UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 20182019

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________to__________

Commission File Number 1-38315

CURO GROUP HOLDINGS CORP.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 90-0934597 |

(State or other jurisdiction Of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

| 3527 North Ridge Road, Wichita, KS | | 67205 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (316) 425-1410772-3801

Former name, former address and former fiscal year, if changed since last report: No Changes

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.001 par value per share | CURO | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☐☒ |

| Non-accelerated filer | ☒☐ | | | |

| Smaller reporting company | ☐☒ | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

At October 31, 2018November 1, 2019 there were 45,992,98341,486,965 shares of the registrant’s Common Stock, $0.001 par value per share, outstanding.

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

FORM 10-Q

THIRD QUARTER ENDED SEPTEMBER 30, 20182019

INDEX

|

| | | | | | | |

| | | | | | | | Page |

|

| |

| Item 1. | Financial Statements (unaudited) |

| | | |

| | September 30, 20182019 and December 31, 20172018 | |

| | | |

| | Three and nine months ended September 30, 20182019 and 20172018 | |

| | | |

| | Three and nine months ended September 30, 20182019 and 20172018 | |

| | | |

| | Nine months ended September 30, 20182019 and 20172018 | |

| | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | | | | | | |

| |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

| | | | | | | |

| | | | | | |

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

| | | | September 30,

2018 | | December 31,

2017 | September 30, 2019 | | December 31,

2018 |

| | (Unaudited) | | | (unaudited) | |

ASSETS | | Cash | $ | 153,361 |

| | $ | 162,374 |

| $ | 62,207 |

| | $ | 61,175 |

|

| Restricted cash (includes restricted cash of consolidated VIEs of $19,107 and $6,871 as of September 30, 2018 and December 31, 2017, respectively) | 24,236 |

| | 12,117 |

| |

| Gross loans receivable (includes loans of consolidated VIEs of $353,384 and $213,846 as of September 30, 2018 and December 31, 2017, respectively) | 567,675 |

| | 432,837 |

| |

| Less: allowance for loan losses (includes allowance for losses of consolidated VIEs of $49,951 and $46,140 as of September 30, 2018 and December 31, 2017, respectively) | (76,068 | ) | | (69,568 | ) | |

| Restricted cash (includes restricted cash of consolidated VIEs of $21,897 and $12,840 as of September 30, 2019 and December 31, 2018, respectively) | | 38,754 |

| | 25,439 |

|

| Gross loans receivable (includes loans of consolidated VIEs of $231,533 and $148,876 as of September 30, 2019 and December 31, 2018, respectively) | | 657,615 |

| | 571,531 |

|

| Less: allowance for loan losses (includes allowance for losses of consolidated VIEs of $25,375 and $12,688 as of September 30, 2019 and December 31, 2018, respectively) | | (108,385 | ) | | (73,997 | ) |

| Loans receivable, net | 491,607 |

| | 363,269 |

| 549,230 |

| | 497,534 |

|

| Right of use asset - operating leases (Note 1) | | 118,260 |

| | — |

|

| Deferred income taxes | — |

| | 772 |

| 1,846 |

| | 1,534 |

|

| Income taxes receivable | 16,363 |

| | 3,455 |

| 23,966 |

| | 16,741 |

|

| Prepaid expenses and other | 40,109 |

| | 42,512 |

| 32,228 |

| | 43,588 |

|

| Property and equipment, net | 79,790 |

| | 87,086 |

| 70,381 |

| | 76,750 |

|

| Goodwill | 143,966 |

| | 145,607 |

| 120,110 |

| | 119,281 |

|

| Other intangibles, net of accumulated amortization of $43,250 and $41,156 as of September 30, 2018 and December 31, 2017, respectively) | 33,208 |

| | 32,769 |

| |

| Other intangibles, net of accumulated amortization | | 32,666 |

| | 29,784 |

|

| Other | 13,090 |

| | 9,770 |

| 18,484 |

| | 12,930 |

|

| Assets from discontinued operations (Note 15) | | — |

| | 34,861 |

|

| Total Assets | $ | 995,730 |

| | $ | 859,731 |

| $ | 1,068,132 |

| | $ | 919,617 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY | | Accounts payable and accrued liabilities | $ | 52,853 |

| | $ | 55,792 |

| |

| Accounts payable and accrued liabilities (includes accounts payable and accrued liabilities of consolidated VIEs of $7,259 and $4,980 as of September 30, 2019 and December 31, 2018, respectively) | | $ | 63,685 |

| | $ | 49,146 |

|

| Deferred revenue | 9,667 |

| | 11,984 |

| 9,052 |

| | 9,483 |

|

| Lease liability - operating leases (Note 1) | | 126,048 |

| | — |

|

| Income taxes payable | 338 |

| | 4,120 |

| — |

| | 1,579 |

|

| Accrued interest (includes accrued interest of consolidated VIEs of $1,603 and $1,266 as of September 30, 2018 and December 31, 2017, respectively) | 7,391 |

| | 25,467 |

| |

| Credit services organization guarantee liability | 13,243 |

| | 17,795 |

| |

| Accrued interest (includes accrued interest of consolidated VIEs of $777 and $831 as of September 30, 2019 and December 31, 2018, respectively) | | 5,625 |

| | 20,904 |

|

| Liability for losses on CSO lender-owned consumer loans | | 10,249 |

| | 12,007 |

|

| Deferred rent | 11,288 |

| | 11,577 |

| — |

| | 10,851 |

|

Long-term debt (includes long-term debt and issuance costs of consolidated VIEs of $169,666 and $7,710 as of September 30, 2018 and $124,590 and $4,188 as of December 31, 2017, respectively) | 868,201 |

| | 706,225 |

| |

| Debt (includes debt and issuance costs of consolidated VIEs of $105,742 and $3,259 as of September 30, 2019 and $111,335 and $3,856 as of December 31, 2018, respectively) | | 805,407 |

| | 804,140 |

|

| Subordinated stockholder debt | 2,319 |

| | 2,381 |

| — |

| | 2,196 |

|

| Other long-term liabilities | 6,949 |

| | 5,768 |

| 8,594 |

| | 5,800 |

|

| Deferred tax liabilities | 13,617 |

| | 11,486 |

| 4,427 |

| | 13,730 |

|

| Liabilities from discontinued operations (Note 15) | | — |

| | 8,882 |

|

| Total Liabilities | 985,866 |

| | 852,595 |

| 1,033,087 |

| | 938,718 |

|

| Commitments and contingencies |

|

| |

|

| |

| Commitments and contingencies (Note 13) | |

|

| |

|

|

| Stockholders' Equity |

|

| |

|

|

|

| |

|

|

| Preferred stock - $0.001 par value, 25,000,000 shares authorized; no shares were issued at either period end | — |

| | — |

| — |

| | — |

|

| Class A common stock - $0.001 par value; 225,000,000 shares authorized; 45,992,983 and 44,561,419 issued and outstanding as of September 30, 2018 and December 31, 2017, respectively) | 9 |

| | 8 |

| |

| Common stock - $0.001 par value; 225,000,000 shares authorized; 46,503,406 and 46,412,231 shares issued as of September 30, 2019 and December 31, 2018, respectively; and 42,347,165 and 46,412,231 shares outstanding as of September 30, 2019 and December 31, 2018, respectively | | 9 |

| | 9 |

|

| Treasury stock, at cost - 4,156,241 as of September 30, 2019 | | (53,064 | ) | | — |

|

| Paid-in capital | 64,148 |

| | 46,079 |

| 67,579 |

| | 60,015 |

|

| (Accumulated deficit) retained earnings | (3,767 | ) | | 3,988 |

| |

| Retained earnings (accumulated deficit) | | 63,205 |

| | (18,065 | ) |

| Accumulated other comprehensive loss | (50,526 | ) | | (42,939 | ) | (42,684 | ) | | (61,060 | ) |

| Total Stockholders' Equity | 9,864 |

| | 7,136 |

| 35,045 |

| | (19,101 | ) |

| Total Liabilities and Stockholders' Equity | $ | 995,730 |

| | $ | 859,731 |

| $ | 1,068,132 |

| | $ | 919,617 |

|

See accompanying Notes to unaudited Condensed Consolidated Financial Statements.

