UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________

FORM 10-Q

| | | | | |

| ☑ | |

þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended DecemberMarch 31, 20172024

OR

| | | | | |

| ☐ | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to ___________

Commission file number 001-37884

VALVOLINE INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Kentucky | 30-0939371 |

| |

Kentucky

(State or other jurisdiction of incorporation or organization) | 30-0939371

(I.R.S. Employer Identification No.) |

100 Valvoline Way, Suite 100

Lexington, Kentucky 40509

(Address of principal executive offices) (Zip Code)

Telephone Number (859) 357-7777

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | | VVV | | New York Stock Exchange |

Indicate by check mark whether the Registrantregistrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þNoo

Indicate by check mark whether the Registrantregistrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrantregistrant was required to submit and post such files).Yes þ Noo

Indicate by check mark whether the Registrantregistrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”,filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

| Large accelerated filer | ☑ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| Large Accelerated Filer þ

| Emerging growth company | Accelerated Filer o

|

Non-Accelerated Filer o

| Smaller Reporting Company o

|

(Do not check if a smaller reporting company) | Emerging Growth Company o

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o☐

Indicate by check mark whether the Registrantregistrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o☐ No þ

At February 1, 2018,May 7, 2024, there were 200,065,752128,854,818 shares of the Registrantregistrant’s common stock outstanding.

VALVOLINE INC. AND CONSOLIDATED SUBSIDIARIES

TABLE OF CONTENTS

| | | | | |

| Page |

| |

| Page |

| PART I – FINANCIAL INFORMATION |

| |

| |

| |

| |

For the three months ended December 31, 2017 and 2016 | |

| |

| |

As of December 31, 2017 and September 30, 2017 | |

| |

| |

For the three months ended December 31, 2017 and 2016 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| PART II – OTHER INFORMATION |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Valvoline Inc. and Consolidated Subsidiaries

Condensed Consolidated Statements of Comprehensive Income |

| | | | | | | |

| | Three months ended December 31 |

| (In millions except per share data - unaudited) | 2017 | | 2016 |

| Sales | $ | 545 |

| | $ | 489 |

|

| Cost of sales | 350 |

| | 304 |

|

| Gross profit | 195 |

| | 185 |

|

| | | | |

| Selling, general and administrative expenses | 114 |

| | 95 |

|

| Separation costs | 2 |

| | 6 |

|

| Equity and other income | (9 | ) | | (10 | ) |

| Operating income | 88 |

| | 94 |

|

| Net pension and other postretirement plan non-service income and remeasurement adjustments | (10 | ) | | (26 | ) |

| Net interest and other financing expense | 14 |

| | 10 |

|

| Income before income taxes | 84 |

| | 110 |

|

| Income tax expense | 94 |

| | 38 |

|

| Net (loss) income | $ | (10 | ) | | $ | 72 |

|

| | | | |

| NET (LOSS) INCOME PER SHARE | | | |

| Basic | $ | (0.05 | ) | | $ | 0.35 |

|

| Diluted | $ | (0.05 | ) | | $ | 0.35 |

|

| | | | |

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING | | | |

| Basic | 202 |

| | 205 |

|

| Diluted | 202 |

| | 205 |

|

| | | | |

| DIVIDENDS PAID PER COMMON SHARE | $ | 0.07 |

| | $ | 0.05 |

|

| | | | |

| COMPREHENSIVE (LOSS) INCOME | | | |

| Net (loss) income | $ | (10 | ) | | $ | 72 |

|

| Other comprehensive income (loss), net of tax | | | |

| Unrealized translation gain (loss) | 1 |

| | (9 | ) |

| Pension and other postretirement obligation adjustment | (2 | ) | | (2 | ) |

| Other comprehensive loss | (1 | ) | | (11 | ) |

| Comprehensive (loss) income | $ | (11 | ) | | $ | 61 |

|

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

March 31 | | Six months ended

March 31 |

| (In millions, except per share amounts - unaudited) | | 2024 | | 2023 | | 2024 | | 2023 |

