UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 20202021

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-38124

GRANITE POINT MORTGAGE TRUST INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Maryland | | 61-1843143 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | |

| 3 Bryant Park, Suite 2400A | | |

| New York, | New York | | 10036 |

| (Address of principal executive offices) | | (Zip Code) |

(646) 540-7940(212) 364-5500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | GPMT | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒☐ | | Accelerated filer | ☐☒ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

As of November 6, 2020,4, 2021, there were 55,205,08253,789,465 shares of outstanding common stock, par value $0.01 per share, issued and outstanding.

GRANITE POINT MORTGAGE TRUST INC.

INDEX

| | | | | | | | |

| | Page |

| PART I - FINANCIAL INFORMATION | |

| Item 1. | Financial Statements (unaudited) | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PART II - OTHER INFORMATION | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements (unaudited)

GRANITE POINT MORTGAGE TRUST INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

| | | September 30,

2020 | | December 31,

2019 | | September 30,

2021 | | December 31,

2020 |

| ASSETS | ASSETS | | | | ASSETS | | | |

| Loans held-for-investment | Loans held-for-investment | $ | 4,052,201 | | | $ | 4,226,212 | | Loans held-for-investment | $ | 3,659,691 | | | $ | 3,914,469 | |

| Allowance for credit losses | Allowance for credit losses | (73,339) | | | — | | Allowance for credit losses | (45,480) | | | (66,666) | |

| Loans held-for-investment, net | Loans held-for-investment, net | 3,978,862 | | | 4,226,212 | | Loans held-for-investment, net | 3,614,211 | | | 3,847,803 | |

| Available-for-sale securities, at fair value | 0 | | | 12,830 | | |

| Held-to-maturity securities | 0 | | | 18,076 | | |

| | Cash and cash equivalents | Cash and cash equivalents | 353,679 | | | 80,281 | | Cash and cash equivalents | 154,916 | | | 261,419 | |

| Restricted cash | Restricted cash | 5,326 | | | 79,483 | | Restricted cash | 20,602 | | | 67,774 | |

| Accrued interest receivable | Accrued interest receivable | 11,933 | | | 11,323 | | Accrued interest receivable | 9,898 | | | 12,388 | |

| | Other assets | Other assets | 53,052 | | | 32,657 | | Other assets | 99,563 | | | 30,264 | |

Total Assets (1) | Total Assets (1) | $ | 4,402,852 | | | $ | 4,460,862 | | Total Assets (1) | $ | 3,899,190 | | | $ | 4,219,648 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Liabilities | Liabilities | | Liabilities | |

| Repurchase agreements | $ | 1,850,845 | | | $ | 1,924,021 | | |

| Repurchase facilities | | Repurchase facilities | $ | 916,758 | | | $ | 1,708,875 | |

| Securitized debt obligations | Securitized debt obligations | 928,623 | | | 1,041,044 | | Securitized debt obligations | 1,356,429 | | | 927,128 | |

| Asset-specific financings | Asset-specific financings | 123,091 | | | 116,465 | | Asset-specific financings | 44,752 | | | 123,091 | |

| Revolving credit facilities | 0 | | | 42,008 | | |

| Term financing facility | | Term financing facility | 127,867 | | | — | |

| Convertible senior notes | Convertible senior notes | 270,847 | | | 269,634 | | Convertible senior notes | 272,512 | | | 271,250 | |

| | Senior secured term loan facilities | Senior secured term loan facilities | 205,647 | | | 0 | | Senior secured term loan facilities | 208,785 | | | 206,448 | |

| | Dividends payable | Dividends payable | 11,065 | | | 23,063 | | Dividends payable | 13,713 | | | 25,049 | |

| | Other liabilities | Other liabilities | 77,272 | | | 24,491 | | Other liabilities | 25,140 | | | 22,961 | |

Total Liabilities (1) | Total Liabilities (1) | 3,467,390 | | | 3,440,726 | | Total Liabilities (1) | 2,965,956 | | | 3,284,802 | |

| 10% cumulative redeemable preferred stock, par value $0.01 per share; 50,000,000 shares authorized and 1,000 and 1,000 shares issued and outstanding, respectively | 1,000 | | | 1,000 | | |

| Commitments and Contingencies (see Note 10) | | Commitments and Contingencies (see Note 10) | 0 | | 0 |

| 10% cumulative redeemable preferred stock, par value $0.01 per share; 50,000,000 shares authorized and 1,000 shares issued and outstanding ($1,000,000 liquidation preference) | | 10% cumulative redeemable preferred stock, par value $0.01 per share; 50,000,000 shares authorized and 1,000 shares issued and outstanding ($1,000,000 liquidation preference) | 1,000 | | | 1,000 | |

| Stockholders’ Equity | Stockholders’ Equity | | Stockholders’ Equity | |

| Common stock, par value $0.01 per share; 450,000,000 shares authorized and 55,205,082 and 54,853,205 shares issued and outstanding, respectively | 552 | | | 549 | | |

| Common stock, par value $0.01 per share; 450,000,000 shares authorized and 53,789,465 and 55,205,082 shares issued and outstanding, respectively | | Common stock, par value $0.01 per share; 450,000,000 shares authorized and 53,789,465 and 55,205,082 shares issued and outstanding, respectively | 538 | | | 552 | |

| Additional paid-in capital | Additional paid-in capital | 1,057,016 | | | 1,048,484 | | Additional paid-in capital | 1,037,395 | | | 1,058,298 | |

| Accumulated other comprehensive income | 0 | | | 32 | | |

| Cumulative earnings | Cumulative earnings | 80,014 | | | 162,076 | | Cumulative earnings | 164,055 | | | 103,165 | |

| Cumulative distributions to stockholders | Cumulative distributions to stockholders | (203,120) | | | (192,005) | | Cumulative distributions to stockholders | (269,879) | | | (228,169) | |

| Total Stockholders’ Equity | 934,462 | | | 1,019,136 | | |

| Total Granite Point Mortgage Trust, Inc. Stockholders’ Equity | | Total Granite Point Mortgage Trust, Inc. Stockholders’ Equity | 932,109 | | | 933,846 | |

| Non-controlling interests | | Non-controlling interests | 125 | | | — | |

| Total Equity | | Total Equity | $ | 932,234 | | | $ | 933,846 | |

| Total Liabilities and Stockholders’ Equity | Total Liabilities and Stockholders’ Equity | $ | 4,402,852 | | | $ | 4,460,862 | | Total Liabilities and Stockholders’ Equity | $ | 3,899,190 | | | $ | 4,219,648 | |

____________________

(1)The condensed consolidated balance sheets include assets of consolidated variable interest entities, or VIEs, that can only be used to settle obligations of these VIEs, and liabilities of the consolidated VIEs for which creditors do not have recourse to Granite Point Mortgage Trust Inc. At September 30, 20202021 and December 31, 2019,2020, assets of the VIEs totaled $1,252,969$1,824,173 and $1,387,148,$1,255,932, respectively, and liabilities of the VIEs totaled $930,066$1,357,675 and $1,042,122,$928,220, respectively. See Note 34 - Variable Interest Entitiesand Securitized Debt Obligations for additional information.

The accompanying notes are an integral part of these condensed consolidated financial statements.

GRANITE POINT MORTGAGE TRUST INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) INCOME

(in thousands, except share data)

| | | | Three Months Ended | | Nine Months Ended | | | Three Months Ended | | Nine Months Ended |

| | | September 30, | | September 30, | | | September 30, | | September 30, |

| | | 2020 | | 2019 | | 2020 | | 2019 | | | | 2021 | | 2020 | | 2021 | | 2020 | |

| Interest income: | Interest income: | | | | | Interest income: | | | | |

| Loans held-for-investment | Loans held-for-investment | | $ | 56,783 | | | $ | 61,796 | | | $ | 180,341 | | | $ | 176,594 | | | Loans held-for-investment | | $ | 48,312 | | | $ | 56,783 | | | $ | 151,701 | | | $ | 180,341 | | |

| Loans held-for-sale | Loans held-for-sale | | 774 | | | 0 | | | 895 | | | 0 | | | Loans held-for-sale | | — | | | 774 | | | — | | | 895 | | |

| Available-for-sale securities | Available-for-sale securities | | 119 | | | 308 | | | 646 | | | 927 | | | Available-for-sale securities | | — | | | 119 | | | — | | | 646 | | |

| Held-to-maturity securities | Held-to-maturity securities | | 113 | | | 530 | | | 659 | | | 1,804 | | | Held-to-maturity securities | | — | | | 113 | | | — | | | 659 | | |

| Cash and cash equivalents | Cash and cash equivalents | | 57 | | | 810 | | | 424 | | | 2,228 | | | Cash and cash equivalents | | 95 | | | 57 | | | 298 | | | 424 | | |

| Total interest income | Total interest income | | 57,846 | | | 63,444 | | | 182,965 | | | 181,553 | | | Total interest income | | 48,407 | | | 57,846 | | | 151,999 | | | 182,965 | | |

| Interest expense: | Interest expense: | | | | Interest expense: | | | |

| Repurchase agreements | | 12,791 | | | 17,951 | | | 46,742 | | | 48,469 | | | |