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF (LOSS) INCOMEOPERATIONS

(in thousands, except per share data)

| | | | Three Months Ended

September 30, | | Nine Months Ended

September 30, | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2018 | | 2017 | | 2018 | | 2017 | 2019 | | 2018 | | 2019 | | 2018 |

| Revenue | $ | 283,004 |

| | $ | 255,119 |

| | $ | 793,745 |

| | $ | 696,643 |

| $ | 297,264 |

| | $ | 269,482 |

| | $ | 839,503 |

| | $ | 757,494 |

|

| Provision for losses | 134,523 |

| | 99,341 |

| | 307,540 |

| | 226,523 |

| 123,867 |

| | 127,692 |

| | 338,262 |

| | 290,922 |

|

| Net revenue | 148,481 |

| | 155,778 |

| | 486,205 |

| | 470,120 |

| 173,397 |

| | 141,790 |

| | 501,241 |

| | 466,572 |

|

| | | | | | | | | | | | | | | |

| Cost of providing services | | | | | | | | | | | | | | |

| Salaries and benefits | 26,515 |

| | 26,821 |

| | 80,341 |

| | 79,554 |

| 27,462 |

| | 26,515 |

| | 82,249 |

| | 80,341 |

|

| Occupancy | 13,522 |

| | 13,815 |

| | 40,269 |

| | 41,421 |

| 14,036 |

| | 13,522 |

| | 42,205 |

| | 40,269 |

|

| Office | 7,742 |

| | 5,715 |

| | 20,799 |

| | 15,519 |

| 5,993 |

| | 7,326 |

| | 16,563 |

| | 19,311 |

|

| Other costs of providing services | 12,604 |

| | 12,991 |

| | 39,731 |

| | 40,954 |

| 12,843 |

| | 12,484 |

| | 39,917 |

| | 38,516 |

|

| Advertising | 24,114 |

| | 16,270 |

| | 51,424 |

| | 35,599 |

| 16,424 |

| | 21,349 |

| | 36,990 |

| | 44,347 |

|

| Total cost of providing services | 84,497 |

| | 75,612 |

| | 232,564 |

| | 213,047 |

| 76,758 |

| | 81,196 |

| | 217,924 |

| | 222,784 |

|

| Gross margin | 63,984 |

| | 80,166 |

| | 253,641 |

| | 257,073 |

| 96,639 |

| | 60,594 |

| | 283,317 |

| | 243,788 |

|

| | | | | | | | | | | | | | | |

| Operating expense | | | | | | | | | | | | | | |

| Corporate, district and other | 35,185 |

| | 34,247 |

| | 114,294 |

| | 103,797 |

| |

| Corporate, district and other expenses | | 38,665 |

| | 27,495 |

| | 123,043 |

| | 95,904 |

|

| Interest expense | 23,396 |

| | 18,844 |

| | 66,210 |

| | 60,694 |

| 17,364 |

| | 23,403 |

| | 52,077 |

| | 66,229 |

|

| Loss on extinguishment of debt | 69,200 |

| | — |

| | 80,883 |

| | 12,458 |

| — |

| | 69,200 |

| | — |

| | 80,883 |

|

| Restructuring costs | — |

| | 7,393 |

| | — |

| | 7,393 |

| |

| Loss from equity method investment | | 1,384 |

| | — |

| | 5,132 |

| | — |

|

| Total operating expense | 127,781 |

| | 60,484 |

| | 261,387 |

| | 184,342 |

| 57,413 |

| | 120,098 |

| | 180,252 |

| | 243,016 |

|

| Net (loss) income before income taxes | (63,797 | ) | | 19,682 |

| | (7,746 | ) | | 72,731 |

| |

| (Benefit) provision for income taxes | (16,775 | ) | | 9,920 |

| | 9 |

| | 29,988 |

| |

| Net (loss) income | $ | (47,022 | ) | | $ | 9,762 |

| | $ | (7,755 | ) | | $ | 42,743 |

| |

| Income (loss) from continuing operations before income taxes | | 39,226 |

| | (59,504 | ) | | 103,065 |

| | 772 |

|

| Provision (benefit) for income taxes | | 11,239 |

| | (16,914 | ) | | 28,738 |

| | (269 | ) |

| Net income (loss) from continuing operations | | 27,987 |

|

| (42,590 | ) | | 74,327 |

| | 1,041 |

|

| Net loss from discontinued operations, before income tax | | — |

| | (4,293 | ) | | (39,048 | ) | | (8,518 | ) |

Income tax expense (benefit) related to disposition

| | $ | 598 |

| | $ | 139 |

| | $ | (45,991 | ) | | $ | 278 |

|

| Net (loss) income from discontinued operations | | $ | (598 | ) | | $ | (4,432 | ) | | $ | 6,943 |

| | $ | (8,796 | ) |

| Net income (loss) | | $ | 27,389 |

|

| $ | (47,022 | ) | | $ | 81,270 |

| | $ | (7,755 | ) |

| | | | | | | | | |

| Basic earnings (loss) per share: | | | | | | | | |

| Continuing operations | | $ | 0.63 |

| | $ | (0.93 | ) | | $ | 1.63 |

| | $ | 0.02 |

|

| Discontinued operations | | (0.01 | ) | | (0.10 | ) | | 0.15 |

| | (0.19 | ) |

| Basic earnings per share | | $ | 0.62 |

| | $ | (1.03 | ) | | $ | 1.78 |

| | $ | (0.17 | ) |

| | | | | | | | | |

| Diluted earnings (loss) per share: | | | | | | | | |

| Continuing operations | | $ | 0.61 |

| | $ | (0.93 | ) | | $ | 1.59 |

| | $ | 0.03 |

|

| Discontinued operations | | (0.01 | ) | | (0.10 | ) | | 0.15 |

| | (0.19 | ) |

Diluted earnings per share (1) | | $ | 0.60 |

| | $ | (1.03 | ) | | $ | 1.74 |

| | $ | (0.16 | ) |

| | | | | | | | | | | | | | | |

| Weighted average common shares outstanding: | | | | | | | | | | | | | | |

| Basic | 45,853 |

| | 37,908 |

| | 45,674 |

| | 37,908 |

| 44,422 |

| | 45,853 |

| | 45,759 |

| | 45,674 |

|

| Diluted | 48,352 |

| | 38,914 |

| | 48,061 |

| | 38,959 |

| |

| Net income per common share: | | | | | | | | |

| Basic earnings per share | $ | (1.03 | ) | | $ | 0.26 |

| | $ | (0.17 | ) | | $ | 1.13 |

| |

| Diluted earnings per share: | $ | (0.97 | ) | | $ | 0.25 |

| | $ | (0.16 | ) | | $ | 1.10 |

| |

Diluted (1) | | 46,010 |

| | 45,853 |

| | 46,887 |

| | 48,061 |

|

| (1) As of December 31, 2018, the Company made certain insignificant adjustments to previously-reported Earnings Per Share ("EPS") to correctly reflect the effect of anti-dilutive shares on diluted EPS calculations in accordance with ASC 260. These changes were immaterial to the overall EPS calculation. Diluted loss per share for the three months ended September 30, 2018 of $0.97 was corrected to $1.03. | | (1) As of December 31, 2018, the Company made certain insignificant adjustments to previously-reported Earnings Per Share ("EPS") to correctly reflect the effect of anti-dilutive shares on diluted EPS calculations in accordance with ASC 260. These changes were immaterial to the overall EPS calculation. Diluted loss per share for the three months ended September 30, 2018 of $0.97 was corrected to $1.03. |

See accompanying Notes to unaudited Condensed Consolidated Financial Statements.

Statements.

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands)

(unaudited)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2018 | | 2017 | | 2018 | | 2017 |

| Net (loss) income | $ | (47,022 | ) | | $ | 9,762 |

| | $ | (7,755 | ) | | $ | 42,743 |

|

| Other comprehensive income (loss): |

| |

| |

| |

|

| Cash flow hedges, net of $0 tax in all periods | (187 | ) | | — |

| | (572 | ) | | 333 |

|

| Foreign currency translation adjustment, net of $0 tax in all periods | 2,648 |

| | 8,397 |

| | (7,015 | ) | | 18,148 |

|

| Other comprehensive income (loss) | 2,461 |

| | 8,397 |

| | (7,587 | ) | | 18,481 |

|

| Comprehensive (loss) income | $ | (44,561 | ) | | $ | 18,159 |

| | $ | (15,342 | ) | | $ | 61,224 |

|

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2019 | | 2018 | | 2019 | | 2018 |

| Net income (loss) | $ | 27,389 |

| | $ | (47,022 | ) | | $ | 81,270 |

| | $ | (7,755 | ) |

| Other comprehensive (loss) income: |

| |

| |

| |

|

| Cash flow hedges, net of $0 tax in both periods | — |

| | (187 | ) | | — |

| | (572 | ) |

| Foreign currency translation adjustment, net of $0 tax in both periods | (1,954 | ) | | 2,649 |

| | 18,376 |

| | (7,015 | ) |

| Other comprehensive (loss) income | (1,954 | ) | | 2,462 |

| | 18,376 |

| | (7,587 | ) |

| Comprehensive income (loss) | $ | 25,435 |

| | $ | (44,560 | ) | | $ | 99,646 |

| | $ | (15,342 | ) |

See accompanying Notes to unaudited Condensed Consolidated Financial Statements.

