UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q/A

Amendment No. 1

☒FORM 10-Q

(Mark One)

xQUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended March 31, 2018

June 30 2019

OR

☐oTRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to ______________

Commission File No.000-1621697

NATURAL HEALTH FARM HOLDINGS INC.

(Exact name of small business issuer as specified in its charter)

| NEVADA | 98-1032170 | |||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

100 Challenger Road, Suite 831

Ridgefield, NJ 07660No.48 & 49, Jalan Velox 2, Taman Velox, Rawang Industrial Park

48000 Rawang, Selangor, Malaysia

(Address of principal executive offices)

(424) 354-4973+60(3) 6091 6321

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes☒x No☐o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes☒x No☐o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | Accelerated filer | ||

| Non-accelerated filer | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐o

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.001 per share | NHEL | OTC Markets Group |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐o No☒x

The number of shares of Common Stock, $0.001 par value, of the registrant outstanding at May 11, 2018August 12, 2019 was 151,150,000.162,186,300.

TABLE OF CONTENTS

| Page No. | |||

| PART I. | |||

| Item 1. Financial Statements. | 1 | ||

| Condensed | 1 | ||

| Condensed 2018 (Unaudited) | 2 | ||

| Condensed | 3 | ||

| Notes to Unaudited Condensed | 4 to 11 | ||

| Item 2 | Management’s Discussion and Analysis or Plan of Operation | 12 | |

| Item 3 | Quantitative and Qualitative Disclosure About Market Risks | 15 | |

| Item 4 | Controls and Procedures | 15 | |

| PART | |||

| Item 1 | |||

| Item 1A | Risk Factors | 16 | |

| Item 2 | |||

| Item 3 | Defaults Upon Senior Securities | 16 | |

| Item 4 | Mine Safety Disclosures | 16 | |

| Item 5 | Other Information | 16 | |

| Item 6 | Exhibits | 16 | |

| SIGNATURES | |||

| EXHIBIT INDEX | |||

Explanatory Note

The sole purpose of this Amendment No. 1 to the Quarterly Report on Form 10-Q of Natural Health Farm Holdings Inc. for the period ended March 31, 2018, originally filed with the Securities and Exchange Commission on May 14, 2018 (the “Form 10-Q”), is to restate its previously reported consolidated financial statements as at March 31, 2018. The restatement of the company’s consolidated financial statements followed an internal review of the company’s consolidated financial statements and accounting records that inadvertently excluded the financials reporting for NHF International Limited and its subsidiaries, Natural Tech R&D Sdn Bhd and NHF Management & Business Sdn Bhd. This restatement has presented the periodic consolidated earnings of the company as a group.

The following sections in the Original Filing are revised in this Form 10-Q/A, solely as a result of, and to reflect, the restatement:

Part I - Item 1 - Financial Statements

Part I - Item 2 - Management’s Discussion and Analysis of Financial Condition and Results of Operations

Part II - Item 6 – Exhibits

Subsequent to the filing of this Quarterly Report on Form 10-Q/A we expect to file the amended Quarterly Report on Form 10-Q/A for the quarterly period ended June 30, 2018 and the Annual Report on Form 10-K for the year ended September 30, 2018 and the quarterly periods ended December 31, 2018 and March 31, 2019. These reports will include restatement of the consolidated financial statements (and related disclosures) for the periods described therein, as set forth in those reports.

No other changes have been made to the Form 10-Q. This Amendment No. 1 to the Form 10-Q speaks as of the original filing date of the Form 10-Q, does not reflect events that may have occurred subsequent to the original filing date and does not modify or update in any way disclosures made in the original Form 10-Q.

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (“Form 10-Q”) contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including, but not limited to, any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements concerning proposed new products or developments; any statements regarding future economic conditions or performance; any statements of belief; and any statements of assumptions underlying any of the foregoing. Although we believe that the expectations reflected in any of our forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of our forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and inherent risks and uncertainties.

Forward-looking statements may include the words “may,” “could,” “will,” “estimate,” “intend,” “continue,” “believe,” “expect,” “desire,” “goal,” “should,” “objective,” “seek,” “plan,” “strive” or “anticipate,” as well as variations of such words or similar expressions, or the negatives of these words. These forward-looking statements present our estimates and assumptions only as of the date of this Form 10-Q. Except for our ongoing obligation to disclose material information as required by the federal securities laws, we do not intend, and undertake no obligation, to update any forward-looking statement. We caution readers not to place undue reliance on any such forward-looking statements. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes will likely vary materially from those indicated.

PART I.

Item 1. Financial Statements.Statements

NATURAL HEALTH FARM HOLDINGS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| March 31, 2018 | September 30, 2017 | |||||||

| ASSETS | (Unaudited & Restated) | (Audited) | ||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 464,216 | $ | - | ||||

| Account receivables | 392,255 | - | ||||||

| Total Current Assets | 856,471 | - | ||||||

| Plant & equipment, net | 183,086 | - | ||||||

| Total Assets | $ | 1,039,557 | $ | - | ||||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

| Current Liabilities | ||||||||

| Account payables | $ | 77,790 | $ | - | ||||

| Accrued expense | 4,000 | 2,070 | ||||||

| Other payables – related parties | 311,338 | 78,067 | ||||||

| Deferred revenue – related parties | 70,508 | - | ||||||

| Deferred revenue – non-related parties | 59,027 | - | ||||||

| Advance from director | 11,813 | - | ||||||

| Total Current Liabilities | 534,476 | 80,137 | ||||||

| Deferred tax liabilities | 7,302 | - | ||||||

| 7,302 | - | |||||||

| Total Liabilities | 541,778 | 80,137 | ||||||

| Stockholders' Equity | ||||||||

| Common Stock, $0.001 par value, 500,000,000 shares authorized, 151,150,000 shares and 150,150,000 shares issued and outstanding at March 31, 2018 and September 30, 2017, respectively | 151,150 | 150,150 | ||||||

| Additional Paid in Capital | 460,016 | (111,821 | ) | |||||

| Accumulated Deficit | (148,348 | ) | (118,466 | ) | ||||

| Foreign currency translation reserve | 34,961 | - | ||||||

| Total Stockholders' Equity | 497,779 | (80,137 | ) | |||||

| Total Liabilities and Stockholders' Equity | $ | 1,039,557 | $ | - | ||||

| June 30, 2019 | September 30, 2018 | |||||||

| ASSETS | (Unaudited) | (Restated) | ||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 868,537 | $ | 439,846 | ||||

| Account receivables – third parties | 454,638 | 105,018 | ||||||

| Account receivables – related parties | - | 226,548 | ||||||

| Other receivables and deposits | 712,165 | 95,569 | ||||||

| Inventories | 578,732 | - | ||||||

| Tax assets | 5,714 | 5,463 | ||||||

| Total Current Assets | 2,619,786 | 872,444 | ||||||

| Property, plant and equipment, net | $ | 795,337 | $ | 159,146 | ||||

| Goodwill | 1,118,843 | - | ||||||

| Total Non-Current Assets | 1,914,180 | 159,146 | ||||||

| Total Assets | $ | 4,533,966 | $ | 1,031,590 | ||||

| LIABILITIES AND EQUITY | ||||||||

| Current Liabilities | ||||||||

| Accounts payable | $ | 163,748 | $ | 69,805 | ||||

| Accrued expense | 738,417 | 38,499 | ||||||

| Payable to affiliate | 644,794 | 311,337 | ||||||

| Deferred revenue – third parties | 40,369 | 48,694 | ||||||

| Deferred revenue – related parties | 30,416 | 57,341 | ||||||

| Short term borrowings | 381,165 | 40,000 | ||||||

| Advances from directors | 9,490 | 11,210 | ||||||

| Commercial bill | 280,360 | - | ||||||

| Total Current Liabilities | 2,288,759 | 576,886 | ||||||

| Deferred tax liabilities – Non-Current liabilities | $ | 8,119 | $ | 6,817 | ||||

| Total Liabilities | 2,296,878 | 583,703 | ||||||

| Equity | ||||||||

| Common Stock, $0.001 par value, 500,000,000 shares authorized, 162,177,000 shares and 161,555,000 shares issued and outstanding at March 31, 2019 and September 30, 2018, respectively | $ | 162,279 | $ | 161,555 | ||||

| Additional Paid in Capital | 2,562 ,782 | 857,783 | ||||||

| Accumulated deficit | (1,022,658 | ) | (1,071,993 | ) | ||||

| Foreign currency translation reserve | (24,596 | ) | (16,758 | ) | ||||

| Merger reserve | 517,300 | 517,300 | ||||||

| Total equity attributable to owners of the Company | 2,195,107 | 447,887 | ||||||

| Non-controlling interests | $ | 41,981 | $ | - | ||||

| Total Equity | 2,237,088 | 447,887 | ||||||

| Total Liabilities and Equity | $ | 4,533,966 | $ | 1,031,590 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

