UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 20212022

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-39725

Maravai LifeSciences Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 8731 | | 85-2786970 |

| (State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer Identification No.) |

| | | | |

10770 Wateridge Circle, Suite 200 San Diego, California | | | | 92121 |

| (Address of principal executive offices) | | | | (Zip code) |

10770 Wateridge Circle Suite 200

San Diego, California 92121

(Address of principal executive offices)

Registrant’s telephone number, including area code: (858) 546-0004

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, $0.01 par value | | MRVI | | The Nasdaq Stock Market LLC |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

| Large accelerated filer | oý | Accelerated filer | o |

| Non-accelerated filer | ýo | Smaller reporting company | o |

| | Emerging growth company | ýo |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No x

As of May 7, 2021, 114,351,371April 29, 2022, 131,538,212 shares of the registrant’s Class A common stock were outstanding and 143,308,170123,669,196 shares of the registrant’s Class B common stock were outstanding.

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTFORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties.1995. All statements other than statements of historical fact included in this report, including, without limitation, statements under the section “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements often may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “can have,” “likely” and other words and terms of similar meaning in connection with any discussionmeaning. These statements are based upon management’s current expectations, assumptions and estimates and are not guarantees of the timing or nature of our future operating or financial performance or other events. All forward-looking statements are subject to risks, uncertainties and uncertaintiesother factors that may cause our actual results to differ materially from those that we expected, including:

•our history of losses, the risk that we may continue to incur losses in the future and our ability to generate sufficient revenue to achieve or maintain profitability;

•the fluctuation of our operating results, which makes our future operating results difficult to predict and could cause our operating results to fall below expectations or any guidance we may provide;

•our dependence on a limited number of customers for a high percentage of our revenue;

•the use of certainCertain of our products are used by customers in the production of vaccines and therapies, thatsome of which represent relatively new and still-developing modes of treatment, which may experience unforeseentreatment. Unforeseen adverse events, negative clinical outcomes, development of alternative therapies, or increased regulatory scrutiny;scrutiny of these and their financial cost may damage public perception of the safety, utility, or efficacy of these vaccines and therapies or other modes of treatment and may harm our customers’ ability to conduct their business. Such events may negatively impact our revenue and have an adverse effect on our performance.

•the impact of COVID-19 and any pandemic, epidemic or outbreak of infectious disease;

•changes in economic conditions;

•We are dependent on our dependence on customers’ spending on and demand for outsourced nucleic acid production and biologics safety testing and protein detection research products and services;services. A reduction in spending or demand could have a material adverse effect on our business, financial condition, results of operations, cash flows and prospects.

•competitionWe compete with life science, pharmaceutical and biotechnology companies who are substantially larger than we are and potentially capable of developing new approaches that could make our products, services and technologies obsolete;technology obsolete.

•the ability ofIf our products and services todo not perform as expected andor the reliability of the technology on which our products and services are based;

•the complexitybased is questioned, we could experience lost revenue, delayed or reduced market acceptance of our products and the fact that theyservices, increased costs and damage to our reputation.

•Our products are highly complex and are subject to quality control requirements;requirements.

•Our success depends on the market acceptance of our reliancelife science reagents. Our reagents may not achieve or maintain significant commercial market acceptance.

•Until the 2020 fiscal year, we had incurred losses for each fiscal year since inception, we may incur losses in the future and we may not be able to generate sufficient revenue to maintain profitability.

•Our operating results may fluctuate significantly in the future, which makes our future operating results difficult to predict and could cause our operating results to fall below expectations or any guidance we may provide.

•Product liability lawsuits against us could cause us to incur substantial liabilities, limit sales of our existing products and limit commercialization of any products that we may develop.

•Our acquisitions expose us to risks that could adversely affect our business, and we may not achieve the anticipated benefits of acquisitions of businesses or technologies.

•We depend on a limited number of customers for a high percentage of our revenue. If we cannot maintain our current relationships with customers, fail to sustain recurring sources of revenue with our existing customers, or if we fail to enter into new relationships, our future operating results will be adversely affected.

•We rely on a limited number of suppliers or, in some cases, sole suppliers, for some of our raw materials and our inabilitymay not be able to find replacements or immediately transition to alternative suppliers;suppliers.

•Our products could become subject to more onerous regulation by the FDA or other regulatory agencies in the future, which could increase our dependence on a stablecosts and adequate supplydelay or prevent commercialization of quality raw materials from our suppliers,products, thereby materially and the riskadversely affecting our business, financial condition, results of adverse impacts from price increases or interruptions of such supply;operations, cash flows and prospects.

•disruptions atIf we are unable to obtain, maintain and enforce intellectual property protection for our sites;

•current or future products, or if the scope of our intellectual property protection is not sufficiently broad, our ability to manufacture in specific quantities;

•natural disasters, geopolitical unrest, war, terrorism, public health issues such as COVID-19 or other catastrophic events that could disrupt the supply, delivery or demand ofcommercialize our products successfully and services;

•our ability to secure additional financing for future strategic transactions;

•our reliance on third-party package delivery services and adverse impacts arising from significant disruptions of these services, damages or losses sustained during shipping or significant increases in prices;

•our ability to continue to hire and retain skilled personnel;

•our ability to successfully identify and implement distribution arrangements and marketing alliances;

•the market acceptance of our life science reagents;

•the market receptivity to our new products and services upon their introduction;

•our ability to implement our strategies for revenue growth;

•the accuracy of our estimates of market opportunity and forecasts of market growth;compete effectively may be materially adversely affected.

•product liability lawsuits;

•the application of privacy laws, security laws, regulations, policies and contractual obligations related to data privacy and security;

•our ability to efficiently manage our growth;

•the success of any opportunistic acquisitions;

•the integrity of our internal computer systems;

•the impact of export and import control laws and regulations;

•risks related to Brexit;

•changes in political, economic or governmental regulations;

•financial, operating, legal and compliance risks associated with global operations;

•risks associated with our acquisitions;

•impacts from foreign currency exchange rates;

•the risk that our products could become subject to more onerous regulation in the future;

•our ability to use net operating loss and tax credit carryforwards;

•the fact that our activities are and will continue to be subject to extensive government regulation;

•the risk thatIf we may be required to record a significant charge to earnings if our goodwill or other amortizable intangible assets become impaired;

•unfavorable accounting charges or effects driven by changes in accounting principles or guidance;

•impacts on our financial results from our revenue recognition and other factors;

•fluctuations in our effective tax rate;

•environmental risks;

•our ability to obtain, maintain and enforce intellectual property protection for our current and future products;

•our ability to protect the confidentiality of our proprietary information;

•risks associated with lawsuits to protect our patents or with respect to the infringement, misappropriations or other violations of intellectual property rights of third parties;

•risks associated with failuresfail to comply with our obligations under any license agreements;agreements, disagree over contract interpretation, or otherwise experience disruptions to our business relationships with our licensors, we could lose intellectual property rights that are necessary to our business.

•potential changes in patent law in the United StatesOur existing indebtedness could adversely affect our business and other jurisdictions;growth prospects.

•Our principal asset is our interest in Maravai Topco Holdings, LLC (“Topco LLC”), and, accordingly, we depend on distributions from Topco LLC to pay our taxes and expenses, including payments under a tax receivable agreement with the former owners of Topco LLC (the “Tax Receivable Agreement” or “TRA”). Topco LLC’s ability to obtainmake such distributions may be subject to various limitations and maintain our patent protection; restrictions.

•impactConflicts of claims by third partiesinterest could arise between our shareholders and Maravai Life Sciences Holdings, LLC (“MLSH 1”), the only other member of Topco LLC, which may impede business decisions that we orcould benefit our employees, consultants or independent contractors have infringed, misappropriated or otherwise violated their intellectual property;shareholders.

•The Tax Receivable Agreement requires us to make cash payments to MLSH 1 and Maravai Life Sciences Holdings 2, LLC (“MLSH 2”), an entity through which certain of our abilityformer owners hold their interests in the Company, in respect of certain tax benefits to protect our intellectual propertywhich we may become entitled, and proprietary rights throughoutwe expect that the world;payments we will be required to make will be substantial.

•our reliance on confidentiality agreements;Our organizational structure, including the Tax Receivable Agreement, confers certain benefits upon MLSH 1 and MLSH 2 that will not benefit the other common shareholders to the same extent as they will benefit MLSH 1 and MLSH 2.

•our ability to protect our trademarksGTCR, LLC (“GTCR”) controls us, and trade names;its interests may conflict with ours or yours in the future.

