,935) |

| Other comprehensive income: | | | | |

| Foreign currency translation gain (loss) | 3,457 | 1,067 | (584) | (1,060) |

| Comprehensive loss | $(1,442,353) | $(904,633) | $(2,537,271) | $(2,282,995) |

| Net loss per share: | | | | |

| Basic and diluted | $(0.14) | $(0.10) | $(0.24) | $(0.25) |

| Weighted average shares outstanding: | | | | |

| Basic and diluted | 10,648,285 | 9,291,421 | 10,628,635 | 9,291,421 |

The accompanying notes are an integral

part of these condensed consolidated financial statements.

Monopar Therapeutics Inc.

Statements of Operations and Comprehensive Loss

(Unaudited)

| | For the Three Months Ended March 31, |

| | | |

| Operating expenses: | | |

| Research and development | $1,206,779 | $344,407 |

| General and administrative | 687,936 | 791,607 |

| Total operating expenses | 1,894,715 | 1,136,014 |

| Loss from operations | (1,894,715) | (1,136,014) |

| Other income: | | |

| Interest income | 10,696 | 45,137 |

| Net loss | (1,884,019) | (1,090,877) |

| Other comprehensive income (loss): | | |

| Foreign currency translation gain (loss) | 2,774 | (4,041) |

| Comprehensive loss | $(1,881,245) | $(1,094,918) |

| Net loss per share: | | |

| Basic and diluted | $(0.16) | $(0.10) |

| Weighted average shares outstanding: | | |

| Basic and diluted | 12,139,422 | 10,608,199 |

The accompanying notes are an integral

part of these condensed consolidated financial statements.

Monopar Therapeutics Inc. Condensed Consolidated Statements of Stockholders’ Equity

Three Months Ended March 31, 2020

(Unaudited)

| | | | | | |

| | | | | | | Total Stockholders' Equity |

| Balance at January 1, 2019 | 9,291,421 | $9,291 | $28,567,221 | $(2,396) | $(21,655,712) | $6,918,404 |

| Stock-based compensation (non-cash) | — | — | 233,776 | — | — | 233,776 |

| Net loss | — | — | — | — | (1,376,235) | (1,376,235) |

| Accumulated other comprehensive loss | — | — | — | (2,127) | — | (2,127) |

| Balance at March 31, 2019 | 9,291,421 | 9,291 | 28,800,997 | (4,523) | (23,031,947) | 5,773,818 |

| Stock-based compensation (non-cash) | — | — | 257,633 | — | — | 257,633 |

| Net loss | — | — | — | — | (905,700) | (905,700) |

| Accumulated other comprehensive gain | — | — | — | 1,067 | — | 1,067 |

| Balance at June 30, 2019 | 9,291,421 | $9,291 | $29,058,630 | $(3,456) | $(23,937,647) | $5,126,818 |

| | | | | | | | |

| | | | | | | Total Stockholders' Equity | | | Additional Paid-in Capital | Accumulated Other Comprehensive Loss | | Total Stockholders' Equity |

| Balance at January 1, 2020 | 10,587,632 | $10,587 | $38,508,825 | $(10,970) | $(25,880,586) | $12,627,856 | 10,587,632 | $10,587 | $38,508,825 | $(10,970) | $(25,880,586) | $12,627,856 |

Issuance of common stock under a Capital on DemandTM Sales Agreement with

JonesTrading Institutional Services LLC, net of commissions and fees of $16,284 | 33,903 | 34 | 526,109 | — | — | 526,143 | |

Issuance of common stock under a Capital on DemandTM Sales Agreement with JonesTrading Institutional Services LLC, net in commissions and fees of $16,284 | | 33,903 | 34 | 526,109 | — | 526,143 |

Issuance of common stock to non-employee directors pursuant to vested restricted stock units | 1,288 | 1 | (1) | — | — | — | 1,288 | 1 | (1) | — |

| Stock-based compensation (non-cash) | — | 338,497 | — | — | 338,497 | — | 338,497 | — | 338,497 |

| Offering costs | — | (2,161) | — | — | (2,161) | — | (2,161) | — | | (2,161) |

| Net loss | — | — | (1,090,877) | (1,090,877) | — | (1,090,877) |

| Accumulated other comprehensive loss | — | (4,041) | — | (4,041) | — | (4,041) | — | (4,041) |

| Balance at March 31, 2020 | 10,622,823 | 10,622 | 39,371,269 | (15,011) | (26,971,463) | 12,395,417 | 10,622,823 | $10,622 | $39,371,269 | $(15,011) | $(26,971,463) | $12,395,417 |

Issuance of common stock under a Capital on DemandTM Sales Agreement with

JonesTrading Institutional Services LLC, net of commissions and fees of $29,425 | 111,858 | 113 | 950,577 | — | — | 950,690 | |

Issuance of common stock to non-employee directors pursuant to vested restricted stock units | 1,292 | 1 | (1) | | — | — | |

| Stock-based compensation (non-cash) | — | 367,358 | — | — | 367,358 | |

| Offering costs | — | (116,605) | | | (116,605) | |

| Net loss | — | — | (1,445,810) | (1,445,810) | |

| Accumulated other comprehensive gain | — | 3,457 | — | 3,457 | |

| Balance at June 30, 2020 | 10,735,973 | $10,736 | $40,572,598 | $(11,554) | $(28,417,273) | $12,154,507 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Monopar Therapeutics Inc.

Condensed Consolidated Statements of Stockholders’ Equity

Three Months Ended March 31, 2021

(Unaudited)

| | | | | | |

| | | | Additional Paid-in Capital | Accumulated Other Comprehensive Loss | | Total Stockholders' Equity |

| Balance at January 1, 2021 | 11,453,465 | $11,453 | $47,873,570 | $(7,873) | $(32,185,159) | $15,691,991 |

Issuance of common stock under a Capital on DemandTM Sales Agreement with JonesTrading Institutional Services LLC, net of commissions and fees of $338,153 | 1,104,047 | 1,104 | 10,924,208 | — | — | 10,925,312 |

| Issuance of common stock to non-employee directors pursuant to vested restricted stock units | 3,004 | 3 | (3) | — | — | — |

| Issuance of common stock to employees pursuant to vested restricted stock units, net of taxes | 6,504 | 7 | (21,507) | — | — | (21,500) |

| Issuance of common stock upon exercise of stock options | 2,913 | 3 | 17,475 | — | — | 17,478 |

| Stock-based compensation (non-cash) | — | — | 368,232 | — | — | 368,232 |

| Net loss | — | — | — | — | (1,884,019) | (1,884,019) |

| Accumulated other comprehensive income | — | — | — | 2,774 | — | 2,774 |

| Balance at March 31, 2021 | 12,569,933 | $12,570 | $59,161,975 | $(5,099) | $(34,069,178) | $25,100,268 |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Monopar Therapeutics Inc.