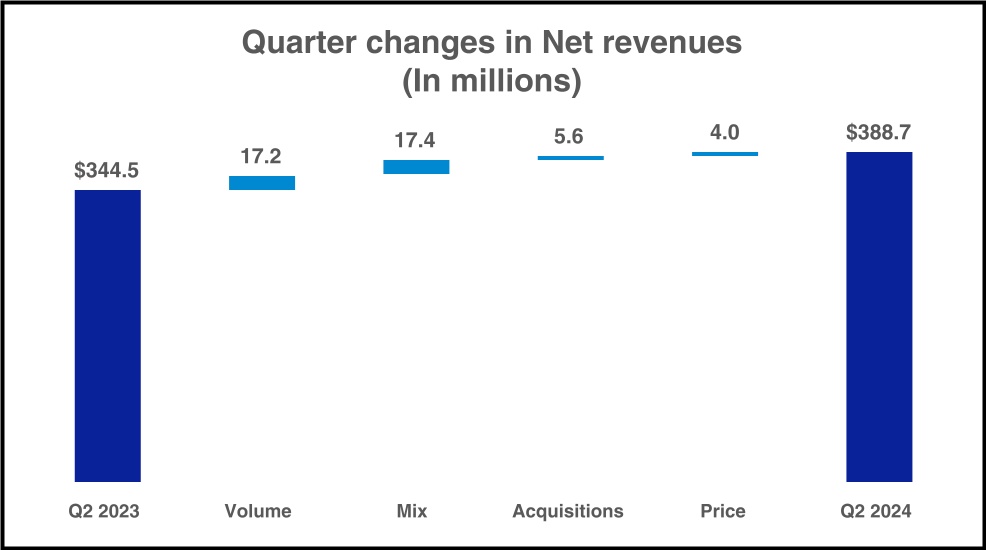

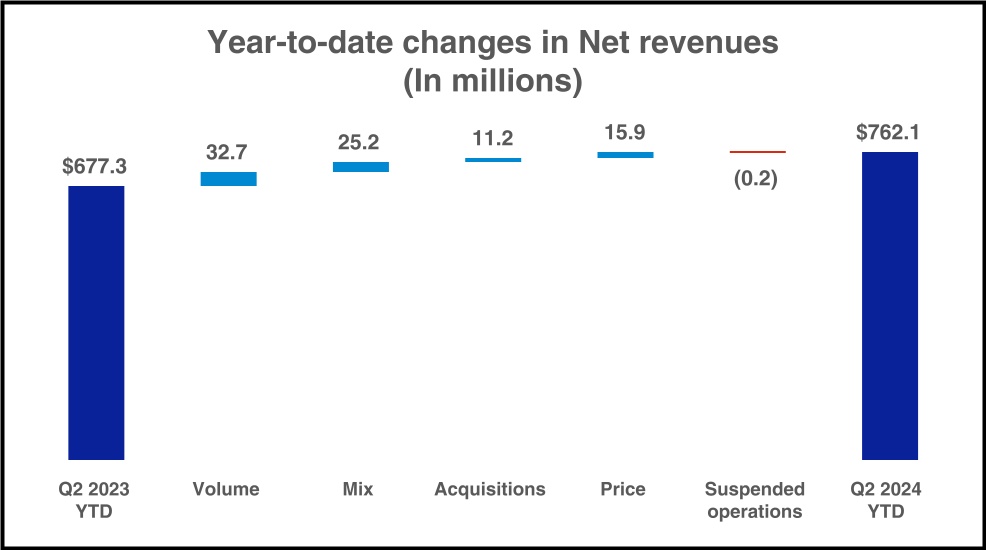

| Net revenues | | $ | 388.7 | | | $ | 344.5 | | | $ | 762.1 | | | $ | 677.3 | |

| Cost of sales | | 242.5 | | | 217.8 | | | 481.1 | | | 431.8 | |

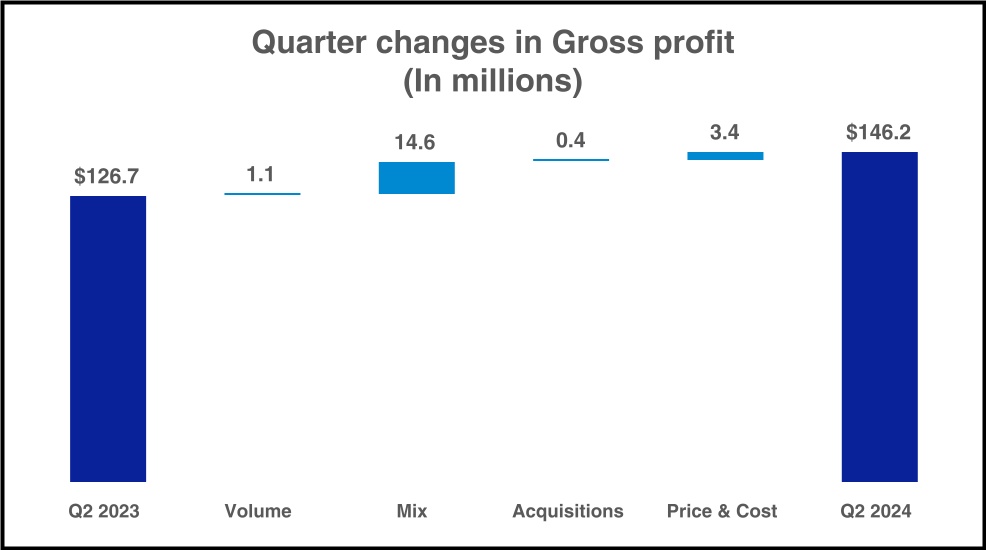

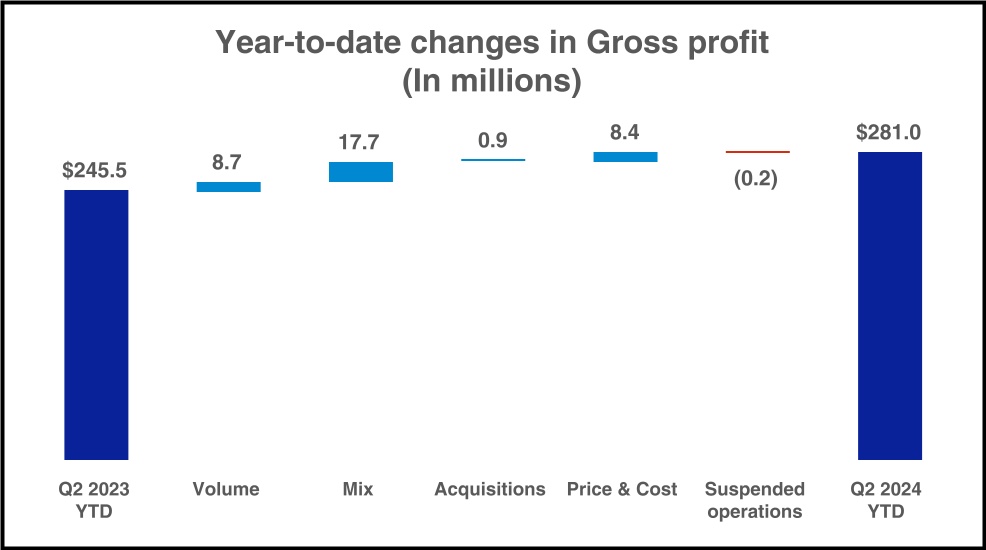

| Gross profit | 146.2 | | | 126.7 | | | 281.0 | | | 245.5 | |

| | | | | | | | |

| Selling, general and administrative expenses | | 72.3 | | | 62.6 | | | 146.8 | | | 128.6 | |

| Net legacy and separation-related expenses | | — | | | 3.8 | | | 0.1 | | | 29.2 | |

| Other income, net | | (2.5) | | | (0.9) | | | (5.1) | | | (2.8) | |

| Operating income | 76.4 | | | 61.2 | | | 139.2 | | | 90.5 | |

| Net pension and other postretirement plan expenses | | 3.6 | | | 3.6 | | | 7.0 | | | 7.3 | |

| Net interest and other financing expenses | | 15.5 | | | 13.3 | | | 29.1 | | | 32.0 | |

| Income before income taxes | 57.3 | | | 44.3 | | | 103.1 | | | 51.2 | |

| Income tax expense (benefit) | | 14.0 | | | 11.4 | | | 25.9 | | | (8.7) | |

| Income from continuing operations | | 43.3 | | | 32.9 | | | 77.2 | | | 59.9 | |

| (Loss) income from discontinued operations, net of tax | | (1.9) | | | 1,194.4 | | | (3.9) | | | 1,249.3 | |

| Net income | $ | 41.4 | | | $ | 1,227.3 | | | $ | 73.3 | | | $ | 1,309.2 | |

| | | | | | | | |

| Net earnings per share | | | | | | | | |

| Basic earnings (loss) per share | | | | | | | |

| Continuing operations | $ | 0.33 | | | $ | 0.19 | | | $ | 0.59 | | | $ | 0.35 | |

| Discontinued operations | (0.01) | | | 6.96 | | | (0.03) | | | 7.20 | |

| Basic earnings per share | $ | 0.32 | | | $ | 7.15 | | | $ | 0.56 | | | $ | 7.55 | |

| | | | | | | | |

| Diluted earnings (loss) per share | | | | | | | |

| Continuing operations | $ | 0.33 | | | $ | 0.19 | | | $ | 0.59 | | | $ | 0.34 | |

| Discontinued operations | (0.01) | | | 6.92 | | | (0.03) | | | 7.16 | |

| Diluted earnings per share | $ | 0.32 | | | $ | 7.11 | | | $ | 0.56 | | | $ | 7.50 | |

| | | | | | | | |

| Weighted average common shares outstanding | | | | | | | | |

| Basic | | 129.8 | | | 171.7 | | | 130.8 | | | 173.5 | |

| Diluted | | 130.7 | | | 172.7 | | | 131.7 | | | 174.5 | |

| | | | | | | | |

| Comprehensive income | | | | | | | | |

| Net income | | $ | 41.4 | | | $ | 1,227.3 | | | $ | 73.3 | | | $ | 1,309.2 | |

| Other comprehensive (loss) income, net of tax | | | | | | | | |

| Currency translation adjustments | | (2.5) | | | 29.3 | | | 4.1 | | | 44.5 | |

| Amortization of pension and other postretirement plan prior service credits | | (0.4) | | | (0.5) | | | (0.9) | | | (0.9) | |

| Unrealized loss on cash flow hedges | | (1.4) | | | (3.1) | | | (3.3) | | | (4.4) | |

| Other comprehensive (loss) income | | (4.3) | | | 25.7 | | | (0.1) | | | 39.2 | |

| Comprehensive income | | $ | 37.1 | | | $ | 1,253.0 | | | $ | 73.2 | | | $ | 1,348.4 | |

| | | | | | | | |

SeeThe accompanying Notes to Condensed Consolidated Financial Statements are an integral part of these Condensed Consolidated Financial Statements.

Valvoline Inc. and Consolidated Subsidiaries

Condensed Consolidated Balance Sheets | | | | | | | | | | | | | | |

| (In millions, except per share amounts - unaudited) | | March 31

2024 | | September 30 2023 |

| Assets |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 494.5 | | | $ | 409.1 | |

| Receivables, net | | 109.6 | | | 81.3 | |

| Inventories, net | | 37.5 | | | 33.3 | |

| Prepaid expenses and other current assets | | 59.8 | | | 65.5 | |

| Short-term investments | | — | | | 347.5 | |

| | | | |

| Total current assets | | 701.4 | | | 936.7 | |

| Noncurrent assets | | | | |

| Property, plant and equipment, net | | 877.9 | | | 818.3 | |

| Operating lease assets | | 288.1 | | | 266.5 | |

| Goodwill and intangibles, net | | 692.3 | | | 680.6 | |

| | | | |

| Other noncurrent assets | | 203.3 | | | 187.8 | |

| | | | |

| Total noncurrent assets | | 2,061.6 | | | 1,953.2 | |

| Total assets | | $ | 2,763.0 | | | $ | 2,889.9 | |

| | | | |

| Liabilities and Stockholders’ Equity | | | | |

| Current liabilities | | | | |

| | | | |

| Current portion of long-term debt | | $ | 623.8 | | | $ | 23.8 | |

| Trade and other payables | | 118.8 | | | 118.7 | |

| Accrued expenses and other liabilities | | 221.1 | | | 215.9 | |

| Current liabilities held for sale | | — | | | 3.9 | |

| Total current liabilities | | 963.7 | | | 362.3 | |

| Noncurrent liabilities | | | | |

| Long-term debt | | 951.3 | | | 1,562.3 | |

| Employee benefit obligations | | 170.2 | | | 168.0 | |

| Operating lease liabilities | | 269.0 | | | 247.3 | |

| | | | |

| Other noncurrent liabilities | | 348.7 | | | 346.8 | |

| | | | |

| Total noncurrent liabilities | | 1,739.2 | | | 2,324.4 | |

| Commitments and contingencies | | | | |

| Stockholders' equity | | | | |

| Preferred stock, no par value, 40.0 shares authorized; no shares issued and outstanding | | — | | | — | |

| Common stock, par value $0.01 per share, 400.0 shares authorized; 128.8 and 134.8 shares issued and outstanding at March 31, 2024 and September 30, 2023, respectively | | 1.3 | | | 1.3 | |

| Paid-in capital | | 45.3 | | | 48.0 | |

| Retained earnings | | 0.4 | | | 140.7 | |

| | | | |

| | | | |

| Accumulated other comprehensive income | | 13.1 | | | 13.2 | |

| Stockholders' equity | | 60.1 | | | 203.2 | |

| Total liabilities and stockholders’ equity | | $ | 2,763.0 | | | $ | 2,889.9 | |

