UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q/A

(Mark one)

| [X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

| SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended SeptemberJune 30, 20182019

Or

| [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

| SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________

Commission File Number: 333-205893000-55760

| THE PARKING REIT, INC. |

| (Exact name of registrant as specified in its charter) |

| MARYLAND | 47-3945882 | |

| (State or Other Jurisdiction of | (I.R.S. Employer | |

| Incorporation or Organization) | Identification No.) |

8880 W. SUNSET RD SUITE 240, LAS VEGAS, NV 89148

N/A

(Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading symbols(s) | Name of each exchange on which registered |

N/A | N/A | N/A |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ X ]X] No [ ]

Indicate by check mark whether the registrant has submitted electronically, and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Sec. 232.405 of this chapter) during the preceding 12 months, (oror for such shorter period that the registrant was required to submit and post such files).files.

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer" andfiler," "smaller reporting company"company," and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] | Accelerated filer [ ] |

Non-accelerated filer | Smaller reporting company |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule bib-212b-2 of the Act).

Yes [ ] No [ X ]

As of November 9, 2018,August 12, 2019, the registrant had 6,545,3666,933,254 shares of common stock outstanding.

| Page | ||

PART I

THE PARKING REIT, INC.

| September 30, 2018 | December 31, 2017 | As of June 30, 2019 | As of December 31, 2018 | |||||||||||||

| (UNAUDITED) | (unaudited) | |||||||||||||||

| ASSETS | ASSETS | ASSETS | ||||||||||||||

| Investments in real estate and fixed assets | ||||||||||||||||

Investments in real estate | ||||||||||||||||

| Land and improvements | $ | 143,202,000 | $ | 131,169,000 | $ | 137,503,000 | $ | 142,607,000 | ||||||||

| Buildings and improvements | 166,158,000 | 153,456,000 | 168,341,000 | 170,206,000 | ||||||||||||

| Construction in progress | 4,121,000 | 750,000 | 1,830,000 | 1,872,000 | ||||||||||||

| Intangible assets | 2,288,000 | 2,427,000 | ||||||||||||||

| Software | 63,000 | -- | ||||||||||||||

| Intangible Assets | 2,288,000 | 2,288,000 | ||||||||||||||

| 315,832,000 | 287,802,000 | 309,962,000 | 316,973,000 | |||||||||||||

| Accumulated depreciation and amortization | (5,847,000 | ) | (2,231,000 | ) | ||||||||||||

| Accumulated depreciation | (9,479,000 | ) | (7,110,000 | ) | ||||||||||||

| Total investments in real estate, net | 309,985,000 | 285,571,000 | 300,483,000 | 309,863,000 | ||||||||||||

| Assets held for sale | 2,531,000 | 6,543,000 | ||||||||||||||

Fixed Assets, net of accumulated depreciation of $31,000 and $21,000 as of June 30, 2019 and December 31, 2018, respectively | 32,000 | 42,000 | ||||||||||||||

Assets held for sale, net of accumulated depreciation of $212,000 | 6,711,000 | -- | ||||||||||||||

| Cash | 5,284,000 | 8,501,000 | 6,061,000 | 5,106,000 | ||||||||||||

| Cash – restricted | 3,929,000 | 8,229,000 | 3,131,000 | 4,329,000 | ||||||||||||

| Prepaid expenses | 705,000 | 184,000 | 2,925,000 | 616,000 | ||||||||||||

| Accounts receivable | 1,269,000 | 409,000 | 403,000 | 712,000 | ||||||||||||

| Investment in DST | 2,821,000 | 2,821,000 | 2,837,000 | 2,821,000 | ||||||||||||

| Deposits | 419,000 | 675,000 | ||||||||||||||

Accounts receivable related parties | -- | 3,000 | ||||||||||||||

| Other assets | 64,000 | 10,000 | 121,000 | 79,000 | ||||||||||||

| Total assets | $ | 327,007,000 | $ | 312,943,000 | $ | 322,704,000 | $ | 323,571,000 | ||||||||

| LIABILITIES AND EQUITY | LIABILITIES AND EQUITY | LIABILITIES AND EQUITY | ||||||||||||||

| Liabilities | ||||||||||||||||

| Notes payable, net of unamortized loan issuance costs of approximately $1.5 million and $1.9 million as of September 30, 2018 and December 31, 2017, respectively | $ | 117,082,000 | $ | 123,770,000 | ||||||||||||

| Lines of credit, net of unamortized loan issuance costs of approximately $0.6 million and $0.5 million as of September 30, 2018 and December 31, 2017, respectively | 38,511,000 | 22,302,000 | ||||||||||||||

Notes payable, net of unamortized loan issuance costs of approximately $2.3 million and $2.4 million as of June 30, 2019 and December 31, 2018, respectively | $ | 160,604,000 | $ | 155,961,000 | ||||||||||||

| Accounts payable and accrued liabilities | 5,542,000 | 3,913,000 | 5,572,000 | 4,605,000 | ||||||||||||

| Security deposit | 141,000 | 202,000 | ||||||||||||||

| Due to related parties | 258,000 | 385,000 | ||||||||||||||

Accounts payable and accrued liabilities – related party | 501,000 | 653,000 | ||||||||||||||

Deferred management internalization | 24,800,000 | -- | ||||||||||||||

Security Deposit | 139,000 | 139,000 | ||||||||||||||

| Deferred revenue | 509,000 | 195,000 | 298,000 | 93,000 | ||||||||||||

| Total liabilities | 162,043,000 | 150,767,000 | 191,914,000 | 161,451,000 | ||||||||||||

| Commitments and contingencies | -- | -- | -- | -- | ||||||||||||

| Equity | ||||||||||||||||

| The Parking REIT, Inc. Stockholders' Equity | ||||||||||||||||

| Preferred stock Series A, $0.0001 par value, 50,000 shares authorized, 2,862 shares issued and outstanding (stated liquidation value of $2,862,000) as of September 30, 2018 and December 31, 2017, respectively. | -- | -- | ||||||||||||||

| Preferred stock Series 1; $0.0001 par value, 97,000 shares authorized, 39,811 and 29,789 shares issued and outstanding (stated liquidation value of $ 39,811,000 and $29,789,000) as of September 30, 2018 and December 31, 2017, respectively. | -- | -- | ||||||||||||||

| Non-voting, non-participating convertible stock, $0.0001 par value, no shares issued and outstanding | -- | -- | ||||||||||||||

| Common stock, $0.0001 par value, 98,999,000 shares authorized, 6,547,977 and 6,532,009 shares issued and outstanding as of September 30, 2018 and December 31, 2017, respectively | -- | -- | ||||||||||||||

The Parking REIT, Inc. Stockholders’ Equity | ||||||||||||||||

| Preferred stock Series A, $0.0001 par value, 50,000 shares authorized, 2,862 shares issued and outstanding (stated liquidation value of $2,862,000 as of June 30, 2019 and December 31, 2018) | -- | -- | ||||||||||||||

| Preferred stock Series 1, $0.0001 par value, 97,000 shares authorized, 39,811 shares issued and outstanding (stated liquidation value of $39,811,000 as of June 30, 2019 and December 31, 2018) | -- | -- | ||||||||||||||

| Non-voting, non-participating convertible stock, $0.0001 par value 1,000 shares authorized, no shares issued and outstanding | -- | -- | ||||||||||||||

| Common stock, $0.0001 par value, 98,999,000 shares authorized, 6,933,934 and 6,542,797 shares issued and outstanding as of June 30, 2019 and December 31, 2018, respectively | -- | -- | ||||||||||||||

| Additional paid-in capital | 184,260,000 | 177,598,000 | 188,665,000 | 183,382,000 | ||||||||||||

| Accumulated deficit | (22,058,000 | ) | (18,173,000 | ) | (60,540,000 | ) | (23,953,000 | ) | ||||||||

| Total The Parking REIT, Inc. Shareholders' Equity | 162,202,000 | 159,425,000 | ||||||||||||||

| Total The Parking REIT, Inc. Shareholders’ Equity | 128,125,000 | 159,429,000 | ||||||||||||||

| Non-controlling interest | 2,762,000 | 2,751,000 | 2,665,000 | 2,691,000 | ||||||||||||

| Total equity | 164,964,000 | 162,176,000 | 130,790,000 | 162,120,000 | ||||||||||||

| Total liabilities and equity | $ | 327,007,000 | $ | 312,943,000 | $ | 322,704,000 | $ | 323,571,000 | ||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

THE PARKING REIT, INC.

