Washington, D.C. 20549

DELEK US HOLDINGS, INC.

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Financial Statements

Delek US Holdings, Inc.

Condensed Consolidated Statements of Income (Unaudited)

(In millions, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | | 2021 | | 2020 | | 2021 | | 2020 |

| Net revenues | | $ | 2,956.5 | | | $ | 2,062.9 | | | $ | 7,540.2 | | | $ | 5,419.6 | |

| Cost of sales: | | | | | | | | |

| Cost of materials and other | | 2,670.1 | | | 1,875.9 | | | 6,871.4 | | | 5,064.3 | |

| Operating expenses (excluding depreciation and amortization presented below) | | 100.7 | | | 115.7 | | | 358.3 | | | 348.3 | |

| Depreciation and amortization | | 55.6 | | | 59.4 | | | 178.4 | | | 160.0 | |

| Total cost of sales | | 2,826.4 | | | 2,051.0 | | | 7,408.1 | | | 5,572.6 | |

| | | | | | | | |

| | | | | | | | |

| Operating expenses related to retail and wholesale business (excluding depreciation and amortization presented below) | | 22.1 | | | 24.0 | | | 74.9 | | | 73.7 | |

| General and administrative expenses | | 58.7 | | | 57.0 | | | 164.4 | | | 184.4 | |

| Depreciation and amortization | | 5.2 | | | 5.8 | | | 17.2 | | | 17.4 | |

| | | | | | | | |

| | | | | | | | |

| Other operating (income) expense, net | | (1.7) | | | 0.3 | | | (4.7) | | | (14.6) | |

| Total operating costs and expenses | | 2,910.7 | | | 2,138.1 | | | 7,659.9 | | | 5,833.5 | |

| Operating income (loss) | | 45.8 | | | (75.2) | | | (119.7) | | | (413.9) | |

| Interest expense | | 37.7 | | | 31.9 | | | 100.5 | | | 98.0 | |

| Interest income | | (0.2) | | | (0.9) | | | (0.5) | | | (3.1) | |

| Income from equity method investments | | (2.9) | | | (12.8) | | | (14.5) | | | (28.6) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Loss (gain) on sale of non-operating refinery | | — | | | 0.1 | | | — | | | (56.8) | |

| | | | | | | | |

| | | | | | | | |

| Other income, net | | (21.8) | | | (1.0) | | | (16.0) | | | (3.4) | |

| Total non-operating expense, net | | 12.8 | | | 17.3 | | | 69.5 | | | 6.1 | |

| Income (loss) before income tax expense (benefit) | | 33.0 | | | (92.5) | | | (189.2) | | | (420.0) | |

| Income tax expense (benefit) | | 6.1 | | | (15.6) | | | (52.3) | | | (134.6) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net income (loss) | | 26.9 | | | (76.9) | | | (136.9) | | | (285.4) | |

| Net income attributed to non-controlling interests | | 8.8 | | | 11.2 | | | 24.7 | | | 29.4 | |

| Net income (loss) attributable to Delek | | $ | 18.1 | | | $ | (88.1) | | | $ | (161.6) | | | $ | (314.8) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Basic income (loss) per share | | $ | 0.24 | | | $ | (1.20) | | | $ | (2.19) | | | $ | (4.28) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Diluted income (loss) per share | | $ | 0.24 | | | $ | (1.20) | | | $ | (2.19) | | | $ | (4.28) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Dividends declared per common share outstanding | | $ | — | | | $ | 0.31 | | | $ | — | | | $ | 0.93 | |

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Nine Months Ended |

| | | September 30, | | September 30, |

| | | 2017 | | 2016 | | 2017 | | 2016 |

| Net sales | | $ | 2,341.5 |

| | $ | 1,079.9 |

| | $ | 4,754.3 |

| | $ | 3,113.3 |

|

| Operating costs and expenses: | | | | | | | | |

| Cost of goods sold | | 1,988.1 |

| | 965.6 |

| | 4,181.6 |

| | 2,806.7 |

|

| Operating expenses | | 153.2 |

| | 61.0 |

| | 276.5 |

| | 187.8 |

|

| Insurance proceeds — business interruption | | — |

| | — |

| | — |

| | (42.4 | ) |

| General and administrative expenses | | 61.8 |

| | 24.9 |

| | 115.8 |

| | 77.5 |

|

| Depreciation and amortization | | 46.9 |

| | 29.0 |

| | 105.4 |

| | 86.6 |

|

| Other operating expense, net | | 0.7 |

| | 2.2 |

| | 1.0 |

| | 2.2 |

|

| Total operating costs and expenses | | 2,250.7 |

| | 1,082.7 |

| | 4,680.3 |

| | 3,118.4 |

|

| Operating income (loss) | | 90.8 |

| | (2.8 | ) | | 74.0 |

| | (5.1 | ) |

| Interest expense | | 34.1 |

| | 13.9 |

| | 62.5 |

| | 40.7 |

|

| Interest income | | (0.9 | ) | | (0.2 | ) | | (2.7 | ) | | (0.9 | ) |

| (Income) loss from equity method investments | | (5.1 | ) | | 5.1 |

| | (9.7 | ) | | 33.7 |

|

| Loss on impairment of equity method investment | | — |

| | 245.3 |

| | — |

| | 245.3 |

|

| Gain on remeasurement of equity method investment | | (190.1 | ) | | — |

| | (190.1 | ) | | — |

|

| Other expense, net | | 0.8 |

| | 0.1 |

| | 0.9 |

| | 0.6 |

|

| Total non-operating (income) expenses, net | | (161.2 | ) | | 264.2 |

| | (139.1 | ) | | 319.4 |

|

| Income (loss) from continuing operations before income tax expense (benefit) | | 252.0 |

| | (267.0 | ) | | 213.1 |

| | (324.5 | ) |

| Income tax expense (benefit) | | 133.5 |

| | (103.3 | ) | | 111.5 |

| | (136.8 | ) |

| Income (loss) from continuing operations | | 118.5 |

| | (163.7 | ) | | 101.6 |

| | (187.7 | ) |

| Discontinued operations: | | | | | | | | |

| (Loss) income from discontinued operations | | (6.4 | ) | | 9.2 |

| | (6.4 | ) | | 8.1 |

|

| Income tax (benefit) expense | | (2.3 | ) | | 3.2 |

| | (2.3 | ) | | 2.6 |

|

| (Loss) income from discontinued operations, net of tax | | (4.1 | ) | | 6.0 |

| | (4.1 | ) | | 5.5 |

|

| Net income (loss) | | 114.4 |

| | (157.7 | ) | | 97.5 |

| | (182.2 | ) |

| Net income attributed to non-controlling interest | | 10.0 |

| | 4.0 |

| | 19.8 |

| | 15.7 |

|

| Net income (loss) attributable to Delek | | $ | 104.4 |

| | $ | (161.7 | ) | | $ | 77.7 |

| | $ | (197.9 | ) |

| Basic income (loss) per share: | | | | | | | | |

| Income (loss) from continuing operations | | $ | 1.35 |

| | $ | (2.71 | ) | | $ | 1.20 |

| | $ | (3.28 | ) |

| (Loss) income from discontinued operations | | $ | (0.05 | ) | | $ | 0.10 |

| | $ | (0.06 | ) | | $ | 0.09 |

|

| Total basic income (loss) per share | | $ | 1.30 |

| | $ | (2.61 | ) | | $ | 1.14 |

| | $ | (3.19 | ) |

| Diluted income (loss) per share: | | | | | | | | |

| Income (loss) from continuing operations | | $ | 1.34 |

| | $ | (2.71 | ) | | $ | 1.19 |

| | $ | (3.28 | ) |

| (Loss) income from discontinued operations | | $ | (0.05 | ) | | $ | 0.10 |

| | $ | (0.06 | ) | | $ | 0.09 |

|

| Total diluted income (loss) per share | | $ | 1.29 |

| | $ | (2.61 | ) | | $ | 1.13 |

| | $ | (3.19 | ) |

| Weighted average common shares outstanding: | | | | | | | | |

| Basic | | 80,581,762 |

| | 61,834,968 |

| | 68,272,918 |

| | 61,931,040 |

|

| Diluted | | 81,245,405 |

| | 61,834,968 |

| | 68,975,974 |

| | 61,931,040 |

|

| Dividends declared per common share outstanding | | $ | 0.15 |

| | $ | 0.15 |

| | $ | 0.45 |

| | $ | 0.45 |

|

See accompanying notes to condensed consolidated financial statements

Delek US Holdings, Inc.

