UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

———————

FORM 10-Q

———————

☒ FORM 10-Q

——————————————

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended: SeptemberJune 30, 20222023

or

☐ |

|

For the transition period from: _____________ to _____________

ISSUER DIRECT CORPORATION |

(Exact name of registrant as specified in its charter) |

——————————————

Delaware |

| 1-10185 |

| 26-1331503 |

(State or Other Jurisdiction |

| (Commission |

| (I.R.S. Employer |

of Incorporation) |

| File Number) |

| Identification No.) |

1One Glenwood Avenue, Suite 1001, Raleigh NC 27603

(Address of Principal Executive Office) (Zip Code)

(919) 481-4000

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

——————————————

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated | ☐ | Smaller reporting company | ☒ |

| (Do not check if a smaller reporting company) | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date 3,791,0203,809,149 shares of common stock were issued and outstanding as of November 3, 2022.August 10, 2023.

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

Common Stock, par value $0.001 |

| ISDR |

| NYSE American |

TABLE OF CONTENTS

PART I - FINANCIAL INFORMATION

| ||

| ||

| ||

Unregistered Sales of Equity Securities and Use of |

| |

| ||

| ||

| ||

| ||

|

| |

| 2 |

| Table of Contents |

PARTPART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

ISSUER DIRECT CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share amounts)

|

| September 30, |

| December 31, |

|

| June 30, |

| December 31, |

| ||||||

|

| 2022 |

|

| 2021 |

|

| 2023 |

|

| 2022 |

| ||||

ASSETS |

| (unaudited) |

|

|

| (unaudited) |

|

| ||||||||

Current assets: |

|

|

|

|

|

|

|

|

|

| ||||||

Cash and cash equivalents |

| $ | 21,812 |

| $ | 23,852 |

|

| $ | 4,961 |

| $ | 4,832 |

| ||

Accounts receivable (net of allowance for doubtful accounts of $610 and $675, respectively) |

| 3,062 |

| 3,291 |

| |||||||||||

Accounts receivable (net of allowance for doubtful accounts of $956 and $745, respectively) |

| 4,311 |

| 2,978 |

| |||||||||||

Income tax receivable |

| 285 |

| — |

|

| — |

| 51 |

| ||||||

Other current assets |

|

| 807 |

|

|

| 750 |

|

|

| 1,597 |

|

|

| 1,559 |

|

Total current assets |

| 25,966 |

| 27,893 |

|

| 10,869 |

| 9,420 |

| ||||||

Capitalized software (net of accumulated amortization of $3,349 and $3,301, respectively) |

| 153 |

| 201 |

| |||||||||||

Fixed assets (net of accumulated depreciation of $572 and $456, respectively) |

| 649 |

| 713 |

| |||||||||||

Capitalized software (net of accumulated amortization of $3,392 and $3,364, respectively) |

| 277 |

| 138 |

| |||||||||||

Fixed assets (net of accumulated depreciation of $683 and $610, respectively) |

| 563 |

| 625 |

| |||||||||||

Right-of-use asset – leases |

| 1,341 |

| 1,533 |

|

| 1,150 |

| 1,277 |

| ||||||

Other long-term assets |

| 110 |

| 94 |

|

| 397 |

| 136 |

| ||||||

Goodwill |

| 6,376 |

| 6,376 |

|

| 22,498 |

| 22,498 |

| ||||||

Intangible assets (net of accumulated amortization of $6,329 and $6,005, respectively) |

|

| 2,123 |

|

|

| 2,447 |

| ||||||||

Intangible assets (net of accumulated amortization of $8,192 and $6,821, respectively) |

|

| 30,860 |

|

|

| 32,231 |

| ||||||||

Total assets |

| $ | 36,718 |

|

| $ | 39,257 |

|

| $ | 66,614 |

|

| $ | 66,325 |

|

|

|

|

|

|

|

|

|

|

|

| ||||||

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

| ||||||

Current liabilities: |

|

|

|

|

|

|

|

|

|

| ||||||

Accounts payable |

| $ | 691 |

| $ | 695 |

|

| $ | 1,286 |

| $ | 1,374 |

| ||

Accrued expenses |

| 1,638 |

| 1,975 |

|

| 2,374 |

| 2,255 |

| ||||||

Income taxes payable |

| 198 |

| 46 |

|

| 695 |

| 157 |

| ||||||

Current portion of long-term debt |

| 2,000 |

| 22,000 |

| |||||||||||

Deferred revenue |

|

| 3,429 |

|

|

| 3,086 |

|

|

| 5,729 |

|

|

| 5,405 |

|

Total current liabilities |

| 5,956 |

| 5,802 |

|

| 12,084 |

| 31,191 |

| ||||||

Long-term debt (net of debt discount of $96 and $0, respectively) |

| 17,904 |

| — |

| |||||||||||

Deferred income tax liability |

| 96 |

| 176 |

|

| 273 |

| 572 |

| ||||||

Lease liabilities – long-term |

|

| 1,422 |

|

|

| 1,659 |

|

|

| 1,175 |

|

|

| 1,339 |

|

Total liabilities |

|

| 7,474 |

|

|

| 7,637 |

|

| 31,436 |

| 33,102 |

| |||

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

| ||||||

Stockholders' equity: |

|

|

|

|

|

|

|

|

|

| ||||||

Preferred stock, $0.001 par value, 1,000,000 shares authorized, no shares issued and outstanding as of September 30, 2022 and December 31, 2021, respectively. |

| — |

| — |

| |||||||||||

Common stock $0.001 par value, 20,000,000 shares authorized, 3,610,839 and 3,793,538 shares issued and outstanding as of September 30, 2022 and December 31, 2021, respectively. |

| 4 |

| 4 |

| |||||||||||

Preferred stock, $0.001 par value, 1,000,000 shares authorized, no shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively. |

| — |

| — | �� | |||||||||||

Common stock $0.001 par value, 20,000,000 shares authorized, 3,809,149 and 3,791,020 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively. |

| 4 |

| 4 |

| |||||||||||

Additional paid-in capital |

| 18,051 |

| 22,401 |

|

| 22,838 |

| 22,147 |

| ||||||

Other accumulated comprehensive loss |

| (88 | ) |

| (19 | ) |

| (51 | ) |

| (96 | ) | ||||

Retained earnings |

|

| 11,277 |

|

|

| 9,234 |

|

|

| 12,387 |

|

|

| 11,168 |

|

Total stockholders' equity |

|

| 29,244 |

|

|

| 31,620 |

|

|

| 35,178 |

|

|

| 33,223 |

|

Total liabilities and stockholders’ equity |

| $ | 36,718 |

|

| $ | 39,257 |

|

| $ | 66,614 |

|

| $ | 66,325 |

|

The accompanying notes are an integral part of these unaudited financial statements.

