UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934FORM 10-Q

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 20172021

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 000-55793

COSMOS GROUP HOLDINGS INC.

(Exact Name of Registrant as Specified in Its Charter)

COSMOS GROUP HOLDINGS INC. | ||

(Exact Name of Registrant as Specified in Its Charter) |

Nevada | 90-1177460 | |

(State or Other Jurisdiction | (I.R.S. Employer | |

of Incorporation or Organization) | Identification No.) |

37th Floor, Singapore Land Tower

Rooms 1309-11, 13th Floor, Tai Yau Building,50 Raffles Place,Singapore 048623

No. 181 Johnston Road+65 6829 7017

Wanchai, Hong Kong

+852 3188 9363

(Address of Principal Executive Offices and Issuer’s

Telephone Number, including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each Class | Trading Symbol | Name of each exchange on which registered | ||

None. | N/A | N/A |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”filer,” “smaller reporting company,” and “smaller reporting“emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 14, 2017,15, 2021, the issuerCompany had outstanding 429,848,898358,067,481 shares of common stock.

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that are not historical facts, and involve risks and uncertainties that could cause actual results to differ materially from those expected and projected. All statements, other than statements of historical facts, included in this Form 10-Q including, without limitation, statements in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” regarding the Company’s financial position, business strategy and the plans and objectives of management for future operations, events or developments which the Company expects or anticipates will or may occur in the future, including such things as future capital expenditures (including the amount and nature thereof); expansion and growth of the Company’s business and operations; and other such matters are forward-looking statements. These statements are based on certain assumptions and analyses made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate under the circumstances. However, whether actual results or developments will conform with the Company’s expectations and predictions is subject to a number of risks and uncertainties, including general economic, market and business conditions; the business opportunities (or lack thereof) that may be presented to and pursued by the Company; changes in laws or regulation and other factors, most of which are beyond the control of the Company.

These forward-looking statements can be identified by the use of predictive, future-tense or forward-looking terminology, such as “believes,” “anticipates,” “expects,” “estimates,” “plans,” “may,” “will,” or similar terms. These statements appear in a number of places in this filing and include statements regarding the intent, belief or current expectations of the Company, and its directors or its officers with respect to, among other things: (i) trends affecting the Company’s financial condition or results of operations for its limited history; (ii) the Company’s business and growth strategies; and, (iii) the Company’s financing plans. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. Such factors that could adversely affect actual results and performance include, but are not limited to, the Company’s limited operating history, potential fluctuations in quarterly operating results and expenses, government regulation, technological change and competition. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, please refer to our filings with the SEC under the Exchange Act and the Securities Act of 1933, as amended, including our Current Report on Form 8-K filed with the Securities and Exchange Commission on September 17, 2021.

Consequently, all of the forward-looking statements made in this Form 10-Q are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by the Company will be realized or, even if substantially realized, that they will have the expected consequence to or effects on the Company or its business or operations. The Company assumes no obligations to update any such forward-looking statements.

| 2 | ||

| Table of Contents |

TABLE OF CONTENTS.

Page | |||||

4 | |||||

F-2 | |||||

F-3 | |||||

F-4 | |||||

|

| ||||

F-5 | |||||

Notes to Condensed Consolidated Financial Statements (Unaudited) | F-6 - F18 | ||||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 5 | ||||

14 | |||||

14 | |||||

| OTHER INFORMATION | |||||

15 | |||||

15 | |||||

15 | |||||

15 | |||||

15 | |||||

15 | |||||

16 | |||||

17 | |||||

| 4 |

| Table of Contents |

COSMOS GROUP HOLDINGS INC.

INDEX TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Page | |||

F-2 | |||

Condensed Consolidated Statements of Operations and Comprehensive (Loss) Income | F-3 | ||

F-4 | |||

Condensed Consolidated Statements of Changes in Stockholders’ Equity (Deficit) | F-5 | ||

F-6 – F-18 |

| F-1 |

| Table of Contents |

COSMOS GROUP HOLDINGS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

AS OF SEPTEMBER 30, 2017 AND DECEMBER 31, 2016

(Currency expressed in United States Dollars (“US$”), except for number of shares)

| September 30, 2017 | December 31, 2016 | |||||||

| (Unaudited) | (Audited) | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 20,195 | $ | 1,581 | ||||

| Amount due from a related party | 63,794 | – | ||||||

| Accounts receivable | 38,178 | 46,282 | ||||||

| Total current assets | 122,167 | 47,863 | ||||||

| Non-current assets: | ||||||||

| Property, plant and equipment, net | 108,521 | 124,161 | ||||||

| TOTAL ASSETS | $ | 230,688 | $ | 172,024 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued liabilities | $ | 75,297 | $ | 13,700 | ||||

| Amounts due to related parties | 69,527 | 41,306 | ||||||

| Income tax payable | 7,734 | – | ||||||

| Current portion of obligation under finance leases | 20,000 | 20,124 | ||||||

| Total current liabilities | 172,558 | 75,130 | ||||||

| Non-current liabilities: | ||||||||

| Deferred tax liabilities | 13,191 | 12,870 | ||||||

| Obligation under finance leases | 33,333 | 48,633 | ||||||

| Total non-current liabilities | 46,524 | 61,503 | ||||||

| TOTAL LIABILITIES | 219,082 | 136,633 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders’ equity: | ||||||||

| Common stock, $0.001 par value; 500,000,000 shares authorized; 429,848,898 and 219,222,938 shares issued and outstanding as of September 30, 2017 and December 31, 2016, respectively | 429,849 | 219,223 | ||||||

| Accumulated losses | (418,243 | ) | (183,832 | ) | ||||

| Total stockholders’ equity | 11,606 | 35,391 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 230,688 | $ | 172,024 | ||||

|

| September 30, |

|

| December 31, |

| ||

|

| 2021 |

|

| 2020 |

| ||

ASSETS |

| (Unaudited) |

|

| (Restated) |

| ||

Current asset: |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ | 2,703,539 |

