SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

| ☒ | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

☒ Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended June 30, 2020March 31, 2021

| ☐ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

☐ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Commission File Number: 000-52015

Western Capital Resources, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | | 47-0848102 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification Number) |

11550 “I” Street, Suite 150, Omaha, Nebraska 68137

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (402) 551-8888

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| None | N/A | N/A |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Emerging growth company ☐ |

| | | |

| Non-accelerated filer ☑ | Smaller reporting company ☑ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☑

As of AugustMay 14, 2020,2021, the registrant had outstanding 9,134,8899,249,900 shares of common stock, $0.0001 par value per share.

Western Capital Resources, Inc.

Index

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

WESTERN CAPITAL RESOURCES, INC. AND SUBSIDIARIES

CONTENTS

WESTERN CAPITAL RESOURCES, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS |

| | | June 30,

2020 | | | December 31,

2019 | |

| | | (Unaudited) | | | | |

| ASSETS | | | | | | | | |

| | | | | | | | | |

| CURRENT ASSETS | | | | | | | | |

| Cash and cash equivalents | | $ | 24,671,152 | | | $ | 27,132,540 | |

| Short-term investments | | | 26,948,347 | | | | 14,756,665 | |

| Loans receivable (net of allowance for losses of $340,000 and $673,000, respectively) | | | 2,099,121 | | | | 3,860,411 | |

| Accounts receivable (net of allowance for losses of $65,000 and $13,000, respectively) | | | 567,715 | | | | 517,476 | |

| Inventories (net of allowance of $751,000 and $1,065,000, respectively) | | | 7,927,993 | | | | 8,330,691 | |

| Prepaid expenses and other | | | 2,168,917 | | | | 2,679,859 | |

| TOTAL CURRENT ASSETS | | | 64,383,245 | | | | 57,277,642 | |

| | | | | | | | | |

| INVESTMENTS | | | 1,000,000 | | | | 1,500,000 | |

| | | | | | | | | |

| PROPERTY AND EQUIPMENT, net | | | 8,934,805 | | | | 9,725,043 | |

| | | | | | | | | |

| OPERATING LEASE RIGHT-OF-USE ASSETS | | | 10,827,671 | | | | 12,344,894 | |

| | | | | | | | | |

| INTANGIBLE ASSETS, net | | | 3,901,997 | | | | 4,041,650 | |

| | | | | | | | | |

| LOAN RECEIVABLE | | | 715,885 | | | | 694,987 | |

| | | | | | | | | |

| OTHER | | | 509,686 | | | | 525,884 | |

| | | | | | | | | |

| GOODWILL | | | 5,796,528 | | | | 5,796,528 | |

| | | | | | | | | |

| TOTAL ASSETS | | $ | 96,069,817 | | | $ | 91,906,628 | |

| | | | | | | | | |

| LIABILITIES AND EQUITY | | | | | | | | |

| | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | |

| Accounts payable | | $ | 7,095,707 | | | $ | 7,710,222 | |

| Accrued payroll | | | 1,929,018 | | | | 2,572,331 | |

| Current portion operating lease liabilities | | | 4,788,516 | | | | 5,079,745 | |

| Other current liabilities | | | 1,260,648 | | | | 1,276,613 | |

| Income taxes payables | | | 2,225,124 | | | | 243,149 | |

| Current portion notes payable | | | 67,299 | | | | 65,414 | |

| Current portion finance lease obligations | | | — | | | | 1,161 | |

| Contract liabilities | | | 472,371 | | | | 794,830 | |

| TOTAL CURRENT LIABILITIES | | | 17,838,683 | | | | 17,743,465 | |

| | | | | | | | | |

| LONG-TERM LIABILITIES | | | | | | | | |

| Notes payable, net of current portion | | | 985,702 | | | | 1,019,837 | |

| Operating lease liabilities, net of current portion | | | 6,642,294 | | | | 7,444,789 | |

| Deferred income taxes | | | 221,000 | | | | 385,000 | |

| TOTAL LONG-TERM LIABILITIES | | | 7,848,996 | | | | 8,849,626 | |

| | | | | | | | | |

| TOTAL LIABILITIES | | | 25,687,679 | | | | 26,593,091 | |

| | | | | | | | | |

| COMMITMENTS AND CONTINGENCIES (Note 15) | | | — | | | | — | |

| | | | | | | | | |

| EQUITY | | | | | | | | |

| | | | | | | | | |

| WESTERN SHAREHOLDERS’ EQUITY | | | | | | | | |

| Common stock, $0.0001 par value, 12,500,000 shares authorized, 9,134,889 and 9,265,778 shares issued and outstanding as of June 30, 2020 and December 31, 2019, respectively | | | 913 | | | | 927 | |

| Additional paid-in capital | | | 29,031,741 | | | | 29,031,741 | |

| Retained earnings | | | 38,982,780 | | | | 33,706,035 | |

| TOTAL WESTERN SHAREHOLDERS’ EQUITY | | | 68,015,434 | | | | 62,738,703 | |

| | | | | | | | | |

| NONCONTROLLING INTERESTS | | | 2,366,704 | | | | 2,574,834 | |

| | | | | | | | | |

| TOTAL EQUITY | | | 70,382,138 | | | | 65,313,537 | |

| | | | | | | | | |

| TOTAL LIABILITIES AND EQUITY | | $ | 96,069,817 | | | $ | 91,906,628 | |

See notes to condensed consolidated financial statements3

WESTERN CAPITAL RESOURCES, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) |

| | | March 31, 2021 | | | December 31, 2020 | |

| ASSETS | | | | | | |

| | | | | | | |

| CURRENT ASSETS | | | | | | | | |

| Cash and cash equivalents | | $ | 39,291,439 | | | $ | 32,504,803 | |

| Short-term investments | | | 15,408,362 | | | | 17,088,073 | |

| Loans receivable (net of allowance for credit losses of $248,000 and $315,000, respectively) | | | 1,386,460 | | | | 1,941,180 | |

| Accounts receivable (net of allowance for credit losses of $47,000 and $33,000, respectively) | | | 2,688,846 | | | | 1,538,377 | |

| Inventories (less reserve of $1,530,000 and $1,321,000, respectively) | | | 14,737,629 | | | | 11,739,228 | |

| Prepaid income taxes | | | — | | | | 246,560 | |

| Prepaid expenses and other | | | 2,931,963 | | | | 3,096,058 | |

| TOTAL CURRENT ASSETS | | | 76,444,699 | | | | 68,154,279 | |

| | | | | | | | | |

| Investments | | | — | | | | 250,000 | |

| Property and equipment, net | | | 8,341,504 | | | | 8,509,971 | |

| Operating lease right-of-use assets | | | 16,598,436 | | | | 15,751,687 | |

| Intangible assets, net | | | 3,423,595 | | | | 3,585,919 | |

| Deferred income taxes | | | 405,000 | | | | 254,000 | |

| Other loans receivable | | | 370,680 | | | | 368,071 | |

| Other | | | 454,396 | | | | 471,991 | |

| Goodwill | | | 5,796,528 | | | | 5,796,528 | |

| | | | | | | | | |

| TOTAL ASSETS | | $ | 111,834,838 | | | $ | 103,142,446 | |

| | | | | | | | | |

| LIABILITIES AND EQUITY | | | | | | | | |

| | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | |

| Accounts payable | | $ | 11,692,469 | | | $ | 8,492,721 | |

| Accrued payroll | | | 2,212,184 | | | | 3,439,535 | |

| Current portion operating lease liabilities | | | 5,449,362 | | | | 5,111,429 | |

| Other current liabilities | | | 1,485,249 | | | | 1,403,249 | |

| Income taxes payables | | | 1,203,028 | | | | — | |

| Current portion long-term debt | | | 1,508,475 | | | | — | |

| Contract and other liabilities | | | 964,041 | | | | 774,625 | |

| TOTAL CURRENT LIABILITIES | | | 24,514,808 | | | | 19,221,559 | |

| | | | | | | | | |

| LONG-TERM LIABILITIES | | | | | | | | |

| Notes payable, net of current portion | | | 2,000,000 | | | | 3,110,148 | |

| Operating lease liabilities, net of current portion | | | 11,655,351 | | | | 11,222,095 | |

| TOTAL LONG-TERM LIABILITIES | | | 13,655,351 | | | | 14,332,243 | |

| | | | | | | | | |

| TOTAL LIABILITIES | | | 38,170,159 | | | | 33,553,802 | |

| | | | | | | | | |

| COMMITMENTS AND CONTINGENCIES (Note 11) | | | — | | | | — | |

| | | | | | | | | |

| EQUITY | | | | | | | | |

| | | | | | | | | |

| WESTERN SHAREHOLDERS’ EQUITY | | | | | | | | |

| Common stock, $0.0001 par value, 12,500,000 shares authorized, 9,249,900 and 8,841,900 shares issued and outstanding as of March 31, 2021 and December 31, 2020, respectively | | | 925 | | | | 925 | |

| Additional paid-in capital | | | 29,562,271 | | | | 29,562,271 | |

| Retained earnings | | | 42,148,787 | | | | 38,470,323 | |

| TOTAL WESTERN SHAREHOLDERS’ EQUITY | | | 71,711,983 | | | | 68,033,519 | |

| Noncontrolling interests | | | 1,952,696 | | | | 1,555,125 | |

| | | | | | | | | |

| TOTAL EQUITY | | | 73,664,679 | | | | 69,588,644 | |

| | | | | | | | | |

| TOTAL LIABILITIES AND EQUITY | | $ | 111,834,838 | | | $ | 103,142,446 | |

| | | | | | | | | |

| See notes to condensed consolidated financial statements | |

WESTERN CAPITAL RESOURCES, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited) |