Statements of Cash Flows

(Unaudited)

| | Six Months Ended June 30, |

| | | |

| Cash flows from operating activities: | | |

| Net loss | $(2,536,687) | $(2,281,935) |

| Adjustments to reconcile net loss to net cash used in operating activities: | | |

| Stock-based compensation expense (non-cash) | 705,855 | 491,409 |

| Changes in operating assets and liabilities, net | | |

| Other current assets | (122,258) | (13,902) |

| Accounts payable, accrued expenses and other current liabilities | (167,954) | 68,721 |

| Net cash used in operating activities | (2,121,044) | (1,735,707) |

| Cash flows from financing activities: | | |

Cash proceeds from the sales of common stock under a Capital on DemandTM Sales Agreement with JonesTrading Institutional Services LLC, net of cash commissions and fees of $43,999 | 1,421,569 | — |

| Offering costs | (89,521) | (26,177) |

| PPP forgivable bank loan | 122,400 | — |

| Net cash provided by (used in) financing activities | 1,454,448 | (26,177) |

| Effect of exchange rates | (1,144) | (1,060) |

| Net decrease in cash and cash equivalents | (667,740) | (1,762,944) |

| Cash and cash equivalents at beginning of period | 13,213,929 | 6,892,772 |

| Cash and cash equivalents at end of period | $12,546,189 | $5,129,828 |

| | For the Three Months Ended March 31, |

| | | |

| Cash flows from operating activities: | | |

| Net loss | $(1,884,019) | $(1,090,877) |

| Adjustments to reconcile net loss to net cash used in operating activities: | | |

| Stock-based compensation expense (non-cash) | 368,232 | 338,497 |

| Changes in operating assets and liabilities, net | | |

| Other current assets | (51,879) | (42,084) |

| Accounts payable, accrued expenses and other current liabilities | (370,394) | (331,106) |

| Net cash used in operating activities | (1,938,060) | (1,125,570) |

| Cash flows from financing activities: | | |

Cash proceeds from the sales of common stock under a Capital on DemandTM Sales Agreement with JonesTrading Institutional Services LLC, net of commissions, fees and offering costs of $338,153 and $34,384 for the three months ended March 31, 2021 and March 31, 2020, respectively | 10,925,312 | 508,044 |

| Taxes paid related to net share settlement of vested restricted stock units | (21,500) | — |

| Cash proceeds from the issuance of stock upon exercise of stock options | 17,478 | — |

| Net cash provided by financing activities | 10,921,290 | 508,044 |

| Effect of exchange rates | 2,774 | (4,041) |

| Net increase (decrease) in cash and cash equivalents | 8,986,004 | (621,567) |

| Cash and cash equivalents at beginning of period | 16,737,109 | 13,213,929 |

| Cash and cash equivalents at end of period | $25,723,113 | $12,592,362 |

The accompanying notes are an integral

part of these condensed consolidated financial statements.

MONOPAR THERAPEUTICS INC.

NOTES TOCONDENSED CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2020March 31, 2021

Note 1 - Nature of Business and Liquidity

Nature of Business

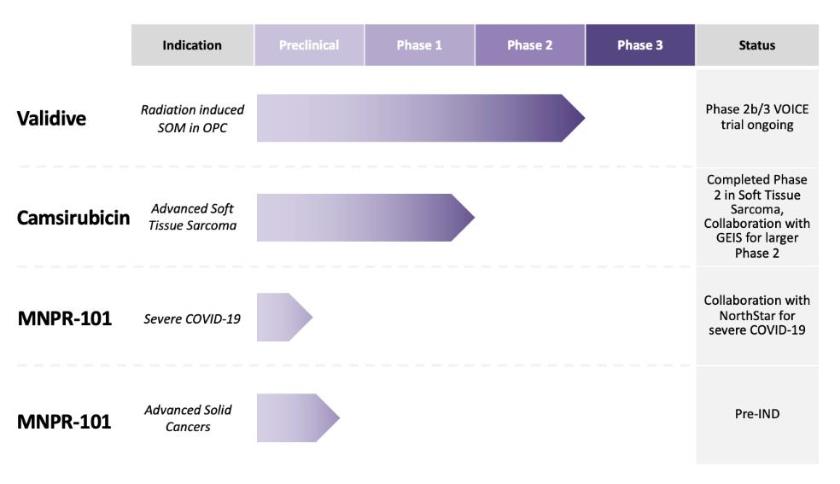

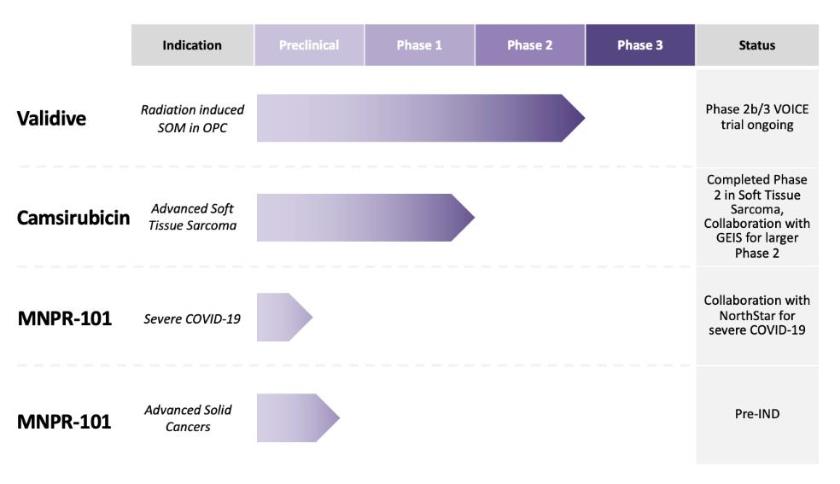

Monopar Therapeutics Inc. (“Monopar” or the “Company”) is a clinical-stage biopharmaceutical company primarily focused on developing proprietary therapeutics designed to extend life or improve quality of life for cancer patients. Monopar currently has three compounds in development: 1) Validive® (clonidine(clonidine mucobuccal tablet; clonidine MBT), a Phase 2b/3-ready,3 clinical stage, first-in-class mucoadhesive buccal tablet for the prevention and treatment of radiation induced severe oral mucositis (“SOM”) in oropharyngeal cancer patients; 2) camsirubicin (generic name for MNPR-201, GPX-150; 5-imino-13-deoxydoxorubicin), a proprietary Phase 2 clinical stage topoisomerase II-alpha selective novel analog of doxorubicin engineered specifically to retain anticancer activity while minimizing toxic effects on the heart; and 3) a preclinical stage uPAR targeted antibody, MNPR-101 and related compounds, for advanced cancers and severe COVID-19.