Condensed Consolidated Statements of Changes in Stockholders' Equity (Unaudited)

(In millions, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2021 |

| | Common Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive Income | | Retained Earnings | | Treasury Stock | | Non-Controlling Interest in Subsidiaries | | Total Stockholders' Equity |

| | Shares | | Amount | | Shares | | Amount | |

| Balance at June 30, 2021 | | 91,637,661 | | $ | 0.9 | | | $ | 1,192.6 | | | $ | (7.4) | | | $ | 342.0 | | | (17,575,527) | | $ | (694.1) | | | $ | 118.4 | | | $ | 952.4 | |

| | | | | | | | | | | | | | | | | |

| Net income | | — | | — | | | — | | | — | | | 18.1 | | | — | | | — | | | 8.8 | | | 26.9 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Distributions to non-controlling interests | | — | | — | | | — | | | — | | | — | | | — | | | — | | | (8.2) | | | (8.2) | |

| Equity-based compensation expense | | — | | — | | | 6.8 | | | — | | | — | | | — | | | — | | | 0.1 | | | 6.9 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Taxes paid due to the net settlement of equity-based compensation | | — | | — | | | (0.4) | | | — | | | — | | | — | | | — | | | — | | | (0.4) | |

| Exercise of equity-based awards | | 62,803 | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Other | | — | | — | | | 0.2 | | | — | | | — | | | — | | | — | | | (0.2) | | | — | |

| Balance at September 30, 2021 | | 91,700,464 | | | $ | 0.9 | | | $ | 1,199.2 | | | $ | (7.4) | | | $ | 360.1 | | | (17,575,527) | | | $ | (694.1) | | | $ | 118.9 | | | $ | 977.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2020 |

| | Common Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive Income | | Retained Earnings | | Treasury Stock | | Non-Controlling Interest in Subsidiaries | | Total Stockholders' Equity |

| | Shares | | Amount | | | | | Shares | | Amount | | |

| Balance at June 30, 2020 | | 91,232,964 | | | $ | 0.9 | | | $ | 1,160.1 | | | $ | 0.5 | | | $ | 926.4 | | | (17,575,527) | | | $ | (694.1) | | | $ | 165.5 | | | $ | 1,559.3 | |

| Net (loss) income | | — | | | — | | | — | | | — | | | (88.1) | | | — | | | — | | | 11.2 | | | (76.9) | |

| Other comprehensive loss related to commodity contracts, net | | — | | | — | | | — | | | (0.5) | | | — | | | — | | | — | | | — | | | (0.5) | |

| Common stock dividends ($0.31 per share) | | — | | | — | | | — | | | — | | | (23.0) | | | — | | | — | | | — | | | (23.0) | |

| Distribution to non-controlling interest | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (8.2) | | | (8.2) | |

| Equity-based compensation expense | | — | | | — | | | 6.7 | | | — | | | — | | | — | | | — | | | — | | | 6.7 | |

| Repurchases of non-controlling interests | | — | | | — | | | (23.5) | | | — | | | — | | | — | | | — | | | 0.4 | | | (23.1) | |

| Impact from IDR Simplification transaction of Delek Logistics LP | | — | | | — | | | 37.2 | | | — | | | — | | | — | | | — | | | (50.8) | | | (13.6) | |

| Taxes paid due to the net settlement of equity-based compensation | | — | | | — | | | (0.4) | | | — | | | — | | | — | | | — | | | — | | | (0.4) | |

| Exercise of equity-based awards | | 68,265 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | |

| Balance at September 30, 2020 | | 91,301,229 | | | $ | 0.9 | | | $ | 1,180.1 | | | $ | — | | | $ | 815.3 | | | (17,575,527) | | | $ | (694.1) | | | $ | 118.1 | | | $ | 1,420.3 | |

Delek US Holdings, Inc.

Condensed Consolidated Statements of Changes in Stockholders' Equity (Unaudited)

(In millions, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, 2021 |

| | Common Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive Income | | Retained Earnings | | Treasury Stock | | Non-Controlling Interest in Subsidiaries | | Total Stockholders' Equity |

| | Shares | | Amount | | Shares | | Amount | |

| Balance at December 31, 2020 | | 91,356,868 | | $ | 0.9 | | | $ | 1,185.1 | | | $ | (7.2) | | | $ | 522.0 | | | (17,575,527) | | $ | (694.1) | | | $ | 118.4 | | | $ | 1,125.1 | |

| Net (loss) income | | — | | — | | | — | | | — | | | (161.6) | | | — | | | — | | | 24.7 | | | (136.9) | |

| Other comprehensive loss related to commodity contracts, net | | — | | — | | | — | | | (0.2) | | | — | | | — | | | — | | | — | | | (0.2) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Distributions to non-controlling interests | | — | | — | | | — | | | — | | | — | | | — | | | — | | | (24.1) | | | (24.1) | |

| Equity-based compensation expense | | — | | — | | | 17.3 | | | — | | | — | | | — | | | — | | | 0.1 | | | 17.4 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Taxes paid due to the net settlement of equity-based compensation | | — | | — | | | (3.4) | | | — | | | — | | | — | | | — | | | — | | | (3.4) | |

| Exercise of equity-based awards | | 343,596 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Other | | — | | | — | | | 0.2 | | | — | | | (0.3) | | | — | | | — | | | (0.2) | | | (0.3) | |

| Balance at September 30, 2021 | | 91,700,464 | | | $ | 0.9 | | | $ | 1,199.2 | | | $ | (7.4) | | | $ | 360.1 | | | (17,575,527) | | | $ | (694.1) | | | $ | 118.9 | | | $ | 977.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, 2020 |

| | Common Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive Income | | Retained Earnings | | Treasury Stock | | Non-Controlling Interest in Subsidiaries | | Total Stockholders' Equity |

| | Shares | | Amount | | | | | Shares | | Amount | | |

| Balance at December 31, 2019 | | 90,987,025 | | | $ | 0.9 | | | $ | 1,151.9 | | | $ | 0.1 | | | $ | 1,205.6 | | | (17,516,814) | | | $ | (692.2) | | | $ | 169.0 | | | $ | 1,835.3 | |

| Cumulative effect of adopting accounting principle regarding measurement of credit losses on financial instruments, net | | — | | | — | | | — | | | — | | | (6.5) | | | — | | | — | | | — | | | (6.5) | |

| Net (loss) income | | — | | | — | | | — | | | — | | | (314.8) | | | — | | | — | | | 29.4 | | | (285.4) | |

| Other comprehensive loss related to commodity contracts, net | | — | | | — | | | — | | | (0.2) | | | — | | | — | | | — | | | — | | | (0.2) | |

| | | | | | | | | | | | | | | | | |

| Common stock dividends ($0.93 per share) | | — | | | — | | | — | | | — | | | (69.0) | | | — | | | — | | | — | | | (69.0) | |

| Distribution to non-controlling interest | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (25.0) | | | (25.0) | |

| Equity-based compensation expense | | — | | | — | | | 17.6 | | | — | | | — | | | — | | | — | | | 0.1 | | | 17.7 | |

| Repurchase of common stock | | — | | | — | | | — | | | — | | | — | | | (58,713) | | | (1.9) | | | — | | | (1.9) | |

| Repurchases of non-controlling interests | | — | | | — | | | (24.3) | | | — | | | — | | | — | | | — | | | (4.6) | | | (28.9) | |

| Impact from IDR Simplification transaction of Delek Logistics LP | | — | | | — | | | 37.2 | | | — | | | — | | | — | | | — | | | (50.8) | | | (13.6) | |

| Taxes paid due to the net settlement of equity-based compensation | | — | | | — | | | (2.3) | | | — | | | — | | | — | | | — | | | — | | | (2.3) | |

| Exercise of equity-based awards | | 314,204 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Other | | — | | | — | | | — | | | 0.1 | | | — | | | — | | | — | | | — | | | 0.1 | |

| Balance at September 30, 2020 | | 91,301,229 | | | $ | 0.9 | | | $ | 1,180.1 | | | $ | — | | | $ | 815.3 | | | (17,575,527) | | | $ | (694.1) | | | $ | 118.1 | | | $ | 1,420.3 | |