(UNAUDITED)

| For the Three Months Ended September 30 | For the Nine Months Ended September 30 | |||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||

| Revenues | ||||||||||||||||

| Base rent income | $ | 4,992,000 | $ | 2,206,000 | $ | 14,511,000 | $ | 5,740,000 | ||||||||

| Management agreement | -- | -- | -- | 518,000 | ||||||||||||

| Percentage rent income | 1,010,000 | 16,000 | 1,776,000 | 523,000 | ||||||||||||

| Total revenues | 6,002,000 | 2,222,000 | 16,287,000 | 6,781,000 | ||||||||||||

| Operating expenses | ||||||||||||||||

| Property taxes | 668,000 | 90,000 | 1,963,000 | 279,000 | ||||||||||||

| Property operating expense | 305,000 | 273,000 | 1,041,000 | 608,000 | ||||||||||||

| Asset management expense – related party | 313,000 | 345,000 | 2,000,000 | 839,000 | ||||||||||||

| General and administrative | 1,246,000 | 400,000 | 6,092,000 | 1,051,000 | ||||||||||||

| Merger costs | -- | 824,000 | -- | 1,596,000 | ||||||||||||

| Acquisition expenses | 7,000 | 113,000 | 411,000 | 2,156,000 | ||||||||||||

| Acquisition expenses – related party | -- | -- | -- | 1,710,000 | ||||||||||||

| Depreciation and amortization | 1,262,000 | 508,000 | 3,653,000 | 1,404,000 | ||||||||||||

| Total operating expenses | 3,801,000 | 2,553,000 | 15,160,000 | 9,643,000 | ||||||||||||

| Income (loss) from operations | 2,201,000 | (331,000 | ) | 1,127,000 | (2,862,000 | ) | ||||||||||

| Other income (expense) | ||||||||||||||||

| Interest expense | (2,170,000 | ) | (1,297,000 | ) | (6,337,000 | ) | (3,146,000 | ) | ||||||||

| Distribution income – related party | -- | 75,000 | -- | 174,000 | ||||||||||||

| Gain from sale of investment in real estate | 962,000 | 1,200,000 | 1,971,000 | 1,200,000 | ||||||||||||

| Other income | 7,000 | -- | 62,000 | -- | ||||||||||||

| Income from DST | 52,000 | -- | 154,000 | -- | ||||||||||||

| Income from investment in equity method investee | -- | 2,000 | -- | 19,000 | ||||||||||||

| Total other expense | (1,149,000 | ) | (20,000 | ) | (4,150,000 | ) | (1,753,000 | ) | ||||||||

| Net income (loss) | 1,052,000 | (351,000 | ) | (3,023,000 | ) | (4,615,000 | ) | |||||||||

| Net income attributable to non-controlling interest | 40,000 | 41,000 | 45,000 | 269,000 | ||||||||||||

| Net income (loss) attributable to The Parking REIT, Inc.'s stockholders | $ | 1,012,000 | $ | (392,000 | ) | $ | (3,068,000 | ) | $ | (4,884,000 | ) | |||||

| Preferred stock distributions declared - Series A | (54,000 | ) | (55,000 | ) | (151,000 | ) | (101,000 | ) | ||||||||

| Preferred stock distributions declared - Series 1 | (697,000 | ) | (157,000 | ) | (1,908,000 | ) | (172,000 | ) | ||||||||

| Net income (loss) attributable to The Parking REIT, Inc.'s common stockholders | 261,000 | (604,000 | ) | (5,127,000 | ) | (5,157,000 | ) | |||||||||

| Basic and diluted income (loss) per weighted average common share: | ||||||||||||||||

| Net income (loss) per share attributable to The Parking REIT, Inc.'s common stockholders - basic and diluted | $ | 0.04 | $ | (0.23 | ) | $ | (0.78 | ) | $ | (2.05 | ) | |||||

| Distributions declared per common share | $ | -- | $ | 0.19 | $ | 0.12 | $ | 0.56 | ||||||||

| Weighted average common shares outstanding, basic and diluted | 6,549,512 | 2,577,514 | 6,552,203 | 2,516,496 | ||||||||||||

| Preferred stock | Common stock | |||||||||||||||

| Number of Shares | Par Value | Number of Shares | Par Value | Additional Paid-in Capital | Accumulated Deficit | Non-controlling interest | Total | |||||||||

| Balance, December 31, 2017 | 32,651 | $ | -- | 6,532,009 | $ | -- | $ | 177,598,000 | $ | (18,173,000) | $ | 2,751,000 | $ | 162,176,000 | ||

| Distributions to non-controlling interest | -- | -- | -- | -- | -- | -- | (34,000) | (34,000) | ||||||||

| Issuance of common stock – DRIP | -- | -- | 11,326 | -- | 307,000 | -- | -- | 307,000 | ||||||||

| Issuance of preferred Series 1 | 10,022 | -- | -- | -- | 9,089,000 | -- | -- | 9,089,000 | ||||||||

| Redeemed Shares | -- | -- | (28,037) | -- | (685,000) | -- | -- | (685,000) | ||||||||

| Distributions - Common | -- | -- | -- | -- | (807,000) | -- | -- | (807,000) | ||||||||

| Distributions – Series A | -- | -- | -- | -- | (151,000) | -- | -- | (151,000) | ||||||||

| Distributions – Series 1 | -- | -- | -- | -- | (1,908,000) | -- | -- | (1,908,000) | ||||||||

| Stock dividend | -- | -- | 32,679 | -- | 817,000 | (817,000) | -- | -- | ||||||||

| Net income (loss) | -- | -- | -- | -- | -- | (3,068,000) | 45,000 | (3,023,000) | ||||||||

| Balance, September 30, 2018 | 42,673 | $ | -- | 6,547,977 | $ | -- | $ | 184,260,000 | $ | (22,058,000) | $ | 2,762,000 | $ | 164,964,000 | ||

| For the Three Months Ended June 30, | For the Six Months Ended June 30, | |||||||||||||||

| 2019 | 2018 | 2019 | 2018 | |||||||||||||

| Revenues | ||||||||||||||||

Base rent income | $ | 5,036,000 | $ | 4,803,000 | $ | 10,090,000 | $ | 9,519,000 | ||||||||

Percentage rent income | 410,000 | 391,000 | 711,000 | 766,000 | ||||||||||||

Total revenues | 5,446,000 | 5,194,000 | 10,801,000 | 10,285,000 | ||||||||||||

| Operating expenses | ||||||||||||||||

Property taxes | 727,000 | 659,000 | 1,520,000 | 1,295,000 | ||||||||||||

Property operating expense | 357,000 | 428,000 | 736,000 | 736,000 | ||||||||||||

Asset management expense – related party | -- | 855,000 | 854,000 | 1,687,000 | ||||||||||||

General and administrative | 1,262,000 | 785,000 | 2,112,000 | 1,892,000 | ||||||||||||

Professional fees | 1,201,000 | 933,000 | 1,729,000 | 2,854,000 | ||||||||||||

Management Internalization | 31,866,000 | 100,000 | 32,004,000 | 100,000 | ||||||||||||

Acquisition expenses | 246,000 | 187,000 | 250,000 | 404,000 | ||||||||||||

Depreciation and amortization | 1,283,000 | 1,197,000 | 2,591,000 | 2,391,000 | ||||||||||||

Impairment | 952,000 | -- | 952,000 | -- | ||||||||||||

Total operating expenses | 37,894,000 | 5,144,000 | 42,748,000 | 11,359,000 | ||||||||||||

| Income (loss) from operations | (32,448,000 | ) | 50,000 | (31,947,000 | ) | (1,074,000 | ) | |||||||||

| Other income (expense) | ||||||||||||||||

Interest expense | (2,433,000 | ) | (2,219,000 | ) | (4,789,000 | ) | (4,167,000 | ) | ||||||||

Gain from sale of investment in real estate | -- | 1,009,000 | -- | 1,009,000 | ||||||||||||

Other Income | -- | 55,000 | 31,000 | 55,000 | ||||||||||||

Income from DST | 48,000 | 50,000 | 118,000 | 102,000 | ||||||||||||

Total other income (expense) | (2,385,000 | ) | (1,105,000 | ) | (4,640,000 | ) | (3,001,000 | ) | ||||||||

Net loss | (34,833,000 | ) | (1,055,000 | ) | (36,587,000 | ) | (4,075,000 | ) | ||||||||

Less net income attributable to non-controlling interest | 1,000 | 3,000 | -- | 5,000 | ||||||||||||

Net loss attributable to The Parking REIT, Inc.’s stockholders | $ | (34,834,000 | ) | $ | (1,058,000 | ) | $ | (36,587,000 | ) | $ | (4,080,000 | ) | ||||

Preferred stock distributions declared - Series A | (54,000 | ) | (54,000 | ) | (108,000 | ) | (97,000 | ) | ||||||||

Preferred stock distributions declared - Series 1 | (696,000 | ) | (688,000 | ) | (1,392,000 | ) | (1,211,000 | ) | ||||||||

| Net loss attributable to The Parking REIT, Inc.’s common stockholders | $ | (35,584,000 | ) | $ | (1,800,000 | ) | $ | (38,087,000 | ) | $ | (5,388,000 | ) | ||||

Basic and diluted loss per weighted average common share: | ||||||||||||||||

| Net loss per share attributable to The Parking REIT, Inc.’s common stockholders - basic and diluted | $ | (5.13 | ) | $ | (0.27 | ) | $ | (5.65 | ) | $ | (0.82 | ) | ||||

| Distributions declared per common share | $ | -- | $ | -- | $ | -- | $ | 0.12 | ||||||||

Weighted average common shares outstanding, basic and diluted | 6,932,806 | 6,555,688 | 6,738,511 | 6,553,221 | ||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

THE PARKING REIT, INC.