| | | | |

|

| | | | | | | |

| (In millions except per share amounts - unaudited) | December 31

2017 | | September 30

2017 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 115 |

| | $ | 201 |

|

| Accounts receivable, net | 418 |

| | 385 |

|

| Inventories, net | 170 |

| | 175 |

|

| Other current assets | 32 |

| | 29 |

|

| Total current assets | 735 |

| | 790 |

|

| Noncurrent assets | | | |

| Property, plant and equipment, net | 384 |

| | 391 |

|

| Goodwill and intangibles, net | 393 |

| | 335 |

|

| Equity method investments | 33 |

| | 30 |

|

| Deferred income taxes | 196 |

| | 281 |

|

| Other noncurrent assets | 86 |

| | 88 |

|

| Total noncurrent assets | 1,092 |

| | 1,125 |

|

| Total assets | $ | 1,827 |

| | $ | 1,915 |

|

| | | | |

| Liabilities and Stockholders’ Deficit | | | |

| Current liabilities | | | |

| Short-term debt | $ | — |

| | $ | 75 |

|

| Current portion of long-term debt | 19 |

| | 15 |

|

| Trade and other payables | 141 |

| | 192 |

|

| Accrued expenses and other liabilities | 208 |

| | 196 |

|

| Total current liabilities | 368 |

| | 478 |

|

| Noncurrent liabilities | | | |

| Long-term debt | 1,147 |

| | 1,034 |

|

| Employee benefit obligations | 331 |

| | 342 |

|

| Other noncurrent liabilities | 175 |

| | 178 |

|

| Total noncurrent liabilities | 1,653 |

| | 1,554 |

|

| Commitments and contingencies |

| |

|

Stockholders’ deficit | | | |

| Preferred stock, no par value, 40 shares authorized; no shares issued and outstanding | — |

| | — |

|

| Common stock, par value $0.01 per share, 400 shares authorized; 201 and 203 shares issued and outstanding at December 31, 2017 and September 30, 2017 | 2 |

| | 2 |

|

| Paid-in capital | — |

| | 5 |

|

| Retained deficit | (238 | ) | | (167 | ) |

| Accumulated other comprehensive income | 42 |

| | 43 |

|

| Total stockholders’ deficit | (194 | ) | | (117 | ) |

Total liabilities and stockholders’ deficit | $ | 1,827 |

| | $ | 1,915 |

|

| | | | |

SeeThe accompanying Notes to Condensed Consolidated Financial Statements are an integral part of these Condensed Consolidated Financial Statements.

Valvoline Inc. and Consolidated Subsidiaries

Condensed Consolidated Statements of Cash Flows | | | | | | | | | | | | | | |

| | Six months ended

March 31 |

| (In millions - unaudited) | | 2024 | | 2023 |

| Cash flows from operating activities | | | | |

| Net income | | $ | 73.3 | | | $ | 1,309.2 | |

| Adjustments to reconcile net income to cash flows from operating activities: | | | | |

| Loss (income) from discontinued operations | | 3.9 | | | (1,249.3) | |

| | | | |

| Depreciation and amortization | | 50.2 | | | 39.1 | |

| | | | |

| Deferred income taxes | | — | | | (26.6) | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Stock-based compensation expense | | 4.9 | | | 5.4 | |

| Other, net | | 1.4 | | | 2.3 | |

| Change in operating assets and liabilities | | | | |

| Receivables | | (23.1) | | | 4.8 | |

| Inventories | | (4.7) | | | (3.7) | |

| Payables and accrued liabilities | | 4.2 | | | 68.5 | |

| Other assets and liabilities | | (18.0) | | | 23.8 | |

| Operating cash flows from continuing operations | | 92.1 | | | 173.5 | |

| Operating cash flows from discontinued operations | | (3.9) | | | (63.4) | |

| Total cash provided by operating activities | | 88.2 | | | 110.1 | |

| Cash flows from investing activities | | | | |

| Additions to property, plant and equipment | | (87.2) | | | (79.4) | |

| | | | |

| Acquisitions of businesses | | (21.3) | | | (18.9) | |

| | | | |

| | | | |

| | | | |

| Proceeds from maturities of short-term investments | | 350.0 | | | — | |

| Other investing activities, net | | (10.9) | | | 2.0 | |

| Investing cash flows from continuing operations | | 230.6 | | | (96.3) | |

| Investing cash flows from discontinued operations | | — | | | 2,623.2 | |

| Total cash provided by investing activities | | 230.6 | | | 2,526.9 | |

| Cash flows from financing activities | | | | |

| Proceeds from borrowings | | — | | | 920.9 | |

| | | | |

| Repayments on borrowings | | (11.8) | | | (909.0) | |

| | | | |

| Repurchases of common stock | | (212.2) | | | (257.4) | |

| | | | |

| Cash dividends paid | | — | | | (21.8) | |

| Other financing activities | | (13.6) | | | (12.1) | |

| Financing cash flows from continuing operations | | (237.6) | | | (279.4) | |

| Financing cash flows from discontinued operations | | — | | | (108.1) | |

| Total cash used in financing activities | | (237.6) | | | (387.5) | |

| Effect of currency exchange rate changes on cash, cash equivalents and restricted cash | | 0.2 | | | 1.1 | |

| Increase in cash, cash equivalents and restricted cash | | 81.4 | | | 2,250.6 | |

| Cash, cash equivalents and restricted cash - beginning of period | | 413.1 | | | 83.9 | |

| Cash, cash equivalents and restricted cash - end of period | | $ | 494.5 | | | $ | 2,334.5 | |

| | | | |

|

| | | | | | | |

| | Three months ended

December 31 |

| (In millions - unaudited) | 2017 | | 2016 |

| Cash flows from operating activities | | | |

| Net (loss) income | $ | (10 | ) | | $ | 72 |

|

| Adjustments to reconcile net income (loss) to cash flows from operating activities | | | |

| Depreciation and amortization | 11 |

| | 9 |

|

| Debt issuance cost and discount amortization | 1 |

| | 1 |

|

| Deferred income taxes | 85 |

| | — |

|

| Equity income from affiliates | (5 | ) | | (4 | ) |

| Distributions from equity affiliates | 3 |

| | — |

|

| Pension contributions | (3 | ) | | (3 | ) |

| Gain on pension and other postretirement plan remeasurements | — |

| | (8 | ) |

| Stock-based compensation expense | 4 |

| | 1 |

|

Change in assets and liabilities (a) | | | |

| Accounts receivable | (34 | ) | | 10 |

|

| Inventories | 7 |

| | (2 | ) |

| Payables and accrued liabilities | (40 | ) | | 23 |

|

| Other assets and liabilities | 1 |

| | (11 | ) |

| Total cash provided by operating activities | 20 |

| | 88 |

|

| Cash flows from investing activities | | | |

| Additions to property, plant and equipment | (14 | ) | | (9 | ) |

| Acquisitions, net of cash acquired | (60 | ) | | — |

|

| Other investing activities, net | — |

| | (1 | ) |

| Total cash used in investing activities | (74 | ) | | (10 | ) |

| Cash flows from financing activities | | | |

| Net transfers to Ashland | — |

| | (2 | ) |

| Proceeds from borrowings, net of issuance costs | 44 |

| | 75 |

|

| Repayments on borrowings | (4 | ) | | (79 | ) |

| Repurchase of common stock | (37 | ) | | — |

|

| Purchase of additional ownership in subsidiary | (15 | ) | | — |

|

| Cash dividends paid | (15 | ) | | (10 | ) |

| Other financing activities | (4 | ) | | — |

|

| Total cash used in financing activities | (31 | ) | | (16 | ) |

| Effect of currency exchange rate changes on cash and cash equivalents | (1 | ) | | 2 |

|

| (Decrease) increase in cash and cash equivalents | (86 | ) | | 64 |

|

| Cash and cash equivalents - beginning of period | 201 |

| | 172 |

|

| Cash and cash equivalents - end of period | $ | 115 |

| | $ | 236 |

|

| | | | |

(a) Excludes changes resulting from operations acquired or sold.

SeeThe accompanying Notes to Condensed Consolidated Financial Statements are an integral part of these Condensed Consolidated Financial Statements.

Valvoline Inc. and Consolidated Subsidiaries

Condensed Consolidated Statements of Stockholders' Equity

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended March 31, 2024 |

| (In millions, except per share amounts - unaudited) | | Common stock | | Paid-in capital | | Retained earnings (deficit) | | Accumulated other comprehensive income | | Totals |

| Shares | | Amount |

| Balance at September 30, 2023 | | 134.8 | | | $ | 1.3 | | | $ | 48.0 | | | $ | 140.7 | | | $ | 13.2 | | | $ | 203.2 | |

| Net income | | — | | | — | | | — | | | 31.9 | | | — | | | 31.9 | |

| | | | | | | | | | | | |

| Stock-based compensation, net of issuances | | 0.2 | | | — | | | (1.7) | | | — | | | — | | | (1.7) | |

| Repurchases of common stock | | (5.4) | | | — | | | — | | | (172.8) | | | — | | | (172.8) | |

| Other comprehensive income, net of tax | | — | | | — | | | — | | | — | | | 4.2 | | | 4.2 | |

| Balance at December 31, 2023 | | 129.6 | | | $ | 1.3 | | | $ | 46.3 | | | $ | (0.2) | | | $ | 17.4 | | | $ | 64.8 | |

| Net income | | — | | | — | | | — | | | 41.4 | | | — | | | 41.4 | |

| | | | | | | | | | | | |

| Stock-based compensation, net of issuances | | 0.2 | | | — | | | (1.0) | | | — | | | — | | | (1.0) | |

| Repurchases of common stock | | (1.0) | | | — | | | — | | | (40.8) | | | — | | | (40.8) | |

| Other comprehensive loss, net of tax | | — | | | — | | | — | | | — | | | (4.3) | | | (4.3) | |

| Balance at March 31, 2024 | | 128.8 | | | $ | 1.3 | | | $ | 45.3 | | | $ | 0.4 | | | $ | 13.1 | | | $ | 60.1 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Six months ended March 31, 2023 |

| (In millions, except per share amounts - unaudited) | | Common stock | | Paid-in capital | | Retained earnings | | Accumulated other comprehensive (loss) income | | Totals |

