UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q/A10-Q

Amendment No. 1

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended SeptemberJune 30, 20222023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________________ to __________________

Commission file number: 000-15746

VIEWBIX INC.

(Exact Name Of Registrant As Specified In Its Charter)

| Delaware | 68-0080601 | |

| (State of | (I.R.S. Employer | |

| Incorporation) | Identification Number) |

| 11 Derech Menachem Begin Street, Ramat Gan, Israel | 5268104 | |

| (Address of Principal Executive | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: +972 9-774-1505

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| N/A | N/A | N/A |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer (as defined in Rule 12b-2 of the Exchange Act) or a smaller reporting company.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

On November 20, 2022,August 14, 2023, the Registrant had shares of common stock issued and outstanding.

EXPLANATORY NOTE

Throughout this report, references to the “Registrant”, “Company,” “Viewbix,” “we,” “us,” and “our” refers to Viewbix Inc., unless the context requires otherwise.

This Amendment No. 1 on Form 10-Q is filed to amend the Registrant’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2022 (“the Form 10-Q/A”), which was filed with Securities and Exchange Commission (the “SEC”) on November 21, 2022 (the “Original Form 10-Q”), for the purpose of correcting the disclosure regarding the changes in internal control over financial reporting and management’s plan to remediate the material weaknesses that were identified in the evaluation of the disclosure controls and procedures, in the last two paragraphs of “Item 4. Controls and Procedures” of the Original Form 10-Q. In addition this Form 10-Q/A is to correct certain technical and typographical errors, consisting primarily of corrections of the numbering of cross references in the Interim Financial Statements and accompanying Notes to Interim Financial Statements.

The following items included in the Original Form 10-Q are amended by this Form 10-Q/A:

In addition, the Registrant’s Principal Executive and Principal Financial Officer has provided new certifications dated as of the date of this filing in connection with this Form 10-Q/A (Exhibits 31.1 and 32.1).

Except as described above, this Form 10-Q/A does not modify or update the disclosures presented in, or exhibits to, the Original Form 10-Q in any way. Those sections of the Original Form 10-Q that are unaffected by this Form 10-Q/A have been included herein as required by the SEC. This Form 10-Q/A continues to speak as of the date of the Original Form 10-Q. Furthermore, the Form 10-Q/A does not reflect events occurring after the filing of the Original Form 10-Q. Accordingly, this Form 10-Q/A should be read in conjunction with the Company’s other filings made with the SEC pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, amended.

VIEWBIX INC.

TABLE OF CONTENTS

| Item | Description | Page | ||

| PART I - FINANCIAL INFORMATION | ||||

| ITEM 1. | FINANCIAL STATEMENTS | 3 | ||

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS AND RESULTS OF OPERATIONS | |||

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |||

| ITEM 4. | CONTROLS AND PROCEDURES | |||

| PART II - OTHER INFORMATION | ||||

| ITEM 1. | LEGAL PROCEEDINGS | |||

| ITEM 1A. | RISK FACTORS | |||

| ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | |||

| ITEM 3. | DEFAULT UPON SENIOR SECURITIES | |||

| ITEM 4. | MINE SAFETY DISCLOSURE | |||

| ITEM 5. | OTHER INFORMATION | |||

| ITEM 6. | EXHIBITS | |||

| SIGNATURES |

| -2- |

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

VIEWBIX INCINC.

INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

SeptemberJune 30, 20222023

CONTENTS

| -3- |

VIEWBIX INC

VIEWBIX INC.

INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

U.S. dollars in thousands (except share data)

| Note | 2023 | 2022 | ||||||||||||||||||||||

As of | As of December 31 | As of June 30 | As of December 31 | |||||||||||||||||||||

| Note | 2022 | 2021 | Note | 2023 | 2022 | |||||||||||||||||||

| ASSETS | ||||||||||||||||||||||||

| CURRENT ASSETS | ||||||||||||||||||||||||

| Cash and cash equivalents | 3,609 | 5,208 | 3,304 | 4,196 | ||||||||||||||||||||

| Restricted deposits | 223 | 234 | 182 | 185 | ||||||||||||||||||||

| Accounts receivable |

| 16,398 | 16,415 | 18,415 | 20,945 | |||||||||||||||||||

| Loan to parent company | 15 | 7,096 | 6,384 | 3 | 3,689 | 3,542 | ||||||||||||||||||

| Other receivables | 3 | 814 | 1,004 | |||||||||||||||||||||

| Other current assets | 693 | 973 | ||||||||||||||||||||||

| Total current assets | 28,140 | 29,245 | 26,283 | 29,841 | ||||||||||||||||||||

| NON-CURRENT ASSETS | ||||||||||||||||||||||||

| Severance pay funds | 73 | 83 | - | 52 | ||||||||||||||||||||

| Deferred taxes | 11 | 62 | 133 | 211 | 340 | |||||||||||||||||||

| Property and equipment, net | 4 | 317 | 334 | 272 | 302 | |||||||||||||||||||

| Operating lease right-of-use assets | 5 | 505 | 569 | |||||||||||||||||||||

| Operating lease right-of-use asset | 4 | 442 | 486 | |||||||||||||||||||||

| Intangible assets, net | 6 | 15,762 | 8,414 | 5 | 13,885 | 15,313 | ||||||||||||||||||

| Goodwill | 6 | 17,615 | 12,483 | 5 | 17,361 | 17,361 | ||||||||||||||||||

| Total non-current assets | 34,334 | 22,016 | 32,171 | 33,854 | ||||||||||||||||||||

| Total assets | 62,474 | 51,261 | 58,454 | 63,695 | ||||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidatedInterim Condensed Consolidated financial statements.

| -4- |

VIEWBIX INC.

INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) (Cont.)

U.S. dollars in thousands (except share data)

As of | As of December 31 | |||||||||||

| Note | 2022 | 2021 | ||||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||||||

| CURRENT LIABILITIES | ||||||||||||

| Current maturities of long-term loan | 10 | 1,500 | 1,500 | |||||||||

| Loan from parent company | 15 | 2,527 | 2,116 | |||||||||

| Accounts payable | 8 | 16,144 | 16,676 | |||||||||

| Other payables | 9 | 1,862 | 1,386 | |||||||||

| Short-term loans | 10 | 5,000 | 5,000 | |||||||||

| Operating lease liabilities - short term | 6 | 93 | 91 | |||||||||

| Total current liabilities | 27,126 | 26,769 | ||||||||||

| NON-CURRENT LIABILITIES | ||||||||||||

| Accrued severance pay | 176 | 188 | ||||||||||

| Long-term loan | 10 | 3,225 | 4,270 | |||||||||

| Operating lease liabilities - long term | 6 | 433 | 491 | |||||||||

| Deferred taxes | 11 | 1,853 | 1,026 | |||||||||

| Total non-current liabilities | 5,687 | 5,975 | ||||||||||

| SHAREHOLDERS’ EQUITY | 13 | |||||||||||

| Share Capital | ||||||||||||

| Common stock of $par value - Authorized: shares; Issued and outstanding: shares as of September 30, 2022 and December 31, 2021, respectively (*) | 3 | 3 | ||||||||||

| Additional paid-in capital | 27,564 | 16,074 | ||||||||||

| Accumulated deficit | (4,043 | ) | (2,366 | ) | ||||||||

| Equity attributed to the company’s shareholders | 23,524 | 13,711 | ||||||||||

| Non-controlling interests | 6,137 | 4,806 | ||||||||||

| Total equity | 29,661 | 18,517 | ||||||||||

| Total liabilities and shareholders’ equity | 62,474 | 51,261 | ||||||||||

As of June 30 | As of December 31 | |||||||||||

| Note | 2023 | 2022 | ||||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||||||

| CURRENT LIABILITIES | ||||||||||||

| Accounts payable | 17,345 | 19,782 | ||||||||||

| Short-term loans | 6 | 6,000 | 5,069 | |||||||||

| Current maturities of long-term loans | 6 | 1,879 | 1,500 | |||||||||

| Other payables | 1,285 | 2,084 | ||||||||||

| Operating lease liabilities - short term | 4 | 83 | 87 | |||||||||

| Total current liabilities | 26,592 | 28,522 | ||||||||||

| NON-CURRENT LIABILITIES | ||||||||||||

| Accrued severance pay | - | 152 | ||||||||||

| Long-term loans, net of current maturities | 6 | 3,128 | 2,881 | |||||||||

| Operating lease liabilities - long term | 4 | 334 | 388 | |||||||||

| Deferred taxes | 1,632 | 1,853 | ||||||||||

| Total non-current liabilities | 5,094 | 5,274 | ||||||||||

| Commitments and Contingencies | 7 | - | - | |||||||||

| SHAREHOLDERS’ EQUITY | 8 | |||||||||||

| Common stock of $ par value - Authorized: shares; Issued and outstanding: and shares as of June 30, 2023 and December 31, 2022, respectively. | 3 | 3 | ||||||||||

| Additional paid-in capital | 25,417 | 25,350 | ||||||||||

| Accumulated deficit | (3,859 | ) | (3,338 | ) | ||||||||

| Equity attributed to shareholders of Viewbix Inc. | 21,561 | 22,015 | ||||||||||

| Non-controlling interests | 5,207 | 7,884 | ||||||||||

| Total equity | 26,768 | 29,899 | ||||||||||

| Total liabilities and shareholders’ equity | 58,454 | 63,695 | ||||||||||

The accompanying notes are an integral part of these condensed consolidatedInterim Condensed Consolidated financial statements.

| -5- |

VIEWBIX INC.