FOR THE SIX MONTHS ENDED JUNE 30, 2019 AND 2018

(UNAUDITED)

For the Nine Months Ended September 30, | ||||||||

| 2018 | 2017 | |||||||

| Cash flows from operating activities: | ||||||||

| Net Loss | $ | (3,023,000 | ) | $ | (4,615,000 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation and amortization expense | 3,653,000 | 1,404,000 | ||||||

| Amortization of loan costs | 646,000 | 335,000 | ||||||

| Gain from sale of investment in real estate | (1,971,000 | ) | (1,200,000 | ) | ||||

| Income from investment in equity method investee | -- | (19,000 | ) | |||||

| Distribution from MVP REIT | -- | (122,000 | ) | |||||

| Distribution from DST | (154,000 | ) | (52,000 | ) | ||||

| Changes in operating assets and liabilities | ||||||||

| Due to/from related parties | (127,000 | ) | (2,164,000 | ) | ||||

| Accounts payable | 1,704,000 | 1,028,000 | ||||||

| Loan Fees | (368,000 | ) | -- | |||||

| Security deposits | 253,000 | 298,000 | ||||||

| Other assets | (54,000 | ) | 258,000 | |||||

| Assets held for sale | -- | 623,000 | ||||||

| Accounts receivable | (860,000 | ) | 93,000 | |||||

| Prepaid expenses | (557,000 | ) | 60,000 | |||||

| Net cash used in operating activities | $ | (858,000 | ) | $ | (4,073,000 | ) | ||

| Cash flows from investing activities: | ||||||||

| Purchase of investment in real estate | (28,938,000 | ) | (81,200,000 | ) | ||||

| Investment in assets held for sale | -- | (1,015,000 | ) | |||||

| Investment in DST | -- | (2,821,000 | ) | |||||

| Building improvements | (4,602,000 | ) | (1,962,000 | ) | ||||

| Fixed asset purchase | (63,000 | ) | -- | |||||

| Proceeds from Investments | 154,000 | 87,000 | ||||||

| Proceeds from sale of investment in real estate | 7,487,000 | 1,577,000 | ||||||

| Deposits applied to purchase of investment in real estate | 256,000 | 4,216,000 | ||||||

| Investment in cost method investee | -- | (8,000 | ) | |||||

| Investment in cost method investee – held for sale | -- | (2,000 | ) | |||||

| Investment in equity method investee | -- | (50,000 | ) | |||||

| Proceeds from non-controlling interest | -- | 5,075,000 | ||||||

| Net cash used in investing activities | (25,706,000 | ) | (76,103,000 | ) | ||||

| Cash flows from financing activities | ||||||||

| Proceeds from note payable | 5,488,000 | 75,752,000 | ||||||

| Payments on note payable | (1,512,000 | ) | (1,388,000 | ) | ||||

| Proceeds from line of credit | 23,100,000 | 32,643,000 | ||||||

| Payments made on line of credit | (13,840,000 | ) | (39,526,000 | ) | ||||

| Loan fees paid | -- | (1,111,000 | ) | |||||

| Distribution to non-controlling interest | (34,000 | ) | (1,809,000 | ) | ||||

| Distribution from investment in equity method investee | -- | 237,000 | ||||||

| Proceeds from issuance of common stock | -- | 5,826,000 | ||||||

| Proceeds from issuance of preferred stock | 9,089,000 | 14,341,000 | ||||||

| Redeemed shares | (685,000 | ) | -- | |||||

| Dividends paid to stockholders | (2,559,000 | ) | (1,837,000 | ) | ||||

| Net cash provided by financing activities | 19,047,000 | 83,128,000 | ||||||

| Net change in cash and cash equivalents and restricted cash | (7,517,000 | ) | 2,952,000 | |||||

| Cash and cash equivalents and restricted cash, beginning of period | 16,730,000 | 4,985,000 | ||||||

| Cash and cash equivalents and restricted cash, end of period | $ | 9,213,000 | $ | 7,937,000 | ||||

| Preferred stock | Common stock | |||||||||||||||||||||||||||||||

| Number of Shares | Par Value | Number of Shares | Par Value | Additional Paid-in Capital | Accumulated Deficit | Non-controlling interest | Total | |||||||||||||||||||||||||

| Balance, December 31, 2018 | 42,673 | $ | -- | 6,542,797 | $ | -- | $ | 183,382,000 | $ | (23,953,000 | ) | $ | 2,691,000 | $ | 162,120,000 | |||||||||||||||||

Distributions to non-controlling interest | -- | -- | -- | -- | -- | -- | (11,000 | ) | (11,000 | ) | ||||||||||||||||||||||

Redeemed Shares | -- | -- | (2,433 | ) | -- | (60,000 | ) | -- | -- | (60,000 | ) | |||||||||||||||||||||

Distributions – Series A | -- | -- | -- | -- | (54,000 | ) | -- | -- | (54,000 | ) | ||||||||||||||||||||||

Distributions – Series 1 | -- | -- | -- | -- | (696,000 | ) | -- | -- | (696,000 | ) | ||||||||||||||||||||||

Net loss | -- | -- | -- | -- | -- | (1,753,000 | ) | (1,000 | ) | (1,754,000 | ) | |||||||||||||||||||||

| Balance, March 31, 2019 | 42,673 | $ | -- | 6,540,364 | $ | -- | $ | 182,572,000 | $ | (25,706,000 | ) | 2,679,000 | $ | 159,545,000 | ||||||||||||||||||

Distributions to non-controlling interest | -- | -- | -- | -- | -- | -- | (15,000 | ) | (15,000 | ) | ||||||||||||||||||||||

Issuance of common stock | -- | -- | 400,000 | -- | 7,000,000 | -- | -- | 7,000,000 | ||||||||||||||||||||||||

Redeemed Shares | -- | -- | (6,430 | ) | -- | (157,000 | ) | -- | -- | (157,000 | ) | |||||||||||||||||||||

Distributions – Series A | -- | -- | -- | -- | (54,000 | ) | -- | -- | (54,000 | ) | ||||||||||||||||||||||

Distributions – Series 1 | -- | -- | -- | -- | (696,000 | ) | -- | -- | (696,000 | ) | ||||||||||||||||||||||

Net income (loss) | -- | -- | -- | -- | -- | (34,834,000 | ) | 1,000 | (34,833,000 | ) | ||||||||||||||||||||||

| Balance, June 30, 2019 | 42,673 | $ | -- | 6,933,934 | $ | -- | $ | 188,665,000 | $ | (60,540,000 | ) | $ | 2,665,000 | $ | 130,790,000 | |||||||||||||||||

| Preferred stock | Common stock | |||||||||||||||||||||||||||||||

| Number of Shares | Par Value | Number of Shares | Par Value | Additional Paid-in Capital | Accumulated Deficit | Non-controlling interest | Total | |||||||||||||||||||||||||

| Balance, December 31, 2017 | 32,651 | $ | -- | 6,532,009 | $ | -- | $ | 177,598,000 | $ | (18,173,000 | ) | $ | 2,751,000 | $ | 162,176,000 | |||||||||||||||||

Distributions to non-controlling interest | -- | -- | -- | -- | -- | -- | (13,000 | ) | (13,000 | ) | ||||||||||||||||||||||

Issuance of common stock – DRIP | -- | -- | 11,326 | -- | 283,000 | -- | -- | 283,000 | ||||||||||||||||||||||||

Issuance of preferred Series 1 | 10,022 | -- | -- | -- | 9,090,000 | -- | -- | 9,090,000 | ||||||||||||||||||||||||

Redeemed Shares | -- | -- | (7,636 | ) | (191,000 | ) | -- | (191,000 | ) | |||||||||||||||||||||||

Distributions - Common | -- | -- | -- | -- | (817,000 | ) | -- | (817,000 | ) | |||||||||||||||||||||||

Distributions – Series A | -- | -- | -- | -- | (43,000 | ) | -- | -- | (43,000 | ) | ||||||||||||||||||||||

Distributions – Series 1 | -- | -- | -- | -- | (523,000 | ) | -- | -- | (523,000 | ) | ||||||||||||||||||||||

Stock dividend | -- | -- | 32,679 | -- | 817,000 | (817,000 | ) | -- | -- | |||||||||||||||||||||||

Net income (loss) | -- | -- | -- | -- | -- | (3,022,000 | ) | 2,000 | (3,020,000 | ) | ||||||||||||||||||||||

| Balance, March 31, 2018 | 42,673 | $ | 6,568,378 | $ | -- | $ | 186,214,000 | $ | (22,012,000 | ) | $ | 2,740,000 | $ | 166,942,000 | ||||||||||||||||||

Distributions to non-controlling interest | -- | -- | -- | -- | -- | -- | (11,000 | ) | (11,000 | ) | ||||||||||||||||||||||

Redeemed Shares | -- | -- | (18,179 | ) | (440,000 | ) | -- | (440,000 | ) | |||||||||||||||||||||||

Distributions – Series A | -- | -- | -- | -- | (54,000 | ) | -- | -- | (54,000 | ) | ||||||||||||||||||||||

Distributions – Series 1 | -- | -- | -- | -- | (688,000 | ) | -- | -- | (688,000 | ) | ||||||||||||||||||||||

Net income (loss) | -- | -- | -- | -- | -- | (1,058,000 | ) | 3,000 | (1,055,000 | ) | ||||||||||||||||||||||

| Balance, June 30, 2018 | 42,673 | $ | -- | 6,550,199 | $ | -- | $ | 185,032,000 | $ | (23,070,000 | ) | $ | 2,732,000 | $ | 164,694,000 | |||||||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

THE PARKING REIT, INC.