| Repurchase facilities | | Repurchase facilities | | 5,451 | | | 12,791 | | | 20,449 | | | 46,742 | | |

| Securitized debt obligations | Securitized debt obligations | | 5,431 | | | 12,467 | | | 21,367 | | | 35,880 | | | Securitized debt obligations | | 8,777 | | | 5,431 | | | 20,523 | | | 21,367 | | |

| Convertible senior notes | Convertible senior notes | | 4,529 | | | 4,503 | | | 13,570 | | | 13,459 | | | Convertible senior notes | | 4,556 | | | 4,529 | | | 13,618 | | | 13,570 | | |

| Term financing facility | | Term financing facility | | 1,453 | | | — | | | 6,208 | | | — | | |

| Asset-specific financings | Asset-specific financings | | 901 | | | 1,119 | | | 2,962 | | | 1,717 | | | Asset-specific financings | | 414 | | | 901 | | | 1,959 | | | 2,962 | | |

| Revolving credit facilities | Revolving credit facilities | | 217 | | | 322 | | | 779 | | | 1,182 | | | Revolving credit facilities | | — | | | 217 | | | — | | | 779 | | |

| Senior secured term loan facilities | Senior secured term loan facilities | | 145 | | | 0 | | | 145 | | | 0 | | | Senior secured term loan facilities | | 5,654 | | | 145 | | | 16,587 | | | 145 | | |

| Total interest expense | Total interest expense | | 24,014 | | | 36,362 | | | 85,565 | | | 100,707 | | | Total interest expense | | 26,305 | | | 24,014 | | | 79,344 | | | 85,565 | | |

| Net interest income | Net interest income | | 33,832 | | | 27,082 | | | 97,400 | | | 80,846 | | | Net interest income | | 22,102 | | | 33,832 | | | 72,655 | | | 97,400 | | |

| | Other (loss) income: | | | | |

| Provision for credit losses | | 5,300 | | | 0 | | | (62,241) | | | 0 | | | |

| Realized losses on sales | | (10,019) | | | 0 | | | (16,913) | | | 0 | | | |

| Other income (loss): | | Other income (loss): | | | |

| Benefit from (provision for) credit losses | | Benefit from (provision for) credit losses | | 5,760 | | | 5,300 | | | 15,072 | | | (62,241) | | |

| | Realized losses on sales of loans held-for-sale | | Realized losses on sales of loans held-for-sale | | — | | | (10,019) | | | — | | | (16,913) | | |

| Fee income | Fee income | | 595 | | | 0 | | | 1,117 | | | 1,115 | | | Fee income | | — | | | 595 | | | — | | | 1,117 | | |

| | Total other (loss) income | | (4,124) | | | 0 | | | (78,037) | | | 1,115 | | | |

| Total other income (loss) | | Total other income (loss) | | 5,760 | | | (4,124) | | | 15,072 | | | (78,037) | | |

| Expenses: | Expenses: | | | | Expenses: | | | |

| Management fees | | 3,974 | | | 3,801 | | | 11,840 | | | 11,013 | | | |

| Incentive fees | | 0 | | | 0 | | | 0 | | | 244 | | | |

| Base management fees | | Base management fees | | — | | | 3,974 | | | — | | | 11,840 | | |

| Compensation and benefits | | Compensation and benefits | | 5,634 | | | — | | | 16,111 | | | — | | |

| Servicing expenses | Servicing expenses | | 914 | | | 1,013 | | | 3,025 | | | 2,671 | | | Servicing expenses | | 1,323 | | | 914 | | | 3,763 | | | 3,025 | | |

| General and administrative expenses | | 5,808 | | | 4,877 | | | 24,421 | | | 15,499 | | | |

| Other operating expenses | | Other operating expenses | | 2,276 | | | 5,808 | | | 6,967 | | | 24,421 | | |

| Restructuring charges | Restructuring charges | | 43,682 | | | 0 | | | 43,682 | | | 0 | | | Restructuring charges | | — | | | 43,682 | | | — | | | 43,682 | | |

| Total expenses | Total expenses | | 54,378 | | | 9,691 | | | 82,968 | | | 29,427 | | | Total expenses | | 9,233 | | | 54,378 | | | 26,841 | | | 82,968 | | |

| (Loss) income before income taxes | | (24,670) | | | 17,391 | | | (63,605) | | | 52,534 | | | |

| Income (loss) before income taxes | | Income (loss) before income taxes | | 18,629 | | | (24,670) | | | 60,886 | | | (63,605) | | |

| Benefit from income taxes | Benefit from income taxes | | (4) | | | (1) | | | (15) | | | (4) | | | Benefit from income taxes | | (1) | | | (4) | | | (4) | | | (15) | | |

| Net (loss) income | | (24,666) | | | 17,392 | | | (63,590) | | | 52,538 | | | |

| Net income (loss) | | Net income (loss) | | 18,630 | | | (24,666) | | | 60,890 | | | (63,590) | | |

| Dividends on preferred stock | Dividends on preferred stock | | 25 | | | 25 | | | 75 | | | 75 | | | Dividends on preferred stock | | 25 | | | 25 | | | 75 | | | 75 | | |

| Net (loss) income attributable to common stockholders | | $ | (24,691) | | | $ | 17,367 | | | $ | (63,665) | | | $ | 52,463 | | | |

| Basic (loss) earnings per weighted average common share | | $ | (0.45) | | | $ | 0.32 | | | $ | (1.15) | | | $ | 1.00 | | | |

| Diluted (loss) earnings per weighted average common share | | $ | (0.45) | | | $ | 0.32 | | | $ | (1.15) | | | $ | 1.00 | | | |

| Net income (loss) attributable to common stockholders | | Net income (loss) attributable to common stockholders | | $ | 18,605 | | | $ | (24,691) | | | $ | 60,815 | | | $ | (63,665) | | |

| Basic earnings (loss) per weighted average common share | | Basic earnings (loss) per weighted average common share | | $ | 0.34 | | | $ | (0.45) | | | $ | 1.11 | | | $ | (1.15) | | |

| Diluted earnings (loss) per weighted average common share | | Diluted earnings (loss) per weighted average common share | | $ | 0.33 | | | $ | (0.45) | | | $ | 1.05 | | | $ | (1.15) | | |

| Dividends declared per common share | Dividends declared per common share | | $ | 0.20 | | | $ | 0.42 | | | $ | 0.20 | | | $ | 1.26 | | | Dividends declared per common share | | $ | 0.25 | | | $ | 0.20 | | | $ | 0.75 | | | $ | 0.20 | | |

| Weighted average number of shares of common stock outstanding: | Weighted average number of shares of common stock outstanding: | | | | | | | | | | Weighted average number of shares of common stock outstanding: | | | | | | | | | |

| Basic | Basic | | 55,205,082 | | | 54,853,205 | | | 55,140,163 | | | 52,492,324 | | | Basic | | 54,453,546 | | | 55,205,082 | | | 54,864,456 | | | 55,140,163 | | |

| Diluted | Diluted | | 55,205,082 | | | 54,853,205 | | | 55,140,163 | | | 52,492,324 | | | Diluted | | 56,735,278 | | | 55,205,082 | | | 70,902,745 | | | 55,140,163 | | |

| Comprehensive (loss) income: | | | | | | | | | | |

| Net (loss) income attributable to common stockholders | | $ | (24,691) | | | $ | 17,367 | | | $ | (63,665) | | | $ | 52,463 | | | |

| Other comprehensive income, net of tax: | | | | |

| Unrealized gain on available-for-sale securities | | 0 | | | 0 | | | 0 | | | 224 | | | |

| Other comprehensive income | | 0 | | | 0 | | | 0 | | | 224 | | | |

| Comprehensive (loss) income | | $ | (24,691) | | | $ | 17,367 | | | $ | (63,665) | | | $ | 52,687 | | | |

| Comprehensive income (loss): | | Comprehensive income (loss): | | | | | | | | | |

| Net income (loss) attributable to common stockholders | | Net income (loss) attributable to common stockholders | | $ | 18,605 | | | $ | (24,691) | | | $ | 60,815 | | | $ | (63,665) | | |

| Other comprehensive income (loss), net of tax: | | Other comprehensive income (loss), net of tax: | | | |

| | Comprehensive income (loss) | | Comprehensive income (loss) | | $ | 18,605 | | | $ | (24,691) | | | $ | 60,815 | | | $ | (63,665) | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