| | | Three Months Ended | |

| | | March 31, 2021 | | | March 31, 2020 | |

| REVENUES | | | | | | |

| Sales and associated fees | | $ | 37,653,669 | | | $ | 28,858,231 | |

| Financing fees and interest | | | 1,002,470 | | | | 2,044,697 | |

| Other revenues | | | 5,529,945 | | | | 4,744,598 | |

| Total Revenues | | | 44,186,084 | | | | 35,647,526 | |

| | | | | | | | | |

| COST OF REVENUES | | | | | | | | |

| Cost of sales | | | 21,405,354 | | | | 15,530,285 | |

| Provisions for loans receivable credit losses | �� | | (86,436 | ) | | | 291,428 | |

| Total Cost of Revenues | | | 21,318,918 | | | | 15,821,713 | |

| | | | | | | | | |

| GROSS PROFIT | | | 22,867,166 | | | | 19,825,813 | |

| | | | | | | | | |

| OPERATING EXPENSES | | | | | | | | |

| Salaries, wages and benefits | | | 8,936,986 | | | | 9,119,172 | |

| Occupancy | | | 2,511,712 | | | | 2,848,068 | |

| Advertising, marketing and development | | | 2,442,191 | | | | 1,936,425 | |

| Depreciation | | | 397,948 | | | | 501,390 | |

| Amortization | | | 159,825 | | | | 184,975 | |

| Other | | | 2,452,469 | | | | 2,560,923 | |

| Total Operating Expenses | | | 16,901,131 | | | | 17,150,953 | |

| | | | | | | | | |

| OPERATING INCOME | | | 5,966,035 | | | | 2,674,860 | |

| | | | | | | | | |

| OTHER INCOME (EXPENSES): | | | | | | | | |

| Dividend and interest income | | | 30,654 | | | | 138,727 | |

| Interest expense | | | (18,056 | ) | | | (103,662 | ) |

| Total Other Income (Expenses) | | | 12,598 | | | | 35,065 | |

| | | | | | | | | |

| INCOME BEFORE INCOME TAXES | | | 5,978,633 | | | | 2,709,925 | |

| | | | | | | | | |

| PROVISION FOR INCOME TAX EXPENSE | | | 1,299,350 | | | | 534,110 | |

| | | | | | | | | |

| | | | | | | | | |

| NET INCOME | | | 4,679,283 | | | | 2,175,815 | |

| | | | | | | | | |

| LESS NET INCOME ATTRIBUTABLE TO NONCONTROLLING INTERESTS | | | (769,571 | ) | | | (462,568 | ) |

| | | | | | | | | |

| NET INCOME ATTRIBUTABLE TO WESTERN COMMON SHAREHOLDERS | | $ | 3,909,712 | | | $ | 1,713,247 | |

| | | | | | | | | |

| EARNINGS PER SHARE ATTRIBUTABLE TO WESTERN COMMON SHAREHOLDERS | | | | | | | | |

| Basic | | $ | 0.42 | | | $ | 0.18 | |

| Diluted | | $ | 0.42 | | | $ | 0.18 | |

| | | | | | | | | |

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING (Note 15) | | | | | | | | |

| Basic | | | 9,249,900 | | | | 9,673,778 | |

| Diluted | | | 9,258,131 | | | | 9,673,778 | |

| | | | | | | | | |

| See notes to condensed consolidated financial statements | |

WESTERN CAPITAL RESOURCES, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY (Unaudited) |

| | | Western Capital Resources, Inc. Shareholders’ | | | | | | | |

| | | Common Stock | | | | | | | | | | | | | | | | | |

| | | Shares | | | Amount | | | Additional

Paid-In Capital | | | Retained

Earnings | | | Noncontrolling

Interests | | | Total | |

| BALANCE – December 31, 2020 | | | 9,249,900 | | | $ | 925 | | | $ | 29,562,271 | | | $ | 38,470,323 | | | $ | 1,555,125 | | | $ | 69,588,644 | |

| Net income | | | — | | | | — | | | | — | | | | 3,909,712 | | | | 769,571 | | | | 4,679,283 | |

| Distributions to noncontrolling interests | | | — | | | | — | | | | — | | | | — | | | | (372,000 | ) | | | (372,000 | ) |

| Dividends paid | | | — | | | | — | | | | — | | | | (231,248 | ) | | | — | | | | (231,248 | ) |

| BALANCE – March 31, 2021 | | | 9,249,900 | | | $ | 925 | | | $ | 29,562,271 | | | $ | 42,148,787 | | | $ | 1,952,696 | | | $ | 73,664,679 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Western Capital Resources, Inc. Shareholders’ | | | | | | | |

| | | Common Stock | | | | | | | | | | | | | | | | | |

| | | Shares | | | Amount | | | Additional

Paid-In Capital | | | Retained

Earnings | | | Noncontrolling

Interests | | | Total | |

| BALANCE – December 31, 2019 | | | 9,673,778 | | | $ | 968 | | | $ | 29,562,271 | | | $ | 33,706,035 | | | $ | 2,574,834 | | | $ | 65,844,108 | |

| Net income | | | — | | | | — | | | | — | | | | 1,713,247 | | | | 462,568 | | | | 2,175,815 | |

| Plus pre-acquisition net loss of acquiree | | | — | | | | — | | | | — | | | | 191,088 | | | | — | | | | 191,088 | |

| Distributions to noncontrolling interests | | | — | | | | — | | | | — | | | | — | | | | (45,000 | ) | | | (45,000 | ) |

| Dividends | | | — | | | | — | | | | — | | | | (463,289 | ) | | | — | | | | (463,289 | ) |

| BALANCE – March 31, 2020 | | | 9,673,778 | | | $ | 968 | | | $ | 29,562,271 | | | $ | 35,147,081 | | | $ | 2,992,402 | | | $ | 67,702,722 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| See notes to condensed consolidated financial statements. | |

| | |

WESTERN CAPITAL RESOURCES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

| | | Three Months Ended | | | Six Months Ended | |

| | | June 30, 2020 | | | June 30, 2019 | | | June 30, 2020 | | | June 30, 2019 | |

| REVENUES | | | | | | | | | | | | |

| Sales and associated fees | | $ | 33,319,275 | | | $ | 24,178,741 | | | $ | 60,127,761 | | | $ | 47,999,579 | |

| Financing fees and interest | | | 1,172,099 | | | | 1,985,774 | | | | 3,216,796 | | | | 4,100,645 | |

| Other revenues | | | 5,080,224 | | | | 3,991,590 | | | | 9,824,822 | | | | 8,014,101 | |

| Total Revenues | | | 39,571,598 | | | | 30,156,105 | | | | 73,169,379 | | | | 60,114,325 | |

| | | | | | | | | | | | | | | | | |

| COST OF REVENUES | | | | | | | | | | | | | | | | |

| Cost of sales | | | 16,973,872 | | | | 13,059,484 | | | | 30,905,221 | | | | 25,795,905 | |

| Provisions for loans receivable losses | | | (212,031 | ) | | | 175,831 | | | | 79,397 | | | | 394,108 | |

| Total Cost of Revenues | | | 16,761,841 | | | | 13,235,315 | | | | 30,984,618 | | | | 26,190,013 | |

| | | | | | | | | | | | | | | | | |

| GROSS PROFIT | | | 22,809,757 | | | | 16,920,790 | | | | 42,184,761 | | | | 33,924,312 | |

| | | | | | | | | | | | | | | | | |

| OPERATING EXPENSES | | | | | | | | | | | | | | | | |

| Salaries, wages and benefits | | | 7,934,605 | | | | 8,065,521 | | | | 16,849,559 | | | | 16,161,468 | |

| Occupancy | | | 2,763,468 | | | | 2,647,662 | | | | 5,590,707 | | | | 5,411,945 | |

| Advertising, marketing and development | | | 1,998,620 | | | | 2,023,838 | | | | 3,826,575 | | | | 3,799,680 | |

| Depreciation | | | 490,966 | | | | 438,198 | | | | 989,624 | | | | 867,698 | |

| Amortization | | | 188,891 | | | | 178,379 | | | | 373,669 | | | | 362,915 | |

| Other | | | 3,004,700 | | | | 2,021,278 | | | | 5,289,018 | | | | 4,285,870 | |

| Total Operating Expenses | | | 16,381,250 | | | | 15,374,876 | | | | 32,919,152 | | | | 30,889,576 | |

| | | | | | | | | | | | | | | | | |

| OPERATING INCOME | | | 6,428,507 | | | | 1,545,914 | | | | 9,265,609 | | | | 3,034,736 | |

| | | | | | | | | | | | | | | | | |

| OTHER INCOME (EXPENSES): | | | | | | | | | | | | | | | | |

| Dividend and interest income | | | 71,720 | | | | 193,976 | | | | 210,447 | | | | 375,519 | |

| Interest expense | | | (15,590 | ) | | | (29,159 | ) | | | (31,406 | ) | | | (55,414 | ) |

| Total Other Income (Expenses) | | | 56,130 | | | | 164,817 | | | | 179,041 | | | | 320,105 | |

| | | | | | | | | | | | | | | | | |

| INCOME BEFORE INCOME TAXES | | | 6,484,637 | | | | 1,710,731 | | | | 9,444,650 | | | | 3,354,841 | |

| | | | | | | | | | | | | | | | | |

| PROVISION FOR INCOME TAX EXPENSE | | | 1,417,000 | | | | 332,000 | | | | 2,010,110 | | | | 676,000 | |

| | | | | | | | | | | | | | | | | |

| NET INCOME | | | 5,067,637 | | | | 1,378,731 | | | | 7,434,540 | | | | 2,678,841 | |

| | | | | | | | | | | | | | | | | |

| LESS NET INCOME ATTRIBUTABLE TO NONCONTROLLING INTERESTS | | | (453,904 | ) | | | (247,531 | ) | | | (916,472 | ) | | | (497,228 | ) |

| | | | | | | | | | | | | | | | | |

| NET INCOME ATTRIBUTABLE TO WESTERN COMMON SHAREHOLDERS | | $ | 4,613,733 | | | $ | 1,131,200 | | | $ | 6,518,068 | | | $ | 2,181,613 | |

| | | | | | | | | | | | | | | | | |

| EARNINGS PER SHARE ATTRIBUTABLE TO WESTERN COMMON SHAREHOLDERS | | | | | | | | | | | | | | | | |

| Basic and diluted | | $ | 0.50 | | | $ | 0.12 | | | $ | 0.71 | | | $ | 0.23 | |

| | | | | | | | | | | | | | | | | |

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING | | | | | | | | | | | | | | | | |

| Basic and diluted | | | 9,212,669 | | | | 9,388,677 | | | | 9,239,224 | | | | 9,388,677 | |

See notes to condensed consolidated financial statements.