For the Nine Months Ended September 30, | ||||||||

| 2018 | 2017 | |||||||

| Reconciliation of Cash and Cash Equivalents and Restricted Cash: | ||||||||

| Cash and cash equivalents at beginning of period | $ | 8,501,000 | $ | 4,885,000 | ||||

| Restricted cash at beginning of period | 8,229,000 | 100,000 | ||||||

| Cash and cash equivalents and restricted cash at beginning of period | $ | 16,730,000 | $ | 4,985,000 | ||||

| Cash and cash equivalents at end of period | $ | 5,284,000 | $ | 2,589,000 | ||||

| Restricted cash at end of period | 3,929,000 | 5,348,000 | ||||||

| Cash and cash equivalents and restricted cash at end of period | $ | 9,213,000 | $ | 7,937,000 | ||||

| Supplemental disclosures of cash flow information: | ||||||||

| Interest Paid | $ | 5,692,000 | $ | 2,737,000 | ||||

| Non-cash investing and financing activities: | ||||||||

| Distributions - DRIP | $ | 307,000 | $ | 901,000 | ||||

| Dividend shares | $ | 817,000 | $ | 1,402,000 | ||||

| Dividends declared not yet paid | $ | 250,000 | $ | 235,000 | ||||

| Deposits applied to purchase of investment in real estate | $ | 2,260,000 | $ | 4,216,000 | ||||

| Conversion from debt to preferred shares | $ | -- | $ | 2,000,000 | ||||

| Payments on note payable through sale of investment in real estate | $ | (11,092,000 | ) | $ | -- | |||

| Proceeds on line of credit through sale of investment in real estate | $ | 7,103,000 | $ | -- | ||||

| For the Six Months Ended June 30 | ||||||||

| 2019 | 2018 | |||||||

| Cash flows from operating activities: | ||||||||

| Net Loss | $ | (36,587,000 | ) | $ | (4,075,000 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation and amortization expense | 2,591,000 | 2,391,000 | ||||||

| Amortization of loan costs | 447,000 | 492,000 | ||||||

| Gain from sale of investment in real estate | -- | (1,009,000 | ) | |||||

| Deferred management internalization consideration | 31,800,000 | -- | ||||||

| Impairment | 952,000 | -- | ||||||

| Income from DST | (118,000 | ) | (102,000 | ) | ||||

| Changes in operating assets and liabilities | ||||||||

| Accounts receivable/payable - related parties | 3,000 | (127,000 | ) | |||||

| Accounts payable | 815,000 | 1,784,000 | ||||||

| Loan fees | (280,000 | ) | (344,000 | ) | ||||

| Security deposits | -- | 338,000 | ||||||

| Other assets | (42,000 | ) | (43,000 | ) | ||||

| Deferred revenue | 205,000 | -- | ||||||

| Accounts receivable | 309,000 | (319,000 | ) | |||||

| Prepaid expenses | (2,309,000 | ) | (507,000 | ) | ||||

| Net cash used in operating activities | (2,214,000 | ) | (1,521,000 | ) | ||||

| Cash flows from investing activities: | ||||||||

| Purchase of investments in real estate | -- | (28,938,000 | ) | |||||

| Building improvements | (864,000 | ) | (3,031,000 | ) | ||||

| Fixed asset purchase | -- | (63,000 | ) | |||||

| Distributions from Investments | 102,000 | 102,000 | ||||||

| Proceeds from sale of investment in real estate | -- | 3,773,000 | ||||||

| Payment of deposit for purchase of investment in real estate or debt | (97,000 | ) | -- | |||||

| Deposits returned or applied to purchase of investment in real estate | 97,000 | 400,000 | ||||||

| Net cash used in investing activities | (762,000 | ) | (27,757,000 | ) | ||||

| Cash flows from financing activities | ||||||||

| Proceeds from notes payable | 9,181,000 | 5,488,000 | ||||||

| Payments on notes payable | (4,705,000 | ) | (1,018,000 | ) | ||||

| Proceeds from line of credit | -- | 23,100,000 | ||||||

| Payments made on line of credit | -- | (10,440,000 | ) | |||||

| Distribution to non-controlling interest | (26,000 | ) | (24,000 | ) | ||||

| Proceeds from issuance of preferred stock | -- | 9,090,000 | ||||||

| Redeemed shares | (217,000 | ) | (631,000 | ) | ||||

| Dividends paid to stockholders | (1,500,000 | ) | (1,842,000 | ) | ||||

| Net cash provided by financing activities | 2,733,000 | 23,723,000 | ||||||

| Net change in cash | (243,000 | ) | (5,555,000 | ) | ||||

| Cash, beginning of period | 9,435,000 | 16,730,000 | ||||||

| Cash, end of period | $ | 9,192,000 | $ | 11,175,000 | ||||

| Reconciliation of Cash and Cash Equivalents and Restricted Cash: | ||||||||

| Cash and cash equivalents at beginning of period | $ | 5,106,000 | $ | 8,501,000 | ||||

| Restricted cash at beginning of period | 4,329,000 | 8,229,000 | ||||||

| Cash and cash equivalents and restricted cash at beginning of period | $ | 9,435,000 | $ | 16,730,000 | ||||

| Cash and cash equivalents at end of period | $ | 6,061,000 | $ | 6,251,000 | ||||

| Restricted cash at end of period | 3,131,000 | 4,924,000 | ||||||

| Cash and cash equivalents and restricted cash at end of period | $ | 9,192,000 | $ | 11,175,000 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

THE PARKING REIT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| For the Six Months Ended June 30 | ||||||||

| 2019 | 2018 | |||||||

| Supplemental disclosures of cash flow information: | ||||||||

| Interest Paid | $ | 4,342,000 | $ | 3,672,000 | ||||

| Non-cash investing and financing activities: | ||||||||

| Distributions - DRIP | $ | -- | $ | 283,000 | ||||

| Dividend shares | $ | -- | $ | 817,000 | ||||

| Dividends declared not yet paid | $ | 250,000 | $ | 250,000 | ||||

| Deposits applied to purchase of investment in real estate or financing | $ | 97,000 | $ | 2,260,000 | ||||

| Payments on note payable through sale of investment in real estate | $ | -- | $ | (11,092,000 | ) | |||

| Proceeds on line of credit through sale of investment in real estate | $ | -- | $ | 7,103,000 | ||||

| Deferred management internalization | $ | 24,800,000 | $ | -- | ||||

| Issuance of common stock - internalization | $ | 7,000,000 | $ | -- | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

THE PARKING REIT, INC.

(UNAUDITED)

Note A — Organization and Business Operations

The Parking REIT, Inc., formerly known as MVP REIT II, Inc. (the "Company"(the “Company,” “we,” “us” or “our”), is a Maryland corporation formed on May 4, 2015 and has elected to be taxed, and has operated and intends to continue to operate in a manner that will allow the Company to qualify as a REIT underreal estate investment trust ("REIT") for U.S. federal income tax purposes beginning with the Sections 856-860 of the Internal Revenue Code of 1986, as amended (the "Code"). As a REIT, thetaxable year ended December 31, 2017. The Company is generally not subjectintends to federal corporate income taxes on amounts that are distributed to stockholders, provided that, on an annual basis, the Company distributes at least 90% of REIT taxable income (excluding net capital gains) to the stockholders and meet certain other conditions. As such, in general, as long as we qualifycontinue operating as a REIT no provision for federal income taxes will be necessary, except for taxes on undistributed REITthe taxable income.

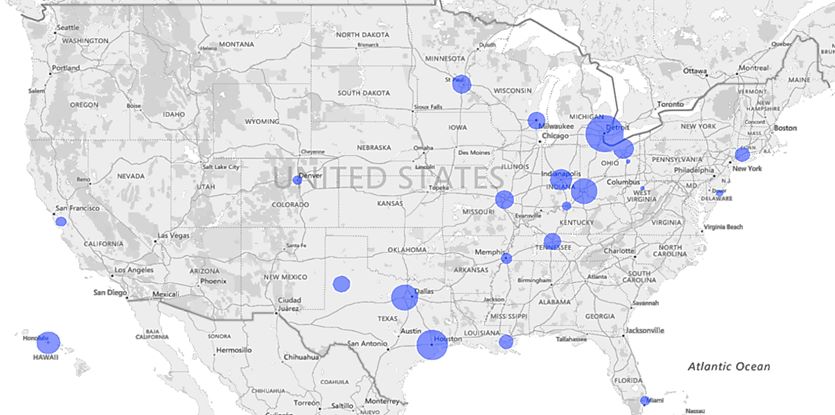

The Company was formed to focus primarily on investments in parking facilities, including parking lots, parking garages and other parking structures throughout the United States.States and Canada. To a lesser extent, the Company may also invest in parking properties that contain other than parking facilities.sources of rental income, potentially including office, retail, storage, residential, billboard or cell towers.

The Company is the sole general partner of MVP REIT II Operating Partnership, LP, a Delaware limited partnership (the "Operating Partnership"“Operating Partnership”). The Company owns substantially all of its assets and conducts substantially all of its operations through the Operating Partnership. The Company'sCompany’s wholly owned subsidiary, MVP REIT II Holdings, LLC, is the sole limited partner of the Operating Partnership. The operating agreement provides that the Operating Partnership is to be operated in a manner that enables the Company to (1) satisfy the requirements to qualify and maintain qualification as a REIT for federal income tax purposes, (2) avoid any federal income or excise tax liability and (3) ensure that the Operating Partnership is not classified as a "publicly“publicly traded partnership"partnership” for purposes of Section 7704 of the Internal Revenue Code of 1986, as amended (the "Code"“Code”), which classification could result in the Operating Partnership being taxed as a corporation.

The Company utilizes an Umbrella Partnership Real Estate Investment Trust ("UPREIT"(“UPREIT”) structure to enable the Company to acquire real property in exchange for limited partnership interests in the Operating Partnership from owners who desire to defer taxable gain that would otherwise normally be recognized by them upon the disposition of their real property or transfer of their real property to the Company in exchange for shares of the Company'sCompany’s common stock or cash.

Merger of November 9, 2018, the Company had no paid employees.MVP REIT with Merger Sub, LLC

On May 26, 2017, the Company, MVP REIT, Inc., a Maryland corporation ("(“MVP I"I”), MVP Merger Sub, LLC, a Delaware limited liability company and a wholly-owned subsidiary of the Company ("(“Merger Sub"Sub”), and the Advisor entered into an agreement and plan of merger (the "Merger Agreement"“Merger Agreement”), pursuant to which MVP I would merge with and into Merger Sub (the "Merger"“Merger”).