NATURAL HEALTH FARM HOLDINGS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| For the Three Months Ended March 31, | For the Six Months Ended March 31, | |||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||

| Restated | Restated | |||||||||||||||

| Revenues – related parties | $ | 213,659 | $ | - | $ | 215,658 | $ | - | ||||||||

| Revenues – third parties | 4,865 | - | 4,865 | - | ||||||||||||

| Total Revenues | 218,524 | - | 220,523 | - | ||||||||||||

| Cost of Goods Sold | (120,494 | ) | - | (121,100 | ) | - | ||||||||||

| Gross Profit | 98,030 | - | 99,423 | - | ||||||||||||

| Operating Expenses: | ||||||||||||||||

| Consulting fees | (20,050 | ) | (4,905 | ) | (35,614 | ) | (9,145 | ) | ||||||||

| Legal and filing fees | (20,810 | ) | - | (23,715 | ) | - | ||||||||||

| Other general and administrative | (70,582 | ) | - | (70,582 | ) | - | ||||||||||

| Total Operating Expenses | (111,442 | ) | (4,905 | ) | (129,911 | ) | (9,145 | ) | ||||||||

| Loss from Operations | (13,412 | ) | (4,905 | ) | (30,488 | ) | (9,145 | ) | ||||||||

| Other Income | 606 | - | 606 | - | ||||||||||||

| Loss Before Provision For Income Tax | (12,806 | ) | (4,905 | ) | (29,882 | ) | (9,145 | ) | ||||||||

| Provision for Income Tax | - | - | - | - | ||||||||||||

| Net Loss | $ | (12,806 | ) | $ | (4,905 | ) | $ | (29,882 | ) | $ | (9,145 | ) | ||||

| Basic and Dilutive Net Loss Per Share | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | ||||

| Weighted Average Number of Shares Outstanding - Basic and Diluted | 151,150,000 | 150,150,000 | 150,151,000 | 150,150,000 | ||||||||||||

| For the Three Months Ended June 30, | For the Six Months Ended June 30, | |||||||||||||||

| 2019 | 2018 | 2019 | 2018 | |||||||||||||

| (Unaudited) | (Restated) | (Unaudited) | (Restated) | |||||||||||||

| Revenues – related parties | $ | 656,137 | $ | 264,692 | $ | 970,676 | $ | 480,350 | ||||||||

| Revenues – third parties | 150,250 | 9,782 | 642,752 | 14,647 | ||||||||||||

| Total Revenues | 806,387 | 274,474 | 1,613,428 | 494,997 | ||||||||||||

| Cost of Goods Sold | (256,206 | ) | (121,513 | ) | (596,148 | ) | (242,613 | ) | ||||||||

| Gross Profit | 550,181 | 152,961 | 1,017,280 | 252,384 | ||||||||||||

| Operating Expenses: | ||||||||||||||||

| Consulting fees | (43,675 | ) | (109,626 | ) | (117,726 | ) | (145,240 | ) | ||||||||

| Legal and filing fees | (12,300 | ) | (12,130 | ) | (58,165 | ) | (35,845 | ) | ||||||||

| Stock compensation | - | (526,295 | ) | - | (526,295 | ) | ||||||||||

| Other general and administrative | (450,688 | ) | (123,892 | ) | (861,375 | ) | (194,474 | ) | ||||||||

| Total Operating and Administrative Expenses | (506,663 | ) | (771,943 | ) | (1,037,266 | ) | (901,854 | ) | ||||||||

| Profit/(Loss) from Operations | 43,518 | (618,982 | ) | (19,986 | ) | (649,470 | ) | |||||||||

| Other income | 74,271 | 446 | 77,764 | 1,052 | ||||||||||||

| Finance costs | (2,803 | ) | - | (11,036 | ) | - | ||||||||||

| Profit/(Loss) Before Provision For Income Tax | 114,986 | (618,536 | ) | 46,742 | (648,418 | ) | ||||||||||

| Provision for income tax | - | - | - | - | ||||||||||||

| Net Profit/(Loss) | $ | 114,986 | $ | (618,536 | ) | $ | 46,742 | $ | (648,418 | ) | ||||||

| Other comprehensive (expenses)/income | ||||||||||||||||

| Foreign currency translation differences | (16,710 | ) | (37,222 | ) | (1,880 | ) | (2,261 | ) | ||||||||

| Total comprehensive income/(expense) for the period | $ | 98,276 | $ | (655,758 | ) | $ | 44,862 | $ | (650,679 | ) | ||||||

| Loss attributable to: | ||||||||||||||||

| Owners of the Company | 74,760 | (655,758 | ) | 49,335 | (648,418 | ) | ||||||||||

| Non-controlling interests | 40,226 | - | (2,593 | ) | - | |||||||||||

| Income /(Loss) for the period | $ | 114,986 | $ | (655,758 | ) | $ | 46,742 | $ | (648,418 | ) | ||||||

| Total comprehensive expense attributable to: | ||||||||||||||||

| Owners of the Company | 52,449 | (655,758 | ) | 41,498 | (650,679 | ) | ||||||||||

| Non-controlling interests | 45,827 | - | 3,364 | - | ||||||||||||

| Total comprehensive income/(expense) for the period | $ | 98,276 | $ | (655,758 | ) | $ | 44,862 | $ | (650,679 | ) | ||||||

| Earnings per share | $ | - | $ | - | $ | - | $ | - | ||||||||

| Weighted Average Number of Shares Outstanding - Basic and Diluted | 162,278,405 | 156,201,374 | 162,278,405 | 150,151,000 | ||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

NATURAL HEALTH FARM HOLDINGS INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| For the Six Months Ended March 31, | For the Nine Months Ended June 30, | |||||||||||||||

| 2018 | 2017 | 2019 | 2018 | |||||||||||||

| Restated | (Unaudited) | (Restated) | ||||||||||||||

| Cash Flows from Operating Activities: | ||||||||||||||||

| Net Loss | $ | (29,882 | ) | $ | (9,145 | ) | $ | 46,742 | $ | (648,418 | ) | |||||

| Adjustment to reconcile net loss to net cash provided by (used in) operating activities | ||||||||||||||||

| Amortization of computer software costs | 4,094 | - | ||||||||||||||

| Depreciation and Amortization of plant and equipment | 111,836 | 7,582 | ||||||||||||||

| Common stock issued to consultants for services | - | 105,000 | ||||||||||||||

| Stock compensation expense upon grant of stock options | - | 526,295 | ||||||||||||||

| Changes in operating assets and liabilities | ||||||||||||||||

| Account receivables | (237,721 | ) | (4,286 | ) | (566,261 | ) | (411,104 | ) | ||||||||