WESTERN CAPITAL RESOURCES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY (Unaudited)

| | | Western Capital Resources, Inc. Shareholders | | | | | | | |

| | | Common Stock | | | | | | | | | | | | | |

| | | Shares | | | Amount | | | Additional Paid-In Capital | | | Retained Earnings | | | Noncontrolling Interests | | | Total | |

| BALANCE – December 31, 2019 | | | 9,265,778 | | | $ | 927 | | | $ | 29,031,741 | | | $ | 33,706,035 | | | $ | 2,574,834 | | | $ | 65,313,537 | |

| Net income | | | — | | | | — | | | | — | | | | 1,904,335 | | | | 462,568 | | | | 2,366,903 | |

| Distributions to Noncontrolling Interests | | | — | | | | — | | | | — | | | | — | | | | (45,000 | ) | | | (45,000 | ) |

| Dividends | | | — | | | | — | | | | — | | | | (463,289 | ) | | | — | | | | (463,289 | ) |

| BALANCE – March 31, 2020 | | | 9,265,778 | | | | 927 | | | | 29,031,741 | | | | 35,147,081 | | | | 2,992,402 | | | | 67,172,151 | |

| Net income | | | — | | | | — | | | | — | | | | 4,613,733 | | | | 453,904 | | | | 5,067,637 | |

| Distributions to Noncontrolling Interests | | | — | | | | — | | | | — | | | | — | | | | (1,079,602 | ) | | | (1,079,602 | ) |

| Stock redemption | | | (130,889 | ) | | | (14 | ) | | | — | | | | (547,169 | ) | | | — | | | | (547,183 | ) |

| Dividends | | | — | | | | — | | | | — | | | | (230,865 | ) | | | — | | | | (230,865 | ) |

| BALANCE – June 30, 2020 | | | 9,134,889 | | | $ | 913 | | | $ | 29,031,741 | | | $ | 38,982,780 | | | $ | 2,366,704 | | | $ | 70,382,138 | |

| | | Western Capital Resources, Inc. Shareholders | | | | | | | |

| | | Common Stock | | | | | | | | | | | | | |

| | | Shares | | | Amount | | | Additional Paid-In Capital | | | Retained Earnings | | | Noncontrolling Interests | | | Total | |

| BALANCE – December 31, 2018 | | | 9,388,677 | | | $ | 939 | | | $ | 29,031,741 | | | $ | 33,774,293 | | | $ | 1,876,908 | | | $ | 64,683,881 | |

| Net income | | | — | | | | — | | | | — | | | | 1,050,413 | | | | 249,697 | | | | 1,300,110 | |

| Noncontrolling Interest equity contribution | | | — | | | | — | | | | — | | | | — | | | | 17,446 | | | | 17,446 | |

| Distributions to Noncontrolling Interests | | | — | | | | — | | | | — | | | | — | | | | (266,600 | ) | | | (266,600 | ) |

| Dividends | | | — | | | | — | | | | — | | | | (469,434 | ) | | | — | | | | (469,434 | ) |

| BALANCE – March 31, 2019 | | | 9,388,677 | | | | 939 | | | | 29,031,741 | | | | 34,355,272 | | | | 1,877,451 | | | | 65,265,403 | |

| Net income | | | — | | | | — | | | | — | | | | 1,131,200 | | | | 247,531 | | | | 1,378,731 | |

| Distributions to Noncontrolling Interests | | | — | | | | — | | | | — | | | | — | | | | (470,000 | ) | | | (470,000 | ) |

| Dividends | | | — | | | | — | | | | — | | | | (469,434 | ) | | | — | | | | (469,434 | ) |

| BALANCE – June 30, 2019 | | | 9,388,677 | | | $ | 939 | | | $ | 29,031,741 | | | $ | 35,017,038 | | | $ | 1,654,982 | | | $ | 65,704,700 | |

See notes to condensed consolidated financial statements.

WESTERN CAPITAL RESOURCES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

| | | Six Months Ended | | | Three Months Ended | |

| | | June 30, 2020 | | | June 30, 2019 | | | March 31, 2021 | | | March 31, 2020 | |

| OPERATING ACTIVITIES | | | | | | | | | | | | | | | | |

| Net income | | $ | 7,434,540 | | | $ | 2,678,841 | | | $ | 4,679,283 | | | $ | 2,175,815 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | | | | | | | | |

| Depreciation | | | 989,624 | | | | 867,698 | | | | 411,602 | | | | 518,551 | |

| Amortization | | | 373,669 | | | | 362,915 | | | | 159,825 | | | | 184,975 | |

| Amortization of operating lease right-of-use assets | | | 2,922,642 | | | | 2,779,807 | | | | 1,245,804 | | | | 1,595,687 | |

| Deferred income taxes | | | (164,000 | ) | | | 234,000 | | | | (151,000 | ) | | | (65,000 | ) |

| Loss (gain) on disposals | | | 436,775 | | | | (147,977 | ) | |

| Accrued interest from investing activities | | | (36,295 | ) | | | (164,295 | ) | |

| Loss (gain) on disposal of assets | | | | 13,056 | | | | (9,337 | ) |

| Changes in operating assets and liabilities: | | | | | | | | | | | | | | | | |

| Loans receivable | | | 1,761,290 | | | | 624,796 | | | | 554,720 | | | | 1,122,391 | |

| Accounts receivable | | | (50,239 | ) | | | (62,492 | ) | | | (1,150,469 | ) | | | (2,191,949 | ) |

| Inventory | | | 468,408 | | | | 1,228,814 | | | | (2,998,401 | ) | | | (931,423 | ) |

| Prepaid expenses and other assets | | | 493,624 | | | | 93,954 | | | | 445,768 | | | | (324,710 | ) |

| Operating lease liabilities | | | (3,284,320 | ) | | | (3,110,370 | ) | | | (1,533,977 | ) | | | (1,796,474 | ) |

| Accounts payable and accrued expenses | | | 999,780 | | | | (3,202,289 | ) | | | 3,432,023 | | | | 1,740,003 | |

| Contract liabilities and other current liabilities | | | (338,424 | ) | | | (584,303 | ) | |

| Contract and other liabilities | | | | 215,770 | | | | (349,801 | ) |

| Net cash and cash equivalents provided by operating activities | | | 12,007,074 | | | | 1,599,099 | | | | 5,324,004 | | | | 1,668,728 | |

| | | | | | | | | | | | | | | | | |

| INVESTING ACTIVITIES | | | | | | | | | | | | | | | | |

| Purchases of investments | | | (33,981,808 | ) | | | (18,942,632 | ) | | | (3,592,303 | ) | | | (16,161,391 | ) |

| Proceeds from held-to-maturity investments | | | 22,308,707 | | | | 17,967,000 | | |

| Proceeds from investments | | | | 5,500,000 | | | | 8,903,588 | |

| Purchases of property and equipment | | | (264,940 | ) | | | (210,995 | ) | | | (253,690 | ) | | | (142,640 | ) |

| Acquisition of stores, net of cash acquired | | | (510,876 | ) | | | (164,400 | ) | | | — | | | | (260,876 | ) |

| Advances on loans receivable | | | (3,184 | ) | | | — | | |

| Proceeds from the disposal of operating assets | | | 382,989 | | | | 1,120,000 | | | | — | | | | 51,600 | |

| Net cash and cash equivalents used in investing activities | | | (12,069,112 | ) | | | (231,027 | ) | |

| Net cash and cash equivalents provided by (used in) investing activities | | | | 1,654,007 | | | | (7,609,719 | ) |

| | | | | | | | | | | | | | | | | |

| FINANCING ACTIVITIES | | | | | | | | | | | | | | | | |

| Net advances on bank revolving loan | | | | 1,258,475 | | | | 662,959 | |

| Payments on notes payable – long-term | | | (32,250 | ) | | | (38,693 | ) | | | (846,602 | ) | | | (16,033 | ) |

| Payments on finance leases | | | (1,161 | ) | | | (24,688 | ) | | | — | | | | (1,161 | ) |

| Distributions to noncontrolling interests | | | (1,124,602 | ) | | | (736,600 | ) | | | (372,000 | ) | | | (45,000 | ) |

| Common stock redemption | | | (547,183 | ) | | | — | | |

| Payments of dividends | | | (694,154 | ) | | | (938,868 | ) | | | (231,248 | ) | | | (463,289 | ) |

| Net cash and cash equivalents used in financing activities | | | (2,399,350 | ) | | | (1,738,849 | ) | |

| Net cash and cash equivalents provided by (used in) financing activities | | | | (191,375 | ) | | | 137,476 | |