On December 15, 2017, the Merger was consummated. Following the Merger, the Company contributed 100% of its equity interests in Merger Sub to the Operating Partnership.

At the effective time of the Merger, each share of MVP I common stock, par value $0.001 per share, that was issued and outstanding immediately prior to the Merger (the "MVP“MVP I Common Stock"Stock”), was converted into the right to receive 0.365 shares of Company common stock. A total of approximately 3.9 million shares of Company common stock were issued to former MVP I stockholders, and former MVP I stockholders, immediately following the Merger, owned approximately 59.7% of the Company's common stock. The Company was subsequently renamed "The Parking REIT, Inc.".

Capitalization

As of SeptemberJune 30, 2018,2019, the Company had 6,547,9776,933,934 shares of common stock issued and outstanding. On December 31, 2016, the Company ceased all selling efforts for the Common Stock Offeringinitial public offering of its common stock.stock (the “Common Stock Offering”). The Company accepted additional subscriptions through March 31, 2017, the last day of the Common Stock Offering. In connection with its formation, the Company sold 8,000 shares of common stock to the SponsorMVP Capital Partners II, LLC (the “Sponsor”) for $200,000.

On October 27, 2016, the Company filed with the State Department of Assessments and Taxation of Maryland Articles Supplementary to the charter of the Company classifying and designating 50,000 shares of Series A Convertible Redeemable Preferred Stock, par value $0.0001 per share (the "Series A"“Series A”). The Company commenced a private placement of the shares of Series A, together with warrants to acquire the Company'sCompany’s common stock, to accredited investors on November 1, 2016 and closed the offering on March 24, 2017. The Company raised approximately $2.5 million, net of offering costs, in the Series A private placement and had 2,862 Series A shares issued and outstanding as of SeptemberJune 30, 2018.2019.

On March 29, 2017, the Company filed with the State Department of Assessments and Taxation of Maryland Articles Supplementary to the charter of the Company classifying and designating 97,000 shares of its authorized capital stock as shares of Series 1 Convertible Redeemable Preferred Stock par value $0.0001 per share (the "Series 1"“Series 1”). On April 7, 2017, the Company commenced a private placement of shares of Series 1, together with warrants to acquire the Company'sCompany’s common stock to accredited investors and closed the offering on January 31, 2018. The Company raised approximately $36.0 million, net of offering costs, in the Series 1 private placements and had 39,811 Series 1 shares issued and outstanding as of SeptemberJune 30, 2018.2019.

Note B — Summary of Significant Accounting Policies

Basis of Accounting

The accompanying unaudited condensed consolidated financial statements of the Company are prepared by management on the accrual basis of accounting and in accordance with principles generally accepted in the United States of America ("GAAP"(“GAAP”) for interim financial information as contained in the Financial Accounting Standards Board ("FASB"(“FASB”) Accounting Standards Codification ("ASC"(“ASC”), and in conjunction with rules and regulations of the SEC. Certain information and footnote disclosures required for annual financial statements have been condensed or excluded pursuant to SEC rules and regulations. Accordingly, the unaudited condensed consolidated financial statements do not include all of the information and footnotes required by GAAP for complete financial statements. The unaudited condensed consolidated financial statements include accounts and related adjustments, which are, in the opinion of management, of a normal recurring nature and necessary for a fair presentation of the Company'sCompany’s financial position, results of operations and cash flows for the interim period. Operating results for the three and ninesix months ended SeptemberJune 30, 20182019 are not necessarily indicative of the results that may be expected for the year ending December 31, 2018.2019. These unaudited condensed consolidated financial statements should be read in conjunction with the financial statements and notes thereto included in the Company'sCompany’s Annual Report on Form 10-K for the year ended December 31, 2017.2018.

The condensed consolidated balance sheet as of December 31, 20172018 contained herein has been derived from the audited financial statements as of December 31, 2017,2018 but does not include all disclosures required by GAAP.

Consolidation

The Company's condensedCompany’s consolidated financial statements for the period ended June 30, 2019, include its accounts, the accounts of the Company'sCompany’s assets, that were sold during 2017 (as applicable), the accounts of its subsidiaries, the Operating Partnership and all of the following subsidiaries. All intercompany profits and losses, balances and transactions are eliminated in consolidation.

The following list includes the subsidiaries that are included in the Company’s June 30, 2019 consolidated financial statements and does not reflect the actual number of properties owned by the Company for the periods presented in this filing as some of the entities own more than one property.

MVP PF Ft. Lauderdale 2013, LLC | Minneapolis City Parking, LLC | MVP |

MVP PF Memphis Poplar 2013, LLC | MVP | MVP Louisville Station Broadway, LLC |

MVP PF Memphis Court 2013, LLC | MVP Indianapolis Meridian Lot, LLC | White Front Garage Partners, LLC |

MVP PF St. Louis 2013, LLC | MVP Milwaukee Clybourn, LLC | Cleveland Lincoln Garage, LLC |

Mabley Place Garage, LLC | MVP Milwaukee Arena Lot, LLC | MVP Houston Preston, LLC |

MVP Denver Sherman, LLC | MVP Clarksburg Lot, LLC | MVP Houston San Jacinto Lot, LLC |

MVP Fort Worth Taylor, LLC | MVP Denver Sherman 1935, LLC | MVP Detroit Center Garage, LLC |

MVP Milwaukee Old World, LLC | MVP Bridgeport Fairfield Garage, LLC | St. Louis Broadway, LLC |

MVP Houston Saks Garage, LLC | West 9th Street Properties II, LLC | |

St. Louis | ||

MVP Milwaukee Wells, LLC | MVP San Jose 88 Garage, LLC | MVP Preferred Parking, LLC |

MVP Wildwood NJ Lot, LLC | MCI 1372 Street, LLC | MVP Raider Park Garage, LLC |

MVP | MVP Cincinnati Race Street, LLC | MVP New Orleans Rampart, LLC |

MVP Indianapolis WA Street Lot, LLC | MVP St. Louis | |

MVP Hawaii Marks Garage, LLC | ||

Under GAAP, the Company's condensedCompany’s consolidated financial statements will also include the accounts of its consolidated subsidiaries and joint ventures in which the Company is the primary beneficiary, or in which the Company has a controlling interest. In determining whether the Company has a controlling interest in a joint venture and the requirement to consolidate the accounts of that entity, the Company'sCompany’s management considers factors such as an entity'sentity’s purpose and design and the Company'sCompany’s ability to direct the activities of the entity that most significantly impacts the entity'sentity’s economic performance, ownership interest, board representation, management representation, authority to make decisions and contractual and substantive participating rights of the partners/members as well as whether the entity is a variable interest entity in which it will absorb the majority of the entity'sentity’s expected losses, if they occur, or receive the majority of the expected residual returns, if they occur, or both.

Equity investments in which the Company exercises significant influence but does not control and is not the primary beneficiary are accounted for using the equity method. The Company's share of its equity method investees' earnings or losses is included in other income in the accompanying condensed consolidated statements of operations. Investments in which the Company is not able to exercise significant influence over the investee are accounted for under the cost method.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Management makes significant estimates regarding revenue recognition, purchase price allocations to record investments in real estate, and derivative financial instruments and hedging activities, as applicable.

Concentration

The Company had fifteensixteen parking tenants as of SeptemberJune 30, 20182019 and nine parking tenants as of September 30, 2017.2018. One tenant, SP Plus Corporation (Nasdaq: SP) ("(“SP+"”), represented 57.4% and 54.9%58.5% of the Company'sCompany’s base parking rental revenue for the ninesix months ended SeptemberJune 30, 2018 and 2017, respectively.2019.

SP+ is one of the largest providers of parking management in the United States. As of SeptemberJune 30, 2018,2019, SP+ managed approximately 2,8003,400 locations in North America.

Below is a table that summarizes base parking rent by tenant:

For the Nine Months Ended September 30, | For the Six months ended June 30, | |||||||

| Parking Tenant | 2018 | 2017 | 2019 | 2018 | ||||

| SP + | 57.4% | 54.9% | 58.5% | 57.3% | ||||

| iPark Services | 13.4% | 10.6% | ||||||

iPark Services * | 12.7% | 13.8% | ||||||

| ABM | 4.6% | 2.3% | 4.3% | 4.7% | ||||

| ISOM Mgmt. | 4.2% | -- | ||||||

| Premier Parking | 3.7% | 8.4% | ||||||

ISOM Mgmt | 4.0% | 4.4% | ||||||

Premier Parking * | 3.5% | 3.8% | ||||||

342 N. Rampart | 3.2% | 2.6% | ||||||

| Interstate Parking | 2.8% | 6.4% | 2.7% | 2.9% | ||||

| 342 N. Rampart | 2.6% | -- | ||||||

Lanier | 2.6% | 1.3% | ||||||

| Denison | 2.5% | -- | 2.4% | 2.6% | ||||

| Lanier | 2.4% | 4.2% | ||||||

| St. Louis Parking | 2.2% | 4.3% | 2.0% | 2.2% | ||||

TNSH, LLC | 1.2% | 0.2% | ||||||

Premium Parking | 1.1% | -- | ||||||

Riverside Parking | 1.0% | 1.0% | ||||||

| BEST PARK | 1.5% | -- | 0.5% | 1.6% | ||||

| Riverside Parking | 1.0% | 2.4% | ||||||

| PCAM, LLC | 0.8% | -- | ||||||

| TNSH, LLC | 0.6% | -- | ||||||

| Denver School | 0.2% | -- | 0.2% | 0.2% | ||||

| Secure | 0.1% | -- | 0.1% | 0.1% | ||||

| Miller Parking | -- | 6.5% | ||||||

PCAM, LLC | -- | 1.3% | ||||||

* Revenue for MillerDuring June 2018 Premier Parking represents a settlement received by MVP Detroit Center Garage, LLC of approximately $408,000 foracquired iPark Services. Subsequent to the operations of the garage through January 2017, at which time SP+ assumed operationsacquisition Premier and iPark continue to operate under a longer-term lease agreement.their original company names.