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTSSTATEMENT OF CASH FLOWS

(dollars in thousands, and unaudited)

|

| | | | | | | |

| | Nine Months Ended September 30, |

| | 2018 | | 2017 |

| Cash flows from operating activities | | | |

| Net (loss) income | $ | (7,755 | ) | | $ | 42,743 |

|

| Adjustments to reconcile net income to net cash (used in) provided by operating activities: | | | |

| Depreciation and amortization | 14,006 |

| | 14,120 |

|

| Provision for loan losses | 307,540 |

| | 226,523 |

|

| Restructuring costs | — |

| | 1,495 |

|

| Amortization of debt issuance costs | 3,411 |

| | 2,637 |

|

| Amortization of bond (premium)/discount | (488 | ) | | 809 |

|

| Deferred income tax benefit | 3,005 |

| | (811 | ) |

| Loss on disposal of property and equipment | 691 |

| | 403 |

|

| Loss on extinguishment of debt | 80,883 |

| | 12,458 |

|

| Increase in cash surrender value of life insurance | (2,458 | ) | | (1,045 | ) |

| Share-based compensation expense | 6,112 |

| | 311 |

|

| Changes in operating assets and liabilities: | | | |

| Loans receivable | (444,350 | ) | | (295,127 | ) |

| Accounts payable and accrued liabilities | (3,643 | ) | | 11,055 |

|

| Income taxes payable | 326 |

| | 11,387 |

|

| Income taxes receivable | (12,908 | ) | | 4,590 |

|

| Other liabilities | (16,973 | ) | | (2,136 | ) |

| Net cash (used in) provided by operating activities | (72,601 | ) | | 29,412 |

|

| Cash flows from investing activities | | | |

| Purchase of property, equipment and software | (8,200 | ) | | (7,917 | ) |

| Cash paid for Cognical Holdings preferred shares | (958 | ) | | (4,975 | ) |

| Changes in restricted cash | (12,284 | ) | | (3,360 | ) |

| Net cash used in investing activities | (21,442 | ) | | (16,252 | ) |

| Cash flows from financing activities | | | |

| Net proceeds from issuance of common stock | 11,549 |

| | — |

|

| Proceeds from exercise of stock options | 408 |

| | — |

|

| Proceeds from Non-Recourse U.S. SPV facility | 17,000 |

| | 52,130 |

|

| Payments on Non-Recourse U.S. SPV facility | (61,590 | ) | | (27,258 | ) |

| Proceeds from Non-Recourse Canada SPV facility | 89,949 |

| | — |

|

| Proceeds from issuance of 12.00% Senior Secured Notes | — |

| | 461,329 |

|

| Payments on 10.75% Senior Secured Notes | — |

| | (414,882 | ) |

| Payments on 12.00% Senior Secured Notes | (605,000 | ) | | — |

|

| Proceeds from 8.25% Senior Secured Notes | 690,000 |

| | — |

|

| Payments on 12.00% Senior Cash Pay Notes | — |

| | (125,000 | ) |

| Debt issuance costs paid | (17,517 | ) | | (14,222 | ) |

| Proceeds from credit facilities | 65,169 |

| | 33,028 |

|

| Payments on credit facilities | (36,169 | ) | | (33,028 | ) |

| Payments of call premiums from early debt extinguishments | (63,350 | ) | | (11,152 | ) |

| Dividends paid to CURO Group Holdings Corp. | — |

| | (166,583 | ) |

| Dividends received from CURO Group Holdings Corp. | — |

| | 166,583 |

|

| Dividends paid to stockholders | — |

| | (36,500 | ) |

| Net cash provided by (used in) financing activities | 90,449 |

| | (115,555 | ) |

Effect of exchange rate changes on cash | (5,419 | ) | | 4,415 |

|

| Net decrease in cash | (9,013 | ) | | (97,980 | ) |

| Cash at beginning of period | 162,374 |

| | 193,525 |

|

| Cash at end of period | $ | 153,361 |

| | $ | 95,545 |

|

|

| | | | | | | |

| | Nine Months Ended September 30, |

| | 2019 | | 2018 |

| Cash flows from operating activities | | | |

| Net income from continuing operations | $ | 74,327 |

| | $ | 1,041 |

|

| Adjustments to reconcile net income to net cash provided by continuing operating activities: | | | |

| Depreciation and amortization | 14,180 |

| | 13,628 |

|

| Provision for loan losses | 338,262 |

| | 290,922 |

|

| Amortization of debt issuance costs and bond discount | 2,273 |

| | 2,923 |

|

| Deferred income tax (benefit) expense | (3,147 | ) | | 3,005 |

|

| Loss on disposal of property and equipment | 47 |

| | 640 |

|

| Loss on extinguishment of debt | — |

| | 80,883 |

|

| Loss from equity method investment | 5,132 |

| | — |

|

| Share-based compensation | 7,587 |

| | 6,112 |

|

| Changes in operating assets and liabilities: | | | |

| Accrued interest on loans receivable | (11,446 | ) | | (5,986 | ) |

| Prepaid expenses and other assets | 14,275 |

| | 2,695 |

|

| Other assets | (8,439 | ) | | (2,458 | ) |

| Accounts payable and accrued liabilities | 13,596 |

| | (4,862 | ) |

| Deferred revenue | (533 | ) | | (1,984 | ) |

| Income taxes payable | 25,117 |

| | 326 |

|

| Income taxes receivable | 5,598 |

| | (12,908 | ) |

| Accrued interest | (15,303 | ) | | (18,060 | ) |

| Other liabilities | 2,767 |

| | 1,162 |

|

| Net cash provided by continuing operating activities | 464,293 |

| | 357,079 |

|

| Net cash (used in) provided by discontinued operating activities | (504 | ) | | 5,562 |

|

| Net cash provided by operating activities | 463,789 |

| | 362,641 |

|

| Cash flows from investing activities | | | |

| Purchase of property, equipment and software | (8,667 | ) | | (8,030 | ) |

| Loans receivable originated or acquired | (1,369,644 | ) | | (1,624,881 | ) |

| Loans receivable repaid | 995,291 |

| | 1,212,446 |

|

| Investments in Cognical Holdings, Inc. ("Zibby") | (8,168 | ) | | (958 | ) |

| Net cash used in continuing investing activities | (391,188 | ) | | (421,423 | ) |

| Net cash used in discontinued investing activities | (14,213 | ) | | (24,481 | ) |

| Net cash used in investing activities | (405,401 | ) | | (445,904 | ) |

| Cash flows from financing activities | | | |

| Net proceeds from issuance of common stock | — |

| | 11,549 |

|

| Proceeds from Non-Recourse U.S. SPV facility | — |

| | 17,000 |

|

| Payments on Non-Recourse U.S. SPV facility | — |

| | (61,590 | ) |

| Proceeds from Non-Recourse Canada SPV facility | 15,992 |

| | 89,949 |

|

| Payments on Non-Recourse Canada SPV facility | (24,835 | ) | | — |

|

| Payments on 12.00% Senior Secured Notes | — |

| | (605,000 | ) |

| Proceeds from 8.25% Senior Secured Notes | — |

| | 690,000 |

|

| Debt issuance costs paid | (198 | ) | | (17,517 | ) |

| Proceeds from credit facilities | 179,811 |

| | 65,169 |

|

| Payments on credit facilities | (174,811 | ) | | (36,169 | ) |

| Payments on subordinated stockholder debt | (2,252 | ) | | — |

|

| Payments of call premiums from early debt extinguishments | — |

| | (63,350 | ) |

| Proceeds from exercise of stock options | 87 |

| | 408 |

|

| Payments to net share settle restricted stock units vesting | (110 | ) | | — |

|

| Repurchase of common stock | (52,172 | ) | | — |

|

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(dollars in thousands, unaudited)

|

| | | | | | | |

Net cash (used in) provided by financing activities (1) | (58,488 | ) | | 90,449 |

|

| Effect of exchange rate changes on cash and restricted cash | 1,204 |

| | (4,080 | ) |

| Net increase in cash and restricted cash | 1,104 |

| | 3,106 |

|

| Cash and restricted cash at beginning of period | 99,857 |

| | 174,491 |

|

| Cash and restricted cash at end of period | 100,961 |

| | 177,597 |

|

| Less: Cash and restricted cash of discontinued operations at end of period | — |

| | 11,303 |

|

| Cash and restricted cash of continuing operations at end of period | $ | 100,961 |

| | $ | 166,294 |

|

| (1) Financing activities include continuing operations only, and were not impacted by discontinued operations |

See accompanying Notes to unaudited Condensed Consolidated Financial Statements.

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND NATURE OF OPERATIONS

Nature of Operations

CURO is a growth-oriented, technology-enabled, highly-diversified consumer finance company serving a wide range of underbanked consumers in the United States ("U.S."), Canada and, through February 25, 2019, the U.K.

U.K. Segment Placed into Administration

On February 25, 2019, the Company announced that a proposed Scheme of Arrangement ("SOA"), as described in the Company's Current Report on Form 8-K filed January 31, 2019, would not be implemented. In accordance with the provisions of the U.K. Insolvency Act 1986 and as approved by the boards of directors of the Company’s U.K. subsidiaries, Curo Transatlantic Limited and SRC Transatlantic Limited (collectively, “the U.K. Subsidiaries”), insolvency practitioners from KPMG were appointed as administrators (“Administrators”) for the U.K. Subsidiaries. The effect of the U.K. Subsidiaries’ entry into administration was to place their management, affairs, business and property under the direct control of the Administrators. Accordingly, the Company deconsolidated the U.K. Subsidiaries as of February 25, 2019 and presented the U.K. Subsidiaries as Discontinued Operations for all periods presented in this Form 10-Q.