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

U.S. dollars in thousands (except share data)

| 2023 | 2022 | 2023 | 2022 | |||||||||||||||||

| Note | For the six months ended June 30, | For the three months ended June 30, | ||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||||||

| Revenues | 48,016 | 43,337 | 27,154 | 22,902 | ||||||||||||||||

| Costs and Expenses: | ||||||||||||||||||||

| Traffic-acquisition and related costs | 42,031 | 37,265 | 24,050 | 19,650 | ||||||||||||||||

| Research and development | 1,513 | 1,641 | 717 | 793 | ||||||||||||||||

| Selling and marketing | 1,438 | 1,225 | 715 | 605 | ||||||||||||||||

| General and administrative | 1,392 | 876 | 688 | 329 | ||||||||||||||||

| Depreciation and amortization | 1,468 | 1,315 | 734 | 729 | ||||||||||||||||

| Other expenses | - | 35 | - | 35 | ||||||||||||||||

| Operating income | 174 | 980 | 250 | 761 | ||||||||||||||||

| Financial expense, net | 431 | 1,073 | 246 | 736 | ||||||||||||||||

| Income (loss) before income taxes | (257 | ) | (93 | ) | 4 | 25 | ||||||||||||||

| Income tax expense (benefit) | 171 | 8 | 87 | (23 | ) | |||||||||||||||

| Net income (loss) | (428 | ) | (101 | ) | (83 | ) | 48 | |||||||||||||

| Less: net income attributable to non-controlling interests | 93 | 430 | 41 | 311 | ||||||||||||||||

| Net loss attributable to shareholders of Viewbix Inc. | (521 | ) | (531 | ) | (124 | ) | (263 | ) | ||||||||||||

| Net income per share – Basic attributed to shareholders: | (0.04 | ) | (0.04 | ) | (0.01 | ) | (0.02 | ) | ||||||||||||

| Net income per share – Diluted attributed to shareholders: | (0.04 | ) | (0.04 | ) | (0.01 | ) | (0.02 | ) | ||||||||||||

| Weighted average number of shares – Basic: | 14,810,974 | 14,783,964 | (*) | 14,837,688 | 14,783,964 | (*) | ||||||||||||||

| Weighted average number of shares – Diluted: | 15,071,640 | 15,044,630 | (*) | 15,098,354 | 15,044,630 | (*) | ||||||||||||||

| (*) | Share and per share data in these financial statements have been retrospectively adjusted to reflect a number of shares that is equivalent to the number of shares of the Company post the Reorganization Transaction (see note 1.B). |

The accompanying notes are an integral part of these Interim Condensed Consolidated financial statements.

| -6- |

VIEWBIX INC.

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (Unaudited)

U.S. dollars in thousands (except share data)

| Note | 2022 | 2021 | 2022 | 2021 | ||||||||||||||||

For the nine months ended September 30 | For the three months ended September 30 | |||||||||||||||||||

| Note | 2022 | 2021 | 2022 | 2021 | ||||||||||||||||

| Revenues | 66,115 | 23,874 | 22,778 | 8,079 | ||||||||||||||||

| Costs and Expenses: | ||||||||||||||||||||

| Traffic-acquisition and related costs | 56,400 | 19,582 | 19,464 | 6,738 | ||||||||||||||||

| Research and development | 14A | 2,957 | 1,530 | 987 | 471 | |||||||||||||||

| Selling and marketing | 14B | 1,853 | 584 | 628 | 215 | |||||||||||||||

| General and administrative | 14C | 1,326 | 907 | 450 | 313 | |||||||||||||||

| Depreciation and amortization | 4,6 | 2,051 | 1,289 | 736 | 427 | |||||||||||||||

| Other expenses | 121 | 26 | 86 | 26 | ||||||||||||||||

| Operating income (loss) | 1,407 | (44 | ) | 427 | (111 | ) | ||||||||||||||

| Financial income (expenses), net | 14D | (1,374 | ) | 91 | (301 | ) | 121 | |||||||||||||

| Income before income taxes | 33 | 47 | 126 | 10 | ||||||||||||||||

| Taxes on income | 11 | (63 | ) | 41 | (55 | ) | 81 | |||||||||||||

| Net income (loss) | (30 | ) | 88 | 71 | 91 | |||||||||||||||

| Net income (loss) for the period is attributable to: | ||||||||||||||||||||

| Shareholders | (677 | ) | 88 | (147 | ) | 91 | ||||||||||||||

| Non-controlling interests | 647 | - | 218 | - | ||||||||||||||||

| Net income (loss) | (30 | ) | 88 | 71 | 91 | |||||||||||||||

| Net income (loss) per Share – Basic and Diluted attributed to shareholders: | (0.05 | ) | 0.01 | (0.01 | ) | 0.01 | ||||||||||||||

| Weighted average number of shares (*) – Basic: | 14,783,964 | 14,783,964 | 14,783,964 | 14,783,964 | ||||||||||||||||

| Weighted average number of shares (*) – Diluted: | 14,783,964 | 15,044,630 | 14,783,964 | 15,044,630 | ||||||||||||||||

| Number | Amount | capital | Deficit | Shareholders | Interests | Equity | ||||||||||||||||||||||

| Common stock | Additional paid-in | Accumulated | Total Attributed to the company’s | Non- Controlling | Total | |||||||||||||||||||||||

| Number | Amount | capital | Deficit | Shareholders | Interests | Equity | ||||||||||||||||||||||

| Balance as of January 1, 2023 | 14,783,964 | 3 | 25,350 | (3,338 | ) | 22,015 | 7,884 | 29,899 | ||||||||||||||||||||

| Net income (loss) | - | - | - | (521 | ) | (521 | ) | 93 | (428 | ) | ||||||||||||||||||

| Share-based compensation (see note 8.A) | 111,111 | - | 67 | - | 67 | 8 | 75 | |||||||||||||||||||||

| Transaction with the non-controlling interests (see note 1.C) | - | - | - | - | - | (2,625 | ) | (2,625 | ) | |||||||||||||||||||

| Dividend declared to non-controlling interests | - | - | - | - | - | (153 | ) | (153 | ) | |||||||||||||||||||

| Balance as of June 30, 2023 | 14,895,075 | 3 | 25,417 | (3,859 | ) | 21,561 | 5,207 | 26,768 | ||||||||||||||||||||

| Common stock | Additional paid-in | Accumulated | Total Attributed to the company’s | Non- Controlling | Total | |||||||||||||||||||||||

| Number | Amount | capital | Deficit | Shareholders | Interests | Equity | ||||||||||||||||||||||

| Balance as of April 1, 2023 | 14,783,964 | 3 | 25,374 | (3,735 | ) | 21,642 | 5,317 | 26,959 | ||||||||||||||||||||

| Net income (loss) | - | - | - | (124 | ) | (124 | ) | 41 | (83 | ) | ||||||||||||||||||

| Share-based compensation (see note 8.A) | 111,111 | - | 43 | - | 43 | 2 | 45 | |||||||||||||||||||||

| Dividend declared to non-controlling interests | - | - | - | - | - | (153 | ) | (153 | ) | |||||||||||||||||||

| Balance as of June 30, 2023 | 14,895,075 | 3 | 25,417 | (3,859 | ) | 21,561 | 5,207 | 26,768 | ||||||||||||||||||||

The accompanying notes are an integral part of these Interim Condensed Consolidated financial statements.

| -7- |

VIEWBIX INC.

