8

| Nine Months Ended September 30, | |||||||

| 2019 | 2018 | ||||||

| Cash flows from operating activities | |||||||

| Net income from continuing operations | $ | 74,327 | $ | 1,041 | |||

| Adjustments to reconcile net income to net cash provided by continuing operating activities: | |||||||

| Depreciation and amortization | 14,180 | 13,628 | |||||

| Provision for loan losses | 338,262 | 290,922 | |||||

| Amortization of debt issuance costs and bond discount | 2,273 | 2,923 | |||||

| Deferred income tax (benefit) expense | (3,147 | ) | 3,005 | ||||

| Loss on disposal of property and equipment | 47 | 640 | |||||

| Loss on extinguishment of debt | — | 80,883 | |||||

| Loss from equity method investment | 5,132 | — | |||||

| Share-based compensation | 7,587 | 6,112 | |||||

| Changes in operating assets and liabilities: | |||||||

| Accrued interest on loans receivable | (11,446 | ) | (5,986 | ) | |||

| Prepaid expenses and other assets | 14,275 | 2,695 | |||||

| Other assets | (8,439 | ) | (2,458 | ) | |||

| Accounts payable and accrued liabilities | 13,596 | (4,862 | ) | ||||

| Deferred revenue | (533 | ) | (1,984 | ) | |||

| Income taxes payable | 25,117 | 326 | |||||

| Income taxes receivable | 5,598 | (12,908 | ) | ||||

| Accrued interest | (15,303 | ) | (18,060 | ) | |||

| Other liabilities | 2,767 | 1,162 | |||||

| Net cash provided by continuing operating activities | 464,293 | 357,079 | |||||

| Net cash (used in) provided by discontinued operating activities | (504 | ) | 5,562 | ||||

| Net cash provided by operating activities | 463,789 | 362,641 | |||||

| Cash flows from investing activities | |||||||

| Purchase of property, equipment and software | (8,667 | ) | (8,030 | ) | |||

| Loans receivable originated or acquired | (1,369,644 | ) | (1,624,881 | ) | |||

| Loans receivable repaid | 995,291 | 1,212,446 | |||||

| Investments in Cognical Holdings, Inc. ("Zibby") | (8,168 | ) | (958 | ) | |||

| Net cash used in continuing investing activities | (391,188 | ) | (421,423 | ) | |||

| Net cash used in discontinued investing activities | (14,213 | ) | (24,481 | ) | |||

| Net cash used in investing activities | (405,401 | ) | (445,904 | ) | |||

| Cash flows from financing activities | |||||||

| Net proceeds from issuance of common stock | — | 11,549 | |||||

| Proceeds from Non-Recourse U.S. SPV facility | — | 17,000 | |||||

| Payments on Non-Recourse U.S. SPV facility | — | (61,590 | ) | ||||

| Proceeds from Non-Recourse Canada SPV facility | 15,992 | 89,949 | |||||

| Payments on Non-Recourse Canada SPV facility | (24,835 | ) | — | ||||

| Payments on 12.00% Senior Secured Notes | — | (605,000 | ) | ||||

| Proceeds from 8.25% Senior Secured Notes | — | 690,000 | |||||

| Debt issuance costs paid | (198 | ) | (17,517 | ) | |||

| Proceeds from credit facilities | 179,811 | 65,169 | |||||

| Payments on credit facilities | (174,811 | ) | (36,169 | ) | |||

| Payments on subordinated stockholder debt | (2,252 | ) | — | ||||

| Payments of call premiums from early debt extinguishments | — | (63,350 | ) | ||||

| Proceeds from exercise of stock options | 87 | 408 | |||||

| Payments to net share settle restricted stock units vesting | (110 | ) | — | ||||

| Repurchase of common stock | (52,172 | ) | — | ||||

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(dollars in thousands, unaudited)

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the unaudited Condensed Consolidated Balance Sheets as of September 30, 2020 and 2019 to the cash, cash equivalents and restricted cash used in the Statement of Cash Flows:

Net cash (used in) provided by financing activities (1) | (58,488 | ) | 90,449 | ||||

| Effect of exchange rate changes on cash and restricted cash | 1,204 | (4,080 | ) | ||||

| Net increase in cash and restricted cash | 1,104 | 3,106 | |||||

| Cash and restricted cash at beginning of period | 99,857 | 174,491 | |||||

| Cash and restricted cash at end of period | 100,961 | 177,597 | |||||

| Less: Cash and restricted cash of discontinued operations at end of period | — | 11,303 | |||||

| Cash and restricted cash of continuing operations at end of period | $ | 100,961 | $ | 166,294 | |||

| (1) Financing activities include continuing operations only, and were not impacted by discontinued operations | |||||||

| September 30, | ||||||||||||||

| 2020 | 2019 | |||||||||||||

| Cash and cash equivalents | $ | 207,071 | $ | 62,207 | ||||||||||

| Restricted cash (includes restricted cash of consolidated VIEs of $33,696 and $21,897 as of September 30, 2020 and September 30, 2019, respectively) | 62,527 | 38,754 | ||||||||||||

| Total cash, cash equivalents and restricted cash used in the Statement of Cash Flows | $ | 269,598 | $ | 100,961 | ||||||||||

See accompanying Notes to unaudited Condensed Consolidated Financial Statements.

9

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND NATURE OF OPERATIONS

Nature of Operations and Basis of Presentation

The terms “CURO" and the “Company” refer to CURO Group Holdings Corp. and its wholly-owned subsidiaries as a consolidated entity, except where otherwise stated.

CURO is a growth-oriented, technology-enabled, highly-diversified consumer finance company serving a wide range of underbankednon-prime consumers in the United States ("U.S."), Canada and, through February 25, 2019, the U.K.United Kingdom.

The Company has prepared the accompanying unaudited Condensed Consolidated Financial Statements ("Condensed Consolidated Financial Statements") in accordance with accounting principles generally accepted in the United States of America (“US GAAP”),U.S. GAAP, and with the accounting policies described in its Annual Report on2019 Form 10-K for the year ended December 31, 2018 filed with the Securities and Exchange Commission (the "SEC") on March 18, 2019 ("2018 Form 10-K"). Operating10-K. Interim results for the three and nine month periods ended September 30, 2019of operations are not necessarily indicative of the results that might be expected for any otherfuture interim periodperiods or for the fiscal year ending December 31, 2019.2020.

Certain information and note disclosures normally included in annual financial statements prepared in accordance with USU.S. GAAP have been condensed or omitted, although the Company believes that the disclosures are adequate to enable a reasonable understanding of the information presented. Additionally, in September 2018, and subsequently expanded in June 2019, the SEC changed the definition of a smaller reporting company ("SRC"). The change in definition ofCompany qualifies as an SRC, which allows more registrants to qualifyit to report information under scaledreduced SEC disclosure requirements. SRC status is determined on an annual basis as of the last business day of the most recently completed second fiscal quarter. Under these rules, CUROthe Company met the definition of an SRC as of June 30, 2019. Refer to "--FASB Definition2020, and it will reevaluate its status as of an SRC as related to the CECL standard and evaluation of the impact of the CECL standard" for information regarding the impact on the Company of meeting the definition of an SRC.June 30, 2021.

The unaudited Condensed Consolidated Financial Statements and the accompanying notes reflect all adjustments (consisting only of adjustments of a normal and recurring nature) which are, in the opinion of management, necessary to present fairly the Company's results of operations, financial position and cash flows for the periods presented. On February 25,

COVID-19

The COVID-19 pandemic, which surfaced in late 2019 and spread worldwide, including to the U.S. and Canada, continues to cause global uncertainty. Macroeconomic conditions, in general, and the Company's United Kingdom ("U.K.") segment,operations have been significantly affected by COVID-19 and there continues to be no reliable estimates of how long the pandemic will last or the scope or magnitude of its near-term or long-term impacts. Resurgences of the pandemic in various states and provinces in which the Company operates also adds uncertainty as definedjurisdictions establish or re-institute protocols to lessen the burden of these cases, as described further below. In recent months, efforts to produce a vaccine and more effective treatments for those that have been infected by ASC 280, was placed into administration, resultingCOVID-19 have progressed rapidly. However, it is not possible to predict if a viable vaccine will in fact be developed, the timing of any such vaccine, and the timing and ability to scale such a vaccine for the general population.

Federal, state/provincial, and local governments continue to monitor COVID-19 cases and resurgences. Decrees were issued by regional governmental entities prohibiting certain businesses from continuing to operate and certain classes of workers from reporting to work during the height of the pandemic or in cases of resurgences. Although CURO's operations are considered essential financial service under federal guidelines and most local regulations in both the U.S. and Canada, the Company experienced a decline in product demand as a result of the macroeconomic conditions, particularly in the treatmentsecond quarter of it as discontinued operations per ASC 205-20. Throughout this Quarterly Report on Form 10-Q ("Form 10-Q"), current and prior-period financial information presents2020, which reflected the U.K. segment as discontinued operations as required. For further information about the placementfirst full quarter of the segment into administration, referpandemic's impact in both countries. During the quarter ended September 30, 2020, CURO experienced a modest sequential increase in demand for its loan products as the effect of government stimulus programs in both countries subsided. The extent of the impact of COVID-19 on the Company's business is highly uncertain and difficult to "--Naturepredict, as information is rapidly evolving with respect to the duration and severity of Operations" below.

As a provider of an essential service, the Company remains focused on protecting the health and well-being of its employees, customers and the communities in which it operates, as well as assuring the continuity of its business operations. While CURO continues serving its customers through both store and online channels, store hours are reduced, enhanced cleaning protocols for all facilities are in place, and social distancing guidelines are in effect to aid in combating the spread of the pandemic.

10

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

U.S. Response to COVID-19

On March 27, 2020, the president of the United States signed the CARES Act into law. The CARES Act was intended to respond to the COVID-19 pandemic and its impact on the economy, public health, state and local governments, individuals, and businesses. The CARES Act also provides supplemental appropriations for federal agencies to respond to the COVID-19 pandemic.

The CARES Act modified the limitation on business interest expense and net operating loss provisions, and provided a payment delay of employer payroll taxes incurred after the date of enactment. The Company expects to delay payment of the Company's portion of the employees' Social Security payroll taxes, otherwise due in 2020 with 50% due by December 31, 2021 and the remaining 50% due by December 31, 2022.