GRANITE POINT MORTGAGE TRUST INC

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | | | | | | | | | |

| Shares | | Amount | | Additional Paid-in Capital | | Accumulated Other Comprehensive Income (Loss) | | Cumulative Earnings | | Cumulative Distributions to Stockholders | | Total Stockholders’ Equity |

| Balance, December 31, 2018 | 43,621,174 | | | $ | 436 | | | $ | 836,288 | | | $ | (192) | | | $ | 91,875 | | | $ | (100,876) | | | $ | 827,531 | |

| Cumulative effect of adoption of new accounting principle | — | | | — | | | 13 | | | — | | | (13) | | | — | | | 0 | |

| Adjusted balance, January 1, 2019 | 43,621,174 | | | 436 | | | 836,301 | | | (192) | | | 91,862 | | | (100,876) | | | 827,531 | |

| Net income | — | | | — | | | — | | | — | | | 16,969 | | | — | | | 16,969 | |

| Other comprehensive income before reclassifications | — | | | — | | | — | | | 192 | | | — | | | — | | | 192 | |

| Amounts reclassified from accumulated other comprehensive income | — | | | — | | | — | | | 0 | | | — | | | — | | | 0 | |

| Net other comprehensive income | — | | | — | | | — | | | 192 | | | — | | | — | | | 192 | |

| Issuance of common stock, net of offering costs | 8,291,829 | | | 83 | | | 157,145 | | | — | | | — | | | — | | | 157,228 | |

| | | | | | | | | | | | | |

| Common dividends declared | — | | | — | | | — | | | — | | | — | | | (21,913) | | | (21,913) | |

| Preferred dividends declared | — | | | — | | | — | | | — | | | — | | | (25) | | | (25) | |

| | | | | | | | | | | | | |

| Non-cash equity award compensation | 258,918 | | | 3 | | | 1,146 | | | — | | | — | | | — | | | 1,149 | |

| Balance, March 31, 2019 | 52,171,921 | | | 522 | | | 994,592 | | | 0 | | | 108,831 | | | (122,814) | | | 981,131 | |

| Net income | — | | | — | | | — | | | — | | | 18,177 | | | — | | | 18,177 | |

| Other comprehensive income before reclassifications | — | | | — | | | — | | | 32 | | | — | | | — | | | 32 | |

| Amounts reclassified from accumulated other comprehensive income | — | | | — | | | — | | | 0 | | | — | | | — | | | 0 | |

| Net other comprehensive income | — | | | — | | | — | | | 32 | | | — | | | — | | | 32 | |

| Issuance of common stock, net of offering costs | 2,663,095 | | | 27 | | | 50,150 | | | — | | | — | | | — | | | 50,177 | |

| | | | | | | | | | | | | |

| Common dividends declared | — | | | — | | | — | | | — | | | — | | | (23,039) | | | (23,039) | |

| Preferred dividends declared | — | | | — | | | — | | | — | | | — | | | (25) | | | (25) | |

| | | | | | | | | | | | | |

| Non-cash equity award compensation | 18,189 | | | 0 | | | 1,283 | | | — | | | — | | | — | | | 1,283 | |

| Balance, June 30, 2019 | 54,853,205 | | | 549 | | | 1,046,025 | | | 32 | | | 127,008 | | | (145,878) | | | 1,027,736 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | — | | | 17,392 | | | — | | | 17,392 | |

| Other comprehensive income before reclassifications | — | | | — | | | — | | | 0 | | | — | | | — | | | 0 | |

| Amounts reclassified from accumulated other comprehensive income | — | | | — | | | — | | | 0 | | | — | | | — | | | 0 | |

| Net other comprehensive income | — | | | — | | | — | | | 0 | | | — | | | — | | | 0 | |

| Issuance of common stock, net of offering costs | 0 | | | 0 | | | 0 | | | — | | | — | | | — | | | 0 | |

| | | | | | | | | | | | | |

| Common dividends declared | — | | | — | | | — | | | — | | | — | | | (23,038) | | | (23,038) | |

| Preferred dividends declared | — | | | — | | | — | | | — | | | — | | | (25) | | | (25) | |

| | | | | | | | | | | | | |

| Non-cash equity award compensation | 0 | | | 0 | | | 1,175 | | | — | | | — | | | — | | | 1,175 | |

| Balance, September 30, 2019 | 54,853,205 | | | $ | 549 | | | $ | 1,047,200 | | | $ | 32 | | | $ | 144,400 | | | $ | (168,941) | | | $ | 1,023,240 | |

| | | | | | | | | | | | | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | | | | | | | | | | | | | |

| Shares | | Amount | | Additional Paid-in Capital | | Accumulated Other Comprehensive Income (Loss) | | Cumulative Earnings | | Cumulative Distributions to Stockholders | | Total Stockholders’ Equity | | Non-controlling Interests | | Total Equity |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Balance, December 31, 2019 | 54,853,205 | | | 549 | | | 1,048,484 | | | 32 | | | 162,076 | | | (192,005) | | | 1,019,136 | | | — | | | 1,019,136 | |

| Cumulative effect of adoption of new accounting principle | — | | | — | | | — | | | — | | | (18,472) | | | — | | | (18,472) | | | — | | | (18,472) | |

| Adjusted balance, January 1, 2020 | 54,853,205 | | | 549 | | | 1,048,484 | | | 32 | | | 143,604 | | | (192,005) | | | 1,000,664 | | | — | | | 1,000,664 | |

| Net loss | — | | | — | | | — | | | — | | | (37,191) | | | — | | | (37,191) | | | — | | | (37,191) | |

| Other comprehensive loss before reclassifications | — | | | — | | | — | | | (4,511) | | | — | | | — | | | (4,511) | | | — | | | (4,511) | |

| Amounts reclassified from accumulated other comprehensive income | — | | | — | | | — | | | 767 | | | — | | | — | | | 767 | | | — | | | 767 | |

| Net other comprehensive loss | — | | | — | | | — | | | (3,744) | | | — | | | — | | | (3,744) | | | — | | | (3,744) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Preferred dividends declared, $25.00 per share | — | | | — | | | — | | | — | | | — | | | (25) | | | (25) | | | — | | | (25) | |

| | | | | | | | | | | | | | | | | |

| Non-cash equity award compensation | 283,680 | | | 3 | | | 1,352 | | | — | | | — | | | — | | | 1,355 | | | — | | | 1,355 | |

| Balance, March 31, 2020 | 55,136,885 | | | 552 | | | 1,049,836 | | | (3,712) | | | 106,413 | | | (192,030) | | | 961,059 | | | — | | | 961,059 | |

| Net loss | — | | | — | | | — | | | — | | | (1,733) | | | — | | | (1,733) | | | — | | | (1,733) | |

| Other comprehensive income before reclassifications | — | | | — | | | — | | | 4,223 | | | — | | | — | | | 4,223 | | | — | | | 4,223 | |

| Amounts reclassified from accumulated other comprehensive income | — | | | — | | | — | | | (511) | | | — | | | — | | | (511) | | | — | | | (511) | |

| Net other comprehensive income | — | | | — | | | — | | | 3,712 | | | — | | | — | | | 3,712 | | | — | | | 3,712 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Preferred dividends declared, $25.00 per share | — | | | — | | | — | | | — | | | — | | | (25) | | | (25) | | | — | | | (25) | |

| | | | | | | | | | | | | | | | | |

| Non-cash equity award compensation | 68,197 | | | — | | | 1,323 | | | — | | | — | | | — | | | 1,323 | | | — | | | 1,323 | |

| Balance, June 30, 2020 | 55,205,082 | | | 552 | | | 1,051,159 | | | — | | | 104,680 | | | (192,055) | | | 964,336 | | | — | | | 964,336 | |

| Net loss | — | | | — | | | — | | | — | | | (24,666) | | | — | | | (24,666) | | | — | | | (24,666) | |

| Issuance of warrants to purchase common stock | — | | | — | | | 4,541 | | | — | | | — | | | — | | | 4,541 | | | — | | | 4,541 | |

| Common dividends declared, $0.20 per share | — | | | $ | — | | | — | | | — | | | — | | | (11,040) | | | (11,040) | | | — | | | (11,040) | |

| Preferred dividends declared, $25.00 per share | — | | | $ | — | | | — | | | — | | | — | | | (25) | | | (25) | | | — | | | (25) | |

| Non-cash equity award compensation | — | | | $ | — | | | 1,316 | | | — | | | — | | | — | | | 1,316 | | | — | | | 1,316 | |

| Balance, September 30, 2020 | 55,205,082 | | | $ | 552 | | | $ | 1,057,016 | | | $ | — | | | $ | 80,014 | | | $ | (203,120) | | | $ | 934,462 | | | — | | | $ | 934,462 | |

| | | | | | | | | | | | | | | | | |

GRANITE POINT MORTGAGE TRUST INC

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(in thousands, except share data) (Continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | | | | | | | | | |

| Shares | | Amount | | Additional Paid-in Capital | | Accumulated Other Comprehensive Income (Loss) | | Cumulative Earnings | | Cumulative Distributions to Stockholders | | Total Stockholders’ Equity |

| Balance, December 31, 2019 | 54,853,205 | | | $ | 549 | | | $ | 1,048,484 | | | $ | 32 | | | $ | 162,076 | | | $ | (192,005) | | | $ | 1,019,136 | |

| Cumulative effect of adoption of new accounting principle | — | | | — | | | — | | | — | | | (18,472) | | | — | | | (18,472) | |

| Adjusted balance, January 1, 2020 | 54,853,205 | | | 549 | | | 1,048,484 | | | 32 | | | 143,604 | | | (192,005) | | | 1,000,664 | |

| Net loss | — | | | — | | | — | | | — | | | (37,191) | | | — | | | (37,191) | |

| Other comprehensive income before reclassifications | — | | | — | | | — | | | (4,511) | | | — | | | — | | | (4,511) | |