Basis of Presentation

The terms “CURO," "we,” “our,” “us,”“CURO" and the “Company,”“Company” refer to CURO Group Holdings Corp. and its directly and indirectly owned subsidiaries as a combinedconsolidated entity, except where otherwise stated. The term "CFTC" refers to CURO Financial Technologies Corp., oura wholly-owned subsidiary of the Company, and its directly and indirectly owned subsidiaries as a consolidated entity, except where otherwise stated.

We haveThe Company has prepared the accompanying unaudited Condensed Consolidated Financial Statements ("Condensed Consolidated Financial Statements") in accordance with accounting principles generally accepted in the United States of America (“US GAAP”), and with the accounting policies described in our 2017its Annual Report on Form 10-K. 10-K for the year ended December 31, 2018 filed with the Securities and Exchange Commission (the "SEC") on March 18, 2019 ("2018 Form 10-K"). Operating results for the three and nine month periods ended September 30, 2019 are not necessarily indicative of the results that might be expected for any other interim period or the fiscal year ending December 31, 2019.

Certain information and note disclosures normally included in our annual financial statements prepared in accordance with US GAAP have been condensed or omitted, although we believethe Company believes that the disclosures are adequate to enable a reasonable understanding of the information presented. Additionally, in September 2018, and subsequently expanded in June 2019, the SEC changed the definition of a smaller reporting company ("SRC"). The change in definition of an SRC allows more registrants to qualify to report under scaled disclosure requirements. Under these rules, CURO met the definition of an SRC as of June 30, 2019. Refer to "--FASB Definition of an SRC as related to the CECL standard and evaluation of the impact of the CECL standard" for information regarding the impact on the Company of meeting the definition of an SRC.

The unaudited Condensed Consolidated Financial Statements and the accompanying notes reflect all adjustments (consisting only of adjustments of a normal and recurring nature) which are, in the opinion of management, necessary to present fairly ourthe Company's results of operations, financial position and cash flows for the periods presented. The adjustments consist solelyOn February 25, 2019, the Company's United Kingdom ("U.K.") segment, as defined by ASC 280, was placed into administration, resulting in the treatment of normal recurring adjustments. You should readit as discontinued operations per ASC 205-20. Throughout this Quarterly Report on Form 10-Q ("Form 10-Q"), current and prior-period financial information presents the U.K. segment as discontinued operations as required. For further information about the placement of the segment into administration, refer to "--Nature of Operations" below.

The Condensed Consolidated Financial Statements should be read in conjunction with the Consolidated Financial Statements and related Notes included in our 2017 Annual Report onthe 2018 Form 10-K. Interim results of operations are not necessarily indicative of results that may be expected for future interim periods or for the year ending December 31, 2018.

We completed our initial public offering ("IPO") in December 2017. Prior to our IPO, we effected a 36-for-1 split of our common stock. We have retroactively adjusted all share and per share data for all periods presented to reflect the stock split as if the stock split had occurred at the beginning of the earliest period presented.

After our IPO, we initially qualified as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"). As an emerging growth company, we elected to take advantage of specified reduced reporting and other requirements that are otherwise generally required of public companies. In August 2018, we completed the issuance of $690.0 million of 8.25% Senior Secured Notes due 2025 ("2025 Notes"). See Note 5 - Long-Term Debt for further discussion of this issuance. This sale, along with the issuance of $605.0 million of 12.00% Senior Secured Notes due 2022 ("2022 Notes") during 2017 exceeded one of the required thresholds to retain emerging growth company status. Specifically, an emerging growth company loses this status on the date on which it has, during the previous three-year period, issued more than $1 billion in non-convertible debt, provided that none of certain other disqualifying conditions have been triggered. As a result of this change of status, we can no longer take advantage of the specified reduced reporting requirements and need to adopt certain recently issued accounting pronouncements for which we were previously allowed to defer. The impact to our accounting policy adoption practices are further described in Note 1. Additionally, the status change will require us to provide an auditor attestation of internal control over financial reporting under Sarbanes-Oxley Act Section 404(b).2019.

Principles of Consolidation

The Condensed Consolidated Financial Statements include the accounts of CURO and its wholly-owned subsidiaries. We have eliminated intercompanyIntercompany transactions and balances have been eliminated in consolidation.

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

Equity Investment in Unconsolidated Entity

During the nine months ended September 30, 2019, the Company invested an additional $6.6 million in Cognical Holdings, Inc. ("Zibby"), offset by a $3.7 million carrying value adjustment as a result of the additional investment. As of September 30, 2019, the Company owned 42.3% of Zibby. See Note 8 - "Fair Value Measurements" for additional detail on Zibby's fair value considerations for the nine months ended September 30, 2019.

Use of Estimates

The preparation of Condensed Consolidated Financial Statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements. Estimates also affect the reported amounts of revenues and expenses during the periods reported. Some of the significant estimates that we havethe Company made in the accompanying Condensed Consolidated Financial Statements include allowances for loan losses, certain assumptions related to equity investments, goodwill and intangibles, accruals related to self-insurance, Credit Services Organizationcredit services organization ("CSO") guarantee liability for losses, and estimated tax liabilities. Actual results may differ from those estimates.

Nature of OperationsOpen-End Loss Recognition

WeEffective January 1, 2019, the Company modified the timeframe for which it charges-off Open-End loans and made related refinements to its loss provisioning methodology. Prior to January 1, 2019, the Company deemed Open-End loans uncollectible and charged-off when a customer missed a scheduled payment and the loan was considered past-due. Because of the continued shift to Open-End loans in Canada and analysis of payment patterns on early-stage versus late-stage delinquencies, the Company revised its estimates and now considers Open-End loans uncollectible when the loan has been contractually past-due for 90 consecutive days. Consequently, past-due Open-End loans and related accrued interest now remain in loans receivable for 90 days before being charged-off against the allowance for loan losses. All recoveries on charged-off loans are credited to the allowance for loan losses. Quarterly, the Company evaluates the adequacy of the allowance for loan losses compared to the related gross loans receivable balances that include accrued interest.

The aforementioned change was treated as a growth-oriented, technology-enabled, highly-diversified consumer finance company servingchange in accounting estimate for accounting purposes and applied prospectively effective January 1, 2019.

The change affects comparability with prior periods as follows:

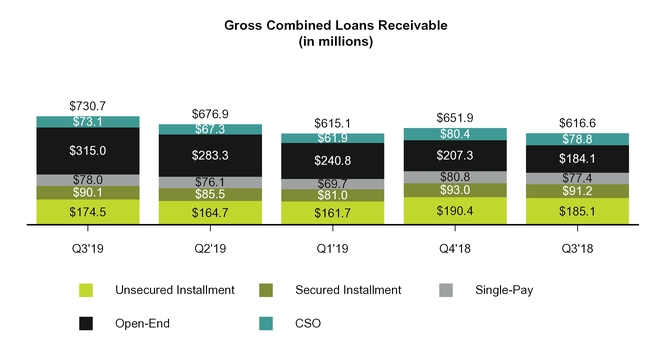

Gross combined loans receivable: balances as of September 30, 2019 include $46.1 million of Open-End loans that are up to 90 days past-due with related accrued interest, while such balances for periods prior to March 31, 2019 do not include any past-due loans.

Revenues: for the three and nine months ended September 30, 2019, gross revenues include interest earned on past-due loan balances of approximately $15 million and $35 million, respectively, while revenues in prior-year periods do not include comparable amounts.

Provision for Losses: prospectively, from January 1, 2019, past-due, unpaid balances plus related accrued interest charge-off on day 91. Provision expense is affected by total charge-offs less total recoveries ("NCOs") plus changes to the Allowance for loan losses. Because NCOs prospectively include unpaid principal and up to 90 days of related accrued interest, NCO amounts and rates are higher and the Open-End Allowance for loan losses as a wide rangepercentage of underbanked consumersOpen-End gross loans receivable is higher. The Open-End Allowance for loan losses as a percentage of Open-End gross loans receivable increased to 17.2% at September 30, 2019, compared to 9.8% in the United States ("U.S."), Canada,comparable prior-year period.