The CARES Act also included two provisions that directly impacted the demand for the Company's loan products as well as its customers’ ability to make payments on their existing loans. The CARES Act included one-time payments of up to $1,200 per adult for individuals whose income was less than $99,000 (or $198,000 for tax joint filers), $500 per child under 17 years old, and up to $3,400 for a family of four if certain eligibility criteria were met. The CARES Act also provided unemployment benefit expansion, including (i) an additional $600 federal stimulus payment automatically added to each week of state benefits received between March 29 and July 25, 2020; (ii) expanded pandemic unemployment assistance coverage to self-employed workers, independent contractors, people with limited employment history and people who had used all of their regular unemployment insurance benefits; and (iii) pandemic emergency unemployment compensation, which extends unemployment insurance benefits from 26 weeks to 39 weeks within a 12-month benefit year.

With the expiration of the $600 federal stimulus payment on July 25, 2020, the president signed an executive order to extend unemployment benefits with an additional $300 per week from the federal government, which is subject to state-by-state implementation efforts. Although the $300 benefit was expected to remain through the end of 2020, most states exhausted the available funds under this plan by October 2020. However, four states in which CURO operates, (Nevada, Kansas, Virginia and Wisconsin), have yet to distribute additional funds under this executive order.

Canada Response to COVID-19

On March 18, 2020, the Canadian government announced a set of pandemic measures as part of the Government of Canada’s COVID-19 Economic Response Plan. This plan included several provisions that directly impacted the demand for the Company's products as well as its customers’ ability to make payments on their existing loans, including (i) the Canada Emergency Response Benefit, which provides a $2,000 benefit every four weeks for 24 weeks to eligible workers who become unemployed or under-employed as a result of COVID-19; (ii) a $300 per child Canada Child Benefit paid on May 20, 2020; (iii) a one-time special payment through Canada’s Goods and Services Tax credit for low and modest-income families that averages $400 for individuals and $600 for couples; and (iv) temporary wage increases for low-income essential workers funded at the federal level but disbursed at the provincial level. The Canada Emergency Response Benefit plan expired on September 26, 2020.

Under the Economic Response Plan, the Canadian government also expanded its Employment Insurance Program ("EI Program"), which provides up to $500 per week of temporary income support to unemployed workers while looking for employment by extending the period of time to determine if sufficient hours were worked to be eligible for this program. The expanded program remains active.

The Economic Response Plan also includes the Canada Recovery Benefit program, which provides $500 per week for up to 26 weeks for workers who have stopped working or had their income reduced by at least 50% due to COVID-19, and who are not necessarily indicative of results that may be expected for future interim periods oreligible for the year ending December 31, 2019.EI Program. This program remains active. Canadian citizens may apply for up to a total of 13 eligibility periods (26 weeks) between September 27, 2020 and September 25, 2021.

Principles of Consolidation

The unaudited Condensed Consolidated Financial Statements include the accounts of CURO and its wholly-owned subsidiaries. Intercompany transactions and balances have been eliminated in consolidation.

11

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

Ad Astra Acquisition

On January 3, 2020, the Company acquired 100% of the outstanding stock of Ad Astra, a related party, for $14.4 million, net of cash received. Prior to the acquisition, Ad Astra was the Company's exclusive provider of third-party collection services for owned and managed loans in the U.S. that are in later-stage delinquency. Ad Astra, now a wholly-owned subsidiary, is included in the unaudited Condensed Consolidated Financial Statements. Prior to the acquisition, all costs related to Ad Astra were included in "Other costs of providing services." Following the acquisition, operating costs for Ad Astra are included within "Corporate, district and other expenses," consistent with presentation of other internal collection costs. See Note 17, "Acquisition" for further information.

U.K. Segment Placed into Administration

On February 25, 2019, the Company placed its U.K. segment into administration, which resulted in the treatment of the U.K. segment as discontinued operations for all periods presented. Throughout this Form 10-Q, current and prior period financial information is presented on a continuing operations basis, excluding the results and positions of the U.K. segment. See Note 15, "Discontinued Operations" for additional information.

Equity InvestmentSecurity Investments in Unconsolidated EntityKatapult

Katapult is a privately-owned lease-to-own platform for online, brick and mortar and omni-channel retailers. Katapult provides the retailers' customers with payment options in store or via the Katapult link on a retailer's website.

During the ninethree months ended September 30, 2019, the Company invested an additional $6.6 million in Cognical Holdings, Inc. ("Zibby"), offset by a $3.7 million carrying value adjustment2020, as a result of additional investments, the additional investment.Company had a change in accounting methodology for its investments in preferred stock of Katapult from the equity method to the measurement alternative under ASC 321 for investments without a readily determinable fair value. As a result, these investments were reclassified from the equity method to investment at cost minus impairment. Other investments are considered in-substance common stock and continue to be accounted for under the equity method of accounting as of September 30, 2019,2020. The Company recognized 42.5% of Katapult's earnings for the quarter ended September 30, 2020 under the equity method of accounting, which is the Company's proportionate share recognized on a two-month lag. The Company owned 42.3% of Zibby.records both the equity method investment and the investment at cost minus impairment in "Investments" on the unaudited Condensed Consolidated Balance Sheets. See Note 8 - "Fair, "Fair Value Measurements"Measurements" for additional detail on Zibby's fair value considerations forregarding the nine months ended September 30, 2019.Company's investment in Katapult.

Use of Estimates

The preparation of the unaudited Condensed Consolidated Financial Statements in conformity with USU.S. GAAP requires management to make estimates and assumptions, including those impacted by COVID-19, that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements. EstimatesSome estimates may also affect the reported amounts of revenues and expenses during the periods reported. Some of the significantpresented. Significant estimates that the Company made in the accompanying unaudited Condensed Consolidated Financial Statements include allowances for loan losses, certain assumptions related to equity investments, goodwill and intangibles, accruals related to self-insurance, credit services organization ("CSO")CSO liability for losses and estimated tax liabilities. Actual results may differ from those estimates.

The Company records its allowance for loan losses comparedrelated to TDRs by discounting the estimated cash flows associated with the respective TDR at the effective interest rate immediately after the loan modification and records any difference between the discounted cash flows and the carrying value as an allowance adjustment. A loan that has been classified as a TDR remains so classified until the loan is paid off or charged off. A TDR is charged off consistent with the Company's policies for the related gross loans receivable balances that include accrued interest.

loan product. For additional information on the Company's loss recognition policy, see the Company's 2019 Form 10-K.

12

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

Loans Receivable on a Non-Accrual Basis

The Company has revisedmay place loans receivable on nonaccrual status due to statutory requirements or at management’s judgment if the timely collection of principal and interest becomes uncertain. After a loan is placed on nonaccrual status, no further interest is accrued. Loans are not typically returned to accrual status and thus remain on nonaccrual status until they are paid or charged off. Payments are applied initially to any outstanding past due loan balances prior to current loan balances. The Company's policy for determining past due status is consistent with that of the Company's accrual loans, depending on the product.

Goodwill

The annual impairment review for goodwill, performed annually as of October 1, consists of performing a qualitative assessment to determine whether it is more likely than not that a reporting unit’s fair value is less than its Condensed Consolidated Financial Statementscarrying amount, as a basis in turn for determining whether or not further testing is required. If the Company determines, on the basis of qualitative factors, that it is more likely than not that the fair value of the reporting unit is less than the carrying amount, the Company will then apply a two-step process of (i) determining the fair value of the reporting unit and (ii) comparing it to the carrying value of the net assets allocated to the reporting unit. When performing the two-step process, if the fair value of the reporting unit exceeds its carrying value, no further analysis or write-down of goodwill is required. In the event the estimated fair value of a reporting unit is less than the carrying value, the Company would recognize an impairment loss equal to such excess, which could significantly and adversely impact reported results of operations and stockholders’ equity. The Company may elect to bypass the qualitative assessment and proceed directly to the two-step process, for any reporting unit, in any period. The Company can resume the qualitative assessment for any reporting unit in any subsequent period.

During the fourth quarter of 2019, the Company performed a quantitative assessment for the U.S. and Canada reporting units. Management concluded that the estimated fair values of these 2 reporting units were greater than their respective carrying values. During the three and nine months ended September 30, 2018 presented in this Form 10-Q. A summary2020, the Company did 0t record an impairment related to goodwill. The Company has not yet completed its annual impairment review for goodwill, performed as of the correction follows (in thousands):October 1.

| Nine Months Ended September 30, 2018 | ||||

As Reported:(1) | ||||

| Net cash used in continuing operating activities | $ | (55,356 | ) | |

| Net cash used in continuing investing activities | (8,988 | ) | ||

| As Corrected: | ||||

| Net cash provided by continuing operating activities | 357,079 | |||

| Net cash used in continuing investing activities | (421,423 | ) | ||

| (1) "As reported" balances include amounts from continuing operations historically presented within these captions. | ||||

Recently Adopted Accounting Pronouncements

ASU 2016-022018-15

In February 2016, the Financial Accounting Standards Board ("FASB") established Topic 842, Leases, by issuing ASU No. 2016-02, which requires lessees to recognize leases on the balance sheet and disclose key information about leasing arrangements. The Company adopted the standard as of January 1, 2019 using the alternative modified retrospective method, also known as the transition relief method, permitted under ASU 2018-11, which allows companies to not recast comparative periods in the period of adoption. The Company elected the package of practical expedients permitted under the transition guidance which, among other things, permits companies to not reassess prior conclusions on lease identification, lease classification and initial direct costs. The Company also elected to combine lease and non-lease components and to exclude short-term leases, defined as having an initial term of 12 months or less, from the Condensed Consolidated Balance Sheets. The Company did not elect the hindsight practical expedient.

ASU 2018-13

In August 2018, the FASB issued ASU 2018-13, Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”), which amends ASC 820, Fair Value Measurement. ASU 2018-13 modifies the disclosure requirements for fair value measurements by removing, modifying or adding certain disclosures. The Company adopted ASU 2018-13 as of January 1, 2020, which did not have a material impact on the unaudited Condensed Consolidated Financial Statements.