Liquidity

The Company has incurred an accumulated deficit of approximately $28.4$34.1 million as of June 30, 2020.March 31, 2021. To date, the Company has primarily funded its operations with the net proceeds from the Company’s initial public offering of its common stock on Nasdaq, private placements of convertible preferred stock and of common stock, from the cash provided in the camsirubicin asset purchase transaction, from sales of its common stock in the public market under a Capital on DemandTM Sales Agreement, private placements of convertible preferred stock and from a forgivable bank loan.of common stock and cash provided in the camsirubicin asset purchase transaction. Management believesestimates that currently available resourcescash will provide sufficient funds to enable the Company to meet its planned obligations past September 2021.at least through June 2022. The Company’s ability to fund its future operations, including the clinical development of Validive and camsirubicin, is dependent primarily upon its ability to execute its business strategy, to obtain additional funding and/or to execute collaborative research agreements. There can be no certainty that future financing or collaborative research agreements will occur.occur at a time needed to maintain operations, if at all.

In December 2019, a novel strain of coronavirus (“COVID-19”) surfaced in China and byspread to essentially all of the remaining world. By March 2020 COVID-19 was designated a global pandemic, resulting in government-mandated travel restrictions and temporary shut-downsshutdowns or limitations of non-essential businesses in many states in the United States.U.S. The Company is able to remain open but has allowed theirits employees to work from home, if required by local authorities. Due to the volatility of the stock markets resulting from travel restrictions and indeterminate but temporary business shut-downs, the Company faces challenges in raising substantial cash in the near-term. In response to the current COVID-19 pandemic and its effects on clinical trials, Monopar has modified the original adaptive design Phase 3 clinical trial for its lead product candidate, Validive, to be a Phase 2b/3 clinical trial (“VOICE”) to better fit the types of trials which can enroll patients in the current environment. This modification will allowallowed the Company to initiateactivate the VOICE clinical trial without requiring near-term financing. The decision to proceed toTo complete the VOICE clinical program, including, if required, completing a smaller second Phase 3 portion of the clinical trial without a delay will largely be dependent on the Company’s cash position closer to that time, anticipated to be in the second half of 2021. To initiate and complete the Phase 3 portion of theconfirmatory clinical trial, Monopar will require additional funding in the millions or tens of millions of dollars (depending on if the Company has consummated a collaboration or partnership or neither for Validive), which it is planning to pursue in the next 12 months. Due to many uncertainties, the Company is unable to estimate the pandemic’s financial impact or duration at this time, or its potential impact on the Company’s plannedcurrent clinical trials.trials including the pandemic’s effect on drug candidate manufacturing, shipping, patient recruitment at clinical sites and regulatory agencies around the globe.

Note 2 - Significant Accounting Policies

Basis of Presentation

These condensed consolidated financial statements include the financial results of Monopar Therapeutics Inc., its wholly-owned French subsidiary, Monopar Therapeutics, SARL, and its wholly-owned Australian subsidiary, Monopar Therapeutics Australia Pty Ltd and have been prepared in accordance with accounting

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2020

principles generally accepted in the United StatesU.S. (“GAAP”) and include all disclosures required by GAAP for interim financial reporting. All intercompany accounts have been eliminated. The principal accounting policies applied in the preparation of these condensed consolidated financial statements are set out below and have been consistently applied in all periods presented. The Company has been primarily involved in performing research activities, developing product candidates, and raising capital to support and expand these activities.

In the opinion of management, the

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2021

The accompanying unaudited condensed consolidated financial statements contain all normal, recurring adjustments necessary to present fairly the Company’s condensed consolidated financial position as of June 30, 2020March 31, 2021, and as of December 31, 2019, the Company’s condensed consolidated results of operations and comprehensive loss for the three and six months ended June 30, 2020 and 2019, and the Company’s condensed consolidated cash flows for the sixthree months ended June 30, 2020March 31, 2021 and 2019. 2020.

The condensed consolidated results of operations and comprehensive loss and condensed consolidated cash flows for the periods presented are not necessarily indicative of the consolidated results of operations or cash flows which may be reported for the remainder of 20202021 or for any future period. Certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted. The accompanying unaudited interim condensed consolidated financial statements should be read in conjunction with the audited financial statements and notes thereto for the year ended December 31, 2019,2020, included in the Company’s Annual Report on Form 10-K filed with the United StatesU.S. Securities and Exchange Commission (the “SEC”) on March 27, 2020.25, 2021.

Functional Currency

The Company's consolidated functional currency is the U.S. Dollar. The Company's Australian subsidiary and French subsidiary use the Australian Dollar and European Euro, respectively, as their functional currency. At each quarter-end, each foreign subsidiary's balance sheets are translated into U.S. Dollars based upon the quarter-end exchange rate, while their statements of operations and comprehensive loss and statements of cash flows are translated into U.S. Dollars based upon an average exchange rate during the period.

Comprehensive Loss

Comprehensive loss represents net loss plus any gains or losses not reported in the condensed consolidated statements of operations and comprehensive loss, such as foreign currency translations gains and losses that are typically reflected on the Company’s condensed consolidated statements of stockholders’ equity.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities, and reported amounts of revenues and expenses in the condensed consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

Going Concern Assessment

The Company applies Accounting Standards Codification 205-40 (“ASC 205-40”), Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern, which the Financial Accounting Standards Board (“FASB”) issued to provide guidance on determining when and how reporting companies must disclose going concern uncertainties in their financial statements. ASC 205-40 requires management to perform interim and annual assessments of an entity’s ability to continue as a going concern within one year of the date of issuance of the entity’s financial statements (or within one year after the date on which the financial statements are available to be issued, when applicable). Further, a company must provide certain disclosures if there is “substantial doubt about the entity’s ability to continue as a going concern.” In July 2020,April 2021, the Company analyzed its cash requirements through September 2021June 2022 and has determined that, based upon the Company’s current available cash, the Company has no substantial doubt about its ability to continue as a going concern.

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2020March 31, 2021

Cash Equivalents

The Company considers all highly liquid investments purchased with a maturity of 90 days or less on the date of purchase to be cash equivalents. Cash equivalents as of June 30,March 31, 2021 and December 31, 2020 and 2019 consisted of one money market account.

Deferred Offering Costs

Deferred offering costs represent legal, auditing, travel and filing fees related to fundraising efforts that have not yet been concluded.

Prepaid Expenses

Prepayments are expenditures for goods or services before the goods are used or the services are received and are charged to operations as the benefits are realized. Prepaid expenses may include payments to development collaborators in excess of actual expenses incurred by the collaborator, measured at the end of each reporting period. Prepayments also include insurance premiums, dues and subscriptions and software costs of $10,000 or more per year that are expensed monthly over the life of the contract.contract, which is typically one year. Prepaid expenses are reflected on the Company’s condensed consolidated balance sheets as other current assets.

Bank Loans

In May 2020, the Company applied for and received a bank loan pursuant to the Paycheck Protection Program (“PPP”) established pursuant to the Coronavirus Aid, Relief, and Economic Security Act, as administered by the U.S. Small Business Administration (“SBA”).