| Shares | | Amount |

| Balance at September 30, 2022 | | 176.1 | | | $ | 1.8 | | | $ | 44.1 | | | $ | 282.0 | | | $ | (21.3) | | | $ | 306.6 | |

| Net income | | — | | | — | | | — | | | 81.9 | | | — | | | 81.9 | |

| Dividends paid, $0.125 per common share | | — | | | — | | | 0.1 | | | (21.9) | | | — | | | (21.8) | |

| Stock-based compensation, net of issuances | | 0.3 | | | — | | | (3.4) | | | — | | | — | | | (3.4) | |

| Repurchases of common stock | | (2.9) | | | (0.1) | | | — | | | (87.4) | | | — | | | (87.5) | |

| | | | | | | | | | | | |

| Other comprehensive income, net of tax | | — | | | — | | | — | | | — | | | 13.5 | | | 13.5 | |

| Balance at December 31, 2022 | | 173.5 | | | $ | 1.7 | | | $ | 40.8 | | | $ | 254.6 | | | $ | (7.8) | | | $ | 289.3 | |

| Net income | | — | | | — | | | — | | | 1,227.3 | | | — | | | 1,227.3 | |

| | | | | | | | | | | | |

| Stock-based compensation, net of issuances | | 0.1 | | | — | | | 1.8 | | | — | | | — | | | 1.8 | |

| Repurchases of common stock | | (4.9) | | | — | | | — | | | (171.7) | | | — | | | (171.7) | |

| Other comprehensive income, net of tax | | — | | | — | | | — | | | — | | | 25.7 | | | 25.7 | |

| Balance at March 31, 2023 | | 168.7 | | | $ | 1.7 | | | $ | 42.6 | | | $ | 1,310.2 | | | $ | 17.9 | | | $ | 1,372.4 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

The accompanying Notes to Condensed Consolidated Financial Statements are an integral part of these Condensed Consolidated Financial Statements.

| | | | | |

Index to Notes to Condensed Consolidated Financial Statements | Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Valvoline Inc. and Consolidated Subsidiaries

Notes to Condensed Consolidated Financial Statements (Unaudited)

NOTE 1 – BASIS OF PRESENTATION AND SIGNIFICANT ACCOUNTING POLICIES

The accompanying unaudited condensed consolidated financial statements have been prepared by Valvoline Inc. (“Valvoline” or the “Company”) in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and Securities and Exchange Commission (“SEC”) regulations for interim financial reporting, which do not include all information and footnote disclosures normally included in annual financial statements. Therefore, these condensed consolidated financial statements should be read in conjunction with Valvoline’s Annual Report on Form 10-K for the fiscal year ended September 30, 2017. 2023.

Use of estimates, risks and uncertainties

The preparation of the condensed consolidated financial statements in conformity with U.S. GAAP requires management to make use of estimates and assumptionsjudgments that affect the reported amounts of assets, liabilities, revenues and disclosures. Actual results may vary from these estimates. In the opinion of management, all adjustments considered necessary for a fair presentation have been included herein,expenses, and the disclosures of contingent matters. Although management bases its estimates on historical experience and various other assumptions underlyingthat are believed to be reasonable under the circumstances, actual results could differ significantly from the estimates under different assumptions or conditions.

Sale of Global Products business

On March 1, 2023, Valvoline completed the sale of its former Global Products reportable segment (“Global Products”) to Aramco Overseas Company B.V. (the “Transaction”). The operating results and cash flows associated with and directly attributed to the Global Products disposal group are reflected as discontinued operations within these condensed consolidated financial statementsstatements.Refer to Note 2 for additional information regarding the Global Products business, including income from discontinued operations. Unless otherwise noted, disclosures within these interim periods are reasonable. The results forremaining Notes to Condensed Consolidated Financial Statements relate solely to the interim periods are not necessarily indicative of results to be expected for the entire year.Company's continuing operations.

Recent accounting pronouncements

A description of new U.S. GAAPThe following accounting standards issued and adopted during the current year is required in interim financial reporting. A detailed listing of recent accounting standardsguidance relevant to Valvoline is included in the Annual Report on Form 10-K for the fiscal year ended September 30, 2017. The following standards relevant to Valvoline werewas either issued or adopted in the current period,fiscal year or areis expected to have a meaningful impact on Valvoline in future periods.periods upon adoption.

RecentlyIssued but not yet adopted

In the first fiscal quarter of 2018, Valvoline adopted the following:

In July 2015,November 2023, the Financial Accounting Standards Board (“FASB”) issued accounting guidance that enhances reportable segment disclosures by requiring disclosure of significant reportable segment expenses and other items regularly provided to simplify the subsequent measurement of certain inventories by replacing the current lower of cost or market test with a lower of cost or net realizable value test. The guidance applies only to inventories for which cost is determined by methods other than last-in, first outChief Operating Decision Maker (“LIFO”CODM”) and retail inventory methods.included within measures of a segment’s profit or loss, inclusive of entities that operate in a single reportable segment. This guidance must be applied retrospectively to all prior periods presented and will become effective for Valvoline adoptedbeginning with its fiscal 2025 annual financial statements and interim periods starting in fiscal 2026, with early adoption permitted. Valvoline is currently evaluating the impact this guidance prospectivelywill have on October 1, 2017. Valvoline utilizes LIFO to value approximately 70% ofthe Company and expects adoption will require enhanced disclosures regarding its gross inventoryCODM and there were no material differencesthe information used in the Company's previous valuation methodology for its remaining inventory using lower of cost or market to lower of cost or net realizable value.assessing performance and allocating resources, including significant expenses.

In March 2017,December 2023, the FASB issued accounting guidance which enhances income tax disclosure requirements to include additional disaggregation within the effective tax rate reconciliation and income taxes paid. This guidance will be effective for Valvoline beginning with its fiscal 2026 annual financial statements, with early adoption permitted. The guidance must be applied prospectively, while retrospective application is permitted. The Company is currently assessing the impact of adoption, which is expected to result in enhanced income tax disclosures.

NOTE 2 - DISCONTINUED OPERATIONS

Sale of Global Products

Financial results

On March 1, 2023, Valvoline completed the sale of Global Products for a cash purchase price of $2.650 billion and recognized a pre-tax gain on the sale within Income from discontinued operations, net of tax, during the second quarter of fiscal 2023, coinciding with the completion of the sale. The Transaction was subject to customary closing settlements that changed how employers who sponsor defined benefit pension and/or postretirement benefit plans present the net periodic benefit costwere finalized in the Condensed Consolidated Statementsthird quarter of Comprehensive Income. This guidance requires employers to present the service cost component of net periodic benefit cost fiscal 2023 and resulted in the same caption as other employee compensation costs from services renderedrecognition of a pre-tax gain on sale of $1.572 billion during the period. All other components of the net periodic benefit cost are presented separately outside of the operating income caption. Valvoline retrospectively adopted this guidance on October 1, 2017. Accordingly, Net pension and other postretirement plan non-service income and remeasurement adjustments has been reclassified to non-operating income for all periods presentedfiscal year ended September 30, 2023.

The following table summarizes Income from discontinued operations within the Condensed ConsolidatedStatements of Comprehensive Income:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

March 31 | | Six months ended

March 31 |

| (In millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| Net revenues | | $ | — | | | $ | 468.6 | | | $ | — | | | $ | 1,174.4 | |

| Cost of sales | | — | | | 367.6 | | | — | | | 924.2 | |

| Gross profit | — | | | 101.0 | | | — | | | 250.2 | |

| | | | | | | | |

| Selling, general and administrative expenses | | — | | | 52.7 | | | — | | | 125.0 | |

| Net legacy and separation-related expenses | | 2.6 | | | 14.4 | | | 4.9 | | | 20.6 | |

| Equity and other income, net | | — | | | (5.0) | | | — | | | (14.2) | |

| Operating (loss) income from discontinued operations | (2.6) | | | 38.9 | | | (4.9) | | | 118.8 | |

| Net pension and other postretirement plan expense | | — | | | — | | | — | | | 0.1 | |

| Net interest and other financing expenses | | — | | | 2.7 | | | — | | | 5.0 | |

Gain on sale of discontinued operations (a) | | — | | | (1,570.8) | | | — | | | (1,570.8) | |

| (Loss) income before income taxes - discontinued operations | (2.6) | | | 1,607.0 | | | (4.9) | | | 1,684.5 | |

Income tax (benefit) expense (b) | | (0.7) | | | 412.6 | | | (1.0) | | | 435.2 | |

| (Loss) income from discontinued operations, net of tax | $ | (1.9) | | | $ | 1,194.4 | | | $ | (3.9) | | | $ | 1,249.3 | |

| | | | | | | | |

(a)The gain on sale recorded in the three months ended March 31, 2023 includes the release of Accumulated other comprehensive income of $30.7 million associated with the realization of cumulative translation losses attributed to the Global Products business.

(b)Income tax expense in the three and six months ended March 31, 2023 includes the tax effects of the gain on sale of $420.2 million comprised of current and deferred expense of $327.6 million and $92.6 million, respectively.

Post-closing arrangements

Valvoline sources substantially all lubricant and certain ancillary products for its stores through a long-term supply agreement with Global Products. Net revenues within the results of Global Products above include product sales to the Company's continuing operations prior to the closing of the Transaction, which reduced previously reported operating income by $26were considered to be effectively settled and were not eliminated. These transactions totaled $34.6 million and $89.7 million for the three and six months ended DecemberMarch 31, 2016.