Recently Issued Accounting Pronouncements Not Yet Adopted

ASU 2016-13

In June 2016, the FASB issued ASU 2016-13, “Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments,” and subsequent amendments to the guidance: ASU 2018-19 in November 2018, ASU 2019-04 in April 2019, and ASU 2019-05 in May 2019.2019, ASU 2019-10 and -11 in November 2019, and ASU 2020-02 in February

13

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

2020. The amended standard as amended, changes how entities will measure credit losses for most financial assets and certain other instruments that are not measured at fair value through net income. The standard will replace the current “incurred loss” approach with an “expected loss” model for instruments measured at amortized cost. For available-for-sale debt securities, entities will be required to record allowances rather than reduce the carrying amount, as they currently do under the

other-than-temporary impairment model. The standard also simplifies the accounting model for purchased credit-impaired debt securities and loans. The amendment will affect loans, debt securities, trade receivables, net investments in leases, off-balance sheet credit exposures, reinsurance receivables, and any other financial assets not excluded from the scope that have the contractual right to receive cash. ASU 2019-04 clarifies that equity instruments without readily determinable fair values for which an entity has elected the measurement alternative should be remeasured to fair value as of the date that an observable transaction occurred. ASU 2019-05 provides an option to irrevocably elect to measure certain individual financial assets at fair value instead of amortized cost. ASU 2019-10 amends the mandatory effective date for ASU 2016-13. The amendments are effective for fiscal years beginning after December 15, 2022 for entities that qualify as an SRC, for which the Company currently qualifies. ASU 2019-11 provides clarity and improves the codification to ASU 2016-13. The amendments should be applied on either a prospective transition or modified-retrospective approach depending on the subtopic. As issued, ASU 2016-13 is effective for annual periods beginning after December 15, 2019, and interim periods therein. Early adoption is permitted for annual periods beginning after December 15, 2018, and interim periods therein.permitted. The Company is evaluating its alternatives with respect to the available accounting methods under ASU 2016‑13,2016-13, including the fair value option. If the fair value option is not utilized, adoption of ASU 2016-13 will increase the allowance for credit losses, with a resulting negative adjustment to retained earnings on the date of adoption. Additionally, as disclosed below in "--FASB Definition of an SRC as related to the CECL standard and evaluation of the impact of the CECL standard", theThe Company expects to deferdeferred the adoption of ASU 2016-13 until at least January 1, 2021.as permitted under ASU 2019-10. The Company is currently assessing the impact that adoption of ASU 2016-13 will have on its unaudited Condensed Consolidated Financial Statements.

ASU 2019-052020-01

In MayJanuary 2020, the FASB issued ASU 2020-01, Investments-Equity Securities (Topic 321), Investments-Equity Method and Joint Ventures (Topic 323), and Derivatives and Hedging (Topic 815) (ASU 2020-01). ASU 2020-01 clarifies the interaction of the accounting for equity securities under Topic 321, the accounting for equity method investments in Topic 323, and the accounting for certain forward contracts and purchased options in Topic 815. ASU 2020-01 is effective for fiscal years beginning after December 15, 2020, and interim periods within those fiscal years. The Company is currently assessing the impact that adoption of ASU 2020-01 will have on its unaudited Condensed Consolidated Financial Statements.

ASU 2020-04

In March 2020, the FASB issued ASU 2020-04, “Reference Rate Reform - Facilitation of the Effects of Reference Rate Reform on Financial Reporting.” This ASU provides temporary optional expedients and exceptions to U.S. GAAP guidance on contract modifications and hedge accounting to ease the financial reporting burdens of the expected market transition from LIBOR and other interbank offered rates to alternative reference rates, such as the Secured Overnight Financing Rate. Entities can elect not to apply certain modification accounting requirements to contracts affected by this reference rate reform, if certain criteria are met. An entity that makes this election would not have to remeasure the contracts at the modification date or reassess a previous accounting determination. Entities also can elect various optional expedients that would allow them to continue applying hedge accounting for hedging relationships affected by reference rate reform, if certain criteria are met. The guidance is effective upon issuance and generally can be applied through December 31, 2022. The Company is currently assessing the impact that adoption of ASU 2020-04 will have on its unaudited Condensed Consolidated Financial Statements.

ASU 2019-12

In December 2019, the FASB issued ASU 2019-05, Financial Instruments - Credit Losses2019-12, “Income Taxes (Topic 326), which amends740): Simplifying the Accounting for Income Taxes” (Topic 740). The ASU 2016-13intends to allow companiessimplify various aspects related to irrevocably elect, upon adoption of ASU 2016-13, the fair value option on financial instruments that (i) were previously recorded at amortized costaccounting for income taxes and (ii) are within the scope of ASC 326-20 if the instruments are eligible for the fair value option under ASC 825-10. The fair value option election does not apply to held-to-maturity debt securities. Entities are required to make this election on an instrument-by-instrument basis. ASU 2019-05’s amendments should be applied on a modified-retrospective basis by means of a cumulative-effect adjustmentremoves certain exceptions to the opening balancegeneral principles in Topic 740. Additionally, the ASU clarifies and amends existing guidance to improve consistent application of retained earnings in the statement of financial position asits requirements. The amendments of the date that an entity adopted the amendments in ASU 2016-13. For entities that have adopted ASU 2016-13, the amendments in ASU 2019-05 are effective for fiscal years beginning after December 15, 2019, including2020, and interim periods therein. An entity may early adoptwithin those fiscal years. Early adoption is permitted. The adoption of ASU 2019-12 is not expected to have a material impact on the ASU in any interim period after its issuance if the entity has adopted ASU 2016-13. For all other entities, the effective date will be the same as the effective date for ASU 2016-13. The Company expects to elect the option to defer adoption to a later effective date, as further described below in "--FASB Definition of an SRC as related to the CECL standard and evaluation of the impact of the CECL standard." The Company is currently evaluating the methods and impact of adopting this new standard on theCompany's unaudited Condensed Consolidated Financial Statements.

14

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

NOTE 2 - VARIABLE INTEREST ENTITIES

The carrying amounts of consolidated VIEs' assets and liabilities associated with the VIE subsidiaries were as follows (in thousands):

| September 30, 2020 | December 31, 2019 | |||||||||||||

| Assets | ||||||||||||||

| Restricted cash | $ | 33,696 | $ | 17,427 | ||||||||||

| Loans receivable less allowance for loan losses | 274,059 | 220,067 | ||||||||||||

| Prepaid expenses and other | 1,165 | 0 | ||||||||||||

| Deferred tax assets | 100 | 0 | ||||||||||||

| Total Assets | $ | 309,020 | $ | 237,494 | ||||||||||

| Liabilities | ||||||||||||||

| Accounts payable and accrued liabilities | $ | 26,665 | $ | 13,462 | ||||||||||

| Deferred revenue | 137 | 46 | ||||||||||||

| Accrued interest | 983 | 871 | ||||||||||||

| Intercompany payable | 35,181 | 69,639 | ||||||||||||

| Debt | 119,894 | 112,221 | ||||||||||||

| Total Liabilities | $ | 182,860 | $ | 196,239 | ||||||||||

NOTE 3 – LOANS RECEIVABLE AND REVENUE

| September 30, 2019 | December 31, 2018 | |||||||

| Assets | ||||||||

| Restricted cash | $ | 21,897 | $ | 12,840 | ||||

| Gross loans receivable less allowance for loan losses | 206,158 | 136,187 | ||||||

| Total Assets | $ | 228,055 | $ | 149,027 | ||||

| Liabilities | ||||||||

| Accounts payable and accrued liabilities | $ | 7,259 | $ | 4,980 | ||||

| Deferred revenue | 44 | 40 | ||||||

| Accrued interest | 777 | 831 | ||||||

| Intercompany payable | 93,671 | 44,330 | ||||||

| Long-term debt | 102,483 | 107,479 | ||||||

| Total Liabilities | $ | 204,234 | $ | 157,660 | ||||

CURO's customers and overall credit performance have been impacted in 2020 as a result of COVID-19. During the third quarter of 2020, consumer demand gradually increased as stay-at-home and self-quarantine orders were lifted in some jurisdictions in response to lower COVID-19 infection rates and the expiration of governmental stimulus programs. Ongoing impacts from and risks related to COVID-19 have caused continued uncertainty regarding the performance of NCOs over the loss-development period as of September 30, 2020. The Company has maintained its historical allowance approach, but has adjusted estimates for changes in past-due gross loans receivable due to market conditions leading up to and at September 30, 2020 caused by COVID-19. The estimates and assumptions used to determine an appropriate allowance for loan losses and liability for losses on CSO lender-owned consumer loans are those that are available through the filing of this Form 10-Q and which are indicative of conditions as of September 30, 2020.

As a result of COVID-19, the Company enhanced its Customer Care Program and began modifying loans for borrowers that experienced financial distress, as discussed in more detail in Note 1, "Summary of Significant Accounting Policies and Nature of Operations" and the "TDR Loans Receivable" tables below.