|

| $ | 773,381 |

|

Digital assets |

|

| 220,513 |

|

|

| 0 |

|

Loan receivables, net |

|

| 18,005,477 |

|

|

| 11,943,595 |

|

Loan interest and fee receivables, net |

|

| 1,429,222 |

|

|

| 679,341 |

|

Inventories |

|

| 1,148,903 |

|

|

| 0 |

|

Amounts due from related parties |

|

| 0 |

|

|

| 138,020 |

|

Prepayment and other receivables |

|

| 796,418 |

|

|

| 702,037 |

|

Income tax receivable |

|

| 0 |

|

|

| 1,420 |

|

Right-of-use assets, net |

|

| 368,947 |

|

|

| 483,537 |

|

|

|

|

|

|

|

|

|

|

Total current assets |

|

| 24,673,019 |

|

|

| 14,721,331 |

|

|

|

|

|

|

|

|

|

|

Non-current assets: |

|

|

|

|

|

|

|

|

Property and equipment, net |

|

| 77,504 |

|

|

| 246,575 |

|

Intangible assets |

|

| 38,891 |

|

|

| 0 |

|

Loan receivables, net |

|

| 1,166,136 |

|

|

| 290,229 |

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

| $ | 25,955,550 |

|

| $ | 15,258,135 |

|

|

|

|

|

|

|

|

|

|

LIABILTIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accrued liabilities and other payables |

| $ | 4,188,607 |

|

| $ | 327,586 |

|

Loan payable |

|

| 1,161,212 |

|

|

| 4,811,843 |

|

Amounts due to related parties |

|

| 20,474,746 |

|

|

| 9,648,400 |

|

Income tax payable |

|

| 374,808 |

|

|

| 0 |

|

Operating lease liabilities |

|

| 381,447 |

|

|

| 483,537 |

|

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

| 26,580,820 |

|

|

| 15,271,366 |

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES |

|

| 26,580,820 |

|

|

| 15,271,366 |

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

| 0 |

|

|

| 0 |

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

|

|

Common stock, $0.001 par value; 500,000,000 shares authorized; 355,628,272 and 333,910,484 issued and outstanding as of September 30, 2021 and December 31, 2020 |

|

| 355,628 |

|

|

| 333,911 |

|

Common stock to be issued |

|

| 800,000 |

|

|

| 800,000 |

|

Additional paid-in capital |

|

| 1,334,529 |

|

|

| 0 |

|

Accumulated other comprehensive loss |

|

| (10,657 | ) |

|

| (5,374 | ) |

Accumulated deficit |

|

| (3,775,794 | ) |

|

| (1,379,358 | ) |

|

|

| (1,296,294 | ) |

|

| (250,821 | ) |

Noncontrolling interest |

|

| 671,024 |

|

|

| 237,590 |

|

|

|

|

|

|

|

|

|

|

Total stockholders’ deficit |

|

| (625,270 | ) |

|

| (13,231 | ) |

|

|

|

|

|

| �� |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT |

| $ | 25,955,550 |

|

| $ | 15,258,135 |

|

See accompanying notes to condensed consolidated financial statements.

| F-2 |

| Table of Contents |

COSMOS GROUP HOLDINGS INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE (LOSS) INCOME

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

|

| Three months ended September 30, |

|

| Nine months ended September 30, |

| ||||||||||

|

| 2021 |

|

| 2020 |

|

| 2021 |

|

| 2020 |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Revenue, net |

| $ | 2,282,399 |

|

| $ | 1,554,251 |

|

| $ | 5,510,344 |

|

| $ | 3,414,244 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

| (220,733 | ) |

|

| (327,845 | ) |

|

| (997,679 | ) |

|

| (795,041 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

| 2,061,666 |

|

|

| 1,226,406 |

|

|

| 4,512,665 |

|

|

| 2,619,203 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing expenses |

|

| (94,508 | ) |

|

| (32,789 | ) |

|

| (136,862 | ) |

|

| (70,889 | ) |

General and administrative expenses |

|

| (4,391,148 | ) |

|

| (825,464 | ) |

|

| (6,040,872 | ) |

|

| (2,154,947 | ) |

Total operating expenses |

|

| (4,485,656 | ) |

|

| (858,253 | ) |

|

| (6,177,734 | ) |

|

| (2,225,836 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(LOSS) INCOME FROM OPERATION |

|

| (2,423,990 | ) |

|

| 368,153 |

|

|

| (1,665,069 | ) |

|

| 393,367 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recovery from bad debt |

|

| 0 |

|

|

| (31,934 | ) |

|

| 0 |

|

|

| 0 |

|

Interest income |

|

| 89 |

|

|

| 162 |

|

|

| 89 |

|

|

| 162 |

|

Other income |

|

| 3,085 |

|

|

| 60,416 |

|

|

| 3,085 |

|

|

| 60,416 |

|

Gain from forgiveness of related party debt |

|

| 0 |

|

|

| 23 |

|

|

| 140,712 |

|

|

| 52,143 |

|

Impairment loss on digital asset |

|

| (37,451 | ) |

|

| 0 |

|

|

| (37,451 | ) |

|

| 0 |

|

Loss from the disposal of digital assets |

|

| (14 | ) |

|

| 0 |

|

|

| (14 | ) |

|

| 0 |

|

Total other income (expense) |

|

| (34,291 | ) |

|

| 28,667 |

|

|

| 106,421 |

|

|

| 112,721 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(LOSS) INCOME BEFORE INCOME TAXES |

|

| (2,458,281 | ) |

|

| 396,820 |

|

|

| (1,558,648 | ) |

|

| 506,088 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax (expense) credit |

|

| (163,524 | ) |

|

| 3 |

|

|

| (377,453 | ) |

|

| 6,051 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET (LOSS) INCOME |

|

| (2,621,805 | ) |

|

| 396,823 |

|

|

| (1,936,101 | ) |

|

| 512,139 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to noncontrolling interest |

|

| 103,026 |

|

|

| 191,088 |

|

|

| 432,802 |

|

|

| 248,061 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income attributable to COSG |

|

| (2,724,831 | ) |

|

| 205,735 |

|

|

| (2,368,903 | ) |

|

| 264,078 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency adjustment (loss) gain |

|

| (4,948 | ) |

|

| 296 |

|

|

| (5,283 | ) |

|

| (1,634 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE (LOSS) INCOME |

| $ | (2,729,779 | ) |

| $ | 206,031 |

|

| $ | (2,374,186 | ) |

| $ | 262,444 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income per share – Basic and Diluted |

| $ | (0.01 | ) |

| $ | 0.00 |

|

| $ | (0.01 | ) |

| $ | 0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

| 336,284,874 |

|

|

| 333,910,484 |

|

|

| 334,710,645 |

|

|

| 333,910,484 |

|

See accompanying notes to condensed consolidated financial statements.