2023, respectively.

Issued but not yet adopted

In May 2014,Valvoline also entered into a Transition Services Agreement with Global Products, effective March 1, 2023, to provide and receive services including information technology (“IT”), legal, finance, and human resources support. Transition services have lapsed periodically as business process transitions have occurred since the FASB issued accounting guidance outlining a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers, which supersedes most current revenue recognition guidance. This guidance introduces a five-step model for revenue recognition that focuses on transfer of control, as opposed to transfer of risksale, and rewards under current guidance. The Company is evaluating the effect of adopting the new revenue guidance on its

financial statements and does not currently expect it to have a material effect to net earnings. Based on an evaluation of current contracts and revenue streams to-date, Valvoline believes that most revenue transactions recorded under the new guidance will be substantially consistent with treatment under existing guidance, with certain reclassifications expected within the Condensed Consolidated Statements of Comprehensive Earnings and certain minimal changes to the timing of the recognition of revenues. The Company's revenue transactionsremaining services are generally consist of a single performance obligation to transfer promised goods and are not accounted for under industry-specific guidance. The Company anticipates expanded footnote disclosures under the new guidance.

Management will continue to complete its assessment of revenue streams and implementation plans, including monitoring developments, and plans to substantially complete the Company's implementation assessment in early 2018 and finalize conclusions by the fourth quarter of fiscal 2018. Valvoline will adopt this standard in the first quarter of fiscal 2019 and will provide updated disclosures of the anticipated impacts of adoption in future filings.

In February 2016, the FASB issued new accounting guidance related to lease transactions. The primary objective of this guidance is to increase transparency and comparability among organizations by requiring lessees to recognize assets and liabilities on the balance sheet for the rights and obligations created by leases and to disclose key information about leasing arrangements. The Company expects to adopt the new guidance in the first quarter of fiscal 2020 using the modified retrospective method. While adoption is expected to lead to aconclude within 18 months post-closing with limited IT transition services that may extend through early calendar year 2025. The income and costs associated with these services were not material increase induring the assetsthree and liabilities recorded on the Condensed Consolidated Balance Sheet and an increase in footnote disclosures related to leases, the Company is in the process of developing assessment and implementation plans to determine the specific impacts, including those on the Condensed Consolidated Statements of Comprehensive Earnings.six months ended March 31, 2024.

NOTE 23 - FAIR VALUE MEASUREMENTS

Recurring fair value measurements

The following table setstables set forth the Company’s financial assets and liabilities by level within the fair value hierarchy the Company's financial assets and liabilities that were accounted for those measured at fair value on a recurring basis:

|

| | | | | | | | | | | | | | | |

| | December 31, 2017 | | September 30, 2017 |

| | | | Quoted prices in active markets for identical assets | | | | Quoted prices in active markets for identical assets |

| (In millions) | Fair Value | | Level 1 | | Fair Value | | Level 1 |

| Assets | | | | | | | |

Cash equivalents (a) | $ | 24 |

| | $ | 24 |

| | $ | 46 |

| | $ | 46 |

|

Foreign currency derivatives (b) | 1 |

| | 1 |

| | 1 |

| | 1 |

|

Non-qualified trust funds (c) | 30 |

| | 30 |

| | 30 |

| | 30 |

|

| Total assets at fair value | $ | 55 |

| | $ | 55 |

| | $ | 77 |

| | $ | 77 |

|

| | | | | | | | |

| Liabilities | | | | | | | |

Foreign currency derivatives (d) | $ | 1 |

| | $ | 1 |

| | $ | 1 |

| | $ | 1 |

|

| Total liabilities at fair value | $ | 1 |

| | $ | 1 |

| | $ | 1 |

| | $ | 1 |

|

| | | | | | | | |

(a) Included in Cash and cash equivalents in the Condensed Consolidated Balance Sheets. | |

(b) | Included in Other current assets in the Condensed Consolidated Balance Sheets.

|

| |

(c) | As of December 31, 2017, $2 million of this balance is included in Other current assets, with the remainder included in Other noncurrent assets in the Condensed Consolidated Balance Sheets. As of September 30, 2017, this balance is included in Other noncurrent assets in the Condensed Consolidated Balance Sheets.

|

| |

(d) | Included in Accrued expense and other liabilities in the Condensed Consolidated Balance Sheets.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of March 31, 2024 |

| (In millions) | | Total | | Level 1 | | Level 2 | | Level 3 | | NAV (a) |

| Cash and cash equivalents | | | | | | | | | | |

| Money market funds | | $ | 360.0 | | | $ | 360.0 | | | $ | — | | | $ | — | | | $ | — | |

| Time deposits | | 2.3 | | | — | | | 2.3 | | | — | | | — | |

| | | | | | | | | | |

| Prepaid expenses and other current assets | | | | | | | | | | |

| | | | | | | | | | |

| Interest rate swap agreements | | 3.3 | | | — | | | 3.3 | | | — | | | — | |

| Other noncurrent assets | | | | | | | | | | |

| Non-qualified trust funds | | 1.8 | | | — | | | — | | | — | | | 1.8 | |

| | | | | | | | | | |

| Deferred compensation investments | | 21.6 | | | 21.6 | | | — | | | — | | | — | |

| Total assets at fair value | | $ | 389.0 | | | $ | 381.6 | | | $ | 5.6 | | | $ | — | | | $ | 1.8 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Other noncurrent liabilities | | | | | | | | | | |

| Deferred compensation obligations | | $ | 21.8 | | | $ | — | | | $ | — | | | $ | — | | | $ | 21.8 | |

| Total liabilities at fair value | | $ | 21.8 | | | $ | — | | | $ | — | | | $ | — | | | $ | 21.8 | |

There were no Level 2 or 3 financial assets or liabilities that were accounted for at fair value on a recurring basis as of December 31, 2017 or September 30, 2017. Additionally, there were no transfers between levels of the fair value hierarchy during the three months ending December 31, 2017 or 2016. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of September 30, 2023 |

| (In millions) | | Total | | Level 1 | | Level 2 | | Level 3 | | NAV (a) |

| Cash and cash equivalents | | | | | | | | | | |

| Money market funds | | $ | 0.6 | | | $ | 0.6 | | | $ | — | | | $ | — | | | $ | — | |

| Time deposits | | 277.3 | | | — | | | 277.3 | | | — | | | — | |

| Prepaid expenses and other current assets | | | | | | | | | | |

Currency derivatives (b) | | 0.1 | | | — | | | 0.1 | | | — | | | — | |

| Interest rate swap agreements | | 7.8 | | | — | | | 7.8 | | | — | | | — | |

| Other noncurrent assets | | | | | | | | | | |

| Non-qualified trust funds | | 2.1 | | | — | | | — | | | — | | | 2.1 | |

| | | | | | | | | | |

| Deferred compensation investments | | 19.0 | | | 19.0 | | | — | | | — | | | — | |

| Total assets at fair value | | $ | 306.9 | | | $ | 19.6 | | | $ | 285.2 | | | $ | — | | | $ | 2.1 | |

| | | | | | | | | | |

| Accrued expenses and other liabilities | | | | | | | | | | |

Currency derivatives (b) | | $ | 0.1 | | | $ | — | | | $ | 0.1 | | | $ | — | | | $ | — | |

| | | | | | | | | | |

| Other noncurrent liabilities | | | | | | | | | | |

| Deferred compensation obligations | | 20.8 | | | — | | | — | | | — | | | 20.8 | |

| Total liabilities at fair value | | $ | 20.9 | | | $ | — | | | $ | 0.1 | | | $ | — | | | $ | 20.8 | |

| | | | | | | | | | |

Cash equivalents

A portion of the Company's excess cash is held in highly liquid investments with maturities of three months or less. Cash equivalents generate interest income and are(a)Funds measured at fair value using prevailing market rates.

Derivatives

The Company uses derivativesthe net asset value ("NAV") per share practical expedient have not designated as hedging instruments consisting primarily of forward contracts to hedge foreign currency denominated balance sheet exposures and exchange one foreign currency for another for a fixed rate at a future date of twelve months or less. Gains and losses recognized for changesbeen classified in the fair value of these instruments were not material during the three months ended December 31, 2017 and 2016 and are included in Selling, general and administrative expense in the Condensed Consolidated Statements of Comprehensive Income to offset the gain or loss on the hedged item in the same period as the remeasurement losses and gains of the related foreign currency-denominated exposures. hierarchy.

(b)The Company had outstanding contracts with highly-rated financial institutions with notional values of $43 million and $47$29.7 million as of December 31, 2017 and September 30, 2017, respectively.2023.

Non-qualified trust funds

The Company maintains a non-qualified trust to fund benefit payments for certain of its U.S. non-qualified pension plans, which primarily consists of highly liquid fixed income U.S. government bonds. Gains and losses related to these investments are immediately recognized within Selling, general and administrative expense in the Condensed Consolidated Statements of Comprehensive Income.Fair value disclosures

Long-term debt

The Company's outstanding fixed rate senior notes consist of 5.500% senior unsecured notes due 2024 with an aggregate principal amount of $375 million issued in July 2016 (the “2024 Notes”)Company’s held-to-maturity U.S. treasury securities and 4.375% senior unsecured notes due 2025 with an aggregate principal amount of $400 million issued in August 2017 (the “2025 Notes” and together with the 2024 Notes, “Senior Notes”).