15

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

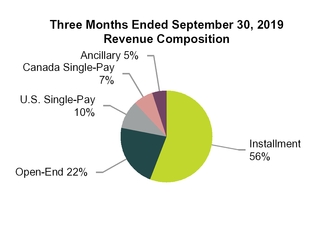

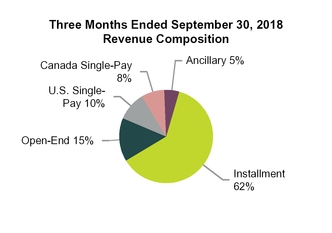

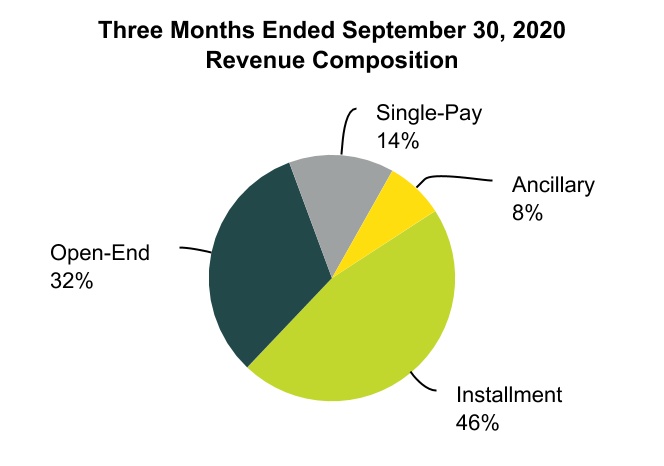

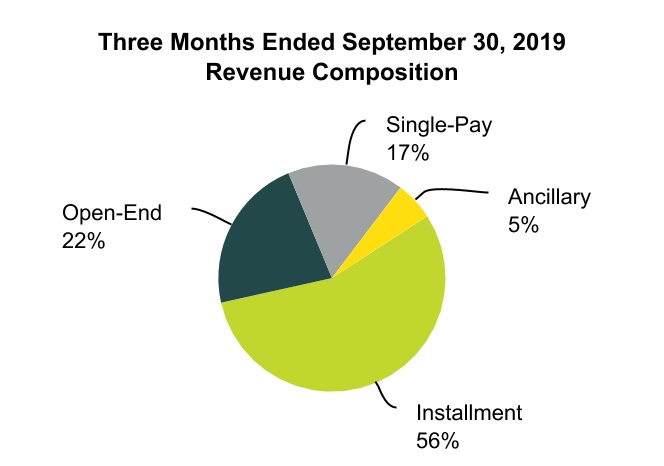

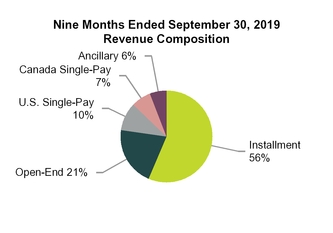

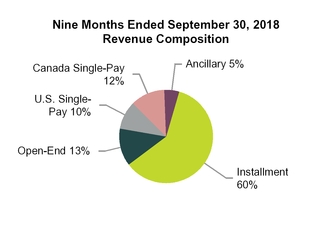

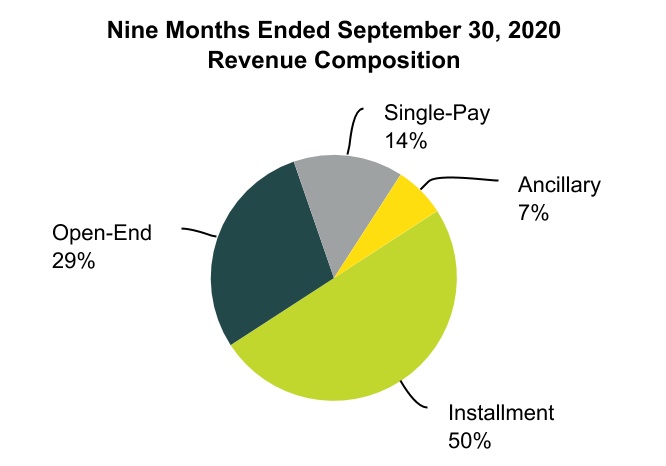

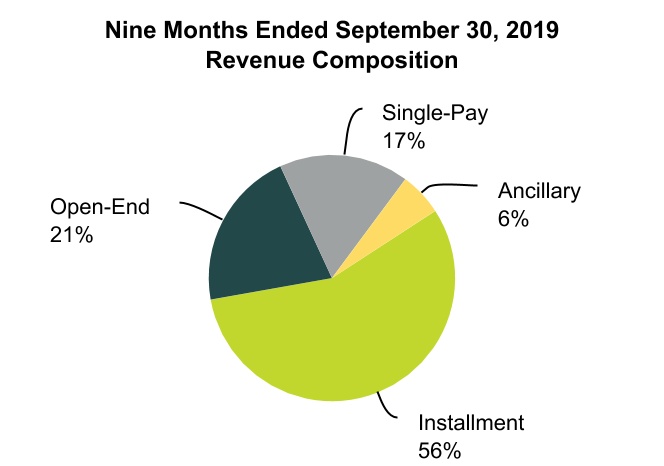

The following table summarizes revenue by product for the periods indicated (in thousands):

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||||||

| Unsecured Installment | $ | 67,408 | $ | 137,233 | $ | 260,328 | $ | 395,119 | ||||||||||||||||||

| Secured Installment | 16,692 | 28,270 | 62,379 | 81,823 | ||||||||||||||||||||||

| Open-End | 58,711 | 66,120 | 186,429 | 173,961 | ||||||||||||||||||||||

| Single-Pay | 25,084 | 49,312 | 92,973 | 141,605 | ||||||||||||||||||||||

| Ancillary | 14,108 | 16,329 | 43,209 | 46,995 | ||||||||||||||||||||||

Total revenue(1) | $ | 182,003 | $ | 297,264 | $ | 645,318 | $ | 839,503 | ||||||||||||||||||

| (1) Includes revenue from CSO programs of $36.7 million and $72.8 million for the three months ended September 30, 2020 and 2019, respectively, and $142.5 million and $199.9 million for the nine months ended September 30, 2020 and 2019, respectively. | ||||||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2019 | 2018 | 2019 | 2018 | |||||||||||||

| Unsecured Installment | $ | 137,233 | $ | 137,660 | $ | 395,119 | $ | 377,976 | ||||||||

| Secured Installment | 28,270 | 28,562 | 81,823 | 81,195 | ||||||||||||

| Open-End | 66,120 | 40,290 | 173,961 | 94,735 | ||||||||||||

| Single-Pay | 49,312 | 50,614 | 141,605 | 169,296 | ||||||||||||

| Ancillary | 16,329 | 12,356 | 46,995 | 34,292 | ||||||||||||

| Total revenue | $ | 297,264 | $ | 269,482 | $ | 839,503 | $ | 757,494 | ||||||||

The following tables summarize Loansloans receivable by product and the related delinquent loans receivable at September 30, 2019 (in thousands):

| September 30, 2020 | ||||||||||||||||||||

Single-Pay(1) | Unsecured Installment | Secured Installment | Open-End | Total | ||||||||||||||||

| Current loans receivable | $ | 41,274 | $ | 67,017 | $ | 41,433 | $ | 290,427 | $ | 440,151 | ||||||||||

| Delinquent loans receivable | 0 | 17,942 | 7,542 | 31,807 | 57,291 | |||||||||||||||

| Total loans receivable | 41,274 | 84,959 | 48,975 | 322,234 | 497,442 | |||||||||||||||

| Less: allowance for losses | (3,197) | (18,859) | (7,109) | (51,417) | (80,582) | |||||||||||||||

| Loans receivable, net | $ | 38,077 | $ | 66,100 | $ | 41,866 | $ | 270,817 | $ | 416,860 | ||||||||||

| (1) Of the $41.3 million of Single-Pay receivables, $10.1 million relate to mandated extended payment options for certain Canada Single-Pay loans. | ||||||||||||||||||||

| September 30, 2019 | ||||||||||||||||

| Single-Pay | Unsecured Installment | Secured Installment | Open-End | Total | ||||||||||||

| Current loans receivable | $ | 78,039 | $ | 127,952 | $ | 72,866 | $ | 268,918 | $ | 547,775 | ||||||

| Delinquent loans receivable | — | 46,537 | 17,250 | 46,053 | 109,840 | |||||||||||

| Total loans receivable | 78,039 | 174,489 | 90,116 | 314,971 | 657,615 | |||||||||||

| Less: allowance for losses | (5,662 | ) | (38,127 | ) | (10,363 | ) | (54,233 | ) | (108,385 | ) | ||||||

| Loans receivable, net | $ | 72,377 | $ | 136,362 | $ | 79,753 | $ | 260,738 | $ | 549,230 | ||||||

| September 30, 2020 | |||||||||||||||||

| Unsecured Installment | Secured Installment | Open-End | Total | ||||||||||||||

| Delinquent loans receivable | |||||||||||||||||

| 0-30 days past due | $ | 7,098 | $ | 3,576 | $ | 14,988 | $ | 25,662 | |||||||||

| 31-60 days past due | 4,758 | 1,883 | 7,505 | 14,146 | |||||||||||||

| 61 + days past due | 6,086 | 2,083 | 9,314 | 17,483 | |||||||||||||

| Total delinquent loans receivable | $ | 17,942 | $ | 7,542 | $ | 31,807 | $ | 57,291 | |||||||||

| December 31, 2019 | ||||||||||||||||||||

Single-Pay(1) | Unsecured Installment | Secured Installment | Open-End | Total | ||||||||||||||||

| Current loans receivable | $ | 81,447 | $ | 117,682 | $ | 70,565 | $ | 285,452 | $ | 555,146 | ||||||||||

| Delinquent loans receivable | 0 | 43,100 | 17,510 | 50,072 | 110,682 | |||||||||||||||

| Total loans receivable | 81,447 | 160,782 | 88,075 | 335,524 | 665,828 | |||||||||||||||

| Less: allowance for losses | (5,869) | (35,587) | (10,305) | (55,074) | (106,835) | |||||||||||||||

| Loans receivable, net | $ | 75,578 | $ | 125,195 | $ | 77,770 | $ | 280,450 | $ | 558,993 | ||||||||||

| (1) Of the $81.4 million of Single-Pay receivables, $22.4 million relate to mandated extended payment options for certain Canada Single-Pay loans. | ||||||||||||||||||||

16

| September 30, 2019 | |||||||||||||

| Unsecured Installment | Secured Installment | Open-End | Total | ||||||||||

| Delinquent loans receivable | |||||||||||||

| 0-30 days past due | $ | 17,187 | $ | 7,456 | $ | 18,734 | $ | 43,377 | |||||

| 31-60 days past due | 13,890 | 4,711 | 13,283 | 31,884 | |||||||||

| 61 + days past due | 15,460 | 5,083 | 14,036 | 34,579 | |||||||||

| Total delinquent loans receivable | $ | 46,537 | $ | 17,250 | $ | 46,053 | $ | 109,840 | |||||

| December 31, 2018 | ||||||||||||||||

| Single-Pay | Unsecured Installment | Secured Installment | Open-End | Total | ||||||||||||

| Current loans receivable | $ | 80,823 | $ | 141,316 | $ | 75,583 | $ | 207,333 | $ | 505,055 | ||||||

| Delinquent loans receivable | — | 49,087 | 17,389 | — | 66,476 | |||||||||||

| Total loans receivable | 80,823 | 190,403 | 92,972 | 207,333 | 571,531 | |||||||||||

| Less: allowance for losses | (4,189 | ) | (37,716 | ) | (12,191 | ) | (19,901 | ) | (73,997 | ) | ||||||

| Loans receivable, net | $ | 76,634 | $ | 152,687 | $ | 80,781 | $ | 187,432 | $ | 497,534 | ||||||