Correction of Immaterial Errors in Previously-Issued Financial Statements

During the year ended December 31, 2018, the Company corrected immaterial errors in its prior presentation of cash flows for loan originations and collections on principal. The Company determined that the United Kingdom ("U.K.").

historical presentation was in error by not conforming to US GAAP because it included outflows for loan originations and receipts on collections in Cash provided by operating activities rather than in Cash used in investing activities. Accordingly, the Company corrected previously filed financial statements by reclassifying cash outflows for loan originations and receipts on collections of principal of $412.4 million from net Cash provided by operating activities to net Cash used in investing activities for the nine months ended September 30, 2018. Total cash flows for each period presented did not change. The Company concluded that the errors were immaterial to the unaudited Condensed Consolidated Financial Statements included in the Company’s Quarterly Report on Form 10-Q for the three and nine months

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

ended September 30, 2018. The Company has revised its Condensed Consolidated Financial Statements for the nine months ended September 30, 2018 presented in this Form 10-Q. A summary of the correction follows (in thousands):

|

| | | | |

| | | Nine Months Ended September 30, 2018 |

As Reported:(1) | | |

| Net cash used in continuing operating activities | | $ | (55,356 | ) |

| Net cash used in continuing investing activities | | (8,988 | ) |

| | | |

| As Corrected: | | |

| Net cash provided by continuing operating activities | | 357,079 |

|

| Net cash used in continuing investing activities | | (421,423 | ) |

| (1) "As reported" balances include amounts from continuing operations historically presented within these captions. |

Recently Adopted Accounting Pronouncements

ASU 2016-02

In May 2017,February 2016, the Financial Accounting Standards Board ("FASB") issuedestablished Topic 842, Leases, by issuing ASU 2017-09, Compensation - Stock Compensation (Topic 718): Scope of Modification Accounting ("ASU 2017-09"). Under modification accounting, an entity is requiredNo. 2016-02, which requires lessees to re-value its equity awards each time there is a modification torecognize leases on the terms ofbalance sheet and disclose key information about leasing arrangements. The Company adopted the awards. The provisions in ASU 2017-09 provide guidance about which changes to the terms or conditions of a share-based payment award require an entity to account for the effects of a modification, unless certain conditions are met. The amendments in this update were effective for all entities for annual periods, and interim periods therein, beginning after December 15, 2017. ASU 2017-09 was effective for all entities for annual periods, and interim periods therein,standard as of January 1, 2018.2019 using the alternative modified retrospective method, also known as the transition relief method, permitted under ASU 2018-11, which allows companies to not recast comparative periods in the period of adoption. The adoptionCompany elected the package of this amendmentpractical expedients permitted under the transition guidance which, among other things, permits companies to not reassess prior conclusions on lease identification, lease classification and initial direct costs. The Company also elected to combine lease and non-lease components and to exclude short-term leases, defined as having an initial term of 12 months or less, from the Condensed Consolidated Balance Sheets. The Company did not have a material impact on our Consolidated Financial Statements.elect the hindsight practical expedient.

InAs of September 30, 2019, the Company held right of use assets ("ROU assets") and operating lease liabilities ("lease liabilities") of $118.3 million and $126.0 million, respectively. Prepaid rent of $2.7 million and deferred liabilities of $10.9 million were included in ROU assets and lease liabilities, respectively, at the time of adoption. During the three months ended September 30, 2019, the Company reduced initial opening balances for ROU assets and lease liabilities recorded on January 2017, FASB issued ASU 2017-01, Business Combinations (Topic 805): Clarifying the Definition1, 2019 by $18.0 million as a result of a Business ("ASU 2017-01"). ASU 2017-01 narrowsprevious misapplication of certain provisions of Topic 842. The impact of this misapplication on the definitionCompany's financial position, results of a businessoperations, and provides a framework that gives an entity a basiscash flows was not material.

See Note 14 - "Leases" for making reasonable judgments about whether a transaction involves an asset or a businessadditional information and provides a screen to determine when a set (an integrated set of assets and activities) is not a business. The screen requires a determination that when substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset or a group of similar identifiable assets, the set is not a business. If the screen is not met, ASU 2017-01 (i) requires that to be considered a business, a set must include, at a minimum, an input and a substantive process that together significantly contribute to the ability to create output and (ii) removes the evaluation of whether a market participant could replace missing elements. The amendments provide a framework to assist entities in evaluating whether both an input and a substantive process are present. ASU 2017-01 is effective prospectively for public companies for annual periods beginning after December 15, 2017, including interim periods therein. With our loss of emerging growth company status, we adopted this guidance during the current quarter. The adoption of ASU 2017-01 did not have a material impact on our Consolidated Financial Statements.disclosures required by Topic 842.

In November 2016, FASB issued ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash ("ASU 2016-18"). ASU 2016-18 requires that a statement of cash flows explain the change during the period in the total of cash, cash equivalents and amounts generally described as restricted cash or restricted cash equivalents. As a result, amounts generally described as restricted cash and restricted cash equivalents should be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the statement of cash flows. The adoption should be applied using a retrospective transition method to each period presented. ASU 2016-18 is effective for public companies for fiscal years beginning after December 15, 2017 and interim periods therein. With our loss of emerging growth company status, we adopted this guidance during the current quarter. The adoption of ASU 2016-18 did not have a material impact on the presentation of our statement of cash flows in our Consolidated Financial Statements.

In August 2016, FASB issued ASU 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments (a consensus of the Emerging Issues Task Force) (“ASU 2016-15”). The amendments in ASU 2016-15 provide guidance on eight specific cash flow issues, including debt prepayment or debt extinguishment costs, contingent consideration payments made after a business combination, distributions received from equity method investees and beneficial interests in securitization transactions. ASU 2016-15 was effective for public companies for fiscal years beginning after December 15, 2017 and interim periods therein. With our loss of emerging growth company status, we adopted this guidance during the current quarter. The adoption of ASU 2016-15 did not have a material impact on our Consolidated Statement of Cash Flows as we have historically presented debt prepayment and extinguishment costs as outflows from financing activities and we had no other material cash flows impacted by the guidance.

In January 2016, FASB issued ASU No. 2016-01, Financial Instruments-Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities (“ASU 2016-01”) which requires (i) equity investments (except those accounted for under the equity method of accounting, or those that result in consolidation of the investee) to be measured at fair value with changes in fair value recognized in net income, (ii) public entities to use the exit price notion when measuring the fair value of financial instruments for disclosure purposes and (iii) separate presentation of financial assets and financial liabilities by measurement category and form of financial asset (i.e., securities or loans and receivables). ASU 2016-01 eliminates the requirement to disclose the method(s) and significant assumptions used to estimate the fair value that is required to be disclosed for financial instruments measured at amortized cost. ASU 2016-01 is currently effective for public companies. With our loss of emerging growth company status during 2018, we adopted this guidance during the current quarter. The adoption of ASU 2016-01 did not have a material impact on our Consolidated Financial Statements.

In November 2015, FASB issued ASU No. 2015-17, Income Taxes (Topic 740): Balance Sheet Classification of Deferred Taxes (“ASU 2015-17”). ASU 2015-07 eliminates the requirement for organizations to present deferred tax liabilities and assets as current and noncurrent in a classified balance sheet. Instead, organizations will be required to classify all deferred tax assets and liabilities as noncurrent. ASU 2015-17 is currently effective for public companies. With our loss of emerging growth company

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

status during 2018, we adopted this guidance during the current quarter. The adoption of ASU 2015-17 did not have a material impact on our Consolidated Financial Statements.

In May 2014, FASB issued ASU No. 2014-09, Revenue from Contracts with Customers (Topic 606) (“ASU 2014-09”), which amended the existing accounting standards for revenue recognition. ASU 2014-09 establishes principles for recognizing revenue upon the transfer of promised goods or services to customers in an amount that reflects the expected consideration received in exchange for those goods or services. In addition to ASU 2014-09, the FASB issued the following ASUs updating the topic:

In December 2016, ASU No. 2016-20, Technical Corrections and Improvements to Topic 606, Revenue from Contracts with Customers

In May 2016, ASU No. 2016-12 , Revenue from Contracts with Customers (Topic 606): Narrow-Scope Improvements and Practical Expedients

In April 2016, ASU No. 2016-10, Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing

In March 2016, ASU No. 2016-08, Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations (Reporting Revenue Gross versus Net).

In August 2015, ASU No. 2015-14, Revenue from Contracts with Customers (Topic 606): Deferral of the Effective Date

We adopted the provisions of Topic 606 during the quarter, which supersedes the revenue recognition requirements in ASC 605, Revenue Recognition (Topic 605). Topic 606 requires entities to recognize revenue when control of the promised goods or services is transferred to customers at an amount that reflects the consideration to which the entity expects to be entitled to in exchange for those goods or services. Most of our revenue is generated from interest or through servicing of financial contracts, both of which are excluded from the scope of ASU 2014-09. As a result, the standard did not have a material impact on our Condensed Financial Statements and we have made no adjustments to retained earnings or prior comparative periods.