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (Unaudited)

U.S. dollars in thousands (except share data)

| Common stock (*) | Additional paid-in | Accumulated | Total Attributed to the company’s | Non- Controlling | Total | |||||||||||||||||||||||

| Number | Amount | capital | Deficit | Shareholders | Interests | Equity | ||||||||||||||||||||||

| Balance as of January 1, 2022 | 14,783,964 | 3 | 16,074 | (2,366 | ) | 13,711 | 4,806 | 18,517 | ||||||||||||||||||||

| Net income (loss) | - | - | - | (531 | ) | (531 | ) | 430 | (101 | ) | ||||||||||||||||||

| Share-based compensation | 5 | 5 | 3 | 8 | ||||||||||||||||||||||||

| Adjustment to ultimate parent’s carrying values (see note 1.B) | - | - | 9,227 | - | 9,227 | 4,101 | 13,328 | |||||||||||||||||||||

| Dividend declared to non-controlling interests | - | - | - | - | - | (742 | ) | (742 | ) | |||||||||||||||||||

| Balance as of June 30, 2022 | 14,783,964 | 3 | 25,306 | (2,897 | ) | 22,412 | 8,598 | 31,010 | ||||||||||||||||||||

| Common stock (*) | Additional paid-in | Accumulated | Total Attributed to the company’s | Non- Controlling | Total | |||||||||||||||||||||||

| Number | Amount | capital | Deficit | Shareholders | Interests | Equity | ||||||||||||||||||||||

| Balance as of April 1, 2022 | 14,783,964 | 3 | 25,302 | (2,634 | ) | 22,671 | 8,676 | 31,347 | ||||||||||||||||||||

| Balance | 14,783,964 | 3 | 25,302 | (2,634 | ) | 22,671 | 8,676 | 31,347 | ||||||||||||||||||||

| Net income (loss) | - | - | - | (263 | ) | (263 | ) | 311 | 48 | |||||||||||||||||||

| Share-based compensation | - | - | 4 | - | 4 | 3 | 7 | |||||||||||||||||||||

| Dividend declared to non-controlling interests | - | - | - | - | - | (392 | ) | (392 | ) | |||||||||||||||||||

| Balance as of June 30, 2022 | 14,783,964 | 3 | 25,306 | (2,897 | ) | 22,412 | 8,598 | 31,010 | ||||||||||||||||||||

| Balance | 14,783,964 | 3 | 25,306 | (2,897 | ) | 22,412 | 8,598 | 31,010 | ||||||||||||||||||||

| (*) |

The accompanying notes are an integral part of these condensed consolidatedInterim Condensed Consolidated financial statements.

VIEWBIX INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (Unaudited)

U.S. dollars in thousands (except share data)

| Number | Amount(*) | capital | Earnings | Shareholders | Interests | Equity | ||||||||||||||||||||||

| Ordinary shares (*) | Additional paid-in | Retained | Total Attributed to the company’s | Non- Controlling | Total | |||||||||||||||||||||||

| Number | Amount | capital | Earnings | Shareholders | Interests | Equity | ||||||||||||||||||||||

| Balance as of January 1, 2022 | 14,783,964 | 3 | 16,074 | (2,366 | ) | 13,711 | 4,806 | 18,517 | ||||||||||||||||||||

| Net income (loss) | - | - | - | (677 | ) | (677 | ) | 647 | (30 | ) | ||||||||||||||||||

Adjustment to ultimate parent’s carrying values (see note 1.c) | 11,462 | 11,462 | 1,867 | 13,329 | ||||||||||||||||||||||||

| Share-based compensation | - | - | 28 | - | 28 | 12 | 40 | |||||||||||||||||||||

| Dividend declared to shareholders | - | - | - | (1,000 | ) | (1,000 | ) | - | (1,000 | ) | ||||||||||||||||||

| Dividend distributed to non-controlling interests | - | - | - | - | - | (1,195 | ) | (1,195 | ) | |||||||||||||||||||

| Balance as of September 30, 2022 | 14,783,964 | 3 | 27,564 | (4,043 | ) | 23,524 | 6,137 | 29,661 | ||||||||||||||||||||

| Ordinary shares (*) | Additional paid-in | Retained | Total Attributed to the company’s | Non- Controlling | Total | |||||||||||||||||||||||

| Number | Amount | capital | Earnings | Shareholders | Interests | Equity | ||||||||||||||||||||||

| Balance as of July 1, 2022 | 14,783,964 | 3 | 27,541 | (2,897 | ) | 24,647 | 6,364 | 31,011 | ||||||||||||||||||||

| Net income (loss) | - | - | - | (146 | ) | (146 | ) | 217 | 71 | |||||||||||||||||||

| Share-based compensation | - | - | 23 | - | 23 | 9 | 32 | |||||||||||||||||||||

| Dividend declared to shareholders | - | - | - | (1,000 | ) | (1,000 | ) | - | (1,000 | ) | ||||||||||||||||||

| Dividend distributed to non-controlling interests | - | - | - | - | - | (453 | ) | (453 | ) | |||||||||||||||||||

| Balance as of September 30, 2022 | 14,783,964 | 3 | 27,564 | (4,043 | ) | 23,524 | 6,137 | 29,661 | ||||||||||||||||||||

| Ordinary shares (*) | Additional paid-in | Retained | Total Attributed to the company’s | Non- Controlling | Total | |||||||||||||||||||||||

| Number | Amount | capital | Earnings | Shareholders | Interests | Equity | ||||||||||||||||||||||

| Balance as of January 1, 2021 | 14,783,964 | 3 | 15,933 | (2,666 | ) | 13,270 | - | 13,270 | ||||||||||||||||||||

| Net income | - | - | - | 88 | 88 | - | 88 | |||||||||||||||||||||

| Share-based compensation | - | - | (38 | ) | - | (38 | ) | - | (38 | ) | ||||||||||||||||||

| Balance as of September 30, 2021 | 14,783,964 | 3 | 15,895 | (2,578 | ) | 13,320 | - | 13,320 | ||||||||||||||||||||

| Ordinary shares (*) | Additional paid-in | Retained | Total Attributed to the company’s | Non- Controlling | Total | |||||||||||||||||||||||

| Number | Amount | capital | Earnings | Shareholders | Interests | Equity | ||||||||||||||||||||||

| Balance as of July 1, 2021 | 14,783,964 | 3 | 15,898 | (2,669 | ) | 13,232 | - | 13,232 | ||||||||||||||||||||

| Net income | - | - | - | 91 | 91 | - | 91 | |||||||||||||||||||||

| Net income (loss) | - | - | - | 91 | 91 | - | 91 | |||||||||||||||||||||

| Share-based compensation | - | - | (3 | ) | - | (3 | ) | - | (3 | ) | ||||||||||||||||||

| Balance as of September 30, 2021 | 14,783,964 | 3 | 15,895 | (2,578 | ) | 13,320 | - | 13,320 | ||||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

VIEWBIX INC.

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

U.S. dollars in thousands (except share data)

| 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||||||||||||

For the nine months ended September 30 | For the three months ended September 30 | |||||||||||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||||

| Unaudited | Unaudited | For the six months ended June 30, | For the three months ended June 30, | |||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||||||||

| Cash flows from Operating Activities | ||||||||||||||||||||||||||||||||

| Net income (loss) | (30 | ) | 88 | 71 | 91 | (428 | ) | (101 | ) | (83 | ) | 48 | ||||||||||||||||||||

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | ||||||||||||||||||||||||||||||||

| Depreciation and amortizations | 2,051 | 1,289 | 736 | 427 | ||||||||||||||||||||||||||||

| Depreciation and amortization | 1,468 | 1,315 | 734 | 729 | ||||||||||||||||||||||||||||

| Share-based compensation | 40 | (38 | ) | 32 | (3 | ) | 75 | 8 | 45 | 7 | ||||||||||||||||||||||

| Deferred taxes | (219 | ) | (65 | ) | (96 | ) | (41 | ) | (92 | ) | (123 | ) | (34 | ) | (68 | ) | ||||||||||||||||

| Accrued interest, net | (50 | ) | (26 | ) | (11 | ) | 62 | (49 | ) | (39 | ) | (22 | ) | (17 | ) | |||||||||||||||||

| Fair value revaluation and exchange rate differences on loans | 1,033 | 14 | 72 | 5 | ||||||||||||||||||||||||||||

| Exchange rate differences on loans | - | 961 | - | 777 | ||||||||||||||||||||||||||||

| Adjustment total | 2,855 | 1,174 | 733 | 450 | ||||||||||||||||||||||||||||

| Changes in assets and liabilities items: | ||||||||||||||||||||||||||||||||

| Decrease in accounts receivable | 17 | 968 | 20 | 447 | ||||||||||||||||||||||||||||

| Decrease (increase) in accounts receivable | 2,530 | (3 | ) | (2,856 | ) | (2,086 | ) | |||||||||||||||||||||||||

| Decrease (increase) in other receivables | 190 | (39 | ) | 378 | (122 | ) | 280 | (188 | ) | 129 | 309 | |||||||||||||||||||||

| Decrease in operating lease right-of-use assets | 64 | 48 | 22 | 21 | 44 | 42 | 22 | 22 | ||||||||||||||||||||||||

| Increase (decrease) in severance pay, net | (2 | ) | (229 | ) | (1 | ) | 3 | |||||||||||||||||||||||||

| Decrease in severance pay, net | (100 | ) | (1 | ) | (97 | ) | (20 | ) | ||||||||||||||||||||||||

| Increase (decrease) in accounts payable | (532 | ) | (57 | ) | 535 | (248 | ) | (2,437 | ) | (1,067 | ) | 3,289 | 2,952 | |||||||||||||||||||

| Decrease in other payables | (525 | ) | (522 | ) | (228 | ) | (158 | ) | (218 | ) | (297 | ) | (96 | ) | (160 | ) | ||||||||||||||||

| Decrease in operating lease liabilities | (56 | ) | (39 | ) | (19 | ) | (17 | ) | (58 | ) | (37 | ) | (28 | ) | (19 | ) | ||||||||||||||||

| Increase in parent company loan | 194 | 172 | 66 | 55 | ||||||||||||||||||||||||||||

| Increase (Decrease) in Operating Capital | (650 | ) | 302 | 773 | (19 | ) | ||||||||||||||||||||||||||

| Increase in loan from parent company | - | 128 | - | 74 | ||||||||||||||||||||||||||||

| Net cash provided by operating activities | 2,175 | 1,564 | 1,577 | 522 | 1,015 | 598 | 1,003 | 2,548 | ||||||||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidatedInterim Condensed Consolidated financial statements.