| 3 |

| Table of Contents |

ISSUERISSUER DIRECT CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

(in thousands, except share and per share amounts)

|

| For the Three Months Ended |

| For the Nine Months Ended |

|

| For the Three Months Ended |

| For the Six Months Ended |

| ||||||||||||||||||||||

|

| September 30, |

| September 30, |

| September 30, |

| September 30, |

|

| June 30, |

| June 30, |

| June 30, |

| June 30, |

| ||||||||||||||

|

| 2022 |

|

| 2021 |

|

| 2022 |

|

| 2021 |

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||||||

Revenues |

| $ | 5,280 |

| $ | 5,465 |

| $ | 16,375 |

| $ | 16,165 |

|

| $ | 9,651 |

| $ | 5,807 |

| $ | 18,270 |

| $ | 11,095 |

| ||||||

Cost of revenues |

|

| 1,212 |

|

|

| 1,355 |

|

|

| 3,808 |

|

|

| 4,229 |

|

|

| 2,336 |

|

|

| 1,364 |

|

|

| 4,165 |

|

|

| 2,596 |

|

Gross profit |

|

| 4,068 |

|

|

| 4,110 |

|

|

| 12,567 |

|

|

| 11,936 |

|

|

| 7,315 |

|

|

| 4,443 |

|

|

| 14,105 |

|

|

| 8,499 |

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||

General and administrative |

| 1,657 |

| 1,258 |

| 4,903 |

| 3,923 |

|

| 2,274 |

| 1,563 |

| 4,606 |

| 3,246 |

| ||||||||||||||

Sales and marketing expenses |

| 1,231 |

| 1,349 |

| 3,866 |

| 3,633 |

|

| 2,039 |

| 1,371 |

| 4,420 |

| 2,635 |

| ||||||||||||||

Product development |

| 245 |

| 373 |

| 734 |

| 878 |

|

| 532 |

| 214 |

| 1,306 |

| 489 |

| ||||||||||||||

Depreciation and amortization |

|

| 146 |

|

|

| 153 |

|

|

| 439 |

|

|

| 457 |

|

|

| 723 |

|

|

| 147 |

|

|

| 1,445 |

|

|

| 293 |

|

Total operating costs and expenses |

|

| 3,279 |

|

|

| 3,133 |

|

|

| 9,942 |

|

|

| 8,891 |

|

|

| 5,568 |

|

|

| 3,295 |

|

|

| 11,777 |

|

|

| 6,663 |

|

Operating income |

| 789 |

| 977 |

| 2,625 |

| 3,045 |

|

| 1,747 |

| 1,148 |

| 2,328 |

| 1,836 |

| ||||||||||||||

Other income |

| — |

| 366 |

| — |

| 366 |

| |||||||||||||||||||||||

Interest income |

|

| 77 |

|

|

| — |

|

|

| 99 |

|

|

| 2 |

| ||||||||||||||||

Interest (expense) income, net |

| (281 | ) |

| 20 |

| (519 | ) |

| 22 |

| |||||||||||||||||||||

Other income (expense), net |

|

| 379 |

|

|

| — |

|

|

| (156 | ) |

|

| — |

| ||||||||||||||||

Income before taxes |

| 866 |

| 1,343 |

| 2,724 |

| 3,413 |

|

| 1,845 |

| 1,168 |

| 1,653 |

| 1,858 |

| ||||||||||||||

Income tax expense |

|

| 180 |

|

|

| 319 |

|

|

| 681 |

|

|

| 738 |

|

|

| 482 |

|

|

| 327 |

|

|

| 434 |

|

|

| 501 |

|

Net income |

| $ | 686 |

|

| $ | 1,024 |

|

| $ | 2,043 |

|

| $ | 2,675 |

|

| $ | 1,363 |

|

| $ | 841 |

|

| $ | 1,219 |

|

| $ | 1,357 |

|

Income per share – basic |

| $ | 0.19 |

|

| $ | 0.27 |

|

| $ | 0.55 |

|

| $ | 0.71 |

|

| $ | 0.36 |

|

| $ | 0.22 |

|

| $ | 0.32 |

|

| $ | 0.36 |

|

Income per share – fully diluted |

| $ | 0.19 |

|

| $ | 0.27 |

|

| $ | 0.55 |

|

| $ | 0.70 |

|

| $ | 0.36 |

|

| $ | 0.22 |

|

| $ | 0.32 |

|

| $ | 0.36 |

|

Weighted average number of common shares outstanding – basic |

| 3,618 |

| 3,788 |

| 3,717 |

| 3,776 |

|

| 3,795 |

| 3,741 |

| 3,793 |

| 3,767 |

| ||||||||||||||

Weighted average number of common shares outstanding – fully diluted |

| 3,636 |

| 3,821 |

| 3,738 |

| 3,818 |

|

| 3,808 |

| 3,772 |

| 3,809 |

| 3,802 |

| ||||||||||||||

The accompanying notes are an integral part of these unaudited financial statements.

| 4 |

| Table of Contents |

ISSUERISSUER DIRECT CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(UNAUDITED)

(in thousands)

|

| For the Three Months Ended |

| For the Nine Months Ended |

|

| For the Three Months Ended |

| For the Six Months Ended |

| ||||||||||||||||||||||

|

| September 30, |

| September 30, |

| September 30, |

| September 30, |

|

| June 30, |

| June 30, |

| June 30, |

| June 30, |

| ||||||||||||||

|

| 2022 |

|

| 2021 |

|

| 2022 |

|

| 2021 |

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||||||

Net income |

| $ | 686 |

| $ | 1,024 |

| $ | 2,043 |

| $ | 2,675 |

|

| $ | 1,363 |

| $ | 841 |

| $ | 1,219 |

| $ | 1,357 |

| ||||||

Foreign currency translation adjustment |

|

| (53 | ) |

|

| 7 |

|

|

| (69 | ) |

|

| 5 |

|

|

| 44 |

|

|

| (23 | ) |

|

| 45 |

|

|

| (16 | ) |

Comprehensive income |

| $ | 633 |

|

| $ | 1,031 |

|

| $ | 1,974 |

|

| $ | 2,680 |

|

| $ | 1,407 |

|

| $ | 818 |

|

| $ | 1,264 |

|

| $ | 1,341 |

|

The accompanying notes are an integral part of these unaudited financial statements.

| 5 |

| Table of Contents |

ISSUER DIRECT CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(UNAUDITED)

(in thousands, except share and per share amounts)