•threats not relatedProvisions of our corporate governance documents could make an acquisition of us more difficult and may prevent attempts by our shareholders to intellectual property; and

•other risks addressed inreplace or remove our Annual Report on Form 10-K for the year ended December 31, 2020.current management, even if beneficial to our shareholders.

We derive many of our forward-looking statements from our operating budgets and forecasts, which are based on many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause our actual results to differ materially from our expectations, or cautionary statements, are disclosed under the sectionsections entitled

“Management’s “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2021 and in this Quarterly Report on Form 10-Q.

The forward-looking statements included in this report are made only as of the date hereof. We undertake no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

Part I.

Item 1. Financial Statements and Supplementary Data

MARAVAI LIFESCIENCES HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share amounts and par value)

(Unaudited)

| | | March 31, 2021 | | December 31, 2020 | | | March 31, 2022 | | December 31, 2021 |

| Assets | Assets | | | | | Assets | | | |

| Current assets: | Current assets: | | | Current assets: | |

| Cash | Cash | $ | 247,675 | | | $ | 236,184 | | | Cash | $ | 431,469 | | | $ | 551,272 | |

| Accounts receivable, net | Accounts receivable, net | 121,821 | | | 51,018 | | | Accounts receivable, net | 120,355 | | | 117,512 | |

| Inventory | Inventory | 47,129 | | | 33,301 | | | Inventory | 51,409 | | | 51,557 | |

| Prepaid expenses and other current assets | Prepaid expenses and other current assets | 8,918 | | | 11,095 | | | Prepaid expenses and other current assets | 15,902 | | | 19,698 | |

| | Total current assets | Total current assets | 425,543 | | | 331,598 | | | Total current assets | 619,135 | | | 740,039 | |

| Property and equipment, net | Property and equipment, net | 105,133 | | | 101,305 | | | Property and equipment, net | 47,702 | | | 46,332 | |

| Goodwill | Goodwill | 224,275 | | | 224,275 | | | Goodwill | 283,535 | | | 152,766 | |

| Intangible assets, net | Intangible assets, net | 172,616 | | | 177,656 | | | Intangible assets, net | 235,405 | | | 117,571 | |

| Deferred tax assets | Deferred tax assets | 419,901 | | | 431,699 | | | Deferred tax assets | 793,210 | | | 808,117 | |

| Other assets | Other assets | 4,300 | | | 4,158 | | | Other assets | 64,243 | | | 53,451 | |

| Total assets | Total assets | $ | 1,351,768 | | | $ | 1,270,691 | | | Total assets | $ | 2,043,230 | | | $ | 1,918,276 | |

| Liabilities and stockholders' equity | Liabilities and stockholders' equity | | | | | Liabilities and stockholders' equity | | | |

| Current liabilities: | Current liabilities: | | | Current liabilities: | |

| Accounts payable | Accounts payable | $ | 9,806 | | | $ | 8,171 | | | Accounts payable | $ | 10,384 | | | $ | 8,154 | |

| Accrued expenses and other current liabilities | Accrued expenses and other current liabilities | 28,973 | | | 38,546 | | | Accrued expenses and other current liabilities | 32,411 | | | 34,574 | |

| Deferred revenue | Deferred revenue | 119,175 | | | 78,061 | | | Deferred revenue | 3,693 | | | 10,211 | |

| Current portion of payable to related parties pursuant to Tax Receivable Agreement | 1,298 | | | 0 | | | |

| Current portion of payable to related parties pursuant to a Tax Receivable Agreement | | Current portion of payable to related parties pursuant to a Tax Receivable Agreement | 34,747 | | | 34,838 | |

| Current portion of long-term debt | Current portion of long-term debt | 6,000 | | | 6,000 | | | Current portion of long-term debt | 5,440 | | | 6,000 | |

| | Total current liabilities | Total current liabilities | 165,252 | | | 130,778 | | | Total current liabilities | 86,675 | | | 93,777 | |

| Long-term debt, less current portion | Long-term debt, less current portion | 527,593 | | | 528,614 | | | Long-term debt, less current portion | 524,499 | | | 524,591 | |

| Deferred tax liabilities | 8,571 | | | 8,609 | | | |

| Lease facility financing obligation, less current portion | 55,924 | | | 56,167 | | | |

| Payable to related parties pursuant to a Tax Receivable Agreement | 382,362 | | | 389,546 | | | |

| | Payable to related parties pursuant to a Tax Receivable Agreement, less current portion | | Payable to related parties pursuant to a Tax Receivable Agreement, less current portion | 711,232 | | | 713,481 | |

| Other long-term liabilities | Other long-term liabilities | 2,310 | | | 2,231 | | | Other long-term liabilities | 66,522 | | | 41,066 | |

| Total liabilities | Total liabilities | 1,142,012 | | | 1,115,945 | | | Total liabilities | 1,388,928 | | | 1,372,915 | |

| Lease commitments (Note 5) | 0 | | 0 | | |

| Stockholders' equity | | | |

| Class A common stock, $0.01 par value - 500,000,000 shares authorized; 96,646,515 shares issued and outstanding as of March 31, 2021 and December 31, 2020 | 966 | | | 966 | | | |

| Class B common stock, $0.01 par value - 300,000,000 shares authorized; 160,974,129 shares issued and outstanding as of March 31, 2021 and December 31, 2020 | 1,610 | | | 1,610 | | | |

| | Stockholders' equity: | | Stockholders' equity: | | | |

| Class A common stock, $0.01 par value - 500,000 shares authorized; 131,490 and 131,488 shares issued and outstanding as of March 31, 2022 and December 31, 2021, respectively | | Class A common stock, $0.01 par value - 500,000 shares authorized; 131,490 and 131,488 shares issued and outstanding as of March 31, 2022 and December 31, 2021, respectively | 1,315 | | | 1,315 | |

| Class B common stock, $0.01 par value - 300,000 shares authorized; 123,669 shares issued and outstanding as of March 31, 2022 and December 31, 2021 | | Class B common stock, $0.01 par value - 300,000 shares authorized; 123,669 shares issued and outstanding as of March 31, 2022 and December 31, 2021 | 1,237 | | | 1,237 | |

| Additional paid-in capital | Additional paid-in capital | 85,976 | | | 85,125 | | | Additional paid-in capital | 128,584 | | | 128,386 | |

| Accumulated other comprehensive loss | (42) | | | (44) | | | |

| | Retained earnings | Retained earnings | 24,101 | | | 854 | | | Retained earnings | 251,423 | | | 184,561 | |

| Total stockholders' equity attributable to Maravai LifeSciences Holdings, Inc. | Total stockholders' equity attributable to Maravai LifeSciences Holdings, Inc. | 112,611 | | | 88,511 | | | Total stockholders' equity attributable to Maravai LifeSciences Holdings, Inc. | 382,559 | | | 315,499 | |

| Non-controlling interests | 97,145 | | | 66,235 | | | |

| Non-controlling interest | | Non-controlling interest | 271,743 | | | 229,862 | |

| Total stockholders' equity | Total stockholders' equity | 209,756 | | | 154,746 | | | Total stockholders' equity | 654,302 | | | 545,361 | |

| Total liabilities and stockholders' equity | Total liabilities and stockholders' equity | $ | 1,351,768 | | | $ | 1,270,691 | | | Total liabilities and stockholders' equity | $ | 2,043,230 | | | $ | 1,918,276 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

MARAVAI LIFESCIENCES HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | |

| Three Months Ended

March 31, | | |

| 2022 | | 2021

(as adjusted)* | | | | |

| Revenue | $ | 244,293 | | | $ | 148,211 | | | | | |

| Operating expenses: | | | | | | | |

| Cost of revenue | 40,032 | | | 31,391 | | | | | |

| Selling, general and administrative | 33,200 | | | 23,471 | | | | | |

| Research and development | 3,695 | | | 2,160 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Total operating expenses | 76,927 | | | 57,022 | | | | | |

| Income from operations | 167,366 | | | 91,189 | | | | | |

| Other income (expense): | | | | | | | |

| Interest expense | (2,664) | | | (7,904) | | | | | |

| Loss on extinguishment of debt | (208) | | | — | | | | | |

| Change in payable to related parties pursuant to a Tax Receivable Agreement | 2,340 | | | 5,886 | | | | | |

| Other income | 7 | | | 3 | | | | | |

| Income before income taxes | 166,841 | | | 89,174 | | | | | |

| Income tax expense | 19,981 | | | 13,709 | | | | | |

| Net income | 146,860 | | | 75,465 | | | | | |

| Net income attributable to non-controlling interests | 79,998 | | | 52,363 | | | | | |

| Net income attributable to Maravai LifeSciences Holdings, Inc. | $ | 66,862 | | | $ | 23,102 | | | | | |

| | | | | | | |

| Net income per Class A common share attributable to Maravai LifeSciences Holdings, Inc.: | | | | | | | |

| Basic | $ | 0.51 | | | $ | 0.24 | | | | | |

| Diluted | $ | 0.50 | | | $ | 0.24 | | | | | |

| | | | | | | |

| Weighted average number of Class A common shares outstanding: | | | | | | | |

| Basic | 131,489 | | | 96,647 | | | | | |

| Diluted | 255,287 | | | 96,673 | | | | | |

____________________

*As adjusted to reflect the impact of the adoption of Accounting Standards Codification 842 (“ASC 842”). See Note 1 to the condensed consolidated financial statements for a summary of the adjustments.