| | | | | | | | | | | | | | | | | |

| NET DECREASE IN CASH AND CASH EQUIVALENTS | | | (2,461,388 | ) | | | (370,777 | ) | |

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | | | | 6,786,636 | | | | (5,803,515 | ) |

| | | | | | | | | | | | | | | | | |

| CASH AND CASH EQUIVALENTS | | | | | | | | | | | | | | | | |

| Beginning of period | | | 27,132,540 | | | | 16,724,983 | | | | 32,504,803 | | | | 27,160,991 | |

| End of period | | $ | 24,671,152 | | | $ | 16,354,206 | | | $ | 39,291,439 | | | $ | 21,357,476 | |

| | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Income taxes paid | | $ | 196,900 | | | $ | 119,563 | | | $ | 6,778 | | | $ | — | |

| Interest paid | | $ | 31,579 | | | $ | 44,865 | | | $ | 150,668 | | | $ | 15,882 | |

| Noncash investing and financing activities: | | | | | | | | | | | | | | | | |

| Assets received in acquisition (see Note 13) | | $ | 1,179,878 | | | $ | 1,694,546 | | |

| Liabilities assumed in acquisition (see Note 13) | | $ | 1,179,878 | | | $ | 1,325,024 | | |

| Note payable assumed in acquisition (see Note 13) | | $ | — | | | $ | 347,918 | | |

| Noncontrolling interest contribution to subsidiary (see Note 13) | | $ | — | | | $ | 17,446 | | |

| Right-of-use assets obtained and operating lease obligations incurred | | $ | 1,426,817 | | | $ | 963,486 | | | $ | 2,156,174 | | | $ | 923,097 | |

| Right-of-use asset disposals | | $ | 1,145,732 | | | $ | — | | |

| Right-of-use liability disposals | | $ | 706,030 | | | $ | — | | |

| Accrued management fees added to note payable – long-term | | | $ | — | | | $ | 96,958 | |

| Noncurrent liability converted to long-term debt | | | $ | 2,500,000 | | | $ | — | |

| Number of shares issued in transaction with entities under common control | | | | 408,000 | | | | — | |

| | | | | | | | | | |

| See notes to condensed consolidated financial statements. | | See notes to condensed consolidated financial statements. | |

See notes to condensed consolidated financial statements.7

WESTERN CAPITAL RESOURCES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

| 1. | Basis of Presentation, Nature of Business – |

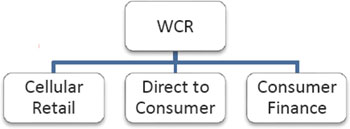

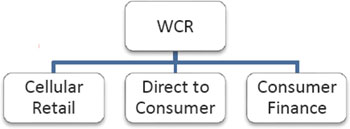

Western Capital Resources, Inc. (“WCR”) is a parent company owning operating subsidiaries, with percentage owned shown parenthetically, as summarized below.

Cellular Retail

PQH Wireless, Inc. (“PQH”) (100%) – operates 205 cellular retail stores as of March 31, 2021 (104 100% owned plus 101 held through its controlled but less than 100% owned subsidiaries), exclusively as an authorized retailer of the Cricket brand.

Direct to Consumer

J&P Park Acquisitions, Inc. (“JPPA”) (100%) – an online and direct marketing distribution retailer of 1) live plants, seeds, holiday gifts and garden accessories selling its products under Park Seed, Jackson & Perkins, and Wayside Gardens brand names and 2) home improvement and restoration products operating under the Van Dyke’s Restorers brand, as well as a seed wholesaler under the Park Wholesale brand.

J&P Real Estate, LLC (“JPRE”) (100%) – owns real estate utilized as JPPA’s distribution and warehouse facility.

Manufacturing

Swisher Acquisition, Inc. (“SAI”) (100%) - a manufacturer of lawn and garden power equipment and emergency safety shelters under the Swisher brand name, and provides turn-key manufacturing services to third parties.

Consumer Finance

Wyoming Financial Lenders, Inc. (“WFL”) (100%) – owns and operates “payday” stores (19 as of March 31, 2021) in four states (Iowa, Kansas, North Dakota and Wyoming) providing sub-prime short-term uncollateralized non-recourse “cash advance” or “payday” loans typically ranging from $100 to $500 with a maturity of generally two to four weeks, sub-prime short-term uncollateralized non-recourse installment loans typically ranging from $300 to $800 with a maturity of six months, check cashing and other money services to individuals.

Express Pawn, Inc. (“EPI”) (100%) – owns and operates retail pawn stores (three as of March 31, 2021) in Nebraska and Iowa providing collateralized non-recourse pawn loans and retail sales of merchandise obtained from forfeited pawn loans or purchased from customers.

References in these financial statement notes to “Company” or “we” refer to Western Capital Resources, Inc. and its subsidiaries. References to specific companies within our enterprise, such as” “PQH,” “JPPA,” “JPRE,” “SAI,” “WFL,” or “EPI” are references only to those companies.

| 2. | Summary of Significant Accounting Policies – |

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared according to the instructions to Form 10-Q and Section 210.8-03(b) of Regulation S-X of the Securities and Exchange Commission (SEC) and, therefore, certain information and note disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America (GAAP) have been omitted.

On January 8, 2021, we completed a merger with SAI (“Merger Transaction”). The Company issued 408,000 shares of our common stock in exchange for all of the equity interest of SAI resulting in SAI becoming a wholly-owned subsidiary of the Company. The transaction falls under the guidance of Accounting Standards Codification (“ASC”) 805, “Business Combinations” for entities under common control. Financial statements and financial information presented herein for prior years has been retrospectively adjusted using the pooling-of-interest method to furnish enhanced comparative information.

In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the three and six month periodsthree-month period ended June 30, 2020March 31, 2021 are not necessarily indicative of the results that may be expected for the year ending December 31, 2020.2021.

Management has analyzed the impact of the Coronavirus pandemic ("COVID-19"(”COVID-19”) on its financial statements as of June 30, 2020March 31, 2021 and has determined that the changes to its significant judgements and estimates did not have a material impact with respect to goodwill, intangible assets or long-lived assets.

For further information, refer to the Consolidated Financial Statements and notes thereto included in our Form 10-K for the year ended December 31, 2019. The condensed consolidated balance sheet at December 31, 2019, has been derived from the audited consolidated financial statements at that date, but does not include all of the information and notes required by GAAP.2020.

Western Capital Resources, Inc. (“WCR”) is a parent company owning operating subsidiaries, with percentage owned shown parenthetically, as summarized below.

| ○ | PQH Wireless, Inc. (“PQH”) (100%) – operates 205 cellular retail stores as of June 30, 2020 (101 100% owned plus 104 held through its controlled but less than 100% owned subsidiaries), exclusively as an authorized retailer of the Cricket brand. |

| ○ | J&P Park Acquisitions, Inc. (“JPPA”) (100%) – an online and direct marketing distribution retailer of 1) live plants, seeds, holiday gifts and garden accessories selling its products under Park Seed, Jackson & Perkins, and Wayside Gardens brand names and 2) home improvement and restoration products operating under the Van Dyke’s Restorers brand, as well as a seed wholesaler under the Park Wholesale brand. |

| ○ | J&P Real Estate, LLC (“JPRE”) (100%) – owns real estate utilized as JPPA’s distribution and warehouse facility and the corporate offices of JPPA. |

| ○ | Wyoming Financial Lenders, Inc. (“WFL”) (100%) – owns and operates “payday” stores (38 as of June 30, 2020, two of which are located within the Company’s retail pawn stores) in six states (Iowa, Kansas, Nebraska, North Dakota, Wisconsin and Wyoming) providing sub-prime short-term uncollateralized non-recourse “cash advance” or “payday” loans typically ranging from $100 to $500 with a maturity of generally two to four weeks, sub-prime short-term uncollateralized non-recourse installment loans typically ranging from $300 to $800 with a maturity of six months, check cashing and other money services to individuals. |

| ○ | Express Pawn, Inc. (“EPI”) (100%) – owns and operates retail pawn stores (three as of June 30, 2020) in Nebraska and Iowa providing collateralized non-recourse pawn loans and retail sales of merchandise obtained from forfeited pawn loans or purchased from customers. |

References in these financial statement notes to “Company” or “we” refer to Western Capital Resources, Inc. and its subsidiaries. References to specific companies within our enterprise, such as” “PQH,” “JPPA,” “JPRE,” “WFL,” or “EPI” are references only to those companies.

Basis of Consolidation

The consolidated financial statements include the accounts of WCR, its wholly ownedwholly-owned subsidiaries and other entities in which the Company owns a controlling financial interest. For financial interests in which the Company owns a controlling financial interest, the Company applies the provisions of Financial Accounting Standards Board Accounting Standards Codification (“ASC”FASB”) ASC 810, “Consolidation” applicable to reporting the equity and net income or loss attributable to noncontrolling interests. All significant intercompanyIntercompany balances and transactions of the Company have been eliminated in consolidation.

Use of Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that may affect certain reported amounts and disclosures in the consolidated financial statements and accompanying notes. Management bases its estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances. Actual results could differ from those estimates. Significant management estimates relate to the notes and loans receivable allowance for credit losses, carrying value and impairment of goodwill, other long-lived goodwill, intangibleassets, right-of-use assets and right-of-use assets,related liabilities (including the applicable discount rate), inventory valuation and obsolescence, estimated useful lives of intangible assets and property and equipment, gift certificate and merchandise credits liability and deferred taxes and tax uncertainties.

ReclassificationsCash and Cash Equivalents

Certain StatementFor purposes of Income reclassifications have been madethe consolidated statements of cash flows, the Company considers all highly liquid investments with a maturity of three months or less at the time of purchase to be cash equivalents.