|

| Common Stock |

| Additional Paid-in |

| Other Accumulated Comprehensive Income |

| Retained |

| Total Stockholders’ |

|

| Common Stock |

| Additional Paid-in |

| Accumulated Other Comprehensive |

| Retained |

| Total Stockholders’ |

| ||||||||||||||||||||||||||

|

| Shares |

|

| Amount |

|

| Capital |

|

| (Loss) |

|

| Earnings |

|

| Equity |

| ||||||||||||||||||||||||||||||

Balance at December 31, 2020 |

| 3,770,752 |

| $ | 4 |

| $ | 22,214 |

| $ | (19 | ) |

| $ | 5,943 |

| $ | 28,142 |

| |||||||||||||||||||||||||||||

Stock-based compensation expense |

| — |

| — |

| 63 |

| — |

| — |

| 63 |

| |||||||||||||||||||||||||||||||||||

Exercise of stock awards, net of tax |

| 15,000 |

| — |

| 199 |

| — |

| — |

| 199 |

| |||||||||||||||||||||||||||||||||||

Stock repurchase and retirement |

| (19,777 | ) |

| — |

| (452 | ) |

| — |

| — |

| (452 | ) | |||||||||||||||||||||||||||||||||

Foreign currency translation |

| — |

| — |

| — |

| 3 |

| — |

| 3 |

| |||||||||||||||||||||||||||||||||||

Net income |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 545 |

|

|

| 545 |

| ||||||||||||||||||||||||

Balance at March 31, 2021 |

| 3,765,975 |

| $ | 4 |

| $ | 22,024 |

| $ | (16 | ) |

| $ | 6,488 |

| $ | 28,500 |

| |||||||||||||||||||||||||||||

Stock-based compensation expense |

| — |

| — |

| 69 |

| — |

| — |

| 69 |

| |||||||||||||||||||||||||||||||||||

Exercise of stock awards, net of tax |

| 20,550 |

| — |

| 20 |

| — |

| — |

| 20 |

| |||||||||||||||||||||||||||||||||||

Foreign currency translation |

| — |

| — |

| — |

| (5 | ) |

| — |

| (5 | ) | ||||||||||||||||||||||||||||||||||

Net income |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 1,106 |

|

|

| 1,106 |

| ||||||||||||||||||||||||

Balance at June 30, 2021 |

| 3,786,525 |

| $ | 4 |

| $ | 22,113 |

| $ | (21 | ) |

| $ | 7,594 |

| $ | 29,690 |

| |||||||||||||||||||||||||||||

Stock-based compensation expense |

| — |

| — |

| 100 |

| — |

| — |

| 100 |

| |||||||||||||||||||||||||||||||||||

Exercise of stock awards, net of tax |

| 4,513 |

| — |

| 55 |

| — |

| — |

| 55 |

| |||||||||||||||||||||||||||||||||||

Foreign currency translation |

| — |

| — |

| — |

| 7 |

| — |

| 7 |

| |||||||||||||||||||||||||||||||||||

Net income |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 1,024 |

|

|

| 1,024 |

| ||||||||||||||||||||||||

Balance at September 30, 2021 |

|

| 3,791,038 |

|

| $ | 4 |

|

| $ | 22,268 |

|

| $ | (14 | ) |

| $ | 8,618 |

|

| $ | 30,876 |

| ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares |

|

| Amount |

|

| Capital |

|

| Income (Loss) |

|

| Earnings |

|

| Equity |

| |||||||||||||||||

Balance at December 31, 2021 |

| 3,793,538 |

| $ | 4 |

| $ | 22,401 |

| $ | (19 | ) |

| $ | 9,234 |

| $ | 31,620 |

|

| 3,793,538 |

| $ | 4 |

| $ | 22,401 |

| $ | (19 | ) |

| $ | 9,234 |

| $ | 31,620 |

| ||||||||||

Stock-based compensation expense |

| — |

| — |

| 184 |

| — |

| — |

| 184 |

|

| — |

| — |

| 184 |

| — |

| — |

| 184 |

| ||||||||||||||||||||||

Exercise of stock awards, net of tax |

| 7,500 |

| — |

| 58 |

| — |

| — |

| 58 |

|

| 7,500 |

| — |

| 58 |

| — |

| — |

| 58 |

| ||||||||||||||||||||||

Stock repurchase and retirement |

| (6,200 | ) |

| — |

| (182 | ) |

| — |

| — |

| (182 | ) |

| (6,200 | ) |

| — |

| (182 | ) |

| — |

| — |

| (182 | ) | ||||||||||||||||||

Foreign currency translation |

| — |

| — |

| — |

| 7 |

| — |

| 7 |

|

| — |

| — |

| — |

| 7 |

| — |

| 7 |

| ||||||||||||||||||||||

Net income |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 516 |

|

|

| 516 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 516 |

|

|

| 516 |

|

Balance at March 31, 2022 |

| 3,794,838 |

| $ | 4 |

| $ | 22,461 |

| $ | (12 | ) |

| $ | 9,750 |

| $ | 32,203 |

|

| 3,794,838 |

| $ | 4 |

| $ | 22,461 |

| $ | (12 | ) |

| $ | 9,750 |

| $ | 32,203 |

| ||||||||||

Stock-based compensation expense |

| — |

| — |

| 188 |

| — |

| — |

| 188 |

|

| — |

| — |

| 188 |

| — |

| — |

| 188 |

| ||||||||||||||||||||||

Exercise of stock awards, net of tax |

| 15,265 |

| — |

| — |

| — |

| — |

| — |

|

| 15,265 |

| — |

| — |

| — |

| — |

| — |

| ||||||||||||||||||||||

Stock repurchase and retirement |

| (163,201 | ) |

| — |

| (3,859 | ) |

| — |

| — |

| (3,859 | ) |

| (163,201 | ) |

| — |

| (3,859 | ) |

| — |

| — |

| (3,859 | ) | ||||||||||||||||||

Foreign currency translation |

| — |

| — |

| — |

| (23 | ) |

| — |

| (23 | ) |

| — |

| — |

| — |

| (23 | ) |

| — |

| (23 | ) | ||||||||||||||||||||

Net income |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 841 |

|

|

| 841 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 841 |

|

|

| 841 |

|

Balance at June 30, 2022 |

| 3,646,902 |

| $ | 4 |

| $ | 18,790 |

| $ | (35 | ) |

| $ | 10,591 |

| $ | 29,350 |

|

|

| 3,646,902 |

|

| $ | 4 |

|

| $ | 18,790 |

|

| $ | (35 | ) |

| $ | 10,591 |

|

| $ | 29,350 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||

Balance at December 31, 2022 |

| 3,791,020 |

| $ | 4 |

| $ | 22,147 |

| $ | (96 | ) |

| $ | 11,168 |

| $ | 33,223 |

| |||||||||||||||||||||||||||||

Stock-based compensation expense |

| — |

| — |

| 337 |

| — |

| — |

| 337 |

| |||||||||||||||||||||||||||||||||||

Foreign currency translation |

| — |

| — |

| — |

| 1 |

| — |

| 1 |

| |||||||||||||||||||||||||||||||||||

Net loss |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| (144 | ) |

|

| (144 | ) | ||||||||||||||||||||||||

Balance at March 31, 2023 |

| 3,791,020 |

| $ | 4 |

| $ | 22,484 |

| $ | (95 | ) |

| $ | 11,024 |

| $ | 33,417 |

| |||||||||||||||||||||||||||||

Stock-based compensation expense |

| — |

| — |

| 187 |

| — |

| — |

| 187 |

|

| — |

| — |

| 354 |

| — |

| — |

| 354 |

| ||||||||||||||||||||||

Exercise of stock awards, net of tax |

| 2,500 |

| — |

| 33 |

| — |

| — |

| 33 |

|

| 18,129 |

| — |

| — |

| — |

| — |

| — |

| ||||||||||||||||||||||

Stock repurchase and retirement |

| (38,563 | ) |

| — |

| (959 | ) |

| — |

| — |

| (959 | ) | |||||||||||||||||||||||||||||||||

Foreign currency translation |

| — |

| — |

| — |

| (53 | ) |

| — |

| (53 | ) |

| — |

| — |

| — |

| 44 |

| — |

| 44 |

| |||||||||||||||||||||

Net income |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 686 |

|

|

| 686 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 1,363 |

|

|

| 1,363 |

|

Balance at September 30, 2022 |

|

| 3,610,839 |

|

| $ | 4 |

|

| $ | 18,051 |

|

| $ | (88 | ) |

| $ | 11,277 |

|

| $ | 29,244 |

| ||||||||||||||||||||||||

Balance at June 30, 2023 |

|

| 3,809,149 |

|

| $ | 4 |

|

| $ | 22,838 |

|

| $ | (51 | ) |

| $ | 12,387 |

|

| $ | 35,178 |

| ||||||||||||||||||||||||

The accompanying notes are an integral part of these unaudited financial statements.

| 6 |

| Table of Contents |

ISSUER DIRECT CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

(in thousands)