The SBA will forgive the bank loan pursuant to the PPP, if certain conditions are met, namely the bank loan must be used primarily for payroll during the 24-week period following receipt of the loan, without significant staffing reductions during that period. The Company believes it is eligible and intends to apply for loan forgiveness in August 2020 when the bank is able to process SBA loan forgiveness application. Should the bank loan not be forgiven, the Company would be required to pay 1% annual interest on the loan with principal and interest payments beginning approximately seven months after receipt of the loan with payments over 18 months. The Company has recorded the PPP loan on the balance sheet as of June 30, 2020 as current (due within 12 months) and non-current portions of bank loan.

Concentration of Credit Risk

Financial instruments that potentially subject the Company to concentration of credit risk consist of cash and cash equivalents. The Company maintains cash and cash equivalents at two reputable financial institutions. As of June 30, 2020,March 31, 2021, the balance at one financial institution was in excess of the $250,000 Federal Deposit Insurance Corporation (“FDIC”) insurable limit. The Company has not experienced any losses on its deposits since inception and management believes the Company is not exposed to significant risks with respect to these financial institutions.

Fair Value of Financial Instruments

For financial instruments consisting of cash and cash equivalents, accounts payable, accrued expenses, and other current liabilities, and bank loans, the carrying amounts are reasonable estimates of fair value due to their relatively short maturities.

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2020

The Company adopted ASC 820, Fair Value Measurements and Disclosures,, as amended, which addresses the measurement of the fair value of financial assets and financial liabilities. Under this standard, fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e., the “exit price”) in an orderly transaction between market participants at the measurement date.

The standard establishes a hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs reflect assumptions market participants would use in pricing an asset or liability based on market data obtained from independent sources. Unobservable inputs reflect a reporting entity’s pricing an asset or liability developed based on the best information available under the circumstances. The fair value hierarchy consists of the following three levels:

Level 1 - instrument valuations are obtained from real-time quotes for transactions in active exchange markets involving identical assets.

Level 2 - instrument valuations are obtained from readily available pricing sources for comparable instruments.

Level 3 - instrument valuations are obtained without observable market values and require a high-level of judgment to determine the fair value.

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2021

Determining which category an asset or liability falls within the hierarchy requires significant judgment. The Company evaluates its hierarchy disclosures each reporting period. There were no transfers between Level 1, 2 or 3 of the fair value hierarchy during the three and six months ended June 30, 2020March 31, 2021 and the year ended December 31, 2019.2020. The following table presents the assets and liabilities recorded that are reported at fair value on our condensed consolidated balance sheets on a recurring basis. No values were recorded in Level 2 or Level 3 at June 30, 2020March 31, 2021 and December 31, 2019.2020.

Assets and Liabilities Measured at Fair Value on a Recurring Basis

| June 30, 2020 | | | |

| March 31, 2021 | | | | |

| Assets | | | |

Cash equivalents(1) | $12,397,916 | | $25,430,341 |

| Total | $12,397,916 | | $25,430,341 |

| December 31, 2019 | | | |

| December 31, 2020 | | | | |

| Assets | | | |

Cash equivalents(1) | $13,083,536 | | $16,605,682 |

| Total | $13,083,536 | | $16,605,682 |

(1)

Cash equivalents represent the fair value of the Company’s investment in a money market account.

Net Loss per Share

Net loss per share for the three and six months ended June 30,March 31, 2021 and 2020 and 2019 is calculated by dividing net loss by the weighted-average shares of common stock outstanding during the period. Diluted net loss per share for the three and six months ended June 30,March 31, 2021 and 2020 and 2019 is calculated by dividing net loss by the weighted-average shares of the sum of a) weighted average common stock outstanding (10,648,285(12,139,422 and 10,628,63510,608,199 shares for the three and six months ended June 30,March 31, 2021 and 2020, respectively; 9,291,421 shares for the three and six months ended June 30, 2019)respectively) and b) potentially dilutive shares of common stock (such as stock options and restricted stock units) outstanding during the period. As of June 30,March 31, 2021 and 2020, and 2019, potentially dilutive securities included

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2020

stock-based awards to purchase up to 1,296,5731,600,215 and 1,105,8961,337,007 shares of the Company’s common stock, respectively. For the three and six months ended June 30,March 31, 2021 and 2020, and 2019, potentially dilutive securities are excluded from the computation of fully-dilutedfully diluted net loss per share as their effect is anti-dilutive.

Research and Development Expenses

Research and development (“R&D”) costs are expensed as incurred. Major components of R&D expenses include salaries and benefits paid to the Company’s R&D staff, fees paid to consultants and to the entities that conduct certain R&D activities on the Company’s behalf and materials and supplies which are used in R&D activities during the reporting period.

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2021

Clinical Trial Expense

The Company accrues and expenses the costs for clinical trial activities performed by third parties based upon estimates of the percentage of work completed over the life of the individual study in accordance with agreements established with contract research organizations, service providers, and clinical trial sites. The Company determines the estimates through discussions with internal clinical personnel and external service providers as to progress or stage of completion of trials or services and the agreed upon fee to be paid for such services. Costs of setting up clinical trial sites for participation in the trials are expensed immediately as R&D expenses. Clinical trial site costs related to patient screening and enrollment are accrued as patients are screened/entered into the trial. During the three and six months ended June 30, 2020 and 2019, the Company had no clinical trials in progress.

Collaborative Agreements

The Company and its collaborative partners are active participants in collaborative arrangementsagreements and all parties would be exposed to significant risks and rewards depending on the technical and commercial success of the activities. Contractual payments to the other parties in collaboration agreements and costs incurred by the Company when the Company is deemed to be the principal participant for a given transaction are recognized on a gross basis in R&D expenses. Royalties and license payments are recorded as earned.

During the three and six months ended June 30,March 31, 2021 and 2020, and 2019, no milestones were met and no royalties were earned, therefore, the Company did not pay or accrue/expense any license or royalty payments.

Licensing Agreements

The Company has various agreements licensing technology utilized in the development of its product or technology programs. The licenses contain success milestone obligations and royalties on future sales. During the three and six months ended June 30,March 31, 2021 and 2020, and 2019, no milestones were met and no royalties were earned, therefore, the Company did not pay or accrue/expense any license or royalty payments under any of its license agreements.

Patent Costs

The Company expenses costs relating to issued patents and patent applications, including costs relating to legal, renewal and application fees, as a component of general and administrative expenses in its condensed consolidated statements of operations and comprehensive loss.

Income Taxes

On December 16, 2015, the Company began using an asset and liability approach for accounting for deferred income taxes, which requires recognition of deferred income tax assets and liabilities for the expected future tax consequences of events that have been recognized in its financial statements but have not been reflected in its taxable income. Estimates and judgments are required in the calculation of certain tax liabilities and in the determination of the recoverability of certain deferred income tax assets, which arise from temporary differences and carryforwards. Deferred income tax assets and liabilities are measured using the currently enacted tax rates that apply to taxable income in effect for the years in which those tax assets and liabilities are expected to be realized or settled.