| F-3 |

| Table of Contents |

COSMOS GROUP HOLDINGS INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

|

| Nine months ended September 30, |

| |||||

|

| 2021 |

|

| 2020 |

| ||

|

|

|

|

|

|

| ||

Cash flows from operating activities: |

|

|

|

|

|

| ||

Net (loss) income |

| $ | (1,936,101 | ) |

| $ | 512,139 |

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net (loss) income to net cash used in operating activities |

|

|

|

|

|

|

|

|

Depreciation of property and equipment |

|

| 10,916 |

|

|

| 16,190 |

|

Amortisation of intangible assets |

|

| 434 |

|

|

| 0 |

|

Gain from forgiveness of related party debts |

|

| (140,712 | ) |

|

| (52,143 | ) |

Digital assets received as revenue |

|

| (257,977 | ) |

|

| 0 |

|

Impairment loss on digital assets |

|

| 37,451 |

|

|

| 0 |

|

Loss on disposal of digital assets |

|

| 14 |

|

|

| 0 |

|

Issuance of common stock for goods and services rendered |

|

| 1,334,710 |

|

|

| 0 |

|

Loss on written-off property and equipment |

|

| 163,058 |

|

|

| 0 |

|

|

|

|

|

|

|

|

|

|

Change in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Loan receivables |

|

| (6,991,052 | ) |

|

| (1,494,917 | ) |

Loan interest and fee receivables |

|

| (752,839 | ) |

|

| (134,646 | ) |

Inventories |

|

| (1,148,903 | ) |

|

| 0 |

|

Prepayment and other receivables |

|

| (97,437 | ) |

|

| (67,691 | ) |

Accrued liabilities and other payables |

|

| 3,856,451 |

|

|

| 100,603 |

|

Right-of-use assets and operating lease liabilities |

|

| 12,500 |

|

|

| 0 |

|

Income tax payable |

|

| 376,222 |

|

|

| (12,367 | ) |

Net cash used in operating activities |

|

| (5,533,265 | ) |

|

| (1,132,832 | ) |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

Payment to acquire property and equipment |

|

| 0 |

|

|

| (17,034 | ) |

Payment to acquire intangible assets |

|

| (39,325 | ) |

|

| 0 |

|

Net cash used in investing activities |

|

| (39,325 | ) |

|

| (17,034 | ) |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

(Repayment of) proceeds from loan payable |

|

| (3,629,682 | ) |

|

| 1,096,075 |

|

Advance from related parties |

|

| 11,146,695 |

|

|

| 168,304 |

|

Net cash provided by financing activities |

|

| 7,517,013 |

|

|

| 1,264,379 |

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

| (14,265 | ) |

|

| (2,639 | ) |

|

|

|

|

|

|

|

|

|

Net change in cash and cash equivalents |

|

| 1,930,158 |

|

|

| 111,874 |

|

|

|

|

|

|

|

|

|

|

BEGINNING OF PERIOD |

|

| 773,381 |

|

|

| 445,144 |

|

|

|

|

|

|

|

|

|

|

END OF PERIOD |

| $ | 2,703,539 |

|

| $ | 557,018 |

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

|

Cash paid for income taxes |

| $ | 0 |

|

| $ | 0 |

|

Cash paid for interest |

| $ | 784,194 |

|

| $ | 795,041 |

|

See accompanying notes to condensed consolidated financial statements.

| F-4 |

| Table of Contents |

COSMOS GROUP HOLDINGS INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (DEFICIT)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 20172021 AND 20162020

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

| Three months ended September 30, | Nine months ended September 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Revenues, net | $ | 292,944 | $ | 90,518 | $ | 572,326 | $ | 276,299 | ||||||||

| Cost of revenue | (180,618 | ) | (44,865 | ) | (381,598 | ) | (212,910 | ) | ||||||||

| Gross profit | 112,326 | 45,653 | 190,728 | 63,389 | ||||||||||||

| Operating expenses | ||||||||||||||||

| General and administrative | (63,100 | ) | (202,402 | ) | (189,937 | ) | (282,159 | ) | ||||||||

| Total operating expenses | (63,100 | ) | (202,402 | ) | (189,937 | ) | (282,159 | ) | ||||||||

| INCOME (LOSS) FROM OPERATIONS | 49,226 | (156,749 | ) | 791 | (218,770 | ) | ||||||||||

| Other (expense) income: | ||||||||||||||||

| Interest expense | (563 | ) | (567 | ) | (1,688 | ) | (1,699 | ) | ||||||||

| Other income | 1 | 105 | 143 | 111 | ||||||||||||

| Total other expense | (562 | ) | (462 | ) | (1,545 | ) | (1,588 | ) | ||||||||

| INCOME (LOSS) BEFORE INCOME TAXES | 48,664 | (157,211 | ) | (754 | ) | (220,358 | ) | |||||||||

| Income tax expense | (7,792 | ) | (454 | ) | (8,054 | ) | (1,585 | ) | ||||||||

| NET INCOME (LOSS) | $ | 40,872 | $ | (157,665 | ) | $ | (8,808 | ) | $ | (221,943 | ) | |||||

| Other comprehensive income (loss): | ||||||||||||||||

| – Foreign currency translation gain (loss) | – | – | – | – | ||||||||||||

| COMPREHENSIVE INCOME (LOSS) | $ | 40,872 | $ | (157,665 | ) | $ | (8,808 | ) | $ | (221,943 | ) | |||||

| Net income (loss) per share | ||||||||||||||||

| – Basic | $ | 0.00 | $ | 0.00 | $ | 0.00 | $ | 0.00 | ||||||||

| – Diluted | $ | 0.00 | $ | 0.00 | $ | 0.00 | $ | 0.00 | ||||||||

| Weighted average common shares outstanding | ||||||||||||||||

| – Basic | 429,848,898 | 219,222,938 | 328,407,719 | 219,222,938 | ||||||||||||

| – Diluted | 429,848,898 | 219,222,938 | 328,407,719 | 219,222,938 | ||||||||||||

|

| Common stock |

|

| Common stock to be |

|

| Additional paid-in |

|

| Accumulated other comprehensive |

|

| (Accumulated losses) retained |

|

| Non-controlling |

|

| Total stockholders’ (deficit) |

| |||||||||||

|

| No. of shares |

|

| Amount |

|

| issued |

|

| capital |

|

| loss |

|

| earnings |

|

| interest |

|

| equity |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Balance as of January 1, 2020 (restated) |