See accompanying notes to condensed consolidated financial statements

Delek US Holdings, Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(In millions)

| | | | | | | | | | | | | | |

| | | Nine Months Ended September 30, |

| | 2021 | | 2020 |

| Cash flows from operating activities: | | | | |

| Net loss | | $ | (136.9) | | | $ | (285.4) | |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | | |

| Depreciation and amortization | | 195.6 | | | 177.4 | |

| | | | |

| Non-cash lease expense | | 40.8 | | | 34.0 | |

| Deferred income taxes | | (50.3) | | | 32.9 | |

| | | | |

| Income from equity method investments | | (14.5) | | | (28.6) | |

| Dividends from equity method investments | | 19.0 | | | 21.6 | |

| Non-cash lower of cost or market/net realizable value adjustment | | (29.9) | | | 65.6 | |

| | | | |

| | | | |

| | | | |

| | | | |

| Gain on sale of non-operating refinery | | — | | | (56.8) | |

| | | | |

| | | | |

| | | | |

| | | | |

| Other | | 22.2 | | | 28.2 | |

| Changes in assets and liabilities: | | | | |

| Accounts receivable | | (473.6) | | | 268.9 | |

| Inventories and other current assets | | (186.0) | | | (42.1) | |

| Fair value of derivatives | | 22.4 | | | (0.5) | |

| Accounts payable and other current liabilities | | 662.2 | | | (464.9) | |

| Obligation under Supply and Offtake Agreements | | 130.8 | | | (154.1) | |

| Non-current assets and liabilities, net | | 8.4 | | | 4.0 | |

| | | | |

| | | | |

| Net cash provided by (used in) operating activities | | 210.2 | | | (399.8) | |

| Cash flows from investing activities: | | | | |

| | | | |

| Equity method investment contributions | | (1.6) | | | (30.8) | |

| Distributions from equity method investments | | 6.3 | | | 72.0 | |

| Purchases of property, plant and equipment | | (163.1) | | | (241.7) | |

| | | | |

| Purchase of intangible assets | | (0.8) | | | (2.6) | |

| Proceeds from sale of property, plant and equipment | | 11.6 | | | 0.2 | |

| | | | |

| Proceeds from sale of non-operating refinery | | — | | | 39.9 | |

| Insurance proceeds | | 4.4 | | | — | |

| | | | |

| | | | |

| | | | |

| Net cash used in investing activities | | (143.2) | | | (163.0) | |

| Cash flows from financing activities: | | | | |

| Proceeds from long-term revolvers | | 1,232.8 | | | 1,798.1 | |

| Payments on long-term revolvers | | (1,718.5) | | | (1,545.8) | |

| Proceeds from term debt | | 400.0 | | | 185.0 | |

| Payments on term debt | | (40.1) | | | (34.6) | |

| Proceeds from product financing agreements | | 667.8 | | | 222.0 | |

| Repayments of product financing agreements | | (532.2) | | | (79.4) | |

| | | | |

| Taxes paid due to the net settlement of equity-based compensation | | (3.4) | | | (2.3) | |

| | | | |

| Repurchase of common stock | | — | | | (1.9) | |

| Repurchase of non-controlling interest | | — | | | (28.9) | |

| Distribution to non-controlling interest | | (24.1) | | | (25.0) | |

| Impact of IDR Simplification transaction of Delek Logistics LP | | — | | | (2.1) | |

| Dividends paid | | — | | | (69.0) | |

| | | | |

| Deferred financing costs paid | | (6.2) | | | (0.7) | |

| | | | |

| | | | |

| Net cash (used in) provided by financing activities | | (23.9) | | | 415.4 | |

| Net increase (decrease) in cash and cash equivalents | | 43.1 | | | (147.4) | |

| Cash and cash equivalents at the beginning of the period | | 787.5 | | | 955.3 | |

| | | | |

| | | | |

| Cash and cash equivalents at the end of the period | | $ | 830.6 | | | $ | 807.9 | |

| | | | |

Delek US Holdings, Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited) (continued)

(In millions)

| | | | | | | | | | | | | | |

| | |

| | | | |

| | Nine Months Ended September 30, |

| | 2021 | | 2020 |

| Supplemental disclosures of cash flow information: | | | | |

| Cash paid during the period for: | | | | |

| Interest, net of capitalized interest of $0.4 million and $0.2 million in the 2021 and 2020 periods, respectively | | $ | 79.1 | | | $ | 91.1 | |

| Income taxes | | $ | 4.1 | | | $ | 3.3 | |

| Non-cash investing activities: | | | | |

| | | | |

| | | | |

| Decrease in accrued capital expenditures | | $ | (1.5) | | | $ | (33.9) | |

| Non-cash financing activities: | | | | |

| | | | |

| Non-cash lease liability arising from obtaining right of use assets during the period | | $ | 44.0 | | | $ | 30.7 | |

| | | | |

| | | | |

| | | | |

| | | | |

See accompanying notes to condensed consolidated financial statements

Delek US Holdings, Inc.

Condensed Consolidated Statements of Comprehensive Income (Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | | 2021 | | 2020 | | 2021 | | 2020 |

| Net income (loss) | | $ | 26.9 | | | $ | (76.9) | | | $ | (136.9) | | | $ | (285.4) | |

| Other comprehensive income (loss): | | | | | | | | |

| Commodity contracts designated as cash flow hedges: | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net loss related to commodity cash flow hedges | | — | | | (0.6) | | | (0.2) | | | (0.3) | |

| Income tax benefit | | — | | | (0.1) | | | — | | | (0.1) | |

| Net comprehensive loss on commodity contracts designated as cash flow hedges | | — | | | (0.5) | | | (0.2) | | | (0.2) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Other (loss) income, net of taxes | | — | | | — | | | — | | | 0.1 | |

| Total other comprehensive loss | | — | | | (0.5) | | | (0.2) | | | (0.1) | |

| Comprehensive income (loss) | | 26.9 | | | (77.4) | | | (137.1) | | | (285.5) | |

| Comprehensive income attributable to non-controlling interest | | 8.8 | | | 11.2 | | | 24.7 | | | 29.4 | |

| Comprehensive income (loss) attributable to Delek | | $ | 18.1 | | | $ | (88.6) | | | $ | (161.8) | | | $ | (314.9) | |

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2017 | | 2016 | | 2017 | | 2016 |

| Net income (loss) attributable to Delek | | $ | 104.4 |

| | $ | (161.7 | ) | | $ | 77.7 |

| | $ | (197.9 | ) |

| Other comprehensive income (loss): | | | | | | | | |

| Commodity contracts designated as cash flow hedges: | | | | | | | | |

| Unrealized gains (losses), net of ineffectiveness gains of $0.1 million and $0.5 million for the three and nine months ended September 30, 2017, respectively, and $2.2 million and $2.7 million for the three and nine months ended September 30, 2016, respectively | | 3.4 |

| | (2.2 | ) | | (6.4 | ) | | 5.7 |

|

| Realized (gains) losses reclassified to cost of goods sold | | (1.0 | ) | | 7.0 |

| | 38.5 |

| | 21.3 |

|

| Increase related to commodity cash flow hedges, net | | 2.4 |

| | 4.8 |

| | 32.1 |

| | 27.0 |

|

| Income tax expense | | (0.8 | ) | | (1.7 | ) | | (11.2 | ) | | (9.4 | ) |

| Net comprehensive income on commodity contracts designated as cash flow hedges | | 1.6 |

| | 3.1 |

| | 20.9 |

| | 17.6 |

|

| | | | | | | | | |

| Interest rate contracts designated as cash flow hedges: | | | | | | | | |

| Unrealized gains | | 0.1 |

| | — |

| | 0.1 |

| | — |

|

| Realized gains reclassified to interest expense | | 0.1 |

| | — |

| | 0.1 |

| | — |

|

| Increase related to interest rate cash flow hedges, net | | 0.2 |

| | — |

| | 0.2 |

| | — |

|

| Income tax expense | | (0.1 | ) | | — |

| | (0.1 | ) | | — |

|

| Net comprehensive income on interest rate contracts designated as cash flow hedges | | 0.1 |

| | — |

| | 0.1 |

| | — |

|

| | | | | | | | | |

| Foreign currency translation gain | | — |

| | — |

| | — |

| | 0.2 |

|

| | | | | | | | | |

| Other comprehensive income (loss) from equity method investments, net of tax expense of $2.2 million for the both the three and nine months ended September 30, 2017, and net of tax expense of a nominal amount and a benefit of $0.1 million for the three and nine months ended September 30, 2016 | | 4.1 |

| | 0.1 |

| | 4.1 |

| | (0.1 | ) |

| | | | | | | | | |

| Postretirement benefit plans: | | | | | | | | |

| Unrealized gain arising during the year related to: | | | | | | | | |

| Net actuarial gain | | 1.0 |

| | — |

| | 1.0 |

| | — |

|

| Curtailment gain | | 6.3 |

| | — |

| | 6.3 |

| | — |

|

| Gain reclassified to earnings: | | | | | | | | |

| Recognized due to curtailment | | (6.1 | ) | | — |

| | (6.1 | ) | | — |

|

| Increase related to postretirement benefit plans, net | | 1.2 |

| | — |

| | 1.2 |

| | — |

|

| Income tax expense | | (0.4 | ) | | — |

| | (0.4 | ) | | — |

|

| Net comprehensive income on postretirement benefit plans | | 0.8 |

| | — |

| | 0.8 |

| | — |

|

| Total other comprehensive income | | 6.6 |

| | 3.2 |

| | 25.9 |

| | 17.7 |

|

| Comprehensive income (loss) attributable to Delek | | $ | 111.0 |

| | $ | (158.5 | ) | | $ | 103.6 |

| | $ | (180.2 | ) |

See accompanying notes to condensed consolidated financial statements

Delek US Holdings, Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(In millions)

|

| | | | | | | | |

| | | Nine Months Ended September 30, |

| | | 2017 | | 2016 |

| Cash flows from operating activities: | | | | |

| Net income (loss) | | $ | 97.5 |

| | $ | (182.2 | ) |

| Adjustments to reconcile net income (loss) to net cash (used in) provided by operating activities: | | | | |