Inventory

Manufacturing

Inventory is stated at the lower of cost or market. Cost for manufactured finished goods is determined using the standard cost method. Raw materials consist primarily of parts used to make products. Fabricated components consist of processed raw materials, capitalized labor and overhead. Finished goods consist of completed products, parts and accessories available for sale. An inventory valuation allowance is provided for excess, obsolete and slow-moving inventory.

Earnings Per Common Share

The Company computes basic earnings per common share in accordance with ASC 260, Earnings Per Share (“EPS”), which is computed by dividing the presentationincome available to common shareholders by the weighted average number of our prior financial statements to conform to the presentation as of andcommon shares outstanding for the three and six months ended June 30, 2020.period. Diluted EPS gives effect to all potentially dilutive common shares outstanding during the period, as calculated using the treasury stock method. In computing diluted EPS, the weighted average market price for the period is used in determining the number of common shares assumed to be purchased from the exercise of stock options. As of December 31, 2020, 65,000 of potential common shares equivalents from stock options were excluded from the diluted EPS calculations as their effect is anti-dilutive.

Recent Accounting Pronouncements

In April, 2020December 2019, the staff of the FinancialFASB issued Accounting Standards Board (FASB) issued a question-and-answer document that says entities can elect not to evaluate whether a concession provided by a lessor to a lessee in responseUpdate (“ASU”) 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes, which eliminates certain exceptions to the effectsexisting guidance for income taxes related to the approach for intra-period tax allocations, the methodology for calculating income taxes in an interim period and the recognition of deferred tax liabilities for outside basis differences. This ASU also simplifies the coronavirus pandemic is a lease modification. Retailers may make the electionsaccounting for any lessor-provided concessionsincome taxes by clarifying and amending existing guidance related to the effects of the coronavirus pandemic as long as the concession does not resultenacted changes in a substantial increasetax laws or rates in the rightseffective tax rate computation, the recognition of franchise tax and the lessor orevaluation of a step-up in the obligationstax basis of the lessee.goodwill, among other clarifications. ASU 2019-12 is effective for fiscal years, and for interim periods within those fiscal years, beginning after December 15, 2020, with early adoption permitted. The Company has made such election. The Company has received minimal rent concessions and hasadopted ASU 2019-12 on January 1, 2021, the adoption of which did not entered into any lease modifications to date. As such, the Company does not believe this election will have a material impact on its financial condition, results of operations or consolidated financial statements.

No other new accounting pronouncements issued or effective during the fiscal year have had or are expected to have a material impact on the consolidated financial statements.

| 2.3. | Risks Inherent in the Operating Environment – |

Supply Chain - Fluctuations in the availability and price of inputs could have an adverse effect on our ability to manufacture and sell our products profitably and could adversely affect our margins and revenue.

Our manufacturing operations depend upon the adequate supply of steel, engines and other components and raw materials. Our direct to consumer operations depend upon an adequate supply of, among other things, seeds and live plants. Our inability to procure any of these production materials, components or finished goods, delays in receiving them or not being able to procure them at competitive prices, particularly during applicable peak seasons, could adversely impact our ability to produce our products and to sell our products on a cost effective basis which, in turn, could adversely affect our revenue and profitability.

Our results of operations may be negatively impacted by product liability lawsuits.

The Company’s Manufacturing segment is subject to potential product liability risks that relate to the design, manufacture, sale and use of our products. To date, we have not incurred material costs related to these product liability claims. While we believe our current general liability and product liability insurance is adequate to protect us from future product liability claims, there can be no assurance that our coverage will be adequate to cover all claims that may arise. Additionally, we may not be able to maintain insurance coverage in the future at an acceptable cost. Significant losses not covered by insurance or for which third-party indemnification is not available could have a material adverse effect on our business, financial condition, results of operations and cash flows. In addition, it may be necessary for us to recall products that do not meet approved specifications, which could result in adverse publicity as well as costs connected to the recall and loss of revenue.

Regulatory

The Company’s Consumer Finance segment activities are highly regulated under numerous federal, state, and local laws, regulations and rules, which are subject to change. New laws, regulations or rules could be enacted or issued, interpretations of existing laws, regulations or rules may change and enforcement action by regulatory agencies may intensify. Over the past several years, consumer advocacy groups and certain media reports have advocated governmental and regulatory action to prohibit or severely restrict sub-prime lending activities of the kind conducted by the Company. After several years of research, debate, and public hearings, in October 2017 the U.S. Consumer Financial Protection Bureau (“CFPB”) adopted a new rule for payday lending. The 2017 rule, originally scheduled to go into effect in August 2019, would imposehave imposed significant restrictions on the industry, and it iswas expected that a large number of lenders would be forced to close their stores. The CFPB’s studies projected a reduction in the number of lenders by 50%, while industry studies forecastforecasted a much higher attrition rate if the rule is implemented as originally adopted.

However, in January 2018, the CFPB issued a statement that it intends to “reconsider” the regulation and delayed the August 19, 2019 compliance date for the other provisions to November 19, 2020.regulation. In July 2020, the CFPB issued a final rule applicable to the 2017 rule. The final rule rescinds the mandatory underwriting provisions of the 2017 rule but does not rescind or alter the payments provisions of the 2017 rule. The BureauCFPB will seek to have these rules go into effect with a reasonable period for entities to come into compliance. The implementation of the final rule could haveis likely to result in a significantreduction of in-house bad debt collections, higher collection costs and thus a negative impact on business conducted withinand further contraction of our Consumer Finance segment.

Consumer advocacy groups in many states are actively seeking state law changes which would effectively end the viability of a payday loan business, including Nebraska where in 2019 we generate approximately 30% of our payday lending revenue, or approximately 2% of our consolidated revenue. If these groups are successful in Nebraska, we will likely cease payday lending activities in Nebraska. In June 2020, a Nebraska group submitted signatures for a ballot initiative that would limit all fees charged by payday lenders in Nebraska to an annual interest rate of 36%. As a result, the initiative is expected to be on the Nebraska statewide ballot for the November 3, 2020 election.

The implementation of the CFPBabove rule the passage of the Nebraska ballot initiative or any other adverse change in present federal, state, or local laws or regulations that govern or otherwise affect lending could result in the Consumer Finance segment’s curtailment or cessation of operations in certain or all jurisdictions or locations. Furthermore, any failure to comply with any applicable local, state or federal laws or regulations could result in fines, litigation, closure of one or more store locations or negative publicity. Any such change or failure would have a corresponding impact on the Company’s and segment’s results of operations and financial condition, primarily through a decrease in revenues resulting from the cessation or curtailment of operations, or a decrease in operating income through increased legal expenditures or fines, and could also negatively affect the Company’s general business prospects due to lost or decreased operating income or if negative publicity effects its ability to obtain additional financing as needed.

In addition, the passage of federal, additional state or local laws and regulations or changes in interpretations of them could, at any point, essentially prohibit the Consumer Finance segment from conducting its lending business in its current form. Any such legal or regulatory change would certainly have a material and adverse effect on the Company, its operating results, financial condition and prospects, and perhaps even the viability of the Consumer Finance segment.

| 4. | Cash and Cash Equivalents and Investments – |

Concentrations

The following table shows the Company’s cash and cash equivalents, held-to-maturity investments, and other investments by significant investment category, recorded as cash and cash equivalents or short- and long-term investments:

| | | March 31, 2021 | | | December 31, 2020 | |

| Cash and cash equivalents | | | | | | | | |

| Operating accounts | | $ | 20,371,027 | | | $ | 16,539,720 | |

| Money Market – U.S. Treasury obligations | | | 5,920,520 | | | | 2,565,296 | |

| U.S. Treasury obligations | | | 12,999,892 | | | | 13,399,787 | |

| Subtotal | | | 39,291,439 | | | | 32,504,803 | |

| | | | | | | | | |

| Investments | | | | | | | | |

| Certificates of deposit (9 – 18 month maturities, FDIC insured) | | | 11,817,751 | | | | 17,338,073 | |

| U.S. Treasury obligations (less than one year maturities) | | | 3,590,611 | | | | — | |

| Subtotal | | | 15,408,362 | | | | 17,338,073 | |

| | | | | | | | | |

| TOTAL | | $ | 54,699,801 | | | $ | 49,842,876 | |

Investments consisted of the following:

| March 31, 2021 |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Amortized

Cost | | | Unrealized

Gain

(Loss) | | | Estimated

Fair Value | |

| Certificates of Deposit | | $ | — | | | $ | 11,817,751 | | | $ | — | | | $ | 11,817,751 | | | $ | (28,124 | ) | | $ | 11,789,627 | |

| U.S. Treasuries | | | 3,590,611 | | | | — | | | | — | | | | 3,590,611 | | | | (465 | ) | | | 3,590,146 | |

| | | $ | 3,590,611 | | | $ | 11,817,751 | | | $ | — | | | $ | 15,408,362 | | | $ | (28,589 | ) | | $ | 15,379,773 | |

| December 31, 2020 |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Amortized

Cost | | | Unrealized

Gain

(Loss) | | | Estimated

Fair Value | |

| Certificates of Deposit | | $ | — | | | $ | 17,338,073 | | | $ | — | | | $ | 17,338,073 | | | $ | (23,814 | ) | | $ | 17,314,259 | |

| U.S. Treasuries | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | $ | — | | | $ | 17,338,073 | | | $ | — | | | $ | 17,338,073 | | | $ | (23,814 | ) | | $ | 17,314,259 | |

Interest income recognized on held-to-maturity investments and other sources was as follows:

| | | | Three Months Ended

March 31, 2021 | | | Three Months Ended

March 31, 2020 | |

| Held-to-maturity | | | $ | 92 | | | $ | 62,974 | |

| Other | | | | 30,562 | | | | 75,753 | |

| | | | $ | 30,654 | | | $ | 138,727 | |

The Company has demand deposits at financial institutions, often times in excess of the limit for insurance by the Federal Deposit Insurance Corporation. As of June 30, 2020,March 31, 2021, the Company had demand deposits in excess of insurance amounts of approximately $7.93$14.10 million.