The accompanying notes are an integral part of these condensed consolidated financial statements.

MARAVAI LIFESCIENCES HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in thousands, except share and unit amounts and per share and per unit amounts)thousands)

(Unaudited)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2021 | | 2020 |

| | | |

| Revenue | $ | 148,211 | | | $ | 50,981 | |

| Operating expenses: | | | |

| Cost of revenue | 30,368 | | | 15,297 | |

| Research and development | 2,164 | | | 3,744 | |

| Selling, general and administrative | 23,237 | | | 16,126 | |

| | | |

| Gain on sale and leaseback transaction | 0 | | | (19,002) | |

| Total operating expenses | 55,769 | | | 16,165 | |

| Income from operations | 92,442 | | | 34,816 | |

| Other income (expense): | | | |

| Interest expense | (8,770) | | | (7,382) | |

| Change in payable to related parties pursuant to a Tax Receivable Agreement | 5,886 | | | 0 | |

| Other income | 3 | | | 80 | |

| Income before income taxes | 89,561 | | | 27,514 | |

| Income tax expense | 13,709 | | | 3,635 | |

| Net income | 75,852 | | | 23,879 | |

| Net income attributable to non-controlling interests | 52,605 | | | 490 | |

| Net income attributable to Maravai LifeSciences Holdings, Inc. | $ | 23,247 | | | $ | 23,389 | |

| | | |

| Net income per Class A common share/unit attributable to Maravai LifeSciences Holdings, Inc.: | | | |

| Basic | $ | 0.24 | | | $ | 0.09 | |

| Diluted | $ | 0.24 | | | $ | 0.09 | |

| | | |

| Weighted average number of Class A common shares/units outstanding: | | | |

| Basic | 96,646,515 | | | 253,916,941 | |

| Diluted | 96,672,968 | | | 253,916,941 | |

| | | | | | | | | | | | | | | |

| Three Months Ended

March 31, | | |

| 2022 | | 2021

(as adjusted)* | | | | |

| Net income | $ | 146,860 | | | $ | 75,465 | | | | | |

| Other comprehensive income: | | | | | | | |

| Foreign currency translation adjustments | — | | | 8 | | | | | |

| Total other comprehensive income | 146,860 | | | 75,473 | | | | | |

| Comprehensive income attributable to non-controlling interests | 79,998 | | | 52,369 | | | | | |

| Total comprehensive income attributable to Maravai LifeSciences Holdings, Inc. | $ | 66,862 | | | $ | 23,104 | | | | | |

____________________

The accompanying notes are an integral part of thesethe condensed consolidated financial statements.

MARAVAI LIFESCIENCES HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOMECHANGES IN STOCKHOLDERS’ EQUITY

(in thousands)

(Unaudited)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| March 31, 2021 | | March 31, 2020 |

| Net income | $ | 75,852 | | | $ | 23,879 | |

| Other comprehensive income: | | | |

| Foreign currency translation adjustments | 8 | | | (71) | |

| Total other comprehensive income | 75,860 | | | 23,808 | |

| Comprehensive income attributable to non-controlling interests | 52,605 | | | 490 | |

| Total comprehensive income attributable to Maravai LifeSciences Holdings, Inc. | $ | 23,255 | | | $ | 23,318 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2022 |

| Class A Common Stock | | Class B Common Stock | | | | | | | | | | |

| Shares | | Amount | | Shares | | Amount | | Additional Paid-In Capital | | | | Retained Earnings | | Non-Controlling Interest | | Total Stockholders' Equity |

| December 31, 2021 | 131,488 | | $ | 1,315 | | | 123,669 | | $ | 1,237 | | | $ | 128,386 | | | | | $ | 184,561 | | | $ | 229,862 | | | $ | 545,361 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Issuance of Class A common stock under employee equity plans, net of shares withheld for employee taxes | 2 | | | — | | | — | | | — | | | 34 | | | | | — | | | — | | | 34 | |

| Non-controlling interest adjustment for changes in proportionate ownership in Topco LLC | — | | | — | | | — | | | — | | | (14) | | | | | — | | | 14 | | | — | |

| Stock-based compensation | — | | | — | | | — | | | — | | | 1,869 | | | | | — | | | 1,758 | | | 3,627 | |

| Distribution for tax liabilities to non-controlling interest holder | — | | | — | | | — | | | — | | | — | | | | | — | | | (39,889) | | | (39,889) | |

| Impact of change to deferred tax asset associated with cash contribution to Topco | — | | | — | | | — | | | — | | | (1,691) | | | | | — | | | — | | | (1,691) | |

| Net income | — | | | — | | | — | | | — | | | — | | | | | 66,862 | | | 79,998 | | | 146,860 | |

| | | | | | | | | | | | | | | | | |

| March 31, 2022 | 131,490 | | $ | 1,315 | | | 123,669 | | $ | 1,237 | | | $ | 128,584 | | | | | $ | 251,423 | | | $ | 271,743 | | | $ | 654,302 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2021 |

| Class A Common Stock | | Class B Common Stock | | | | | | | | | | |

| Shares | | Amount | | Shares | | Amount | | Additional Paid-In Capital | | Accumulated Other Comprehensive Loss | | Retained Earnings | | Non-Controlling Interest | | Total Stockholders' Equity |

| December 31, 2020 | 96,647 | | $ | 966 | | | 160,974 | | $ | 1,610 | | | $ | 85,125 | | | $ | (44) | | | $ | 854 | | | $ | 66,235 | | | $ | 154,746 | |

| Cumulative effect of adoption of ASC 842, net of tax | — | | | — | | | — | | | — | | | — | | | — | | | 1,670 | | | 2,784 | | | 4,454 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | — | | | — | | | 854 | | | — | | | — | | | 1,424 | | | 2,278 | |

| Distribution for tax liabilities to non-controlling interest holder | — | | | — | | | — | | | — | | | (3) | | | — | | | — | | | (23,125) | | | (23,128) | |

| Net income | — | | | — | | | — | | | — | | | — | | | — | | | 23,102 | | | 52,363 | | | 75,465 | |

| Foreign currency translation adjustment | — | | | — | | | — | | | — | | | — | | | 2 | | | — | | | 6 | | | 8 | |

March 31, 2021

(as adjusted)* | 96,647 | | $ | 966 | | | 160,974 | | $ | 1,610 | | | $ | 85,976 | | | $ | (42) | | | $ | 25,626 | | | $ | 99,687 | | | $ | 213,823 | |

____________________

*As adjusted to reflect the impact of the adoption of ASC 842. See Note 1 to the condensed consolidated financial statements for a summary of the adjustments.

The accompanying notes are an integral part of the condensed consolidated financial statementsstatements.