| Depreciation and amortization | | 105.4 |

| | 86.6 |

|

| Amortization of deferred financing costs and debt discount | | 5.3 |

| | 3.5 |

|

| Accretion of asset retirement obligations | | 0.4 |

| | 0.3 |

|

| Amortization of unfavorable contract liability | | (4.4 | ) | | — |

|

| Deferred income taxes | | 97.8 |

| | (138.6 | ) |

| (Income) loss from equity method investments | | (9.7 | ) | | 33.7 |

|

| Dividends from equity method investments | | 12.0 |

| | 15.2 |

|

| Loss on disposal of assets | | 1.0 |

| | 2.2 |

|

| Impairment of equity method investment | | — |

| | 245.3 |

|

| Gain on remeasurement of equity method investment |

| (190.1 | ) |

| — |

|

| Equity-based compensation expense | | 12.6 |

| | 12.5 |

|

| Income tax benefit of equity-based compensation | | — |

| | 2.0 |

|

| Loss (income) from discontinued operations | | 4.1 |

| | (5.5 | ) |

| Changes in assets and liabilities, net of acquisitions: | | |

| | |

|

| Accounts receivable | | (57.5 | ) | | 20.7 |

|

| Inventories and other current assets | | (38.1 | ) | | (35.7 | ) |

| Fair value of derivatives | | 18.9 |

| | 28.0 |

|

| Accounts payable and other current liabilities | | 6.6 |

| | 9.5 |

|

| Obligation under Supply and Offtake Agreement | | 64.1 |

| | (0.5 | ) |

| Non-current assets and liabilities, net | | (35.4 | ) | | (1.7 | ) |

| Cash provided by operating activities - continuing operations | | 90.5 |

| | 95.3 |

|

| Cash (used in) provided by operating activities - discontinued operations | | (7.2 | ) | | 26.2 |

|

| Net cash provided by operating activities | | 83.3 |

| | 121.5 |

|

| Cash flows from investing activities: | | |

| | |

| Cash acquired in business combinations | | 200.5 |

| | — |

|

| Equity method investment contributions | | (4.8 | ) | | (54.7 | ) |

| Purchases of property, plant and equipment | | (108.4 | ) | | (28.2 | ) |

| Purchase of intangible assets | | (5.5 | ) | | (0.7 | ) |

| Proceeds from sales of assets | | — |

| | 0.2 |

|

| Cash provided by (used in) investing activities - continuing operations | | 81.8 |

| | (83.4 | ) |

| Cash used in investing activities - discontinued operations | | 13.5 |

| | (14.2 | ) |

| Net cash provided by (used in) investing activities | | 95.3 |

| | (97.6 | ) |

| Cash flows from financing activities: | | |

| | |

| Proceeds from long-term revolvers | | 781.7 |

| | 235.6 |

|

| Payments on long-term revolvers | | (920.5 | ) | | (212.2 | ) |

| Proceeds from term debt | | 248.1 |

| | 40.4 |

|

| Payments on term debt | | (79.9 | ) | | (42.3 | ) |

| Proceeds from product financing agreements | | 21.0 |

| | 50.4 |

|

| Repayments of product financing agreements | | (9.0 | ) | | — |

|

| Taxes paid due to the net settlement of equity-based compensation | | — |

| | (0.8 | ) |

| Income tax benefit expense of equity-based compensation | | (2.7 | ) | | (2.0 | ) |

| Repurchase of common stock | | — |

| | (6.0 | ) |

| Repurchase of non-controlling interest | | (7.3 | ) | | — |

|

| Distribution to non-controlling interest | | (23.8 | ) | | (17.7 | ) |

| Dividends paid | | (31.3 | ) | | (28.1 | ) |

| Deferred financing costs paid | | (6.1 | ) | | (1.9 | ) |

| Cash (used in) provided by financing activities - continuing operations | | (29.8 | ) | | 15.4 |

|

| Cash used in financing activities - discontinued operations | | — |

| | (11.2 | ) |

| Net cash (used in) provided by financing activities | | (29.8 | ) | | 4.2 |

|

| Net increase in cash and cash equivalents | | 148.8 |

| | 28.1 |

|

| Cash and cash equivalents at the beginning of the period | | 689.2 |

| | 287.2 |

|

| Cash and cash equivalents at the end of the period | | 838.0 |

| | 315.3 |

|

| Less cash and cash equivalents of discontinued operations at the end of the period | | 6.3 |

| | 17.9 |

|

| Cash and cash equivalents of continuing operations at the end of the period | | $ | 831.7 |

| | $ | 297.4 |

|

| | | | | |

Delek US Holdings, Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)(Continued)

(In millions)

|

| | | | | | | | |

| | | Nine Months Ended September 30, |

| | | 2017 | | 2016 |

| Supplemental disclosures of cash flow information: | | | | |

| Cash paid during the period for: | | | | |

| Interest, net of capitalized interest of $0.2 and $0.1 for the nine months ended September 30, 2017 and 2016, respectively. | | $ | 52.7 |

| | $ | 36.6 |

|

| Income taxes | | $ | 70.6 |

| | $ | 1.7 |

|

| Non-cash investing activities: | | | | |

| Increase (decrease) in accrued capital expenditures | | $ | 2.4 |

| | $ | (4.0 | ) |

| Non-cash financing activities: |

|

|

|

|

| Common stock issued in connection with the Delek/Alon Merger |

| $ | 509.0 |

|

| $ | — |

|

| Equity instruments issued in connection with the Delek/Alon Merger | | $ | 21.7 |

| | $ | — |

|

See accompanying notes to condensed consolidated financial statements

Delek US Holdings, Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

1.

Note 1 - Organization and Basis of Presentation

Delek US Holdings, Inc. is the sole shareholder or owner of membership interests,operates through its wholly-owned subsidiaryconsolidated subsidiaries, which include Delek US Energy, Inc., of ("Delek Refining, Inc. ("Refining"Energy"), Delek Finance, Inc., Delek Marketing & Supply, LLC, Lion Oil Company ("Lion Oil"), Delek Renewables, LLC, Delek Rail Logistics, Inc., Delek Logistics Services Company, Delek Helena, LLC, Delek Land Holdings, LLC, (and its subsidiaries) and is also the sole shareholder of Alon USA Energy, Inc. ("Alon") (and in Alon's wholly-owned subsidiaries by virtue of Delek's ownership of Alon)its subsidiaries).

Effective July 1, 2017 (the "Effective Time"), we acquired the outstanding common stock of Alon (previously listed under NYSE: ALJ) (the "Delek/Alon Merger", as further discussed in Note 2), resulting in a new post-combination consolidated registrant renamed as Delek US Holdings, Inc. (“New Delek”), with Alon and the previous Delek US Holdings, Inc. (“Old Delek”) surviving as wholly-owned subsidiaries. New Delek is the successor issuer to Old Delek and Alon pursuant to Rule 12g-3(c) under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). In addition, as a result of the Delek/Alon Merger, the shares of common stock of Old Delek and Alon were delisted from the New York Stock Exchange in July 2017, and their respective reporting obligations under the Exchange Act were terminated.

Unless otherwise noted or the context requires otherwise, the disclosures and financial information included in this report for the periods prior to July 1, 2017 reflect that of Old Delek, and the disclosures and financial information included in this report for the periods beginning July 1, 2017 reflect that of New Delek. The terms "we," "our," "us," "Delek" and the "Company" are used in this report to refer to Old Delek and its consolidated subsidiaries for the periods prior to July 1, 2017, and New Delek and its consolidated subsidiaries for the periods on or after July 1, 2017, unless otherwise noted. Newsubsidiaries. Delek's Common Stockcommon stock is listed on the New York Stock Exchange ("NYSE") under the symbol "DK."

In August 2016, we entered into a definitive equity purchase agreement (the "Purchase Agreement") with Compañía de Petróleos de Chile COPEC S.A. and its subsidiary, Copec Inc., a Delaware corporation (collectively, "COPEC"). Under the terms of the Purchase Agreement, Delek agreed to sell, and COPEC agreed to purchase, 100% of the equity interests in Delek's wholly-owned subsidiaries MAPCO Express, Inc., MAPCO Fleet, Inc., Delek Transportation, LLC, NTI Investments, LLC and GDK Bearpaw, LLC (collectively, the “Retail Entities”) for cash consideration of $535.0 million, subject to customary adjustments (the “Retail Transaction”). The Retail Transaction closed in November 2016.

As a result of the Purchase Agreement, we met the requirements under the provisions of Accounting Standards Codification ("ASC") 205-20, Presentation of Financial Statements - Discontinued Operations ("ASC 205-20") and ASC 360, Property, Plant and Equipment ("ASC 360"), to report the results of the Retail Entities as discontinued operations and to classify the Retail Entities as a group of assets held for sale. See Note 5 for further information regarding the Retail Entities.

Having classified the Retail Entities as assets held for sale, the condensed consolidated statements of income for the three and nine months ended September 30, 2016 have been reclassified to reflect the results of the Retail Entities as income from discontinued operations, net of taxes.