The fair values shown in the table belowlong-term debt are based on the prices at which the bonds have recently traded in the market as well as the overall market conditions on the date of valuation, stated coupon rates, the number of coupon payments each year and the maturity dates. Long-term debt is includedreported in the Condensed Consolidated Balance Sheets at carrying value, rather than fair value, and isare therefore excluded from the disclosure above of financial assets and liabilities measured at fair value table above. within the condensed consolidated financial statements on a recurring basis. The following disclosures summarize the fair value of these assets and liabilities at each relevant balance sheet date.

U.S. treasury securities

The fair values of the Company’s U.S. treasury securities summarized below were determined utilizing quoted prices for identical securities from less active markets, which are considered Level 2 inputs within the fair value hierarchy. The U.S. treasury securities were fully matured as of March 31, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | September 30, 2023 |

| (In millions) | | | | | | | | Amortized cost | | Gross unrealized losses | | Fair value |

| Cash and cash equivalents | | | | | | | | | | | | |

U.S. treasury securities (a) | | | | | | | | $ | 2.2 | | | $ | — | | | $ | 2.2 | |

| Short-term investments | | | | | | | | | | | | |

U.S. treasury securities (b) | | | | | | | | $ | 347.5 | | | $ | (0.5) | | | $ | 347.0 | |

| | | | | | | | | | | | |

(a)U.S. treasury securities with original maturity dates of three months or less.

(b)U.S. treasury securities with original maturities greater than three months and less than 12 months.

Debt

The fair values of the Company's outstanding fixed rate senior notes shown below are based on recent trading values, which are considered Level 2 inputs within the fair value hierarchy.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | March 31, 2024 | | September 30, 2023 |

| (In millions) | | Fair value | | Carrying value (a) | | Unamortized

discounts and

issuance costs | | Fair value | | Carrying value (a) | | Unamortized

discounts and

issuance costs |

2030 Notes (b) | | $ | 599.5 | | | $ | 594.9 | | | $ | (5.1) | | | $ | 589.8 | | | $ | 594.5 | | | $ | (5.5) | |

| 2031 Notes | | 461.2 | | | 530.1 | | | (4.9) | | | 416.6 | | | 529.9 | | | (5.2) | |

| Total | | $ | 1,060.7 | | | $ | 1,125.0 | | | $ | (10.0) | | | $ | 1,006.4 | | | $ | 1,124.4 | | | $ | (10.7) | |

| | | | | | | | | | | | |

(a)Carrying values shown in the following table are net of unamortized discounts and debt issuance costs.

(b)The 2030 Notes were reported in Current portion of long-term debt within the Condensed Consolidated Balance Sheet as of March 31, 2024 due to the execution of the Tender Offer in April 2024 as further described in Note 5. |

| | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2017 | | September 30, 2017 |

| (In millions) | Fair value | | Carrying value | | Unamortized discount and issuance costs | | Fair value | | Carrying value | | Unamortized discount and issuance costs |

| 2024 Notes | $ | 399 |

| | $ | 370 |

| | $ | 5 |

| | $ | 401 |

| | $ | 370 |

| | $ | 5 |

|

| 2025 Notes | 404 |

| | 395 |

| | 5 |

| | 408 |

| | 394 |

| | 6 |

|

| Total | $ | 803 |

| | $ | 765 |

| | $ | 10 |

| | $ | 809 |

| | $ | 764 |

| | $ | 11 |

|

Refer to Note 75 for more information on the Senior Notes anddetails of these senior notes as well as Valvoline's other debt instruments that have variable interest rates and accordingly, theirwith carrying amounts that approximate fair value.

NOTE 4 - BUSINESS COMBINATIONS

The Company acquired fifteen service center stores in single and multi-store transactions for an aggregate purchase price of $21.3 million during the six months ended March 31, 2024. These acquisitions expand Valvoline's retail presence in key North American markets, increase the number of company-operated service center stores, and contribute to growing the retail footprint to 1,928 system-wide service center stores.

During the six months ended March 31, 2023, the Company acquired 13 service center stores in single and multi-store transactions for an aggregate purchase price of $18.9 million.

NOTE 3 - ACQUISITIONS

Henley Bluewater acquisition

On October 2, 2017, the Company completed the acquisition of 56 Quick Lubes franchise service centers from Henley Bluewater LLCThe Company’s acquisitions are accounted for $60 million. These stores build on the infrastructure and talent baseas business combinations. A summary follows of the existing Company-owned operationsaggregate cash consideration paid and the total assets acquired and liabilities assumed for the six months ended March 31:

| | | | | | | | | | | | | | |

| (In millions) | | 2024 | | 2023 |

| | | | |

| | | | |

| Inventories | | $ | — | | | $ | 0.3 | |

| | | | |

Property, plant and equipment (a) | | 4.0 | | | 3.5 | |

| Operating lease assets | | 6.5 | | | 4.0 | |

Goodwill (b) | | 20.3 | | | 15.1 | |

Intangible assets (c) | | | | |

Reacquired franchise rights (d) | | — | | | 2.3 | |

| | | | |

| | | | |

| Other | | 0.1 | | | 0.1 | |

| | | | |

| | | | |

Other current liabilities (a) | | (0.4) | | | (0.4) | |

| Operating lease liabilities | | — | | | (3.7) | |

Other noncurrent liabilities (a) | | (9.2) | | | (2.3) | |

| Total net assets acquired | | $ | 21.3 | | | $ | 18.9 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

(a)Includes finance lease assets in northern Ohioproperty, plant and adds Company-owned locationsequipment and finance lease liabilities in Michigan.other current and noncurrent liabilities. During the six months ended March 31, 2024, finance lease assets acquired were $3.1 million and finance lease liabilities of $0.1 million and $3.0 million in other current and noncurrent liabilities, respectively. During the six months ended March 31, 2023, finance lease assets acquired were $2.4 million and finance lease liabilities of $0.1 million and $2.3 million in other current and noncurrent liabilities.

(b)Goodwill is generally expected to be deductible for income tax purposes and is primarily attributed to the operational synergies and potential growth expected to result in economic benefits in the respective markets of the acquisitions.

(c)Intangible assets acquired during the six months ended March 31, 2024 and 2023 have weighted average amortization periods of five and nine years, respectively.

(d)Prior to the acquisition Valvolineof former franchise service center stores, the Company licensed the right to operate quick lubefranchised service centers, including the use of the Company'sValvoline's trademarks and trade name, to the franchisee whose assets were acquired.name. In connection with the acquisition,these acquisitions, Valvoline reacquired those rights and recognized a separate definite-lived reacquired franchise rights intangible assetassets, which was assigned a preliminary fair value of $22 million that will beare being amortized on a straight-line basis over the weighted average remaining term of approximately eight years.ten years for the rights reacquired in fiscal 2023. The effective settlement of these arrangements resulted in no settlement gain or loss as the contractual terms were at market. There have been no franchise rights reacquired during fiscal 2024.

The fair values above are preliminary for up to one year from the date of acquisition resulted in $36 million of goodwillas they may be subject to measurement period adjustments if new information is obtained about facts and the remaindercircumstances that existed as of the acquisition date. The Company does not currently expect any material changes to the preliminary purchase price was allocated to working capital and property, plant and equipment. Goodwill is primarily attributed toallocations for acquisitions completed during the potential growth of the business in the northern Ohio and Michigan markets, has been allocated to the Company's Quick Lubes reportable segment, and is expected to be deductible for income tax purposes.last twelve months.

Remaining ownership interest in subsidiary

Valvoline historically owned a 70% controlling interest and consolidated the financial results of its subsidiary in Thailand. In December 2017, Valvoline purchased the remaining 30% interest for total consideration of approximately $16 million, making it a wholly-owned subsidiary of the Company. This interest was not material to the current or prior period financial statements for presentation and disclosure as a noncontrolling interest, which was eliminated as a result of this purchase through a net charge to Paid-in capital and Retained deficit.

NOTE 4 - ACCOUNTS RECEIVABLE

The following summarizes Valvoline’s accounts receivable:

|

| | | | | | | |

| (In millions) | December 31

2017 | | September 30

2017 |

| Trade and other accounts receivable | $ | 424 |

| | $ | 390 |

|

| Less: Allowance for doubtful accounts | (6 | ) | | (5 | ) |

| | $ | 418 |

| | $ | 385 |

|

Prior to May 2017 when Valvoline's former parent company, Ashland Global Holdings Inc. (which together with its predecessors and consolidated subsidiaries is referred to as “Ashland”), distributed its net investment in Valvoline (the “Distribution”), Ashland was party to an agreement to sell certain Valvoline customer accounts receivable in the form of drafts or bills of exchange to a financial institution. Each draft constituted an order to pay for obligations of the customer to Ashland arising from the sale of goods to the customer. The intention of the arrangement was to decrease the time accounts receivable was outstanding and increase cash flows as Ashland in turn remitted payment to Valvoline. During the three months ended December 31, 2016, $11 million of accounts receivable were sold to the financial institution under this agreement.

Following the Distribution, Valvoline became party to the arrangement to sell certain customer accounts receivable in the form of draft or bills of exchange to the financial institution. During the three months ended December 31, 2017, Valvoline did not sell accounts receivable to the financial institution.