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

| December 31, 2019 | |||||||||||||||||

| Unsecured Installment | Secured Installment | Open-End | Total | ||||||||||||||

| Delinquent loans receivable | |||||||||||||||||

| 0-30 days past due | $ | 15,369 | $ | 8,039 | $ | 21,823 | $ | 45,231 | |||||||||

| 31-60 days past due | 12,403 | 4,885 | 13,191 | 30,479 | |||||||||||||

| 61 + days past due | 15,328 | 4,586 | 15,058 | 34,972 | |||||||||||||

| Total delinquent loans receivable | $ | 43,100 | $ | 17,510 | $ | 50,072 | $ | 110,682 | |||||||||

| December 31, 2018 | ||||||||||

| Unsecured Installment | Secured Installment | Total | ||||||||

| Delinquent loans receivable | ||||||||||

| 0-30 days past due | $ | 17,850 | $ | 7,870 | $ | 25,720 | ||||

| 31-60 days past due | 14,705 | 4,725 | 19,430 | |||||||

| 61 + days past due | 16,532 | 4,794 | 21,326 | |||||||

| Total delinquent loans receivable | $ | 49,087 | $ | 17,389 | $ | 66,476 | ||||

The following tables summarize loans guaranteedGuaranteed by the Company under CSO programs and the related delinquent receivables at September 30, 2019 (in thousands):

| September 30, 2020 | ||||||||||||||||||||

| Unsecured Installment | Secured Installment | Total | ||||||||||||||||||

| Current loans receivable Guaranteed by the Company | $ | 32,869 | $ | 786 | $ | 33,655 | ||||||||||||||

| Delinquent loans receivable Guaranteed by the Company | 5,953 | 160 | 6,113 | |||||||||||||||||

| Total loans receivable Guaranteed by the Company | 38,822 | 946 | 39,768 | |||||||||||||||||

| Less: Liability for losses on CSO lender-owned consumer loans | (6,130) | (68) | (6,198) | |||||||||||||||||

| Loans receivable Guaranteed by the Company, net | $ | 32,692 | $ | 878 | $ | 33,570 | ||||||||||||||

| September 30, 2019 | ||||||||||

| Unsecured Installment | Secured Installment | Total | ||||||||

| Current loans receivable guaranteed by the Company | $ | 58,862 | $ | 1,966 | $ | 60,828 | ||||

| Delinquent loans receivable guaranteed by the Company | 11,842 | 396 | 12,238 | |||||||

| Total loans receivable guaranteed by the Company | 70,704 | 2,362 | 73,066 | |||||||

| Less: Liability for losses on CSO lender-owned consumer loans | (10,181 | ) | (68 | ) | (10,249 | ) | ||||

| Loans receivable guaranteed by the Company, net | $ | 60,523 | $ | 2,294 | $ | 62,817 | ||||

| September 30, 2020 | ||||||||||||||

| Unsecured Installment | Secured Installment | Total | ||||||||||||

| Delinquent loans receivable | ||||||||||||||

| 0-30 days past due | $ | 5,404 | $ | 111 | $ | 5,515 | ||||||||

| 31-60 days past due | 433 | 9 | 442 | |||||||||||

| 61+ days past due | 116 | 40 | 156 | |||||||||||

| Total delinquent loans receivable | $ | 5,953 | $ | 160 | $ | 6,113 | ||||||||

| December 31, 2019 | ||||||||||||||||||||

| Unsecured Installment | Secured Installment | Total | ||||||||||||||||||

| Current loans receivable Guaranteed by the Company | $ | 61,840 | $ | 1,944 | $ | 63,784 | ||||||||||||||

| Delinquent loans receivable Guaranteed by the Company | 12,477 | 392 | 12,869 | |||||||||||||||||

| Total loans receivable Guaranteed by the Company | 74,317 | 2,336 | 76,653 | |||||||||||||||||

| Less: Liability for losses on CSO lender-owned consumer loans | (10,553) | (70) | (10,623) | |||||||||||||||||

| Loans receivable Guaranteed by the Company, net | $ | 63,764 | $ | 2,266 | $ | 66,030 | ||||||||||||||

| December 31, 2019 | ||||||||||||||

| Unsecured Installment | Secured Installment | Total | ||||||||||||

| Delinquent loans receivable | ||||||||||||||

| 0-30 days past due | $ | 10,392 | $ | 326 | $ | 10,718 | ||||||||

| 31-60 days past due | 1,256 | 40 | 1,296 | |||||||||||

| 61 + days past due | 829 | 26 | 855 | |||||||||||

| Total delinquent loans receivable | $ | 12,477 | $ | 392 | $ | 12,869 | ||||||||

17

| September 30, 2019 | ||||||||||

| Unsecured Installment | Secured Installment | Total | ||||||||

| Delinquent loans receivable | ||||||||||

| 0-30 days past due | $ | 9,859 | $ | 330 | $ | 10,189 | ||||

| 31-60 days past due | 1,229 | 41 | 1,270 | |||||||

| 61+ days past due | 754 | 25 | 779 | |||||||

| Total delinquent loans receivable | $ | 11,842 | $ | 396 | $ | 12,238 | ||||

| December 31, 2018 | ||||||||||

| Unsecured Installment | Secured Installment | Total | ||||||||

| Current loans receivable guaranteed by the Company | $ | 65,743 | $ | 2,504 | $ | 68,247 | ||||

| Delinquent loans receivable guaranteed by the Company | 11,708 | 446 | 12,154 | |||||||

| Total loans receivable guaranteed by the Company | 77,451 | 2,950 | 80,401 | |||||||

| Less: Liability for losses on CSO lender-owned consumer loans | (11,582 | ) | (425 | ) | (12,007 | ) | ||||

| Loans receivable guaranteed by the Company, net | $ | 65,869 | $ | 2,525 | $ | 68,394 | ||||

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

| December 31, 2018 | ||||||||||

| Unsecured Installment | Secured Installment | Total | ||||||||

| Delinquent loans receivable | ||||||||||

| 0-30 days past due | $ | 9,684 | $ | 369 | $ | 10,053 | ||||

| 31-60 days past due | 1,255 | 48 | 1,303 | |||||||

| 61 + days past due | 769 | 29 | 798 | |||||||

| Total delinquent loans receivable | $ | 11,708 | $ | 446 | $ | 12,154 | ||||

The following table summarizes activity in the allowance for loan losses during the three months ended September 30, 2019 (in thousands):

| Three Months Ended September 30, 2019 | ||||||||||||||||||

| Single-Pay | Unsecured Installment | Secured Installment | Open-End | Other | Total | |||||||||||||

| Balance, beginning of period | $ | 4,941 | $ | 35,223 | $ | 9,996 | $ | 51,717 | $ | — | $ | 101,877 | ||||||

| Charge-offs | (40,512 | ) | (34,252 | ) | (10,592 | ) | (31,993 | ) | (1,382 | ) | (118,731 | ) | ||||||

| Recoveries | 26,599 | 5,279 | 2,445 | 3,791 | 845 | 38,959 | ||||||||||||

| Net charge-offs | (13,913 | ) | (28,973 | ) | (8,147 | ) | (28,202 | ) | (537 | ) | (79,772 | ) | ||||||

| Provision for losses | 14,736 | 31,891 | 8,514 | 31,220 | 537 | 86,898 | ||||||||||||

| Effect of foreign currency translation | (102 | ) | (14 | ) | — | (502 | ) | — | (618 | ) | ||||||||

| Balance, end of period | $ | 5,662 | $ | 38,127 | $ | 10,363 | $ | 54,233 | $ | — | $ | 108,385 | ||||||

| Allowance for loan losses as a percentage of gross loan receivables | 7.3 | % | 21.9 | % | 11.5 | % | 17.2 | % | N/A | 16.5 | % | |||||||

| Three Months Ended September 30, 2019 | |||||||||

| Unsecured Installment | Secured Installment | Total | |||||||

| Balance, beginning of period | $ | 9,433 | $ | 71 | $ | 9,504 | |||

| Charge-offs | (43,072 | ) | (888 | ) | (43,960 | ) | |||

| Recoveries | 7,156 | 580 | 7,736 | ||||||

| Net charge-offs | (35,916 | ) | (308 | ) | (36,224 | ) | |||

| Provision for losses | 36,664 | 305 | 36,969 | ||||||

| Balance, end of period | $ | 10,181 | $ | 68 | $ | 10,249 | |||

| Three Months Ended September 30, 2020 | ||||||||||||||||||||

| Single-Pay | Unsecured Installment | Secured Installment | Open-End | Other | Total | |||||||||||||||

| Allowance for loan losses: | ||||||||||||||||||||

| Balance, beginning of period | $ | 2,802 | $ | 18,798 | $ | 7,883 | $ | 47,319 | $ | 0 | $ | 76,802 | ||||||||

| Charge-offs | (21,473) | (14,781) | (6,648) | (22,781) | (972) | (66,655) | ||||||||||||||

| Recoveries | 17,034 | 5,186 | 2,635 | 4,618 | 498 | 29,971 | ||||||||||||||

| Net charge-offs | (4,439) | (9,595) | (4,013) | (18,163) | (474) | (36,684) | ||||||||||||||

| Provision for losses | 4,799 | 9,647 | 3,239 | 21,655 | 474 | 39,814 | ||||||||||||||

| Effect of foreign currency translation | 35 | 9 | 0 | 606 | 0 | 650 | ||||||||||||||

| Balance, end of period | $ | 3,197 | $ | 18,859 | $ | 7,109 | $ | 51,417 | $ | 0 | $ | 80,582 | ||||||||

| Liability for losses on CSO lender-owned consumer loans: | ||||||||||||||||||||