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2020March 31, 2021

The Company regularly assesses the likelihood that its deferred income tax assets will be realized from recoverable income taxes or recovered from future taxable income. To the extent that the Company believes any amounts are morenot “more likely than notnot” to be realized, the Company records a valuation allowance to reduce the deferred income tax assets. In the event the Company determines that all or part of the net deferred tax assets are not realizable in the future, an adjustment to the valuation allowance would be charged to earnings in the period such determination is made. Similarly, if the Company subsequently determines deferred income tax assets that were previously determined to be unrealizable are now realizable, the respective valuation allowance would be reversed, resulting in an adjustment to earnings in the period such determination is made.

Internal Revenue Code SectionSections 382 and 383 (“Section 382”Sections 382 and 383”) provides that, after an ownership change,limit the amountuse of a loss corporation’s net operating loss (“NOL”) for any post-change year that may be offset by pre-change losses shall not exceed the Section 382 limitation for that year.carryforwards and R&D credits, after an ownership change. To date, the Company has not conducted a Section 382 or 383 study, however, because the Company will continue to raise significant amounts of equity in the coming years, the Company expects that SectionSections 382 and 383 will limit the Company’s usage of NOLs and R&D credits in the future.

ASC 740, Income Taxes, requires that the tax benefit of net operating losses, temporary differences, and credit carryforwards be recorded as an asset to the extent that management assesses that realization is "more likely than not." Realization of the future tax benefits is dependent on the Company's ability to generate sufficient taxable income within the carryforward period. The Company has reviewed the positive and negative evidence relating to the realizability of the deferred tax assets and has concluded that the deferred tax assets are not more“more likely than notnot” to be realized with the exception of its U.S. Federal R&D tax credits which will be utilized to reduce payroll taxes in future periods.realized. As a result, the Company recorded a full valuation allowance as of June 30, 2020March 31, 2021 and December 31, 2019.2020. U.S. Federal R&D tax credits from 2016 to 2019 were utilized to reduce payroll taxes in future periods and were recorded as other current assets for amounts anticipated to be received within 12 months and other non-current assets for amounts anticipated to be received beyond 12 months on the Company’s condensed consolidated balance sheets. The Company intends to maintain the valuation allowance until sufficient evidence exists to support its reversal. The Company regularly reviews its tax positions. For a tax benefit to be recognized, the related tax position must be more“more likely than notnot” to be sustained upon examination. Any amount recognized is generally the largest benefit that is more“more likely than notnot” to be realized upon settlement. The Company’s policy is to recognize interest and penalties related to income tax matters as an income tax expense. For the three and six months ended June 30,March 31, 2021 and 2020, and 2019, the Company did not have any interest or penalties associated with unrecognized tax benefits.

The Company is subject to U.S. Federal, Illinois and California income taxes. In addition, the Company is subject to local tax laws of France and Australia. Tax regulations within each jurisdiction are subject to the interpretation of the related tax laws and regulations and require significant judgment to apply. The Company was incorporated on December 16, 2015 and is subject to U.S. Federal, state and local tax examinations by tax authorities for the tax years ended December 31, 2019, 2018, 2017 and 2016, and for the short tax period December 16, 2015 to December 31, 2015.through 2020. The Company does not anticipate significant changes to its current uncertain tax positions through June 30, 2020.March 31, 2021. The Company plans on filing its U.S. Federal and state tax returns for the year endingended December 31, 20192020 prior to the extended filing deadlines in all jurisdictions.

Stock-Based Compensation

The Company accounts for stock-based compensation arrangements with employees, non-employee directors and consultants using a fair value method, which requires the recognition of compensation expense for costs related to all stock-based awards, including stock option and restricted stock unit (“RSU”) grants. The fair value method requires the Company to estimate the fair value of stock-based payment awards on the date of grant using an option pricing model or the closing stock price on the date of grant in the case of RSUs.

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2020March 31, 2021

Stock-based compensation costsexpense for awards granted to employees, and non-employee directors and consultants are based on the fair value of the underlying instrument calculated using the Black-Scholes option-pricing model on the date of grant for stock options and using the closing stock price on the date of grant for RSUs and recognized as expense on a straight-line basis over the requisite service period, which is the vesting period. Determining the appropriate fair value model and related assumptions requires judgment, including estimating the future stock price volatility, forfeiture rates and expected terms. The expected volatility rates are estimated based on the actual volatility of comparable public companies over recent historical periods of the same length as the expected term. The Company selected these companies based on reasonably comparable characteristics, including market capitalization, stage of corporate development and with historical share price information sufficient to meet the expected term (life) of the stock-based awards. The expected term for options granted to date is estimated using the simplified method. Forfeitures are estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures differ from those estimates. The Company has not paid dividends and does not anticipate paying a cash dividend in the future vesting period and, accordingly, uses an expected dividend yield of zero. The risk-free interest rate is based on the rate of U.S. Treasury securities with maturities consistent with the estimated expected term of the awards. Prior to January 1, 2019, the measurement of consultant stock-based compensation was subject to periodic adjustments as the underlying equity instruments vested and was recognized as an expense over the period in which services were rendered. Since January 1, 2019, consultant stock-based compensation is valued on the grant date and is recognized as an expense over the period in which services are rendered.

Recent Accounting Pronouncements

In August 2018, the FASB issued Accounting Standards Updates (“ASU”) No. 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement. The ASU modifies, and in certain cases eliminates, the disclosure requirements on fair value measurements in Topic 820. The amendments in ASU No. 2018-13 are effective for all entities for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019. The Company adopted this ASU and has determined that it had no material effect on its condensed consolidated financial statements and footnote disclosures for the three and six months ended June 30, 2020.

Note 3 - Capital Stock

Holders of the common stock are entitled to receive such dividends as may be declared by the Board of Directors out of funds legally available therefor. Upon dissolution and liquidation of the Company, holders of the common stock are entitled to a ratable share of the net assets of the Company remaining after payments to creditors of the Company. The holders of shares of common stock are entitled to one vote per share for the election of each director nominated to the boardBoard and one vote per share on all other matters submitted to a vote of stockholders.

The Company’s amended and restated certificate of incorporation authorizes the Company to issue 40,000,000 shares of common stock with a par value of $0.001 per share.