COVID-19

In December 2019 COVID-19 emerged in Wuhan, China. While initially the outbreak was largely concentrated in China and caused significant disruptions to its economy, it has now spread to almost all other countries, including the United States, and infections have been reported globally.

Because COVID-19 infections have been reported throughout the United States, certain federal, state and local governmental authorities have issued stay-at-home orders, proclamations and/or directives aimed at minimizing the spread of COVID-19. Additional, more restrictive proclamations and/or directives may be issued in the future. Since the start of the pandemic, the Company’s Cellular Retail segment had temporarily closed approximately 75 locations, all but 22 of which subsequently re-opened by the end of April 2020. In June 2020, those 22 closed locations plus five others were permanently closed.

The ultimate impact of the COVID-19 pandemic on the Company’s operations is unknown and will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the duration of the COVID-19 outbreak, new information which may emerge concerning the severity of the COVID-19 pandemic, and any additional preventative and protective actions that governments, or the Company, may direct, which may result in an extended period of continued business disruption, reduced customer traffic and reduced operations. Any resulting financial impact cannot be reasonably estimated at this time but may have a material impact on our business, financial condition and results of operations. The significance of the impact of the COVID-19 outbreak on the Company’s businesses and the duration for which it may have an impact cannot be determined at this time.

| 3. | Cash Equivalents and Marketable Investments – |

The following table shows the Company’s cash and cash equivalents and held-to-maturity investments, by significant investment category, recorded as cash and cash equivalents or short- and long-term investments:

| | | June 30, 2020 | | | December 31, 2019 | |

| Cash and cash equivalents | | | | | | | | |

| Operating accounts | | $ | 16,202,326 | | | $ | 10,163,845 | |

| Money Market – U.S. Treasury obligations | | | 4,438,931 | | | | 4,450,433 | |

| U.S. Treasury obligations | | | 4,029,895 | | | | 12,518,262 | |

| Subtotal | | | 24,671,152 | | | | 27,132,540 | |

| | | | | | | | | |

| Held to Maturity Investments | | | | | | | | |

| Certificates of deposit (4 – 24 month maturities, FDIC insured) | | $ | 17,588,365 | | | $ | 9,049,787 | |

| U.S. Treasury obligations (less than one year maturities) | | | 10,359,982 | | | | 7,206,878 | |

| Subtotal | | | 27,948,347 | | | | 16,256,665 | |

| | | | | | | | | |

| TOTAL | | $ | 52,619,499 | | | $ | 43,389,205 | |

Held to maturity investments consisted of the following:

| June 30, 2020 | |

| | | Cost | | | Accrued Interest | | | Amortized Discount | | | Amortized Cost | | | Unrealized Gain (Loss) | | | Estimated Fair Value | |

| | | | | | | | | | | | | | | | | | | |

| Certificates of Deposit | | $ | 17,525,765 | | | $ | 62,600 | | | $ | — | | | $ | 17,588,365 | | | $ | 34,074 | | | $ | 17,622,439 | |

| U.S. Treasuries | | | 10,359,214 | | | | — | | | | 768 | | | | 10,359,982 | | | | 18 | | | | 10,360,000 | |

| | | $ | 27,884,979 | | | $ | 62,600 | | | $ | 768 | | | $ | 27,948,347 | | | $ | 34,092 | | | $ | 27,982,439 | |

| December 31, 2019 | |

| | | Cost | | | Accrued Interest | | | Amortized Discount | | | Amortized Cost | | | Unrealized Gain (Loss) | | | Estimated Fair Value | |

| | | | | | | | | | | | | | | | | | | |

| Certificates of Deposit | | $ | 9,015,618 | | | $ | 34,169 | | | $ | — | | | $ | 9,049,787 | | | $ | (32,429 | ) | | $ | 9,017,358 | |

| U.S. Treasuries | | | 7,153,587 | | | | — | | | | 53,291 | | | | 7,206,878 | | | | 2,883 | | | | 7,209,761 | |

| | | $ | 16,169,205 | | | $ | 34,169 | | | $ | 53,291 | | | $ | 16,256,665 | | | $ | (29,546 | ) | | $ | 16,227,119 | |

Interest income recognized on held-to-maturity investments and other sources was as follows:

| | | | Three Months Ended

June 30, 2020 | | | Three Months Ended

June 30, 2019 | | | Six Months Ended June 30, 2020 | | | Six Months Ended June 30, 2019 | |

| | | | | | | | | | | | | | |

| Held-to-maturity | | | $ | 67,733 | | | $ | 158,551 | | | $ | 183,808 | | | $ | 300,697 | |

| Other | | | | 3,987 | | | | 35,425 | | | | 26,639 | | | | 74,822 | |

| | | | $ | 71,720 | | | $ | 193,976 | | | $ | 210,447 | | | $ | 375,519 | |

The Company has deposited in aggregate $1.75$2.79 million of cash across seven different accounts at a financial institutioninstitutions as an accommodation to its majority stockholder, who has other business relationships with the financial institution. The funds in these accounts can be withdrawn at any time, do not serve as collateral in any way, and are held on market terms.

The Consumer Finance segment’s outstanding loans receivable aging is as follows:

| June 30, 2020 |

| | | Payday | | | Installment | | | Pawn | | | Total | |

| Current | | $ | 1,815,634 | | | $ | 24,059 | | | $ | 203,730 | | | $ | 2,043,423 | |

| 1-30 | | | 85,070 | | | | 1,812 | | | | — | | | | 86,882 | |

| 31-60 | | | 29,805 | | | | 264 | | | | — | | | | 30,069 | |

| 61-90 | | | 56,317 | | | | — | | | | — | | | | 56,317 | |

| 91-120 | | | 67,655 | | | | — | | | | — | | | | 67,655 | |

| 121-150 | | | 72,138 | | | | — | | | | — | | | | 72,138 | |

| 151-180 | | | 82,637 | | | | — | | | | — | | | | 82,637 | |

| | | | 2,209,256 | | | | 26,135 | | | | 203,730 | | | | 2,439,121 | |

| Less Allowance | | | (340,000 | ) | | | — | | | | — | | | | (340,000 | ) |

| | | $ | 1,869,256 | | | $ | 26,135 | | | $ | 203,730 | | | $ | 2,099,121 | |

| December 31, 2019 | | |

| March 31, 2021 | | March 31, 2021 |

| | | Payday | | | Installment | | | Pawn | | | Total | | | Payday | | | Pawn | | | Total | |

| Current | | $ | 3,322,131 | | | $ | 67,891 | | | $ | 309,934 | | | $ | 3,699,956 | | | $ | 1,107,990 | | | $ | 211,971 | | | $ | 1,319,961 | |

| 1-30 | | | 216,753 | | | | 10,590 | | | | — | | | | 227,343 | | | | 79,771 | | | | — | | | | 79,771 | |

| 31-60 | | | 140,872 | | | | 6,234 | | | | — | | | | 147,106 | | | | 44,171 | | | | — | | | | 44,171 | |

| 61-90 | | | 117,544 | | | | 2,649 | | | | — | | | | 120,193 | | | | 46,272 | | | | — | | | | 46,272 | |

| 91-120 | | | 118,626 | | | | 840 | | | | — | | | | 119,466 | | | | 51,184 | | | | — | | | | 51,184 | |

| 121-150 | | | 110,278 | | | | 395 | | | | — | | | | 110,673 | | | | 51,850 | | | | — | | | | 51,850 | |

| 151-180 | | | 108,674 | | | | — | | | | — | | | | 108,674 | | | | 41,251 | | | | — | | | | 41,251 | |

| | | | 4,134,878 | | | | 88,599 | | | | 309,934 | | | | 4,533,411 | | | | 1,422,489 | | | | 211,971 | | | | 1,634,460 | |

| Less Allowance | | | (673,000 | ) | | | — | | | | — | | | | (673,000 | ) | |

| Less Allowance for Credit Losses | | | | (248,000 | ) | | | — | | | | (248,000 | ) |

| | | $ | 3,461,878 | | | $ | 88,599 | | | $ | 309,934 | | | $ | 3,860,411 | | | $ | 1,174,489 | | | $ | 211,971 | | | $ | 1,386,460 | |

| 5. | Loans Receivable Allowance – |

A rollforward of the Consumer Finance segment’s loans receivable allowance is as follows:

| | | Six Months Ended June 30, 2020 | | | Year Ended December 31, 2019 | |

| Loans receivable allowance, beginning of period | | $ | 673,000 | | | $ | 818,000 | |

| Provision for loan losses charged to expense | | | 79,397 | | | | 975,938 | |

| Write-offs, net | | | (412,397 | ) | | | (1,120,938 | ) |

| Loans receivable allowance, end of period | | $ | 340,000 | | | $ | 673,000 | |

| December 31, 2020 |

| | | Payday | | | Installment | | | Pawn | | | Total | |

| Current | | $ | 1,558,292 | | | $ | 11,718 | | | $ | 272,669 | | | $ | 1,842,679 | |

| 1-30 | | | 117,747 | | | | 3,547 | | | | — | | | | 121,294 | |

| 31-60 | | | 94,135 | | | | 1,434 | | | | — | | | | 95,569 | |

| 61-90 | | | 59,263 | | | | 370 | | | | — | | | | 59,633 | |

| 91-120 | | | 46,777 | | | | — | | | | — | | | | 46,777 | |

| 121-150 | | | 38,422 | | | | — | | | | — | | | | 38,422 | |

| 151-180 | | | 51,806 | | | | — | | | | — | | | | 51,806 | |

| | | | 1,966,442 | | | | 17,069 | | | | 272,669 | | | | 2,256,180 | |

| Less Allowance for Credit Losses | | | (315,000 | ) | | | — | | | | — | | | | (315,000 | ) |

| | | $ | 1,651,442 | | | $ | 17,069 | | | $ | 272,669 | | | $ | 1,941,180 | |

A breakdown of accounts receivables by segment is as follows:

| June 30, 2020 | | |

| March 31, 2021 | | March 31, 2021 |

| | | Cellular Retail | | | Direct to Consumer | | | Consumer Finance | | | Total | | | Cellular