|

| For the Nine Months Ended |

|

| For the Six Months Ended |

| ||||||||||

|

| September 30, |

| September 30, |

|

| June 30, |

| June 30, |

| ||||||

|

| 2022 |

|

| 2021 |

|

| 2023 |

|

| 2022 |

| ||||

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

| ||||||

Net income |

| $ | 2,043 |

| $ | 2,675 |

|

| $ | 1,219 |

| $ | 1,357 |

| ||

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

| ||||||

Depreciation and amortization |

| 487 |

| 854 |

|

| 1,472 |

| 324 |

| ||||||

Bad debt expense |

| 279 |

| 236 |

|

| 260 |

| 197 |

| ||||||

Deferred income taxes |

| (80 | ) |

| (14 | ) |

| (299 | ) |

| (63 | ) | ||||

Change in fair value of interest rate swaps |

| (214 | ) |

| — |

| ||||||||||

Stock-based compensation expense |

| 559 |

| 232 |

|

| 691 |

| 372 |

| ||||||

Amortization of debt issuance costs |

| 4 |

| — |

| |||||||||||

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

| ||||||

Decrease (increase) in accounts receivable |

| (61 | ) |

| (767 | ) |

| (1,587 | ) |

| (390 | ) | ||||

Decrease (increase) in other assets |

| (166 | ) |

| (273 | ) |

| (256 | ) |

| (245 | ) | ||||

Increase (decrease) in accounts payable |

| (2 | ) |

| 365 |

|

| (89 | ) |

| (111 | ) | ||||

Increase (decrease) in accrued expenses |

| (409 | ) |

| (489 | ) |

| 488 |

| (194 | ) | |||||

Increase (decrease) in deferred revenue |

|

| 375 |

|

|

| 500 |

|

|

| 314 |

|

|

| 397 |

|

Net cash provided by operating activities |

|

| 3,025 |

|

|

| 3,319 |

|

|

| 2,003 |

|

|

| 1,644 |

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

| ||||||

Capitalized software |

| — |

| (215 | ) |

| (167 | ) |

| — |

| |||||

Purchase of fixed assets |

|

| (52 | ) |

|

| (49 | ) |

| (11 | ) |

| (38 | ) | ||

Net cash used in investing activities |

|

| (52 | ) |

|

| (264 | ) | ||||||||

Purchase of acquired business, net of cash received |

|

| 350 |

|

|

| — |

| ||||||||

Net cash provided by (used in) investing activities |

|

| 172 |

|

|

| (38 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

| ||||||

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

| ||||||

Exercise of stock options |

| 91 |

| 274 |

|

| — |

| 58 |

| ||||||

Payment for stock repurchase and retirement |

|

| (5,000 | ) |

|

| (452 | ) |

| — |

| (4,041 | ) | |||

Payment of note payable |

| (22,000 | ) |

| — |

| ||||||||||

Proceeds from issuance of term loan |

| 19,988 |

| — |

| |||||||||||

Payment for capitalized debt issuance costs |

|

| (88 | ) |

|

| — |

| ||||||||

Net cash used in financing activities |

|

| (4,909 | ) |

|

| (178 | ) |

|

| (2,100 | ) |

|

| (3,983 | ) |

|

|

|

|

|

|

|

|

|

|

| ||||||

Net change in cash and cash equivalents |

| (1,936 | ) |

| 2,877 |

|

| 75 |

| (2,377 | ) | |||||

Cash – beginning |

| 23,852 |

| 19,556 |

| |||||||||||

Cash and cash equivalents – beginning |

| 4,832 |

| 23,852 |

| |||||||||||

Currency translation adjustment |

|

| (104 | ) |

|

| (18 | ) |

|

| 54 |

|

|

| (17 | ) |

Cash and cash equivalents – ending |

| $ | 21,812 |

|

| $ | 22,415 |

|

| $ | 4,961 |

|

| $ | 21,458 |

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Supplemental disclosures: |

|

|

|

|

|

|

|

|

|

| ||||||

Cash paid for income taxes |

| $ | 782 |

|

| $ | 893 |

|

| $ | 158 |

|

| $ | 643 |

|

Cash paid for interest |

| $ | 887 |

|

| $ | — |

| ||||||||

The accompanying notes are an integral part of these unaudited financial statements.

| 7 |

| Table of Contents |

ISSUER DIRECT CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Note 1. Basis of Presentation

The unaudited interim consolidated balance sheet as of SeptemberJune 30, 20222023 and consolidated statements of operations, comprehensive income, stockholders’ equity and cash flows for the three and nine-monthsix-month periods ended SeptemberJune 30, 20222023 and 20212022 included herein, have been prepared in accordance with the instructions for Form 10-Q under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Article 10 of Regulation S-X under the Exchange Act. In the opinion of management, they include all normal recurring adjustments necessary for a fair presentation of the financial statements. Results of operations reported for the interim periods are not necessarily indicative of results for the entire year. Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States ("US GAAP") have been condensed or omitted pursuant to such rules and regulations relating to interim financial statements. The interim financial information should be read in conjunction with the 20212022 audited financial statements of Issuer Direct Corporation (the “Company”, “We”, or “Our”) filed on our Form 10-K.

Note 2. Summary of Significant Accounting Policies

The consolidated financial statements include the accounts of the Company and its wholly-ownedwholly owned subsidiaries. Significant intercompany accounts and transactions are eliminated in consolidation.

Earnings Per Share (EPS)

Earnings per share accounting guidance requires that basic net income per common share be computed by dividing net income for the period by the weighted average number of common shares outstanding during the period. Diluted net income per share is computed by dividing the net income for the period by the weighted average number of common and dilutive common equivalent shares outstanding during the period. Shares issuable upon the exercise of stock options totaling 50,25072,750 were excluded in the computation of diluted earnings per common share during the three and nine-monthsix-month periods ended SeptemberJune 30, 2022,2023, because their impact was anti-dilutive. There were no50,250 shares issuable upon the exercise of stock options excluded in the computation of diluted earnings per common share during the three and nine-monthsix-month periods ended SeptemberJune 30, 2021,2022, because their impact was anti-dilutive.

Revenue Recognition

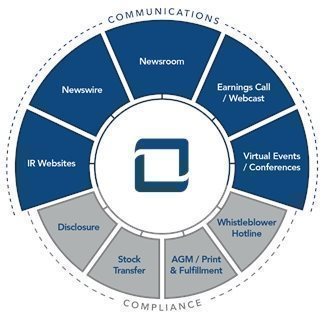

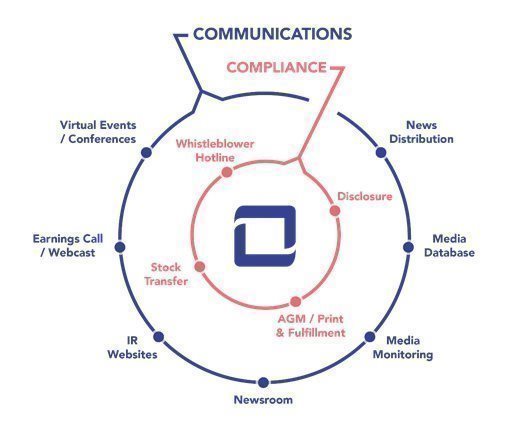

Substantially all the Company’s revenue comes from contracts with customers for subscriptions to its cloud-based products or contracts for Communications and Compliance products and services. Customers consist of public corporate issuers and professional firms, such as investor and public relations firms. In the case of our news distribution and webcasting offerings, our customers also include private companies. The Company accounts for a contract with a customer when there is an enforceable contract between the Company and the customer, the rights of the parties are identified, the contract has economic substance, and collectability of the contract consideration is probable. The Company's revenues are measured based on consideration specified in the contract with each customer.

The Company's contracts include either a subscription to ourits entire platform, or certain modules within ourthe platform or to its Press Release Optimizer Plan (PRO), or an agreement to perform services, or any combination thereof, and often contain multiple subscriptions and services. For these bundled contracts, the Company accounts for individual subscriptions and services as separate performance obligations if they are distinct, which is when a product or service is separately identifiable from other items in the bundled package, and a customer can benefit from it on its own or with other resources that are readily available to the customer. The Company separates revenue from its contracts into two revenue streams: i) Communications and ii) Compliance. Performance obligations of Communications contracts include providing subscriptions to certain modules or theour entire Platform id.Communications module,platform, distributing press releases on a per release basis or conducting webcasts, virtual annual meetings, or other events on a per event basis. PRO subscription contracts contain two performance obligations of which the first is a series of distinct services that include, but are not limited to, developing specific media plans, and creating content to be distributed and the second performance obligation being access to the PRO platform along with distribution of press releases, ongoing support, and assessment of performance as a stand-ready obligation. Performance obligations of Compliance contracts include providing subscriptions to our cloud-based Platform id.certain Compliance module, Whistleblower modulemodules or other stand-ready obligations to deliver services and annual report printing and distribution. Additionally, services are provided on a per project basis. Set up fees for disclosure services are considered a separate performance obligation and are satisfied upfront. Set up fees for ourthe transfer agent module and investor relations content management module are immaterial. The Company’s subscription and service contracts are generally for one year, with automatic renewal clauses included in the contract until the contract is cancelled. The contracts do not contain any rights of returns, guarantees, or warranties. Since contracts are generally for one year, all the revenue is expected to be recognized within one year from the contract start date. As such, the Company has elected the optional exemption that allows the Company not to disclose the transaction price allocated to performance obligations that are unsatisfied or partially satisfied at the end of each reporting period.