Recently Issued Accounting Pronouncements Not Yet Adopted

In August 2018, FASB issued ASU No. 2018-13, Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”), which amends ASC 820, Fair Value Measurement. ASU 2018-13 modifies the disclosure requirements for fair value measurements by removing, modifying, or adding certain disclosures. The provisions of ASU 2018-13 are effective for all entities for fiscal years beginning after December 15, 2019, and interim periods therein. Early adoption is permitted. An entity is permitted to early adopt any removed or modified disclosures upon issuance of ASU 2018-13 and delay adoption of the additional disclosures until their effective date. The removed and modified disclosures will be adopted on a retrospective basis and the new disclosures will be adopted on a prospective basis. We are currently assessing the impact adoption of ASU 2018-13 will have on our Consolidated Financial Statements.2018-02

In February 2018, the FASB issued ASU 2018-02, Income Statement - Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive income ("ASU 2018-02"). Current US GAAP requires deferred, which permits the reclassification to retained earnings of disproportionate tax liabilities and assets to be adjusted for the effect of a changeeffects in tax laws or rates with the effect included in income from continuing operations in the period the change is enacted, including items ofaccumulated other comprehensive income for which the related tax effects are presented in other comprehensive income (“stranded tax effects”). ASU 2018-02 allows, but does not require, companies to reclassify stranded tax effects(loss) caused by the Tax Cuts and Jobs Act of 2017 (the "2017("2017 Tax Act") from accumulated other comprehensive income to retained earnings. Additionally,. The Company adopted ASU 2018-02 requires new disclosures by all companies, whether they opt to doas of January 1, 2019, which did not have a material impact on the reclassification or not. The provisions of ASU 2018-02 are effective for all entities for fiscal years beginning after December 15, 2018, and interim periods therein. Early adoption is permitted. Companies should apply the proposed amendments either in the period of adoption or retrospectively to each period (or periods) in which the effect of the change in the U.S. federal corporate income tax rate in the 2017 Tax Act is recognized. We are currently assessing the impact adoption of ASU 2018-02 will have on ourCondensed Consolidated Financial Statements.

In January 2017, FASB issued ASU 2017-04, Intangibles - Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment ("ASU 2017-04"). ASU 2017-04 simplified the goodwill impairment test by eliminating Step 2 of the test which requires an entity to compute the implied fair value of goodwill. Instead, an entity should recognize an impairment charge for the amount by which the carrying amount exceeds the reporting unit's fair value, and is limitedRecently Issued Accounting Pronouncements Not Yet Adopted

Accounting Pronouncements Related to the amount of total goodwill allocated to that reporting unit. Under Current Expected Credit Loss ("CECL") Standard

ASU 2017-04, an entity still has the option to perform the qualitative assessment for a reporting unit to determine if the quantitative impairment test is necessary. The provisions of ASU 2017-04 are effective for a public entity's annual or interim goodwill impairment tests in fiscal years beginning after December 15, 2019. We are currently assessing the impact adoption of ASU 2017-04 will have on our Consolidated Financial Statements.2016-13

In June 2016, the FASB issued ASU 2016-13, “Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments,”” (" and subsequent amendments to the guidance: ASU 2016-13"). This2018-19 in November 2018, ASU modifies2019-04 in April 2019 and ASU 2019-05 in May 2019. The standard, as amended, changes how entities will measure credit losses for most financial assets and certain other instruments that are not measured at fair value through net income. The standard will replace the impairmentcurrent “incurred loss” approach with an “expected loss” model for instruments measured at amortized cost. For available-for-sale debt securities, entities will be required to utilize an expected loss methodology inrecord allowances rather than reduce the carrying amount, as they currently do under the

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

placeother-than-temporary impairment model. The standard also simplifies the accounting model for purchased credit-impaired debt securities and loans. The amendment will affect loans, debt securities, trade receivables, net investments in leases, off-balance sheet credit exposures, reinsurance receivables, and any other financial assets not excluded from the scope that have the contractual right to receive cash. ASU 2019-04 clarifies that equity instruments without readily determinable fair values for which an entity has elected the measurement alternative should be remeasured to fair value as of the currently used incurred loss methodology, which will result indate that an observable transaction occurred. ASU 2019-05 provides an option to irrevocably elect to measure certain individual financial assets at fair value instead of amortized cost. The amendments should be applied on either a prospective transition or modified-retrospective approach depending on the more timely recognitionsubtopic. As issued, ASU 2016-13 is effective for annual periods beginning after December 15, 2019, and interim periods therein. Early adoption is permitted for annual periods beginning after December 15, 2018, and interim periods therein. The Company is evaluating its alternatives with respect to the available accounting methods under ASU 2016‑13, including the fair value option. If the fair value option is not utilized, adoption of losses. ASU 2016-13 will increase the allowance for credit losses with a resulting negative adjustment to retained earnings on the date of adoption. Additionally, as disclosed below in "--FASB Definition of an SRC as related to the CECL standard and evaluation of the impact of the CECL standard", the Company expects to defer the adoption of ASU 2016-13 until at least January 1, 2021.

ASU 2019-05

In May 2019, the FASB issued ASU 2019-05, Financial Instruments - Credit Losses (Topic 326), which amends ASU 2016-13 to allow companies to irrevocably elect, upon adoption of ASU 2016-13, the fair value option on financial instruments that (i) were previously recorded at amortized cost and (ii) are within the scope of ASC 326-20 if the instruments are eligible for the fair value option under ASC 825-10. The fair value option election does not apply to held-to-maturity debt securities. Entities are required to make this election on an instrument-by-instrument basis. ASU 2019-05’s amendments should be applied on a modified-retrospective basis by means of a cumulative-effect adjustment to the opening balance of retained earnings in the statement of financial position as of the date that an entity adopted the amendments in ASU 2016-13. For entities that have adopted ASU 2016-13, the amendments in ASU 2019-05 are effective for public companiesfiscal years beginning after December 15, 2019, including interim periods therein. An entity may early adopt the ASU in any interim period after its issuance if the entity has adopted ASU 2016-13. For all other entities, the effective date will be the same as the effective date for ASU 2016-13. The Company expects to elect the option to defer adoption to a later effective date, as further described below in "--FASB Definition of an SRC as related to the CECL standard and evaluation of the impact of the CECL standard." The Company is currently evaluating the methods and impact of adopting this new standard on the Condensed Consolidated Financial Statements.

ASU 2019-04

In May 2019, the FASB issued ASU 2019-04, Codification Improvements to Topic 326, Financial Instruments - Credit Losses, Topic 815, Derivatives and Hedging, and Topic 825, Financial Instruments, which clarifies certain aspects of accounting for credit losses, hedging activities, and financial instruments. The ASU’s amendments apply to all entities within the scope of the affected guidance. Accrued interest - Amortized cost basis is defined in ASU 2016-13 as "the amount at which a financing receivable or investment is originated or acquired, adjusted for applicable accrued interest, accretion or amortization of premium, discount, and net deferred fees or costs, collection of cash, write-offs, foreign exchange, and fair value hedge accounting adjustments." To address stakeholders’ concerns that the inclusion of accrued interest in the definition of amortized cost basis could make application of the credit loss guidance operationally burdensome, ASU 2019-04 provides certain alternatives for the measurement of the allowance for credit losses ("ALL") on accrued interest receivable ("AIR"). These measurement alternatives include (i) measuring an ALL on AIR separately, (ii) electing to provide separate disclosure of the AIR component of amortized cost as a practical expedient, and (iii) making accounting policy elections to simplify certain aspects of the presentation and measurement of such AIR. As issued, for entities that have adopted ASU 2016-13, the amendments in ASU 2019-04 related to ASU 2016-13 are effective for fiscal years beginning after December 15, 2019, and interim periods therein. We anticipate thatASU 2019-04’s amendments should be applied "on a modified-retrospective basis by means of a cumulative-effect adjustment to the opening retained earnings balance in the statement of financial position as of the date an entity adopted the amendments in ASU 2016-13." Certain disclosures are also required. Due to the FASB's decision to allow a deferment option for SRCs applying ASU 2016-13, will impact our current process for measuring credit lossesthe Company expects to defer adoption of both ASU 2016-13 and are currently assessingASU 2019-04.

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

FASB Definition of an SRC as related to the CECL standard and evaluation of the impact itof the CECL standard

On October 16, 2019, the FASB approved a proposal to defer required adoption of the CECL standard for SRCs until fiscal periods beginning after December 15, 2022. Under current SEC definitions, CURO met the definition of an SRC as of June 30, 2019. The FASB further confirmed that for CECL, a company makes an evaluation of SRC status in accordance with SEC rules at the time of standard effectiveness (i.e., as of June 30, 2019) and that status is effective for purposes of adopting the CECL standard regardless of future changes in SRC status. The FASB is expected to codify the approved proposal with issuance of a new ASU during the fourth quarter of 2019. The Company will havecontinue to monitor the standard-setting activities of the FASB and expects to elect to defer adoption of the CECL standard. The Company is currently evaluating the methods and impact of adopting the CECL standard on ourthe Condensed Consolidated Financial Statements.