| Amounts reclassified from accumulated other comprehensive income | — | | | — | | | — | | | 767 | | | — | | | — | | | 767 | |

| Net other comprehensive income | — | | | — | | | — | | | (3,744) | | | — | | | — | | | (3,744) | |

| Preferred dividends declared | — | | | — | | | — | | | — | | | — | | | (25) | | | (25) | |

| Non-cash equity award compensation | 283,680 | | | 3 | | | 1,352 | | | — | | | — | | | — | | | 1,355 | |

| Balance, March 31, 2020 | 55,136,885 | | | 552 | | | 1,049,836 | | | (3,712) | | | 106,413 | | | (192,030) | | | 961,059 | |

| Net loss | — | | | — | | | — | | | — | | | (1,733) | | | — | | | (1,733) | |

| Other comprehensive income before reclassifications | — | | | — | | | — | | | 4,223 | | | — | | | — | | | 4,223 | |

| Amounts reclassified from accumulated other comprehensive income | — | | | — | | | — | | | (511) | | | — | | | — | | | (511) | |

| Net other comprehensive income | — | | | — | | | — | | | 3,712 | | | — | | | — | | | 3,712 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Preferred dividends declared | — | | | — | | | — | | | — | | | — | | | (25) | | | (25) | |

| | | | | | | | | | | | | |

| Non-cash equity award compensation | 68,197 | | | 0 | | | 1,323 | | | — | | | — | | | — | | | 1,323 | |

| Balance, June 30, 2020 | 55,205,082 | | | 552 | | | 1,051,159 | | | 0 | | | 104,680 | | | (192,055) | | | 964,336 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net loss | — | | | — | | | — | | | — | | | (24,666) | | | — | | | (24,666) | |

| Other comprehensive income before reclassifications | — | | | — | | | — | | | 0 | | | — | | | — | | | 0 | |

| Amounts reclassified from accumulated other comprehensive income | — | | | — | | | — | | | 0 | | | — | | | — | | | 0 | |

| Net other comprehensive income | — | | | — | | | — | | | 0 | | | — | | | — | | | 0 | |

| Issuance of common stock, net of offering costs | 0 | | | 0 | | | 0 | | | — | | | — | | | — | | | 0 | |

| Issuance of warrants to purchase common stock | — | | | — | | | 4,541 | | | — | | | — | | | — | | | 4,541 | |

| Common dividends declared | — | | | — | | | — | | | — | | | — | | | (11,040) | | | (11,040) | |

| Preferred dividends declared | — | | | — | | | — | | | — | | | — | | | (25) | | | (25) | |

| | | | | | | | | | | | | |

| Non-cash equity award compensation | 0 | | | 0 | | | 1,316 | | | — | | | — | | | — | | | 1,316 | |

| Balance, September 30, 2020 | 55,205,082 | | | $ | 552 | | | $ | 1,057,016 | | | $ | 0 | | | $ | 80,014 | | | $ | (203,120) | | | $ | 934,462 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | | | | | | | | | | | | | |

| Shares | | Amount | | Additional Paid-in Capital | | Accumulated Other Comprehensive Income (Loss) | | Cumulative Earnings | | Cumulative Distributions to Stockholders | | Total Stockholders’ Equity | | Non-controlling Interests | | Total Equity |

| Balance, December 31, 2020 | 55,205,082 | | | 552 | | | 1,058,298 | | | — | | | 103,165 | | | (228,169) | | | 933,846 | | | — | | | 933,846 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | — | | | 27,991 | | | — | | | 27,991 | | | — | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Restricted stock forfeiture | (97,425) | | | (1) | | | (918) | | | — | | | — | | | — | | | (919) | | | — | | | (919) | |

| Common dividends declared, $0.25 per share | — | | | — | | | — | | | — | | | — | | | (14,008) | | | (14,008) | | | — | | | (14,008) | |

| Preferred dividends declared, $25.00 per share | — | | | — | | | — | | | — | | | — | | | (25) | | | (25) | | | — | | | (25) | |

| Non-cash equity award compensation | — | | | — | | | 1,887 | | | — | | | — | | | — | | | 1,887 | | | — | | | 1,887 | |

| Contributions from non-controlling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 125 | | | 125 | |

| Balance, March 31, 2021 | 55,107,657 | | | 551 | | | 1,059,267 | | | — | | | 131,156 | | | (242,202) | | | 948,772 | | | 125 | | | 948,897 | |

| Net income | — | | | — | | | — | | | — | | | 14,269 | | | — | | | 14,269 | | | — | | | 14,269 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Restricted stock forfeiture | (17,628) | | | | | (275) | | | — | | | — | | | — | | | (275) | | | — | | | (275) | |

| Repurchase of common stock | (300,891) | | | (3) | | | (4,267) | | | — | | | — | | | — | | | (4,270) | | | — | | | (4,270) | |

| Common dividends declared, $0.25 per share | — | | | — | | | — | | | — | | | — | | | (13,939) | | | (13,939) | | | — | | | (13,939) | |

| Preferred dividends declared, $25.00 per share | — | | | — | | | — | | | — | | | — | | | (25) | | | (25) | | | — | | | (25) | |

| | | | | | | | | | | | | | | | | |

| Non-cash equity award compensation | 1,048 | | | — | | | 1,639 | | | — | | | — | | | — | | | 1,639 | | | — | | | 1,639 | |

| Balance, June 30, 2021 | 54,790,186 | | | 548 | | | 1,056,364 | | | — | | | 145,425 | | | (256,166) | | | 946,171 | | | 125 | | | 946,296 | |

| Net income | — | | | — | | | — | | | — | | | 18,630 | | | — | | | 18,630 | | | — | | | 18,630 | |

| Settlement of warrants to purchase common stock | — | | | — | | | (7,478) | | | — | | | — | | | — | | | (7,478) | | | — | | | (7,478) | |

| Repurchase of common stock | (1,000,721) | | | (10) | | | (13,523) | | | — | | | — | | | — | | | (13,533) | | | — | | | (13,533) | |

| Common dividends declared, $0.25 per share | — | | | — | | | — | | | — | | | — | | | (13,688) | | | (13,688) | | | — | | | (13,688) | |

| Preferred dividends declared, $25.00 per share | — | | | — | | | — | | | — | | | — | | | (25) | | | (25) | | | — | | | (25) | |

| Non-cash equity award compensation | — | | | — | | | 2,032 | | | — | | | — | | | — | | | 2,032 | | | — | | | 2,032 | |

| Balance, September 30, 2021 | 53,789,465 | | | $ | 538 | | | $ | 1,037,395 | | | $ | — | | | $ | 164,055 | | | $ | (269,879) | | | $ | 932,109 | | | $ | 125 | | | $ | 932,234 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

GRANITE POINT MORTGAGE TRUST INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in (in thousands)

| | | | | | | | | | | | | | |

| | Nine Months Ended | | |

| | September 30, | | |

| | 2020 | | 2019 | | |

| Cash Flows From Operating Activities: | | | | |

| Net (loss) income | | $ | (63,590) | | | $ | 52,538 | | | |

| Adjustments to reconcile net (loss) income to net cash provided by operating activities: | | | | | | |

| Accretion of discounts and net deferred fees on loans held-for-investment | | (12,557) | | | (11,038) | | | |

| Amortization of deferred debt issuance costs on convertible senior notes, securitized debt obligations and term loan facilities | | 4,646 | | | 5,792 | | | |

| Provision for credit losses | | 62,241 | | | 0 | | | |

| | | | | | |

| Realized losses on sales | | 16,913 | | | 0 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Equity based compensation | | 3,994 | | | 3,607 | | | |

| | | | | | |

| Net change in assets and liabilities: | | | | | | |

| Increase in accrued interest receivable | | (610) | | | (530) | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Increase in other assets | | (19,899) | | | (10,157) | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Increase in other liabilities | | 44,911 | | | 10,197 | | | |

| | | | | | |

| Net cash provided by operating activities | | 36,049 | | | 50,409 | | | |

| Cash Flows From Investing Activities: | | | | | | |

| Originations, acquisitions and additional fundings of loans held-for-investment, net of deferred fees | | (314,722) | | | (1,216,679) | | | |

| | | | | | |

| Proceeds from repayment of loans held-for-investment | | 290,838 | | | 468,534 | | | |

| | | | | | |

| | | | | | |

| Principal payments on available-for-sale securities | | 12,798 | | | 0 | | | |

| | | | | | |

| | | | | | |

| Principal payments on held-to-maturity securities | | 18,076 | | | 7,102 | | | |

| | | | | | |

| Proceeds from sales of loans held-for-sale | | 193,538 | | | 0 | | | |

| | | | | | |

| | | | | | |

| Net cash provided by (used in) investing activities | | 200,528 | | | (741,043) | | | |

| | | | | | |

| Cash Flows From Financing Activities: | | | | | | |

| Proceeds from repurchase agreements | | 397,004 | | | 1,014,802 | | | |

| Principal payments on repurchase agreements | | (470,180) | | | (790,433) | | | |

| Proceeds from issuance of securitized debt obligations | | 0 | | | 646,868 | | | |

| Principal payments on securitized debt obligations | | (115,853) | | | (181,000) | | | |