The Company recognizes revenue for subscriptions evenly over the contract period, upon distribution for per release contracts and upon event completion for webcasting and virtual annual meeting events. For service contracts that include stand ready obligations, revenue is recognized evenly over the contract period. For all other services delivered on a per project or event basis, the revenue is recognized at the completion of the event. The Company believes recognizing revenue for subscriptions and stand ready obligations using a time-based measure of progress, best reflects the Company’s performance in satisfying the obligations.

| 8 |

| Table of Contents |

For bundled contracts, revenue is allocated to each performance obligation based on its relative standalone selling price. Standalone selling prices are based on observable prices at which the Company separately sells the subscription or service. If a standalone selling price is not directly observable, the Company uses the residual method to allocate any remaining price to that subscription or service. The Company reviews standalone selling prices, at least annually, and updates these estimates if necessary.

The Company invoices its customers based on the billing schedules designated in its contracts, typically upfront on either a monthly, quarterly or annual basis or per transaction at the completion of the performance obligation. Deferred revenue for the periods presented was primarily related to press release packages which have been prepaid, however the releases have not yet been disseminated, as well as, subscription and service contracts, which are billed upfront, quarterly, or annually, however the revenue has not yet been recognized. The associated deferred revenue is generally recognized as releases are disseminated for press release packages and ratably over the billing period for subscriptions. Deferred revenue as of SeptemberJune 30, 2022,2023 and December 31, 2021,2022, was $3,429,000$5,729,000 and $3,086,000,$5,405,000, respectively, and is expected to be recognized within one year. Revenue recognized for the ninesix months ended SeptemberJune 30, 2023 and 2022, and 2021, thatwhich was included in the deferred revenue balance at the beginning of each reporting period, was approximately $2,763,000$4,337,000 and $1,948,000,$1,970,000, respectively. Accounts receivable, net of allowance for doubtful accounts, related to contracts with customers was $3,062,000$4,311,000 and $3,291,000$2,978,000 as of SeptemberJune 30, 2022,2023 and December 31, 2021,2022, respectively. Since substantially all the contracts have terms of one year or less, the Company has elected to use the practical expedient regarding the existence of a significant financing.

Costs to obtain contracts with customers consist primarily of sales commissions. As of SeptemberJune 30, 20222023 and December 31, 2021,2022, the Company has capitalized $80,000$153,000 and $53,000,$105,000, respectively, of costs to obtain contracts that are expected to be amortized over more than one year. For contract costs expected to be amortized in less than one year, the Company has elected to use the practical expedient allowing the recognition of incremental costs of obtaining a contract as an expense when incurred. The Company has considered historical renewal rates, expectations of future renewals and economic factors in making these determinations.

Cash Equivalents

For purposes of the Company’s financial statements, the Company considers all highly liquid investments purchased with an original maturity date of three months or less to be cash equivalents.

Accounts Receivable and Allowance for Doubtful Accounts

The Company monitors outstanding receivables based on factors surroundingadopted Financial Accounting Standards Codification (“ASC”) Topic 326, Financial Statements – Credit Losses (“Topic 326”) with an adoption date of January 1, 2023. As a result, the credit risk of specific customers, historical trends, and other information. Credit is granted on an unsecured basis. TheCompany changed its accounting policy for allowance for doubtful accounts using an expected losses model rather than using incurred losses. The new model is estimated based on an assessmentthe credit losses expected to arise over the life of the asset based on the Company’s ability to collect onexpectations as of the balances sheet date through analyzing historical customer accounts receivable. There is judgment involved with estimatingdata as well as taking into consideration current economic trends. The Company adopted Topic 326 and determined it did not have a material financial impact.

The roll forward of the allowance for doubtful accounts for the three and if the financial condition of the Company’s customers were to deteriorate, resulting in their inability to make the required payments, the Company may be required to record additional allowances or charges against revenues. Given the ongoing environment of the COVID-19 pandemic and recent economic downturn, additional attention has been paid to the financial viability of our customers. The Company generally writes off accounts receivable against the allowance when it determines a balance is uncollectible and no longer actively pursues its collection.six-months ended June 30, 2023, was as follows:

|

| Three months ended March 31, 2023 |

|

| Three months ended June 30, 2023 |

| ||

Beginning balance |

| $ | 745 |

|

| $ | 858 |

|

Bad debt expense |

|

| 151 |

|

|

| 109 |

|

Write-offs |

|

| (38 | ) |

|

| (11 | ) |

Ending Balance |

| $ | 858 |

|

| $ | 956 |

|

Concentration of Credit Risk

Financial instruments and related items which potentially subject the Company to concentrations of credit risk consist primarily of cash, cash equivalents and accounts receivable.receivables. The Company places its cash and temporary cash investments with credit quality institutions. Such cash balances are currently in excess of the FDIC insurance limit of $250,000. To reduce its risk associated with the failure of such financial institutions, each quarter the Company evaluates the rating of theeach financial institution in which it holds deposits. As of SeptemberJune 30, 2022,2023, the total amount exceeding such limit was $19,375,000.$2,408,000. The Company also had cash-on-hand of $2,137,000$41,000 in Europe and $1,480,000 in Canada and $50,000 in Europe as of SeptemberJune 30, 2022.2023.

The Company believes it did not have any financial instruments that could have potentially subjected us to significant concentrations of credit risk for any relevant period.

| 9 |

| Table of Contents |

Use of Estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Significant estimates include the allowance for doubtful accounts and the valuation of goodwill, intangible assets, deferred tax assets, and stock-based compensation. Actual results could differ from those estimates.

Income Taxes

Deferred income tax assets and liabilities are computed for differences between the financial statement and tax bases of assets and liabilities that will result in future taxable or deductible amounts based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred income tax assets to the amounts expected to be realized. For any uncertain tax positions, we recognizethe Company recognizes the impact of a tax position, only if it is more likely than not of being sustained upon examination, based on the technical merits of the position. OurThe Company’s policy regarding the classification of interest and penalties is to classify them as income tax expense in ourthe financial statements, if applicable.

Capitalized Software

Costs incurred to develop ourthe Company’s cloud-based platform products are capitalized when the preliminary project phase is complete, management commits to fund the project and it is probable the project will be completed and used for its intended purposes. Once the software is substantially complete and ready for its intended use, the software is amortized over its estimated useful life, which is typically four years. Costs related to design or maintenance of the software are expensed as incurred. Capitalized costs and amortization for the three and nine-monthsix-month periods ended SeptemberJune 30, 20222023 and 2021,2022, are as follows (in thousands):

|

| For the Three Months Ended |

| For the Nine Months Ended |

|

| For the Three Months Ended |

| For the Six Months Ended |

| ||||||||||||||||||||||

|

| September 30, |

| September 30, |

| September 30, |

| September 30, |

|

| June 30, |

| June 30, |

| June 30, |

| June 30, |

| ||||||||||||||

|

| 2022 |

|

| 2021 |

|

| 2022 |

|

| 2021 |

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||

Capitalized software development costs |

| $ | — |

| $ | 54 |

| $ | — |

| $ | 215 |

|

| $ | 167 |

| $ | — |

| $ | 167 |

| $ | — |

| ||||||

Amortization included in cost of revenues |

| 17 |

| 137 |

| 48 |

| 398 |

|

| 13 |

| 15 |

| 28 |

| 31 |

| ||||||||||||||

Impairment of Long-lived Assets

In accordance with the authoritative guidance for accounting for long-lived assets, assets such as property and equipment, trademarks, and intangible assets subject to amortization, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset group may not be recoverable. Recoverability of asset groups to be held and used is measured by a comparison of the carrying amount of an asset group to estimated undiscounted future cash flows expected to be generated by the asset group. If the carrying amount of an asset group exceeds its estimated future cash flows, an impairment charge is recognized by the amount by which the carrying amount of an asset group exceeds fair value of the asset group.