| Balance, beginning of period | $ | 0 | $ | 5,128 | $ | 36 | $ | 0 | $ | 0 | $ | 5,164 | ||||||||

| Increase in liability | 0 | (1,002) | (32) | 0 | 0 | (1,034) | ||||||||||||||

| Balance, end of period | $ | — | $ | 6,130 | $ | 68 | $ | 0 | $ | 0 | $ | 6,198 | ||||||||

| Three Months Ended September 30, 2019 | ||||||||||||||||||||

| Single-Pay | Unsecured Installment | Secured Installment | Open-End | Other | Total | |||||||||||||||

| Allowance for loan losses: | ||||||||||||||||||||

| Balance, beginning of period | $ | 4,941 | $ | 35,223 | $ | 9,996 | $ | 51,717 | $ | 0 | $ | 101,877 | ||||||||

| Charge-offs | (40,512) | (34,252) | (10,592) | (31,993) | (1,382) | (118,731) | ||||||||||||||

| Recoveries | 26,599 | 5,279 | 2,445 | 3,791 | 845 | 38,959 | ||||||||||||||

| Net charge-offs | (13,913) | (28,973) | (8,147) | (28,202) | (537) | (79,772) | ||||||||||||||

| Provision for losses | 14,736 | 31,891 | 8,514 | 31,220 | 537 | 86,898 | ||||||||||||||

| Effect of foreign currency translation | (102) | (14) | 0 | (502) | 0 | (618) | ||||||||||||||

| Balance, end of period | $ | 5,662 | $ | 38,127 | $ | 10,363 | $ | 54,233 | $ | 0 | $ | 108,385 | ||||||||

| Liability for losses on CSO lender-owned consumer loans: | ||||||||||||||||||||

| Balance, beginning of period | $ | 0 | $ | 9,433 | $ | 71 | $ | 0 | $ | 0 | $ | 9,504 | ||||||||

| (Increase) / decrease in liability | 0 | (748) | 3 | 0 | 0 | (745) | ||||||||||||||

| Balance, end of period | $ | 0 | $ | 10,181 | $ | 68 | $ | 0 | $ | 0 | $ | 10,249 | ||||||||

18

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

| Nine Months Ended September 30, 2020 | ||||||||||||||||||||

| Single-Pay | Unsecured Installment | Secured Installment | Open-End | Other | Total | |||||||||||||||

| Allowance for loan losses: | ||||||||||||||||||||

| Balance, beginning of period | $ | 5,869 | $ | 35,587 | $ | 10,305 | $ | 55,074 | $ | 0 | $ | 106,835 | ||||||||

| Charge-offs | (83,162) | (83,468) | (31,505) | (104,074) | (3,000) | (305,209) | ||||||||||||||

| Recoveries | 68,804 | 17,982 | 8,505 | 17,129 | 1,475 | 113,895 | ||||||||||||||

| Net charge-offs | (14,358) | (65,486) | (23,000) | (86,945) | (1,525) | (191,314) | ||||||||||||||

| Provision for losses | 11,850 | 48,766 | 19,804 | 83,987 | 1,525 | 165,932 | ||||||||||||||

| Effect of foreign currency translation | (164) | (8) | 0 | (699) | 0 | (871) | ||||||||||||||

| Balance, end of period | $ | 3,197 | $ | 18,859 | $ | 7,109 | $ | 51,417 | $ | 0 | $ | 80,582 | ||||||||

| Liability for losses on CSO lender-owned consumer loans: | ||||||||||||||||||||

| Balance, beginning of period | $ | 0 | $ | 10,553 | $ | 70 | $ | 0 | $ | 0 | $ | 10,623 | ||||||||

| Decrease in liability | 0 | 4,423 | 2 | 0 | 0 | 4,425 | ||||||||||||||

| Balance, end of period | $ | 0 | $ | 6,130 | $ | 68 | $ | 0 | $ | 0 | $ | 6,198 | ||||||||

| Nine Months Ended September 30, 2019 | ||||||||||||||||||||

| Single-Pay | Unsecured Installment | Secured Installment | Open-End | Other | Total | |||||||||||||||

| Allowance for loan losses: | ||||||||||||||||||||

| Balance, beginning of period | $ | 4,189 | $ | 37,716 | $ | 12,191 | $ | 19,901 | $ | 0 | $ | 73,997 | ||||||||

| Charge-offs | (112,792) | (115,825) | (33,558) | (66,319) | (4,075) | (332,569) | ||||||||||||||

| Recoveries | 78,811 | 16,963 | 8,261 | 14,487 | 2,565 | 121,087 | ||||||||||||||

| Net charge-offs | (33,981) | (98,862) | (25,297) | (51,832) | (1,510) | (211,482) | ||||||||||||||

| Provision for losses | 35,450 | 99,250 | 23,469 | 85,910 | 1,510 | 245,589 | ||||||||||||||

| Effect of foreign currency translation | 4 | 23 | 0 | 254 | 0 | 281 | ||||||||||||||

| Balance, end of period | $ | 5,662 | $ | 38,127 | $ | 10,363 | $ | 54,233 | $ | 0 | $ | 108,385 | ||||||||

| Liability for losses on CSO lender-owned consumer loans: | ||||||||||||||||||||

| Balance, beginning of period | $ | 0 | $ | 11,582 | $ | 425 | $ | 0 | $ | 0 | $ | 12,007 | ||||||||

| Decrease in liability | 0 | 1,401 | 357 | 0 | 0 | 1,758 | ||||||||||||||

| Balance, end of period | $ | 0 | $ | 10,181 | $ | 68 | $ | 0 | $ | 0 | $ | 10,249 | ||||||||

As of September 30, 2020, Installment and Open-End loans classified as nonaccrual were $5.4 million and $4.1 million, respectively. As of December 31, 2019, Installment and Open-End loans classified as nonaccrual were $16.6 million and $7.9 million, respectively. The Company's loans receivable inherently considers nonaccrual loans in its estimate of the allowance for loan losses as delinquencies are a primary input into the Company's roll rate-based model.

19

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

| Three Months Ended September 30, 2019 | ||||||||||||||||||

| Single-Pay | Unsecured Installment | Secured Installment | Open-End | Other | Total | |||||||||||||

| Balance, beginning of period | $ | 4,941 | $ | 44,656 | $ | 10,067 | $ | 51,717 | $ | — | $ | 111,381 | ||||||

| Charge-offs | (40,512 | ) | (77,324 | ) | (11,480 | ) | (31,993 | ) | (1,382 | ) | (162,691 | ) | ||||||

| Recoveries | 26,599 | 12,435 | 3,025 | 3,791 | 845 | 46,695 | ||||||||||||

| Net charge-offs | (13,913 | ) | (64,889 | ) | (8,455 | ) | (28,202 | ) | (537 | ) | (115,996 | ) | ||||||

| Provision for losses | 14,736 | 68,555 | 8,819 | 31,220 | 537 | 123,867 | ||||||||||||

| Effect of foreign currency translation | (102 | ) | (14 | ) | — | (502 | ) | — | (618 | ) | ||||||||

| Balance, end of period | $ | 5,662 | $ | 48,308 | $ | 10,431 | $ | 54,233 | $ | — | $ | 118,634 | ||||||

The following table summarizes activitybelow presents TDRs included in gross loans receivable and the impairment included in the allowance for loan losses (in thousands):

As of September 30, 2020 | ||||||||||||||||||||

| Current TDR gross receivables | $ | 14,085 | ||||||||||||||||||

| Delinquent TDR gross receivables | 6,547 | |||||||||||||||||||

| Total TDR gross receivables | 20,632 | |||||||||||||||||||

| Less: Impairment included in the allowance for loan losses | (6,622) | |||||||||||||||||||

| Less: Additional allowance | (2,086) | |||||||||||||||||||

| Outstanding TDR receivables, net of impairment | $ | 11,924 | ||||||||||||||||||

There were 0 TDR's as of December 31, 2019.

The tables below reflect new loans modified and classified as TDRs during the periods presented (in thousands):

| Three Months Ended September 30, 2020 | Nine Months Ended September 30, 2020 | |||||||||||||||||||||||||

| Pre-modification TDR loans receivable | $ | 9,007 | $ | 37,948 | ||||||||||||||||||||||

| Post-modification TDR loans receivable | 8,186 | 34,195 | ||||||||||||||||||||||||

| Total concessions included in gross charge-offs | $ | 821 | $ | 3,753 | ||||||||||||||||||||||

There were $5.1 million and $6.0 million of loans classified as TDRs that were charged off and included as a reduction in the allowance for loan losses during the three months ended September 30, 2018 (in thousands):

| Three Months Ended September 30, 2018 | ||||||||||||||||||

| Single-Pay | Unsecured Installment | Secured Installment | Open-End | Other | Total | |||||||||||||

| Balance, beginning of period | $ | 3,604 | $ | 30,291 | $ | 10,386 | $ | 9,717 | $ | — | $ | 53,998 | ||||||

| Charge-offs | (40,753 | ) | (32,115 | ) | (11,188 | ) | (32,770 | ) | (1,494 | ) | (118,320 | ) | ||||||

| Recoveries | 27,861 | 4,807 | 2,325 | 9,191 | 931 | 45,115 | ||||||||||||

| Net charge-offs | (12,892 | ) | (27,308 | ) | (8,863 | ) | (23,579 | ) | (563 | ) | (73,205 | ) | ||||||

| Provision for losses | 12,757 | 32,946 | 9,698 | 31,686 | 563 | 87,650 | ||||||||||||

| Effect of foreign currency translation | (179 | ) | 231 | — | 189 | — | 241 | |||||||||||

| Balance, end of period | $ | 3,290 | $ | 36,160 | $ | 11,221 | $ | 18,013 | $ | — | $ | 68,684 | ||||||

| Allowance for loan losses as a percentage of gross loan receivables | 4.3 | % | 19.5 | % | 12.3 | % | 9.8 | % | N/A | 12.8 | % | |||||||