MARAVAI LIFESCIENCES HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’/MEMBER’S EQUITY

(in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A Common Stock | | Class B Common Stock | | | | | | | | | | |

| Shares | | Amount | | Shares | | Amount | | Additional Paid In Capital | | Accumulated Other Comprehensive Loss | | Retained Earnings | | Non-Controlling Interest | | Total Stockholders'/Member's Equity |

| December 31, 2020 | 96,647 | | $ | 966 | | | 160,974 | | $ | 1,610 | | | $ | 85,125 | | | $ | (44) | | | $ | 854 | | | $ | 66,235 | | | $ | 154,746 | |

| Equity-based compensation | — | | | — | | | — | | | — | | | 854 | | | — | | | — | | | 1,424 | | | 2,278 | |

| Distribution for tax liabilities to non-controlling interest holder | — | | | — | | | — | | | — | | | (3) | | | — | | | — | | | (23,125) | | | (23,128) | |

| Net income | — | | — | | | — | | — | | | — | | — | | | 23,247 | | | 52,605 | | | 75,852 | |

| Foreign currency translation adjustment | — | | | — | | | — | | | — | | | — | | | 2 | | | — | | | 6 | | | 8 | |

| March 31, 2021 | 96,647 | | $ | 966 | | | 160,974 | | $ | 1,610 | | | $ | 85,976 | | | $ | (42) | | | $ | 24,101 | | | $ | 97,145 | | | $ | 209,756 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Units | | Amount | | Contributed Capital | | Accumulated Other Comprehensive Loss | | Accumulated Deficit | | Non-Controlling Interest | | Total Member's Equity |

| December 31, 2019 | 253,917 | | $0 | | $183,910 | | $ | (133) | | | $ | (42,381) | | | $ | 3,231 | | | $ | 144,627 | |

| Unit-based compensation | — | | — | | 420 | | — | | | — | | | 88 | | | 508 | |

| Net income | — | | — | | — | | — | | | 23,389 | | | 490 | | | 23,879 | |

| Foreign currency translation adjustment | — | | — | | — | | (71) | | | — | | | — | | | (71) | |

| March 31, 2020 | 253,917 | | $ | 0 | | | $ | 184,330 | | | $ | (204) | | | $ | (18,992) | | | $ | 3,809 | | | $ | 168,943 | |

The accompanying notes are an integral part of the condensed consolidated financial statements

MARAVAI LIFESCIENCES HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(Unaudited)

| | | Three Months Ended March 31, | | Three Months Ended

March 31, |

| | 2021 | | 2020 | | 2022 | | 2021

(as adjusted)* |

| Operating activities | | | | |

| Operating activities: | | Operating activities: | | | |

| Net income | Net income | $ | 75,852 | | | $ | 23,879 | | Net income | $ | 146,860 | | | $ | 75,465 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | Adjustments to reconcile net income to net cash provided by operating activities: | | Adjustments to reconcile net income to net cash provided by operating activities: | |

| Depreciation | Depreciation | 1,854 | | | 1,691 | | Depreciation | 1,855 | | | 1,256 | |

| Amortization of intangible assets | Amortization of intangible assets | 5,040 | | | 5,075 | | Amortization of intangible assets | 5,527 | | | 5,041 | |

| Non-cash operating lease expense | | Non-cash operating lease expense | 1,874 | | | 2,378 | |

| Amortization of deferred financing costs | Amortization of deferred financing costs | 654 | | | 431 | | Amortization of deferred financing costs | 699 | | | 654 | |

| Equity-based compensation expense | Equity-based compensation expense | 2,278 | | | 508 | | Equity-based compensation expense | 3,627 | | | 2,278 | |

| Loss on extinguishment of debt | | Loss on extinguishment of debt | 208 | | | — | |

| Deferred income taxes | Deferred income taxes | 11,760 | | | (1,274) | | Deferred income taxes | 13,217 | | | 11,760 | |

| Gain on sale and leaseback transaction | 0 | | | (19,002) | | |

| Acquired and in-process research and development costs | 0 | | | 2,881 | | |

| Non-cash interest expense recognized on lease facility financing obligation | 162 | | | 215 | | |

| Revaluation of liabilities under Tax Receivable Agreement | (5,886) | | | 0 | | |

| | Revaluation of liabilities under the Tax Receivable Agreement | | Revaluation of liabilities under the Tax Receivable Agreement | (2,340) | | | (5,886) | |

| Other | Other | (144) | | | 38 | | Other | (985) | | | (300) | |

| Changes in operating assets and liabilities: | Changes in operating assets and liabilities: | | Changes in operating assets and liabilities: | |

| Accounts receivable | Accounts receivable | (70,812) | | | (10,086) | | Accounts receivable | (2,217) | | | (70,812) | |

| Inventory | Inventory | (13,828) | | | (5,365) | | Inventory | 1,201 | | | (13,808) | |

| Prepaid expenses and other assets | Prepaid expenses and other assets | 98 | | | 209 | | Prepaid expenses and other assets | 2,517 | | | (581) | |

| Accounts payable | Accounts payable | 1,897 | | | 3,402 | | Accounts payable | 1,950 | | | 1,896 | |

| Accrued expenses and other current liabilities | Accrued expenses and other current liabilities | (11,044) | | | 9,044 | | Accrued expenses and other current liabilities | (4,062) | | | (10,746) | |

| Deferred revenue | | Deferred revenue | (6,518) | | | 41,114 | |

| Other long-term liabilities | Other long-term liabilities | (280) | | | (1,925) | | Other long-term liabilities | (1,109) | | | (1,383) | |

| Deferred revenue | 41,114 | | | (8) | | |

| Net cash provided by operating activities | Net cash provided by operating activities | 38,715 | | | 9,713 | | Net cash provided by operating activities | 162,304 | | | 38,326 | |

| Investing activities | | | | |

| Cash paid for asset acquisition, net of cash acquired | 0 | | | (3,024) | | |

| Investing activities: | | Investing activities: | | | |

| Cash paid for acquisition of a business, net of cash acquired | | Cash paid for acquisition of a business, net of cash acquired | (238,836) | | | — | |

| | Purchases of property and equipment | Purchases of property and equipment | (3,580) | | | (3,409) | | Purchases of property and equipment | (2,748) | | | (3,332) | |

| Proceeds from sale of building | Proceeds from sale of building | 548 | | | 34,500 | | Proceeds from sale of building | — | | | 548 | |

| Net cash (used in) provided by investing activities | (3,032) | | | 28,067 | | |

| Financing activities | | | | |

| | Net cash used in investing activities | | Net cash used in investing activities | (241,584) | | | (2,784) | |

| Financing activities: | | Financing activities: | | | |

| Distributions for tax liabilities to non-controlling interests holders | Distributions for tax liabilities to non-controlling interests holders | (23,128) | | | 0 | | Distributions for tax liabilities to non-controlling interests holders | (39,889) | | | (23,128) | |

| Proceeds from borrowings of long-term debt, net of discount | 0 | | | 15,000 | | |

| Proceeds from borrowings of long-term debt | | Proceeds from borrowings of long-term debt | 8,455 | | | — | |

| Principal repayments of long-term debt | Principal repayments of long-term debt | (1,500) | | | (625) | | Principal repayments of long-term debt | (9,815) | | | (1,500) | |

| Payments made on facility financing lease obligation and capital lease | (141) | | | (36) | | |

| Proceeds from employee stock purchase plan | 570 | | | 0 | | |

| Net cash (used in) provided by financing activities | (24,199) | | | 14,339 | | |

| | Proceeds from employee stock purchase plan and exercise of stock options, net of shares withheld for employee taxes | | Proceeds from employee stock purchase plan and exercise of stock options, net of shares withheld for employee taxes | 726 | | | 570 | |

| Net cash used in financing activities | | Net cash used in financing activities | (40,523) | | | (24,058) | |

| Effects of exchange rate changes on cash | Effects of exchange rate changes on cash | 7 | | | (72) | | Effects of exchange rate changes on cash | — | | | 7 | |

| Net increase in cash, and restricted cash | 11,491 | | | 52,047 | | |

| | Net (decrease) increase in cash | | Net (decrease) increase in cash | (119,803) | | | 11,491 | |

| Cash, beginning of period | Cash, beginning of period | 236,184 | | | 24,700 | | Cash, beginning of period | 551,272 | | | 236,184 | |

| Cash, end of period | Cash, end of period | $ | 247,675 | | | $ | 76,747 | | Cash, end of period | $ | 431,469 | | | $ | 247,675 | |

| Supplemental cash flow information | | | | |

| | Supplemental cash flow information: | | Supplemental cash flow information: | |

| Cash paid for interest | Cash paid for interest | $ | 7,947 | | | $ | 6,236 | | Cash paid for interest | $ | 1,373 | | | $ | 7,219 | |

| Cash paid for income taxes | Cash paid for income taxes | $ | 2,725 | | | $ | 0 | | Cash paid for income taxes | $ | 914 | | | $ | 2,725 | |

| Supplemental disclosures of non-cash investing and financing activities | | | | |

| | Supplemental disclosures of non-cash investing and financing activities: | | Supplemental disclosures of non-cash investing and financing activities: | | | |

| Property and equipment included in accounts payable and accrued expenses | Property and equipment included in accounts payable and accrued expenses | $ | 1,415 | | | $ | 581 | | Property and equipment included in accounts payable and accrued expenses | $ | 1,742 | | | $ | 1,202 | |

| | Right-of-use assets obtained in exchange for new operating lease liabilities | | Right-of-use assets obtained in exchange for new operating lease liabilities | $ | 773 | | | $ | — | |

|

MARAVAI LIFESCIENCES HOLDINGS, INC.

| | | | | | | | | | | |

| Three Months Ended

March 31, |

| 2022 | | 2021

(as adjusted)* |

| Fair value of contingent consideration liability recorded in connection with acquisition of business in other long-term liabilities | $ | 7,800 | | | $ | — | |

| Accrued consideration payable | $ | 10,000 | | | $ | — | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

____________________

*As adjusted to reflect the impact of the adoption of ASC 842. See Note 1 to the condensed consolidated financial statements for a summary of the adjustments.