NOTE 5 - INVENTORIESDEBT

Certain lubricants are valued at the lower of cost or market using the last-in, first-out (“LIFO”) method. Remaining inventories are carried at the lower of cost or net realizable value using the weighted average cost method.

The following summarizes Valvoline’s inventories:

|

| | | | | | | |

| (In millions) | December 31

2017 | | September 30

2017 |

| Finished products | $ | 178 |

| | $ | 180 |

|

| Raw materials, supplies and work in process | 28 |

| | 31 |

|

| LIFO reserves | (33 | ) | | (33 | ) |

| Obsolete inventory reserves | (3 | ) | | (3 | ) |

| | $ | 170 |

| | $ | 175 |

|

NOTE 6 - GOODWILL AND OTHER INTANGIBLES

Goodwill

The following table summarizes the changes in the carrying amount of goodwill by reportable segment and in total during the three months ended December 31, 2017.

|

| | | | | | | | | | | | | | | |

| (In millions) | Core North America | | Quick Lubes | | International | | Total |

| September 30, 2017 | $ | 89 |

| | $ | 201 |

| | $ | 40 |

| | $ | 330 |

|

Acquisitions (a) | — |

| | 30 |

| | — |

| | 30 |

|

| December 31, 2017 | $ | 89 |

| | $ | 231 |

| | $ | 40 |

| | $ | 360 |

|

| | | | | | | | |

(a) Relates to the acquisition of Henley Bluewater LLC during the three months ended December 31, 2017 and adjustments related to prior year acquisitions.

Other Intangible Assets

Valvoline's purchased intangible assets were specifically identified when acquired and have finite lives. Intangible assets were $37 million in gross carrying amount, net of $4 million in accumulated amortization as of December 31, 2017 and were reported in Goodwill and intangibles, net on the Condensed Consolidated Balance Sheet. Amortization expense recognized on intangible assets during the three months ended December 31, 2017 and 2016 was not material. Amortization expense expected in the next five fiscal years is as follows:

|

| | | | |

| (In millions) | | |

| Years ending September 30 (estimated) | | |

| 2018 | | $ | 5 |

|

| 2019 | | $ | 5 |

|

| 2020 | | $ | 5 |

|

| 2021 | | $ | 4 |

|

| 2022 | | $ | 4 |

|

| | | |

NOTE 7 - DEBT OBLIGATIONS

The following table summarizes Valvoline’s short-term borrowings and long-term debt:total debt as of:

| | | | | | | | | | | | | | |

| (In millions) | | March 31

2024 | | September 30 2023 |

| 2031 Notes | | $ | 535.0 | | | $ | 535.0 | |

| 2030 Notes | | 600.0 | | | 600.0 | |

| Term Loan | | 451.3 | | | 463.1 | |

Revolver (a) | | — | | | — | |

| | | | |

| | | | |

| | | | |

| Debt issuance costs and discounts | | (11.2) | | | (12.0) | |

| Total debt | | 1,575.1 | | | 1,586.1 | |

| | | | |

| Current portion of long-term debt | | 623.8 | | | 23.8 | |

| Long-term debt | | $ | 951.3 | | | $ | 1,562.3 | |

| | | | | |

(a)As of March 31, 2024, the total borrowing capacity remaining under the $475.0 million revolving credit facility was $471.8 million due to a reduction of $3.2 million for letters of credit outstanding.

|

| | | | | | | | |

| (In millions) | December 31 2017 | | September 30 2017 |

| 2025 Notes | $ | 400 |

| | $ | 400 |

|

| 2024 Notes | 375 |

| | 375 |

|

| Term Loans | 281 |

| | 285 |

|

| Trade Receivables Facility | 120 |

| | 75 |

|

| Revolver | — |

| | — |

|

Other (a) | (10 | ) | | (11 | ) |

| Total debt | $ | 1,166 |

| | $ | 1,124 |

|

| Short-term debt | — |

| | 75 |

|

| Current portion of long-term debt | 19 |

| | 15 |

|

| Long-term debt | $ | 1,147 |

| | $ | 1,034 |

|

| | | | |

(a) At December 31, 2017, Other includes $12 million of debt issuance cost discounts and $2 million of debt acquired through acquisitions. At September 30, 2017, Other included $13 million of debt issuance cost discounts and $2 million of debt acquired through acquisitions.

Senior Notes

During August 2017, Valvoline completedOn March 14, 2024, the issuance of 4.375%Company commenced a tender offer (the “Tender Offer”) to purchase its outstanding 4.250% senior unsecured notes due 20252030 with an aggregate principal amount of $400 million.$600.0 million (the “2030 Notes”). The net proceeds fromTender Offer was made to comply with the offeringrequirements of the 2025asset sale covenant under the indenture governing the 2030 Notes was $394 million (after deducting initial purchasers' discounts and debt issuance costs), which were used to make a voluntary contribution toin connection with the Company's qualified U.S. pension plan.sale of Global Products.

During July 2016,On April 16, 2024, Valvoline completed the issuanceTender Offer with 99.7% of 5.500% senior unsecured notes due 2024 with an aggregatethe outstanding principal amount of $375 million. The net proceeds fromtendered by the offeringholders of the 2030 Notes. The Company used cash and cash equivalents on hand, in addition to borrowing $175.0 million on the Revolver to facilitate the $598.3 million purchase of the 2030 Notes at par, plus accrued and unpaid interest, and cancelled the 2030 Notes accepted for purchase. The Company elected to redeem the remaining balance outstanding of $1.7 million on April 29, 2024 pursuant to the terms and conditions of the indenture governing the 2030 Notes. Valvoline expects to recognize a loss on extinguishment of the 2030 Notes was $370of $5.1 million (after deducting initial purchasers’ discounts andduring the third quarter of fiscal 2024 due to the write-off of unamortized debt issuance costs), which were transferred to Valvoline's former parent, Ashland.

costs and discounts. The Senior2030 Notes are subject to customary eventsreported in Current portion of default for similarlong-term debt securities, which if triggered may accelerate paymentwithin the Condensed Consolidated Balance Sheet as of principal, premium, if any, and accrued but unpaid interest on the notes. Such events of default include non-payment of principal and interest, non-performance of covenants and obligations, default on other material debt, and bankruptcy or insolvency. If a change of control repurchase event occurs, Valvoline may be required to offer to purchase the Senior Notes from the holders thereof. The Senior Notes are not otherwise required to be repaid prior to maturity, although they may be redeemed at the option of Valvoline at any time prior to their maturity in the manner specified in the indentures governing the notes. The notes are guaranteed by each of Valvoline's subsidiaries that guarantee obligations under the existing senior secured credit facility described below.March 31, 2024.

In December 2017, Valvoline completed registered exchange offers for the Senior Notes.

Senior Credit Agreement

The 2016 Senior Credit Agreement provides for an aggregate principal amount of $1,325 million in senior secured credit facilities (“2016 Credit Facilities”), composed of (i) a five-year $875 million term loan facility (“Term Loans”), and (ii) a five-year $450 million revolving credit facility (including a $100 million letter of credit sublimit) (“Revolver”). At December 31, 2017 and September 30, 2017, the Term Loans had outstanding principal balances of $281 million and $285 million, respectively. At December 31, 2017 and September 30, 2017, there were no amounts outstanding under the Revolver. As of DecemberMarch 31, 2017, total borrowing capacity remaining under the Revolver was $439 million due to a reduction of $11 million for letters of credit outstanding.

The outstanding principal balance of the Term Loans is required to be repaid in quarterly installments of approximately $4 million for fiscal 2018, $8 million for fiscal 2019 and 2020, and $15 million for fiscal 2021 with the balance due at maturity. At Valvoline’s option, amounts outstanding under the 2016 Senior Credit Agreement bear interest at either LIBOR or an alternate base rate, in each case plus the applicable interest rate margin. The interest rate fluctuates between LIBOR plus 1.500% per annum and LIBOR plus 2.500% per annum (or between the alternate base rate plus 0.500% per annum and the alternate base rate plus 1.500% annum), based upon Valvoline’s corporate credit ratings or the consolidated first lien net leverage ratio (as defined in the 2016 Senior Credit Agreement).

The 2016 Credit Facilities are guaranteed by Valvoline’s existing and future subsidiaries (other than certain immaterial subsidiaries, joint ventures, special purpose financing subsidiaries, regulated subsidiaries, foreign subsidiaries and certain other subsidiaries), and are secured by a first-priority security interest in substantially all the personal property assets, and certain real property assets, of Valvoline and the guarantors, including all or a portion of the equity interests of certain of Valvoline’s domestic subsidiaries and first-tier foreign subsidiaries. The 2016 Credit Facilities may be prepaid at any time without premium.

The 2016 Senior Credit Agreement contains usual and customary representations and warranties, and usual and customary affirmative and negative covenants, including limitations on liens, additional indebtedness, investments, restricted payments, asset sales, mergers, affiliate transactions and other customary limitations, as well as financial covenants (including maintenance of a maximum consolidated net leverage ratio and a minimum consolidated interest coverage ratio). As of the end of any fiscal quarter, the maximum consolidated net leverage ratio and minimum consolidated interest coverage ratio permitted under the 2016 Senior Credit Agreement are 4.5 and 3.0, respectively. As of December 31, 2017,2024, Valvoline was in compliance with all covenants under the 2016 Senior Credit Agreement.its long-term borrowings.