In addition, the Company had concentrations in various cities based on base parking rental revenue for the ninesix months ended SeptemberJune 30, 20182019 and 2017,2018, as well as concentrations in various cities based on the real estate the Company owned as of SeptemberJune 30, 20182019 and December 31, 2017.2018. The below tables summarize this information by city.

| City Concentration for Parking Rental Revenue | ||||

| For the Six months ended June 30, | ||||

| 2019 | 2018 | |||

Detroit | 17.3% | 18.8% | ||

Houston | 12.7% | 13.8% | ||

Cincinnati | 8.8% | 9.5% | ||

Fort Worth | 7.7% | 8.4% | ||

Cleveland | 7.7% | 5.5% | ||

Indianapolis | 6.1% | 6.7% | ||

St. Louis | 5.1% | 6.5% | ||

Honolulu | 4.8% | 0.3% | ||

Lubbock | 4.0% | 4.4% | ||

Minneapolis | 4.0% | 4.4% | ||

Nashville | 3.5% | 3.8% | ||

Milwaukee | 3.3% | 3.1% | ||

New Orleans | 3.2% | 2.6% | ||

St. Paul | 2.7% | 2.9% | ||

San Jose | 2.3% | 1.2% | ||

Bridgeport | 2.1% | 2.2% | ||

Memphis | 1.6% | 1.7% | ||

Louisville | 1.0% | 1.0% | ||

Denver | 0.8% | 0.5% | ||

Ft. Lauderdale | 0.4% | 0.7% | ||

Wildwood | 0.4% | 0.4% | ||

Clarksburg | 0.3% | 0.3% | ||

Canton | 0.2% | 0.3% | ||

Kansas City | -- | 1.0% | ||

| City Concentration for Parking Rental Revenue | ||||||||

| Real Estate Investment Concentration by City | Real Estate Investment Concentration by City | |||||||

For the Nine Months Ended September 30, | As of June 30, | |||||||

| 2018 | 2017 | 2019 | 2018 | |||||

| Detroit | 18.2% | 43.4% | 17.6% | 17.7% | ||||

| Houston | 13.4% | 10.6% | 12.0% | 11.8% | ||||

Fort Worth | 8.8% | 8.8% | ||||||

| Cincinnati | 9.1% | 3.9% | 8.7% | 8.6% | ||||

| Fort Worth | 8.2% | -- | ||||||

Honolulu | 6.7% | 6.7% | ||||||

Cleveland | 6.2% | 5.2% | ||||||

| Indianapolis | 6.5% | -- | 5.8% | 5.8% | ||||

Minneapolis | 4.4% | 4.4% | ||||||

| St. Louis | 5.7% | 6.3% | 4.4% | 4.4% | ||||

| Cleveland | 5.4% | 12.1% | ||||||

Milwaukee | 3.8% | 3.8% | ||||||

Nashville | 3.7% | 3.7% | ||||||

| Lubbock | 4.3% | -- | 3.7% | 3.5% | ||||

| Minneapolis | 4.2% | -- | ||||||

| Nashville | 3.7% | 8.4% | ||||||

| Milwaukee | 3.5% | -- | ||||||

| St Paul | 2.8% | 6.4% | ||||||

St. Paul | 2.7% | 2.7% | ||||||

Bridgeport | 2.6% | 2.6% | ||||||

| New Orleans | 2.6% | -- | 2.6% | 2.6% | ||||

Memphis | 1.3% | 1.6% | ||||||

| San Jose | 2.4% | 5.9% | 1.1% | 1.2% | ||||

| Bridgeport | 2.1% | -- | ||||||

| Honolulu | 1.8% | -- | ||||||

| Memphis | 1.6% | -- | ||||||

Fort Lauderdale | 1.1% | 1.1% | ||||||

Denver | 1.0% | 1.0% | ||||||

| Louisville | 1.0% | 2.4% | 1.0% | 1.0% | ||||

| Ft. Lauderdale | 0.9% | -- | ||||||

| Denver | 0.8% | -- | ||||||

Wildwood | 0.4% | 0.5% | ||||||

Clarksburg | 0.2% | 0.2% | ||||||

Canton | 0.2% | 0.2% | ||||||

| Kansas City | 0.8% | -- | -- | 0.9% | ||||

| Wildwood | 0.4% | -- | ||||||

| Canton | 0.3% | 0.6% | ||||||

| Clarksburg | 0.3% | -- | ||||||

| Real Estate Investment Concentration by City | ||||

| As of September 30, 2018 | As of December 31, 2017 | |||

| Detroit | 17.8% | 18.9% | ||

| Houston | 12.1% | 12.7% | ||

| Fort Worth | 8.9% | 9.5% | ||

| Cincinnati | 8.6% | 8.8% | ||

| Honolulu | 6.7% | -- | ||

| Indianapolis | 5.9% | 6.2% | ||

| Cleveland | 5.2% | 5.5% | ||

| Minneapolis | 4.4% | 5.6% | ||

| St Louis | 4.4% | 7.1% | ||

| Milwaukee | 3.9% | 4.1% | ||

| Nashville | 3.8% | 3.9% | ||

| Lubbock | 3.5% | 3.8% | ||

| St Paul | 2.7% | 2.8% | ||

| Bridgeport | 2.7% | 2.8% | ||

| New Orleans | 2.6% | -- | ||

| Memphis | 1.6% | 1.7% | ||

| San Jose | 1.2% | 1.2% | ||

| Fort Lauderdale | 1.1% | 1.2% | ||

| Denver | 1.0% | 1.1% | ||

| Louisville | 1.0% | 1.1% | ||

| Kansas City | -- | 1.0% | ||

| Wildwood | 0.5% | 0.6% | ||

| Clarksburg | 0.2% | 0.2% | ||

| Canton | 0.2% | 0.2% | ||

Acquisitions

The Company records the acquired tangible and intangible assets and assumed liabilities of acquisitions of all operating properties and those development and redevelopment opportunities that meet the accounting criteria to be accounted for as business combinations at fair value at the acquisition date. The Company assesses and considers fair value based on estimated cash flow projections that utilize available market information and discount and/or capitalization rates that the Company deems appropriate. Estimates of future cash flows are based on a number ofseveral factors including historical operating results, known and anticipated trends, and market and economic conditions. The acquired assets and assumed liabilities for an operating property acquisition generally include but are not limited to: land, buildings and improvements, construction in progress and identified tangible and intangible assets and liabilities associated with in-place leases, including tenant improvements, leasing costs, value of above-market and below-market operating leases and ground leases, acquired in-place lease values and tenant relationships, if any. Costs directly associated with all operating property acquisitions and those development and redevelopment acquisitions that meet the accounting criteria to be accounted for as business combinations are expensed as incurred within operating expenses in the consolidated statement of operations.

Impairment of Long LivedLong-Lived Assets

When circumstances indicate the carrying value of a property may not be recoverable, the Company reviews the asset for impairment. This review is based on an estimate of the future undiscounted cash flows, excluding interest charges, expected to result from the property'sproperty’s use and eventual disposition. These estimates consider factors such as expected future operating income, market and other applicable trends and residual value, as well as the effects of leasing demand, competition and other factors. If impairment exists, due to the inability to recover the carrying value of a property, the property is written down to fair value and an impairment loss is recorded to the extent that the carrying value exceeds the estimated fair value of the property for properties to be held and used. For properties held for sale, the impairment loss is the adjustment to fair value less estimated cost to dispose of the asset. These assessments have a direct impact on net income because recording an impairment loss results in an immediate negative adjustment to net income.

During the three and six months ended June 30, 2019, the Company recorded asset impairment charges totaling approximately $952,000. These impairment charges consisted of $558,000 associated with the Memphis Court lot, $344,000 associated with the San Jose 88 garage and $50,000 associated with the St. Louis Washington lot. These charges were recorded to write down the carrying value of these assets to their current appraised values net of estimated closing costs. The appraisals were performed by independent third-party appraisers primarily using the income approach based on the contracted rent to be received from the operator (i.e. leased fee for St. Louis and San Jose) and the fee simple method for Memphis Court. The Company recorded no impairment charges for the three and six months ended June 30, 2018. The estimated fair values, as they relate to property carrying values were primarily based upon estimated sales prices from third-party offers or indicative bids.

Cash

The Company maintains a significant portion of its cash deposits at KeyBank, which are held by the Company'sCompany’s subsidiaries allowing the Company to maximize FDIC insurance coverage. The balances are insured by the Federal Deposit Insurance Corporation ("FDIC"(“FDIC”) under the same ownership category of $250,000. As of SeptemberJune 30, 20182019, and as of December 31, 2017,2018, the Company had approximately $0.6$2.2 million and $5.6$0.5 million, respectively, in excess of the federally-insuredfederally insured limits. As of SeptemberJune 30, 2018,2019, the Company has not experienced any losses on cash deposits.

Restricted Cash

Restricted cash primarily consists of escrowed tenant improvement funds, real estate taxes, capital improvement funds, insurance premiums and other amounts required to be escrowed pursuant to loan agreements.

Revenue Recognition

The Company's revenues, which are derived primarily from rental income, include rents that each tenant pays in accordance with the terms of each lease reported on a straight-line basis over the initial term of the lease. Since manysome of the Company's leases will provide for rental increases at specified intervals, straight-line basis accounting requires the Company to record a receivable, and include in revenues, unbilled rent receivables that the Company will only receive if the tenant makes all rent payments required through the expiration of the initial term of the lease. Percentage rents will beare recorded when earned and certain thresholds have been met.