The accompanying notes are an integral part of the condensed consolidated financial statementsstatements.

MARAVAI LIFESCIENCES HOLDINGS, INC.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1.Organization and Significant Accounting Policies

Description of Business

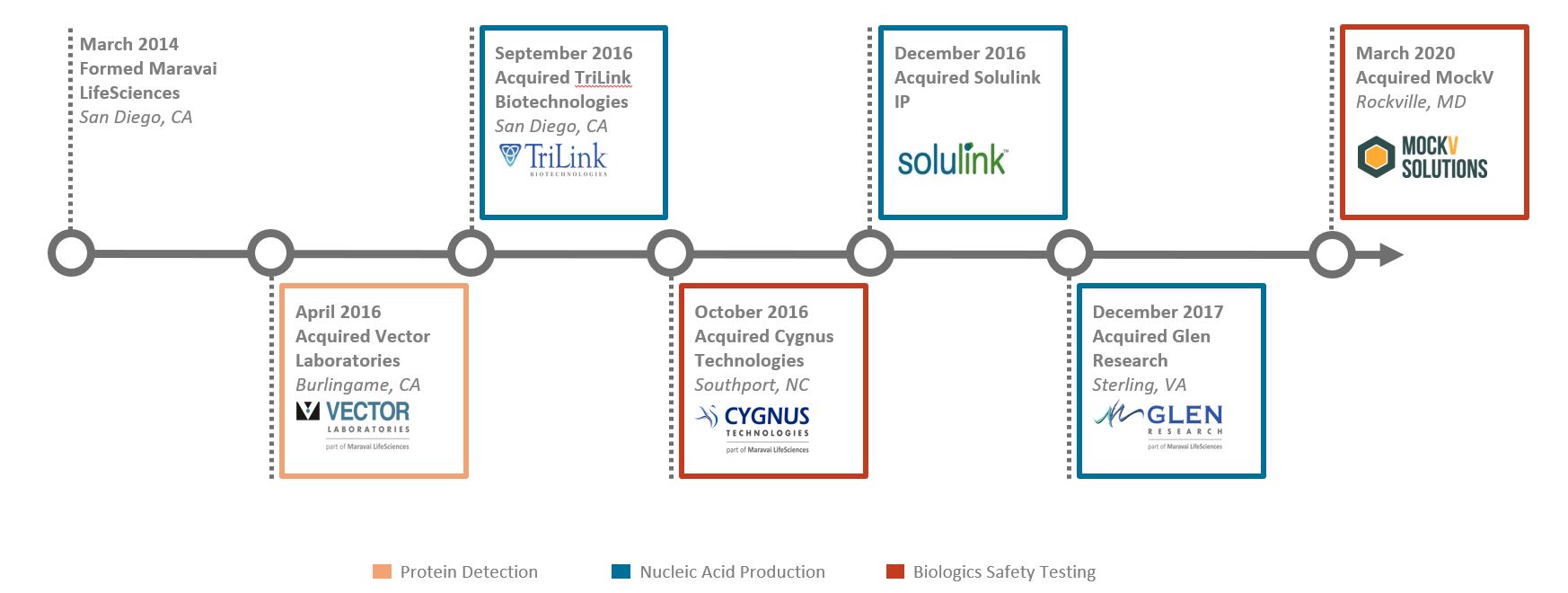

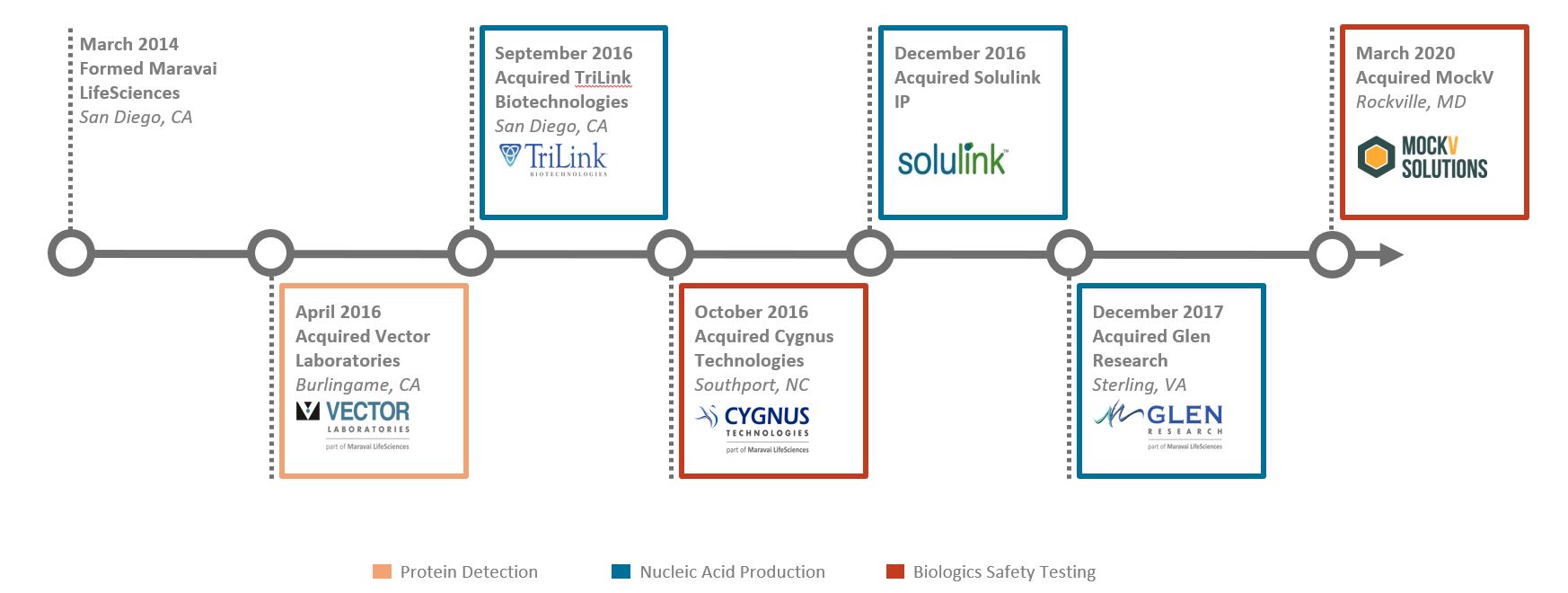

Maravai LifeSciences Holdings, Inc. (the “Company”, and together with its consolidated subsidiaries, “Maravai”, “we”, “us”, and “our”) was formed as a Delaware corporation in August 2020 for the purpose of facilitating an initial public offering (“IPO”) of its Class A common stock, facilitating certain organizational transactions and to operate the business of Maravai Topco Holdings, LLC (“Topco LLC”) and its consolidated subsidiaries.

We are a leading life sciences company providingprovides critical products to enable the development of drug therapies,drugs, therapeutics, diagnostics noveland vaccines and to support research on human diseases. Our products address the key phases of biopharmaceutical development and include complex nucleic acids for diagnostic and therapeutic applications and antibody-based products to detect impurities during the production of biopharmaceutical products, and products to detect the expression of proteins in tissues of various species.products.

The Company is headquartered in San Diego, California and has threehistorically operated in 3 principal businesses: Nucleic Acid Production, Biologics Safety Testing and Protein Detection. In September 2021, the Company completed the divestiture of its Protein Detection business. Our Nucleic Acid Production business manufactures and sells products used in the fields of gene therapy, vaccines, nucleoside chemistry, oligonucleotide therapy and molecular diagnostics, including reagents used in the chemical synthesis, modification, labelling and purification of deoxyribonucleic acid (“DNA”) and ribonucleic acid (“RNA”). Our core Nucleic Acid Production offerings include messenger ribonucleic acid (“mRNA”), long and short oligonucleotides, our proprietary CleanCap® capping technology and oligonucleotide building blocks. Our Biologics Safety Testing business sells highly specialized analytical products for use in biologic manufacturing process development, including custom product-specific development antibody and assay development services. Our Protein Detection business sells innovative labeling and detection reagents

Organization

We were incorporated as a Delaware corporation in August 2020 for researchers in immunohistochemistry.