Lease Accounting

The Company determines if an arrangement is a lease at inception. Operating lease agreements are primarily for office space and are included within lease right-of-use (“ROU”) assets and lease liabilities on the consolidated balance sheet.

ROU assets represent the right to use an underlying asset for the lease term and lease liabilities represent the obligation to make lease payments arising from the lease. ROU assets and lease liabilities are recognized at the commencement date based on the present value of lease payments over the lease term. Variable lease payments consist of non-lease services related to the lease and payments under operating leases classified as short-term. Variable lease payments are excluded from the ROU assets and lease liabilities and are recognized in the period in which the obligation for those payments is incurred. As most of the leases do not provide an implicit rate, the Company uses its incremental borrowing rate based on the information available at commencement date in determining the present value of lease payments. ROU assets include any lease payments due and exclude lease incentives. Rental expense for lease payments related to operating leases is recognized on a straight-line basis over the lease term.

Fair Value Measurements

ASCAccounting Standards Codification (“ASC”) Topic 820 establishes a fair value hierarchy that requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. Assets and liabilities recorded at fair value in the financial statements are categorized based upon the hierarchy of levels of judgment associated with the inputs used to measure their fair value. Hierarchical levels directly related to the amount of subjectivity associated with the inputs to fair valuation of these assets and liabilities, are as follows:

| 10 |

| Table of Contents |

| · | Level 1 |

| · | Level 2 |

|

|

|

| · | Level 3 |

As of SeptemberJune 30, 20222023 and December 31, 2021,2022, the Company believes that the fair value of ourits financial instruments, such as, accounts receivable, ourlong-term debt, the line of credit, and accounts payable approximate their carrying amounts.

Translation of Foreign Financial Statements

The financial statements of the foreign subsidiaries of the Company have been translated into U.S. dollars. All assets and liabilities have been translated at current rates of exchange in effect at the end of the period. Income and expense items have been translated at the average exchange rates for the year or the applicable interim period. The gains or losses that result from this process are recorded as a separate component of other accumulated comprehensive income until the entity is sold or substantially liquidated.

Business Combinations, Goodwill, and Intangible Assets

The authoritative guidance for business combinations specifies the criteria for recognizing and reporting intangible assets apart from goodwill. The Company records the assets acquired and liabilities assumed in business combinations at their respective fair values at the date of acquisition, with any excess purchase price recorded as goodwill. Goodwill is an asset representing the future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognized. Intangible assets consist of client relationships, customer lists, distribution partner relationships, software, technology, non-compete agreements and trademarks that are initially measured at fair value. At the time of the business combination, trademarks aremay be considered an indefinite-lived asset and, as such, are not amortized as there ismay be no foreseeable limit to cash flows generated from them. For the Newswire acquisition (see Note 3), the Company determined the trademarks acquired were considered a definite lived asset which will be amortized over a period of 15 years. The goodwill and intangible assets are assessed annually for impairment, or whenever conditions indicate the asset may be impaired, and any such impairment will be recognized in the period identified. The client relationships (7-10(5-10 years), customer lists (3 years), distribution partner relationships (10 years), non-compete agreements (5 years) and software and technology (3-6(3-7 years) are amortized over their estimated useful lives.

Comprehensive Income

Comprehensive income consists of net income and other comprehensive income related to changes in the cumulative foreign currency translation adjustment.

Advertising

The Company expenses advertising as incurred. During the three and nine-monthsix-month periods ended SeptemberJune 30, 2023, advertising expense was $364,000 and $826,000, respectively. During the three and six-month periods ended June 30, 2022, advertising expense was $95,000$114,000 and $304,000,$209,000, respectively. DuringMost of the three and nine-month periods ended September 30, 2021,increase is due to additional advertising expense resulting from Newswire, which was $37,000 and $169,000, respectively.acquired in November 2022.

Stock-based Compensation

The authoritative guidance for stock compensation requires that companies estimate the fair value of share-based payment awards on the date of the grant using an option-pricing model. The associated cost is recognized over the period during which an employee or director is required to provide service in exchange for the award.

Employee Retention CreditNewly Adopted Accounting Pronouncements

On March 27, 2020,Topic 326 was effective for the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) was signed into law providing numerous tax provisions and other stimulus measures, including an employee retentionCompany beginning on January 1, 2023. This update requires a financial asset (or group of financial assets) measured at amortized cost basis, to be presented at the net amount expected to be collected. This allowance for credit (“ERC”), whichlosses is a refundable tax credit against certain employment taxes. The Taxpayer Certainty and Disaster Tax Relief Act of 2020 andvaluation account that is deducted from the American Rescue Plan Act of 2021 extended and expanded the availabilityamortized cost basis of the ERC.

We are eligible underfinancial asset(s) to present the CARES Act ERC as an employer that carried on a trade or business during calendar year 2020 and whose business operations were fully or partially suspended during any calendar quarter in 2020 due to orders from an appropriate governmental authority limiting commerce, travel, or group meetings (for commercial, social, religious, or other purposes) due to COVID-19.

ASC 105, Generally Accepted Accounting Principles, describes the decision-making framework when no guidance exists in US GAAP for a particular transaction. Specifically, ASC 105-10-05-2 instructs companies to look for guidance for a similar transaction within US GAAP and apply that guidance by analogy. As such, forms of government assistance, such as the ERC, provided to business entities would not be within the scope of ASC 958, but it may be applied by analogy under ASC 105-10-05-2. We accounted for the ERC as a government grant in accordance with Accounting Standards Update 2013-06, Not-for-Profit Entities (Topic 958) by analogy under ASC 105-10-05-2. Under this standard, government grants are recognized when the conditions or conditions on which they depend are substantially met. The conditions for recognitionnet carrying value of the ERC include, but areamount expected to be collected on the financial asset. The company has evaluated the impact of Topic 326 and has determined it does not limited to:

| ||

| ||

|

During the three and nine months ended September 30, 2021, we recorded an ERC benefit of 366,000 in other income in our Consolidated statements of operations and in other current assets in our Consolidated balance sheets as of September 30, 2021.have a material financial impact.

| 11 |

| Table of Contents |

Note 3: Acquisition of iNewswire LLC

On November 1, 2022, the Company entered into a Membership Interest Purchase Agreement with Lead Capital, LLC, a Delaware limited liability company (“Seller”), whereby the Company purchased all the issued and outstanding membership interests of iNewswire.com LLC, a Delaware limited liability company (“Newswire”). Newswire is a leading media and marketing communications technology company that provides press release distribution, media databases, media monitoring, and newsrooms through its PRO Plan.

In connection with the transaction (the “Acquisition”), the Company paid to the Seller aggregate consideration of $43.5 million, consisting of the following: (i) a cash payment of $18.0 million subject to a 60-day escrow to secure the payment of any working capital adjustments or any employee bonus obligations of Newswire, (ii) the issuance of a secured promissory note in the principal amount of $22.0 million (the “Secured Note”), and (iii) the issuance of 180,181 shares of the Company’s common stock, par value $0.001, valued at $3.9 million based on the Company’s closing stock price of $21.60 on the Closing Date. During the three months ended March 31, 2023, the Seller paid a $350,000 net working capital adjustment to the Company.