| Three Months Ended September 30, 2018 | |||||||||

| Unsecured Installment | Secured Installment | Total | |||||||

| Balance, beginning of period | $ | 11,193 | $ | 426 | $ | 11,619 | |||

| Charge-offs | (44,896 | ) | (1,088 | ) | (45,984 | ) | |||

| Recoveries | 6,901 | 665 | 7,566 | ||||||

| Net charge-offs | (37,995 | ) | (423 | ) | (38,418 | ) | |||

| Provision for losses | 39,552 | 490 | 40,042 | ||||||

| Balance, end of period | $ | 12,750 | $ | 493 | $ | 13,243 | |||

| Three Months Ended September 30, 2018 | ||||||||||||||||||

| Single-Pay | Unsecured Installment | Secured Installment | Open-End | Other | Total | |||||||||||||

| Balance, beginning of period | $ | 3,604 | $ | 41,484 | $ | 10,812 | $ | 9,717 | $ | — | $ | 65,617 | ||||||

| Charge-offs | (40,753 | ) | (77,011 | ) | (12,276 | ) | (32,770 | ) | (1,494 | ) | (164,304 | ) | ||||||

| Recoveries | 27,861 | 11,708 | 2,990 | 9,191 | 931 | 52,681 | ||||||||||||

| Net charge-offs | (12,892 | ) | (65,303 | ) | (9,286 | ) | (23,579 | ) | (563 | ) | (111,623 | ) | ||||||

| Provision for losses | 12,757 | 72,498 | 10,188 | 31,686 | 563 | 127,692 | ||||||||||||

| Effect of foreign currency translation | (179 | ) | 231 | — | 189 | — | 241 | |||||||||||

| Balance, end of period | $ | 3,290 | $ | 48,910 | $ | 11,714 | $ | 18,013 | $ | — | $ | 81,927 | ||||||

| Nine Months Ended September 30, 2019 | ||||||||||||||||||

| Single-Pay | Unsecured Installment | Secured Installment | Open-End | Other | Total | |||||||||||||

| Balance, beginning of period | $ | 4,189 | $ | 37,716 | $ | 12,191 | $ | 19,901 | $ | — | $ | 73,997 | ||||||

| Charge-offs | (112,792 | ) | (115,825 | ) | (33,558 | ) | (66,319 | ) | (4,075 | ) | (332,569 | ) | ||||||

| Recoveries | 78,811 | 16,963 | 8,261 | 14,487 | 2,565 | 121,087 | ||||||||||||

| Net charge-offs | (33,981 | ) | (98,862 | ) | (25,297 | ) | (51,832 | ) | (1,510 | ) | (211,482 | ) | ||||||

| Provision for losses | 35,450 | 99,250 | 23,469 | 85,910 | 1,510 | 245,589 | ||||||||||||

| Effect of foreign currency translation | 4 | 23 | — | 254 | — | 281 | ||||||||||||

| Balance, end of period | $ | 5,662 | $ | 38,127 | $ | 10,363 | $ | 54,233 | $ | — | $ | 108,385 | ||||||

| Allowance for loan losses as a percentage of gross loan receivables | 7.3 | % | 21.9 | % | 11.5 | % | 17.2 | % | N/A | 16.5 | % | |||||||

The following table summarizes activity inbelow presents the liabilityCompany's average outstanding TDR loans receivable, interest income recognized on TDR loans and number of TDR loans for losses on CSO lender-owned consumer loans during the three and nine months ended September 30, 2019 (in2020 (dollars in thousands):

| Nine Months Ended September 30, 2019 | |||||||||

| Unsecured Installment | Secured Installment | Total | |||||||

| Balance, beginning of period | $ | 11,582 | $ | 425 | $ | 12,007 | |||

| Charge-offs | (118,617 | ) | (2,647 | ) | (121,264 | ) | |||

| Recoveries | 24,794 | 2,039 | 26,833 | ||||||

| Net charge-offs | (93,823 | ) | (608 | ) | (94,431 | ) | |||

| Provision for losses | 92,422 | 251 | 92,673 | ||||||

| Balance, end of period | $ | 10,181 | $ | 68 | $ | 10,249 | |||

| Three Months Ended September 30, 2020 | Nine Months Ended September 30, 2020 | |||||||||||||||||||||||||

Average outstanding TDR loans receivable (1) | $ | 20,484 | $ | 21,011 | ||||||||||||||||||||||

| Interest income recognized | 6,510 | 10,907 | ||||||||||||||||||||||||

| Number of TDR loans | 5,361 | 22,190 | ||||||||||||||||||||||||

| (1) For the three months ended September 30, 2020, the average is calculated using a simple average of the ending TDR balance as of June 30, 2020 and September 30, 2020. For the nine months ended September 30, 2020, the average is calculated based on the amount immediately after the loan was classified as a TDR and the ending TDR balance as of September 30, 2020 as there were 0 TDRs prior to April 1, 2020. | ||||||||||||||||||||||||||

| Nine Months Ended September 30, 2019 | ||||||||||||||||||

| Single-Pay | Unsecured Installment | Secured Installment | Open-End | Other | Total | |||||||||||||

| Balance, beginning of period | $ | 4,189 | $ | 49,298 | $ | 12,616 | $ | 19,901 | $ | — | $ | 86,004 | ||||||

| Charge-offs | (112,792 | ) | (234,442 | ) | (36,205 | ) | (66,319 | ) | (4,075 | ) | (453,833 | ) | ||||||

| Recoveries | 78,811 | 41,757 | 10,300 | 14,487 | 2,565 | 147,920 | ||||||||||||

| Net charge-offs | (33,981 | ) | (192,685 | ) | (25,905 | ) | (51,832 | ) | (1,510 | ) | (305,913 | ) | ||||||

| Provision for losses | 35,450 | 191,672 | 23,720 | 85,910 | 1,510 | 338,262 | ||||||||||||

| Effect of foreign currency translation | 4 | 23 | — | 254 | — | 281 | ||||||||||||

| Balance, end of period | $ | 5,662 | $ | 48,308 | $ | 10,431 | $ | 54,233 | $ | — | $ | 118,634 | ||||||

| Nine Months Ended September 30, 2018 | ||||||||||||||||||

| Single-Pay | Unsecured Installment | Secured Installment | Open-End | Other | Total | |||||||||||||

| Balance, beginning of period | $ | 5,204 | $ | 38,977 | $ | 13,472 | $ | 6,426 | $ | — | $ | 64,079 | ||||||

| Charge-offs | (126,328 | ) | (98,946 | ) | (33,755 | ) | (76,926 | ) | (4,474 | ) | (340,429 | ) | ||||||

| Recoveries | 88,945 | 15,110 | 7,487 | 30,451 | 2,728 | 144,721 | ||||||||||||

| Net charge-offs | (37,383 | ) | (83,836 | ) | (26,268 | ) | (46,475 | ) | (1,746 | ) | (195,708 | ) | ||||||

| Provision for losses | 35,750 | 80,904 | 24,017 | 57,962 | 1,746 | 200,379 | ||||||||||||

| Effect of foreign currency translation | (281 | ) | 115 | — | 100 | — | (66 | ) | ||||||||||

| Balance, end of period | $ | 3,290 | $ | 36,160 | $ | 11,221 | $ | 18,013 | $ | — | $ | 68,684 | ||||||

| Allowance for loan losses as a percentage of gross loan receivables | 4.3 | % | 19.5 | % | 12.3 | % | 9.8 | % | N/A | 12.8 | % | |||||||

| Nine Months Ended September 30, 2018 | |||||||||

| Unsecured Installment | Secured Installment | Total | |||||||

| Balance, beginning of period | $ | 17,073 | $ | 722 | $ | 17,795 | |||

| Charge-offs | (119,632 | ) | (3,300 | ) | (122,932 | ) | |||

| Recoveries | 25,227 | 2,610 | 27,837 | ||||||

| Net charge-offs | (94,405 | ) | (690 | ) | (95,095 | ) | |||

| Provision for losses | 90,082 | 461 | 90,543 | ||||||

| Balance, end of period | $ | 12,750 | $ | 493 | $ | 13,243 | |||

| Nine Months Ended September 30, 2018 | ||||||||||||||||||

| Single-Pay | Unsecured Installment | Secured Installment | Open-End | Other | Total | |||||||||||||

| Balance, beginning of period | $ | 5,204 | $ | 56,050 | $ | 14,194 | $ | 6,426 | $ | — | $ | 81,874 | ||||||

| Charge-offs | (126,328 | ) | (218,578 | ) | (37,055 | ) | (76,926 | ) | (4,474 | ) | (463,361 | ) | ||||||

| Recoveries | 88,945 | 40,337 | 10,097 | 30,451 | 2,728 | 172,558 | ||||||||||||

| Net charge-offs | (37,383 | ) | (178,241 | ) | (26,958 | ) | (46,475 | ) | (1,746 | ) | (290,803 | ) | ||||||

| Provision for losses | 35,750 | 170,986 | 24,478 | 57,962 | 1,746 | 290,922 | ||||||||||||

| Effect of foreign currency translation | (281 | ) | 115 | — | 100 | — | (66 | ) | ||||||||||

| Balance, end of period | $ | 3,290 | $ | 48,910 | $ | 11,714 | $ | 18,013 | $ | — | $ | 81,927 | ||||||

NOTE 4 – CREDIT SERVICES ORGANIZATION

The CSO fee receivables under CSO programs were $13.4$4.6 million and $14.3$14.7 million at September 30, 20192020 and December 31, 2018, respectively.2019, respectively, and are reflected in "Prepaid expenses and other" in the unaudited Condensed Consolidated Balance Sheets. The Company bears the risk of loss through its guarantee to purchase specific customer loans that are in default with the lenders. The terms of these loans range up to six months. See Note 1, "Summary of Significant Accounting Policies and Nature of Operations" of the 20182019 Form 10-K for further details of the Company's accounting policy.

As of September 30, 20192020 and December 31, 2018,2019, the incremental maximum amount payable under all such guarantees was $60.4$32.8 million and $66.9$62.7 million, respectively. If the Company is required to pay any portion of the total amount of the loans it has guaranteed, it will attempt to recover some or the entire amount or a portion from the applicable customers. The Company holds no collateral in respect of the guarantees. The Company estimates a liability for losses associated with the guaranty provided to the CSO lenders, using assumptions and methodologies similar to the Allowance for loan losses, which it recognizes for its consumer loans. Liability for incurred losses on CSO loans Guaranteed by the Company was $10.2$6.2 million and $12.0$10.6 million at September 30, 20192020 and December 31, 2018,2019, respectively.