VIEWBIX INC.

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) (Cont.)

U.S. dollars in thousands (except share data)

| For the six months ended June 30, | For the three months ended June 30, | |||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Cash flows from Investing Activities | ||||||||||||||||

| Purchase of property and equipment | (10 | ) | (45 | ) | (8 | ) | (6 | ) | ||||||||

| Cash paid to non-controlling interests (see note 1.C) | (2,625 | ) | - | - | - | |||||||||||

| Capitalization of software development costs | - | (16 | ) | - | - | |||||||||||

| Net cash used in investing activities | (2,635 | ) | (61 | ) | (8 | ) | (6 | ) | ||||||||

| Cash flows from Financing Activities | ||||||||||||||||

| Receipt of short-term bank loan | 1,200 | 1,000 | 1,200 | 1,000 | ||||||||||||

| Repayment of short-term loans | (269 | ) | - | (22 | ) | - | ||||||||||

| Receipt of long-term bank loan | 1,500 | - | - | - | ||||||||||||

| Repayment of long-term bank loans | (874 | ) | (702 | ) | (457 | ) | (353 | ) | ||||||||

| Payment of dividend to non-controlling interests | (598 | ) | (742 | ) | (153 | ) | (392 | ) | ||||||||

| Payment of dividend to shareholders (see note 8.E.1) | (130 | ) | - | - | - | |||||||||||

| Increase in loan to parent company | (104 | ) | (856 | ) | (32 | ) | (627 | ) | ||||||||

| Net cash provided by (used in) financing activities | 725 | (1,300 | ) | 536 | (372 | ) | ||||||||||

| Increase (decrease) in cash and cash equivalents and restricted cash | (895 | ) | (763 | ) | 1,531 | 2,170 | ||||||||||

| Cash and cash equivalents and restricted cash at beginning of period | 4,381 | 5,442 | 1,955 | 2,509 | ||||||||||||

| Cash and cash equivalents and restricted cash at end of period | 3,486 | 4,679 | 3,486 | 4,679 | ||||||||||||

| Supplemental Disclosure of Cash Flow Activities: | ||||||||||||||||

| Cash paid during the period | ||||||||||||||||

| Taxes paid | 512 | 416 | 327 | 90 | ||||||||||||

| Interest paid | 444 | 227 | 247 | 124 | ||||||||||||

| 956 | 643 | 574 | 214 | |||||||||||||

| Substantial non-cash activities: | ||||||||||||||||

| Share-based compensation to a director (see note 8.A) | 34 | - | 34 | - | ||||||||||||

For the nine months ended September 30 | For the three months ended September 30 | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Unaudited | Unaudited | |||||||||||||||

| Cash flows from Investing Activities | ||||||||||||||||

| Purchase of property and equipment | (54 | ) | (298 | ) | (7 | ) | (70 | ) | ||||||||

| Capitalization of software development costs | (14 | ) | (211 | ) | - | (69 | ) | |||||||||

| Net cash used in investing activities | (68 | ) | (509 | ) | (7 | ) | (139 | ) | ||||||||

| Cash flows from Financing Activities | ||||||||||||||||

| Receipt of short-term loan | 1,000 | 602 | ||||||||||||||

| Repayment of short-term loan | (1,000 | ) | (1,219 | ) | (1,000 | ) | (619 | ) | ||||||||

| Increase in loan to parent company | (1,462 | ) | (1,308 | ) | (606 | ) | (822 | ) | ||||||||

| Repayment of long-term loan | (1,060 | ) | - | (358 | ) | - | ||||||||||

| Payment of dividend to non-controlling interests | (1,195 | ) | - | (453 | ) | - | ||||||||||

| Net cash used in financing activities | (3,717 | ) | (1,925 | ) | (2,417 | ) | (1,441 | ) | ||||||||

| Increase in cash and cash equivalents and restricted cash | (1,610 | ) | (870 | ) | (847 | ) | (1,058 | ) | ||||||||

| Cash and cash equivalents and restricted cash at beginning of the period | 5,442 | 3,564 | 4,679 | 3,752 | ||||||||||||

| Cash and cash equivalents and restricted cash at end of the period | 3,832 | 2,694 | 3,832 | 2,694 | ||||||||||||

| Supplemental Disclosure of Cash Flow Activities: | ||||||||||||||||

| Cash paid and received during the period | ||||||||||||||||

| Taxes paid | (551 | ) | (222 | ) | (135 | ) | (88 | ) | ||||||||

| Interest paid | (391 | ) | (21 | ) | (164 | ) | (7 | ) | ||||||||

| Total Cash paid and received during the period | (942 | ) | (243 | ) | (299 | ) | (95 | ) | ||||||||

| Substantial non-cash activities: | ||||||||||||||||

Right of use assets obtained in exchange for operating lease liabilities | - | 637 | - | - | ||||||||||||

| Dividend declared | 1,000 | - | 1,000 | - | ||||||||||||

The accompanying notes are an integral part of these condensed consolidatedInterim Condensed Consolidated financial statements.

VIEWBIX INC.

NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

U.S. dollars in thousands (except share data)

NOTE 1:GENERAL

A. Organizational Background

Viewbix Inc. (formerly known as Virtual Crypto Technologies, Inc.) (the “Company”) was incorporated in the State of Delaware on August 16, 1985, under a predecessor name, The InFerGene Company (“InFerGene Company”). On August 25, 1995, a wholly owned subsidiary of InFerGene Company merged with Zaxis International, Inc., an Ohio corporation, which following such merger, the surviving entity, InFerGene Company, changed its name to Zaxis International, Inc (“Zaxis”). In 2015 the Company changed its name to Emerald Medical Applications Corp., subsequent to which the Company, through its subsidiarity, was engaged in the development of technology for use in detection of skin cancer. On January 29, 2018, the Company ceased its business operations in this field.

On January 17, 2018, the Company formed a new wholly-ownedwholly owned subsidiary under the laws of the State of Israel, Virtual Crypto Technologies Ltd. (“VCT Israel”), to develop and market software and hardware products facilitating and supporting the purchase and/or sale of cryptocurrencies. Effective as of March 7, 2018, the Company’s name was changed from Emerald Medical Applications Corp. to Virtual Crypto Technologies, Inc. VCT Israel ceased its business operation in 2019 and prior to reflect its new operations and business focus.consummation of the Recapitalization Transaction. On January 27, 2020, VCT Israel was sold to a third party for NIS 50 thousand (approximately $13).

On February 7, 2019, the Company entered into a share exchange agreement (the “Share Exchange Agreement” or the “Recapitalization Transaction”) with Gix Internet Ltd., a company organized under the laws of the State of Israel (“Gix” or “Parent Company’’), pursuant to which, Gix assigned, transferred and delivered its % holdings in Viewbix Ltd., a company organized under the laws of the State of Israel (“Viewbix Israel”), to the Company in exchange for shares of the Company, which resulted in Viewbix Israel becoming a subsidiary of the Company. In connection with the Share Exchange Agreement, effective as of August 7, 2019, the Company’s name was changed from Virtual Crypto Technologies, Inc. to Viewbix Inc.

B. Definitions

In these financial statements:

The Company – Viewbix Inc.

The Group – Viewbix Inc. and its subsidiaries

The Parent Company or Gix – Gix Internet Ltd.

Gix Media – Gix Media Ltd.

Cortex – Cortex Media Group Ltd.

VIEWBIX INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

U.S. dollars in thousands (except share data)

NOTE 1:GENERAL (Cont.)

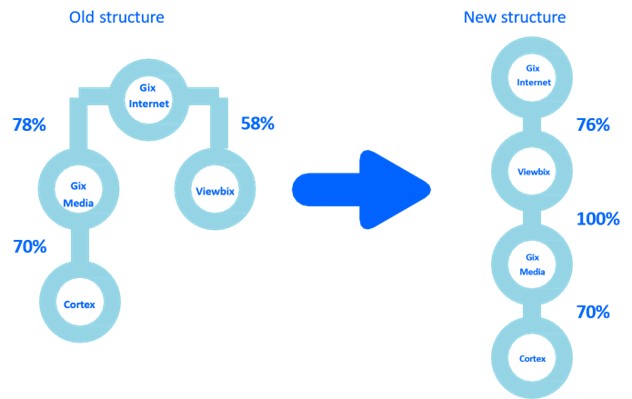

C. Reorganization Transaction

On December 5, 2021, the Company entered into a certain Agreement and Plan of Merger with Gix Media Ltd. (“Gix Media”), an Israeli company and the majority-owned (77.92%) subsidiary of Gix, the Parent Company and Vmedia Merger Sub Ltd., an Israeli company and wholly-owned subsidiary of the Company (“Merger Sub”), pursuant to which, Merger Sub merged with and into Gix Media, with Gix Media being the surviving entity and a wholly-owned subsidiary of the Company (the “Reorganization Transaction”).