| Account payables | 488,283 | - | (69,540 | ) | 457,681 | |||||||||||

| Cash advance from director | 11,813 | 4,905 | ||||||||||||||

| Directors | (1,720 | ) | 11,418 | |||||||||||||

| Inventories | (160,838 | ) | - | |||||||||||||

| Net Cash Flows Provided by (Used in) Operating Activities | 236,587 | (8,526 | ) | |||||||||||||

| Net Cash Flows (Used in)/Provided by Operating Activities | (639,781 | ) | 48,454 | |||||||||||||

| Cash Flows from Investing Activities | ||||||||||||||||

| Purchase of plant & equipment | (49,551 | ) | - | (61,808 | ) | - | ||||||||||

| Acquisition of subsidiaries, net of cash and cash equivalents | (1,196,967 | ) | (55,611 | ) | ||||||||||||

| Cash inflows from merger and acquisition, net | 277,180 | - | 277,180 | |||||||||||||

| Net Cash Flows Provided by Investing Activities | 227,629 | - | ||||||||||||||

| Net Cash Flows (Used in)/Provided by Investing Activities | (1,258,775 | ) | 221,569 | |||||||||||||

| Cash Flows from Financing Activities | ||||||||||||||||

| Payable to affiliate | - | 8,526 | ||||||||||||||

| Cash Flows from Financing Activity | ||||||||||||||||

| Drawdowns of borrowings, net | 621,525 | - | ||||||||||||||

| Proceeds from issuance of shares | 1,705,722 | 40,724 | ||||||||||||||

| Net Cash Flows Provided by Financing Activities | - | 8,526 | ||||||||||||||

| Net Cash Flows Provided by Financing Activity | 2,327,247 | 40,724 | ||||||||||||||

| Net Increase in Cash and Cash Equivalents | 464,216 | - | 428,691 | 310,747 | ||||||||||||

| Cash and Cash Equivalents, Beginning of the Period | - | - | 439,846 | - | ||||||||||||

| Cash and Cash Equivalents, End of the Period | $ | 464,216 | $ | - | $ | 868,537 | $ | 310,747 | ||||||||

| Supplemental Disclosures of Cash Flow Information: | ||||||||||||||||

| Cash paid for Income Taxes | $ | - | $ | - | $ | - | $ | - | ||||||||

| Cash paid for Interest | $ | - | $ | - | $ | - | $ | - | ||||||||

| Supplemental disclosures of non-cash investing and financing activities: | ||||||||||||||||

| Forgiveness of debt by a former director | $ | - | $ | 9,247 | ||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

NATURAL HEALTH FARM HOLDINGS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2018

JUNE 30, 2019

(UNAUDITED)

NOTE 1 – NATURE OF OPERATIONS, BASIS OF PRESENTATION AND GOING CONCERN

Natural Health Farm Holdings Inc. (the “Company”, “We”, “Its”, and “NHEL”) was incorporated under the laws of the State of Nevada on July 10, 2014 (Inception date). The Company has developed web-based business and launched itself into the healthcare industry. The Company has plans to provide through its subsidiaries, retail nutritional supplements, organic foods, personal care, and other health care products. The company has positioned itself to be a fully integrated nutraceutical biotechnology company offering products and related services through healthcare practitioners and direct-to-consumers. The company now owns a research & development laboratory in Malaysia, franchisee management services company and an Australia manufacturing facility producing practitioner only naturopathic and homeopathic medicines.

On November 30, 2016, the Company filed a certificate of amendment to its articles of incorporation with the Nevada Secretary of State to change its name from Amber Group Inc. to Natural Health Farm Holdings Inc. and effectuated a 30:1 forward stock split of its common stock and increased its authorized share capital to 500,000,000 (Five Hundred Million). This amendment was unanimously approved by the Company’s board of directors on November 29, 2016, and with the stockholders holding a majority of the Company’s voting power.

On March 16, 2017, Financial Industry Regulatory Authority (FINRA) approved the corporate name change to Natural Health Farm Holdings Inc., approved the increase in the Company’s authorized shares of common stock to 500,000,000 shares, and approved 30:1 forward stock split effective March 17, 2017. The new trading symbol for our common stock is “NHEL”.

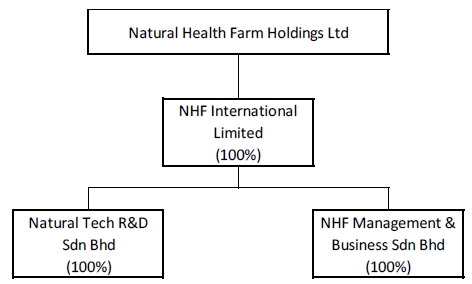

On January 31, 2018, the company acquired the total outstanding share of NHF International Limited at at USD$1.nominal value. Upon the completion of the acquisition, its subsidiaries, both Natural Tech R&D Sdn Bhd and NHF Management & Business Sdn Bhd become wholly subsidiaries of the Group. As this transaction is business combination under common control, as deliberated and determined by Directors of the Company, difference between purchase considerations and net tangible assets acquired is recorded in merger reserves which amounted to $517,300. Natural Tech R&D Sdn Bhd, a BioNexus Status Company in Malaysia, specializes in research and development, cultivation, extraction and commercialization of nutraceuticals based on medicinal fungi and NHF Management & Business Sdn Bhd, providing franchisee management services and consultation, such as point-of-sales system, resources, branding and marketing.

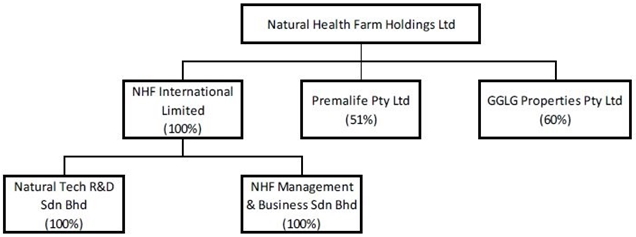

On December 3, 2018, the Company agreed to purchase 51% of the issued and outstanding capital stock of Prema Life Pty Ltd and 60% of the issued and outstanding capital stock of GGLG Properties Pty Ltd, collectively in exchange for 304,500 shares of the Company’s common stock. On December 28, 2018, the parties mutually agreed to extend the closing date of the purchase transaction on January 1, 2019. The Company issued 304,500 shares of its common stock on December 3, 2018 in good faith for consummating the purchase.

The corporate structure is depicted below:

| 4 |

Basis of Presentation

The accompanying interim condensed consolidated financial statements are unaudited, but in the opinion of management of the Company, contain all adjustments, which include normal recurring adjustments necessary to present fairly the financial position at March 31, 2018,June 30, 2019, and the results of operations for three months and six months ended March 31, 2018,June 30, 2019, and cash flows for the six months ended March 31, 2018June 30, 2019 and 2017.2018. The balance sheet as of September 30, 20172018 is derived from the Company’s audited financial statements.

Certain information and footnote disclosures normally included in financial statements that have been prepared in accordance with generally accepted accounting principles have been condensed or omitted pursuant to the rules and regulations of the Securities and Exchange Commission, although management of the Company believes that the disclosures contained in these interim condensed consolidated financial statements are adequate to make the information presented therein not misleading. For further information, refer to the financial statements and the notes thereto contained in the Company’s September 30, 20172018 Annual Report filed with the Securities and Exchange Commission on Form 10-K on December 28, 2017.

Basis of Consolidation

The condensed consolidated financial statements include the accounts of Natural Health Farm Holdings Inc. and all controlled subsidiaries. All intercompany transactions and balances have been eliminated.

The condensed consolidated financial statements as of March 31, 2018 and for the period ended March 31, 2018, in the opinion of management, all adjustments (consisting of normal recurring adjustments and reclassifications) necessary to present fairly the Company's condensed consolidated financial position, results of operations, statements of comprehensive income, and statements of stockholders' equity and cash flows for all periods presented.2018.