Organizational Transactions and Initial Public Offering

In November 2020, the Company completed itspurpose of facilitating an initial public offering (“IPO”) and sold 69,000,000 shares of Class A common stock at a public offering price of $27.00 per share and received proceeds of $1.8 billion, net of underwriting discounts and commissions, which the Company used to purchase previously-issued and newly-issued LLC units in Topco LLC, to pay Maravai Life Sciences Holdings 2, LLC (“MLSH 2”) as consideration for certain organizational transactions that occurred before the IPO, and to purchase outstanding shares of Class A common stock from MLSH 2.

. Immediately prior to and in connection with, the completion of our IPO, the Company completedwe effected a series of organizational transactions (“Organizational(the “Organizational Transactions”), including:

•The amendmentwhich, together with the IPO, were completed in November 2020, that resulted in the Company operating, controlling all of the business affairs and restatementbecoming the ultimate parent company of Maravai Topco LLC’s operating agreement (the “NewHoldings, LLC Operating Agreement”) to, among other things, (i) modify (“Topco LLC’s capital structure by replacing the membership interests held by Topco LLC’s existing owners with a new class of Topco LLC units (the “LLC Units”LLC”) and (ii) appoint the Company as the sole managing member of Topco LLC;

•Amend and restate the Company’s certificate of incorporation to among other things, authorize the Company to issue two classes of common stock: Class A common stock and Class B common stock;

•The issuance of shares of the Company’s Class B common stock toits consolidated subsidiaries. Maravai Life Sciences Holdings, LLC (“MLSH 1”), which was Topco LLC’s pre-IPO owner on a one-to-one basisis controlled by investment entities affiliated with GTCR, is the number of LLC Units owned; and

•The acquisition, by merger, of two membersonly other member of Topco LLC (“the Blocker Entities”), for which we issued shares of Class A common stock and paid cash as consideration (“the Blocker Mergers”).LLC.

The Company is the sole managing member of Topco LLC, which operates and controls TriLink Biotechnologies, LLC (“TriLink”), Glen Research, LLC, Vector Laboratories, Inc., MockV Solutions, LLC and Cygnus Technologies, LLC (“Cygnus”) and their respective subsidiaries. MLSH 1 is the only other member of Topco LLC.

The Organizational Transactions were considered transactions between entities under common control. As a result, the consolidated financial statements for periods priorPrior to the IPOCompany’s divestiture of its Protein Detection business in September 2021, Topco LLC also operated and the Organizational Transactions have been adjusted to combine the previously separate entities for presentation purposes.

controlled Vector Laboratories, Inc. and its subsidiaries (“Vector”). Basis of Presentation

The Company operates and controls all of the business and affairs of Topco LLC, and through Topco LLC and its subsidiaries, conducts its business. Because we manage and operate the business and control the strategic decisions and day-to-day operations of Topco LLC and also have a substantial financial interest in Topco LLC, we consolidate the financial results of Topco LLC, and a portion of our net income is allocated to the non-controlling interests in Topco LLC held by MLSH 1.

The accompanying unaudited interim condensed consolidated financial statements include the accounts of the Company and its subsidiaries. All intercompany transactions and accounts between the businesses comprising the Company have been eliminated in the accompanying consolidated financial statements.

Unaudited Interim Condensed Consolidated Financial Statements

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and pursuant to Form 10-Q of Regulation S-X of the Securities and Exchange Commission (“SEC”). Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. These unaudited condensed consolidated financial statements include all adjustments necessary to fairly state the financial position and the results of our operations and cash flows for interim periods in accordance with GAAP. All such adjustments are of a normal, recurring nature. Operating results for the three months ended March 31, 20212022 are not necessarily indicative of the results that may be expected for the year ending December 31, 20212022 or for any future period.

The condensed consolidated balance sheet presented as of December 31, 2020,2021, has been derived from the audited consolidated financial statements as of that date. The condensed consolidated financial statements and notes are presented as permitted by Form 10-Q and do not contain all information that is included in the annual financial statements and notes thereto of the Company. The condensed consolidated financial statements and notes included in this report should be read in conjunction with

the 2020consolidated financial statements and notes included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 (“2021 Form 10-K”) filed with the SEC.

Use of Estimates

The preparation of consolidated financial statements in accordance with GAAP requires the Company to make judgments, estimates and assumptions that affect the reported amounts of assets, liabilities, equity, revenue and expenses, and related disclosures. These estimates form the basis for judgments the Company makes about the carrying values of assets and liabilities that are not readily apparent from other sources. The Company bases its estimates and judgments on historical experience and on various other assumptions that the Company believes are reasonable under the circumstances. These estimates are based on management’s knowledge about current events and expectations about actions the Company may undertake in the future. Significant estimates include, but are not limited to, revenue recognition, the net realizable valuemeasurement of inventory, expected future cash flows including growth rates, discount rates, terminal values and other assumptions and estimates used to evaluate the recoverability of long-lived assets, estimated fair values of intangibleright-of-use assets and goodwill,lease liabilities and related incremental borrowing rate, the payable to related parties pursuant to the Tax Receivable Agreement (“TRA”)(as defined in Note 9), amortization methods and periods, the fair value of leased buildings and other assumptions associated with lease financing transactions, the estimated fair valuerealizability of our long-term debt, equity-based compensation, thenet deferred tax assets, and valuation of incentive units, allowance for doubtful accounts,goodwill and accounting for income taxes and assessment of valuation allowances.intangible assets acquired in business combinations. Actual results could differ materially from those estimates.

Significant Accounting Policies

A description of the Company’s significant accounting policies is included in Note 1 of the audited financial statements withinNotes to the Consolidated Financial Statements included in its Annual Report on2021 Form 10-K for the year ended December 31, 2020. There10-K. Except as noted below, there have been no material changes in the Company’s significant accounting policies during the three months ended March 31, 2021.2022.

Revenue Recognition

The Company generates revenue primarily from the sale of products, and services and the performance ofto a much lesser extent, services in the fields of nucleic acid production, biologics safety testing and protein detection. Revenue is recognized when control of promised goods or services is transferred to a customer in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. To determine revenue recognition for its arrangements with customers, the Company performs the following five steps: (i) identify the contract(s) with a customer; (ii) identify the performance obligations in the contract; (iii) determine the transaction price; (iv) allocate the transaction price to the performance obligations in the contract; and (v) recognize revenue when (or as) the entity satisfies a performance obligation. The majority of the Company’s contracts include only one performance obligation. A performance obligation is a promise in a contract to transfer a distinct good or

service to the customer and is defined as the unit of account for revenue recognition. The Company also recognizes revenue from other contracts that may include a combination of products and services, the provision of solely services, or from license fee arrangements which may be associated with the delivery of product. Where there is a combination of products and services, the Company accounts for the promises as individual performance obligations if they are concluded to be distinct. Performance obligations are considered distinct if they are both capable of being distinct and distinct within the context of the contract. In determining whether performance obligations meet the criteria for being distinct, the Company considers a number of factors, such as the degree of interrelation and interdependence between obligations, and whether or not the good or service significantly modifies or transforms another good or service in the contract. As a practical expedient, we do not adjust the transaction price for the effects of a significant financing component if, at contract inception, the period between customer payment and the transfer of goods or services is expected to be one year or less. Contracts with customers are evaluated on a contract-by-contract basis as contracts may include multiple types of goods and services as described below.

Revenue for an individual contract is recognized at the related transaction price, which is the amount the Company expects to be entitled to in exchange for transferring the products and/or services. The transaction price for product sales is calculated at the contracted product selling price. The transaction price for a contract with multiple performance obligations is allocated to the separate performance obligations on a relative standalone selling price basis. Standalone selling prices for products are determined based on the prices charged to customers, which are directly observable. Standalone selling price of services are mostly based on time and materials. Generally, payments from customers are due when goods and services are transferred. As most contracts contain a single performance obligation, the transaction price is representative of the standalone selling price charged to customers. Revenue is recognized only to the extent that it is probable that a significant reversal of the cumulative amount recognized will not occur in future periods. Variable consideration has not been material to our consolidated financial statements.

The Company accepts returns only if the products do not meet customer specifications and historically, the Company’s volume of product returns has not been significant. Further, no warranties are provided for promised goods and services other than assurance type warranties.