On September 19, 2022, (the “Closing Date”) the Reorganization Transaction was consummated and as a result, all outstanding ordinary shares of Gix Media, having no par value (the “Gix Media Shares”) were delivered to the Company’sCompany in exchange for the Company’s shares of common stock. Prior to the closing of the Reorganization Transaction, Gix Media was a majority-owned subsidiary of Gix.stock, par value $ per share (“Common Stock”). As a result of the Reorganization Transaction, the former holders of Gix Media Shares, who previously held approximately 69% of the Company’s shares on a fully diluted basis, hold 90%68% of the Company’s Common Stock, on a fully diluted basis,hold approximately 97% of the Company’s Common Stock, and Gix Media became a wholly-ownedwholly owned subsidiary of the Company , which holds 100% of its.

| -11- |

VIEWBIX INC.

NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

U.S. dollars in thousands (except share capital.data)

NOTE 1: GENERAL (Cont.)

B. Reorganization Transaction (Cont.)

As the Company and Gix Media Ltd. were consolidated both by the same parent and ultimate parent, Gix Internet Ltd.Parent Company and Medigus Ltd. (the “Ultimate Parent”), respectively, before and after the Reorganization Transaction, the Reorganization Transaction was accounted for as a transaction between entities under common control. Accordingly, the combined financial information of the Company and Gix Media Ltd. is presented in these financial statements, for all periods presented, reflecting the historical cost of the Company and Gix Media Ltd., as it is reflected in the consolidated financial statements of the direct parent, Gix Internet Ltd.,Parent Company, for all periods preceding March 1, 2022, the date Medigus Ltd.the Ultimate Parent obtained controla controlling interest in Gix Internet Ltd.,the Parent Company and as it is reflected in the consolidated financial statements of Medigus Ltd.the Ultimate Parent for all periods subsequent to March 1, 2022.

Share and per share data in these financial statements have been retrospectively adjusted, for all periods preceding the Reorganization Transaction,six and three months ended June 30, 2022, to reflect a number of shares that is equivalent to the equivalent number of shares of the Company corresponding topost the combined financial information of theReorganization Transaction.

C. Business Overview

The Company and Gix Media Ltd.

D. Business Overview

The Group, through its subsidiaries (the “Group”), Gix Media Ltd. and Cortex Media Group Ltd. (“Cortex”), operatesoperate in the field of digital advertising. The Group has two main activities that are reported as separate businessoperating segments: the search segment and the digital content segment.

The search segment develops a variety of technological software solutions, which perform automation, optimization, and monetization of internet campaigns, for the purposes of acquiringobtaining and routing internet user traffic to its customers. The search segment activity is operatedconducted by Gix Media.

The digital content segment is engaged in the creation and editing of content, in different languages, for different target audiences, for the purposes of generating revenues from leading advertising platforms, including Google, Facebook, Yahoo and Apple, by utilizing such content to obtain and route internet user traffic for its customers. The digital content segment activity is operatedconducted by Cortex.

As of December 31, 2022, Gix Media holdsheld 70% of Cortex’s share capital.

On January 23, 2023, Gix Media acquired an additional 10% of the share capital of Cortex, increasing its holdings to 80% in consideration for $2,625 (the “Subsequent Purchase”). The Subsequent Purchase was financed by Gix Media’s existing cash balances and by a long-term bank loan received on January 17, 2023, in the amount of $1,500.

The Group’s technological tools allow advertisers and website owners to earn more from their advertising campaigns and generate additional profits from their websites.Subsequent Purchase was recorded as a transaction with non-controlling interests in the Company’s statement of changes in shareholders equity for the six month period ended June 30, 2023.

E.D. Reverse Stock Split

In connection with the Closing of the Reorganization Transaction, the Company filed an Amended and Restated Certificate of Incorporation (the “Amended COI”) with the Secretary of State of Delaware, effective as of August 31, 2022, pursuant to which, concurrently with the effectiveness of the Amended COI, the Company, among other things, effected a reverse stock split of its Common Stock at a ratio of 1-for-28.1-for-28. Share and per share data in these financial statements have been retrospectively adjusted to reflect the reverse stock split for all periods presented.the six and three months ended June 30, 2022.

VIEWBIX INC.

NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

U.S. dollars in thousands (except share data)

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

A. Basis of Presentation and Principles of Consolidation:Unaudited Interim Financial Statements

The accompanying unaudited interim condensed financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of U.S. Securities and Exchange Commission Regulation S-X. Accordingly, they do not include all the information and footnotes required by generally accepted accounting principles for complete financial statements. In the opinion of management, all adjustments considered necessary for a fair presentation have been included (consisting only of normal recurring adjustments except as otherwise discussed). For further information, reference is made to the consolidated financial statements and footnotes thereto included in the Group’s Annual Report on Form 10-K for the year ended December 31, 2022.

B. Principles of Consolidation

The accompanying condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries and were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

wholly owned subsidiaries. All intercompany accountsbalances and transactions have been eliminated in consolidation.

B.Unaudited Interim Financial Information

The Company’s unaudited condensed consolidated financial statements have been prepared in accordance with U.S. GAAP and pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). Certain information and footnote disclosures normally included in financial statements prepared in accordance with U.S .GAAP have been condensed or omitted from this report, as is permitted by such rules and regulations. Accordingly, these condensed consolidated financial statements should be read in conjunction with the audited financial statements as of and for the year ended December 31, 2021 and the notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 filed with the SEC on March 17, 2022 (the “2021 Annual Report”). The results for any interim period are not necessarily indicative of results for any future period.

In the opinion of the Company’s management, the accompanying unaudited condensed consolidated financial statements contain all adjustments that are necessary to present fairly the Company’s financial position and results of operations for the interim periods presented. The results for the nine months ended September 30, 2022, are not necessarily indicative of the results for the year ending December 31, 2022, or for any future period.

As of September 30, 2022, following the retrospective presentation of the combined financial information of the Company and Gix Media Ltd., the Company adopted the significant accounting policies described in Note 2 in these unaudited condensed consolidated financial statements. Other than these significant accounting policies, there have been no material changes in the Company’s significant accounting policies from those that were disclosed in the 2021 Annual Report.

VIEWBIX INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

U.S. dollars in thousands (except share data)

NOTE 2:SIGNIFICANT ACCOUNTING POLICIES (Cont.)

C.Use of Estimatesestimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates judgments and assumptions that affect the reported amounts reported of assets and liabilities, the disclosure of contingent assets and disclosureliabilities at the date of the consolidated financial statements and the reported amounts of incomerevenue and expenseexpenses during the reporting period. The Company evaluates on an ongoing basis its assumptions, including those related to contingencies, income taxes, deferred taxes, share-basedinventory impairment, stock-based compensation, and leases.as well as in estimates used in applying the revenue recognition policy. Actual results couldmay differ from those estimates.

D. Functional Currency and Foreign Currency Transactions

Most of the revenues of the Company are received in U.S. dollars. In addition, a substantial portion of the costs of the Company are incurred in U.S. dollars. Therefore, the Company’s management believes that the U.S. dollar is the currency of the primary economic environment in which the Company and each of its subsidiaries operates. Thus, the functional and reporting currency of the Company is the U.S. dollar.

Accordingly, monetary balances denominated in currencies other than the U.S. dollar are re-measured into U.S. dollars in accordance with Statement of theSignificant Accounting Standard Codification (“ASC”) No. 830 “Foreign Currency Matters” (“ASC No. 830”).

Transactions and balances originally denominated in U.S. dollars are presented at their original amounts. Balances in non U.S. dollar currencies are translated into U.S. dollars using historical and current exchange rates for non-monetary and monetary balances, respectively. For non-U.S. dollar transactions and other items in the statements of operations (indicated below), the following exchange rates are used: (i) for transactions exchange rates at transaction dates and (ii) for other items (derived from non-monetary balance sheet items such as depreciation and amortization) historical exchange rates. Currency transaction gains and losses are presented in the financial income or expenses, as appropriate

E.Cash and cash equivalentsPolicies

The Company considers all short-term investments, which are highly liquid investments with original maturities of three months or less at the date of purchase, to be cash equivalents.

F.Restricted Deposits

Restricted cash held in interest bearing saving accounts which are used as a security for the Group’s credit card and lease obligations.

G.Accounts receivable and allowance for credit losses

Accounts receivables are recorded at the invoiced amount, net of an allowance for credit losses. The Group evaluates its outstanding accounts receivables and establishes an allowance for credit losses based on information available on their credit condition, current aging, historical experience, future economic and market conditions. These allowances are reevaluated and adjusted periodically as additional information is available. Changessignificant accounting policies followed in the allowance for expected credit lossespreparation of these unaudited interim condensed consolidated financial statements are recorded under general and administrative expensesidentical to those applied in the condensed consolidated statements of income.

VIEWBIX INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

U.S. dollars in thousands (except share data)

NOTE 2:SIGNIFICANT ACCOUNTING POLICIES (Cont.)