Sales of Common Stock

On December 23, 2019, the Company closed the initial public offering of its common stock. The Company sold 1,277,778 shares of its common stock at a public offering price of $8.00 per share pursuant to an underwriting agreement with JonesTrading Institutional Services, LLC (“JonesTrading”). The Company paid JonesTrading a customary commission and reimbursement of a portion of their legal fees incurred in connection with the offering, which in aggregate totaled approximately $0.7 million. Net proceeds on a cash basis were approximately $9.4 million, after deducting underwriting discounts and accrued, unpaid offering expenses. The Company had incurred and paid prior to the initial public offering approximately $0.6 million of fundraising expenses which were capitalized on the Company’s balance sheet as deferred offering costs and were reclassified as offering expenses (a contra-equity balance sheet account) upon the closing of the Company’s initial public offering. After deducting previously paid offering expenses of approximately $0.6 million, the accrual basis net proceeds were $8.8 million as reported on the Company’s consolidated statement of stockholders’ equity as of December 31, 2019 included in the Company’s Annual Report on Form 10-K filed with the SEC on March 27, 2020. The Company’s common stock began trading on the Nasdaq Capital Market on December 19, 2019.

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2020

On January 13, 2020, the Company entered into a Capital on Demand™ Sales Agreement with JonesTrading, as sales agent, pursuant to which Monopar may offer and sell (at its discretion), from time to time, through or to JonesTrading shares of Monopar’s common stock, having an aggregate offering price of up to $19.7 million. Pursuant to this agreement, as of June 30,during the three months ended March 31, 2020, the Company sold 145,76133,903 shares of its common stock at an average gross price per share of $10.45$16.00 for net proceeds of $1,476,833,$508,043 after fees, commissions and offering costs of $34,384. Also pursuant to this agreement, during the three months ended March 31, 2021, the Company sold 1,104,047 shares of its common stock at an average gross price per share of $10.20 for net proceeds of $10,925,311 after fees and commissions of $45,709.$338,153. In aggregate pursuant to this agreement, the Company sold 1,964,724 shares of its common stock at an average gross price per share of $10.02 for net proceeds of $19,100,602, after fees and commissions of $591,188.

As of June 30, 2020,March 31, 2021, the Company had 10,735,97312,569,933 shares of common stock issued and outstanding.

Note 4 - Stock Incentive Plan

In April 2016, the Company’s Board of Directors and stockholders representing a majority of the Company’s outstanding stock at that time, approved the Monopar Therapeutics Inc. 2016 Stock Incentive Plan, as amended (the “Plan”), allowing the Company to grant up to an aggregate 700,000 shares of stock-based awards in the form of stock options, restricted stock units, stock appreciation rights and other stock-based awards to employees, non-employee directors and consultants. In October 2017, the Company’s Board of Directors voted to increase the stock award pool to 1,600,000 shares of common stock, which subsequently was approved by the Company’s stockholders. In April 2020, the Company’s Board of Directors voted to increase the stock award pool to 3,100,000 (and increase of 1,500,000 shares of common stock), which was approved by the Company’s stockholders in June 2020.

In January 2020, the Company's Plan Administrator Committee granted two new hire stock option grants and a consultant stock option grant to the Company’s acting chief medical office, in aggregate, for the purchase of 15,125 shares of the Company’s common stock with exercise prices ranging from $16.80 to $17.75. The stock options have a 10-year term and vest over 1 to 4 years.

In February 2020,

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2021

During the Company'sthree months ended March 31, 2021, the Company’s Plan Administrator Committee (with regards to non-officer employees)employees and consultants) and the Company'sCompany’s Compensation Committee, as ratified by the Board of Directors (in the case of executive officers and non-employee directors) granted an aggregate of 189,985 stock options with exercise prices ranging from $12.93 to $14.35 as annual equity grants to executive officers, non-officer employees, consultants and non-employee directors and staff. Allaggregate stock options have a 10-year term and vest over 1 to 4 years. The annual equity grants also included an aggregate 45,722 restricted stock units to executive officers, non-employee directors and staff which vest over 1 to 4 years.

In May 2020, the Company's Plan Administrator Committee granted stock option grants to a new hire and an employee, in aggregate, for the purchase of 4,000196,476 shares of the Company’s common stock with exercise prices ranging from $7.61$5.76 to $7.66.$9.67 which vest from one year to four years. All stock optionsoption grants have a 10-year termterm. In addition, an aggregate 124,374 restricted stock units were granted to executive officers, non-officer employees and non-employee directors which vest over 4one to four years.

Under the Plan, the per share exercise price for the shares to be issued upon exercise of an option shall be determined by the Plan Administrator, except that the per share exercise price shall be no less than 100% of the fair market value per share on the grant date. Fair market value is established by the Company’s Board of Directors, using third party valuation reports, recent private financings or the Company’s closing pricesprice on Nasdaq since the Company’s listing on December 19, 2019.Nasdaq. Stock options generally expire after 10 years.

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2020

Stock option activity under the Plan was as follows:

| | | Options Outstanding | |

| | | Number of Options | | Weighted-Average Exercise Price | Number of Shares Subject to Options | Weighted-Average Exercise Price |

| Balances at January 1, 2019 | | 1,105,896 | | $ 2.99 | |

| Balances at January 1, 2020 | | 1,087,463 | $ 2.94 |

| Granted | | — | | — | 174,357 | 14.08 |

| Forfeited | | — | | — | (3,243) | 8.47 |

| Balances at December 31, 2020 | | 1,258,577 | 4.47 |

Granted(1) | | 196,476 | 6.93 |

Forfeited(2) | | (3,344) | 17.25 |

| Exercised | | (18,433) | | 5.97 | (2,913) | 6.00 |

| Balances at December 31, 2019 | | 1,087,463 | | 2.94 | |

Granted(1) | | 209,110 | | 14.42 | |

| Forfeited | | — | | — | |

| Exercised | | — | | — | |

| Balances at June 30, 2020 | | 1,296,573 | | 4.79 | |

| Balances at March 31, 2021 | | 1,448,796 | 4.77 |

(1)

209,110196,476 options vest as follows: options to purchase up to 180,401168,704 shares of the Company’s common stock vest 6/48ths on the six-month anniversary of grant date and 1/48th per month thereafter; options to purchase up to 22,58417,772 shares of the Company’s common stock vest quarterly over one year; and options to purchase up to 6,12510,000 shares of the Company’s common stock vest monthly over one year. The exerciseExercise prices range from $5.76 to $9.67 per share of the 209,110 options are as follows: for 186,985 options $14.35; for 9,000 options $17.75; for 6,125 options $16.80; for 3,000 options $12.93; for 2,000 options $7.66 and for 2,000 options $7.61.share.

(2)

Forfeited options represent unvested shares and vested, expired shares related to employee terminations.