During the third quarter 2017, we committed to a plan to sell 100% of our equity interests in (or substantially all of the assets of) our subsidiaries associated with our Paramount and Long Beach, California refineries and Alon's California renewable fuels facility, which were acquired as part of the Delek/Alon Merger (collectively, the "California Discontinued Entities"). As a result of this decision and commitment to a plan, and because it was made within three months of the Delek/Alon Merger, we met the requirements under ASC 205-20 and ASC 360 to report the results of the California Discontinued Entities as discontinued operations and to classify the California Discontinued Entities as a group of assets held for sale. The sale of the California Discontinued Entities is currently anticipated to occur within the next 12 months. See Note 5 for further information regarding the California Discontinued Entities.

Our condensed consolidated financial statements include the accounts of Delek and its consolidated subsidiaries. Certain information and footnote disclosures normally included in annual financial statements prepared in accordance with United States ("U.S.") Generally Accepted Accounting Principles ("GAAP") have been condensed or omitted, although management believes that the disclosures herein are adequate to make the financial information presented not misleading. Our unaudited condensed consolidated financial statements have been prepared in conformity with GAAP applied on a consistent basis with those of the annual audited consolidated financial statements included in our Annual Report on Form 10-K filed with the Securities and Exchange Commission ("SEC") on February 28, 2017March 1, 2021 (the "Annual Report on Form 10-K") and in accordance with the rules and regulations of the SEC. These unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and the notes thereto for the year ended December 31, 20162020 included in our Annual Report on Form 10-K.

Our condensed consolidated financial statements include Delek Logistics Partners, LP ("Delek Logistics"), Alon USA Partners, LP (the "Alon Partnership") and AltAir Paramount LLC ("AltAir")NYSE:DKL), allwhich is a variable interest entities.entity ("VIE"). As the indirect owner of the general partnerspartner of Delek Logistics, and the Alon Partnership and the managing member of AltAir, we have the ability to direct the activities of these entitiesthis entity that most significantly impact theirits economic performance. We are also considered to be the primary beneficiary for accounting purposes for all of these

entitiesthis entity and are Delek Logistics' primary customer. As Delek Logistics does not derive an amount of gross margin material to us from third parties, there is limited risk to Delek associated with Delek Logistics' operations. However, in the event that Delek Logistics the Alon Partnership or AltAir incurs a loss, our operating results will reflect theirsuch loss, net of intercompany eliminations, to the extent of our ownership interest in these entities. AltAir's results are included in discontinued operations - see Note 5.this entity.

In the opinion of management, all adjustments necessary for a fair presentation of the financial condition and the results of operations for the interim periods have been included. All significant intercompany transactions and account balances have been eliminated in consolidation. All adjustments are of a normal, recurring nature. Operating results for the interim period should not be viewed as representative of results that may be expected for any future interim period or for the full year.

Accounting Policies

With the exception of the policy updates below, there have been no new or material changes to the significant accounting policies discussed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020.

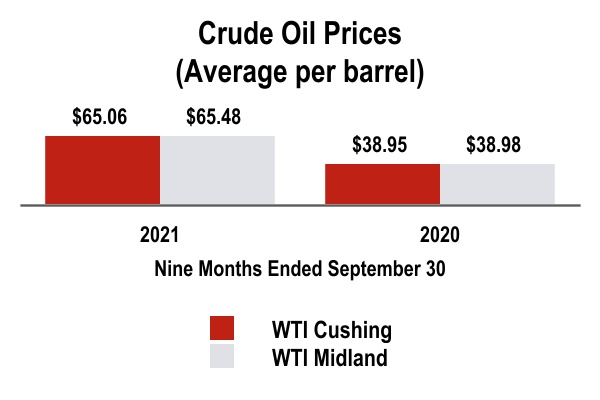

Risks and Uncertainties Arising from the COVID-19 Pandemic

U.S. economic activity continued on a recovery trend during the quarter ended September 30, 2021, albeit remaining subject to heightened levels of uncertainty related to the on-going impact of the COVID-19 outbreak that developed into a pandemic in March 2020 (the “COVID-19 Pandemic” or the “Pandemic”), and the spread of new variants of the virus. Most of the restrictions imposed in the prior year to prevent its spread have been eased and government vaccination campaigns continue. Compared to the prior year, the economic recovery trends in the three and nine months ended September 30, 2021 included a resumption of flights by major airlines and increased motor vehicle use. This has in turn resulted in increased demand and market prices for crude oil and certain of our products. Nonetheless, there remains continued uncertainty about the duration and future impact of the COVID-19 Pandemic.

Uncertainties related to the impact of the COVID-19 Pandemic and other events exist that could impact our future results of operations and financial position, the nature of which and the extent to which are currently unknown. To the extent these uncertainties have been identified and are believed to have had a material impact on our current period results of operations or financial position based on the requirements for assessing such financial statement impact under GAAP, we have considered them in the preparation of our unaudited financial statements as of and for the three and nine months ended September 30, 2021. The application of accounting policies impacted by such considerations include (but are not necessarily limited to) the following:

•The interim evaluation of indefinite-lived intangibles and goodwill for potential impairment, where indicators exist, as defined by GAAP;

•The interim evaluation of long-lived assets for potential impairment, where indicators exist, as defined by GAAP;

•The interim evaluation of joint ventures for potential impairment, where indicators exist, as defined by GAAP;

•The evaluation of derivatives and hedge accounting for counterparty risk and changes in forecasted transactions, as provided for under GAAP;

•The evaluation of inventory valuation allowances that may be warranted under the lower of cost or net realizable value analysis, for first-in, first-out (“FIFO”), and the lower of cost or market analysis, for last-in, first-out ("LIFO"), pursuant to GAAP;

Notes to Condensed Consolidated Financial Statements (Unaudited)

•The consideration of debt modifications and/or covenant requirements, as applicable;

•The evaluation of commitments and contingencies, including changes in concentrations, as applicable;

•The interim evaluation of the impact of changing forecasts on our assessment of deferred tax asset valuation allowances and annual effective tax rates; and

•The interim evaluation of our ability to continue as a going concern.

Reclassifications

Certain prior period amounts have been reclassified in order to conform to the current yearperiod presentation.

Accounting Policies Update

The following condensed accounting policies represent updates to those policies disclosed in our annual report on Form 10-K, and primarily relate to the integration of the Alon operations and accounts into our accounting and reporting framework.

Segment Reporting

Following the Delek/Alon Merger, Delek's business includes retail operations. Management views aggregated operating results in primarily three reportable segments: refining, logistics and retail. Our corporate activities, results of our asphalt operations and certain other immaterial operating segments, our equity method investments in Alon prior to the Delek/Alon Merger and intercompany eliminations are reported in the corporate, other and eliminations segment. The retail segment markets gasoline, diesel and other refined petroleum products, and convenience merchandise through a network of company-operated retail fuel and convenience stores. Segment reporting is more fully discussed in Note 14.

Accounts Receivable

Accounts receivable primarily consists of trade receivables generated in the ordinary course of business. Delek recorded an allowance for doubtful accounts related to trade receivables of $4.8 million as of September 30, 2017. Delek had no allowance for doubtful accounts as of December 31, 2016.

Credit is extended based on evaluation of the customer’s financial condition. We perform ongoing credit evaluations of our customers and require letters of credit, prepayments or other collateral or guarantees as management deems appropriate. Allowance for doubtful accounts is based on a combination of current sales and specific identification methods.

Credit risk is minimized as a result of the ongoing credit assessment of our customers and a lack of concentration in our customer base. Credit losses are charged to allowance for doubtful accounts when deemed uncollectible. Our allowance for doubtful accounts is reflected as a reduction of accounts receivable in the consolidated balance sheets.

Inventory

Crude oil, work-in-process, refined products, blendstocks and asphalt inventory for all of our operations, excluding the refinery located in Tyler, Texas (the "Tyler refinery") and merchandise inventory in our Retail segment, are stated at the lower of cost determined using the first-in, first-out (“FIFO”) basis or net realizable value. Cost of all inventory at the Tyler refinery is determined using the last-in, first-out (“LIFO”) inventory valuation method and inventory is stated at the lower of cost or market. Retail merchandise inventory consists of cigarettes, beer, convenience merchandise and food service merchandise and is stated at estimated cost as determined by the retail inventory method.

Property, Plant and Equipment

Depreciation for retail store equipment and site improvements is computed using the straight-line method over management's estimated useful lives of the related assets, which is 7-40 years.

Asset Retirement Obligations

In the retail segment, we have asset retirement obligations related to the removal of underground storage tanks and the removal of brand signage at owned and leased retail sites which are legally required under the applicable leases. The asset retirement obligation for storage tank removal on leased retail sites is accreted over the expected life of the owned retail site or the average retail site lease term.

We have asset retirement obligations with respect to our refineries due to various legal obligations to clean and/or dispose of these assets at the time they are retired. However, the majority of these assets can be used for extended and indeterminate periods of time provided that they are properly maintained and/or upgraded. It is our practice and intent to continue to maintain these assets and make improvements based on technological advances.