|

| 333,910,484 |

|

| $ | 333,911 |

|

| $ | 800,000 |

|

|

| 0 |

|

| $ | (3,515 | ) |

| $ | (1,625,053 | ) |

| $ | 15,561 |

|

| $ | (479,096 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

| - |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| (964 | ) |

|

| 0 |

|

|

| 0 |

|

|

| (964 | ) |

Net income for the period |

|

| - |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 29,172 |

|

|

| 28,487 |

|

|

| 57,659 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of March 31, 2020 |

|

| 333,910,484 |

|

|

| 333,911 |

|

|

| 800,000 |

|

|

| 0 |

|

|

| (4,479 | ) |

|

| (1,595,881 | ) |

|

| 44,048 |

|

|

| (422,401 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

| - |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| (965 | ) |

|

| 0 |

|

|

| 0 |

|

|

| (965 | ) |

Net income for the period |

|

| - |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 29,168 |

|

|

| 28,486 |

|

|

| 57,654 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of June 30, 2020 |

|

| 333,910,484 |

|

|

| 333,911 |

|

|

| 800,000 |

|

|

| 0 |

|

|

| (5,444 | ) |

|

| (1,566,713 | ) |

|

| 72,534 |

|

|

| (365,712 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

| - |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 295 |

|

|

| 0 |

|

|

| 0 |

|

|

| 295 |

|

Net income for the period |

|

| - |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 205,735 |

|

|

| 191,088 |

|

|

| 396,823 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of September 30, 2020 |

|

| 333,910,484 |

|

| $ | 333,911 |

|

| $ | 800,000 |

|

|

| 0 |

|

| $ | (5,149 | ) |

| $ | (1,360,978 | ) |

| $ | 263,622 |

|

| $ | 31,406 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of January 1, 2021 (restated) |

|

| 333,910,484 |

|

| $ | 333,911 |

|

| $ | 800,000 |

|

|

| 0 |

|

| $ | (5,374 | ) |

| $ | (1,379,358 | ) |

| $ | 237,590 |

|

| $ | (13,231 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

| - |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| (168 | ) |

|

| 0 |

|

|

| 0 |

|

|

| (168 | ) |

Net income for the period |

|

| - |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 177,964 |

|

|

| 164,888 |

|

|

| 342,852 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of March 31, 2021 |

|

| 333,910,484 |

|

|

| 333,911 |

|

|

| 800,000 |

|

|

| 0 |

|

|

| (5,542 | ) |

|

| (1,201,394 | ) |

|

| 402,478 |

|

|

| 329,453 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

| - |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| (167 | ) |

|

| 0 |

|

|

| 0 |

|

|

| (167 | ) |

Net income for the period |

|

| - |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 177,964 |

|

|

| 164,888 |

|

|

| 342,852 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of June 30, 2021 |

|

| 333,910,484 |

|

|

| 333,911 |

|

|

| 800,000 |

|

|

| 0 |

|

|

| (5,709 | ) |

|

| (1,023,430 | ) |

|

| 567,366 |

|

|

| 672,138 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares issued for acquisition of legal acquirer |

|

| 21,536,933 |

|

|

| 21,536 |

|

|

| 0 |

|

|

| 395,516 |

|

|

| (1,436 | ) |

|

| (421,613 | ) |

|

| 0 |

|

|

| (5,997 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recapitalization of legal acquirer |

|

| - |

|

|

| - |

|

|

| - |

|

|

| (395,516 | ) |

|

| 1,436 |

|

|

| 394,080 |

|

|

| - |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares issued for goods and services rendered |

|

| 180,855 |

|

|

| 181 |

|

|

| 0 |

|

|

| 1,334,529 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 1,334,710 |

|

Foreign currency translation adjustment |

|

| - |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| (4,948 | ) |

|

|

|

|

|

| 632 |

|

| (4,316 | ) | |

Net (loss) income for the period |

|

| - |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| (2,724,831 | ) |

|

| 103,026 |

|

|

| (2,621,805 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of September 30, 2021 |

|

| 355,628,272 |

|

| $ | 355,628 |

|

| $ | 800,000 |

|

|

| 1,334,529 |

|

| $ | (10,657 | ) |

| $ | (3,775,794 | ) |

| $ | 671,024 |

|

| $ | (625,270 | ) |

See accompanying notes to condensed consolidated financial statements.

COSMOS GROUP HOLDINGS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS OF CASH FLOWS

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 20172021 AND 20162020

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

| Nine months ended September 30, | ||||||||

| 2017 | 2016 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (8,808 | ) | $ | (221,943 | ) | ||

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities | ||||||||

| Depreciation of property, plant and equipment | 14,876 | 14,968 | ||||||

| Change in operating assets and liabilities: | ||||||||

| Accounts receivable | 8,104 | 35,851 | ||||||

| Accounts payable and accrued liabilities | 61,597 | (4,054 | ) | |||||

| Income tax payable | 7,734 | – | ||||||

| Deferred tax liabilities | 321 | 1,585 | ||||||

| Net cash provided by (used in) operating activities | 83,824 | (173,593 | ) | |||||

| Cash flows from financing activities: | ||||||||

| (Repayment to) advances from related parties | (49,786 | ) | 191,062 | |||||

| Repayment of finance lease | (15,424 | ) | (15,093 | ) | ||||

| Net cash (used in) provided by financing activities | (65,210 | ) | 175,969 | |||||

| NET CHANGE IN CASH AND CASH EQUIVALENTS | 18,614 | 2,376 | ||||||

| BEGINNING OF PERIOD | 1,581 | 4,148 | ||||||

| END OF PERIOD | $ | 20,195 | $ | 6,524 | ||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | ||||||||

| Cash paid for tax | $ | – | $ | – | ||||

| Cash paid for interest | $ | 1,688 | $ | 1,699 | ||||

See accompanying notes to condensed consolidated financial statements.

COSMOS GROUP HOLDINGS INC.

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2017

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

| Common stock | Accumulated | Total stockholders’ | ||||||||||||||

| No. of shares | Amount | losses | equity | |||||||||||||

| Balance as of January 1, 2017 (restated) | 219,222,938 | $ | 219,223 | $ | (183,832 | ) | $ | 35,391 | ||||||||

| Shares issued for acquisition | 210,625,960 | 210,626 | (225,603 | ) | (14,977 | ) | ||||||||||

| Net loss for the period | – | – | (8,808 | ) | (8,808 | ) | ||||||||||

| Balance as of September 30, 2017 | 429,848,898 | 429,849 | $ | (418,243 | ) | $ | 11,606 | |||||||||

See accompanying notes to condensed consolidated financial statements.NOTE 1 - BASIS OF PRESENTATION

COSMOS GROUP HOLDINGS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2017

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

The accompanying unaudited condensed consolidated financial statements have been prepared by management in accordance with both accounting principles generally accepted in the United States (“GAAP”), and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Certain information and note disclosures normally included in audited financial statements prepared in accordance with generally accepted accounting principles have been condensed or omitted pursuant to those rules and regulations, although the Company believes that the disclosures made are adequate to make the information not misleading.