Going Concern

The Company’s financial statements are prepared using generally accepted accounting principles in the United States of America applicable to a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has generated small revenues and has sustained cumulative operating losses since July 10, 2014 (Inception Date) to date and allow it to continue as a going concern. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders and affiliates, the ability of the Company to obtain necessary financing to continue operations, and the attainment of profitable operations. The Company recorded a net losscash out flows in operating activities of $12,806 from October 1, 2017 to March 31, 2018$639,781 and has an accumulated deficit of $148,348$1,022,658 as of March 31, 2018.June 30, 2019.

These factors, among others, raise a substantial doubt regarding the Company’s ability to continue as a going concern. If the Company is unable to obtain adequate capital, it could be forced to cease operations. The accompanying consolidated financial statements do not include any adjustments to reflect the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following summary of significant accounting policies of the Company is presented to assist in the understanding of the Company’s financial statements. The financial statements and notes are the representation of the Company’s management who is responsible for their integrity and objectivity. These accounting policies conform to accounting principles generally accepted in the United States of America (“GAAP”) in all material respects and have been consistently applied in preparing the accompanying financial statements.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company regularly evaluates estimates and assumptions related to the valuation of accounts payable, accrued liabilities and payable to related party. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

Cash and Cash Equivalents

The Company considers all highly liquid instruments with maturity of three months or less at the time of issuance to be cash equivalents. The Company had a cash balance of $464,216$868,537 at March 31, 2018June 30, 2019 and $0$439,846 at September 30, 2017,2018, respectively.

Property, Plant and Equipment Costs

EquipmentProperty, plant and equipment costs include direct costs incurred for purchase of fixed assets and payments made to independent suppliers. The Company accounts for property, plant and equipment costs in accordance with the FASB guidance for the costs of property, plant and equipment to be sold, leased, or otherwise marketed (“ASC Subtopic 985-20”). As for the equipmentcomputer software costs, they are capitalized once the technological feasibility of a product is established and such costs are determined to be recoverable. Technological feasibility of a product encompasses technical design documentation and integration documentation, or the completed and tested product design and working model. Computer software costs are capitalized once technological feasibility of a product is established and such costs are determined to be recoverable against future revenues. Technological feasibility is evaluated on a project-by-project basis. Amounts related to computer software development that are not capitalized are charged immediately to the appropriate expense account. Amounts that are considered ‘research and development’ that are not capitalized are immediately charged to engineering, research, and development expense. Capitalized costs for those products that are cancelled or abandoned are charged to product development expense in the period of cancellation.

Commencing upon product release, capitalized computer software costs are amortized on the straight-line method over a thirty-six months period. The Company evaluates the future recoverability of capitalized computer software costs on an annual basis.

Revenue Recognition and Concentrations

We generate revenue from licensing and other software services from our web-based software to distributors and retailers of nutritional supplements in the healthcare industry. We recognize licensing fees and other software services as revenue over the period of the contract at the time that the computer software is delivered and accepted by the customer, the selling price is fixed, and collection is reasonably assured, provided no significant obligations remain. We consider authoritative guidance on multiple deliverables in determining whether each deliverable represents a separate unit of accounting.

Deferred revenues represent billings or cash received in excess of revenue recognizable on service agreements that are not accounted for as revenues.

Through our subsidiary,subsidiaries, Natural Tech R&D Sdn Bhd and Prema Life Pty Ltd, we generate revenue from the sales ofdistributing health supplementsupplements,naturopathic medicines and other health food products, as well as in providing laboratory analytical testing services. Asproducts. Prema Life Pty Ltd also manufactured goods and packaging for NHF Management & Business Sdn Bhd, we generate revenue in providing franchisee management and consultation services to client.contract clients.

Concentration of Risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of cash. The Company places its cash with high quality banking institutions. The Company does not have the cash balances in excess of Federal Deposit Insurance Corporation limit at March 31, 2018June 30, 2019 and September 30, 2017,2018, respectively.

Income Taxes

The Company accounts for income taxes using the asset and liability method in accordance with ASC 740, “Income Taxes”. The asset and liability method provideprovides that deferred tax assets and liabilities are recognized for the expected future tax consequences of temporary differences between the financial reporting and tax basis of assets and liabilities, and for operating loss and tax credit carry forwards. Deferred tax assets and liabilities are measured using the currently enacted tax rates and laws. The Company records a valuation allowance to reduce deferred tax assets to the amount that is believed more likely than not to be realized.

The Company follows the provisions of ASC 740-10, “Accounting for Uncertain Income Tax Positions.” When tax returns are filed, it is highly certain that some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the position taken or the amount of the position that would be ultimately sustained. In accordance with the guidance of ASC 740-10, the benefit of a tax position is recognized in the financial statements in the period during which, based on all available evidence, management believes it is more likely than not that the position will be sustained upon examination, including the resolution of appeals or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that meet the more-likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than 50 percent likely of being realized upon settlement with the applicable taxing authority. The portion of the benefits associated with tax positions taken that exceeds the amount measured as described above should be reflected as a liability for unrecognized tax benefits in the accompanying condensed balance sheets along with any associated interest and penalties that would be payable to the taxing authorities upon examination.

Earnings (Loss) Per Common Share

The Company computes net earnings (loss) per share in accordance with ASC 260, “Earnings per Share”. ASC 260 requires presentation of both basic and diluted net earnings per share (“EPS”) on the face of the income statement. Basic EPS is computed by dividing earnings (loss) available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible note and preferred stock using the if-converted method. In computing diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential shares if their effect is anti-dilutive. At March 31, 2018June 30, 2019 and September 30, 2017,2018, there were no convertible notes, options or warrants available for conversion that if exercised, may dilute future earnings per share.

Fair value of Financial Instruments and Fair Value Measurements

ASC 820, “Fair Value Measurements and Disclosures”,requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 820 establishes a fair value hierarchy based on the level of independent, objective evidence surrounding the inputs used to measure fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. ASC 820 prioritizes the inputs into three levels that may be used to measure fair value:

Level 1

Level 1 applies to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities.

Level 2

Level 2 applies to assets or liabilities for which there are inputs other than quoted prices that are observable for the asset or liability such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical assets or liabilities in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which significant inputs are observable or can be derived principally from, or corroborated by, observable market data. If the asset or liability has a specified (contractual) term, the Level 2 input must be observable for substantially the full term of the asset or liability.

Fair value of Financial Instruments and Fair Value Measurements (Continued)

Level 3

Level 3 applies to assets or liabilities for which there are unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities.

The Company’s financial instruments consist principally of cash, accounts payable, accrued expenses and payable to an affiliate. Pursuant to ASC 820, “Fair Value Measurements and Disclosures” and ASC 825, “Financial Instruments”, the fair value of our cash equivalents is determined based on “Level 1” inputs, which consist of quoted prices in active markets for identical assets. The Company believes that the recorded values of all the other financial instruments approximate their current fair values because of their nature and respective maturity dates or durations.

The following table presents assets and liabilities that were measured and recognized at fair value as of March 31, 20182019 on a recurring basis:

| Description | Level 1 | Level 2 | Level 3 | |||||||||

| None | $ | - | $ | - | $ | - |

The following table presents assets and liabilities that were measured and recognized at fair value as of September 30, 2017 on a recurring basis:

| Description | Level 1 | Level 2 | Level 3 | |||||||||

| None | $ | - | $ | - | $ | - |

Recent Accounting Pronouncements

In June 2016, the FASB issued Accounting Standards Update (“ASU”) 2016-13, “Financial Instruments - Credit Losses(Topic (Topic 326).” The new standard amends guidance on reporting credit losses for assets held at amortized cost basis and available-for-sale debt securities. This ASU is effective for financial statements issued for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. The Company is currently evaluating this guidance to determine the impact it may have on its financial statements.