H.Fixed assets

Property and equipment are stated at cost, net of accumulated depreciation. Depreciation is calculated using the straight-line basis over the estimated useful lives, at the following annual rates:

SCHEDULE OF ESTIMATED USEFUL LIVES

I.Leases

In accordance with ASC No. 842 “Leases”, the Company determines if an arrangement is a lease at inception. If an arrangement is a lease, the Company determines whether it is an operating lease or a finance lease at the lease commencement date. Operating leases are included in operating lease assets, operating lease liabilities – current, and non-current operating lease liabilities in the Company’s condensed consolidated balance sheets.

Operating lease assets represent the Company’s right to control the use of an underlying asset for the lease term and lease liabilities represent the Company’s obligation to make lease payments arising from the estimated lease.

Operating lease assets and liabilities are recognized on the commencement date based on the present value of lease payments over the lease term.

The Company uses its incremental borrowing rate based on the information available at the commencement date to determine the present valuepreparation of the lease payments. The incremental borrowing rate is estimated based on factors such as the lease term, credit standing and the economic environment of the location of the lease.

Variable lease payments, including payments based on an index or a rate, are expensed as incurred and are not included within the operating lease asset and operating lease liabilities. The Company does not separate non-lease components from lease components for its leases of real estate.

The Company’s lease terms are the noncancelable periods, including any rent-free periods provided by the lessor, and include options to extend or terminate the lease when it is reasonably certain that the Company will exercise that option. At lease inception, and in subsequent periods as necessary, the Company estimates the lease term based on its assessment of extension and termination options that are reasonably certain to be exercised. Lease costs are recognized on a straight-line basis over the lease term.

The Company does not recognize operating lease asset and operating lease liabilities for leases with terms shorter than 12 months. Lease costs for short-term leases are recognized on a straight-line basis over the lease term.

The Company has material non-functional currency leases. Lease liabilities in respect of leases denominated in a foreign currency are remeasured using the exchange rate at each reporting date. Lease assets are measured at historical rates, which are not affected by subsequent changes in the exchange rates.

VIEWBIX INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

U.S. dollars in thousands (except share data)

NOTE 2:SIGNIFICANT ACCOUNTING POLICIES (Cont.)

J.Revenue Recognition

As described in note 1.d the Company generates revenues from obtaining internet user traffic and routing such traffic to its customers. The Company is entitled to receive consideration for its service upon each individual internet user traffic routed to and is monetized by its customers.

The Company’s revenues are measured according to the ASC 606, “Revenue from Contracts with Customers” (“ASC 606”). Under ASC 606, revenues are measured according to the amount of consideration that the Company expects to be entitled in exchange for transferring promised goods or services to a customer, excluding amounts collected on behalf of third parties, such as VAT taxes. Revenues are presented net of VAT. The Company’s payments terms are less than one year. Therefore, no finance component is recognized.

The Company recognizes revenues upon routing of internet users’ traffic that is monetized by its customers. As the Company operates as the primary obligor in its arrangements and has sole discretion in determining to which of its customers internet user traffic is to be routed, revenues are presented on a gross basis.

K.Traffic-acquisition and related costs

Traffic acquisition and related costs consist primarily of fees paid to suppliers in connection with the Company’s internet traffic sources, as well as internal costs incurred in connection with the acquisition of such traffic. Traffic acquisition costs are expensed as incurred.

L.Research and development expenses

Research and development costs are charged to the condensed consolidated statements of income as incurred, except for certain costs relating to internally developed software, which are capitalized.

The Company capitalizes certain internal software development costs, consisting of direct subcontractors’ costs associated with creating the internally developed software. Software development projects generally include three stages: (i) the preliminary project stage (all costs expensed as incurred); (ii) the application development stage (costs are capitalized) and (iii) the post implementation/operation stage (all costs expensed as incurred).

The costs capitalized in the application development stage primarily include the costs of designing the application, coding and testing of the system. Capitalized costs are amortized using the straight-line method over the estimated useful life of the software, once it is ready for its intended use.

The Company believes that the straight-line recognition method best approximates the manner in which the expected benefit will be derived. Management evaluates the useful lives of these assets on anlatest annual basis and tests for impairment whenever events or changes in circumstances occur that could impact the recoverability of these assets.

VIEWBIX INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

U.S. dollars in thousands (except share data)

NOTE 2:SIGNIFICANT ACCOUNTING POLICIES (Cont.)

M.Income taxes

The Company accounts for income taxes in accordance with ASC 740, “Income Taxes”, and (“ASC 740”). ASC 740 prescribes the use of the asset and liability method whereby deferred tax asset and liability account balances are determined based on differences between the financial reporting and tax bases of assets and liabilities and for carry forward tax losses. Deferred taxes are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. The Company records a valuation allowance, if necessary, to reduce deferred tax assets to their estimated realizable value if it is more-likely-than-not that some portion or all of the deferred tax asset will not be realized.

Uncertain tax positions are accounted for in accordance with the provisions of ASC 740-10, under which a company may recognize the tax benefit from an uncertain tax position claimed or expected to be claimed on a tax return only if it is more likely than not that the tax position will be sustained on examination by the taxation authorities, based on the technical merits of the position, at the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement. Interest and penalties, if any, related to unrecognized tax benefits, are recognized in tax expense.

N.Fair Value of Financial Instruments

The carrying amounts of cash and cash equivalents, restricted deposits, accounts receivable, loan to parent company, other current assets, current maturities of long-term loan, accounts payable, other payables and short-term loans approximate their fair value due to the short-term maturities of such instruments.

The carrying amount of the variable interest rate long-term loan is approximates to its fair value as it bears interest at approximate market rate.

O.Business Combinations

The Company accounts for its business combinations in accordance with ASC 805, “Business Combinations” (“ASC 805”). ASC 805 specifies the accounting for business combinations and the criteria for recognizing and reporting intangible assets apart from goodwill. ASC 805 requires recognition of assets acquired, liabilities assumed and any non-controlling interest at the acquisition date, measured at their fair values as of that date.

Acquisition-related intangible assets result from the Company’s acquisitions of businesses accounted for under the purchase method and consist of the fair value of identifiable intangible assets including customer relations, technology, as well as goodwill. Goodwill is the amount by which the acquisition cost exceeds the fair values of identifiable acquired net assets on the date of purchase. Acquisition-related definite lived intangible assets are reported at cost, net of accumulated amortization.

VIEWBIX INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

U.S. dollars in thousands (except share data)

NOTE 2:SIGNIFICANT ACCOUNTING POLICIES (Cont.)

P.Goodwill

The Company’s goodwill reflects the excess of the consideration paid or transferred including the fair value of contingent consideration over the fair values of the identifiable net assets acquired.

Goodwill is not amortized but instead is tested for impairment, in accordance with ASC 350, “Intangibles – Goodwill and Other” (“ASC 350”), at the reporting unit level, at least annually at December 31 each year, or more frequently if events or changes in circumstances indicate that the carrying value may be impaired.

The goodwill impairment test is performed by evaluating an initial qualitative assessment of the likelihood of impairment. If this step indicates that the qualitative assessment does not result in a more likely than not indication of impairment, no further impairment testing is required. If it does result in a more likely than not indication of impairment, the impairment test is performed.

In the impairment test, the Company compares the fair value of the reporting unit to the carrying value of the reporting unit. If the fair value of the reporting unit exceeds the carrying value of the net assets allocated to that unit, goodwill is not impaired, and no further testing is required. If the fair value is less than the carrying value of the reporting unit, then the second step of the impairment test is performed to measure the amount of the impairment.

Q.Intangible assets, other than goodwill

Intangible assets are identifiable non-monetary assets that have no physical substance. Intangible assets with indefinite useful lives are not amortized and are tested for impairment once a year, or whenever there is a sign indicating that impairment may have occurred, in accordance with ASC 350. An estimate of the useful life of intangible assets with an indefinite useful life is examined at the end of each reporting year. A change in the estimated useful life of an intangible asset that changes from indefinite to defined is treated prospectively.

Intangible assets with a defined useful life are amortized in a straight line over their estimated useful life subject to impairment testing. A change in the estimated useful life of an intangible asset with a defined useful life is treated prospectively.

The useful life used to amortize intangible assets with a defined useful life is as follows:

SCHEDULE OF AMORTIZE INTANGIBLE ASSETS

VIEWBIX INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

U.S. dollars in thousands (except share data)

NOTE 2:SIGNIFICANT ACCOUNTING POLICIES (Cont.)

R.Impairment of long-lived assets

The Company’s long-lived assets to be held or used, including property and equipment, right of use assets and intangible assets subject to amortization are reviewed for impairment in accordance with ASC 360, “Property, Plants and Equipment” (“ASC 360”), whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets is measured by a comparison of the carrying amount of an asset to the future undiscounted cash flows expected to be generated by the asset. If such asset is considered to be impaired, the impairment to be recognized is measured as the amount by which the carrying amount of the asset exceeds the fair value of the asset.