20

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

The Company placed $5.9$4.9 million and $17.2$6.2 million in collateral accounts for the benefit of lenders at September 30, 20192020 and December 31, 2018,2019, respectively, which is reflected in "Prepaid expenses and other" in the unaudited Condensed Consolidated Balance Sheets. The balances required to be maintained in these collateral accounts vary by lender, typically based on a percentage of the outstanding loan balances held by the lender. The percentage of outstanding loan balances required for collateral is negotiated between the Company and each such lender.

Deferred revenue associated with the CSO program was immaterial as of September 30, 2020 and December 31, 2019 and there were no costs to obtain, or costs to fulfill, capitalized under the program. See Note 3, "Loans Receivable and Revenue" for additional information related to loan balances and the revenue recognized under the program.

NOTE 5 – DEBT

Debt consisted of the following (in thousands):

| September 30, 2020 | December 31, 2019 | |||||||||||||

| 8.25% Senior Secured Notes | $ | 679,566 | $ | 678,323 | ||||||||||

| Non-Recourse U.S. SPV Facility | 28,884 | 0 | ||||||||||||

| Non-Recourse Canada SPV Facility | 91,010 | 112,221 | ||||||||||||

| Debt | $ | 799,460 | $ | 790,544 | ||||||||||

| September 30, 2019 | December 31, 2018 | |||||||

| 8.25% Senior Secured Notes (due 2025) | $ | 677,924 | $ | 676,661 | ||||

| Non-Recourse Canada SPV Facility | 102,483 | 107,479 | ||||||

| Senior Revolver | 25,000 | 20,000 | ||||||

| Debt | $ | 805,407 | $ | 804,140 | ||||

8.25% Senior Secured Notes

In August 2018, the Company issued $690.0 million of 8.25% Senior Secured Notes which mature on September 1, 2025 ("8.25% Senior Secured Notes").2025. Interest on the notes is payable semiannually, in arrears, on March 1 and September 1. In connection with the 8.25% Senior Secured Notes, the remaining balance of capitalized financing costs of $12.1$10.4 million, net of amortization, is included in the unaudited Condensed Consolidated Balance Sheets as a component of "Debt." These costs are amortized over the term of the 8.25% Senior Secured Notes as a component of interest expense.

Non-Recourse U.S. SPV Facility

In April 2020, Curo Receivables Finance II, LLC, a bankruptcy-remote special purpose vehicle (the “U.S. SPV Borrower”) and an indirect wholly-owned subsidiary of the Company, entered into the Non-Recourse U.S. SPV Facility with Midtown Madison Management LLC, as administrative agent, and Atalaya Asset Income Fund VI LP, as the initial lender. As of September 30, 2020, the Non-Recourse U.S. SPV Facility provided for $200.0 million of borrowing capacity, which was increased from $100.0 million on July 31, 2020 after obtaining additional commitments.

The proceedsNon-Recourse U.S. SPV Facility is secured by a first lien against all assets of this issuance were usedthe U.S. SPV Borrower. The lenders will make advances against the principal balance of the eligible Installment, Open-End and bank partner loans sold to the U.S. SPV Borrower. Interest accrues at an annual rate of one-month LIBOR (with a floor of 1.65%) plus the lesser of (a) 6.95% and (b) the sum of (i) 6.25% on balances up to redeem$145.5 million, and (ii) 9.75% on balances greater than $145.5 million. The U.S. SPV Borrower will pay the outstanding 12.00% Senior Secured Noteslenders additional interest if it does not borrow minimum specified percentages of CFTC, (ii) to repaythe available commitments and a monthly 0.50% per annum commitment fee on the unused portion of the commitments. The Non-Recourse U.S. SPV Facility may not be prepaid prior to April 8, 2021. Prepayments incur a fee equal to (a) prior to September 8, 2021, 3.0% of the aggregate commitments, (b) thereafter, until March 8, 2022, 2.0% of the aggregate commitments, and (c) thereafter, 0. The Company is currently evaluating the impact of the expected transition from LIBOR to alternative reference rates.

As of September 30, 2020, outstanding indebtednessborrowers under the five-year revolving credit facilityNon-Recourse U.S. SPV Facility were $28.9 million, net of CURO Receivables Finance I, LLC, a wholly-deferred financing costs of $6.3 million. For further information on the Non-Recourse U.S. SPV Facility, refer to Note 2, "Variable Interest Entities."

21

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

Non-Recourse Canada SPV Facility

On August 2, 2018, CURO Canada Receivables Limited Partnership, a newly created, bankruptcy-remote special purpose vehicle (the "Canada SPV Borrower") and a wholly-owned subsidiary, entered into a four-year revolving credit facilitythe Non-Recourse Canada SPV Facility with Waterfall Asset Management, LLC that provided for C$175.0 million of initial borrowing capacity and the ability to expand such capacity up to C$250.0 million ("Non-Recourse Canada SPV Facility").million. The loans bear interest at an annual rate of 6.75% plus the three-month CDOR. The Canada SPV Borrower also pays a 0.50% per annum commitment fee on the unused portion of the commitments. In April 2019, the facility's maturity date was extended one year, to September 2, 2023.

As of September 30, 2019,2020, outstanding borrowings under the Non-Recourse Canada SPV Facility were $102.5$91.0 million, net of deferred financing costs of $3.3$2.1 million. For further information on the Non-Recourse Canada SPV, refer to Note 2, "Variable Interest Entities."

Senior Revolver

The terms of the Senior Revolver require that its outstanding balance be zero0 for at least 30 consecutive days in each calendar year. The Senior Revolver is guaranteed by all subsidiaries that guarantee the 8.25% Senior Secured Notes and is secured by a lien on substantially all assets of CURO and the guarantor subsidiaries that is senior to the lien securing the 8.25% Senior Secured Notes. Additionally, the negative covenants of the Senior Revolver generally conform to the related provisions in the Indenture for the 8.25% Senior Secured Notes. The revolver had an outstanding balance of $25.0 million at September 30, 2019.

The Senior Revolver contains various conditions to borrowing and affirmative, negative and financial maintenance covenants. Certain of the more significant covenants are (i) minimum eligible collateral value, (ii) consolidated interest coverage ratio and (iii) consolidated leverage ratio. The Senior Revolver also contains various events of default, the occurrence of which could result in termination of the lenders’ commitments to lend and the acceleration of all obligations under the Senior Revolver.

Cash Money Revolving Credit Facility

Cash Money Cheque Cashing, Inc., a Canadian subsidiary ("maintains the Cash Money"), maintainsMoney Revolving Credit Facility, a C$10.0 million revolving credit facility with Royal Bank of Canada, (the "Cash Money Revolving Credit Facility"), which provides short-term liquidity required to meet the working capital needs of the Company's Canadian operations. Aggregate draws under the revolving credit facility are limited to the lesser of: (i) the borrowing base, which is defined as athe percentage of cash, deposits in transit and accounts receivable, and (ii) C$10.0 million. As of September 30, 2019,2020, the borrowing capacity under the Cash Money Revolving Credit Facility which was C$9.79.9 million, net of C$0.30.1 million in outstanding stand-by-letters of credit.

The Cash Money Revolving Credit Facility is collateralized by substantially all of Cash Money’s assets and contains various covenants that require, among other things, that the aggregate borrowings outstanding under the facility not exceed the borrowing base, as well as restrictions on the encumbrance of assets and the creation of indebtedness. Borrowings under the Cash Money Revolving Credit Facility bear interest per annum at the prime rate of a Canadian chartered bank plus 1.95%.

The Cash Money Revolving Credit Facility was undrawn at September 30, 2019 and December 31, 2018.2020.

NOTE 6 – SHARE-BASED COMPENSATION

The Company's stockholder-approved 2017 Incentive Plan provides for the issuance of up to 5.0 million shares, subject to certain adjustment provisions,adjustments, which may be issued in the form of stock options, restricted stock awards, restricted stock units (“RSUs”),RSUs, stock appreciation rights, performance awards and other awards that may be settled in or based on common stock. Awards may be granted to officers, employees, consultants and directors. The 2017 Incentive Plan provides that shares of common stock subject to awards granted become available for re-issuance if such awards expire, terminate, are canceled for any reason or are forfeited by the recipient.

22

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

Restricted Stock Units

Grants of time-based RSUs are valued at the date of grant based on the valueclosing market price of common stock and are expensed using the straight-line method over the service period. TheseTime-based RSUs are subject to time-based vesting and typically vest over a three-year period.

Grants of market-based RSUs are valued using the Monte Carlo simulation pricing model. In March 2019, the Company awardedThe market-based RSUs designedgranted to drive the performance of the management team toward achievement of key corporate objectives. The market-based RSUsdate vest after three years depending uponif the Company's total stockholder return over the three-year performance period meets a specified target relative to other companies in its selected peer group. Expense recognition for the market-based awardsRSUs occurs over the service period using the straight-line method.

A summary of the statusactivity of time-based and market-based unvested RSUs as of September 30, 20192020 and changes during the nine months ended September 30, 20192020 are presented in the following table:

| Number of RSUs | ||||||||||||||

| Time-Based | Market-Based | Weighted Average Grant Date Fair Value per Share | ||||||||||||

| December 31, 2019 | 1,061,753 | 394,861 | $ | 11.47 | ||||||||||

| Granted | 679,413 | 368,539 | 10.42 | |||||||||||

| Vested | (308,140) | 0 | 11.34 | |||||||||||

| Forfeited | (24,025) | (4,687) | 11.99 | |||||||||||

| September 30, 2020 | 1,409,001 | 758,713 | $ | 10.97 | ||||||||||

| Number of RSUs | ||||||||

| Time-Based | Market-Based | Weighted Average Grant Date Fair Value per Share | ||||||

| December 31, 2018 | 1,060,350 | — | $ | 14.29 | ||||

| Granted | 598,114 | 397,752 | 10.08 | |||||

| Vested | (83,481 | ) | — | 15.59 | ||||

| Forfeited | (68,778 | ) | — | 14.05 | ||||

| September 30, 2019 | 1,506,205 | 397,752 | $ | 12.04 | ||||