The Company will continually reviewreviews receivables related to rent and unbilled rent receivables and determinedetermines collectability by taking into consideration the tenant'stenant’s payment history, the financial condition of the tenant, business conditions in the industry in which the tenant operates and economic conditions in the area in which the property is located. In the event thatIf the collectability of a receivable is in doubt, the Company will recordrecords an increase in the Company's allowance for uncollectible accounts or recordrecords a direct write-off of the receivable after exhaustive efforts at collection.

Advertising Costs

Advertising costs incurred in the normal course of operations and are expensed as incurred. During the three and ninesix months ended SeptemberJune 30, 20182019 and 2017,2018, the Company had no advertising costs.

Investments in Real Estate and Fixed Assets

Investments in real estate and fixed assets are stated at cost less accumulated depreciation. Depreciation is provided principally on the straight-line method over the estimated useful lives of the assets, which are primarily 3 to 40 years. The cost of repairs and maintenance is charged to expense as incurred. Expenditures for property betterments and renewals are capitalized. Upon sale or other disposition of a depreciable asset, cost and accumulated depreciation are removed from the accounts and any gain or loss is reflected in other income (expense).

The Company periodically evaluates whether events and circumstances have occurred that may warrant revision of the estimated useful lives of fixed assets or whether the remaining balance of fixed assets should be evaluated for possible impairment. The Company uses an estimate of the related undiscounted cash flows over the remaining life of the fixed assets in measuring their recoverability.

Assets Held for Sale

The Company classifies a property as held for sale when all of the criteria set forth in ASC Topic 360: Property, Plant and Equipment (“ASC 360”) have been met. The criteria are as follows: (i) management, having the authority to approve the action, commits to a plan to sell the property; (ii) the property is available for immediate sale in its present condition, subject only to terms that are usual and customary; (iii) an active program to locate a buyer and other actions required to complete the plan to sell have been initiated; (iv) the sale of the property is probable and is expected to be completed within one year; (v) the property is being actively marketed for sale at a price that is reasonable in relation to its current fair value; and (vi) actions necessary to complete the plan of sale indicate that it is unlikely that significant changes to the plan will be made or that the plan will be withdrawn. At the time the Company classifies a property as held for sale, the Company ceases recording depreciation and amortization. A property classified as held for sale is measured and reported at the lower of the carrying amount or its estimated fair value less cost to sell.

Purchase Price Allocation

The Company allocates the purchase price of acquired properties to tangible and identifiable intangible assets acquired based on their respective fair values. Tangible assets include land, land improvements, buildings, fixtures and tenant improvements on an as-if vacant basis. The Company utilizes various estimates, processes and information to determine the as-if vacant property value. Estimates of value are made using customary methods, including data from appraisals, comparable sales, discounted cash flow analysis and other methods. Amounts allocated to land, land improvements, buildings and fixtures are based on cost segregation studies performed by independent third parties or on the Company's analysis of comparable properties in the Company's portfolio. Identifiable intangible assets include amounts allocated to acquire leases for above- and below-market lease rates, the value of in-place leases, and the value of customer relationships, as applicable. The aggregate value of intangible assets related to in-place leases is primarily the difference between the property valued with existing in-place leases adjusted to market rental rates and the property valued as if vacant. Factors considered by the Company in its analysis of the in-place lease intangibles include an estimate of carrying costs during the expected lease-up period for each property, taking into accountconsidering current market conditions and costs to execute similar leases. In estimating carrying costs, the Company will includeincludes real estate taxes, insurance and other operating expenses and estimates of lost rentals at market rates during the expected lease-up period. Estimates of costs to execute similar leases including leasing commissions, legal and other related expenses are also utilized.

Above-market and below-market in-place lease values for owned properties are recorded based on the present value (using an interest rate which reflects the risks associated with the leases acquired) of the difference between the contractual amounts to be paid pursuant to the in-place leases and management'smanagement’s estimate of fair market lease rates for the corresponding in-place leases, measured over a period equal to the remaining non-cancelable term of the lease. The capitalized above-market lease intangibles are amortized as a decrease to rental income over the remaining term of the lease.

The capitalized below-market lease values will be amortized as an increase to rental income over the remaining term and any fixed rate renewal periods provided within the respective leases. In determining the amortization period for below-market lease intangibles, the Company initially will consider, and periodically evaluate on a quarterly basis, the likelihood that a lessee will execute the renewal option. The likelihood that a lessee will execute the renewal option is determined by taking into consideration the tenant'stenant’s payment history, the financial condition of the tenant, business conditions in the industry in which the tenant operates and economic conditions in the area in which the property is located.

The aggregate value of intangible assets related to customer relationship, as applicable, is measured based on the Company's evaluation of the specific characteristics of each tenant'stenant’s lease and the Company's overall relationship with the tenant. Characteristics considered by the Company in determining these values include the nature and extent of its existing business relationships with the tenant, growth prospects for developing new business with the tenant, the tenant'stenant’s credit quality and expectations of lease renewals, among other factors.

The value of in-place leases is amortized to expense over the initial term of the respective leases. The value of customer relationship intangibles is amortized to expense over the initial term and any renewal periods in the respective leases, but in no event does the amortization period for intangible assets exceed the remaining depreciable life of the building. If a tenant terminates its lease, the unamortized portion of the in-place lease value and customer relationship intangibles is charged to expense.

In making estimates of fair values for purposes of allocating purchase price, the Company will utilize a number ofseveral sources, including independent appraisals that may be obtained in connection with the acquisition or financing of the respective property and other market data. The Company will also consider information obtained about each property as a result of the Company's pre-acquisition due diligence, as well as subsequent marketing and leasing activities, in estimating the fair value of the tangible and intangible assets acquired and intangible liabilities assumed.

Organization, Offering and Related Costs

Certain organization and offering costs will bewere previously incurred by the Advisor. Pursuant to the terms of the Amended and Restated Advisory Agreement, the Company willdid not reimburse the Advisor for these out of pocket costs and future organization and offering costs it may incur.incurred. Such costs shall includeincluded legal, accounting, printing and other offering expenses, including marketing, and direct expenses of the Advisor'sAdvisor’s employees and employees of the Advisor'sAdvisor’s affiliates and others.

All direct offering costs incurred and or paid by the Company that are directly attributable to a proposed or actual offering, including sales commissions, if any, were charged against the gross proceeds of the Common Stock Offering and recorded as an offset to additional paid-in-capital. All indirect costs will bewere expensed as incurred.

Stock-Based Compensation

The Company has a stock-based incentive award plan, which is accounted for under the guidance for share based payments. The expense for such awards will be included in general and administrative expenses and is recognized overon the vesting periodmeasurement date which is generally the grant date of the award or when the requirements for exercise of the award have been met (See(See Note G — Stock-Based Compensation)Compensation).

Share Repurchase Program

On May 29, 2018, the Company’s Board of Directors suspended the Share Repurchase Program, other than for hardship repurchases in connection with a shareholder’s death. Repurchase requests made in connection with the death or disability of a stockholder will be repurchased at a price per share equal to 100% of the amount the stockholder paid for each share, or once the Company has established an estimated NAV per share, 100% of such amount as determined by the Company’s board of directors, subject to any special distributions previously made to the Company’s stockholders.

On May 28, 2019, the Company established an estimated NAV equal to $25.10 per common share.

Income Taxes

A full valuation allowance for deferred tax assets was provided since the Company believes that it is more likely than not that it will not realize the benefits of its deferred tax assets. A change in circumstances may cause the Company to change its judgment about whether deferred tax assets should be recorded, and further whether any such assets would more likely than not be realized. The Company would generally report any change in the valuation allowance through its income statement in the period in which such changes in circumstances occur. Because the Company is a REIT, it will generally not be subject to corporate level federal income taxes on earnings distributed to its stockholders and therefore may not realize any benefit from deferred tax assets arising during 2019 or any prior period in which a valid REIT election was in effect. The Company intends to distribute at least 100% of its taxable income annually and intends to do so for the tax year ending December 31, 2019 and in all future periods. The Company has placed a full valuation allowance on all of its deferred tax assets, and thus no asset is recorded on the financial statements. The net income tax provision for the year ended December 31, 2017 was approximately zero.Company’s balance sheet.

Per Share Data

The Company calculates basic income (loss) per share by dividing net income (loss) for the period by weighted-average shares of its common stock outstanding for the respective period. Diluted income per share takes into accountconsiders the effect of dilutive instruments, such as stock options and convertible stock, but uses the average share price for the period in determining the number of incremental shares that are to be added to the weighted-average number of shares outstanding. The Company had no outstanding common share equivalents during the three and ninesix months ended SeptemberJune 30, 20182019 and 2017.

There is a potential for dilution from the Company'sCompany’s Series A Convertible Redeemable Preferred Stock which may be converted upon a holder's election into the Company'sCompany’s common stock at any time beginning upon the earlier of (i) 90 days after the occurrence of a listing event or (ii) the second anniversary of the final closing of the offering (whether or not a listing event has occurred).time. As of SeptemberJune 30, 2018,2019, there were 2,862 shares of the Series A Convertible Redeemable Preferred Stock issued and outstanding. As of filing date, the Company has not received any requests to convert.