S.Severance Pay

The Company’s liability for severance pay for some of its Israeli employees is calculated pursuant to Israeli Severance Pay Law, 1963 (the “Israeli Severance Pay Law”) based on the most recent salary of the employee multiplied by the number of years of employment, as of the balance sheet date. These employees are entitled to one month’s salary for each year of employment or a portion thereof. The Company records the liability as if it were payable at each balance sheet date on an undiscounted basis. The liability is classified based on the expected date of settlement and therefore is usually classified as a long-term liability unless the cessation of the employees is expected during the upcoming year.

The Company’s liability for these Israeli employees is partially covered by monthly deposits for insurance policies and the remainder by an accrual. The deposited funds for these policies are recorded as an asset in the Company’s balance sheet and include profits and losses accumulated up to the balance sheet date. The deposited funds may be withdrawn only upon the fulfillment of the obligation pursuant to the Israeli Severance Pay Law or labor agreements. The value of the deposited funds is based on the cash redemption value of these policies.

With respect to other Israeli employees, the Company acts pursuant to the general approval of the Israeli Ministry of Labor and Welfare, pursuant to the terms of Section 14 of the Israeli Severance Pay Law (“Section 14”), according to which the current deposits with the pension fund and/or with the insurance company exempt the Company from any additional obligation to these employees for whom the said depository payments are made. As a result, the Company does not recognize any liability for severance pay due to these employees and the deposits under Section 14 are not recorded as an asset in the Company’s balance sheet.

Severance expenses for the nine months ended September 30, 2022, and September 30, 2021, amounted to $101 and $120, respectively.

The Company accounts for share-based compensation in accordance with ASC 718, “Stock Compensation” (“ASC 718”), which requires companies to estimate the fair value of share-based payment awards on the date of grant using an option-pricing model. The value of the portion of the award that is ultimately expected to vest is recognized as expense over the requisite service periods, which is generally the vesting period, in the Company’s condensed consolidated statement of income.

VIEWBIX INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

U.S. dollars in thousands (except share data)

NOTE 2:SIGNIFICANT ACCOUNTING POLICIES (Cont.)

T. Share-based compensation (Cont.)

The Company selected the Black-Scholes option pricing model as the most appropriate fair value method for its share-options awards. The option-pricing model requires several assumptions, of which the most significant are the expected share price volatility and the expected option term.

The Company accounts for forfeitures as they occur.

In accordance with ASC 260, “Earnings Per Share” (“ASC 260”), basic net earnings per share is computed by dividing net earnings attributable to ordinary shareholders by the weighted average number of ordinary shares outstanding during the period. Diluted net earnings per share reflects the potential dilution that could occur if share options, warrants or other commitments to issue ordinary shares were exercised or equity awards vested, resulting in the issuance of ordinary shares that could share in the net earnings of the Company.

V.Segment reporting

The Company reports financial and descriptive information about its reportable segments. Reportable segments are operating segments or aggregations of operating segments that meet specified criteria as defined in ASC 280, “Segments Reporting”.

Operating segments are distinguishable components of an entity for each of which a separate financial information is available and is reported in a manner consistent with the internal reporting provided to the entity’s Chief Operating Decision Maker (“CODM”) in making decisions about how to allocate resources and in assessing performance.

The review of the CODM is carried out according to the results of the segment’s activity. His review does not include certain expenses that are not related specifically to the activity of each of the segments. Those expenses are presented as reconciliation between segments operating results to total operating results in financial statements.

W.E. Recent accounting pronouncementsAccounting Pronouncements

ASU 2019-12, Income Taxes

In December 2019, the FASB issued ASU 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes. The amendments in this ASU simplify the accounting for income taxes, eliminates certain exceptions to the general principles in Topic 740 and clarifies certain aspects of the current guidance to improve consistent application among reporting entities. ASU 2019-12 is effective for annual periods beginning after January 1, 2022 and interim periods within annual periods beginning after January 1, 2023, and early adoption was permitted.

The Company currentlyManagement does not expect the adoption of thisbelieve that any recently issued, but not yet effective, accounting standard willstandards, if currently adopted, would have a material impacteffect on itsthe Group’s condensed consolidated financial statementsstatements.

VIEWBIX INC.

NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

U.S. dollars in thousands (except share data)

NOTE 2:SIGNIFICANT ACCOUNTING POLICIES (Cont.)

W. Recent accounting pronouncements (cont.)

ASU 2019-10, Financial Instruments—Credit Losses (Topic 326)

In September 2016, the Financial Accounting Standards Board (“FASB”) issued ASU No. 2016-13, “Financial Instruments – Credit Losses (Topic 326)” (“ASU 2016-13”), which requires the immediate recognition of management’s estimates of current and expected credit losses. In November 2018, the FASB issued ASU 2018-19, which makes certain improvements to Topic 326. In April and May 2019, the FASB issued ASUs 2019-04 and 2019-05, respectively, which adds codification improvements and transition relief for Topic 326. In November 2019, the FASB issued ASU 2019-10, which delays the effective date of Topic 326 for Smaller Reporting Companies to interim and annual periods beginning after December 15, 2022, with early adoption permitted. In November 2019, the FASB issued ASU 2019-11, which makes improvements to certain areas of Topic 326. In February 2020, the FASB issued ASU 2020-02, which adds an SEC paragraph, pursuant to the issuance of SEC Staff Accounting Bulletin No. 119, to Topic 326.

The amendments in this update are effective for fiscal years beginning after December 15, 2023, including interim periods within those fiscal years, and early adoption is permitted.

The Company currently does not expect that the adoption of this accounting standard will have a material impact on its consolidated financial statements

ASU 2021-08, Business Combinations

In October 2021 the FASB issued ASU 2021-08, “Business Combinations (Topic 805) – Accounting for Contract Assets and Contract Liabilities from Contracts with Customers”. The amendments in this update require that an entity (acquirer), recognize and measure contract assets and contract liabilities acquired in a business combination in accordance with Topic 606. At the acquisition date, an acquirer should account for the related revenue contracts in accordance with Topic 606 as if it had originated the contracts. To achieve this, an acquirer may assess how the acquiree applied Topic 606 to determine what to record for the acquired revenue contracts.

The amendments in this update are effective for fiscal years beginning after December 15, 2023, including interim periods within those fiscal years, and early adoption is permitted.

The Company currently does not expect that the adoption of this accounting standard will have a material impact on its consolidated financial statements

VIEWBIX INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

U.S. dollars in thousands (except share data)

NOTE 3:LOAN TO PARENT COMPANY

OTHER RECEIBALESSCHEDULE OF LOAN FROM TO PARENT COMPANY

As of June 30 2023 | As of December 31 2022 | |||||||

| Loan to Parent Company | $ | 3,689 | $ | 3,542 | ||||

The balance with the Parent Company represents a balance of an intercompany loan under a loan agreement signed between Gix Media and the Parent Company on March 22, 2020. The loan bears interest at a rate to be determined from time to time in accordance with Section 3(j) of the Income Tax Ordinance, new version, and the Income Tax Regulations (Determination of Interest Rate for the purposes of Section 3(j), 1986) or according to a market interest rate decision as agreed between the parties. The amount of the loan is in U.S. dollars.

Composition:

SCHEDULE OF OTHER ACCOUNTS RECEIVABLES COMPOSITION

As of September 30 | As of December 31 | |||||||

| 2022 | 2021 | |||||||

| Prepaid expenses | $ | 301 | $ | 350 | ||||

| Government authorities | $ | 513 | $ | 624 | ||||

| Other receivables | $ | - | $ | 30 | ||||

| Other accounts receivables | 814 | 1,004 | ||||||

NOTE 4:PROPERTY AND EQUIPMENT, NETOn November 20, 2022, the Company, Gix Media and the Parent Company agreed to restructure loan agreements between the parties (see note 15 in the 2022 annual financial statements) such that the Company fully repaid the loan to the Parent Company by offsetting its amount from the loan owed by the Parent Company to Gix Media. As a result, as of June 30, 2023, and December 31, 2022, the Company has no further obligations under the loan agreement with the Parent Company.

Composition:

SCHEDULE OF PROPERTY AND EQUIPMENT, NET

| As of September 30 | As of December 31 | |||||||

| 2022 | 2021 | |||||||

| Cost: | ||||||||

| Computers and peripheral equipment | $ | 490 | $ | 436 | ||||

| Office furniture and equipment | $ | 134 | $ | 134 | ||||

| Leasehold improvements | $ | 273 | $ | 273 | ||||

| Total cost | $ | 897 | $ | 843 | ||||

| Less: accumulated depreciation | (580 | ) | (509 | ) | ||||

| Property and equipment, net | 317 | 334 | ||||||

Depreciation expenses totaled toFor the six months ended June 30, 2023, and the year ended 2022, Gix Media recognized interest income in the amount of $7143 and $54143 for the nine months ended September 30, 2022, and September 30 2021,, respectively.

VIEWBIX INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

U.S. dollars in thousands (except share data)

NOTE 5:4: LEASES

On February 25, 2021, Gix Media entered into a lease agreement for a new corporate office of 479 square meters in Ramat Gan, Israel, at a monthly rent fee of $10. The lease period is for 36 months (the “initial lease period”) with an option by the Company to extend for two additional terms of 24 months each. In accordance with the lease agreement, the Company made leasehold improvements in exchange for a rent fee discount of $67 which will be spread over the initial lease period.