A summary of options outstanding as of June 30, 2020March 31, 2021 is shown below:

| Number of Shares Subject to Options Outstanding | Weighted-Average Remaining Contractual Term in Years | Number of Shares Subject to Options Fully Vested and Exercisable | Weighted-Average Remaining Contractual Term in Years | | Number of Shares Subject to Options Outstanding | | Weighted-Average Remaining Contractual Term in Years | | Number of Shares Subject to Options Fully Vested and Exercisable | | Weighted-Average Remaining Contractual Term in Years |

$0.00-$5.00 | 555,420 | 6.21 years | 509,500 | 6.17 years | |

$5.01-$10.00 | 536,043 | 8.02 years | 328,154 | 7.97 years | |

$10.01-$15.00 | 189,985 | 9.59 years | 32,218 | 9.59 years | |

$15.01-$20.00 | 15,125 | 9.55 years | 3,063 | 9.59 years | |

| $0.001-$5.00 | | | 557,420 | | 5.47 | | 555,670 | | 5.46 |

| $5.01-$10.00 | | | 732,519 | | 7.98 | | 400,390 | | 7.28 |

| $10.01-$15.00 | | | 146,732 | | 8.84 | | 74,428 | | 8.84 |

| $15.01-$20.00 | | | 12,125 | | 8.09 | | 8,583 | | 7.81 |

| | 1,296,573 | 7.49 years | 872,935 | 6.99 years | | 1,448,796 | | | | 1,039,071 | | |

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2020March 31, 2021

Restricted stock unit activity under the Plan was as follows:

| | | Weighted-Average Grant Date Fair Value per Unit | | Weighted-Average Grant Date Fair Value per Unit |

| Unvested balance at January 1, 2020 | — | $— | — | $ — |

| Granted | 45,722 | 12.93 | 45,722 | 12.93 |

| Vested | (2,580) | 12.93 | (5,156) | 12.93 |

| Forfeited | — | — | (500) | 12.93 |

| Unvested Balance at June 30, 2020 | 43,142 | 12.93 | |

| Unvested balance at January 1, 2021 | | 40,066 | 12.93 |

| Granted | | 124,374 | 6.81 |

| Vested | | (13,021) | 11.52 |

| Unvested Balance at March 31, 2021 | | 151,419 | 8.02 |

During the three months ended June 30, March 31, 2021 and 2020,and 2019, the Company recognized $248,889$246,343 and $164,600, respectively,$220,765 of employee and non-employee director stock-based compensation expense as general and administrative expenses, respectively, and $100,898$111,589 and $72,324, respectively,$100,171 as research and development expenses. During the six months ended June 30, 2020 and 2019, the Company recognized $469,655 and $315,326, respectively, of employee and non-employee director stock-based compensation expense as general and administrative expenses, and $201,069 and $134,665, respectively, as research and development expenses.respectively. The stock-based compensation expense is allocated on a departmental basis, based on the classification of the stock-based award holder. No income tax benefits have been recognized in the condensed consolidated statements of operations and comprehensive loss for stock-based compensation arrangements.

The Company recognizes as an expense the fair value of options granted to persons (currently consultants) who are neither employees nor non-employee directors. Stock-based compensation expense for consultants which waswere recorded as research and development expense for the three months ended June 30, March 31, 2021 and 2020 was $10,300 and 2019 was $17,571 and $20,708, and for the six months ended June 30, 2020 and 2019 $35,131 and $41,418,$17,561, respectively.

The fair value of options granted from inception to June 30, 2020March 31, 2021 was based on the Black-Scholes option-pricing model assuming the following factors: 4.7 to 6.2 years expected term, 55% to 85% volatility, 0.4% to 2.9% risk free interest rate and zero dividends. The expected term for options granted to date was estimated using the simplified method. There were 4,000196,476 and 209,110163,357 stock option grantsoptions granted during the three and six months ended June 30,March 31, 2021 and 2020, respectively. For the three and six months ended June 30,March 31, 2021 and 2020, the weighted averageweighted-average grant date fair value was $5.43$4.90 and $9.34 per share, and $9.22 per share, respectively. There were no stock option grants during the three and six months ended June 30, 2019. For the three months ended June 30,March 31, 2021 and 2020 and 2019, the fair value of shares vested was $0.4$0.3 million and $0.3 million, respectively. For the six months ended June 30, 2020 and 2019, the fair value of shares vested was $0.6 million and $0.5$0.2 million, respectively. At June 30, 2020,March 31, 2021, the aggregate intrinsic value of outstanding stock options was approximately $4.9$3.6 million of which approximately $4.3$3.5 million was vested and approximately $0.6$0.1 million is expected to vest (representing options to purchase up to 423,638409,725 shares of the Company'sCompany’s common stock)stock expected to vest), and the weighted-average exercise price in aggregate was $4.79$4.77 which includes $2.84$3.49 for fully vested stock options and $8.79$8.01 for stock options expected to vest. At June 30, 2020, theMarch 31, 2021, unamortized unvested balance of stock-based compensation was approximately $3.0$3.2 million, to be amortized over 2.933.0 years.

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2020March 31, 2021

Note 5 - Related Party Transactions

In December 2019,As of March 31, 2021, Tactic Pharma, LLC (“Tactic Pharma”), purchased 125,000 sharesthe Company’s initial investor, beneficially owned 34.0% of Monopar’s common stock in Monopar’s initial public offering at $8 per share for an aggregate $1 million, at which time its beneficial ownership in Monopar was 41.6%. As of June 30, 2020,and during the three months ended March 31, 2021, there were no transactions between Tactic Pharma beneficially owned 41.0% of Monopar’s common stock.and Monopar.

During the three and six months ended June 30, 2020 and 2019, the Company was governed by six members of its Board of Directors (“Related Parties”). The Related Parties are also current common stockholders (owning approximately an aggregate 3% of the common stock outstanding as of June 30, 2020). None of the Related Partiesrelated parties discussed below received compensation other than market-rate salary, market-rate stock-based compensation and benefits and performance-based bonus or in the case of non-employee directors, market-rate Board fees and market-rate stock-based compensation. The Company considers the following individuals as related parties: Three of the BoardCompany’s board members arewere also Managing Members of Tactic Pharma as of June 30, 2020.March 31, 2021. Chandler D. Robinson is the Company’s Co-Founder, Chief Executive Officer, common stockholder, Managing Member of Tactic Pharma, former Manager of the predecessor LLC, Manager of CDR Pharma, LLC and Board member of Monopar as a C Corporation. Andrew P. Mazar is the Company’s Co-Founder, Executive Vice President of Research and Development, Chief Scientific Officer, common stockholder, Managing Member of Tactic Pharma, former Manager of the predecessor LLC and Board member of Monopar as a C Corporation. Michael Brown is a Managing Member of Tactic Pharma (as of February 1, 2019 with no voting power as it relates to the Company)Monopar), a previous managing member of Monopar as an LLC, common stockholder and Board member of Monopar as a C Corporation. Christopher M. Starr is the Company’s Co-Founder, Executive Chairman of the Board of Directors, common stockholder, former Manager of the predecessor LLC and Board member of Monopar as a C Corporation.

During the three months ended March 31, 2019, the Company paid or accrued approximately $33,725 in legal fees to a large national law firm, in which a family member of the Company’s Chief Executive Officer was a law partner through January 31, 2019. The family member personally billed a de minimis amount of time on the Company’s legal engagement with the law firm in this period.

Note 6 – Commitments and Contingencies

License, Development and Collaboration Agreements

Onxeo S.A.