In the opinion of management, the consolidated balance sheet as of December 31, 20162020 which has been derived from audited financial statements and these unaudited condensed consolidated financial statements reflect all normal and recurring adjustments considered necessary to state fairly the results for the periods presented. The results for the period ended September 30, 20172021 are not necessarily indicative of the results to be expected for the entire fiscal year ending December 31, 20172021 or for any future period.

These unaudited condensed consolidated financial statements and notes thereto should be read in conjunction with the Management’s Discussion and Analysis, and the audited financial statements and notes thereto included in the Special Report on Form 8-K for the year ended December 31, 20162020, filed on Form 10.September 17, 2021.

NOTE 2 - ORGANIZATION AND BUSINESS BACKGROUND

Cosmos Group Holdings Inc. (the “Company” or “COSG”) was incorporated in the state of Nevada on August 14, 1987, under the name Shur De Cor, Inc. and engaged in developing certain mining claims. In April 1999, Shur De Cor merged with Interactive Marketing Technology, a New Jersey corporation that was engaged in the business of developing and direct marketing of consumer products. As the surviving company, Shur De Cor changed its name to Interactive Marketing Techology, Inc. Shur De Cor's then management resigned and the management of Interactive New Jersey became the Company’s management. The prior management of Shur De Cor retained Shur De Cor’s business and assets. The Company filed a registration statement on Form 10-SB on January 19, 2000.

The Company, through a wholly owned subsidiary, IMT's Plumber, Inc., produced, marketed, and sold a licensed product called the Plumber's Secret, which was discontinued in fiscal 2001. In May 2002, the Company ceased to actively pursue its product development and marketing business and actively sought to either acquire a third party, merge with a third party or pursue a joint venture with a third party in order to re-enter its former business of development and direct marketing of proprietary consumer products in the United States and worldwide.

On November 17, 2004, the Company acquired MPL, a company organized under the laws of the British Virgin Islands, and its subsidiaries in accordance with the terms of a Share Exchange Agreement executed by the parties (the “2004 Agreement”). In connection with the acquisition, the Company issued an aggregate of 109,623,006 shares of its common stock to Imperial International Limited, a company incorporated under the laws of the British Virgin Islands (“Imperial”), the sole shareholder of MPL, in exchange for 100% of the issued and outstanding shares of MPL capital stock (the "2004 Share Exchange"). Upon completion of the share exchange, MPL became the Company's wholly owned subsidiary and the Company’s former owner transferred control of the Company to Imperial. The Company relied on Rule 506 of Regulation D of the Securities Act of 1933, as amended (the "Act"), in regard to the shares that we issued pursuant to the 2004 Share Exchange. The Company treated this transaction as a qualified "business combination" as defined by Rule 501(d). The Company relied on the exemption from registration pursuant to Section 4(2) of, and or Regulation D promulgated under, the Act in issuing the Company’s securities.

In connection with the 2004 Share Exchange, the Company: (i) changed its name from Interactive Marketing Technology, Inc. to China Artists Agency, Inc. ("China Artists"); (ii) obtained a new stock symbol, "CAAY", and CUSIP Number, effective on December 21, 2004; (iii) increased its authorized common stock to 200,000,000 shares; (iv) effectuated a 1 for 1.69 reverse stock split; and (v) spun off the Company’s existing business into a separate public company, All Star Marketing, Inc., a Nevada corporation ("All Star"). All Star was formed as a wholly owned subsidiary of the Company. The Spin-off was satisfied by means of a pro-rata share dividend to the Company's shareholders of record as of December 10, 2004. The purpose of the Spin-Off was to allow the subsidiary to operate as a separate public company and raise working capital through the sale of its own equity. This allowed the Company’s management to focus on its business, while at the same time, allowing the spun-off company to have greater exposure by trading as an independent public company. Additionally, the shareholders and the market would then more easily identify the results and performance of the Company as a separate entity from that of All Star. In August 2005, the Company changed its name to China Entertainment Group, Inc. and, effective August 9, 2005, obtained a new stock symbol "CGRP", and CUSIP Number.

COSMOS GROUP HOLDINGS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2017

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

Because the Company failed to generate revenues in its new business, prior management commenced litigation in the Superior Court for Los Angeles County California which action was removed to the United States District Court for the Central District of California Case No. CV07-1068 GHK. On January 30, 2008, the parties entered into a Settlement Agreement and Conditional Release (the “Settlement Agreement”), pursuant to which, among other things, the Company’s former management reacquired control of the Company and all assets related to the Chinese entertainment business were transferred out of the Company. The Company, under its former management, once again entered the business of locating products to develop and mass market. These efforts did not prove fruitful and the Company, while continuing its product development business, also began to seek another business to acquire.

On January 22, 2010, the Company filed a Form 15-12G to withdraw from its reporting obligations.

Effective July 22, 2010, the Company merged with Safe and Secure TV Channel, LLC, a Delaware limited liability company (the “Merger”). In connection with the Merger, the management of the Company resigned and was replaced by the management and principals of Safe and Secure TV Channel, LLC. The holders of interests in Safe and Secure TV Channel, LLC exchanged their interests for approximately 50.2% of the issued and outstanding stock of the Company. In September 2010, the Company effectuated a 9.85 for one stock split to shareholders of record as of August 23, 2010. After the Merger, the Company became a television network and multimedia information and distribution company focused on serving the homeland security and emergency preparedness industry.

On February 15, 2016, the Company sold to Asia Cosmos Group Limited, a private limited liability company incorporated under the laws of British Virgin Islands (“ACOSG”), 10,000,000 shares of its common stock at a per share price of $0.027. ACOSG’s sole shareholder is Miky Wan. The Company relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under the Act in selling the Company’s securities to ACOSG.