Retail | | | Direct to

Consumer | | | Manufacturing | | | Consumer

Finance | | | Total | |

| Accounts receivable | | $ | 224,953 | | | $ | 389,795 | | | $ | 17,967 | | | $ | 632,715 | | | $ | 335,936 | | | $ | 1,384,228 | | | $ | 995,935 | | | $ | 19,747 | | | $ | 2,735,846 | |

| Less allowance | | | — | | | | (65,000 | ) | | | — | | | | (65,000 | ) | |

| Less allowance for credit losses | | | | — | | | | (32,000 | ) | | | (15,000 | ) | | | — | | | | (47,000 | ) |

| Net accounts receivable | | $ | 224,953 | | | $ | 324,795 | | | $ | 17,967 | | | $ | 567,715 | | | $ | 335,936 | | | $ | 1,352,228 | | | $ | 980,935 | | | $ | 19,747 | | | $ | 2,688,846 | |

| December 31, 2019 | |

| | | Cellular Retail | | | Direct to Consumer | | | Consumer Finance | | | Total | |

| Accounts receivable | | $ | 184,519 | | | $ | 318,235 | | | $ | 27,722 | | | $ | 530,476 | |

| Less allowance | | | — | | | | (13,000 | ) | | | — | | | | (13,000 | ) |

| Net accounts receivable | | $ | 184,519 | | | $ | 305,235 | | | $ | 27,722 | | | $ | 517,476 | |

| December 31, 2020 |

| | | Cellular

Retail | | | Direct to

Consumer | | | Manufacturing | | | Consumer

Finance | | | Total | |

| Accounts receivable | | $ | 325,041 | | | $ | 271,742 | | | $ | 920,712 | | | $ | 53,882 | | | $ | 1,571,377 | |

| Less allowance for credit losses | | | — | | | | (18,000 | ) | | | (15,000 | ) | | | — | | | | (33,000 | ) |

| Net accounts receivable | | $ | 325,041 | | | $ | 253,742 | | | $ | 905,712 | | | $ | 53,882 | | | $ | 1,538,377 | |

A portion of accounts receivable are unsettled credit card sales from the prior one to five business days. This makes up 79%Included in Accounts Receivable is $1,054,354 and 68%$492,213 of the netmerchant accounts receivable balance at June 30, 2020as of March 31, 2021 and December 31, 2019,2020, respectively.

Inventories consist of:A breakdown of inventory is as follows:

| | | June 30, 2020 | | | December 31, 2019 | |

| Finished Goods | | | | | | | | |

| Cellular Retail | | $ | 5,609,452 | | | $ | 5,687,771 | |

| Direct to Consumer | | | 2,345,894 | | | | 2,888,483 | |

| Consumer Finance | | | 723,647 | | | | 819,437 | |

| Reserve | | | (751,000 | ) | | | (1,065,000 | ) |

| TOTAL | | $ | 7,927,993 | | | $ | 8,330,691 | |

| March 31, 2021 |

| | | Cellular

Retail | | | Direct to

Consumer | | | Manufacturing | | | Consumer

Finance | | | Reserve | | | Total | |

| Raw Materials | | $ | — | | | $ | — | | | $ | 1,890,612 | | | $ | — | | | $ | (329,000 | ) | | $ | 1,561,612 | |

| WIP | | $ | — | | | $ | — | | | $ | 414,872 | | | $ | — | | | $ | — | | | $ | 414,872 | |

| Finished Goods | | $ | 6,374,145 | | | $ | 4,837,482 | | | $ | 2,014,314 | | | $ | 736,204 | | | $ | (1,201,000 | ) | | $ | 12,761,145 | |

| Total | | $ | 6,374,145 | | | $ | 4,837,482 | | | $ | 4,319,798 | | | $ | 736,204 | | | $ | (1,530,000 | ) | | $ | 14,737,629 | |

| December 31, 2020 |

| | | Cellular

Retail | | | Direct to

Consumer | | | Manufacturing | | | Consumer

Finance | | | Reserve | | | Total | |

| Raw Materials | | $ | — | | | $ | — | | | $ | 1,620,157 | | | $ | — | | | $ | (311,000 | ) | | $ | 1,309,157 | |

| WIP | | $ | — | | | $ | — | | | $ | 260,421 | | | $ | — | | | $ | — | | | $ | 260,421 | |

| Finished Goods | | $ | 5,405,993 | | | $ | 3,433,460 | | | $ | 1,603,282 | | | $ | 736,915 | | | $ | (1,010,000 | ) | | $ | 10,169,650 | |

| Total | | $ | 5,405,993 | | | $ | 3,433,460 | | | $ | 3,483,860 | | | $ | 736,915 | | | $ | (1,321,000 | ) | | $ | 11,739,228 | |

As a result of changes in the market for certain Company products and the resulting deteriorating value, carrying amounts for those inventories were reduced by approximately $751,000$1.53 million and $1,065,000$1.32 million at June 30, 2020March 31, 2021 and December 31, 2019,2020, respectively. These inventory write-downs have been reflected in adjustments to cost of goods sold in the statement of operations. Management believes that these reductions properly reflect inventory at lower of cost or market,values, and no additional losses will be incurred upon disposition.

| 8. | LeasesAdvertising, Marketing and Development – |

The Company lease accounting policy followsPrepaid direct-response advertising costs as of March 31, 2021 and December 31, 2020 were $0 and $0.48 million, respectively. Included in Advertising, Marketing and Development for the guidance from ASC 842 - Leases, which provides guidance on the recognition, presentationthree-month periods ended March 31, 2021 and disclosure2020 was advertising expenses of leases in consolidated condensed financial statements.$1.96 million and $1.66 million, respectively.

Total components of operating lease expense for the real property asset class (in thousands) were as follows:follows for the three months ended:

| | | Three Months Ended June 30, 2020 | | | Six Months Ended June 30, 2020 | |

| Operating lease expense | | $ | 1,620 | | | $ | 3,240 | |

| Variable lease expense | | | 586 | | | | 1,157 | |

| Total lease expense | | $ | 2,206 | | | $ | 4,397 | |

| | | Three Months Ended June 30, 2019 | | Six Months Ended June 30, 2019 | | | March 31, 2021 | | | March 31, 2020 | |

| Operating lease expense | | $ | 1,365 | | | $ | 2,769 | | | $ | 1,534 | | | $ | 1,806 | |

| Variable lease expense | | | 684 | | | | 1,375 | | | | 531 | | | | 517 | |

| Total lease expense | | $ | 2,049 | | | $ | 4,144 | | | $ | 2,065 | | | $ | 2,323 | |

Other information related to operating leases was as follows:

| | | June 30, 2020 | | | June 30, 2019 | | | March 31, 2021 | | | December 31, 2020 | |

| Weighted average remaining lease term, in years | | | 2.90 | | | | 2.71 | | | | 6.25 | | | | 6.49 | |

| | | | | | | | | | | | | | | | | |

| Weighted Average Discount Rate | | | 5.7 | % | | | 5.9 | % | |

| Weighted average discount rate | | | | 4.6 | % | | | 4.8 | % |

Future minimum lease payments under operating leases as of June 30, 2020March 31, 2021 (in thousands) were as follows:

| | | Operating Leases | | | Operating Leases | |

| Remainder of 2020 | | | $ | 2,875 | | |

| 2021 | | | | 4,464 | | |

| Remainder of 2021 | | | | $ | 4,694 | |

| 2022 | | | | 2,928 | | | | | 4,884 | |

| 2023 | | | | 1,399 | | | | | 3,081 | |

| 2024 | | | | 717 | | | | | 1,687 | |

| 2025 | | | | 113 | | | | | 877 | |

| 2026 | | | | | 4,243 | |

| Thereafter | | | | 28 | | | | | 11 | |

| Total future minimum lease payments | | | | 12,524 | | | | | 19,477 | |

| Less: imputed interest | | | | (1,093 | ) | | | | (2,373 | ) |

| Total | | | $ | 11,431 | | | | $ | 17,104 | |

| | | | | | | | | | |

| Current portion operating lease liabilities | | | $ | 4,789 | | | $ | 5,449 | |

| Non-Current operating lease liabilities | | | | 6,642 | | |

| Non-current operating lease liabilities | | | | | 11,655 | |

| Total | | | $ | 11,431 | | | | $ | 17,104 | |

| 9.10. | Notes Payable – Long Term – |

| | | June 30, 2020 | | | December 31, 2019 | | | March 31, 2021 | | | December 31, 2020 | |

| Subsidiary subordinated note payable to seller with monthly interest only payments at 6%, guaranteed by PQH, maturing August 5, 2022 when the principal balance is due. | | $ | 789,216 | | | $ | 789,216 | | |

| Subsidiary note payable to a financial institution, with monthly principal and interest payments of $6,692, bearing interest at 5.5%, secured by substantially all assets of the subsidiary, and maturing January 4, 2024. | | | 263,785 | | | | 296,035 | | |

| Bank revolving loan | | | $ | 1,258,475 | | | $ | — | |

| Subordinated loans – related parties | | | | — | | | | 596,602 | |

| Note payable – related party | | | | 2,250,000 | | | | 2,513,546 | |

| Total | | | 1,053,001 | | | | 1,085,251 | | | | 3,508,475 | | | | 3,110,148 | |

| Less current maturities | | | (67,299 | ) | | | (65,414 | ) | | | 1,508,475 | | | | — | |

| | | $ | 985,702 | | | $ | 1,019,837 | | | $ | 2,000,000 | | | $ | 3,110,148 | |