Revenue Recognition

In the retail segment, we derive service revenues from the sale of lottery tickets, money orders, car washes and other ancillary product and service offerings. Retail segment service revenue and related costs are recorded at gross amounts and net amounts, as appropriate, in accordance with the provisions of ASC 605-45, Revenue Recognition - PrincipalAgent Considerations ("ASC 605-45").

Cost of Goods Sold and Operating Expenses

For the retail segment, cost of goods sold comprises the costs of specific products sold. Retail cost of sales includes motor fuels and merchandise. Retail fuel cost of sales represents the cost of purchased fuel, including transportation costs. Merchandise cost of sales includes the delivered cost of merchandise purchases, net of merchandise rebates and commissions. Operating expenses include costs such as wages of employees, lease expense, utility expense and other costs of operating the stores.

Asphalt cost of sales includes costs of purchased asphalt, blending materials and transportation costs.

Interest Expense

Interest expense includes interest expense on debt, letters of credit, financing fees, the amortization, net of accretion, of debt discounts or premium and amortization of deferred debt issuance costs, but excludes capitalized interest. Original issuance discount and debt issuance costs are amortized ratably over the term of the related debt.

Postretirement Benefits

In connection with the Delek/Alon Merger, we now have defined benefit pension and postretirement medical plans for certain former Alon employees. We recognize the underfunded status of our defined benefit pension and postretirement medical plans as a liability. Changes in the funded status of our defined benefit pension and postretirement medical plans are recognized in other comprehensive income in the period when the changes occur. The funded status represents the difference between the projected benefit obligation and the fair value of the plan assets. The projected benefit obligation is the present value of benefits earned to date by plan participants, including the effect of assumed future salary increases. Plan assets are measured at fair value. We use December 31, of each year, as the measurement date for plan assets and obligations for all of our defined benefit pension and postretirement medical plans. See Note 18 for more information regarding our postretirement benefits.

New Accounting Pronouncements Adopted During 2021

ASU 2020-01, Investments—Equity Securities (Topic 321), Investments—Equity Method and Joint Ventures (Topic 323), and Derivatives and Hedging (Topic 815)—Clarifying the Interactions between Topic 321, Topic 323, and Topic 815

In August 2017,January 2020, the Financial Account Standards Board ("FASB") issued Accounting Standards Board (the "FASB"Update ("ASU") issued2020-01 which is intended to clarify interactions between the guidance to better align financial reportingaccount for hedging activities with the economic objectivescertain equity securities under Topics 321, 323 and 815, and improve current GAAP by reducing diversity in practice and increasing comparability of those activities for both financial (e.g., interest rate) and commodity risks.accounting. The guidance was intended to create more transparency in the presentation of financial results, both on the face of the financial statements and in the footnotes, and simplify the application of hedge accounting guidance. This amendmentpronouncement is effective for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. Companies are required to apply the amendment on a modified retrospective transition method in which the cumulative effect of the change will be recognized within equity in the consolidated balance sheet as of the date of adoption. Early adoption is permitted, including in an interim period. If a company early adopts in an interim period, any adjustments should be reflected as of the beginning of the fiscal year that includes the interim period. We expect to adopt this guidance on or before the effective date and are currently evaluating the impact that adopting this new guidance will have on our business, financial condition and results of operations.

In May 2017, the FASB issued guidance that clarifies when changes to the terms or conditions of a share-based payment award must be accounted for as modifications. The modification accounting guidance applies if the value, vesting conditions or classification of the award changes. This guidance is effective for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years and can be early adopted for any interim or annual financial statements that have not yet been issued. We expect to adopt this guidance on or before the effective date and are currently evaluating the impact that adopting this new guidance will have on our business, financial condition and results of operations.

In March 2017, the FASB issued guidance that will require that an employer disaggregate the service cost component from the other components of net benefit cost with respect to defined benefit postretirement employee benefit plans. Service cost is required to be reported in the same line item or items as other compensation costs arising from services rendered by the pertinent employees during the period. The other components of net periodic benefit cost are required to be reported outside the subtotal for operating income. Additionally, only the service cost component of net benefit costs are eligible for capitalization. The guidance is effective January 1, 2018, with early adoption permitted. We expect to adopt this guidance on or before the effective date and are currently evaluating the impact that adopting this new guidance will have on our business, financial condition and results of operations.

In January 2017, the FASB issued guidance concerning the goodwill impairment test that eliminates Step 2, which required a comparison of the implied fair value of goodwill of the reporting unit with the carrying amount of that goodwill for that reporting unit. It also eliminates the requirements for any reporting unit with a zero or negative carrying amount to perform a qualitative assessment and, if it fails that qualitative assessment, to perform Step 2 of the goodwill impairment test. An entity still has the option to perform the qualitative assessment for a reporting unit to determine if the quantitative impairment test is necessary. This guidance is effective for annual or any interim goodwill impairment tests in fiscal years beginning after December 15, 2019. Early adoption is permitted for interim or annual goodwill impairment tests performed on testing dates after January 1, 2017.2020. We expect to adopt this guidance on or before the effective date and we do not anticipate that the adoption will have a material impact on our business, financial condition or results of operations.

In January 2017, the FASB issued guidance clarifying the definition of a business in order to assist entities with evaluating when a set of transferred assets and activities is considered a business. In general, we expect that the revised definition will result in fewer acquisitions being accounted for as business combinations than under the current guidance. This guidance is effective for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. Early adoption is permitted under certain circumstances. We early adopted this guidance during the three months ended September 30, 2017, and as a result accounted for two immaterial acquisitions occurring during the three months ended September 30, 2017 as asset acquisitions rather than business combinations. The adoption did not have a material impact on our business, financial condition and results of operations.

In June 2016, the FASB issued guidance requiring the measurement of all expected credit losses for financial assets held at the reporting date based on historical experience, current conditions, and reasonable and supportable forecasts. Financial institutions and other organizations will now use forward-looking information to better inform their credit loss estimates. This guidance is effective for interim and annual periods beginning after December 15, 2019. We expect to adopt this guidance on or before the effective date and are currently evaluating the impact that adopting this new guidance will have on our business, financial condition and results of operations.

In March 2016, the FASB issued guidance that simplifies several aspects of the accounting for share-based payment award transactions, including the accounting for excess tax benefits and deficiencies, classification of awards as either equity or liabilities and classification of excess tax benefits on the statement of cash flows. This guidance is effective for fiscal years beginning after December 15, 2016, and interim periods within those fiscal years and can be early adopted for any interim or annual financial statements that have not yet been issued. We prospectively adopted this guidance on January 1, 20172021 and the adoption did not have a material impact on our business, financial condition or results of operations.

ASU 2019-12, Simplifying the Accounting for Income Taxes

In January 2016,December 2019, the FASB issued guidance that affects theintended to simplify various aspects related to accounting for equity investments, financial liabilities accounted for underincome taxes, eliminate certain exceptions within Accounting Standards Codification ("ASC") 740, Income Taxes (“ASC 740”) and clarify certain aspects of the fair value option and the presentation and disclosure requirements for financial instruments. Under the newcurrent guidance all equity investments in

unconsolidated entities (other than those accounted for using the equity method of accounting) will generally be measured at fair value through earnings. There will no longer be an available-for-sale classification for equity securities with readily determinable fair values. For financial liabilities when the fair value option has been elected, changes in fair value due to instrument-specific credit risk will be recognized separately in other comprehensive income. It will require public business entities to use the exit price notion when measuring the fair value of financial instruments for disclosure purposes and separate presentation of financial assets and financial liabilities by measurement category and form of financial asset, and will eliminate the requirement for public business entities to disclose the method and significant assumptions used to estimate the fair value that is required to be disclosed for financial instruments measured at amortized cost.The new guidancepromote consistency among reporting entities. The pronouncement is effective for annual reportingfiscal years and for interim periods within those fiscal years beginning after December 15, 2017, including interim reporting periods within that reporting period.2020. We expect to adoptadopted this guidance on or beforeJanuary 1, 2021 and the effective date and currently doadoption did not expect this new guidance to have a material impact on our business, financial condition or results of operations.

ASU 2018-14, Compensation - Changes to the Disclosure Requirements for Defined Benefit Plans

In July 2015,August 2018, the FASB issued guidance requiring entitiesrelated to measure FIFO or average cost inventory at the lower of costdisclosure requirements for defined benefit plans. The pronouncement eliminates, modifies and net realizable value. Net realizable value is the estimated selling prices in the ordinary course of business, less reasonably predictable costs of completion, disposal, and transportation. This guidance does not change the measurement of inventory measured using LIFO or the retail inventory method. This guidanceadds disclosure requirements for defined benefit plans. The pronouncement is effective for fiscal years beginning after December 15, 2016, and interim periods within those fiscal years.2020. We adopted this guidance on January 1, 20172021 and the adoption did not have a material impact on our business, financial condition or results of operations.