| | | | | | |

| Proceeds from asset-specific financings | | 6,626 | | | 114,080 | | | |

| | | | | | |

| Proceeds from revolving credit facilities | | 38,361 | | | 164,598 | | | |

| Repayment of revolving credit facilities | | (80,369) | | | (239,598) | | | |

| Proceeds from senior secured term loan facilities | | 205,647 | | | 0 | | | |

| Proceeds from issuance of warrants to purchase common stock | | 4,541 | | | 0 | | | |

| | | | | | |

| Proceeds from issuance of common stock, net of offering costs | | 0 | | | 207,405 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Dividends paid on preferred stock | | (75) | | | (75) | | | |

| Dividends paid on common stock | | (23,038) | | | (63,273) | | | |

| Net cash (used in) provided by financing activities | | (37,336) | | | 873,374 | | | |

| Net increase in cash, cash equivalents and restricted cash | | 199,241 | | | 182,740 | | | |

| Cash, cash equivalents and restricted cash at beginning of period | | 159,764 | | | 123,423 | | | |

| Cash, cash equivalents and restricted cash at end of period | | $ | 359,005 | | | $ | 306,163 | | | |

| Supplemental Disclosure of Cash Flow Information: | | | | | | |

| Cash paid for interest | | $ | 83,366 | | | $ | 95,847 | | | |

| | | | | | |

| Noncash Activities: | | | | | | |

| Transfers of loans held-for-investment to loans held-for-sale | | $ | 210,452 | | | $ | 0 | | | |

| Dividends declared but not paid at end of period | | $ | 11,065 | | | $ | 23,063 | | | |

| | | | | | | | | | | | | | |

| | Nine Months Ended |

| | September 30, |

| | 2021 | | 2020 | | |

| Cash Flows From Operating Activities: | | | | |

| Net income (loss) | | $ | 60,890 | | | $ | (63,590) | | | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | | | |

| Accretion of discounts and net deferred fees on loans held-for-investment and deferred interest capitalized to loans held-for-investment | | (20,310) | | | (12,557) | | | |

| Amortization of deferred debt issuance costs on repurchase facilities, asset-specific financings, convertible senior notes, securitized debt obligations, senior secured term loan facilities and term financing facilities | | 9,692 | | | 4,646 | | | |

| (Benefit from) provision for credit losses | | (15,072) | | | 62,241 | | | |

| | | | | | |

| | | | | | |

| Realized losses on sales of loans held-for-sale | | — | | | 16,913 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Amortization of equity-based compensation | | 5,558 | | | 3,994 | | | |

| Depreciation of fixed assets | | — | | | — | | | |

| Net change in assets and liabilities: | | | | | | |

| Decrease (increase) in accrued interest receivable | | 2,490 | | | (610) | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Increase in other assets | | (4,069) | | | (19,899) | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Increase in other liabilities | | 5,846 | | | 44,911 | | | |

| | | | | | |

| Net cash provided by operating activities | | 45,025 | | | 36,049 | | | |

| Cash Flows From Investing Activities: | | | | | | |

| Originations, acquisitions and additional fundings of loans held-for-investment, net of deferred fees | | (549,705) | | | (314,722) | | | |

| | | | | | |

| Proceeds from repayment of loans held-for-investment | | 815,054 | | | 290,838 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Increase in other assets, due from servicer/trustee on repayments of loans held-for-investment | | (66,944) | | | — | | | |

| Principal payments on available-for-sale securities | | — | | | 12,798 | | | |

| | | | | | |

| | | | | | |

| Principal payments on held-to-maturity securities | | — | | | 18,076 | | | |

| | | | | | |

| Proceeds from sales of loans held-for-sale | | — | | | 193,538 | | | |

| | | | | | |

| | | | | | |

| Net cash provided by investing activities | | 198,405 | | | 200,528 | | | |

| | | | | | |

| Cash Flows From Financing Activities: | | | | | | |

| Proceeds from repurchase facilities | | 347,261 | | | 397,004 | | | |

| Principal payments on repurchase facilities | | (1,139,378) | | | (470,180) | | | |

| Proceeds from issuance of securitized debt obligations | | 685,766 | | | — | | | |

| Principal payments on securitized debt obligations | | (254,647) | | | (115,853) | | | |

| Proceeds from senior secured term loan facilities | | — | | | 205,647 | | | |

| Proceeds from asset-specific financings | | 2,785 | | | 6,626 | | | |

| Repayment of asset-specific financings | | (81,123) | | | — | | | |

| Proceeds from revolving credit facilities | | — | | | 38,361 | | | |

| Repayment of revolving credit facilities | | — | | | (80,369) | | | |

| Proceeds from term financing facility | | 349,291 | | | — | | | |

| Repayment of term financing facility | | (219,311) | | | — | | | |

| Payment of debt issuance costs | | (8,353) | | | — | | | |

| Proceeds from issuance of warrants to purchase common stock | | — | | | 4,541 | | | |

| Settlement of warrants to purchase common stock | | (7,478) | | | 0 | | |

| Contributions from non-controlling interests | | 125 | | | — | | | |

| Tax withholding on restricted stock | | (1,194) | | | — | | | |

| Repurchase of common stock | | (17,804) | | | — | | | |

| Dividends paid on preferred stock | | (75) | | | (75) | | | |

| Dividends paid on common stock | | (52,970) | | | (23,038) | | | |

| Net cash used in financing activities | | (397,105) | | | (37,336) | | | |

| Net (decrease) increase in cash, cash equivalents and restricted cash | | (153,675) | | | 199,241 | | | |

| Cash, cash equivalents and restricted cash at beginning of period | | 329,193 | | | 159,764 | | | |

| Cash, cash equivalents and restricted cash at end of period | | $ | 175,518 | | | $ | 359,005 | | | |

| Supplemental Disclosure of Cash Flow Information: | | | | | | |

| Cash paid for interest | | $ | 75,818 | | | $ | 83,366 | | | |

| Cash paid for taxes | | $ | 607 | | | $ | — | | | |

| Noncash Activities: | | | | | | |

| | | | | | |

| Transfers of loans held-for-investment to loans held-for-sale | | $ | — | | | $ | 210,452 | | | |

| Dividends declared but not paid at end of period | | $ | 13,713 | | | $ | 11,065 | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

GRANITE POINT MORTGAGE TRUST INC.

Notes to the Condensed Consolidated Financial Statements (unaudited)

Note 1. Organization and Operations

Granite Point Mortgage Trust Inc., or the Company, is a Maryland corporationan internally managed real estate finance company that focuses primarily on directly originating, investing in and managing senior floating-rate commercial mortgage loans and other debt and debt-like commercial real estate investments. The Company’sThese investments are capitalized by accessing a variety of funding options, including borrowing under our bank credit facilities or other asset-specific financings, issuing commercial real estate collateralized loan obligations, or CRE CLOs, entering into term financing agreements, and issuing other forms of secured and unsecured debt and equity securities, depending on market conditions and our view of the most appropriate funding option available for our investments. Our investment objective is to preserve our stockholders’ capital while generating attractive risk-adjusted returns over the long term, primarily through dividends derived from current income produced by our investment portfolio. Our common stock is listed on the New York Stock Exchange, or NYSE, under the symbol “GPMT.”

Although“GPMT”. The Company operates its business in a manner that is intended to permit it to maintain its exclusion from registration under the Investment Company is currently externally managed by Pine River Capital Management L.P.,Act of 1940, as amended, or the Manager, subsequent to September 30, 2020, theInvestment Company entered into an internalization agreement with the Manager pursuant to which theAct. The Company will become an internally managed real estate investment trust, or REIT,operates its business as of 11:59 p.m.1 segment. The Company was incorporated in Maryland on December 31, 2020. See Note 21 – Subsequent Events for additional discussion of the Company’s internalization.April 7, 2017 and commenced operations as a publicly traded company on June 28, 2017.

The Company has elected to be treated as a real estate investment trust, or REIT, as defined under the Internal Revenue Code of 1986, as amended, or the Code, for U.S. federal income tax purposes. As long as the Company continues to comply with a number of requirements under federal tax law and maintains its qualification as a REIT, the Company generally will not be subject to U.S. federal income taxes to the extent that the Company distributes its taxable income to its stockholders on an annual basis and does not engage in prohibited transactions. However, certain activities that the Company may perform may cause it to earn income which will not be qualifying income for REIT purposes. The Company has designated one of its subsidiaries as a taxable REIT subsidiary, or TRS, as defined in the Code, to engage in such activities.

The Company was externally managed by Pine River Capital Management L.P., or the Former Manager, through December 31, 2020, at which time the Company internalized its management function, or the Internalization.

Note 2. Basis of Presentation and Significant Accounting Policies

Consolidation and Basis of Presentation

The interim unaudited condensed consolidated financial statements of the Company have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission, or the SEC. Certain information and note disclosures normally included in financial statements prepared in accordance with U.S. generally accepted accounting principles, or GAAP, have been condensed or omitted according to such SEC rules and regulations. However, management believes that the disclosures included in these interim unaudited condensed consolidated financial statements are adequate to make the information presented not misleading. The accompanying interim unaudited condensed consolidated financial statements should be read in conjunction with the financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019.2020. In the opinion of management, all normal and recurring adjustments necessary to present fairly the financial condition of the Company at September 30, 20202021 and results of operations for all periods presented have been made. The results of operations for the three and nine months ended September 30, 20202021 should not be construed as indicative of the results to be expected for future periods or the full year.