The Company has elected the practical exemption to not disclose the unfulfilled performance obligations for contracts with an original length of one year or less. The Company had no material unfulfilled performance obligations for contracts with an original length greater than one year for any period presented.

Nucleic Acid Production

Nucleic Acid Production revenue is generated from the manufacture and sale of highly modified, complex nucleic acids products to support the needs of our of customers’ research, therapeutic and vaccine programs. The primary offering of products include; CleanCap®includes CleanCap®, mRNA and specialized oligonucleotides. Contracts typically consist of a single performance obligation. We also sell nucleic acid products for labeling and detecting proteins in cells and tissue samples research. The Company recognizes revenue from these products in the period in which the performance obligation is satisfied by transferring control to the customer. Revenue for nucleic acid catalog products is recognized at a single point in time, generally upon shipment to the customer. Revenue for contracts for certain custom nucleic acid products, with an enforceable right to payment and a reasonable margin for work performed to date, is recognized over time, based on a cost-to-cost input method over the manufacturing period. Payments received from customers in advance of manufacturing their products is recorded as deferred revenue until the products were delivered.

Biologics Safety Testing

The Company’s Biologics Safety Testing revenue is associated with the sale of bioprocess impurity detection kit products. We also enter into contracts that include custom antibody development, assay development and antibody

affinity extraction services. These products and services enable the detection of impurities that occur in the manufacturing of biologic drugs and other therapeutics. The Company recognizes revenue from the sale of bioprocess impurity detection kits in the period in which the performance obligation is satisfied by transferring control to the customer. Custom antibody development contracts consist of a single performance obligation, typically with an enforceable right to payment and a reasonable margin for work performed to date. Revenue is recognized over time based on a cost-to-cost input method over the contract term. Where an enforceable right to payment does not exist, revenue is recognized at a point in time when control is transferred to the customer. Assay development service contracts consist of a single performance obligation, revenue is recognized at a point in time when a successful antigen test and report is provided to the customer. Affinity extraction services, which generally occur over a short period of time, consist of a single performance obligation to perform the extraction service and provide a summary report to the customer. Revenue is recognized either over time or at a point in time depending on contractual payment terms with the customer.

Protein Detection

ThePrior to the divestiture of its Protein Detection business in September 2021, the Company also manufacturesmanufactured and sellssold protein labeling and detection reagents to customers that arewere used for basic research and development. The contracts to sell these catalog products consistconsisted of a single performance obligation to deliver the reagent products. Revenue from these contracts iswas recognized at a point in time, generally upon shipment of the final product to the customer.

The Company elected the practical expedient to not disclose the unfulfilled performance obligations for contracts with an original length of one year or less. The Company had no material unfulfilled performance obligations for contracts with an original length greater than one year for any period presented.

The Company accepts returns only if the products do not meet customer specifications and historically, the Company’s volume of product returns has not been significant. Further, no warranties are provided for promised goods and services other than assurance type warranties.

Revenue for an individual contract is recognized at the related transaction price, which is the amount the Company expects to be entitled to in exchange for transferring the products and/or services. The transaction price for product sales is calculated at the contracted product selling price. The transaction price for a contract with multiple performance obligations is allocated to the separate performance obligations on a relative standalone selling price basis. Standalone selling prices for products are determined based on the prices charged to customers, which are directly observable. Standalone selling price of services are mostly based on time and materials. Generally, payments from customers are due when goods and services are transferred. As most contracts contain a single performance obligation, the transaction price is representative of the standalone selling price charged to customers. Revenue is recognized only to the extent that it is probable that a significant reversal of the cumulative amount recognized will not occur in future periods. Variable consideration has not been material to our consolidated financial statements.

Sales taxes

Sales taxes collected by the Company are not included in the transaction price as revenue as they are ultimately remitted to a governmental authority.

Shipping and handling costs

ShippingThe Company has elected to account for shipping and handling activities related to contracts with customers as costs which are charged to customers, are included infulfill the promise to transfer the associated products. Accordingly, revenue for shipping and handling is recognized at the same time that the related product revenue is recognized.

Contract costs

The Company recognizes the incremental costs of obtaining contracts as an expense when incurred when the amortization period of the assets that otherwise would have been recognized is one year or less. These costs are included in sales and marketing and general and administrative expenses. The costs to fulfill the contracts are determined to be immaterial and are recognized as an expense when incurred.

Contract balances

Contract assets are generated when contractual billing schedules differ from revenue recognition timing and the Company records a contract receivable when it has an unconditional right to consideration. Contract assetsThere were no contract asset balances which are included in prepaid and other current assets, totaled $1.0 million and $0.2 million as of March 31, 20212022 and December 31, 2020, respectively.2021.

Contract liabilities include billings in excess of revenue recognized, such as customer deposits and deferred revenue. Customer deposits, which are included in accrued expenses, are recorded when cash payments are received or due in advance of performance. Deferred revenue is recorded when the Company has unsatisfied performance obligations. Total contract liabilities were $120.7$5.3 million and $79.2$12.6 million as of March 31, 20212022 and December 31, 2020,2021, respectively. Contract liabilities are expected to be recognized into revenue within the next twelve months.

Disaggregation of Revenue

The following tables summarize the revenue by segment and region for the periods presented (in thousands):

| | For the three months ended March 31, 2021 | | Nucleic Acid

Production | | Biologics

Safety

Testing | | Protein

Detection | | Total | |

| | | Three Months Ended March 31, 2022 |

| | | Nucleic Acid Production | | Biologics Safety Testing | | | Total |

| North America | North America | | $ | 68,132 | | $ | 6,412 | | $ | 3,752 | | $ | 78,296 | North America | $ | 79,418 | | $ | 7,519 | | | $ | 86,937 |

| Europe, the Middle East and Africa | Europe, the Middle East and Africa | | 47,898 | | 4,349 | | 1,468 | | 53,715 | Europe, the Middle East and Africa | 131,350 | | 4,697 | | | 136,047 |

| Asia Pacific | Asia Pacific | | 7,885 | | 6,735 | | 1,360 | | 15,980 | Asia Pacific | 12,867 | | 8,328 | | | 21,195 |

| Latin and Central America | Latin and Central America | | 17 | | 153 | | 50 | | 220 | Latin and Central America | 15 | | 99 | | | 114 |

| Total revenue | Total revenue | | $ | 123,932 | | $ | 17,649 | | $ | 6,630 | | $ | 148,211 | Total revenue | $ | 223,650 | | $ | 20,643 | | | $ | 244,293 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2021 |

| Nucleic Acid Production | | Biologics Safety Testing | | Protein Detection | | Total |

| North America | $ | 68,132 | | $ | 6,412 | | $ | 3,752 | | $ | 78,296 |

| Europe, the Middle East and Africa | 47,898 | | 4,349 | | 1,468 | | 53,715 |

| Asia Pacific | 7,885 | | 6,735 | | 1,360 | | 15,980 |

| Latin and Central America | 17 | | 153 | | 50 | | 220 |

| Total revenue | $ | 123,932 | | $ | 17,649 | | $ | 6,630 | | $ | 148,211 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended March 31, 2020 | | Nucleic Acid

Production | | Biologics

Safety

Testing | | Protein

Detection | | Total |

| North America | | $ | 24,869 | | $ | 5,125 | | $ | 3,429 | | $ | 33,423 |

| Europe, the Middle East and Africa | | 2,049 | | 3,541 | | 1,622 | | 7,212 |

| Asia Pacific | | 3,558 | | 5,562 | | 1,107 | | 10,227 |

| Latin and Central America | | 13 | | 66 | | 40 | | 119 |

| Total revenue | | $ | 30,489 | | $ | 14,294 | | $ | 6,198 | | $ | 50,981 |

The following table provides a disaggregation ofTotal revenue is attributed to geographic regions based on the patternbill-to location of the transaction. For all periods presented, the majority of our revenue recognition (in thousands):

| | | | | | | | | | | | | | |

| | For the three months ended March 31, |

| | 2021 | | 2020 |

| Revenue recognized at a point in time | | $ | 136,231 | | | $ | 49,775 | |

| Revenue recognized over time | | 11,980 | | | 1,206 | |

| Total revenue | | $ | 148,211 | | | $ | 50,981 | |

Non-Controlling Interests

Non-controlling interests represent the portion of profit or loss, net assets and comprehensive income of our consolidated subsidiaries that is not allocable to the Company based on our percentage of ownership of such entities. Non-controlling interests consist of the following:

•Until November, 2020 Topco LLC held a 70% ownership interest in MLSC Holdings, LLC (“MLSC”) through its consolidated subsidiaries with the remaining 30% being recorded as non-controlling interests in our consolidated financial statements. MLSC net income or loss was attributed to the non-controlling interests using an attribution method, similar to the hypothetical liquidation at book value method, based on the distribution provisions of the MLSC Amended and Restated Limited Liability Company Agreement (“MLSC LLC Agreement”). In November 2020, and beforefollowing the closingcompletion of the IPO, Topco LLC repurchased all of the outstanding non-controlling interests in MLSC for $166.4 million.