Accounting Pronouncements Not Yet Adopted

ASU 2020-06, Debt—Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging—Contracts in Entity's Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity

In May 2014,August 2020, the FASB issued ASU 2020-06, which is intended to simplify the accounting for certain financial instruments with characteristics of liabilities and equity, including convertible instruments and contracts in an entity's own equity. The guidance regarding “Revenue from Contracts with Customers,” to clarifyallows for either full retrospective adoption or modified retrospective adoption. The pronouncement is effective for fiscal years and interim periods within those fiscal years beginning after December 15, 2021, and early adoption is permitted. The Company is evaluating the principles for recognizing revenue. The core principleimpact of this guidance but does not currently expect adopting this new guidance will have a material impact on its condensed consolidated financial statements and related disclosures.

ASU 2020-04, Facilitation of the newEffects of Reference Rate Reform on Financial Reporting (Topic 848)

In March 2020, the FASB issued an amendment which is intended to provide temporary optional expedients and exceptions to GAAP guidance is that an entity should recognize revenue to depicton contracts, hedge accounting and other transactions affected by the transfer of promised goods or services to customers in an amount that reflectsexpected market transition from the consideration to which the entity expects to be entitled in exchange for those goods or services. The guidance also requires improved interimLondon Interbank Offered Rate ("LIBOR") and annual disclosures that enable the users of financial statements to better understand the nature, amount, timing, and uncertainty of revenues and cash flows arising from contracts with customers. The newother interbank rates. This guidance is effective for annual reporting periodsall entities at any time beginning afteron March 12, 2020 through December 15, 2017, including31, 2022 and may be applied from the beginning of an interim reporting periods withinperiod that reporting period, and can be adopted retrospectively. We expect to adoptincludes the issuance date of the ASU. The Company is currently evaluating the impact this guidance may have on January 1, 2018.its condensed consolidated financial statements and related disclosures.

Notes to Condensed Consolidated Financial Statements (Unaudited)

Note 2 - Segment Data

We aggregate our operating units into three reportable segments: Refining, Logistics, and Retail. Operations that are not specifically included in the reportable segments are included in Corporate, Other and Eliminations, which consist of the following:

•our corporate activities;

•results of certain immaterial operating segments, including our Canadian crude trading operations (as discussed in Note 9);

•wholesale crude operations;

•Alon's asphalt terminal operations; and

•intercompany eliminations.

Decisions concerning the allocation of resources and assessment of operating performance are made based on this segmentation. Management measures the operating performance of each of the reportable segments based on the segment contribution margin. Segment contribution margin is defined as net revenues less cost of materials and other and operating expenses, excluding depreciation and amortization.

Refining Segment

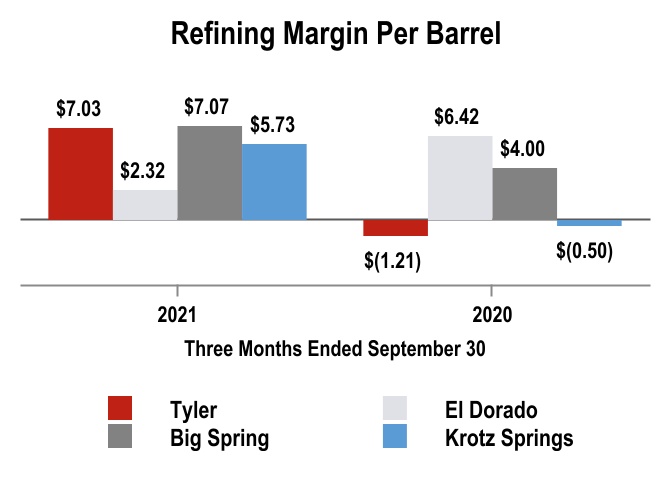

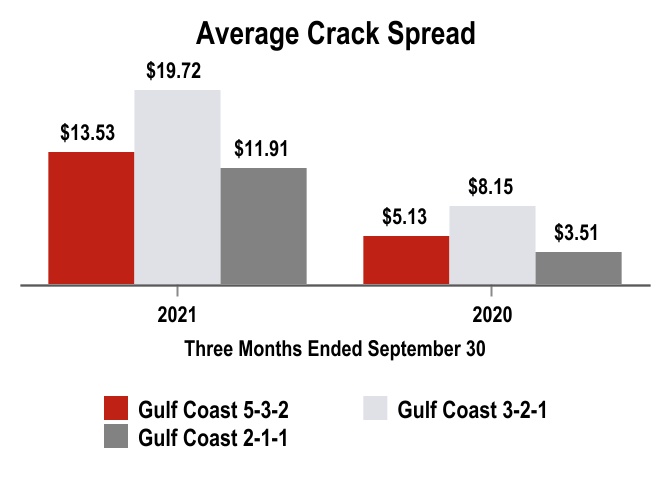

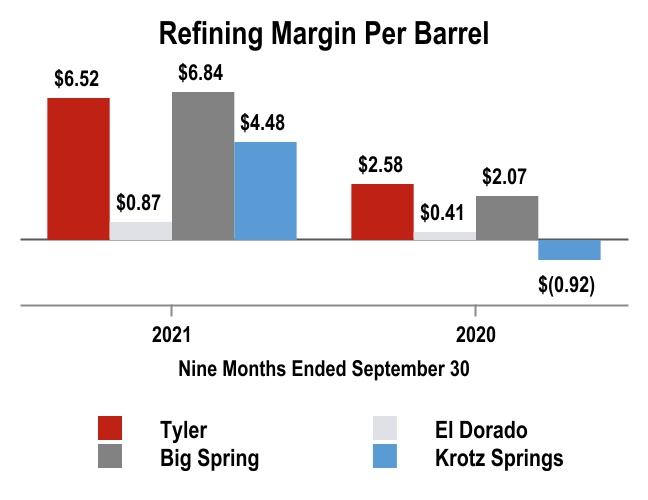

The refining segment processes crude oil and other feedstocks for the manufacture of transportation motor fuels, including various grades of gasoline, diesel fuel and aviation fuel, asphalt and other petroleum-based products that are distributed through owned and third-party product terminals. The refining segment has a combined nameplate capacity of 302,000 barrels per day ("bpd") as of September 30, 2021, including the following:

•75,000 bpd Tyler, Texas refinery (the "Tyler refinery");

•80,000 bpd El Dorado, Arkansas refinery (the "El Dorado refinery");

•73,000 bpd Big Spring, Texas refinery (the "Big Spring refinery"); and

•74,000 bpd Krotz Springs, Louisiana refinery (the "Krotz Springs refinery").

The refining segment also owns and operates 3 biodiesel facilities involved in the production of biodiesel fuels and related activities, located in Crossett, Arkansas, Cleburne, Texas and New Albany, Mississippi. The biodiesel industry has historically been substantially aided by federal and state tax incentives. One tax incentive program that has been significant to our renewable fuels facilities is the federal blender's tax credit (also known as the biodiesel tax credit or "BTC"). The BTC provides a $1.00 refundable tax credit per gallon of pure biodiesel to the first blender of biodiesel with petroleum-based diesel fuel. The blender's tax credit was re-enacted in December 2019 for the years 2020 through 2022.

On May 7, 2020, we sold our equity interests in Alon Bakersfield Property, Inc., an indirect wholly-owned subsidiary that owned our non-operating refinery located in Bakersfield, California, to a subsidiary of Global Clean Energy Holdings, Inc. (“GCE”) for total cash consideration of $40.0 million. As a result of this sale, we recognized a gain of $56.8 million, largely due to the buyer assuming substantially all of the asset retirement obligations and environmental liabilities associated with this refinery. As part of our effortsthe transaction, GCE granted a call option to prepare for adoption, beginning in 2016, we formedDelek to acquire up to a project implementation team as well as a project timeline to evaluate this new standard for the subsidiaries of Delek prior to the acquisition of Alon. We also reviewed and gained an understanding of the new revenue recognition accounting guidance, performed scoping to identify and evaluate revenue streams under the new standard, and continue to review industry specific implementation guidance. During the third quarter of 2017, we developed our control framework over revenue recognition, including implementation, and we performed testing to confirm our understanding of identified revenue streams of Old Delek. In connection with the Delek/Alon Merger which was effective July 1, 2017, we performed a similar analysis of the revenue streams/contracts of Alon and its subsidiaries in connection with our integration efforts.

We are continuing to evaluate the impact of the standard on our business processes, accounting systems, controls and financial statement disclosures, including the integration of Alon, and expect to implement any changes to accommodate the new accounting and disclosure requirements prior to adoption on January 1, 2018. We preliminarily expect to use the modified retrospective adoption method to apply this standard, under which the cumulative effect of initially applying the new guidance will be recognized as an adjustment to the opening balance of retained earnings33 1/3% limited member interest in the first quarteracquiring subsidiary of 2018.

