TINGO,AGRI-FINTECH HOLDINGS, INC. (f/k/a Tingo, Inc.)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 20222023

(Unaudited)

(1)Description of Business and Basis of Presentation

| (1) | Description of Business and Basis of Presentation |

Description of Business—Tingo,Agri-Fintech Holdings, Inc. (collectively, with our subsidiary, “we,, formerly known as ‘Tingo, Inc.’ (“we,” “us,” “our,” “Tingo” and the “Company”), a Nevada corporation, was formed on February 17, 2015. Our shares trade on the OTC Markets trading platform under the symbol ‘TMNA’. We acquired our wholly-owned subsidiary,

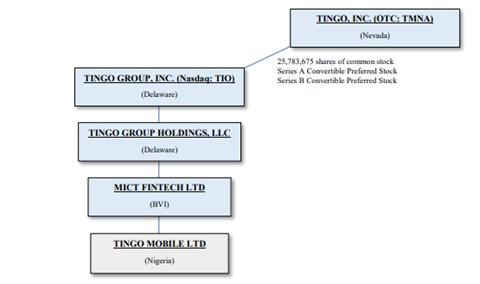

As described more fully under Note 2 - Sale of Tingo Mobile PLC, a Nigerian public limited company below, on December 1, 2022, we sold Tingo Mobile Limited (“Tingo Mobile”), our sole operating subsidiary, to Tingo Group, Inc. (“TIO”), a Nasdaq-traded financial services company (formerly known as MICT, Inc.), in exchange for 25,783,675 shares of TIO common stock and two series of preferred stock that are convertible into TIO common stock upon the occurrence of certain conditions (“Preferred Stock”). On July 27, 2023, we converted one of these series of Preferred Stock into 26,043,808 additional shares of TIO common stock. If we convert the remainder of the Preferred Stock, our shareholding in TIO will be equal to 75.0% of TIO’s outstanding common stock, calculated as of the date of the sale of Tingo Mobile. Importantly, because we expect to hold 75.0% of the outstanding TIO common stock at some point during 2023, this report will discuss the historical operations of Tingo Mobile as a share exchangeformer subsidiary of the Company, and will discuss the future operations of Tingo Mobile, including the discussion of Risk Factors below, as a pending subsidiary of the Company.

Prior to our sale of Tingo Mobile, the Company, together with its sole shareholder effective August 15, 2021. The Company, including itsoperating subsidiary, Tingo Mobile, iswas an Agri-Fintech company offering a comprehensive platform service through use of smartphones – ‘device as a service’ (using GSM technology) to empower a marketplace to enable subscribers/farmers within and outside of the agricultural sector to manage their commercial activities of growing and selling their production to market participants both domestically and internationally. The ecosystem provides a ‘one stop shop’ solution to enable such subscribers to manage everything from airtime top ups, bill pay services for utilities and other service providers, access to insurance services and micro finance to support their value chain from ‘seed to sale’.

AsOur principal office is located at 11650 South State Street, Suite 240, Draper, UT 84020, and the telephone number is +1-385-463-8168. Our corporate website is located at www.tingoinc.com. We make available free of June 30, 2022, Tingo had approximately 9.3 million subscribers using its mobile phones and Nwassa payment platform (www.nwassa.com). Nwassa is Africa’s leading digital agriculture ecosystem that empowers rural farmers and agri-businesses by using proprietary technology to enable access to market. Nwassa’s payment gateway also has an escrow structure that creates trust between buyers and sellers. Our system provides real-time pricing, straight from the farms, eliminating middlemen. Our users’ customers pay for produce bought using available pricingcharge on our platform. Our platformwebsite our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is paperless, verifiedelectronically filed or furnished to the Securities and matched against a smart contract. Data is efficiently stored on the blockchain.

Our platform has created an escrow solution that secures the buyer, funds are not released to our members until fulfilment. The platform also facilitates trade financing, ensuring that banks and other lenders compete to provide credit to our members.

Tingo aims to be Africa’s leading Agri-Fintech player that transforms rural farming communities by enabling growers to connect through our proprietary platform to meet their complete needs from inputs, agronomy, off take and marketplace which delivers sustainable income in an impactful way. Additional information about the Company can be obtained from our website at www.tingoinc.comExchange Commission (“SEC”). Our website, however, does not constitute a part of this Quarterly Report.

Basis of Presentation— The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and Articles 3 and 3A of Regulation S-X. The interim unaudited financial statements and notes thereto should be read in conjunction with the financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, including any amendments thereto, as filed with the Securities and Exchange Commission (“SEC”). All normal recurring adjustments considered necessary for a fair presentation have been included. The financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”).

As a result of the sale of our operating business on December 1, 2022 as described in Note 2, Sale of Tingo Mobile below, the following terms refer to our operations before and after the sale:

| ● | “Predecessor” and “Predecessor Period” refers to the consolidated operations of the Company from January 1, 2022 through June 30, 2022; and |

| ● | “Successor” and “Successor Period” refers to the operations of the Company from December 1, 2022, the date of our sale of Tingo Mobile, through December 31, 2022, and from January 1, 2023 through June 30, 2023. |

Our financial statements include our accounts and those of our wholly-owned subsidiaries, as applicable. All intercompany transactions and balances have been eliminated in the accompanying consolidated financial statements.

Our results of operations for the quarter andPredecessor Period ended June 30, 2022, the year ended December 31, 2022, or the six months ended June 30, 20222023 are not necessarily indicative of results that ultimately may be achieved for the remainder of 2022.2023.

The Impact of COVID-19—In responseDue to the COVID-19 pandemic, there have been a broad numberlack of governmental and commercial actions taken to limit the spreadcomparability of the virus, including social distancing measures, stay-at-home orders, travel restrictions, business shutdowns and slowdowns. The COVID-19 pandemic continues to be dynamic, and near-term challenges across the economy remain. Although vaccines are now being distributed and administered across many partsfinancial statements of the world, new variantsPredecessor Period with the Successor Period, our financial statements and related footnotes are presented with a “black line” division to emphasize the lack of the virus have emergedcomparability between amounts presented as of, and may continue to emerge that have shown to be more contagious. We continue to adhere to applicable governmentalafter, December 1, 2022 and commercial restrictions and to work to mitigate the impact of COVID-19 on our employees, customers, communities, liquidity and financial position.

amounts presented for all prior periods.