•In November 2020, based on the Organizational Transactions, described above, we became the sole managing member of Topco LLC. As of March 31, 2021,2022, we holdheld approximately 38%51.5% of the outstanding LLC Units of Topco LLC, and MLSH 1 held approximately 62%48.5% of the outstanding LLC Units of Topco LLC are held by MLSH 1.LLC. Therefore, we report non-controlling interests based on the percentage of LLC Units of Topco LLC held by MLSH 1 on ourthe condensed consolidated balance sheet as of March 31, 2021.2022. Income or loss attributed to the non-controlling interest in Topco LLC is based on the LLC Units outstanding during the period for which the income or loss is generated and is presented on the condensed consolidated statements of income and condensed consolidated statements of comprehensive income.

MLSH 1 is entitled to exchange its LLC Units of Topco LLC, together with an equal number of shares of our Class B common stock (together referred to as “Paired Interests”), for shares of Class A common stock on a one-for-one basis or, at our election, for cash, from a substantially concurrent public offering or private sale (based on the price of our Class A common stock in such public offering or private sale). As such, future exchanges of Paired Interests by MLSH 1 will result in a change in ownership and reduce or increase the amount recorded as non-controlling interests and increase or decrease additional paid-in-capital when Topco LLC has positive or negative net assets, respectively. For the three months ended March 31, 2022 and 2021, MLSH 1 did not exchange any Paired Interests. In April 2021, MLSH 1 executed an exchange

Distributions of Paired Interest immediately prior to the closing of the Company’s secondary offering (see Note 11)

A distribution of$39.9 million and $23.1 million for tax liabilities waswere made to MLSH 1 during the three months ended March 31, 2021. NaN distributions were made during the three months ended March 31, 2020.2022 and 2021, respectively.

Segment Information

The Company operateshas historically operated in 3 reportable segments. Operating segments are defined as components of an enterprise aboutfor which separate financial information is evaluated regularly by the chief operating decision maker in deciding how

to allocate resources and assessing performance. The Company’s chief operating decision maker (“CODM”), its Chief Executive Officer,

allocates resources and assesses performance based upon discrete financial information at the segment level. Substantially allAll of our long-lived assets are located in the United States. After the divestiture of Vector in September 2021, the Company no longer has the Protein Detection segment. The Company has reported the historical results of the Protein Detection business as such discrete financial information evaluated by the CODM for the periods presented included the information for this legacy segment. As of March 31, 2022, the Company operated in 2 reportable segments: Nucleic Acid Production and Biologics Safety Testing.

Net Income per Class A Common Share/UnitShare Attributable to Maravai LifeSciences Holdings, Inc.

Basic net income per Class A Common share/unitshare attributable to Maravai LifeSciences Holdings, Inc. is computed by dividing net income attributable to us by the weighted average number of Class A Common shares/unitsshares outstanding during the period. The non-controlling interest, for historical periods prior to the IPO, is calculated pursuant to the terms of the MLSC LLC Agreement on a fully-distributed basis, taking into account the various classes of equity of MLSC, including the cumulative yields on MLSC’s preferred units. Diluted net income per Class A Common share/unitshare is calculated by giving effect to all potential weighted average dilutive LLC incentive units for historical periods prior to the IPO and stock options, restricted stock units, and Topco LLC Units, that together with an equal number of shares of our Class B common stock (together referred to as “Paired Interests”), are convertible into shares of our Class A Common stock, for the periods after the IPO. For historical periods prior to the IPO, the weighted average number of common units outstanding during the period and the potential dilutive common unit equivalents is determined under the two-class method.stock. The dilutive effect of outstanding awards, if any, is reflected in diluted earnings per share/unitshare by application of the treasury stock method or if-converted method, as applicable. The Company reported net income attributable to Maravai LifeSciences Holdings, Inc. for the three months ended March 31, 20212022 and 2020.2021.

Contingent Consideration

Contingent consideration represents additional consideration that may be transferred to former owners of an acquired entity in the future if certain future events occur or conditions are met. Contingent consideration resulting from the acquisition of a business is recorded at fair value on the acquisition date. Such contingent consideration is re-measured to its estimated fair value at each reporting date with the change in fair value recognized within operating expenses in the Company’s condensed consolidated statements of income. Subsequent changes in the fair value of the contingent consideration are classified as an adjustment to cash flows from operating activities in the condensed consolidated statements of cash flows because the change in fair value is an input in determining net income. Cash paid in settlement of contingent consideration liabilities are classified as cash flows from financing activities up to the acquisition date fair value with any excess classified as cash flows from operating activities.

Changes in the fair value of contingent consideration liabilities associated with the acquisition of a business can result from updates to assumptions such as the expected timing or probability of achieving customer related performance targets, specified sales milestones, changes in projected revenue or changes in discount rates. Judgment is used in determining those assumptions as of the acquisition date and for each subsequent reporting period. Therefore, any changes in the fair value will impact the Company’s results of operations in such reporting period thereby resulting in potential variability in the Company’s operating results until such contingencies are resolved.

Fair Value of Financial Instruments

The Company defines fair value as the amount that would be received to sell an asset, or paid to transfer a liability, in an orderly transaction between market participants at the measurement date. The Company follows accounting guidance that has a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of the asset or liability as of the measurement date. Instruments with readily available actively quoted prices, or for which fair value can be measured from actively quoted prices in an orderly market, will generally have a higher degree of market price transparency and a lesser degree of judgment used in measuring fair value. The three levels of the hierarchy are defined as follows:

Level 1—Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets;

Level 2—Include other inputs that are directly or indirectly observable in the marketplace; and

Level 3—Unobservable inputs which are supported by little or no market activity.

As of March 31, 20212022 and December 31, 2020,2021, the carrying value of the Company’s current assets and liabilities approximatesapproximated fair value due to the short maturities of these instruments. The fair values of the Company’s long-term debt approximateapproximated carrying value, excluding the effect of unamortized debt discount, as it is based on borrowing rates currently available to the Company for debt with similar terms and maturities (Level 2 inputs).

Acquisitions

The Company evaluates mergers, acquisitions and other similar transactions to assess whether or not the transaction should be accounted for as a business combination or an acquisition of assets. The Company first identifies who is the acquiring entity by determining if the target is a legal entity or a group of assets or liabilities. If control over a legal entity is being evaluated, the

Company also evaluates if the target is a variable interest or voting interest entity. For acquisitions of voting interest entities, the Company applies a screen test to determine if substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset or group of similar identifiable assets. If the screen test is met, the transaction is accounted for as an acquisition of assets. If the screen is not met, further determination is required as to whether or not the Company has acquired inputs and processes that have the ability to create outputs which would meet the definition of a business.

The Company accounts for its business combinations using the acquisition method of accounting which requires that the assets acquired and liabilities assumed of acquired businesses be recorded at their respective fair values at the date of acquisition. The purchase price, which includes the fair value of consideration transferred, is attributed to the fair value of the assets acquired and liabilities assumed. The purchase price may also include contingent consideration. The Company assesses whether such contingent consideration is subject to liability classification and fair value measurement or meets the definition of a derivative. Contingent consideration liabilities are recognized at their estimated fair value on the acquisition date. Contingent consideration arrangements that are determined to be compensatory in nature are recognized as post combination expense in our condensed consolidated statements of income ratably over the implied service period beginning in the period it becomes probable such amounts will become payable. The excess of the purchase price of the acquisition over the fair value of the identifiable net assets of the acquiree is recorded as goodwill. The fair value of assets acquired and liabilities assumed in certain cases may be subject to revision based on the final determination of fair value during a period of time not to exceed twelve months from the acquisition date. The results of acquired businesses are included in the Company’s consolidated financial statements from the date of acquisition. Transaction costs directly attributable to acquired businesses are expensed as incurred.

Determining the fair value of assets acquired and liabilities assumed requires management to use significant judgment and estimates, including the selection of valuation methodologies and assumptions about future net cash flows, discount rates and market participants. Each of these factors can significantly affect the value attributed to the identifiable intangible asset acquired in a business combination.

Concentration of Credit Risk