In 2015, the FASB issued ASU No. 2015-17, “Income Taxes”(Topic (Topic 740):Balance Sheet Classification of Deferred Taxes, which requires all deferred tax assets and liabilities to be classified as noncurrent in a classified balance sheet. Current US GAAP requires an entity to separate deferred tax assets and liabilities into current and noncurrent amounts in a classified balance sheet. For public entities, ASU 2015-17 is effective for financial statements issued for annual periods beginning after December 15, 2016, and interim periods within those annual periods. For all other entities, ASU 2015-17 is effective for annual reporting periods beginning after December 15, 2017, and interim periods within annual periods beginning after December 15, 2018, and may be applied either prospectively or retrospectively, with early application permitted for financial statements that have not been previously issued. The Company has not yet determined the effect of the adoption of this standard on the Company’s financial position and results of operations.

NOTE 3 – PROPERTY, PLANT &AND EQUIPMENT

The Company purchased web-based naturopathic learning management system computer software, developed by a third party, to educate users with the health-related products for various illnesses, and how the Company’s learning systems could be used to improve their general wellbeing. The amount capitalized include direct costs and incidental costs incurred in developing the software purchased from the third party.

The following table presents details of our computer softwareproperty, plant and equipment costs as of March 31, 2018June 30, 2019 and September 30, 2017:2018:

Balance at September 30, 2017 | Additions and consolidated through merger of subsidiaries | Amortization | Balance at March 31, 2018 | |||||||||||||

| Equipment, net | $ | - | $ | 178,992 | $ | (4,094 | ) | $ | 183,086 | |||||||

Balance at September 30, 2018 | Additions through acquisition of subsidiaries | Amortization | Balance at June 30, 2019 | |||||||||||||

| Property, plant and equipment, net | $ | 159,146 | $ | 712,027 | $ | (111,836 | ) | $ | 759,337 | |||||||

Equipment

Property, plant and equipment costs are being amortized on a straight-line basis over their estimated lives.

The future amortization expense of property, plant and equipment costs as of March 31, 2018June 30, 2019 are to be recorded in accordance with their estimated useful lives.

NOTE 4 – ACCOUNTS PAYABLE AND ACCRUED EXPENSES

Account payablesAccounts payable at March 31, 2018June 30, 2019 and September 30, 20172018 totaled $77,790$163,748 and $0,$69,805, respectively. While the accrued expenses as of March 31, 2018at June 30, 2019 and September 30, 20172018 totaled $4,000$738,417 and $2,070,38,499, respectively.

NOTE 5 – PAYABLE TO RELATED PARTIESAFFILIATES AND DRAWDOWNS OF SHORT TERM BORROWINGS

The Company has received an advance of $11,813 and $4,905paid $1,720 previously advanced from a director for its working capital needs as of March 31, 2018 and September 30, 2017, respectively (see NOTE 6).

The Company has received advanceswas granted short term borrowings from an affiliatefinancial institutions for its working capital needsneeds. The short term borrowings received is interest bearing as summarized below:

Balance June 30, 2019 | Balance September 30, | |||||||

| (Unaudited) | (Restated) | |||||||

| Short term borrowings | $ | 381,165 | $ | 40,000 | ||||

| Commercial bills | $ | 280,360 | $ | - | ||||

| Total | $ | 661,525 | $ | 40,000 | ||||

On February 15, 2019, the Company executed a convertible promissory note with Power Up Lending Group LTD (the “Power Up”), an unrelated-party, the sum of

$138,888 together with any interest as set forth herein, on February 15, 2020 (the “Maturity Date”), and to pay interest on the unpaid principal balance hereof at the rate of eight percent (8%)(the “Interest Rate”) per annum from the date hereof (the “Issue Date”) until the same becomes due and payable, whether at maturity or upon acceleration or by prepayment or otherwise. The total consideration received against the Note was $138,888, with the Note bearing $500 as a due diligence fee and $2,500 for legal expenses.

On March 12, 2019, , the Company executed another convertible promissory note with Power Up Lending Group LTD (the “Power Up”), the sum of $128,000 together with any interest as set forth herein, on March 12, 2020 (the “Maturity Date”), and to pay interest on the unpaid principal balance hereof at the rate of eight percent (8%)(the “Interest Rate”) per annum from the date hereof (the “Issue Date”) until the same becomes due and payable, whether at maturity or upon acceleration or by prepayment or otherwise. The total consideration received against the Note was $128,000, with the Note bearing $500 as a due diligence fee and

$2,500 for legal expenses.

On March 12, 2019, the Company executed a convertible promissory note with Labrys Fund, LP (the “Labrys”), an entity in which its Chief Executive Officer is alsounrelated-party, a director in such entity (NOTE 6)sum of up to $850,000, bearing an interest rate of 12%, per annum from the date hereof (the “Issue Date”) until the same becomes due and payable, whether at maturity or upon acceleration or by prepayment or otherwise as provided herein. The maturity date of each tranche funded under this convertible promissory note shall be six (6) months from the funding date of the respective tranche (each a “Maturity Date”). The advanceconsideration to the Company for this Note is up to $765,000.00 (the “Consideration”) and carries a prorated original issue discount of up to $85,000.00 (the “OID”) Total consideration received is non-interest bearing, unsecuredof the first tranche was $126,000, including $3,000 for legal expenses. At the closing of the First Tranche, the outstanding principal amount under this Note shall be $140,000.00, consisting of the First Tranche plus the prorated portion of the OID. In connection with the funding of the First Tranche of the Note, the Company shall issue to Labrys, as a commitment fee, 92,105 shares of its common stock (the “First Returnable Shares”), as further provided in the Note, as well as to issue 15,000 shares (the “Commitment Shares”) to Labrys on the Closing Date, as a commitment fee.

On March 19, 2019, the Company executed a convertible promissory note with Auctus Fund, LLC (the “Auctus”), an unrelated-party, a sum of $350,000, together with any interest as set forth herein, on December 19, 2019 (the “Maturity Date”), and to pay interest on the unpaid principal balance hereof at the rate of twelve percent (12%) (the “Interest Rate”) per annum from the date hereof (the “Issue Date”) until the same becomes due and payable, whether at maturity or upon acceleration or by prepayment or otherwise. ). The total consideration received against the Note was $350,000, with the Note bearing $35,000 as a due diligence fee and $2,750 for legal expenses. In connection with the funding of the Note, the Company shall issue to Auctus on demand is summarizedthe Closing Date, as follows.a commitment fee, 35,000 shares of the Company’s common stock (the “Commitment Shares”), as well as 175,000 shares of its common stock (the “Returnable Shares”, as further provided in the Note). The Returnable Shares and Commitment Shares shall be deemed earned in full as of the Closing Date.

Balance March 31, 2018 | Balance September 30, | |||||||

| (Unaudited) | ||||||||

| Other payables – related parties | $ | 311,338 | $ | 78,067 | ||||

| Total | $ | 311,338 | $ | 78,067 | ||||

The Company’s subsidiary, GGLG Properties Pty Ltd executed an $280,360 (AUD$400,000) commercial bill with National Australia Bank Limited, with a fixed interest rate for each rollover period.

NOTE 6 – RELATED PARTY TRANSACTIONS

TheDuring the financial period under review, the Company paid an amount of $1,720 to the directors of the Company as of June 30, 2019, whilst received an advanceadvances of $11,813 and $4,905$11,210 from a directordirectors for its working capital needs as of March 31, 2018 and September 30, 2017,2018, respectively. Funds advanced to the Company by the director are non-interestnon- interest bearing, unsecured and due on demand (NOTE 5).demand.

The Company has received advances for its working capital needs from an affiliate in which the Company’s Chief Executive Officer holds the position of director in such entity (see NOTE 5).

As for the sales to related parties, the amounts are disclosed on Condensed Consolidated Statements Of Operations (Page(PAGE 2).

NOTE 7 – COMMITMENTS AND CONTINGENCIES

Litigation Costs and Contingencies

From time to time, the Company may become involved in various lawsuits and legal proceedings, which arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm business. Other than as set forth below, management is currently not aware of any such legal proceedings or claims that could have, individually or in the aggregate, a material adverse effect on our business, financial condition, or operating results.