In connection with the private placement to ACOSG, a change of control occurred and Bryan Glass resigned from his position as President, Secretary, Treasurer and Chairman of the Company. Miky Wan was appointed to serve as Chief Executive Officer, Chief Operating Officer, President and Director, effective February 19, 2016. Peter Tong, our Chief Financial Officer, Secretary and director continued in his positions with the Company. Calvin K.W. Lai, Anthony H.H. Chan, Jenher Jeng, Alice K.M. Tang, Connie Y.M. Kwok were appointed to serve on our Board of Directors effective February 19, 2016. Effective February 26, 2016, the Company changed its name to Cosmos Group Holdings Inc. and filed a Certificate of Amendment to such effect with the Nevada Secretary of State. The name change and the related stock symbol change to “COSG” were approved by the Financial Industry Regulatory Authority on March 31, 2016. The Company also increased the number of its authorized common stock, par value $0.001, from 90,000,0000 shares to 500,000,000 and its preferred stock, par value $0.001, from 10,000,000 to 30,000,000 shares. After the private placement, the Company shifted its business plan to focus on acquiring undervalued companies including those in the Greater China region.

On May 12, 2017, the Company acquired all of the issued and outstanding shares of Lee Tat from Mr. Koon Wing CHEUNG, Lee Tat’s sole shareholder, in exchange for 219,222,938 shares of our issued and outstanding common stock. In connection with the Lee Tat acquisition, Miky Wan resigned from her positions as Chief Executive Officer and Chief Operating Officer and Koon Wing CHEUNG and Yongwei HU were appointed to serve as our Chief Executive Officer and Chief Operating Officer, respectively, and also as our directors. In addition, Anthony H.H. CHAN and Alice K. M. TANG resigned from their positions as directors, and Zhigang LIAO and Weiming CHEN were appointed to fill the vacancies created by their resignations. The Company relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under the Act in selling the Company’s securities to the shareholders of Lee Tat.

Prior to the acquisition, the Company was considered as a shell company due to its nominal assets and limited operation. Upon the acquisition, Lee Tat will comprise the ongoing operations of the combined entity and its senior management will serve as the senior management of the combined entity, Lee Tat is deemed to be the accounting acquirer for accounting purposes. The transaction will be treated as a recapitalization of the Company. Accordingly, the consolidated assets, liabilities and results of operations of the Company will become the historical financial statements of Lee Tat, and the Company’s assets, liabilities and results of operations will be consolidated with Lee Tat beginning on the acquisition date. Lee Tat was the legal acquiree but deemed to be the accounting acquirer. The Company was the legal acquirer but deemed to be the accounting acquiree in the reverse merger. The historical financial statements prior to the acquisition are those of the accounting acquirer (Lee Tat). Historical stockholders’ equity of the accounting acquirer prior to the merger are retroactively restated (a recapitalization) for the equivalent number of shares received in the merger. Operations prior to the merger are those of the acquirer. After completion of the share exchange transaction, the Company’s consolidated financial statements include the assets and liabilities, the operations and cash flow of the accounting acquirer.

COSMOS GROUP HOLDINGS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2017

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

1987.

The Company, through its subsidiaries, mainly engagesengaged in the provision of truckload transportation service in Hong Kong, in which the Company utilizesutilized its owned trucks or independent contractor owned trucks for the pickup and delivery of freight from port to the designated destination, upon the customers’ request. On June 28, 2021, the transportation service ceased and was sold to its related party, Koon Wing Cheung the former director.

On June 28, 2021, the Company’s Chief Executive Officer, and Koon Wing Cheung completed the sale of their 6,230,618 and 8,149,670 shares, respectively, to Chan Man Chung. The common stock sold constituted sixty-six and seventy-seven hundredth percent (66.77%) of the issued and outstanding shares of our common stock. It resulted in a change of control.

In connection with such sale, Miky Wan, the Company’s CEO, President and CFO, resigned from her positions as a director and sole executive officer of the Company. Concurrently therewith, Messrs. Chan Man Chung, Lee Ying Chiu Herbert and Tan Tee Soo were appointed to the Company’s Board of Directors and Chan Man Chung was appointed to serve as the CEO, CFO and Secretary of the Company.

On June 17, 2021, the Company entered into a Share Exchange Agreement with the shareholders of Massive Treasure Limited (“MTL”). Pursuant to the Share Exchange Agreement, the Company agreed to issue 1,078,269,470 in exchange for 100% of MTL. MTL is a party to numerous agreements to acquire 12 additional business entities. As such, the Company further agreed to issue an additional 55,641,014 shares of common stock to complete the acquisition of 12 business entities concurrently. This acquisition was consummated on September 17, 2021.

This Acquisition is considered as a related party transaction, whereas CHAN Man Chung is a director and shareholder of the Company and also controls MTL and its subsidiaries.

Prior to the Share Exchange, the Company was considered as a shell company due to its nominal assets and limited operation. The transaction will be treated as a recapitalization of the Company. Upon the Share Exchange between the Company and MTL on June 17, 2021, is considered as a merger of entities under common control that CHAN Man Chung is the common director of both the Company and MTL. Under the guidance in ASC 805 for transactions between entities under common control, the assets, liabilities and results of operations, are recognized at their carrying amounts on the date of the Share Exchange, which required retrospective combination of the Company and MTL for all periods presented, therefore, the accompanying condensed consolidated financial statements for the nine months ended September 30, 2021 and 2020 have been restated accordingly.

| F-6 |

| Table of Contents |

COSMOS GROUP HOLDINGS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

The Company currently offers financial and money lending services in Hong Kong and operates a business selling works of art and collectibles in Singapore.