2. Acquisitions

In January 2017, we announced that Old Delek (and various related entities) entered into the Merger Agreement with Alon, as subsequently amended on February 27 and April 21, 2017. The related Merger (the "Merger" or the "Delek/Alon Merger") was effective July 1, 2017 (as previously defined, the “Effective Time”), resulting in a new post-combination consolidated registrant renamed as Delek US Holdings, Inc. (as previously defined, “New Delek”), with Alon and Old Delek surviving as wholly-owned subsidiaries of New Delek. New Delek is the successor issuerGCE for up to Old Delek and Alon pursuant to Rule 12g-3(c) under the Exchange Act, as amended. In addition, as a result of the Delek/Alon Merger, the shares of common stock of Old Delek and Alon were delisted from the New York Stock Exchange in July 2017, and their respective reporting obligations under the Exchange Act were terminated. Prior to the Merger, Old Delek owned a non-controlling equity interest of approximately 47% of the outstanding shares of Alon , which was accounted for under the equity method of accounting (See Note 4).

Subject to the terms and conditions of the Merger Agreement, at the Effective Time, each issued and outstanding share of Alon Common Stock, other than shares owned by Old Delek and its subsidiaries or held in the treasury of Alon, was converted into the right to receive 0.504 of a share of New Delek Common Stock, or, in the case of fractional shares of New Delek Common Stock, cash (without interest) in an amount equal to the product of (i) such fractional part of a share of New Delek Common Stock multiplied by (ii) $25.96 per share, which was the volume weighted average price of the Old Delek Common Stock, par value $0.01 per share as reported on the NYSE Composite Transactions Reporting System for the twenty consecutive New York Stock Exchange (“NYSE”) full trading days ending on June 30, 2017. Each outstanding share of restricted Alon Common Stock was assumed by New Delek and converted into restricted stock denominated in shares of New Delek Common Stock, using the conversion rate applicable to the Merger. Committed but unissued share-based awards were exchanged and converted into rights to receive share-based awards indexed to New Delek Common Stock.

In addition,$13.3 million, subject to certain adjustments. Such option is exercisable by Delek through the terms and conditions of the Merger Agreement, each share of Old Delek Common Stock or fraction thereof issued and outstanding immediately prior to the Effective Time (other than Old Delek Common Stock held in the treasury of Old Delek,90th day after GCE demonstrates commercial operations, as contractually defined, which was retired in connection with the Merger) was converted at the Effective Time into the right to receive one validly issued, fully paid and non‑assessable share of New Delek Common Stock or such fraction thereof equal to the fractional share of New Delek Common Stock. All existing Old Delek stock options, restricted stock awards and stock appreciation rights were converted into equivalent rights with respect to New Delek Common Stock.

In connection with the Merger, Alon, New Delek and U.S. Bank National Association, as trustee (the “Trustee”) entered into a First Supplemental Indenture (the “Supplemental Indenture”), effective as of July 1, 2017, supplementing the Indenture, datedhas not yet occurred as of September 16, 2013 (the “Indenture”), pursuant to which Alon issued its 3.00% Convertible Senior Notes due 2018 (the “Notes”), which were convertible into shares of Alon’s Common Stock, par value $0.01 per share or cash or a combination of cash and Alon Common Stock, all as provided in the Indenture. 30, 2021.

The Supplemental Indenture provides that, as of the Effective Time, the right to convert each $1,000 principal amount of the Notes based on a number of shares of Alon Common Stock equal to the Conversion Rate (as defined in the Indenture) in effect immediately prior to the Merger was changed into a right to convert each $1,000 principal amount of Notes into or based on a number of shares of New Delek Common Stock (at the exchange rate of 0.504), par value $0.01 per share, equal to the Conversion Rate in effect immediately prior to the Merger. In addition, the Supplemental Indenture provides that, as of the Effective Time, New Delek fully and unconditionally guaranteed, on a senior basis, Alon’s obligations under the Notes.

In connection with the Indenture, Alon also entered into equity instruments, including Purchased Options and Warrants (see Note 8 for further discussion), designed, in combination, to hedge the risk associated with the potential exercise of the conversion feature of the Notes and to minimize the dilutive effect of such potential conversion. These equity instruments, in addition to the conversion feature, represent equity instruments originally indexed to Alon Common Stock that were exchanged for instruments with terms designed to preserve the original economic intent of such instruments and indexed to New Delek Common Stock in connection with the Merger. See Note 8.

Alon is a refiner and marketer of petroleumrefining segment's petroleum-based products operatingare marketed primarily in the south central, southwestern and western regions of the United States. Alon owns 100% of the general partnerThis segment also ships and 81.6% of the limited partner interestssells gasoline into wholesale markets in the southern and eastern United States. Motor fuels are sold under the Alon Partnership, which owns a crude oil refinery in Big Spring, Texas with a crude oil throughput capacity of 73,000 bpd and an integrated wholesale marketing business.or Delek brand through various terminals to supply Alon or Delek branded retail sites. In addition, Alon directlysells motor fuels through its wholesale distribution network on an unbranded basis.

Logistics Segment

Our logistics segment owns aand operates crude oil refinery in Krotz Springs, Louisiana with aand refined products logistics and marketing assets. The logistics segment generates revenue by charging fees for gathering, transporting and storing crude oil throughput capacityand for marketing, distributing, transporting and storing intermediate and refined products in select regions of 74,000 bpd. Alon also owns crude oil refineries in California, which have not processed crude oil since 2012. Alon is a marketer of asphalt, which it distributes through asphalt terminals located predominantly in the southwestern and western United States. Alon is the largest 7-Eleven licensee in thesoutheastern United States and operates approximately 300 convenience stores which market motor fuels in centralWest Texas for our refining segment and west Texasthird parties, and New Mexico.

Transaction costs incurred by the Company totaled approximately $18.4 million, inclusivesales of $11.3 million of merger costs and $7.1 million of non-recurring costs associated with the transaction, for the three months ended September 30, 2017, and $22.4 million, inclusive of $15.3 million of merger costs and $7.1 million of non-recurring costs associated with the transaction, for the nine months ended September 30, 2017. Such costs were included in general and administrative expenseswholesale products in the accompanying condensed consolidated statementsWest Texas market.

Retail Segment

Our retail segment consists of income.

The Merger is accounted for using the acquisition method of accounting, which requires, among other things, that assets acquired at their fair values250 owned and liabilities assumed be recognized on the balance sheet as of the acquisition date.

The components of the consideration transferred were as follows (dollars in millions, except per share amounts):

|

| | | | | | |

| Delek common stock issued | 19,250,795 |

| |

| Ending price per share of Delek Common Stock immediately before the Effective Time | $ | 26.44 |

| |

| Total value of common stock consideration | | $ | 509.0 |

|

Additional consideration (1) | | 21.7 |

|

Fair value of Delek's pre-existing equity method investment in Alon (2) | | 449.0 |

|

| | | $ | 979.7 |

|

The preliminary allocation of the aggregate purchase priceleased convenience store sites as of September 30, 2017 is summarized as follows (in millions),2021, located primarily in Central and is inclusiveWest Texas and New Mexico. These convenience stores typically offer various grades of gasoline and diesel primarily under the California Discontinued Entities discussed in Note 5:

|

| | | | |

| Cash | | $ | 215.3 |

|

| Receivables | | 176.9 |

|

| Inventories | | 255.5 |

|

| Prepaids and other current assets | | 31.4 |

|

Property, plant and equipment (3) | | 1,183.1 |

|

| Equity method investments | | 31.0 |

|

Acquired intangible assets (4) | | 65.0 |

|

Goodwill (5) | | 784.8 |

|

| Other non-current assets | | 37.0 |

|

| Accounts payable | | (259.7 | ) |

| Obligation under Supply & Offtake Agreements | | (198.0 | ) |

| Current portion of environmental liabilities | | (7.5 | ) |

| Other current liabilities | | (266.5 | ) |

| Environmental liabilities and asset retirement obligations, net of current portion | | (141.7 | ) |

| Deferred income taxes | | (280.4 | ) |

| Debt | | (568.0 | ) |

Other non-current liabilities (6) | | (78.5 | ) |

| Fair value of net assets acquired | | $ | 979.7 |

|

(1) Additional consideration includes the fair value of certain equity instruments originally indexed to Alon stock that were exchanged for instruments indexed to New Delek's stock,or Delek brand name and food products, food service, tobacco products, non-alcoholic and alcoholic beverages, general merchandise as well as money grams to the fair valuepublic, primarily under the 7-Eleven and DK or Alon brand names. Substantially all of certain share-based payments that were requiredthe motor fuel sold through

Notes to Condensed Consolidated Financial Statements (Unaudited)

our retail segment is supplied by our Big Spring refinery, which is transferred to the retail segment at prices substantially determined by reference to published commodity pricing information. In November 2018, we terminated the license agreement with 7-Eleven, Inc. The terms of such agreement and subsequent amendments require the removal of all 7-Eleven branding on a store-by-store basis by December 31, 2023.

Significant Inter-segment Transactions

All inter-segment transactions have been eliminated in consolidation and consist primarily of the following:

•refining segment refined product sales to the retail segment to be exchanged for awards indexedsold through the store locations;