SEC Disclosure Update

In February 2016, FASB issued its new lease accounting guidanceAugust 2018, the SEC adopted final rules under SEC Release No. 33-10532, Disclosure Update and Simplification, amending certain disclosure requirements that had become redundant, duplicative, overlapping, outdated or superseded. Other than the amendment's expanded disclosure requirement for interim financial statements to disclose both current and comparative quarter and year-to-date reconciliations of changes in ASU No. 2016-02, Leases (Topic 842) (“ASU 2016-02”). ASU 2016-02 requires lessees to recognize the following for all leases (with the exception of short-term leases) at the commencement date: (i) a lease liability, which is a lessee’s obligation to make lease payments, measured on a discounted basis; and (ii) a right-of-use asset, which is an asset that represents the lessee’s right to use, or control the use of, a specified asset for the lease term. Under the new guidance, lessor accounting is largely unchanged and lessees will no longer be provided with a source of off-balance sheet financing. In 2018, FASB released an additional transition method to adopt this new ASU. It allows companies to recognize a cumulative-effect adjustment in the period of adoption and tostockholders' equity, it did not restate prior periods. We will elect this transition method and it will be effective for us beginning January 1, 2019, with early adoption permitted. We plan, and are on schedule, to adopt the standard effective January 1, 2019. We expect ASU 2016-02 will have a material impact on our balance sheet with recognition of right-of-use assetsthe Company's Condensed Consolidated Financial Statements or Notes thereto for the three and lease liabilities for operating leases. However, we do not expect adoption willnine months ended September 30, 2019, nor is it expected to have a material impact on our income statement. We do not expect the new standard will have material impacts on our liquidityCompany's annual Consolidated Financial Statements or on our debt-covenant compliance under our current agreements.Notes thereto.

NOTE 2 - VARIABLE INTEREST ENTITIES

At September 30,In August 2018, we held two credit facilitiesthe Company closed the Non-Recourse Canada SPV facility, whereby we sell certain loan receivables were sold to wholly-owned, bankruptcy-remote special purpose subsidiaries which are considered variable interest entities ("VIEs"). We incur additional to collateralize debt throughincurred under the non-recourse facilities (See Note 5 - Long-Term Debt for further discussion) that is collateralized by these underlying loan receivables. We entered into the new Non-Recourse Canada SPV facility in August 2018. We extinguished the Non-Recourse U.S. SPV facility using the using the proceeds from the 8.25% Senior Secured Notes due September 1, 2025 ("8.25% Senior Secured Notes") in October 2018 (See Note 15 - Subsequent Events).facility.

We have determined that we areAs the Company is the primary beneficiary of the VIEs, and are required to consolidate them. We includeit includes the assets and liabilities related to the VIEs in ourits Condensed Consolidated Financial Statements and we account for them as secured borrowings. WeStatements. As required, the Company parenthetically disclosediscloses on ourthe Condensed Consolidated Balance Sheets the VIEs’ assets that can only be used to settle the VIEs' obligations and liabilities if the VIEs’ creditors have no recourse against ourthe Company's general credit.

The carrying amounts of the consolidated VIEs' assets and liabilities associated with our special purposethe VIE subsidiaries were as follows (September 30, 2018 includes balances for both the U.S. and Canada VIEs while the December 31, 2017 includes the U.S. VIE)(in thousands):

| | | (in thousands) | September 30, 2018 | | December 31, 2017 | |

| | | | September 30, 2019 | | December 31, 2018 |

| Assets | | | | | | | |

| Restricted cash | $ | 19,107 |

| | $ | 6,871 |

| | $ | 21,897 |

| | $ | 12,840 |

|

| Loans receivable less allowance for loan losses | 303,433 |

| | 167,706 |

| |

| Gross loans receivable less allowance for loan losses | | | 206,158 |

| | 136,187 |

|

| Total Assets | $ | 322,540 |

| | $ | 174,577 |

| | $ | 228,055 |

| | $ | 149,027 |

|

| Liabilities | | | | | | | |

| Accounts payable and accrued liabilities | $ | 1,360 |

| | $ | 12 |

| | $ | 7,259 |

| | $ | 4,980 |

|

| Deferred revenue | 149 |

| | — |

| | 44 |

| | 40 |

|

| Accrued interest | 1,603 |

| | 1,266 |

| | 777 |

| | 831 |

|

| Intercompany payable | | | 93,671 |

| | 44,330 |

|

| Long-term debt | 161,956 |

| | 120,402 |

| | 102,483 |

| | 107,479 |

|

| Total Liabilities | $ | 165,068 |

| | $ | 121,680 |

| | $ | 204,234 |

| | $ | 157,660 |

|

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

NOTE 3 – LOANS RECEIVABLE AND REVENUE

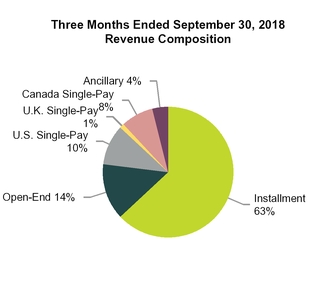

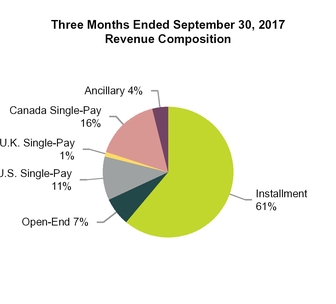

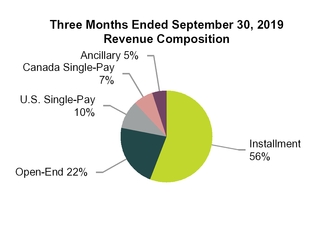

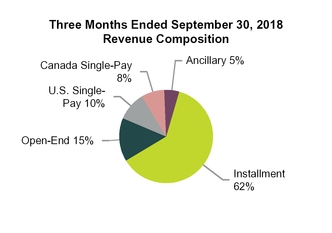

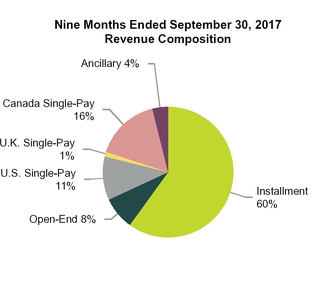

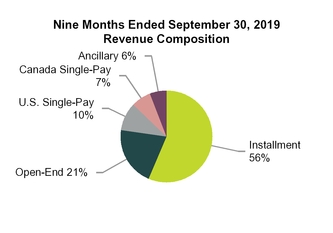

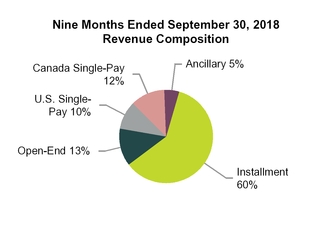

The following table summarizes revenue by product for the periods indicated:indicated (in thousands):

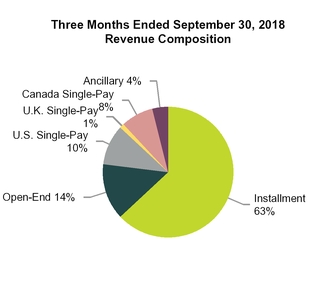

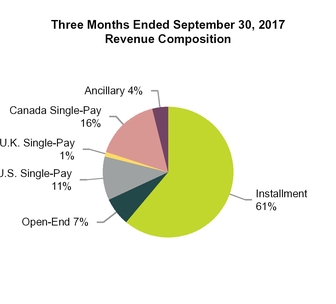

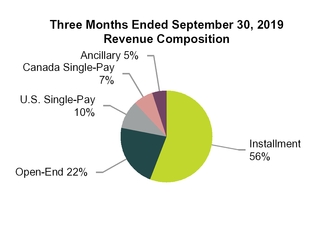

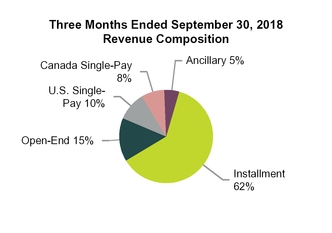

| | | | Three Months Ended September 30, | | Nine Months Ended September 30, | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in thousands) | 2018 | | 2017 | | 2018 | | 2017 | |

| | | | 2019 | | 2018 | | 2019 | | 2018 |

| Unsecured Installment | $ | 148,591 |

| | $ | 128,785 |

| | $ | 405,010 |

| | $ | 343,365 |

| | $ | 137,233 |

| | $ | 137,660 |

| | $ | 395,119 |

| | $ | 377,976 |

|

| Secured Installment | 28,562 |

| | 26,407 |

| | 81,195 |

| | 73,249 |

| | 28,270 |

| | 28,562 |

| | 81,823 |

| | 81,195 |

|

| Open-End | 40,290 |

| | 18,630 |

| | 94,735 |

| | 52,342 |

| | 66,120 |

| | 40,290 |

| | 173,961 |

| | 94,735 |

|

| Single-Pay | 53,205 |

| | 70,895 |

| | 178,512 |

| | 197,926 |

| | 49,312 |

| | 50,614 |

| | 141,605 |

| | 169,296 |

|

| Ancillary | 12,356 |

| | 10,402 |

| | 34,293 |

| | 29,761 |

| | 16,329 |

| | 12,356 |

| | 46,995 |

| | 34,292 |

|

| Total revenue | $ | 283,004 |

| | $ | 255,119 |

| | $ | 793,745 |

| | $ | 696,643 |

| | $ | 297,264 |

| | $ | 269,482 |

| | $ | 839,503 |

| | $ | 757,494 |

|

The following tables summarize Loans receivable by product and the related delinquent loans receivable at September 30, 2018:2019 (in thousands):