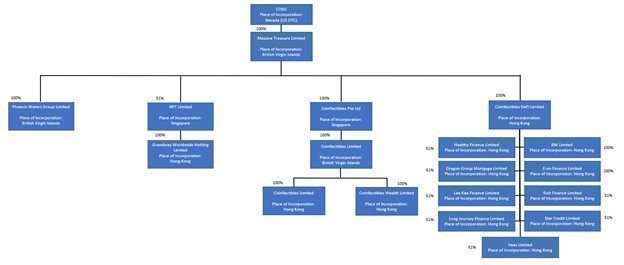

Description of subsidiaries

Company name | Place of incorporation and kind of legal entity | Principal activities and place of operation | Particulars of

capital | Effective interest held | ||||

Massive Treasure Limited | BVI, limited liability company | Investment holding | 50,000 ordinary shares at par value of US$1 | 100% | ||||

Coinllectibles Pte Limited | Singapore, limited liability company | Corporate management and IT development in Singapore | 1,000 ordinary shares for S$1,000 | 100% | ||||

Coinllectibles Limited | BVI, limited liability company | Procurement of art and collectibles in Singapore | 1,000 ordinary shares at par value of US$1 | 100% | ||||

Coinllectibles (HK) Limited | Hong Kong, limited liability company | Corporate management in Hong Kong | 1,000 ordinary shares for HK$1,000 | 100% | ||||

Coinllectibles Wealth Limited | Hong Kong, limited liability company | Corporate management in Hong Kong | 1 ordinary share for HK$1 | 100% | ||||

Coinllectibles DeFi Limited | Hong Kong, limited liability company | Financing service management in Hong Kong | 10,000 ordinary shares for HK$10,000 | 100% | ||||

8M Limited | Hong Kong, limited liability company | Money lending service in Hong Kong | 10 ordinary shares for HK$10 | 100% | ||||

Dragon Group Mortgage Limited | Hong Kong, limited liability company | Money lending service in Hong Kong | 10,000 ordinary shares for HK$10,000 | 51% | ||||

E-on Finance Limited | Hong Kong, limited liability company | Money lending service in Hong Kong | 2 ordinary shares for HK$2 | 100% | ||||

Healthy Finance Limited | Hong Kong, limited liability company | Money lending service in Hong Kong | 10,000 ordinary shares for HK$10,000 | 51% | ||||

Lee Kee Finance Limited | Hong Kong, limited liability company | Money lending service in Hong Kong | 920,000 ordinary shares for HK$920,000 | 51% | ||||

Rich Finance (Hong Kong) Limited | Hong Kong, limited liability company | Money lending service in Hong Kong | 10,000 ordinary shares for HK$10,000 | 51% | ||||

Long Journey Finance Limited | Hong Kong, limited liability company | Money lending service in Hong Kong | 100 ordinary shares for HK$100 | 51% | ||||

Vaav Limited | Hong Kong, limited liability company | Money lending service in Hong Kong | 10,000 ordinary shares for HK$10,000 | 51% | ||||

Star Credit Limited | Hong Kong, limited liability company | Money lending service in Hong Kong | 1,000,000 ordinary shares for HK$1,000,000 | 51% |

COSG

COSMOS GROUP HOLDINGS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

The Company and its subsidiaries are hereinafter referred to as (the “Company”).

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accompanying condensed consolidated financial statements reflect the application of certain significant accounting policies as described in this note and elsewhere in the accompanying condensed consolidated financial statements and notes.

· | Basis of presentation |

· Use

These accompanying condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of estimatesAmerica (“US GAAP”).

· | Use of estimates and assumptions |

In preparing these condensed consolidated financial statements, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheet and revenues and expenses during the periods reported. Actual results may differ from these estimates. Significant estimates in the nine months ended September 30, 2021 and 2020 include the allowance for loan receivables, the useful life of property and equipment and intangible assets, assumptions used in assessing impairment of long-term assets, and valuation of deferred tax assets.

· Basis of consolidation

· | Basis of consolidation |

The condensed consolidated financial statements include the financial statementsaccounts of COSG and its subsidiaries. All significant inter-company balances and transactions within the Company have been eliminated upon consolidation.

· Cash and cash equivalents

· | Cash and cash equivalents |

Cash and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

| F-8 |

|

| Table of Contents |

Accounts receivable are recorded at the invoiced amount and do not bear interest, which are due within contractual payment terms, generally 30 to 90 days from completion of service. Credit is extended based on evaluation of a customer's financial condition, the customer credit-worthiness and their payment history. Accounts receivable outstanding longer than the contractual payment terms are considered past due. Past due balances over 90 days and over a specified amount are reviewed individually for collectibility. At the end of fiscal year, the Company specifically evaluates individual customer’s financial condition, credit history, and the current economic conditions to monitor the progress of the collection of accounts receivables. The Company will consider the allowance for doubtful accounts for any estimated losses resulting from the inability of its customers to make required payments. For the receivables that are past due or not being paid according to payment terms, the appropriate actions are taken to exhaust all means of collection, including seeking legal resolution in a court of law. Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. The Company does not have any off-balance-sheet credit exposure related to its customers. As of September 30, 2017, there was no allowance for doubtful accounts.

COSMOS GROUP HOLDINGS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 20172021 AND 2020

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

· | Digital assets |

The Company’s digital assets represent the cryptocurrency of Ethereum and OEC Token. The Company accounts for its digital assets in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Subtopic 350-30, General Intangibles Other Than Goodwill. ASC Subtopic 350-30 requires assets to be measured based on the fair value of the consideration given or the fair value of the assets (or net assets) acquired, whichever is more clearly evident and, thus, more reliably measurable. The Company’s cryptocurrencies are deemed to have an indefinite useful life; therefore amounts are not amortized, but rather are assessed for impairment.

· | Loan receivables, net |

Loans receivables are carried at unpaid principal balances, less the allowance for loan losses and charge-offs. The loans receivables portfolio consists of real estate mortgage loans and personal loans.

· Property, plantLoans are placed on nonaccrual status when they are past due 180 days or more as to contractual obligations or when other circumstances indicate that collection is not probable. When a loan is placed on nonaccrual status, any interest accrued but not received is reversed against interest income. Payments received on a nonaccrual loan are either applied to protective advances, the outstanding principal balance or recorded as interest income, depending on an assessment of the ability to collect the loan. A nonaccrual loan may be restored to accrual status when principal and equipmentinterest payments have been brought current and the loan has performed in accordance with its contractual terms for a reasonable period (generally six months).

If the Company determines that a loan is impaired, the Company next determines the amount of the impairment. The amount of impairment on collateral dependent loans is charged off within the given fiscal quarter. Generally the amount of the loan and negative escrow in excess of the appraised value less estimated selling costs, for the fair value of collateral valuation method, is charged off. For all other loans, impairment is measured as described below in Allowance for Loan Losses.

· | Allowance for loan losses (“ALL”) |

The adequacy of the Company’s ALL is determined, in accordance with ASC Subtopics 450-20 Loss Contingencies includes management’s review of the Company’s loan portfolio, including the identification and review of individual problem situations that may affect a borrower’s ability to repay. In addition, management reviews the overall portfolio quality through an analysis of delinquency and non-performing loan data, estimates of the value of underlying collateral, current charge-offs and other factors that may affect the portfolio, including a review of regulatory examinations, an assessment of current and expected economic conditions and changes in the size and composition of the loan portfolio.