On October 22, 2010 SAI obtained a senior credit facility (“Revolving Loan”) with a bank. The Revolving Loan, as amended, has a credit limit of up to $4,500,000 based on percentages of eligible inventory, an interest rate of LIBOR plus 4.5%, and a maturity date of October 21, 2021, is secured by substantially all assets of SAI and contains certain restrictive financial covenants.

| Date Declared | Record Date | Dividend Per Share | Payment Date | Dividend Paid |

| February 13, 2020 | February 28, 2020 | $0.05 | March 9, 2020 | $463,289 |

| May 5, 2020 | May 22, 2020 | $0.025 | June 2, 2020 | $230,865 |

On August 6, 2010 SAI executed secured subordinated promissory notes (“Subordinated Loans”) to borrow $1,350,000 from parties that were majority shareholders up until the Merger Transaction on January 8, 2021. The notes, as amended, included interest at 16% and a maturity date of December 31, 2023. Pursuant to the Merger Transaction, $596,602 of principal and $123,572 of accrued interest was paid at or around the closing of the Merger Transaction and the remaining principal balance of $922,178 was repaid with WCR stock issued in the Merger Transaction. The $922,178 repayment is presented herein retrospectively to furnish comparative information.

SAI was party to a Management and Advisory Agreement dated August 6, 2010, as amended April 1, 2012, with Blackstreet Capital Management, LLC (“Blackstreet”) under which Blackstreet provides certain financial, managerial, strategic and operating advice and assistance. The agreement required SAI to pay Blackstreet a fee in an amount equal to the greater of (i) $250,000 (subject to annual increases of five percent) or (ii) five percent of SAI’s “EBITDA” as defined under the agreement. As of December 31, 2020, SAI owed Blackstreet $2,513,546 of accrued fees under the agreement. On January 8, 2021, pursuant to the Merger Transaction, the agreement was terminated, $13,546 of the accrued fees were paid to Blackstreet and the remaining $2,500,000 was converted into a note payable to Blackstreet. The note is payable in ten consecutive annual lump sum installments of $250,000, without interest thereon, commencing on January 31, 2021, is unsecured and is guaranteed by the Company. The accrued liability converted to a note is presented herein retrospectively to furnish comparative information.

| 11. | Commitments and Contingencies – |

Legal Proceedings

The Company is party to a variety of legal actions arising out of the normal course of business. Plaintiffs occasionally seek punitive or exemplary damages. The Company does not believe that such normal and routine litigation will have a material impact on its consolidated financial results.

Revenue generated from contracts with customers and recognized per ASC 606 primarily consists of sales of merchandise and services at the point of sale and compensationCellular Retail

Compensation from Cricket Wireless.Wireless – As a Cricket Wireless authorized retailer, we earn compensation from Cricket Wireless for activating a new customer on the Cricket Wireless network and activating new devices for existing Cricket Wireless customers (“back-end compensation”) and upon an existing Cricket Wireless customer whom we originally activated on the Cricket Wireless GSM network making a continuing service payment (“CSP”). Compensation from Cricket Wireless for the three-month periods ended March 31, 2021 and 2020 was $8.71 million and $8.53 million, respectively.

Due to COVID-19 and at the request of Cricket Wireless, the 13

Cellular Retail segment temporarily closed approximately 75 retail locations in March 2020. In conjunction with the request, Cricket Wireless notified the Company that it would be providing temporary supplemental commissions for the store closures. In addition, Cricket Wireless temporarily increased other supplemental commissions for qualifying activations. COVID-19 related supplemental commissions of approximately $1,245,000 and $1,530,000, as reported to us by Cricket, was included in revenue in the three and six month periods ended June 30, 2020. The closure related supplemental compensation assistance from Cricket ended by June 30, 2020.

Revenue generated from short-term lending agreements in the Consumer Finance segment and from Company investmentsrevenues are recognized in accordance withper ASC 825.

Total net sales606 and consist of merchandise, which exclude sales taxes, are generally recorded as follows:the following:

| ● | Cellular RetailMerchandise – netmerchandise sales, reflectswhich exclude sales taxes, reflect the transaction price at point of sale when payment is received or receivable, the customer takes control of the merchandise and, applicable to devices, the device has been activated on the Cricket Wireless network. The sale and activation of a wireless device also correlates to the recording of back-end compensation from Cricket Wireless. Sales returns are generally not material to our financial statements. Merchandise sales revenue, which included back-end compensation from Cricket Wireless, is recorded in Sales and associated fees in the income statement. |

| ● | DirectOther revenue – services revenue from customer paid fees is recorded at point of sale when payment is received and the customer receives the benefit of the service. CSP compensation from Cricket Wireless is recorded as of the time certain Cricket Wireless customers make a service payment, as reported to us by Cricket Wireless. |

Direct to Consumer

Direct to Consumer revenue is recognized per ASC 606 and consists of the following:

| ● | Merchandise – netmerchandise sales, which exclude sales taxes, reflect the transaction price when product is shipped to customers, FOB shipping point, reduced by variable consideration. Shipping and handling fees are also included in total net sales. Variable consideration is comprised of estimated future returns and merchandise credits which are estimated based primarily on historical rates and sales levels. |

Manufacturing

Manufacturing revenue is recognized per ASC 606 and consists of the following:

| ● | Consumer Finance -Merchandise – merchandise sales, which exclude sales taxes, reflect the transaction price when product is shipped to customers, FOB shipping point, or at point of sale and are reduced by variable consideration. Shipping and handling fees are not included in total net sales and are an offset to freight-out expense. Variable consideration is comprised of estimated future returns and warranty liability which are estimated based primarily on historical rates and sales levels. |

Consumer Finance

Consumer Finance revenue from merchandise sales is recognized per ASC 606 and consists of the following:

| ● | Merchandise – merchandise sales, which exclude sales taxes, reflects the transaction price at point of sale in our pawn stores when payment in full is received and the customer takes control of the merchandise. Sales returns are generally not material to our financial statements. |

| ● | Other revenue – services revenue from customer paid fees for ancillary services is recorded at point of sale when payment is received and the customer receives the benefit of the service. |

Services

Consumer finance revenue from customer paid fees is generally recorded at point of sale when payment is received and the customer receives the benefit of the service. CSP compensation from Cricket Wireless is recorded as of the time certain Cricket Wireless customers make a service payment, as reported to us by Cricket Wireless.

Recognized as revenue per ASC 825, Consumer Finance loan fees and interest on cash advance loans areis recognized on a constant-yield basis ratably over a loan’s term. Installment loan feesper ASC 825 and interest are recognized usingconsist of the interest method, except that installment loan origination fees are recognized as they become non-refundable and installment loan maintenance fees are recognized when earned. The Company recognizes fees on pawn loans on a constant-yield basis ratably over the loans’ terms, less an estimated amount for expected forfeited pawn loans which is based on historical forfeiture rates.following:

| ● | Loan fees and interest – loan fees and interest on cash advance loans are recognized on a constant-yield basis ratably over a loan’s term. Installment loan fees and interest are recognized using the interest method, except that installment loan origination fees are recognized as they become non-refundable and installment loan maintenance fees are recognized when earned. The Company recognizes fees on pawn loans on a constant-yield basis ratably over the loans’ terms, less an estimated amount for expected forfeited pawn loans which is based on historical forfeiture rates. |

See Note 14,15, “Segment Information,” for disaggregation of revenue by segment.

| 12.13. | Other Operating Expense – |

A breakout of other expense is as follows:

| | | Three Months Ended June 30, | | Six Months Ended June 30, | | | Three Months Ended | |

| | | 2020 | | | 2019 | | | 2020 | | | 2019 | | | March 31, 2021 | | | March 31, 2020 | |

| Bank fees | | $ | 733,415 | | | $ | 539,586 | | | $ | 1,294,393 | | | $ | 1,044,567 | | | $ | 724,645 | | | $ | 608,675 | |

| Collection costs | | | 79,406 | | | | 82,637 | | | | 157,475 | | | | 160,352 | | | | 72,283 | | | | 78,069 | |

| Insurance | | | 199,951 | | | | 178,346 | | | | 396,332 | | | | 366,642 | | | | 164,521 | | | | 205,933 | |

| Management and advisory fees | | | 220,303 | | | | 211,001 | | | | 431,306 | | | | 413,148 | | | | 224,771 | | | | 307,961 | |

| Professional and consulting fees | | | 269,240 | | | | 236,184 | | | | 649,736 | | | | 789,805 | | | | 431,678 | | | | 405,153 | |

| Supplies | | | 202,575 | | | | 144,219 | | | | 420,154 | | | | 282,811 | | | | 166,872 | | | | 222,320 | |

| Loss on disposal | | | 670,259 | | | | 12,613 | | | | 662,522 | | | | 11,198 | | |

| Loss (Gain) on disposal | | | | 13,056 | | | | (9,337 | ) |

| Other | | | 629,551 | | | | 616,692 | | | | 1,277,100 | | | | 1,217,347 | | | | 654,643 | | | | 742,149 | |

| | | $ | 3,004,700 | | | $ | 2,021,278 | | | $ | 5,289,018 | | | $ | 4,285,870 | | | $ | 2,452,469 | | | $ | 2,560,923 | |

Cellular Retail Acquisitions

In 2020, PQH completed Cricket retail location transactions, acquiring 18 locations.