The Secured Note was due and payable on November 8, 2023, with an annual interest rate of 6%. The Secured Note allowed for prepayment, however, the 6% interest payment was guaranteed through the Maturity Date even if prepayments were made. On March 20, 2023, the Company paid $370,000 to pay the Secured Note in full, with the Seller agreeing to forgive $440,000 of interest which would have otherwise been due. The $370,000 payment is recorded in Other income (expense) on the Consolidated statements of operations for the six month-period ended June 30, 2023. As a result, there is no longer any obligation to the Seller as of June 30, 2023.

The Company has determined that the acquisition of Newswire constitutes a business acquisition as defined by ASC 805, Business Combinations. Accordingly, the assets acquired, and the liabilities assumed in the transaction were recorded at their acquisition date estimated fair value, while the transaction costs associated with the acquisition, which totaled $178,000, were expensed as incurred pursuant to the purchase method of accounting in accordance with ASC 805. The Company’s preliminary purchase price allocation was based on an evaluation of the appropriate fair values and represents management’s best estimate based on available data. Any changes within the measurement period resulting from facts and circumstances that existed as of the acquisition date may result in retrospective adjustments to the provisional amounts recorded at the acquisition date. The Company employed a third-party valuation firm to assist in determining the purchase price allocation of assets and liabilities acquired from Newswire. The income approach was used to determine the value of trademarks/tradename and client relationships. The income approach determines the fair value for the asset based on the present value of cash flows projected to be generated by the asset. Projected cash flows are discounted at a rate of return that reflects the relative risk of achieving the cash flow and the time value of money. Projected cash flows for each asset considered multiple factors, including current revenue from existing customers; analysis of expected revenue and attrition trends; reasonable contract renewal assumptions from the perspective of a marketplace participant; expected profit margins giving consideration to marketplace synergies; and required returns to contributory assets. The relief from royalty method was used to value the technology. This approach applies an industry-based royalty rate to future projected cashflows to express the fair value as the expected after-tax royalty savings of the asset. Fair values are determined based on the requirements of ASC 820, Fair Measurements and Disclosure. As of June 30, 2023, the calculation and allocation of the purchase price to tangible and intangible assets and liabilities is preliminary, as the Company is still in the process of accumulating all the required information to finalize the opening balance sheet and calculations of intangible assets.

A summary of the fair value consideration transferred for the Acquisition and the preliminary allocation to the fair value of the assets and liabilities of Newswire are as follows (in 000's):

Consideration transferred: |

|

|

| |

Cash payment |

| $ | 18,000 |

|

Secured promissory note |

|

| 22,000 |

|

Shares of Issuer Direct common stock based on closing market price prior to the Acquisition |

|

| 3,892 |

|

Net working capital adjustment and other costs paid on behalf of Seller, net of cash |

|

| (350 | ) |

Total consideration transferred |

| $ | 43,542 |

|

|

|

|

|

|

Preliminary allocation of tangible and intangible assets and liabilities: |

|

|

|

|

Goodwill |

| $ | 16,122 |

|

Trademarks/Tradenames |

|

| 27,500 |

|

Technology |

|

| 2,520 |

|

Customer relationships |

|

| 580 |

|

Net liabilities assumed |

|

| (3,180 | ) |

Total amount allocated |

| $ | 43,542 |

|

Net liabilities assumed: |

|

|

| |

Cash |

| $ | 37 |

|

Accounts Receivable |

|

| 90 |

|

Other Current Assets |

|

| 14 |

|

Accounts Payable |

|

| (645 | ) |

Accrued Expenses |

|

| (226 | ) |

Deferred Revenue |

|

| (1,775 | ) |

Deferred tax liability |

|

| (675 | ) |

|

| $ | (3,180 | ) |

| 12 |

| Table of Contents |

Supplemental pro forma information

The following unaudited supplemental pro forma information summarizes the Company’s results of operations for the current reporting period, as if the Company completed the acquisition as of the beginning of the annual reporting period.

Supplemental pro forma information is as follows:

in $000’s, except per share amounts |

|

|

|

|

| |||

|

| Three months ended June 30, 2022 |

|

| Six months ended June 30, 2022 |

| ||

Revenues |

| $ | 8,893 |

|

| $ | 17,643 |

|

Net income |

|

| 437 |

|

|

| 1,102 |

|

Basic earnings per share |

|

| 0.11 |

|

|

| 0.28 |

|

Diluted earnings per share |

|

| 0.11 |

|

|

| 0.28 |

|

The unaudited pro forma combined financial information is presented for information purposes only and is not intended to represent or be indicative of the combined results of operations or financial position that we would have reported had the acquisitions been completed as of the date and for the periods presented and should not be taken as representative of our consolidated results of operations or financial condition following the acquisition. In addition, the unaudited pro forma combined financial information is not intended to project the future financial position or results of operations of the combined company.

The unaudited pro forma financial information was prepared using the acquisition method of accounting for the acquisition under existing US GAAP. Issuer Direct has been treated as the acquirer.

Note 4: Equity

Dividends

The Company did not pay any dividends during the three and six-month periods ended June 30, 2023 and 2022.

Preferred stock and common stock

There were no issuances of preferred stock or common stock during the three and six-month periods ended June 30, 2023 and 2022, other than stock awarded to employees and the Board of Directors.

Stock repurchase and retirement

On March 1, 2022, the Company’s board of directors authorized a stock repurchase program under which the Company was authorized to repurchase up to $5,000,000 of its common shares. As of August 31, 2022, the Company completed the repurchase program by purchasing a total of 207,964 shares as shown in the table below ($ in 000’s, except share or per share amounts):

|

| Shares Repurchased |

| |||||||||||||

Period |

| Total Number of Shares Repurchased |

|

| Average Price Paid Per Share |

|

| Total Number of Shares Purchased as Part of Publicly Announced Program |

|

| Maximum Dollar Value of Shares that May Yet Be Purchased Under the Program |

| ||||

March 1-31, 2022 |

|

| 6,200 |

|

| $ | 29.35 |

|

|

| 6,200 |

|

| $ | 4,818 |

|

April 1-30, 2022 |

|

| 8,226 |

|

|

| 27.76 |

|

|

| 8,226 |

|

|

| 4,590 |

|

May 1-31, 2022 |

|

| 80,748 |

|

|

| 22.92 |

|

|

| 80,748 |

|

|

| 2,739 |

|

June 1-30, 2022 |

|

| 74,227 |

|

|

| 23.98 |

|

|

| 74,227 |

|

|

| 959 |

|

July 1-31, 2022 |

|

| 32,392 |

|

|

| 24.88 |

|

|

| 32,392 |

|

|

| 153 |

|

August 1-31, 2022 |

|

| 6,171 |

|

|

| 24.79 |

|

|

| 6,171 |

|

|

| — |

|

No shares repurchased between September 2022 and June 2023 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

| 207,964 |

|

| $ | 24.04 |

|

|

| 207,964 |

|

| $ | — |

|

| 13 |

| Table of Contents |

2014 Equity Incentive Plan

On May 23, 2014, the shareholders of the Company approved the 2014 Equity Incentive Plan, as amended (the “2014 Plan”). Under the terms of the 2014 Plan, the Company is authorized to issue incentive awards for common stock up to 200,000 shares to employees and other personnel. On June 10, 2016 and June 17, 2020, the shareholders of the Company approved an additional 200,000 and 200,000 awards, respectively, to be issued under the 2014 Plan, bringing the total number of shares to be awarded to 600,000. The awards may be in the form of incentive stock options, nonqualified stock options, restricted stock, restricted stock units and performance awards. The 2014 Plan is effective through March 31, 2024. As of SeptemberJune 30, 2022,2023, there are 140,99545,995 shares which remain eligible to be granted under the 2014 Plan.Plan, which were assumed by the 2023 Plan described below.