Trade Receivables Facility

On November 29, 2016, Valvoline entered into a $125 million, one-year revolving trade receivables securitization facility (“Trade Receivables Facility”) with certain financial institutions. On November 20, 2017, the Company amended the Trade Receivables Facility to extend the maturity date to November 19, 2020 and increase the maximum funding under the facility to $175 million based on the availability of eligible receivables and other customary factors and conditions.

Under the Trade Receivables Facility, Valvoline sells and/or transfers a majority of its U.S. trade receivables to a wholly-owned, bankruptcy-remote subsidiary as they are originated, and advances by the lenders to that subsidiary (in the form of cash or letters of credit) are secured by those trade receivables. The assets of this financing subsidiary are restricted as collateral for the payment of its obligations under the Trade Receivables Facility, and its assets and credit are not available to satisfy the debts and obligations owed to the creditors of the Company. The Company includes the assets, liabilities and results of operations of this financing subsidiary in its condensed consolidated financial statements.

During the first fiscal quarter of 2017, Valvoline borrowed $75 million under the Trade Receivables Facility and used the net proceeds to repay an equal amount of the Term Loans. During the first fiscal quarter of 2018, Valvoline borrowed $45 million under the Trade Receivables Facility and used the proceeds to supplement the daily cash needs of the Company's operations. The Company accounts for the Trade Receivables Facility as secured borrowings. Based upon the maturity dates in place in each respective period, as of December 31, 2017, the $120 million balance outstanding was classified as Long-term debt and the $75 million balance outstanding as of September 30, 2017 was classified as Short-term debt in the Condensed Consolidated Balance Sheets. Based on the availability of eligible receivables, the total borrowing capacity remaining under the Trade Receivables Facility at December 31, 2017 was $39 million. The financing subsidiary owned $253 million and $247 million of outstanding accounts receivable as of December 31, 2017 and September 30, 2017, respectively, and these amounts are included in Accounts receivable, net in the Company’s Condensed Consolidated Balance Sheets.

The financing subsidiary pays customary fees to the lenders, and advances by a lender under the Trade Receivables Facility accrue interest for which the weighted average interest rates were 2.2% and 1.5% for the three months ended December 31, 2017 and 2016, respectively. The Trade Receivables Facility contains various customary affirmative and negative covenants and default and termination provisions, which provide for acceleration of amounts owed under the Trade Receivables Facility in circumstances including, but not limited to, the failure to pay interest or other amounts when due, defaults on certain other indebtedness, certain insolvency events, and breach of representation.

NOTE 86 – INCOME TAXES

Income tax provisions for interim quarterly periods are based on an estimated annual effective income tax rate calculated separately from the effect of significant, infrequent or unusual discrete items related specifically to interim periods. IncomeThe following summarizes income tax expense and the effective tax rate in each interim period:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

March 31 | | Six months ended

March 31 |

| | |

| (In millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| Income tax expense (benefit) | | $ | 14.0 | | | $ | 11.4 | | | $ | 25.9 | | | $ | (8.7) | |

| Effective tax rate percentage | | 24.4 | % | | 25.7 | % | | 25.1 | % | | (17.0) | % |

The increase in income tax expense for the three months ended DecemberMarch 31, 20172024 was $94 million, anprincipally driven by higher pre-tax earnings, while the reduction in the effective tax rate was primarily attributed to the favorable impact of 111.9% compared to expense of $38 million and an effectivediscrete tax rate of 34.5% for the three months ended December 31, 2016.benefits. The increaseincreases in income tax expense and the effective tax rate was principallyfor the six months ended March 31, 2024 were driven by the enactment of tax reform legislationmore normalized activity in the U.S. in December 2017,current year period as compared to the prior year period which resulted inincluded the recognition of a net increase in$26.5 million income tax expensebenefit for the release of approximately $68 million that more than offset benefits relateda valuation allowance due to the reductionchange in expectations regarding the estimated annual effective tax rate for fiscal 2018.

U.S. tax reform legislation

On December 22, 2017, the President of the United States signed into law tax reform legislation (the “Act”), which is generally effective January 1, 2018. The Act includes a number of provisions, including lowering the U.S. corporate federal income tax rate from a maximum of 35% to 21% and changing or limiting certain tax deductions. While the Company expects this rate reduction will ultimately benefit Valvoline, the Act also includes provisions that are expected to offset some of the benefit of the rate reduction, including the repeal of the deduction for domestic production activities and the expansion of the limitation on the deductionutilization of certain executive compensation. In addition, the Act alters the landscape of taxation of non-U.S. operations and provides immediate deductions for certain new investments, among other provisions. Based on the Company's provisional estimates of the impacts of the Act, the Company expects the Act will result in a lower estimated annual effectivelegacy tax rate for Valvoline in fiscal 2018 and beyond and decrease the Company's cash taxes, particularly in years beyond fiscal 2018.

During the three months ended December 31, 2017, enactment of the Act resulted in the following provisional impacts on income tax expense, which are described further below:

The remeasurement of net deferred tax assets at the lower enacted corporate tax rate resulted in a net $67 million increase in income tax expense;

The deemed repatriation tax on unremitted non-U.S. earnings and profits resulted in a $4 million increase in income tax expense; and

The remeasurement of net indemnity liabilities associated with the Tax Matters Agreement increased pre-tax expense by $7 million and generated a $3 million tax benefit primarily related to the higher expected utilization of tax attributes payable to Ashland.

The estimated impacts of the Act recorded during the three months ended December 31, 2017 are provisional in nature, and the Company will continue to assess the impact of the Act and will record adjustments through the income tax provision in the relevant period as amounts are known and reasonably estimable during the measurement period. Accordingly, the impact of the Act may differ from the Company's provisional estimates due to and among other factors, information currently not available, changes in interpretations and the issuance of additional guidance, as well as changes in assumptions the Company has currently made, including actions the Company may take in future periods as a result of the Act.

In particular, there is currently a lack of clarity regarding the applicationterms of the executive compensation deduction limitations and state tax implications as a result of the Act. The Company currently estimates that the effect of the Act on executive compensation deduction limitations will primarily be effective in future periods. With regard to state tax implications, the Company generally expects taxable state income will increase as a result of deduction limitations associated with the Act, though the impact is not currently reasonably estimable as most U.S. state tax jurisdictions have not responded to the specific effects of the Act. The Company will make relevant updates to management's estimates and assumptions as additional information becomes available.

Given the effective date of the rate reduction in the Act, the Company's statutory federal corporate tax rate for fiscal 2018 will be a blended rate of 24.5% and will decline to 21% for fiscal 2019 and beyond.

Deferred tax remeasurement

The Company's net deferred income taxes represent benefits that will be used to reduce corporate taxes expected to be paid as well as differences between the tax bases and carrying amounts of assets and liabilities that will result in taxable or deductible amounts in future years. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in years in which those temporary differences are expected to be recovered or settled. As changes in tax laws or rates occur, deferred tax assets and liabilities are adjusted in the period changes are enacted through income tax expense.

The Company’s net deferred tax assets of $281 million were determined at September 30, 2017 based on the then-current enacted income tax rates prior to the passage of the Act. As a result of the reduction in the federal corporate income tax rate from 35% to 21% under the Act, the Company revalued its net deferred tax assets as of December 31, 2017, which resulted in a reduction in the value of net deferred tax assets of approximately $67 million that was recorded as additional income tax expense in the Company’s Condensed Consolidated Statements of Comprehensive Income for the three months ended December 31, 2017.

Deemed repatriation

The Act implements a new territorial tax system that imposes a one-time transition tax, or deemed repatriation, on unremitted earnings of certain non-U.S. subsidiaries that is based in part on the amount of these earnings held in cash and other specified assets. The mandatory deemed repatriation resulted in a $22 million gross liability, but allows for the realization of $18 million of previously unrecognized foreign tax credits related to taxes previously paid in relevant local jurisdictions. The net result was $4 million of income tax expense which was recognized during the three months ended December 31, 2017.

The Company has historically intended to indefinitely reinvest undistributed earnings of its non-U.S. subsidiaries. As undistributed earnings of the Company's non-U.S. subsidiaries were subject to the one-time deemed repatriation tax, the Company began to reevaluate its intentions to indefinitely reinvest its non-U.S. undistributed earnings. The Company now plans to repatriate up to $45 million of previously undistributed earnings of certain non-U.S. subsidiaries where the withholding tax implications are expected to be minimal. The Company is presently not aware of any significant restrictions on the repatriation of these funds and additional taxes and other costs that may arise between the deemed and actual distribution dates are not estimated to be material.

The Company's intent is to continue to indefinitely reinvest the remainder of its undistributed earnings of non-U.S. subsidiaries. Upon any future determination to distribute these earnings, the Company would be subject to certain income and withholding taxes, the amount of which is not practicable to determine given the complexities associated with such a hypothetical calculation, including dependencies on income tax laws and other circumstances in place at the time amounts are distributed.

Tax Matters Agreement

Total liabilities related to obligations owed to Ashland under the Tax Matters Agreement were $67 million and $62 million at December 31, 2017 and September 30, 2017, respectively. At December 31, 2017 and September 30, 2017, $1 million was recorded in Accrued expenses and other liabilities, and $66 million and $61 million was recorded in Other noncurrent liabilities in the Condensed Consolidated Balance Sheets as of December 31, 2017 and September 30, 2017, respectively.