The interim unaudited condensed consolidated financial statements of the Company include the accounts of all subsidiaries; inter-company accounts and transactions have been eliminated. Certain prior period amounts have been reclassified to conform to the current period presentation.

All entities in which the Company holds investments that are considered VIEs for financial reporting purposes were reviewed for consolidation under the applicable consolidation guidance. Whenever the Company has both the power to direct the activities of an entity that most significantly impact the entity’s performance, and the obligation to absorb losses or the right to receive benefits of the entity that could be significant, the Company consolidates the entity.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make a number of significant estimates. These include estimates of amount and timing of allowances for credit losses, fair value of certain assets and liabilities, and other estimates that affect the reported amounts of certain assets and liabilities as of the date of the condensed consolidated financial statements and the reported amounts of certain revenues and expenses during the reported period. It is likely that changes in these estimates (e.g.(e.g., valuation changes to the underlying collateral of loans due to changes in market capitalization rates, leasing, credit worthiness of major tenants, occupancy rates, availability of financing, exit plan, loan sponsorship, actions of other lenders, overall economic and capital markets conditions, the broader commercial real estate market, local geographic sub-markets or other factors) will occur in the near term. As of September 30, 2021, the COVID-19

GRANITE POINT MORTGAGE TRUST INC.

Notes to the Condensed Consolidated Financial Statements (unaudited)

pandemic remains ongoing. Since the beginning of 2020, the COVID-19 pandemic remains ongoing,has significantly impacted the global economy, created disruptions in the global supply chain, increased rates of unemployment and as a result, numerous countries, including the United States, have declared national emergencies. Such actions have resulted in significant macroeconomic disruptions and have adversely impacted many industries. Theindustries, including those related to the real estate collateral underlying certain of our loans. So far in 2021, the global and U.S. economic activity has, to varying degrees, begun to improve, as wider distribution of the COVID-19 vaccines has continued. As a result, macroeconomic forecasts have improved over the last few quarters, including expectations for unemployment rates and overall economic output. Nonetheless, the ongoing pandemic may continue to adversely impact the macroeconomic recovery, particularly with respect to the emergence of new variants of the COVID-19 virus, the continued distribution and acceptance of vaccines and the effectiveness of such vaccines against new variants of the COVID-19 virus. Accordingly, given the ongoing nature of the outbreak, at this time the Company cannot reasonably estimate the magnitude of the long-term impact that COVID-19 may have on the economic activity and real estate market conditions, resulting in a period of global economic slowdown. The rapidly evolvingas well as the Company’s business, financial performance and fluid nature of this situation precludes any prediction as to the ultimate adverse impact of COVID-19 on economic and market conditions.operating results. The Company believes the estimates and assumptions underlying its interim unaudited condensed consolidated financial statements are reasonable and supportable based on the information available as of September 30, 2020.2021. However, the significant degree of uncertainty over the ultimate impact the COVID-19 pandemic will have on the global economy generally, and the Company’s business in particular, makes any estimates and assumptions as of September 30, 20202021 inherently less certain than they would be absent the current and potential impacts of

GRANITE POINT MORTGAGE TRUST INC.

Notes to the Condensed Consolidated Financial Statements (unaudited)

COVID-19.COVID-19 pandemic. The Company’s actual results could ultimately differ from its estimates and such differences may be material.

Significant Accounting Policies

Included in Note 2 to the consolidated financial statementsConsolidated Financial Statements of the Company’s Annual Report on Form 10-K for the year ended December 31, 20192020 is a summary of the Company’s significant accounting policies. Provided below is a summary of additional accounting policies that are significant to the Company’s condensed consolidated financial condition and results of operations for the three and nine months ended September 30, 2020.2021.

Loans Held-for-SaleTerm Financing Facility

The Company classifiesfinances certain of its loans as held-for-sale based on management’s intent to sell or otherwise disposeheld-for-investment through the use of them. Loans held-for-sale are reported at the lower of amortized cost or fair value. Fair value is determineda term financing facility. Borrowings under the guidanceterm financing facility bear an interest rate of ASC 820. Interest income on loans held-for-sale is recognizeda specified margin over the one-month London Interbank Offered Rate, or LIBOR. The term financing facility financings are treated as collateralized financing transactions and are carried at the loan coupon rate and recorded on the consolidated statements of comprehensive income.

Restructuring Charges

Subsequent to September 30, 2020, the Company entered into an internalization agreement with the Manager pursuant to which the Company’s management agreement with the Manager, or the Management Agreement, will terminate effectivetheir contractual amounts, as of, 11:59 p.m. on December 31, 2020, and the Company will no longer pay base management fees or incentive fees with respect to any period thereafter. The termination of the Management Agreement will be a material changespecified in the management structure of the business, and is accounted for under ASC 420, Exit or disposal cost obligations. The one-time payment to be made to the Manager under the internalization agreement, and other associated costs incurred as part of the internalization of the Company’s management function, are recorded within restructuring charges with a corresponding liability recorded within other liabilities. See Note 17 – Restructuring Charges for additional discussion of the restructuring charges related to the Company’s internalization and Note 21 – Subsequent Events for additional discussion of the Company’s internalization.

Senior Secured Term Loan Facilities

The Company records senior secured term loan facilities as liabilities on the Company’s consolidated balance sheets. Where applicable, any issue discount or transaction expenses are deferred and amortized over the term of the loan using the effective interest method, and is included within interest expense in the Company’s consolidated statements of comprehensive (loss) income, while the unamortized balance is included as a reduction to the carrying amount on the Company’s consolidated balance sheets.respective agreements.

Recently Issued and/or Adopted Accounting Standards

Measurement of Credit Losses on Financial Instruments

On January 1, 2020, the Company adopted Accounting Standard Update, or ASU, 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, or ASU 2016-13. ASU 2016-13 significantly changes how entities measure credit losses for most financial assets and certain other instruments that are not measured at fair value through net income. ASU 2016-13 replaces the incurred loss model under existing guidance with a Current Expected Credit Loss, or CECL, model for instruments measured at amortized cost, and also require entities to record allowances for available-for-sale, or AFS, debt securities rather than reduce the amortized cost, as they did under the other-than-temporary impairment model. It also simplifies the accounting model for purchased credit-impaired debt securities and loans. In addition, the new model applies to off-balance sheet credit exposures, such as unfunded loan commitments. ASU 2016-13 was adopted by the Company through a cumulative-effect adjustment to cumulative earnings of $18.5 million as of January 1, 2020.

The allowance for credit losses required under ASU 2016-13 is a valuation account that is deducted from the amortized cost basis of related loans and debt securities on the Company’s condensed consolidated balance sheets, and which reduces the Company’s total stockholders’ equity. The initial allowance for credit losses recorded on January 1, 2020 is reflected as a direct charge to cumulative earnings; however, going forward, changes to the allowance for credit losses are recognized through net income on the Company’s condensed consolidated statements of comprehensive (loss) income. While ASU 2016-13 does not require any particular method for determining the allowance for credit losses, it does specify the allowance should be based on relevant information about past events, including historical loss experience, current portfolio, market conditions, and reasonable and supportable forecasts for the duration of each respective loan. In addition, other than a few narrow exceptions, ASU 2016-13 requires that all financial instruments subject to the CECL model have some amount of expected loss to reflect the GAAP principal underlying the CECL model that all loans, debt securities, and similar assets have some inherent risk of loss, regardless of credit quality, subordinate capital or other mitigating factors.

The Company’s loans typically include commitments to fund incremental proceeds to its borrowers over the life of the loan. Those future funding commitments are also subject to an allowance for credit losses. The allowance for credit losses related to future loan fundings is recorded as a component of other liabilities on the Company’s condensed consolidated balance sheets,

GRANITE POINT MORTGAGE TRUST INC.

Notes to the Condensed Consolidated Financial Statements (unaudited)

and not as an offset to the related loan balance. This allowance for credit losses is estimated using the same process outlined below for the Company’s outstanding loan balances, and changes in this component of the allowance for credit losses similarly flow through the Company’s condensed consolidated statements of comprehensive (loss) income.

The Company elected not to measure an allowance for credit losses on accrued interest receivable when the accrued interest is due within 90 days. The Company generally writes off accrued interest receivable balance when interest is 90 days or more past due unless the loan is both well secured and in the process of collection. Write-offs of accrued interest receivable are recognized within provision for credit losses in the condensed consolidated statements of comprehensive (loss) income. Accrued interest receivable includes deferred interest that may be collected at the loan maturity or past 90 days, and an allowance for credit losses has been included as part of the loan’s amortized cost. The Company did not write-off any accrued interest receivable during the three and nine months ended September 30, 2020.