In June 2016, the Company executed an option and license agreement with Onxeo S.A. (“Onxeo”), a public French company, which gave Monopar the exclusive option to license (on a world-wide exclusive basis) Validive to pursue treating severe oral mucositis in patients undergoing chemoradiation treatment for head and neck cancers. The pre-negotiated Onxeo license agreement for Validive as part of the option agreement includes clinical, regulatory, developmental and sales milestones that could reach up to $108 million if the Company achieves all milestones, and escalating royalties on net sales from 5% to 10%. On September 8, 2017, the Company exercised the license option, and therefore paid Onxeo the $1 million fee under the option and license agreement.

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2020

Under the agreement, the Company is required to pay royalties to Onxeo on a product-by-product and country-by-country basis until the later of (1) the date when a given product is no longer within the scope of a patent claim in the country of sale or manufacture, (2) the expiry of any extended exclusivity period in the relevant country (such as orphan drug exclusivity, pediatric exclusivity, new chemical entity exclusivity, or other exclusivity granted beyond the expiry of the relevant patent), or (3) a specific time period after the first commercial sale of the product in such country. In most countries, including the U.S., the patent term is generally 20 years from the earliest claimed filing date of a non-provisional patent application in the applicable country, not taking into consideration any potential patent term adjustment that may be filed in the future or any regulatory extensions that may be obtained. The royalty termination provision pursuant to (3) described above is shorter than 20 years and is the least likely cause of termination of royalty payments.

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2021

The Onxeo license agreement does not have a pre-determined term, but expires on a product-by-product and country-by-country basis; that is, the agreement expires with respect to a given product in a given country whenever the Company’s royalty payment obligations with respect to such product have expired. The agreement may also be terminated early for cause if either the Company or Onxeo materially breach the agreement, or if either the Company or Onxeo become insolvent. The Company may also choose to terminate the agreement, either in its entirety or as to a certain product and a certain country, by providing Onxeo with advance notice.

The Company plans tois internally developdeveloping Validive with the near-term goal of commencing a Phase 2b/3and has activated clinical sites and began dosing for its VOICE clinical trial, which, if successful, may allow the Company to apply for marketing approval within the next several years. The Company will need to raise significant funds or enter into a collaboration partnership to support the further development, including potential commercialization of Validive. As of June 30, 2020,March 31, 2021, the Company had not reached any of the pre-specified milestones and has not been required to pay Onxeo any funds under this license agreement other than the $1 million one-time license fee.

Grupo Español de Investigación en Sarcomas (“GEIS”)

In June 2019, the Company executed a clinical collaboration agreement with GEIS for the development of camsirubicin in patients with advanced soft tissue sarcoma (“ASTS”). Following completion of the dose escalation run-in clinical trial in the U.S. (or another country) that Monopar currently anticipates initiating in the second half of 2021, the Company continues to expect that GEIS will be the study sponsor and will lead a multi-country, randomized, open-label Phase 2 clinical trial to evaluate camsirubicin head-to-head against the current 1st-linefirst-line treatment for ASTS, doxorubicin. Enrollment of the trial is anticipated to begin in the second half of 2020 and will include approximately 170 ASTS patients. The Company will provide study drug and supplemental financial support for the clinical trial averaging approximately $2 million to $3 million per year. During the three and six months ended June 30, 2020,March 31, 2021, the Company incurred approximately $33,000$0.3 million in expenses under the GEIS agreement and other clinical-related expenses. In addition, the Company incurred approximately $246,000 and $264,000 inexpenses including clinical material manufacturing and database management expenses for thein support of GEIS’s Phase 2 camsirubicin clinical trial fortrial. During the three and six months ended June 30,March 31, 2020, respectively.the Company provided a nominal amount of financial support and incurred a nominal amount of drug manufacturing costs under the GEIS agreement. The Company can terminate the agreement by providing GEIS with advance notice, and without affecting the Company’s rights and ownership to any intellectual property or clinical data.

XOMA Ltd.

The intellectual property rights contributed by Tactic Pharma LLC (“Tactic Pharma”) to the Company included the non-exclusive license agreement with XOMA Ltd. for the humanization technology used in the development of MNPR-101. Pursuant to such license agreement, the Company is obligated to pay XOMA Ltd. clinical, regulatory and sales milestones for MNPR-101 that could reach up to $14.925 million if the Company achieves all milestones. The agreement does not require the payment of sales royalties. There can be no assurance that the Company will reach any milestones under the XOMA agreement. As of June 30, 2020,March 31, 2021, the Company had not reached any milestones and has not been required to pay XOMA Ltd. any funds under this license agreement.

MONOPAR THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2020March 31, 2021

Operating Leases

Commencing January 1, 2018, theThe Company entered into a leaseis currently leasing office space for its executive headquarters at 1000 Skokie Blvd., Suite 350, Wilmette, Illinois. The lease term was January 1, 2018 through December 31, 2019, at which time the lease was on a month-to-month basis. In addition, effective February 2019, the Company leased additional office space in the same buildingVillage of Wilmette, Illinois for $4,487 per month on a month-to-month basis.

During the three months ended June 30,March 31, 2021 and 2020, and 2019, the Company recognized operating lease expenses of $14,620$13,462 and $13,462, respectively. During the six months ended June 30, 2020 and 2019, the Company recognized operating lease expenses of $28,103 and $24,965,$13,483, respectively.

Effective January 1, 2019, the Company adopted ASU 2016-02, as amended by ASU 2018-10, which requires the Company to record leases on its condensed consolidated balance sheet (a) a lease liability and (b) a right-of-use asset. Because the Company had no lease obligation (other than on a month-to-month basis) past December 31, 2019, the Company had no lease liability and right-of-use asset on its condensed consolidated balance sheet as of June 30, 2020 or December 31, 2019.

Legal Contingencies

The Company may be subject to claims and assessments from time to time in the ordinary course of business. No claims have been asserted to date.

Indemnification

In the normal course of business, the Company enters into contracts and agreements that contain a variety of representations and warranties and provide for general indemnification. The Company’s exposure under these agreements is unknown because it involves claims that may be made against the Company in the future, but that have not yet been made. To date, the Company has not paid any claims nor been required to defend any action related to its indemnification obligations. However, the Company may record charges in the future as a result of future claims against these indemnification obligations.

In accordance with its second amended and restated certificate of incorporation, amended and restated bylaws and the indemnification agreements entered into with each officer and non-employee director, the Company has indemnification obligations to its officers and non-employee directors for certain events or occurrences, subject to certain limits, while they are serving at the Company’s request in such capacities. There have been no claims to date.

Paycheck Protection Program (“PPP”) Bank Loan

In May 2020, the Company applied for and received a $122,400 PPP bank loan established pursuant to the Coronavirus Aid, Relief, and Economic Security Act, as administered by the U.S. Small Business Administration (“SBA”).