The ALL reflects management’s evaluation of the loans presenting identified loss potential, as well as the risk inherent in various components of the portfolio. There is significant judgment applied in estimating the ALL. These assumptions and estimates are susceptible to significant changes based on the current environment. Further, any change in the size of the loan portfolio or any of its components could necessitate an increase in the ALL even though there may not be a decline in credit quality or an increase in potential problem loans.

· | Property and equipment, net |

Property plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses, if any. Depreciation is calculated on the straight-line basis over the following expected useful lives from the date on which they become fully operational and after taking into account their estimated residual values:

Expected useful life | ||||

Computer and office equipment | 5 years |

Expenditure for repairs and maintenance is expensed as incurred. When assets haveare retired or sold, the cost and related accumulated depreciation are removed from the accounts and any resulting gain or loss is recognized in the results of operations.

Depreciation expenseexpenses for the three months ended September 30, 20172021 and 2016 was $4,9592020 were $856 and $4,988,$1,028, respectively.

Depreciation expenseexpenses for the nine months ended September 30, 20172021 and 2016 was $14,8762020 were $10,916 and $14,968,$16,190, respectively.

• | Intangible assets, net |

·

Intangible assets represent the licensing cost for the trademark registration. Amortization is calculated on the straight-line basis over ten (10) years of useful lives from the registration date. Amortization expense for the three and nine months ended September 30, 2021 and 2020 were $434 and $0, respectively.

· | Impairment of long-lived assets |

| F-9 |

| Table of Contents |

COSMOS GROUP HOLDINGS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

In accordance with the provisions of ASC Topic 360, “Impairment or Disposal of Long-Lived Assets,”, all long-lived assets such as property plant and equipment heldowned and usedheld by the Company are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is evaluated by a comparison of the carrying amount of an asset to its estimated future undiscounted cash flows expected to be generated by the asset. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amounts of the assets exceed the fair value of the assets. There has been no impairment charge

· | Revenue recognition |

Accounting Standards Codification (“ASC”) 606, Revenue from Contracts with Customers (“ASC 606”), establishes principles for reporting information about the nature, amount, timing and uncertainty of revenue and cash flows arising from the entity’s contracts to provide goods or services to customers. The core principle requires an entity to recognize revenue to depict the transfer of goods or services to customers in an amount that reflects the consideration that it expects to be entitled to receive in exchange for those goods or services recognized as performance obligations are satisfied. The Company applies the following five steps in order to determine the appropriate amount of revenue to be recognized as it fulfills its obligations under each of its agreements:

· | identify the contract with a customer; |

· | identify the performance obligations in the contract; |

· | determine the transaction price; |

· | allocate the transaction price to performance obligations in the contract; and |

· | recognize revenue as the performance obligation is satisfied. |

The Company is licensed to originate consumer, mortgage and commercial loans in Hong Kong. During the three and nine months ended September 30, 2017.2021 and 2020, the Company originated loans generally ranging from $644 to $579,000, with terms ranging from 3 months to more than 1 year. The Company mainly derives a portion of its revenue from loan which is specifically excluded from the scope of this standard.

· | Leases |

· Revenue recognition

At the inception of an arrangement, the Company determines whether the arrangement is or contains a lease based on the unique facts and circumstances present. Leases with a term greater than one year are recognized on the balance sheet as right-of-use assets, lease liabilities and long-term lease liabilities. The Company has elected not to recognize on the balance sheet leases with terms of one year or less. Operating lease liabilities and their corresponding right-of-use assets are recorded based on the present value of lease payments over the expected remaining lease term. However, certain adjustments to the right-of-use assets may be required for items such as prepaid or accrued lease payments. The interest rate implicit in lease contracts is typically not readily determinable. As a result, the Company utilizes its incremental borrowing rates, which are the rates incurred to borrow on a collateralized basis over a similar term an amount equal to the lease payments in a similar economic environment.

In accordance with the guidance in ASC Topic 605,“Revenue Recognition”842, components of a lease should be split into three categories: lease components (e.g. land, building, etc.), non-lease components (e.g. common area maintenance, consumables, etc.), and non-components (e.g. property taxes, insurance, etc.). Subsequently, the Company recognizes revenue when persuasive evidence of an arrangement exists, transfer of title has occurred or services have been rendered,fixed and in-substance fixed contract consideration (including any related to non-components) must be allocated based on the selling price is fixed or determinablerespective relative fair values to the lease components and collectibility is reasonably assured.non-lease components.

RevenueThe Company made the policy election to not separate lease and non-lease components. Each lease component and the related non-lease components are accounted for together as a single component.

· | Income taxes |

The Company adopted the ASC 740 Income tax provisions of paragraph 740-10-25-13, which addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the consolidated financial statements. Under paragraph 740-10-25-13, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in fullthe consolidated financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent (50%) likelihood of being realized upon completion of deliveryultimate settlement. Paragraph 740-10-25-13 also provides guidance on de-recognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures. The Company had no material adjustments to its liabilities for unrecognized income tax benefits according to the receiver’s location.provisions of paragraph 740-10-25-13.

· ComprehensiveThe estimated future tax effects of temporary differences between the tax basis of assets and liabilities are reported in the accompanying balance sheets, as well as tax credit carry-backs and carry-forwards. The Company periodically reviews the recoverability of deferred tax assets recorded on its balance sheets and provides valuation allowances as management deems necessary.

| F-10 |

| Table of Contents |

COSMOS GROUP HOLDINGS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”), except for number of shares)

(Unaudited)

· | Uncertain tax positions |

The Company did not take any uncertain tax positions and had no adjustments to its income tax liabilities or benefits pursuant to the ASC 740 provisions of Section 740-10-25 for the periods ended September 30, 2021 and, 2020.

· | Foreign currencies translation |

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded in the consolidated statement of operations.

The reporting currency of the Company is United States Dollar (“US$”) and the accompanying consolidated financial statements have been expressed in US$. In addition, the Company is operating in Hong Kong and maintain its books and record in its local currency, Hong Kong Dollars (“HKD”), which is a functional currency as being the primary currency of the economic environment in which their operations are conducted. In general, for consolidation purposes, assets and liabilities of its subsidiary whose functional currency is not US$ are translated into US$, in accordance with ASC Topic 830-30, Translation of Financial Statement, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements of foreign subsidiary are recorded as a separate component of accumulated other comprehensive income within the statements of changes in stockholder’s equity.