In the normal course of business, the Company incurs costs to hire and retain external legal counsel to advise it on regulatory, litigation and other matters. The Company expenses these costs as the related services are received. If a loss is considered probable and the amount can be reasonable estimated, the Company recognizes an expense for the estimated loss.

Contingent liabilities that are probable to arise from the recent legal related to the company’s subsidiary Prema Life Pty Ltd, the details are disclosed on Part II, Item 1. Legal Proceedings (Page 16).

NOTE 8 –8: STOCKHOLDERS’ DEFICIT

The Company’s capitalization at March 31, 2018June 30, 2019 was 500,000,000 authorized common shares with a par value of $0.001 per share.

Common Stock

On November 30, 2016,December 3, 2018, the Company increasedagreed to purchase 51% of the authorized shareissued and outstanding capital from 75,000,000stock of Prema Life Pty Ltd and 60% of the issued and outstanding capital stock of GGLG Properties PTY Ltd, collectively in exchange for 304,500 shares of the Company’s common stock to 500,000,000 shares of common stock. In addition,valued at $1,218,000 based on the Company effectuated a 30:1 forward stock splitfair value of the common stock on suchthe closing date.

On February 1,December 28, 2018, the Company entered into consulting agreements with two contractors for providing business advisory and consulting services.parties mutually agreed to extend the closing of the purchase transaction on January 1, 2019. The Company issued 1,000,000304,500 shares of its common stock valued at $20,000 ason December 3, 2018 in good faith for consummating the purchase. The Company has recorded the fair market value of the stock.common stock issued as stock subscriptions receivable at December 31, 2018.

On March 1, 2018,12, 2019, the Company entered intoexecuted a Share Exchange Agreementconvertible promissory note with Labrys Fund, LP (the “Agreement”“Labrys”). In connection with the funding of the First Tranche of the Note, the Company shall issue to Labrys, as a commitment fee, 92,105 shares of its common stock (the “First Returnable Shares”), as further provided in the Note, as well as to issue 15,000 shares (the “Commitment Shares”) to Labrys on the Closing Date, as a commitment fee.

On March 19, 2019, the Company executed a convertible promissory note with Auctus Fund, LLC (the “Auctus”). In connection with the funding of the Note, the Company shall issue to Auctus on the Closing Date, as a commitment fee, 35,000 shares of the Company’s common stock (the “Commitment Shares”), as well as 175,000 shares of its shareholders whereby,common stock (the “Returnable Shares”, as further provided in the shareholders agreedNote). The Returnable Shares and Commitment Shares shall be deemed earned in full as of the Closing Date.

On March 20, 2019, the company executed a convertible promissory note with EMA Financial, LLC (the “EMA”). In connection with the funding of the First Tranche of the Note, the Company shall issue to exchange, sell, convey, transfer and assignEMA, 15,000 shares of restricted common stock as a commitment fee the “Commitment Shares”), as well as 86,800 shares of restricted common stock (the “Returnable Shares”), as further provided in the Note). In the event the Company fails to redeem the tranche by its maturity date the Returnable Shares shall not be returned to the Company their shareholdings, free and clear of all liens, pledges, encumbrances, changes, restrictions or known claims of any kind, nature or description plus pay to the Company an aggregate purchase price of $50 (the “Purchase Price”), and the Company agreed to accept from its shareholders the old shares plus the Purchase Price in exchange for the transfer of old shares the new shares. As of March 31, 2018, the Company received cash proceeds of $35,537 from its shareholders to exchange the old shares for new shares, and recorded it as contributed capital in the accompanying financial statements.

As a result of all common stock issuances, the Company had 151,150,000162,278,405 shares and 150,150,000161,555,000 shares of common stock issued and outstanding as of March 31, 2018at June 30, 2019 and September 30, 2017,2018, respectively.

NOTE 9 – RELATED PARTIES

Parties, which can be a corporation or individual, are considered to be related if the Company has the ability, directly or indirectly, to control the other party or exercise significant influence over the other party in making financial and operating decisions. Companies are also considered to be related if they are subject to common control or common significant influence.

NOTE 10 – RESTATEMENT

On January 31, 2018, the company acquired the total outstanding share of NHF International Limited, an investment holding company, at nominal value. Upon the completion of the acquisition, its subsidiaries, both Natural Tech R&D Sdn Bhd and NHF Management & Business Sdn Bhd, in turn, became wholly-owned subsidiaries of the Company. As this transaction is business combination under common control, as deliberated and determined by Directors of the Company, difference between purchase considerations and net tangible assets acquired is recorded in merger reserves which amounted to $517,300. Natural Tech R&D Sdn Bhd, a BioNexus Status Company in Malaysia, specializes in research and development, cultivation, extraction and commercialization of nutraceuticals based on medicinal fungi and NHF Management & Business Sdn Bhd, providing franchisee management services and consultation, such as point-of-sales system, resources, branding and marketing.

The following balances and amounts in the initial financial statements announced on 11 May 2018 were inadvertently reported on the condensed consolidated balance sheets and condensed consolidated statements of operations. The effects of correction of errors are disclosed as below:

Condensed Consolidated Balance Sheets

As previously reported | Adjustments arising from merger of subsidiaries |

As restated | ||||||||||

| $ | $ | $ | ||||||||||

| Current assets | 117,038 | 739,433 | 856,471 | |||||||||

| Non-current assets | 37,756 | 145,330 | 183,086 | |||||||||

| Total assets | 154,794 | 884,763 | 1,039,557 | |||||||||

| Current liabilities | 239,499 | 294,977 | 534,476 | |||||||||

| Non-current liabilities | - | 7,302 | 7,302 | |||||||||

| Total liabilities | 239,499 | 302,279 | 541,778 | |||||||||

| Share Capital | 151,150 | - | 151,150 | |||||||||

| Reserves | (235,855 | ) | 582,484 | 346,629 | ||||||||

| Total equity | (84,705 | ) | 582,484 | 497,779 | ||||||||

Condensed Consolidated Statement of Operations For the Six Months Ended March 31, 2018

As previously reported | Adjustments arising from merger of subsidiaries |

As restated | ||||||||||

| $ | $ | $ | ||||||||||

| Revenues – related parties | 8,492 | 207,166 | 215,658 | |||||||||

| Revenues – third parties | 2,973 | 1,892 | 4,865 | |||||||||

| Total revenues | 11,465 | 209,058 | 220,523 | |||||||||

| Cost of Goods Sold | (4,094 | ) | (117,006 | ) | (121,100 | ) | ||||||

| Gross Profit | 7,371 | 92,052 | 99,423 | |||||||||

| Total Operating Expenses | (67,476 | ) | (62,435 | ) | (129,911 | ) | ||||||

| Loss From Operations | (60,105 | ) | 29,617 | (30,488 | ) | |||||||

| Other Income | - | 606 | 606 | |||||||||

| Loss Before Tax | (60,105 | ) | 30,223 | (29,882 | ) | |||||||

| Tax expense | - | - | - | |||||||||

| Net Loss | (60,105 | ) | 30,223 | (29,882 | ) | |||||||

The above restatements do not have any significant impact to the basic and dilutive net loss per share as compared to initial announcement on 11 May 2018.

NOTE 119 – SUBSEQUENT EVENTS

On December 3, 2018, the Company agreed to purchase 51% of the issued and outstanding capital stock of Prema Life Pty Ltd and 60% of the issued and outstanding capital stock of GGLG Properties Pty Ltd, collectively in exchange for 304,500 shares of the Company’s common stock. On December 28, 2018, the parties mutually agreed to extend the closing date of the purchase transaction on January 1, 2019. The Company issued 304,500 shares of its common stock on December 3, 2018 in good faith for consummating the purchase. These newly acquired entities were consolidated for period ended 31 March 2019.