The Company’s implementation process included a selection of a credit loss analytical model, completion and documentation of policies and procedures, changes to internal reporting processes and related internal controls and additional disclosures. A control framework for governance, data, forecast and model controls was developed to support the CECL process. The allowance for credit losses is estimated on a quarterly basis and represents management’s estimates of current expected credit losses in the Company’s investment portfolio. Pools of loans with similar risk characteristics are collectively evaluated while loans that no longer share risk characteristics with loan pools are evaluated individually. Estimating an allowance for credit losses is inherently subjective, as it requires management to exercise significant judgment in establishing appropriate factors used to determine the allowance and a variety of subjective assumptions, including (i) determination of relevant historical loan loss data sets, (ii) the expected timing and amount of future loan fundings and repayments, (iii) the current credit quality of loans and operating performance of loan collateral and the Company’s expectations of performance, (iv) selecting the forecast for macroeconomic conditions and (v) determining the reasonable and supportable forecast period.

Considering the lack of historical Company data related to any realized loan losses since its inception, the Company elected to estimate its allowance for credit losses by using a probability-weighted analytical model that considers the likelihood of default and loss-given-default for each individual loan. The analytical model incorporates a third-party licensed database with historical loan losses from 1998 to 2019 for over 100,000 commercial real estate loans. The Company’s allowance for credit losses reflects its estimates of the current and future economic conditions that impact the performance of the commercial real estate properties serving as collateral for the Company’s loan investments. These estimates include unemployment rates, interest rates, price indices for commercial property and other macroeconomic factors impacting the likelihood and magnitude of potential credit losses for the Company’s loans during their anticipated term. The Company licenses certain macroeconomic financial forecasts from a third-party to inform its view of the potential future impact that broader macroeconomic conditions may have on the performance of its loan portfolio. The forecasts are embedded in the licensed analytical model that the Company uses to estimate its allowance for credit losses. The Company may use one or more of these forecasts in the process of estimating its allowance for credit losses. Selection of these economic forecasts requires significant judgment about future events that, while based on the information available to the Company as of the balance sheet date, are ultimately unknowable with certainty, and the actual economic conditions impacting the Company’s portfolio could vary significantly from the estimates the Company made for the periods presented. At the time of adoption of ASU No. 2016-13, in determining its initial allowance for credit losses estimate, the Company employed a macroeconomic forecast that largely reflected management’s views at the time and projected a stable overall economic scenario over the reasonable projection period. Significant inputs to the Company’s estimate of the allowance for credit losses include the reasonable and supportable forecast period and loan specific factors such as debt service coverage ratio, or DSCR, loan-to-value, or LTV, remaining contractual loan term, property type and others. In addition, the Company also considers relevant loan-specific qualitative factors to estimate its allowance for credit losses. In certain instances, for loans with unique risk characteristics, the Company may instead elect to employ different methods to estimate loan losses that also conform to ASU 2016-13 and related guidance.

Upon adoption of ASU No. 2016-13 on January 1, 2020, based on the Company’s loan portfolio, pre-COVID-19 economic environment and management’s expectations for future economic and market conditions at the time, the Company recorded an initial allowance for credit losses, as a cumulative-effective adjustment to the cumulative earnings in its consolidated statements of stockholders’ equity, of approximately $18.5 million, or approximately $0.34 per share.

The following table illustrates the day-one financial statement impact of the adoption of ASU 2016-13 on January 1, 2020:

GRANITE POINT MORTGAGE TRUST INC.

Notes to the Condensed Consolidated Financial Statements (unaudited)

| | | | | | | | | | | | | | | | | |

| (in thousands) |

| ASSETS | Pre-ASU 2016-13 Adoption | | Cumulative Effect of Adoption | | As Reported Under ASU 2016-13 |

| Loans and securities | $ | 4,257,086 | | | $ | 0 | | | $ | 4,257,086 | |

| Allowance for credit losses | 0 | | | (16,692) | | | (16,692) | |

| Loans and securities, net | $ | 4,257,086 | | | $ | (16,692) | | | $ | 4,240,394 | |

| | | | | |

| LIABILITIES | | | | | |

Liability for off-balance sheet credit losses (1) | $ | 0 | | | $ | 1,780 | | | $ | 1,780 | |

| | | | | |

| STOCKHOLDERS’ EQUITY | | | | | |

| Cumulative earnings | $ | 162,076 | | | $ | (18,472) | | | $ | 143,604 | |

____________________

(1)Represents expected loss on unfunded commitments.

Facilitation of the Effects of Reference Rate Reform on Financial Reporting

In March 2020, the Financial Accounting Standards Board, or FASB, issued ASU No. 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting,,or ASU No. 2020-04, which provides optional expedients and exceptions for applying GAAP to contracts, hedging relationshipsdebt instruments, derivatives, and other transactions affected by reference rate reform if certain criteria are met. The amendments apply only to contracts hedging relationships and other transactions that reference the London Interbank Offered Rate, or LIBOR or anotherother reference raterates expected to be discontinued becauseas a result of reference rate reform. ASU No. 2020-04This guidance is effective for all entities as of March 12, 2020optional and may be elected through December 31, 2022.2022 using a prospective application on all eligible contract modifications. The Company has loan agreements, and debt agreements that incorporate LIBOR as a referenced interest rate. It is currently evaluatingdifficult to predict what effect, if any, the impactphase-out of adopting this ASULIBOR and the use of alternative benchmarks may have on its consolidatedthe Company’s business or on the overall financial statements.markets. The Company has not adopted any of the optional expedients or exceptions through September 30, 2021, but will continue to evaluate the possible adoption of any such expedients or exceptions.

Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity

In August 2020, the FASB issued ASU No. 2020-06, Debt – Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging – Contracts in an Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity,.or ASU No. 2020-06. The intention of ASU No. 2020-06 is to address the complexities in accounting for certain financial instruments with a debt and equity component. Under ASU No. 2020-06, the number of accounting models for convertible notes will be reduced and entities that issue convertible debt will be required to use the if-converted method for the computation of diluted "Earnings per share" under ASC 260. ASC 2020-06 is effective for fiscal years beginning after December 15, 2021 and may be adopted through either a modified retrospective method of transition or a fully retrospective method of transition. The Company is currently assessing the impact this guidance will have on its condensed consolidated financial statements.

Note 3. Variable Interest Entities

The Company finances pools of its commercial real estate loans through collateralized loan obligations, or CLOs, which are considered VIEs for financial reporting purposes and, thus, are reviewed for consolidation under the applicable consolidation guidance. The Company has both the power to direct the activities of the CLOs that most significantly impact the entities’ performance and the obligation to absorb losses or the right to receive benefits of the entities that could be significant, therefore, the Company consolidates the CLOs.

GRANITE POINT MORTGAGE TRUST INC.

Notes to the Condensed Consolidated Financial Statements (unaudited)

The following table presents a summary of the assets and liabilities of all VIEs consolidated on the Company’s condensed consolidated balance sheets as of September 30, 2020 and December 31, 2019:

| | | | | | | | | | | |

| (in thousands) | September 30,

2020 | | December 31,

2019 |

| Loans held-for-investment | $ | 1,262,619 | | | $ | 1,301,369 | |

| Allowance for credit losses | (19,677) | | | 0 | |

| Loans held-for-investment, net | 1,242,942 | | | 1,301,369 | |

| | | |

| Restricted cash | 1,921 | | | 76,093 | |

| | | |

| Other assets | 8,106 | | | 9,686 | |

| Total Assets | $ | 1,252,969 | | | $ | 1,387,148 | |

| Securitized debt obligations | $ | 928,623 | | | $ | 1,041,044 | |

| | | |

| Other liabilities | 1,443 | | | 1,078 | |

| Total Liabilities | $ | 930,066 | | | $ | 1,042,122 | |

The Company is not required to consolidate VIEs for which it has concluded it does not have both the power to direct the activities of the VIEs that most significantly impact the entities’ performance and the obligation to absorb losses or the right to receive benefits of the entities that could be significant. The Company’s investments in these unconsolidated VIEs include commercial mortgage-backed securities, or CMBS, which are classified within AFS securities, at fair value, and held-to-maturity, or HTM, securities on the condensed consolidated balance sheets. As of December 31, 2019, the carrying value, net of allowance for credit losses, which also represents the maximum exposure to loss, of all CMBS in unconsolidated VIEs was $30.9 million. The Company did 0t hold any CMBS as of September 30, 2020.

Note 4.3. Loans Held-for-Investment, Net of Allowance for Credit Losses

The Company originates and acquires commercial real estate debt and related instruments generally to be held as long-term investments. These assets are classified as “loans held-for-investment” on the condensed consolidated balance sheets. Loans held-for-investment are reported at cost, net of any unamortized acquisition premiums or discounts, loan fees, origination costs and allowance for credit losses, as applicable.

GRANITE POINT MORTGAGE TRUST INC.