On June 7, 2023, the shareholders of the Company approved the 2023 Equity Incentive Plan (the “2023 Plan”). Under the terms of the 2023 Plan, the Company is authorized to issue incentive awards for common stock up to 300,000 shares to employees and other personnel. The awards may be in the form of incentive stock options, nonqualified stock options, restricted stock, restricted stock units and performance awards. The 2023 Plan is effective through April 1, 2033. As of June 30, 2023, there are 331,663 shares which remain to be granted under the 2023 Plan, including 45,995 shares assumed under the 2014 Plan described above.

The following table summarizes information about stock options outstanding and exercisable at SeptemberJune 30, 2022:2023:

|

|

|

| Options Outstanding |

|

| Options Exercisable |

| |||||||||||

| Exercise Price Range |

|

| Number |

|

| Weighted Average Remaining Contractual Life (in Years) |

|

| Weighted Average Exercise Price |

|

| Number |

| |||||

| $ | 0.01 - 8.00 |

|

|

| 7,500 |

|

|

| 2.42 |

|

| $ | 7.12 |

|

|

| 7,500 |

|

|

| 8.01 - 11.00 |

|

|

| 3,500 |

|

|

| 4.82 |

|

|

| 10.11 |

|

|

| 3,500 |

|

|

| 11.01 - 16.00 |

|

|

| 18,000 |

|

|

| 5.78 |

|

|

| 13.12 |

|

|

| 18,000 |

|

|

| 16.01 - 27.00 |

|

|

| 38,000 |

|

|

| 8.55 |

|

|

| 24.19 |

|

|

| 8,000 |

|

| $ | 27.01 - 27.71 |

|

|

| 20,250 |

|

|

| 9.30 |

|

|

| 27.71 |

|

|

| 1,500 |

|

|

| Total |

|

|

| 87,250 |

|

|

| 7.48 |

|

| $ | 20.69 |

|

|

| 38,500 |

|

|

|

| Options Outstanding |

|

| Options Exercisable |

| ||||||||||

| Exercise Price Range |

| Number |

|

| Weighted Average Remaining Contractual Life (in Years) |

|

| Weighted Average Exercise Price |

|

| Number |

| ||||

$ | 0.01 - 8.00 |

|

| 7,500 |

|

|

| 1.67 |

|

| $ | 7.12 |

|

|

| 7,500 |

|

$ | 8.01 - 11.00 |

|

| 3,000 |

|

|

| 4.50 |

|

| $ | 10.25 |

|

|

| 3,000 |

|

$ | 11.01 - 16.00 |

|

| 18,000 |

|

|

| 5.04 |

|

| $ | 13.12 |

|

|

| 18,000 |

|

$ | 16.01 - 27.00 |

|

| 68,000 |

|

|

| 8.56 |

|

| $ | 25.42 |

|

|

| 15,500 |

|

$ | 27.01 - 27.71 |

|

| 12,750 |

|

|

| 8.55 |

|

| $ | 27.71 |

|

|

| — |

|

| Total |

|

| 109,250 |

|

|

| 7.39 |

|

| $ | 21.99 |

|

|

| 44,000 |

|

As of SeptemberJune 30, 2022,2023, the Company had unrecognized stock compensation related to the options of $489,000,$682,000, which will be recognized through 2026.2027.

During the nine monthsthree and six-months ended SeptemberJune 30, 2023, the Company granted 14,332 and 74,832, respectively, of restricted stock units to employees, which vest at various intervals over the next 3 years. The average grant date fair value of these grants was $18.70 and $26.08 per share during the three and six-month periods ended June 30, 2023, respectively. During the three and six-months ended June 30, 2022, the Company granted 32,24012,440 and 32,440 restricted stock units. No restricted stock units, were granted during the three months ended September 20, 2022. An executive officer was granted 20,000 shares which do not vest until the third anniversary of the grant date and have a grant date fair value of $26.00 per share. Non-employee directors were granted 12,240 shares with a grant date fair value of $26.92 and vest at the earlier of the 2023 annual meeting of the shareholders or one year.$26.35 per share, respectively. During the nine monthsthree and six-month periods ended SeptemberJune 30, 2022, 15,2652023, 18,129 restricted stock units with an average intrinsic value of $26.05$25.85 per share, vested. No restricted stock units vested during the three months ended September 30, 2022. As of SeptemberJune 30, 2022,2023, there was $666,000$2,117,000 of unrecognized compensation cost related to our unvested restricted stock units, which will be recognized through 2025.2026.

Stock repurchase and retirement

On August 7, 2019, the Company publicly announced a share repurchase program under which the Company was authorized to repurchase up to $1,000,000 of its common shares. On March 16, 2020, the Company publicly announced that the Company increased the share repurchase program to repurchase up to $2,000,000 of its common shares. As of March 31, 2021, the Company completed the repurchase program by purchasing 179,845 shares as shown in the table below ($ in 000’s, except share or per share amounts):

|

| Shares Repurchased |

| |||||||||||||

Period |

| Total Number of Shares Repurchased |

|

| Average Price Paid Per Share |

|

| Total Number of Shares Purchased as Part of Publicly Announced Program |

|

| Maximum Dollar Value of Shares that May Yet Be Purchased Under the Program |

| ||||

August 7-31, 2019 |

|

| 22,150 |

|

| $ | 9.34 |

|

|

| 22,150 |

|

| $ | 793 |

|

September 1-30, 2019 |

|

| 2,830 |

|

| 10.00 |

|

|

| 2,830 |

|

| 765 |

| ||

October 1-31, 2019 |

|

| 39,363 |

|

| 10.44 |

|

|

| 39,363 |

|

| 354 |

| ||

November 1-30, 2019 |

|

| 11,827 |

|

| 10.43 |

|

|

| 11,827 |

|

| 231 |

| ||

December 1-31, 2019 |

|

| — |

|

|

| — |

|

|

| — |

|

| 231 |

| |

January 1-31, 2020 |

|

| — |

|

|

| — |

|

|

| — |

|

| 231 |

| |

February 1-29, 2020 |

|

| — |

|

|

| — |

|

|

| — |

|

| 231 |

| |

March 1-31, 2020 |

|

| 21,700 |

|

| 9.33 |

|

|

| 21,700 |

|

| 1,028 |

| ||

April 1-30, 2020 |

|

| 22,698 |

|

| 9.02 |

|

|

| 22,698 |

|

| 823 |

| ||

May 1-31, 2020 |

|

| 39,500 |

|

| 9.51 |

|

|

| 39,500 |

|

| 448 |

| ||

No shares repurchased between June 2020 and February 2021 | ||||||||||||||||

March 1-31, 2021 |

|

| 19,777 |

|

| 22.89 |

|

|

| 19,777 |

|

| — |

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

| 179,845 |

|

| $ | 11.15 |

|

|

| 179,845 |

|

| $ | — |

|

On March 1, 2022, the Company’s board of directors authorized a stock repurchase program under which the Company was authorized to repurchase up to $5,000,000 of its common shares. The Company completed the repurchase program by purchasing 38,563 and 207,964 shares during the three and nine-month periods ended September 30, 2022, respectively, as shown in the table below ($ in 000’s, except share or per share amounts):

|

| Shares Repurchased |

| |||||||||||||

Period |

| Total Number of Shares Repurchased |

|

| Average Price Paid Per Share |

|

| Total Number of Shares Purchased as Part of Publicly Announced Program |

|

| Maximum Dollar Value of Shares that May Yet Be Purchased Under the Program |

| ||||

March 1-31, 2022 |

|

| 6,200 |

|

| $ | 29.35 |

|

|

| 6,200 |

|

| $ | 4,818 |

|

April 1-30, 2022 |

|

| 8,226 |

|

|

| 27.76 |

|

|

| 8,226 |

|

|

| 4,590 |

|

May 1-31, 2022 |

|