There is a potential for dilution from the Company'sCompany’s Series 1 Convertible Redeemable Preferred Stock which may be converted upon a holder'sholder’s election into the Company'sCompany’s common stock at any time beginning upon the earlier of (i) 45 days after the occurrence of a listing event or (ii) April 7, 2019 (whether or not a listing event has occurred).time. As of SeptemberJune 30, 2018,2019, there were 39,811 shares of the Series 1 Convertible Redeemable Preferred Stock issued and outstanding. As of filing date, the Company has not received any requests to convert.

Each share of Series A preferred stock and Series 1 preferred stock will convert into the number of shares of the Company'sCompany’s common stock determined by dividing (i) the stated value per Series A share or Series 1 share of $1,000 (as may be adjusted pursuant to the applicable articles supplementary) plus any accrued but unpaid dividends to, but not including, the conversion date by (ii) the conversion price. The conversion price is equal to 100% or,the net asset value per share of the Company’s common stock; provided that if a “Listing Event” (as defined in the applicable articles supplementary) occurs, the conversion notice is received on or prior to December 1, 2017 (for Series 1 shares) or on or prior to the day immediately preceding the first anniversary of the issuance of such share (for Series A shares), 110%price will be 100% of the volume weighted average price per share of the Company'sCompany’s common stock for the 20 trading days prior to the delivery date of the conversion notice; provided that if the Company's common stock is not then traded on a national securities exchange, the conversion price will be equal to the net asset value per share of the Company's common stock.notice. The Company will have the right (but not the obligation) to redeem any Series A or Series 1 shares that are subject to a conversion notice on the terms set forth in the applicable articles supplementary.

Reportable Segments

The Company currently operates one reportable segment.

Reclassifications

Accounting and Auditing Standards Applicable to "Emerging“Emerging Growth Companies"Companies”

The Company is an "emerging“emerging growth company"company” under the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"“JOBS Act”). For as long as the Company remains an "emerging“emerging growth company,"” which may be up to five fiscal years, the Company is not required to (1) comply with any new or revised financial accounting standards that have different effective dates for public and private companies until those standards would otherwise apply to private companies, (2) provide an auditor'sauditor’s attestation report on management'smanagement’s assessment of the effectiveness of internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act, (3) comply with any new requirements adopted by the Public Company Accounting Oversight Board (the "PCAOB"“PCAOB”), requiring mandatory audit firm rotation or a supplement to the auditor'sauditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer or (4) comply with any new audit rules adopted by the PCAOB after April 5, 2012, unless the SEC determines otherwise. The Company intends to take advantage of such extended transition period. Since the Company will not be required to comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for other public companies, the Company'sCompany’s financial statements may not be comparable to the financial statements of companies that comply with public company effective dates. If the Company were to subsequently elect to instead comply with these public company effective dates, such election would be irrevocable pursuant to Section 107 of the JOBS Act.

Non-controlling Interests

The FASB issued authoritative guidance for non-controlling interests in December 2007, which establishes accounting and reporting standards for the non-controlling interest in a subsidiary and for the deconsolidation of a subsidiary. The guidance clarifies that a non-controlling interest in a subsidiary, which is sometimes referred to as an unconsolidated investment, is an ownership interest in the consolidated entity that should be reported as a component of equity in the consolidated financial statements. Among other requirements, the guidance requires consolidated net income to be reported at amounts attributable to both the parent and the non-controlling interest. It also requires disclosure, on the face of the consolidated income statement, of the amounts of consolidated net income attributable to the parent and to the non-controlling interest.

Note C — Commitments and Contingencies

Environmental Matters

During the Company'sCompany’s predecessor’s due diligence of a property purchased on December 15, 2017 (originally purchased by predecessor on March 31, 2015) and located in Milwaukee, it was discovered that the soil and ground water at the subject property had been impacted by the site'ssite’s historical use as a printing press as well as neighboring property uses. As a result, the Company retained a local environmental engineer to seek a closure letter or similar certificate of no further action from the State of Wisconsin due to the Company'sCompany’s use of the property as a parking lot. As of SeptemberJune 30, 2018,2019, management has not received the closure letter, however the Company does not anticipate a material adverse effect related to this environmental matter. As

The Company believes that it complies, in all material respects, with all federal, state and local ordinances and regulations regarding hazardous or toxic substances. Furthermore, as of SeptemberJune 30, 2018,2019, the Company has not been notified by any governmental authority of any non-compliance, liability or other claim, and is not aware of any other environmental condition that it believes will have a material adverse effect on the results of operations. The Company, however, cannot predict the impact of any unforeseen environmental contingencies or new or changed laws or regulations on properties in which the Company holds an interest, or on properties that may be acquired directly or indirectly in the future.

Note D – Investments in Real Estate and Fixed Assets

As of SeptemberJune 30, 2018,2019, the Company had the following Investments in Real Estate that were consolidated on the Company'sCompany’s balance sheet:

| Property Name | Location | Date Acquired | Property Type | # Spaces | Property Size (Acres) | Retail Sq. Ft | Investment Amount | Parking Tenant |

| MVP Cleveland West 9th (1) | Cleveland, OH | 5/11/2016 | Lot | 260 | 2 | N/A | $5,840,000 | SP + |

| 33740 Crown Colony (1) | Cleveland, OH | 5/17/2016 | Lot | 82 | 0.54 | N/A | $3,050,000 | SP + |

| MVP San Jose 88 Garage | San Jose, CA | 6/15/2016 | Garage | 328 | 1.33 | N/A | $3,844,000 | Lanier |

| MCI 1372 Street | Canton, OH | 7/8/2016 | Lot | 66 | 0.44 | N/A | $700,000 | ABM |

| MVP Cincinnati Race Street Garage | Cincinnati, OH | 7/8/2016 | Garage | 350 | 0.63 | N/A | $5,558,000 | SP + |

| MVP St. Louis Washington | St Louis, MO | 7/18/2016 | Lot | 63 | 0.39 | N/A | $3,007,000 | SP + |

| MVP St. Paul Holiday Garage | St Paul, MN | 8/12/2016 | Garage | 285 | 0.85 | N/A | $8,396,000 | Interstate Parking |

| MVP Louisville Station Broadway | Louisville, KY | 8/23/2016 | Lot | 165 | 1.25 | N/A | $3,107,000 | Riverside Parking |

| White Front Garage Partners | Nashville, TN | 9/30/2016 | Garage | 155 | 0.26 | N/A | $11,672,000 | Premier Parking |

| Cleveland Lincoln Garage Owners | Cleveland, OH | 10/19/2016 | Garage | 536 | 1.14 | 45,272 | $7,406,000 | SP + |

| MVP Houston Preston Lot | Houston, TX | 11/22/2016 | Lot | 46 | 0.23 | N/A | $2,820,000 | iPark Services |

| MVP Houston San Jacinto Lot | Houston, TX | 11/22/2016 | Lot | 85 | 0.65 | 240 | $3,250,000 | iPark Services |

| MVP Detroit Center Garage | Detroit, MI | 2/1/2017 | Garage | 1,275 | 1.28 | N/A | $55,476,000 | SP + |

| St. Louis Broadway | St Louis, MO | 5/6/2017 | Lot | 161 | 0.96 | N/A | $2,400,000 | St. Louis Parking |

| St. Louis Seventh & Cerre | St Louis, MO | 5/6/2017 | Lot | 174 | 1.06 | N/A | $3,300,000 | St. Louis Parking |

| MVP Preferred Parking (4) | Houston, TX | 8/1/2017 | Garage/Lot | 530 | 0.75 | 784 | $21,109,000 | iPark Services |

| MVP Raider Park Garage | Lubbock, TX | 11/21/2017 | Garage | 1,495 | 2.15 | 20,536 | $11,030,000 | ISOM Management |

| MVP PF Ft. Lauderdale | Ft. Lauderdale, FL | 12/15/2017 | Lot | 66 | 0.75 | 4,017 | $3,423,000 | SP + |

| MVP PF Memphis Court | Memphis, TN | 12/15/2017 | Lot | 37 | 0.41 | N/A | $1,208,000 | SP + |

| MVP PF Memphis Poplar | Memphis, TN | 12/15/2017 | Lot | 125 | 0.86 | N/A | $3,735,000 | Best Park |

| MVP PF St. Louis | St Louis, MO | 12/15/2017 | Lot | 179 | 1.22 | N/A | $5,145,000 | SP + |

| Mabley Place Garage (2) | Cincinnati, OH | 12/15/2017 | Garage | 775 | 0.9 | 8,400 | $21,185,000 | SP + |

| MVP Denver Sherman | Denver, CO | 12/15/2017 | Lot | 28 | 0.14 | N/A | $705,000 | Denver School |

| MVP Fort Worth Taylor | Fort Worth, TX | 12/15/2017 | Garage | 1,013 | 1.18 | 11,828 | $27,663,000 | SP + |

| Property Name | Location | Date Acquired | Property Type | # Spaces | Property Size (Acres) | Retail Sq. Ft | Investment Amount | Parking Tenant | ||||||||

| MVP Cleveland West 9th (1) | Cleveland, OH | 5/11/2016 | Lot | 260 | 2.00 | N/A | $5,845,000 | SP + | ||||||||

| 33740 Crown Colony (1) | Cleveland, OH | 5/17/2016 | Lot | 82 | 0.54 | N/A | $3,049,000 | SP + | ||||||||

| MCI 1372 Street | Canton, OH | 7/8/2016 | Lot | 66 | 0.44 | N/A | $700,000 | ABM | ||||||||

| MVP Cincinnati Race Street Garage | Cincinnati, OH | 7/8/2016 | Garage | 350 | 0.63 | N/A | $6,331,000 | SP + | ||||||||

| MVP St. Louis Washington | St. Louis, MO | 7/18/2016 | Lot | 63 | 0.39 | N/A | $2,957,000 | SP + | ||||||||