Notes to the Condensed Consolidated Financial Statements (unaudited)

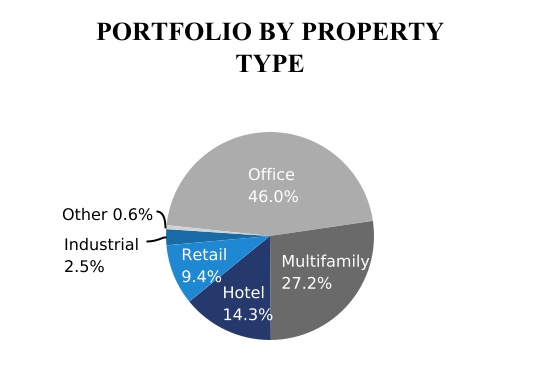

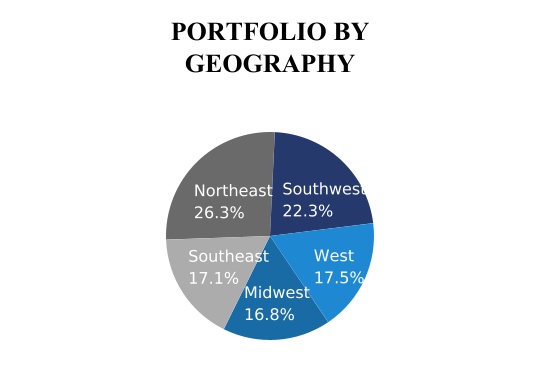

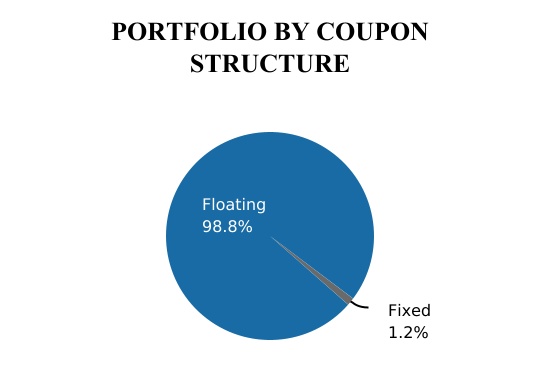

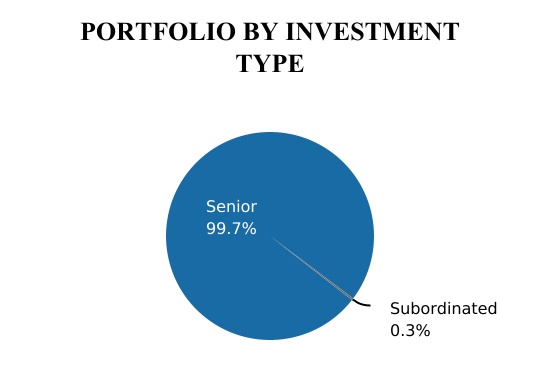

The following tables summarize the Company’s loans held-for-investment by asset type, property type and geographic location as of September 30, 20202021 and December 31, 2019:2020:

| | | September 30,

2020 | | September 30,

2021 |

| (dollars in thousands) | (dollars in thousands) | Senior Loans (1) | | Mezzanine Loans | | B-Notes | | Total | (dollars in thousands) | Senior Loans (1) | | Mezzanine Loans | | B-Notes | | Total |

| Unpaid principal balance | Unpaid principal balance | $ | 4,045,912 | | | $ | 12,586 | | | $ | 14,290 | | | $ | 4,072,788 | | Unpaid principal balance | $ | 3,657,401 | | | $ | 1,387 | | | $ | 14,065 | | | $ | 3,672,853 | |

| Unamortized (discount) premium | Unamortized (discount) premium | (72) | | | 0 | | | 0 | | | (72) | | Unamortized (discount) premium | (67) | | | — | | | — | | | (67) | |

| Unamortized net deferred origination fees | Unamortized net deferred origination fees | (20,543) | | | 28 | | | 0 | | | (20,515) | | Unamortized net deferred origination fees | (13,095) | | | — | | | — | | | (13,095) | |

| Allowance for credit losses | Allowance for credit losses | (71,632) | | | (1,421) | | | (286) | | | (73,339) | | Allowance for credit losses | (40,897) | | | (1,387) | | | (3,196) | | | (45,480) | |

| Carrying value | Carrying value | $ | 3,953,665 | | | $ | 11,193 | | | $ | 14,004 | | | $ | 3,978,862 | | Carrying value | $ | 3,603,342 | | | $ | — | | | $ | 10,869 | | | $ | 3,614,211 | |

| Unfunded commitments | Unfunded commitments | $ | 596,440 | | | $ | 0 | | | $ | 0 | | | $ | 596,440 | | Unfunded commitments | $ | 430,105 | | | $ | — | | | $ | — | | | $ | 430,105 | |

| Number of loans | Number of loans | 107 | | | 2 | | | 1 | | | 110 | | Number of loans | 98 | | | 1 | | | 1 | | | 100 | |

| Weighted average coupon | Weighted average coupon | 5.1 | % | | 10.4 | % | | 8.0 | % | | 5.1 | % | Weighted average coupon | 4.6 | % | | 13.0 | % | | 8.0 | % | | 4.6 | % |

Weighted average years to maturity (2) | Weighted average years to maturity (2) | 1.3 | | 1.2 | | 6.3 | | 1.3 | Weighted average years to maturity (2) | 1.0 | | 4.1 | | 5.3 | | 1.0 |

GRANITE POINT MORTGAGE TRUST INC.

Notes to the Condensed Consolidated Financial Statements (unaudited)

| | | December 31,

2019 | | December 31,

2020 |

| (dollars in thousands) | (dollars in thousands) | Senior Loans (1) | | Mezzanine Loans | | B-Notes | | Total | (dollars in thousands) | Senior Loans (1) | | Mezzanine Loans | | B-Notes | | Total |

| Unpaid principal balance | Unpaid principal balance | $ | 4,229,194 | | | $ | 13,503 | | | $ | 14,448 | | | $ | 4,257,145 | | Unpaid principal balance | $ | 3,915,833 | | | $ | 2,366 | | | $ | 14,235 | | | $ | 3,932,434 | |

| Unamortized (discount) premium | Unamortized (discount) premium | (124) | | | 0 | | | 0 | | | (124) | | Unamortized (discount) premium | (75) | | | — | | | — | | | (75) | |

| Unamortized net deferred origination fees | Unamortized net deferred origination fees | (30,788) | | | (21) | | | 0 | | | (30,809) | | Unamortized net deferred origination fees | (17,890) | | | — | | | — | | | (17,890) | |

| Allowance for credit losses | | Allowance for credit losses | (60,130) | | | (2,366) | | | (4,170) | | | (66,666) | |

| Carrying value | Carrying value | $ | 4,198,282 | | | $ | 13,482 | | | $ | 14,448 | | | $ | 4,226,212 | | Carrying value | $ | 3,837,738 | | | $ | — | | | $ | 10,065 | | | $ | 3,847,803 | |

| Unfunded commitments | Unfunded commitments | $ | 748,878 | | | $ | 0 | | | $ | 0 | | | $ | 748,878 | | Unfunded commitments | $ | 503,726 | | | $ | — | | | $ | — | | | $ | 503,726 | |

| Number of loans | Number of loans | 117 | | | 2 | | | 1 | | | 120 | | Number of loans | 101 | | | 1 | | | 1 | | | 103 | |

| Weighted average coupon | Weighted average coupon | 5.4 | % | | 11.7 | % | | 8.0 | % | | 5.4 | % | Weighted average coupon | 5.1 | % | | 13.0 | % | | 8.0 | % | | 5.1 | % |

Weighted average years to maturity (2) | Weighted average years to maturity (2) | 1.8 | | 2.0 | | 7.1 | | 1.8 | Weighted average years to maturity (2) | 1.1 | | 4.9 | | 6.1 | | 1.1 |

____________________

(1)Loans primarily secured by a first priority lien on commercial real property and related personal property and also includes, when applicable, any companion subordinate loans.

(2)Based on contractual maturity date. Certain loans are subject to contractual extension options with such conditions stipulated in the applicable loan documents. Actual maturities may differ from contractual maturities stated herein as certain borrowers may have the right to prepay with or without paying a prepayment fee. The Company may also extend contractual maturities in connection with certain loan modifications.

| | (dollars in thousands) | (dollars in thousands) | | September 30,

2020 | | December 31,

2019 | (dollars in thousands) | | September 30,

2021 | | December 31,

2020 |

| Property Type | Property Type | | Carrying Value | | % of Loan Portfolio | | Carrying Value | | % of Loan Portfolio | Property Type | | Carrying Value | | % of Loan Portfolio | | Carrying Value | | % of Loan Portfolio |

| Office | Office | | $ | 1,758,637 | | | 44.2 | % | | $ | 1,779,173 | | | 42.0 | % | Office | | $ | 1,663,478 | | | 46.0 | % | | $ | 1,720,705 | | | 44.7 | % |

| Multifamily | Multifamily | | 954,910 | | | 24.0 | % | | 1,058,708 | | | 25.1 | % | Multifamily | | 982,624 | | | 27.2 | % | | 910,557 | | | 23.7 | % |

| Hotel | Hotel | | 645,544 | | | 16.2 | % | | 640,503 | | | 15.2 | % | Hotel | | 517,028 | | | 14.3 | % | | 646,869 | | | 16.8 | % |

| Retail | Retail | | 336,064 | | | 8.4 | % | | 398,742 | | | 9.4 | % | Retail | | 340,265 | | | 9.4 | % | | 332,218�� | | | 8.6 | % |