| | | | | September 30, 2018 | | September 30, 2019 |

| (in thousands) | | Single-Pay | Unsecured Installment | Secured Installment | Open-End | Total | |

| | | | Single-Pay | Unsecured Installment | Secured Installment | Open-End | Total |

| Current loans receivable | | $ | 80,867 |

| $ | 156,947 |

| $ | 74,017 |

| $ | 184,067 |

| $ | 495,898 |

| | $ | 78,039 |

| $ | 127,952 |

| $ | 72,866 |

| $ | 268,918 |

| $ | 547,775 |

|

| Delinquent loans receivable | | — |

| 54,618 |

| 17,159 |

| — |

| 71,777 |

| | — |

| 46,537 |

| 17,250 |

| 46,053 |

| 109,840 |

|

| Total loans receivable | | 80,867 |

| 211,565 |

| 91,176 |

| 184,067 |

| 567,675 |

| | 78,039 |

| 174,489 |

| 90,116 |

| 314,971 |

| 657,615 |

|

| Less: allowance for losses | | (3,768 | ) | (43,066 | ) | (11,221 | ) | (18,013 | ) | (76,068 | ) | | (5,662 | ) | (38,127 | ) | (10,363 | ) | (54,233 | ) | (108,385 | ) |

| Loans receivable, net | | $ | 77,099 |

| $ | 168,499 |

| $ | 79,955 |

| $ | 166,054 |

| $ | 491,607 |

| | $ | 72,377 |

| $ | 136,362 |

| $ | 79,753 |

| $ | 260,738 |

| $ | 549,230 |

|

| | | | | September 30, 2018 | | September 30, 2019 |

| (in thousands) | | Unsecured Installment | Secured Installment | Total | |

| | | | Unsecured Installment | Secured Installment | Open-End | Total |

| Delinquent loans receivable | | | | | | |

| 0-30 days past due | | $ | 21,374 |

| $ | 8,117 |

| $ | 29,491 |

| | $ | 17,187 |

| $ | 7,456 |

| $ | 18,734 |

| $ | 43,377 |

|

| 31-60 days past due | | 16,542 |

| 4,395 |

| 20,937 |

| | 13,890 |

| 4,711 |

| 13,283 |

| 31,884 |

|

| 61-90 days past due | | 16,702 |

| 4,647 |

| 21,349 |

| |

| 61 + days past due | | | 15,460 |

| 5,083 |

| 14,036 |

| 34,579 |

|

| Total delinquent loans receivable | | $ | 54,618 |

| $ | 17,159 |

| $ | 71,777 |

| | $ | 46,537 |

| $ | 17,250 |

| $ | 46,053 |

| $ | 109,840 |

|

The following tables summarize Loans receivable by product and the related delinquent loans receivable at December 31, 2017:2018 (in thousands):

|

| | | | | | | | | | | | | | | | |

| | | December 31, 2017 |

| (in thousands) | | Single-Pay | Unsecured Installment | Secured Installment | Open-End | Total |

| Current loans receivable | | $ | 99,400 |

| $ | 151,343 |

| $ | 73,165 |

| $ | 47,949 |

| $ | 371,857 |

|

| Delinquent loans receivable | | — |

| 44,963 |

| 16,017 |

| — |

| 60,980 |

|

| Total loans receivable | | 99,400 |

| 196,306 |

| 89,182 |

| 47,949 |

| 432,837 |

|

| Less: allowance for losses | | (5,916 | ) | (43,754 | ) | (13,472 | ) | (6,426 | ) | (69,568 | ) |

| Loans receivable, net | | $ | 93,484 |

| $ | 152,552 |

| $ | 75,710 |

| $ | 41,523 |

| $ | 363,269 |

|

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

|

| | | | | | | | | | |

| | | December 31, 2017 |

| (in thousands) | | Unsecured Installment | Secured Installment | Total |

| Delinquent loans receivable | | | |

|

|

| 0-30 days past due | | $ | 18,358 |

| $ | 8,116 |

| $ | 26,474 |

|

| 31-60 days past due | | 12,836 |

| 3,628 |

| 16,464 |

|

| 61-90 days past due | | 13,769 |

| 4,273 |

| 18,042 |

|

| Total delinquent loans receivable | | $ | 44,963 |

| $ | 16,017 |

| $ | 60,980 |

|

The following tables summarize loans guaranteed by us under our CSO programs and the related delinquent receivables at September 30, 2018:

|

| | | | | | | | | | |

| | | September 30, 2018 |

| (in thousands) | | Unsecured Installment | Secured Installment | Total |

| Current loans receivable guaranteed by the Company | | $ | 63,688 |

| $ | 2,425 |

| $ | 66,113 |

|

| Delinquent loans receivable guaranteed by the Company | | 12,119 |

| 593 |

| 12,712 |

|

| Total loans receivable guaranteed by the Company | | 75,807 |

| 3,018 |

| 78,825 |

|

| Less: CSO guarantee liability | | (12,750 | ) | (493 | ) | (13,243 | ) |

| Loans receivable guaranteed by the Company, net | | $ | 63,057 |

| $ | 2,525 |

| $ | 65,582 |

|

|

| | | | | | | | | | |

| | | September 30, 2018 |

| (in thousands) | | Unsecured Installment | Secured Installment | Total |

| Delinquent loans receivable | | | |

|

|

| 0-30 days past due | | $ | 10,419 |

| $ | 462 |

| $ | 10,881 |

|

| 31-60 days past due | | 1,077 |

| 65 |

| 1,142 |

|

| 61-90 days past due | | 623 |

| 66 |

| 689 |

|

| Total delinquent loans receivable | | $ | 12,119 |

| $ | 593 |

| $ | 12,712 |

|

The following tables summarize loans guaranteed by us under our CSO programs and the related delinquent receivables at December 31, 2017:

|

| | | | | | | | | | |

| | | December 31, 2017 |

| (in thousands) | | Unsecured Installment | Secured Installment | Total |

| Current loans receivable guaranteed by the Company | | $ | 62,676 |

| $ | 3,098 |

| $ | 65,774 |

|

| Delinquent loans receivable guaranteed by the Company | | 12,480 |

| 537 |

| 13,017 |

|

| Total loans receivable guaranteed by the Company | | 75,156 |

| 3,635 |

| 78,791 |

|

| Less: CSO guarantee liability | | (17,073 | ) | (722 | ) | (17,795 | ) |

| Loans receivable guaranteed by the Company, net | | $ | 58,083 |

| $ | 2,913 |

| $ | 60,996 |

|

|

| | | | | | | | | | | | | | | | |

| | | December 31, 2018 |

| | | Single-Pay | Unsecured Installment | Secured Installment | Open-End | Total |

| Current loans receivable | | $ | 80,823 |

| $ | 141,316 |

| $ | 75,583 |

| $ | 207,333 |

| $ | 505,055 |

|

| Delinquent loans receivable | | — |

| 49,087 |

| 17,389 |

| — |

| 66,476 |

|

| Total loans receivable | | 80,823 |

| 190,403 |

| 92,972 |

| 207,333 |

| 571,531 |

|

| Less: allowance for losses | | (4,189 | ) | (37,716 | ) | (12,191 | ) | (19,901 | ) | (73,997 | ) |

| Loans receivable, net | | $ | 76,634 |

| $ | 152,687 |

| $ | 80,781 |

| $ | 187,432 |

| $ | 497,534 |

|

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

| | | | | December 31, 2017 | | December 31, 2018 |

| (in thousands) | | Unsecured Installment | Secured Installment | Total | |

| | | | Unsecured Installment | Secured Installment | Total |

| Delinquent loans receivable | | | | |

|

|

| 0-30 days past due | | $ | 10,477 |

| $ | 459 |

| $ | 10,936 |

| | $ | 17,850 |

| $ | 7,870 |

| $ | 25,720 |

|

| 31-60 days past due | | 1,364 |

| 41 |

| 1,405 |

| | 14,705 |

| 4,725 |

| 19,430 |

|

| 61-90 days past due | | 639 |

| 37 |

| 676 |

| |

| 61 + days past due | | | 16,532 |

| 4,794 |

| 21,326 |

|

| Total delinquent loans receivable | | $ | 12,480 |

| $ | 537 |

| $ | 13,017 |

| | $ | 49,087 |

| $ | 17,389 |

| $ | 66,476 |

|

The following tables summarize loans guaranteed by the Company under CSO programs and the related delinquent receivables at September 30, 2019 (in thousands):

|

| | | | | | | | | | |

| | | September 30, 2019 |

| | | Unsecured Installment | Secured Installment | Total |

| Current loans receivable guaranteed by the Company | | $ | 58,862 |

| $ | 1,966 |

| $ | 60,828 |

|

| Delinquent loans receivable guaranteed by the Company | | 11,842 |

| 396 |

| 12,238 |

|

| Total loans receivable guaranteed by the Company | | 70,704 |

| 2,362 |