Management has evaluated subsequent events through June 30,August 14 , 2019, the date the financial statements were available to be issued, noting no items that would impact the accounting for events or transactions in the current period or require additional disclosure.except for:

| · | On July 2, 2019 and August 2, 2019, the Company settled the remaining balances of the convertible promissory note in full for total $140,000 to Labrys Fund, LP, the 92,105 returnable shares was returned to company on August 7, 2019; |

| · | On July 3, 2019 and July 29, 2019 the Company settled the remaining balances of the convertible promissory note in full for total $350,000 to Auctus Fund, LLC. The arrangement with Auctus to return the returnable shares of 175,000 is in progress; and |

| · | On July 5, 2019 and July 31, 2019, the Company settled the remaining balances of the convertible promissory note in full for total $266,000 to Power Up Lending Group LTD. |

Item 2. Management’s Discussion and Analysis or Plan of Operation

This Quarterly Report Form 10-Q contains forward-looking statements. Our actual results could differ materially from those set forth as a result of general economic conditions and changes in the assumptions used in making such forward-looking statements. The following discussion and analysis of our financial condition and results of operations should be read together with the unaudited condensed financial statements and accompanying notes and the other financial information appearing elsewhere in this report. The analysis set forth below is provided pursuant to applicable Securities and Exchange Commission regulations and is not intended to serve as a basis for projections of future events.

Natural Health Farm Holdings Inc., incorporated in the State of Nevada on July 10, 2014 (inception date), has developed and launched itself into the healthcare industry. The company started as a nutritional consulting service provider by offering a web based naturopathic learning management system that allows distributors, chiropractors and consumers to be educated on health-related aspects of various diseases. The company has positioned itself to be a fully integrated nutraceutical biotechnology company offering products and related services through healthcare practitioners and direct-to-consumers. The company now owns a research & development laboratory in Malaysia, franchisee management services company and an Australia manufacturing facility producing practitioner only naturopathic and homeopathic medicines.

On January 31, 2018, the company acquired the total outstanding share of NHF International Limited at at nominal value.USD$1. Upon the completion of the acquisition, its subsidiaries, both Natural Tech R&D Sdn Bhd and NHF Management & Business Sdn Bhd become wholly subsidiaries of the Group. As this transaction is business combination under common control, as deliberated and determined by Directors of the Company, difference between purchase considerations and net tangible assets acquired is recorded in merger reserves which amounted to $517,300. Natural Tech R&D Sdn Bhd, a BioNexus Status Company in Malaysia, specializes in research and development, cultivation, extraction and commercialization of nutraceuticals based on medicinal fungi and NHF Management & Business Sdn Bhd, providing franchisee management services and consultation, such as point-of-sales system, resources, branding and marketing.

On December 3, 2018, the Company agreed to purchase 51% of the issued and outstanding capital stock of Prema Life Pty Ltd and 60% of the issued and outstanding capital stock of GGLG Properties Pty Ltd, collectively in exchange for 304,500 shares of the Company’s common stock. On December 28, 2018, the parties mutually agreed to extend the closing date of the purchase transaction on January 1, 2019. The Company issued 304,500 shares of its common stock on December 3, 2018 in good faith for consummating the purchase.

Prema Life Pty Ltd is a manufacturer and supplier of functional foods, vitamins and supplements, of practitioner only naturopathic and homeopathic medicines in Australia. The Company hosts regular educational webinars and seminars for practitioners to learn about the natural products. The Company operates from a Hazard Analysis and Critical Control Point (“HACCP”) certified manufacturing facility and has the capacity to produce a wide range of powder and liquid products to requirements.

GGLG Properties Pty Ltd. owns industrial property and factory at Brendale in Brisbane, Queensland, Australia. The Company leases this property to Prema Life Pty Ltd, and incurs costs in connection with owning and maintaining that property and recovers these costs through rental charges and rental recoveries pursuant to a long-term lease.

We anticipate that we will need substantial working capital over the next 12 months to continue as a going concern and to expand our business. Our independent auditors have expressed substantial doubt as to the ability of the Company to continue as a going concern. We intend to make an equity offering of our common stock for the acquisition and operation expenses. If we cannot raise the required cash, we will issue additional shares of our common stock in lieu of cash.

Restatement of Financial Results

The company is restating its previously reported consolidated financial statements as at March 31, 2018. The restatement of the company’s consolidated financial statements followed an internal review of the company’s consolidated financial statements and accounting records that inadvertently excluded the financials reporting for NHF International Limited and its subsidiaries, Natural Tech R&D Sdn Bhd and NHF Management & Business Sdn Bhd. This restatement has presented the periodic consolidated earnings of the company as a group.

Results of Operations

Our results of operations for the three months ended March 31,June 30, 2019 and 2018 and 2017 included the operations of the Company, NHF International and its subsidiaries as a common control situation.situation, and both Prema Life Pty Ltd and GGLG Properties Pty Ltd from January 1, 2019.

For the three months ended March 31,June 30, 2019 and 2018, and 2017, we recorded total revenues of $218,524$806,387 ($213,659656,137 from related parties and $4,865$150,249 from third parties) and $0$274,474 ($264,692 from related parties and $9,782 from third parties) respectively. Revenues recorded were earned by supplying manufactured goods, selling supplements, providing laboratory testing services and providing franchisee and marketing consultation. Cost of goods sold recorded was $120,494$256,206 and $0,$121,513, for the three months ended March 31,June 30, 2019 and 2018, respectively.

For the nine months ended June 30, 2019 and 2017,2018, we recorded total revenues of $1,613,428 ($970,676 from related parties and $642,752 from third parties) and $494,997 ($480,350 from related parties and $14,647 from third parties), respectively. Revenues recorded were earned by supplying manufactured goods, selling supplements, providing laboratory testing services and providing franchisee and marketing consultation. Cost of goods sold of $596,148 and $242,613, for the nine months ended June 30, 2019 and 2018, respectively.

Operating expenses for the three months ended March 31,June 30, 2019 and 2018 were $506,663 and 2017 were $111,442 and $4,905,$771,943, respectively. Operating expenses for the three months ended March 31, 2018 totaled $111,442, consistingJune 30, 2019, consisted of $20,050 inthe Company recording consulting fees paidof $43,675 payable to professional consultants and business advisors for services, $20,810$12,300 in legal and filing fees, and $70,582$450,688 in other general and administrative expenses. Operating expenses for the three months ended March 31, 2017June 30, 2018, consisted of the Company recording consulting$109,626 in fees of $4,905 payablepaid to professional consultants and business advisors for services.services, $12,130 in legal and filing fees, stock compensation expense of $526,295 for grant of options to employees, directors and consultants, and $123,892 in other general and administrative expenses.

Operating expenses for the nine months ended June 30, 2019 and 2018 were $1,037,266 and $901,854, respectively. Operating expenses for the nine months ended June 30, 2019 consisted of the Company engaging consultants and business advisors for consulting fees totaling $117,725, legal and filing fees of $58,165 upon becoming a public reporting entity, and $861,375 in other general and administrative expenses. Operating expenses for the nine months ended June 30, 2018 consisted of the Company engaging consultants and business advisors for consulting fees totaling $145,240, legal and filing fees of $35,845 upon becoming a public reporting entity, stock compensation expense of $526,295 for grant of stock options to employees, directors and consultants, and $194,474 in other general and administrative expenses.

As a result of the above, we reported a net profit of $114,986 and a net loss of $618,536 for the three months ended March 31,June 30, 2019 and 2018, and 2017, wewhile reported a net lossprofit of $12,806 and a loss of $4,905. The net loss for the three months ended March 31, 2018 resulted primarily due to the Company incurring legal and filing fees upon becoming a public reporting entity and hiring third party consultants for providing business and advisory services to the Company. Our results of operations for the six months ended March 31, 2018 and 2017 included the operations of the Company. We reported a net loss of $29,882$46,742 and a net loss of $9,145$648,418 for the sixnine months ended March 31,June 30, 2019 and 2018, and 2017 primarily due to the Company incurring legal and filing fees upon becoming a public reporting entity and engaging consultants for providing business and advisory services to the Company.respectively.