The Company includes renewal options that it is reasonably certain to exercise in the measurement of the lease liabilities.

Leases recorded on the balance sheet consist of the following:

SCHEDULE OF LEASE

As of September 30 | As of December 31 | |||||||

| 2022 | 2021 | |||||||

| Assets | ||||||||

| Right-of-use assets | $ | 505 | $ | 569 | ||||

| Liabilities | ||||||||

| Operating lease – current | $ | 93 | $ | 91 | ||||

| Operating lease – non-current | $ | 433 | $ | 491 | ||||

| Total lease liabilities | $ | 526 | $ | 582 | ||||

Weighted-average remaining lease term and discount rate were as follows:

SCHEDULE OF WEIGHTED AVERAGE REMAINING LEASE TERMS AND DISCOUNT RATES

As of June 30 | ||||||

| Operating leases weighted average remaining lease term (in years) | 4.67 | |||||

| Operating leases weighted average discount rate | 3.10 | % | ||||

Maturities of operating lease liabilities as of September 30, 2022 and December 31, 2021, are as follows:

SCHEDULE OF MATURITIES OF OPERATING LEASE LIABILITIES

As of September 30 | As of December 31 | |||||||

| 2022 | 2021 | |||||||

| 2022 | $ | 22 | $ | 99 | ||||

| 2023 | $ | 88 | $ | 100 | ||||

| 2024 | $ | 88 | $ | 100 | ||||

| 2025 | $ | 88 | $ | 100 | ||||

| Thereafter | $ | 251 | $ | 285 | ||||

| Total lease payments | 537 | 684 | ||||||

| Less: imputed interest | (11 | ) | (102 | ) | ||||

| Present value of lease liabilities | 526 | 582 | ||||||

As of December 31 2022 | ||||

| Operating leases weighted average remaining lease term (in years) | 5.17 | |||

| Operating leases weighted average discount rate | 3.10 | % | ||

Operating lease expenses amounted to $7751 and $6025 for the ninesix and three months ended SeptemberJune 30, 2022, and September 30, 2021,2023, respectively.

Operating lease expenses amounted to $51 and $26 for the six and three months ended June 30, 2022, respectively.

VIEWBIX INC.

NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

U.S. dollars in thousands (except share data)

NOTE 6:5: GOODWILL AND INTANGIBLE ASSETS, NET

Composition:

SCHEDULE OF GOODWILL AND INTANGIBLE ASSETS

| (*) | ||||||||||||||||||||

| Internal Software (*) | Customer Relations | Technology | Goodwill | Total | ||||||||||||||||

| Cost: | ||||||||||||||||||||

| Balance as of January 1, 2022 | 449 | 10,720 | 4,790 | 12,483 | 28,442 | |||||||||||||||

| Adjustments to ultimate parent company earning values (see note 1.c) | - | 2,356 | 6,958 | 5,132 | 14,446 | |||||||||||||||

| Additions | 14 | - | - | - | 14 | |||||||||||||||

| Acquisitions | ||||||||||||||||||||

| Balance as of September 30, 2022 | 463 | 13,076 | 11,748 | 17,615 | 42,902 | |||||||||||||||

| Accumulated amortization: | ||||||||||||||||||||

| Balance as of January 1, 2022 | - | 4,261 | 3,284 | - | 7,545 | |||||||||||||||

| Amortization recognized during the period | 85 | 667 | 1,228 | - | 1,980 | |||||||||||||||

| Balance as of September 30, 2022 | 85 | 4,928 | 4,512 | - | 9,525 | |||||||||||||||

| Amortized cost: | ||||||||||||||||||||

| As of September 30, 2022 | 378 | 8,148 | 7,236 | 17,615 | 33,377 | |||||||||||||||

| * | ||||||||||||||||||||

| Internal-use Software (*) | Customer Relations | Technology | Goodwill | Total | ||||||||||||||||

| (*) | ||||||||||||||||||||

| Cost: | ||||||||||||||||||||

| Balance as of January 1, 2023 | 465 | 6,234 | 11,008 | 17,361 | 35,068 | |||||||||||||||

| Adjustments to Ultimate Parent company carrying values (see note 1.B) | - | (1,519 | ) | 3,251 | 4,878 | 6,610 | ||||||||||||||

| Additions | - | - | - | - | - | |||||||||||||||

| Balance as of June 30, 2023 | 465 | 6,234 | 11,008 | 17,361 | 35,068 | |||||||||||||||

| Accumulated amortization: | ||||||||||||||||||||

| Balance as of January 1, 2023 | 122 | 741 | 1,531 | - | 2,394 | |||||||||||||||

| Adjustments to Ultimate Parent company carrying values (see note 1.B) | - | (4,457 | ) | (3,413 | ) | - | (7,870 | ) | ||||||||||||

| Amortization recognized during the period | 69 | 444 | 915 | - | 1,428 | |||||||||||||||

| Balance as of June 30, 2023 | 191 | 1,185 | 2,446 | - | 3,822 | |||||||||||||||

| Amortized cost: | ||||||||||||||||||||

| As of June 30, 2023 | 274 | 5,049 | 8,562 | 17,361 | 31,246 | |||||||||||||||

| Internal Software (*) | Customer Relations | Technology | Goodwill | Total | ||||||||||||||||

| Cost: | ||||||||||||||||||||

| Balance As of January 1, 2021 | 180 | 6,080 | 3,117 | 2,902 | 12,279 | |||||||||||||||

| Cost: beginning balance | 180 | 6,080 | 3,117 | 2,902 | 12,279 | |||||||||||||||

| Acquisition of Cortex (see note 7) | - | 4,640 | 1,673 | 9,581 | 15,894 | |||||||||||||||

| Additions | 269 | - | - | - | 269 | |||||||||||||||

| Balance as of December 31, 2021 | 449 | 10,720 | 4,790 | 12,483 | 28,442 | |||||||||||||||

| Cost: ending balance | 449 | 10,720 | 4,790 | 12,483 | 28,442 | |||||||||||||||

| Accumulated amortization: | ||||||||||||||||||||

| Balance as of January 1, 2021 | - | 3,274 | 2,424 | - | 5,698 | |||||||||||||||

| Accumulated amortization: beginning balance | - | 3,274 | 2,424 | - | 5,698 | |||||||||||||||

| Amortization recognized during the year | - | 987 | 860 | - | 1,847 | |||||||||||||||

| Balance as of December 31, 2021 | - | 4,261 | 3,284 | - | 7,545 | |||||||||||||||

| Accumulated amortization: ending balance | - | 4,261 | 3,284 | - | 7,545 | |||||||||||||||

| Amortized cost: | ||||||||||||||||||||

| As of December 31, 2021 | 449 | 6,459 | 1,506 | 12,483 | 20,897 | |||||||||||||||

| Amortized cost: | 449 | 6,459 | 1,506 | 12,483 | 20,897 | |||||||||||||||

| * | ||||||||||||||||||||

| Internal-use Software (*) | Customer Relations | Technology | Goodwill | Total | ||||||||||||||||

| Cost: | ||||||||||||||||||||

| Balance as of January 1, 2022 | 449 | 7,753 | 7,757 | 12,483 | 28,442 | |||||||||||||||

| Beginning balance | 449 | 7,753 | 7,757 | 12,483 | 28,442 | |||||||||||||||

| Adjustments to Ultimate Parent company carrying values (see note 1.B) | - | (1,519 | ) | 3,251 | 4,878 | 6,610 | ||||||||||||||

| Additions | 16 | - | - | - | 16 | |||||||||||||||

| Balance as of December 31, 2022 | 465 | 6,234 | 11,008 | 17,361 | 35,068 | |||||||||||||||

| Ending balance | 465 | 6,234 | 11,008 | 17,361 | 35,068 | |||||||||||||||

| Accumulated amortization: | ||||||||||||||||||||

| Balance as of January 1, 2022 | - | 4,261 | 3,284 | - | 7,545 | |||||||||||||||

| Beginning balance | - | 4,261 | 3,284 | - | 7,545 | |||||||||||||||

| Adjustments to Ultimate Parent company carrying values (see note 1.B) | - | (4,457 | ) | (3,413 | ) | - | (7,870 | ) | ||||||||||||

| Amortization recognized during the year | 122 | 937 | 1,660 | - | 2,719 | |||||||||||||||

| Balance as of December 31, 2022 | 122 | 741 | 1,531 | - | 2,394 | |||||||||||||||

| Ending balance | 122 | 741 | 1,531 | - | 2,394 | |||||||||||||||

| Amortized cost: | ||||||||||||||||||||

| As of December 31, 2022 | 343 | 5,493 | 9,477 | 17,361 | 32,674 | |||||||||||||||

(*) | During 2020, Gix Media engaged with a subcontractor for the development of an

|

VIEWBIX INC.

NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

U.S. dollars in thousands (except share data)

NOTE 7:6: BUSINESS COMBINATIONLOANS

Cortex AcquisitionA.