Liquidity and Capital Resources

Cash and cash equivalents were $464,216$838,120 at March 31, 2018June 30, 2019 as compared to $0$439,846 at September 30, 2017.2018. As reported in the accompanying financial statements, we recorded a net lossprofit of $12,806$46,742 for the threenine months ended March 31, 2018.June 30, 2019. Our accumulated deficit at March 31, 2018June 30, 2019 was $148,348.$1,022,658. These factors and our ability to raise additional capital to accomplish our objectives, raises doubt about our ability to continue as a going concern. We expect our expenses will continue to increase during the foreseeable future as a result of increased operational expenses and the development of our current business operations. Consequently, we are dependent on the proceeds from future debt or equity investments to sustain our operations and implement our business plan. If we are unable to raise sufficient capital, we will be required to delay or forego some portion of our business plan, which would have a material adverse effect on our anticipated results from operations and financial condition. There is no assurance that we will be able to obtain necessary amounts of capital or that our estimates of our capital requirements will prove to be accurate.

We presently do not have any significant credit available, bank financing or other external sources of liquidity. Due to our accumulated operating losses, our operations have not been a source of liquidity. We will need to acquire other profitable entities or obtain additional capital in order to expand operations and become profitable. In order to obtain capital, we may need to sell additional shares of our common stock or borrow funds from private lenders. There can be no assurance that we will be successful in obtaining additional funding.

To the extent that we raise additional capital through the sale of equity or convertible debt securities, the issuance of such securities may result in dilution to existing stockholders. If additional funds are raised through the issuance of debt securities, these securities may have rights, preferences and privileges senior to holders of common stock and the terms of such debt could impose restrictions on our operations. Regardless of whether our cash assets prove to be inadequate to meet our operational needs, we may seek to compensate providers of services by issuance of stock in lieu of cash, which may also result in dilution to existing shareholders. Even if we are able to raise the funds required, it is possible that we could incur unexpected costs and expenses, fail to collect significant amounts owed to us, or experience unexpected cash requirements that would force us to seek alternative financing.

No assurance can be given that sources of financing will be available to us and/or that demand for our equity/debt instruments will be sufficient to meet our capital needs, or that financing will be available on terms favorable to us. If funding is insufficient at any time in the future, we may not be able to take advantage of business opportunities or respond to competitive pressures or may be required to reduce the scope of our planned service development and marketing efforts, any of which could have a negative impact on our business and operating results.

Operating Activities

Net cash flows provided by operating activities for the sixnine months ended March 31, 2018June 30, 2019, was $236,587a negative $668,479, which resulted primarily from our net lossprofit of $29,882, amortization of computer software46,742, depreciation costs of $4,094,$111,836, and a net change in operating assets and liabilities of $262,375a negative $827,056. Net cash flows used in operating activities for the sixnine months ended March 31, 2017June 30, 2018 was $8,526,$48,454 which resulted due to theprimarily from our net loss of $9,145$648,418, amortization of software costs of $7,582, common stock valued at $105,000 issued to consultants for business advisory services, stock compensation expense of $526,295 for grant of stock options to employees, directors and consultants, and a net negativechange in operating assets and liabilities of $8,526.57,995.

Investing Activities:

Net cash flows used in investing activities for the nine months ended June 30, 2019 was primarily due to the acquisition of Prema Life Pty Ltd and GGLG Properties Pty Ltd of $1,196,967 and purchase of equipment of $61,808. Net cash flows used in investing activities for the nine months ended June 30, 2018 were primarily due to the purchase of plant & equipment of $49,551,$55,611 and cash inflow from merger and acquisition of 277,180 during the six months ended March 31, 2018. We did not record any cash flows in investing activities during the six months ended March 31, 2017.277,180.

Financing Activities

Net cash flows provided by financing activities for the sixnine months ended March 31, 2018June 30, 2019 was $11,813, primarily due$2,325,527, consisting of cash advance receivedadvances from company directors for working capital needs.Directors $1,720, drawdowns of borrowings $621,525 and proceeds from issuance of shares $1,705,722. Net cash flows provided by financing activities for the sixnine months ended March 31, 2017June 30, 2018 was $13,431 attributable to $8,526$40,724, consisting of cash received from an affiliateshareholders for our working capital needs and $4,905 cash advanced from director.stock subscription.

As a result of the above activities, we experienced a net increase in cash of $464,216$838,120 and $0$310,747 for the sixnine months ended March 31,June 30, 2019 and 2018, and 2017, respectively. We expect that working capital will continue to be funded through a combination of our existing sales and further issuance of securities or obtaining financing. Our ability to continue as a going concern is still dependent on our success in obtaining additional financing from investors or from sale of our common shares.

Critical Accounting Policies and Significant Judgments and Estimates

Our management’s discussion and analysis of our financial condition and results of operations is based on our financial statements which we have prepared in accordance with U.S. generally accepted accounting principles. In preparing our financial statements, we are required to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. We have identified the following accounting policies that we believe require application of management’s most subjective judgments, often requiring the need to make estimates about the effect of matters that are inherently uncertain and may change in subsequent periods. Our actual results could differ from these estimates and such differences could be material.

While our significant accounting policies are described in more details in Note 2 of our annual financial statements included in our Annual Report filed with the SEC on December 28, 2017, we believe the following accounting policies to be critical to the judgments and estimates used in the preparation of our financial statements.

JOBS Act Accounting Election

We are an “emerging growth company,” as defined in the JOBS Act. Under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards issued subsequent to the enactment of the JOBS Act until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards, and, therefore, will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

Fair value of Financial Instruments and Fair Value Measurements

ASC 820, “FairValue Measurements and Disclosures”,requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 820 establishes a fair value hierarchy based on the level of independent, objective evidence surrounding the inputs used to measure fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement.

Off-Balance Sheet Arrangements

We have not engaged in any off-balance sheet arrangements as defined in Item 303(c) of the SEC’s Regulation S-B. We did not have any relationships with unconsolidated organizations or financial partnerships, such as structured finance or special-purpose entities that would have been established for the purpose of facilitating off-balance sheet arrangements or other contractually narrow or limited purposes.

Recent Accounting Pronouncements

We have implemented all new accounting pronouncements that are in effect and that may impact our financial statements and do not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on our financial position or results of operations.

| Item 3. | Quantitative and Qualitative Disclosures About Market Risks. |

Not Applicable.

| Item 4. | Controls and Procedures. |

Evaluation of Disclosure Controls and Procedures

We carried out an evaluation of the effectiveness of disclosure controls and procedures as of the end of the period covered by this report under the supervision and with the participation of our management, including our Principal Executive Officer and Principal Financial Officer, as defined in Rules 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934. Based on that evaluation, our Principal Executive Officer and Principal Financial Officer have concluded that our disclosure controls and procedures as of March 31, 2018 were not effective to ensure that information required to be disclosed by us in reports that we file or submit under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms. The term “disclosure controls and procedures,” as defined under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), means controls and other procedures of a company that are designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms. Management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving their objectives and management necessarily applies its judgment in evaluating the cost benefit relationship of possible controls and procedures. Notwithstanding the identified material weaknesses, management believes the financial statements included in this quarterly report on Form 10-Q fairly represent in all material respects our financial condition, results of operations and cash flows at and for the periods presented in accordance with U.S. GAAP.

Changes in Internal Control over Financial Reporting

There have been no changes in our internal control over financial reporting identified in connection with the evaluation required by paragraph (d) of Rule 13a-15 or Rule 15d-15 under the Exchange Act that occurred during the three months ended March 31, 2018, that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

PART II

PART II.

| Item 1. | Legal Proceedings. |